The Daily Shot: 08-Mar-21

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

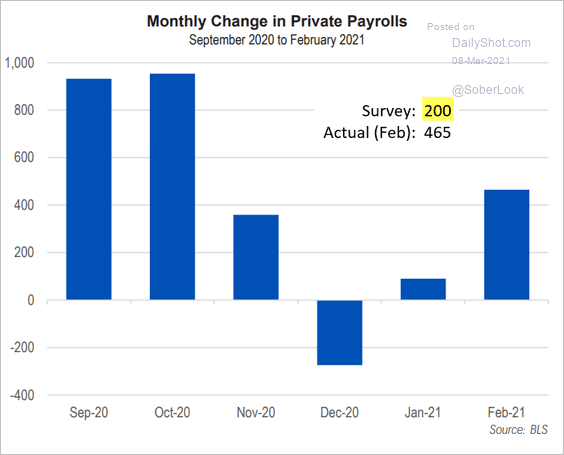

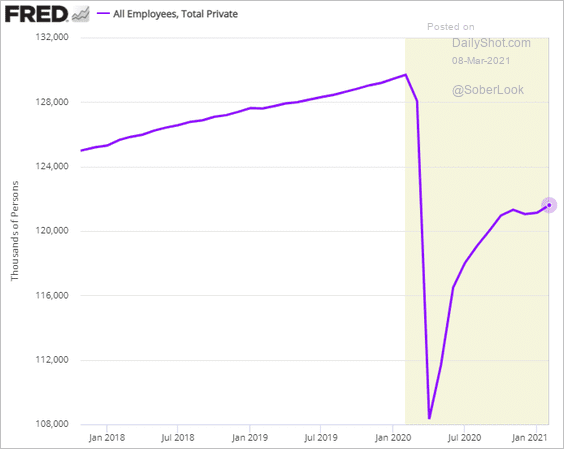

1. The February jobs report surprised to the upside, with private-sector job gains exceeding forecasts by over 250k.

Source: FHN Financial

Source: FHN Financial

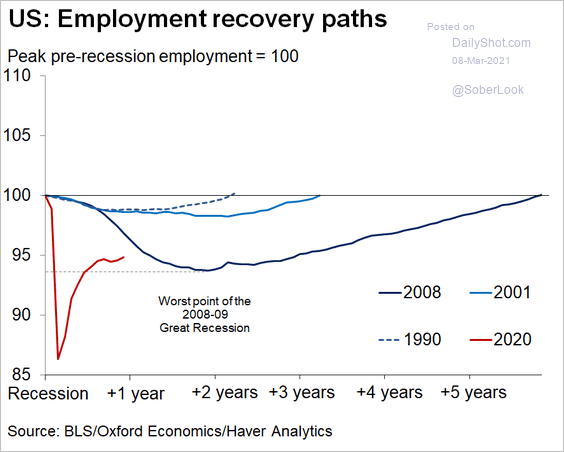

• Here is how the current labor market recovery compares to previous downturns.

Source: @GregDaco

Source: @GregDaco

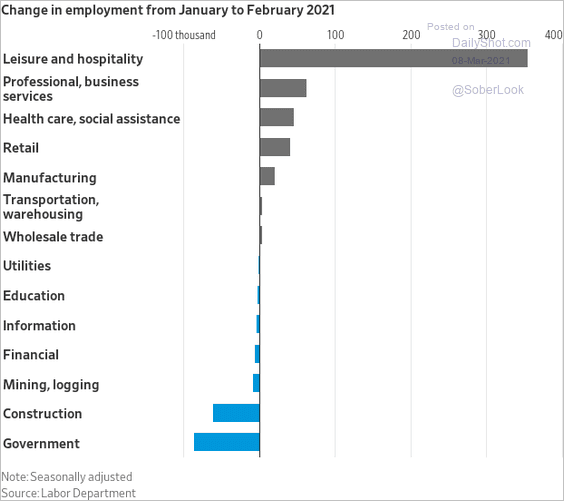

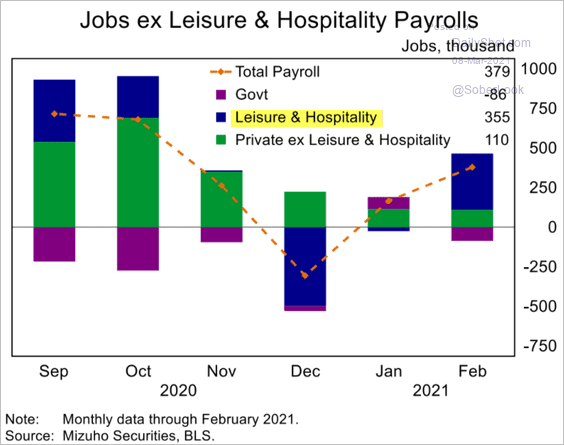

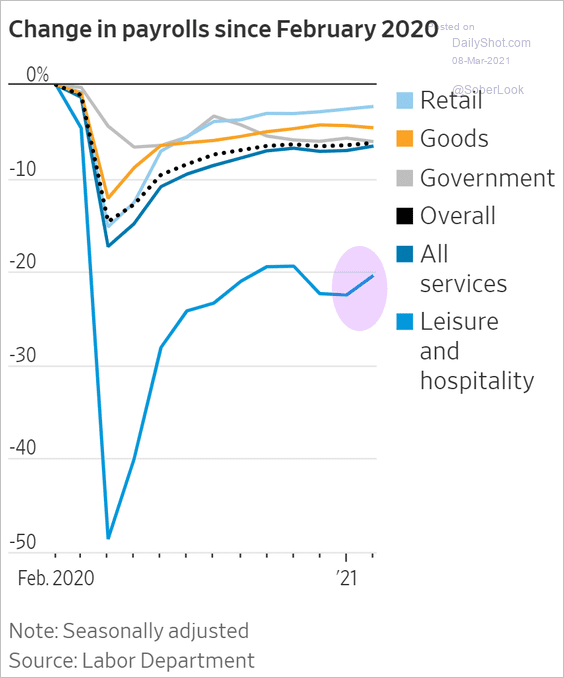

• The February gains in payrolls were driven by the leisure and hospitality sector (3 charts), particularly restaurants and bars.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Source: @WSJ Read full article

Source: @WSJ Read full article

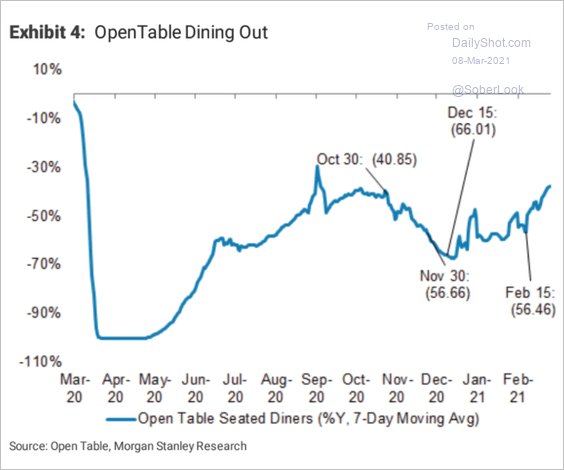

Here is the OpenTable seated diners index.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

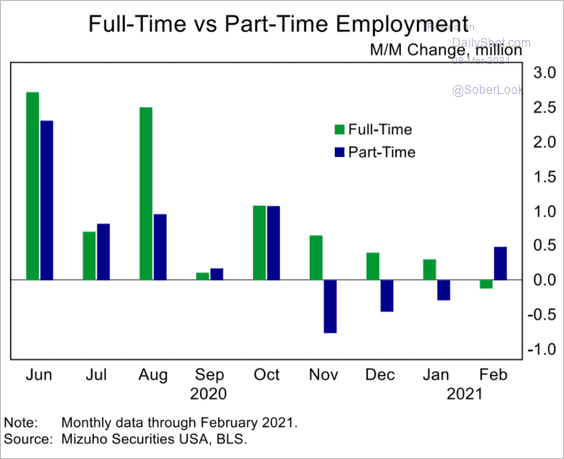

• Many of the new positions were part-time.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

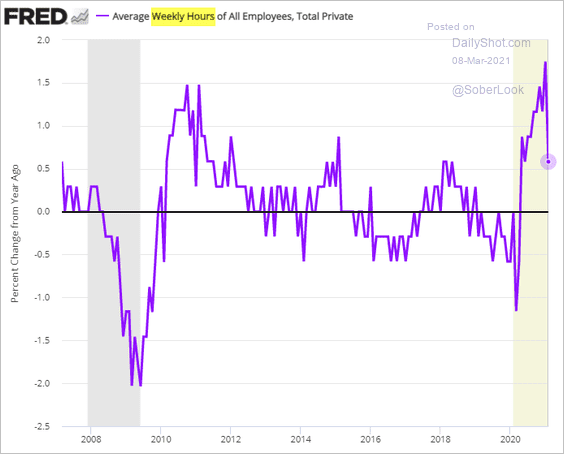

As a result, average weekly hours declined last month.

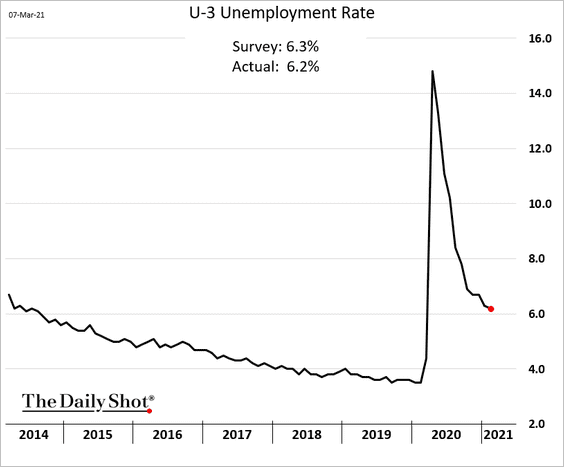

• The unemployment rate ticked lower.

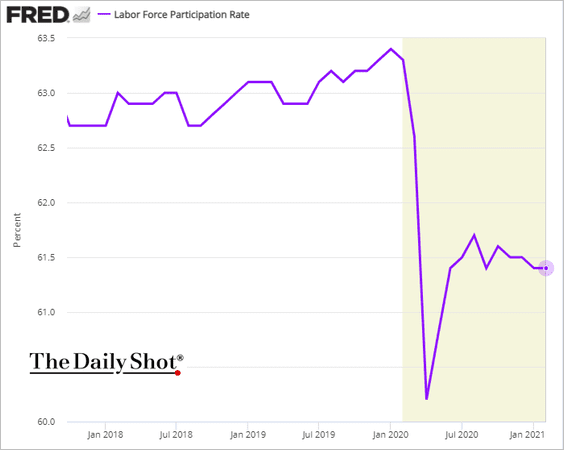

However, the rebound in labor force participation has stalled.

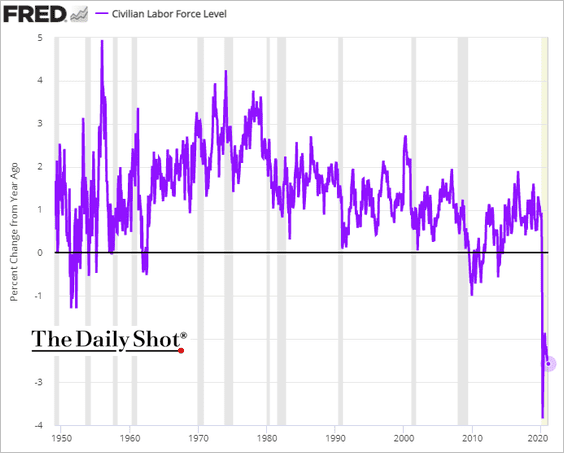

The pandemic-driven drop in the nation’s civilian labor force has been unprecedented in the post-WW-II era.

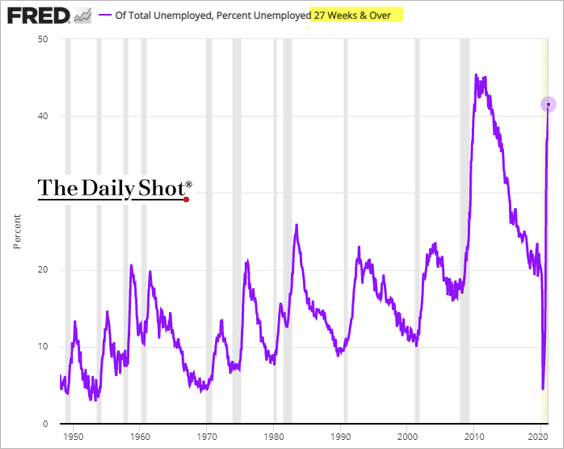

• Long-term unemployment is approaching the financial crisis peak.

• Below are a few additional updates on the jobs report.

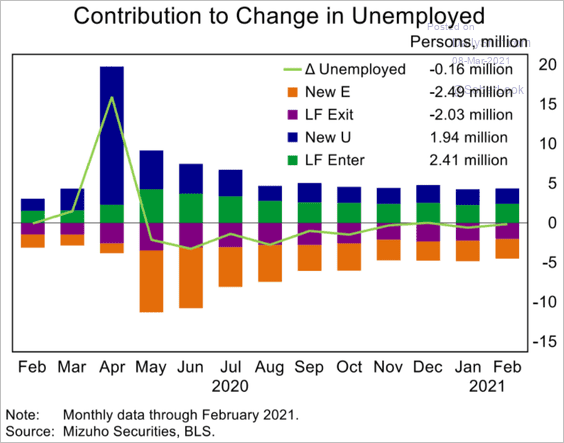

– Employment change attribution (New E = newly employed, New U = newly unemployed, LF Exit = exiting the labor force, LF Enter = entering the labor force):

Source: Mizuho Securities USA

Source: Mizuho Securities USA

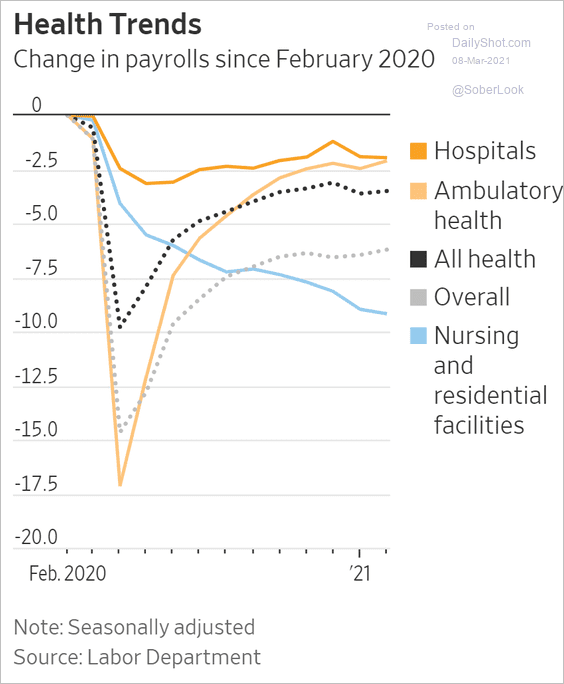

– Healthcare jobs:

Source: @WSJ Read full article

Source: @WSJ Read full article

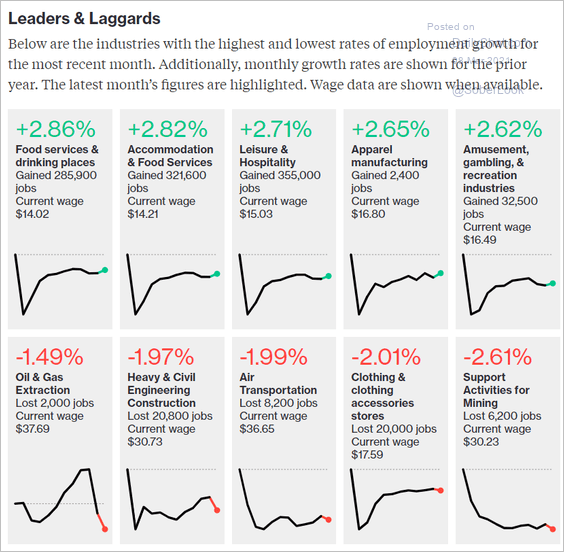

– Highest and lowest employment growth sectors:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

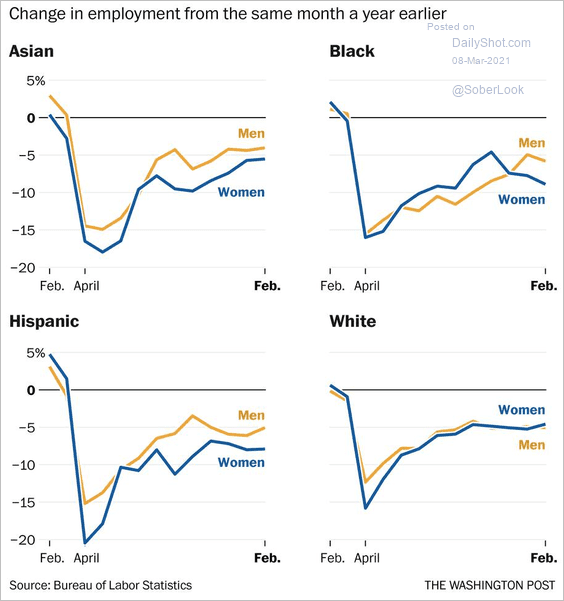

– Employment by race/ethnicity and gender:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

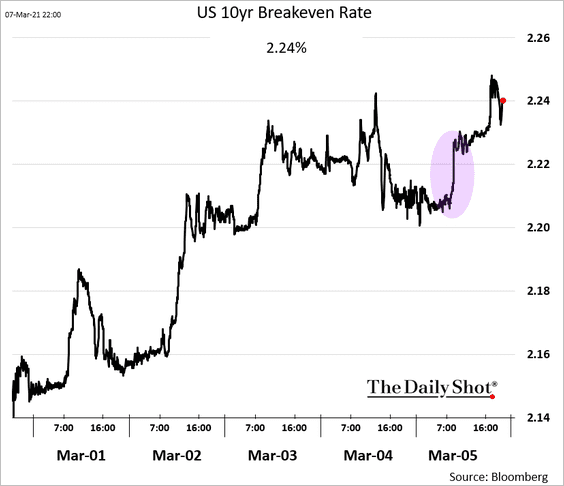

2. Market-based inflation expectations jumped in response to the employment report strength.

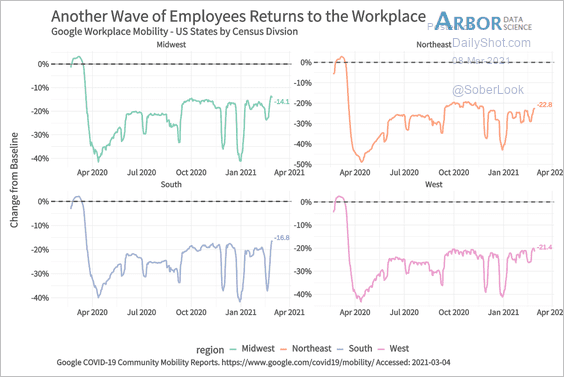

3. Mobility indicators show a modest improvement.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

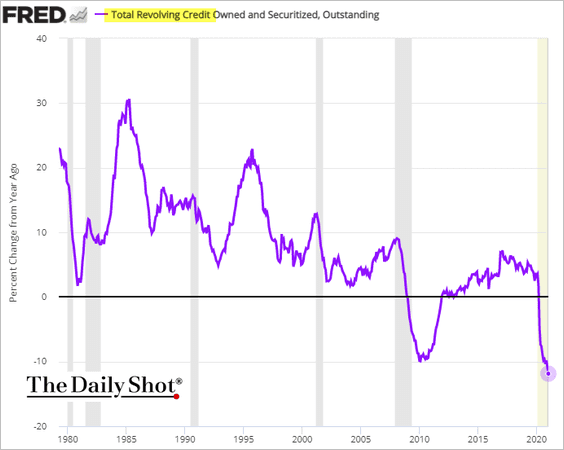

4. US consumers continue to cut back on their credit card balances. Revolving credit is down almost 12% from the same time last year – a record drop.

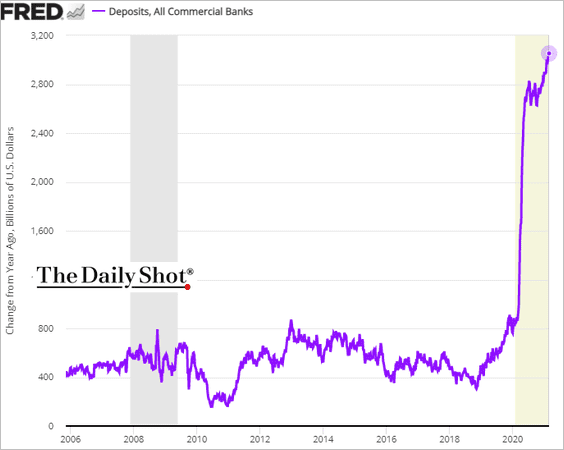

5. US bank deposits are up over $3 trillion from the same time last year, …

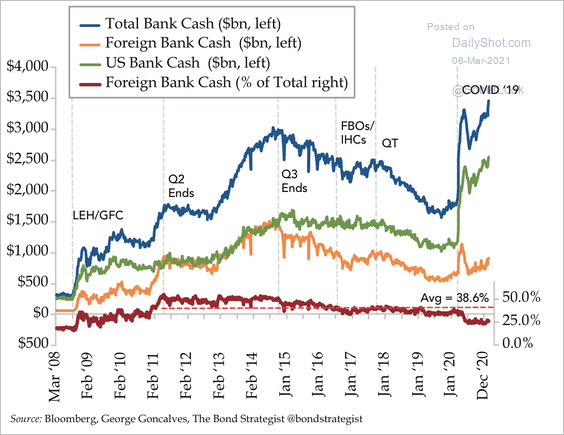

… driven by domestic banks.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

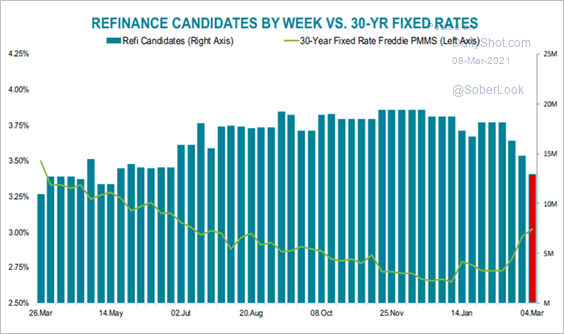

6. Higher mortgage rates have reduced the number of borrowers who would benefit from refinancing their loans.

Source: Black Knight

Source: Black Knight

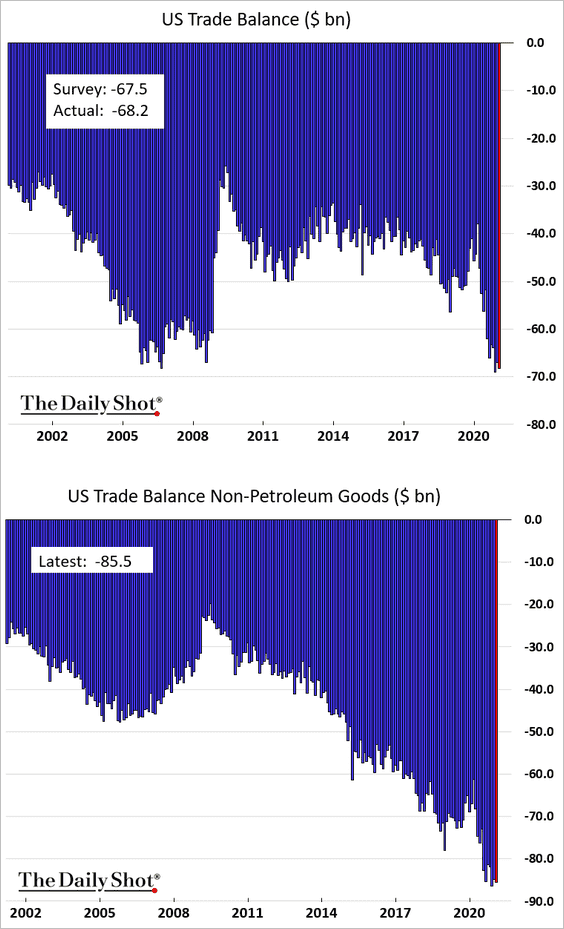

7. The trade deficit remains near record highs.

Back to Index

Canada

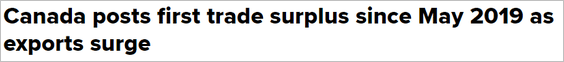

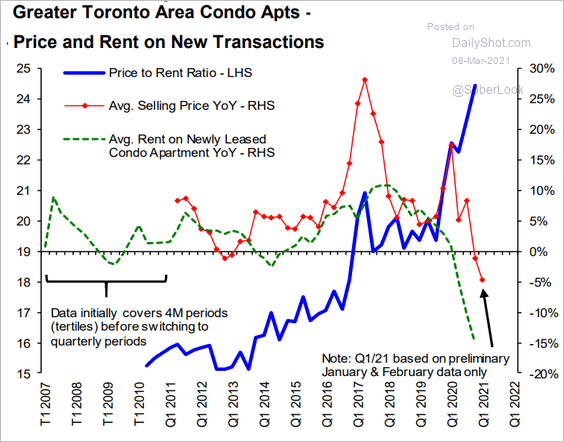

1. Canada posted a surprise trade surplus as exports surged.

Source: Global News Read full article

Source: Global News Read full article

——————–

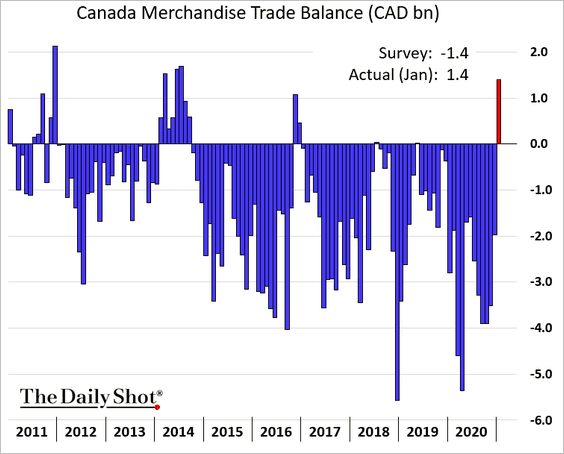

2. Ivey PMI showed an acceleration in business activity last month.

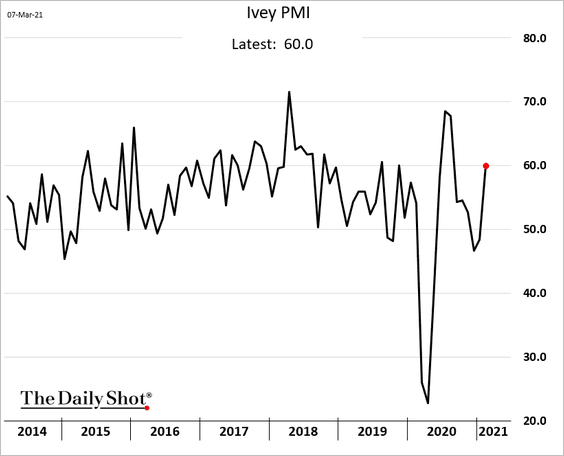

3. While Toronto-area overall housing sales surged, condo prices have been weakening.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

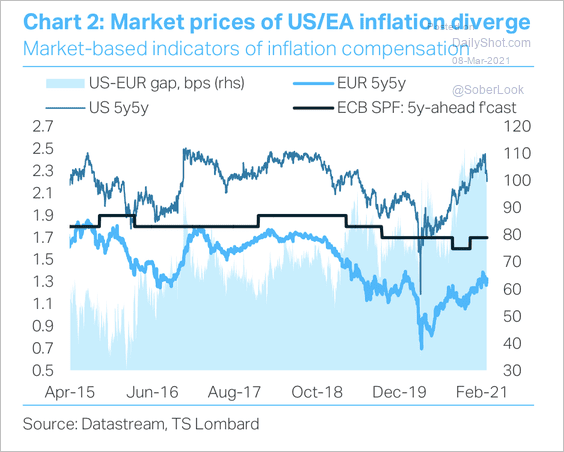

1. Market-based inflation expectations for the US and euro-area have diverged in recent months.

Source: TS Lombard

Source: TS Lombard

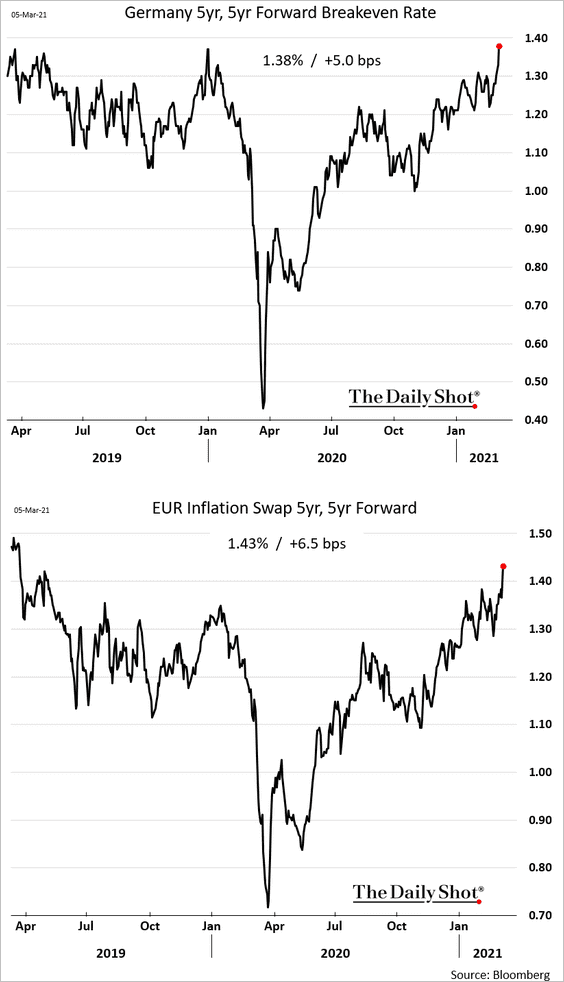

However, Eurozone inflation expectations perked up last week.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

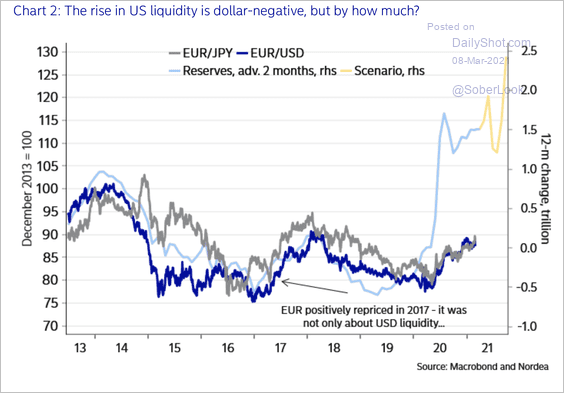

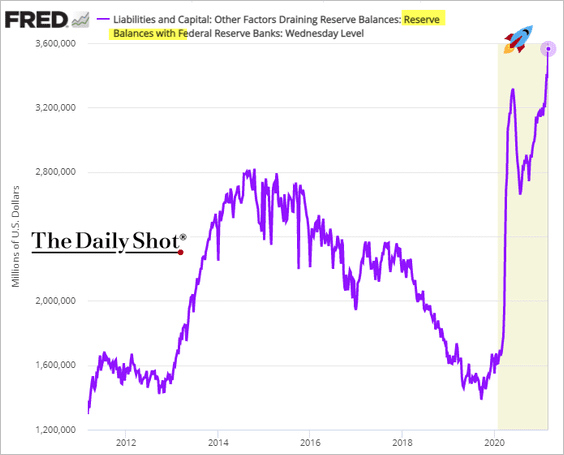

2. Will the rise in US bank reserves (see the rates section) push EUR/USD higher?

Source: Nordea Markets

Source: Nordea Markets

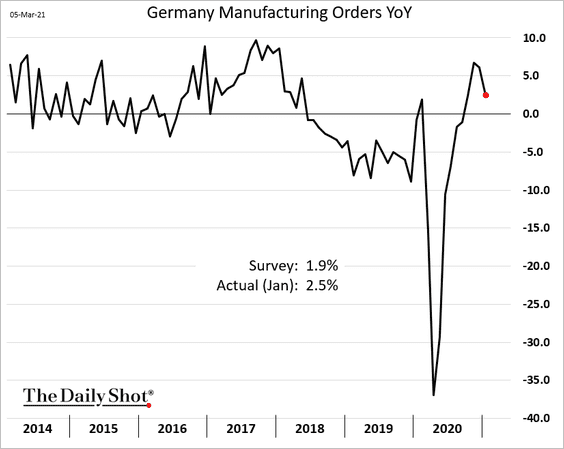

3. Next, we have some updates on Germany.

• Factory orders held up better than expected in January, …

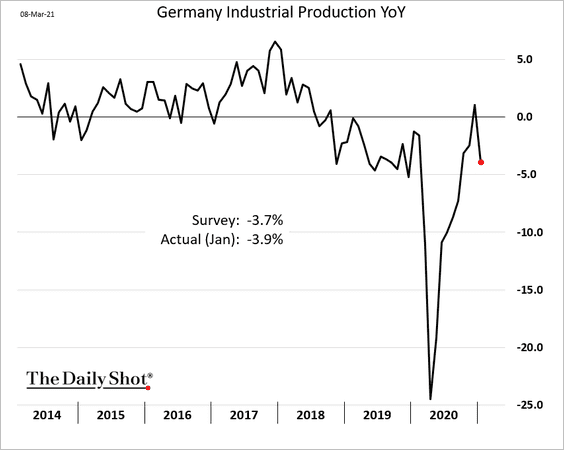

… but industrial production declined sharply.

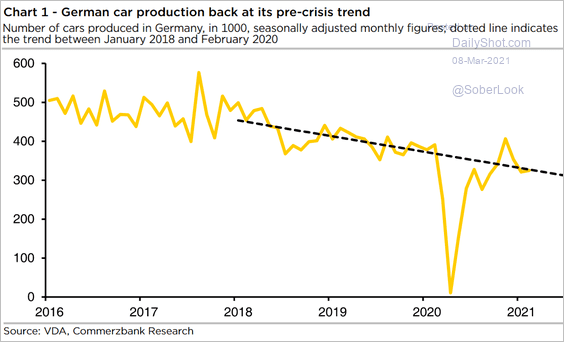

• Car production is back at the pre-crisis downward trend.

Source: Commerzbank Research

Source: Commerzbank Research

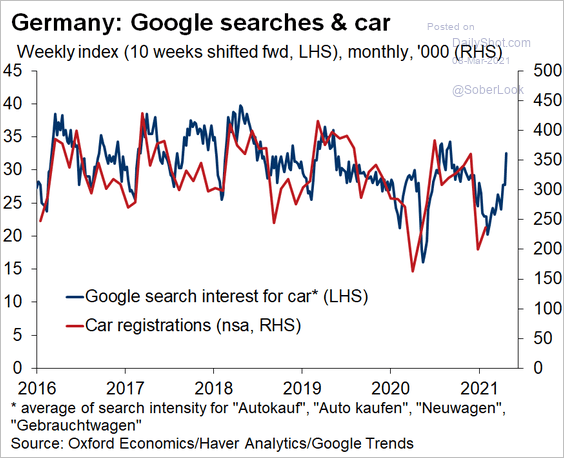

• Online search activity for cars has rebounded.

Source: @OliverRakau

Source: @OliverRakau

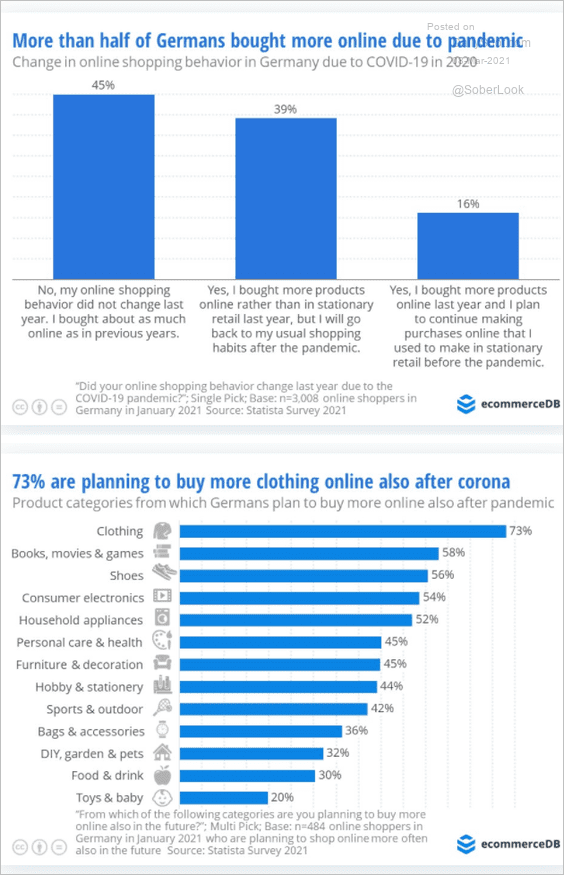

• Next, we have some shopping behavior data and plans for post-pandemic spending.

Source: ecommerceDB Read full article

Source: ecommerceDB Read full article

——————–

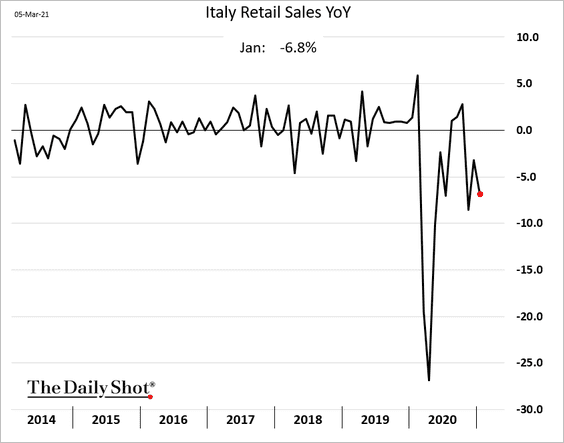

4. Italian retail sales softened again in January.

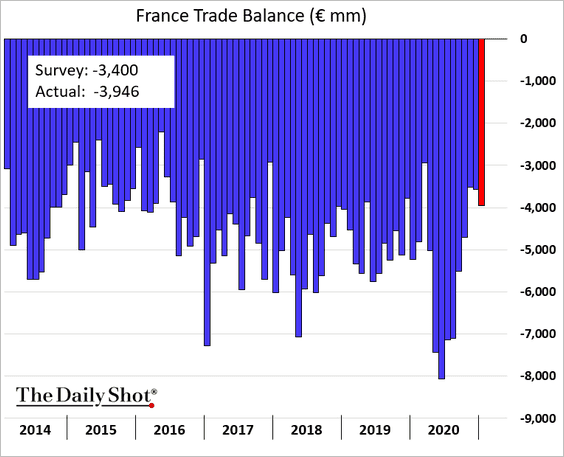

5. Is the French trade balance recovery over for now?

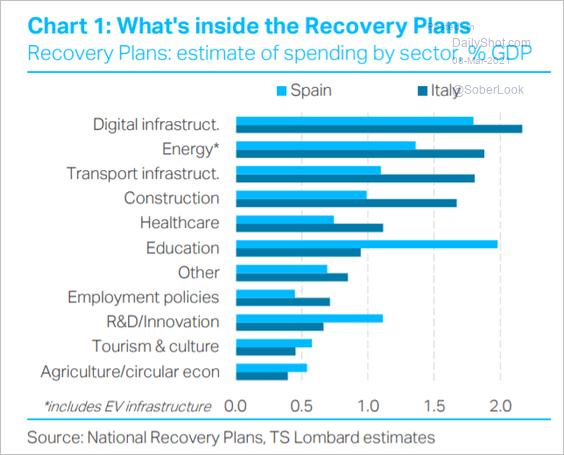

6. Here is a look at the national recovery plans for Spain and Italy.

Source: TS Lombard

Source: TS Lombard

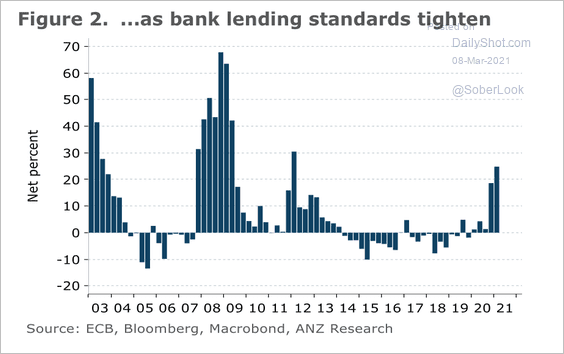

7. Credit standards have tightened in the euro area.

Source: ANZ Research

Source: ANZ Research

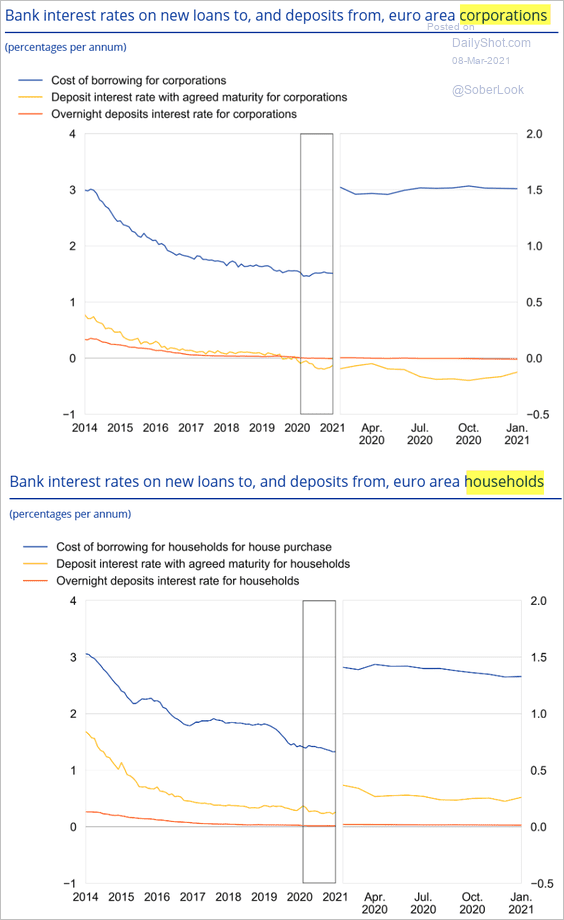

8. Finally, we have the euro-area deposit rates and the cost of borrowing for corporations and households.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

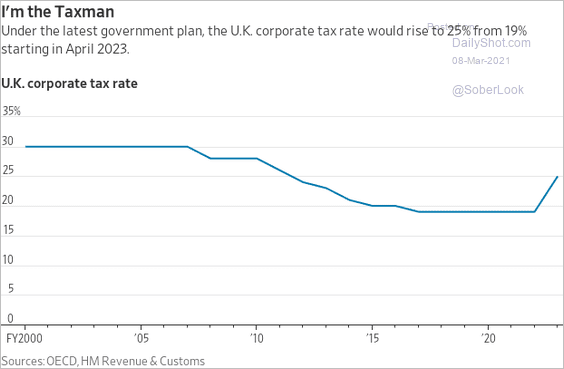

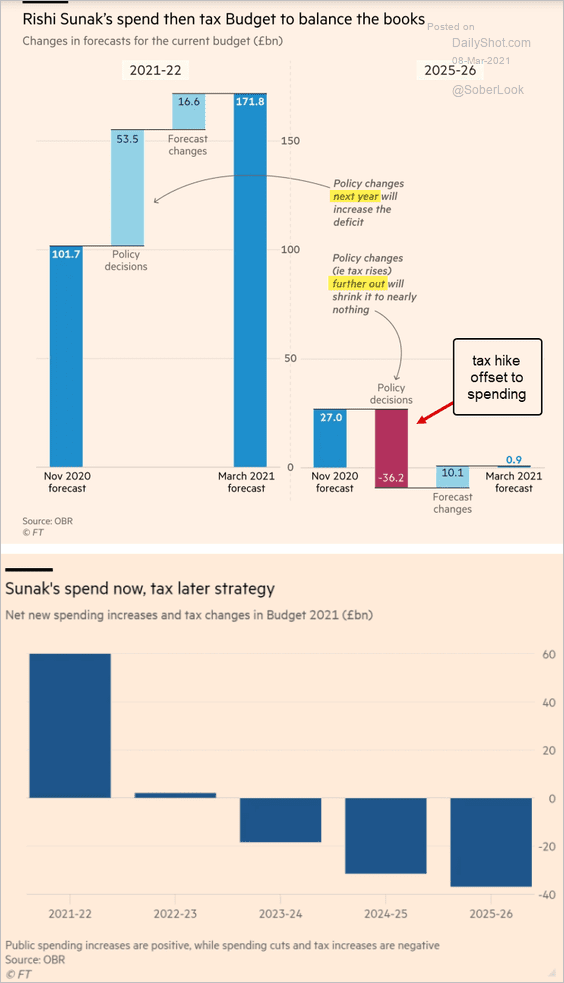

1. The UK corporate tax rate is going up …

Source: @WSJ Read full article

Source: @WSJ Read full article

… as the government tries to offset some of the increase in spending.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

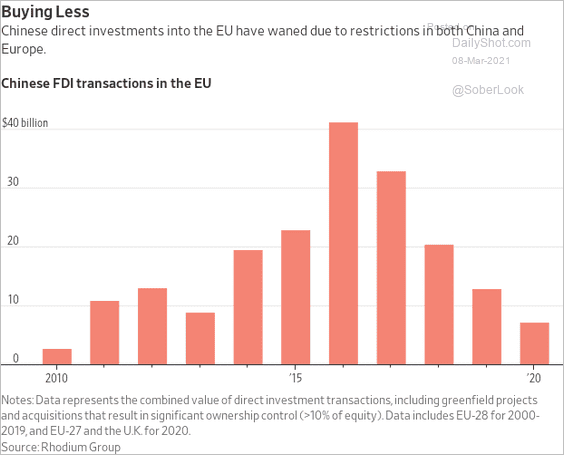

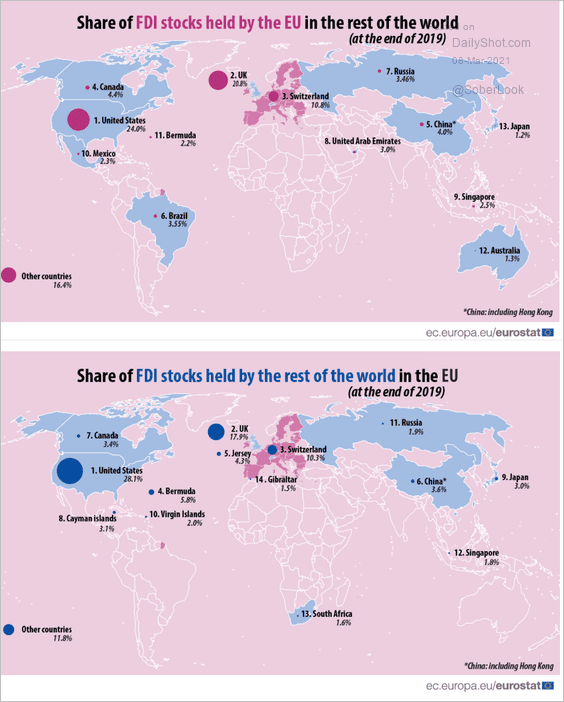

2. China’s direct investment in the EU has been declining.

Source: @WSJ Read full article

Source: @WSJ Read full article

This map shows foreign direct investment held by the EU in the rest of the world as well as the world’s investment in the EU (as % of total).

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

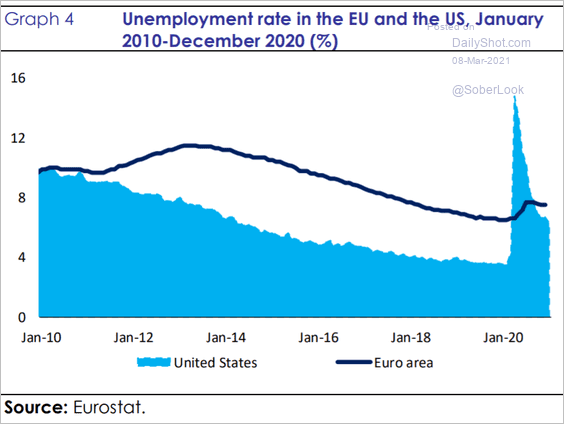

3. Here is the EU unemployment rate vs. the US.

Source: EC Read full article

Source: EC Read full article

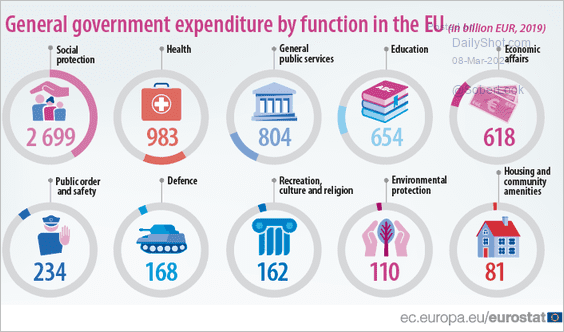

4. Finally, we have pre-pandemic government spending in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

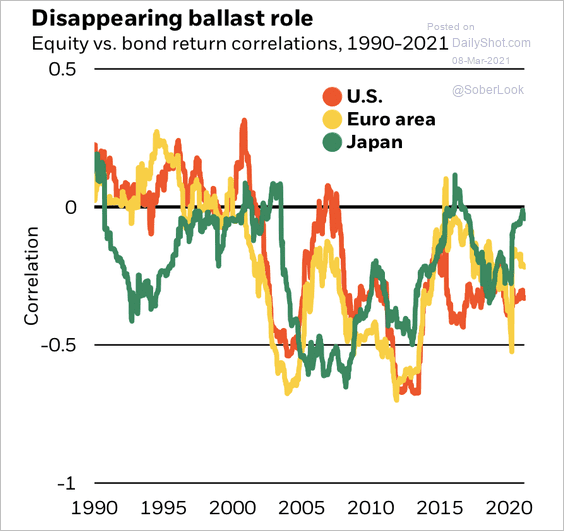

1. The equity/bond correlation is rising in Japan, more so than in the US and euro-area.

Source: BlackRock

Source: BlackRock

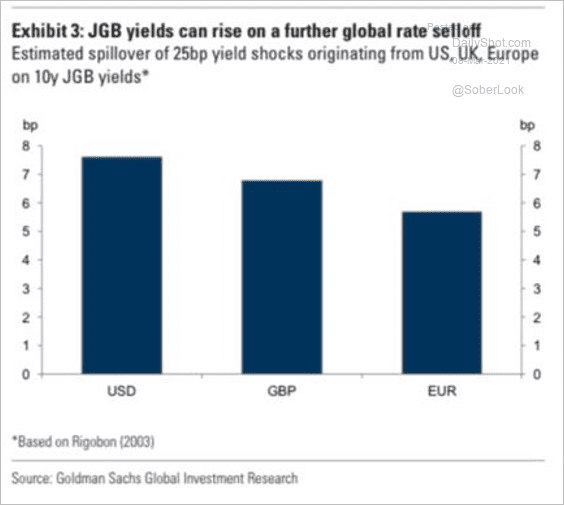

2. How sensitive are JGBs to yield increases in the US, the UK, and the Eurozone?

Source: J B; Goldman Sachs

Source: J B; Goldman Sachs

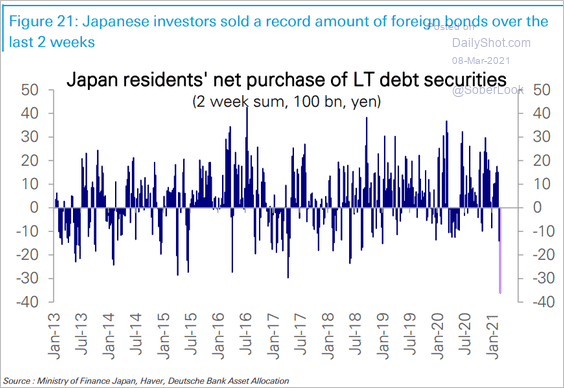

3. Japan’s residents have been dumping foreign bonds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia – Pacific

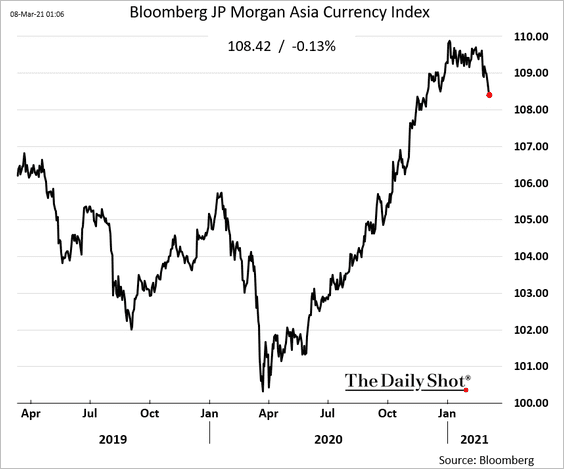

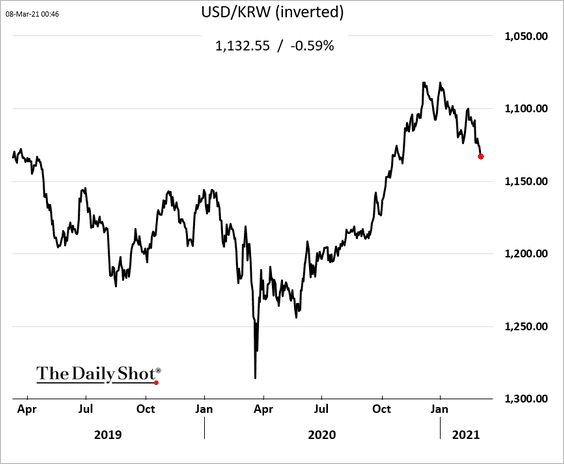

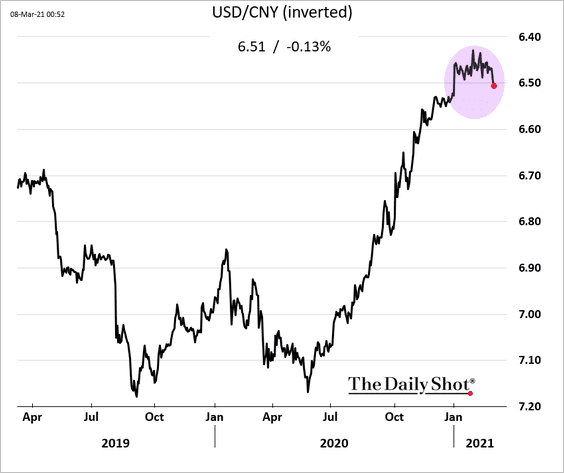

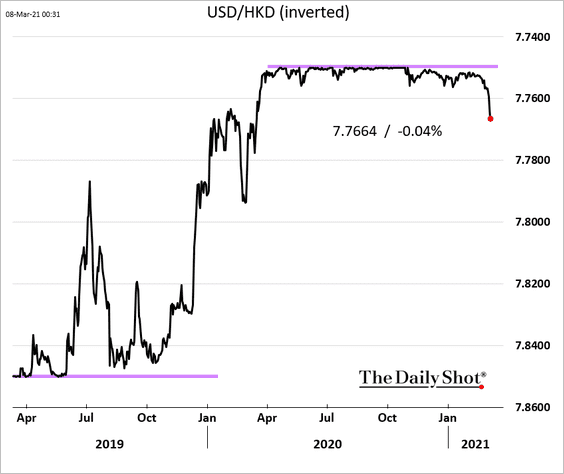

Asian currencies are rolling over, in part due to the global tech selloff.

• Bloomberg’s Asia currency index:

• The South Korean won:

• The renminbi:

• The Hong Kong dollar:

Back to Index

China

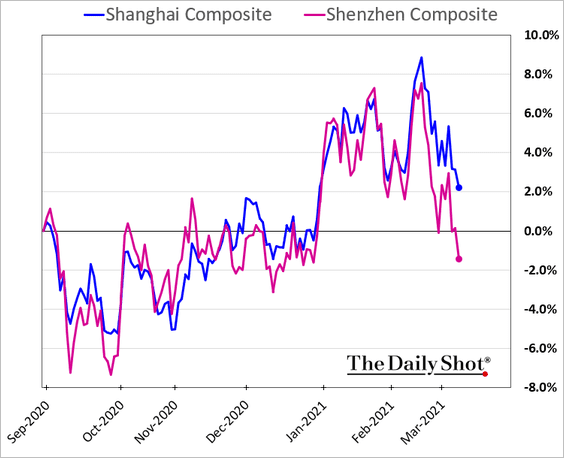

1. The Shenzhen Composite is underperforming due to higher tech exposure.

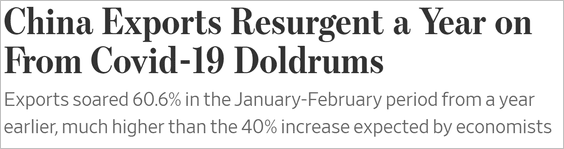

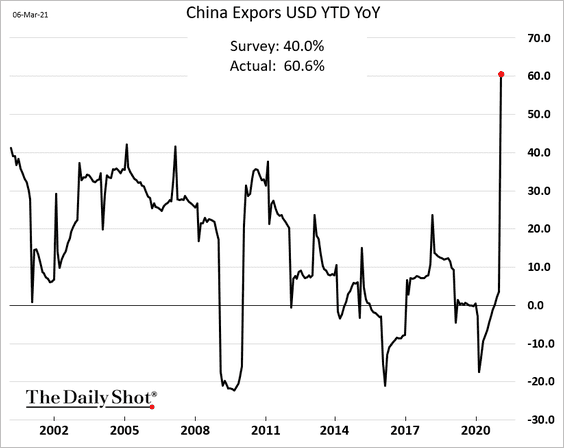

2. China’s exports rose sharply. A large portion of the year-over-year increase was due to base effects (China was shut down a year ago) – but not all.

Source: @WSJ Read full article

Source: @WSJ Read full article

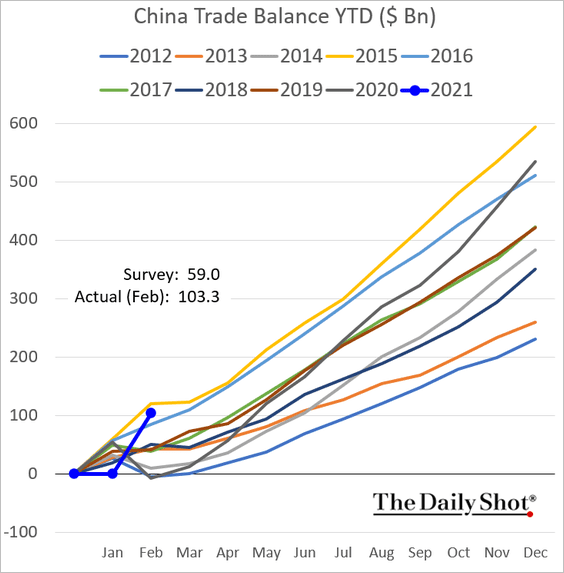

Here is the cumulative trade surplus.

——————–

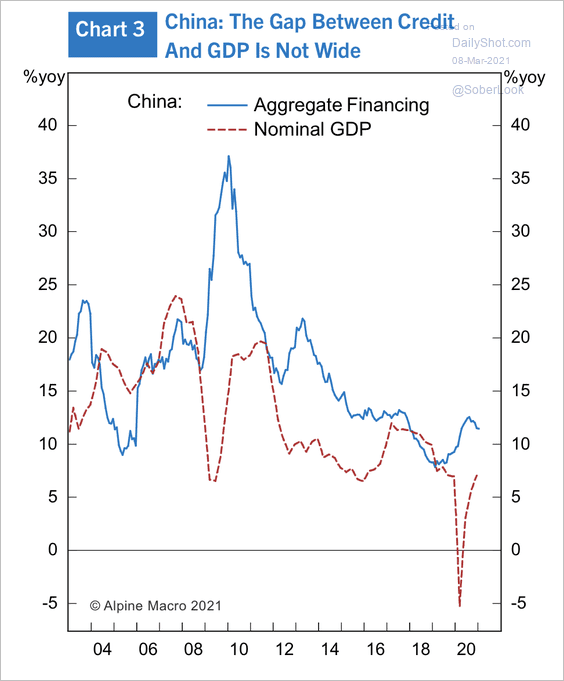

3. The current pace of credit expansion has been fairly modest by historical standards.

Source: Alpine Macro

Source: Alpine Macro

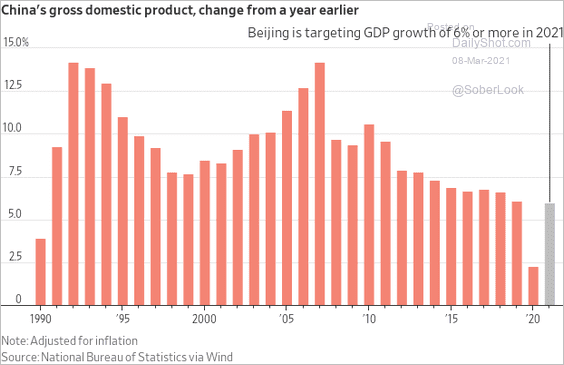

4. Beijing is targeting 6%+ growth for 2021.

Source: @WSJ Read full article

Source: @WSJ Read full article

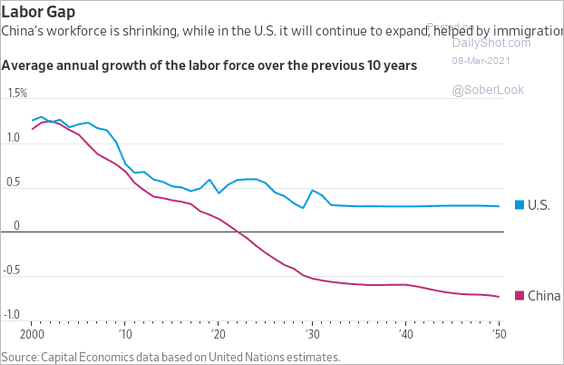

5. Finally, this chart shows China’s labor force growth vs. the US.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

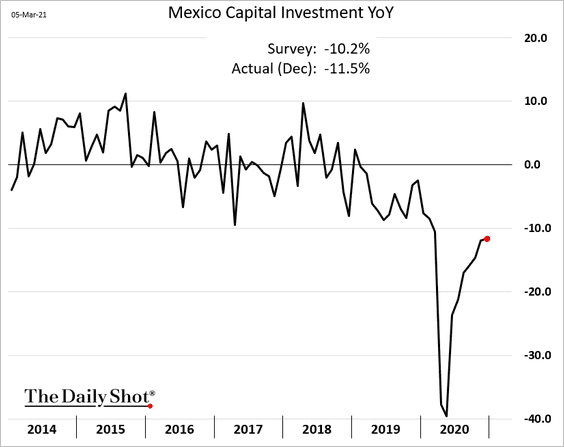

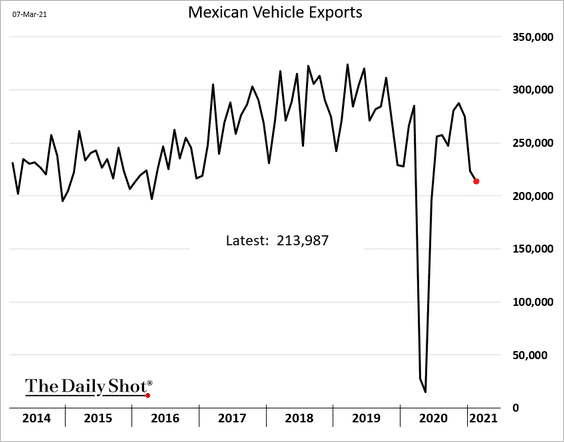

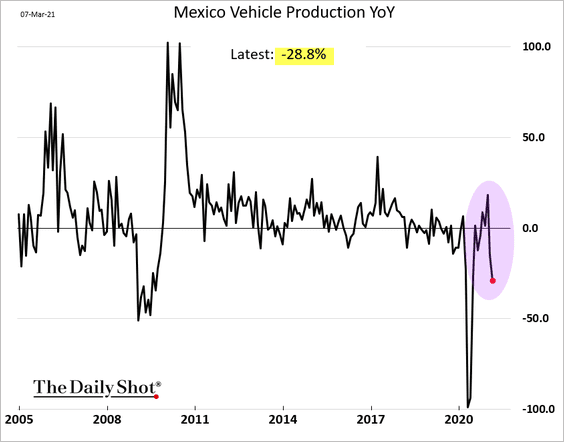

1. Let’s begin with Mexico.

• CapEx recovery stalled in December.

• Vehicle exports slowed further last month.

Vehicle production is down nearly 30% vs. the same time last year.

——————–

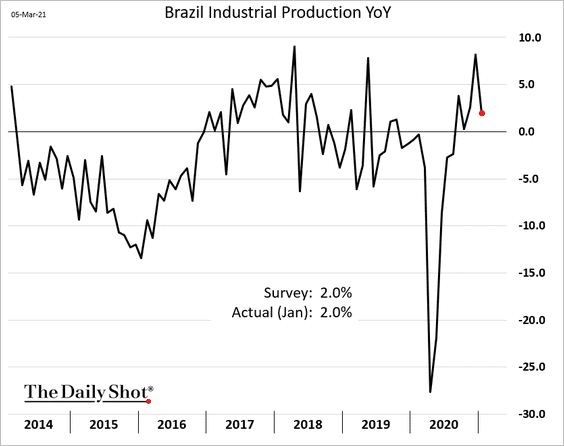

2. Brazil’s industrial production declined in line with expectations.

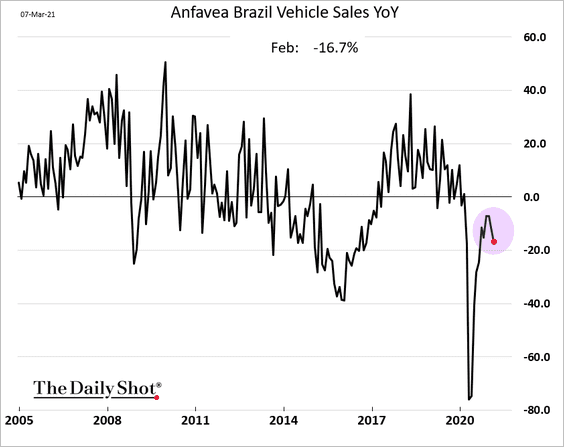

• Vehicle sales fell last month.

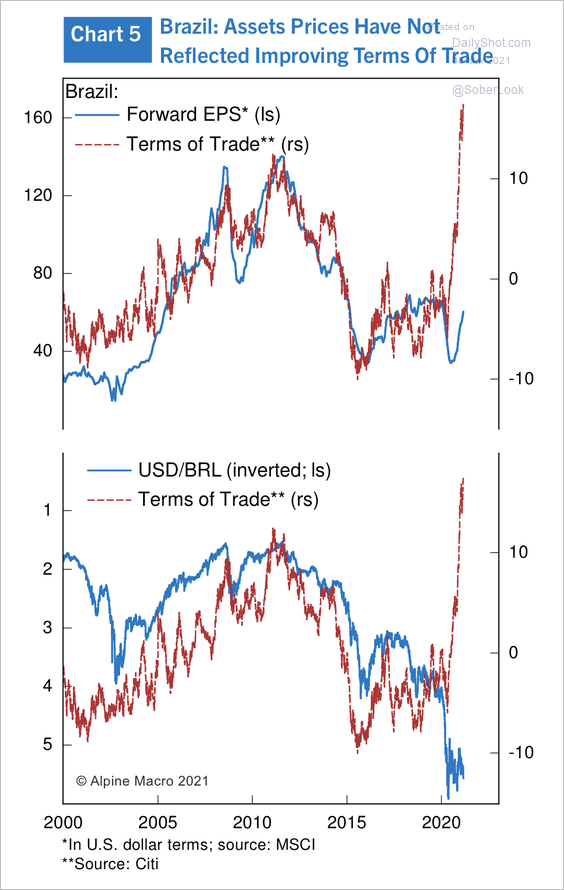

• So far, the surge in Brazil’s terms of trade has done little to improve company earnings and the exchange rate.

Source: Alpine Macro

Source: Alpine Macro

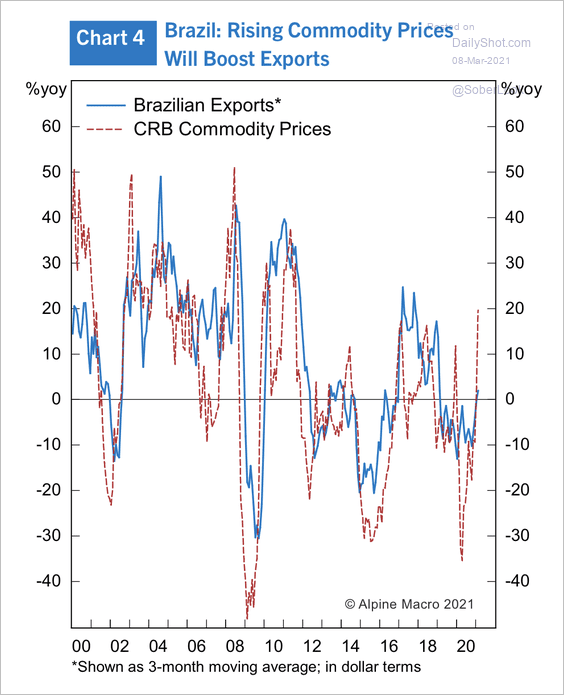

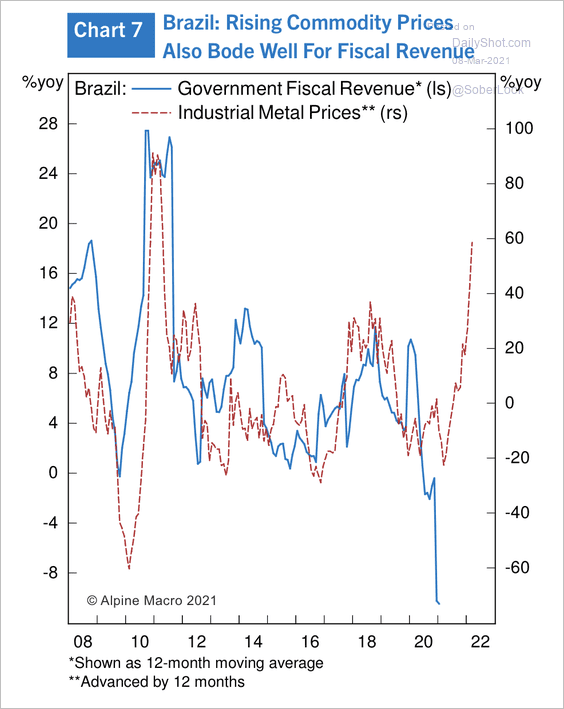

• Rising commodity prices could boost Brazilian exports and fiscal revenue (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

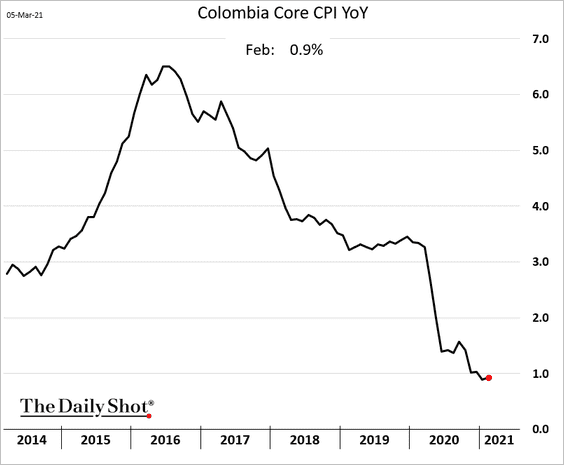

3. Colombia’s core CPI remains below 1%.

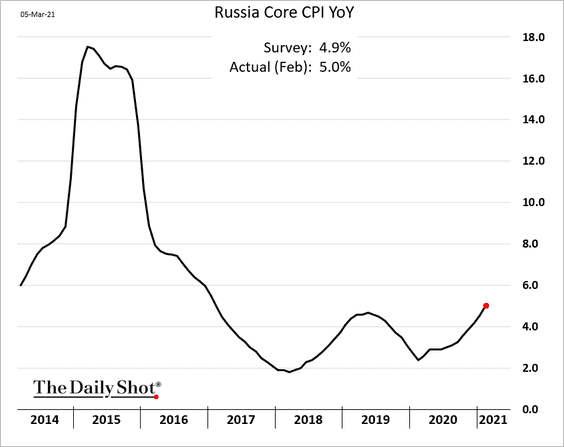

4. Russia’s core inflation continues to grind higher.

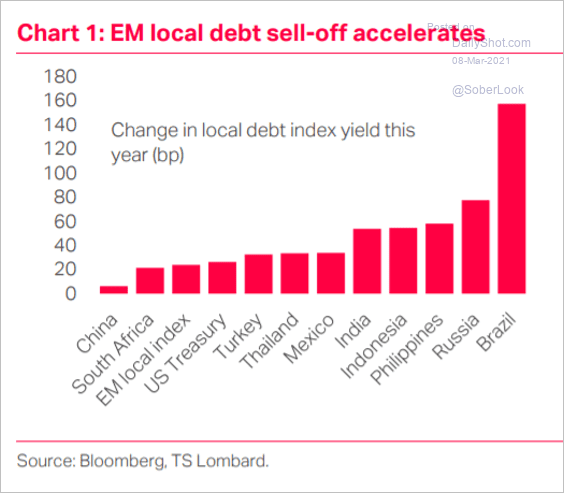

5. Here is a summary of the local debt selloff.

Source: TS Lombard

Source: TS Lombard

Back to Index

Commodities

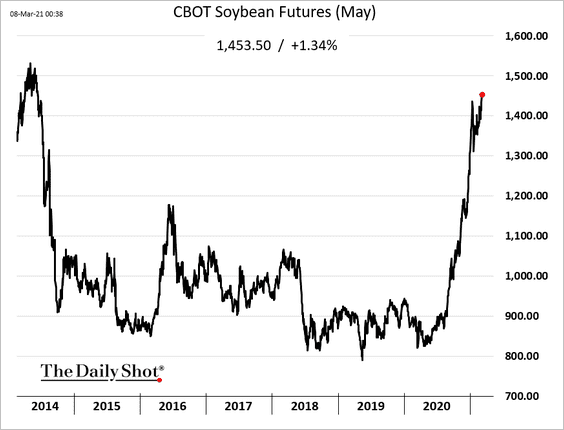

1. US soybean futures hit a multi-year high.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

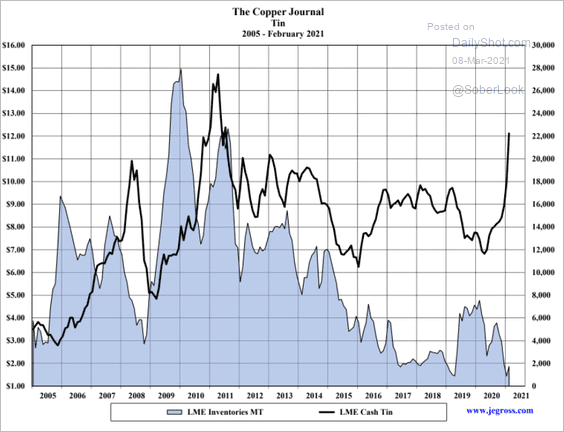

2. The rally in tin prices has been impressive as inventories collapse.

Source: The Copper Journal

Source: The Copper Journal

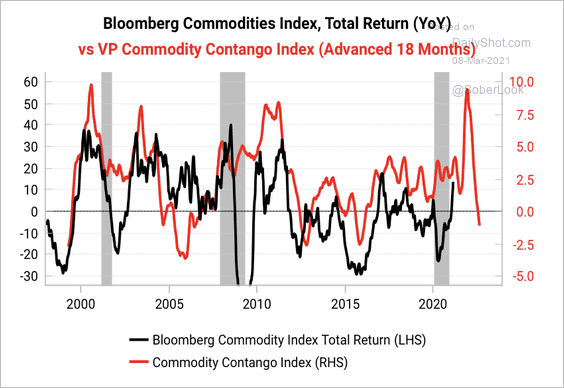

3. Far fewer commodity futures curves are in contango as supply/demand fundamentals improve.

Source: Variant Perception

Source: Variant Perception

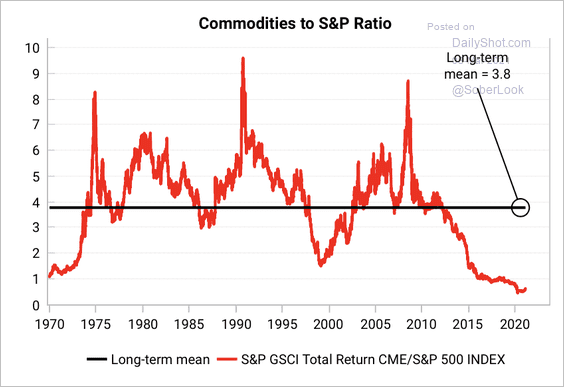

4. Commodities are near a 50-year low relative to the S&P 500.

Source: Variant Perception

Source: Variant Perception

Back to Index

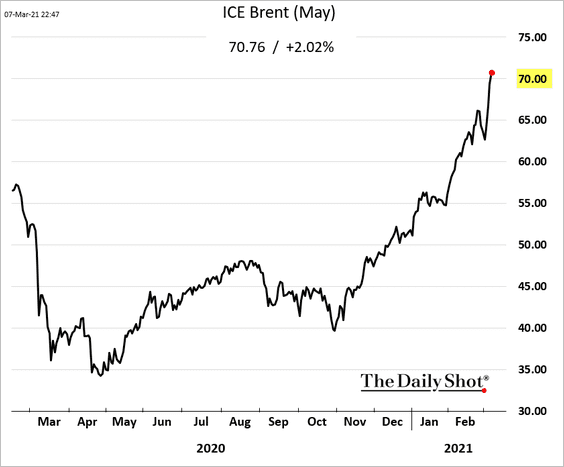

Energy

1. The attack on Saudi oil facilities sent Brent futures sharply higher. Will we see an escalation of hostilities in the region?

Source: Reuters Read full article

Source: Reuters Read full article

——————–

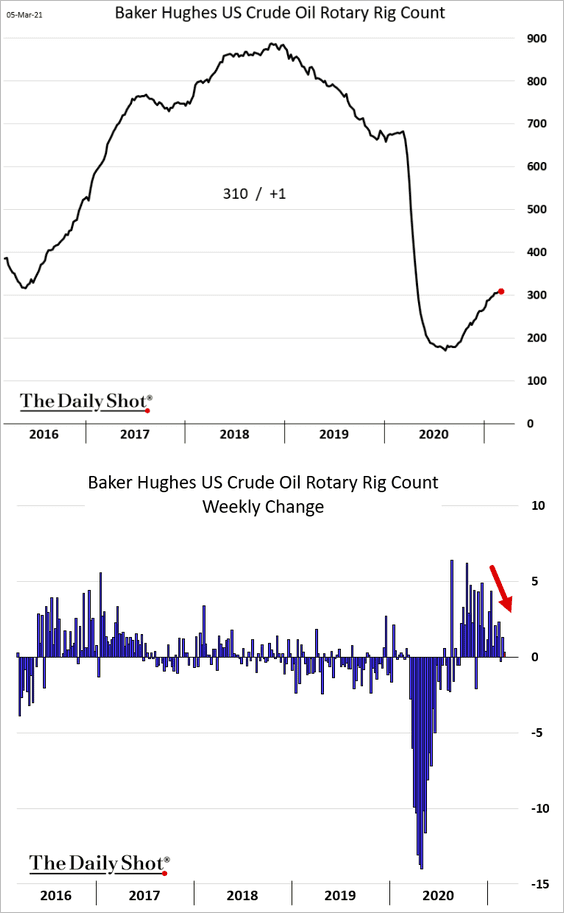

2. US oil rig recovery has stalled.

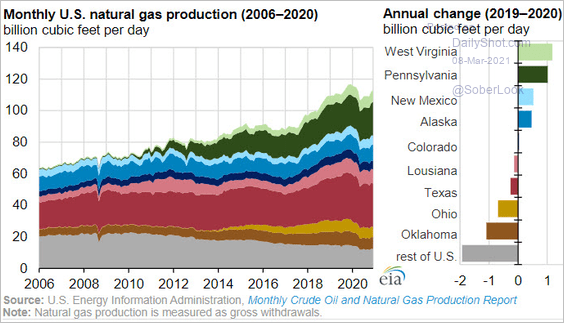

3. This chart shows the changes in US natural gas production.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

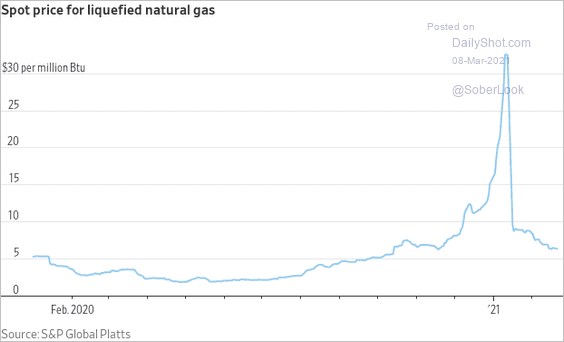

4. LNG prices are returning to more typical levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

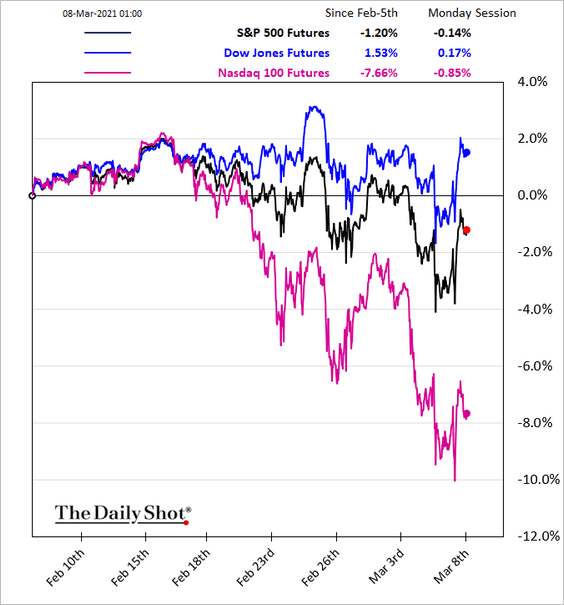

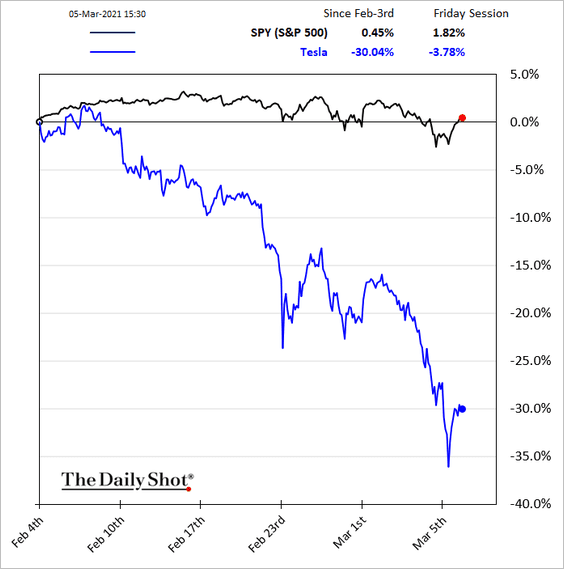

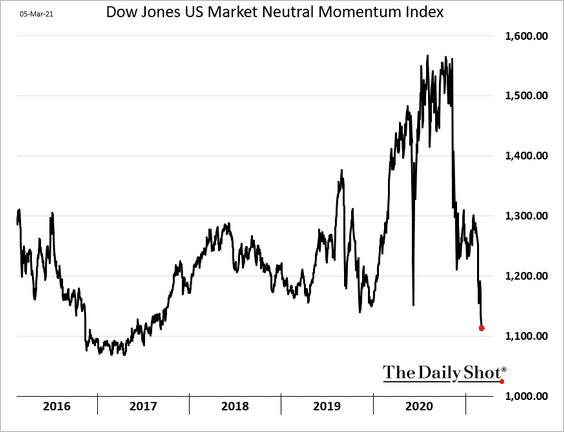

1. Tech and other high-flying stocks remain a drag on the market.

Momentum shares are under pressure.

——————–

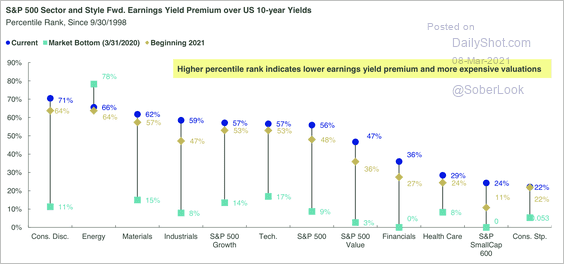

2. Here is a look at the valuations of select equity segments based on earnings yield premiums.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

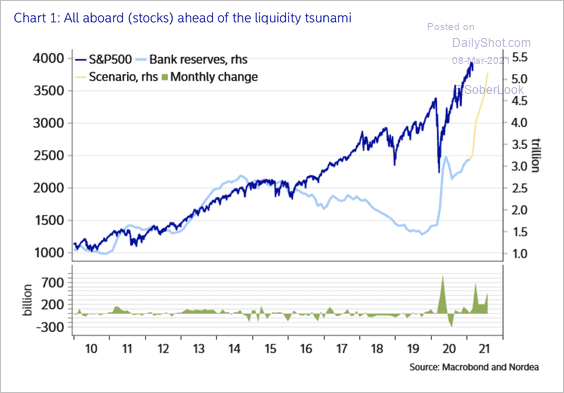

3. Nordea expects a “liquidity tsunami,” fueled by continued Fed asset purchases and a drawdown in the Treasury general account (see the rates section). This could be supportive for equities.

Source: Nordea Markets

Source: Nordea Markets

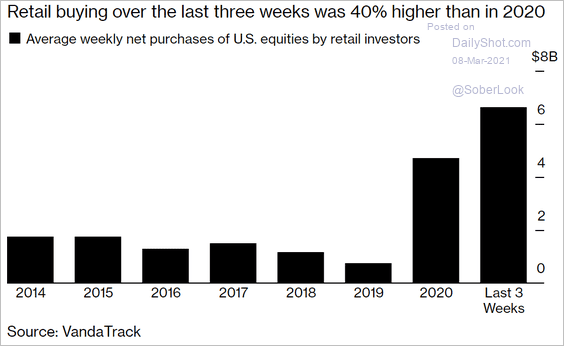

4. Retail investors are flooding into the market.

Source: @markets Read full article

Source: @markets Read full article

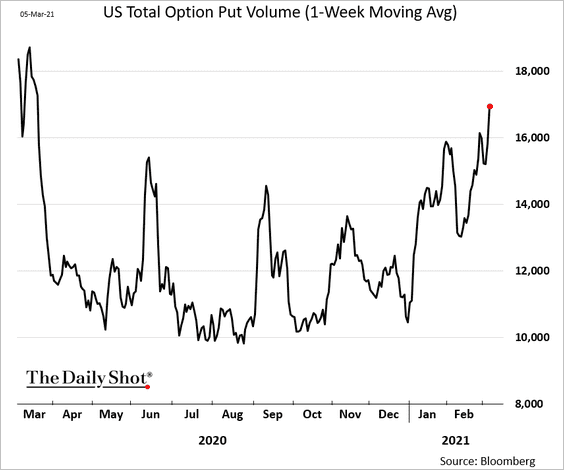

5. Put option volumes have picked up as some caution returns to the market.

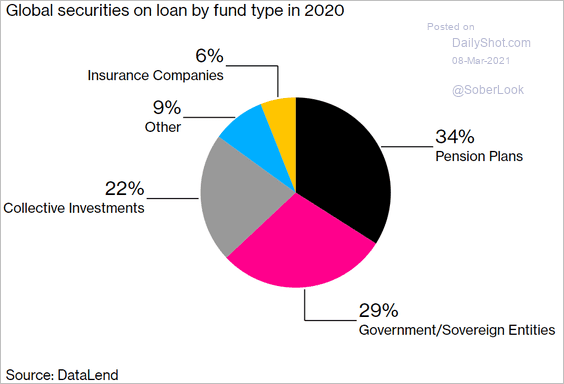

6. Finally, this chart shows the distribution of securities lending globally (collective investments = funds).

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Credit

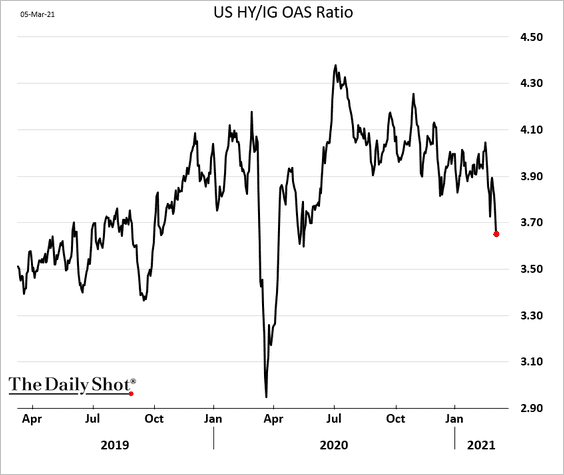

1. US high-yield bonds have been outperforming investment-grade on a spread basis. Here is the spread ratio.

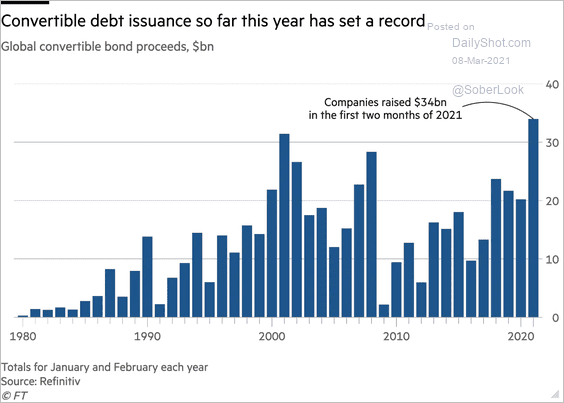

2. Convert issuance accelerated this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

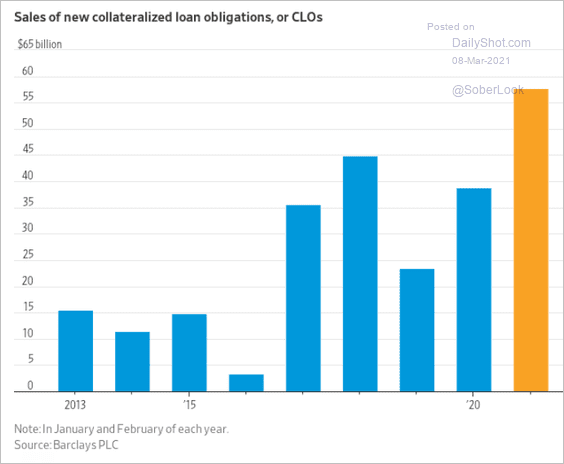

3. CLO sales surged amid demand for floating-rate debt.

Source: @WSJ Read full article

Source: @WSJ Read full article

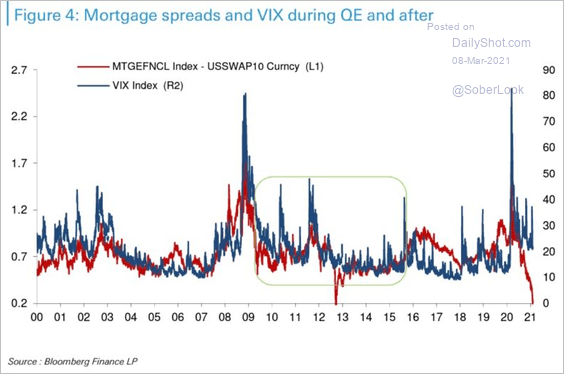

4. Mortgage spreads have diverged from equity vol (VIX).

Source: J B; Deutsche Bank Research

Source: J B; Deutsche Bank Research

Back to Index

Rates

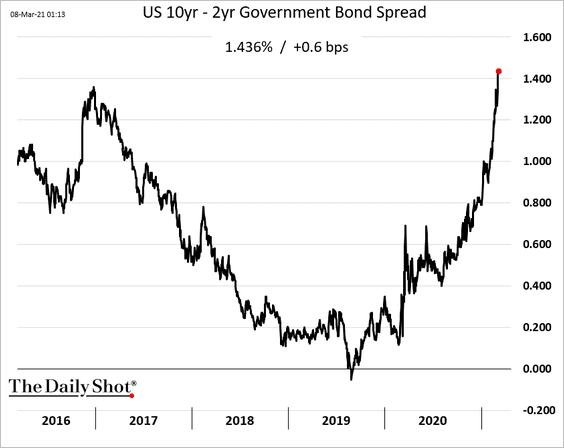

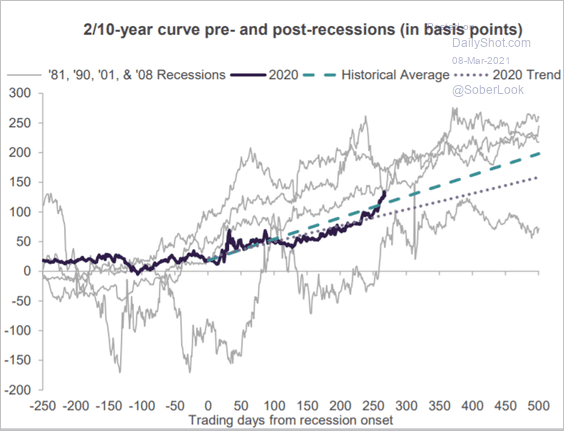

1. The Treasury curve continues to steepen.

Here is a comparison to previous recoveries.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

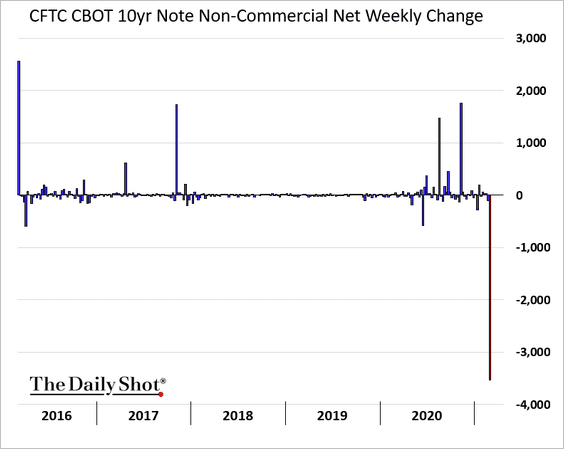

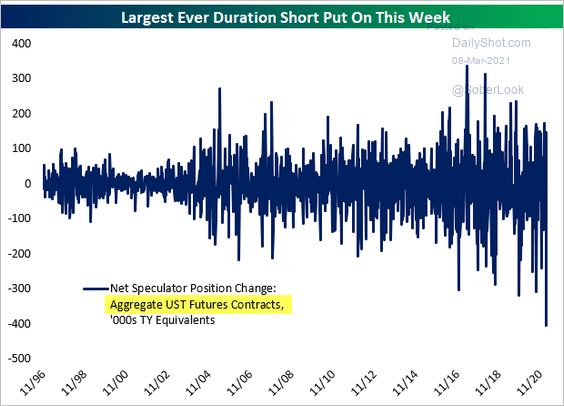

2. Speculative accounts sharply boosted their bets against Treasury futures last week.

Source: @jsblokland

Source: @jsblokland

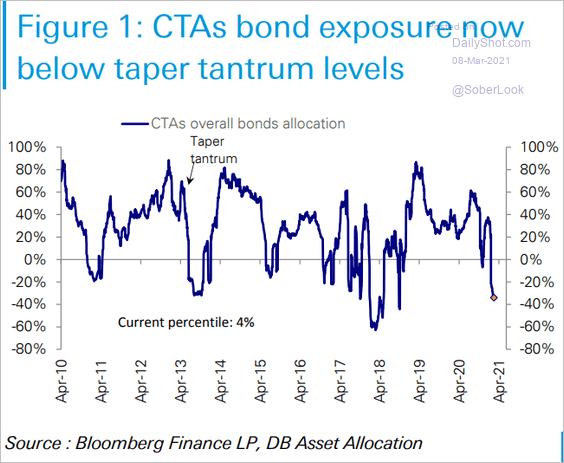

• CTAs’ bond exposure is now below taper-tantrum levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

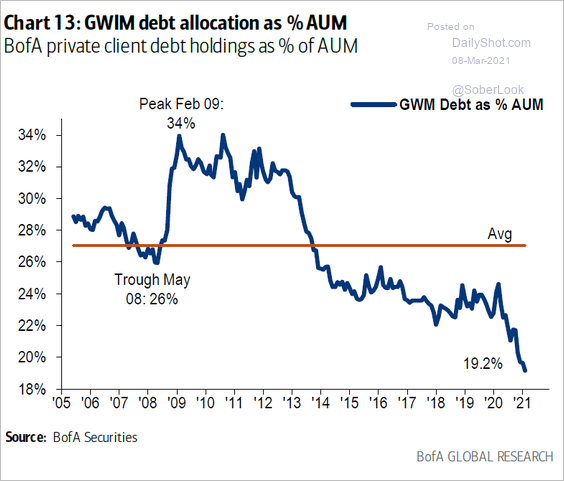

• Below is BofA private clients’ debt allocation.

Source: BofA Global Research

Source: BofA Global Research

——————–

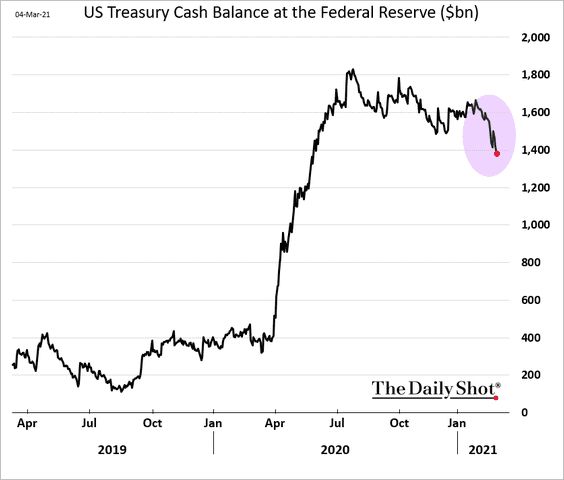

3. Here we go. Treasury cash held at the Fed continues to decline. This trend will accelerate as the government gets going on the $1.9 trillion package.

As a result, reserve balances hit a record high, and there is much more on the way.

——————–

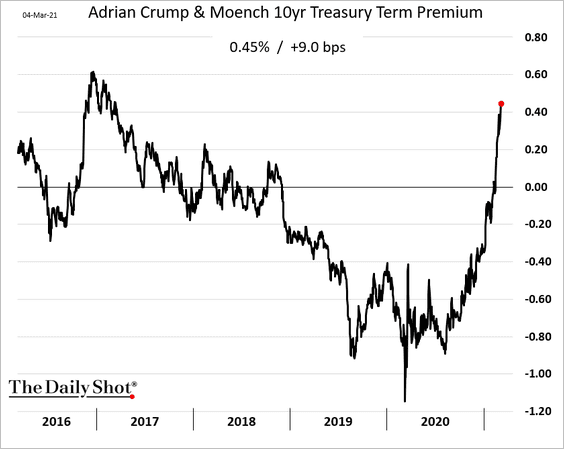

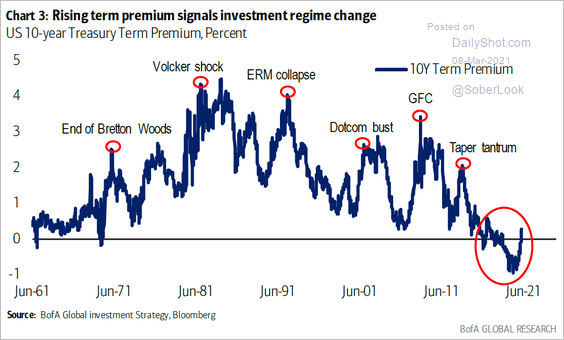

4. Treasury term premium keeps climbing, …

… suggesting a regime change.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

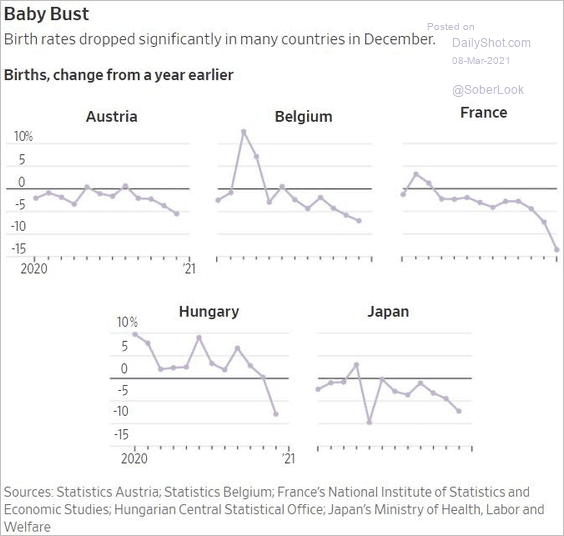

1. Declines in birth rates in select countries:

Source: @WSJ Read full article

Source: @WSJ Read full article

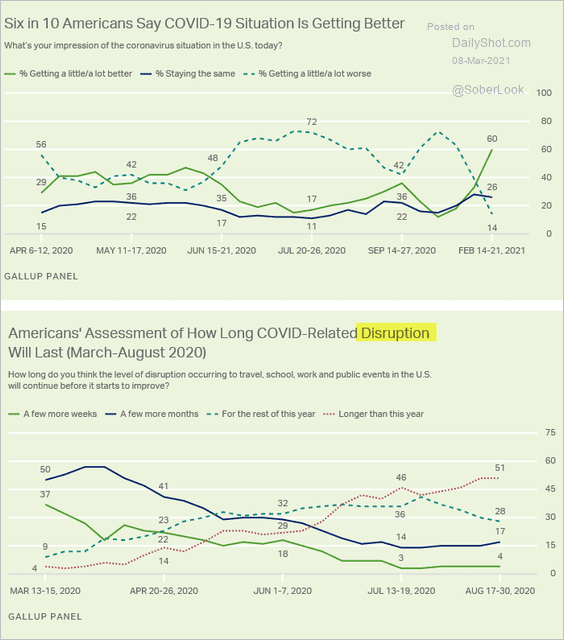

2. Views on the COVID situation in the US:

Source: Gallup Read full article

Source: Gallup Read full article

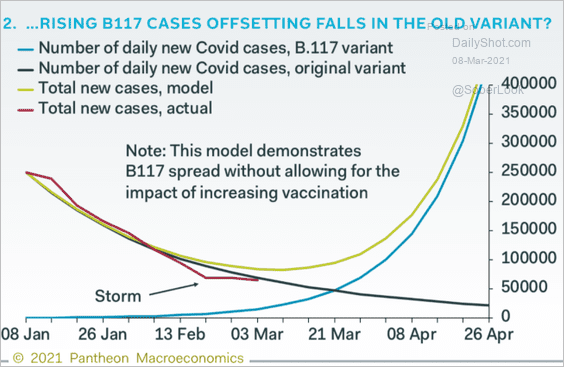

3. The new COVID variant:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

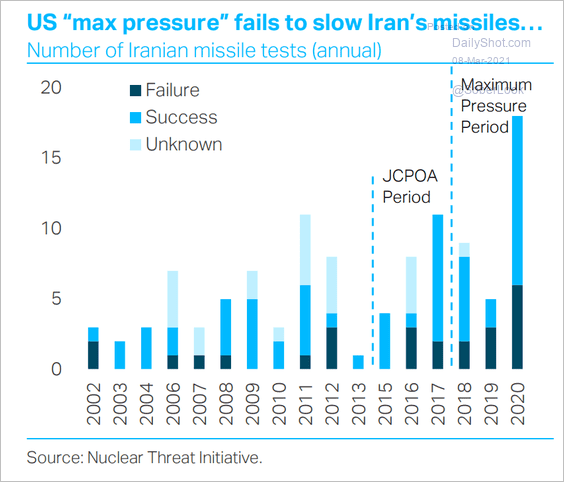

4. Iran’s missile tests:

Source: TS Lombard

Source: TS Lombard

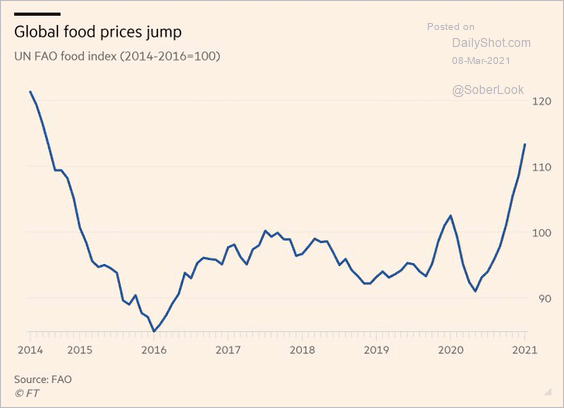

5. Global food prices:

Source: @jessefelder, @financialtimes Read full article

Source: @jessefelder, @financialtimes Read full article

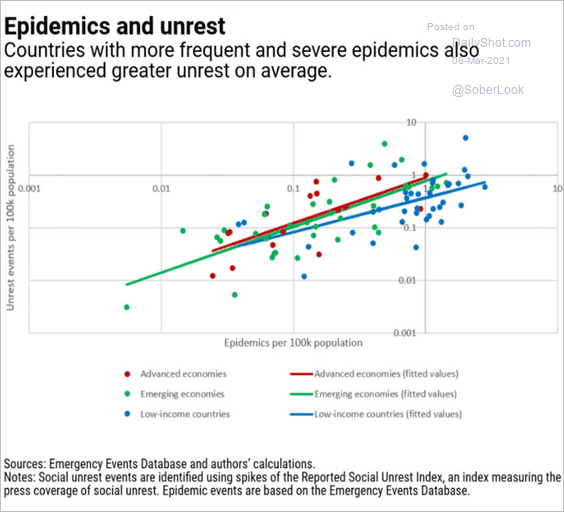

6. Epidemics and unrest:

Source: IMF Read full article

Source: IMF Read full article

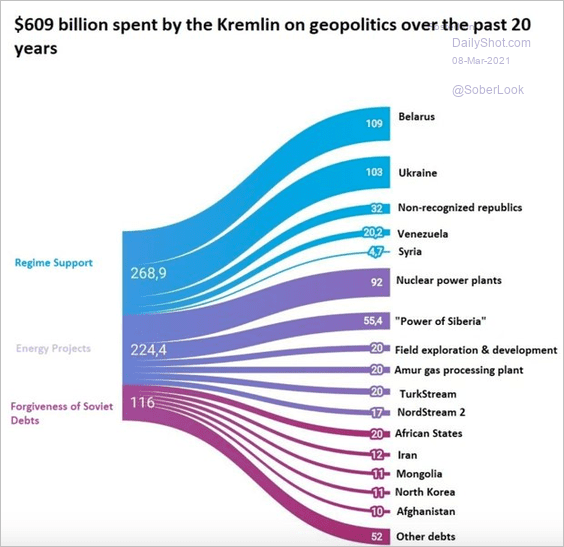

7. The Kremlin’s spending on geopolitics:

Source: @adam_tooze, @VictorPPetrov Read full article

Source: @adam_tooze, @VictorPPetrov Read full article

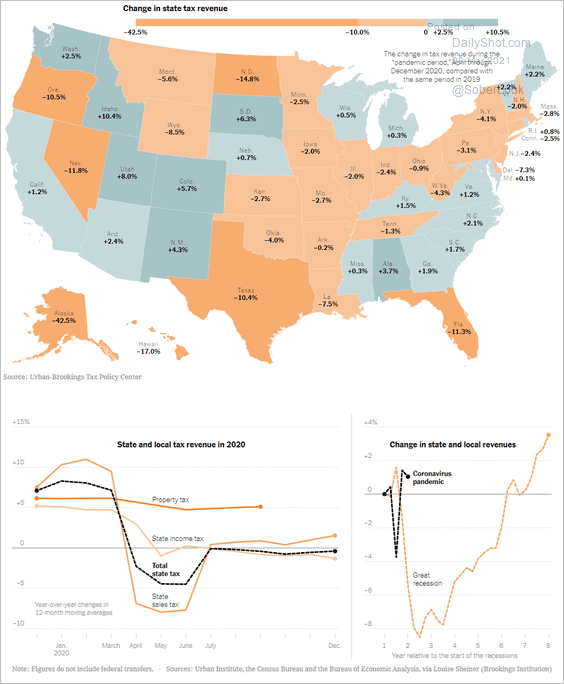

8. Changes in state tax revenues:

Source: The New York Times Read full article

Source: The New York Times Read full article

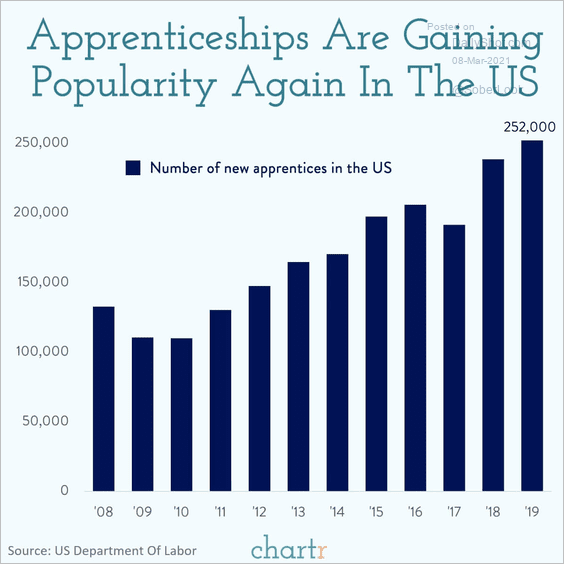

9. Apprenticeships gaining popularity in the US:

Source: @chartrdaily

Source: @chartrdaily

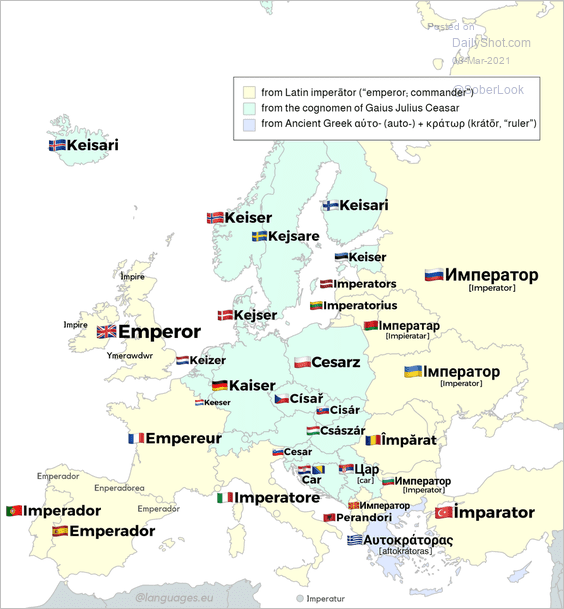

10. Word for “emperor” in various European languages and dialects:

Source: reddit

Source: reddit

——————–

Back to Index