The Daily Shot: 06-Aug-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia- Pacific

• China

• Emerging Markets

• Cryptocurrency

• Equities

• Alternatives

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the labor market.

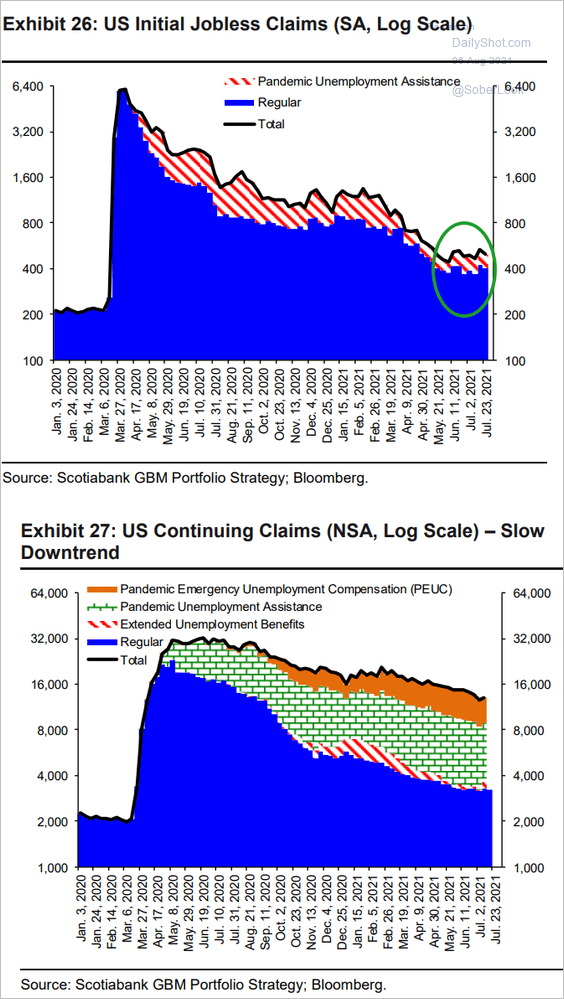

• Initial jobless claims are not budging, with the regular applications holding near 400k a week.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

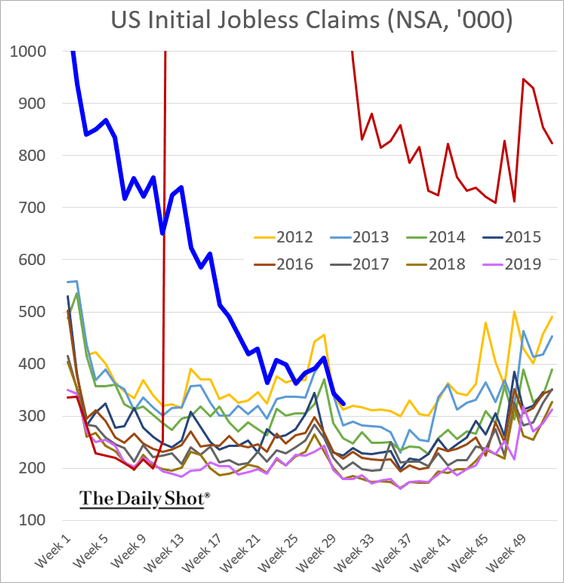

When we look at the data without seasonal adjustments, claims are running just above 2012 levels.

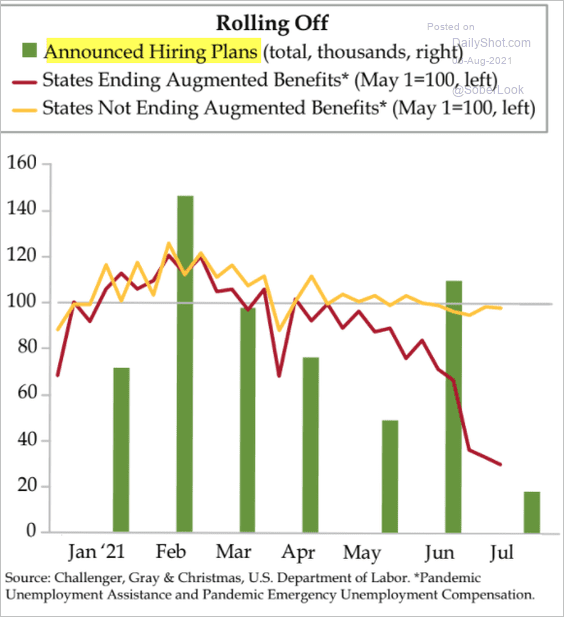

• Announced hiring plans were relatively low in July.

Source: The Daily Feather

Source: The Daily Feather

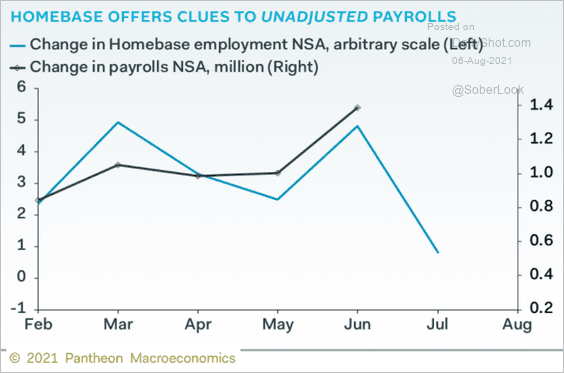

• As we saw previously, Homebase’s small business employment data hasn’t been particularly strong.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

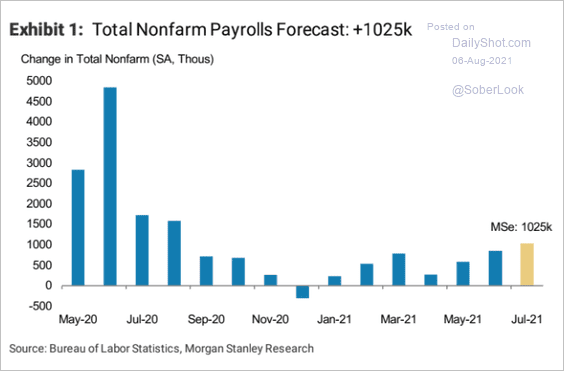

• Nonetheless, Morgan Stanley expects to see over a million net hires in July (similar to Oxford Economics).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

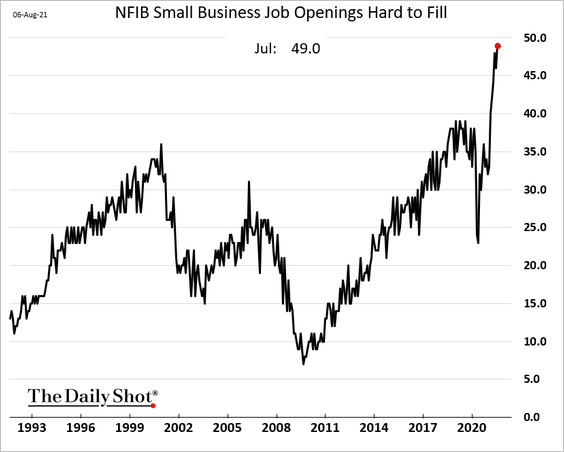

• Small businesses report that the job market tightened further in July. The NFIB’s index of “job openings hard to fill” hit another record high.

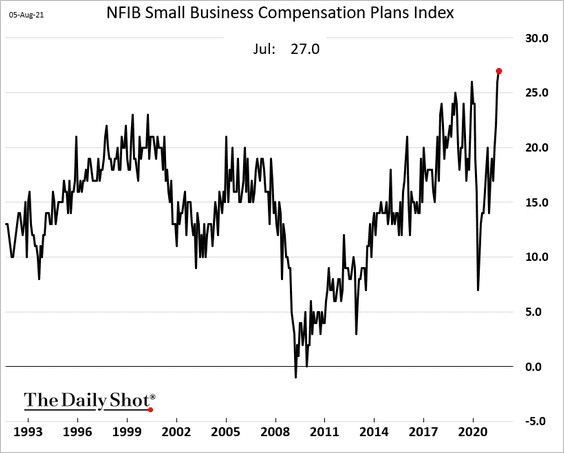

Companies are forced to pay more to attract workers. The percentage of small firms planning to boost compensation hit a record high.

——————–

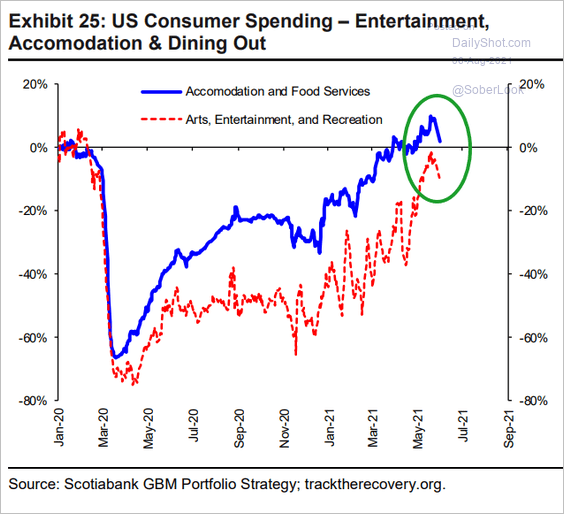

2. The delta variant is becoming a drag on spending.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

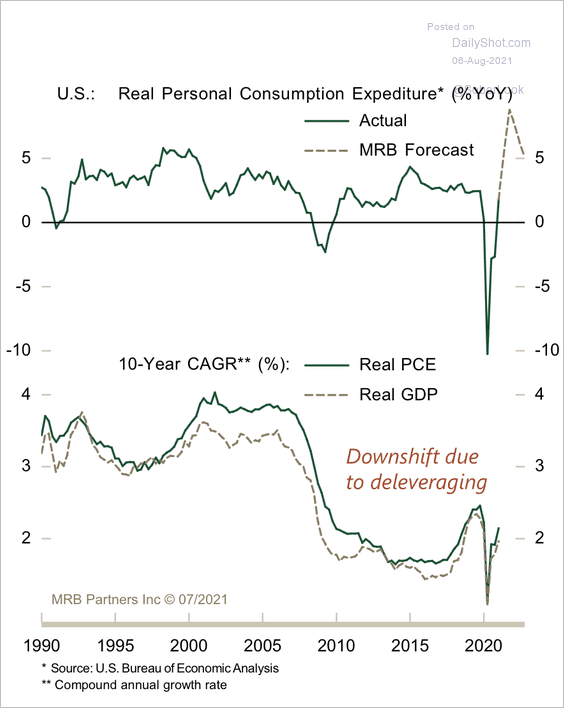

3. MRB expects personal consumption to moderate but remain much stronger compared to previous years.

Source: MRB Partners

Source: MRB Partners

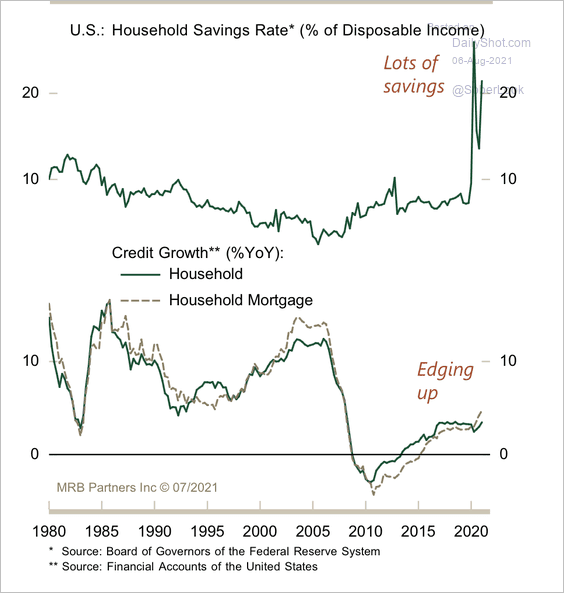

One reason is that consumers are sitting on a lot of cash and enjoy lower housing payments.

Source: MRB Partners

Source: MRB Partners

——————–

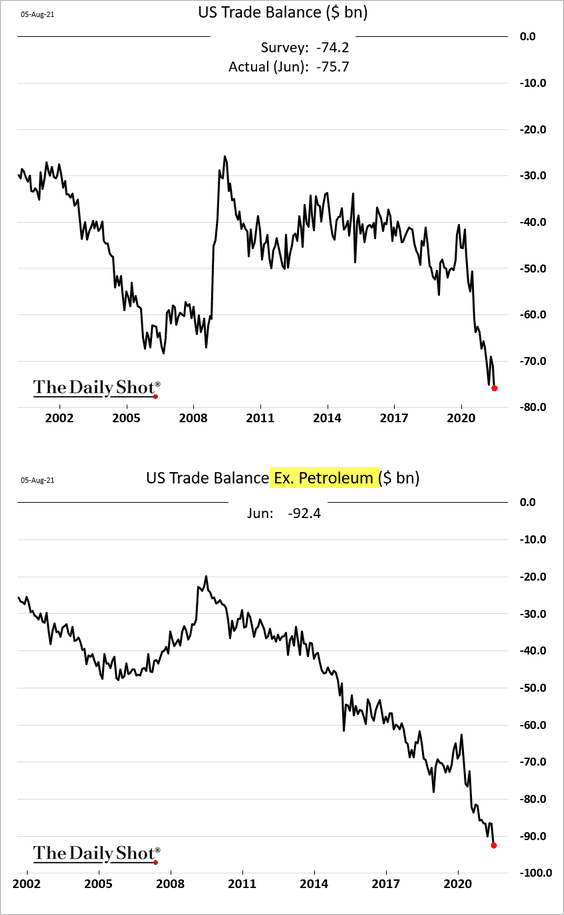

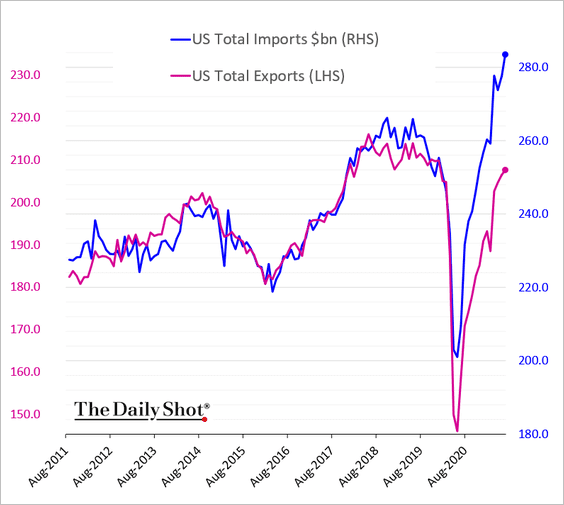

4. The nation’s trade deficit hit another record amid surging domestic demand.

Plotting imports and exports on different axes shows a massive divergence in trends.

Back to Index

Canada

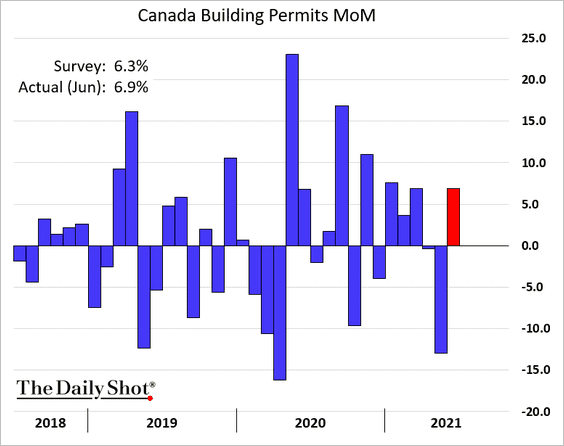

1. Building permits rebounded in June.

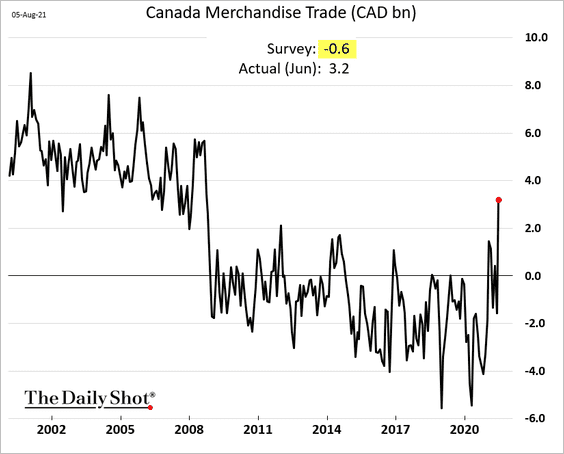

2. The trade balance unexpectedly swung into the highest surplus since 2008.

Back to Index

The United Kingdom

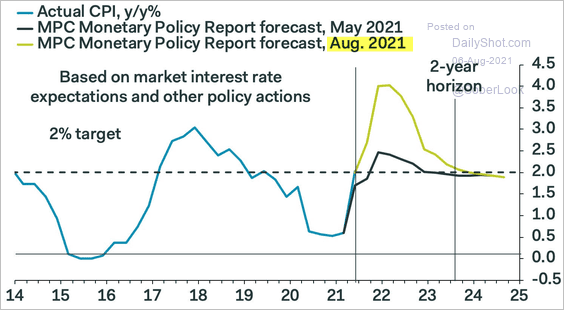

1. The BoE is starting to talk about tightening but remains relatively dovish.

Source: Reuters Read full article

Source: Reuters Read full article

As expected, the central bank upgraded its near-term inflation forecast.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

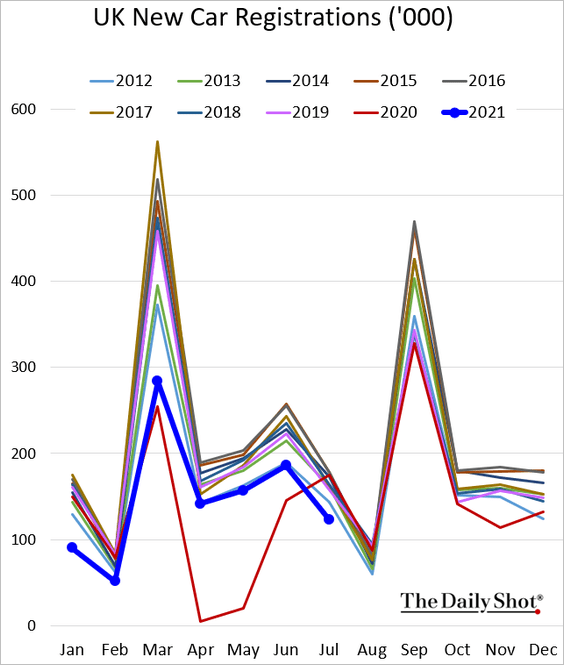

2. New car registrations remain soft (the worst July in a decade).

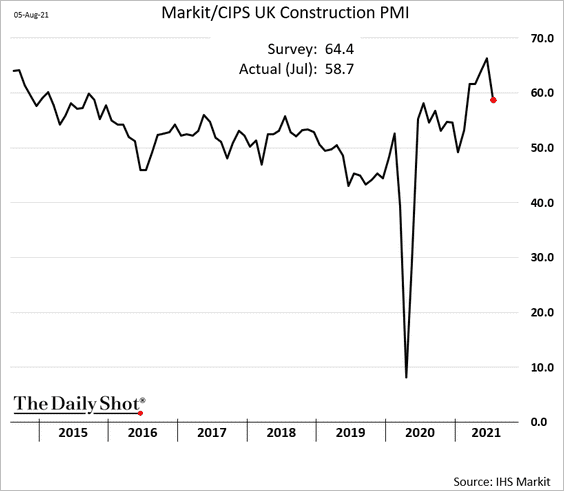

3. Construction growth is off the highs.

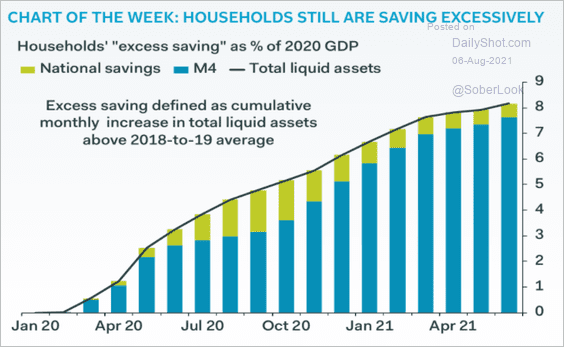

4. Households’ excess savings continue to climb.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

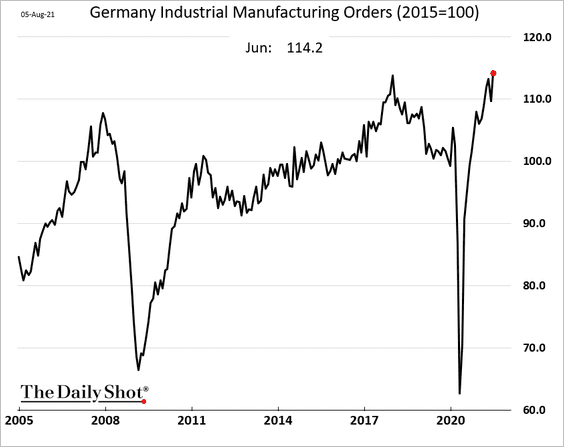

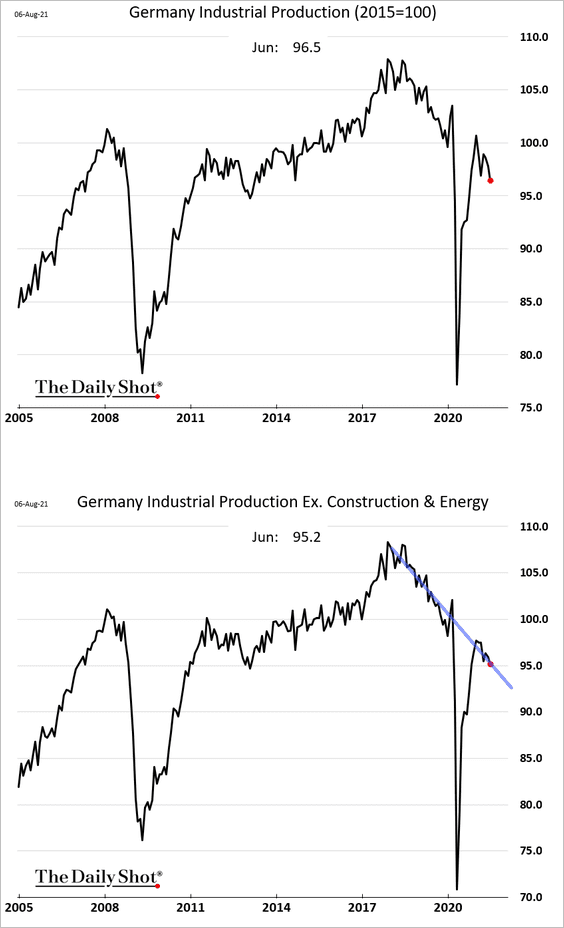

1. German manufacturing orders surged to a record high.

But industrial production continues on its pre-COVID downward trend. The divergence between new orders and industrial output continues to widen.

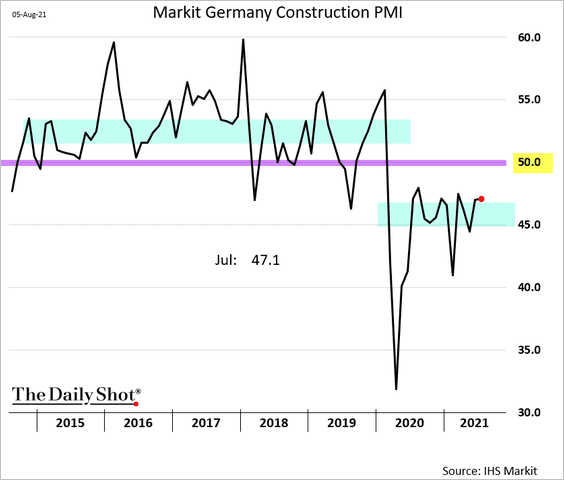

• German construction activity remains in contraction territory (PMI < 50).

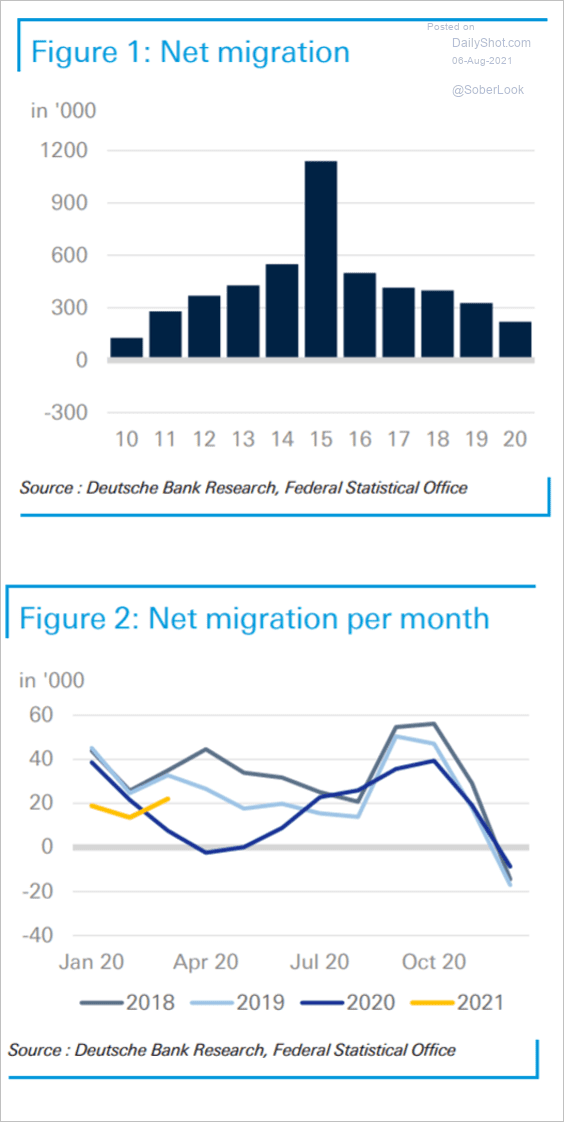

• On a separate note, the charts below show Germany’s migration trends.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

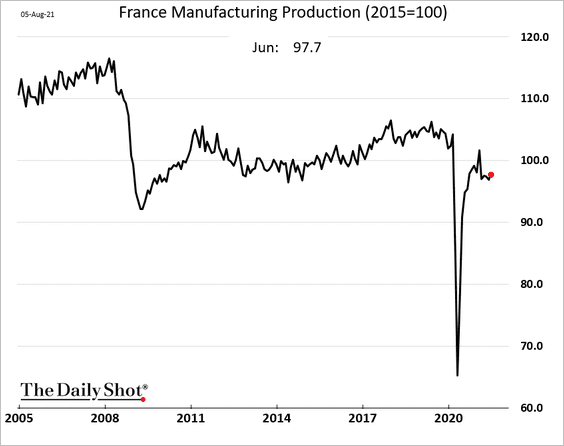

2. French manufacturing production is stuck below pre-COVID levels.

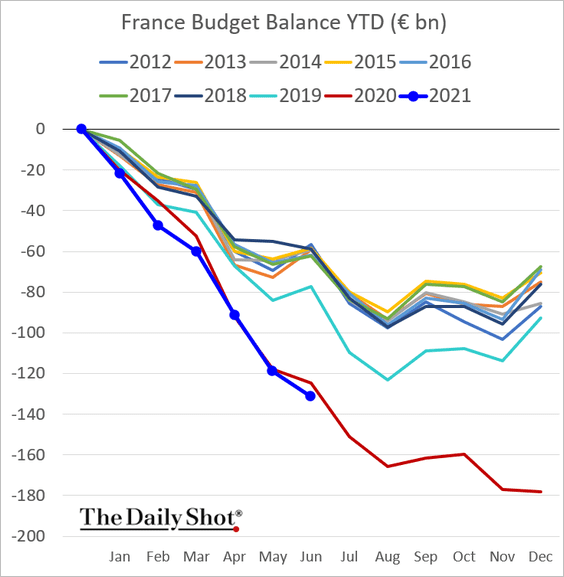

The nation’s budget deficit is following the 2020 path.

——————–

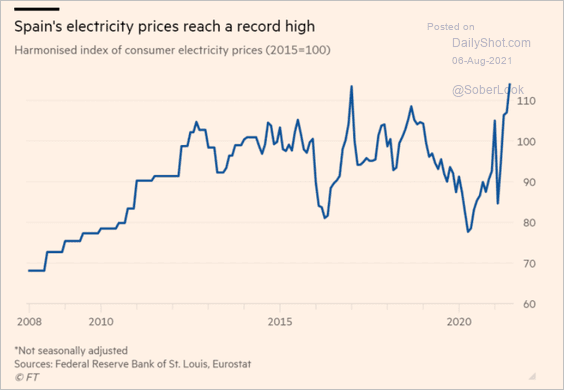

3. Spain’s electricity prices are surging, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

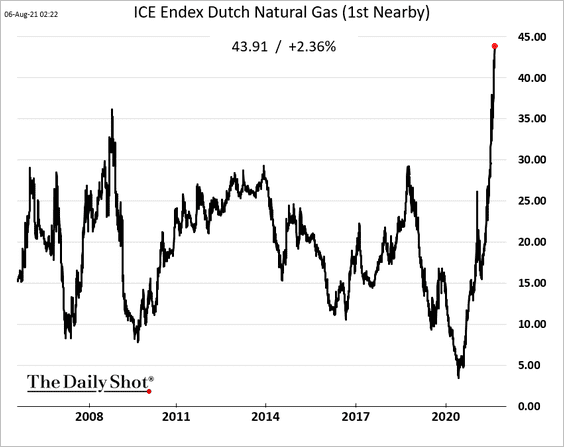

… as European natural gas prices hit record highs.

——————–

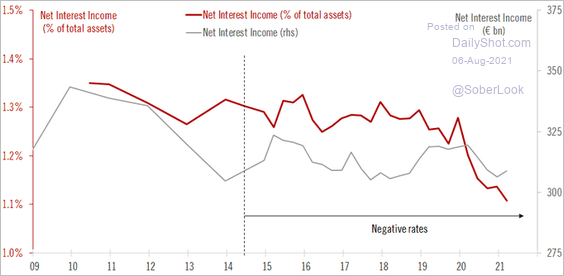

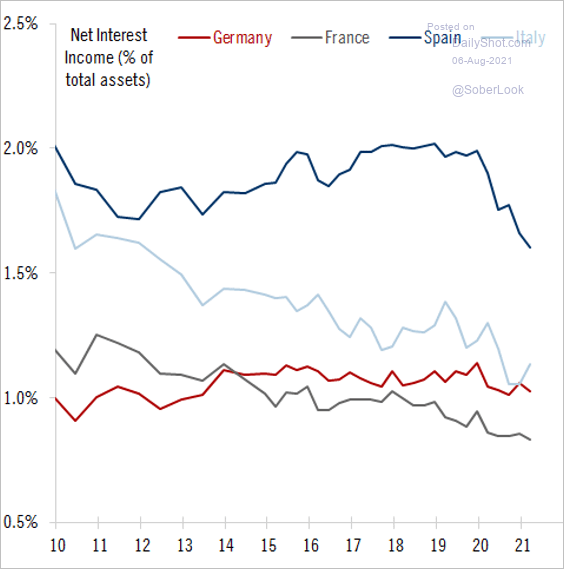

4. Euro-area banks’ net interest income as a percent of assets dropped to a record low in Q1.

Source: @fwred

Source: @fwred

The sharpest declines were in Spain.

Source: @fwred

Source: @fwred

Back to Index

Europe

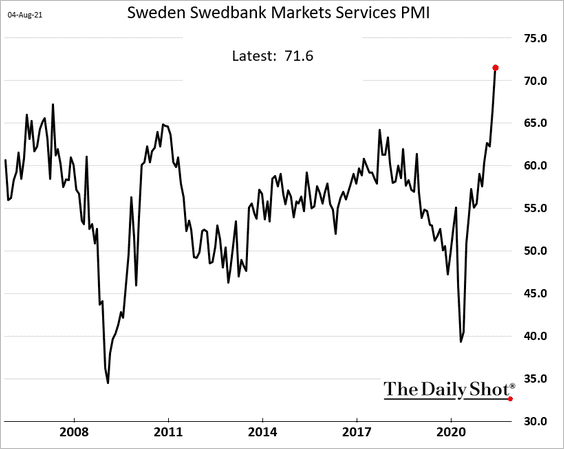

1. Sweden’s service-sector PMI is surging.

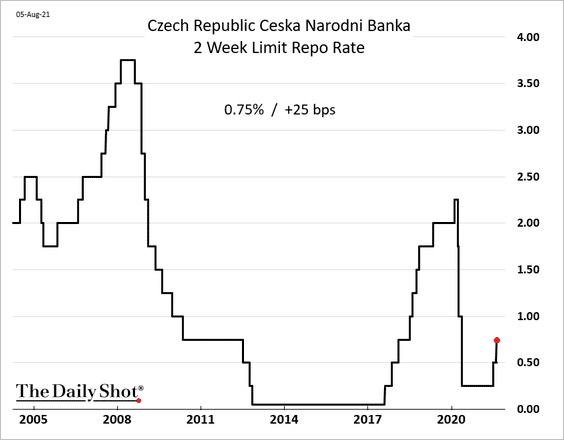

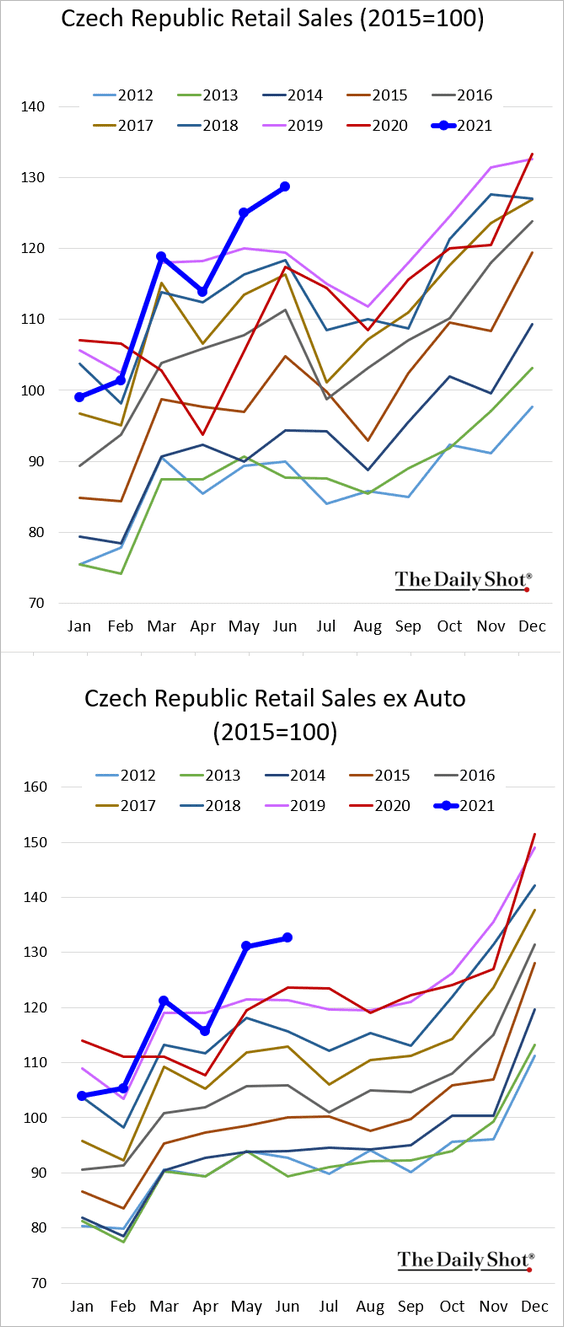

2. The Czech Republic’s central bank hiked rates again, …

… as economic growth accelerates. Retail sales are at record highs.

——————–

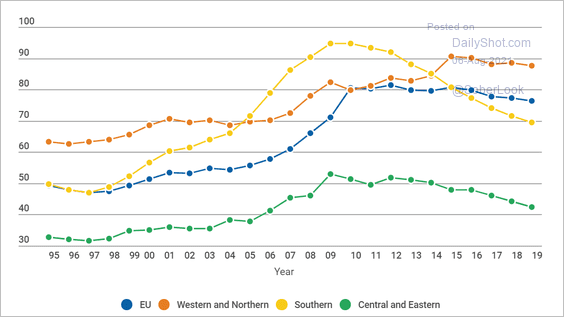

3. This chart shows the evolution of corporate indebtedness as a percent of GDP.

Source: EIB Read full article

Source: EIB Read full article

Back to Index

Asia- Pacific

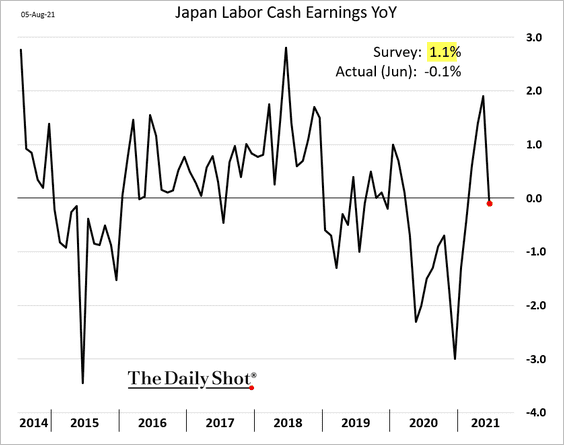

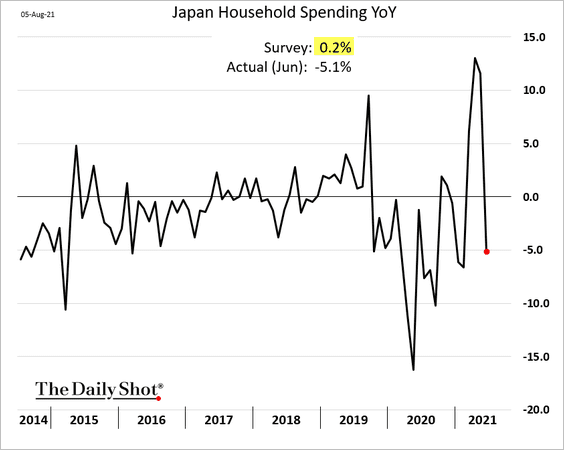

1. Japan’s June household spending and wage growth figures were well below consensus forecasts.

——————–

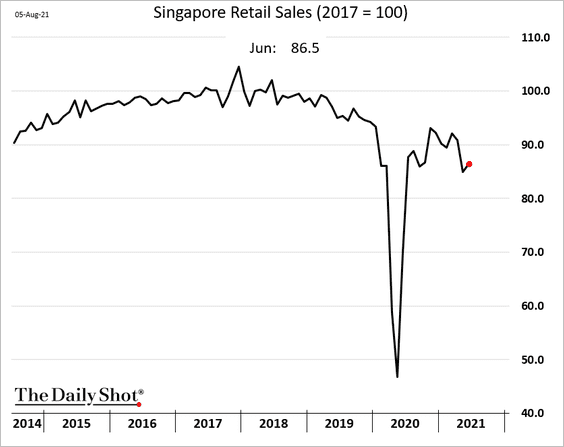

2. Singapore’s retail sales ticked higher in June but remained below pre-COVID levels.

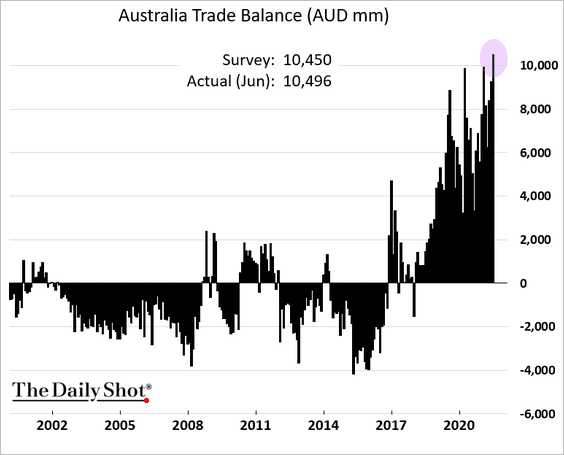

3. Australia’s trade surplus hit a record high.

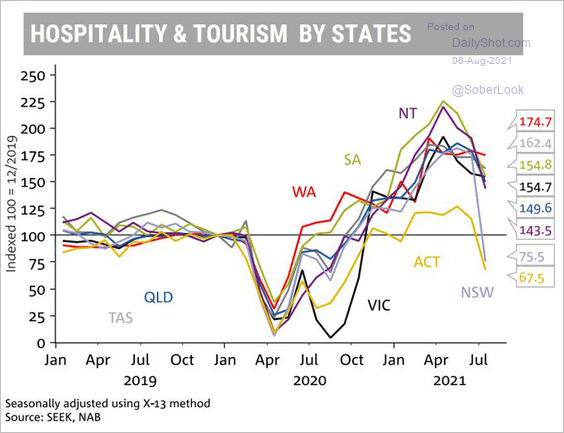

• The latest lockdowns in Australia are pressuring the hospitality and tourism sectors.

Source: NAB; @Scutty

Source: NAB; @Scutty

——————–

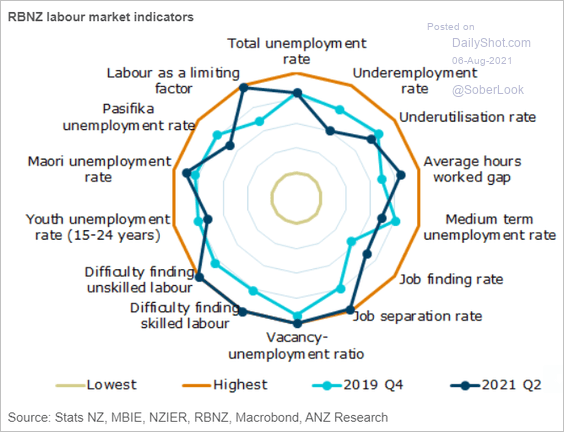

4. New Zealand’s labor market is stronger than it was before COVID.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

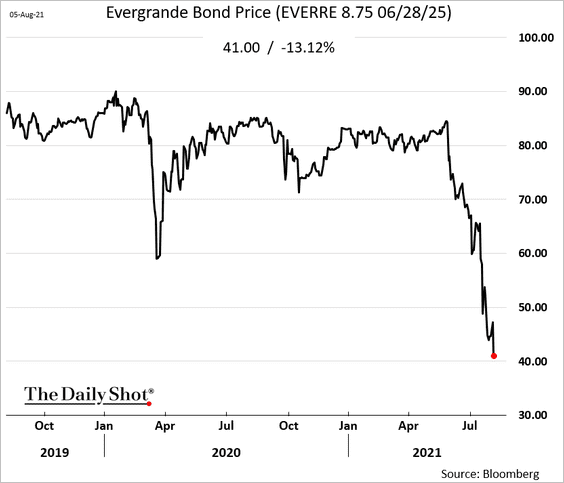

1. Evergrande’s bonds continue to drop amid downgrades.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

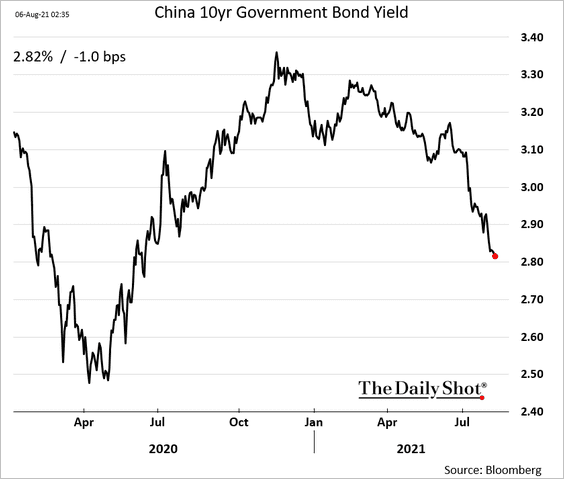

2. China’s government bond yields keep drifting lower, …

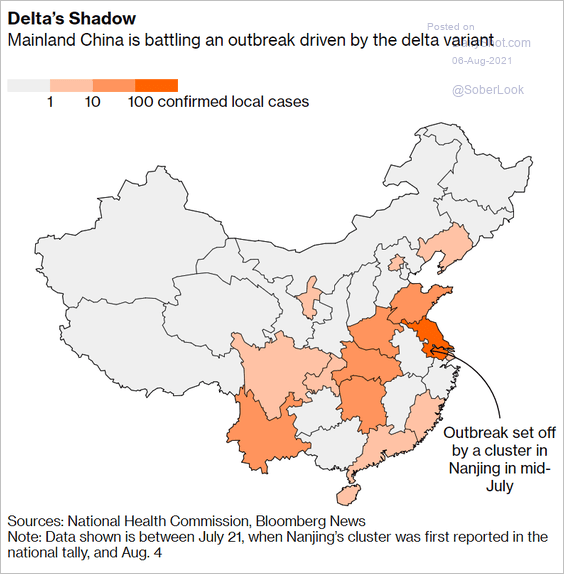

… as the delta variant spreads.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

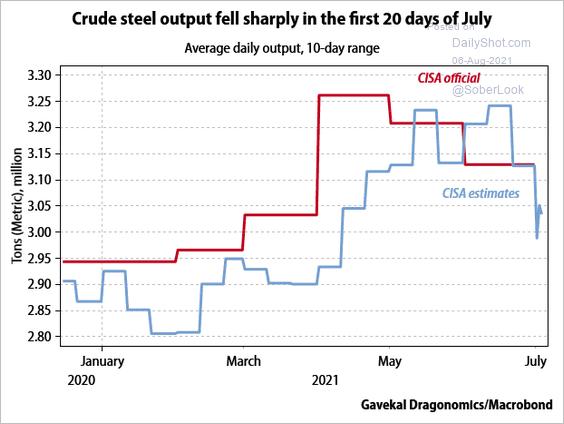

3. Steel output is down due to production restrictions, which puts upward pressure on prices.

Source: Gavekal Research

Source: Gavekal Research

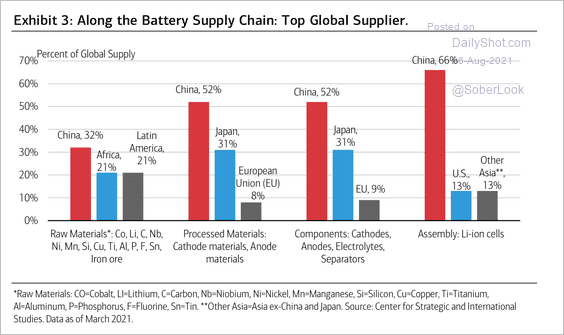

4. China has a commanding position across the global battery supply chain.

Source: BofA Global Research

Source: BofA Global Research

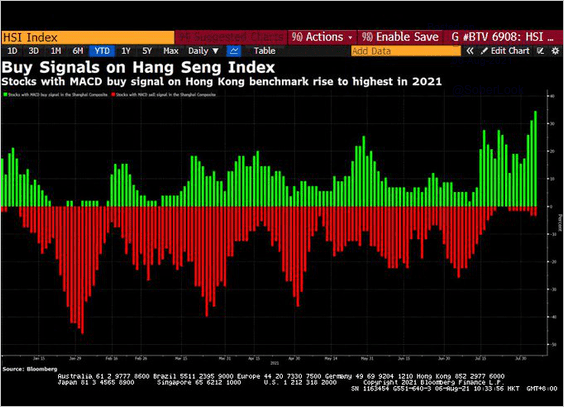

5. Technicals suggest that Hong Kong’s stock market is oversold.

Source: @DavidInglesTV

Source: @DavidInglesTV

Back to Index

Emerging Markets

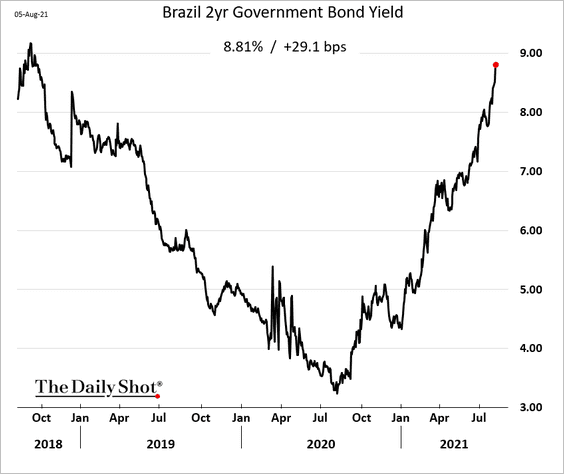

1. Brazil’s 2yr domestic bond yield is approaching 9%.

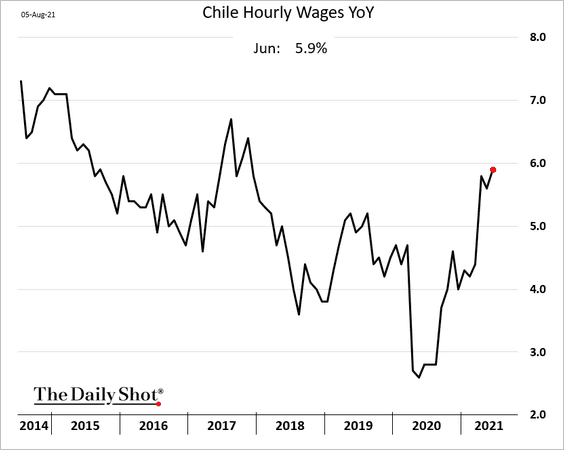

2. Chile’s wage growth continues to strengthen.

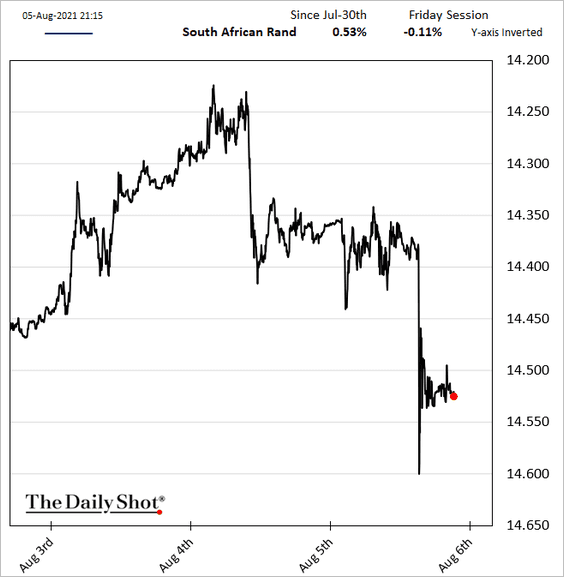

3. The rand dipped after South Africa’s finance minister resigned.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

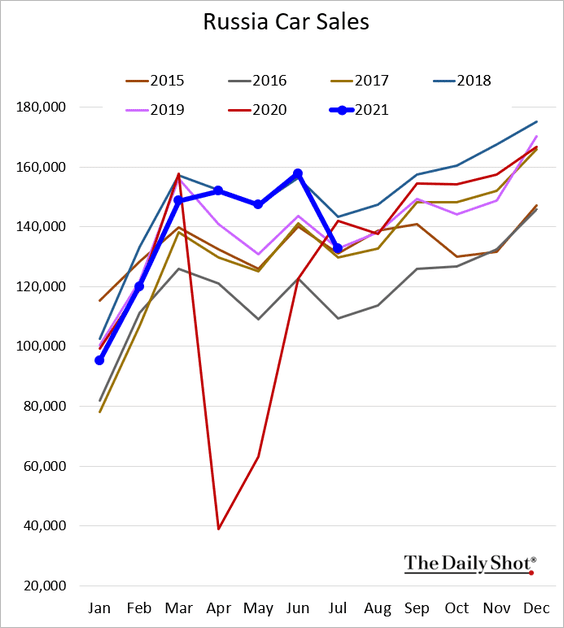

4. Russia’s car sales dropped more than expected last month.

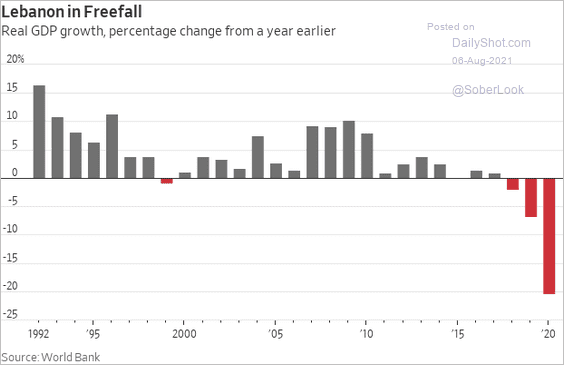

5. Lebanon’s economy is collapsing.

Source: @WSJ Read full article

Source: @WSJ Read full article

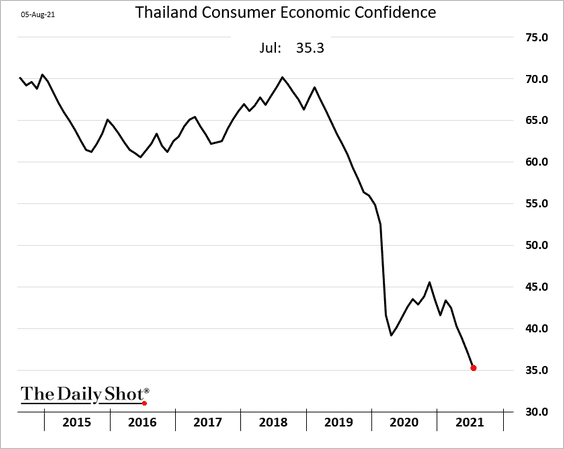

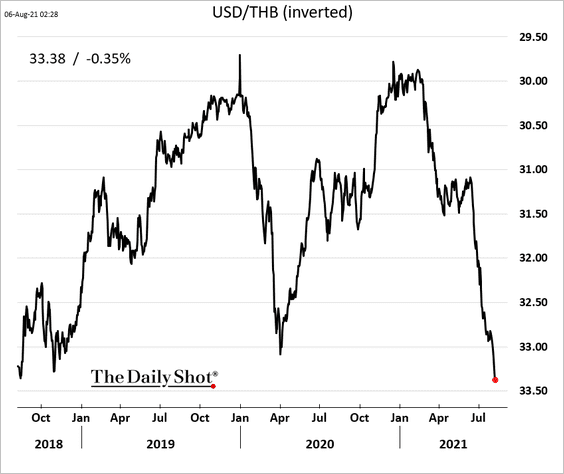

6. Thailand’s consumer confidence continues to sink amid COVID concerns.

The Thai baht hit the lowest level since 2018.

——————–

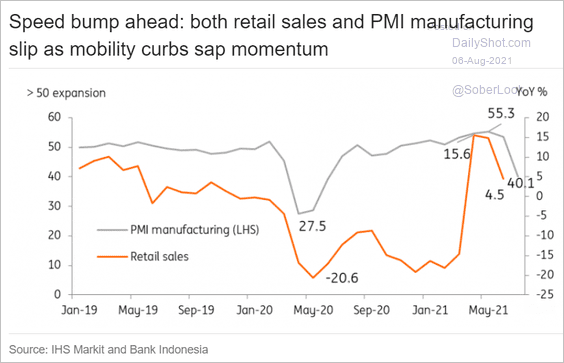

7. Indonesia’s economic activity has lost momentum due to the resurging pandemic.

Source: ING

Source: ING

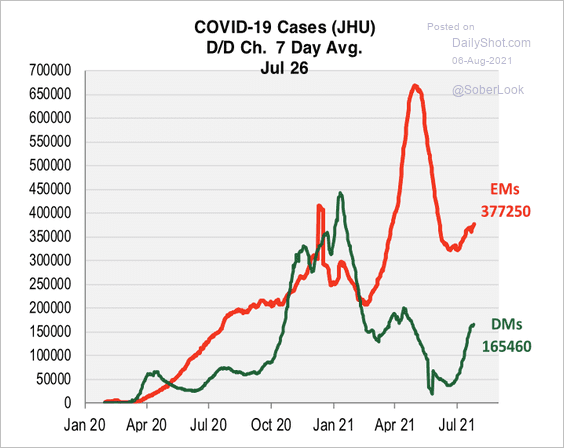

8. EM COVID-19 cases are far above developed markets.

Source: Cornerstone Macro

Source: Cornerstone Macro

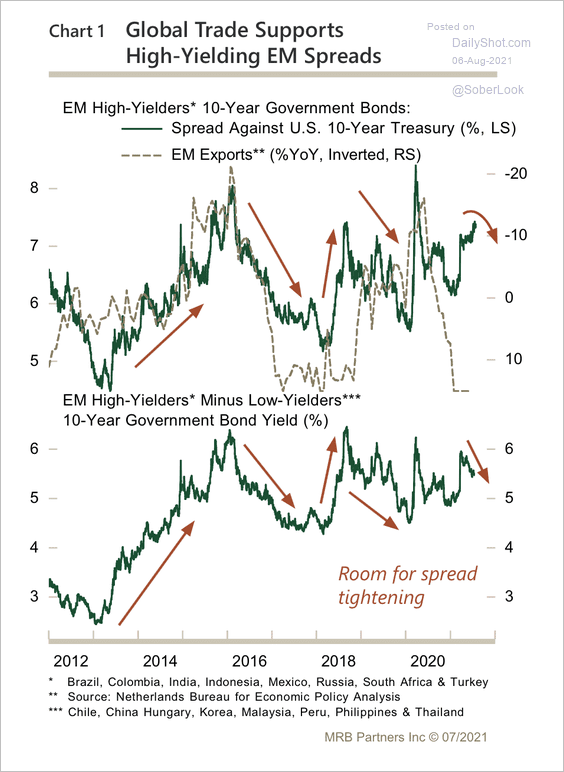

9. There is plenty of room for high-yielding EM spreads to tighten as global trade remains positive, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

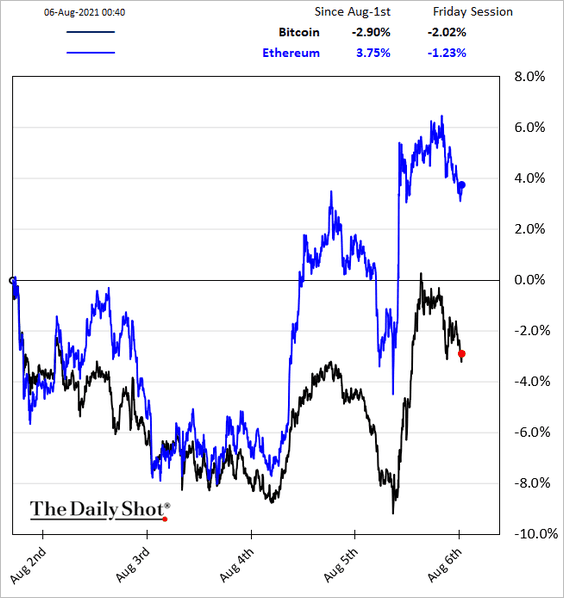

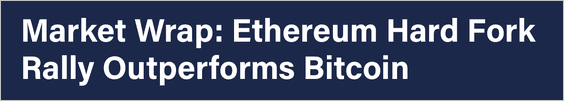

1. Ether (ETH) rallied on Thursday as the blockchain network experienced a “hard fork” upgrade.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

2. ETH is approaching initial resistance around $3K after clearing the 100-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

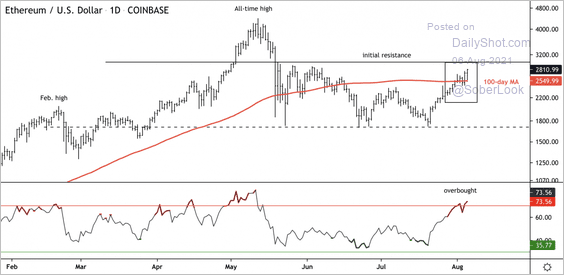

ETH/BTC has broken out of a two-month consolidation.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

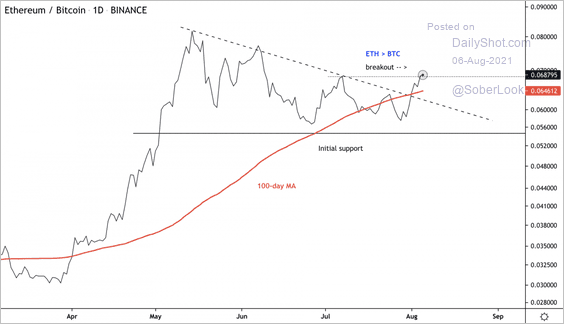

3. Bitcoin is entering a seasonally weak period in August and September.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

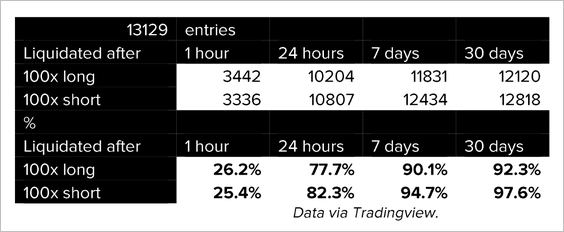

4. Here is a look at the liquidation chances of a non-hedged 100x leveraged bitcoin position using data over the past year, according to Enigma Securities.

Source: Enigma Securities

Source: Enigma Securities

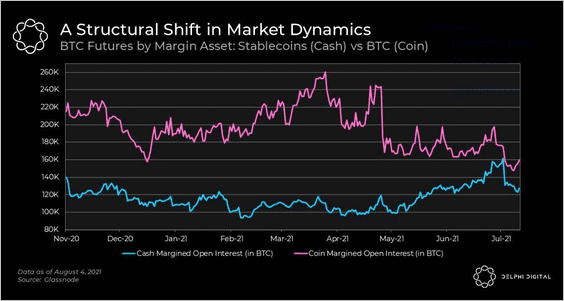

5. The margin assets for Bitcoin futures trading are shifting from Bitcoin to stablecoins. This means longs are less exposed to deeper losses when their positions turn against them (because their margin is in stablecoins, not BTC), according to Delphi Digital.

Source: Delphi Digital

Source: Delphi Digital

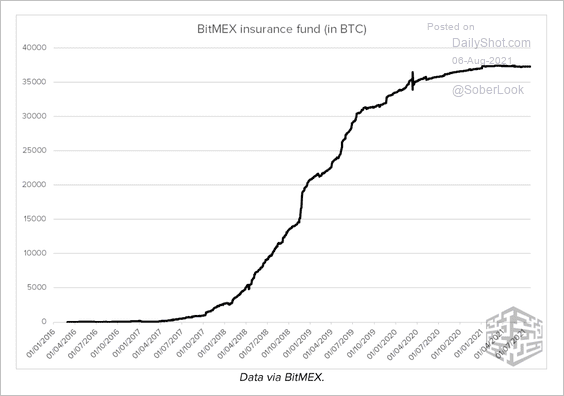

6. The chart below shows the value of crypto exchange BitMEX’s insurance fund, which grows from liquidations executed in the market at a price greater than the bankruptcy price of a particular position. The fund’s growth has flattened over the past year.

Source: Enigma Securities

Source: Enigma Securities

Back to Index

Equities

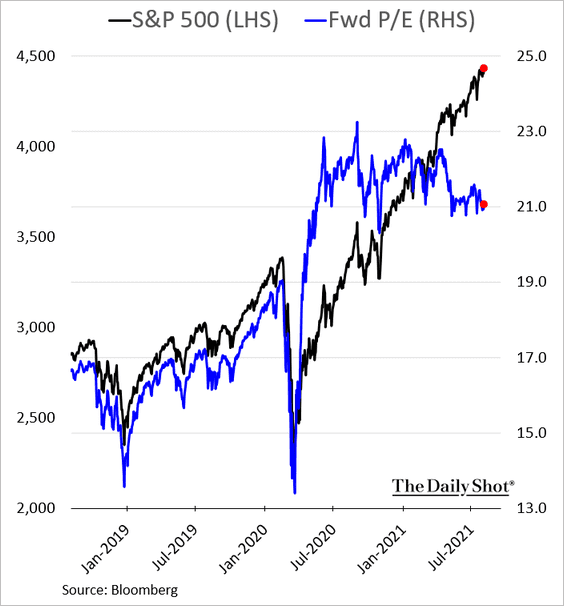

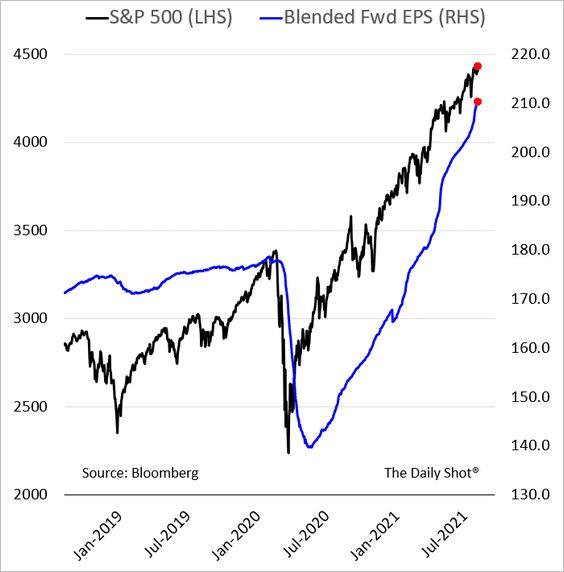

1. Stock valuations have been improving even as the market hits record highs.

Analysts’ expectations for S&P 500 earnings per share (a year out) have been surging.

Source: @axios Read full article

Source: @axios Read full article

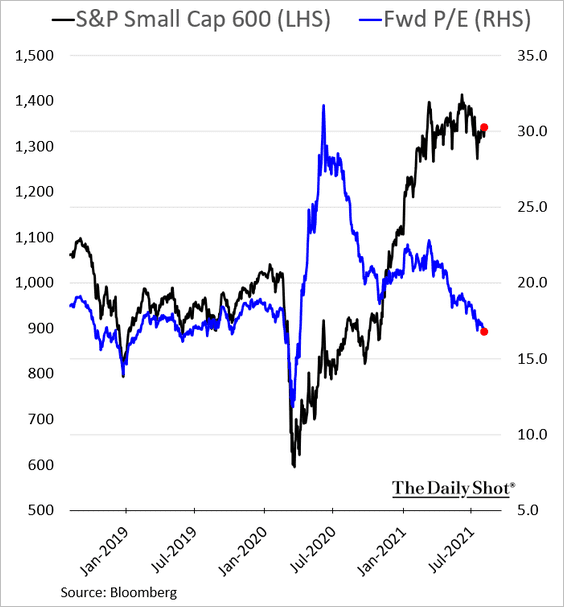

Based on the same metric, small-cap valuations are now at pre-pandemic levels.

——————–

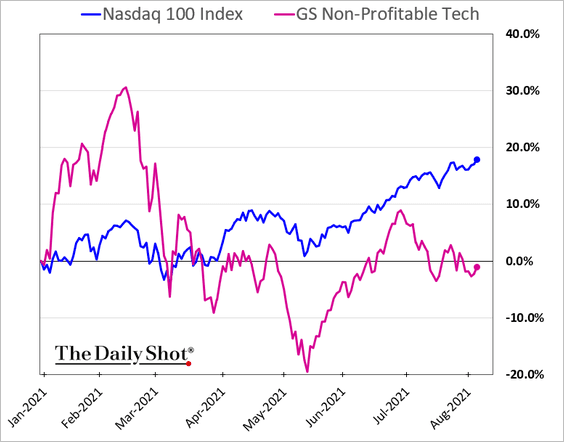

2. Non-profitable tech shares have been struggling since the massive Reddit-driven rally at the beginning of the year.

Back to Index

Alternatives

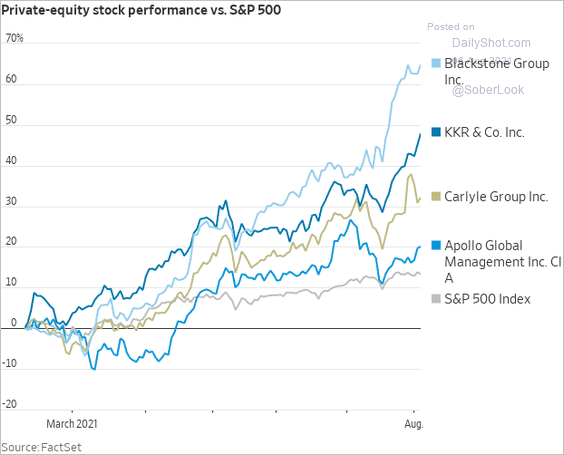

1. Shares of private-equity managers have been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

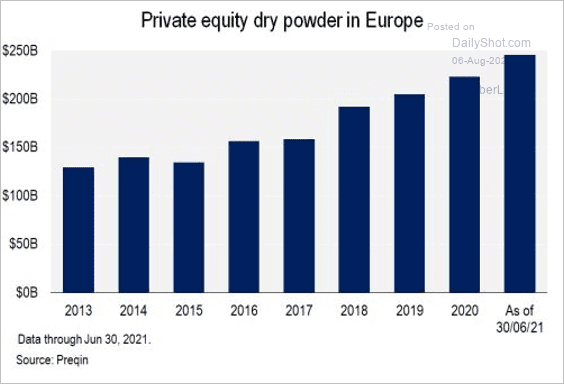

2. This chart shows private equity dry powder in Europe.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

Back to Index

Global Developments

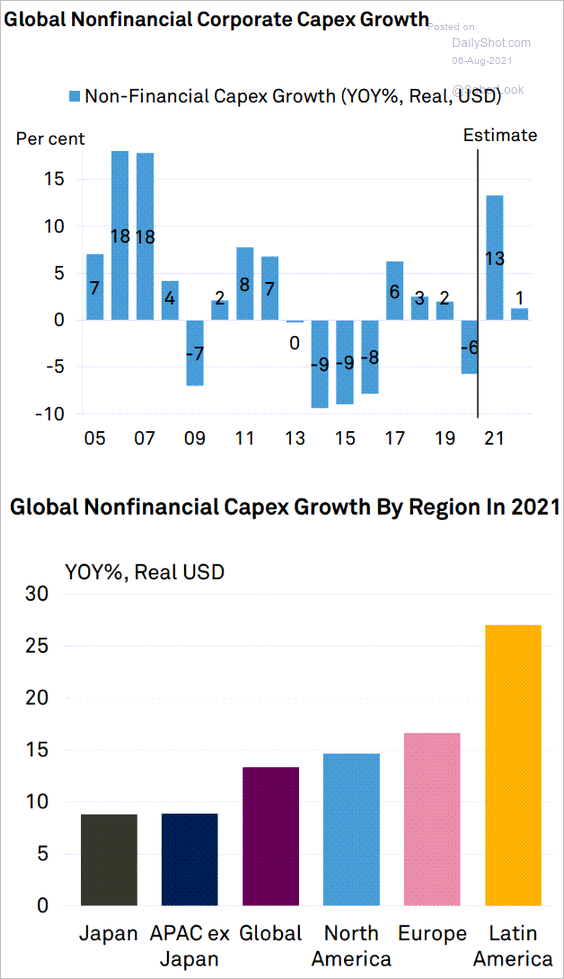

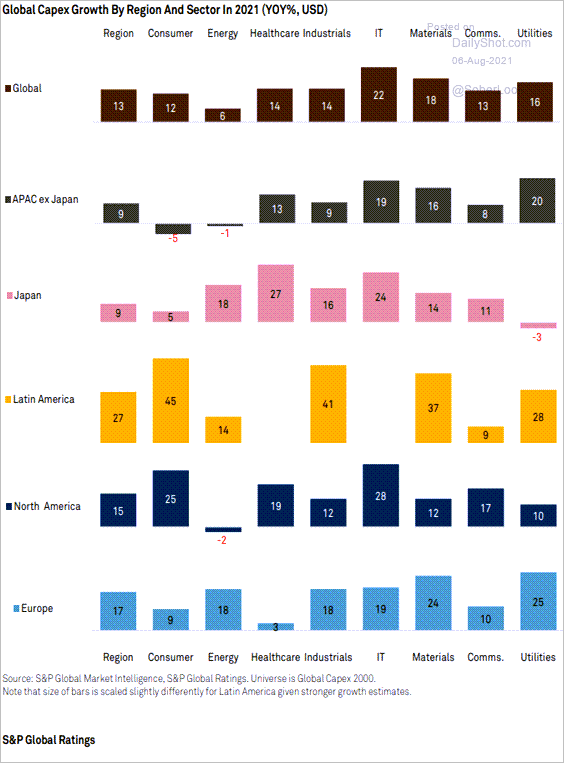

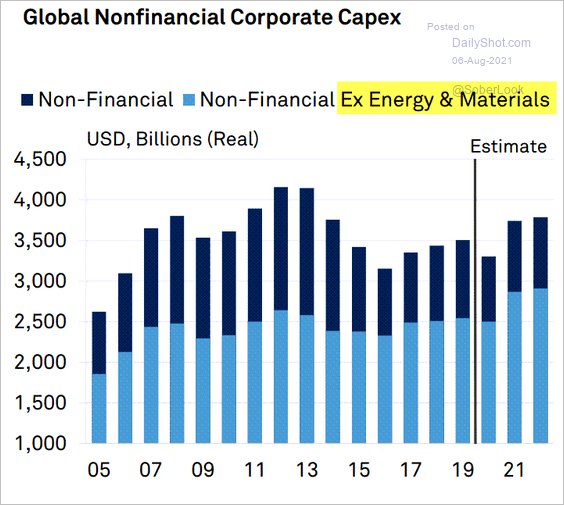

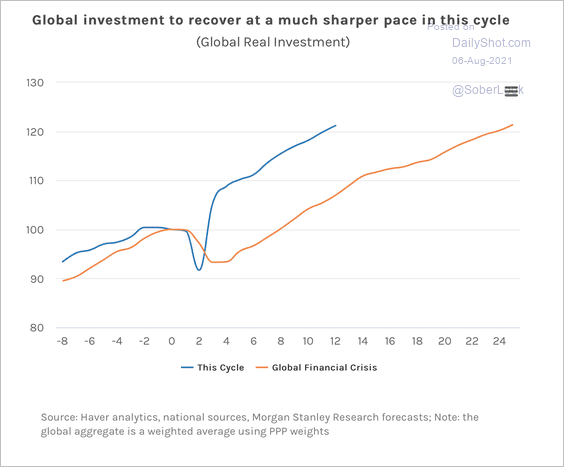

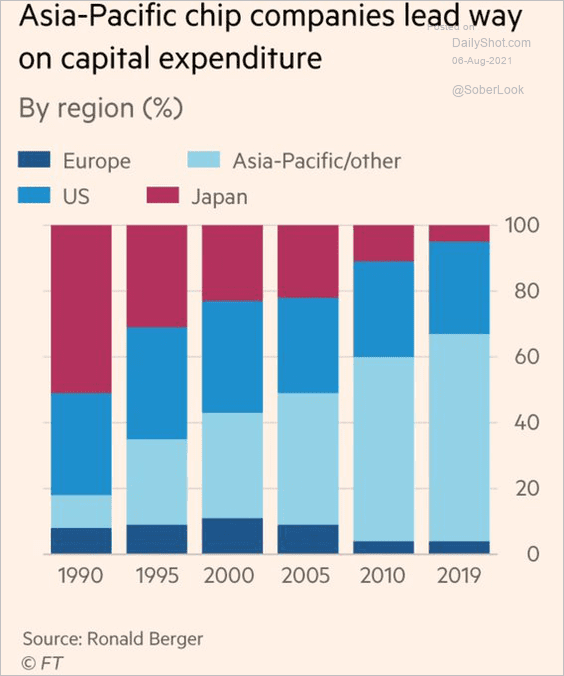

1. Let’s start with some trends in business investment.

• S&P Global Ratings’ corporate capital expenditure survey:

Source: S&P Global Ratings

Source: S&P Global Ratings

• Regional growth:

Source: S&P Global Ratings

Source: S&P Global Ratings

• Financial vs. non-financial companies:

Source: S&P Global Ratings

Source: S&P Global Ratings

• Investment recovering at a faster pace than after the financial crisis:

Source: Morgan Stanley Research Read full article

Source: Morgan Stanley Research Read full article

• Semiconductor CapEx:

Source: @TonyCarterJones, @FT Read full article

Source: @TonyCarterJones, @FT Read full article

——————–

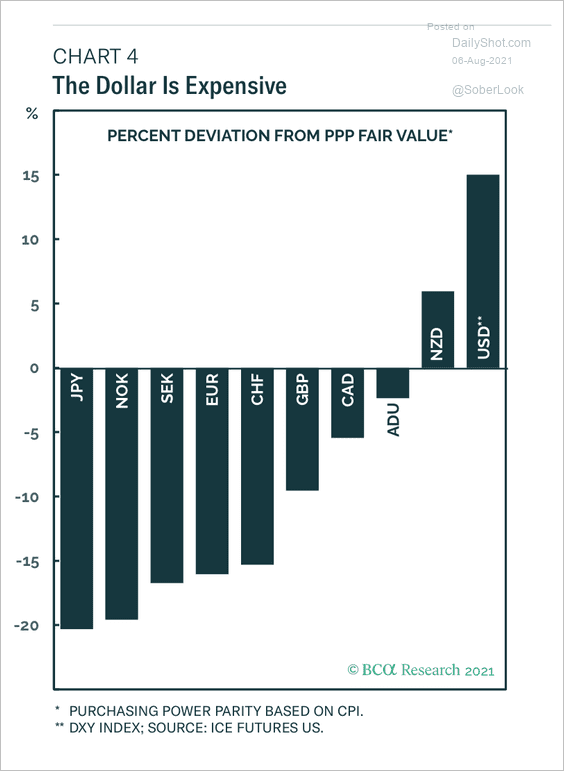

2. The dollar has deviated about 15% above fair value, while the Japanese yen and Norwegian krone are among the most discounted currencies in the G10, according to BCA Research.

Source: BCA Research

Source: BCA Research

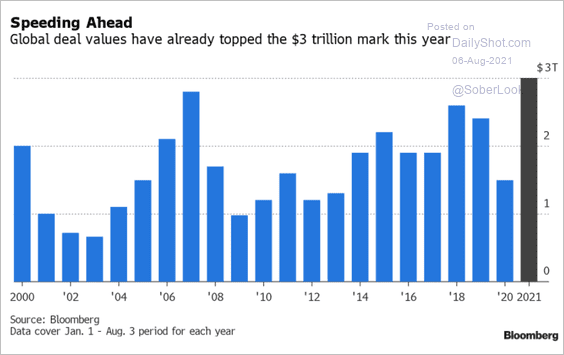

3. Corporate deals hit $3 trillion this year.

Source: @sahloul81 Read full article

Source: @sahloul81 Read full article

——————–

Food for Thought

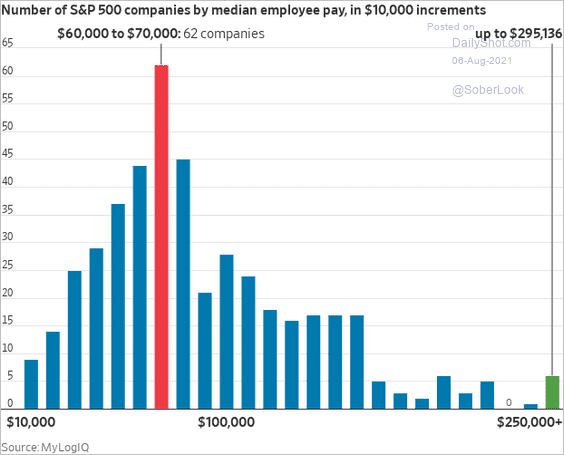

1. Median wage distribution across S&P 500 companies:

Source: @WSJ Read full article

Source: @WSJ Read full article

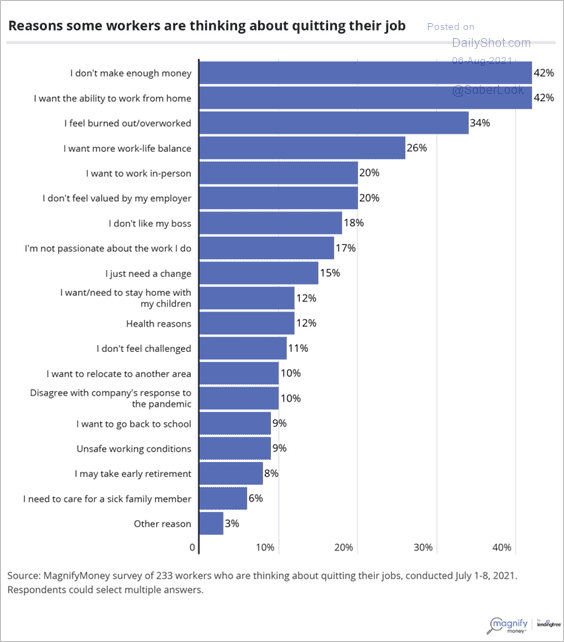

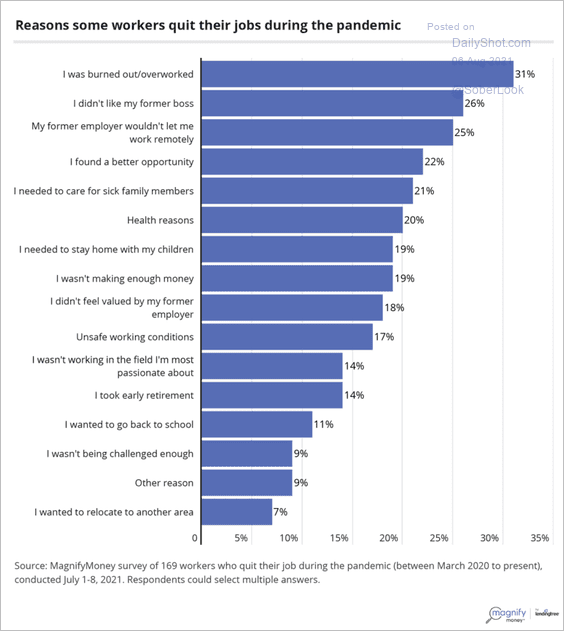

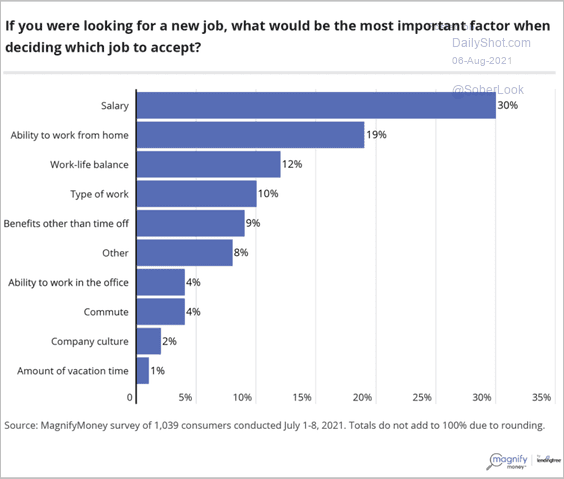

2. A MagnifyMoney survey on employment:

• Reasons some workers are thinking about quitting:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

• Reasons some workers quit their jobs during the pandemic:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

• What would be the most important factor when deciding which job to accept?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

——————–

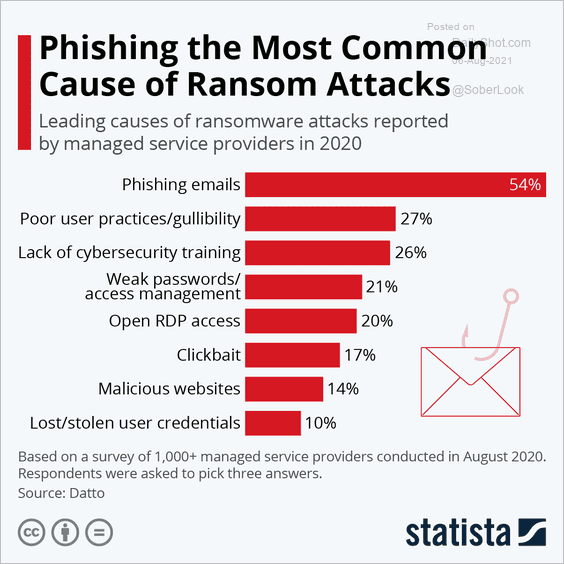

3. Entry points for ransomware attacks:

Source: Statista Read full article

Source: Statista Read full article

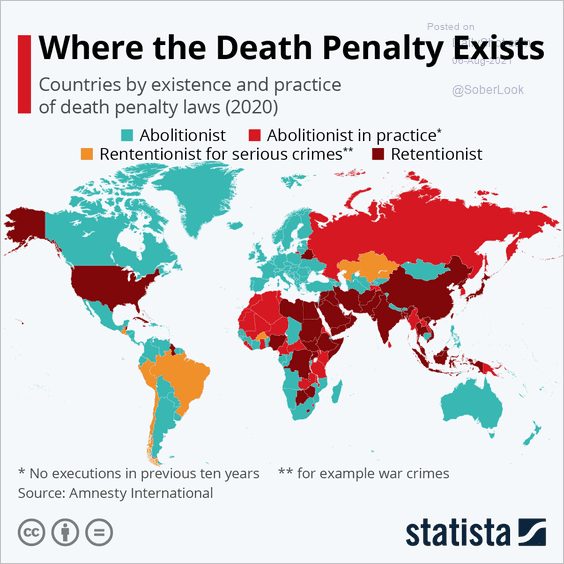

4. Death penalty laws globally:

Source: Statista

Source: Statista

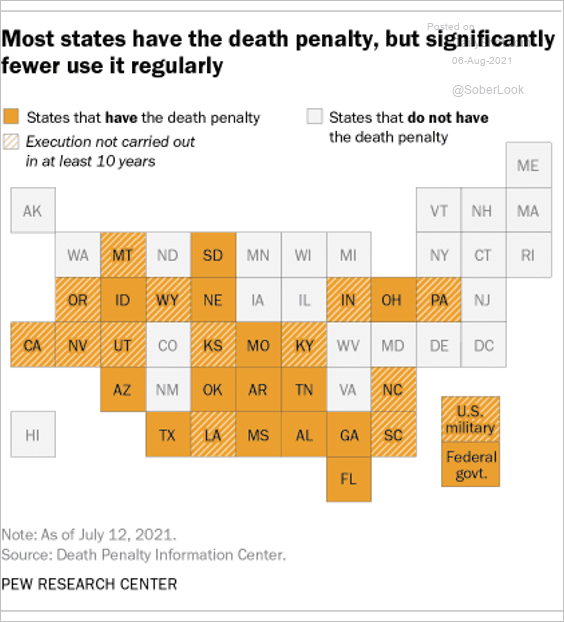

• Death penalty usage by state:

Source: @pewresearch Read full article

Source: @pewresearch Read full article

——————–

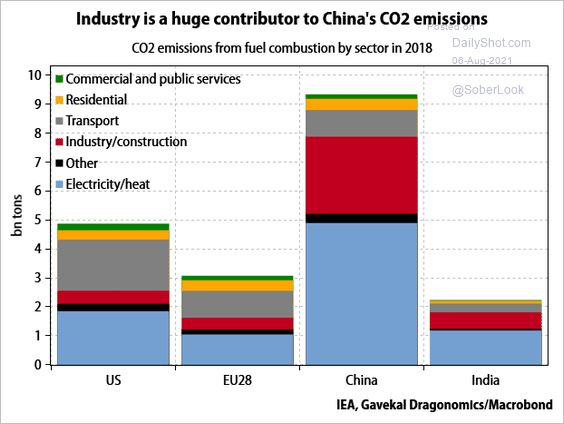

5. Contributions to CO2 emissions by sector:

Source: Gavekal Research

Source: Gavekal Research

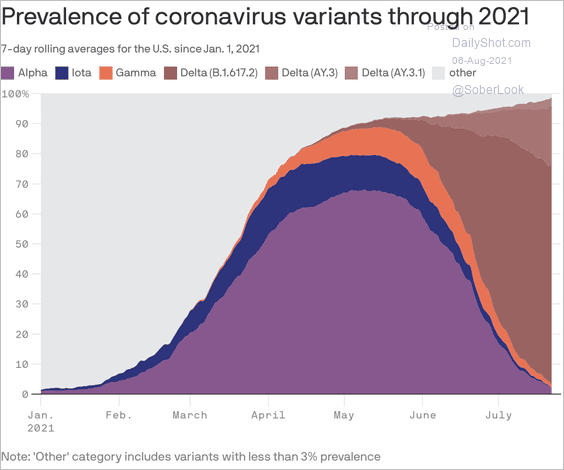

6. Prevalence of coronavirus variants:

Source: @axios Read full article

Source: @axios Read full article

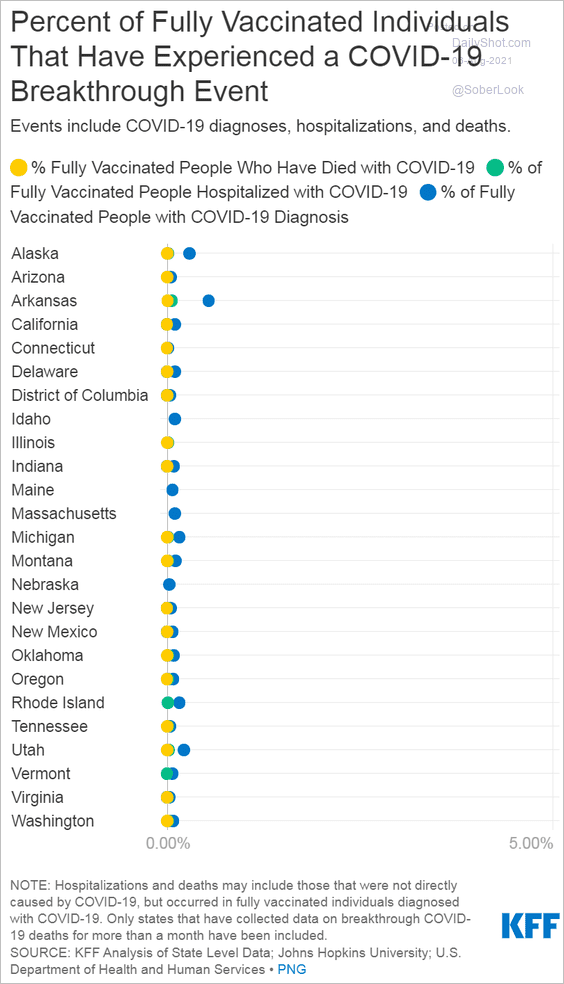

7. Fully vaccinated individuals experiencing a breakthrough event:

Source: KFF Read full article

Source: KFF Read full article

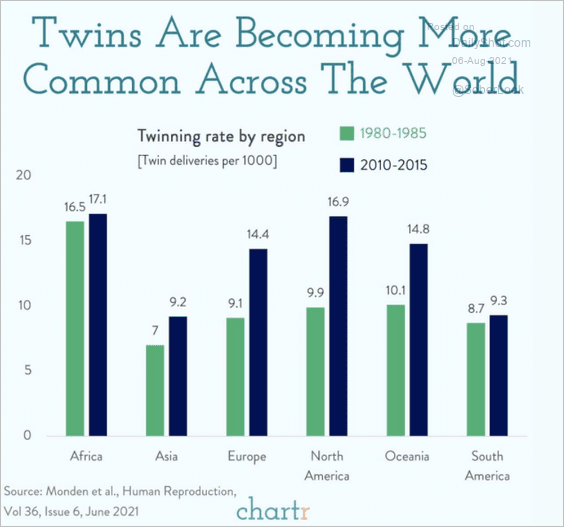

8. Twins are becoming more common:

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index