The Daily Shot: 20-Aug-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

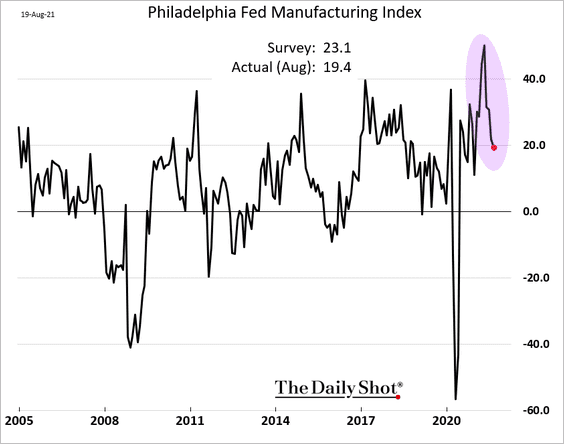

1. The Philly Fed’s manufacturing index declined further in August, showing some loss of momentum.

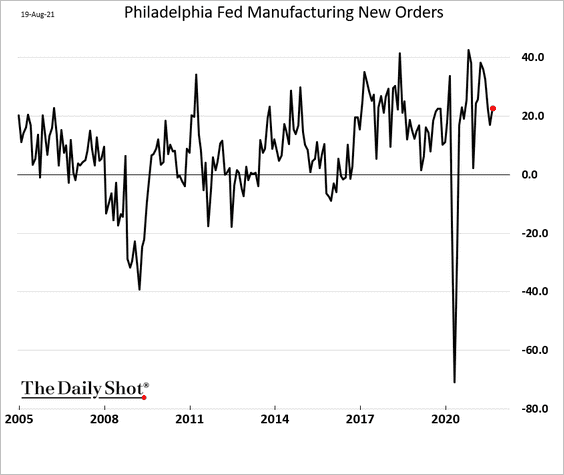

However, the new orders index ticked higher, …

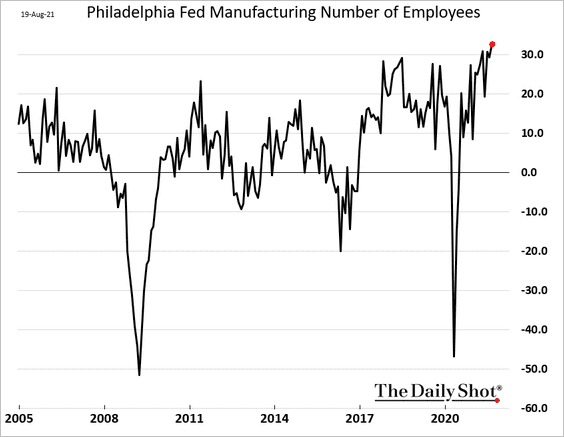

… and hiring accelerated further. The number of employees index hit a record high (going back to the late 1960s).

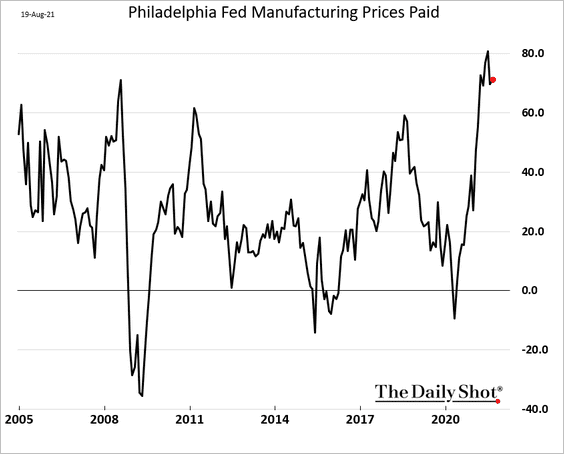

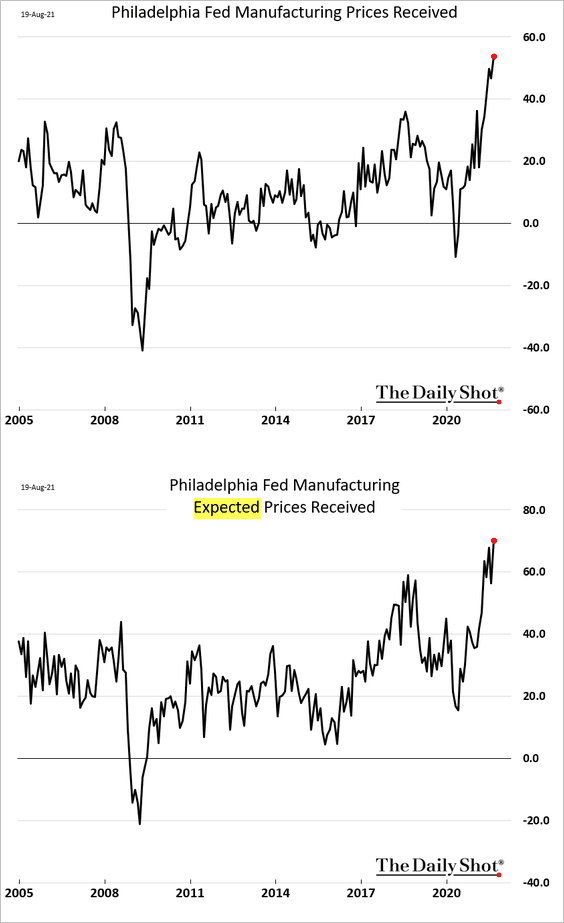

• Price pressures persist.

Manufacturers are rapidly raising prices and plan to continue doing so in the months ahead.

• Factories are drawing down inventories to meet demand for goods.

Source: ShareCast Read full article

Source: ShareCast Read full article

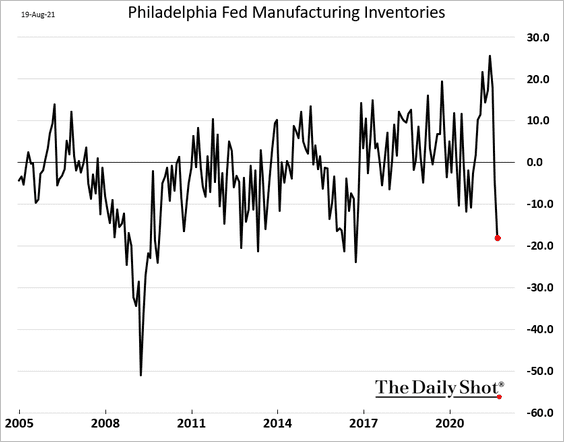

• But the unfilled orders index has been declining. Will delivery times follow?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

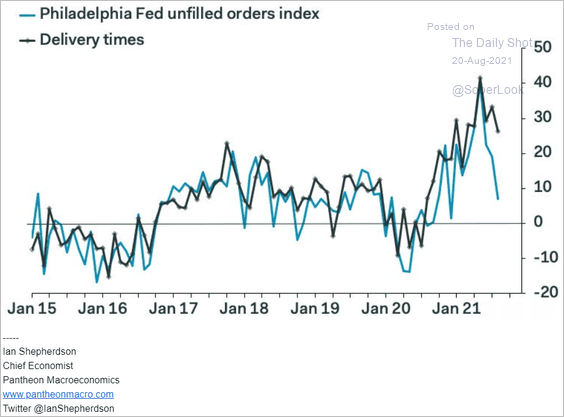

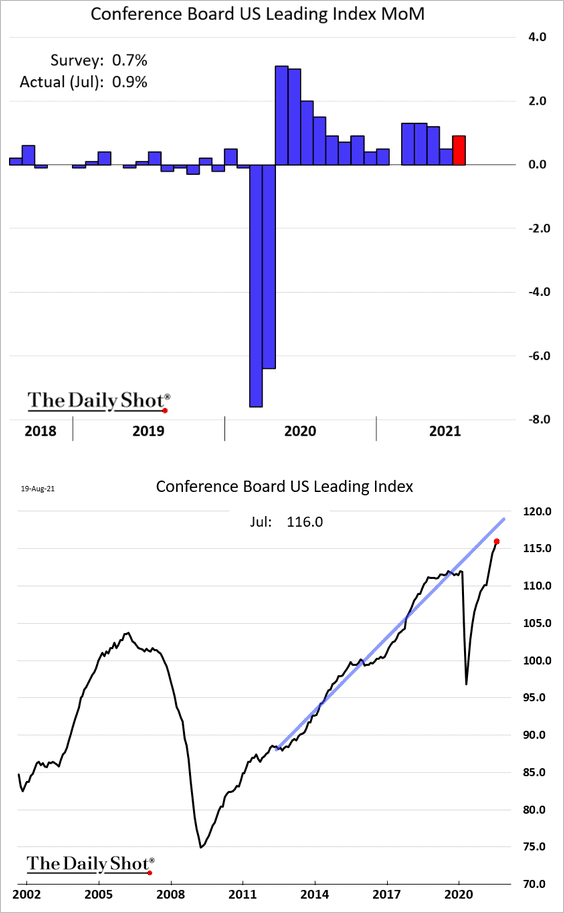

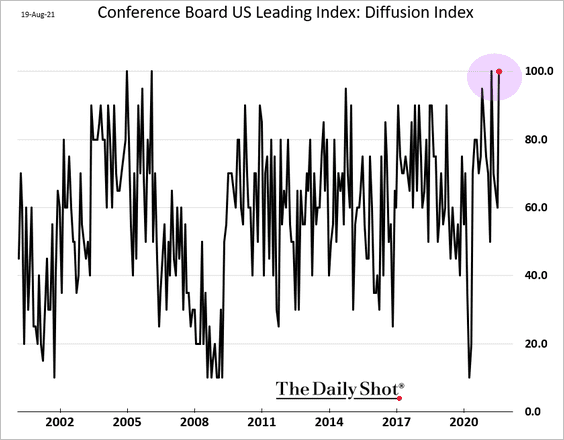

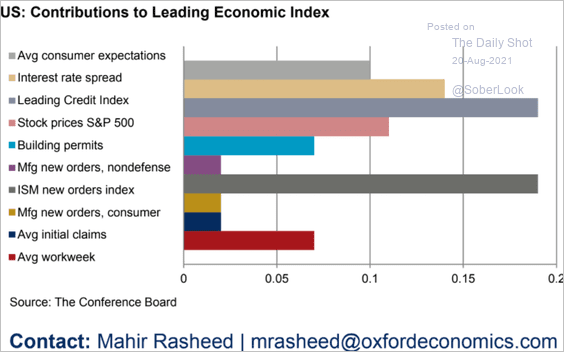

2. The Conference Board’s leading index climbed more than expected in July.

All of the components were up last month.

Source: Oxford Economics

Source: Oxford Economics

——————–

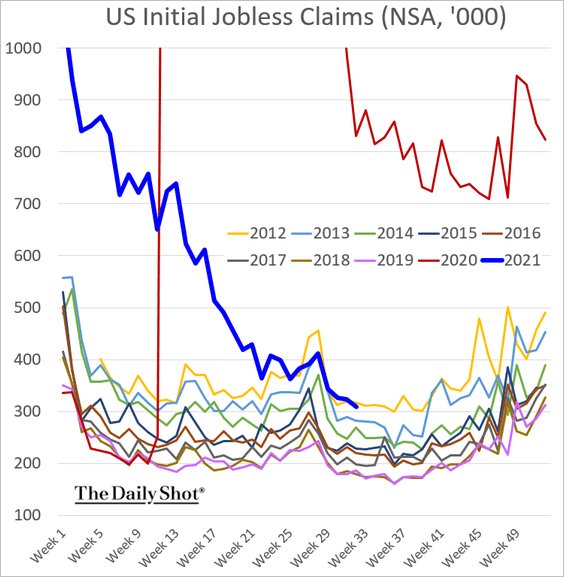

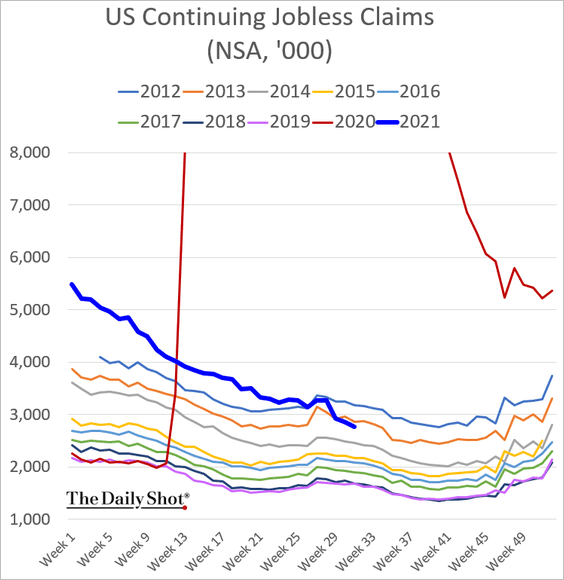

3. Next, we have some updates on the labor market.

• Initial jobless claims (excluding emergency programs) keep decreasing.

Continuing claims were also lower. If the trend keeps up, it will give the FOMC hawks further ammunition to argue for taper.

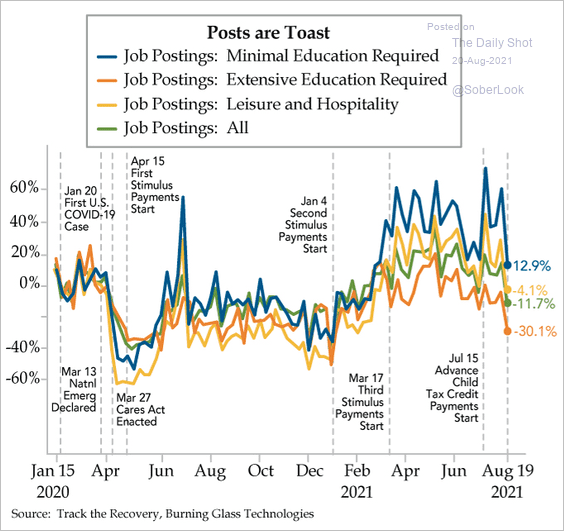

• The Opportunity Insights high-frequency indicators point to a decline in job postings.

Source: The Daily Feather

Source: The Daily Feather

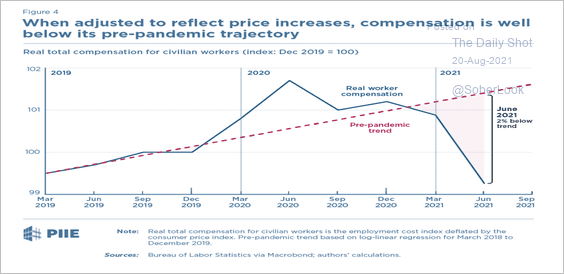

• Real wages are far below the pre-pandemic level (due to the recent spike in prices).

Source: PIIE

Source: PIIE

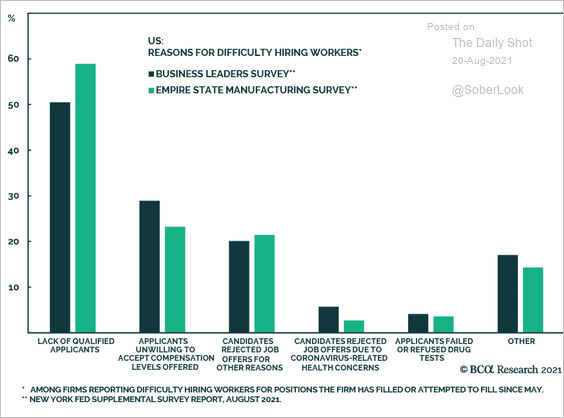

• What are the reasons for difficulties in hiring workers?

Source: BCA Research

Source: BCA Research

——————–

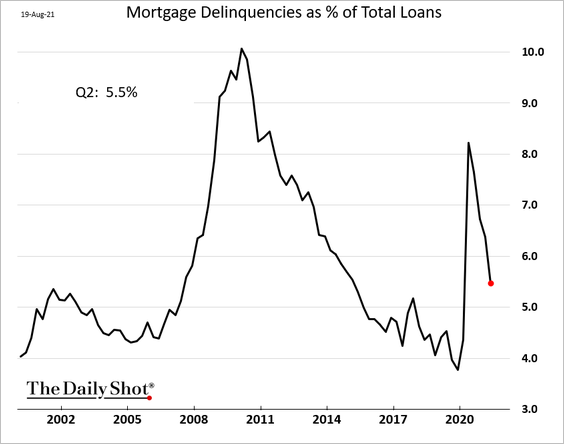

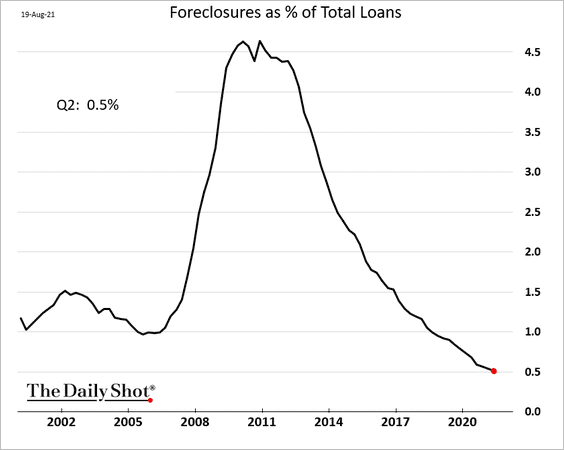

4. Mortgage delinquencies continue to fall.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Helped by forbearance programs, foreclosures dropped to the lowest level since the early 1980s.

——————–

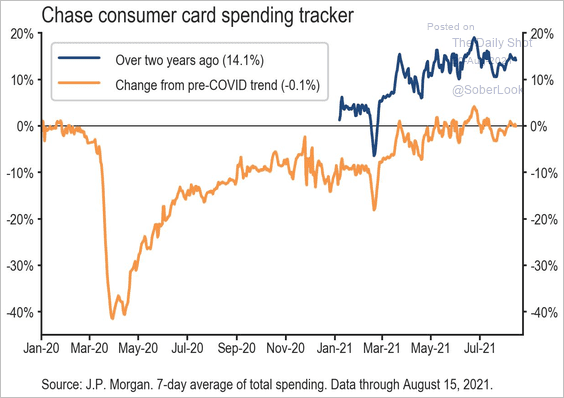

5. Chase card spending activity is holding up well despite weaker consumer sentiment.

Source: JP Morgan; @carlquintanilla

Source: JP Morgan; @carlquintanilla

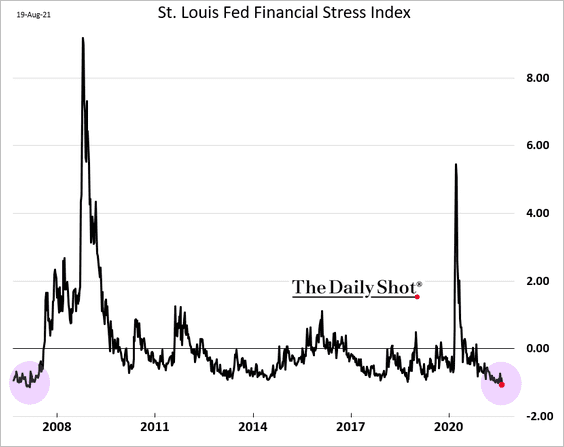

6. US financial conditions have been easing, with the St. Louis Fed Financial Stress Index hitting the lowest level since 2007.

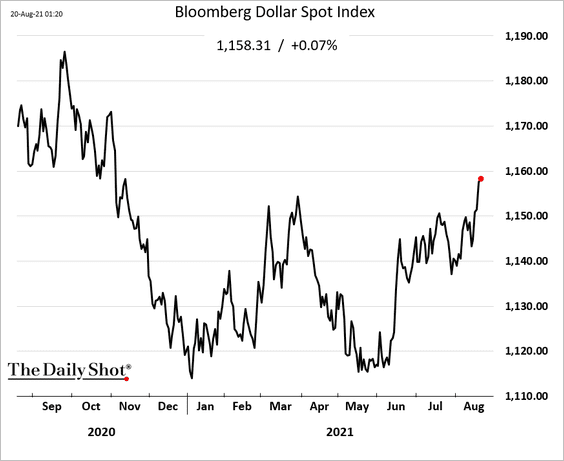

However, if the US dollar continues to climb, we may see some tightening in financial conditions ahead.

Back to Index

Canada

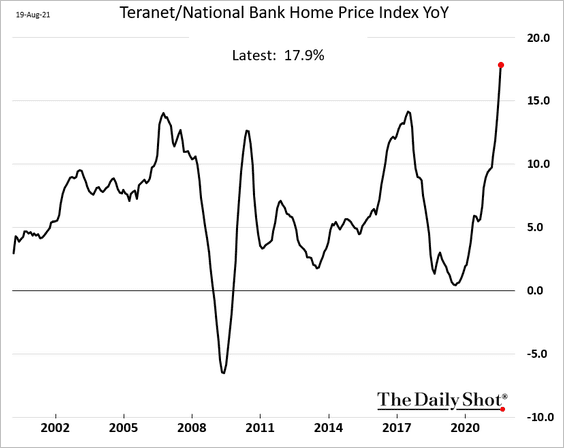

1. Home price appreciation increasingly looks like a bubble.

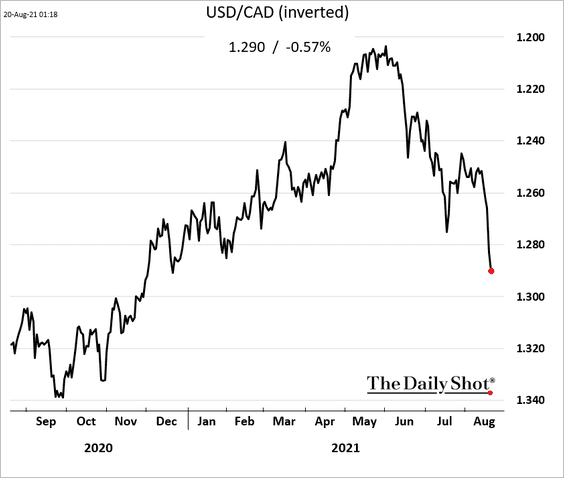

2. The loonie tumbled this week amid Fed taper talk and increased risk aversion.

Back to Index

The United Kingdom

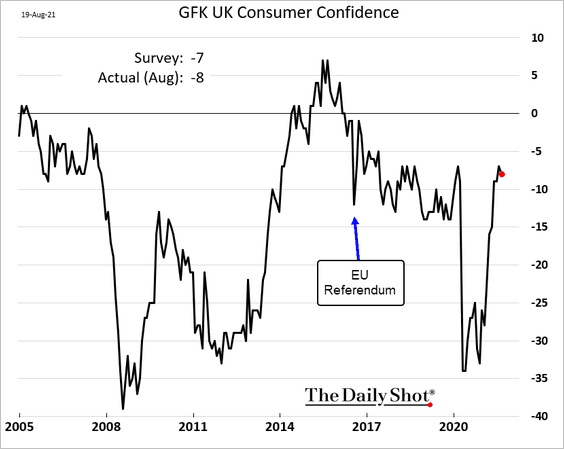

1. Consumer confidence ticked lower in August.

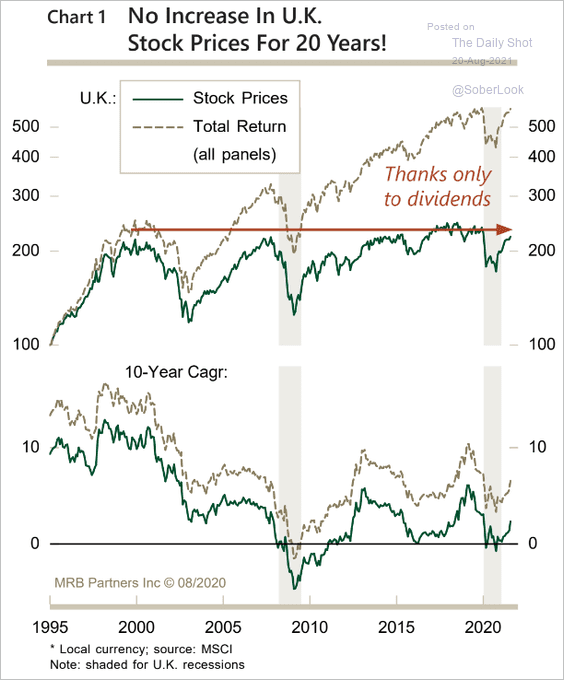

2. Stock prices have been flat for some 20 years, with all the gains coming from dividends.

Source: MRB Partners

Source: MRB Partners

Back to Index

The Eurozone

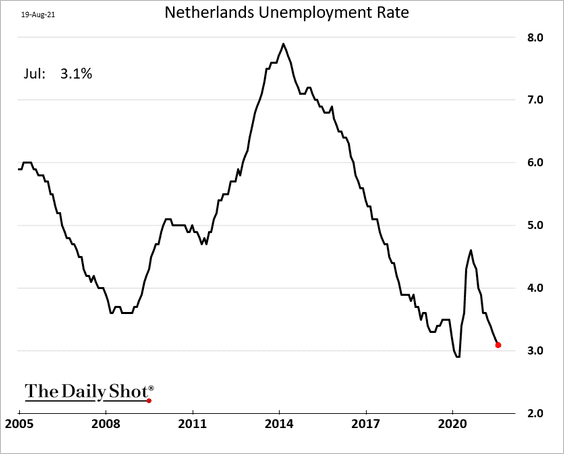

1. Dutch unemployment is approaching pre-COVID levels.

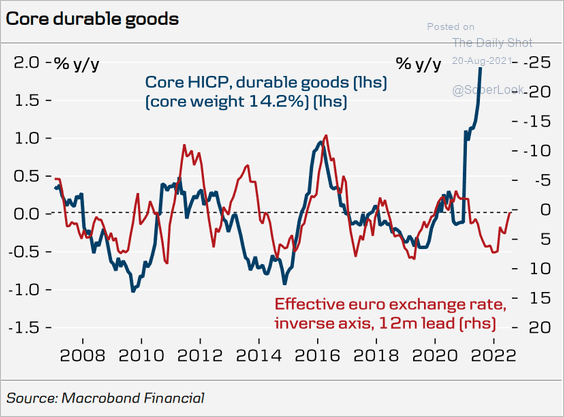

2. The euro’s stability points to a pullback in the Eurozone’s durable goods CPI.

Source: Danske Bank

Source: Danske Bank

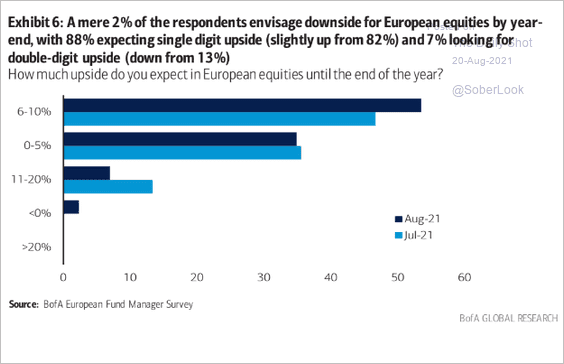

3. Fund managers remain bullish on European stocks.

Source: BofA Global Research; @Saburgs

Source: BofA Global Research; @Saburgs

Back to Index

Asia – Pacific

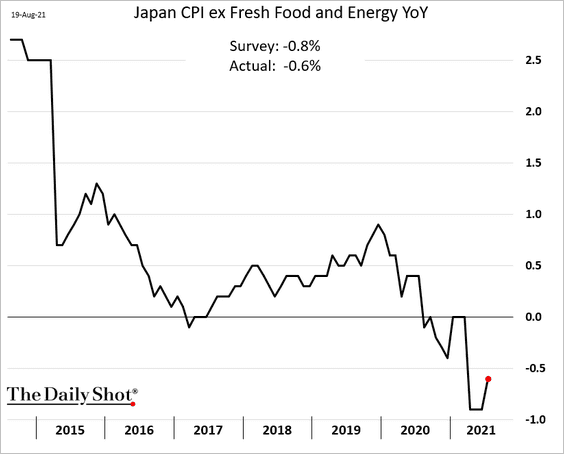

1. Japan’s core CPI ticked higher last month but remains in negative territory.

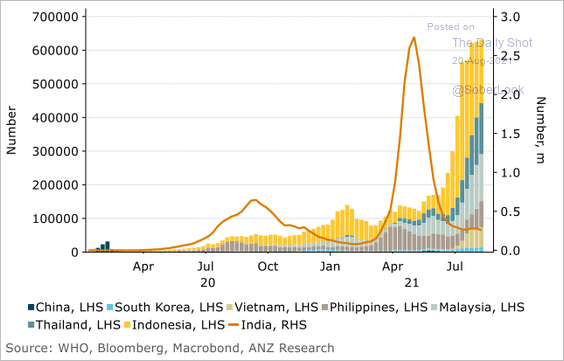

2. COVID cases remain elevated across Asia.

Source: ANZ Research

Source: ANZ Research

3. Next, we have some updates on Australia.

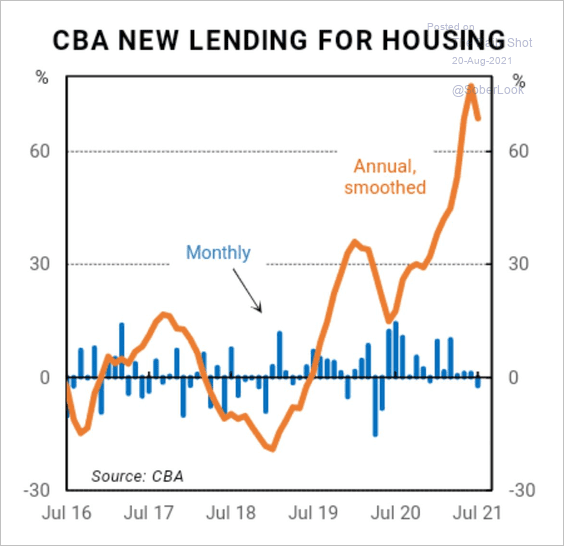

• Has housing finance growth peaked? Will home price appreciation follow?

Source: CBA; @Scutty

Source: CBA; @Scutty

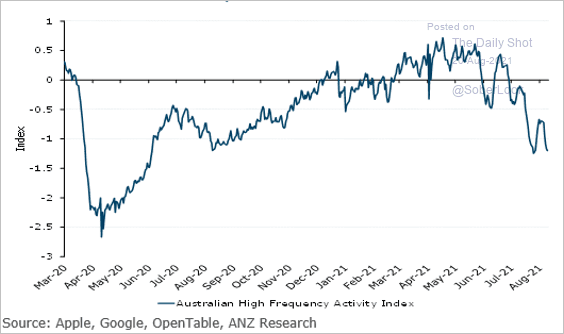

• The ANZ high-frequency activity index is near the lowest level since last summer.

Source: ANZ Research

Source: ANZ Research

• The Aussie dollar remains under pressure.

Back to Index

China

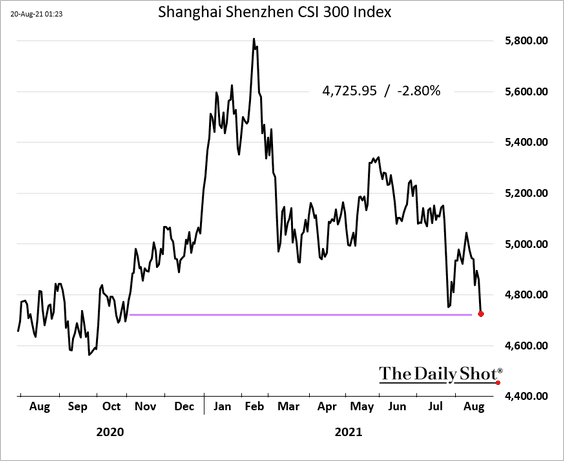

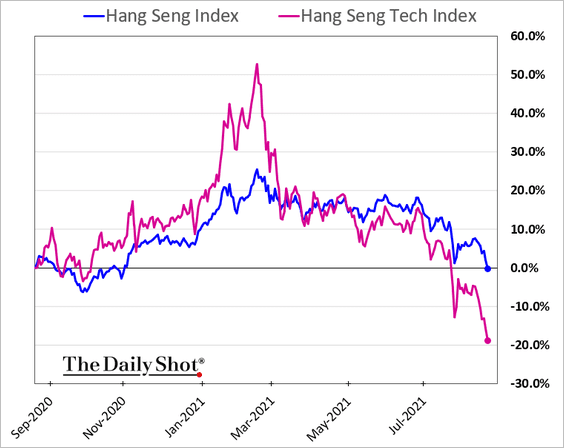

1. Stocks are down again today, with the CSI 300 index at the lowest level since last November.

Shares are also down in Hong Kong, with tech shares tumbling.

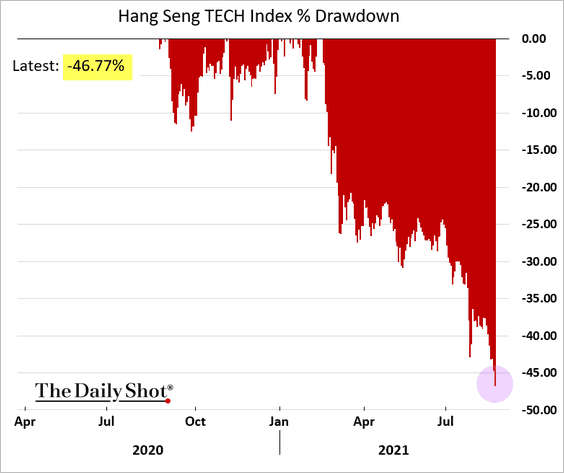

The Hang Seng Tech Index drawdown is approaching 50%.

——————–

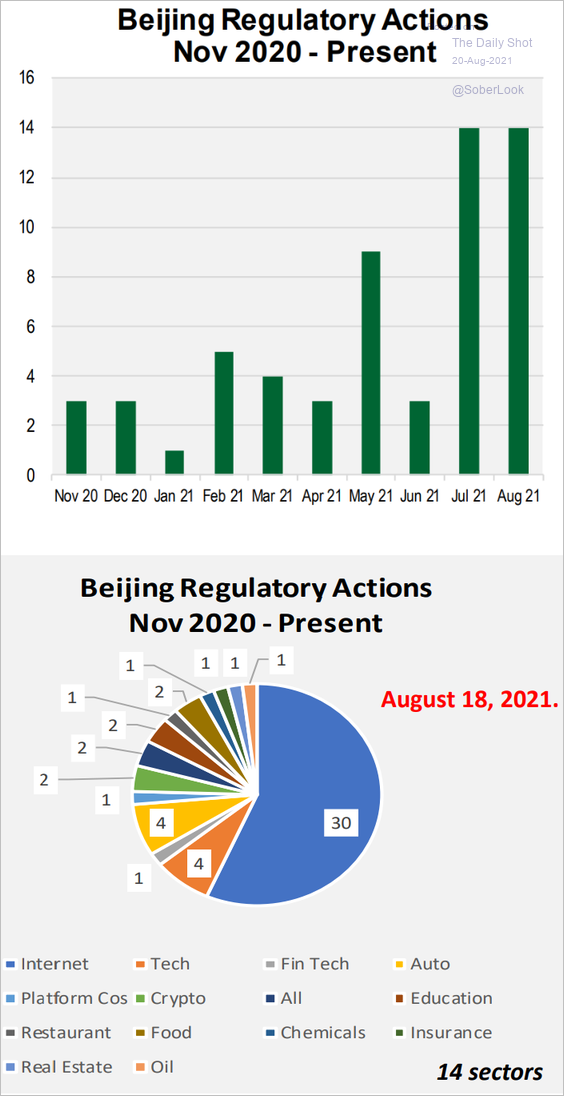

2. Here is an update on Beijing’s regulatory actions from Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

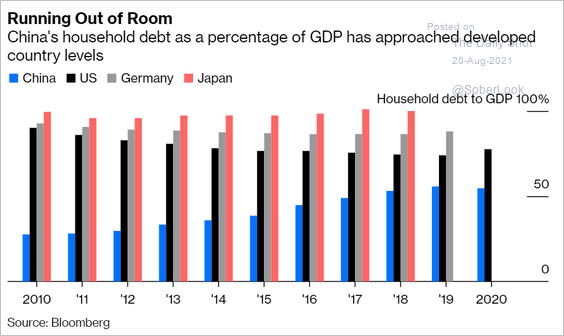

3. Household debt has been approaching levels we see in advanced economies.

Source: @bopinion Read full article

Source: @bopinion Read full article

Back to Index

Emerging Markets

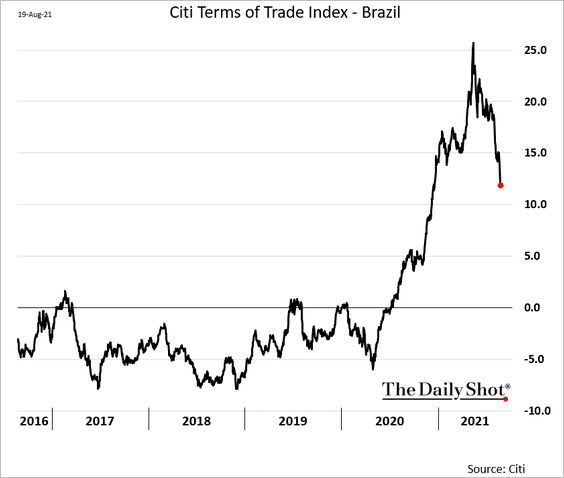

1. Brazil’s terms of trade continue to deteriorate as commodity prices weaken.

h/t @RobinBrooksIIF

h/t @RobinBrooksIIF

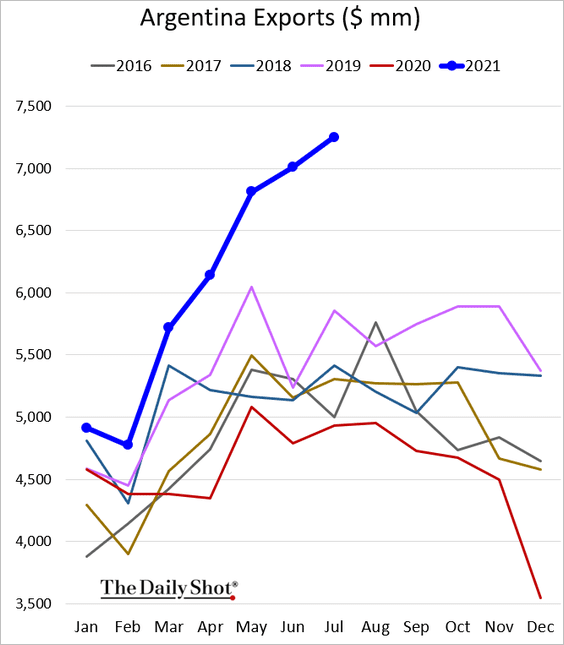

2. Argentina’s exports have been surging this year, boosted by agricultural commodity prices.

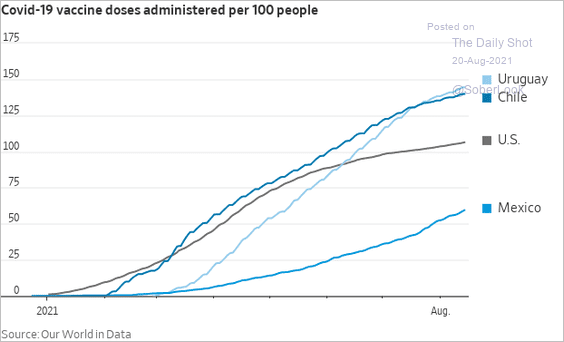

3. LatAm vaccination programs continue to show good progress.

Source: @WSJ Read full article

Source: @WSJ Read full article

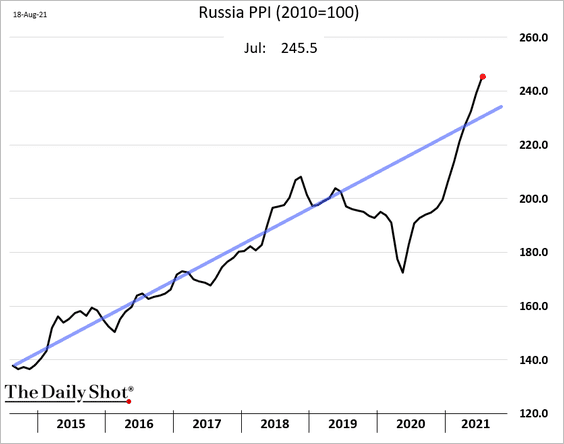

4. Russia’s producer prices are surging.

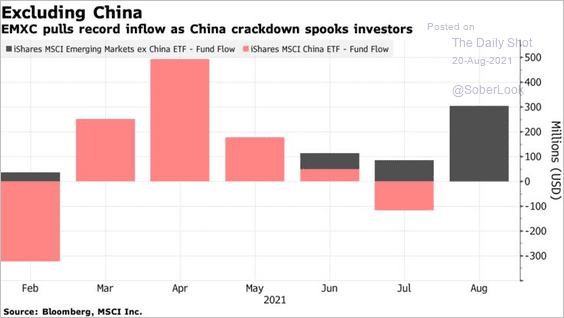

5. Investors have been buying the EMXC ETF (EM ex China).

Source: @markets Read full article

Source: @markets Read full article

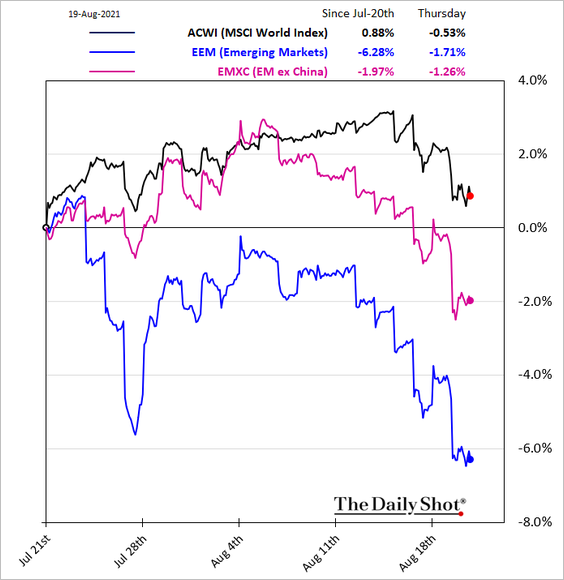

Here is the relative performance.

——————–

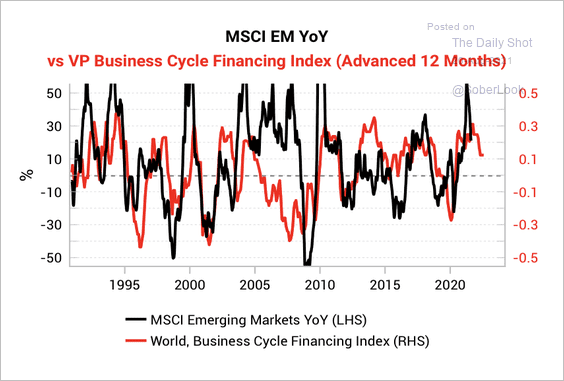

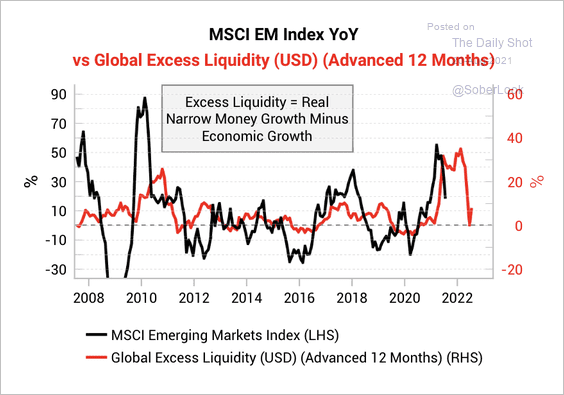

6. The slowdown in global liquidity growth could weigh on EM equities (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Back to Index

Cryptocurrency

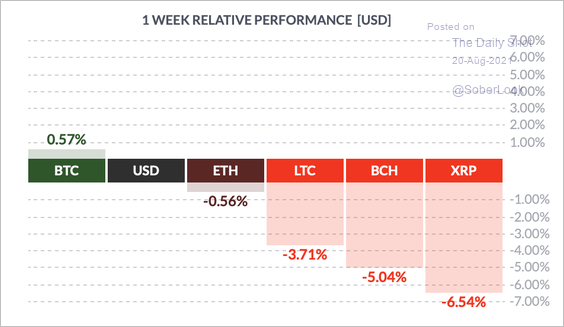

1. Bitcoin has outperformed other large cryptocurrencies over the past week.

Source: FinViz

Source: FinViz

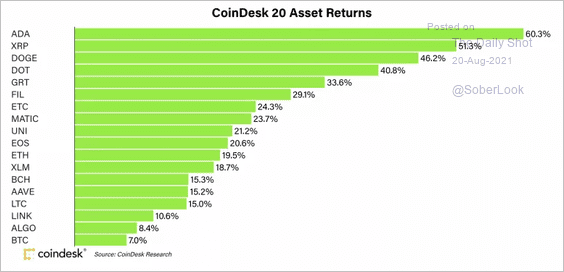

Here is a look at cryptocurrency returns month to date.

Source: CoinDesk

Source: CoinDesk

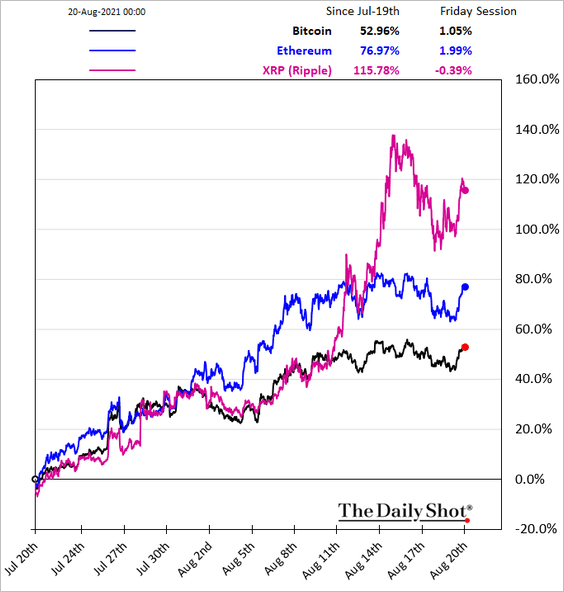

And this chart shows the relative performance over the past 30 days.

——————–

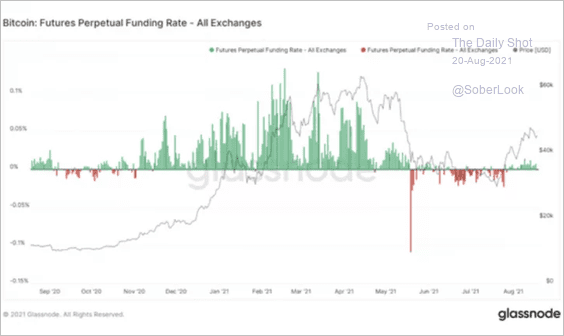

2. The cost to fund long positions in the market for bitcoin perpetual swaps, a type of derivative in the crypto markets similar to futures contracts in traditional markets, remains relatively low compared to previous market rallies.

Source: Glassnode

Source: Glassnode

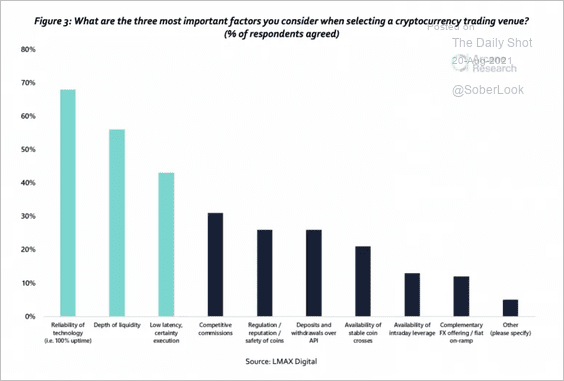

3. Reliability of technology, depth of liquidity, and execution are some of the important factors that institutions consider when selecting a crypto trading venue, according to a survey by LMAX Digital.

Source: LMAX Digital Read full article

Source: LMAX Digital Read full article

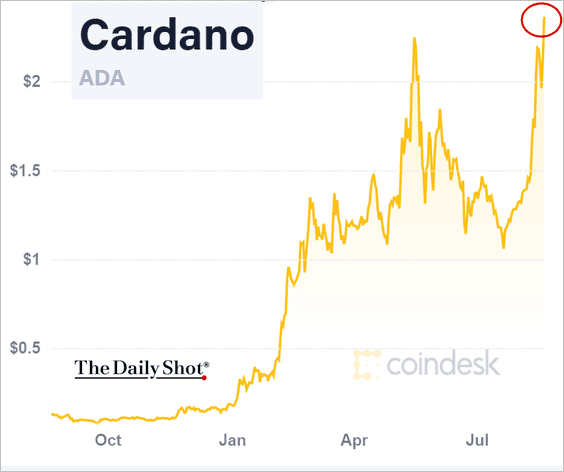

4. Cardano (ADA) is trading near an all-time high of around $2.40 ahead of a planned network upgrade. The cryptocurrency rallied about 60% over the past month.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

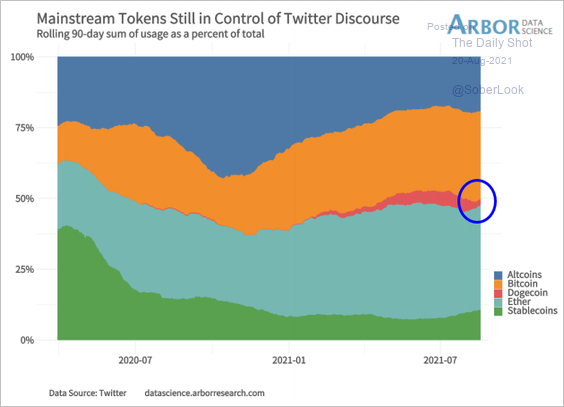

5. Dogecoin coverage in Twitter discourse is shrinking.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

6. Coinbase plans to add over $500 million worth of crypto to its balance sheet.

Source: @brian_armstrong

Source: @brian_armstrong

Back to Index

Commodities

1. Bloomberg’s broad commodity index broke below support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

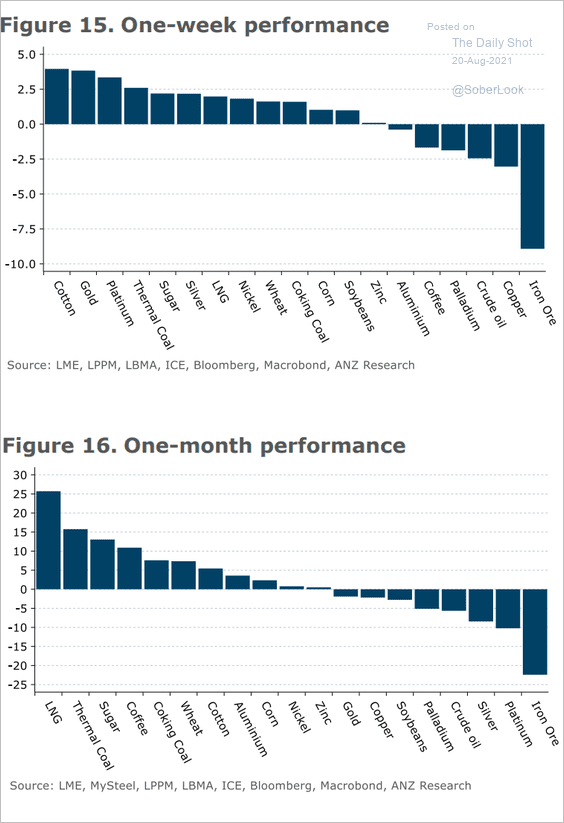

2. Here is the one-week and one-month performance across commodity markets.

Source: ANZ Research

Source: ANZ Research

Back to Index

Equities

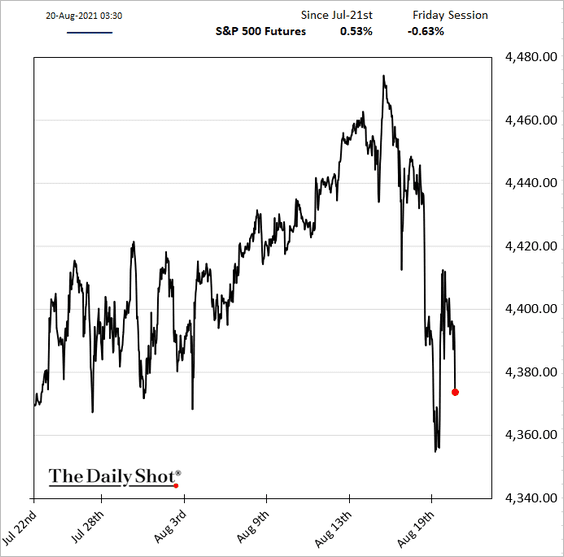

1. Stock futures are softer this morning.

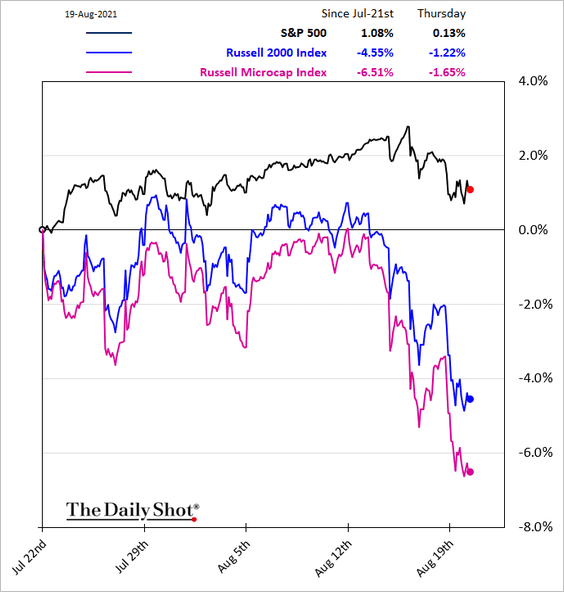

2. It’s been a tough couple of weeks for small caps.

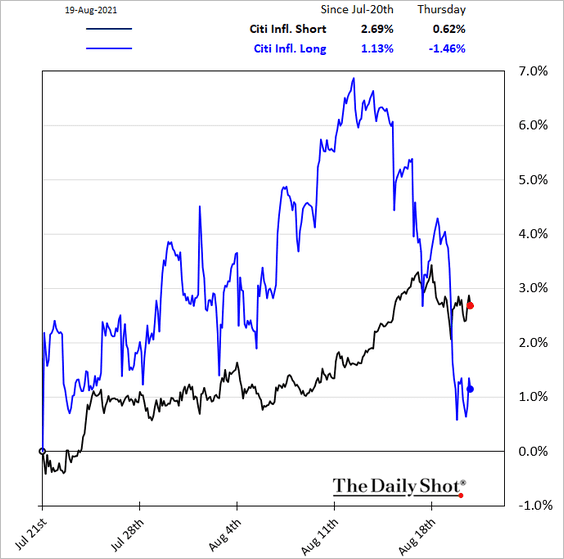

3. Shares that benefit from higher prices (Citi Inflation Long Index) have underperformed recently.

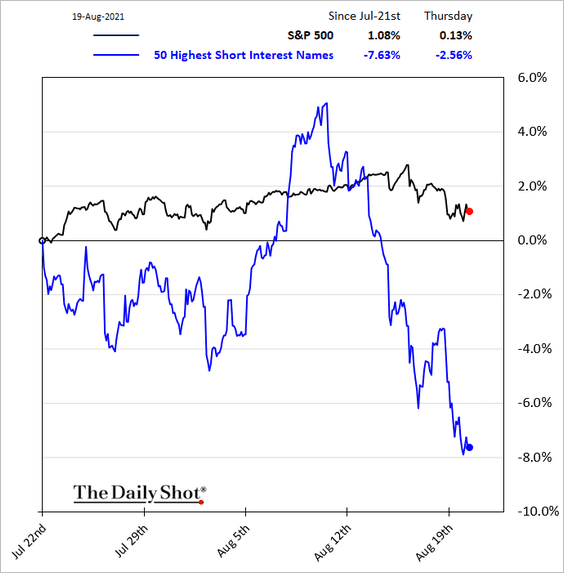

4. Most-shorted names are struggling as the retail investors step away.

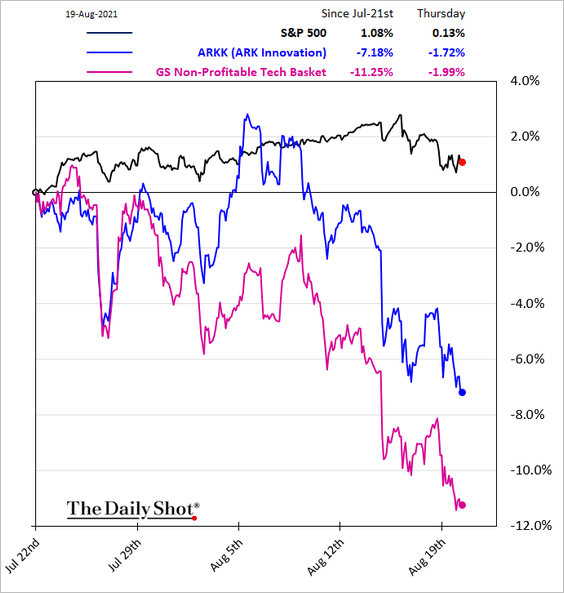

• Speculative tech shares are under pressure.

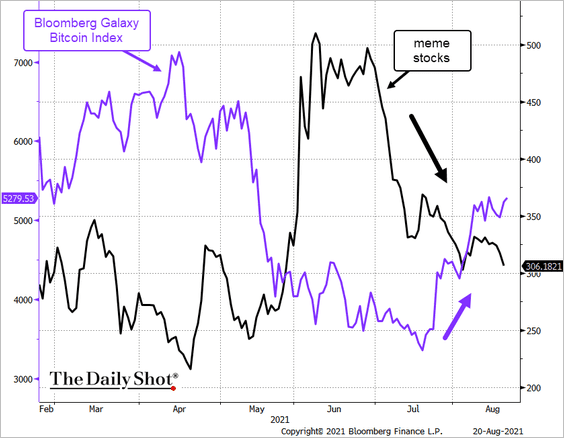

• The Reddit crowd is rotating out of meme stocks into crypto.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

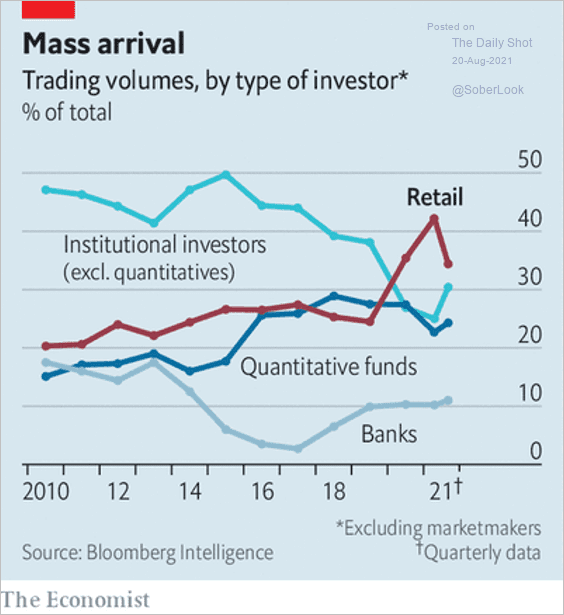

5. Retail trading volume is off the highs but remains elevated.

Source: The Economist Read full article

Source: The Economist Read full article

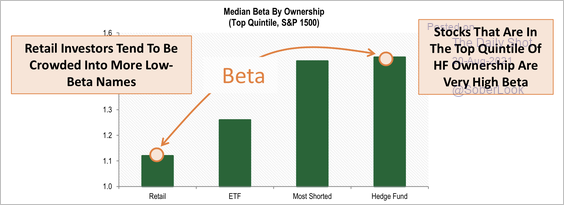

Separately, retail investors tend to hold low-beta stocks.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

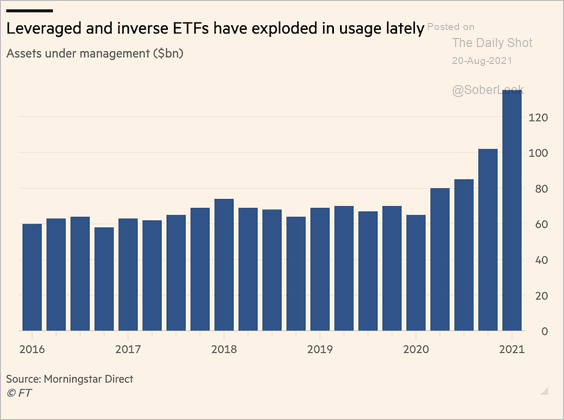

6. Leveraged ETFs have been very popular this year.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

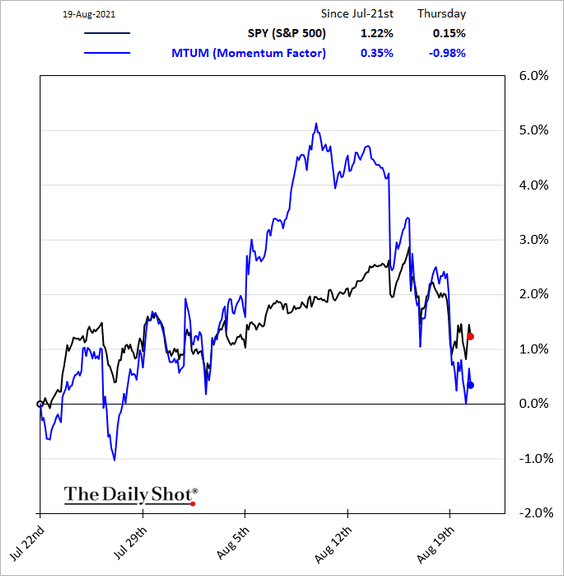

7. The momentum factor has given up its recent outperformance.

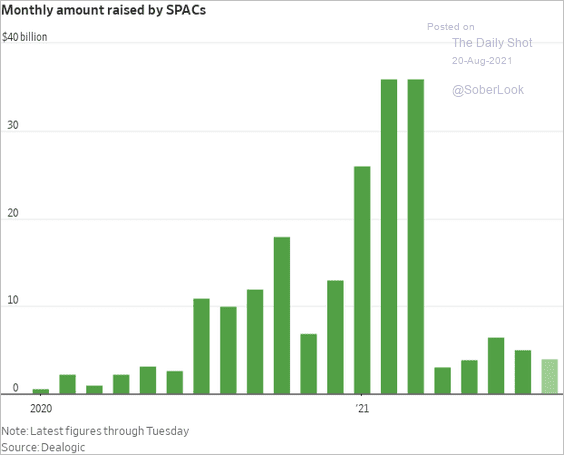

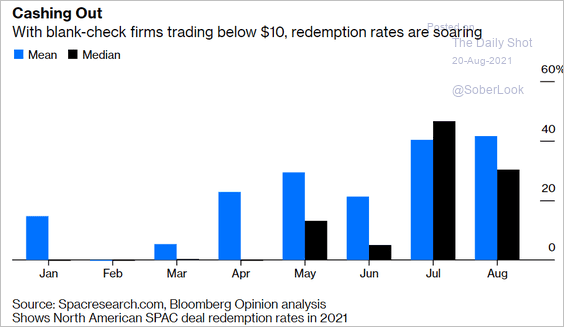

8. SPAC IPO activity has been modest relative to the post-pandemic boom.

Source: @WSJ Read full article

Source: @WSJ Read full article

SPAC redemptions are up sharply as hedge funds collect their warrants and walk away.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

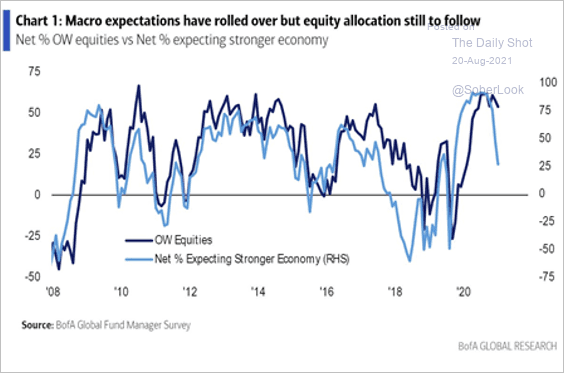

9. Fund investors are highly overweight equities, even as they temper their views on economic growth.

Source: BofA Global Research; @MikaelSarwe

Source: BofA Global Research; @MikaelSarwe

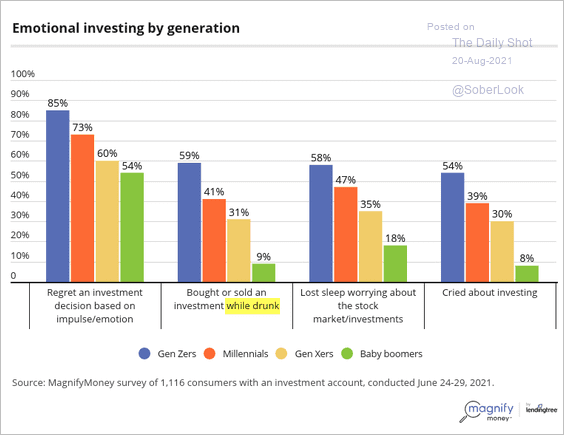

10. Have you made an investment decision while drunk?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

Back to Index

Credit

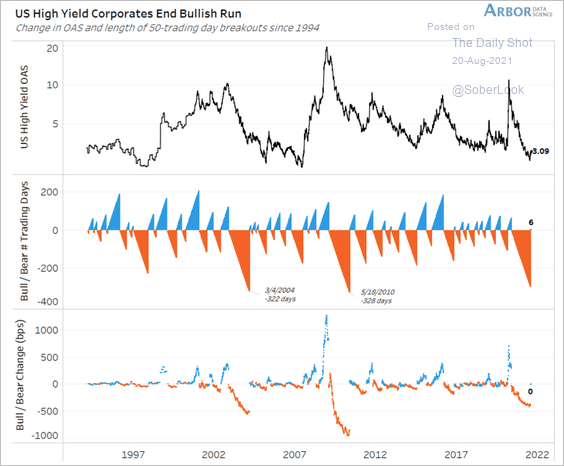

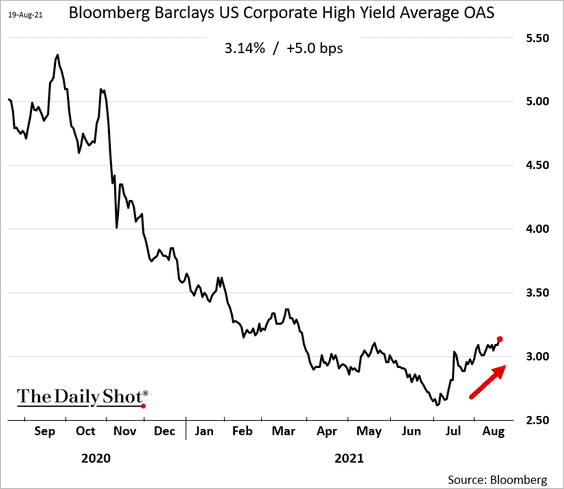

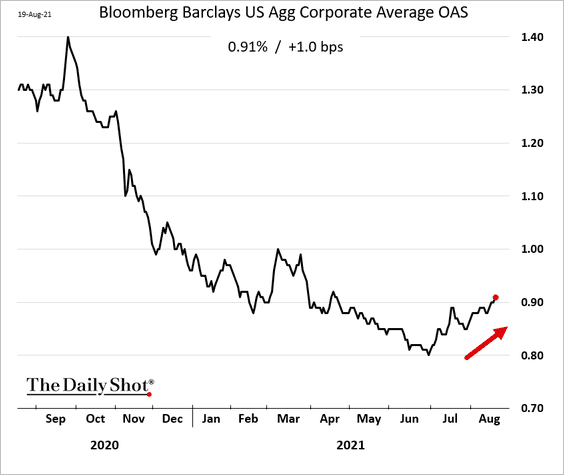

1. US high-yield corporate bonds have seen their extended bull run since May 2020 come to an end, according to Arbor Data Science.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Spreads have been widening since early July.

Investment-grade spreads have widened as well.

——————–

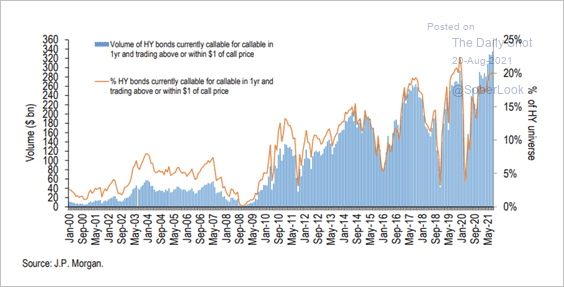

2. Over $300 billion of the US high-yield corporate bond market (~20%) is trading within $1 of call price and is callable within a year.

Source: J.P. Morgan; III Capital Management

Source: J.P. Morgan; III Capital Management

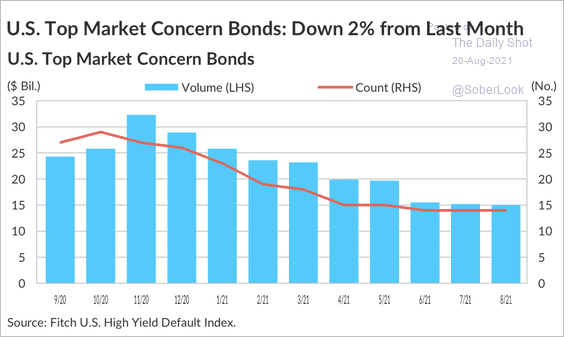

3. US “top market concern” high-yield bonds continue to decline this year, according to Fitch.

Source: Fitch Ratings

Source: Fitch Ratings

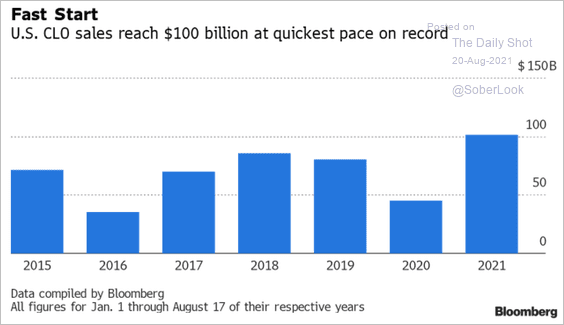

4. CLO sales topped $100 billion this year.

Source: Charles E Williams, Bloomberg Finance L.P. Read full article

Source: Charles E Williams, Bloomberg Finance L.P. Read full article

Back to Index

Rates

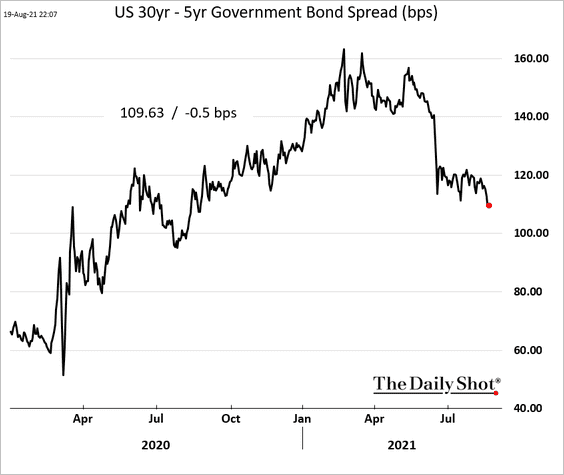

1. The Treasury curve is flattening.

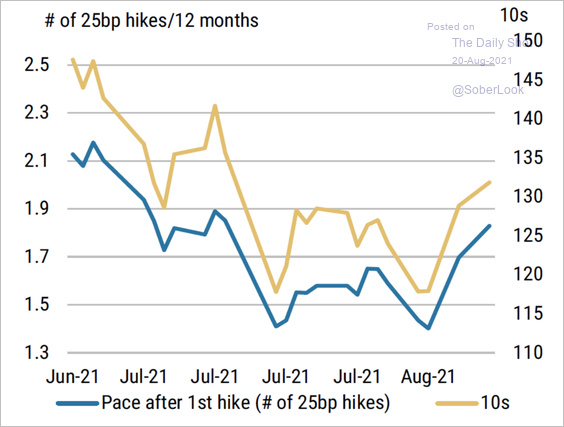

2. The 10-year Treasury yield has been highly correlated with the pace of projected Fed rate hikes.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Global Developments

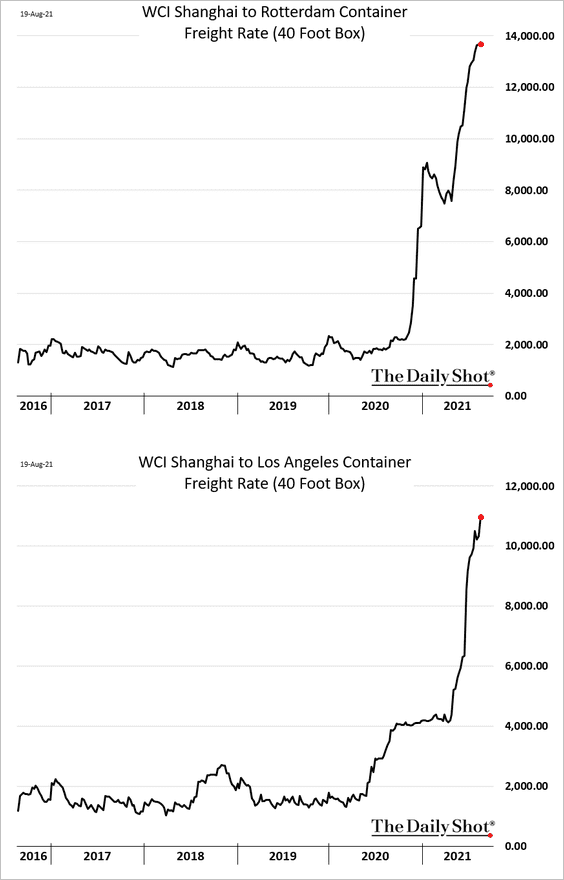

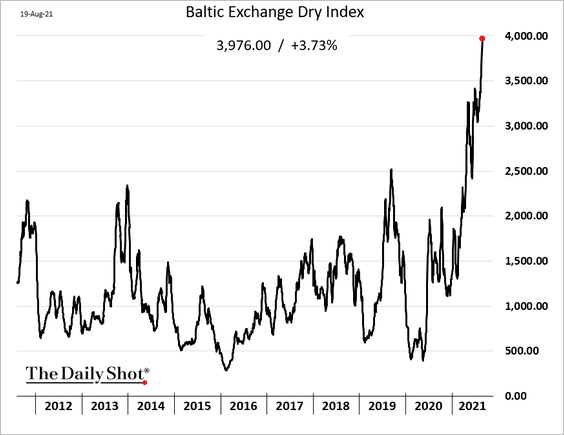

1. Shipping costs continue to surge.

• Container shipping:

• Dry bulk:

——————–

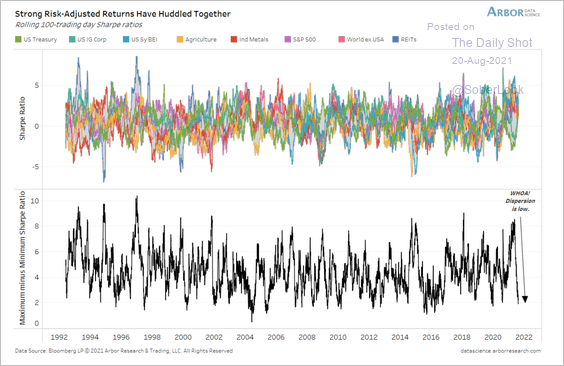

2. The dispersion of risk-adjusted returns has tightened, with nearly all major assets performing similarly. Is the “everything rally” nearing a peak?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

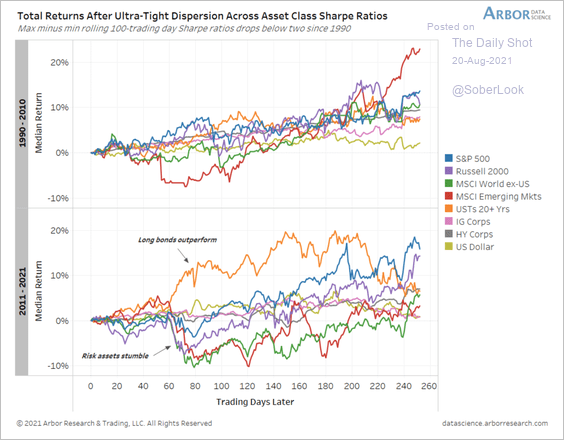

Here is a look at median returns after periods of tight dispersion in Sharpe ratios.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

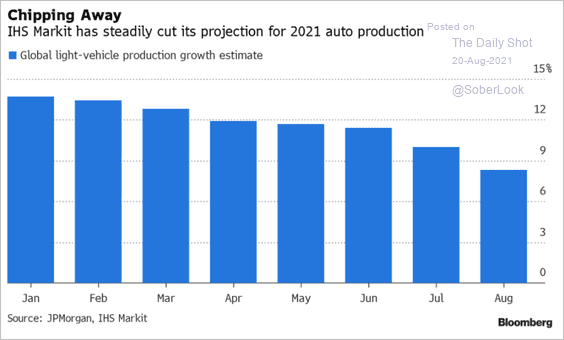

3. Global vehicle production continues to shrink.

Source: @crtrud Read full article

Source: @crtrud Read full article

——————–

Food for Thought

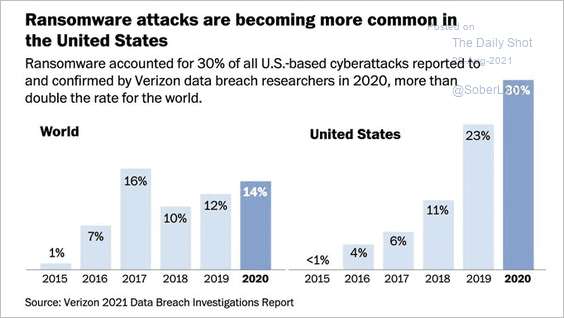

1. Ransomware attacks:

Source: @RitholtzWealth Read full article

Source: @RitholtzWealth Read full article

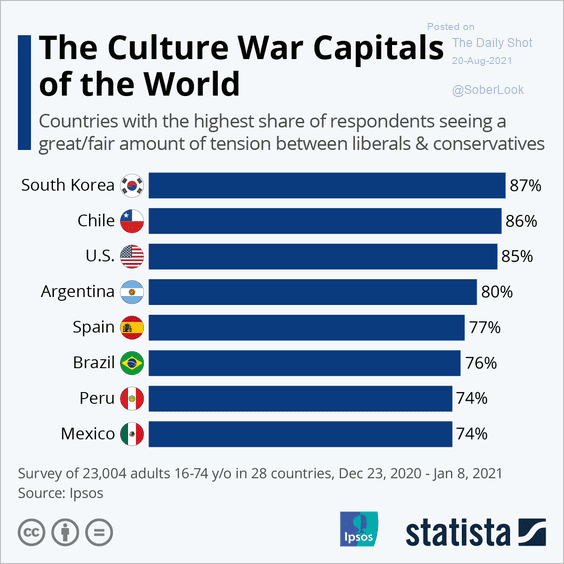

2. Tensions between liberals and conservatives:

Source: Statista

Source: Statista

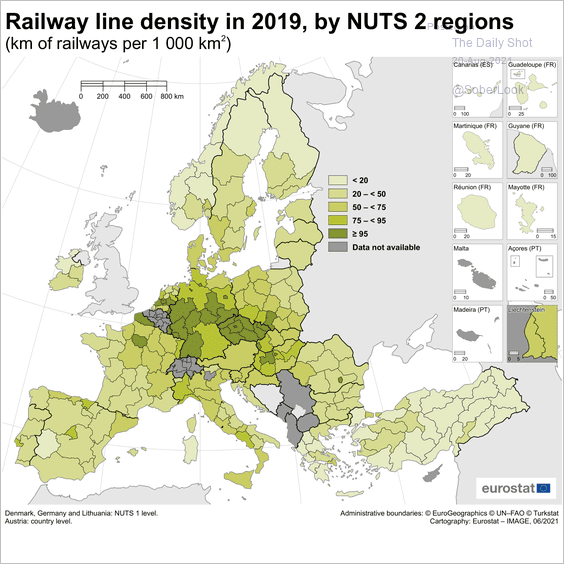

3. Railway density in Europe:

Source: Eurostat Read full article

Source: Eurostat Read full article

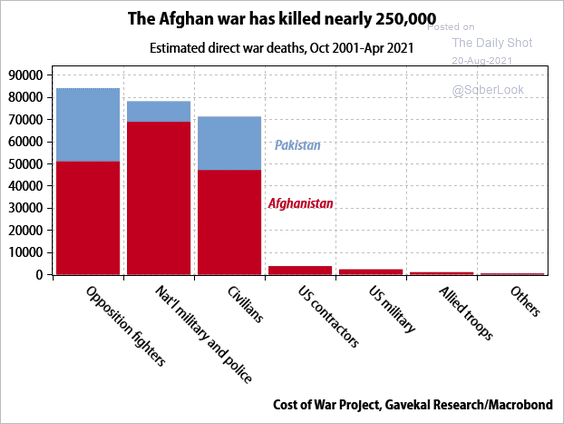

4. Afghan war deaths:

Source: Gavekal Research

Source: Gavekal Research

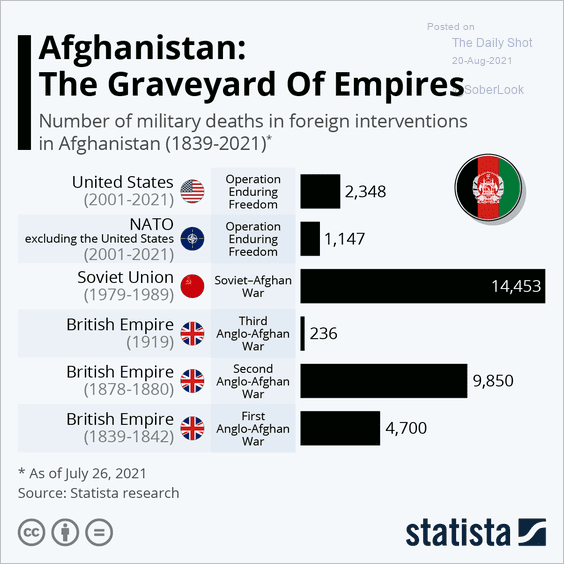

5. Afghanistan, the graveyard of empires:

Source: Statista

Source: Statista

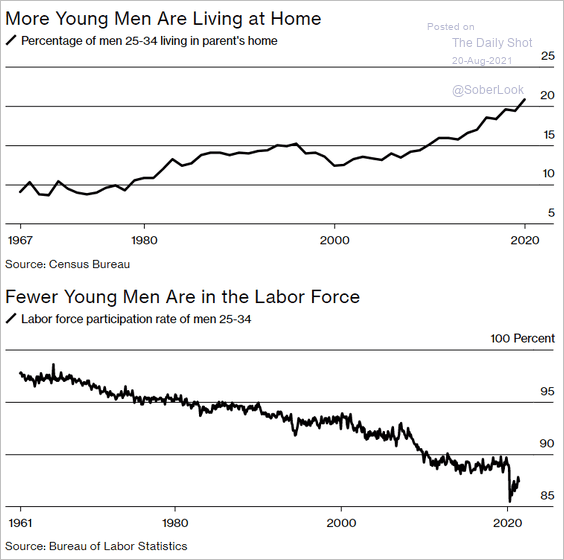

6. Young men living with parents and their labor force participation:

Source: @BW Read full article

Source: @BW Read full article

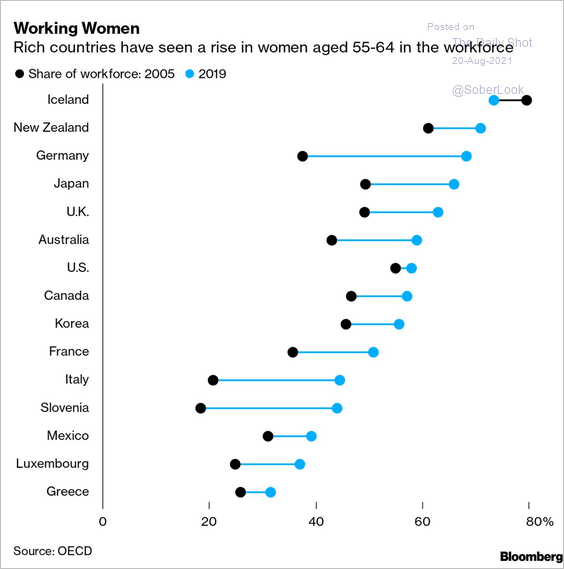

7. Women aged 55-64 in the workplace:

Source: @bbgequality Read full article

Source: @bbgequality Read full article

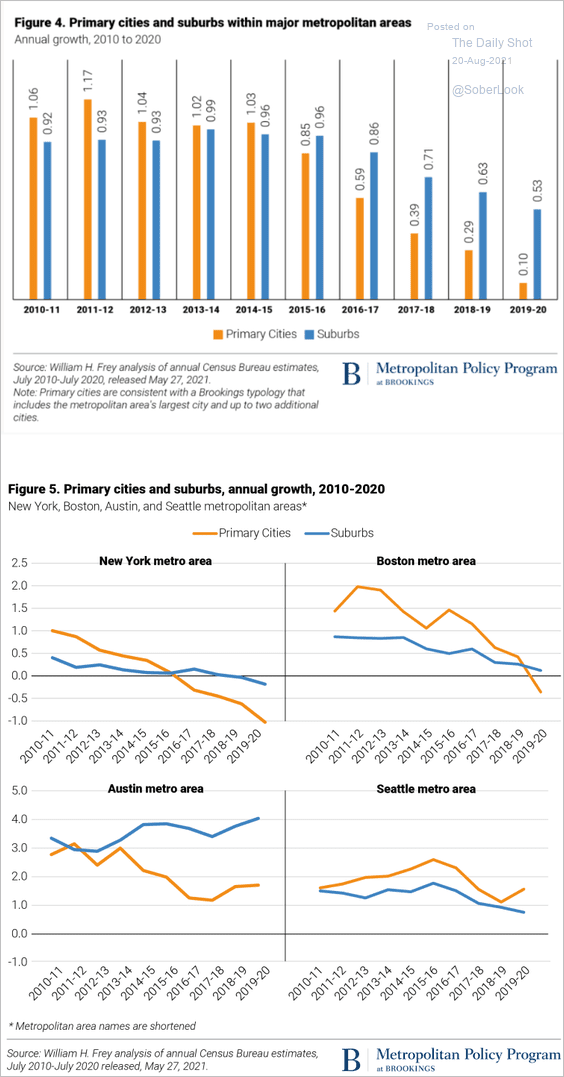

8. Population growth in US primary cities and suburbs within metro areas:

Source: The Brookings Institution Read full article

Source: The Brookings Institution Read full article

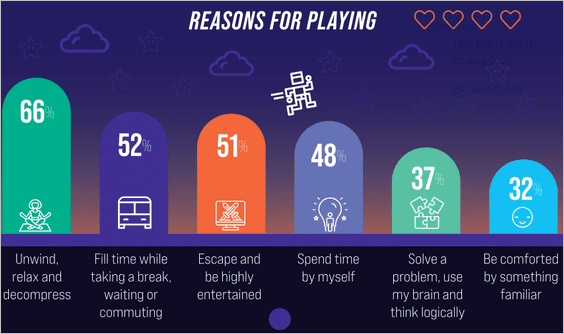

9. Reasons for playing videogames:

Source: ESA Read full article

Source: ESA Read full article

——————–

Have a great weekend!

Back to Index