The Daily Shot: 27-Aug-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

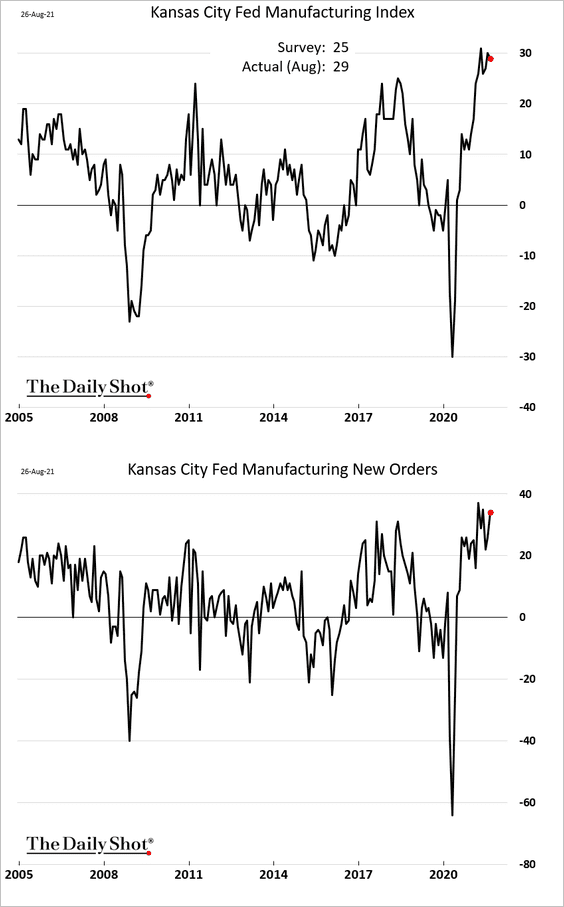

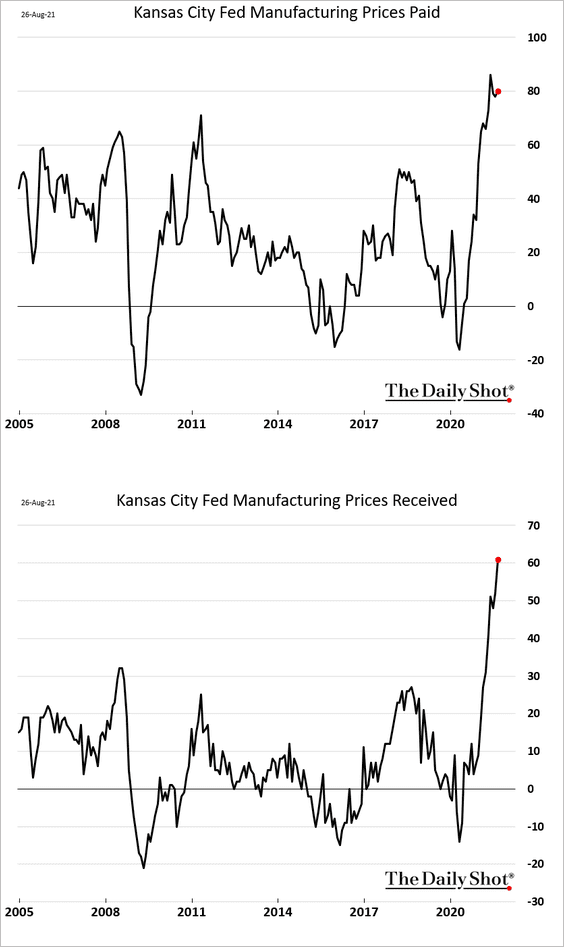

1. The Kansas City Fed’s manufacturing report continues to show robust expansion in factory activity (in contrast to what we saw from the Richmond Fed).

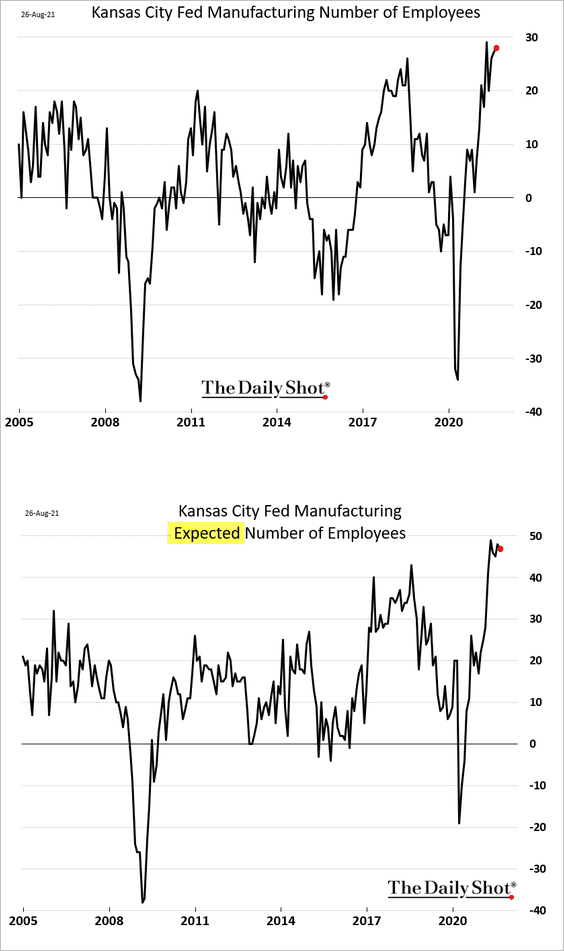

• Factory employment remains strong, and manufacturers expect to keep on hiring.

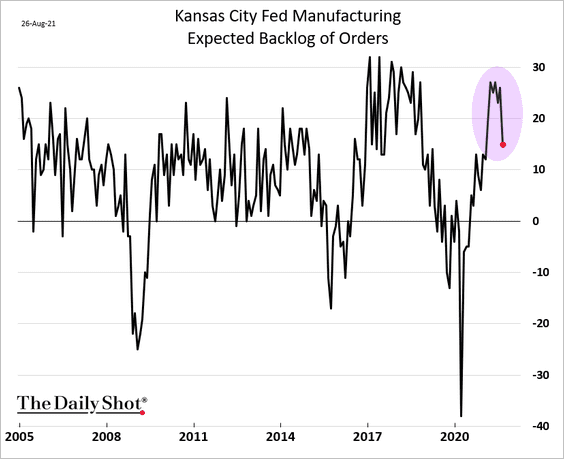

• The region’s manufacturers expect the backlog of orders to ease.

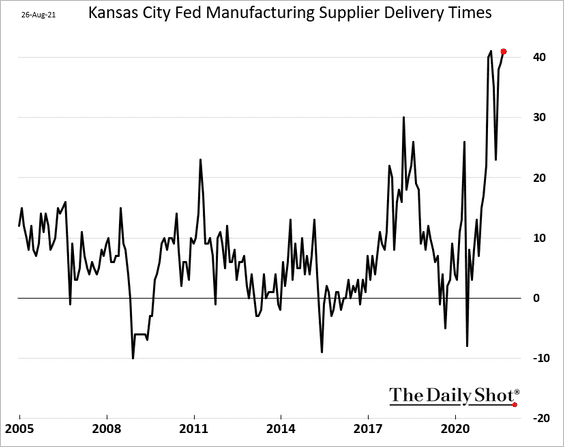

For now, however, supplier delivery times remain at extreme levels.

• And just as we saw in other regional and national surveys, price pressures persist.

——————–

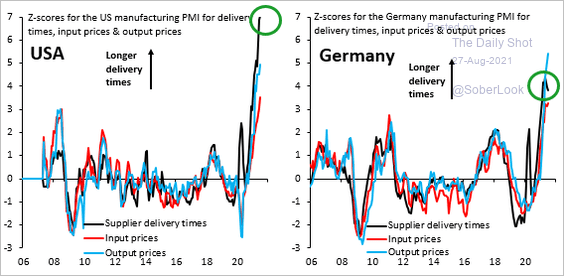

2. Supplier bottlenecks have been worse in the US than in Europe because the massive US fiscal stimulus has been pumping up demand.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

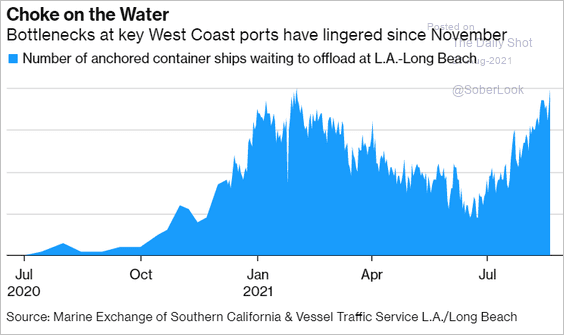

The number of anchored container ships at key West Coast ports is back near the highs.

Source: @markets Read full article

Source: @markets Read full article

——————–

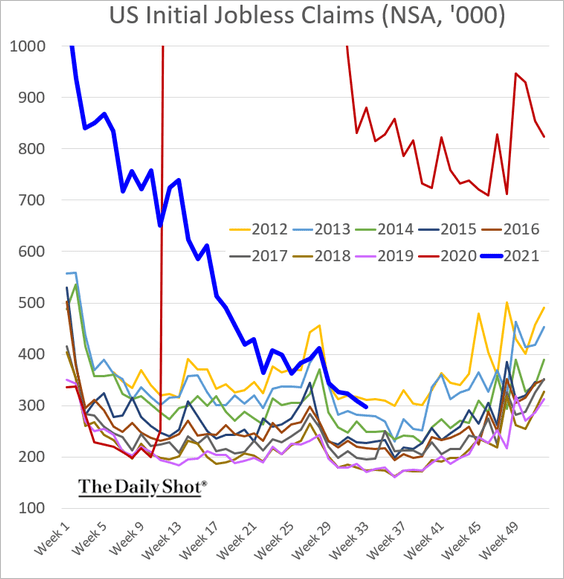

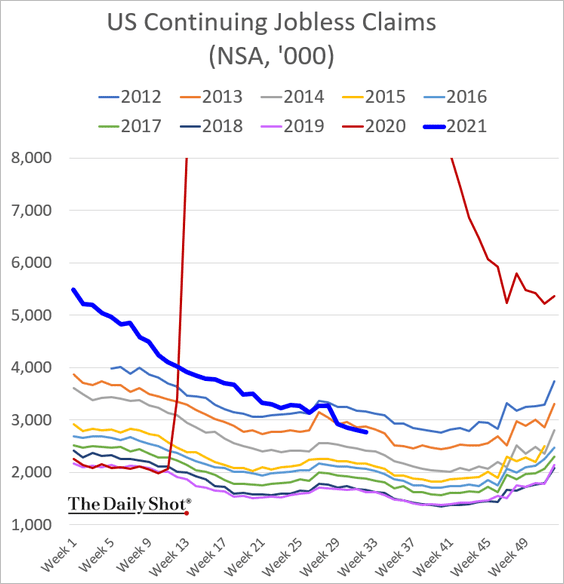

3. Unemployment claims (excluding emergency benefits) continue to move lower.

• Continuing claims have been holding near 2013 levels.

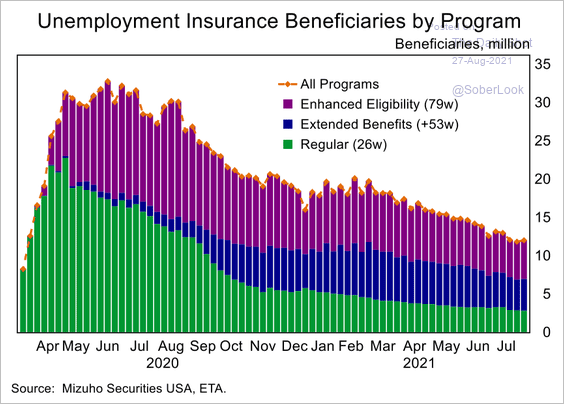

This chart shows continuing claims, including the emergency benefits.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

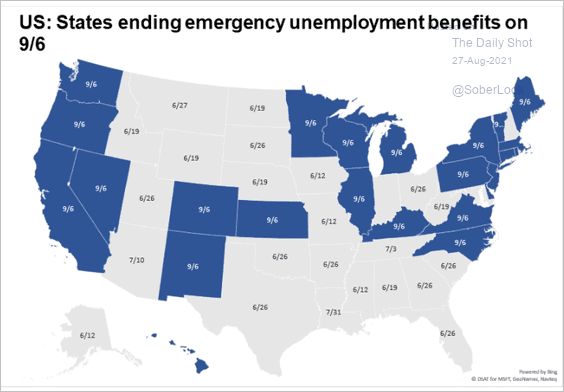

• These extra benefits are about to expire, creating an income cliff.

Source: Oxford Economics

Source: Oxford Economics

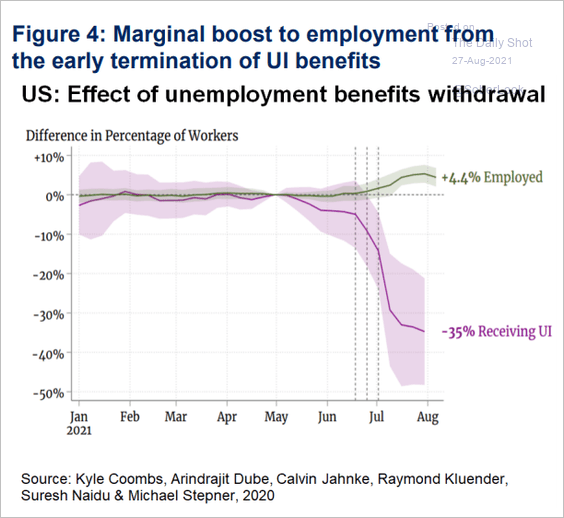

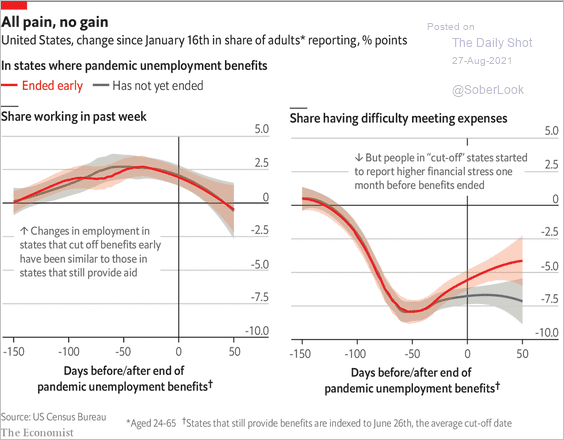

Will Americans return to work after losing unemployment benefits? The employment boost in states that already terminated these programs was modest, with labor shortages persisting.

Source: Oxford Economics

Source: Oxford Economics

Source: The Economist Read full article

Source: The Economist Read full article

——————–

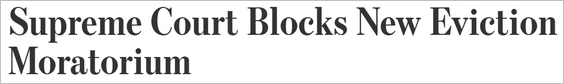

4. Adding to the income cliff will be a massive wave of evictions, …

Source: @WSJ Read full article

Source: @WSJ Read full article

… while rents are surging.

Source: Evercore ISI

Source: Evercore ISI

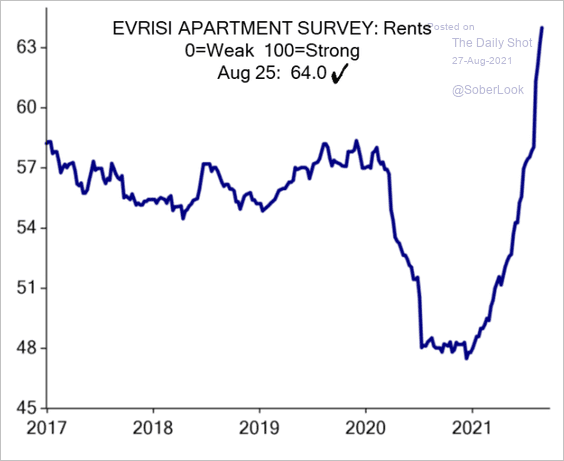

• The trend of households moving out of their rentals to buy a house has petered out …

Source: Evercore ISI

Source: Evercore ISI

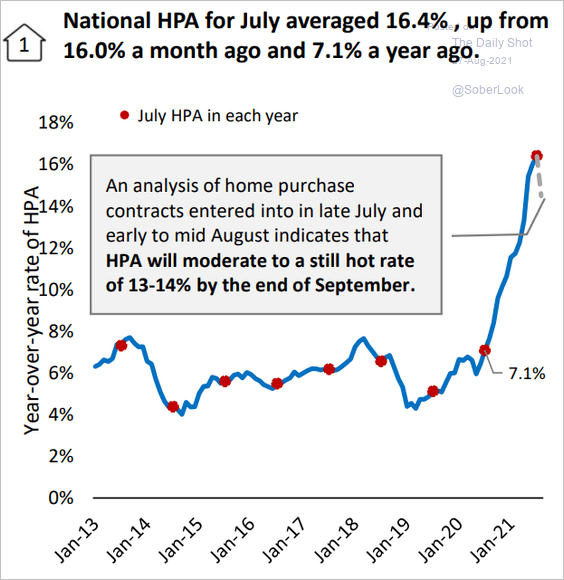

… as house prices soared.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

——————–

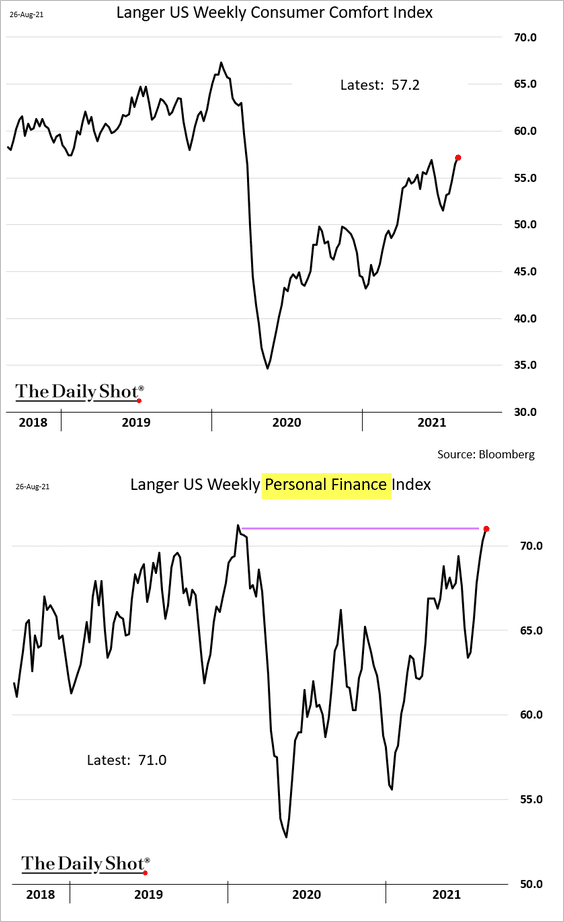

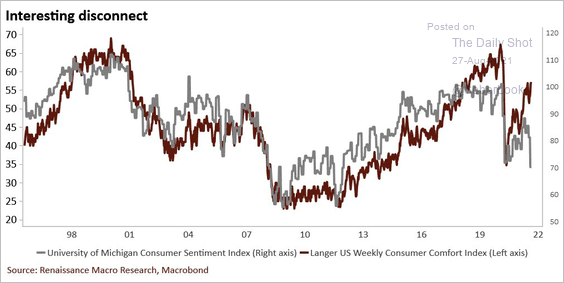

5. Unlike the U. Michigan report, the Langer Consumer Comfort Index shows improvements in household sentiment.

Source: @RenMacLLC

Source: @RenMacLLC

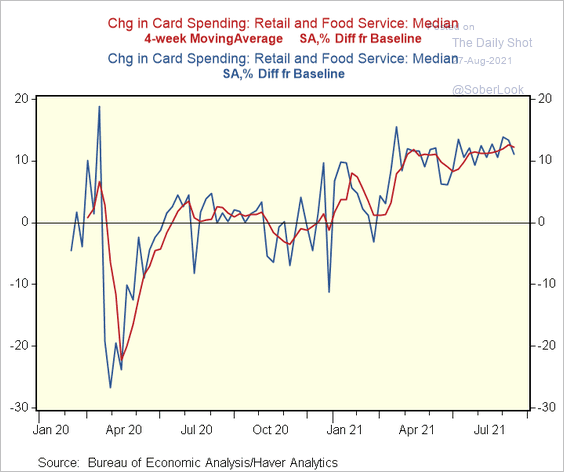

Card data indicate that spending remains robust. Will the income cliff derail this trend?

Source: @RenMacLLC, @BEA_News

Source: @RenMacLLC, @BEA_News

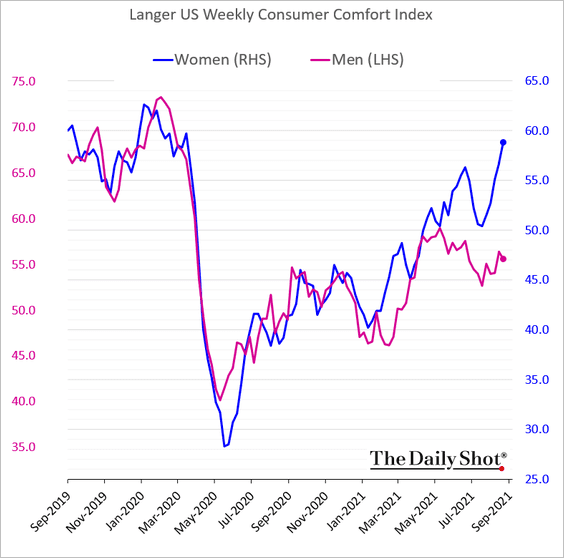

6. There is a widening gap in US consumer confidence between women and men.

——————–

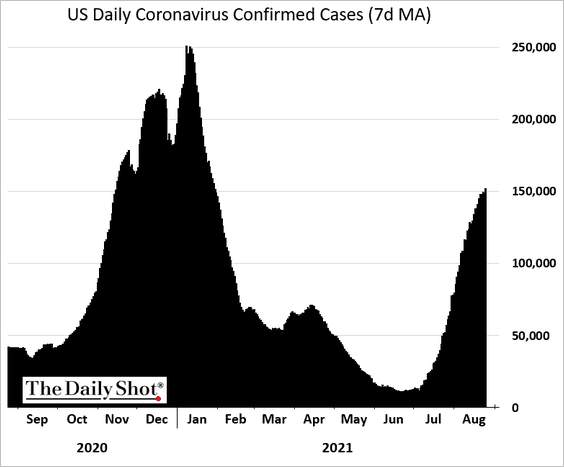

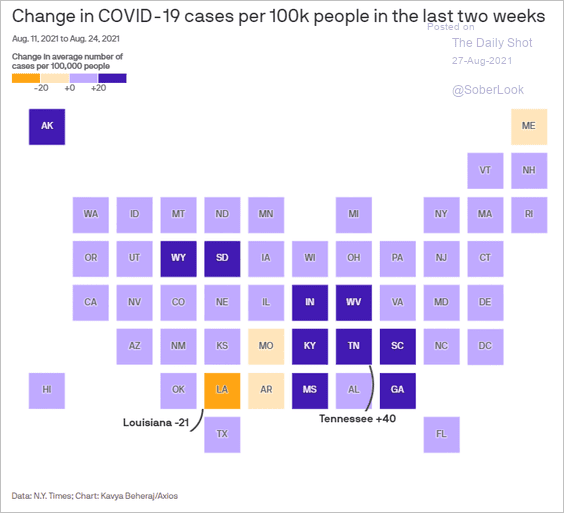

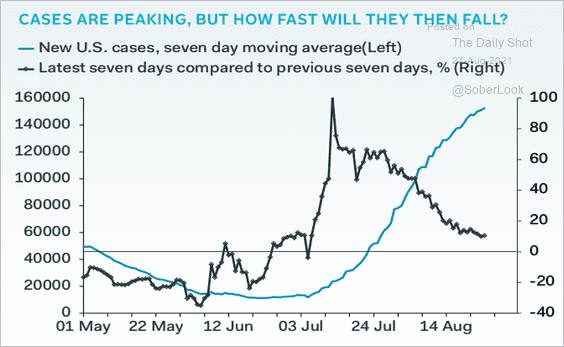

7. Models continue to suggest that US COVID cases should be peaking. They haven’t so far.

Source: @axios Read full article

Source: @axios Read full article

But the increases in new daily cases are moderating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

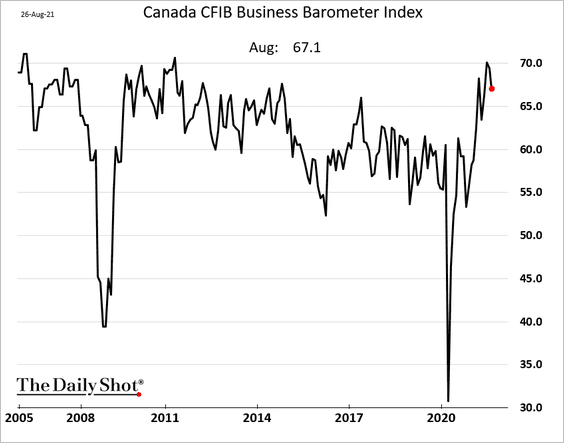

The CFIB small/medium business activity index pulled back from the highs this month.

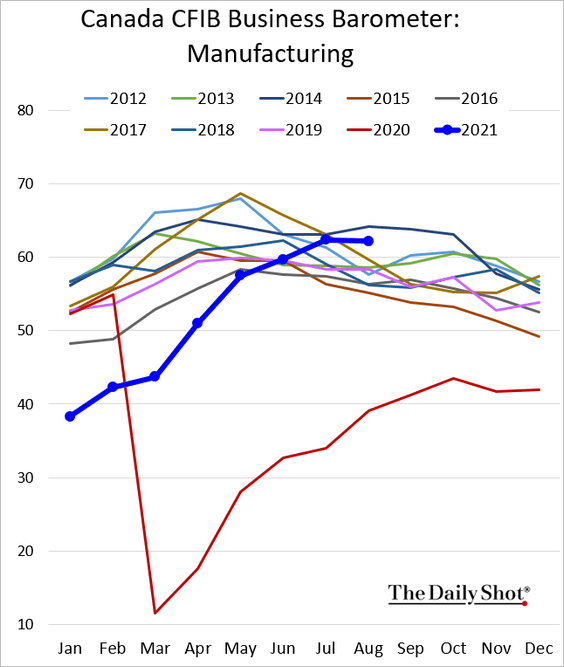

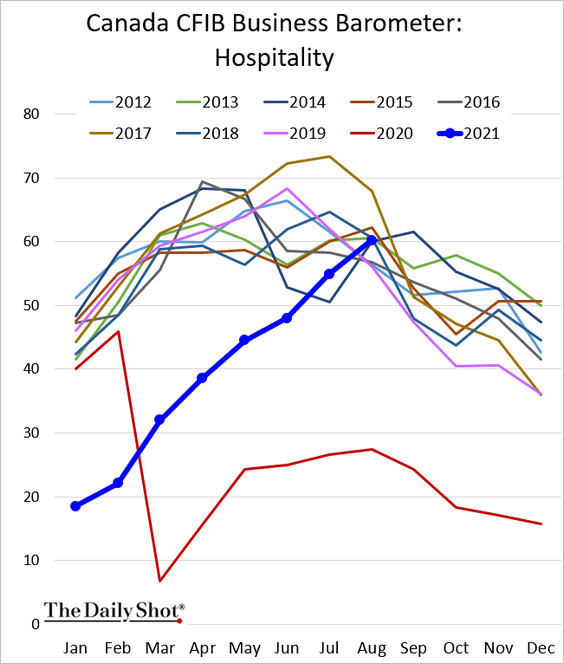

The underlying trends remain strong.

• Manufacturing:

• Hospitality:

Back to Index

The United Kingdom

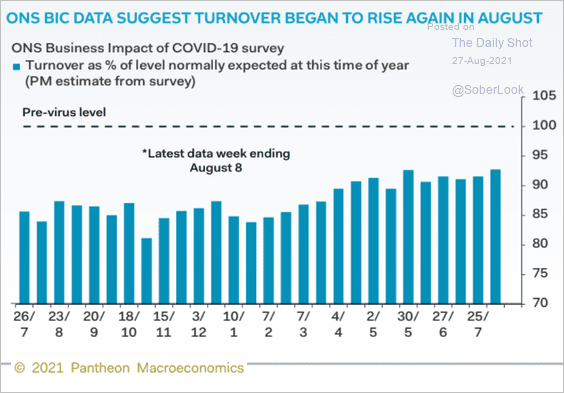

1. In contrast to the PMI reports, the ONS survey points to faster sales growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

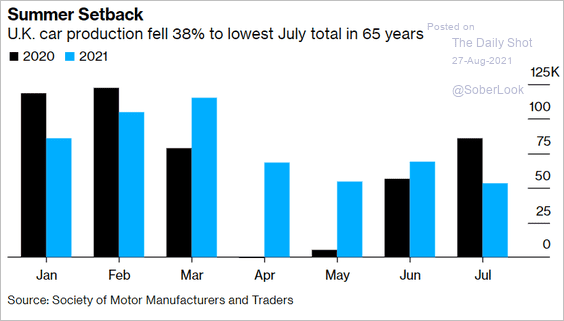

2. Automobile production in July was the lowest in 65 years.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

The Eurozone

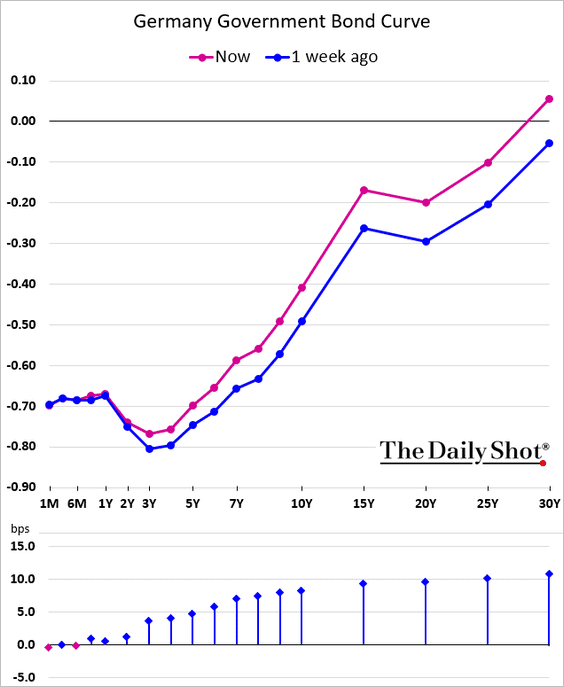

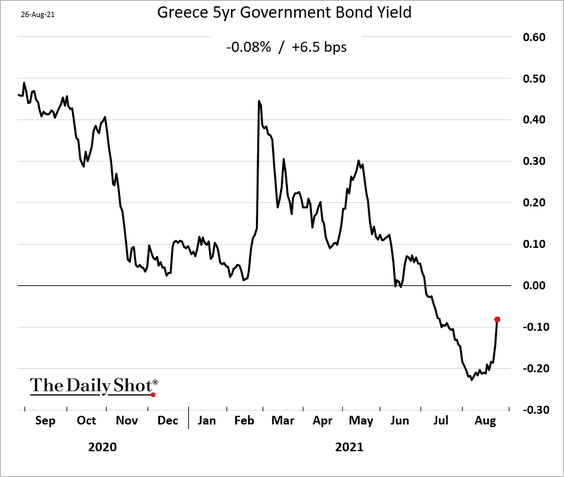

1. The Bund curve has steepened.

Yields moved higher across Europe.

——————–

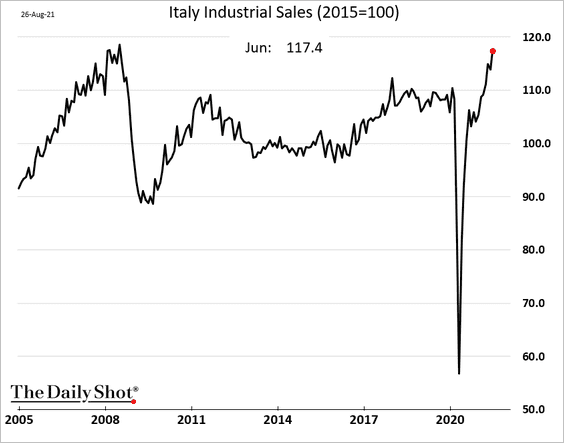

2. Italian industrial sales continued to surge in June.

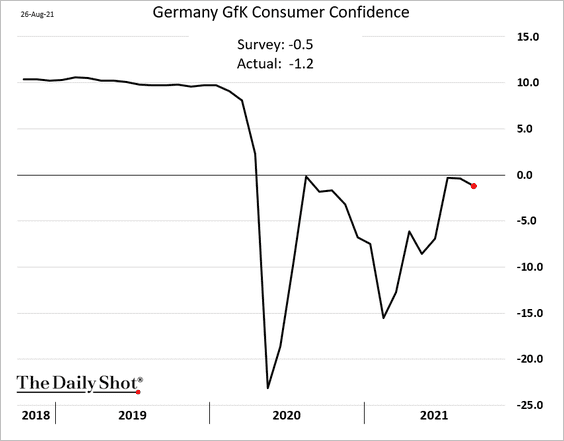

3. German consumer confidence retreated this month.

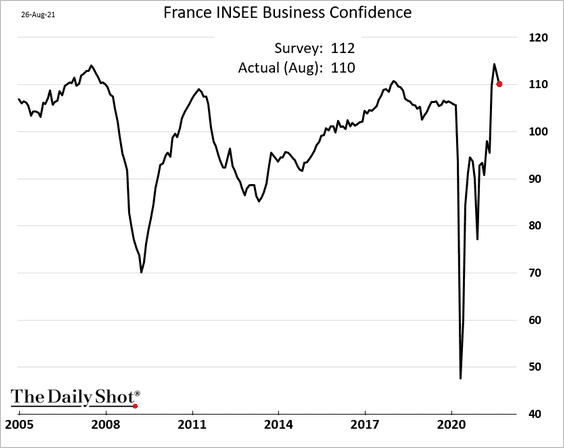

4. French business confidence came off the highs but remains healthy.

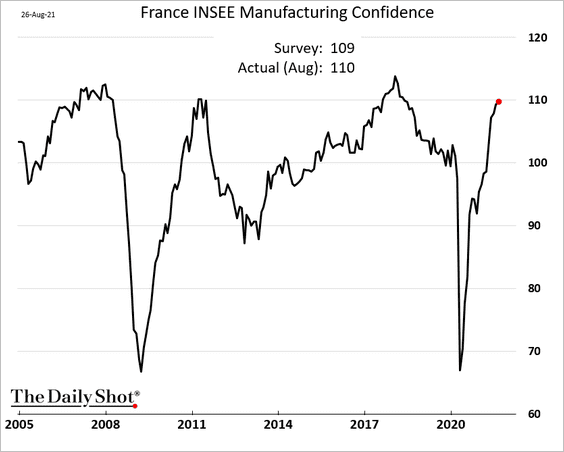

Manufacturing confidence continues to improve.

——————–

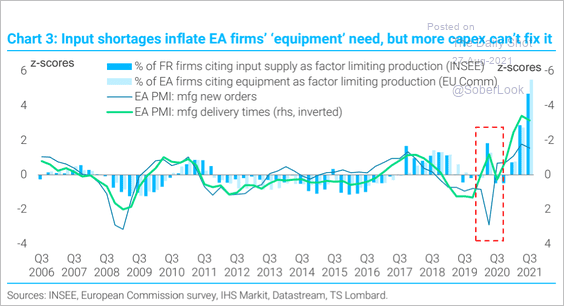

5. Shortages of supplies and equipment are hindering production.

Source: TS Lombard

Source: TS Lombard

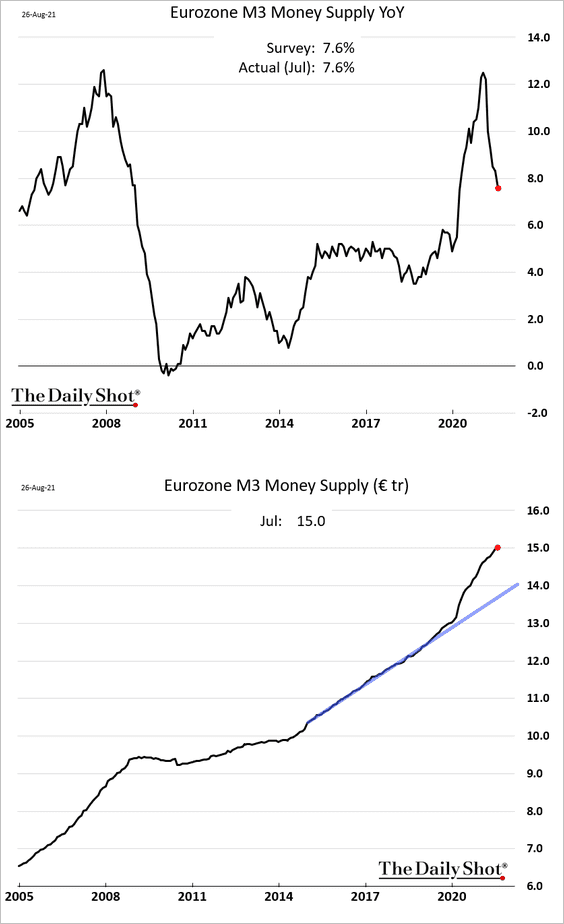

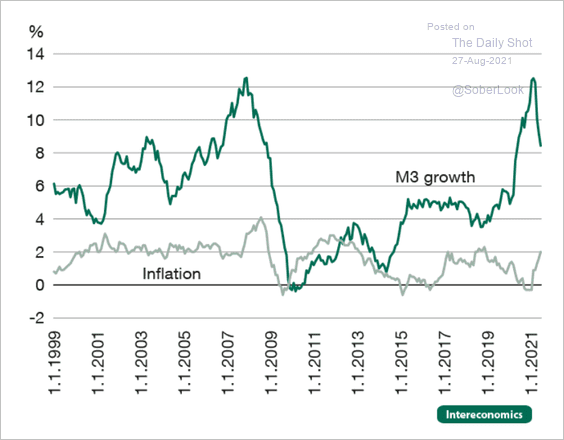

6. The broad money supply growth has been moderating.

Does that mean lower inflation? Unlikely. There isn’t much of a relationship between the two.

Source: Intereconomics Read full article

Source: Intereconomics Read full article

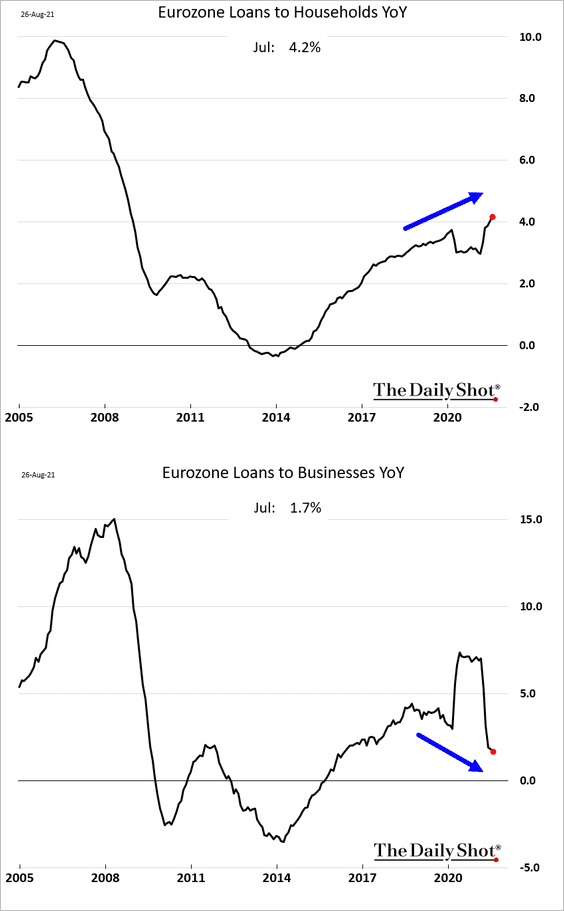

7. The divergence in loan growth trends between households and businesses keeps widening.

Back to Index

Europe

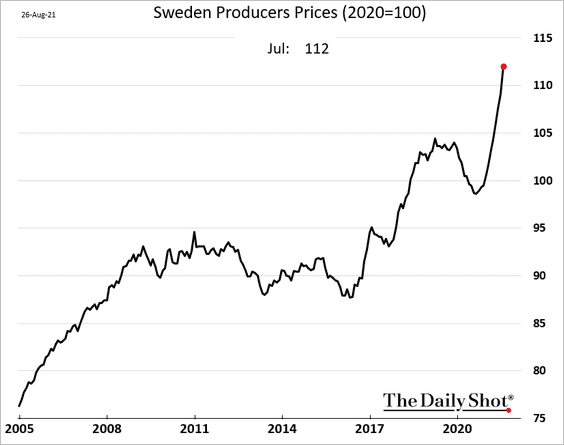

1. Sweden’s producer prices are soaring.

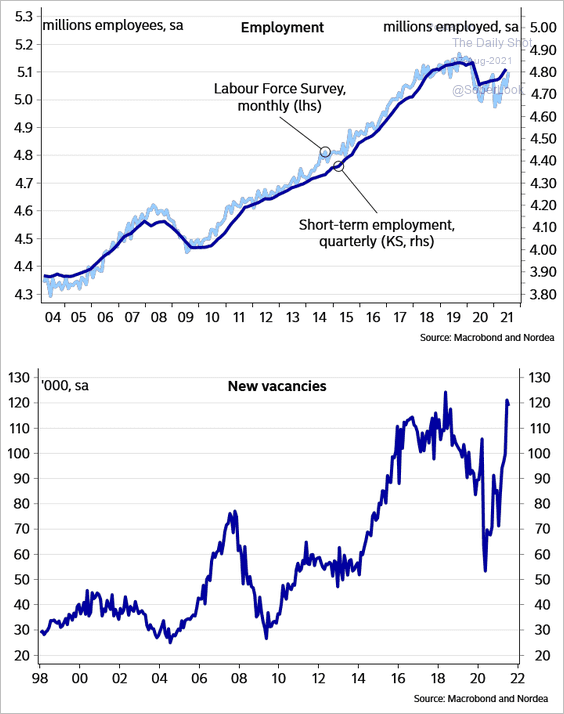

The Swedish labor market continues to improve.

Source: Nordea Markets

Source: Nordea Markets

——————–

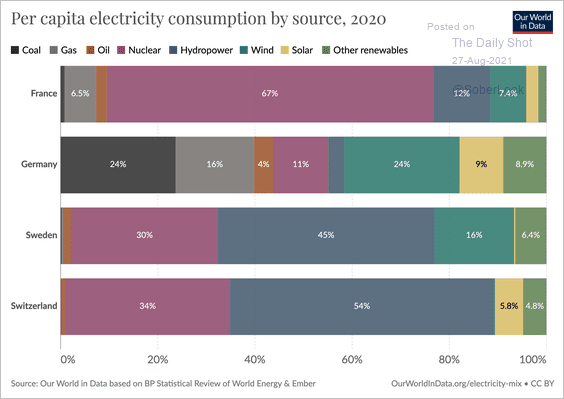

2. Next, we have a couple of updates on European energy usage.

• Electricity consumption by source:

Source: @MaxCRoser Read full article

Source: @MaxCRoser Read full article

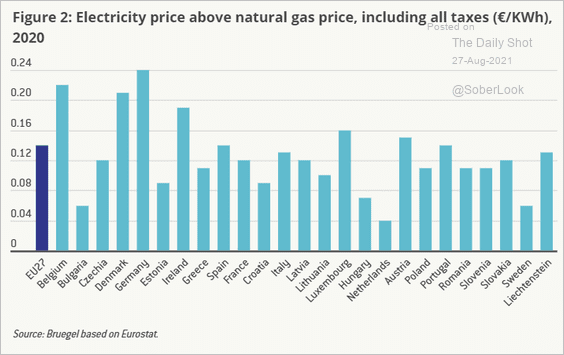

• The spread between electricity and natural gas prices:

Source: Bruegel Read full article

Source: Bruegel Read full article

Back to Index

Asia – Pacific

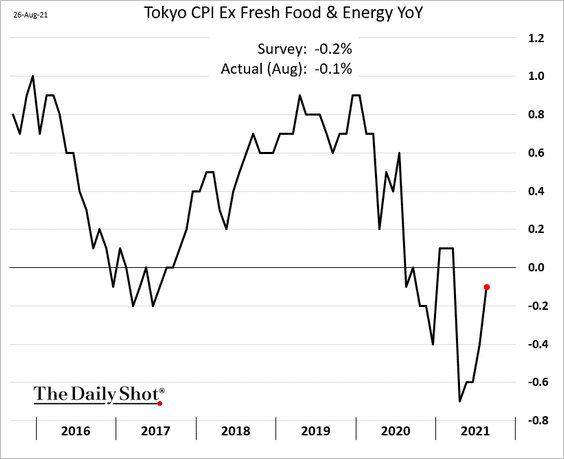

1. The August Tokyo core CPI was a touch stronger than expected. Will the index finally move into positive territory next month?

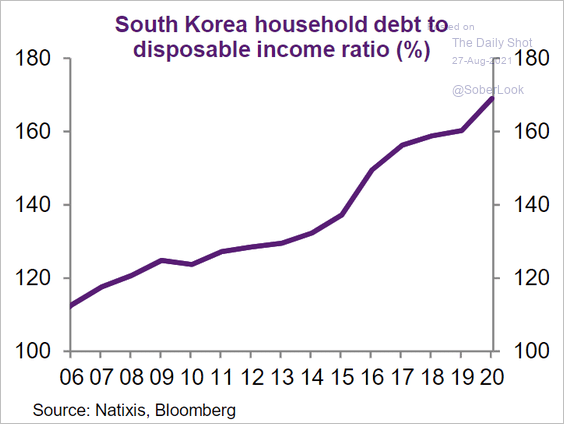

2. South Korea’s household leverage has been climbing for years. This was a consideration for the central bank as it hiked rates from record lows.

Source: Natixis

Source: Natixis

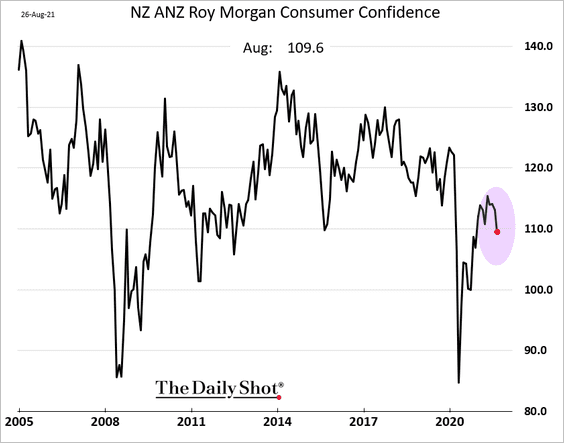

3. New Zealand’s consumer confidence deteriorated this month.

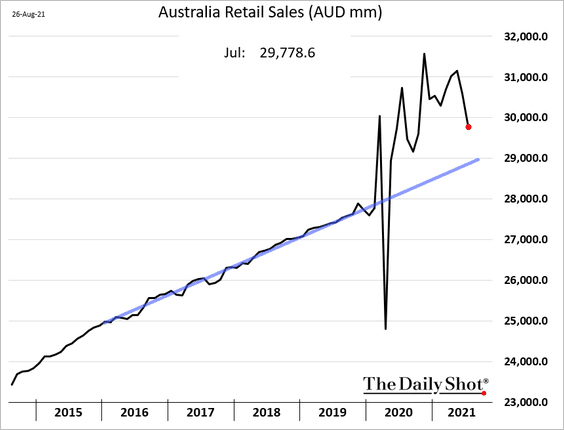

4. Australian retail sales declined again.

Back to Index

China

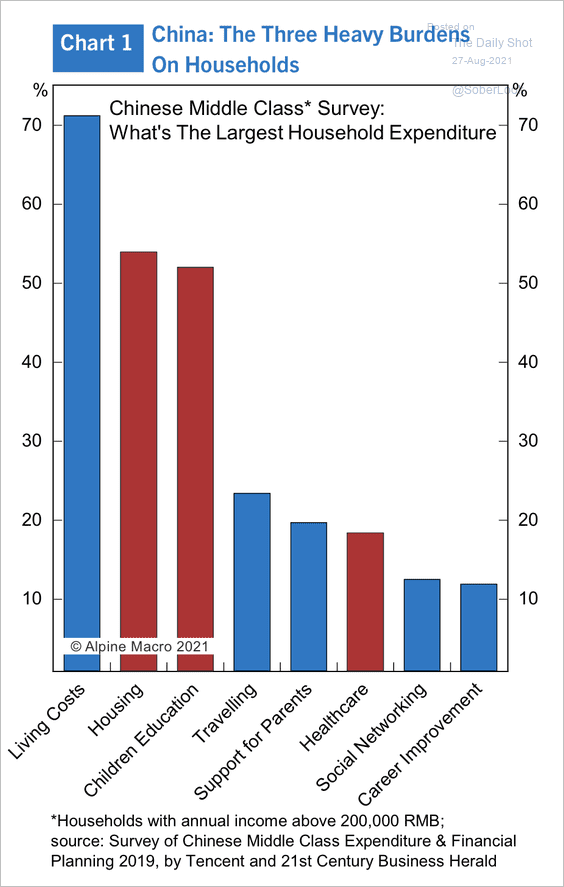

1. Middle-class households are burdened by the high cost of living and childcare, which is one reason for recent government reforms.

Source: Alpine Macro

Source: Alpine Macro

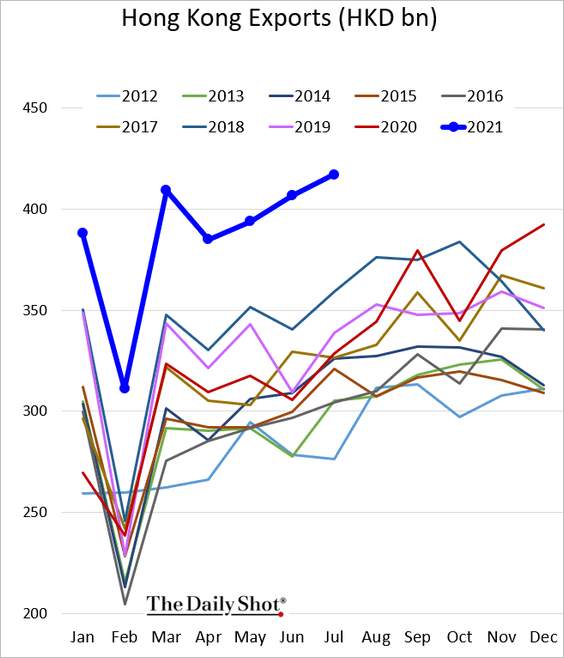

2. Hong Kong’s exports hit a record high.

Back to Index

Emerging Markets

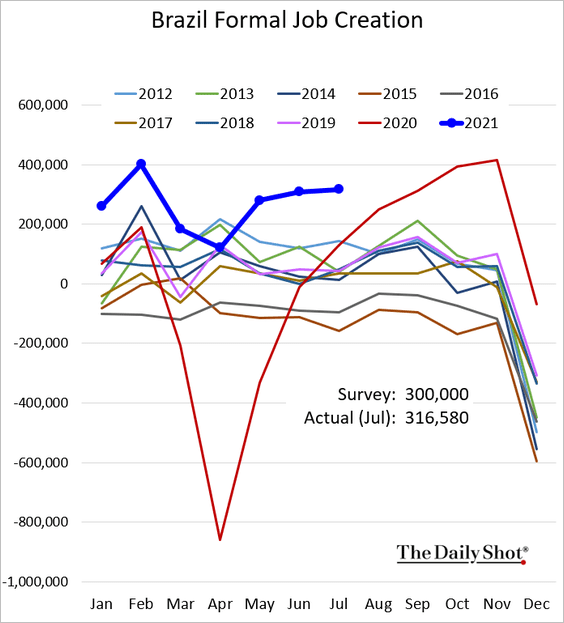

1. Formal job creation in Brazil remains firm.

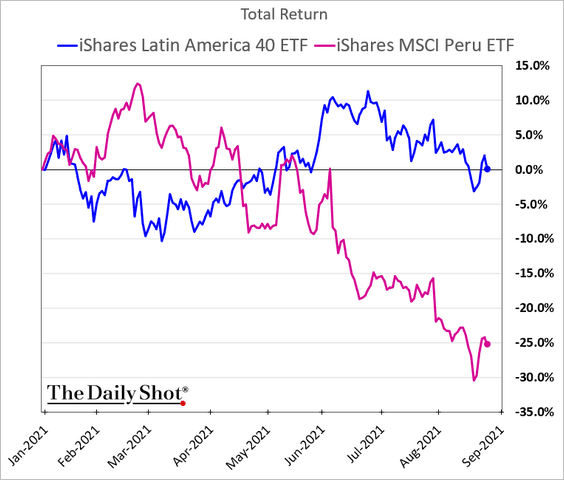

2. Capital outflows from Peru continue to pressure asset prices amid concerns about the new leftist government.

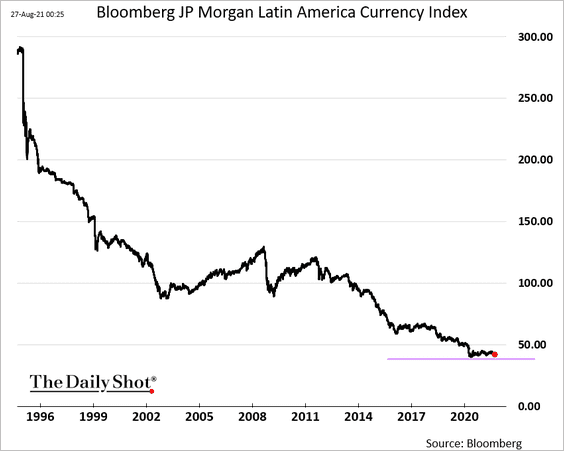

3. Have LatAm currencies finally bottomed?

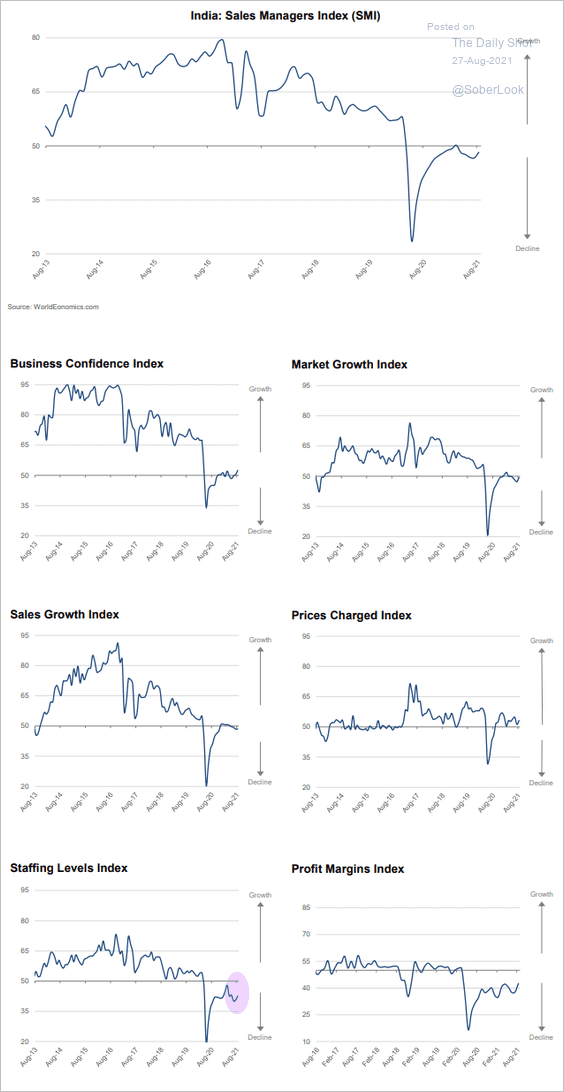

4. India’s business sector remains in contraction mode, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

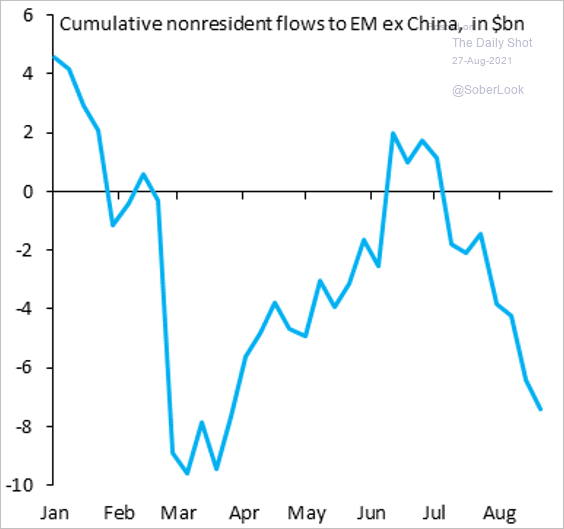

5. Emerging markets continue to see capital outflows.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

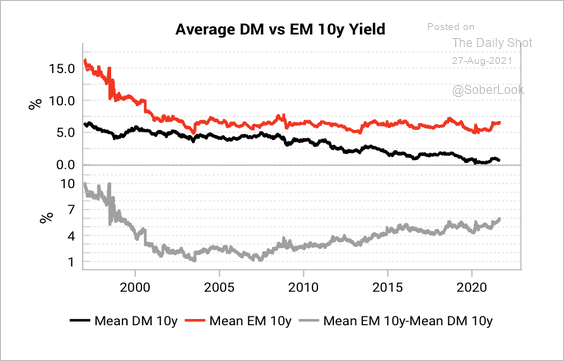

6. The spread between EM and DM real yields is the highest in 20 years.

Source: Variant Perception

Source: Variant Perception

Back to Index

Commodities

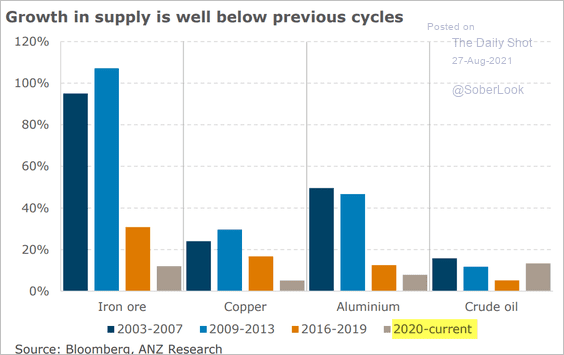

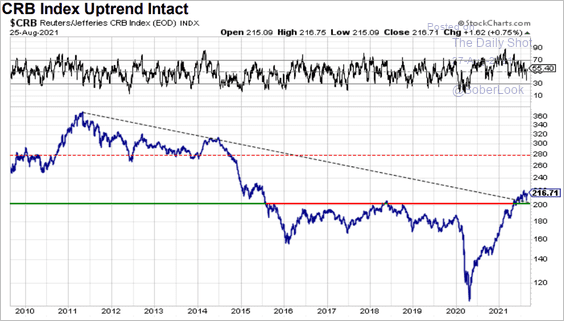

1. Both fundamental and technical indicators remain bullish for commodities.

• Supply growth is low relative to previous cycles.

Source: ANZ Research

Source: ANZ Research

• The CRB broad commodities index broke above long-term resistance.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

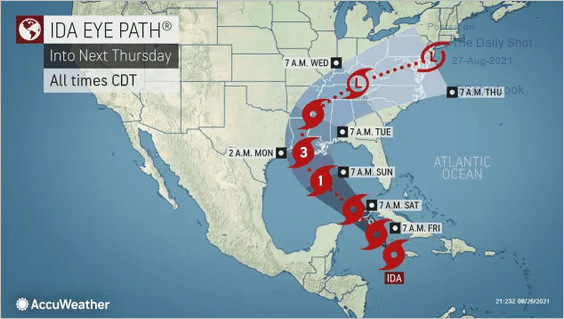

2. Soybean backwardation (Sep – Nov spread) jumped as Tropical Storm Ida heads toward the US Gulf Coast.

Source: @markets Read full article

Source: @markets Read full article

Source: AccuWeather

Source: AccuWeather

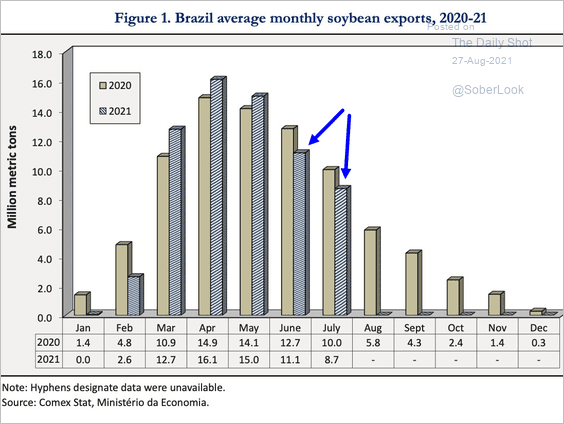

Traders are also watching softer soybean exports from Brazil.

Source: @FarmPolicy, @USDA_AMS Read full article

Source: @FarmPolicy, @USDA_AMS Read full article

Back to Index

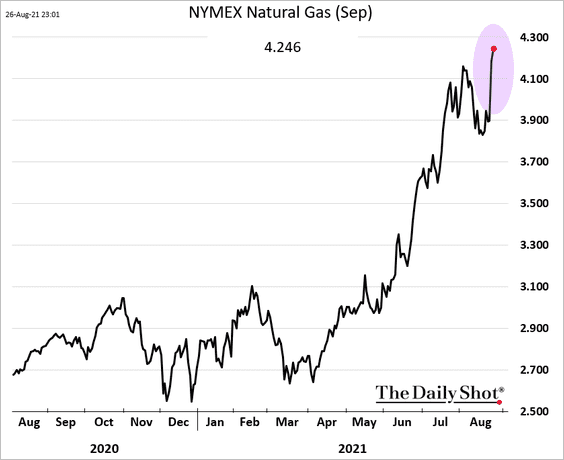

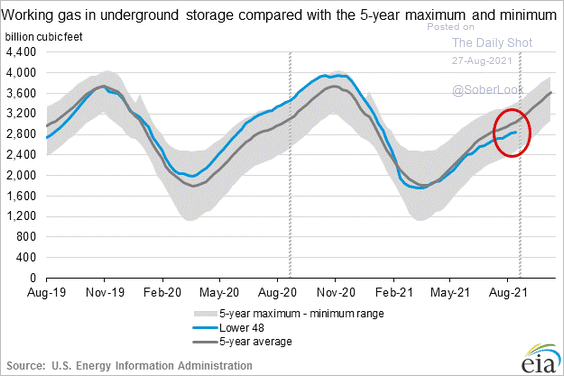

Energy

US natural gas futures surged 8% after the Department of Energy report showed smaller than expected injections into storage.

Back to Index

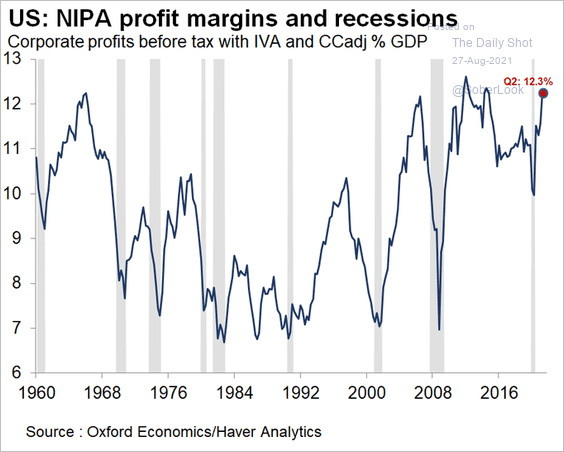

Equities

1. Corporate profits have been surging.

Source: @GregDaco

Source: @GregDaco

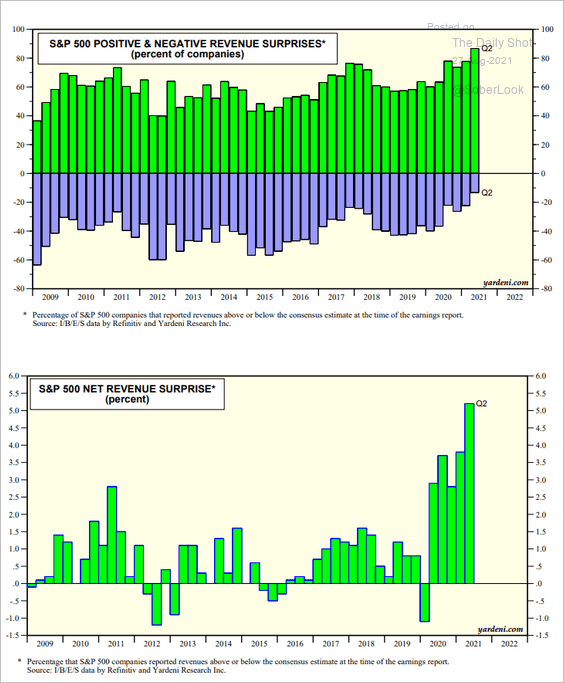

2. This chart shows S&P 500 revenue surprises over time.

Source: Yardeni Research

Source: Yardeni Research

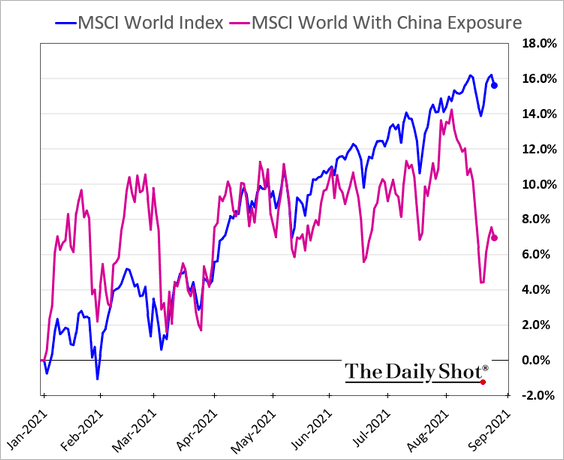

3. Companies with substantial sales in China have been underperforming.

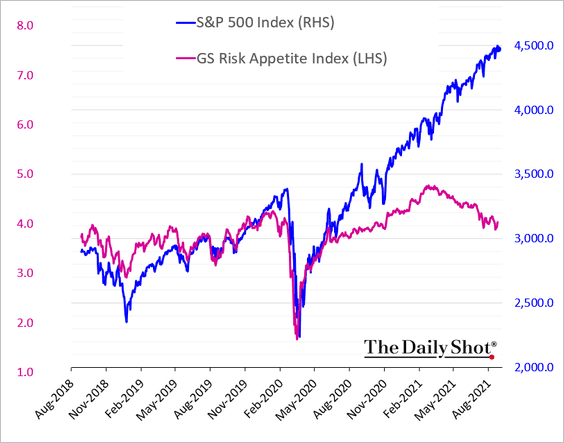

4. Stocks continue to rally despite moderating risk appetite.

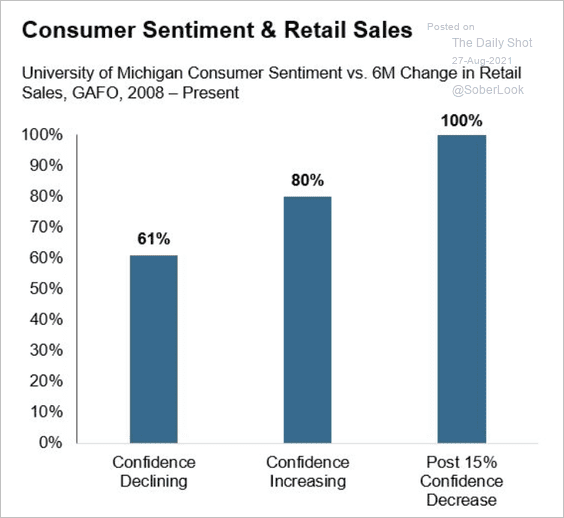

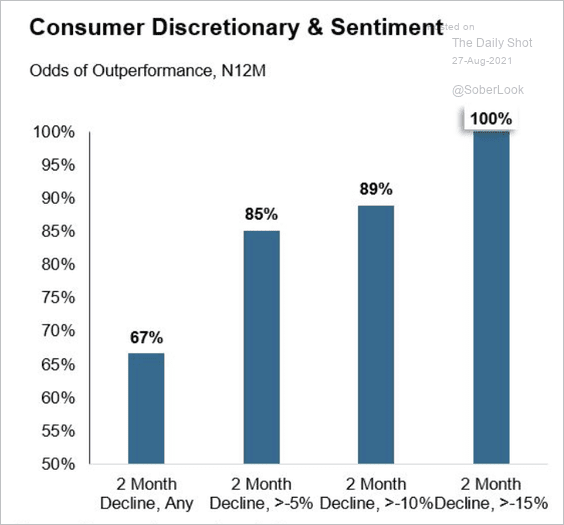

5. The sharp decline in US consumer sentiment typically precedes periods of outperformance for discretionary stocks (2 chars).

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

——————–

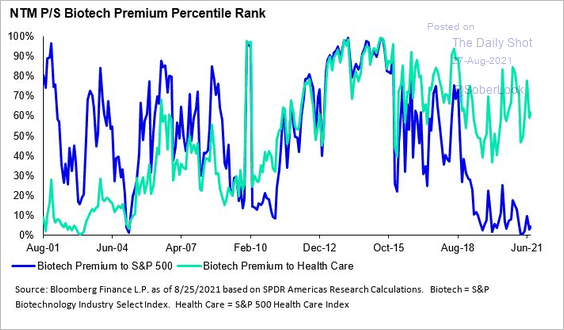

6. Biotech’s premium to the S&P 500 is in the bottom 5th percentile. Biotech has been underperforming the broader healthcare sector this year.

Source: Matthew Bartolini; SPDR Americas Research

Source: Matthew Bartolini; SPDR Americas Research

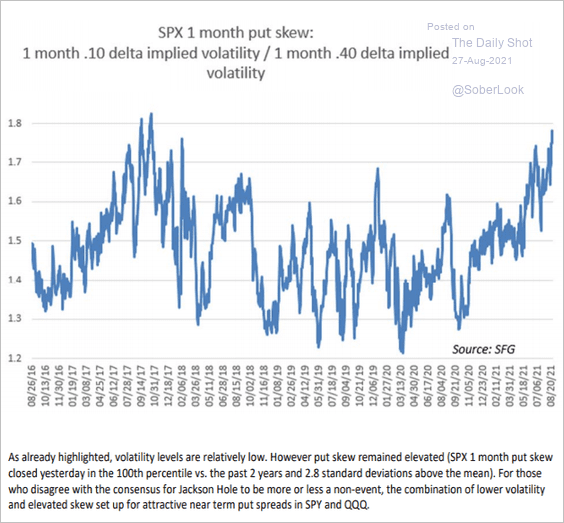

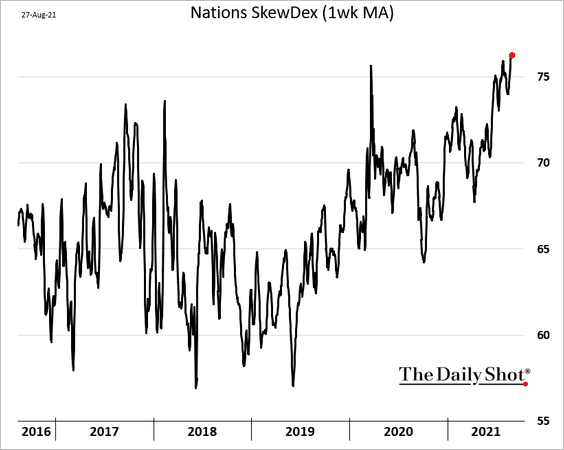

7. Option skew remains elevated ahead of Powell’s Jackson Hole speech (2 charts).

Source: Chris Murphy

Source: Chris Murphy

Back to Index

Credit

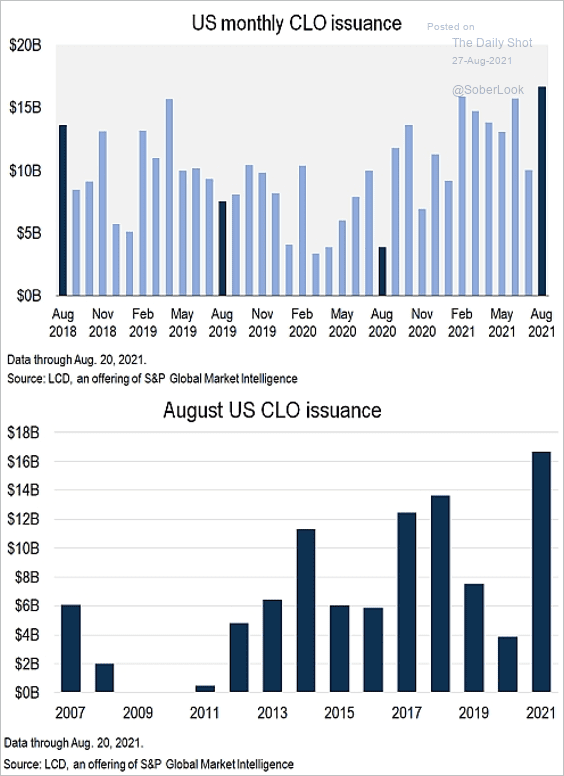

1. It’s been a good month for CLO issuance, …

Source: @lcdnews Read full article

Source: @lcdnews Read full article

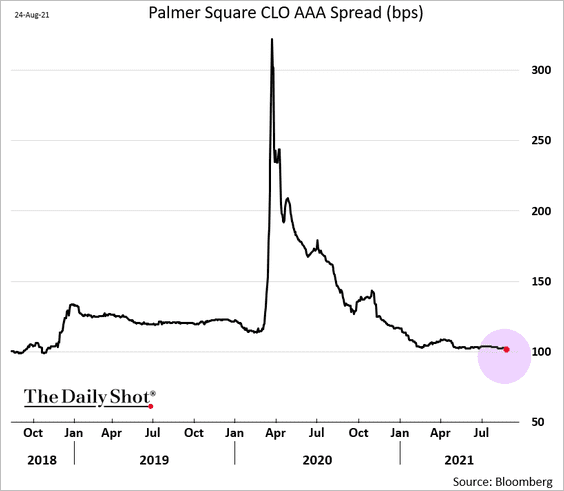

… as AAA spreads hit the lowest level since 2018. Demand remains robust.

——————–

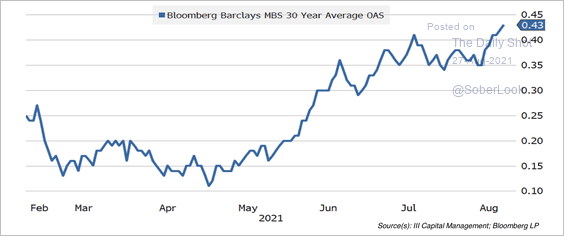

2. Mortgages have cheapened over the past few months, possibly in anticipation of a Fed taper.

Source: III Capital Management

Source: III Capital Management

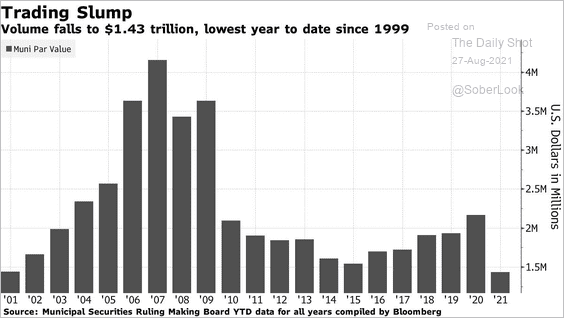

3. It’s been a slow year for muni trading.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

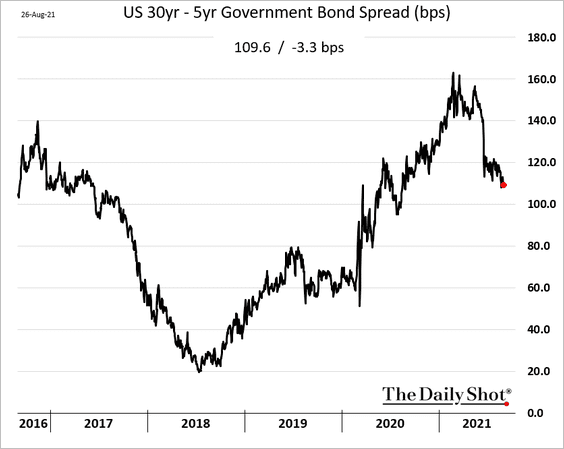

1. The Treasury curve flattened further at the longer end after a mediocre 7-year auction.

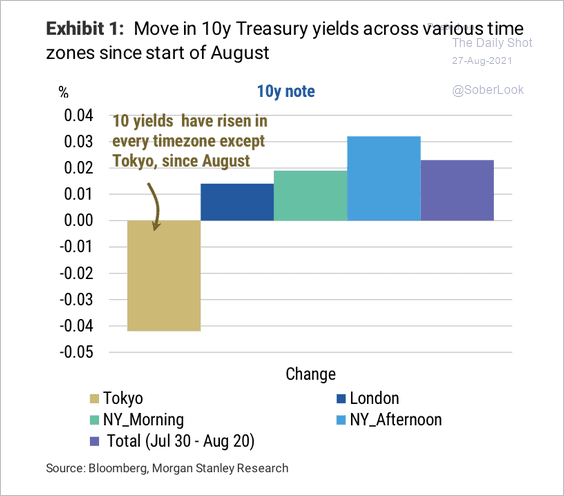

2. The 10-year Treasury yield has only declined during Tokyo trading hours this month.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

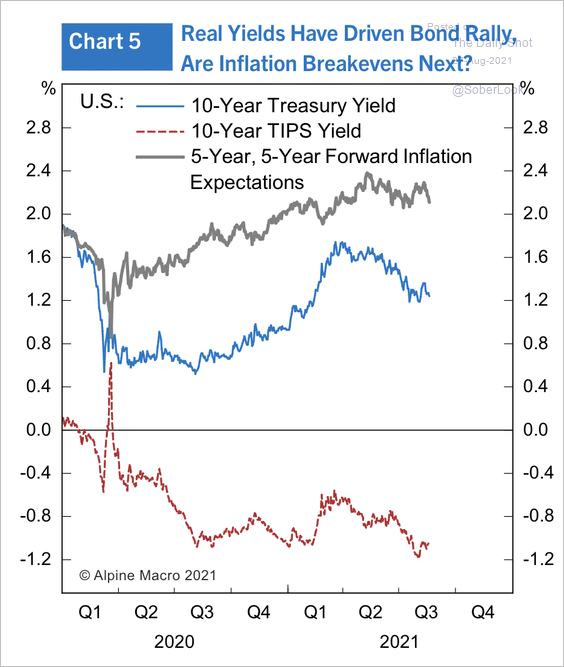

3. Real yields have not risen along with the 10-year Treasury yield over the past year.

Source: Alpine Macro

Source: Alpine Macro

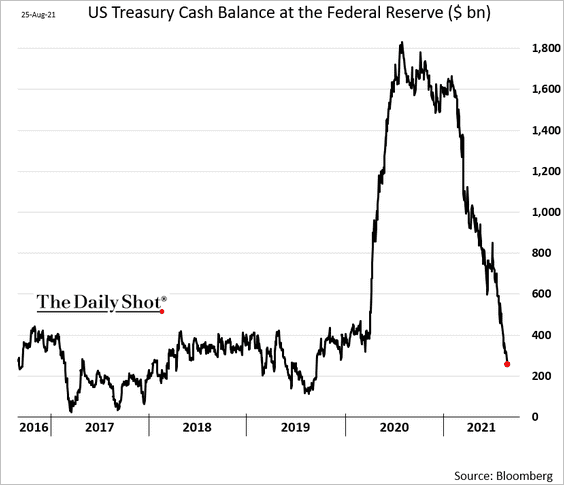

4. The US Treasury’s cash balances are rapidly declining, injecting more liquidity into the banking system.

Back to Index

Global Developments

1. Let’s begin with the currency markets.

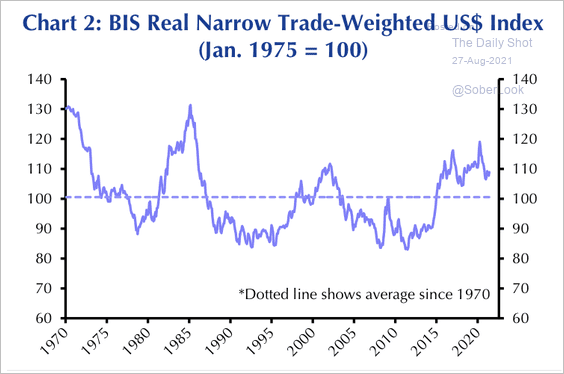

• The dollar’s overvaluation is not extreme by historical standards.

Source: Capital Economics

Source: Capital Economics

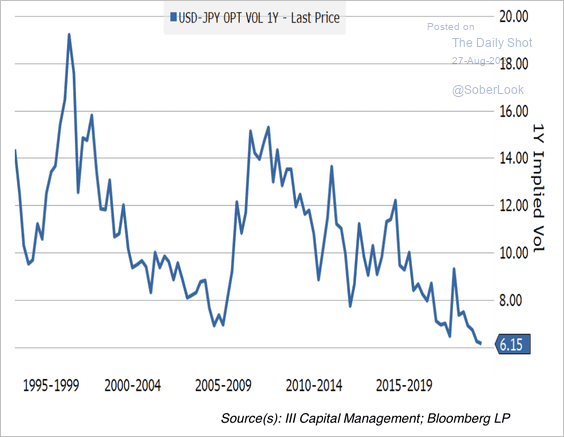

• The 1-year implied volatility of USD/JPY is at an extreme low.

Source: III Capital Management

Source: III Capital Management

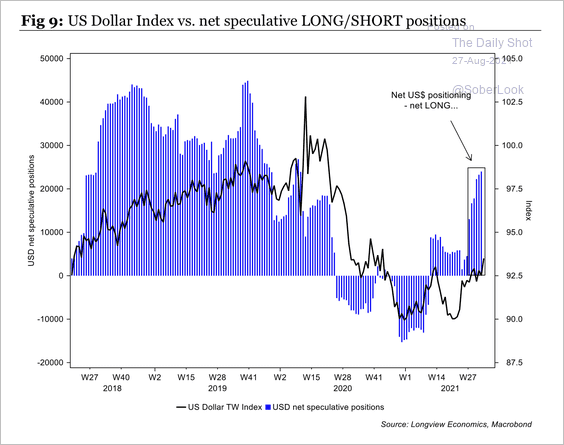

• Net-long dollar positioning appears to be stretched.

Source: Longview Economics

Source: Longview Economics

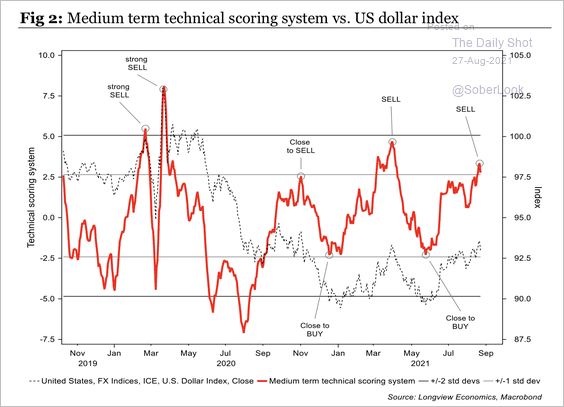

• Technicals suggest an intermediate-term pullback in the dollar.

Source: Longview Economics

Source: Longview Economics

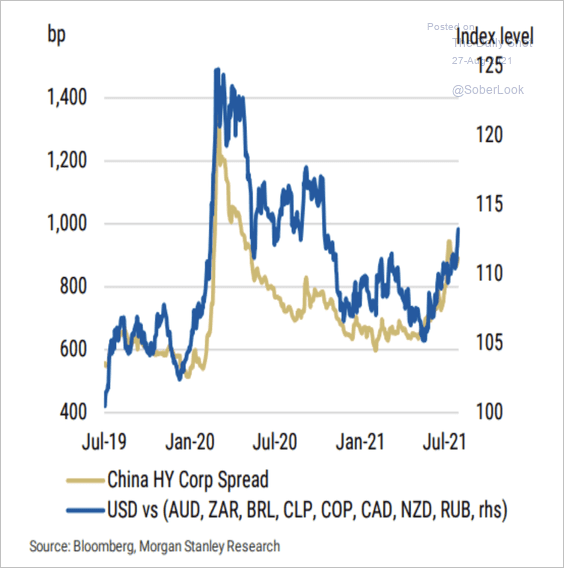

• Risk-on currencies have weakened along with the rise in China’s high-yield corporate bond spread.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

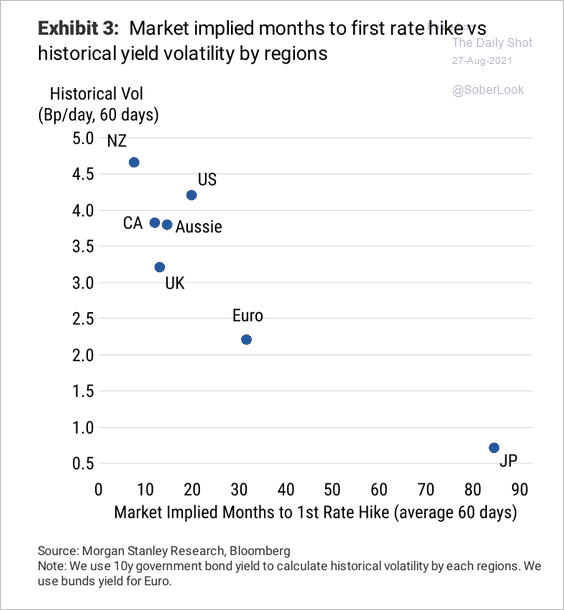

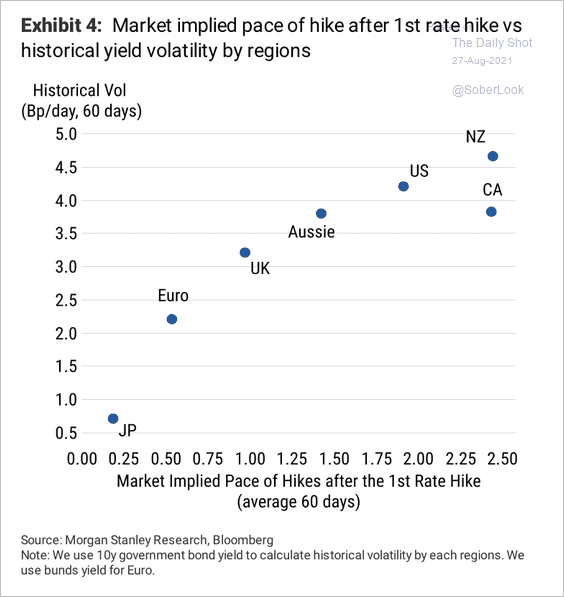

2. Yield volatility is highest in countries where the central bank is expected to tighten sooner rather than later and faster than slower (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

3. Semiconductor sales are at a record high but deliveries are supply-constrained.

![]() Source: Gavekal Research

Source: Gavekal Research

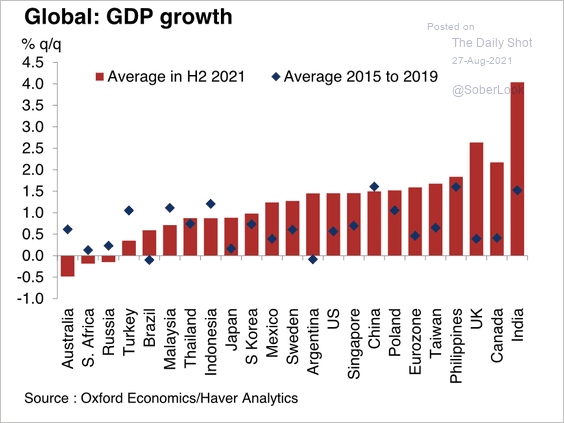

4. Oxford Economics expects most economies to grow at a much faster than average pace in the second half of the year.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

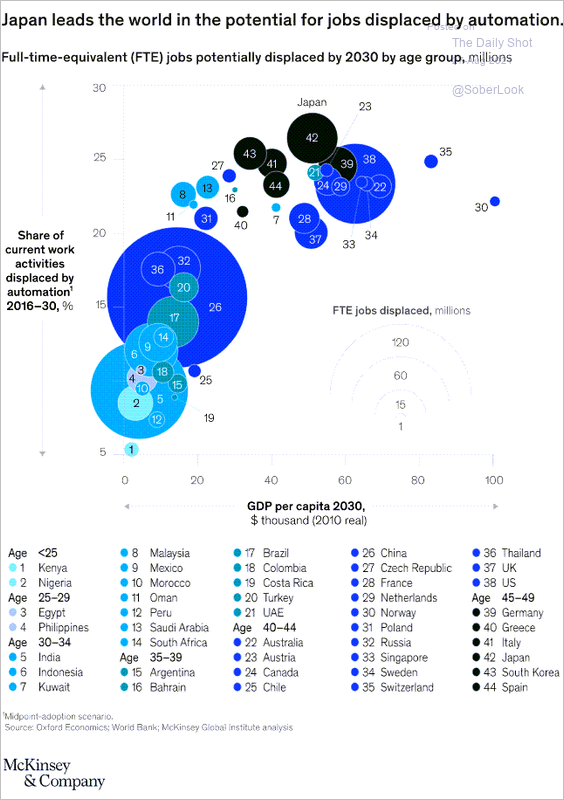

1. Jobs displaced by automation:

Source: McKinsey Read full article

Source: McKinsey Read full article

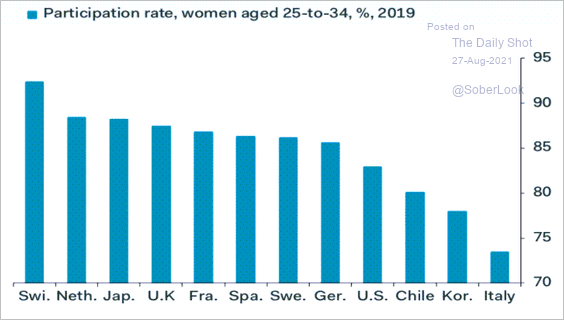

2. Labor force participation for women aged 25-34:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

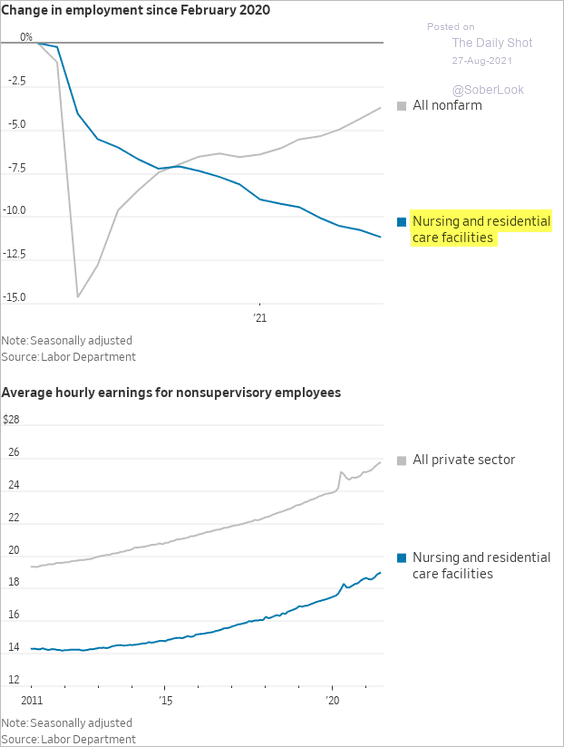

3. US nursing-home staff quitting because of “low pay, burnout, and fear of COVID”:

Source: @WSJ Read full article

Source: @WSJ Read full article

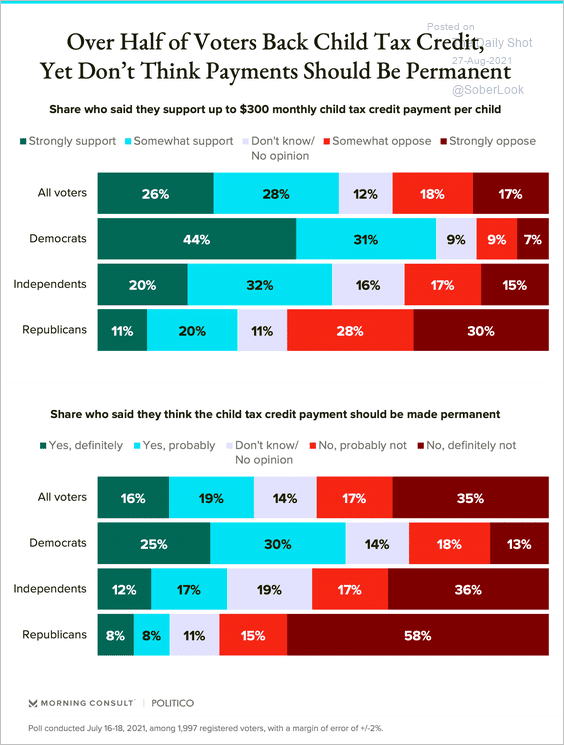

4. Support for Child Tax Credit:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

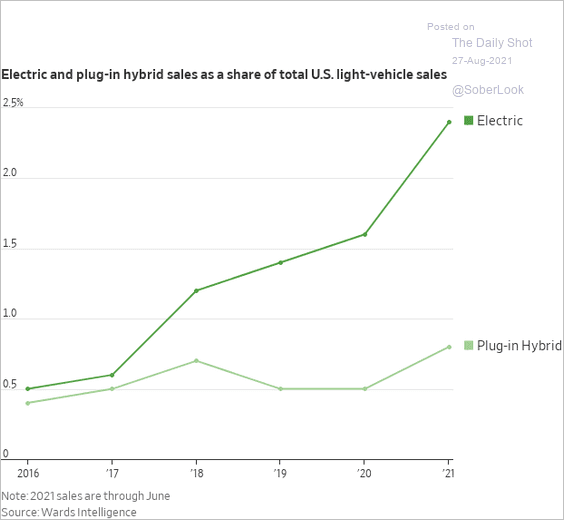

5. US EV sales growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

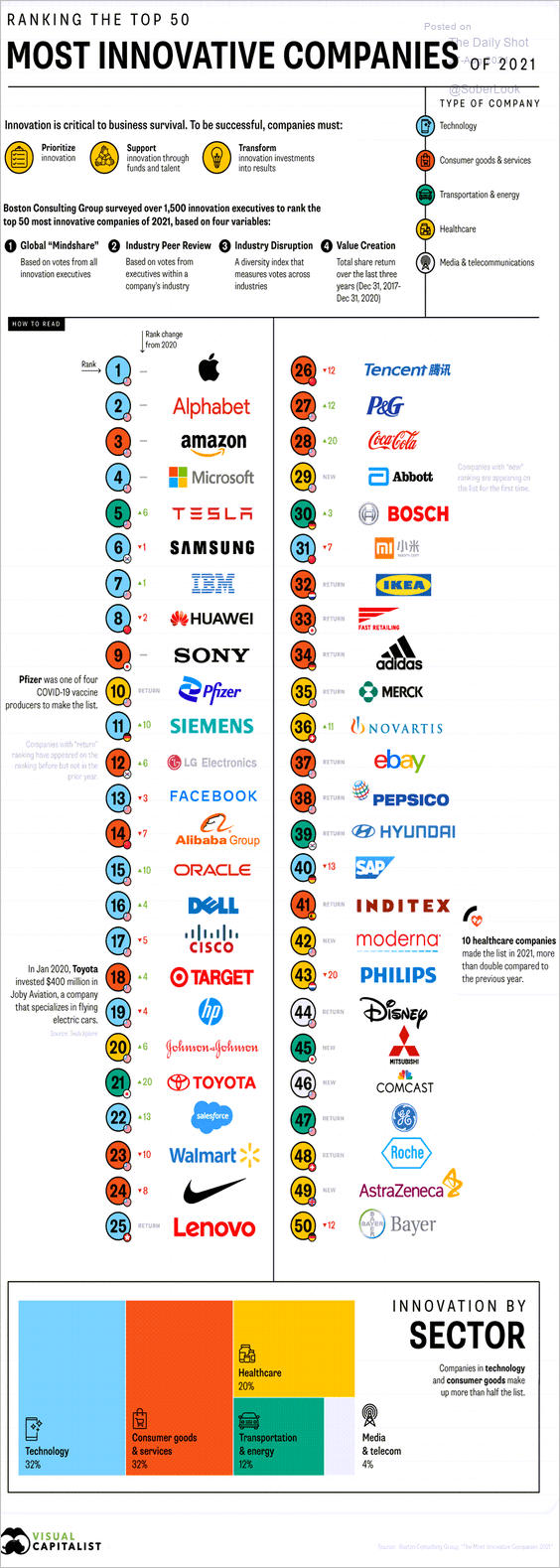

6. Most innovative companies:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

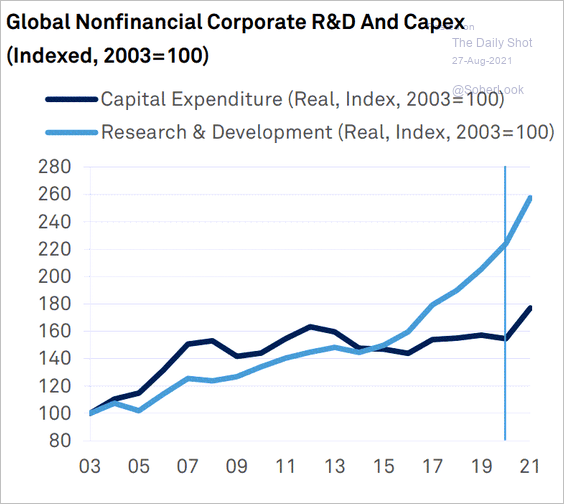

7. Global corporate R&D and business investment:

Source: S&P Global Ratings

Source: S&P Global Ratings

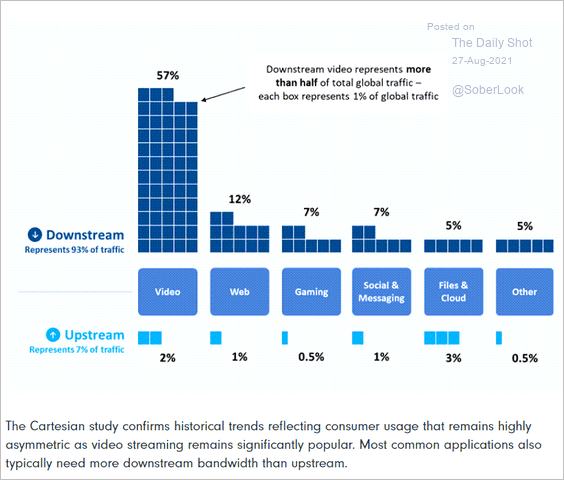

8. Internet traffic, by activity:

Source: NCTA Read full article

Source: NCTA Read full article

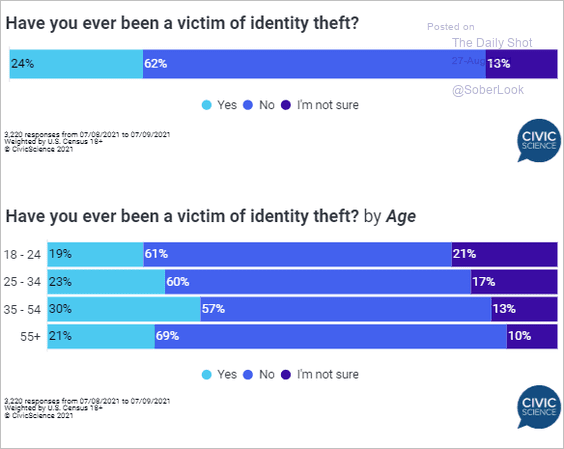

9. Identity theft:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

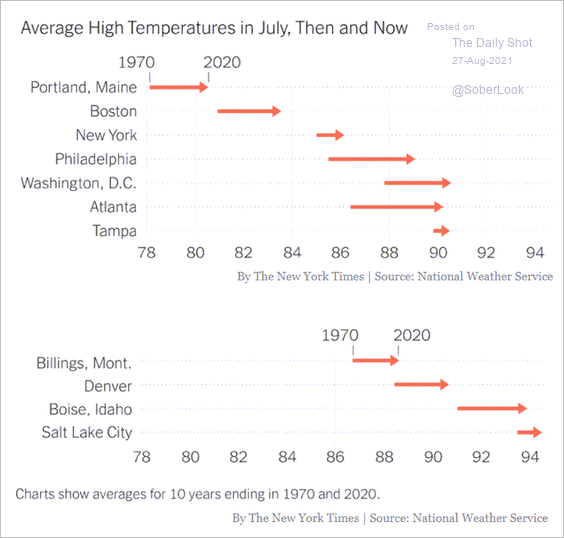

10. A hot July:

Source: The New York Times Read full article

Source: The New York Times Read full article

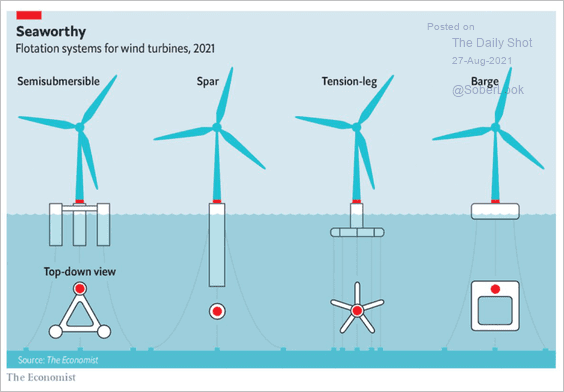

11. Flotation systems for wind turbines:

Source: @adam_tooze; The Economist Read full article

Source: @adam_tooze; The Economist Read full article

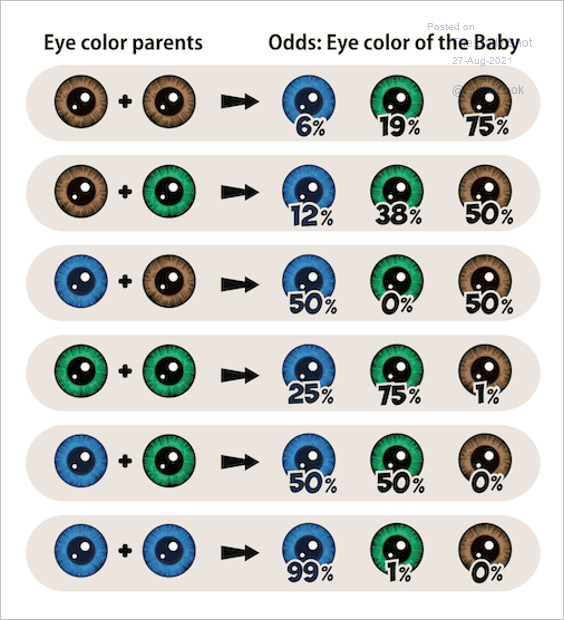

12. Parents’ and baby’s eye color:

Source: Simcoe et al. 2021: Read full article

Source: Simcoe et al. 2021: Read full article

——————–

Have a great weekend!

Back to Index