The Daily Shot: 01-Sep-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

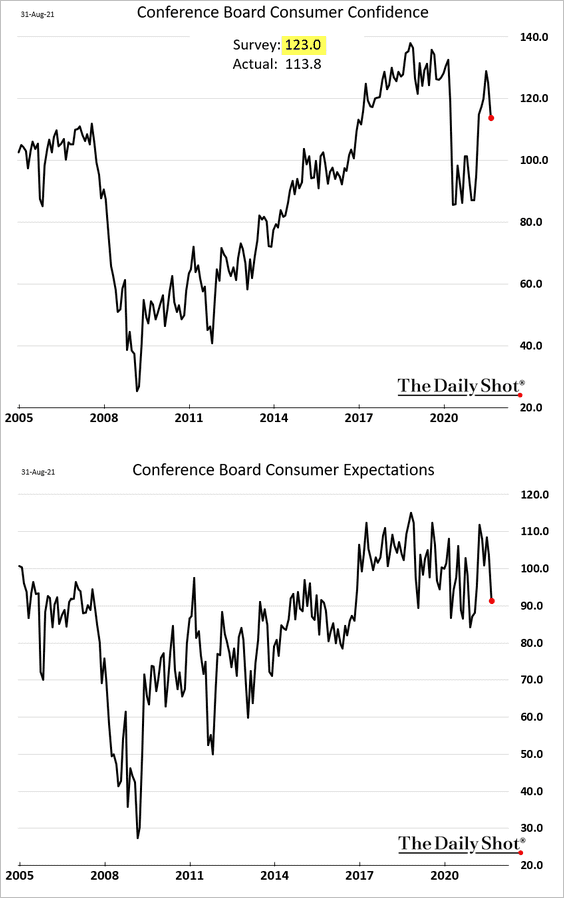

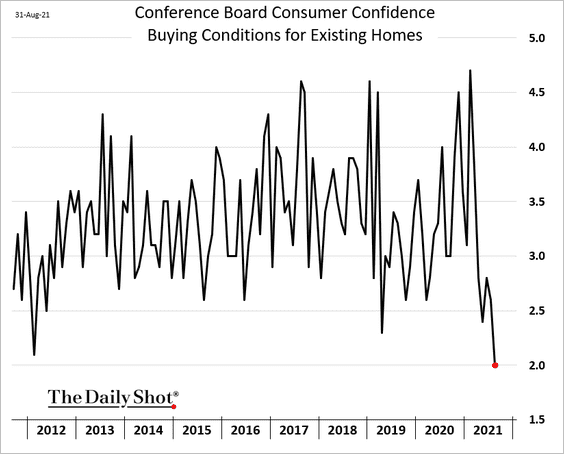

1. The Conference Board’s consumer confidence report surprised to the downside. It’s the latest indication that sentiment weakened in August.

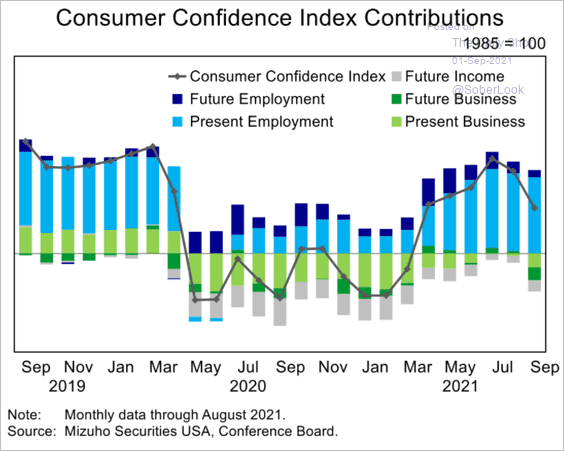

• Here are the contributions to the index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

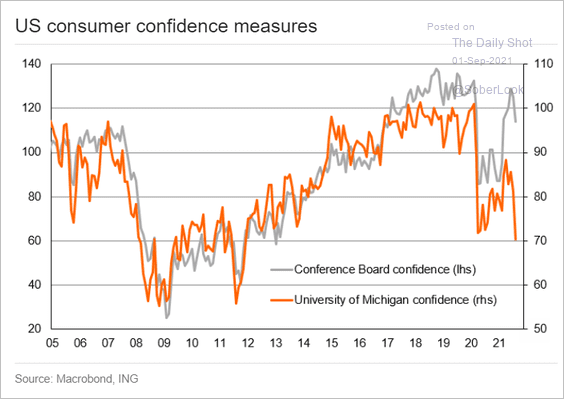

• The decline wasn’t as severe as what we saw in the U. Michigan data (the two indicators have decoupled).

Source: ING

Source: ING

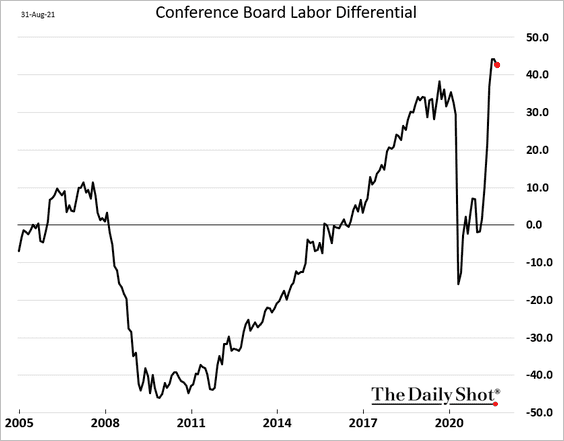

• The labor differential (spread between “jobs plentiful” and “jobs hard to get”) appears to have peaked.

The employment outlook moderated further.

Source: Piper Sandler

Source: Piper Sandler

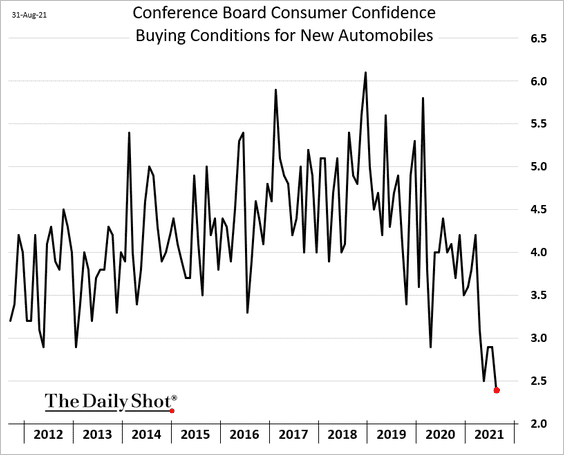

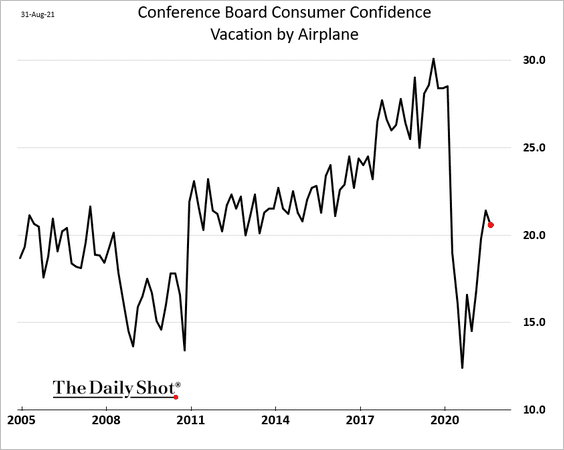

• Buying conditions for vehicles have deteriorated.

Intentions to take a vacation by airplane ticked lower and remain well below pre-COVID levels.

——————–

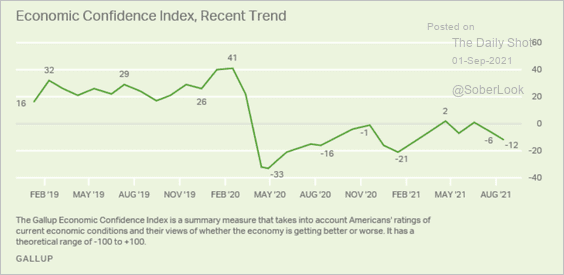

2. Gallup’s confidence indicator also declined.

Source: Gallup Read full article

Source: Gallup Read full article

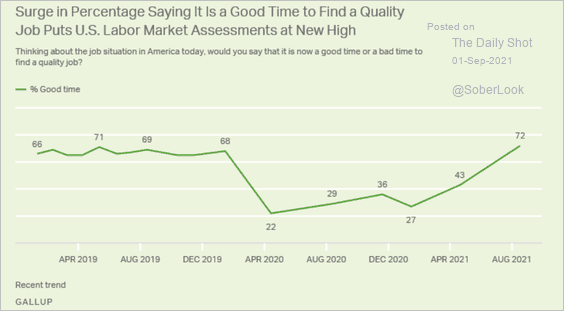

But labor market sentiment remains robust.

Source: Gallup Read full article

Source: Gallup Read full article

——————–

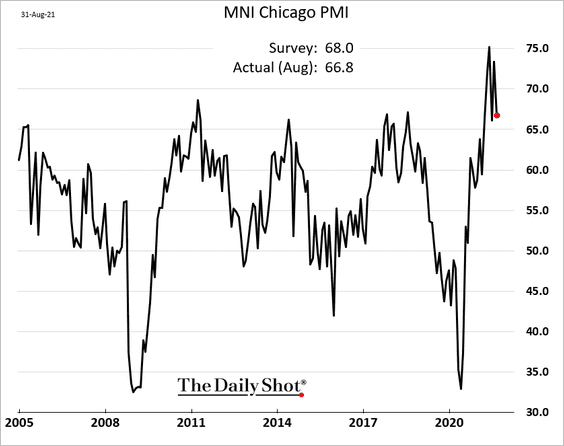

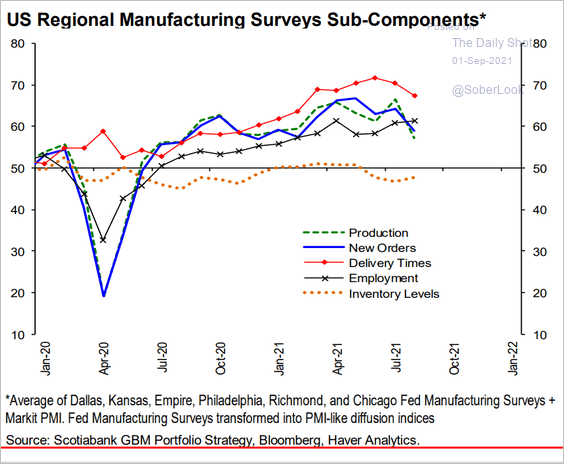

3. The Chicago PMI shows a moderate slowdown in Midwest regional factory activity.

It’s consistent with the regional Fed surveys in other parts of the country.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

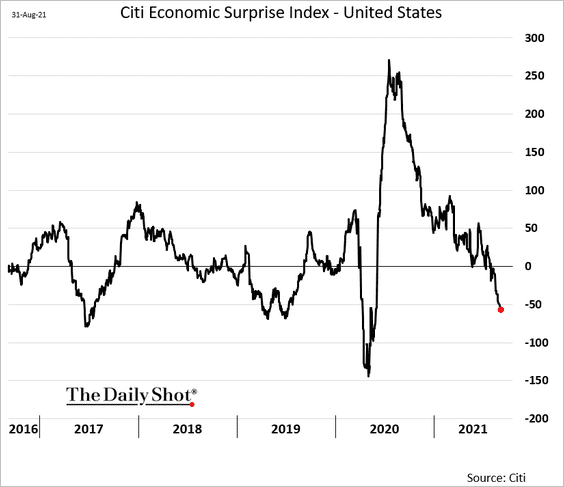

4. The Citi Economic Surprise Index continues to deteriorate.

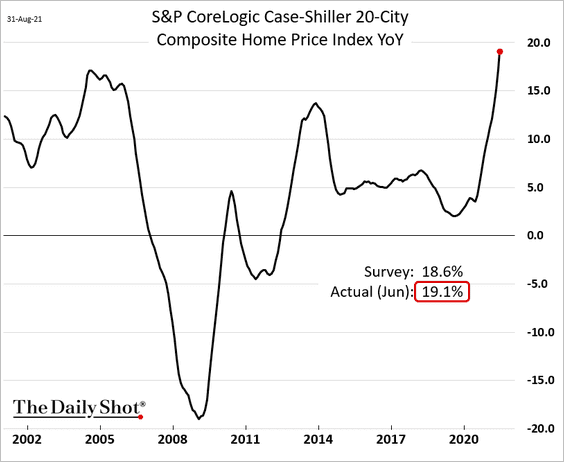

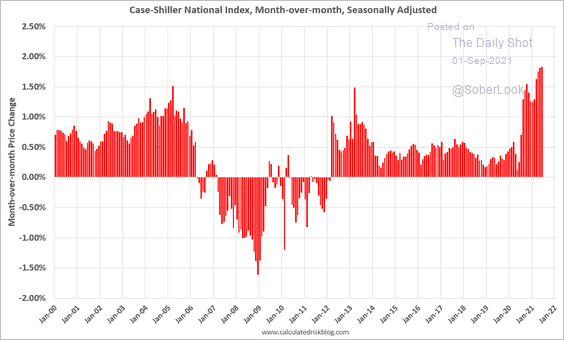

5. Home price appreciation hit new highs in June, with the Case-Shiller index rising by over 19% (year over year).

• The Case-Shiller index monthly changes:

Source: @calculatedrisk Read full article

Source: @calculatedrisk Read full article

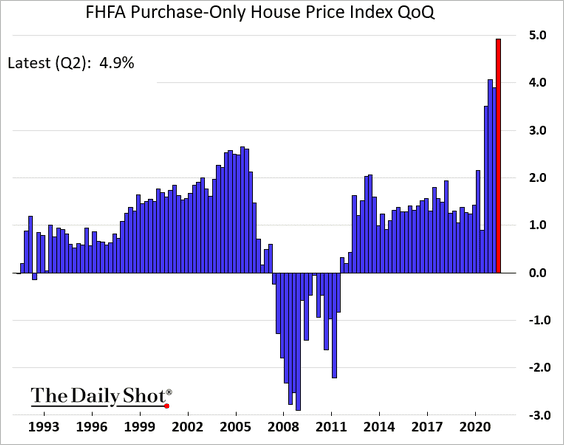

• The FHFA housing index quarterly changes:

Rising home prices are spooking potential buyers.

——————–

6. Next, we have some updates on inflation.

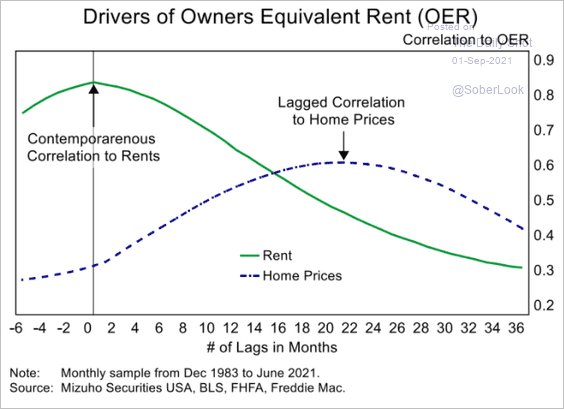

• Home price appreciation takes longer to affect the owners’ equivalent rent (OER) inflation. The massive spike in housing prices (#5 above) will show up in the CPI data in the months ahead.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

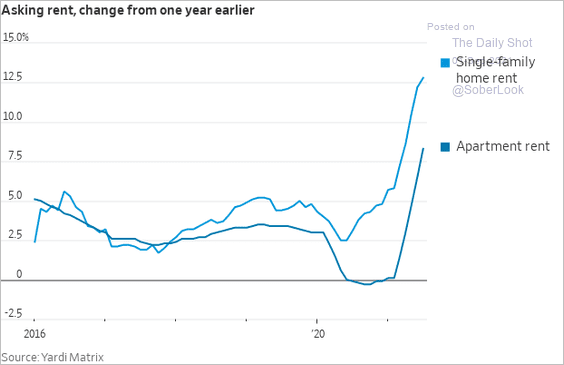

• Rent inflation has been accelerating.

Source: @WSJ Read full article

Source: @WSJ Read full article

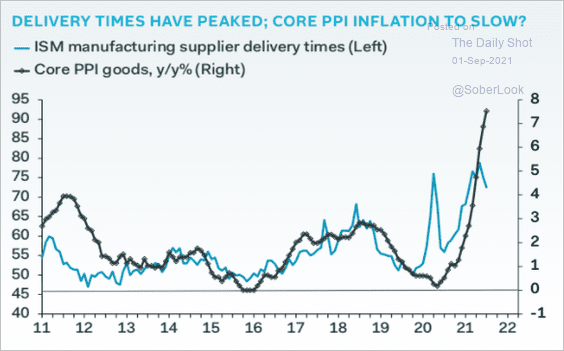

• Does the peak in supplier delivery times suggest a slowdown in the goods PPI?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

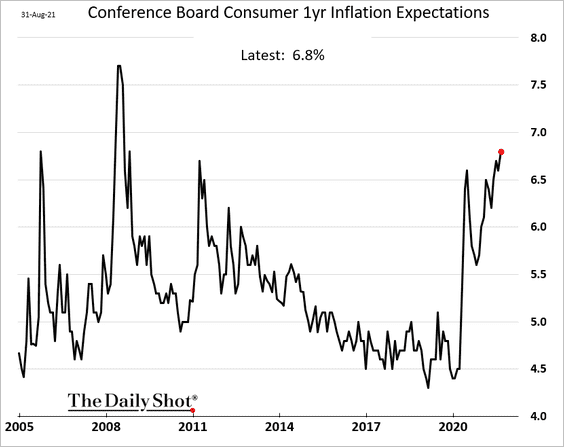

• Similar to the U. Michigan report, the Conference Board’s consumer inflation expectations have been rising.

——————–

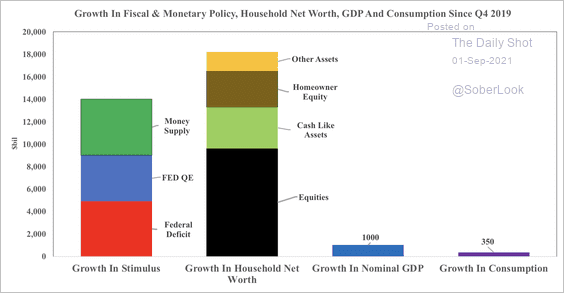

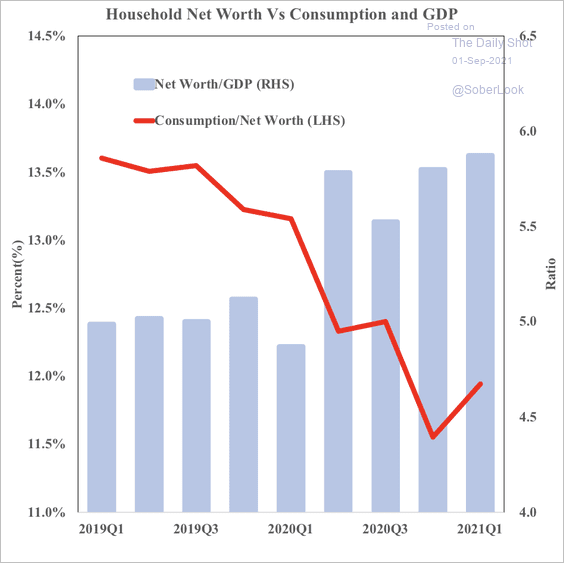

7. This chart shows growth in pandemic-related stimulus as well as household net worth compared to nominal GDP and consumption growth.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

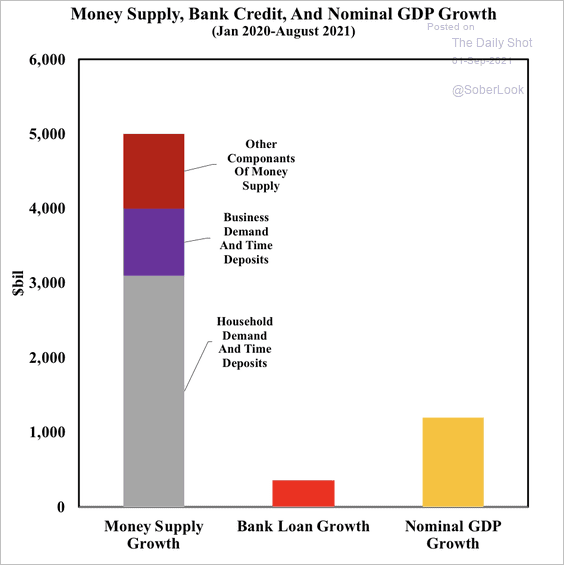

And here is money supply growth versus loan growth and nominal GDP growth.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

• Will households turn stimulus and wealth growth into consumption growth?

Source: SOM Macro Strategies

Source: SOM Macro Strategies

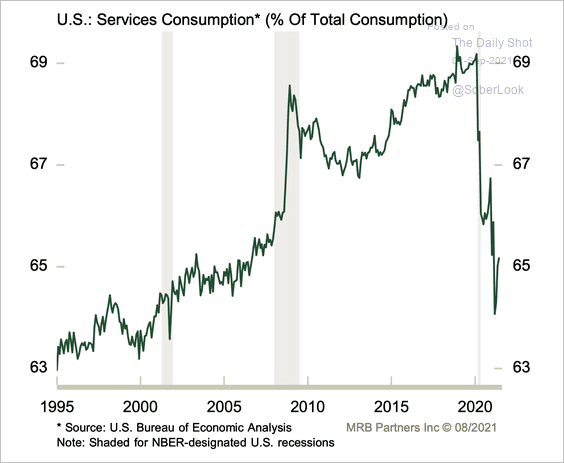

• Services consumption still has a lot of room to recover as a share of total consumption.

Source: MRB Partners

Source: MRB Partners

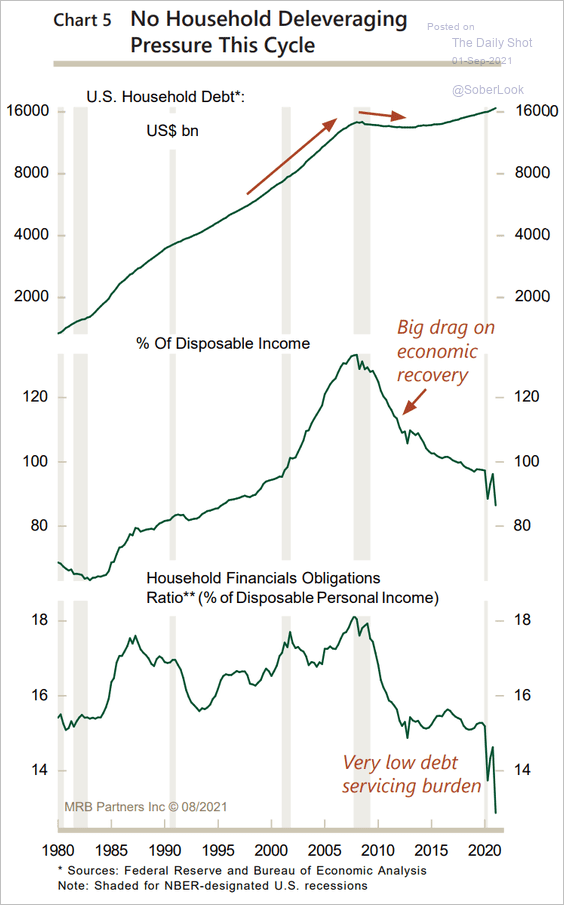

• There is no deleveraging pressure for households in this economic cycle.

Source: MRB Partners

Source: MRB Partners

——————–

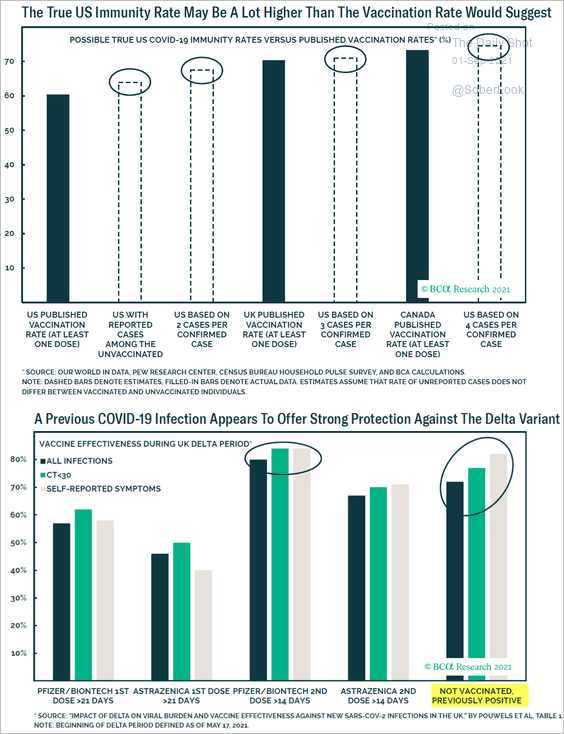

8. High previous infection rates in the US offer additional protection for the population going forward.

Source: BCA Research

Source: BCA Research

Back to Index

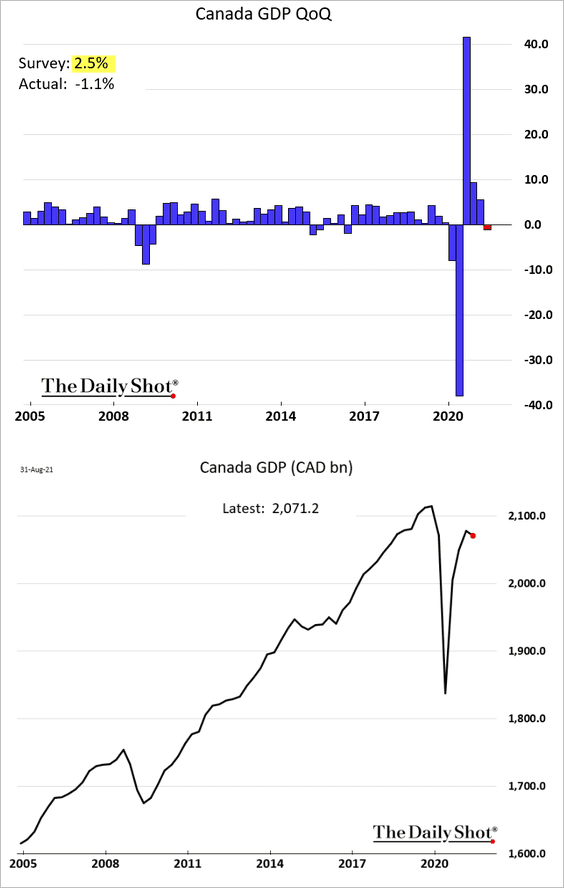

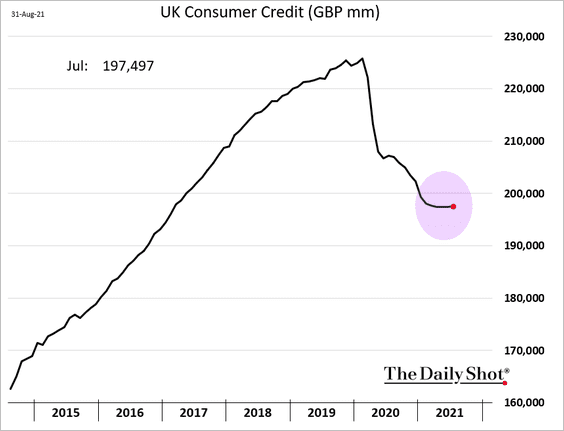

Canada

The economy unexpectedly contracted in the second quarter.

But there was a rebound in June.

Back to Index

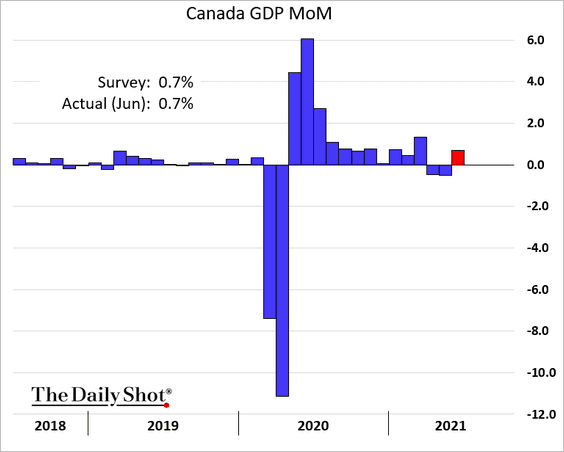

The United Kingdom

1. UK consumers remain cautious when it comes to credit.

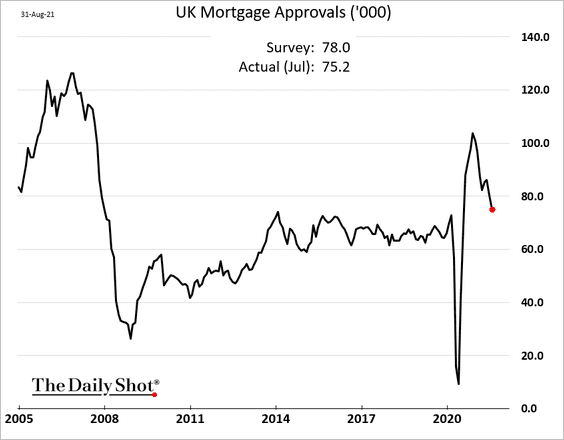

2. Mortgage approvals surprised to the downside.

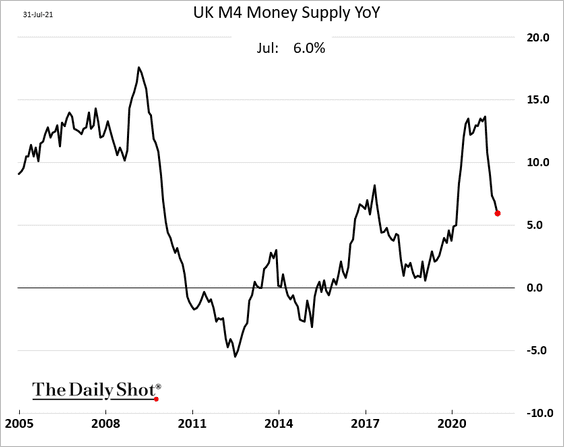

3. The expansion rate in the broad money supply continues to moderate.

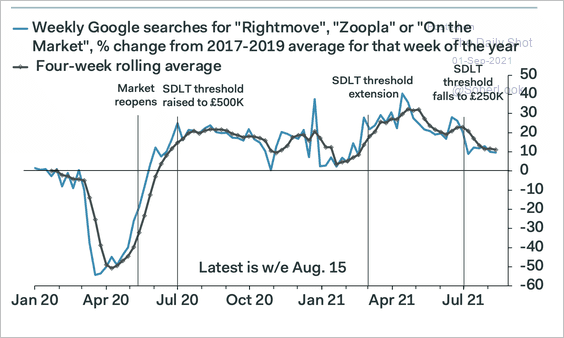

4. Based on search data, the UK housing market is showing signs of cooling.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

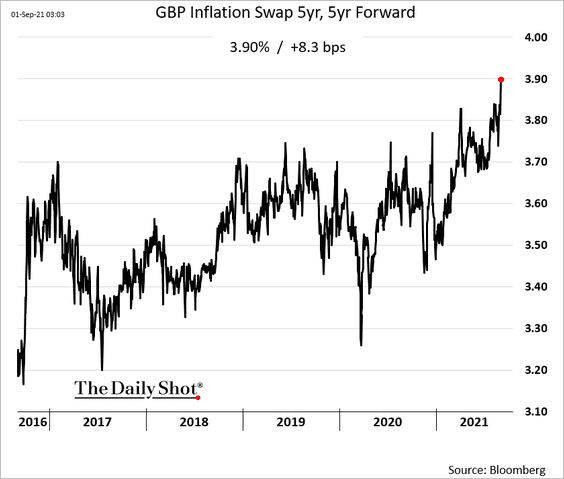

5. Longer-term market-based inflation expectations continue to move higher.

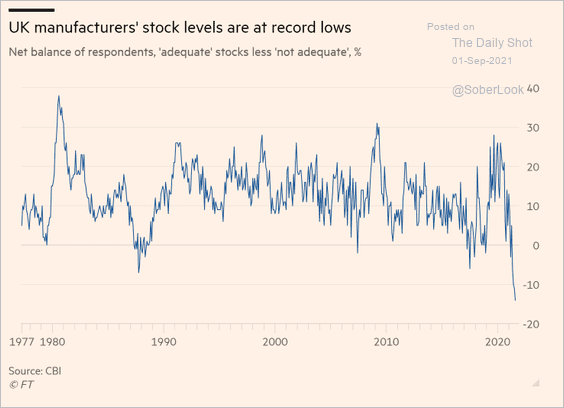

6. Manufacturers’ inventories are at record lows amid supply bottlenecks.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

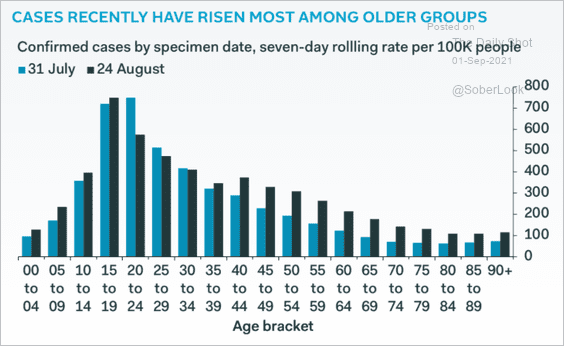

7. COVID cases among the UK’s older population have risen.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

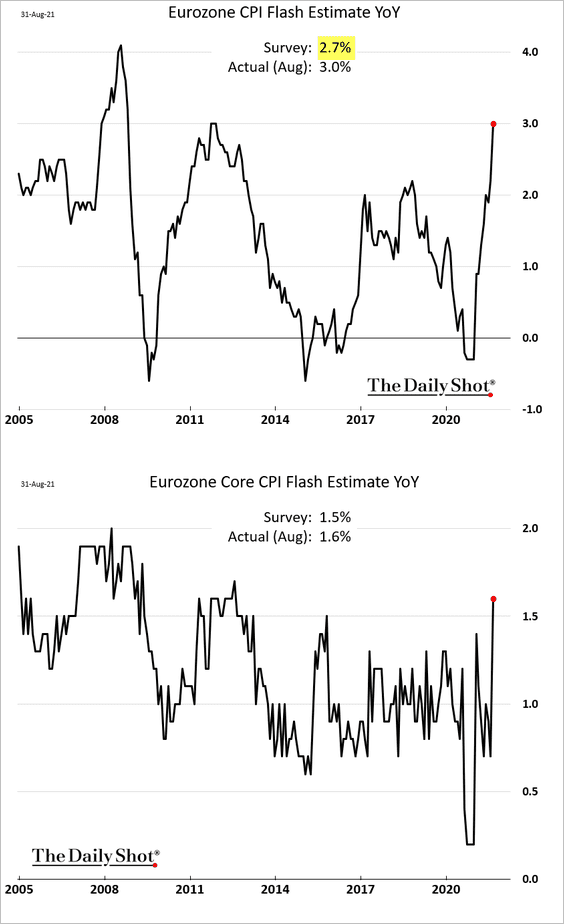

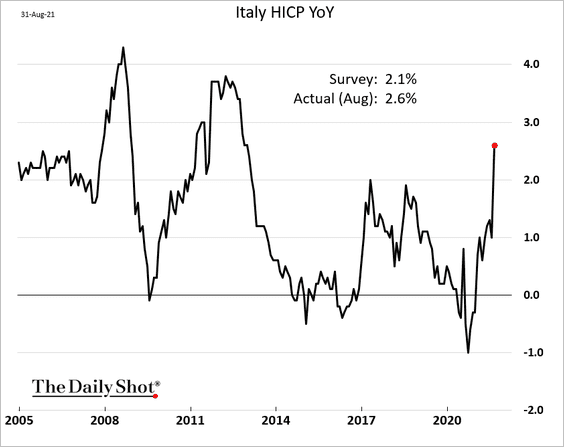

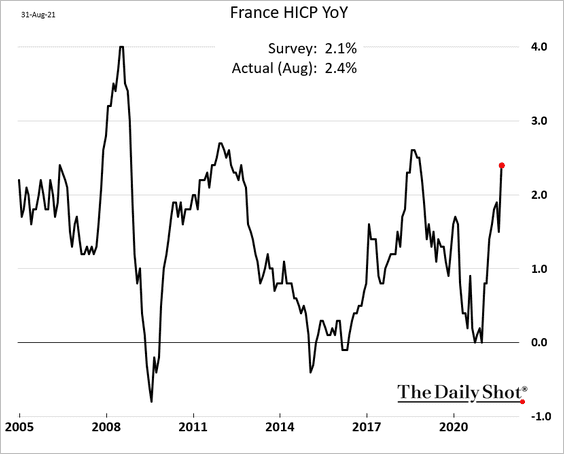

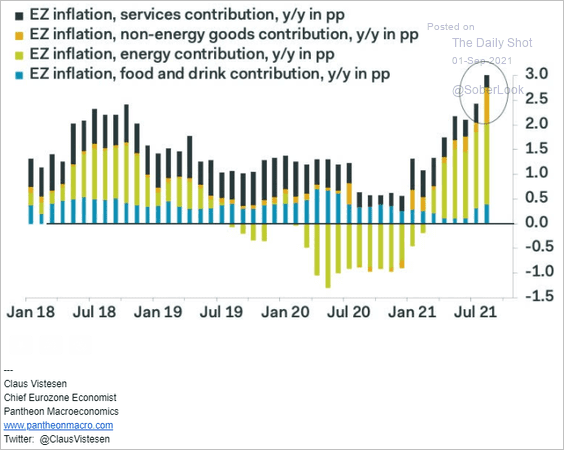

1. Inflation surprised to the upside, hitting the highest level in a decade.

• CPI data from Italy and France topped forecasts.

• Here are the contributions, …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

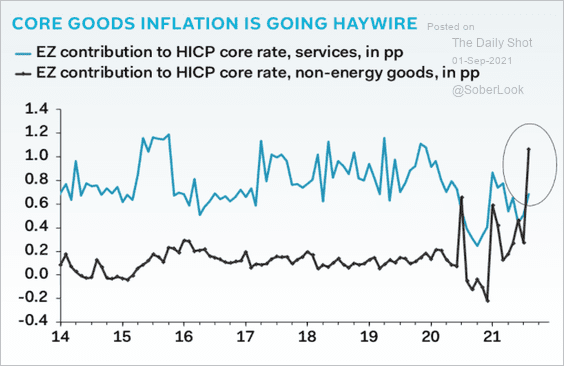

… with goods inflation surging.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

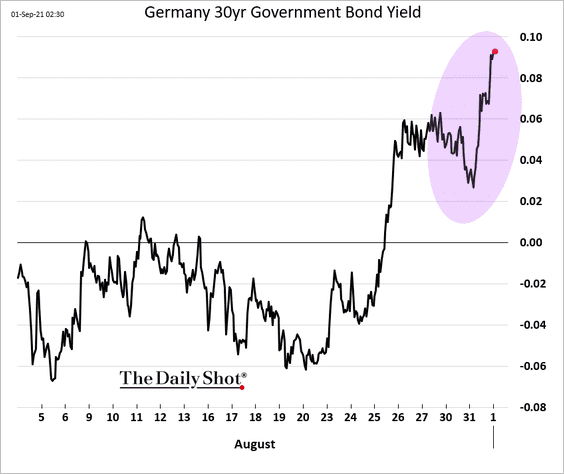

2. ECB’s Knot made some hawkish comments in response to rising inflation. Will taper come sooner than expected?

Source: Forexlive Read full article

Source: Forexlive Read full article

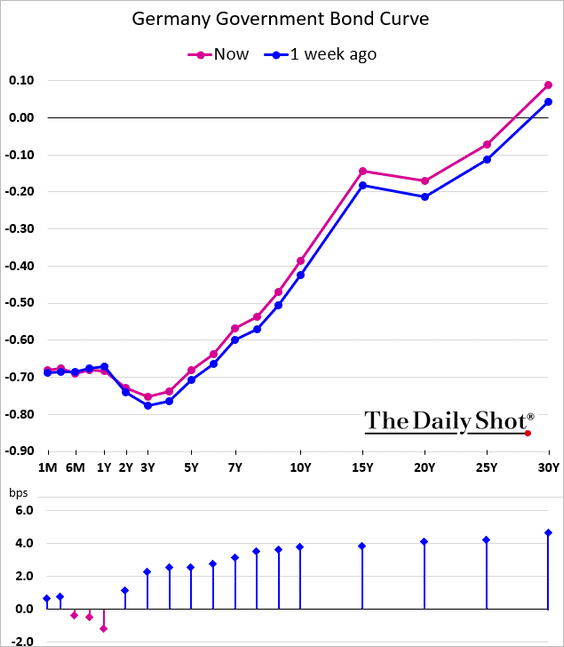

Bond yields climbed across Europe.

The Bund curve has been steepening.

——————–

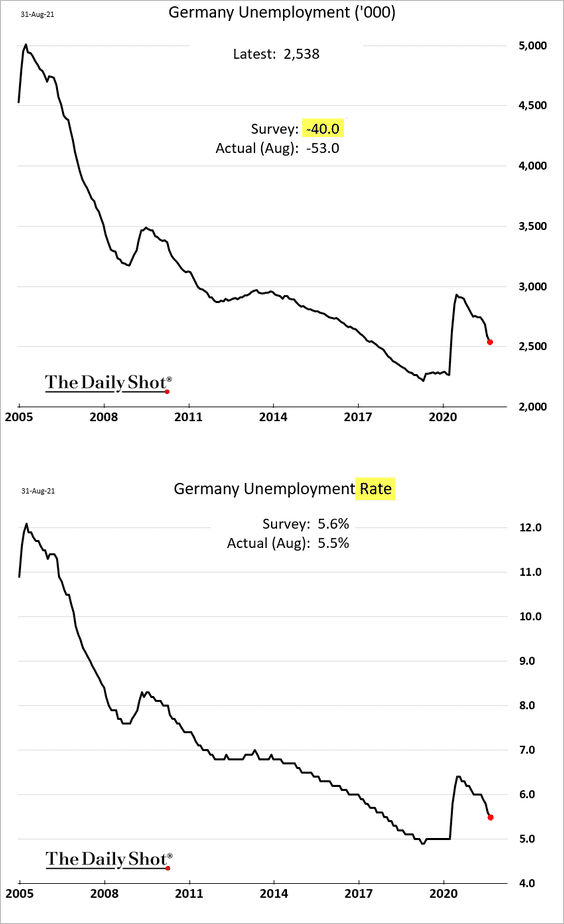

3. Germany’s labor market is healing rapidly.

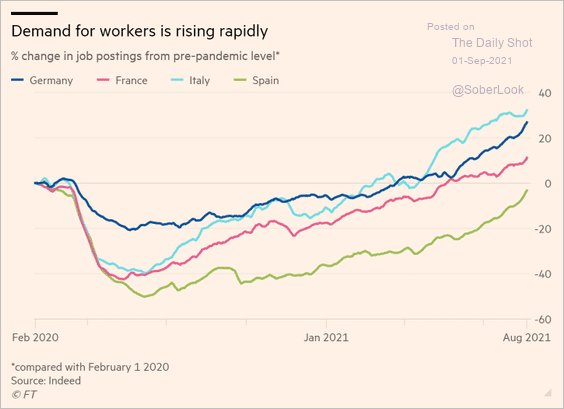

Demand for workers is strengthening across the Eurozone.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

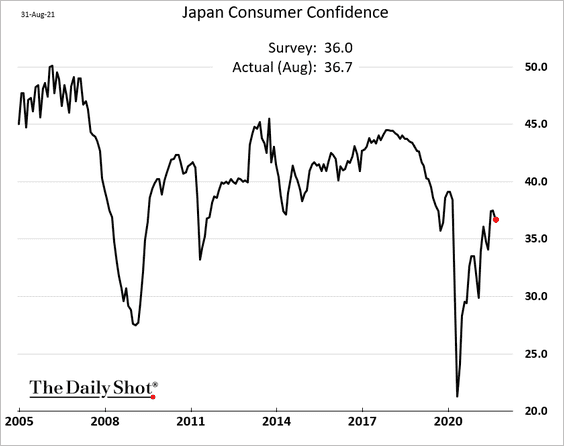

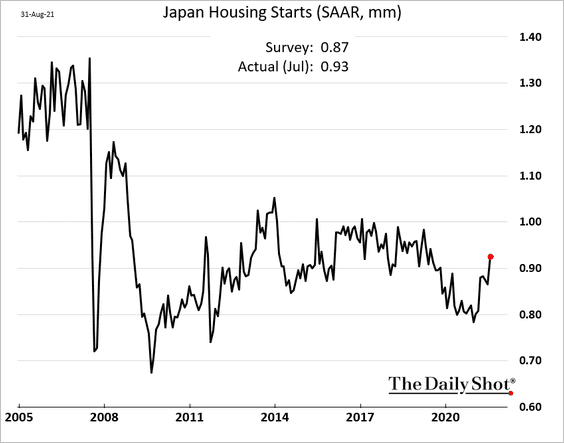

Japan

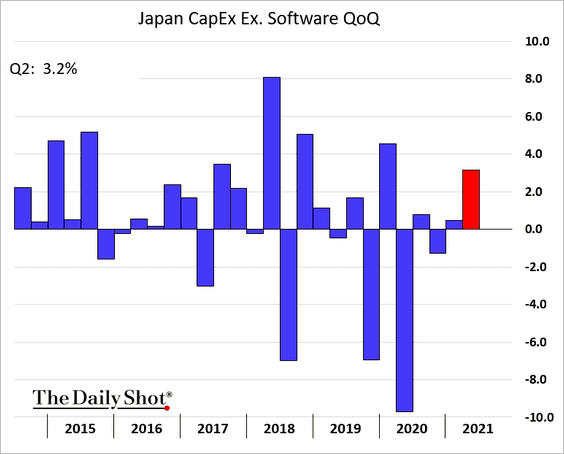

1. CapEx (business investment) was robust in the second quarter.

2. Consumer confidence remains resilient.

3. Housing starts continue to climb.

Back to Index

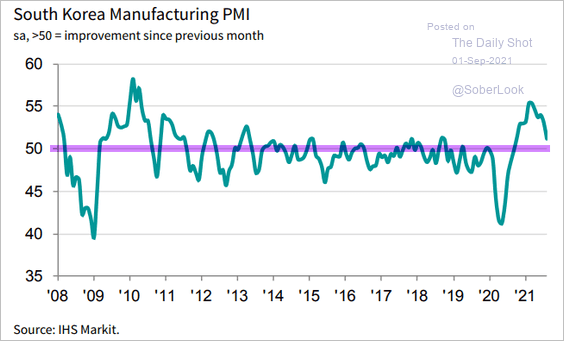

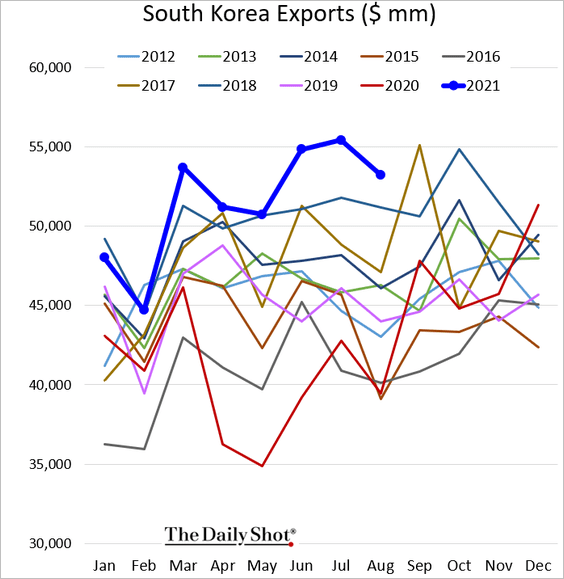

Asia – Pacific

1. South Korea’s manufacturing growth has slowed markedly.

Source: IHS Markit

Source: IHS Markit

Exports have been robust.

——————–

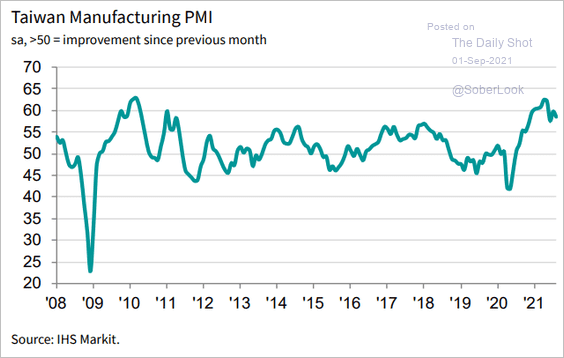

2. Taiwan’s factory activity remains strong.

Source: IHS Markit

Source: IHS Markit

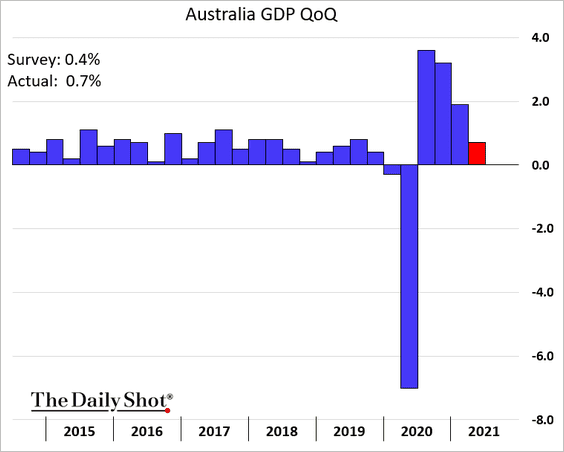

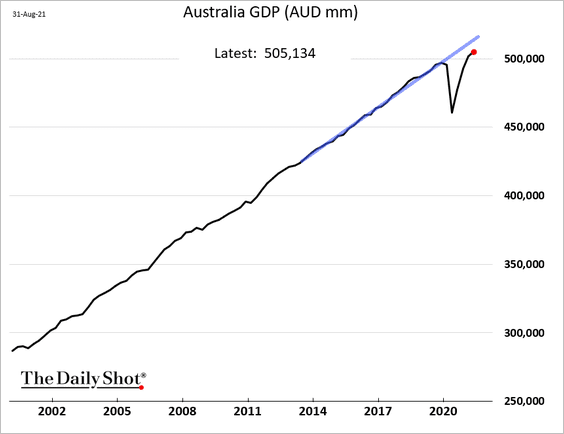

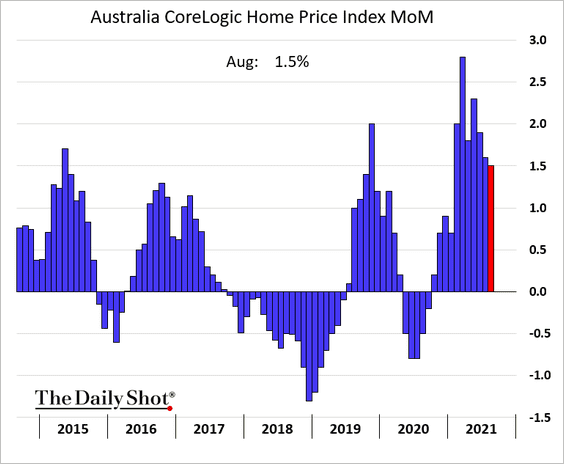

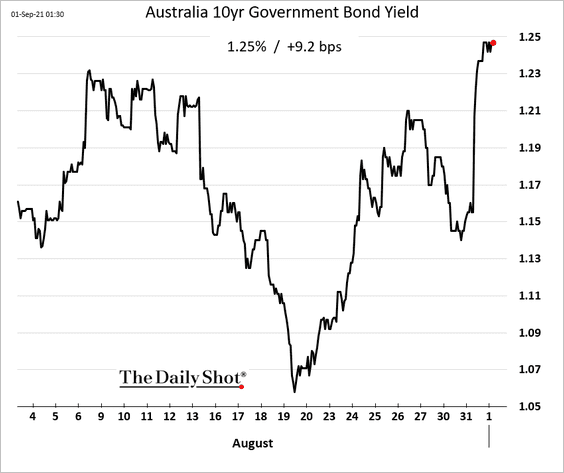

3. Next, we have some updates on Australia.

• Second-quarter economic growth topped forecasts.

• Home price appreciation remains elevated.

• Bond yields jumped today, partially in response to some hawkish ECB comments.

Back to Index

China

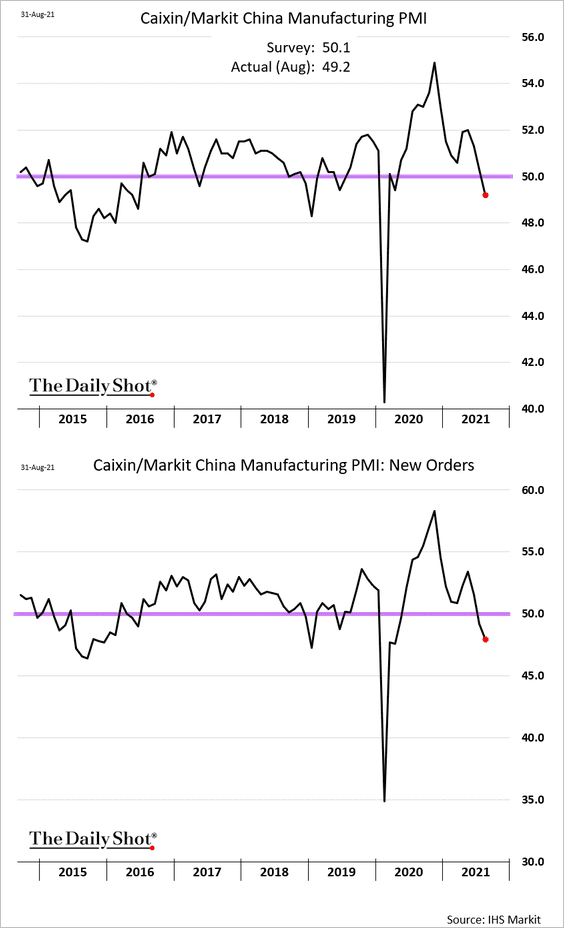

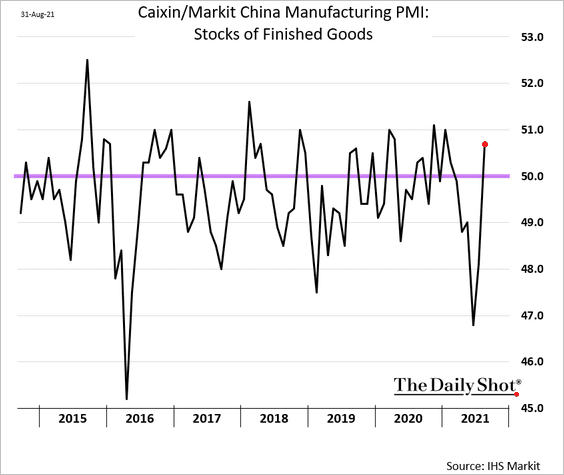

1. Markit’s manufacturing PMI confirmed what we saw in the official data yesterday. Business activity is slowing.

Moreover, manufacturing inventories are now rising.

——————–

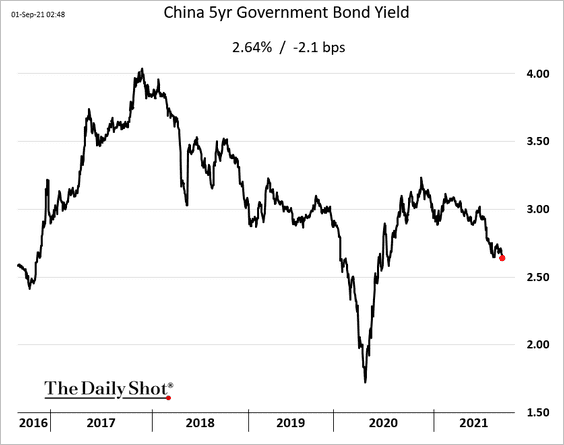

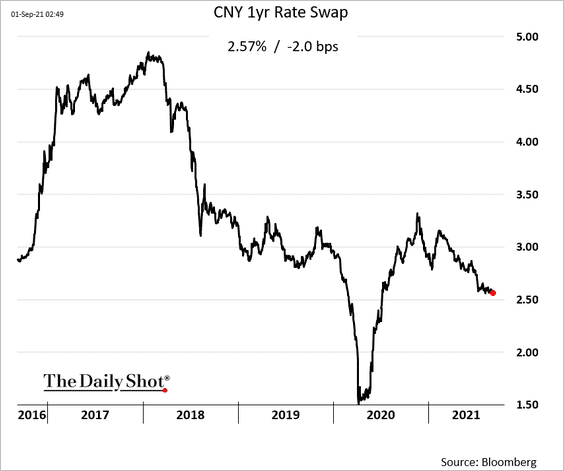

2. The market increasingly expects monetary easing.

• The 5yr bond yield:

• The 1yr interest rate swap:

——————–

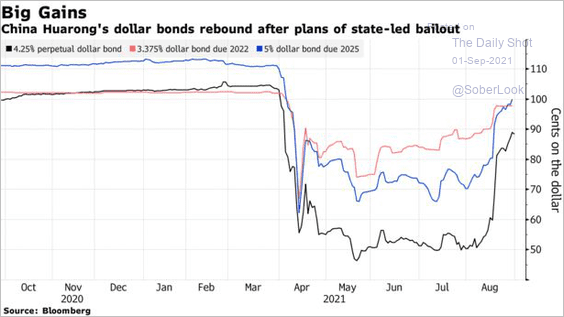

3. Huarong’s bonds continue to rebound in response to the bailout.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

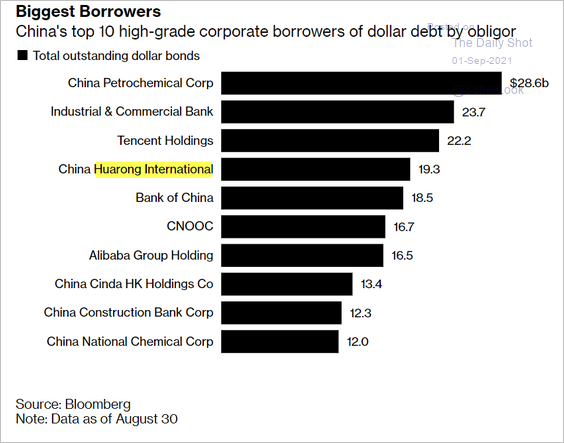

4. Here are China’s biggest corporate borrowers.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

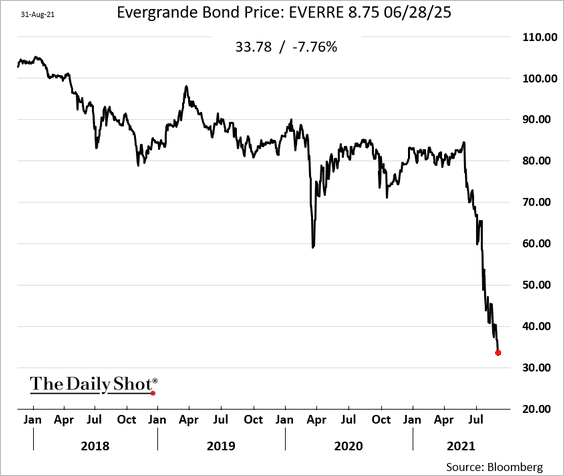

5. Evergrande’s bonds are collapsing amid talk of default.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

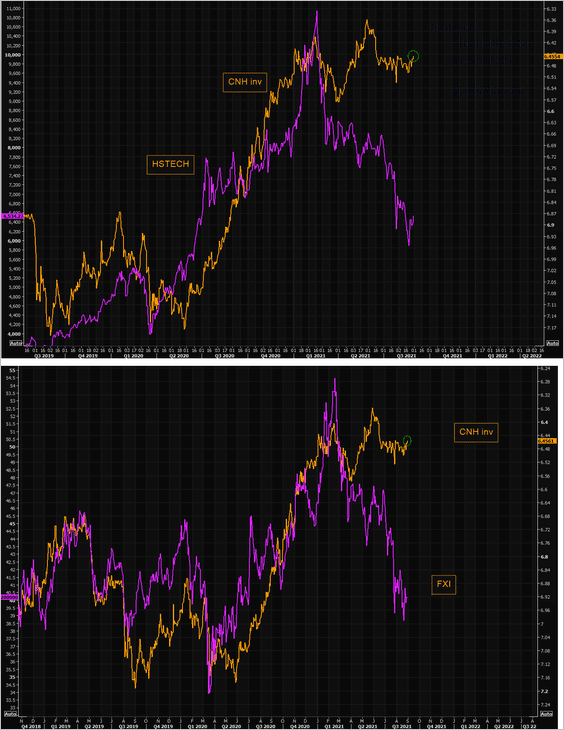

6. Stocks have decoupled from the yuan.

Source: @themarketear

Source: @themarketear

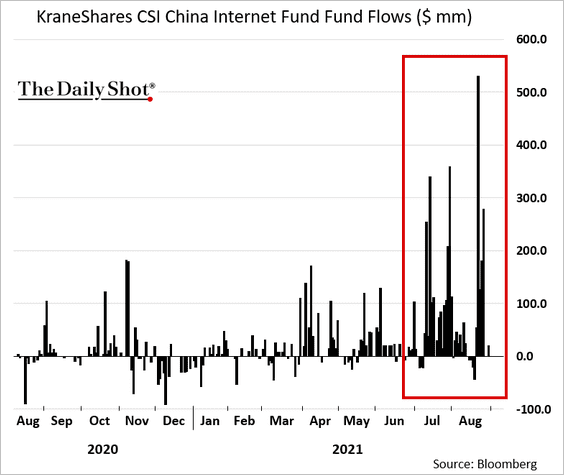

7. KraneShares’ China internet ETF has been seeing substantial inflows.

Back to Index

Emerging Markets

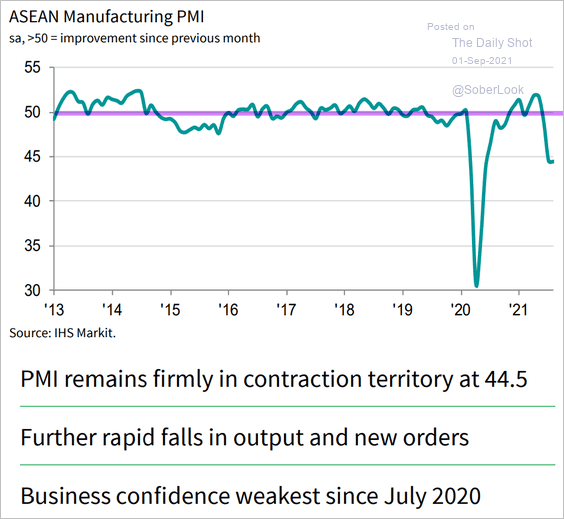

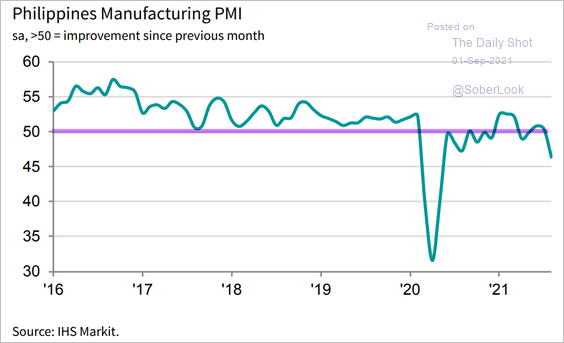

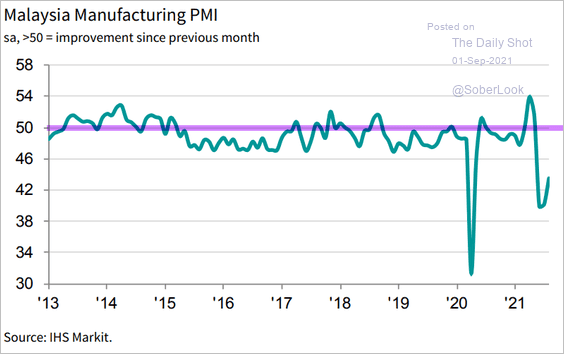

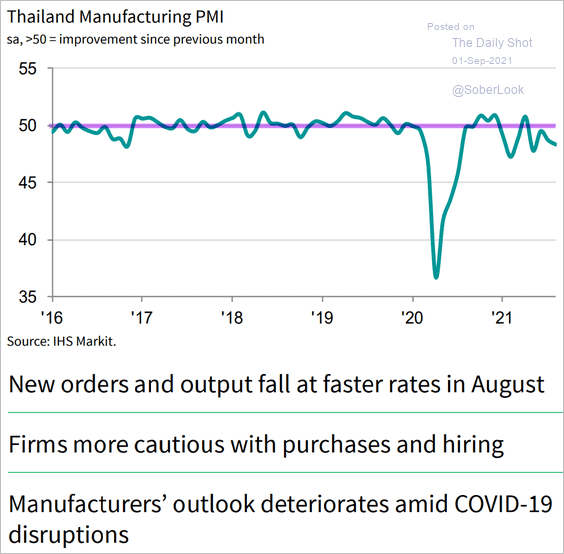

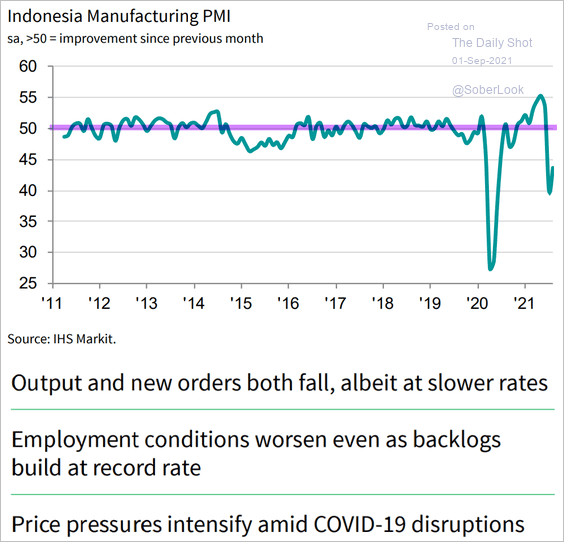

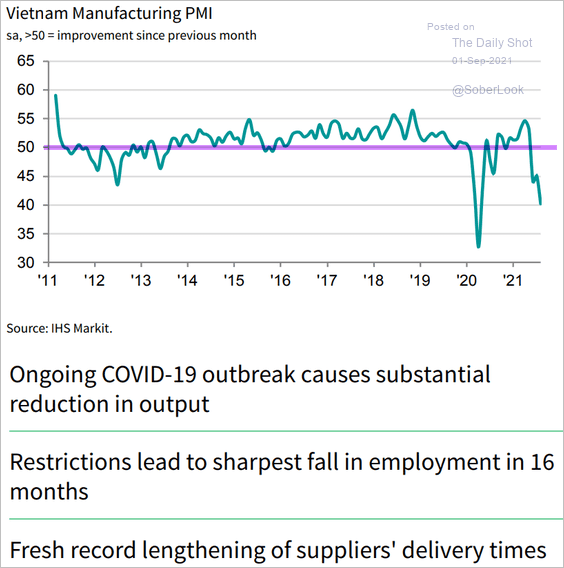

1. Asian PMI reports point to an ongoing manufacturing recession (PMI < 50 = contraction).

• ASEAN:

Source: IHS Markit

Source: IHS Markit

• The Philippines:

Source: IHS Markit

Source: IHS Markit

• Malaysia:

Source: IHS Markit

Source: IHS Markit

• Thailand:

Source: IHS Markit

Source: IHS Markit

• Indonesia:

Source: IHS Markit

Source: IHS Markit

• Vietnam:

Source: IHS Markit

Source: IHS Markit

——————–

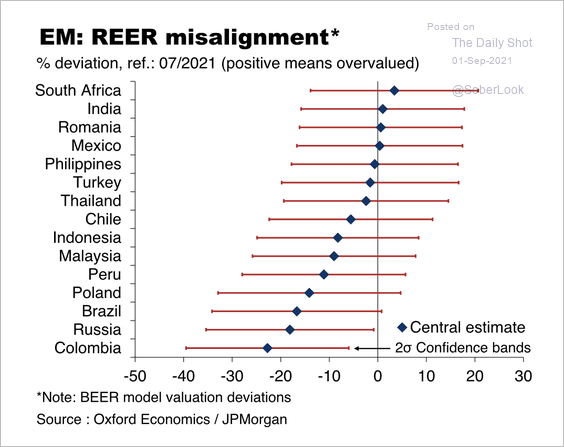

2. Columbia, Russia, and Brazil are among some of the EM currencies trading far below fair value, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

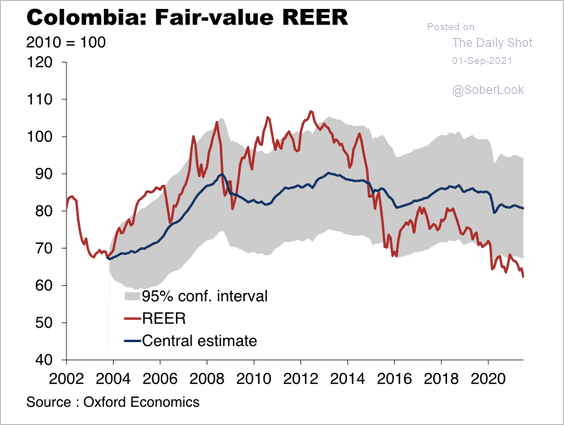

• The Colombian peso has never managed to fully recover since the 2014 oil market crash.

Source: Oxford Economics

Source: Oxford Economics

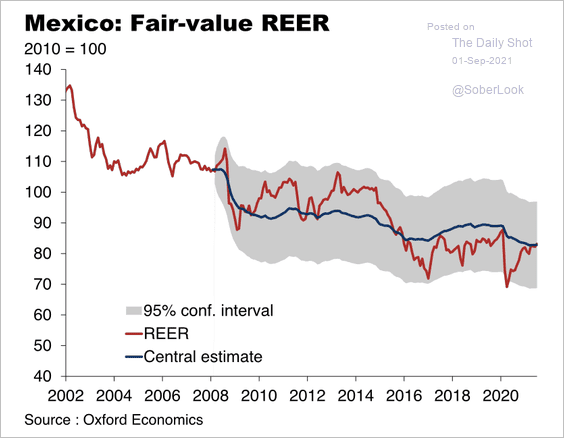

• The Mexican peso is the only Latin American currency trading at a “fair price”, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

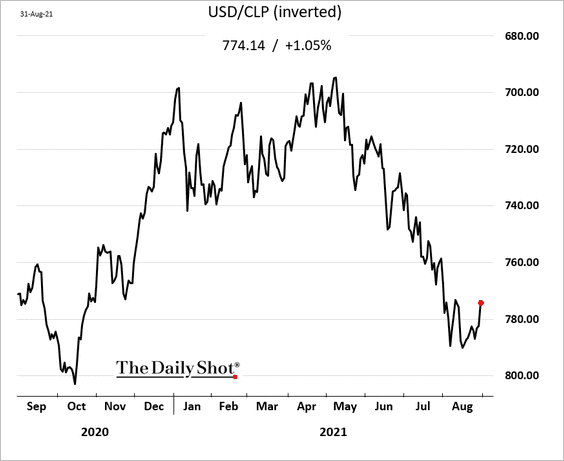

• The Chilean peso appears to have bottomed.

Back to Index

Cryptocurrency

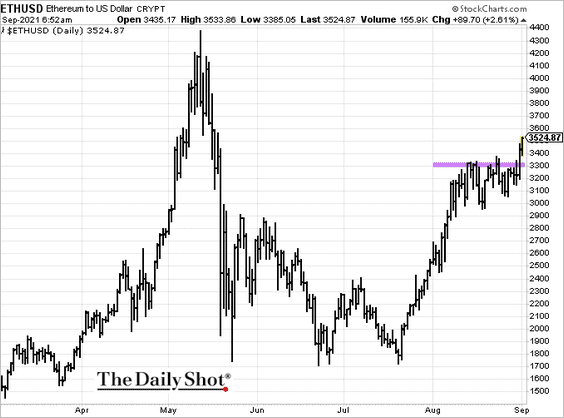

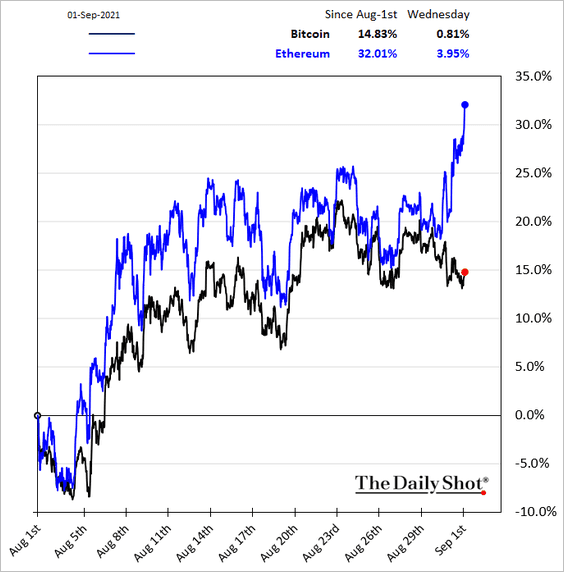

1. Ether is surging after breaking above resistance.

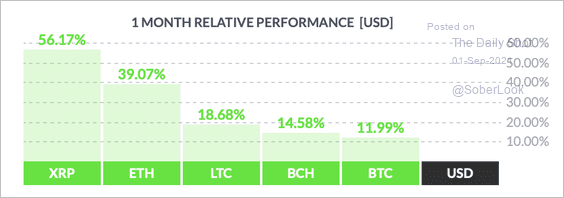

Bitcoin underperformed some of the largest cryptocurrencies in August. Altcoins led the way higher.

Source: FinViz

Source: FinViz

——————–

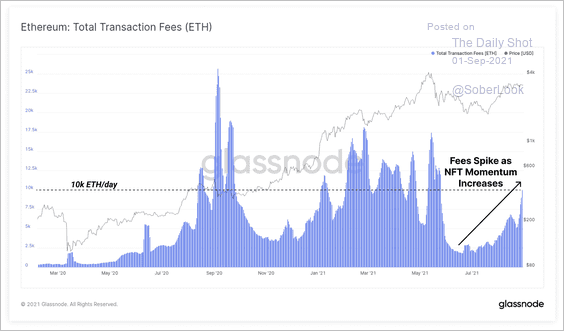

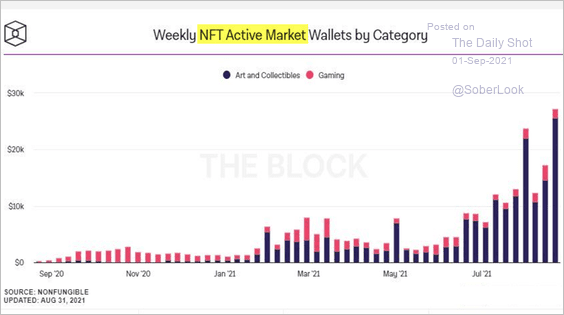

2. Transaction fees on the Ethereum blockchain have spiked recently, partly due to the resurgence of non-fungible token (NFT) activity (second chart).

Source: Glassnode Read full article

Source: Glassnode Read full article

Source: @michaelbatnick Read full article

Source: @michaelbatnick Read full article

——————–

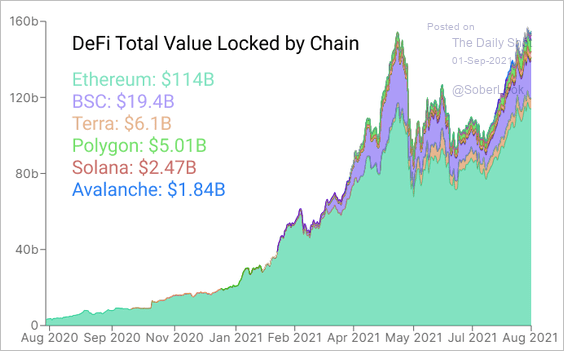

3. This chart shows the rise in total value locked in decentralized finance (DeFi) chains.

Source: Glassnode Read full article

Source: Glassnode Read full article

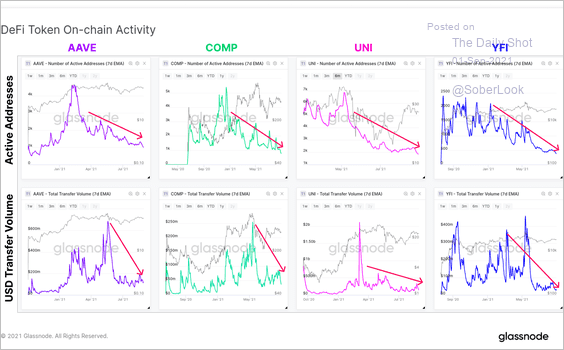

Blockchain transaction activity has reached new lows for some of the largest DeFi tokens.

Source: Glassnode Read full article

Source: Glassnode Read full article

Back to Index

Commodities

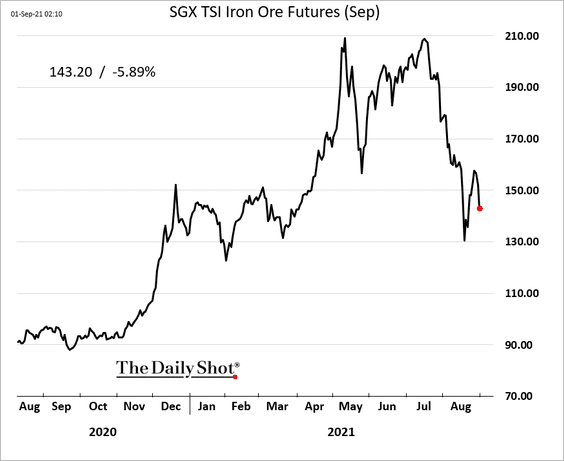

1. Iron ore is under pressure again as China’s economic growth weakens.

Source: MINING.COM Read full article

Source: MINING.COM Read full article

——————–

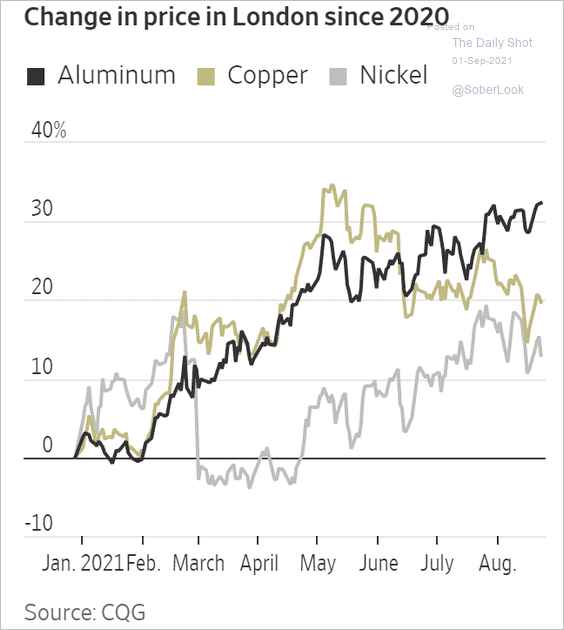

2. Aluminum has been outperforming other industrial metals.

Source: @WSJ Read full article

Source: @WSJ Read full article

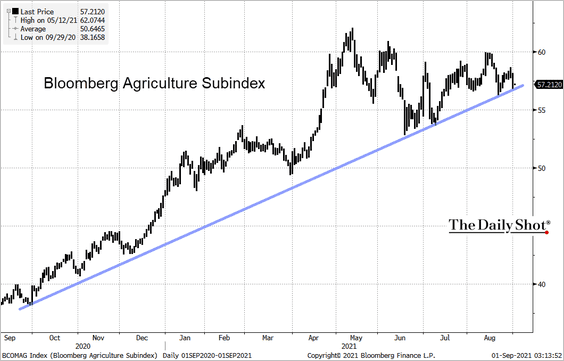

3. Bloomberg’s agriculture index is testing support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

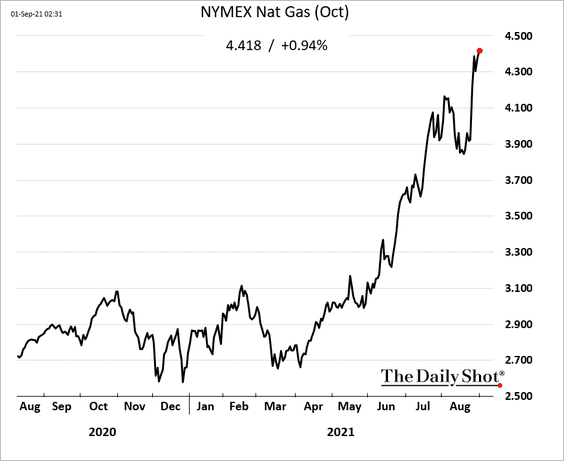

Energy

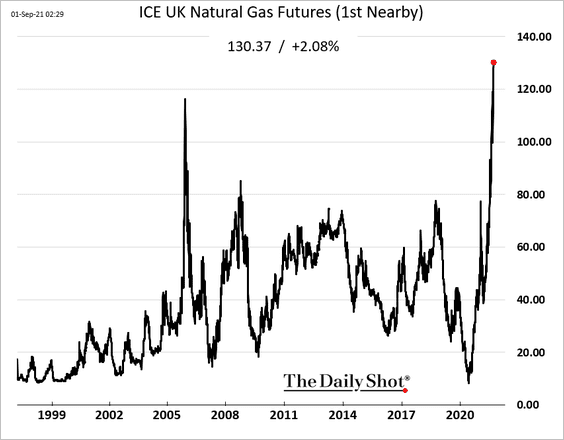

1. European natural gas prices have gone parabolic as Russia pumps less gas to Europe.

US gas prices are also surging.

——————–

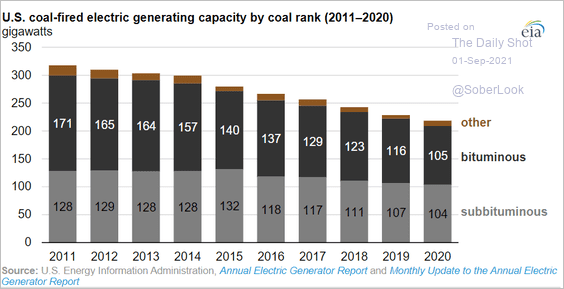

2. This chart shows US coal-fired electric generating capacity.

Source: EIA Read full article

Source: EIA Read full article

Back to Index

Equities

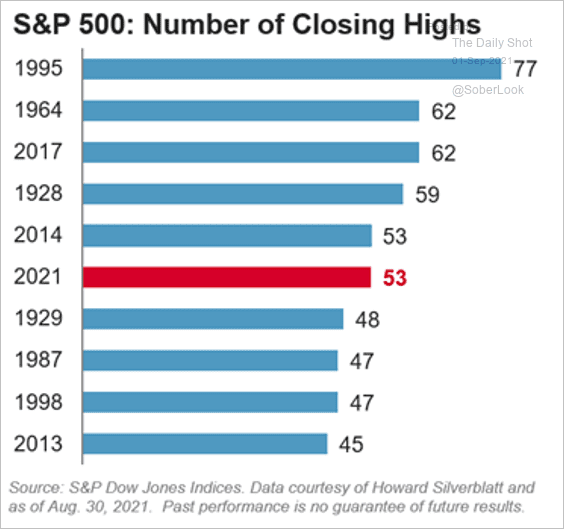

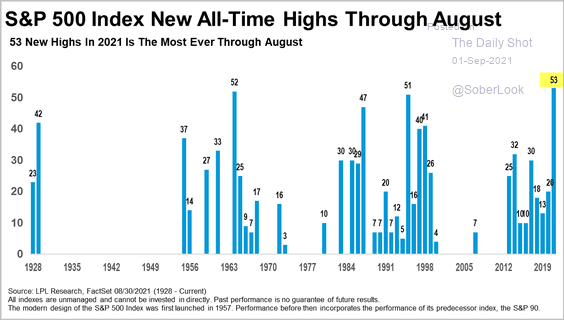

1. So far, the S&P 500 hit 53 new highs this year, …

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

… the most ever through August.

Source: LPL Research

Source: LPL Research

——————–

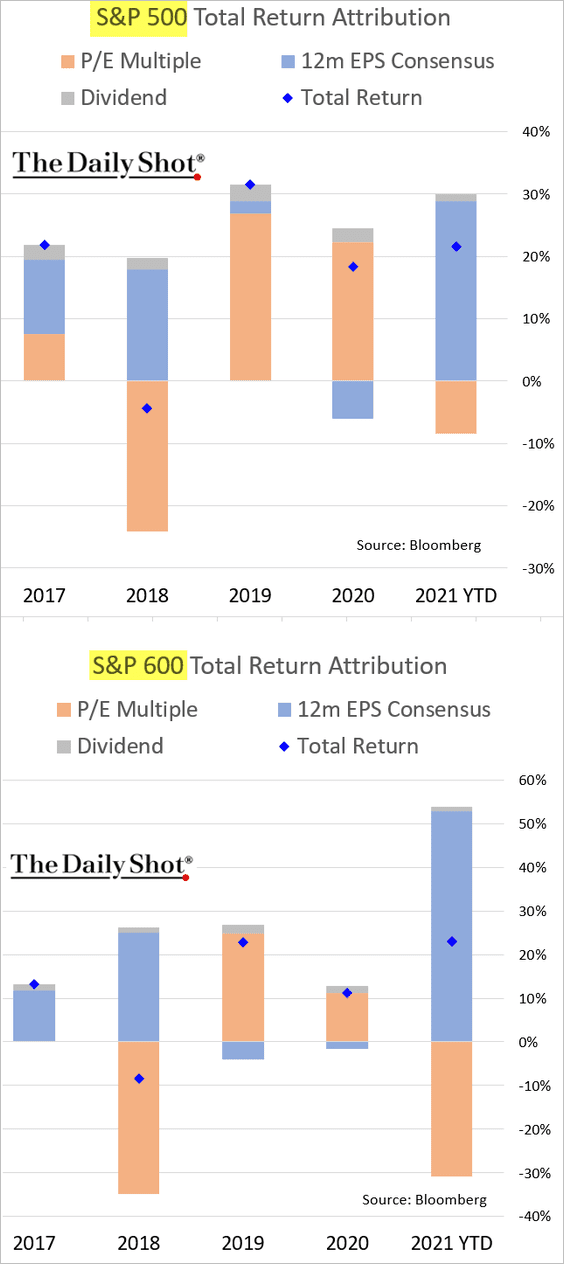

2. Returns have been driven by rising earnings expectations.

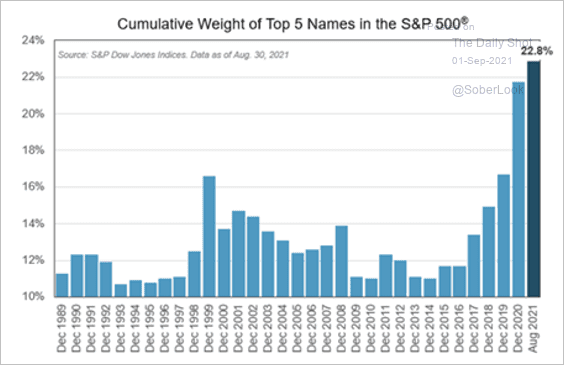

3. Top five names now represent 22.8% of the S&P 500.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

The market value of the US tech mega-caps is now above $10 trillion.

Source: @Schuldensuehner

Source: @Schuldensuehner

——————–

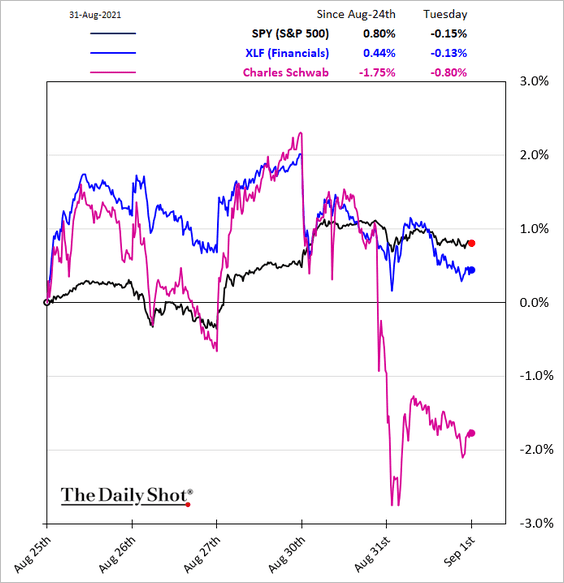

4. Retail brokers could face substantial revenue losses if the SEC prohibits order flow sales. Such an outcome would result in lower market liquidity. Will we also see a return to transaction fees?

Source: Barron’s Read full article

Source: Barron’s Read full article

——————–

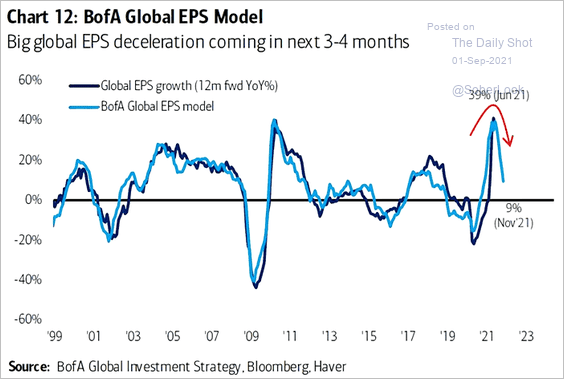

5. EPS growth is peaking, with tougher comps ahead.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

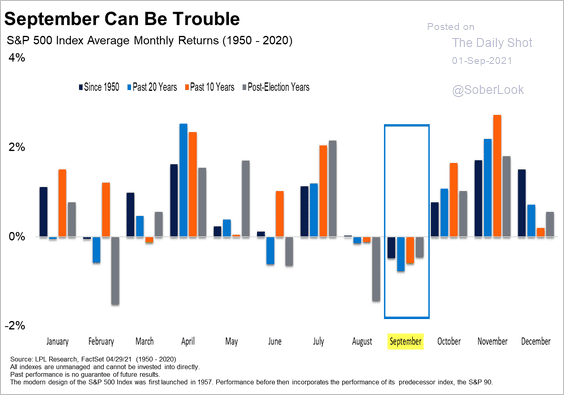

6. September can be a challenging month for stock returns.

Source: LPL Research

Source: LPL Research

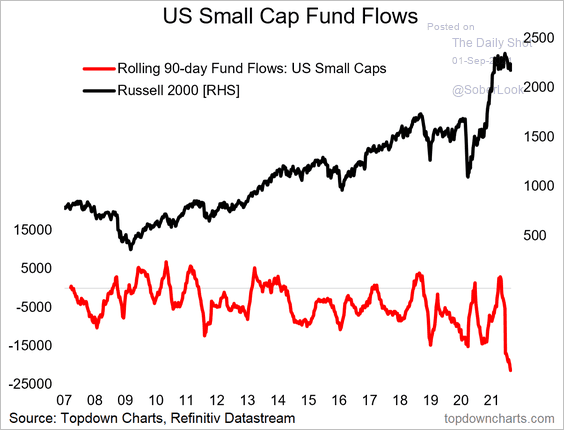

7. Small-cap funds have been experiencing outflows.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

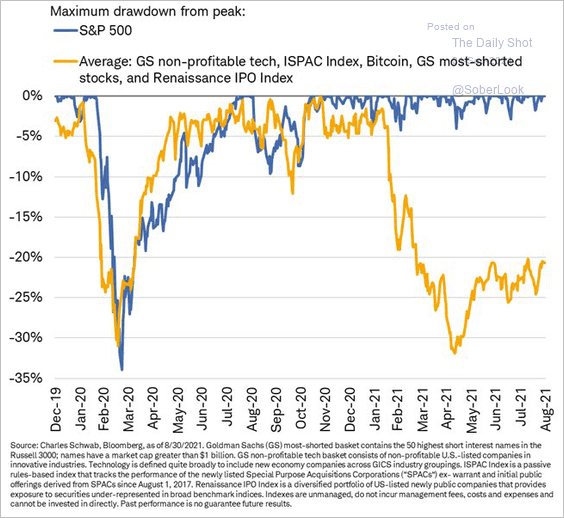

8. Speculative assets have not recovered from the selloff at the beginning of the year.

Source: @LizAnnSonders

Source: @LizAnnSonders

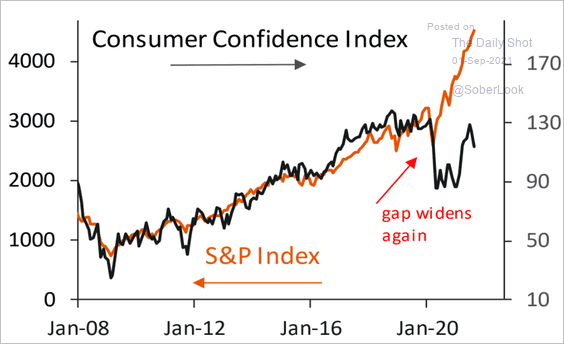

9. The gap between stocks and consumer confidence continues to widen.

Source: Piper Sandler

Source: Piper Sandler

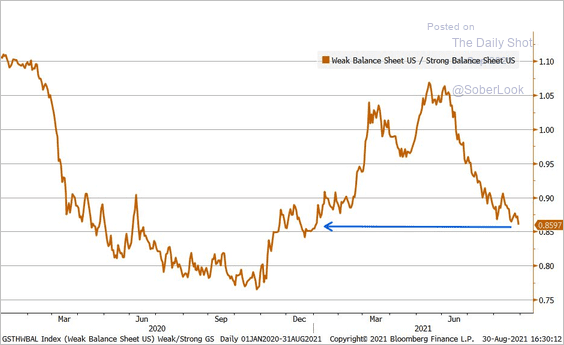

10. Companies with weak balance sheets have been underperforming this summer.

Source: @LizAnnSonders

Source: @LizAnnSonders

Back to Index

Rates

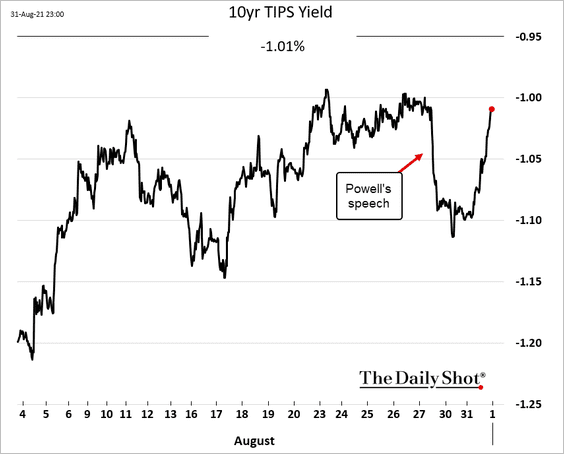

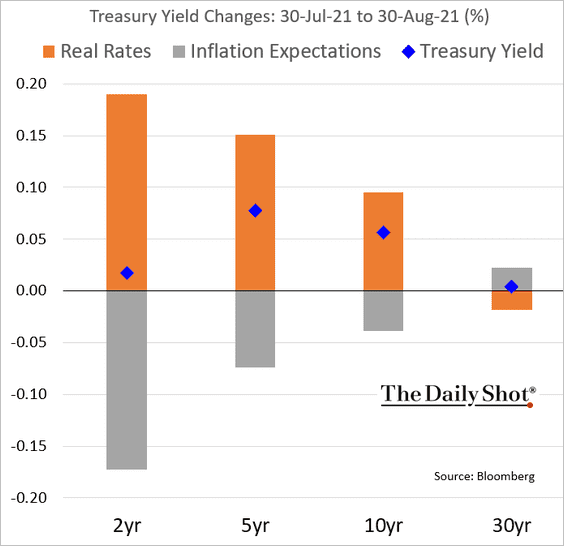

1. Real yields rebounded going into month-end.

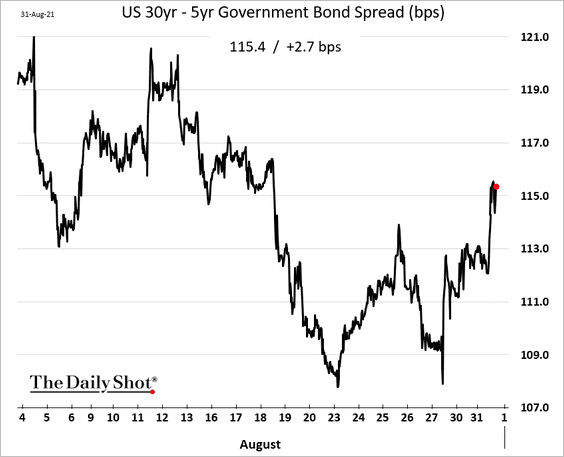

The Treasury curve steepened at the longer end.

——————–

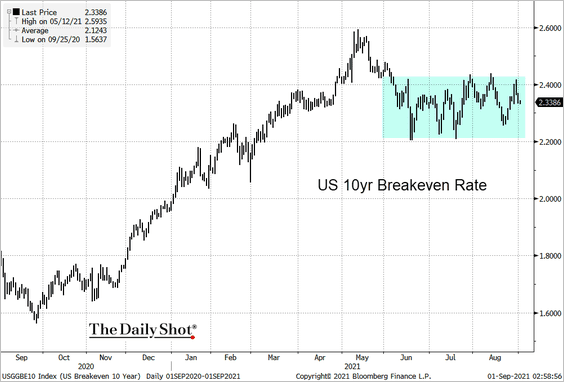

2. The US 10yr breakeven rate (inflation expectations) remains stuck in a range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

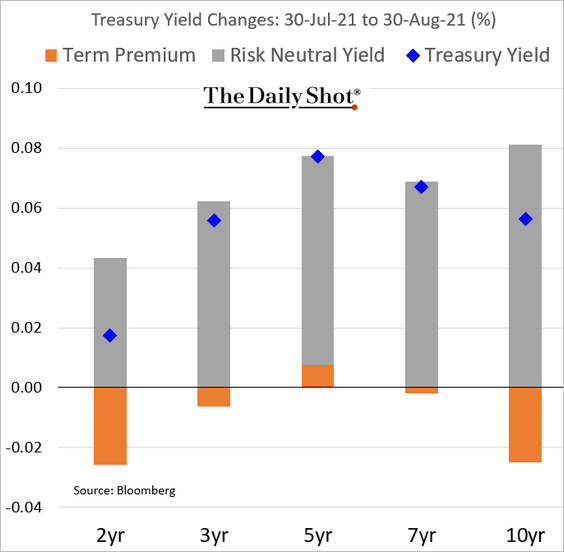

3. Here is the attribution of Treasury yield changes in August.

• Inflation expectations vs. real rates:

• Term premium vs. risk-neutral yield (expectations of short-term rates):

Back to Index

Global Developments

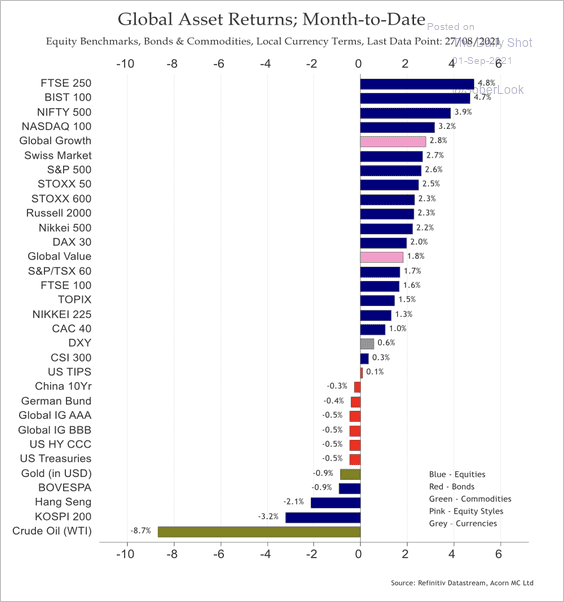

1. Here is a look at asset class returns in August.

Source: Acorn Macro Consulting

Source: Acorn Macro Consulting

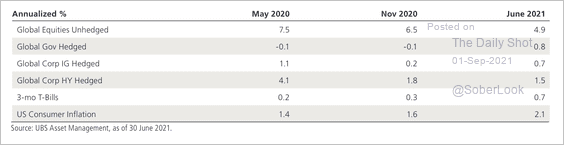

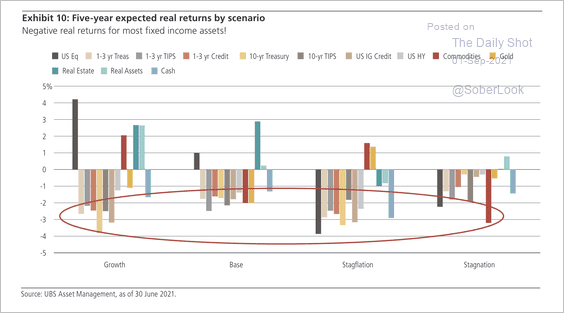

2. This table shows UBS Asset Management’s five-year expected market returns (in dollar terms).

Source: UBS Asset Management

Source: UBS Asset Management

UBS expects negative real returns for most fixed-income assets over the next five years.

Source: UBS Asset Management

Source: UBS Asset Management

——————–

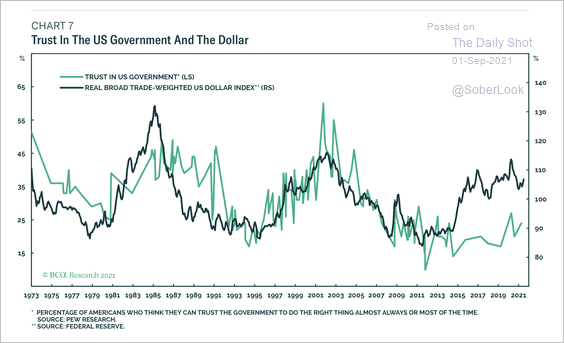

3. Moves in the dollar have correlated with trust in the US government.

Source: BCA Research

Source: BCA Research

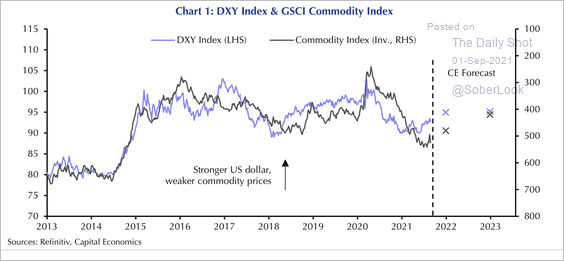

Capital Economics expects the dollar to rise further as commodity prices fall and long-term government bond yields rise in the US more than elsewhere.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

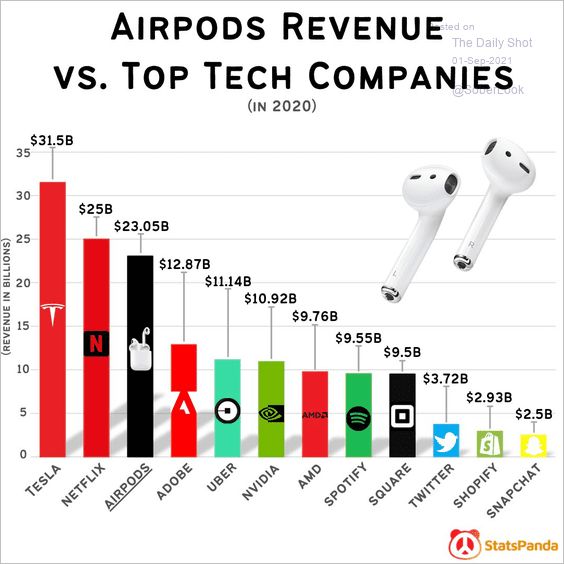

1. Airpods revenue in perspective:

Source: @statspanda1, @nxthompson Read full article

Source: @statspanda1, @nxthompson Read full article

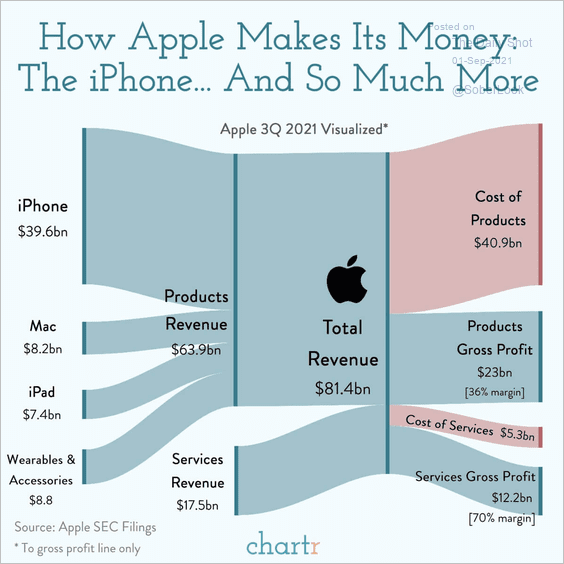

2. How Apple makes its money:

Source: @chartrdaily

Source: @chartrdaily

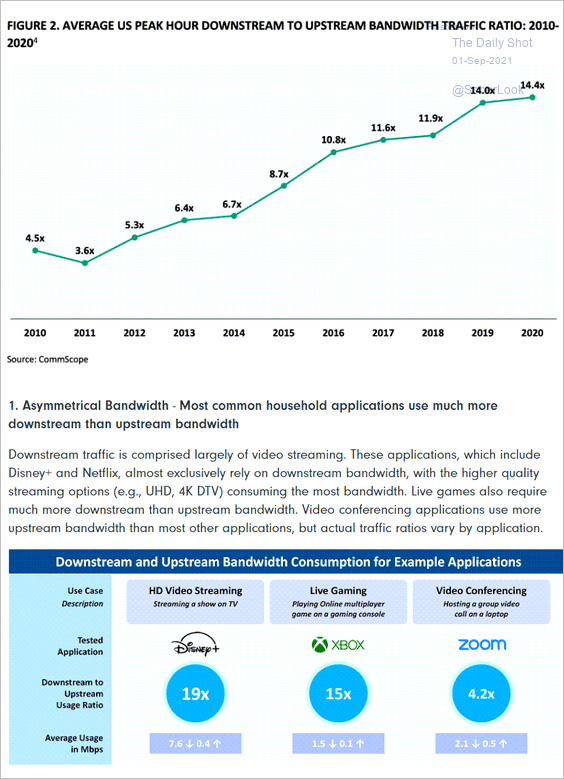

3. Downstream-to-upstream internet traffic ratio:

Source: NCTA Read full article

Source: NCTA Read full article

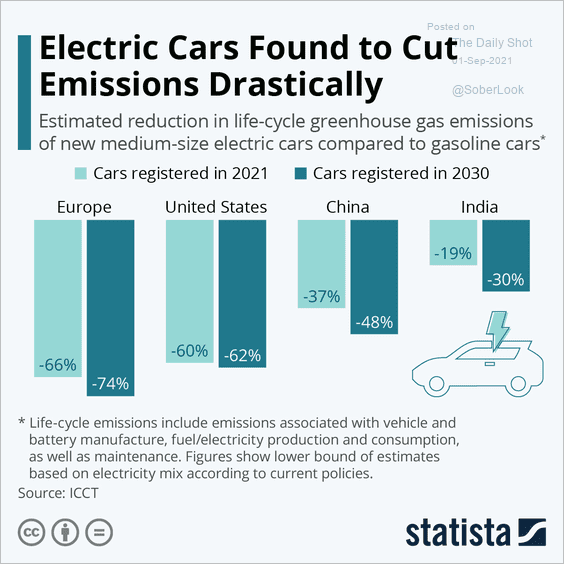

4. Emissions reduction from EVs:

Source: Statista

Source: Statista

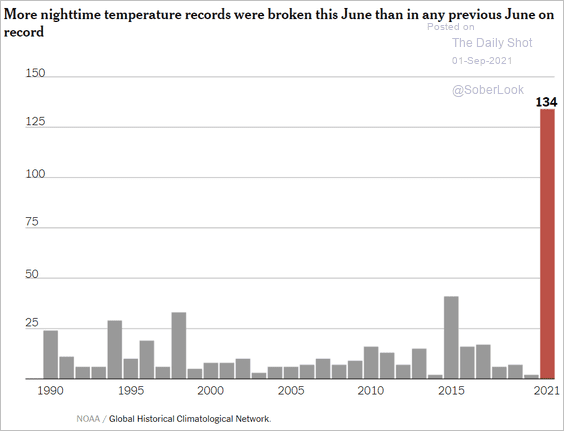

5. Warm nights:

Source: The New York Times Read full article

Source: The New York Times Read full article

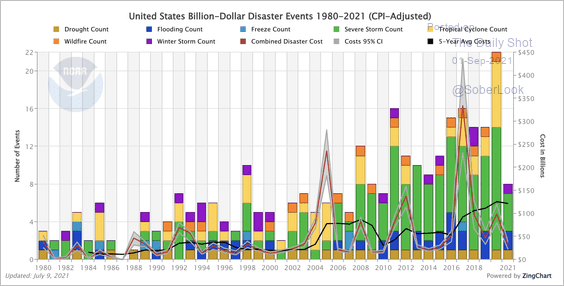

6. Billion-dollar weather disasters:

Source: NOAA Further reading

Source: NOAA Further reading

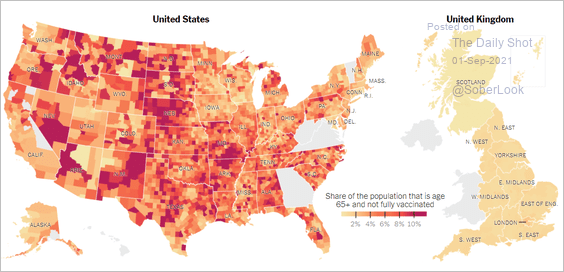

7. Share of the population that is 65+ and not fully vaccinated – the US vs. the UK:

Source: The New York Times Read full article

Source: The New York Times Read full article

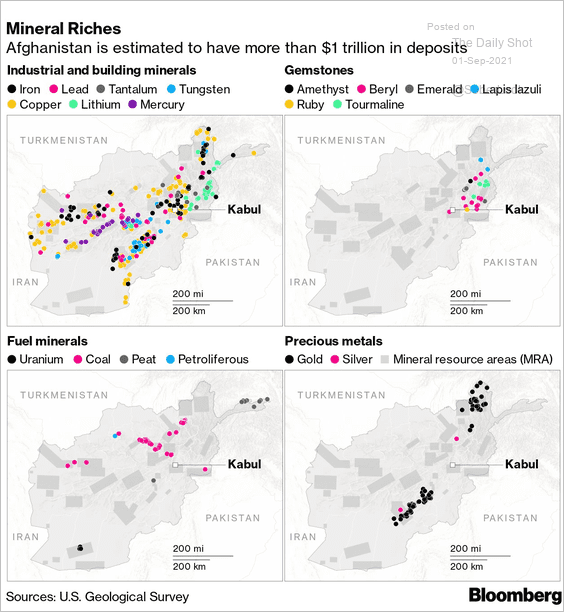

8. Afghanistan’s mineral deposits:

Source: @economics, @iainmarlow, @EndaCurran Read full article

Source: @economics, @iainmarlow, @EndaCurran Read full article

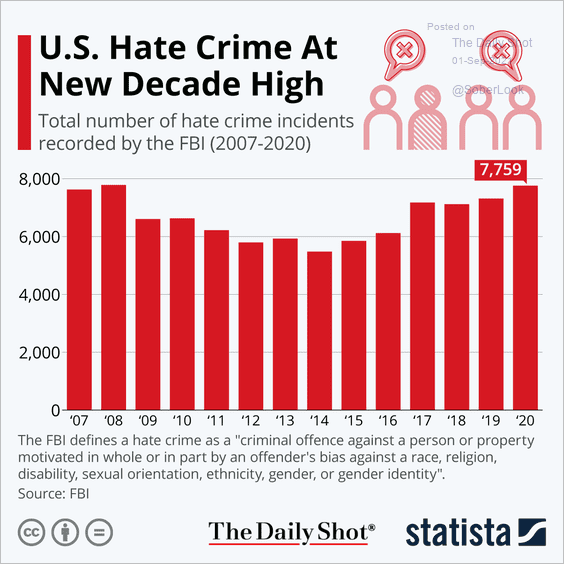

9. Hate crime incidents in the US:

Source: Statista

Source: Statista

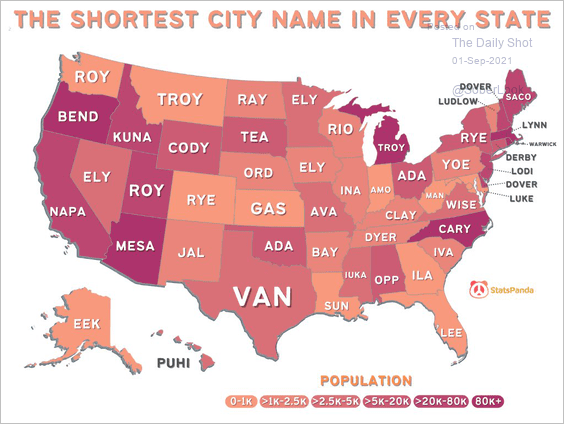

10. The shortest city name in each state:

Source: @statspanda1

Source: @statspanda1

——————–

Back to Index