The Daily Shot: 13-Sep-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

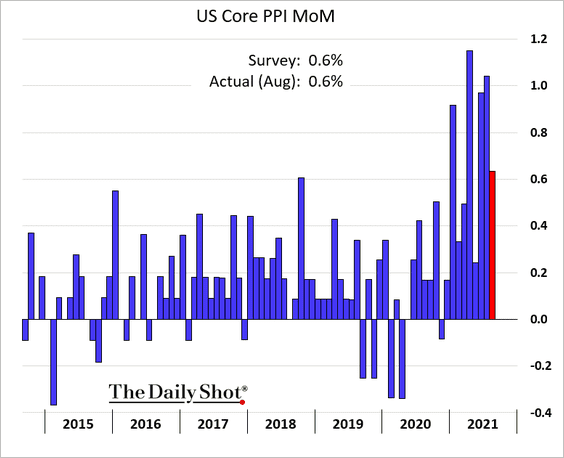

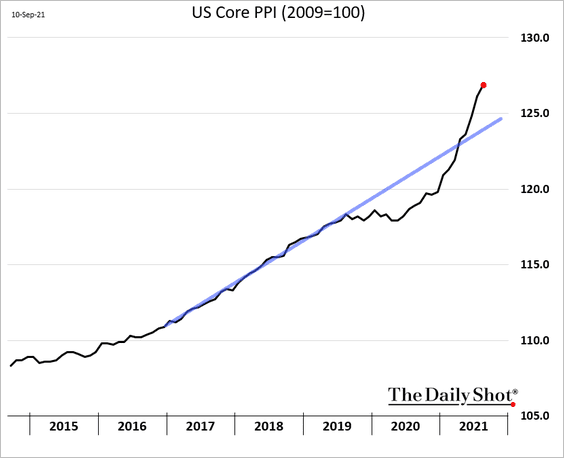

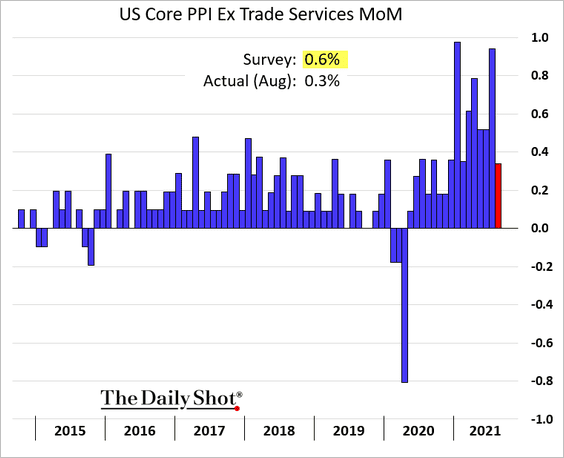

1. Let’s begin with some updates on inflation.

• The August core PPI was in line with Street expectations.

The price level is now well above the pre-COVID trend.

As we saw last week, corporate markups (“trade services”) have been a significant contributor to producer price increases. Businesses have gained pricing power, and they are using it. Excluding trade services, the core PPI was below consensus.

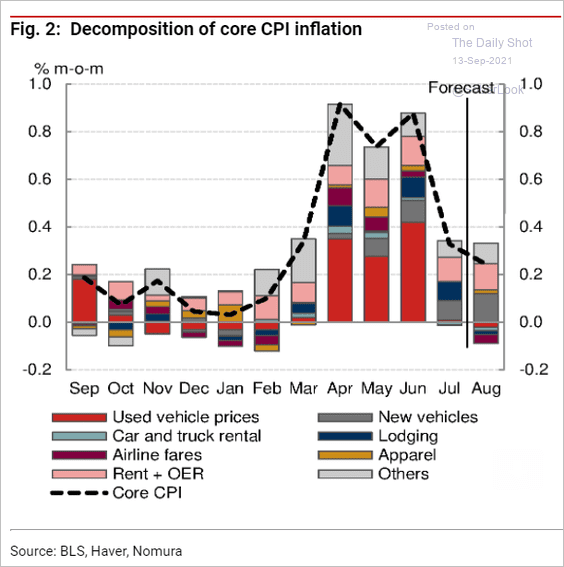

• Nomura is estimating a slightly lower CPI gain last month, …

Source: Nomura Securities

Source: Nomura Securities

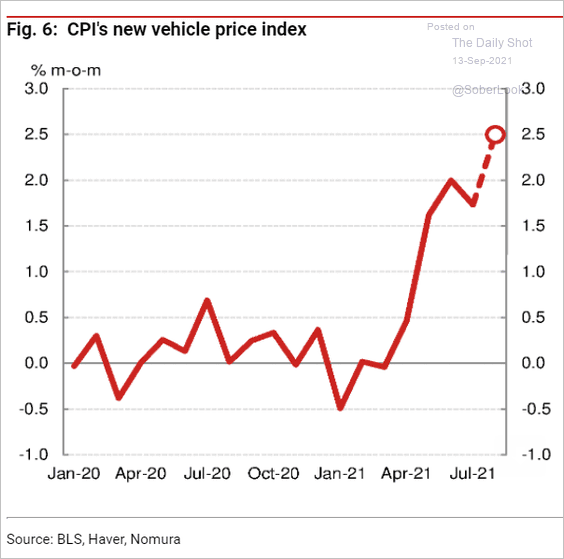

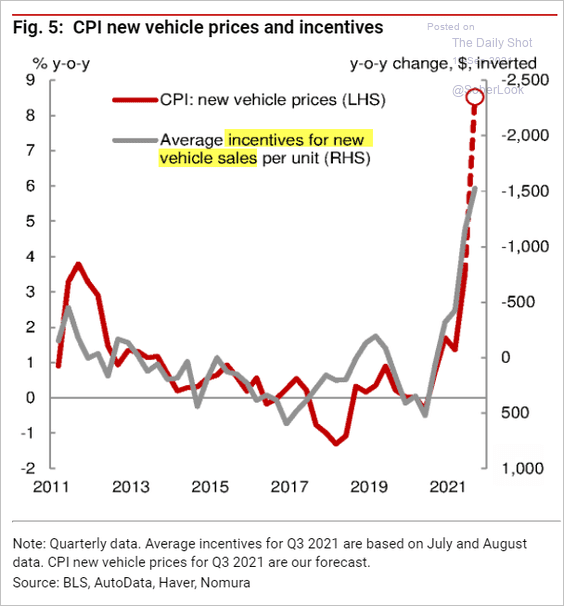

… with a substantial contribution coming from new vehicles (2 charts).

Source: Nomura Securities

Source: Nomura Securities

Source: Nomura Securities

Source: Nomura Securities

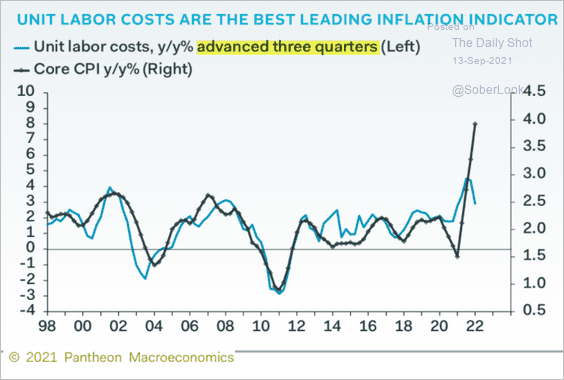

• Unit labor costs point to further acceleration in the core CPI over the next few quarters.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

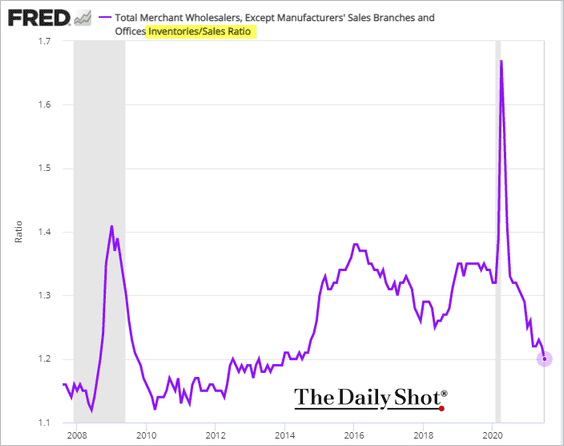

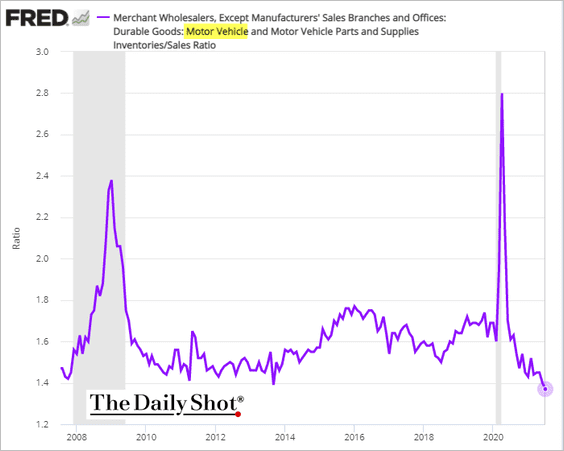

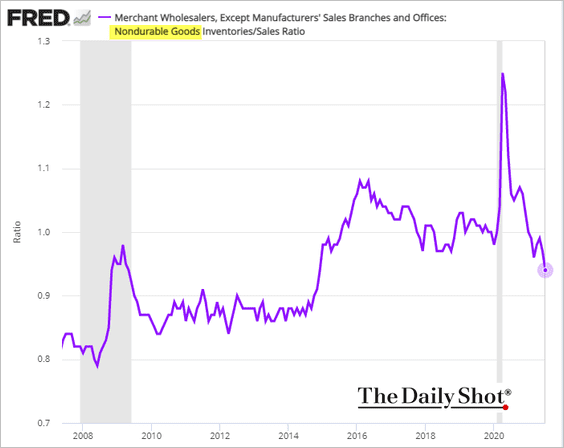

2. Wholesale inventories improved in July, but demand was even stronger. The inventories-to-sales ratio continues to tumble, pushing producer prices higher.

Source: Reuters Read full article

Source: Reuters Read full article

Here is the ratio for vehicles.

But it’s not just about cars. The nondurable goods inventories-to-sales ratio is also at multi-year lows.

——————–

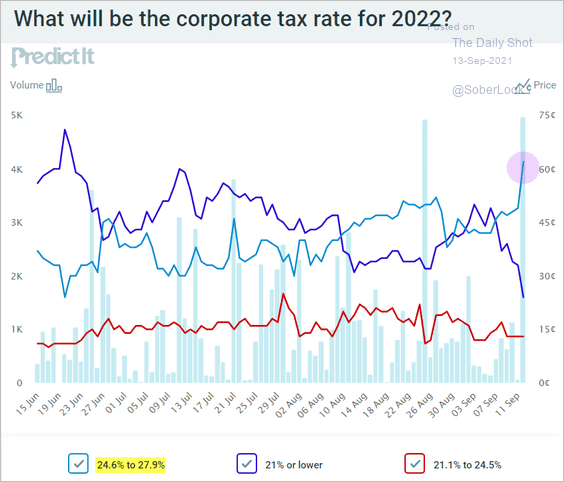

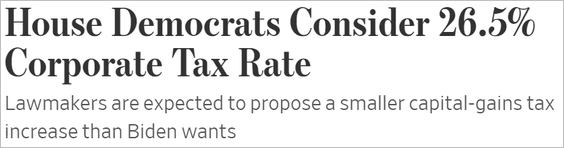

3. The betting markets increasingly expect a corporate tax hike.

Source: @PredictIt

Source: @PredictIt

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

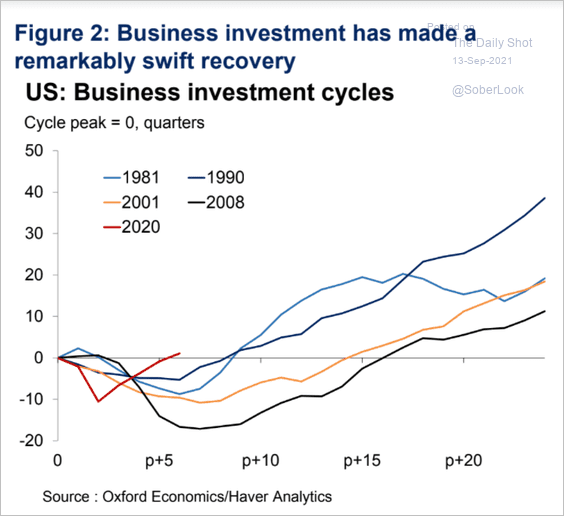

4. Business investment has been rebounding quickly, …

Source: Oxford Economics

Source: Oxford Economics

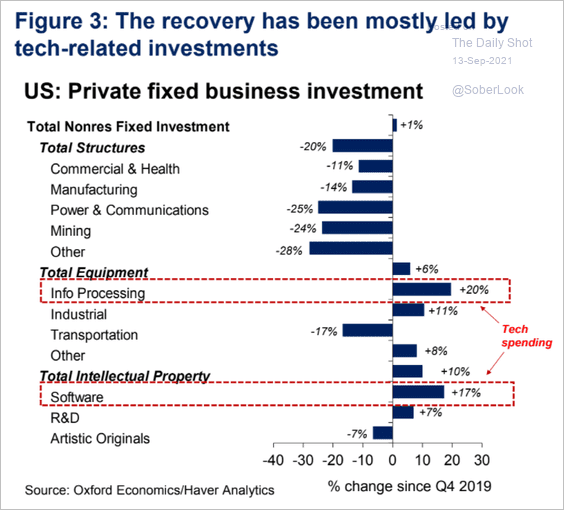

… dominated by tech spending.

Source: Oxford Economics

Source: Oxford Economics

——————–

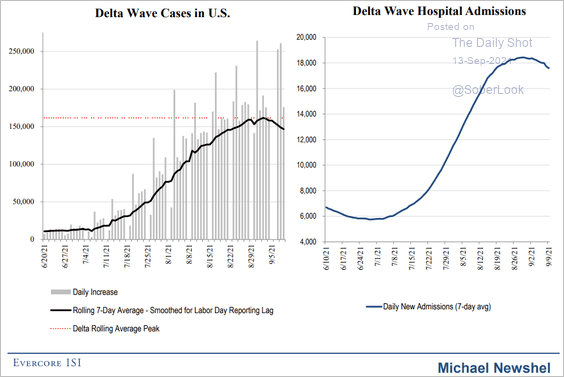

5. As discussed previously, the Delta-variant wave has peaked.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Canada

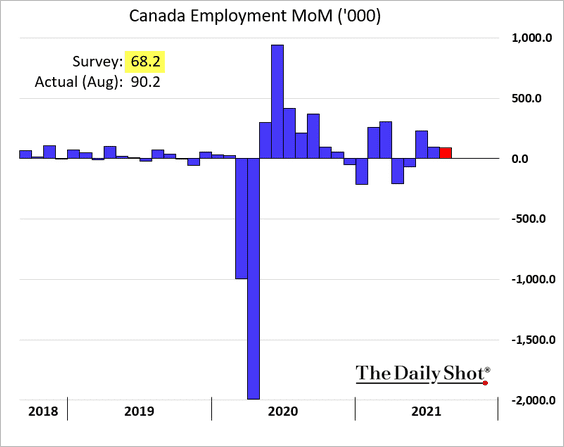

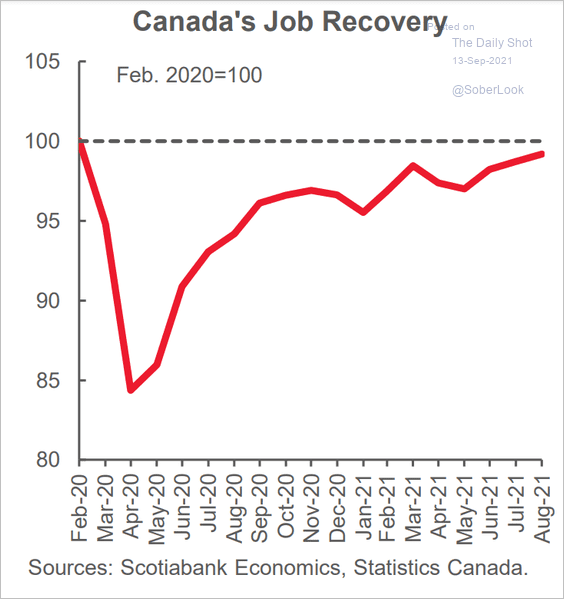

1. The employment report exceeded economists’ expectations.

• The labor market has almost fully recovered.

Source: Scotiabank Economics

Source: Scotiabank Economics

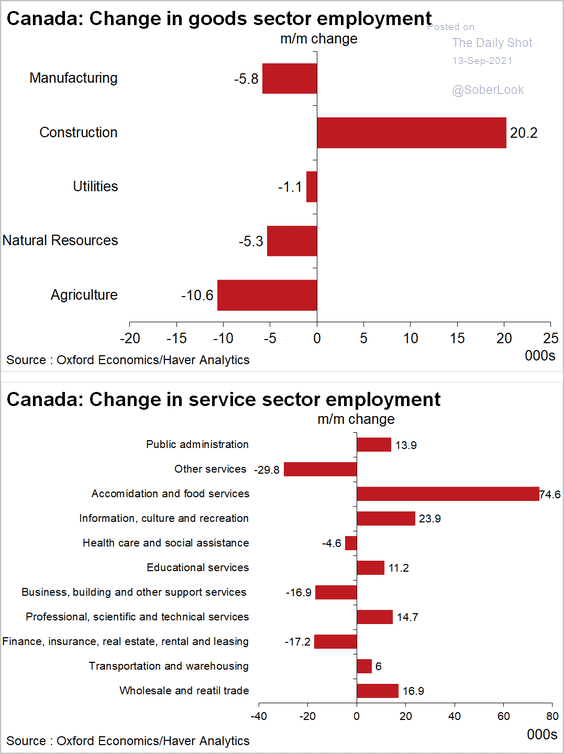

• Here are the changes by sector.

Source: Oxford Economics

Source: Oxford Economics

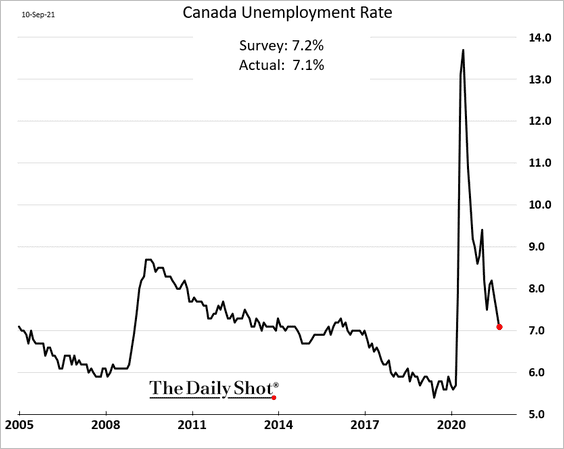

• The unemployment rate continues to fall.

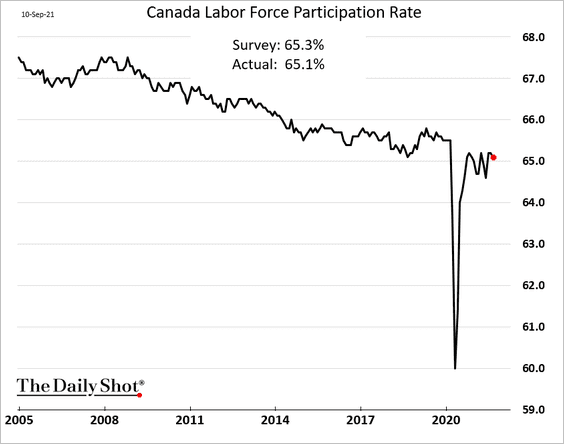

• Labor force participation ticked lower.

——————–

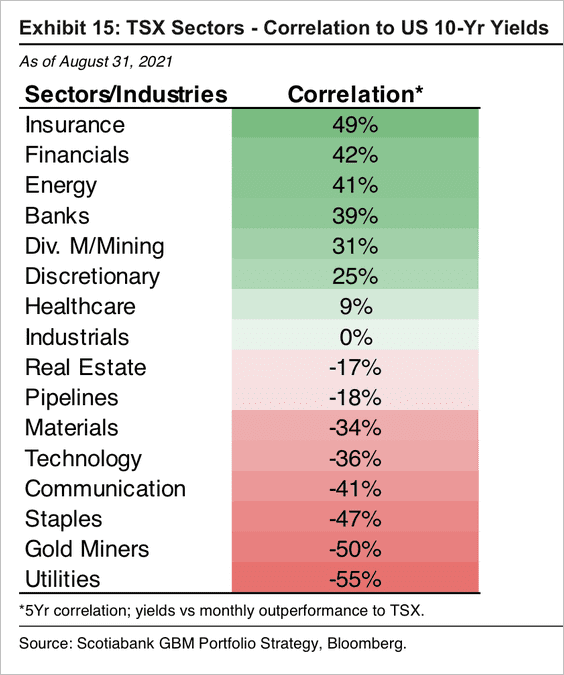

2. Insurance, financial, and energy stocks have the highest correlation to the 10-year Treasury yield.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

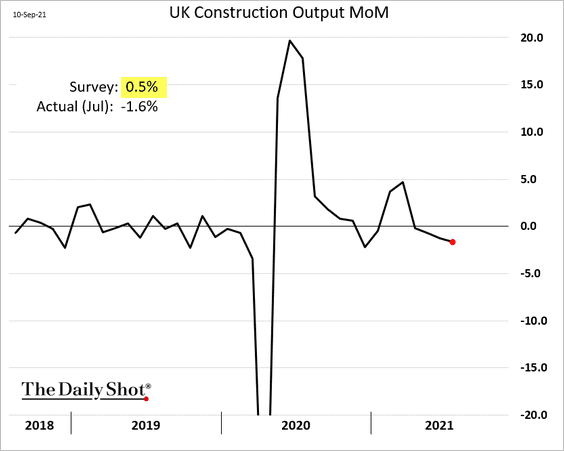

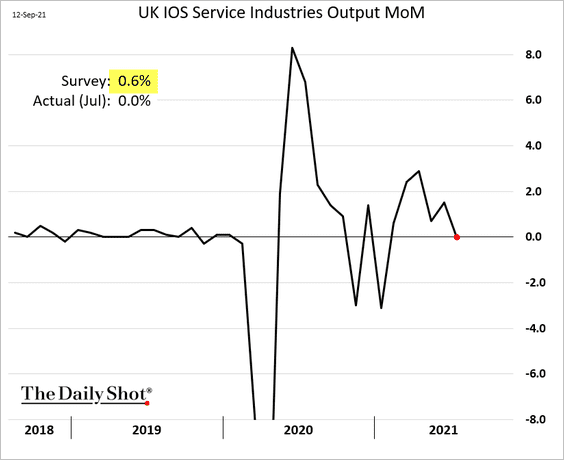

The United Kingdom

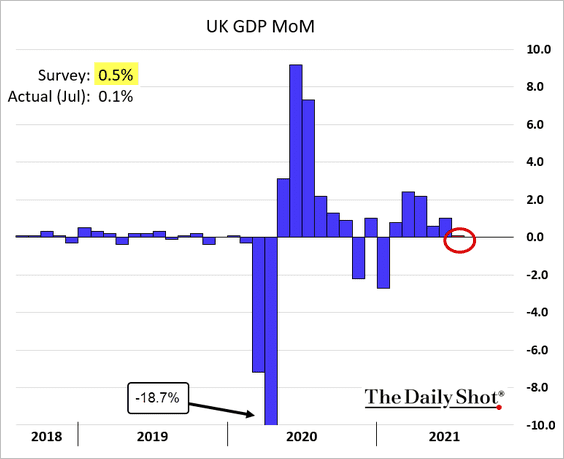

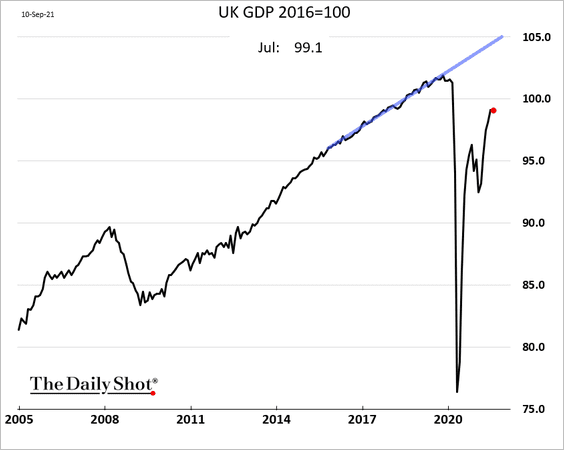

The July monthly GDP estimate was shockingly bad.

The recovery to pre-COVID levels (let alone trend) will take a while.

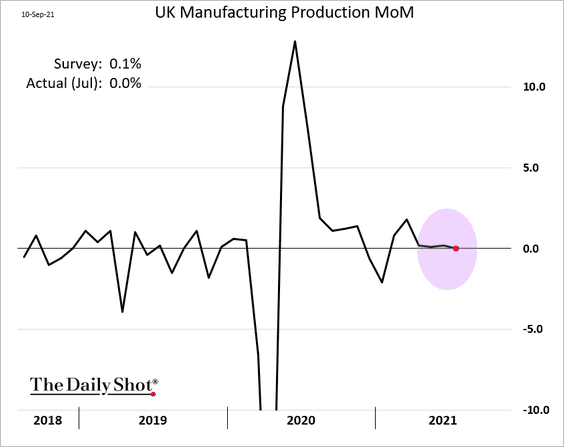

There was weakness across the board.

• Manufacturing (flat):

• Construction:

• Services:

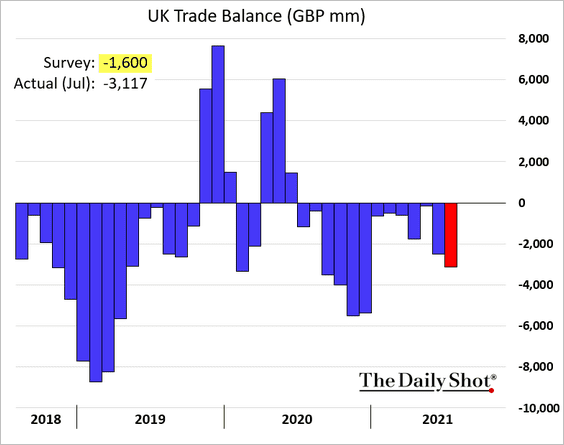

The trade deficit was worse than expected.

Back to Index

The Eurozone

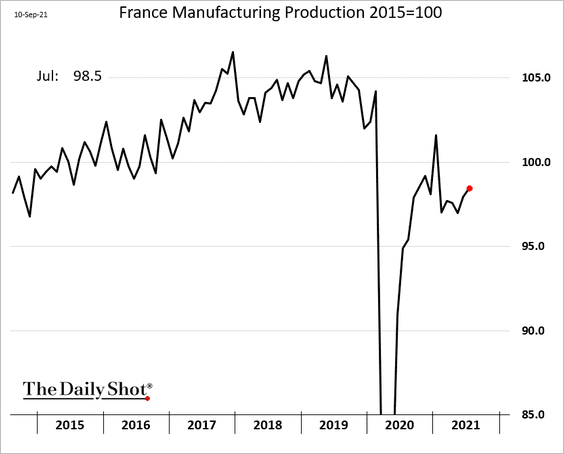

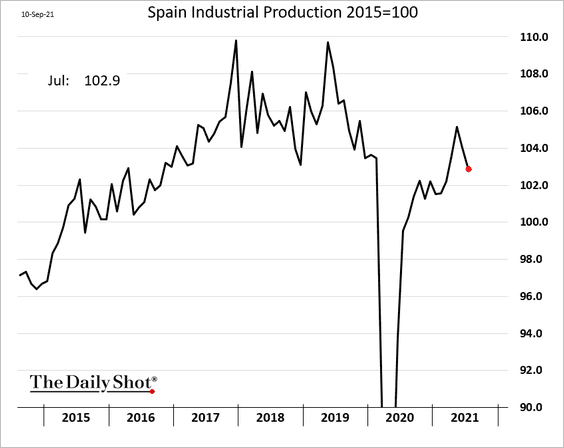

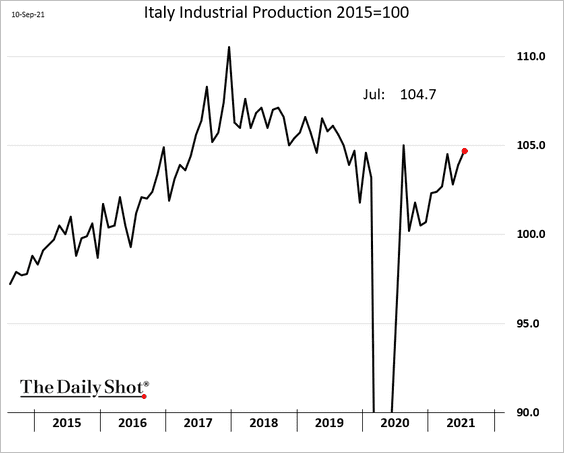

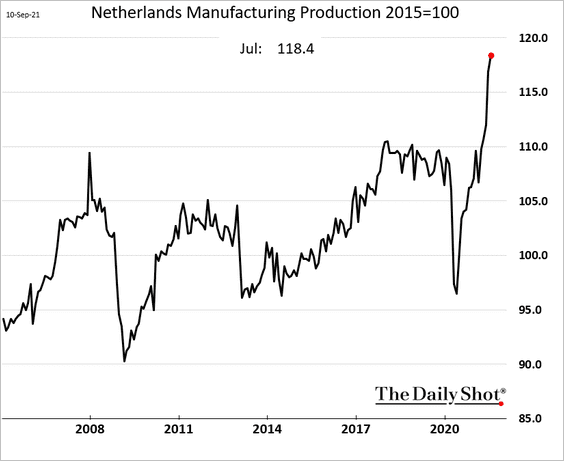

1. Industrial production reports have been mixed.

• France (another improvement in factory output):

• Spain (a sharp decline):

• Italy (back above pre-COVID levels):

• The Netherlands (surging):

——————–

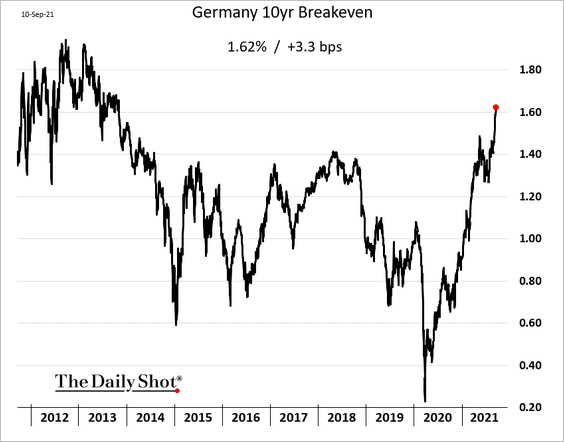

2. Market-based inflation expectations keep moving higher.

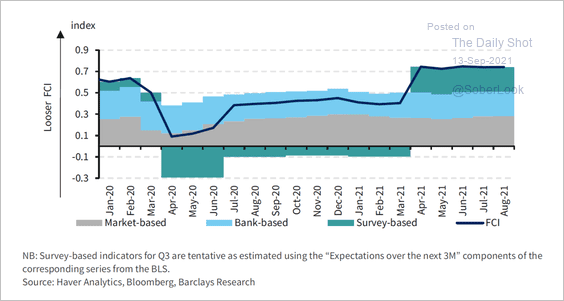

3. Euro-area financing conditions have improved significantly over the past year.

Source: Barclays Research

Source: Barclays Research

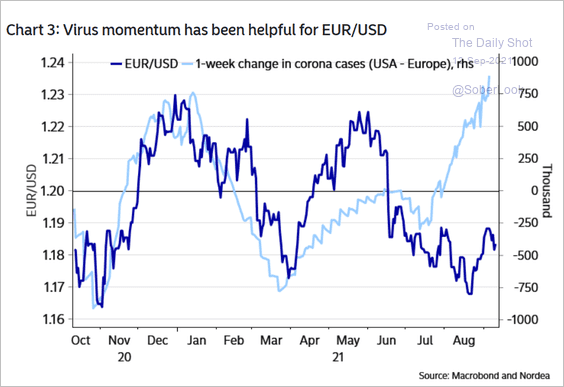

4. The US-Europe differential in COVID cases has been supportive for the euro.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Europe

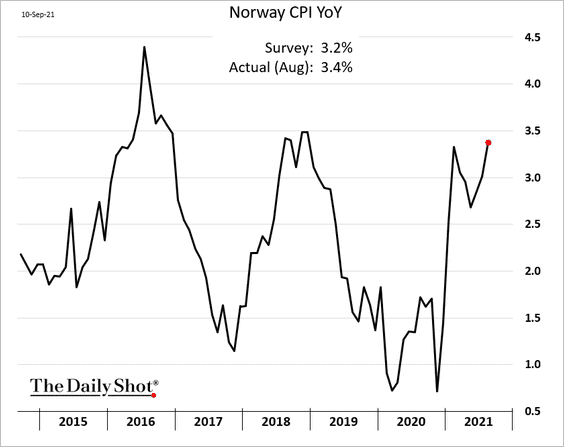

1. Norway’s inflation continues to climb.

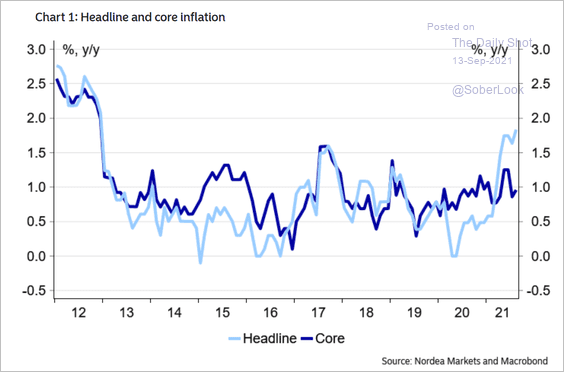

2. Danish inflation hit the highest level since 2012, although the core CPI remains tepid.

Source: Nordea Markets

Source: Nordea Markets

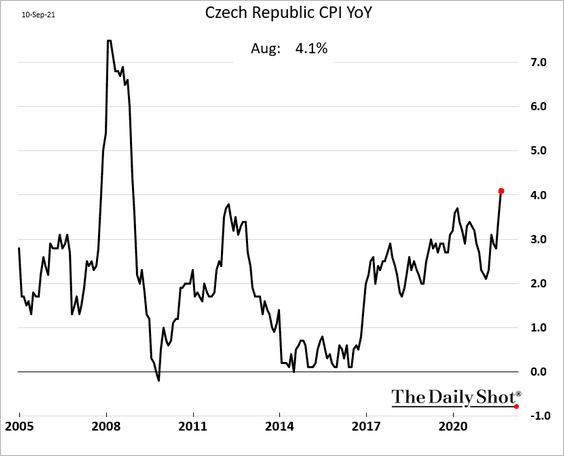

3. Czech Republic’s CPI climbed above 4% for the first time since the financial crisis.

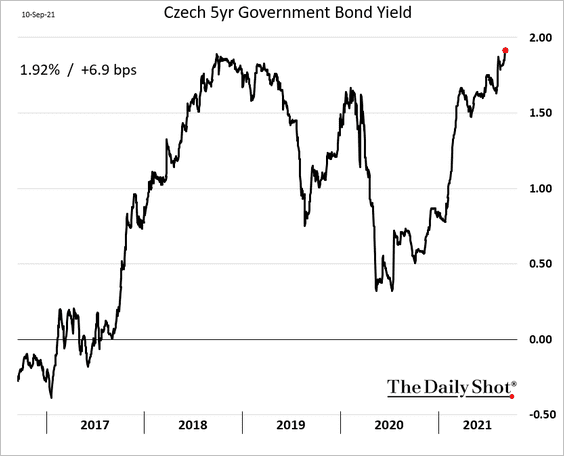

Bond yields jumped.

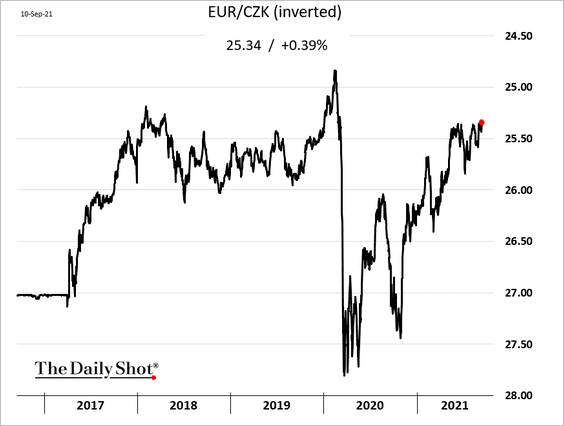

And the Czech koruna continues to rise vs. the euro.

——————–

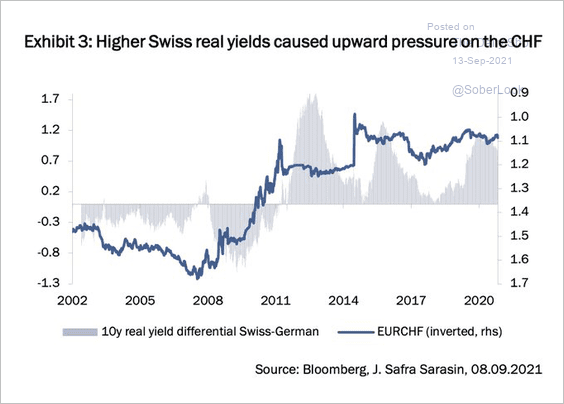

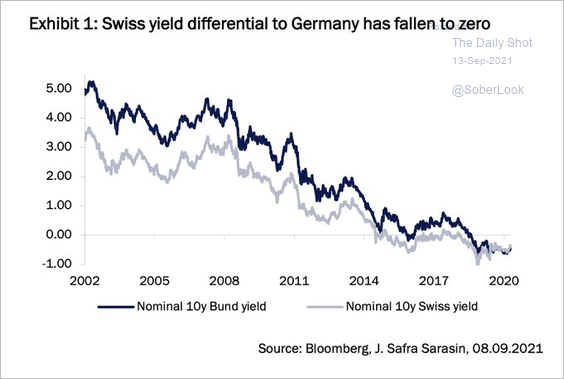

4. The Swiss-German yield differential has been supportive for the Swiss franc.

Source: @acemaxx, @KarstenJunius

Source: @acemaxx, @KarstenJunius

Source: @acemaxx, @KarstenJunius

Source: @acemaxx, @KarstenJunius

——————–

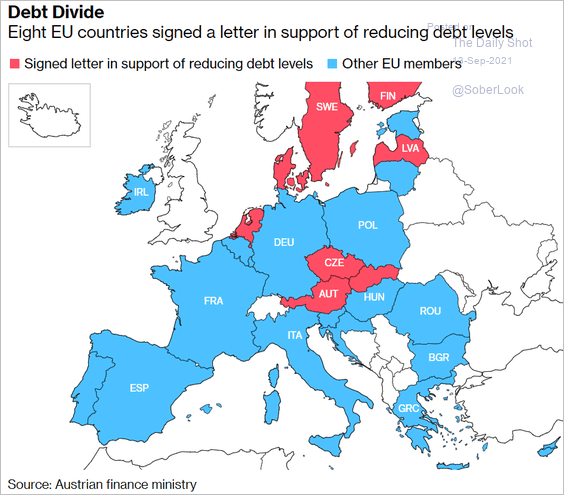

5. Some nations want the EU to focus on debt reduction again (after the budget rules were suspended in 2020).

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Asia – Pacific

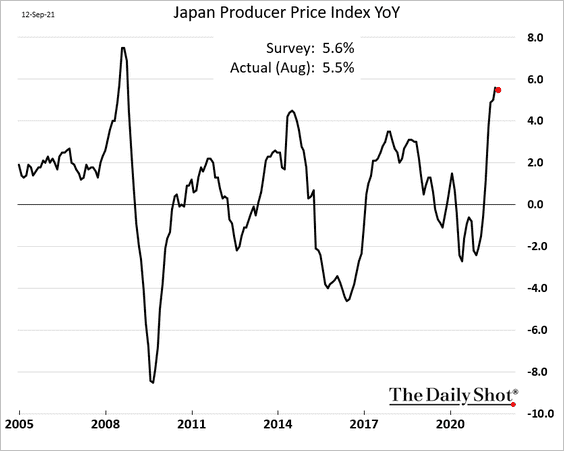

1. Japan’s PPI seems to have peaked.

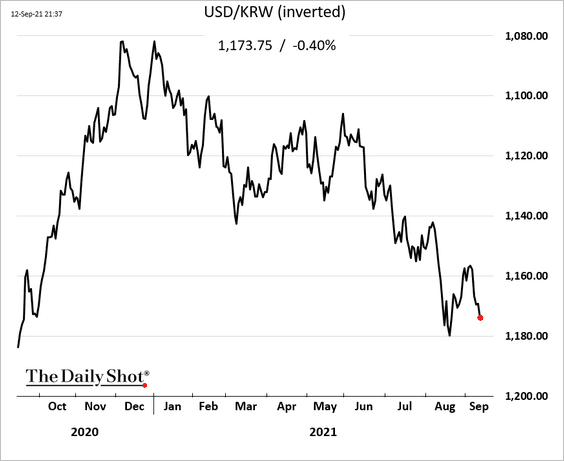

2. The South Korean won is sinking again.

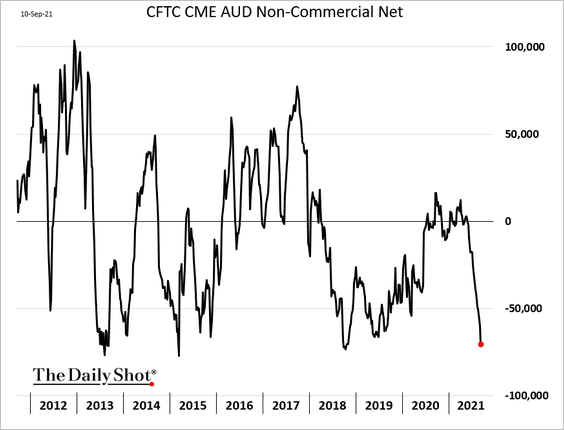

3. Traders have been boosting their bets against the Aussie dollar.

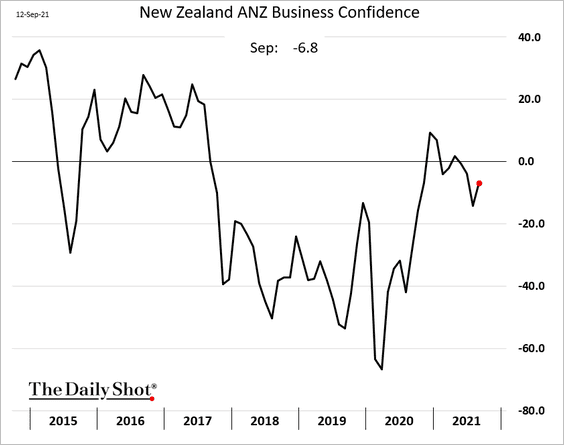

4. New Zealand’s business confidence ticked higher this month.

Back to Index

China

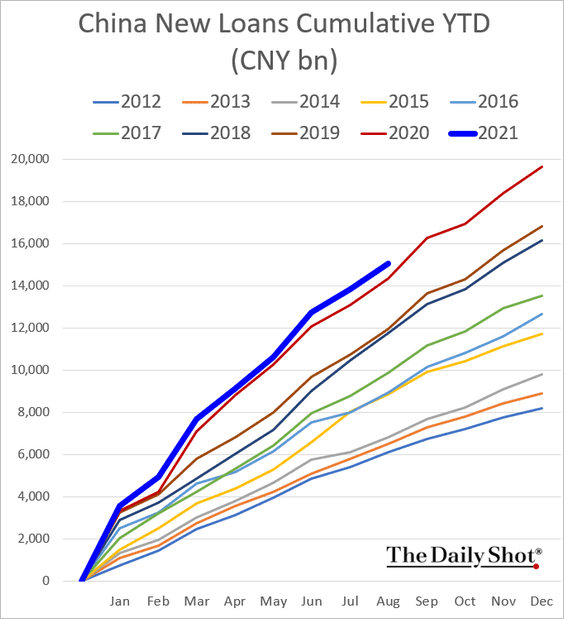

1. Loan growth is holding above 2020 levels on a year-to-date basis, but gains were lower than expected.

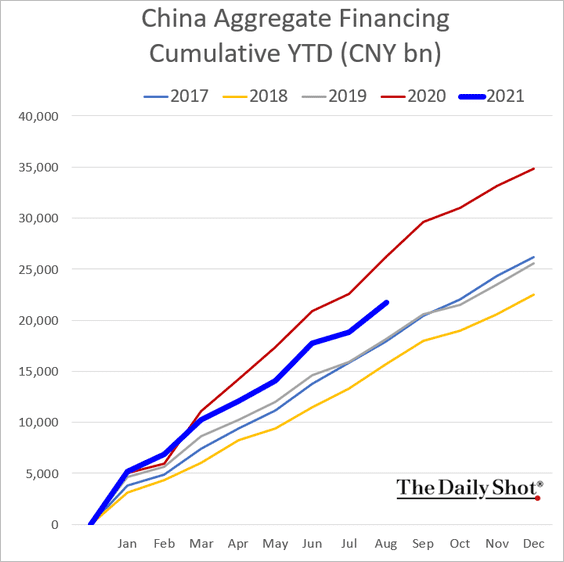

Here is China’s aggregate financing.

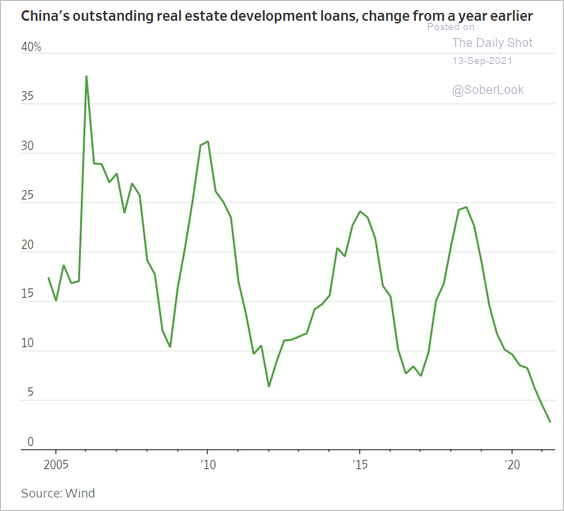

Real estate development loan growth is collapsing.

Source: @WSJ Read full article

Source: @WSJ Read full article

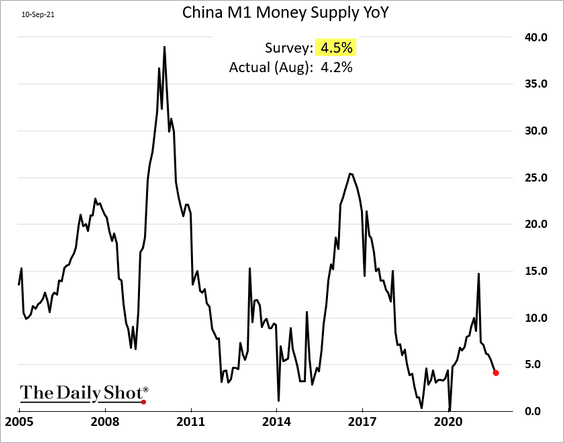

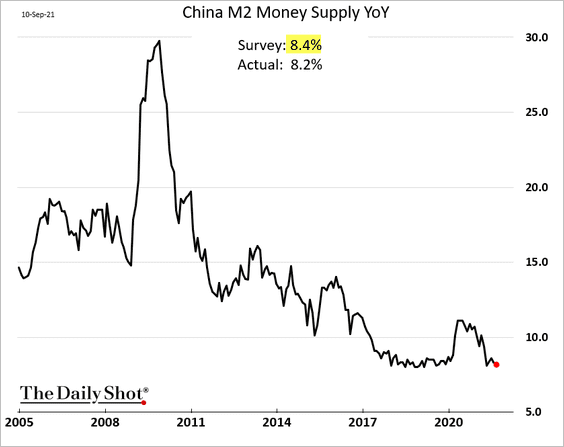

Money stock expansion measures surprised to the downside.

Are Beijing’s latest regulatory actions cooling the credit market?

Source: ING Read full article

Source: ING Read full article

——————–

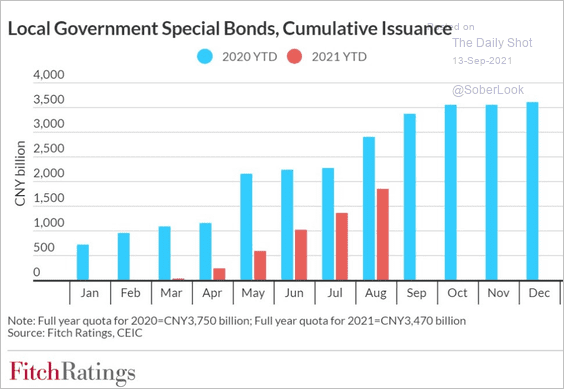

2. According to Fitch Ratings,

Fixed asset investment contracted by 1.2% yoy in July, based on our estimates, led by a sharp decline in infrastructure spending. Infrastructure was a critical component of the government’s fiscal stimulus package during the initial stage of the pandemic but has fallen yoy since April as policy support has faded and local governments have fallen short on their issuance quotas for infrastructure-linked bonds.

Source: Fitch Ratings

Source: Fitch Ratings

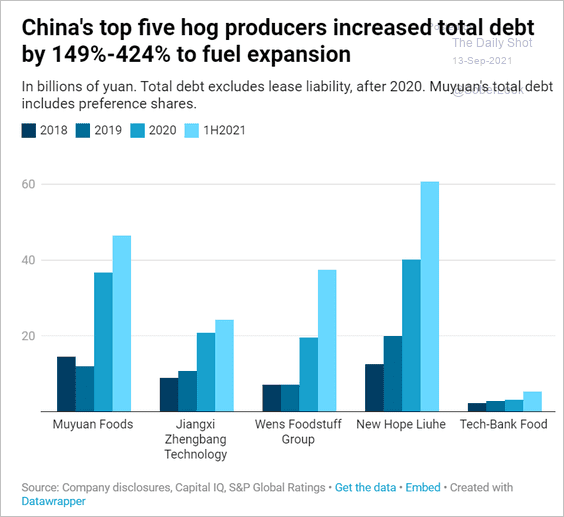

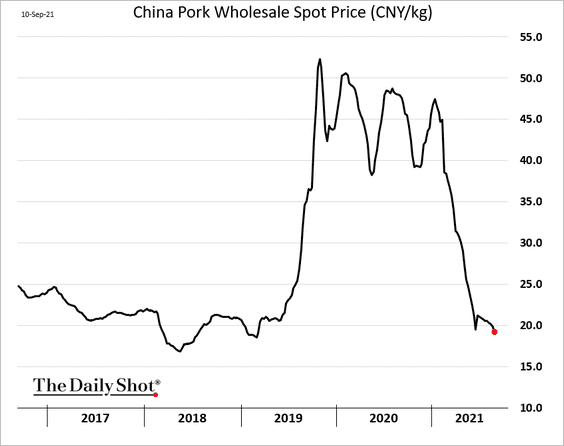

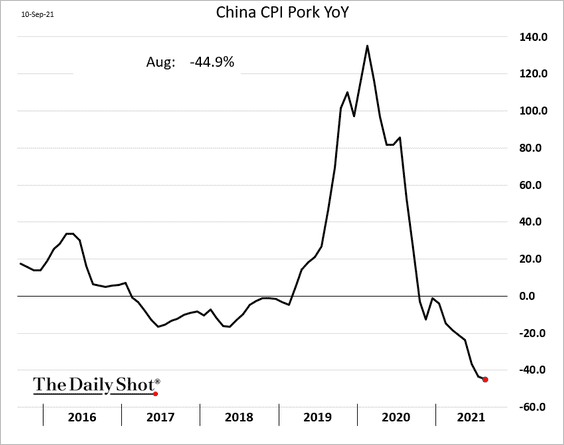

3. A couple of years ago, the African Swine Fever decimated China’s pig population, sending prices sharply higher. Many companies borrowed heavily to rebuild their herds.

Source: CNBC Read full article

Source: CNBC Read full article

But prices tumbled over the past few months, putting pressure on the nation’s indebted pork producers.

——————–

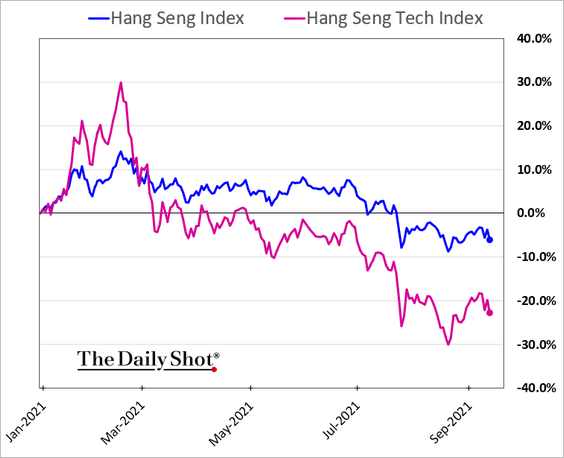

4. Stocks in Hong Kong are under pressure again.

Back to Index

Emerging Markets

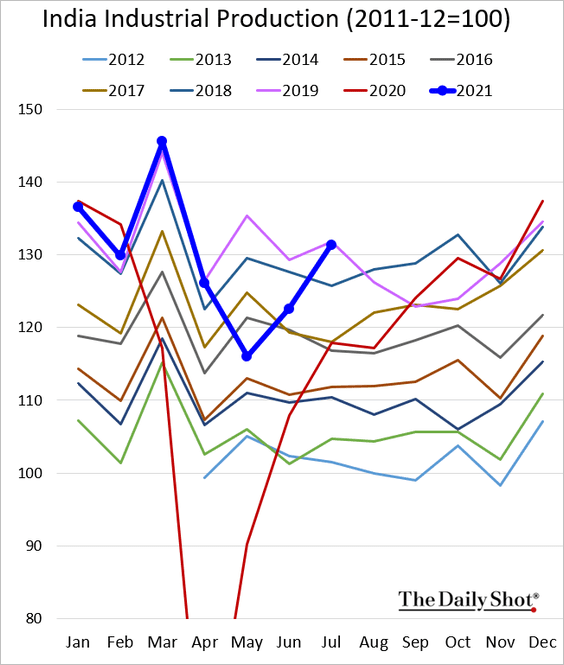

1. India’s industrial production has been rebounding.

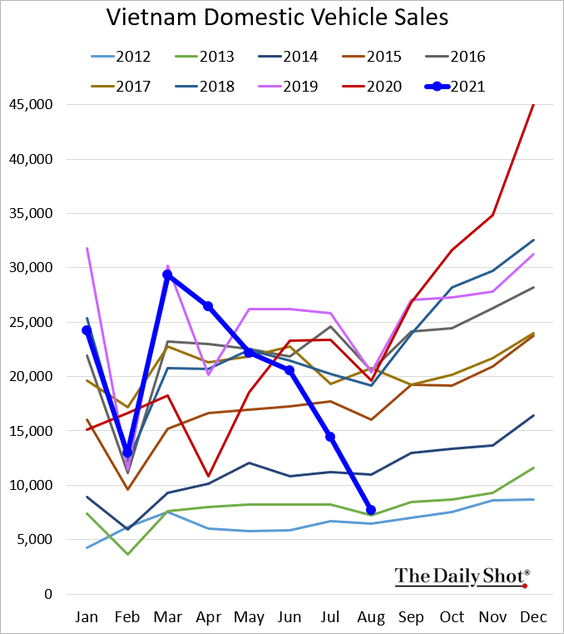

2. Vietnam’s vehicle sales hit a multi-year low.

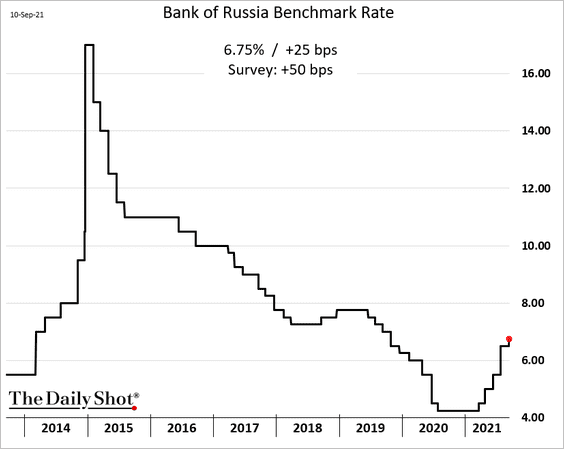

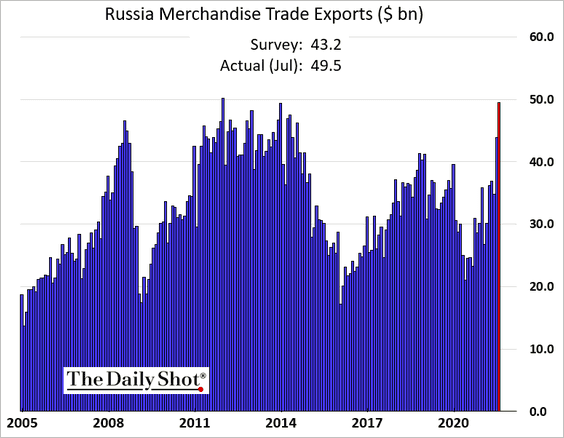

3. Russia’s central bank rate hike was smaller than expected.

Russia’s exports are surging as natural gas prices hit record highs.

——————–

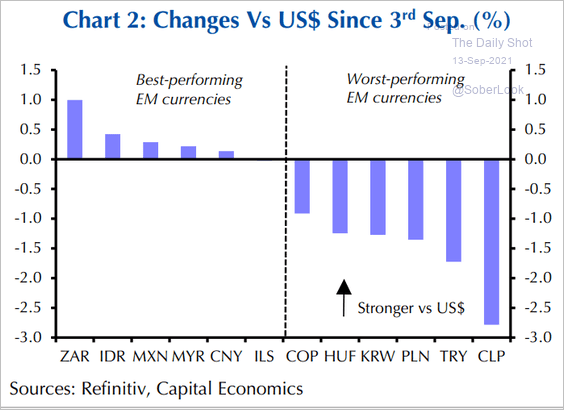

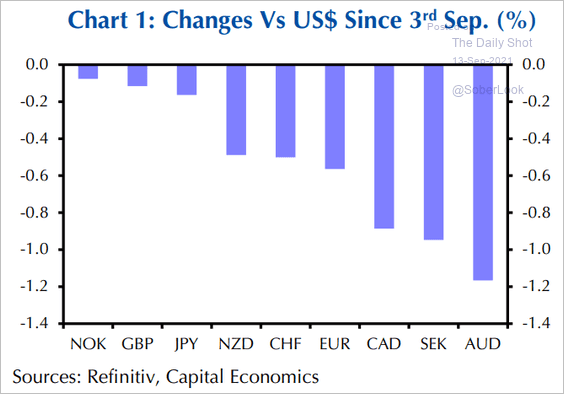

4. This chart shows EM currency movements against the dollar since Sep 3rd.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

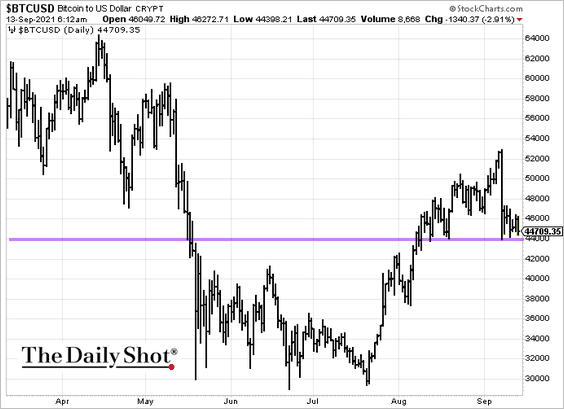

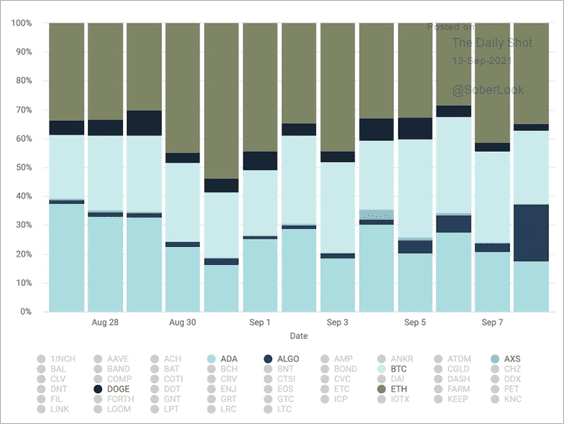

1. Bitcoin is holding support at $44k.

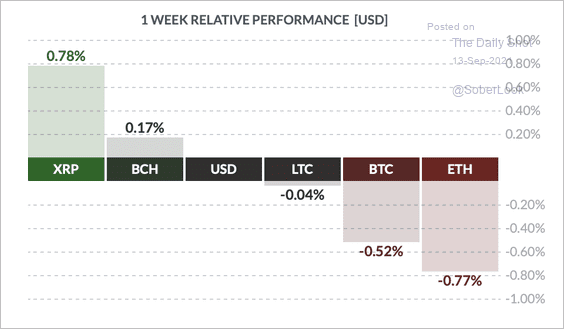

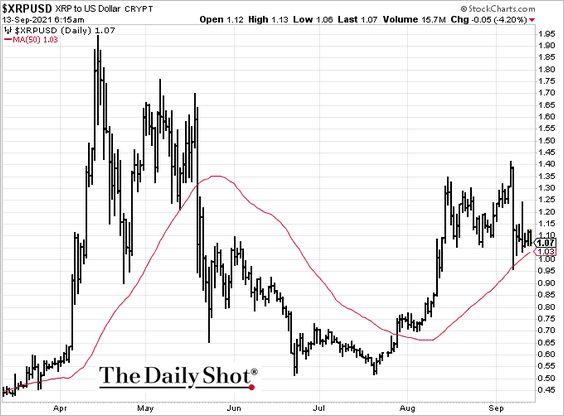

2. Ether has underperformed other large cryptocurrencies over the past week, while XRP took the lead.

Source: FinViz

Source: FinViz

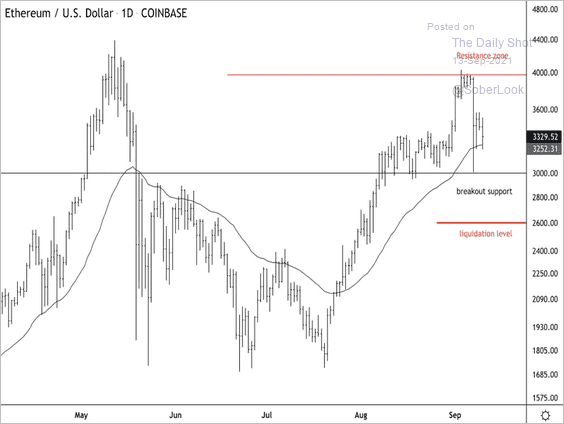

• Ether is holding support above $3,000.

Source: Dantes Outlook

Source: Dantes Outlook

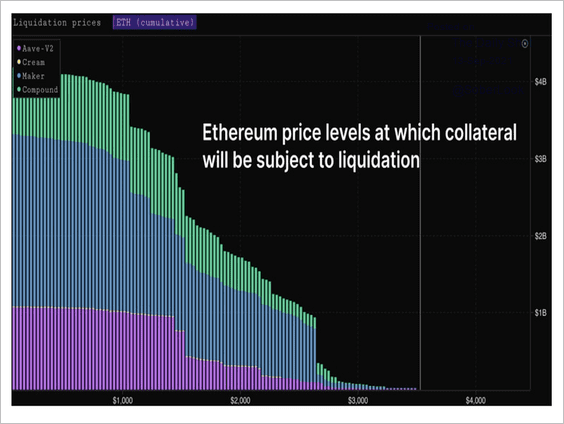

• This chart shows the next round of significant ETH liquidations don’t start until the $2,600 level.

Source: Glassnode Read full article

Source: Glassnode Read full article

• XRP held support at the 50-day moving average.

——————–

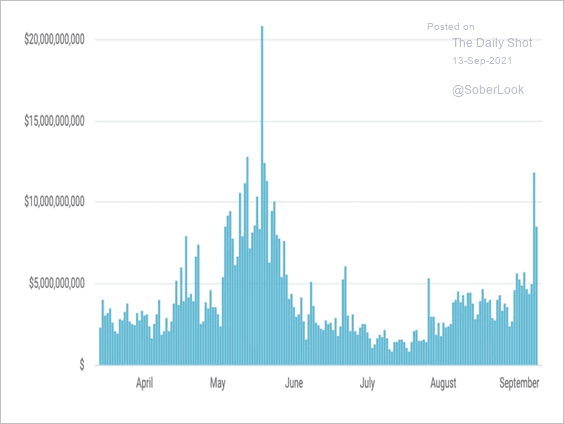

3. Coinbase trading volumes rose to the highest level since May.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

Bitcoin, ether, and Cardano’s ADA continue to dominate trading volumes on the Coinbase exchange. Dogecoin trading volumes have been fairly lackluster over the past few weeks.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

——————–

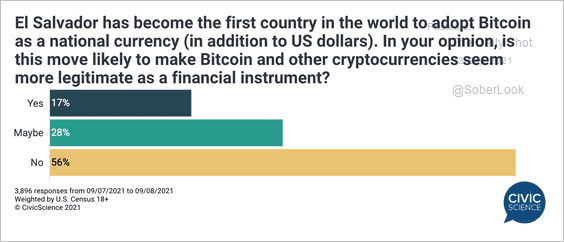

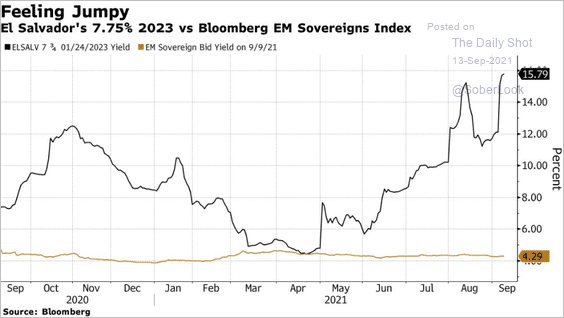

4. Did El Salvador’s move add legitimacy to cryptos?

Source: @CivicScience

Source: @CivicScience

It certainly didn’t help the nation’s bonds.

Source: @acemaxx, @tracyalloway Read full article

Source: @acemaxx, @tracyalloway Read full article

——————–

5. Will stablecoins be regulated like money market funds?

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

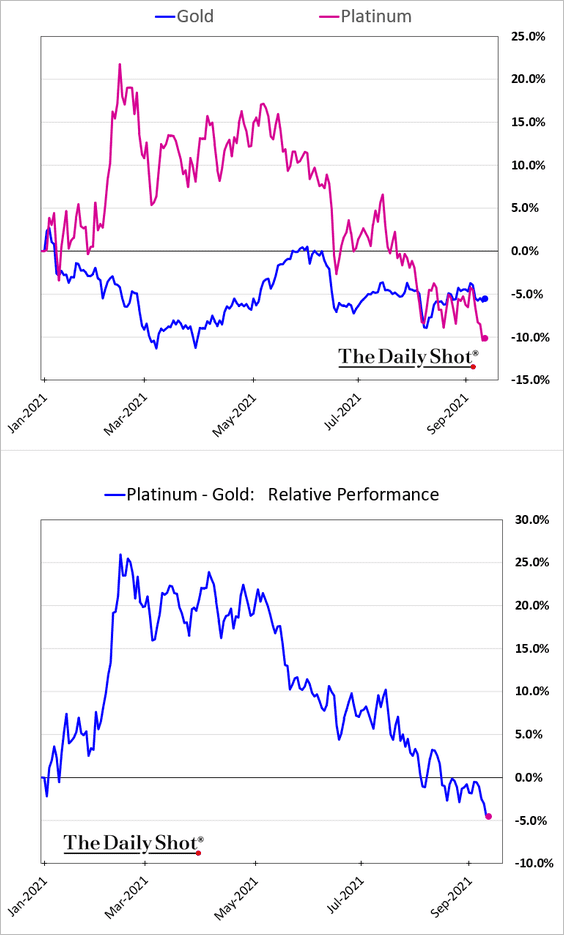

Commodities

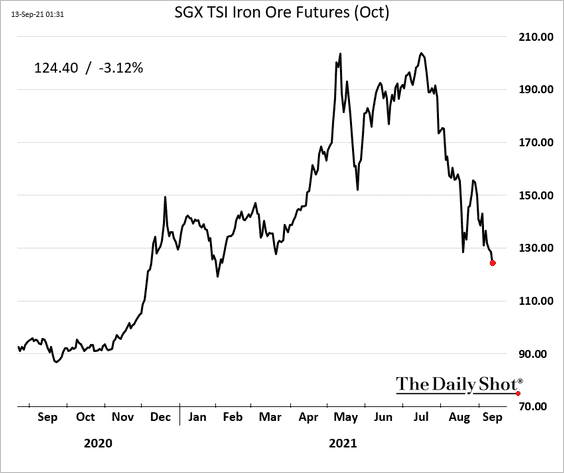

1. Iron ore prices continue to retreat.

2. Platinum has been under pressure lately.

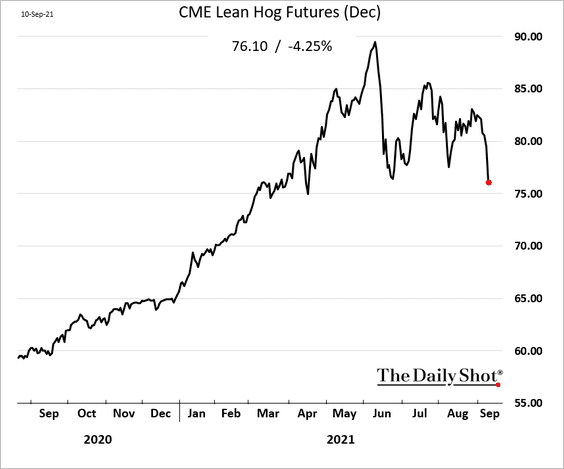

3. US hog futures tumbled last week.

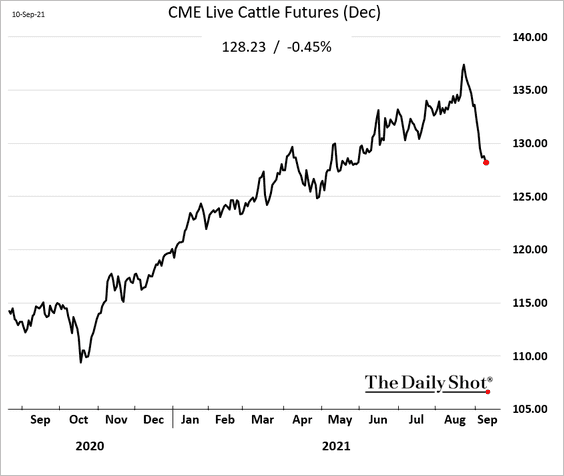

Cattle futures are also lower.

——————–

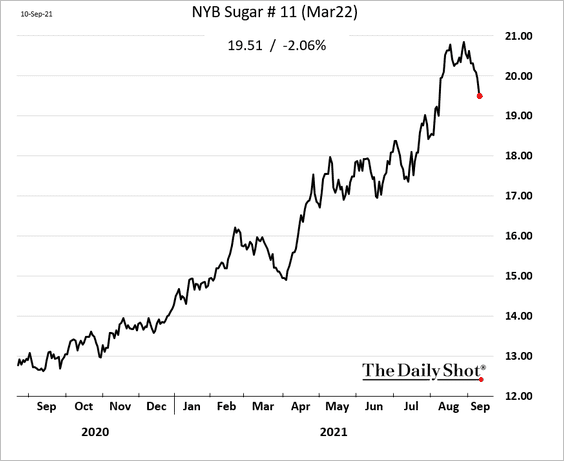

4. Sugar futures appear to have peaked.

Back to Index

Energy

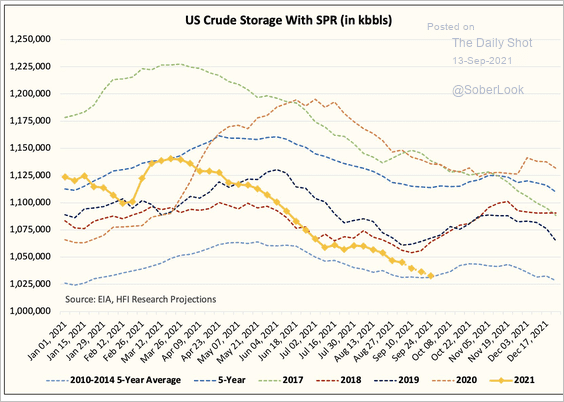

1. Total US crude oil in storage continues to fall.

Source: @HFI_Research

Source: @HFI_Research

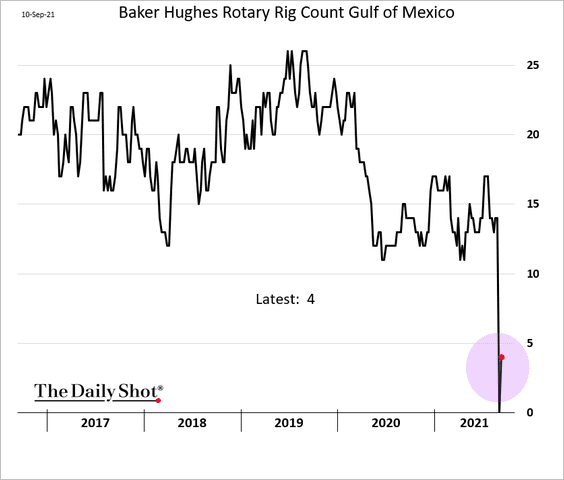

2. Most rigs in the Gulf of Mexico are still not back in operation.

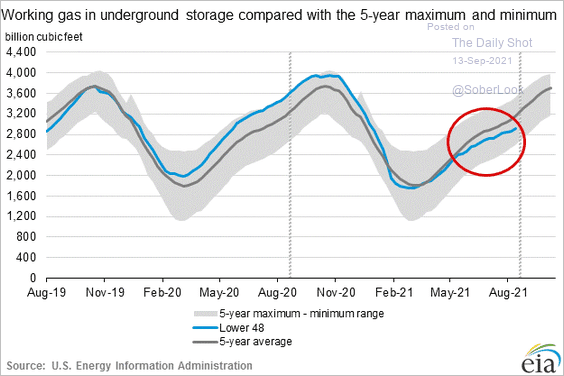

3. US natural gas in storage has been deviating from the 5-year mean.

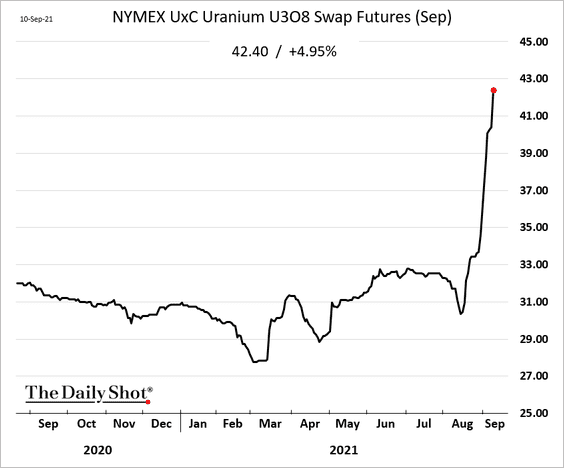

4. Uranium prices are surging. The market is not very liquid, and it doesn’t take much to boost prices.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

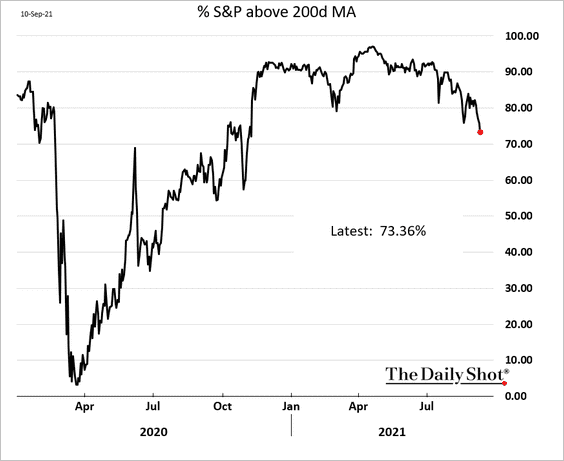

1. Market breadth has been weakening.

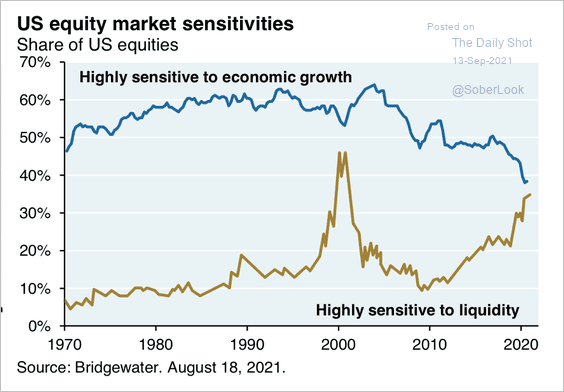

2. Stocks have been more sensitive to liquidity conditions rather than economic growth over the past decade.

Source: Michael Cembalest; J.P. Morgan Asset Management

Source: Michael Cembalest; J.P. Morgan Asset Management

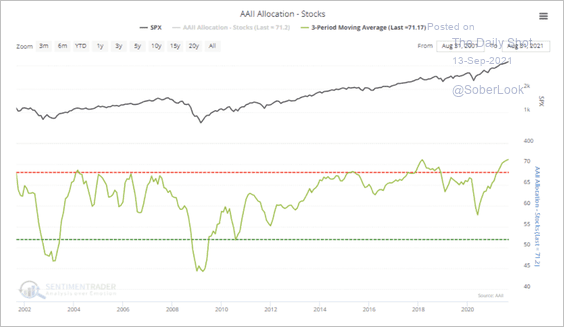

4. Individual investors had an average of more than 71% of their portfolios allocated to stocks over the past three months – the highest in more than 20 years.

Source: SentimenTrader

Source: SentimenTrader

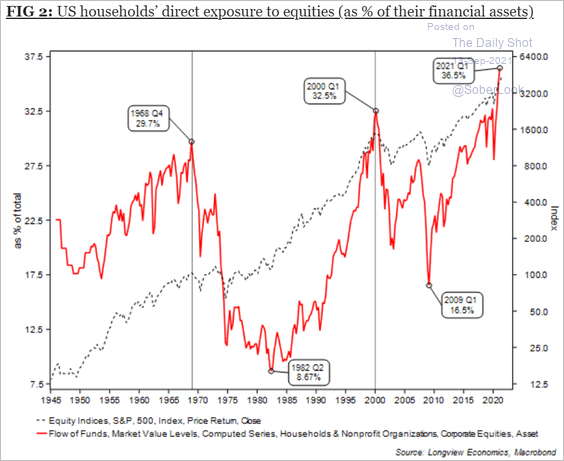

• Overall, US households are highly exposed to stocks.

Source: Longview Economics

Source: Longview Economics

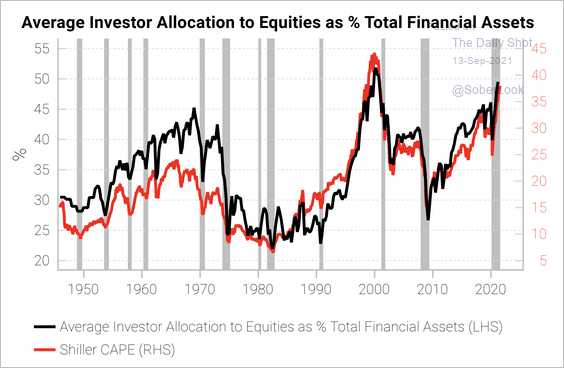

• The co-movement of the allocation to equities by investors and long-term valuations has been remarkable.

Source: Variant Perception

Source: Variant Perception

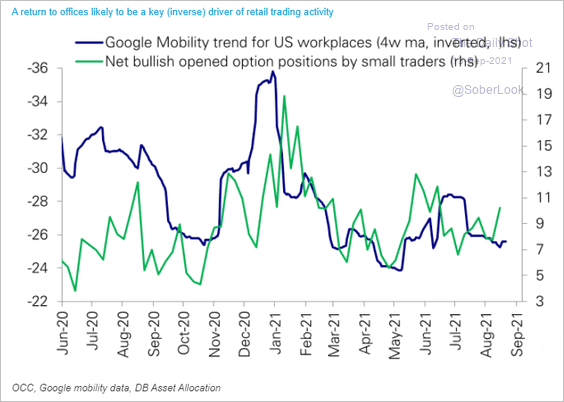

• Will return to the office result in a pullback in retail trading activity?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

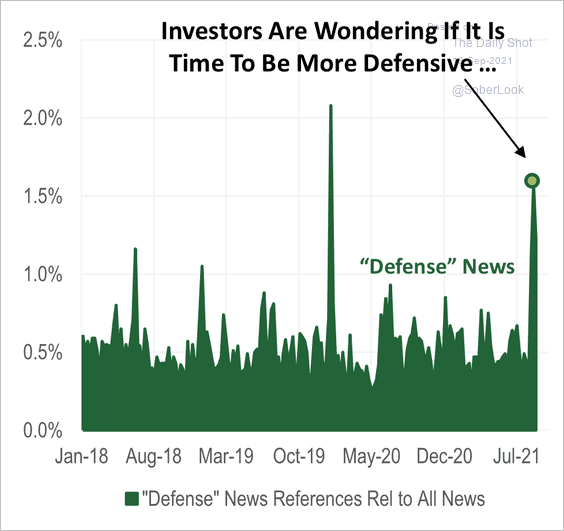

5. News references to defensive strategies have ticked higher.

Source: Cornerstone Macro

Source: Cornerstone Macro

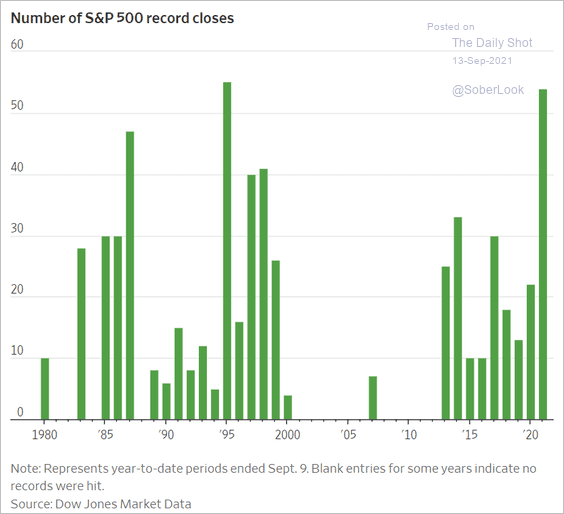

6. More record highs on the way this year?

Source: @WSJ Read full article

Source: @WSJ Read full article

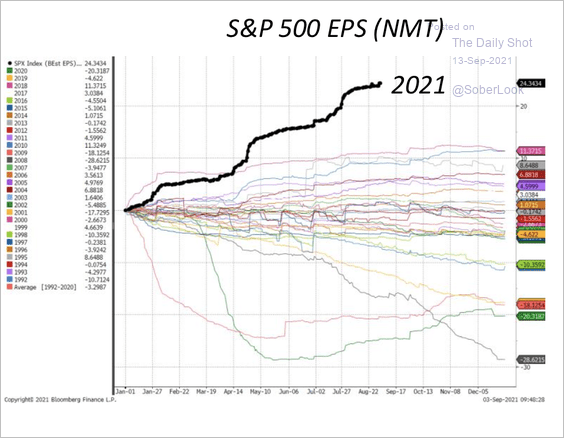

7. Earnings per share estimates have been rising at a historic rate …

Source: Cornerstone Macro

Source: Cornerstone Macro

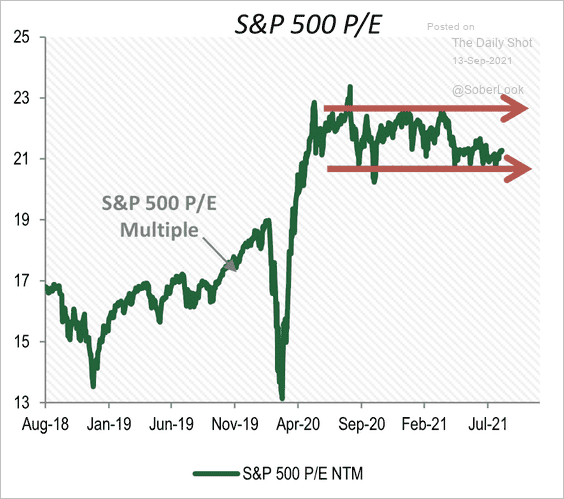

… while price-to-earnings have been range-bound this year.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

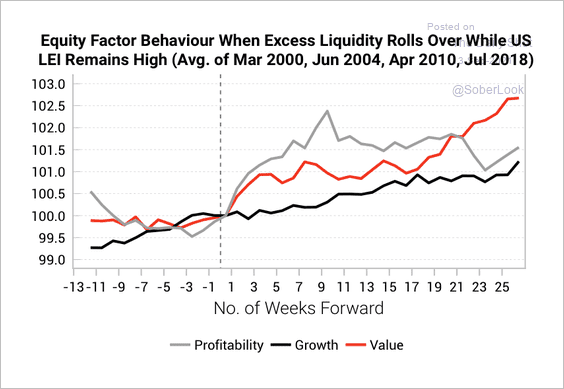

8. The value and quality (profitability) factors tend to outperform when excess liquidity declines and leading economic indicators remain high.

Source: Variant Perception

Source: Variant Perception

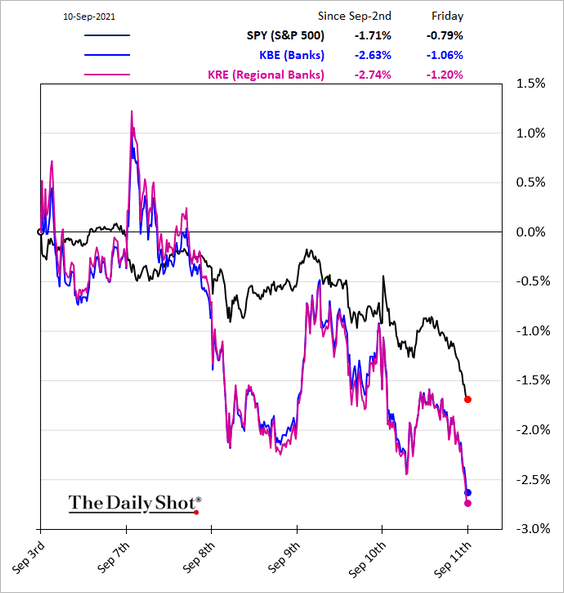

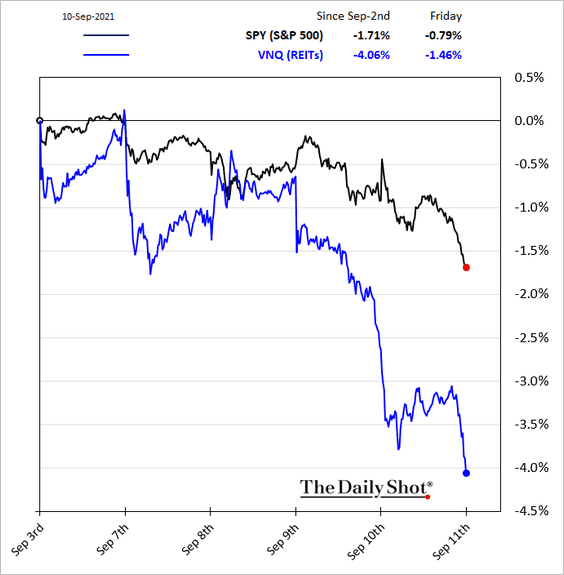

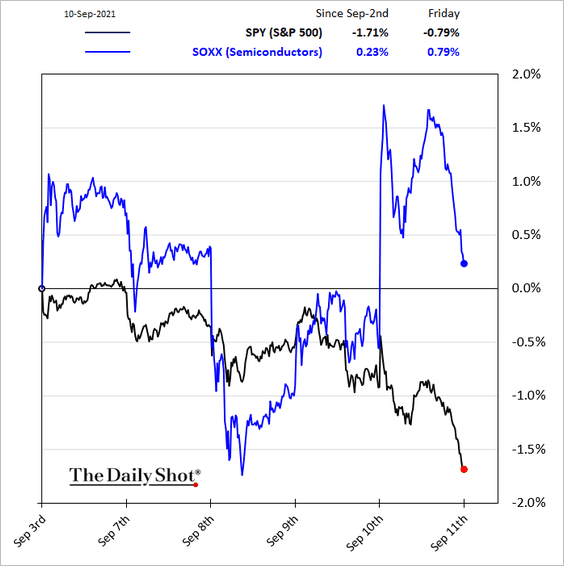

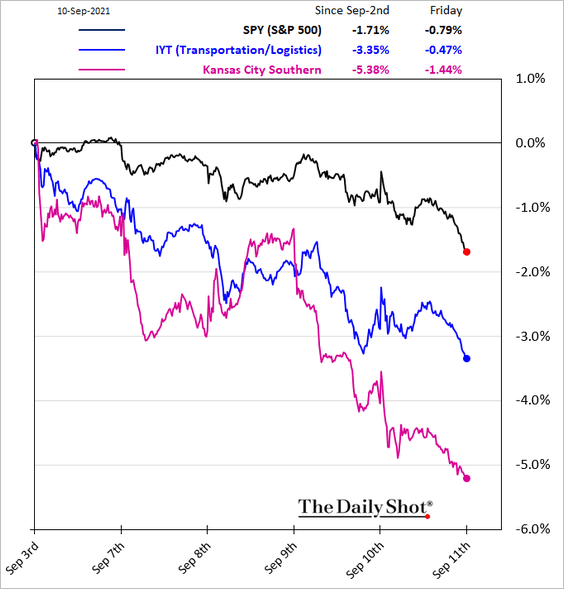

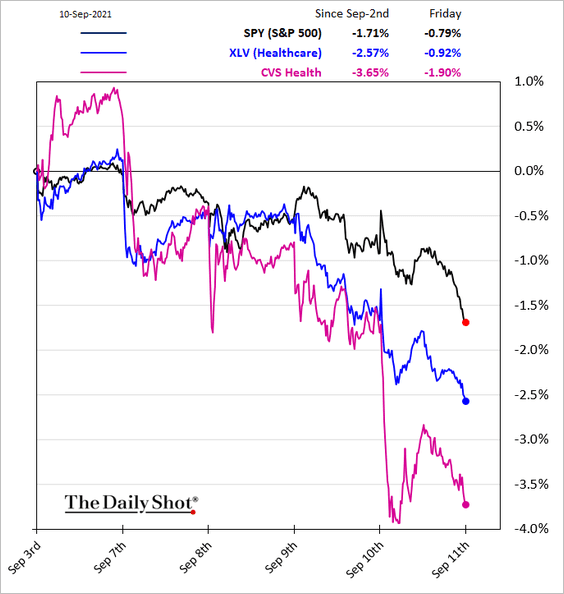

9. Next, we have some sector performance updates.

• Banks:

• REITs:

• Semiconductors:

• Transportation:

• Healthcare:

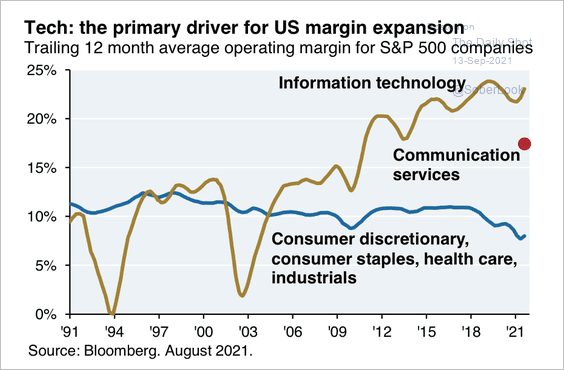

10. The tech sector has experienced the most margin expansion in recent years.

Source: Michael Cembalest; J.P. Morgan Asset Management

Source: Michael Cembalest; J.P. Morgan Asset Management

Back to Index

Global Developments

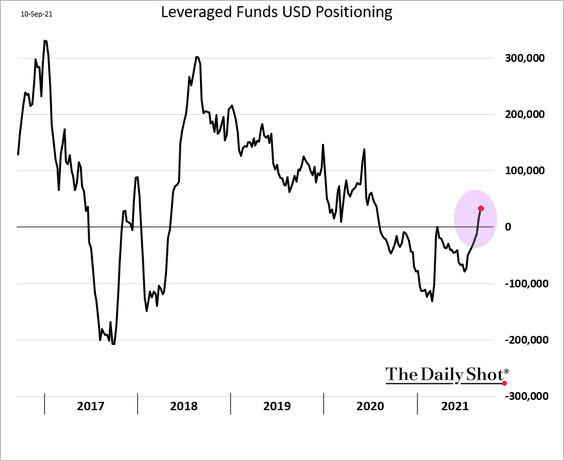

1. Leveraged funds are increasing their bets on the US dollar.

The dollar has performed well since September 3rd.

Source: Capital Economics

Source: Capital Economics

——————–

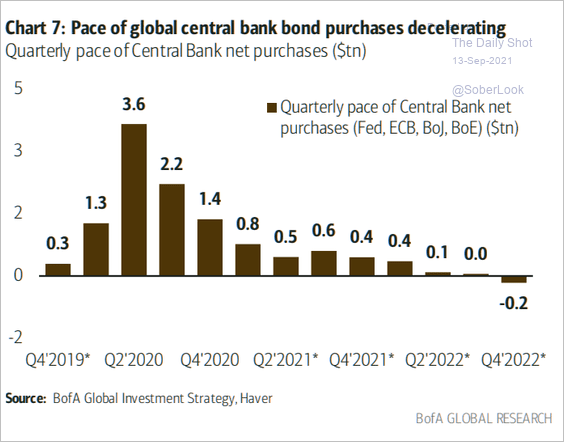

2. Central banks’ securities purchases are slowing.

Source: BofA Global Research; @themarketear

Source: BofA Global Research; @themarketear

3. After a decade of stagnation, the shipping business is hot again.

Source: @markets Read full article

Source: @markets Read full article

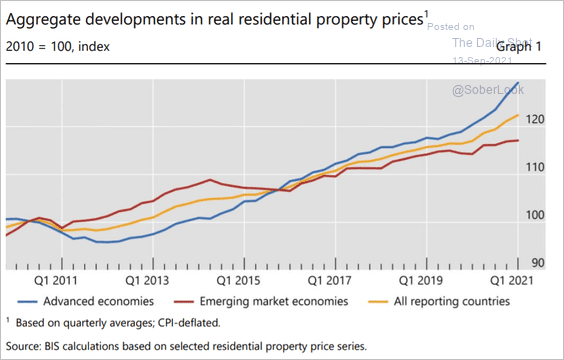

4. Residential properties in advanced economies have been outperforming EM.

Source: BIS Read full article

Source: BIS Read full article

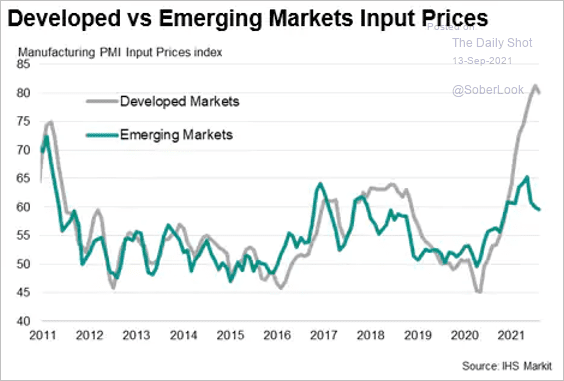

5. Manufacturers in advanced economies have been experiencing much faster input price inflation than their peers in EM countries.

Source: IHS Markit

Source: IHS Markit

——————–

Food for Thought

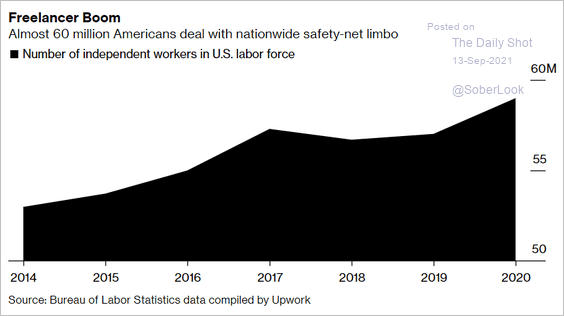

1. Independent workers in the US:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

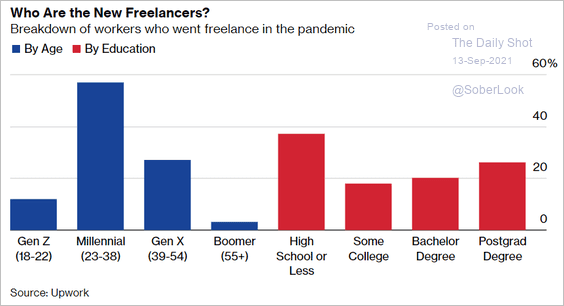

2. Freelancing during the pandemic:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

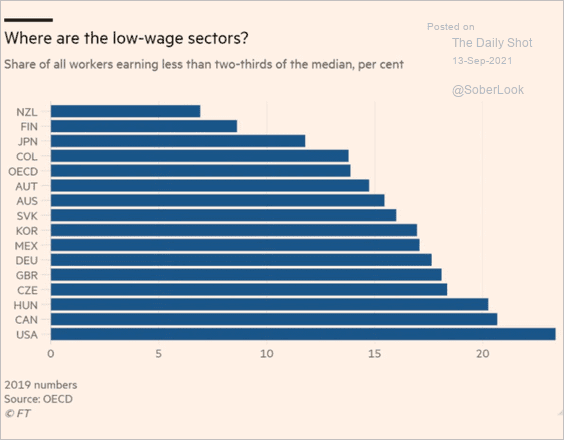

3. Workers earning less than two-thirds of the median:

Source: @adam_toozem, @FT Read full article

Source: @adam_toozem, @FT Read full article

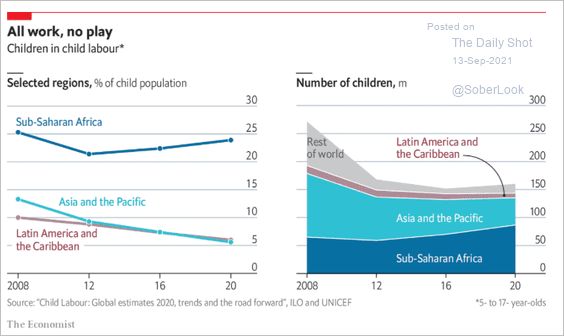

4. Child labor:

Source: The Economist Read full article

Source: The Economist Read full article

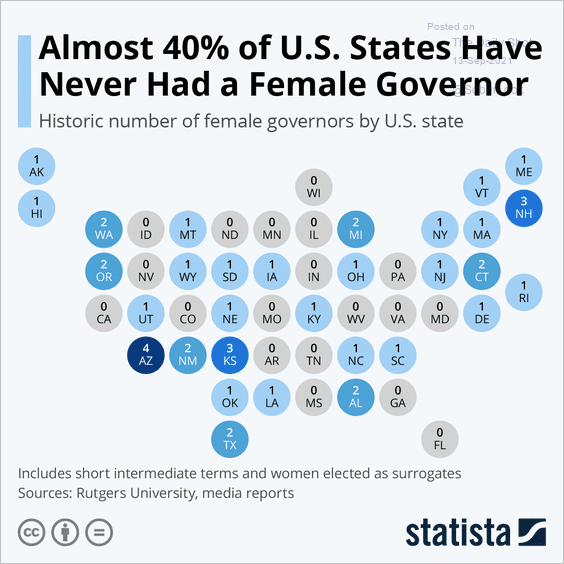

5. Female governors in the US:

Source: Statista

Source: Statista

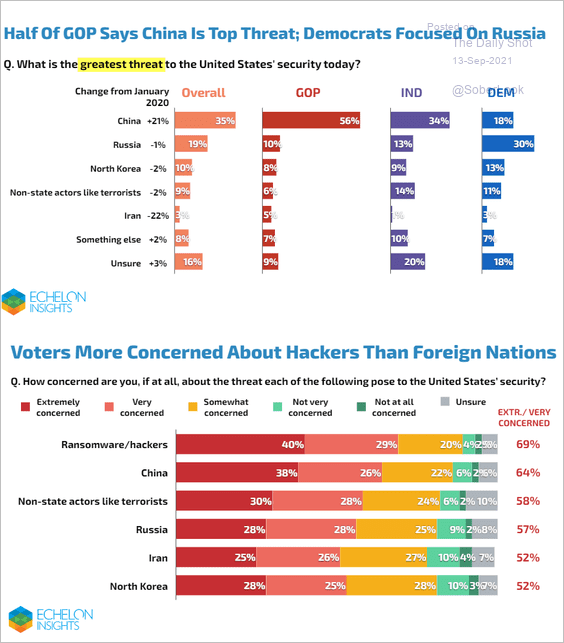

6. Greatest threats to US security:

Source: Echelon Insights

Source: Echelon Insights

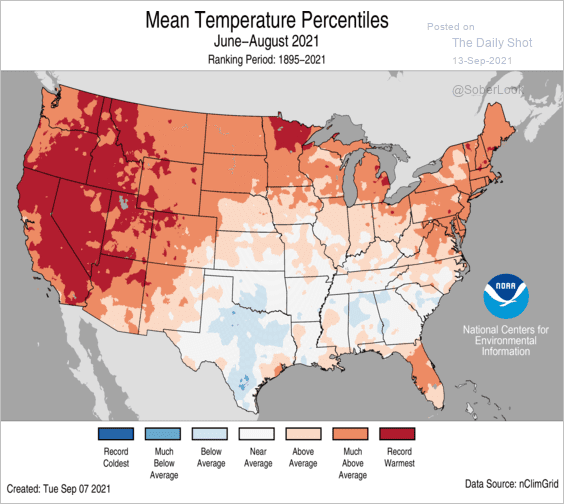

7. Summer temperature percentiles:

Source: NOAA Read full article

Source: NOAA Read full article

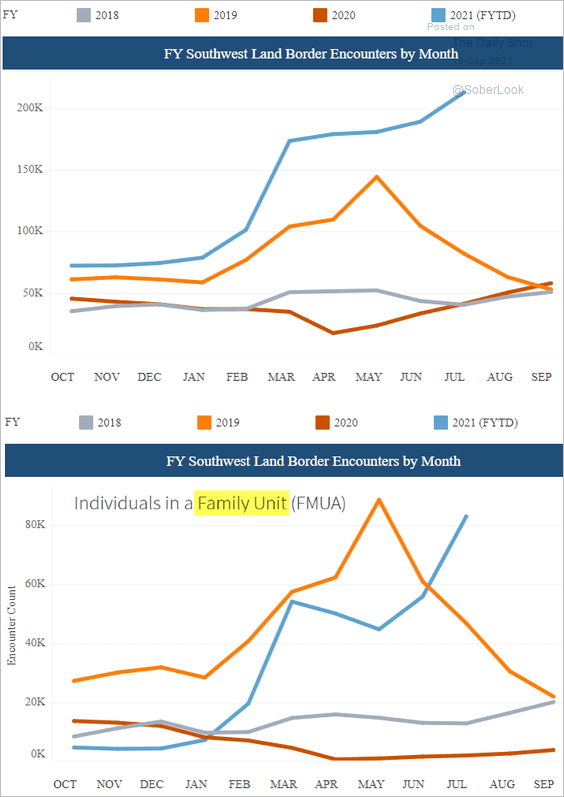

8. US Southwest border illegal crossings:

Source: CPB Further reading

Source: CPB Further reading

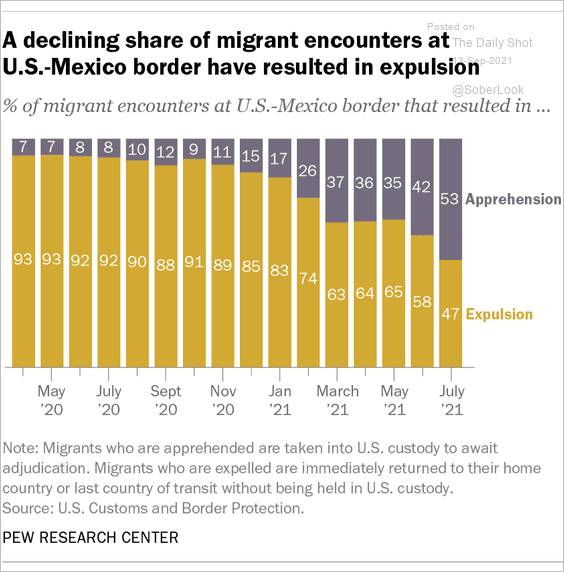

• Apprehensions and expulsions:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

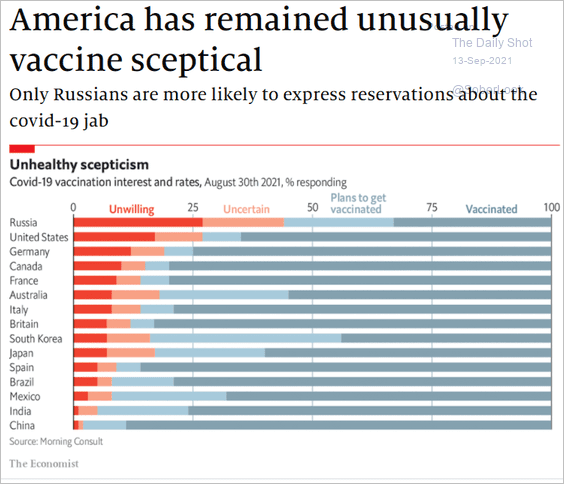

9. Vaccine skepticism:

Source: The Economist Read full article

Source: The Economist Read full article

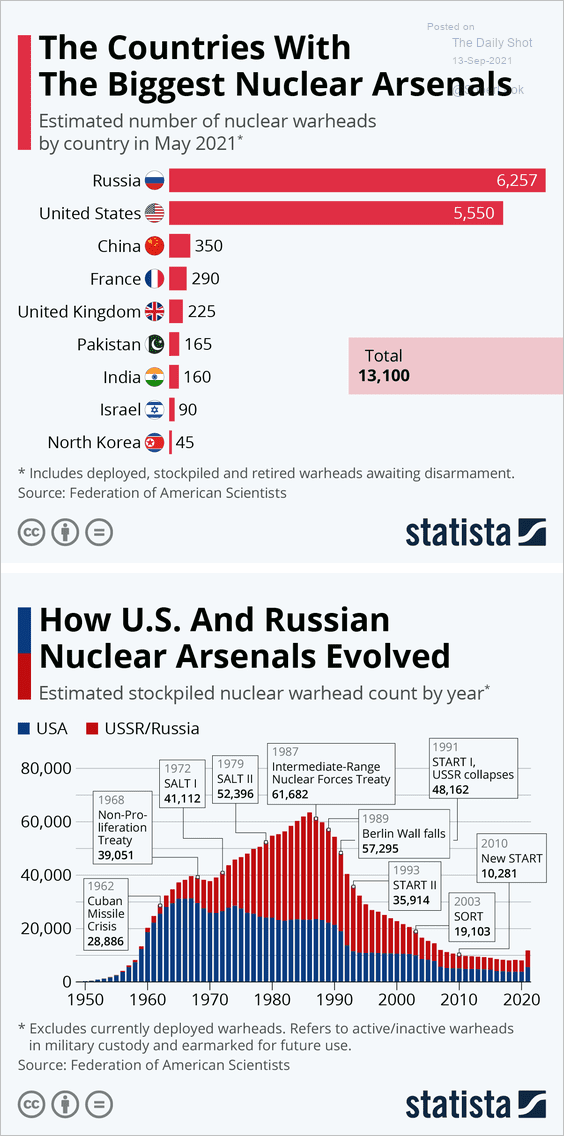

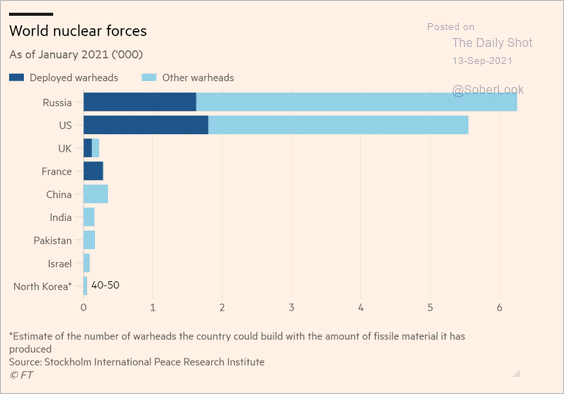

10. Nuclear arsenals:

Source: Statista

Source: Statista

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

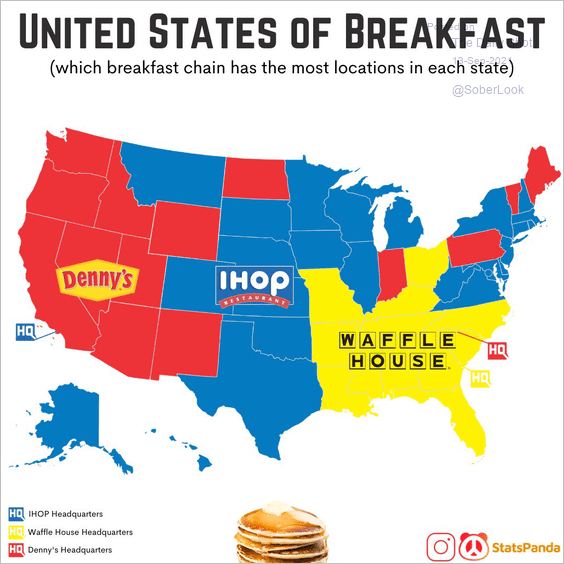

11. Breakfast chain locations by region:

Source: @statspanda1

Source: @statspanda1

——————–

Back to Index