The Daily Shot: 07-Apr-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

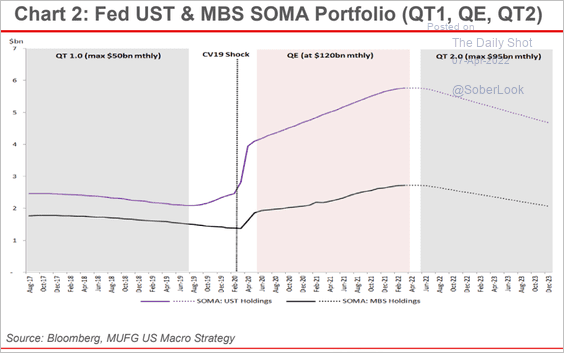

1. The FOMC minutes confirmed what the market already heard from Lael Brainard. The Fed’s quantitative tightening program will be faster than the last time the central bank reduced its balance sheet.

Source: CNBC Read full article

Source: CNBC Read full article

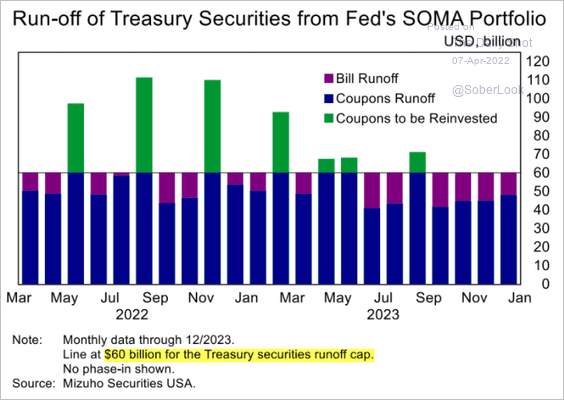

The Fed will target to trim its Treasury holdings by $60 billion and MBS by $35 billion per month, with a short ramp-up period. At some point, the Fed will sell MBS debt outright because the runoff is expected to be too slow to meet the reduction targets (due to low mortgage refi activity).

Source: MUFG Securities

Source: MUFG Securities

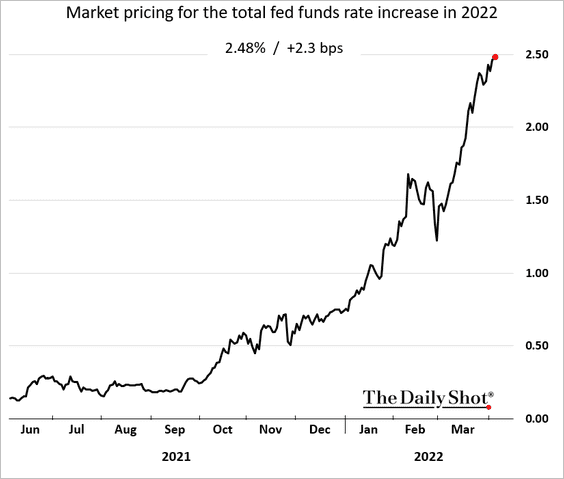

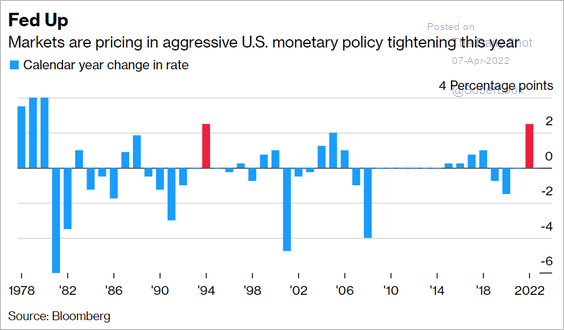

• The minutes also confirmed the FOMC’s objective to have a few 50 bps rate hikes (March would have also been 50 bps if it wasn’t for Russia’s invasion). The market now sees about 2.5% worth of rate hikes this year.

It’s been a while since the Fed tightened this aggressively.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

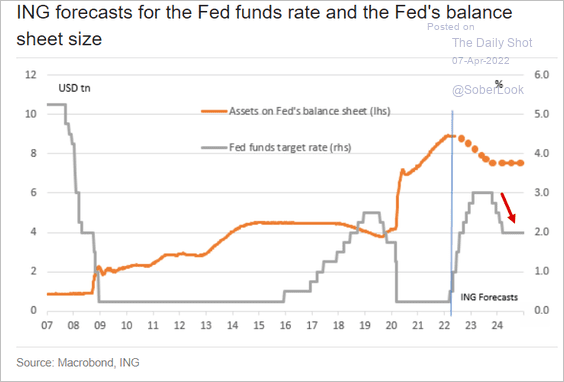

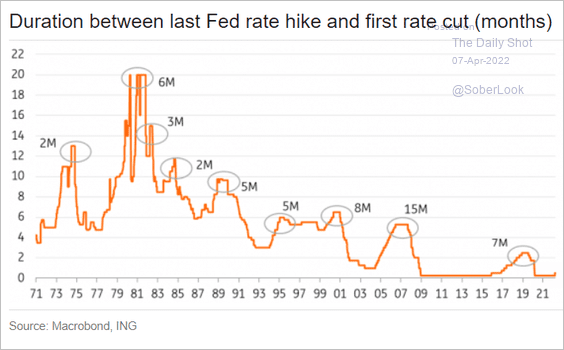

• The market and some economists see the Fed starting to cut rates at the beginning of 2024. Here is a forecast from ING, which also shows the Fed ending quantitative tightening at that time.

Source: ING

Source: ING

This chart shows the duration between the last hike of each cycle and the first rate cut.

Source: ING

Source: ING

——————–

2. According to the Atlanta Fed’s wage tracker, compensation growth accelerated further, with hourly-paid workers outperforming.

![]() Source: @AtlantaFed

Source: @AtlantaFed

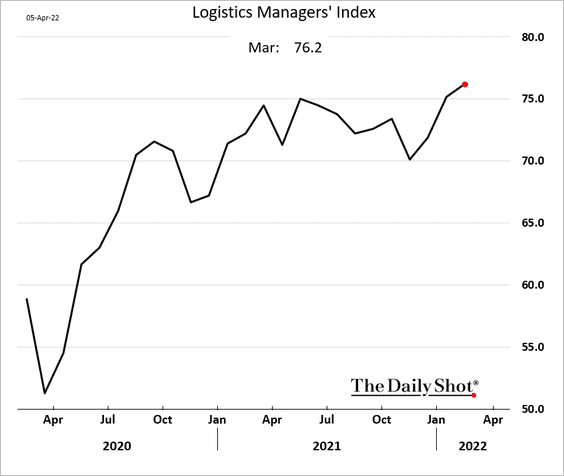

3. The Logistics Managers’ Index shows no let-up in logistics pressures.

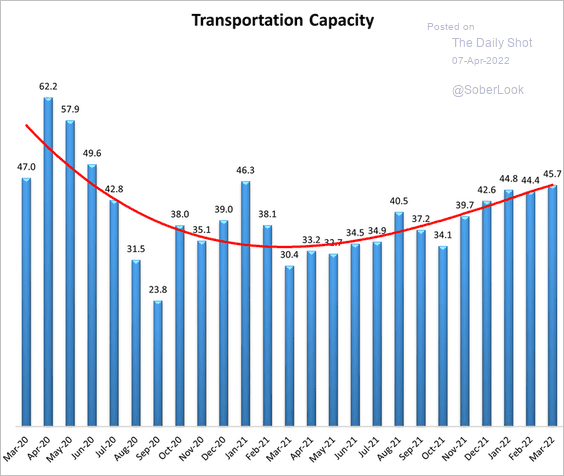

While transportation capacity is recovering, …

Source: Logistics Managers’ Index

Source: Logistics Managers’ Index

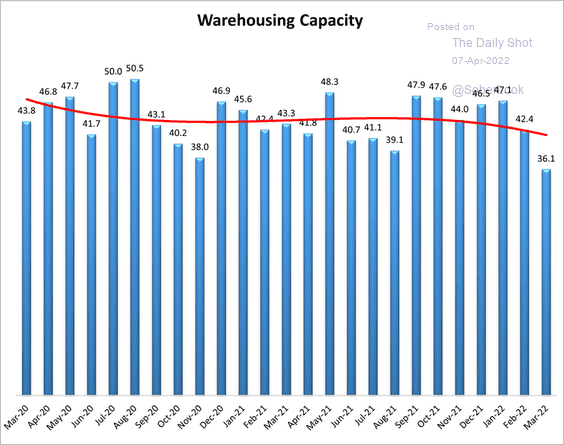

… warehousing capacity deteriorated last month.

Source: Logistics Managers’ Index

Source: Logistics Managers’ Index

——————–

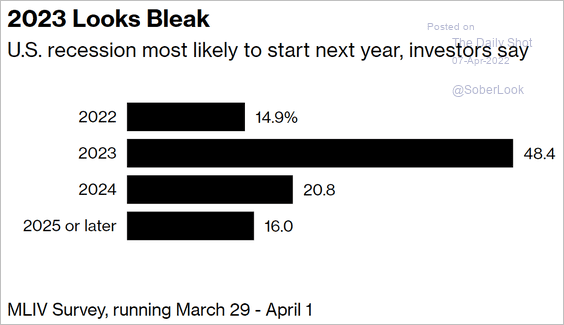

4. Investors see a high chance of recession next year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

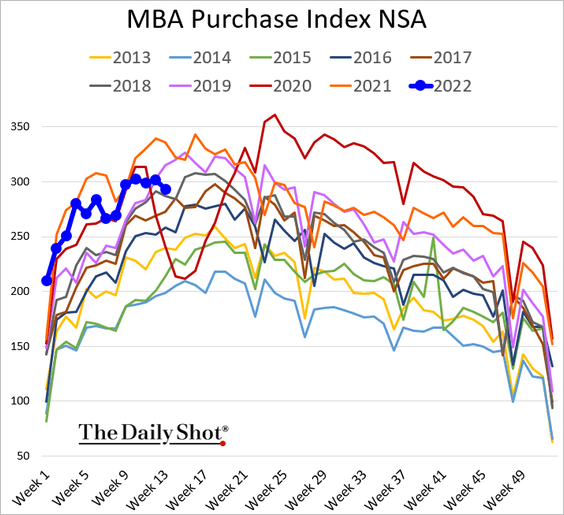

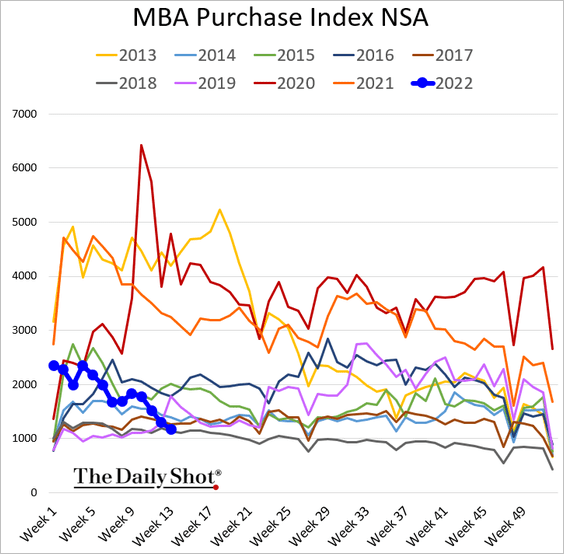

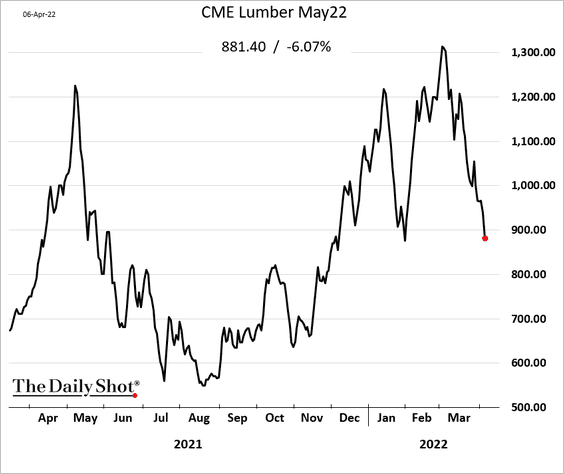

5. Next, we have some updates on the housing market.

• Mortgage applications for house purchase continue to ease.

Refi activity is collapsing.

• Lumber futures are selling off as mortgage rates climb.

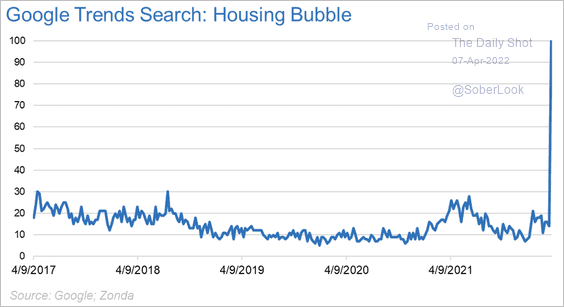

• Online search activity for “housing bubble” has exploded.

Source: @AliWolfEcon

Source: @AliWolfEcon

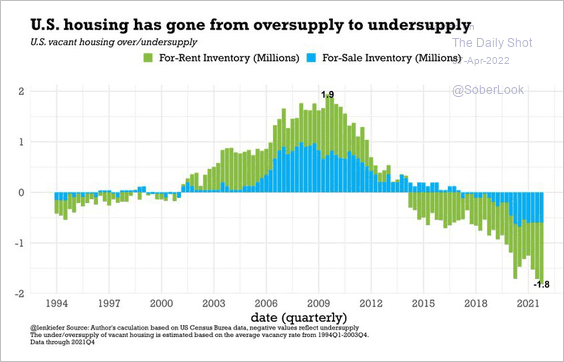

• US housing shortages continue to worsen.

Source: @lenkiefer

Source: @lenkiefer

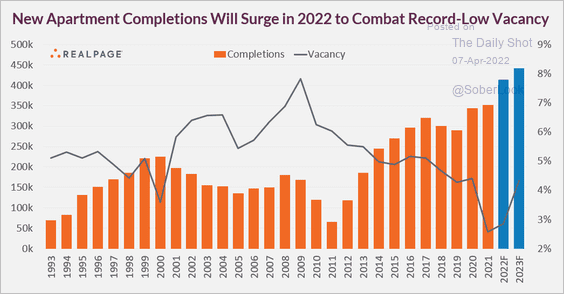

• New apartment completions will hit record highs in 2022 and 2023.

Source: @jayparsons

Source: @jayparsons

Back to Index

Canada

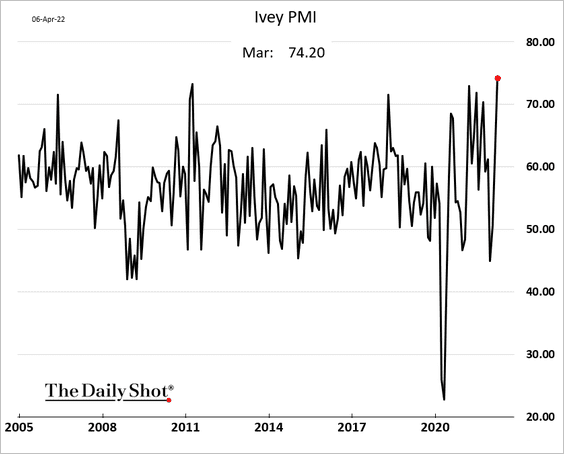

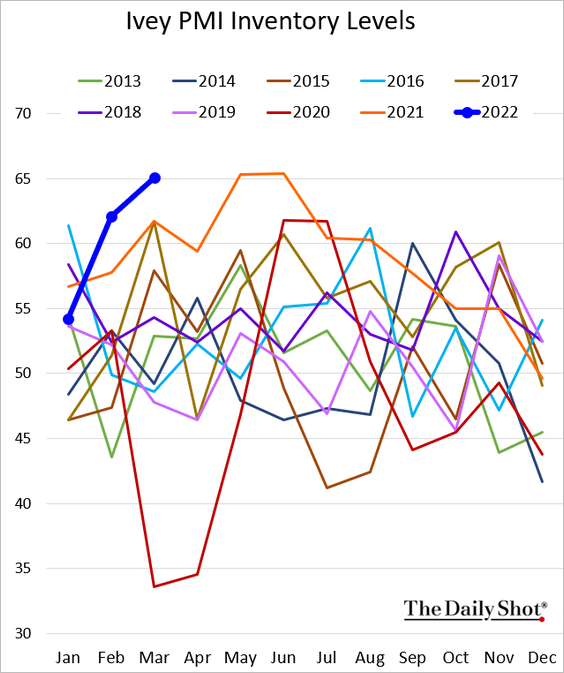

1. Business activity surged to multi-year highs last month, according to the Ivey PMI report.

Source: Reuters Read full article

Source: Reuters Read full article

Companies are rapidly building inventories.

——————–

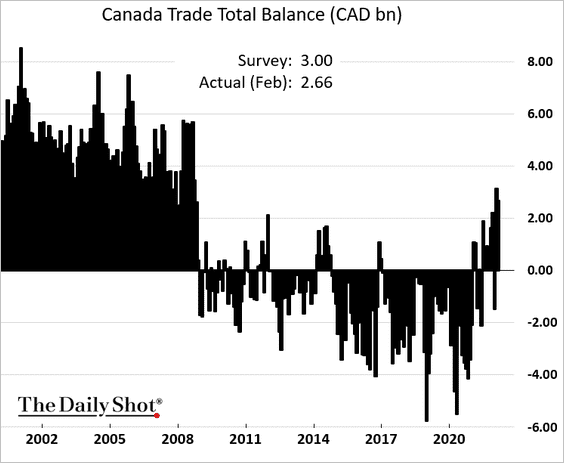

2. The trade surplus remains elevated.

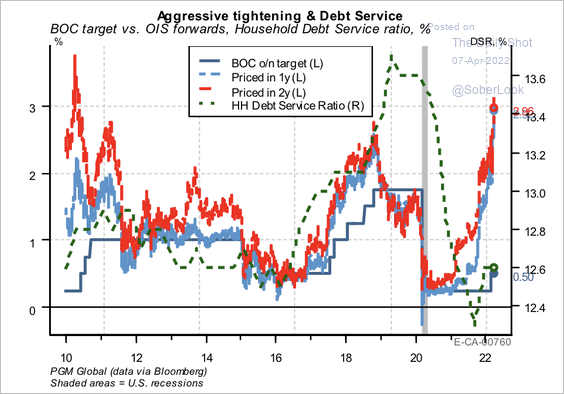

3. The market has priced in an aggressive rate hike cycle.

Source: PGM Global

Source: PGM Global

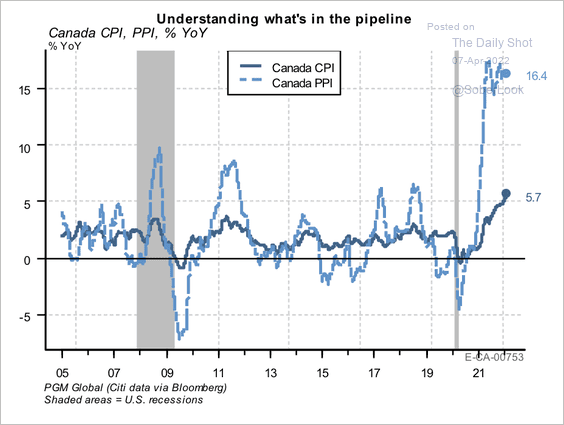

4. Producer prices are rising significantly more than consumer prices. Will this trend put pressure on corporate margins?

Source: PGM Global

Source: PGM Global

Back to Index

The United Kingdom

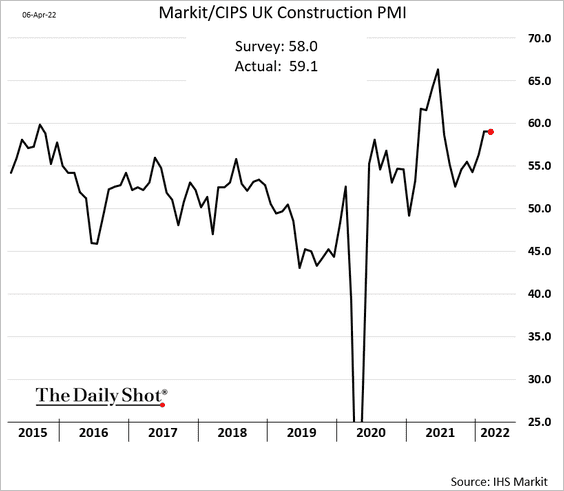

1. Construction activity was strong last month.

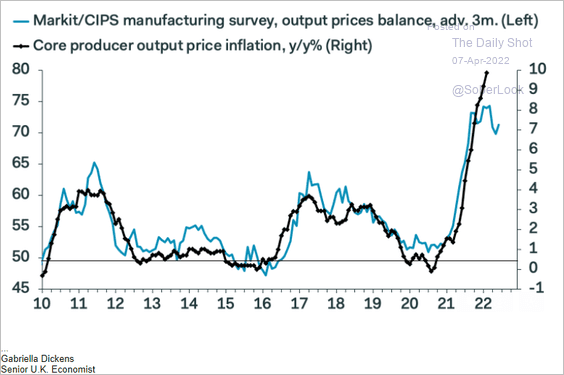

2. Upstream price pressures should begin to ease.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

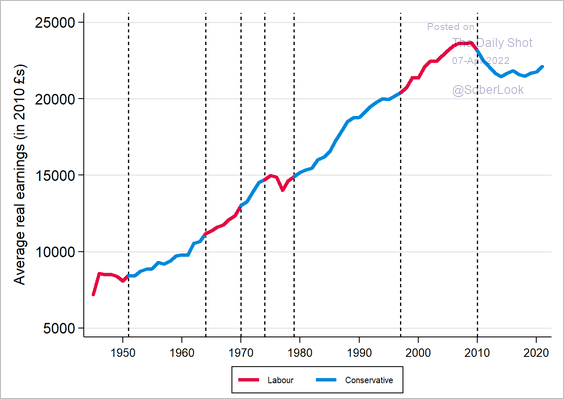

3. This chart shows UK average real earnings since WW-II.

Source: @drjennings

Source: @drjennings

Back to Index

The Eurozone

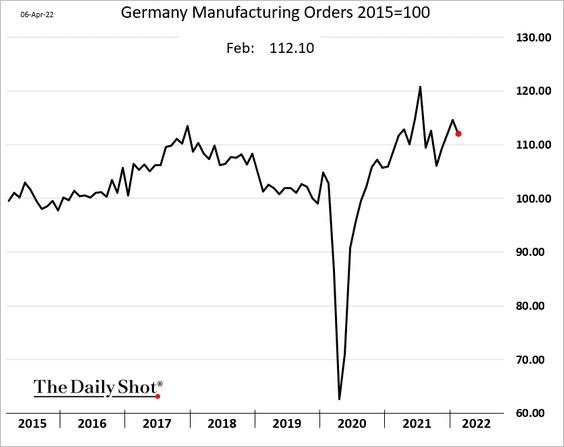

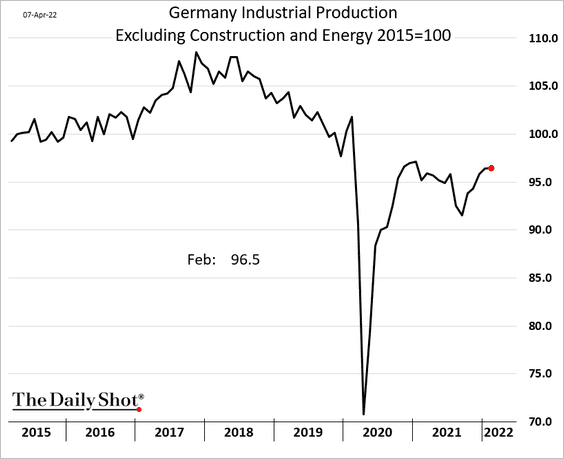

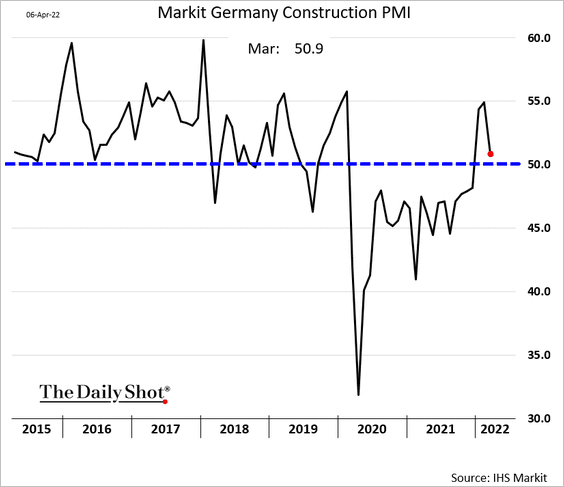

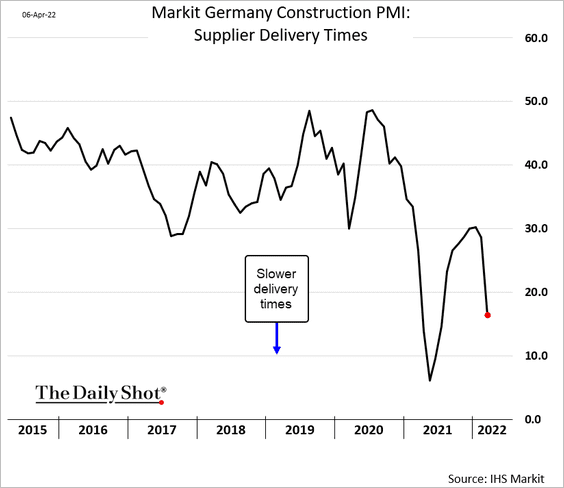

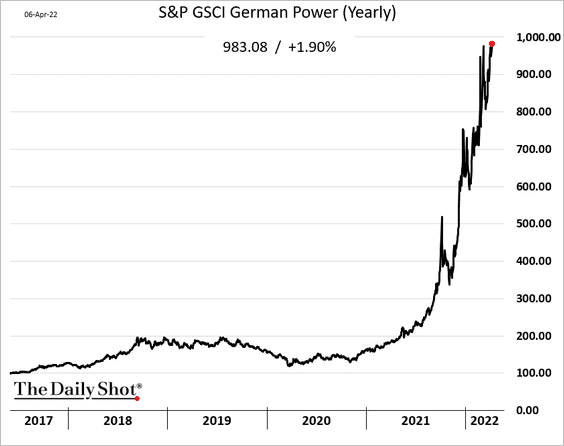

1. Let’s begin with Germany.

• Factory orders declined in February.

But manufacturing output held steady.

• Growth in construction activity slowed in March, …

… as supply bottlenecks worsened again.

• Here is a measure of Germany’s power market performance. This is going to be a headwind for the economy for some time.

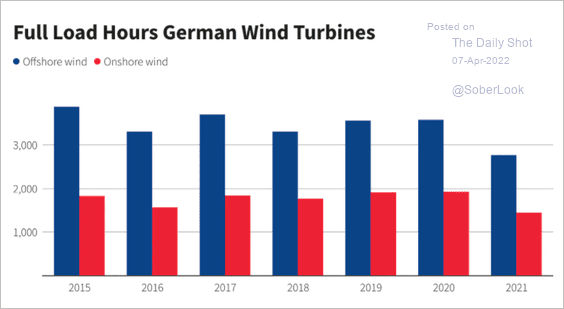

• It wasn’t windy enough in Germany last year during full-load hours. Power storage capacity needs to grow substantially.

Source: Reuters Read full article

Source: Reuters Read full article

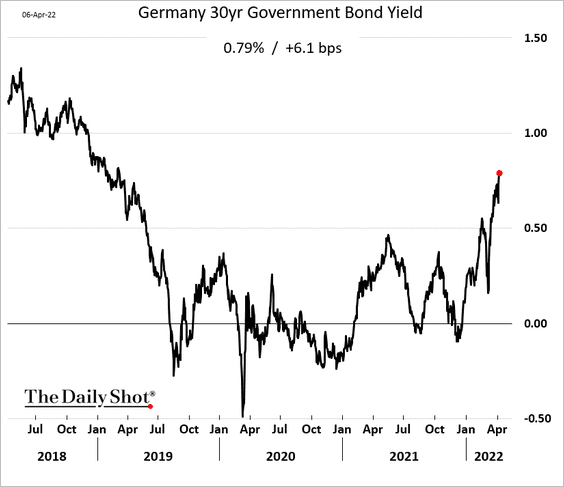

• The 30-year Bund yield continues to climb.

——————–

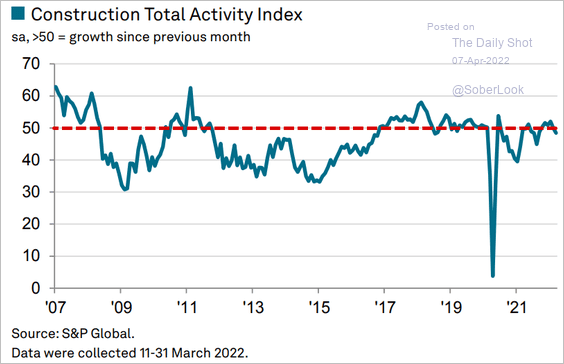

2. French construction activity contracted last month.

Source: IHS Markit

Source: IHS Markit

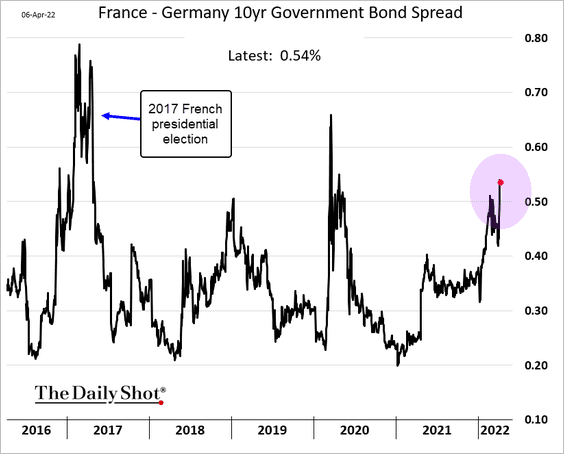

Separately, French bond spreads are elevated ahead of the election.

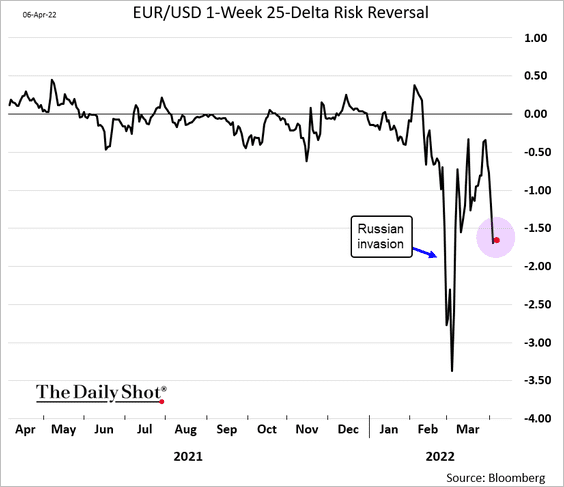

The F/X options market also shows some jitters around the French election.

Back to Index

Europe

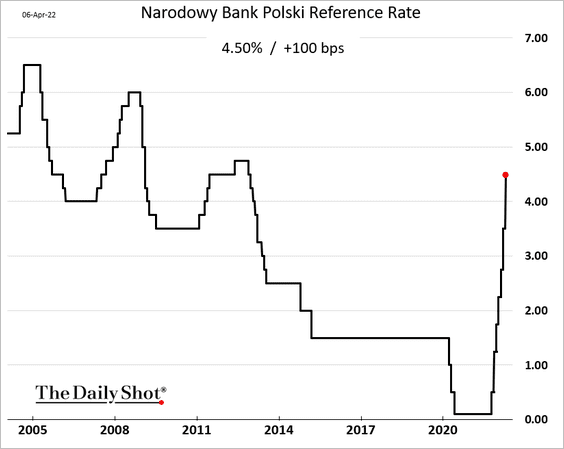

1. Poland’s central bank hiked rates by 100 bps as inflation surges (the market expected 50 bps).

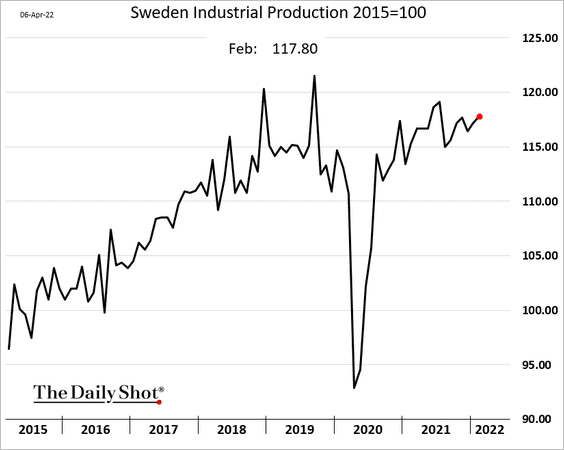

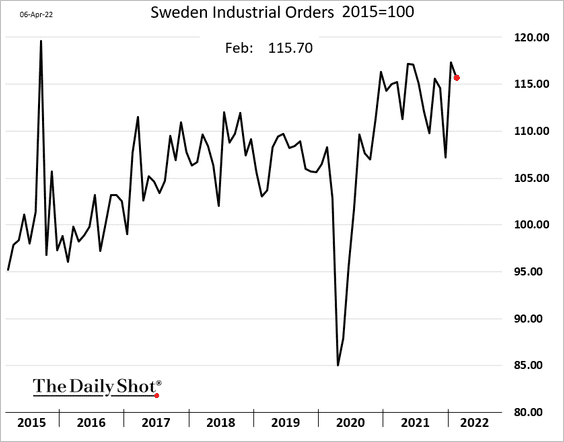

2. Next, we have some updates on Sweden.

• Industrial production:

• Industrial orders:

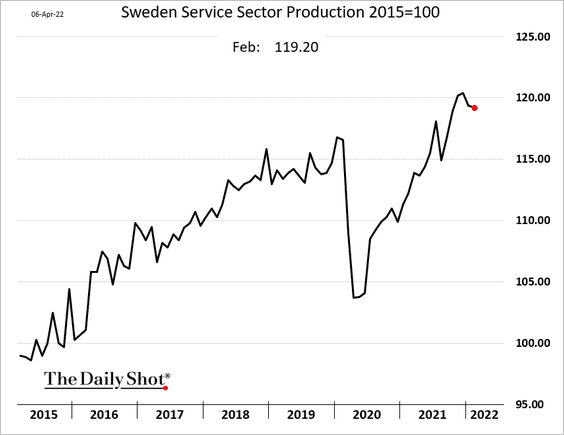

• Service-sector output:

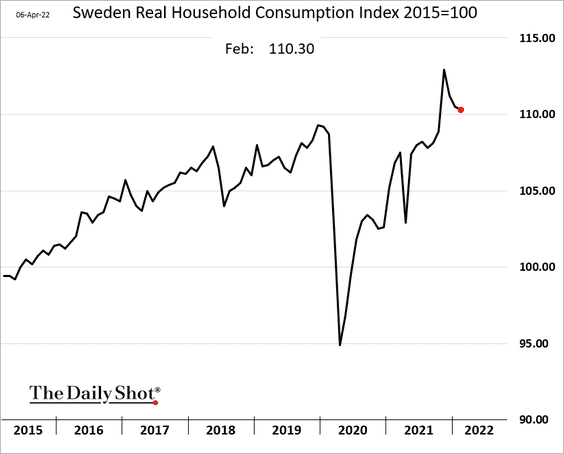

• Household consumption (moderating):

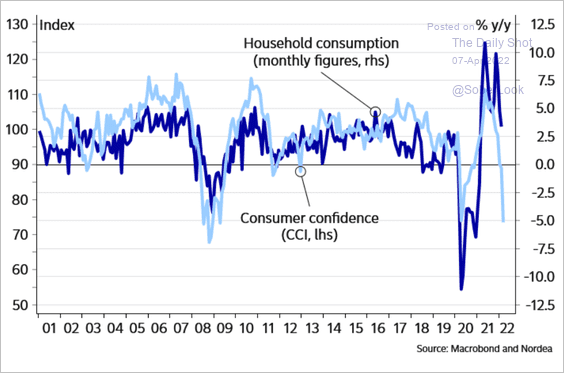

Weakness in consumer confidence points to further declines in spending.

Source: Nordea Markets

Source: Nordea Markets

——————–

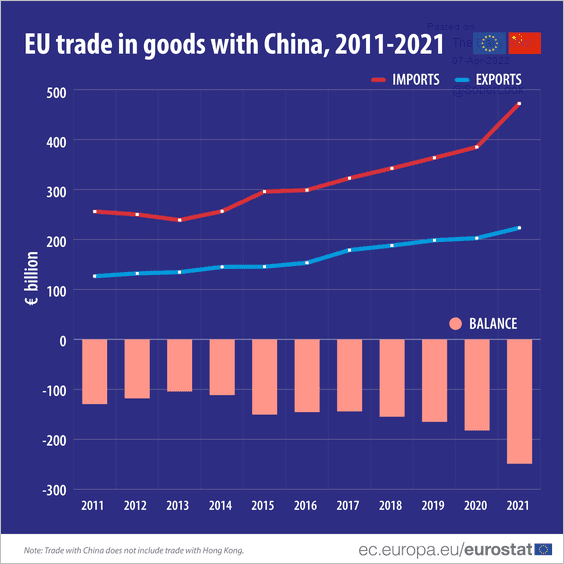

3. The EU’s trade deficit with China widened sharply last year.

Source: @EU_Eurostat Read full article

Source: @EU_Eurostat Read full article

Back to Index

China

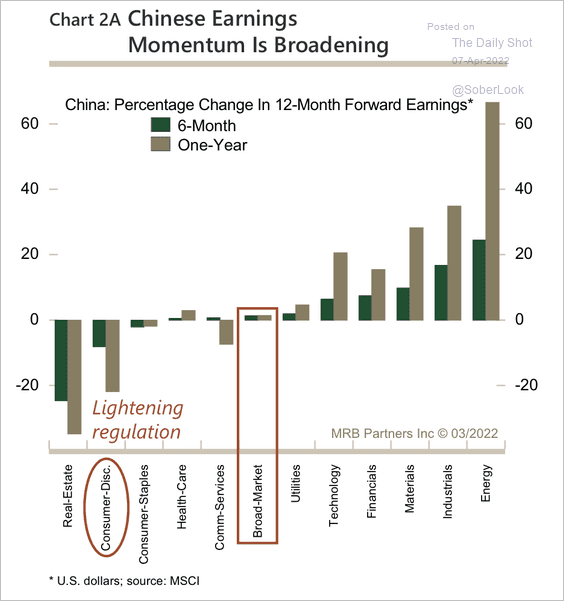

1. Earnings are primarily being held back by the consumer discretionary sector, dominated by mega-cap internet platform stocks facing regulatory pressure.

Source: MRB Partners

Source: MRB Partners

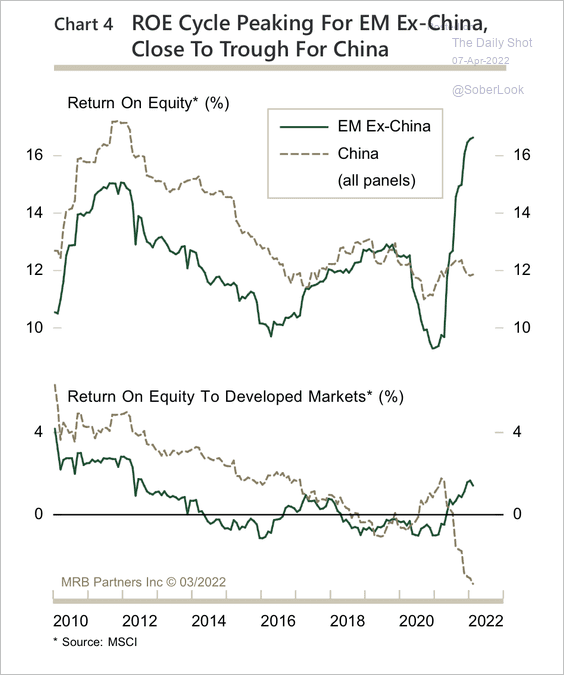

2. On a relative basis, return-on-equity is close to a trough.

Source: MRB Partners

Source: MRB Partners

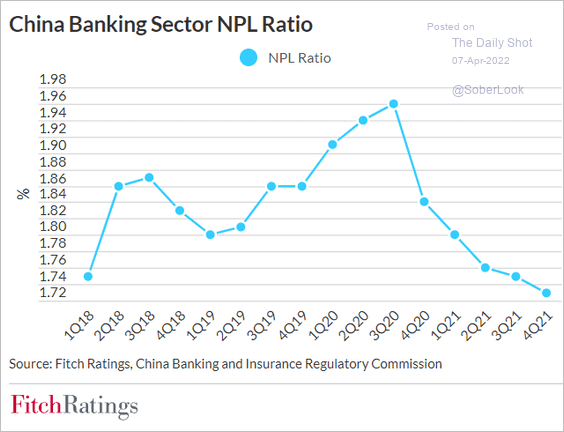

3. Here is the non-performing loan ratio in the banking system. Has it bottomed?

Source: Fitch Ratings

Source: Fitch Ratings

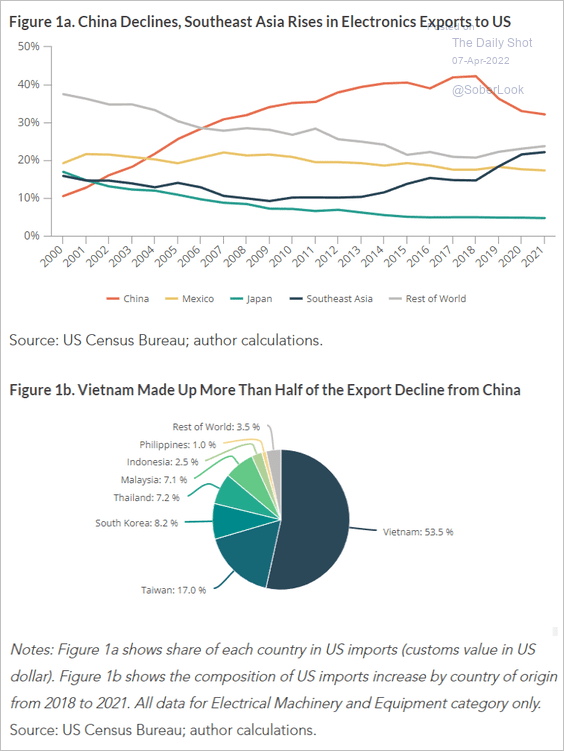

4. Manufacturers have been shifting their final assembly of electronics products to Southeast Asia to skirt US tariffs.

Source: MacroPolo Read full article

Source: MacroPolo Read full article

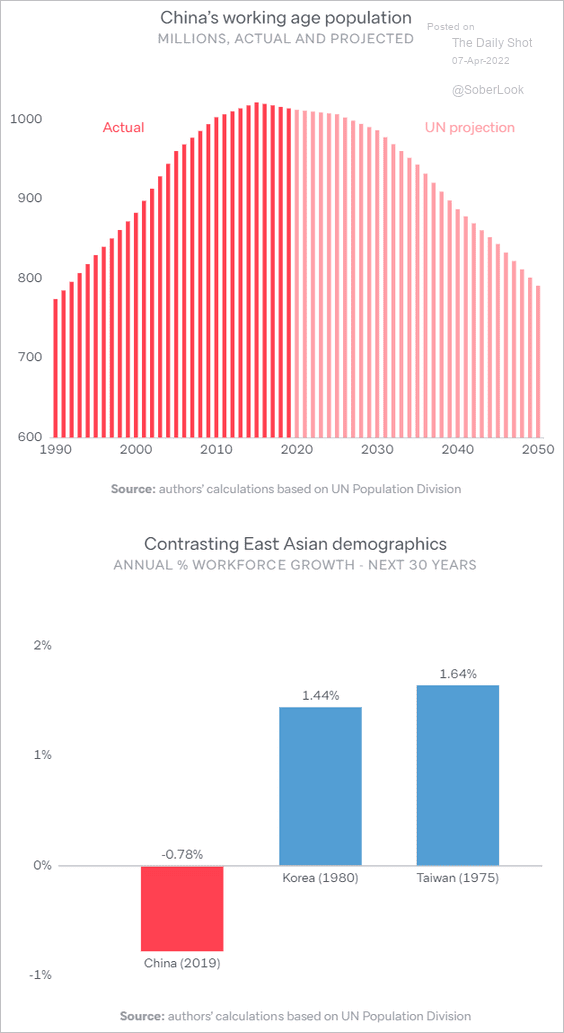

5. Working-age population is expected to keep declining over the next three decades creating a severe headwind for economic growth.

Source: Lowy Institute

Source: Lowy Institute

Back to Index

Emerging Markets

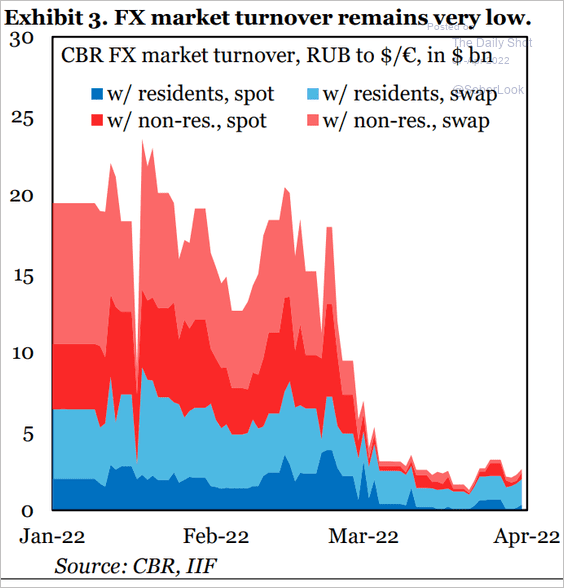

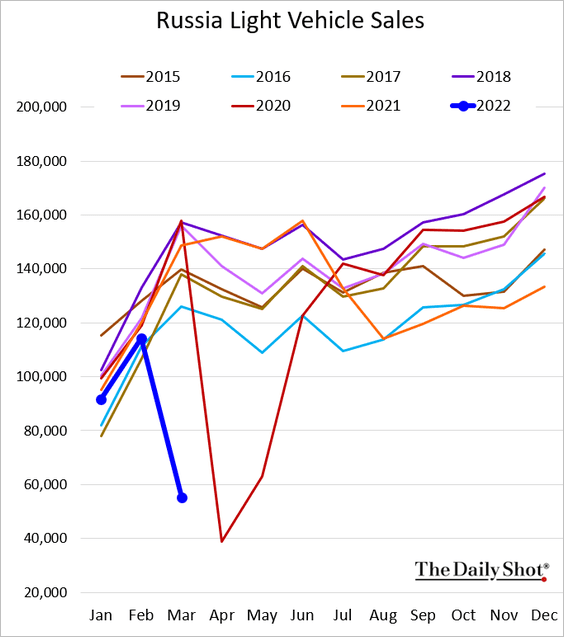

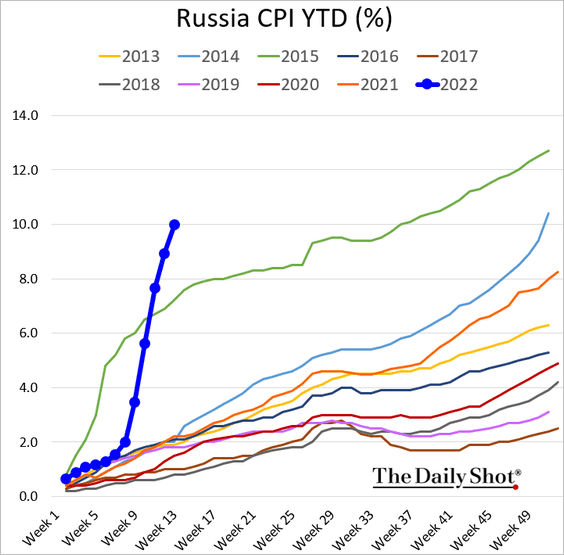

1. Let’s start with Russia.

• Ruble trading activity has collapsed.

Source: IIF

Source: IIF

• Vehicle sales tumbled last month.

• Inflation continues to surge.

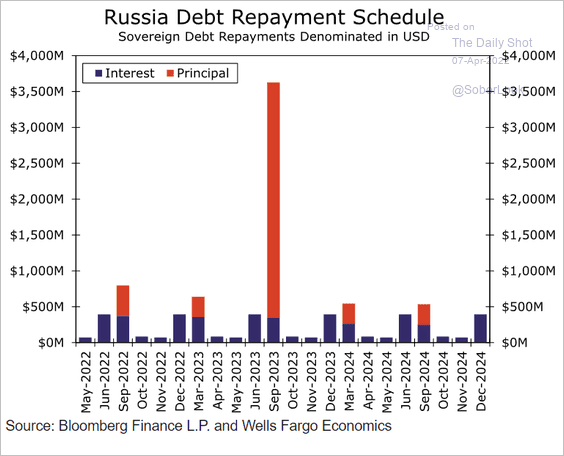

• Here is the USD-denominated debt repayment schedule.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

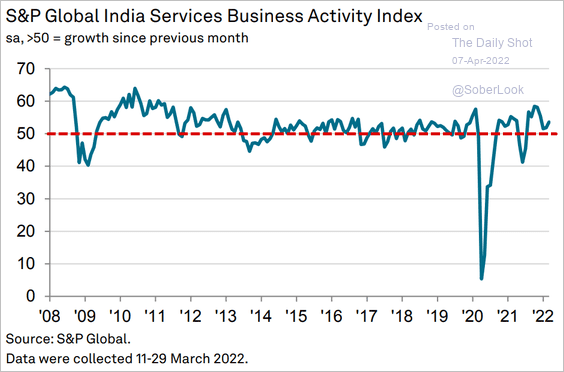

2. India’s service activity improved last month.

Source: IHS Markit

Source: IHS Markit

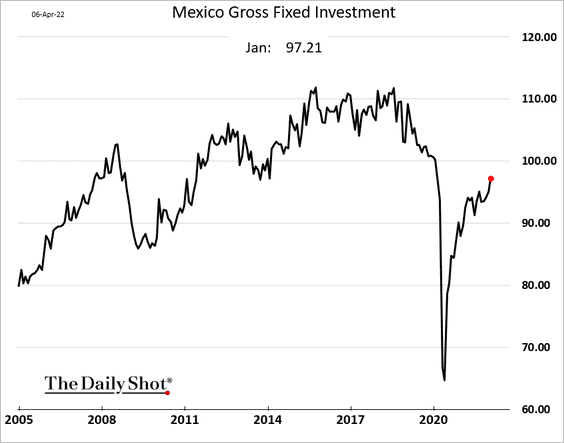

3. Mexican business investment accelerated in January.

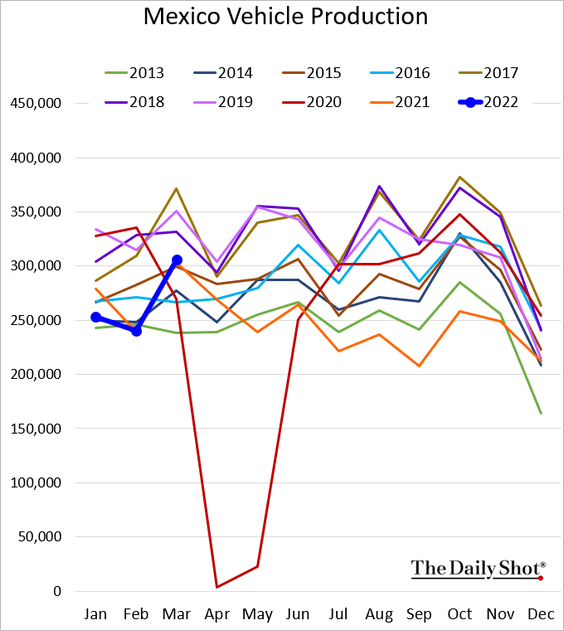

Vehicle production increased sharply last month.

Back to Index

Cryptocurrency

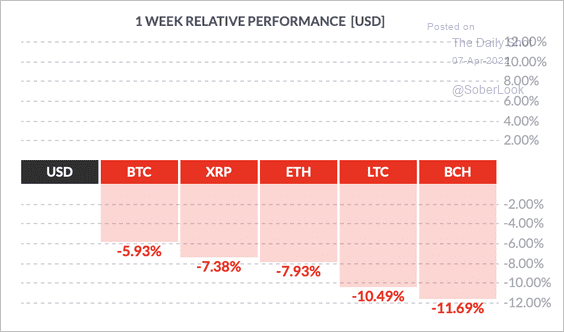

1. Cryptos are having a tough week so far.

Source: FinViz

Source: FinViz

2. Bitcoin’s market cap relative to the total crypto market cap ticked higher on Wednesday, indicating a slight risk-off tone.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

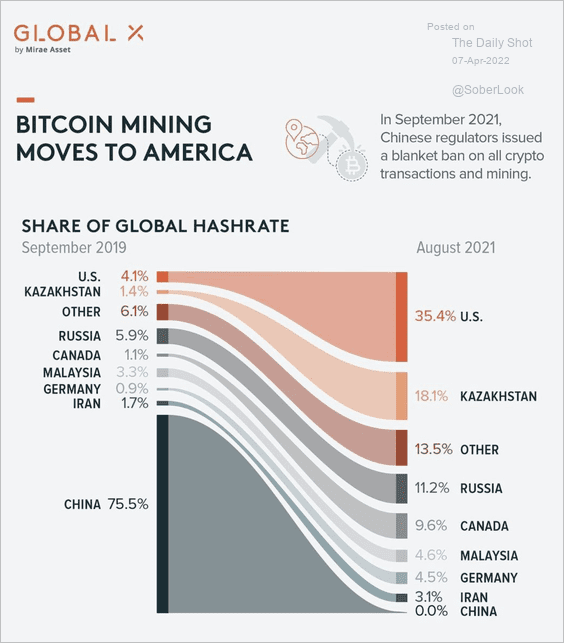

3. The US has taken up a larger share of bitcoin mining activity since the China ban last year.

Source: @GlobalXETFs

Source: @GlobalXETFs

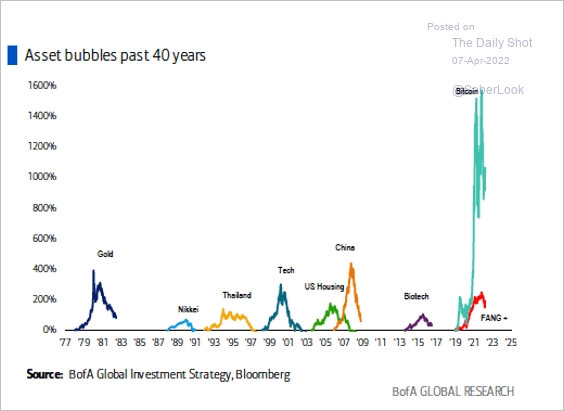

4. Did someone say “asset bubble”?

Source: BofA Global Research; @jindalmukesh1

Source: BofA Global Research; @jindalmukesh1

Back to Index

Energy

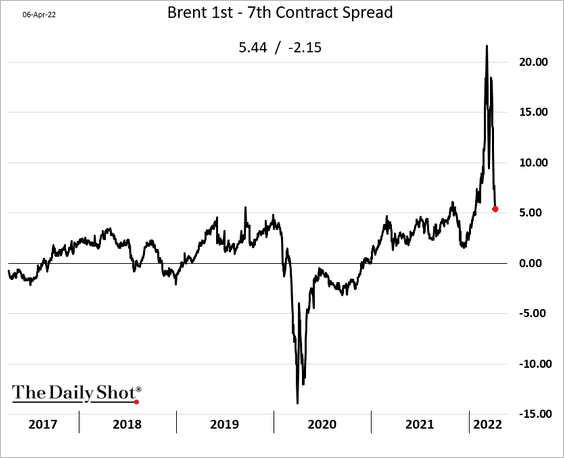

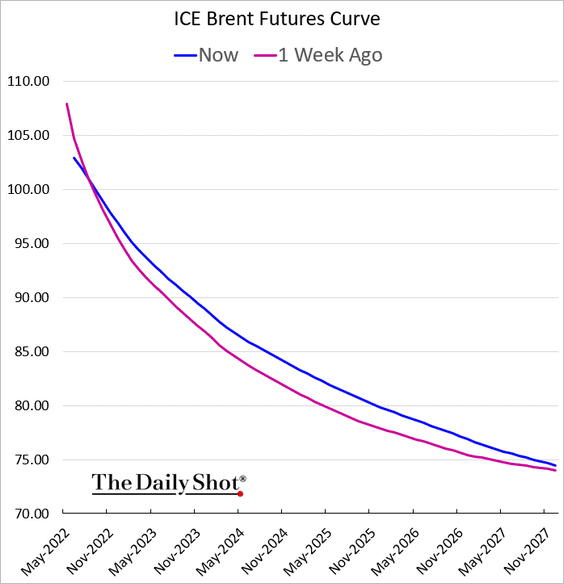

1. Brent’s backwardation continues to ease.

But longer-dated futures are higher relative to last week.

——————–

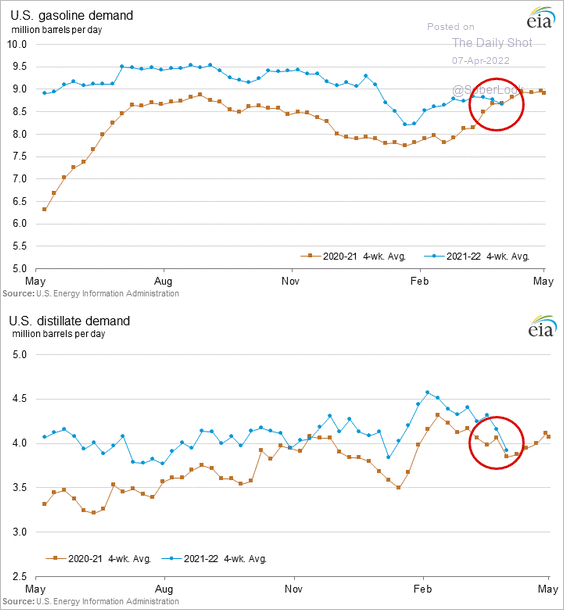

2. US refined products demand is showing signs of fatigue as prices surge.

Back to Index

Equities

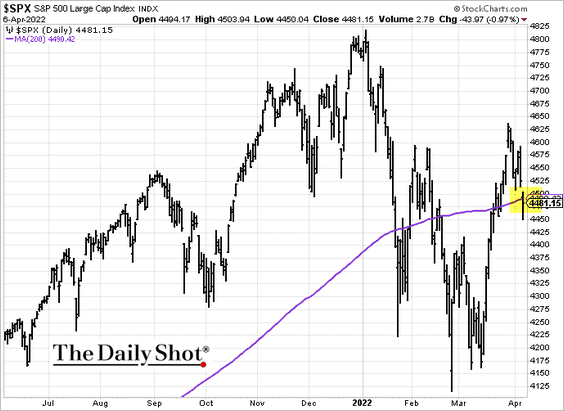

1. The S&P 500 dipped below its 200-day moving average.

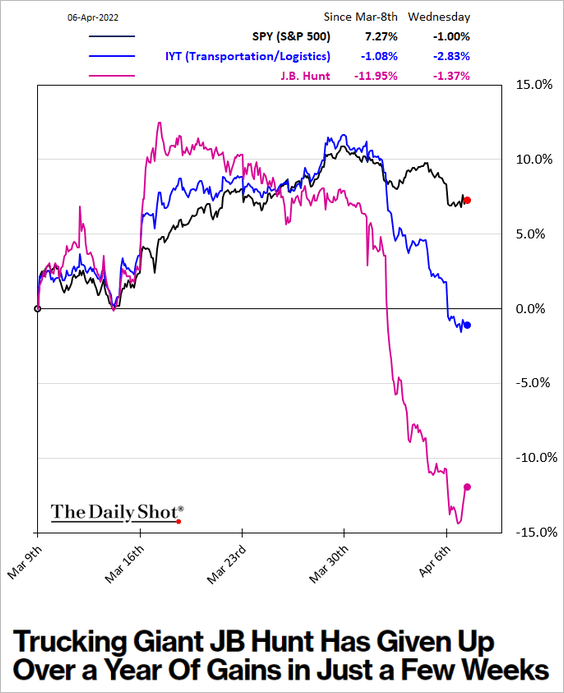

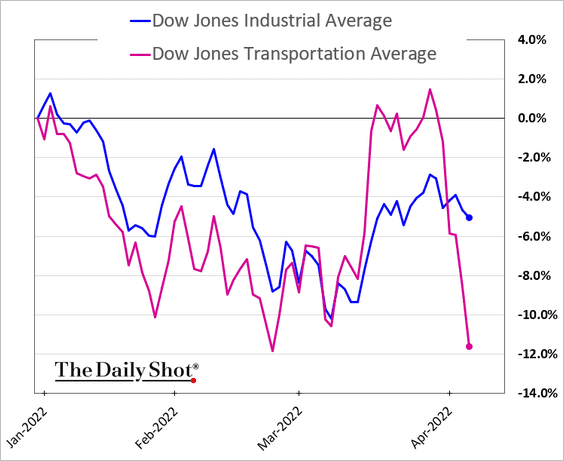

2. The transportation sector has been under pressure.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

For those who follow the Dow Theory, this is not a good sign.

——————–

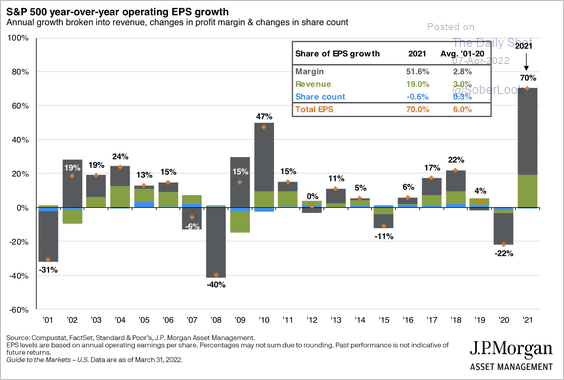

3. Margins contributed the most to S&P 500 earnings-per-share growth over the past year.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

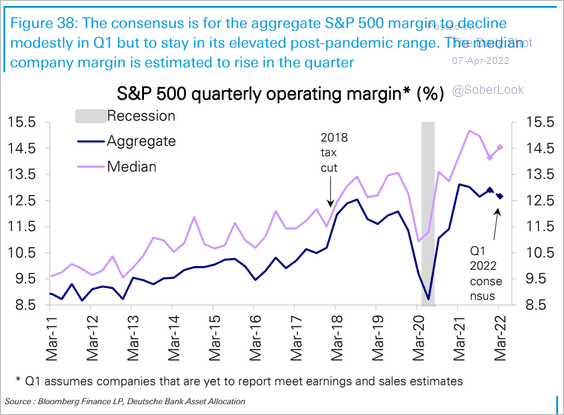

Analysts expect operating margins to remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

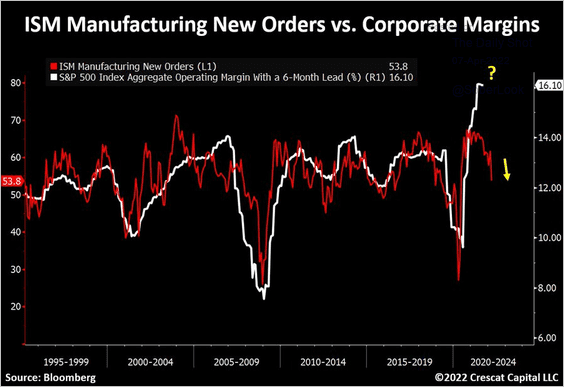

But the ISM PMI says otherwise.

Source: @TaviCosta

Source: @TaviCosta

——————–

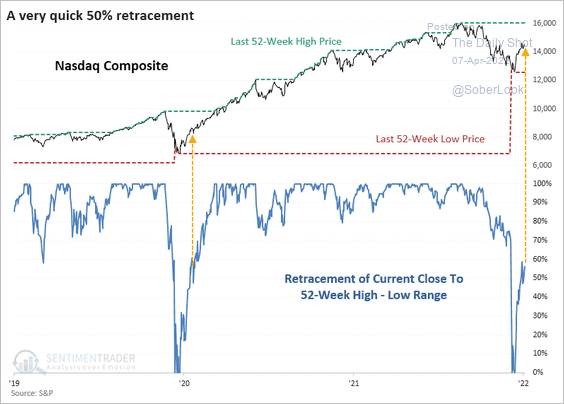

4. The Nasdaq’s recovery from its recent 52-week low looks similar to the 2020 rebound.

Source: SentimenTrader

Source: SentimenTrader

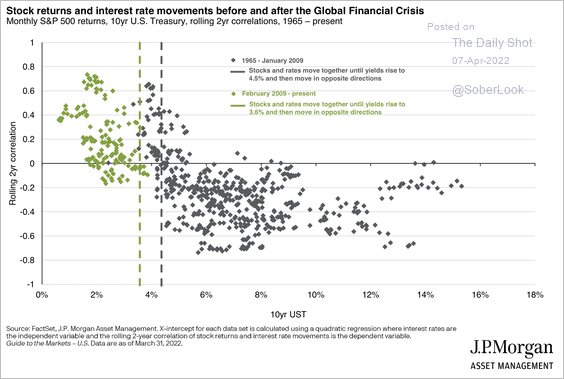

5. Stocks and rates tend to move together until the 10-year Treasury yield rises toward 3%-4%.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

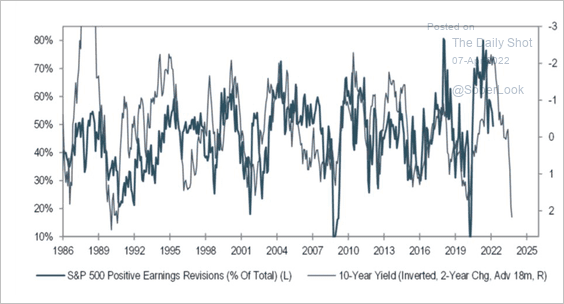

6. The recent sharp increase in bond yields doesn’t bode well for earnings growth.

Source: @MichaelKantro

Source: @MichaelKantro

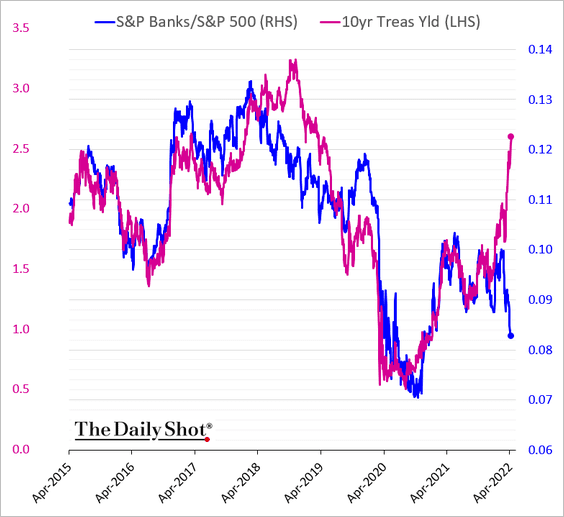

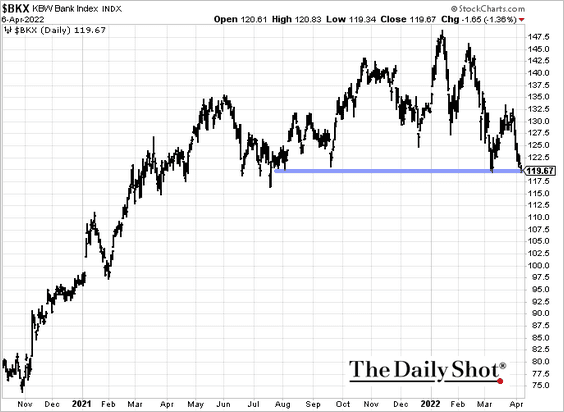

7. Bank shares have decoupled from bond yields.

The KBW Bank Index is at support.

——————–

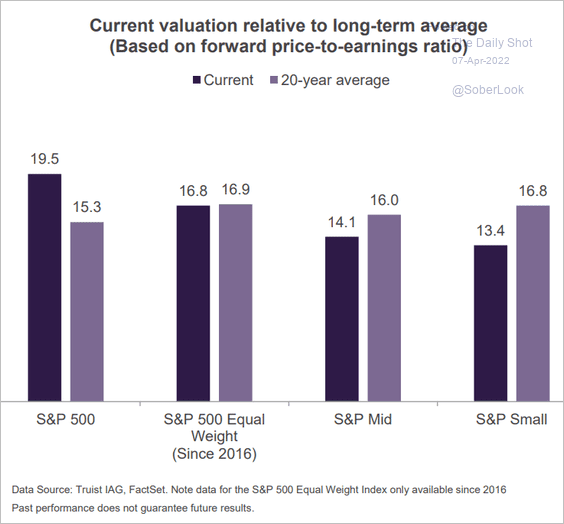

9. This chart shows index valuations relative to long-term averages.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Rates

1. Here is how the Fed plans to implement quantitative tightening.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

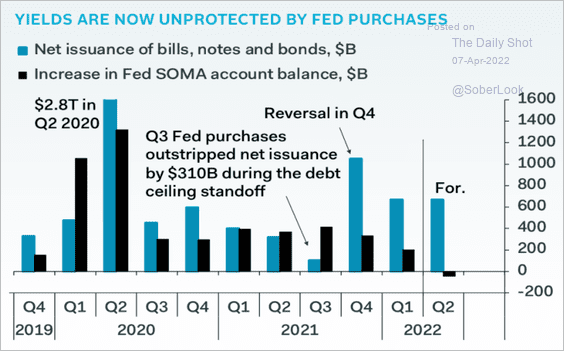

2. The US Treasury has lost a key source of financing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Global Developments

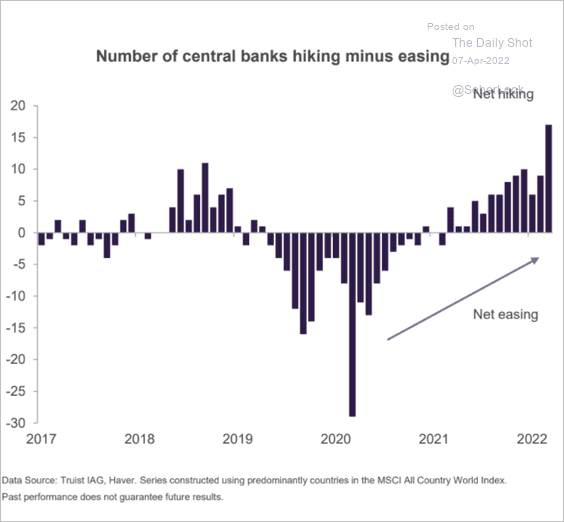

1. The net number of central banks hiking rates hit a multi-year high.

Source: Truist Advisory Services

Source: Truist Advisory Services

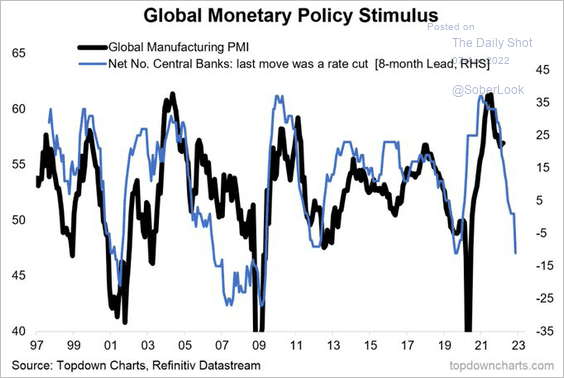

That doesn’t bode well for economic growth.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

——————–

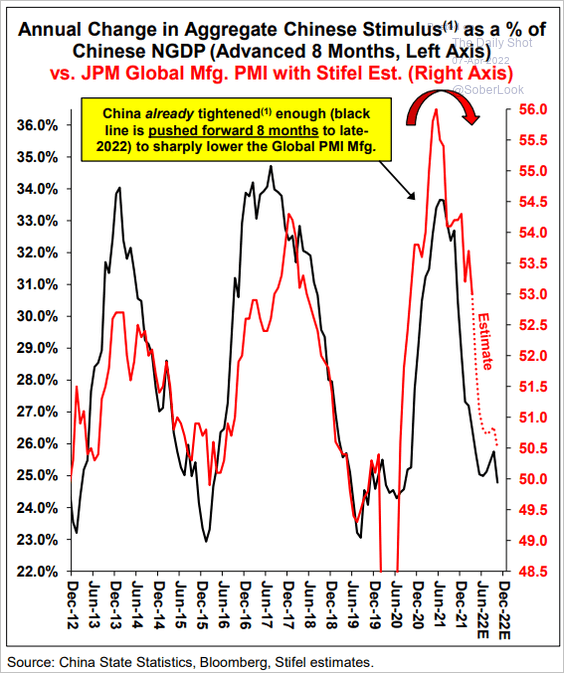

2. China’s slowdown will pull global economic activity lower.

Source: Stifel

Source: Stifel

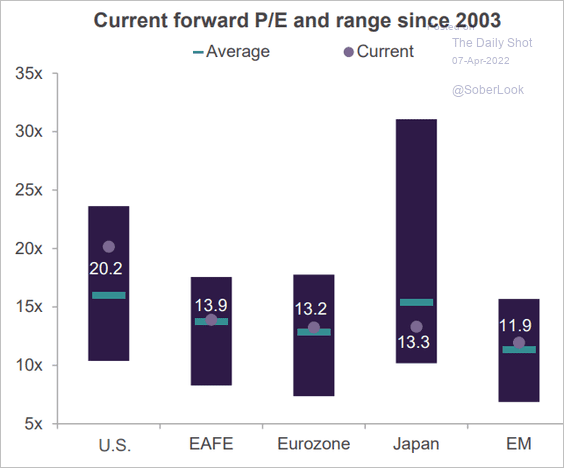

3. This chart shows current equity valuations relative to long-term averages and ranges.

Source: Truist Advisory Services

Source: Truist Advisory Services

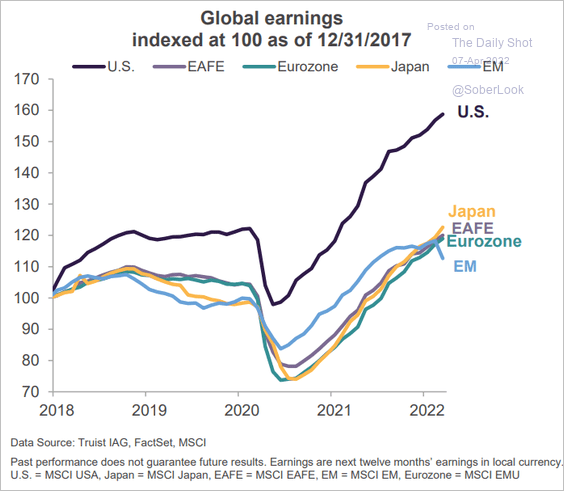

4. Finally, we have corporate earnings growth trends since the start of 2018.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

Food for Thought

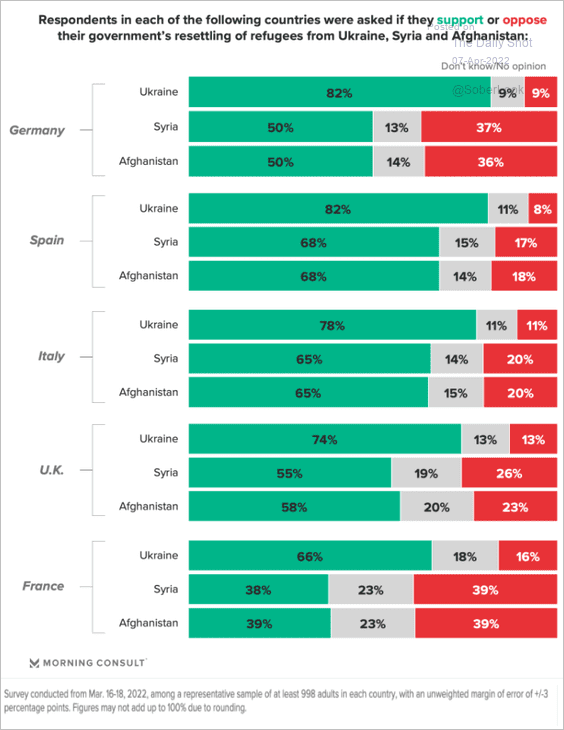

1. Views on resettling refugees in Europe:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

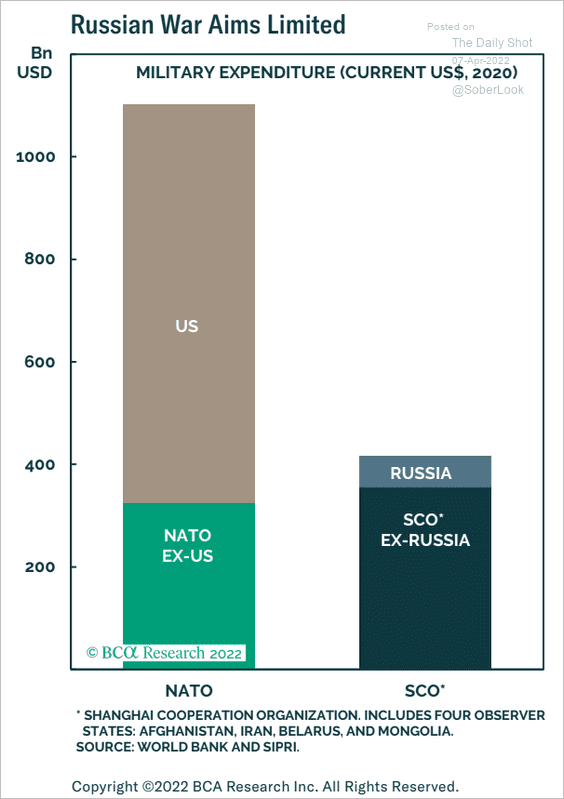

2. Defense spending by NATO vs. Russia and China:

Source: BCA Research

Source: BCA Research

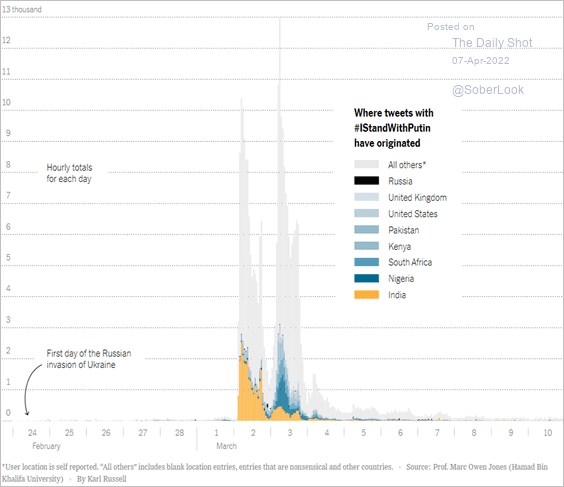

3. Origins of #IStandWithPutin tweets:

Source: The New York Times Read full article

Source: The New York Times Read full article

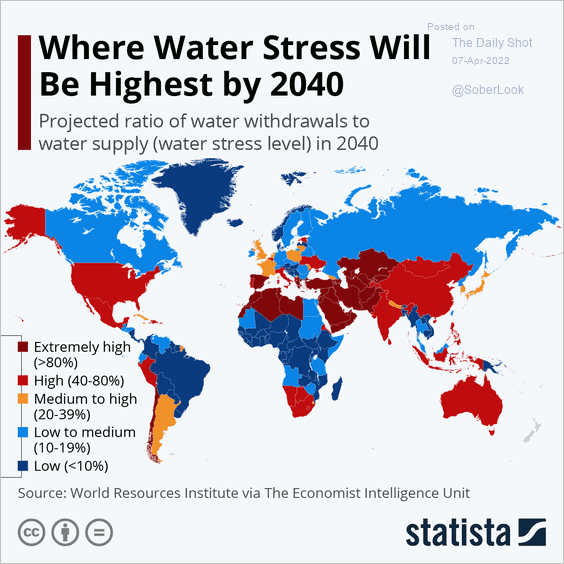

4. Projected water stress levels:

Source: Statista

Source: Statista

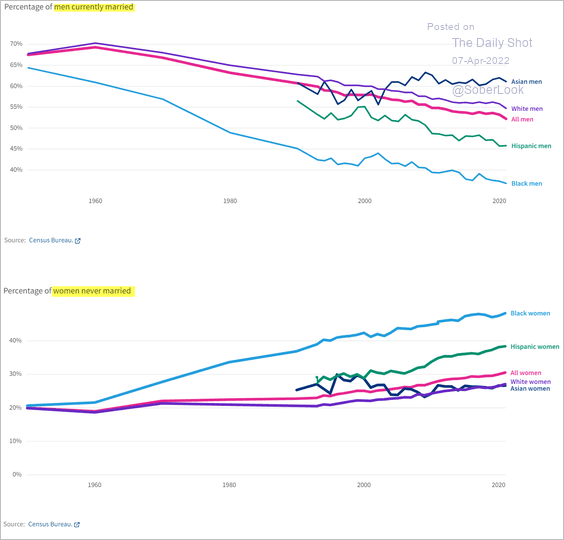

5. US marriage rates by race/ethnicity:

Source: USAFacts Read full article

Source: USAFacts Read full article

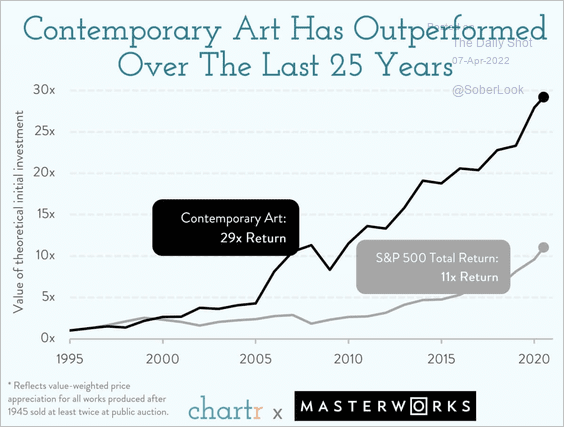

6. The contemporary art market performance:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

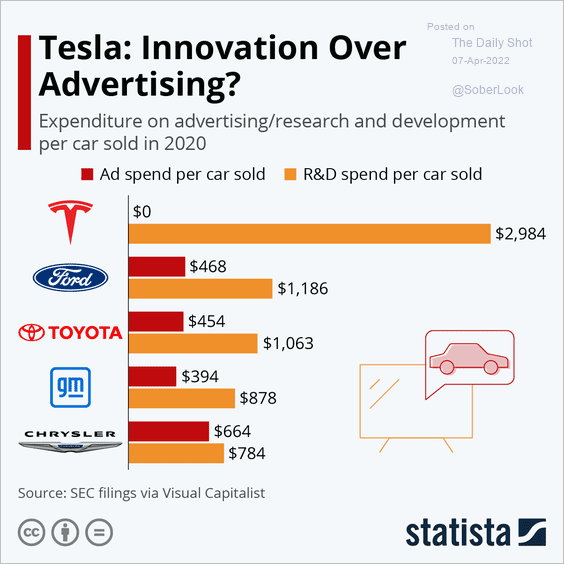

7. Auto manufacturers’ R&D vs. ad spending:

Source: Statista

Source: Statista

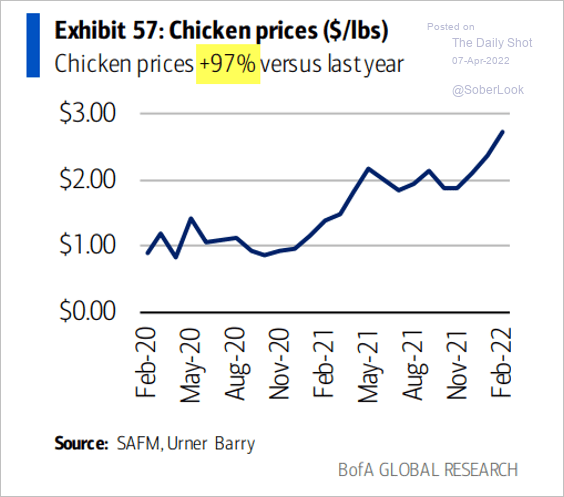

8. Chicken prices:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

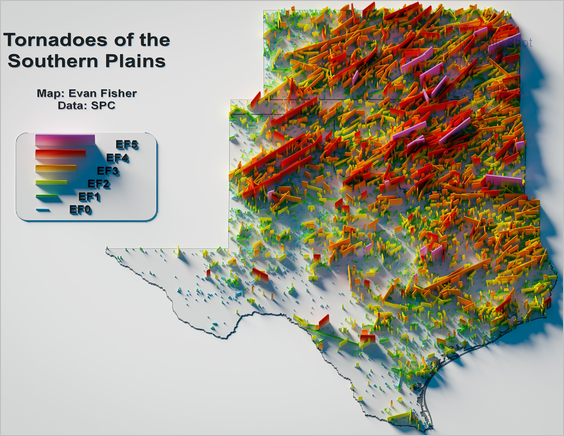

9. A map of all tornadoes in the Southern Plains from 1950 to 2020:

Source: @EFisherWX

Source: @EFisherWX

——————–

Back to Index