The Daily Shot: 24-May-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

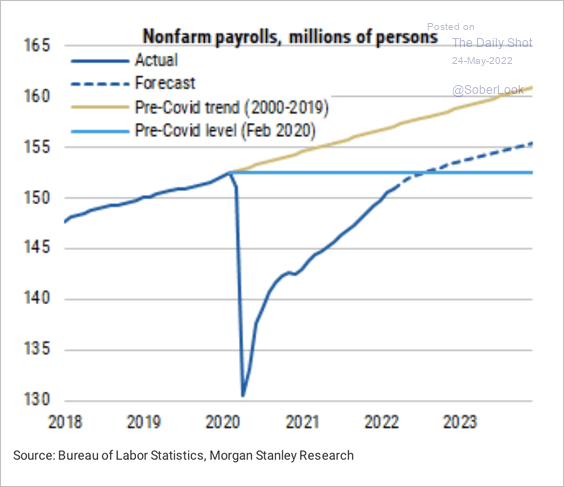

1. Let’s begin with some updates on the labor market and wages.

• Payrolls should return to the pre-COVID level but fall short of the trend, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

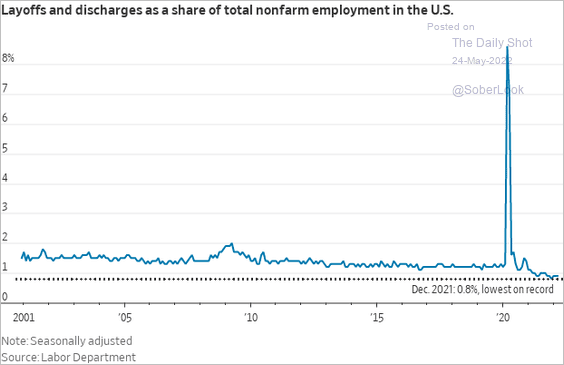

• Layoffs have been very low in recent months.

Source: @WSJ Read full article

Source: @WSJ Read full article

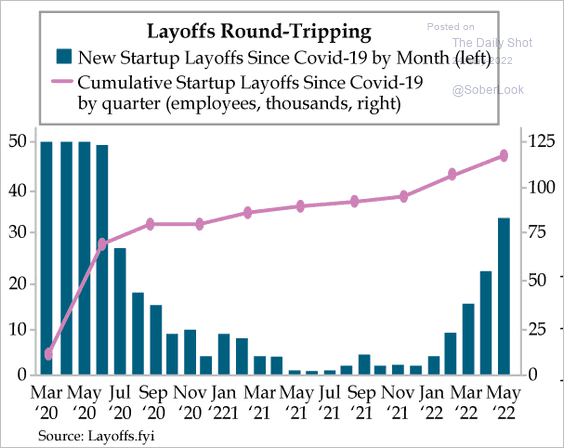

But startups are laying off employees to reduce their cash burn as the VC funding market tightens.

Source: Quill Intelligence

Source: Quill Intelligence

Source: TechCrunch Read full article

Source: TechCrunch Read full article

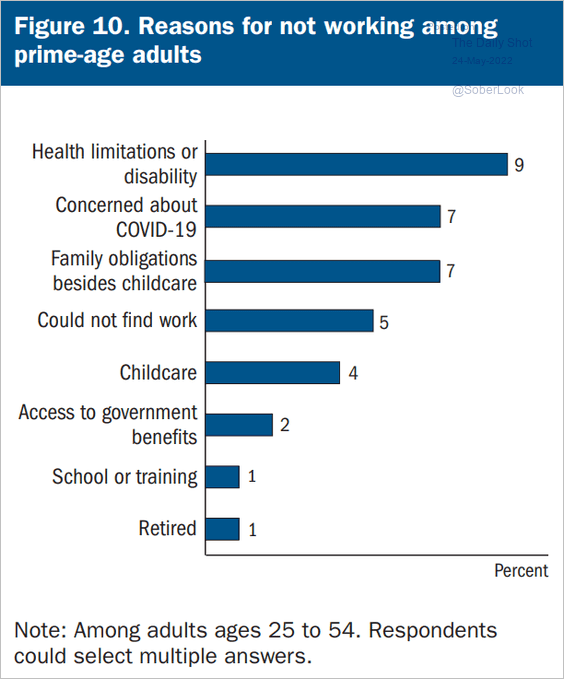

• What are the reasons for not working for prime-age adults?

Source: Federal Reserve Board

Source: Federal Reserve Board

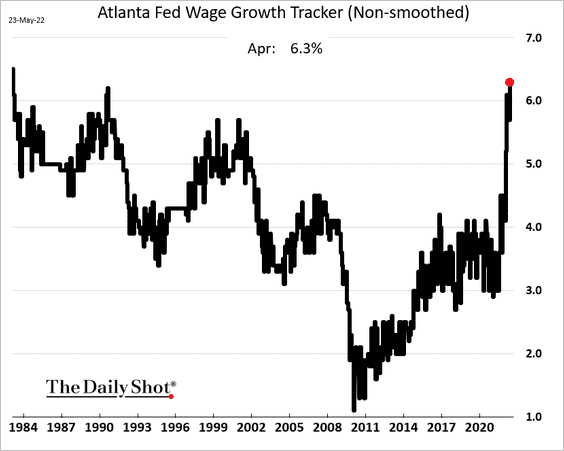

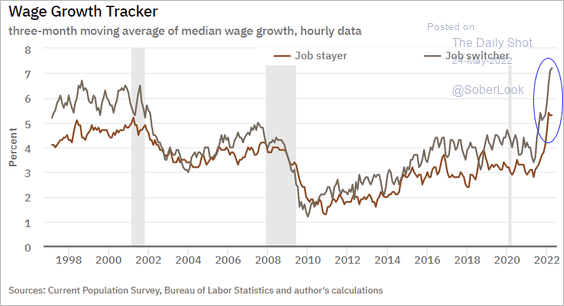

• Wage growth hit the highest level in nearly 40 years, according to the Atlanta Fed’s wage tracker.

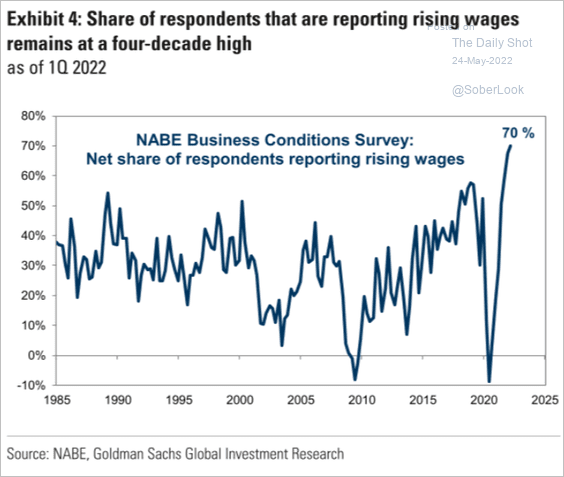

– 70% of companies were boosting wages last quarter.

Source: Goldman Sachs

Source: Goldman Sachs

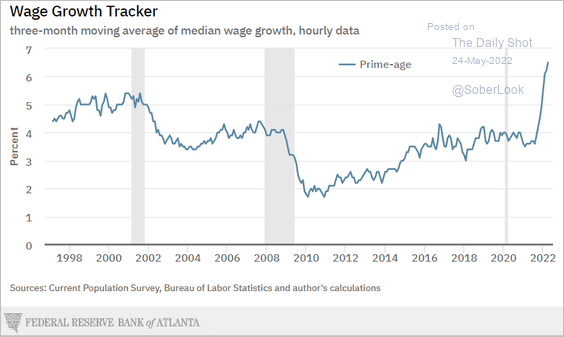

– Prime-age workers have seen particularly strong wage gains.

Source: @AtlantaFed

Source: @AtlantaFed

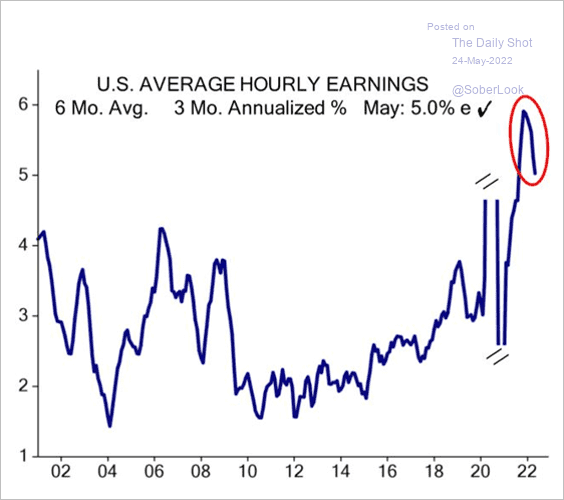

– But is wage growth starting to slow?

Source: Evercore ISI Research

Source: Evercore ISI Research

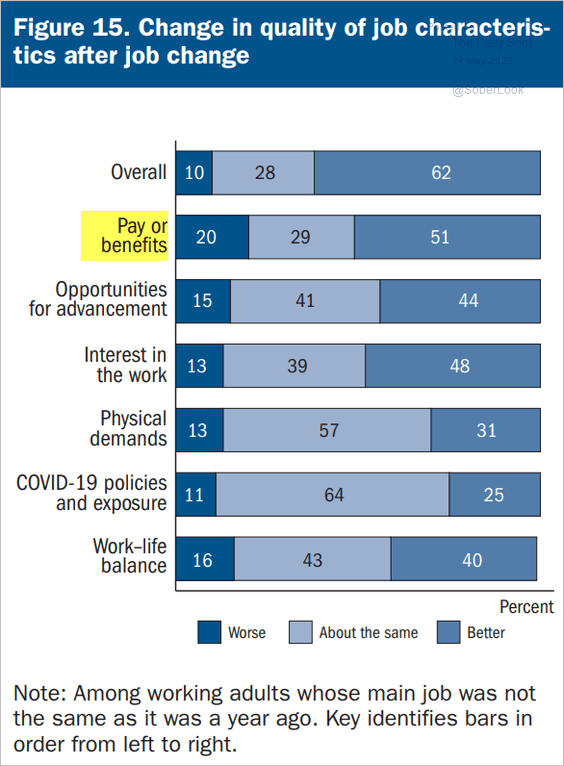

• Job hopping has been lucrative.

Source: @AtlantaFed

Source: @AtlantaFed

Source: Federal Reserve Board, h/t @SamRo

Source: Federal Reserve Board, h/t @SamRo

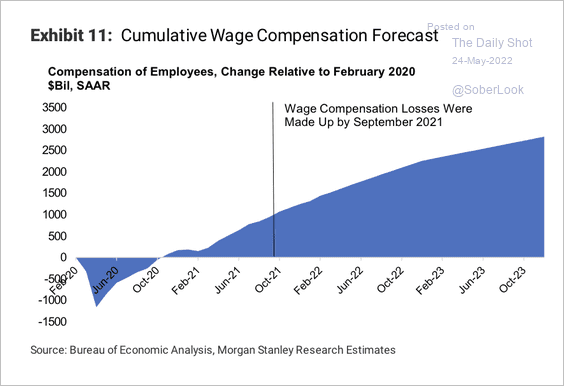

• This chart shows the cumulative labor-market generated income.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

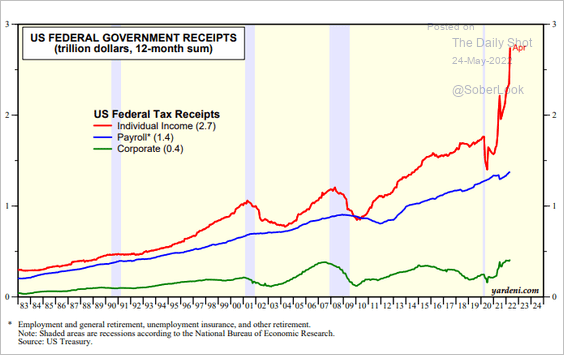

• Wage gains have been boosting federal tax receipts.

Source: Yardeni Research

Source: Yardeni Research

——————–

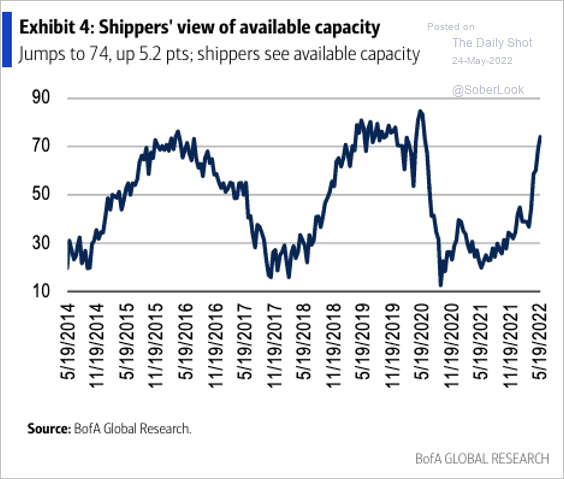

2. Next, let’s take a look at supply bottlenecks.

• Shipping capacity is improving.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

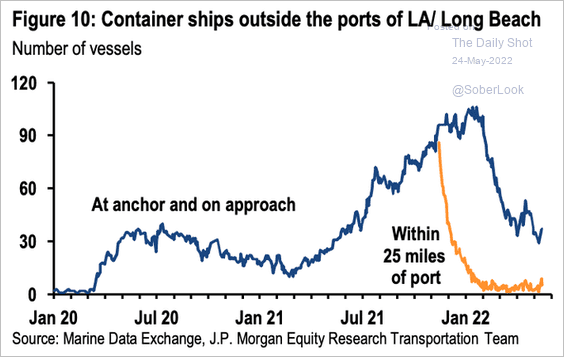

• The congestion at West Coast ports has been easing.

Source: JP Morgan Research; @SamRo

Source: JP Morgan Research; @SamRo

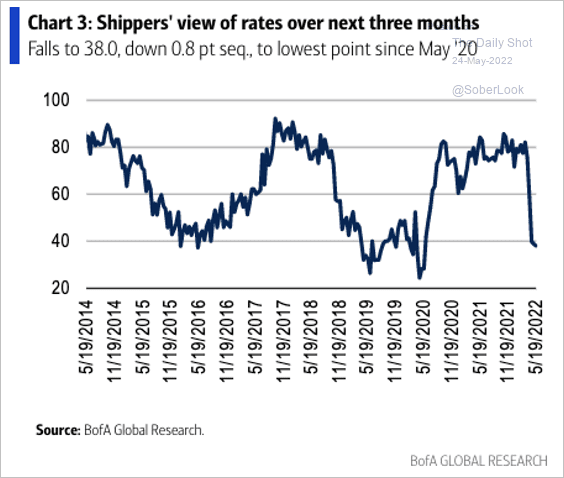

• Shipping rates are expected to moderate.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

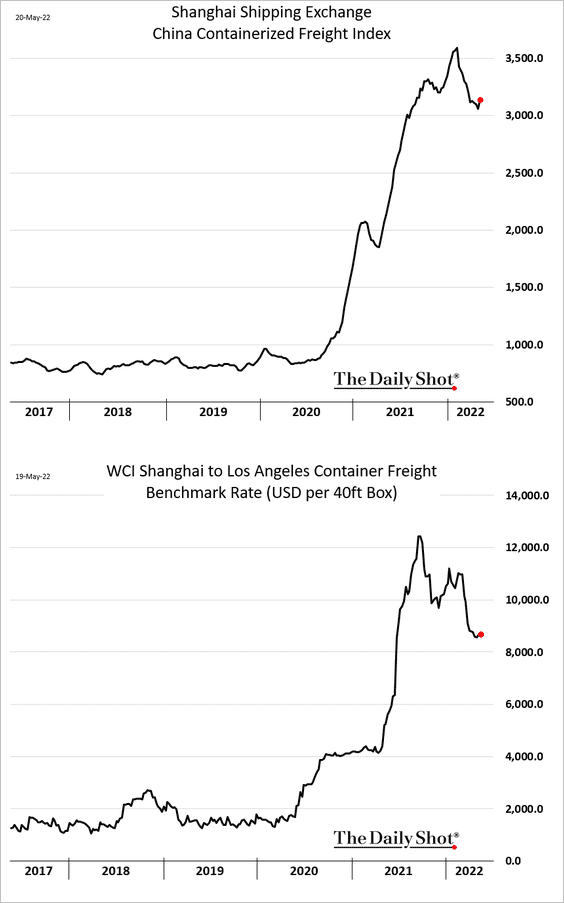

• But container shipping costs ticked higher last week. Demand is not crashing.

——————–

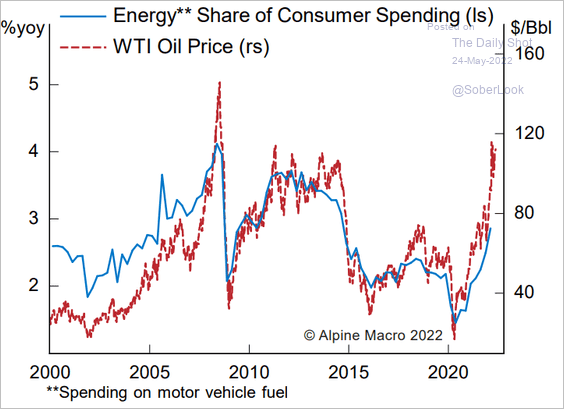

3. Will the energy share of consumer spending keep climbing?

Source: Alpine Macro

Source: Alpine Macro

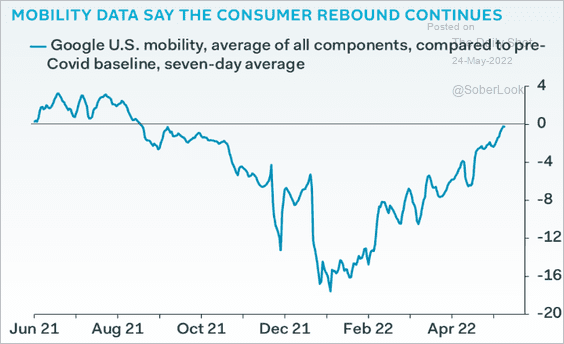

4. Mobility continues to recover.

Source: Capital Economics

Source: Capital Economics

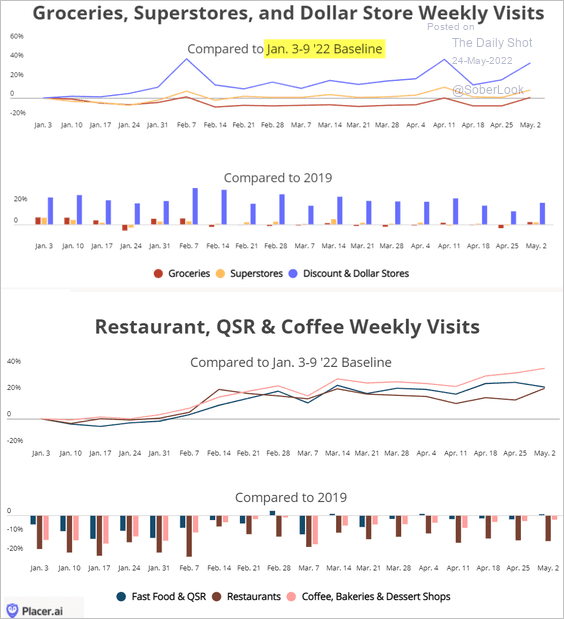

Visits to coffee shops have been surging (2nd panel).

Source: Placer.ai

Source: Placer.ai

——————–

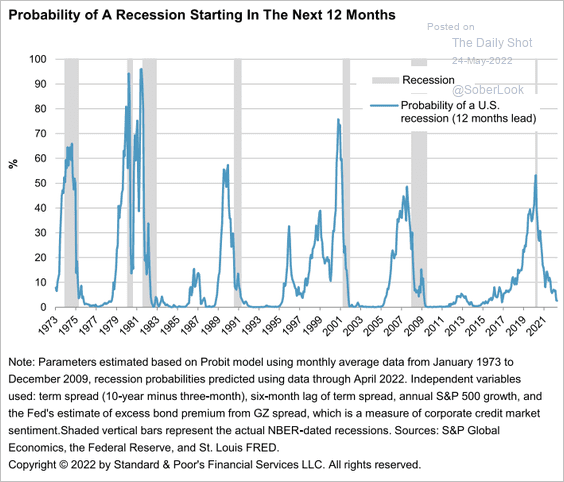

5. Here is the S&P Global Ratings’ recession model.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

The United Kingdom

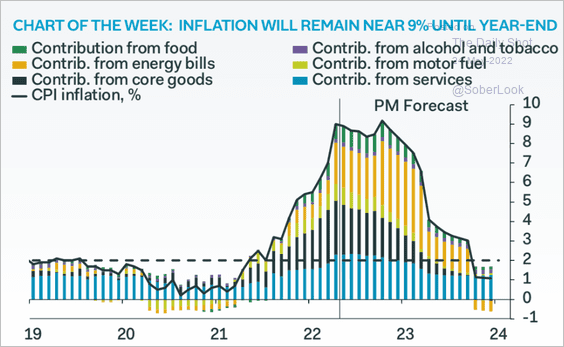

1. Inflation will remain elevated for some time, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

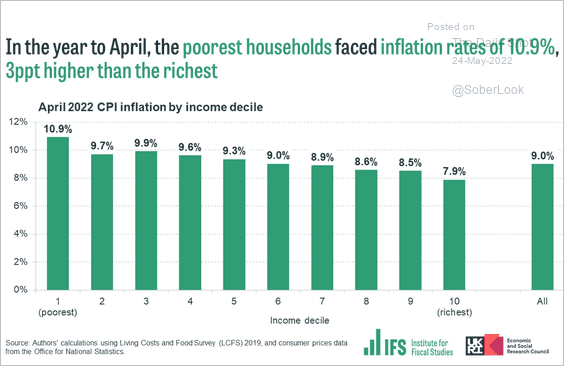

Low-income households have experienced the highest inflation.

Source: @TheIFS

Source: @TheIFS

——————–

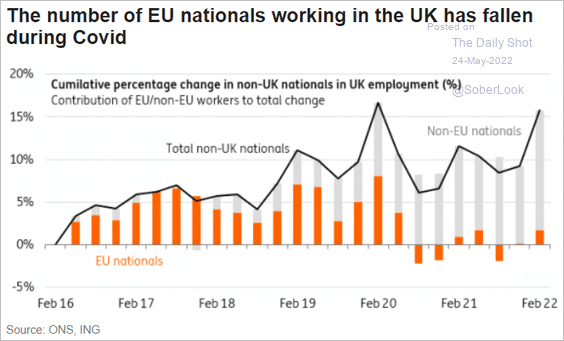

2. The number of EU nationals working in the UK declined during COVID.

Source: ING

Source: ING

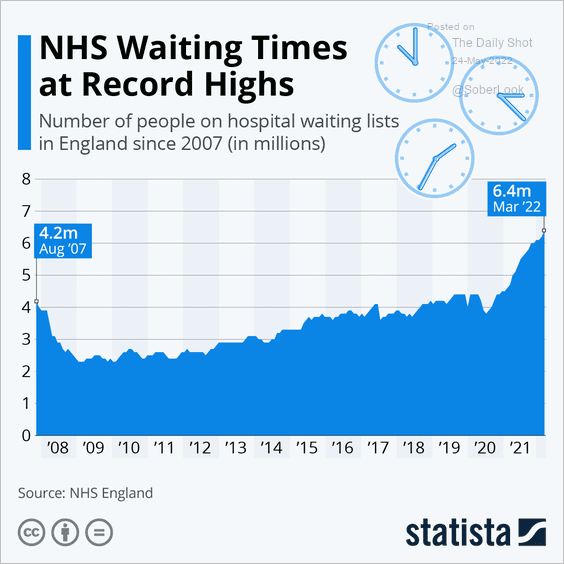

3. Hospital waiting times keep rising.

Source: Statista

Source: Statista

Back to Index

The Eurozone

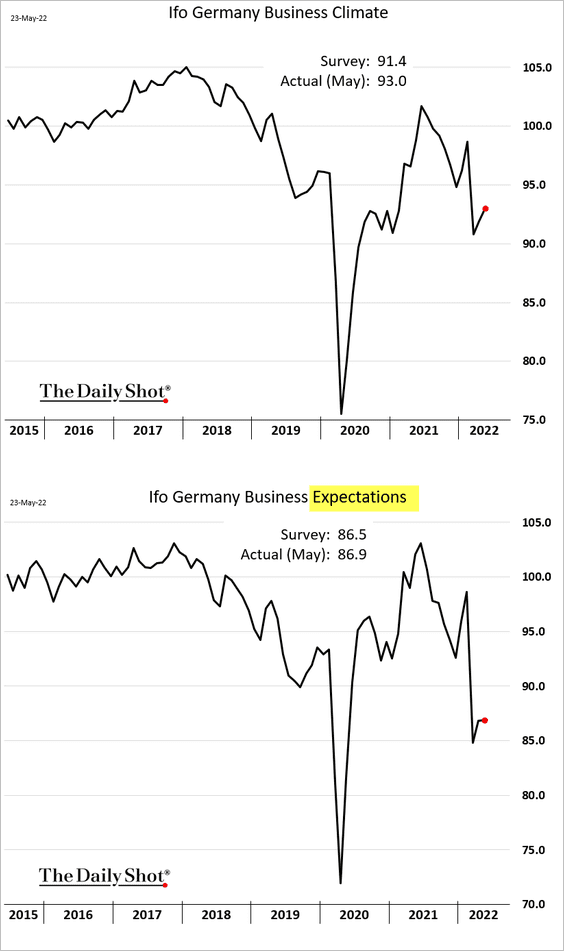

1. Germany’s business sentiment improved this month, although the expectations index was roughly flat.

Source: Reuters Read full article

Source: Reuters Read full article

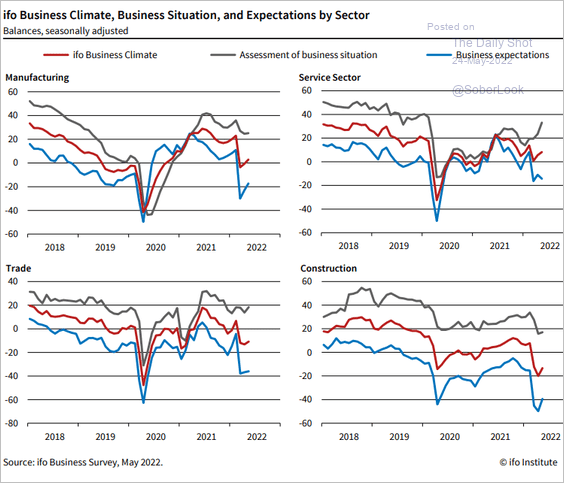

Service-sector current conditions and expectations indices diverged in May.

Source: ifo Institute

Source: ifo Institute

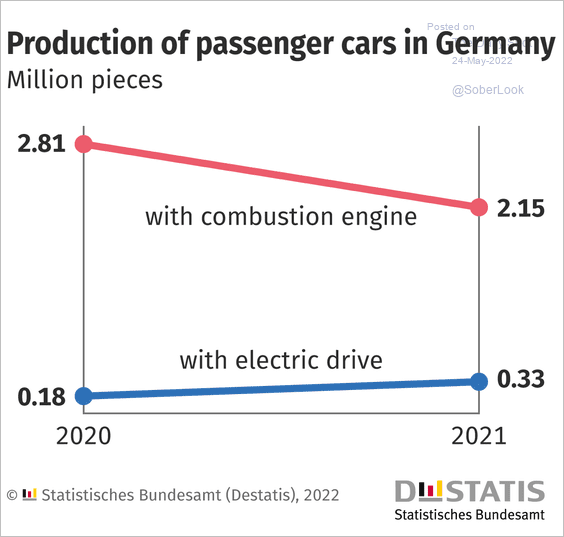

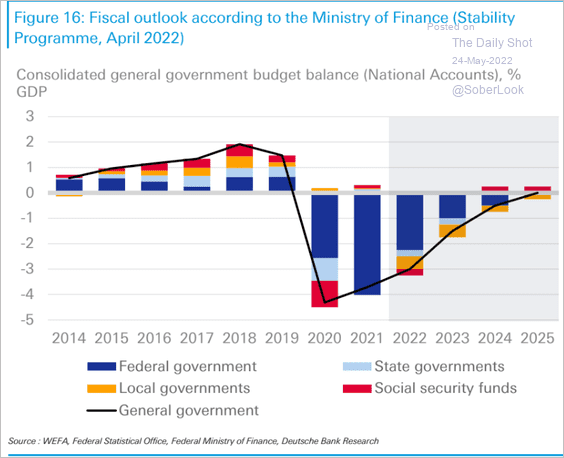

Here are a couple of additional updates on Germany.

• Auto manufacturing shifting toward EVs:

Source: @destatis_news Read full article

Source: @destatis_news Read full article

• German fiscal outlook:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

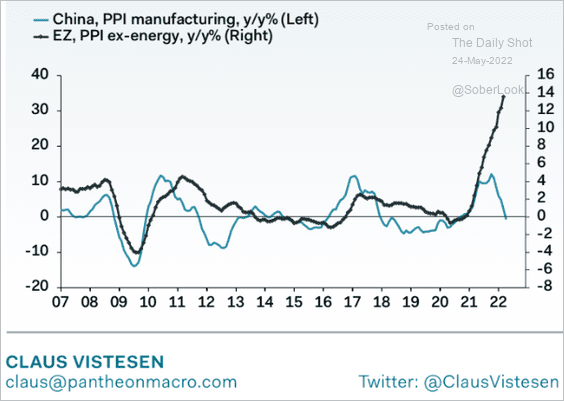

2. China’s PPI points to slower producer price gains in the Eurozone going forward.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

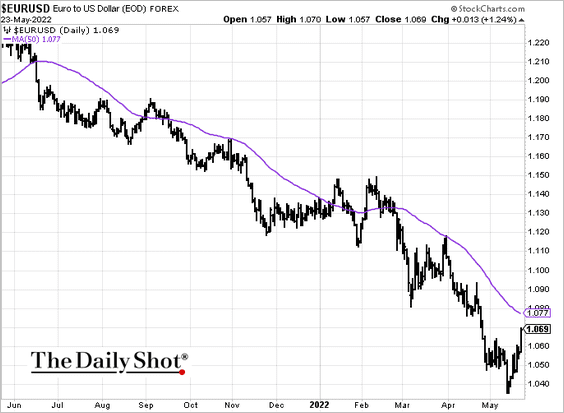

3. The euro rebounded from the lows but will face resistance at the 50-day moving average.

Back to Index

Europe

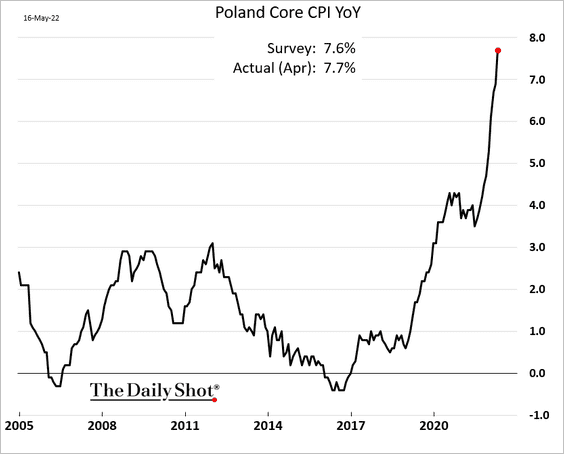

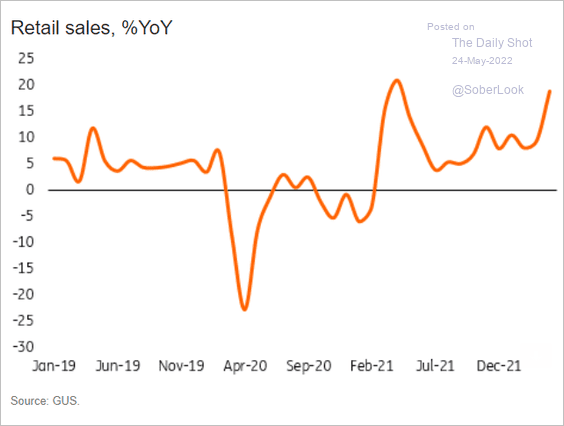

1. Let’s begin with Poland.

• Core inflation:

• Retail sales (very strong):

Source: ING

Source: ING

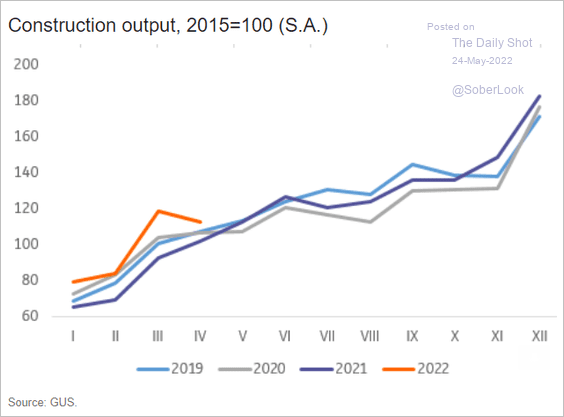

• Construction activity:

Source: ING

Source: ING

——————–

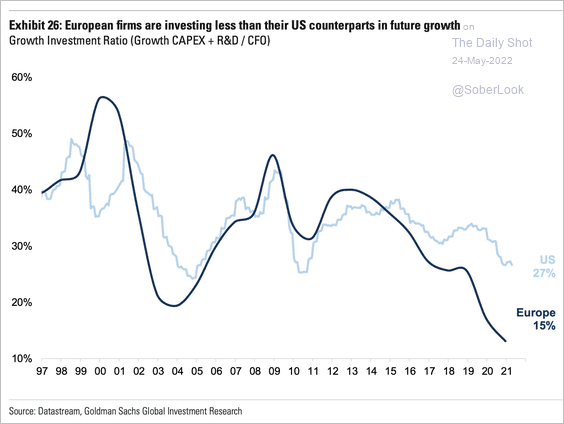

2. European CapEx has been lagging the US.

Source: @acemaxx, @GoldmanSachs

Source: @acemaxx, @GoldmanSachs

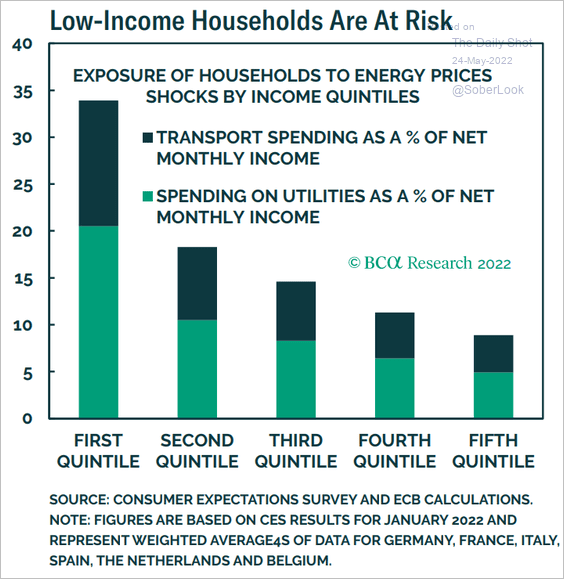

3. The surge in energy prices has been particularly painful for lower-income households.

Source: BCA Research

Source: BCA Research

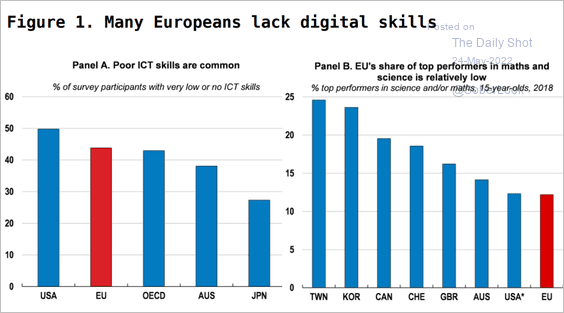

4. Many Europeans lack digital skills (ICT = information and communications technology).

Source: ECOSCOPE Read full article

Source: ECOSCOPE Read full article

Back to Index

Asia – Pacific

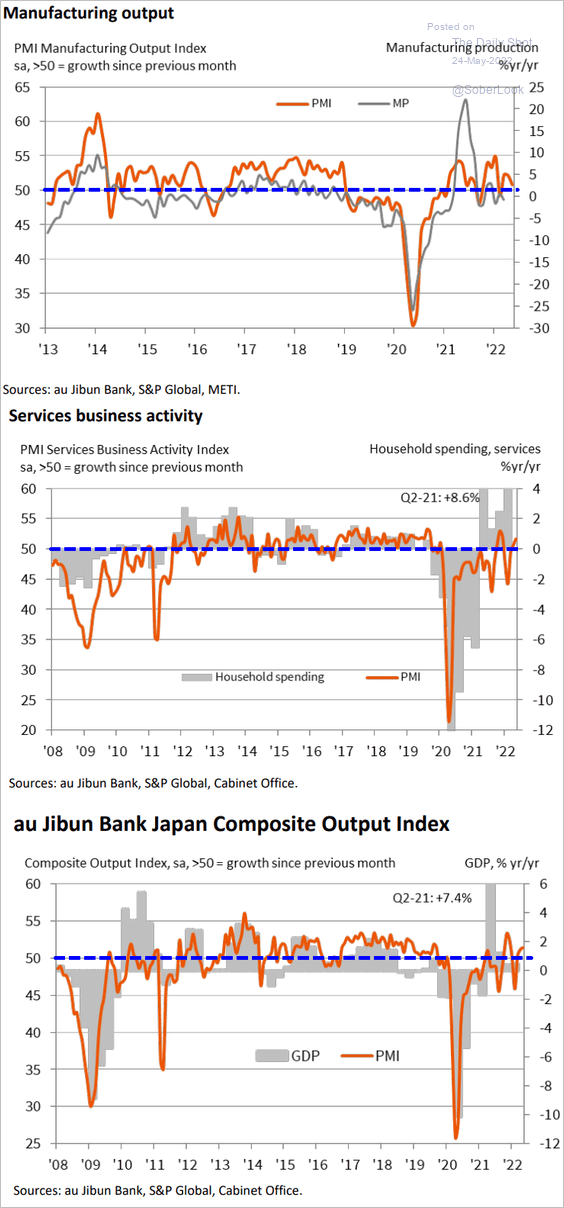

1. Japan’s business activity once again showed modest growth this month as service sectors improve.

Source: IHS Markit

Source: IHS Markit

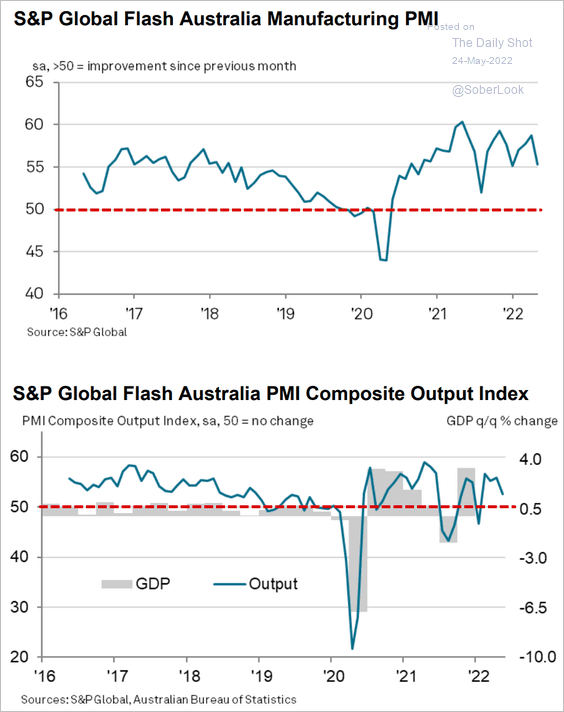

2. Growth in Australian business activity slowed but held in positive territory.

Source: IHS Markit

Source: IHS Markit

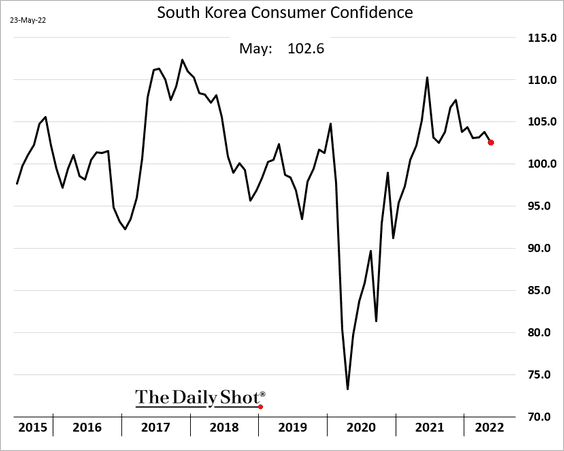

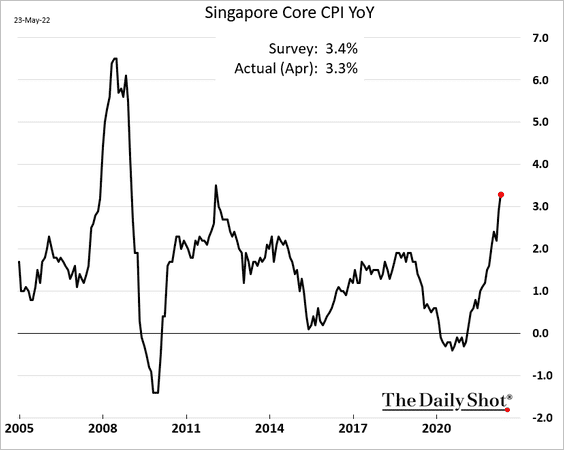

3. South Korean consumer confidence has been moderating but remains elevated.

4. Singapore’s CPI continues to rise.

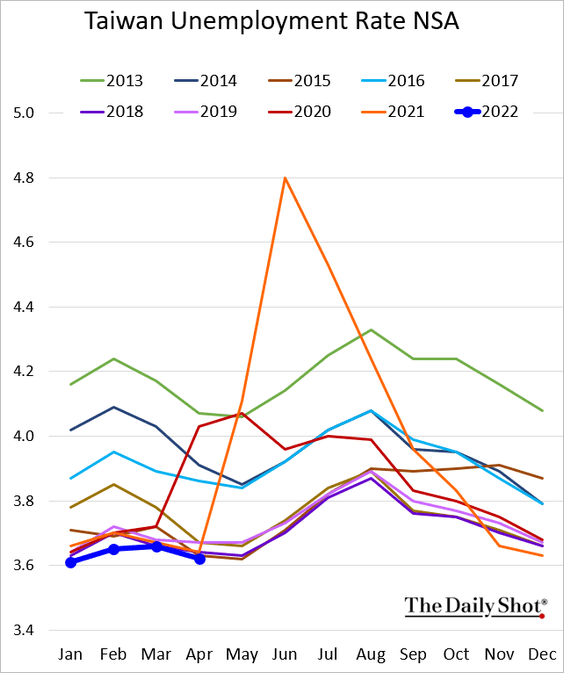

5. Taiwan’s unemployment rate remains very low for this time of the year.

Back to Index

China

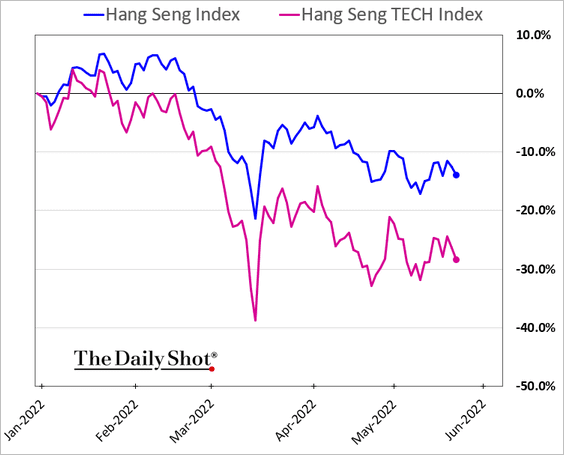

1. Hong-Kong listed tech giants continue to struggle.

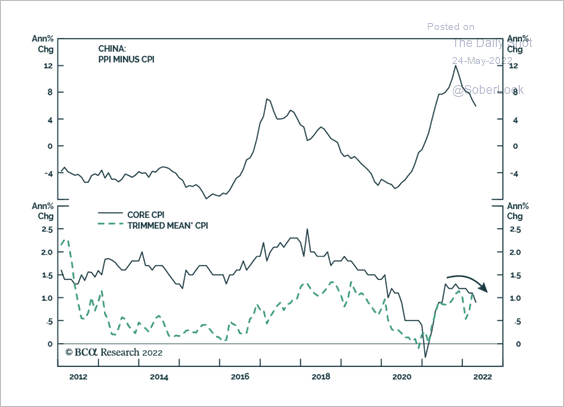

2. The spread between PPI and CPI suggests that manufacturers have been unable to pass on rising input costs to consumers (putting pressure on margins).

Source: BCA Research

Source: BCA Research

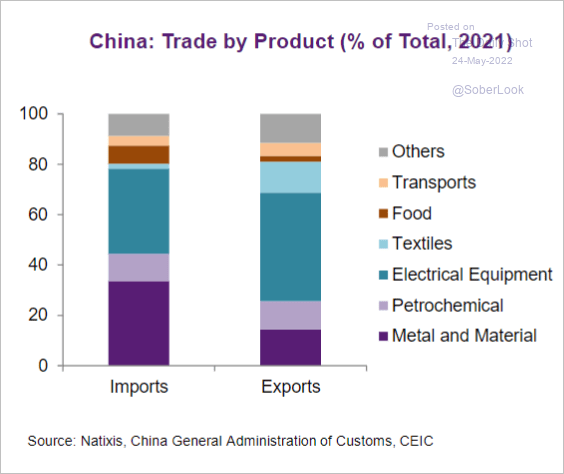

3. This chart shows China’s imports and exports by product.

Source: Natixis

Source: Natixis

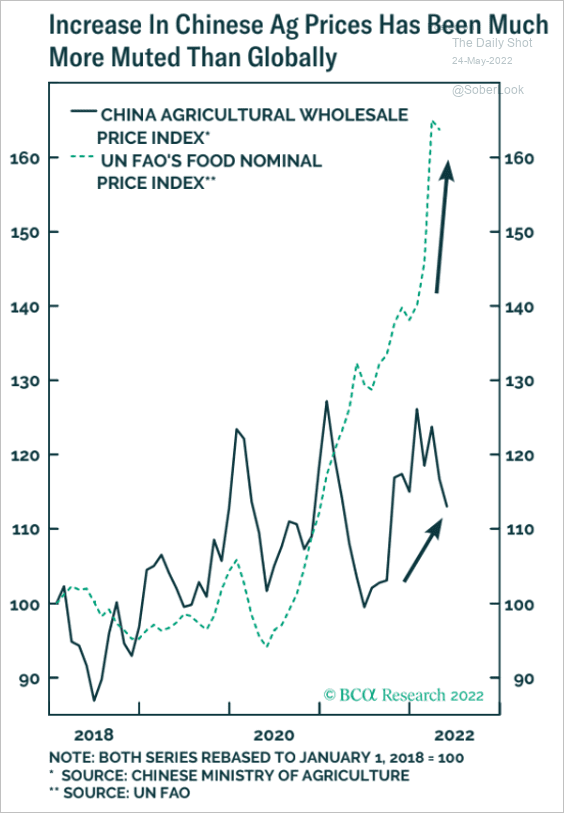

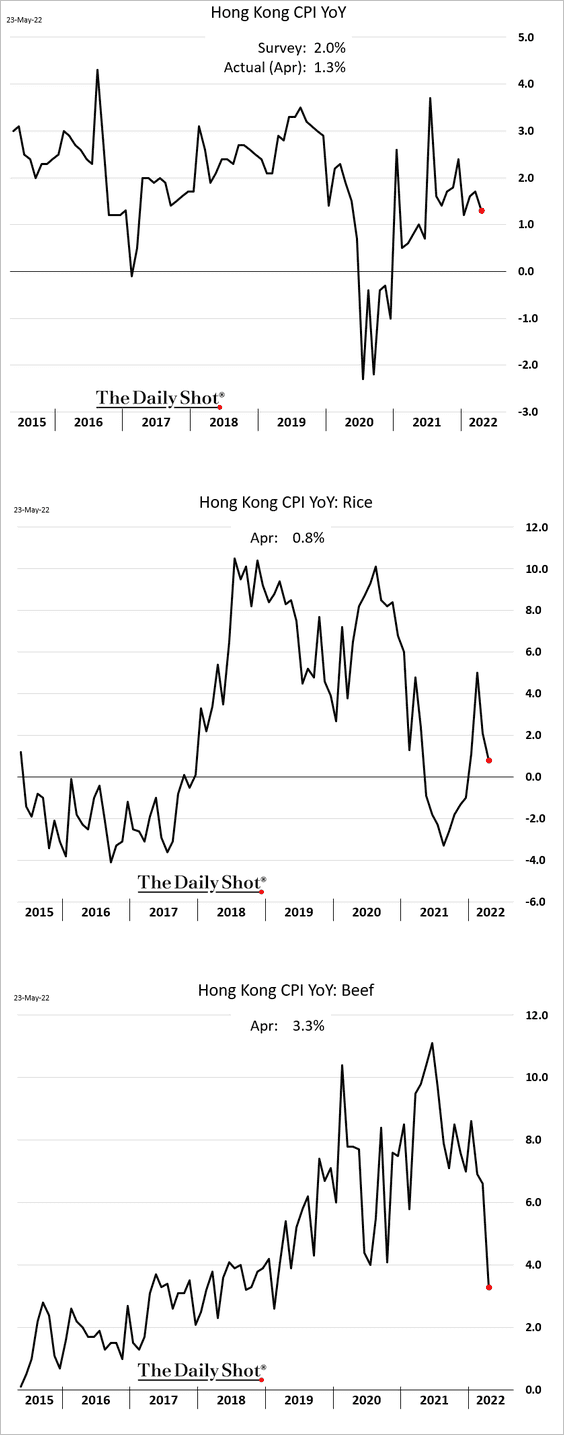

4. Pork deflation and other factors helped keep China’s food prices from following the global inflation surge.

Source: BCA Research

Source: BCA Research

Hong Kong’s inflation remains modest.

——————–

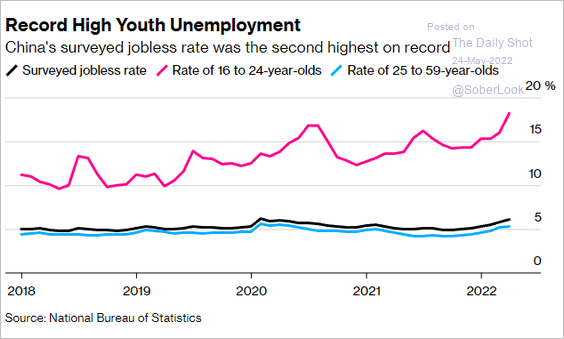

5. Youth unemployment has been rising.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

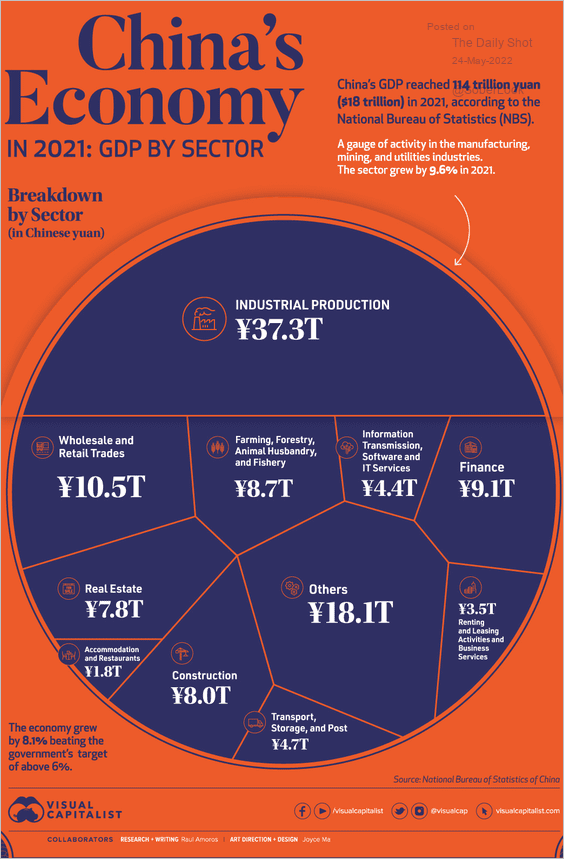

6. Here is the breakdownd of China’s GDP by sector.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Emerging Markets

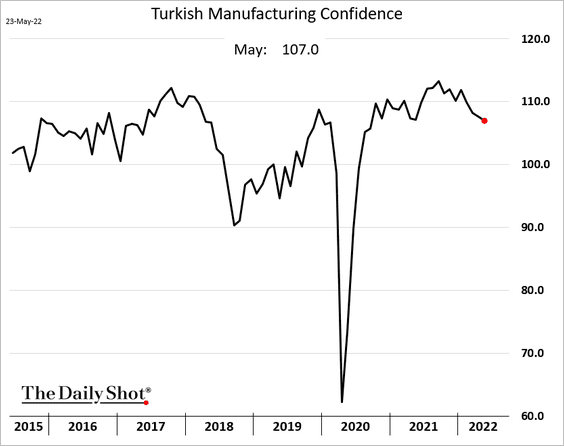

1. Turkish manufacturing confidence has been declining but not collapsing.

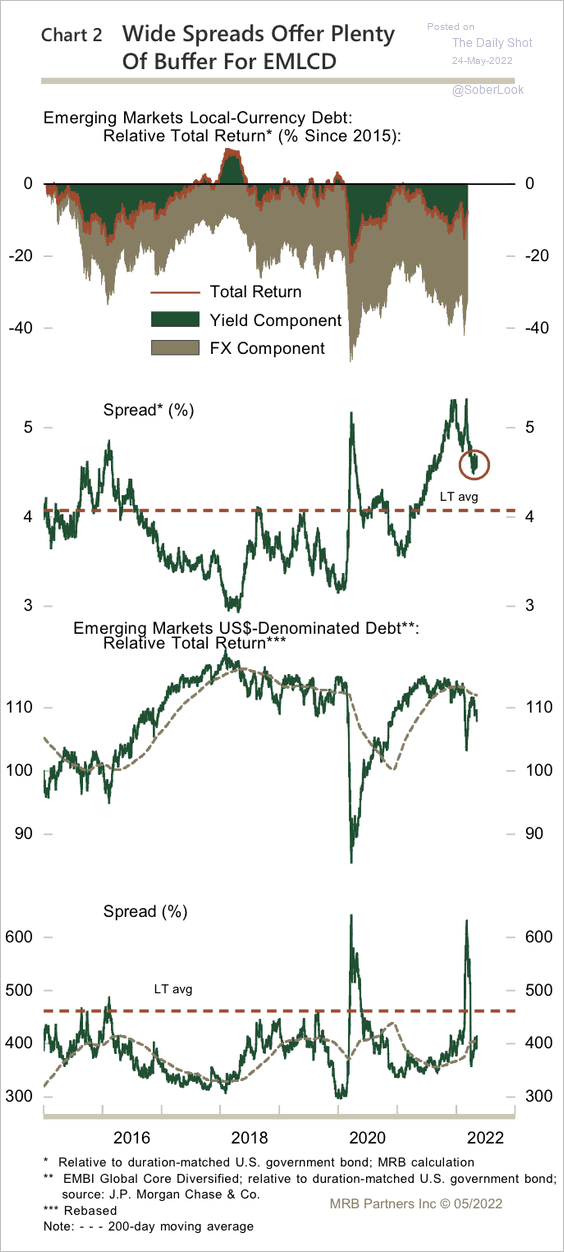

2. EM local-currency debt (EMLCD) spreads started the year at above-average levels, reflecting the early tightening by many EM central banks. Spreads have declined sharply since then, albeit still higher than their long-term average.

Source: BCA Research

Source: BCA Research

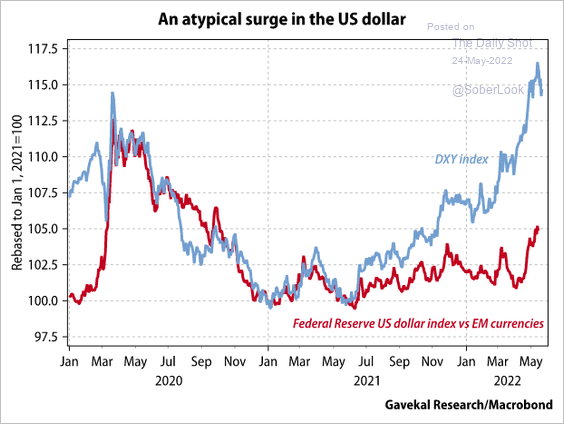

3. EM currencies have been more resilient against USD than DM currencies.

Source: Gavekal Research

Source: Gavekal Research

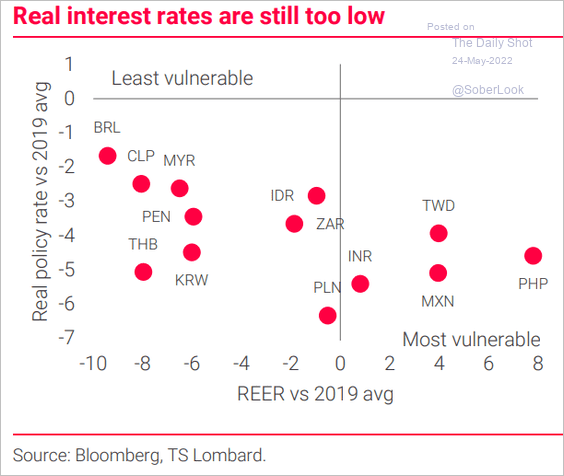

But low real policy rates make some countries’ currencies vulnerable.

Source: TS Lombard

Source: TS Lombard

——————–

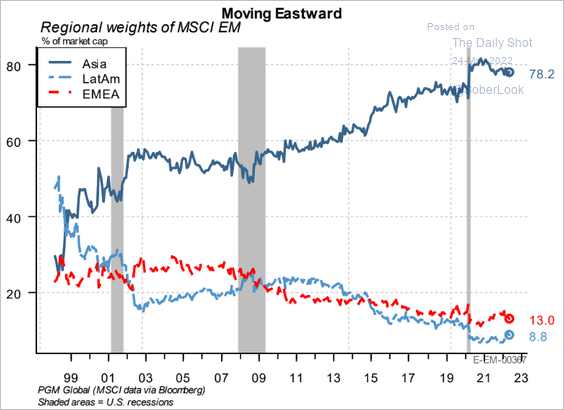

4. The MSCI equity index weights have been shifting toward Asia.

Source: PGM Global

Source: PGM Global

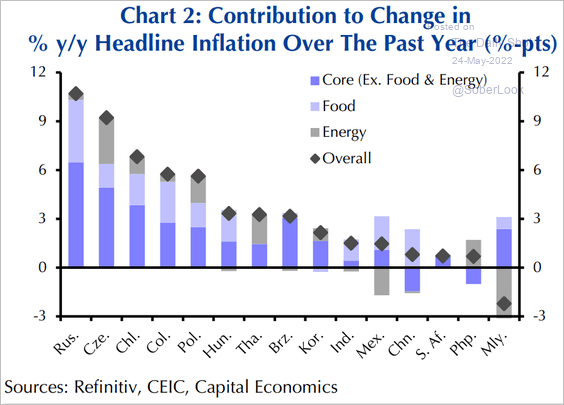

5. Here are the drivers of inflation in select economies.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

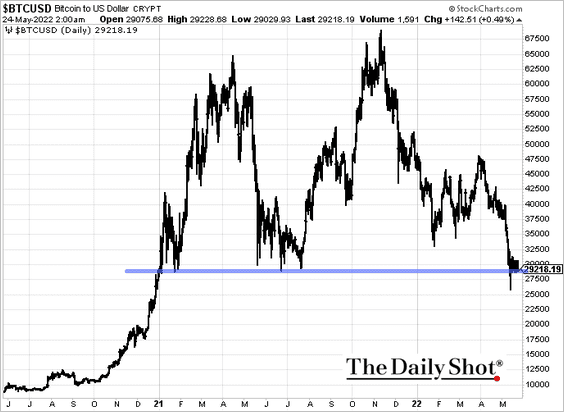

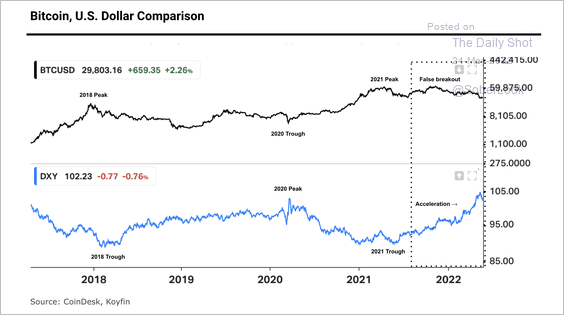

1. Bitcoin is trading near support (just below $30k).

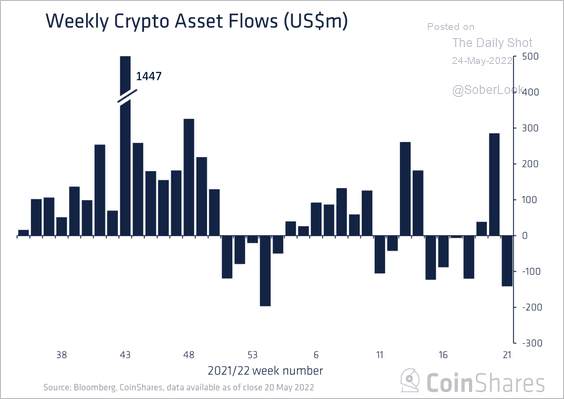

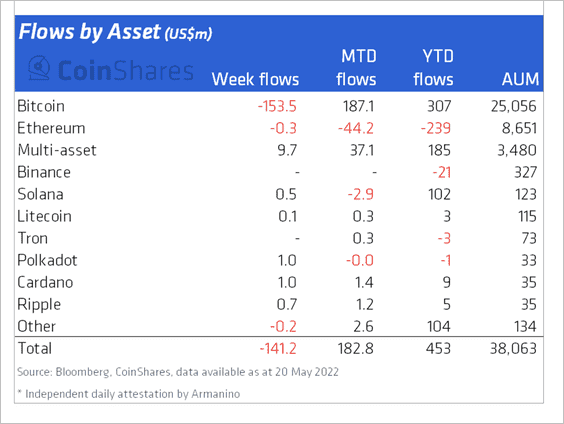

2. Crypto investment products saw outflows totaling $141 million last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin and Ethereum-focused products saw the most outflows last week, while multi-asset funds attracted inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

3. This chart shows prior peaks and troughs in bitcoin and the dollar.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

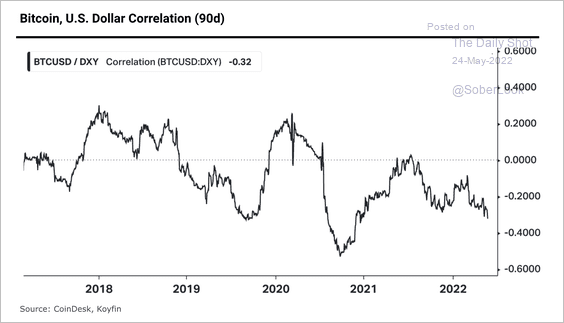

4. Bitcoin’s correlation with the dollar is mostly negative, but has risen during times of market turbulence such as 2018 and 2020.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

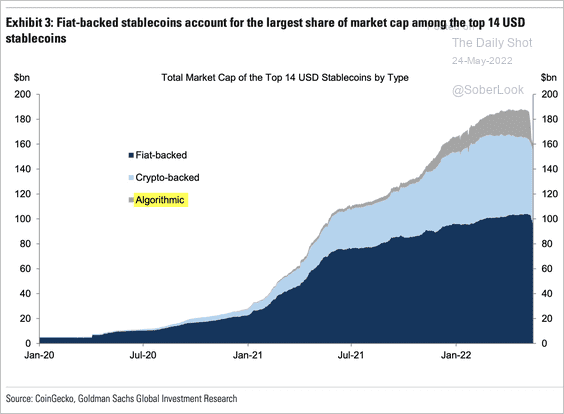

5. The algorithmic stablecoin market didn’t last very long.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Commodities

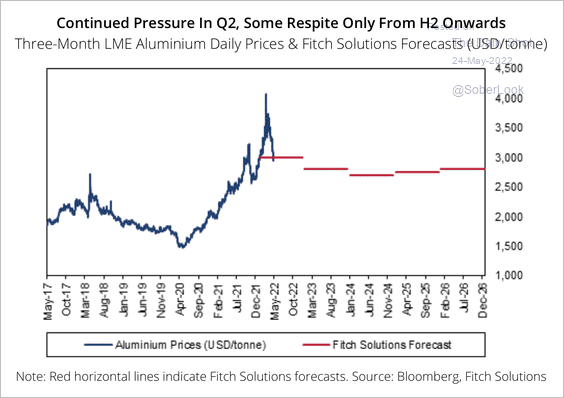

1. Fitch expects aluminum prices to decline this quarter because of the economic slowdown in China. Although prices could stabilize in the second half of the year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

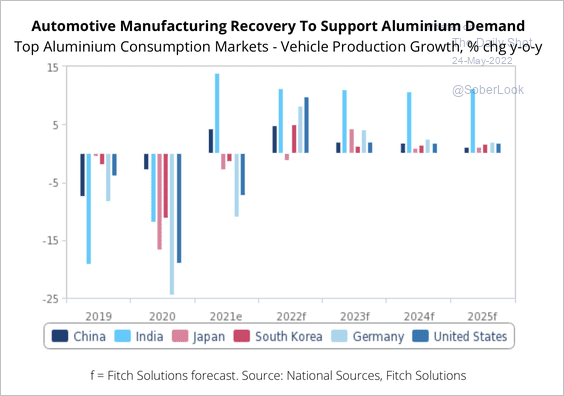

Over time, prices could remain elevated as manufacturers increase aluminum intensity in light-weight electric vehicles, according to Fitch.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

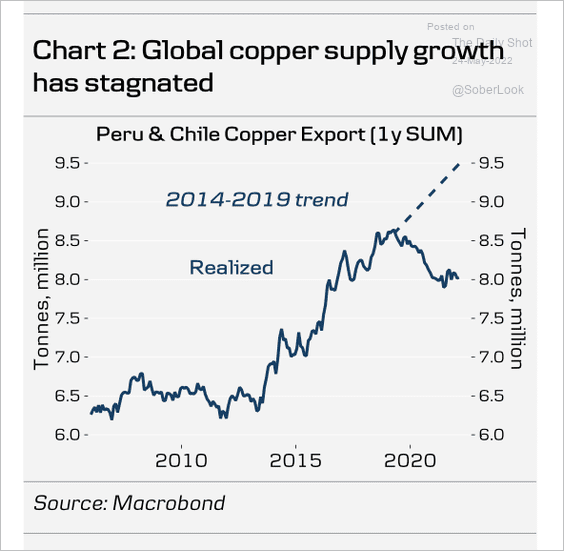

2. Copper exports from Chile and Peru have fallen below trend.

Source: Danske Bank

Source: Danske Bank

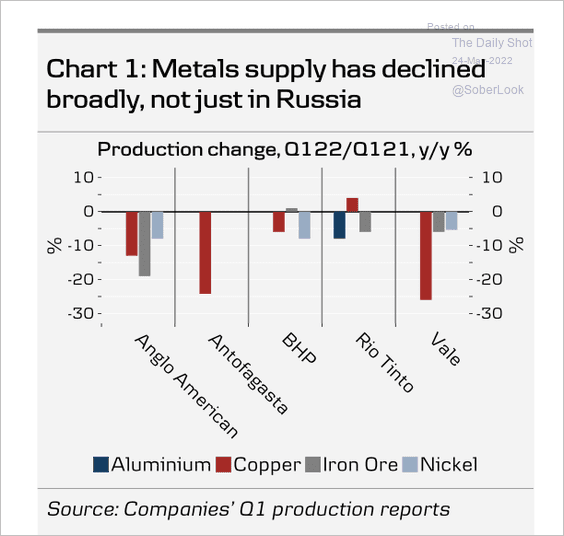

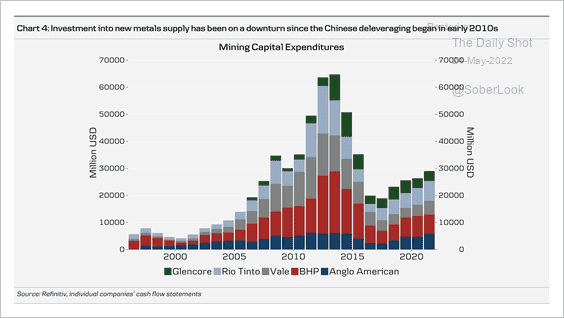

3. Several large miners reported a reduction in metal supply last quarter.

Source: Danske Bank

Source: Danske Bank

Mining firms have significantly reduced capital spending over the past decade.

Source: Danske Bank

Source: Danske Bank

——————–

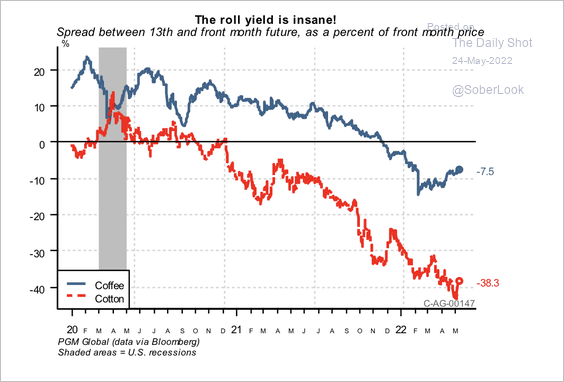

4. Both coffee and cotton futures curves are in deep backwardation, providing an opportunity for traders to buy longer-dated contracts and pick up the roll yield.

Source: PGM Global

Source: PGM Global

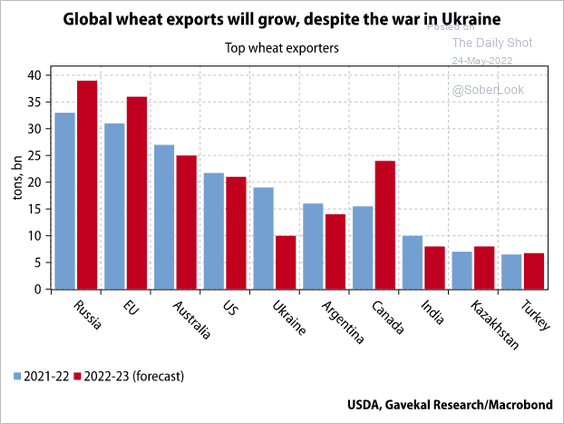

5. Global wheat exports are expected to grow over the next year.

Source: Gavekal Research

Source: Gavekal Research

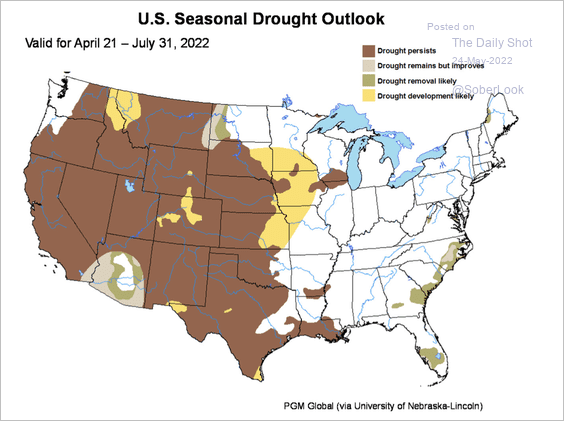

6. Severe heat and drought conditions could lower US agriculture supplies. That could keep food prices elevated this season.

Source: PGM Global

Source: PGM Global

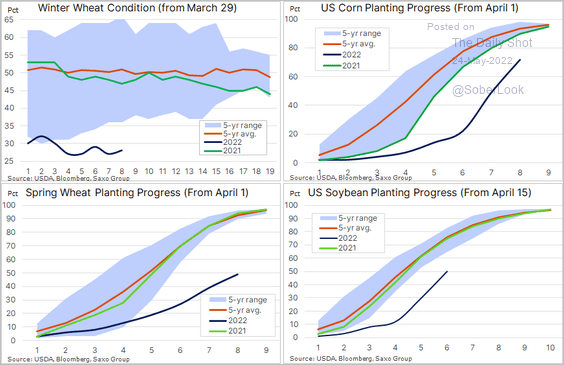

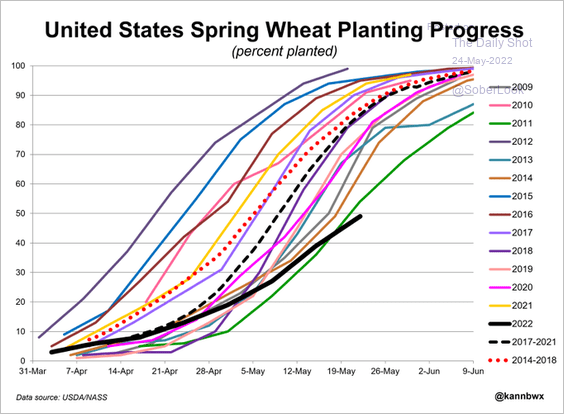

7. US corn and soy planting progress is rebounding, but wheat remains a problem.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

Source: @kannbwx

Source: @kannbwx

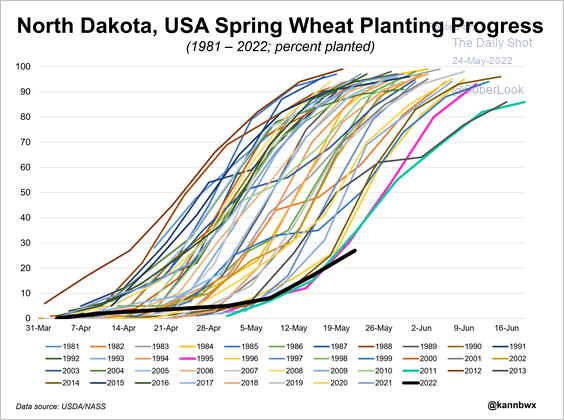

Here is North Dakota’s spring (high-protein) wheat planting progress.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

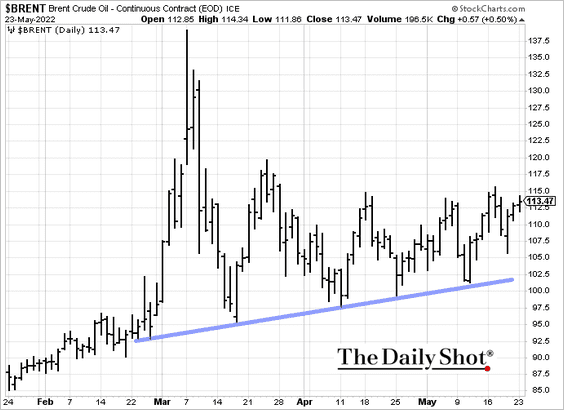

1. Brent has been holding the uptrend support.

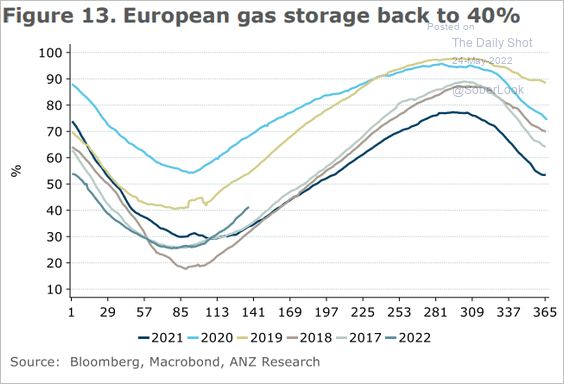

2. European natural gas inventories have been improving.

Source: @ANZ_Research

Source: @ANZ_Research

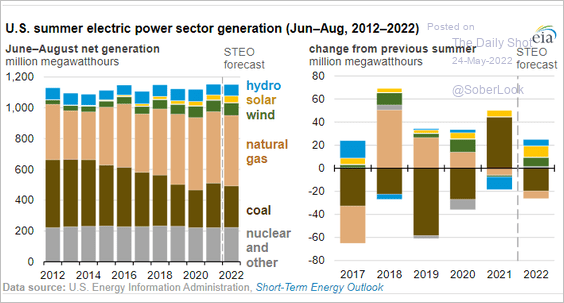

3. This chart shows US summer electricity generation by source.

Source: EIA Read full article

Source: EIA Read full article

Back to Index

Equities

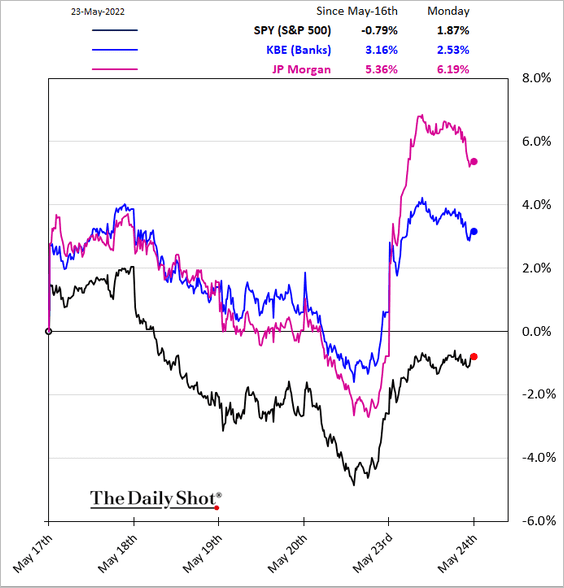

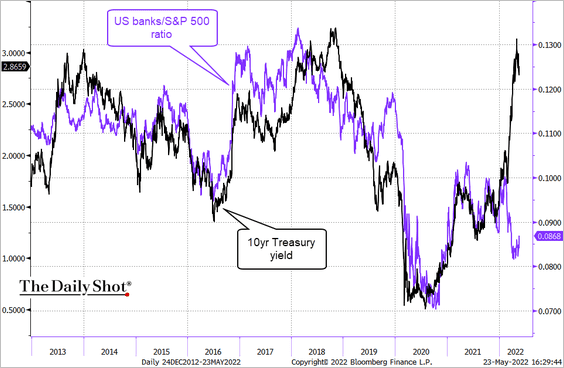

1. Stocks jumped on Monday, boosted by banks.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

If there is no recession, the banking sector has room to outperform.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

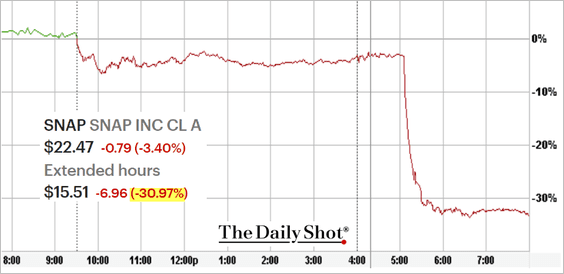

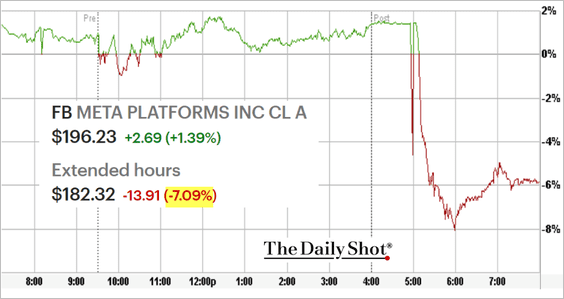

2. The social media sector got some bad news after hours from Snap.

Source: CNBC Read full article

Source: CNBC Read full article

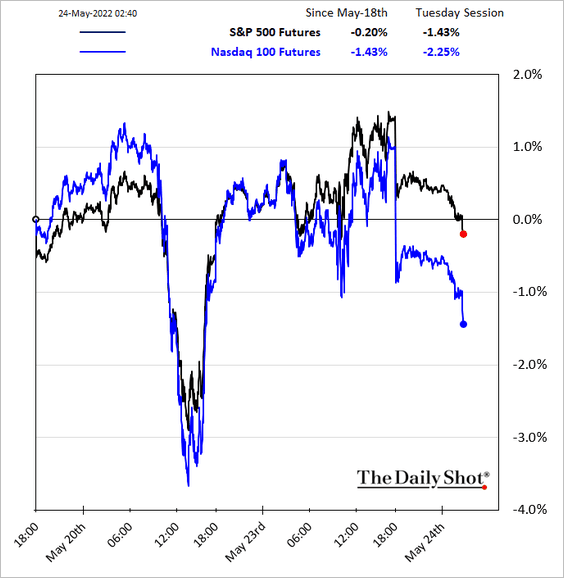

Social media stocks tumbled …

… pulling stock futures sharply lower (giving up Monday’s gains).

——————–

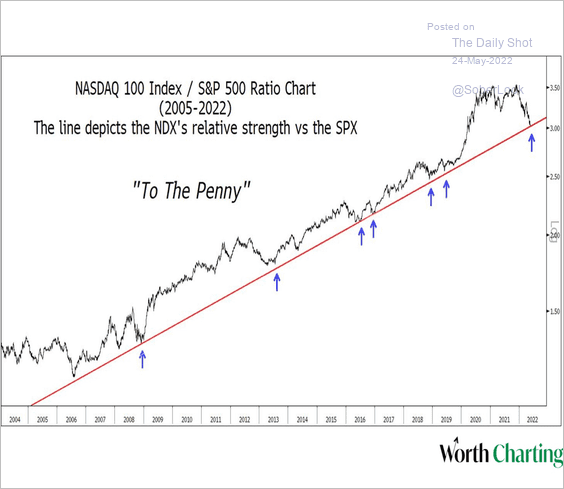

3. The Nasdaq 100/S&P 500 ratio is at long-term support.

Source: @CarterBWorth

Source: @CarterBWorth

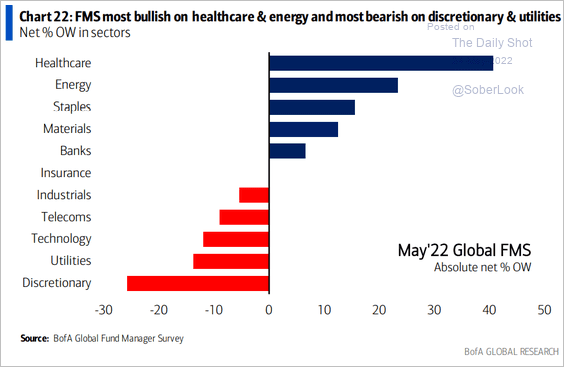

4. This chart shows fund managers’ positioning by sector, based on a survey from BofA.

Source: BofA Global Research

Source: BofA Global Research

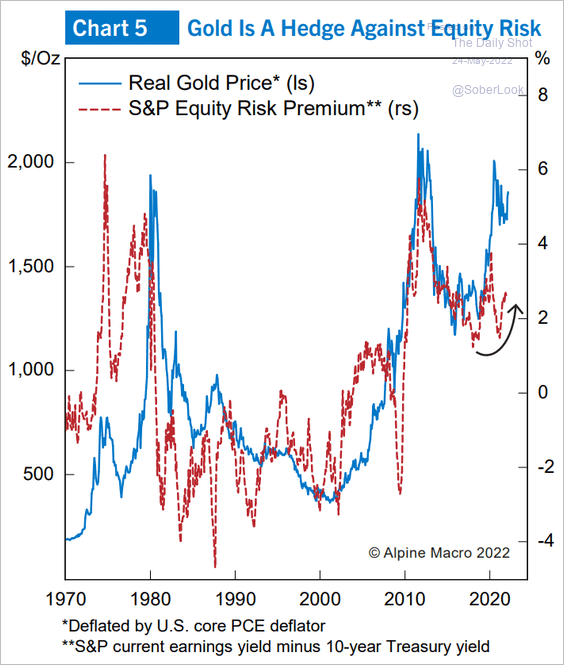

5. Gold points to further upside in equity risk premium.

Source: Alpine Macro

Source: Alpine Macro

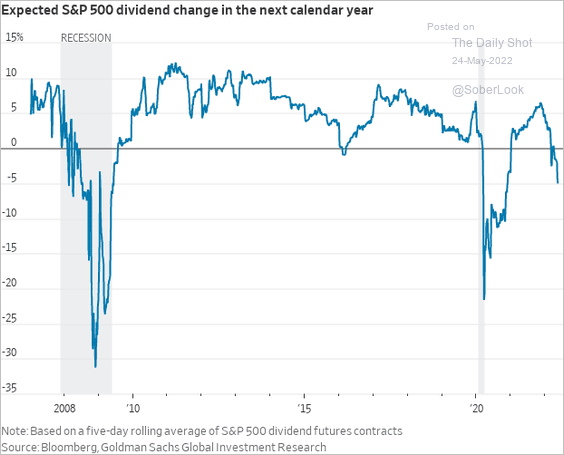

6. Markets expect a decline in dividends next year.

Source: @WSJ

Source: @WSJ

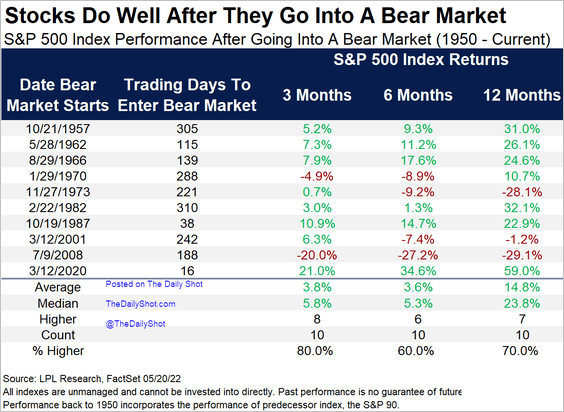

7. How do stocks perform after moving into a bear market?

Source: LPL Research

Source: LPL Research

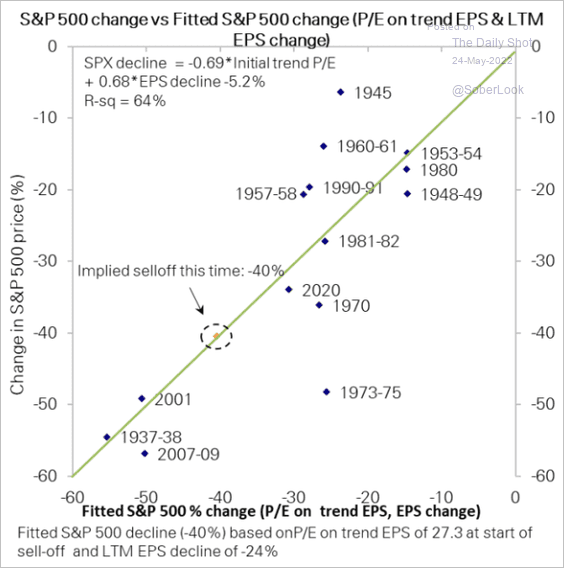

8. How much of a selloff should we expect if the US economy enters a recession?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

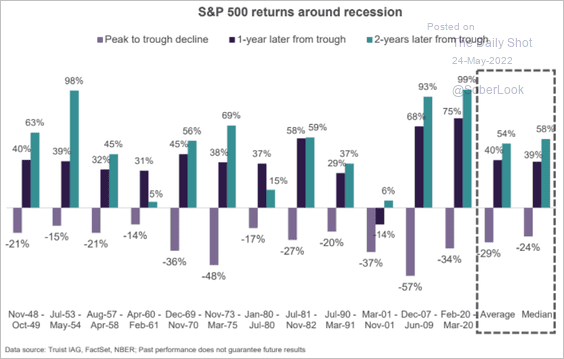

How do stocks perform around recessions?

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

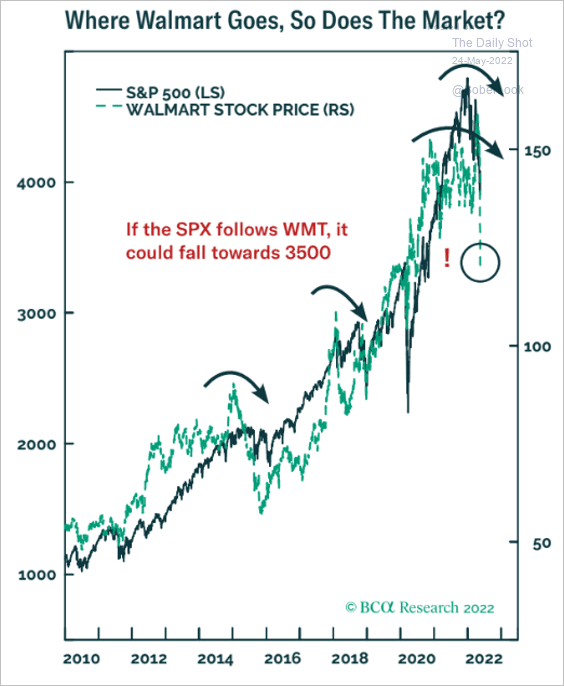

9. Is Walmart signaling further pain for the stock market?

Source: BCA Research

Source: BCA Research

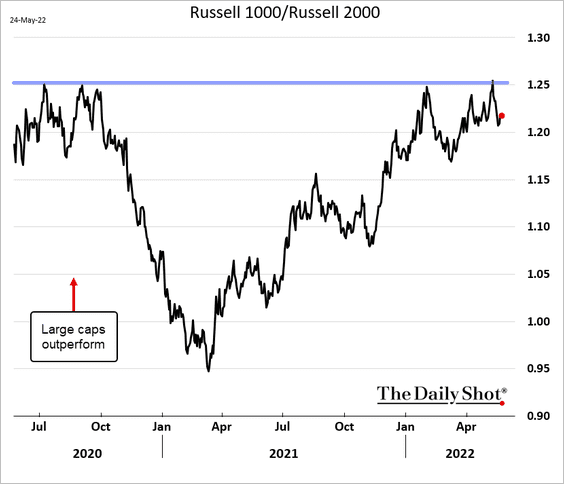

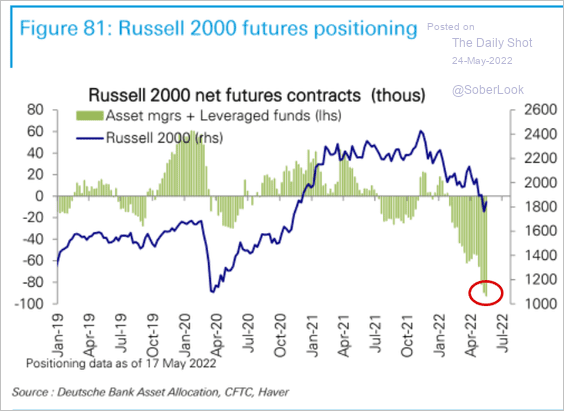

10. The ratio of Russell 1000 to Russell 2000 held resistance. Will small caps outperform from here?

Speculative accounts have been very short Russell 2000 futures.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

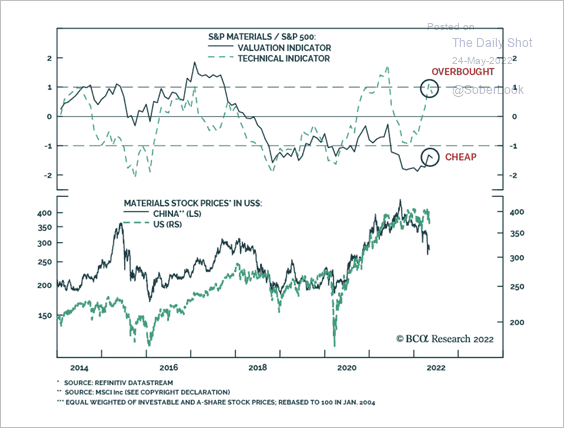

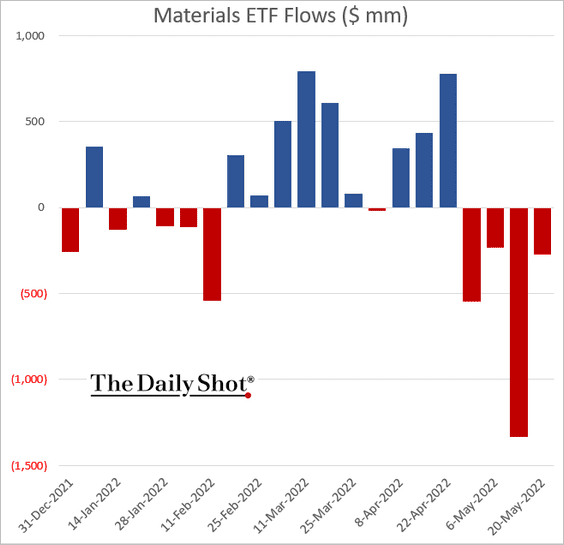

11. US material stocks face downside risks as they converge with their Chinese counterparts. Still, valuations are relatively attractive despite being overbought in the short term.

Source: BCA Research

Source: BCA Research

Materials sector ETFs saw outflows over the past four weeks.

——————–

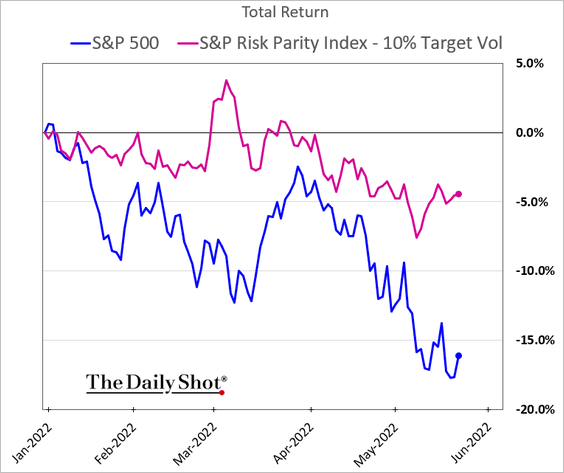

12. The S&P Risk Parity index has outperformed substantially in recent weeks.

Back to Index

Rates

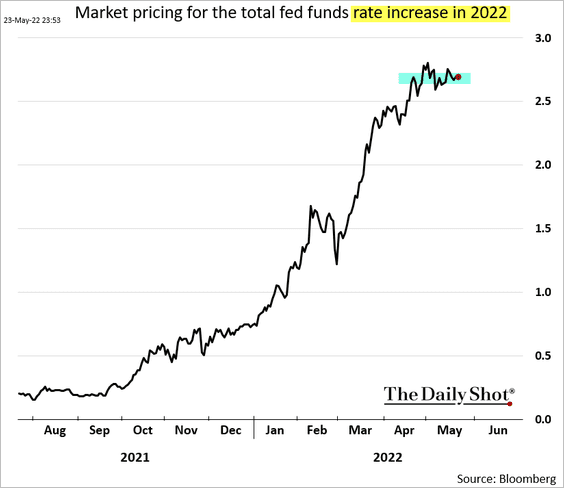

1. Market pricing for the total rate hike in 2022 has stabilized at around 2.7%.

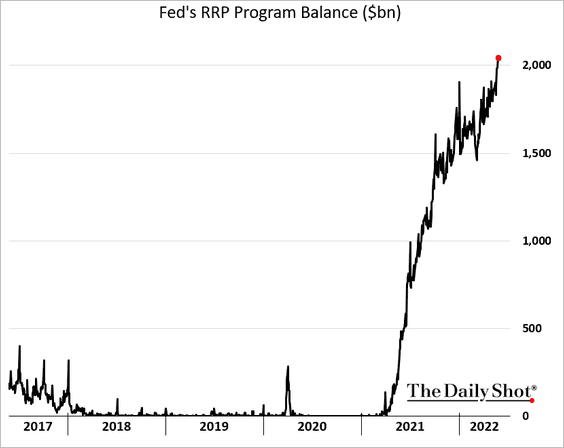

2. Demand for cash instruments has been surging as risk assets slump. The Fed’s RRP balances jumped above $2 trillion.

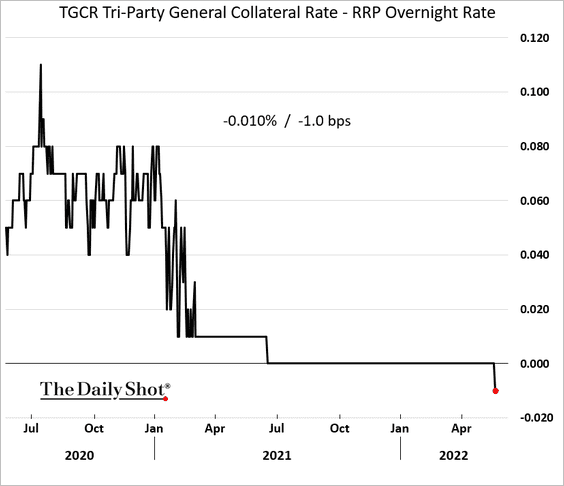

The spread between the TGCR tri-party collateral rate in the Fed’s reverse repo overnight rate has moved into negative territory. Will the Fed raise the counterparty limits to let more money market fund cash into the program?

Back to Index

Global Developments

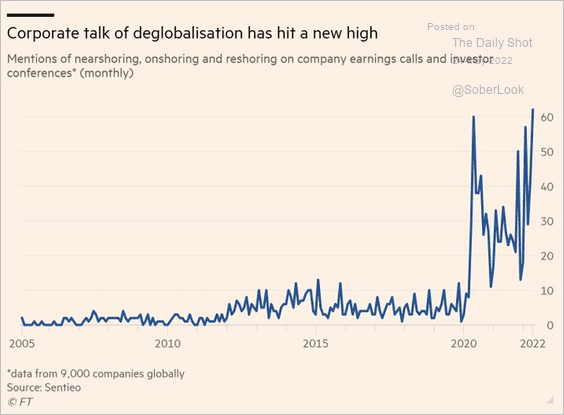

1. Global firms are increasingly talking about “nearshoring,” “onshoring,” and “reshoring.”

Source: @jessefelder, @financialtimes Read full article

Source: @jessefelder, @financialtimes Read full article

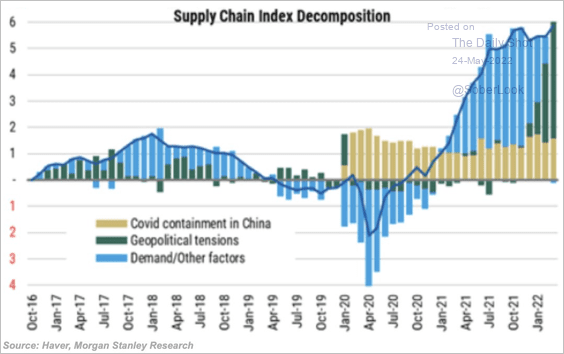

2. Global supply chain stress is no longer driven by demand.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

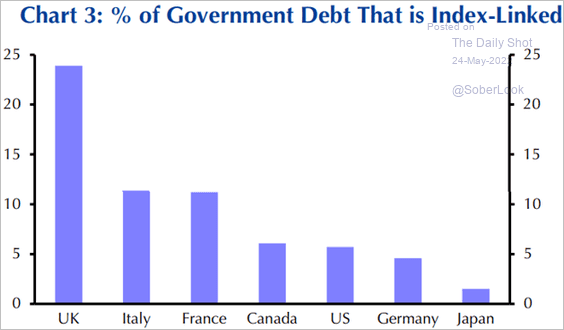

3. In most G-10 economies, a relatively small portion of outstanding debt is linked to inflation rates. Therefore, higher inflation can reduce the real cost of government debt over time.

Source: Capital Economics

Source: Capital Economics

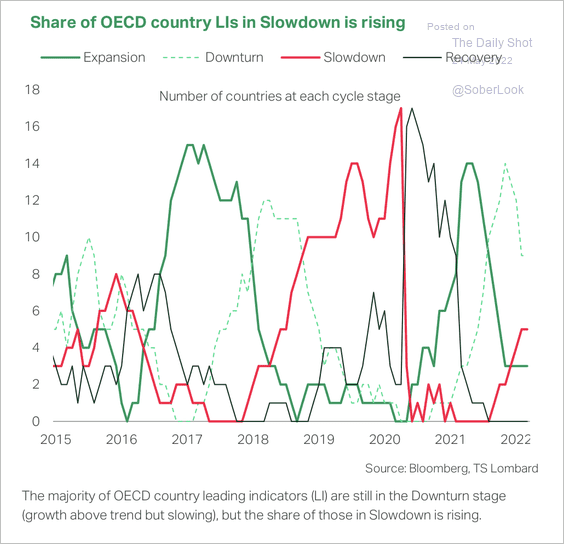

4. More OECD countries are experiencing an economic slowdown.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

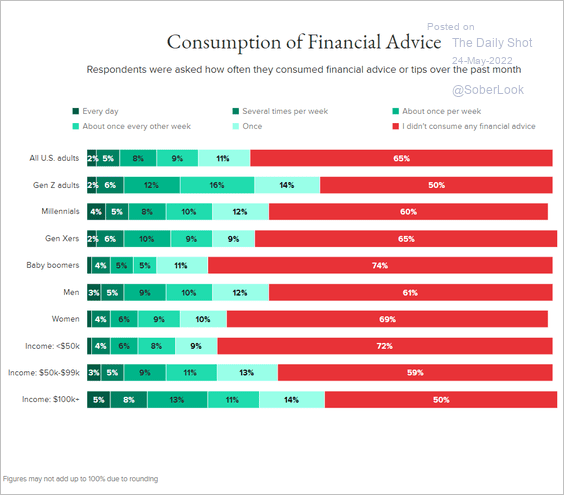

1. Consumption of financial advice in the US:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

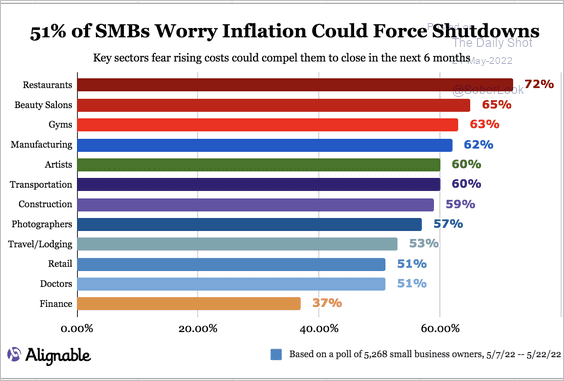

2. Small firms’ concerns about having to shut down due to inflation:

Source: Alignable

Source: Alignable

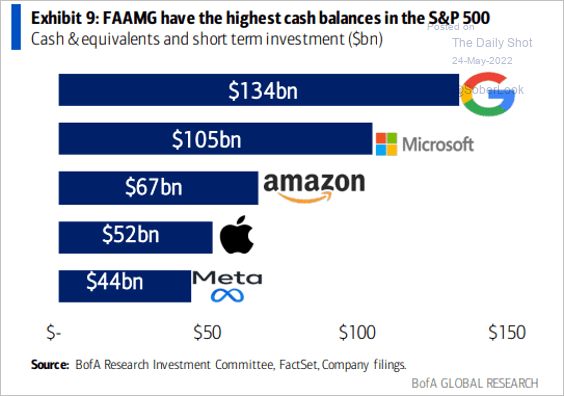

3. Tech mega-caps’ cash balances:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

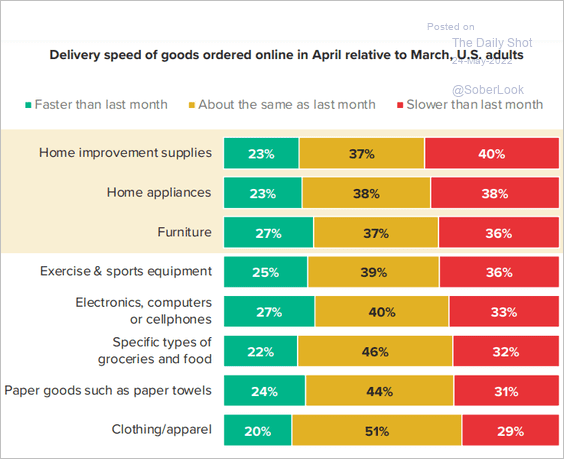

4. Delivery speed of online orders:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

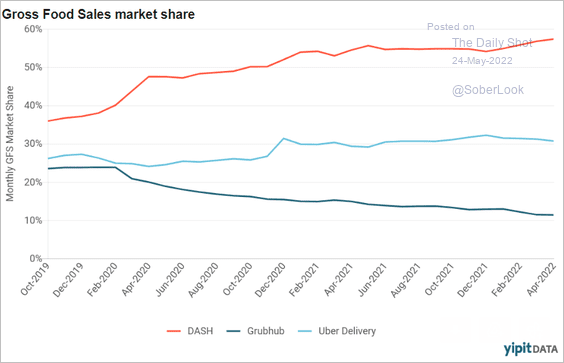

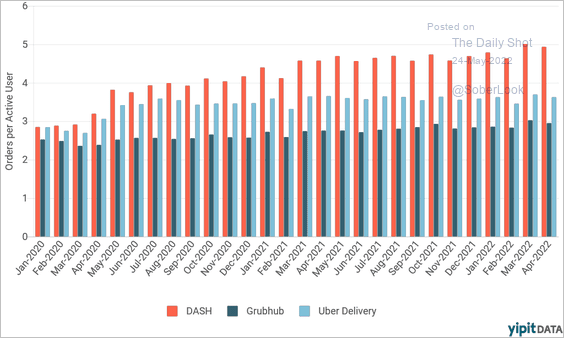

5. Food delivery online platforms’ market share:

Source: YipitData

Source: YipitData

• Orders per active customer:

Source: YipitData

Source: YipitData

——————–

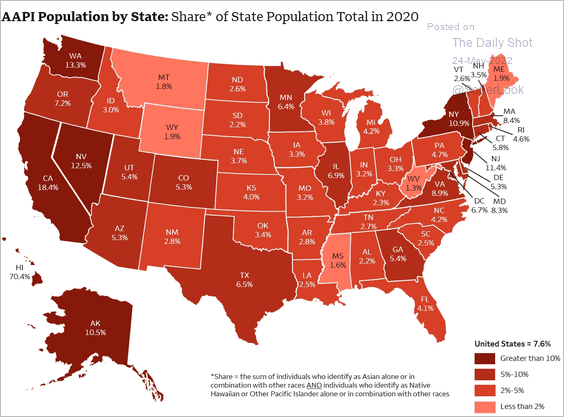

6. Asian American & Pacific Islander share of the population:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

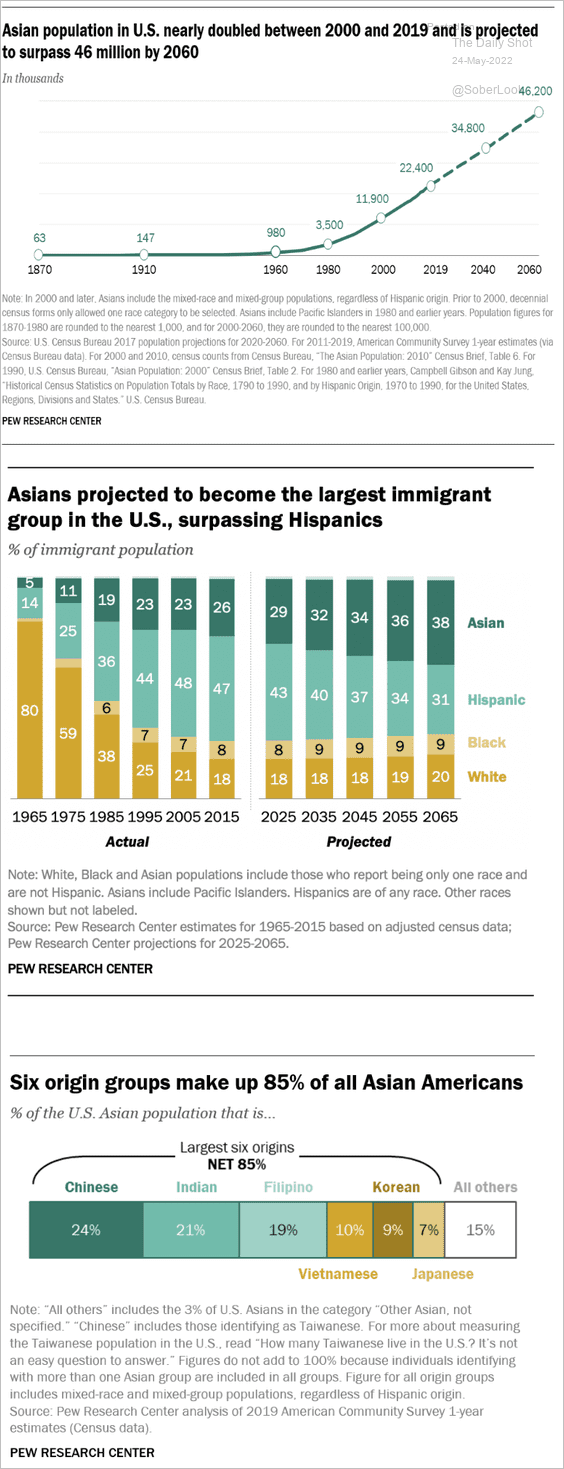

• Asian American population growth:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

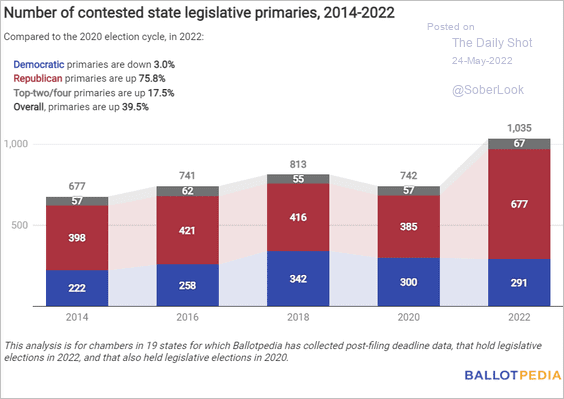

7. Contested state legislative primaries:

Source: @ballotpedia

Source: @ballotpedia

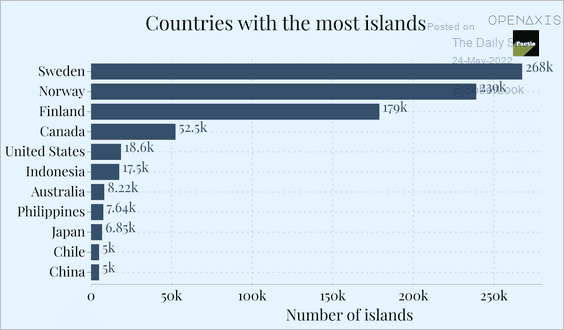

8. Countries with the most islands:

Source: OpenAxis Read full article

Source: OpenAxis Read full article

——————–

Back to Index