The Daily Shot: 06-Jul-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Australia

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

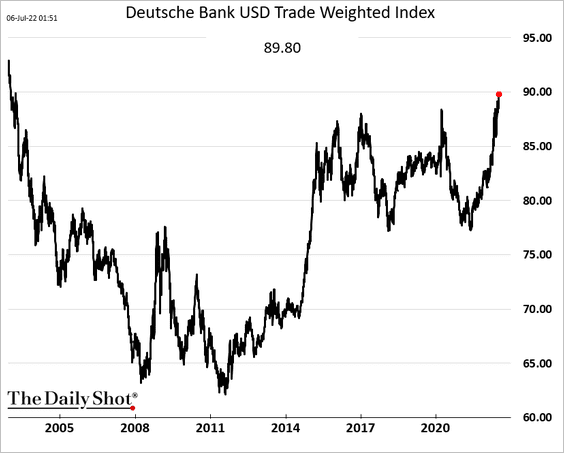

1. The trade-weighted US dollar index hit the highest level in nearly two decades, …

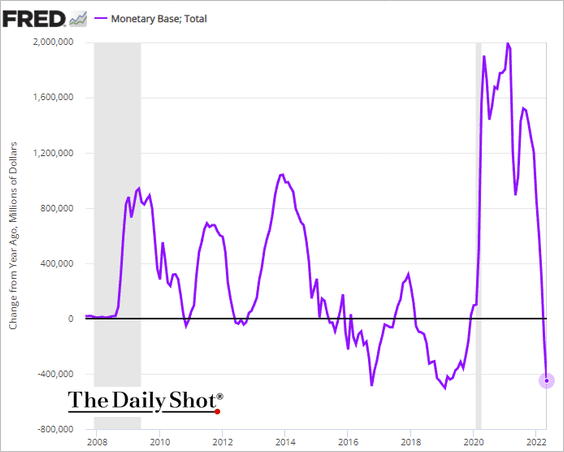

… as USD liquidity tightens …

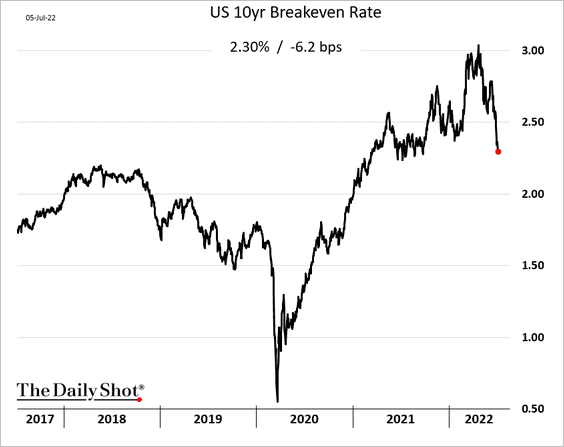

… and markets shift to risk-off sentiment. While a stronger dollar should help ease inflationary pressures (chart shows market-based inflation expectations), …

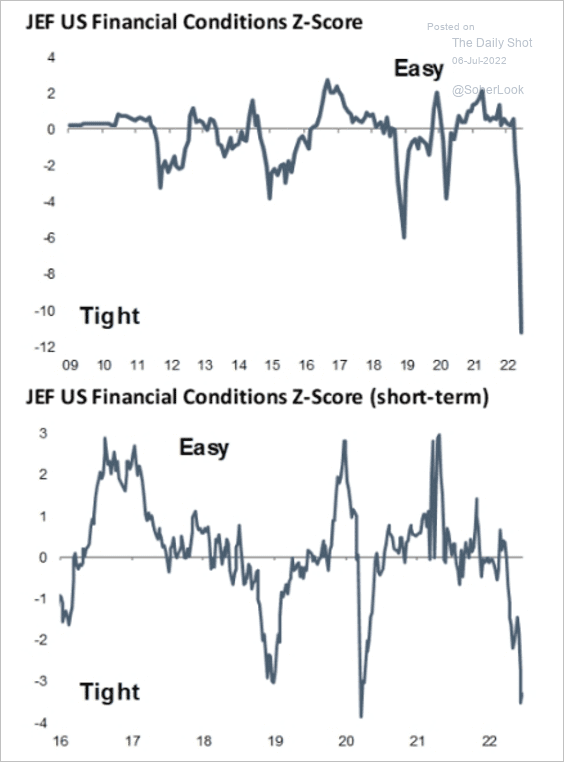

… it is a headwind for risk assets such as stocks, commodities, and emerging markets. The greenback rally is contributing to tighter US financial conditions.

Source: Jefferies; @WallStJesus

Source: Jefferies; @WallStJesus

——————–

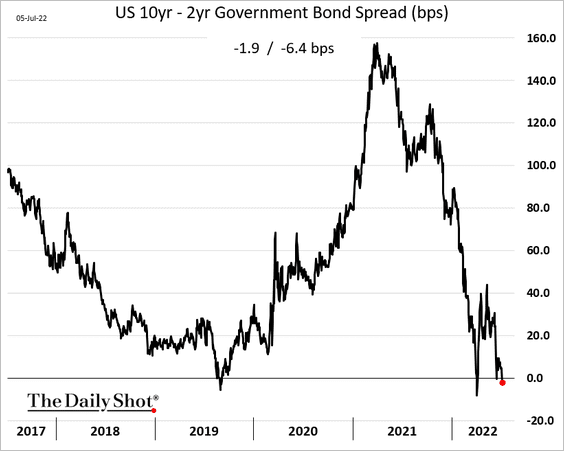

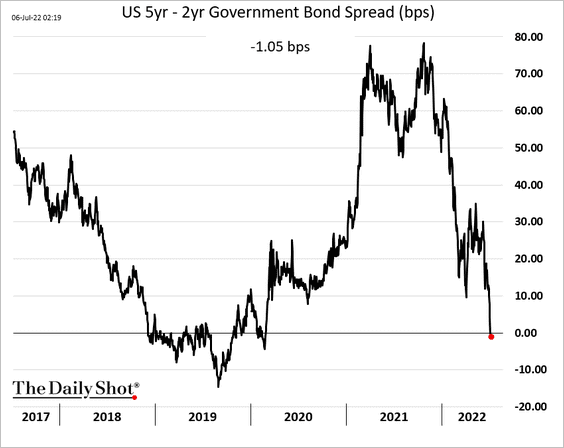

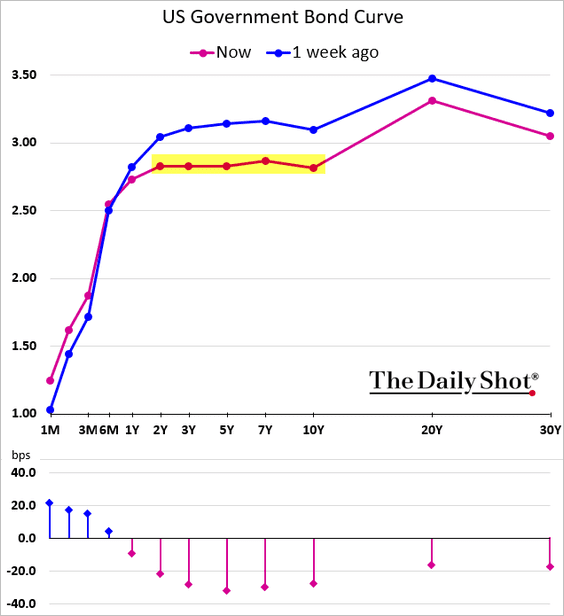

2. The Treasury curve is inverted, …

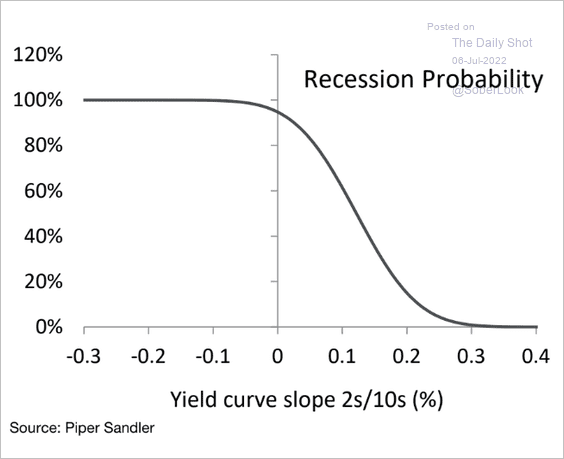

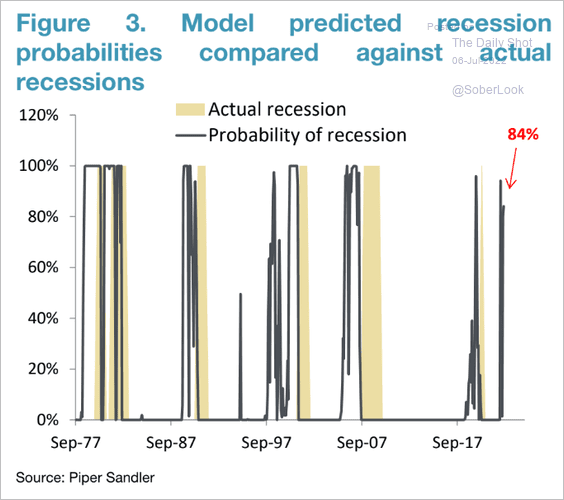

… which boosts the risk of recession.

Source: Piper Sandler

Source: Piper Sandler

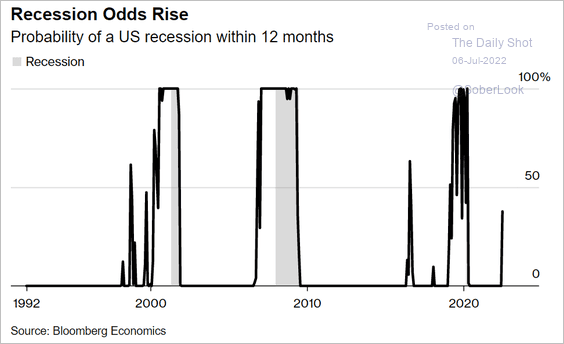

Recession probability estimates vary, but most models show a significant increase.

– Piper Sandler:

Source: Piper Sandler

Source: Piper Sandler

– Bloomberg Economics:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

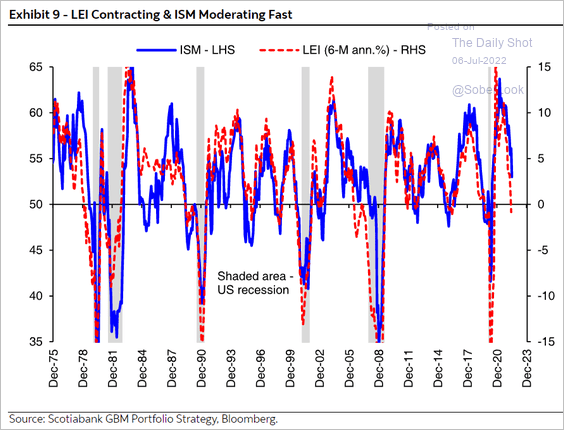

• Leading indicators are pointing to a sharp slowdown.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

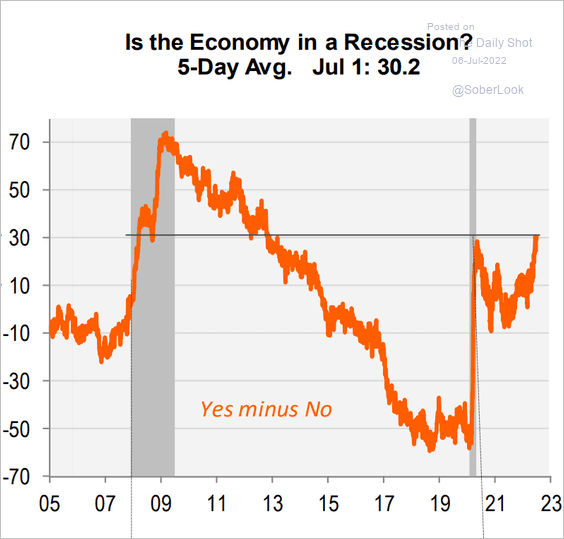

• Many households think that we are already in a recession.

Source: Piper Sandler

Source: Piper Sandler

——————–

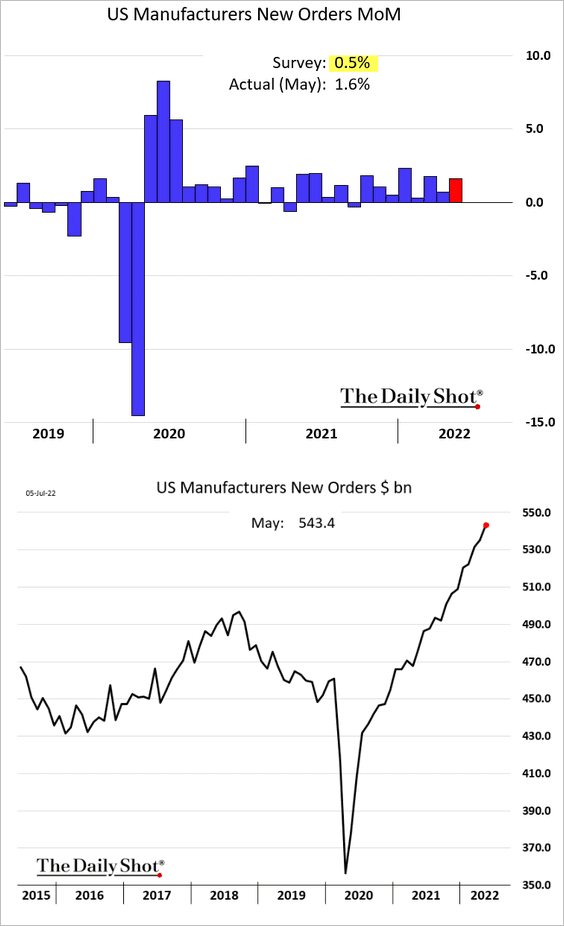

3. May factory orders surprised to the upside, but the June ISM PMI report shows that demand has softened since then.

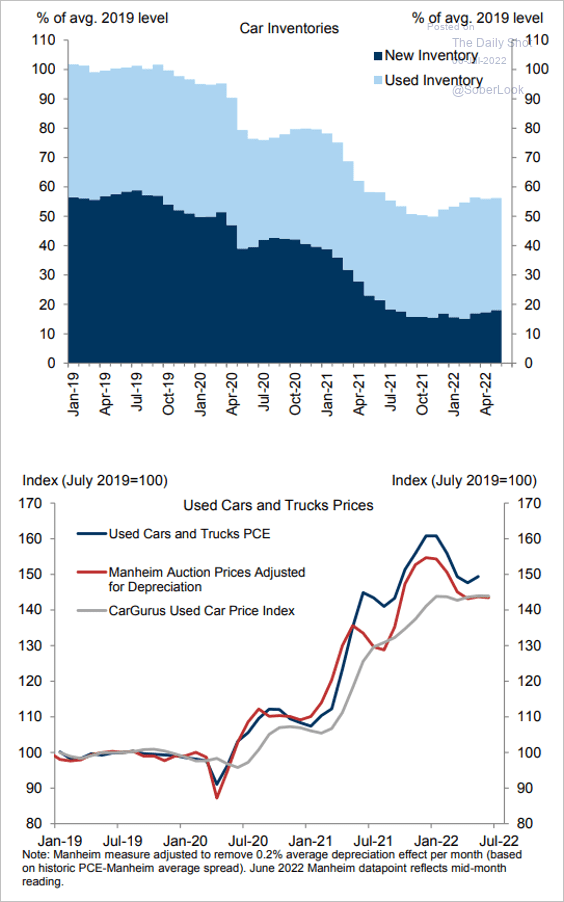

4. Automobile inventories remain tight, keeping prices elevated.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

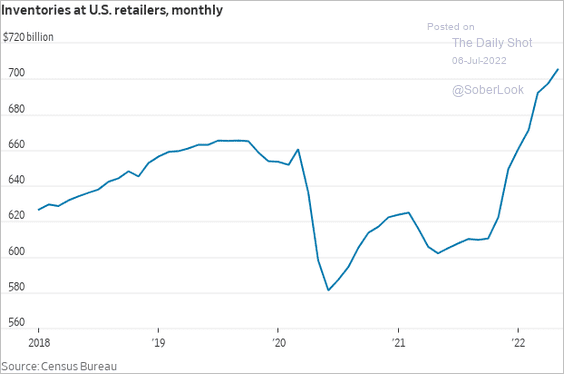

5. Outside of autos, retail inventories have risen sharply, …

Source: @WSJ Read full article

Source: @WSJ Read full article

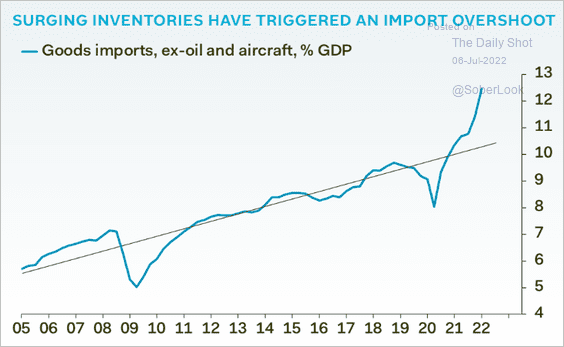

… as imports surged.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

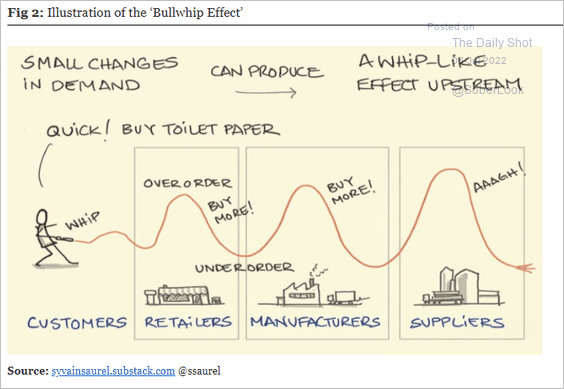

The Bullwhip Effect has been amplified by massive delivery delays. By the time inventories were rebuilt, consumer demand shifted.

Source: Longview Economics

Source: Longview Economics

Back to Index

Canada

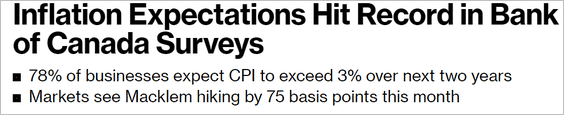

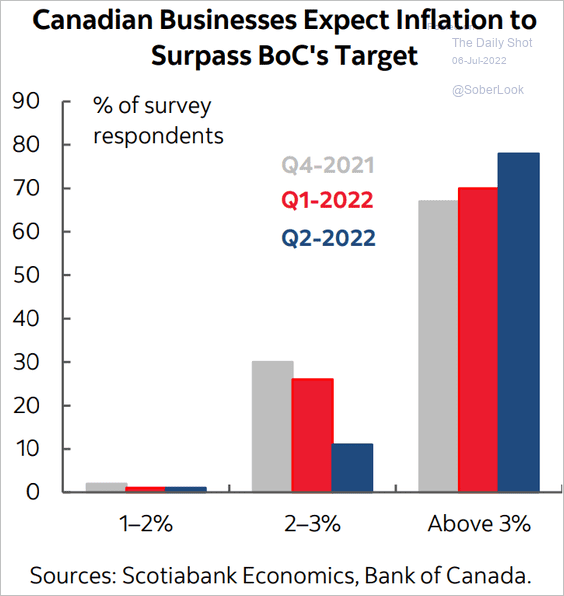

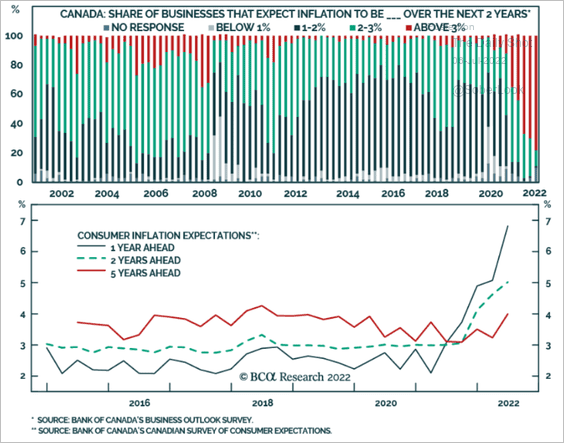

1. The latest BoC survey shows business and consumer inflation expectations climbing (3 charts).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: BCA Research

Source: BCA Research

——————–

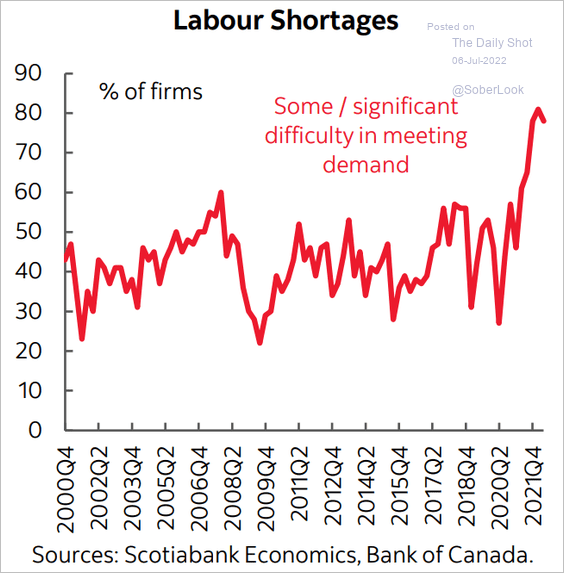

2. Labor shortages persist.

Source: Scotiabank Economics

Source: Scotiabank Economics

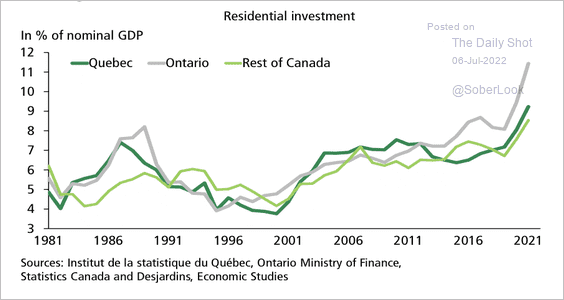

3. Ontario stands out for its share of economic activity tied to housing.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

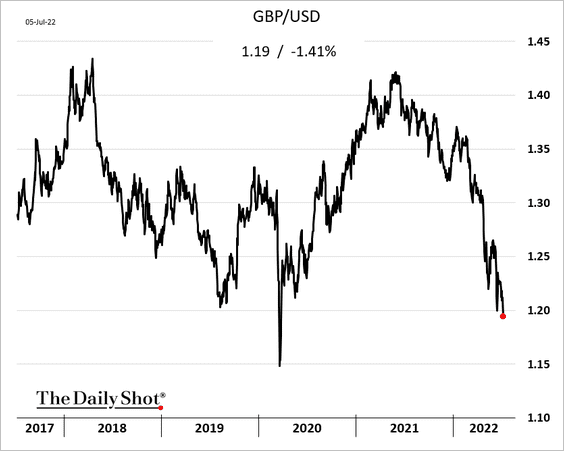

1. The pound dipped below $1.20 amid increased political uncertainty in the UK.

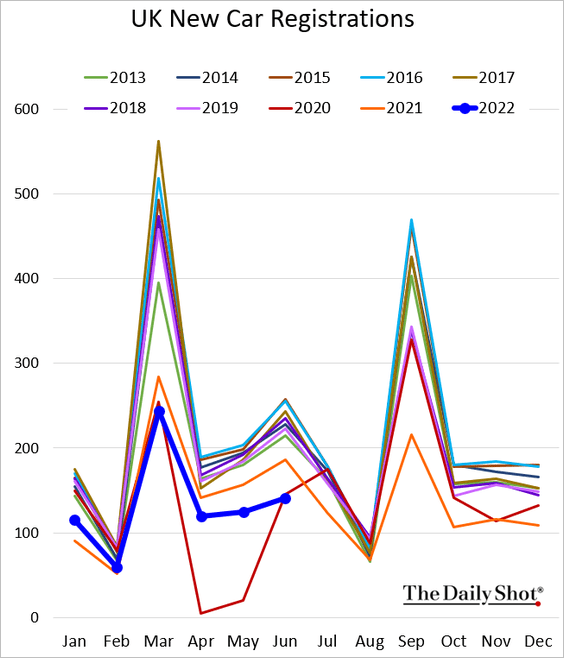

2. New car registrations are now below 2020 levels.

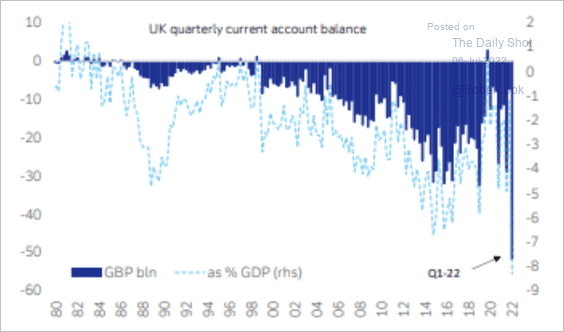

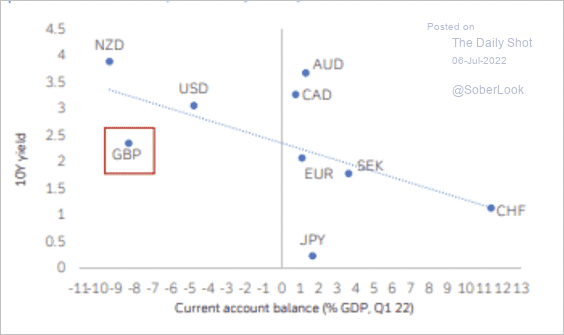

3. The current account deficit reached record levels in Q1 …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

…with comparatively low yields.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

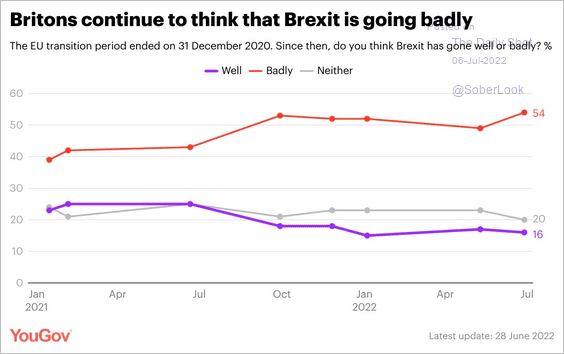

4. Here are the views on Brexit.

Source: @YouGov Read full article

Source: @YouGov Read full article

Back to Index

The Eurozone

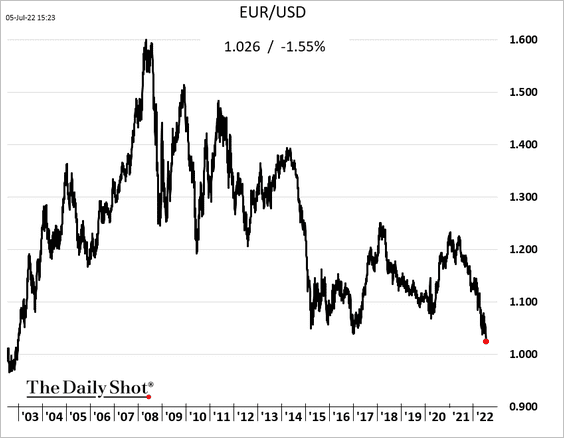

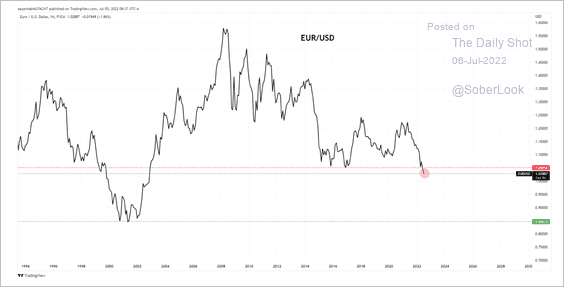

1. The euro hit the lowest level in nearly two decades vs. USD.

The euro is approaching parity with the greenback. The next major support is around 0.85.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

——————–

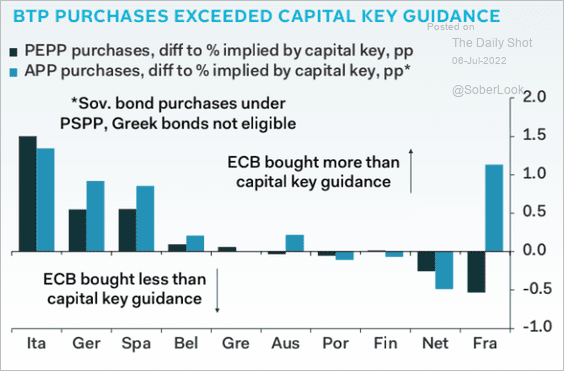

2. How much freedom does the ECB have to deviate from the capital key guidance to address fragmentation risks?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

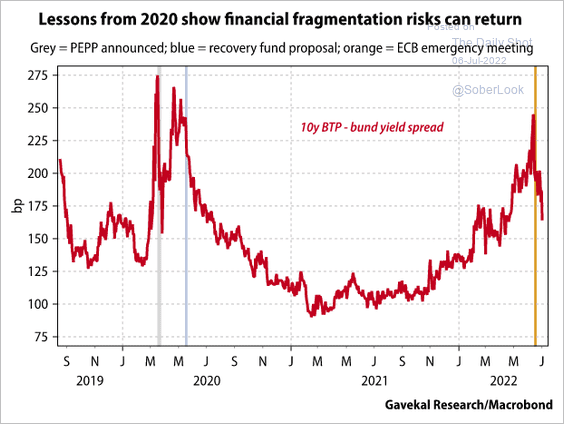

For now, markets are confident in the ECBs “de-fragmentation” efforts.

Source: Gavekal Research

Source: Gavekal Research

——————–

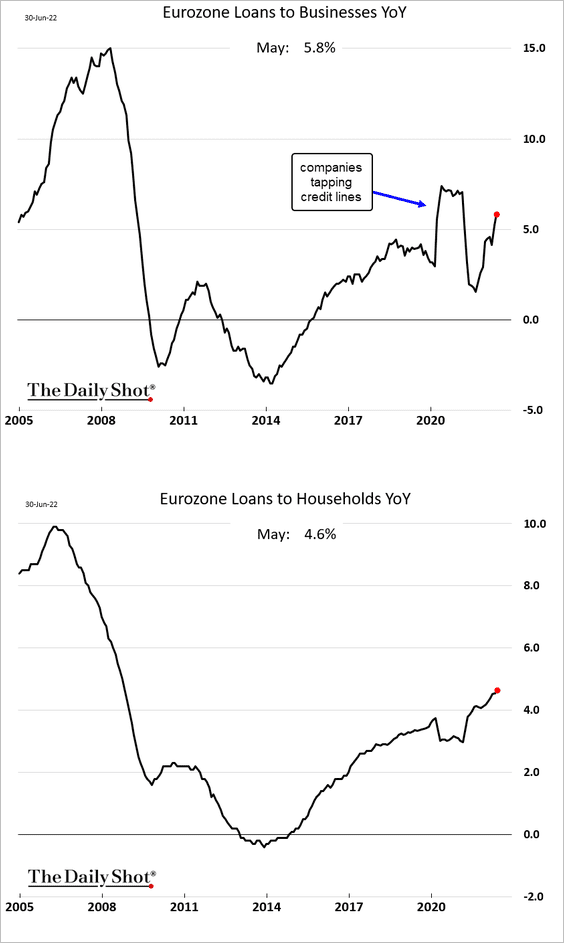

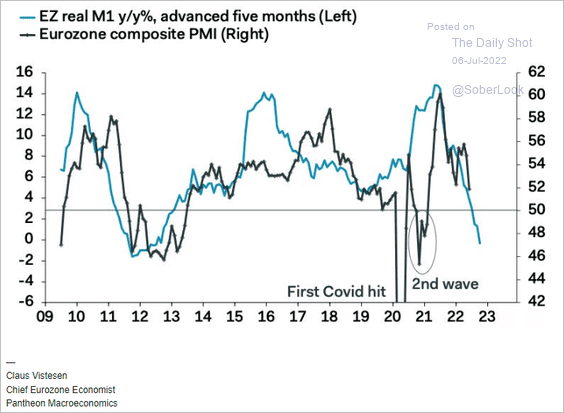

3. Loan growth has been robust, …

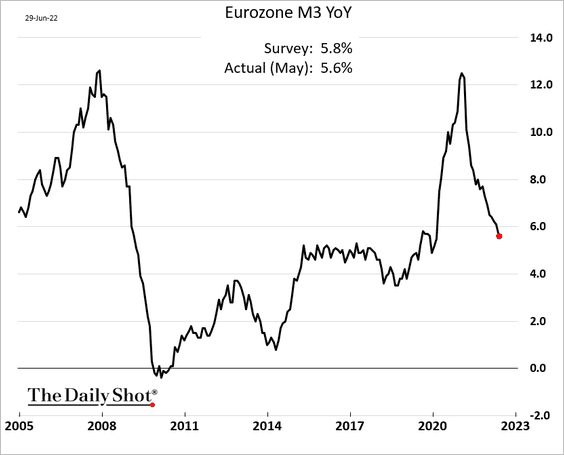

… but the money supply expansion continues to surprise to the downside.

The deteriorating liquidity situation could significantly weaken business activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

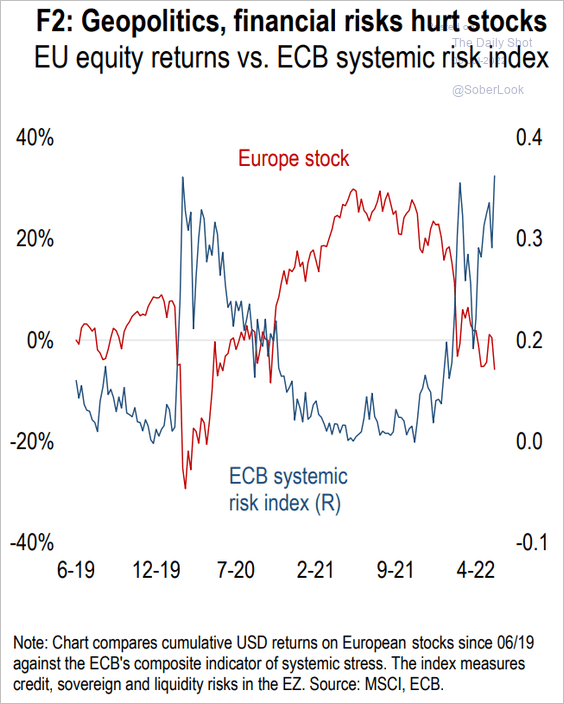

4. Systemic risks have been pressuring stocks.

Source: Numera Analytics

Source: Numera Analytics

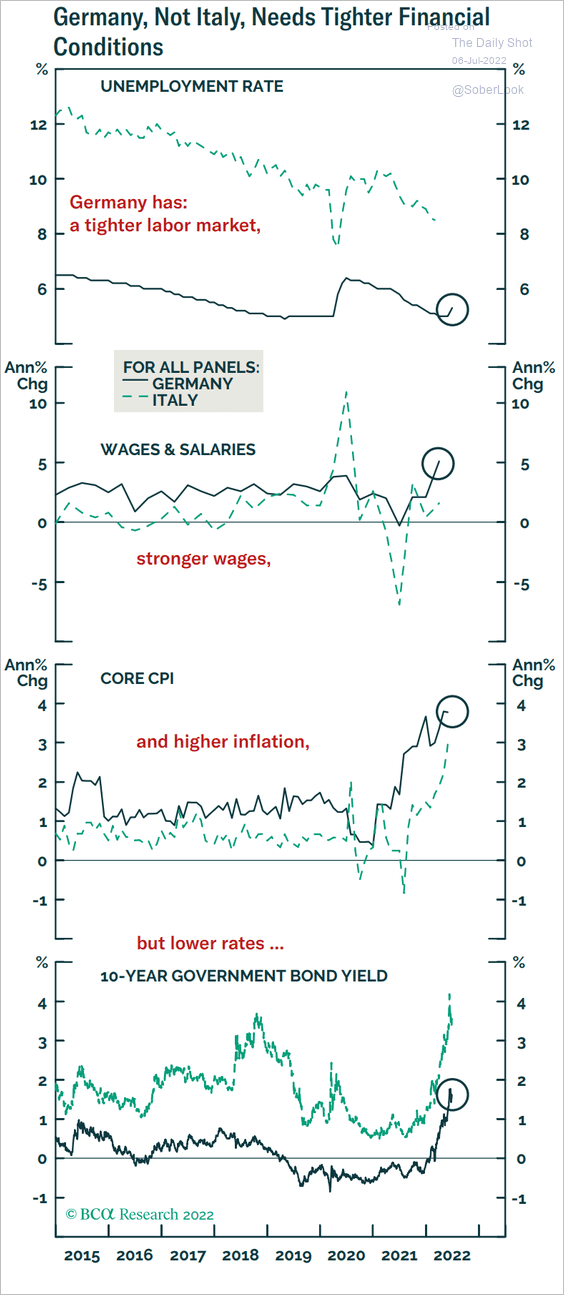

5. This time around, it’s Germany, not Italy, that needs tighter financial conditions.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

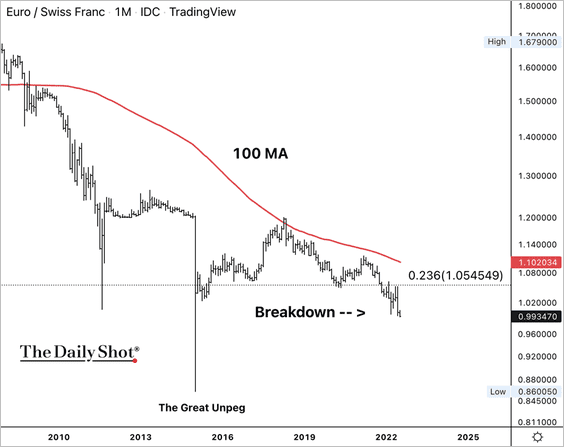

1. EUR/CHF dipped below long-term support.

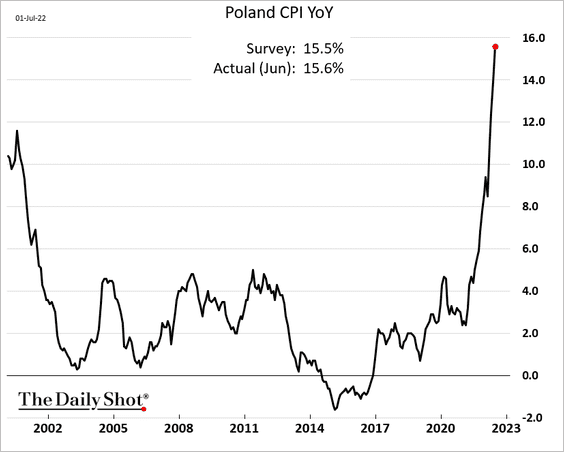

2. Poland’s consumer inflation is nearing 16%.

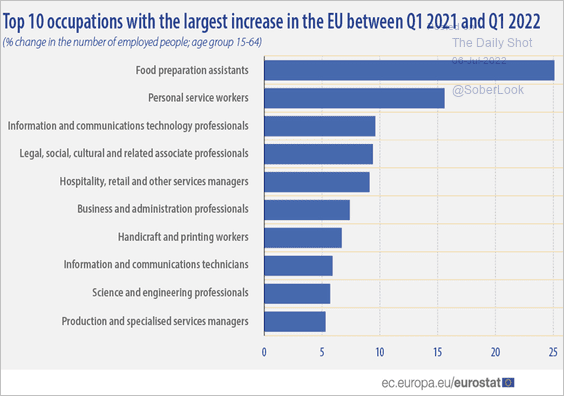

3. Here are the occupations with the largest gains in employment across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

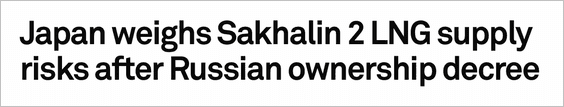

1. Japan is now entangled in natural gas supply risk.

Source: S&P Global Market Intelligence Read full article

Source: S&P Global Market Intelligence Read full article

The public is more upbeat about nuclear energy.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

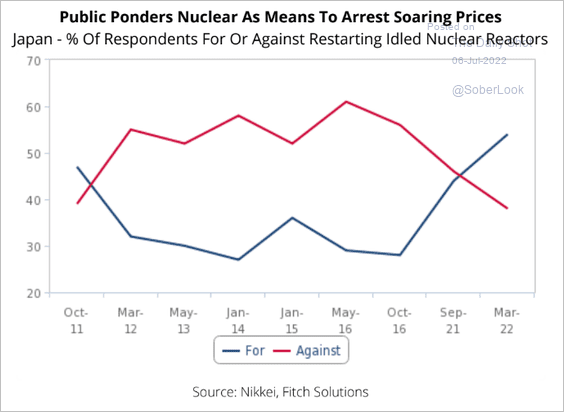

2. Japan’s sovereign CDS spread has been rising.

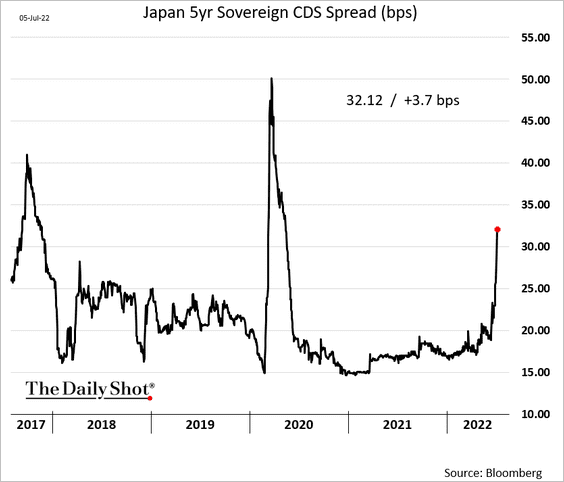

3. The divergence between wages and corporate profits has been extreme.

Source: @JamieHalse, @CacheThatCheque, @JCVpartners

Source: @JamieHalse, @CacheThatCheque, @JCVpartners

Back to Index

Australia

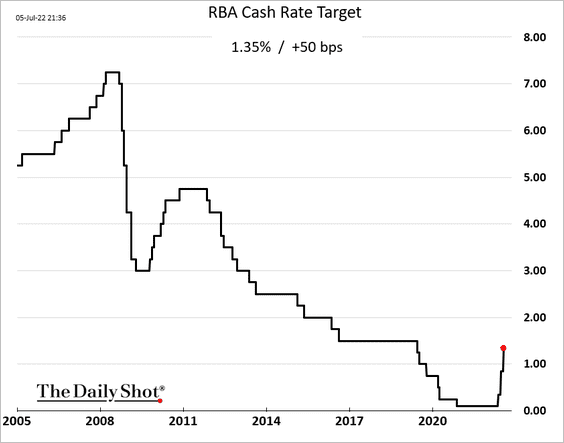

1. The RBA hiked rates by 50 bps (as expected).

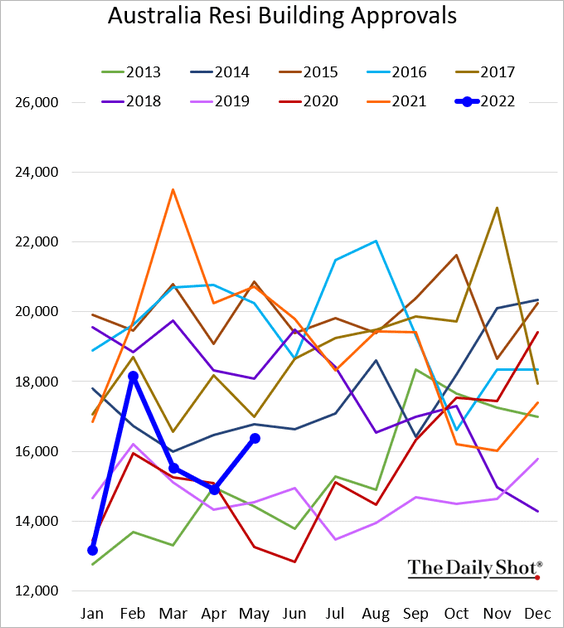

2. Building approvals jumped in May.

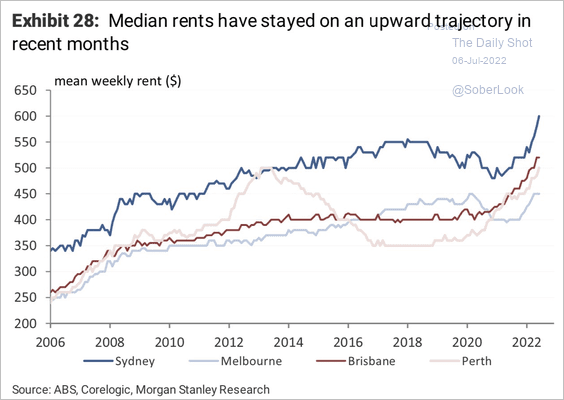

3. Rents continue to surge.

Source: Morgan Stanley Research; @Scutty

Source: Morgan Stanley Research; @Scutty

Back to Index

China

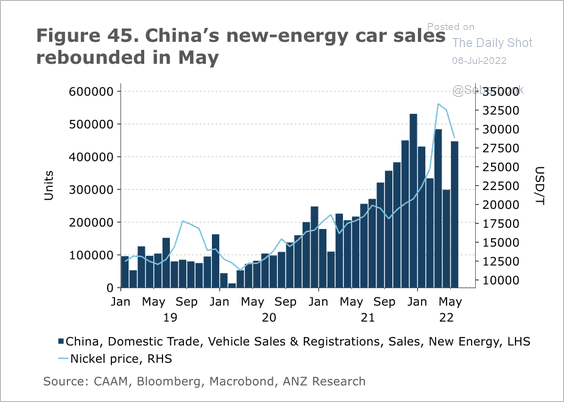

1. New energy car sales rebounded in May.

Source: @ANZ_Research

Source: @ANZ_Research

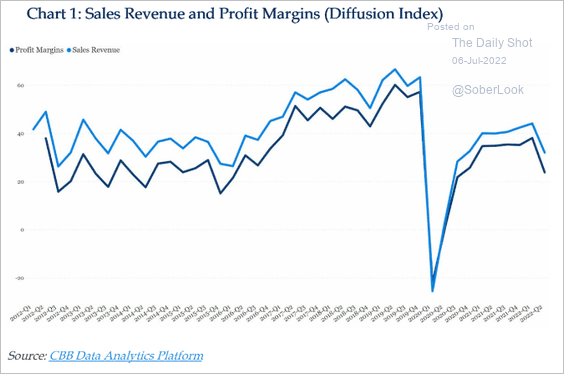

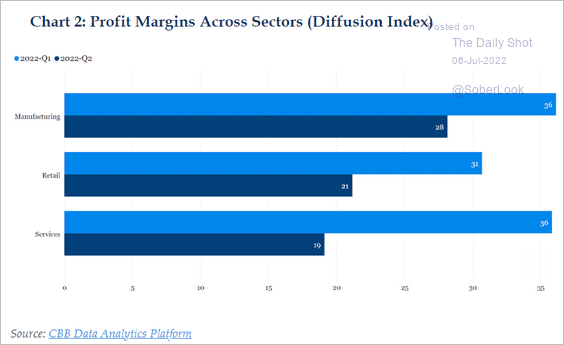

2. Corporate sales and margins came under pressure in Q2.

Source: China Beige Book International

Source: China Beige Book International

Source: China Beige Book International

Source: China Beige Book International

——————–

3. The Shanghai Composite held resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

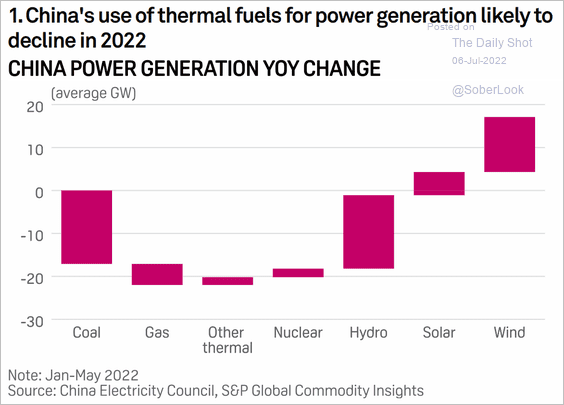

4. This chart illustrates China’s changes in power generation by source.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Back to Index

Emerging Markets

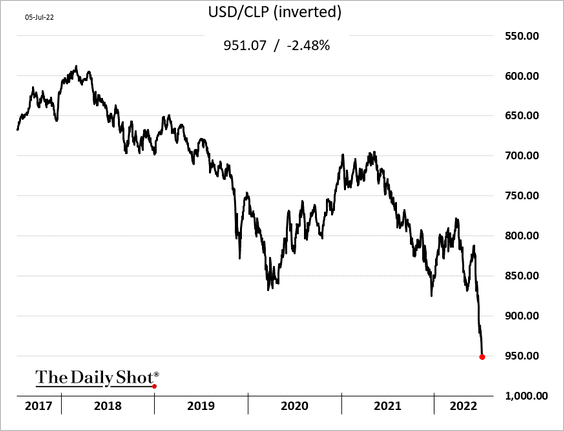

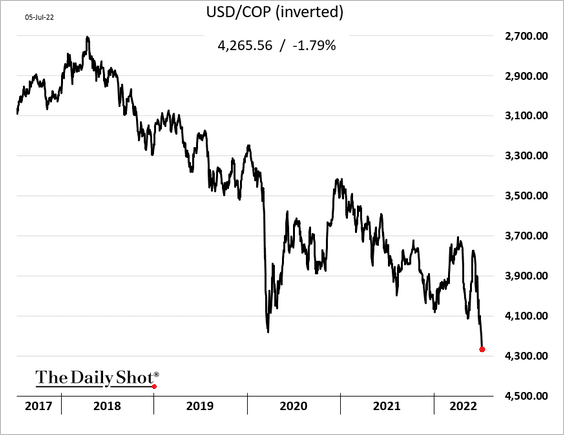

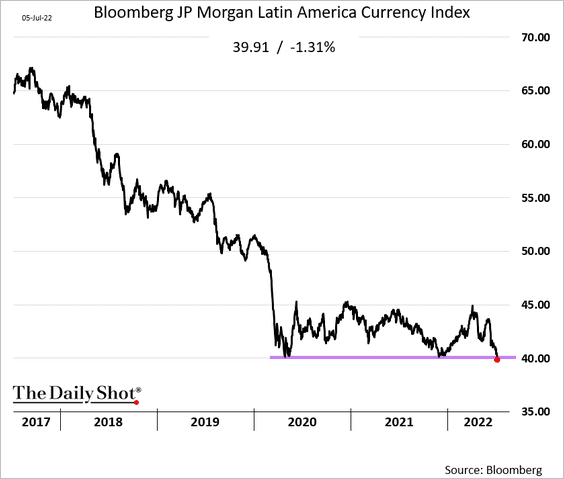

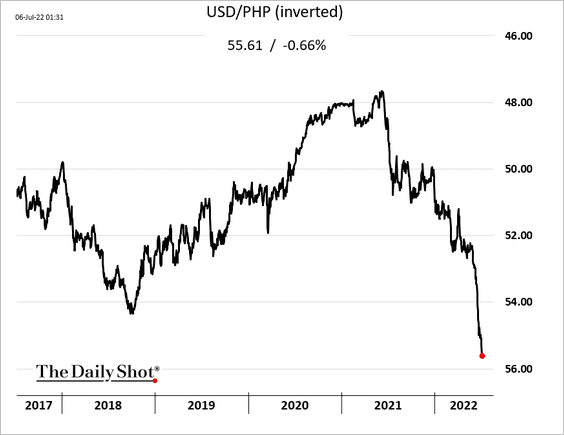

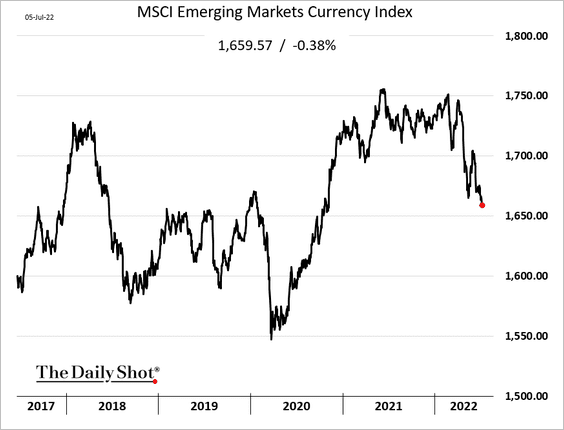

1. EM currencies are under pressure amid risk-off sentiment.

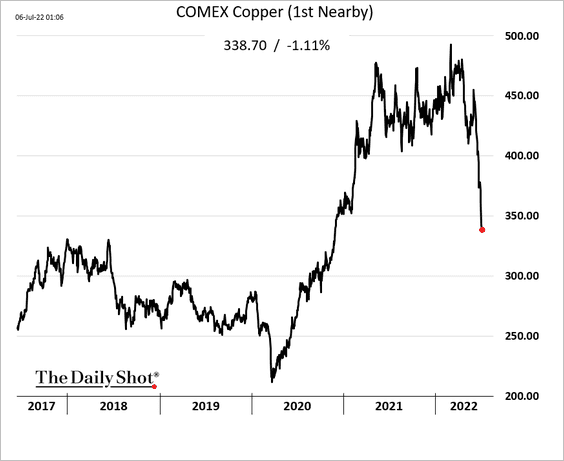

• The Chilean peso (hit by lower copper prices – 2nd chart):

• The Colombian peso (hurt by the selloff in crude oil):

• The JP Morgan LatAm currency index:

• The Philippine peso:

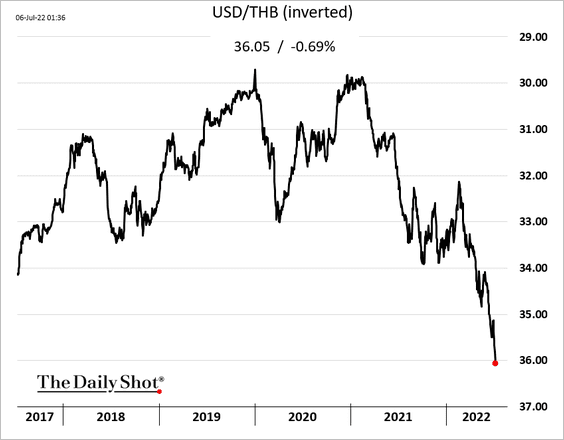

• The Thai baht:

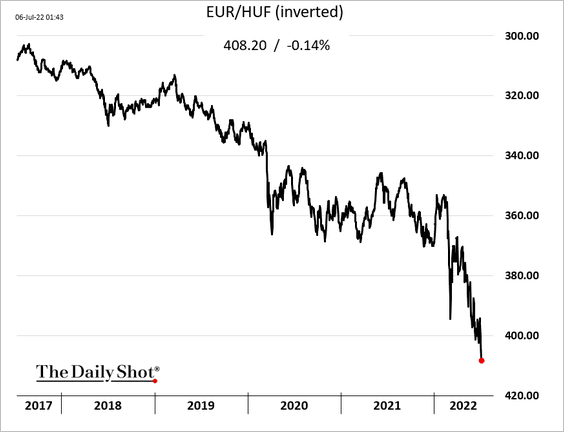

• The Hungarian forint (vs. EUR):

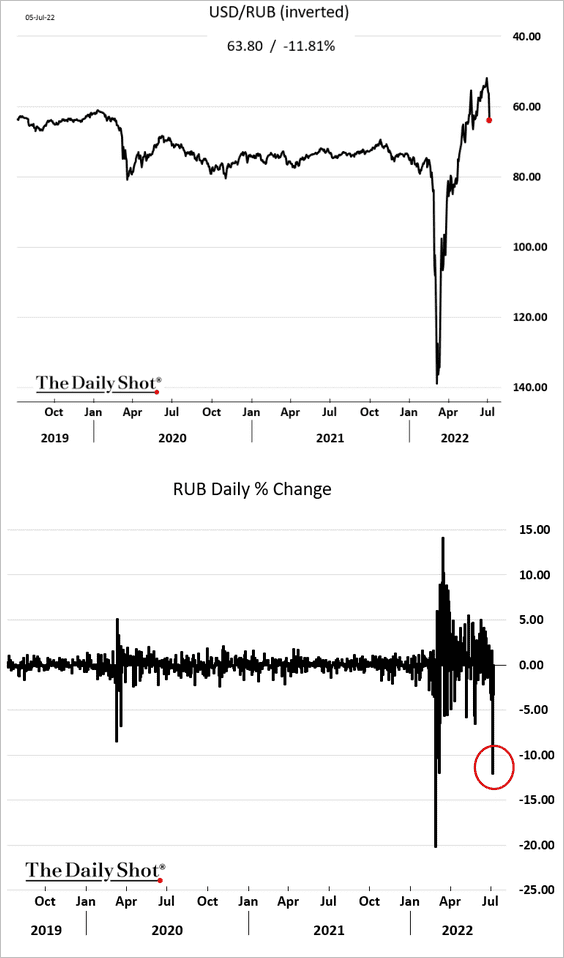

• The Russian ruble (hit by the drop in crude oil):

• The MSCI EM Currency Index:

——————–

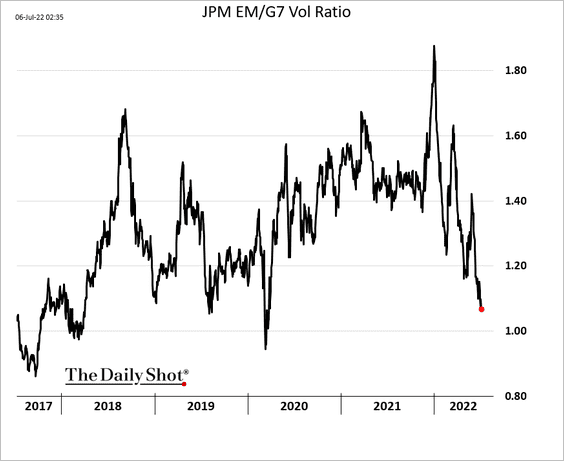

2. Despite the selloff, DM currency markets’ implied volatility has been outpacing EM.

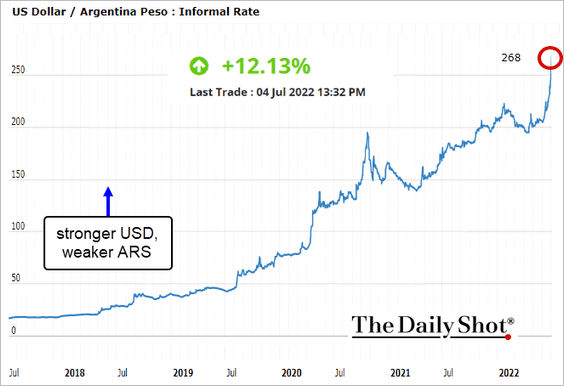

3. The situation in Argentina has become more precarious after Martin Guzman’s resignation.

Source: Reuters Read full article

Source: Reuters Read full article

The black-market peso slumped vs. USD, …

Source: Blue Dollar

Source: Blue Dollar

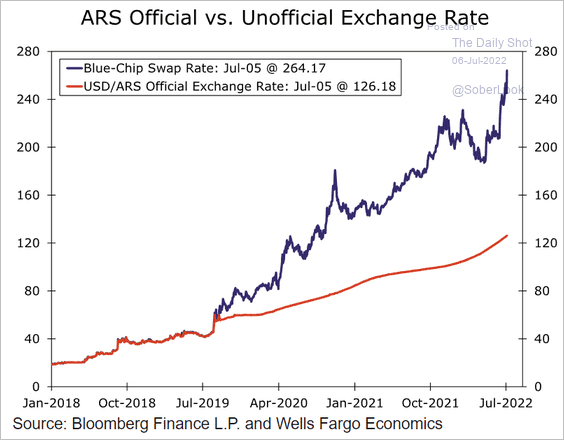

… further widening the gap with the official rate.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

A sharp devaluation in the official rate is coming.

Source: @ioliveradoll Read full article

Source: @ioliveradoll Read full article

——————–

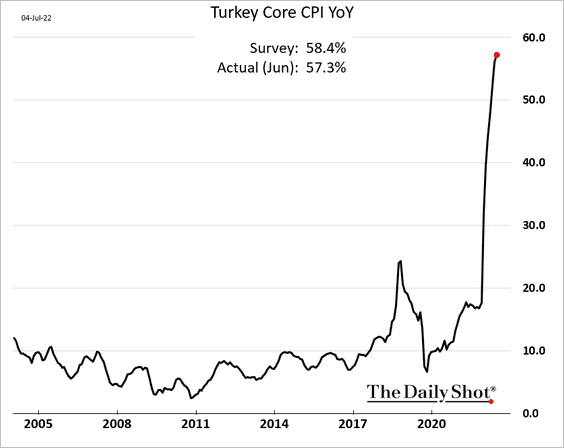

4. Turkey’s core consumer inflation is approaching 60%.

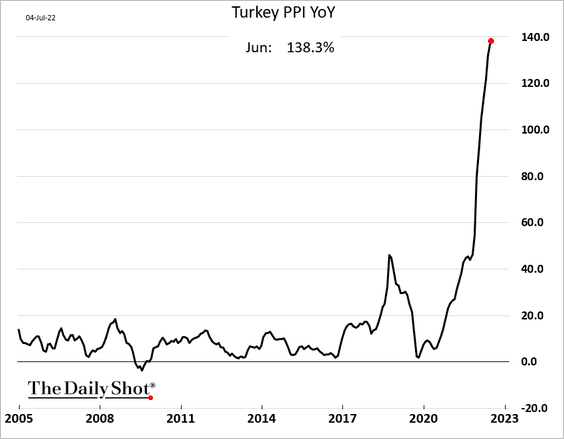

And the PPI is nearing 140%.

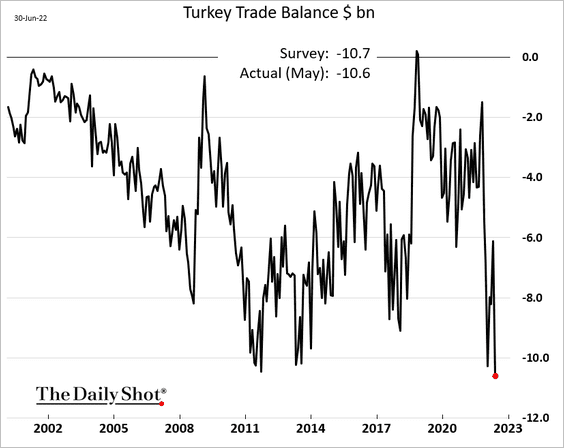

The trade deficit reached a new record.

Back to Index

Cryptocurrency

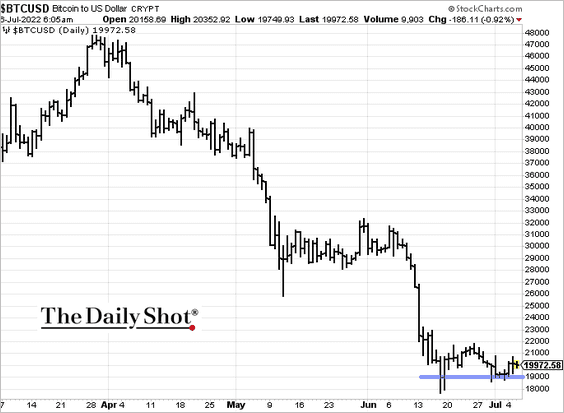

1. Bitcoin held support at $19k but is having trouble moving above $20k.

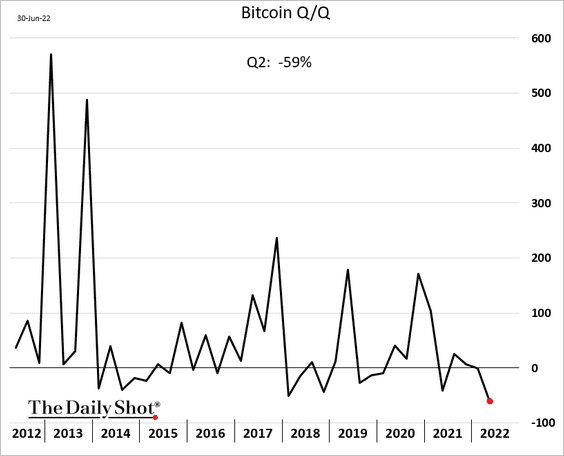

2. Q2 was a rough quarter for bitcoin.

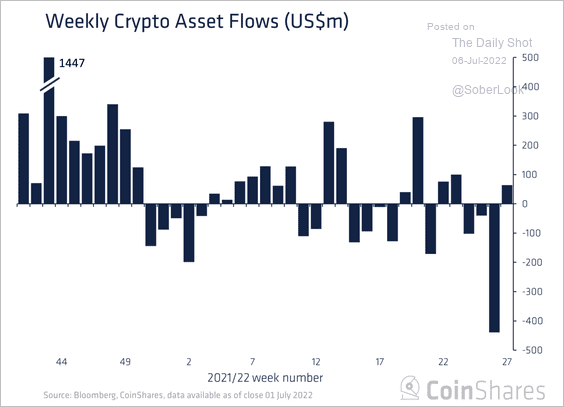

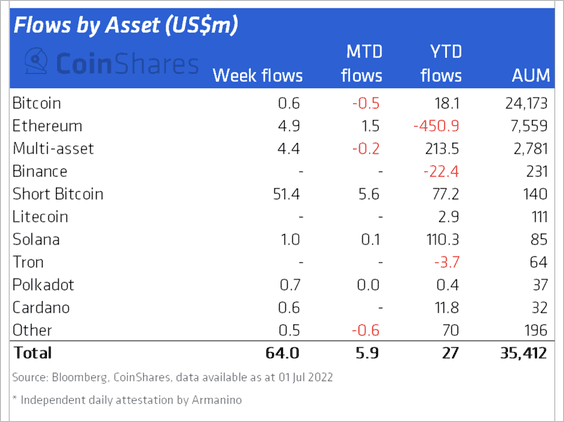

3. Crypto funds saw inflows totaling $64 million last week, driven by short-bitcoin investment products (2 charts).

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

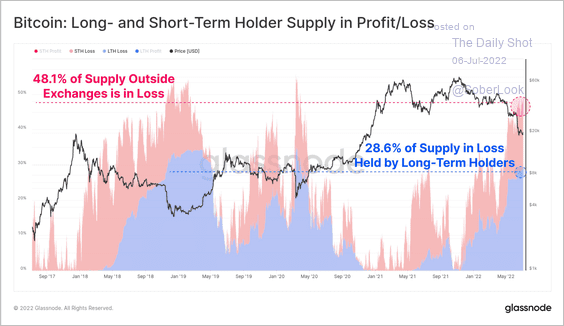

3. Roughly 48% of all BTC held outside exchanges are at a loss, and 60% of those coins are held by long-term holders, according to blockchain data compiled by Glassnode.

Source: @glassnode

Source: @glassnode

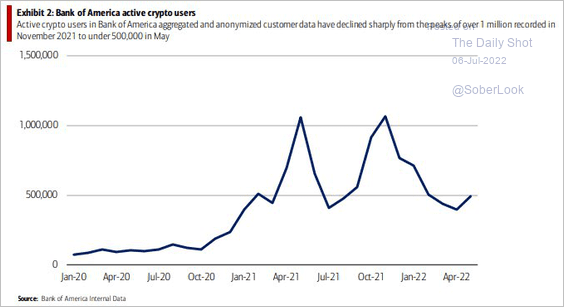

4. Here is the number of active crypto users over time.

Source: @LizAnnSonders, @BankofAmerica

Source: @LizAnnSonders, @BankofAmerica

Back to Index

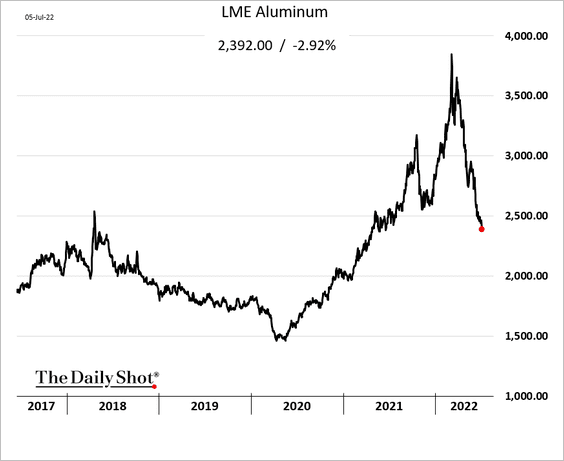

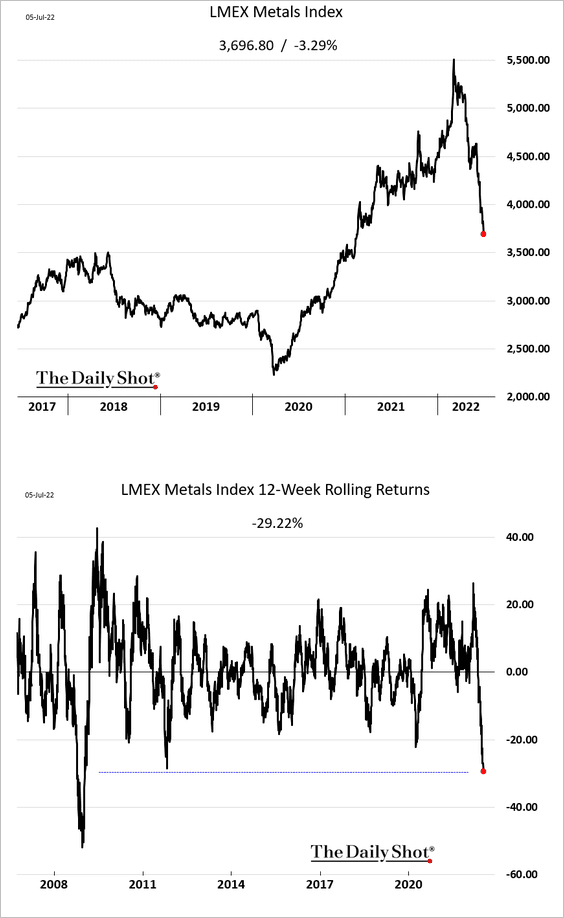

Commodities

1. Industrial metals keep falling.

• Aluminum:

• The LMEX index:

——————–

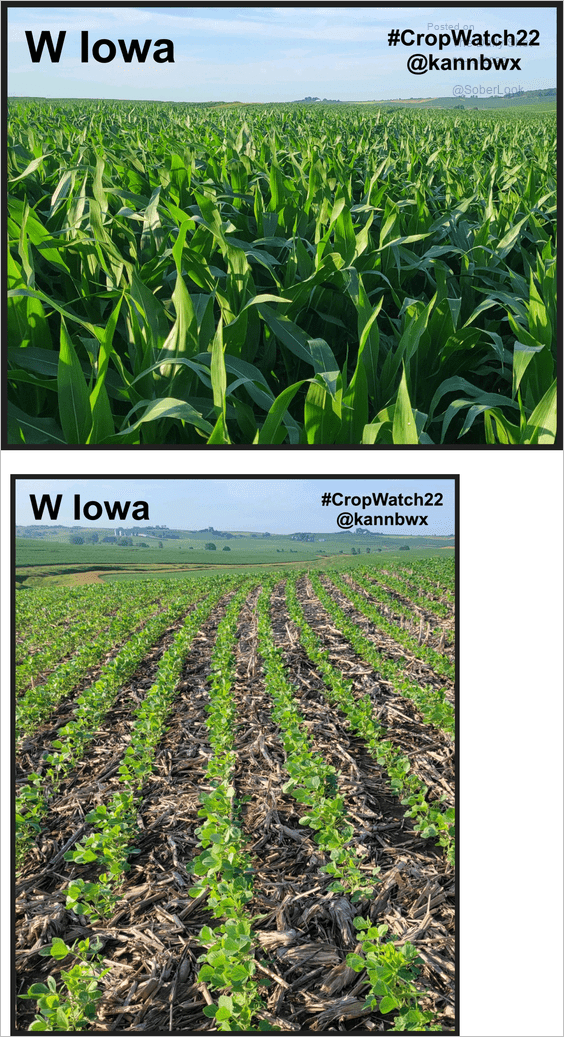

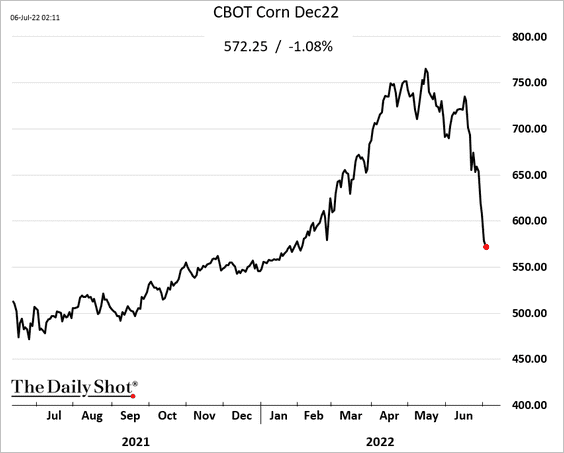

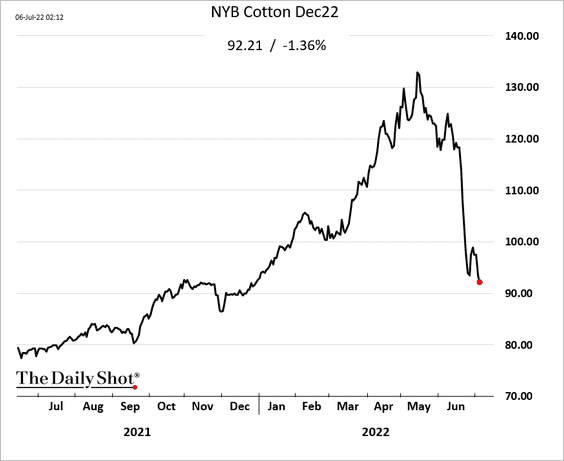

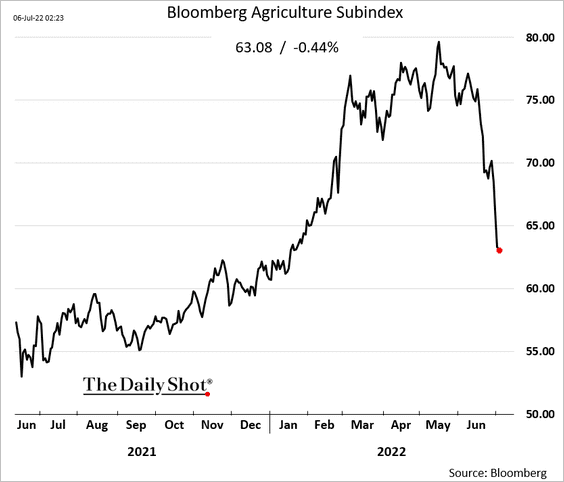

2. Agricultural commodity prices remain under pressure.

• Iowa corn and soybean crops look good.

Source: @kannbwx

Source: @kannbwx

• Corn:

• Cotton:

• Bloomberg’s agriculture index:

——————–

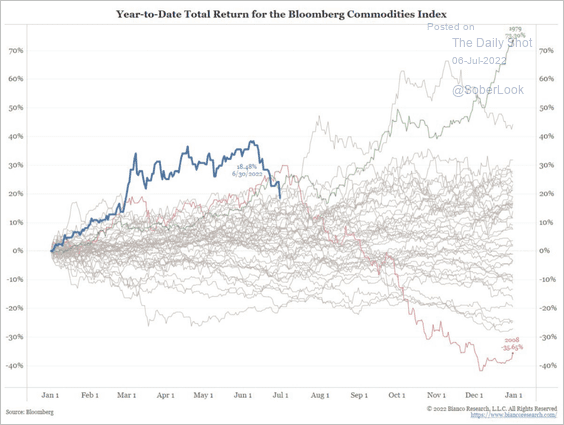

3. The Bloomberg Commodities Index corrected last month, although it has rarely produced such a positive return during the first half of the year.

Source: @biancoresearch

Source: @biancoresearch

Back to Index

Energy

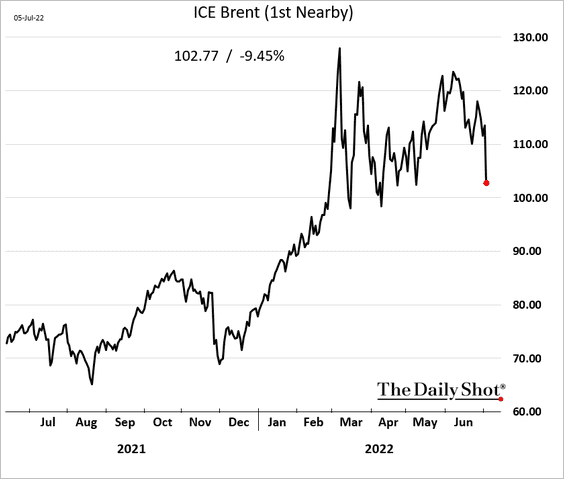

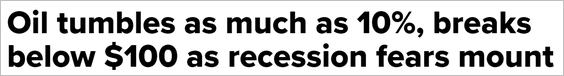

1. Crude oil tumbled on Tuesday amid recession concerns.

Source: CNBC Read full article

Source: CNBC Read full article

Energy shares slumped.

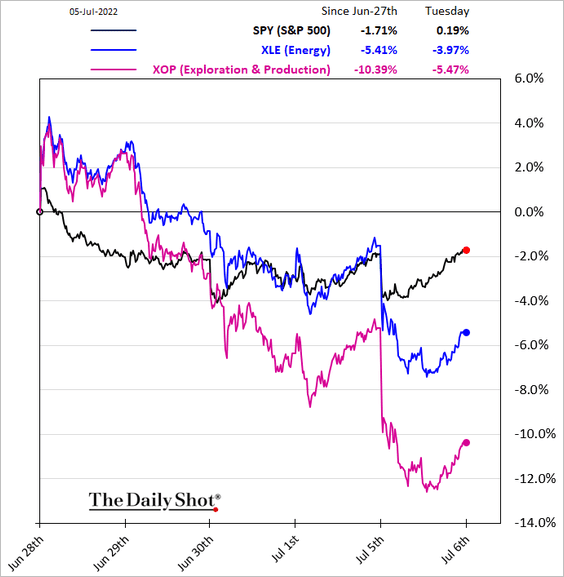

Oil vol jumped.

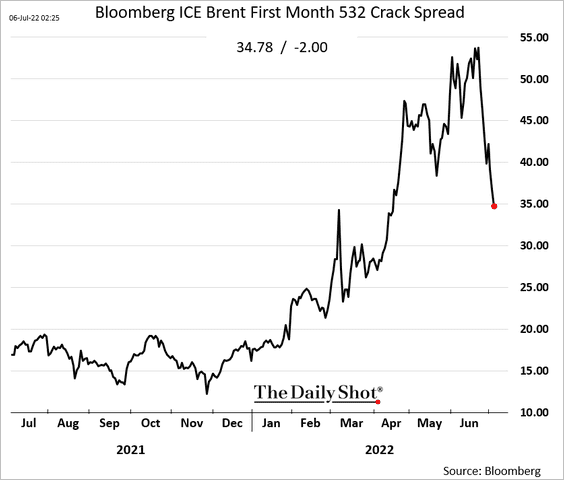

2. Crack spreads are moderating.

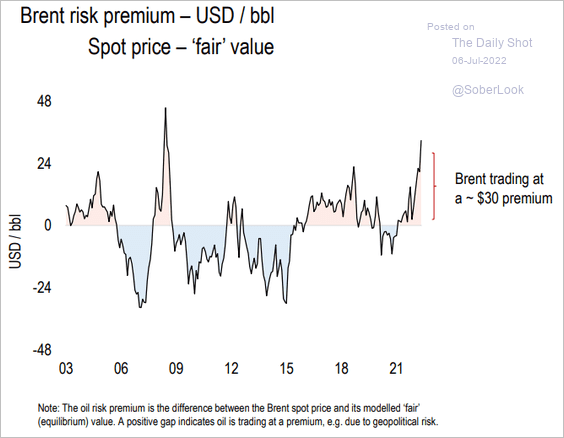

3. According to Numera Analytics, Brent is trading at a $30 premium to fair value.

Source: Numera Analytics

Source: Numera Analytics

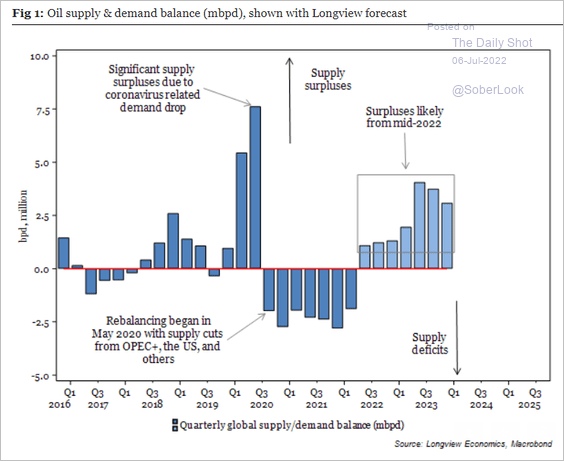

Will we see crude oil surpluses in the months ahead?

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

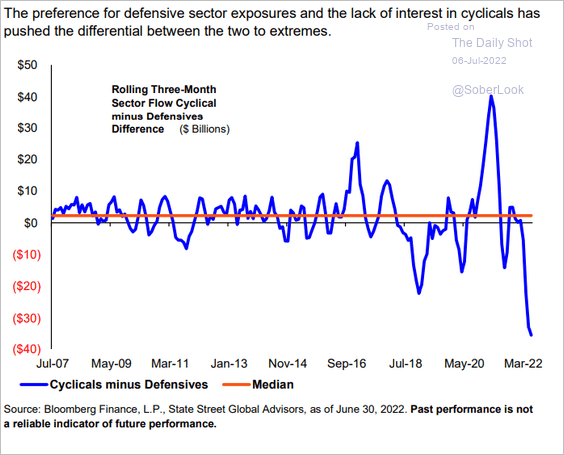

1. Relative fund flows between defensive and cyclical sectors have been extreme.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

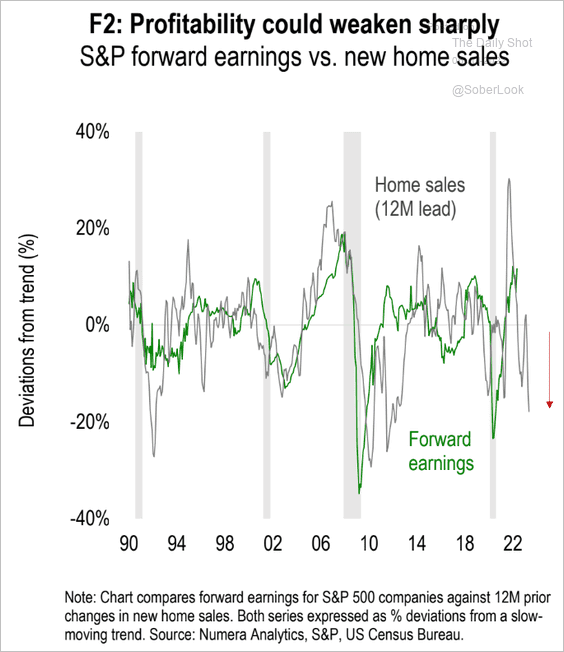

2. US housing sales tend to lead earnings expectations.

Source: Numera Analytics

Source: Numera Analytics

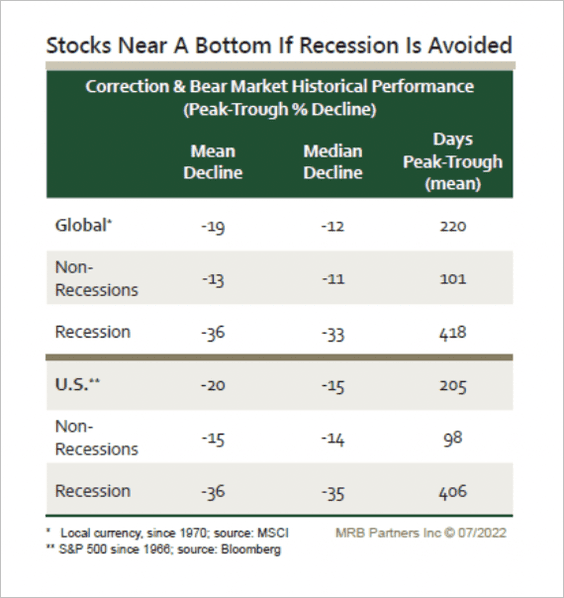

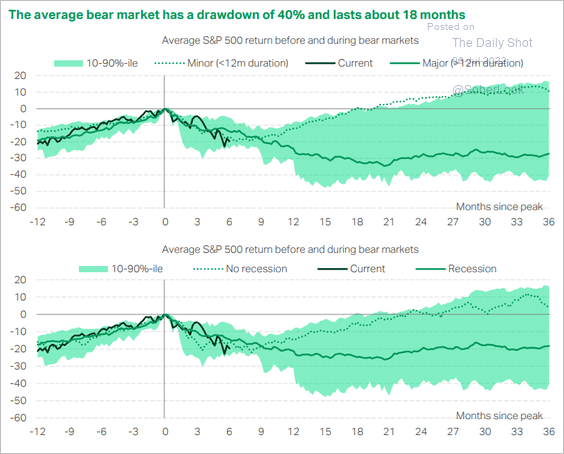

3. Here is a look at previous bear market drawdowns with and without a recession (2 charts).

Source: MRB Partners

Source: MRB Partners

Source: TS Lombard

Source: TS Lombard

——————–

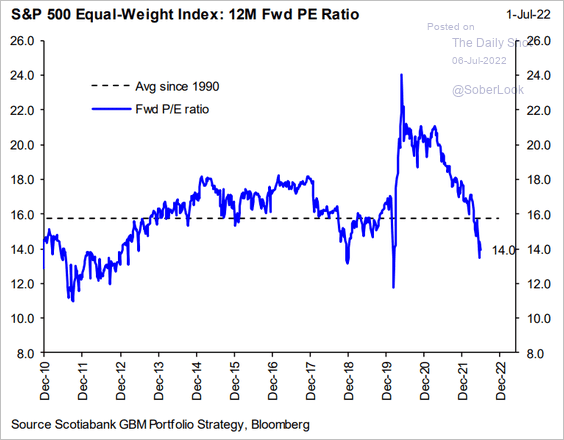

4. The forward P/E ratio for the equal-weight S&P 500 is around 14x.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

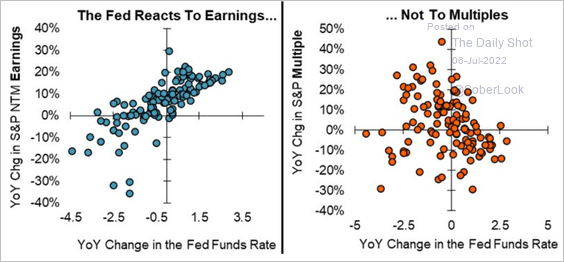

5. The Fed tends to react to earnings, not multiples (no Fed put from price declines without significant earnings weakness).

Source: Piper Sandler

Source: Piper Sandler

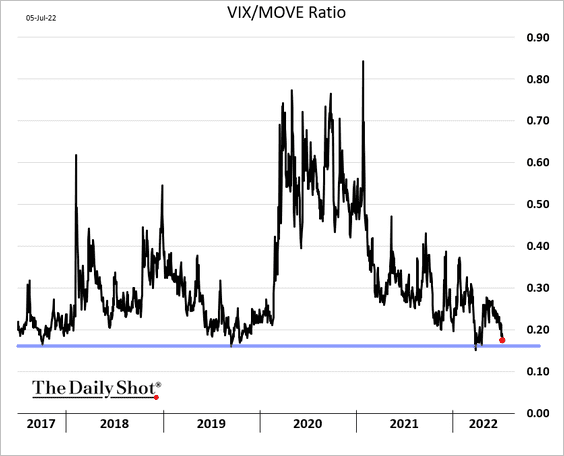

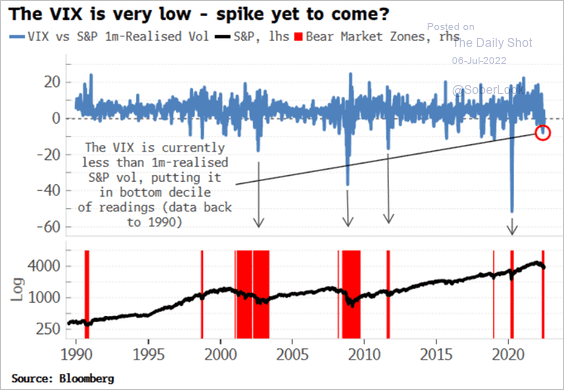

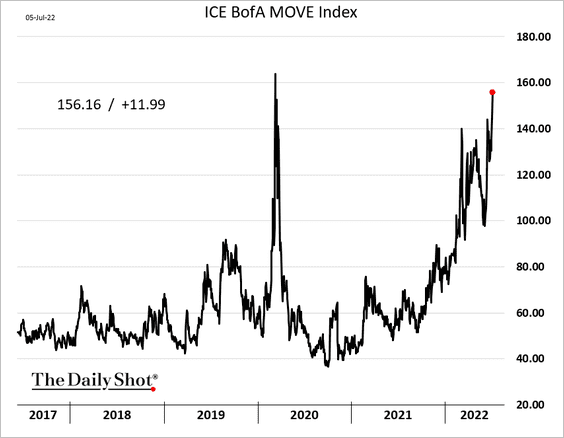

6. Equity implied volatility (VIX) is low relative to rates (MOVE).

VIX is also low relative to realized volatility. Should we expect significant gains in equity implied vol?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Credit

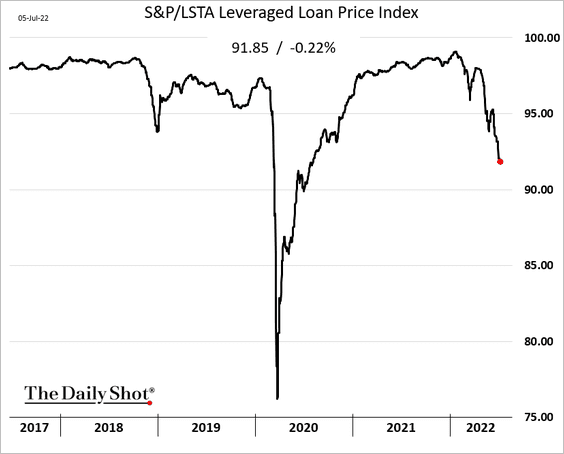

1. Leveraged loan prices continue to drift lower.

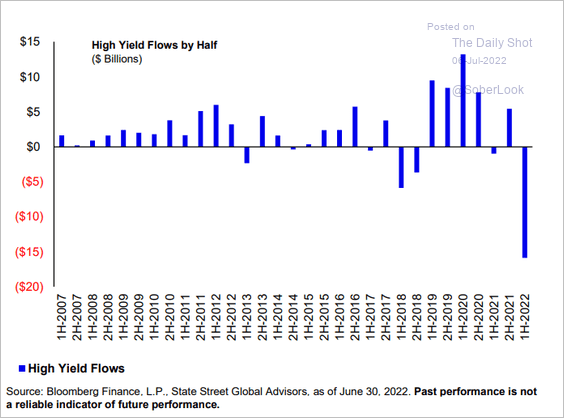

2. Outflows from high-yield bonds have been extreme in the first half of the year.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

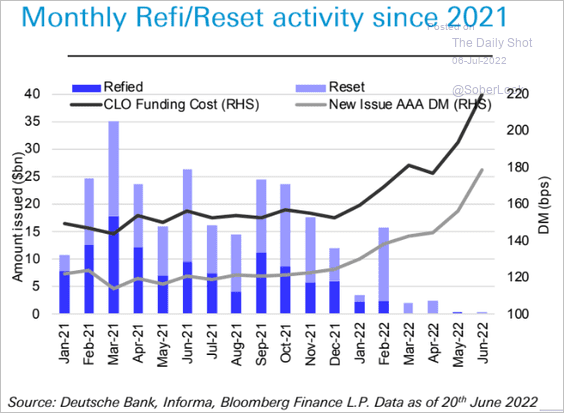

3. CLO refi/reset activity dwindles as liability costs surge.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

1. Treasury market implied volatility is surging.

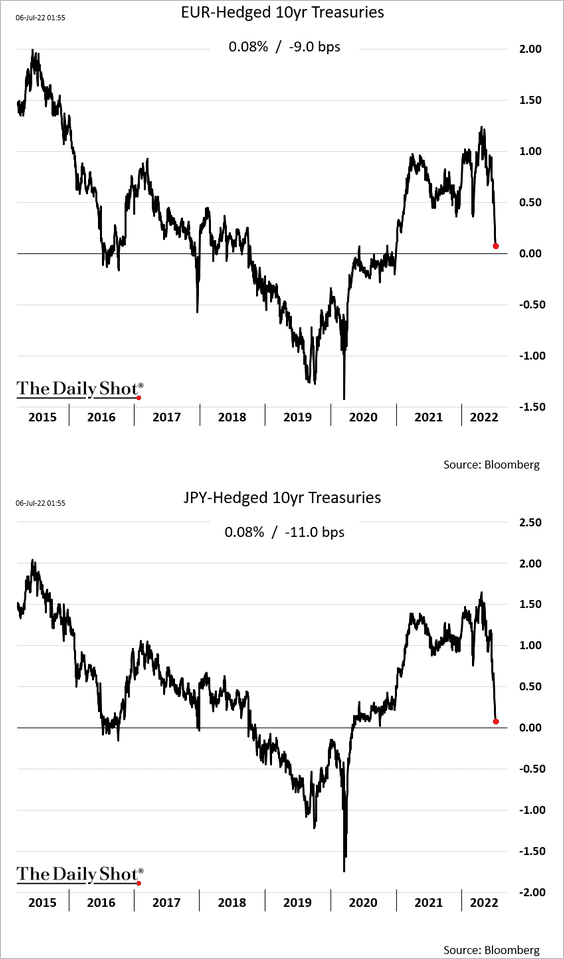

2. Treasuries are no longer attractive when hedged into euros or yen.

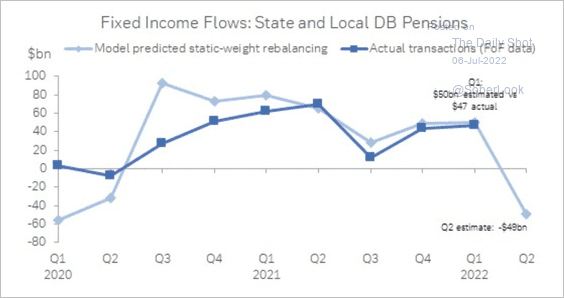

3. Deutsche Bank estimates that US public pension funds will have to sell $49 billion in fixed income securities this quarter.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

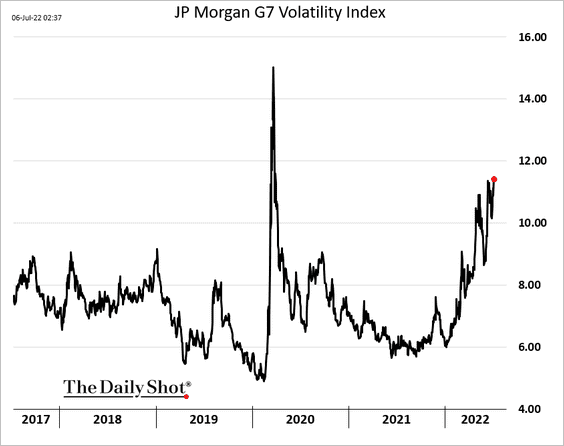

1. The implied volatility across G7 currencies is rising rapidly as the dollar surges.

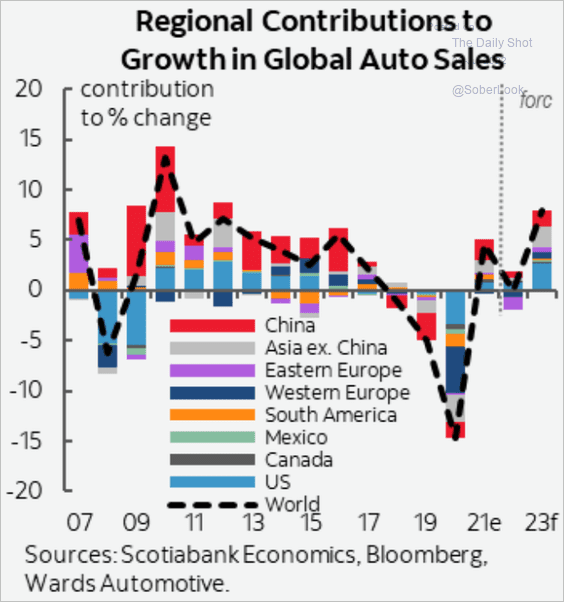

2. Automobile sales are forecast to rebound next year.

Source: Scotiabank Economics

Source: Scotiabank Economics

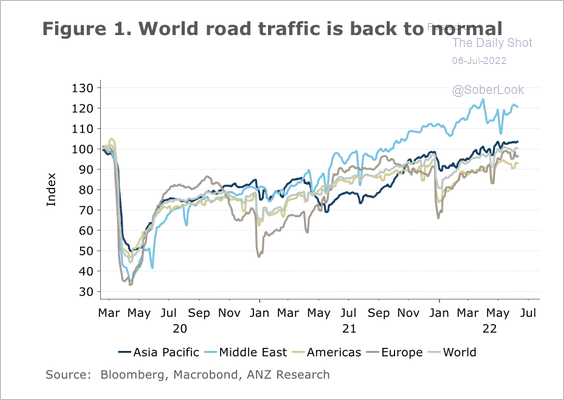

3. Road traffic has returned toward pre-pandemic levels, most notably in the Middle East.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

Food for Thought

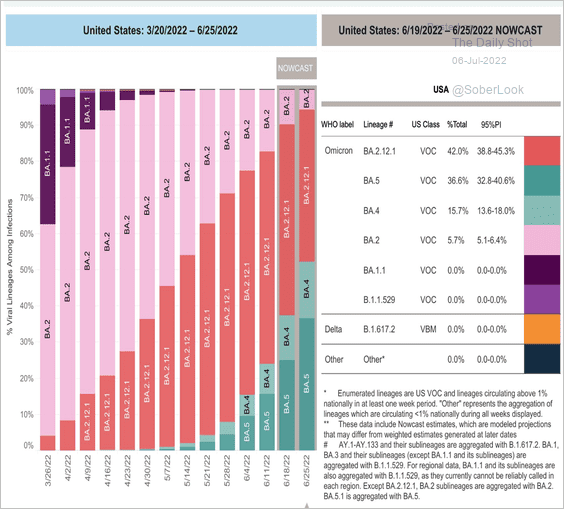

1. Omicron is mutating quickly.

Source: @EricTopol Read full article

Source: @EricTopol Read full article

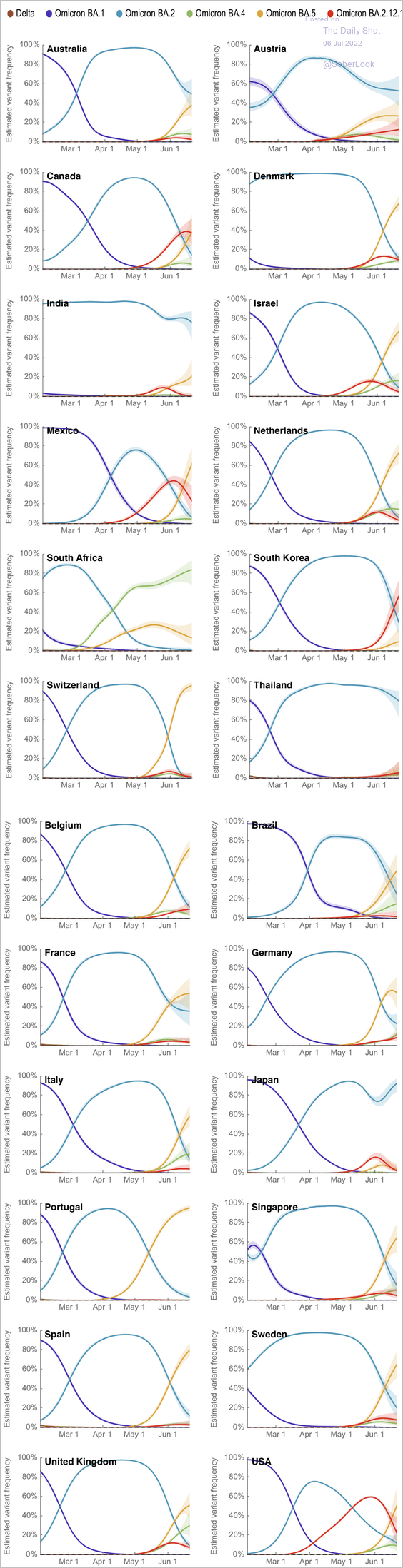

• COVID variant distributions over time:

Source: @trvrb, @marlinfiggins Read full article

Source: @trvrb, @marlinfiggins Read full article

——————–

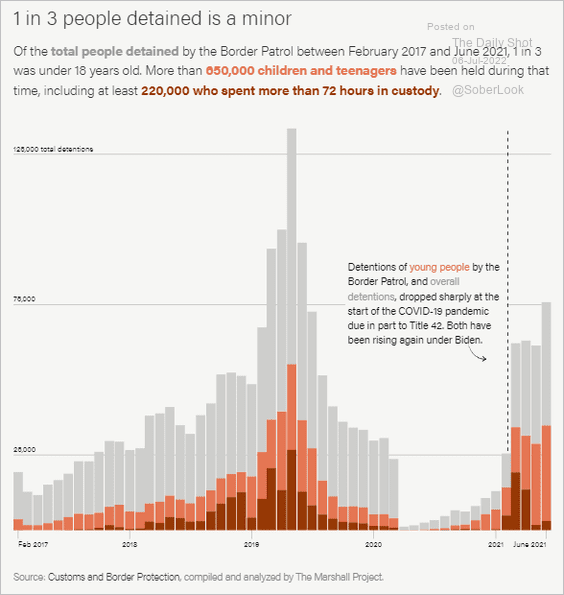

2. Migrant children in detention:

Source: The Marshall Project Read full article

Source: The Marshall Project Read full article

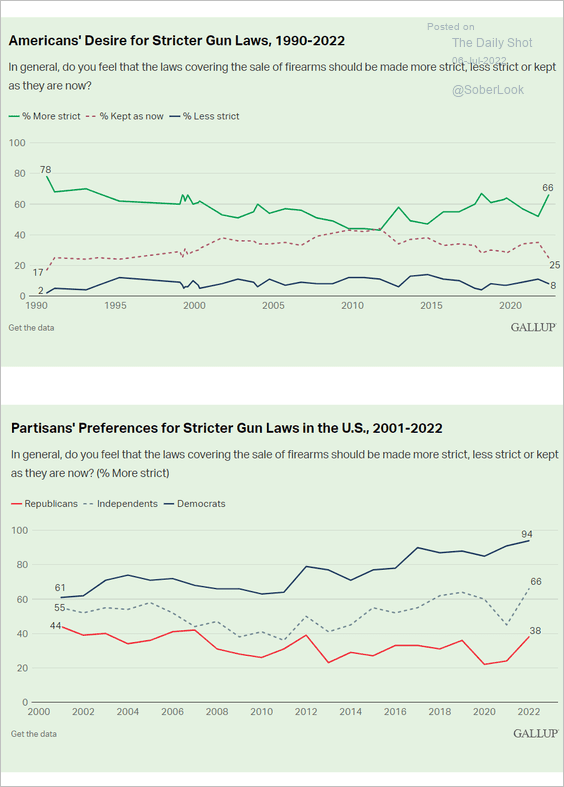

3. Support for stricter gun laws:

Source: Gallup Read full article

Source: Gallup Read full article

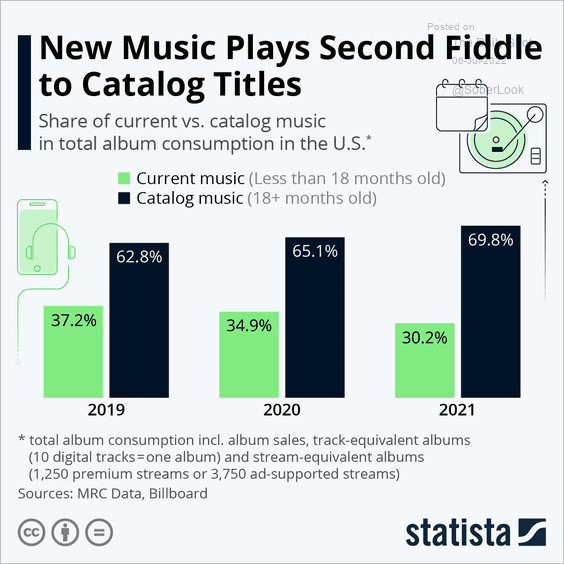

4. Album consumption of current vs. catalog music:

Source: Statista

Source: Statista

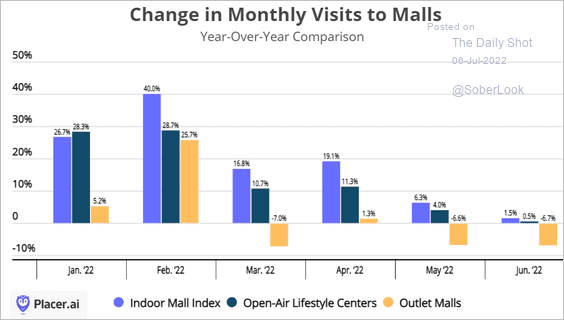

5. US mall visits:

Source: Placer.ai

Source: Placer.ai

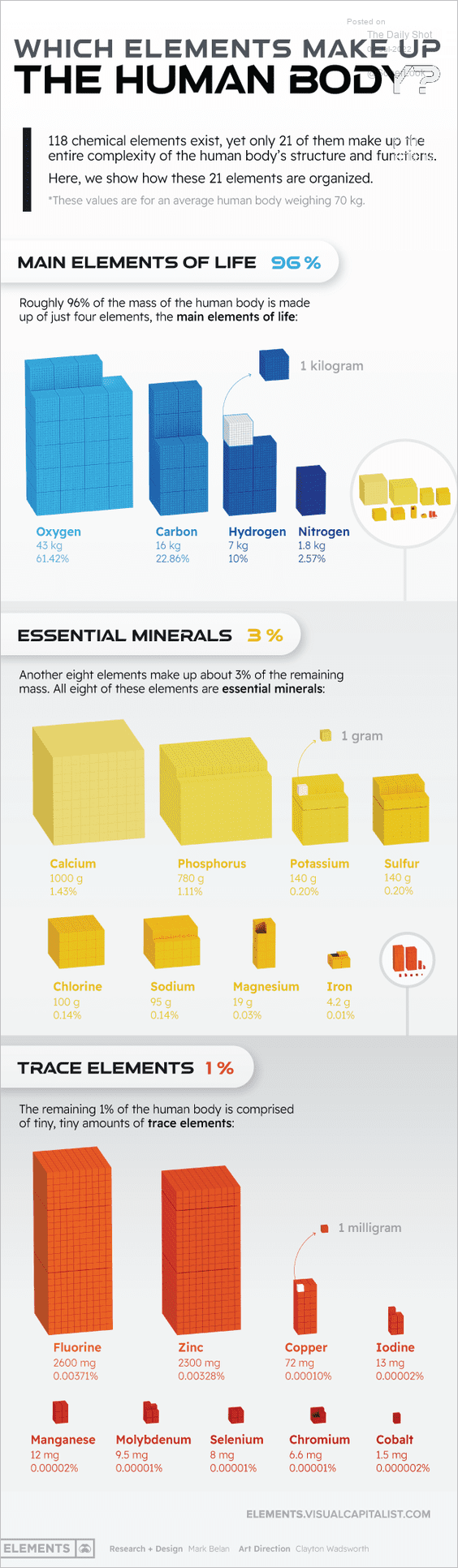

6. Elements that make up the human body:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–