The Daily Shot: 08-Jul-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

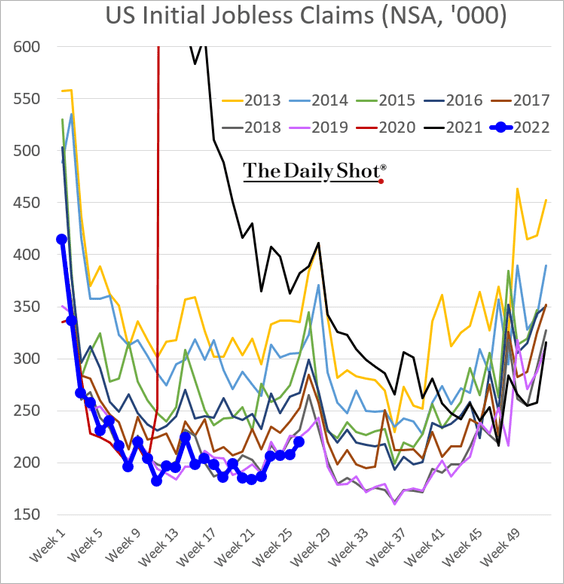

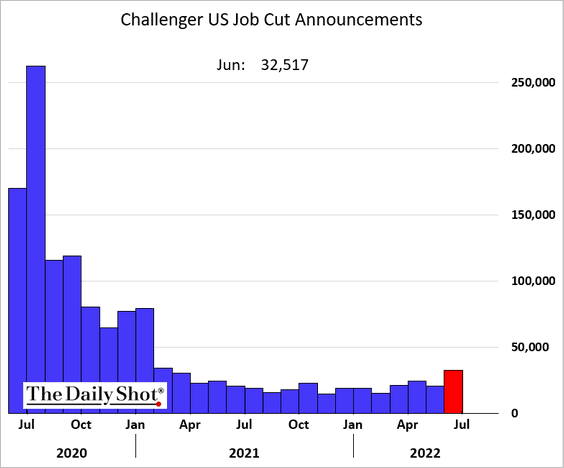

1. Let’s begin with the labor market.

• Initial jobless claims are still very low for this time of the year (below 2019 levels). The job market remains tight (for now).

• Layoffs have picked up, but most workers are finding jobs quickly.

Source: @axios Read full article

Source: @axios Read full article

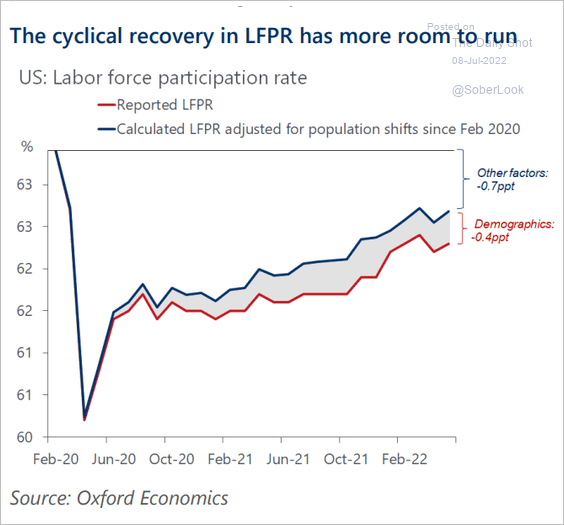

• There is room for labor force participation to recover further.

Source: Oxford Economics

Source: Oxford Economics

——————–

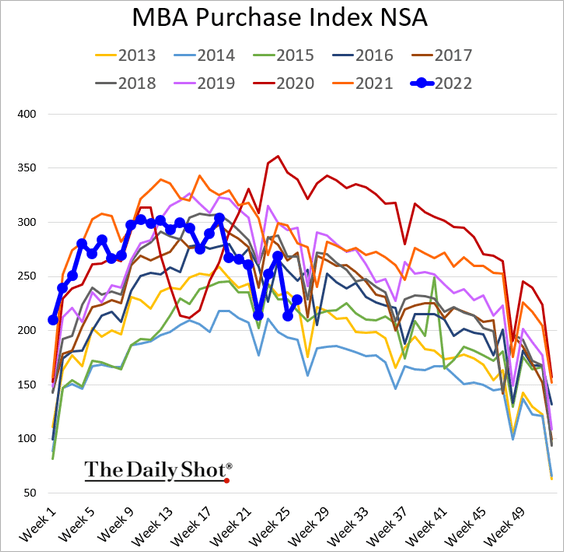

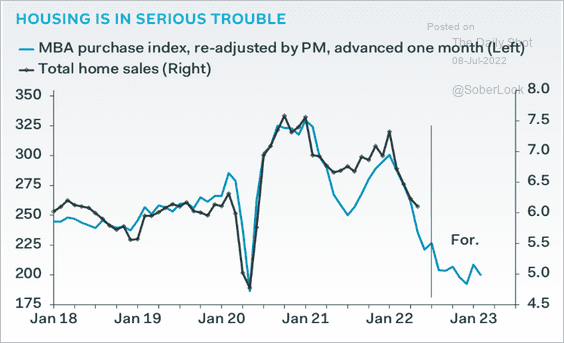

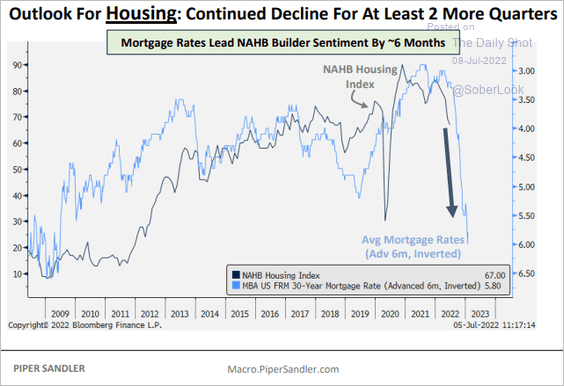

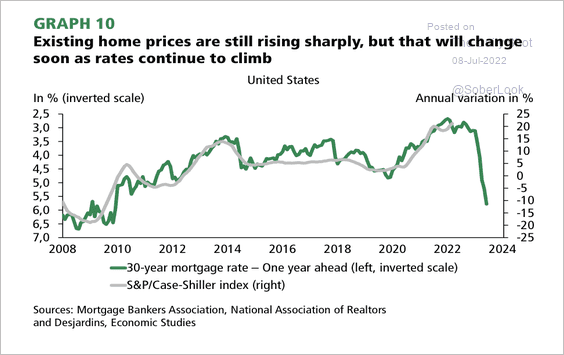

2. Next, let’s take a look at housing.

• Mortgage applications ticked up going into the holiday weekend but are still some 17% below last year’s levels.

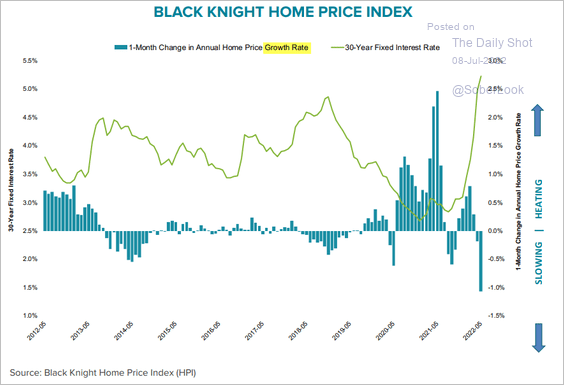

• The decline in mortgage applications and higher mortgage rates point to much slower home price appreciation in the months ahead (3 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Piper Sandler

Source: Piper Sandler

Source: Desjardins

Source: Desjardins

• Home price gains have been slowing but are still positive.

Source: Black Knight McDash

Source: Black Knight McDash

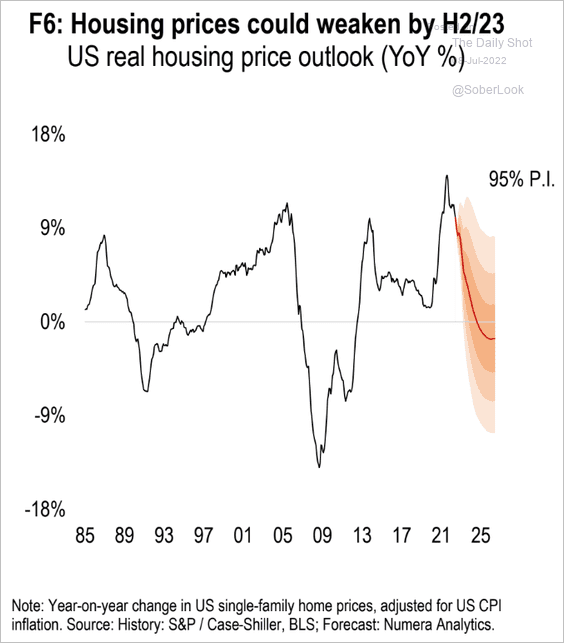

• Will we see real home price declines at the national level?

Source: Numera Analytics

Source: Numera Analytics

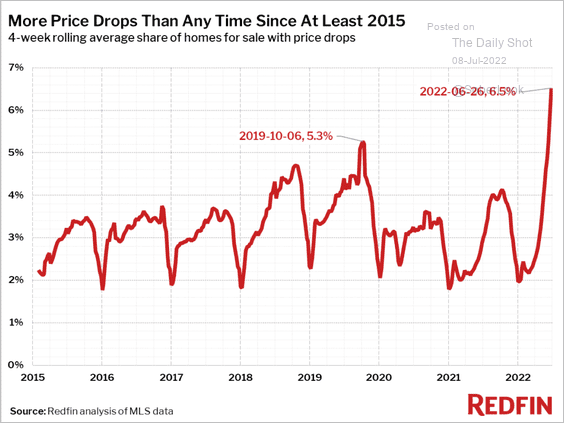

• More sellers have been cutting prices.

Source: Redfin

Source: Redfin

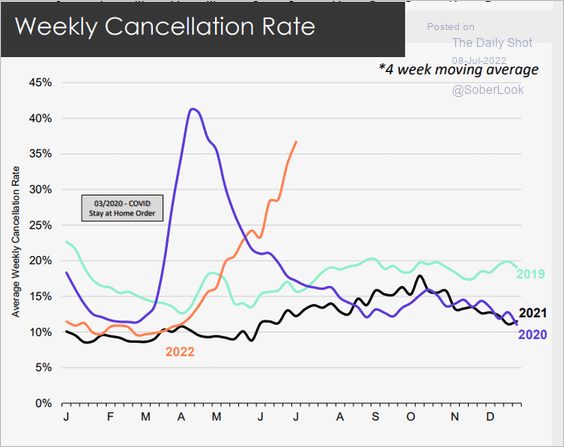

• Purchase contract cancellations are surging in Denver.

Source: @AliWolfEcon

Source: @AliWolfEcon

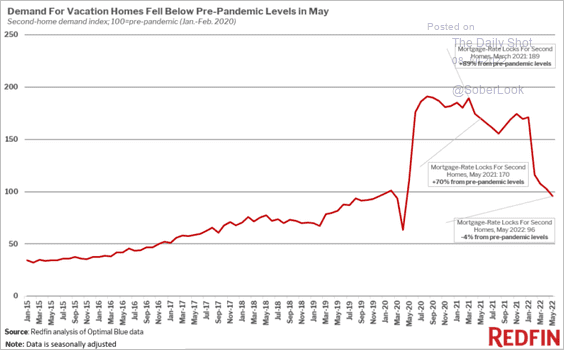

• Demand for vacation homes has been falling.

Source: Redfin

Source: Redfin

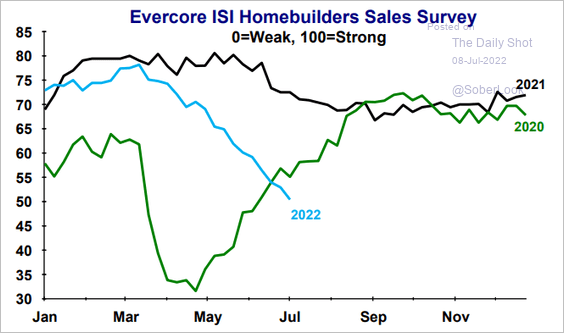

• Homebuilder sales continue to deteriorate.

Source: Evercore ISI Research

Source: Evercore ISI Research

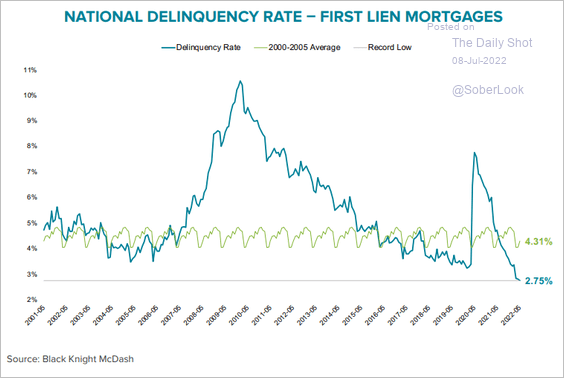

• US mortgage delinquency rates hit a record low.

Source: Black Knight McDash

Source: Black Knight McDash

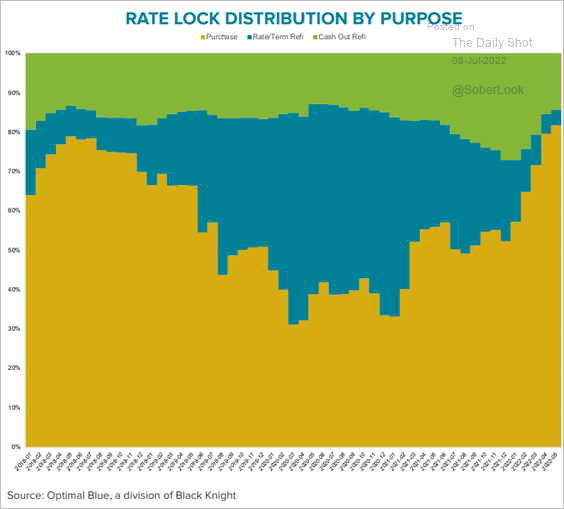

• This chart shows rate lock distribution by purpose.

Source: Black Knight McDash

Source: Black Knight McDash

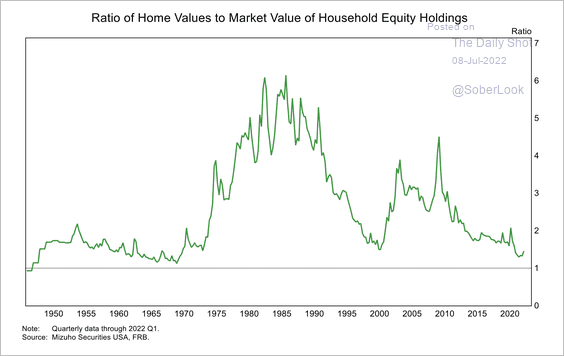

• Home values and equities have become roughly equal portions of household wealth.

Source: Desjardins

Source: Desjardins

——————–

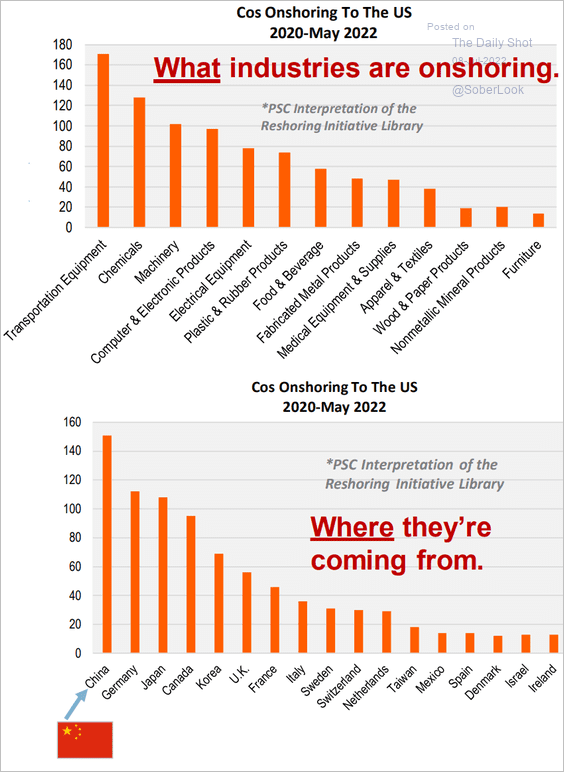

3. Manufacturing “onshoring” has been picking up momentum.

Source: Piper Sandler

Source: Piper Sandler

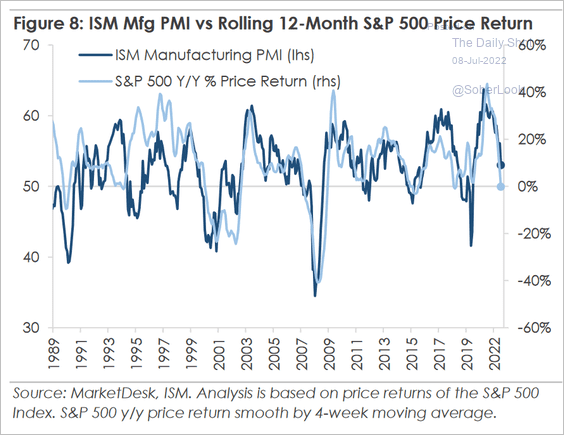

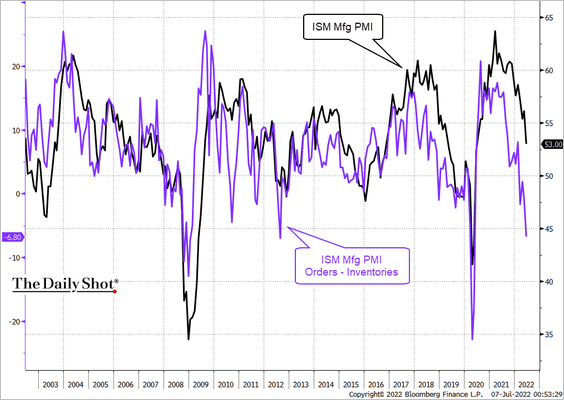

However, slowing demand could dampen companies’ willingness to keep investing in domestic production (2 charts).

Source: MarketDesk Research

Source: MarketDesk Research

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

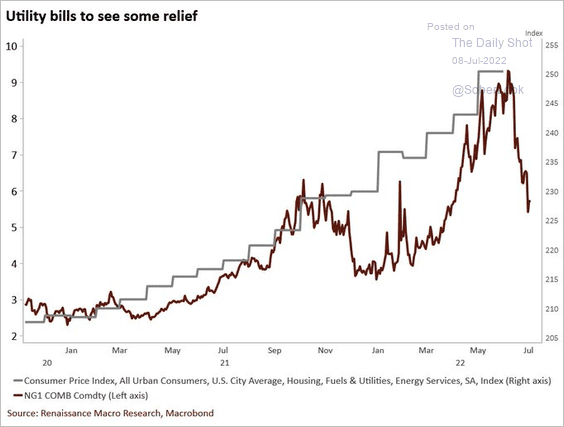

4. It’s hard to see US utilities lowering prices even if natural gas prices don’t rebound.

Source: @RenMacLLC

Source: @RenMacLLC

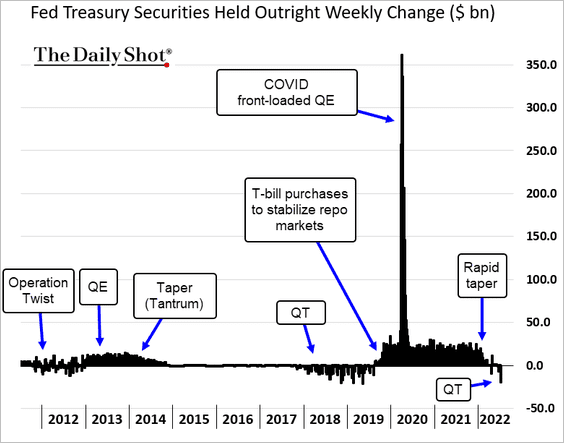

5. And so it begins. The Fed’s securities portfolio saw its first meaningful reduction in recent days (quantitative tightening).

Back to Index

Canada

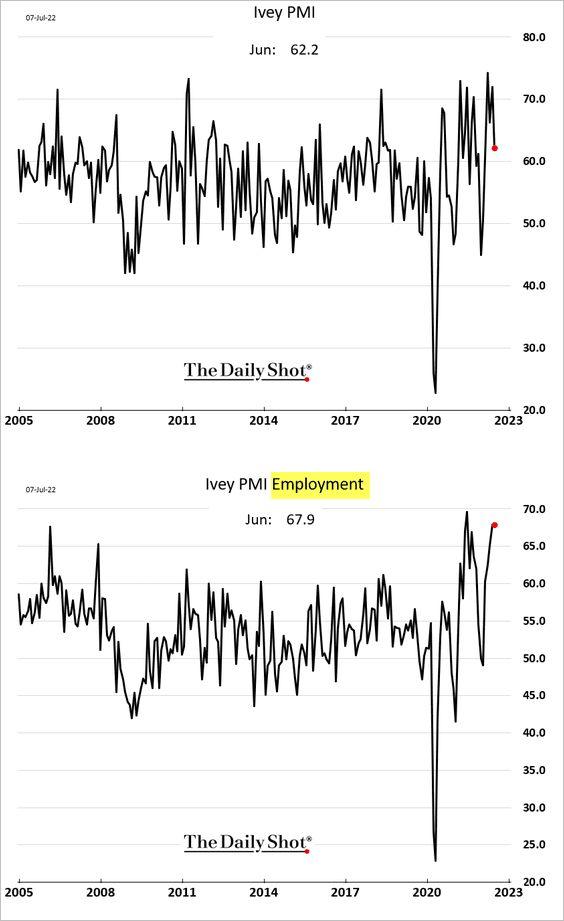

1. The Ivey PMI report showed robust growth in business activity last month.

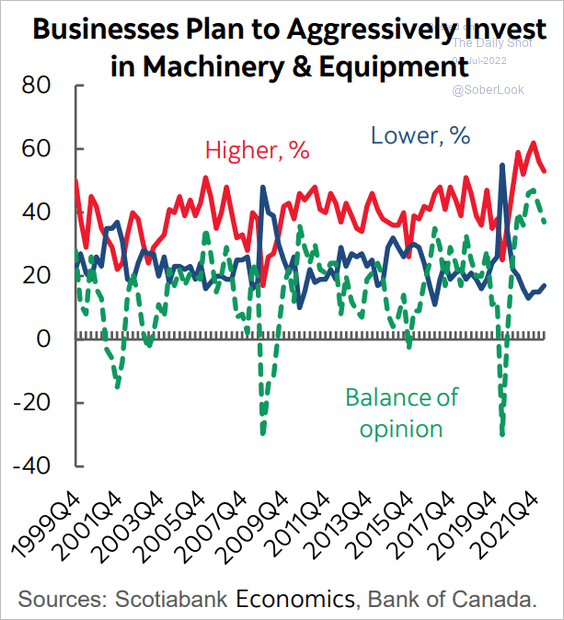

2. CapEx plans remain strong.

Source: Scotiabank Economics

Source: Scotiabank Economics

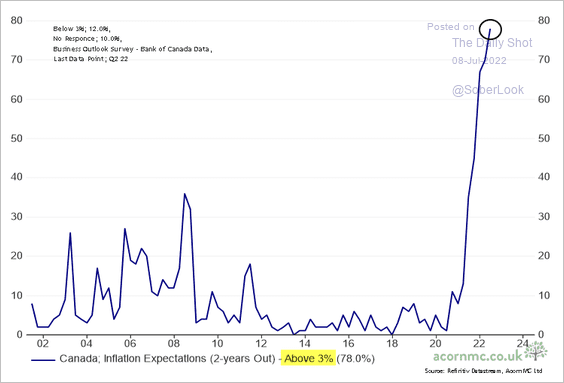

3. As we saw yesterday, inflation expectations continue to climb.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

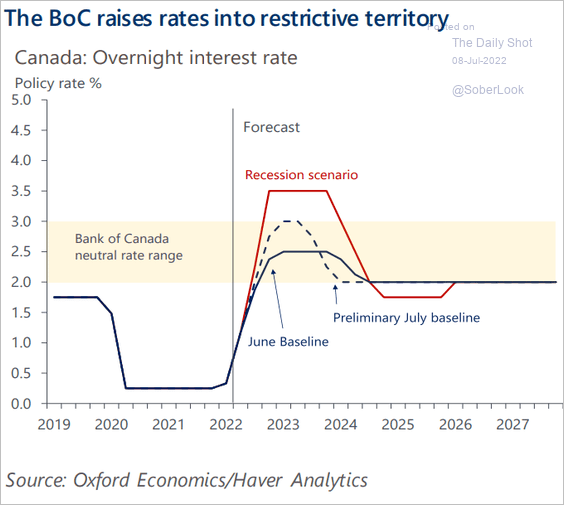

4. Could the BoC push Canada’s economy into recession if inflation remains stubbornly high?

Source: Oxford Economics

Source: Oxford Economics

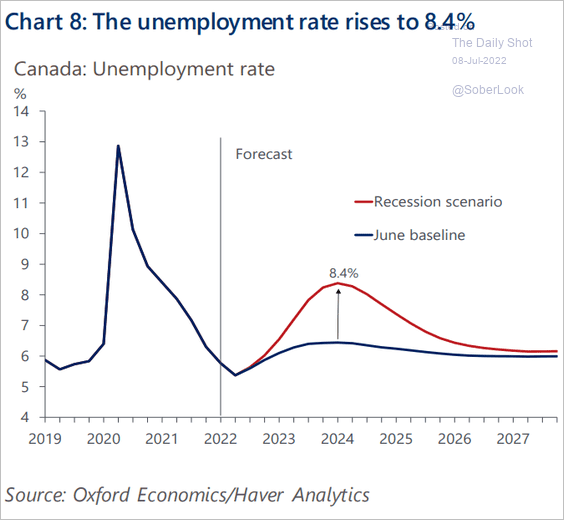

Here is what could happen to the unemployment rate, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

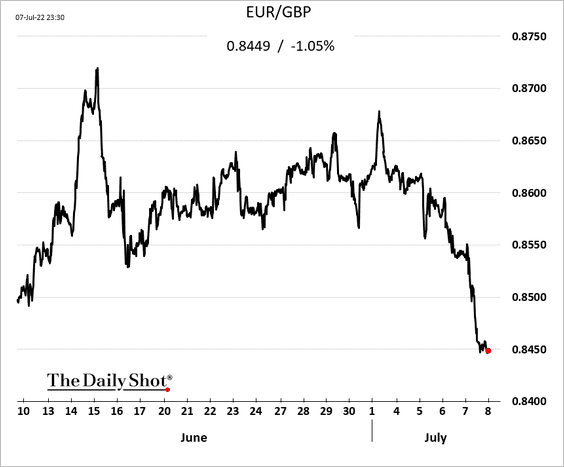

The United Kingdom

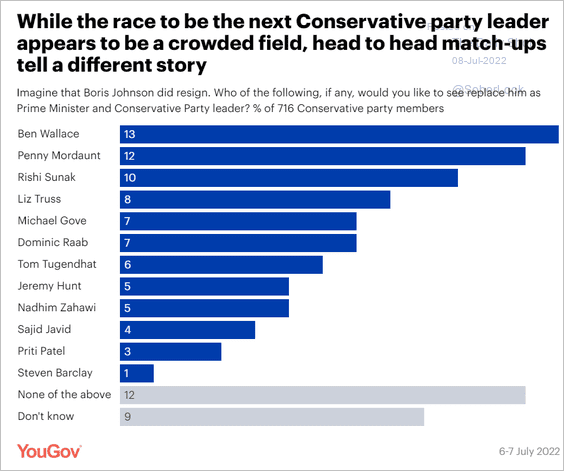

The pound strengthened substantially vs. the euro after the news of Boris Johnson’s resignation.

Who will replace Johnson?

Source: YouGov

Source: YouGov

Back to Index

The Eurozone

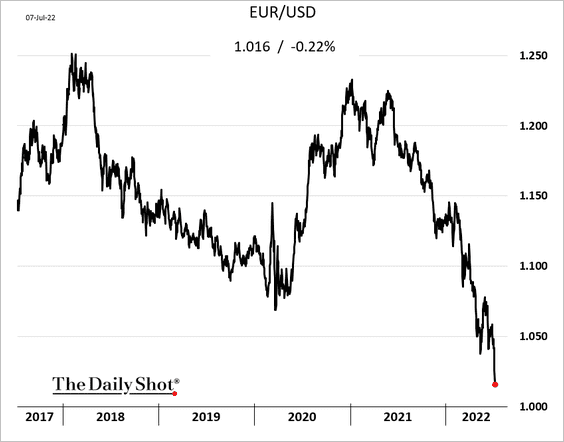

1. The euro remains under pressure.

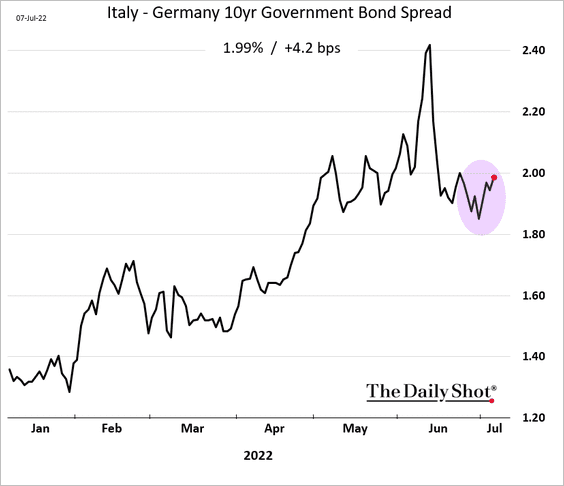

2. There are some concerns about the ECB’s defragmentation effort getting delayed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Italian spreads widened.

——————–

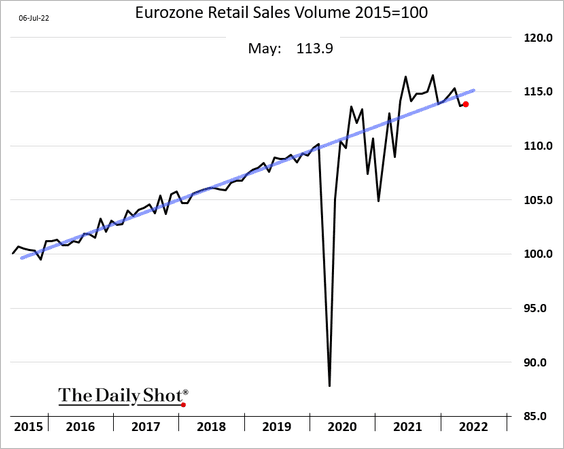

3. Euro-area retail sales are not crashing despite deteriorating sentiment.

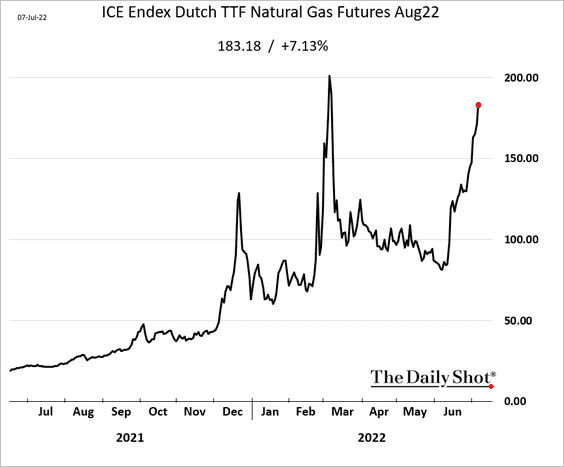

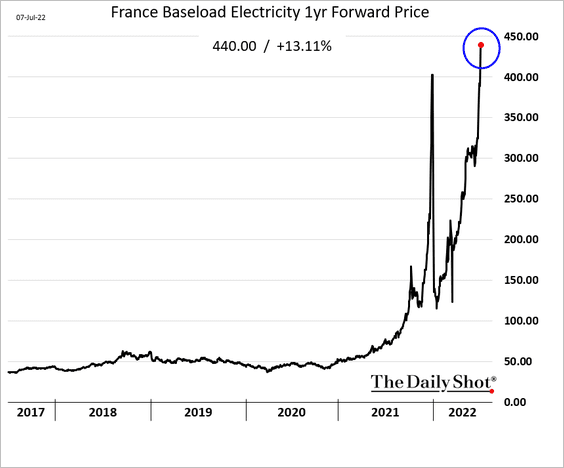

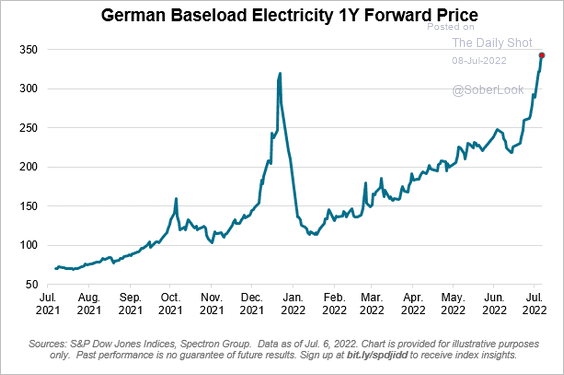

4. European natural gas prices continue to surge as Russia tightens supplies.

As a result, one-year electricity contract prices are hitting record highs.

• France:

• Germany:

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

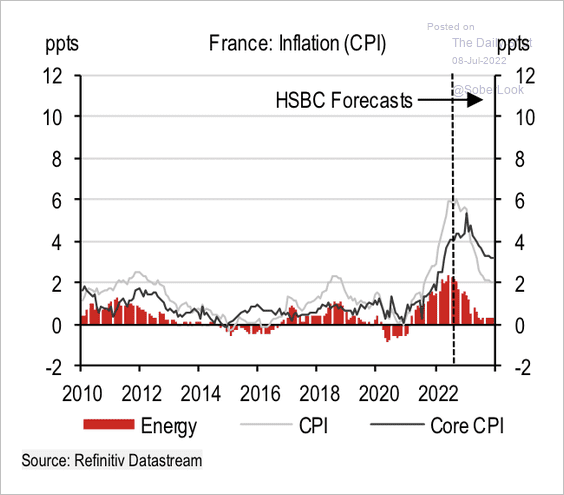

5. HSBC expects inflation in France to ease as the government prevents the full pass-through of energy price rises, rather than subsidizing income.

Source: HSBC Global Research

Source: HSBC Global Research

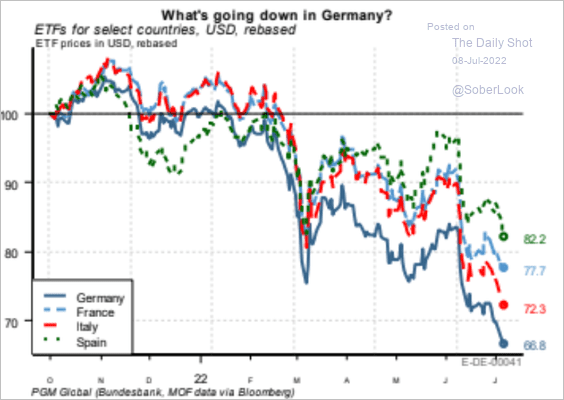

6. German shares have been underperforming.

Source: PGM Global

Source: PGM Global

Back to Index

Europe

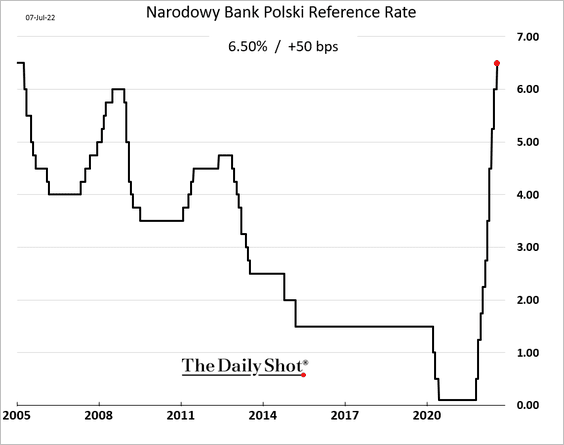

1. Poland’s latest rate hike was a bit more cautious. Markets expected to see a 75 bps increase.

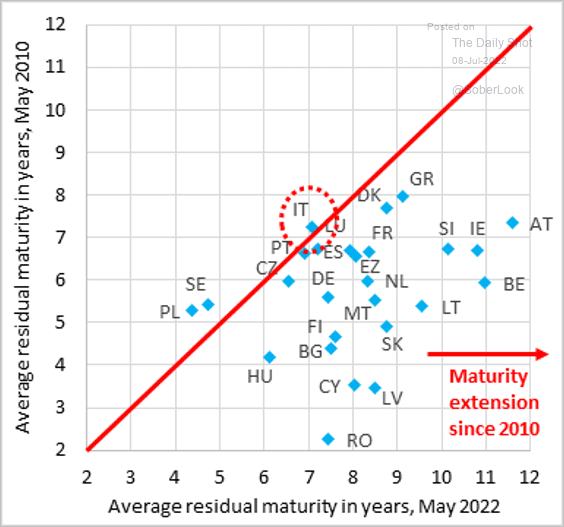

2. Which countries extended their debt maturities since 2010?

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Japan

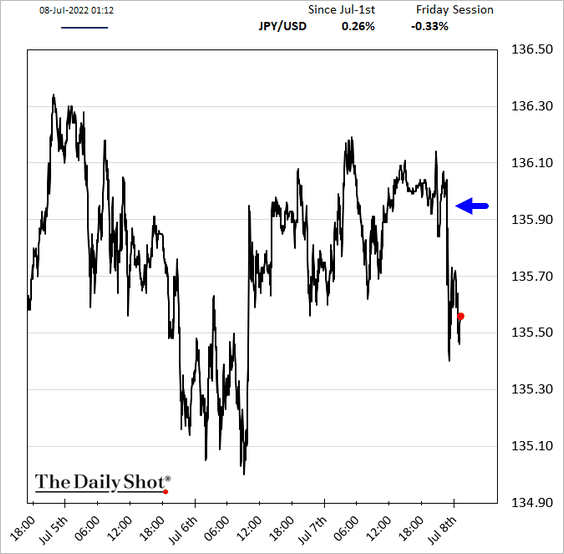

Shinzo Abe, Japan’s longest-serving prime minister, has been shot and is in “grave condition.”

Source: Reuters Read full article

Source: Reuters Read full article

The yen strengthened (chart shows the dollar falling against the yen – the title should say “USD/JPY”).

Back to Index

China

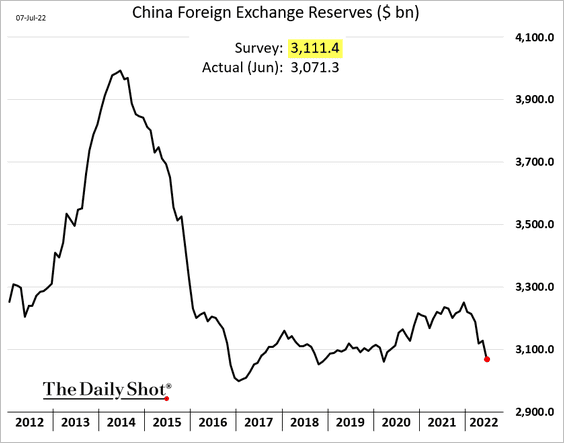

1. FX reserves declined again, surprising the markets.

Hong Kong’s FX reserves are also falling.

——————–

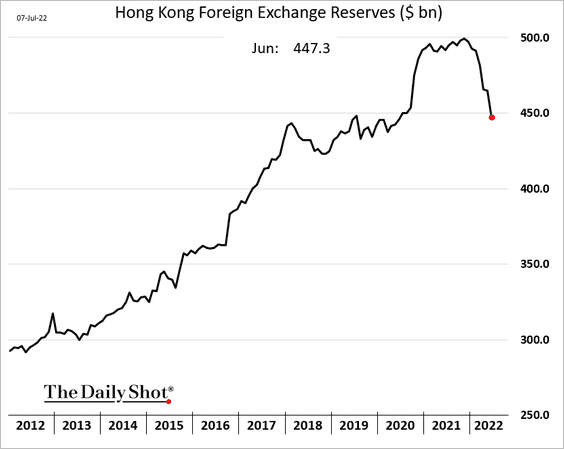

2. China is considering a massive stimulus package to focus on infrastructure. Copper prices perked up in response.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

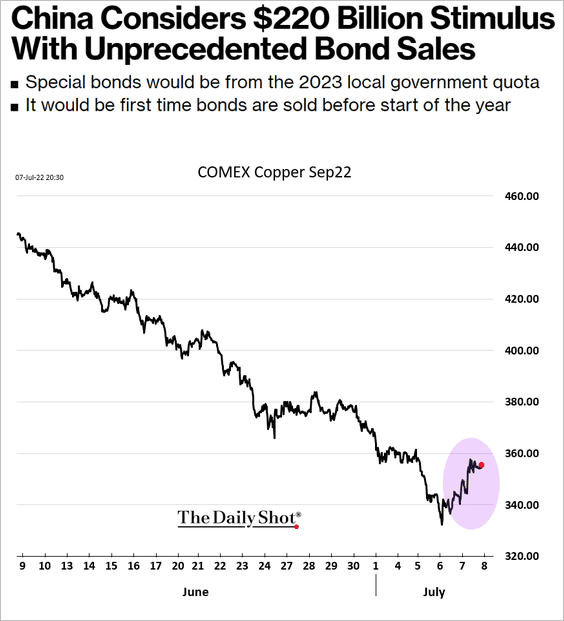

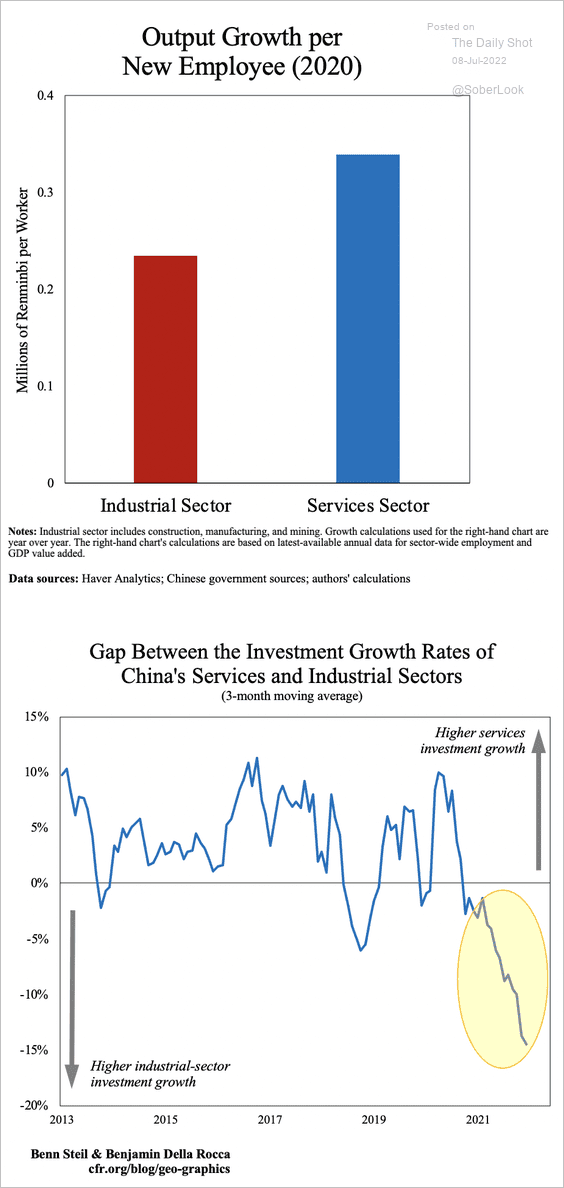

This effort will delay China’s shift toward services, a more productive part of the economy. As a result, the nation will have a difficult time realizing its full economic potential.

Source: @CFR_org Read full article

Source: @CFR_org Read full article

——————–

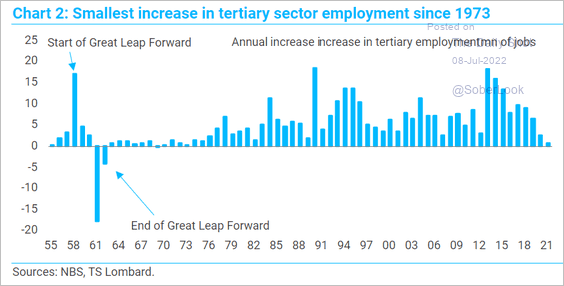

3. Service sector employment growth has been slowing.

Source: TS Lombard

Source: TS Lombard

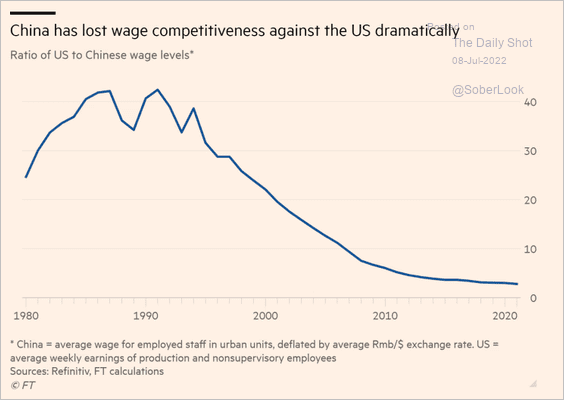

4. China has lost most of its wage advantage vs. the US.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

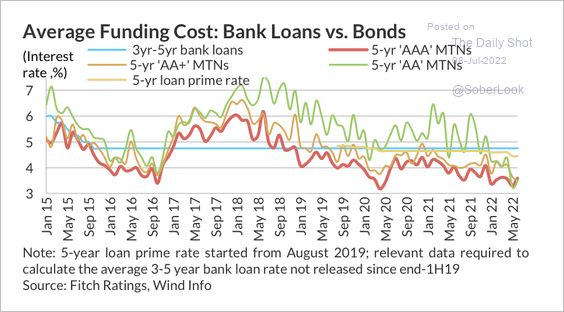

5. Average funding costs remain relatively low.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

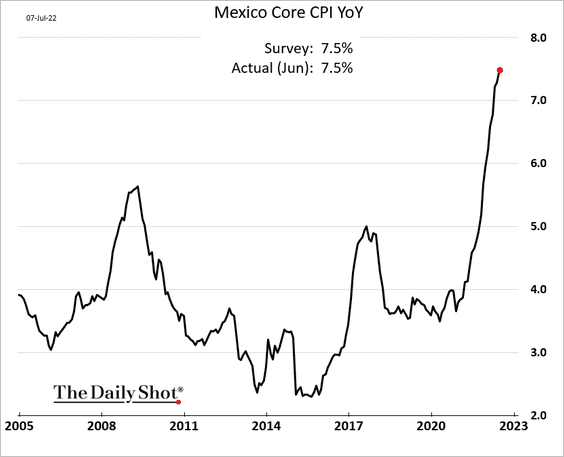

1. Let’s begin with Mexico.

• Is inflation about to peak?

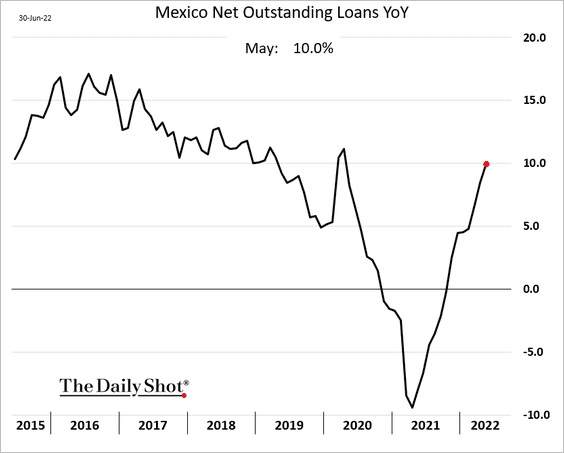

• Loan growth reached 10%.

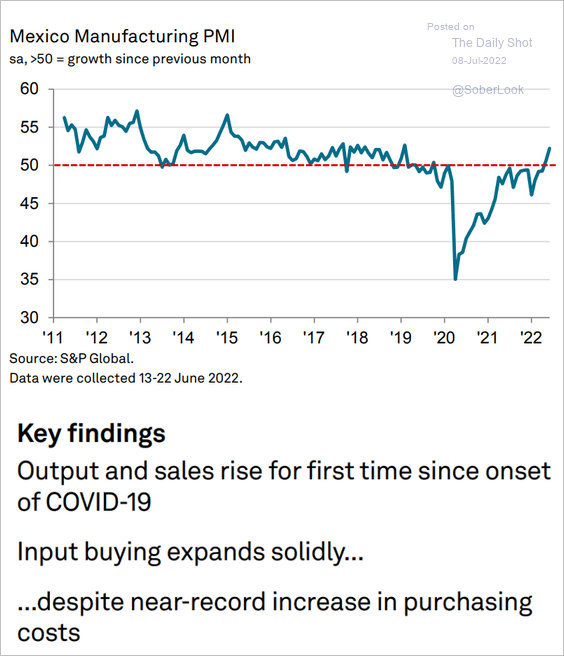

• Manufacturing growth accelerated last month.

Source: S&P Global PMI

Source: S&P Global PMI

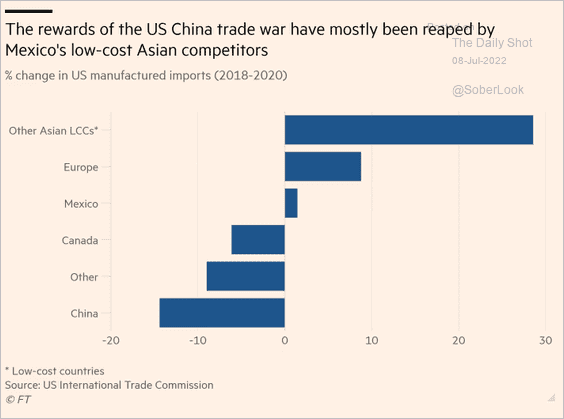

• Mexico hasn’t benefitted much from the US-China trade war.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

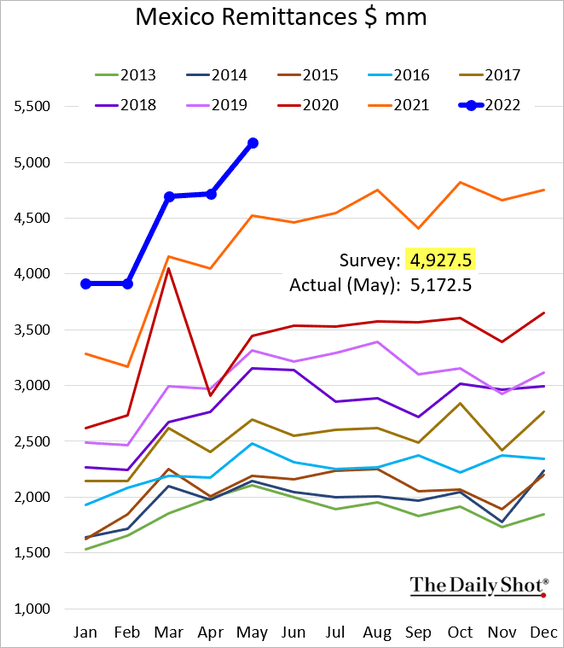

• Remittances continue to surge.

——————–

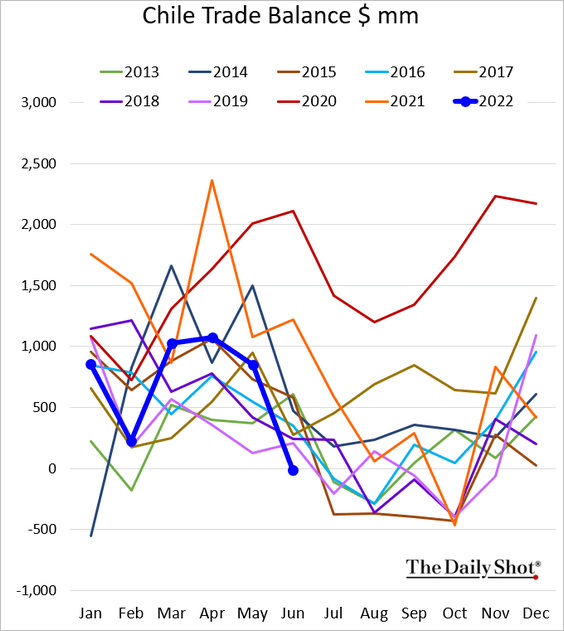

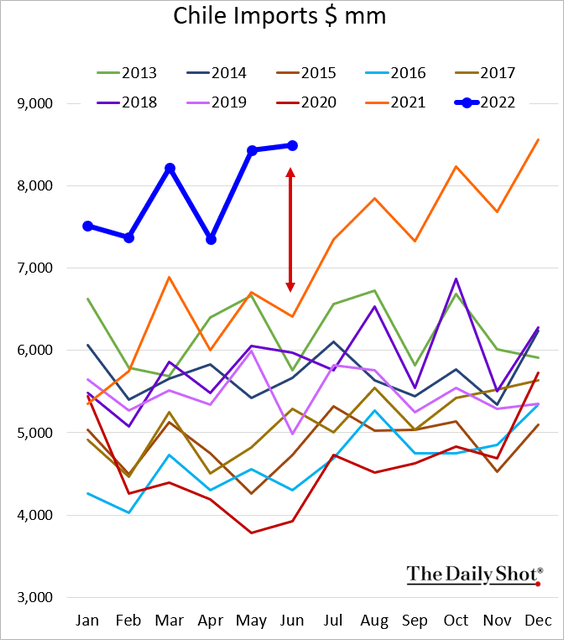

2. Chile’s trade swung into deficit earlier than usual …

… due to high imports.

——————–

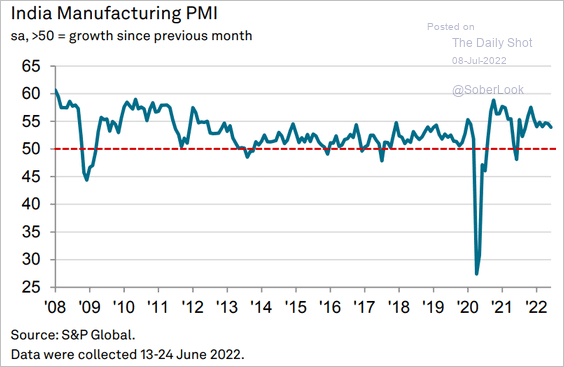

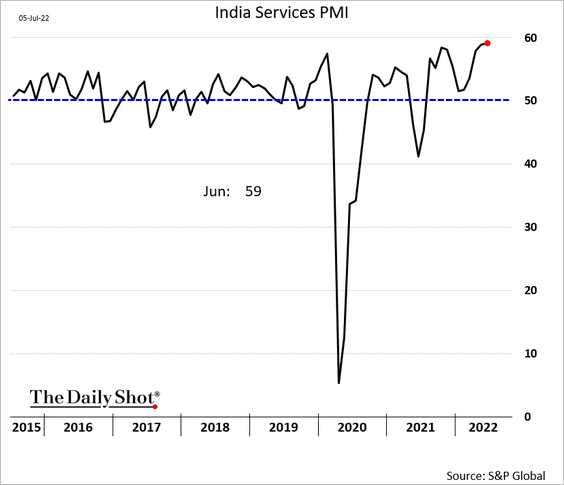

3. India’s business activity remained robust last month (2 charts).

Source: S&P Global PMI

Source: S&P Global PMI

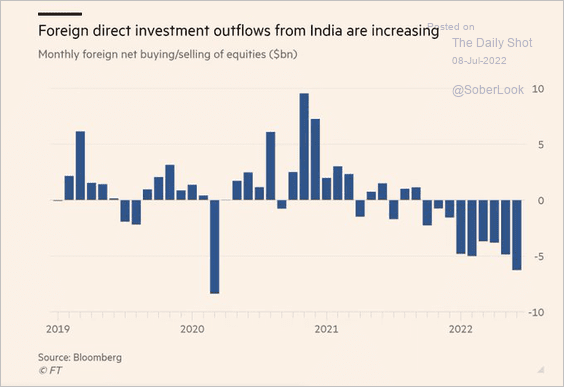

India’s foreign direct investment outflows have accelerated.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

——————–

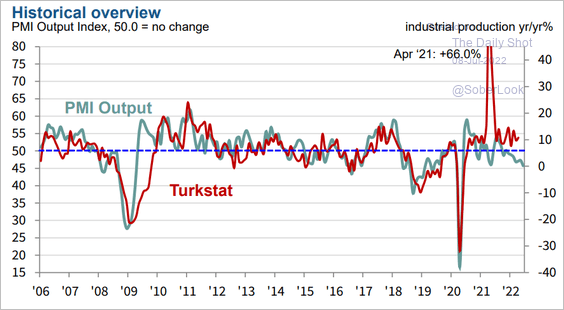

4. Turkey’s PMI report shows output declines picking up momentum.

Source: S&P Global PMI

Source: S&P Global PMI

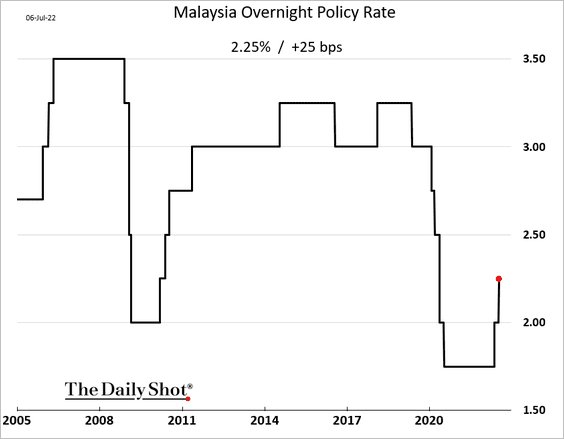

5. Malaysia’s central bank hiked rates again.

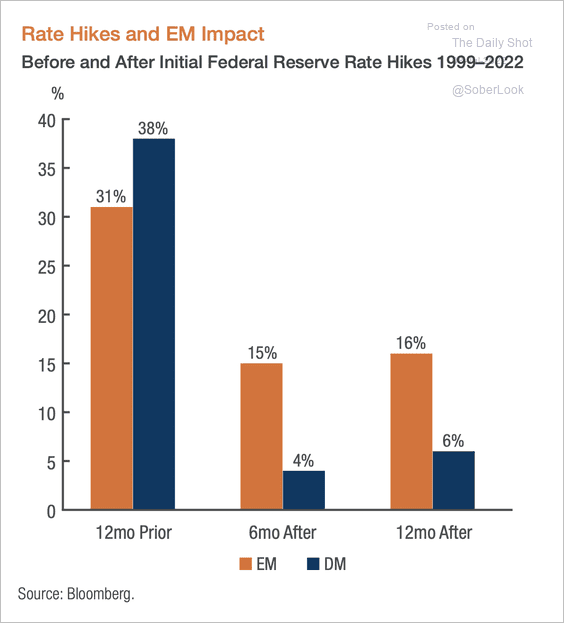

6. Historically, EM equities have outperformed the following six and 12 months after initial Fed rate hikes.

Source: Mirae Asset Read full article

Source: Mirae Asset Read full article

Back to Index

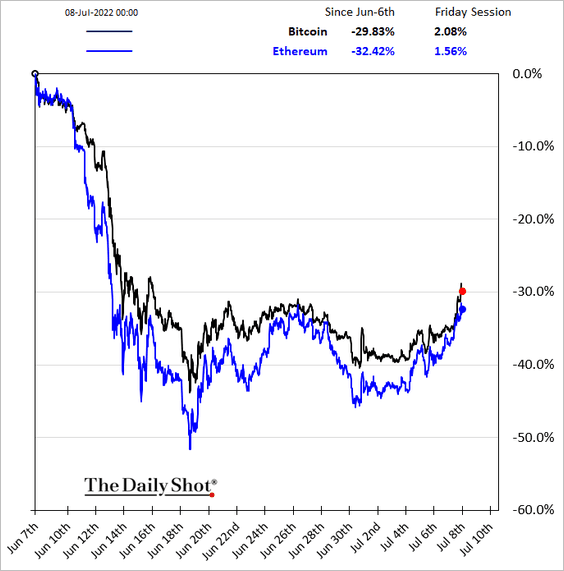

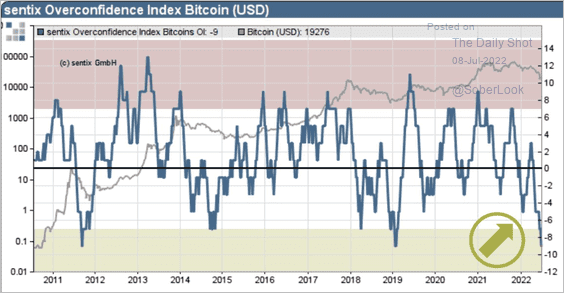

Cryptocurrency

1. Cryptos bounced with stocks …

… amid extreme bearishness.

Source: @Callum_Thomas

Source: @Callum_Thomas

——————–

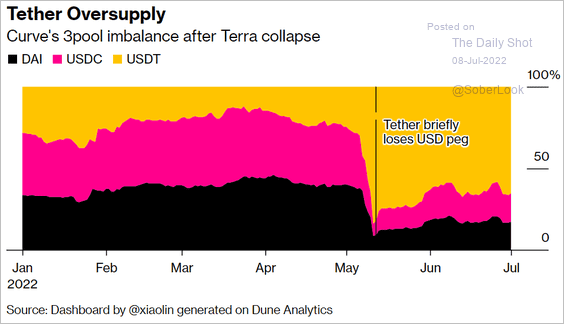

2. The supply of Tether remains elevated.

Source: @sidcoins, @emilyjnicolle Read full article

Source: @sidcoins, @emilyjnicolle Read full article

Back to Index

Commodities

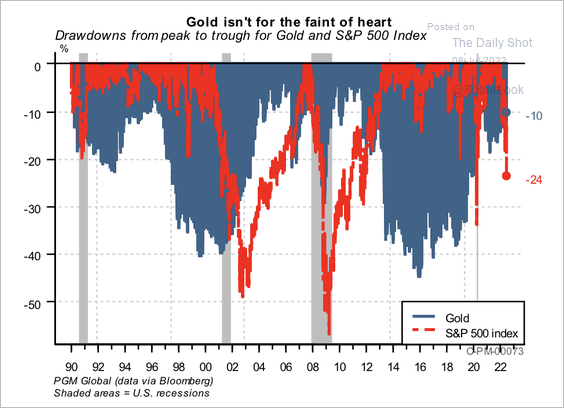

1. At times, gold’s drawdowns have coincided with large equity declines.

Source: PGM Global

Source: PGM Global

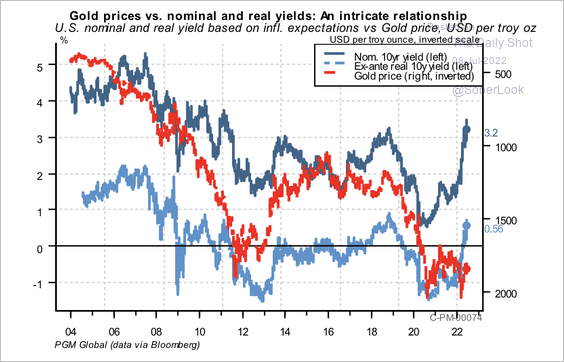

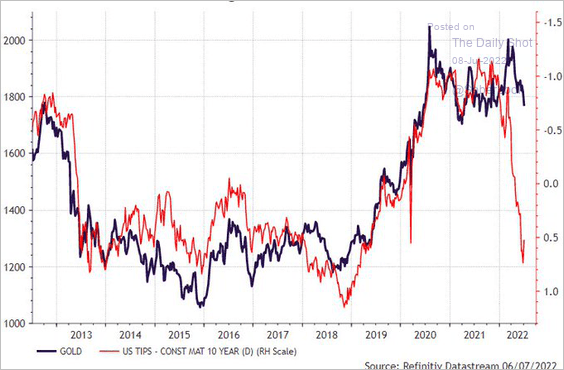

• Gold is usually sensitive to real yields, …

Source: PGM Global

Source: PGM Global

… making it vulnerable in this environment.

Source: @beursanalist

Source: @beursanalist

——————–

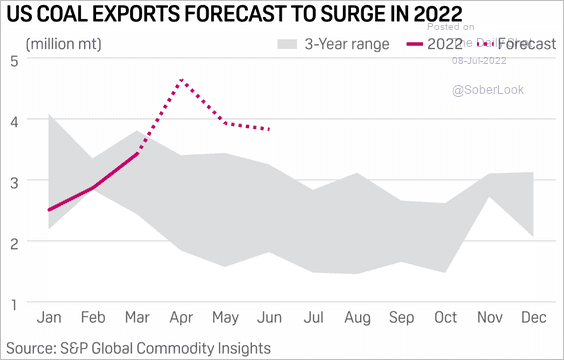

2. US coal exports are expected to surge.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Back to Index

Energy

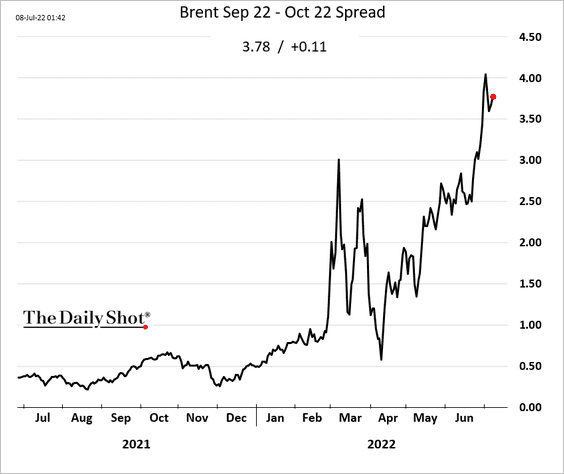

1. Crude oil markets remain tight (elevated backwardation).

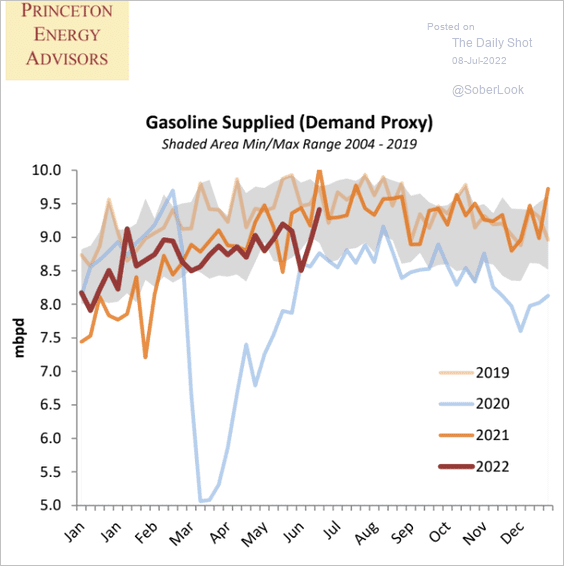

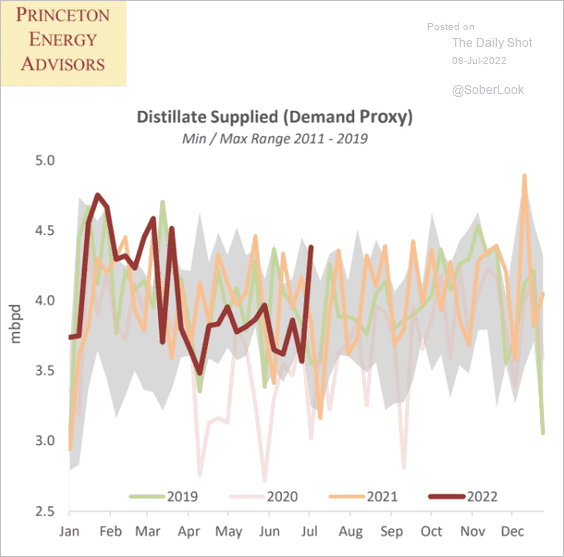

2. US gasoline and diesel demand was firmer last week ahead of the 4th of July weekend.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

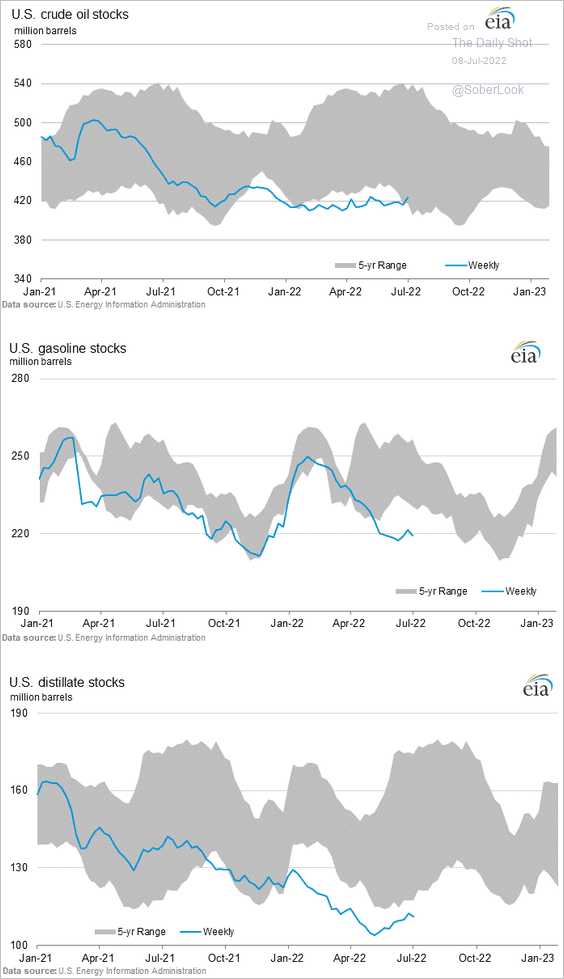

Here is the inventory data (somewhat distorted by the holiday weekend).

——————–

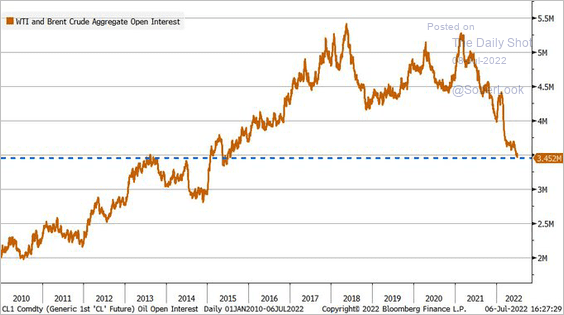

3. Crude oil futures open interest has been deteriorating.

Source: @LizAnnSonders

Source: @LizAnnSonders

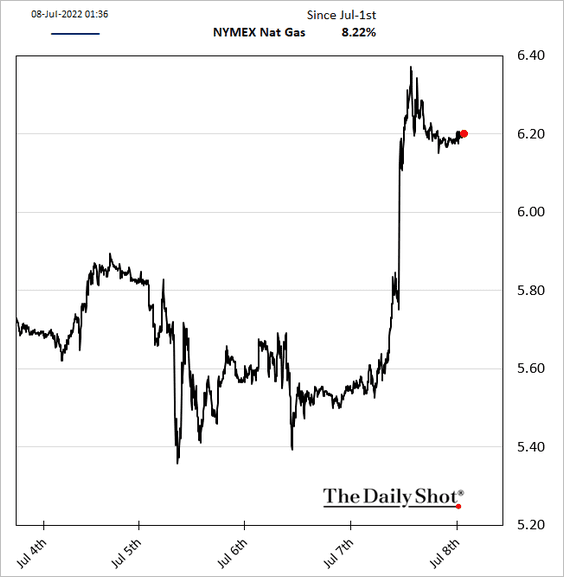

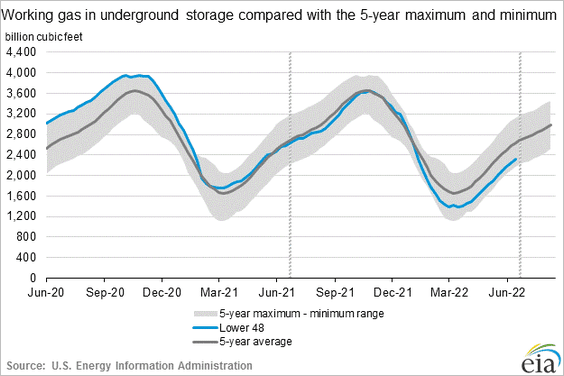

4. US natural gas surged as last week’s inventories were tighter than expected – despite the Freeport LNG outage.

——————–

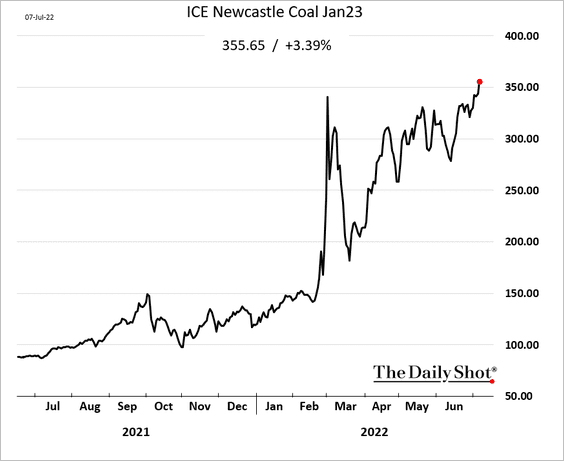

5. Coal prices are climbing due to tight natural gas supplies globally.

Back to Index

Equities

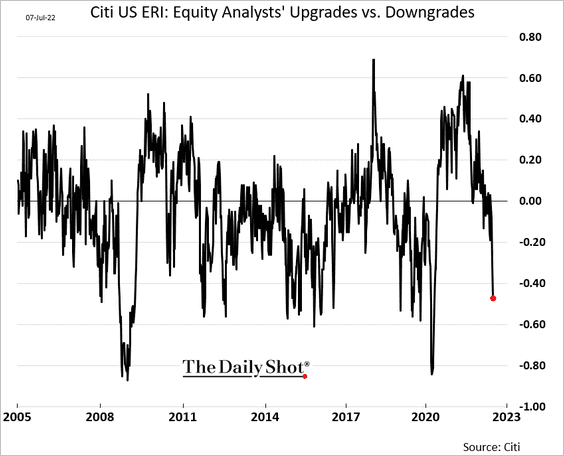

1. Earnings forecast downgrades continue to outpace upgrades as equity analysts attempt to catch up with the market.

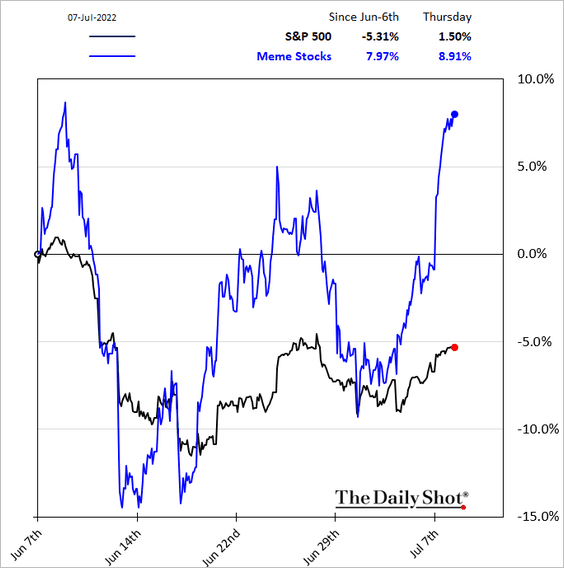

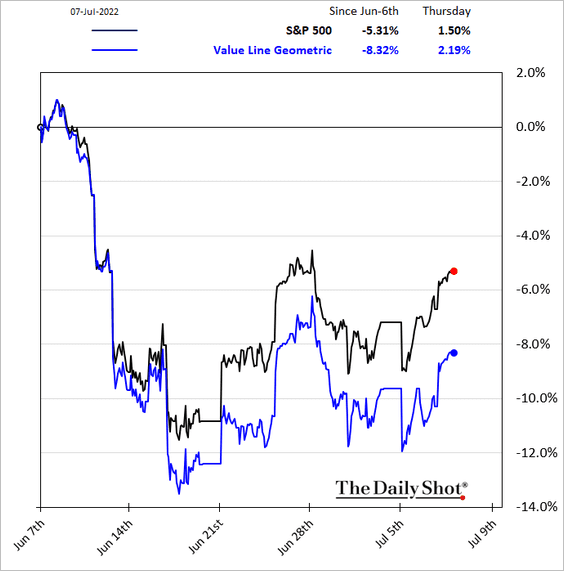

2. Meme stocks outperformed this week as Gamestop announced a 4-for-1 stock split.

But the median stock price is lagging the S&P 500.

——————–

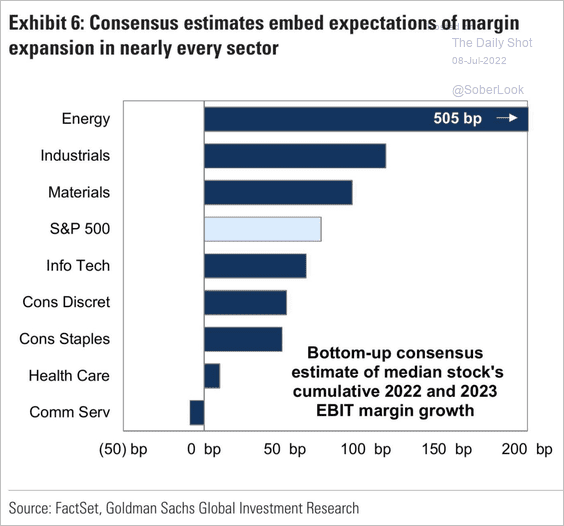

3. Corporate margin expansion forecasts look too optimistic.

Source: Goldman Sachs; @MaverickBogdan

Source: Goldman Sachs; @MaverickBogdan

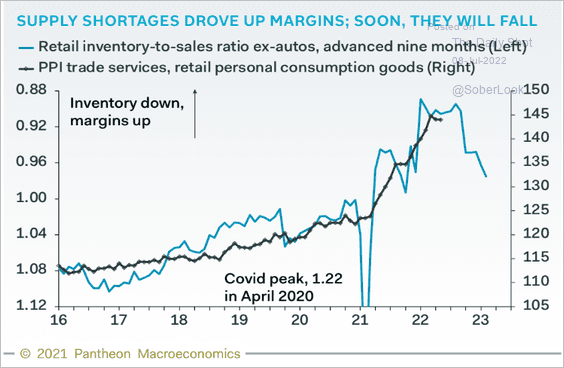

Economic data point to falling margins ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

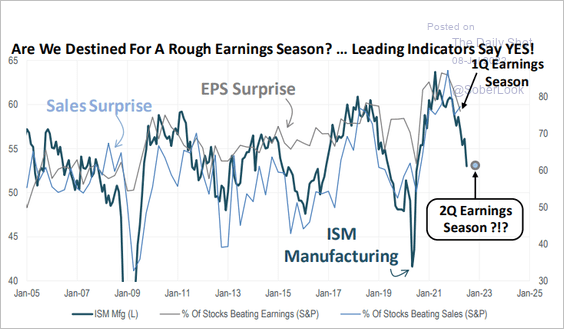

4. We are in for a rough earnings season.

Source: Piper Sandler

Source: Piper Sandler

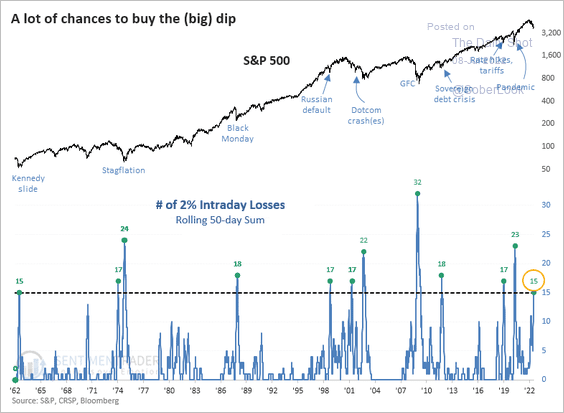

5. The S&P 500 experienced a cluster of 2% intraday losses in the past 50 sessions, which is rare. Previous instances occurred near market troughs.

Source: SentimenTrader

Source: SentimenTrader

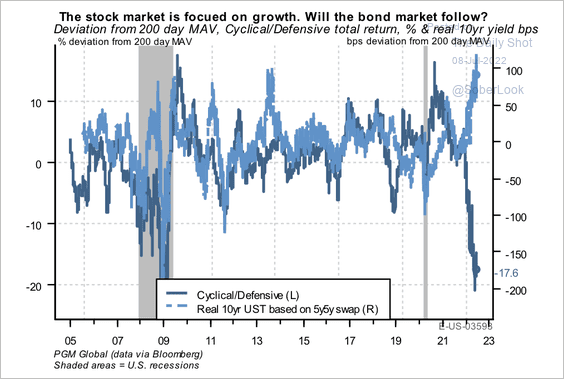

6. The ratio of cyclical stocks to defensive stocks has decoupled from real yields.

Source: PGM Global

Source: PGM Global

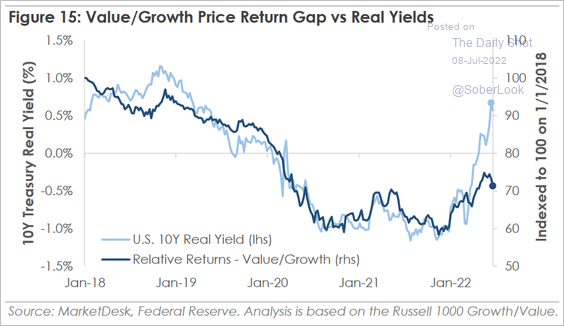

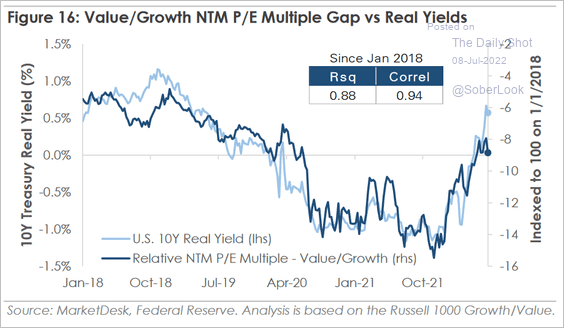

The same is true for value vs. growth and their earnings multiples.

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

——————–

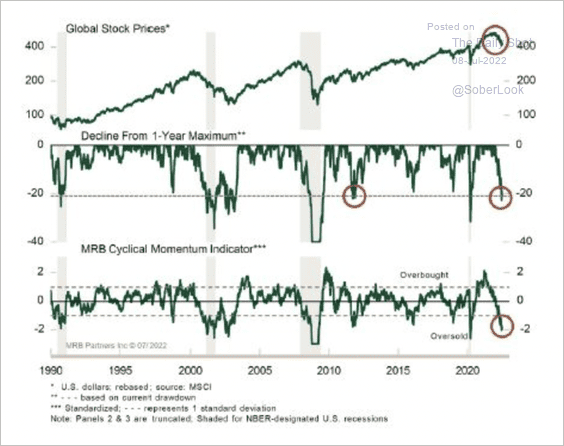

7. Global equities have discounted a lot of bad news.

Source: MRB Partners

Source: MRB Partners

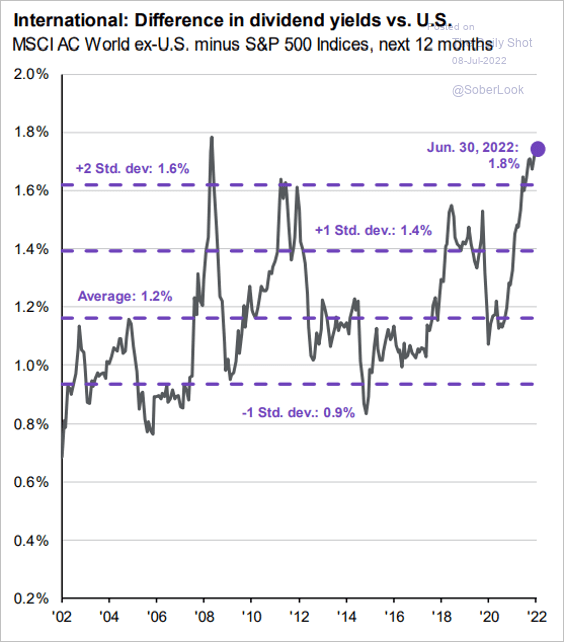

8. Dividend yields on non-US (vs. US) equities have been much higher than usual.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

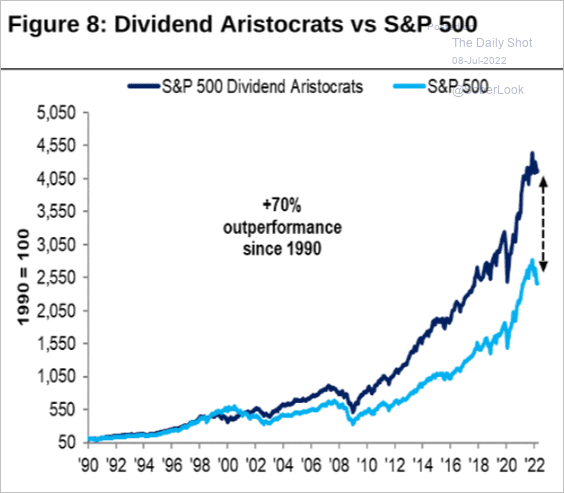

9. Dividend aristocrats have massively outperformed the S&P 500 in recent decades.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Rates

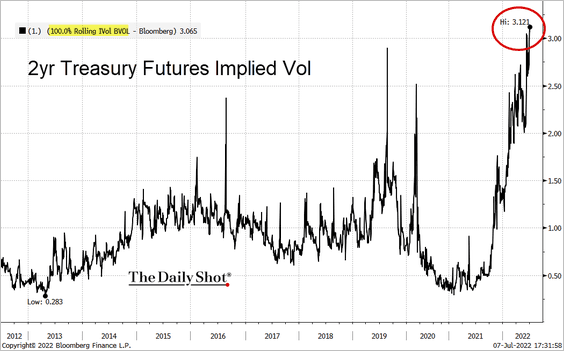

Rates implied volatility remains very high, especially at shorter maturities.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

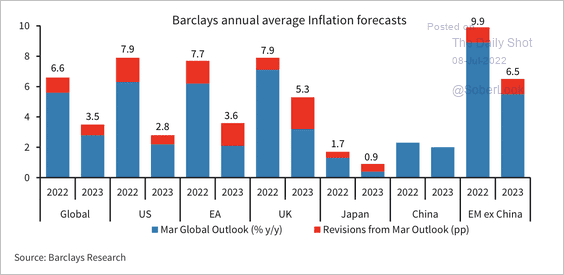

1. Annual inflation averages are reaching multi-decade highs, with the exception of China and Japan.

Source: Barclays Research

Source: Barclays Research

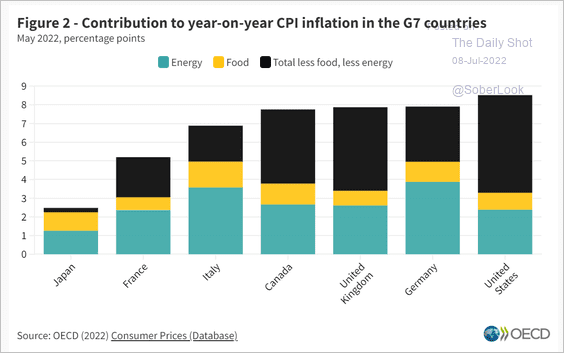

2. Here is the breakdown of inflation across G7 economies.

Source: OECD Read full article

Source: OECD Read full article

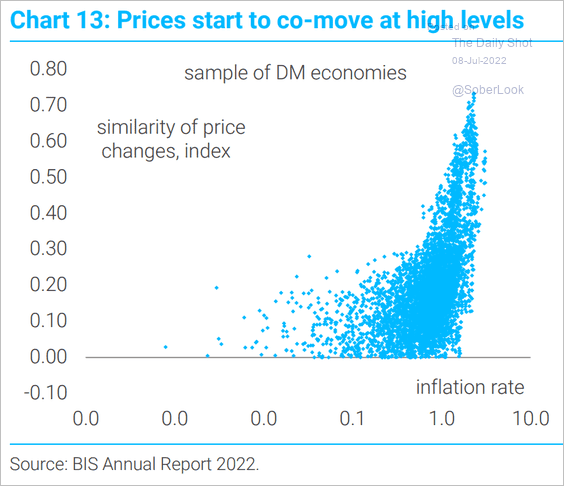

3. Price changes become correlated across DM economies in high-inflation regimes.

Source: TS Lombard

Source: TS Lombard

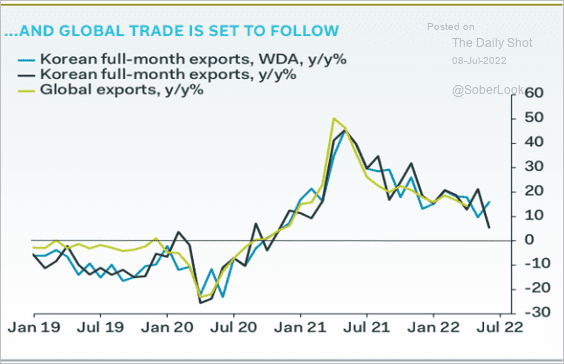

4. South Korea’s exports slowdown points to weaker global trade ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

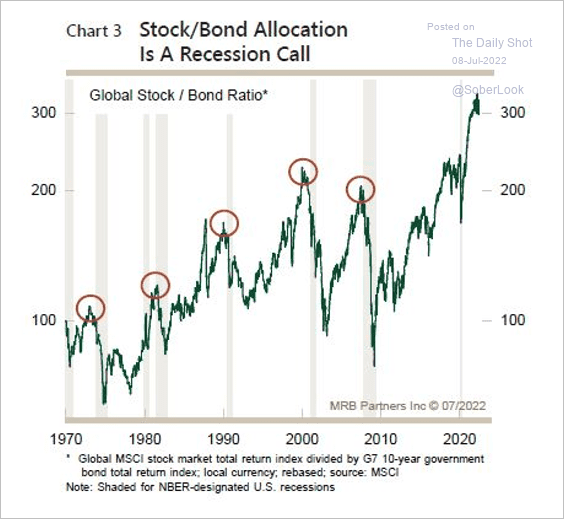

5. Historically, peaks in the global stock/bond ratio have coincided with US recessions.

Source: MRB Partners

Source: MRB Partners

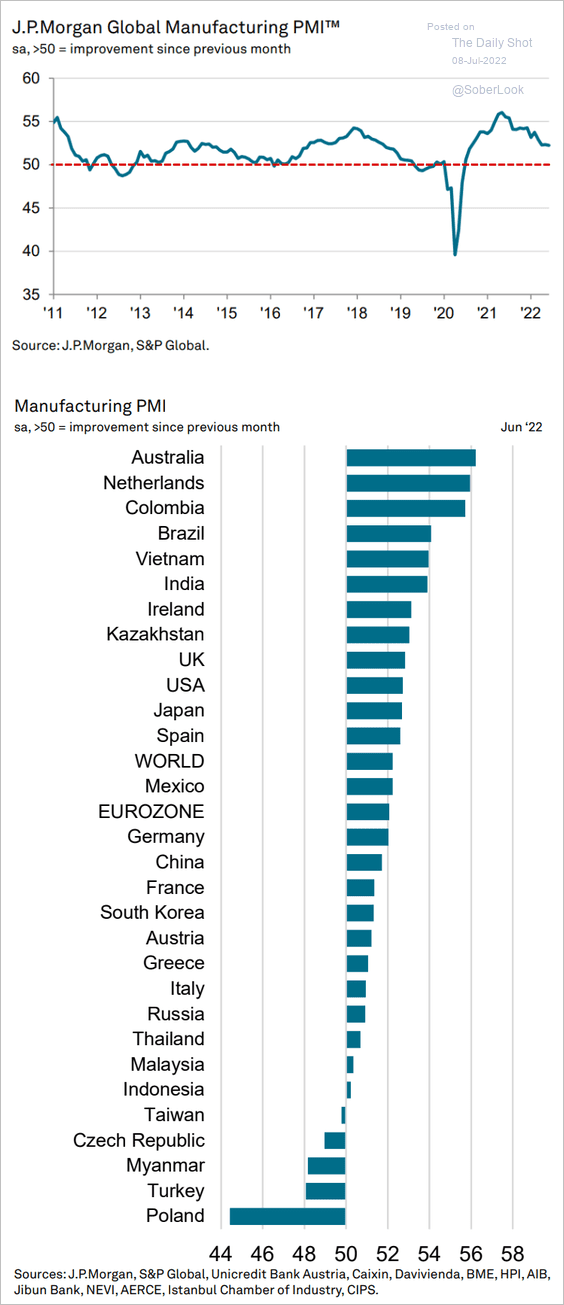

6. Despite the headwinds, global manufacturing activity held up relatively well last month.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

Food for Thought

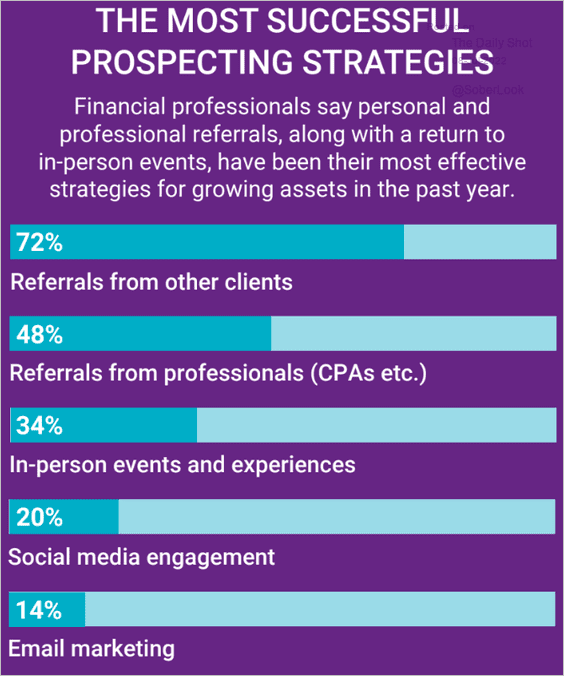

1. How do financial advisors get new clients?

Source: Natixis Investment Managers

Source: Natixis Investment Managers

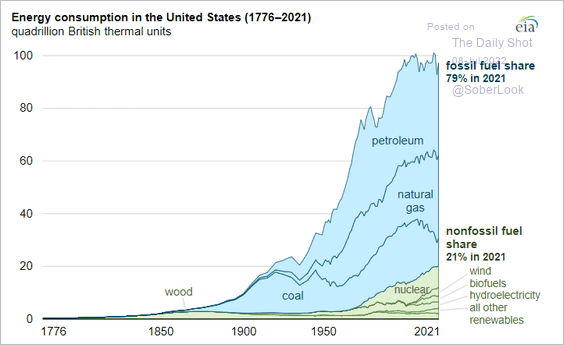

2. Energy consumption in the US since 1776:

Source: @EIAgov

Source: @EIAgov

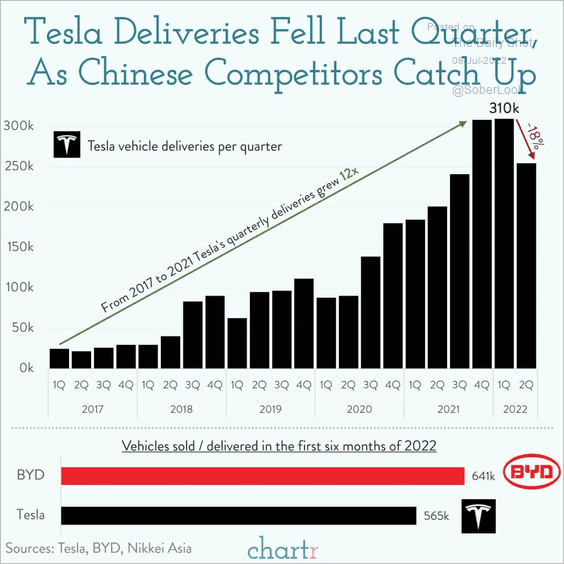

3. Tesla deliveries:

Source: @chartrdaily

Source: @chartrdaily

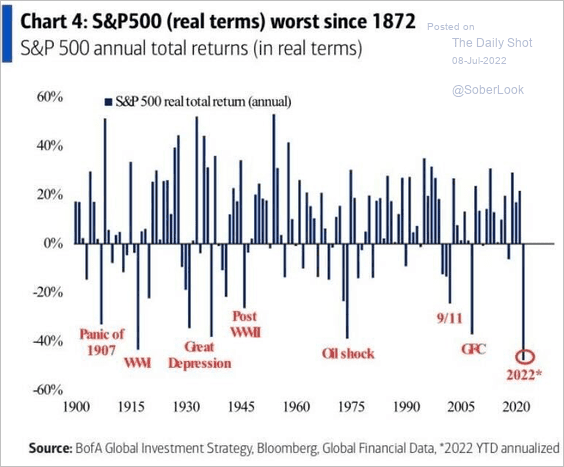

4. US inflation-adjusted stock market returns:

Source: BofA Global Research

Source: BofA Global Research

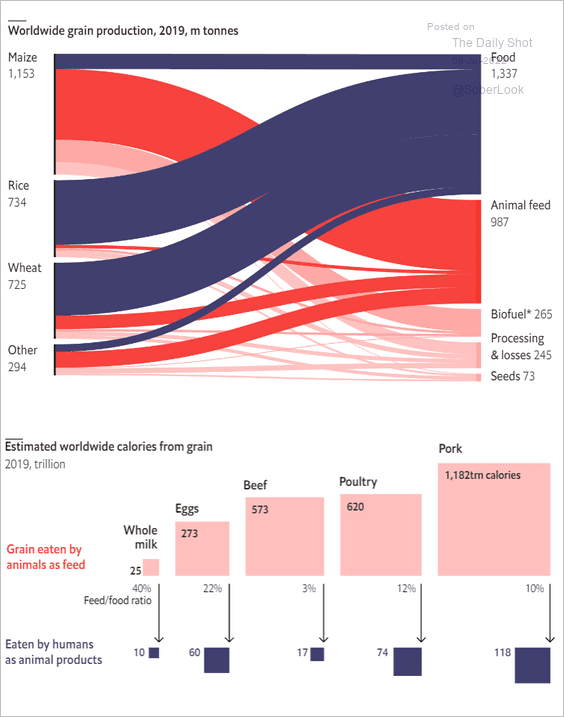

5. Global grain production:

Source: The Economist Read full article

Source: The Economist Read full article

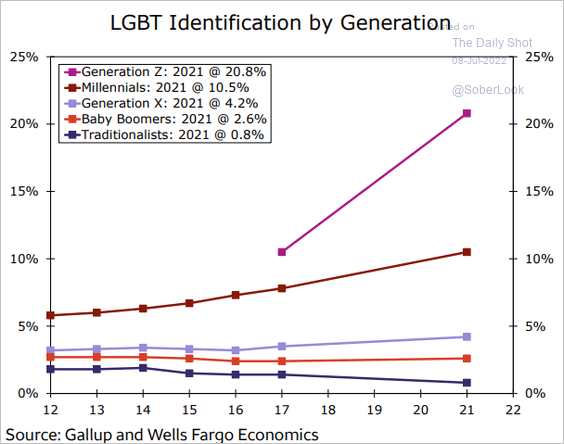

6. LGBT identification by generation:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

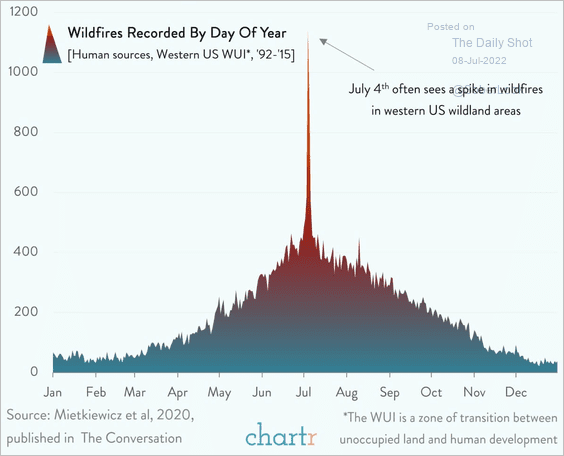

7. US wildfires by day of the year:

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index