The Daily Shot: 29-Jul-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

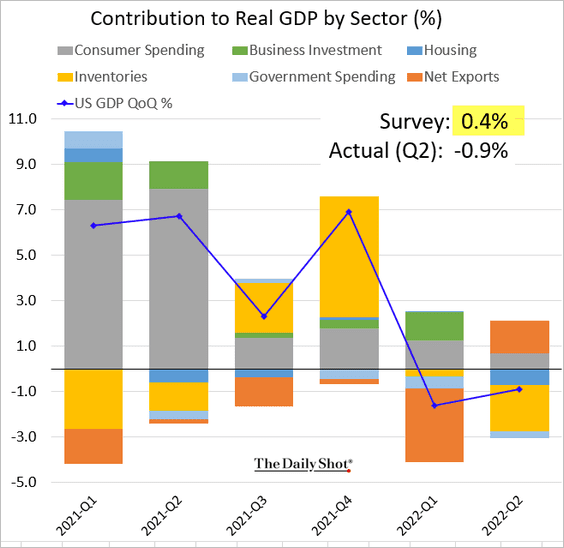

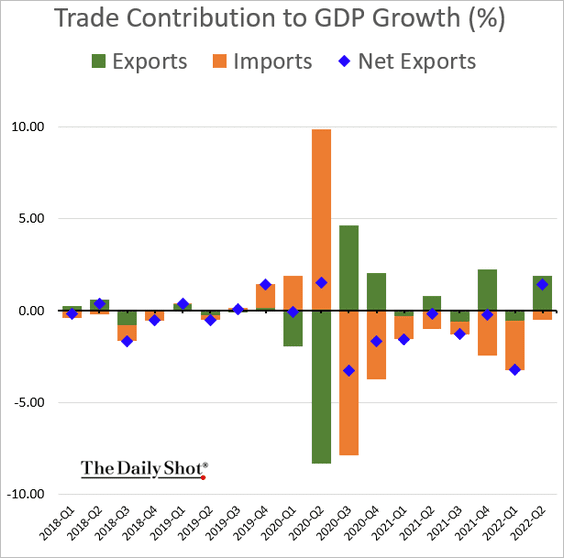

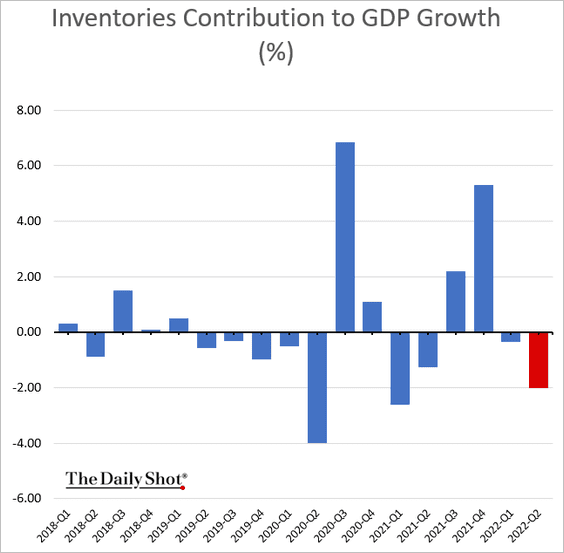

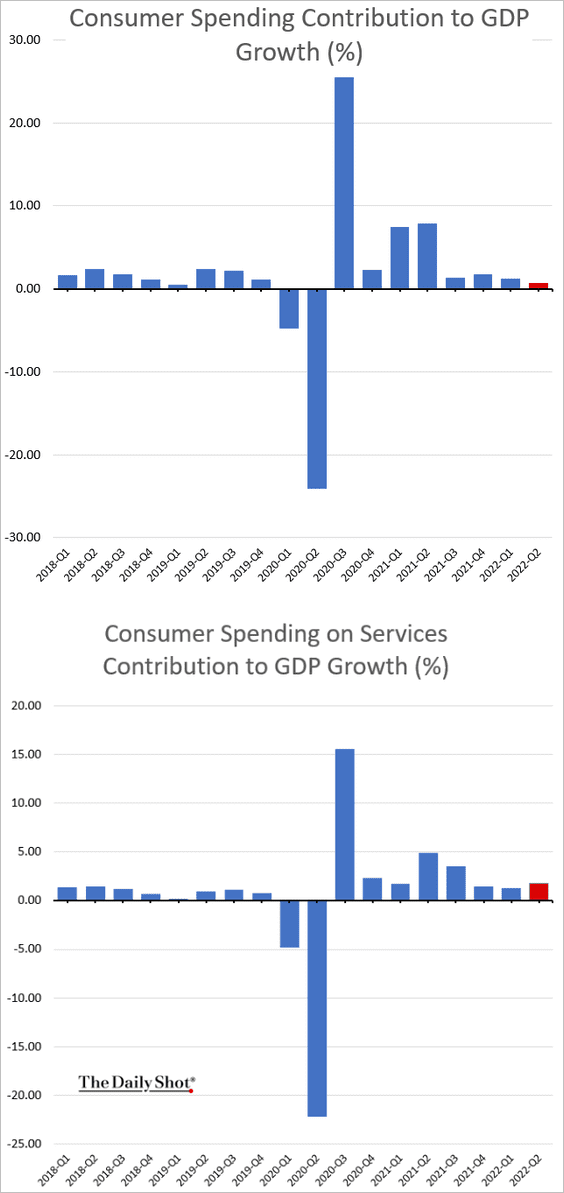

1. The second-quarter GDP report surprised to the downside, with the US entering a technical recession.

While lower imports provided a boost, …

… the inventory adjustment was very large.

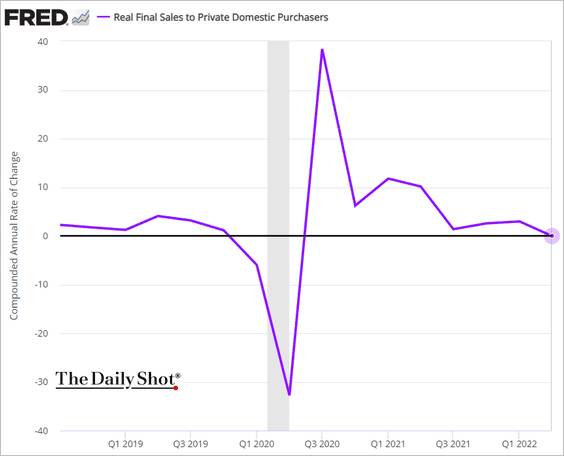

A greater concern than the overall GDP decline was that outside of the more volatile measures, economic growth was still soft.

– Consumer spending:

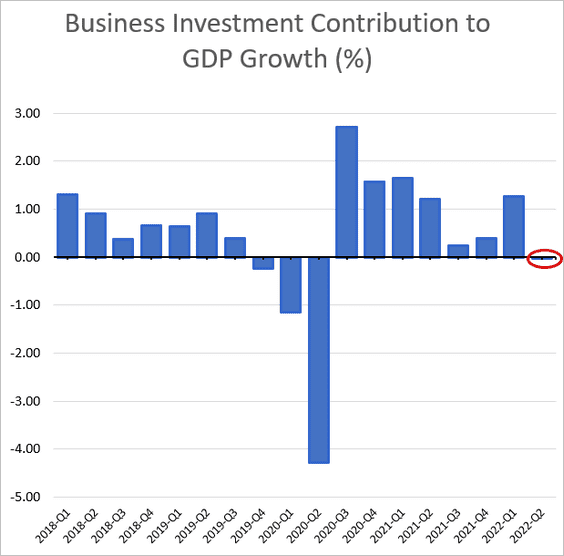

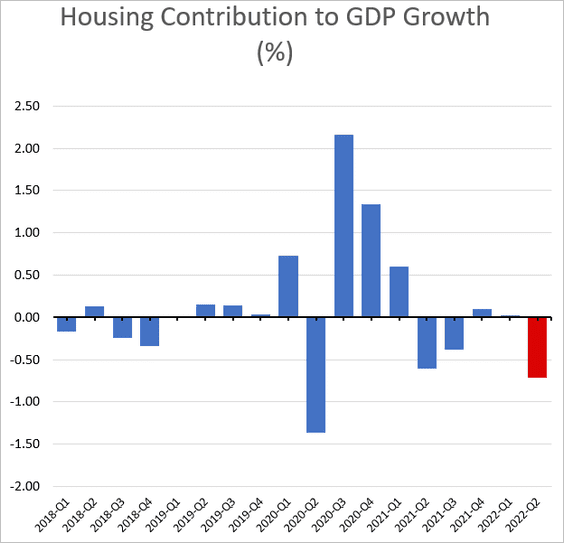

– Business investment:

– Residential investment:

– Real final sales to private domestic purchasers (“core” GDP):

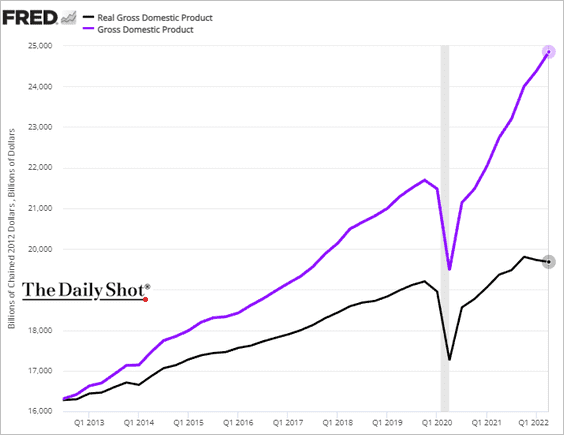

• The nominal GDP continues to surge, but inflation is taking a toll.

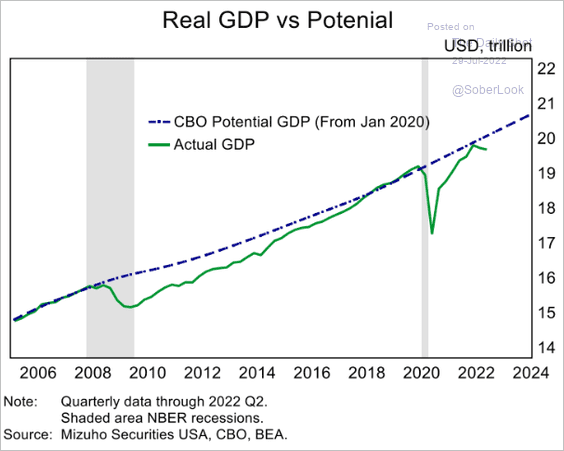

• The GDP is running below potential, and that’s where the Fed wants it for now.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

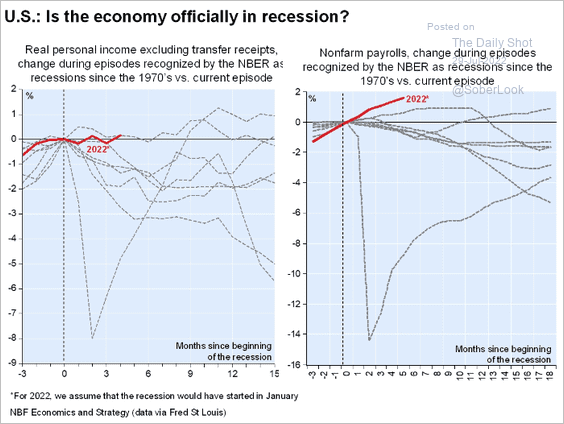

• The NBER will not call this a recession because the fundamentals are still relatively strong.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

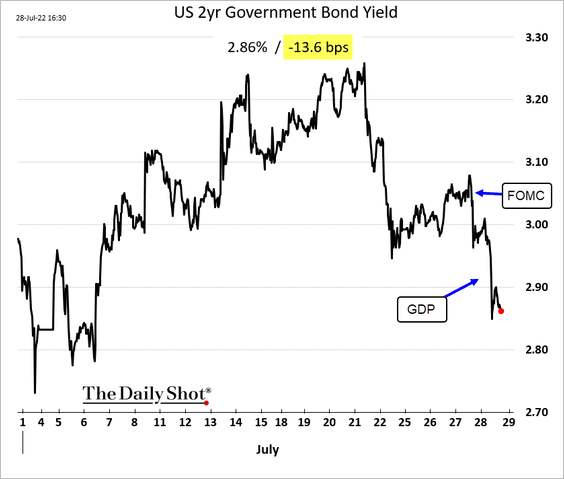

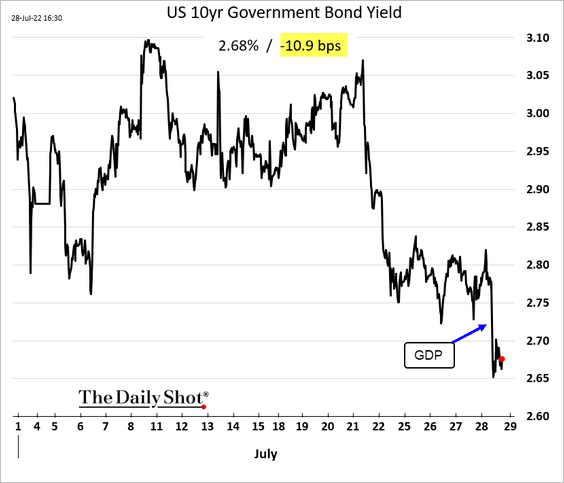

2. With the economy slowing more than expected, Treasury yields tumbled.

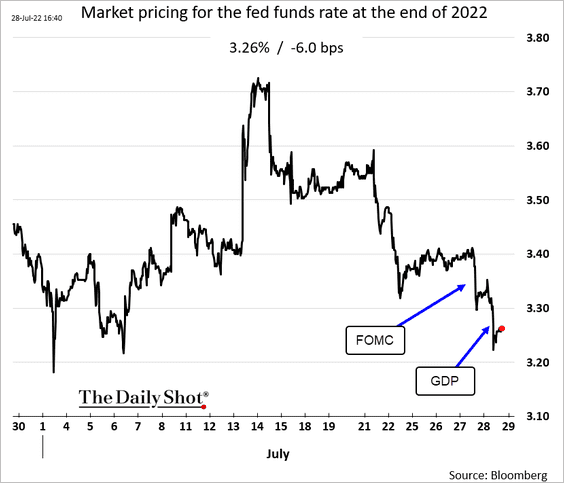

• Market expectations for the year-end fed funds rate dipped further.

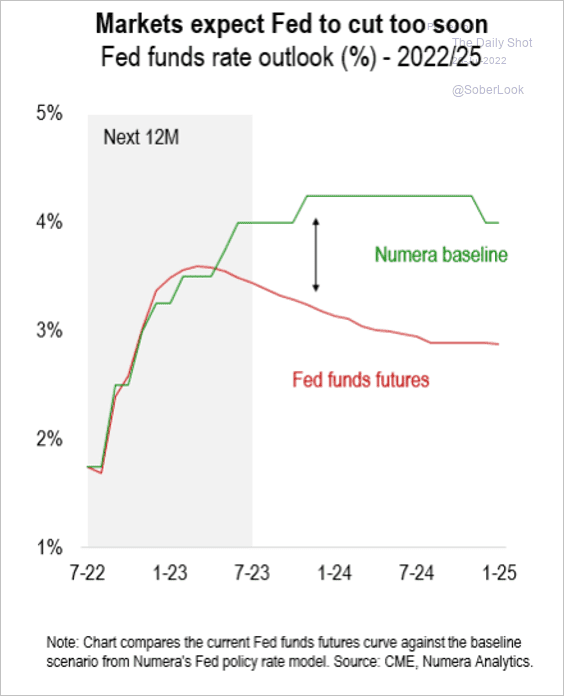

• Is the market wrong to assume that all the Fed hikes will be completed by the end of the year, and the Fed will start cutting rates?

Source: Numera Analytics

Source: Numera Analytics

——————–

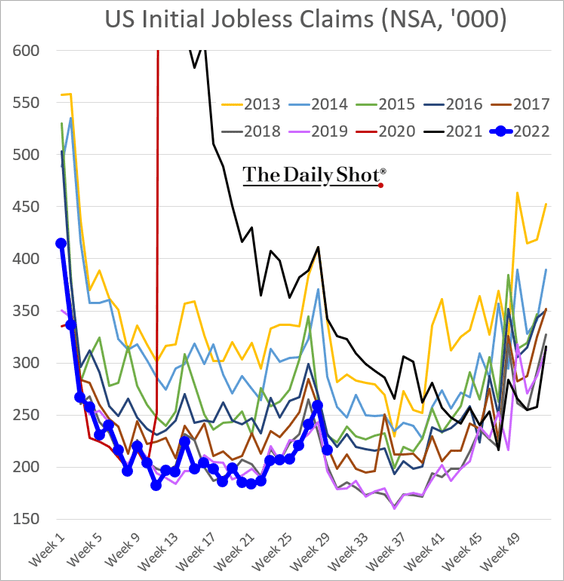

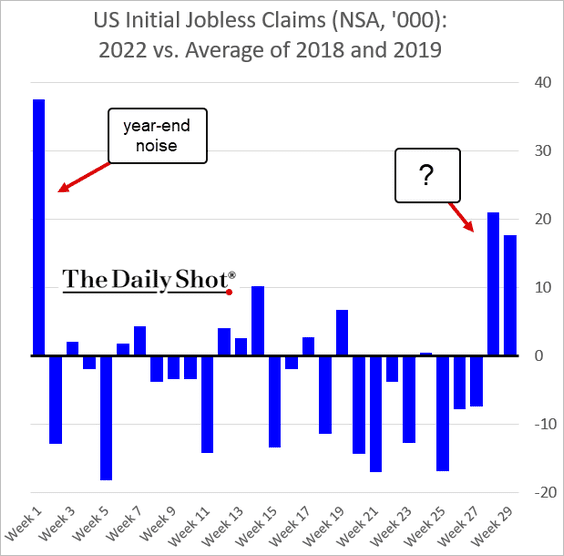

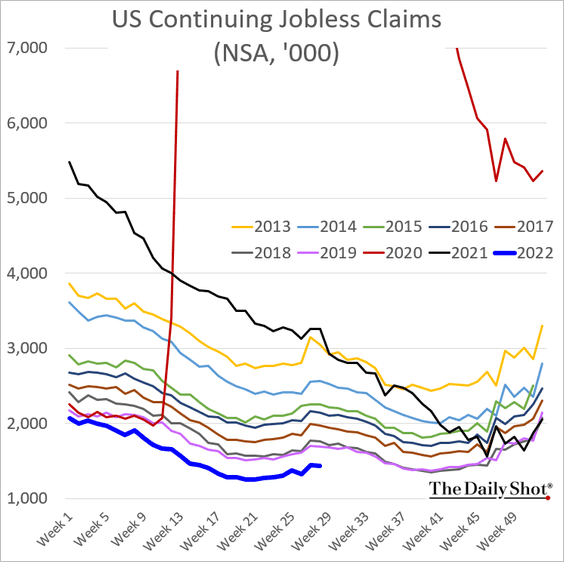

3. Initial jobless claims are still above pre-COVID levels. A temporary blip or a start of a trend?

This chart shows the 2022 jobless claims relative to the 2018 and 2019 average.

Continuing claims remain at multi-year lows.

——————–

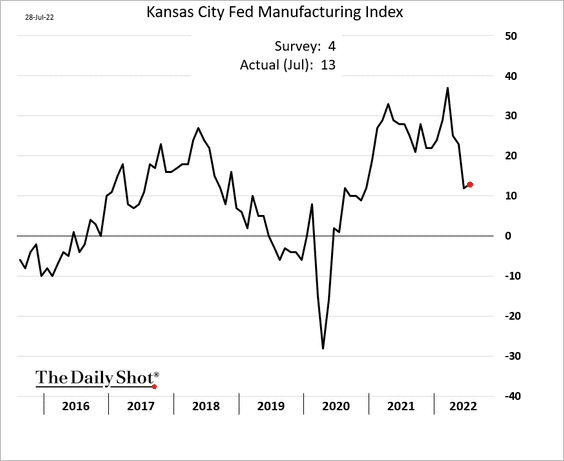

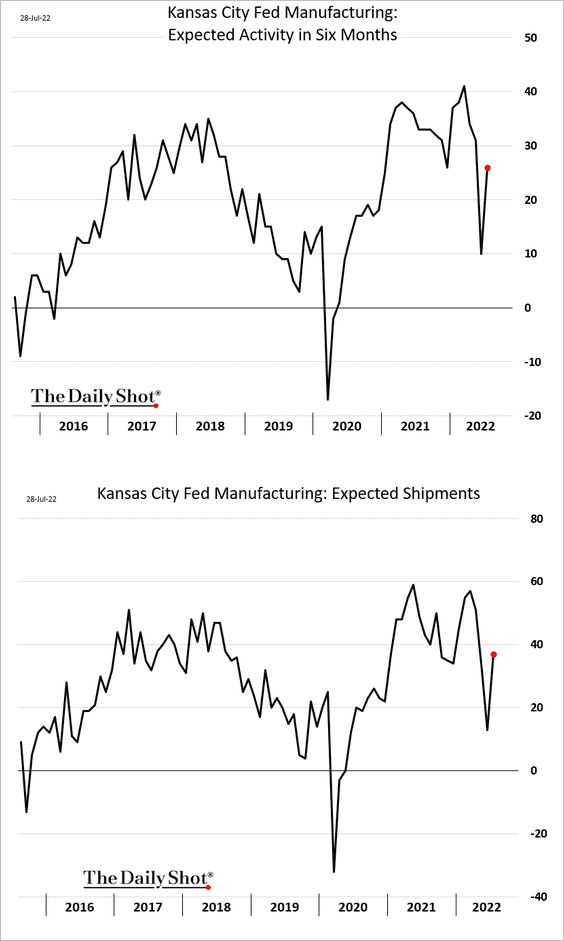

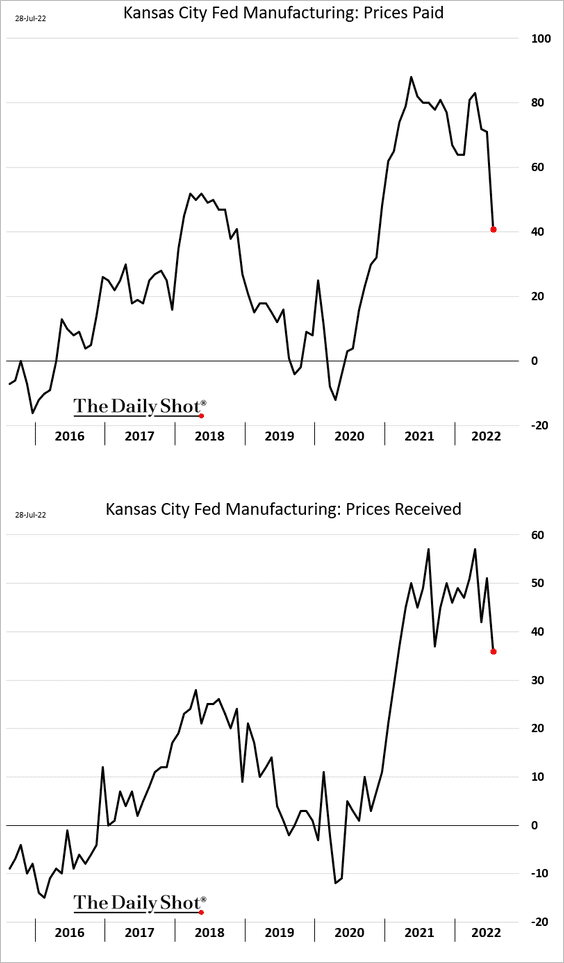

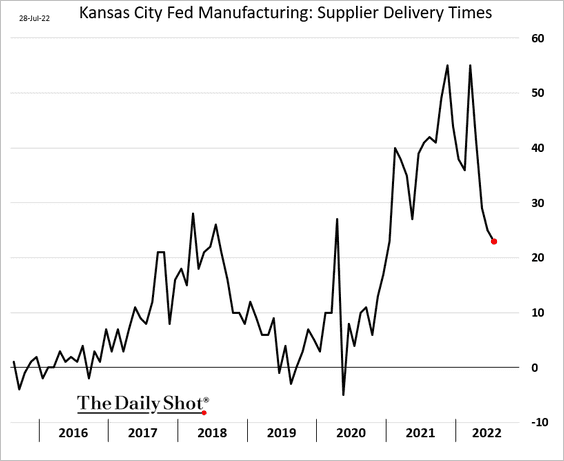

4. The Kansas City Fed’s factory activity report surprised to the upside.

• Expectations rebounded.

• Price pressures and supply stress are moderating.

——————–

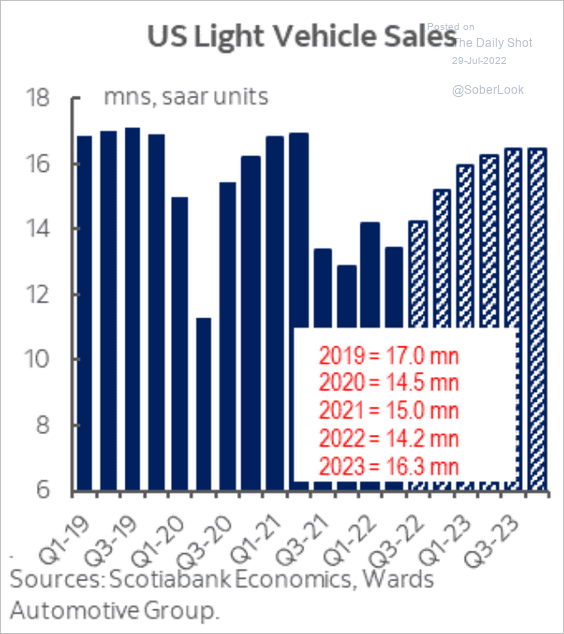

5. Vehicle sales have bottomed.

Source: Scotiabank Economics

Source: Scotiabank Economics

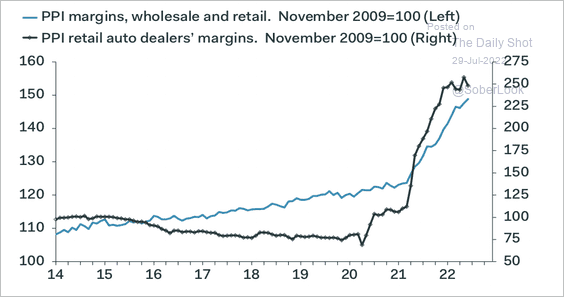

Supply shortages have been good for auto dealers’ margins.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

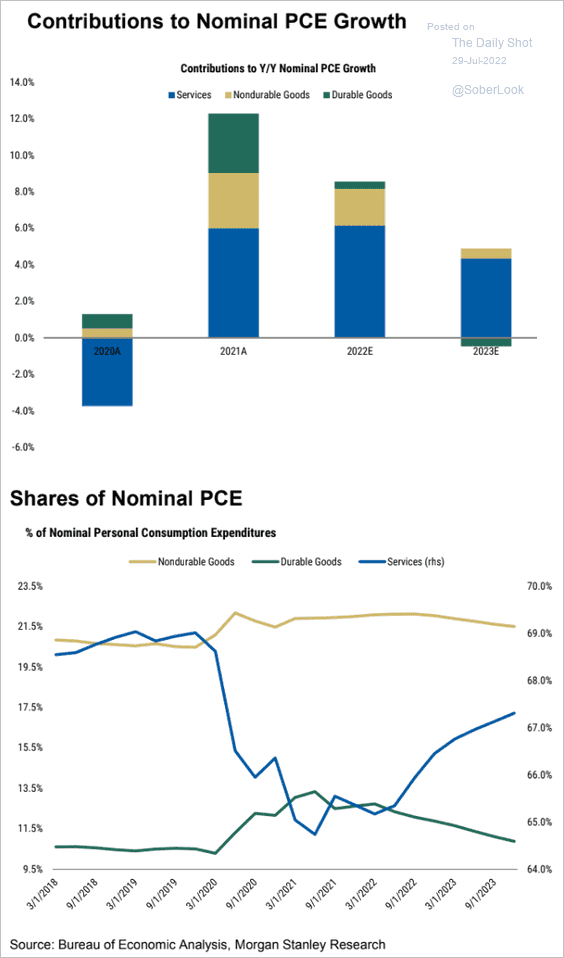

6. US households’ spending shift from goods to services continues.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

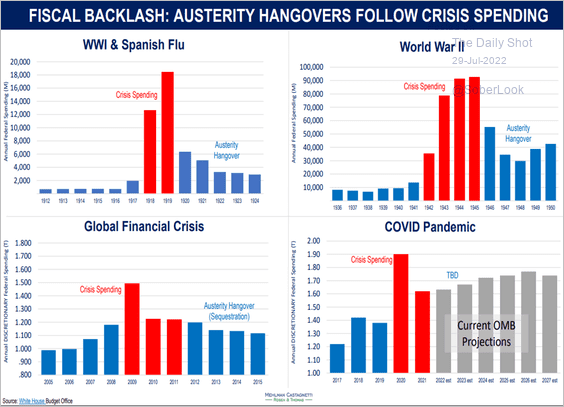

7. An austerity hangover ahead?

Source: @bpmehlman Read full article

Source: @bpmehlman Read full article

Back to Index

Canada

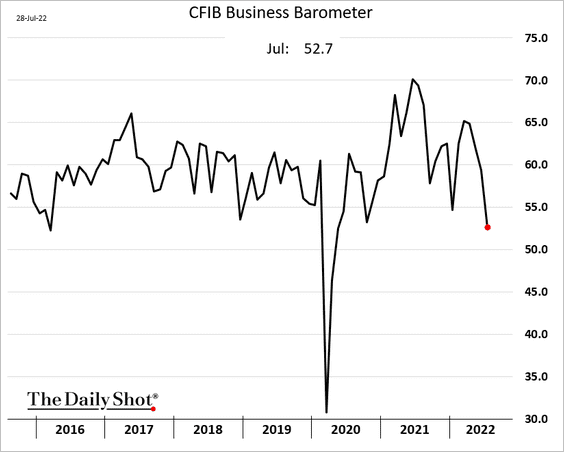

1. Small business activity deteriorated in July.

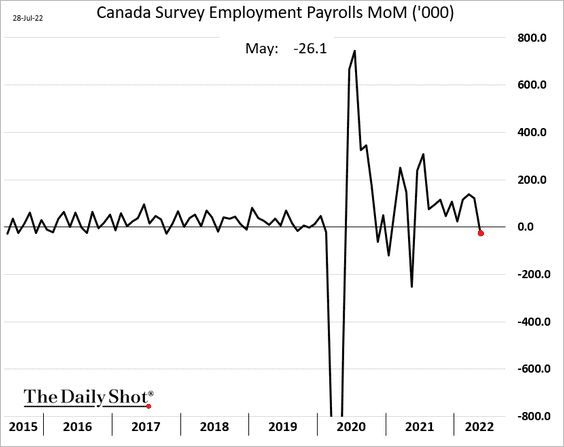

2. Payrolls declined in May.

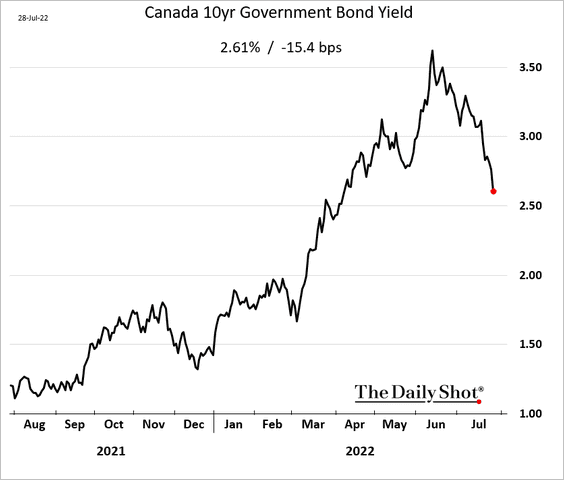

3. Bond yields tumbled in recent days.

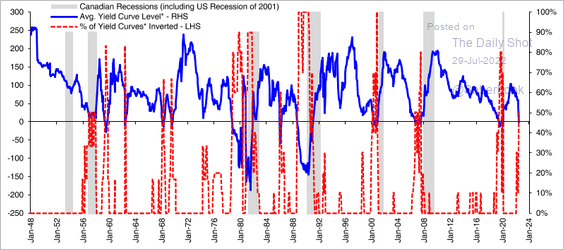

The yield curve is signaling recession.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

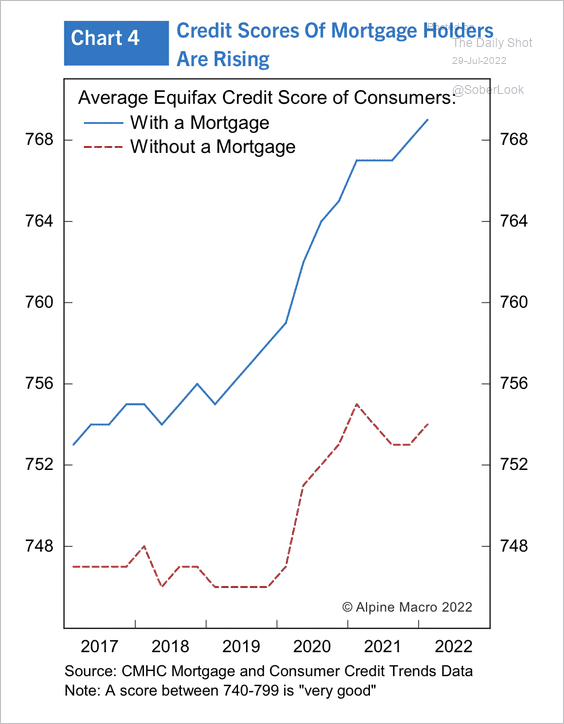

4. The average credit score of mortgage borrowers has increased over the past few years.

Source: Alpine Macro

Source: Alpine Macro

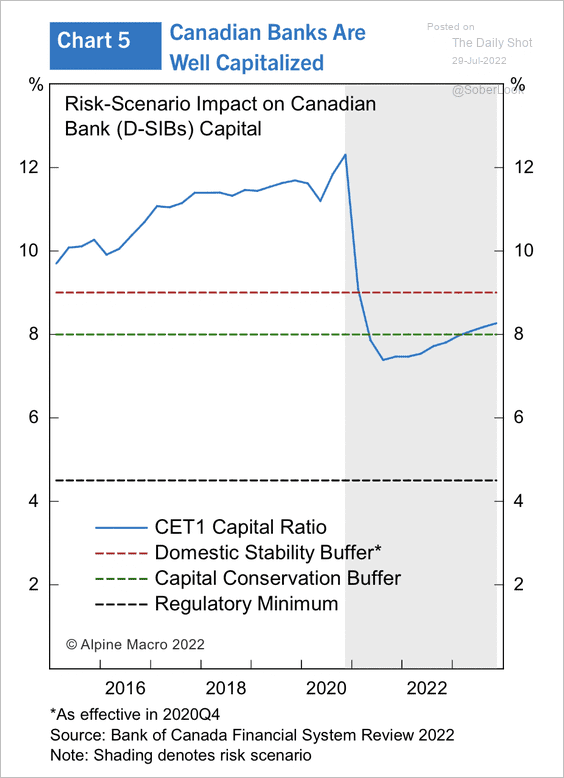

5. Banks could avoid breaching the regulatory minimum capital requirement in the event of a severe recession.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The United Kingdom

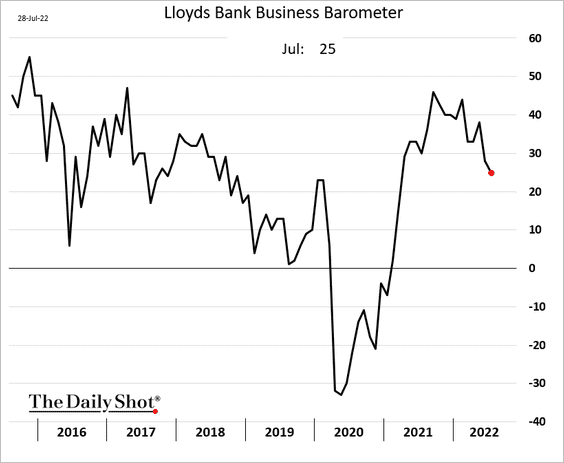

1. The Lloyds business barometer is moving lower but remains relatively strong.

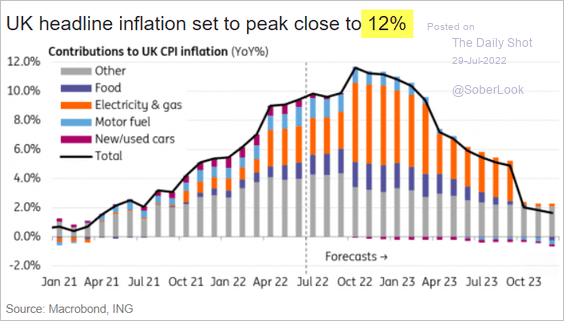

2. The CPI growth is expected to hit 12% at its peak.

Source: ING

Source: ING

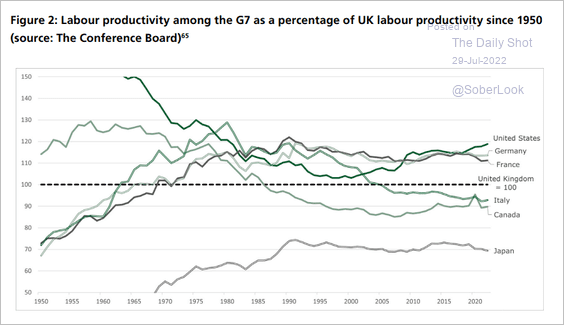

3. This chart compares the UK labor productivity to the rest of the G7.

Source: UK Parliament Read full article

Source: UK Parliament Read full article

Back to Index

The Eurozone

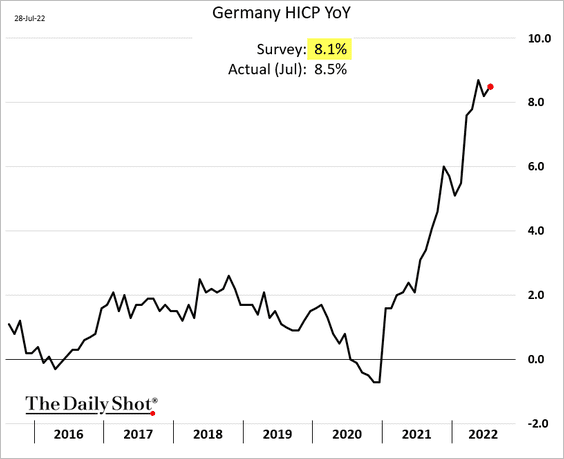

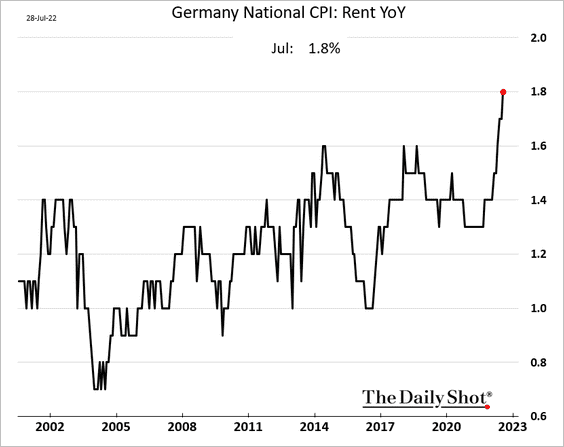

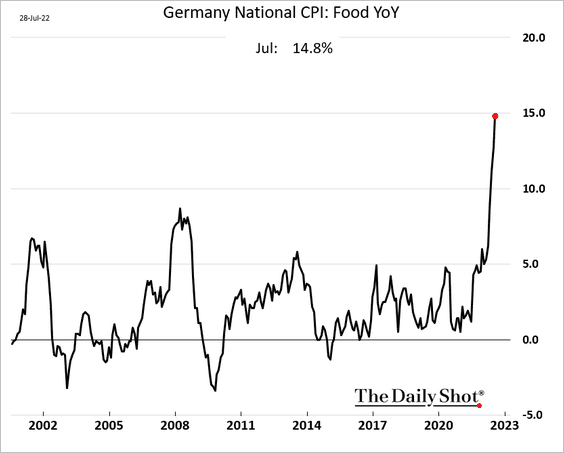

1. German CPI surprised to the upside (EU-harmonized).

Households are hurting (2 charts).

——————–

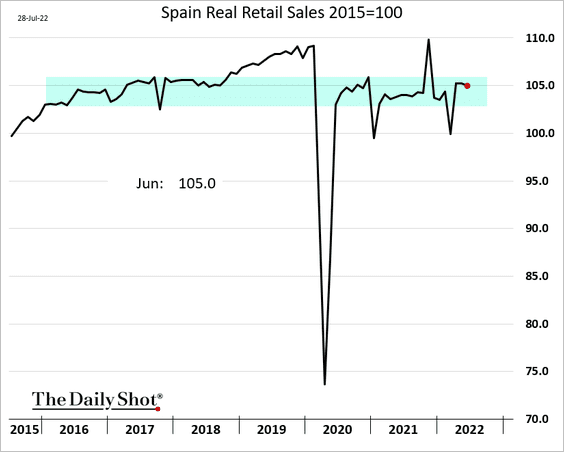

2. Spain’s retail sales remain relatively stable.

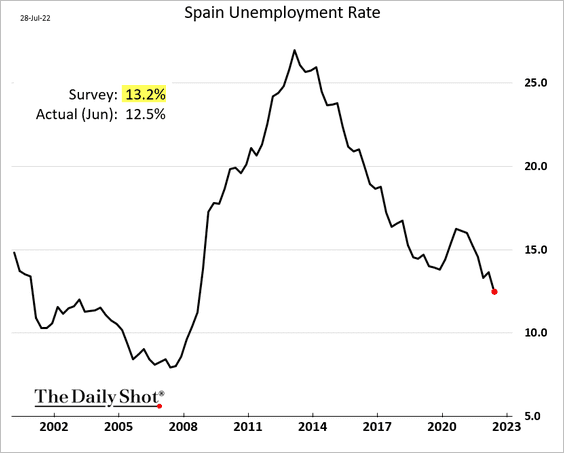

The unemployment rate surprised to the downside.

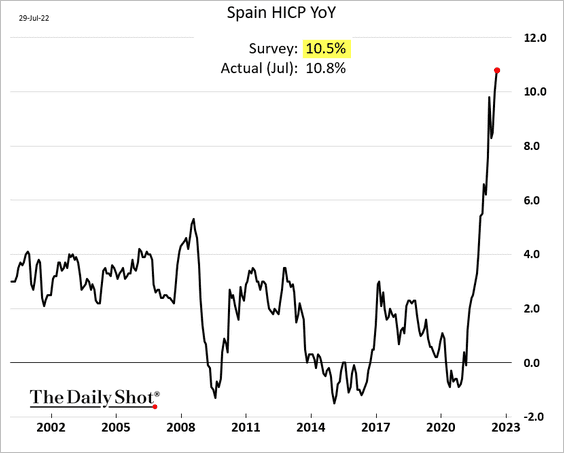

The July inflation report delivered another shocker.

——————–

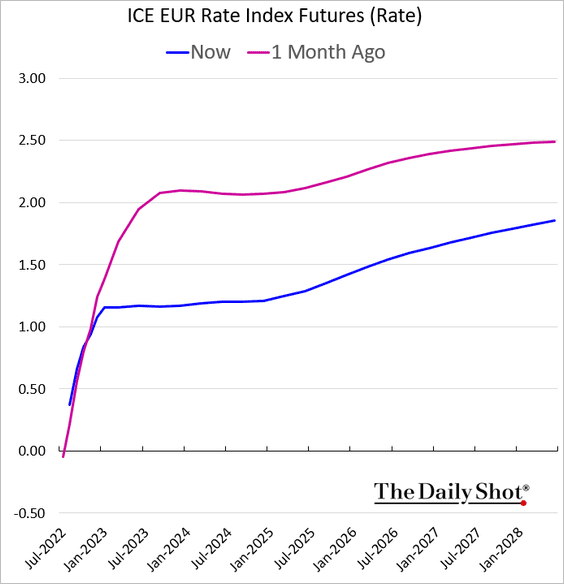

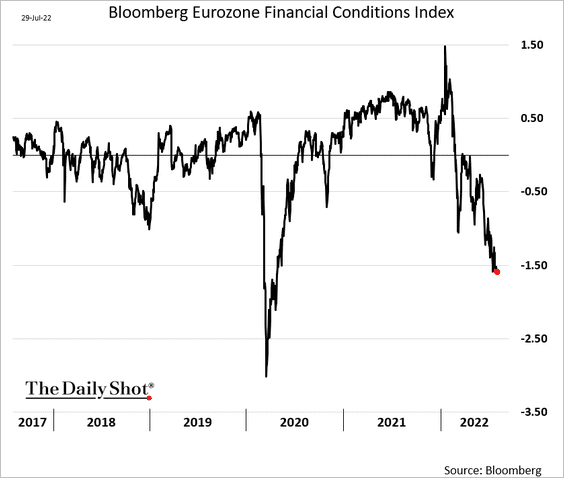

3. The market pricing for the ECB policy rate trajectory shifted down massively in July, …

… as the Eurozone financial conditions deteriorate.

——————–

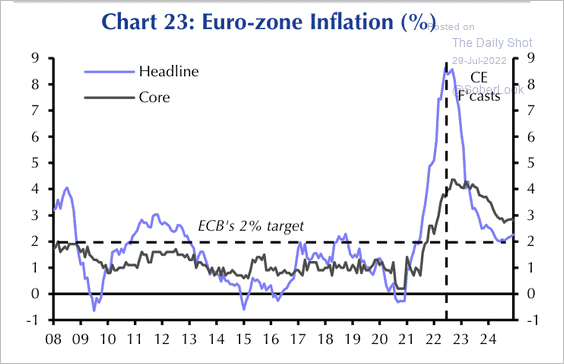

4. Core inflation could remain above 2% for at least another two years, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

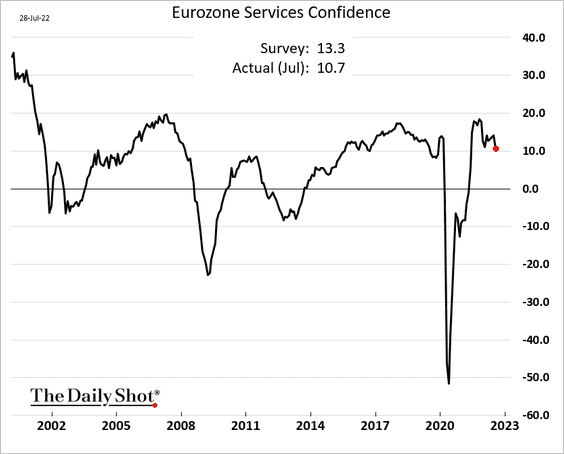

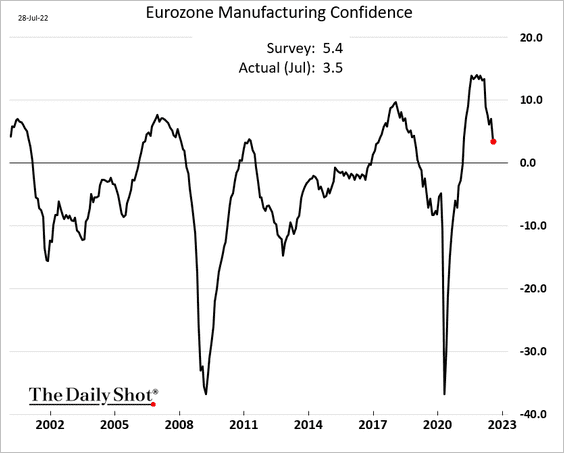

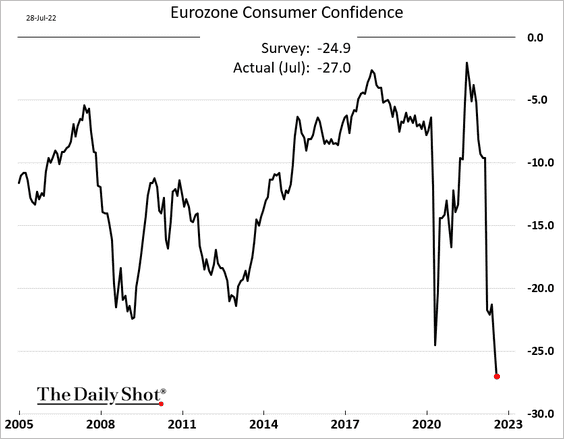

5. The gap between business and consumer sentiment indicators remains wide, but all measures are now moving lower.

• Business (2 charts):

• Consumer:

Back to Index

Japan

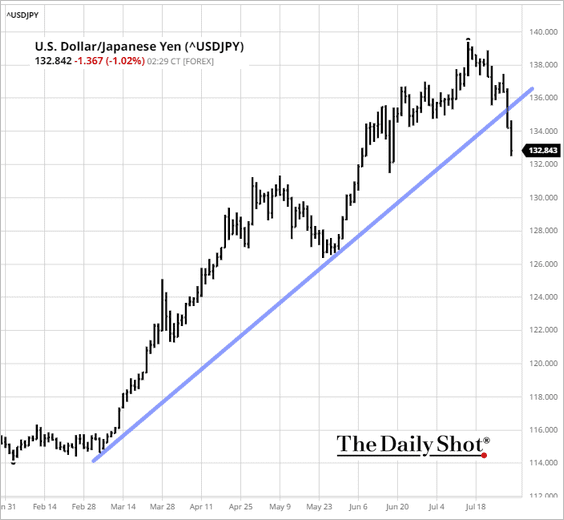

1. The yen is rebounding (chart shows the US dollar weaker against the yen).

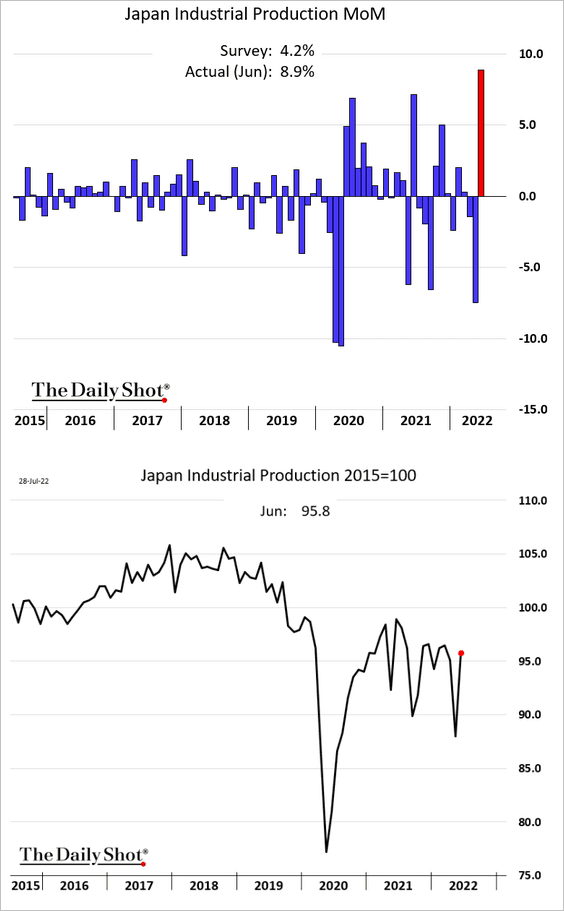

2. Industrial production bounced from recent lows in June.

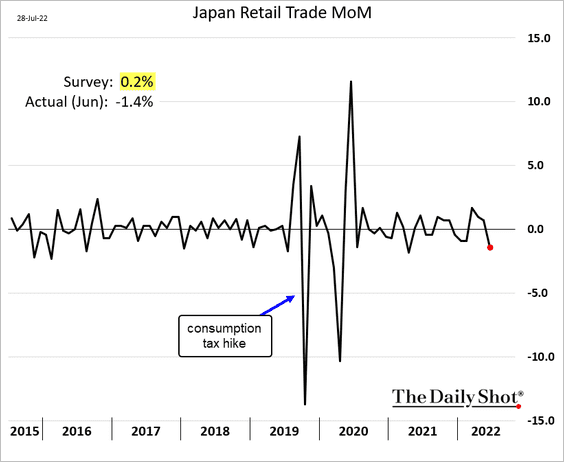

3. Retail sales have been soft.

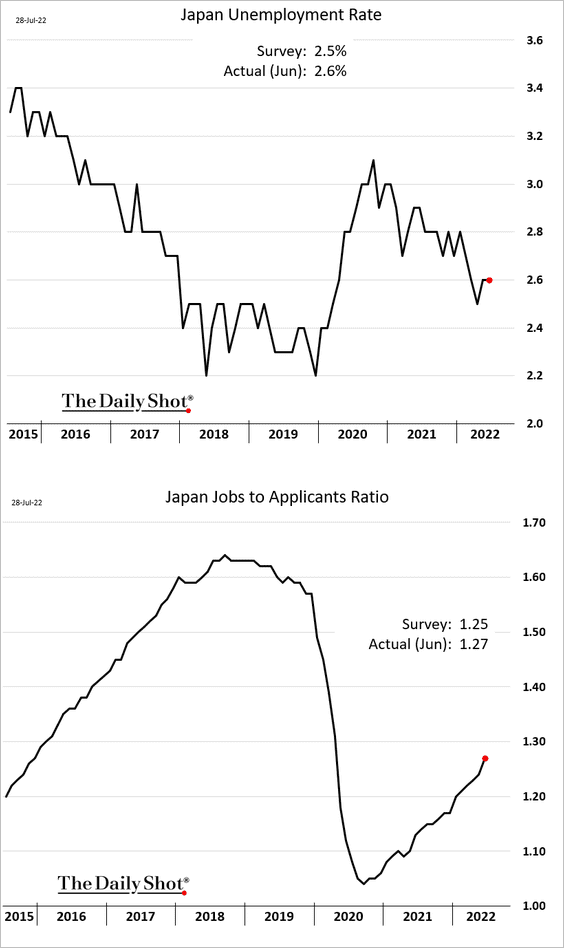

4. The jobs-to-applicants ratio continues to recover.

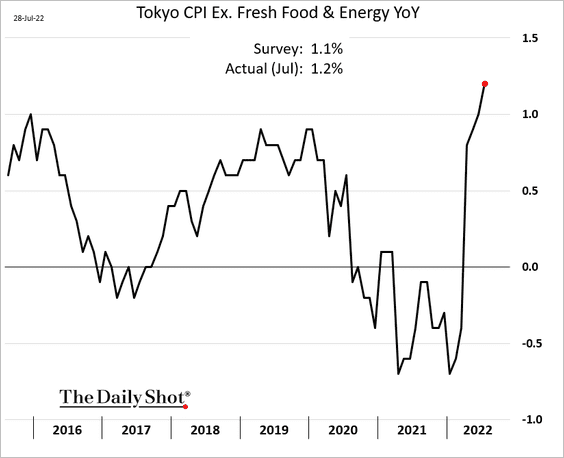

5. The July Tokyo core CPI surprised to the upside. Japan is facing some inflationary pressures.

Back to Index

Asia – Pacific

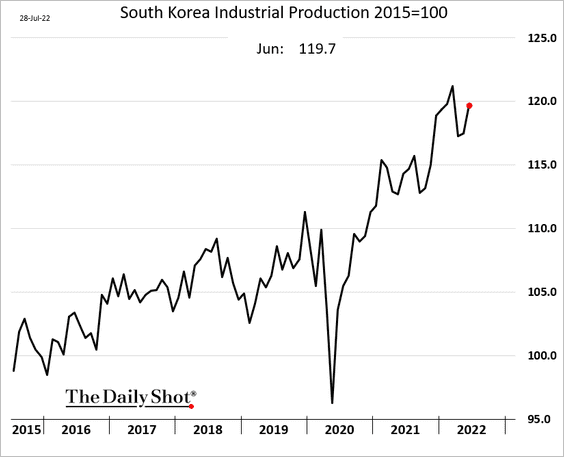

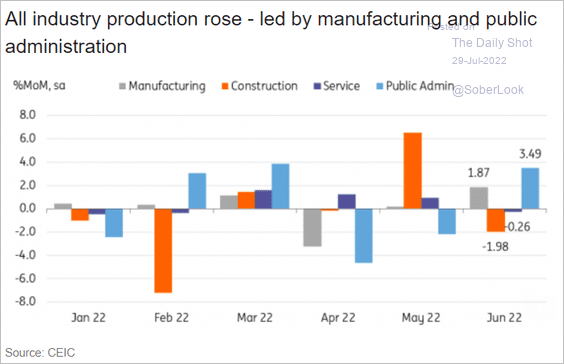

1. South Korea’s industrial production remains robust.

Source: ING

Source: ING

——————–

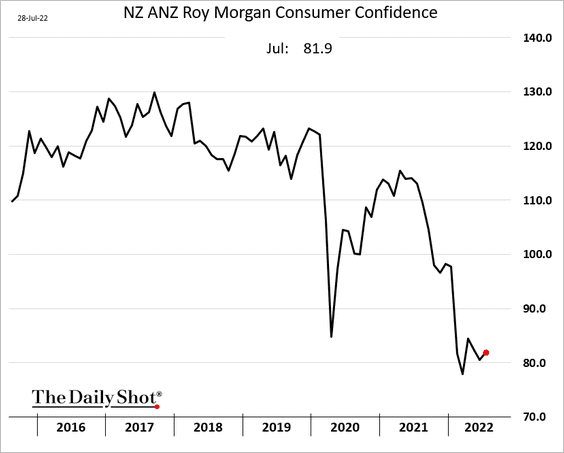

2. New Zealand’s consumer confidence has stabilized.

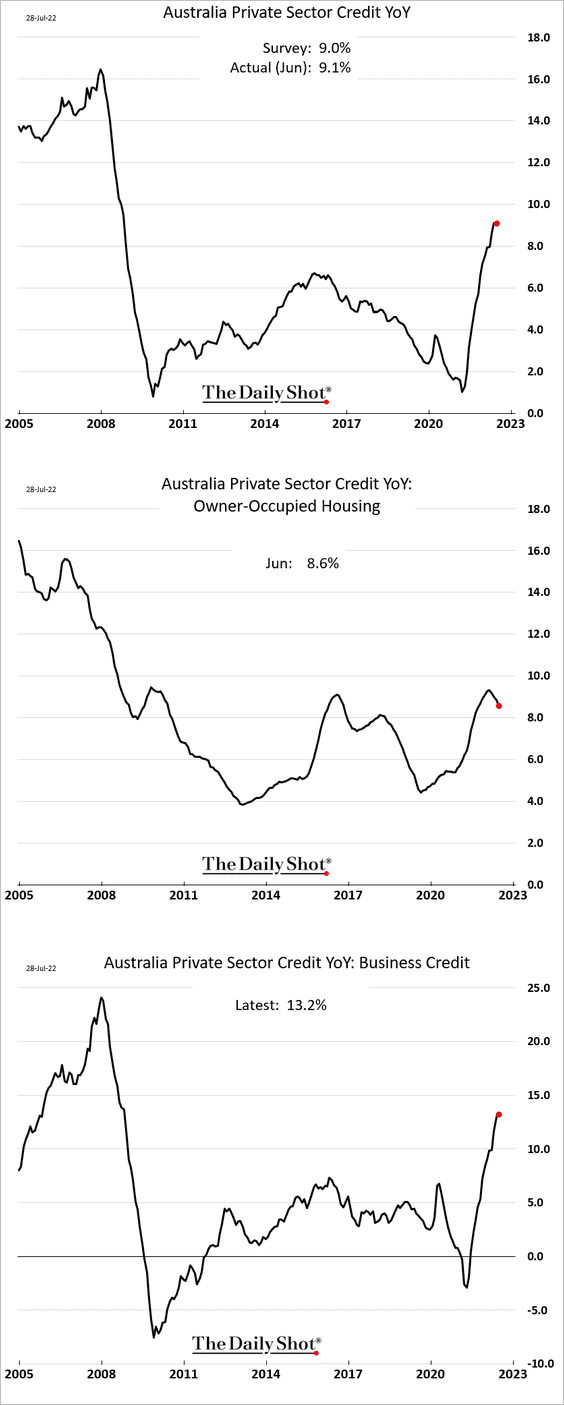

3. Australia’s credit growth is still quite strong.

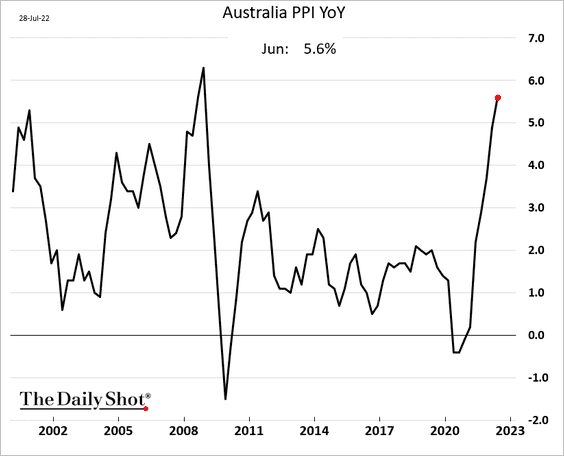

• Producer prices are rising faster.

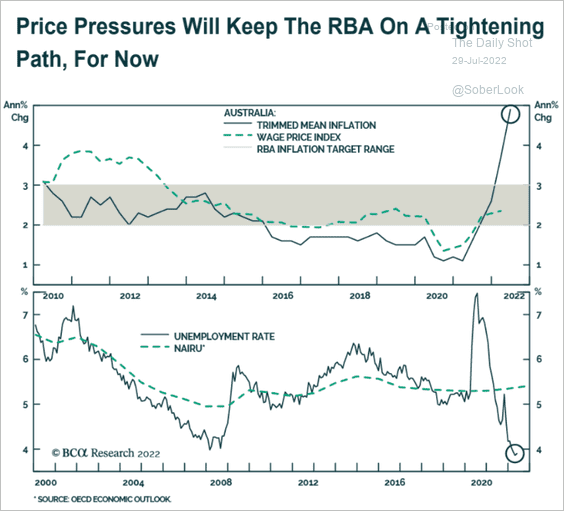

• More rate hikes are coming.

Source: BCA Research

Source: BCA Research

Back to Index

China

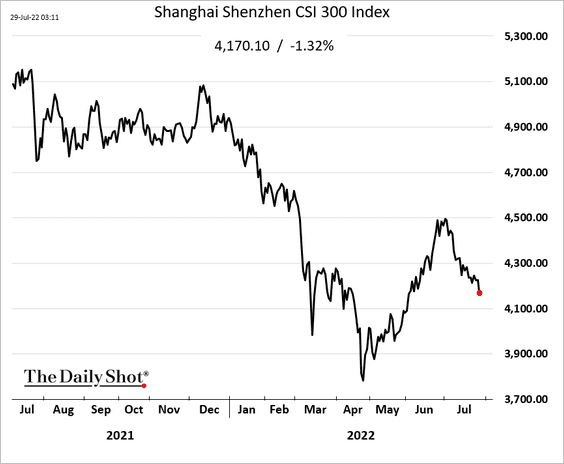

1. The stock market continues to struggle.

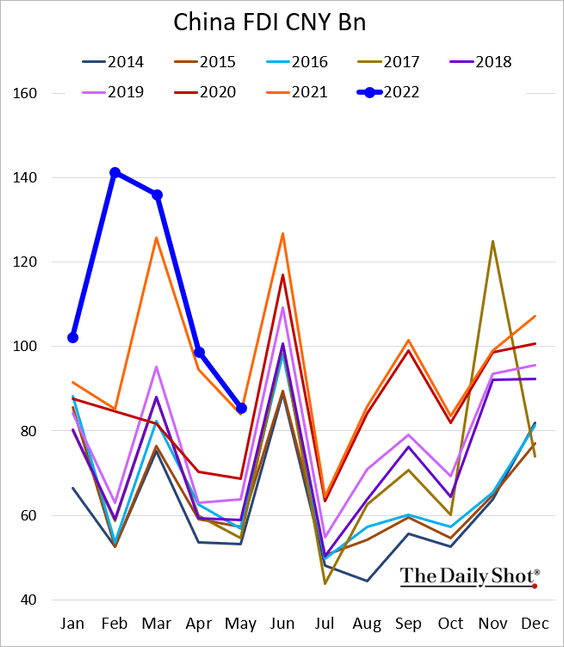

2. Foreign direct investment slowed.

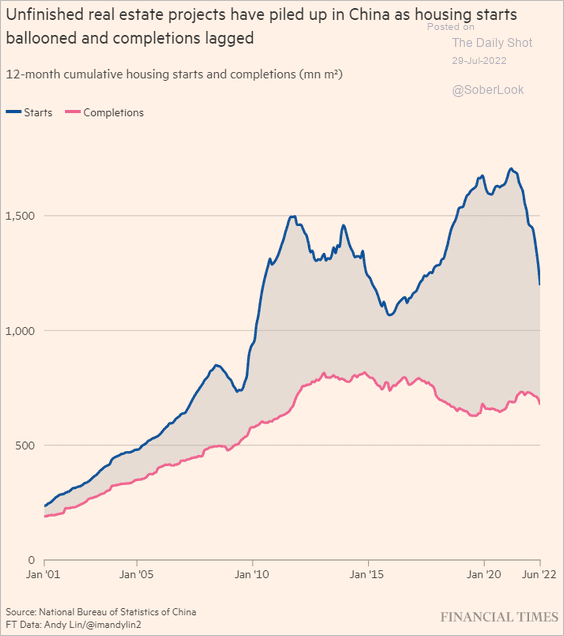

3. This chart shows housing starts and completions.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

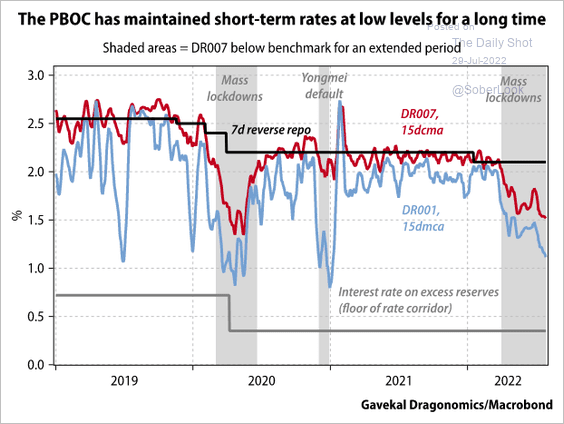

4. The PBoC continues to conduct “stealth” monetary easing.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

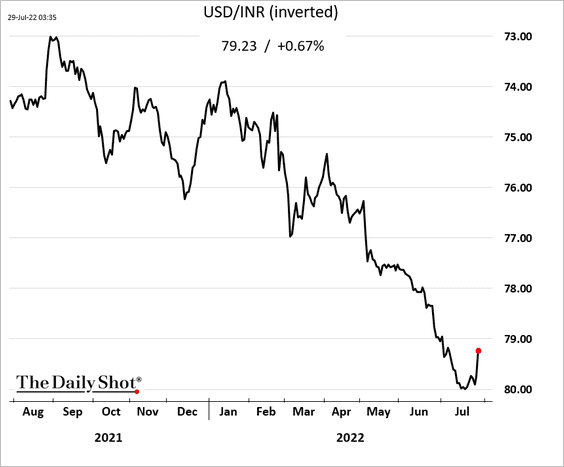

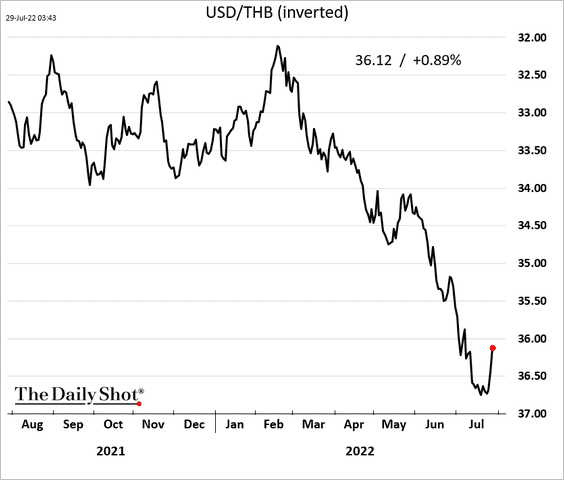

1. EM currencies are rebounding as the market sees a “friendlier” Federal Reserve.

• The Indian rupee:

• The Thai baht:

——————–

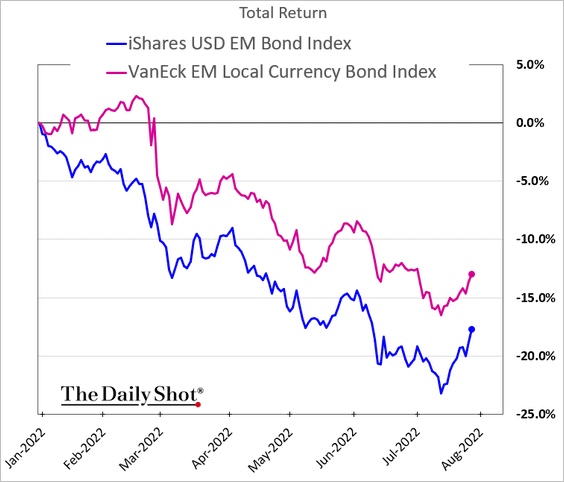

2. EM bonds are also stronger.

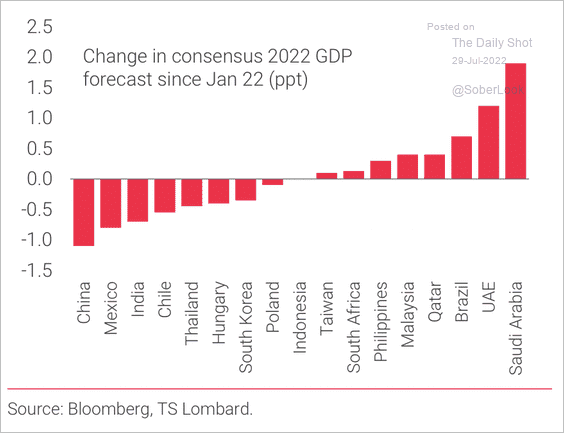

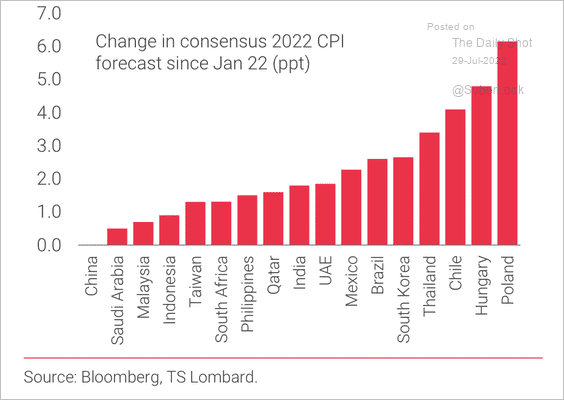

3. GDP forecasts across some EMs are starting to trend lower as inflation surges (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

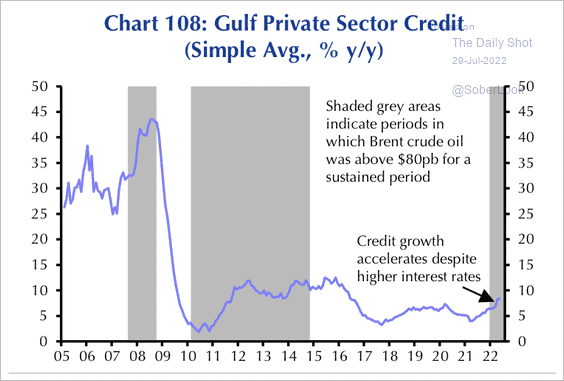

4. Oil prices have a stronger bearing on credit growth than interest rates in the Gulf region.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

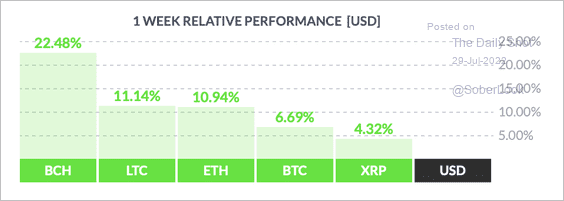

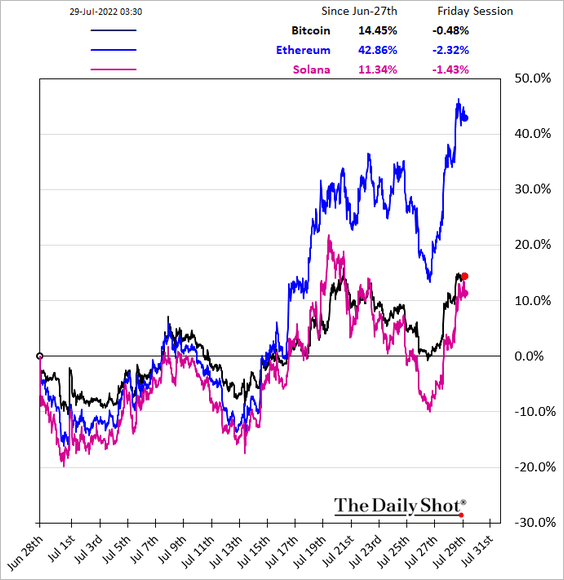

1. It’s been a good week for cryptos, with bitcoin cash (BCH), litecoin (LTC) and ether (ETH) in the lead among large tokens.

Source: FinViz

Source: FinViz

——————–

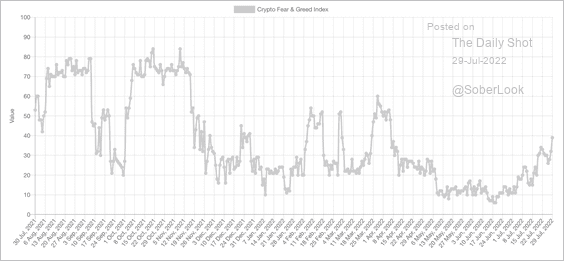

2. The crypto Fear & Greed Index continued to tick higher this week, exiting “extreme fear” territory.

Source: Alternative.me

Source: Alternative.me

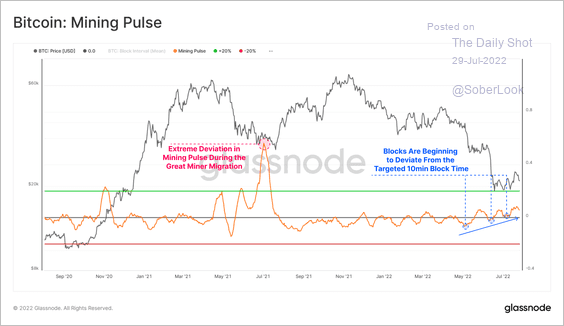

3. More bitcoin blocks (transaction data structures on the blockchain) are coming in slower than the target 10 minutes. That signifies continued stress in the bitcoin mining industry.

Source: @glassnode

Source: @glassnode

4. Will tokens be classified as securities?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

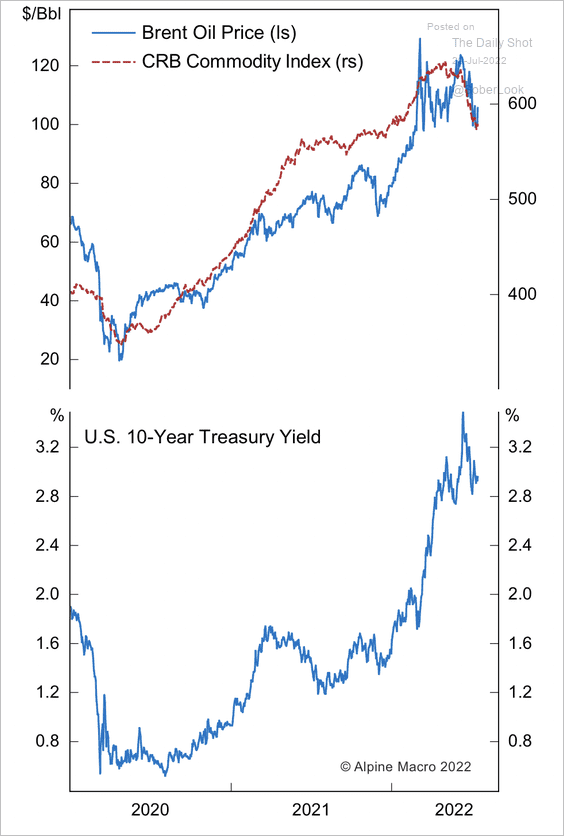

1. Commodities and Treasury yields tend to move together.

Source: Alpine Macro

Source: Alpine Macro

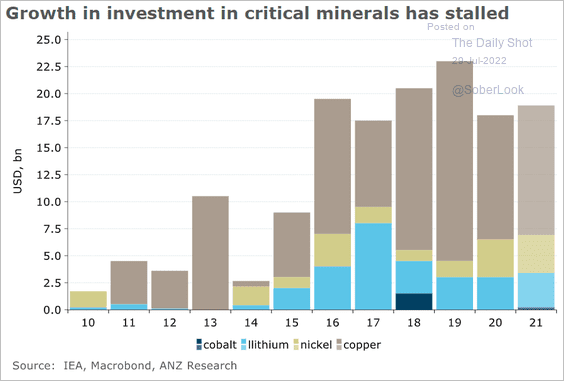

2. Investment in the production of critical minerals has been slowing.

Source: Visual Capitalist

Source: Visual Capitalist

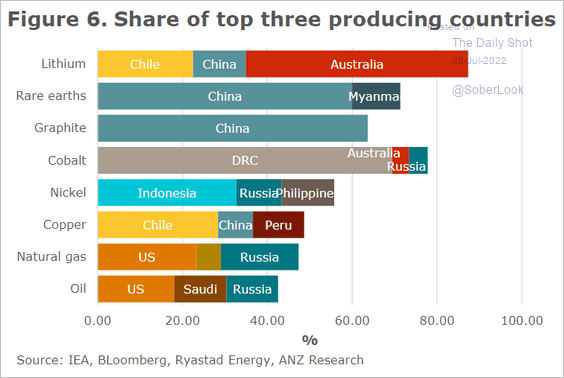

3. Here are the top three producing countries for each key mineral.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Energy

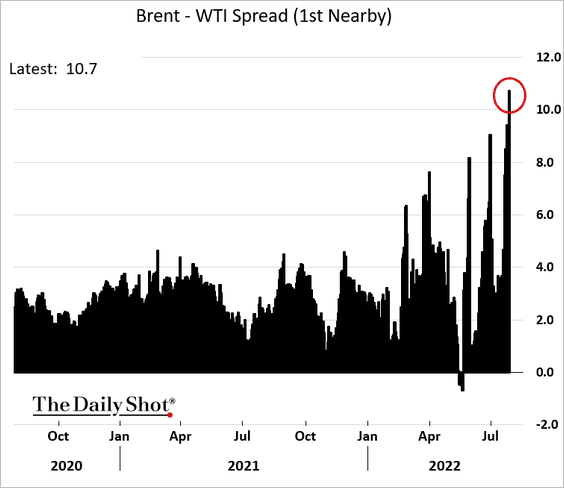

1. The Brent – WTI spread has blown out due to the US releasing oil from the Strategic Petroleum Reserves.

h/t @pav_chartbook

h/t @pav_chartbook

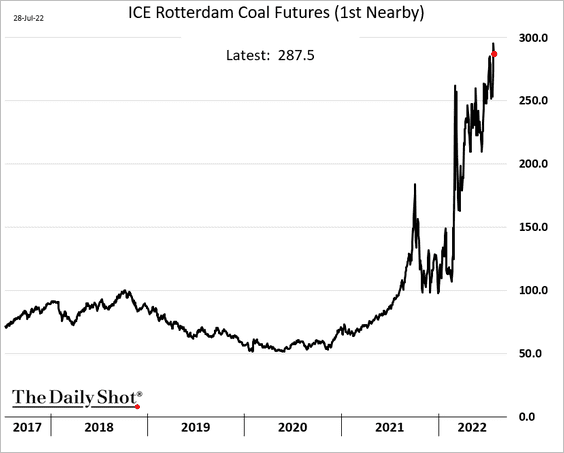

2. European coal prices are near record highs.

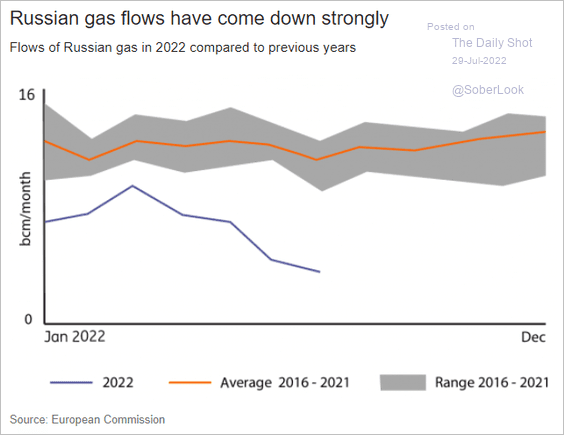

3. Next, we have the flows of Russian natural gas to Europe.

Source: ING

Source: ING

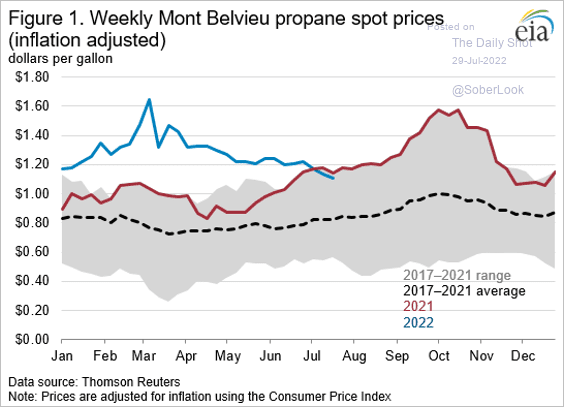

4. US propane prices have been moderating (many homes are heated with propane).

Source: @EIAgov Read full article

Source: @EIAgov Read full article

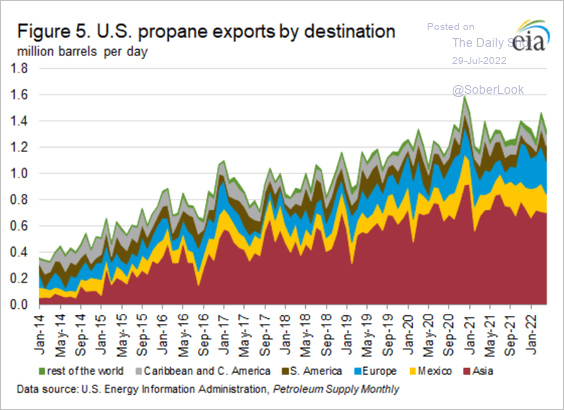

This chart shows US propane exports by destination.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

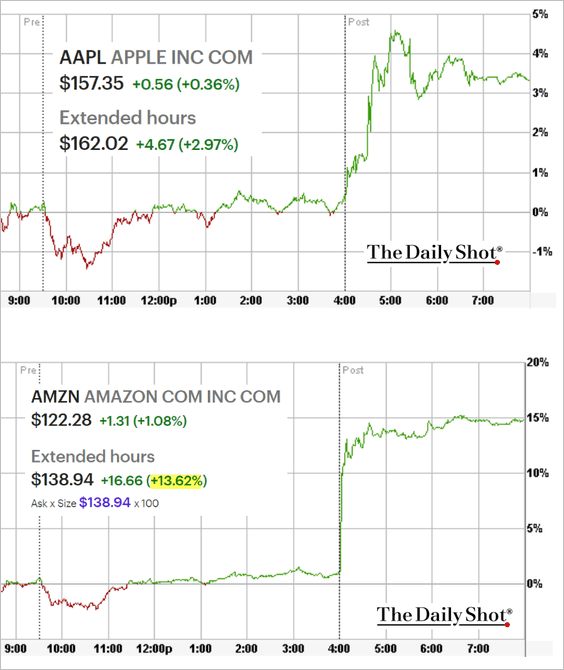

1. Mega-cap earnings are taking a hit, …

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

… but the results are not as disastrous as some had feared. And investors are willing to look beyond the current pain. Amazon and Apple shares jumped after the close.

——————–

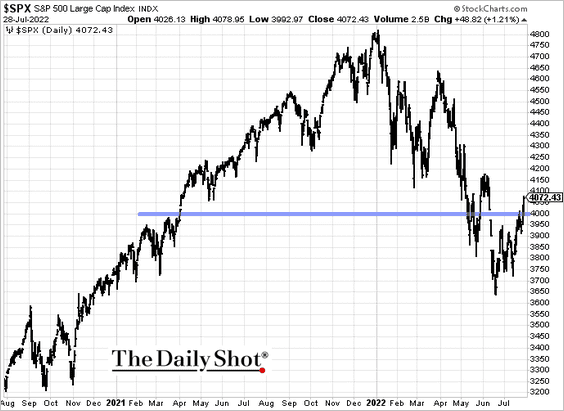

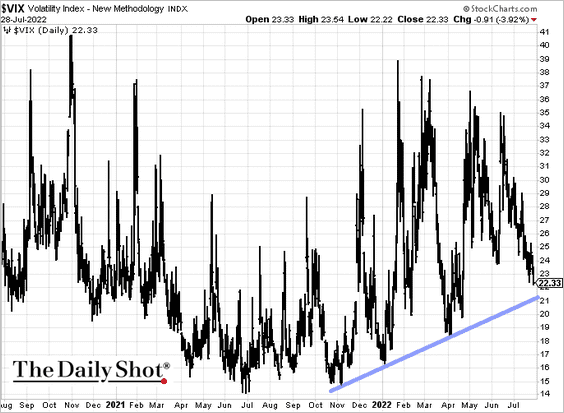

2. The S&P 500 moved above 4k, …

… and VIX hit the lowest level since April 21st.

——————–

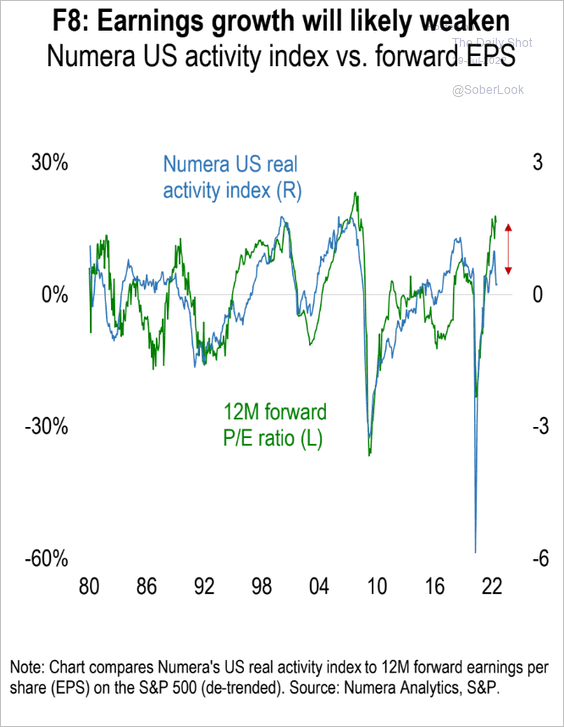

3. But significant risks remain. Softer economic activity points to weaker earnings growth.

Source: Numera Analytics

Source: Numera Analytics

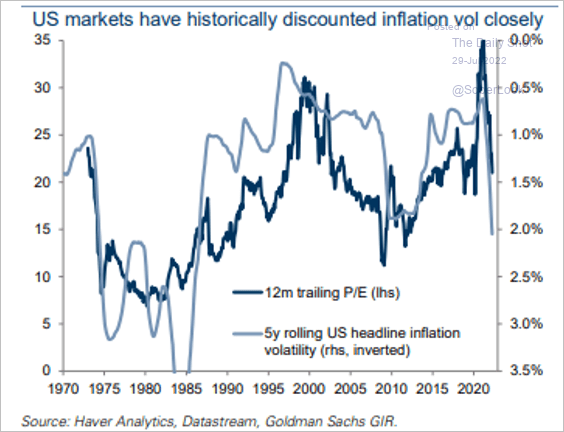

4. Valuations are sensitive to inflation volatility, not just price gains.

Source: Goldman Sachs; @simon_ree

Source: Goldman Sachs; @simon_ree

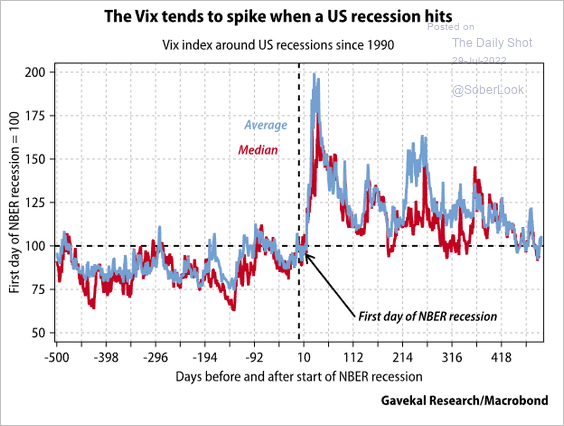

5. This chart shows VIX changes around recessions.

Source: Gavekal Research

Source: Gavekal Research

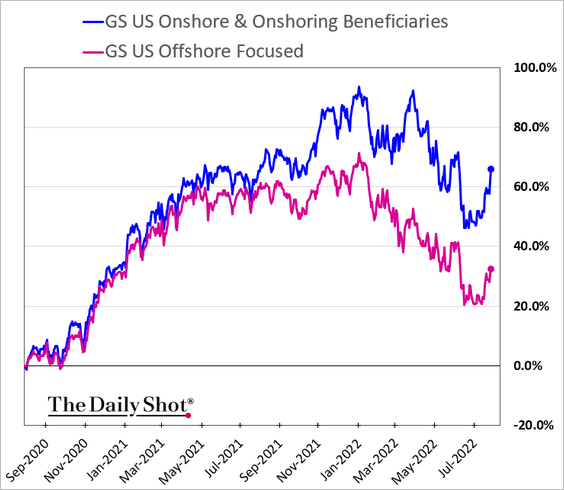

6. The market is rewarding US companies for onshoring.

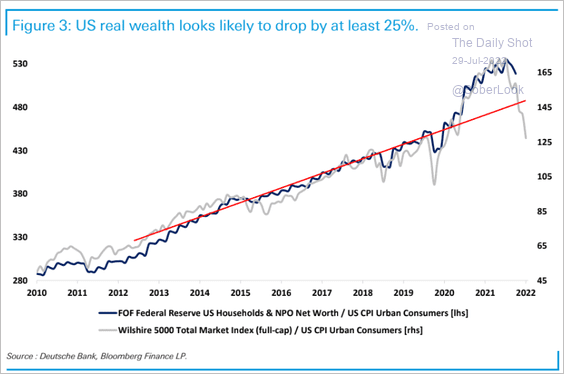

7. The drop in US real wealth has been massive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

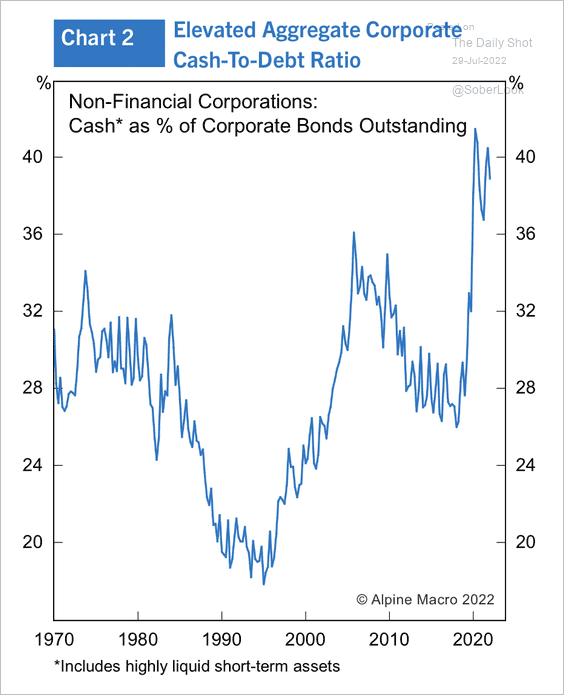

1. The ratio of US cash-to-corporate bonds outstanding is the highest in decades.

Source: Alpine Macro

Source: Alpine Macro

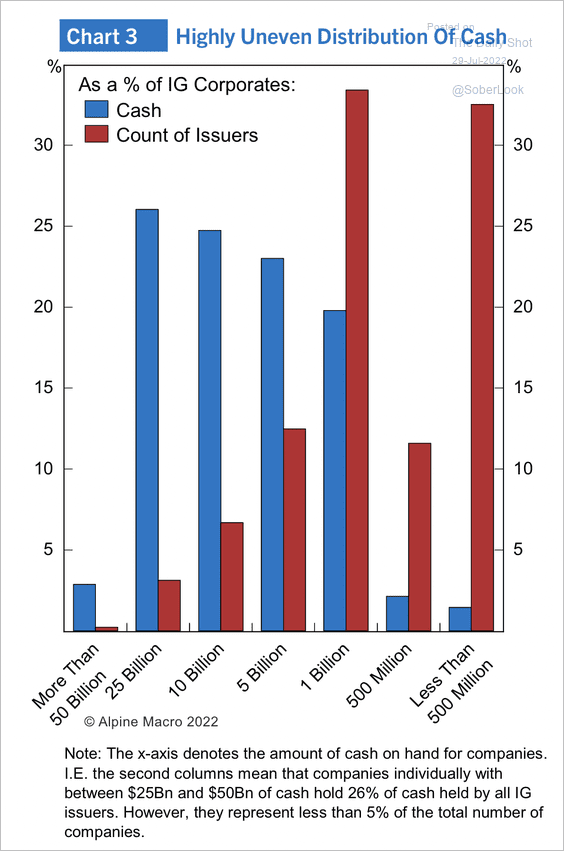

Still, the distribution of cash is highly uneven across investment-grade companies.

Source: Alpine Macro

Source: Alpine Macro

——————–

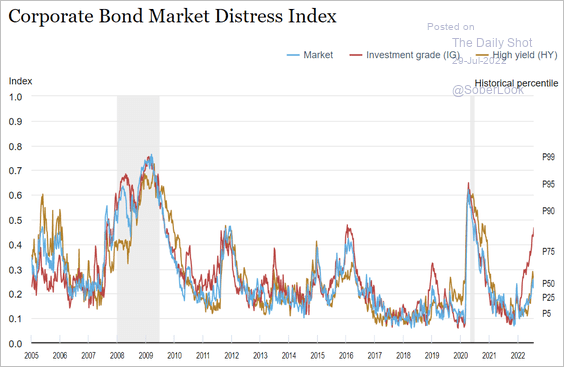

2. According to the NY Fed’s Corporate Bond Market Distress Index, “market functioning continues to be somewhat more strained in the investment-grade segment of the market.”

Source: NY Fed Read full article

Source: NY Fed Read full article

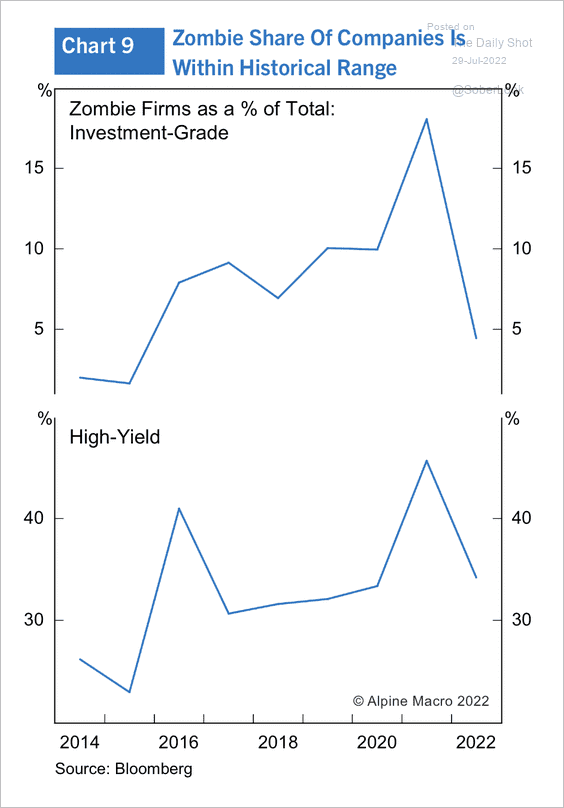

3. Companies with insufficient cash flow to cover interest payments (zombies) account for about a third of high-yield issuers, although it is less than 5% of investment-grade issuers.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Global Developments

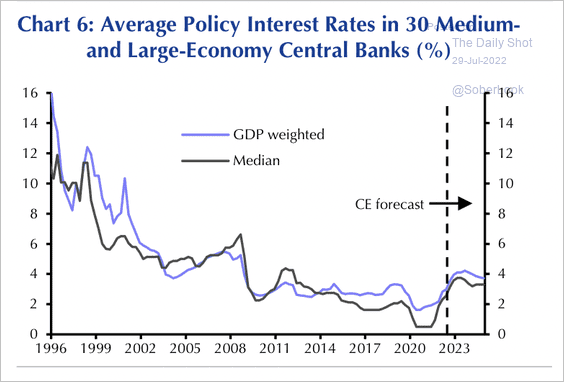

1. Capital Economics expects a slower pace of interest rate hikes among major central banks over the next year.

Source: Capital Economics

Source: Capital Economics

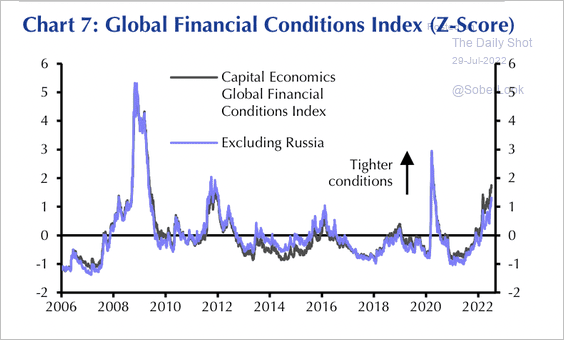

Interest rate hikes have already caused financial conditions to tighten, which could weaken economic growth around the world.

Source: Capital Economics

Source: Capital Economics

——————–

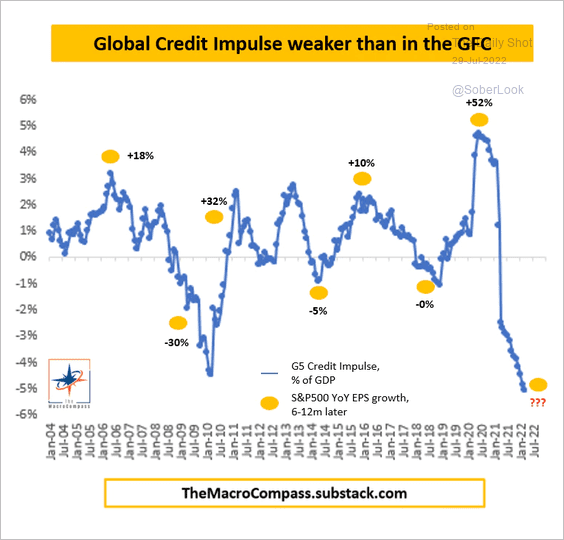

2. The global credit impulse is weaker than it was in the financial crisis.

Source: The Macro Compass Read full article

Source: The Macro Compass Read full article

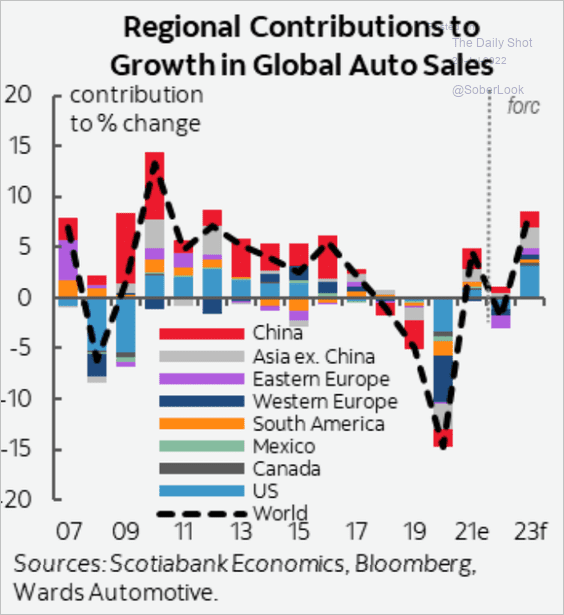

3. Scotiabank Economics expects automobile production to rebound next year.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

Food for Thought

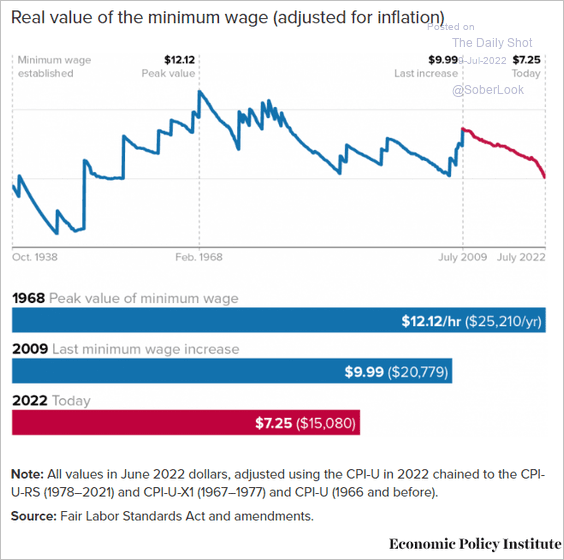

1. US real minimum wage:

Source: EPI Read full article

Source: EPI Read full article

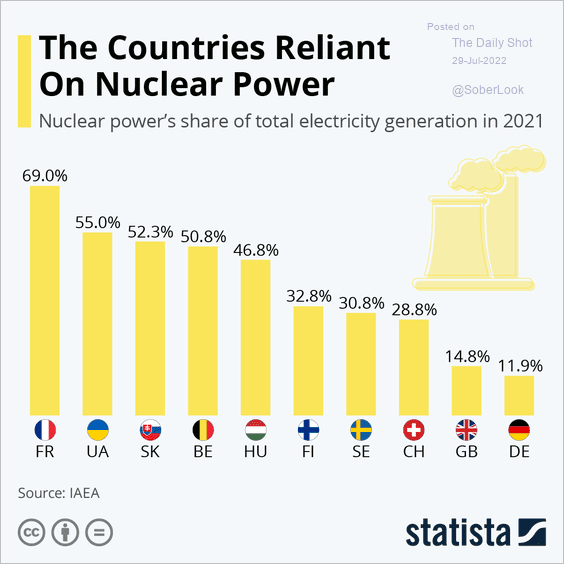

2. Reliance on nuclear power:

Source: Statista

Source: Statista

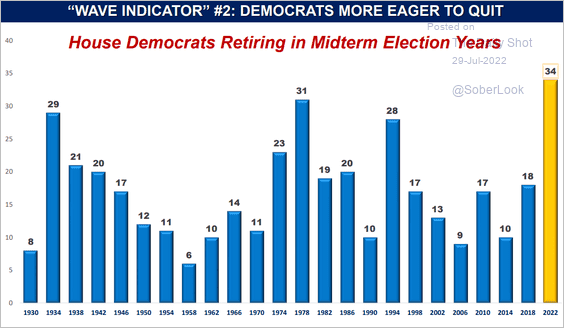

3. House Democrats retiring in midterm election years:

Source: @bpmehlman Read full article

Source: @bpmehlman Read full article

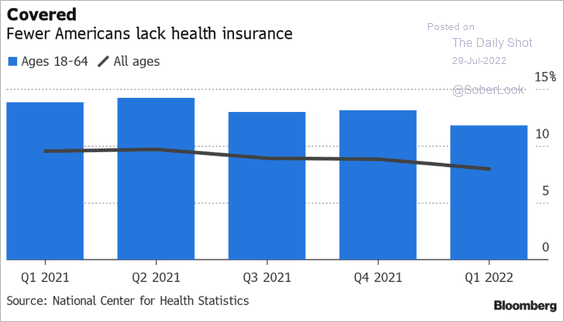

4. Americans without health insurance:

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

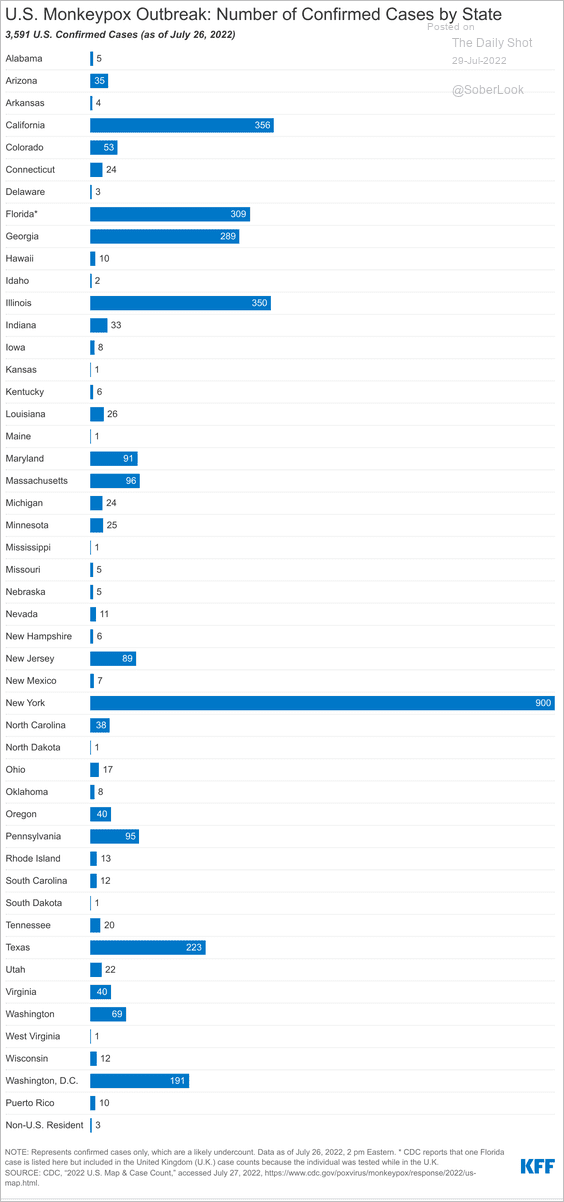

5. Monkeypox outbreak:

Source: KFF Read full article

Source: KFF Read full article

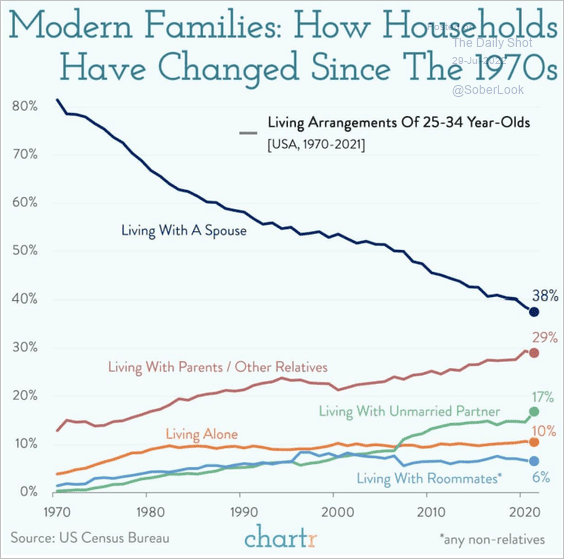

6. Living arrangements of 25-34 year-olds:

Source: @chartrdaily

Source: @chartrdaily

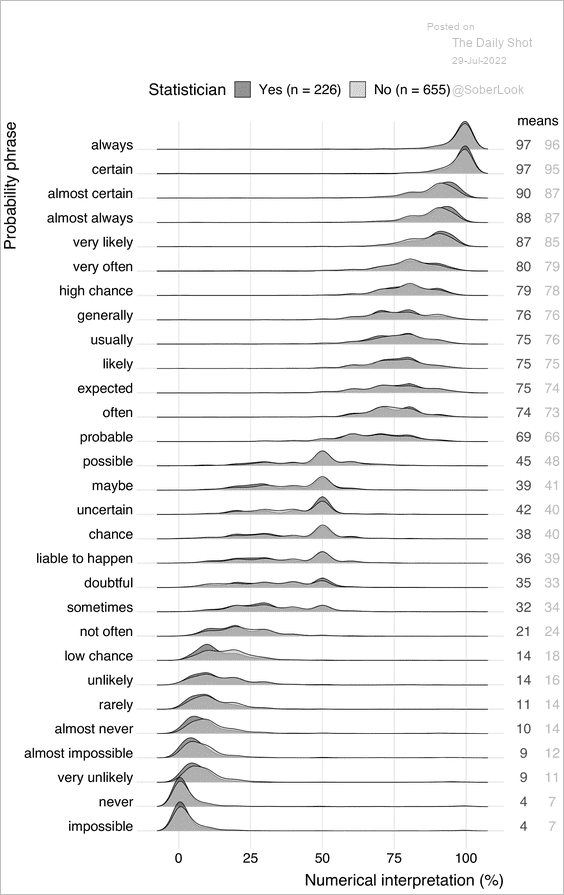

7. Probability density distributions associated with each word/phrase:

Source: Willems, Albers, and Smeets Read full article

Source: Willems, Albers, and Smeets Read full article

——————–

Have a great weekend!

Back to Index