The Daily Shot: 05-Aug-22

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

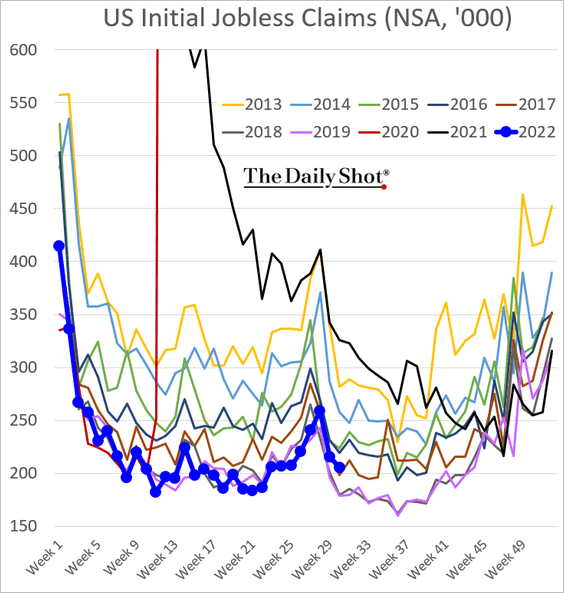

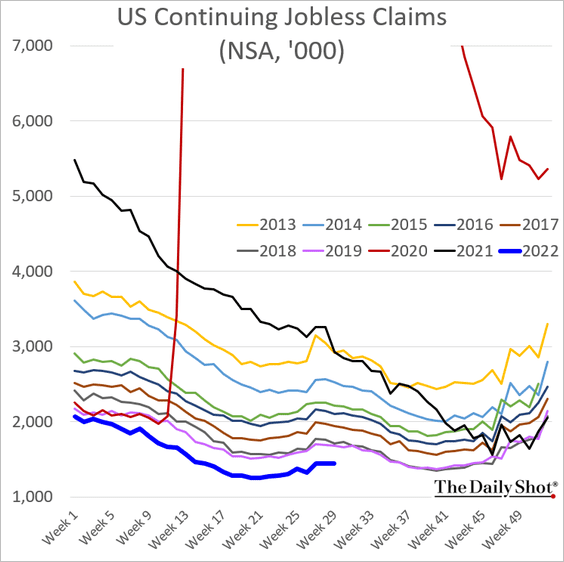

1. Initial jobless claims are now firmly above the 2018/19 levels.

Here is the spread.

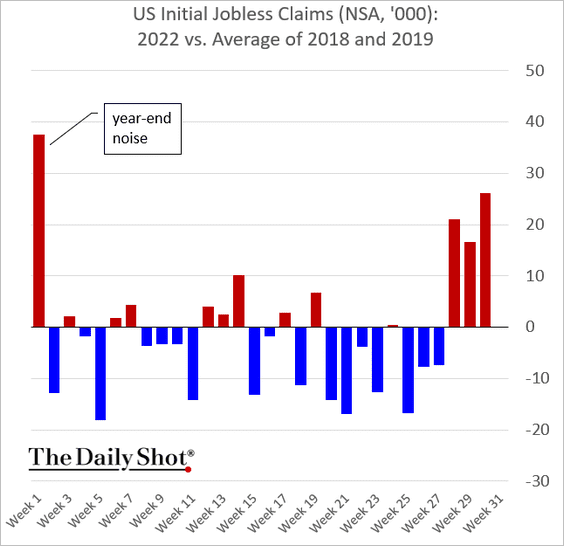

As a result, JP Morgan now sees a gain of only 200k payrolls for July (vs. consensus of 250k).

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

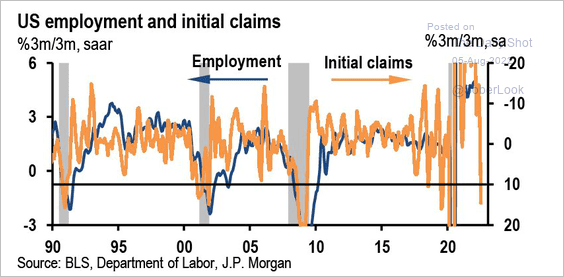

• Continuing claims are still at multi-year lows.

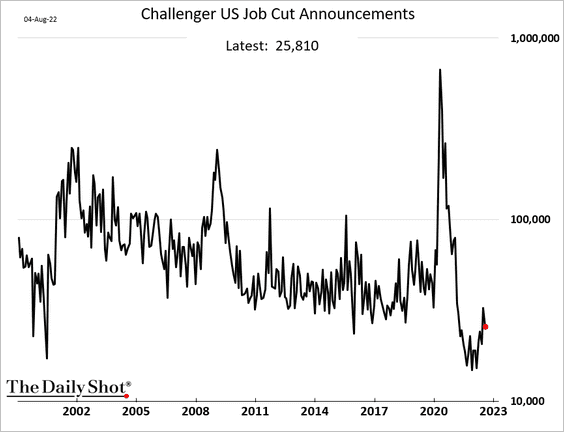

• Layoffs are also quite low (shown in log scale).

——————–

2. Next, we have some updates on inflation.

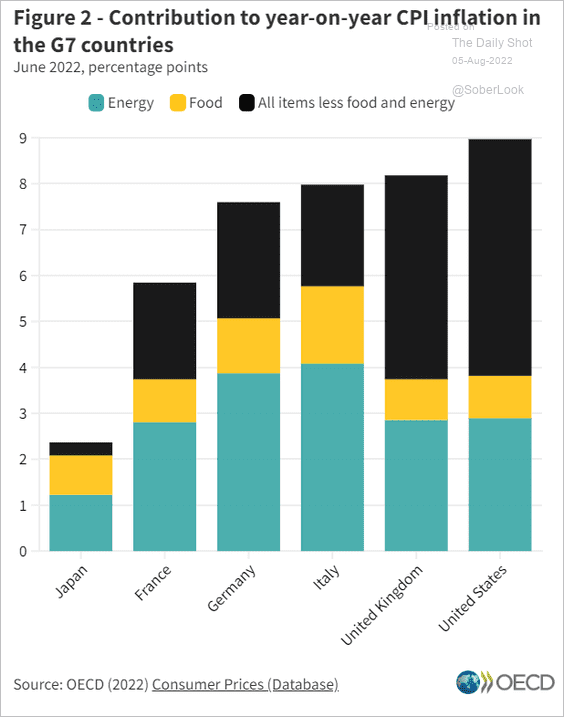

• The core CPI is a more dominant component of inflation in the US than in the rest of G7.

Source: @GregDaco, @OECD Read full article

Source: @GregDaco, @OECD Read full article

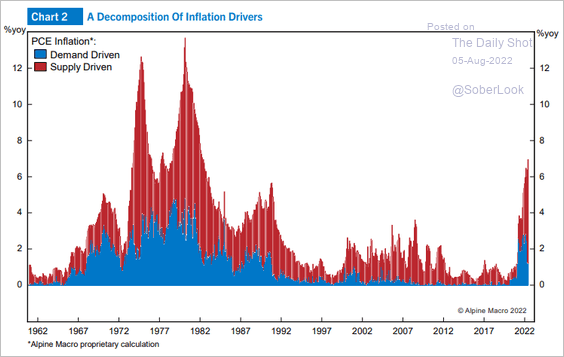

• Here is the decomposition of the PCE inflation into supply- and demand-driven components.

Source: Alpine Macro

Source: Alpine Macro

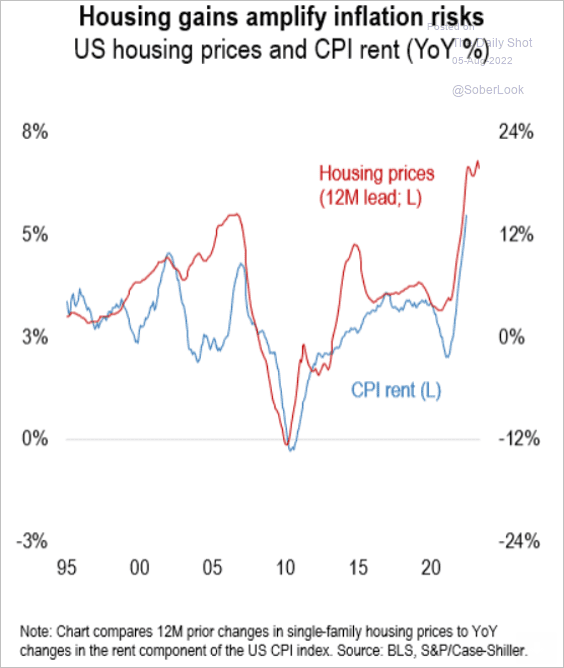

• Home price appreciation has been supporting rent inflation.

Source: Numera Analytics

Source: Numera Analytics

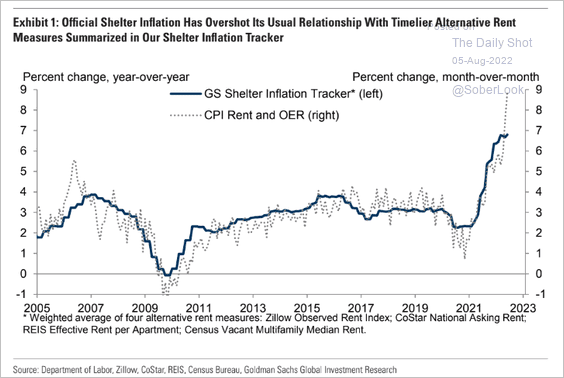

Shelter inflation has been surprising to the upside.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

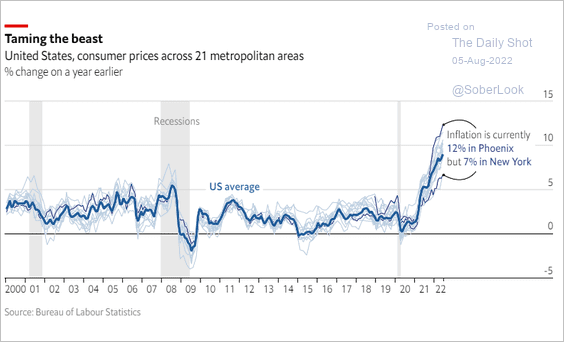

• Inflation dispersion has widened substantially.

Source: The Economist Read full article

Source: The Economist Read full article

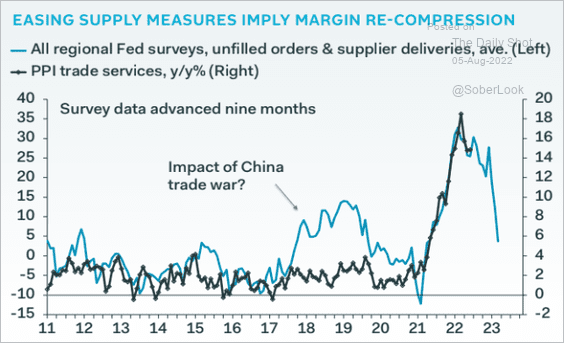

• Regional Fed surveys point to slower growth in business markups (PPI trade services).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

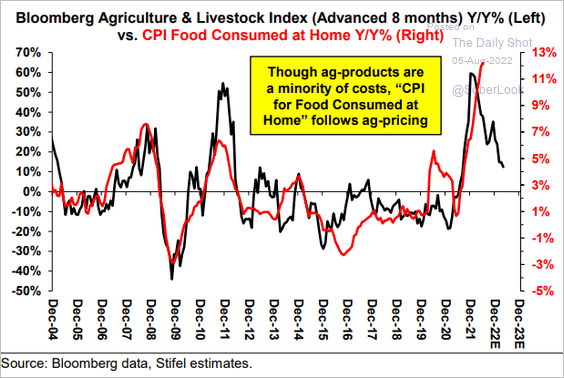

• Food inflation should begin to moderate.

Source: Stifel

Source: Stifel

——————–

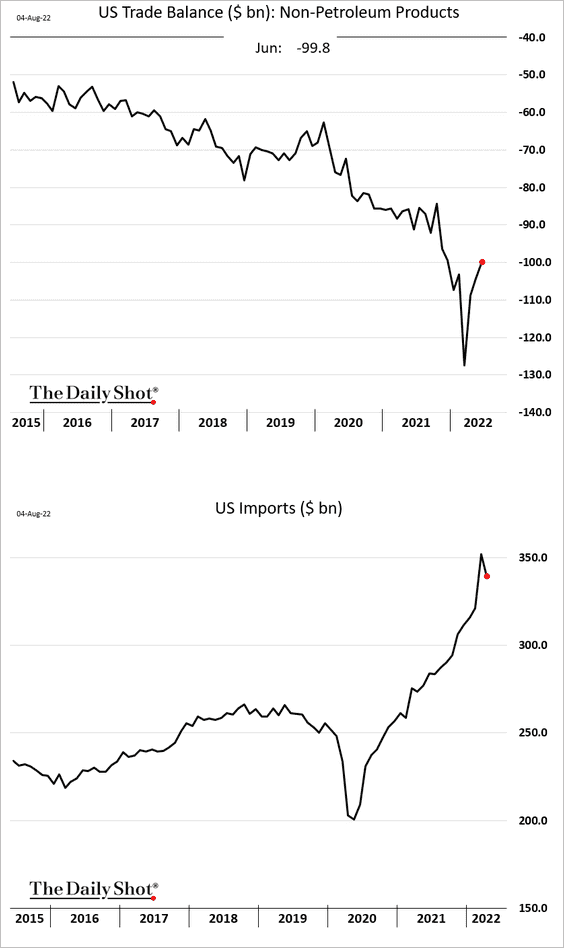

3. As we saw earlier, the trade deficit narrowed further in June.

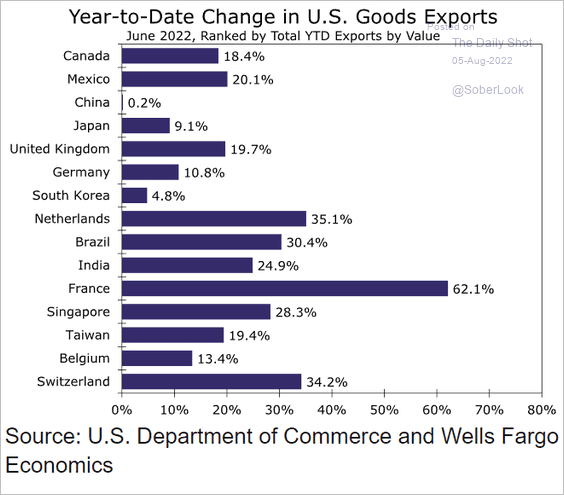

• US exports growth has been robust this year, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

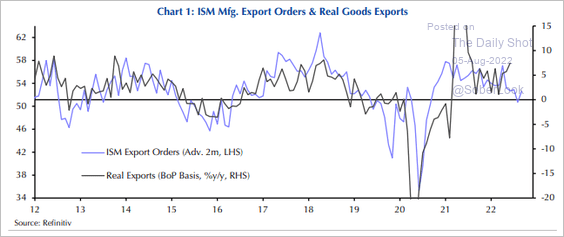

… but it’s expected to slow (driven by weaker global demand and a strong US dollar).

Source: Capital Economics

Source: Capital Economics

——————–

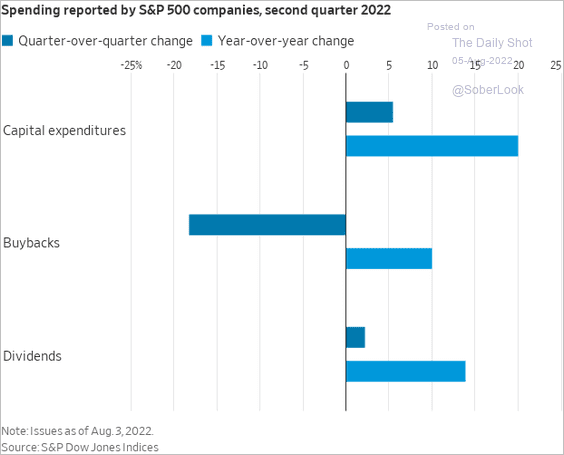

4. CapEx strengthened in Q2.

Source: @WSJ Read full article

Source: @WSJ Read full article

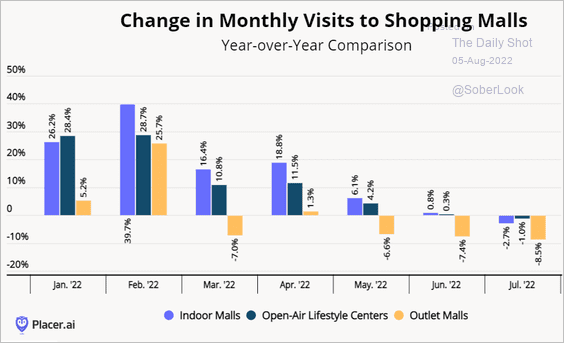

5. Mall visits are down vs. 2021.

Source: Placer.ai

Source: Placer.ai

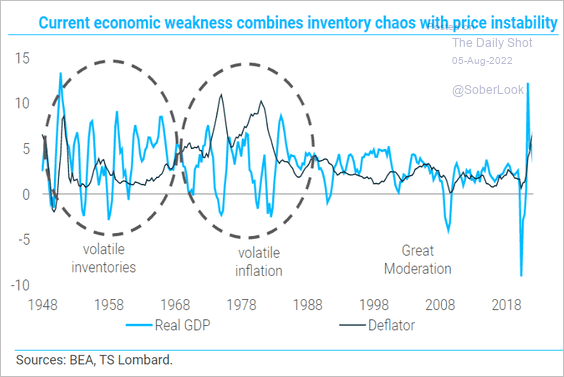

6. Has the US entered a new period of macro instability?

Source: TS Lombard

Source: TS Lombard

Back to Index

The United Kingdom

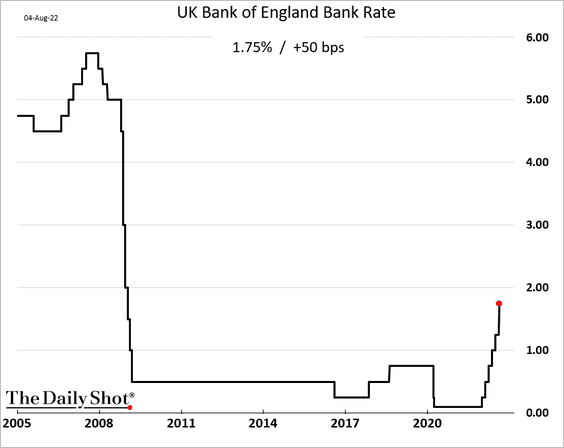

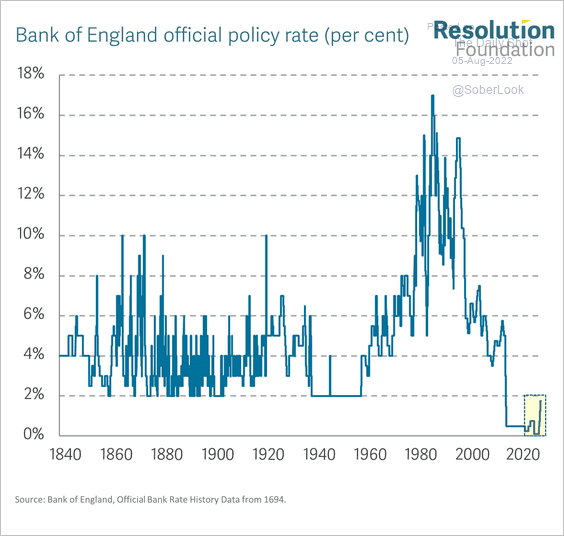

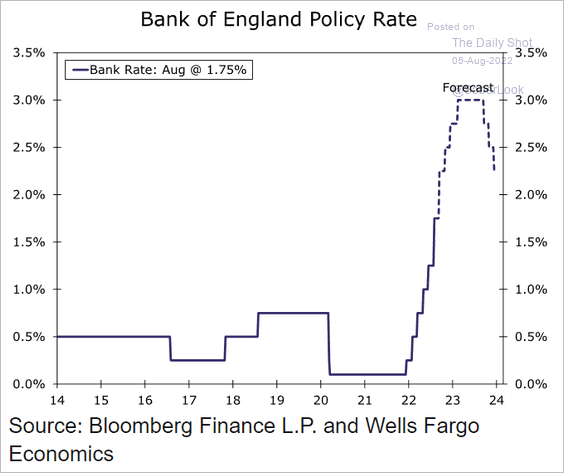

1. The BoE hiked rates by 50 bps.

Source: CNBC Read full article

Source: CNBC Read full article

• Here is the history of BoE rates going back to 1840.

Source: @JamesSmithRF

Source: @JamesSmithRF

• How much more tightening should we expect? Below is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

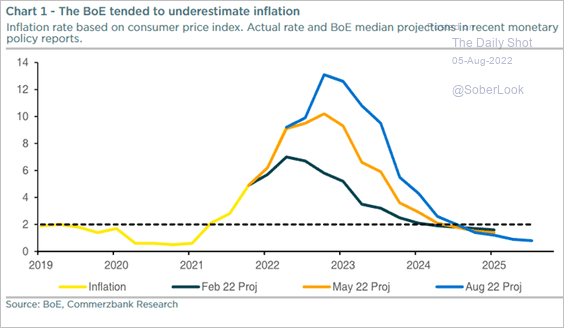

2. The BoE boosted its inflation forecast – again.

Source: Commerzbank Research

Source: Commerzbank Research

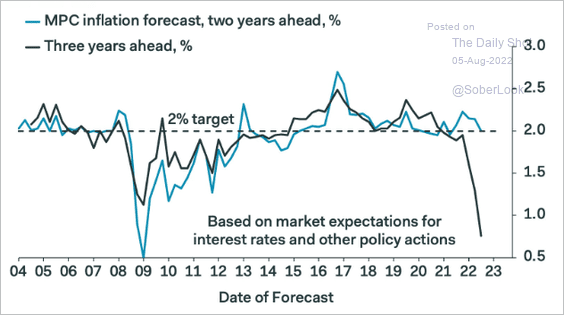

The central bank’s model points to a sharp CPI decline in three years.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

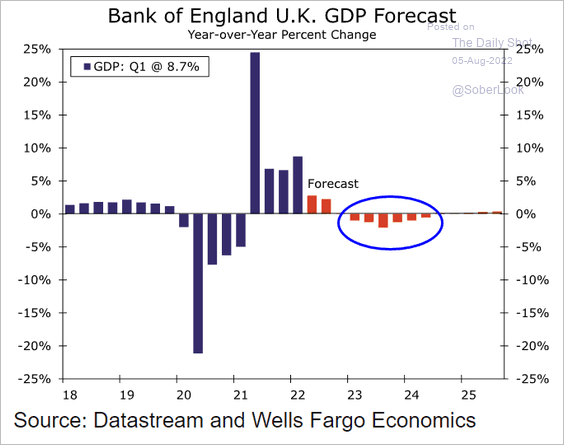

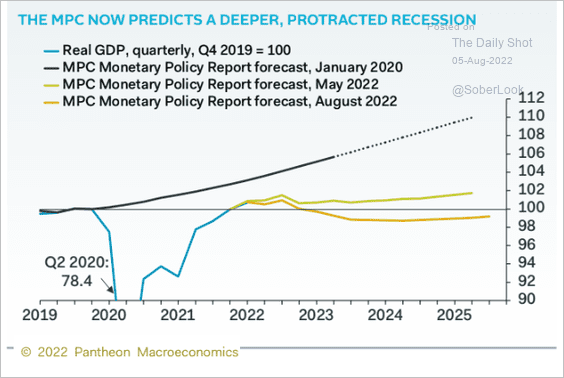

3. The BoE is now forecasting a prolonged recession in the UK (2 charts).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

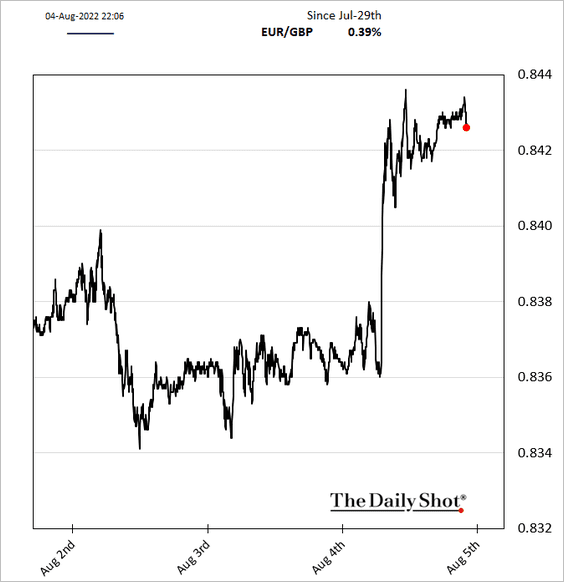

4. The pound dropped in response to the BoE action/forecasts (the chart shows the euro gaining vs. GBP).

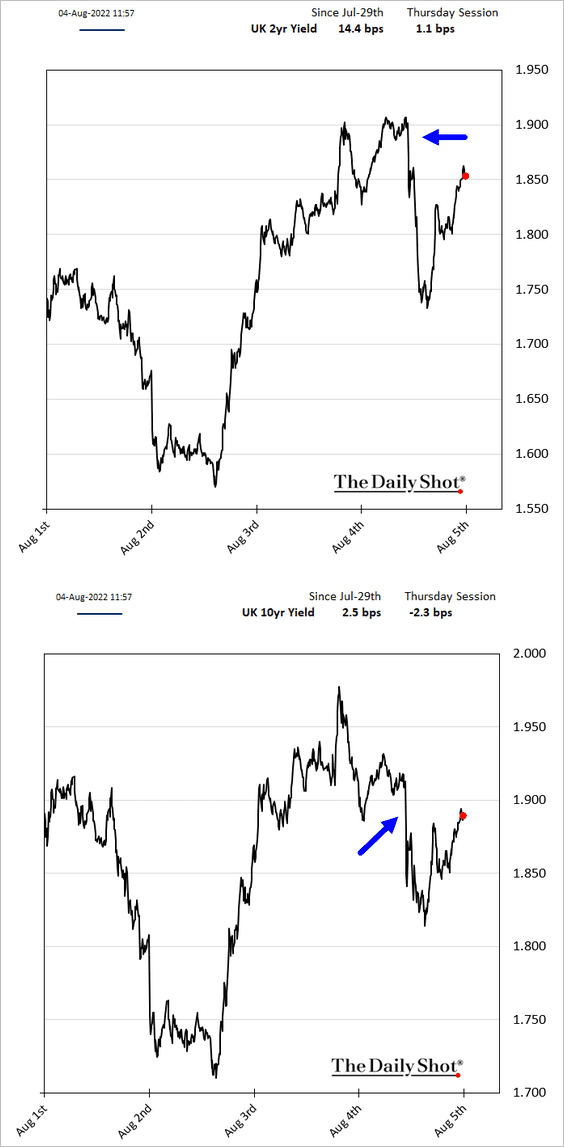

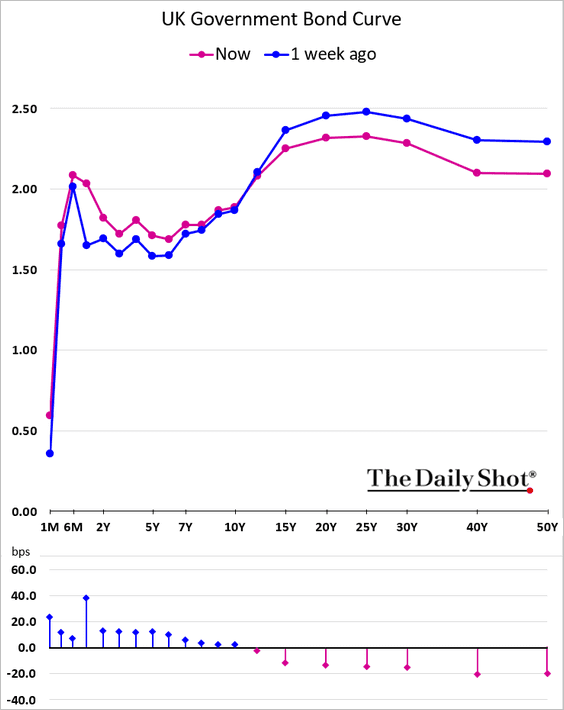

Gilt yields declined but rebounded shortly after.

The yield curve has flattened considerably.

——————–

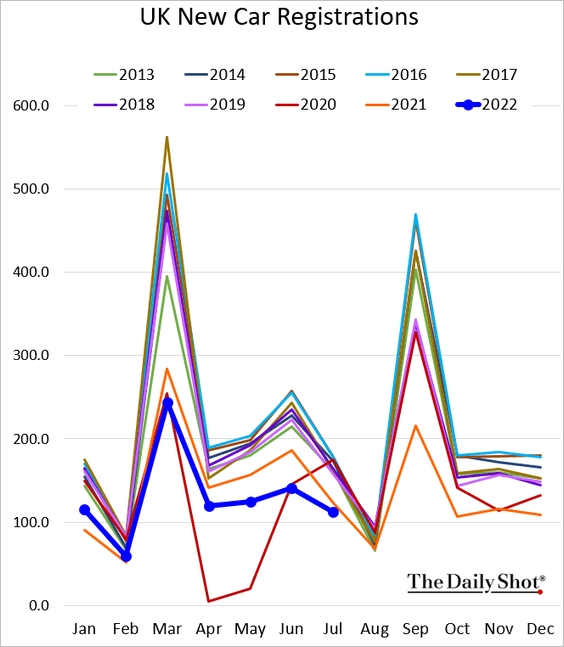

5. New car registrations remain at multi-year lows for this time of the year.

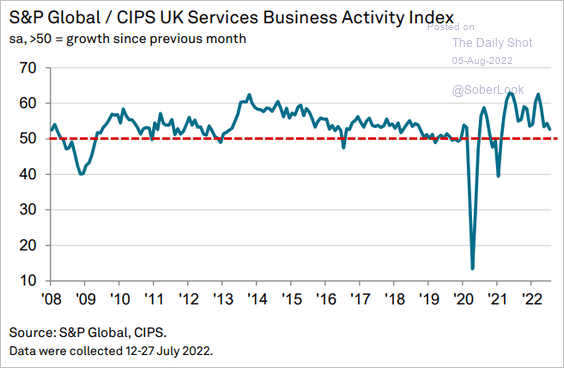

6. Service sector growth has slowed but remains positive.

Source: S&P Global PMI

Source: S&P Global PMI

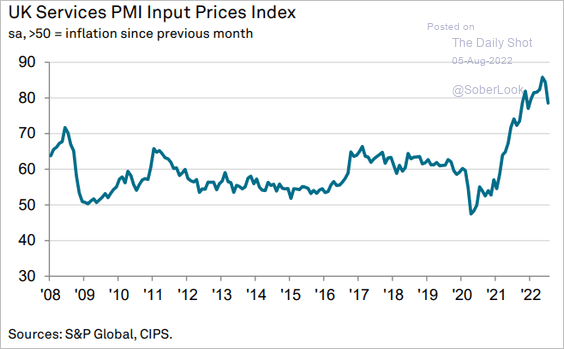

Price pressures persist.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

The Eurozone

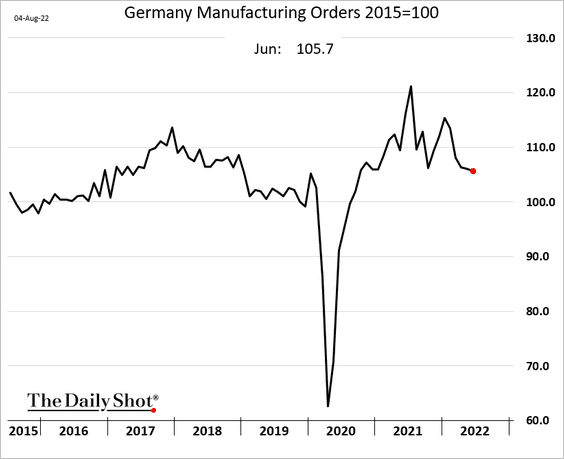

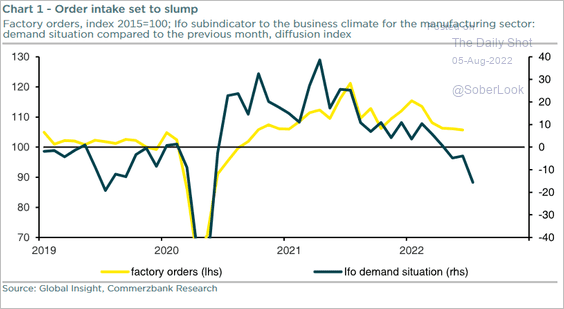

1. Germany’s factory orders edged lower in June.

Sentiment indicators point to further declines.

Source: Commerzbank Research

Source: Commerzbank Research

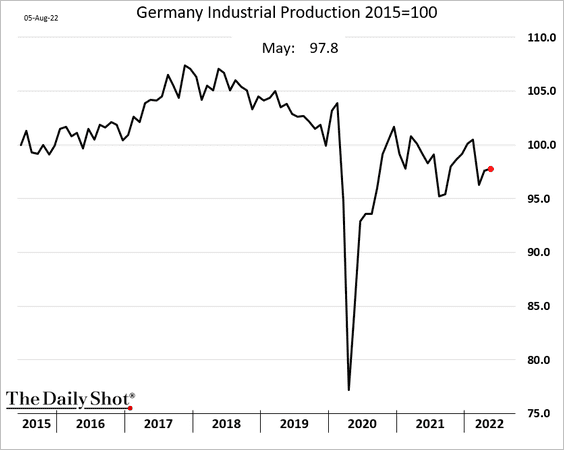

• Industrial production edged higher in June, topping forecasts.

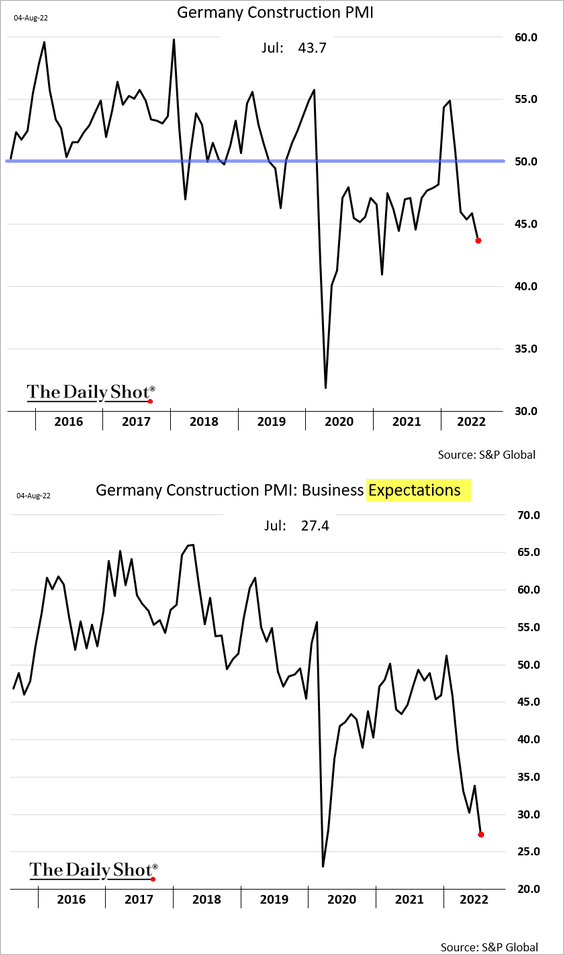

• Germany’s construction activity is tumbling.

——————–

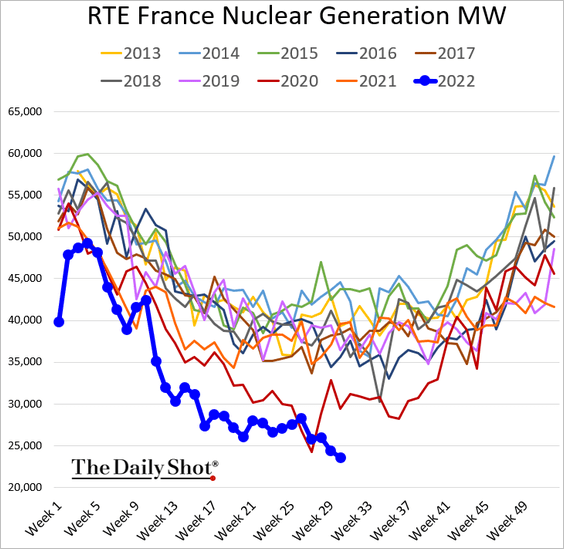

2. French nuclear power output hit a multi-year low. This could not have come at a worse time.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

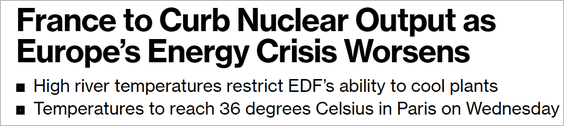

3. Ireland’s unemployment rate is nearing 4%.

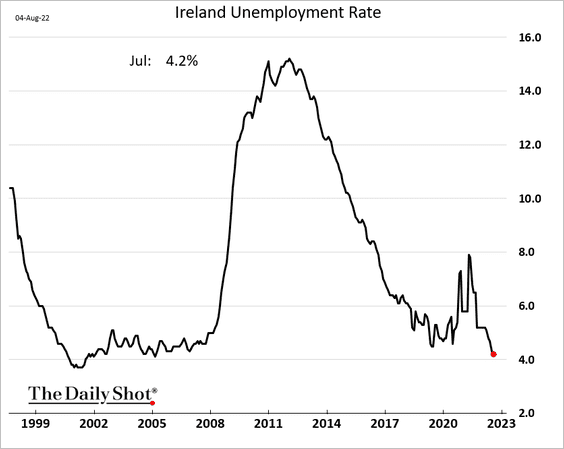

4. Euro-area bank loan rates have been rising this year.

Source: ECB Read full article

Source: ECB Read full article

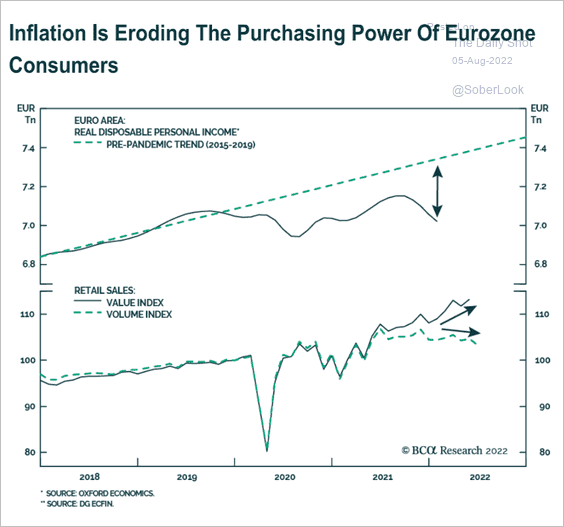

5. Households are hit by the erosion of purchasing power.

Source: BCA Research

Source: BCA Research

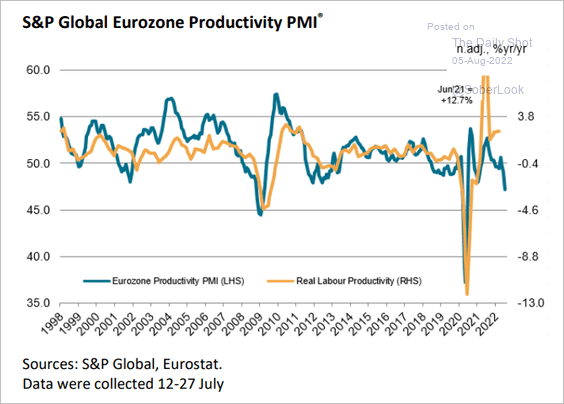

6 The S&P Global PMI data point to weaker productivity in the Eurozone.

Source: S&P Global PMI

Source: S&P Global PMI

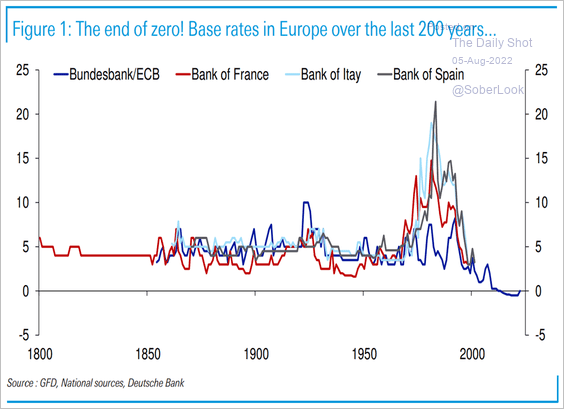

7. This chart shows base rates in Europe going back to 1800.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Japan

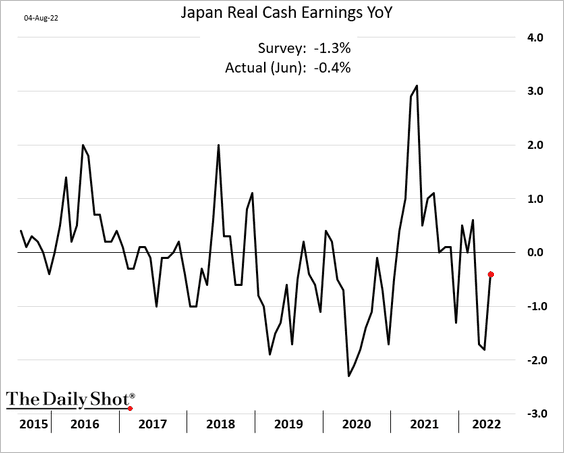

1 Japan’s real wages showed some improvement in June.

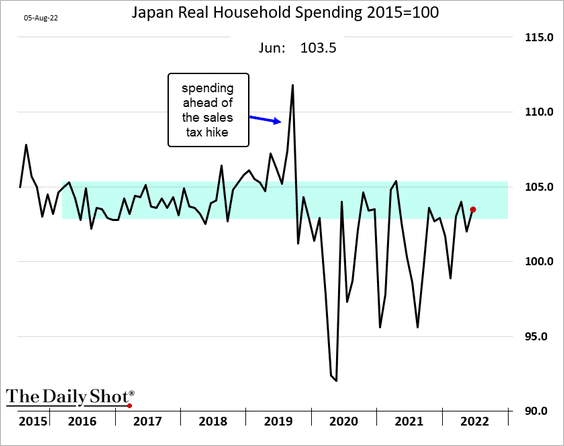

2. Household spending is inside the pre-COVID range.

Back to Index

Emerging Markets

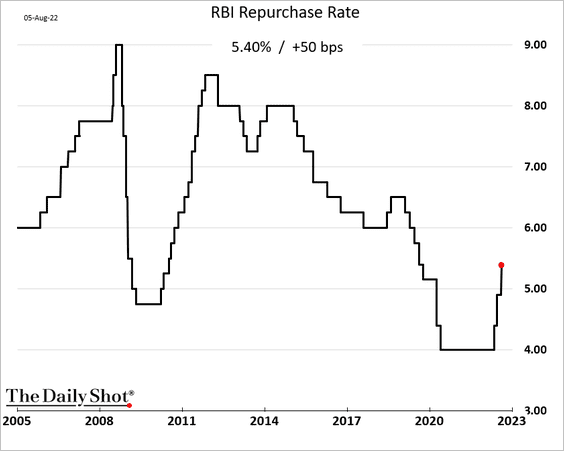

1. India’s central bank delivered a bigger-than-expected rate hike.

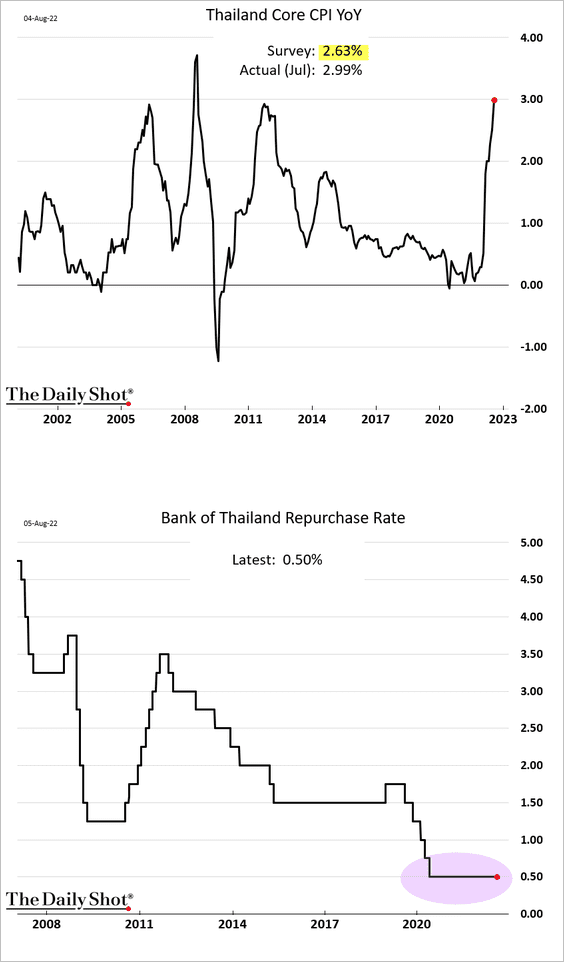

2. Thailand’s core inflation surprised to the upside, but the central bank is not raising rates.

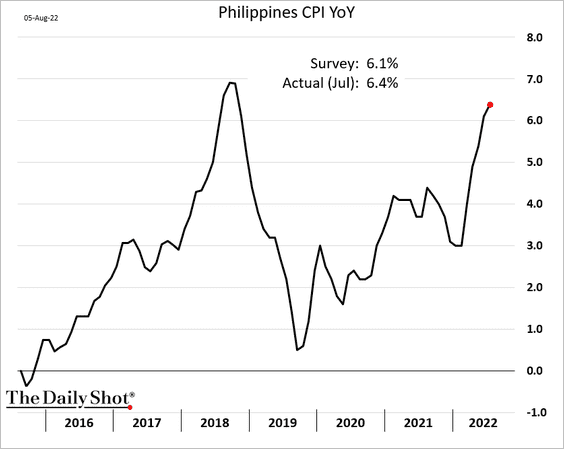

3. The Philippine CPI also surprised to the upside.

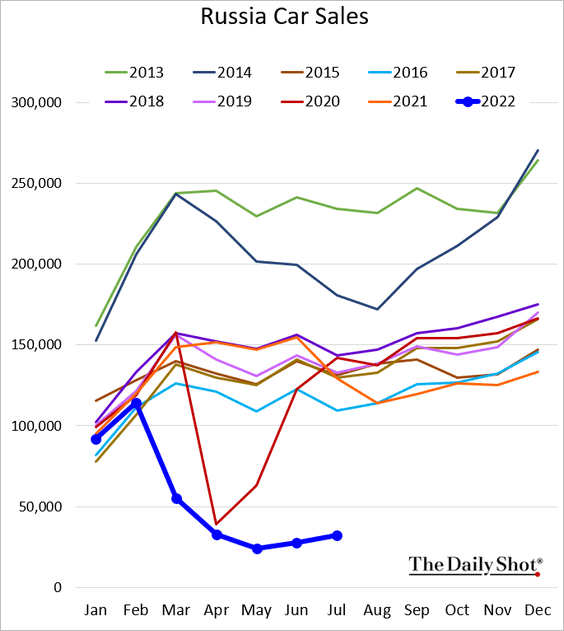

4. Russia’s car sales remain depressed.

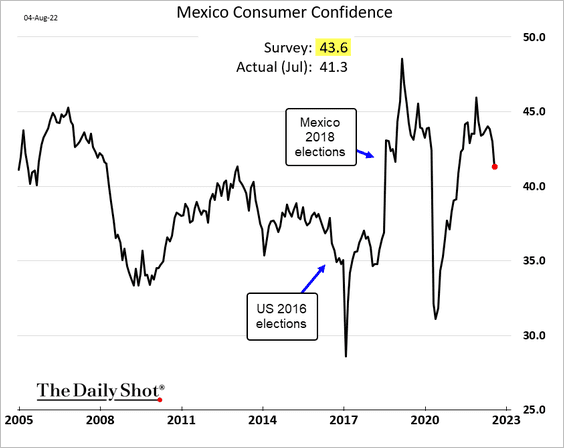

5. Mexican consumer confidence deteriorated last month.

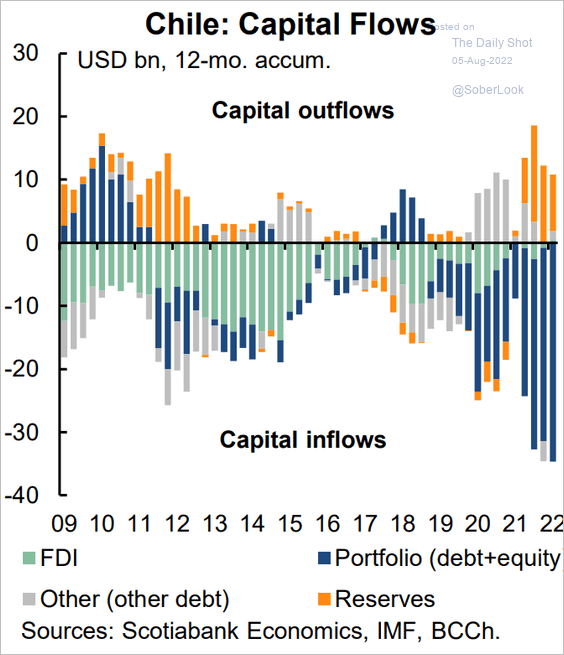

6. Chile has been hit with portfolio outflows.

Source: Scotiabank Economics

Source: Scotiabank Economics

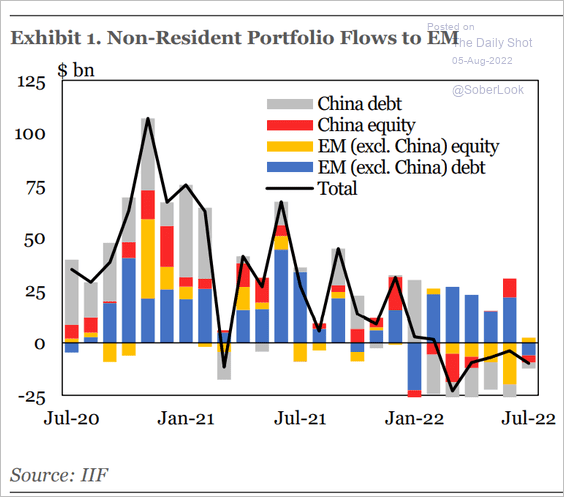

7. Emerging markets continue to see outflows.

Source: IIF

Source: IIF

Back to Index

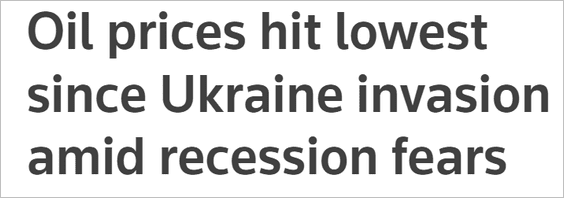

Energy

1. OPEC+ essentially left output unchanged.

Source: Reuters Read full article

Source: Reuters Read full article

But demand concerns continue to weigh on oil prices.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

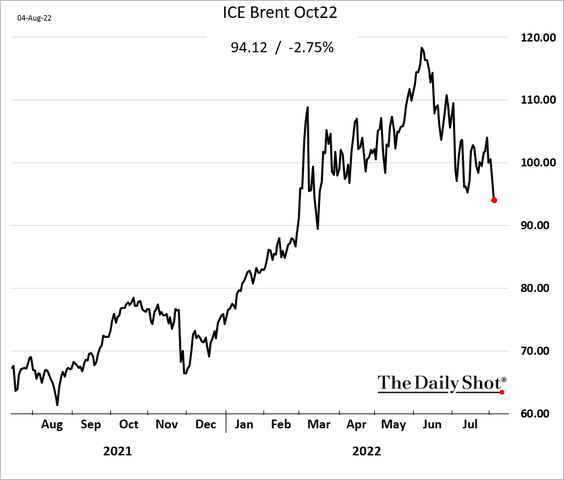

2. This chart shows natural gas sales to the EU by source.

Source: ECB Read full article

Source: ECB Read full article

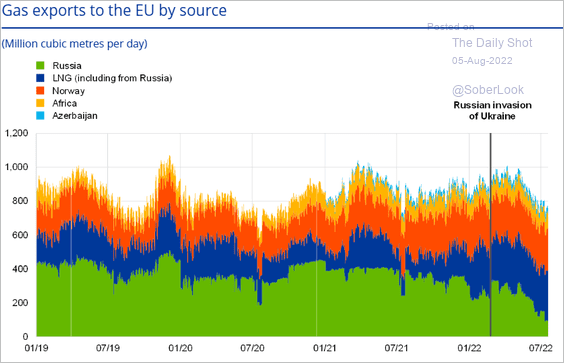

3. Permian natural gas pipeline capacity has been expanding.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

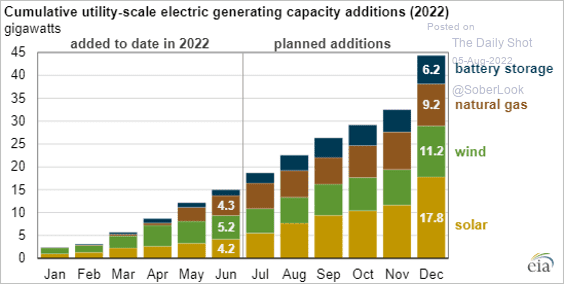

4. Finally, we have US power generating capacity additions.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

Equities

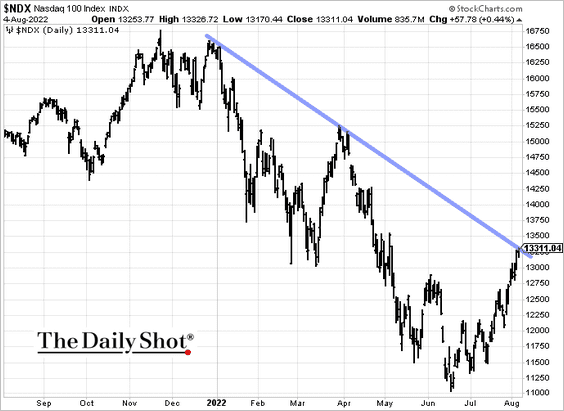

1. The Nasdaq 100 is at resistance.

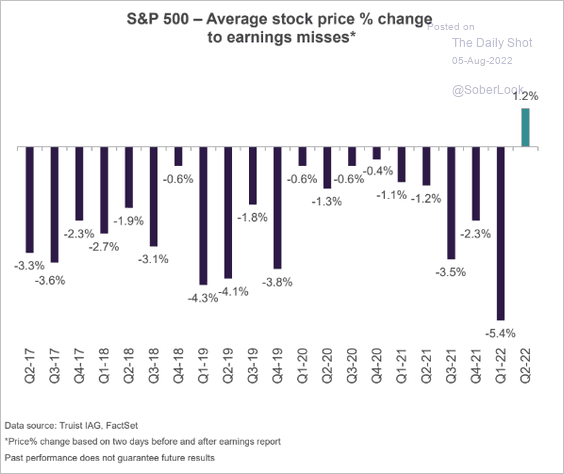

2. Responses to earnings misses have been unusually benign.

Source: Truist Advisory Services

Source: Truist Advisory Services

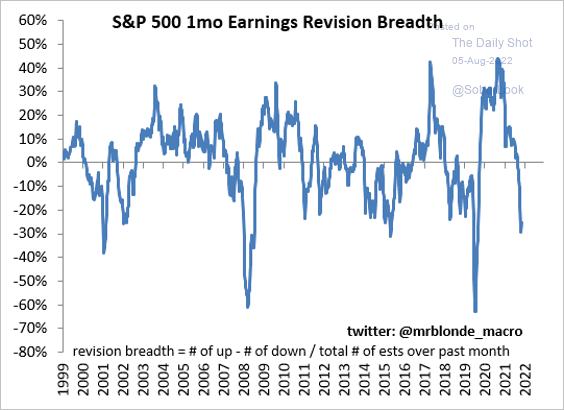

3. This chart shows the breadth of earnings revisions.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

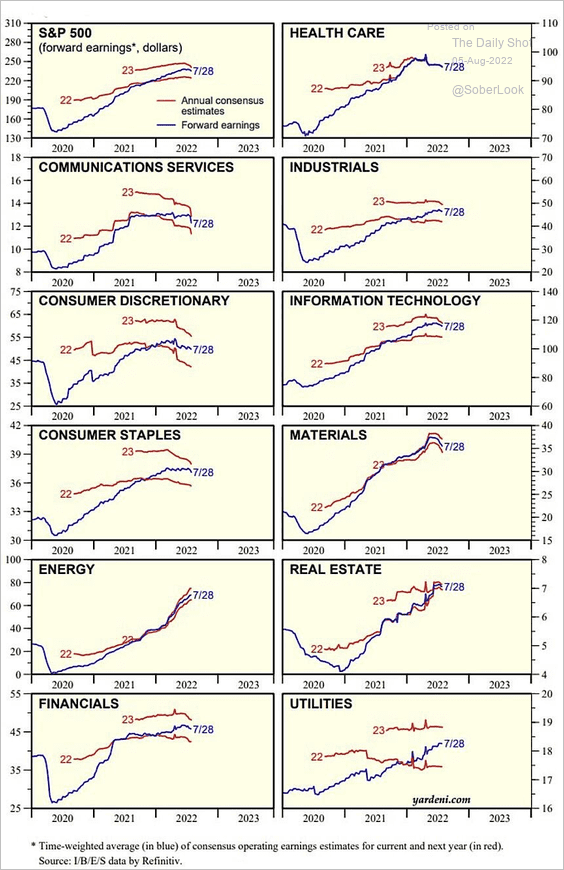

4. Here is the evolution of consensus earnings estimates by sector.

Source: Yardeni Research

Source: Yardeni Research

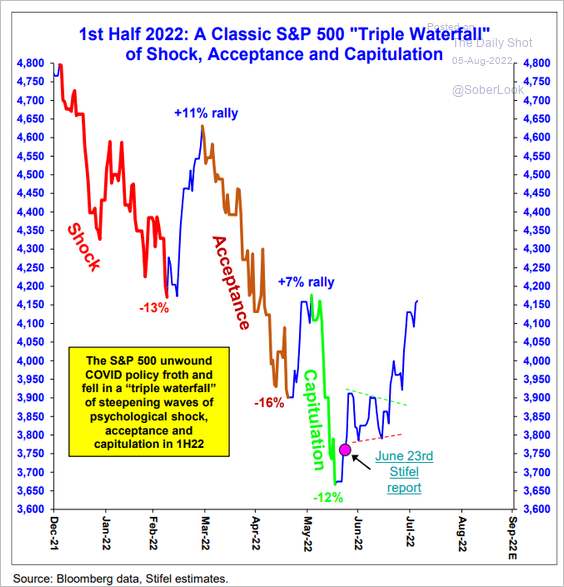

5. A classic “triple waterfall”?

Source: Stifel

Source: Stifel

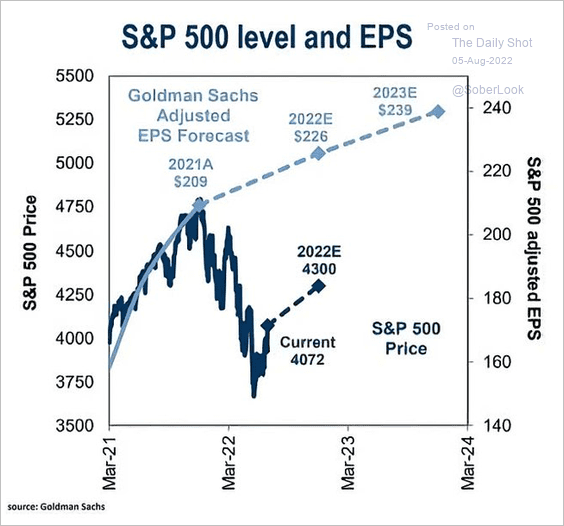

6. Goldman sees the S&P 500 at 4300 by the end of the year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

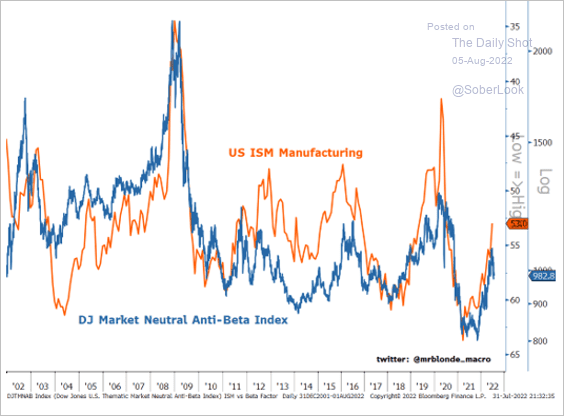

7. Low-beta shares tend to outperform when economic activity slows.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

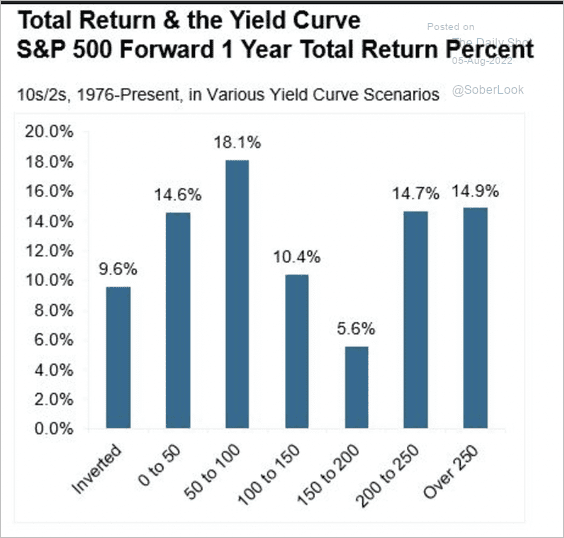

8. The average total return for the S&P 500 the year following a yield curve inversion is almost 10%.

Source: Denise Chisholm, Fidelity Investments

Source: Denise Chisholm, Fidelity Investments

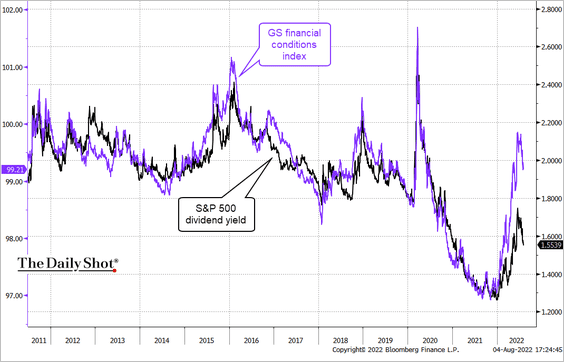

9. Given tighter financial conditions, the S&P 500 dividend yield should be higher.

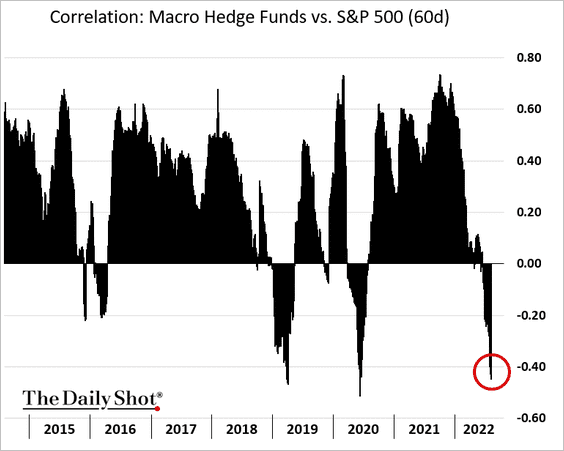

10. Macro hedge funds are short stocks.

h/t @pav_chartbook

h/t @pav_chartbook

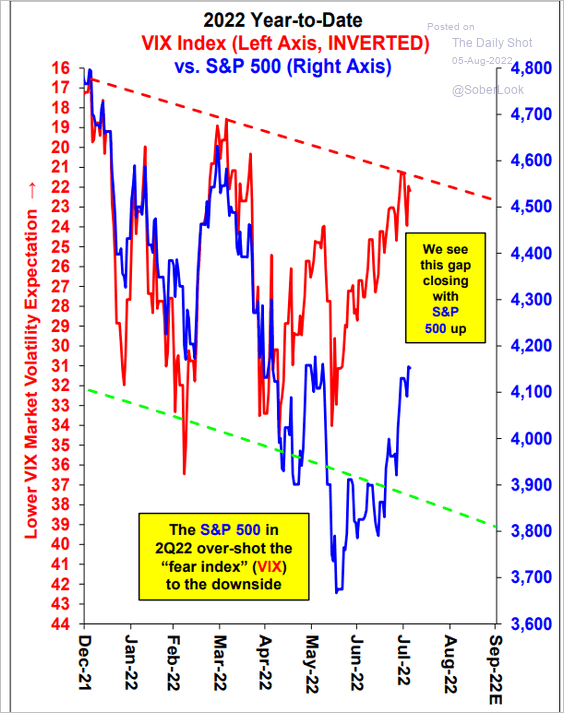

11. The VIX – S&P 500 divergence is closing.

Source: Stifel

Source: Stifel

Back to Index

Credit

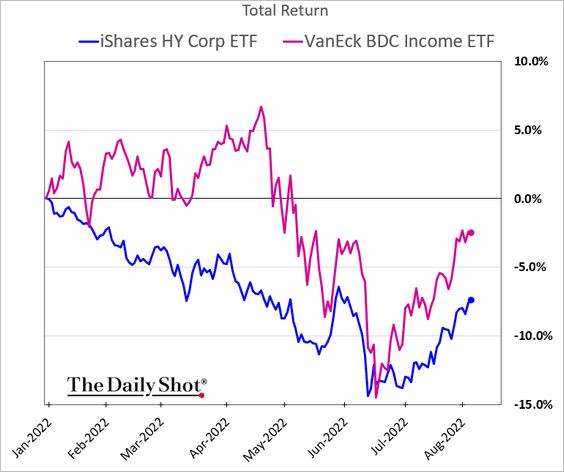

1. BDCs are still outperforming high-yield bonds.

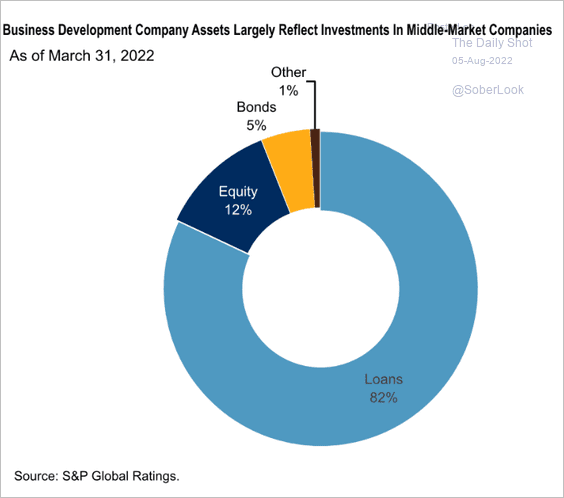

Here is the composition of BDC portfolios.

Source: S&P Global Ratings

Source: S&P Global Ratings

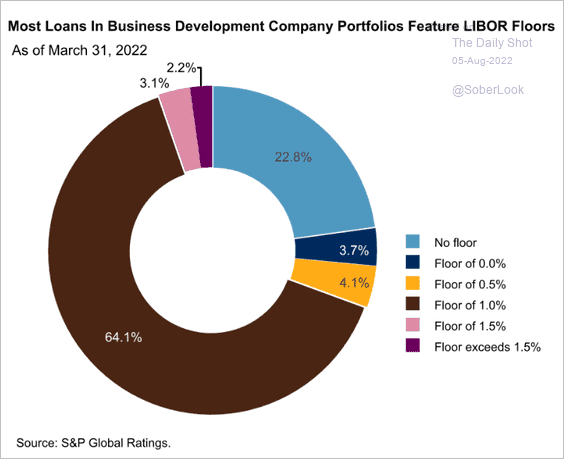

BDC portfolio loans tend to have a LIBOR floor.

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

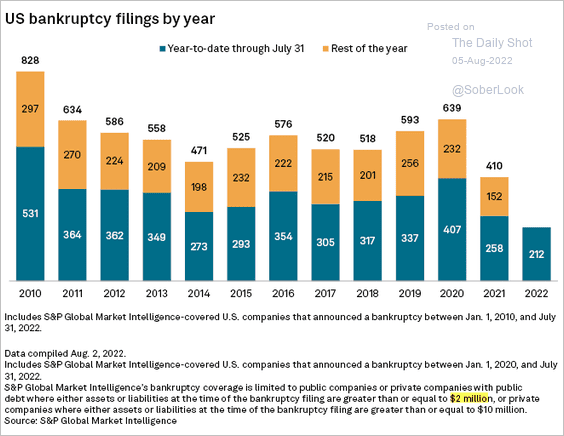

2. Bankruptcy filings among middle-market and larger firms have been relatively low this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

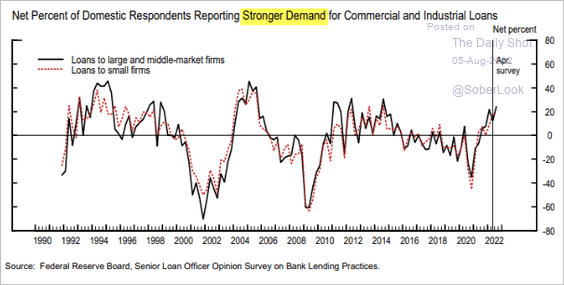

3. US banks are seeing stronger demand for business loans.

Source: Board of Governors of The Federal Reserve System

Source: Board of Governors of The Federal Reserve System

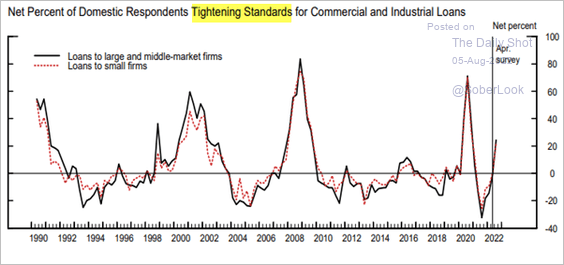

But they are tightening lending standards.

Source: Board of Governors of The Federal Reserve System

Source: Board of Governors of The Federal Reserve System

Back to Index

Rates

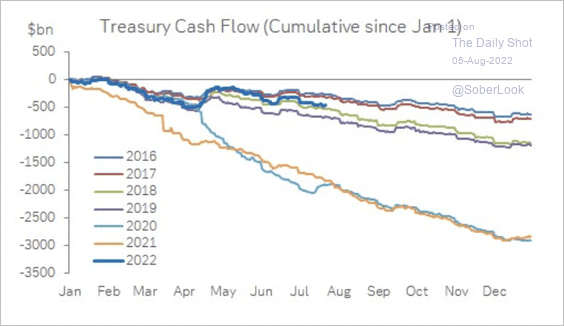

1. Treasury cash flows have improved markedly compared to the last two years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

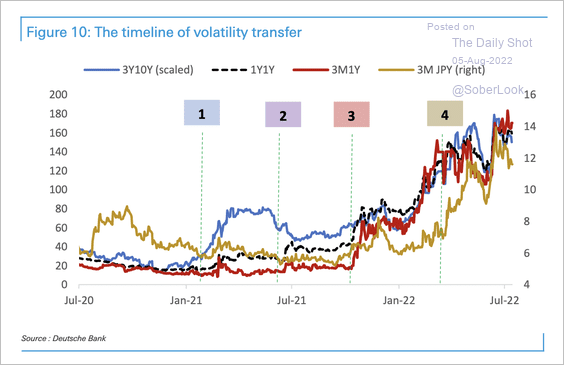

2. The rise in real rates over the past quarter has caused considerable turbulence in the market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

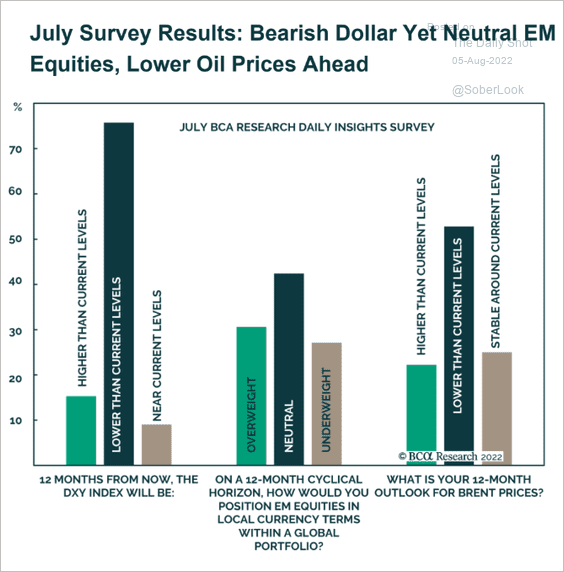

1. Investors see both the dollar and oil lower in 12 months.

Source: BCA Research

Source: BCA Research

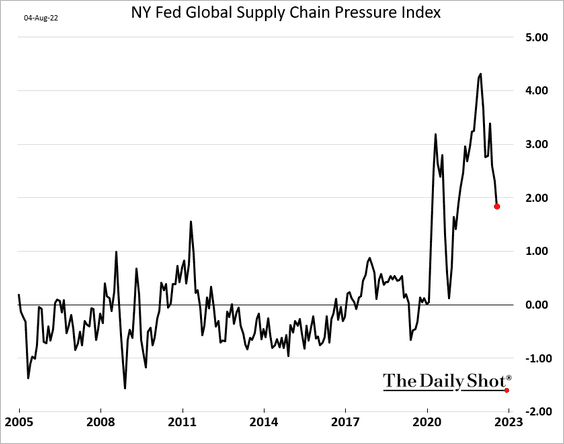

2. Supply chain stress continues to ease.

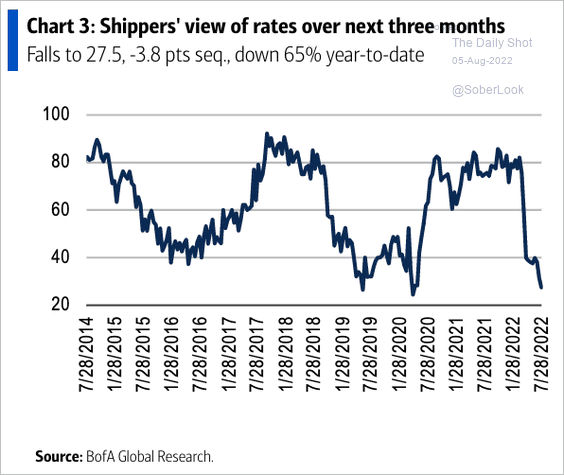

3. Shipping rates are expected to move lower.

Source: BofA Global Research

Source: BofA Global Research

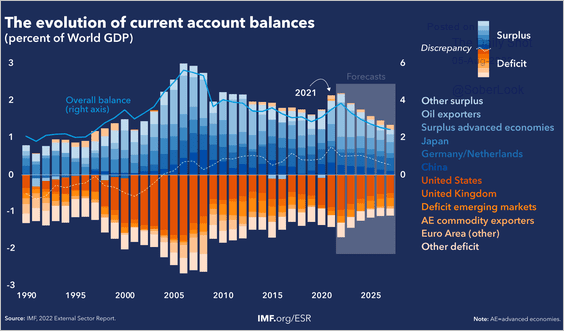

4. This chart shows the contributions to global current account imbalances.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

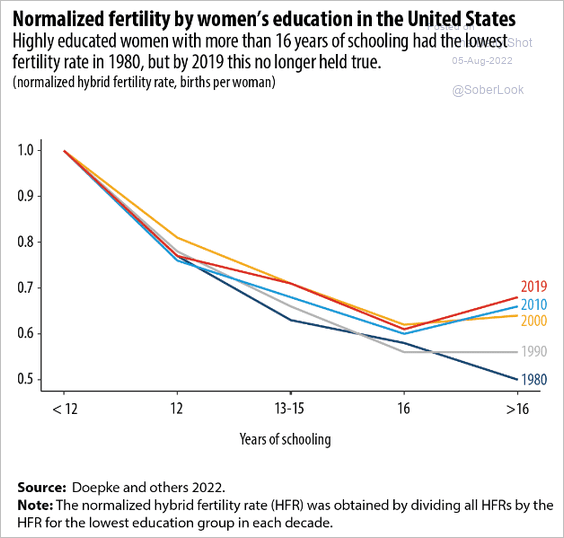

1. Fertility rates by women’s education:

Source: IMF Read full article

Source: IMF Read full article

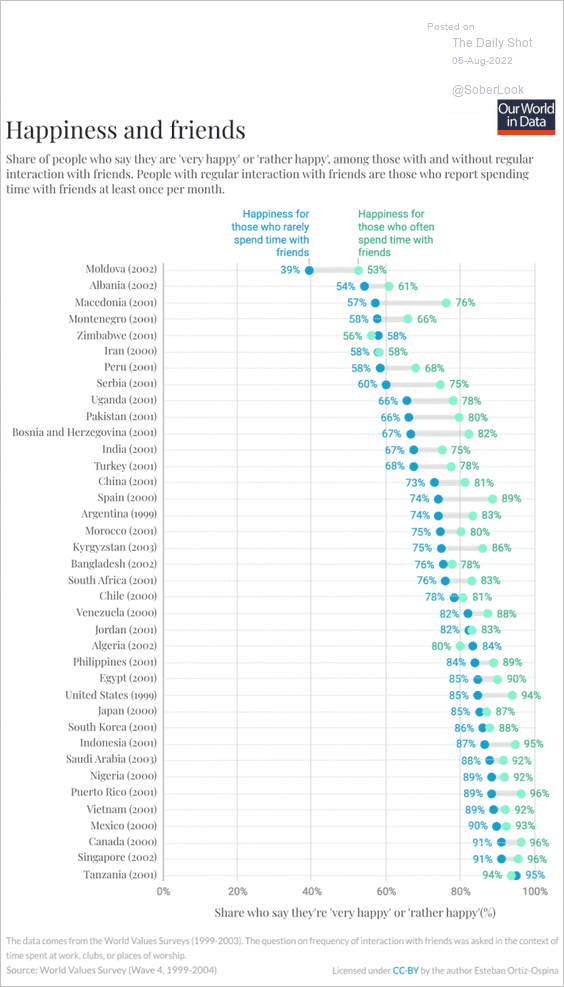

2. Happiness and friends:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

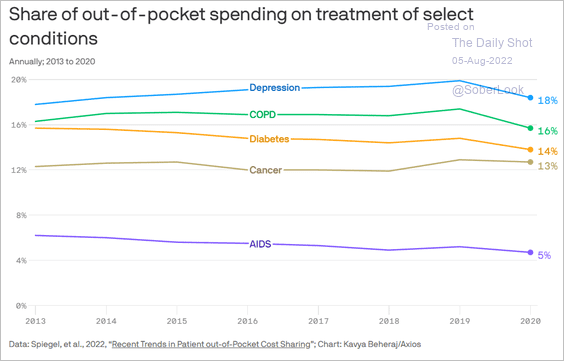

3. Out-of-pocket medical spending:

Source: @axios Read full article

Source: @axios Read full article

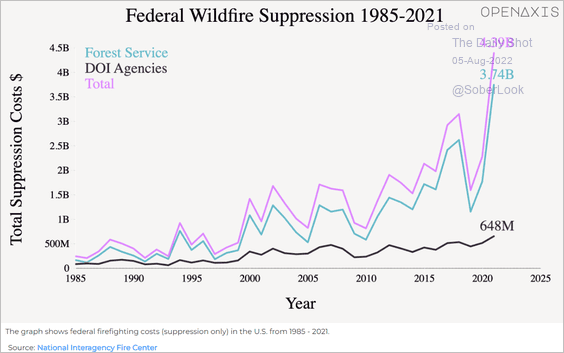

4. US federal wildfire suppression costs:

Source: OpenAxis

Source: OpenAxis

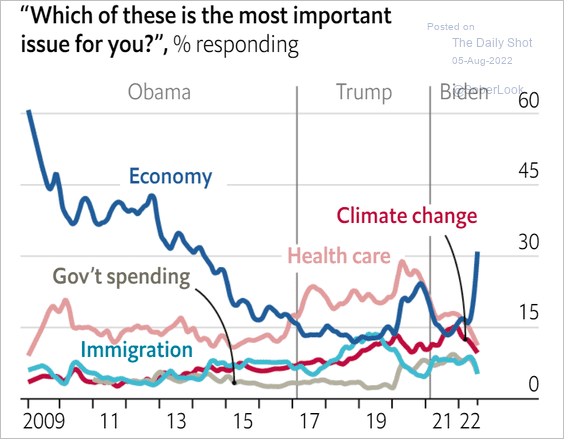

5. The most important issues in the US over time:

Source: The Economist Read full article

Source: The Economist Read full article

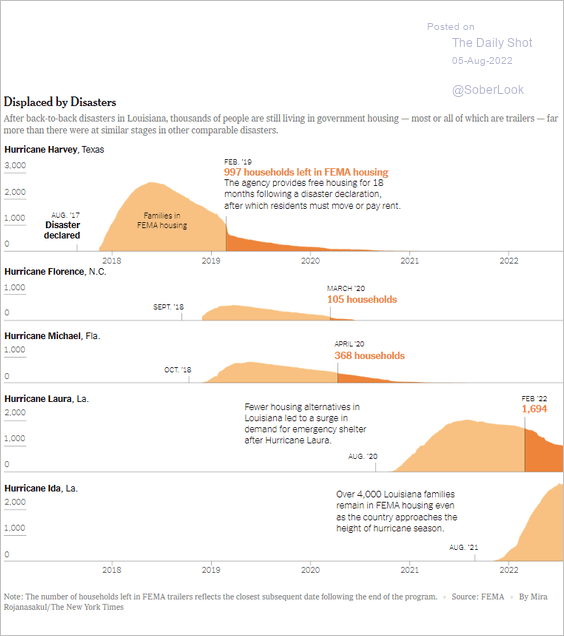

6. Living in emergency shelters:

Source: The New York Times Read full article

Source: The New York Times Read full article

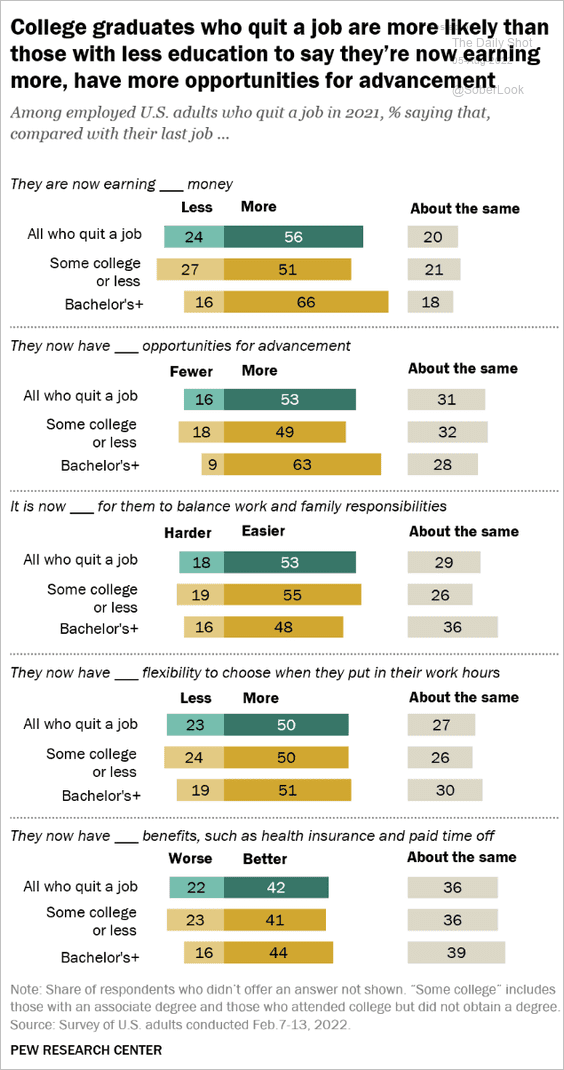

7. Comparing the current vs. previous job:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

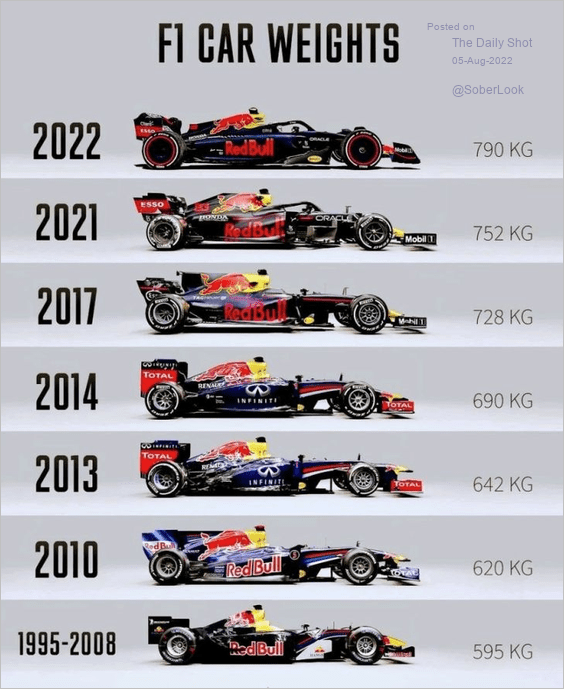

8. Formula 1 car weight over time:

Source: r/formula1

Source: r/formula1

——————–

Have a great weekend!

Back to Index