The Daily Shot: 24-Aug-22

• The United States.

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States.

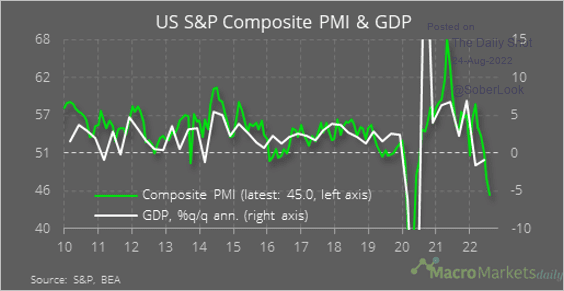

1. US business activity is in recession mode, according to the S&P Global PMI.

Source: @macro_daily

Source: @macro_daily

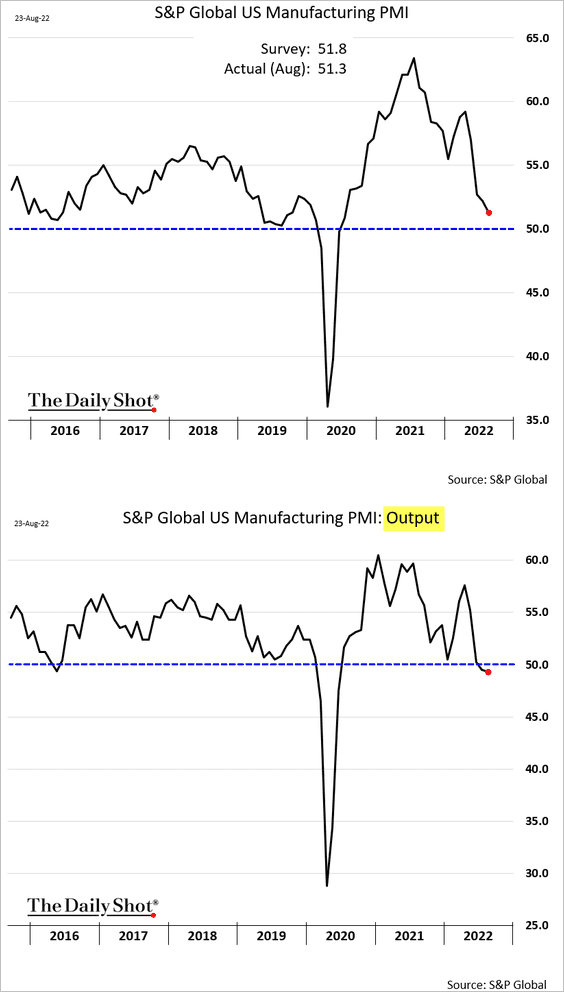

• Growth in factory activity is slowing rapidly as output contracts.

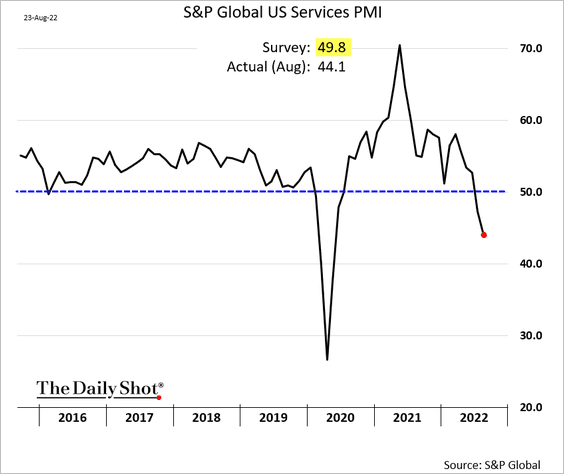

• The services PMI came in well below forecasts, with activity deteriorating quickly. Some of this weakness is driven by the housing market.

——————–

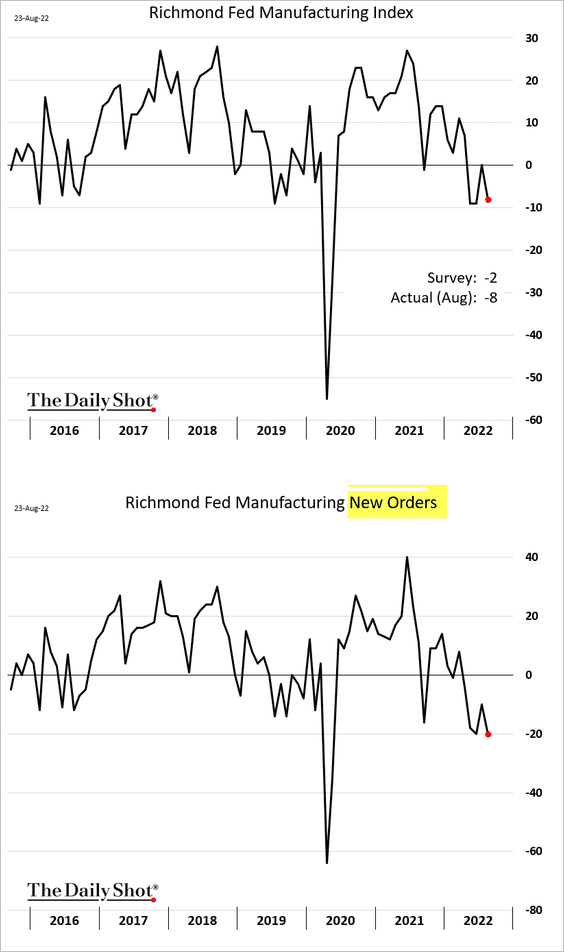

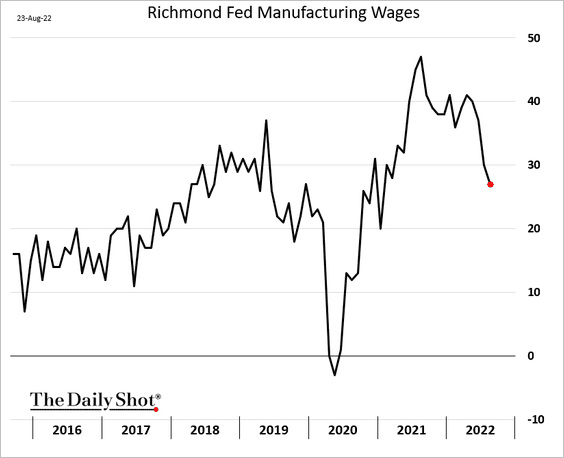

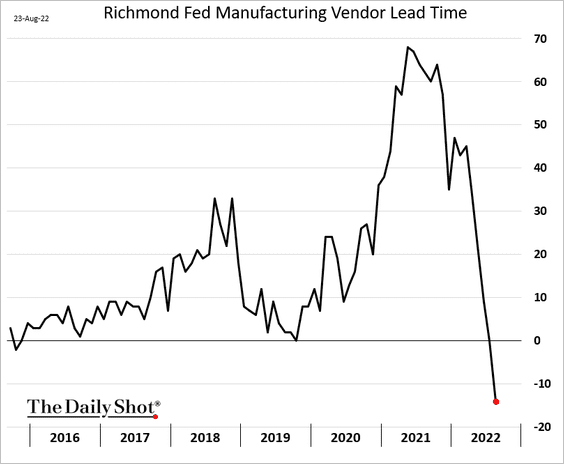

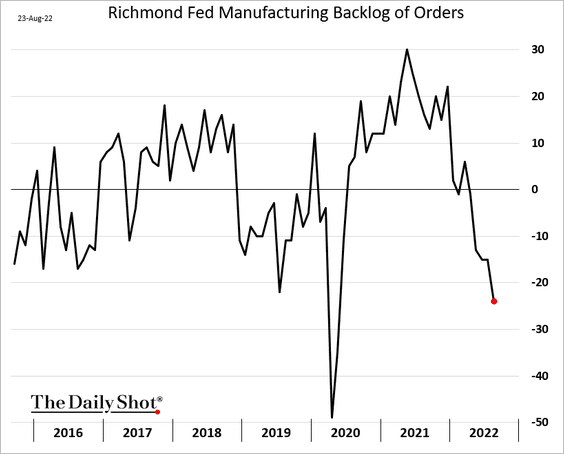

2. The Richmond Fed’s regional manufacturing report also shows deteriorating conditions.

• Fewer companies are boosting wages.

• Supplier bottlenecks are gone in the region as demand slumps.

Here is the backlog of orders.

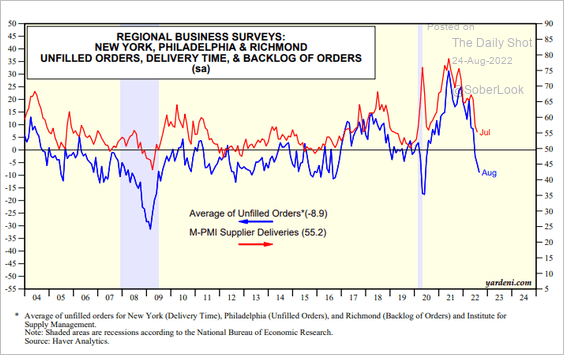

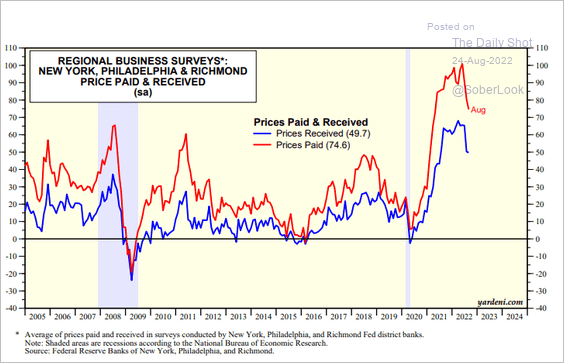

The combination of data from the NY Fed, the Philly Fed, and the Richmond Fed points to rapidly easing supply chain stress at the national level.

Source: Yardeni Research

Source: Yardeni Research

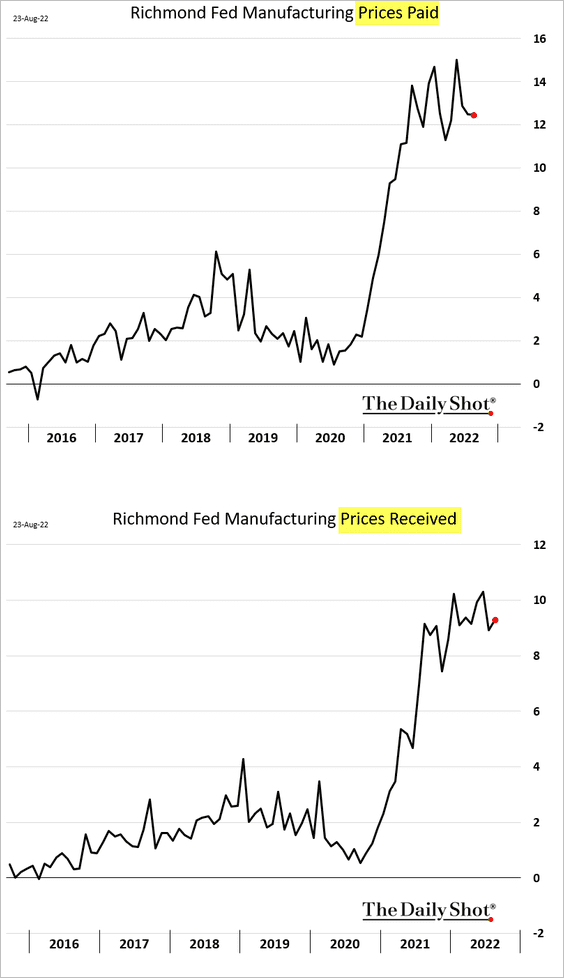

• The Richmond Fed’s report shows persistent price pressures.

– Here is what happens when the three Fed price indices are combined.

Source: Yardeni Research

Source: Yardeni Research

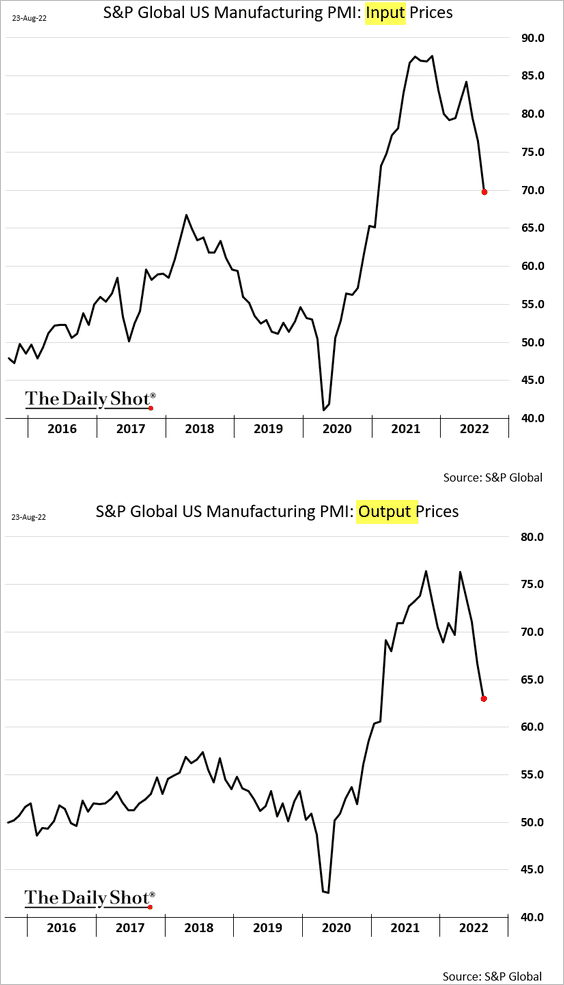

– And these are the manufacturing price indices at the national level from the S&P Global PMI report.

——————–

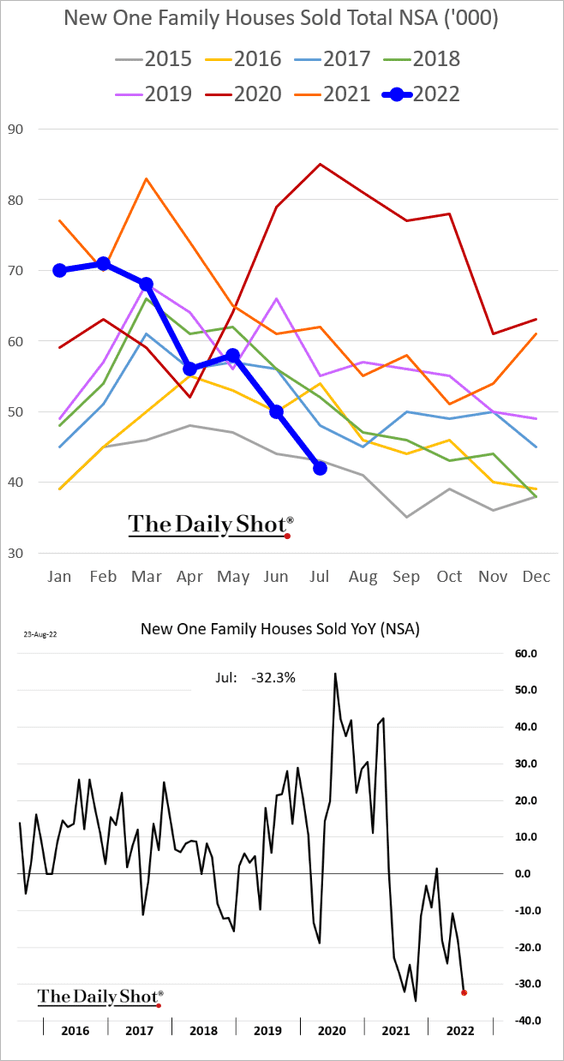

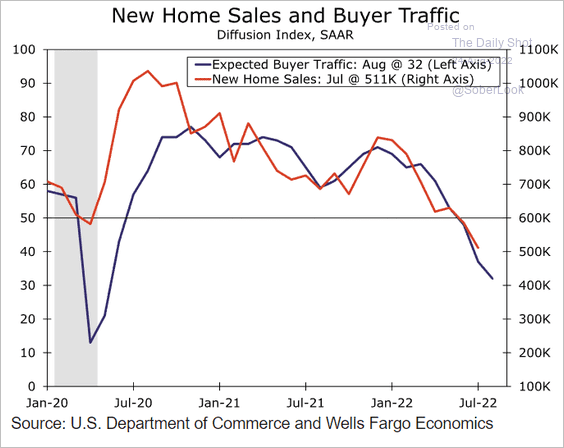

3. New home sales slumped last month, dipping below 2015 levels (down more than 30% vs. last year).

And we could see more pain ahead.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

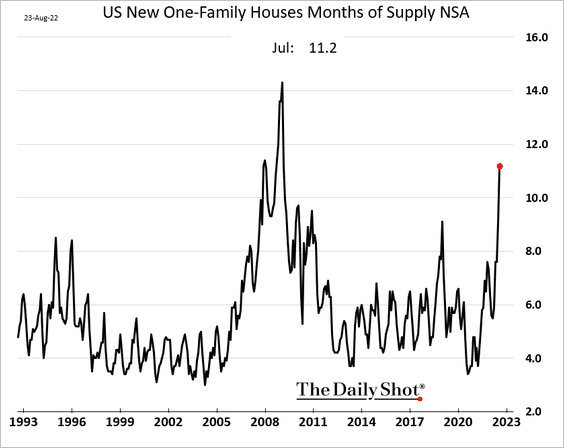

• Measured in months of supply, new home inventories hit the highest level since the financial crisis.

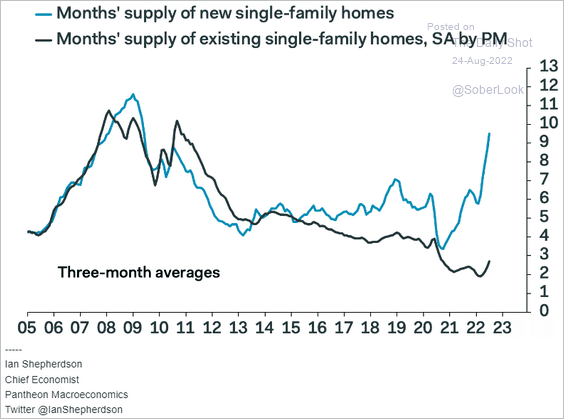

– What do these bloated supplies mean for existing home inventories?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

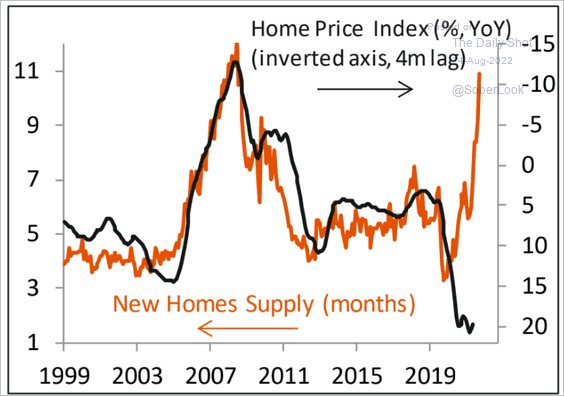

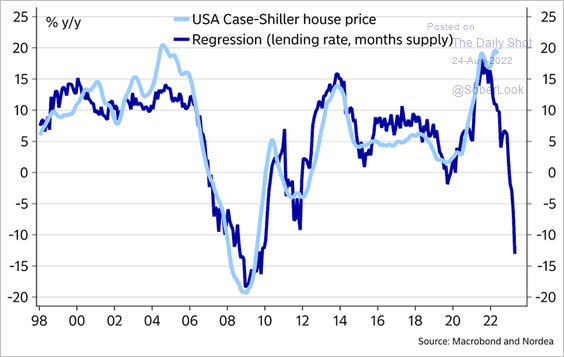

… and home prices (2 charts)?

Source: Piper Sandler

Source: Piper Sandler

Source: @MikaelSarwe

Source: @MikaelSarwe

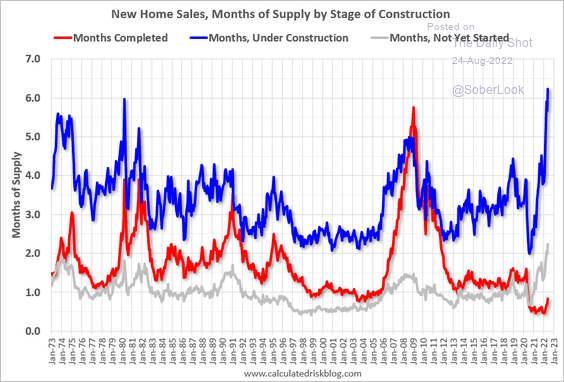

– Here are the inventories by stage of construction.

Source: @calculatedrisk

Source: @calculatedrisk

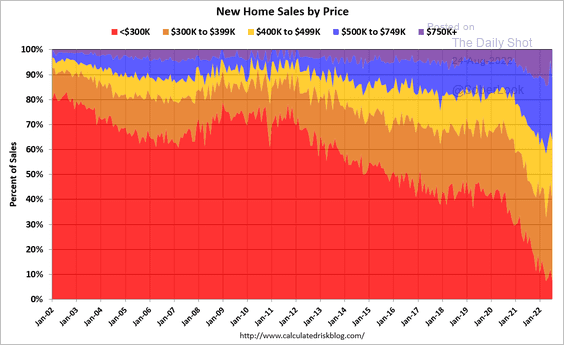

– This chart shows new home price distribution over time.

Source: @calculatedrisk

Source: @calculatedrisk

——————–

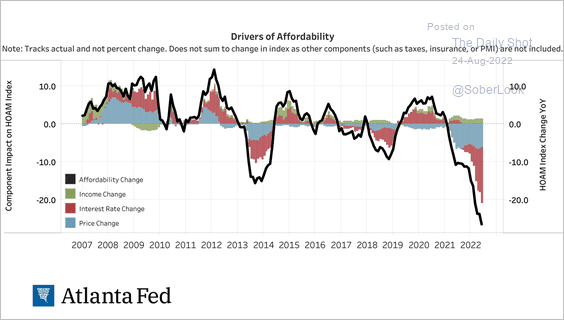

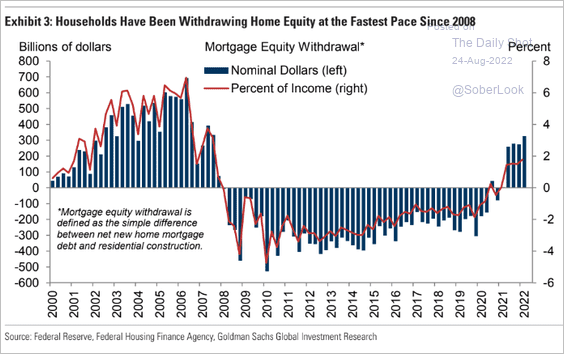

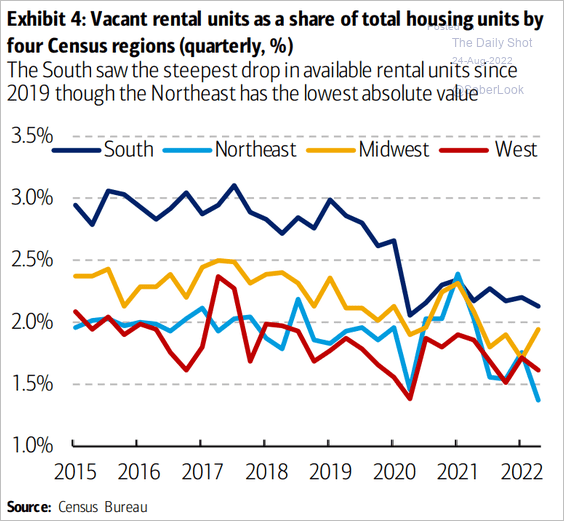

4. Next, we have some additional data on the housing market.

• Drivers of housing affordability:

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

• Housing equity withdrawals (mostly through cash-out refi):

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Tightening rental markets:

Source: Bank of America Institute

Source: Bank of America Institute

——————–

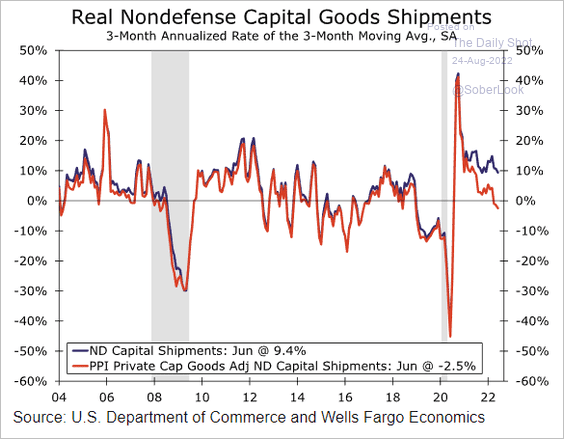

5. Real business investment has been slowing.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Slumping semiconductor demand points to further weakness in business investment.

![]() Source: Quill Intelligence

Source: Quill Intelligence

![]() Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

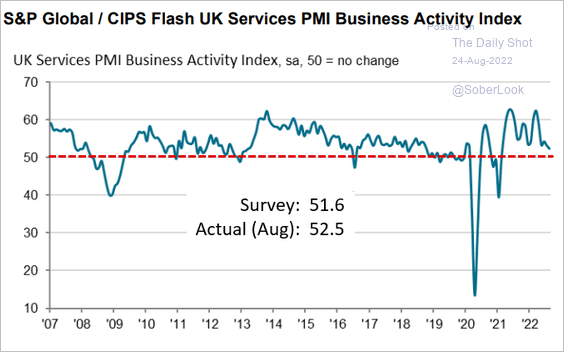

The United Kingdom

1. UK service sector activity remains in growth territory, according to the S&P Global PMI.

Source: S&P Global PMI

Source: S&P Global PMI

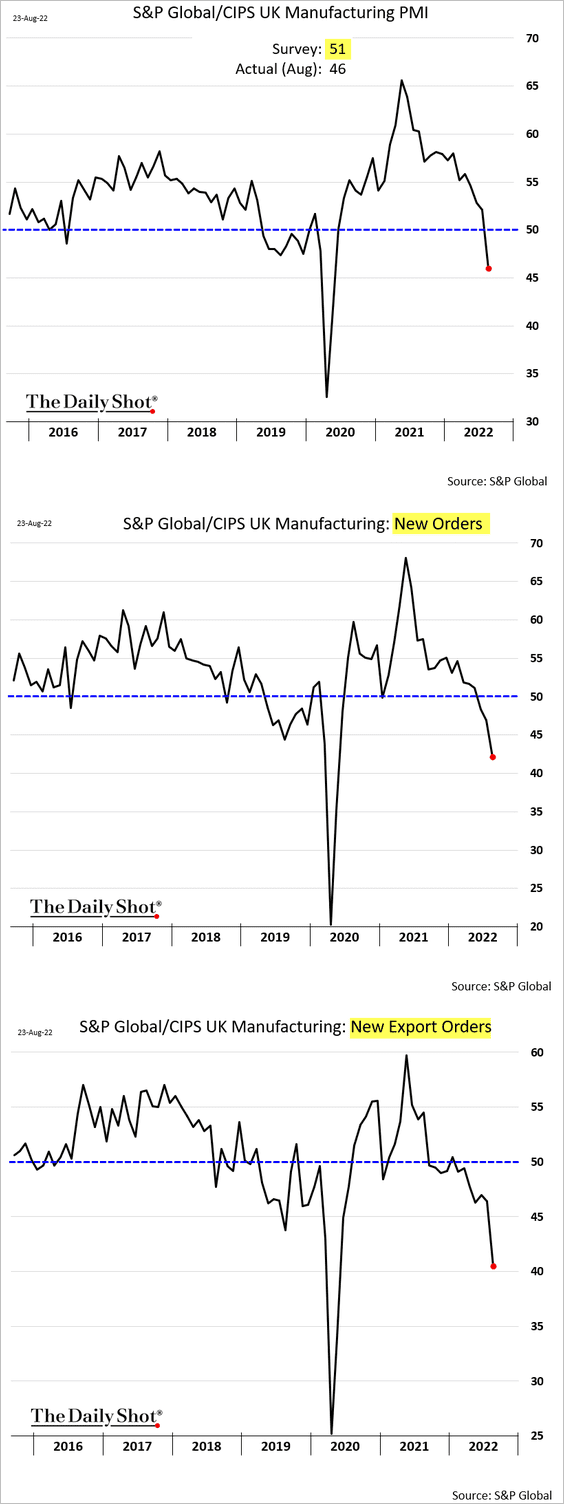

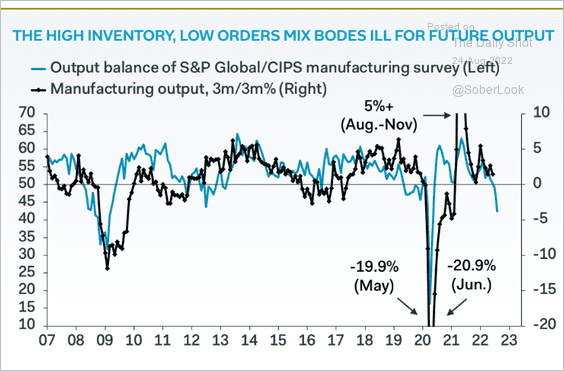

But manufacturing is in recession as demand crashes.

• Industrial production is expected to deteriorate sharply.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

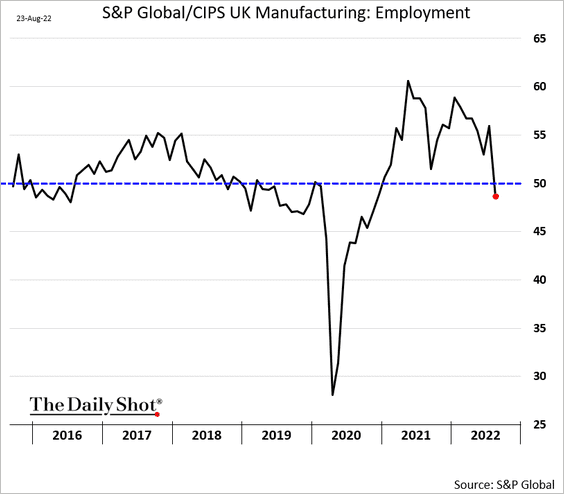

.• Factories are starting to shed workers.

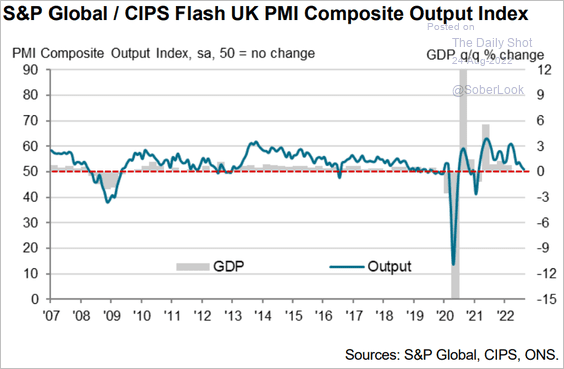

• Growth in composite output (manufacturing and services) has stalled.

Source: S&P Global PMI Read full article

Source: S&P Global PMI Read full article

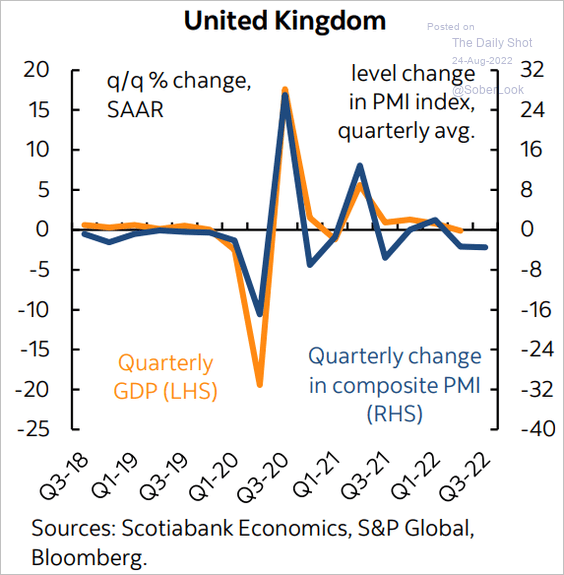

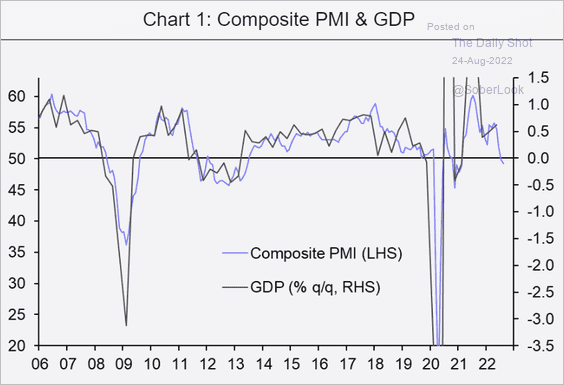

• What does the PMI report mean for GDP growth?

Source: Scotiabank Economics

Source: Scotiabank Economics

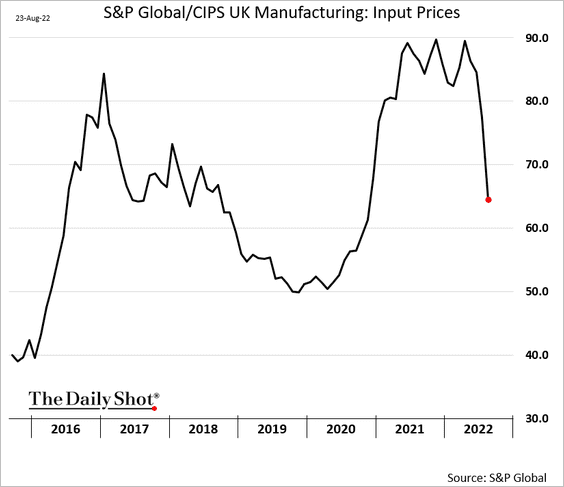

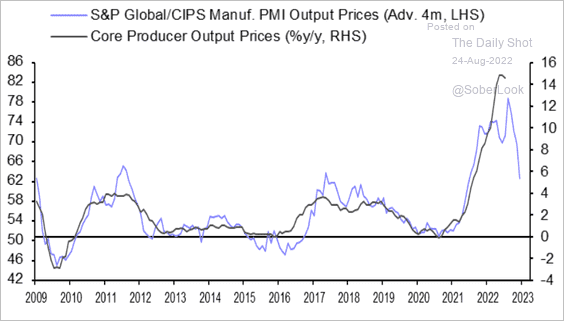

• Manufacturing prices are moderating, …

… which is good news for the PPI.

Source: Capital Economics

Source: Capital Economics

——————–

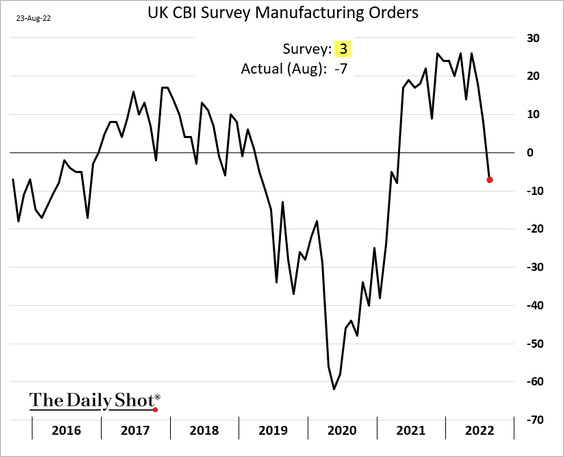

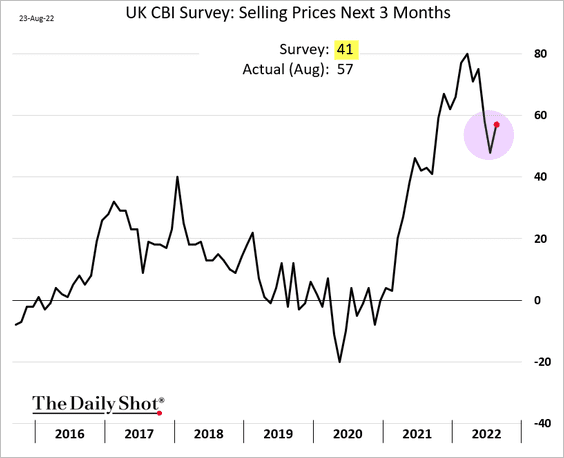

2. The CBI report unexpectedly showed a contraction in industrial orders.

Source: Reuters Read full article

Source: Reuters Read full article

Price pressures persist, according to the CBI.

——————–

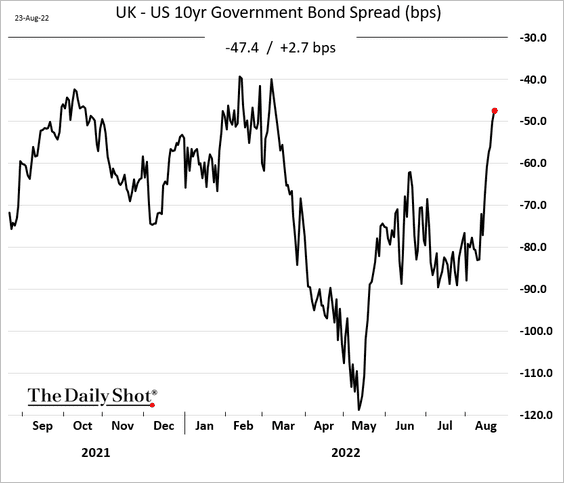

3. The UK – US bond spreads are tightening.

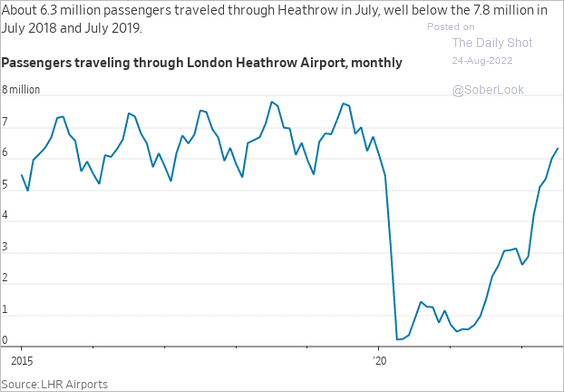

4. Heathrow travel volume has recovered.

Source: @WSJ Read full article

Source: @WSJ Read full article

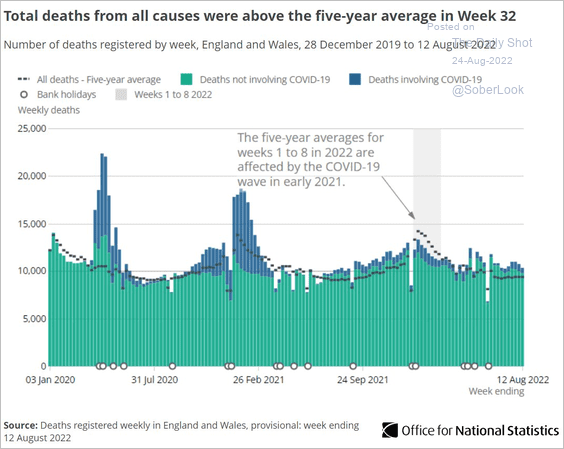

5. England and Wales death rates remain above the 5-year average.

Source: @ONS Read full article

Source: @ONS Read full article

Back to Index

The Eurozone

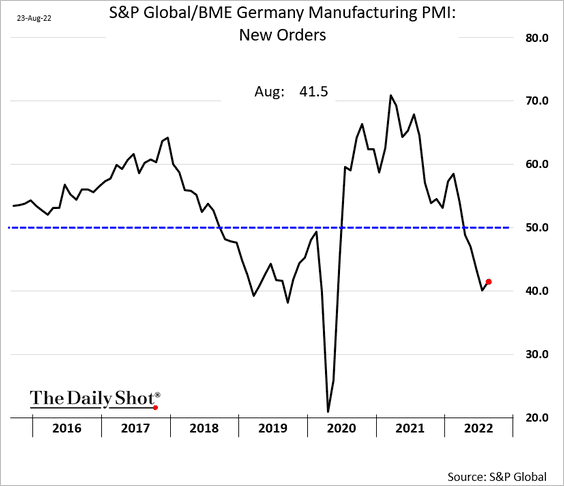

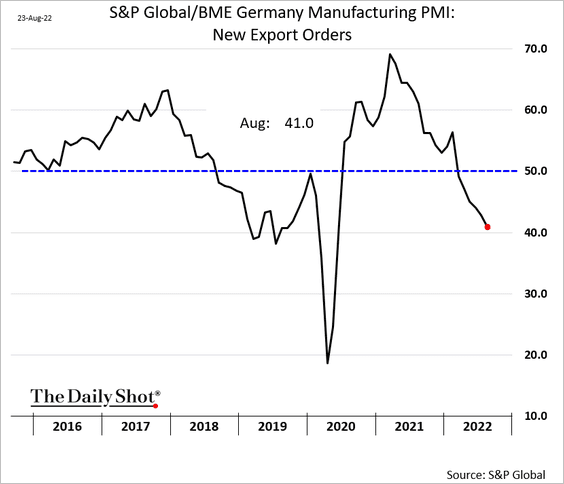

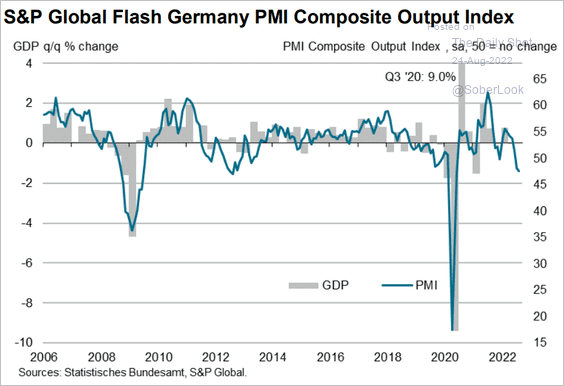

1. As we saw yesterday (chart), Germany’s manufacturing PMI surprised to the upside. However, new orders continue to shrink (PMI < 50).

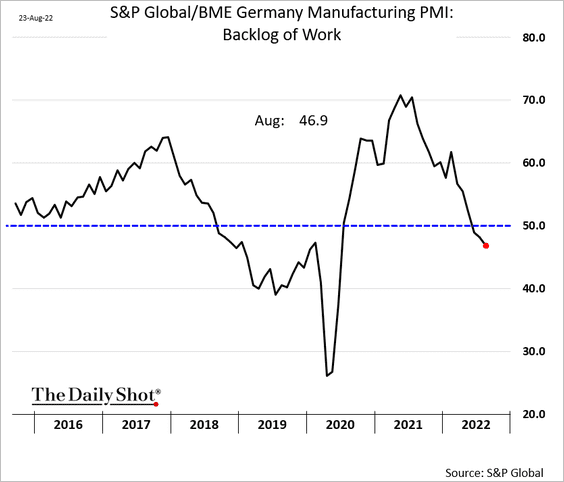

Order backlog is easing.

Germany’s service activity moved deeper into contraction this month (chart). Here is the composite PMI.

Source: S&P Global PMI

Source: S&P Global PMI

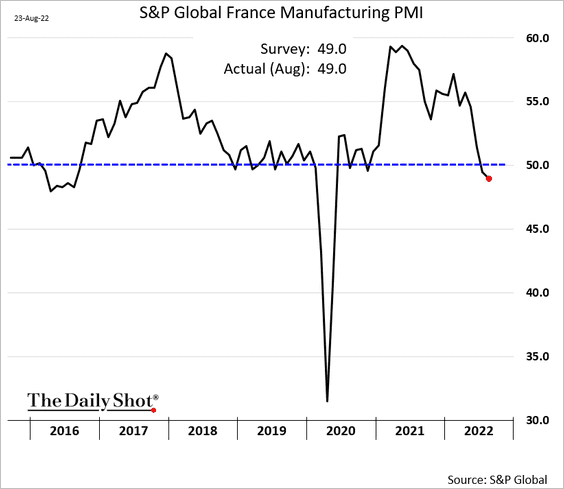

• French manufacturing is retreating, …

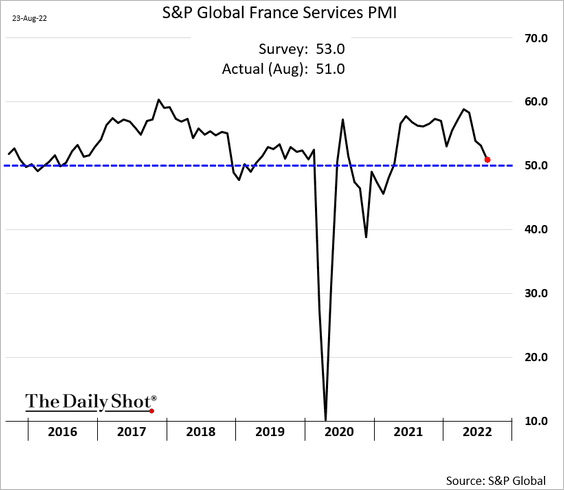

… and service-sector growth is about to stall.

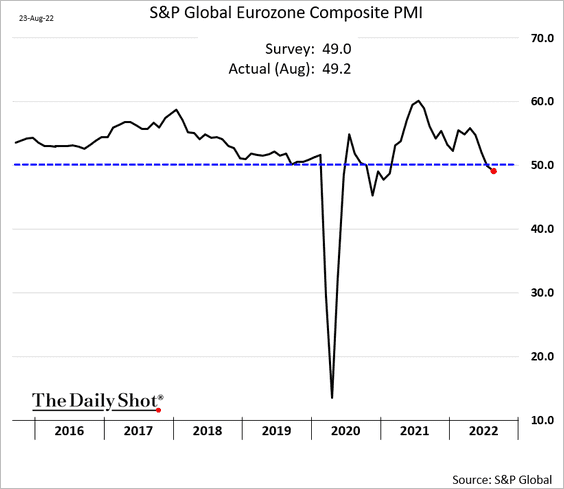

• At the Eurozone level, the PMI data looks recessionary.

Source: Capital Economics

Source: Capital Economics

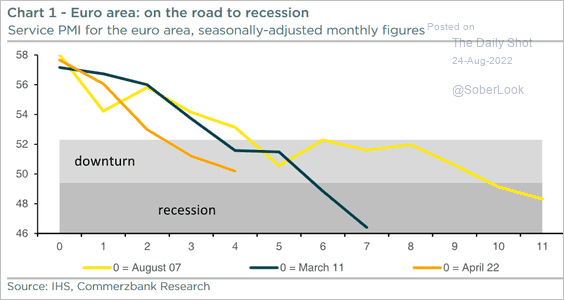

Here is the service sector PMI compared to previous recessions.

Source: Commerzbank Research

Source: Commerzbank Research

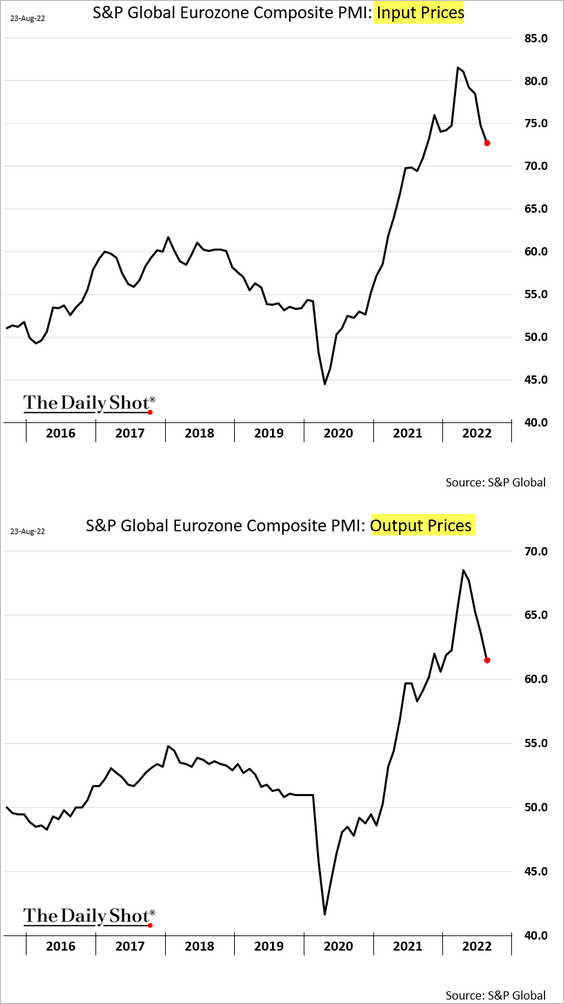

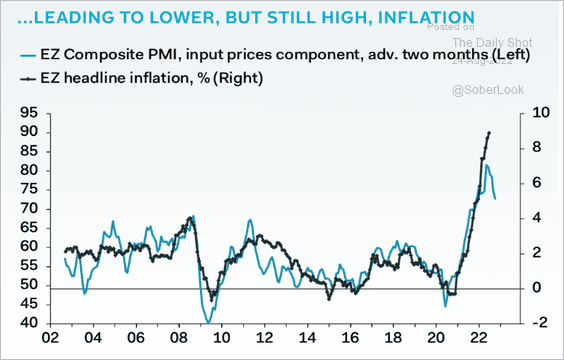

• Price pressures are starting to moderate, …

… which should slow consumer inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

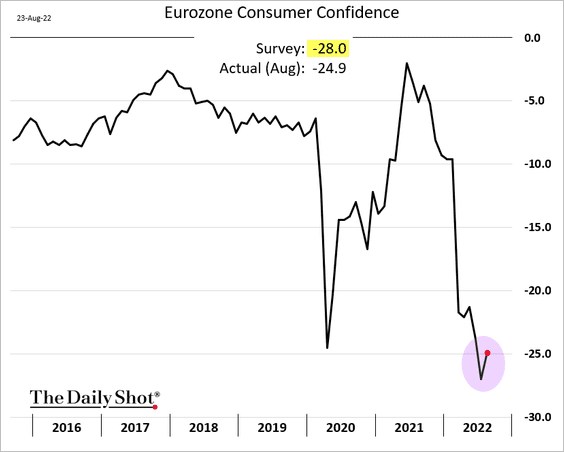

2. Consumer confidence appears to have bottomed.

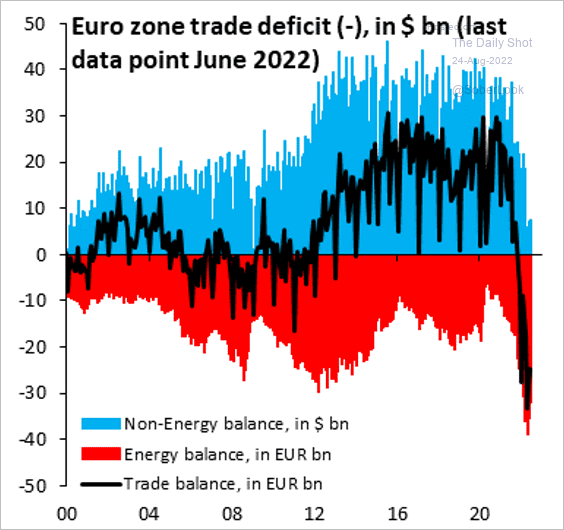

3. The era of cheap Russian energy is over for now.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

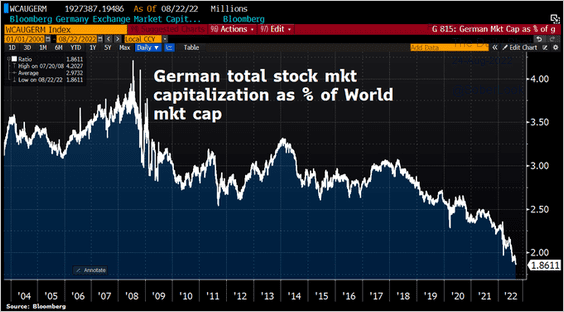

4. Here is Germany’s stock market capitalization as a share of the global market cap.

Source: @Schuldensuehner

Source: @Schuldensuehner

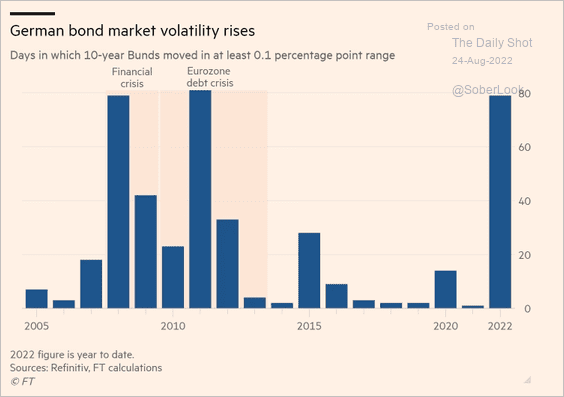

5. Bund volatility surged this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

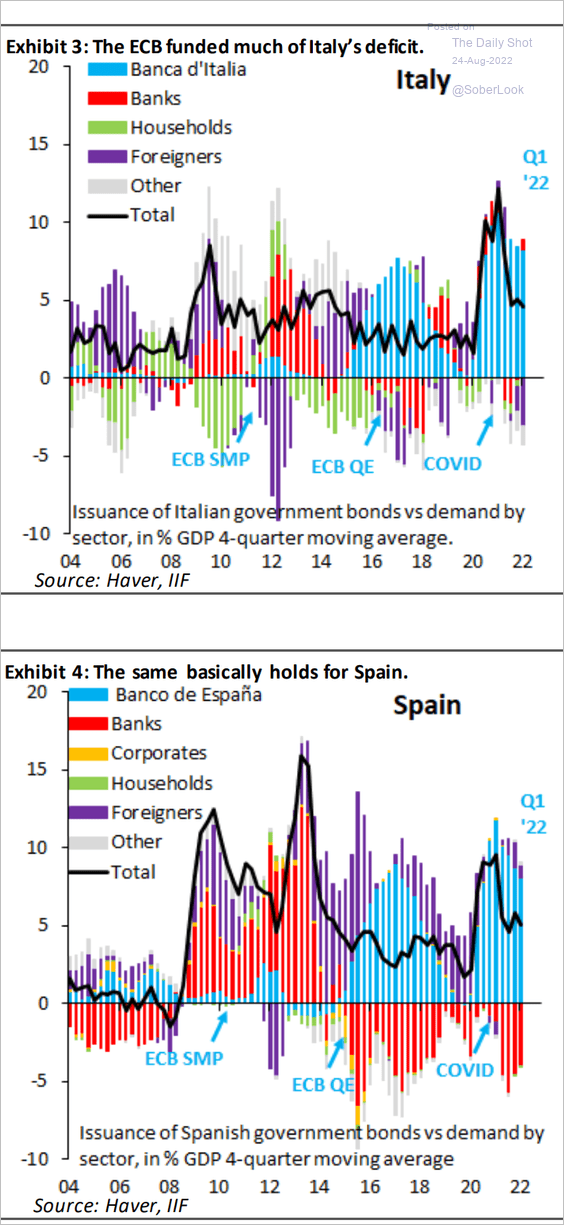

6. Italian and Spanish yields are likely to widen further without the ECB’s support.

Source: IIF

Source: IIF

Back to Index

Europe

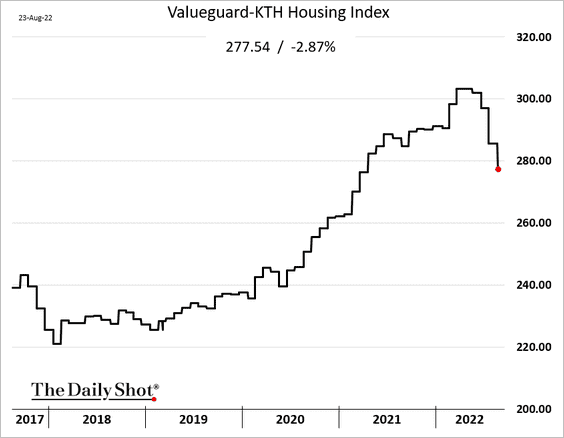

1. Sweden’s housing market is rolling over.

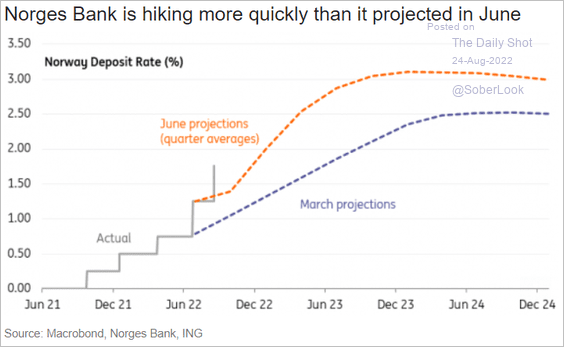

2. Norway’s hiking cycle is outpacing expectations.

Source: ING

Source: ING

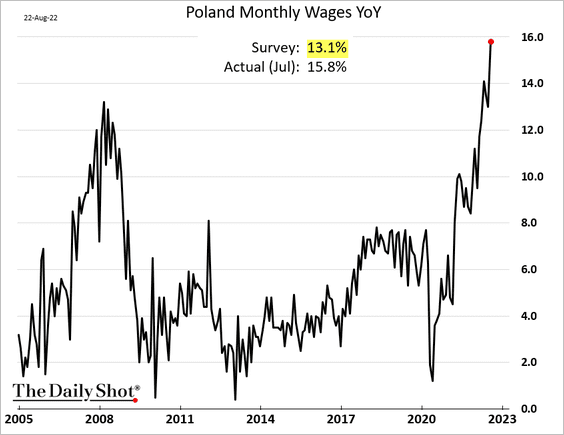

3. Wage growth is surging in Poland.

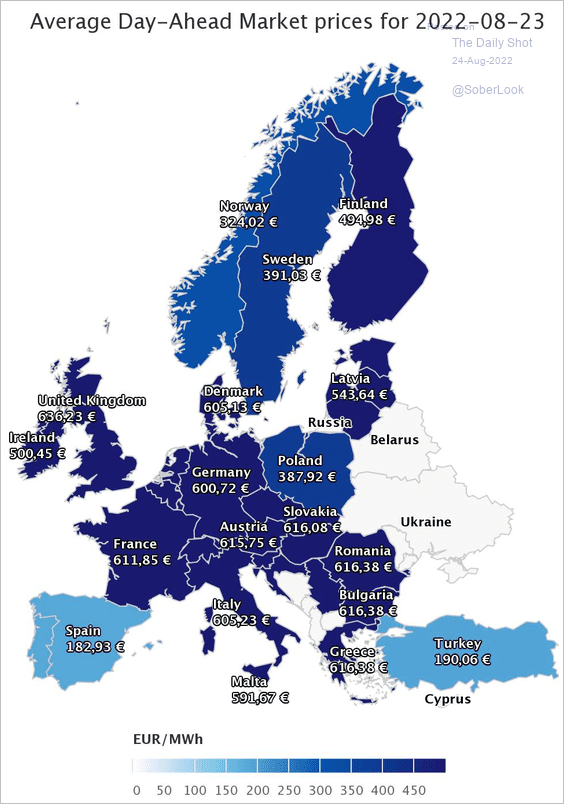

4. European electricity prices are out of control.

Source: @JavierBlas

Source: @JavierBlas

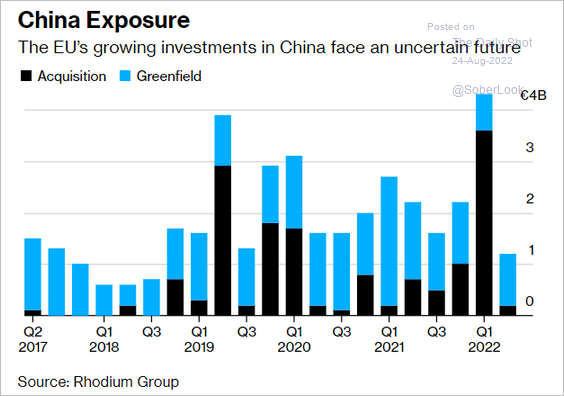

5. This chart shows the EU’s investment in China.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Asia – Pacific

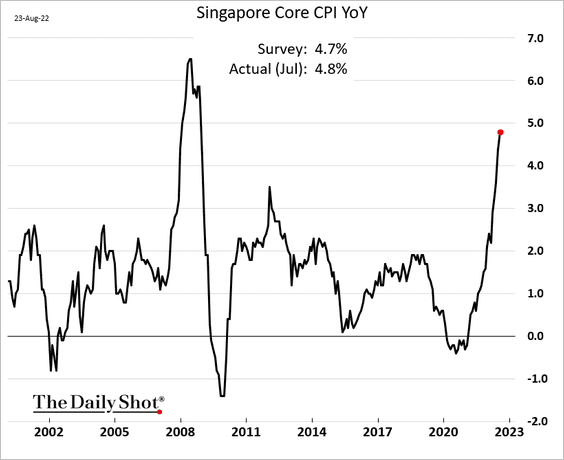

1. Singapore’s inflation has accelerated.

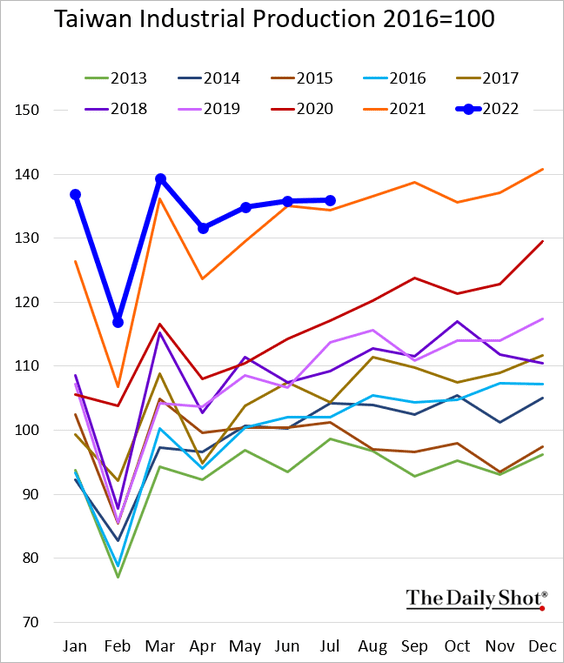

2. Taiwan’s industrial production (volume) is still holding above 2021 levels.

Back to Index

China

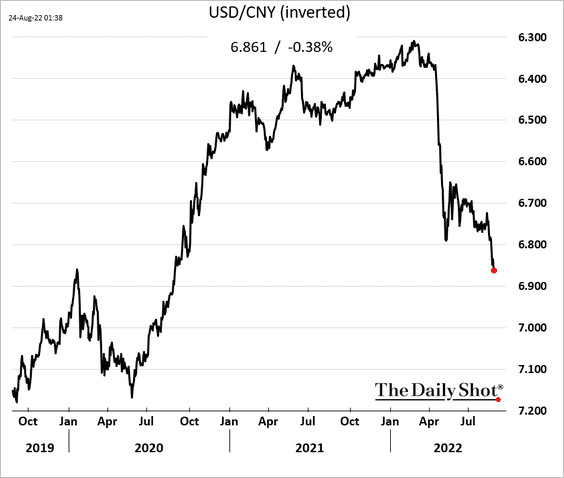

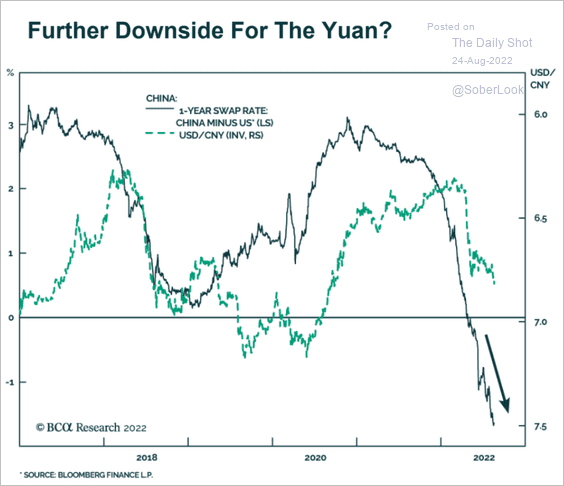

1. Beijing continues to let the renminbi weaken (a form of stimulus).

Diverging US/China monetary policies support further RMB declines.

Source: BCA Research

Source: BCA Research

——————–

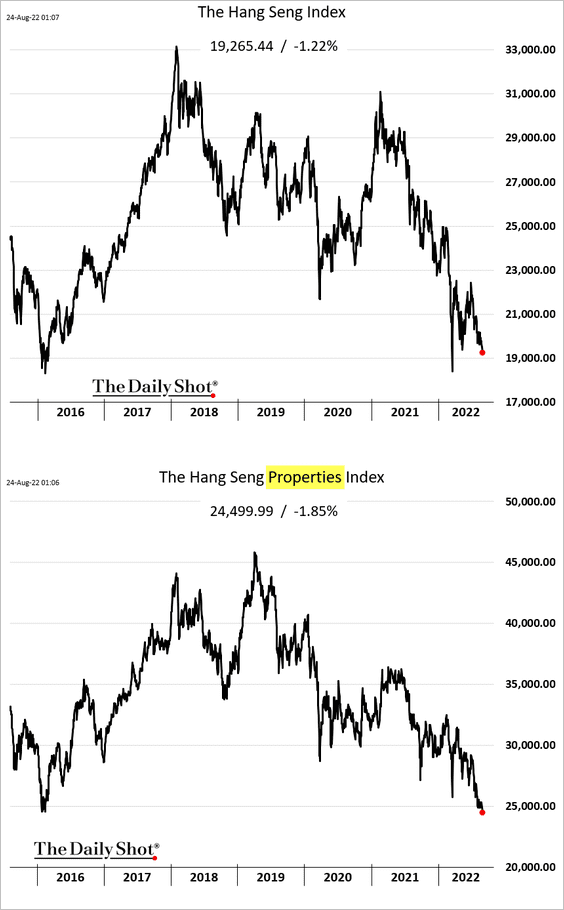

2. Stocks are under pressure in Hong Kong, with the properties index about to take out the 2016 low.

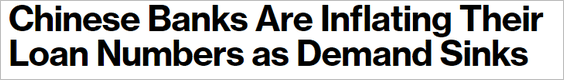

3. Banks are struggling to grow assets.

Source: @markets Read full article

Source: @markets Read full article

Bloomberg: … some state-owned banks are extending loans to companies and then allowing them to deposit funds at the same interest rate, according to executives at six banks who spoke to Bloomberg News on condition of anonymity. Others are borrowing from each other through short-term financing arrangements that can be dressed up as new loans to boost volumes …

——————–

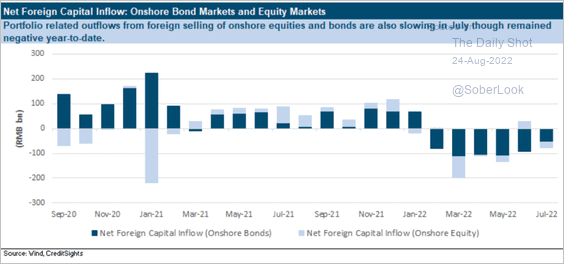

4. Will capital outflows end this quarter?

Source: CreditSights

Source: CreditSights

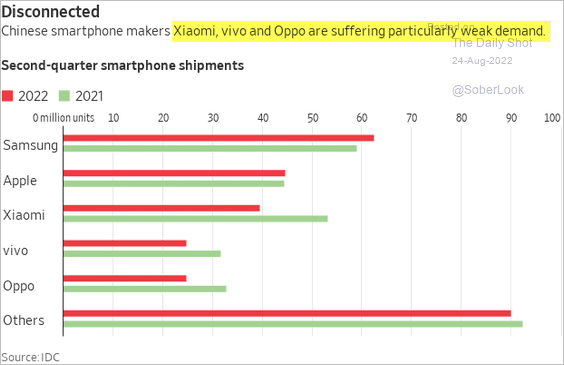

5. Smartphone demand has slowed.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

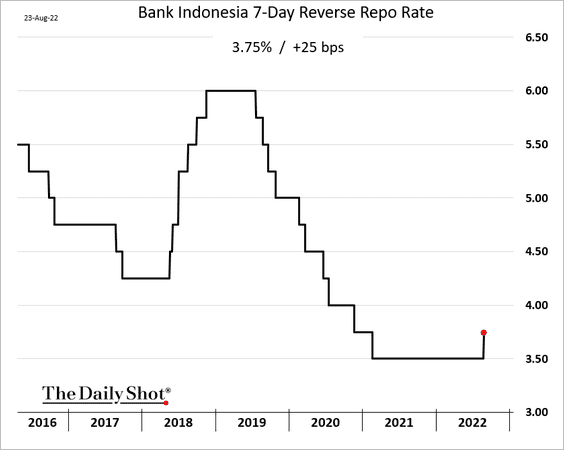

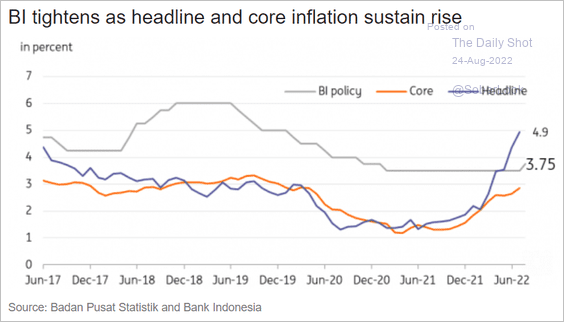

1. Indonesia’s central bank finally raised rates as inflation strengthens.

Source: ING

Source: ING

——————–

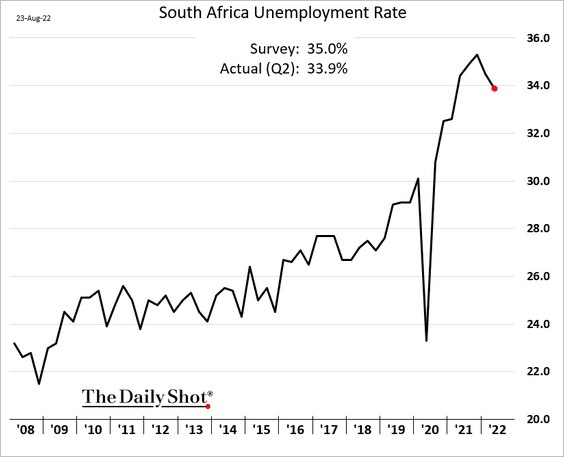

2. South Africa’s unemployment rate appears to have peaked.

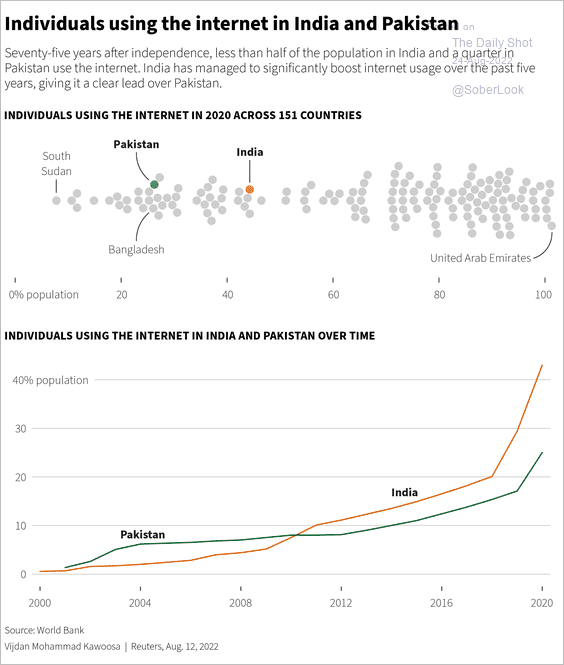

3. This chart shows internet usage in India and Pakistan.

Source: @ReutersGraphics

Source: @ReutersGraphics

Back to Index

Cryptocurrency

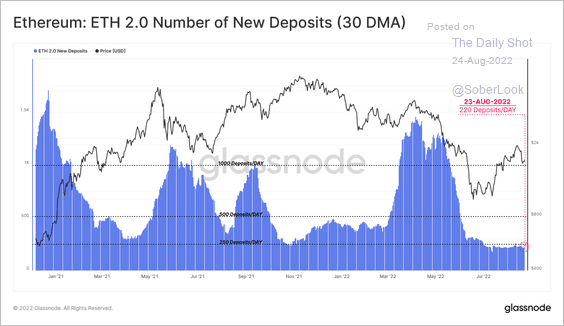

1. The number of ETH deposits into the Beacon chain contract has stabilized at relatively low levels as investors await The Merge.

Source: @glassnode

Source: @glassnode

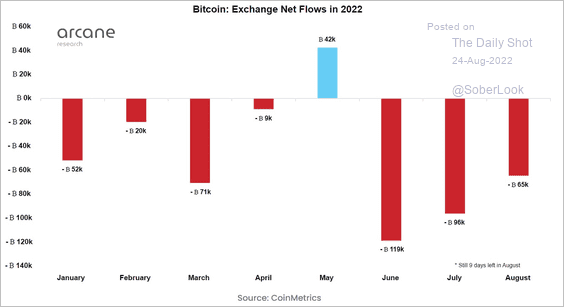

2. Bitcoin holders have been moving their tokens outside of exchanges over the past few months.

Source: @ArcaneResearch

Source: @ArcaneResearch

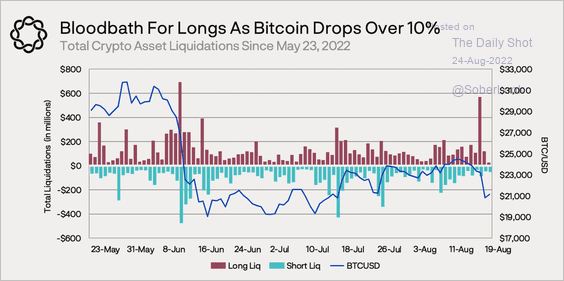

3. Bitcoin’s recent sell-off triggered the largest amount of long liquidations since June.

Source: @Delphi_Digital

Source: @Delphi_Digital

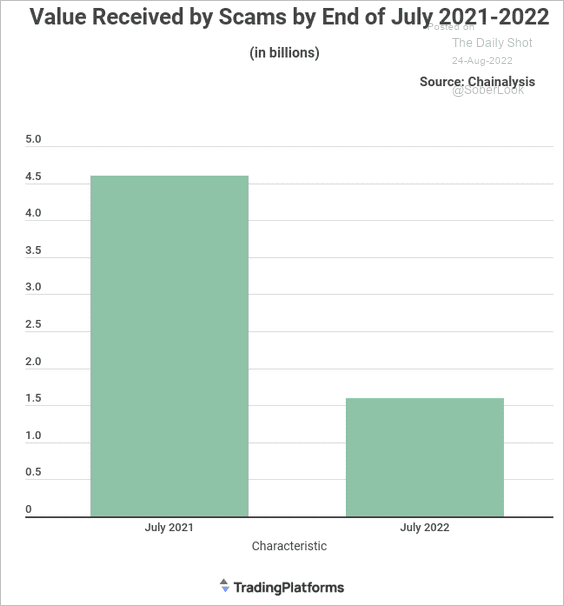

4. Crypto fraud revenue declined substantially after the market meltdown.

Source: Tradingplatforms.com Read full article

Source: Tradingplatforms.com Read full article

Back to Index

Commodities

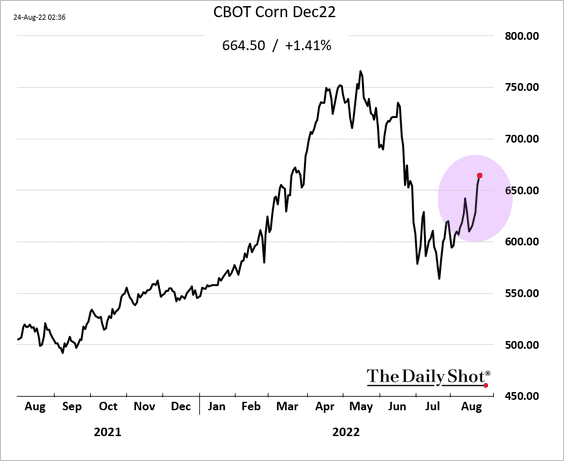

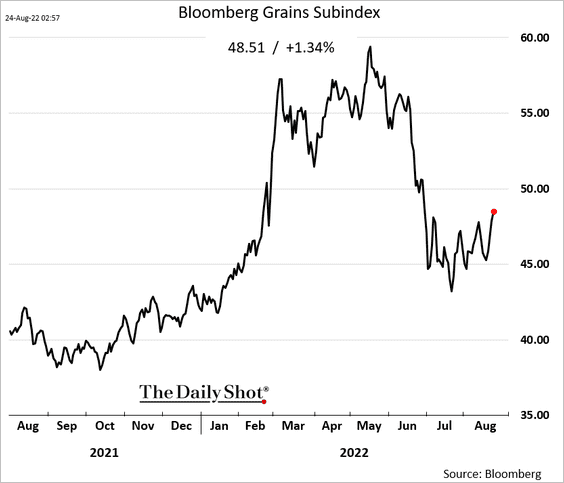

1. US corn futures are rebounding amid poor crop conditions (see chart).

Here is Bloomberg’s grains index.

——————–

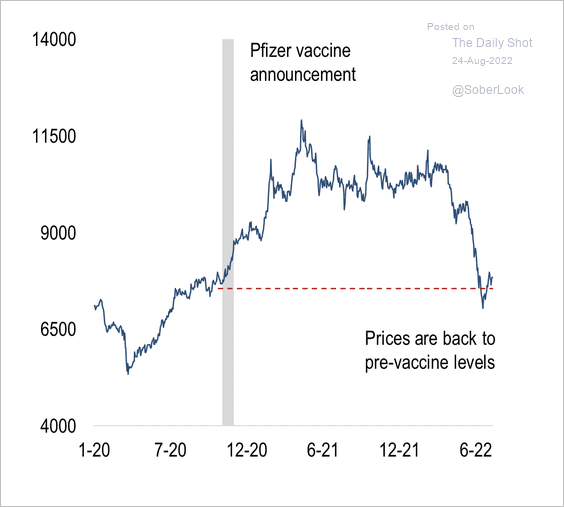

2. LME copper prices have returned to pre-vaccine levels.

Source: Numera Analytics

Source: Numera Analytics

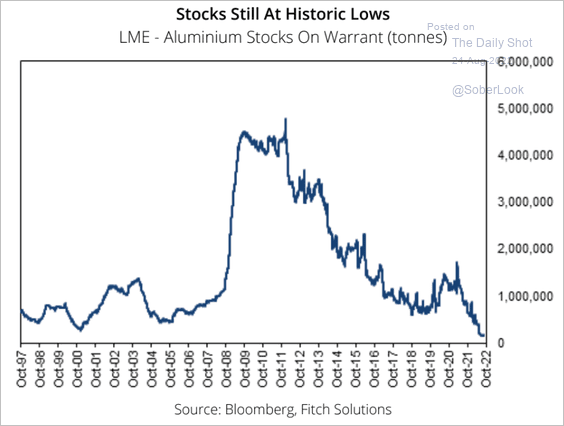

3. LME aluminum inventories are at historic lows.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Energy

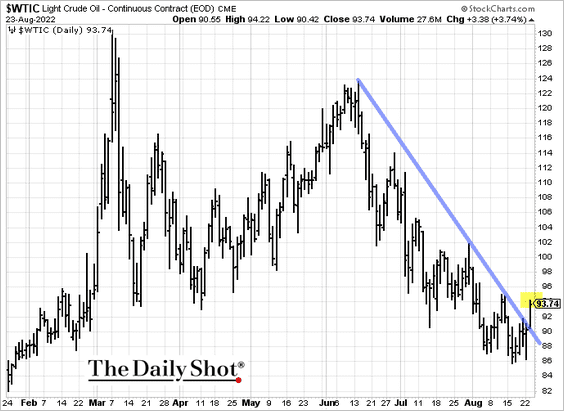

1. We have liftoff on crude oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

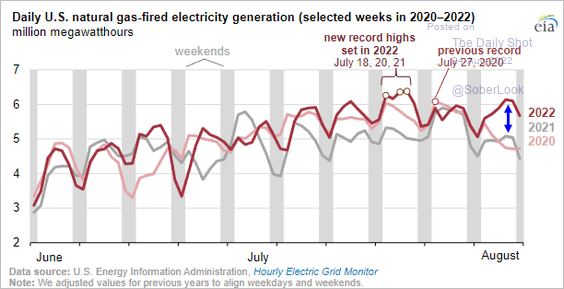

2. US natural gas demand has been strong this month.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

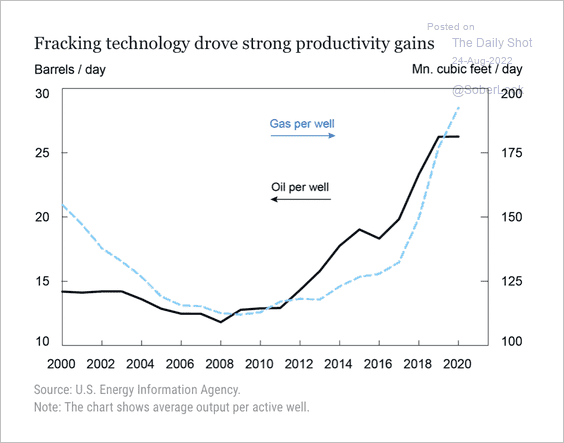

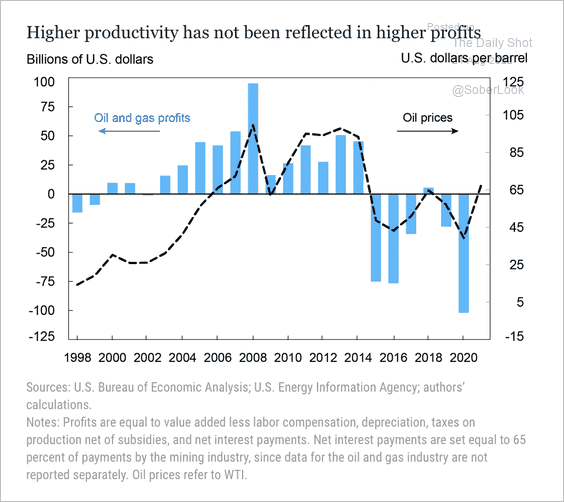

3. The US oil and gas sector experienced a productivity boom over the past decade.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

However, the mismatch between productivity and financial performance was partly driven by weaker oil prices.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

——————–

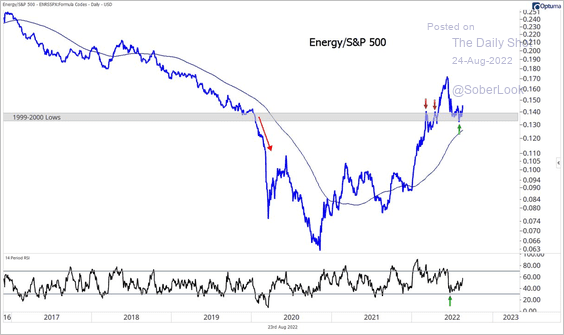

4. So far, energy stocks are holding support relative to the S&P 500.

Source: @meanstoatrend

Source: @meanstoatrend

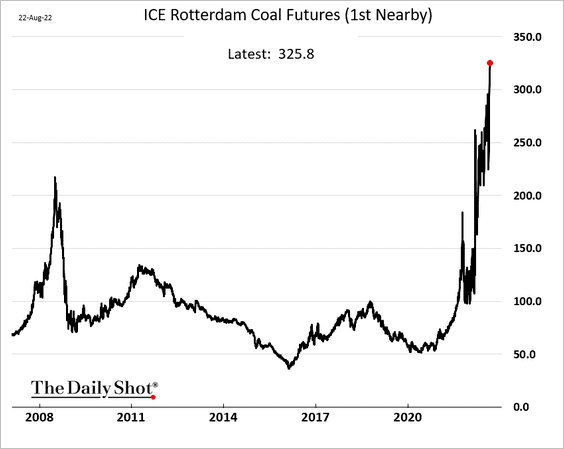

5. European coal prices have been surging with natural gas.

Back to Index

Equities

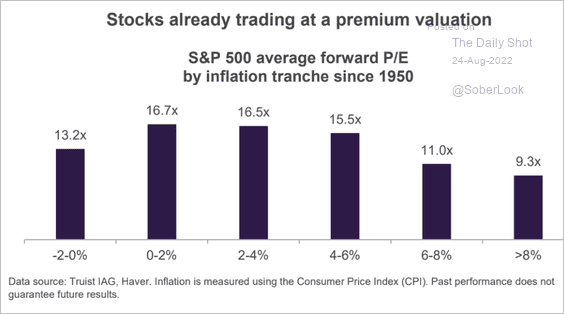

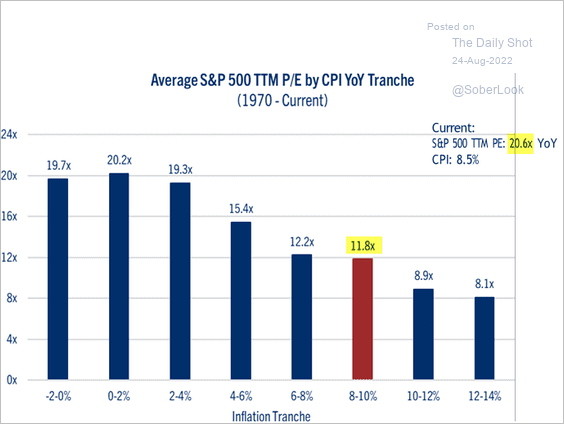

1. This charts shows the S&P 500 average forward P/E ratio under different inflation regimes (we are currently at 17.4x).

Source: Truist Advisory Services

Source: Truist Advisory Services

Here is a similar comparison showing the trailing P/E.

Source: John Lynch, Comerica Wealth Management

Source: John Lynch, Comerica Wealth Management

——————–

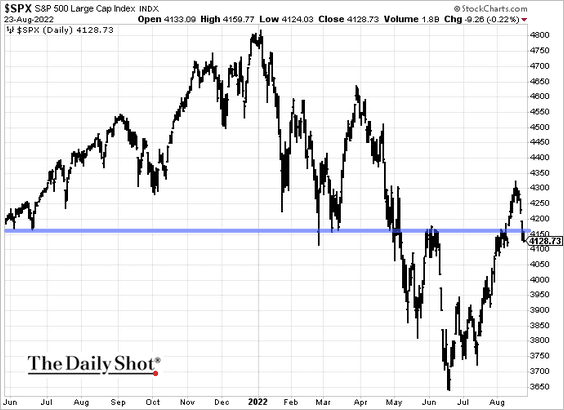

2. Is 4160 the new resistance level for the S&P 500?

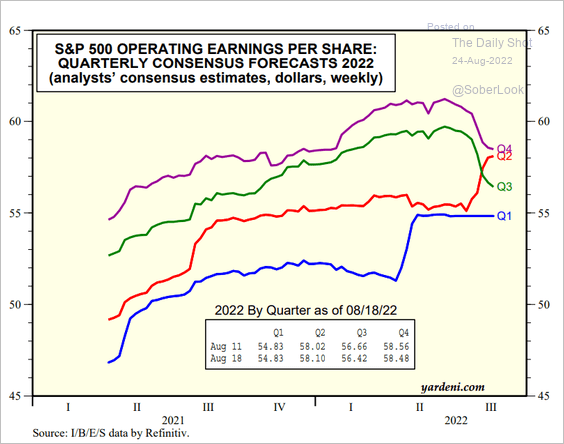

3. The 2022 Q3 and Q4 earnings downgrades continue, albeit at a slower pace.

Source: Yardeni Research

Source: Yardeni Research

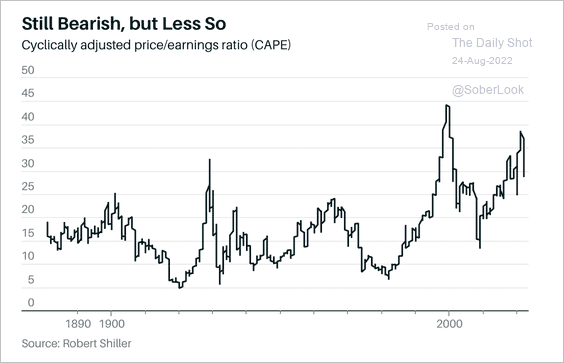

4. The S&P 500’s CAPE ratio remains elevated relative to history, which implies a period of lower market returns.

Source: Barron’s Read full article

Source: Barron’s Read full article

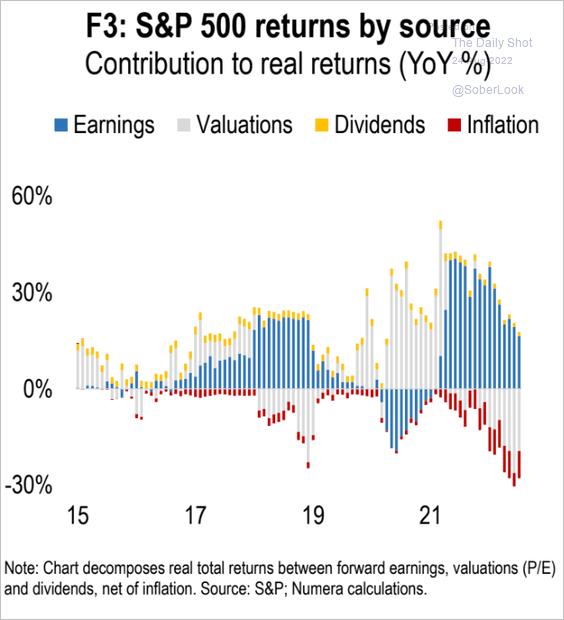

5. Here are the drivers of S&P 500 real returns (rolling year-over-year).

Source: Numera Analytics

Source: Numera Analytics

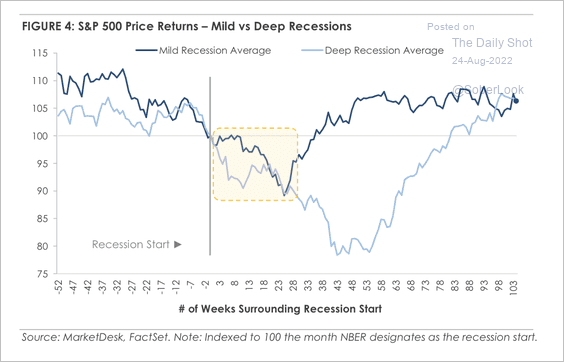

6. The S&P 500 tends to bottom and trade higher shortly after the start of a mild recession, while sell-offs extend for about six months during deep recessions.

Source: MarketDesk Research

Source: MarketDesk Research

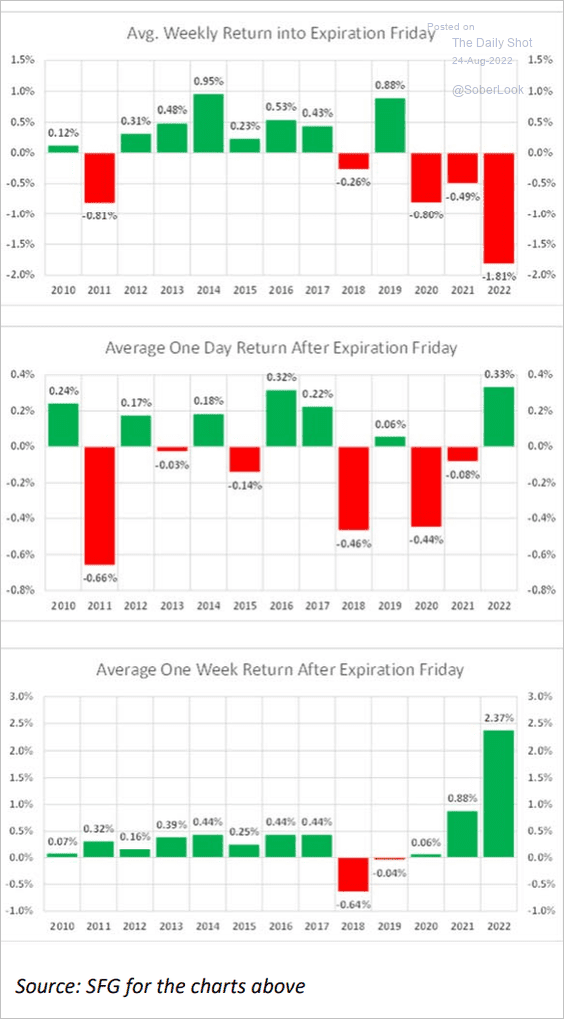

7. Finally, we have some return data around Expiration Fridays (from Chris Murphy).

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

Back to Index

Alternatives

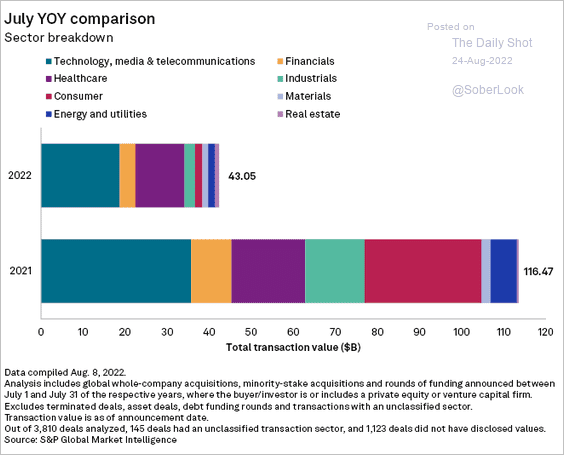

1. Global private equity and VC deal value is down 63%.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

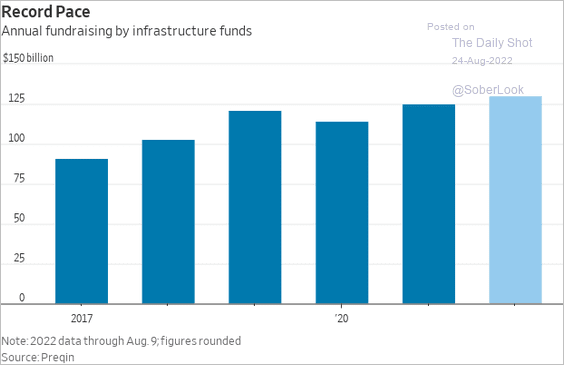

2. Infrastructure-focused fundraisng remains robust.

Source: @WSJ Read full article

Source: @WSJ Read full article

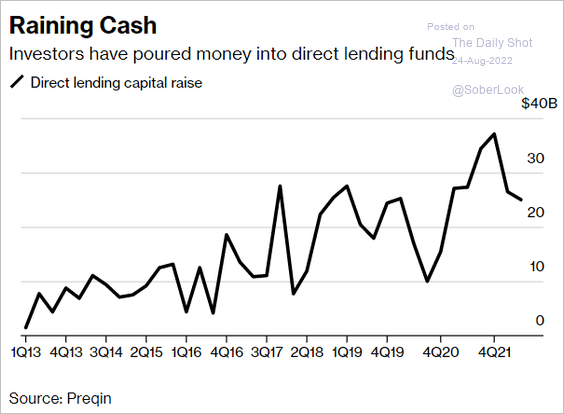

3. Direct-lending funds’ capital raise continues to trend higher, …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

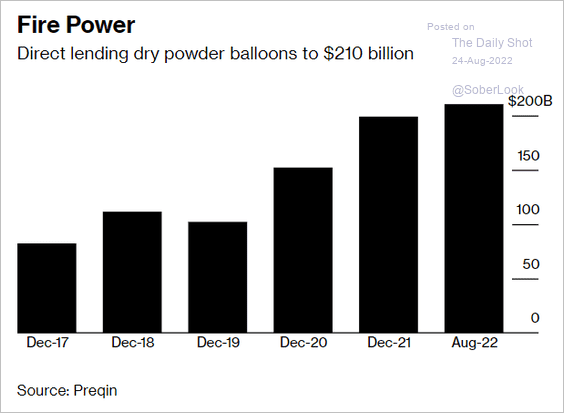

… boosting dry powder to $210 billion, according to Bloomberg.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

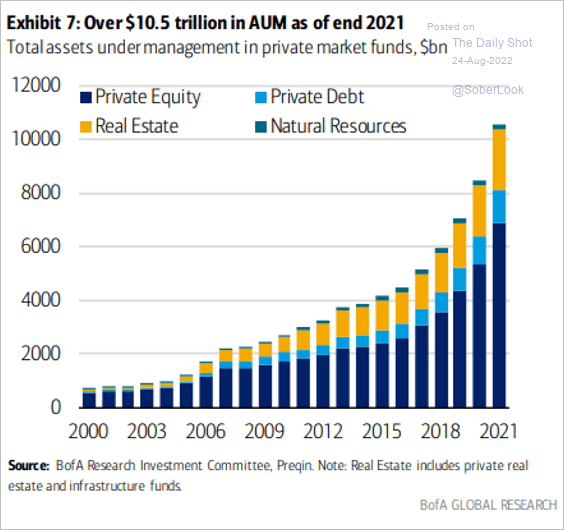

4. Private markets’ AUM is above $10 trillion.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Rates

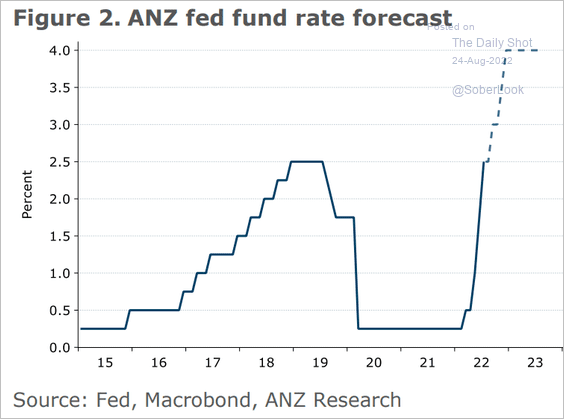

1. ANZ sees the Fed raising rates to 4% in this cycle.

Source: @ANZ_Research

Source: @ANZ_Research

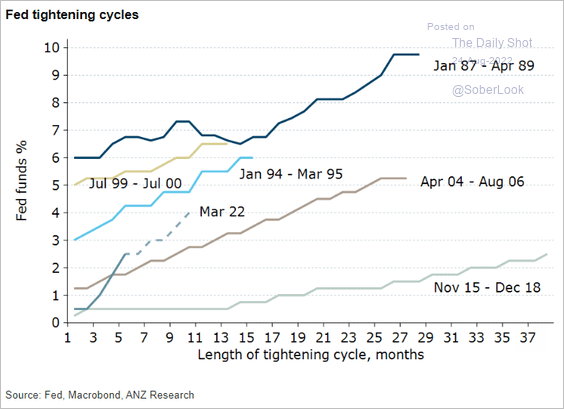

How does the current tightening cycle compare to previous ones?

Source: @ANZ_Research

Source: @ANZ_Research

——————–

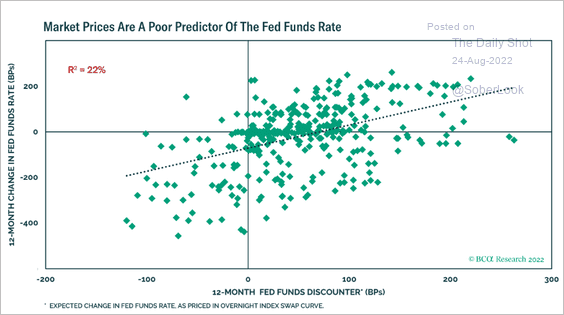

2. Market expectations are a poor predictor of the fed funds rate.

Source: BCA Research

Source: BCA Research

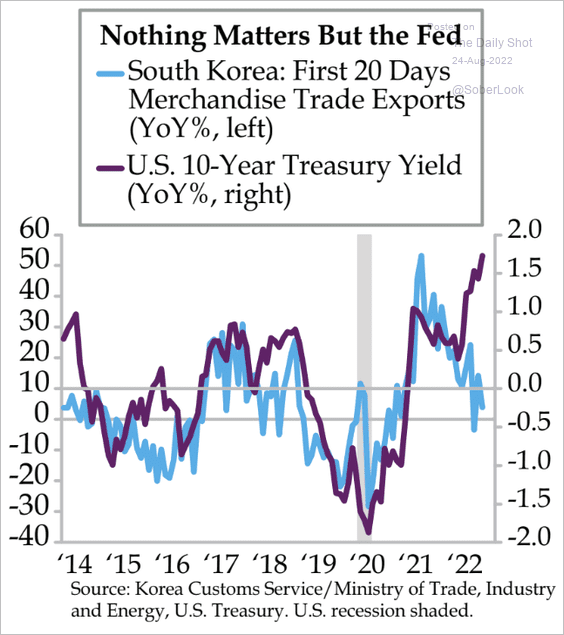

3. Softer global demand (particularly for semiconductors) points to lower Treasury yields.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Global Developments

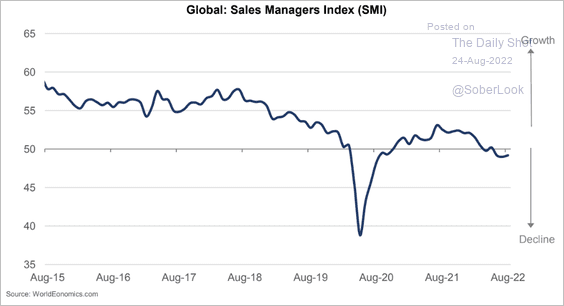

1. Global business activity is contracting, according to the Wold Economics SMI.

Source: World Economics

Source: World Economics

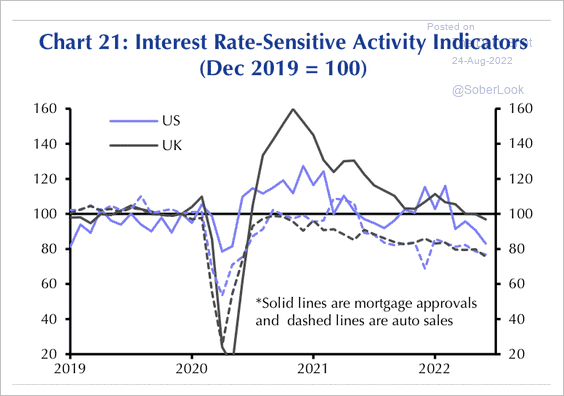

2. Indicators that are more sensitive to interest rate changes, such as mortgage approvals and auto sales, have declined over the past year.

Source: Capital Economics

Source: Capital Economics

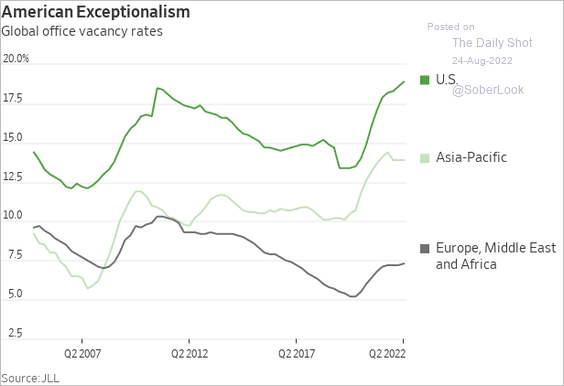

3. This chart shows office vacancy rates by region.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

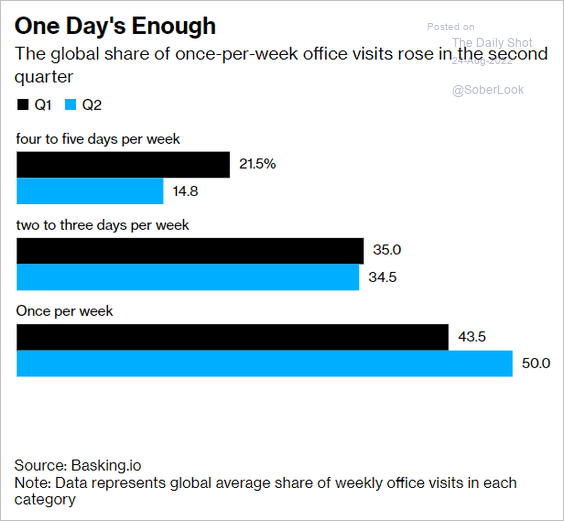

1. Once-per-week office visits:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

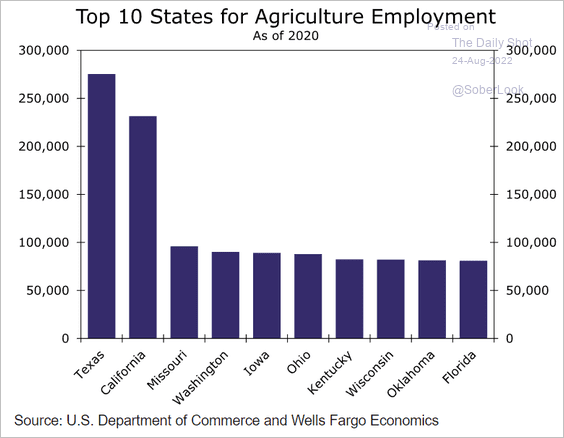

2. US agriculture employment:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

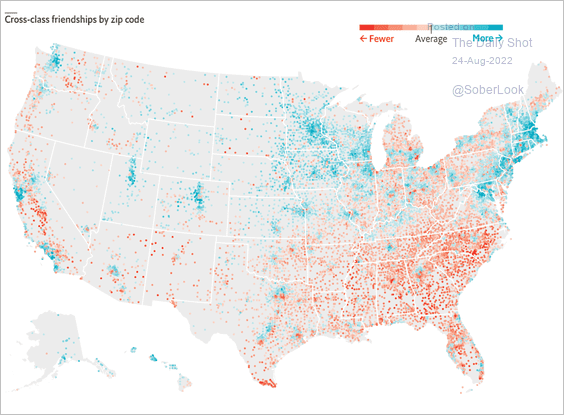

3. Cross-class friendships:

Source: The Economist Read full article

Source: The Economist Read full article

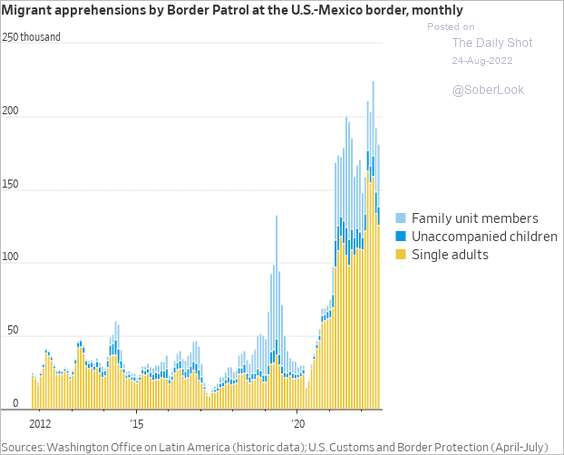

4. Migrants arrested at the US southwest border:

Source: @WSJ Read full article

Source: @WSJ Read full article

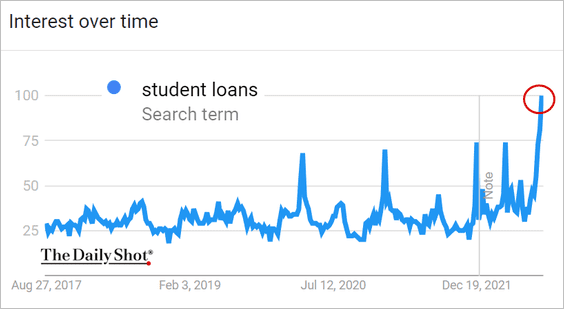

5. Google search activity for “student loans”:

Source: Google Trends Further reading

Source: Google Trends Further reading

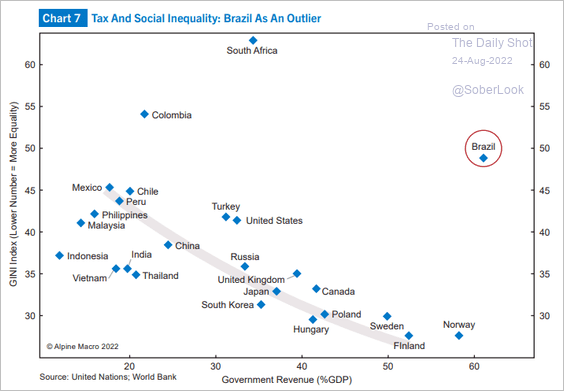

6. Inequality vs. taxation:

Source: Alpine Macro

Source: Alpine Macro

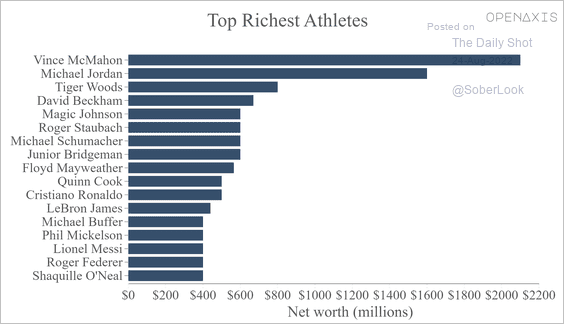

7. The richest athletes:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

Back to Index