The Daily Shot: 13-Oct-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

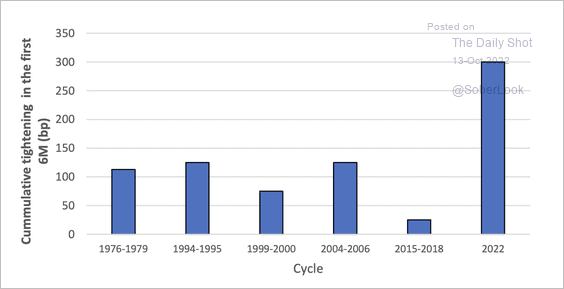

1. Let’s begin with a look at the September FOMC minutes.

• The FOMC sees inflation risks skewed to the upside amid concerns about a wage-price spiral.

Participants agreed that the uncertainty associated with their economic outlooks was high and that risks to their inflation outlook were weighted to the upside. Some participants noted rising labor tensions, a new round of global energy price increases, further disruptions in supply chains, and a larger-than-expected pass-through of wage increases into price increases as potential shocks that, if they materialized, could compound an already challenging inflation problem. A number of participants commented that a wage–price spiral had not yet developed but cited its possible emergence as a risk.

• The goal is to move rates into restrictive territory …

In light of the broad-based and unacceptably high level of inflation, the intermeeting news of higher-than-expected inflation, and upside risks to the inflation outlook, participants remarked that purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations. Many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.

… and stay there for some time.

Many participants indicated that, once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time until there was compelling evidence that inflation was on course to return to the 2 percent objective.

• Tight financial conditions are yet to work their way through much of the economy.

Participants noted that the Committee’s commitment to restoring price stability, together with its purposeful policy actions and communications, had contributed to a notable tightening of financial conditions over the past year that would likely help reduce inflation pressures by restraining aggregate demand. Participants observed that this tightening had led to substantial increases in real interest rates across the maturity spectrum. Most participants remarked that, although some interest-sensitive categories of spending-such as housing and business fixed investment-had already started to respond to the tightening of financial conditions, a sizable portion of economic activity had yet to display much response.

• Debate is emerging around the pace of tightening amid deteriorating “global economic and financial environment.”

Several participants noted that, particularly in the current highly uncertain global economic and financial environment, it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook. Participants observed that, as the stance of monetary policy tightened further, it would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation.

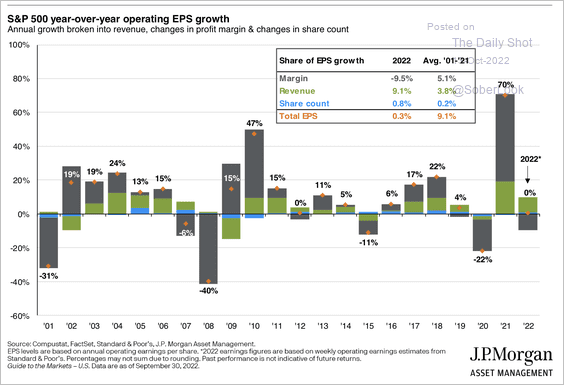

• Falling corporate margins will help cool inflation.

With respect to the medium term, participants judged that inflation pressures would gradually recede in coming years. Various factors were cited as likely to contribute to this outcome, including the Committee’s tightening of its policy stance, a gradual easing of supply and demand imbalances in labor and product markets, and the likelihood that weaker consumer demand would result in a reduction of business profit margins from their current elevated levels.

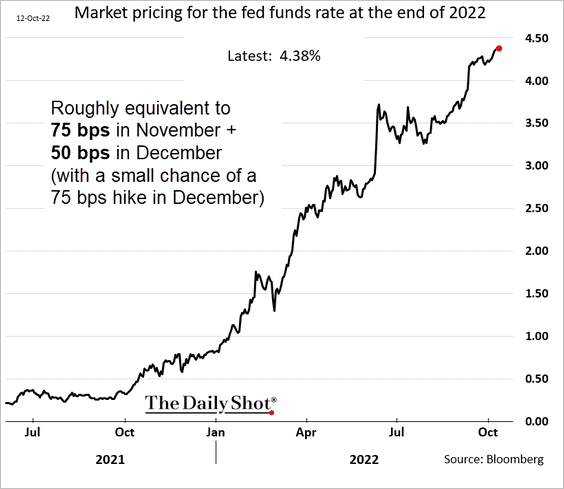

The market continues to price a 75 bps rate hike in November and 50 bps in December.

——————–

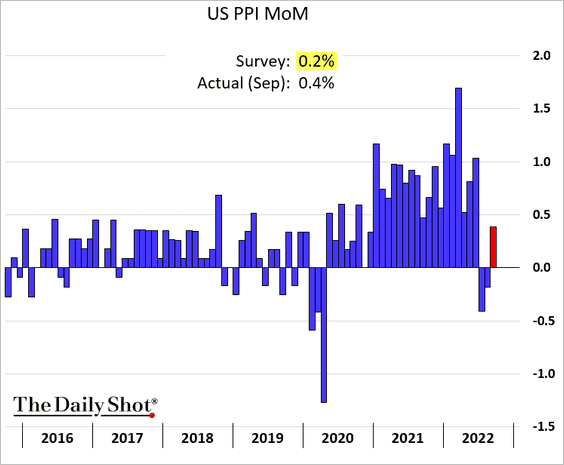

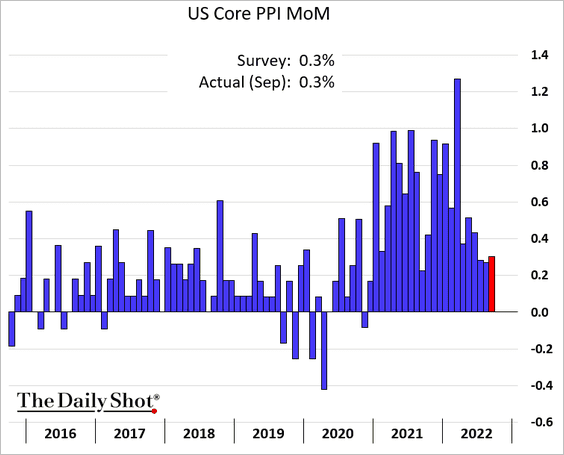

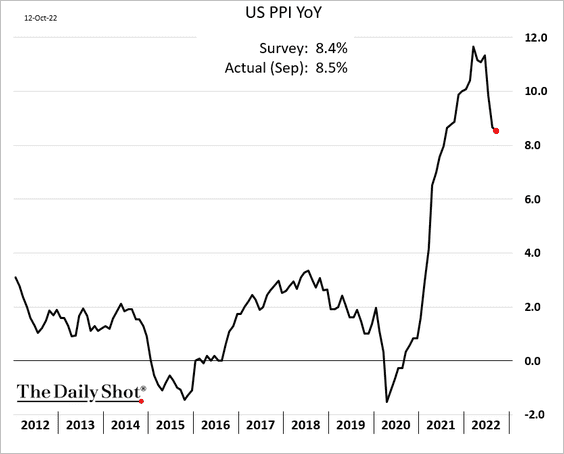

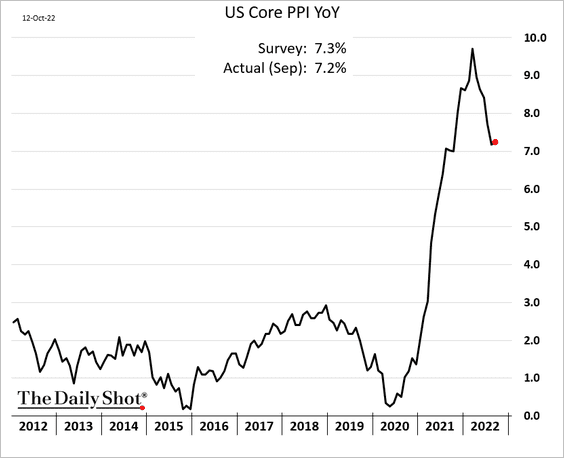

2. The PPI report surprised to the upside.

• The core PPI was in line with forecasts, …

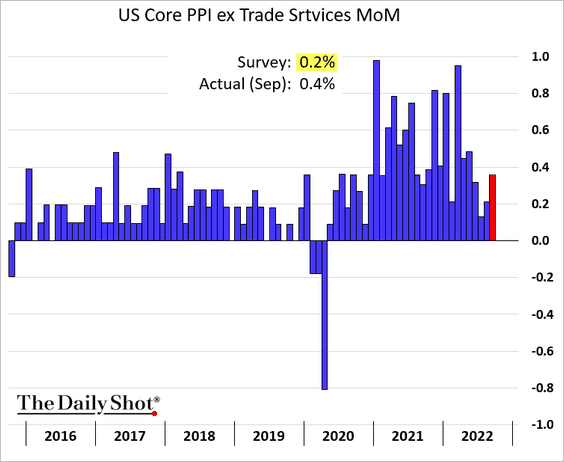

… but excluding trade services, the index was higher than expected.

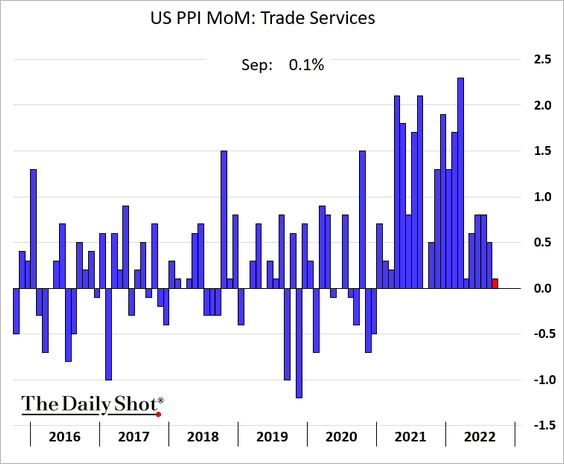

• Trade services PPI, a measure of business markups, shows moderating corporate margins.

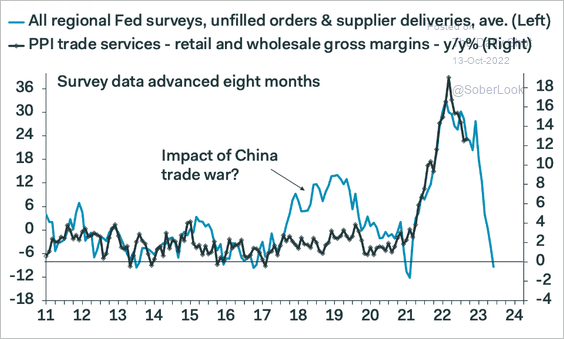

And corporate margins are expected to keep tightening.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

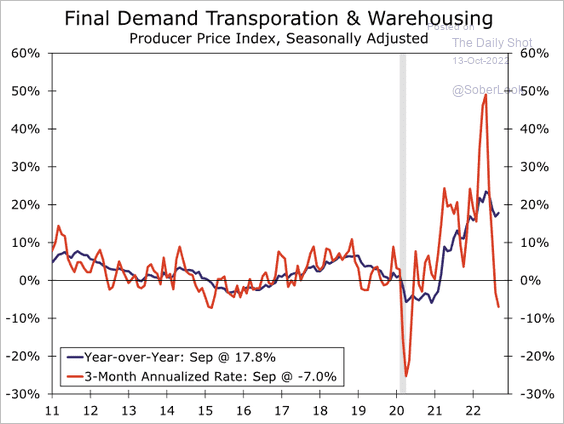

• Goods demand shows signs of easing.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Below are the year-over-year PPI measures.

——————–

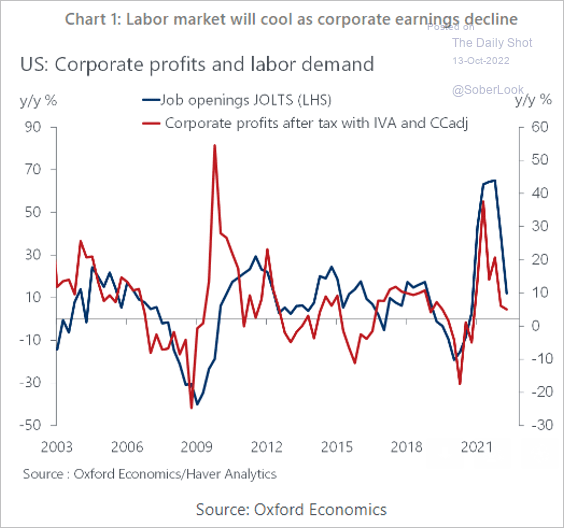

3. Next, we have some updates on the labor market.

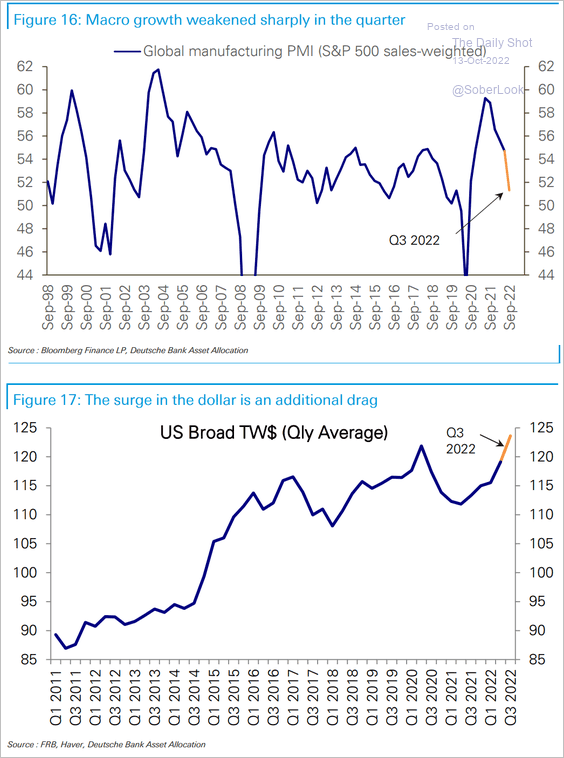

• Corporate earnings face headwinds from a slowing economy and a strong dollar, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… which should cool the labor market.

Source: Oxford Economics

Source: Oxford Economics

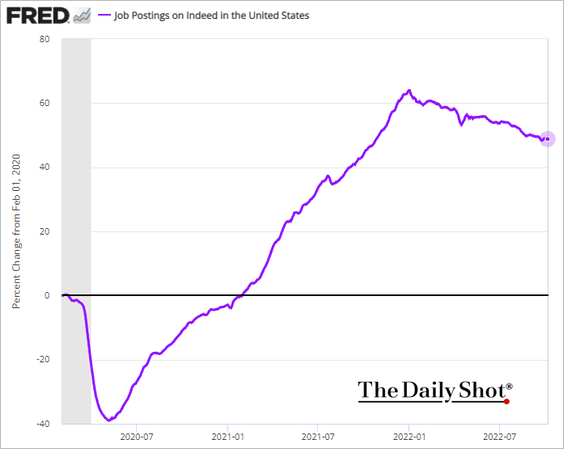

• Job postings on Indeed continue to drift lower but not quickly enough for the Fed.

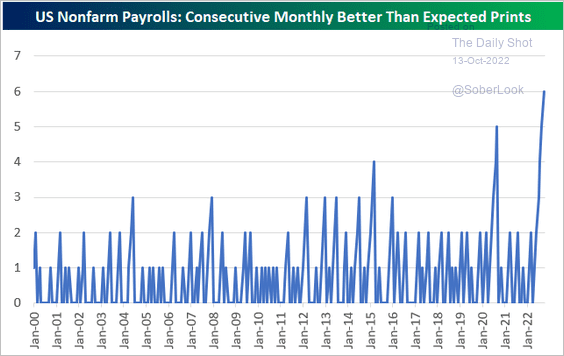

• The jobs report has surprised to the upside for six months in a row.

Source: @bespokeinvest

Source: @bespokeinvest

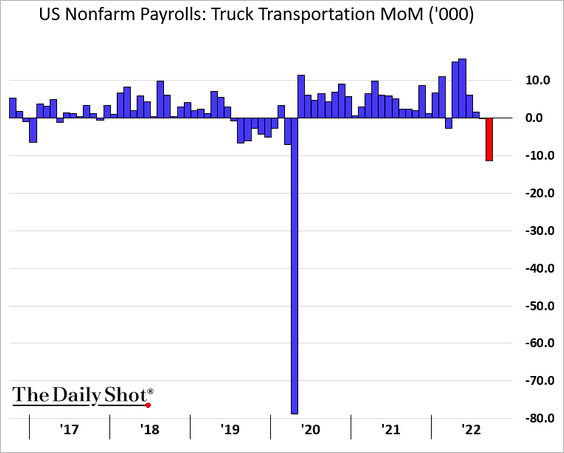

• Demand for truckers is fading.

h/t @dailychartbook

h/t @dailychartbook

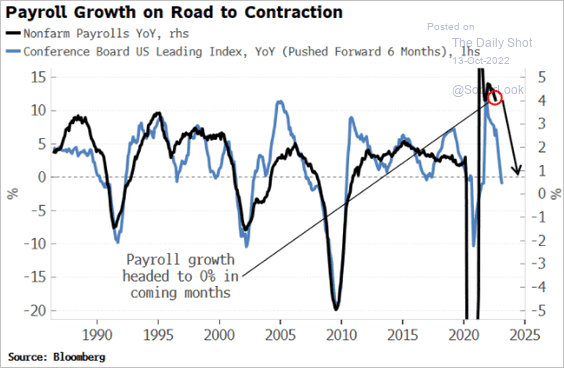

• The leading index points to softer payrolls growth ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

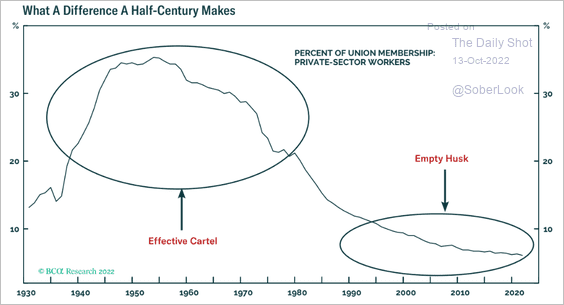

• Union membership has been trending down for years.

Source: BCA Research

Source: BCA Research

——————–

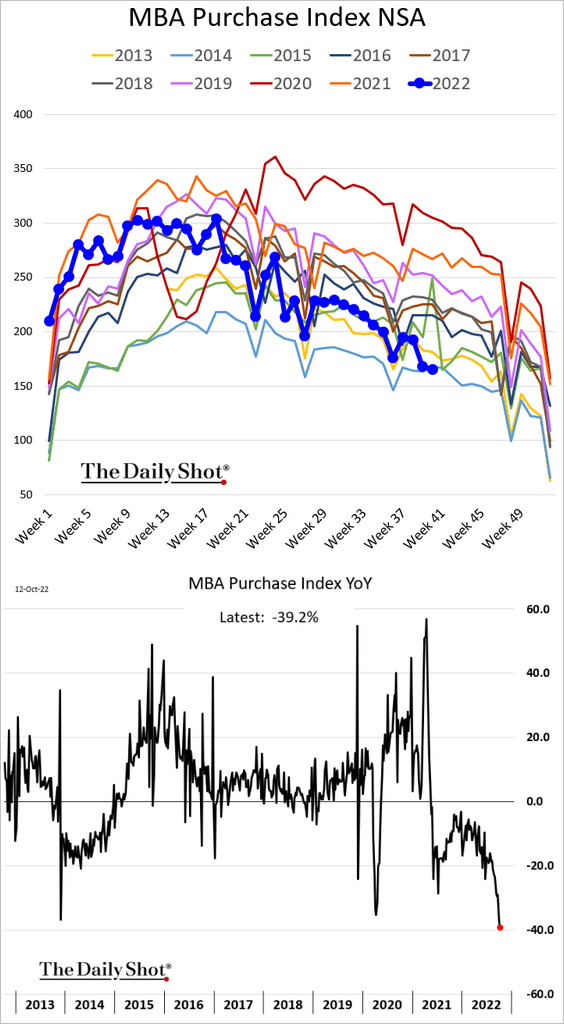

4. Mortgage applications continue to weaken.

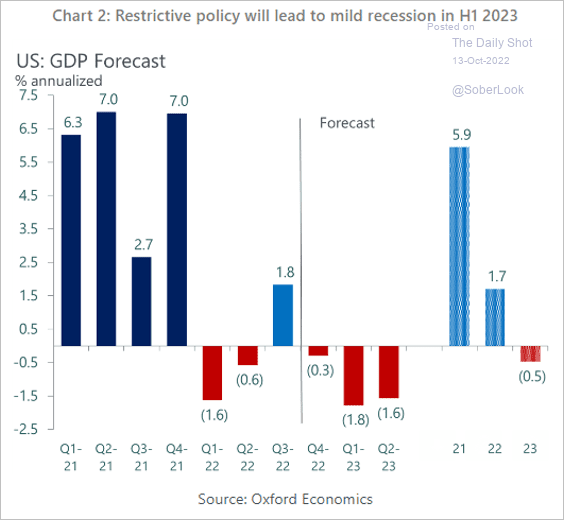

5. Oxford Economics sees a mild recession in the first half of 2023.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

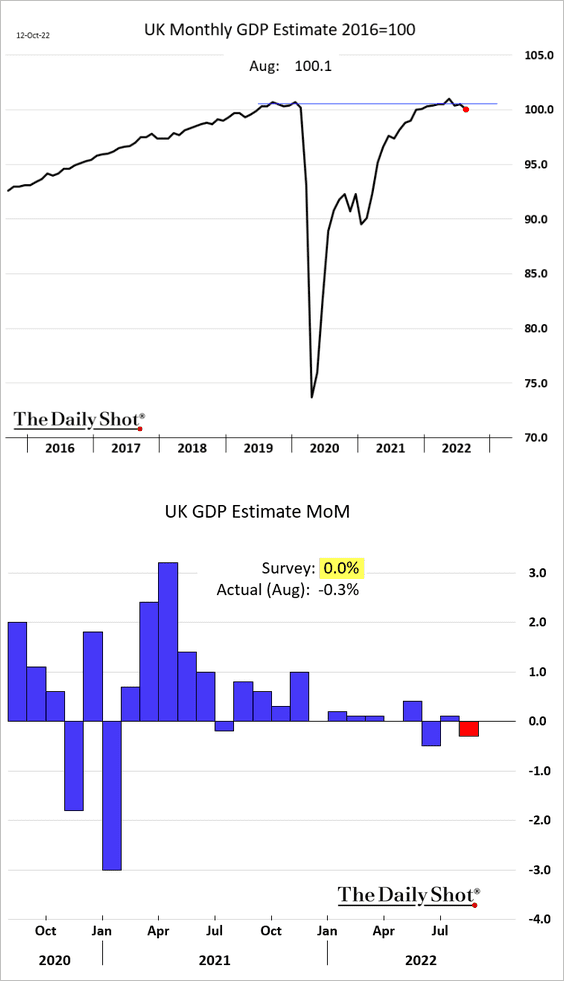

1. The GDP unexpectedly declined in August and is back below pre-COVID levels.

Source: BBC Read full article

Source: BBC Read full article

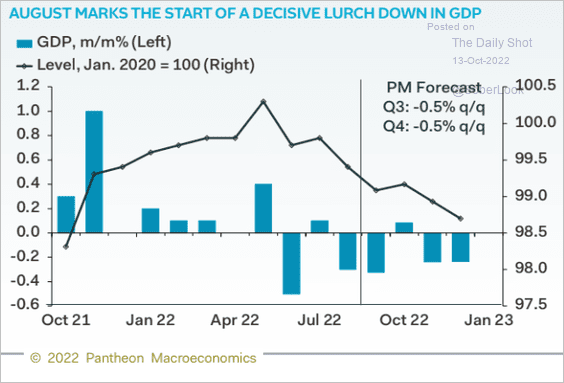

The economy will continue to contract, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

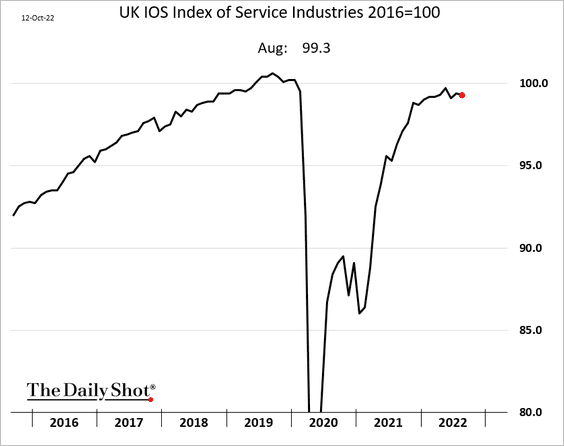

• Services output edged lower.

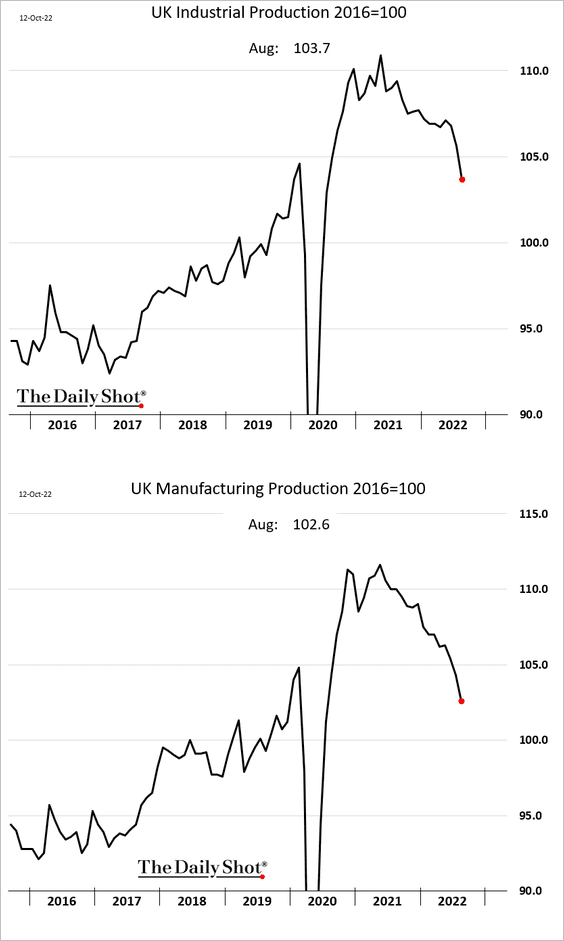

• Manufacturing has rolled over.

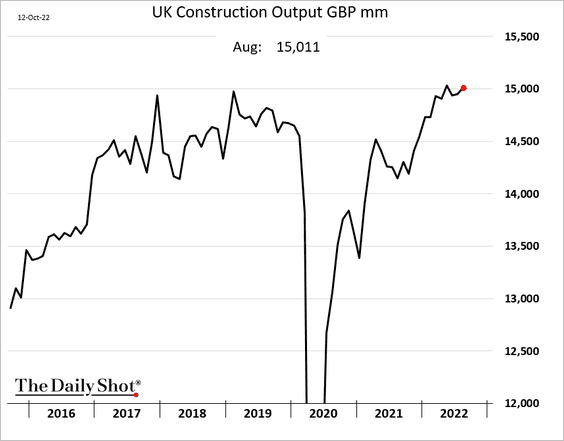

• Construction remains robust for now.

——————–

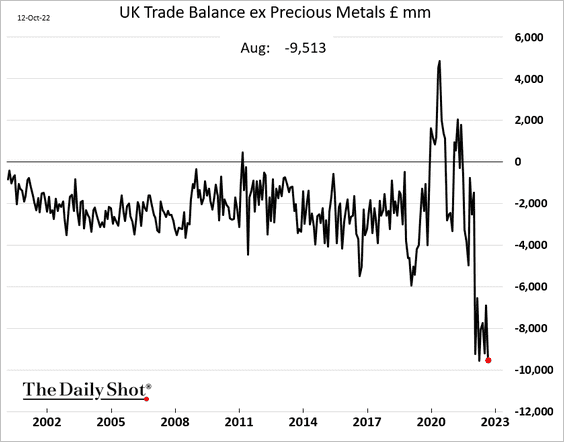

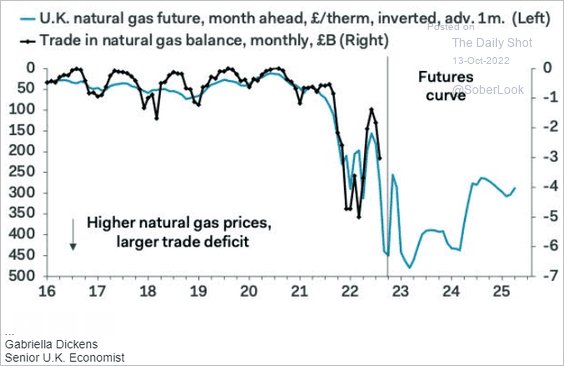

2. The trade deficit, excluding precious metals, is near record levels.

And there is more trade gap widening ahead due to natural gas imports.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

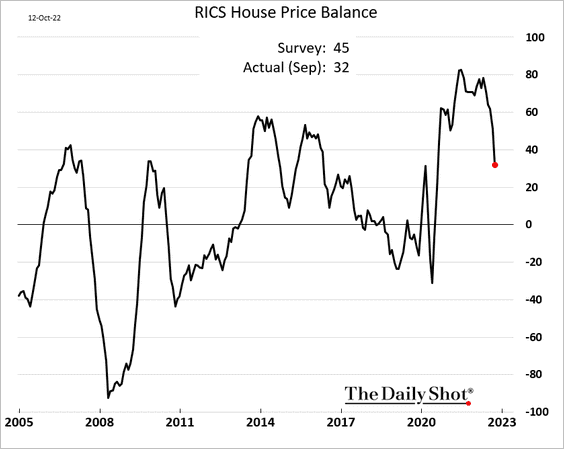

3. The RICS housing index tumbled last month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

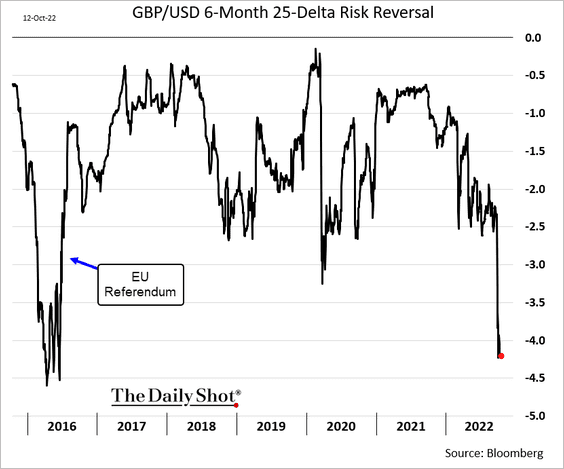

4. Options bets on further weakness in the pound haven’t been this extreme since the Brexit vote.

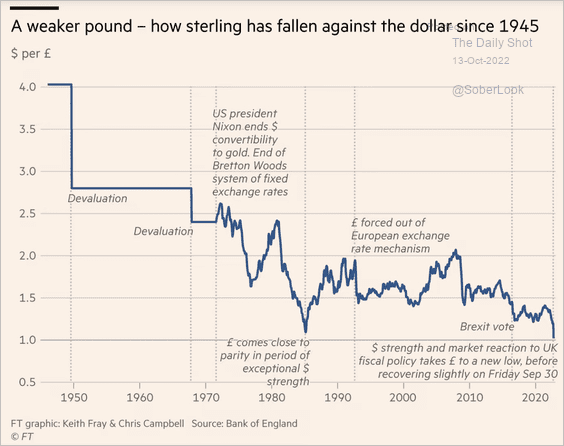

By the way, here is the history of GBP/USD since WW-II.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

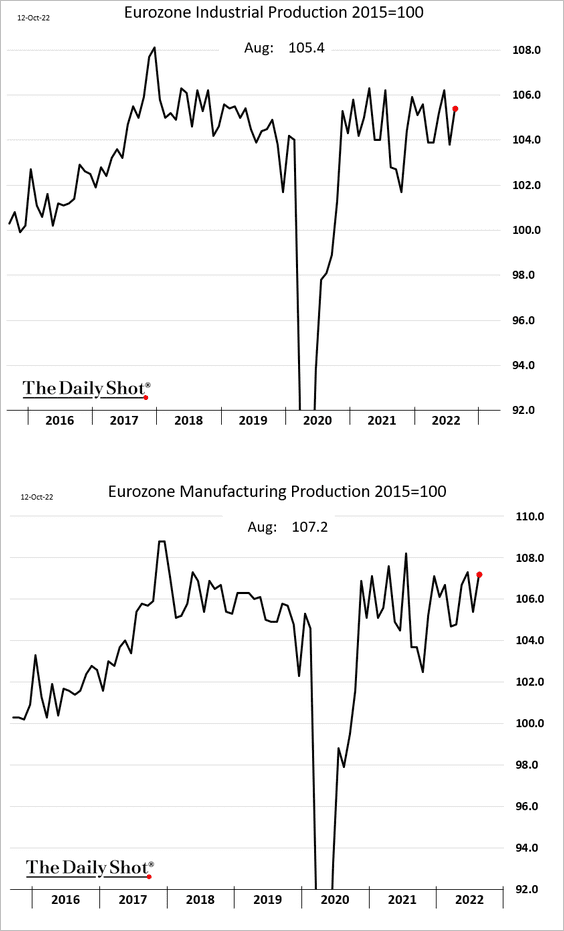

1. Industrial production surprised to the upside.

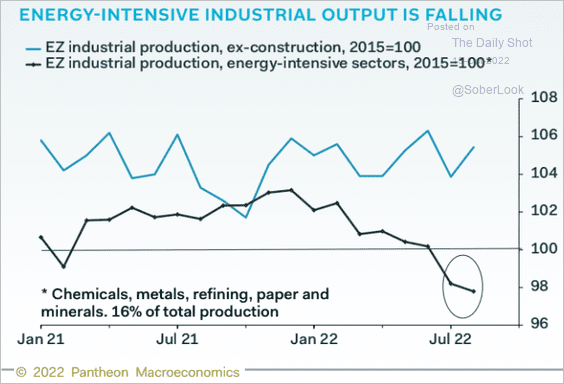

But energy-sensitive sectors continue to struggle.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

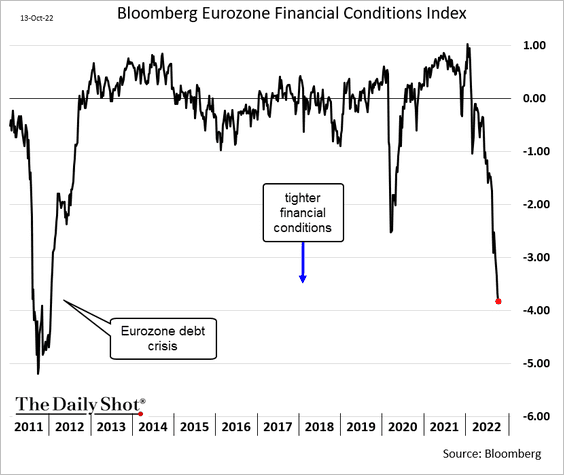

2. Euro-area financial conditions haven’t been this tight since the debt crisis.

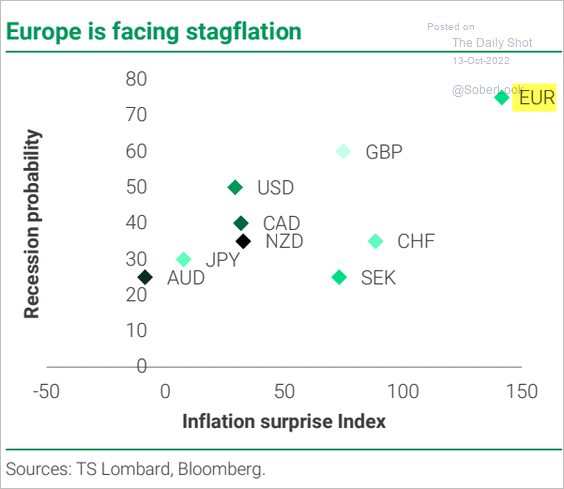

3. The Eurozone’s stagflationary risks are extreme.

Source: TS Lombard

Source: TS Lombard

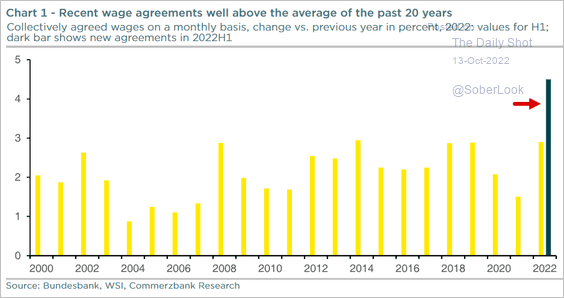

4. Germany is facing a wage/price spiral.

Source: Commerzbank Research

Source: Commerzbank Research

Back to Index

Europe

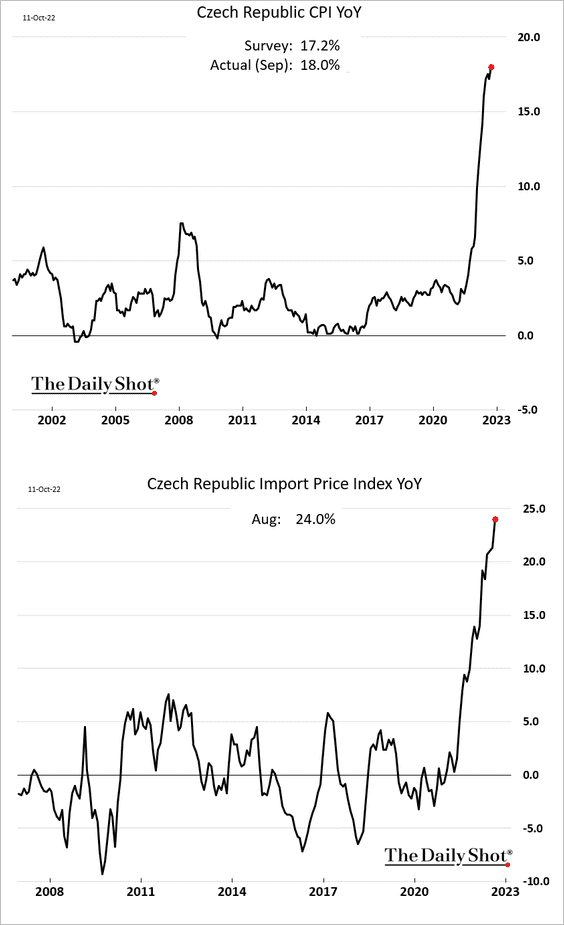

1. Czech inflation hit 18%.

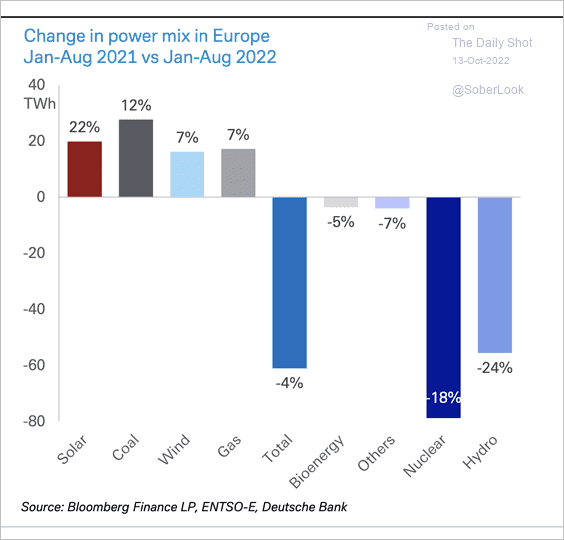

2. Next, we have some updates on the EU energy markets.

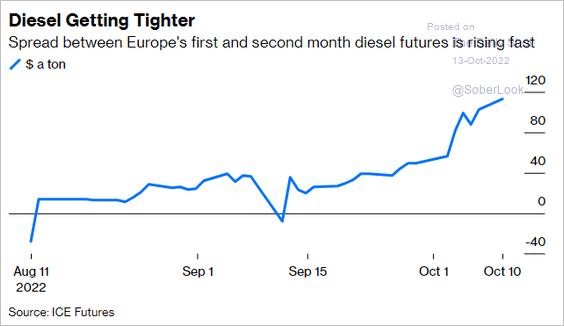

• The European diesel market has been tightening.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Natural gas use has actually increased this year amid challenges accessing other energy sources.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

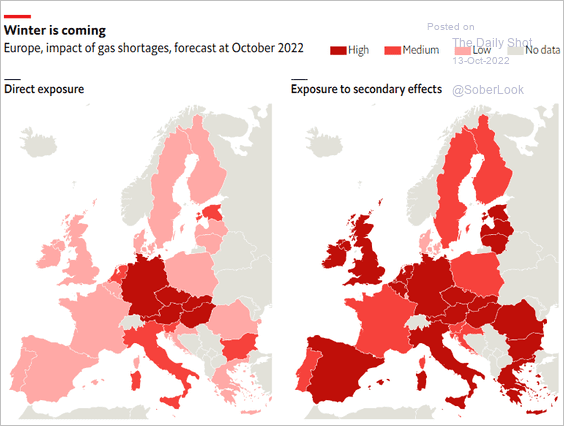

• Here is the impact of gas shortages in the EU.

Source: The Economist Read full article

Source: The Economist Read full article

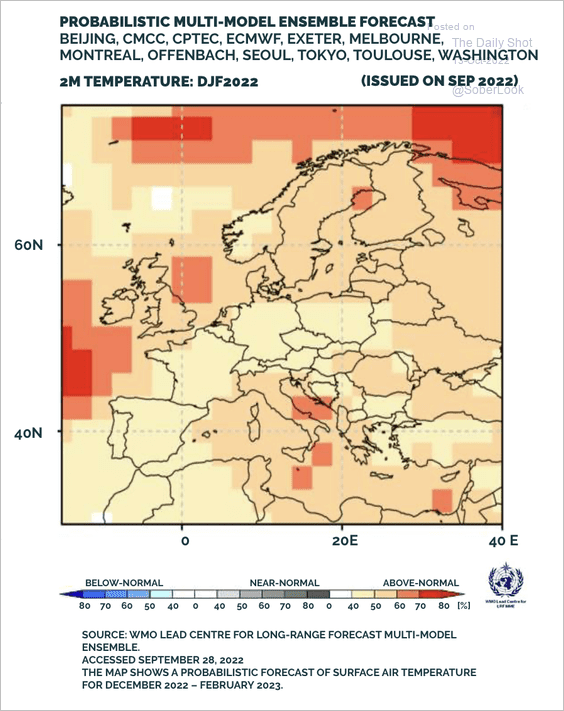

• The good news is that some weather models are predicting above-normal temperatures in Europe this winter.

Source: BCA Research

Source: BCA Research

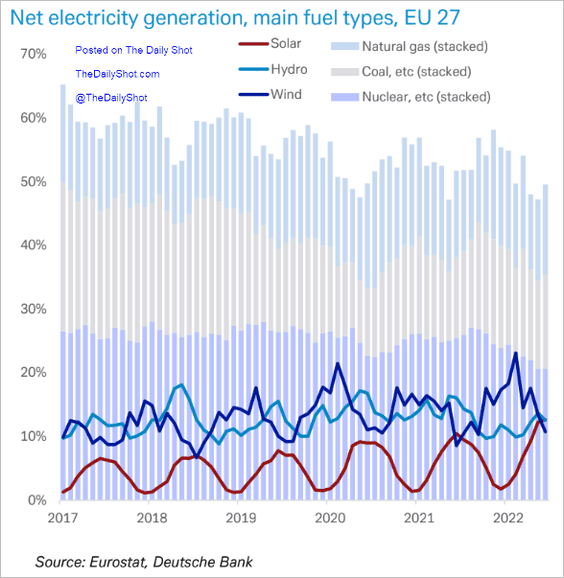

• This chart shows the EU’s sources of electricity production.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

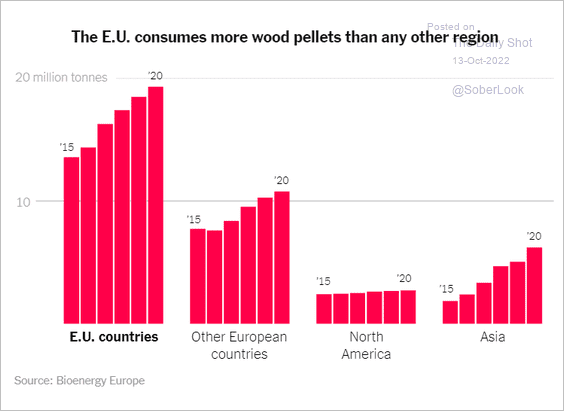

• The EU consumes a lot of wood pellets.

Source: The New York Times Read full article

Source: The New York Times Read full article

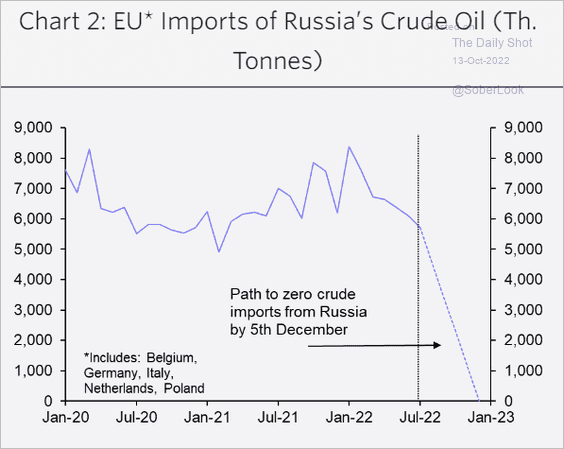

• How much will the EU reduce its imports of Russian oil?

Source: Capital Economics

Source: Capital Economics

Back to Index

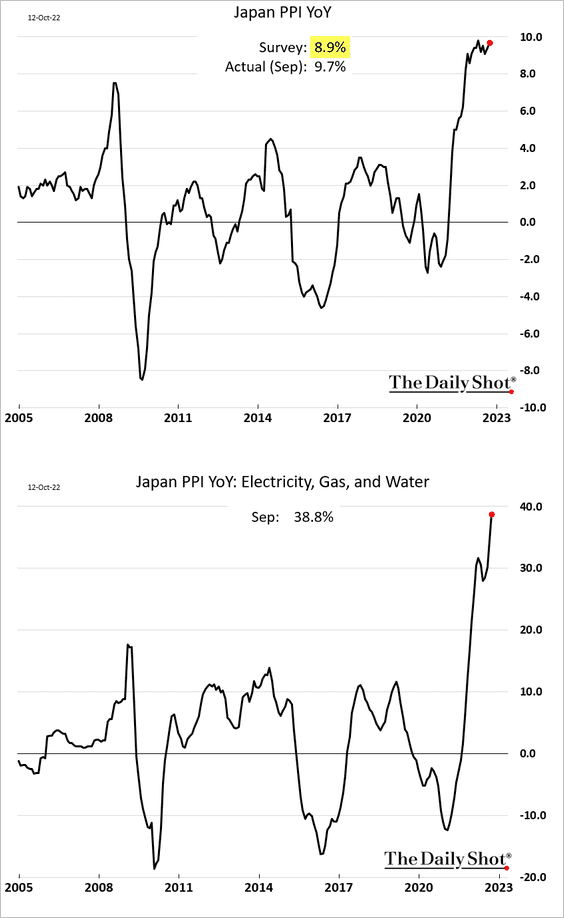

Japan

1. Gains in producer prices surprised to the upside.

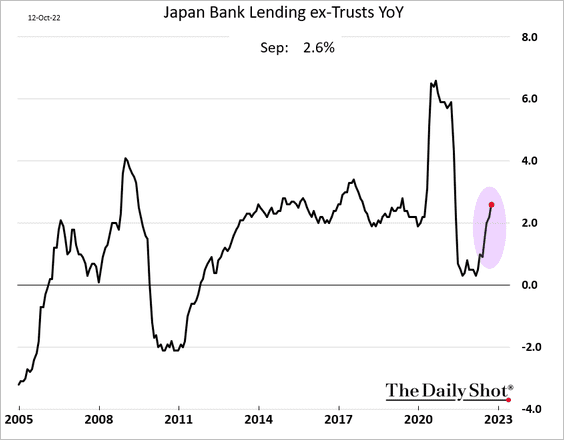

2. Bank lending is recovering.

Back to Index

China

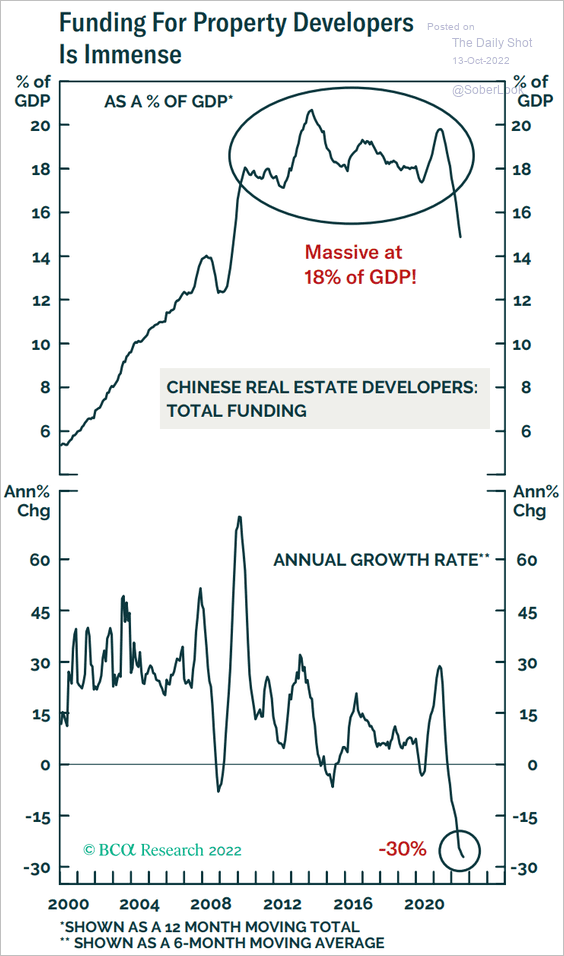

1. Funding for property developers has been around 18% of GDP in recent years.

Source: BCA Research

Source: BCA Research

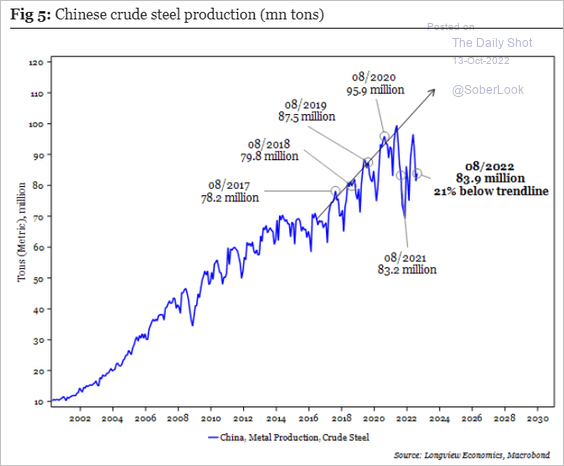

2. Steel production is now well below trend.

Source: Longview Economics

Source: Longview Economics

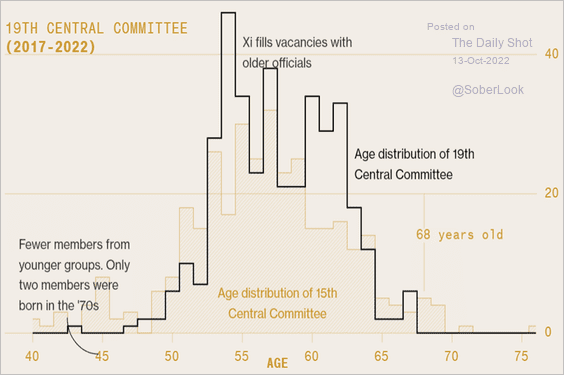

3. The Central Committee has become more homogeneous.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Emerging Markets

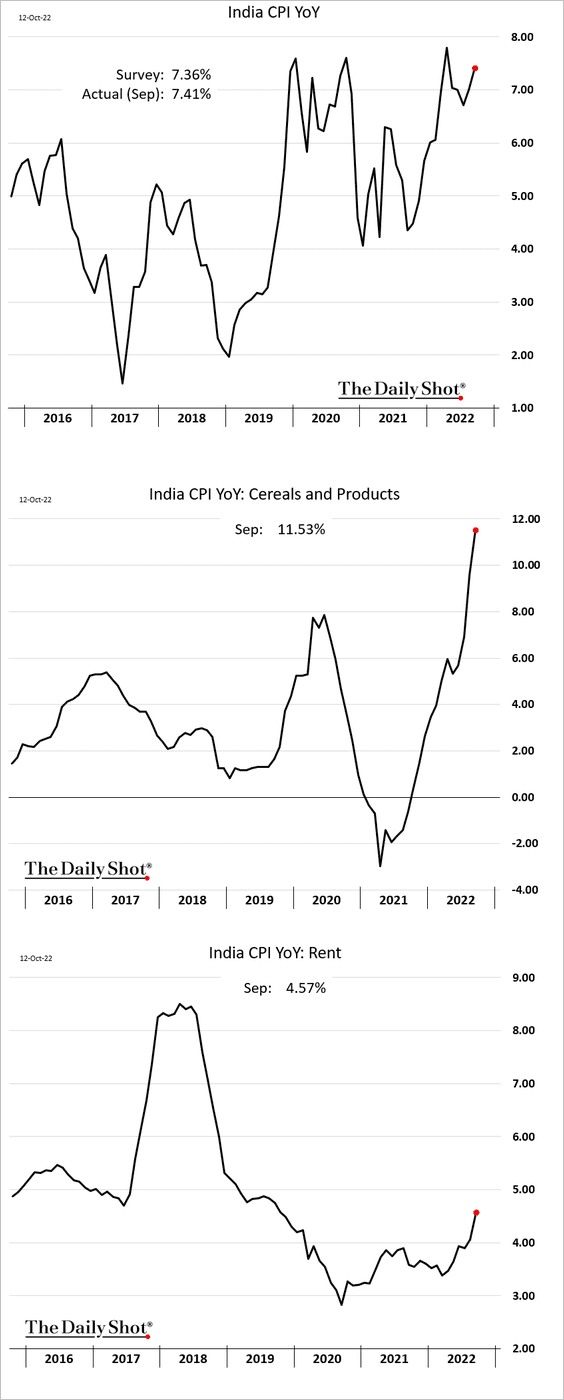

1. Let’s begin with India.

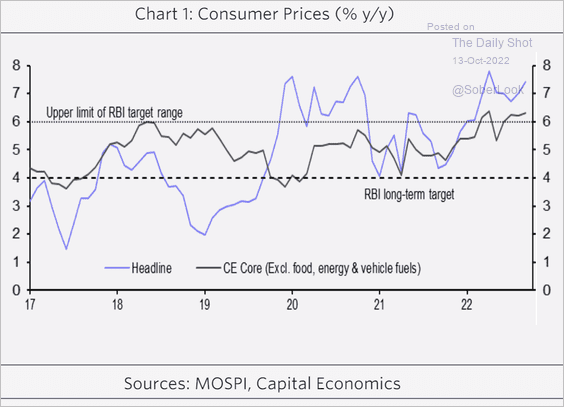

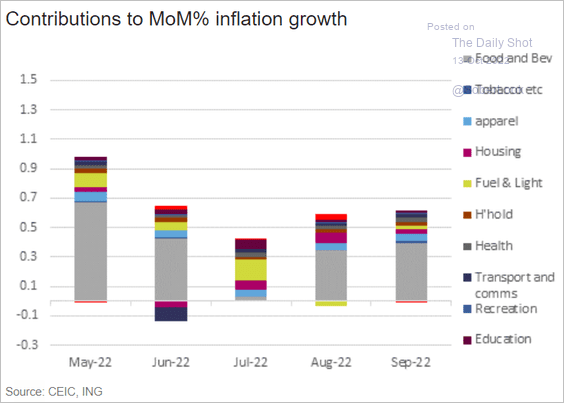

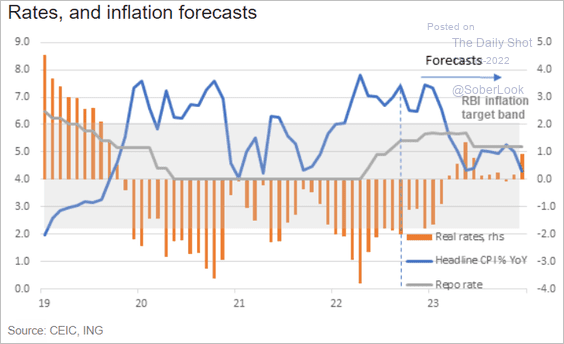

• Inflation was a bit higher than expected last month.

– The core CPI is now above the RBI’s target range.

Source: Capital Economics

Source: Capital Economics

– Here are the contributions.

Source: ING

Source: ING

– This chart shows a forecast from ING.

Source: ING

Source: ING

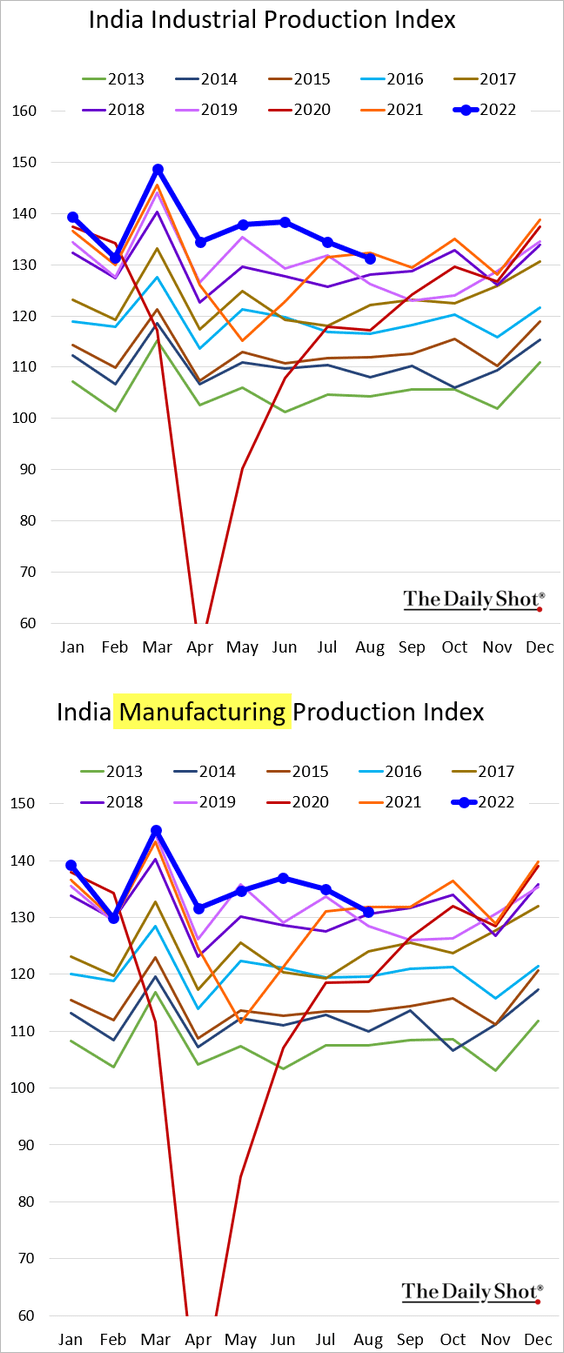

• Industrial production dipped below last year’s level.

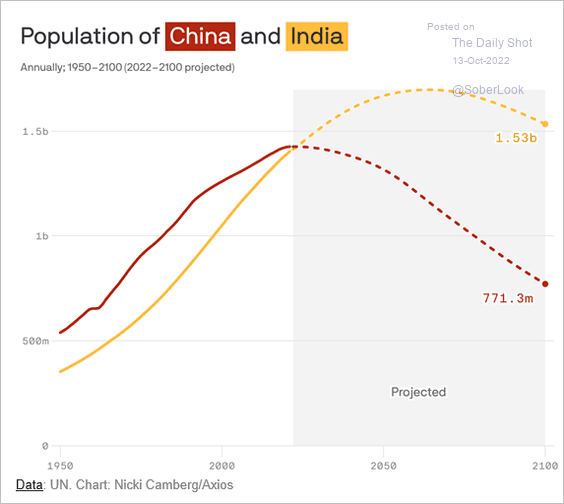

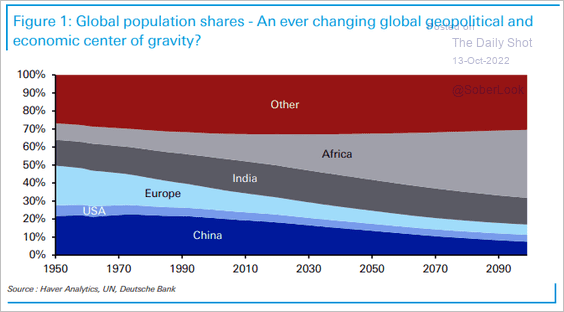

• India’s population is on track to overtake China’s next year, …

Source: The Stratecon Group Read full article

Source: The Stratecon Group Read full article

… and Africa’s population is likely to have overtaken India’s and China’s this year for the first time.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

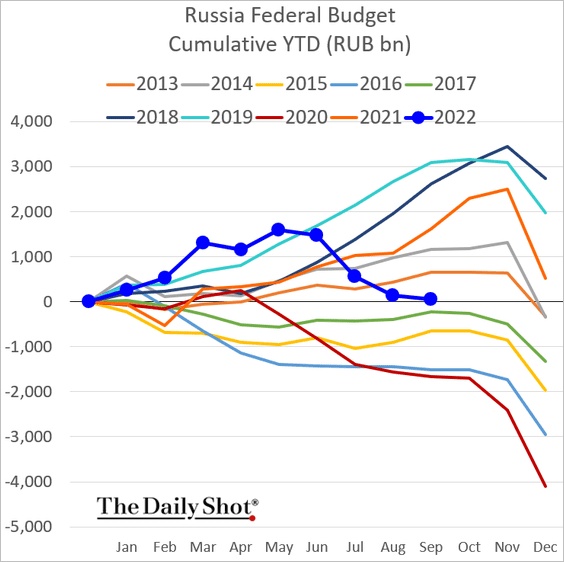

2. Here is Russia’s federal budget (assuming the figures can be trusted).

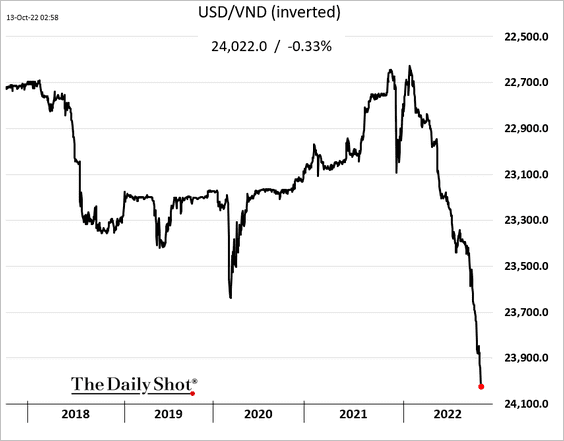

3. Vietnam’s currency (the Vietnamese dong) has been falling vs. USD despite portfolio inflows.

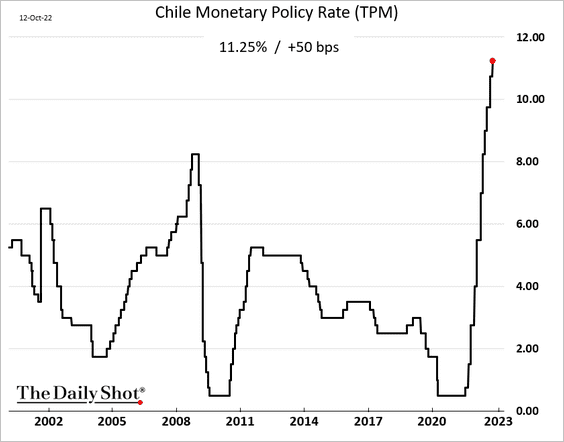

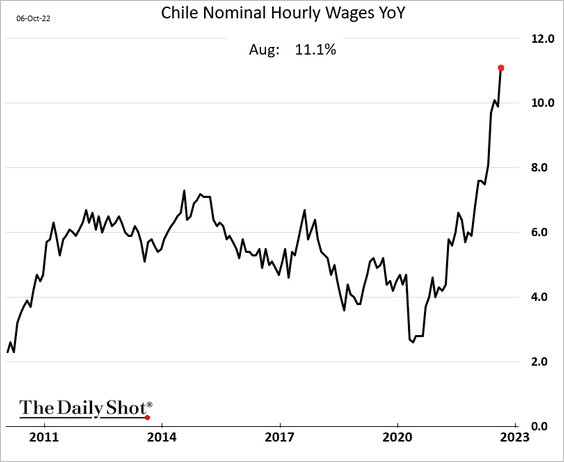

4. Chile’s central bank hiked rates above 11%, …

… amid accelerating labor costs.

——————–

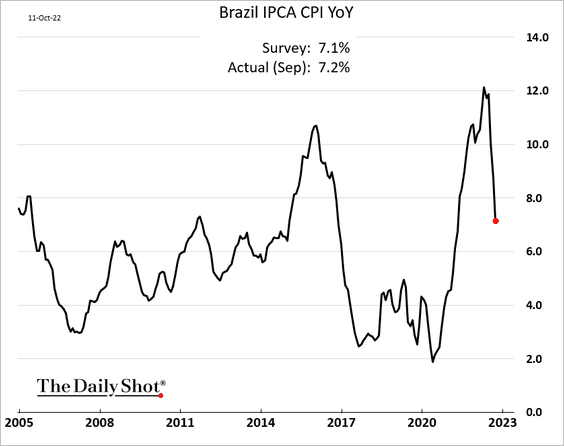

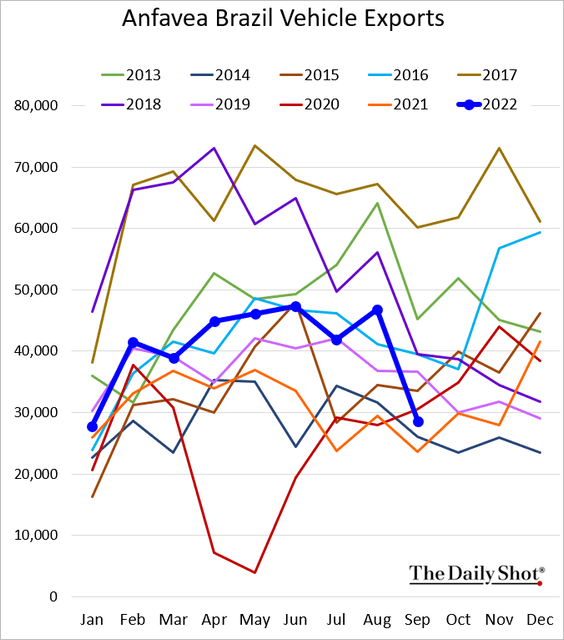

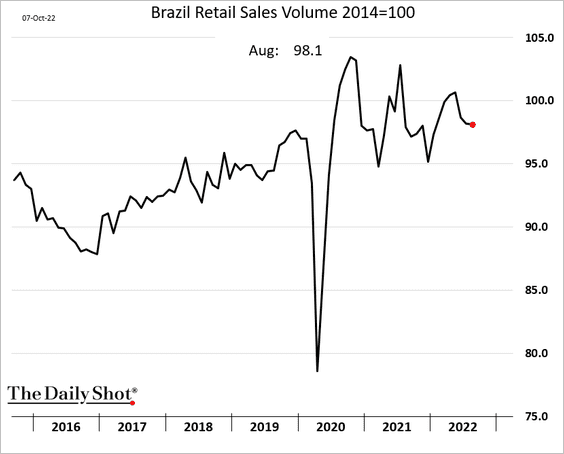

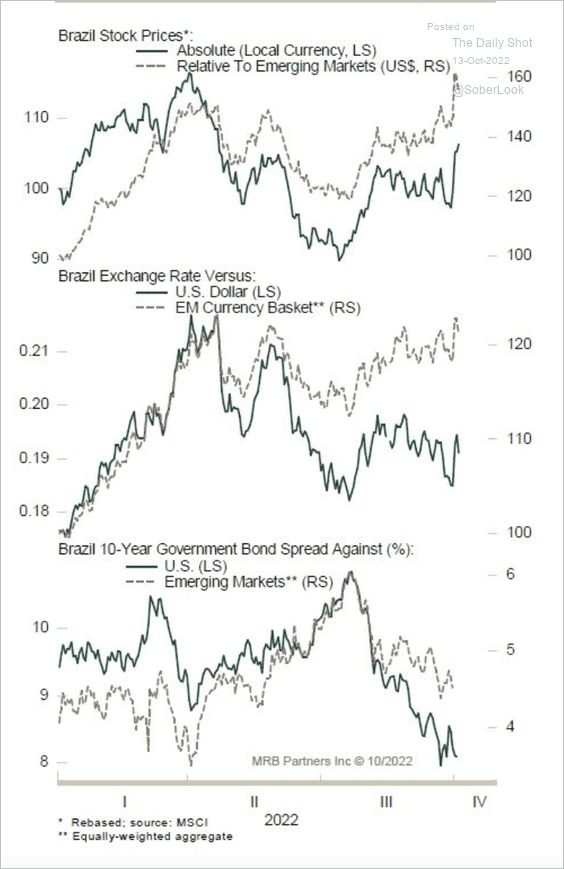

5. Next, we have some updates on Brazil.

• Inflation continues to ease.

• Vehicle exports slumped last month.

• Retail sales edged lower in August.

• Brazilian assets have been outperforming.

Source: MRB Partners

Source: MRB Partners

——————–

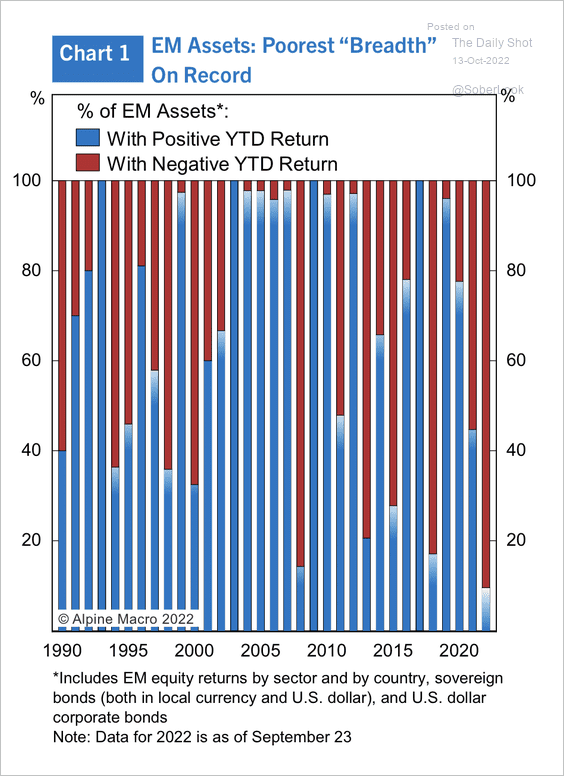

6. So far, most EM assets have negative returns this year, measured in dollars. This has been the weakest breadth since the financial crisis.

Source: Alpine Macro

Source: Alpine Macro

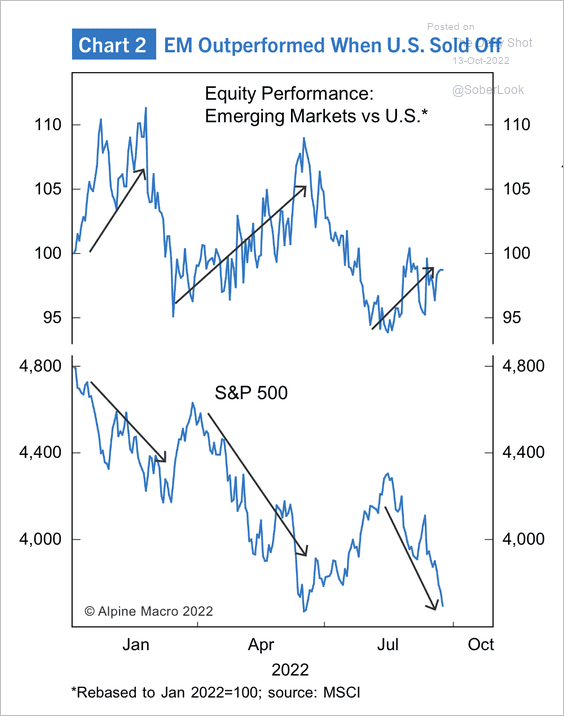

However, EM equities have been fairly resilient versus the S&P 500 during market sell-offs this year.

Source: Alpine Macro

Source: Alpine Macro

——————–

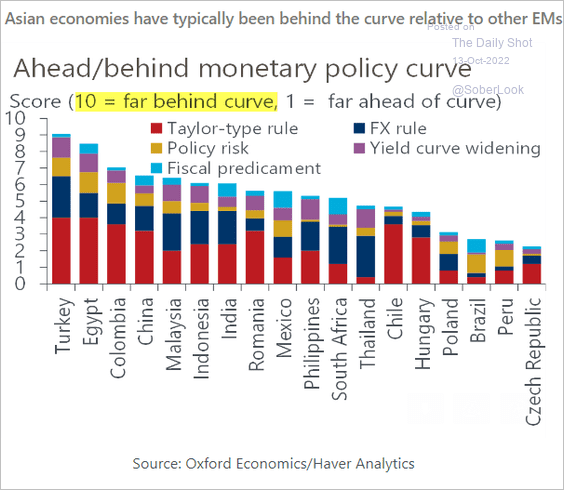

7. Which central banks are behind the curve?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

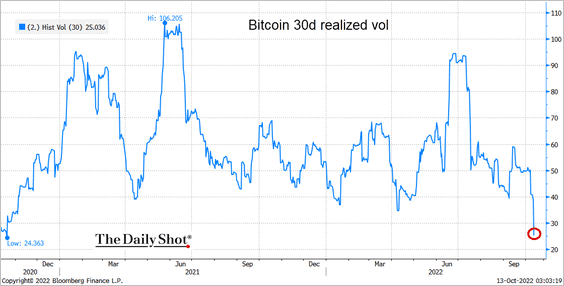

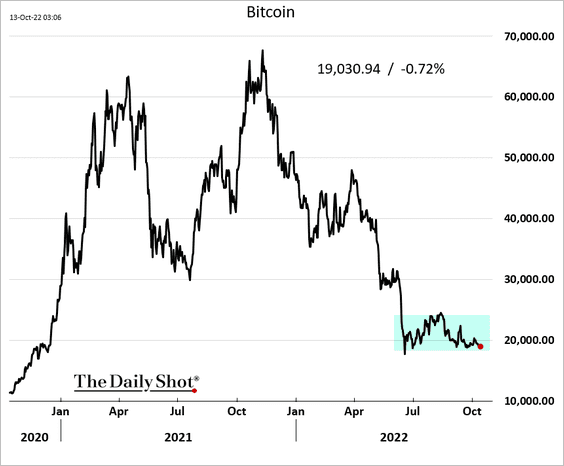

1. Bitcoin’s volatility hit a 2-year low.

——————–

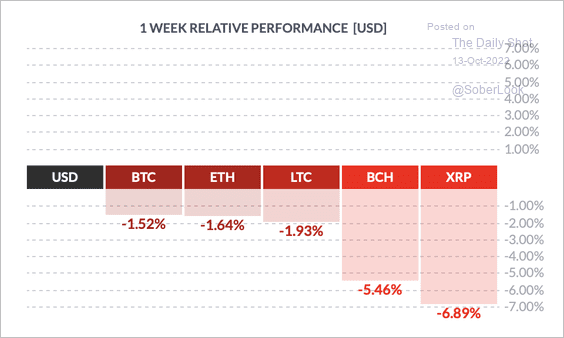

2. So far, bitcoin has declined less than other top cryptos this week, while XRP underperformed.

Source: FinViz

Source: FinViz

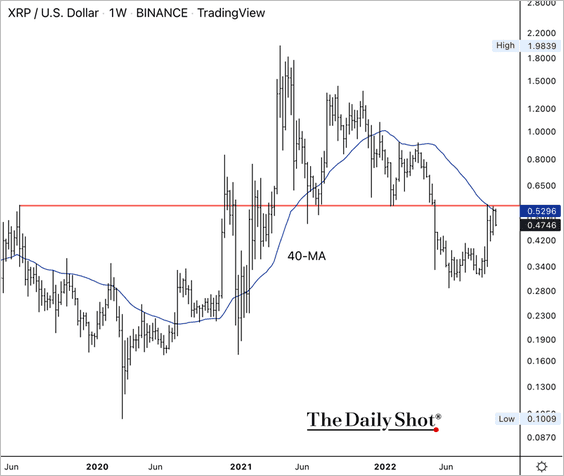

By the way, XRP is testing resistance at its 40-week moving average.

——————–

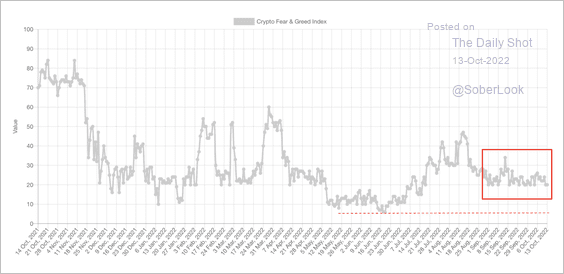

3. The Crypto Fear & Greed Index has been in “extreme fear” territory over the past month, although not as severe as the June low.

Source: Alternative.me

Source: Alternative.me

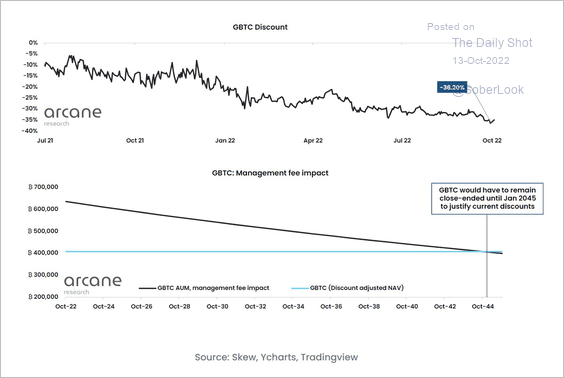

4. The Grayscale Bitcoin Trust’s (GBTC) record discount to NAV suggests the fund will have to remain close-ended until July 2045, according to Arcane Research.

Source: @ArcaneResearch

Source: @ArcaneResearch

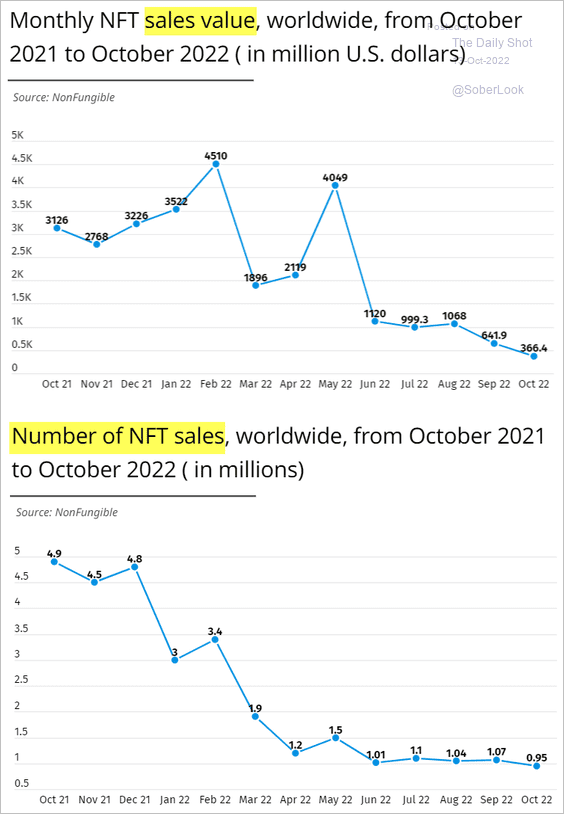

5. The slump in NFT sales continues.

Source: Augusta Free Press

Source: Augusta Free Press

Back to Index

Commodities

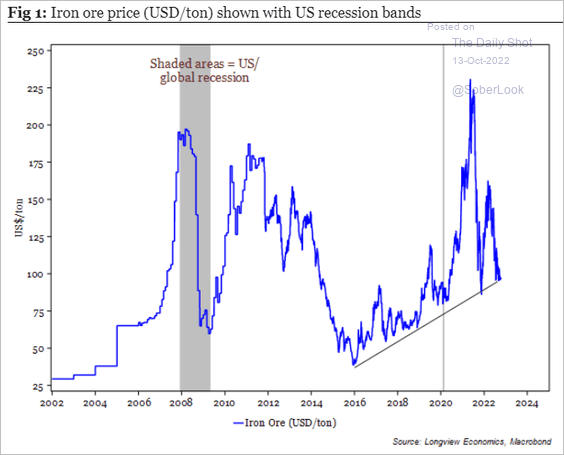

1. Iron ore is at support.

Source: Longview Economics

Source: Longview Economics

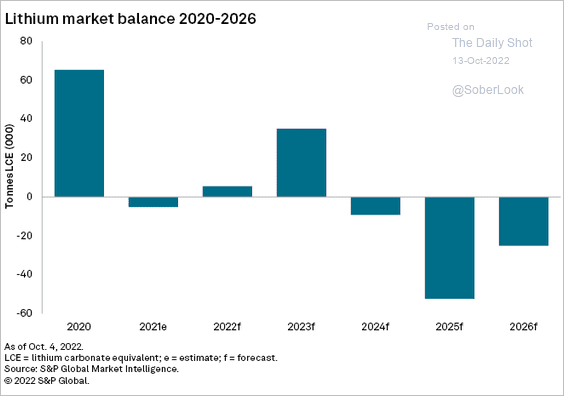

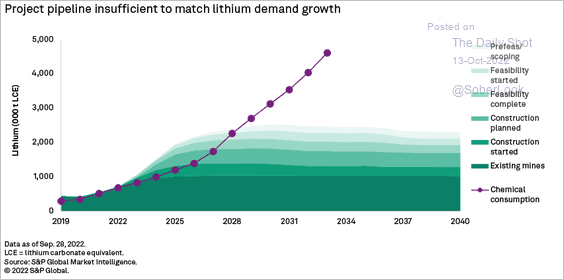

2. S&P Global is forecasting a deficit in the lithium market starting in 2024, which will require additional investment (2 charts).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

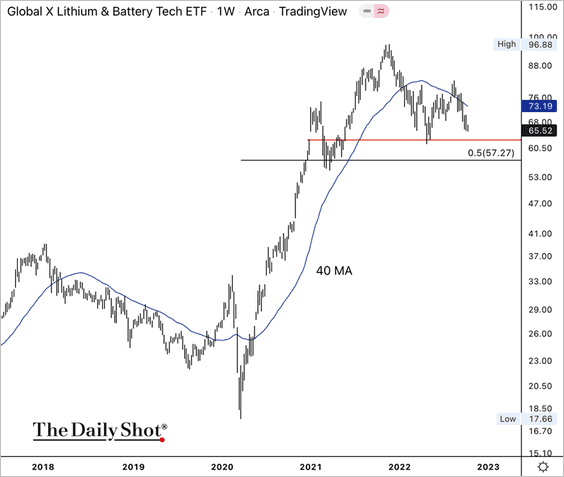

For now, the Global X Lithium ETF (LIT) is capped below its 40-week moving average, similar to what occurred in 2018.

——————–

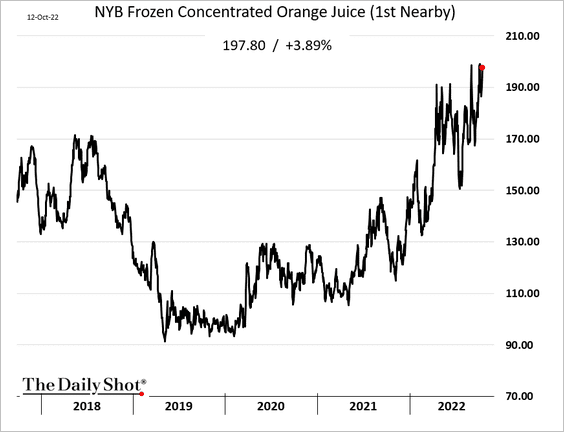

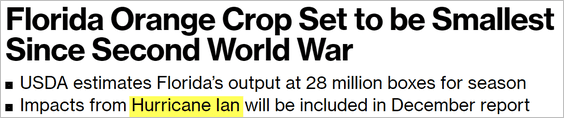

3. Orange juice futures have been surging in the pandemic era.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Energy

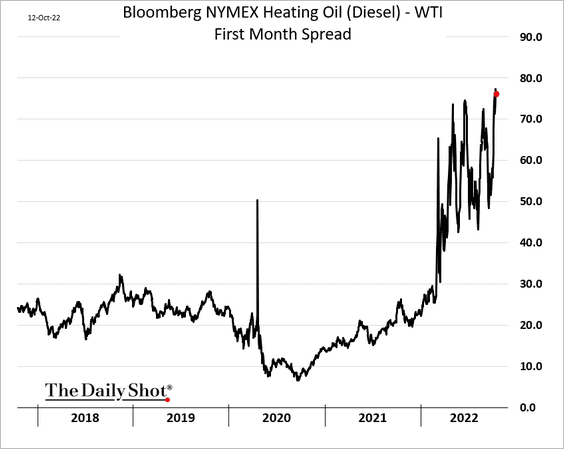

1. US diesel crack spreads are hitting new highs amid tight supplies (see chart).

h/t @juliafanzeres

h/t @juliafanzeres

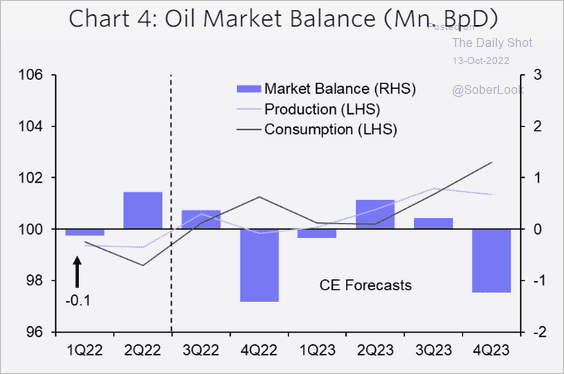

2. Capital Economics sees global oil markets remaining tight.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

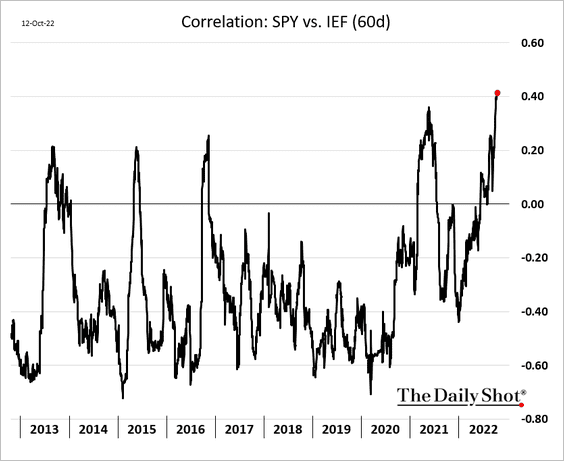

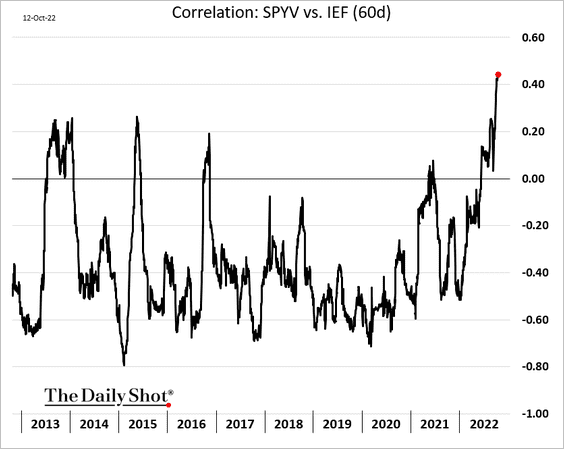

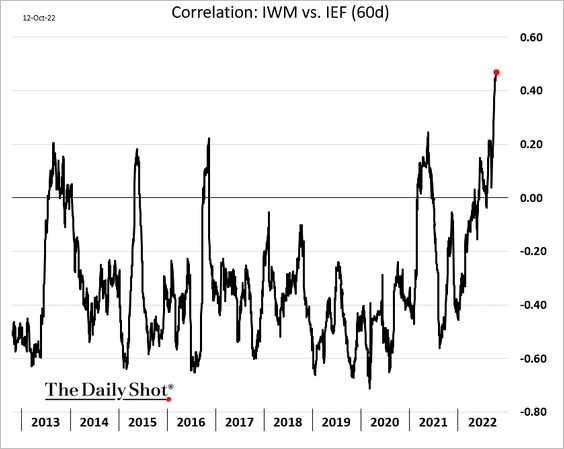

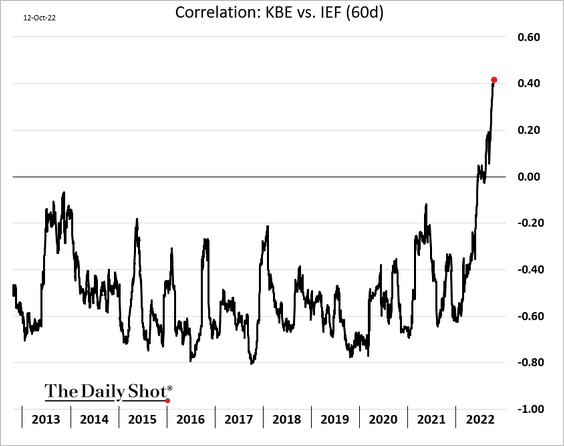

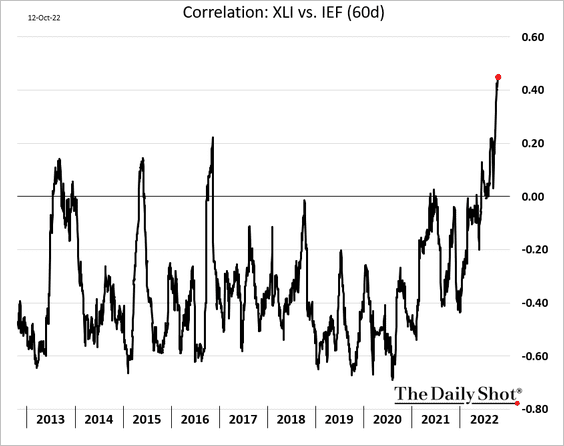

1. The S&P 500 correlation to Treasuries hit a multi-year high (IEF = iShares 7-10 Year Treasury Bond ETF).

Moreover, this correlation has broadened across US equity markets.

• Growth stocks have been highly correlated with Treasuries this year, but now value stocks are as well.

• Small caps are now also moving with bond prices.

• Banks are supposed to be negatively correlated with Treasury prices. But here we are …

• Below are a few other sectors.

– Industrials:

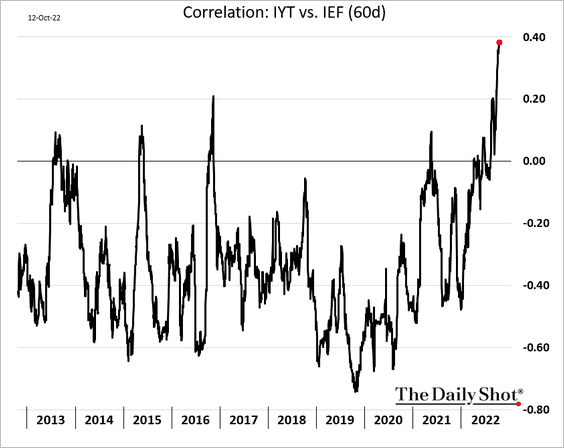

– Transportation:

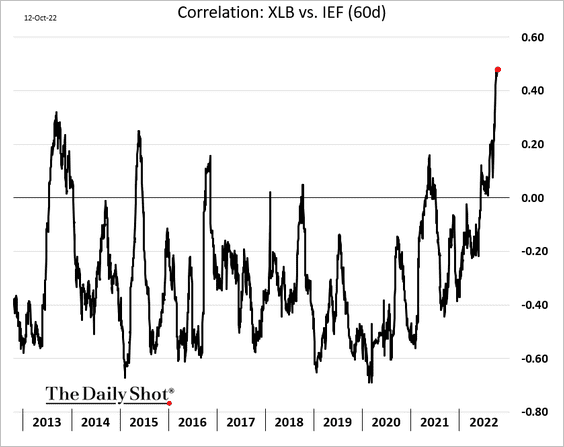

– Materials:

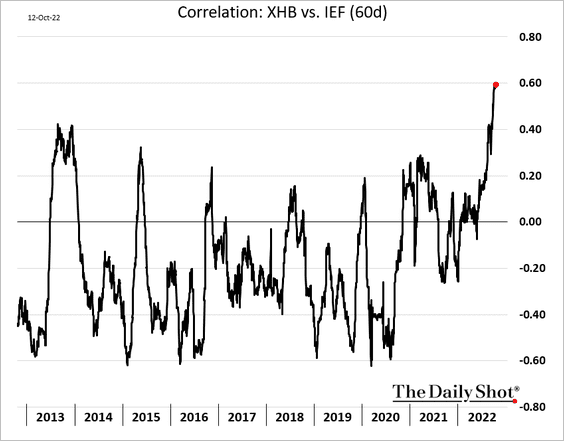

– Housing:

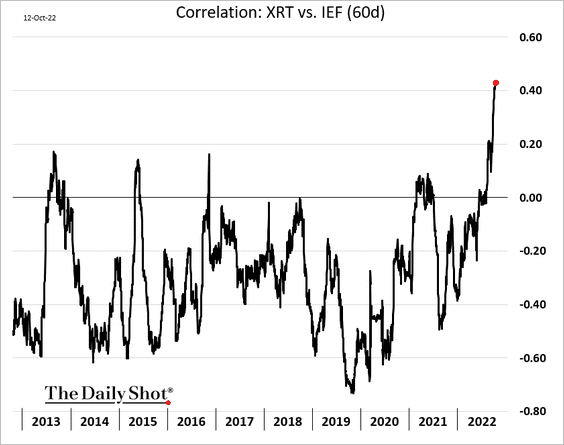

– Retail:

——————–

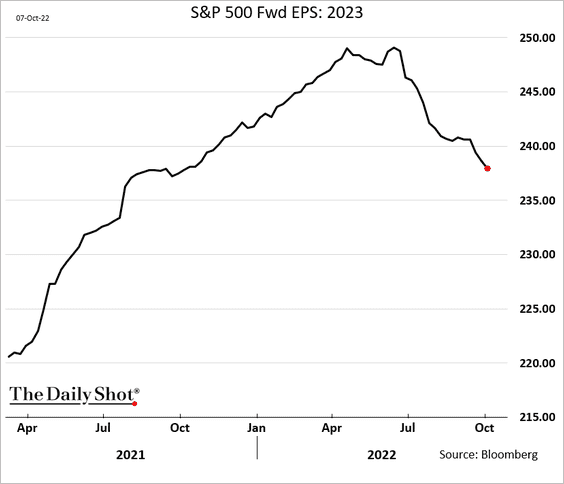

2. Expected 2023 earnings continue to get downgraded.

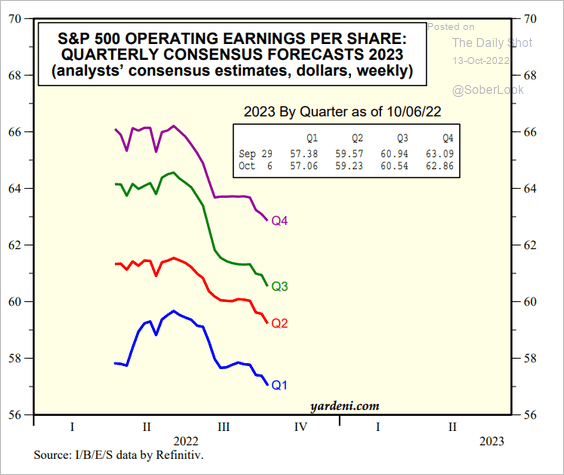

Here is the breakdown by quarter.

Source: Yardeni Research

Source: Yardeni Research

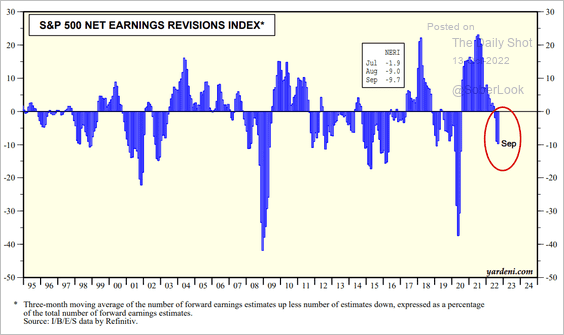

And this chart shows the revisions index. There is more to go …

Source: Yardeni Research

Source: Yardeni Research

——————–

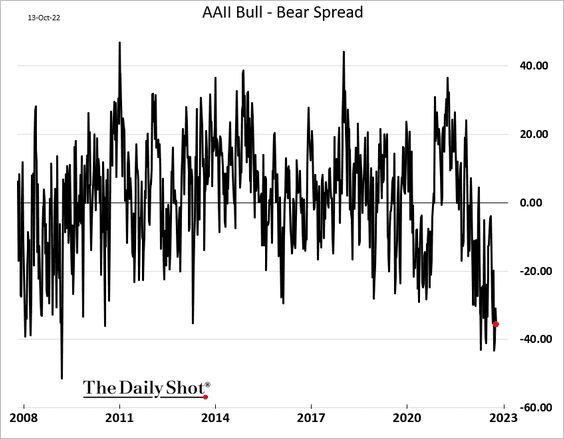

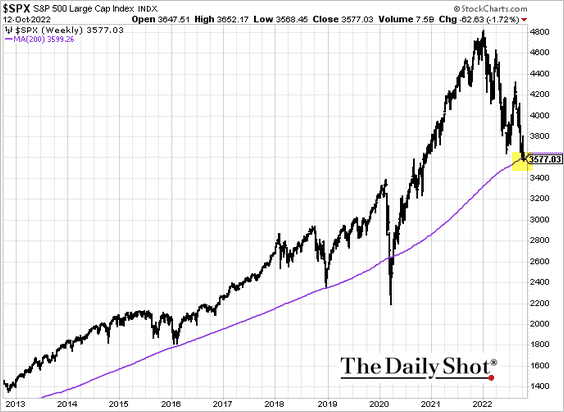

3. Investor sentiment remains extremely bearish.

4. The S&P 500 is testing support at the 200-week moving average.

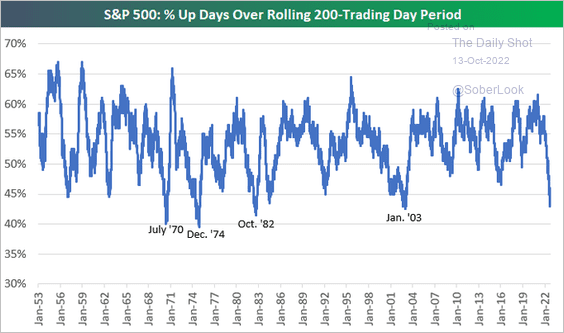

5. We’ve had very few up days this year.

Source: @bespokeinvest

Source: @bespokeinvest

6. Declining margins have been a drag on earnings growth this year.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

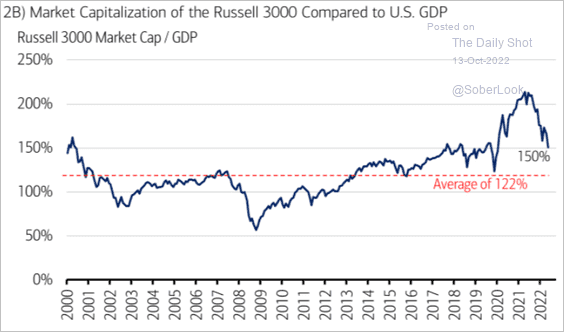

7. The broad US market cap as a share of US GDP remains elevated. However, US firms now have substantial sales abroad.

Source: Merrill Lynch

Source: Merrill Lynch

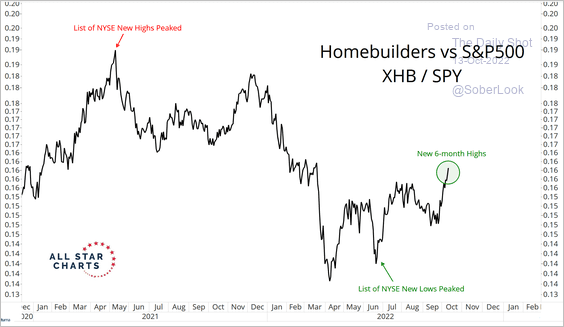

8. Despite the headwinds, housing stocks have been outperforming.

Source: @allstarchartsIN

Source: @allstarchartsIN

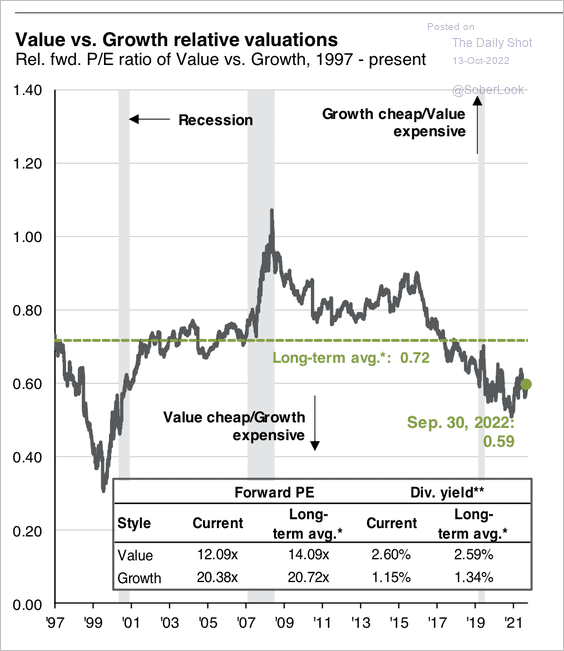

9. Value stocks still appear cheap relative to growth stocks.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

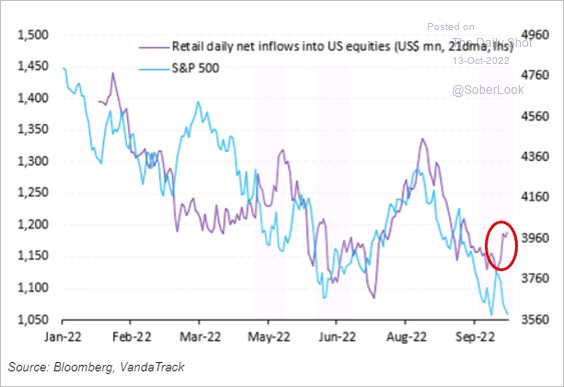

10. Retail purchases picked up in recent days.

Source: Vanda Research

Source: Vanda Research

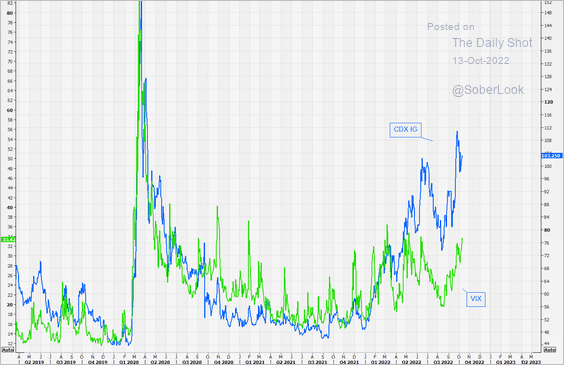

11. VIX is lagging credit spreads (chart shows investment-grade CDX spread).

Source: @themarketear

Source: @themarketear

Back to Index

Credit

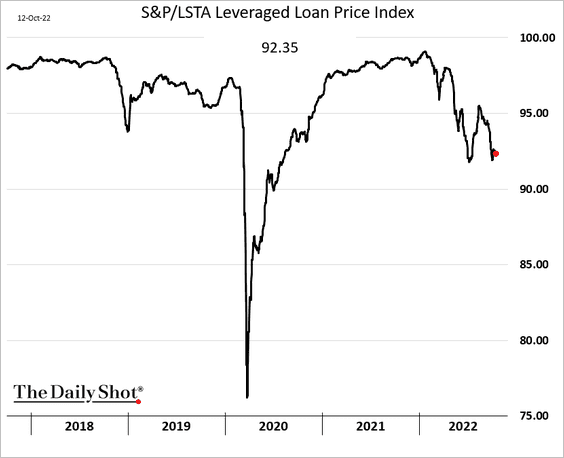

1. Leveraged loan prices are near the lowest levels since 2020.

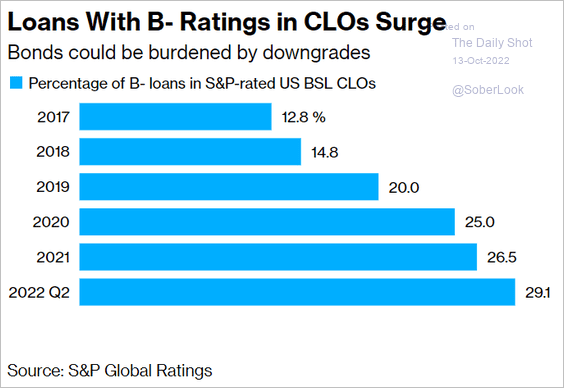

2. CLOs could see their CCC buckets overflow, pressuring overcollateralization limits.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

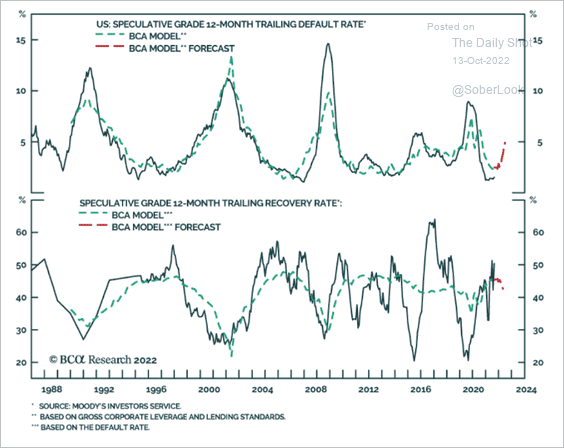

3. BCA Research sees a relatively modest increase in defaults next year.

Source: BCA Research

Source: BCA Research

Back to Index

Rates

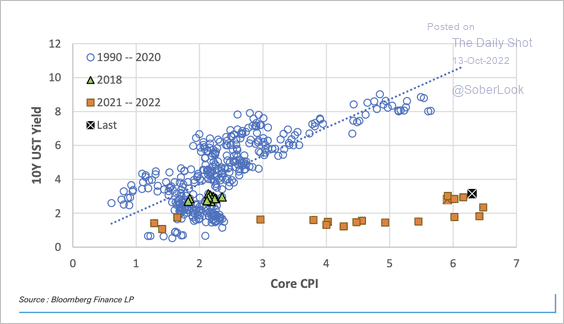

1. The 10-year Treasury yield has lost its connection with inflation. This is probably because of the Fed’s faster pace of tightening, according to Deutsche Bank (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

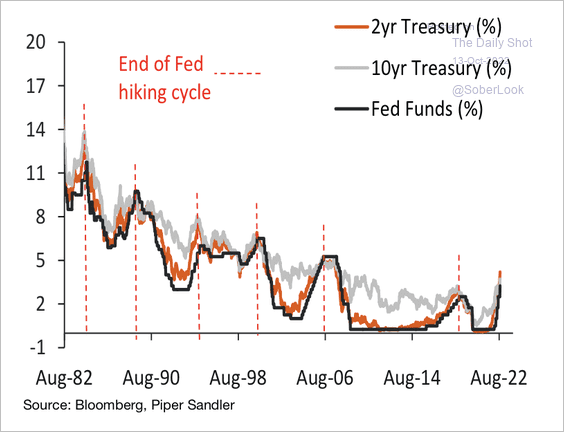

2. Treasury yields tend to peak around the end of a tightening cycle.

Source: Piper Sandler

Source: Piper Sandler

——————–

Food for Thought

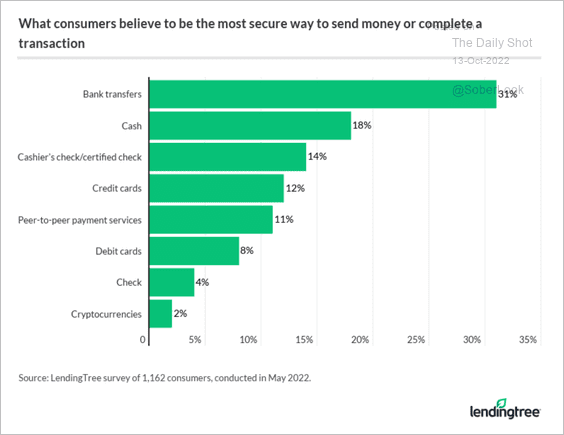

1. The most secure way to send money (a survey):

Source: LendingTree Read full article

Source: LendingTree Read full article

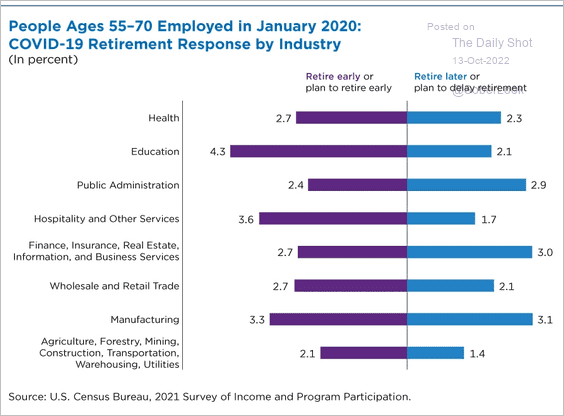

2. Retire early or delay retirement? (by industry)

Source: US Census Read full article

Source: US Census Read full article

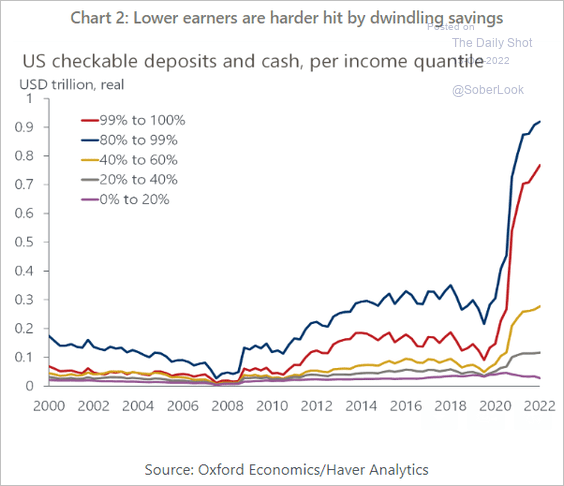

3. Savings per income quantile:

Source: Oxford Economics

Source: Oxford Economics

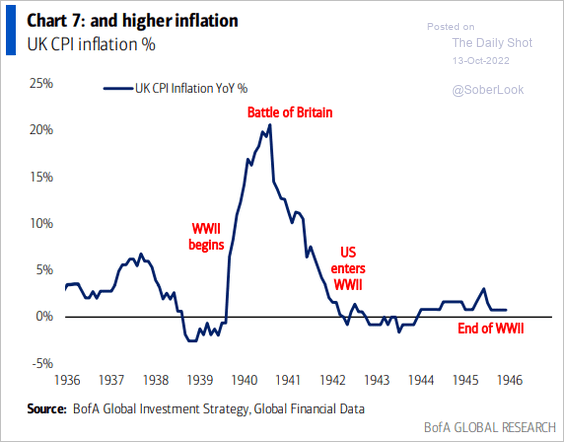

4. UK inflation during WW-II:

Source: BofA Global Research

Source: BofA Global Research

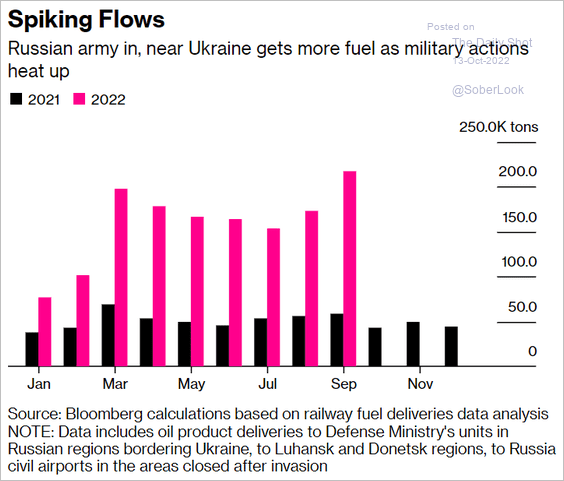

5. Russia boosting fuel supplies for its troops fighting in Ukraine:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

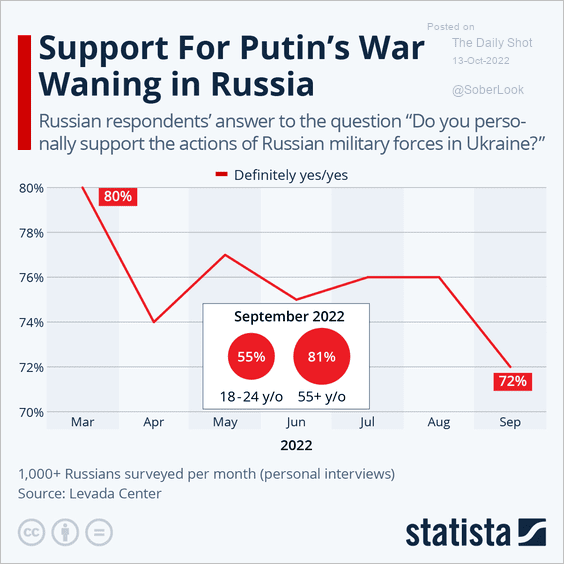

6. Support for the war in Russia:

Source: Statista

Source: Statista

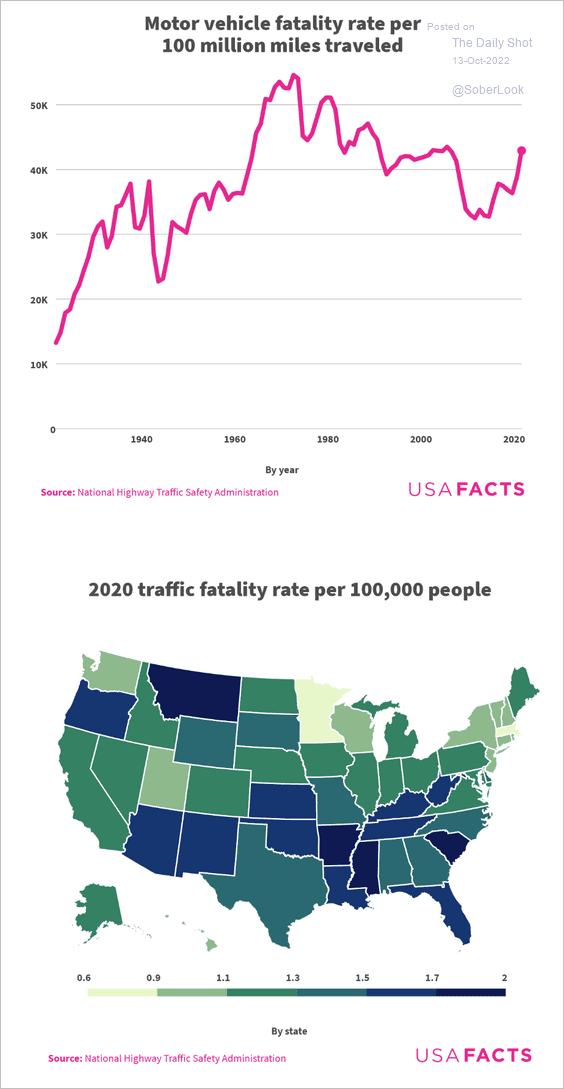

7. Vehicle fatality rate:

Source: USAFacts

Source: USAFacts

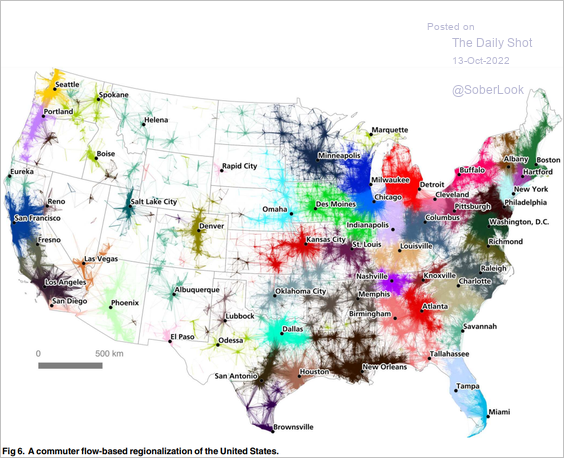

8. Commuter flows:

Source: Garrett Dash Nelson, Alasdair Rae Read full article

Source: Garrett Dash Nelson, Alasdair Rae Read full article

——————–

Back to Index