The Daily Shot: 02-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

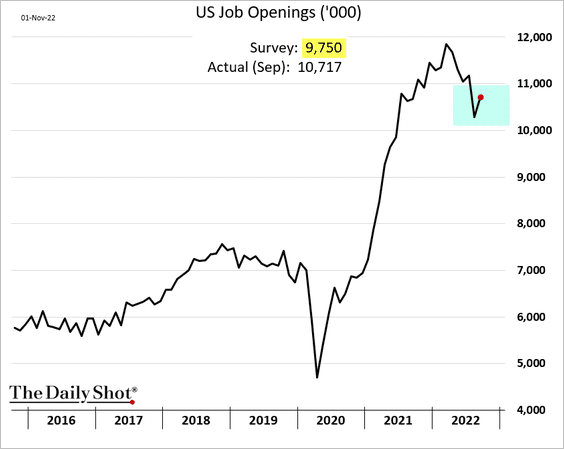

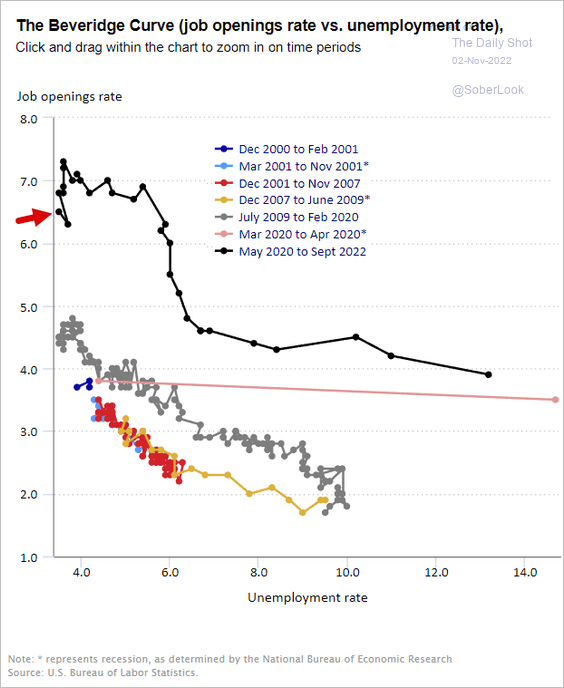

1. Job openings unexpectedly increased in September, pointing to persistent strength in the labor market.

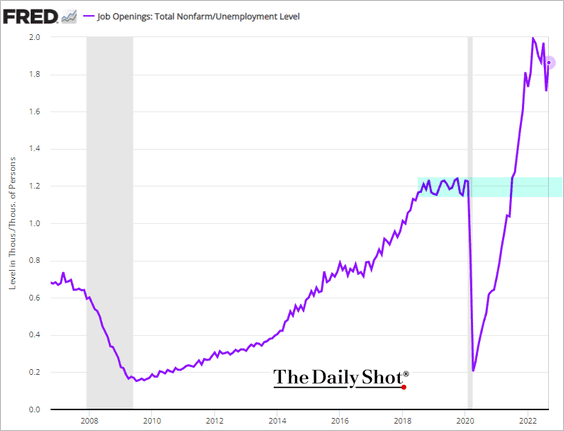

The Fed would like to see the openings-to-unemployment ratio closer to pre-COVID levels, but it’s not budging for now. This does not look like a signal to “pivot.”

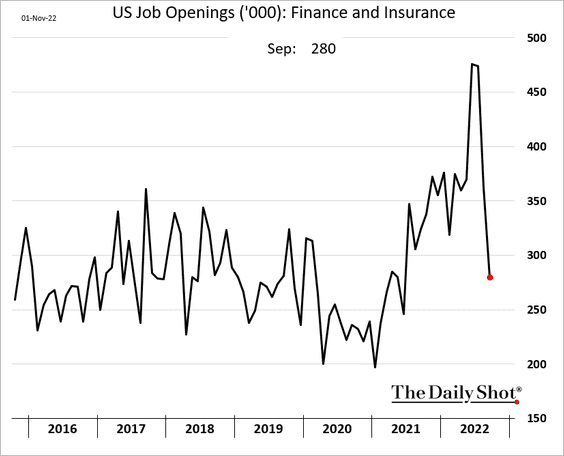

• Deteriorating mortgage activity sent labor demand in “finance and insurance” lower, …

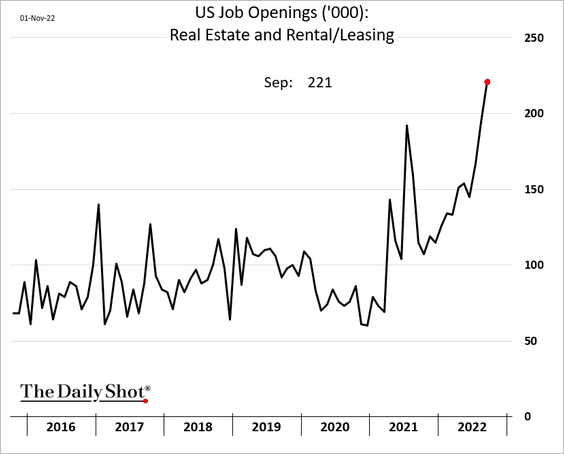

… but real estate rental and leasing vacancies have been surging.

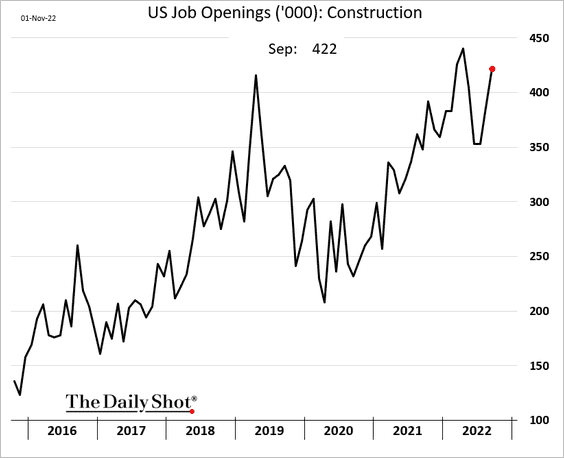

Moreover, construction openings unexpectedly increased in September.

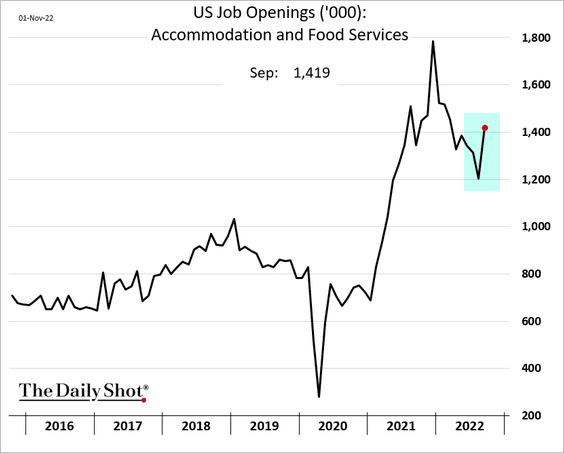

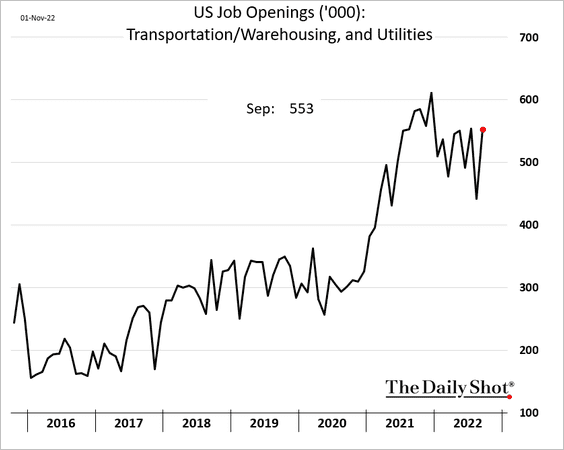

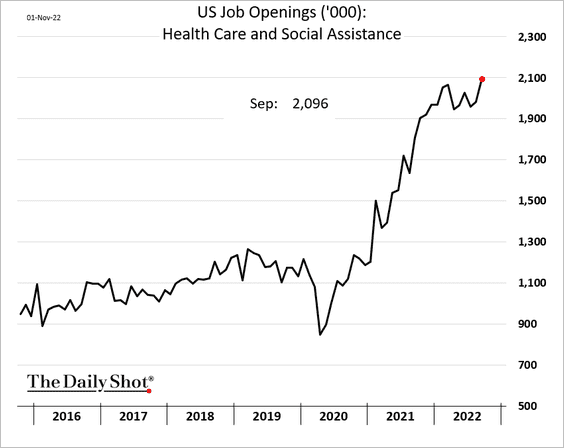

Here are some additional job openings trends.

– Hotels and restaurants:

– Logistics:

– Healthcare:

——————–

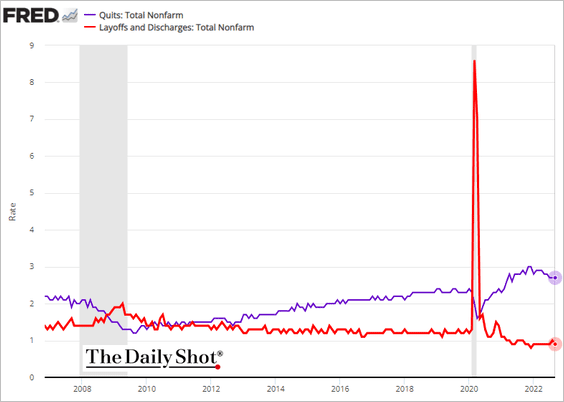

• Layoffs remain extremely low (red line).

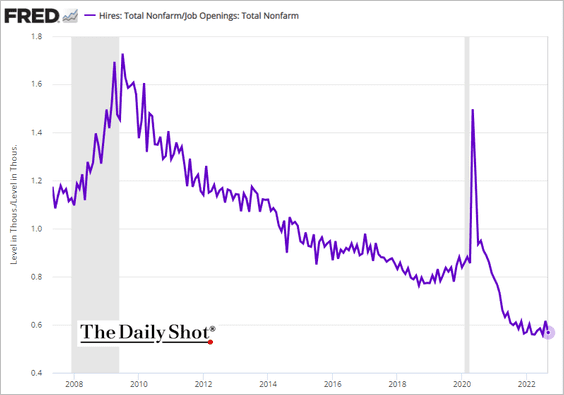

• Below is the hires-to-openings ratio.

• The Beveridge curve illustrates the imbalances in the labor market.

Source: BLS

Source: BLS

——————–

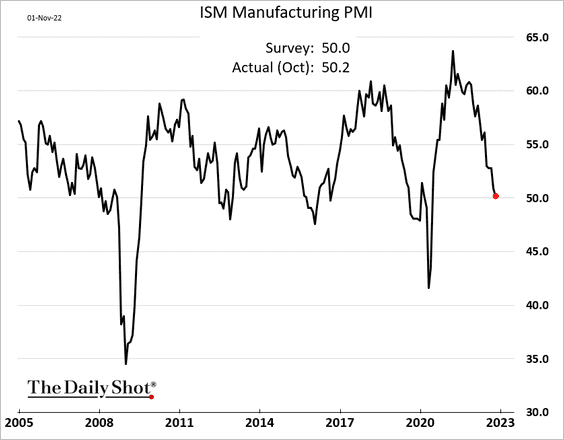

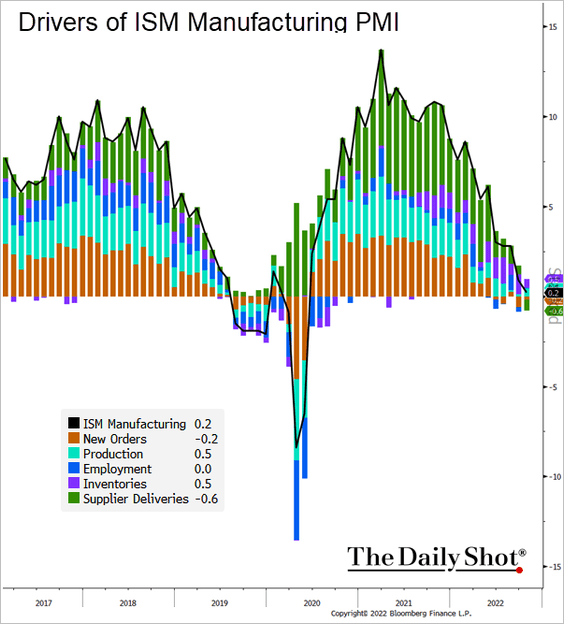

2. The ISM Manufacturing PMI declined again in October but held above 50 (indicating modest growth).

Here are the contributions to the PMI index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

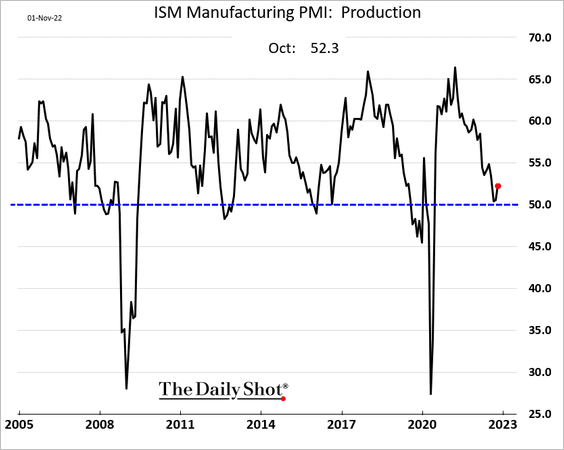

• Manufacturing production is growing again.

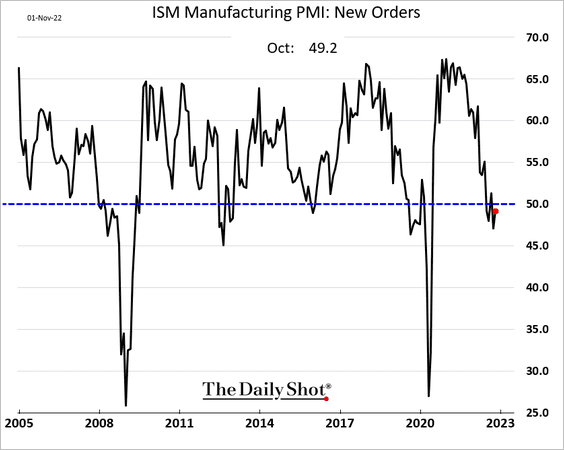

• New orders are still in contraction territory, but not by much.

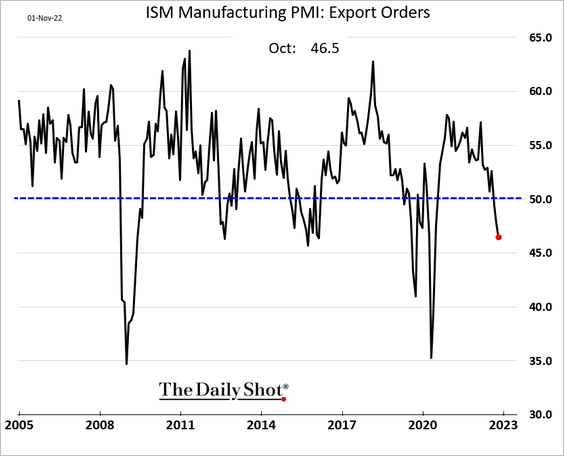

The decline in export orders accelerated, partially driven by the US dollar strength.

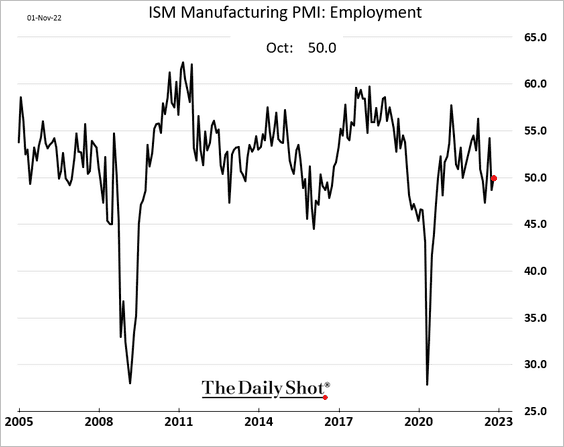

• The employment index is holding at 50 (no change).

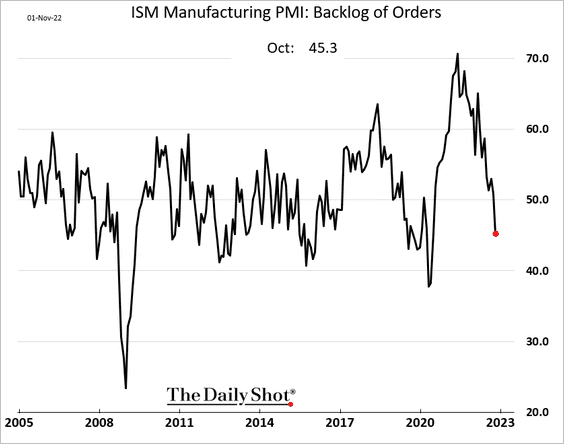

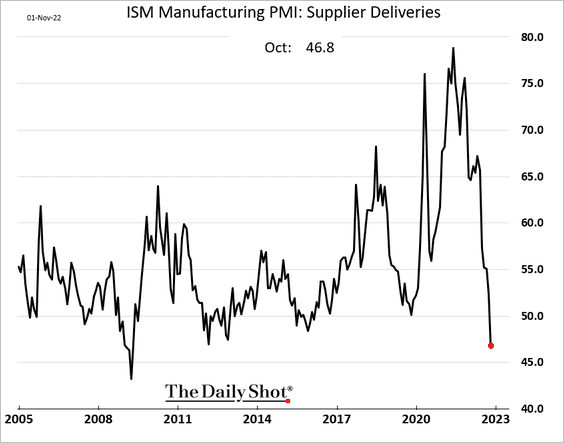

• Supply stresses are gone.

– Order backlogs (now declining):

– Supplier delivery times (also declining):

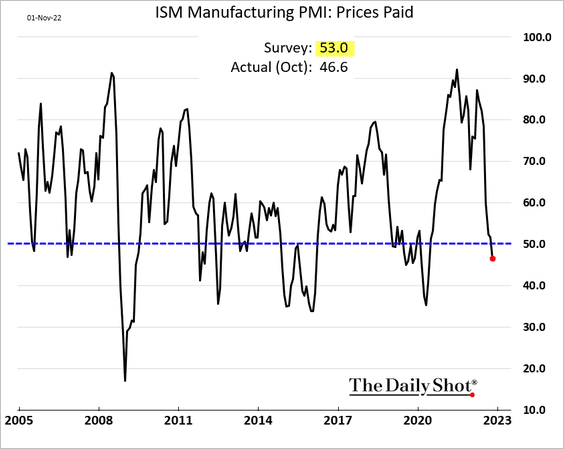

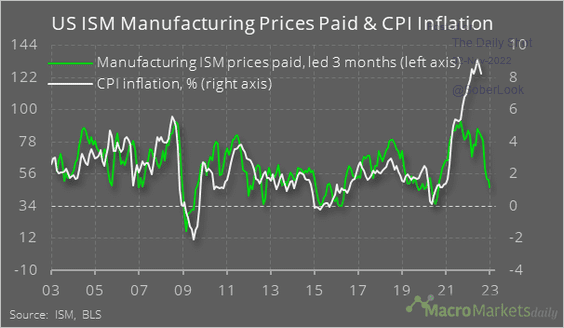

• Input prices are now falling, surprising to the downside.

That’s good news for consumer inflation.

Source: @macro_daily

Source: @macro_daily

——————–

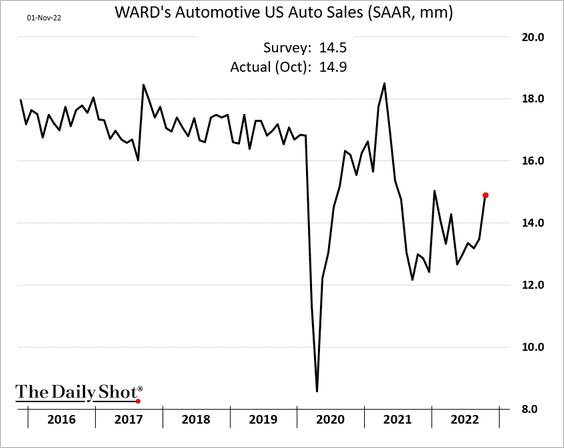

3. US vehicle sales picked up in October.

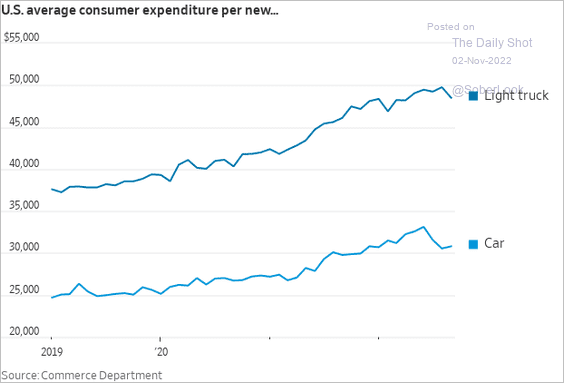

As prices moderate.

Source: @WSJ Read full article

Source: @WSJ Read full article

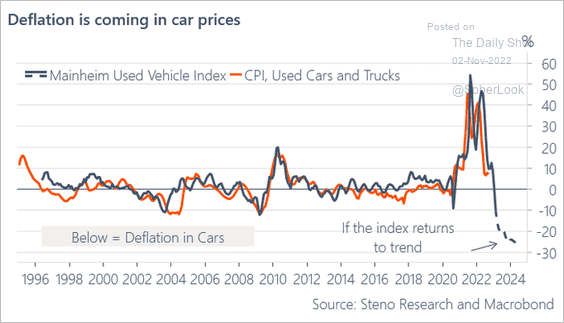

Used car prices are in deflation territory.

Source: @AndreasSteno

Source: @AndreasSteno

——————–

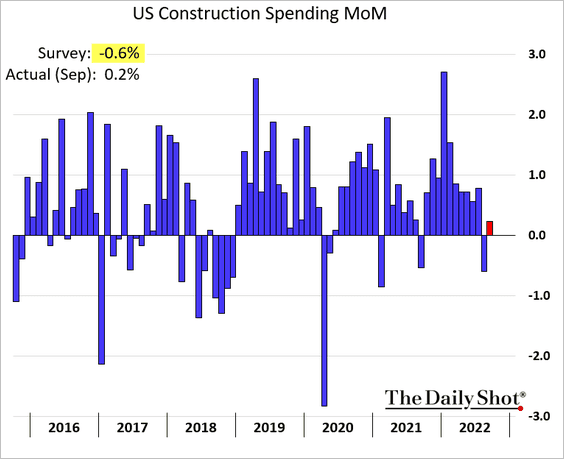

4. Construction spending unexpectedly increased in September.

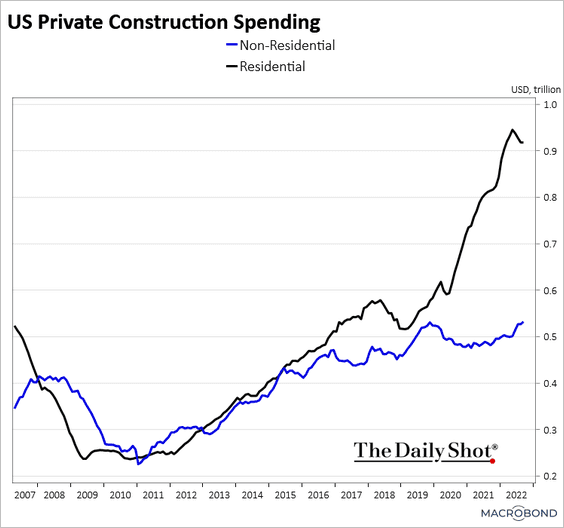

Residential spending stabilized, while non-residential expenditures are trending higher.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

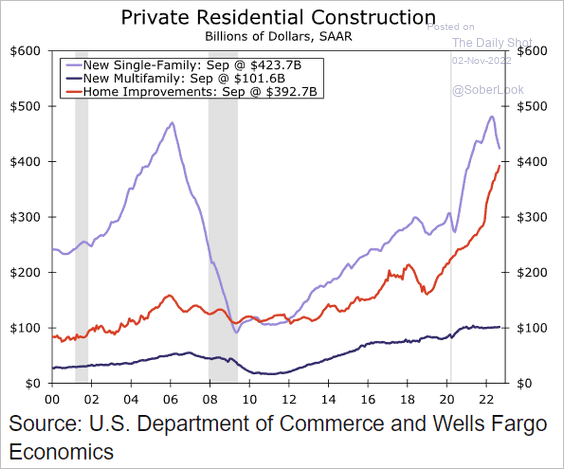

Here is the breakdown of residential spending (fueled in part by excess savings).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

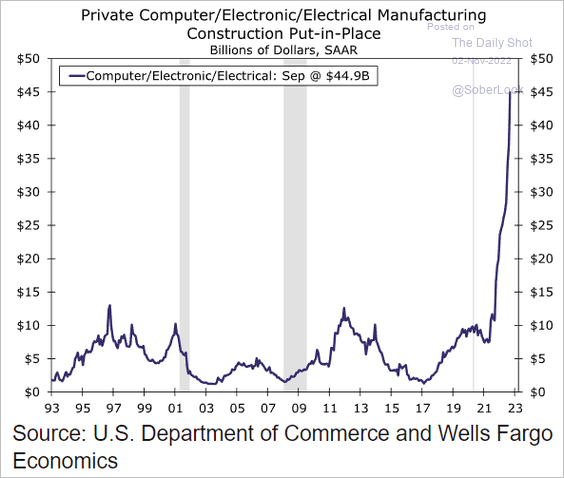

Construction spending on electronics manufacturing facilities has been surging amid reshoring efforts.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

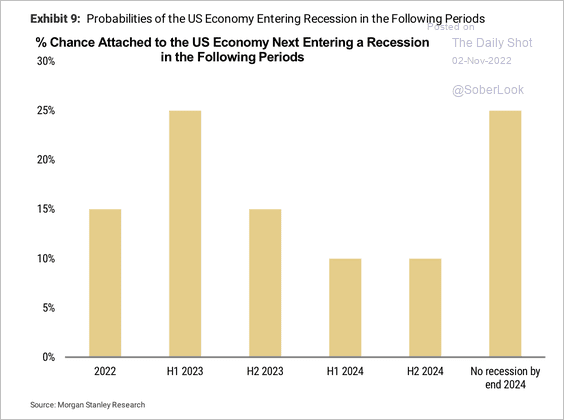

5. Here are some recession probabilities from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

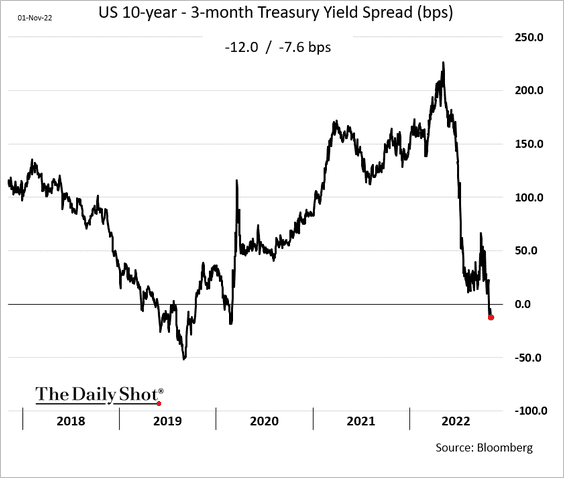

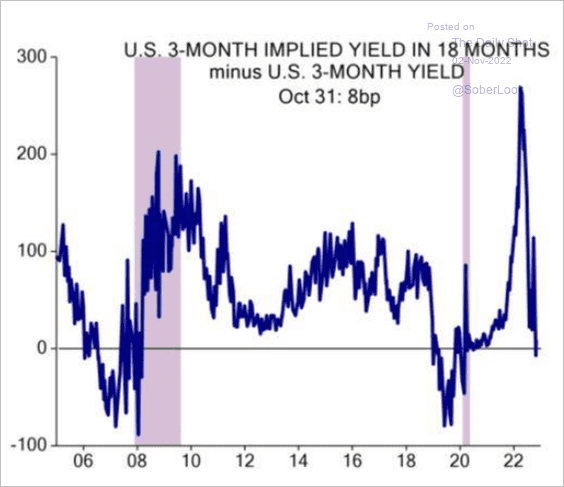

The 3-month/10-year portion of the Treasury curve remains inverted.

The short end of the curve is now also inverted.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Canada

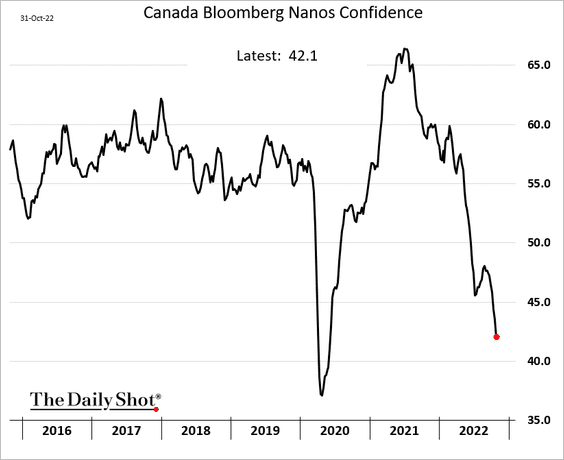

1. Consumer confidence continues to plunge.

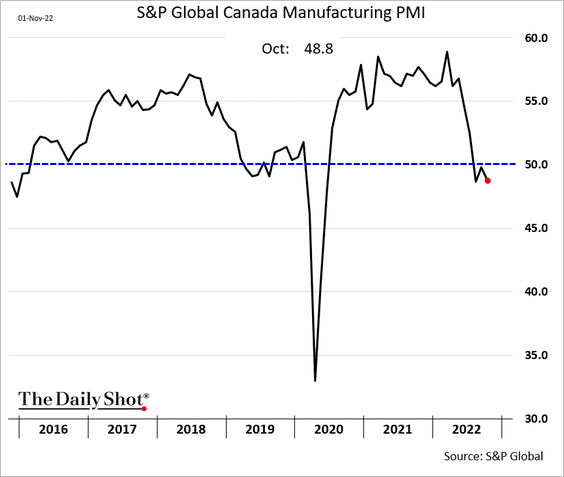

2. The October PMI report showed factory activity still in contraction territory.

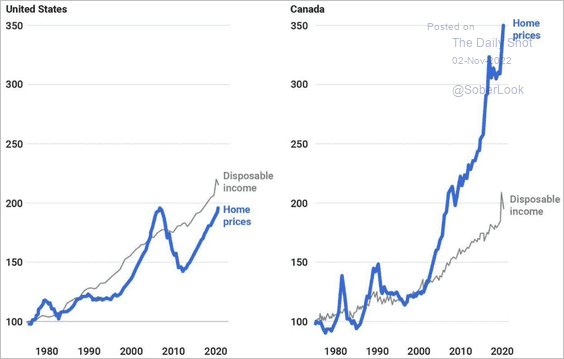

3. Here is home price appreciation vs. disposable income for the US and Canada.

Source: @MPelletierCIO

Source: @MPelletierCIO

Back to Index

The United Kingdom

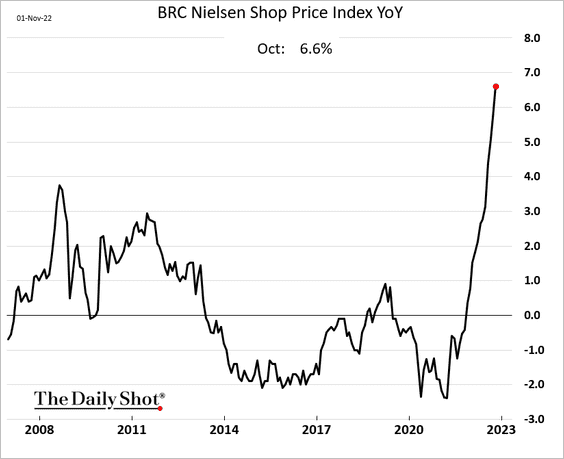

1. Prices charged by shops continue to surge.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

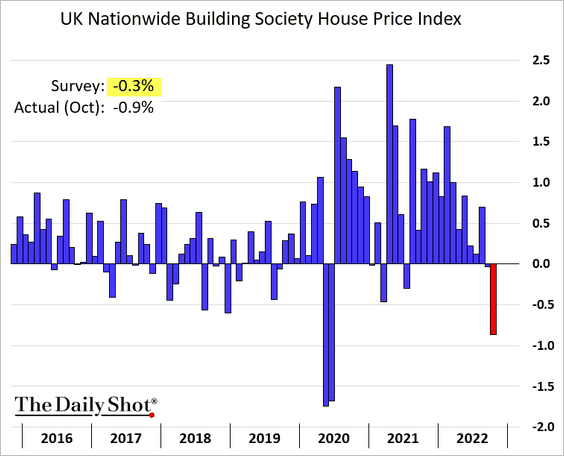

2. Home prices tumbled in October.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

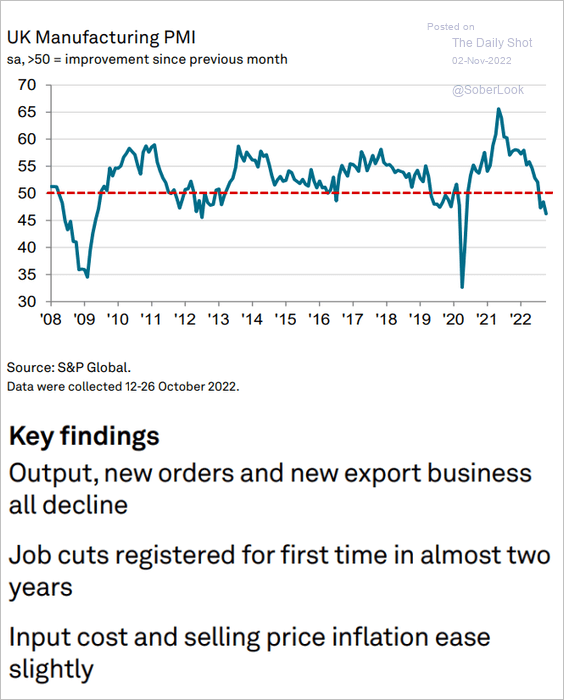

3. The UK manufacturing sector is in recession territory.

Source: Reuters Read full article

Source: Reuters Read full article

Source: S&P Global PMI

Source: S&P Global PMI

——————–

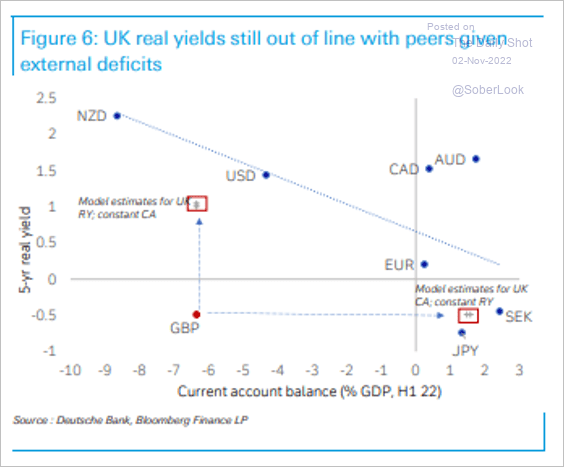

4. UK real yields are still too low compared with other major economies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

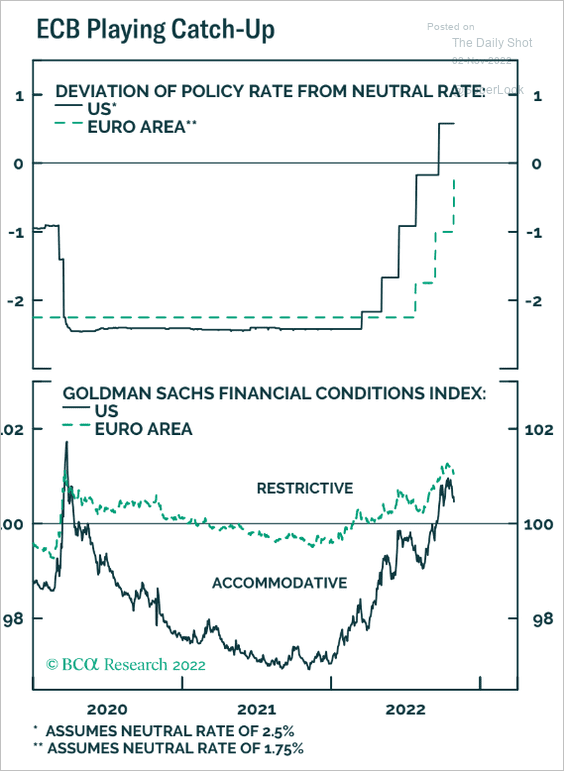

1. The ECB rate is approaching restrictive territory

Source: BCA Research

Source: BCA Research

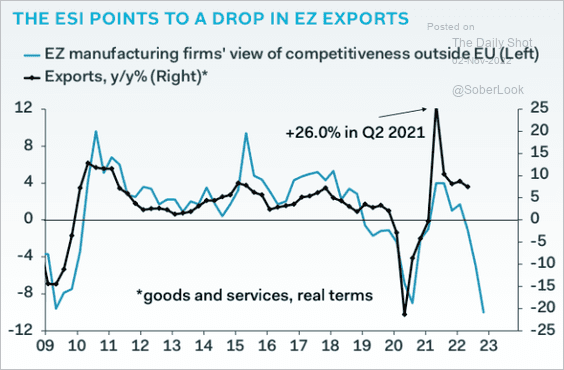

2. Surveys point to a deterioration in euro-area exports.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

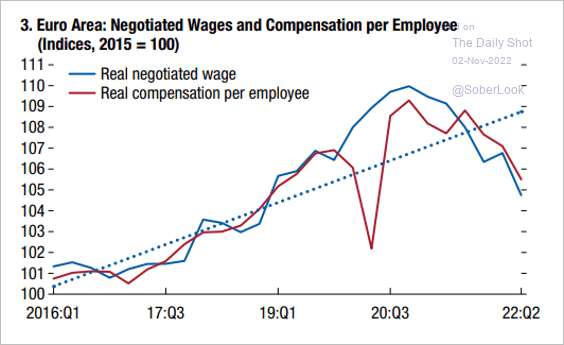

3. Real wages have been falling.

Source: IMF Read full article

Source: IMF Read full article

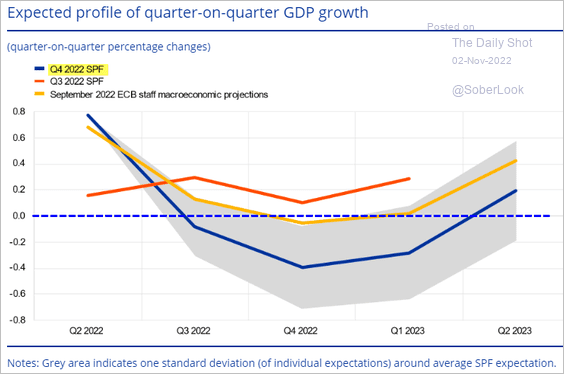

4. The ECB’s survey of forecasters points to a prolonged recession.

Source: ECB Read full article

Source: ECB Read full article

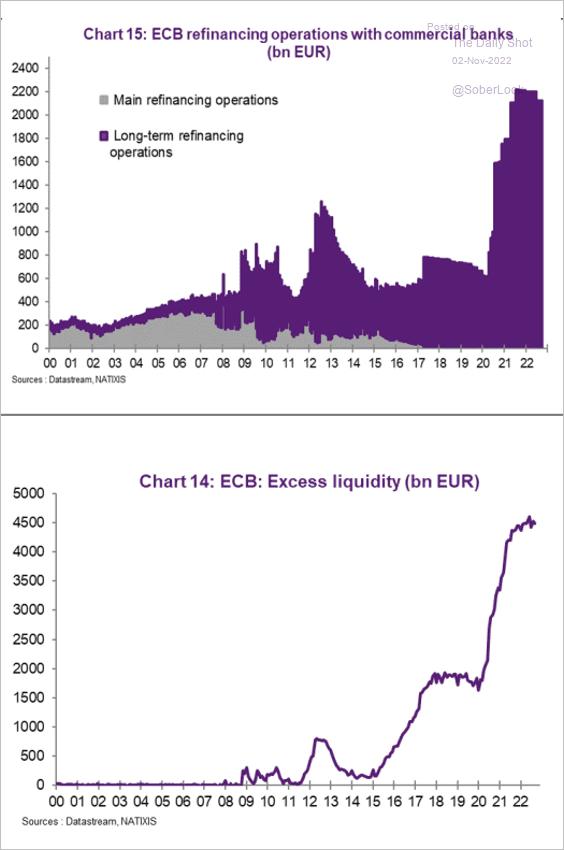

5. The ECB’s €4.5 trillion of reserves will become increasingly expensive for the Eurosystem as rates climb.

Source: Natixis

Source: Natixis

Back to Index

Japan

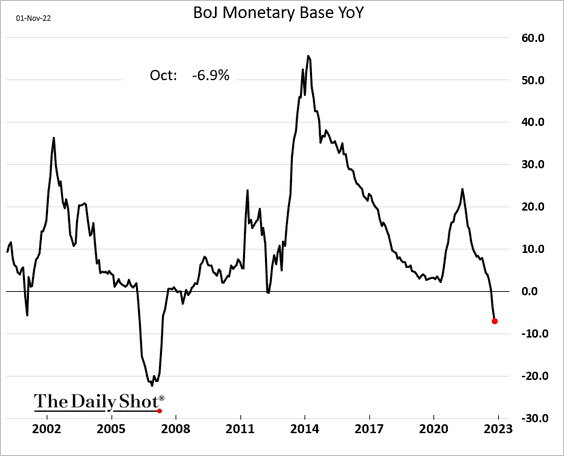

1. The monetary base is now down vs. last year.

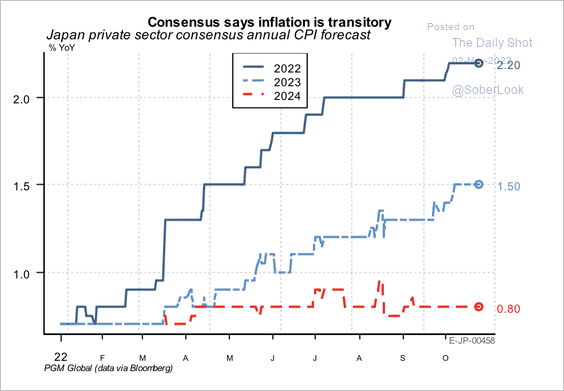

2. Headline CPI is expected to slow over the next two years.

Source: PGM Global

Source: PGM Global

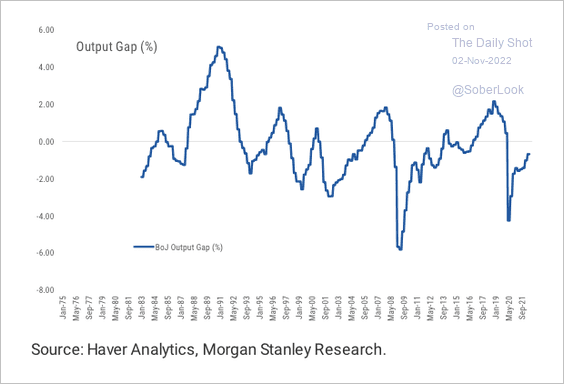

3. The output gap is still negative, a persistent drag on inflation.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

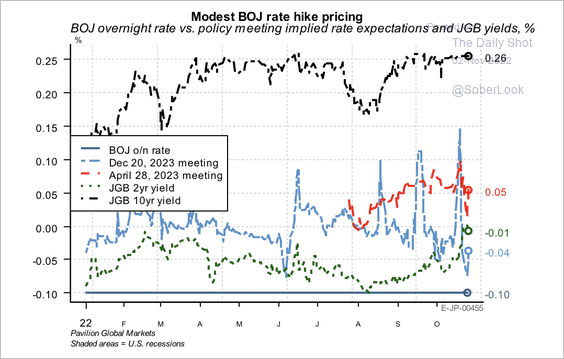

4. Short-term interest rate markets are pricing the overnight rate at five basis points by next April’s policy meeting. Will the BoJ signal the end of negative rates?

Source: PGM Global

Source: PGM Global

Back to Index

Asia – Pacific

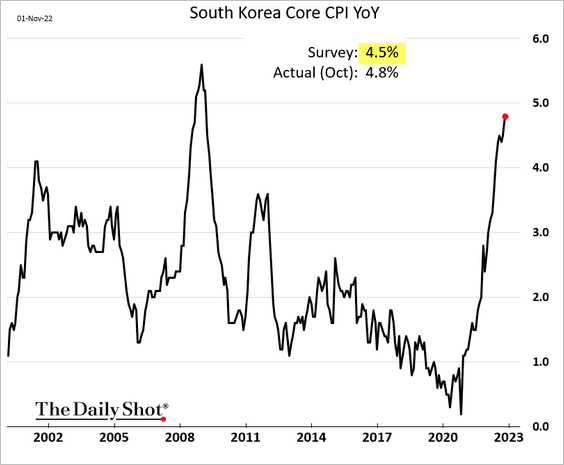

1. South Korea’s core CPI surprised to the upside.

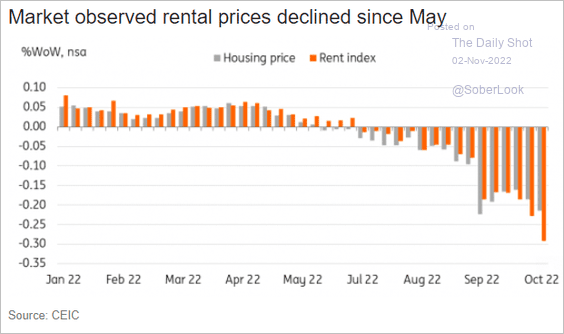

But rental prices have been declining.

Source: ING

Source: ING

——————–

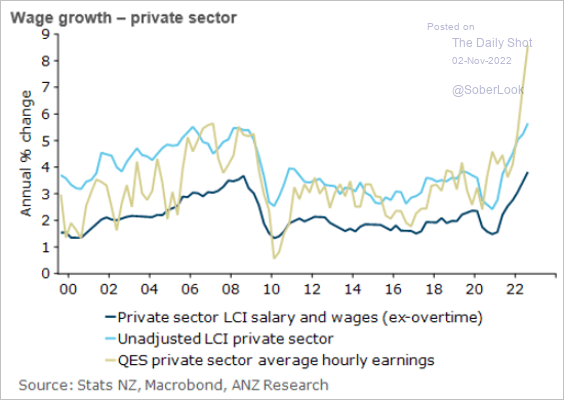

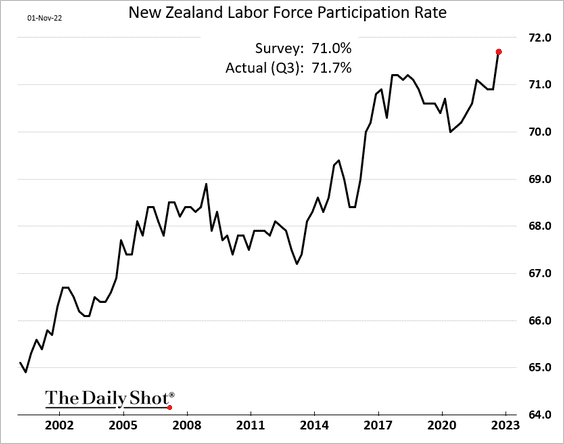

2. Next, we have some updates on New Zealand.

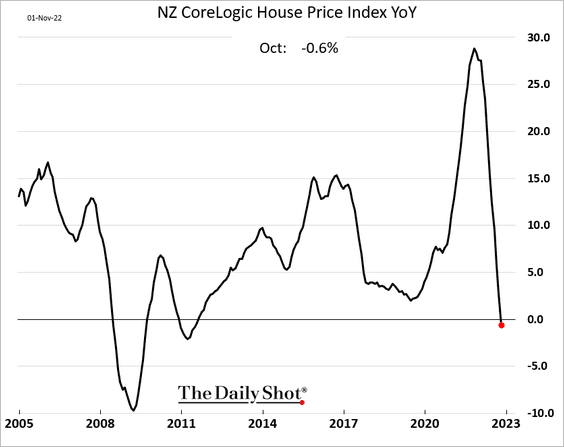

• Home prices are now down vs. a year ago.

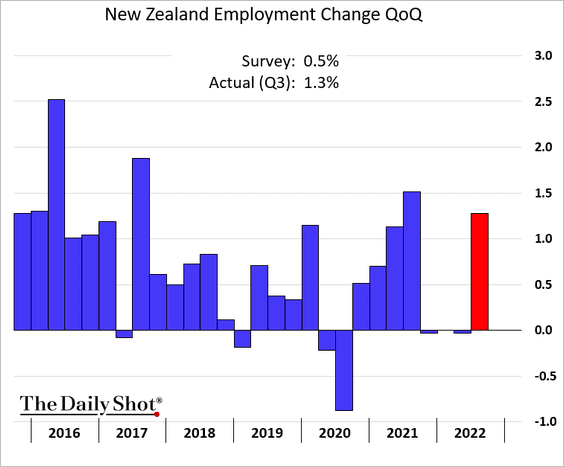

• Employment surprised to the upside last quarter.

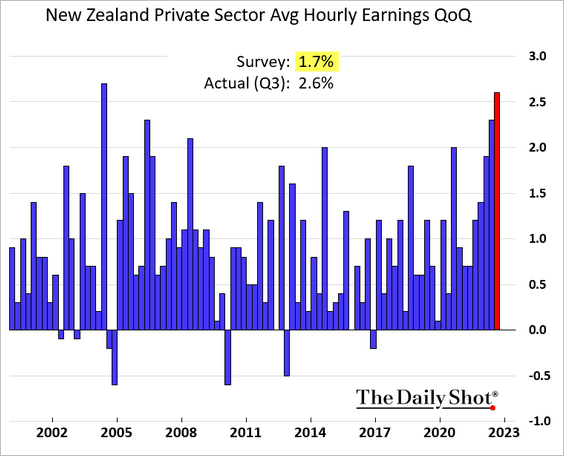

– Wages are surging.

Source: @ANZ_Research

Source: @ANZ_Research

– The participation rate hit a new high.

——————–

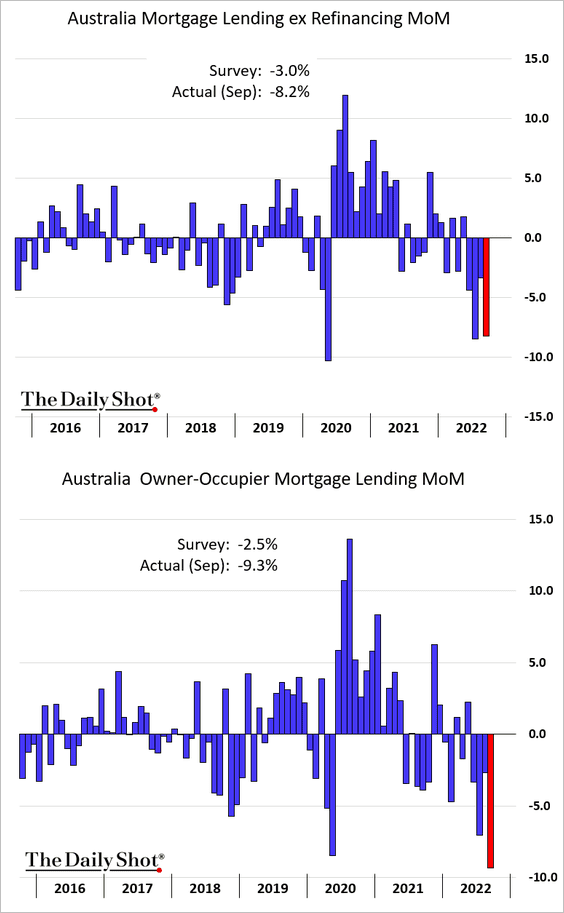

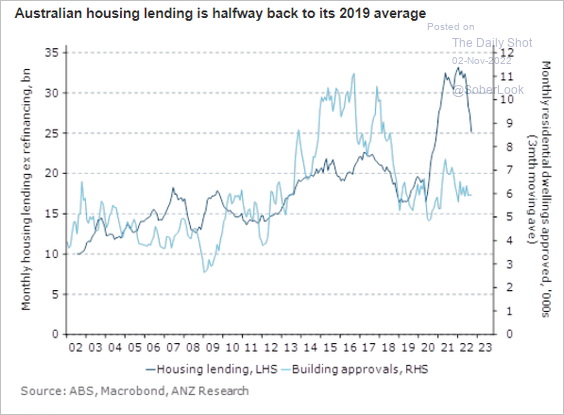

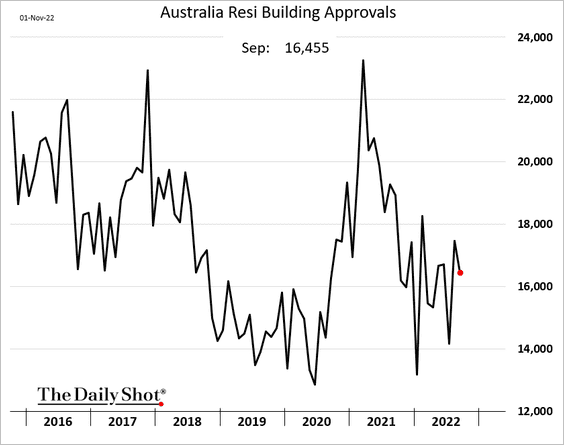

3. Australian mortgage lending declined much more than expected in September.

Source: @ANZ_Research

Source: @ANZ_Research

But building approvals remain stable.

Back to Index

China

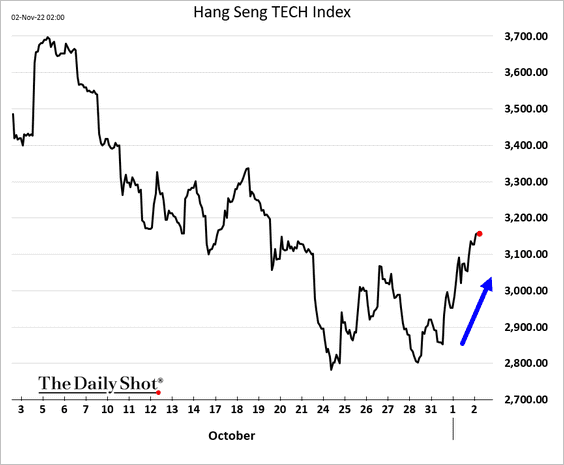

1. Stocks are rising on rumors of reopening plans.

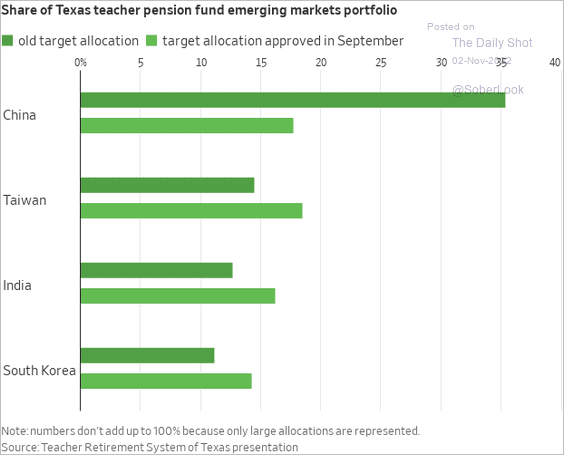

2. Some pension funds are allocating away from China.

Source: @WSJ Read full article

Source: @WSJ Read full article

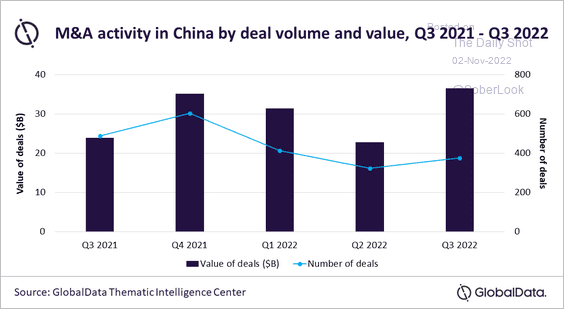

3. M&A activity has been strong.

Source: GlobalData

Source: GlobalData

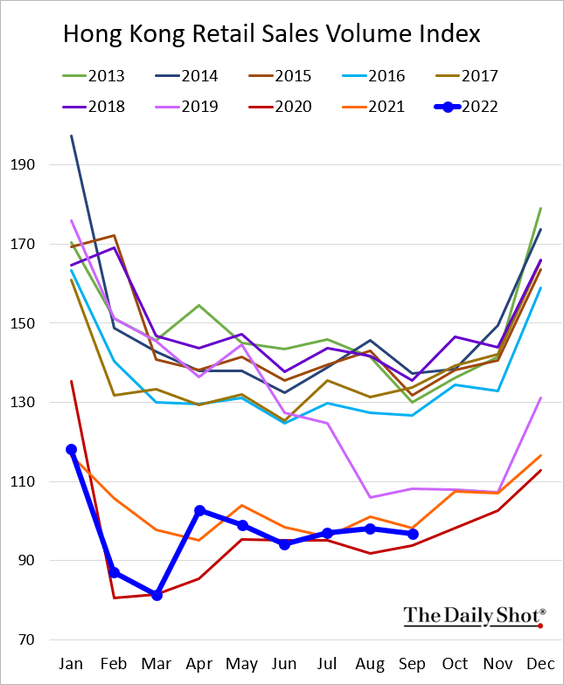

4. Hong Kong’s retail sales remain depressed.

Back to Index

Emerging Markets

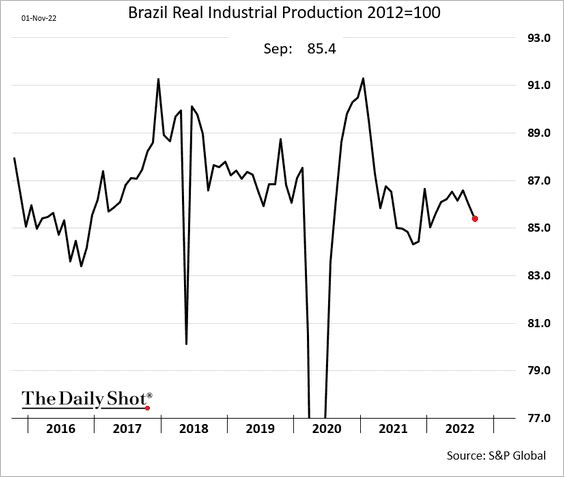

1. Brazil’s industrial production declined in September.

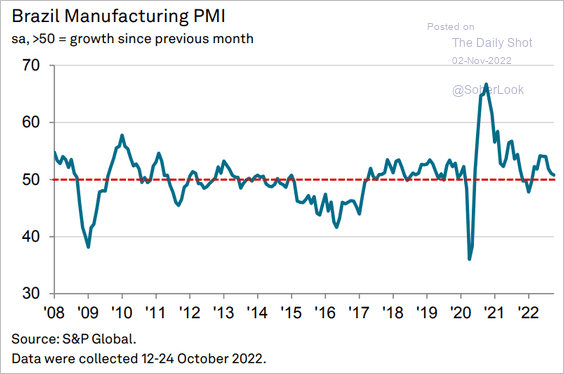

The PMI report shows stalling growth in manufacturing.

Source: S&P Global PMI

Source: S&P Global PMI

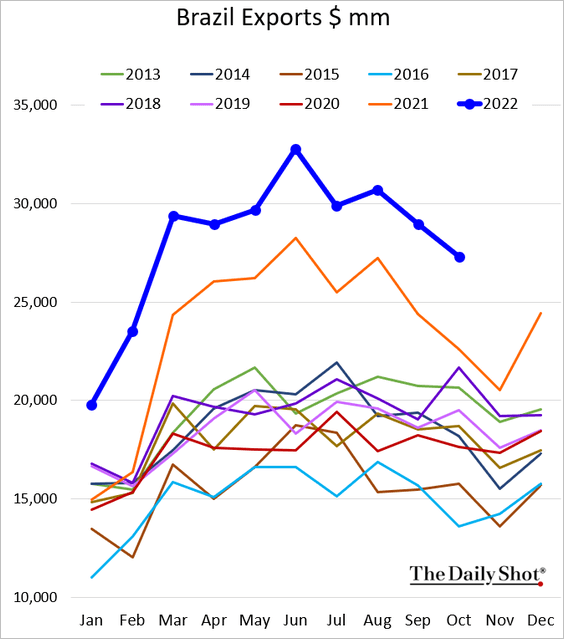

But exports remain strong.

——————–

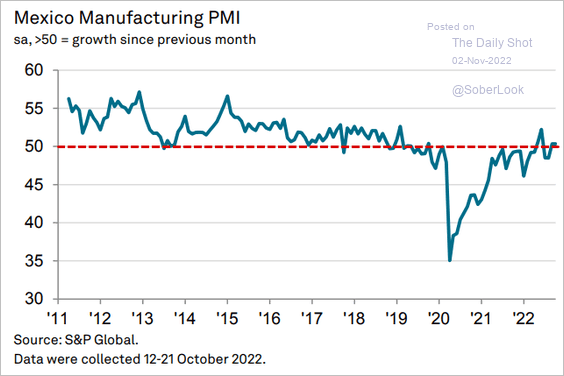

2. Mexico’s manufacturing is stable but shows little growth.

Source: S&P Global PMI

Source: S&P Global PMI

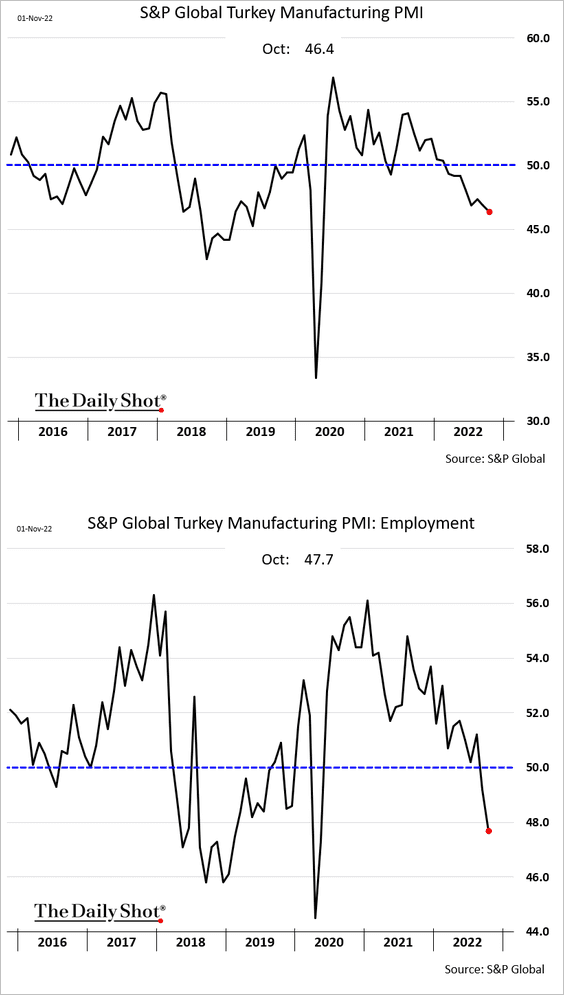

3. Turkey’s factory activity continues to contract.

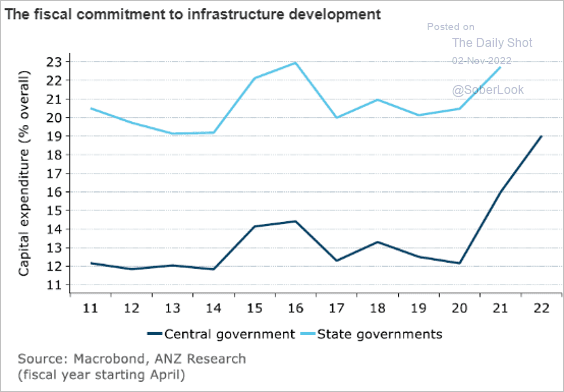

4. India’s infrastructure push has been accelerating.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Commodities

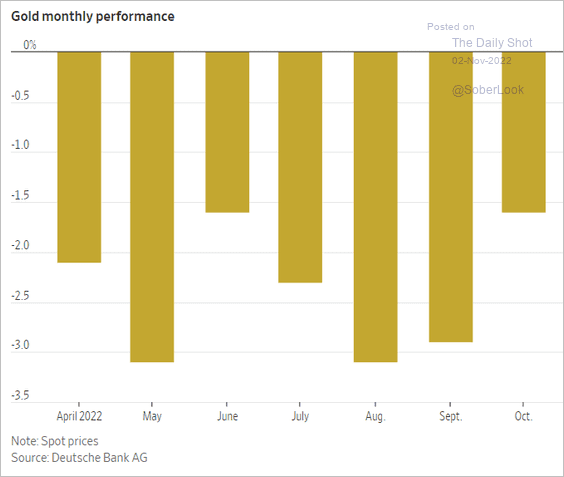

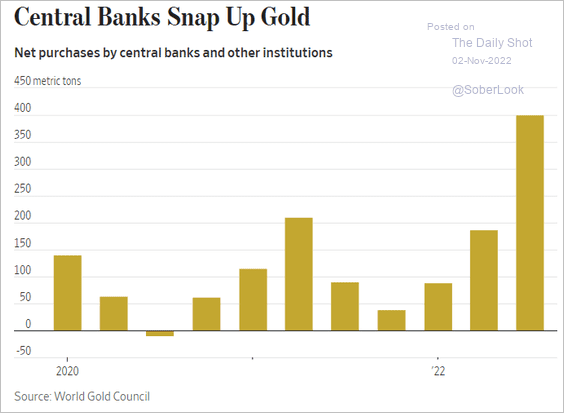

1. Gold has experienced the worst losing (monthly) streak since 1869.

Source: @WSJ Read full article

Source: @WSJ Read full article

But central banks have accelerated gold purchases.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

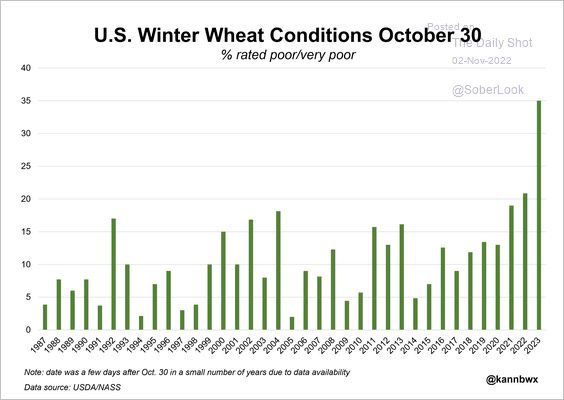

2. The US winter wheat crop is not in great shape.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

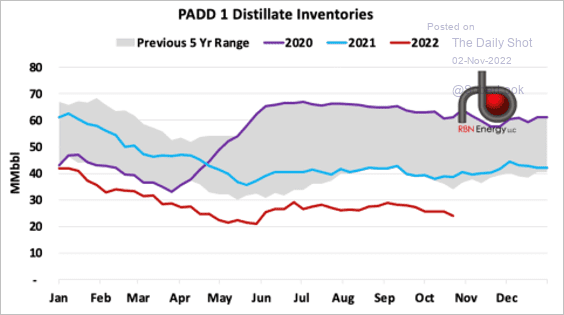

1. US East Coast diesel shortages have been severe.

Source: RBN Energy Read full article

Source: RBN Energy Read full article

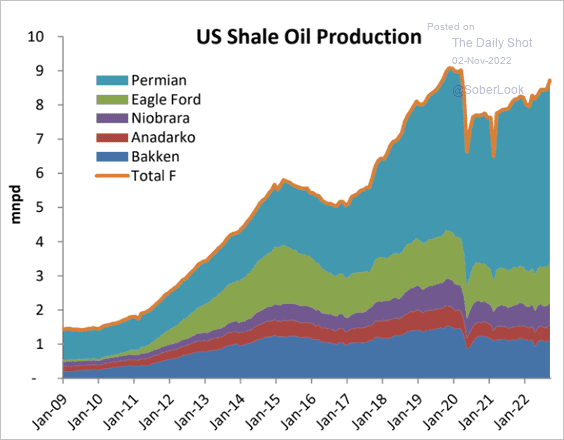

2. This chart shows the breakdown of US shale production.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Back to Index

Equities

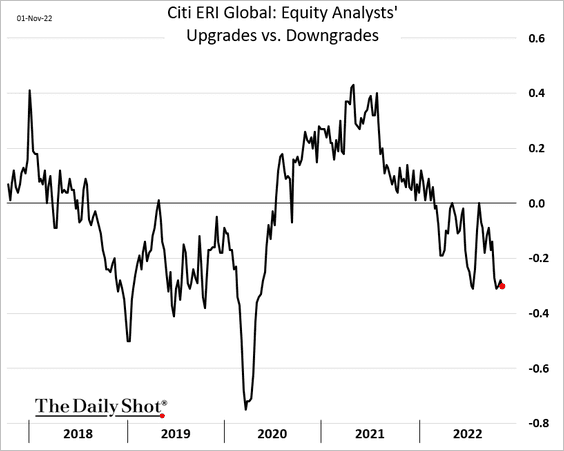

1. Global corporate earnings continue to see a wave of downgrades.

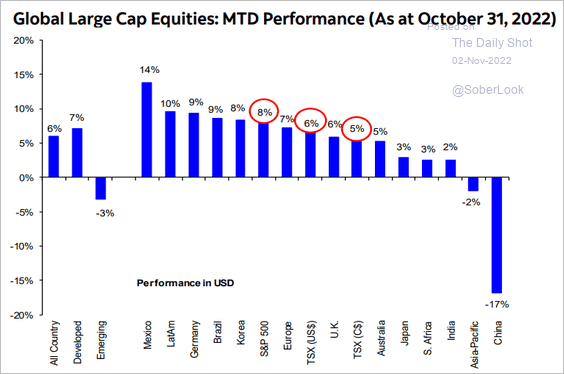

2. This chart shows large-cap performance in October across global markets.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

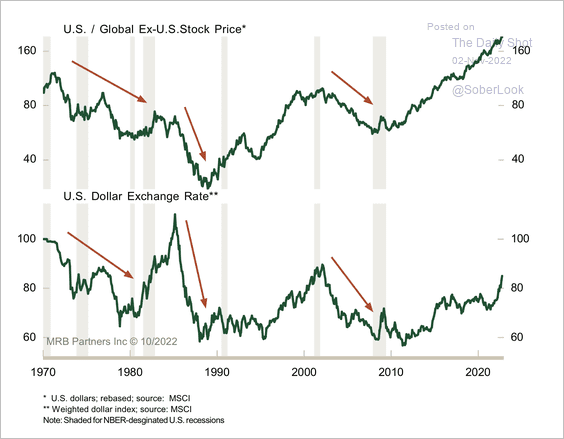

3. US equities tend to underperform international markets when the dollar weakens.

Source: MRB Partners

Source: MRB Partners

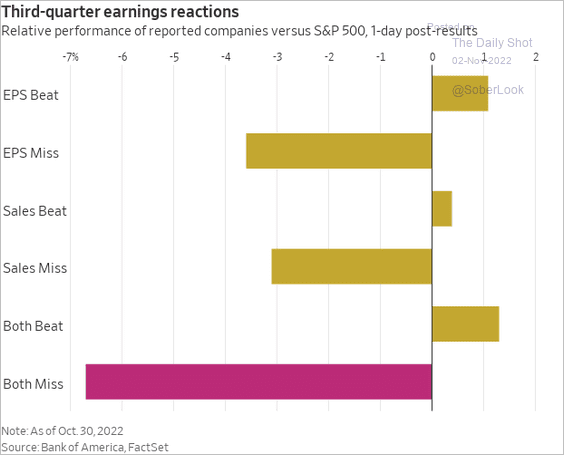

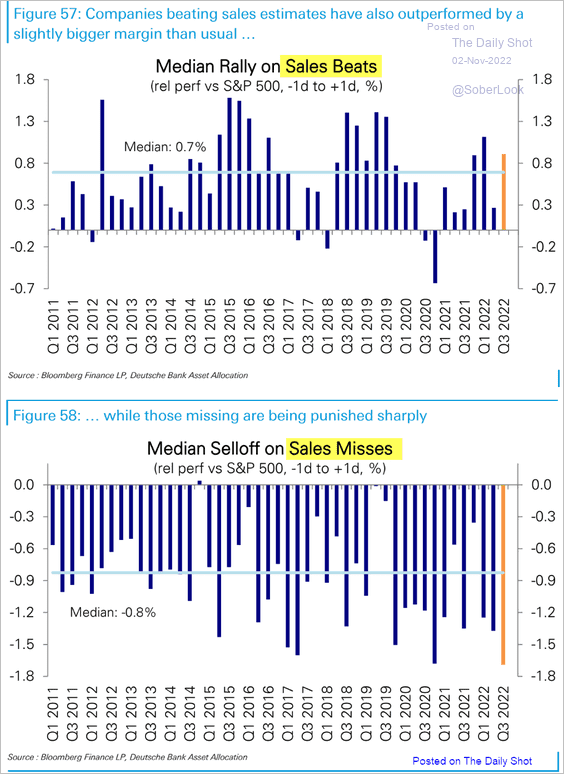

4. Next, we have market reactions to earnings/sales announcements.

Source: @WSJ Read full article

Source: @WSJ Read full article

Here is some history of reactions to sales beats and misses.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

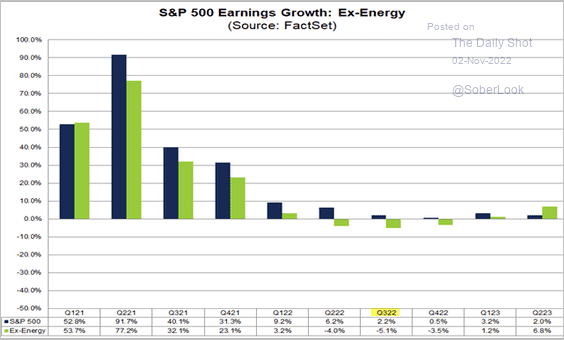

5. Earnings growth ex-energy is negative again in Q3.

Source: @FactSet Read full article

Source: @FactSet Read full article

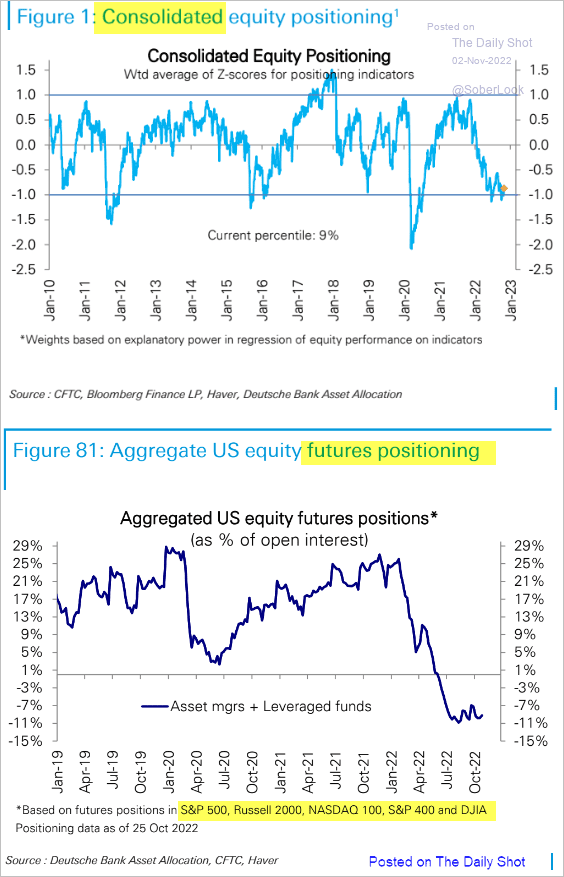

6. Positioning is still very bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

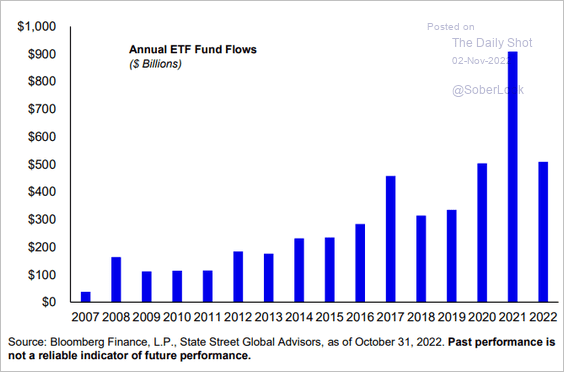

7. Next, we have ETF flows by year.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

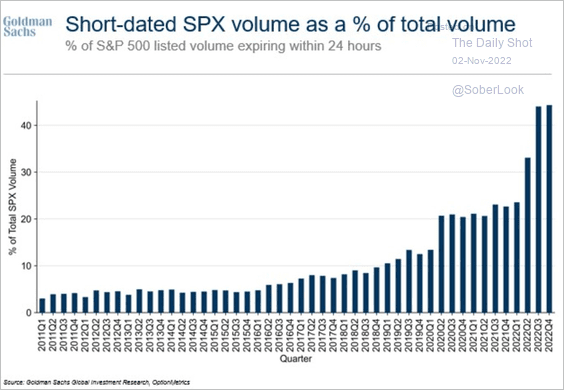

8. Short-dated S&P 500 options volume has been extreme, exacerbating market volatility.

Source: Goldman Sachs; @luwangnyc, @markets Read full article

Source: Goldman Sachs; @luwangnyc, @markets Read full article

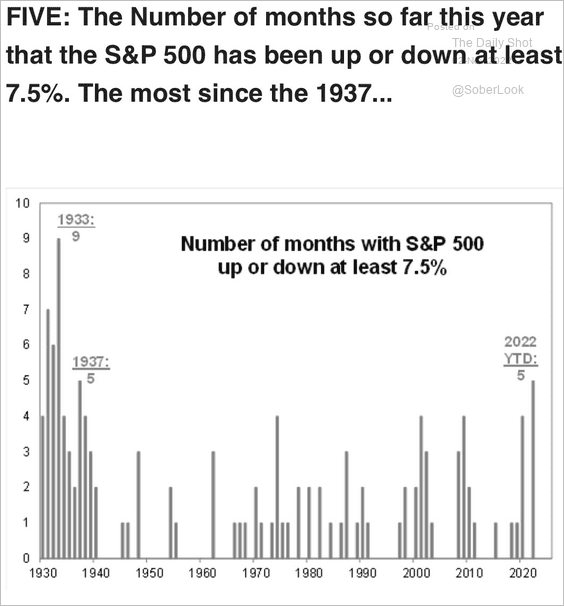

9. And it’s been a volatile year, …

Source: @PhilipJagd

Source: @PhilipJagd

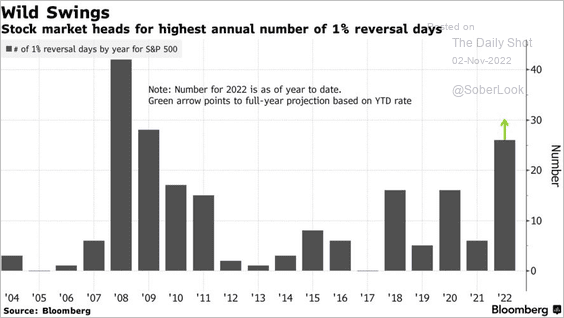

… including intraday volatility. This chart shows 1%+ reversal days.

Source: @luwangnyc, @markets Read full article

Source: @luwangnyc, @markets Read full article

Back to Index

Credit

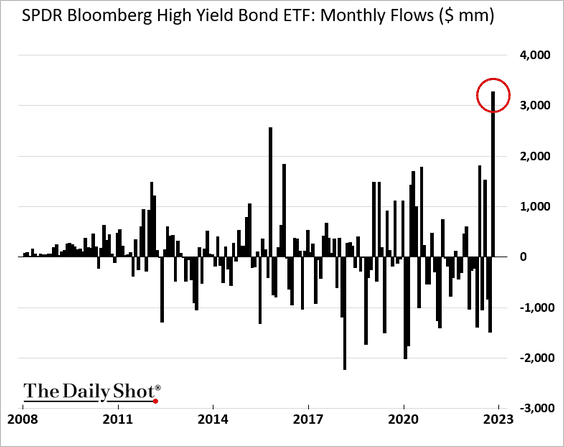

1. High-yield ETFs got some inflows last month.

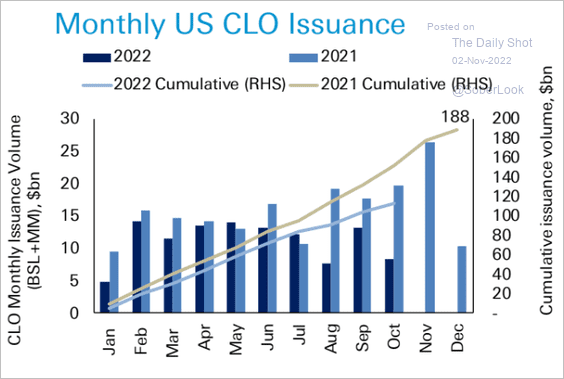

2. CLO issuance is trailing last year’s volume.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

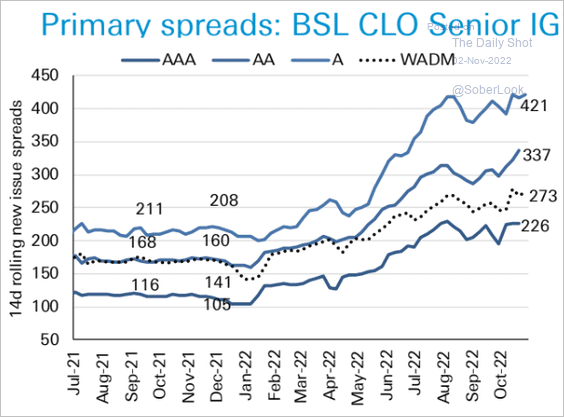

CLO senior debt spreads remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

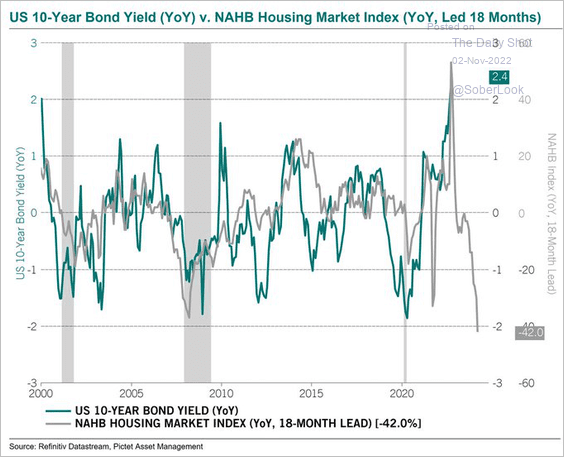

1. Does the housing market pain signal lower Treasury yields ahead?

Source: @steve_donze

Source: @steve_donze

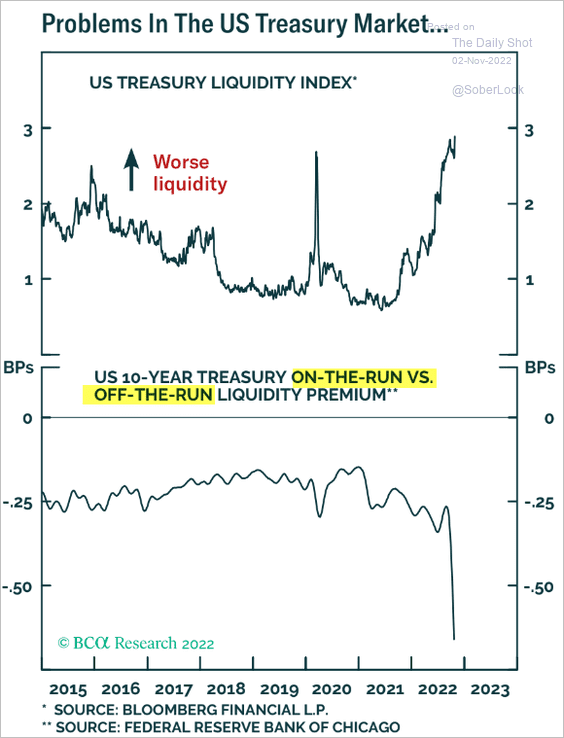

2. Off-the-run Treasury liquidity has been terrible.

Source: BCA Research

Source: BCA Research

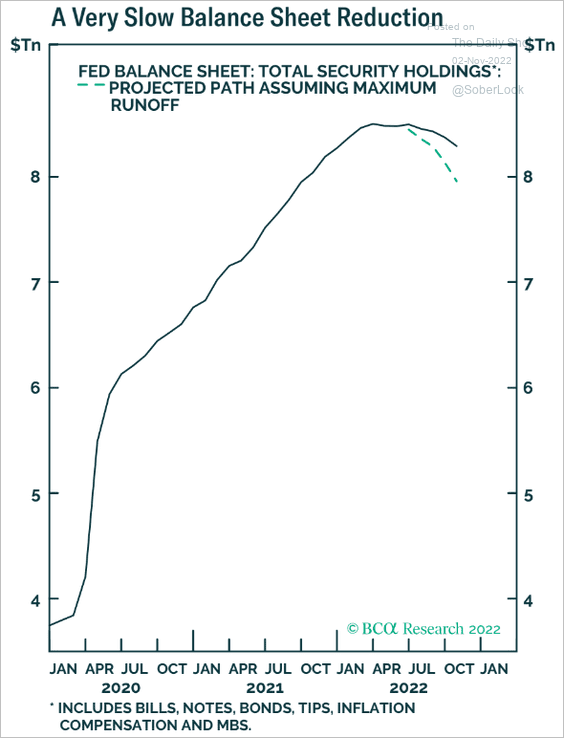

3. QT has been slower than expected in part due to the collapse in MBS refinancing rates (the Fed’s MBS portfolio is taking much longer to reduce without direct sales).

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

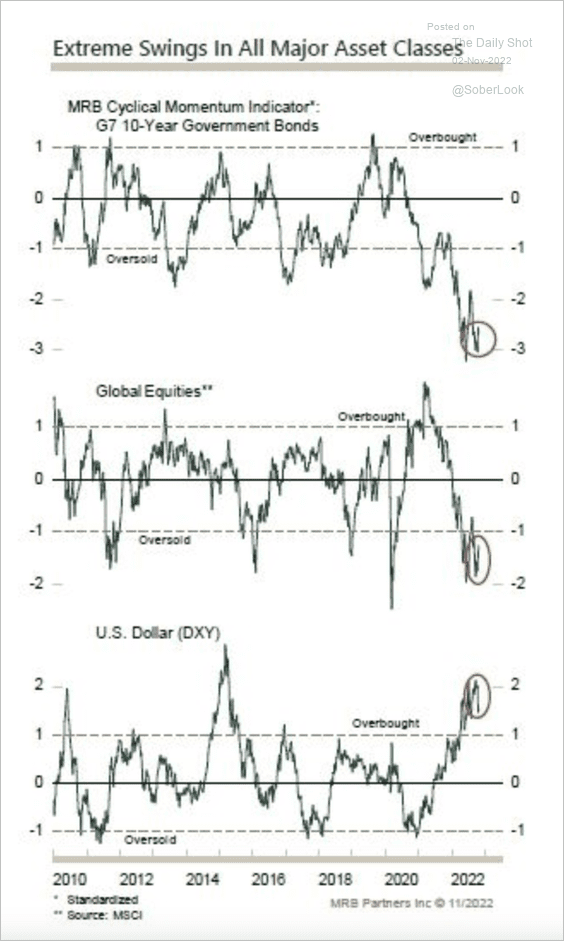

1. Global equities and G7 government bonds are oversold, while the dollar is overbought.

Source: MRB Partners

Source: MRB Partners

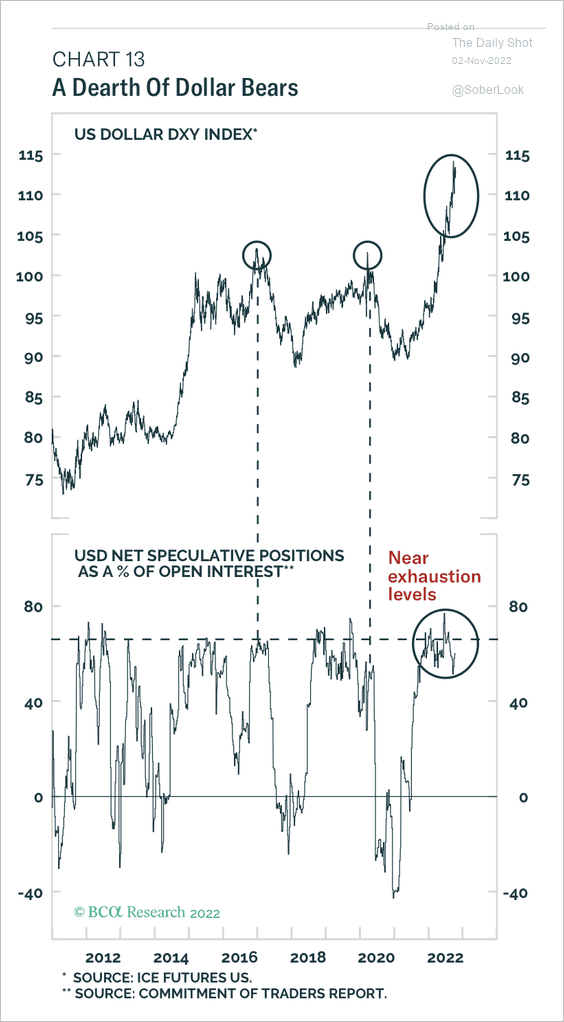

2. Speculative long positioning in the dollar is at an extreme.

Source: BCA Research

Source: BCA Research

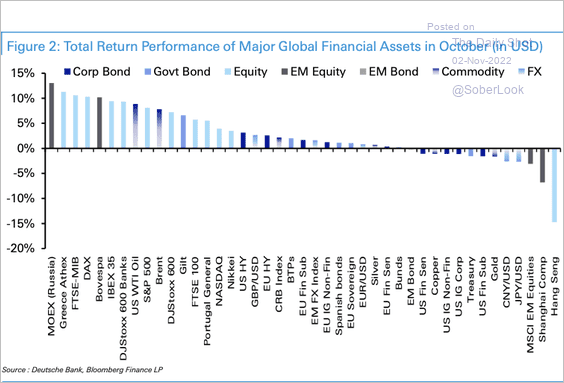

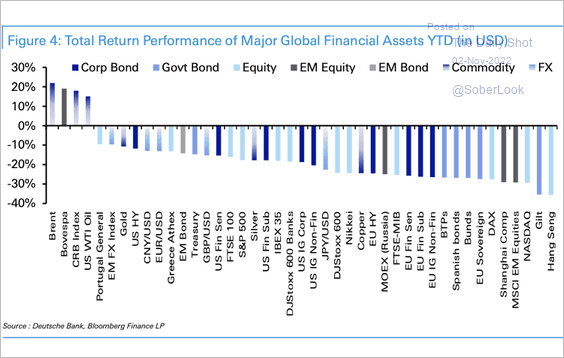

3. Here is a look at major asset class returns in October, led by Russian and European equities, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… and Hong Kong equities and UK government bonds have underperformed year-to-date.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

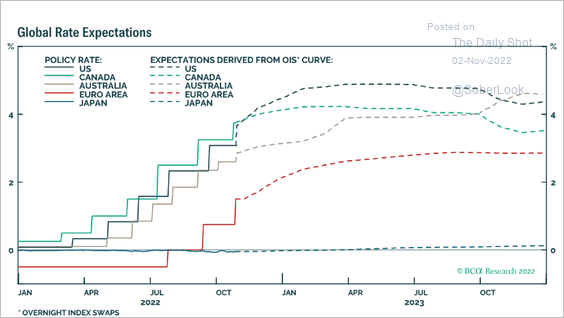

4. This chart shows market expectations for policy rates in advanced economies.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

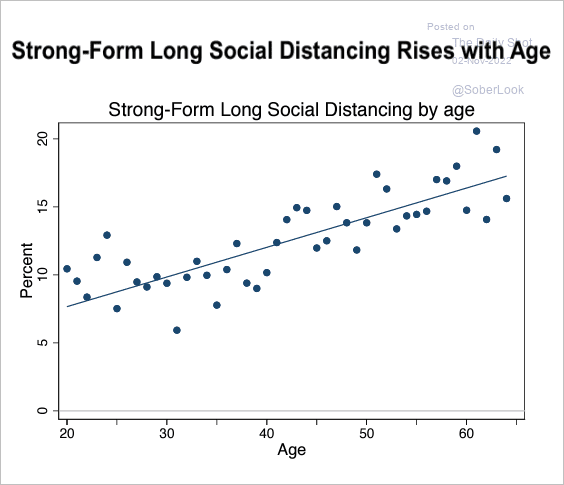

1. Strong-form social distancing by age (people with no plans to return to pre-COVID activities):

Source: Barrero, Bloom, Davis Read full article

Source: Barrero, Bloom, Davis Read full article

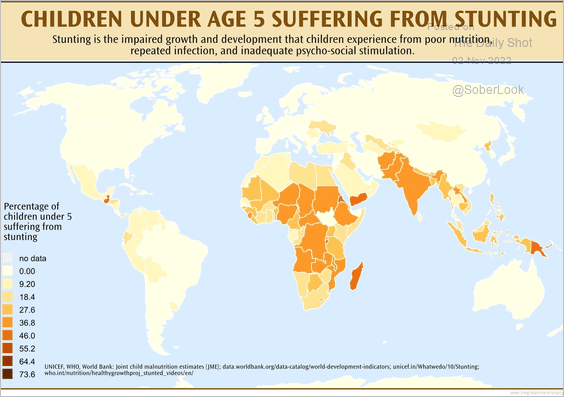

2. Children suffering from stunting:

Source: @dr_appie

Source: @dr_appie

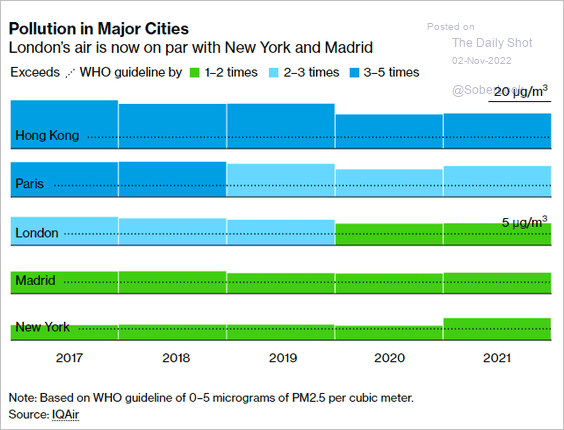

3. Pollution in major cities:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

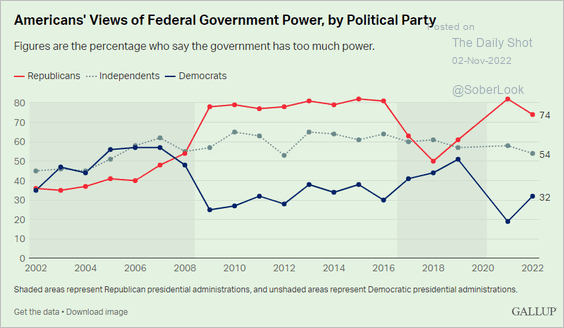

4. Does the federal government have too much power?

Source: Gallup Read full article

Source: Gallup Read full article

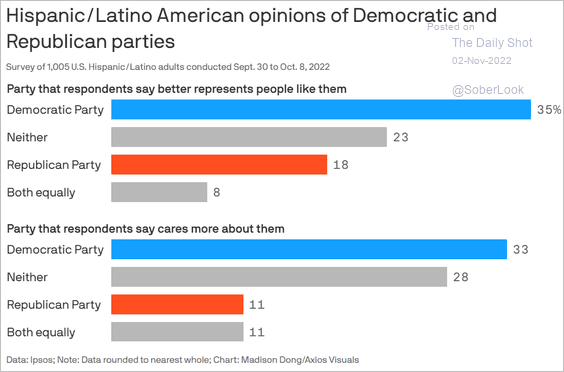

5. Latino Americans’ views on Democrats and Republicans:

Source: @axios Read full article

Source: @axios Read full article

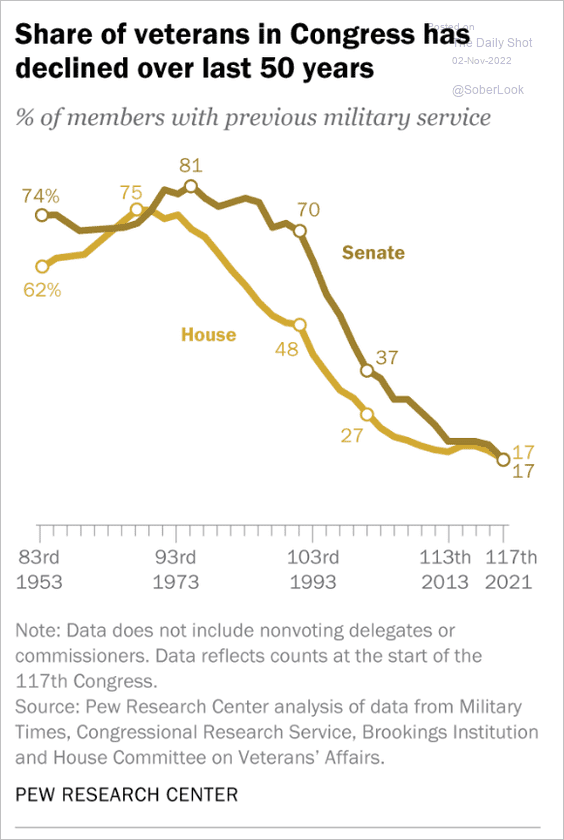

6. Military veterans in Congress:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

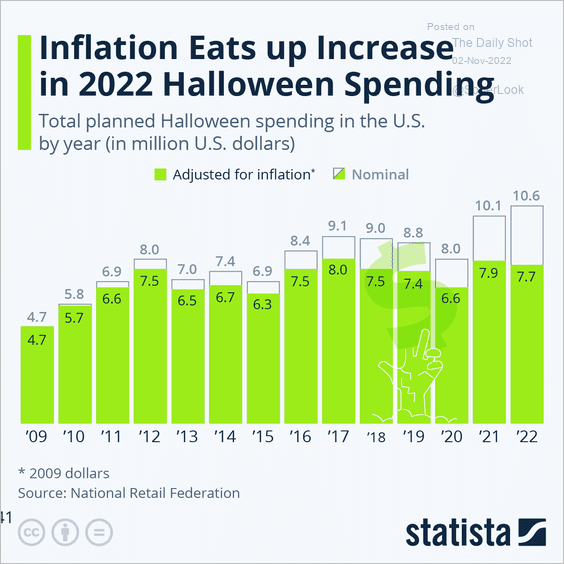

7. Nominal and real Halloween spending:

Source: Statista

Source: Statista

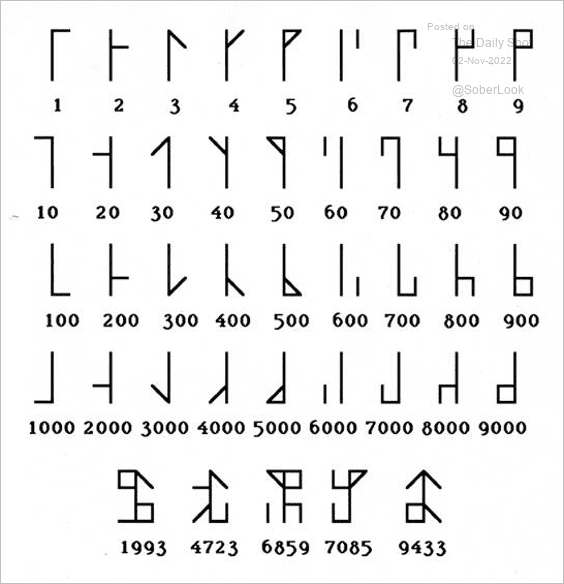

8. The Cistercian numerals:

Source: @Rainmaker1973 Read full article

Source: @Rainmaker1973 Read full article

——————–

Back to Index