The Daily Shot: 08-Nov-22

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

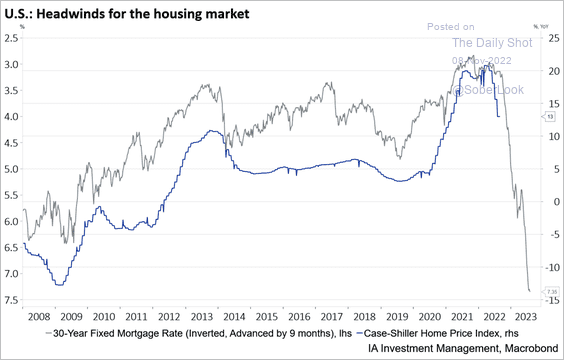

• The surge in mortgage rates suggests that home prices will see year-over-year declines at the national level.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

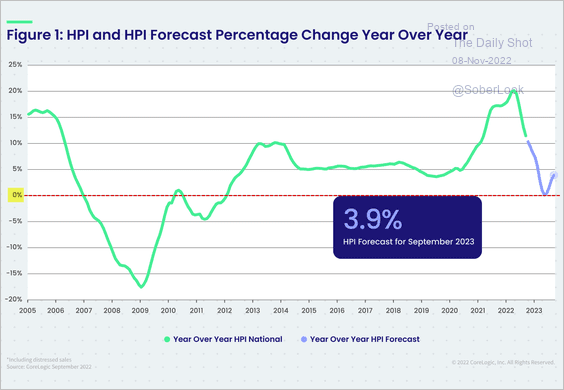

But CoreLogic does not see home price appreciation dipping into negative territory.

Source: CoreLogic

Source: CoreLogic

Why? It’s about persistently tight supplies. Here is a quote from Selma Hepp.

CoreLogic HPI forecast does suggest that home price appreciation will slow considerably by early 2023 and record about 0% YOY change in May. And while the national HPI is not expected to turn negative, there are markets that are expected to see YoY declines, such as Phoenix, Las Vegas, Houston. The reason that national price growth is not expected to turn considerably negative is the continued inventory constraint and the fact that existing homeowners are not forced to sell (households have locked in low mortgage payments and mortgage rates and most have built up substantial equity). Consumer sentiment for home sellers suggests that sellers increasingly don’t believe it’s a good time to sell right now.

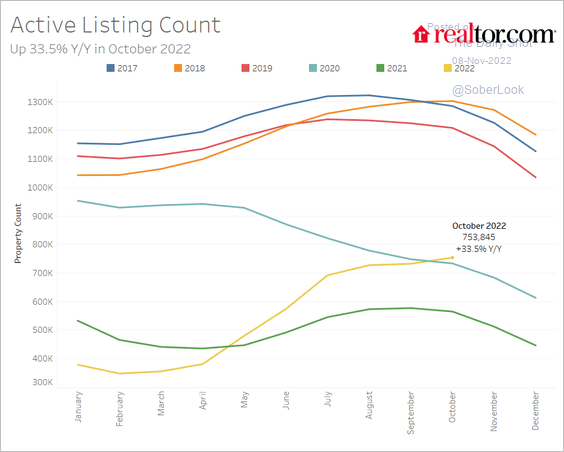

• Listings are up substantially vs. last year but still relatively low.

Source: National Association of REALTORS

Source: National Association of REALTORS

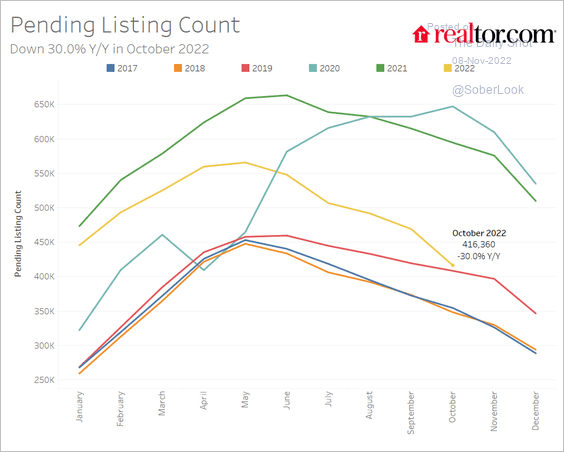

And pending listings are falling.

Source: National Association of REALTORS

Source: National Association of REALTORS

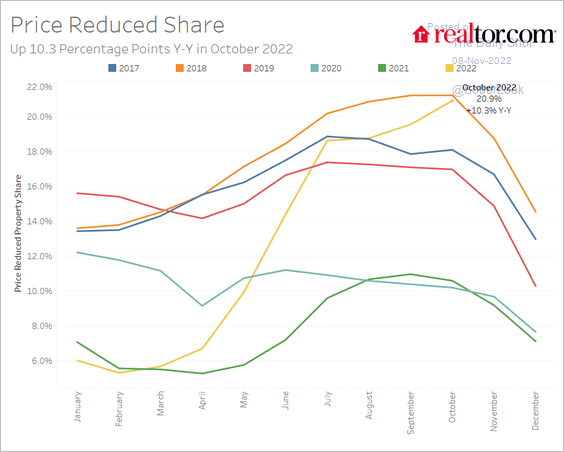

• Price cuts are more common.

Source: National Association of REALTORS

Source: National Association of REALTORS

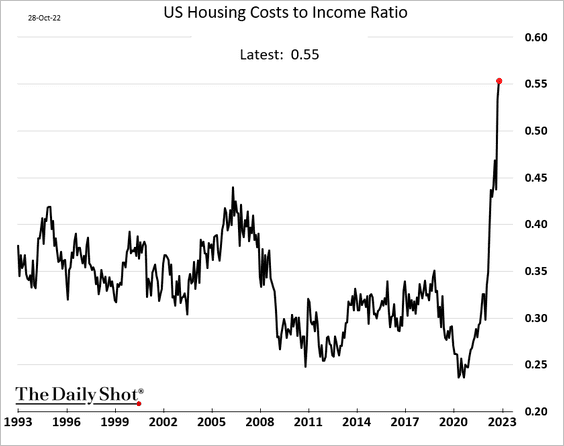

• This chart shows the US housing market costs-to-income ratio.

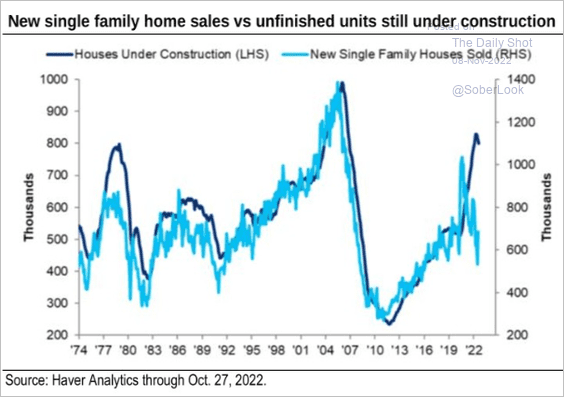

• Housing employment has been held up by an elevated stock of homes under construction. A downturn is coming next year.

Source: Citi Private Bank

Source: Citi Private Bank

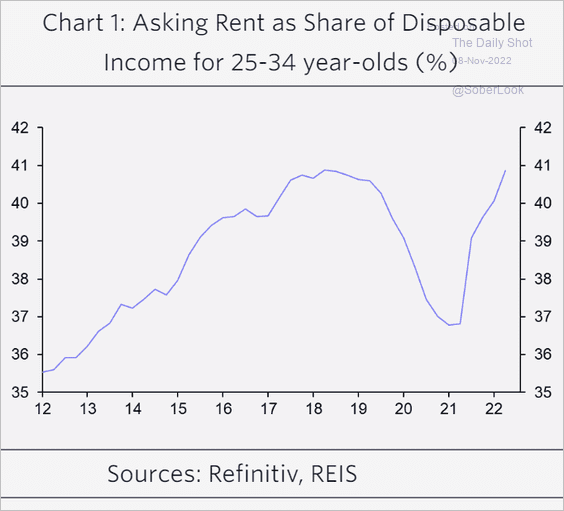

2. Next, let’s take a look at rental market trends.

• Rents as a share of disposable income are at the pre-COVID peak.

Source: Capital Economics

Source: Capital Economics

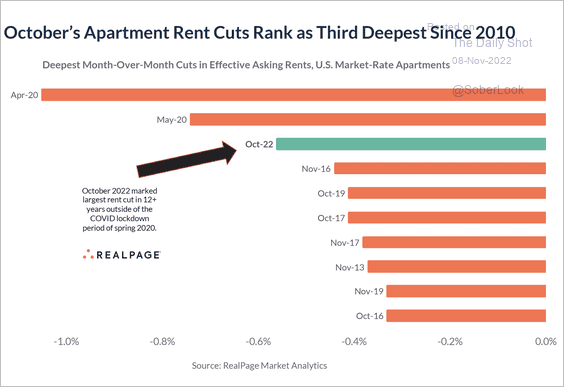

• Rents declined sharply in October.

Source: RealPage

Source: RealPage

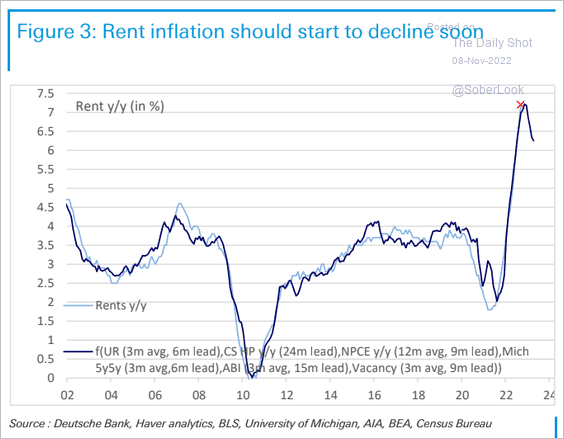

• Numerous leading indicators are signaling lower rent inflation ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

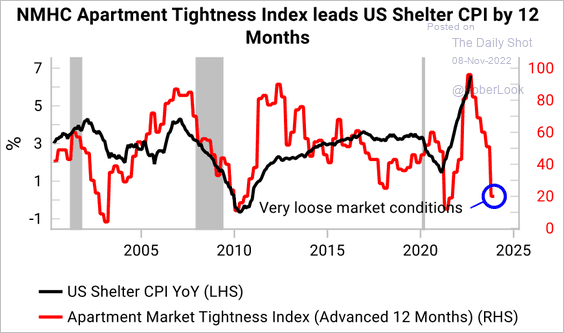

– Apartment tightness index:

Source: Variant Perception

Source: Variant Perception

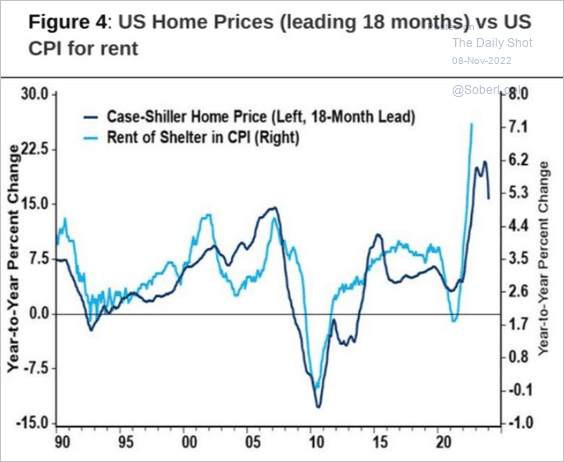

– Home price appreciation:

Source: Citi Private Bank

Source: Citi Private Bank

——————–

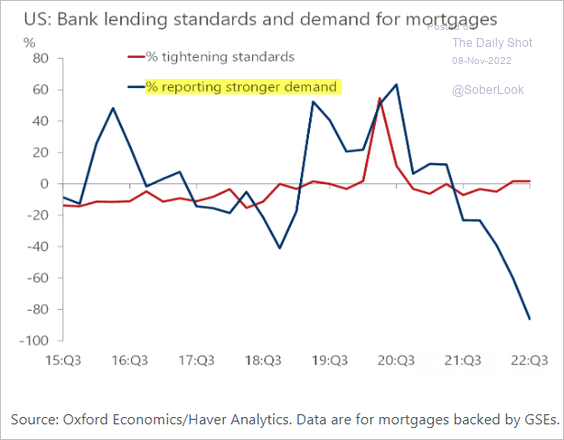

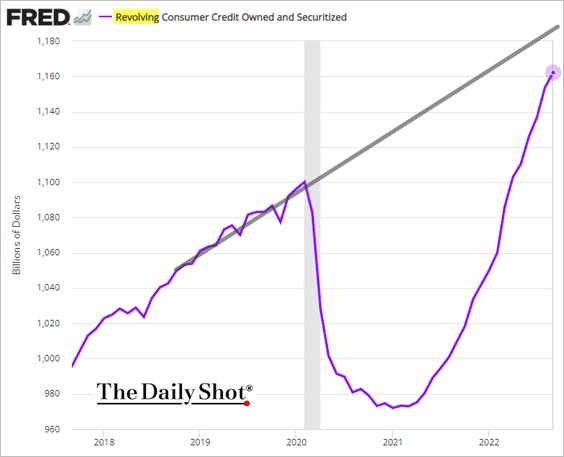

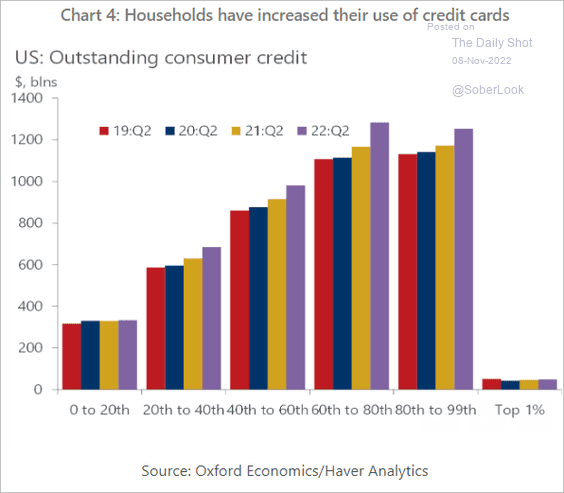

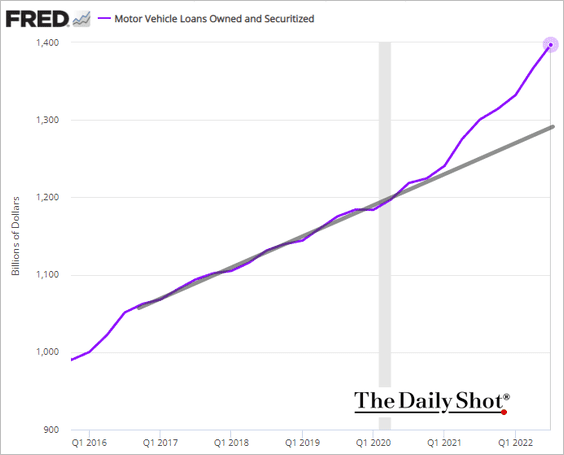

3. Here are some trends in household credit.

• Demand for mortgages is sinking.

Source: Oxford Economics

Source: Oxford Economics

• Credit card debt continues to climb (2 charts).

Source: Oxford Economics

Source: Oxford Economics

• Auto loan balances are rising much faster than the pre-COVID trend.

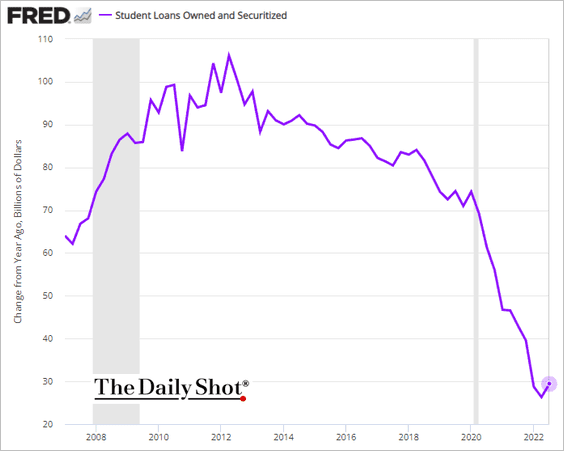

• Student debt growth has stabilized.

——————–

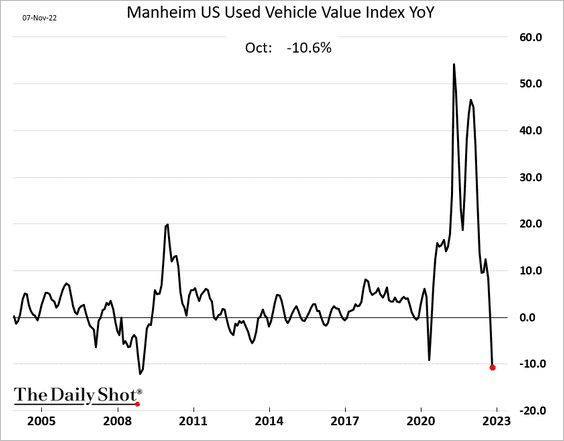

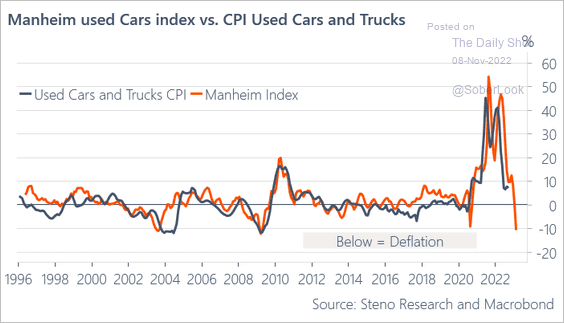

4. Winter is coming to the used car market. Wholesale prices are down almost 11% from a year ago, …

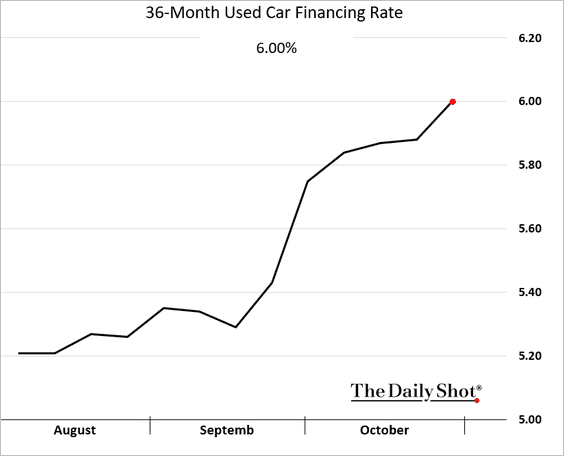

… as used car financing rates surge.

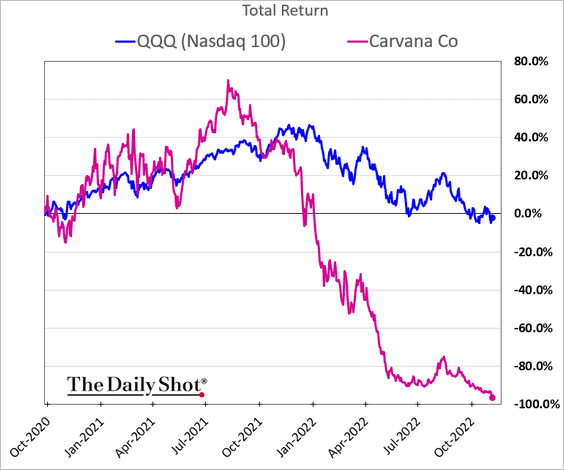

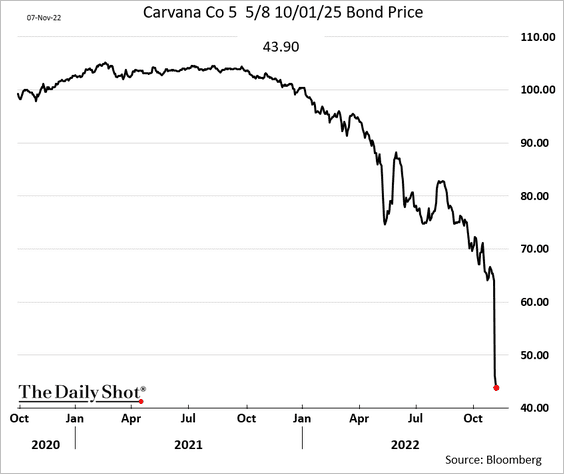

• Carvana’s share price has collapsed, …

… and bond prices are crashing.

• Used car deflation should be a drag on the core CPI.

Source: @AndreasSteno

Source: @AndreasSteno

——————–

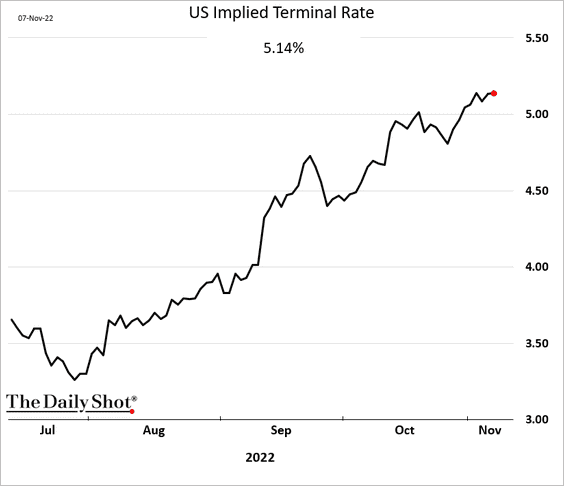

5. The terminal rate continues to grind higher.

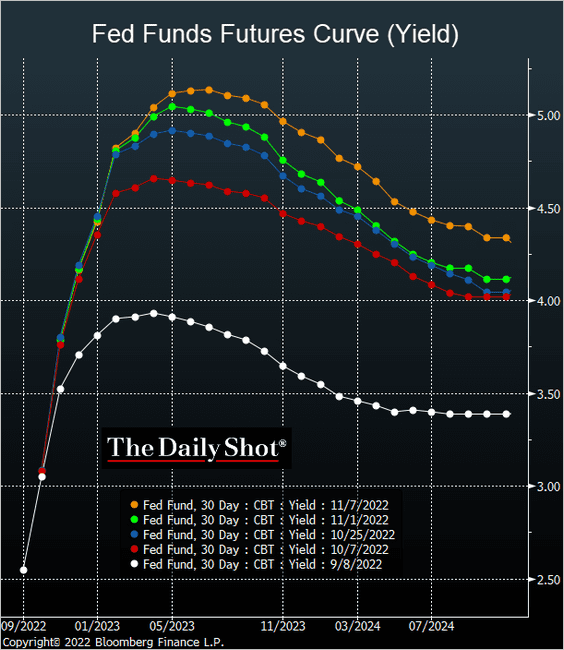

Here is the evolution of the market-based fed funds rate trajectory.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The United Kingdom

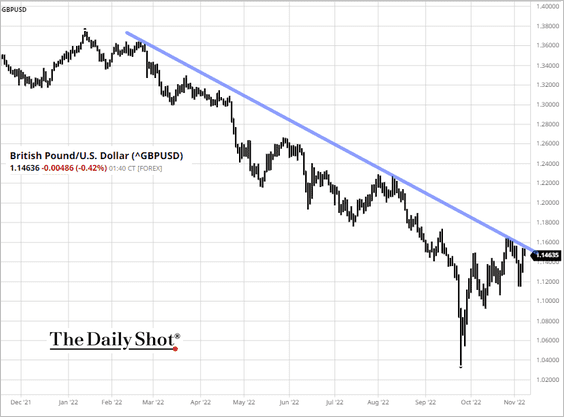

1. The pound is holding its downtrend resistance.

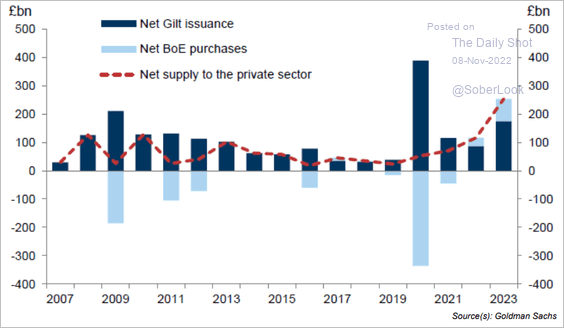

2. There is still a large supply of gilts hitting the market next year.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

Back to Index

The Eurozone

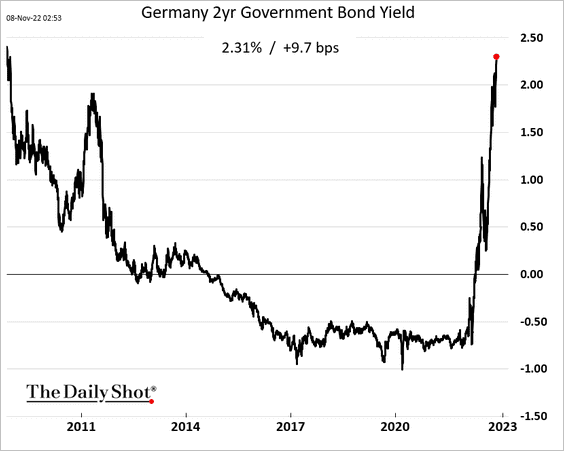

1. Germany’s 2-year yield hit the highest level since 2008.

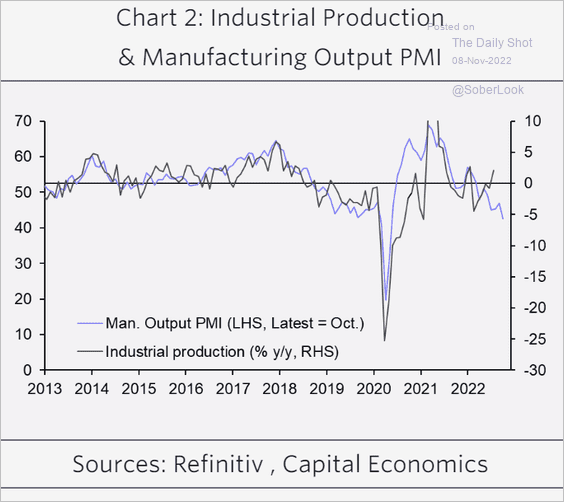

2. How long will Germany’s industrial production remain resilient?

Source: Capital Economics

Source: Capital Economics

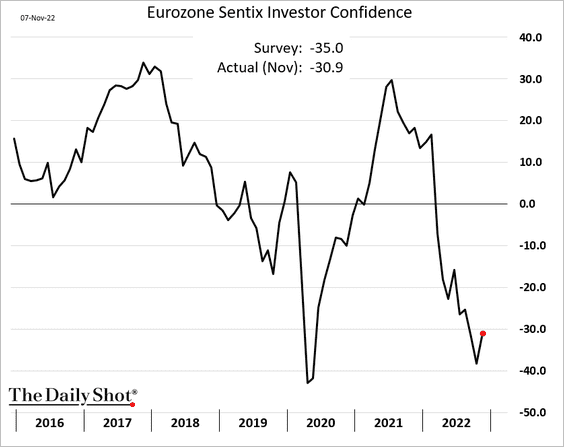

3. The Eurozone Sentix investor confidence index bounced from the lows.

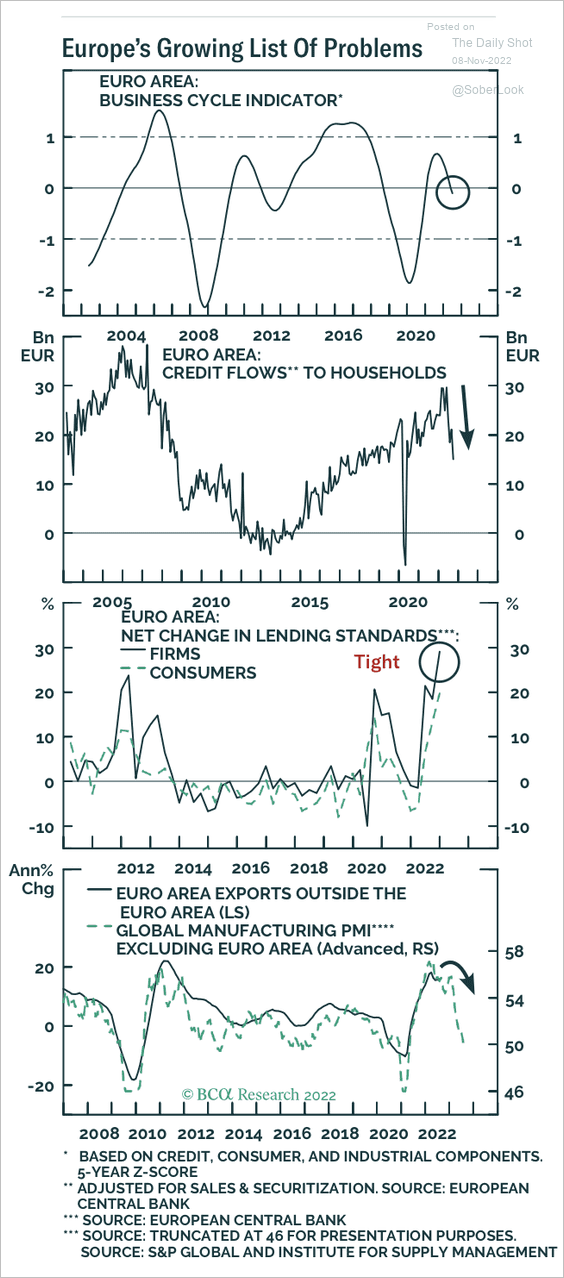

4. The economy faces a growing list of problems.

Source: BCA Research

Source: BCA Research

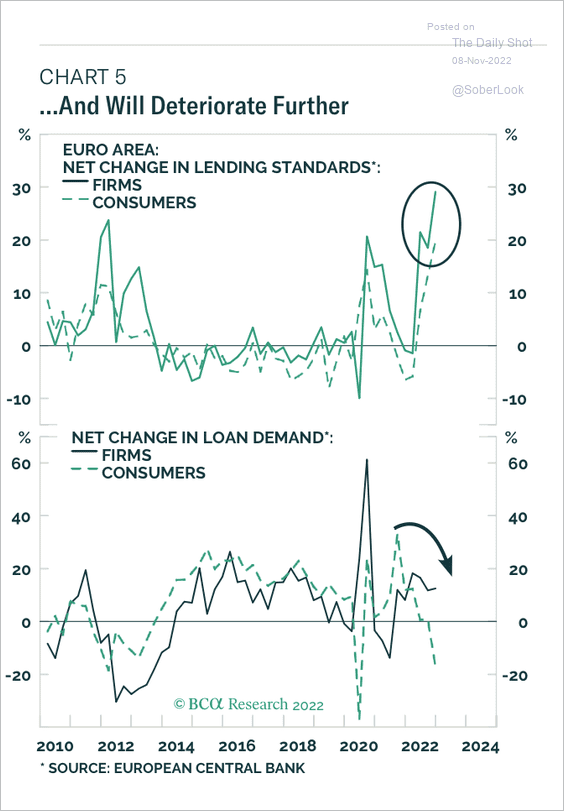

5. The reduction in loan demand amid tighter lending standards points to a substantial decline in credit and money growth.

Source: BCA Research

Source: BCA Research

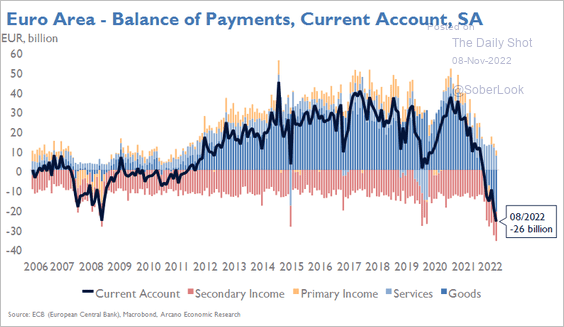

6. Here is the breakdown of the euro-area current account balance.

Source: Arcano Economics

Source: Arcano Economics

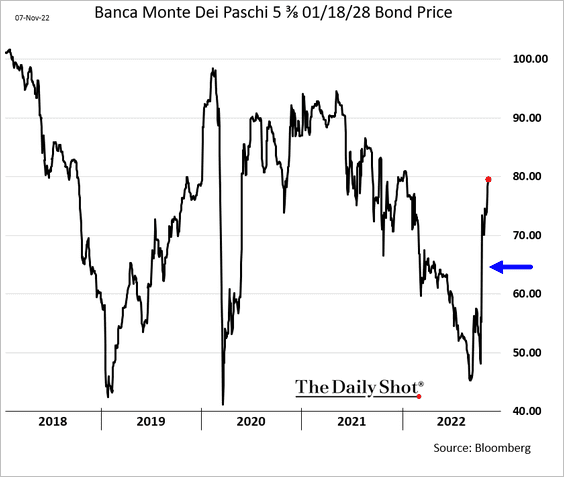

7. Italy’s troubled bank Banca Monte dei Paschi completed its recapitalization.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Bond prices jumped.

Back to Index

Japan

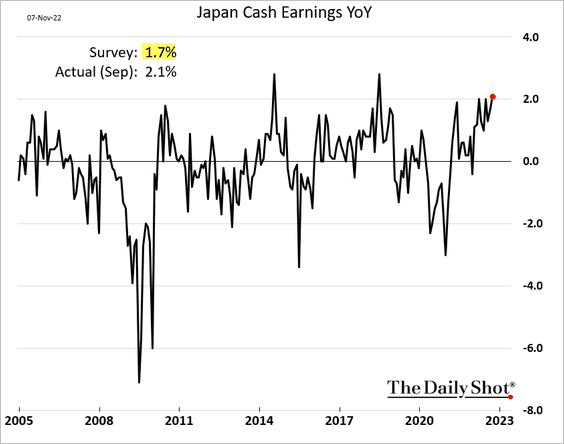

1. Wage growth surprised to the upside, fueling inflation concerns.

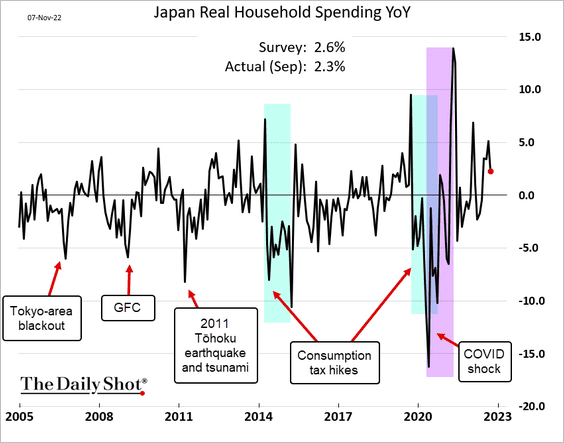

2. But household spending slowed.

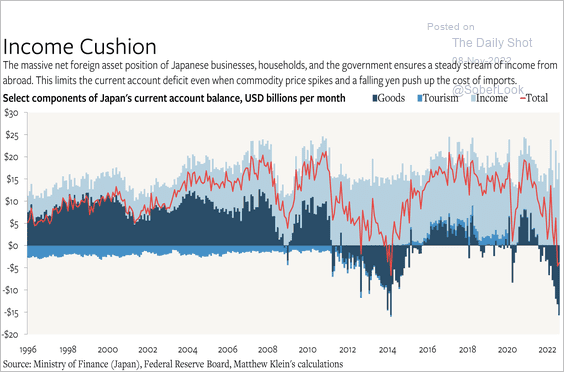

3. Massive foreign income cushions the current account from the surge in commodity costs.

Source: @Brad_Setser, @M_C_Klein Read full article

Source: @Brad_Setser, @M_C_Klein Read full article

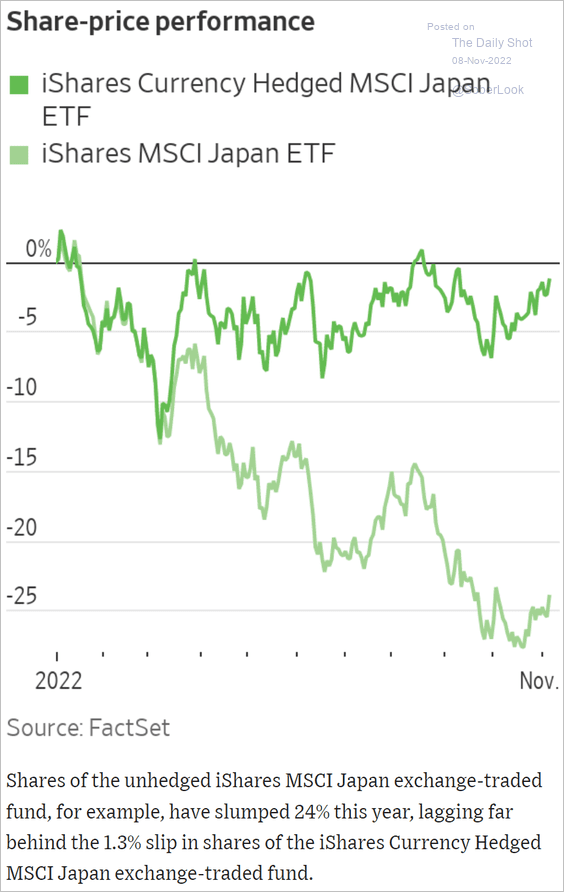

4. Currency hedging made all the difference for USD investors in Japanese shares.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia – Pacific

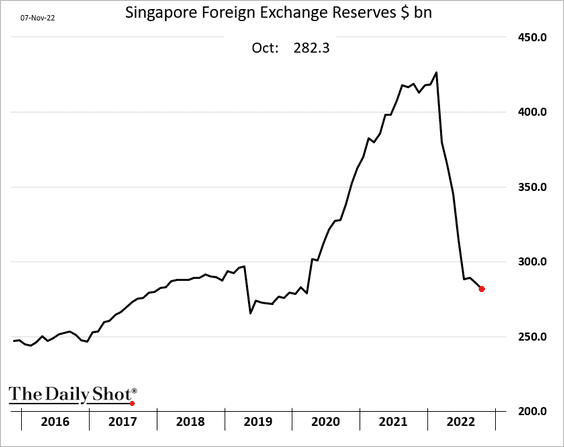

1. Singapore’s FX reserves continue to move lower.

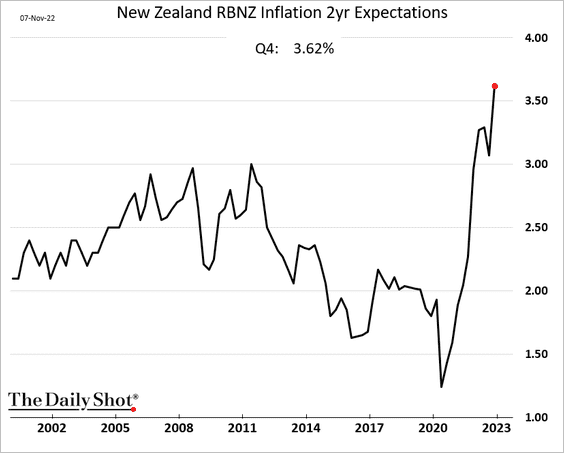

2. New Zealand’s inflation expectations continue to climb.

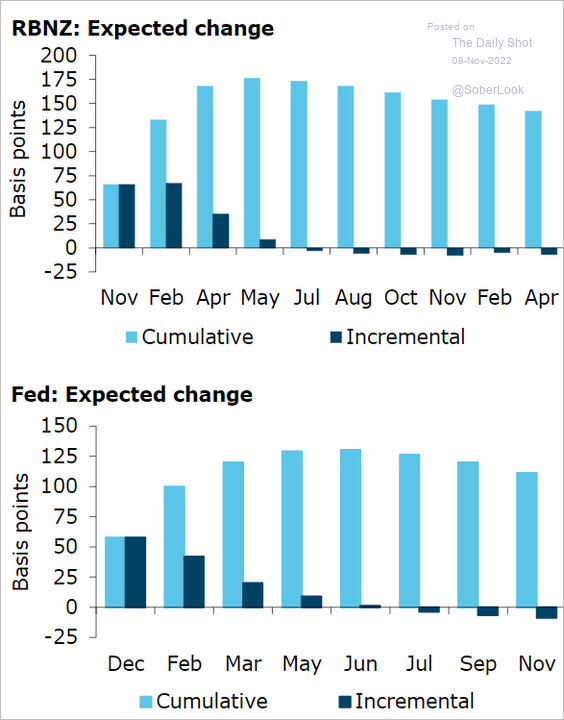

Going forward, the RBNZ rate hikes are expected to outpace the Fed.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

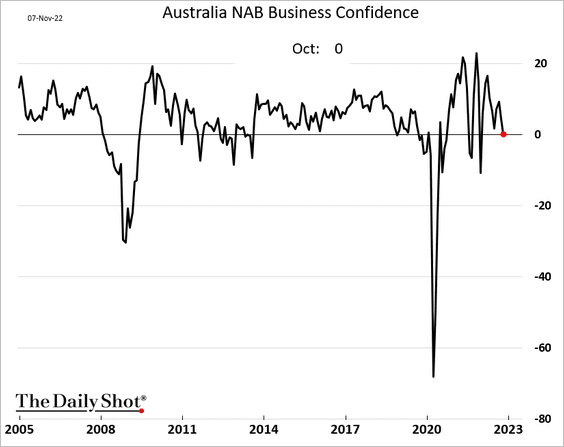

3. Australian business confidence declined last month.

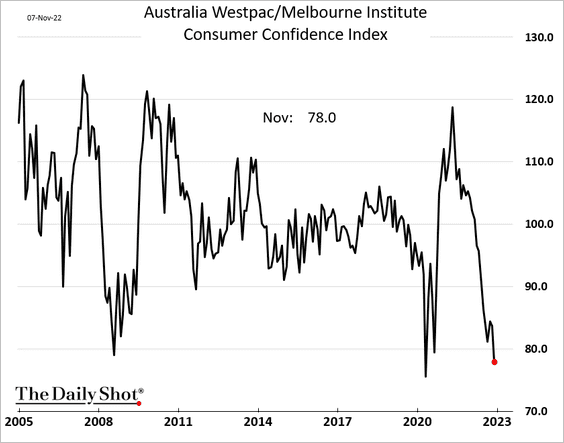

Consumer confidence continues to deteriorate.

Back to Index

China

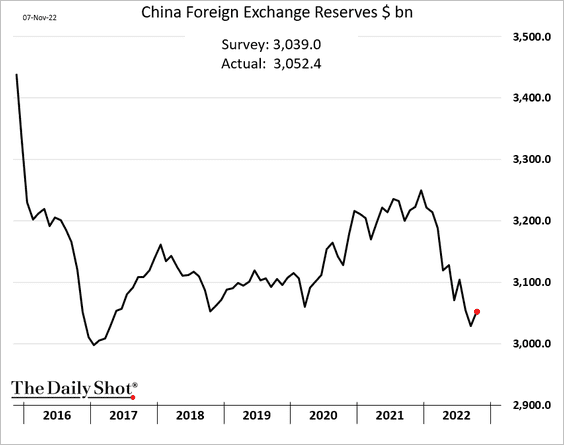

1. FX reserves edged higher last month.

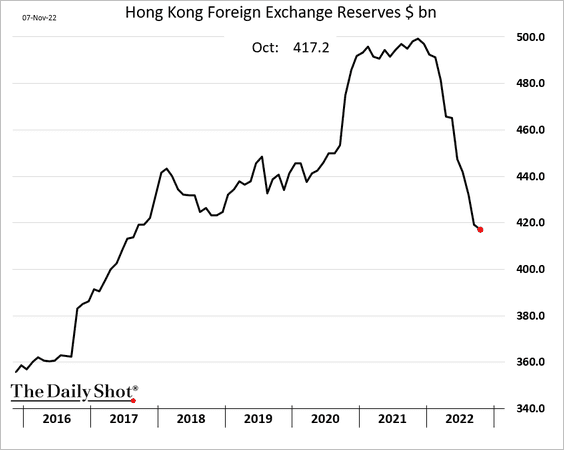

2. Hong Kong’s FX reserves continue to move lower.

3. The Hang Seng Tech Index is at resistance.

Source: @brettamiller30, @markets Read full article

Source: @brettamiller30, @markets Read full article

Back to Index

Emerging Markets

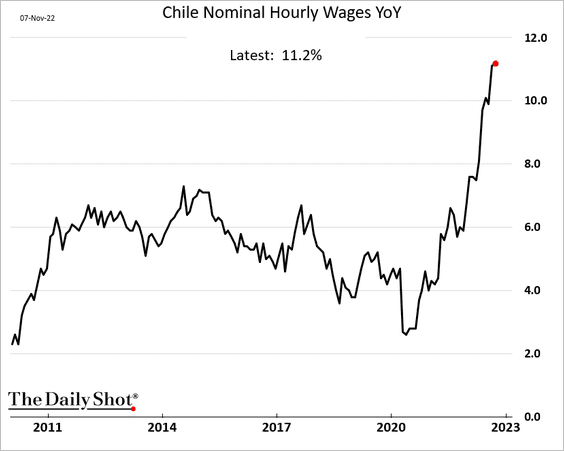

1. Chile’s wage growth is above 11%, fueling price pressures.

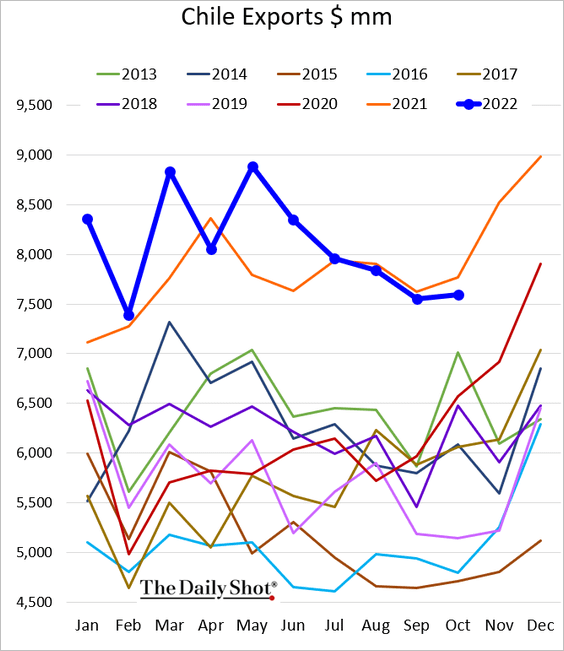

Exports are now firmly below last year’s levels.

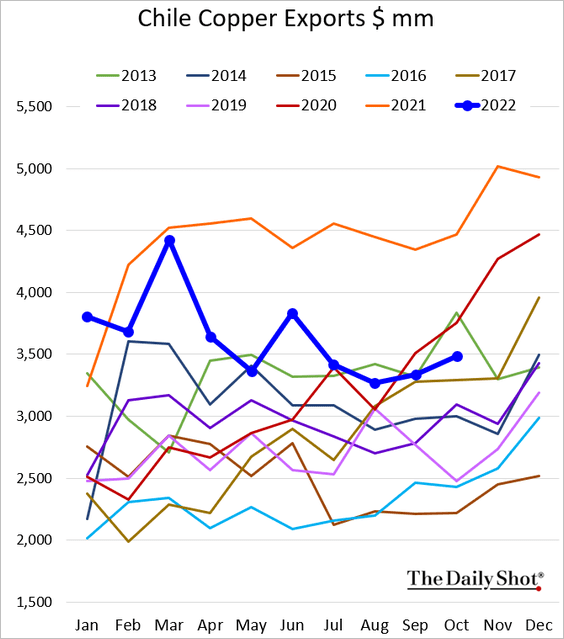

This chart shows Chile’s copper exports.

——————–

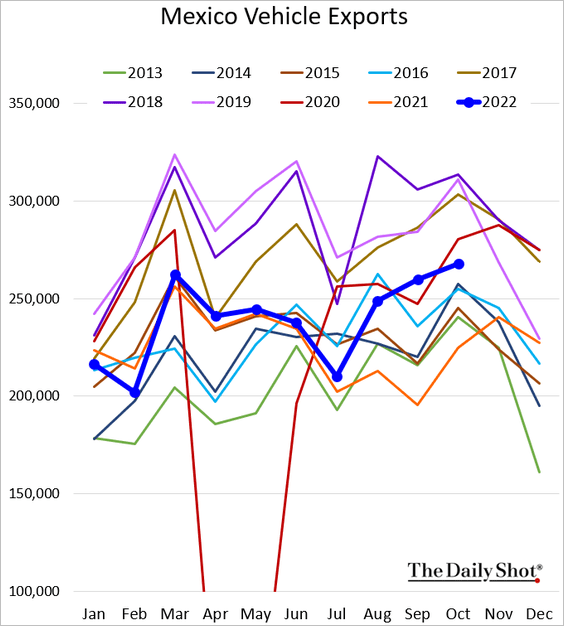

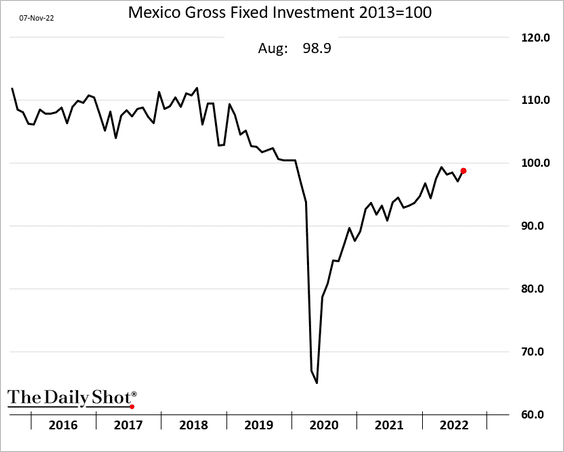

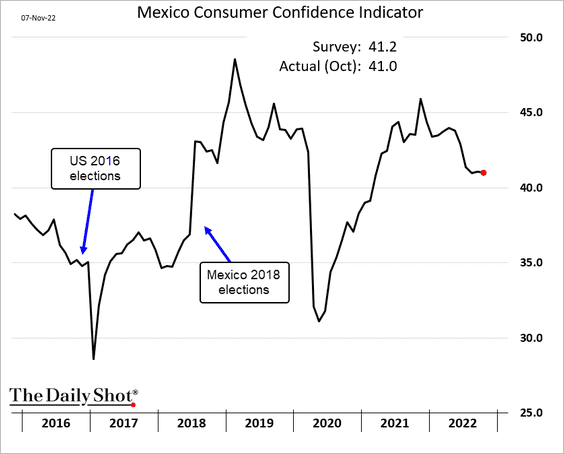

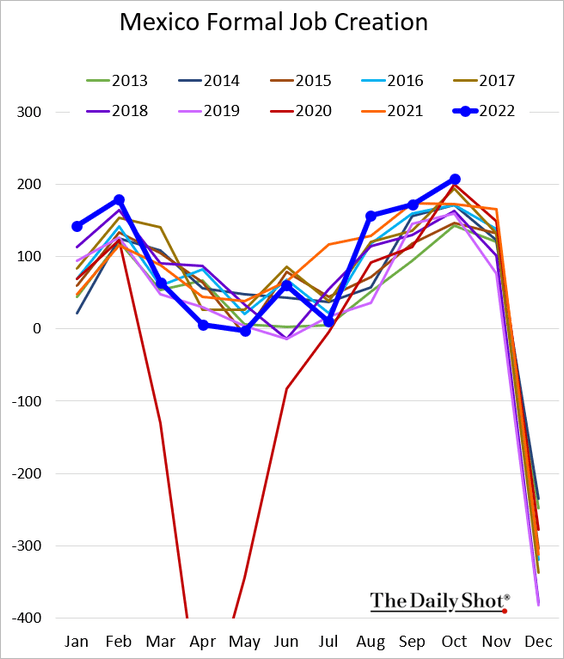

2. Next, we have some updates on Mexico.

• Vehicle exports are improving.

• Business investment is nearing pre-COVID levels.

• Consumer confidence remains stable.

• Formal job creation hit a new high.

——————–

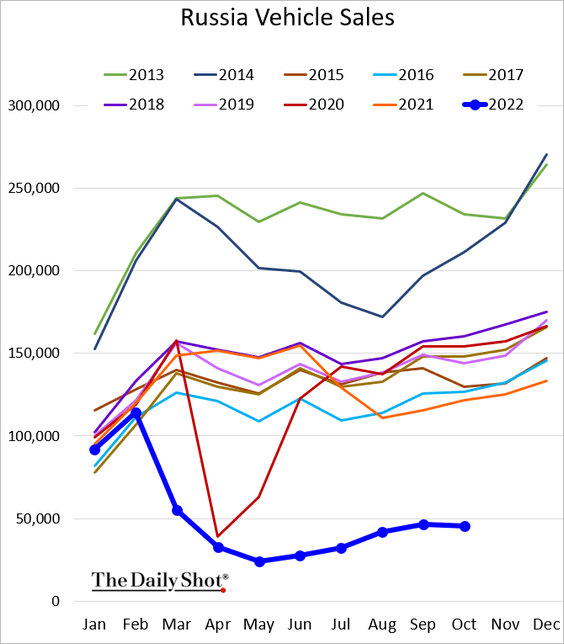

3. Russian vehicle sales remain depressed.

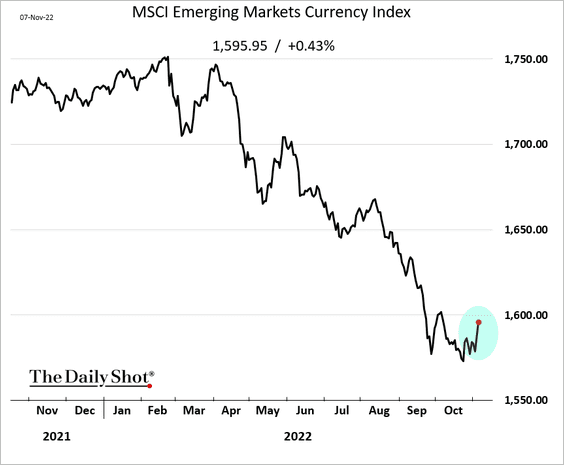

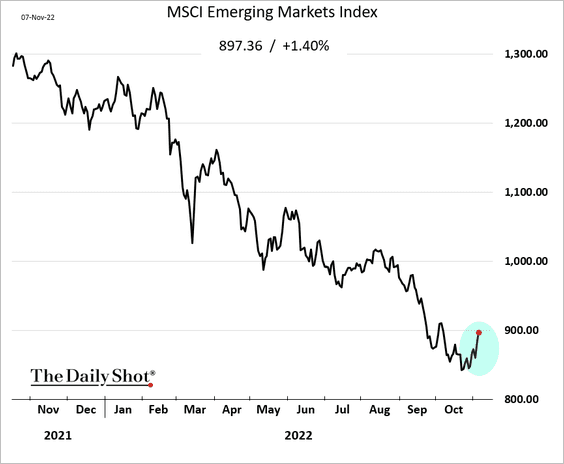

4. EM currencies and stocks (2nd chart) bounced from recent lows.

——————–

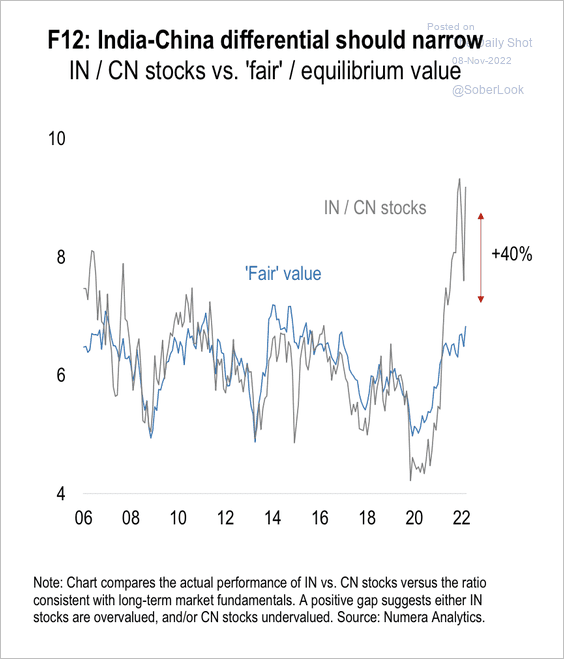

5. Indian stocks appear overvalued versus Chinese stocks.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Cryptocurrency

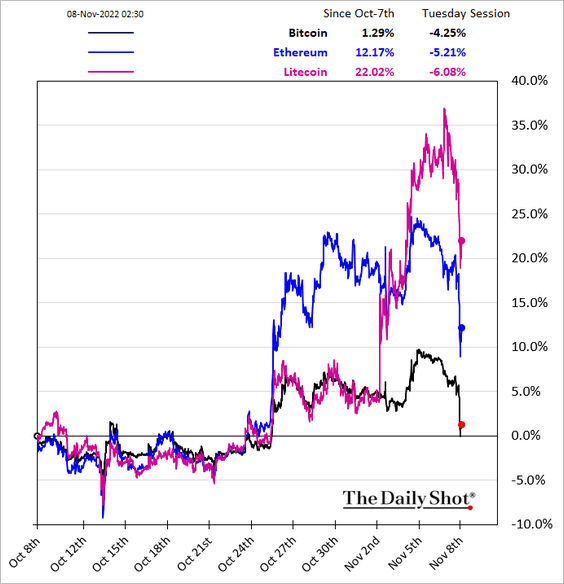

1. Cryptos are under pressure this morning, …

… as bitcoin dips below $20k again.

——————–

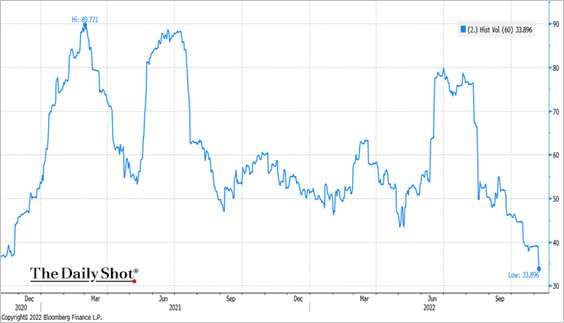

2. Bitcoin’s realized volatility continues to trend lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

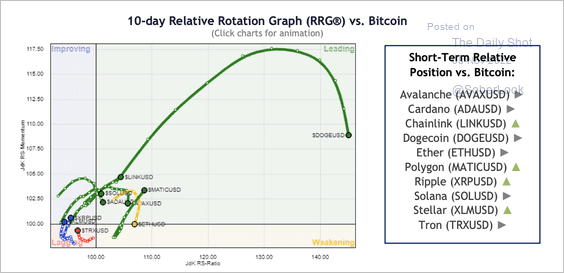

3. Several altcoins are improving relative to bitcoin, especially dogecoin (DOGE), Chainlink (LINK), and Polygon (MATIC). Chart compares relative strength and momentum versus BTC over the past 10 days.

Source: @StocktonKatie

Source: @StocktonKatie

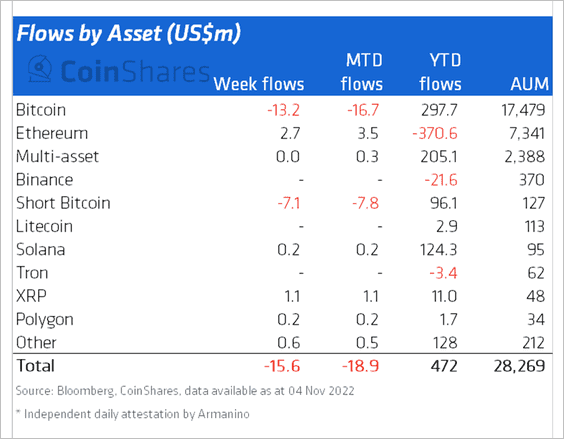

4. Crypto investment products saw minor outflows last week, driven by long and short-bitcoin funds. Investors returned to Ether-focused funds after four straight weeks of outflows

Source: CoinShares Read full article

Source: CoinShares Read full article

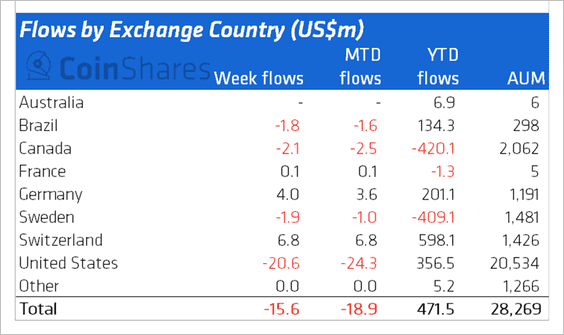

US and Canadian funds continued to see outflows, while some European funds saw inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

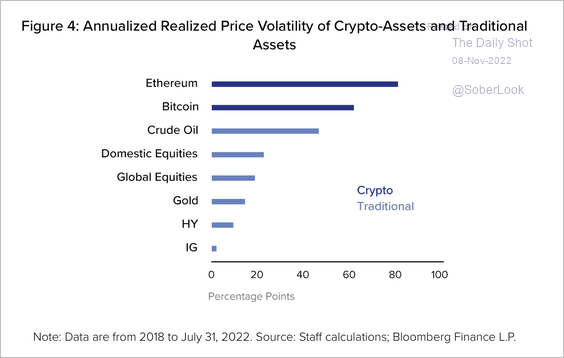

5. On an annualized basis, realized volatility of bitcoin and ether prices are higher than traditional assets.

Source: Financial Stability Oversight Council

Source: Financial Stability Oversight Council

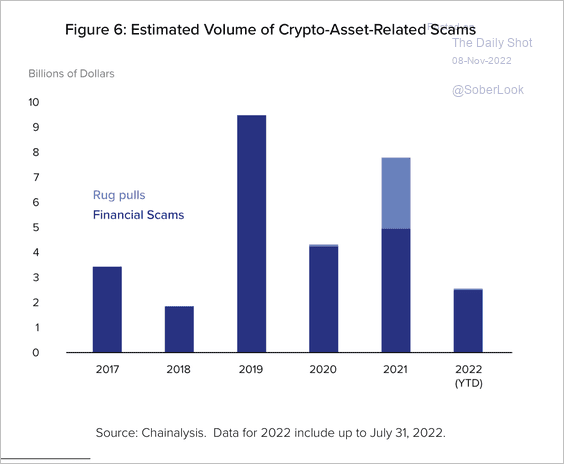

6. This chart shows the estimated extent of global financial scams and “rug pulls” during the past six years.

Source: Financial Stability Oversight Council

Source: Financial Stability Oversight Council

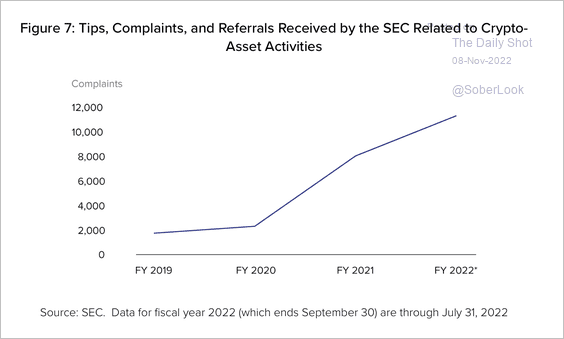

7. The SEC has seen an increase in crypto complaints.

Source: Financial Stability Oversight Council

Source: Financial Stability Oversight Council

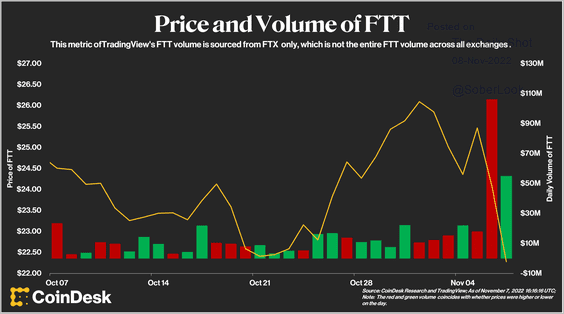

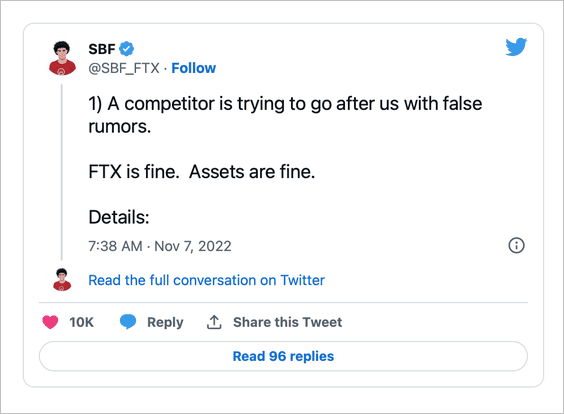

8. FTX’s FTT token dipped with a significant spike in volume on rumors about insolvency at the crypto exchange.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: @SBF_FTX

Source: @SBF_FTX

Back to Index

Commodities

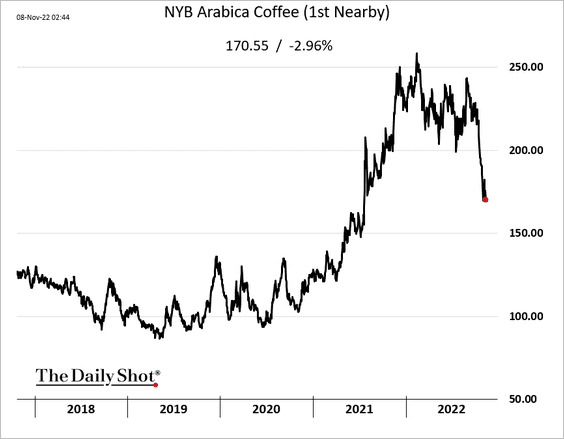

1. Coffee futures continue to sink.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

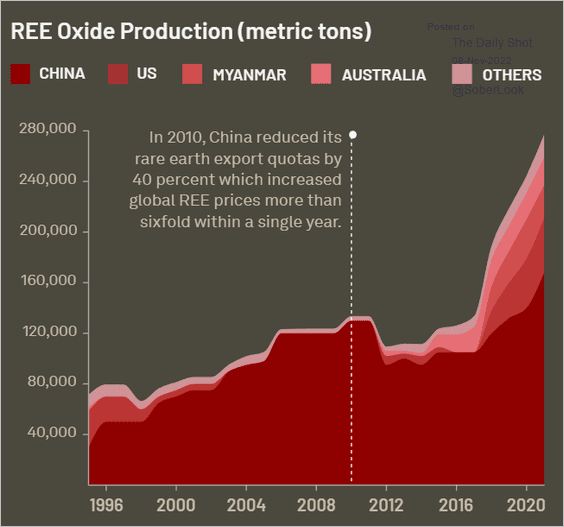

2. This chart shows rare earths output over time.

Source: kontinentalist.com Read full article

Source: kontinentalist.com Read full article

Back to Index

Equities

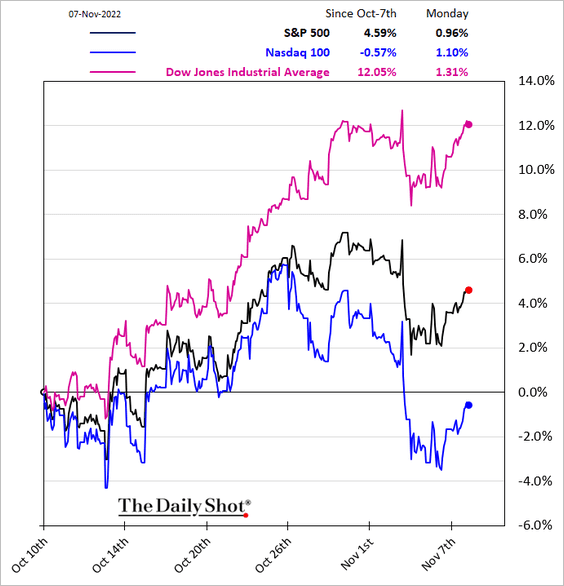

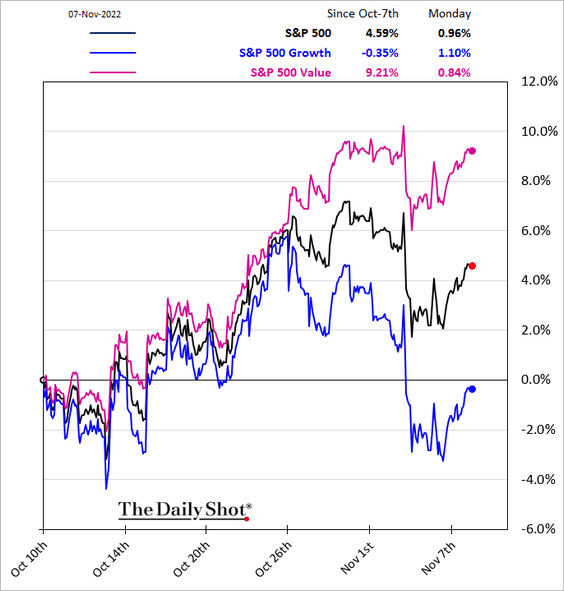

1. The Dow continues to outperform, …

… as growth shares lag.

——————–

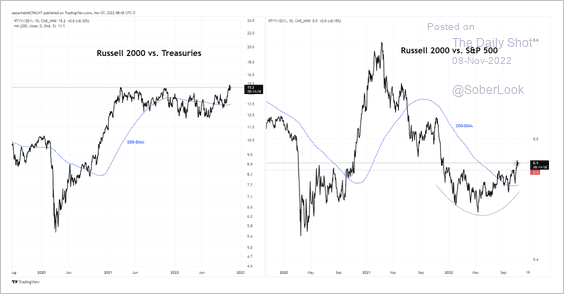

2. The Russell 2,000 small-cap index is strengthening versus large-caps and Treasuries.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

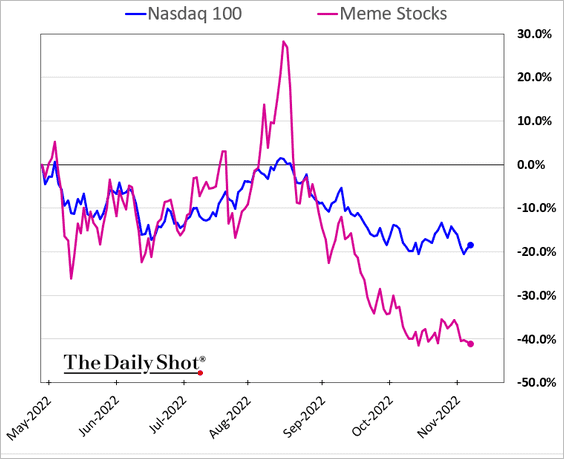

3. The Reddit crowd’s attempt to stage a meme comeback in August didn’t end well.

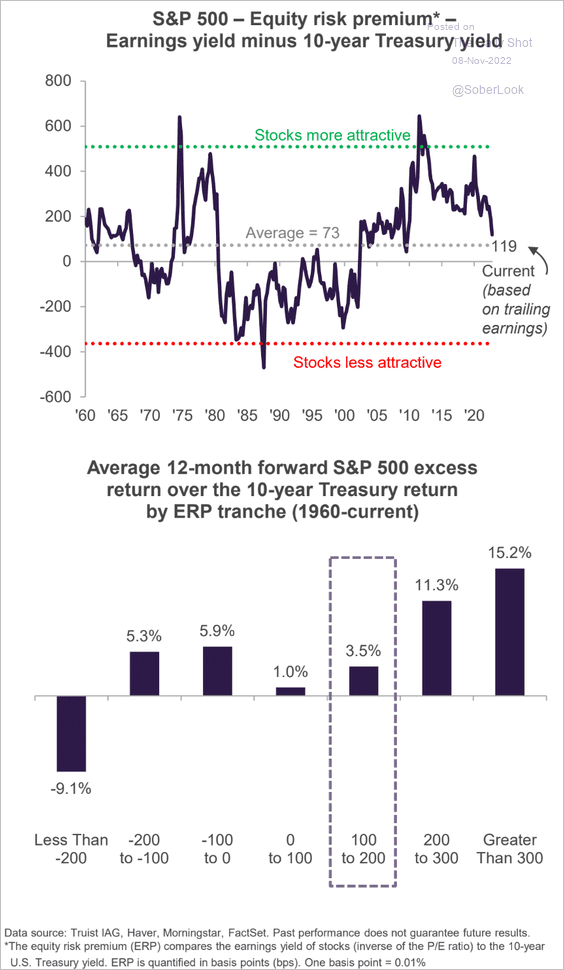

4. The current equity risk premium points to weak long-term market performance relative to Treasuries.

Source: Truist Advisory Services

Source: Truist Advisory Services

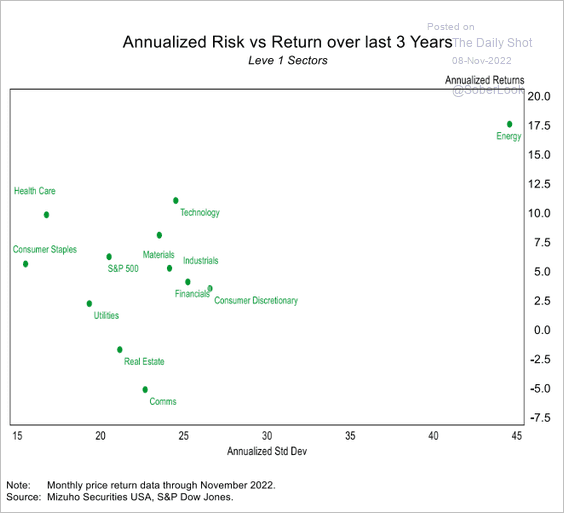

5. This figure shows the risk/return profile by sector based on the past three years.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

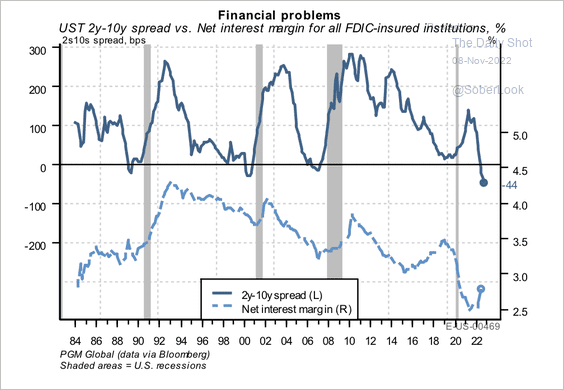

6. US bank net interest margins are starting to recover despite increasingly inverted yield curves.

Source: PGM Global

Source: PGM Global

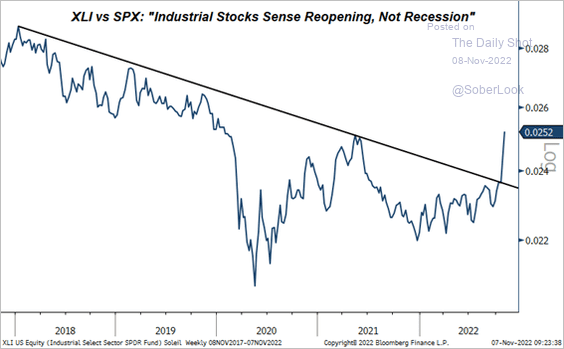

7. Industrials have been outperforming.

Source: Evercore ISI Research

Source: Evercore ISI Research

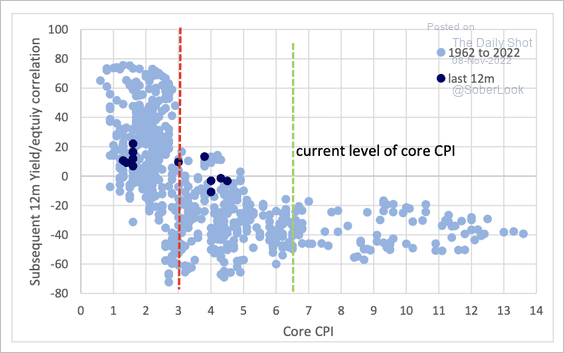

8. The Treasury yield/equity correlation is likely to remain negative for some time, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

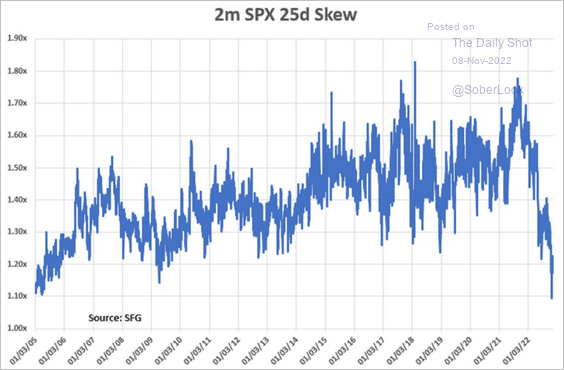

9. The S&P 500 skew is near multi-decade lows.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

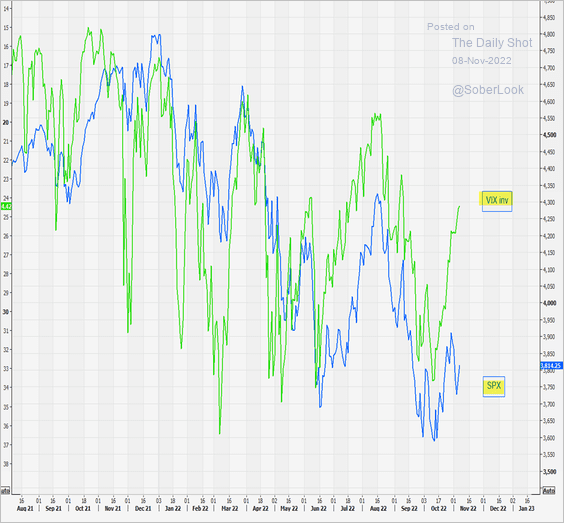

10. VIX has diverged from the S&P 500 again.

Source: @themarketear

Source: @themarketear

Back to Index

Alternatives

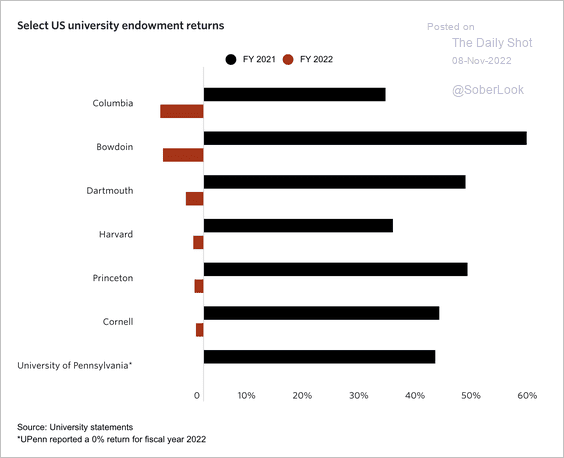

1. US university endowments have faced recent losses. High exposure to venture capital helped some endowments outperform in prior years but has now become a drag on returns, according to PitchBook.

Source: PitchBook Read full article

Source: PitchBook Read full article

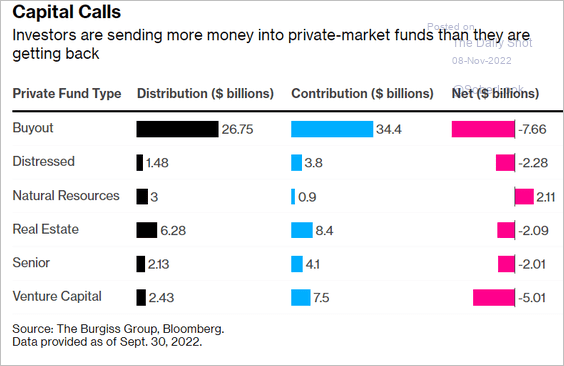

2. Private funds’ capital calls have been outpacing distributions, which could force investors to sell liquid assets.

Source: @markets, @SofiaHCBBG, @richhend Read full article

Source: @markets, @SofiaHCBBG, @richhend Read full article

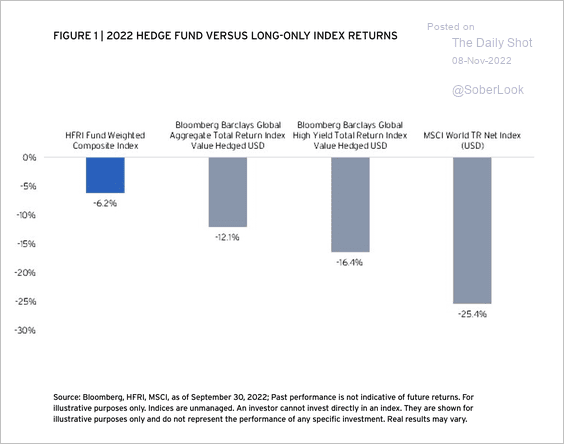

3. Overall, hedge funds have declined less than equity, fixed income, and credit indices this year.

Source: Citi Private Bank

Source: Citi Private Bank

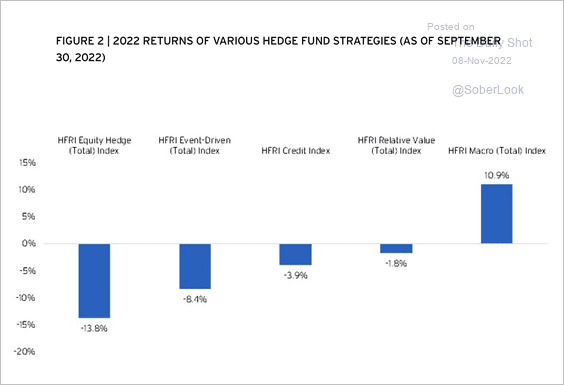

But there has been a significant dispersion in hedge fund strategy returns this year.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

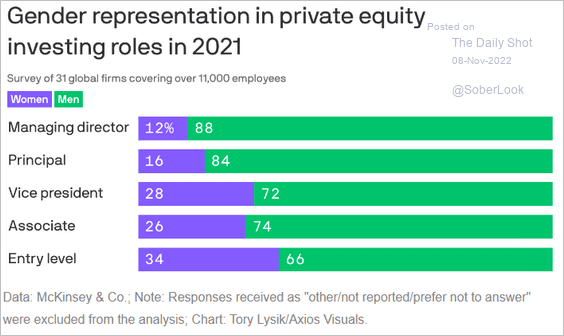

4. This chart shows gender representation in private equity.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Rates

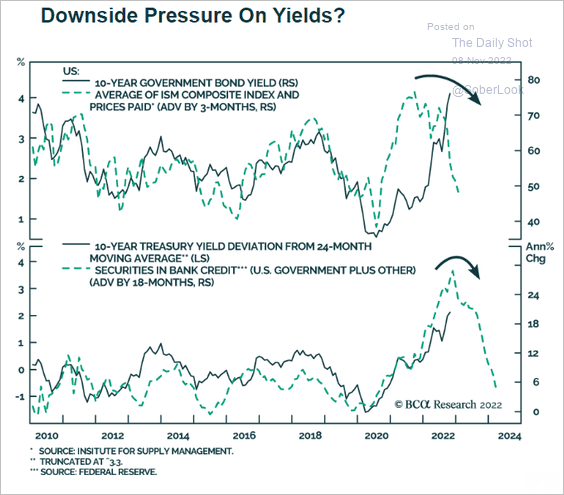

1. Will Treasury yields face downside pressure as the economy slows?

Source: BCA Research

Source: BCA Research

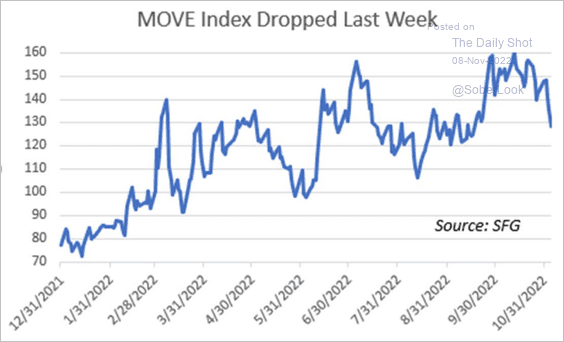

2. Treasury implied volatility declined sharply last week.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

Back to Index

Global Developments

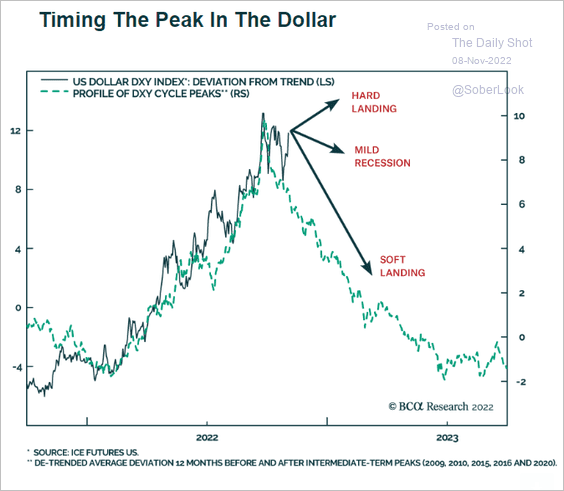

1. What’s next for the US dollar?

Source: BCA Research

Source: BCA Research

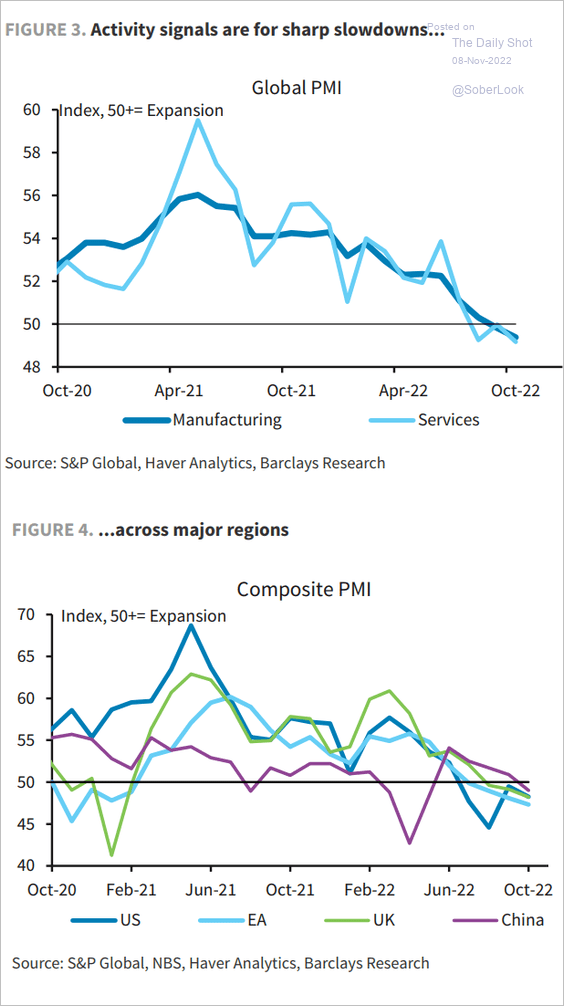

2. Economic activity has slowed sharply around the world.

Source: Barclays Research

Source: Barclays Research

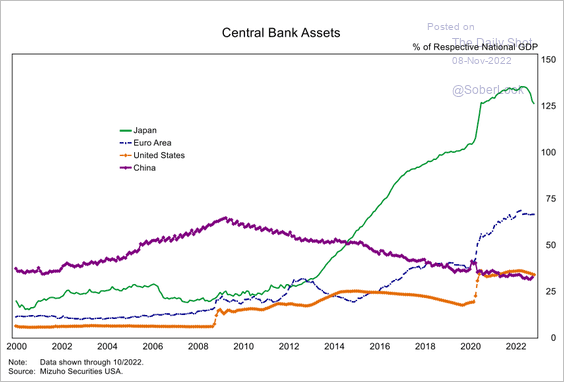

3. This chart shows central bank assets relative to GDP.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

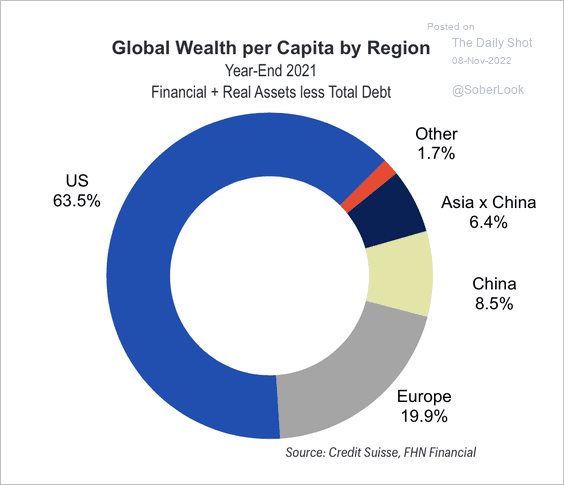

4. Here is a look at global wealth per capita by region.

Source: FHN Financial

Source: FHN Financial

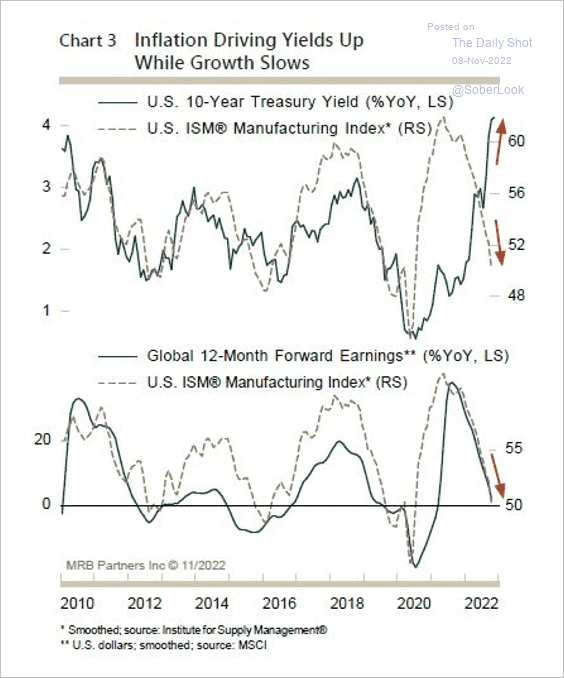

5. Yields have increased amid slowing economic growth, which is negative for earnings.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

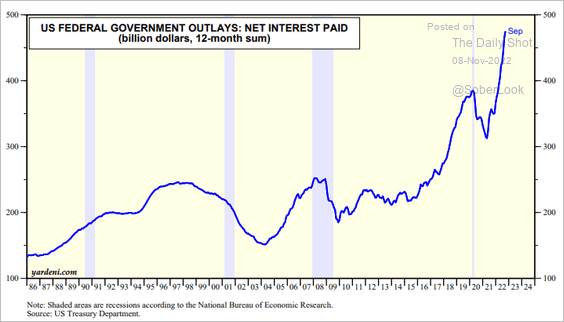

1. US federal government’s net interest paid:

Source: Yardeni Research

Source: Yardeni Research

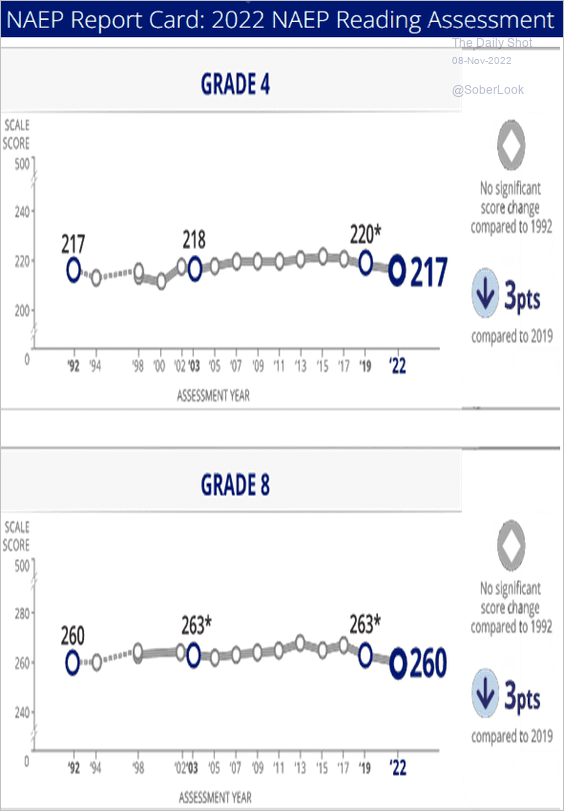

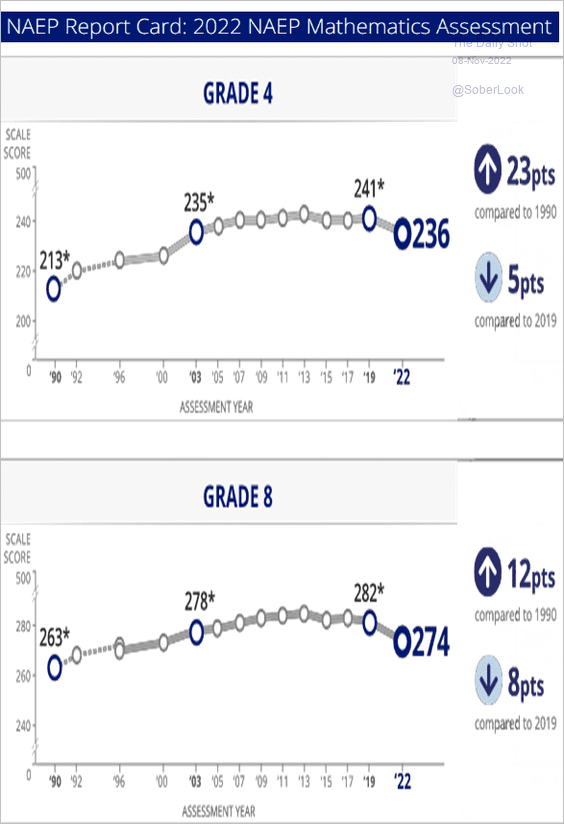

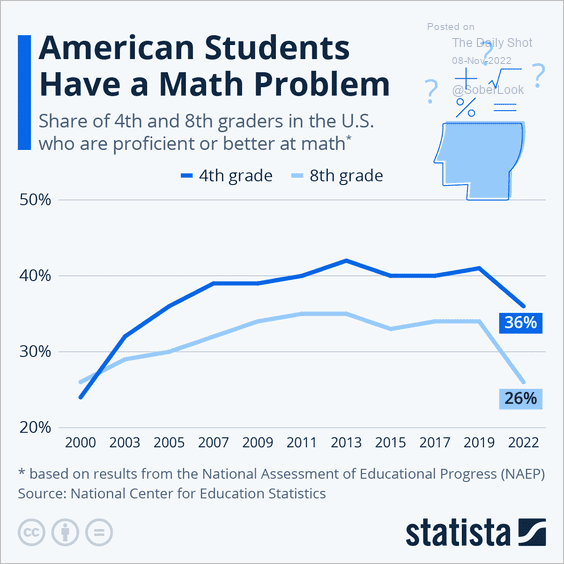

2. Further deterioration in student test scores in the US (3 charts):

Source: The Nation’s Report Card Further reading

Source: The Nation’s Report Card Further reading

Source: The Nation’s Report Card Further reading

Source: The Nation’s Report Card Further reading

Source: Statista

Source: Statista

——————–

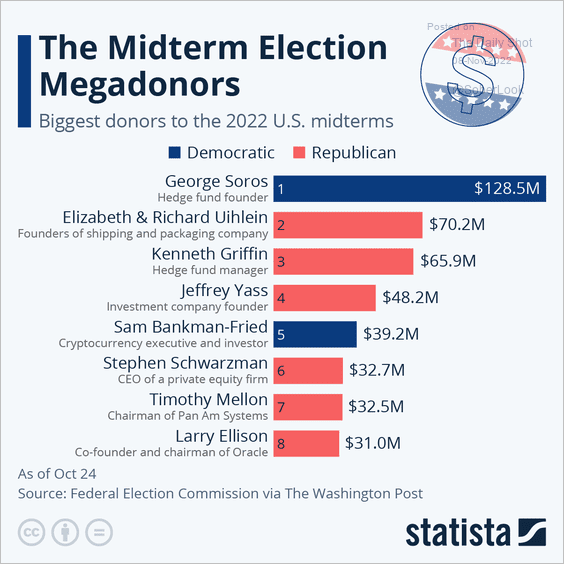

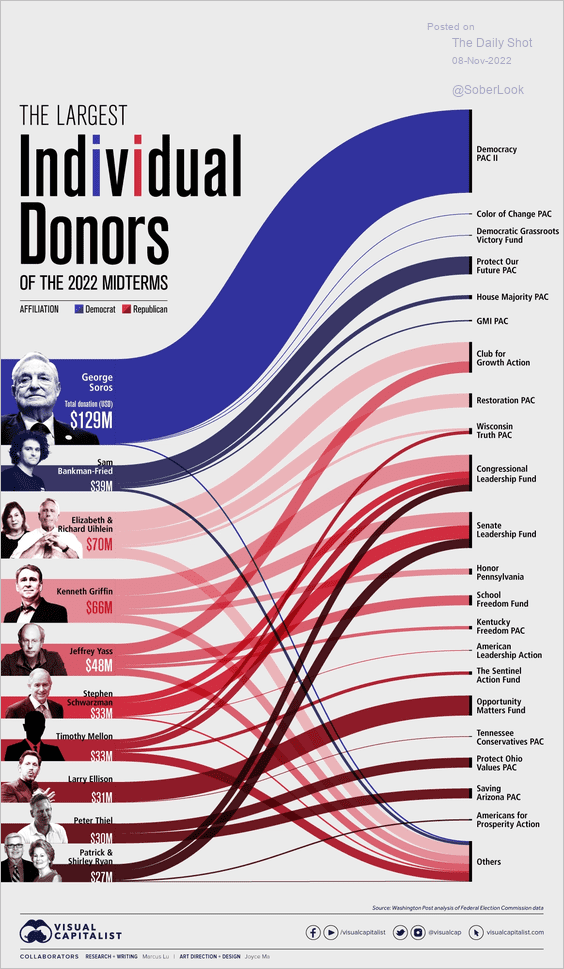

3. The midterm election megadonors (2 charts):

Source: Statista

Source: Statista

Source: Visual Capitalist

Source: Visual Capitalist

——————–

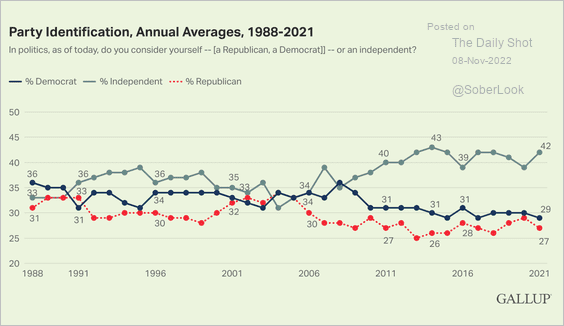

4. US political party identification:

Source: Gallup Read full article

Source: Gallup Read full article

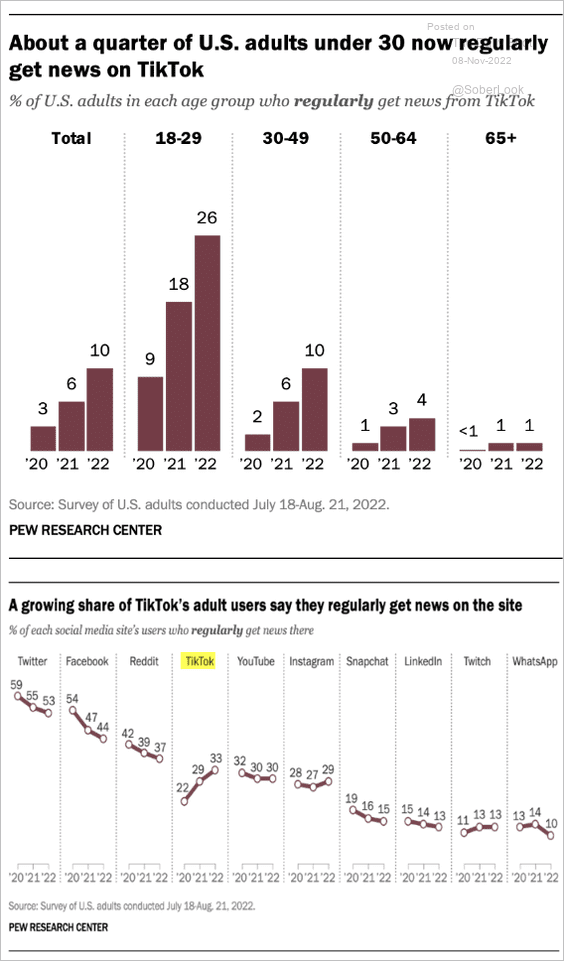

5. Getting news on TikTok:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

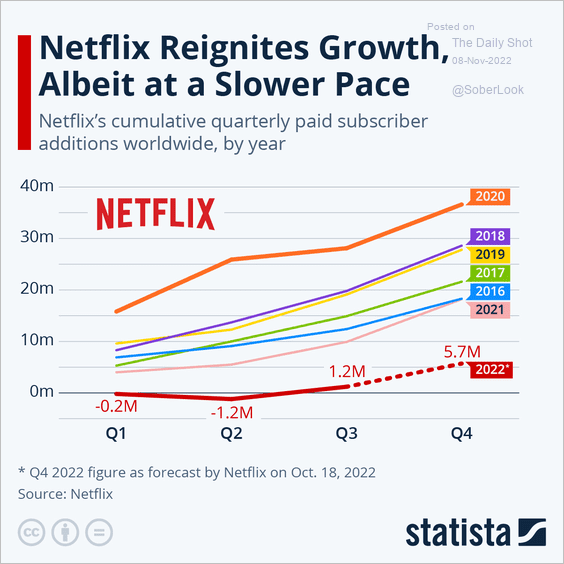

6. Netflix subscriber growth:

Source: Statista

Source: Statista

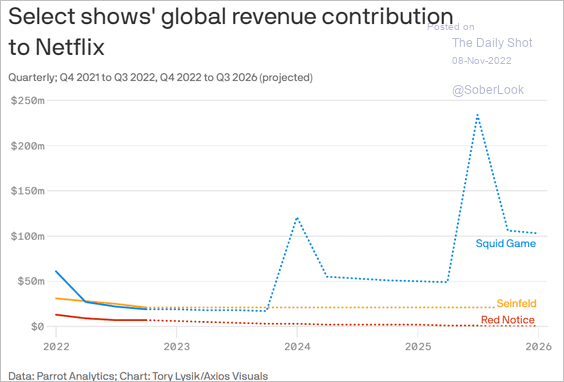

7. Squid Game projected revenue:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index