The Daily Shot: 03-Jan-23

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

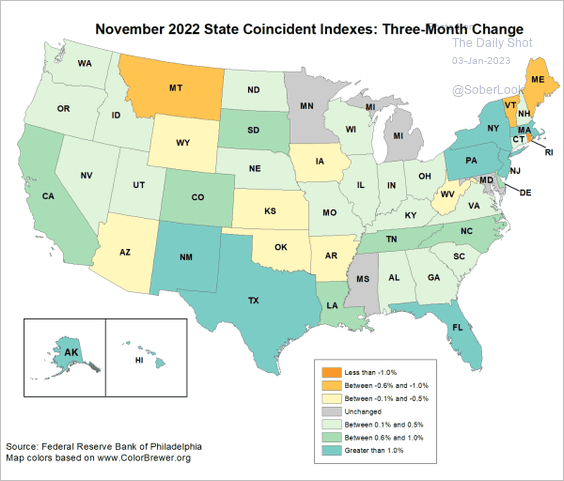

1. The number of states with negative growth is now at the level that signals a recession.

Source: St. Louis Fed Further reading

Source: St. Louis Fed Further reading

Source: Federal Reserve Bank of Philadelphia

Source: Federal Reserve Bank of Philadelphia

——————–

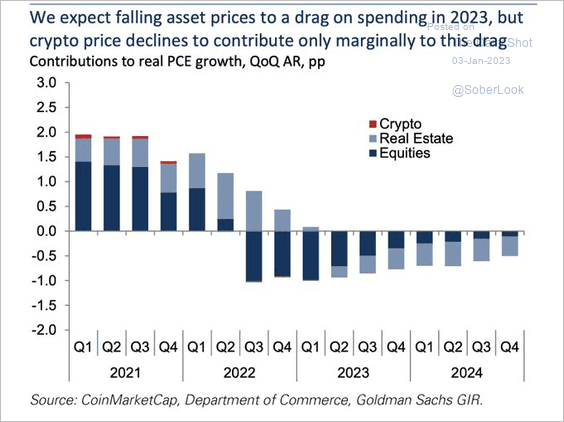

2. Weak asset prices will be a drag on spending over the next couple of years.

Source: @GoldmanSachs, @acemaxx

Source: @GoldmanSachs, @acemaxx

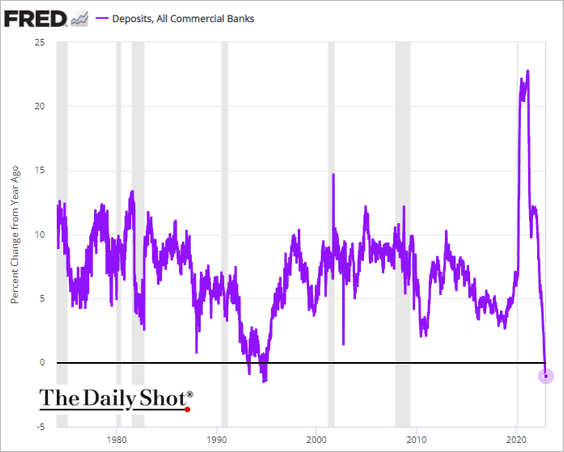

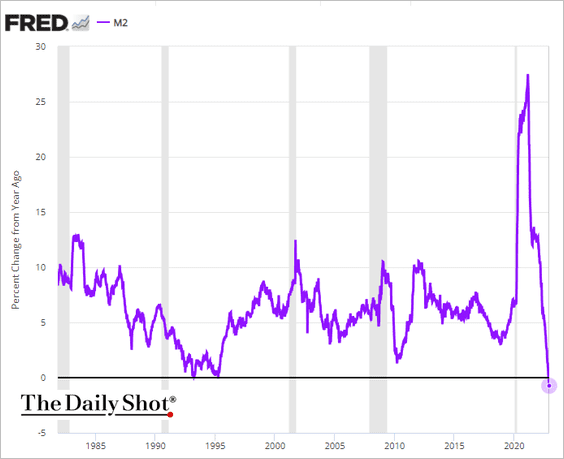

3. The year-over-year change in US liquidity indicators is now firmly in negative territory.

• Bank deposits:

• The broad money supply (M2):

——————–

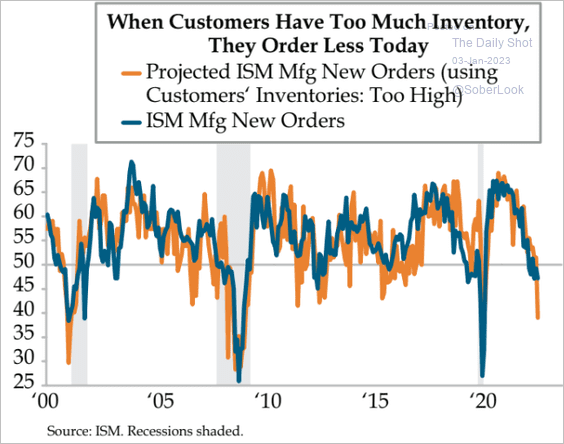

4. How weak was the nation’s manufacturing demand in December? The ISM report is out tomorrow at 10 AM.

Source: Quill Intelligence

Source: Quill Intelligence

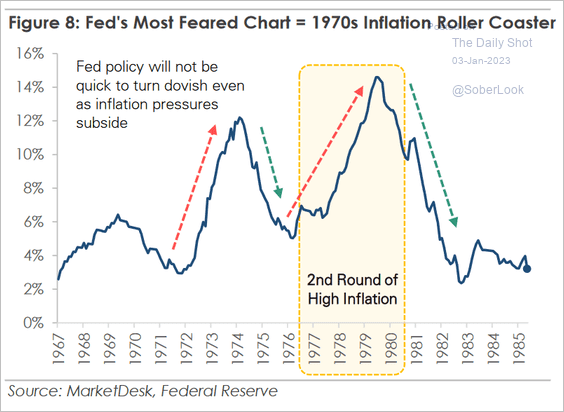

5. Here is why the Fed will keep rates higher for longer.

Source: MarketDesk Research

Source: MarketDesk Research

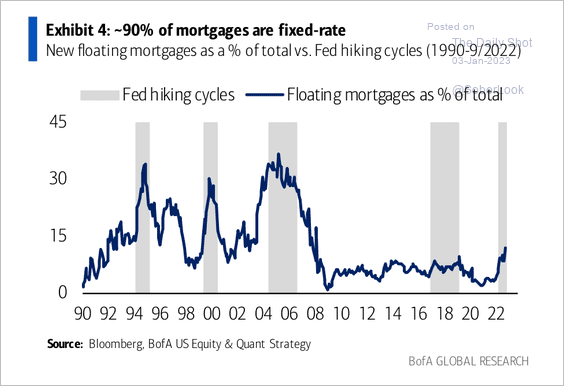

6. Next, we have a couple of updates on the housing market.

• The percentage of floating-rate mortgages has increased, but it is still well below the levels seen prior to the financial crisis.

Source: BofA Global Research

Source: BofA Global Research

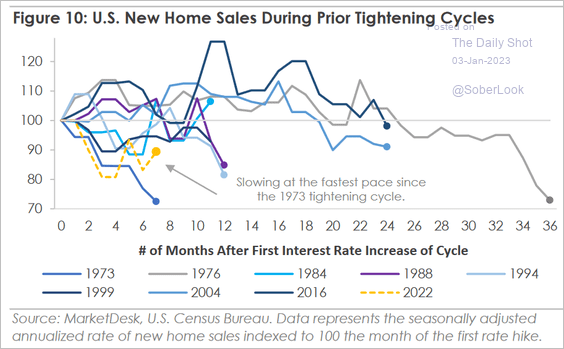

• New home sales surprised to the upside in November, but the overall decline has been severe relative to previous Fed tightening cycles.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

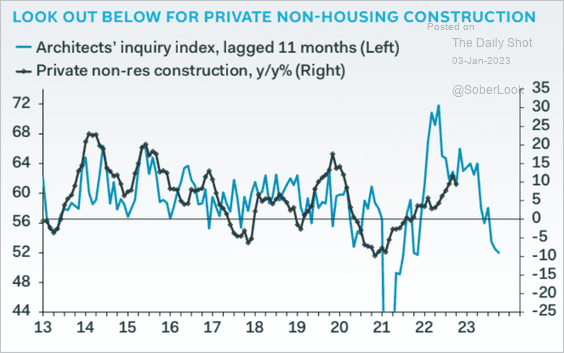

7. Non-residential construction faces substantial downside risks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

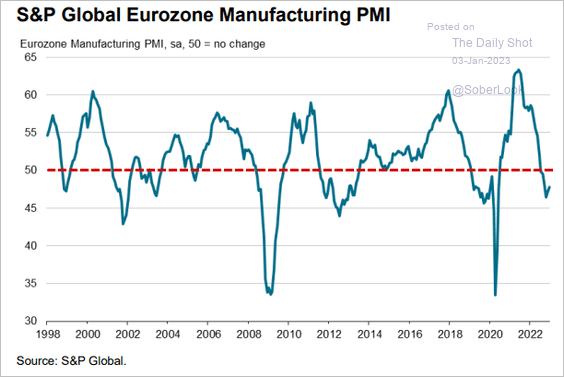

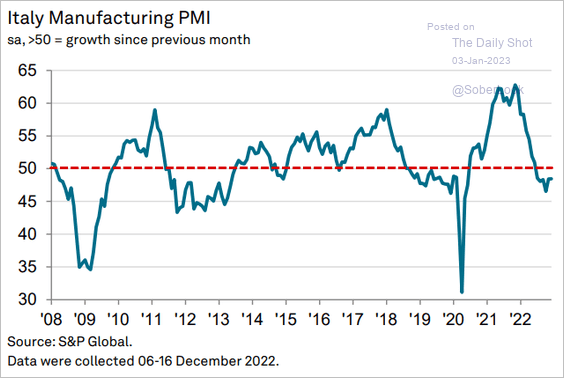

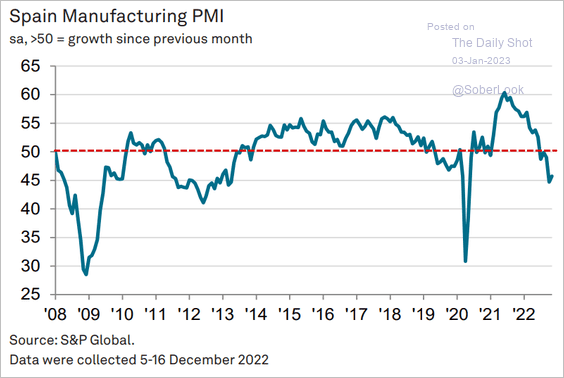

1. While factory activity continues to contract, the pace of declines appears to have slowed a bit.

• Eurozone PMI:

Source: S&P Global PMI

Source: S&P Global PMI

• Italy:

Source: S&P Global PMI

Source: S&P Global PMI

• Spain:

Source: S&P Global PMI

Source: S&P Global PMI

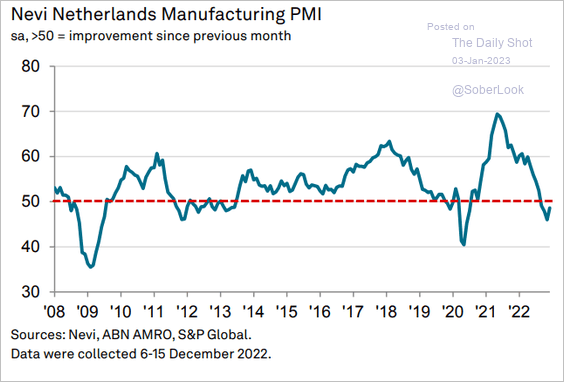

• The Netherlands:

Source: S&P Global PMI

Source: S&P Global PMI

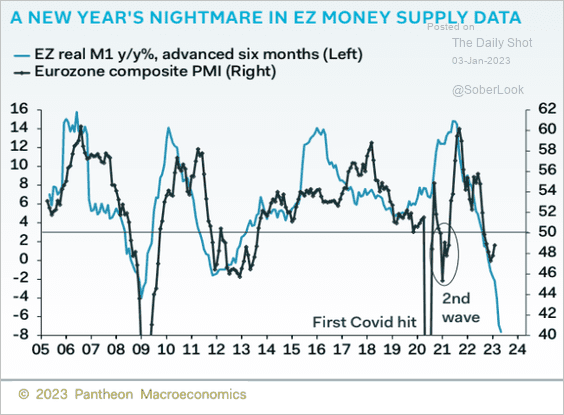

However, the sharp decline in the M1 (narrow) money supply growth points to downside risks for business activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

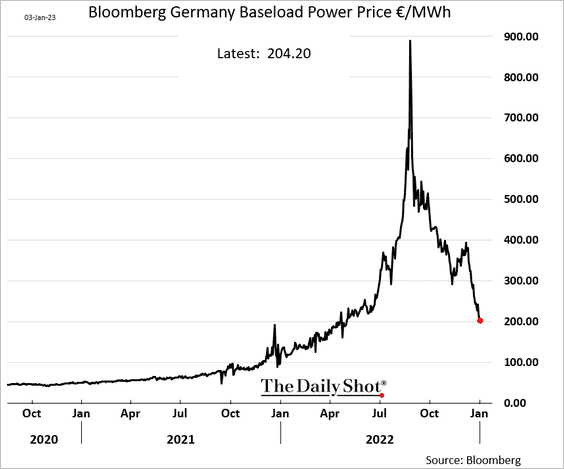

2. Germany’s electricity costs continue to follow natural gas prices lower.

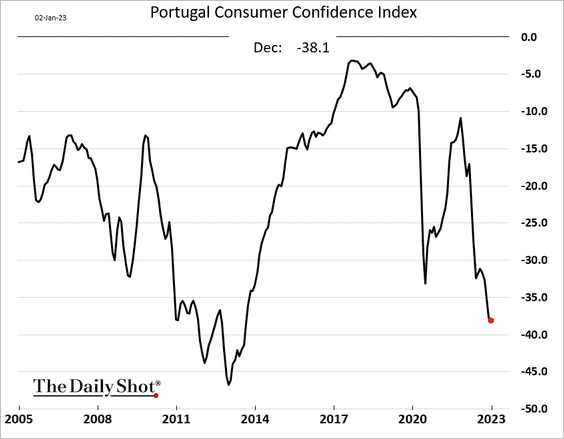

3. Portugal’s consumer confidence remains depressed.

Back to Index

Europe

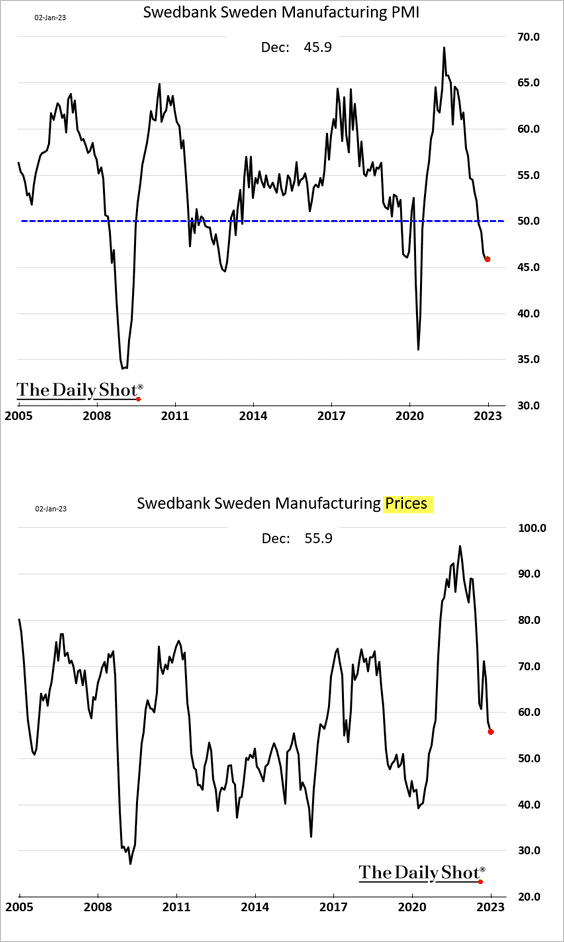

1. Manufacturing activity in Sweden remains in decline. Price pressures are easing.

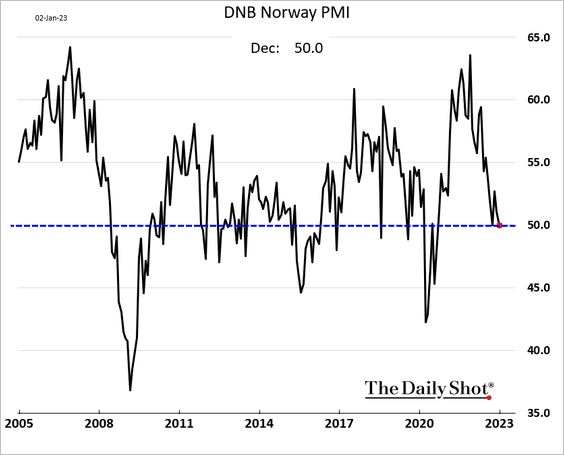

2. Norway’s manufacturing growth has stalled.

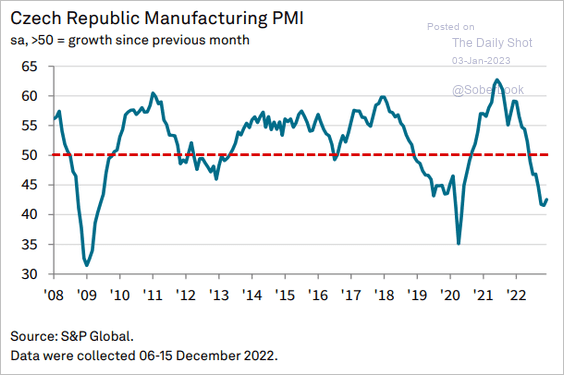

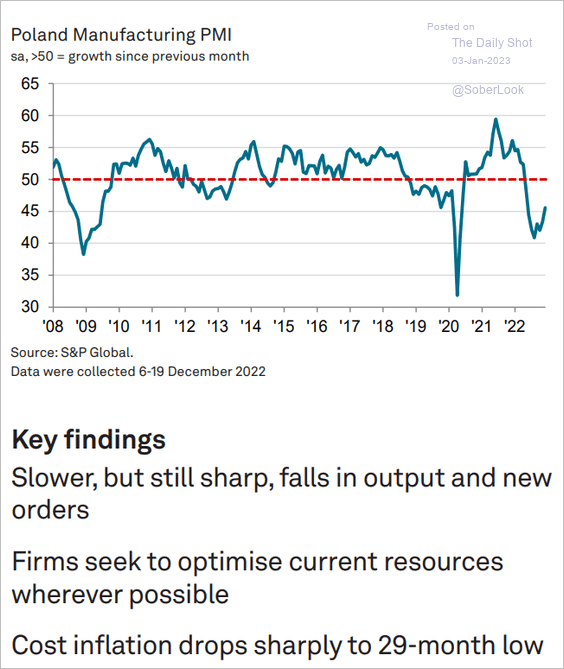

3. Manufacturing PMIs in Poland and the Czech Republic appear to have bottomed but remain deep in contraction territory.

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

——————–

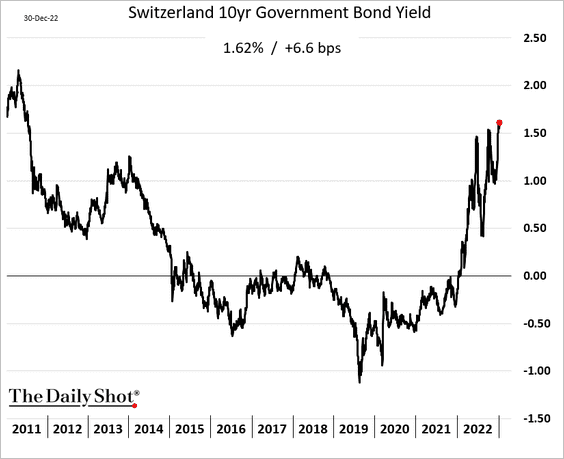

4. The Swiss 10-year yield hit a multi-year high last week.

Back to Index

Asia – Pacific

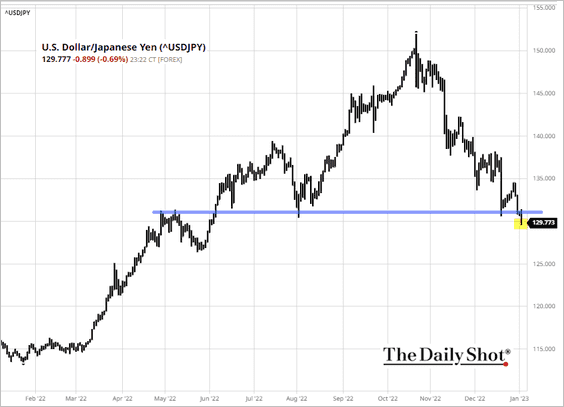

1. Dollar-yen has breached support.

Source: barchart.com

Source: barchart.com

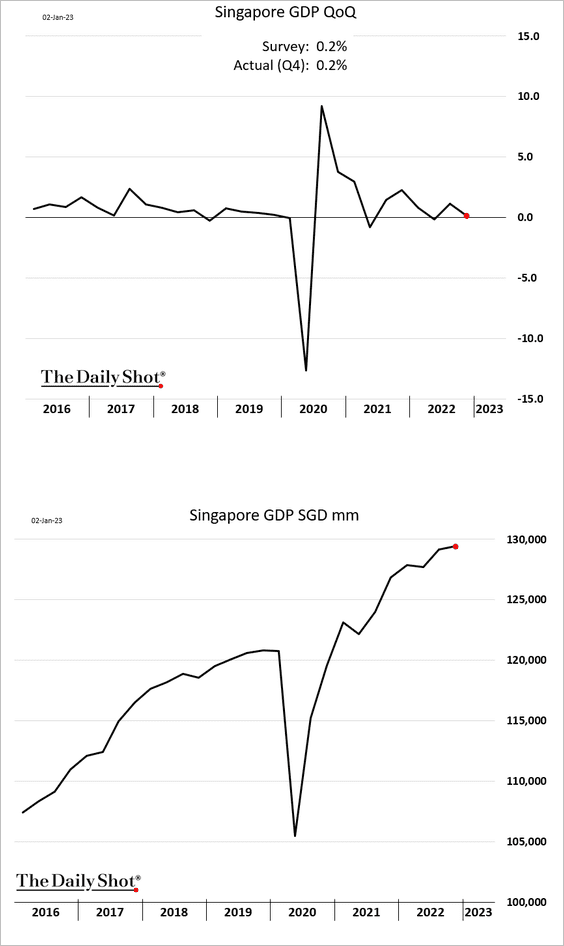

2. Singapore’s economy continues to grow.

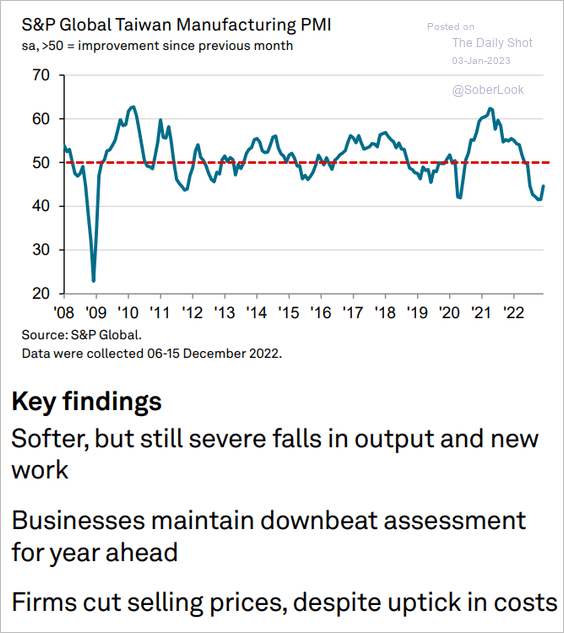

3. The pace of Taiwan’s manufacturing sector contraction has softened.

Source: S&P Global PMI

Source: S&P Global PMI

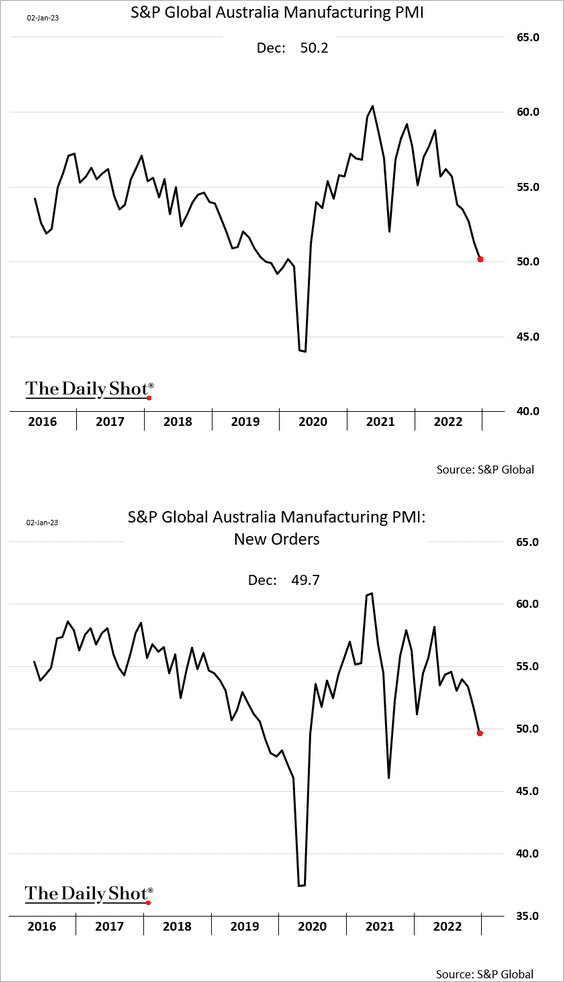

4. Australian manufacturing growth has stalled.

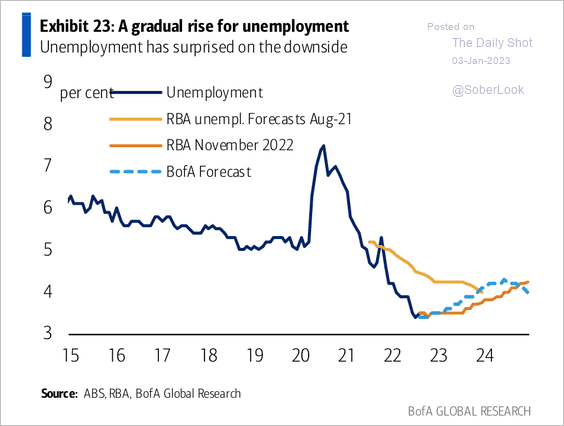

BofA expects a gradual rise in Australian unemployment over the next year.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

China

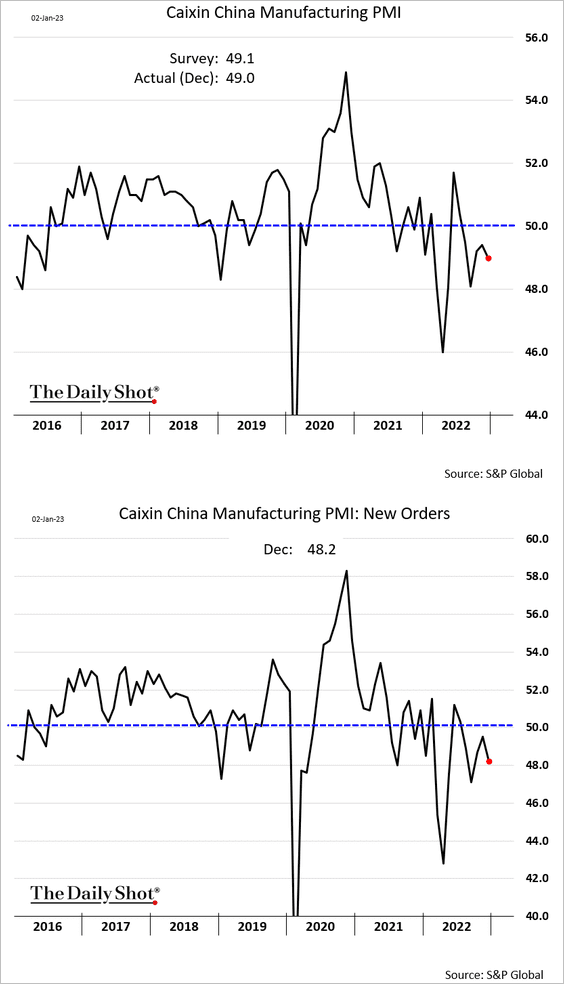

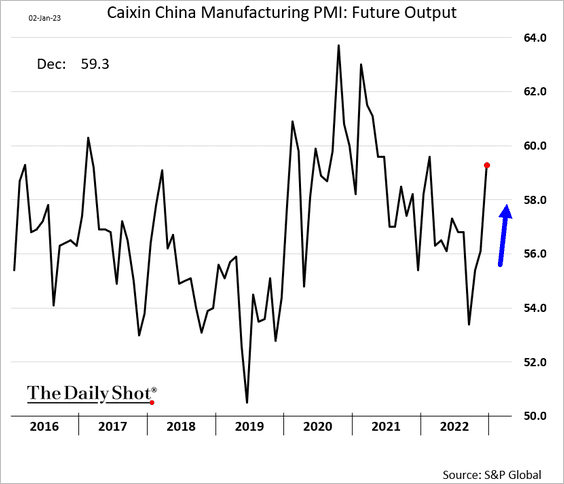

1. The S&P Global Manufacturing PMI confirmed weakness in China’s manufacturing sector.

But factories are more optimistic as lockdowns end.

——————–

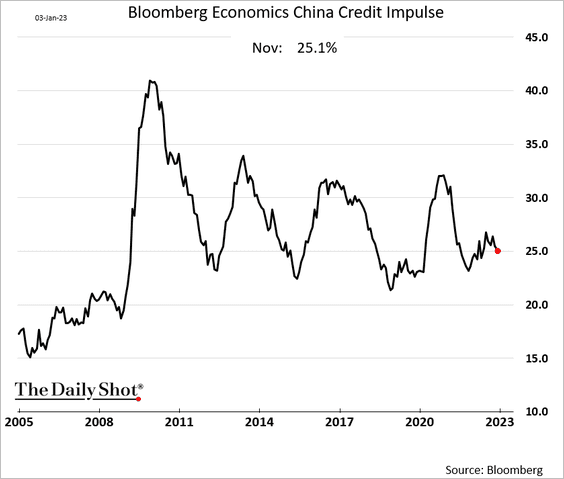

2. China’s credit impulse turned lower in Q4.

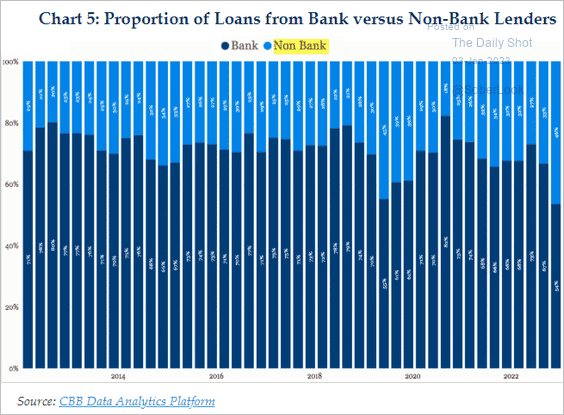

Companies are increasingly tapping “shadow” lenders for credit.

Source: China Beige Book

Source: China Beige Book

——————–

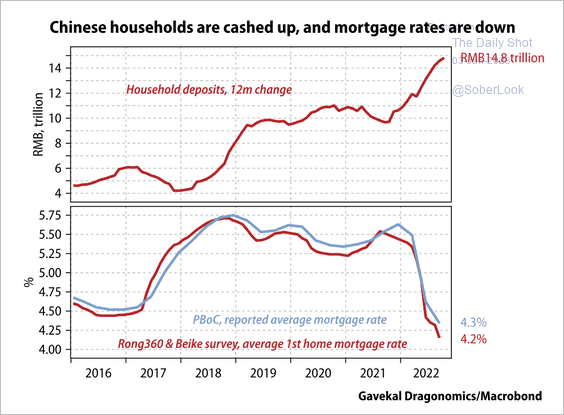

3. Chinese households have accumulated savings during the pandemic. A successful reopening could spur spending and housing demand.

Source: Gavekal Research

Source: Gavekal Research

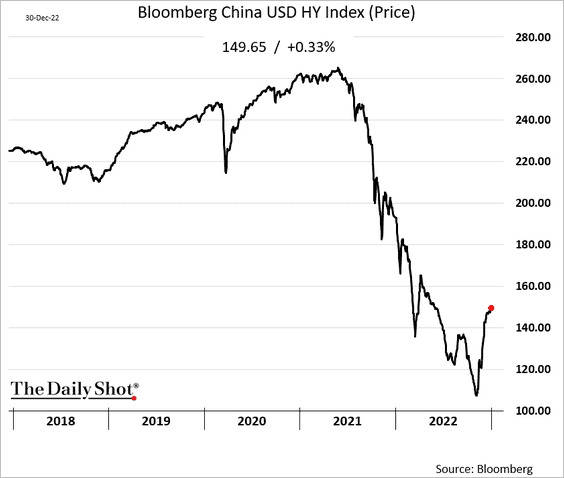

Dollar-denominated HY bonds (dominated by property developers) are rebounding amid hopes for housing sector stabilization.

——————–

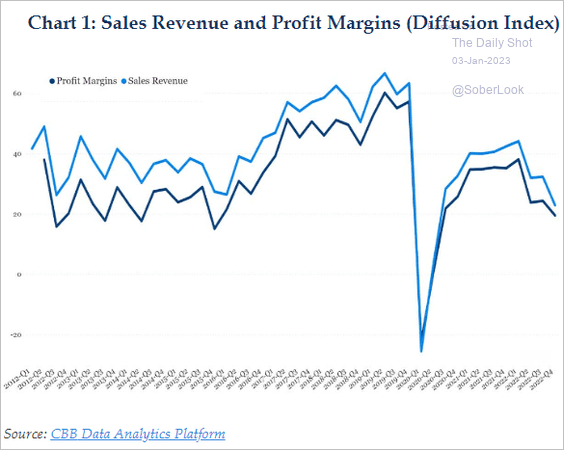

4. Corporate revenues and margins were under pressure in Q4.

Source: China Beige Book

Source: China Beige Book

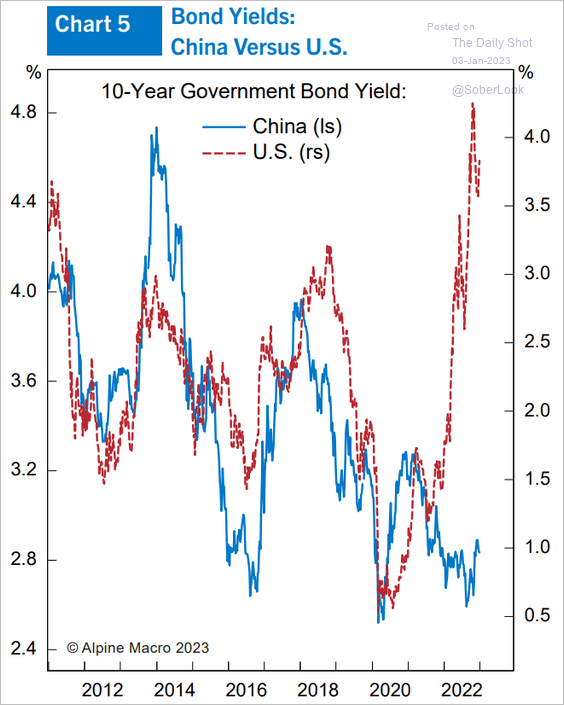

5. The US/China yield differential has blown out, driven by diverging monetary policies.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

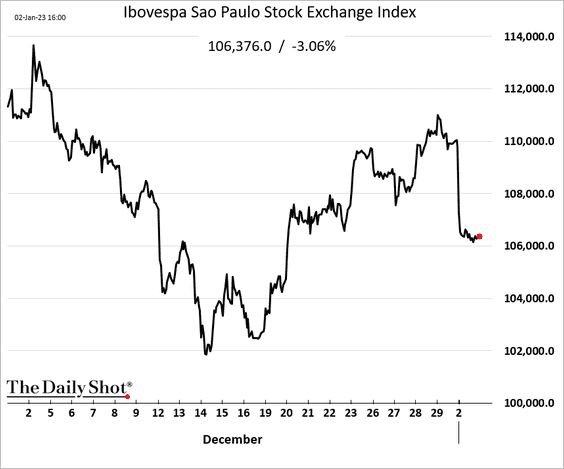

1. Let’s begin with Brazil.

• Stocks tumbled on Monday.

Source: Reuters Read full article

Source: Reuters Read full article

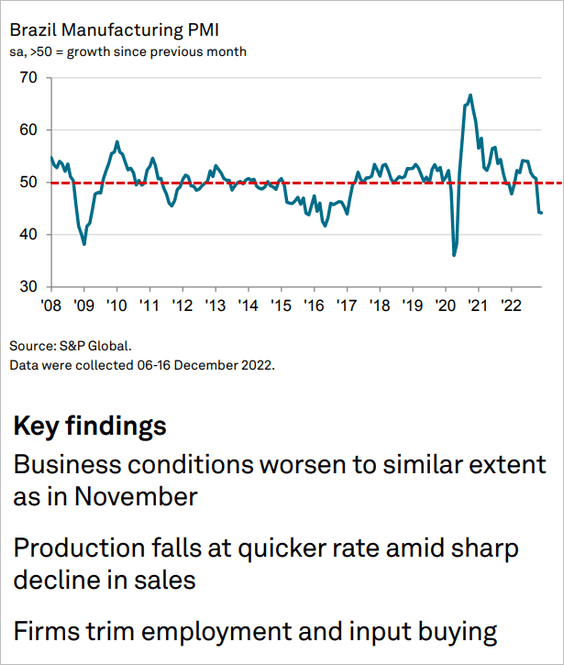

• The manufacturing sector is in recession.

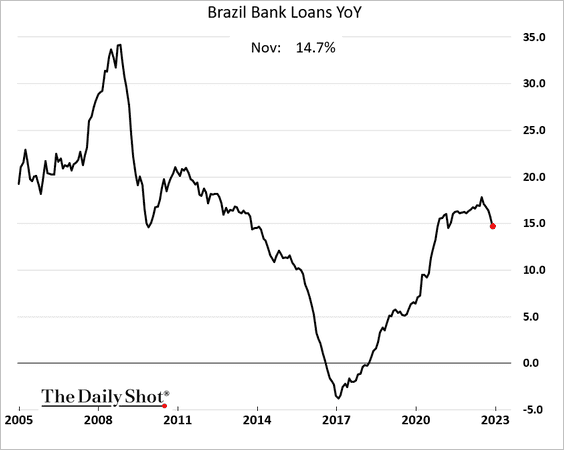

• Credit growth appears to have peaked.

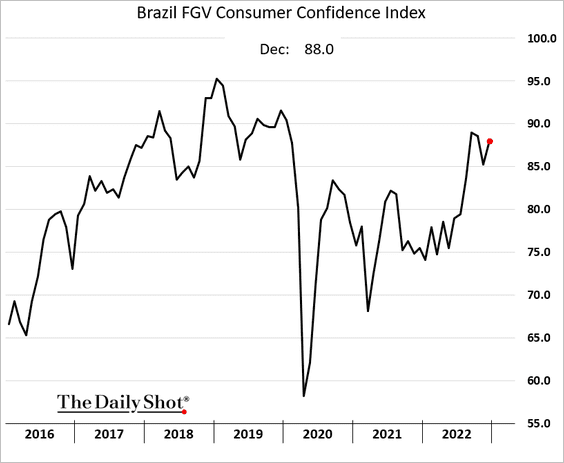

• Consumer confidence remains robust.

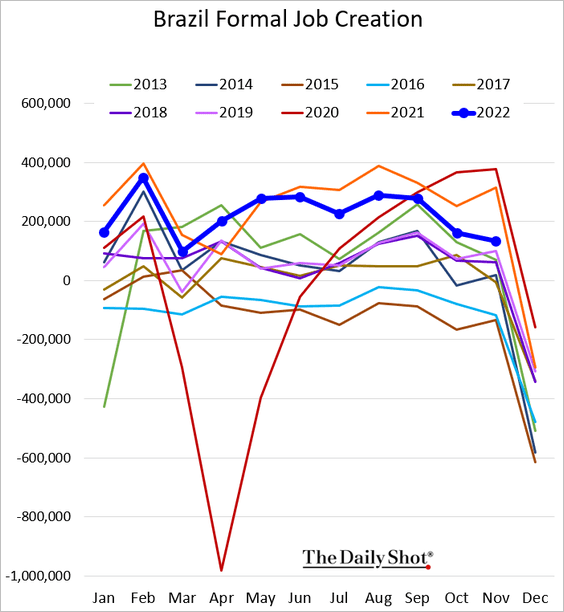

• Job creation has slowed.

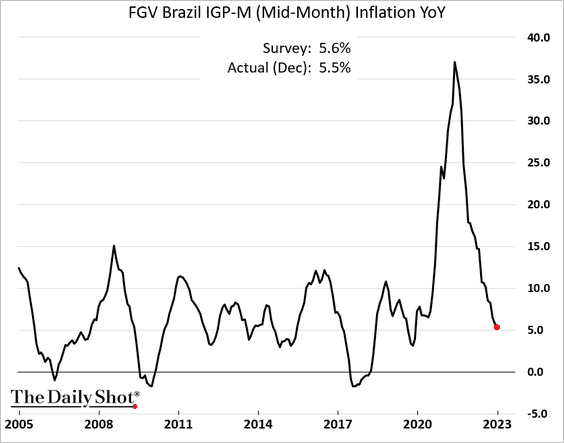

• Inflation continues to ease.

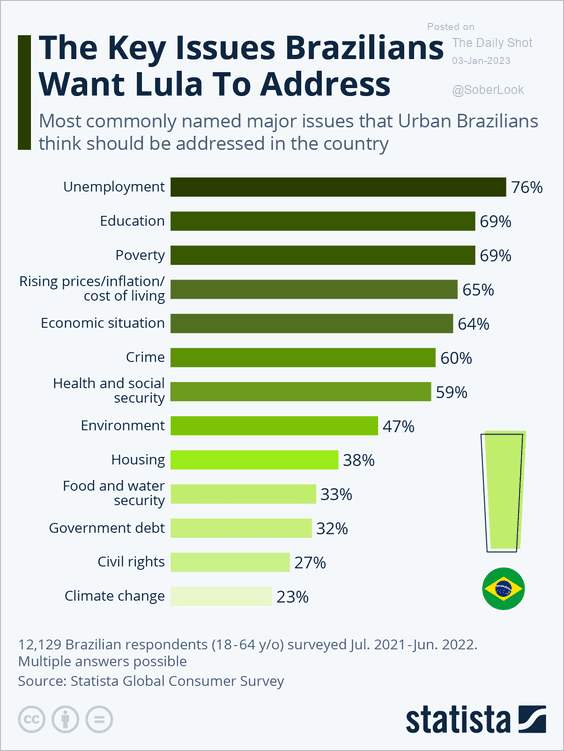

• What do Brazilians see as the key issues Lula should address?

Source: Statista

Source: Statista

——————–

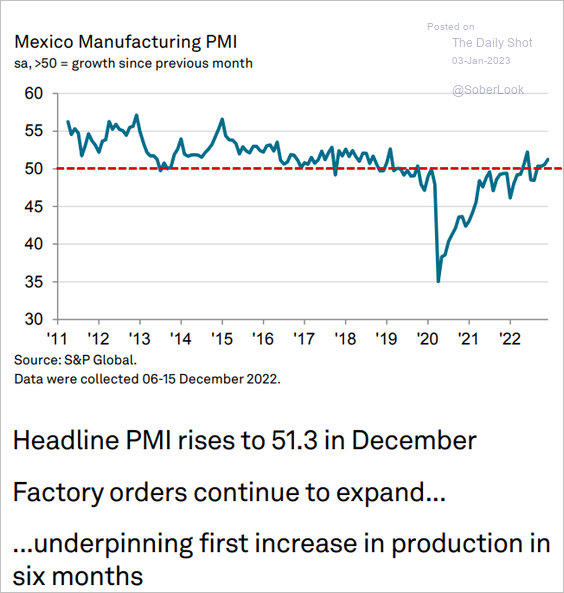

2. Mexican manufacturing growth improved in December.

Source: S&P Global PMI

Source: S&P Global PMI

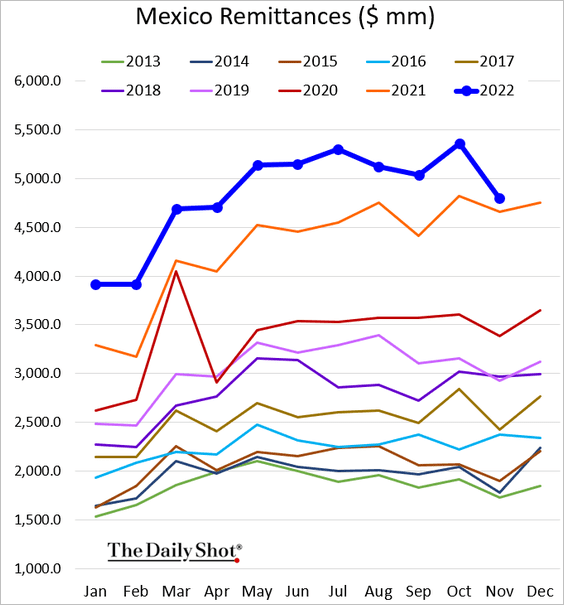

Remittances dropped.

——————–

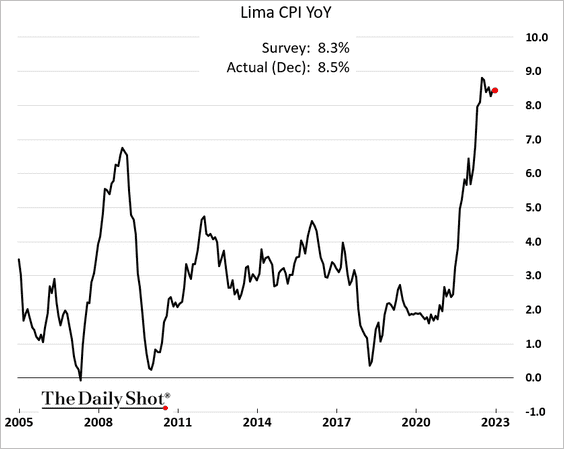

3. Peru’s inflation remains elevated, fueling unrest.

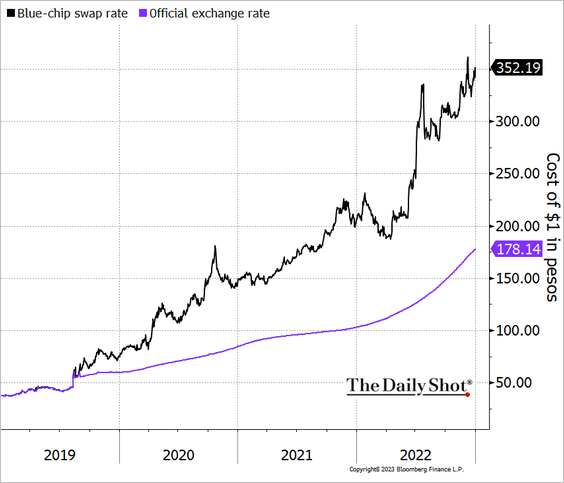

4. The gap between the official and market-based measures of Argentina’s exchange rate has blown out.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

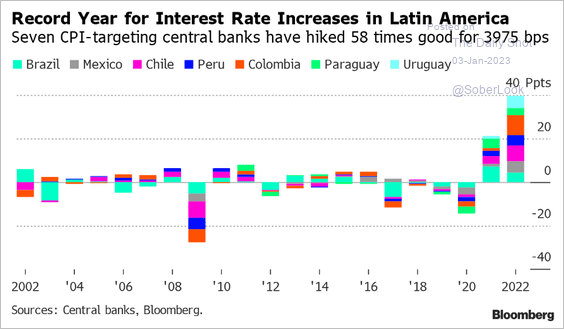

5. The synchronized LatAm rate hikes were unprecedented last year.

Source: @rhjameson, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @rhjameson, @TheTerminal, Bloomberg Finance L.P. Read full article

——————–

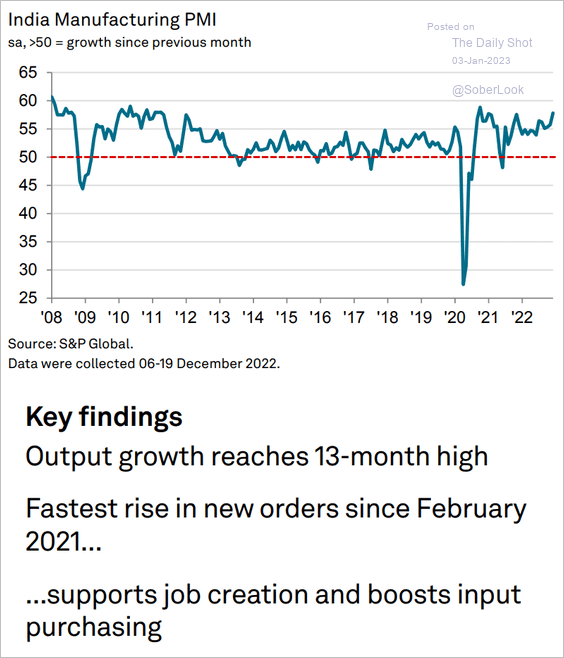

6. India’s manufacturing growth is surging.

Source: S&P Global PMI

Source: S&P Global PMI

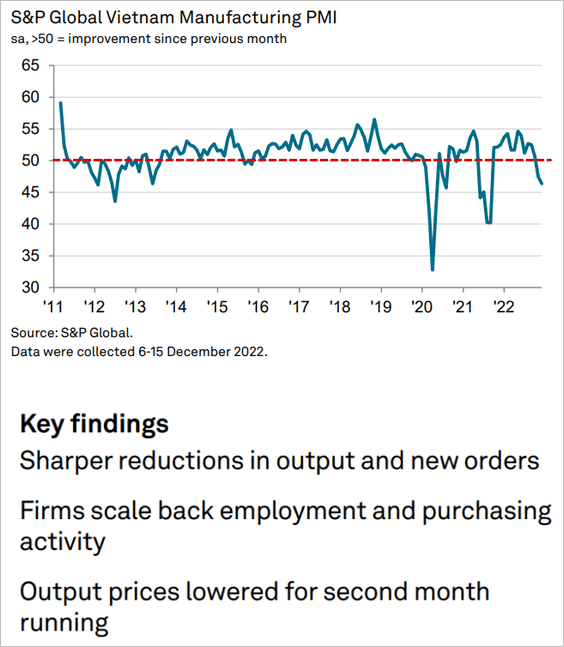

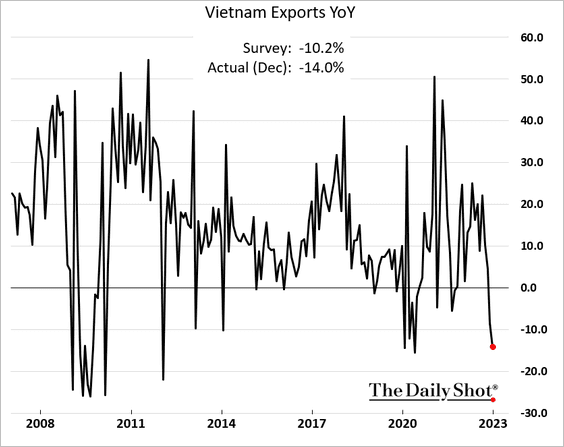

7. The contraction in Vietnam’s factory activity has accelerated, …

… as exports tumble.

——————–

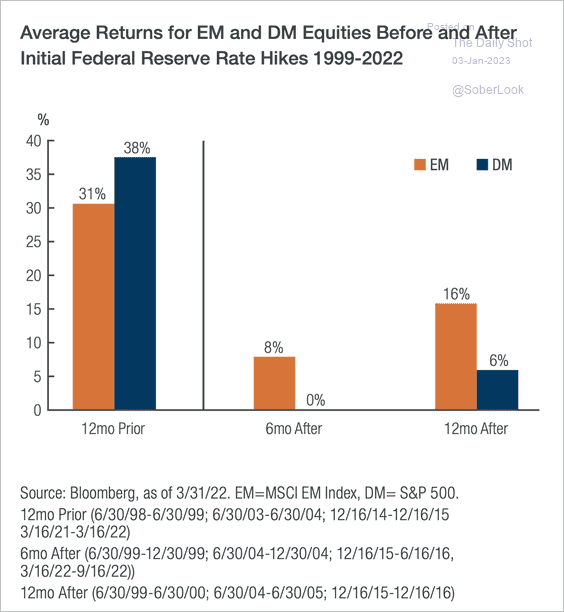

8. EM equity returns are typically higher than in developed markets 6-12 months after the first Fed rate hike.

Source: Mirae Asset Read full article

Source: Mirae Asset Read full article

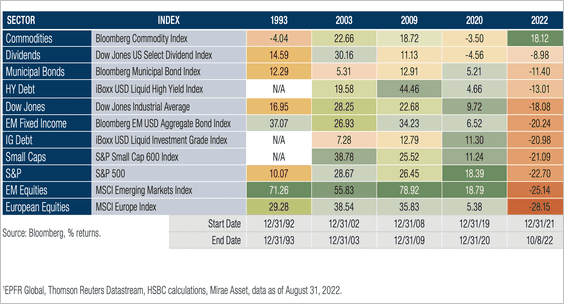

EM previously led global equity rallies after recessions.

Source: Mirae Asset Read full article

Source: Mirae Asset Read full article

Back to Index

Commodities

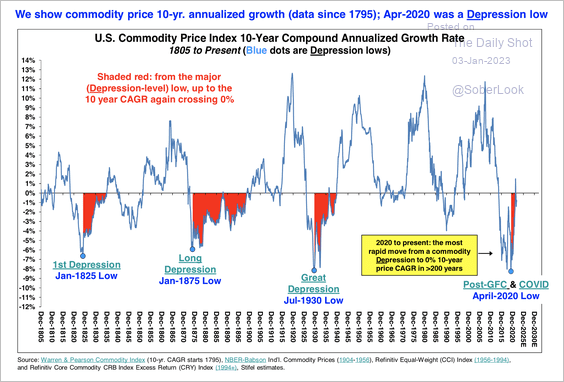

1. Commodity prices have risen from significant lows. Could we see further gains?

Source: Stifel

Source: Stifel

2. The Thomson Reuters Commodity Index is about 10% away from lower support.

The price ratio of the Thomson Reuters Commodity Index and the S&P 500 is testing support.

——————–

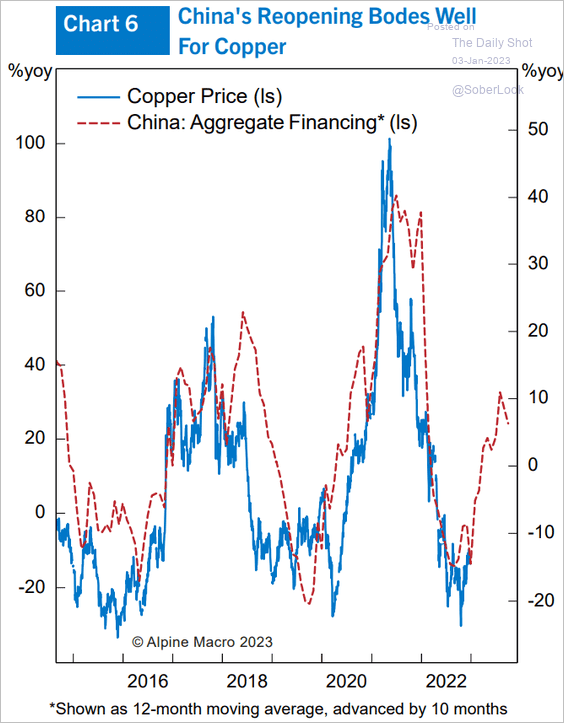

3. Copper could see further upside as China reopens.

Source: Alpine Macro

Source: Alpine Macro

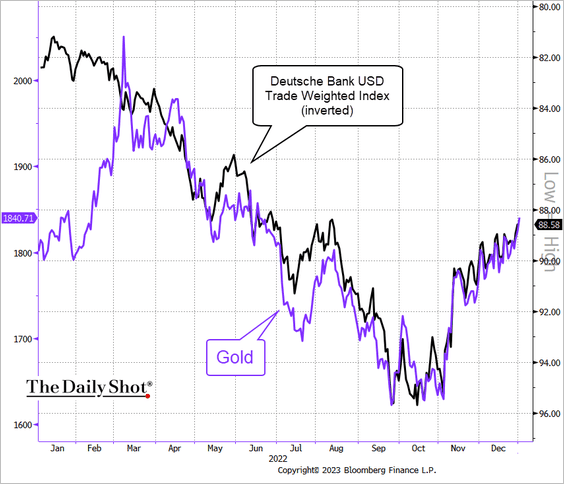

4. Gold has been (inversely) tied to the US dollar over the past ten months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Energy

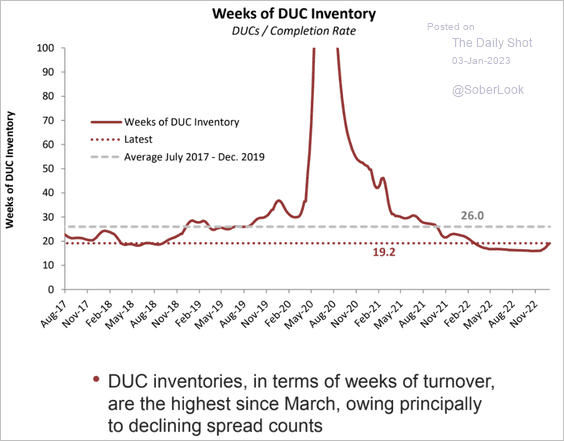

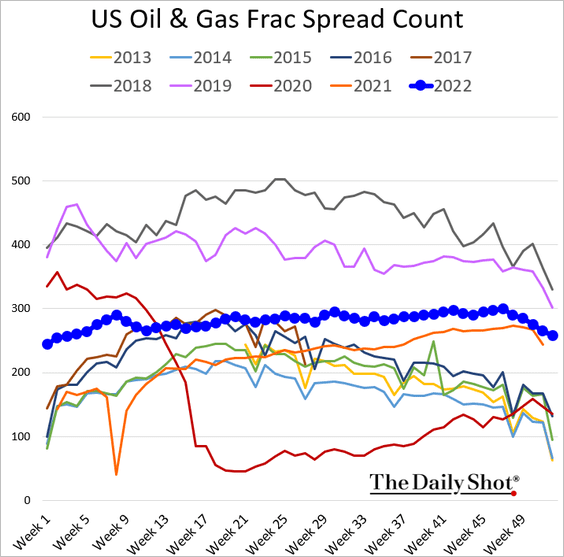

1. US drilled but uncompleted (DUC) wells have risen in terms of weeks of turnover, …

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

… as fracking activity slowed.

——————–

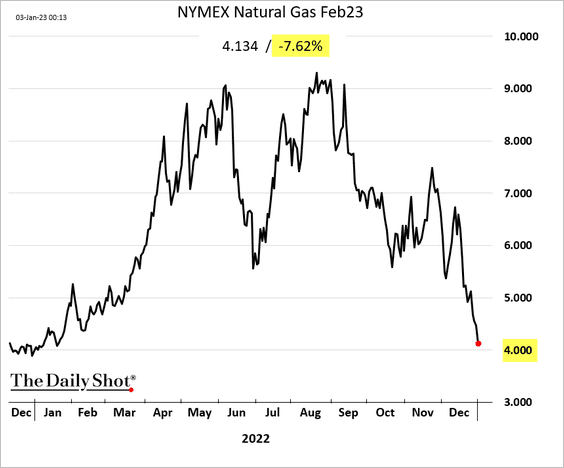

2. US natural gas continues to tumble, …

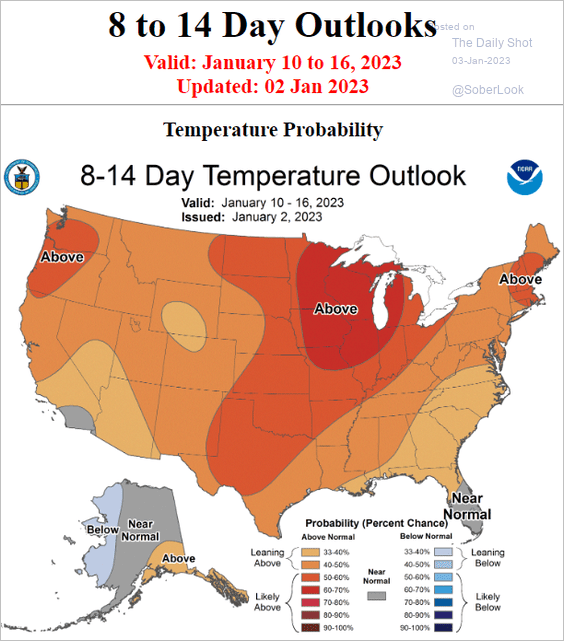

… amid warmer weather.

Source: NOAA

Source: NOAA

Back to Index

Equities

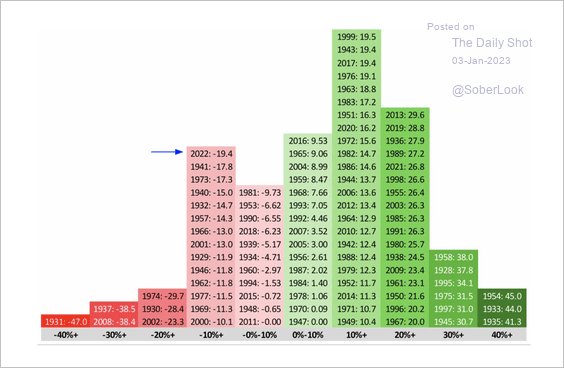

1. 2022 saw the largest annual decline for the S&P 500 since 2008.

Source: @bespokeinvest

Source: @bespokeinvest

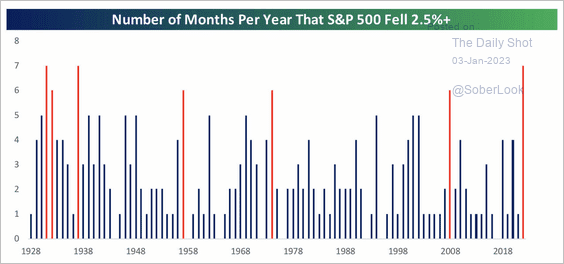

Roughly half of all months in 2022 saw a decline of at least 2.5%.

Source: @bespokeinvest

Source: @bespokeinvest

——————–

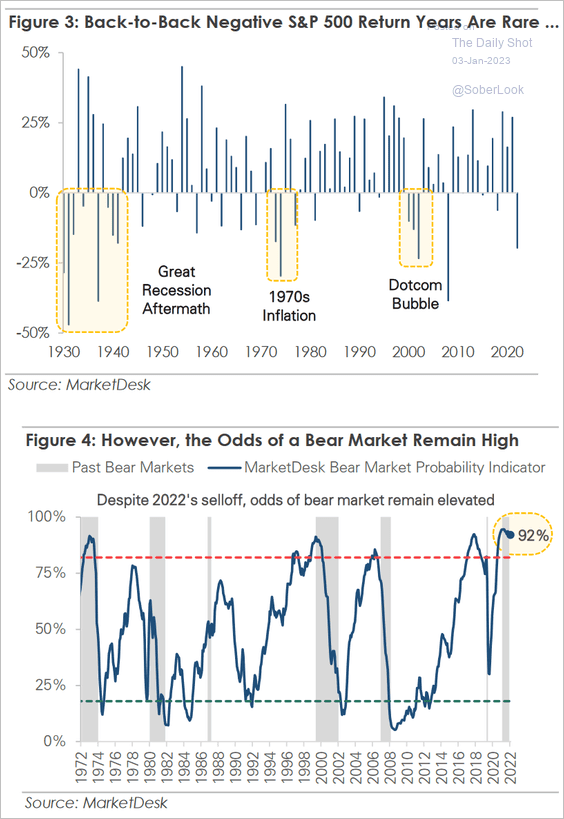

2. Back-to-back annual losses are rare, but the odds of the bear market continuing remain elevated, according to MarketDesk Research.

Source: MarketDesk Research

Source: MarketDesk Research

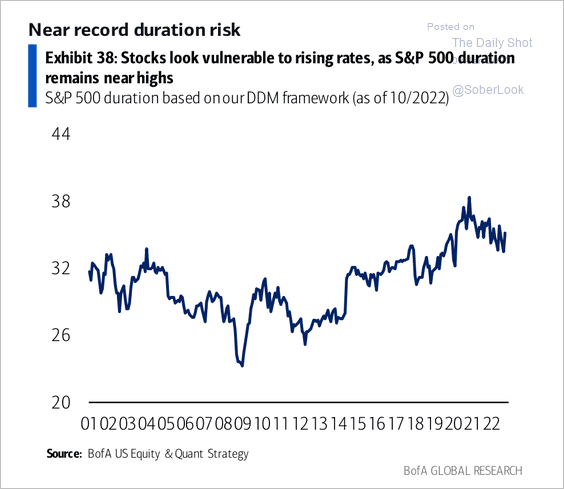

3. S&P 500 duration remains elevated.

Source: BofA Global Research

Source: BofA Global Research

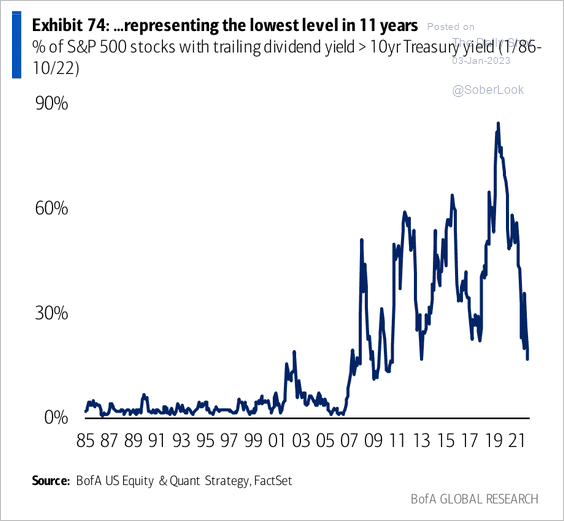

Roughly 16% of S&P 500 stocks have a dividend yield above 4%, the lowest level in 11 years.

Source: BofA Global Research

Source: BofA Global Research

——————–

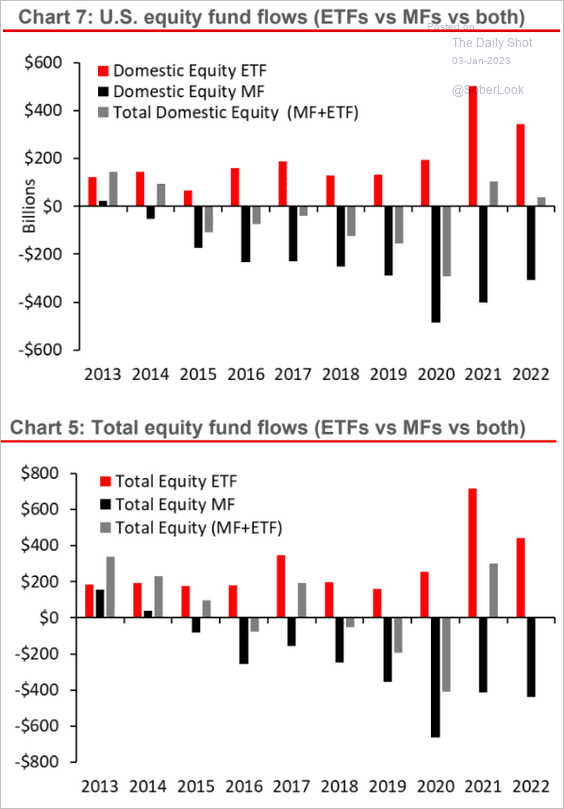

4. US equity funds saw net inflows in 2022. The rotation from mutual funds to ETFs continues.

Source: MUFG Securities

Source: MUFG Securities

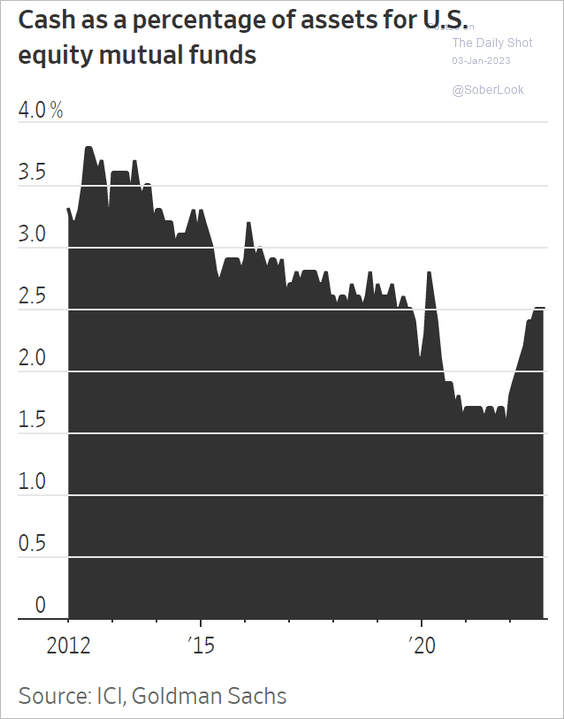

5. Mutual funds boosted cash holdings last year to manage redemptions.

Source: @WSJ Read full article

Source: @WSJ Read full article

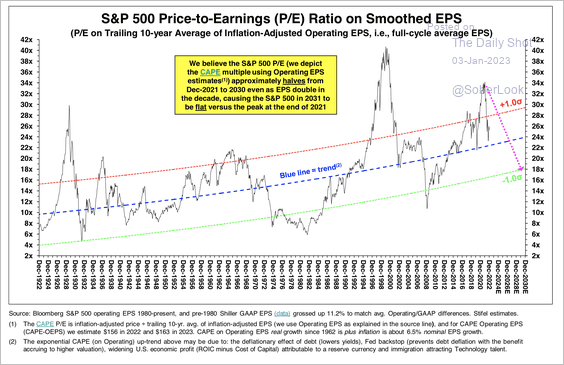

6. There is plenty of room for S&P 500 valuation compression, similar to the early 2000s.

Source: Stifel

Source: Stifel

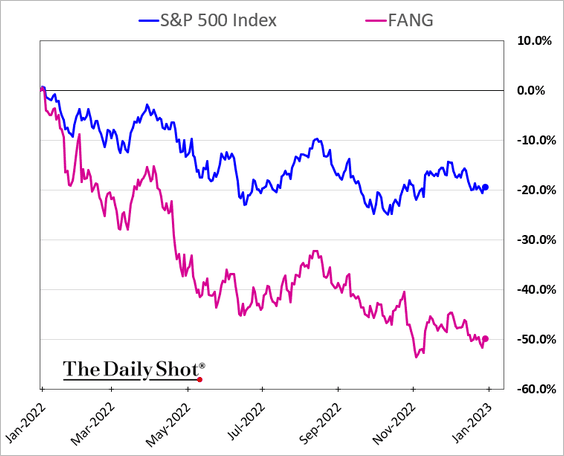

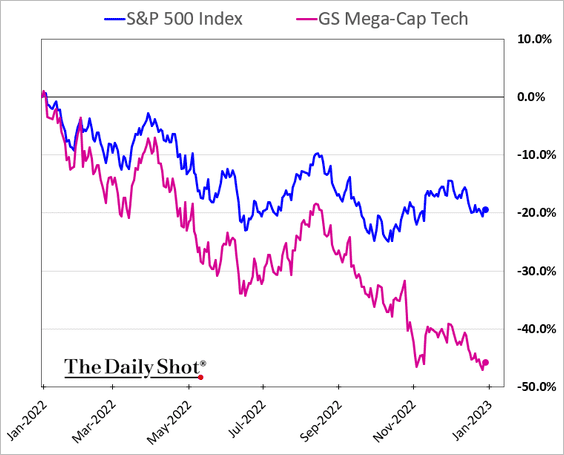

7. FANG stocks underperformed the S&P 500 by 30% in 2022.

Goldman’s basket of mega-cap tech shares is not far behind.

——————–

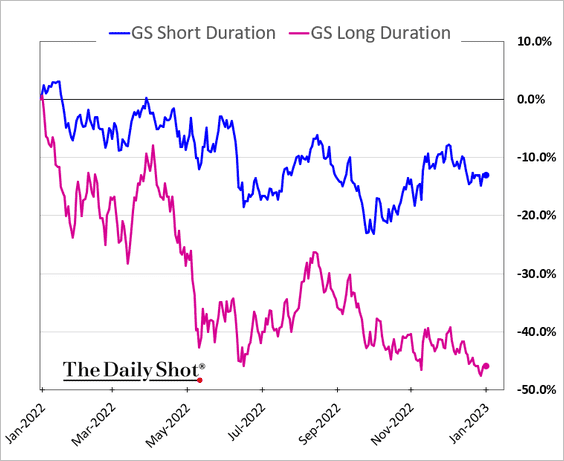

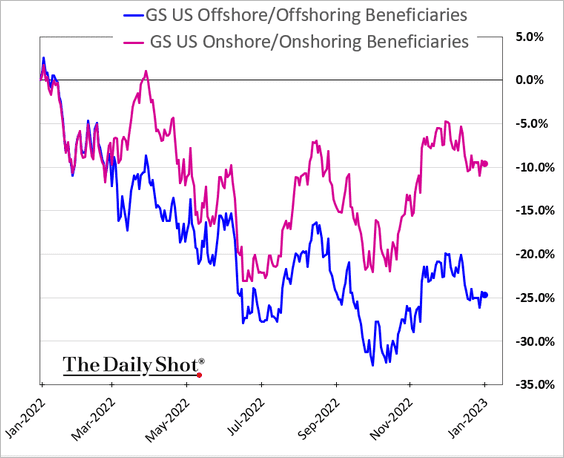

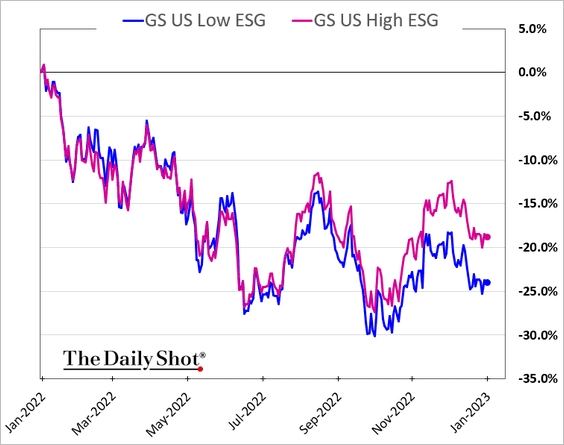

8. Next, we have some additional performance trends in 2022.

• Short- vs. long-duration shares:

• US companies that are onshoring or have significant onshore presence/supply chains (vs. those with significant offshore production/supply chains):

• High vs. low ESG baskets:

Back to Index

Credit

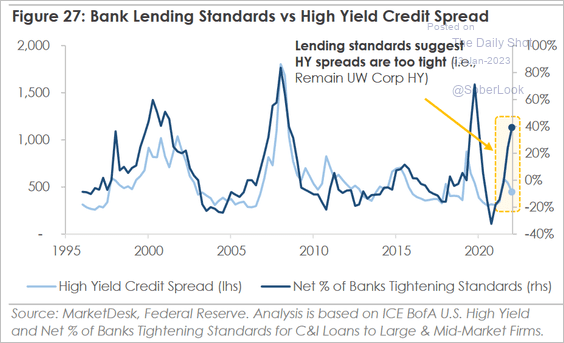

1. Tighter bank lending standards point to wider HY spreads ahead.

Source: MarketDesk Research

Source: MarketDesk Research

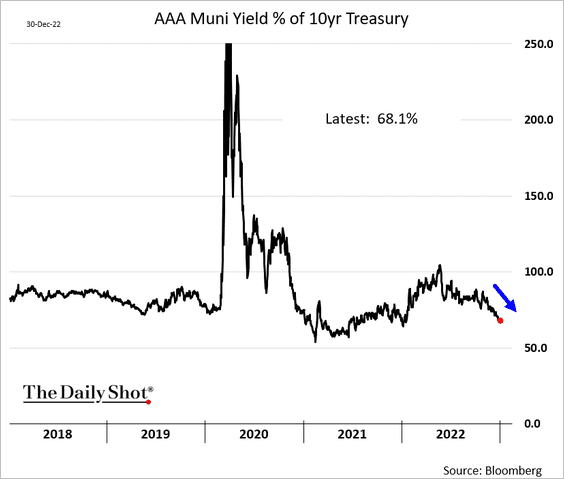

2. Munis have been outperforming Treasuries in recent months.

Back to Index

Rates

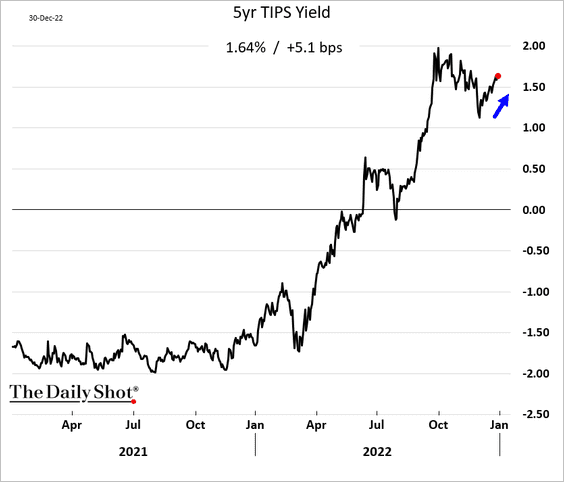

1. Real yields have been rising, putting pressure on growth stocks.

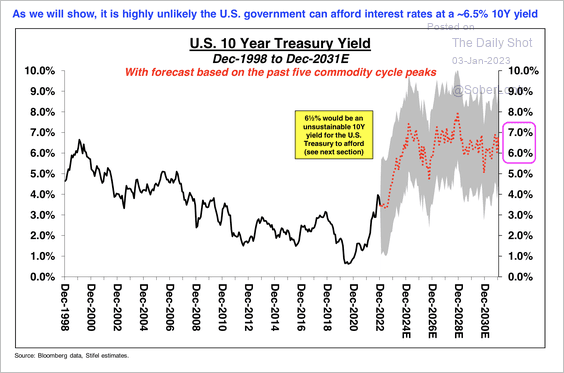

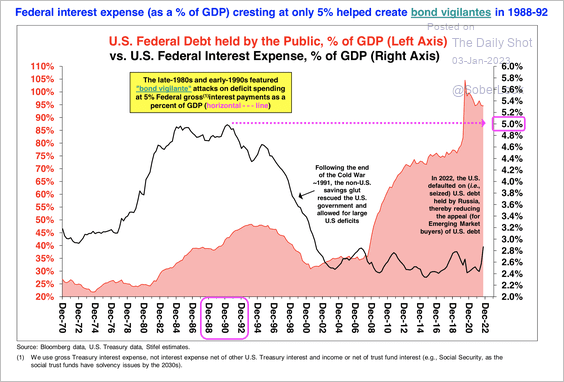

2. Stifel expects the 10-year Treasury yield to reach 6%-7% over the next couple of years, making government borrowing much more expensive. (2 charts)

Source: Stifel

Source: Stifel

Source: Stifel

Source: Stifel

——————–

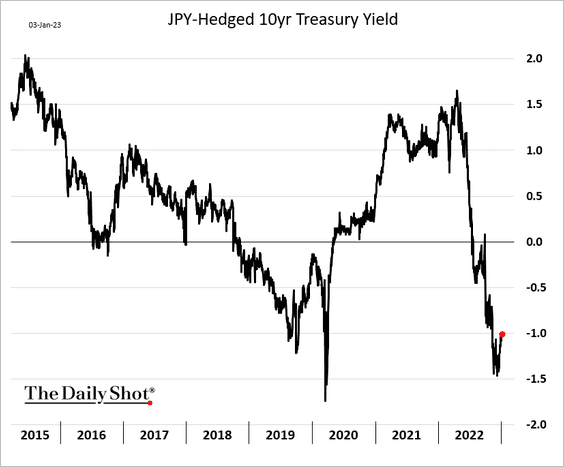

3. Treasuries are not attractive to Japanese investors.

Back to Index

Global Developments

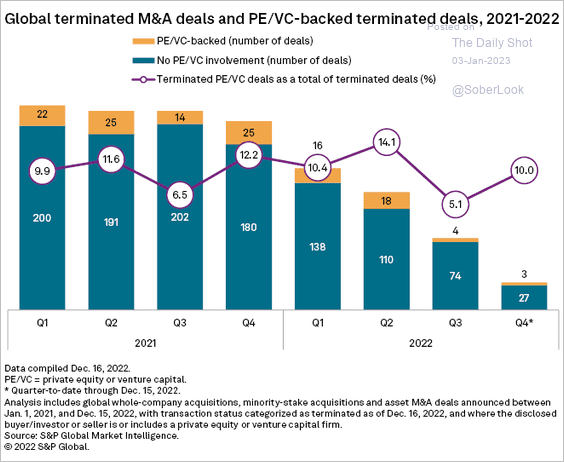

1. M&A activity slowed sharply as 2022 progressed.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

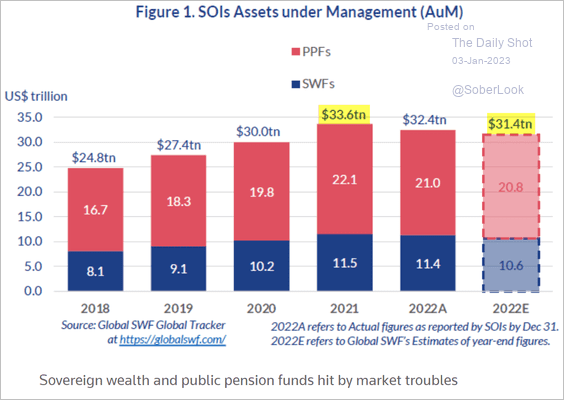

2. Sovereign wealth and public pension funds took a hit in 2022.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

Food for Thought

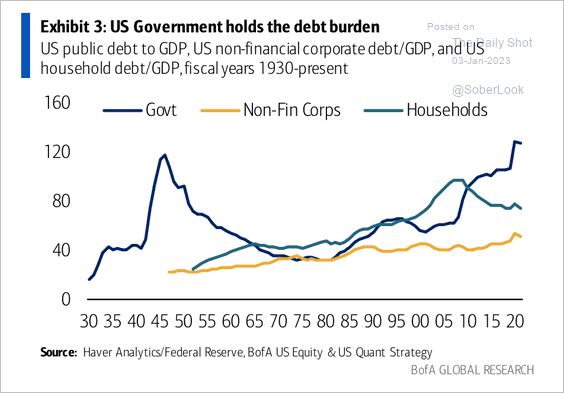

1. US public, corporate, and household debt as a share of GDP:

Source: BofA Global Research

Source: BofA Global Research

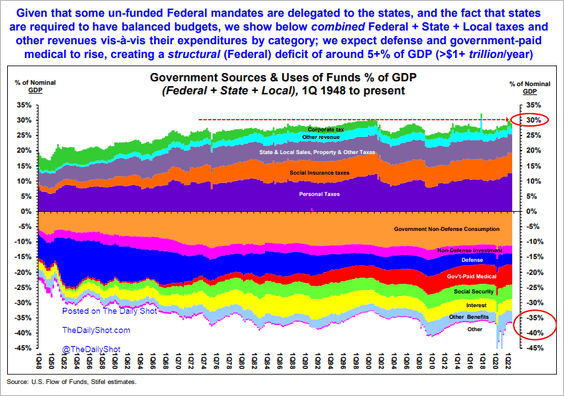

2. US federal, state, and local revenues and expenditures:

Source: Stifel

Source: Stifel

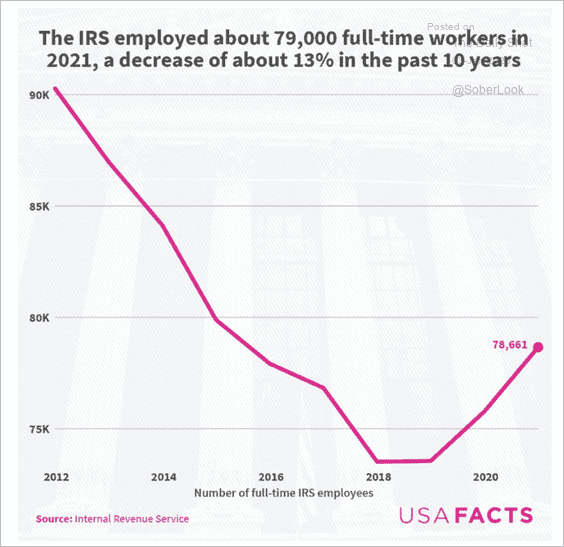

3. IRS employment:

Source: USAFacts

Source: USAFacts

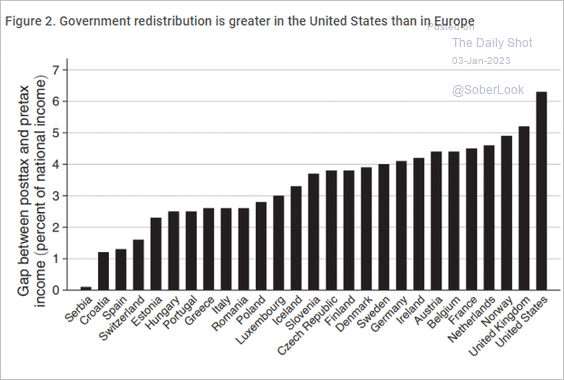

4. Income “redistribution” rates:

Source: LSE Read full article

Source: LSE Read full article

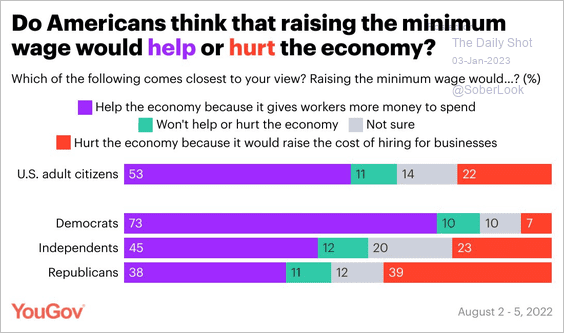

5. Views on raising the minimum wage:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

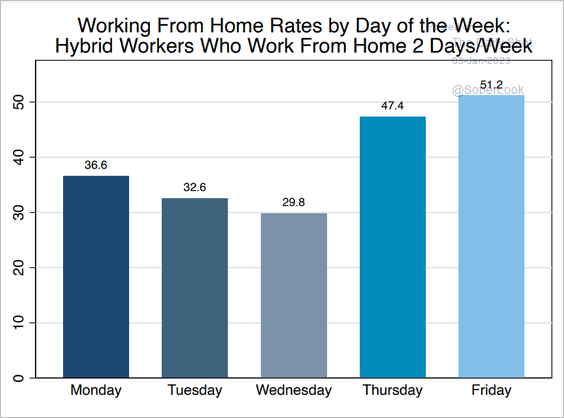

6. Working-from-home rates by day of the week:

Source: WFH Research Read full article

Source: WFH Research Read full article

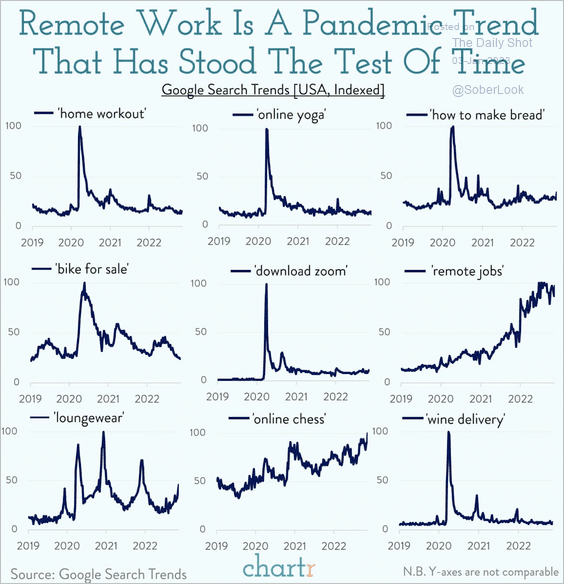

7. Remote work and online chess after lockdowns:

Source: @chartrdaily

Source: @chartrdaily

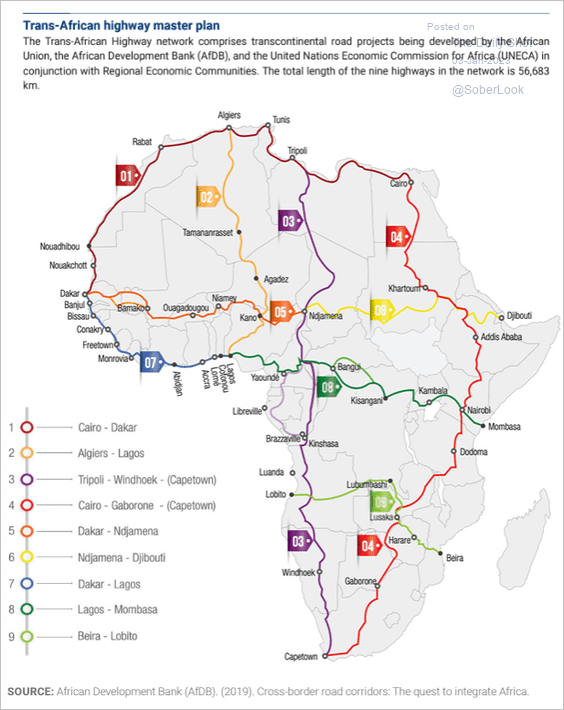

8. The Trans-African highway master plan:

Source: Brookings Read full article

Source: Brookings Read full article

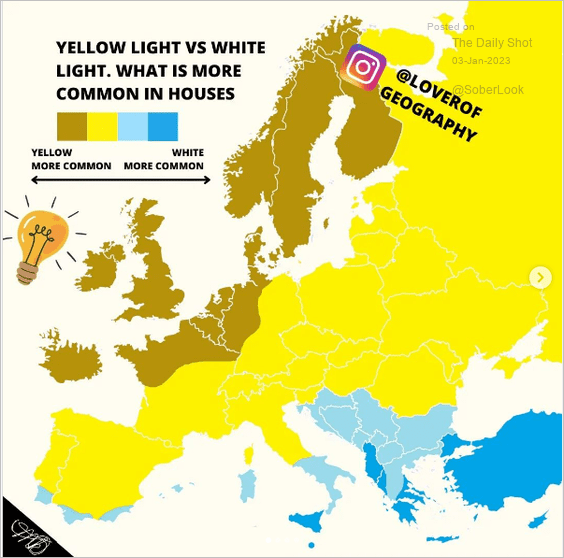

9. Yellow or white light:

Source: @loverofgeography

Source: @loverofgeography

——————–

Back to Index