The Daily Shot: 13-Feb-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

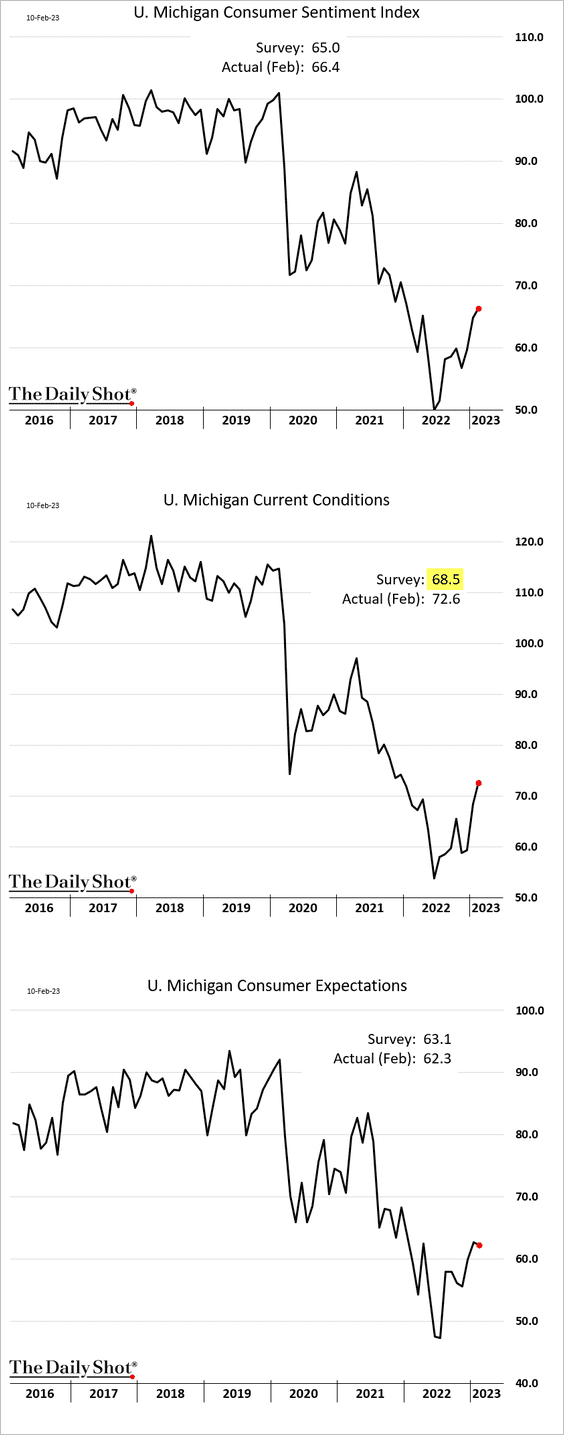

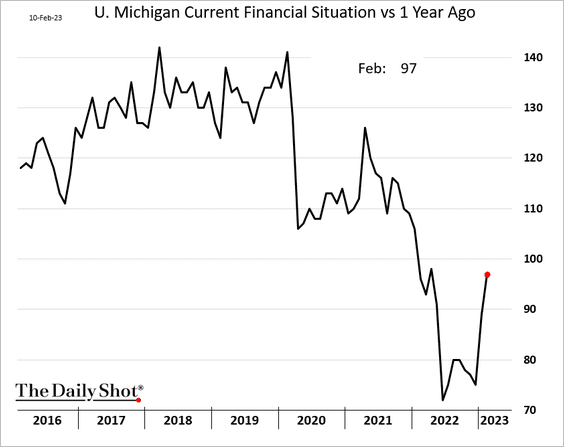

1. The U. Michigan sentiment index showed further improvement this month. The “current conditions” component (which tends to be correlated to consumer spending) drove the gains in the headline index, while the expectations indicator edged lower.

The indicator of current financial conditions (vs. a year ago) bounced from the lows this year.

——————–

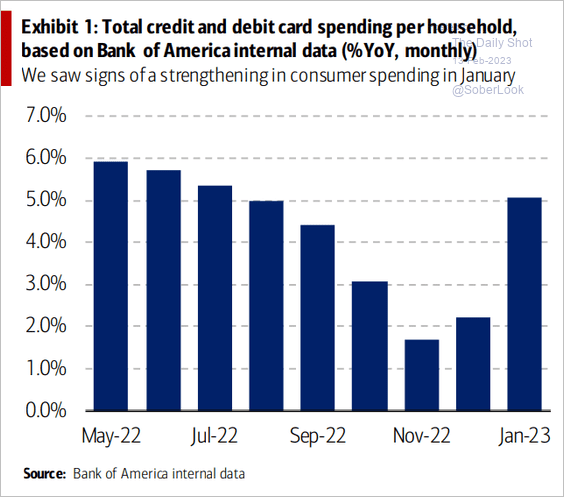

2. BofA card data signaled robust consumption in January. Where is that recession everyone keeps talking about?

Source: BofA Global Research

Source: BofA Global Research

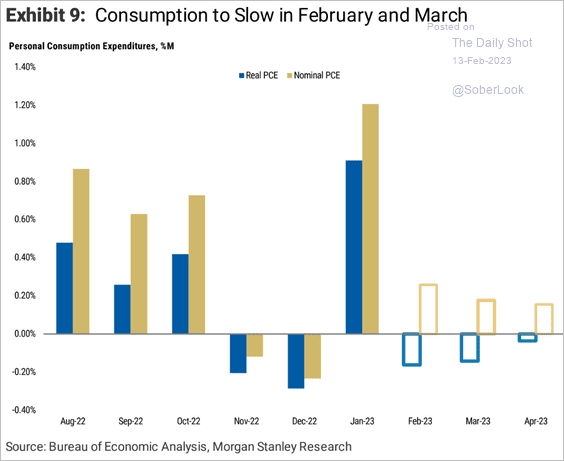

• Consumption is expected to slow in February and March.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

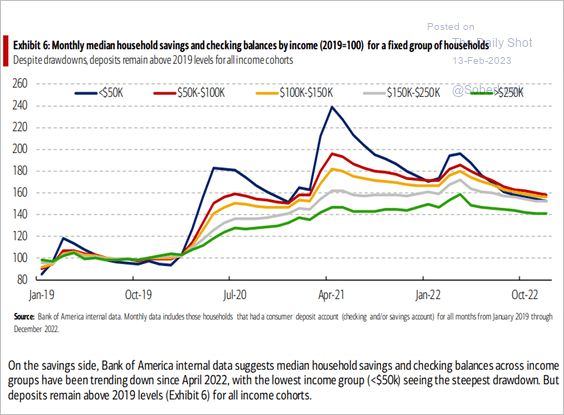

• The decline in household savings has been relatively slow, according to data from BofA.

Source: BofA Global Research

Source: BofA Global Research

——————–

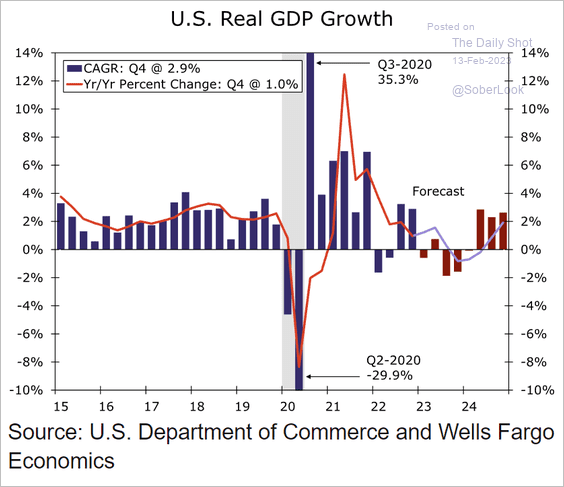

3. Wells Fargo sees three down quarters this year (including the current quarter), …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

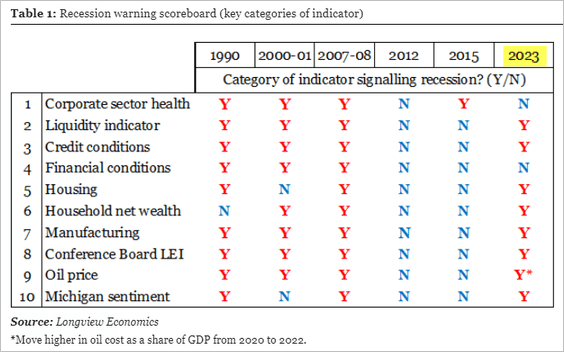

… with most leading indicators now signaling a recession.

Source: Longview Economics

Source: Longview Economics

——————–

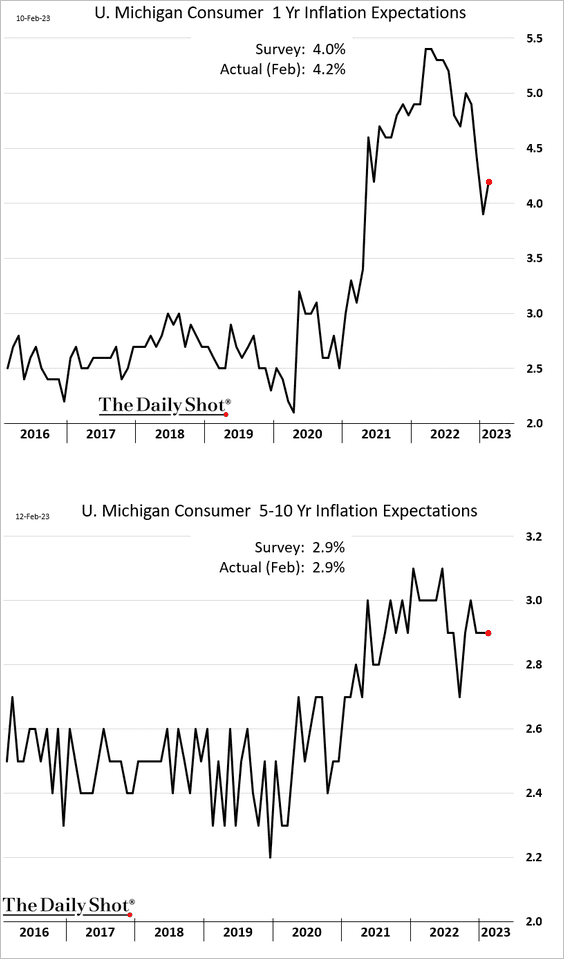

4. The U. Michigan short-term inflation expectations increased this month.

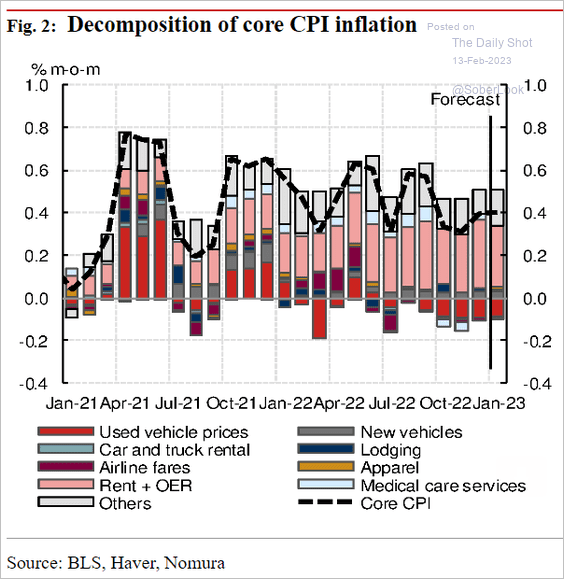

• What should we expect from the CPI report this week? Nomura sees the core inflation holding at elevated levels (consistent with consensus estimates).

Source: Nomura Securities

Source: Nomura Securities

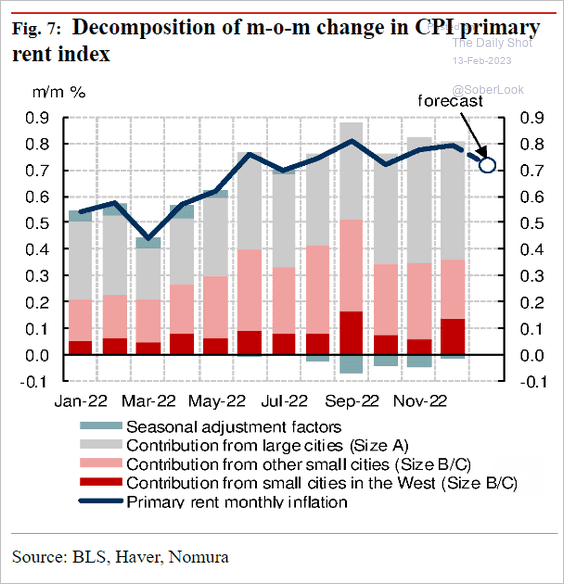

– Rent inflation remains high.

Source: Nomura Securities

Source: Nomura Securities

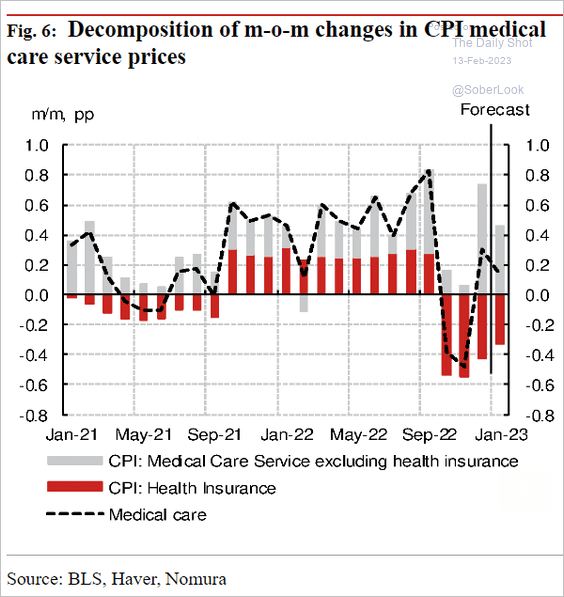

– Medical care services inflation jumped last month, partially offset by lower health insurance costs.

Source: Nomura Securities

Source: Nomura Securities

——————–

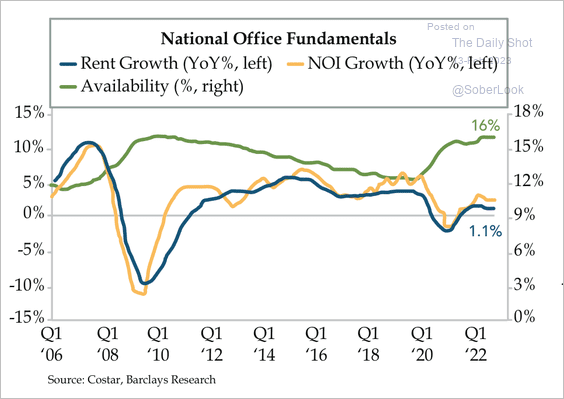

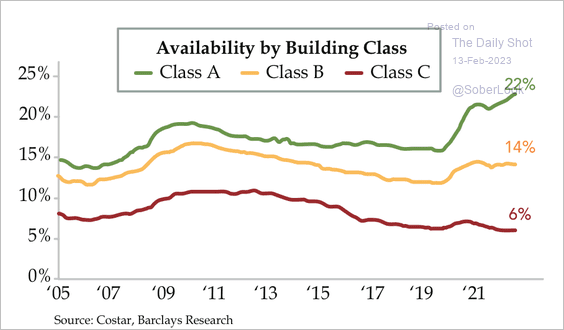

5. Office availability is rising, while rent growth remains below pre-COVID levels.

Source: Quill Intelligence

Source: Quill Intelligence

The availability of Class A office space (prime spots with above-average rents) has risen.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

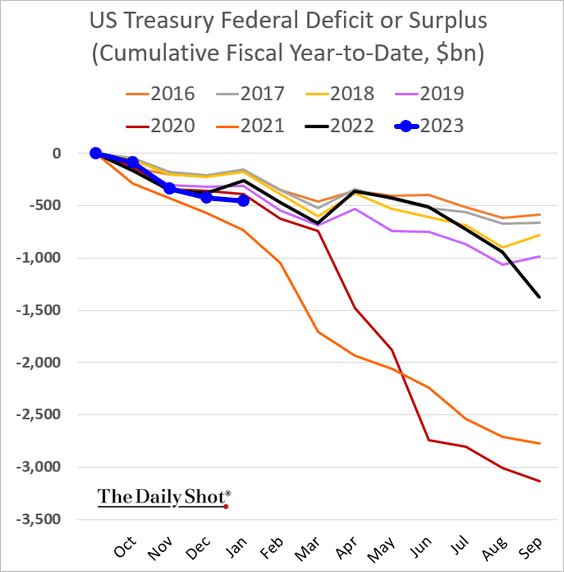

6. The budget deficit was narrower than expected in January.

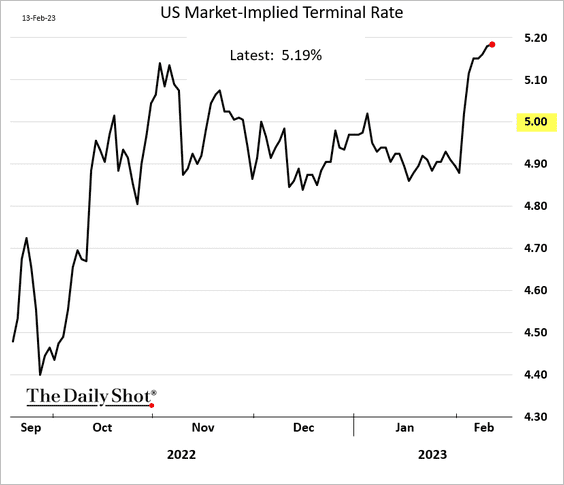

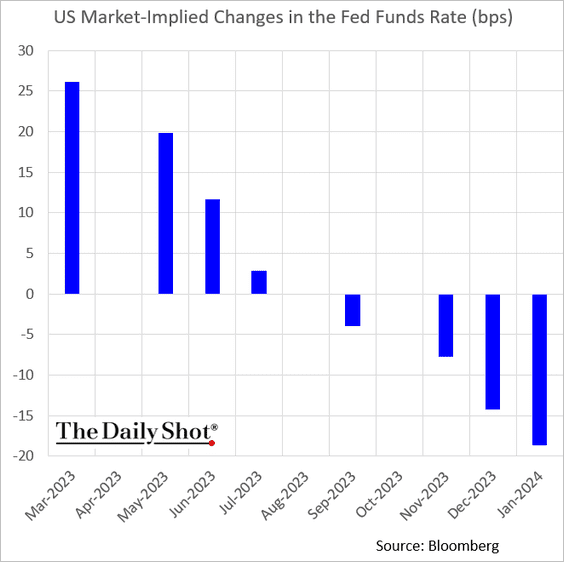

7. The market now expects the Fed to send the overnight rate near 5.2% before ending the tightening cycle.

Back to Index

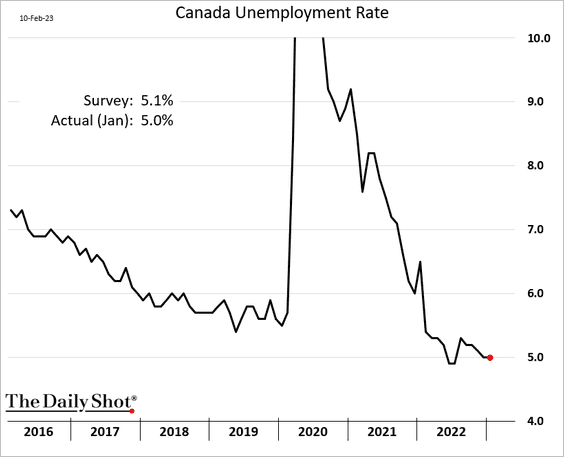

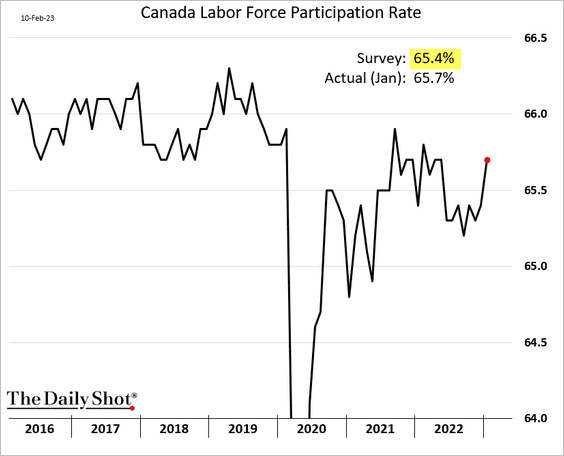

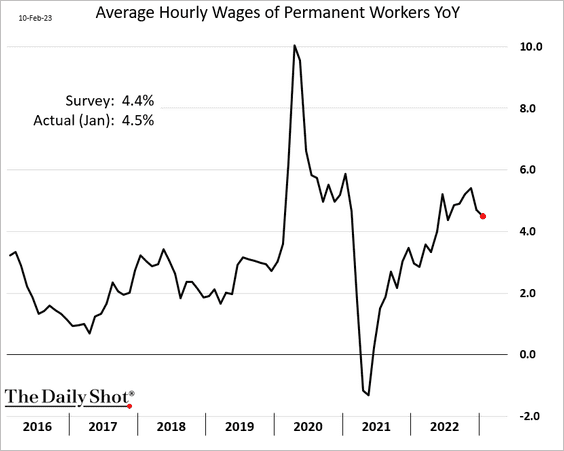

Canada

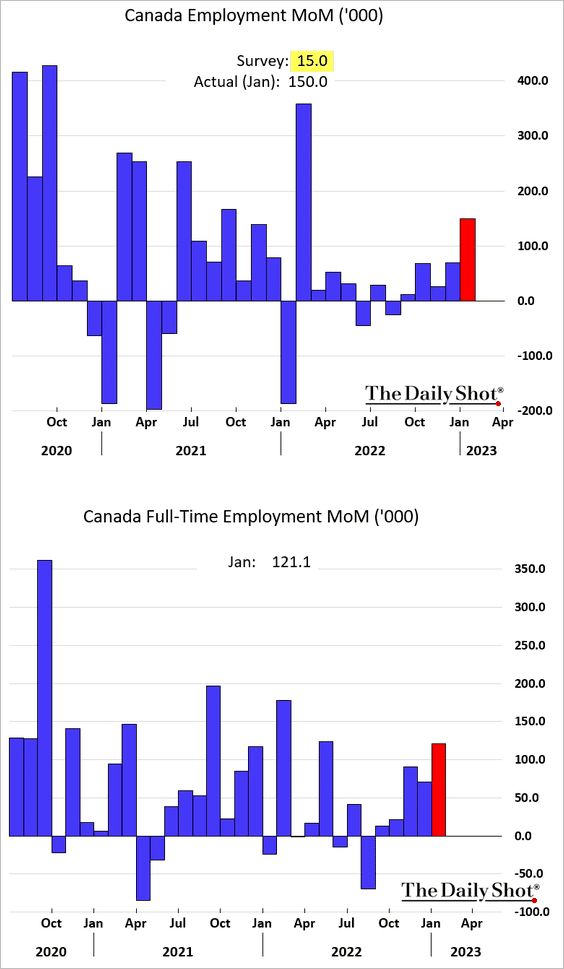

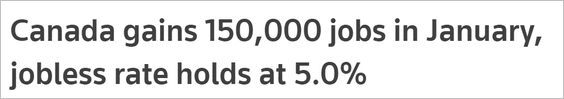

1. Canada’s January employment report massively exceeded expectations (similar to the US).

Source: Reuters Read full article

Source: Reuters Read full article

• Total payrolls breached 20 million for the first time.

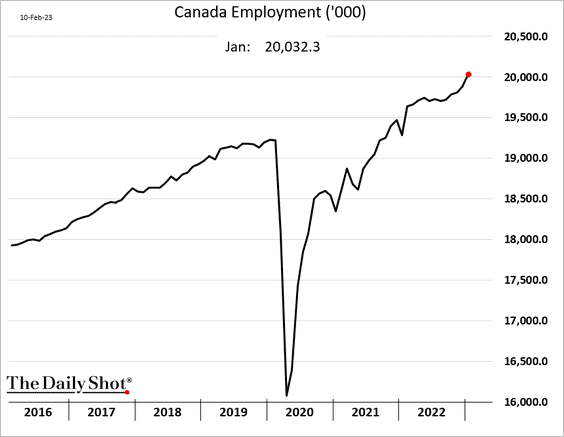

• Job gains were relatively broad.

Source: Oxford Economics

Source: Oxford Economics

• The unemployment rate held at 5%.

• Labor force participation jumped.

• Wage growth remains elevated.

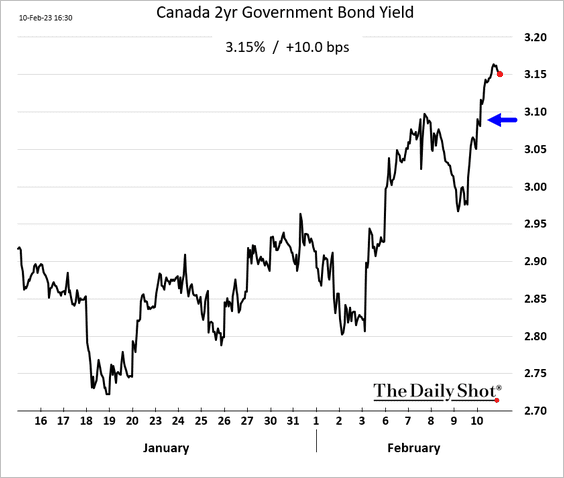

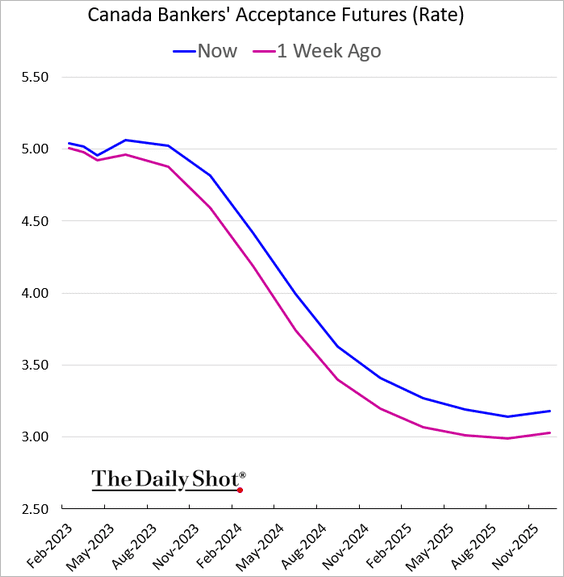

2. Bond yields climbed in response to the jobs report. More BoC rate hikes ahead?

The expected rate trajectory shifted up.

——————–

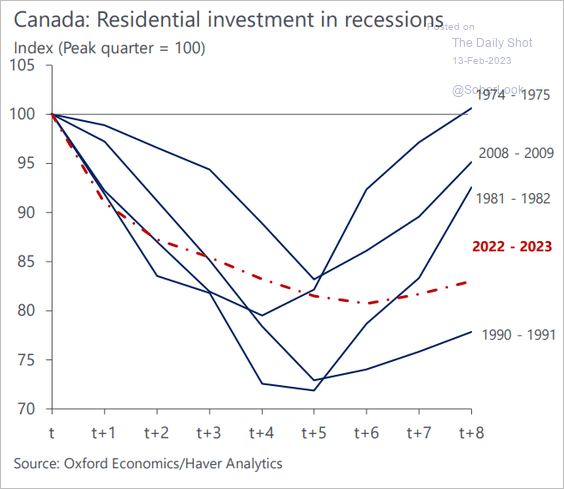

3. According to Oxford Economics, the recovery in residential investment will take longer than in a typical recession.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

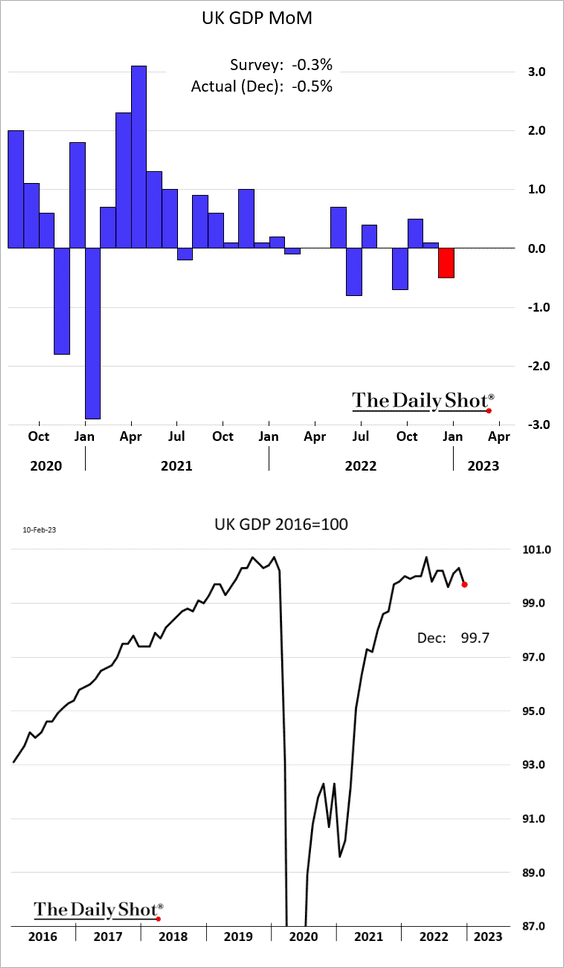

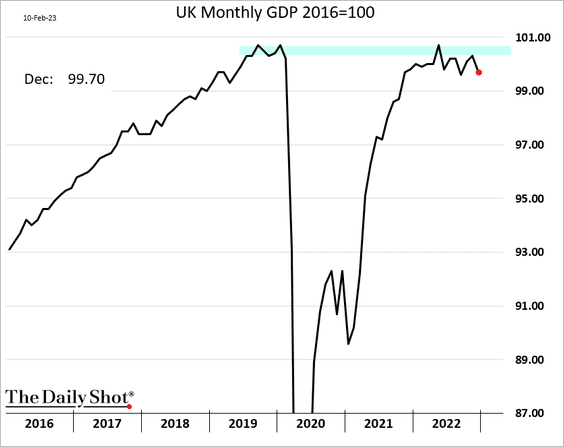

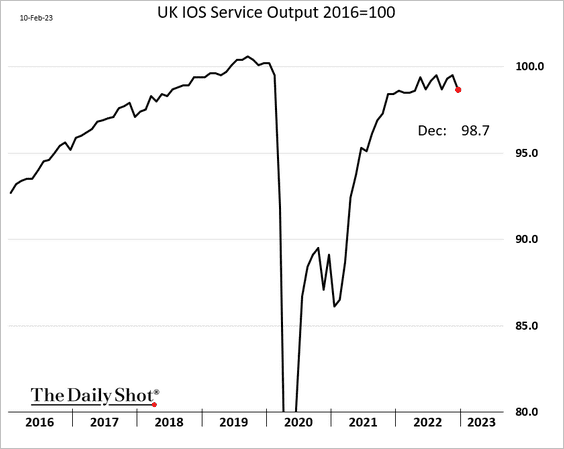

The monthly GDP index declined more than expected in December.

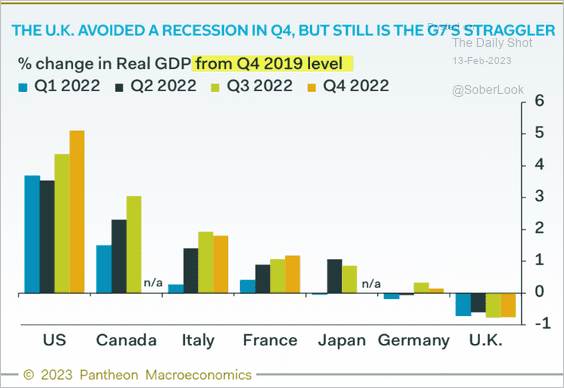

• The GDP remains below pre-COVID levels.

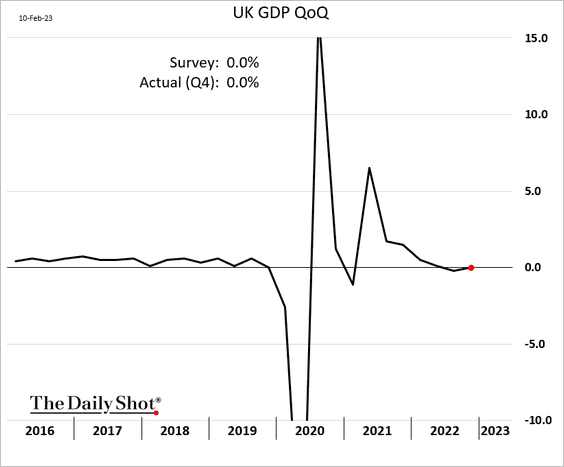

• The quarterly GDP was flat in Q4, …

… lagging the COVID-era recovery in other advanced economies.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

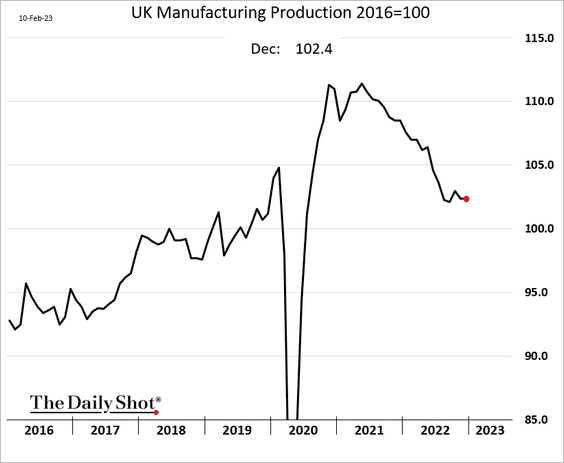

• Industrial production was unchanged in December.

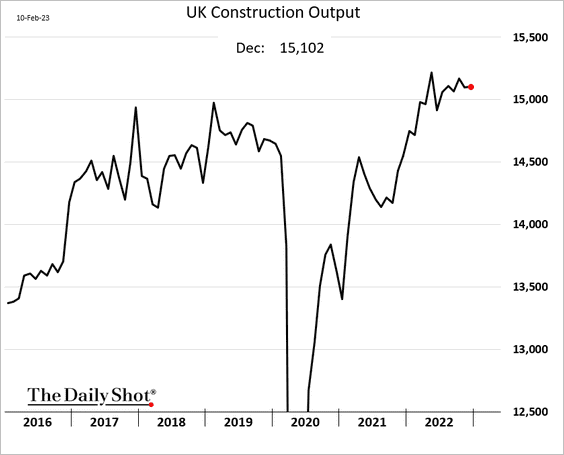

And so was construction activity.

But services output declined.

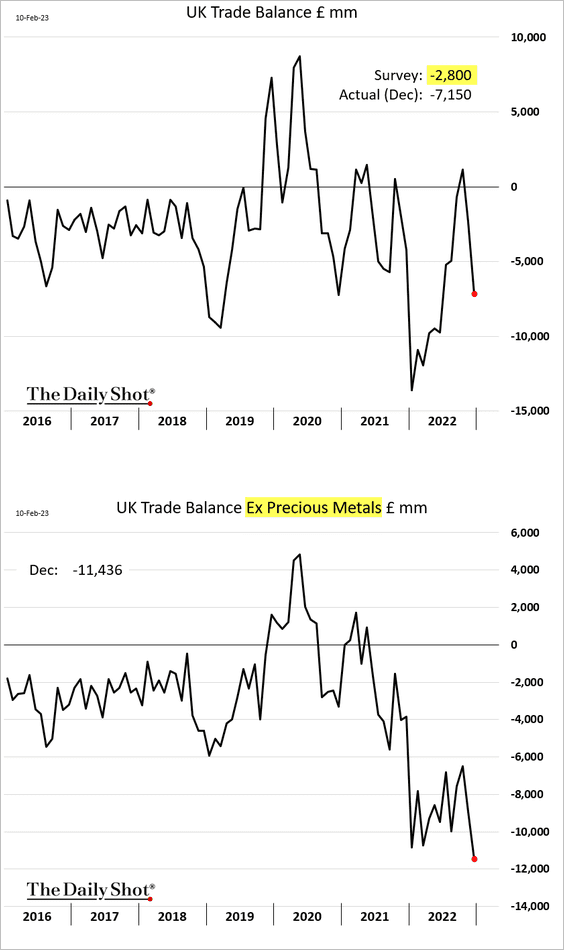

• The trade deficit widened sharply.

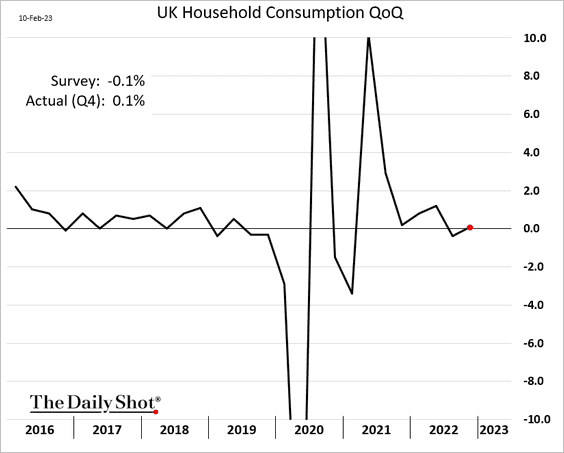

• Household consumption edged higher in Q4, …

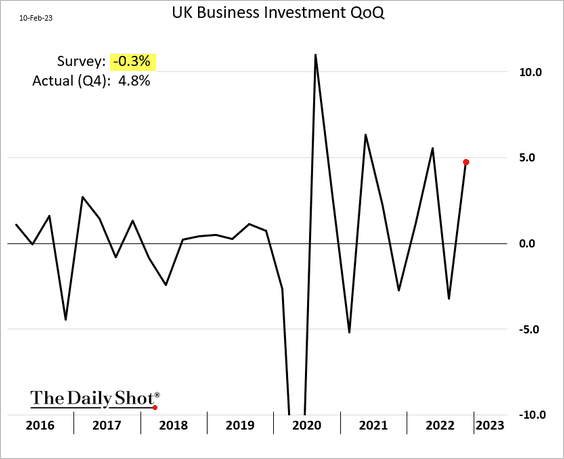

… and business investment improved.

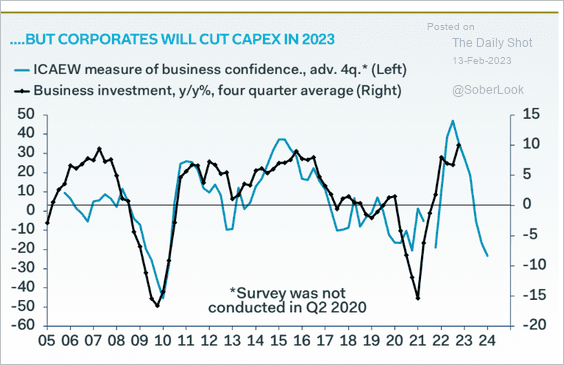

But business confidence signals a deterioration in CapEx ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

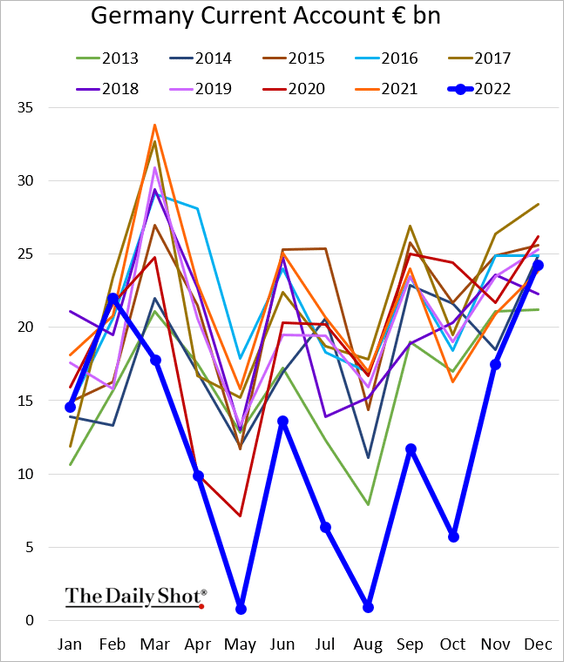

1. Germany’s current account surplus rebounded in recent months as energy costs cooled.

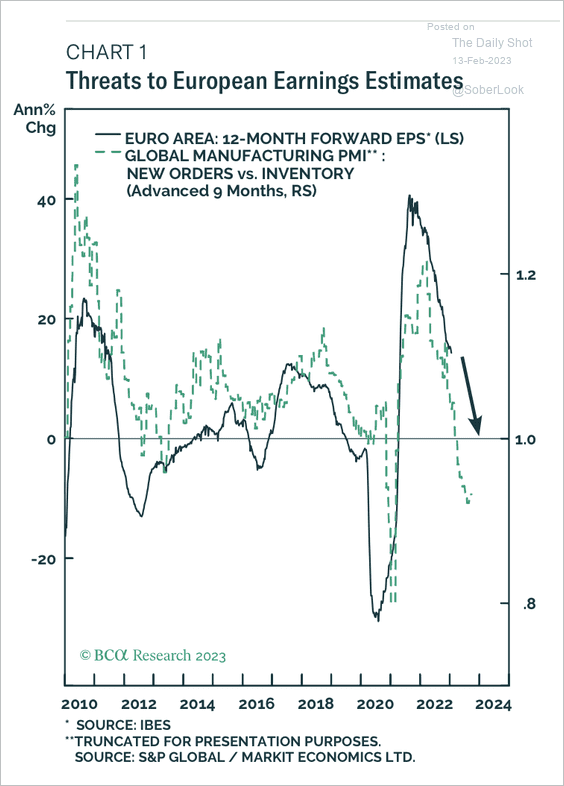

2. Weakness in global manufacturing could pressure earnings.

Source: BCA Research

Source: BCA Research

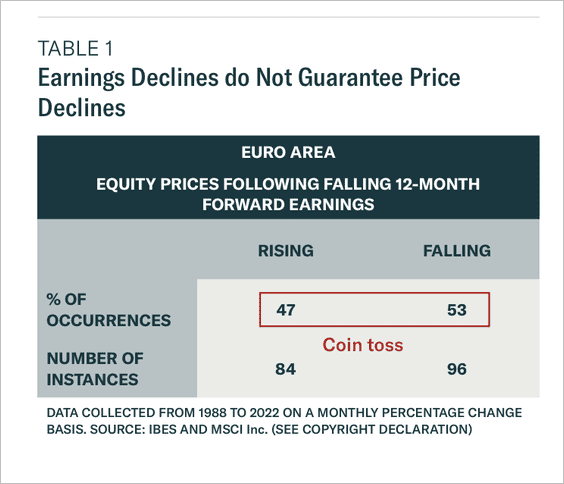

But lower earnings do not necessarily translate into falling stock prices.

Source: BCA Research

Source: BCA Research

——————–

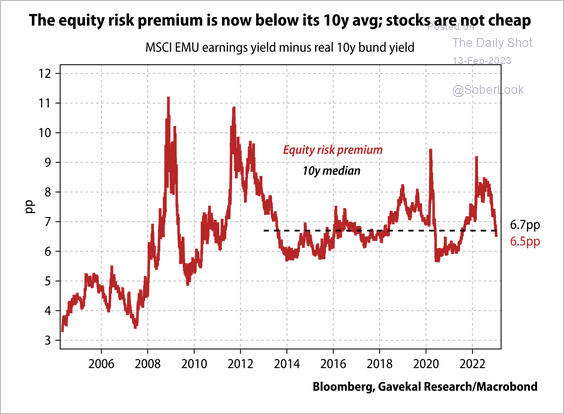

3. The recent equity market rally has eliminated the excess risk premium over bonds.

Source: Gavekal Research

Source: Gavekal Research

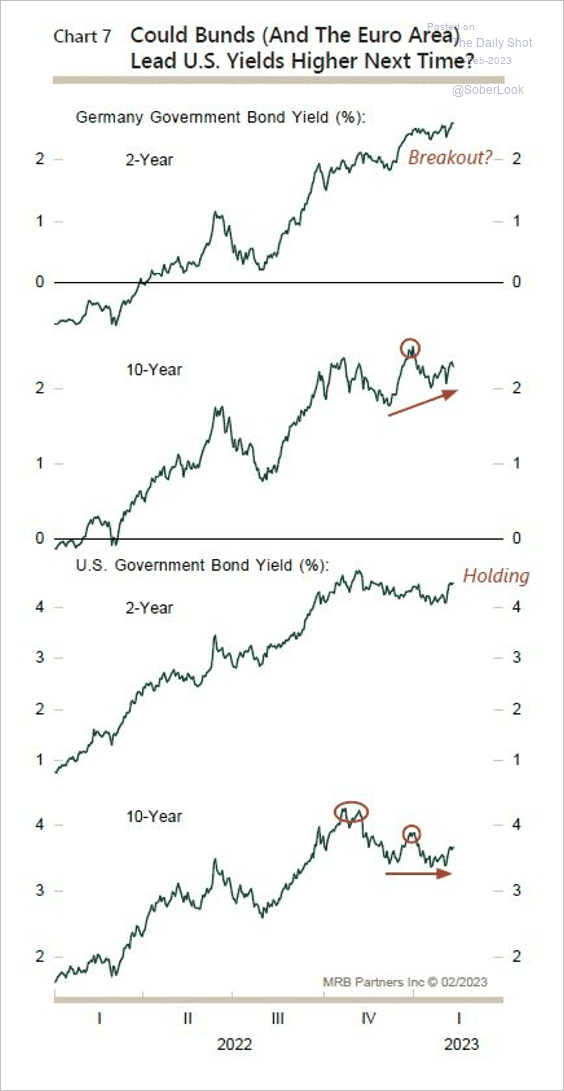

4. German bond yields exhibit stronger upside momentum versus US yields. A wider yield differential could bode well for EUR/USD.

Source: MRB Partners

Source: MRB Partners

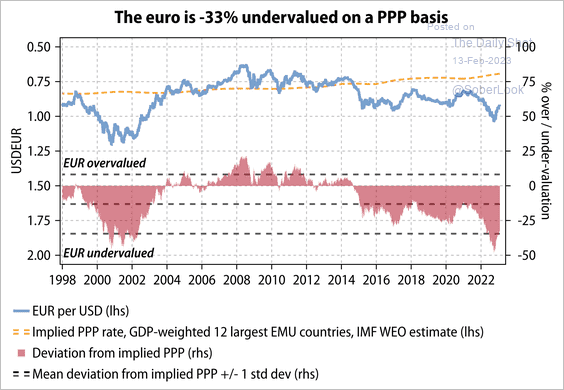

• The euro appears undervalued based on purchasing power parity.

Source: Gavekal Research

Source: Gavekal Research

• EUR/USD faced initial resistance at its 200-week moving average.

Back to Index

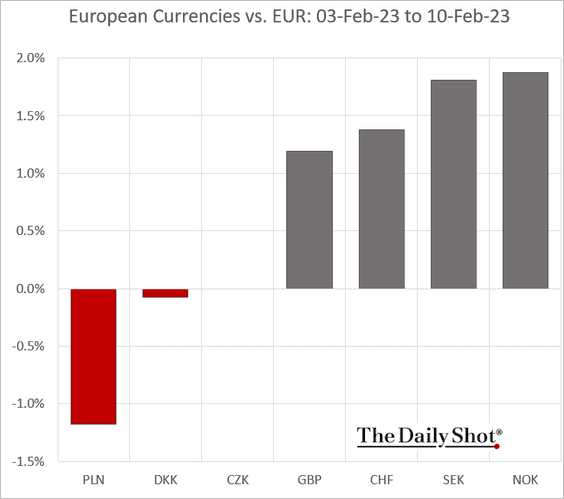

Europe

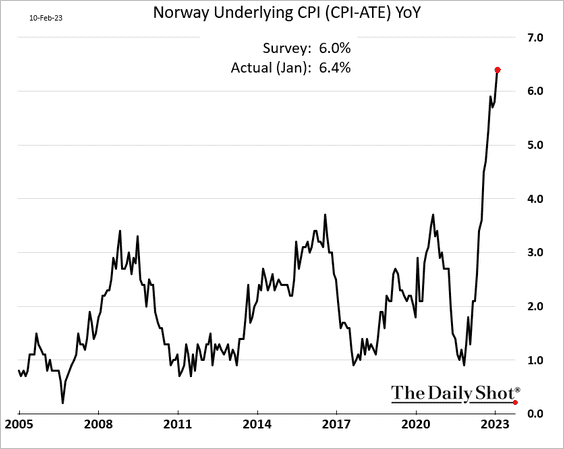

1. Norway’s core inflation continues to surge.

The krone outperformed last week.

——————–

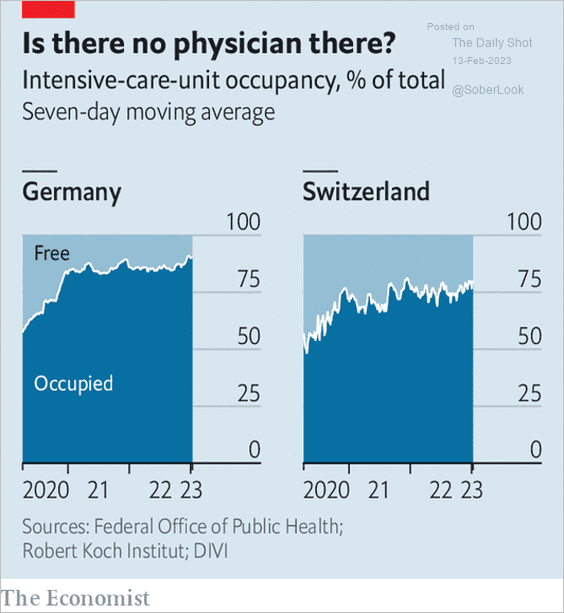

2. Intensive-care units have been getting busier in Germany and Switzerland.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

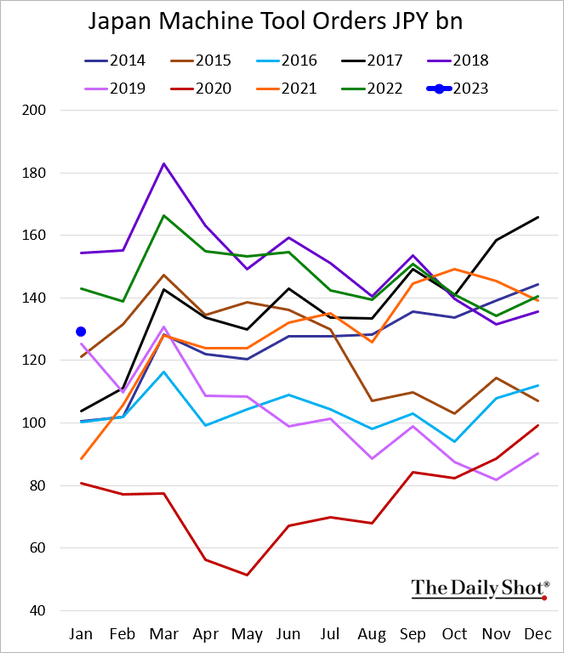

Japan

1. Machine tool orders were below last year’s levels in January.

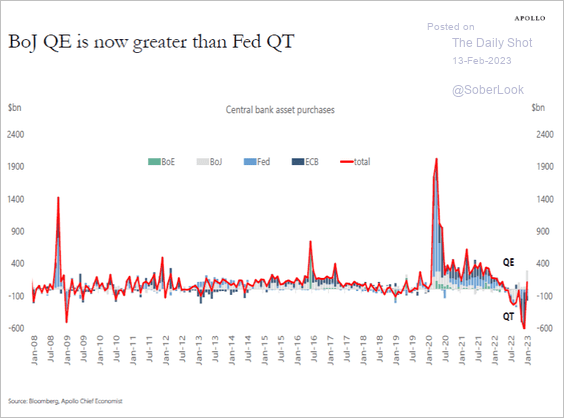

2. The BoJ’s QE is more than offsetting balance sheet reductions by other central banks. It’s not sustainable.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

China

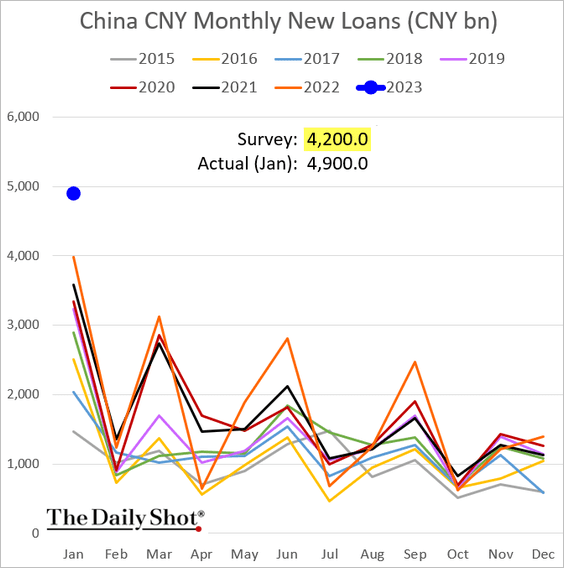

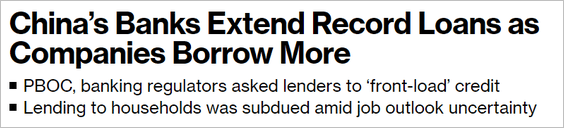

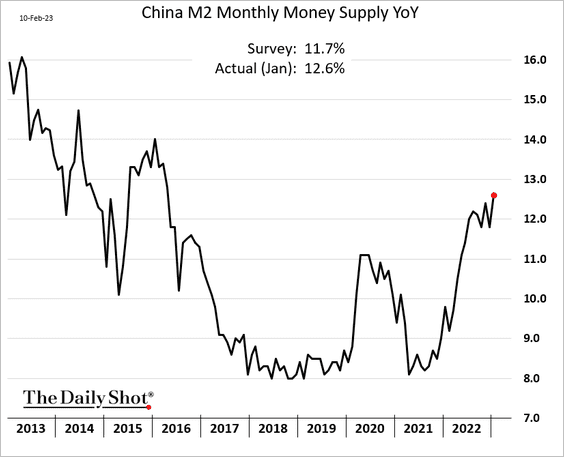

1. January loan growth surprised to the upside.

Source: @markets Read full article

Source: @markets Read full article

• Total credit growth was slightly below last year’s levels but also topped expectations.

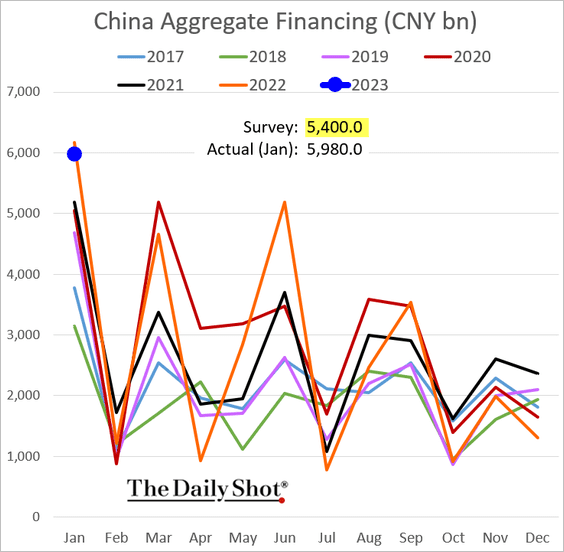

• The broad money supply expansion accelerated.

——————–

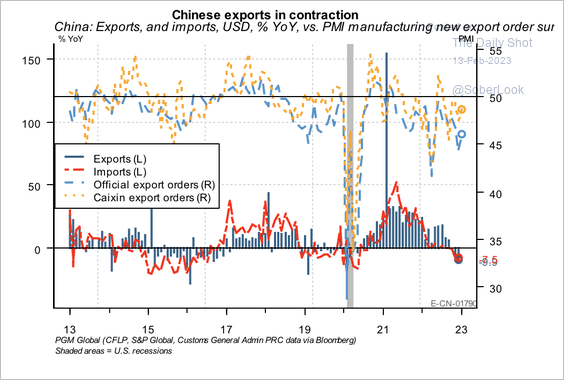

2. China’s exports have been contracting faster than the pace of global trade.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

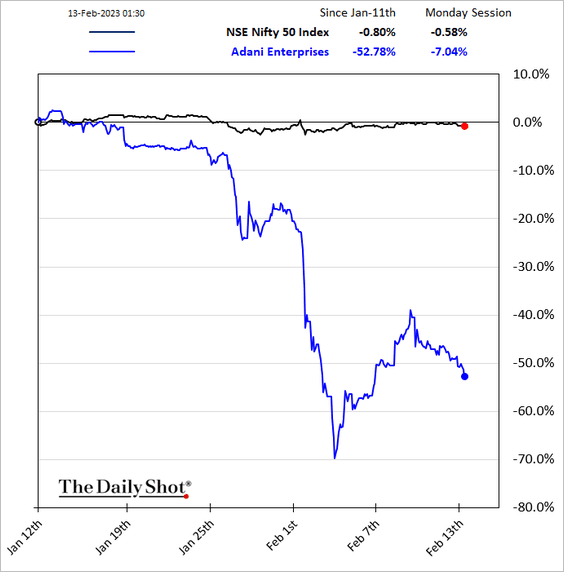

1. The rebound in Adani shares is fading rapidly. India’s other large-cap stocks have been holding up well.

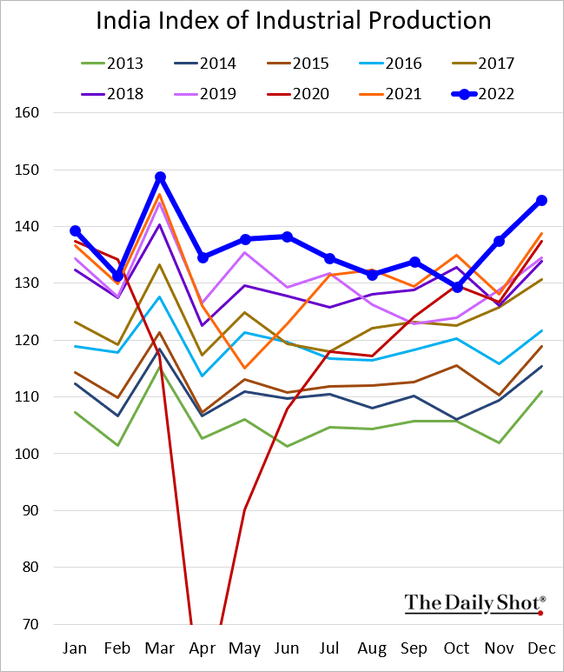

• India’s industrial production climbed less than expected in December.

——————–

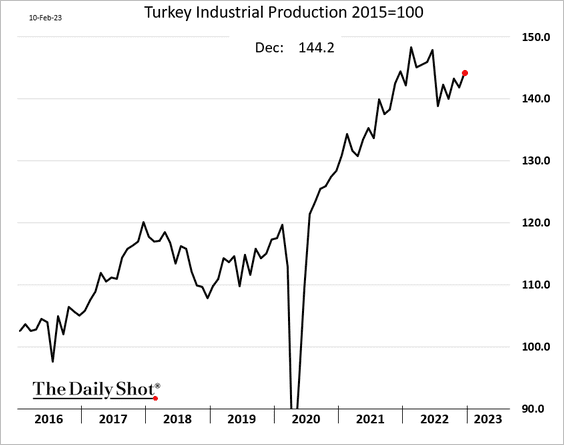

2. Turkey’s industrial production continued to rebound in December.

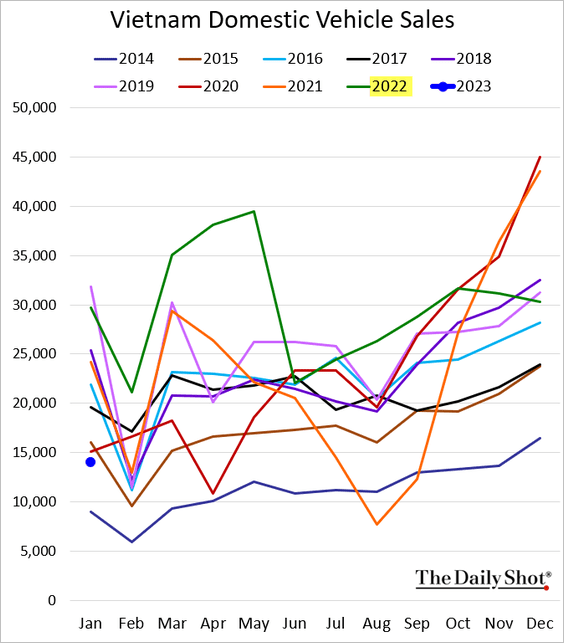

3. Vietnam’s vehicle sales plunged last month relative to January 2022 levels.

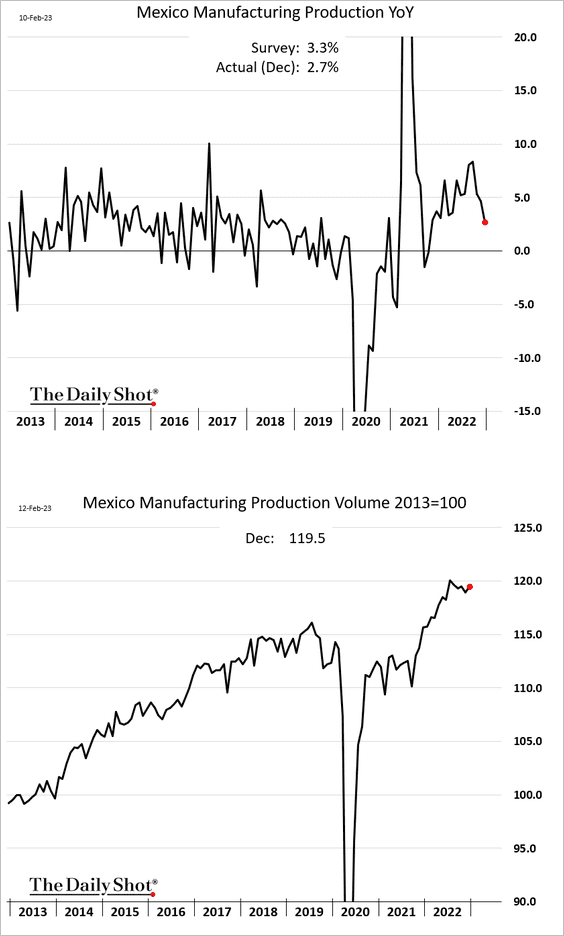

4. Mexico’s manufacturing output growth has been slowing but remains elevated.

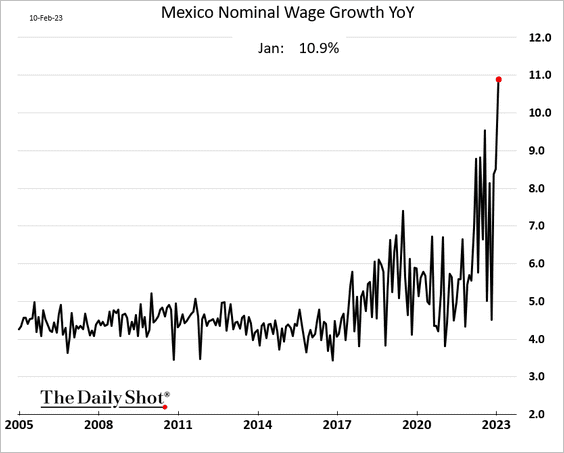

Wage growth surged in January.

——————–

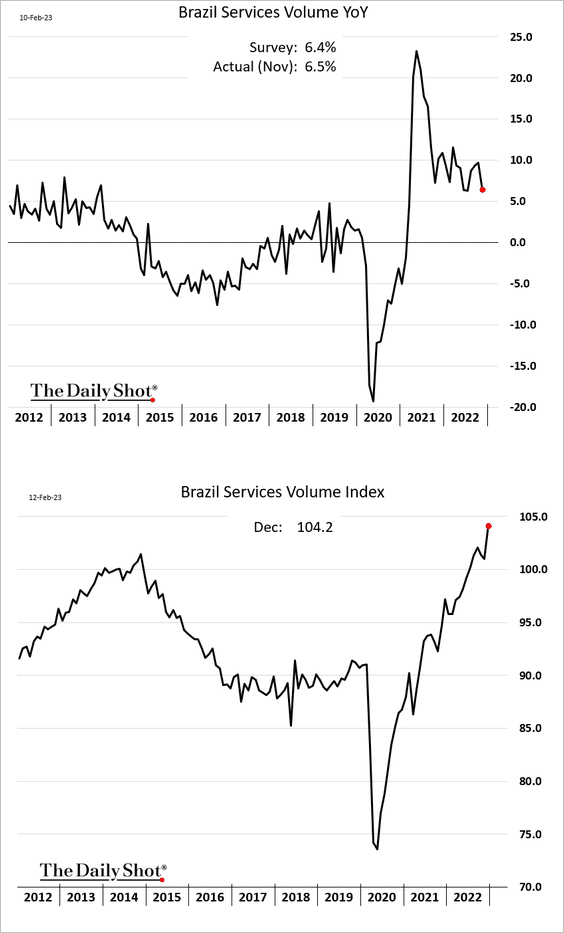

5. Brazil’s service sector output continues to climb.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

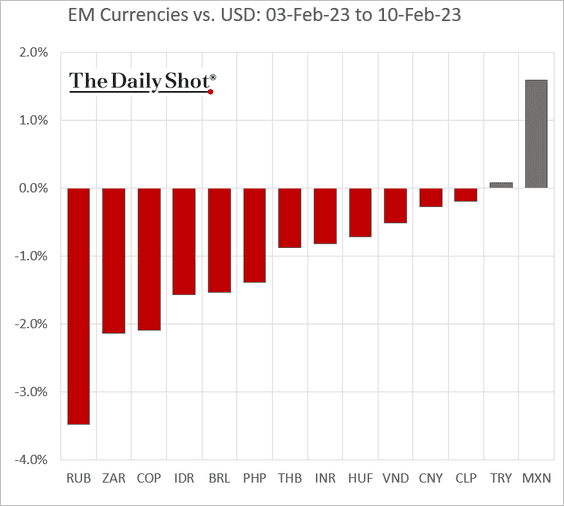

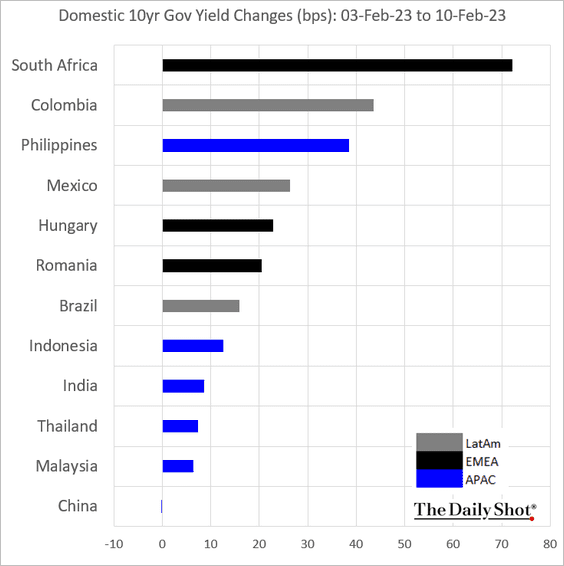

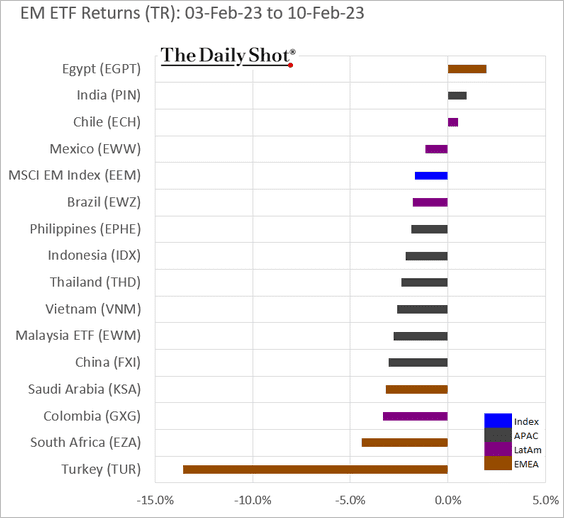

6. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

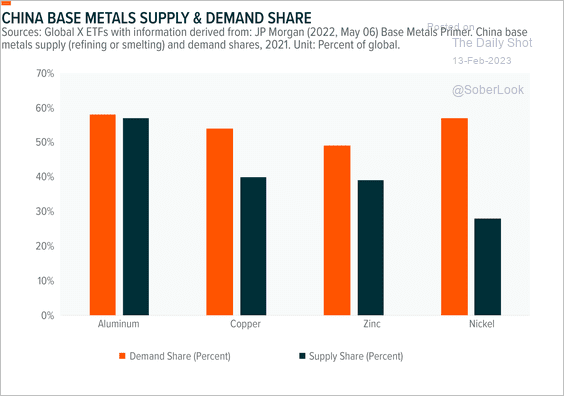

1. China imports more base metals than it consumes, which has a significant impact on prices.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

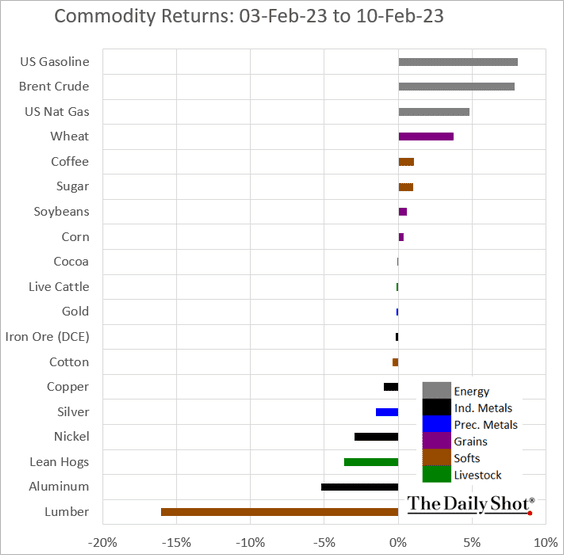

2. Here is last week’s performance across key commodity markets.

Back to Index

Energy

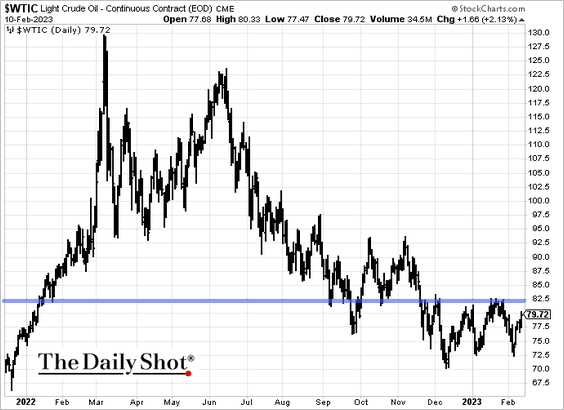

1. Oil prices rose in response to Russia’s production cut announcement, but demand concerns tempered gains.

Source: Reuters Read full article

Source: Reuters Read full article

Here is NYMEX crude.

——————–

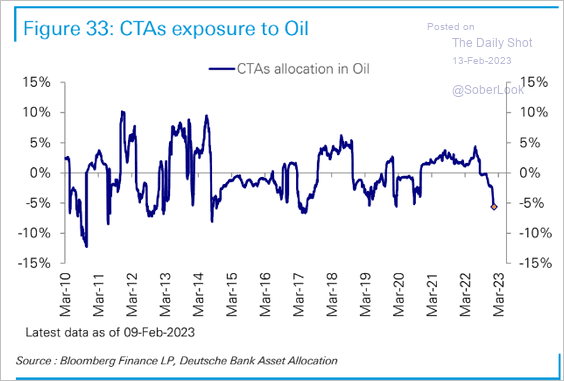

2. CTAs have been cutting their exposure to oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

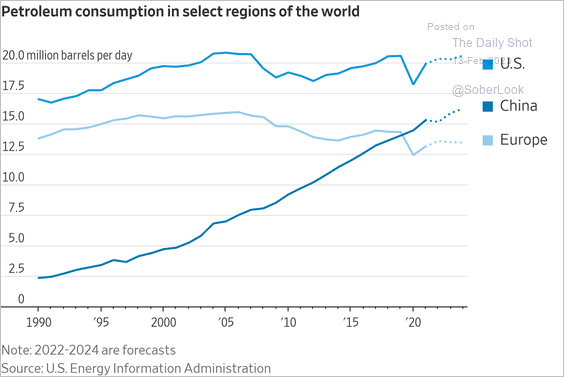

3. This chart shows petroleum consumption in select regions.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

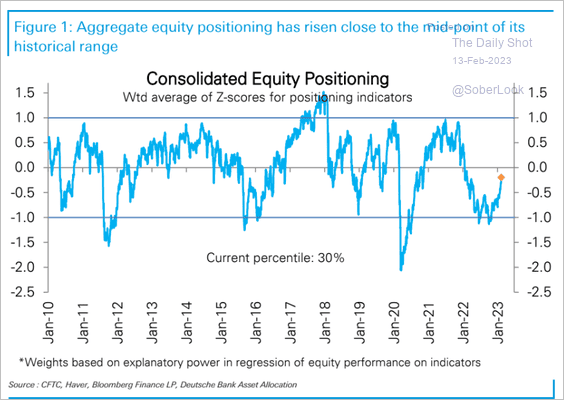

1. Deutsche Bank’s positioning indicator has been nearing its midpoint level.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

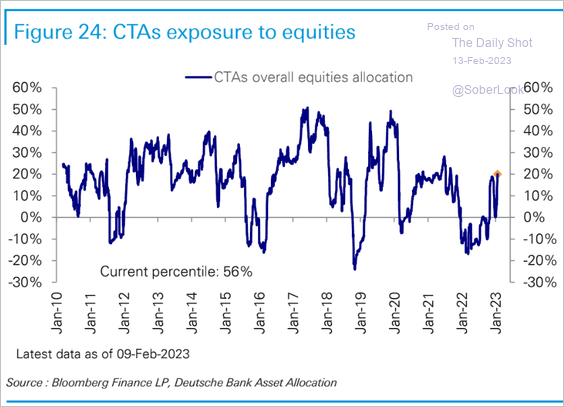

• CTAs continue to boost their exposure.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

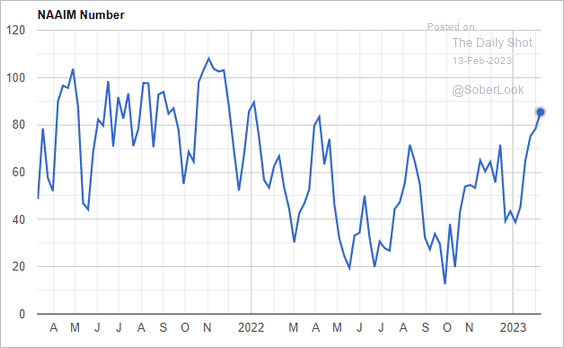

• Investment managers’ aggregate exposure index has also been rising.

Source: NAAIM

Source: NAAIM

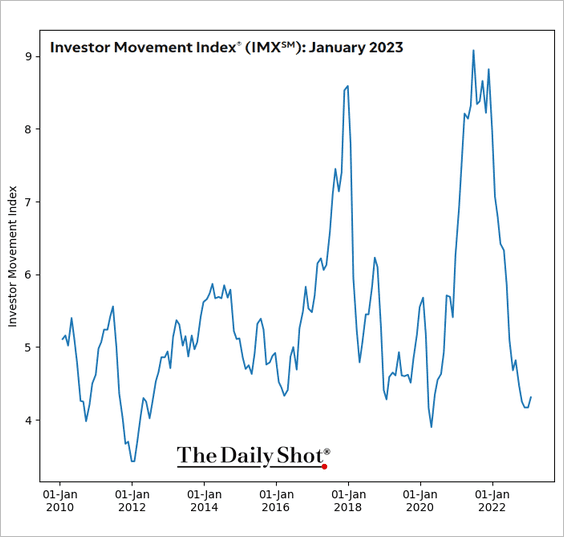

• The TD Ameritrade retail positioning index remained depressed in January.

Source: TD Ameritrade

Source: TD Ameritrade

——————–

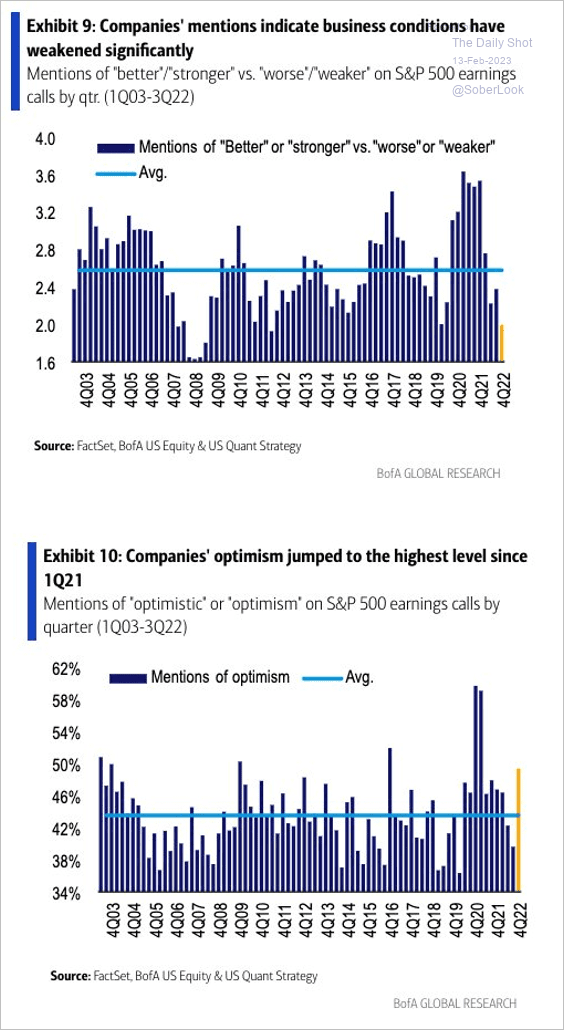

2. Companies have been less gloomy on earnings calls.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

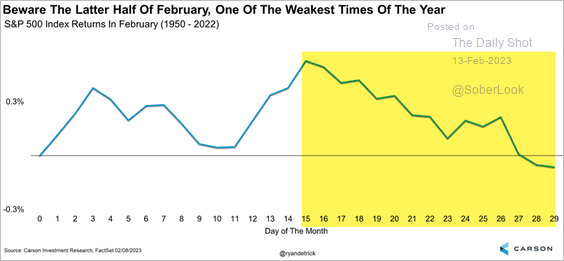

3. Stocks typically struggle during the second half of February.

Source: @RyanDetrick

Source: @RyanDetrick

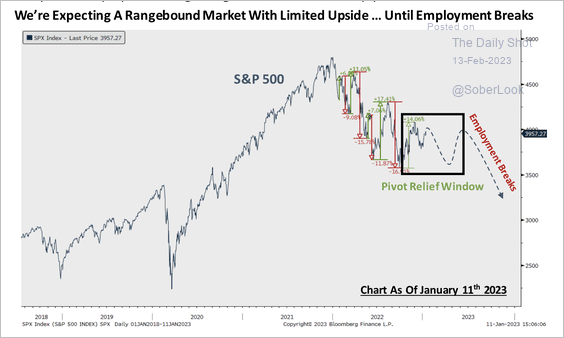

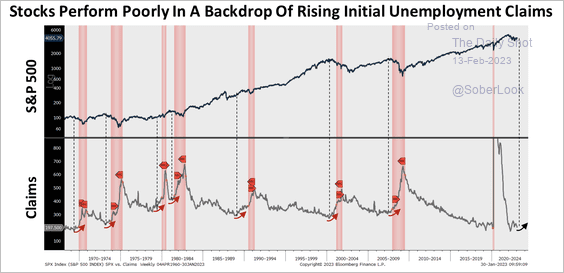

4. Piper Sandler expects further downside for the S&P 500 if the labor market weakens. (2 charts)

Source: Piper Sandler

Source: Piper Sandler

Source: Piper Sandler

Source: Piper Sandler

——————–

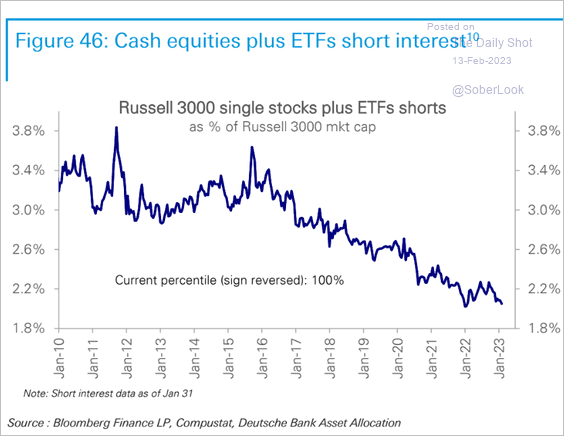

5. Short interest in stocks and ETFs is nearing multi-year lows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

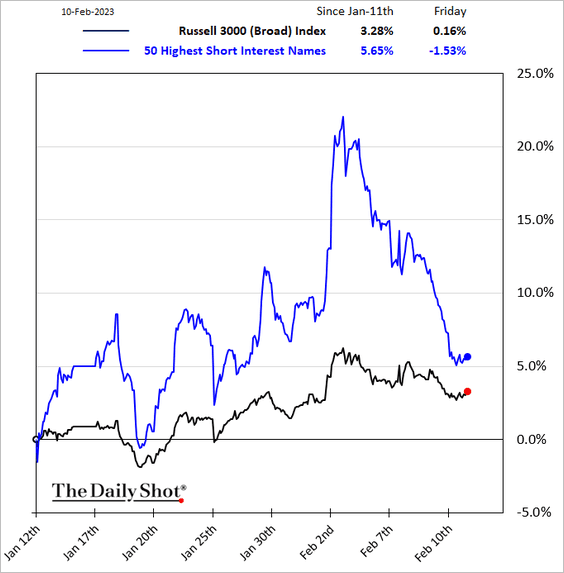

• After a massive short-covering surge, the most-shorted shares retreated last week.

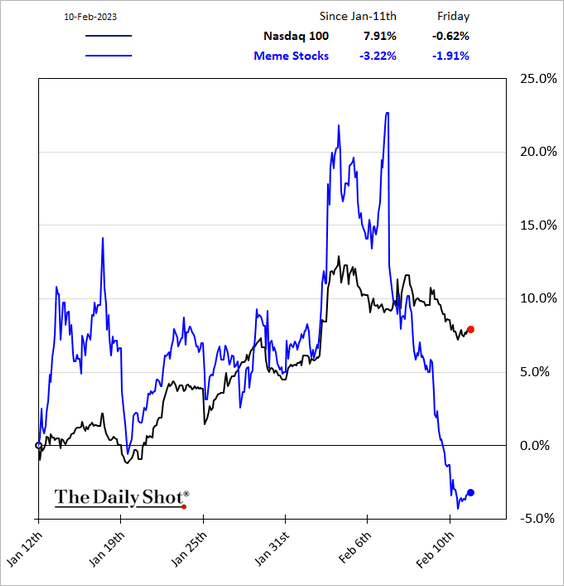

• Meme stocks tumbled in recent days.

——————–

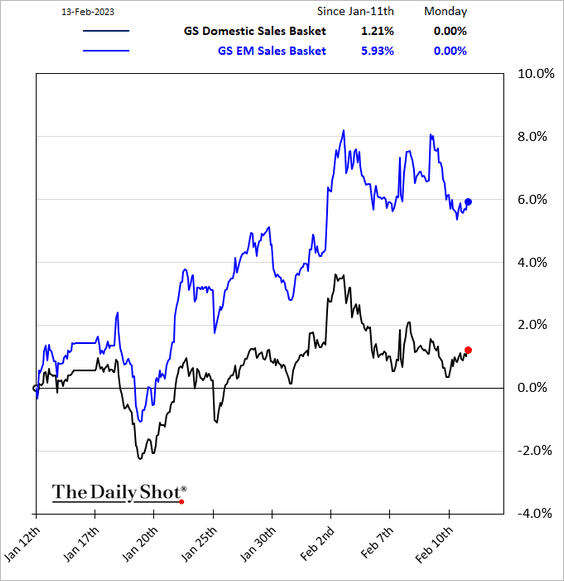

6. Companies with significant sales in emerging markets have been outperforming.

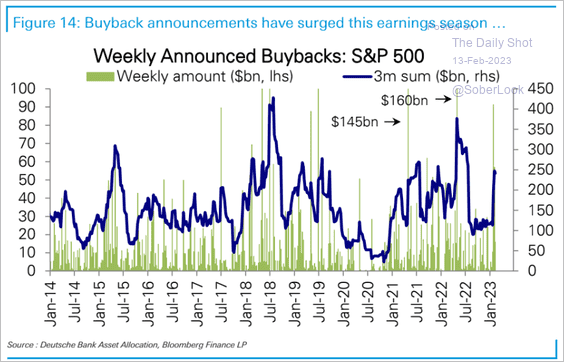

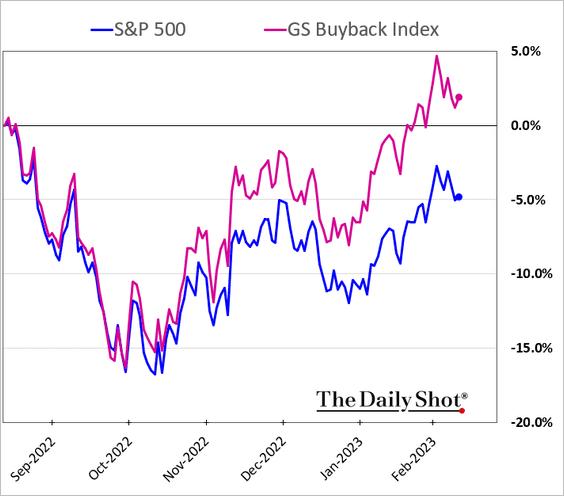

7. Share buyback announcements jumped in this earnings season.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Companies known for share buybacks continue to outperform.

——————–

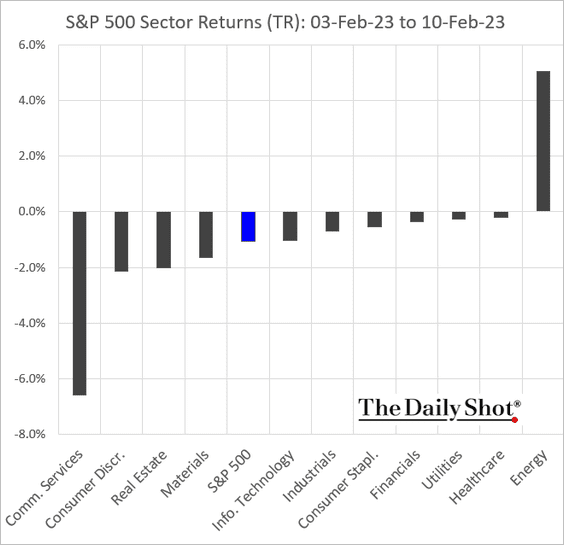

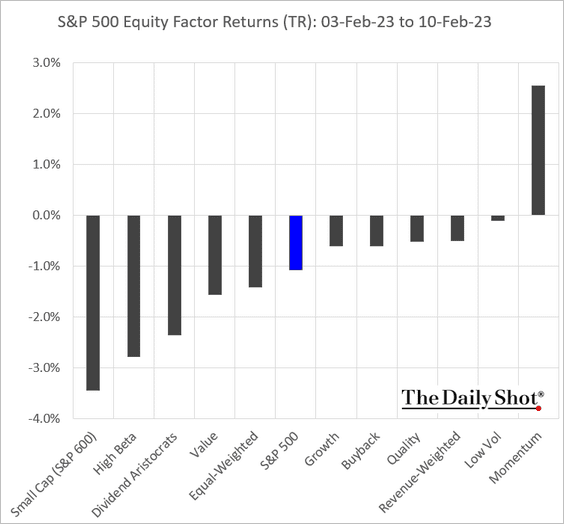

8. Next, we have last week’s performance data.

• Sectors:

• Equity factors:

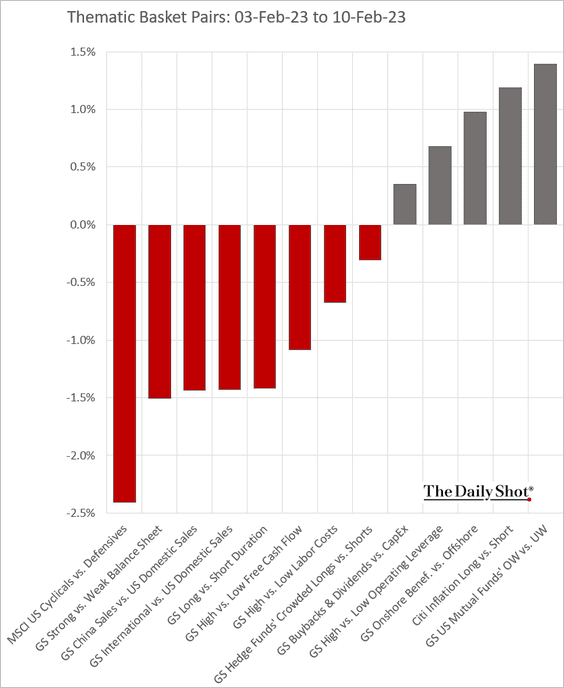

• Macro theme basket pairs’ relative performance:

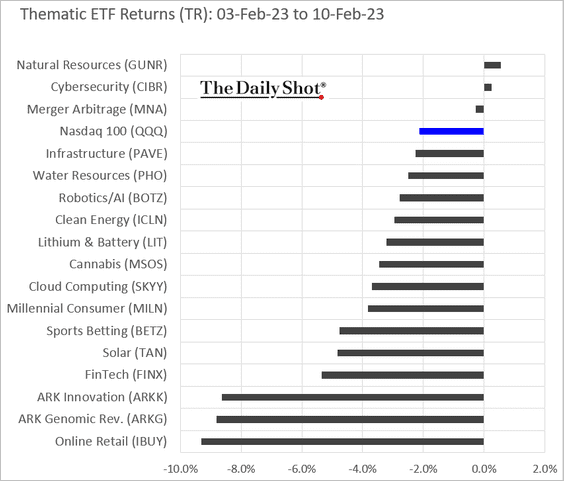

• Thematic ETFs:

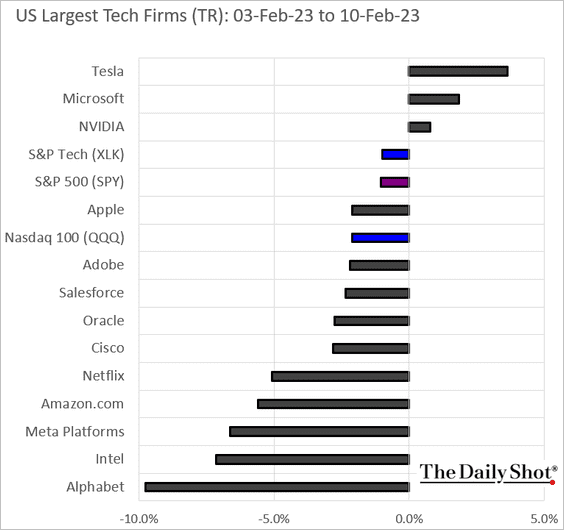

• Largest US tech firms:

Back to Index

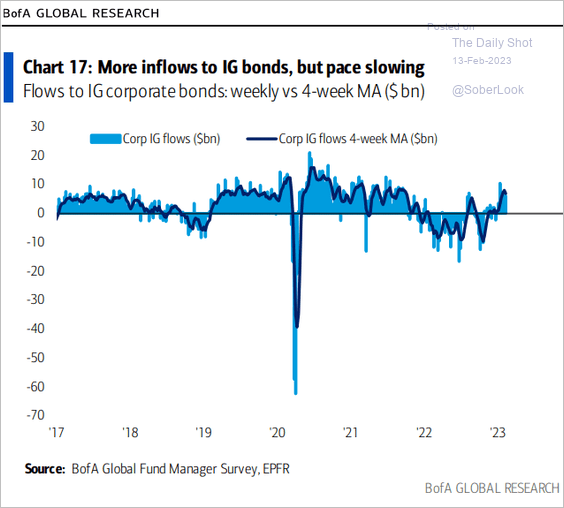

Credit

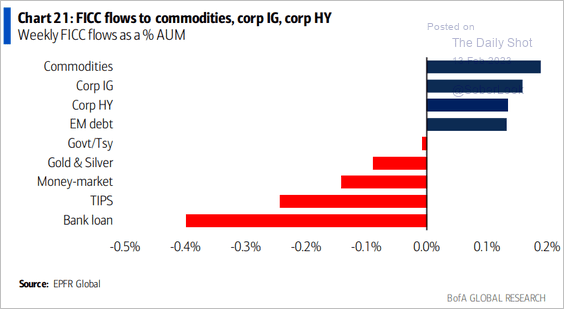

1. Leveraged loans experienced some outflows recently.

Source: BofA Global Research

Source: BofA Global Research

• Inflows into investment-grade bonds have been slowing.

Source: BofA Global Research Read full article

Source: BofA Global Research Read full article

——————–

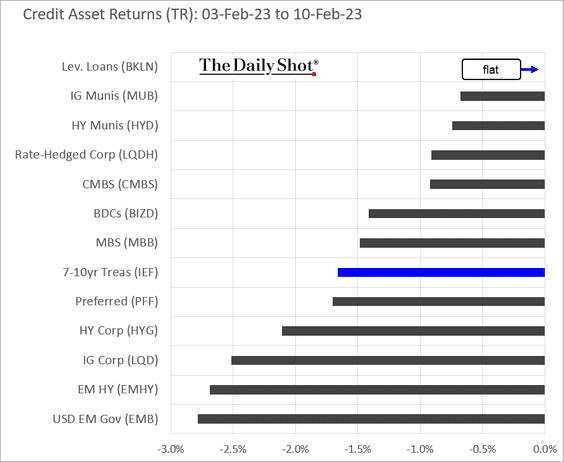

2. Here is last week’s performance by asset class.

Back to Index

Global Developments

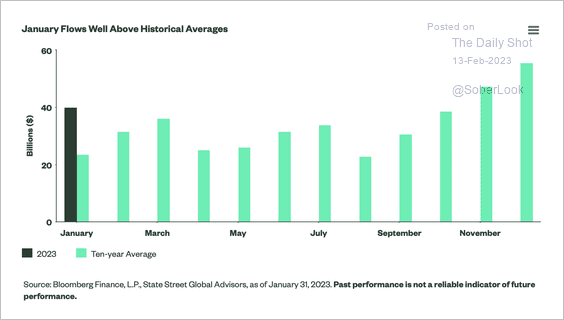

1. ETF flows in January were well above historical averages, with both equities and bonds in favor.

Source: State Street Global Advisors Read full article

Source: State Street Global Advisors Read full article

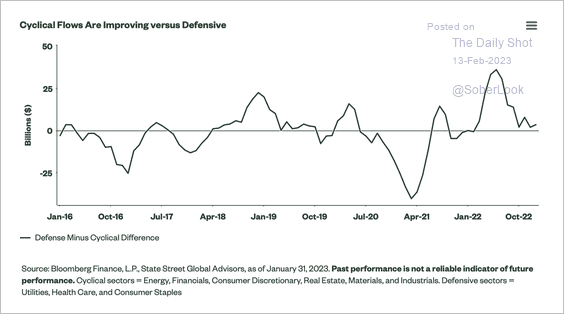

Investors favored more cyclical ETF exposure versus defensive over the past few months.

Source: State Street Global Advisors Read full article

Source: State Street Global Advisors Read full article

——————–

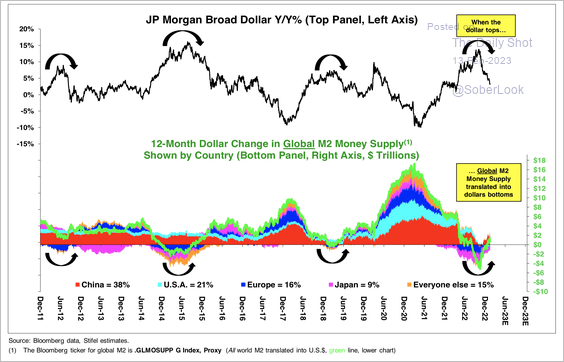

2. A peak in the dollar could signal improvements in global liquidity.

Source: Stifel

Source: Stifel

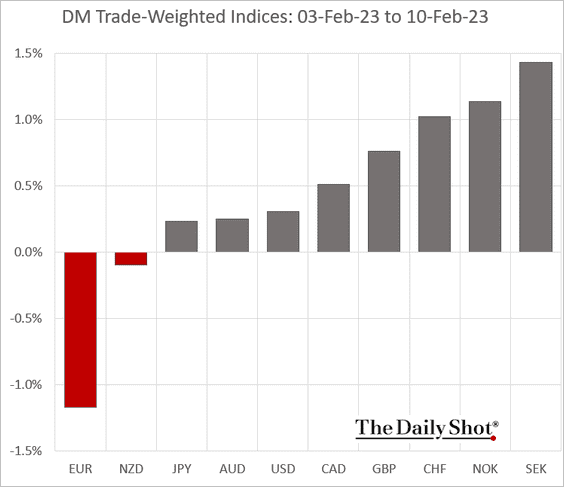

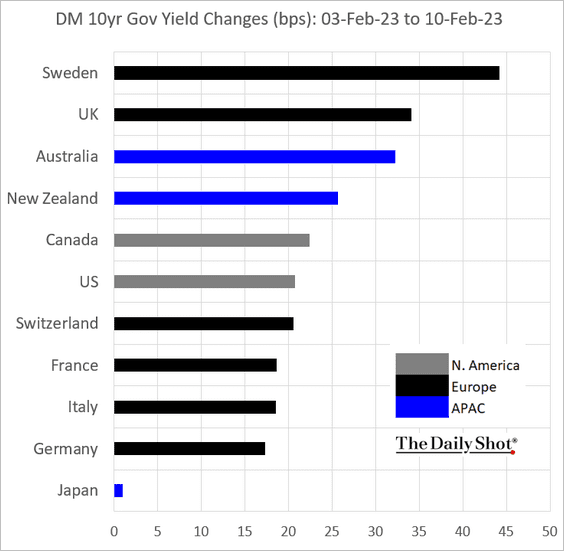

3. Here is last week’s currency and bond performance in advanced economies.

• Trade-weighted currency indices:

• Sovereign bond yields:

——————–

Food for Thought

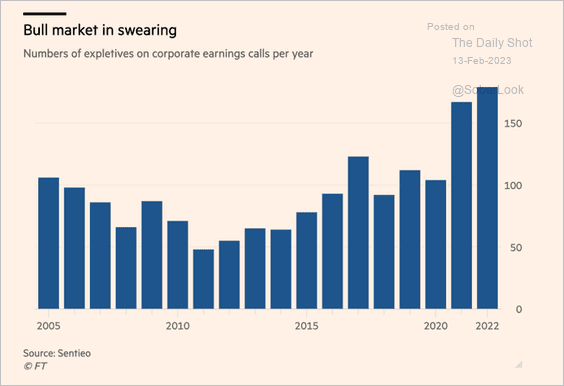

1. Executives swearing on earnings calls:

Source: @TonyTassell, @robinwigg, @FTAlphaville Read full article

Source: @TonyTassell, @robinwigg, @FTAlphaville Read full article

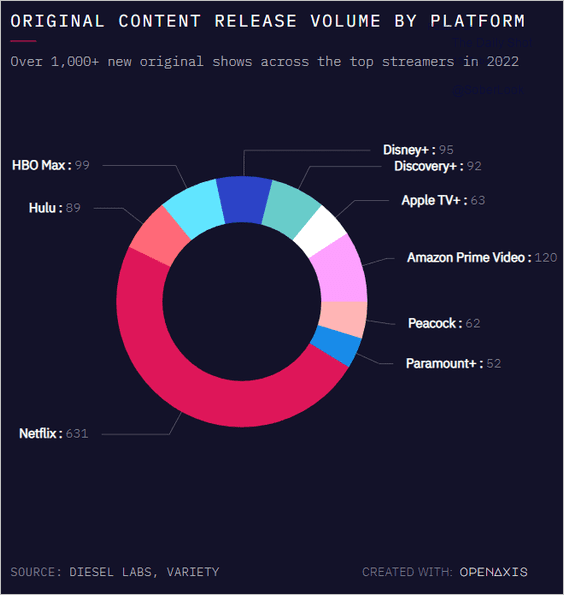

2. Original content by platform:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

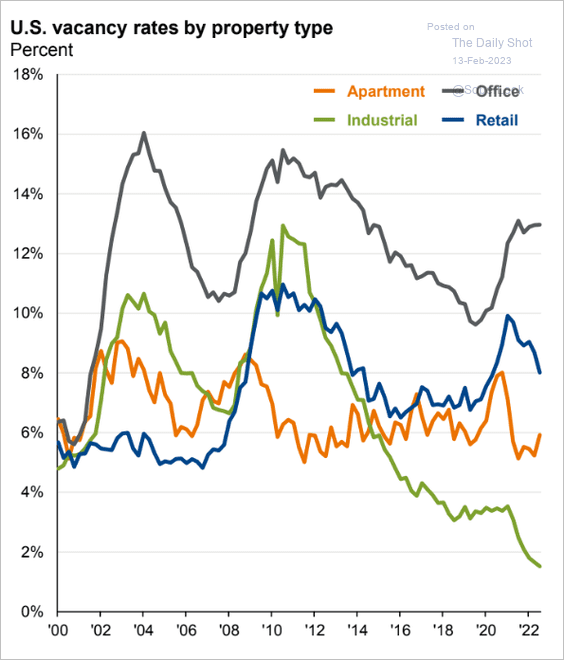

3. Vacancy rates by property type:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

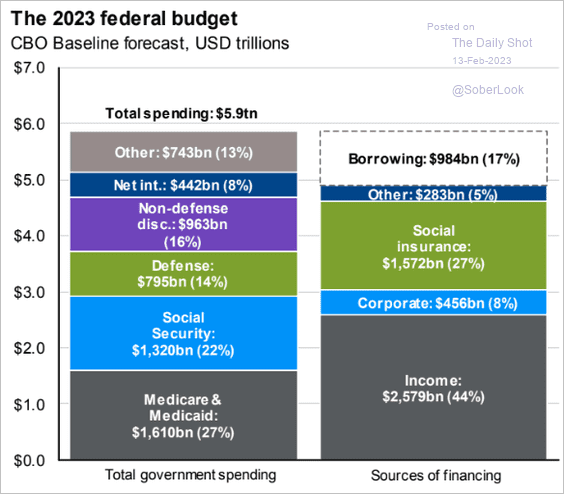

4. The 2023 US federal budget:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

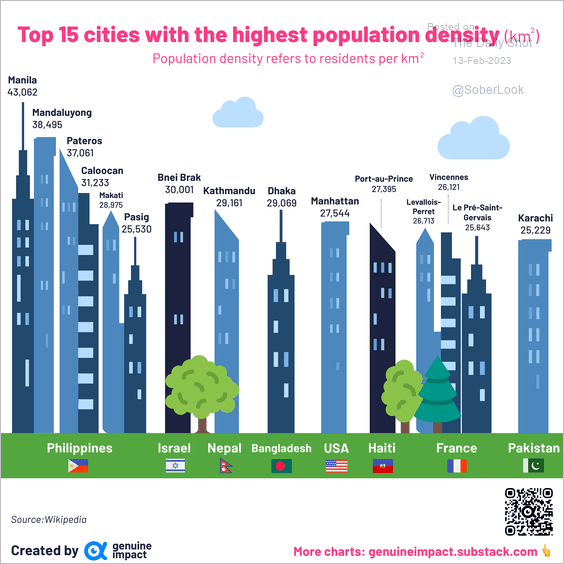

5. Cities with the highest population density:

Source: @genuine_impact

Source: @genuine_impact

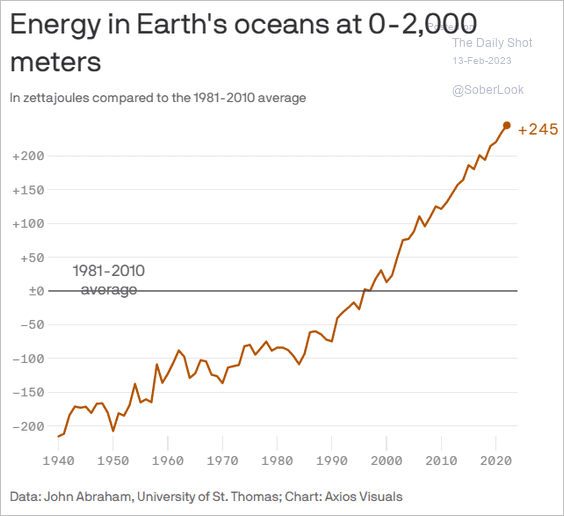

6. Warmer oceans:

Source: @axios Read full article

Source: @axios Read full article

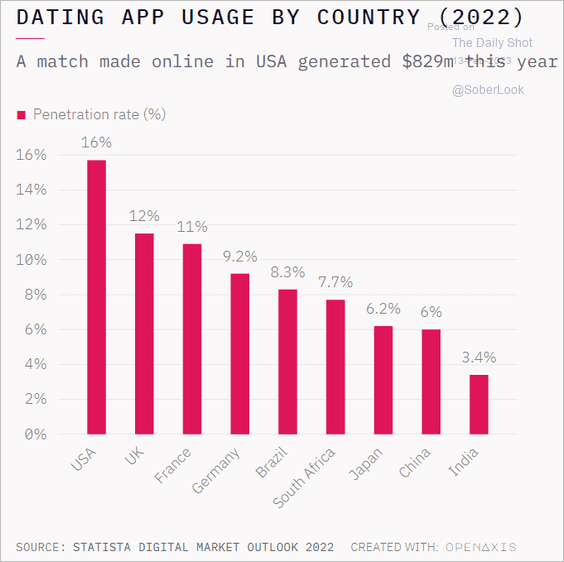

7. Dating app usage by country:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

Back to Index