The Daily Shot: 21-Mar-23

• The United States

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

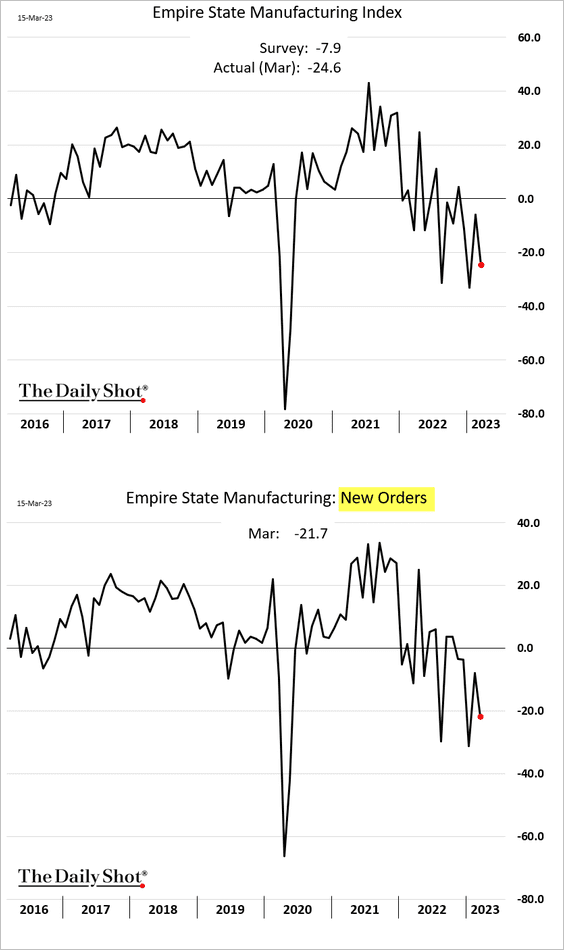

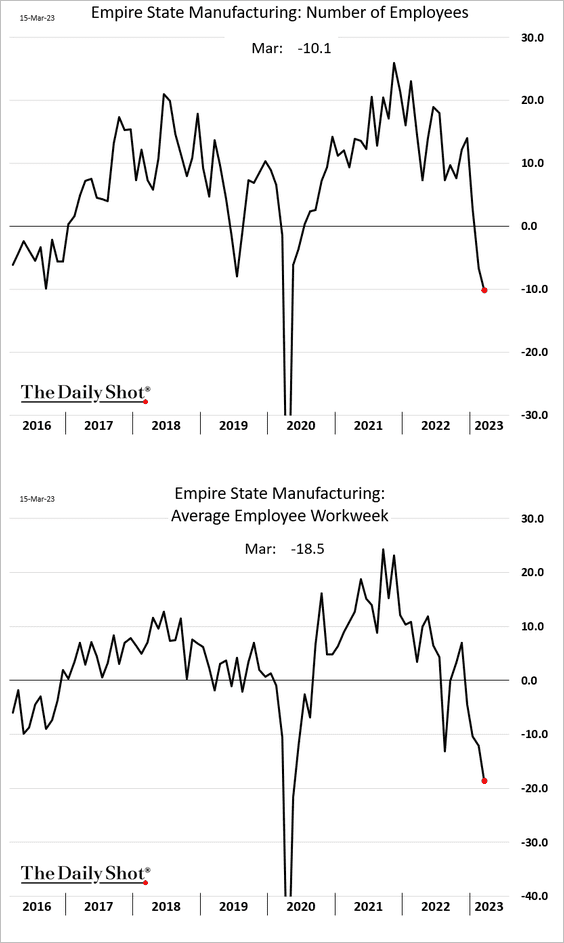

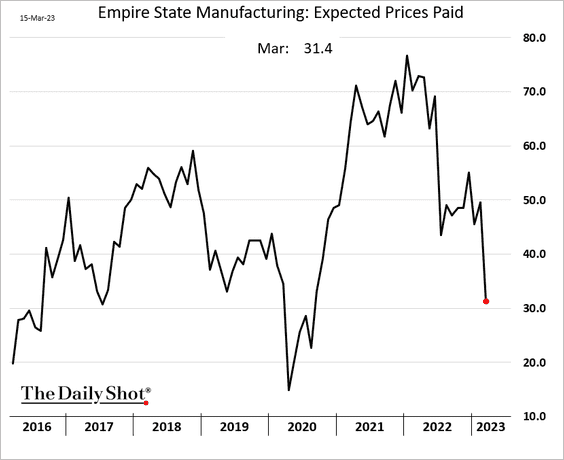

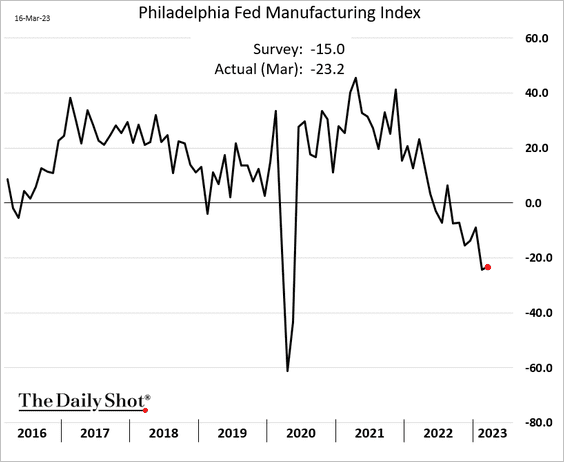

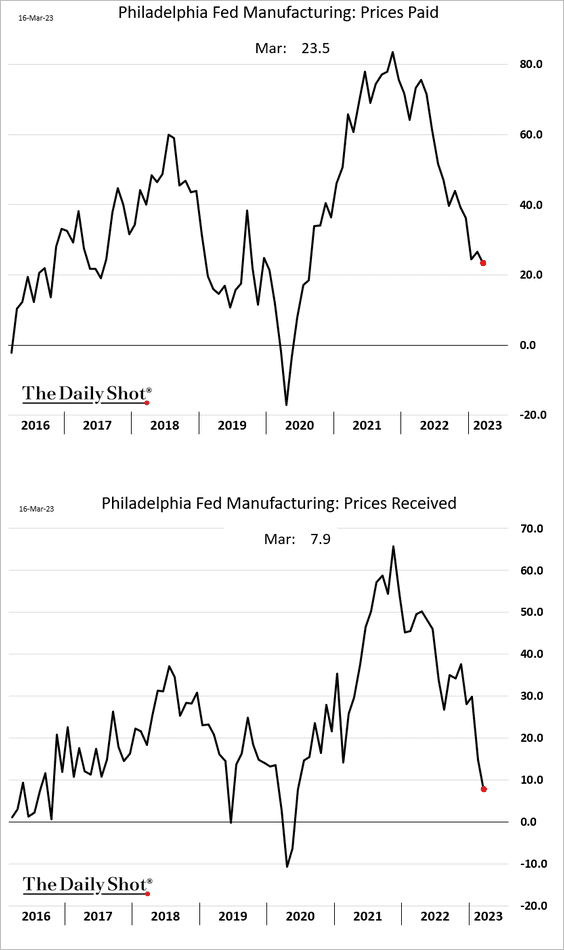

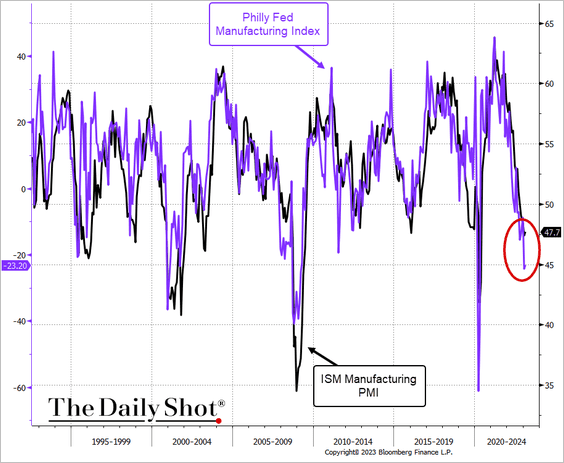

1. The pace of manufacturing activity in the US continued to slow this month.

• The NY Fed’s regional index was well below forecasts, as demand slumped.

– Companies accelerated staff reductions and cuts in workers’ hours.

– Businesses see softening price pressures ahead.

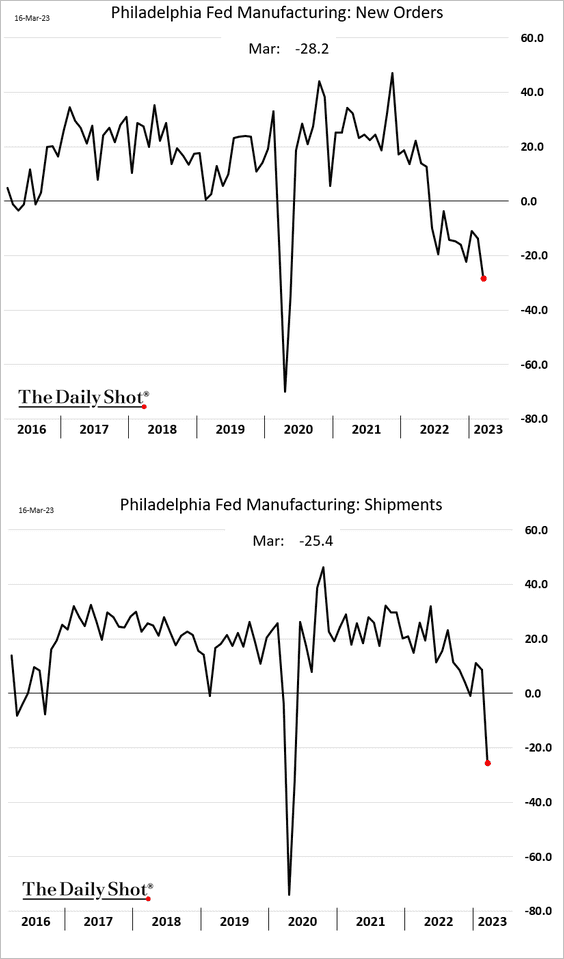

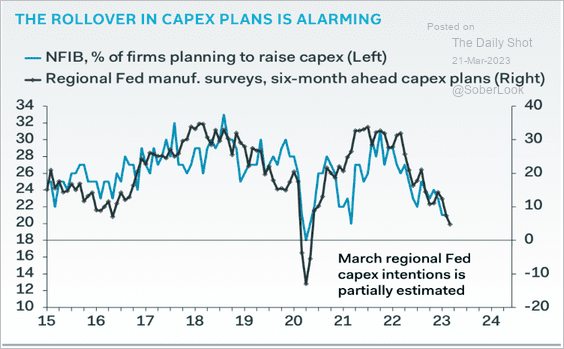

• The Philly Fed’s regional index was also depressed, …

… with demand crashing.

– Similar to the NY Fed’s region, factories in PA, southern NJ, and DE accelerated staff reductions and cuts in workers’ hours.

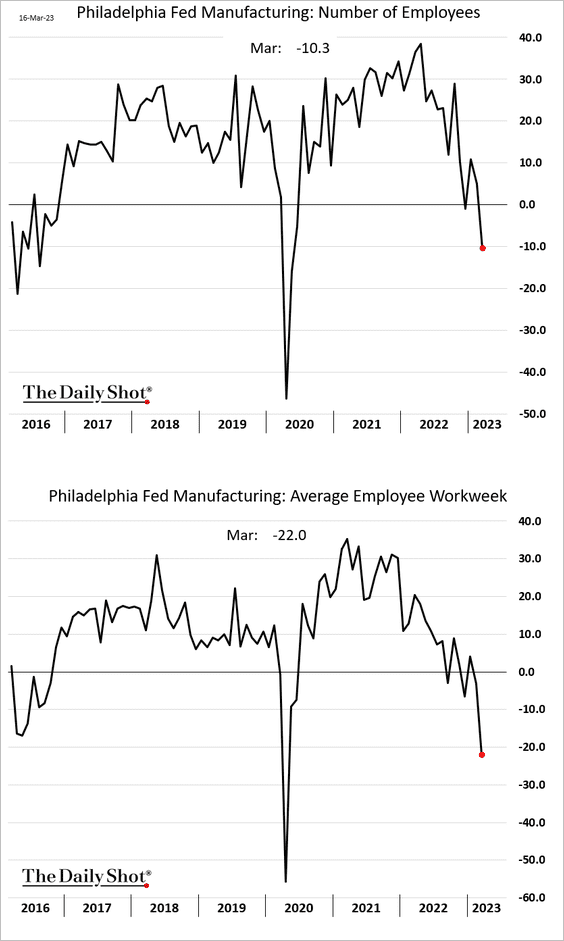

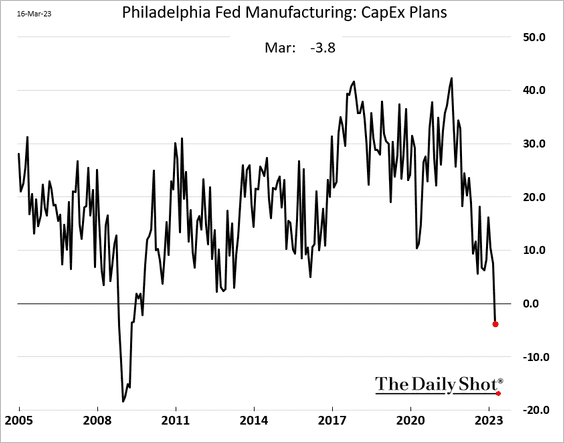

– CapEx expectations are tanking …

… which is now a national trend.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Price pressures continue to ease.

• The regional Fed surveys don’t bode well for factory activity at the national level.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

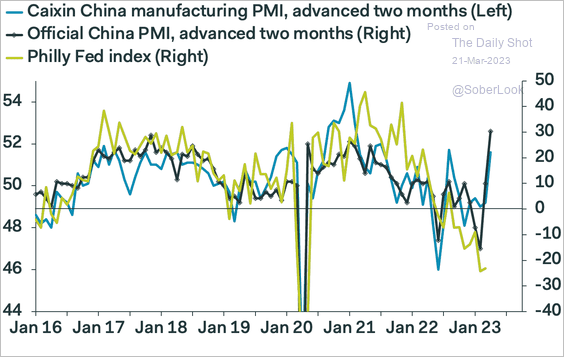

• Will the rebound in China give US manufacturing a boost?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

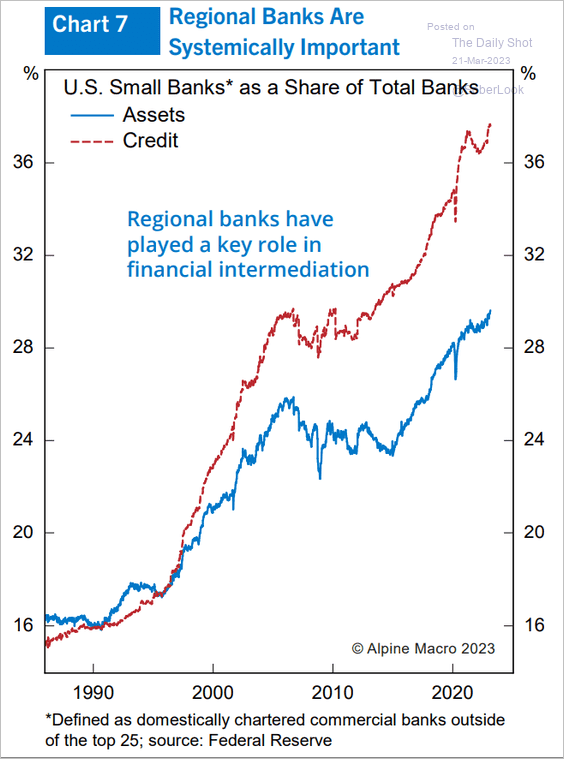

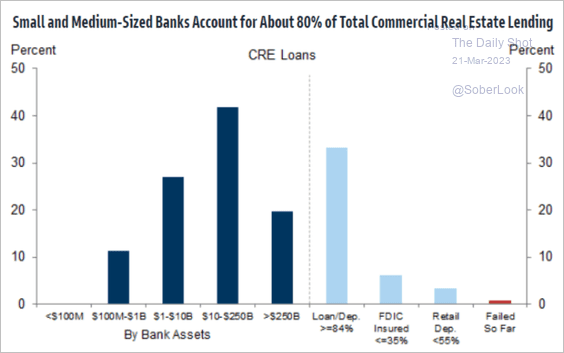

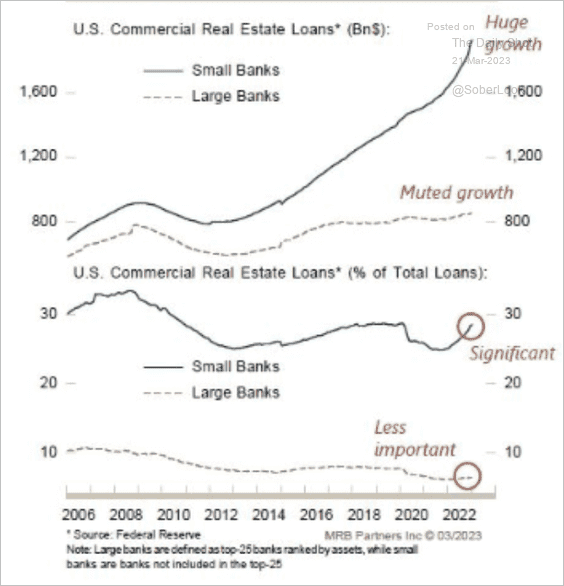

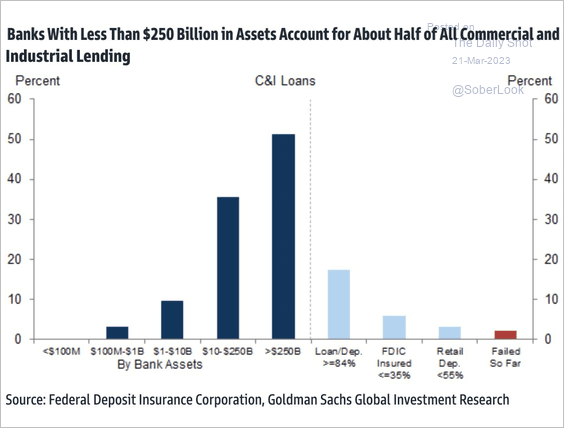

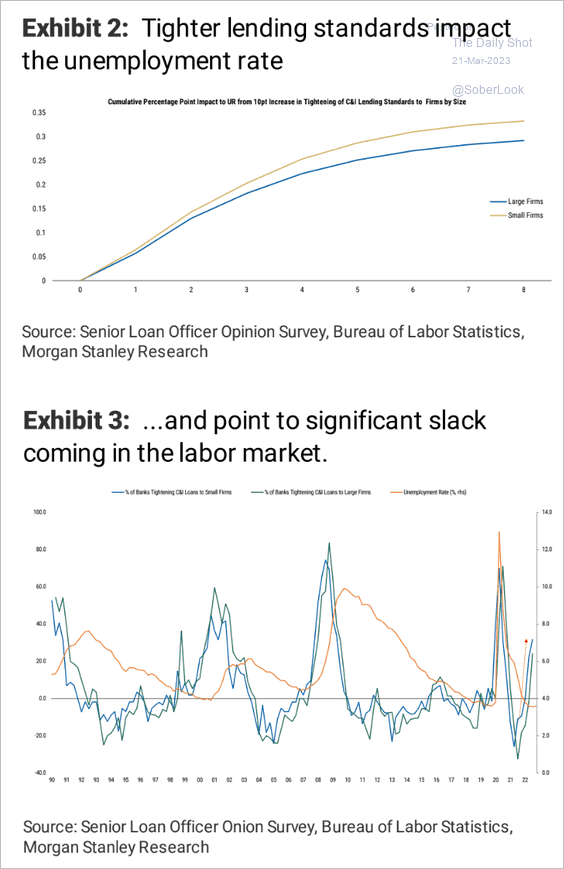

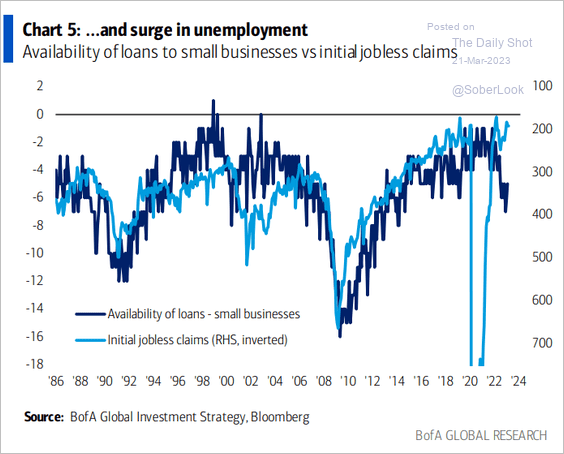

2. Next, let’s take a look at the fallout from the banking sector fiasco. As deposit availability decreases and costs rise, small banks will need to restructure their balance sheets, leading to a contraction in credit availability.

• Rising importance of small banks:

Source: Alpine Macro

Source: Alpine Macro

• Small banks and commercial real estate lending (2 charts):

Source: Goldman Sachs

Source: Goldman Sachs

Source: MRB Partners

Source: MRB Partners

• Business loans:

Source: Goldman Sachs

Source: Goldman Sachs

• The impact on jobs amid tighter bank lending standards (2 charts):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: BofA Global Research

Source: BofA Global Research

——————–

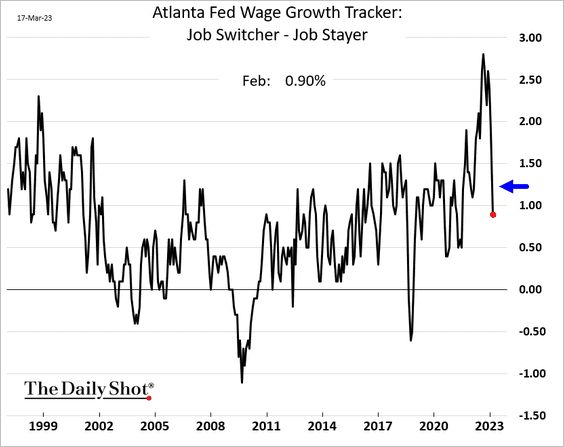

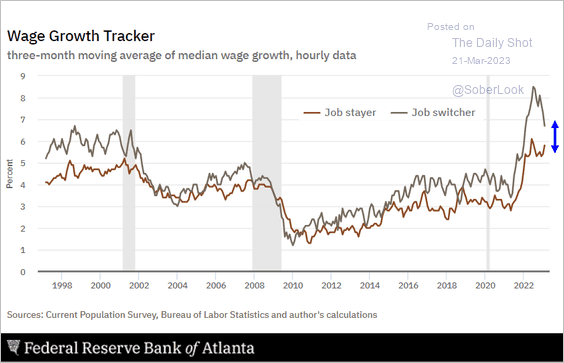

3. The spread between wage growth for “job switchers” and “job stayers” tightened sharply last month, suggesting that demand for labor may be easing (2 charts).

Source: @AtlantaFed

Source: @AtlantaFed

——————–

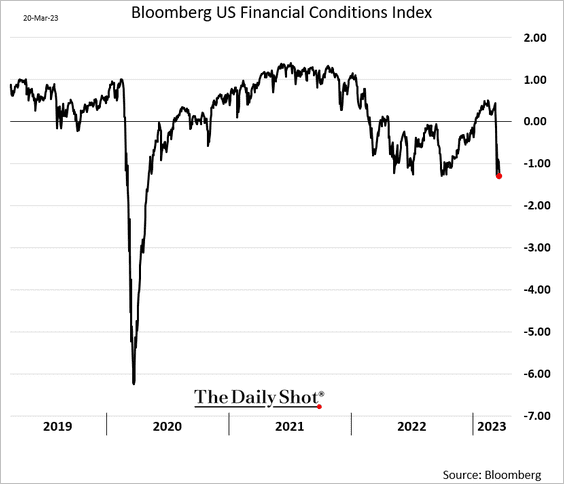

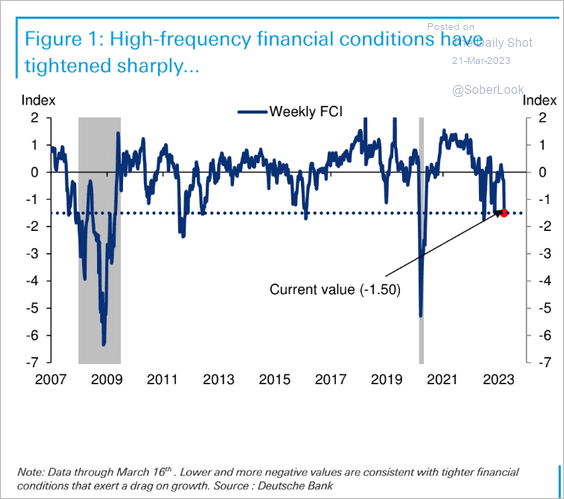

4. US financial conditions have tightened rapidly in recent days (2 charts):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The United Kingdom

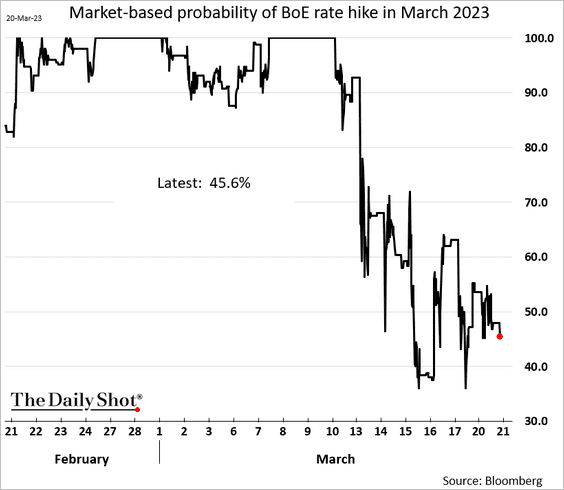

1. The market is now indicating a probability of less than 50% for a rate hike by the Bank of England this month.

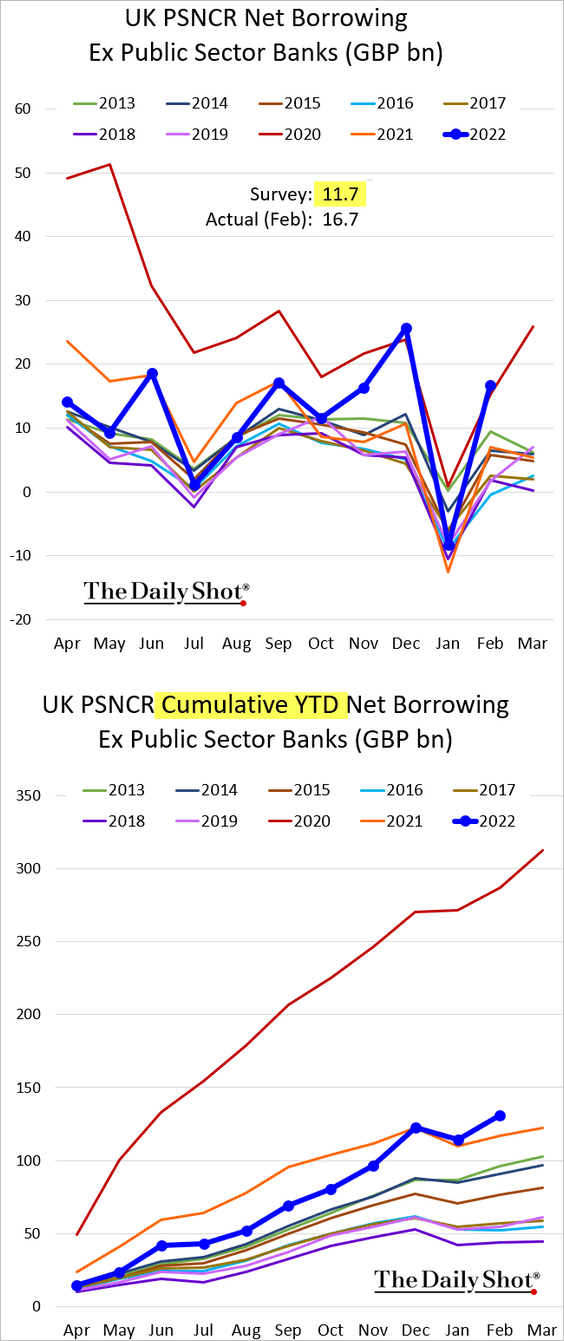

2. Last month’s government borrowing topped forecasts, climbing above 2021 levels for the fiscal year.

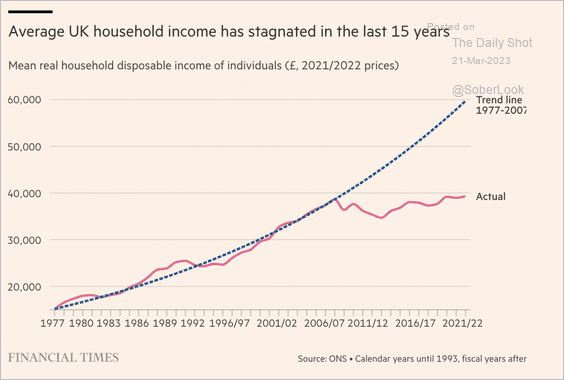

3. Real incomes have stagnated over the past 15 years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

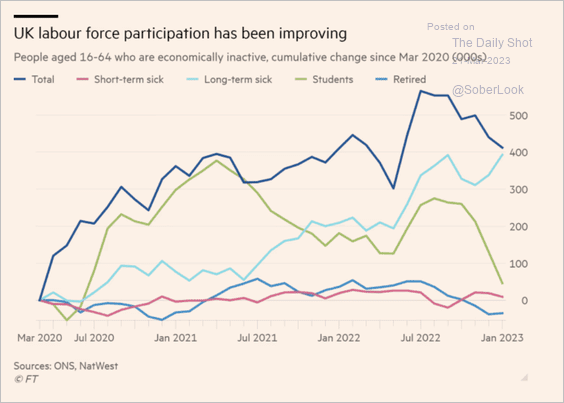

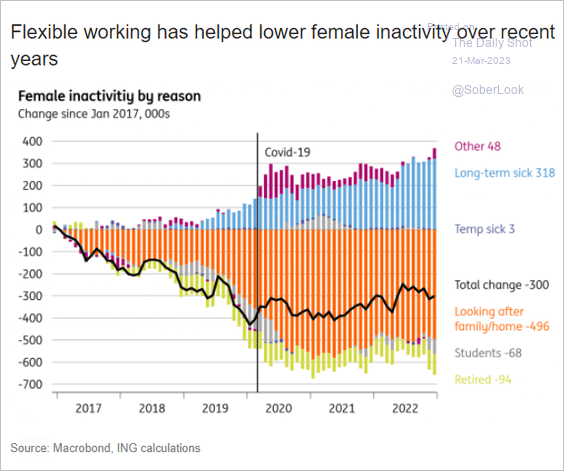

4. Labor force participation has been improving (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: ING

Source: ING

——————–

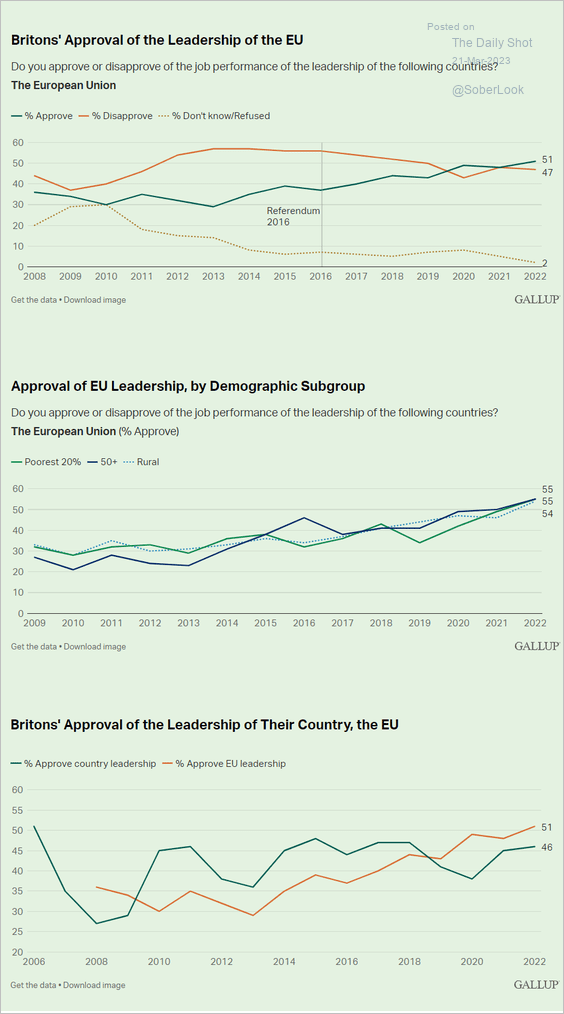

5. How do Britons feel about the leadership of the EU?

Source: Gallup Read full article

Source: Gallup Read full article

Back to Index

Europe

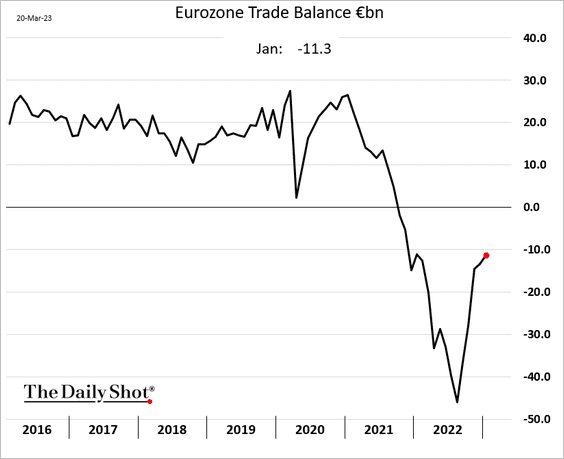

1. The euro-area trade deficit has been narrowing.

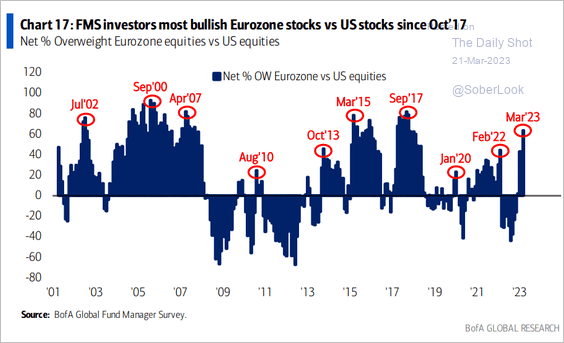

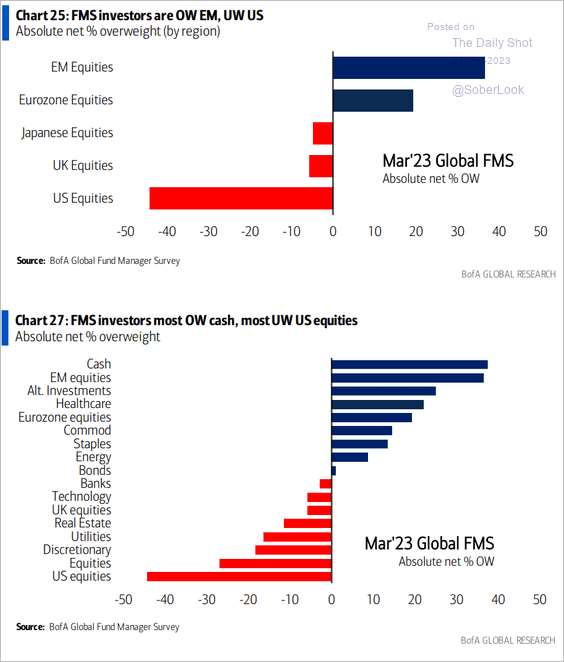

2. Investors are bullish on Eurozone vs. US equities.

Source: BofA Global Research

Source: BofA Global Research

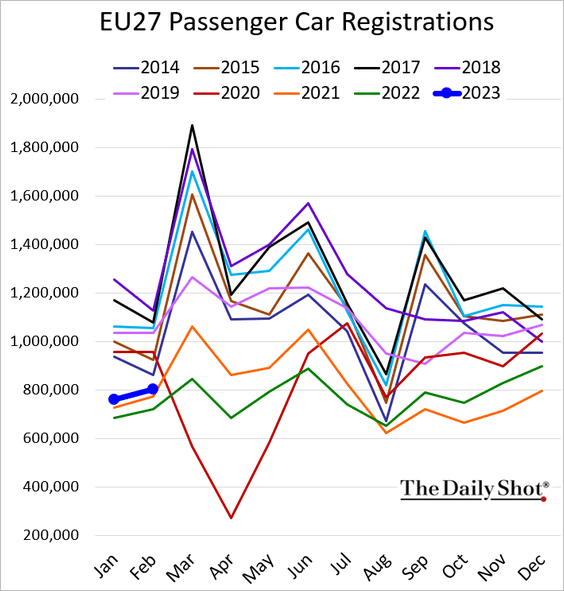

3. EU car registrations remained slightly above 2021 levels last month.

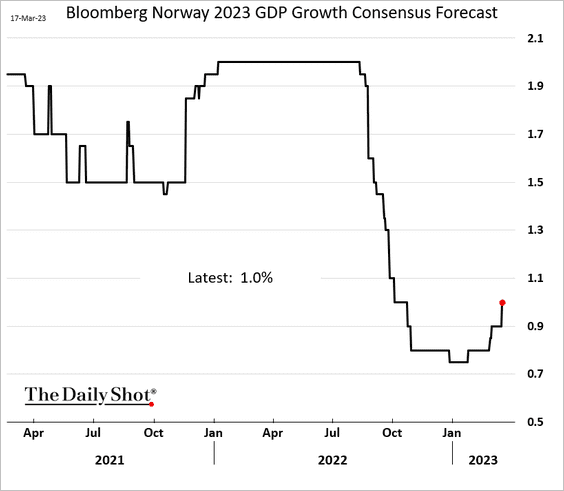

4. Economists are boosting their forecasts for Norway’s GDP.

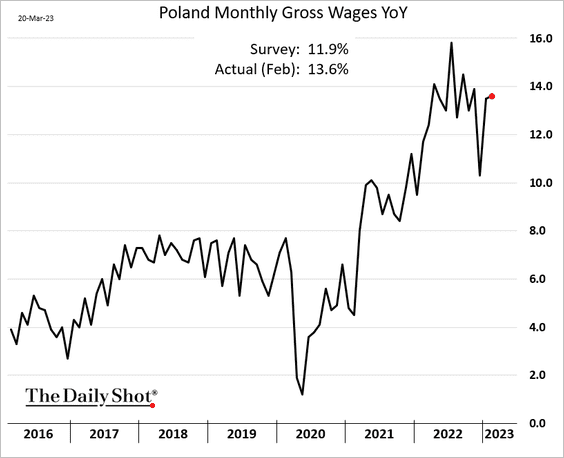

5. Poland’s wage growth remains very high, fueling inflation.

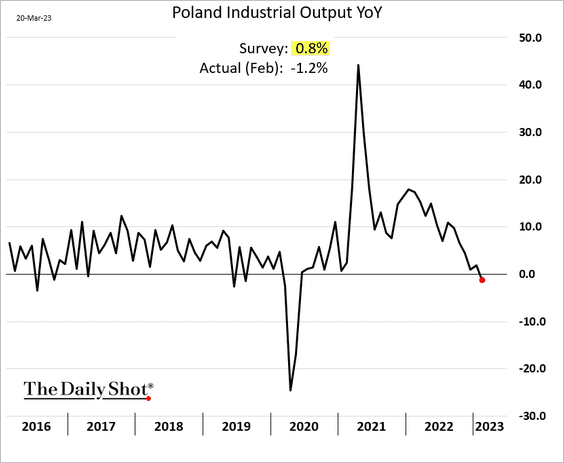

The nation’s industrial output was down on a year-over-year basis for the first time since the initial COVID shock.

Back to Index

Asia – Pacific

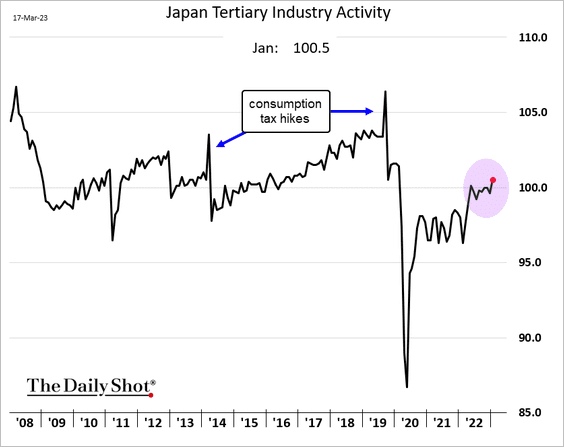

1. Japan’s service sector activity improved in January.

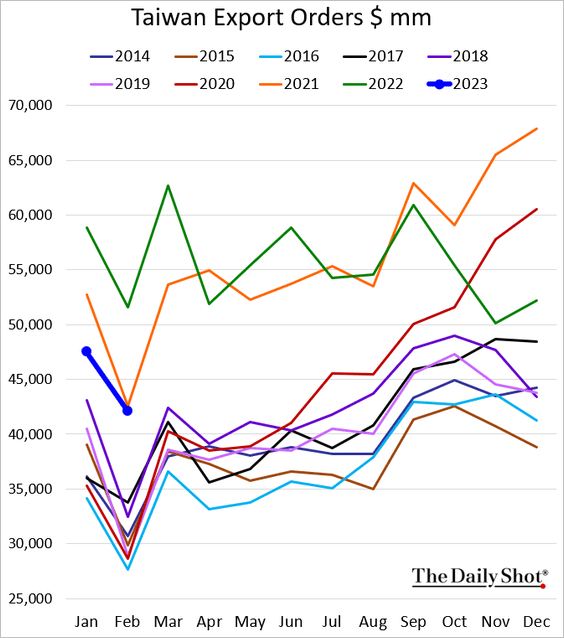

2. Taiwan’s export orders remain well below last year’s levels.

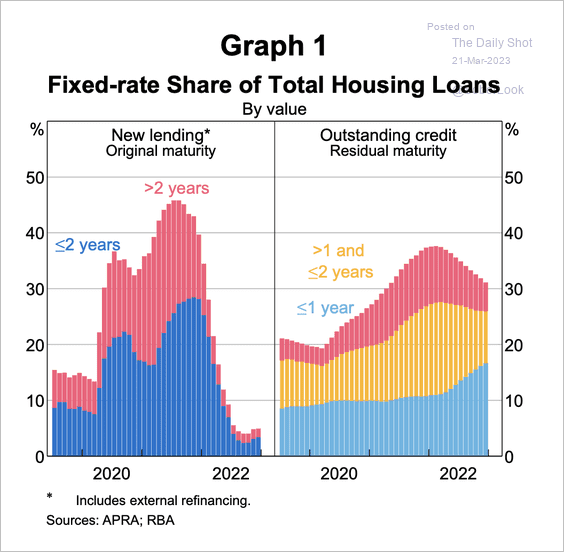

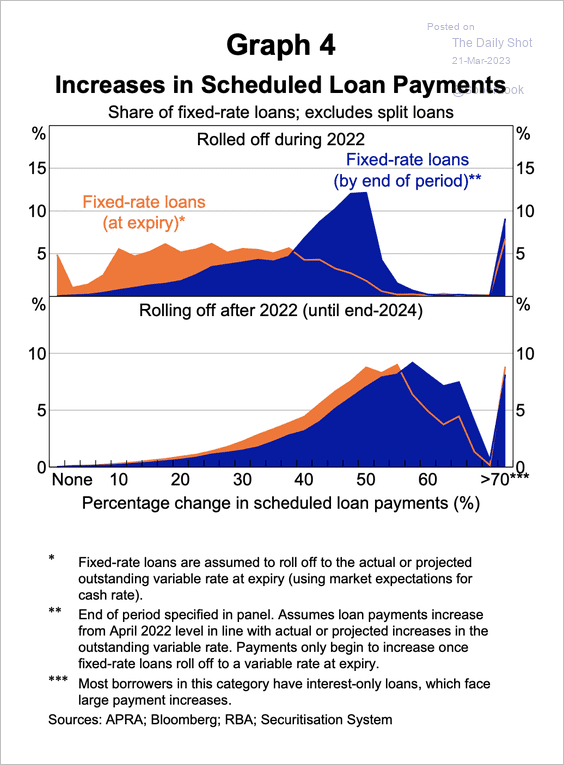

3. The share of fixed-rate housing loans increased substantially, peaking at almost 40% of outstanding housing credit early last year.

Source: RBA Read full article

Source: RBA Read full article

Loans that are yet to roll off their fixed rate could face a larger increase in scheduled repayments than those rolled over last year. This is because the cash rate increased along with expectations for further hikes, according to the RBA.

Source: RBA Read full article

Source: RBA Read full article

Back to Index

China

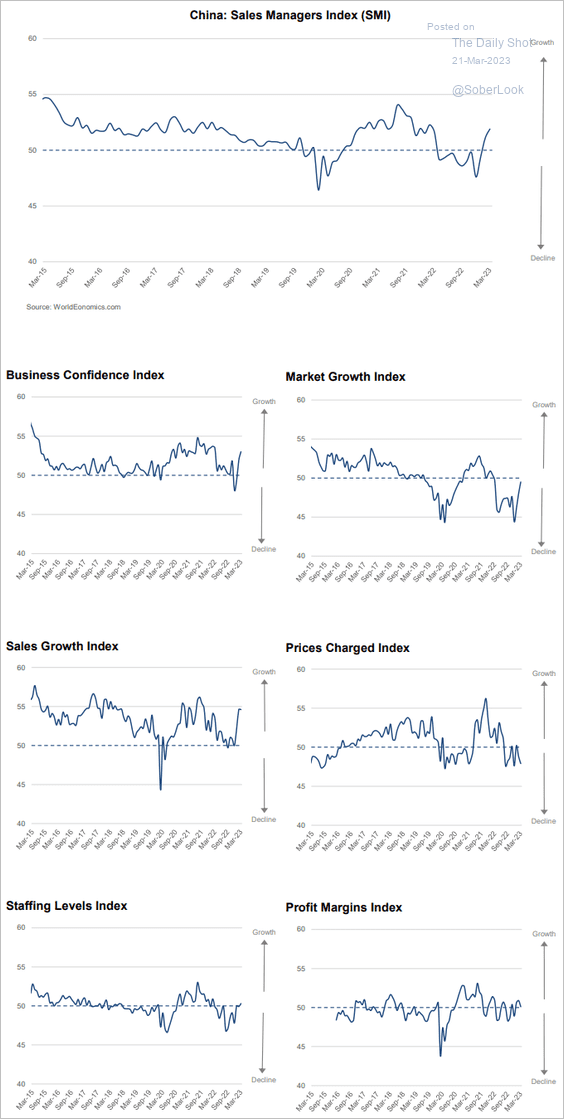

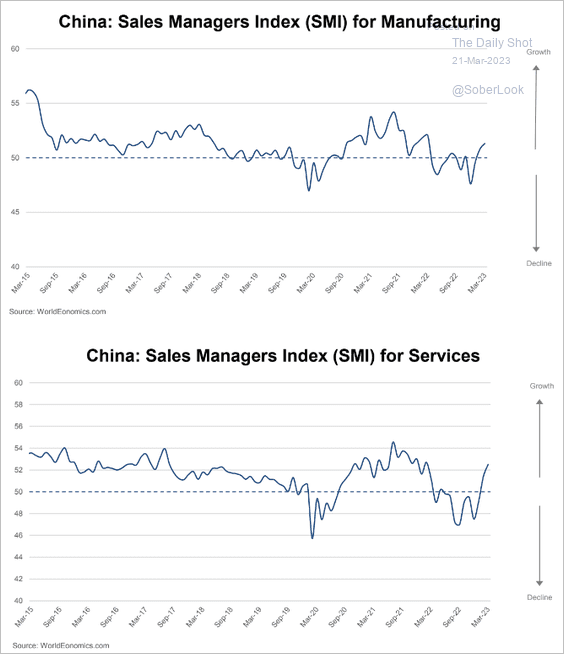

1. The World Economics SMI report showed a further acceleration in China’s business activity this month.

Source: World Economics

Source: World Economics

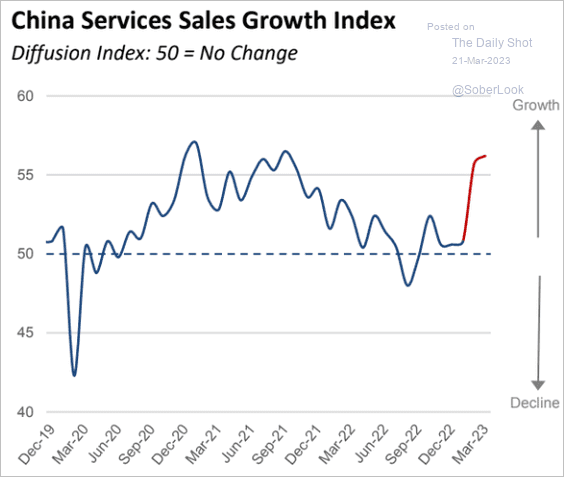

The rate of growth in the service sector has been particularly strong.

Source: World Economics

Source: World Economics

Source: World Economics

Source: World Economics

——————–

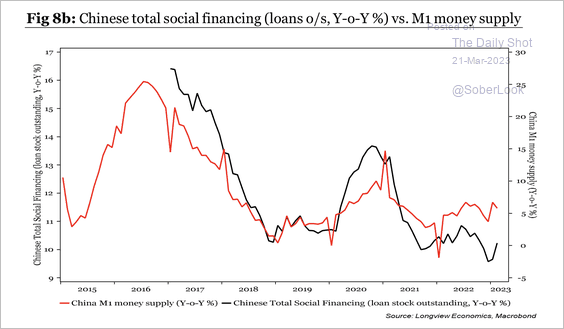

2. Money supply growth and aggregate financing remain relatively low.

Source: Longview Economics

Source: Longview Economics

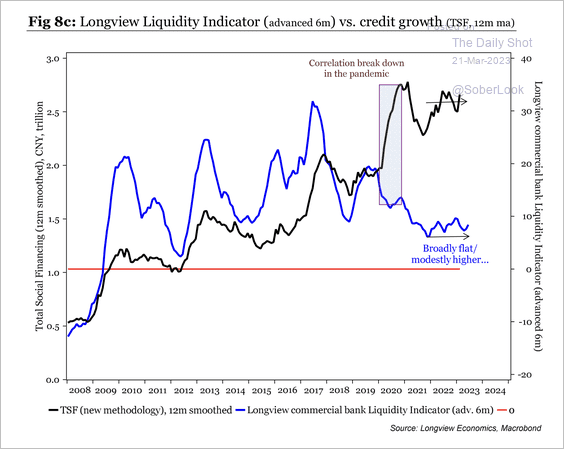

Liquidity remains weak, pointing to a decline in credit growth off its pandemic peak.

Source: Longview Economics

Source: Longview Economics

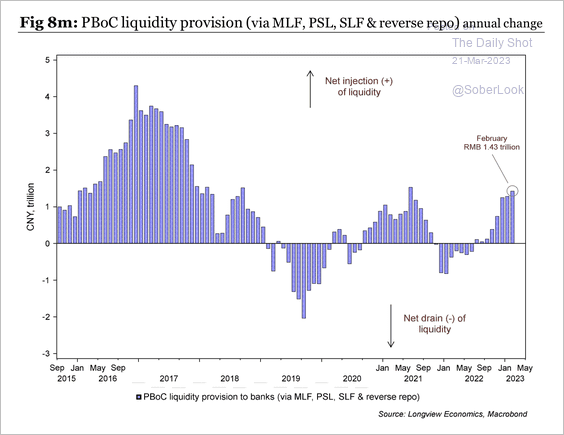

The PBoC’s liquidity provision has been much lower compared to the 2015-2018 cycle.

Source: Longview Economics

Source: Longview Economics

——————–

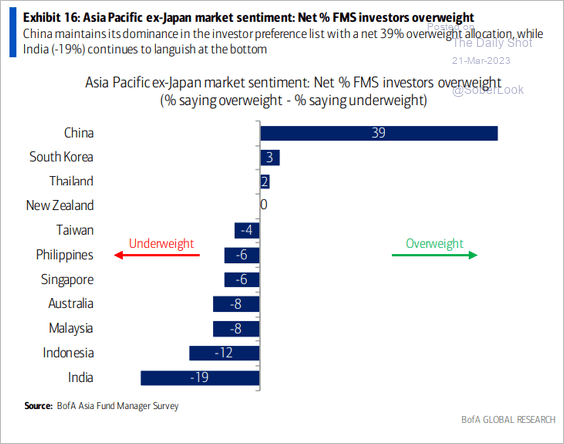

3. Asian fund managers have allocated an overweight position to China in their portfolios.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

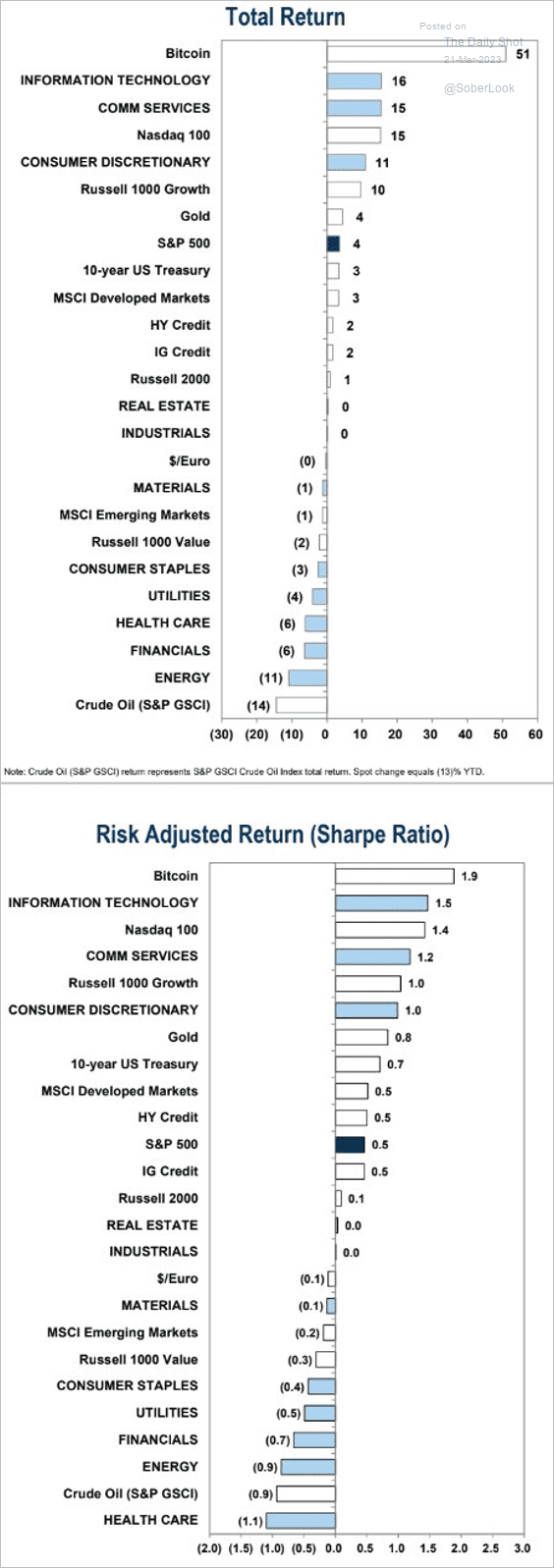

1. Bitcoin has outperformed other asset classes year-to-date.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

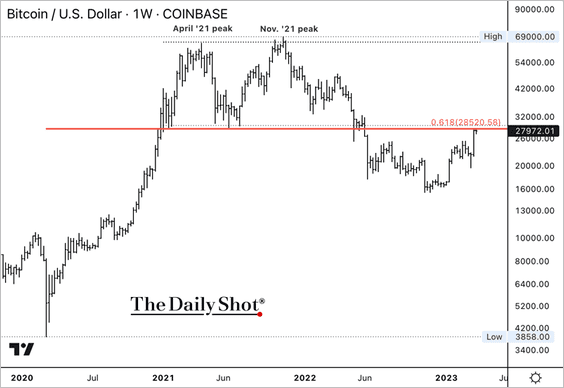

2. Bitcoin is now testing resistance around $28K. A breakout could signal a potential downtrend reversal.

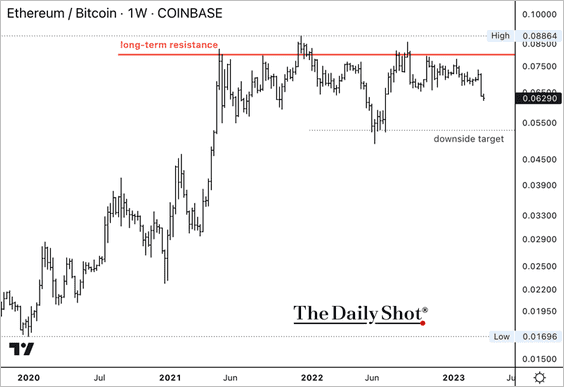

• The ETH/BTC price ratio continues to decline from long-term resistance, suggesting further outperformance ahead for BTC.

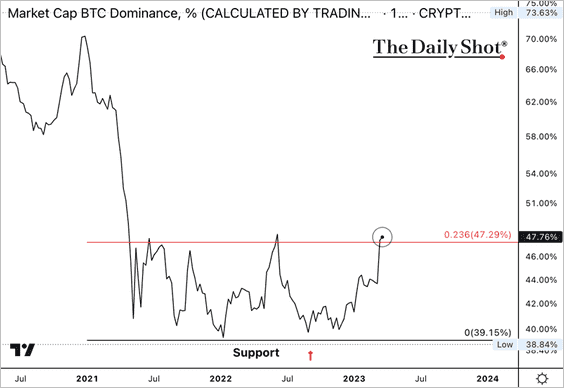

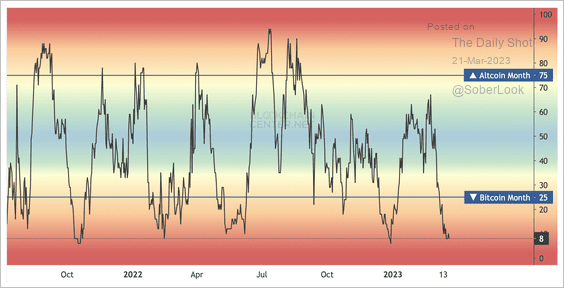

3. Bitcoin’s market cap relative to the total crypto market cap, or dominance ratio, is breaking above the two-year long range.

4. Only 8% of the top 50 altcoins have outperformed BTC over the past month. This is rare and typically indicates risk-off conditions. So far, traders are not taking aggressive bets outside of bitcoin.

Source: BlockchainCenter

Source: BlockchainCenter

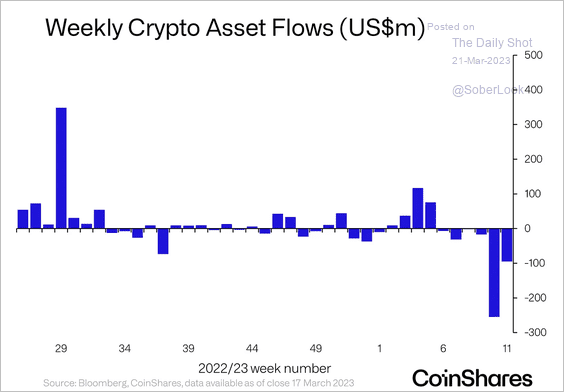

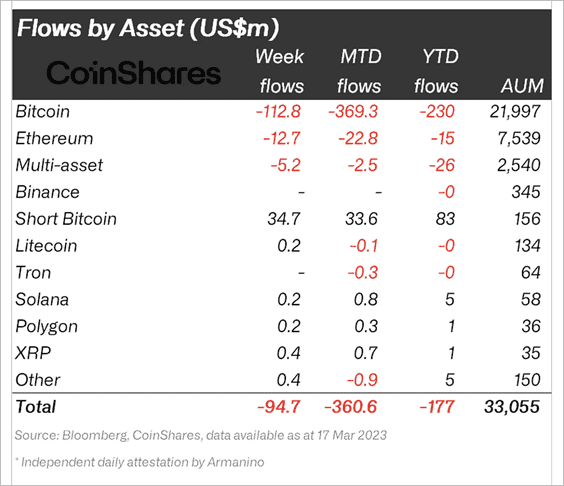

5. Crypto investment products saw the sixth straight week of outflows. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

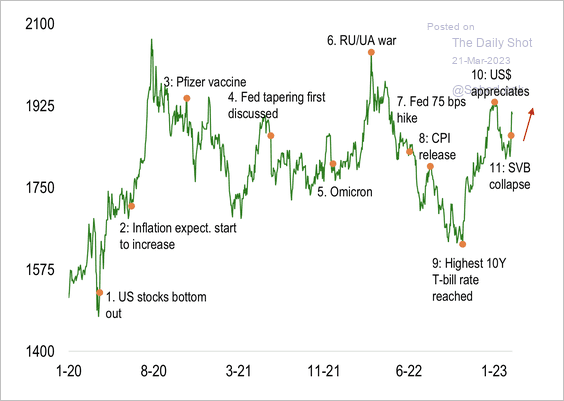

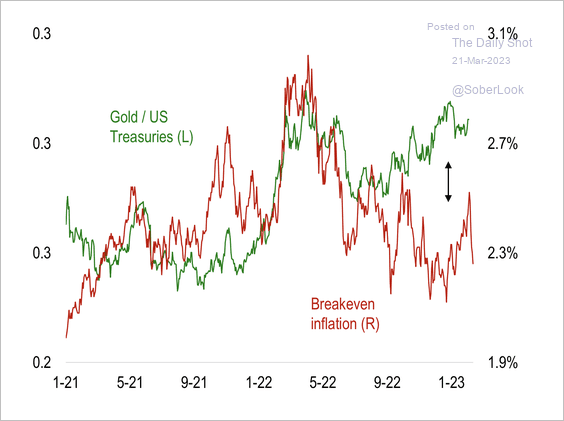

1. The SVB collapse is the latest event to spark a rise in gold prices.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Lower inflation beliefs could limit the upside in gold prices.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

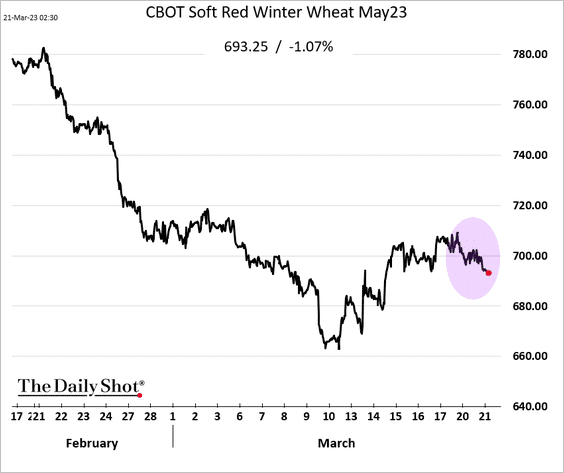

2. The rebound in wheat prices is fading.

Source: @KF_Wright, @markets Read full article

Source: @KF_Wright, @markets Read full article

Back to Index

Equities

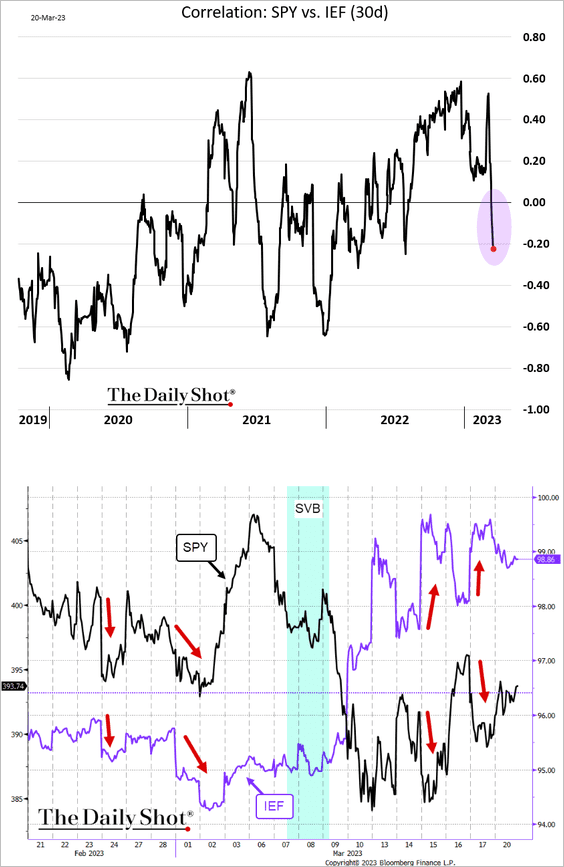

1. The stock-bond correlation has turned negative since the SVB fiasco.

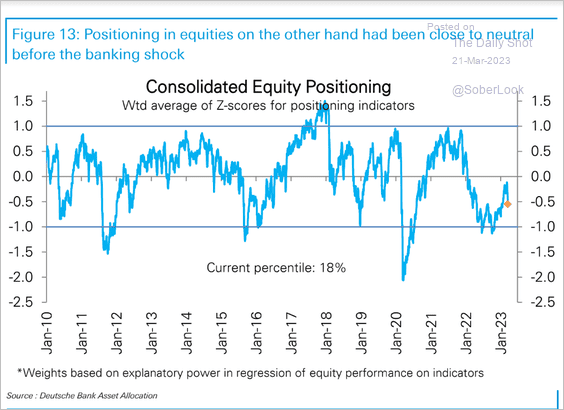

2. Positioning has become more bearish, according to Deutsche Bank’s consolidated equity positioning index.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

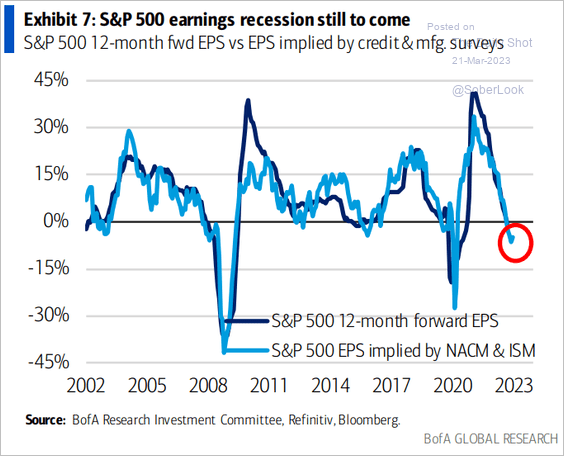

3. Leading indicators continue to signal an earnings recession ahead.

Source: BofA Global Research

Source: BofA Global Research

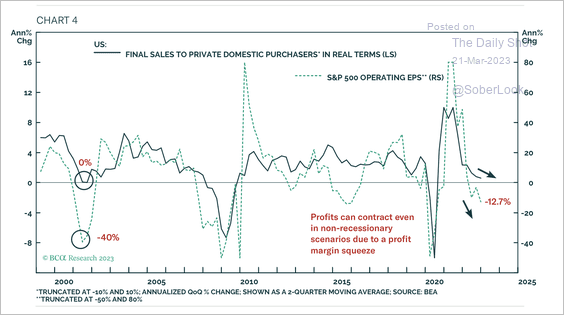

• The slowdown in domestic demand growth will cause a contraction in profits.

Source: BCA Research

Source: BCA Research

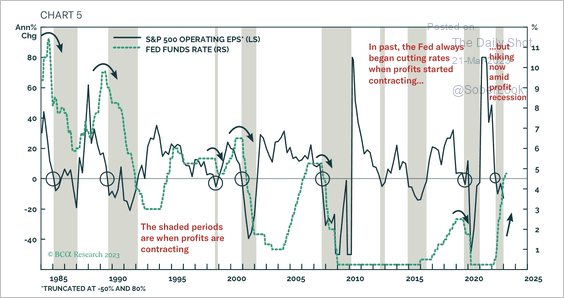

• Rate hike cycles typically precede profit recessions.

Source: BCA Research

Source: BCA Research

——————–

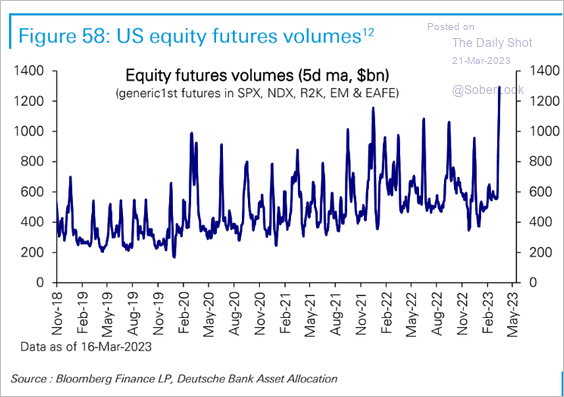

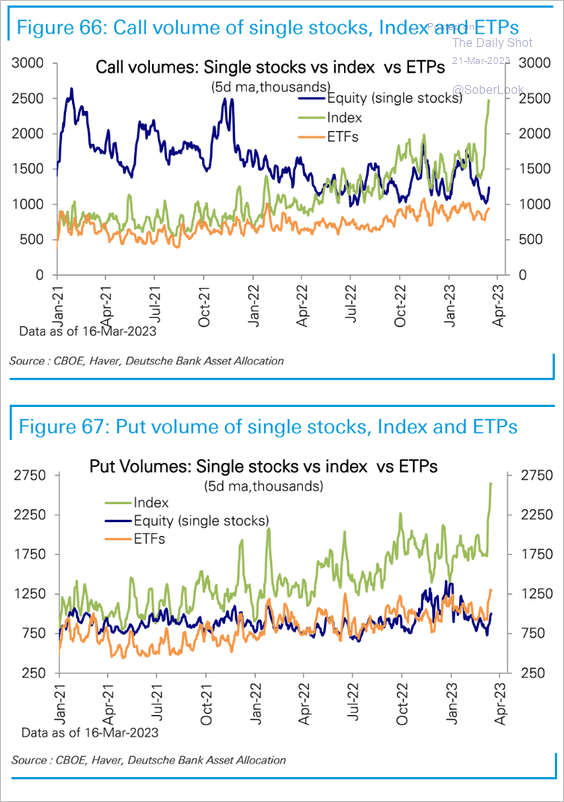

4. Equity futures volume surged in recent days.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Equity index options volumes hit multi-year highs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

5. Global fund managers do not like US stocks.

Source: BofA Global Research

Source: BofA Global Research

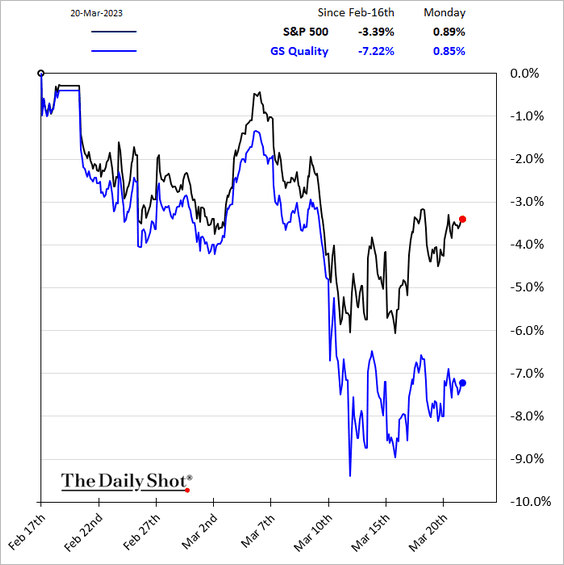

6. Since the beginning of the banking scare, the quality factor has been lagging.

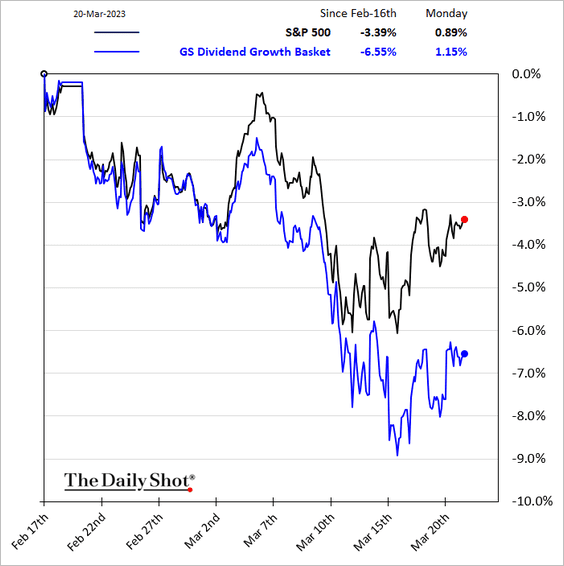

Here are dividend growers.

——————–

7. The SPDR Tech Sector ETF (XLK) is firmly above its 40-week moving average relative to the S&P 500. In just three months, the XLK/SPY price ratio reversed roughly 78% of its downtrend since December 2021.

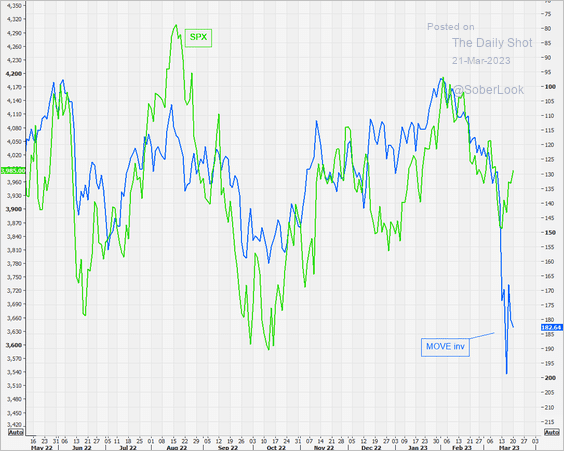

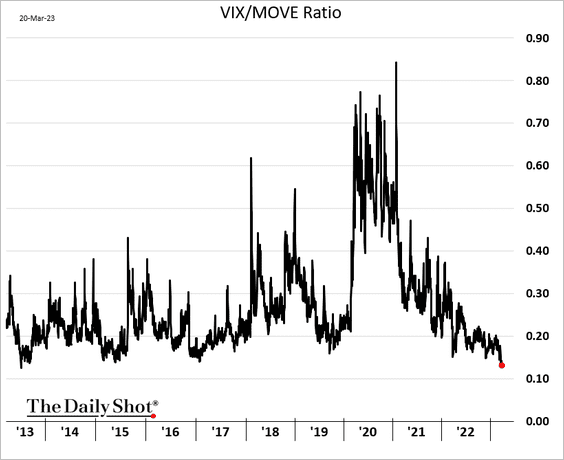

8. Is the stock market ignoring elevated rates volatility (MOVE)?

Source: @themarketear

Source: @themarketear

The VIX/MOVE ratio is at multi-year lows.

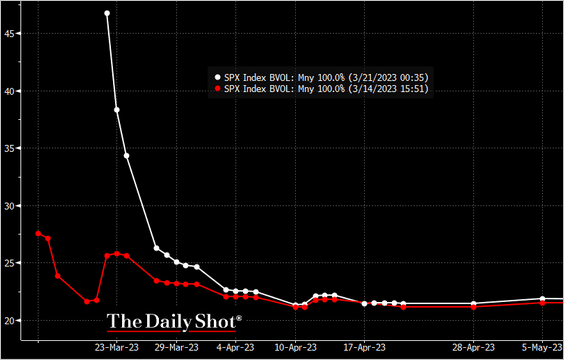

9. The S&P 500 implied vol curve is massively inverted ahead of the FOMC.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

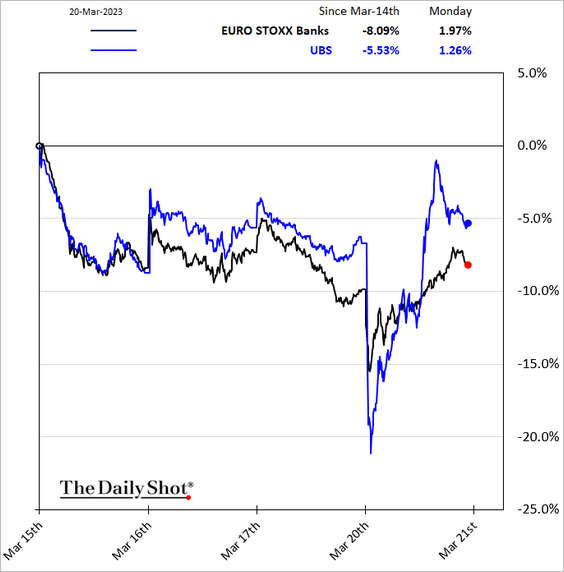

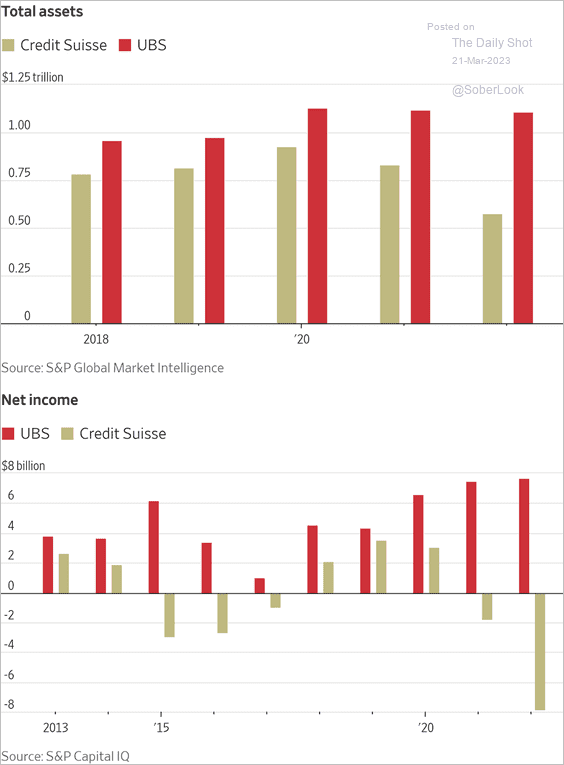

1. UBS shares swooned at the start of trading but then rebounded.

• The Swiss authorities hope the merger will arrest the Credit Suisse bleed.

Source: @WSJ Read full article

Source: @WSJ Read full article

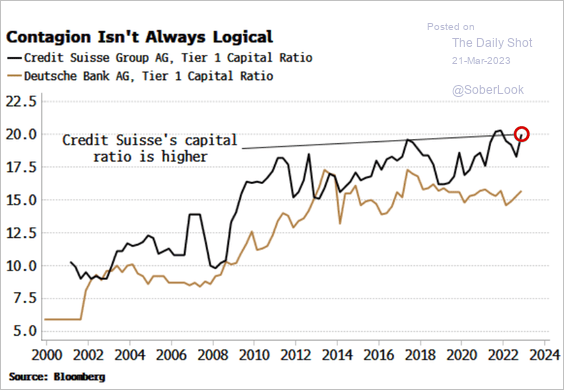

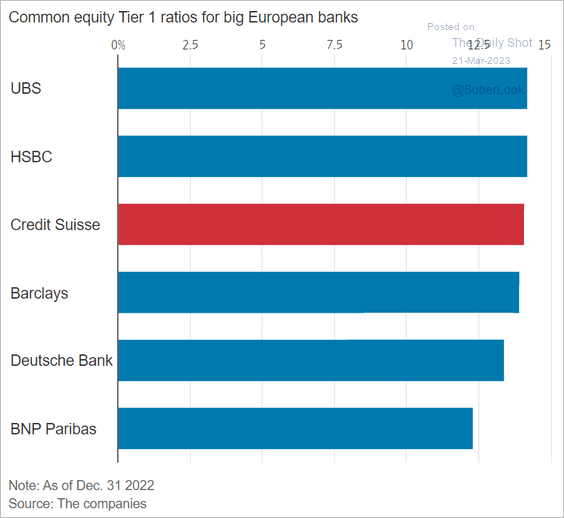

• It’s important to note that key risk ratios for Credit Suisse were quite strong before the collapse (2 charts).

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Source: @WSJ Read full article

Source: @WSJ Read full article

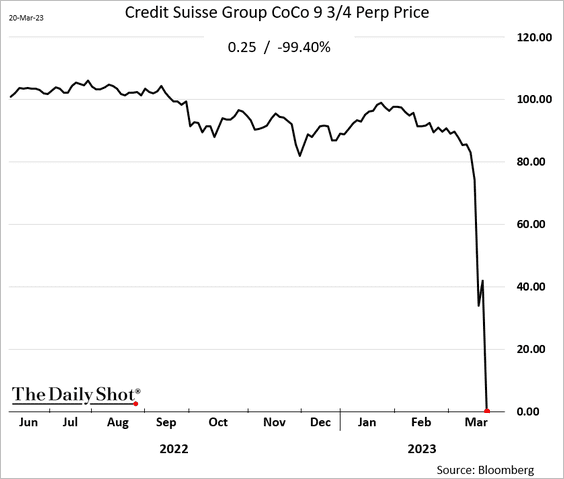

• Credit Suisse CoCo prices are trading near zero.

Source: @EK_Hudson, @gmorpurgo, @rachel_butt, @markets Read full article

Source: @EK_Hudson, @gmorpurgo, @rachel_butt, @markets Read full article

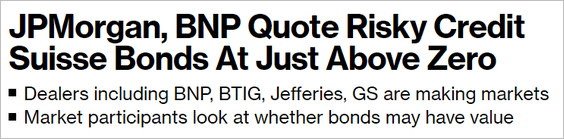

• The overall CoCo market took a hit. Will issuance stall after the Credit Suisse fiasco?

——————–

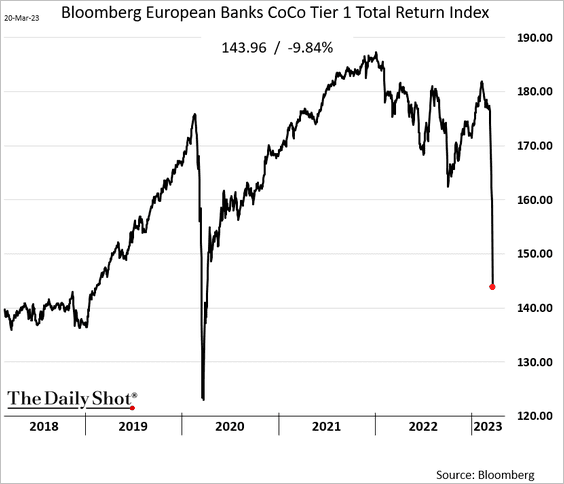

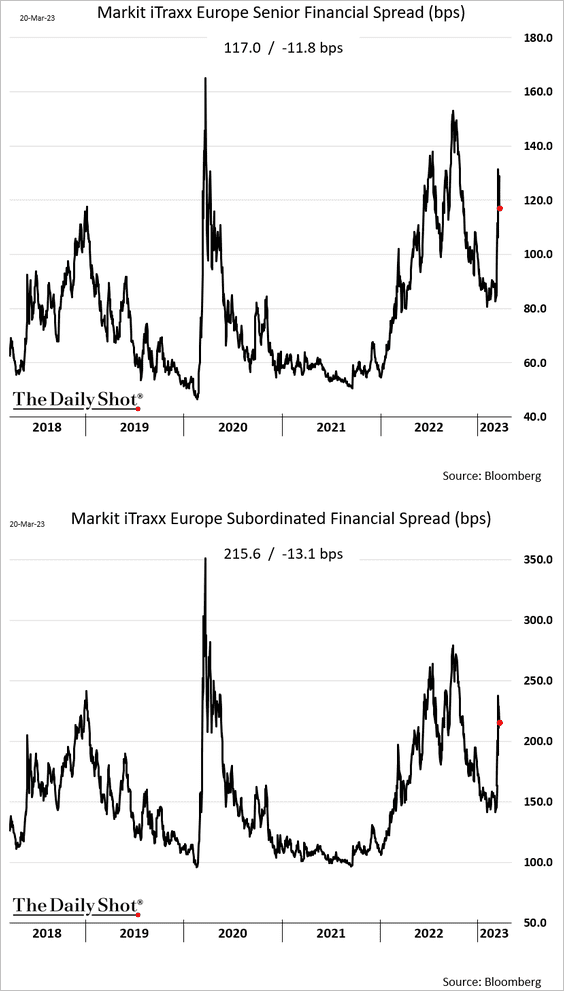

2. European banks’ CDS spreads are not signaling a contagion.

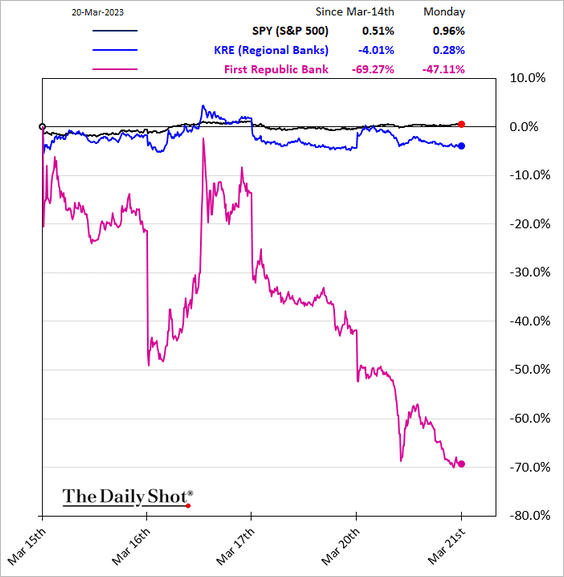

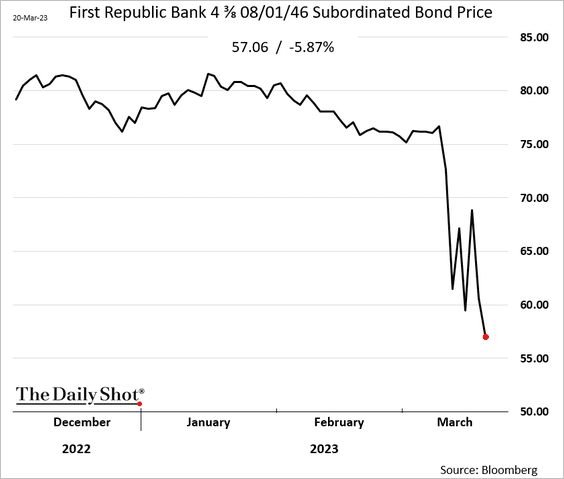

3. In the US, First Republic Bank’s shares and bonds continued to sell off on Monday.

What to do?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

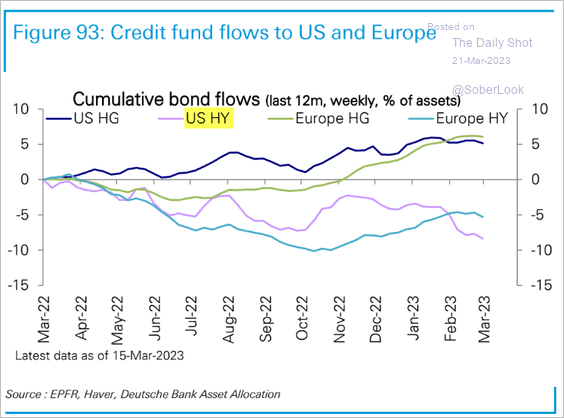

4. US HY funds still see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

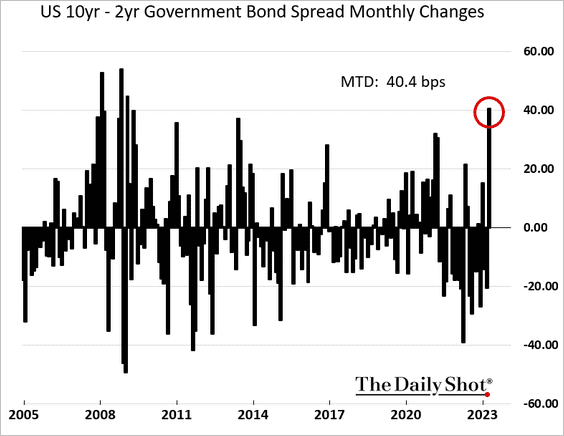

1. The Treasury curve has steepened sharply.

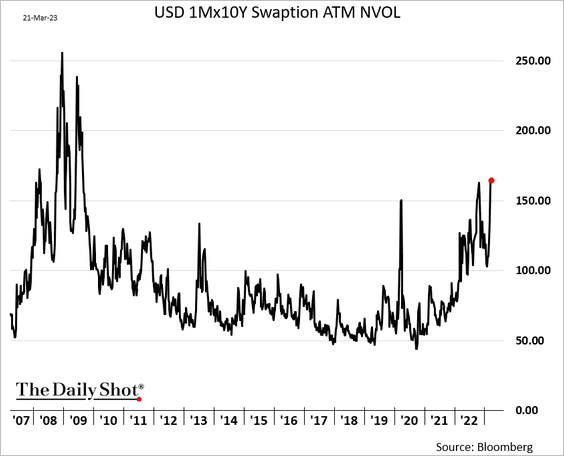

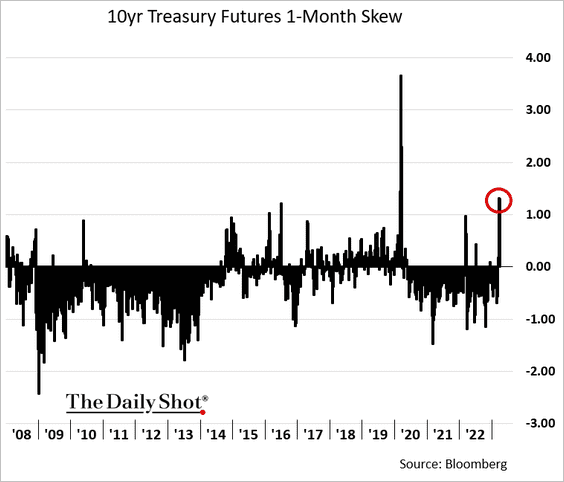

2. Rates vol is near the highest levels since the financial crisis.

The 10-year note futures skew is elevated (high demand for call options on Treasuries).

——————–

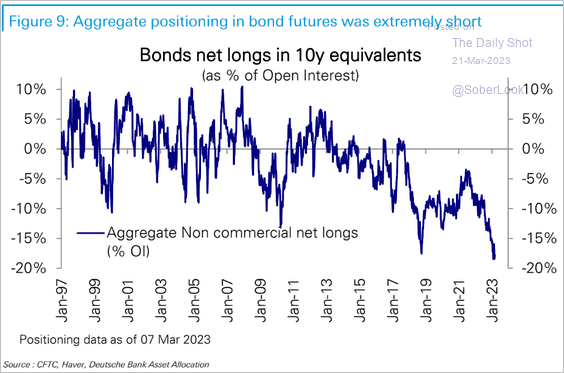

3. Treasury futures positioning was extremely bearish going into the banking sector fiasco.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

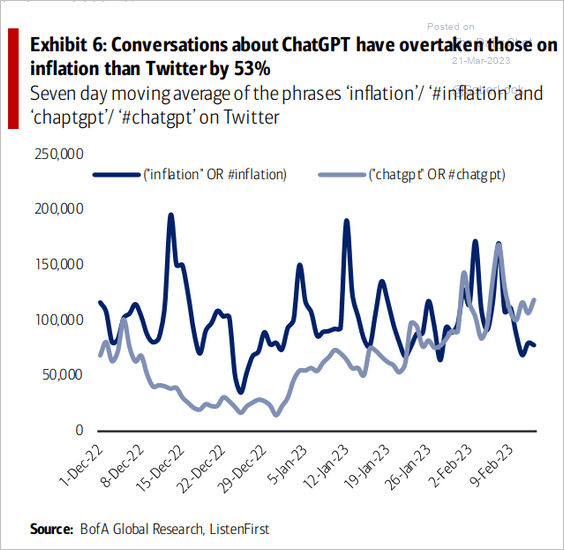

1. Mentions of “ChatGPT” vs. “inflation” on Twitter:

Source: BofA Global Research

Source: BofA Global Research

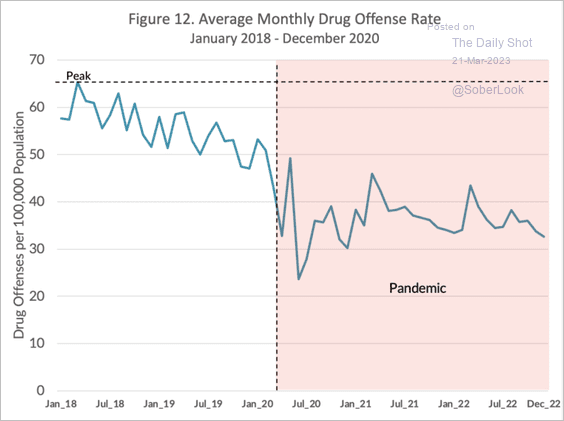

2. Drug offense rates in the 19 US cities with available data:

Source: Council on Criminal Justice

Source: Council on Criminal Justice

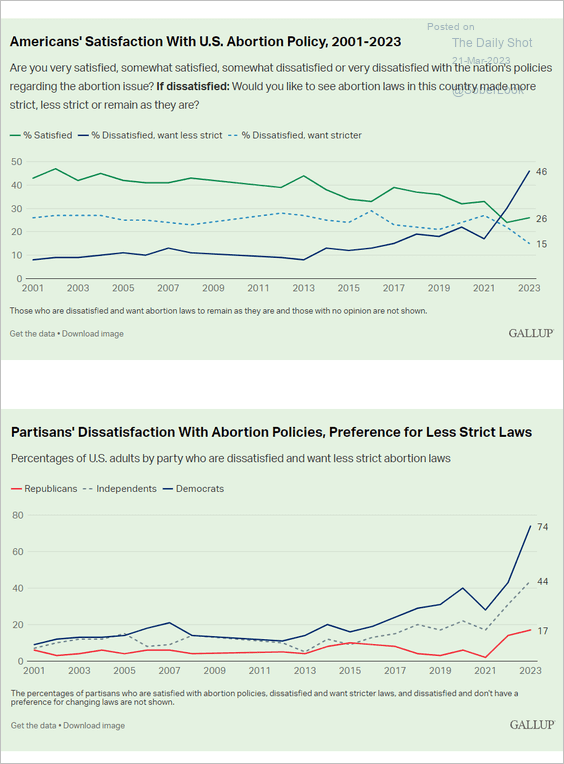

3. US satisfaction with abortion policies:

Source: Gallup Read full article

Source: Gallup Read full article

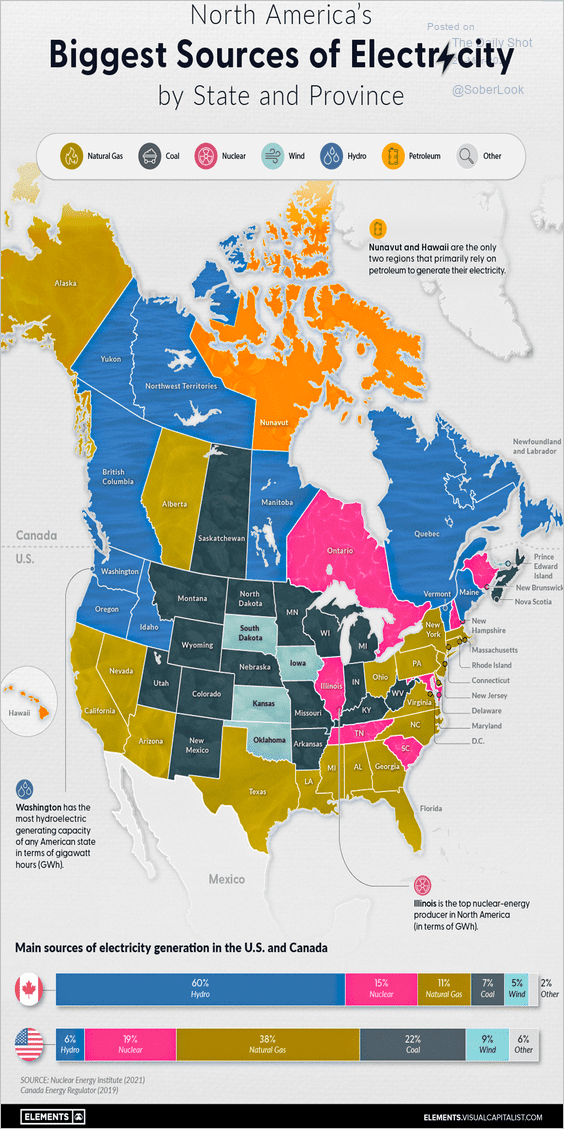

4. Biggest sources of electricity by state/province:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

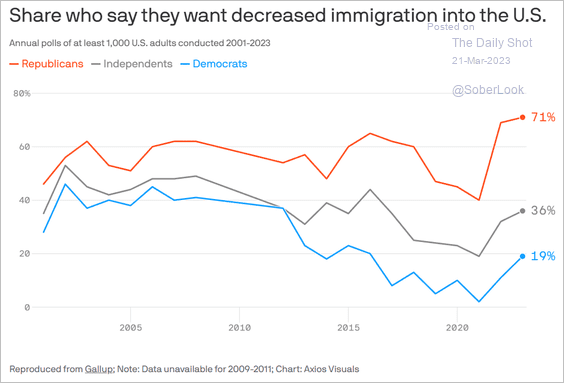

5. Views on immigration in the US:

Source: @axios

Source: @axios

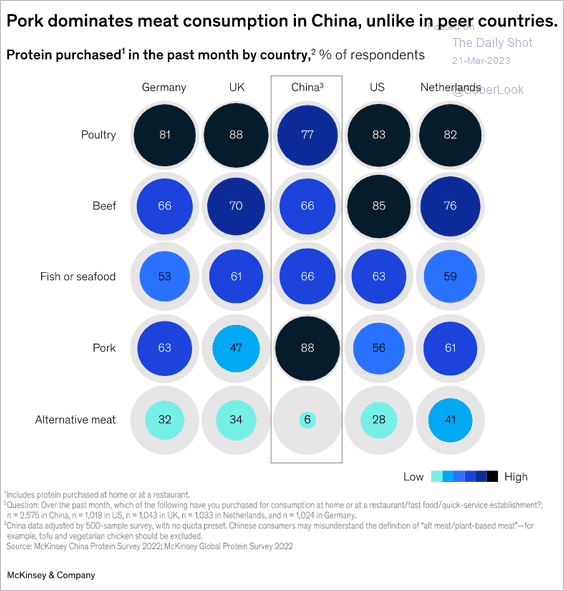

6. Meat preferences:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

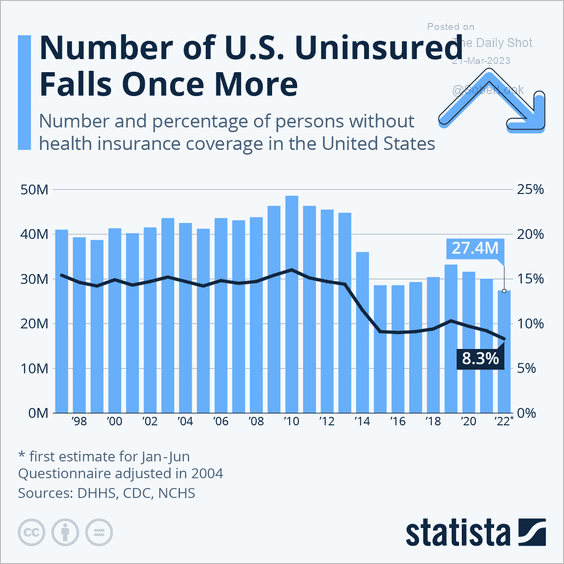

7. Americans without health insurance:

Source: Statista

Source: Statista

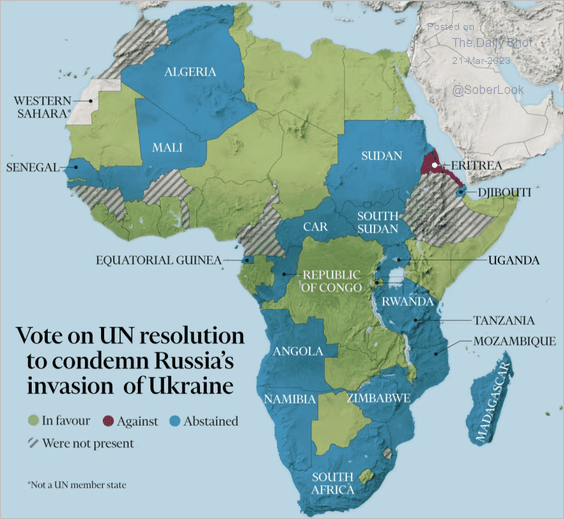

8. How did African nations vote on the UN resolution to condemn Russia’s invasion?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

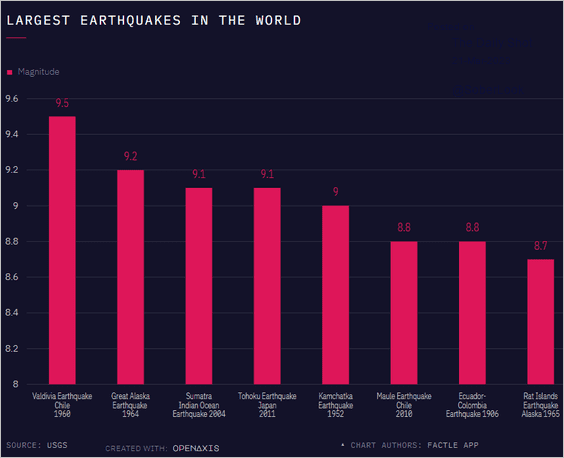

9. Largest earthquakes:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

Back to Index