The Daily Shot: 24-Mar-23

• Global Developments

• Credit

• Equities

• Alternatives

• Commodities

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• The United Kingdom

• The United States

• Food for Thought

Global Developments

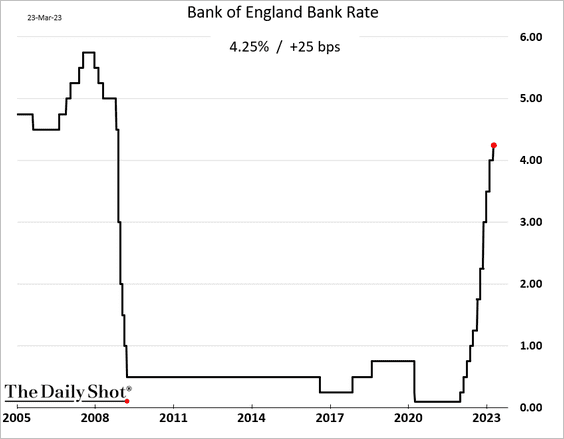

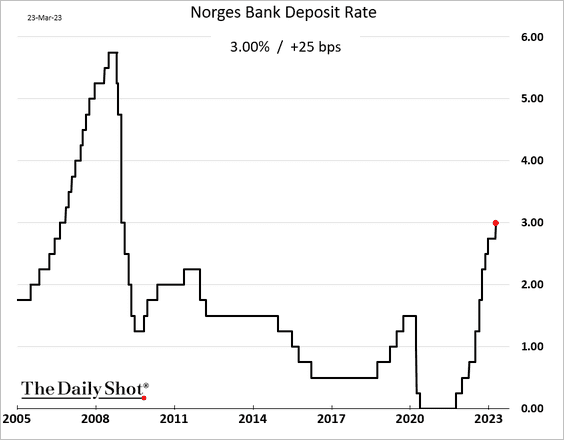

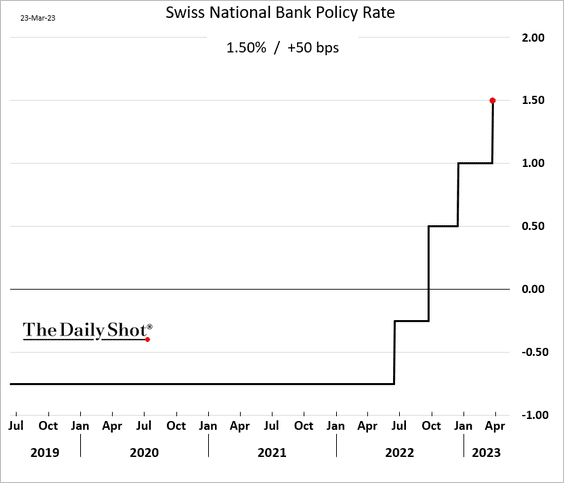

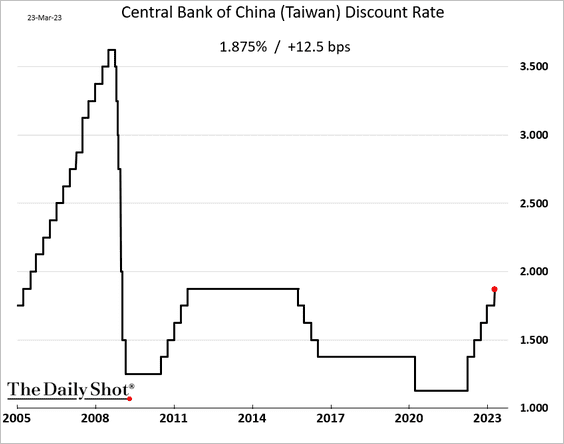

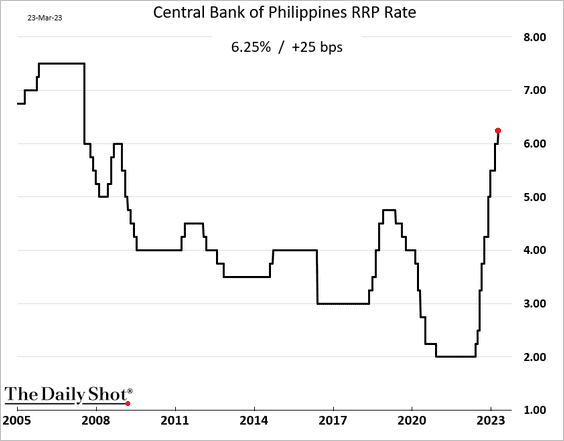

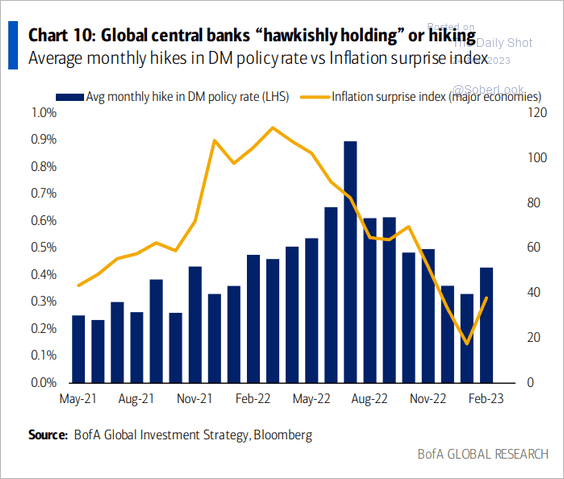

1. Despite the banking industry turmoil, five central banks joined in on the Fed’s rate hike this week by also raising their rates on Thursday, …

• UK:

• Norway:

• Switzerland:

• Taiwan:

• The Philippines:

… as inflation surprises to the upside.

Source: BofA Global Research

Source: BofA Global Research

——————–

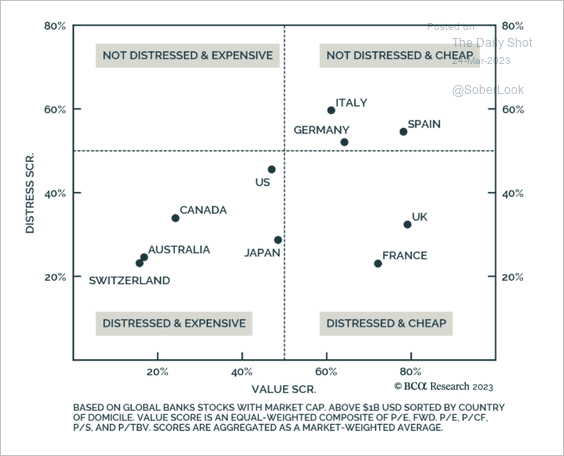

2. This chart compares distressed scores and value factors for banks by region.

Source: BCA Research

Source: BCA Research

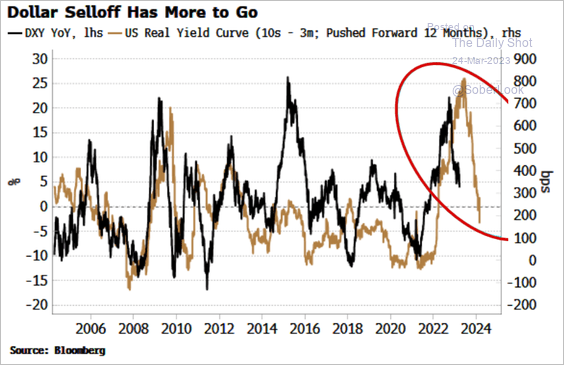

3. A flatter US real yield curve signals a weaker dollar.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

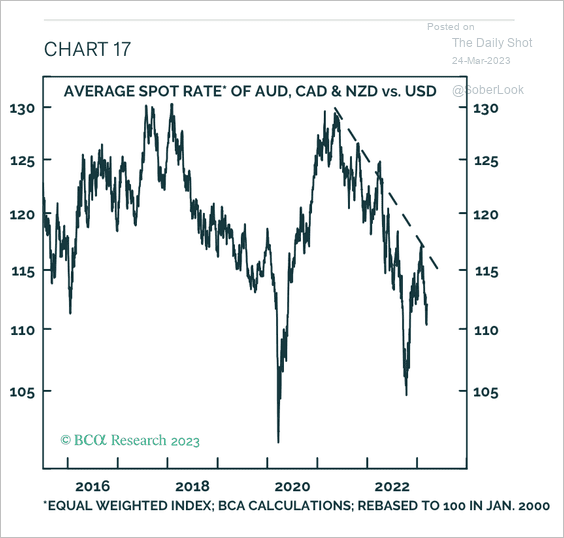

• Growth-sensitive commodity currencies remain in a downtrend. So far, China’s reopening theme has not sustained buying strength.

Source: BCA Research

Source: BCA Research

——————–

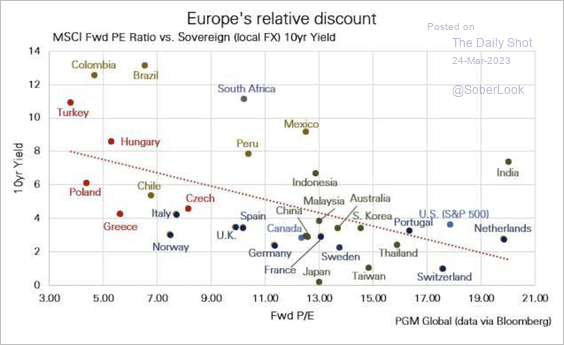

4. Most DM European equities trade at a relative discount, while EM Europe and LatAm are impacted by higher rates. The US still trades at a premium.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Credit

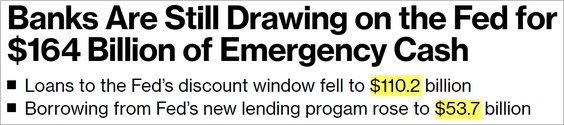

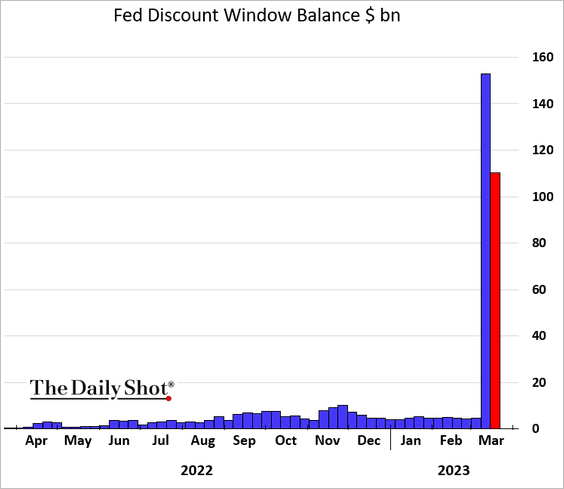

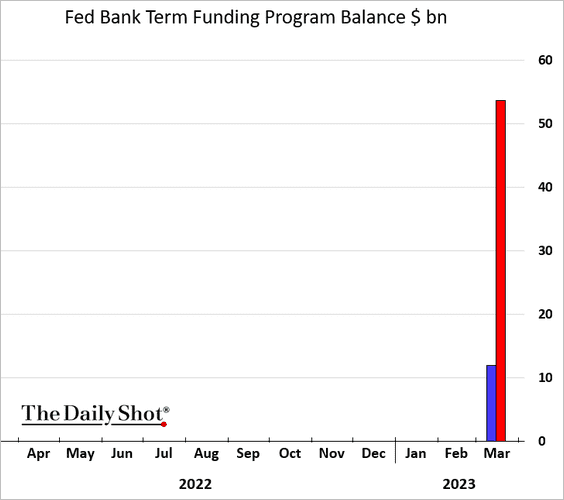

1. US regional and small banks continue to rely heavily on emergency financing from the Fed.

Source: @ctorresreporter, @markets Read full article

Source: @ctorresreporter, @markets Read full article

– The Discount Window:

– BTFP:

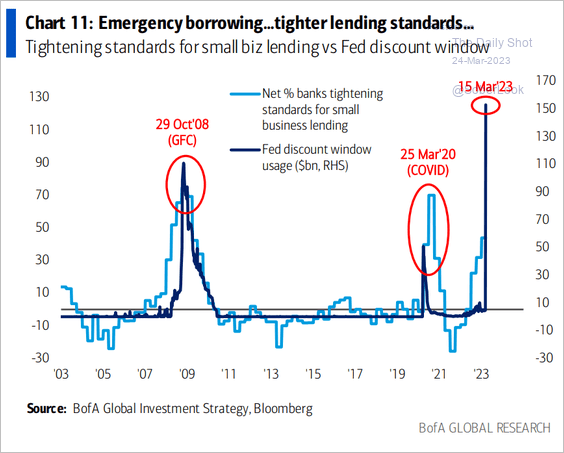

• Heavy reliance on emergency funding tends to coincide with tighter lending conditions.

Source: BofA Global Research

Source: BofA Global Research

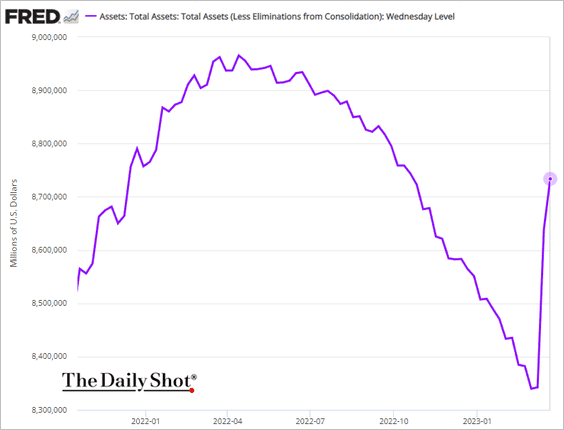

• Here is the Fed’s balance sheet, with five months of QT reversed in two weeks.

——————–

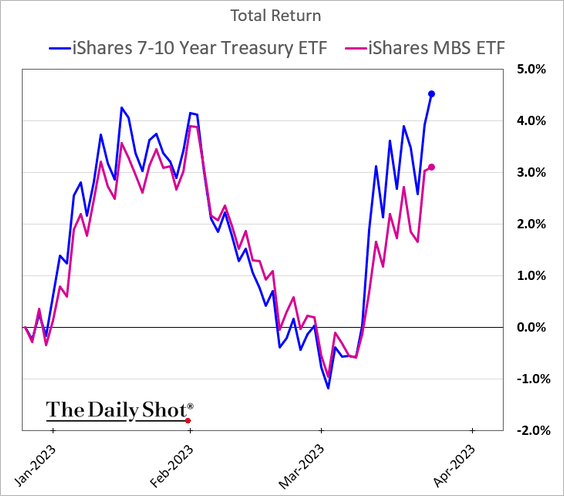

2. Agency MBS securities continue to underperform Treasuries, which keeps mortgage rates elevated.

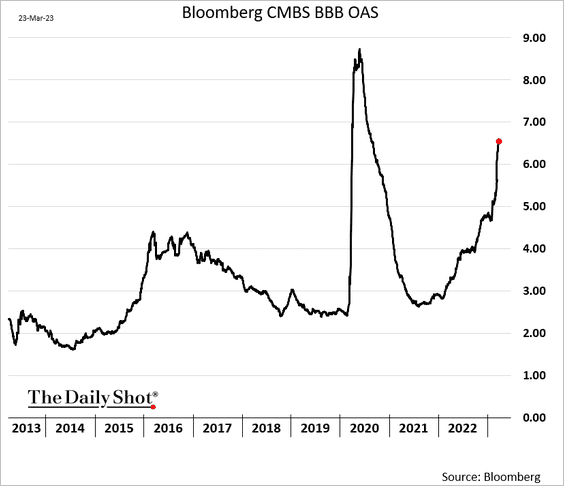

3. Commercial mortgage-backed securities spreads have been widening, …

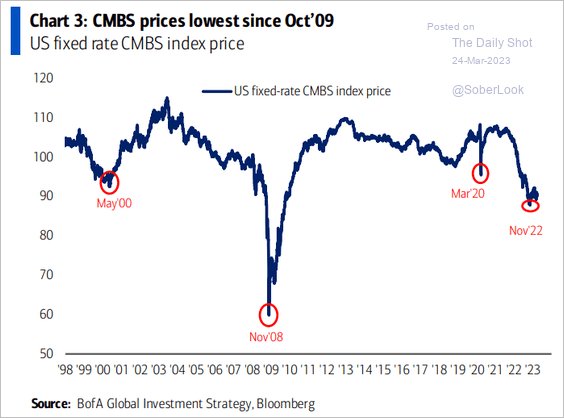

… with prices under pressure.

Source: BofA Global Research

Source: BofA Global Research

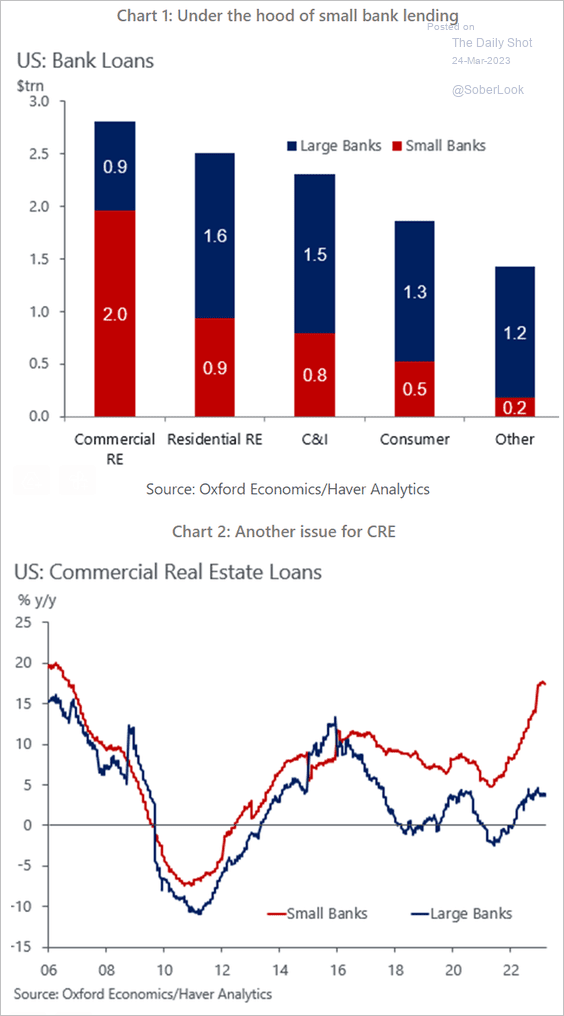

• Commercial property lending is on the verge of a substantial downturn, as regional banks retreat.

Source: Oxford Economics

Source: Oxford Economics

——————–

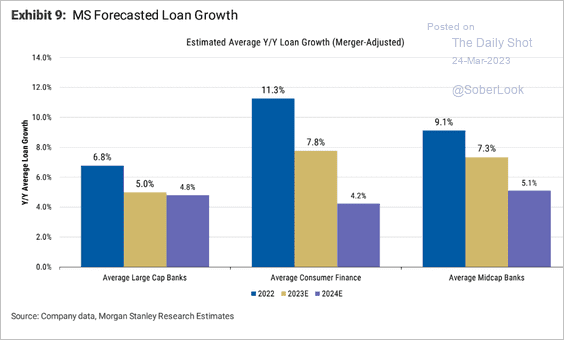

4. Loan growth is expected to slow.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

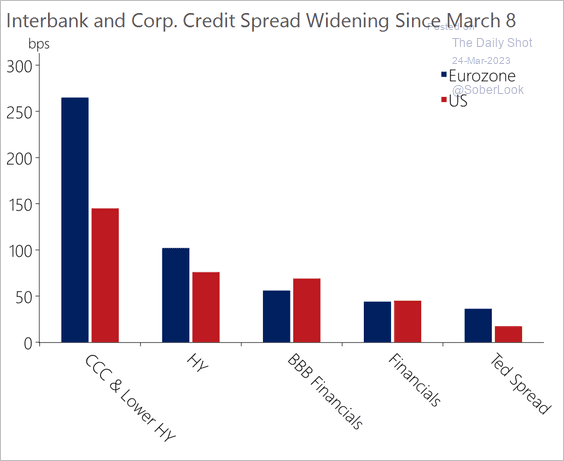

5. Low-grade corporate bond spreads have widened during the recent banking crisis.

Source: Oxford Economics

Source: Oxford Economics

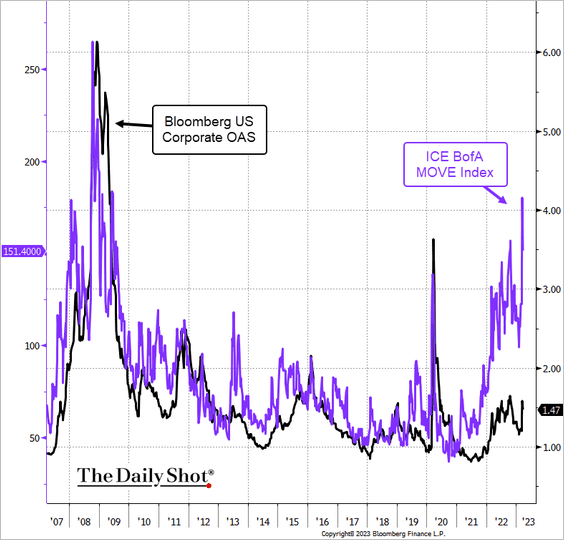

• Elevated Treasury-market implied volatility points to wider corporate bond spreads.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @tavicosta

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @tavicosta

——————–

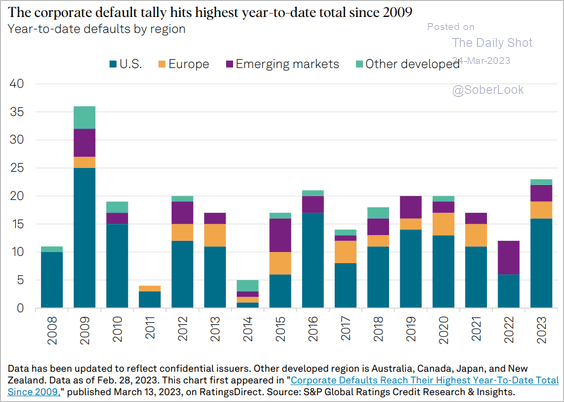

6. This chart shows corporate defaults through February.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Equities

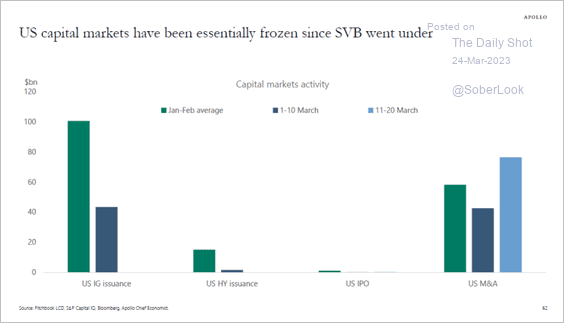

1. Capital markets have been frozen since the SVB fiasco.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

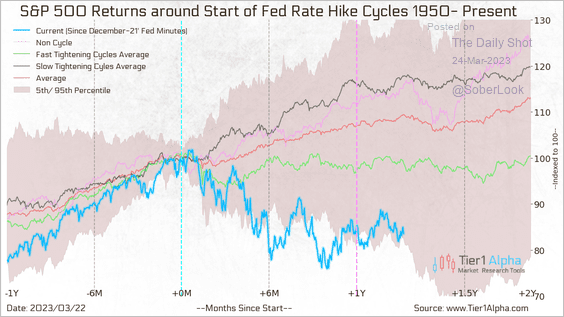

2. Here is the S&P 500 around Fed hiking cycles.

Source: @t1alpha

Source: @t1alpha

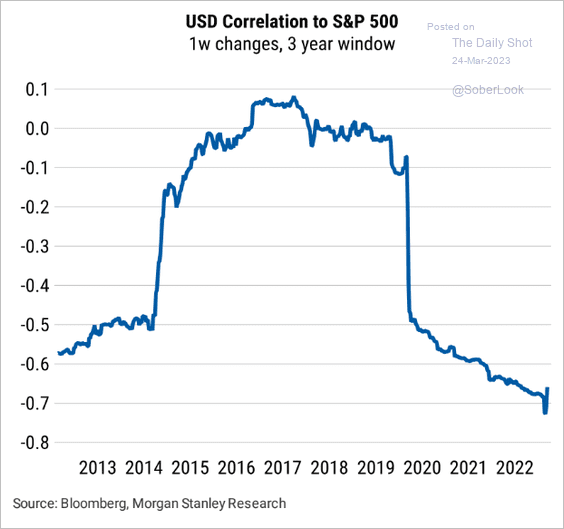

3. Below is the correlation between stocks and the dollar.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

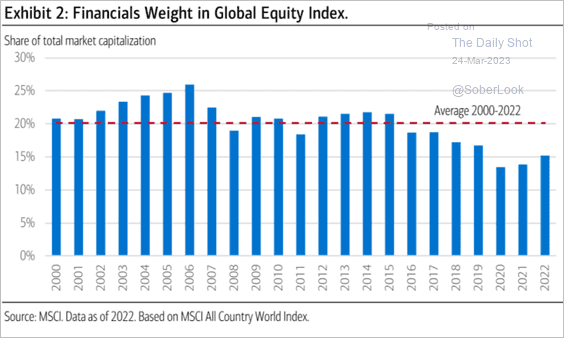

4. This chart shows financials’ weight in the MSCI World Index.

Source: Merrill Lynch

Source: Merrill Lynch

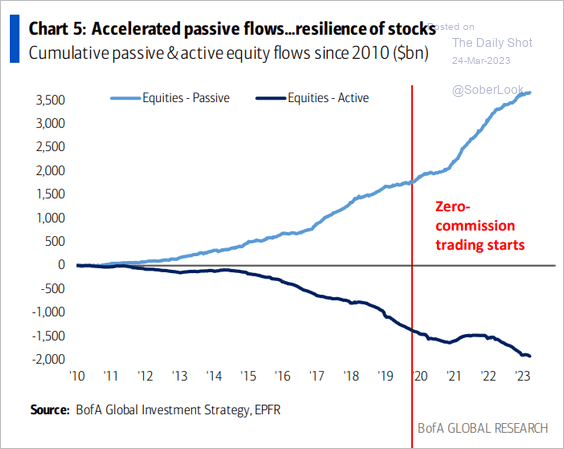

5. The active/passive fund flows divergence continues to widen.

Source: BofA Global Research

Source: BofA Global Research

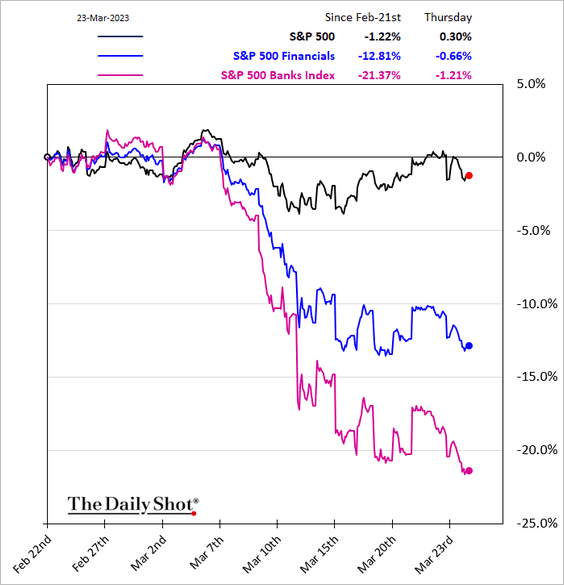

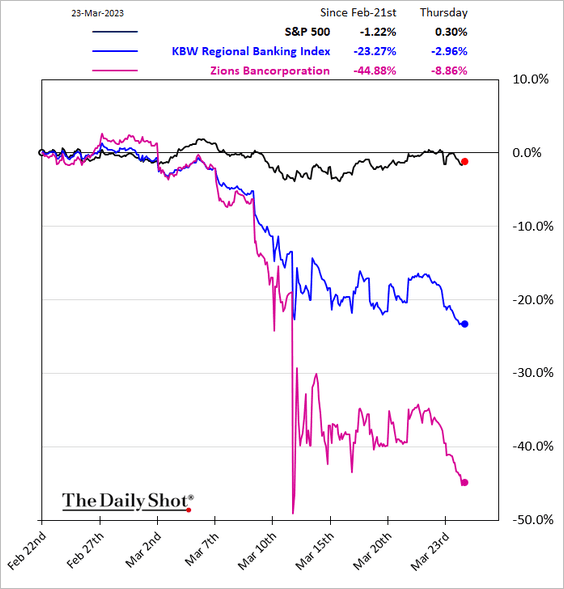

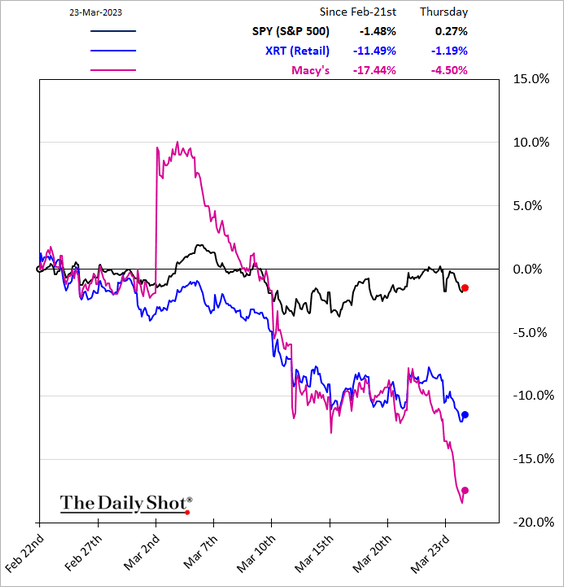

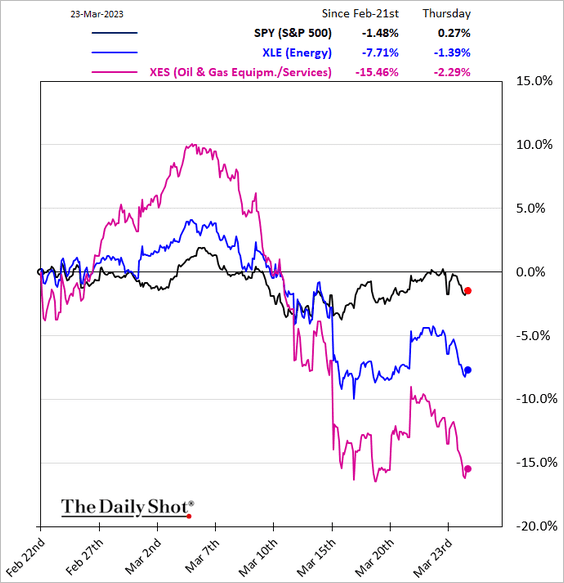

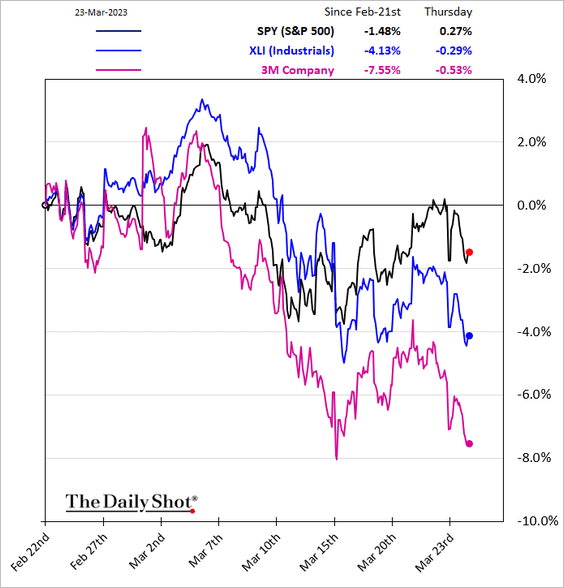

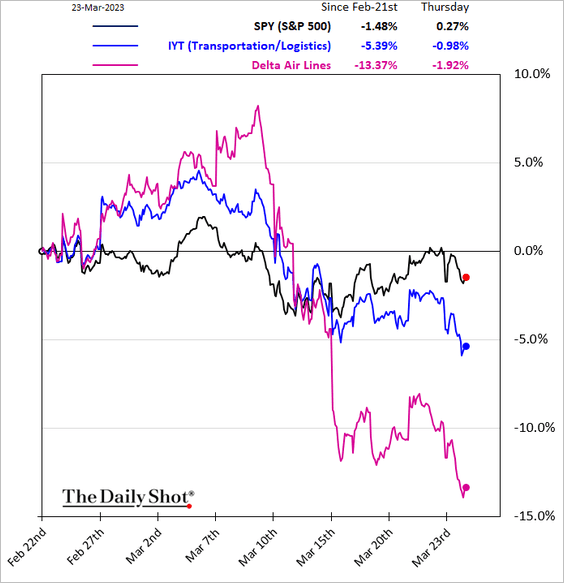

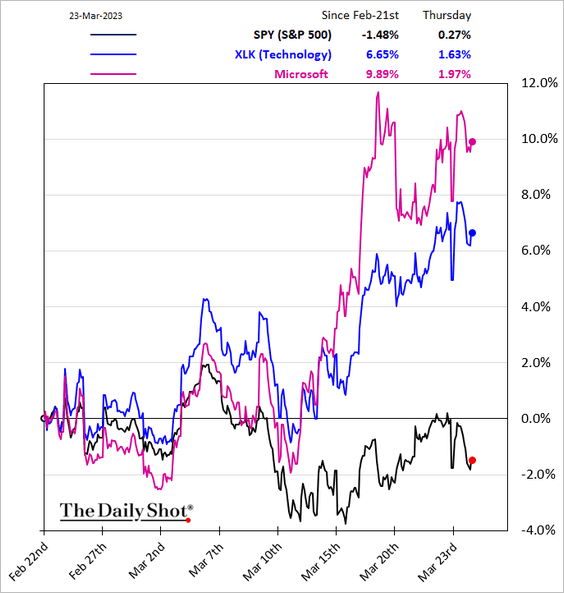

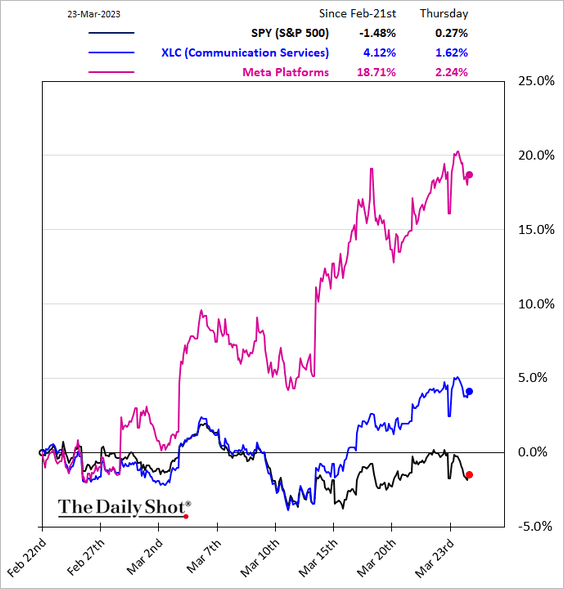

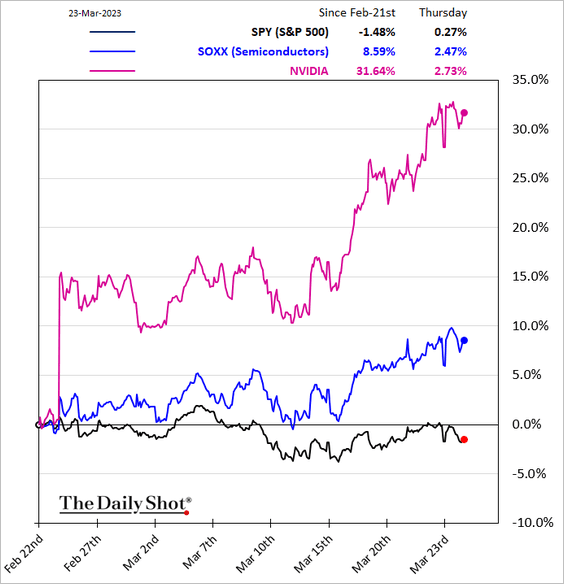

6. Next, we have some sector performance data over the past month.

• Banks:

– Regional banks:

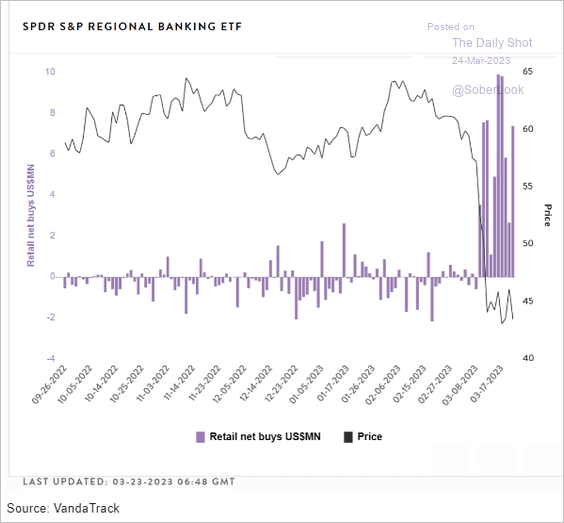

– By the way, retail investors have been buying the regional banking ETF.

Source: Vanda Research

Source: Vanda Research

——————–

• Retail:

• Energy:

• Industrials:

• Transportation:

• Tech:

– Communication Services:

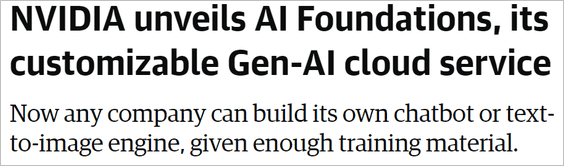

– Semiconductors:

Source: Engadget Read full article

Source: Engadget Read full article

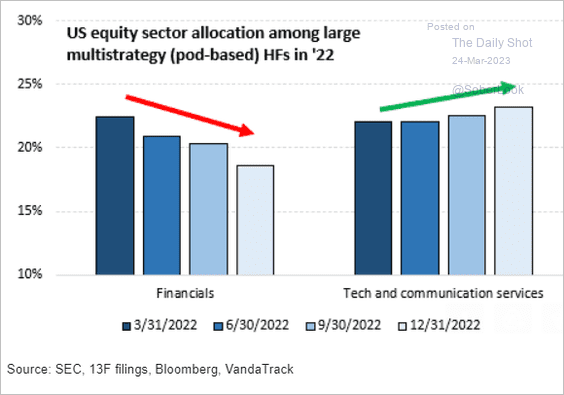

– Institutional investors have been rotating out of financials into tech.

Source: Vanda Research

Source: Vanda Research

——————–

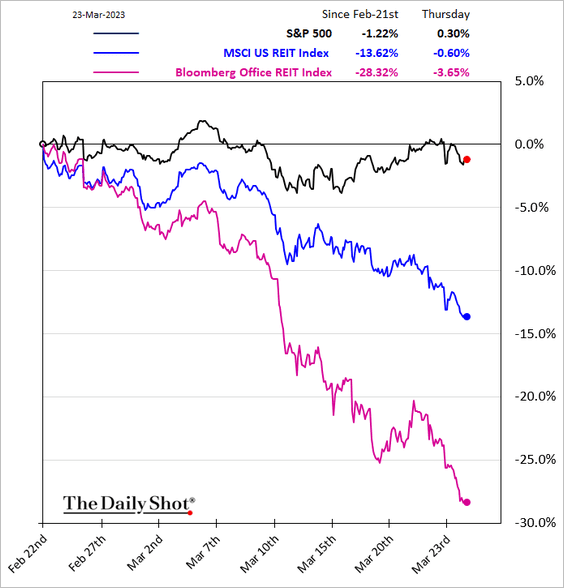

• REITs:

Source: CoStar Read full article

Source: CoStar Read full article

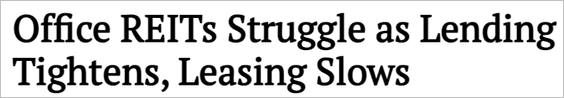

– Office vacancy rates:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Alternatives

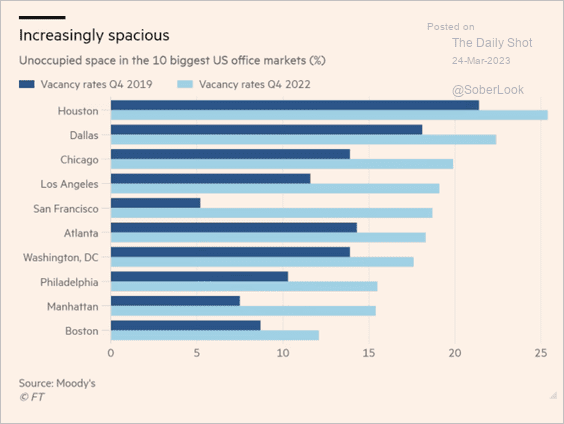

1. Private equity and debt funds have a lot of capital to put to work.

Source: @markets Read full article

Source: @markets Read full article

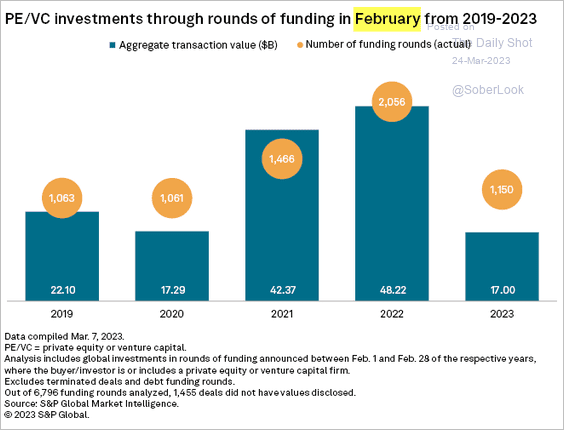

2. February was a slow month for VC funding.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

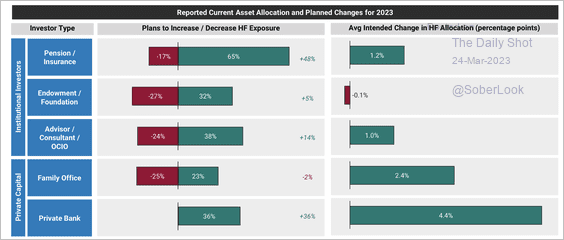

3. Pension funds, insurance companies, and private banks are most constructive in their plans for hedge fund allocations this year. Endowments and foundations are somewhat less bullish.

Source: Goldman Sachs

Source: Goldman Sachs

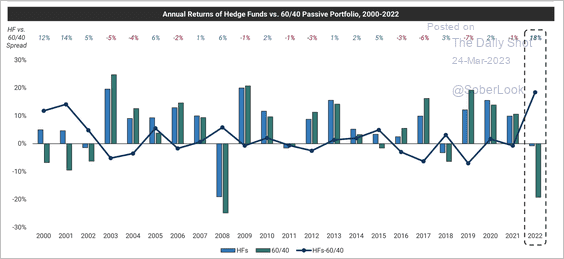

4. Hedge funds were able to preserve capital and outperformed traditional 60/40 stock/bond portfolios by a record margin last year.

Source: Goldman Sachs

Source: Goldman Sachs

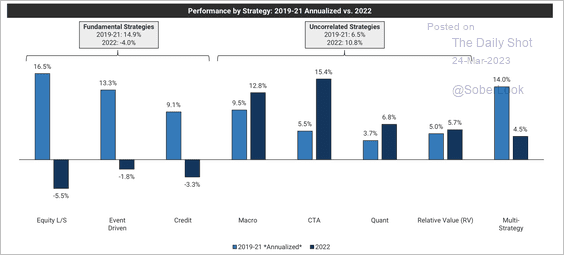

5. 2022 was a strong year for uncorrelated strategies, while fundamental strategies were challenged.

Source: Goldman Sachs

Source: Goldman Sachs

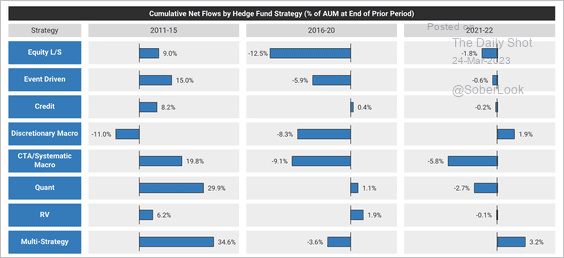

6. CTAs have seen notable outflows last year despite strong performance.

Source: Goldman Sachs

Source: Goldman Sachs

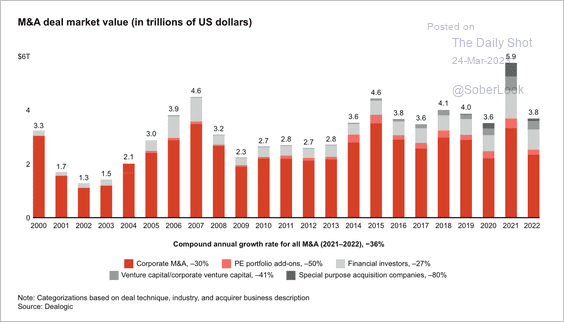

7. Global M&A deal value fell by 36% in 2022.

Source: Bain & Company

Source: Bain & Company

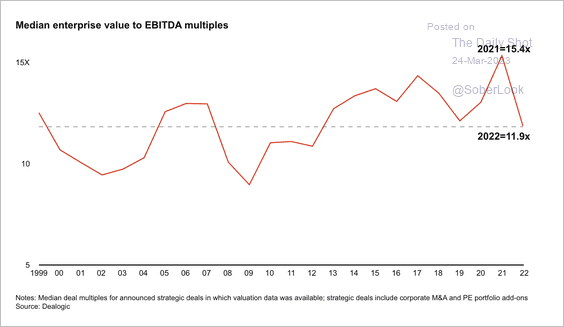

• Strategic M&A multiples fell to nearly 12x from 2021’s historic high of 15.4x.

Source: Bain & Company

Source: Bain & Company

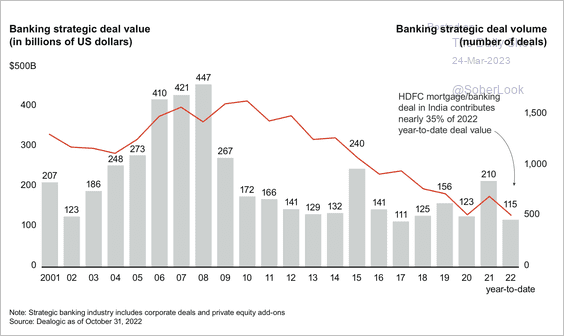

• Banking deal value and volume continued to decline.

Source: Bain & Company

Source: Bain & Company

Back to Index

Commodities

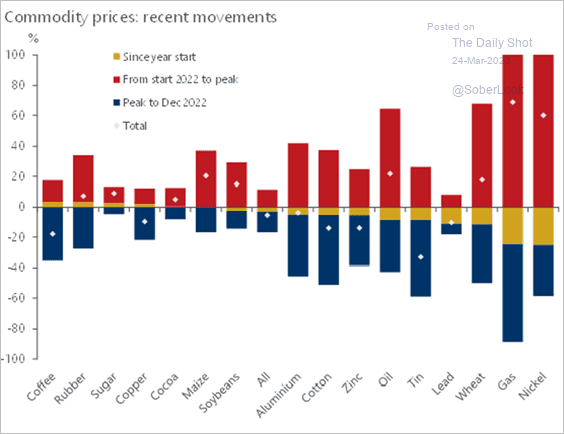

1. Commodity prices have fallen this year, though most remain above early 2022 levels.

Source: Oxford Economics

Source: Oxford Economics

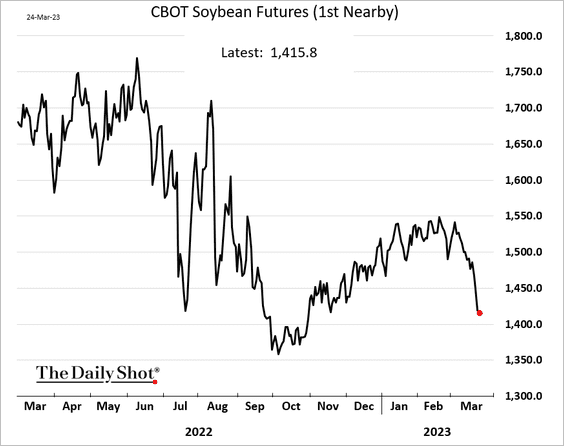

2. A record soybean crop in Brazil (155 million tonnes) is pressuring soybean futures.

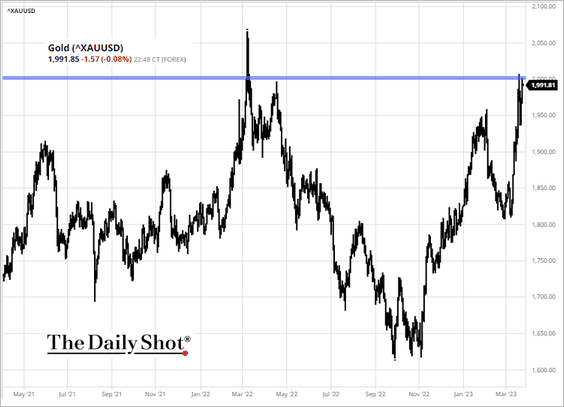

3. Almost there …

Source: barchart.com

Source: barchart.com

Back to Index

Cryptocurrency

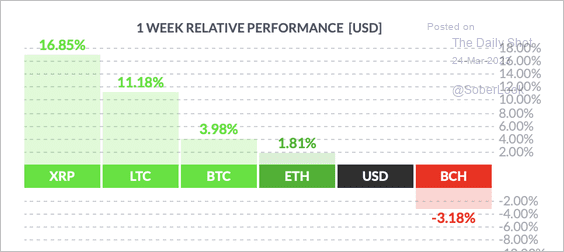

1. So far, it has been a good week for cryptos, with XRP outperforming other large tokens. Bitcoin Cash (BCH) has lagged.

Source: FinViz

Source: FinViz

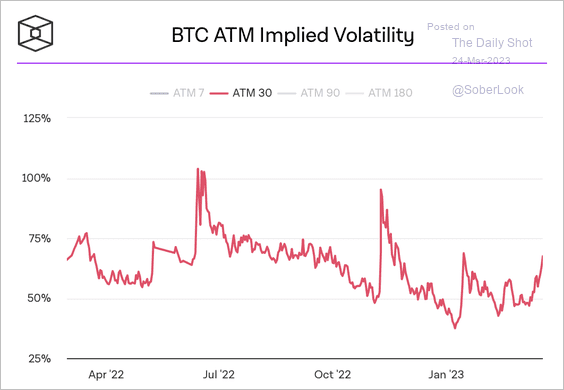

2. Bitcoin’s implied volatility ticked higher but remains below last year’s peak.

Source: The Block Research

Source: The Block Research

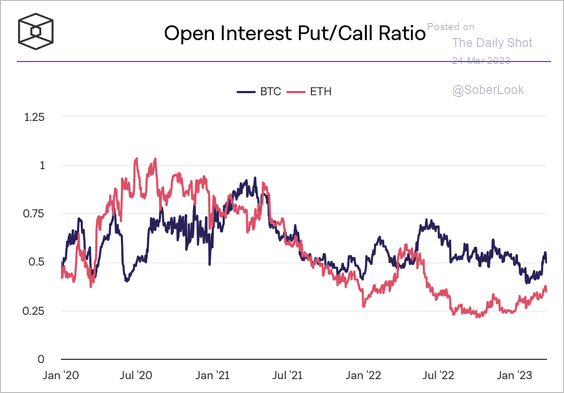

3. Bitcoin and ether’s put/call ratios continue to rise from low levels.

Source: The Block Research

Source: The Block Research

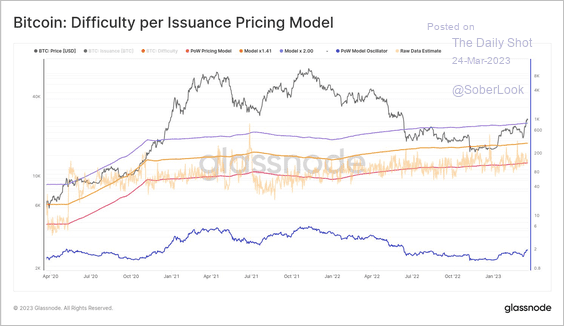

4. Bitcoin’s price is now above the estimated cost of production at about $26K, which benefits miners.

Source: @glassnode

Source: @glassnode

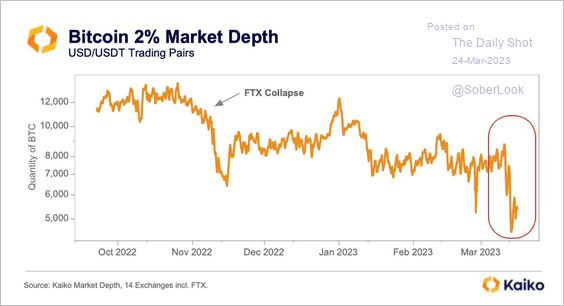

5. Bitcoin’s market liquidity remains low, impacted by the FTX collapse and the recent banking crisis.

Source: @KaikoData

Source: @KaikoData

Back to Index

Emerging Markets

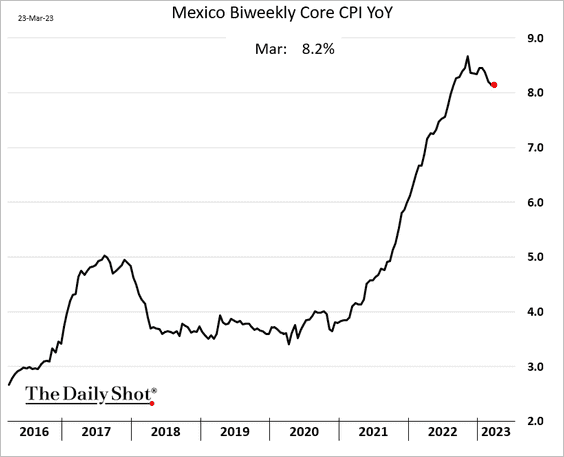

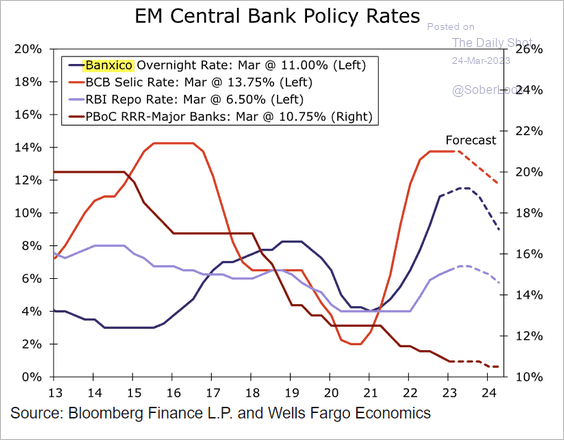

1. Mexican core inflation remains elevated.

Another rate hike ahead?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

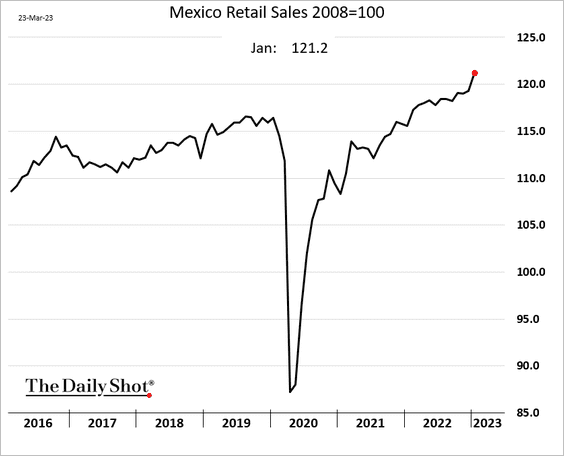

Mexican real retail sales rose sharply in January.

——————–

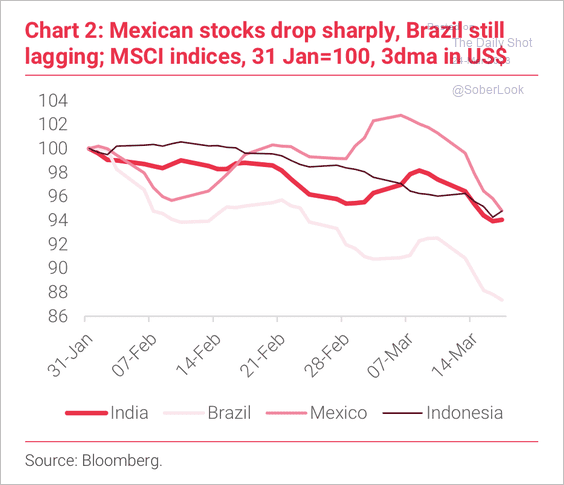

2. So far, Brazilian stocks have lagged EM peers this year.

Source: TS Lombard

Source: TS Lombard

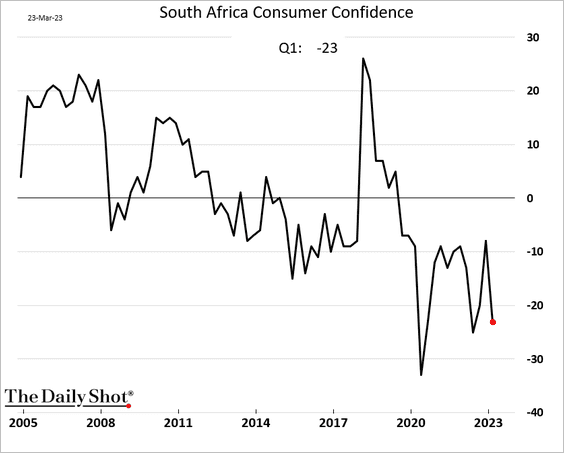

3. South Africa’s consumer confidence declined this quarter.

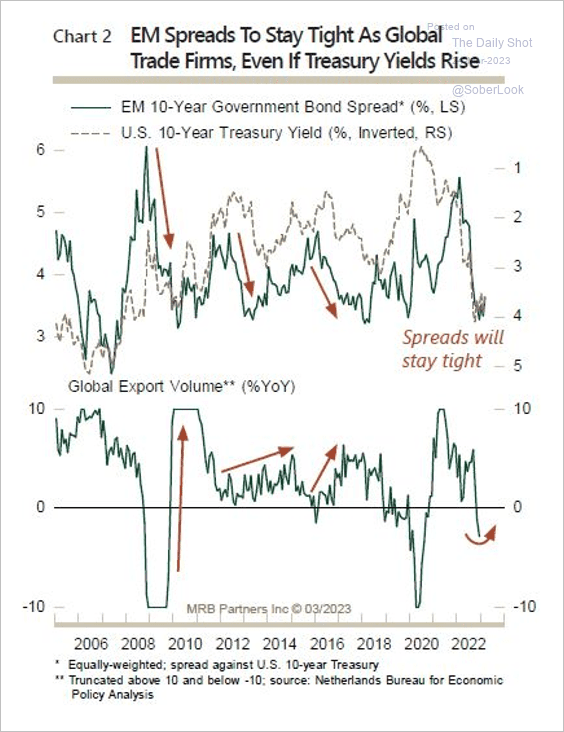

4. A recovery in global trade could benefit EM debt.

Source: MRB Partners

Source: MRB Partners

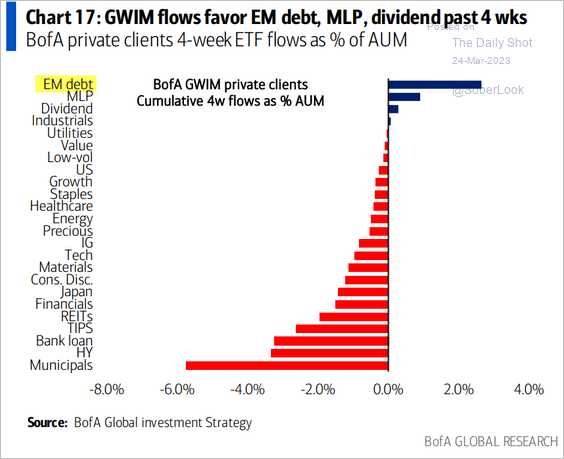

And BofA’s private clients are betting on it.

Source: BofA Global Research

Source: BofA Global Research

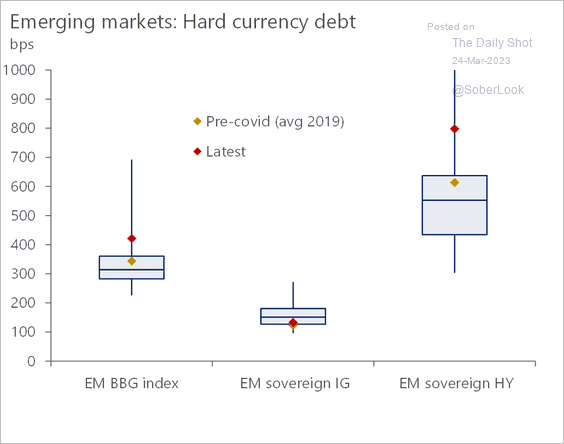

5. Valuation gaps have re-emerged for high-yield sovereign credit.

Source: Oxford Economics

Source: Oxford Economics

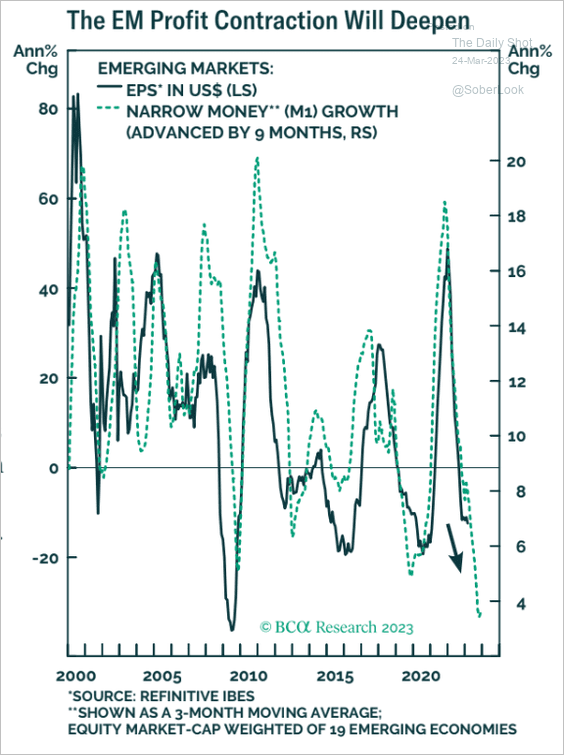

6. Tighter liquidity points to falling EM corporate profits.

Source: BCA Research

Source: BCA Research

Back to Index

China

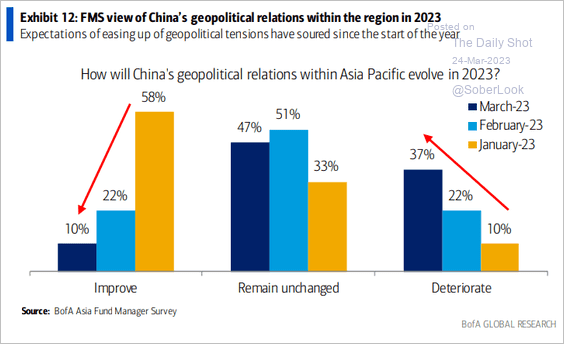

1. Investors see China’s regional geopolitical relations deteriorating.

Source: BofA Global Research

Source: BofA Global Research

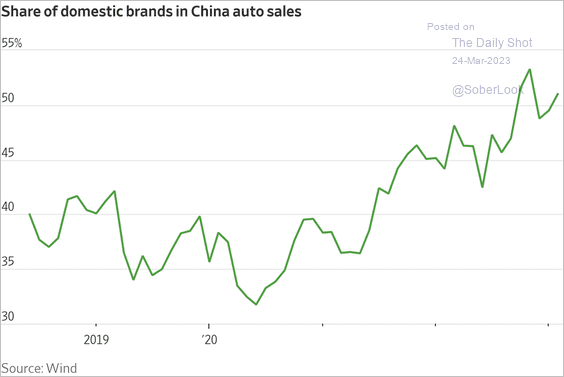

2. Domestic brands are increasingly dominant in China’s automobile market.

Source: @WSJ Read full article

Source: @WSJ Read full article

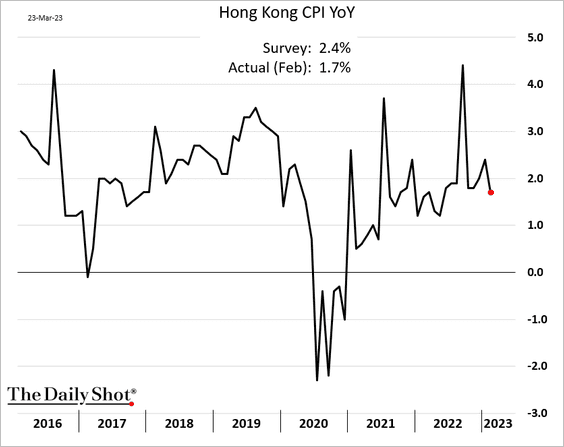

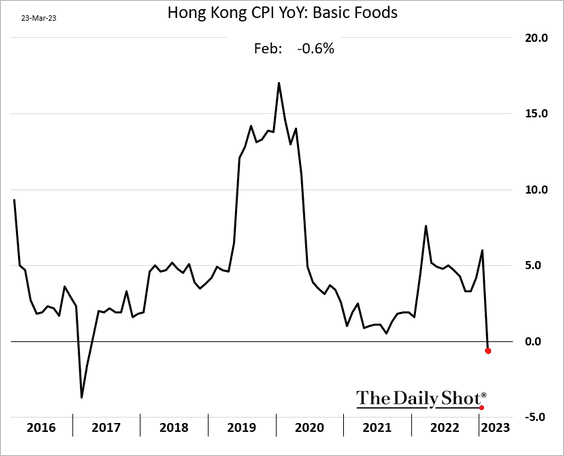

3. Hong Kong’s CPI surprised to the downside, …

… with food prices reversing some of last year’s increases.

Back to Index

Asia – Pacific

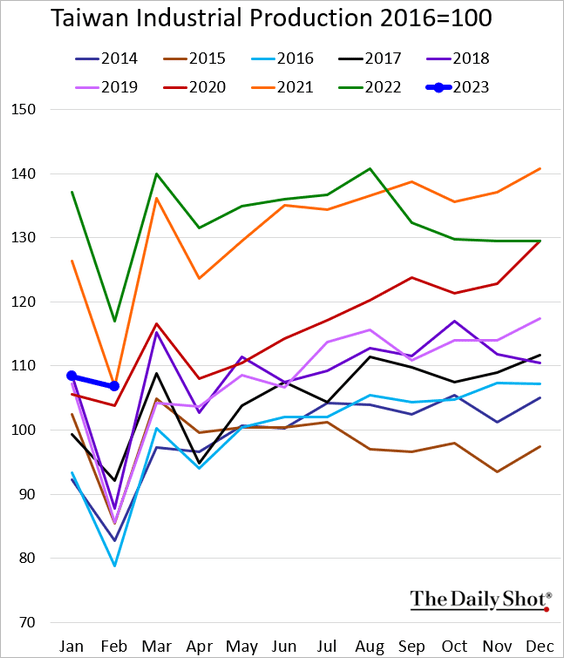

1. Taiwan’s industrial production hit 2021 levels last month, an improvement from January.

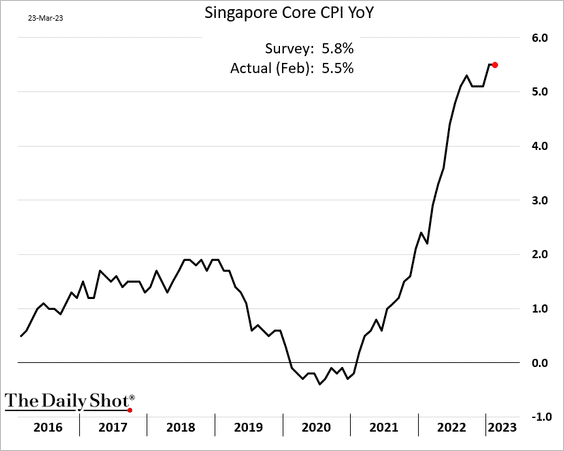

2. Singapore’s CPI was lower than expected.

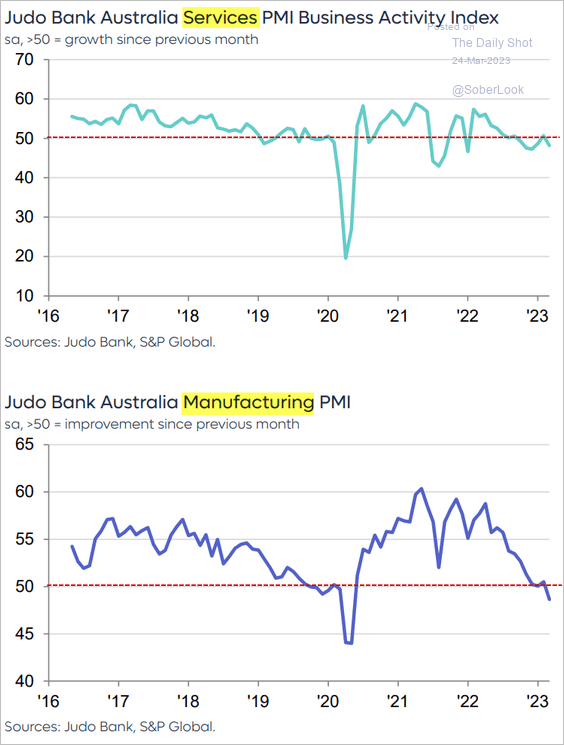

3. Australia’s business activity is contracting this month, with both manufacturing and services PMIs below 50.

Source: S&P Global PMI

Source: S&P Global PMI

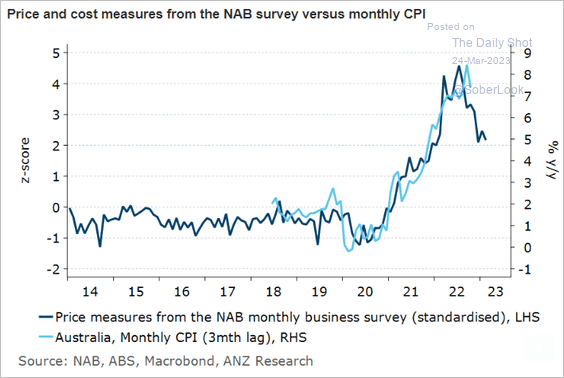

Australia’s inflation will be declining quickly from here.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Japan

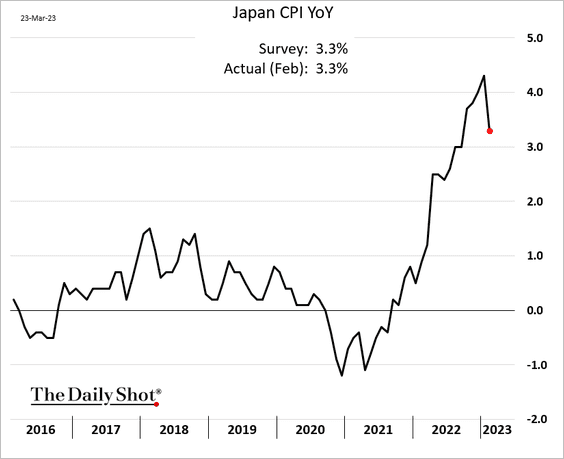

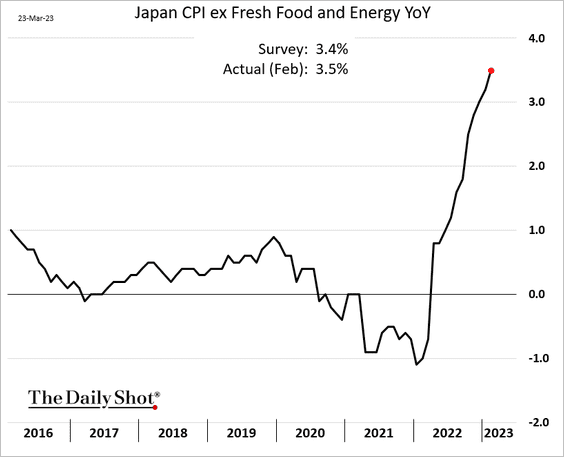

1. Government energy subsidies shaved some 1% from last month’s headline CPI.

But core inflation continues to climb.

——————–

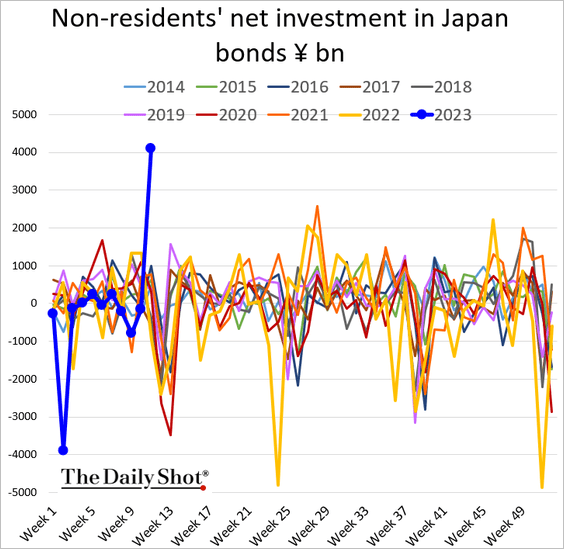

2. Foreigners bought a massive amount of JGBs last week, as the banking turmoil sent investors into yen.

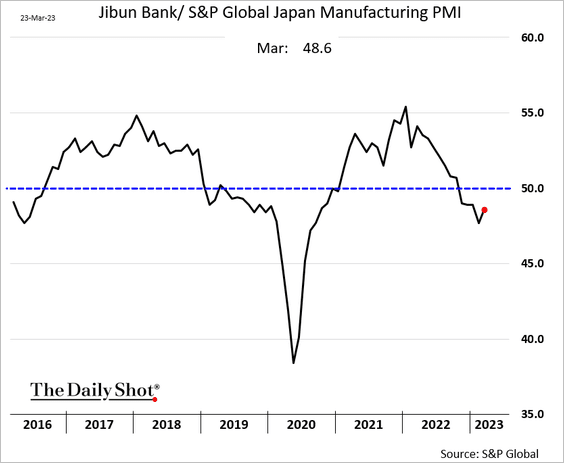

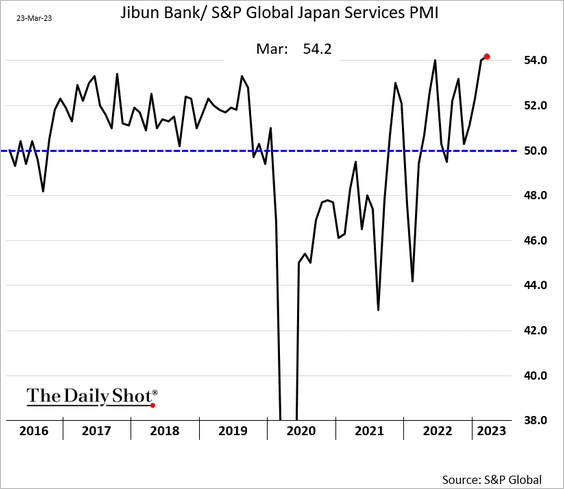

3. The decline in Japan’s factory activity slowed this month.

Service sector growth hit a multi-year high.

——————–

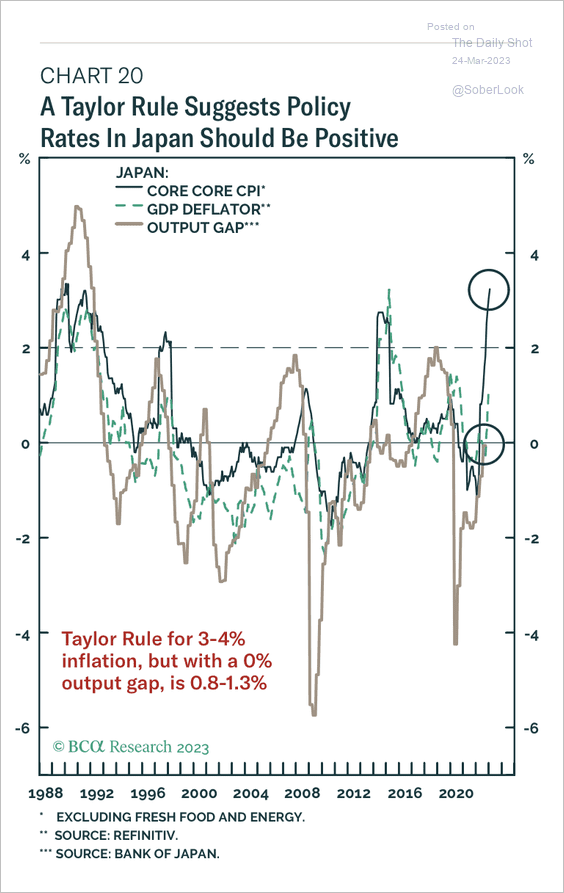

4. The Taylor Rule suggests policy rates should be between 0.88% and 1.38%.

Source: BCA Research

Source: BCA Research

Back to Index

The Eurozone

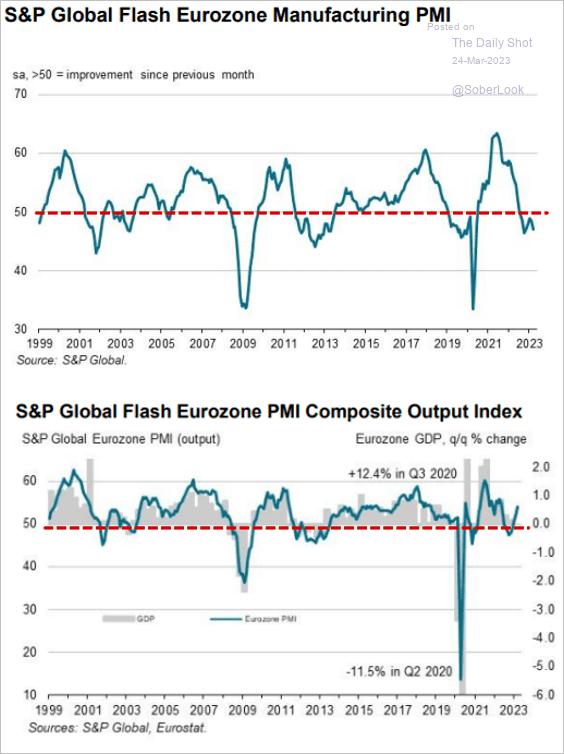

1. Euro-area manufacturing sector contraction worsened this month (1st panel), but services activity jumped, boosting the composite PMI (2nd panel). We will have more on the PMI report next week.

Source: S&P Global PMI

Source: S&P Global PMI

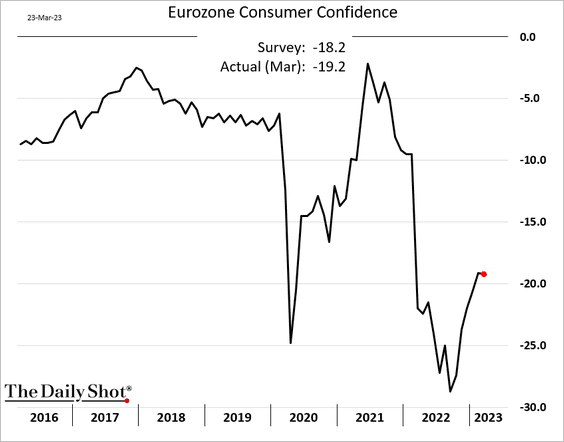

2. The rebound in consumer confidence stalled this month.

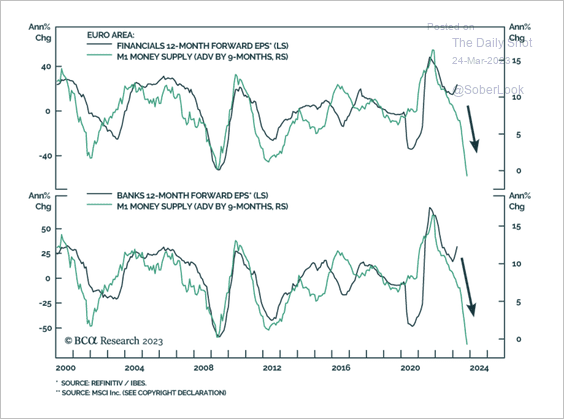

3. The rapid decline in money supply could weigh on bank earnings.

Source: BCA Research

Source: BCA Research

Back to Index

The United Kingdom

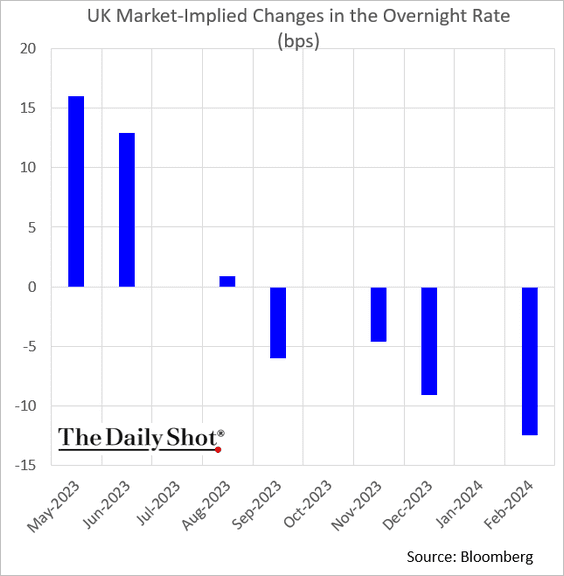

1. The market sees more BoE rate hikes ahead.

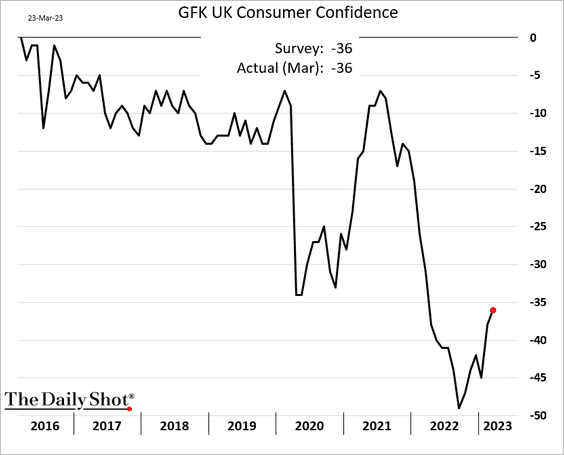

2. Consumer confidence edged higher but remains depressed.

Back to Index

The United States

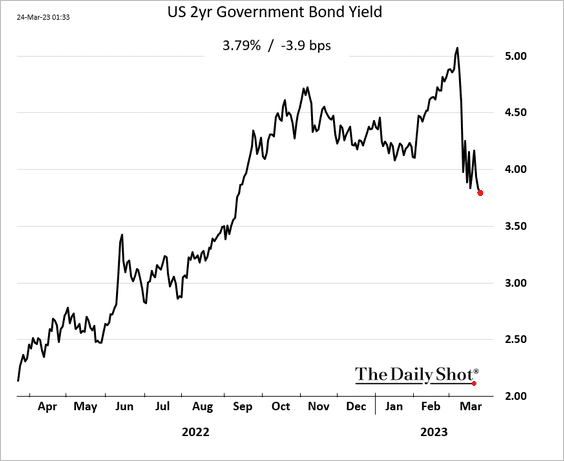

1. The 2-year Treasury yield hit the lowest level since last September.

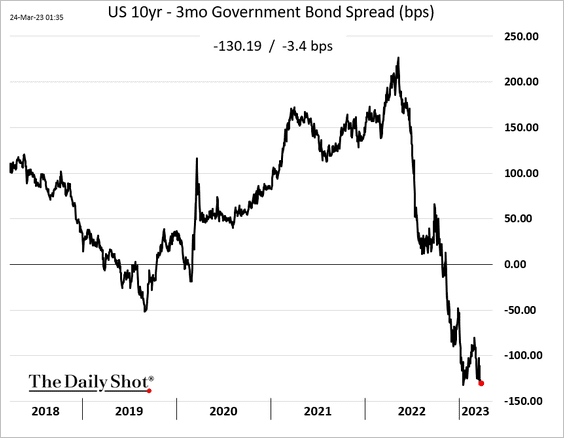

• The 10-year/3-month portion of the Treasury curve remains heavily inverted.

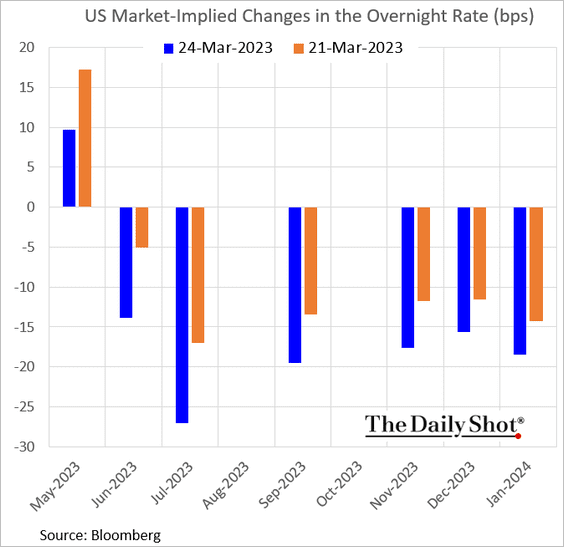

• The market sees rate cuts starting as soon as June.

——————–

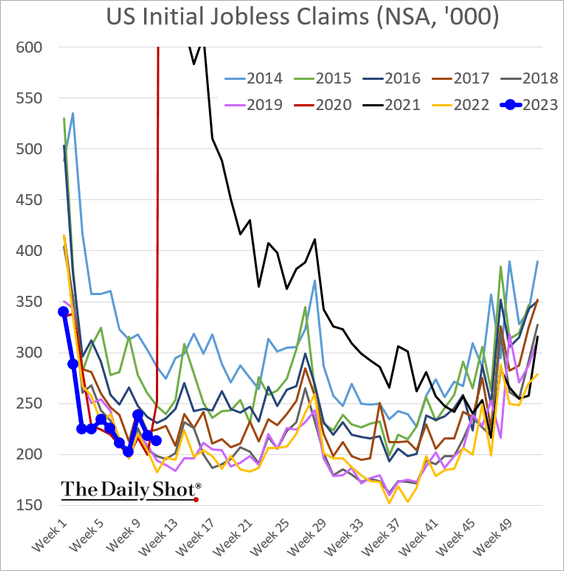

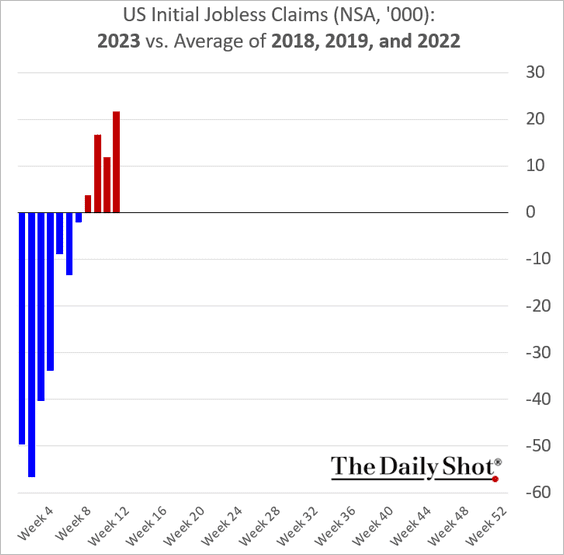

2. Initial jobless claims remain above the average of 2018, 2019, and 2022 (years with some of the lowest claims in recent history).

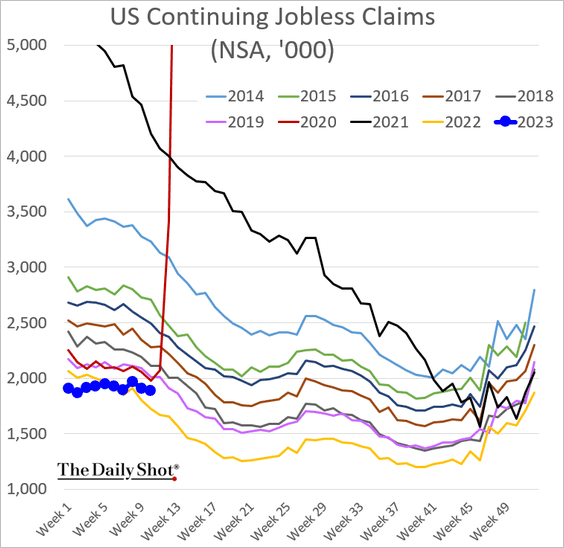

• Continuing claims are holding above last year’s levels.

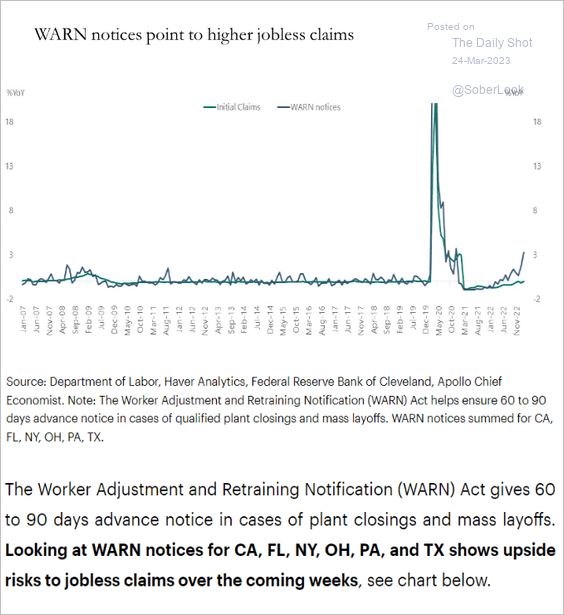

• WARN notices point to increasing unemployment applications going forward (see comment below).

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

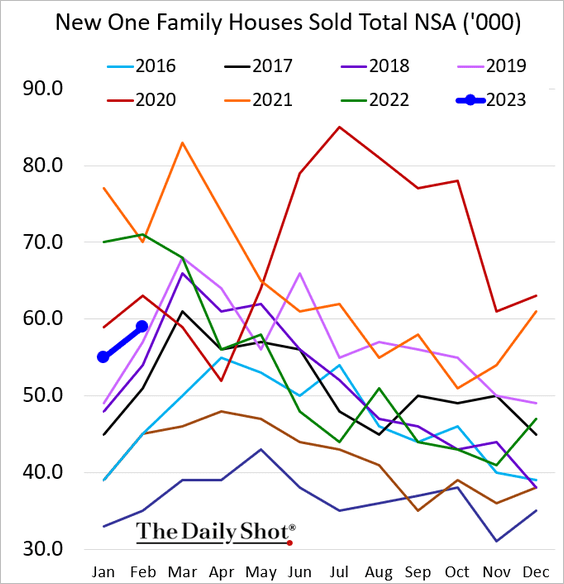

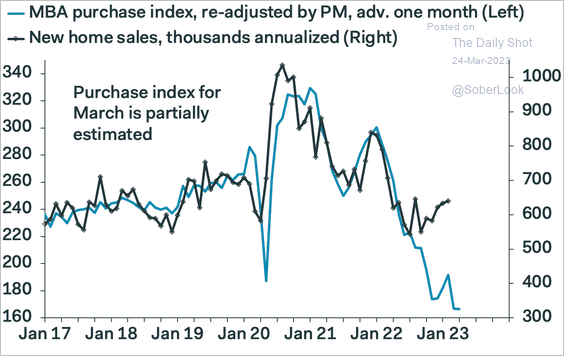

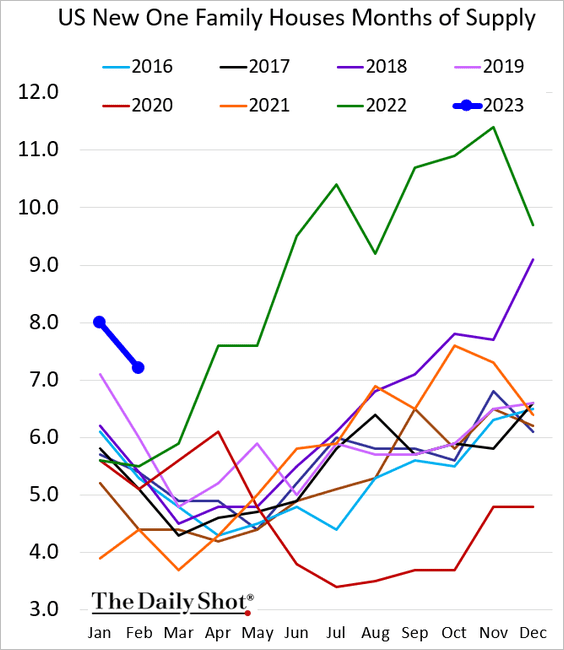

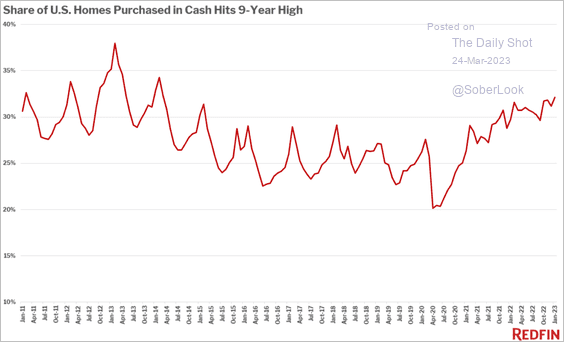

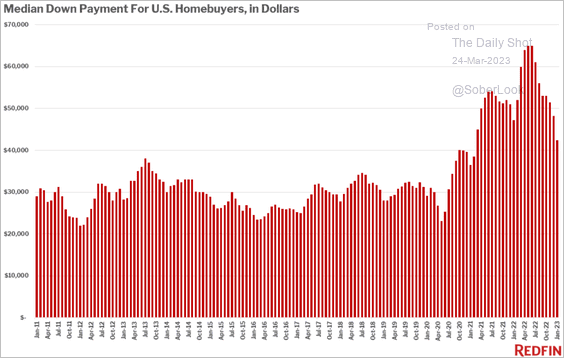

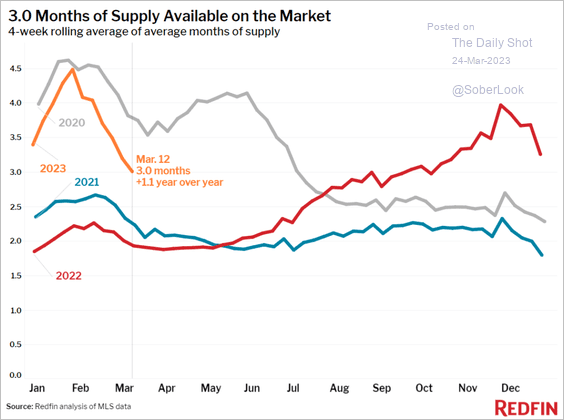

3. Next, we have some updates on the housing market.

• New home sales surprised to the upside.

– But weak mortgage applications point to weakness ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Inventories of new homes are elevated for this time of the year.

• The proportion of homes bought with cash has reached a nine-year high.

Source: Redfin

Source: Redfin

• The median down payment has been declining.

Source: Redfin

Source: Redfin

• Housing inventories are still tight.

Source: Redfin

Source: Redfin

——————–

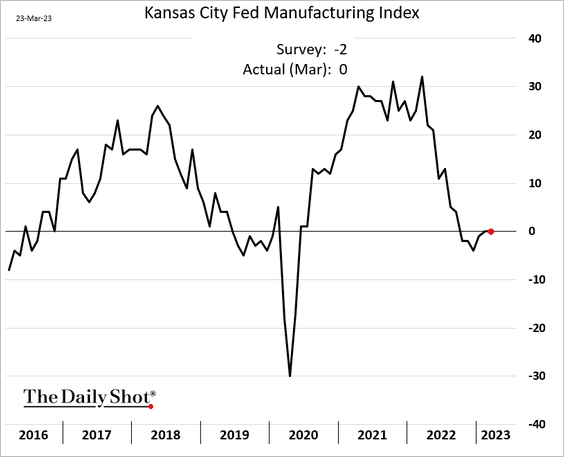

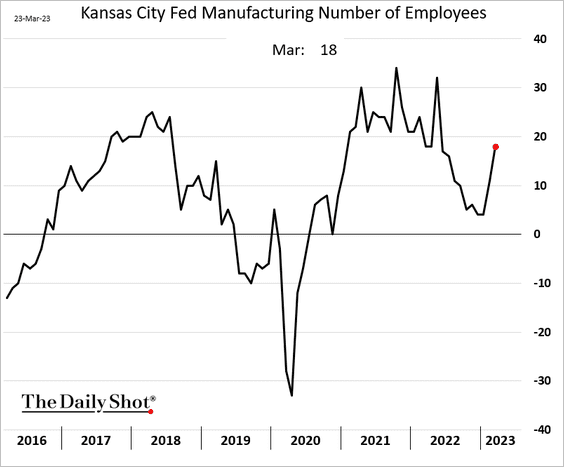

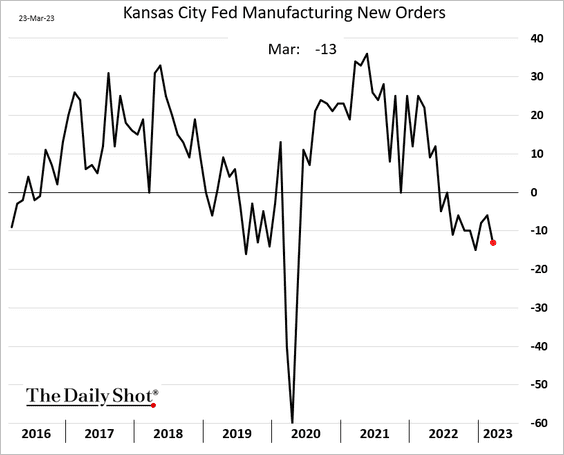

4. The Kansas City Fed’s regional manufacturing index was stable this month.

• Hiring jumped.

• But demand has been softening.

——————–

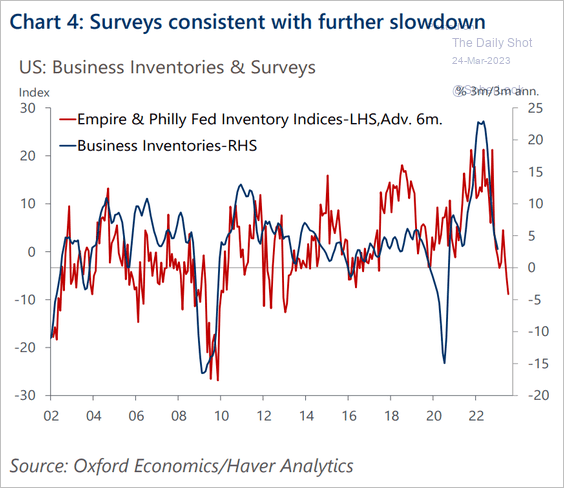

5. Business inventories will be a drag on growth this year.

Source: Oxford Economics

Source: Oxford Economics

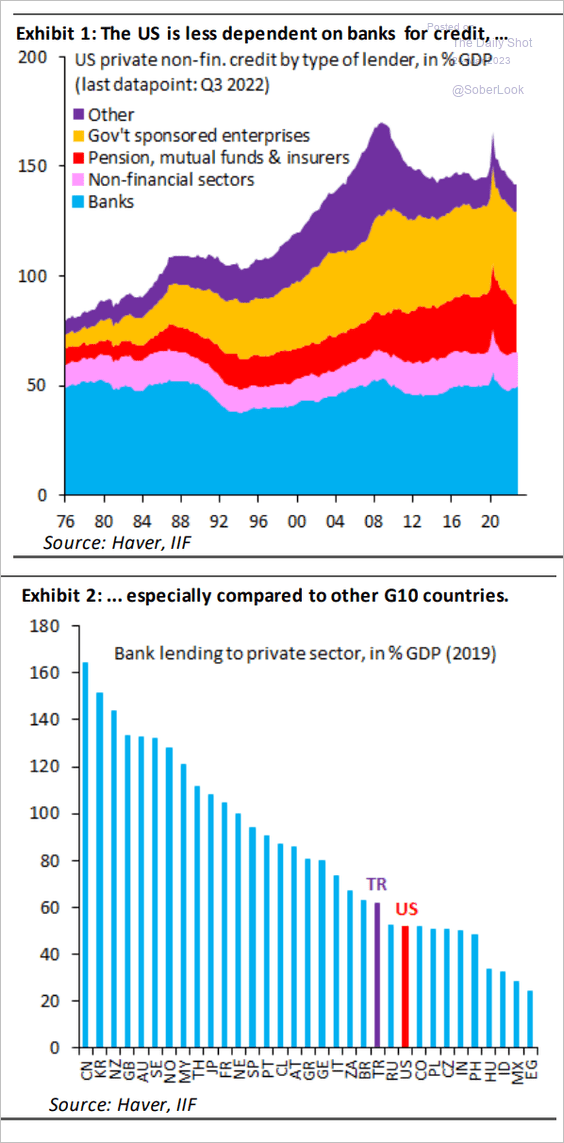

6. The US is less dependent on banks for credit than many other economies.

Source: IIF

Source: IIF

——————–

Food for Thought

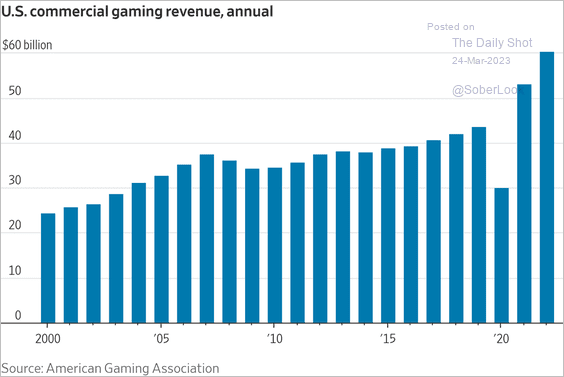

1. US gaming revenues:

Source: @WSJ Read full article

Source: @WSJ Read full article

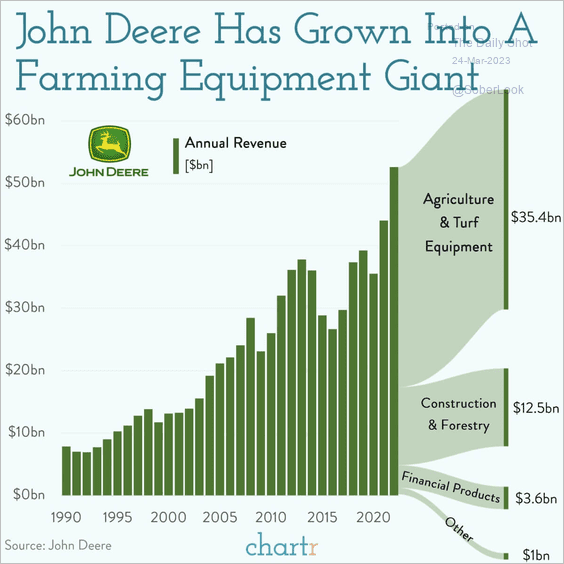

2. John Deere’s revenue components:

Source: @chartrdaily

Source: @chartrdaily

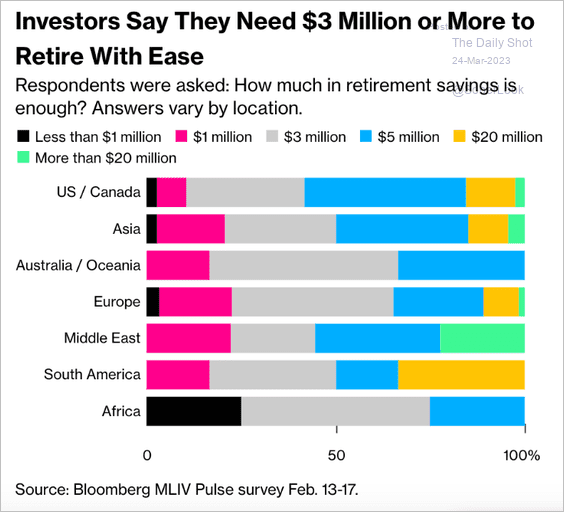

3. How much do you need in savings to live comfortably in retirement?

Source: @WealthWatch Read full article

Source: @WealthWatch Read full article

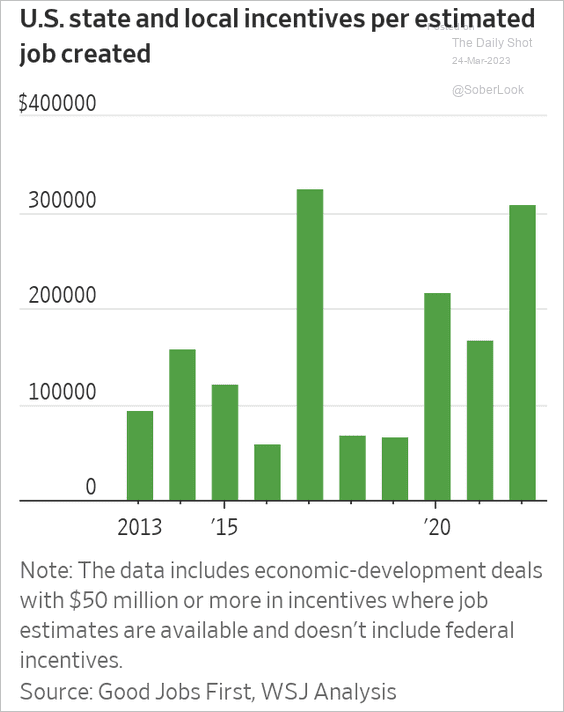

4. State and local tax incentives per job created:

Source: @WSJ Read full article

Source: @WSJ Read full article

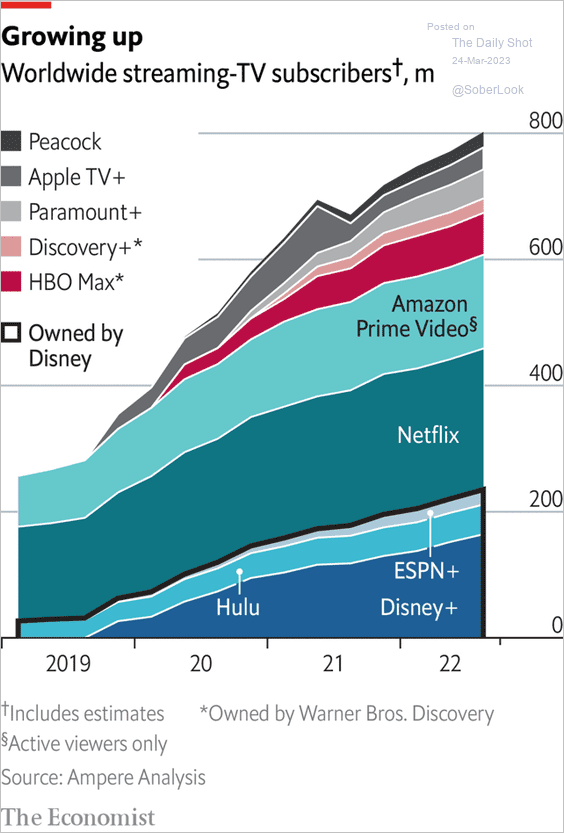

5. Streaming-TV subscribers:

Source: The Economist Read full article

Source: The Economist Read full article

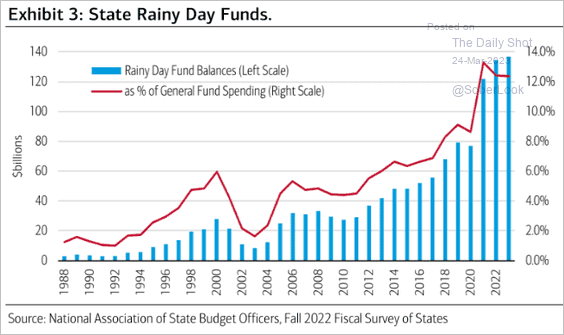

6. US states’ rainy day funds:

Source: Merrill Lynch

Source: Merrill Lynch

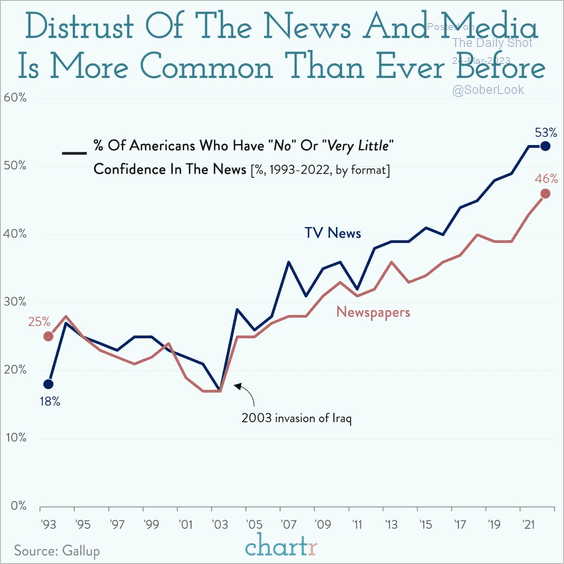

7. American distrust of the news/media:

Source: @chartrdaily

Source: @chartrdaily

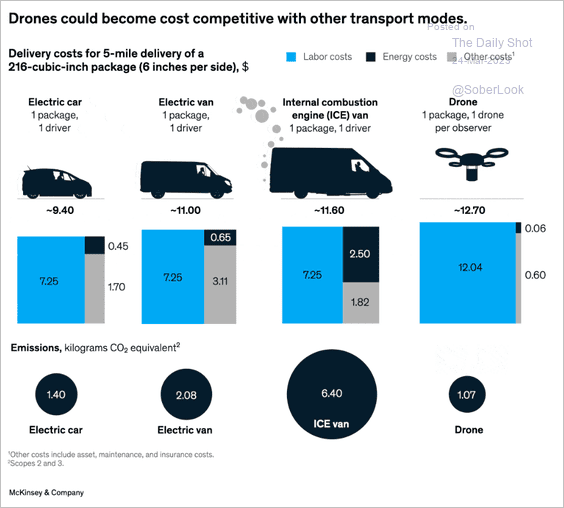

8. Package delivery costs:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

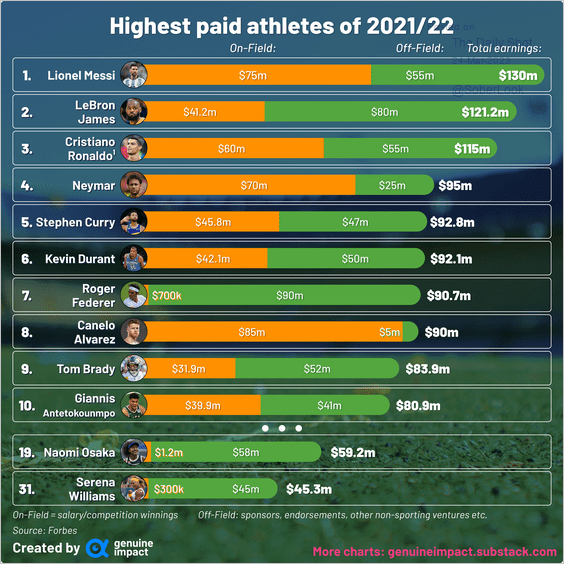

9. Highest-paid athletes:

Source: @genuine_impact

Source: @genuine_impact

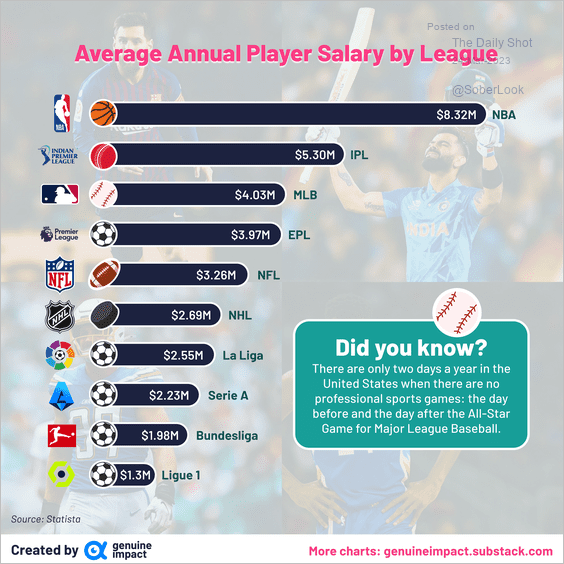

Average annual player salary by league:

Source: @genuine_impact

Source: @genuine_impact

——————–

Have a great weekend!

Back to Index