The Daily Shot: 18-May-23

• The United States

• Canada

• The Eurozone

• Japan

• Australia

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

1. Let’s begin with the housing market.

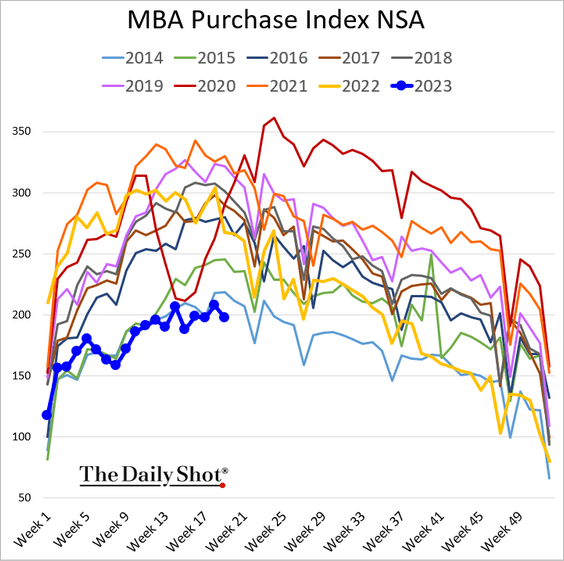

• Mortgage applications dipped below 2014 levels last week.

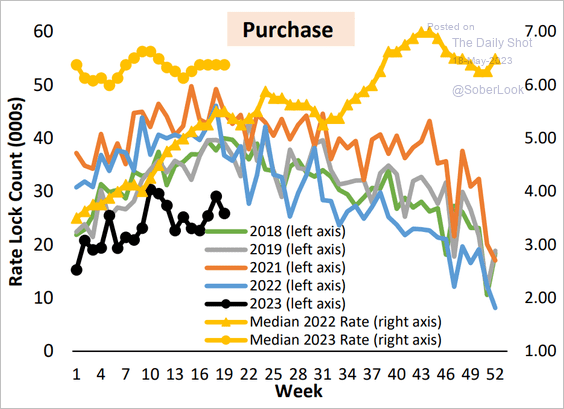

The number of mortgage rate locks is also at multi-year lows.

Source: AEI Housing Center

Source: AEI Housing Center

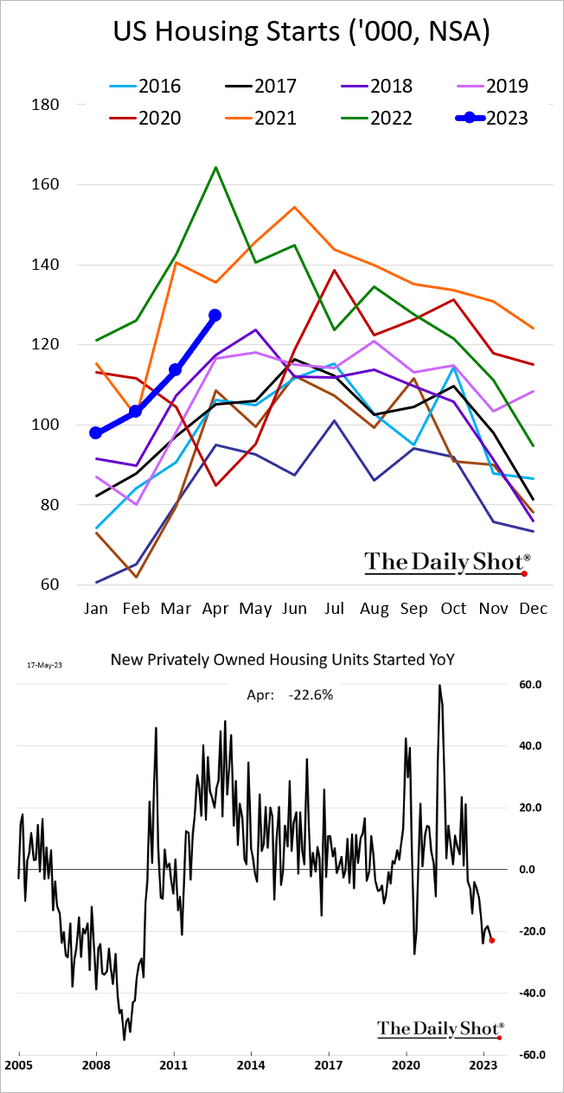

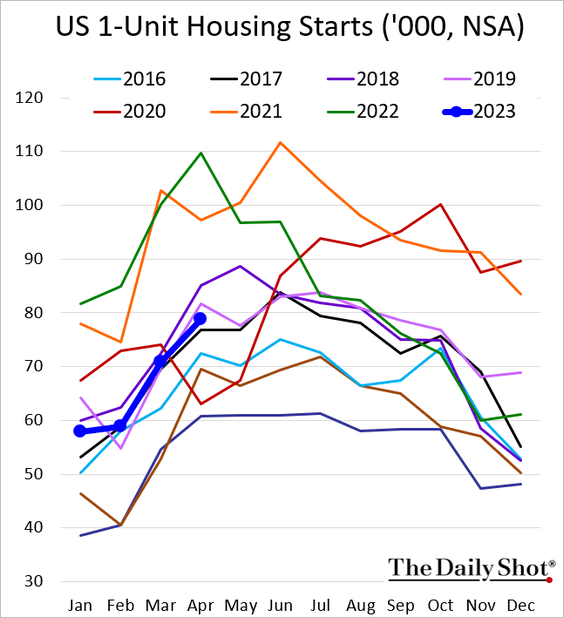

• Housing starts were almost 23% below last year’s levels in April, but residential construction has been stabilizing.

Source: @gutavsaraiva, @economics Read full article

Source: @gutavsaraiva, @economics Read full article

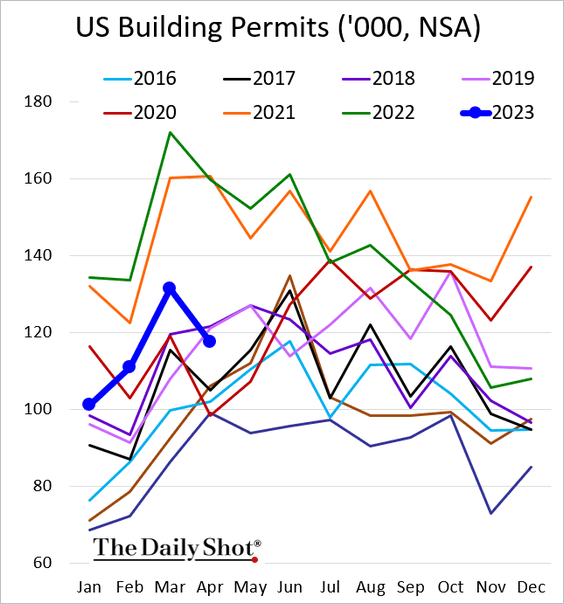

– Construction permits dipped below 2018 levels, …

… which points to weakness ahead for housing starts.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

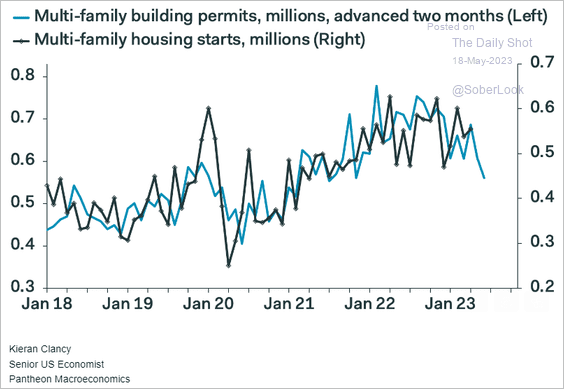

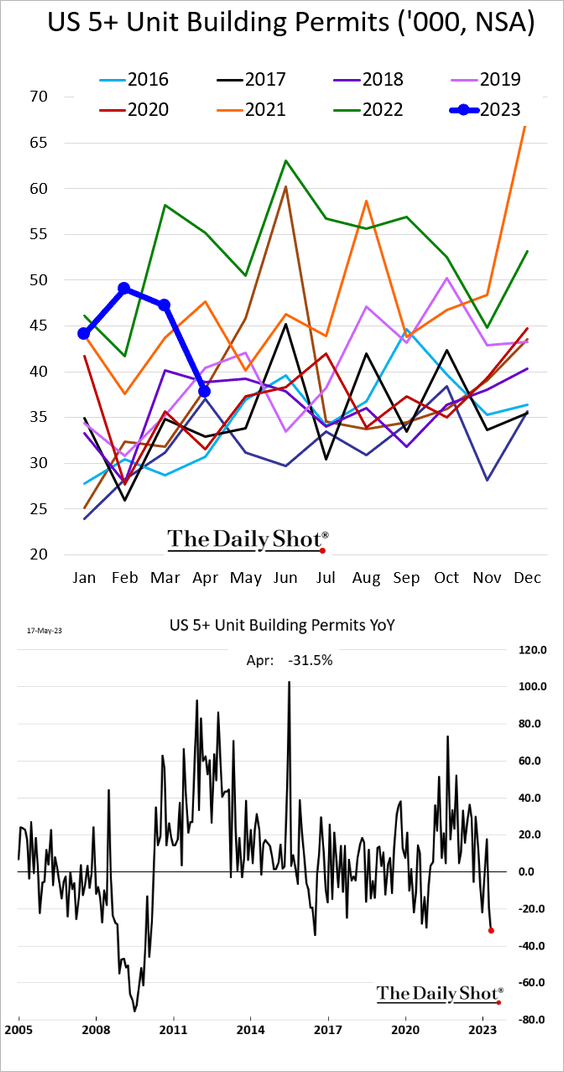

Construction permits for multi-family housing tumbled, …

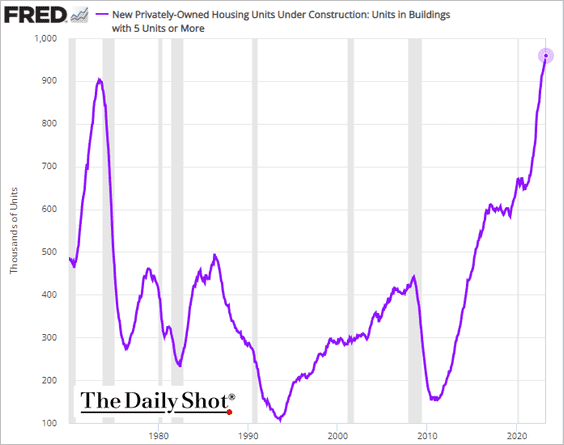

… as the pipeline of new supply grows. Multi-family housing under construction hit another record high.

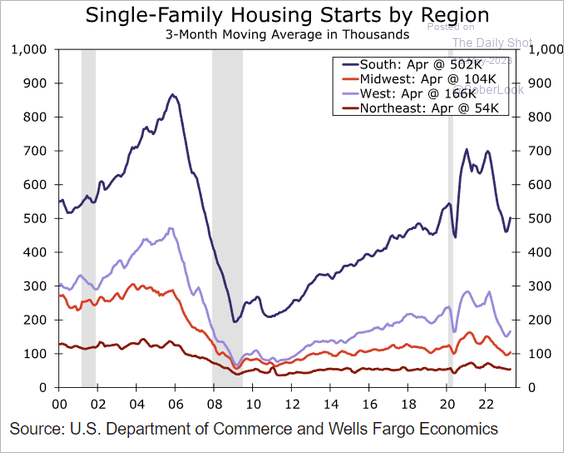

– This chart shows housing starts by region.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

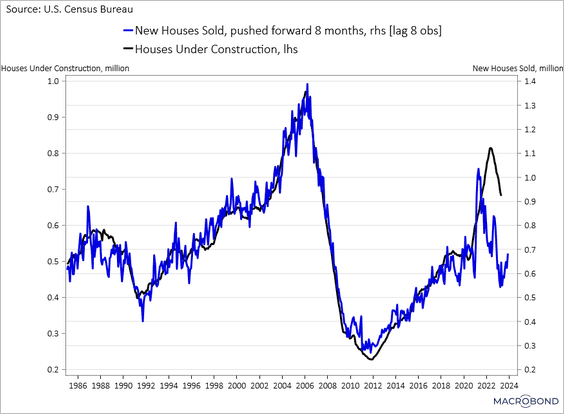

• The number of houses under construction has been rolling over but remains well above new home sales.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

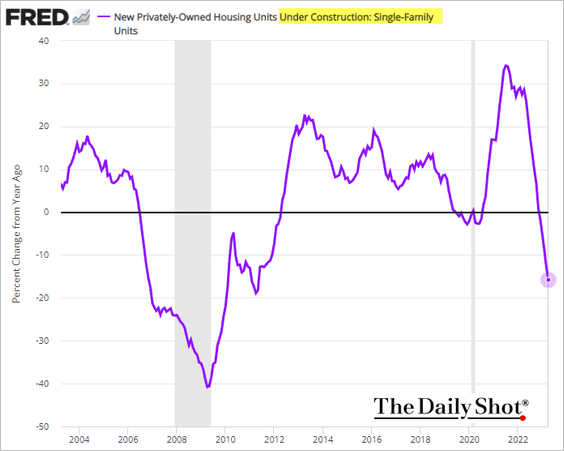

Single-family homes under construction are down 16% on a year-over-year basis.

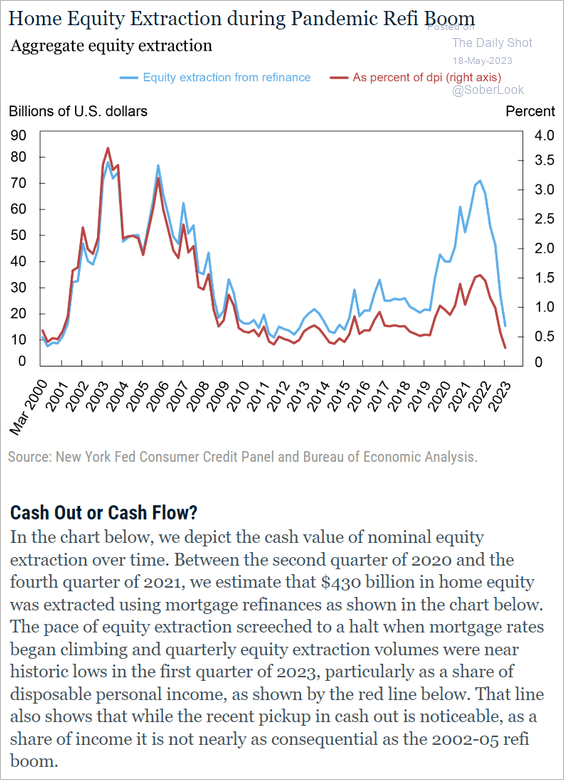

• The recent spike in home-equity extraction was well below pre-GFC levels as a ratio to disposable personal income.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

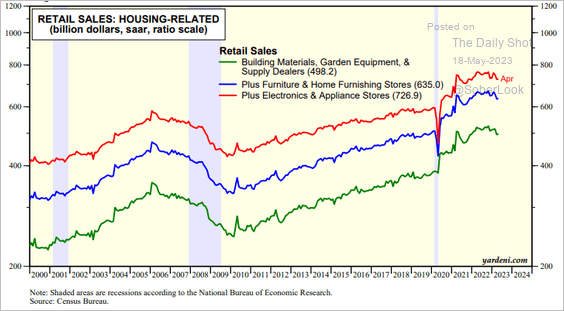

• The housing market has been a drag on retail sales.

Source: Yardeni Research

Source: Yardeni Research

——————–

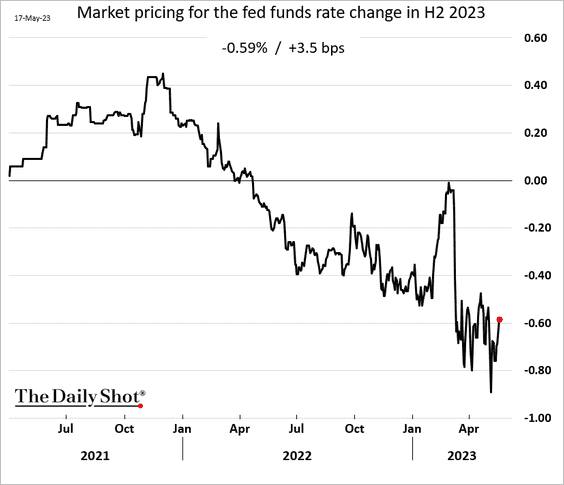

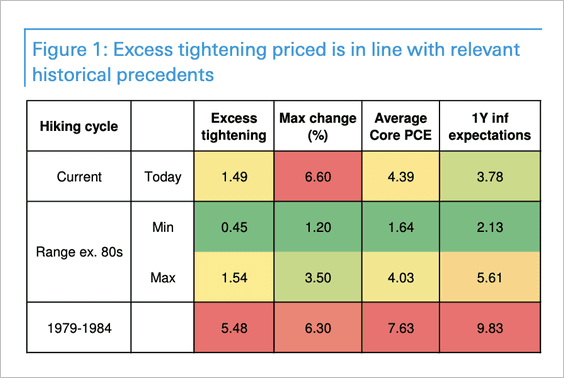

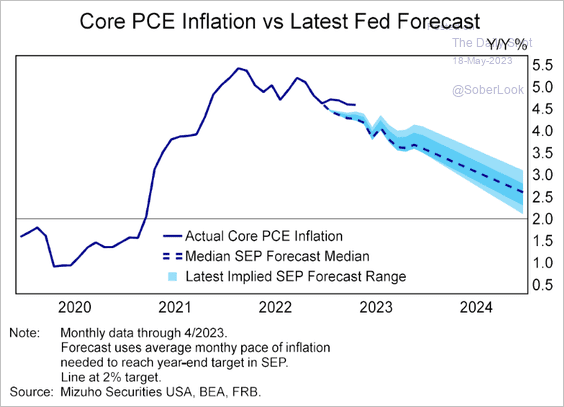

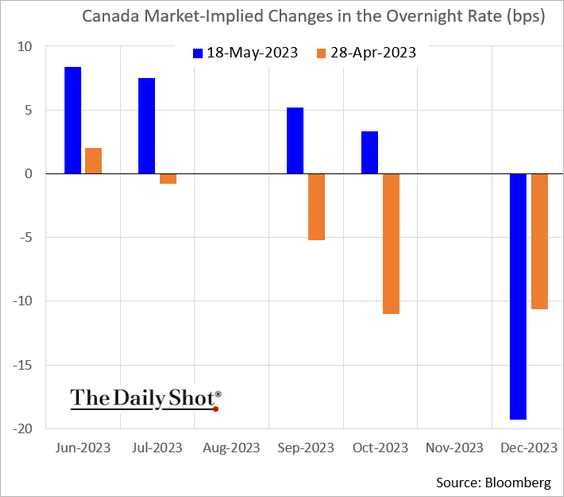

2. The market continues to price in Fed rate cuts later this year.

Here is a look at excess Fed tightening versus historical precedents.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But Fed officials have been pushing back on rate cut expectations.

Source: AP News Read full article

Source: AP News Read full article

Source: Chattanooga Times Free Press Read full article

Source: Chattanooga Times Free Press Read full article

Source: CNBC Read full article

Source: CNBC Read full article

Source: Reuters Read full article

Source: Reuters Read full article

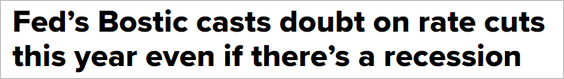

• Most fund managers think that rete curs will begin in the first half of next year.

Source: BofA Global Research

Source: BofA Global Research

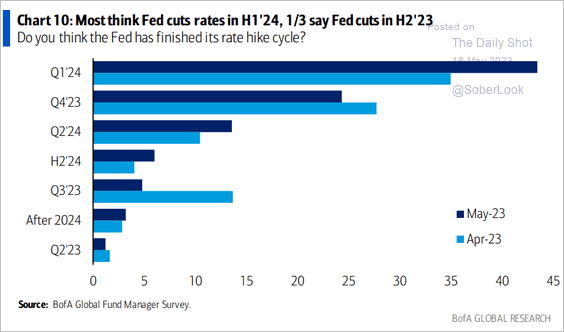

• The Fed is concerned that inflation could remain well above the FOMC’s forecasts.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• If the impasse over the debt ceiling is resolved, the possibility of a rate hike in June cannot be ruled out.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

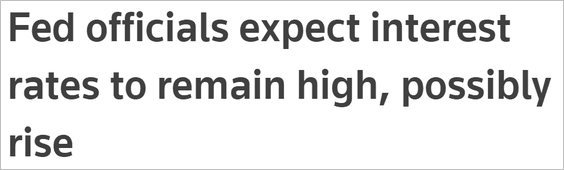

3. US Treasury cash balances continue to sink.

Source: @WSJ Read full article

Source: @WSJ Read full article

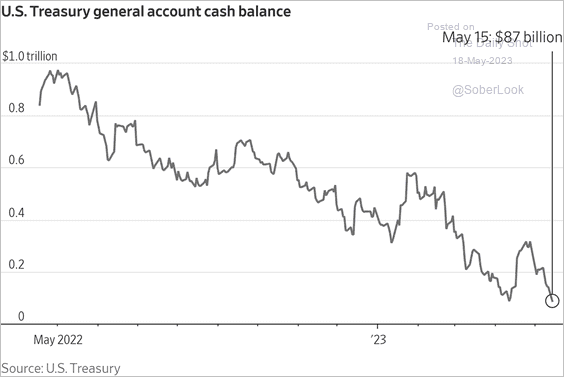

4. US vehicle miles traveled hit a new high.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

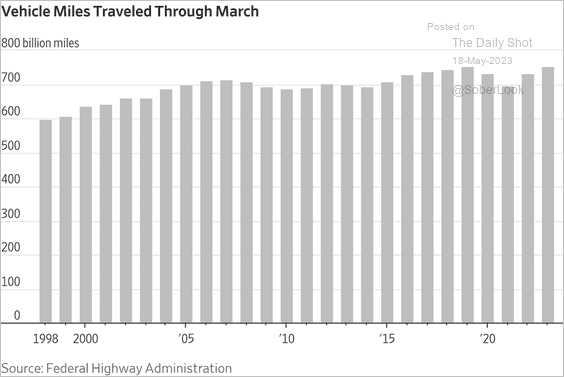

Canada

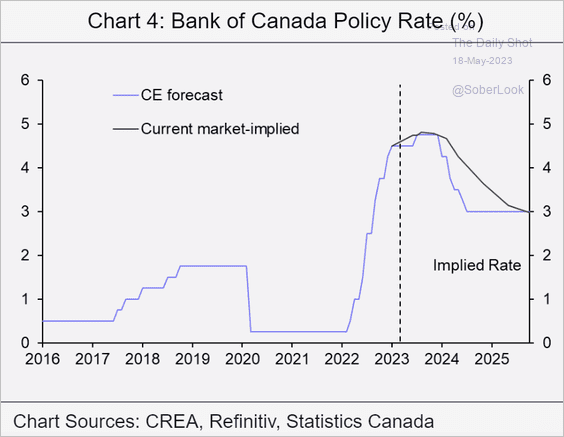

1. A BoC rate hike this summer looks increasingly likely.

Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

——————–

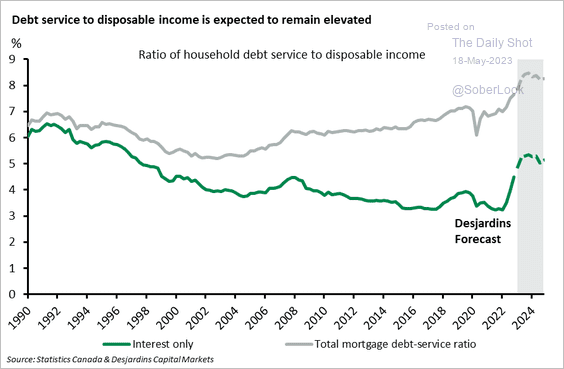

2. Debt service ratios will rise further. Here is a forecast from Desjardins.

Source: Desjardins

Source: Desjardins

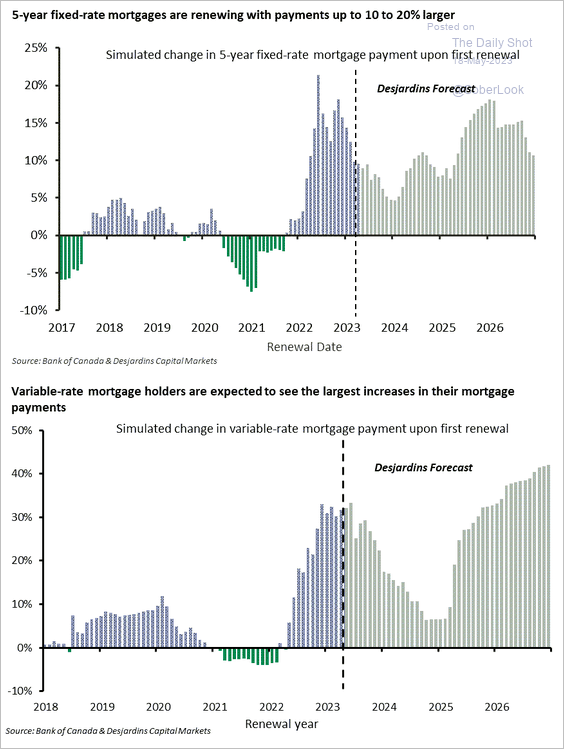

Resetting mortgages will be painful for homeowners.

Source: Desjardins

Source: Desjardins

——————–

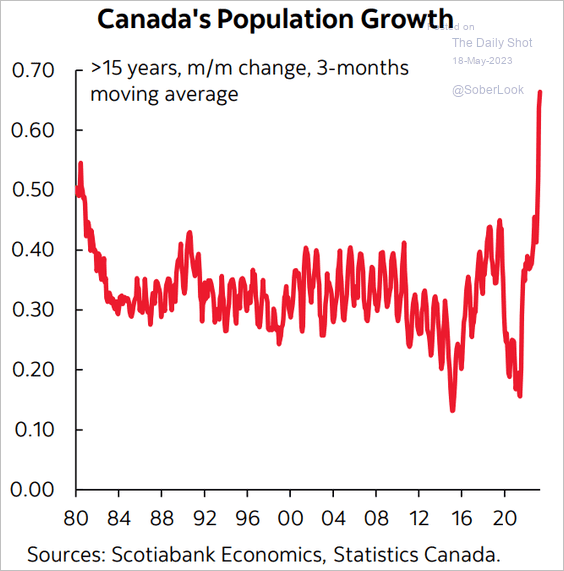

3. Strong population growth is boosting demand for housing.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The Eurozone

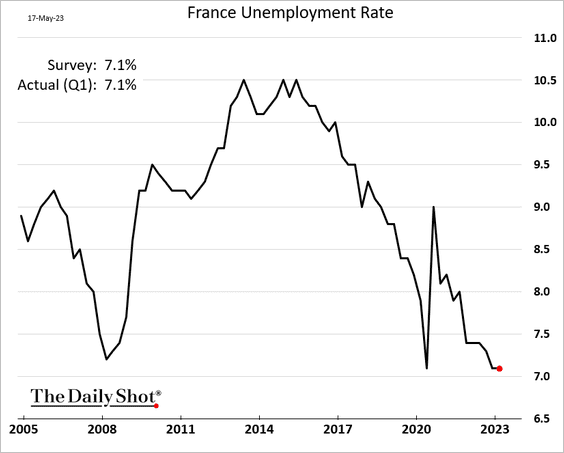

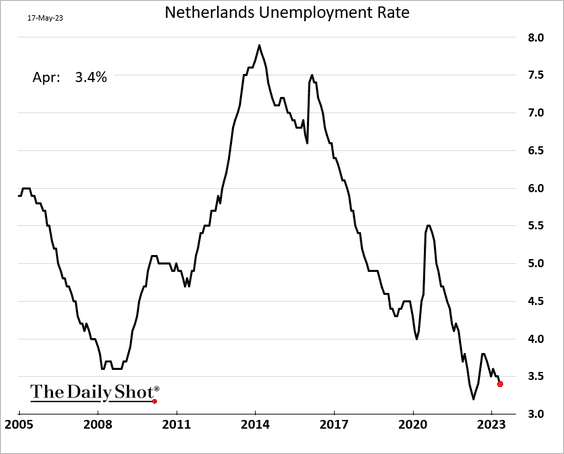

1. Unemployment remains low for now.

• France:

• The Netherlands:

——————–

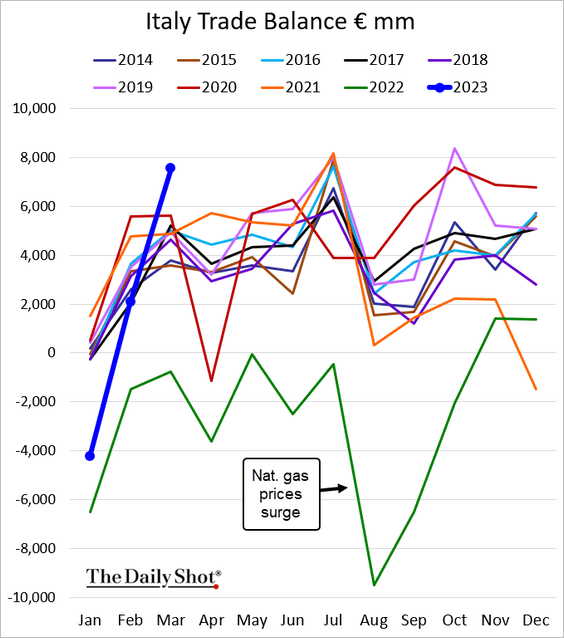

2. Italy’s trade surplus hit a record high for this time of the year, boosted by improving terms of trade and exports to China.

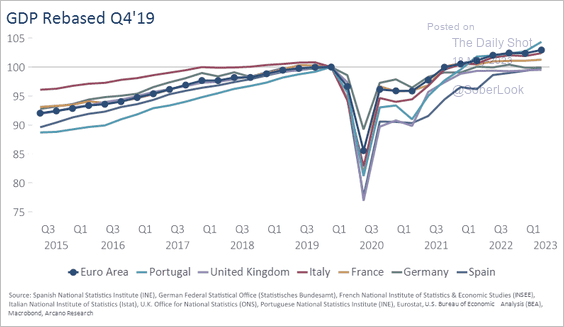

3. Portugal’s economy is outperforming its euro-area peers.

Source: Arcano Economics

Source: Arcano Economics

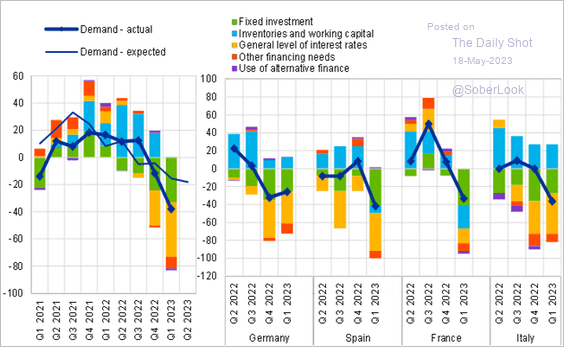

4. Demand for credit has deteriorated sharply.

Source: ECB Read full article

Source: ECB Read full article

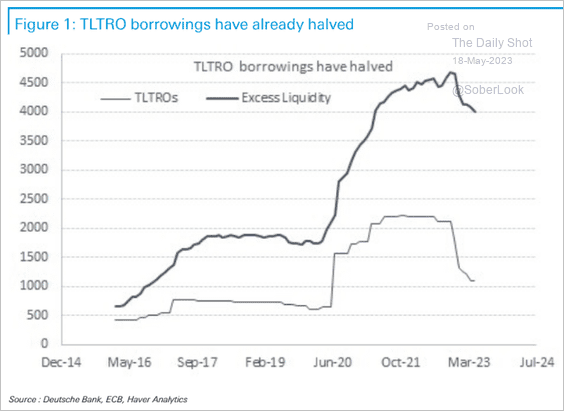

5. TLTRO balances have halved from peak levels, tightening liquidity in the Eurozone (a form of QT).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

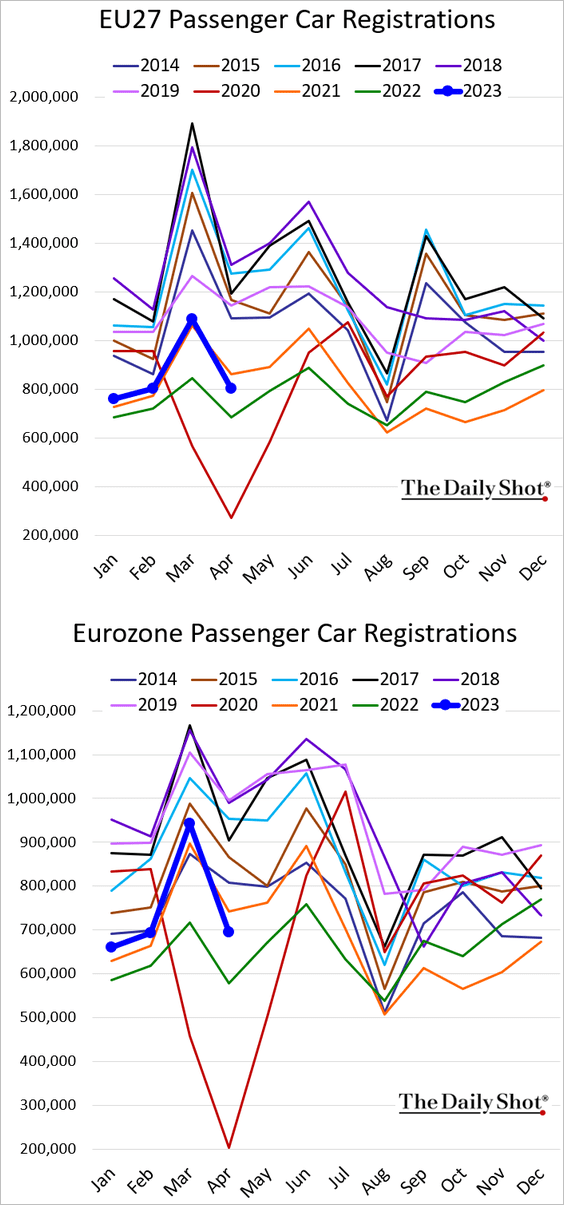

6. New car registrations dipped back below 2021 levels.

Back to Index

Japan

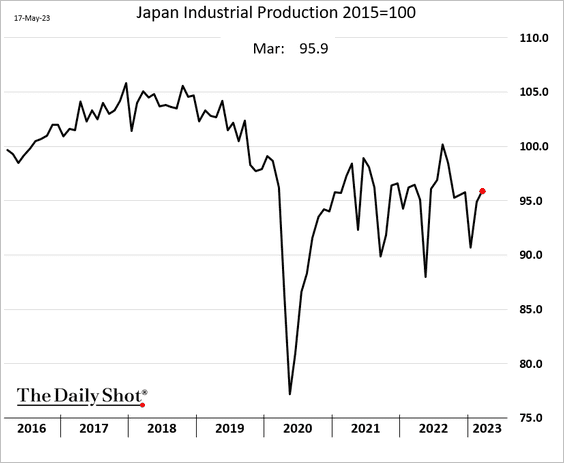

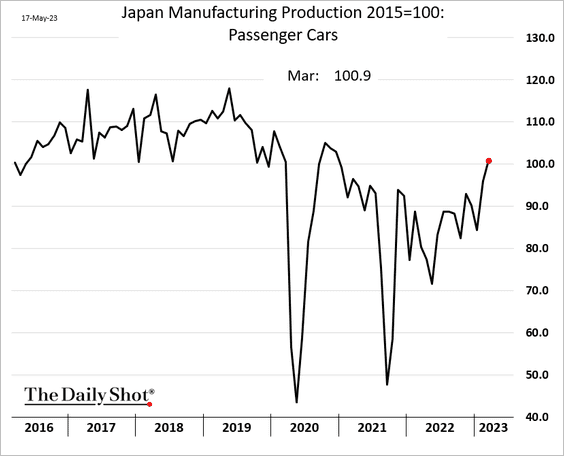

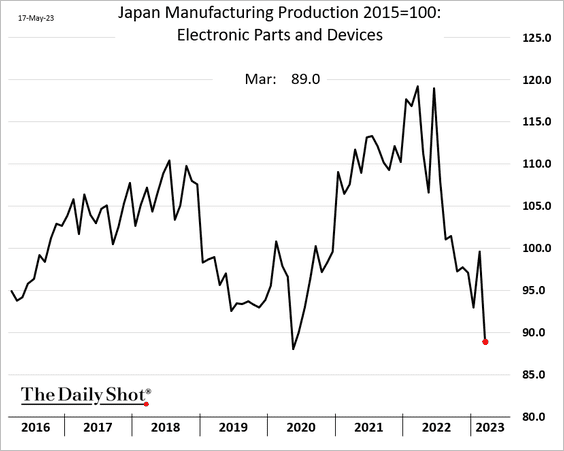

1. Industrial production increased again in March.

Automobile manufacturing has been rebounding.

But electronics output is near the 2020 lows.

——————–

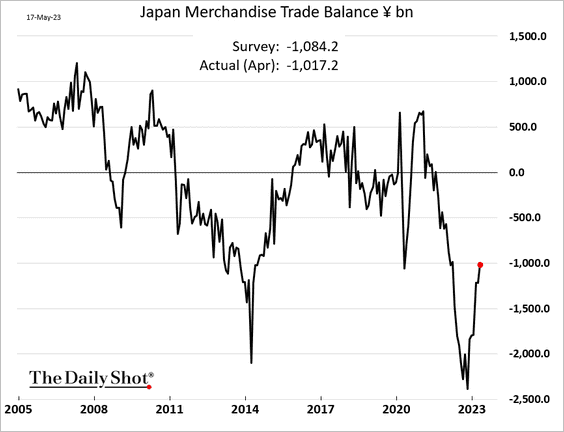

2. The trade deficit is narrowing, helped by improving terms of trade.

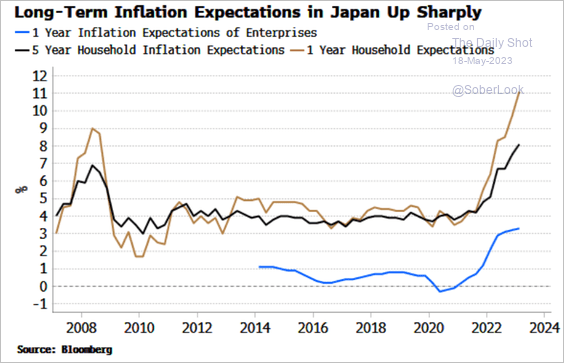

3. Inflation expectations continue to climb.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

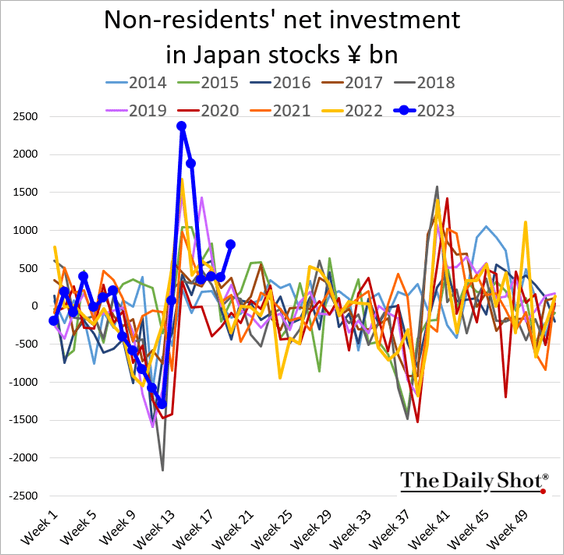

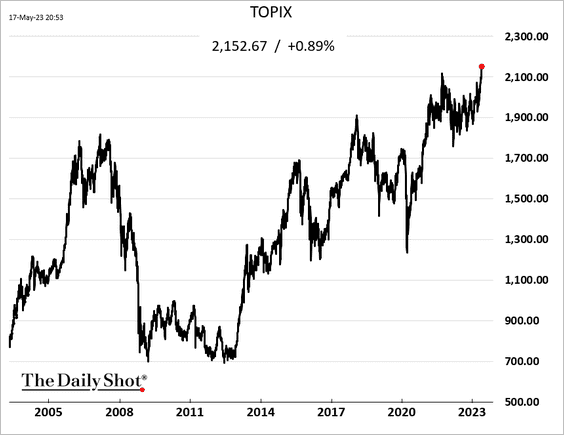

4. Foreigners have been jumping into Japanese equities, …

… boosting prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

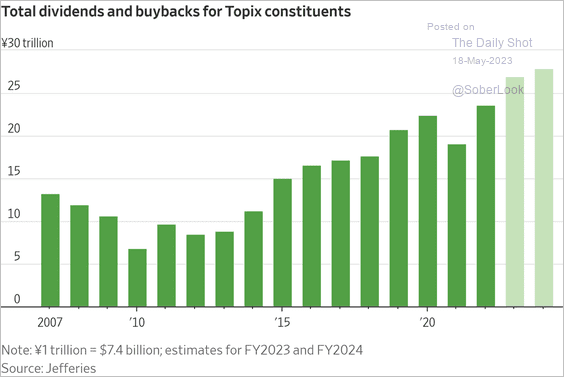

Foreign investors appreciate the investor-friendly policies implemented by Japanese companies.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Australia

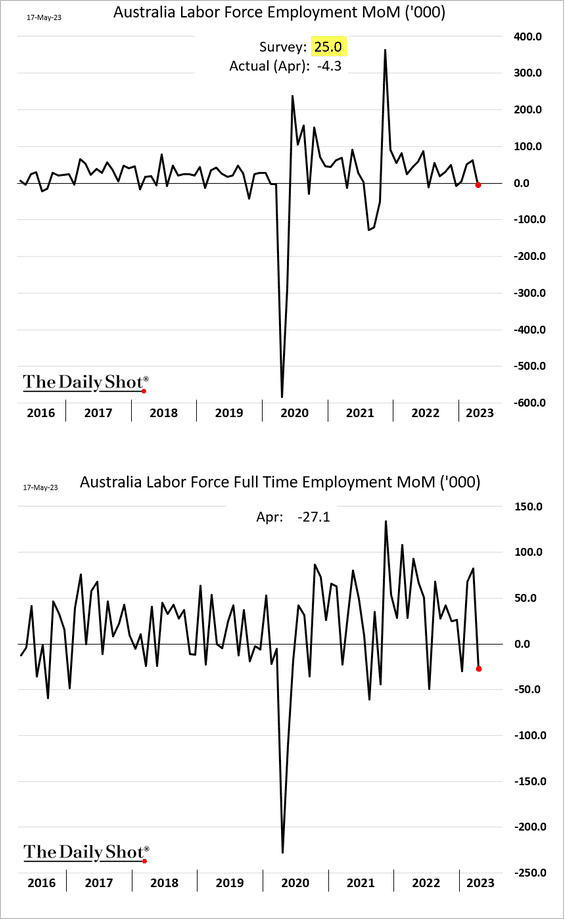

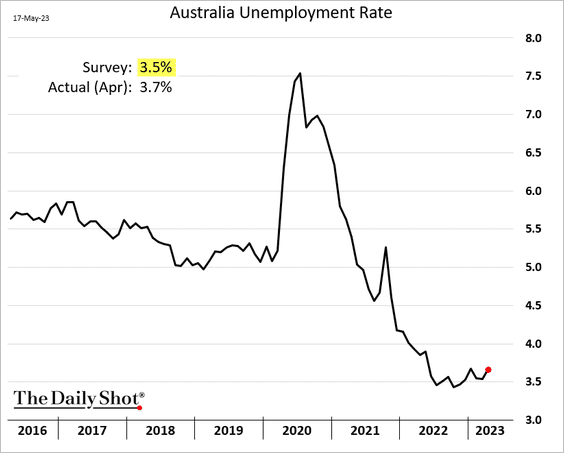

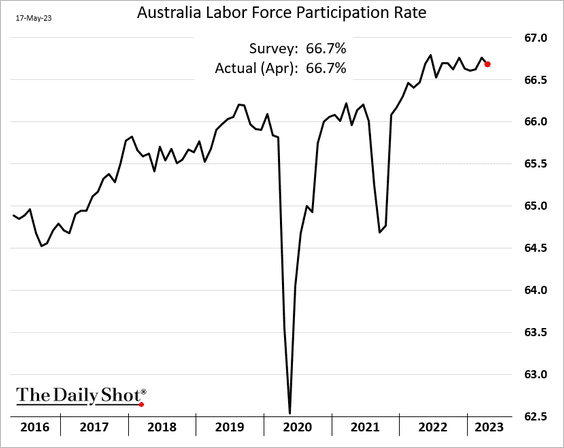

1. The employment report was disappointing.

Source: Reuters Read full article

Source: Reuters Read full article

• The unemployment rate:

• Labor force participation:

——————–

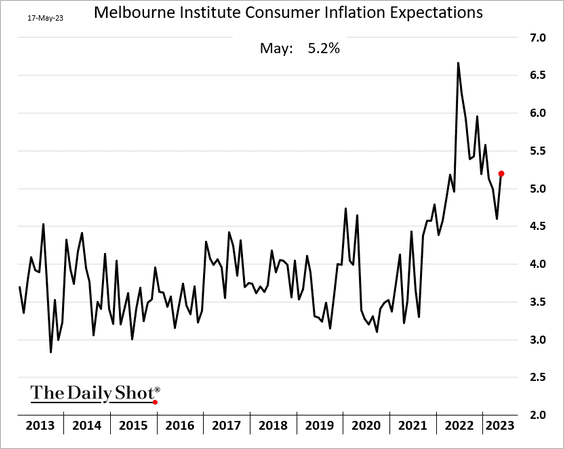

2. Inflation expectations jumped this month.

Back to Index

China

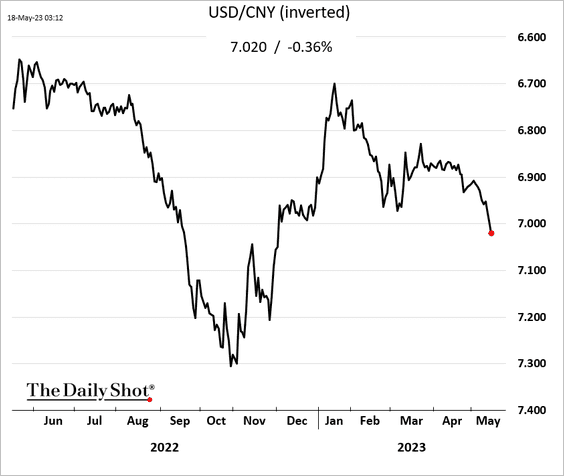

1. The renminbi is rolling over.

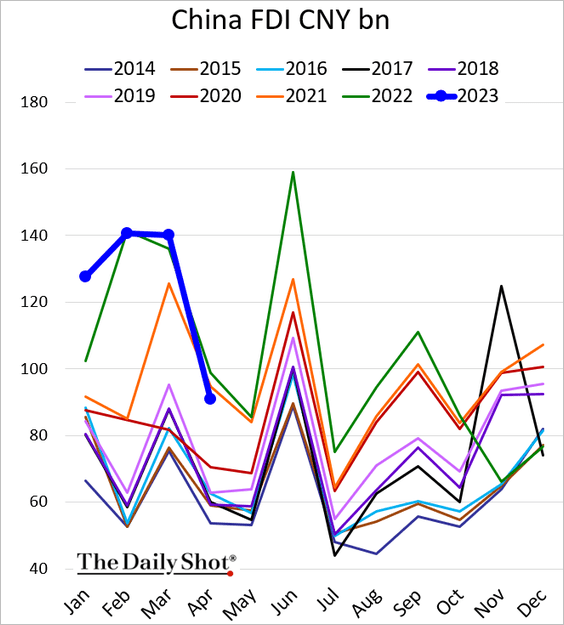

2. Foreign direct investment dipped below 2021 levels.

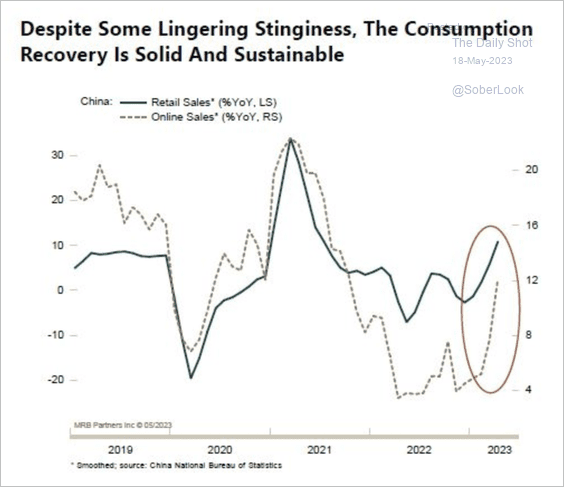

3. Consumers are spending much more than last year, albeit well below pre-pandemic levels.

Source: MRB Partners

Source: MRB Partners

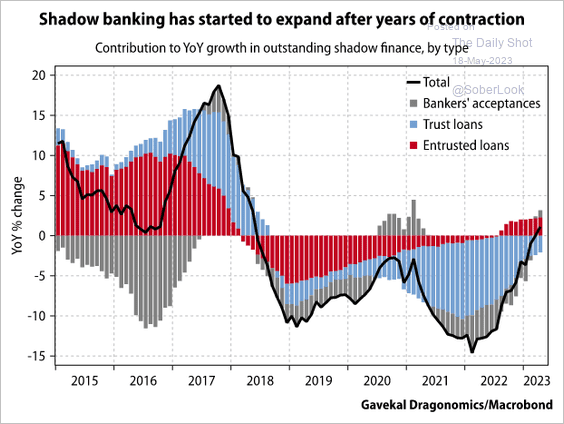

4. Shadow banking activity has started to expand.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

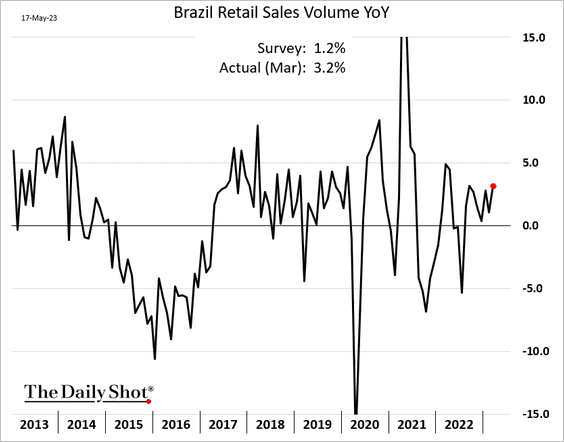

1. Brazil’s retail sales topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

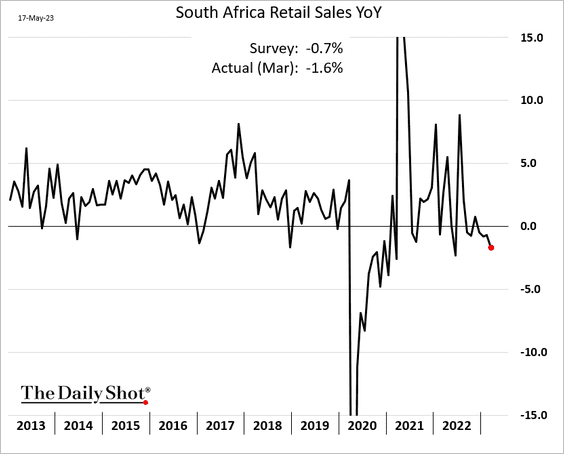

2. South Africa’s retail sales are trending lower.

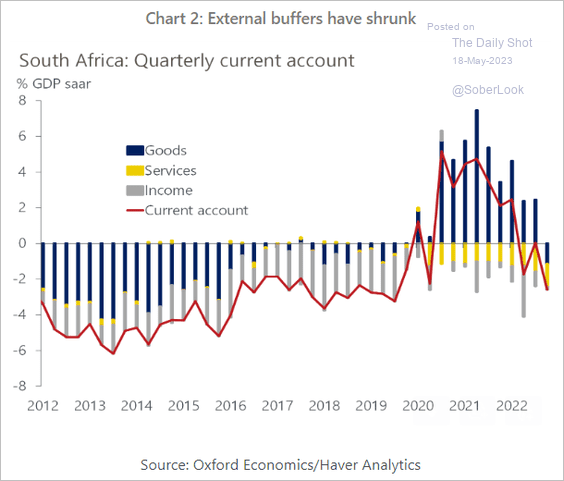

• The nation’s current account is back in deficit.

Source: Oxford Economics

Source: Oxford Economics

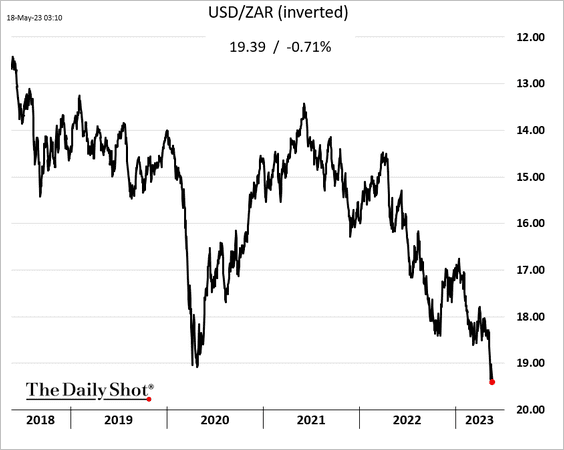

• The rand hit a new low.

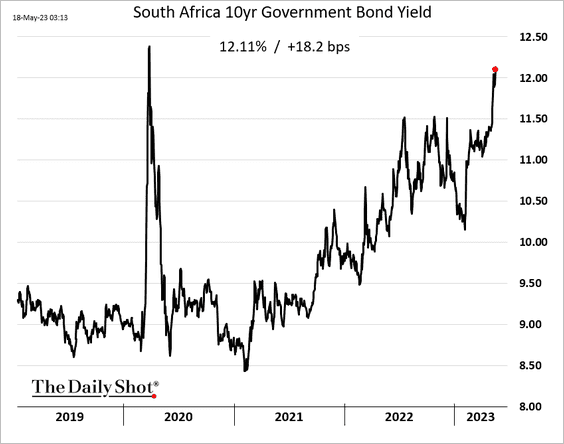

Bond yields are surging.

Back to Index

Cryptocurrency

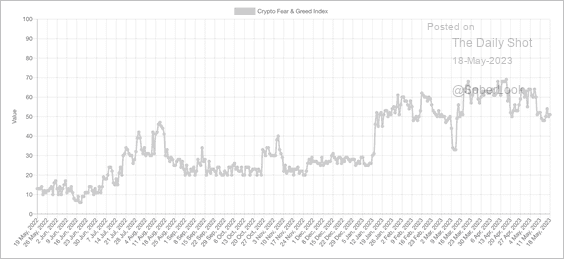

1. The Crypto Fear & Greed Index has been stuck in neutral over the past week.

Source: Alternative.me

Source: Alternative.me

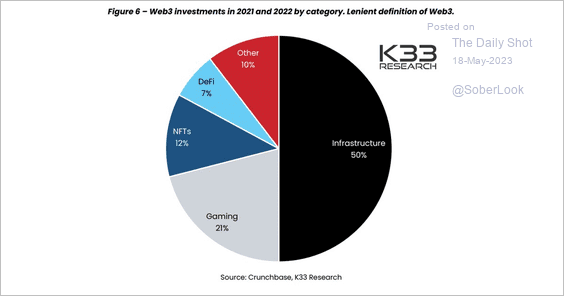

2. Most Web3 investments have been related to foundation blockchain infrastructure and NFT projects connected to gaming.

Source: @K33Research

Source: @K33Research

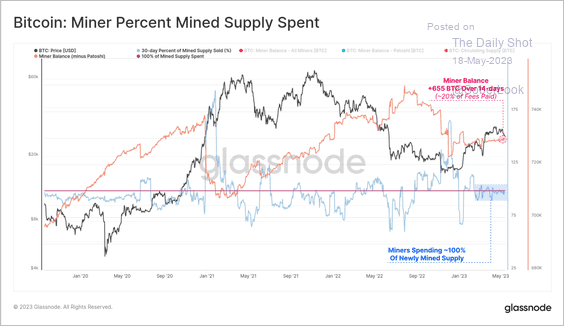

3. Bitcoin miners have retained just 20% of BTC on balance over the past two weeks. Mining is competitive, and it has been difficult to acquire enough revenue to cover costs.

Source: @glassnode

Source: @glassnode

4. Tether, the company behind the largest stablecoin USDT, said it will acquire BTC for reserves.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

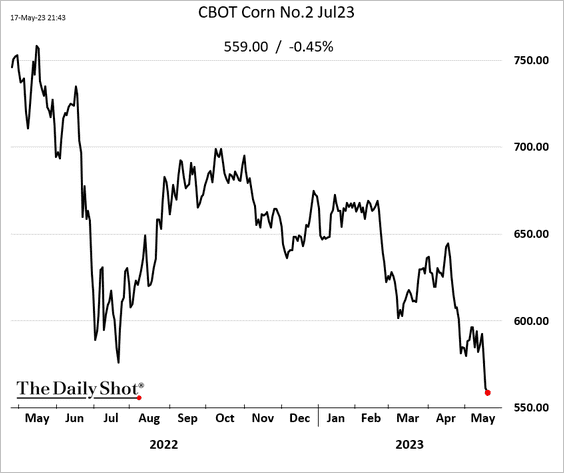

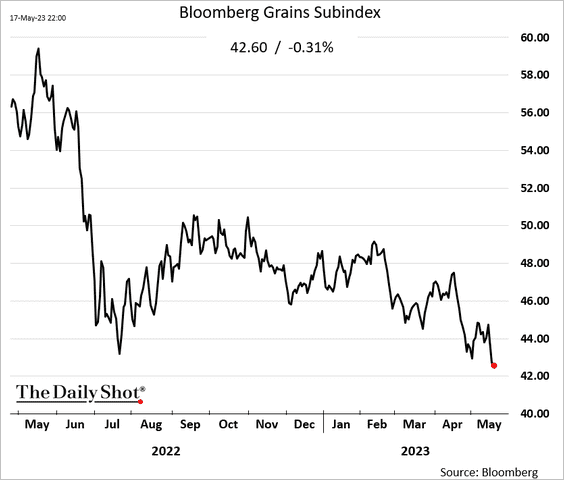

1. Grains continue to struggle.

• Corn:

• Bloomberg’s grains index:

——————–

2. Cotton surged on Wednesday, hitting resistance at the 200-day moving average.

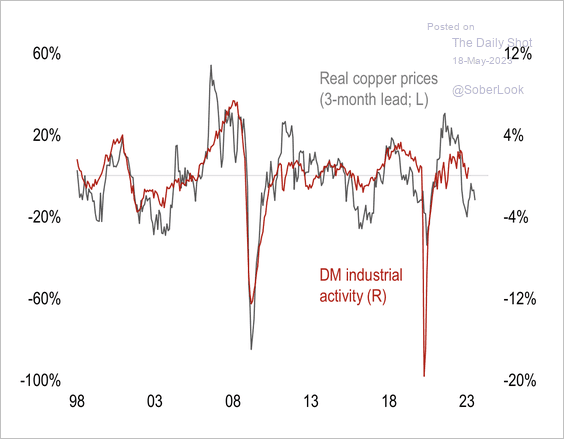

3. The drop in copper prices could point to a decline in developed market industrial activity.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

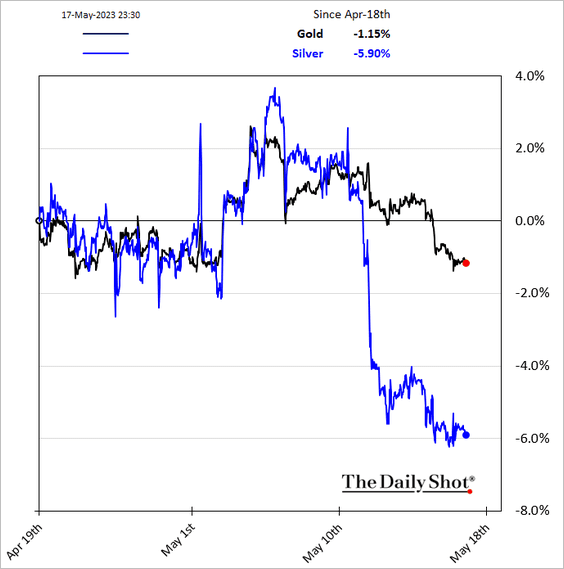

3. The selloff in silver continues.

Back to Index

Energy

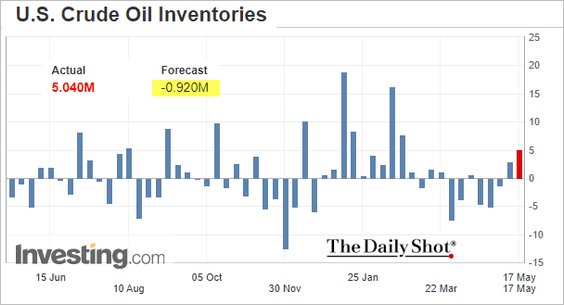

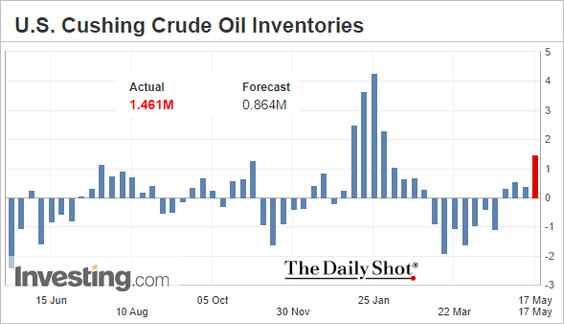

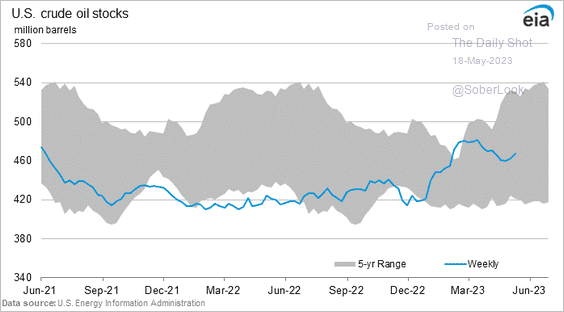

1. US oil inventories increased again last week (3 charts).

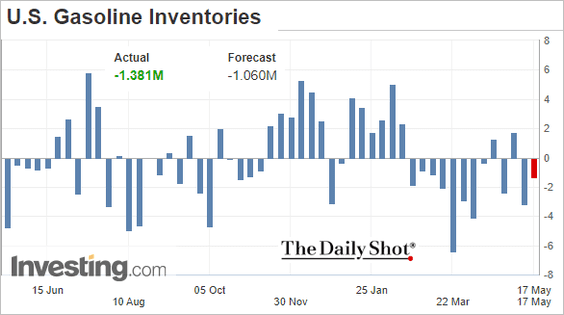

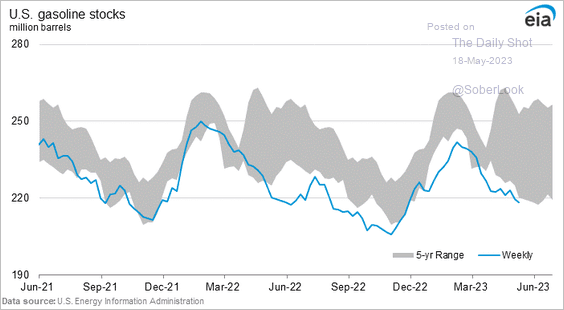

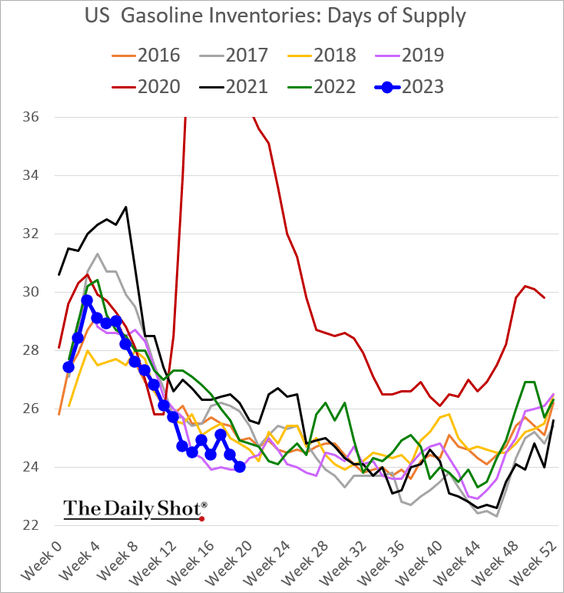

• But gasoline inventories declined (3 charts).

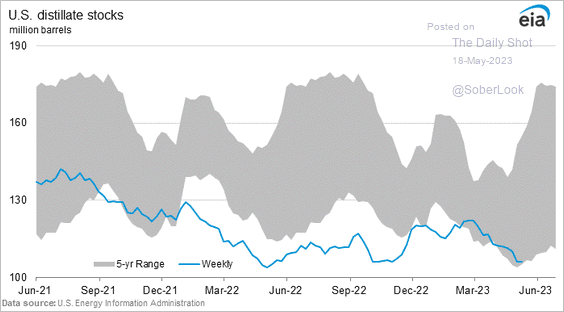

• Distillates inventories remain tight.

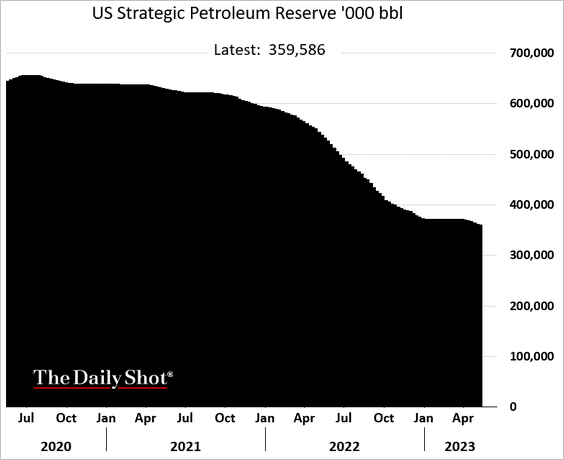

• Here is the US Strategic Petroleum Reserve.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

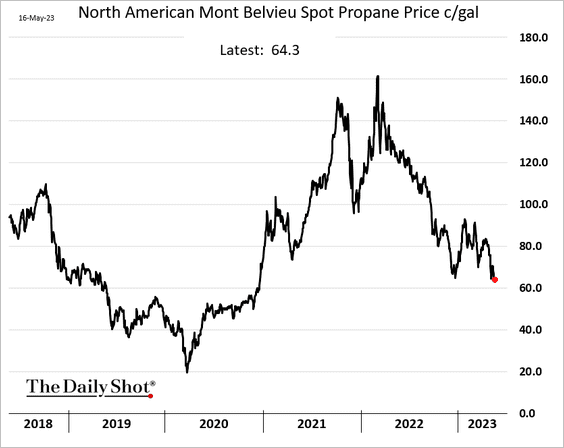

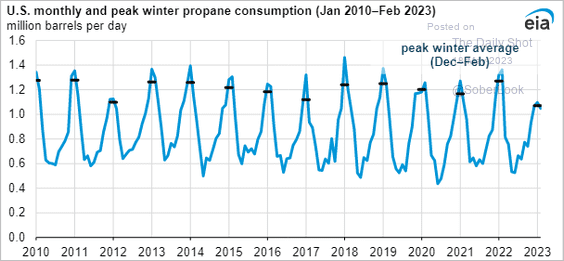

2. US propane prices have weakened …

… due to soft demand this past winter.

Source: @EIAgov

Source: @EIAgov

——————–

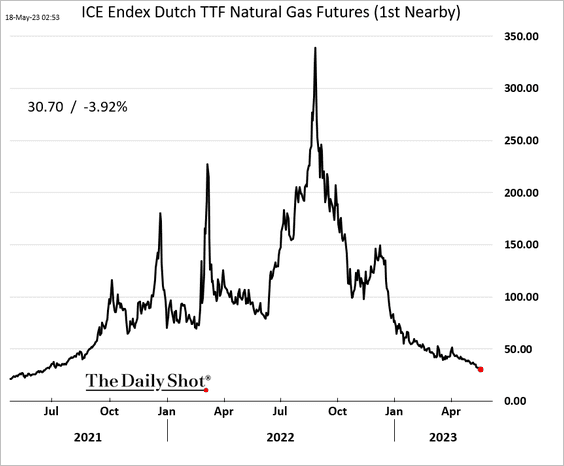

3. European natural gas prices continue to sink.

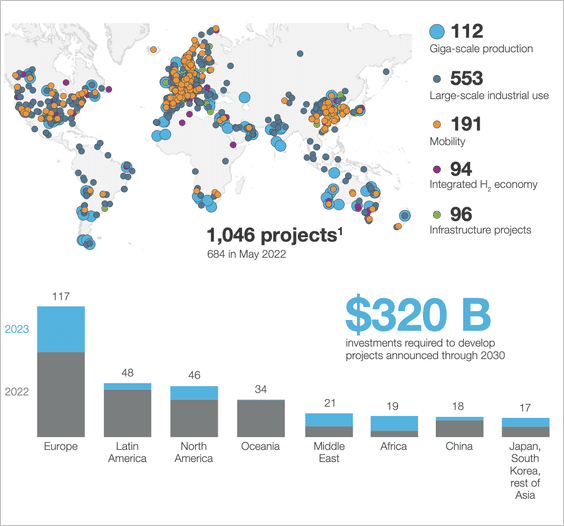

4. More than 1,000 hydrogen project proposals have been announced globally, according to McKinsey.

Source: McKinsey & Company

Source: McKinsey & Company

Back to Index

Equities

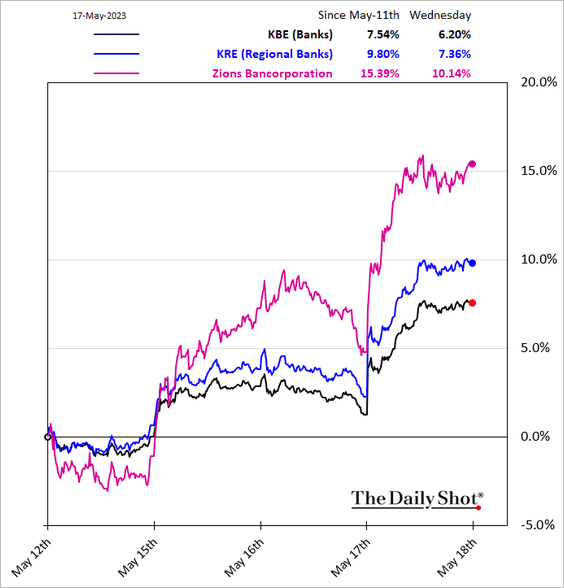

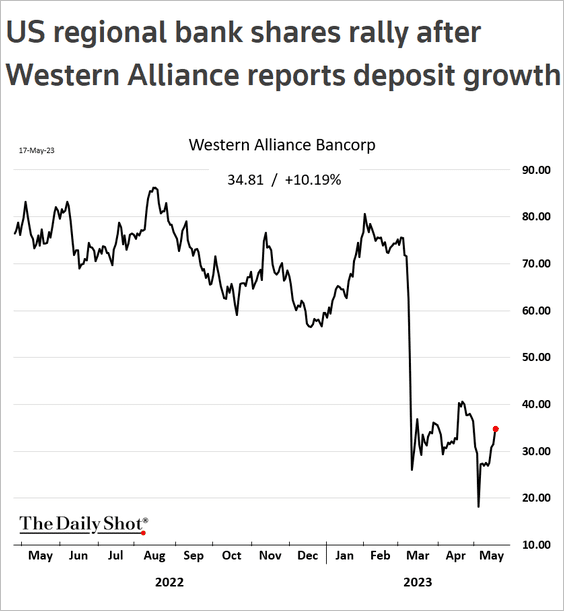

1. Regional banks surged on Wednesday.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

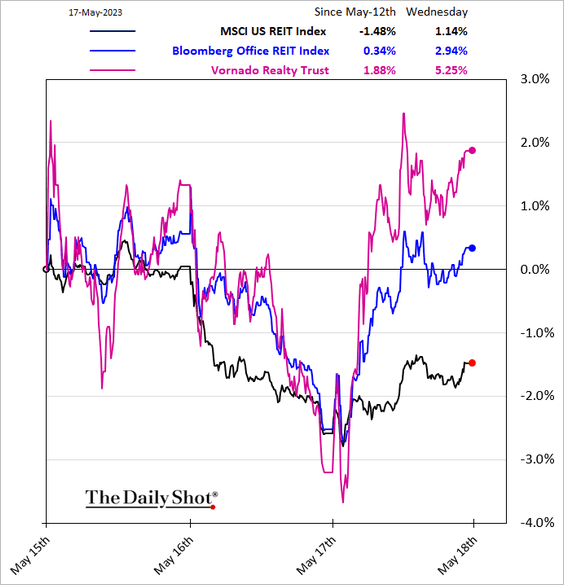

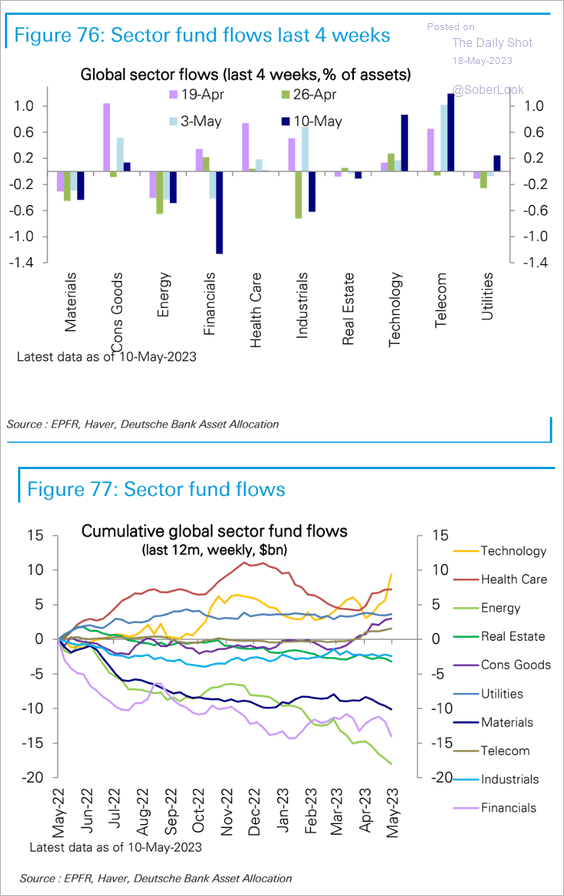

2. Office REITs bounced from the lows.

Financials and REITs have been seeing persistent outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

3. Semiconductor shares have been surging.

![]()

4. Is the rally in homebuilder shares showing signs of being overextended? According to the performance of Home Depot stock, the answer appears affirmative.

Source: @t1alpha

Source: @t1alpha

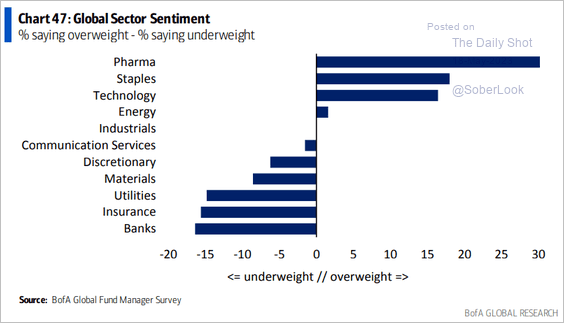

5. Here is a look at fund managers’ sector sentiment.

Source: BofA Global Research

Source: BofA Global Research

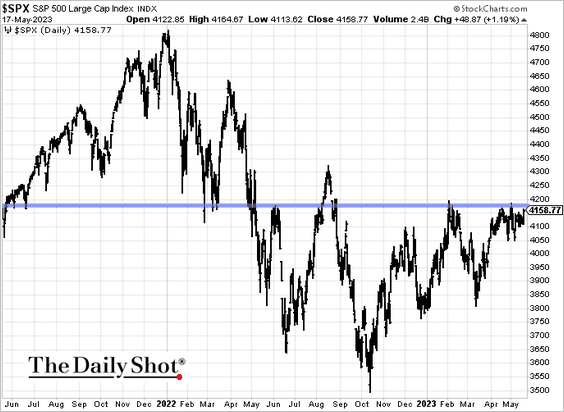

5. The S&P 500 is back at resistance.

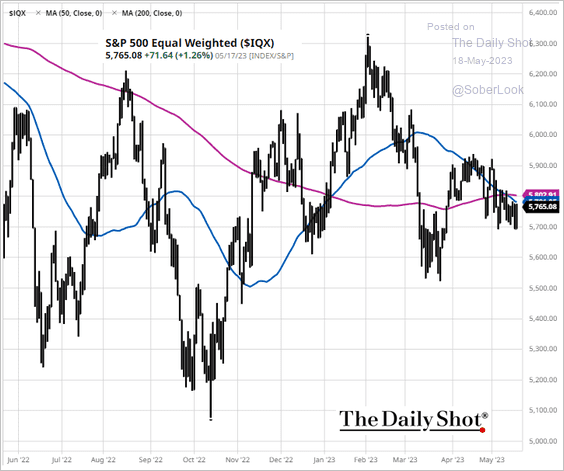

7. The S&P 500 equal-weight index has entered a death cross.

h/t @Barchart

h/t @Barchart

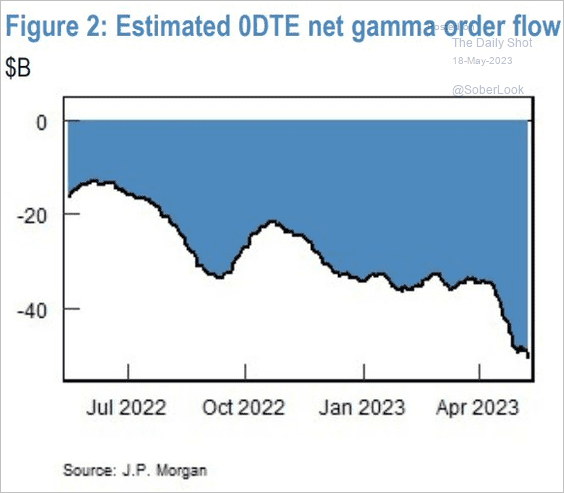

8. Investors have increasingly been sellers of overnight gamma (options maturing within 24 hours).

Source: JP Morgan Research

Source: JP Morgan Research

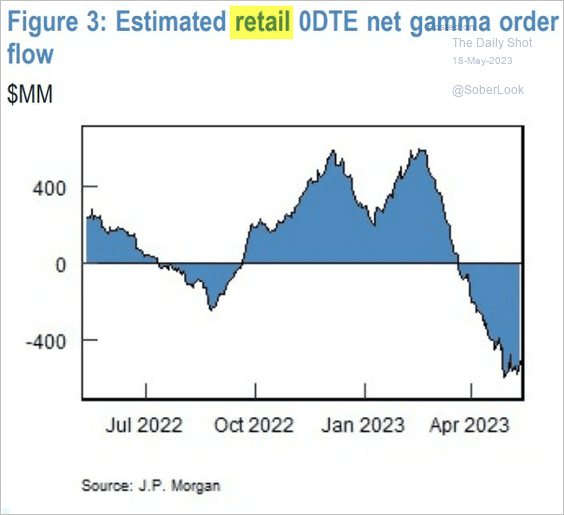

Even retail investors have become net sellers of short-term options.

Source: JP Morgan Research

Source: JP Morgan Research

Back to Index

Credit

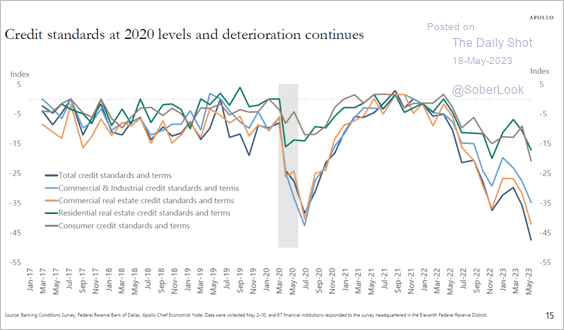

1. A regional bank survey by the Dallas Fed (67 banks) shows credit tightening accelerating through May.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

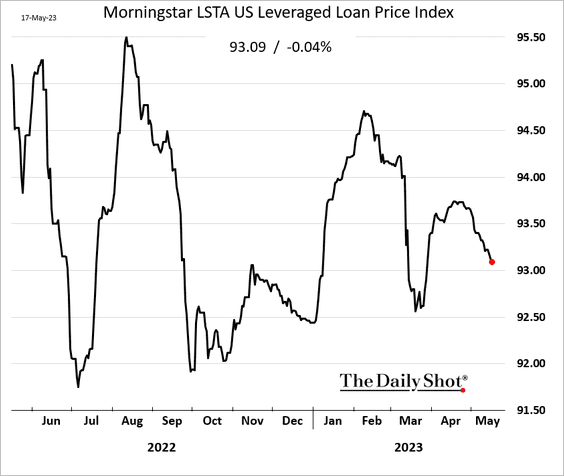

2. Leveraged loan prices have been trending lower.

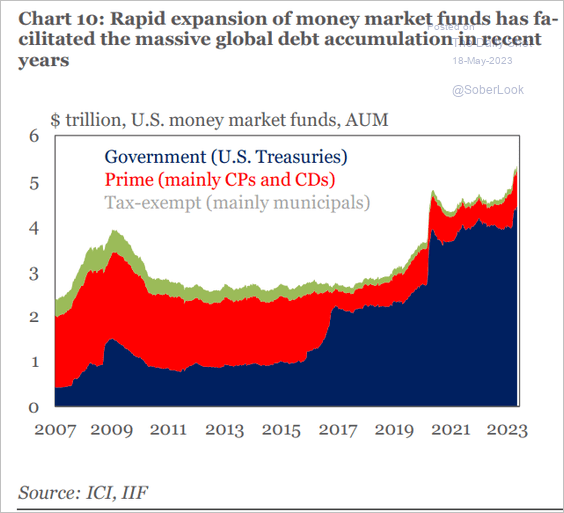

3. Government debt funds now dominate the money market fund universe.

Source: IIF

Source: IIF

Back to Index

Rates

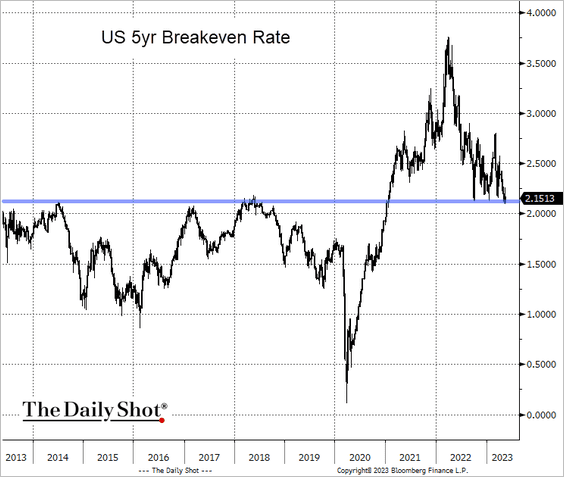

1. The 5-year breakeven inflation expectations index is now at pre-COVID highs. Will the current level continue to act as support?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

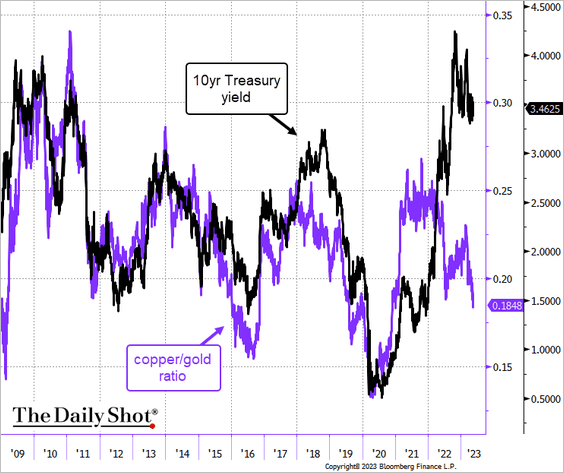

2. The commodity market is pricing a slowdown, as evidenced by the copper-to-gold ratio. Will Treasury yields follow?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

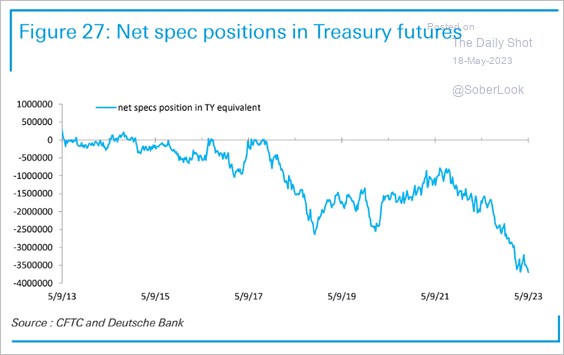

3. Speculative accounts remain very short on Treasury futures.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

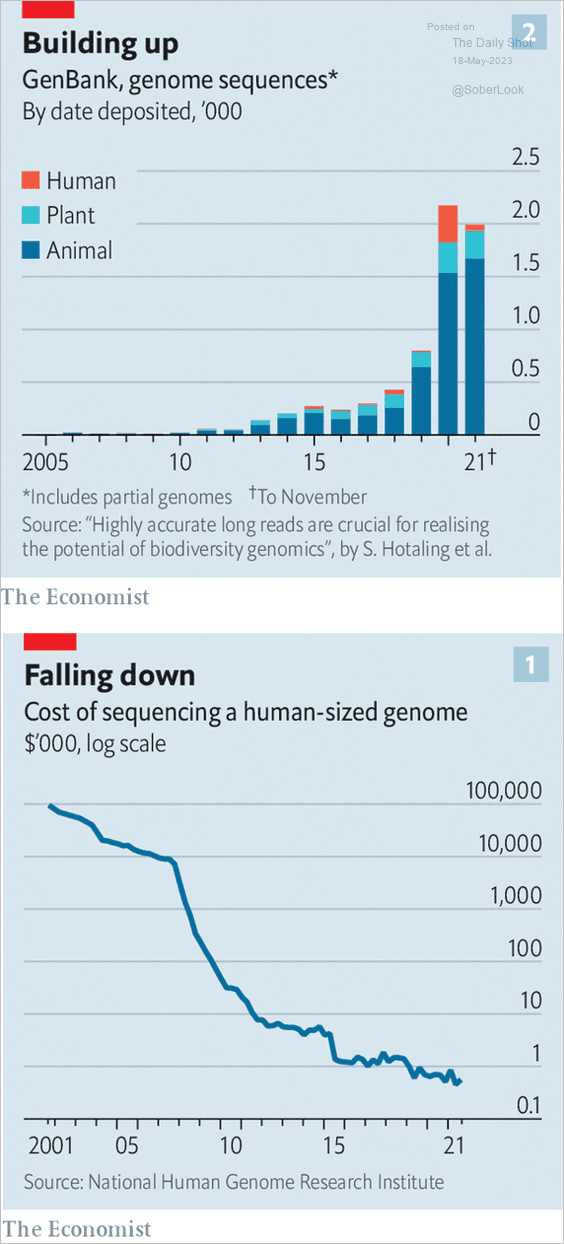

1. Genome sequencing:

Source: The Economist Read full article

Source: The Economist Read full article

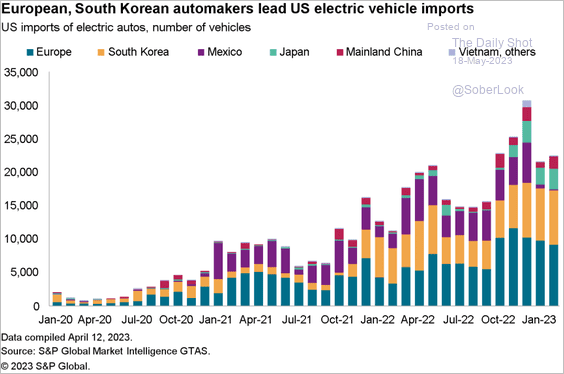

2. US EV imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

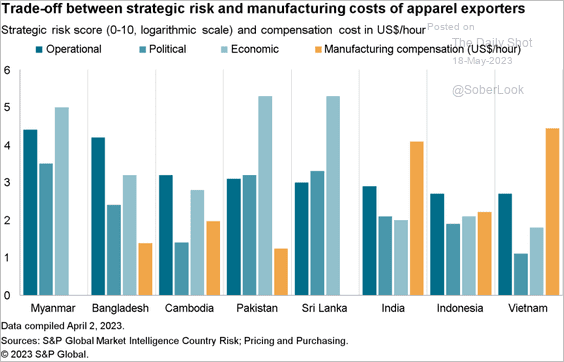

3. Choosing an apparel exporter:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

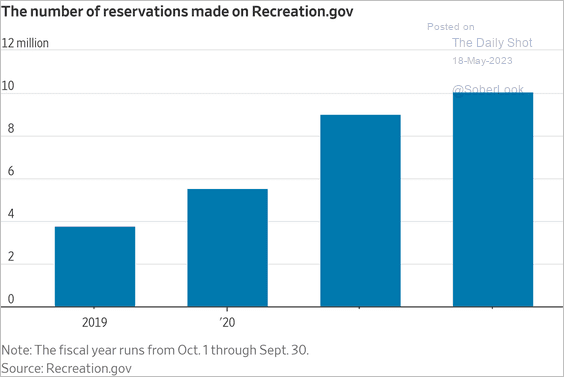

4. National parks visits:

Source: @WSJ Read full article

Source: @WSJ Read full article

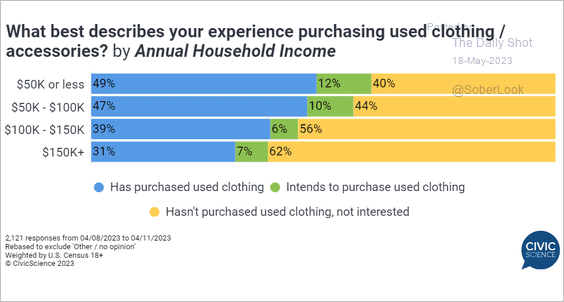

5. Purchasing used clothing:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

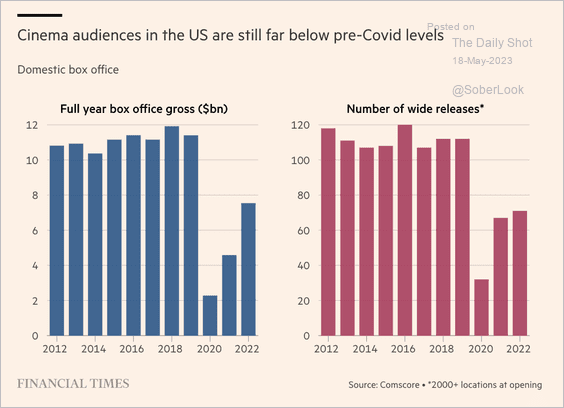

6. US box office sales:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

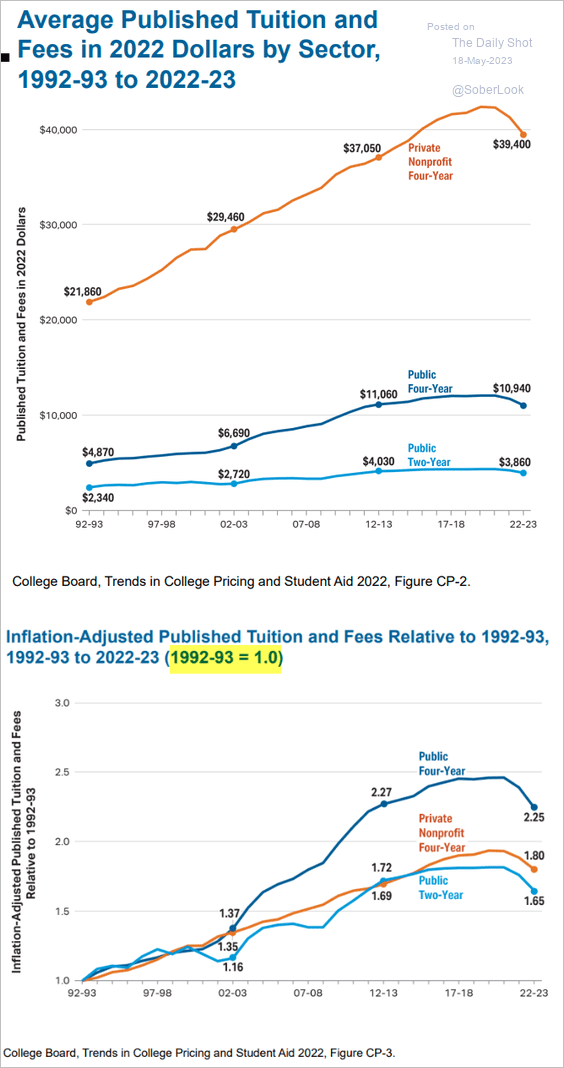

7. College costs adjusted for inflation:

Source: CollegeBoard

Source: CollegeBoard

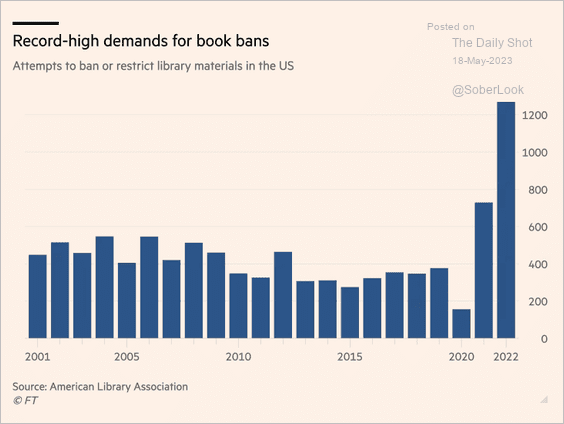

8. Book bans in the US:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

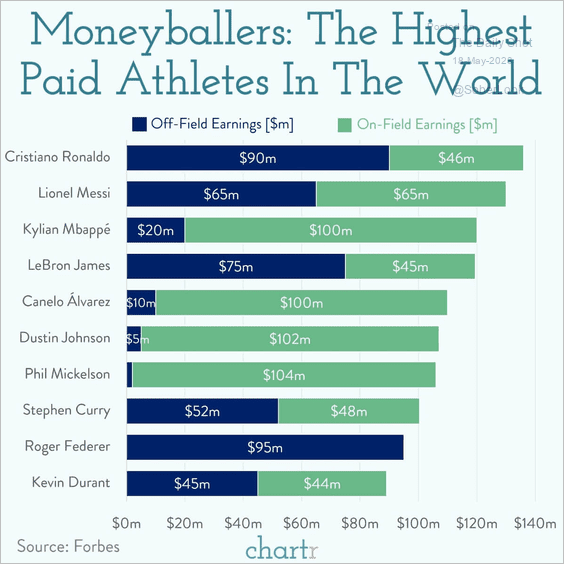

9. Highest-paid athletes:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index