The Daily Shot: 17-May-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

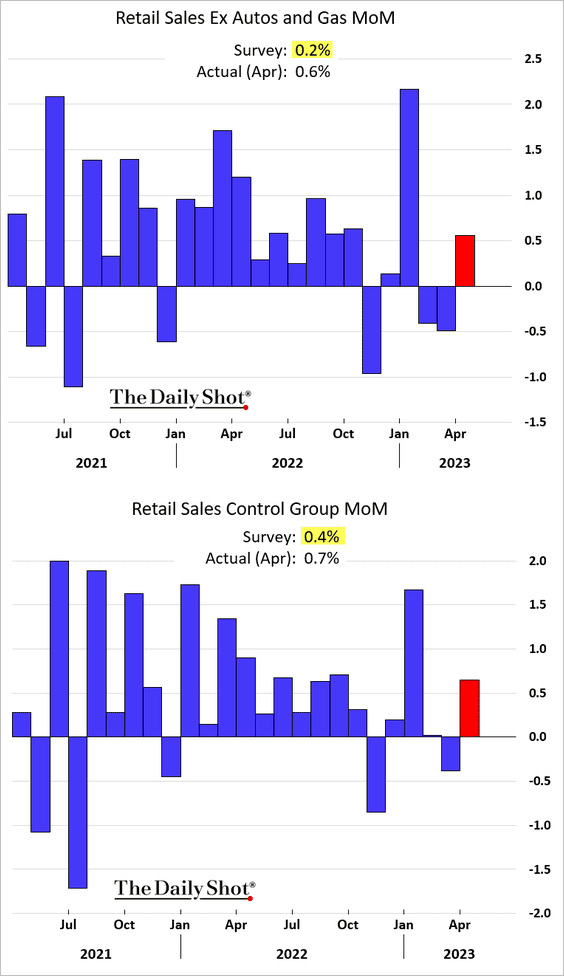

1. April’s core retail sales topped expectations.

Source: @WSJ Read full article

Source: @WSJ Read full article

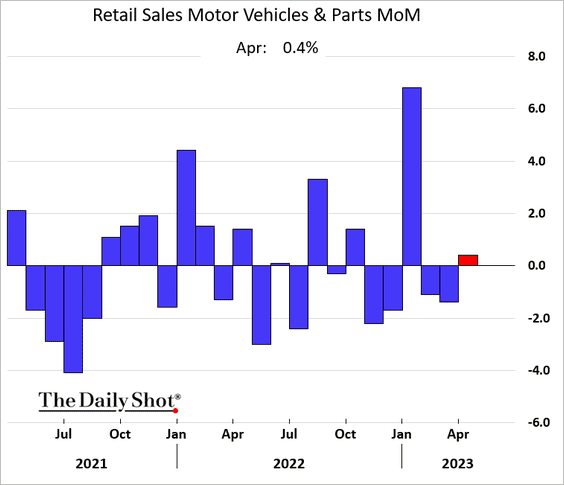

• Auto sales edged higher.

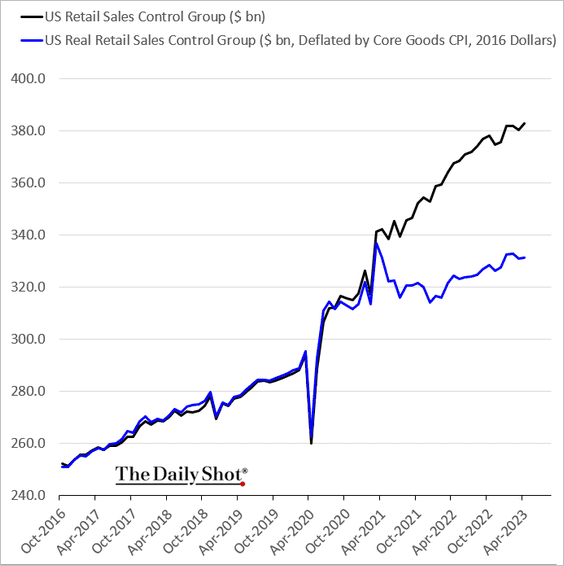

• Adjusted for inflation, the retail sales control group (“core” retail sales) is still trending higher.

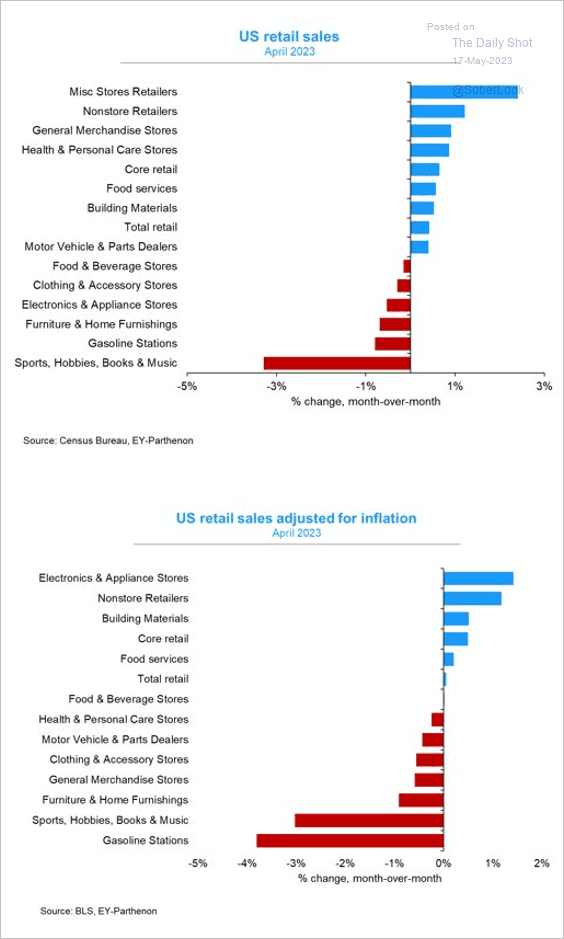

• Here is a breakdown of retail sales components reflecting the April changes.

Source: @GregDaco

Source: @GregDaco

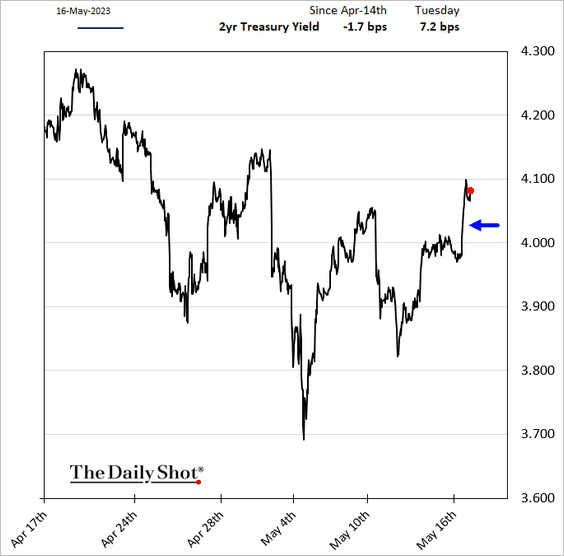

• Bond yields jumped in response to the retail sales report.

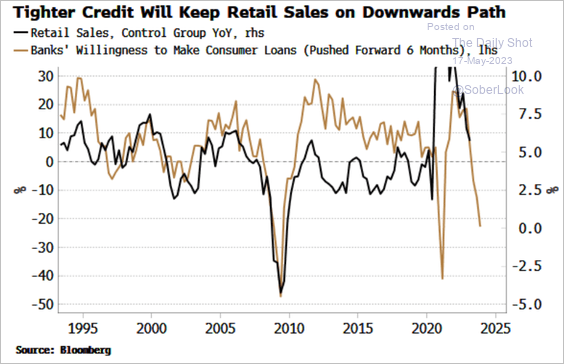

• Tighter credit conditions point to a deterioration in retail sales going forward.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

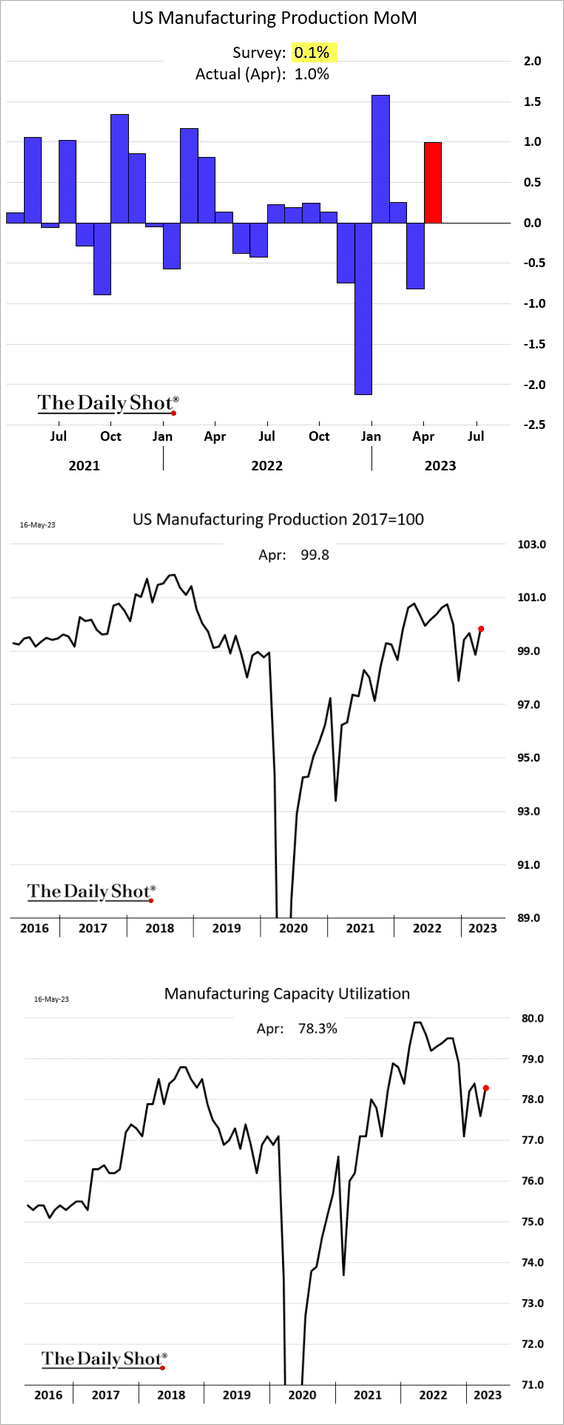

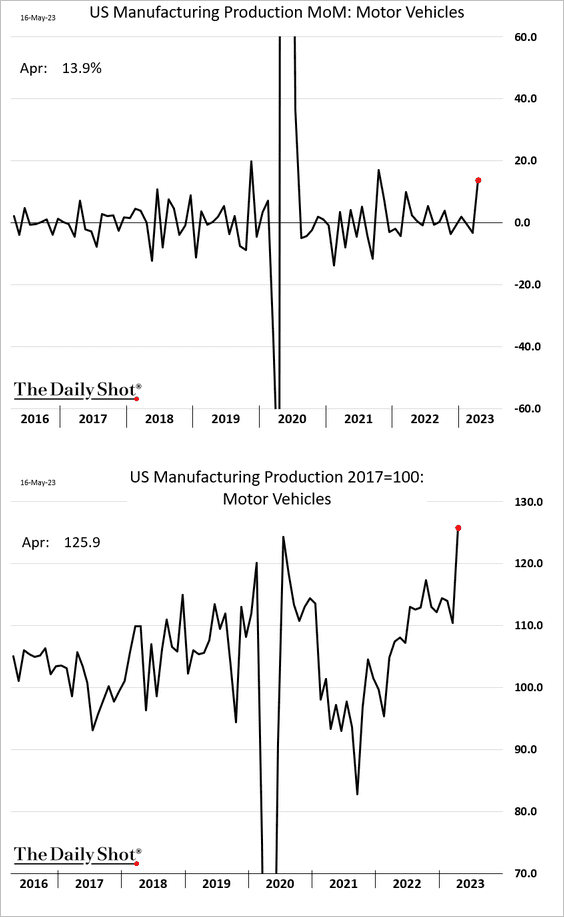

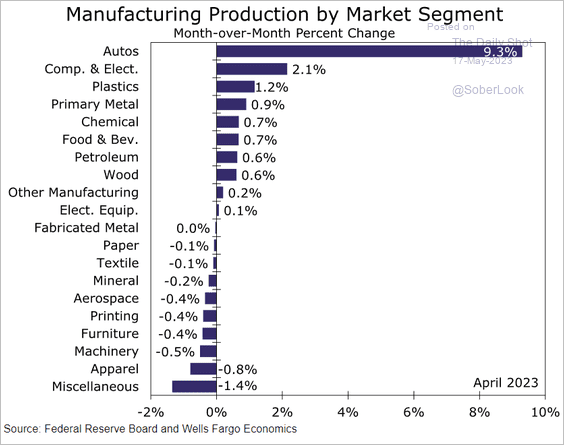

2. Manufacturing output jumped last month, …

… boosted by vehicle production. Excluding the growth in auto manufacturing, industrial production would have remained nearly stagnant.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

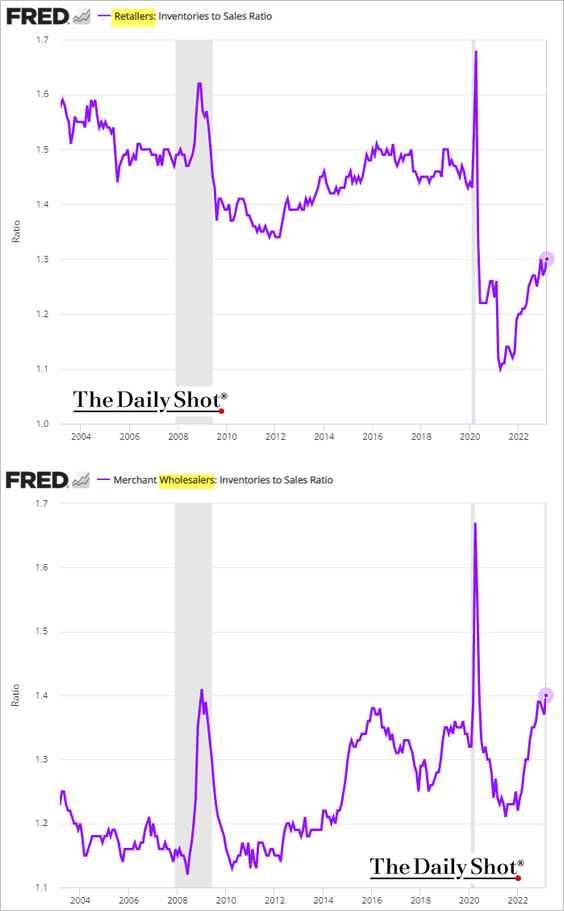

3. Inventories-to-sales ratios continue to climb.

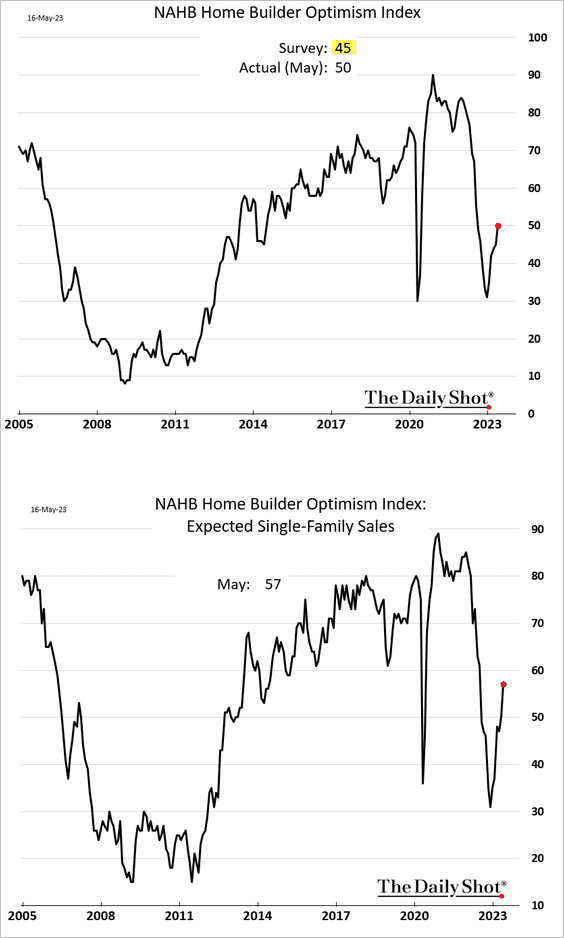

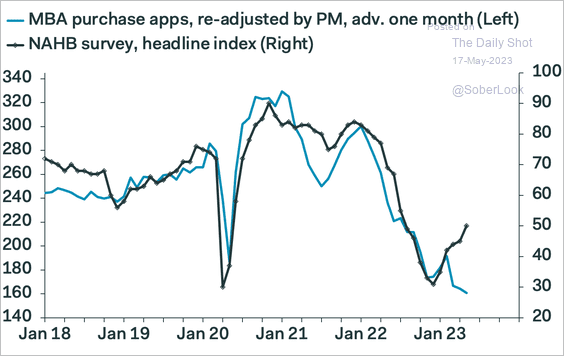

4. Homebuilder sentiment improved again this month, topping expectations. The scarcity of housing inventory is spurring new construction activity.

However, falling mortgage applications point to downside risks for homebuilders.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

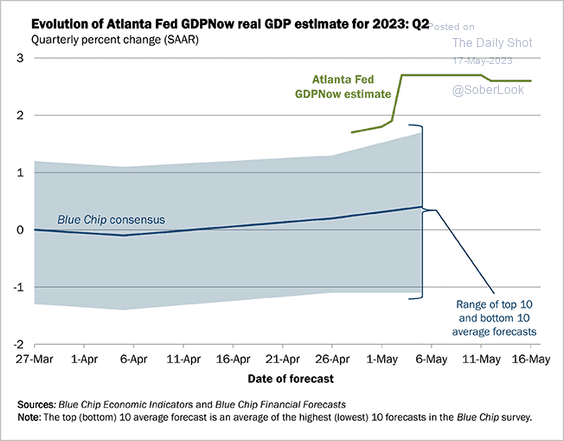

5. At present, the Atlanta Fed’s GDPNow nowcast model indicates no signs of a recession, with the Q2 growth estimate tracking at 2.6% (annualized).

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

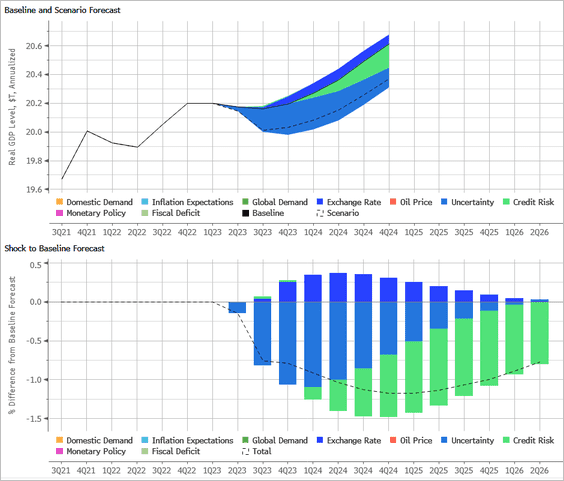

• However, failure to resolve the debt ceiling impasse will trigger a massive downturn. According to Anna Wong of Bloomberg Economics, “If the Treasury is forced to cut spending to meet debt obligations, a conservative estimate would put the downturn at 8%.”

Source: @AnnaEconomist, @TheTerminal, Bloomberg Finance L.P.

Source: @AnnaEconomist, @TheTerminal, Bloomberg Finance L.P.

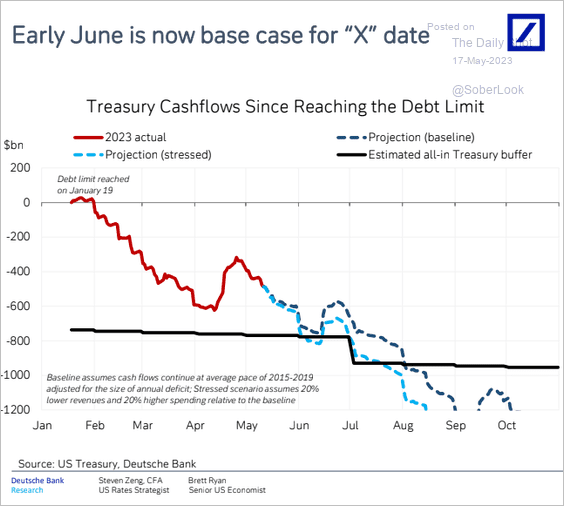

• Deutsche Bank sees the early-June X-date as the base case.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

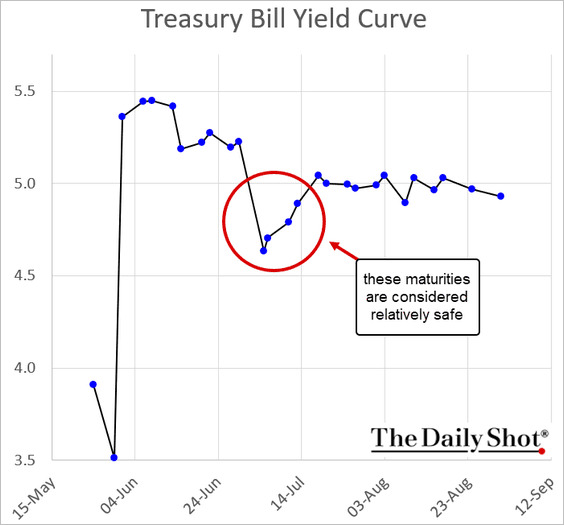

• Here is the Treasury bill curve.

Back to Index

Canada

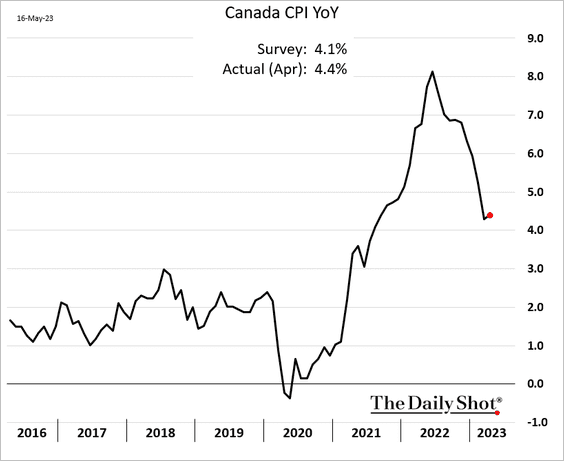

1. The headline CPI unexpectedly accelerated.

Source: Reuters Read full article

Source: Reuters Read full article

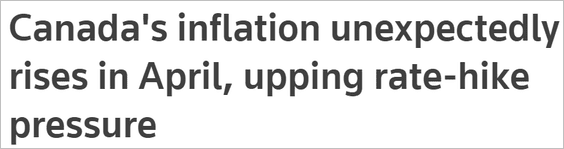

• Here are the contributions.

Source: iA Global Asset Management

Source: iA Global Asset Management

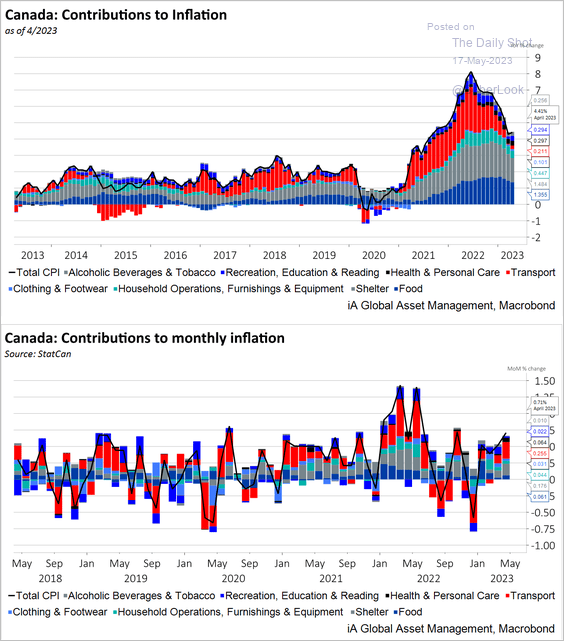

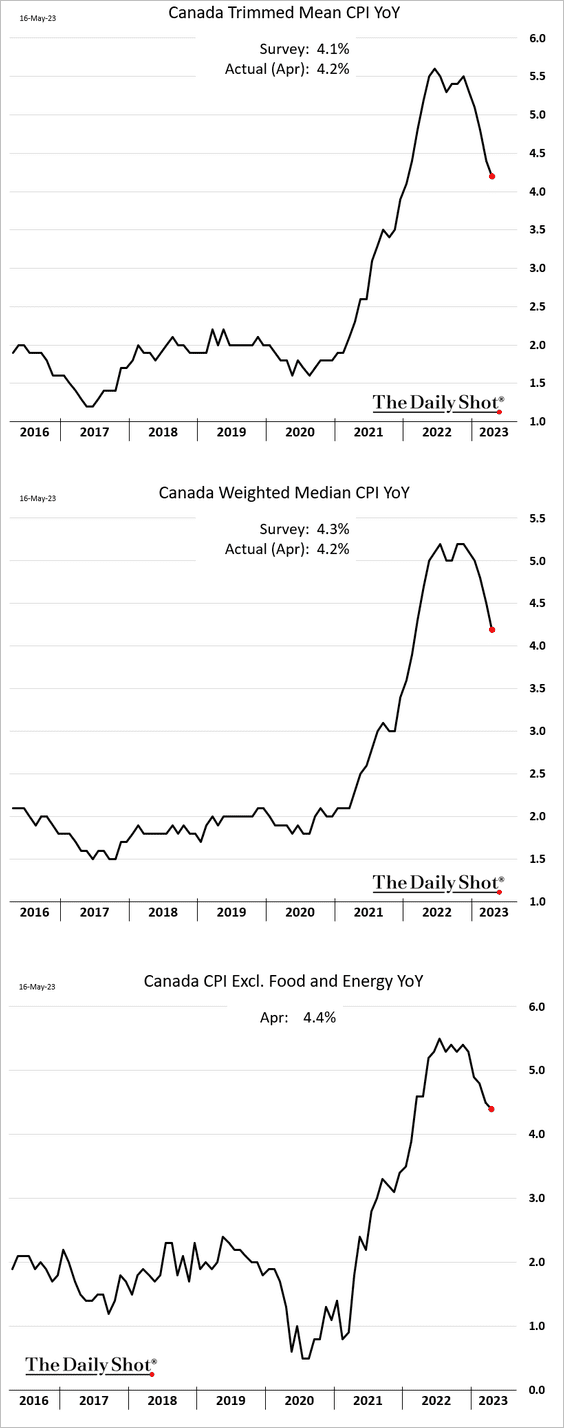

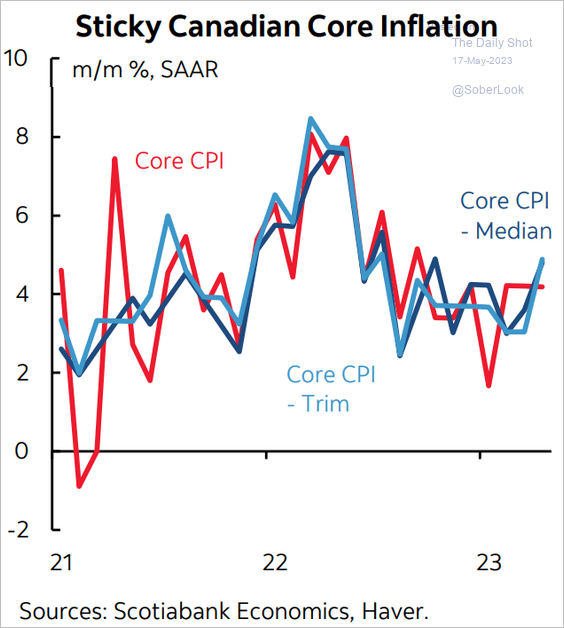

• Core inflation measures are moderating, …

… but are still elevated on a month-over-month basis.

Source: Scotiabank Economics

Source: Scotiabank Economics

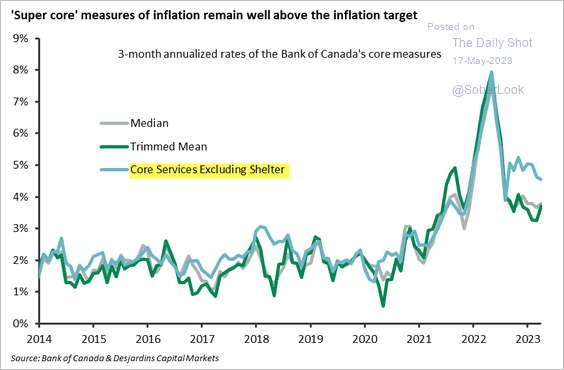

• Supercore inflation has been outpacing the core inflation measures.

Source: Desjardins

Source: Desjardins

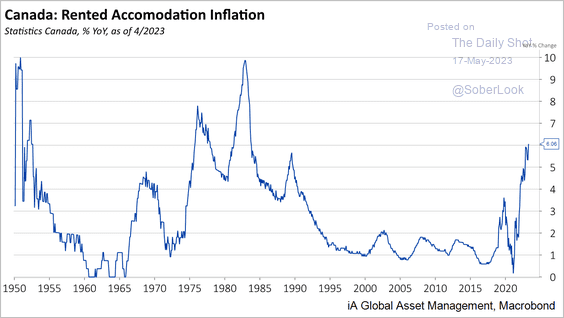

• Rent inflation remains high.

Source: iA Global Asset Management

Source: iA Global Asset Management

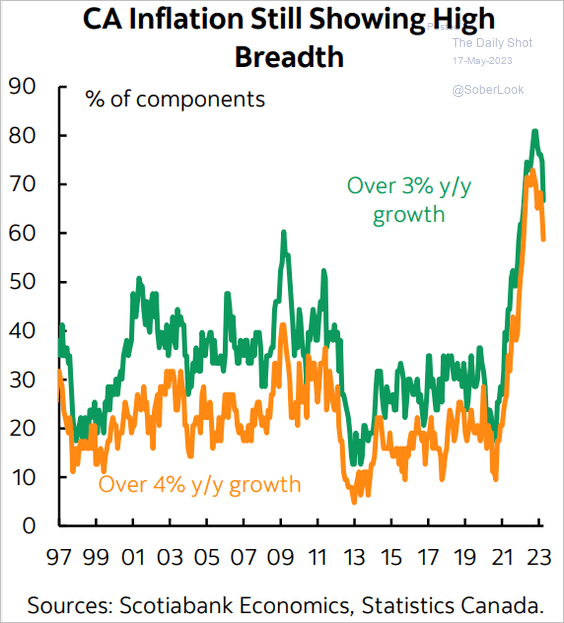

• Here is the CPI breadth.

Source: Scotiabank Economics

Source: Scotiabank Economics

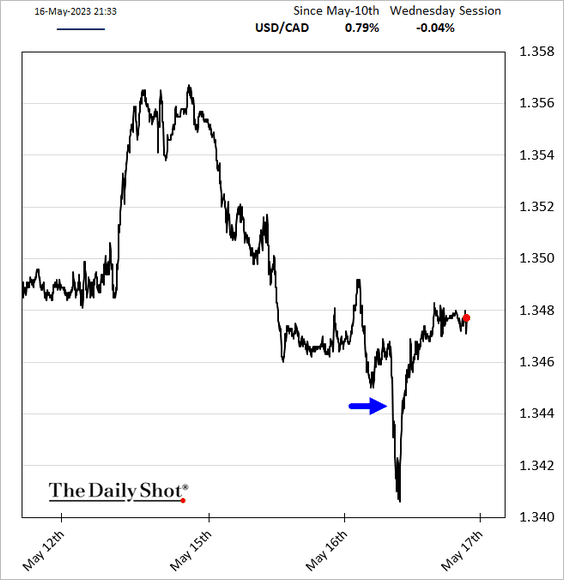

2. The loonie initially strengthened in response to the CPI surprise but sold off shortly after.

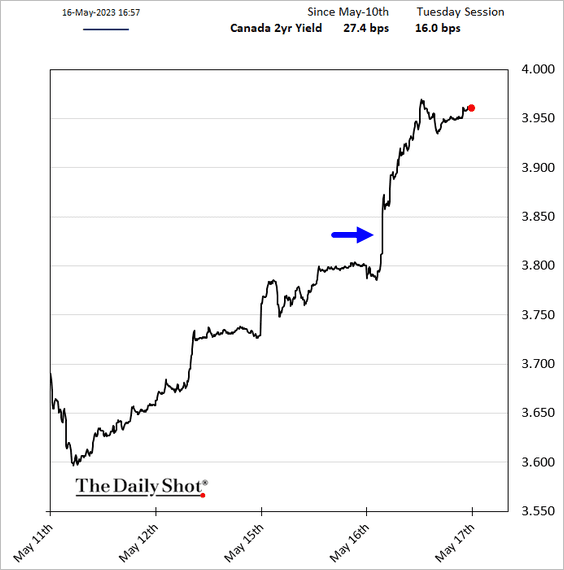

Bond yields surged.

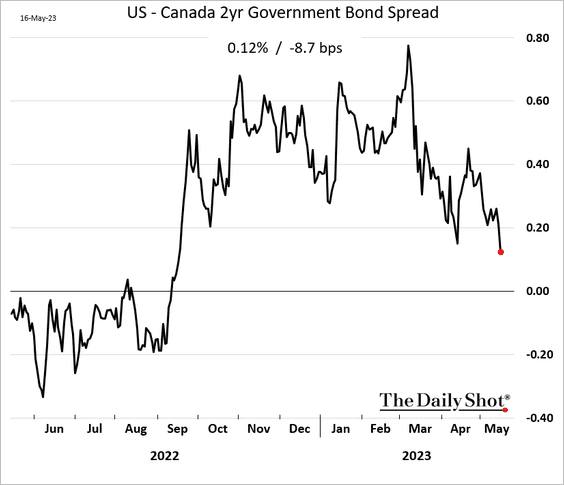

• Here is the US-Canada 2-year spread.

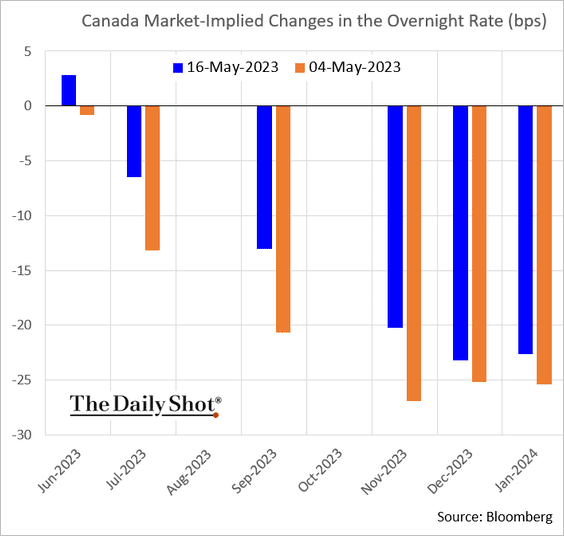

• The probability of another BoC rate hike is small but no longer zero.

——————–

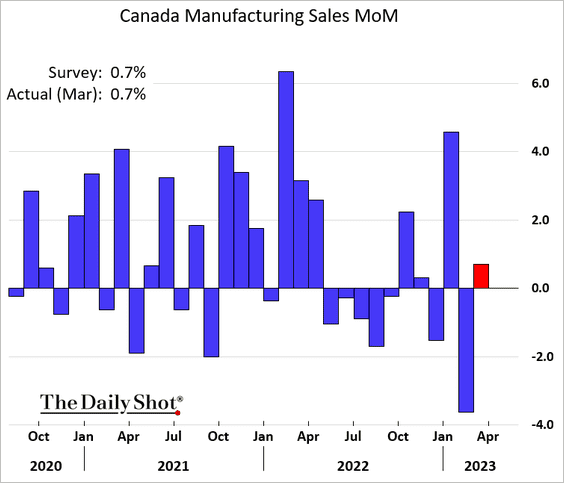

3. Manufacturing sales improved in March.

Back to Index

The United Kingdom

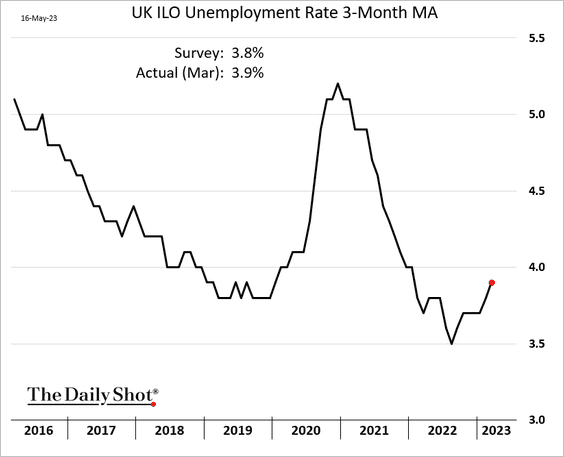

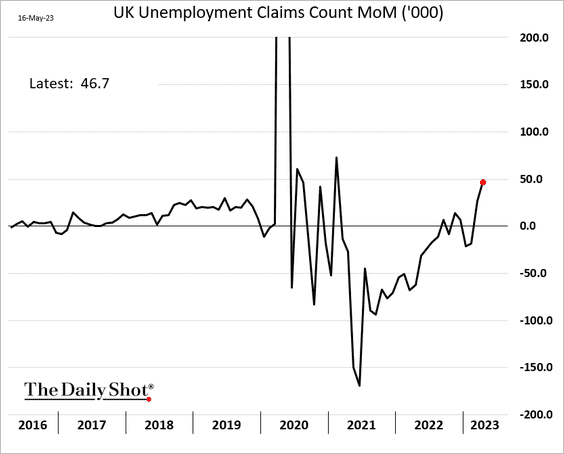

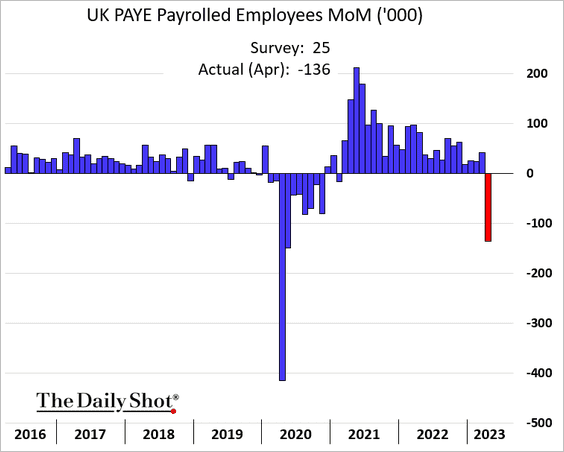

1. The labor market is starting to soften.

– Unemployment:

– Claims:

– Payrolls:

Source: The Guardian Read full article

Source: The Guardian Read full article

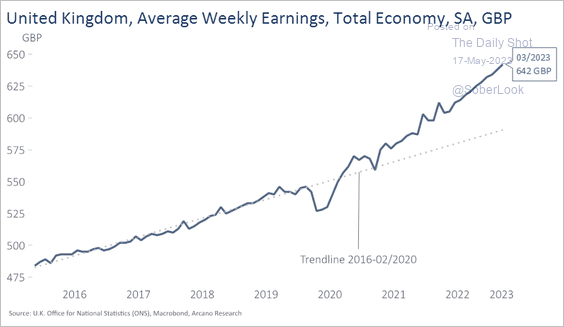

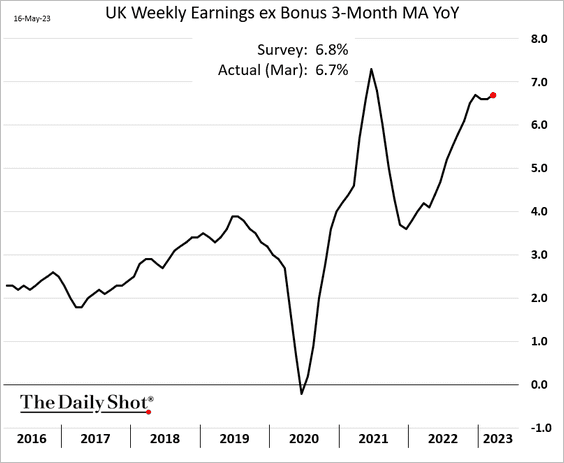

2. Wage growth is still elevated.

Source: Arcano Economics

Source: Arcano Economics

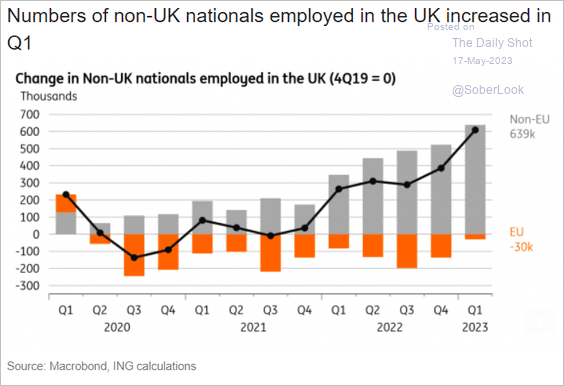

• The influx of non-UK nationals will put downward pressure on wage growth.

Source: ING

Source: ING

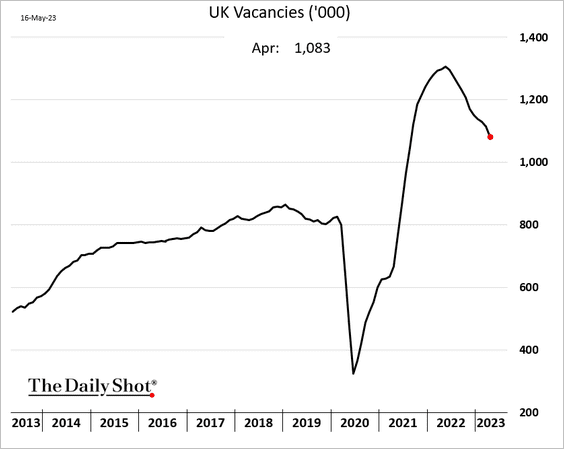

• Vacancies continue to moderate.

——————–

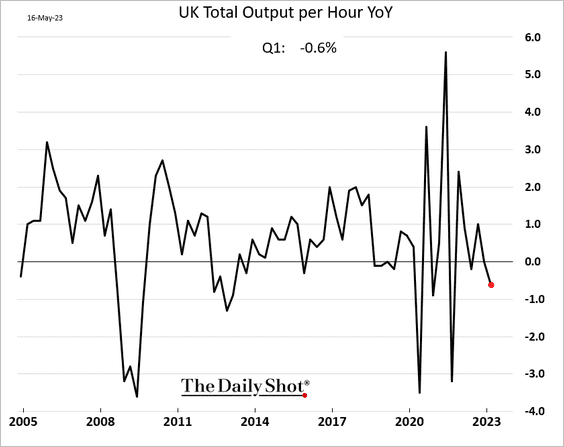

3. Labor productivity declined last quarter.

Back to Index

The Eurozone

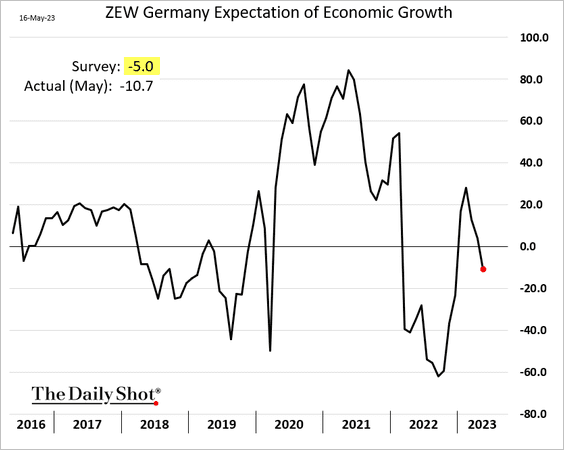

1. Germany’s ZEW index surprised to the downside.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

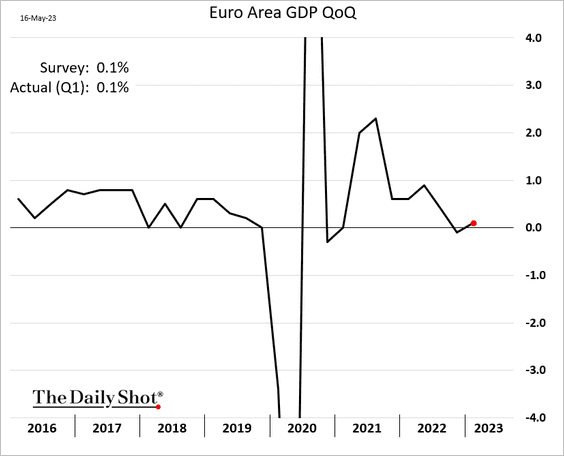

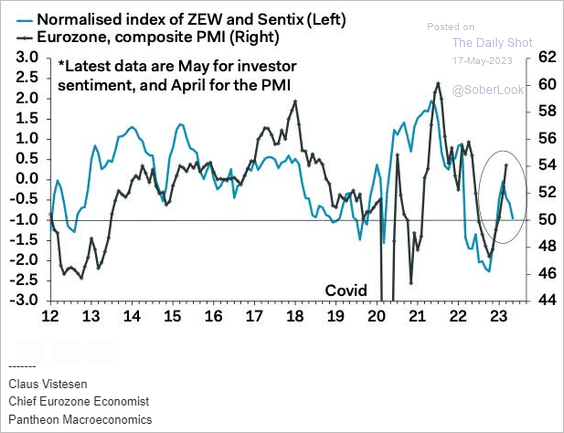

2. The euro-area economy managed to achieve modest growth in the last quarter.

Source: Reuters Read full article

Source: Reuters Read full article

But leading indicators point to downside risks for economic activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

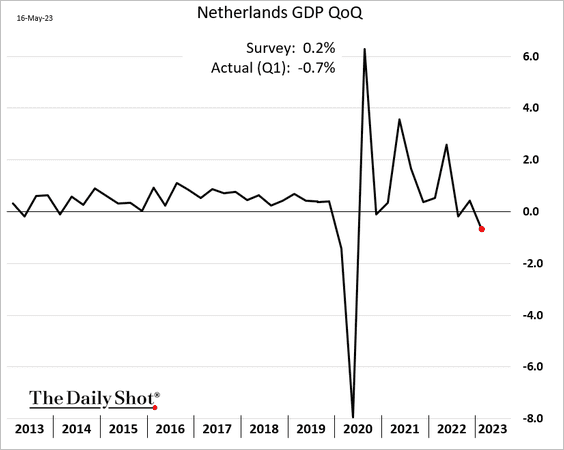

3. Dutch GDP declined sharply in Q1.

Source: ING Read full article

Source: ING Read full article

——————–

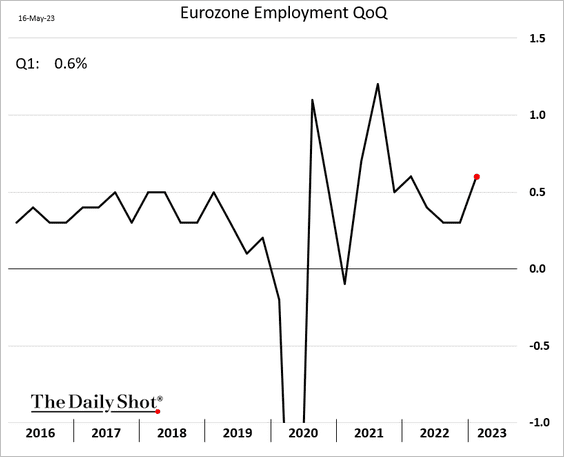

4. Euro-area employment jumped last quarter.

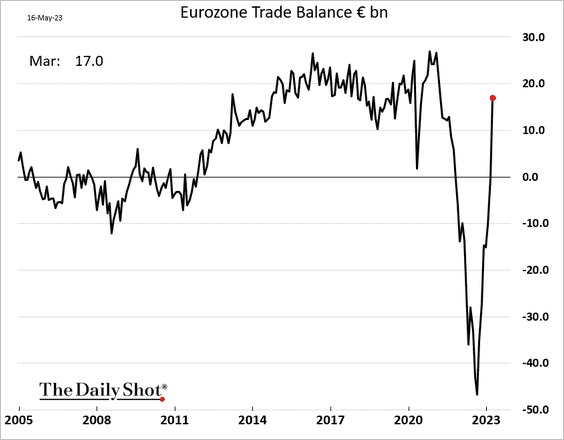

5. The Eurozone’s trade balance is back in surplus as terms of trade improve (lower costs of energy imports).

Back to Index

Europe

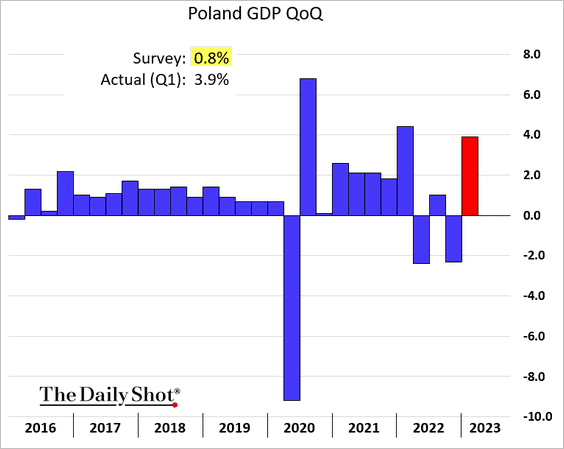

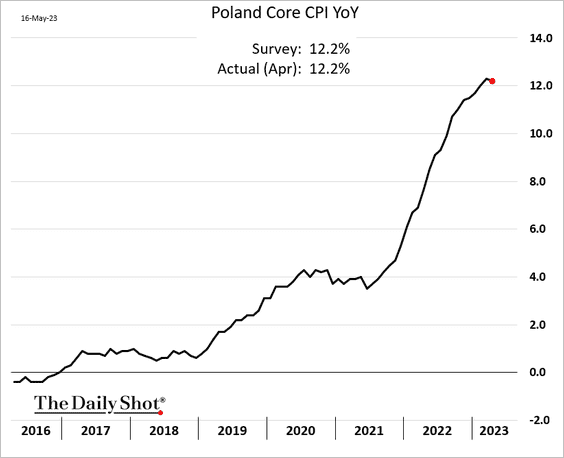

1. Poland’s GDP growth topped expectations.

Core inflation appears to have peaked.

——————–

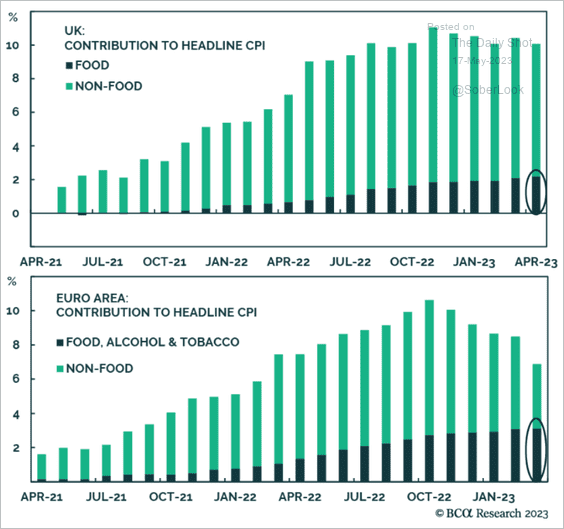

2. The contribution of food to the headline CPI has been rising in the UK and Eurozone.

Source: BCA Research

Source: BCA Research

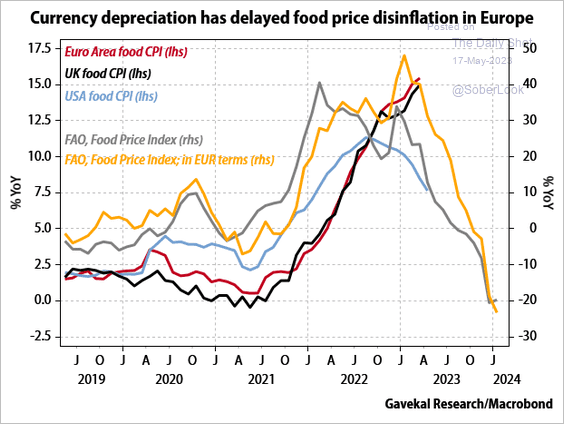

The euro’s recent rebound should help lower food inflation.

Source: Gavekal Research

Source: Gavekal Research

——————–

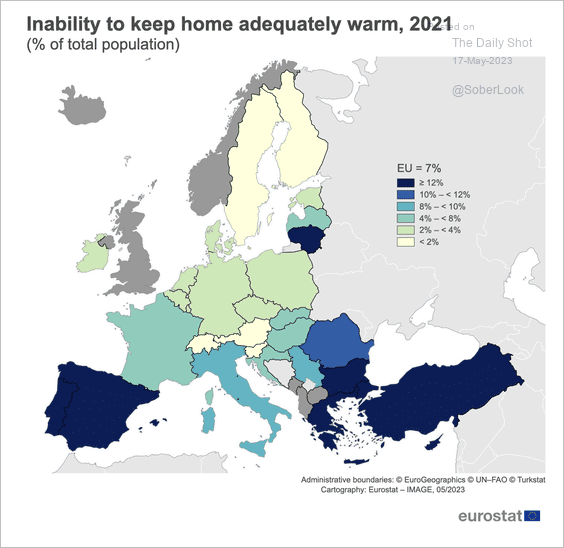

3. Which countries faced the greatest challenges in maintaining adequate home heating?

Source: Eurostat Read full article

Source: Eurostat Read full article

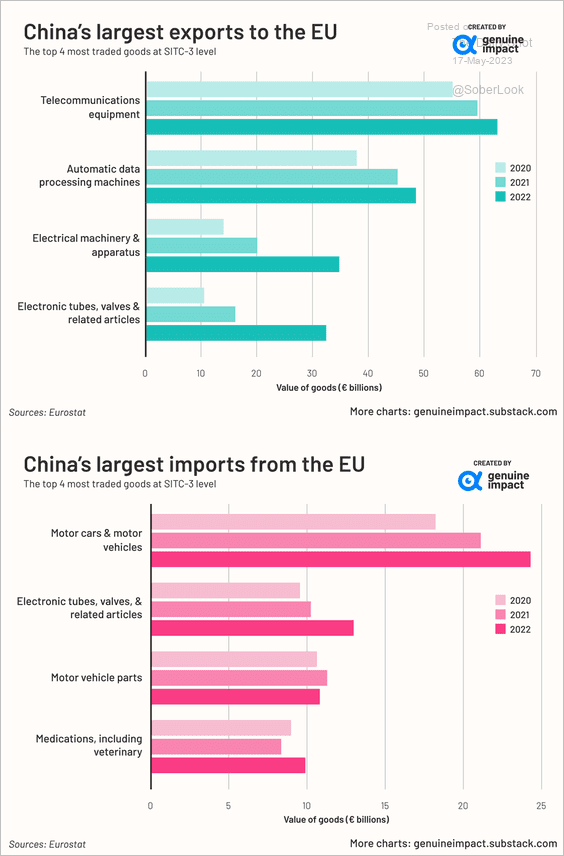

4. This chart shows the EU’s trade with China.

Source: @genuine_impact

Source: @genuine_impact

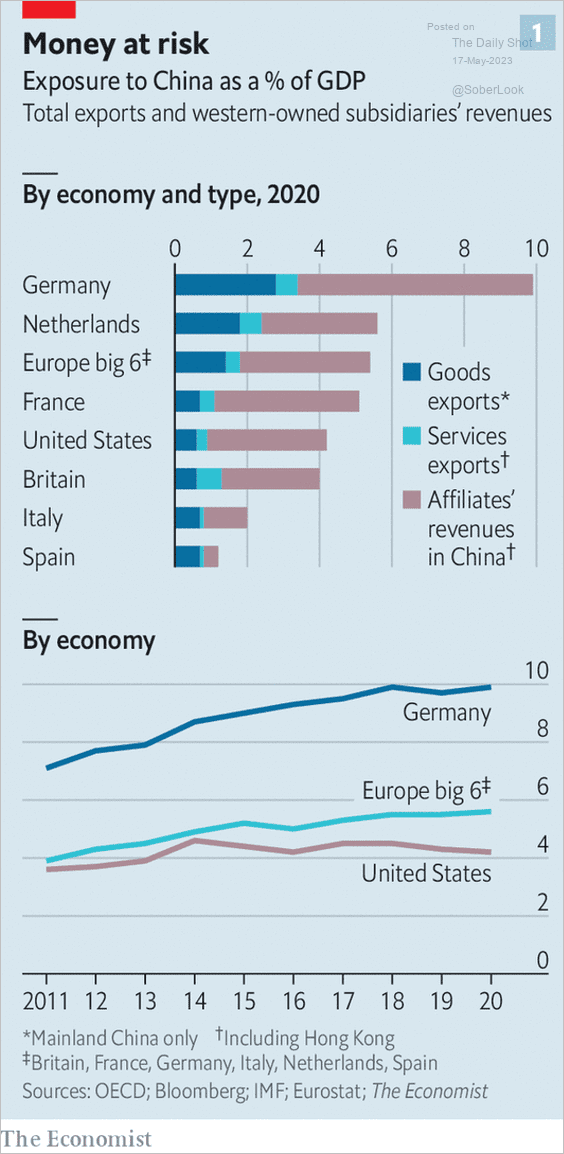

Which countries have the most exposure to China?

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Asia-Pacific

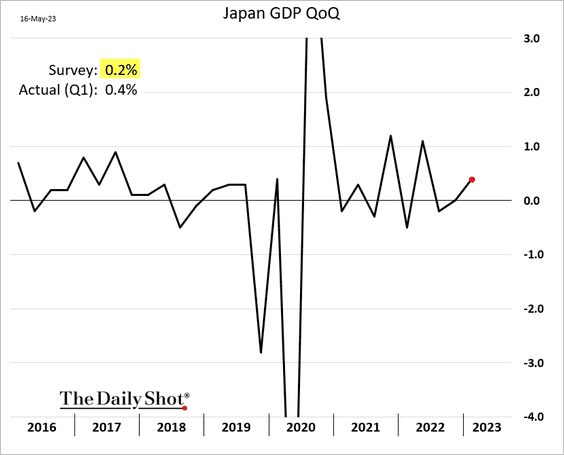

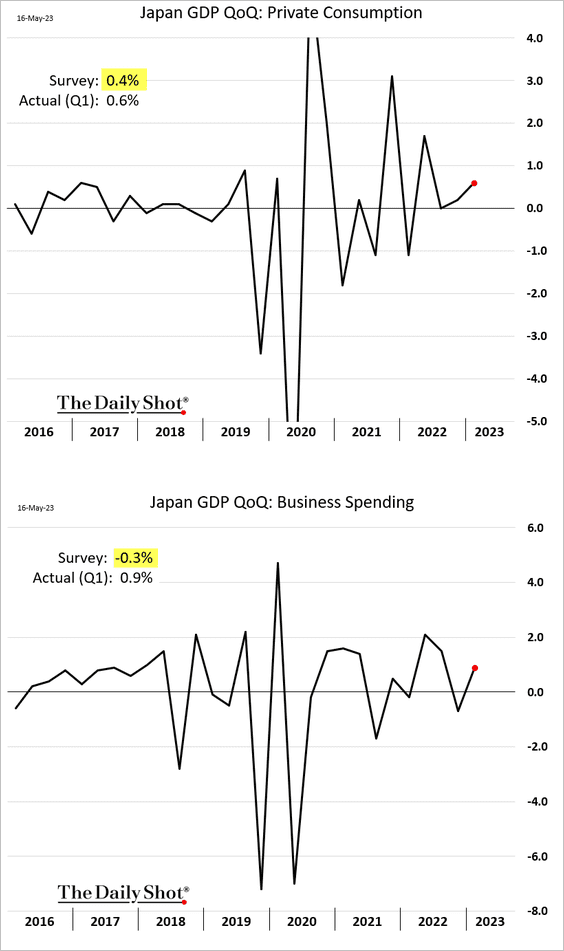

1. Japan’s Q1 GDP growth topped expectations, …

… boosted by robust domestic demand. The rebound in business investment was a surprise.

——————–

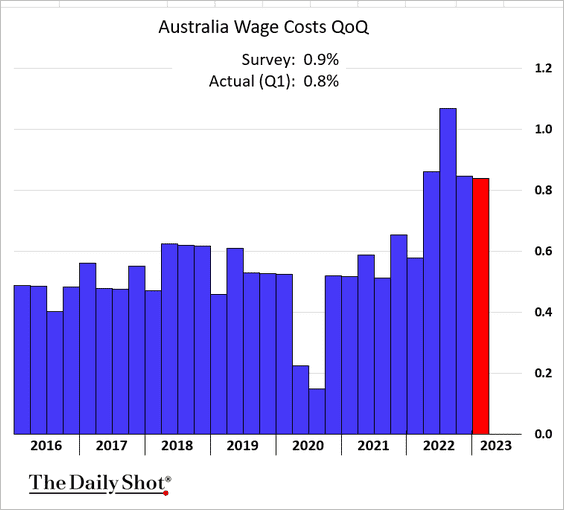

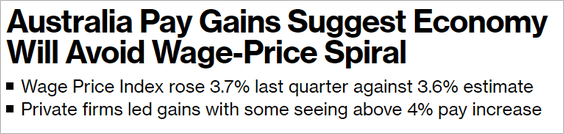

2. Australia’s Q1 wage growth was slightly below forecasts but still elevated.

Source: @Swatisays, @economics Read full article

Source: @Swatisays, @economics Read full article

The market is still pricing a ~40% chance of another RBA rate hike this summer.

Back to Index

China

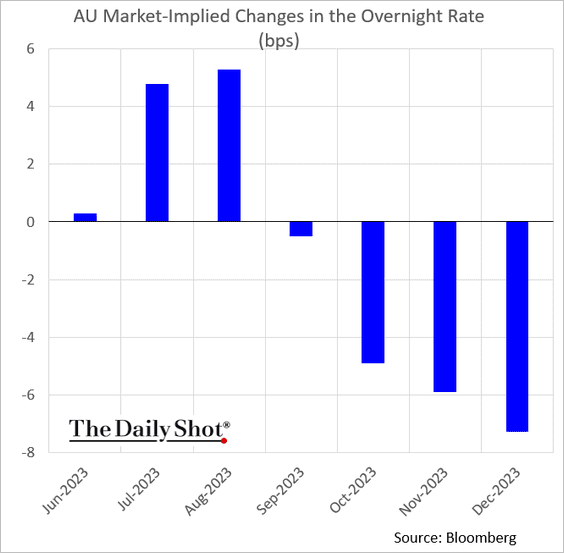

1. New home prices increased again last month.

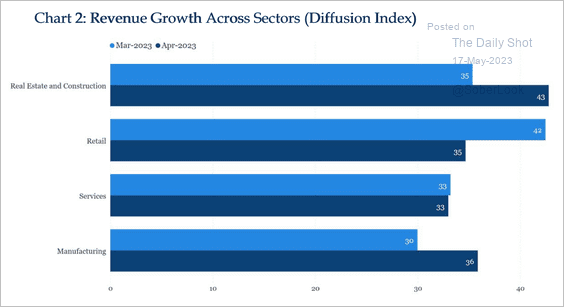

2. The property sector notched the strongest revenue results in April, while retail slowed.

Source: China Beige Book

Source: China Beige Book

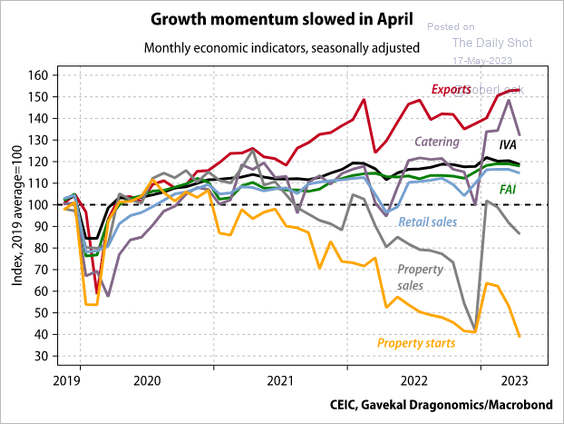

3. Here is a summary of key economic indicators from Gavekal Research.

Source: Gavekal Research

Source: Gavekal Research

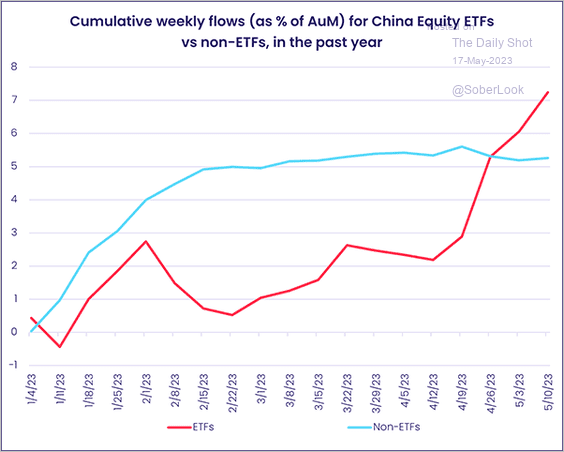

4. China-focused ETFs saw substantial inflows in recent weeks. On the other hand, non-ETF products have not attracted much capital since February.

Source: EPFR

Source: EPFR

Back to Index

Emerging Markets

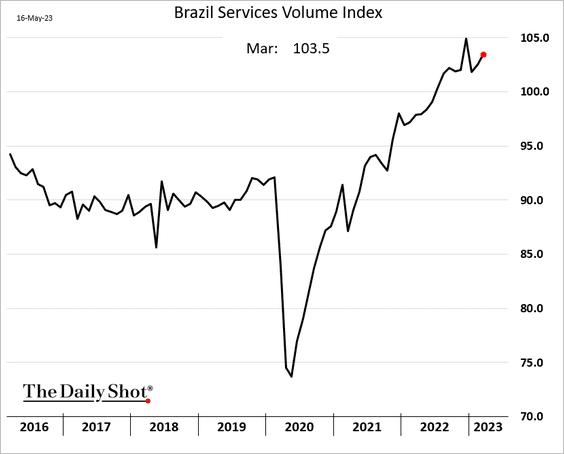

1. Brazil’s service-sector output improved in March.

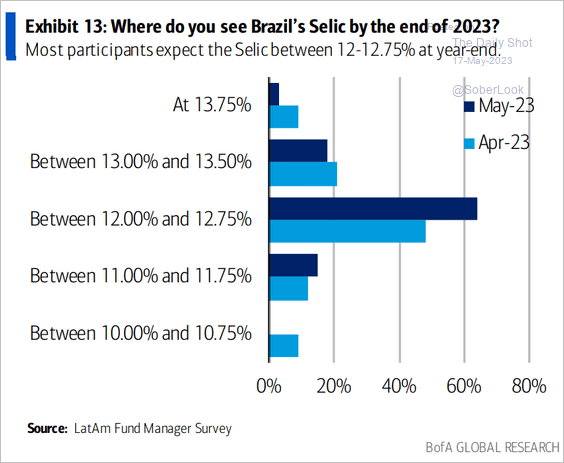

Investors increasingly see rate cuts in Brazil later this year.

Source: BofA Global Research

Source: BofA Global Research

——————–

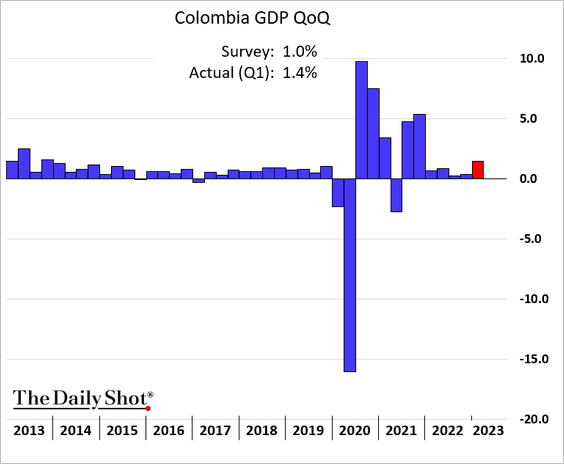

2. Colombia’s GDP has been holding up well.

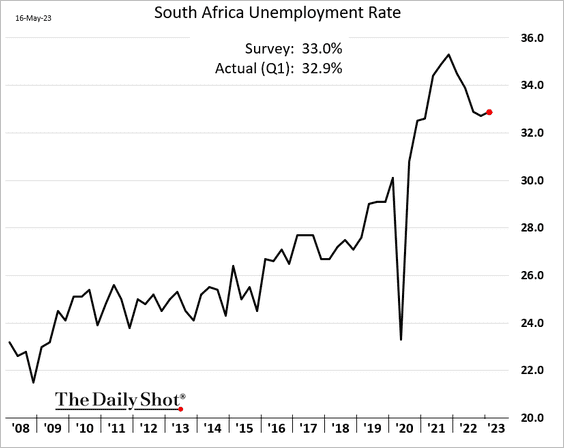

3. A third of South Africa’s labor force remains unemployed.

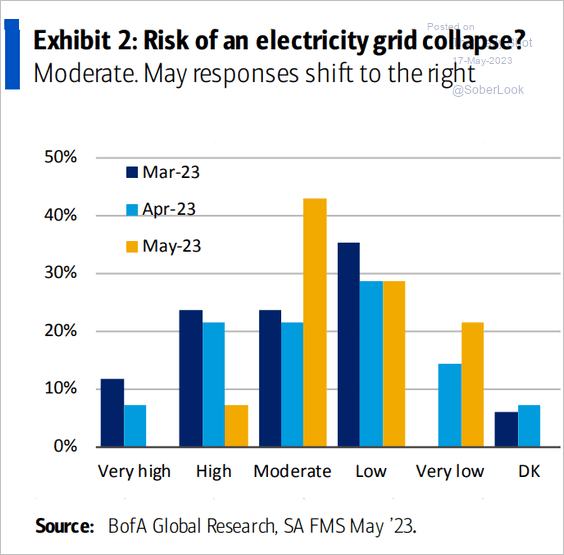

Investors are becoming less concerned about South Africa’s electricity grid.

Source: BofA Global Research

Source: BofA Global Research

——————–

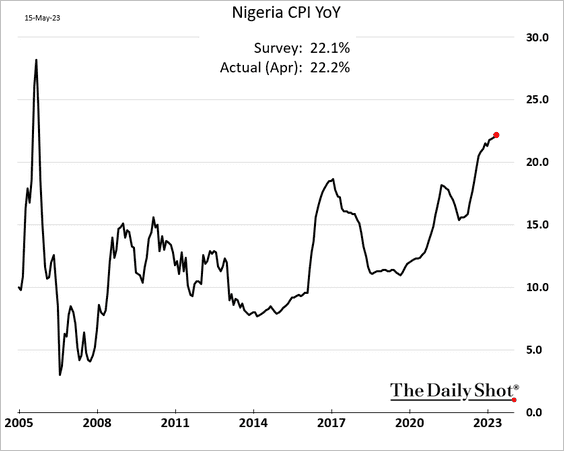

4. Nigeria’s CPI is now above 22%.

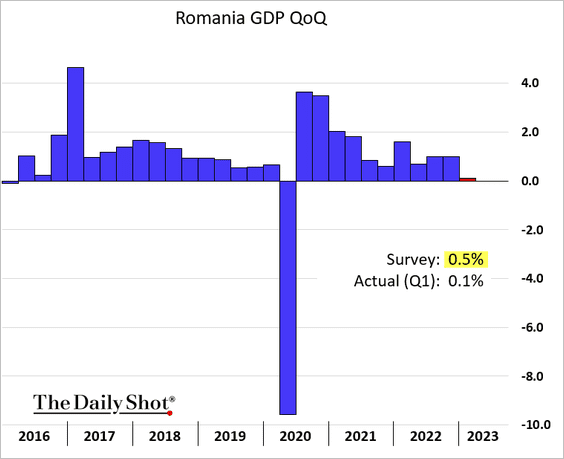

5. Romania’s economic growth, which has been robust, slowed more than expected in Q1.

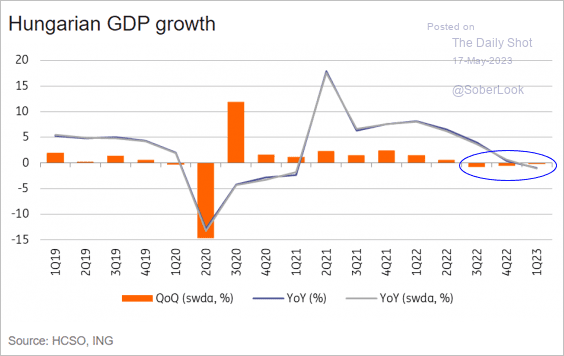

6. Hungary remains in recession.

Source: ING

Source: ING

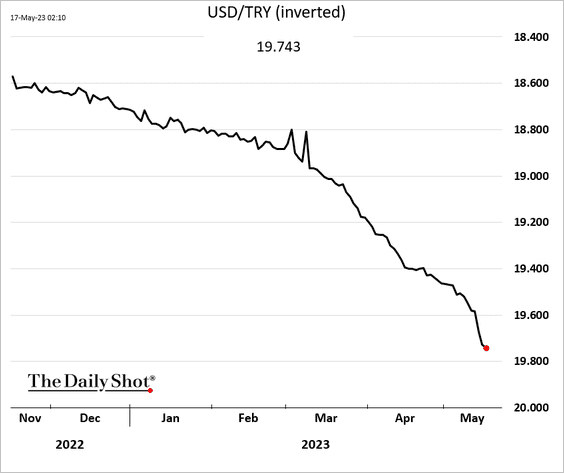

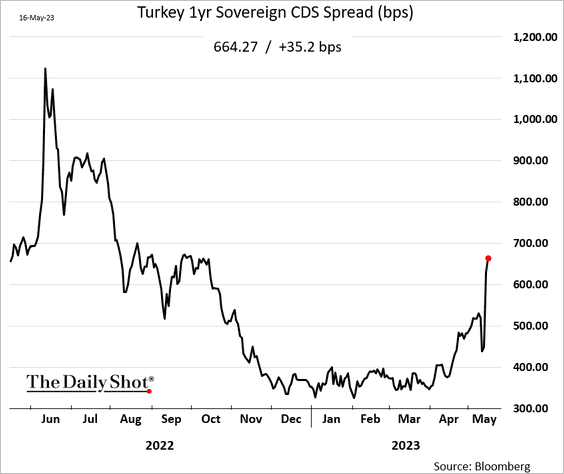

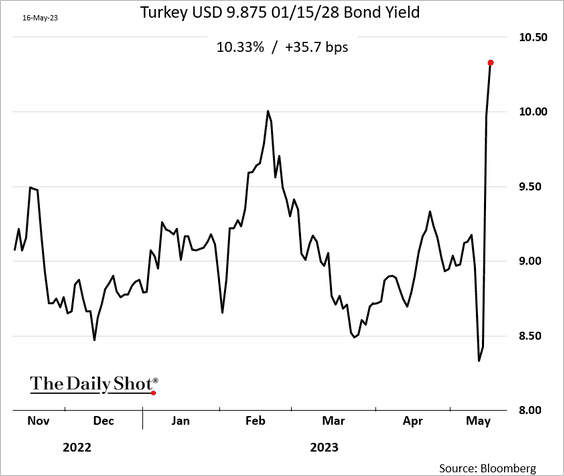

7. Market sentiment towards Turkey continues to be pessimistic due to the country’s economic challenges and political uncertainty.

• The Turkish lira:

• The 1-year CDS spread:

• The 5-year USD-denominated bond yield:

——————–

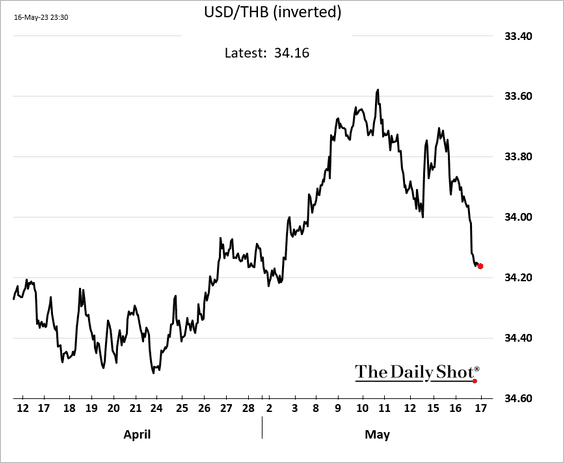

6. The Thai baht took a hit this week amid political uncertainty.

Source: CNN Read full article

Source: CNN Read full article

Back to Index

Cryptocurrency

Bitcoin is holding support at the 200-week moving average.

Back to Index

Commodities

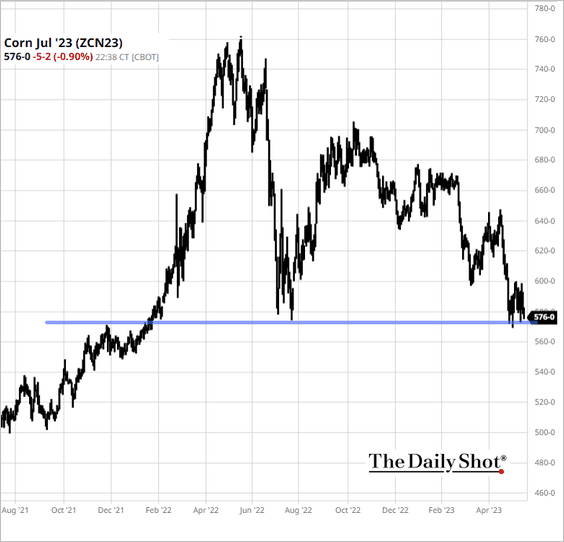

1. US grains saw some selling pressure on Tuesday. The July corn contract is now at support.

Source: barchart.com

Source: barchart.com

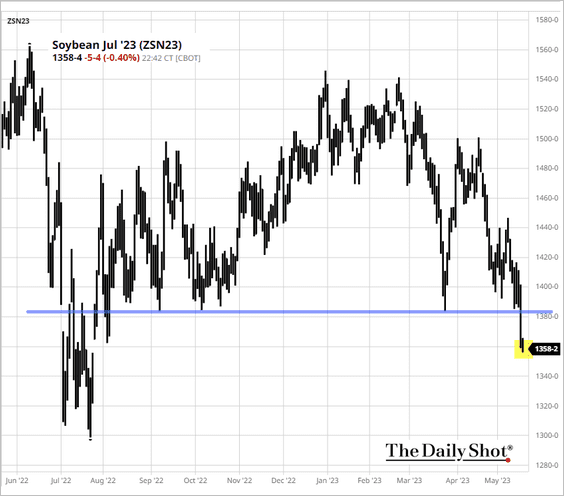

The soybean contract broke below support.

Source: barchart.com

Source: barchart.com

Source: Reuters Read full article

Source: Reuters Read full article

——————–

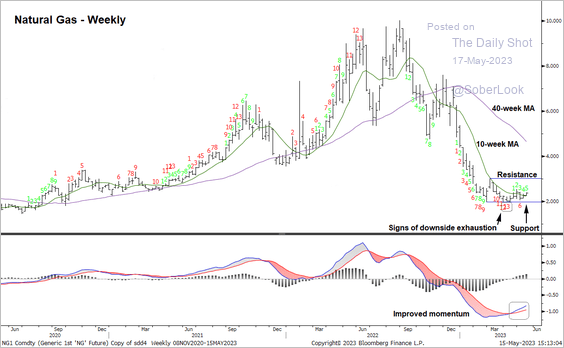

2. The downtrend in Henry Hub Natural Gas futures has slowed. Technicals point to a bottoming process.

Source: @StocktonKatie

Source: @StocktonKatie

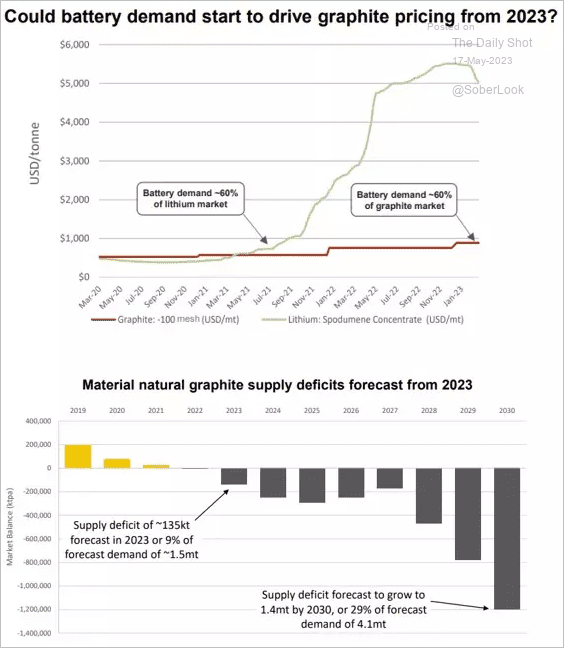

3. Could graphite be the next beneficiary of rising battery demand?

Source: Livewire Markets Read full article

Source: Livewire Markets Read full article

Back to Index

Equities

1. Risk appetite deteriorated this month, according to BofA’s fund manager survey.

Source: BofA Global Research

Source: BofA Global Research

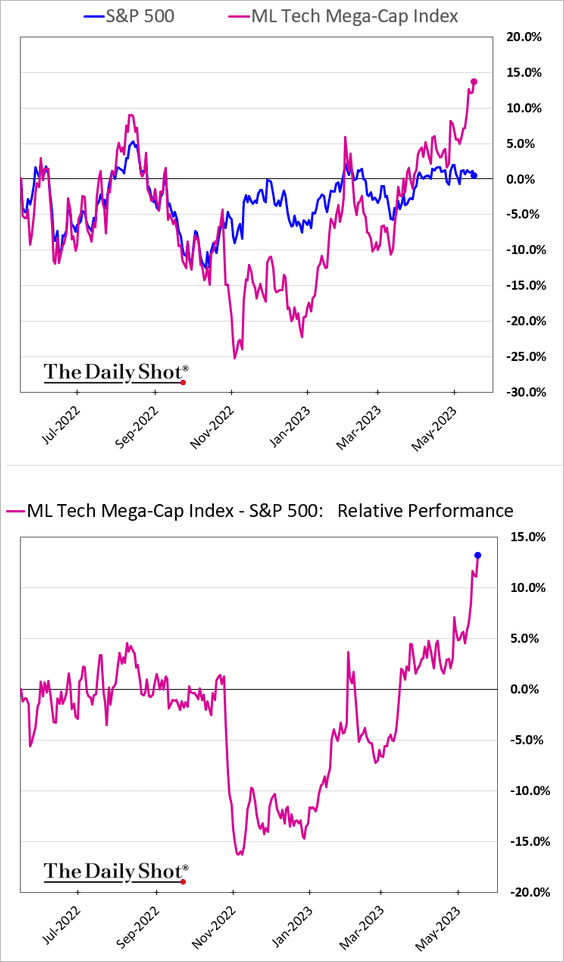

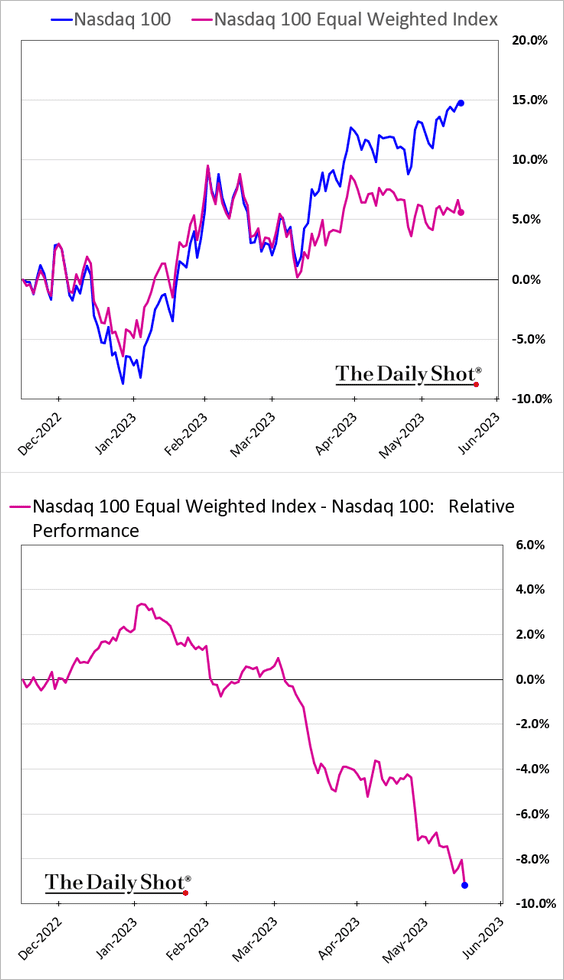

2. The tech mega-cap surge has been remarkable.

The Nasdaq 100 equal-weigh index continues to widen its underperformance.

——————–

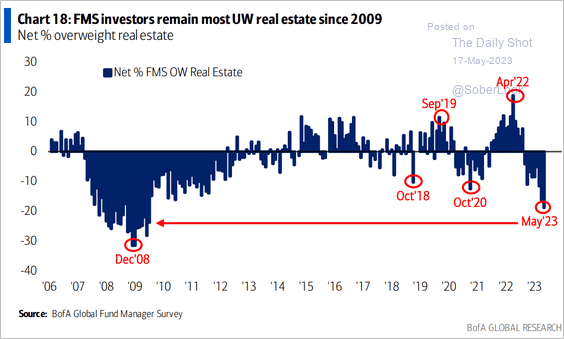

3. Investors haven’t been this negative about REITs since the GFC.

Source: BofA Global Research

Source: BofA Global Research

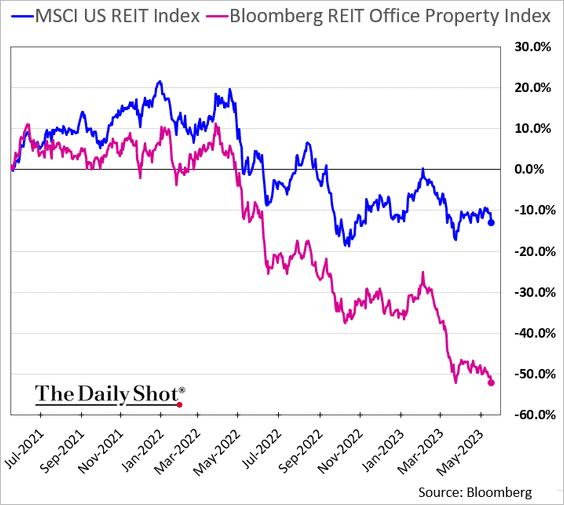

Office REITs have lost about half of their market value over the past 12 months.

——————–

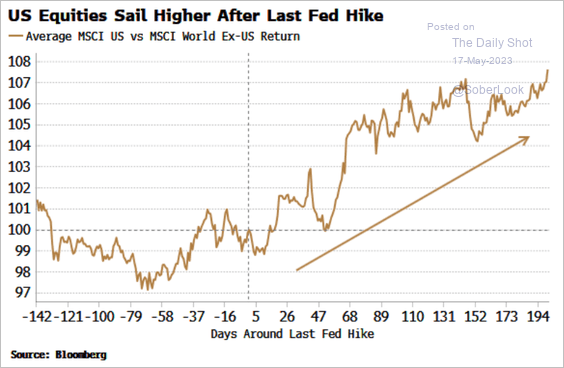

4. US stocks tend to outperform global peers after the last Fed hike.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

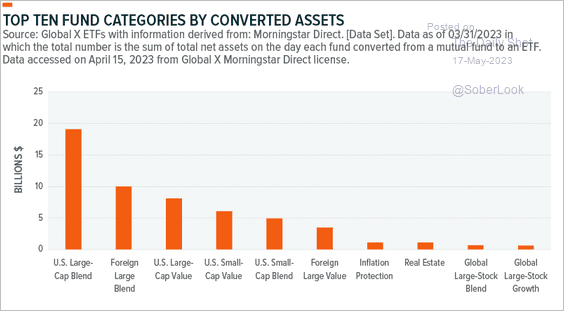

5. More US mutual funds are being converted to an ETF wrapper.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Alternatives

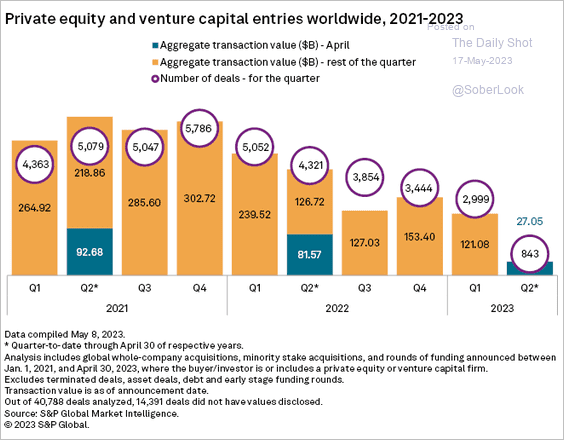

1. April was a slow month for PE activity.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

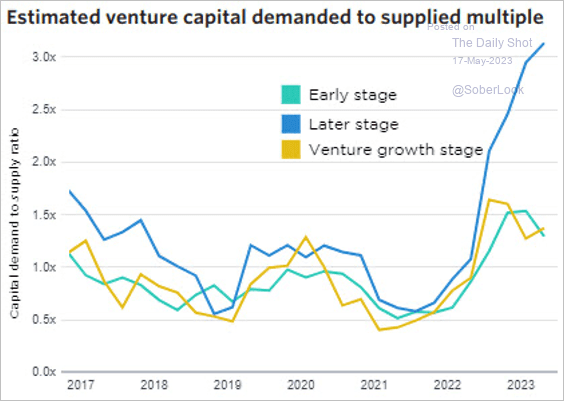

2. Late-stage ventures’ capital demand/supply ratio spiked to new highs.

Source: PitchBook

Source: PitchBook

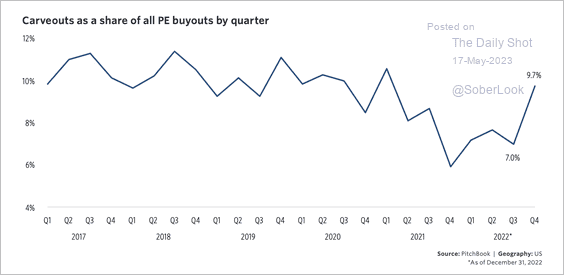

3. More private equity firms are buying smaller pieces of large companies to restore, bolster growth prospects, or flip assets, according to PitchBook.

Source: PitchBook

Source: PitchBook

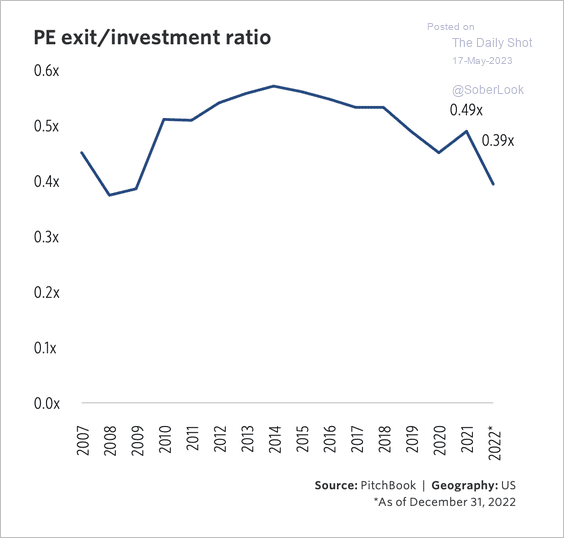

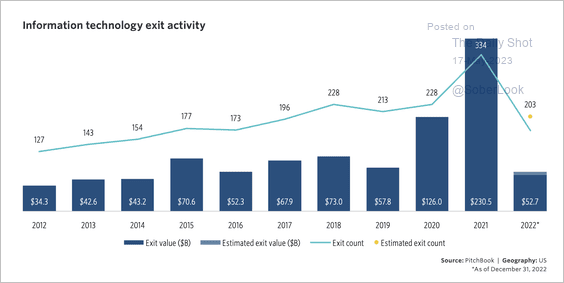

4. US private equity exit activity dropped sharply compared to investments. Elevated valuations and market volatility discouraged public listings last year, particularly in the tech space. (2 charts)

Source: PitchBook

Source: PitchBook

Source: PitchBook

Source: PitchBook

Back to Index

Credit

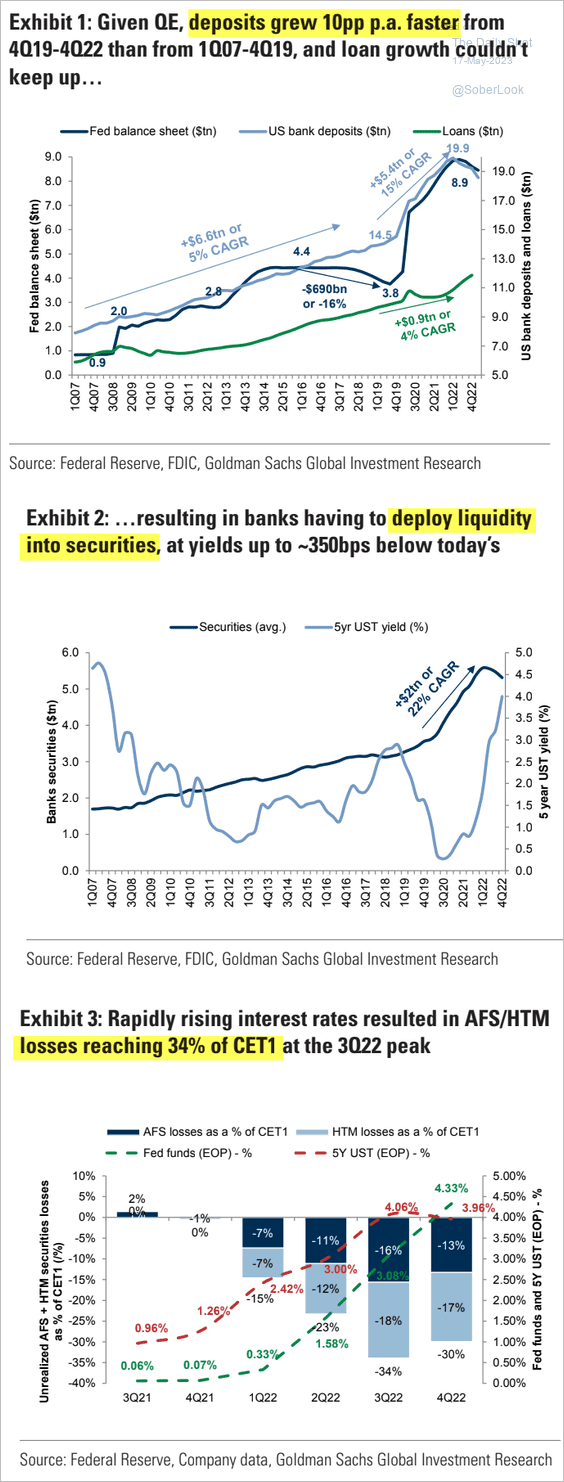

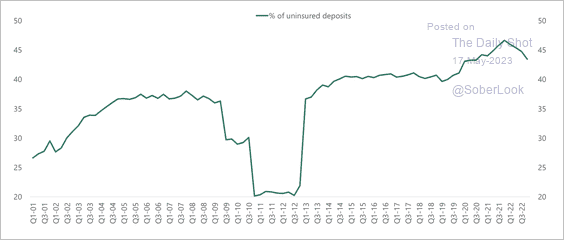

1. Let’s take another look at the banking turmoil that caught the markets off guard this year. The post-COVID quantitative easing period marked a significant shift in the banking landscape, as financial institutions experienced a surge in deposits. This influx of liquidity was difficult for banks to manage, as they struggled to lend at a pace that matched the growth of deposits. Consequently, they sought alternative methods to deploy excess liquidity, turning to the purchase of Treasuries, agency mortgage-backed securities (MBS), and other liquid fixed-income products. However, these assets were acquired at yields approximately 3.5% below current levels, making them vulnerable to an increase in interest rates.

As the Federal Reserve proceeded to hike rates, the value of these securities dropped precipitously, leading to losses amounting to 34% of Common Equity Tier 1 (CET1) capital. This situation was further exacerbated by accelerated deposit withdrawals from smaller banks, a phenomenon facilitated by the convenience of modern banking applications. In a bid to maintain liquidity, some institutions were compelled to sell their securities, incurring substantial mark-to-market losses and leaving them severely undercapitalized.

Source: Goldman Sachs

Source: Goldman Sachs

2. The share of bank deposits paying a zero interest rate is declining.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

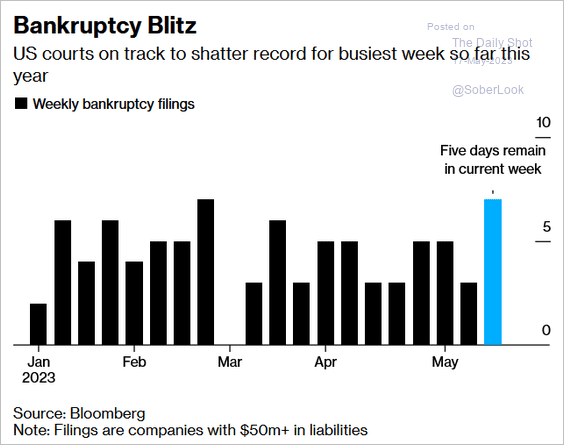

3. Bankruptcy courts have been busy.

Source: @LibbyCherry98, @markets Read full article

Source: @LibbyCherry98, @markets Read full article

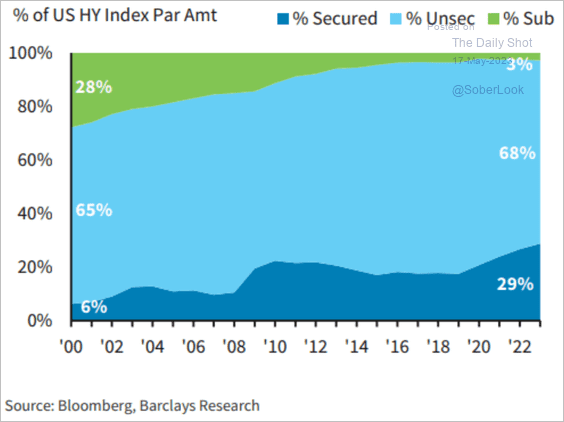

4. The US high-yield market now includes a higher percentage of secured bonds.

Source: Barclays Research; III Capital Management

Source: Barclays Research; III Capital Management

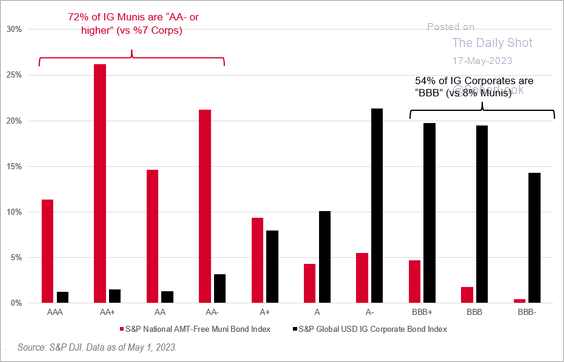

5. This chart shows the distribution of the credit ratings for muni bonds and IG corporates.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

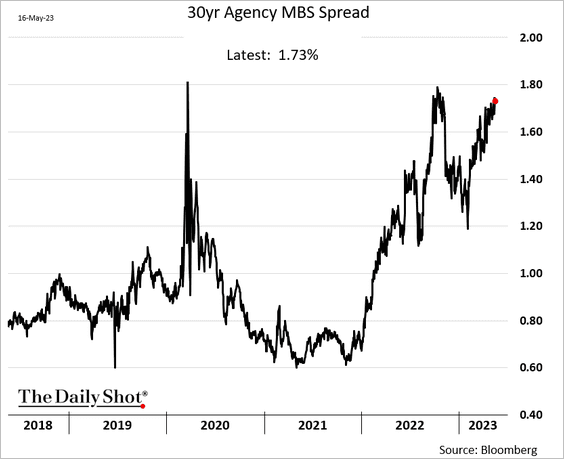

6. Agency MBS spreads remain elevated as the Fed and commercial banks reduce holdings.

Back to Index

Rates

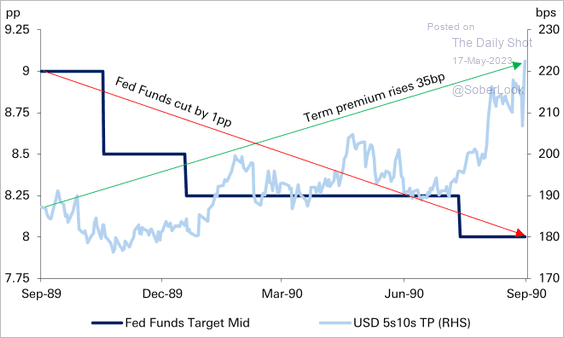

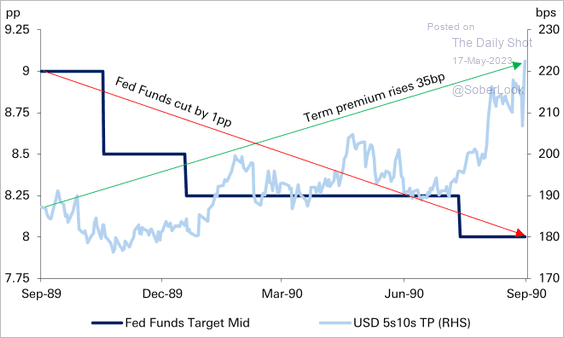

1. Higher inflation expectations could boost Treasury term premium.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

In 1989/90, Treasury term premium increased as the Fed cut rates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

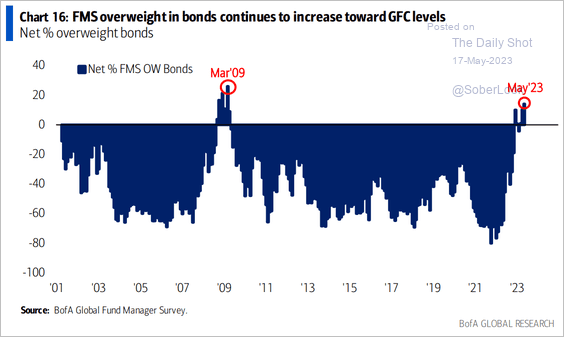

2. Fund managers are still overweight bonds.

Source: BofA Global Research

Source: BofA Global Research

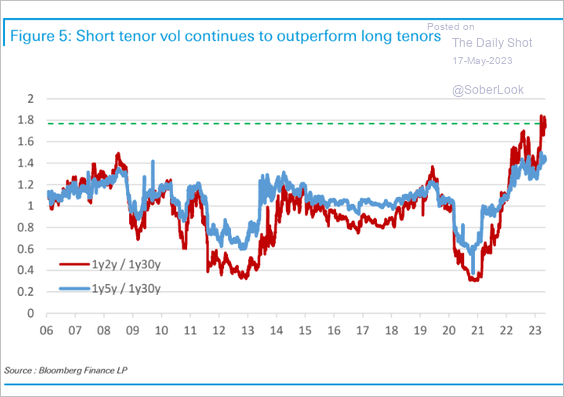

3. Short-term rates vol remains elevated relative to long-dated markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

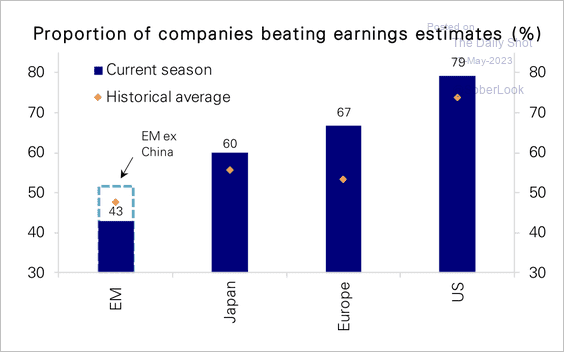

1. The breadth of earnings beats spiked across most regions. The US and Japan were well above average, while China weighed on emerging markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

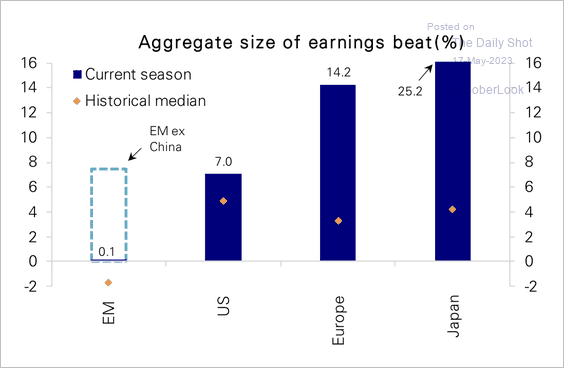

The size of earnings beats rose sharply. Chinese firms fell short of high reopening expectations, which also weighed on EM.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

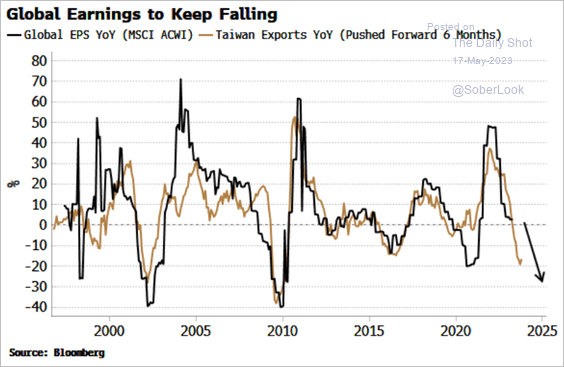

2. Taiwan’s export weakness signals lower global corporate earnings ahead.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

Food for Thought

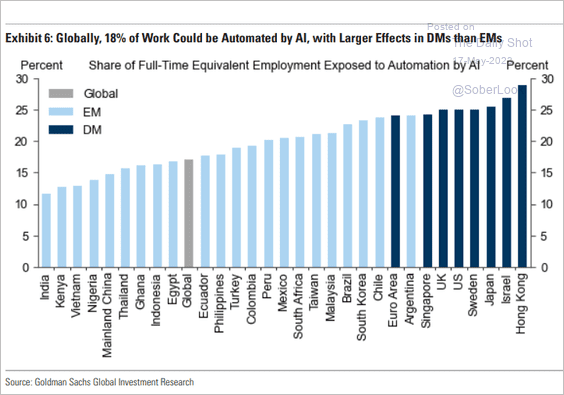

1. Jobs exposed to automation by AI:

Source: Goldman Sachs

Source: Goldman Sachs

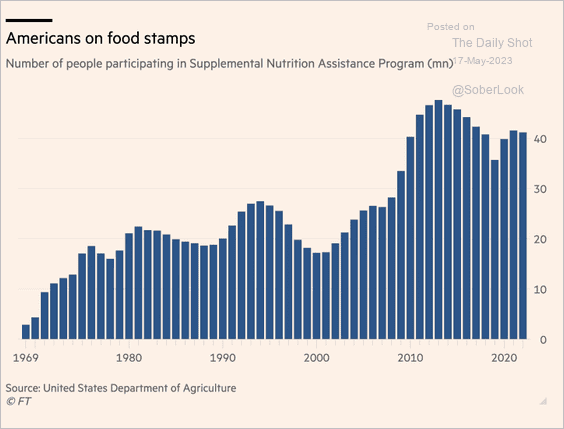

2. SNAP participation:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

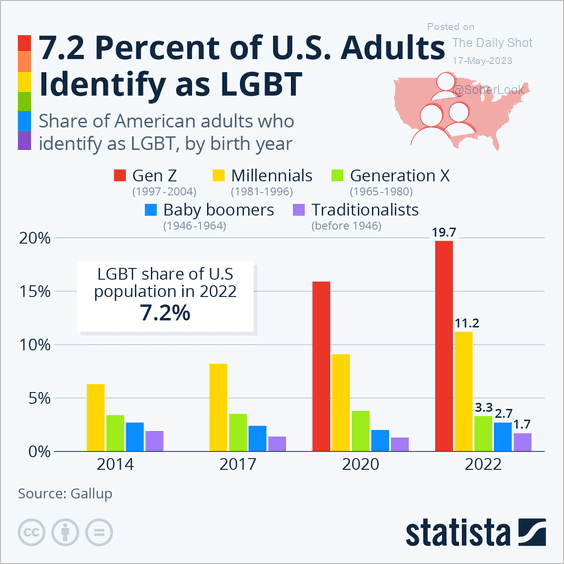

3. Share of Americans who identify as LGBT:

Source: Statista

Source: Statista

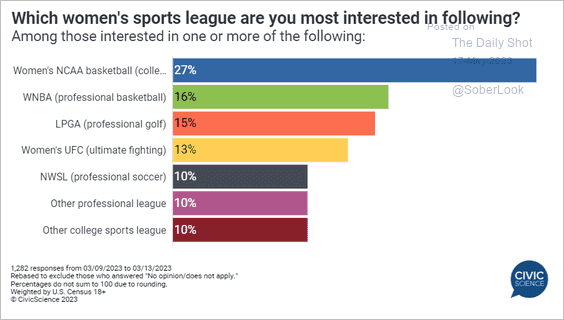

4. Interest in women’s sports:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

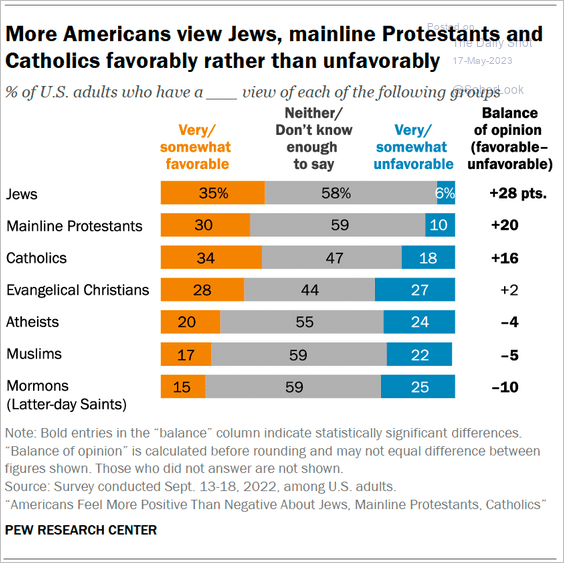

5. Views on various religions in the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

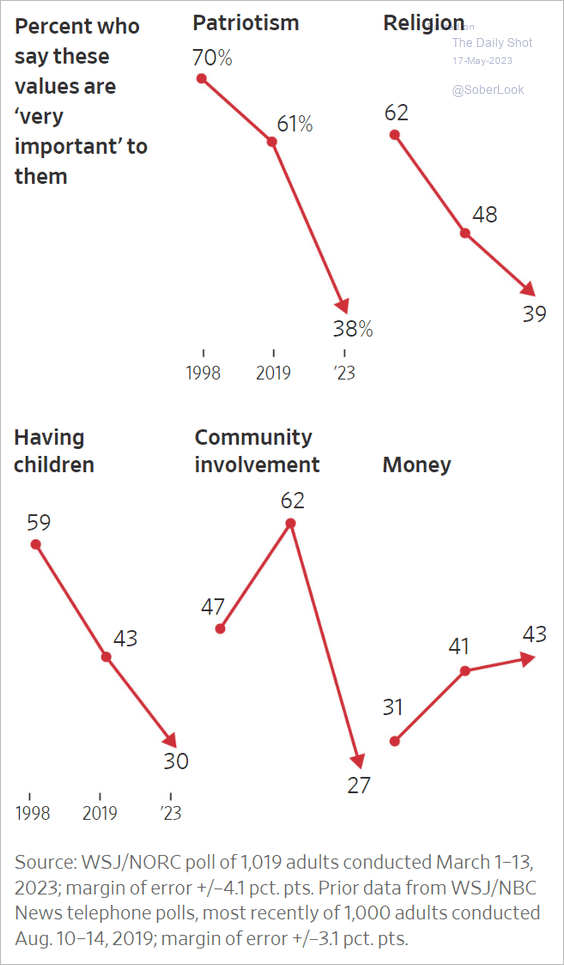

6. What Americans view as “very important”:

Source: @WSJ Read full article

Source: @WSJ Read full article

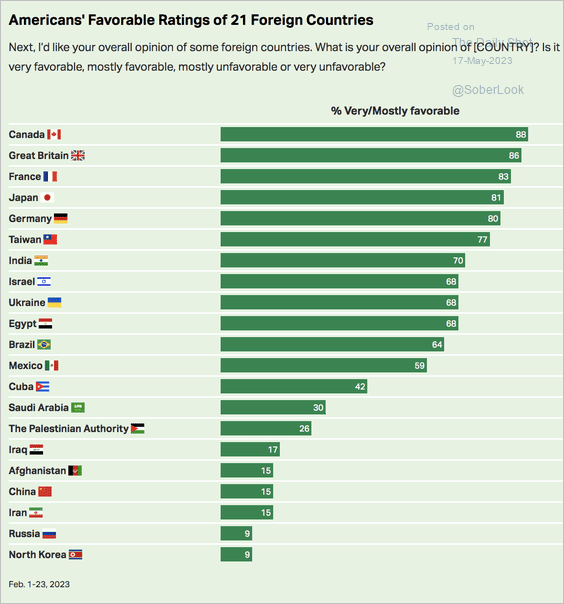

7. US favorability ratings of 21 countries:

Source: Gallup Read full article

Source: Gallup Read full article

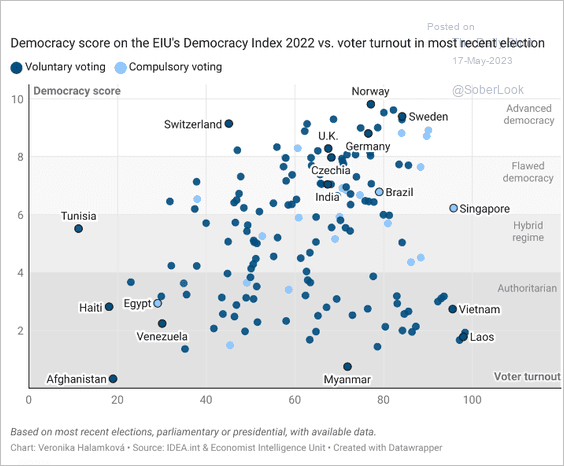

8. The democracy score vs. voter turnout:

Source: Datawrapper

Source: Datawrapper

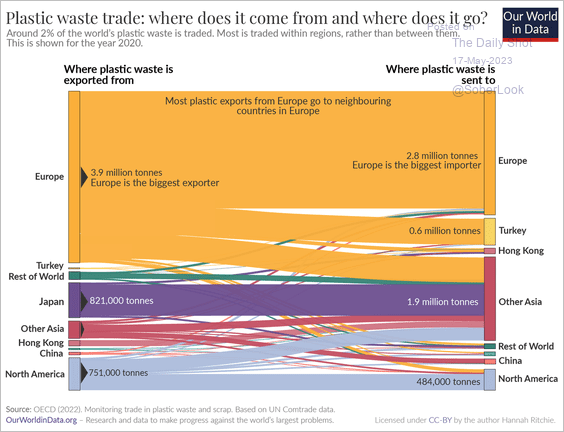

9. Plastic waste trade:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

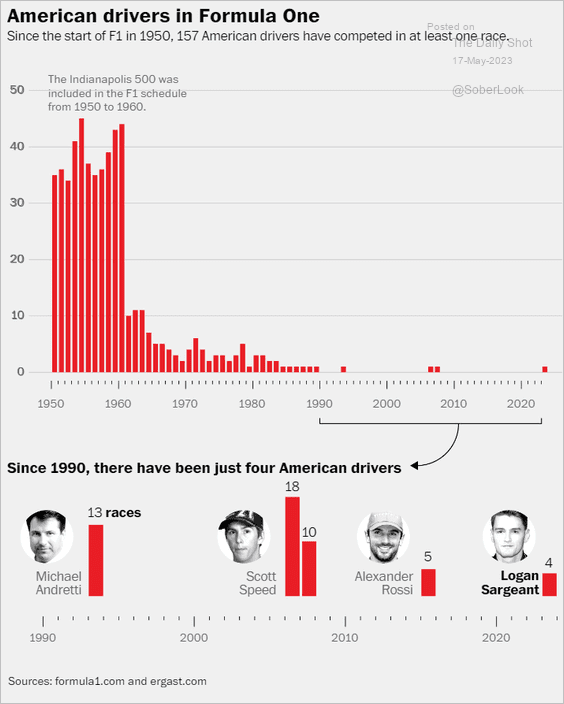

10. American drivers in Formula One:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

Back to Index