The Daily Shot: 16-May-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

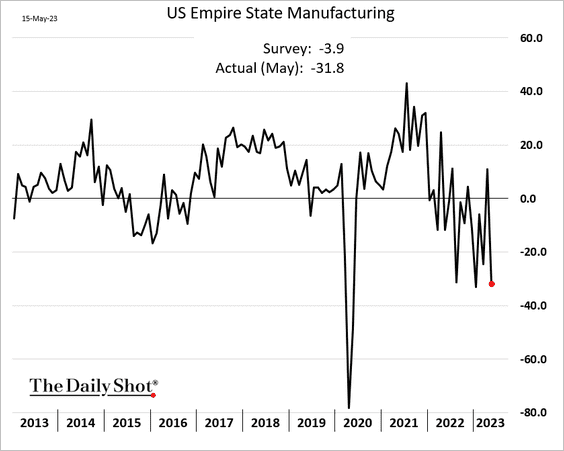

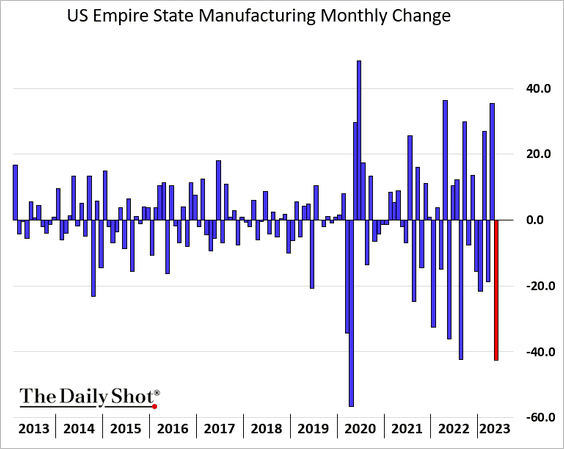

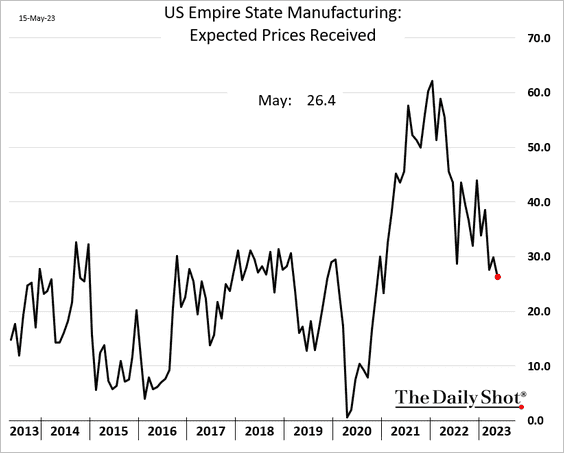

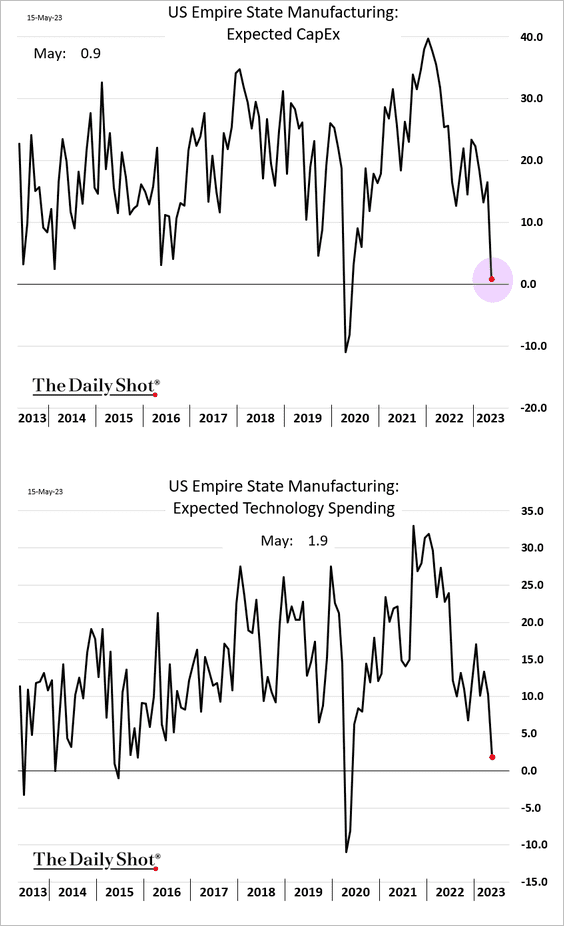

1. The NY Fed’s Empire Manufacturing Index, the first regional factory report of the month, was disappointing.

• The drop from April was substantial.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

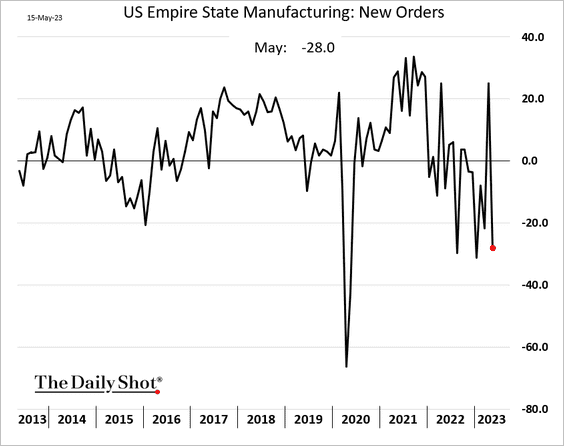

• The index of new orders tumbled back into negative territory.

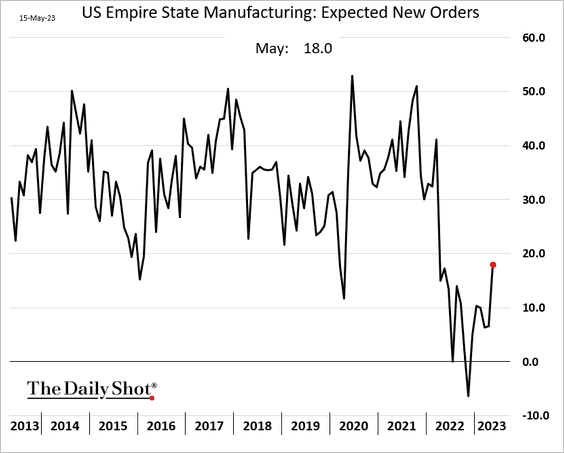

But expectations for new orders improved.

• Fewer companies plan to raise prices.

• The report showed a sharp decline in CapEx plans, which has become a national trend.

——————–

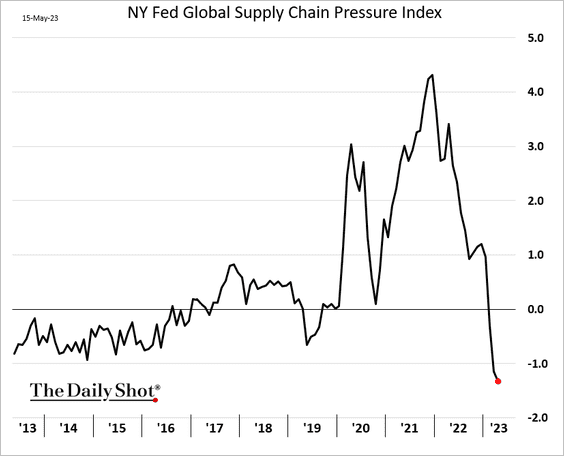

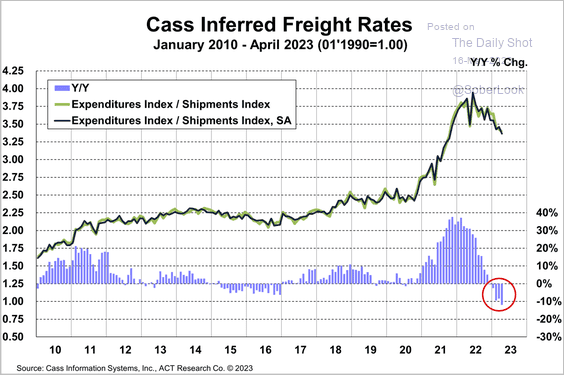

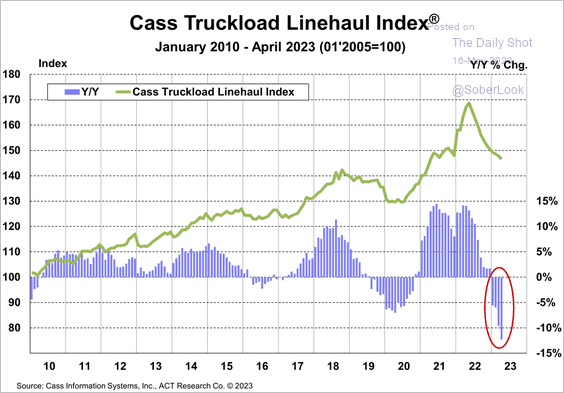

2. With supply chain pressures easing amid softer demand, …

… freight costs continue to moderate.

Source: Cass Information Systems

Source: Cass Information Systems

The Cass Truckload Linehaul Index measures per-mile costs of dry van truckload transportation.

Source: Cass Information Systems

Source: Cass Information Systems

——————–

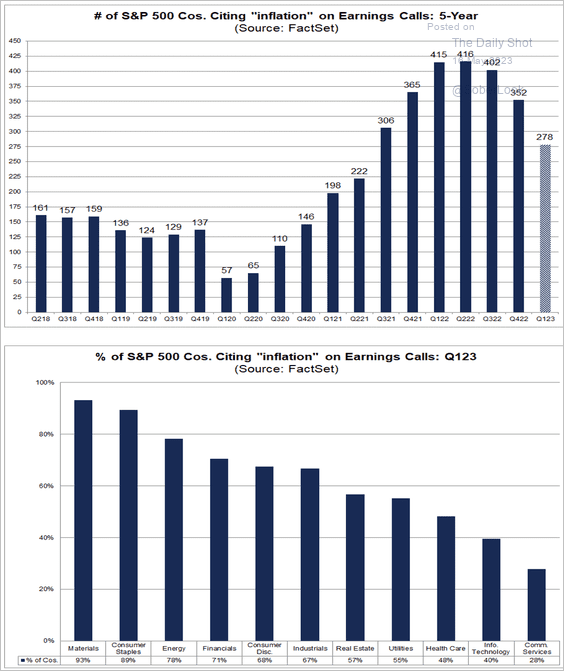

3. Fewer companies are mentioning inflation on earnings calls.

Source: @FactSet Read full article

Source: @FactSet Read full article

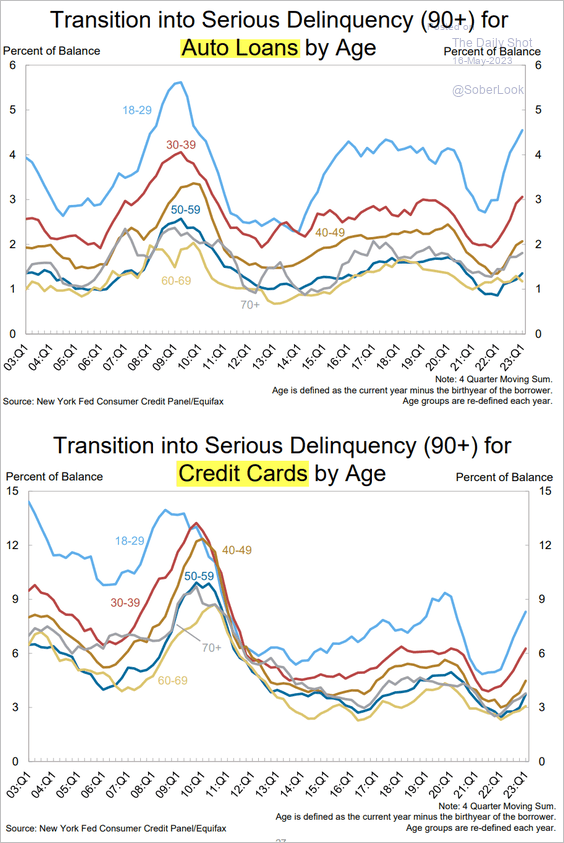

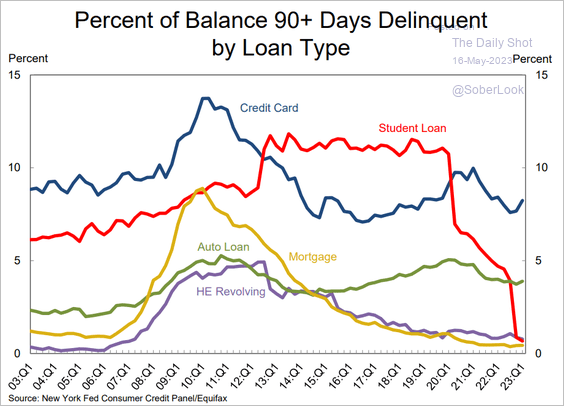

4. Consumer credit delinquency rates are climbing, rising above pre-COVID levels for some cohorts.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

• Federal student loan payments will be due at the end of August or sooner. The payment moratorium party is about to end.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

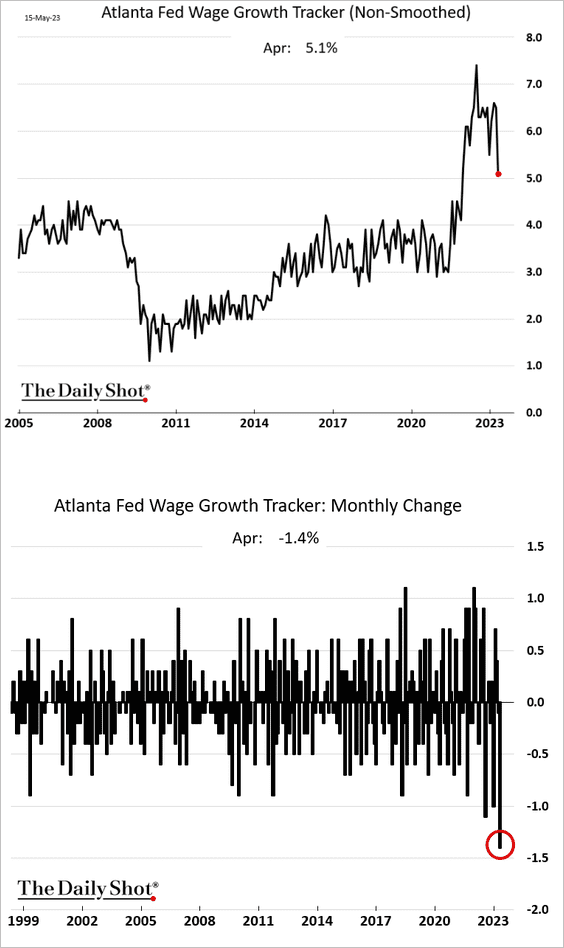

5. The Atlanta Fed’s wage growth tracker declined sharply in April.

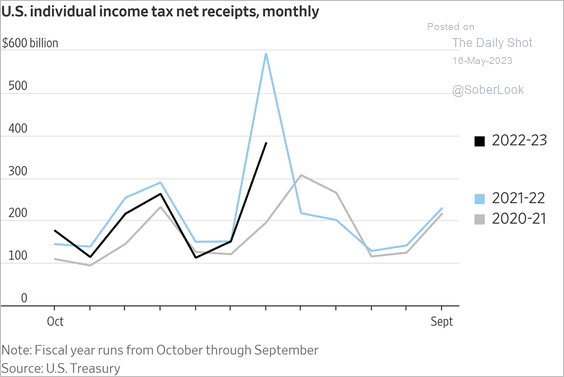

6. Lower tax receipts have increased the chances of an early-June X-date.

Source: @WSJ Read full article

Source: @WSJ Read full article

There isn’t much time left.

Source: CNBC Read full article

Source: CNBC Read full article

Source: Fox News Read full article

Source: Fox News Read full article

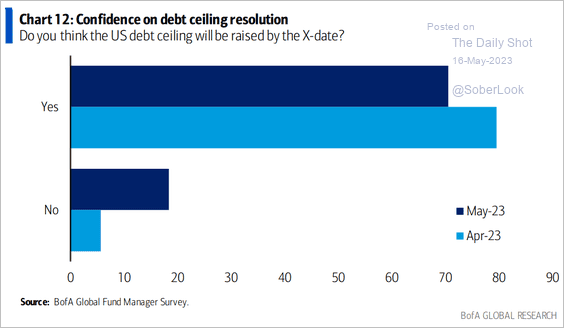

For now, investors expect a resolution by the X-date.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Canada

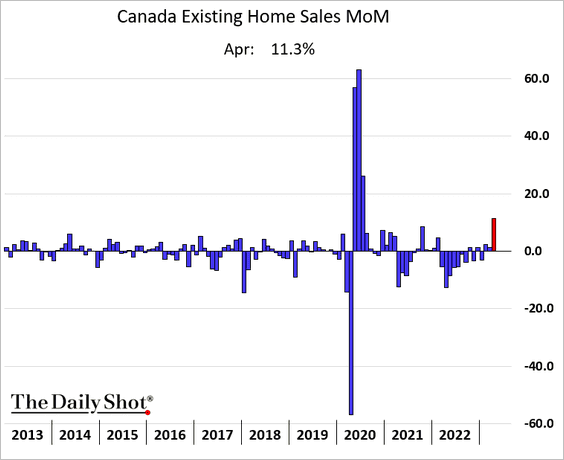

1. Existing home sales surged last month.

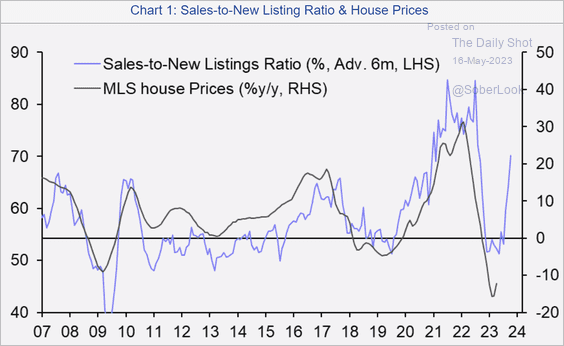

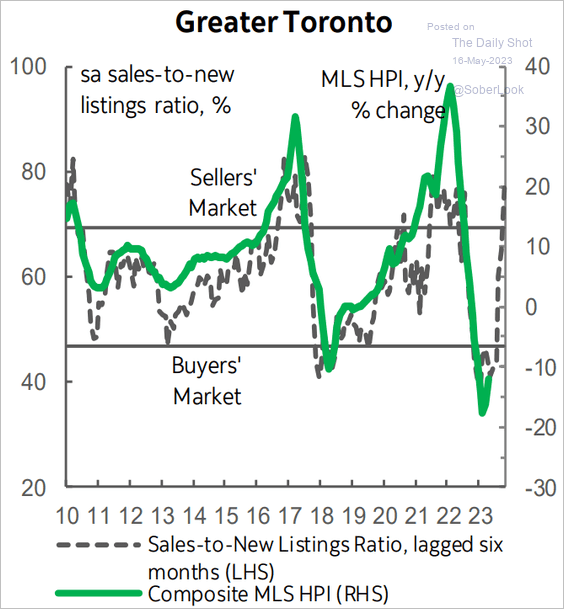

• The sales-to-listings ratio continues to signal price stabilization (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

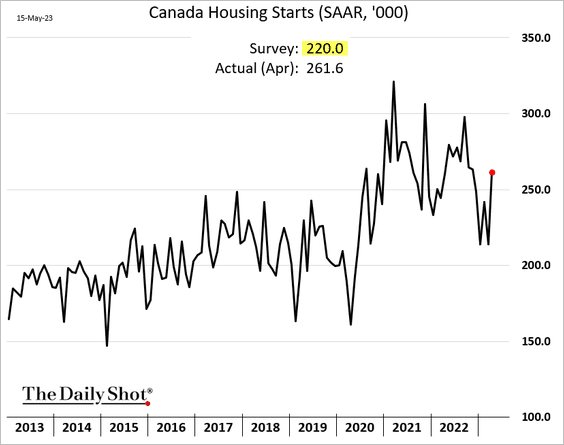

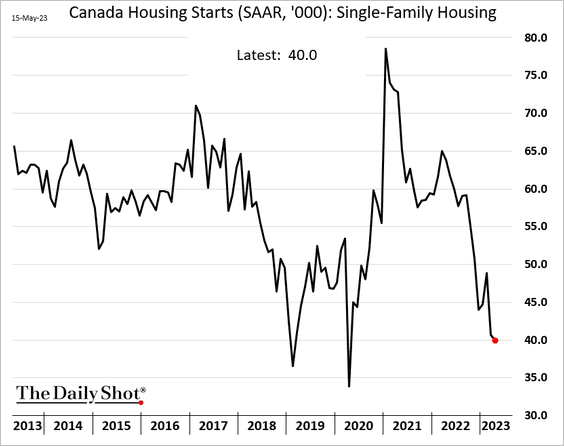

2. Boosted by multi-family construction, housing starts topped expectations, …

… but single-family activity remains depressed.

——————–

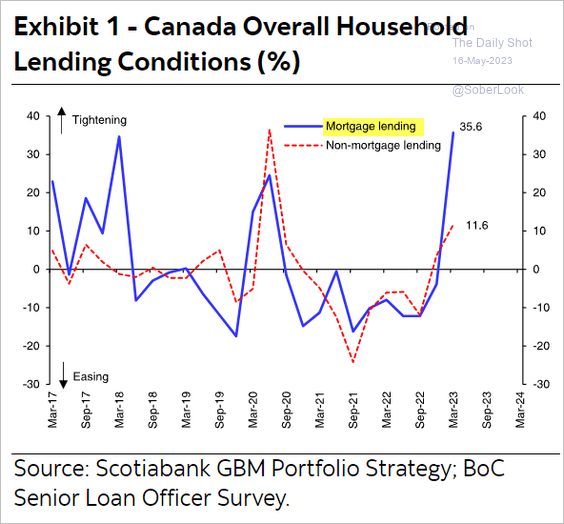

3. Canadian banks have tightened mortgage lending standards significantly.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

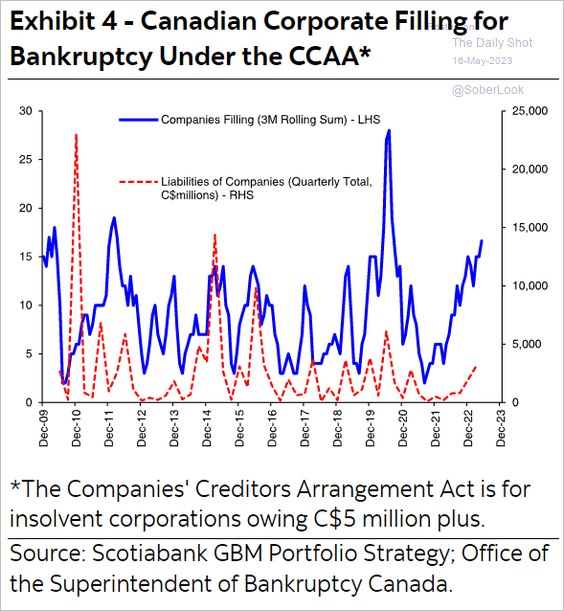

4. The number of companies filing for bankruptcy continues to rise.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

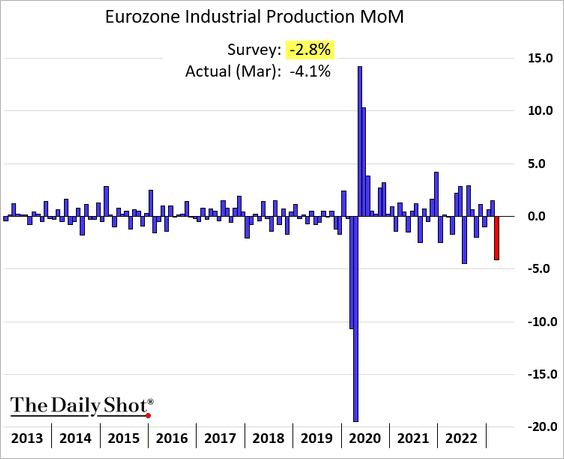

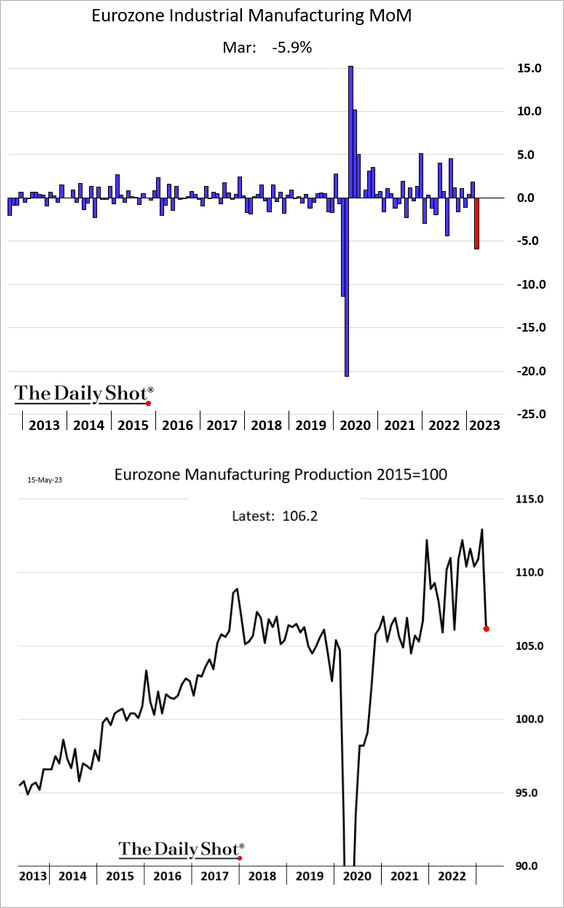

1. Euro-area industrial production declined sharply in March, …

… as factory output tumbled.

Source: RTTNews Read full article

Source: RTTNews Read full article

——————–

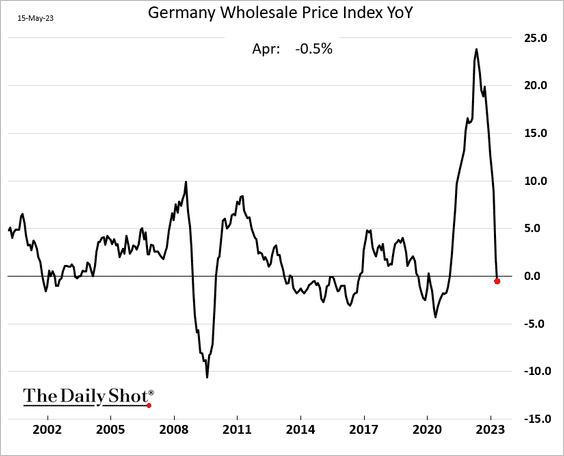

2. Germany’s wholesale inflation is now in negative territory.

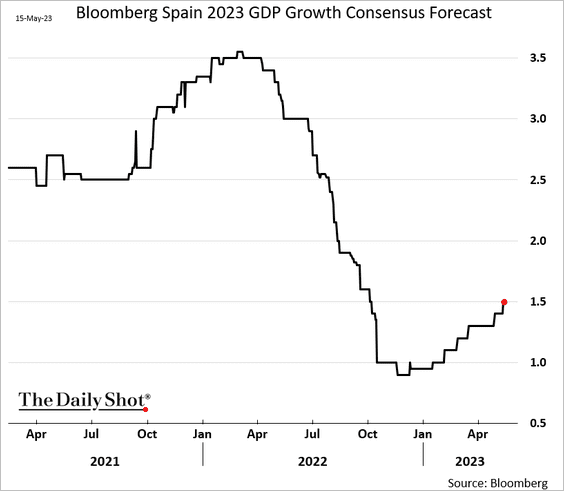

3. Economists continue to upgrade estimates for Spain’s 2023 GDP growth.

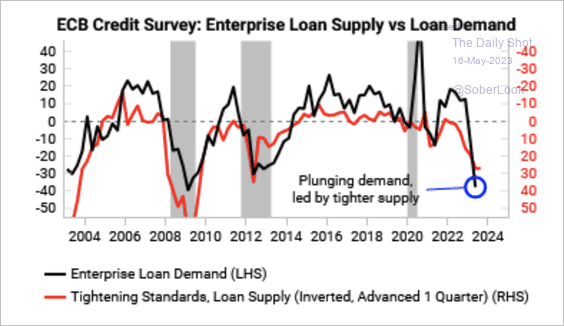

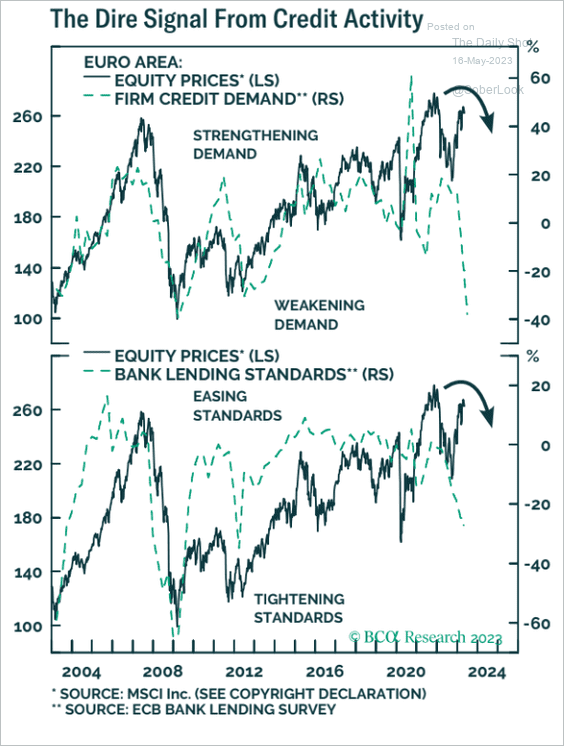

4. Enterprise loan demand declined sharply as credit conditions tightened.

Source: Variant Perception

Source: Variant Perception

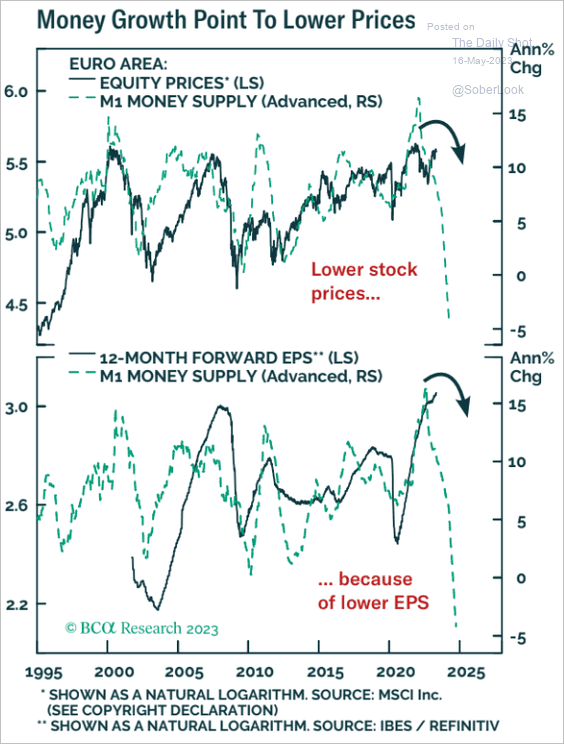

5. Tighter credit (chart below) and shrinking liquidity (2nd chart) are a headwind for stocks.

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

Back to Index

Europe

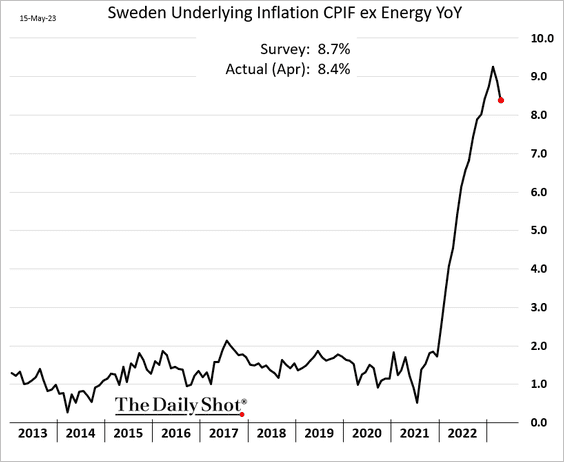

1. Sweden’s inflation has finally peaked.

Source: @nicrolander, @economics Read full article

Source: @nicrolander, @economics Read full article

——————–

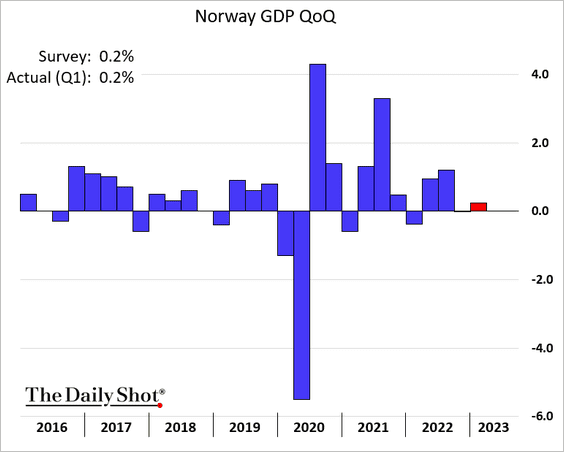

2. Norway’s GDP edged higher in Q1.

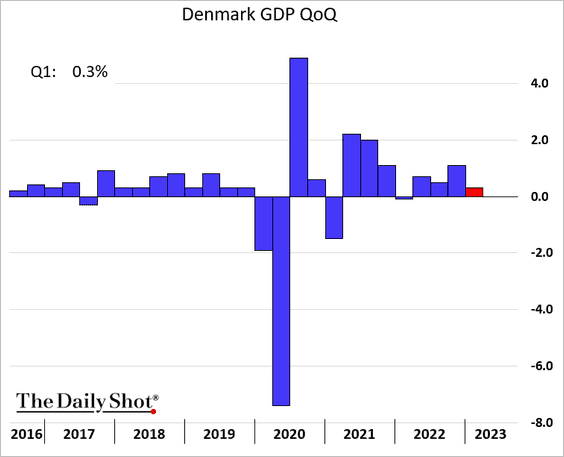

3. Denmark’s growth slowed, but the economy is holding up well.

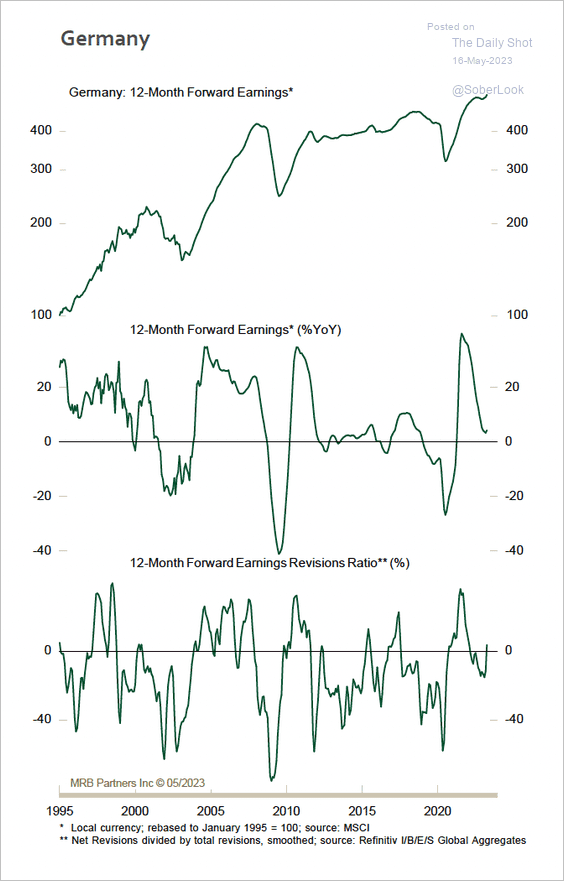

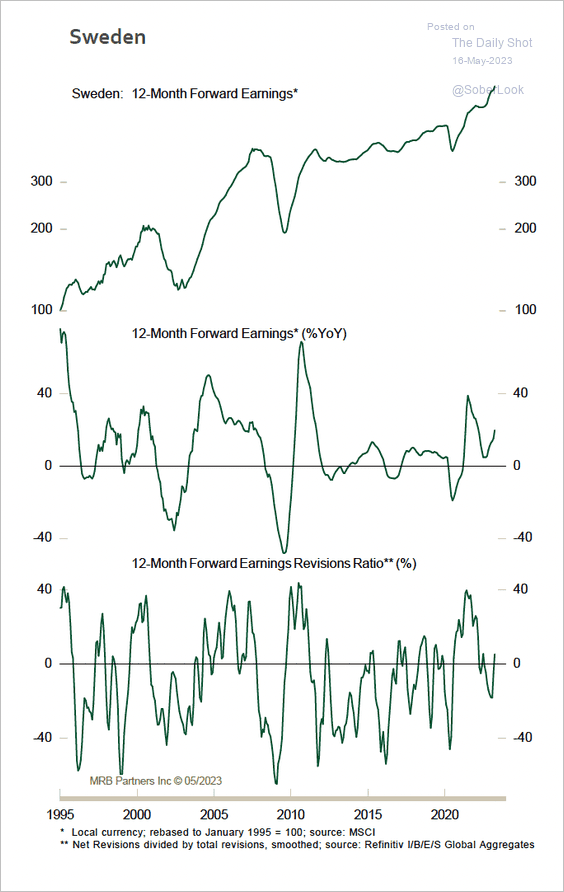

4. Earnings revisions are mildly positive and improving in Germany and Sweden. (2 charts)

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

——————–

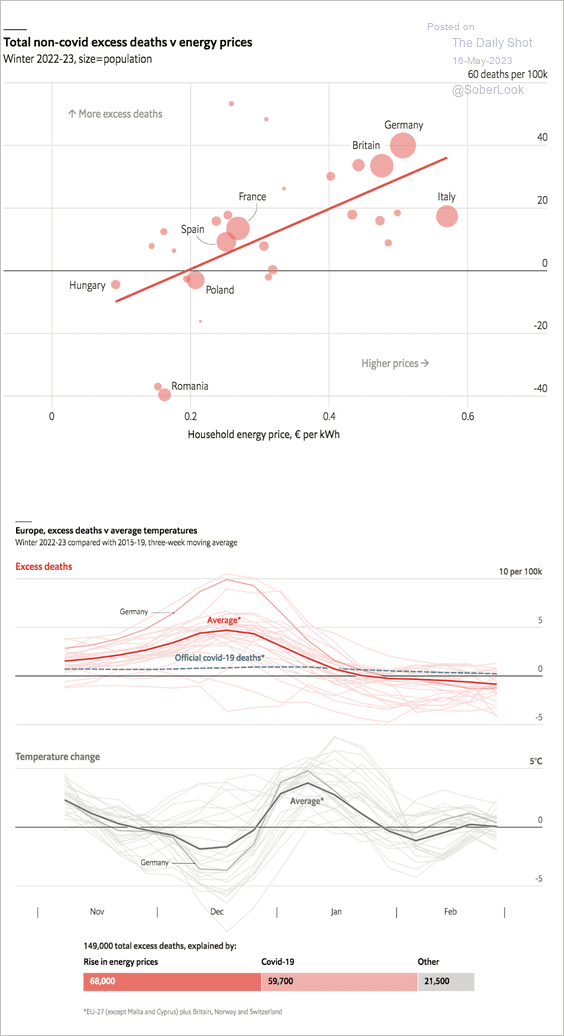

5. Extreme energy prices caused a lot of fatalities this past winter.

Source: The Economist Read full article

Source: The Economist Read full article

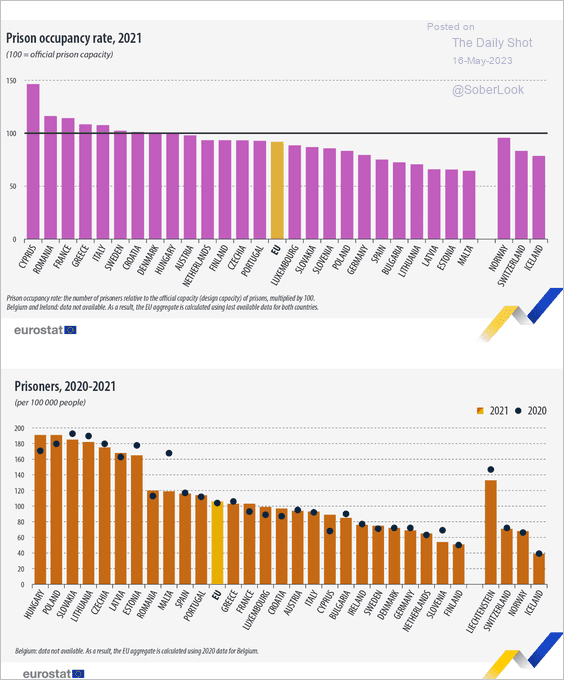

6. Next, we have some data on EU prisons.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

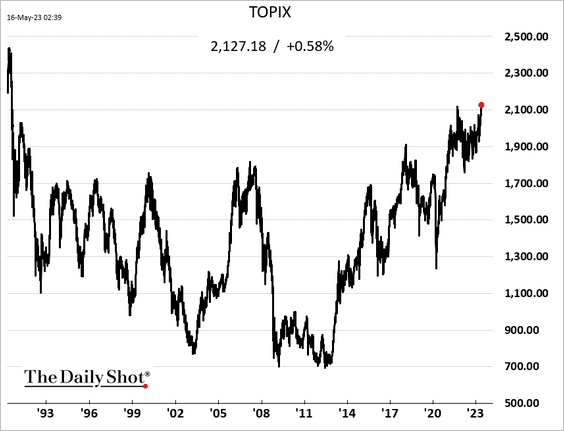

1. Japan’s TOPIX hit a multi-decade high.

Source: @winnieuu0316, @aya_wagatsuma, @markets Read full article

Source: @winnieuu0316, @aya_wagatsuma, @markets Read full article

——————–

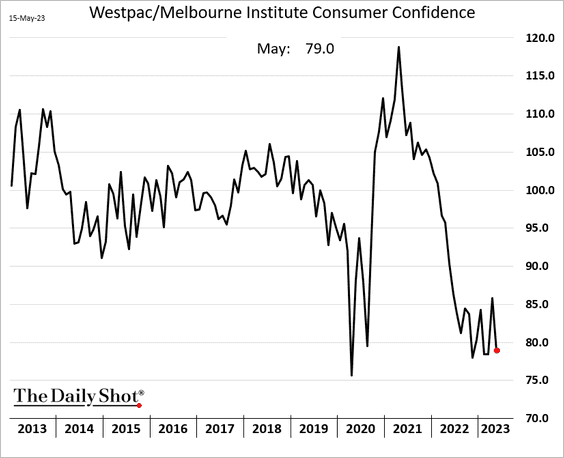

2. Australia’s consumer confidence declined this month.

Back to Index

China

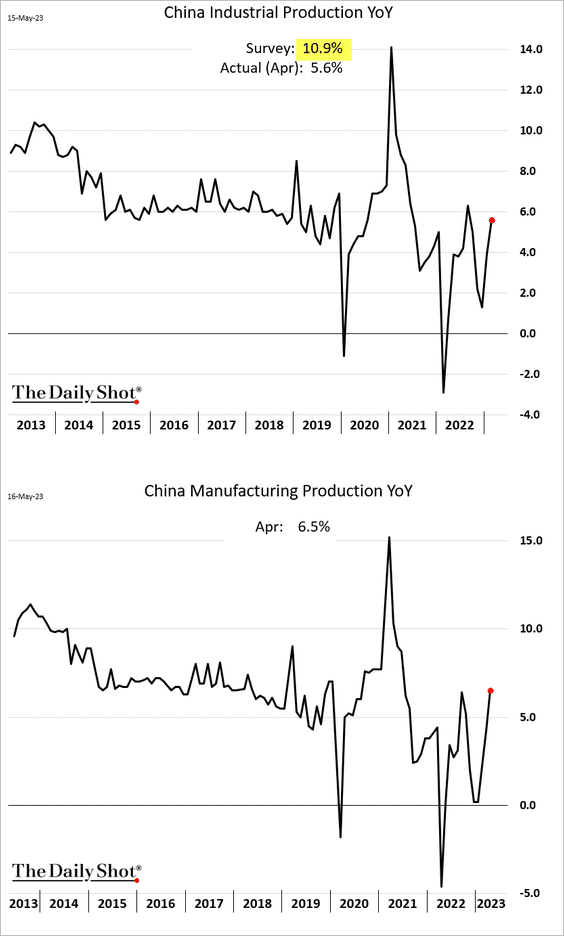

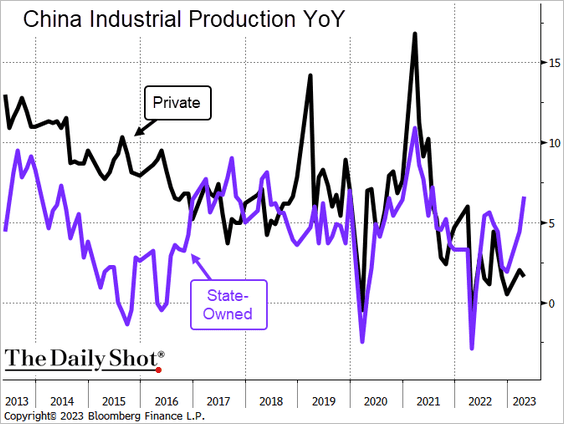

1. Industrial production surprised to the downside, …

…with output gains driven by state enterprises.

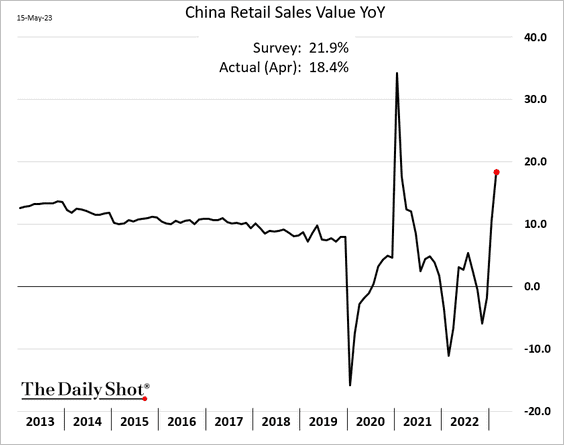

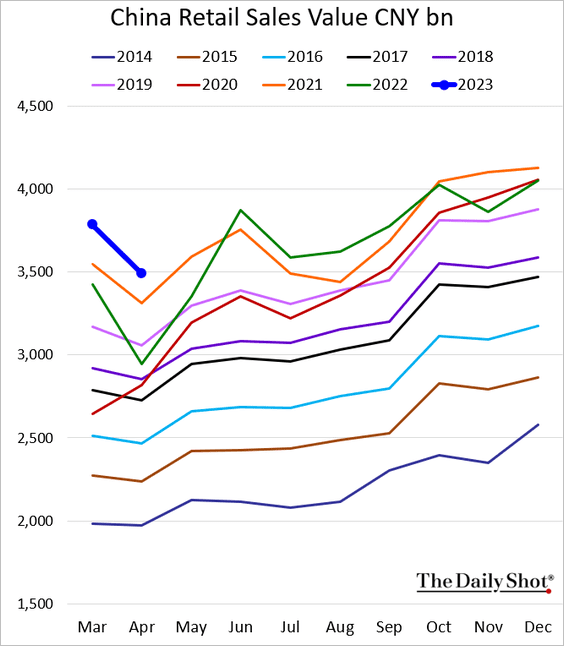

2. Retail sales were also softer than expected.

The big spike (above) is from last year’s low base (due to lockdowns).

Source: @economics Read full article

Source: @economics Read full article

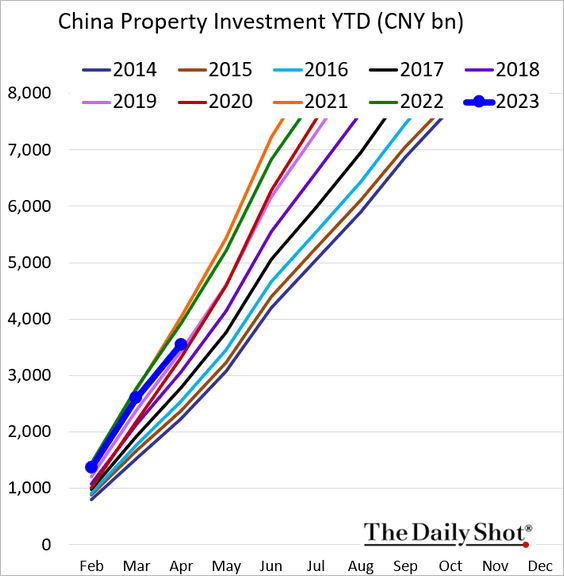

3. Property investment is running well below the 2022 and 2021 levels.

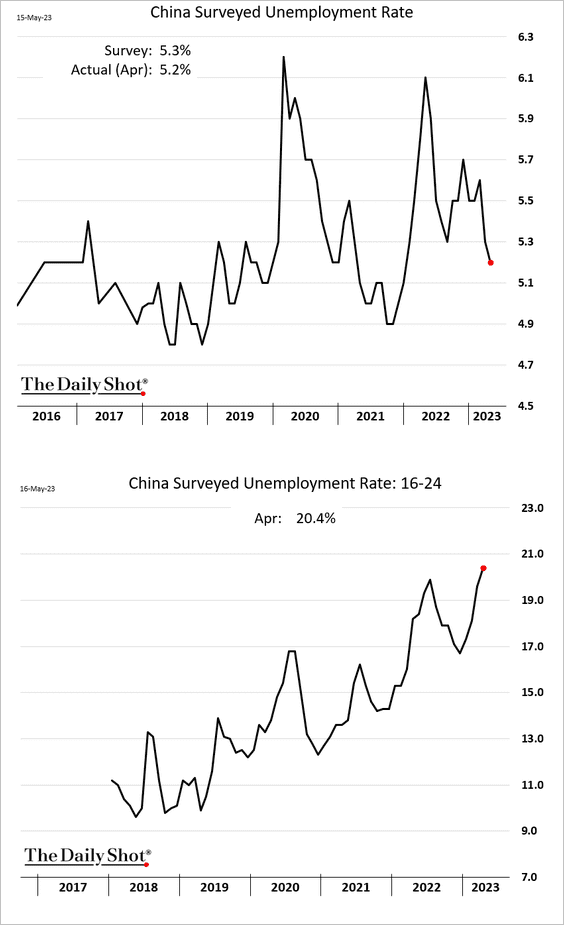

4. The unemployment rate edged lower, but youth unemployment climbed above 20%.

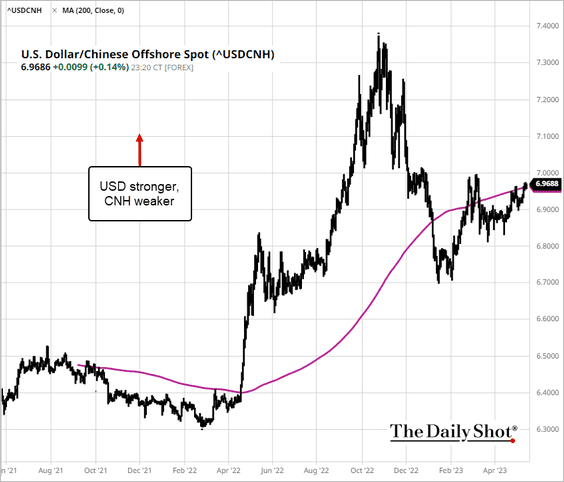

5. The renminbi has been weakening, with USD/CNH testing resistance at the 200-day moving average.

Source: barchart.com

Source: barchart.com

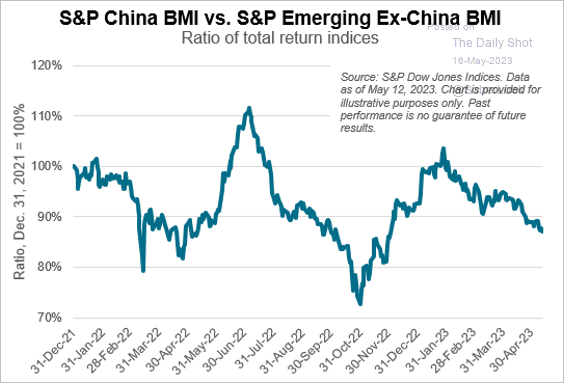

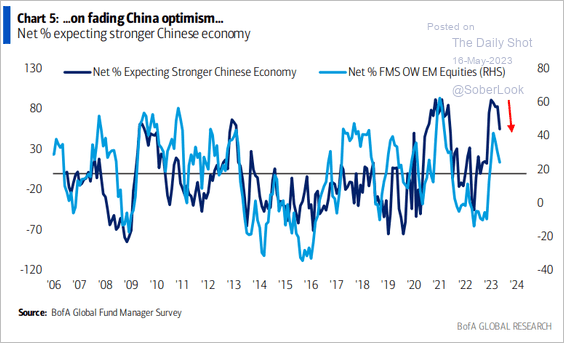

6. China’s stocks have been lagging behind EM peers.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

Investor optimism is fading.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Emerging Markets

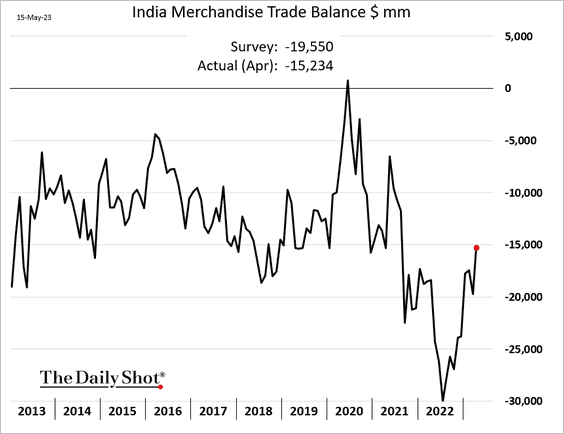

1. India’s trade deficit narrowed more than expected, …

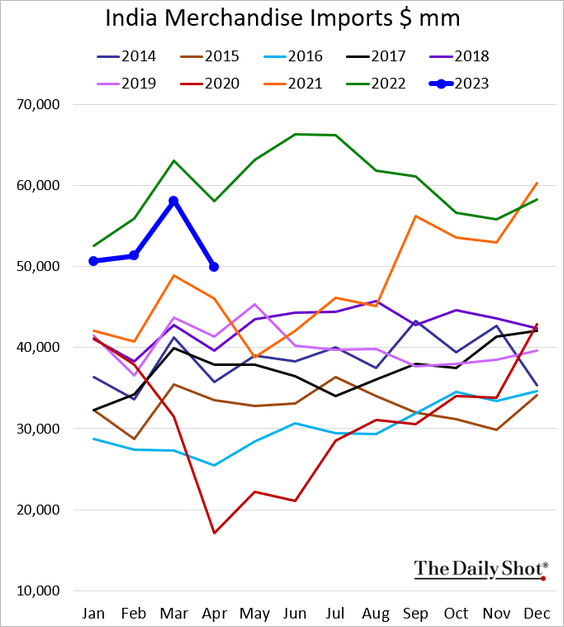

… as imports slumped.

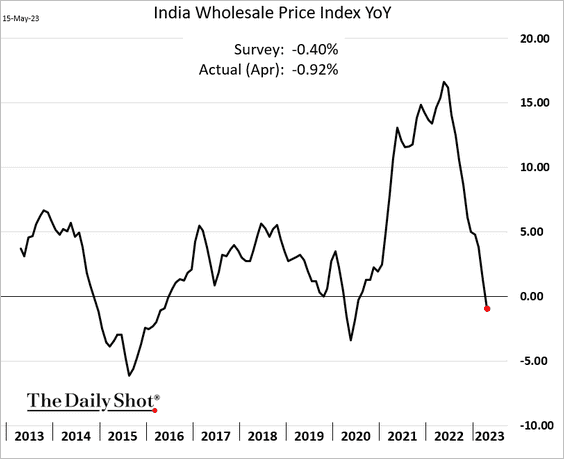

India’s wholesale prices are now down on a year-over-year basis.

——————–

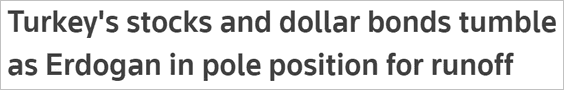

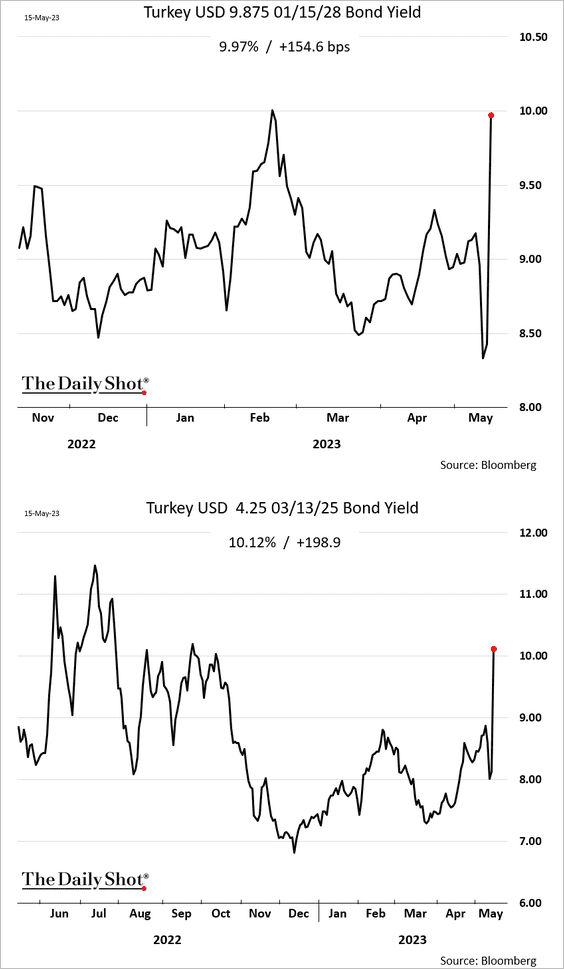

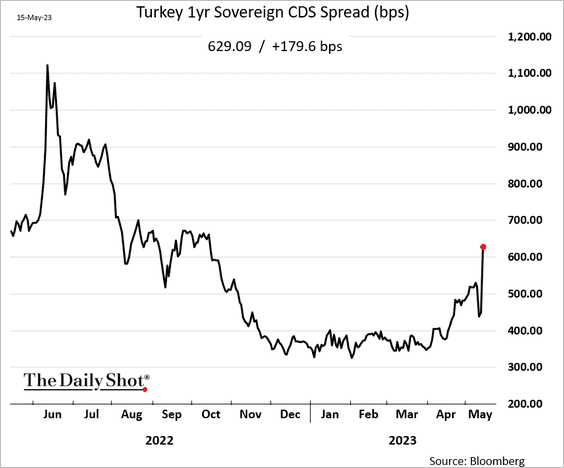

2. Turkey’s assets are under pressure.

Source: Reuters Read full article

Source: Reuters Read full article

• USD-denominated bonds:

• Sovereign CDS spread:

Back to Index

Cryptocurrency

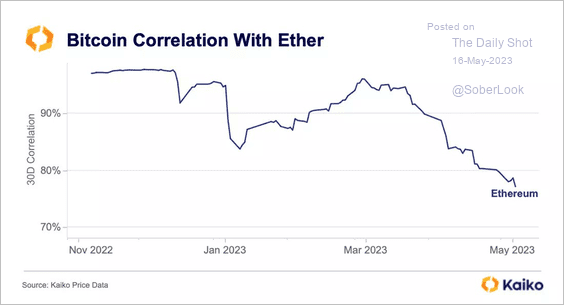

1. Bitcoin’s correlation with Ether has weakened to the lowest level in two years.

Source: @KaikoData

Source: @KaikoData

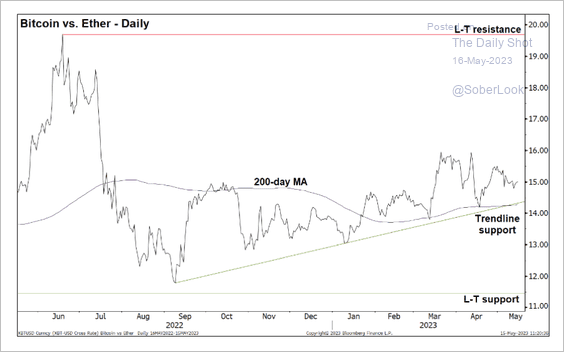

2. The BTC/ETH price ratio is holding support above its 200-day moving average.

Source: @StocktonKatie

Source: @StocktonKatie

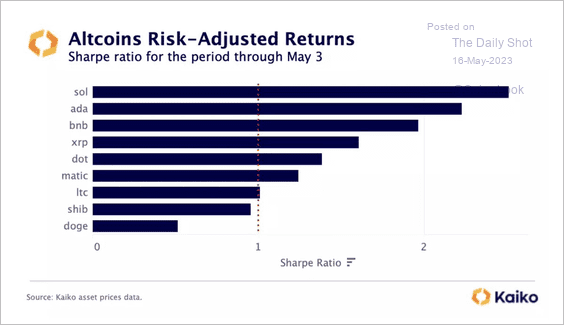

3. Here is a look at year-to-date risk-adjusted returns of select altcoins.

Source: @KaikoData

Source: @KaikoData

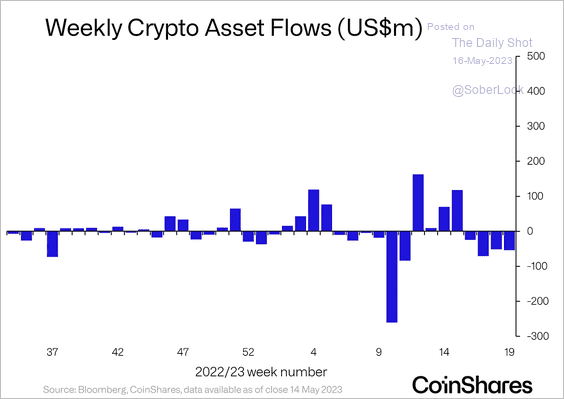

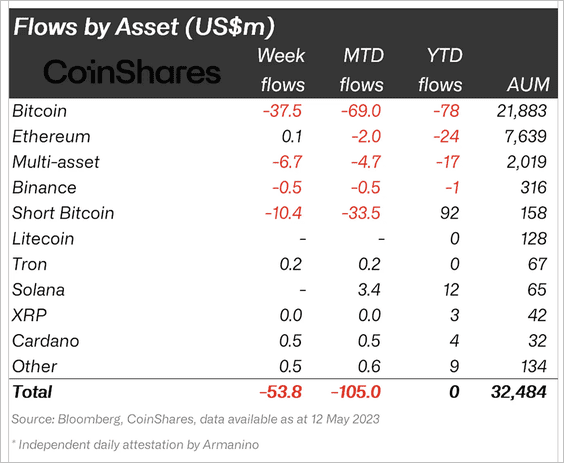

4. Crypto funds saw the fourth consecutive week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin-focused funds accounted for most outflows, while altcoin funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

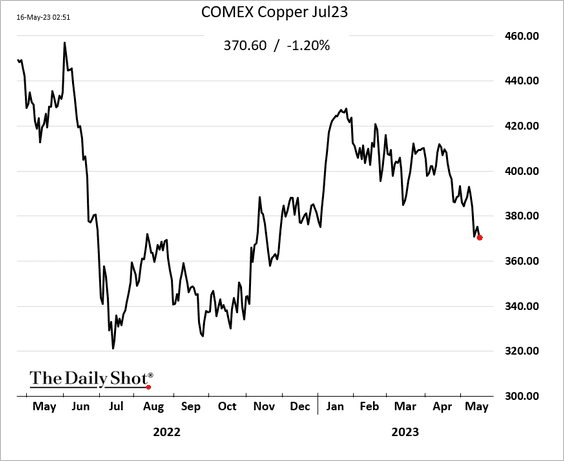

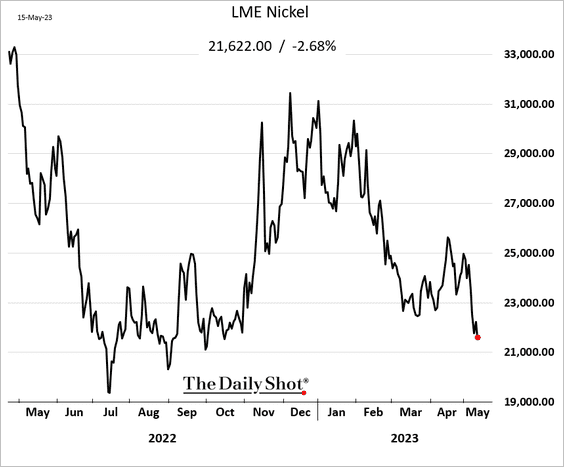

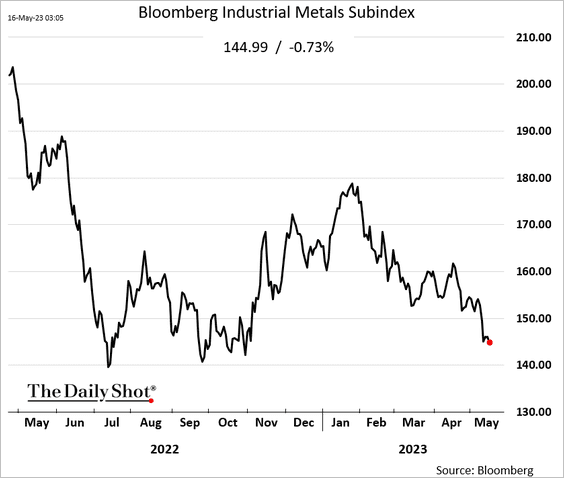

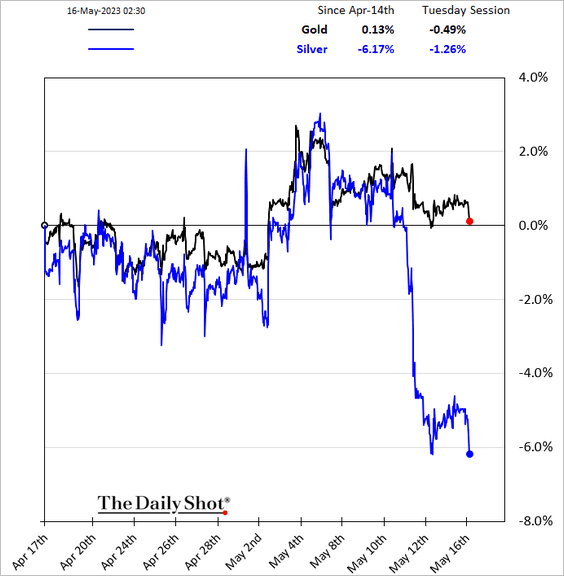

Commodities

1. Industrial metals continue to retreat.

• Copper:

• Nickel:

• Bloomberg’s industrial metals index:

——————–

2. Silver is under pressure.

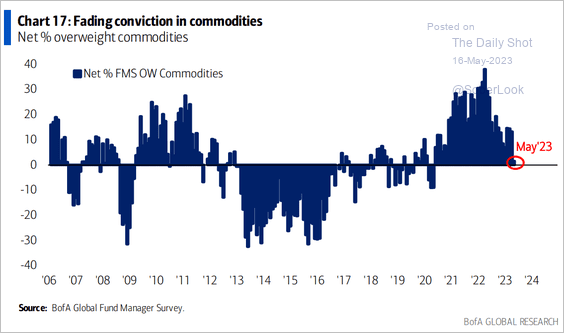

3. Global fund managers are souring on commodities.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Equities

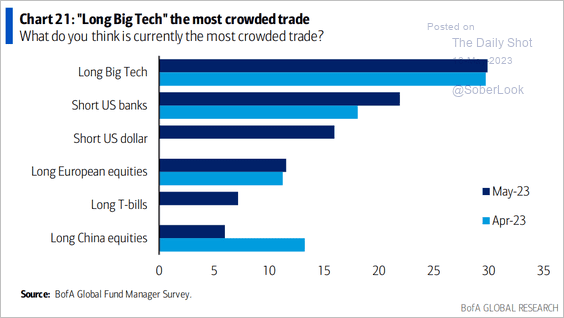

1. Investors still view long tech mega-caps as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

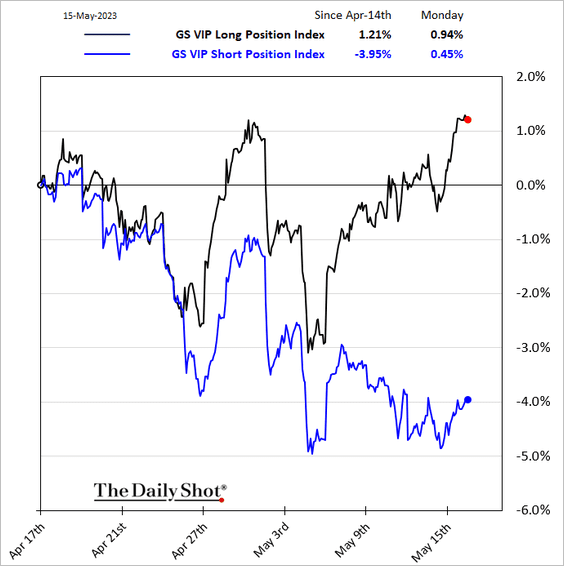

2. Hedge funds’ stock picks have been strong outperformers.

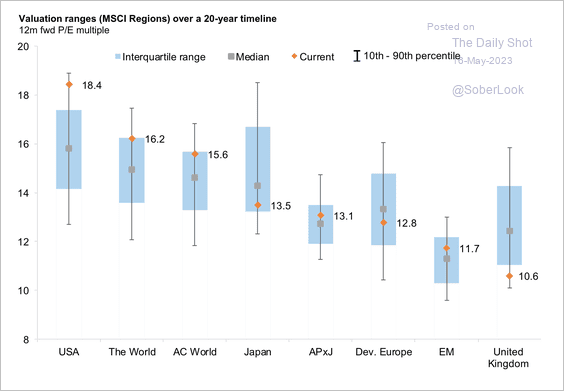

3. US equity valuations are near the top of their historical range.

Source: Goldman Sachs

Source: Goldman Sachs

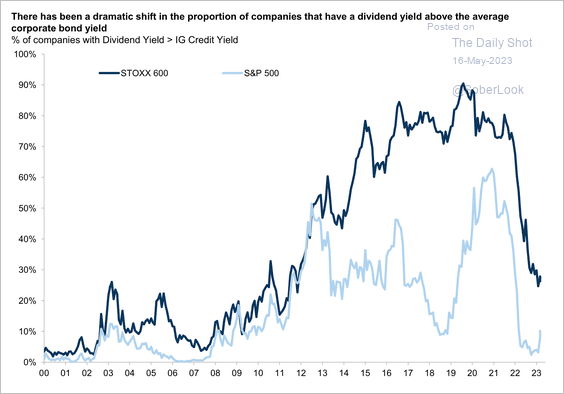

4. US and European equities no longer offer an attractive yield compared to credit.

Source: Goldman Sachs

Source: Goldman Sachs

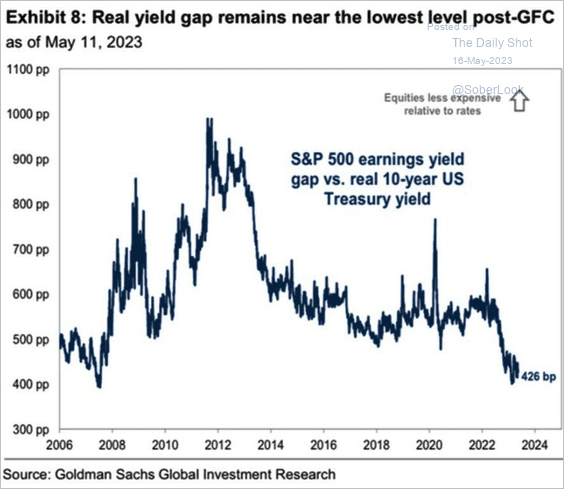

• The S&P 500 earnings yield is at multi-year lows relative to real yields.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

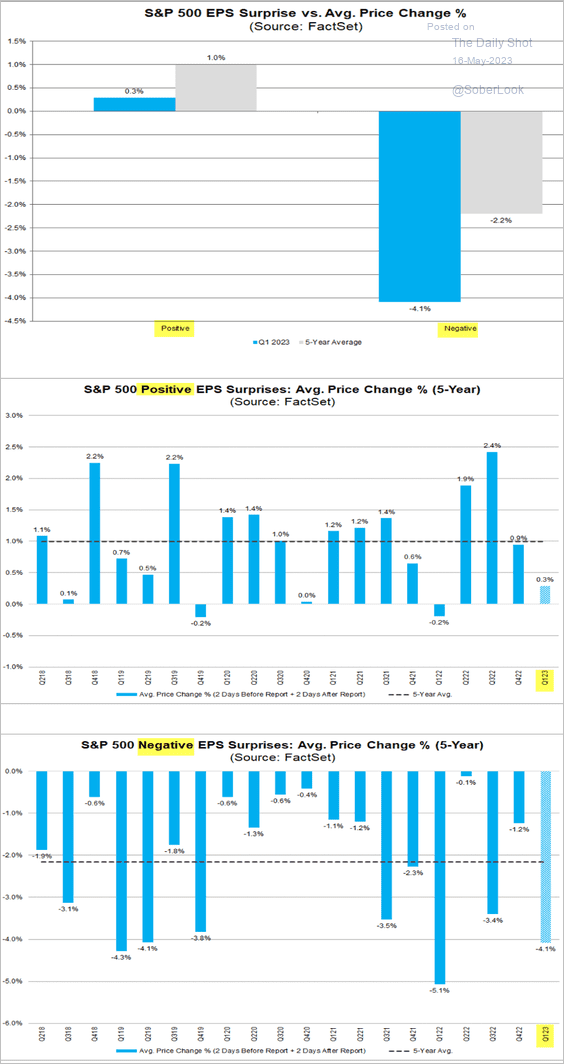

5. Positive earnings surprises haven’t been met with a lot of enthusiasm.

Source: @FactSet Read full article

Source: @FactSet Read full article

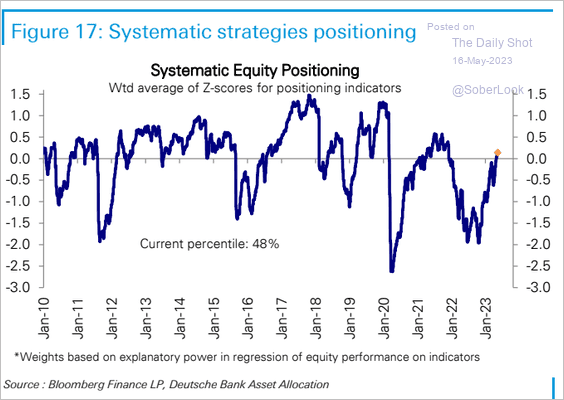

6. Systematic equity positioning, such as risk parity and vol control, is moving into bullish territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

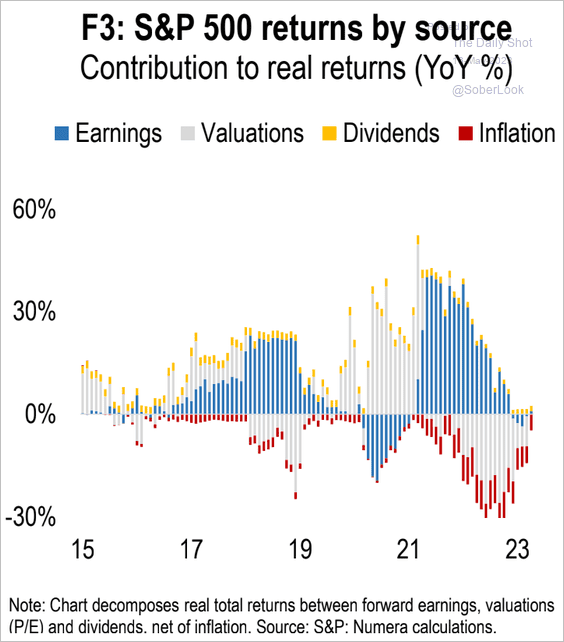

7. This chart shows the year-over-year S&P 500 real return attribution from Numera Analytics.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

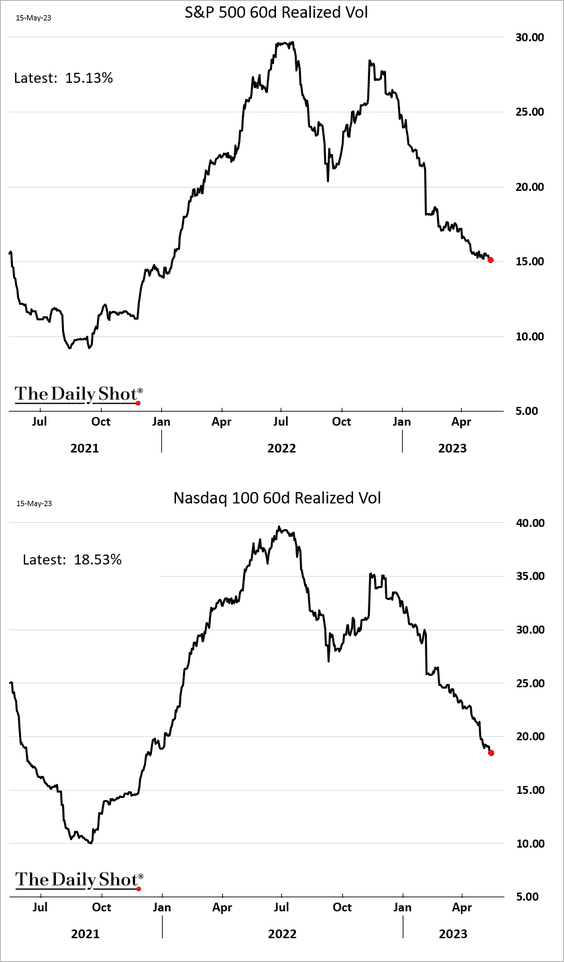

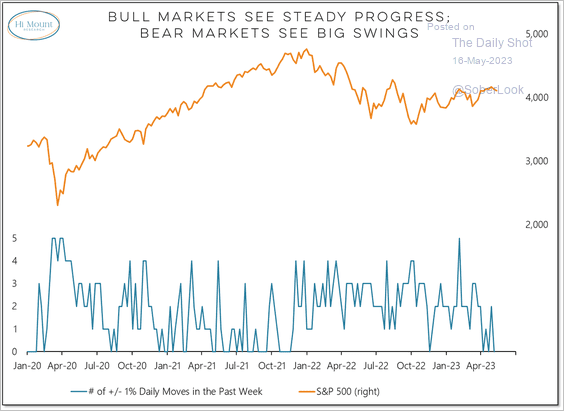

8. Volatility measures continue to trend lower.

The S&P 500 went an entire week without a 1% daily swing for the third time this quarter.

Source: @WillieDelwiche

Source: @WillieDelwiche

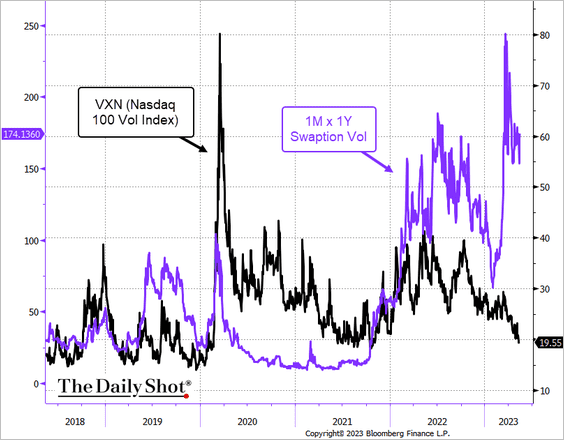

• Equity options markets are not concerned about elevated short-term rate uncertainty.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

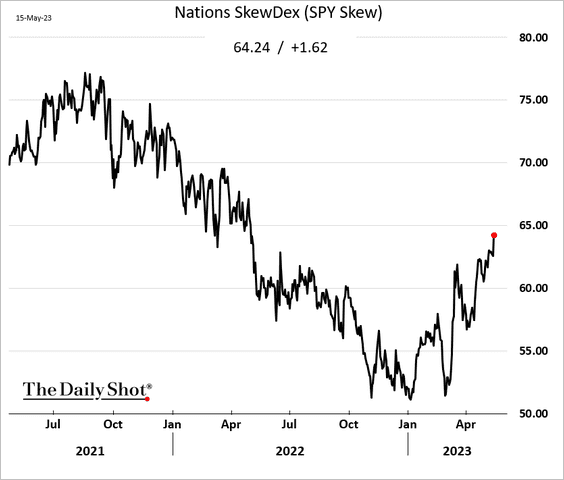

• But option skew has been climbing, signaling increased demand for downside protection.

Back to Index

Credit

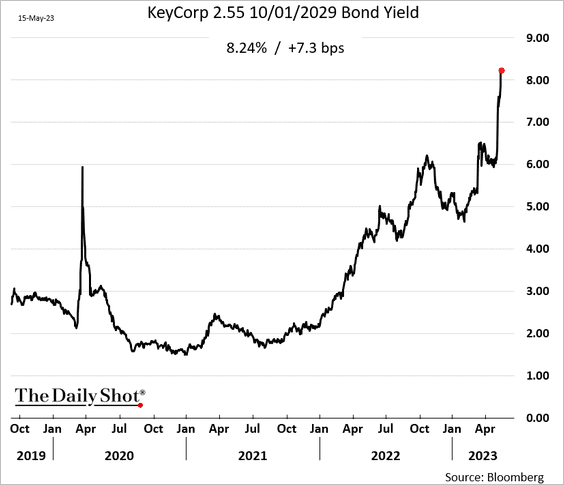

1. Regional banks’ bond yields remain elevated.

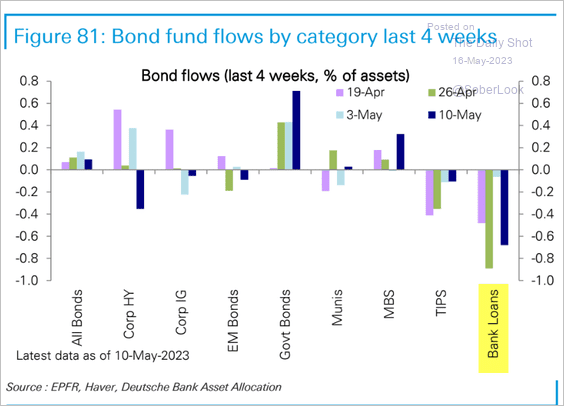

2. Leveraged loan funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

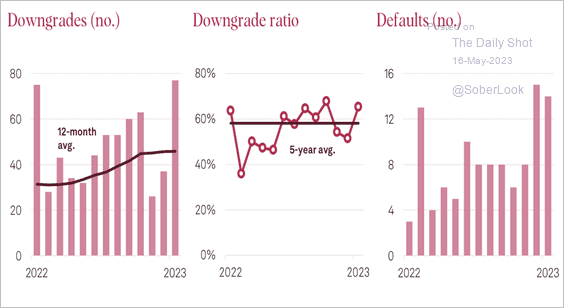

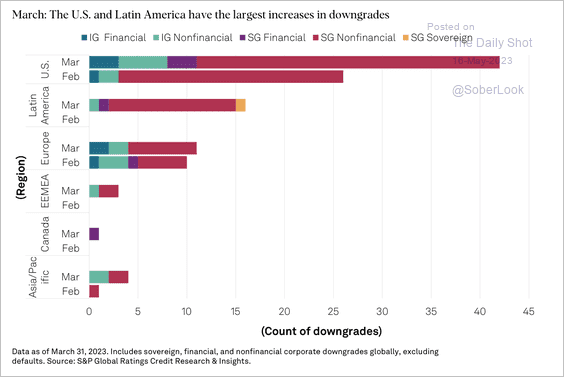

3. Global credit downgrades and defaults surged in March, led by the US and LatAm. (2 charts)

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

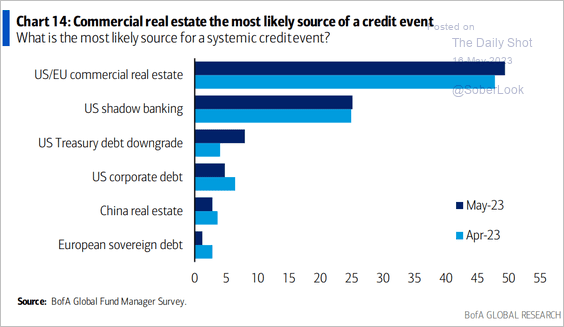

4. Investors remain concerned about commercial real estate.

Source: BofA Global Research

Source: BofA Global Research

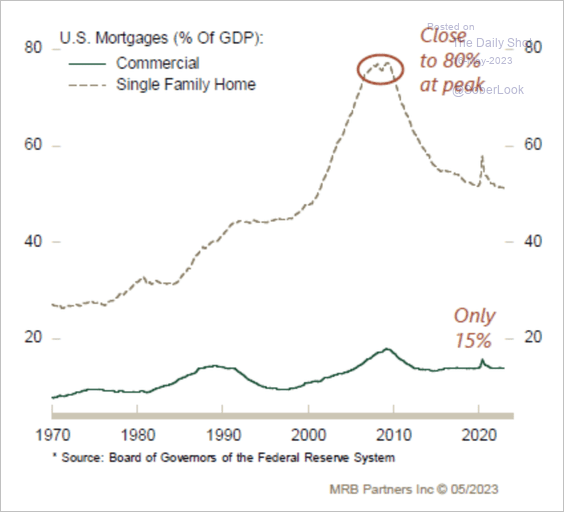

Commercial real estate debt as a share of GDP is much smaller than mortgages.

Source: MRB Partners

Source: MRB Partners

Back to Index

Global Developments

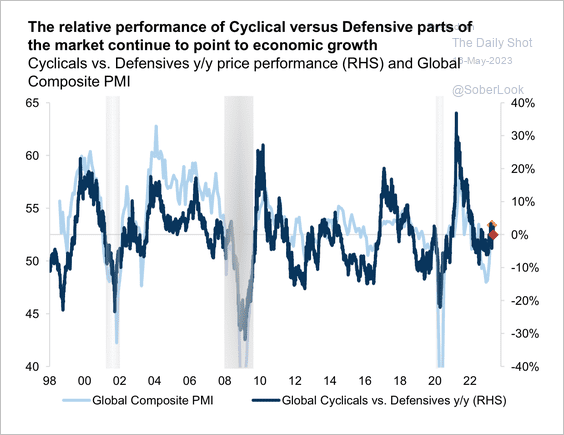

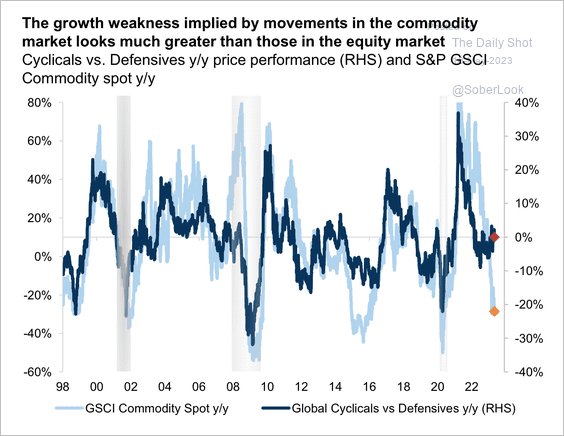

1. The rise in cyclical stocks relative to defensives could reflect improving global growth, although commodities have not confirmed a cycle shift. (2 charts)

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

——————–

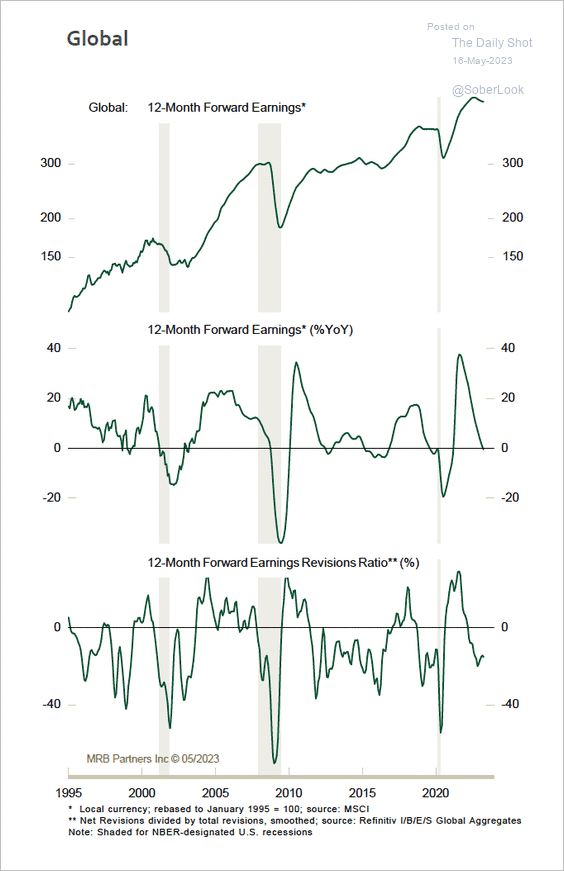

2. Global forward earnings continue to slide, although upward revisions ticked up slightly in April.

Source: MRB Partners

Source: MRB Partners

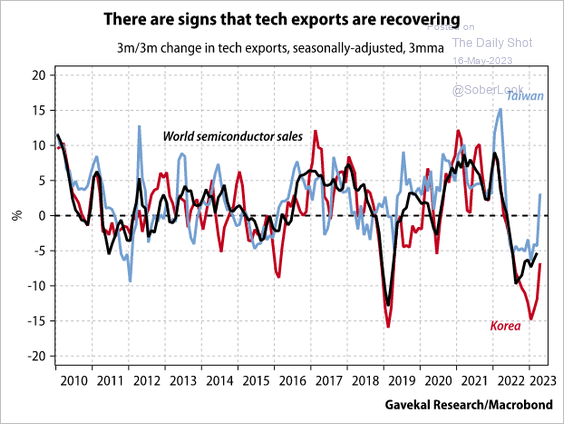

3. Tech exports are rebounding.

Source: Gavekal Research

Source: Gavekal Research

——————–

Food for Thought

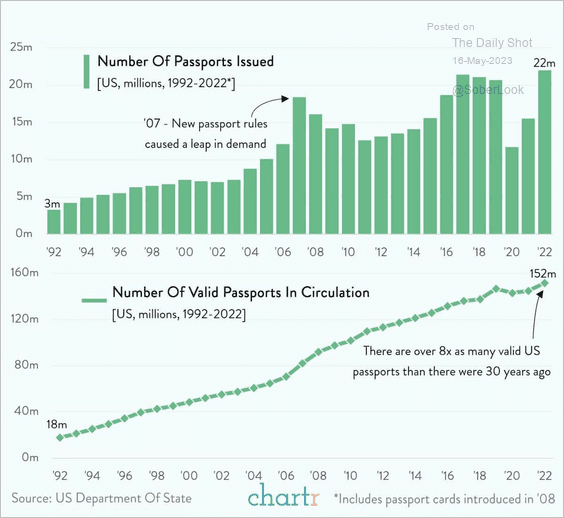

1. Number of US passports issued:

Source: @chartrdaily

Source: @chartrdaily

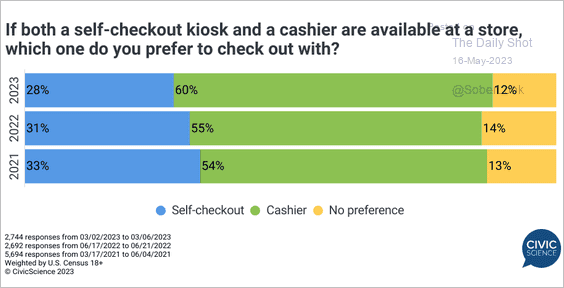

2. The self-checkout option:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

3. Share of US goods imports from China:

Source: @WSJ Read full article

Source: @WSJ Read full article

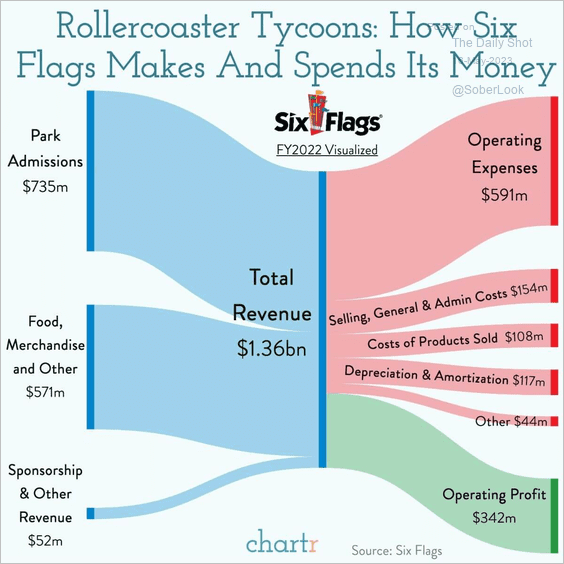

4. Six Flags 2022 results visualized:

Source: @chartrdaily

Source: @chartrdaily

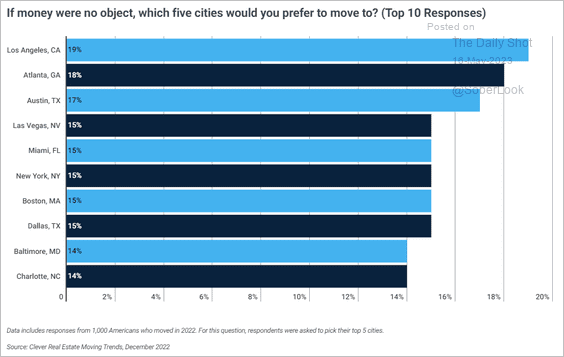

5. If money were no object, where would you prefer to move?

Source: Home Bay; h/t Walter Read full article

Source: Home Bay; h/t Walter Read full article

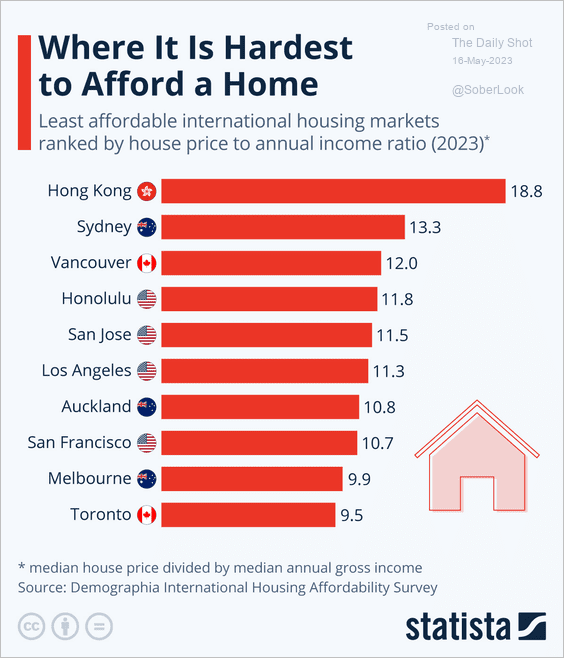

6. Least-affordable housing markets:

Source: Statista

Source: Statista

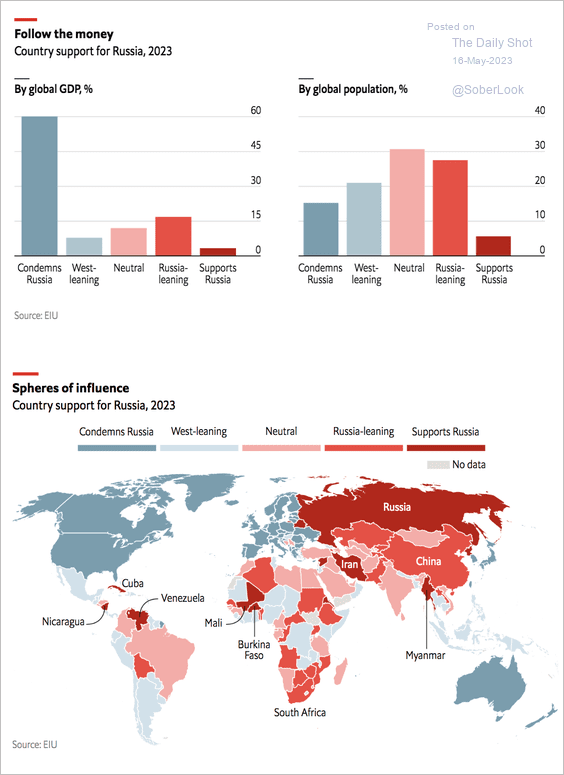

7. Support for Russia around the world:

Source: The Economist Read full article

Source: The Economist Read full article

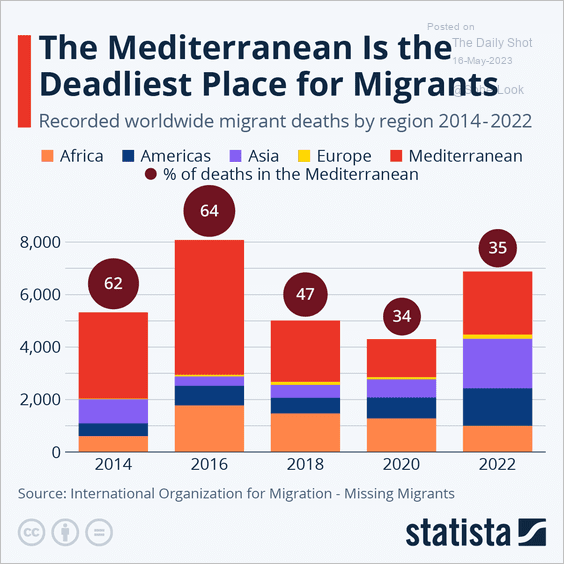

8. Migrant deaths:

Source: Statista

Source: Statista

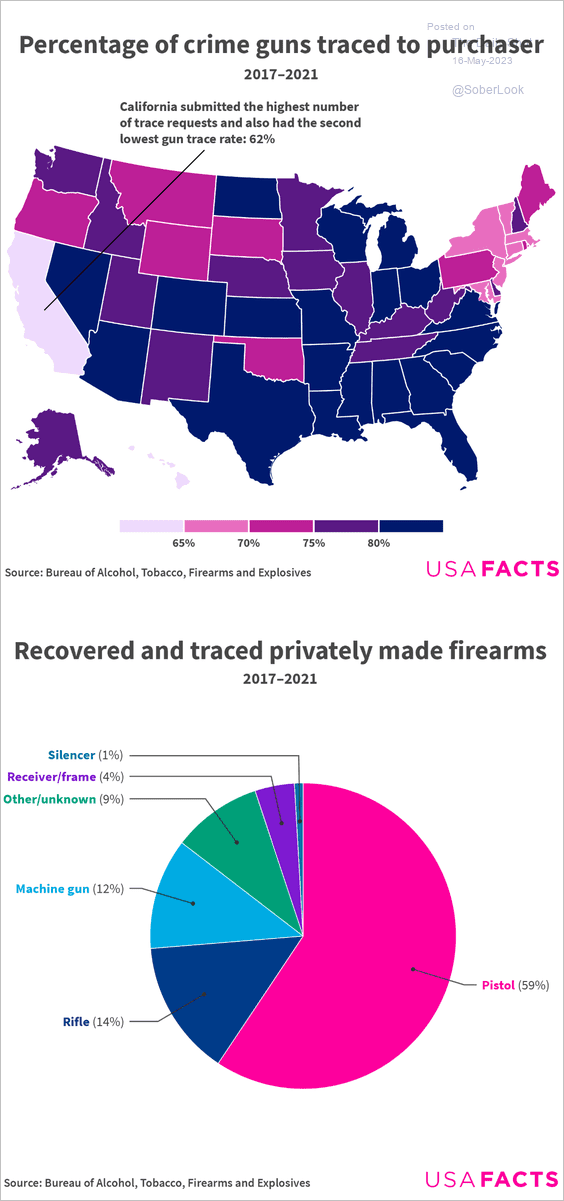

9. Tracing crime guns to purchasers:

Source: USAFacts

Source: USAFacts

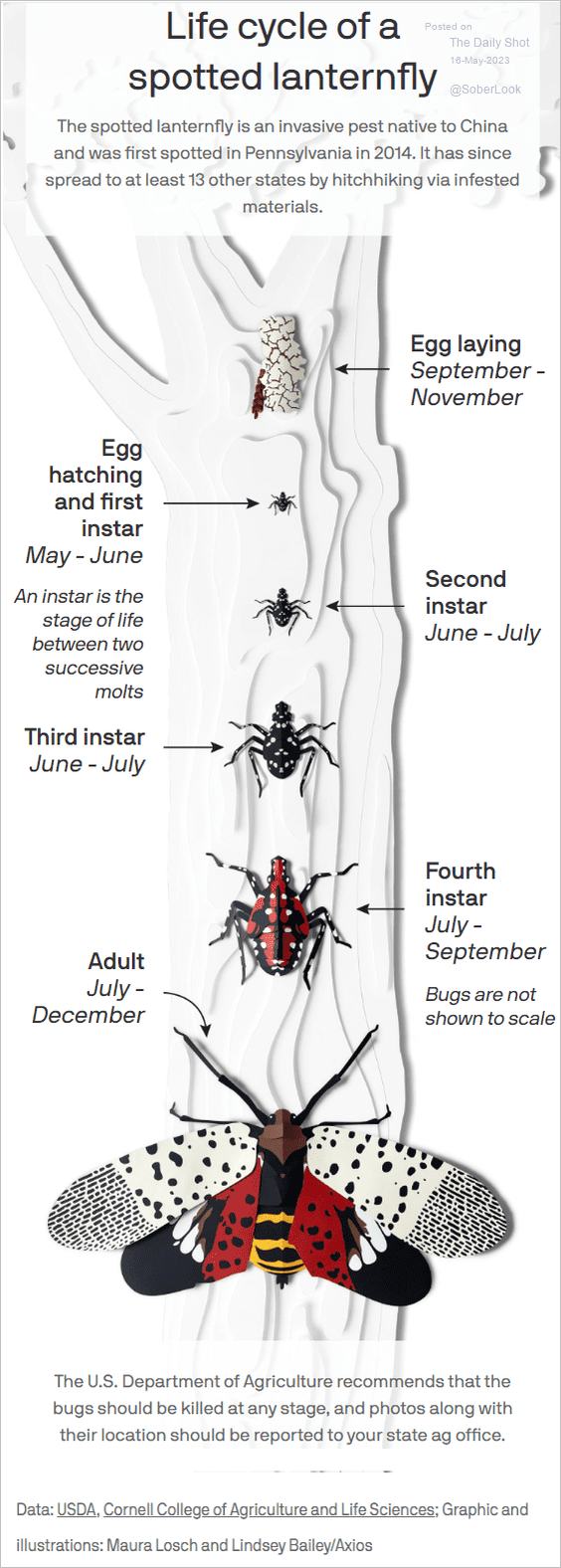

10. The invasive spotted lanternfly:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index