The Daily Shot: 06-Mar-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

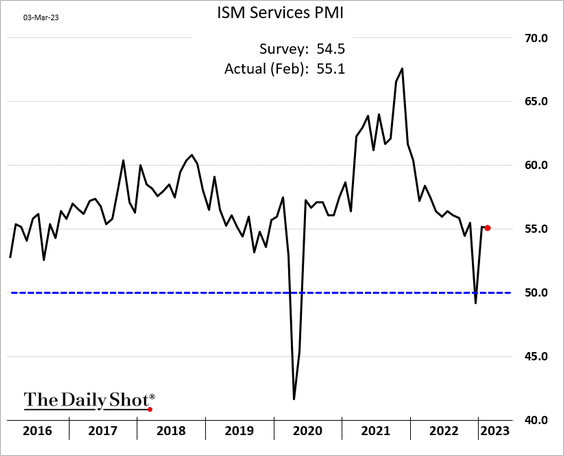

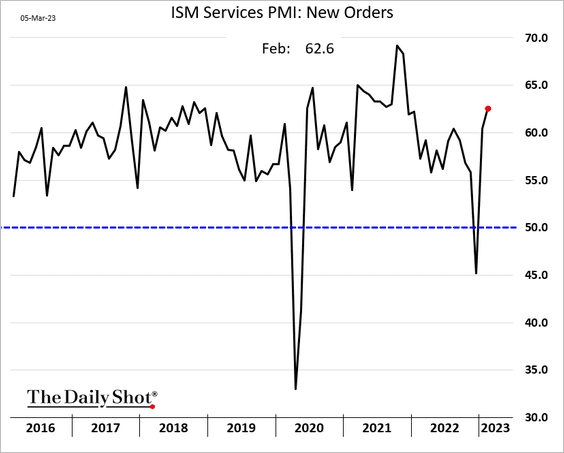

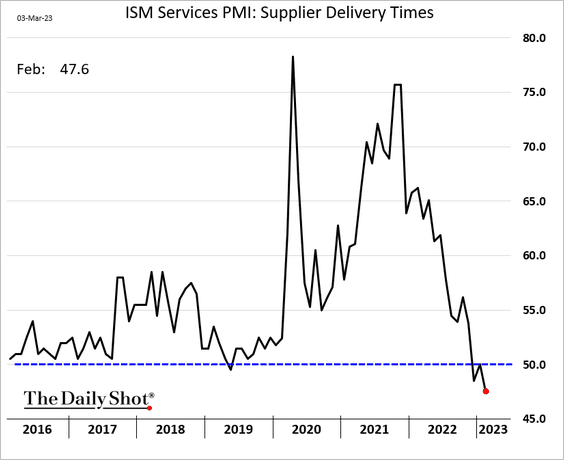

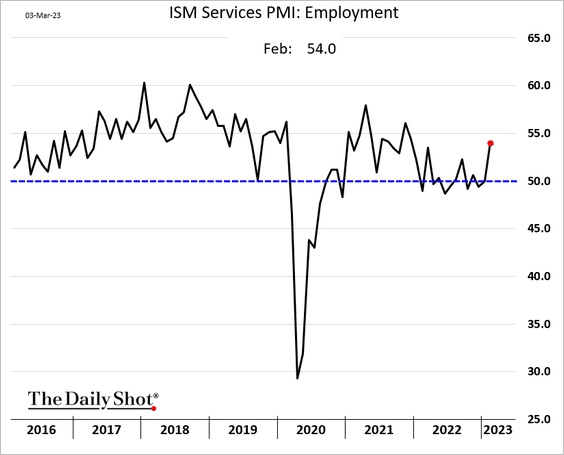

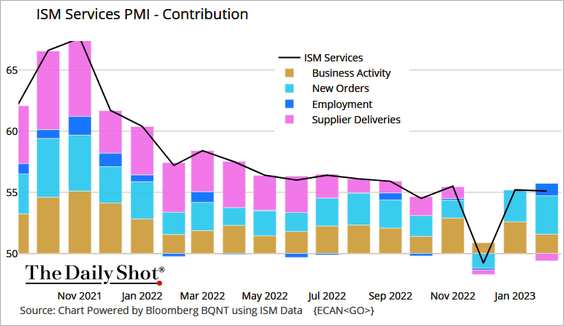

1. The ISM Services PMI report points to robust service sector activity in February.

• New orders grew at the fastest pace since 2021.

• Supplier delivery times continued to shorten.

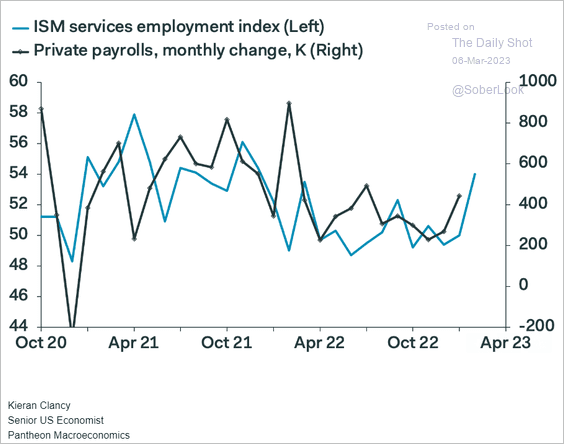

• Companies sharply boosted hiring in February, indicating strength in the labor market.

The ISM services employment index signals healthy job gains last month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

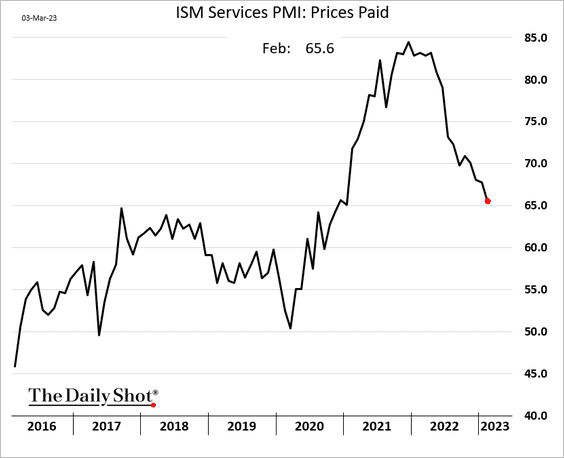

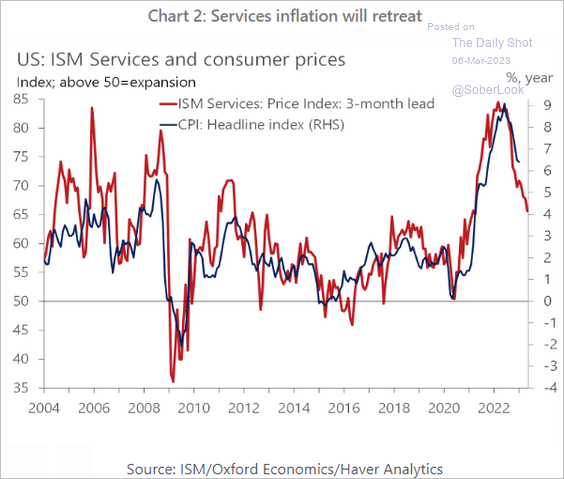

• Price pressures are easing, …

… which points to lower inflation ahead.

Source: Oxford Economics

Source: Oxford Economics

• Here are the contributions to the ISM Services PMI index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

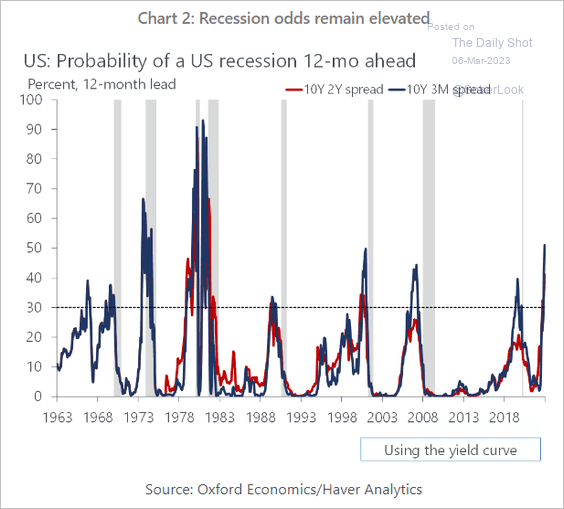

2. The inverted yield curve has been hinting at a recession for some time now.

Source: Oxford Economics

Source: Oxford Economics

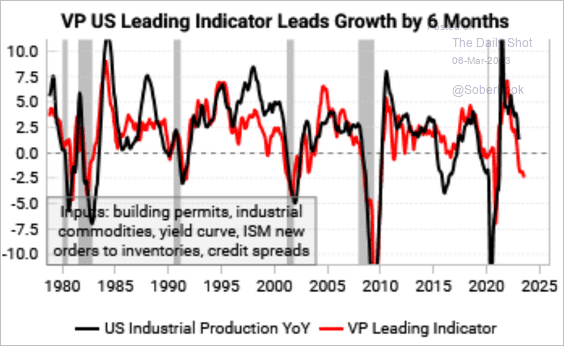

• Variant Perception’s model signals a sharp downturn.

Source: Variant Perception

Source: Variant Perception

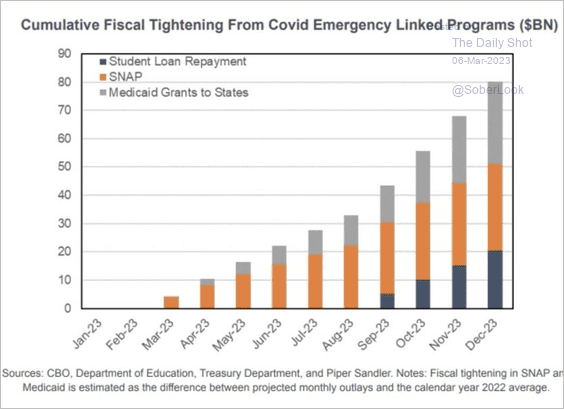

• Fiscal tightening is expected to be a drag on growth this year.

Source: @MichaelKantro, @DonFSchneider

Source: @MichaelKantro, @DonFSchneider

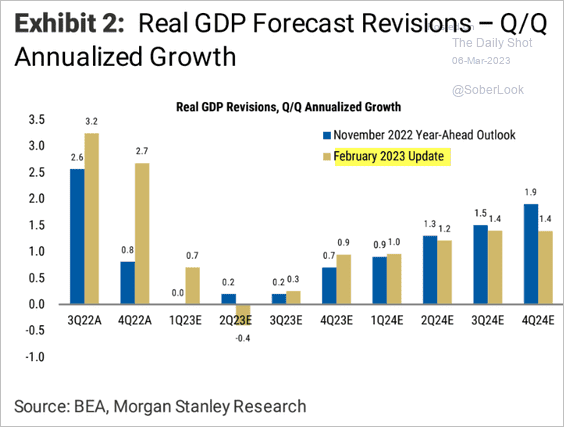

• But Morgan Stanley sees only one down quarter in 2023.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

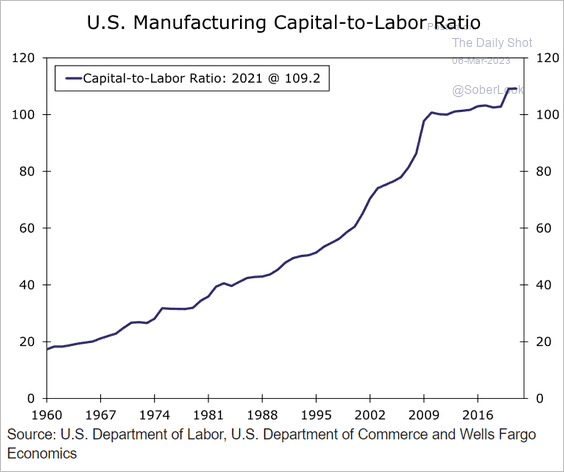

3. Will US manufacturing capital-to-labor ratio gains accelerate amid strong wage growth?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

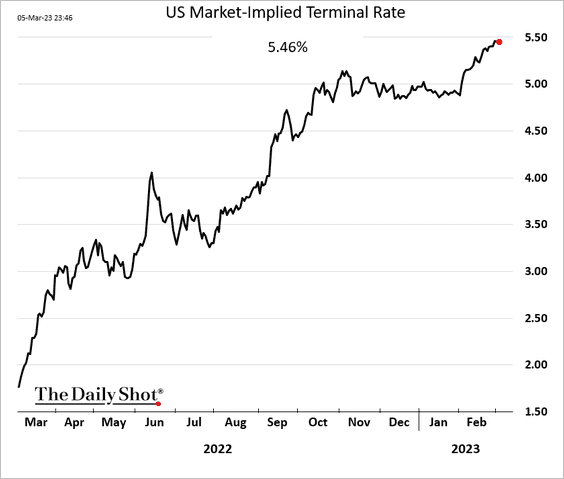

4. The implied terminal rate is holding just below 5.5%.

Back to Index

Canada

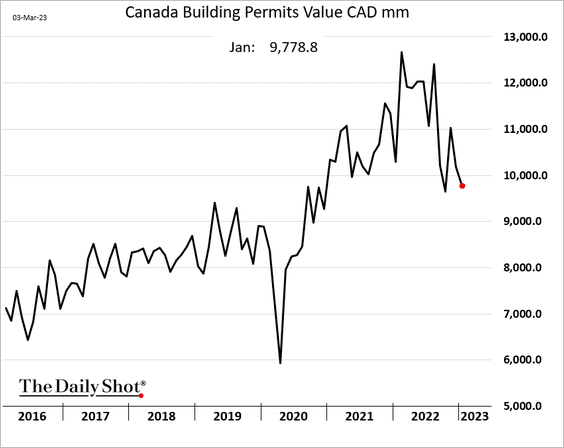

1. Building permits have been trending lower.

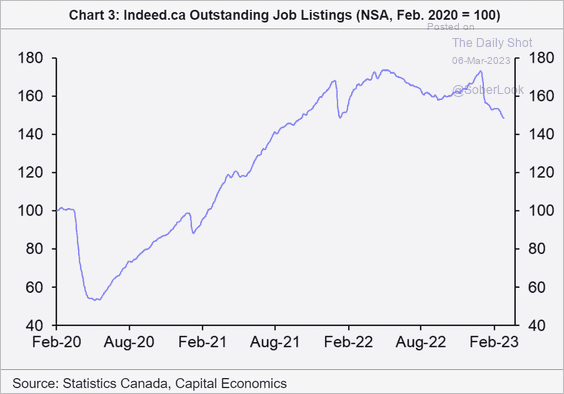

2. Job postings on Indeed are rolling over.

Source: Capital Economics

Source: Capital Economics

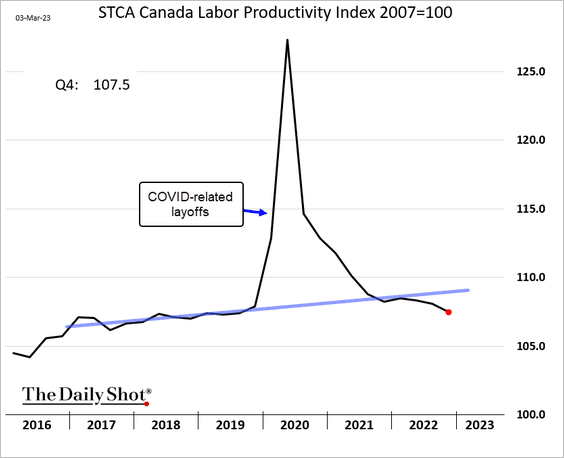

3. Labor productivity is now below the pre-COVID trend.

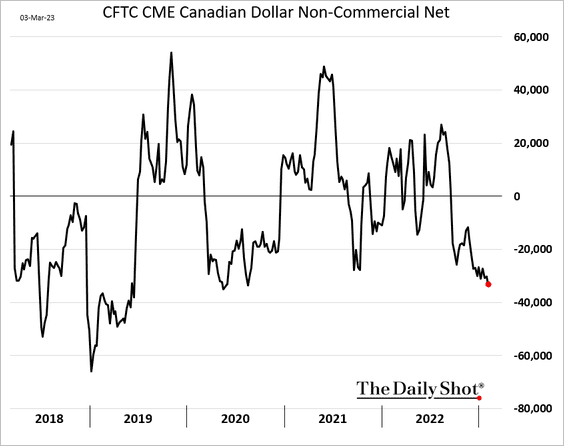

4. Speculative accounts are boosting their bets against the loonie.

Back to Index

The United Kingdom

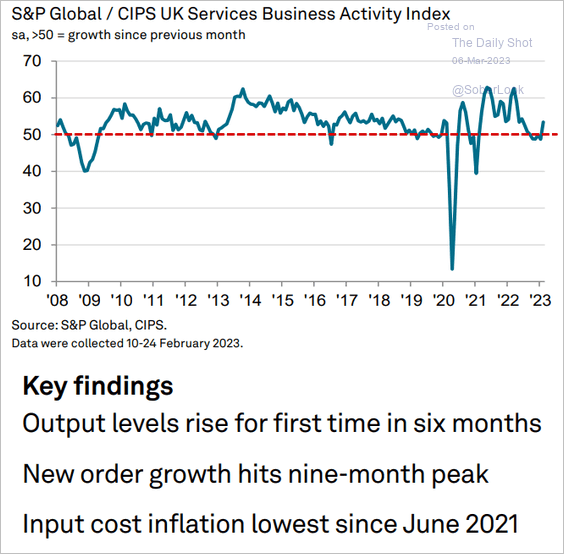

1. As we saw earlier, service-sector activity picked up momentum last month.

Source: S&P Global PMI

Source: S&P Global PMI

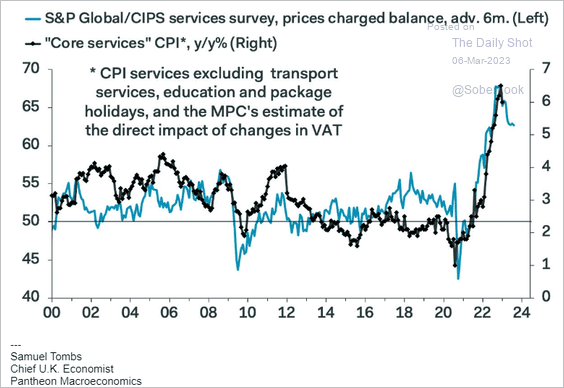

The PMI prices index points to slowing inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

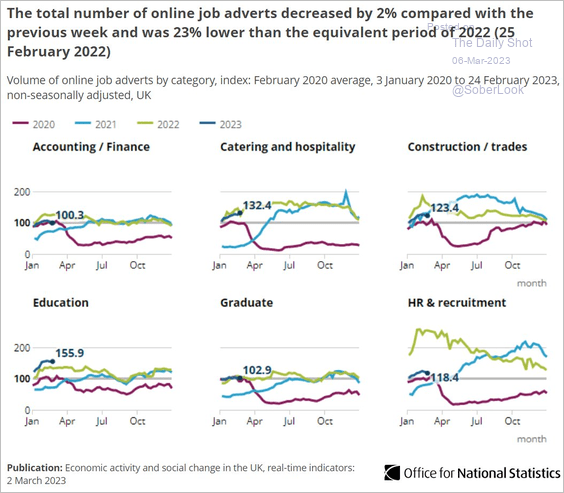

2. Job postings are mostly below last year’s levels but still strong.

Source: @ONS, @adzuna Read full article

Source: @ONS, @adzuna Read full article

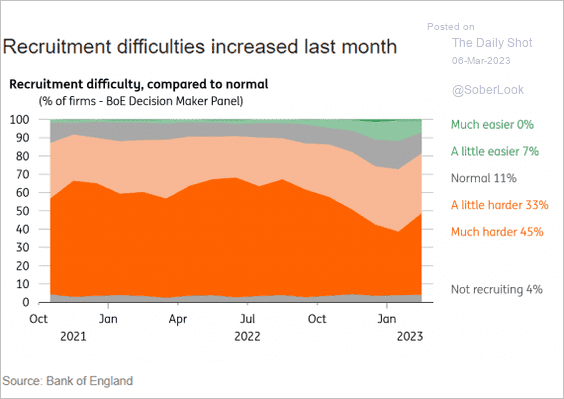

Companies are having a tough time recruiting.

Source: ING

Source: ING

——————–

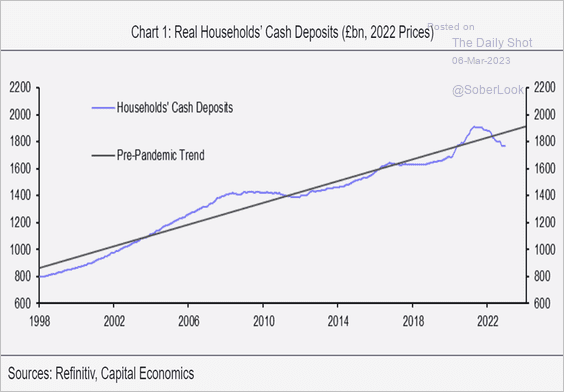

3. This chart shows households’ real cash deposits.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

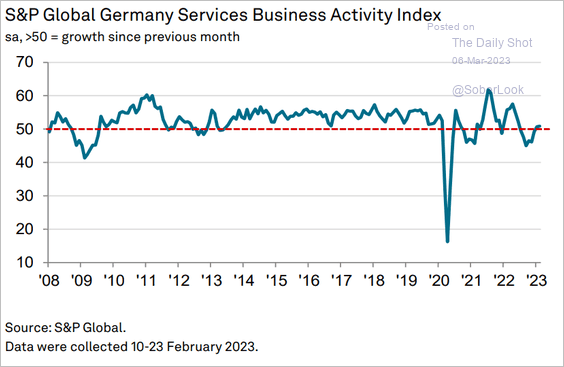

1. The updated services PMI indicators were a bit softer than the flash report.

• Germany:

Source: S&P Global PMI

Source: S&P Global PMI

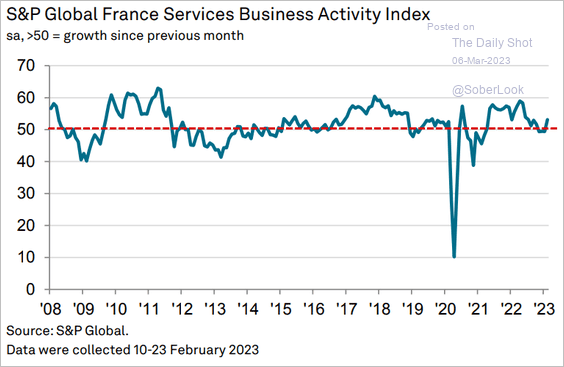

• France:

Source: S&P Global PMI

Source: S&P Global PMI

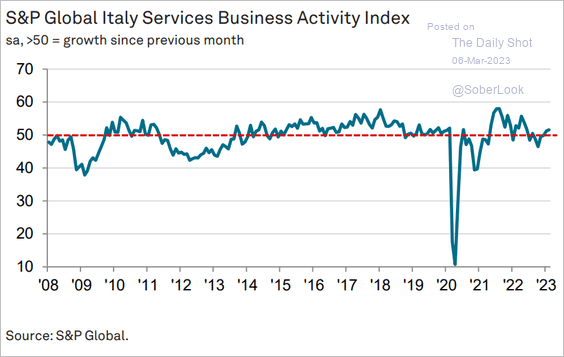

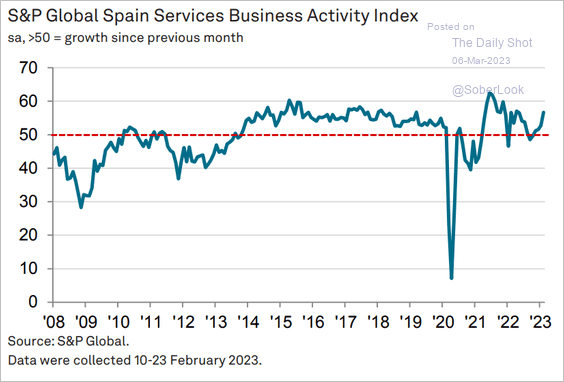

• Spain and Italy show expanding business activity.

Source: S&P Global PMI

Source: S&P Global PMI

Span’s growth is particularly strong.

Source: S&P Global PMI

Source: S&P Global PMI

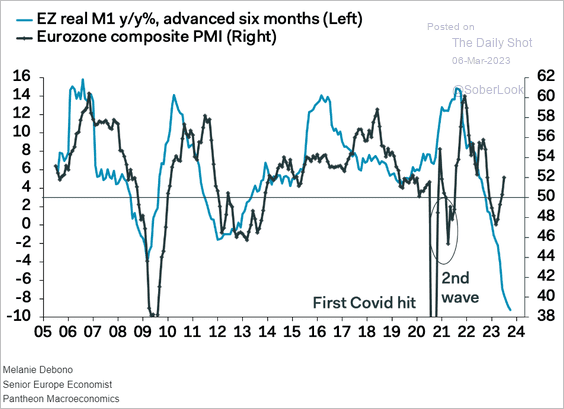

At the Eurozone level, business expansion is inconsistent with crashing real money supply.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

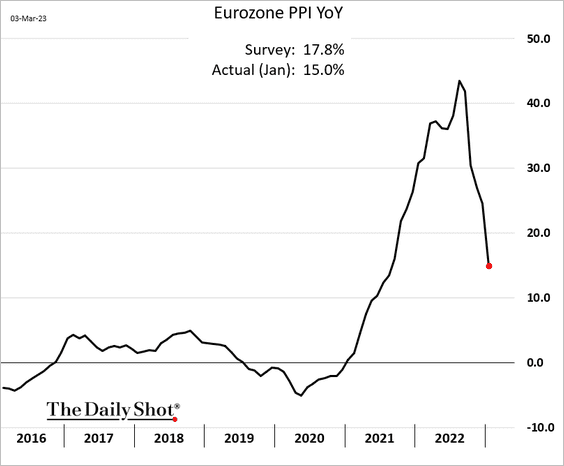

2. The January euro-area PPI surprised to the downside.

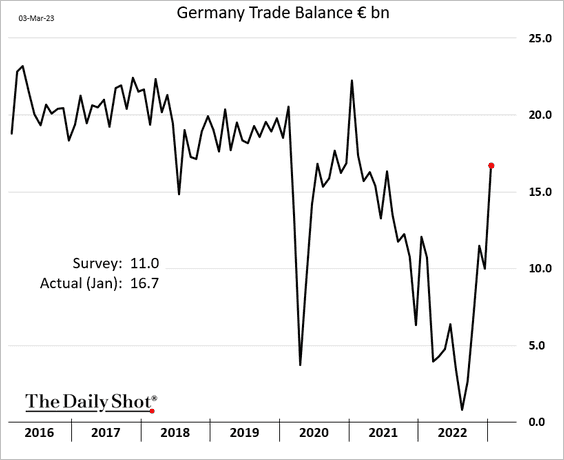

3. Germany’s trade surplus surged in January as exports strengthened, while energy costs eased.

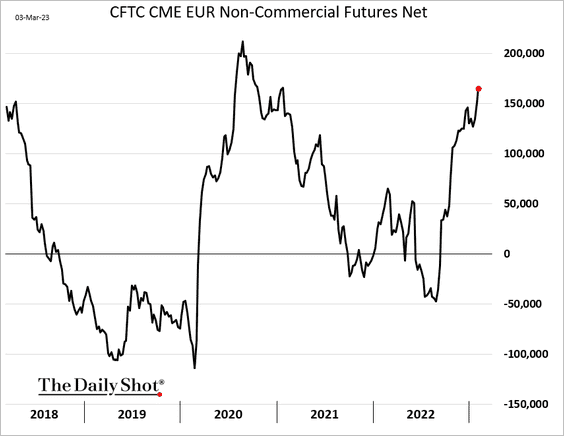

4. Speculative accounts have been boosting their bets on the euro.

Back to Index

Europe

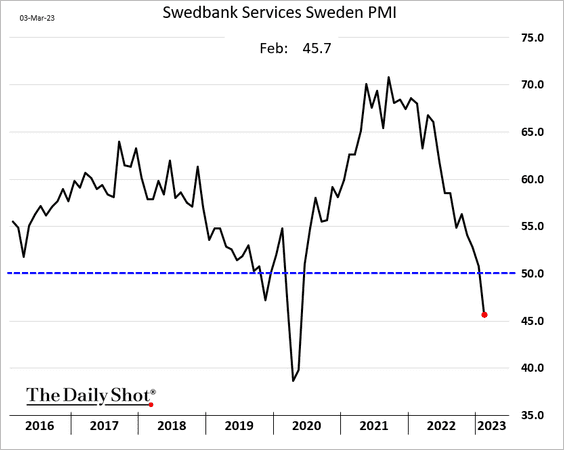

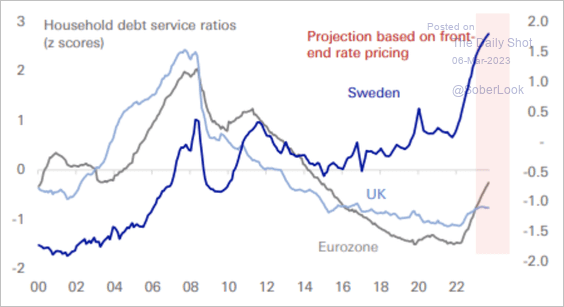

1. Let’s begin with Sweden.

• Service-sector PMI looks recessionary.

• A significant rise in Swedish debt service payments is underway.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

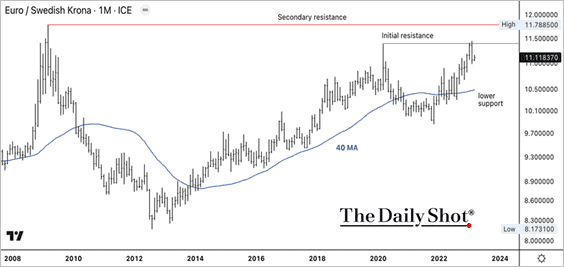

• EUR/SEK is testing long-term resistance. Despite rising debt service, Sweden’s Riksbank is raising rates to shore up Krona and lower inflation.

——————–

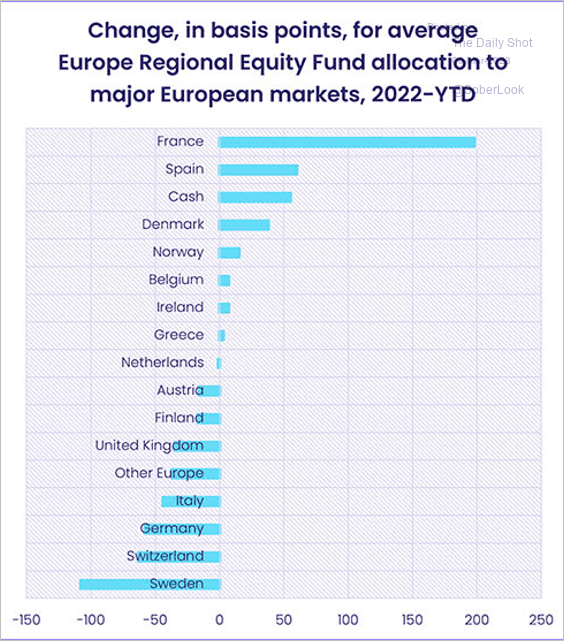

2. This chart shows the year-to-date change in regional equity fund allocations.

Source: EPFR

Source: EPFR

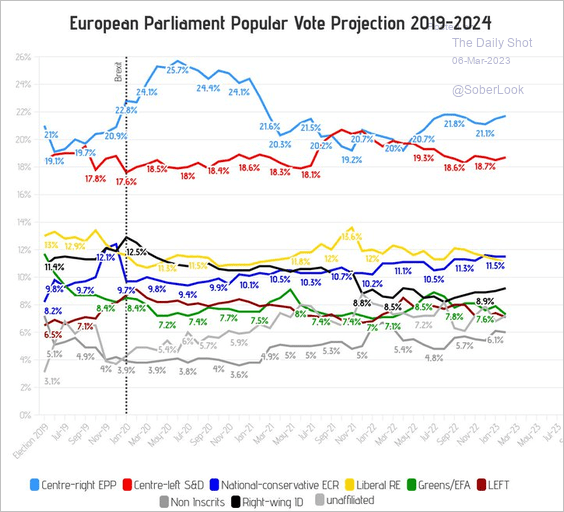

3. Here are the latest polls on the European Parliament vote.

Source: @EuropeElects Read full article

Source: @EuropeElects Read full article

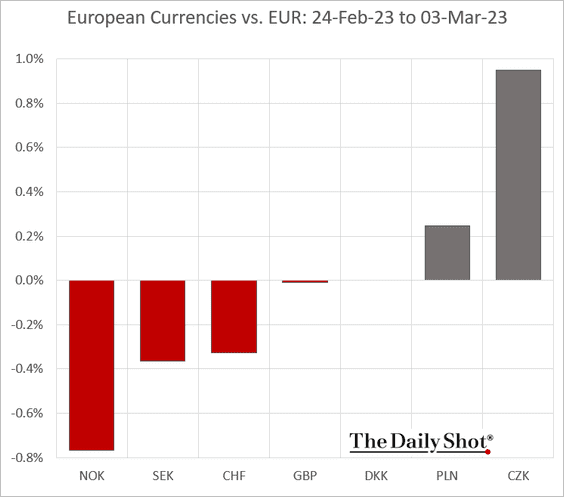

4. Finally, we have last week’s performance of European currencies against the euro.

Back to Index

Asia – Pacific

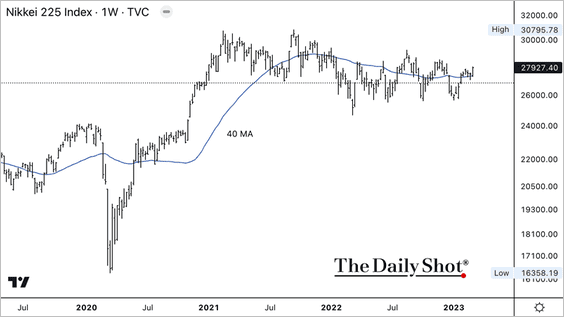

1. The Nikkei 225 index returned above its 40-week moving average.

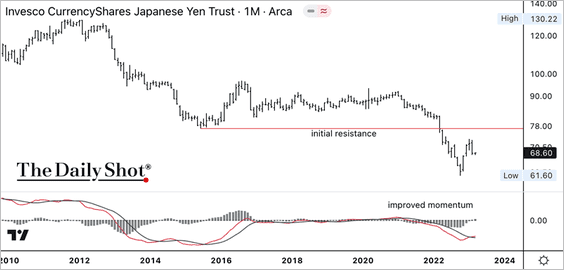

The Invesco Japanese Yen ETF (FXY) declined from long-term resistance, although upside momentum is improving.

——————–

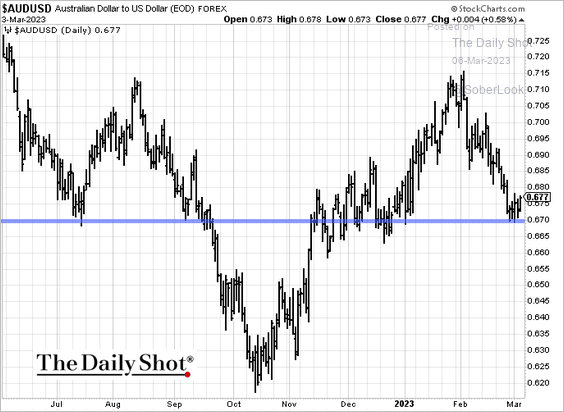

2. The Aussie dollar is at support.

h/t Simon White, Bloomberg Markets Live Blog

h/t Simon White, Bloomberg Markets Live Blog

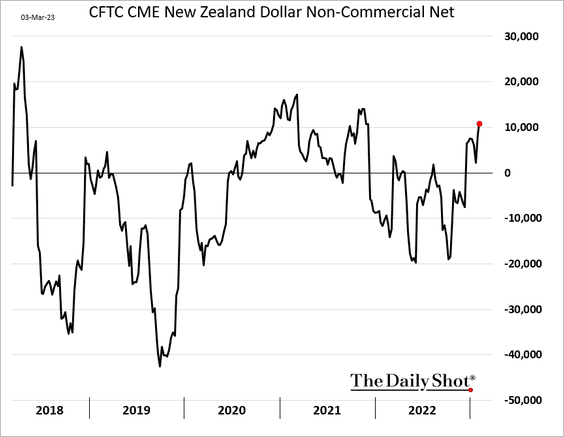

3. Speculative accounts are boosting their bets on the Kiwi dollar.

Back to Index

China

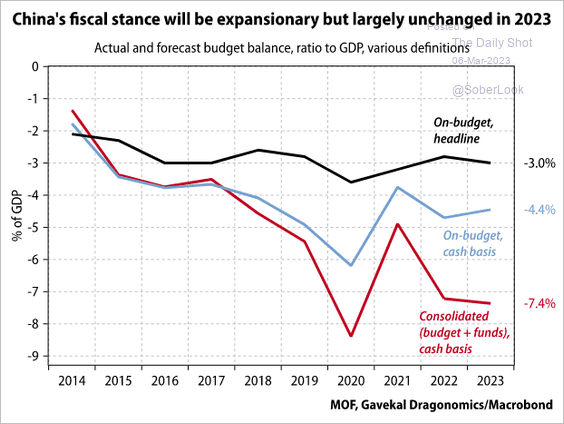

1. The budget will be largely unchanged in 2023, according to Gavekal Research.

Source: Gavekal Research

Source: Gavekal Research

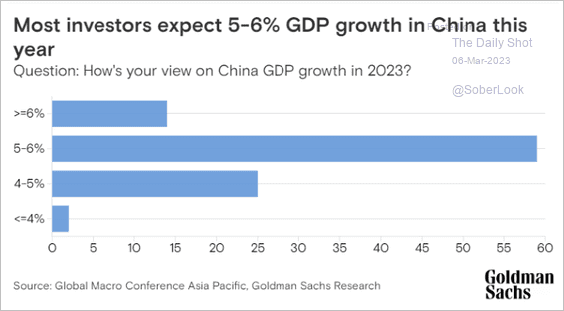

2. Investors expect 5-6% growth this year.

Source: Goldman Sachs

Source: Goldman Sachs

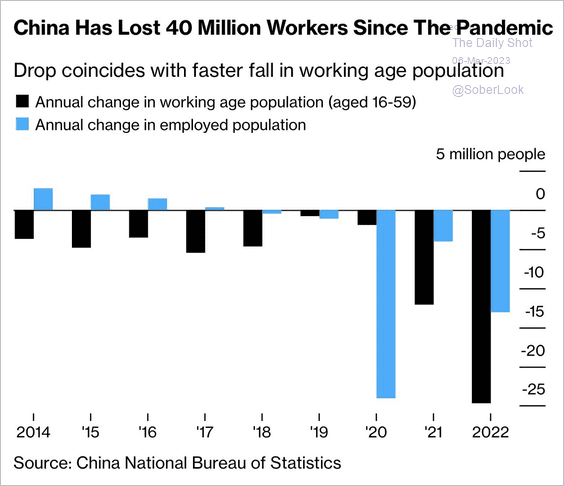

3. China faces tight labor markets.

Source: @hancocktom, @business Read full article

Source: @hancocktom, @business Read full article

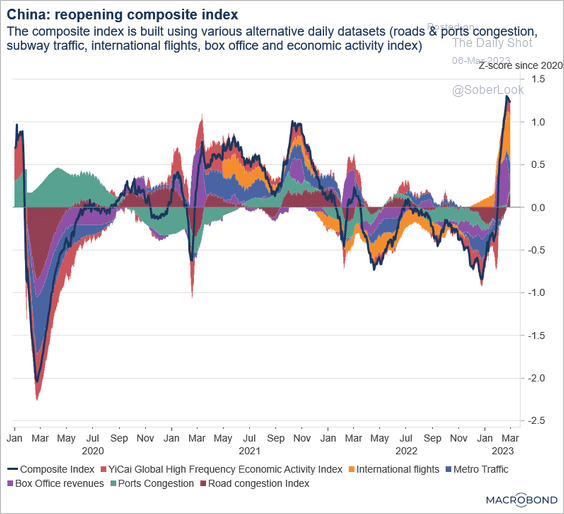

4. Here is Macrobond’s reopening index.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Back to Index

Emerging Markets

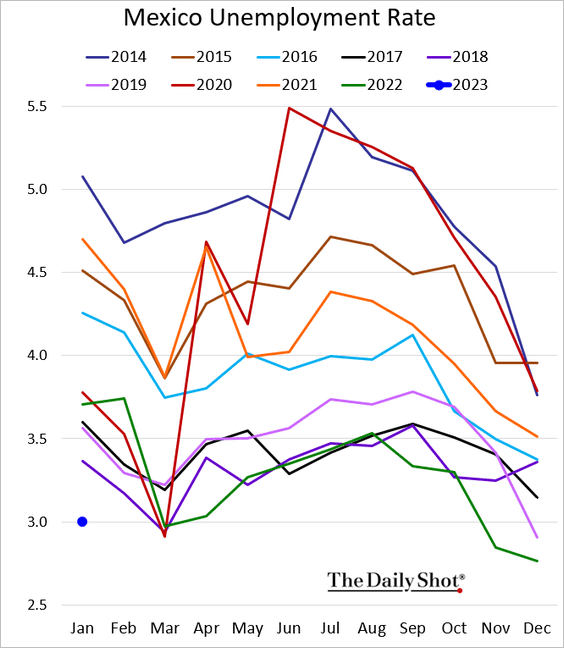

1. Mexico’s unemployment rate hit a multi-year low in January.

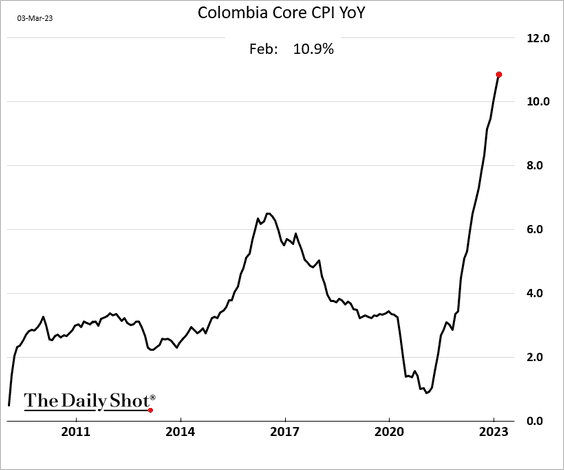

2. Colombia’s core inflation continues to surge.

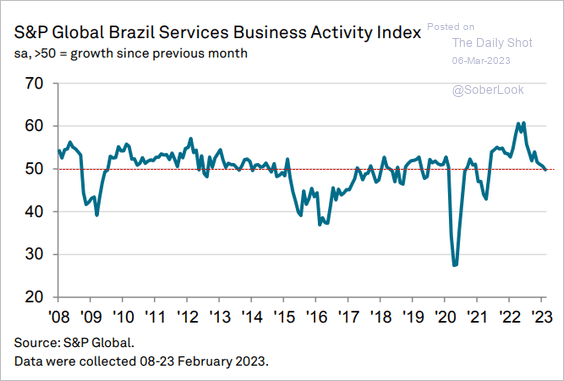

3. Brazil’s service sector growth has stalled.

Source: S&P Global PMI

Source: S&P Global PMI

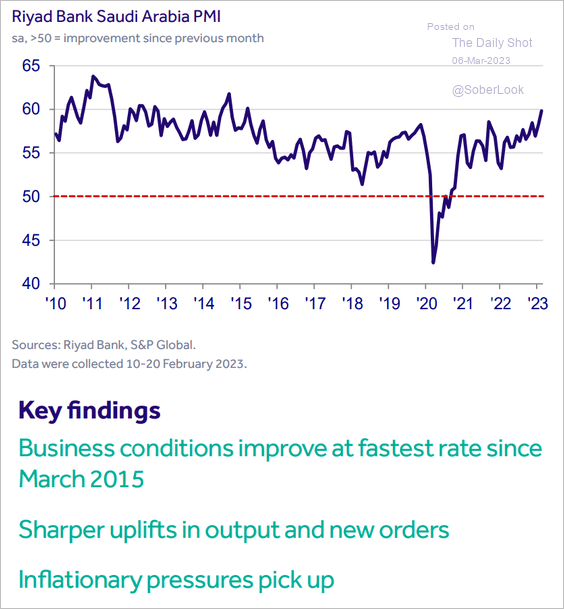

4. Saudi business activity is expanding at the fastest pace since 2015.

Source: S&P Global PMI

Source: S&P Global PMI

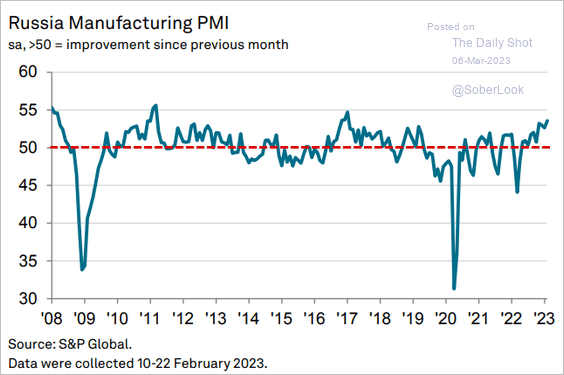

5. Next, we have some updates on Russia.

• Manufacturing growth has been strengthening. However, a source told us that large companies were “asked” to “put their best foot forward” on the PMI surveys.

Source: S&P Global PMI

Source: S&P Global PMI

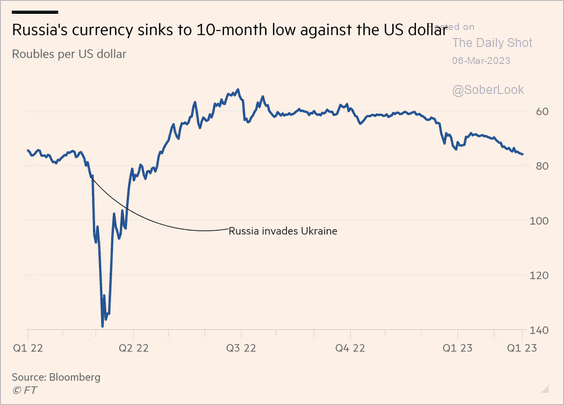

• The ruble has been trending lower.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

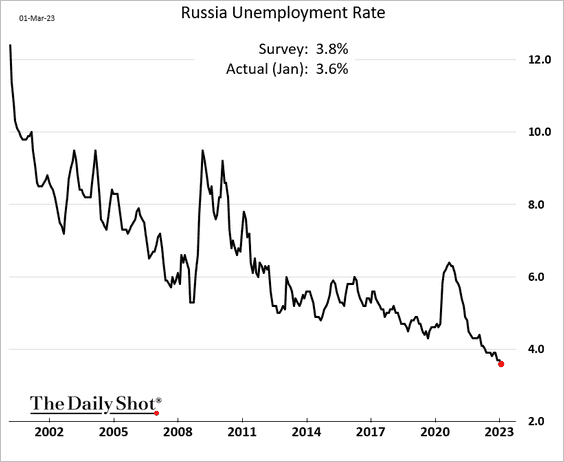

• Here are some additional indicators (all are from the Russian government).

– The unemployment rate:

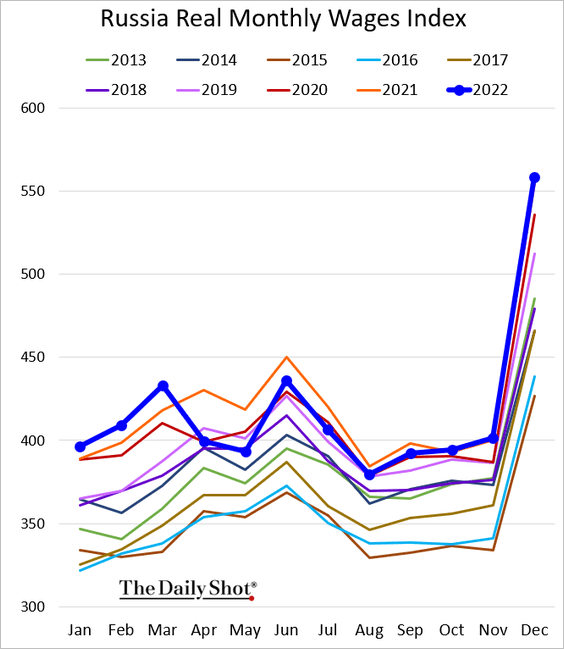

– Wages index:

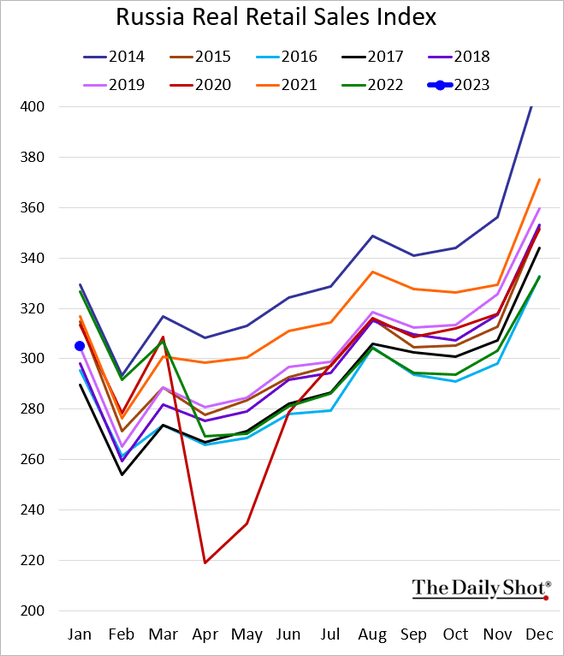

– Retail sales index:

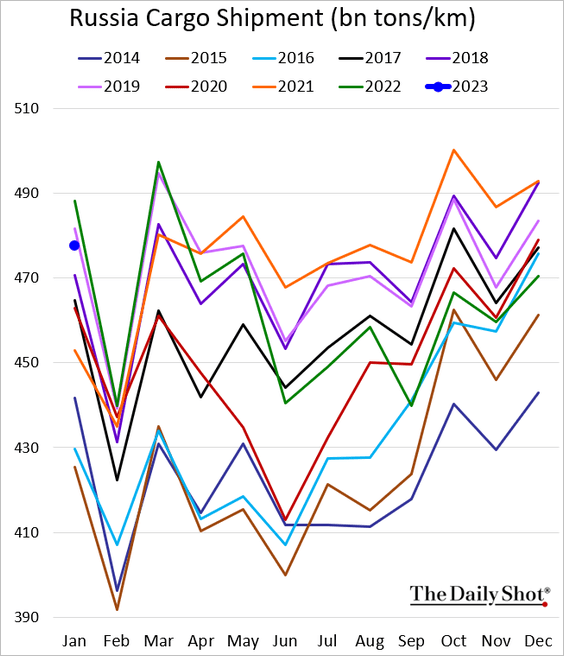

– Cargo shipments:

——————–

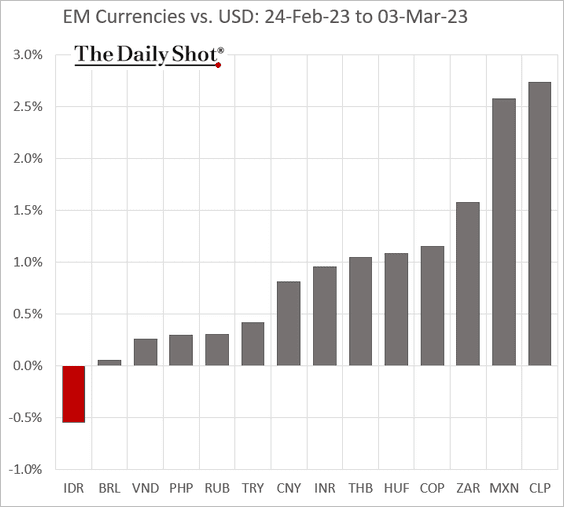

6. Finally, we have last week’s performance data.

• Currencies:

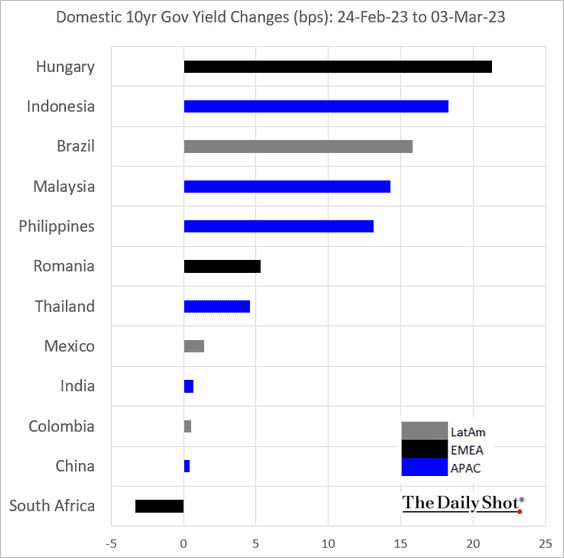

• Bond yields:

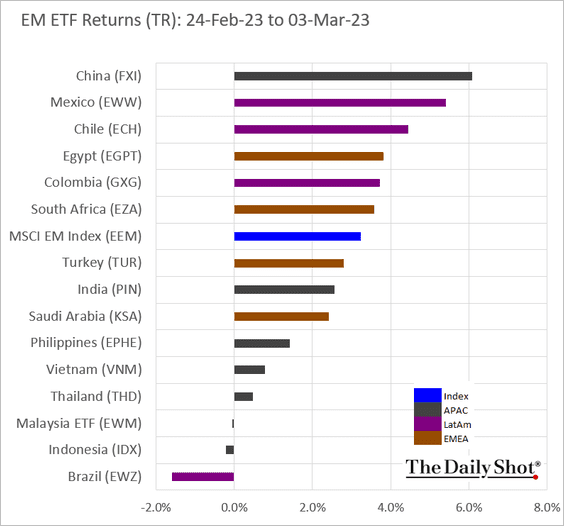

• Equity ETFs:

Back to Index

Commodities

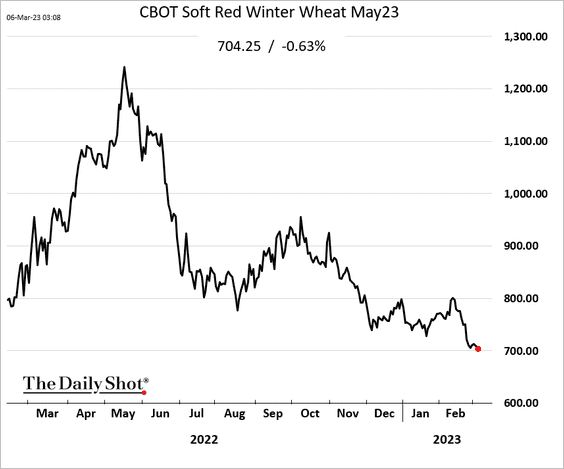

1. US wheat futures remain under pressure.

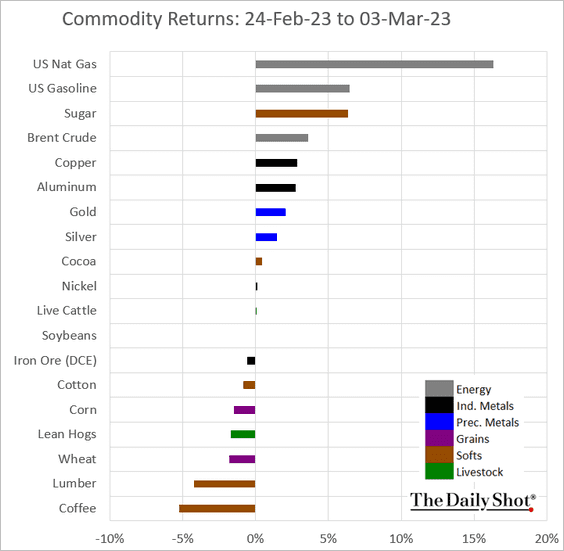

2. Here is last week’s performance across key commodity markets.

Back to Index

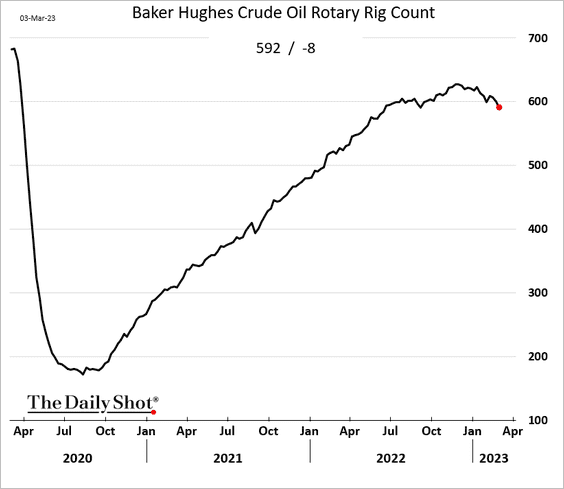

Energy

1. The US rig count declined again last week.

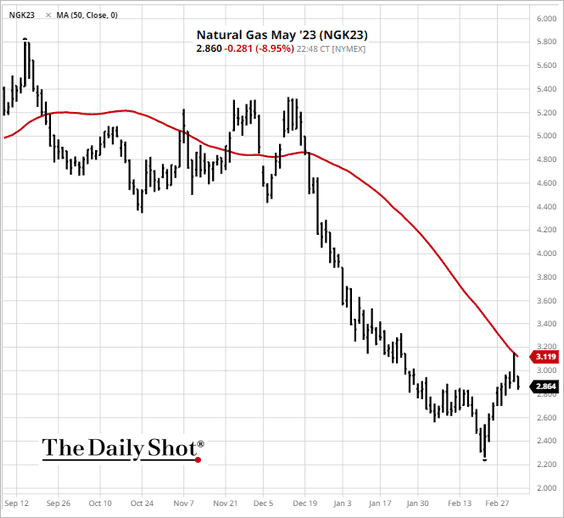

2. US natural gas held resistance at the 50-day moving average.

Source: barchart.com

Source: barchart.com

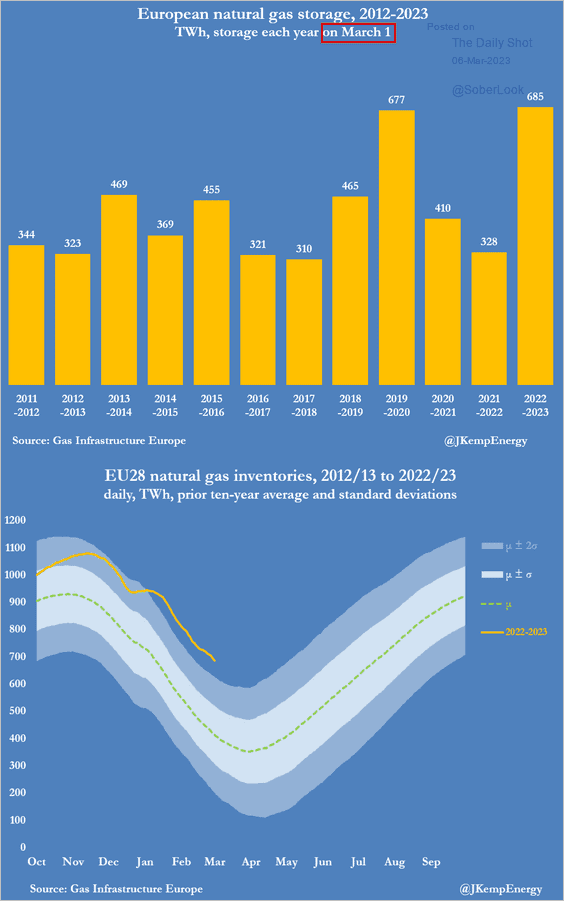

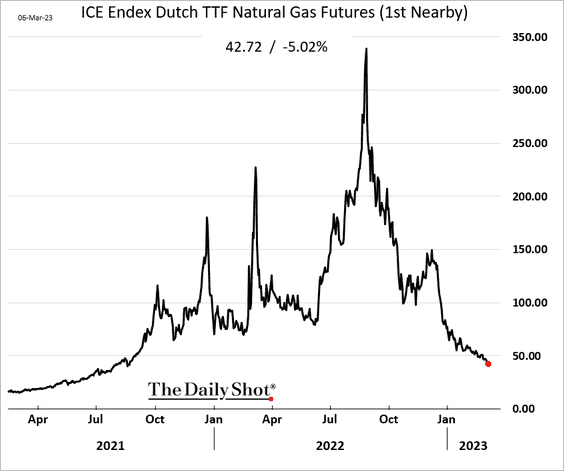

3. European natural gas storage hit a record high for this time of the year.

Source: @JKempEnergy

Source: @JKempEnergy

And prices have been reflecting this trend.

——————–

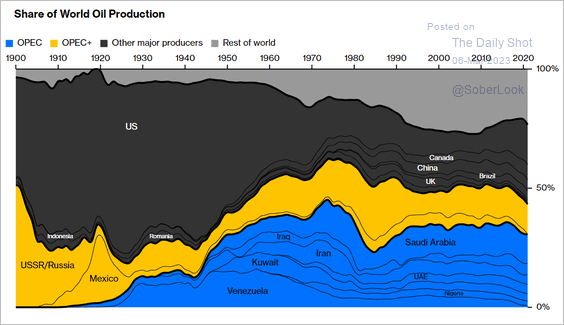

4. This chart shows the share of world oil production by country.

Source: @claradfmarques, @davidfickling, @opinion Read full article

Source: @claradfmarques, @davidfickling, @opinion Read full article

Back to Index

Equities

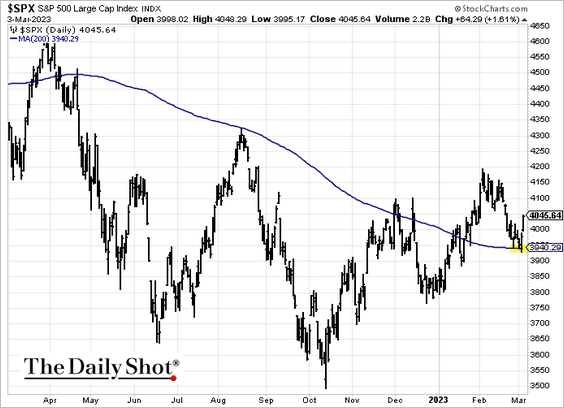

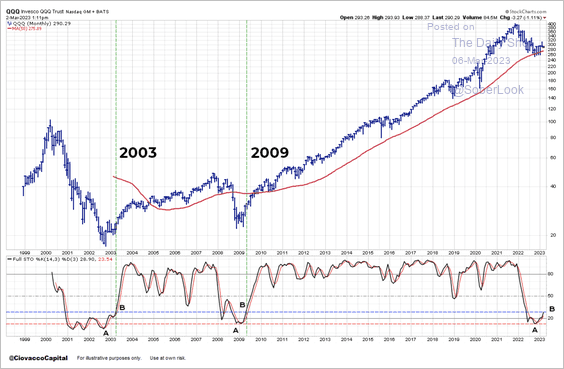

1. The S&P 500 held support at the 200-day moving average.

The Nasdaq 100 index is holding support at its 50-month moving average. The index is the most oversold since the financial crisis, but long-term momentum remains negative.

Source: @CiovaccoCapital

Source: @CiovaccoCapital

——————–

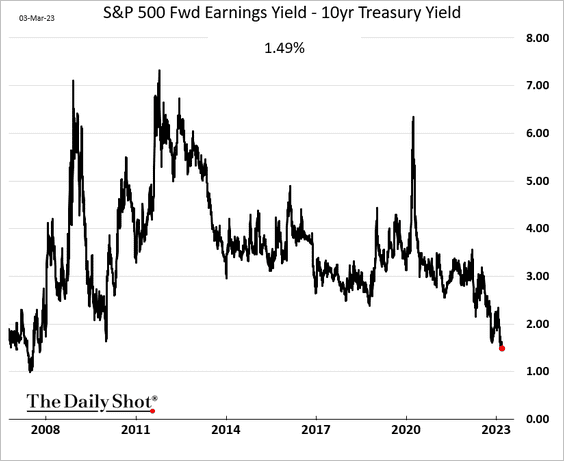

2. Persistently low risk premium poses a downside risk for stocks.

Source: Capital Economics

Source: Capital Economics

——————–

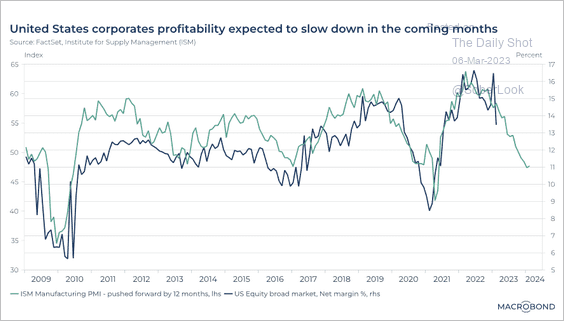

3. The ISM Manufacturing PMI is signaling much lower margins ahead.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

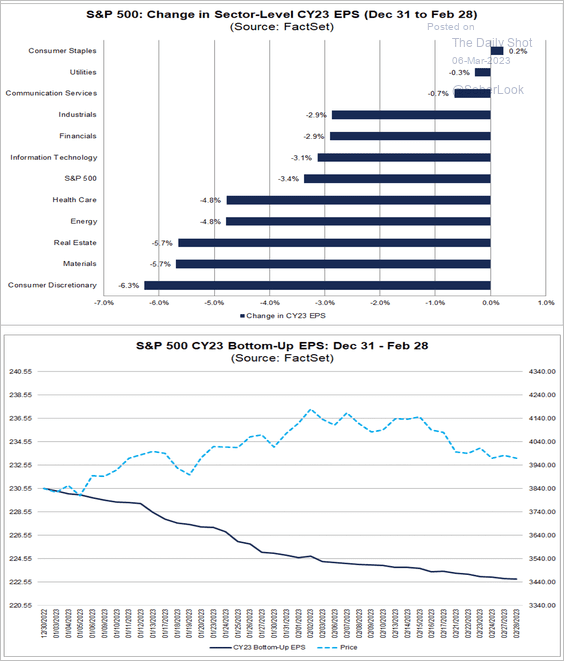

4. How much have the 2023 earnings projections changed year-to-date?

Source: @FactSet Read full article

Source: @FactSet Read full article

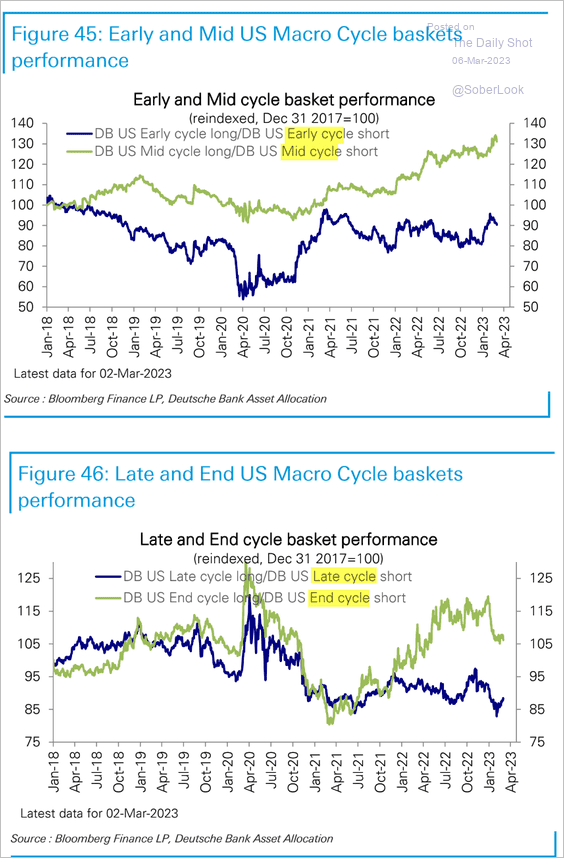

5. Deutsche Bank’s mid-cycle index has been outperforming.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

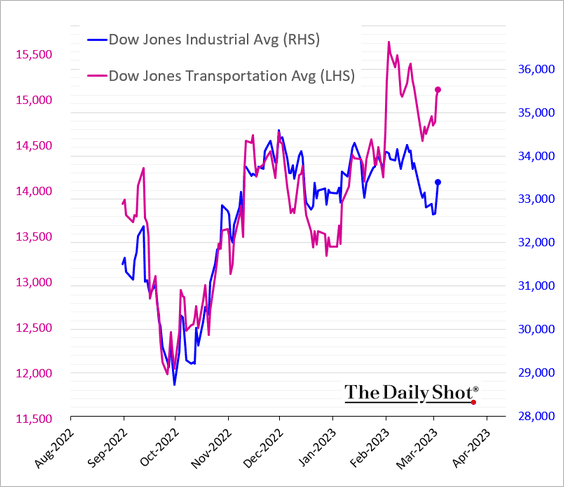

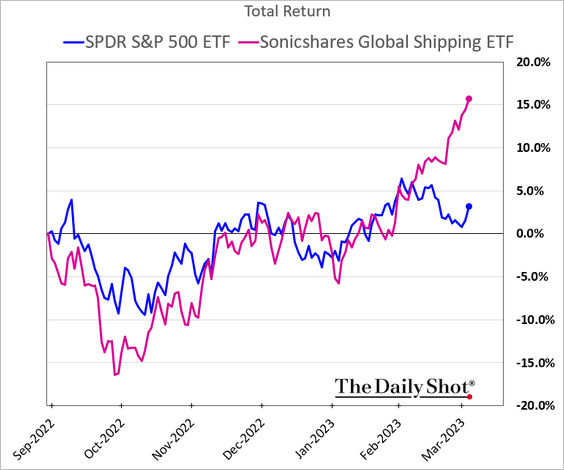

6. Transport stocks have outperformed year-to-date.

Shipping companies have been particularly strong.

h/t Walter

h/t Walter

——————–

7. Next, we have some trends in market volatility.

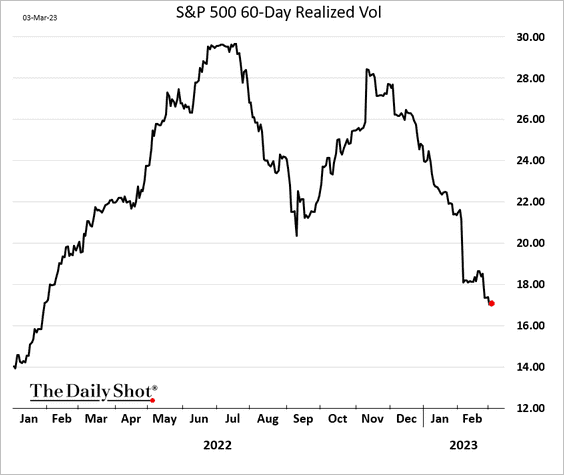

• S&P 500 realized volatility hit the lowest level in over a year.

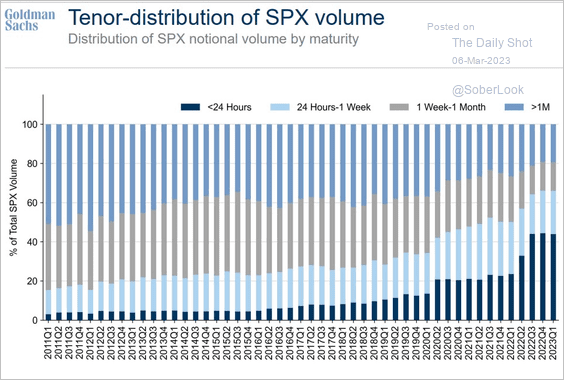

• Short-term options volume remains elevated.

Source: Goldman Sachs; @luwangnyc, @markets Read full article

Source: Goldman Sachs; @luwangnyc, @markets Read full article

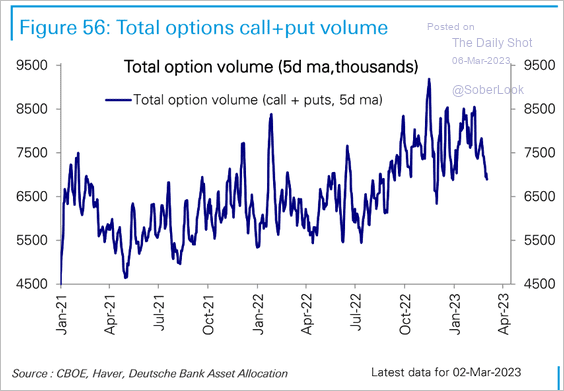

• Total options volume has been moving lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

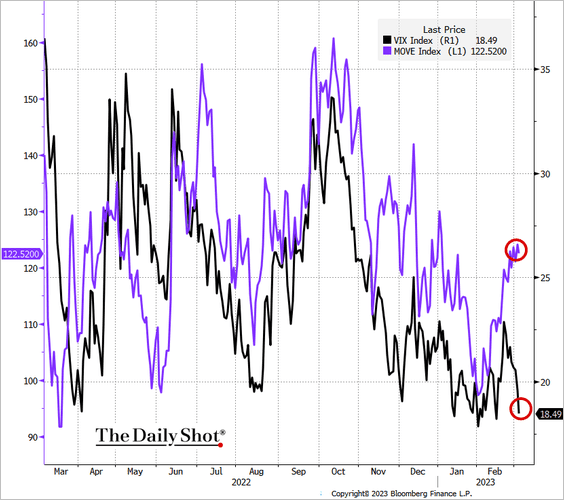

• Equity implied vol (VIX) has diverged form rates vol (MOVE).

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

——————–

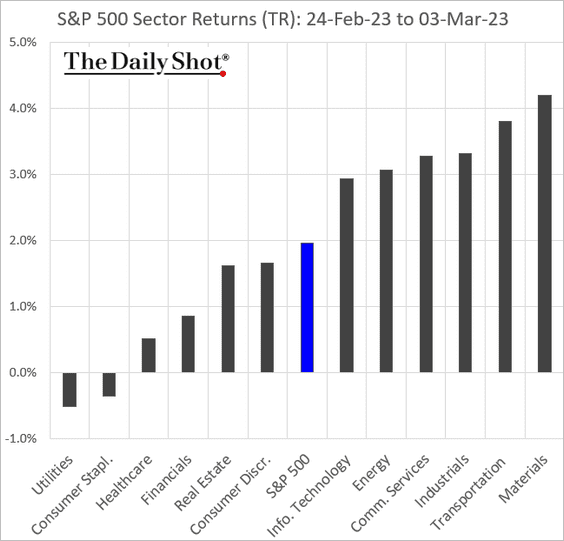

8. Finally, we have some performance data from last week.

• Sectors:

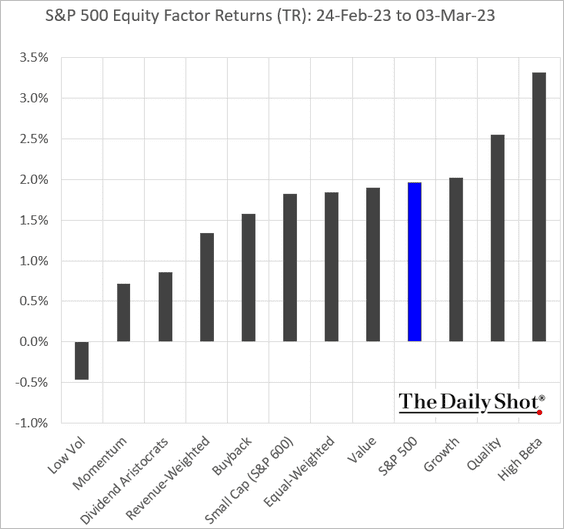

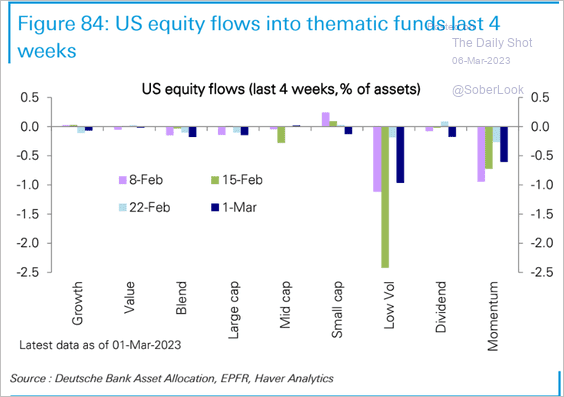

• Equity factors:

Momentum and low-vol funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

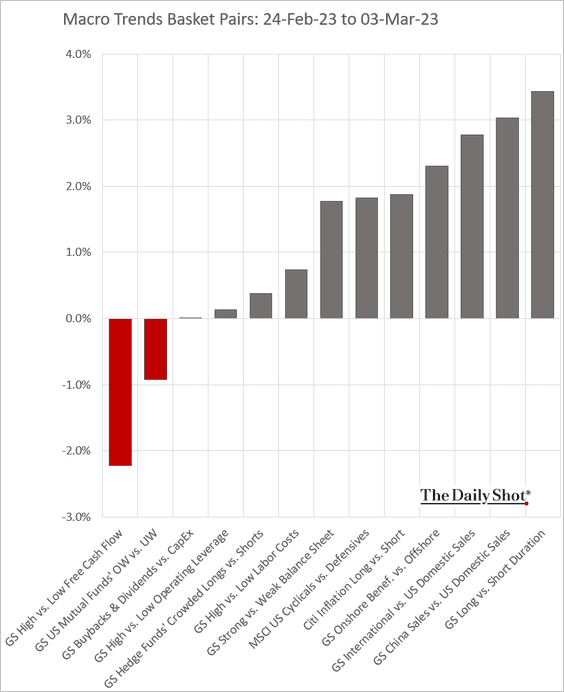

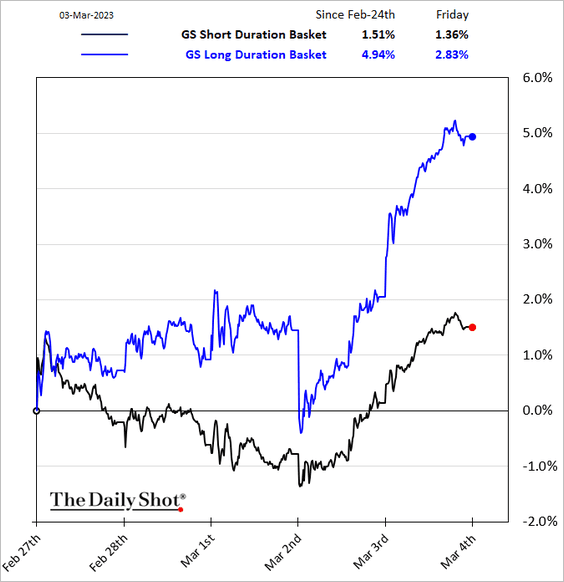

• Macro-trend basket pairs:

Long-duration stocks outperformed last week.

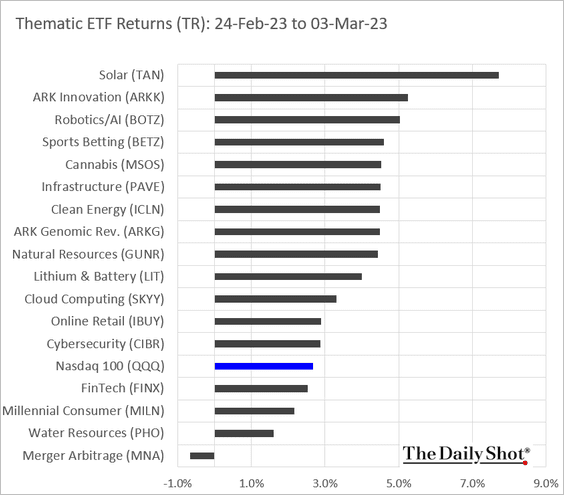

• Thematic ETFs:

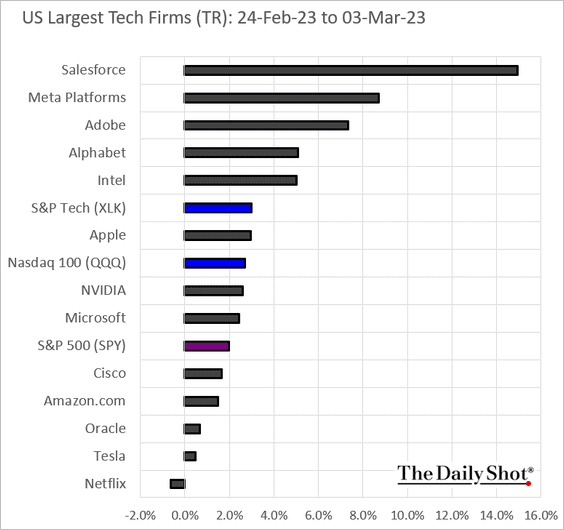

• Largest US tech firms:

Back to Index

Credit

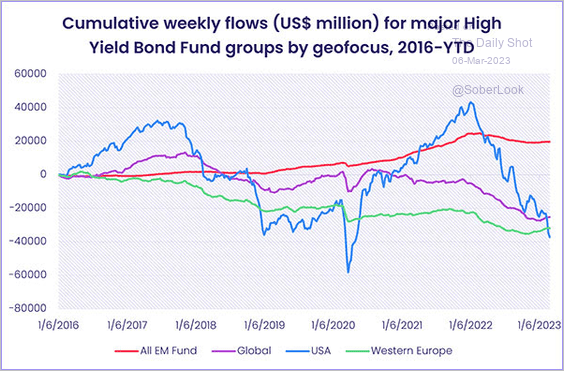

1. US HY funds continue to see outflows.

Source: EPFR

Source: EPFR

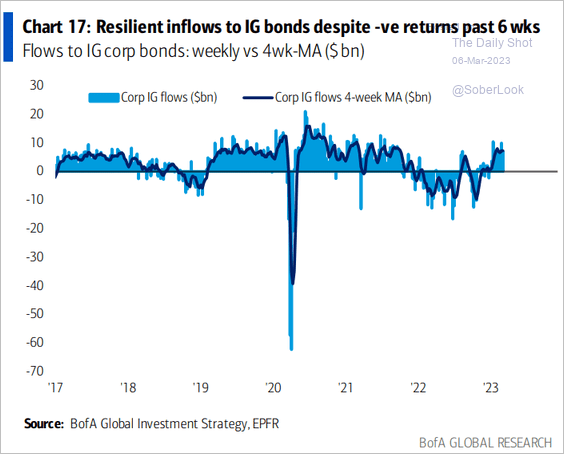

IG fund inflows remain resilient despite the selloff.

Source: BofA Global Research

Source: BofA Global Research

——————–

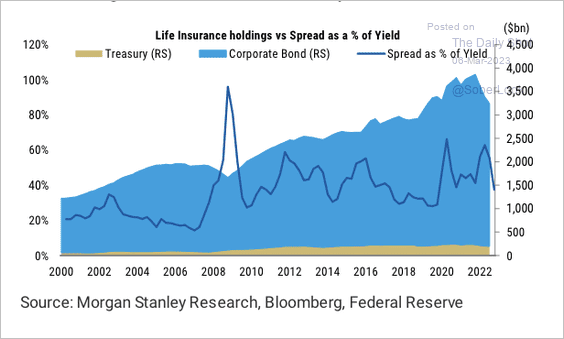

2. US life insurance holdings have a high allocation to corporate bonds.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

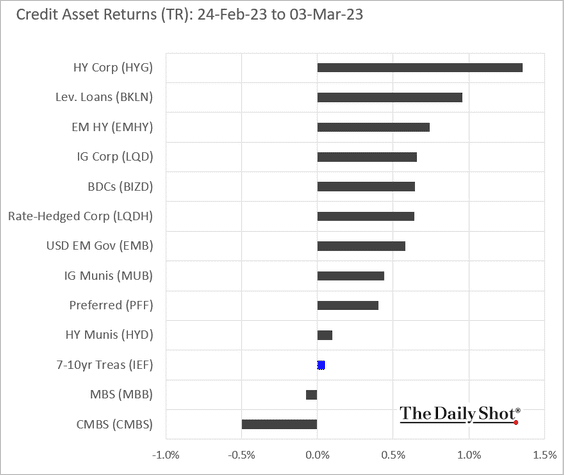

3. Finally, we have last week’s performance by asset class.

Back to Index

Global Developments

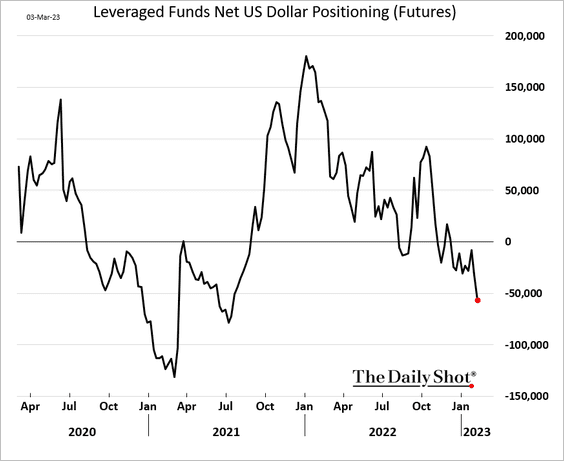

1. Hedge funds have been boosting their bets against the US dollar.

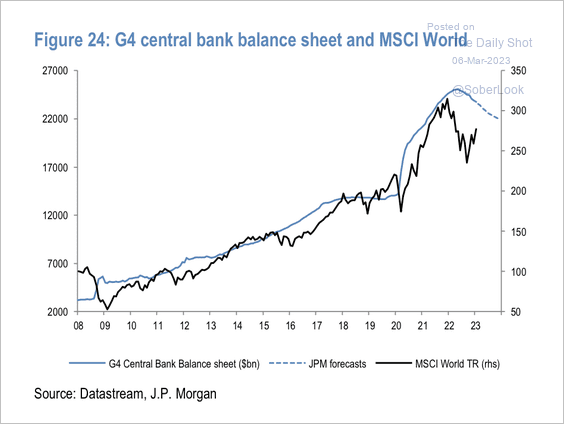

2. The reduction in G4 central bank balance sheets could be a persistent headwind for global stocks.

Source: JP Morgan Research

Source: JP Morgan Research

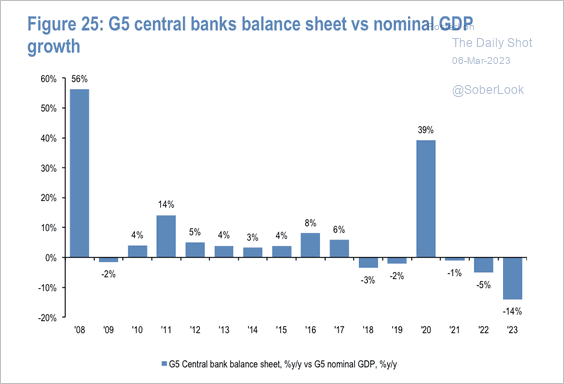

The aggregate G5 central bank balance sheet vs. nominal GDP growth is set to contract by another 14% this year.

Source: JP Morgan Research

Source: JP Morgan Research

——————–

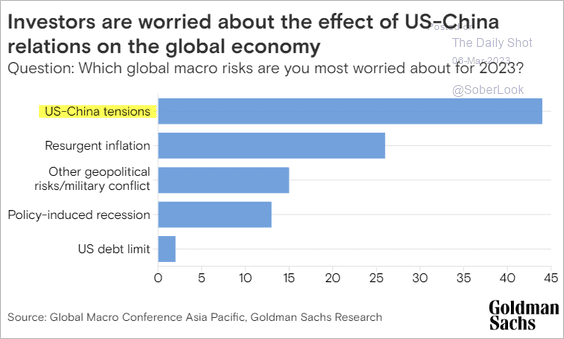

3. Investors are concerned about the impact of the US-China tensions on global GDP.

Source: Goldman Sachs

Source: Goldman Sachs

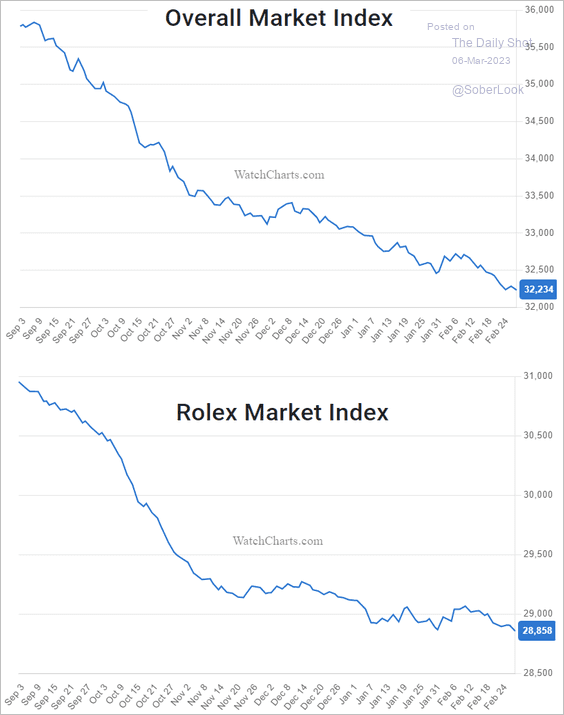

4. Secondhand luxury watch prices continue to fall.

Source: WatchEnthusiasts

Source: WatchEnthusiasts

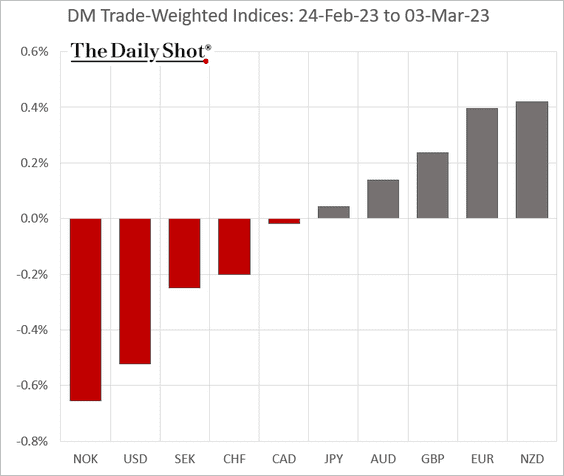

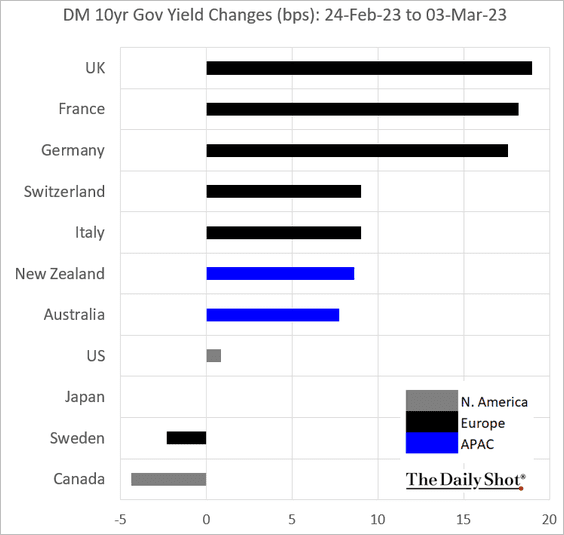

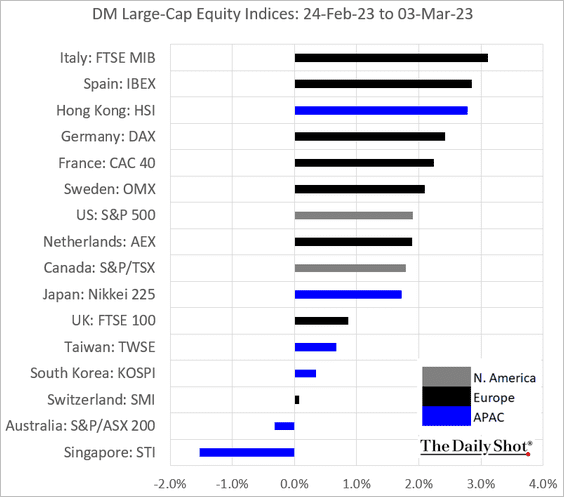

5. Finally, we have some performance data from last week.

• Currency indices:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

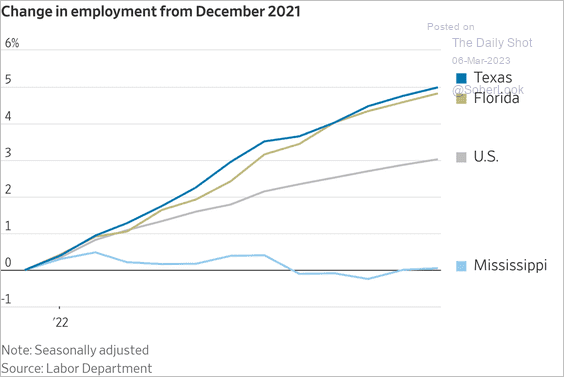

1. 2022 employment changes in select states:

Source: @WSJ Read full article

Source: @WSJ Read full article

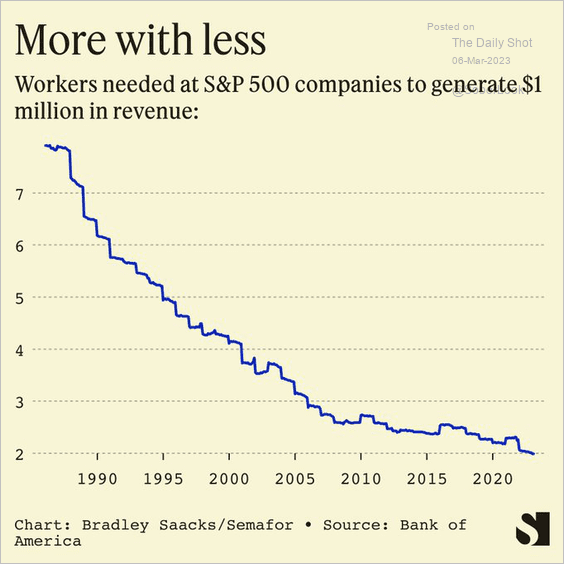

2. Workers needed to generate $1 million at S&P 500 companies:

Source: @semafor Read full article

Source: @semafor Read full article

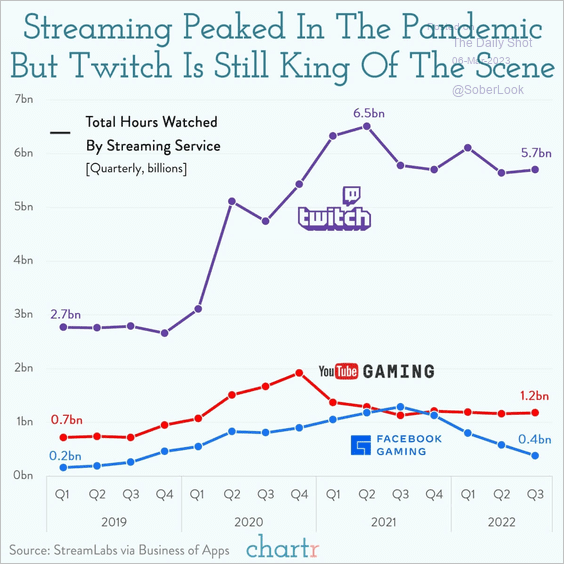

3. Streaming gaming platforms:

Source: @chartrdaily

Source: @chartrdaily

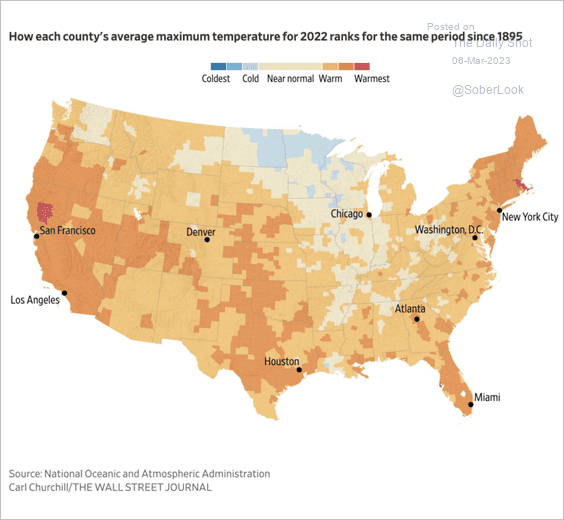

4. Peak temperatures in 2022 vs. 1985:

Source: @Datawrapper

Source: @Datawrapper

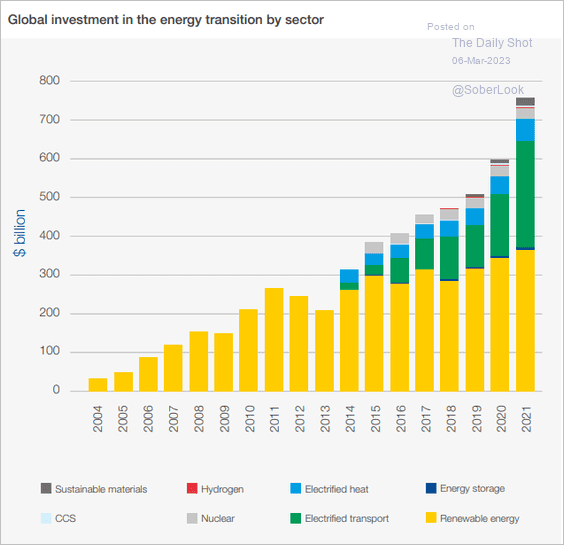

5. Investment in energy transition:

Source: WEF Read full article

Source: WEF Read full article

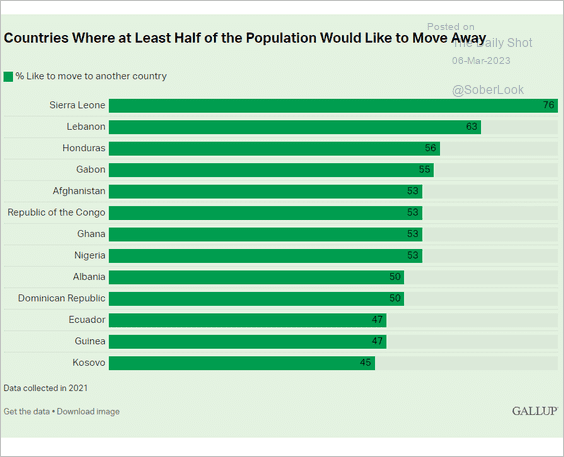

6. Share of the population that would like to leave their country:

Source: Gallup Read full article

Source: Gallup Read full article

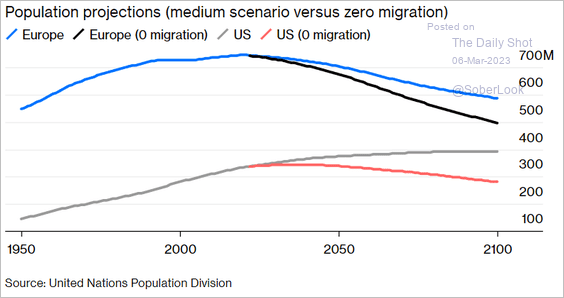

7. Population projections with and without immigration:

Source: @portereduardo, @opinion Read full article

Source: @portereduardo, @opinion Read full article

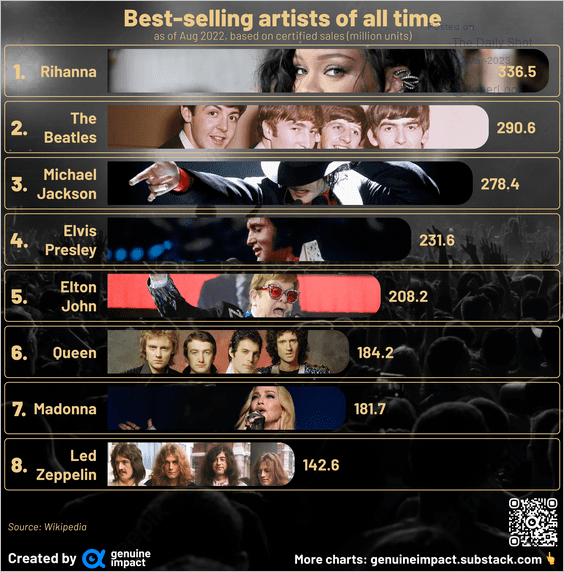

8. Best-selling artists of all time:

Source: @genuine_impact

Source: @genuine_impact

——————–

Back to Index