The Daily Shot: 22-Feb-23

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

If you would like to cancel your subscription to The Daily Shot, please log into your account (here) and click “cancel.” More information is available here.

Back to Index

The United States

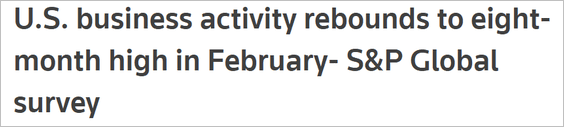

1. The PMI report from S&P Global points to somewhat firmer business activity in February.

Source: Reuters Read full article

Source: Reuters Read full article

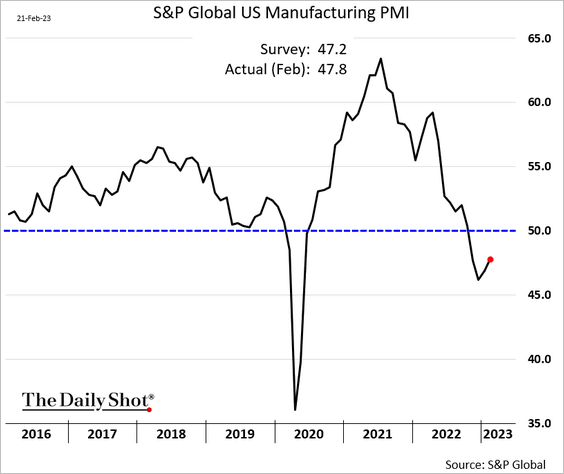

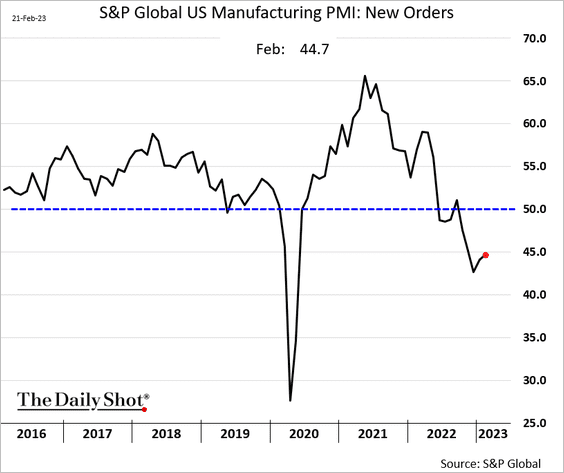

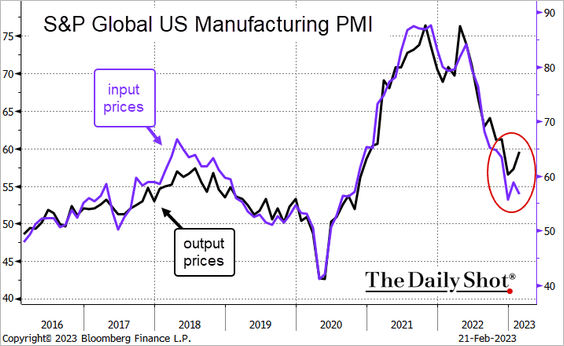

• The pace of contraction is moderating in the manufacturing sector.

– Demand remains soft.

– Hiring has picked up.

– There is some divergence between the indices of input and output prices. Some manufacturers still have pricing power.

Source: S&P Global, @TheTerminal, Bloomberg Finance L.P.

Source: S&P Global, @TheTerminal, Bloomberg Finance L.P.

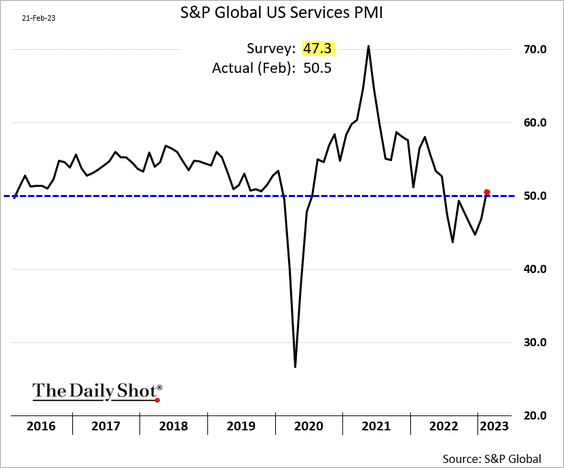

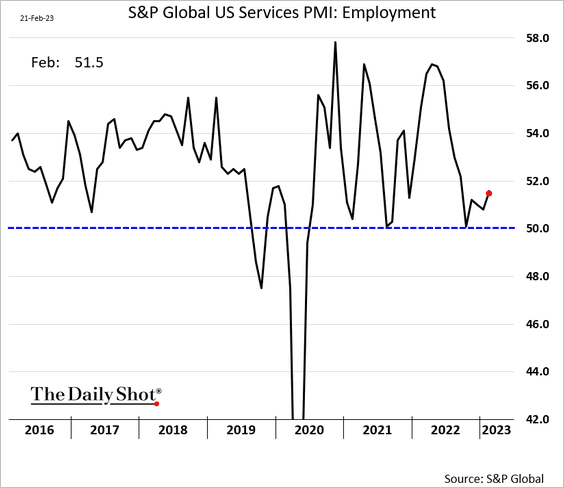

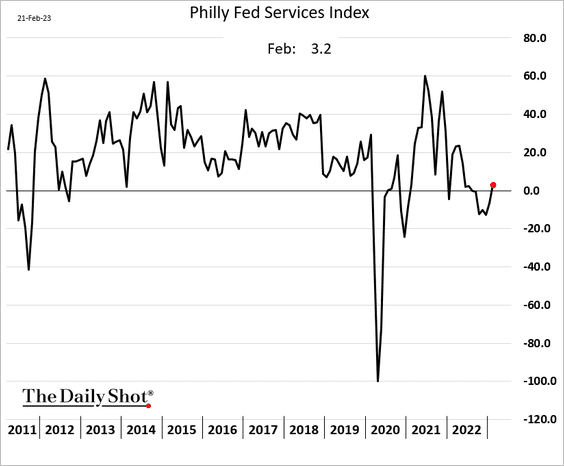

• Services unexpectedly shifted to expansion.

– Services employment also strengthened.

– The Philly Fed’s regional services index corroborates the services PMI rebound.

——————–

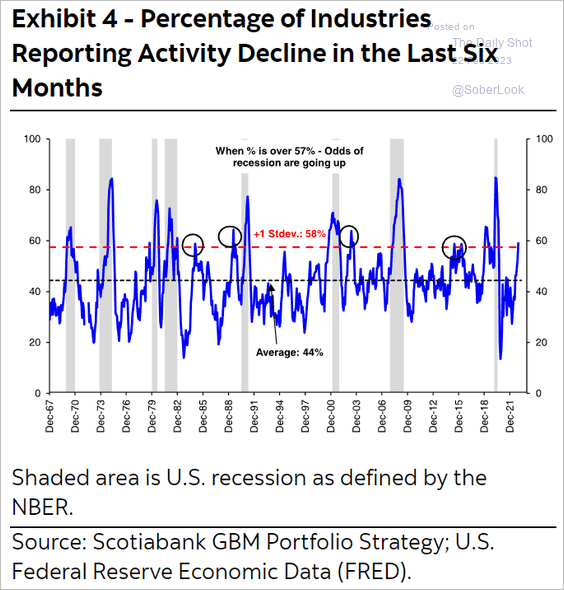

2. This chart shows the percentage of industries reporting declining activity over the past six months.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

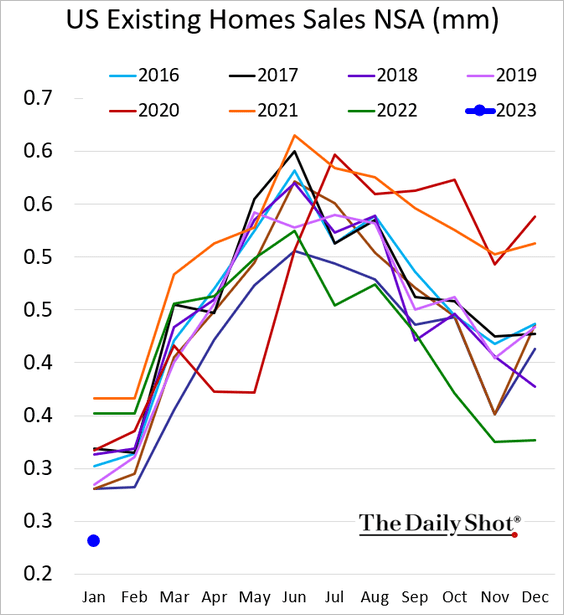

3. Next, we have some updates on the housing market.

• Existing home sales were terrible last month.

Source: Reuters Read full article

Source: Reuters Read full article

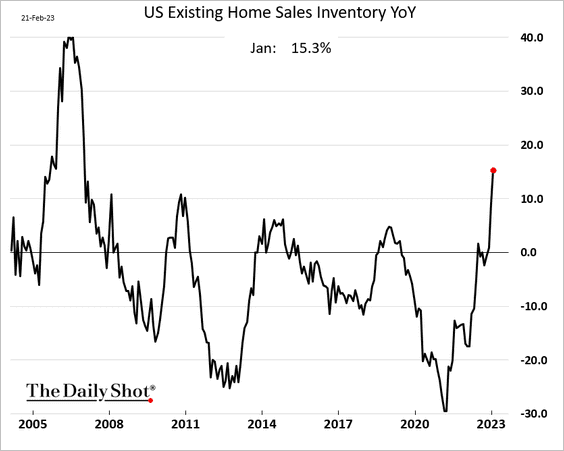

– Inventories are up 15% from last year, …

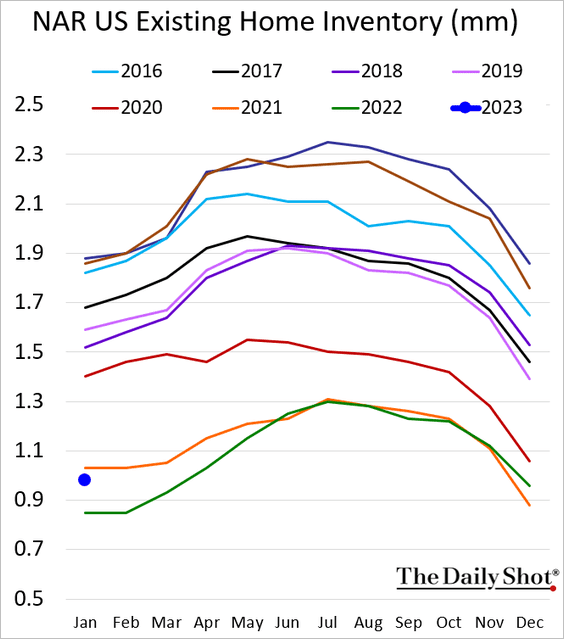

… but are still tight.

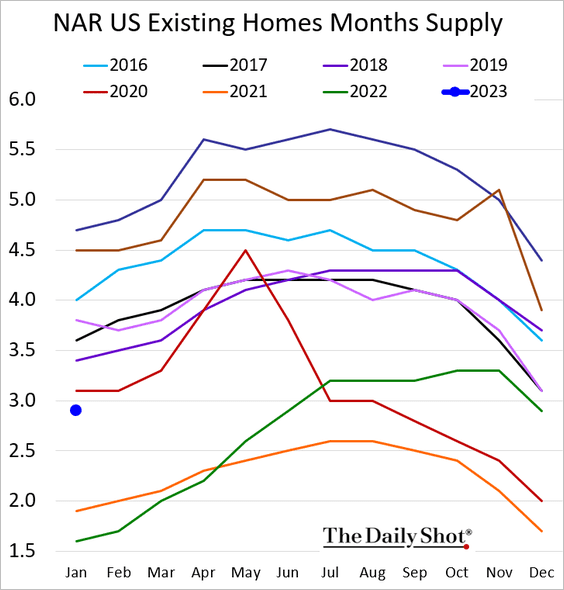

This chart shows existing homes for sale in months of supply.

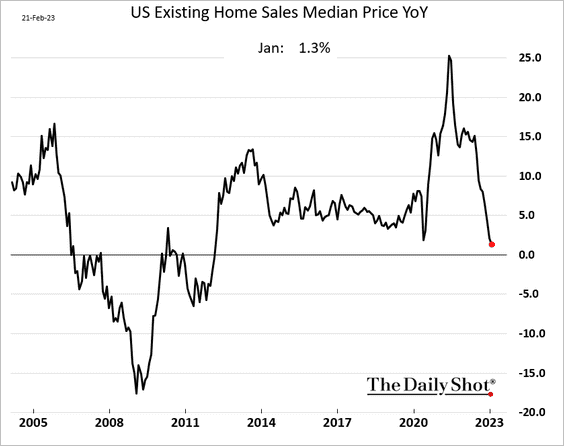

– The median home price is still slightly above last year’s levels, …

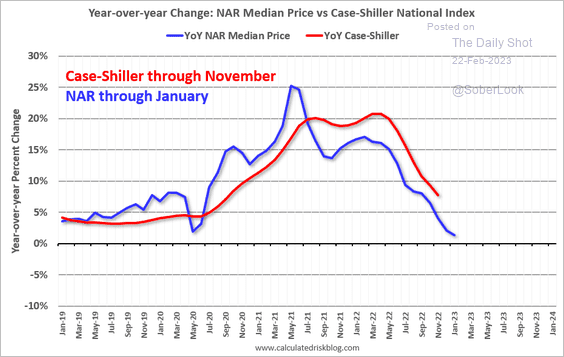

… but it points to softer Case-Shiller home price index in January.

Source: Calculated Risk

Source: Calculated Risk

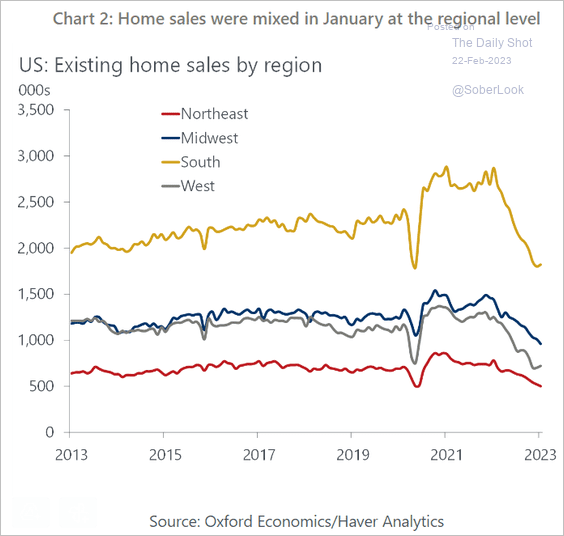

– This chart shows existing home sales by region (seasonally adjusted).

Source: Oxford Economics

Source: Oxford Economics

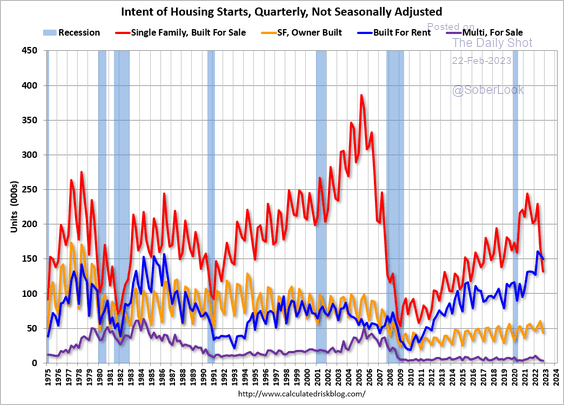

• The number of homes built for sale dipped below those built for rent.

Source: Calculated Risk

Source: Calculated Risk

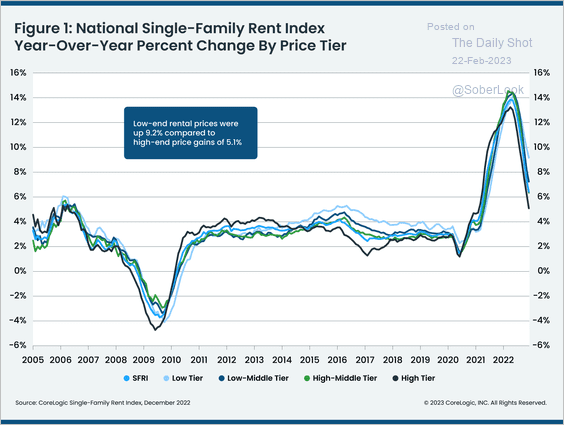

• Gains in single-family rental costs continue to moderate.

Source: CoreLogic

Source: CoreLogic

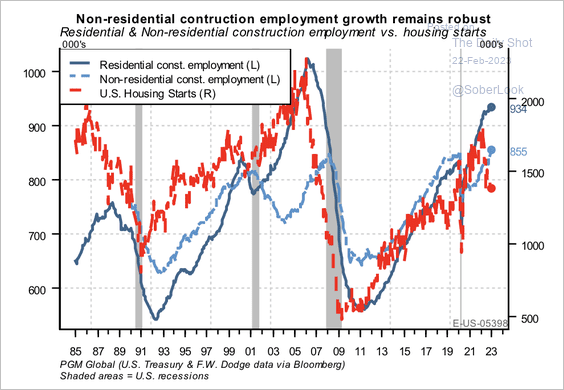

• Construction employment has held up despite weaker housing conditions. The rise in infrastructure spending contributed to non-residential construction jobs.

Source: PGM Global

Source: PGM Global

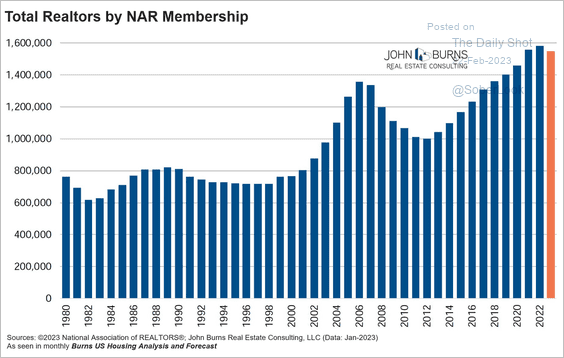

• The number of realtors has peaked.

Source: @rickpalaciosjr; h/t @dailychartbook

Source: @rickpalaciosjr; h/t @dailychartbook

——————–

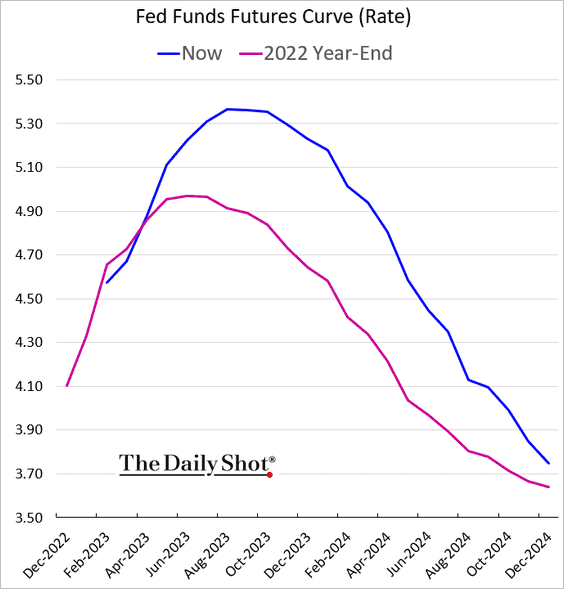

4. Here is how much the fed funds rate trajectory has repriced year-to-date.

Back to Index

Canada

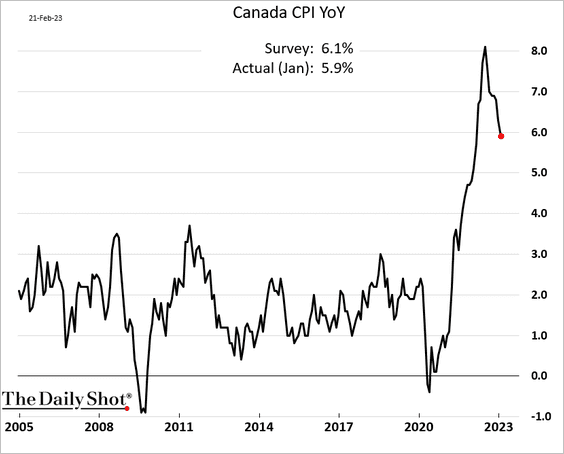

1. The CPI print came in below forecasts.

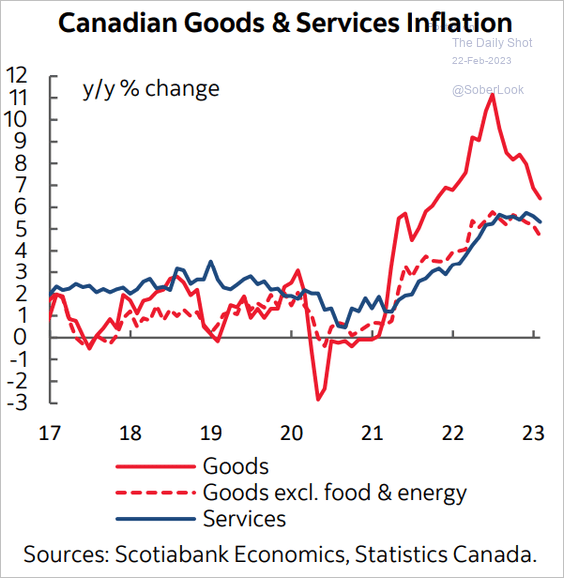

• Here are the CPI trends for goods and services.

Source: Scotiabank Economics

Source: Scotiabank Economics

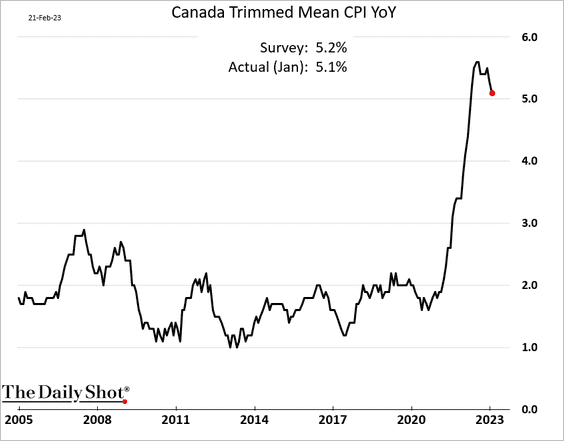

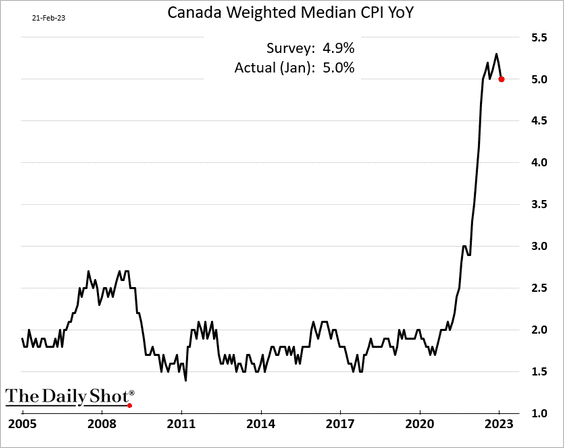

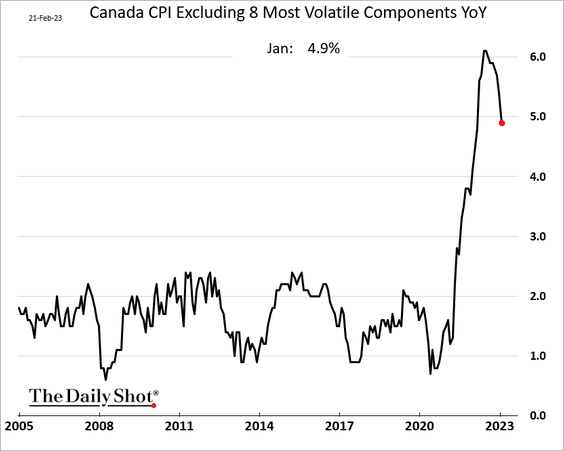

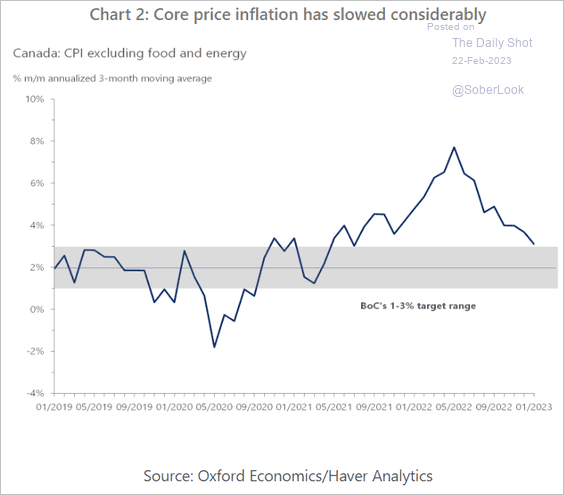

• Core inflation remains elevated.

– Trimmed-mean:

– Median:

– Here is the CPI excluding the eight most-volatile components.

– This chart shows the monthly changes in the CPI excluding food and energy.

Source: Oxford Economics

Source: Oxford Economics

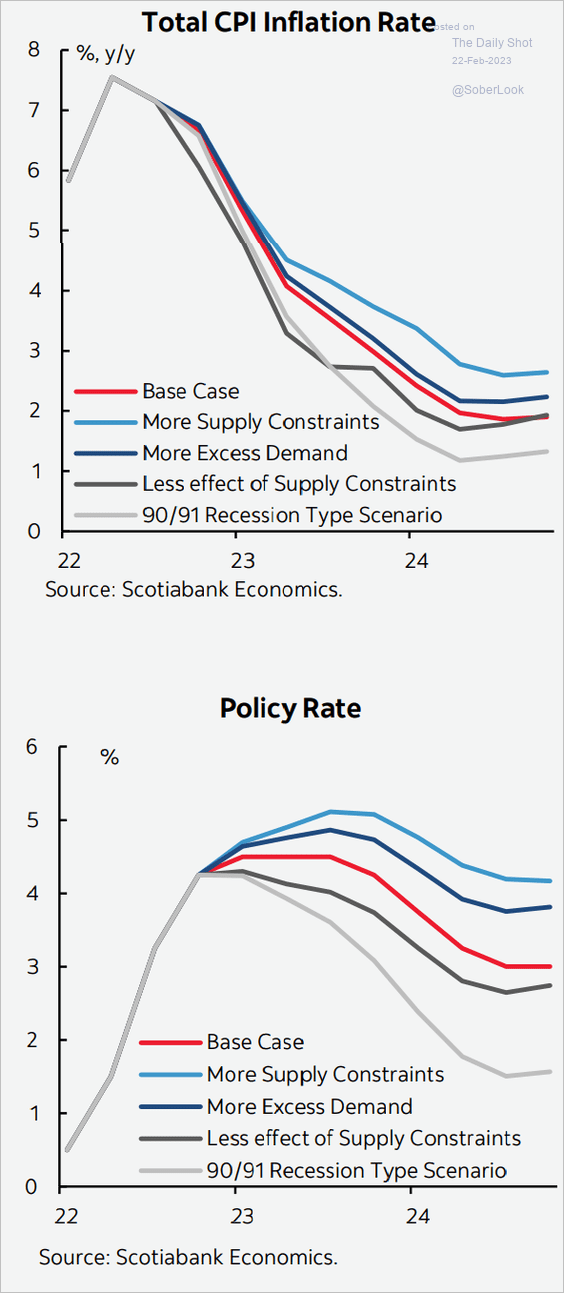

2. How will different CPI scenarios impact BoC policy rates?

Source: Scotiabank Economics

Source: Scotiabank Economics

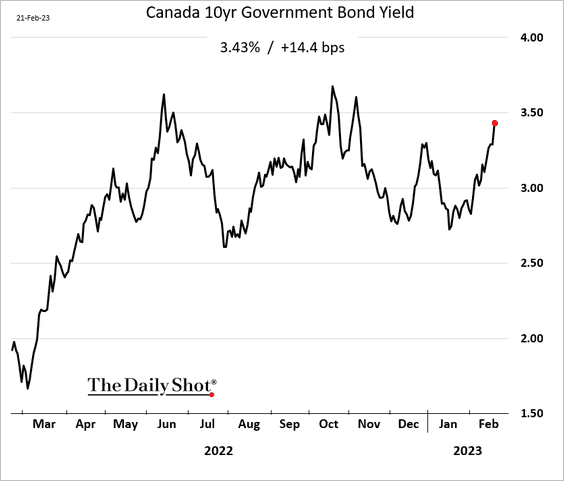

3. Despite a softer CPI report, bond yields are still on the rise.

Back to Index

The United Kingdom

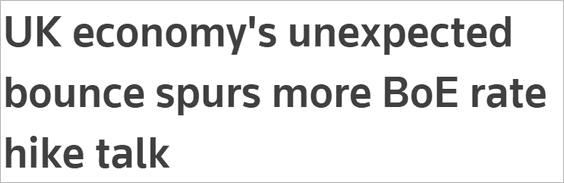

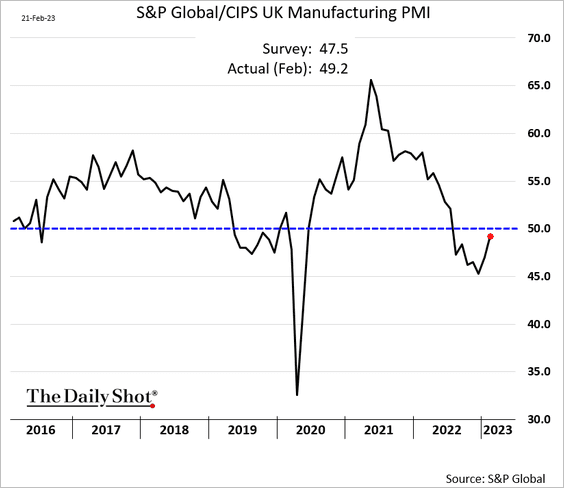

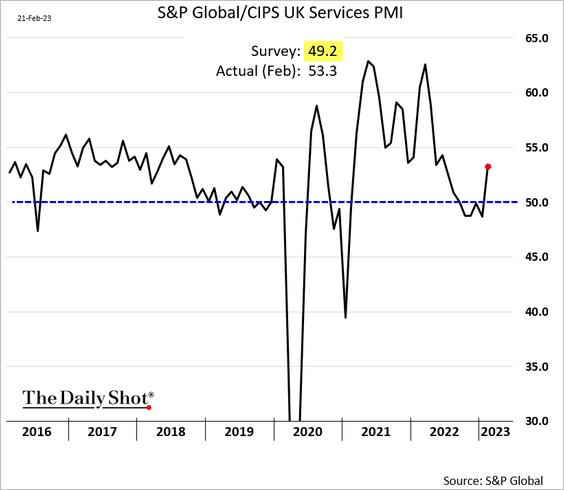

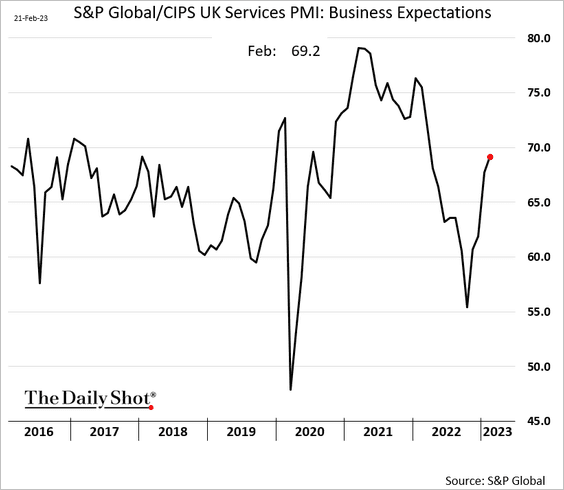

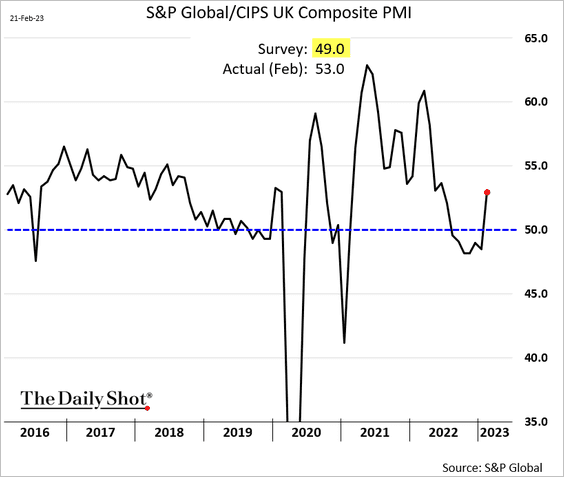

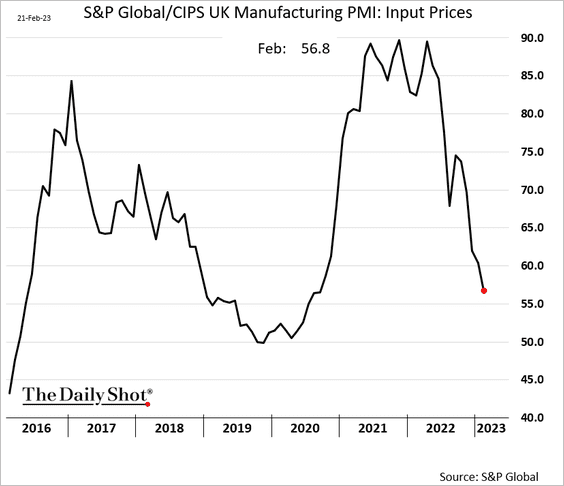

1. The February PMI report surprised to the upside.

Source: Reuters Read full article

Source: Reuters Read full article

• Manufacturing (stabilizing):

• Services (very strong):

• Composite PMI:

• Price pressures continue to ease.

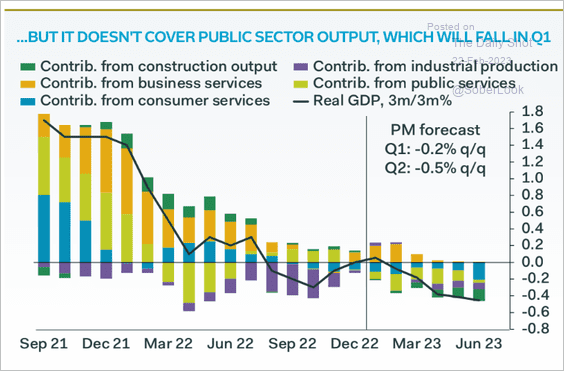

• It should be noted that the PMI report doesn’t capture the public sector output, which will be facing headwinds, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

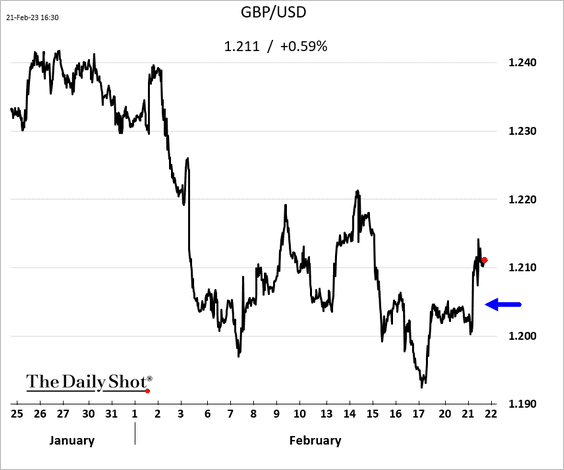

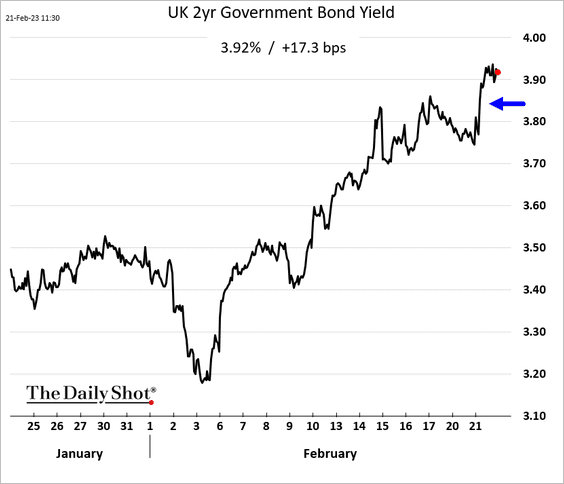

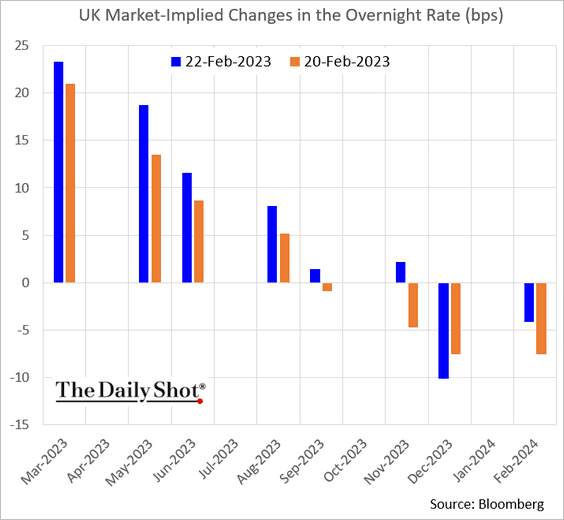

2. The pound and gilt yields jumped in response to the PMI surprise.

Rate hike expectations increased.

——————–

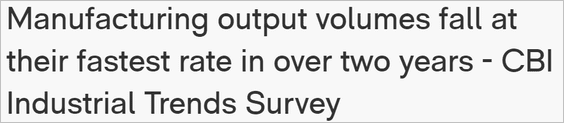

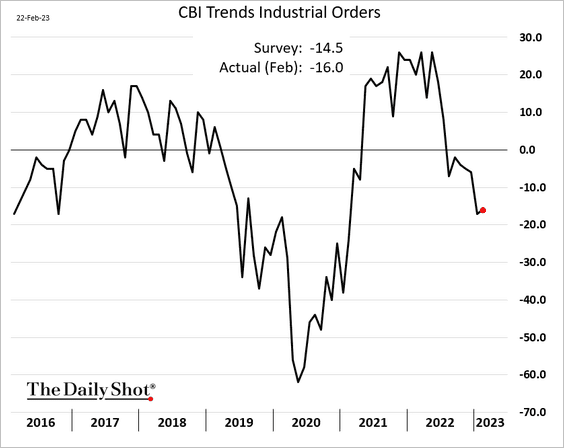

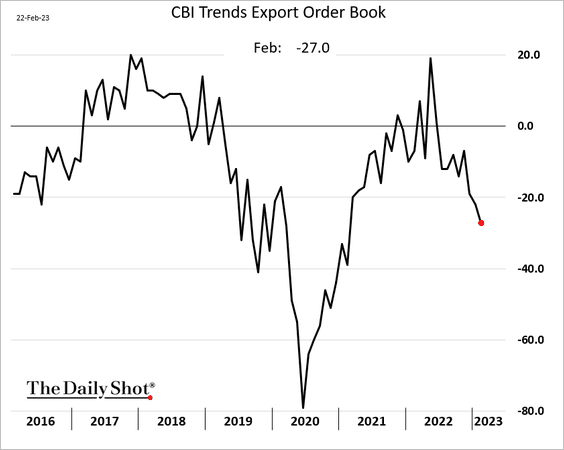

3. The CBI orders report was much less upbeat than the PMI data.

Source: CBI Read full article

Source: CBI Read full article

• Orders:

• Exports:

Price pressures remain elevated.

——————–

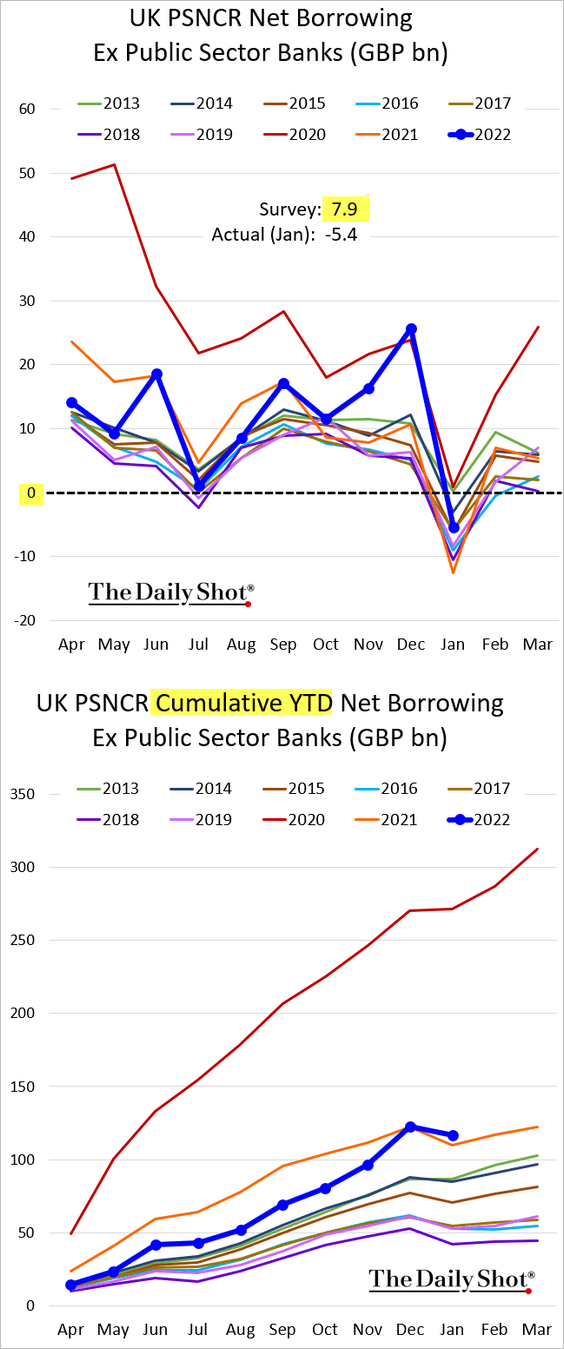

4. The public sector unexpectedly posted a surplus last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

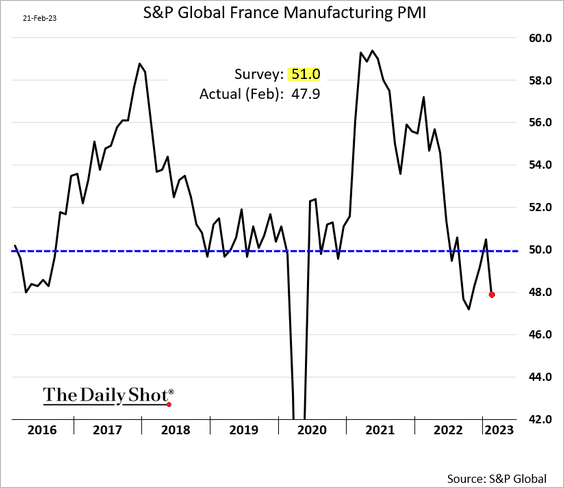

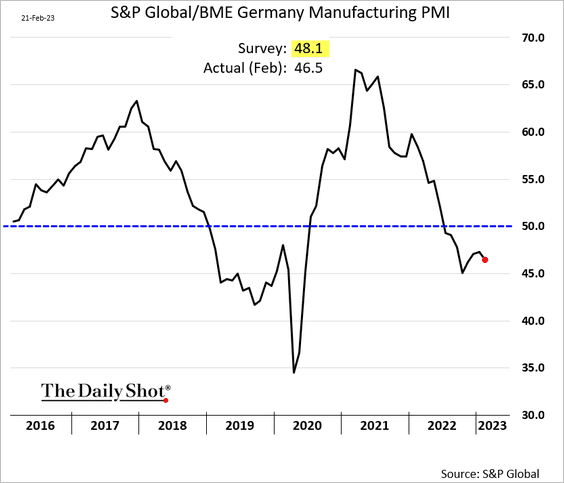

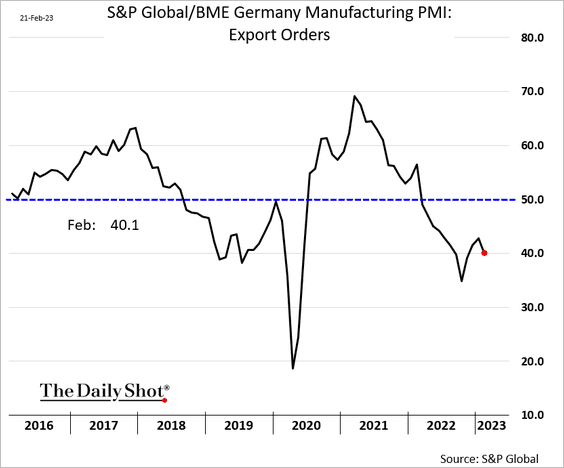

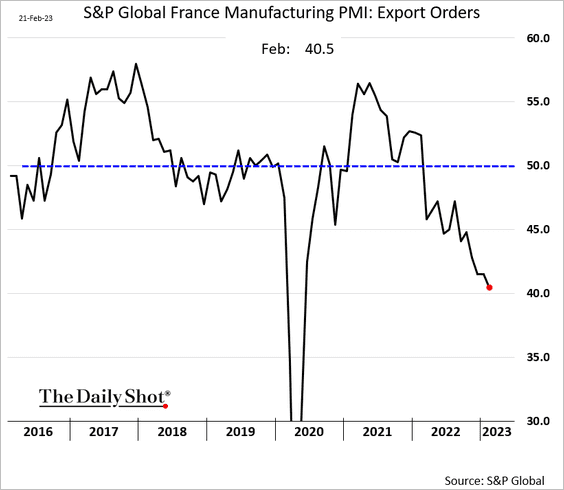

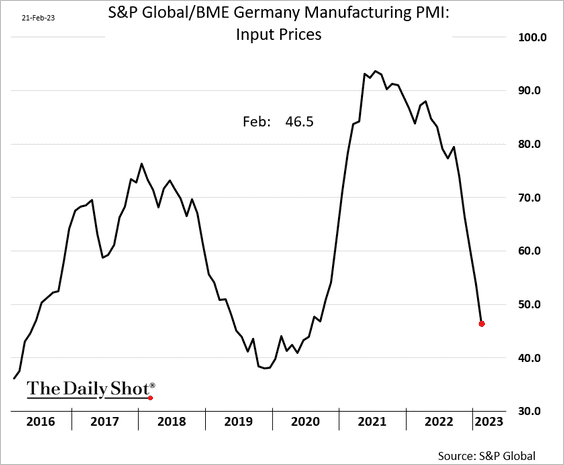

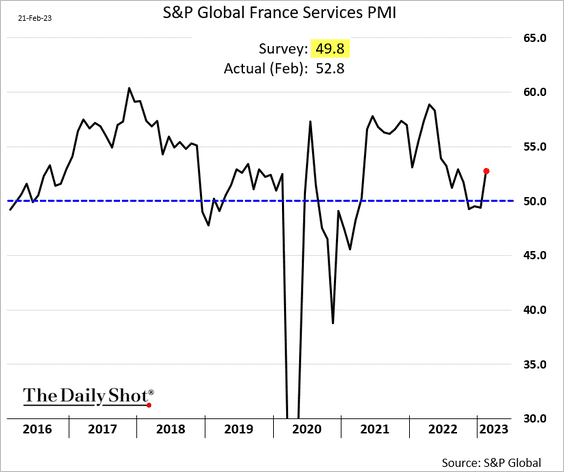

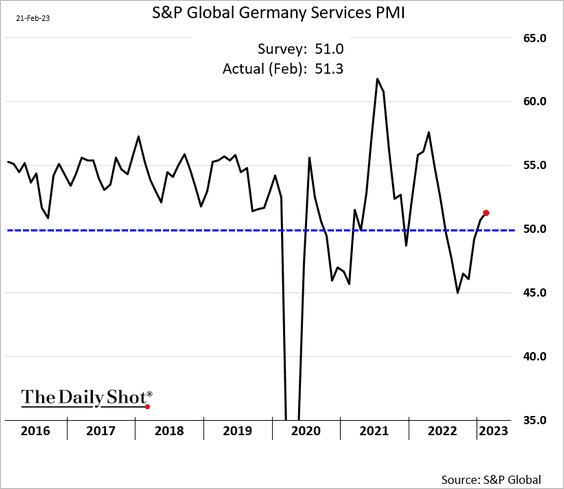

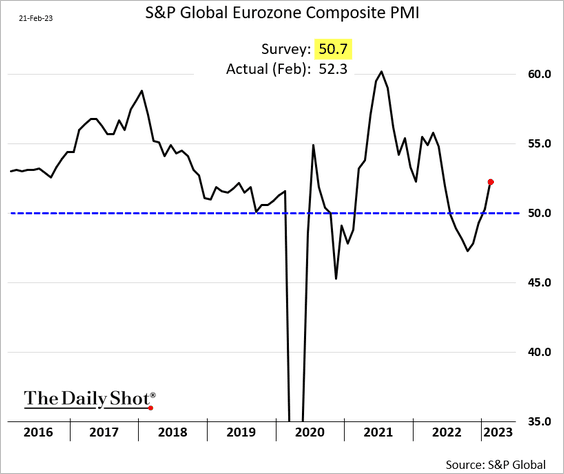

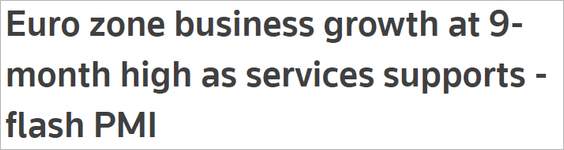

1. The PMI report was mixed.

• Factory activity contracted.

– France:

– Germany:

– Export orders continue to shrink.

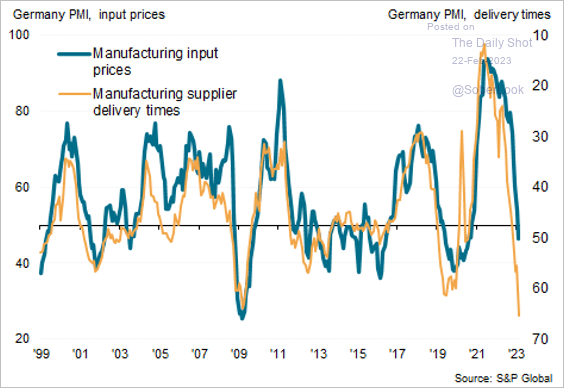

– Price pressures are easing.

And faster supplier deliveries signal softer inflation ahead.

Source: @WilliamsonChris

Source: @WilliamsonChris

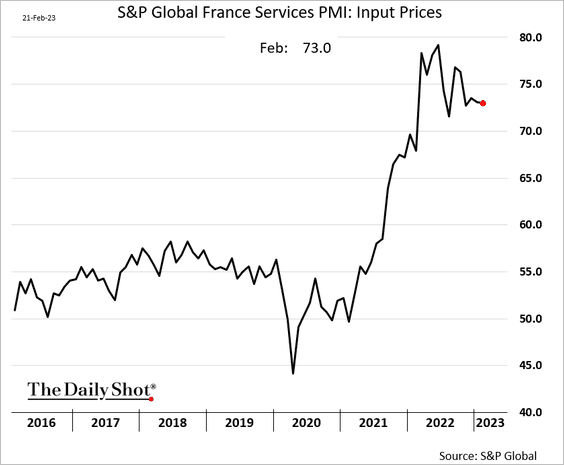

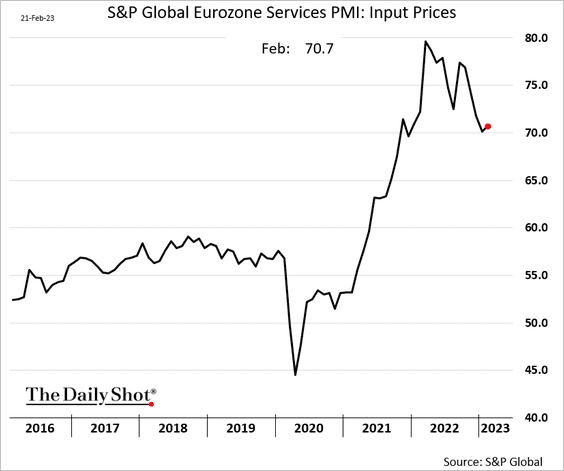

• On the other hand, services topped expectations, as expansion accelerated.

– Service firms continue to face substantial price pressures.

• The composite PMI strengthened.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

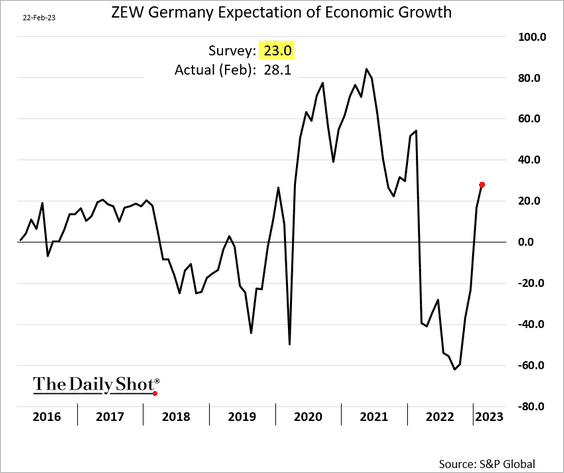

2. Germany’s ZEW expectations index topped forecasts.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

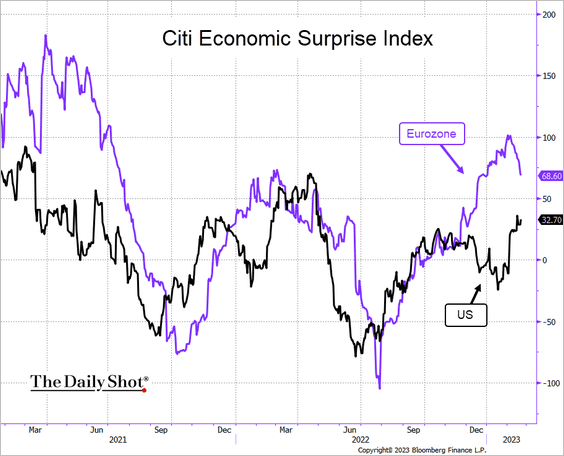

3. The gap between the euro-area and US economic surprise indices is closing.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

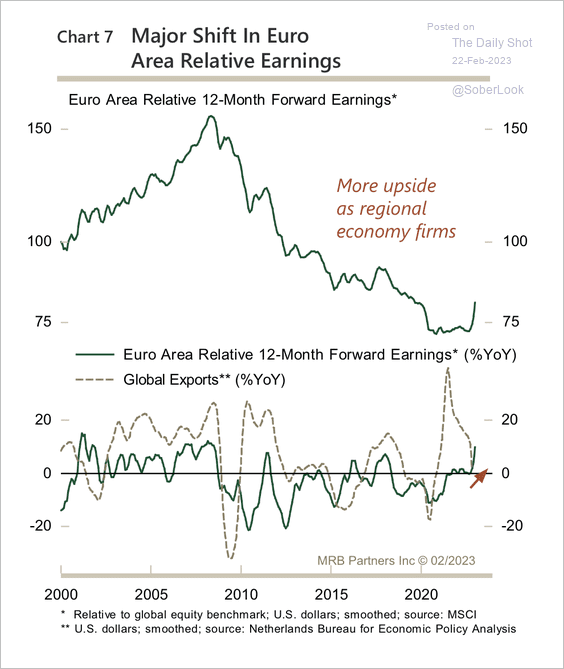

4. Euro area earnings are improving relative to global equities. This typically coincides with a pickup in world exports.

Source: MRB Partners

Source: MRB Partners

Back to Index

Europe

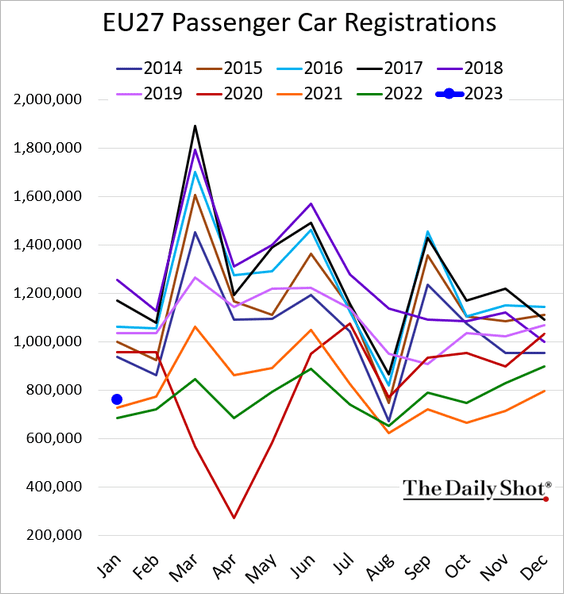

1. EU car registrations were slightly above 2021 levels.

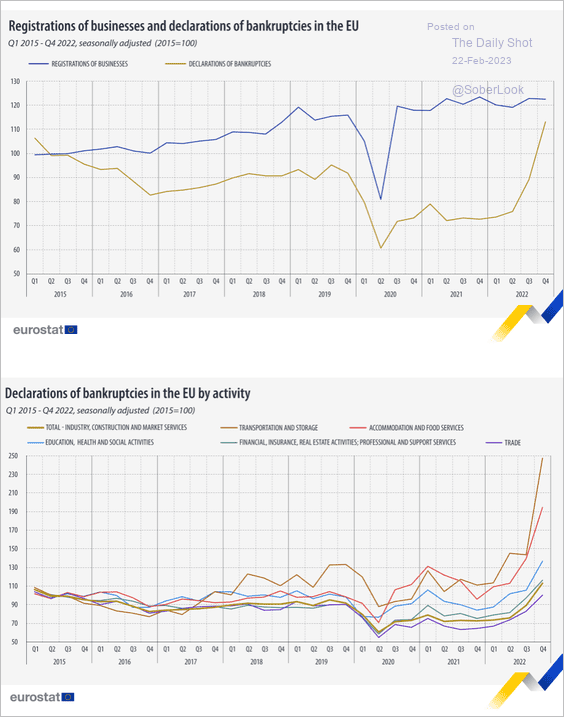

2. Bankruptcies have been surging in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

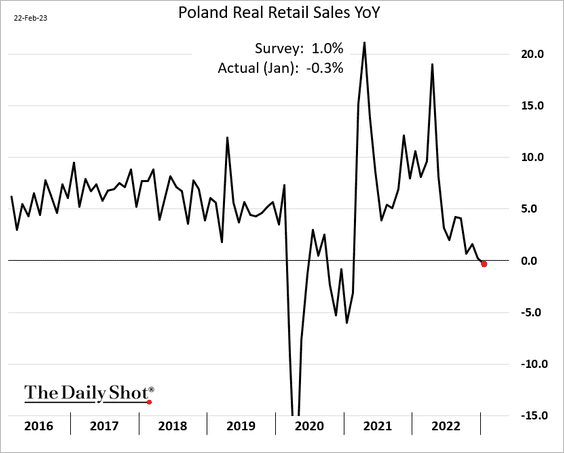

3. Poland’s retail sales are now down on a year-over-year basis.

Back to Index

Asia – Pacific

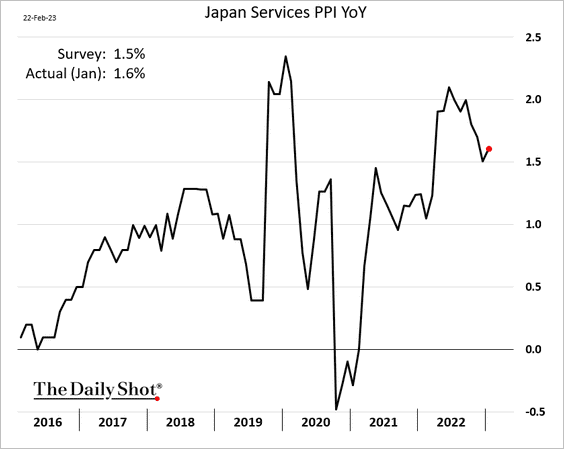

1. Japan’s services PPI remains elevated.

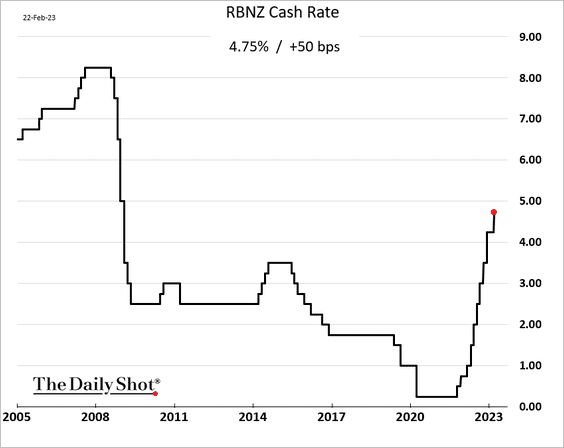

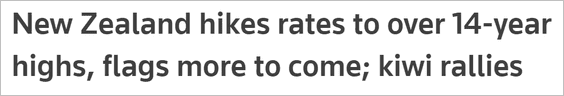

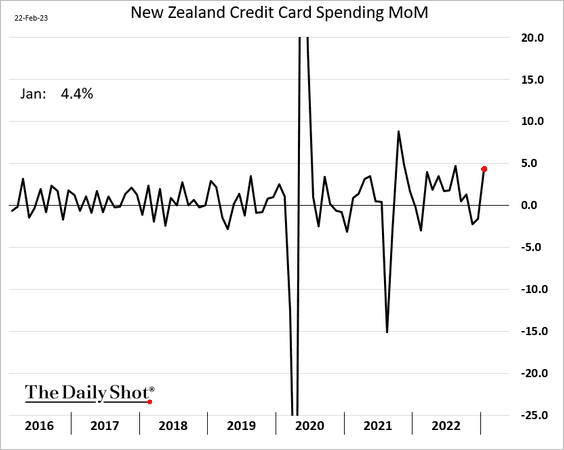

2. New Zealand’s central bank hiked rates by 50 bps.

Source: Reuters Read full article

Source: Reuters Read full article

The Kiwi dollar jumped.

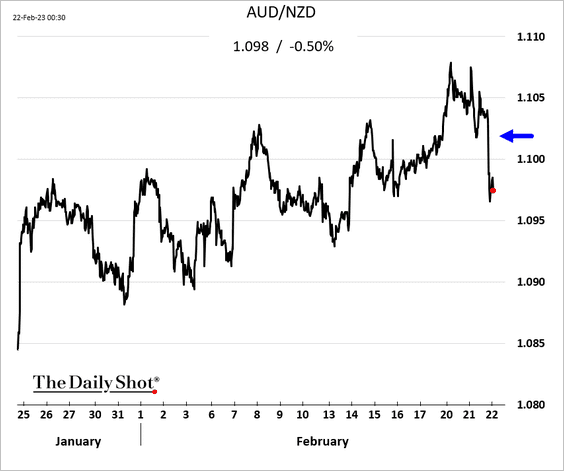

• Credit card spending increased last month.

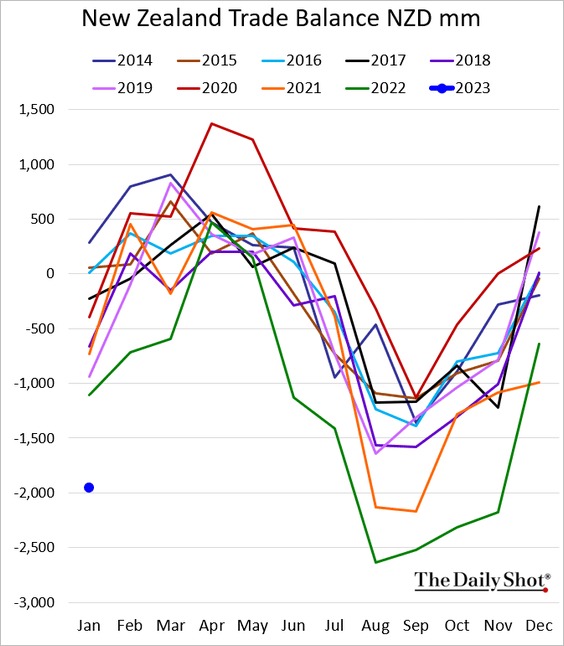

• New Zealand’s trade deficit hit a record (for January).

——————–

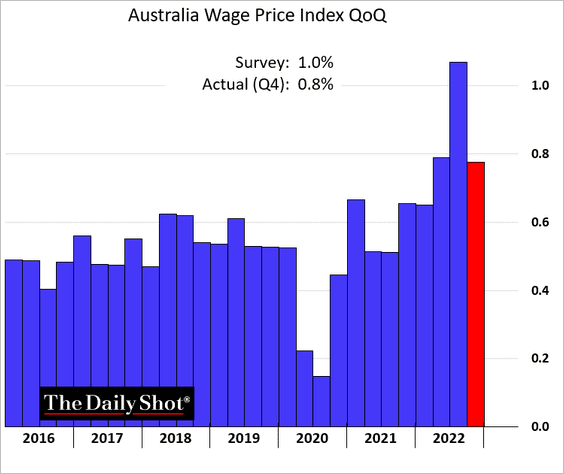

3. Australia’s wage growth is off the peak but remains elevated.

Back to Index

Emerging Markets

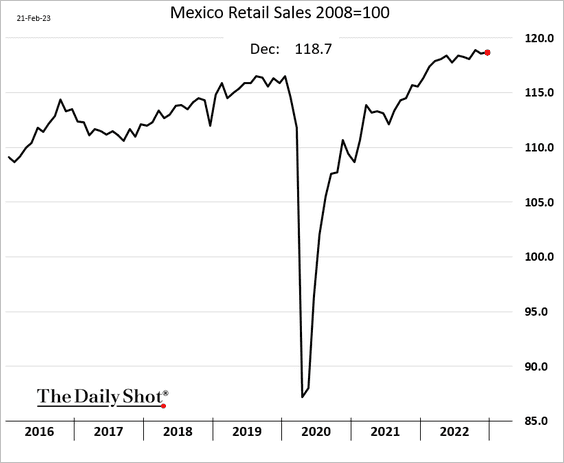

1. Mexico’s retail sales held up well in December.

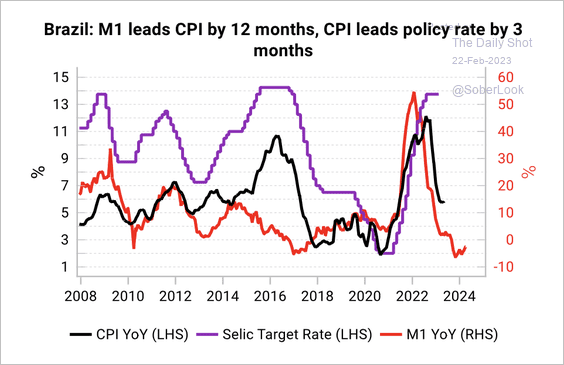

2. Brazil’s inflation rollover could continue for about three months, evidenced by the decline in the money supply. Could we see rate cuts?

Source: Variant Perception

Source: Variant Perception

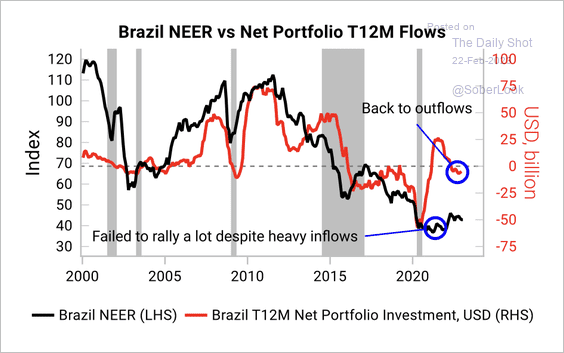

A sustained rally in the Brazilian real would require a pickup in equity and debt inflows.

Source: Variant Perception

Source: Variant Perception

——————–

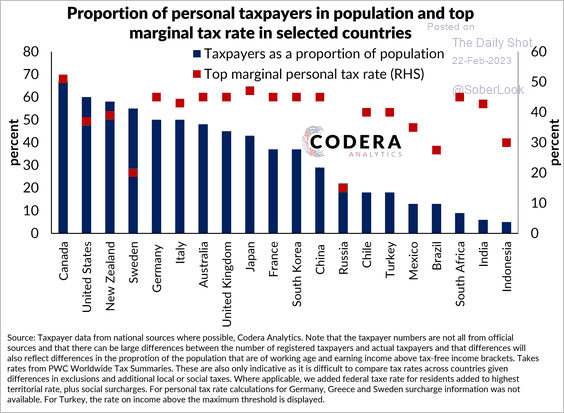

3. South Africa and India stand out for having a low proportion of individual taxpayers in the total population but high top marginal tax rates.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

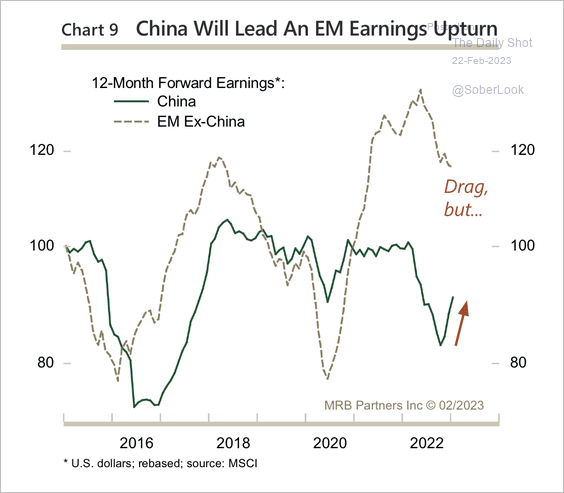

4. China could lead an advance in EM forward earnings.

Source: MRB Partners

Source: MRB Partners

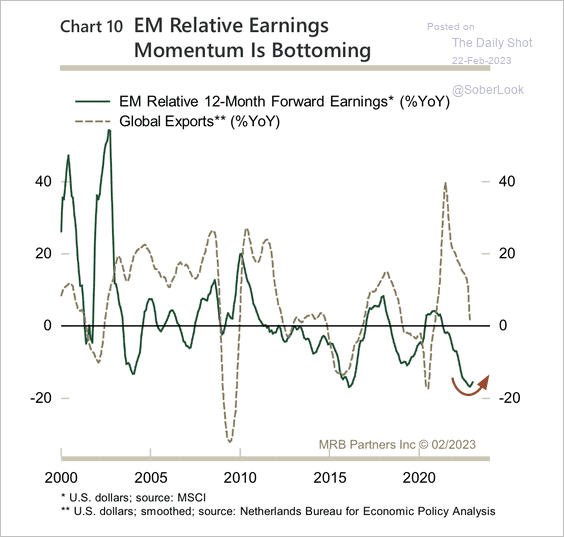

EM relative earnings momentum is bottoming.

Source: MRB Partners

Source: MRB Partners

Back to Index

Commodities

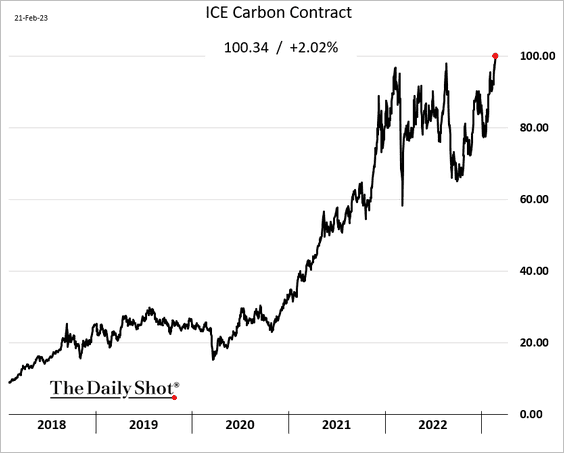

1. European carbon credit prices hit a record high.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

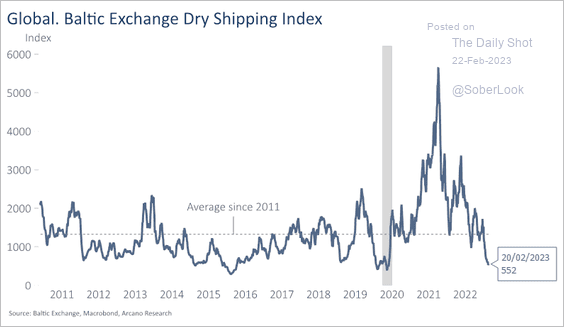

2. Dry-bulk shipping costs continue to ease.

Source: Arcano Economics

Source: Arcano Economics

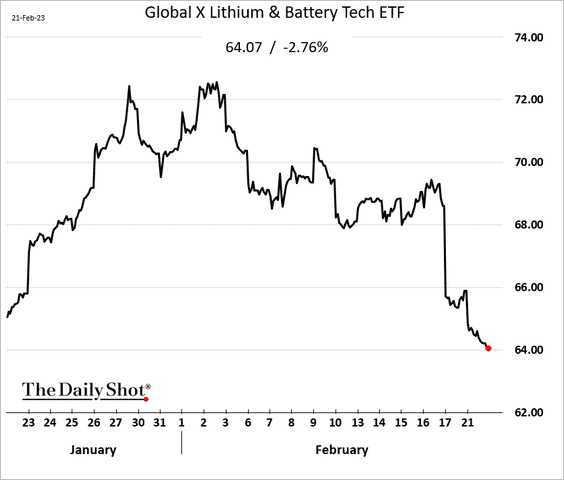

3. Lithium equities are under pressure as lithium prices fall (see chart).

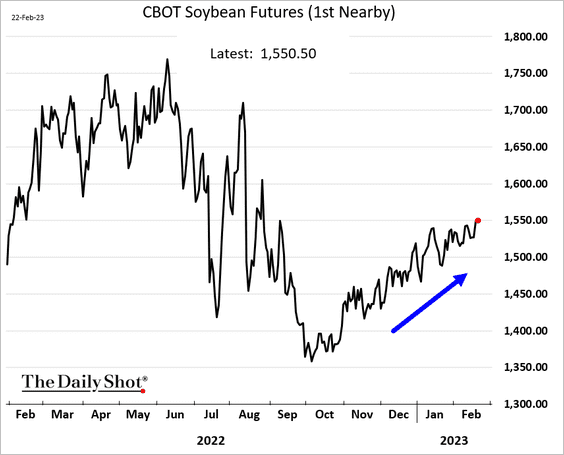

4. US soybean futures continue to trend higher.

Back to Index

Energy

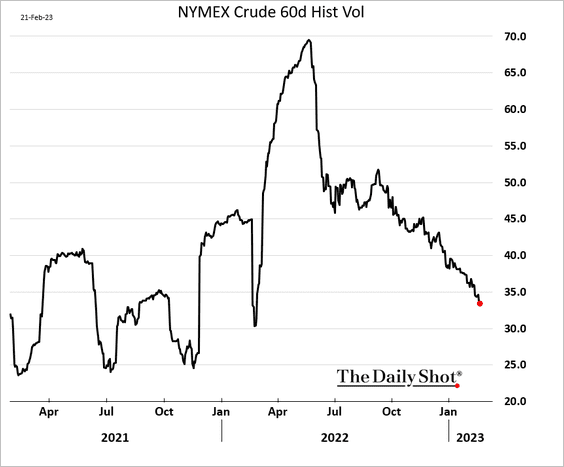

1. Crude oil realized volatility has been falling in recent months.

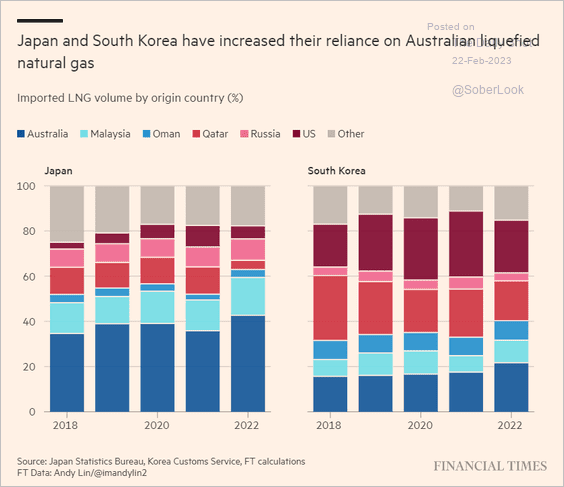

2. South Korea and Japan increasingly buy Australia’s LNG.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

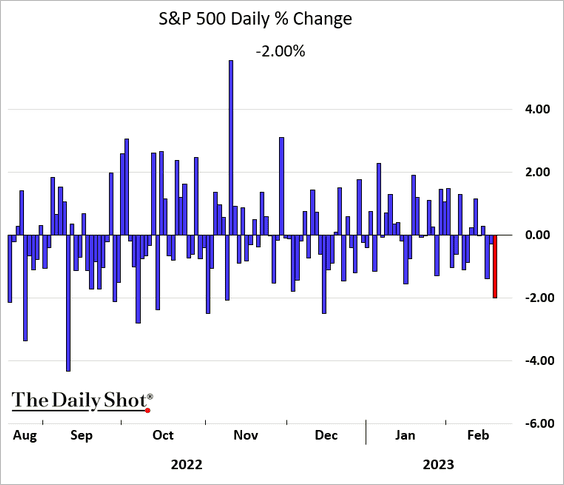

1. The market finally responded to the recent repricing in rate hike expectations (see # 4 in the US section).

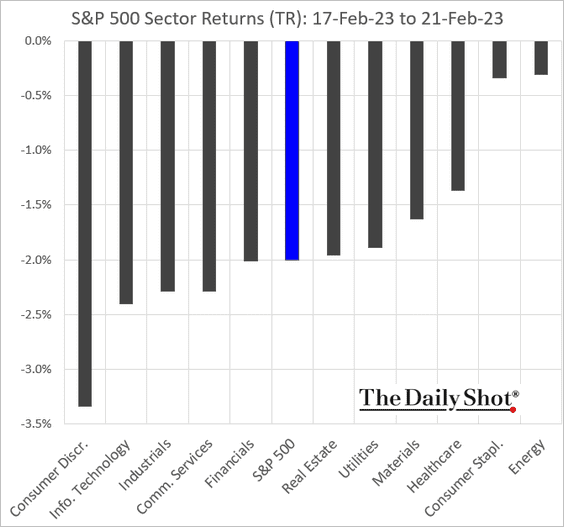

• How did different sectors respond on Tuesday to renewed concerns about rising rates?

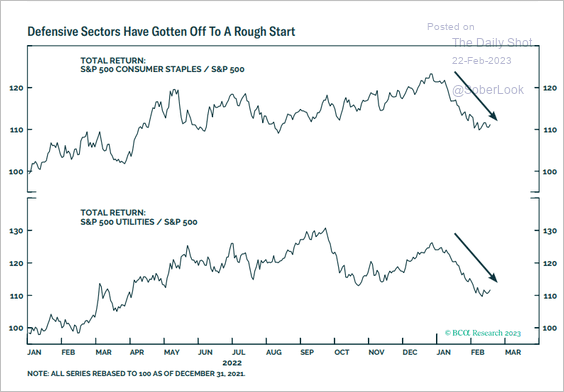

• Is the underperformance of defensive sectors over for now?

Source: BCA Research

Source: BCA Research

——————–

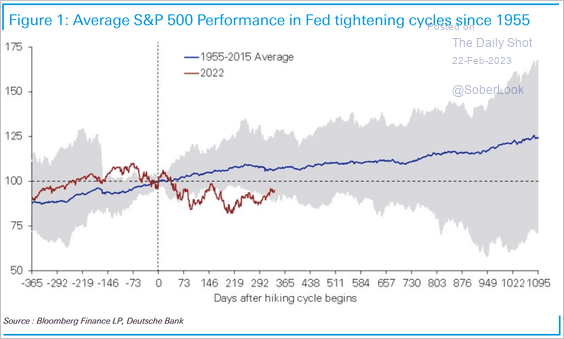

2. The S&P 500 has undercut its historical price path during Fed tightening cycles.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

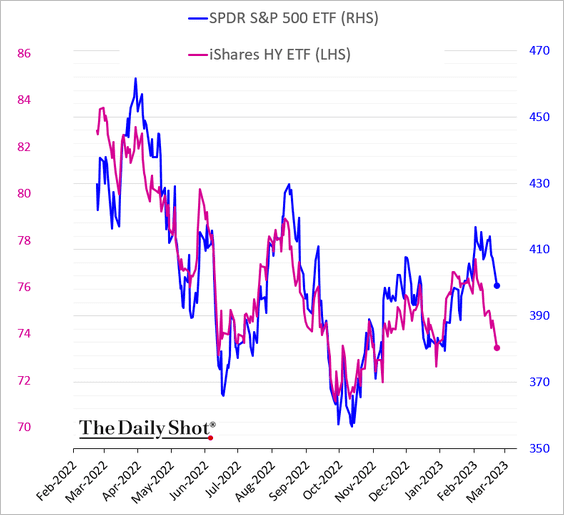

3. Is credit signaling further weakness in stocks?

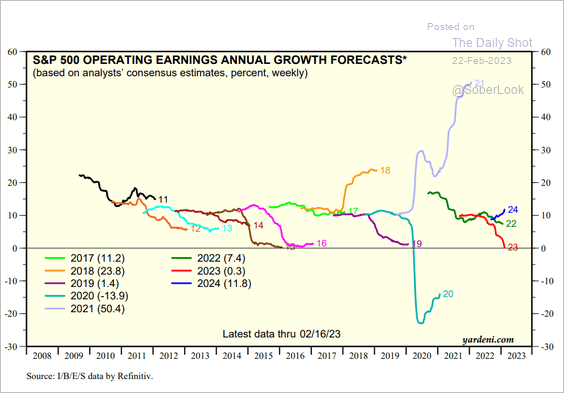

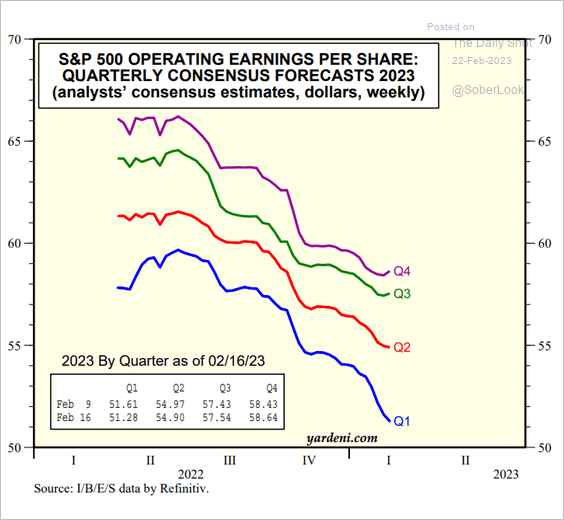

4. Analysts see flat earnings for the full year in 2023.

Source: Yardeni Research

Source: Yardeni Research

• Earnings forecasts for Q3 and Q4 have been moved up as Q1 expectations tumble.

Source: Yardeni Research

Source: Yardeni Research

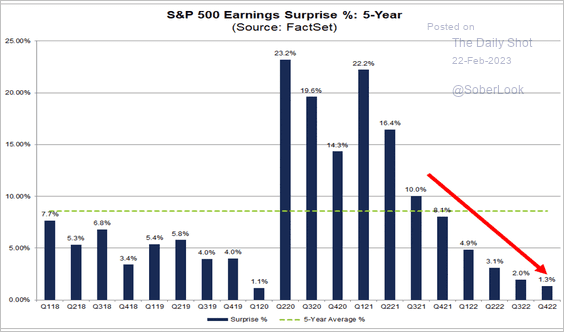

• Q4 earnings surprises were the lowest since the COVID shock.

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

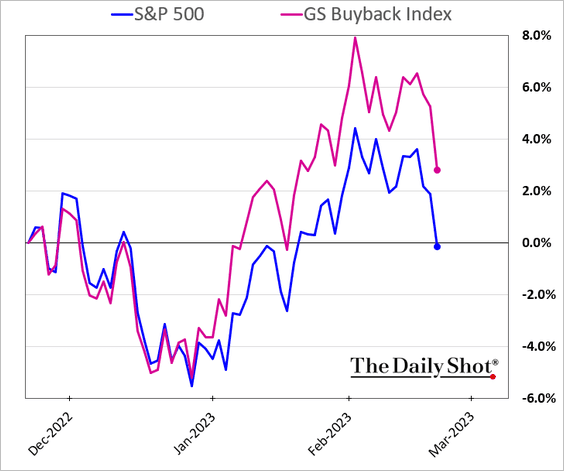

5. Companies with a strong history of share buybacks have been outperforming.

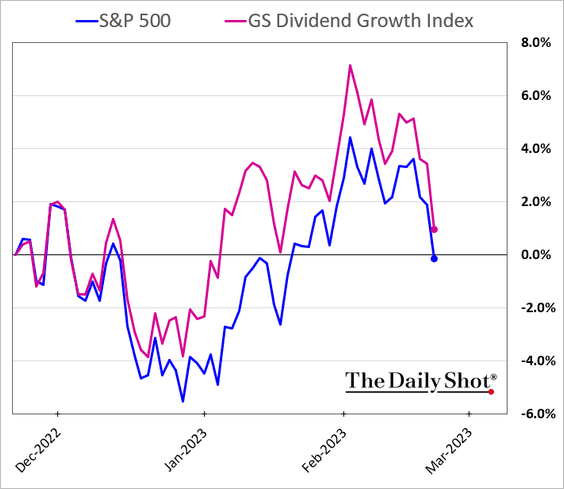

But dividend growers are giving up their recent outperformance.

Back to Index

Credit

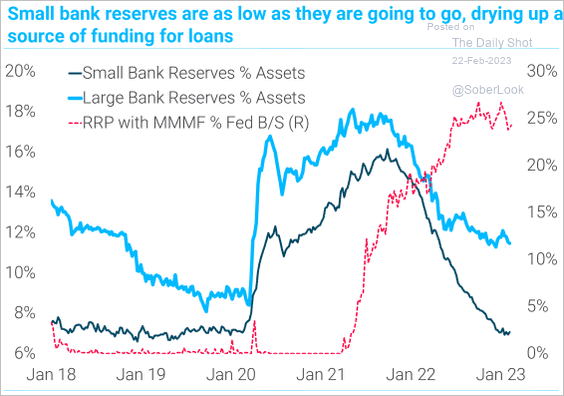

1. Reserves at small US banks have collapsed since the start of the Fed’s QT.

Source: TS Lombard

Source: TS Lombard

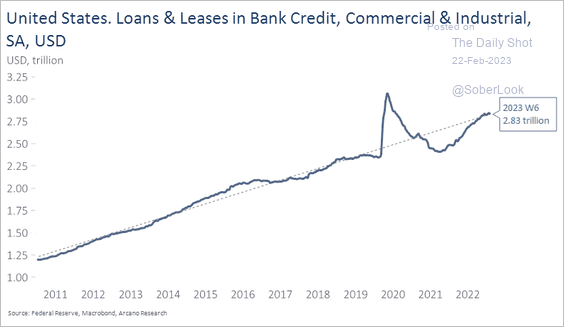

2. Business loans held by US banks are back on the pre-COVID trend.

Source: Arcano Economics

Source: Arcano Economics

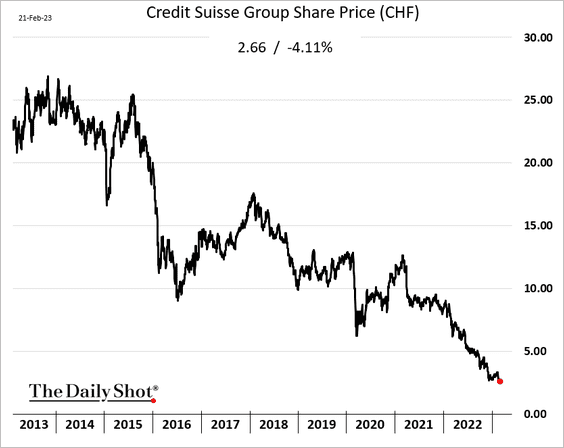

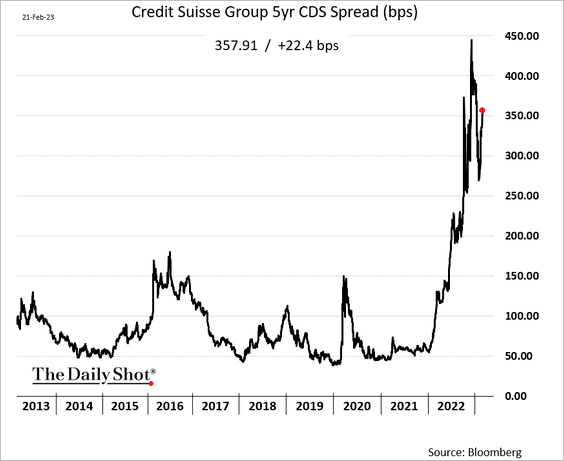

3. Credit Suisse shares hit a new low.

Source: @WSJ Read full article

Source: @WSJ Read full article

CDS spreads are rising again.

——————–

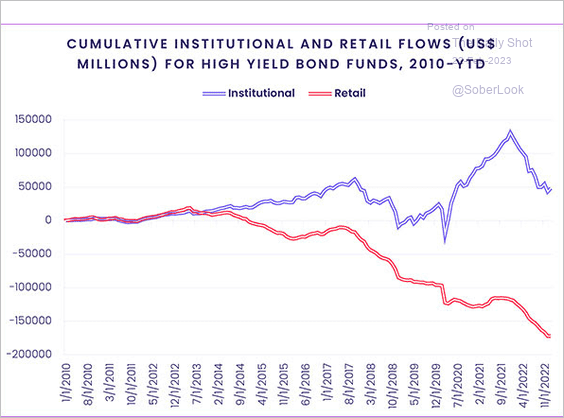

4. This chart shows institutional and retail flows into HY bond funds.

Source: EPFR

Source: EPFR

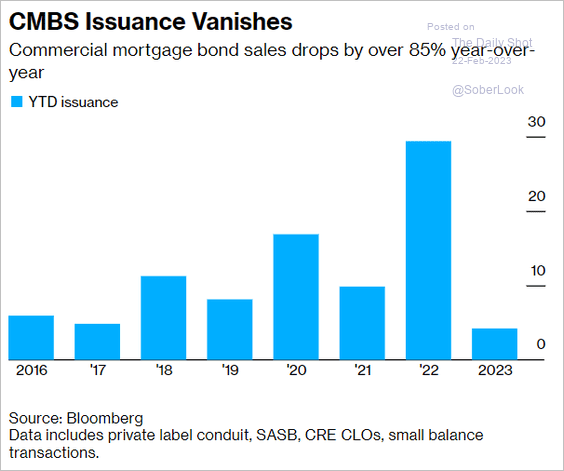

5. CMBS issuance tumbled this year amid challenging market conditions.

Source: @ArroyoNieto, @business Read full article

Source: @ArroyoNieto, @business Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

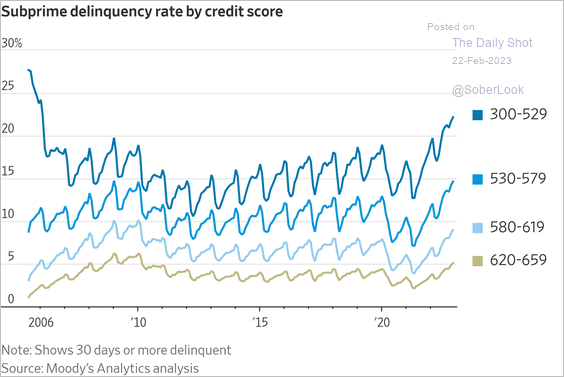

6. US subprime auto delinquencies are hitting multi-year highs.

Back to Index

Rates

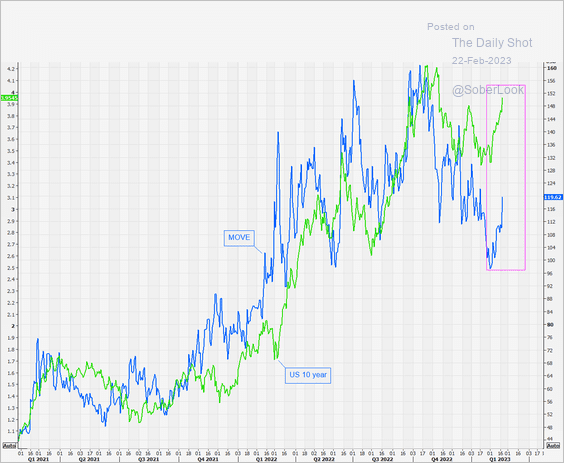

1. Rates implied vol could move higher as Treasury yields climb.

Source: @themarketear

Source: @themarketear

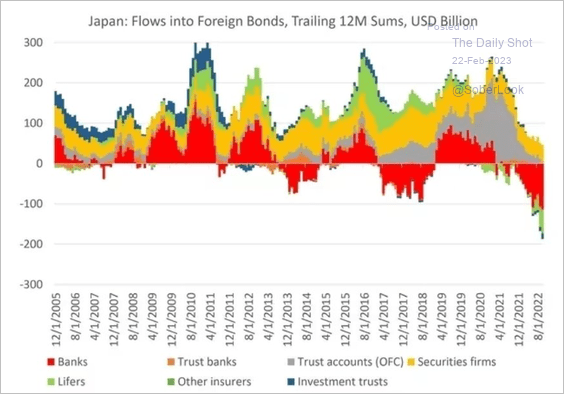

2. Japanese investors have been cutting back on their holdings of foreign bonds.

Source: @Marcomadness2

Source: @Marcomadness2

Back to Index

Global Developments

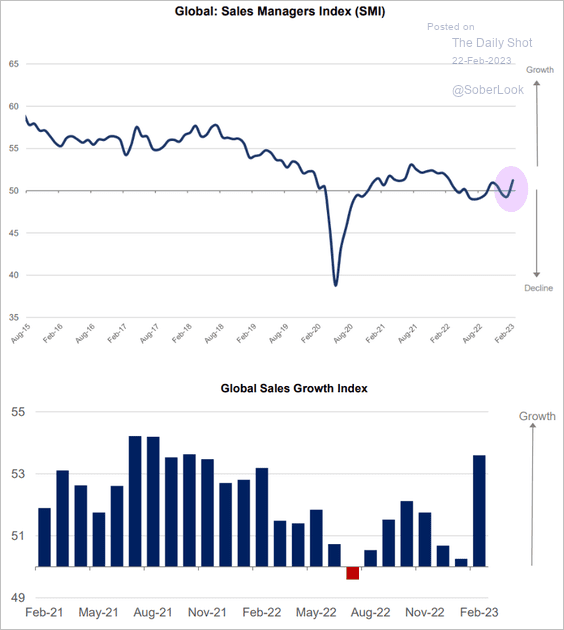

1. The World Economics global SMI report showed business activity accelerating this month as China reopened.

Source: World Economics

Source: World Economics

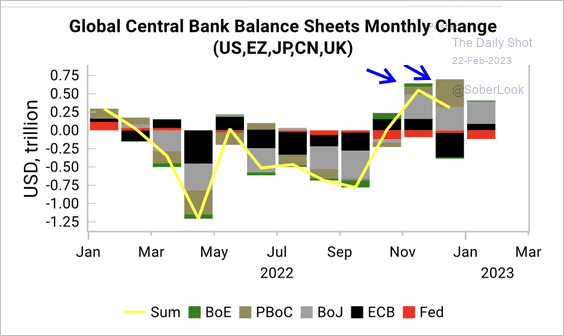

2. Global central banks’ balance sheets have expanded recently, led by the BoJ and PBoC.

Source: Variant Perception

Source: Variant Perception

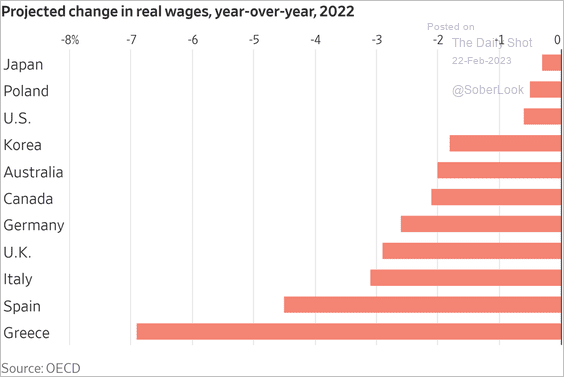

3. Real wages took a hit across advanced economies last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

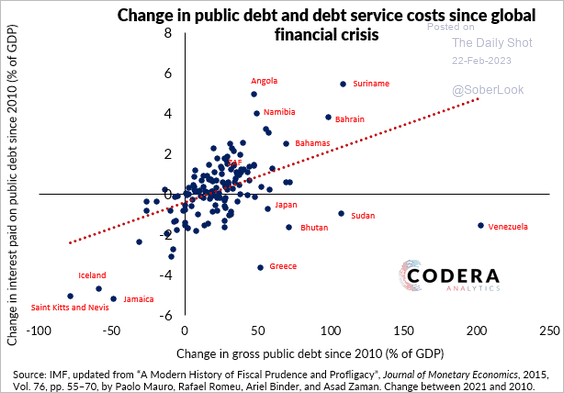

4. The relationship between public debt and debt service costs has been strongly positive across the world overall, despite lower interest rates.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

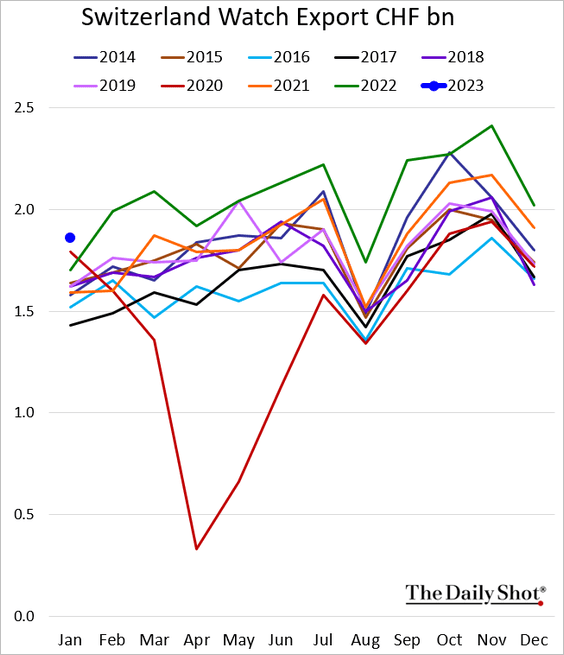

5. Swiss watch exports point to healthy demand for luxury goods.

——————–

Food for Thought

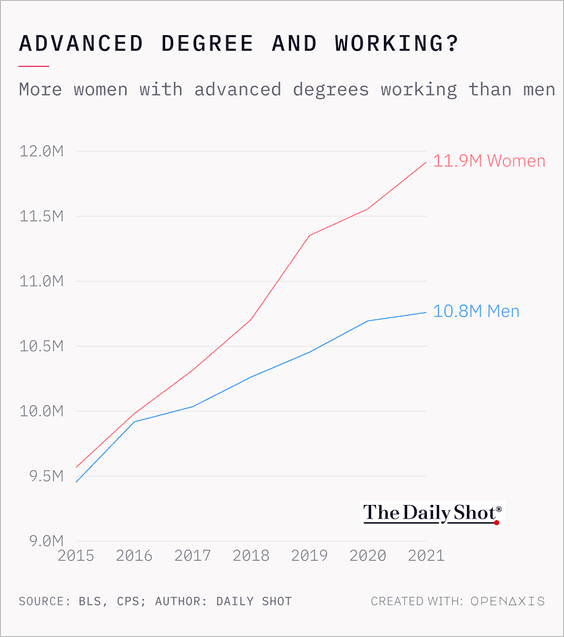

1. Working US men and women with advanced degrees:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

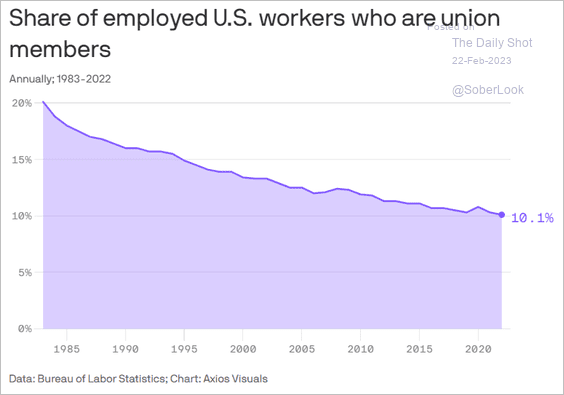

2. Union membership:

Source: @axios Read full article

Source: @axios Read full article

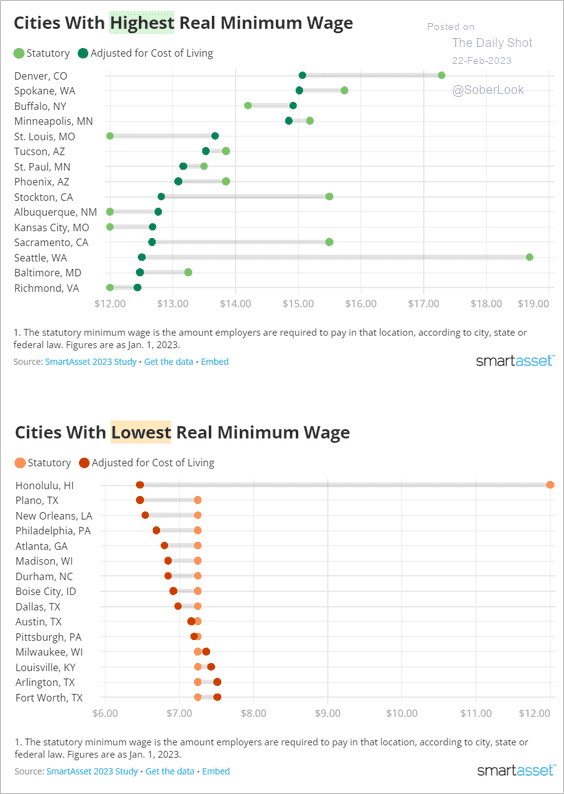

3. Real minimum wage in select cities:

Source: SmartAsset Read full article

Source: SmartAsset Read full article

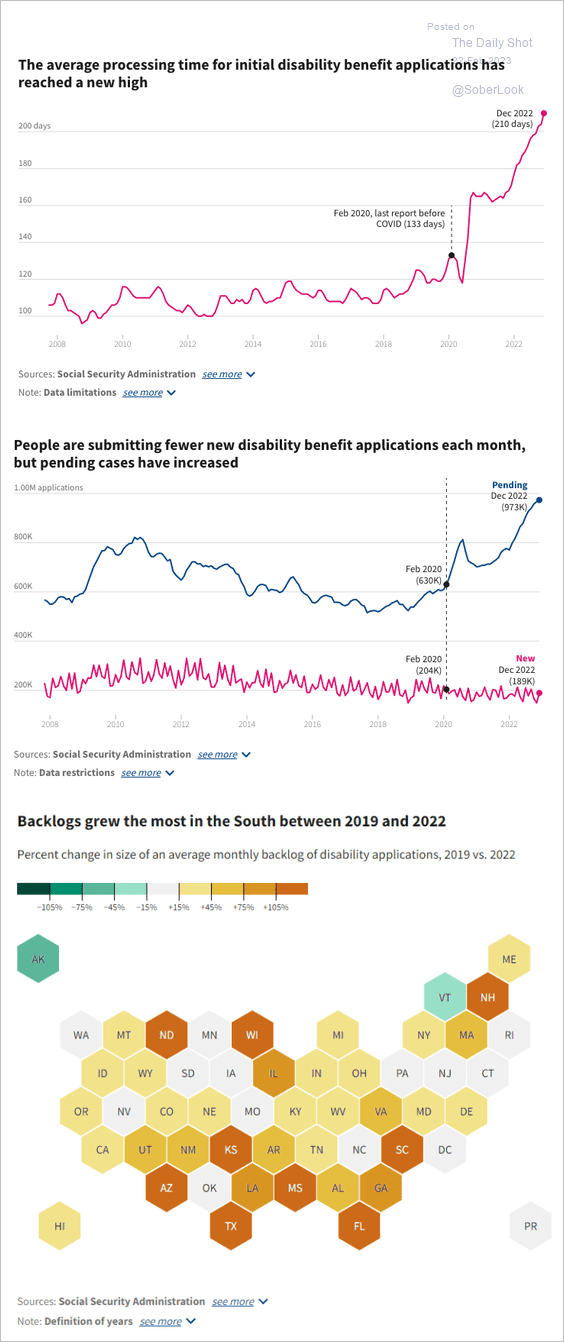

4. Processing times for Social Security disability benefits applications:

Source: USAFacts

Source: USAFacts

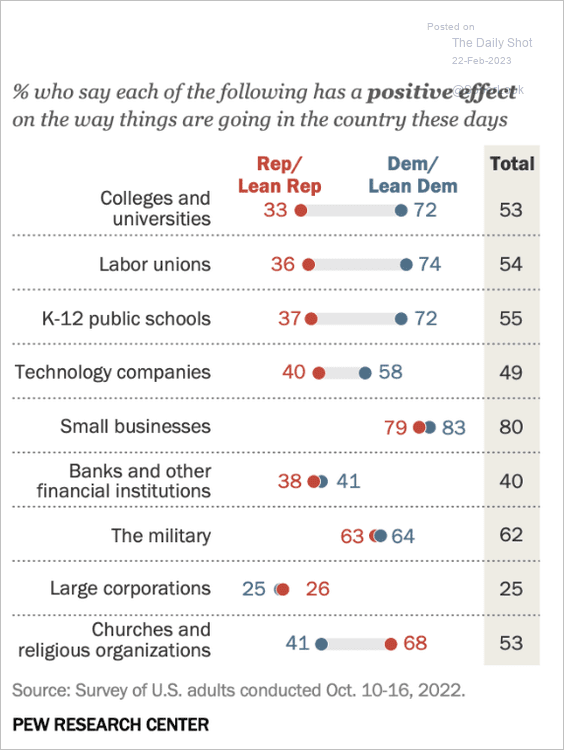

5. Views on US institutions:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

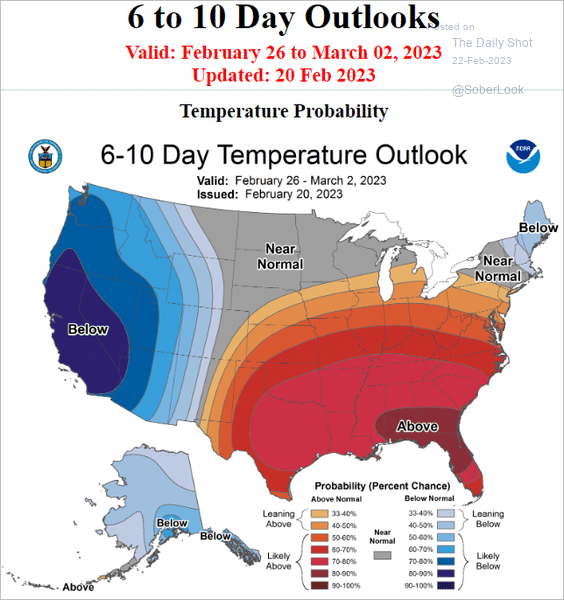

6. Weather extremes:

Source: NOAA Further reading

Source: NOAA Further reading

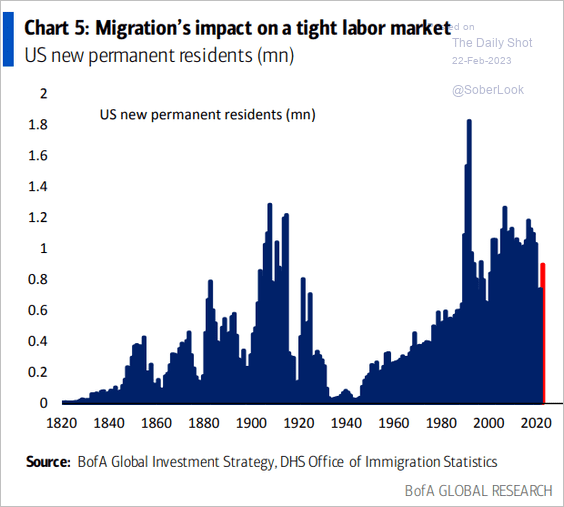

7. US new permanent residents:

Source: BofA Global Research

Source: BofA Global Research

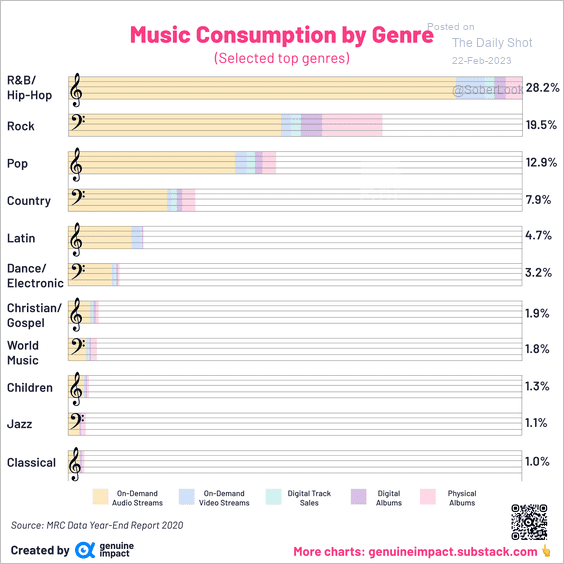

8. Music consumption by genre:

Source: @genuine_impact

Source: @genuine_impact

——————–

Back to Index