The Daily Shot: 25-Jan-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

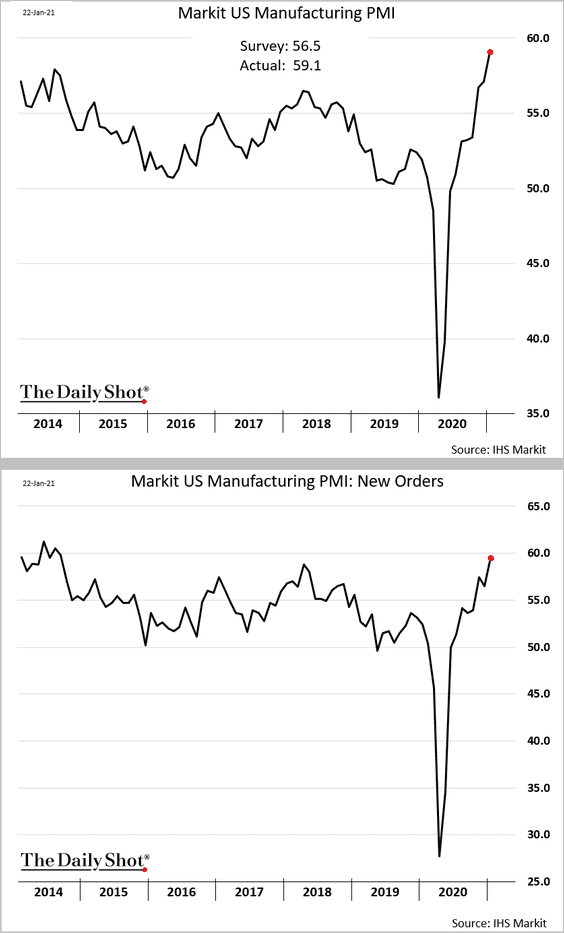

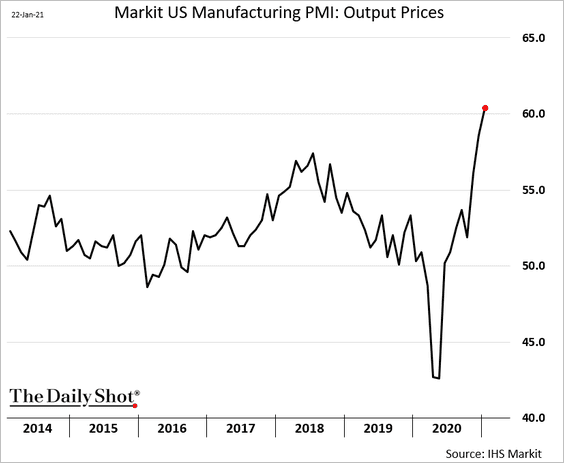

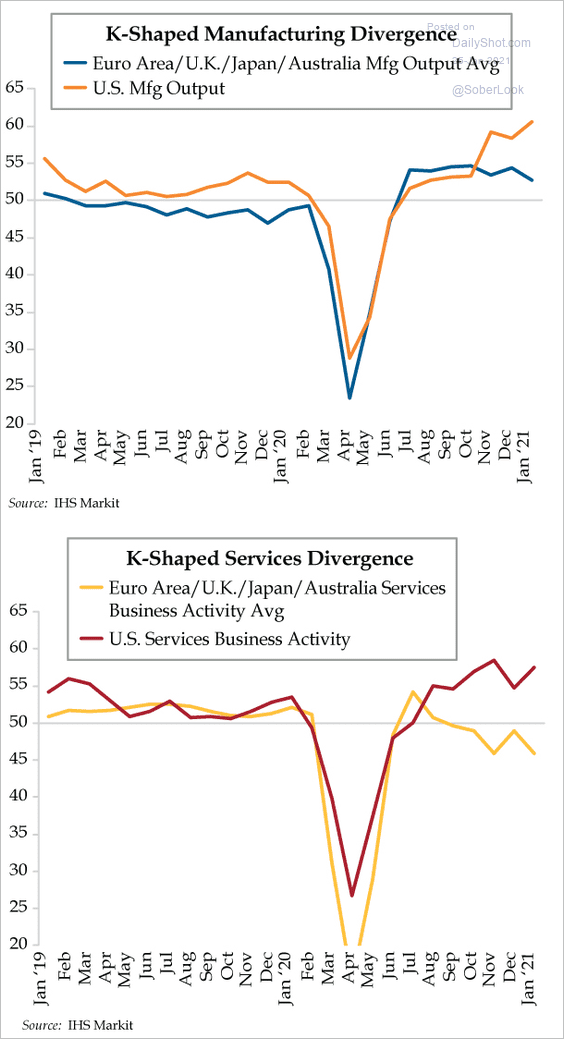

1. The January flash PMI report from Markit surprised to the upside. US manufacturing expansion continues to strengthen, while growth in services remains robust despite the pandemic pressures.

– Manufacturing PMI:

– Services PMI:

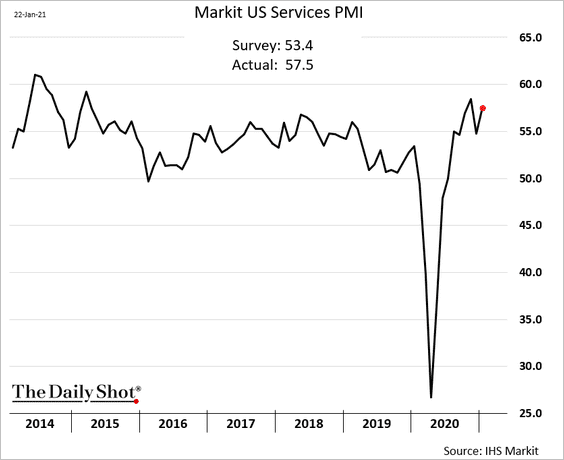

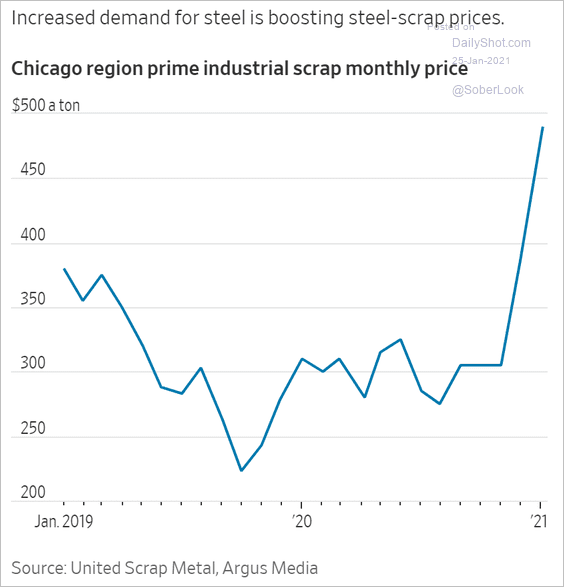

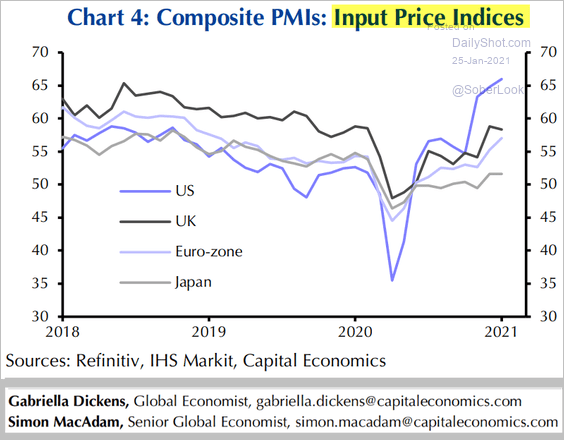

• The trend of rising prices we saw last month spilled over into January.

Here is an example.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The nation’s business activity is now outperforming other advanced economies.

Source: The Daily Feather

Source: The Daily Feather

Moreover, US business costs appear to be well ahead of other nations.

Source: Capital Economics

Source: Capital Economics

——————–

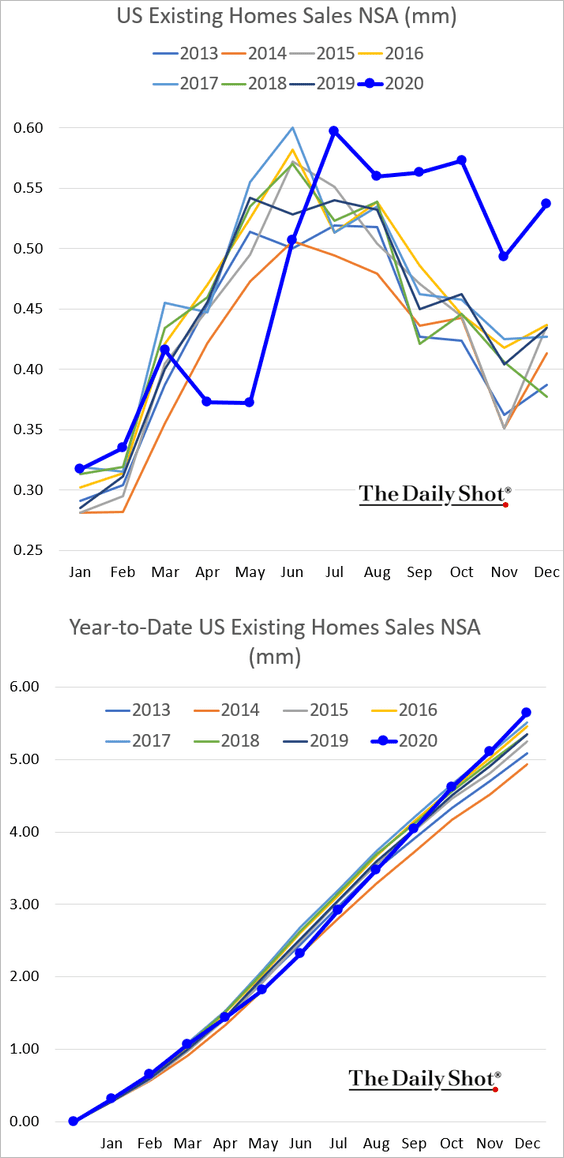

2. Existing home sales were quite strong in December. The second chart shows the year-to-date cumulative trends.

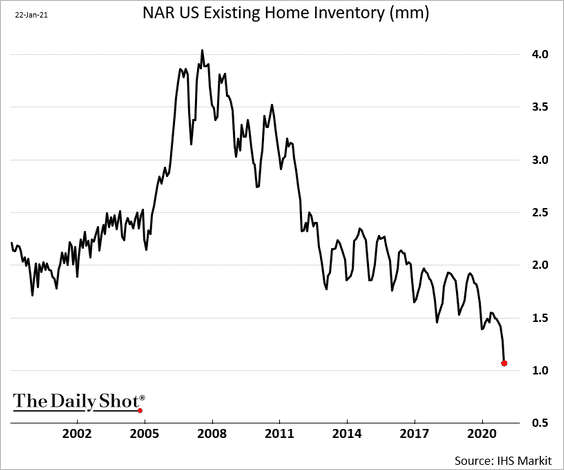

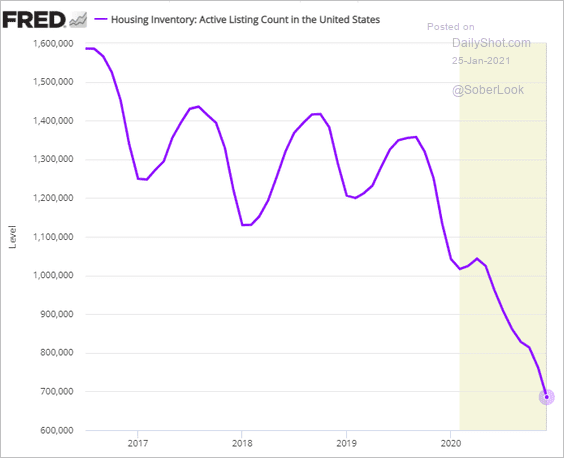

The number of US homes for sale is at multi-decade lows.

This chart is based on inventory data from Realtor.com.

——————–

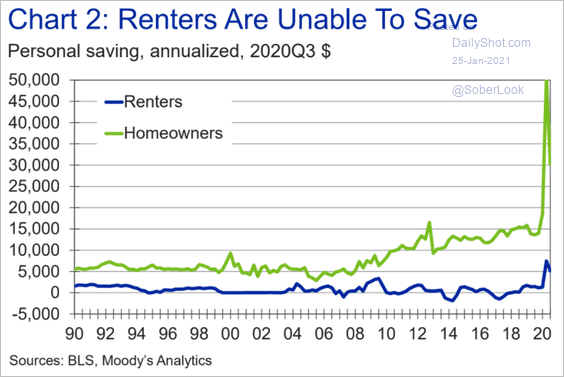

3. US household savings spiked last year, but renters had a tougher time saving than homeowners.

Source: Moody’s Analytics

Source: Moody’s Analytics

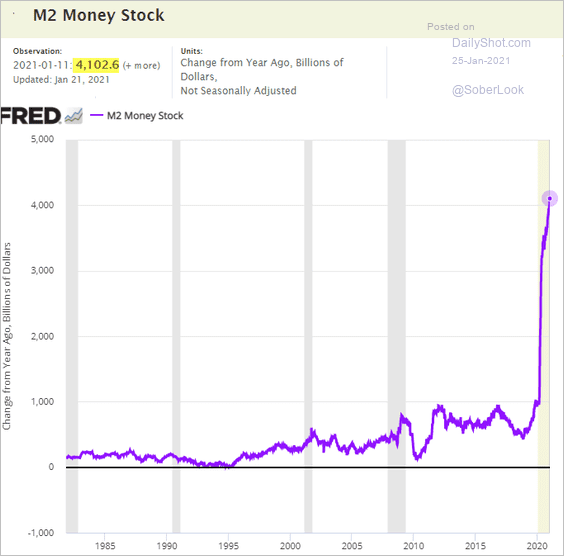

4. The US broad money supply (M2) is now over $4 trillion higher than a year ago.

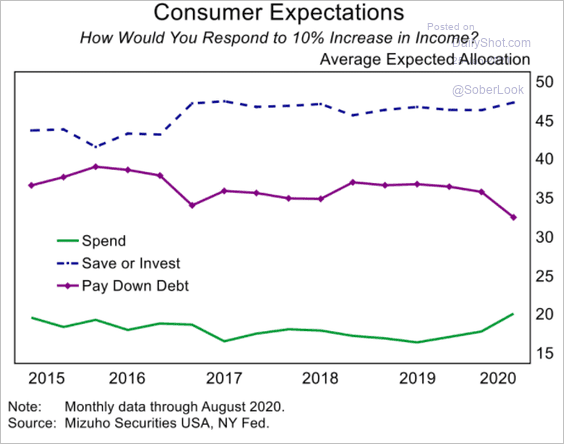

5. How would US consumers respond to a 10% increase in income?

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

The United Kingdom

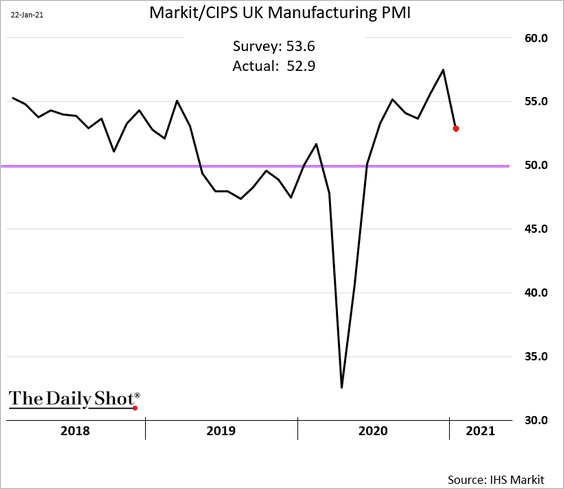

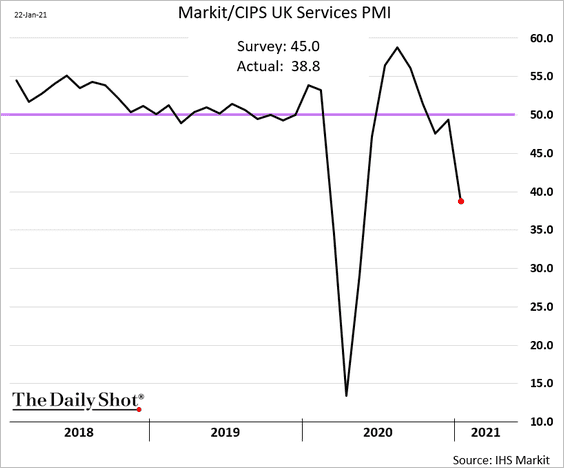

1. The January PMI report was softer than expected.

Service activity tumbled amid lockdowns.

——————–

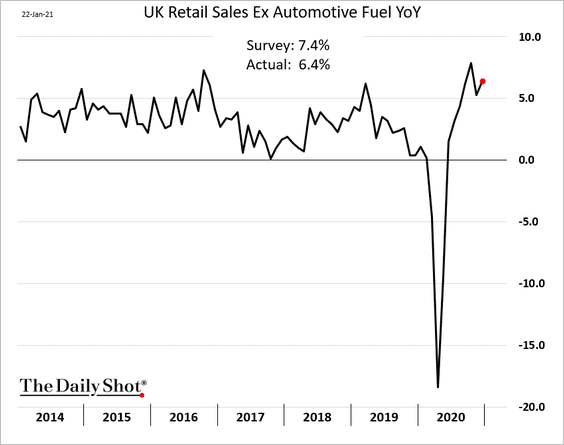

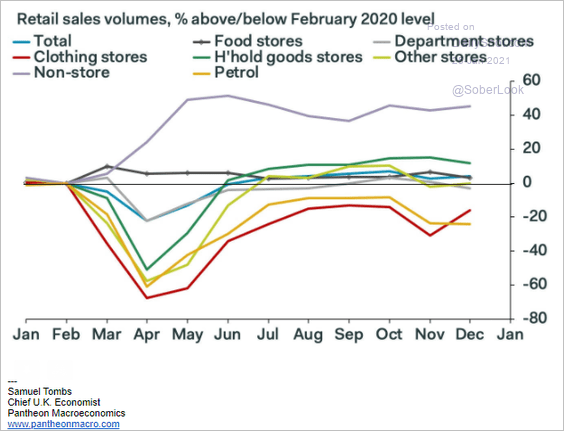

2. Retail sales picked up in December, but gains were lower than expected.

Here are a couple of additional updates.

• Retail sales paths by sector:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

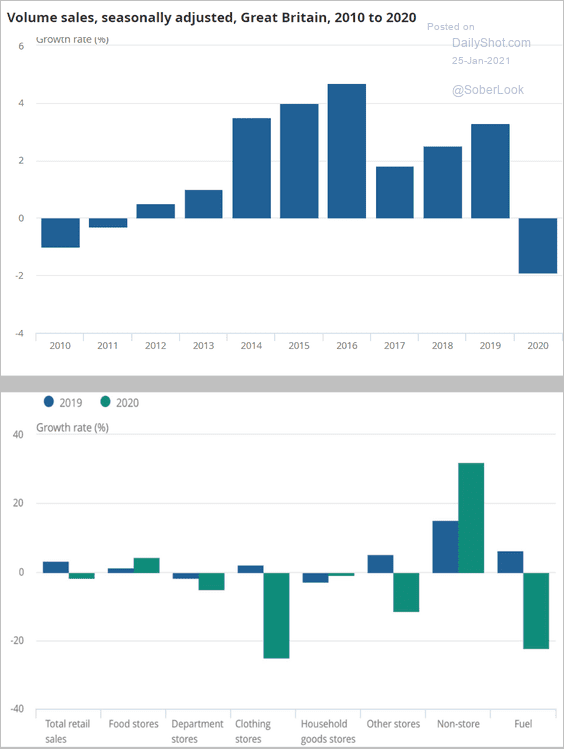

• Annual changes in retail sales:

Source: ONS Read full article

Source: ONS Read full article

——————–

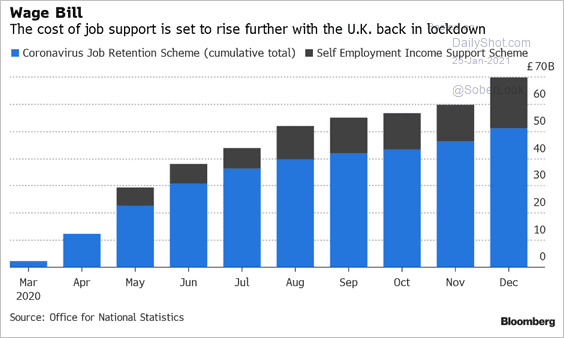

3. The government’s support for the job market is expected to climb further, …

Source: @bpolitics Read full article

Source: @bpolitics Read full article

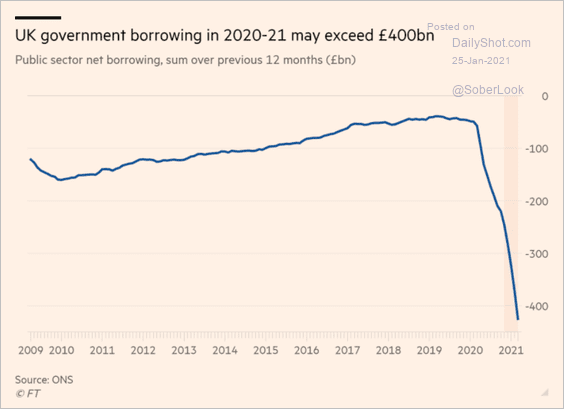

… pushing borrowing beyond £400bn this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

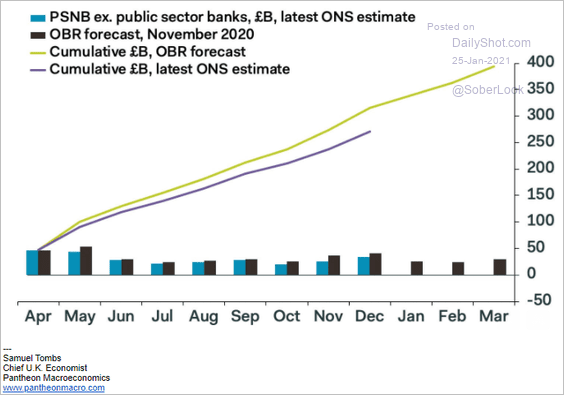

For now, government borrowing has been running below the ONS estimates.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

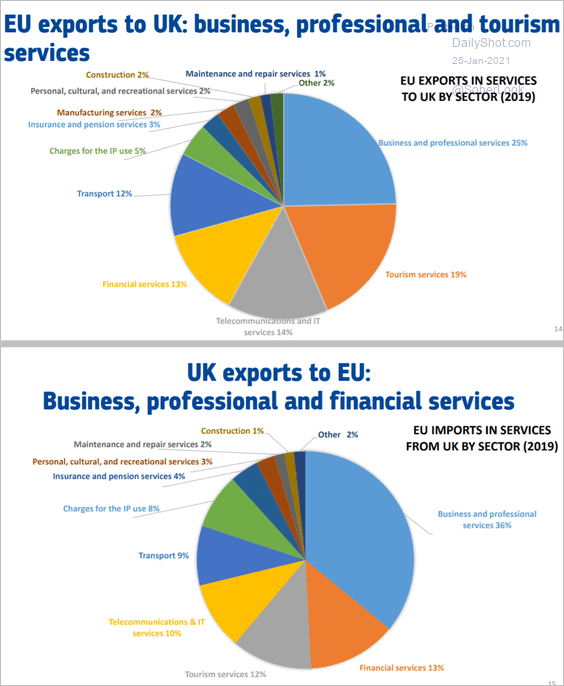

4. These charts show the distribution of the UK’s trade with the EU in business, professional, and tourism services.

Source: European Commission Read full article

Source: European Commission Read full article

Back to Index

The Eurozone

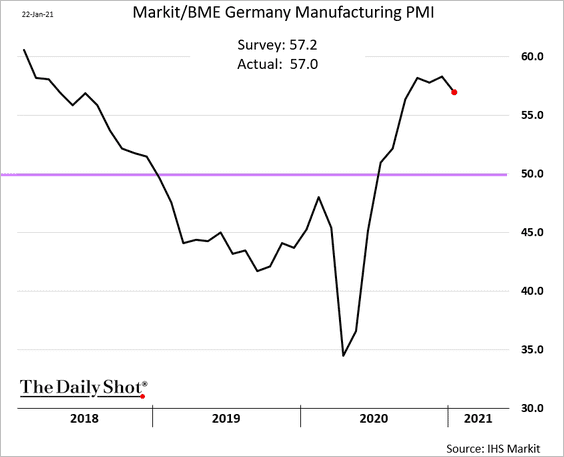

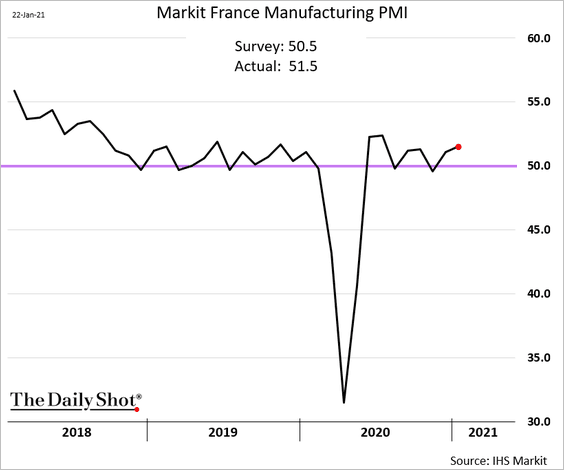

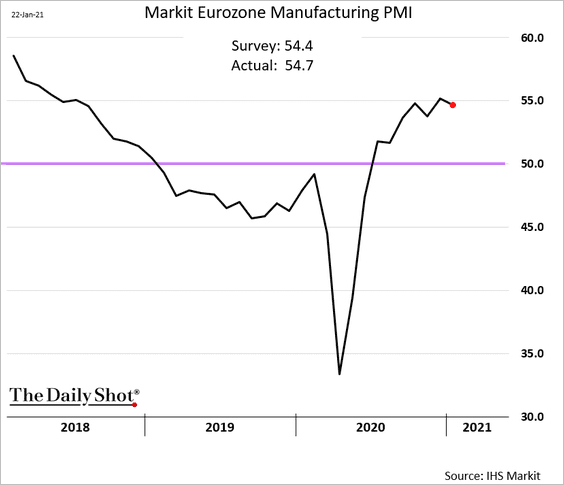

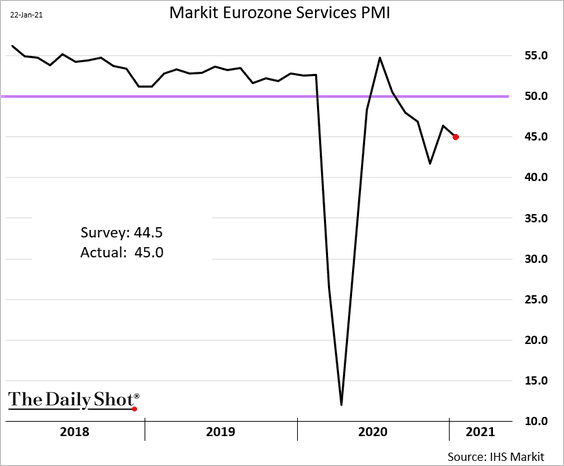

1. Manufacturing activity continued to expand this month, according to Markit’s flash PMI report.

• Germany:

• France:

• The Eurozone:

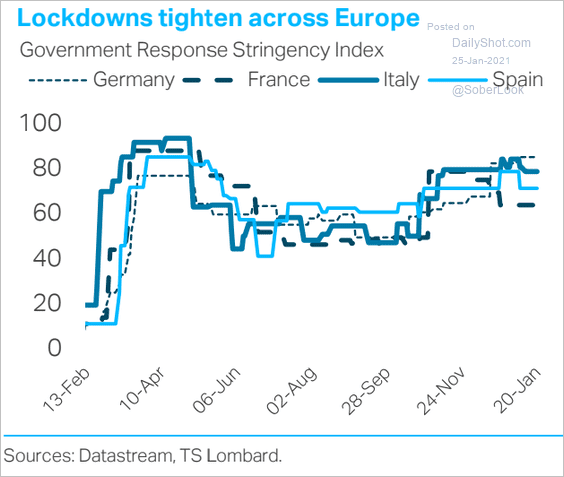

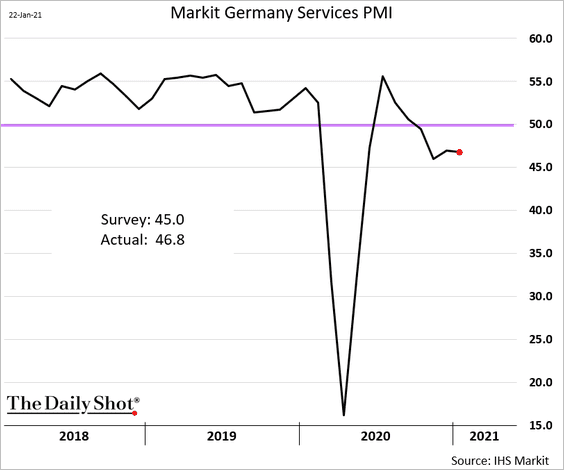

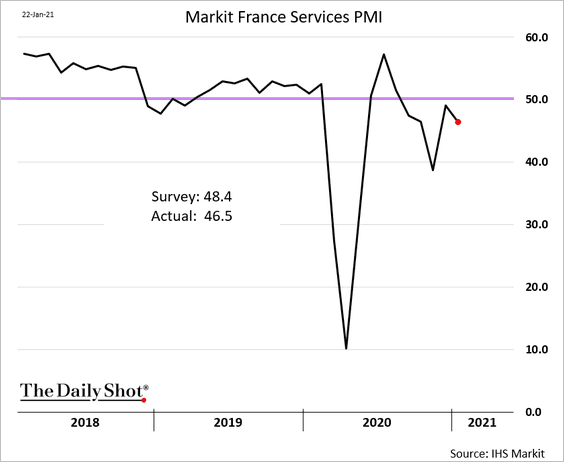

However, pressured by the lockdowns (chart below), services are still in contraction territory.

Source: TS Lombard

Source: TS Lombard

• Germany:

• France:

• The Eurozone:

——————–

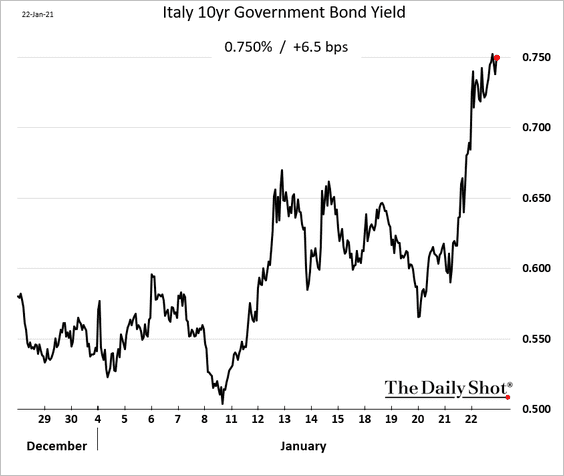

2. The political situation in Italy remains precarious.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Bond yields climbed further on Friday.

——————–

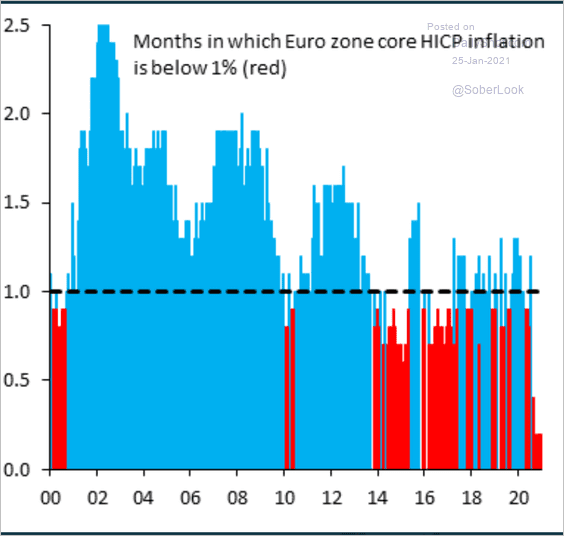

3. The frequency of the core CPI dipping below 1% increased in recent years.

Source: @RobinBrooksIIF, @adam_tooze, @heimbergecon

Source: @RobinBrooksIIF, @adam_tooze, @heimbergecon

Back to Index

Asia – Pacific

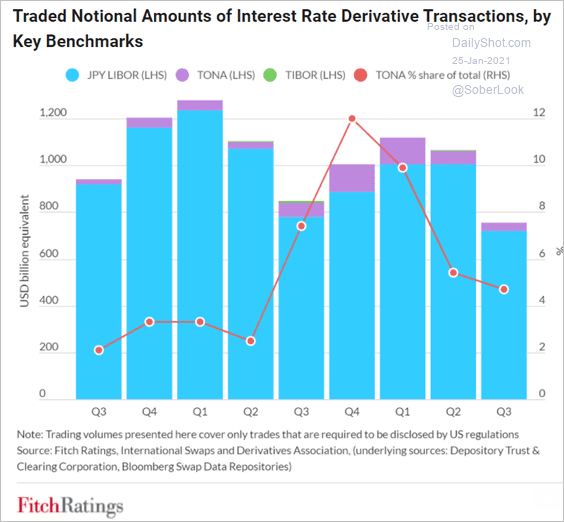

1. The transition out of yen LIBOR is facing challenges (less than 5% of interest rate derivatives are linked to TONA).

Source: Fitch Ratings

Source: Fitch Ratings

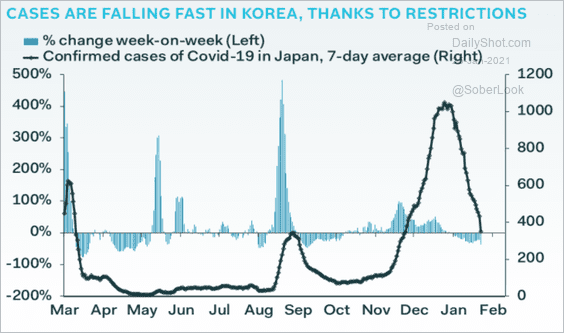

2. South Korea’s COVID cases have declined sharply in recent weeks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

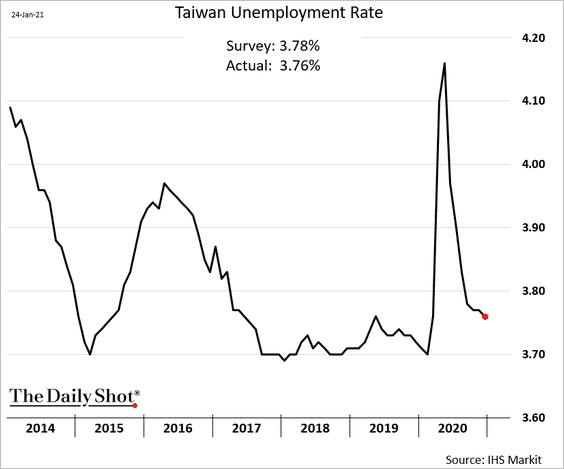

3. Taiwan’s labor market has almost fully recovered.

Back to Index

China

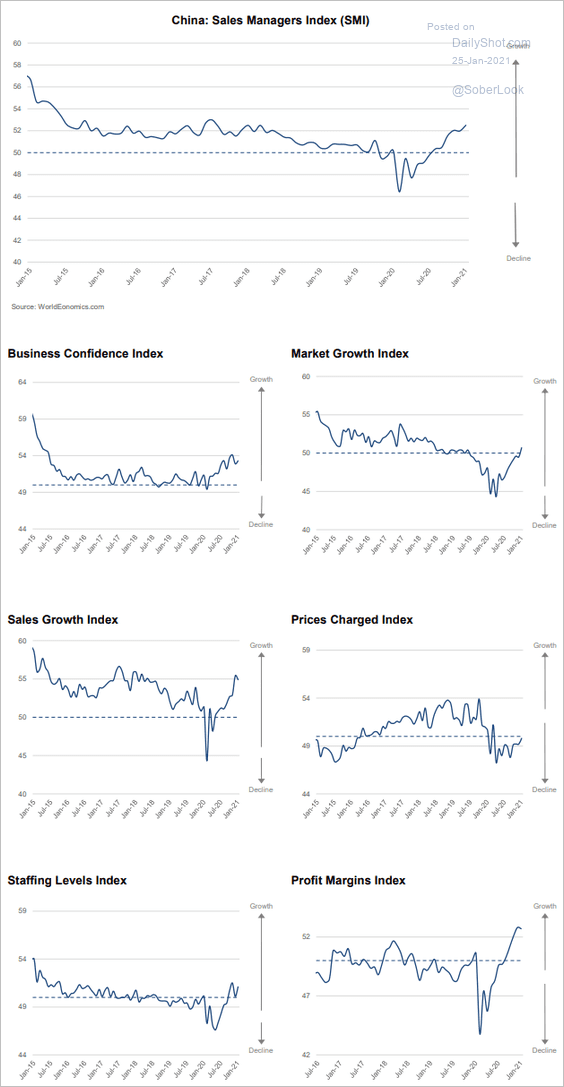

1. The World Economics SMI report shows further strengthening in business activity this month.

Source: World Economics

Source: World Economics

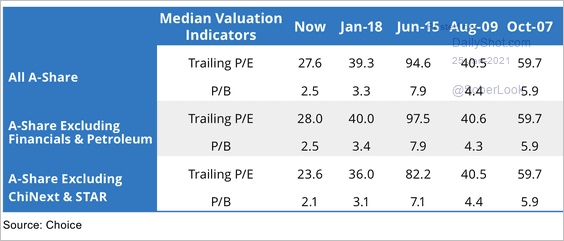

2. A-share valuations are not as extreme as previous peaks.

Source: Alpine Macro

Source: Alpine Macro

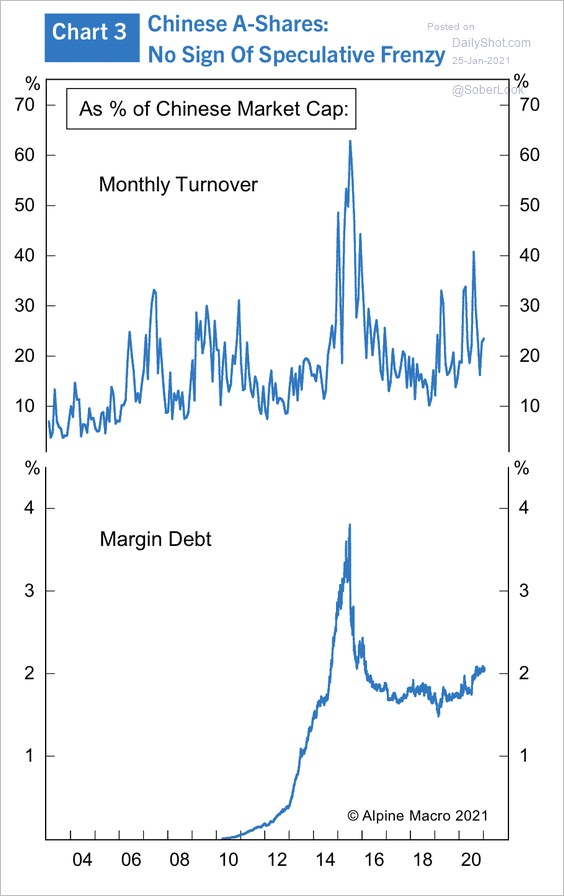

Equity turnover and margin purchases have been rising but are well below prior highs.

Source: Alpine Macro

Source: Alpine Macro

——————–

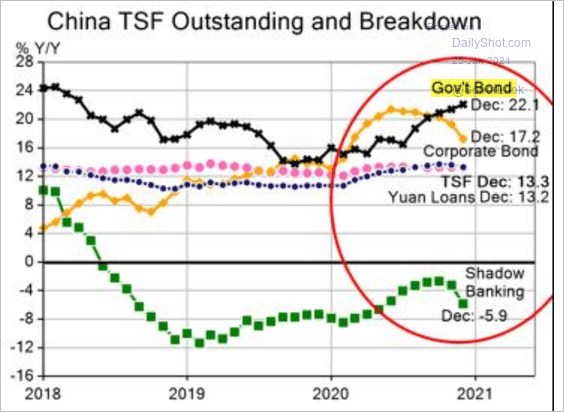

3. The rise in China’s total financing has been dominated by government debt.

Source: Evercore ISI

Source: Evercore ISI

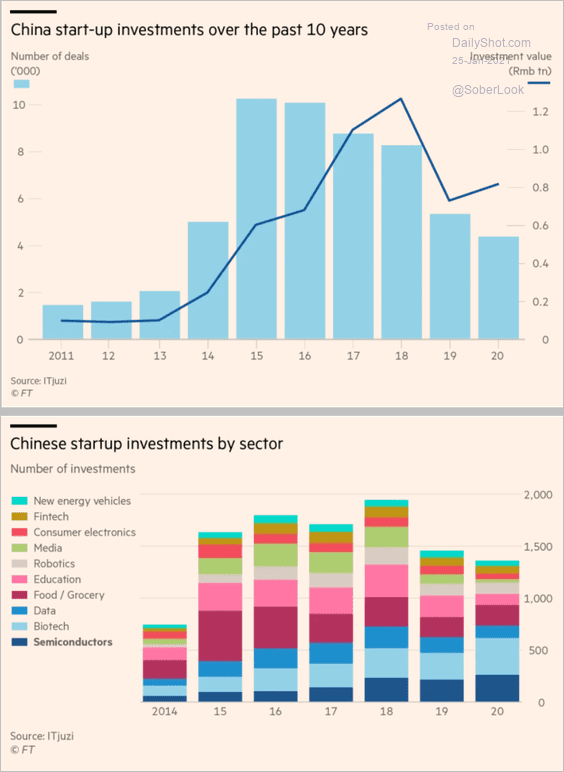

4. Here are some data on startup investment.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

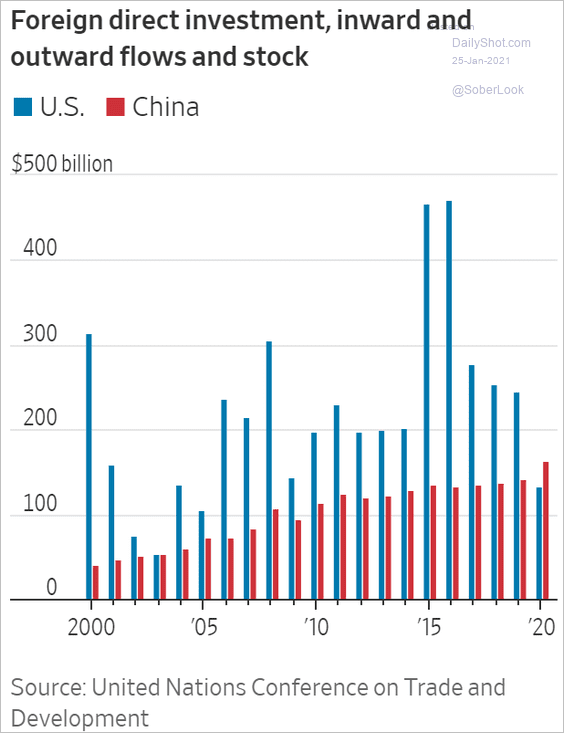

5. China overtook the US in foreign direct investment last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

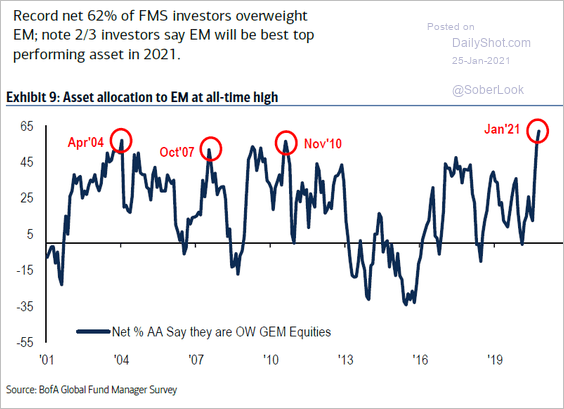

1. Fund managers continue to boost their allocations to EM.

Source: BofA Global Research

Source: BofA Global Research

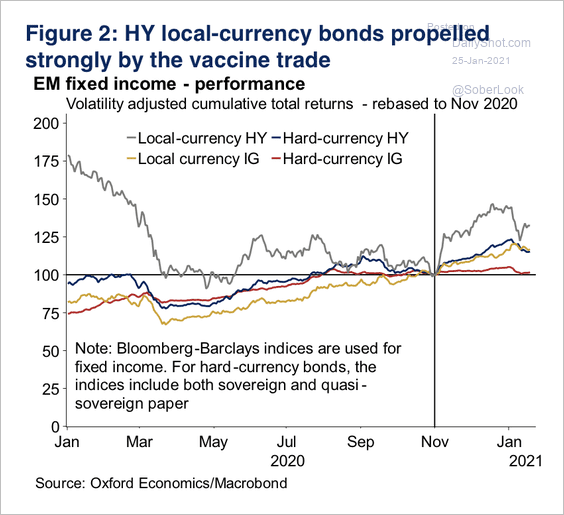

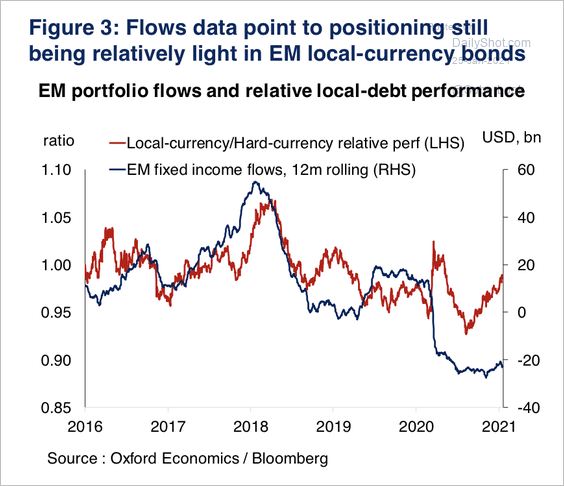

2. High-yield local currency bonds have been outperforming since November, although flows are still relatively light compared to broader EM fixed income (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

——————–

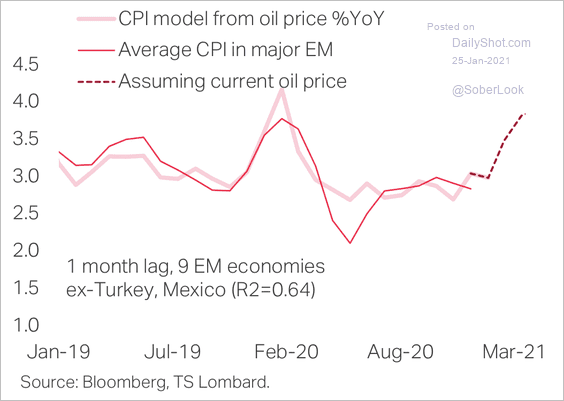

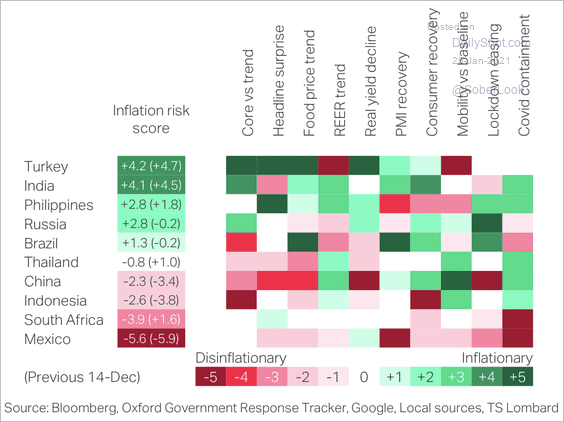

3. Oil prices are set to become more inflationary for some EM countries.

Source: TS Lombard

Source: TS Lombard

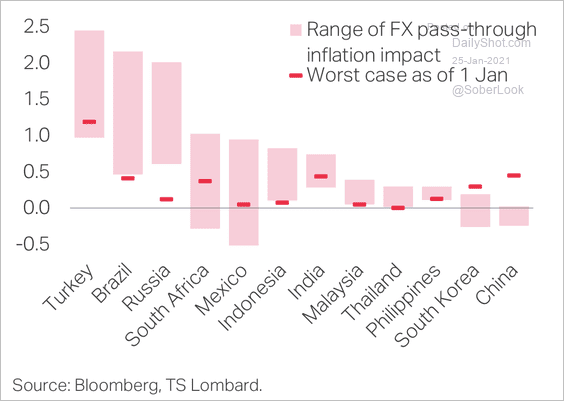

And with undervalued currencies, the pass-through risk of inflation is high.

Source: TS Lombard

Source: TS Lombard

Which EM countries face higher inflation risk?

Source: TS Lombard

Source: TS Lombard

——————–

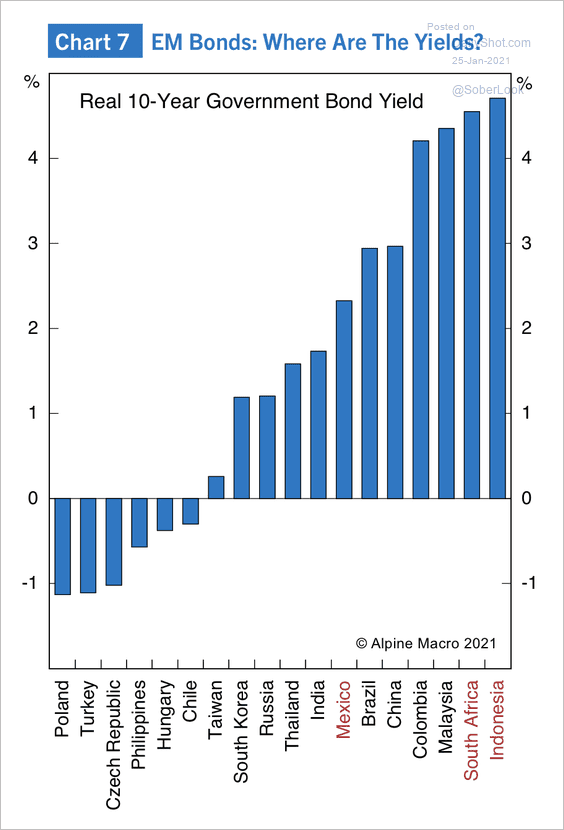

4. Where are the “high yielders”?

Source: Alpine Macro

Source: Alpine Macro

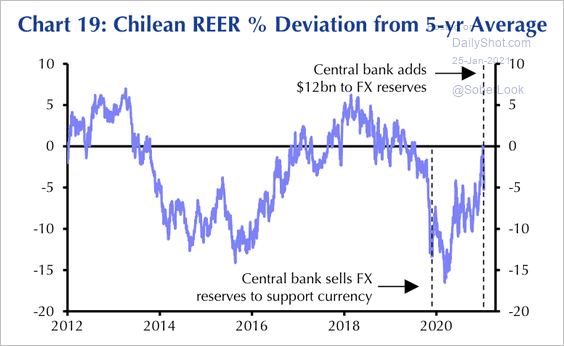

5. The Chilean peso rebounded toward its 5-year average. The country’s central bank has leaned against further currency appreciation by adding to its FX reserves.

Source: Capital Economics

Source: Capital Economics

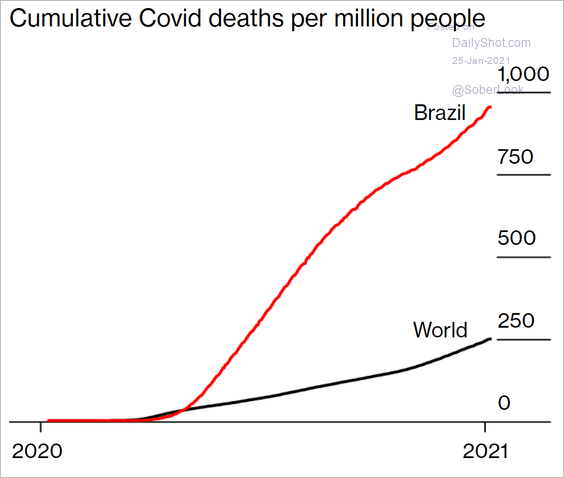

6. COVID deaths in Brazil significantly outpaced the world.

Source: @BW Read full article

Source: @BW Read full article

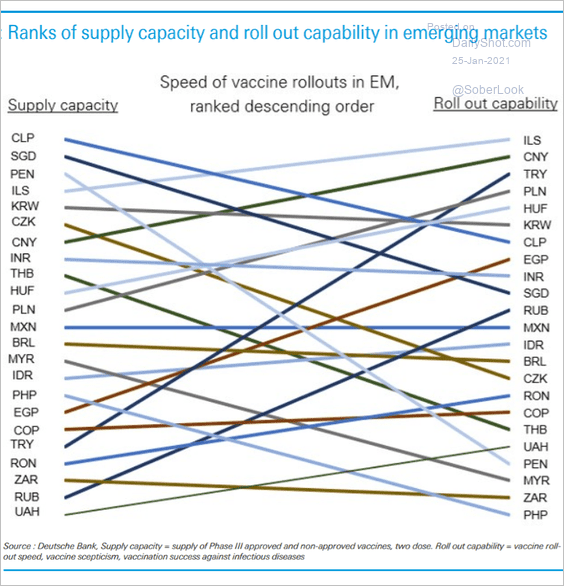

7. Here is an illustration of EM vaccine supply capacity vs. roll-out capacity.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Cryptocurrency

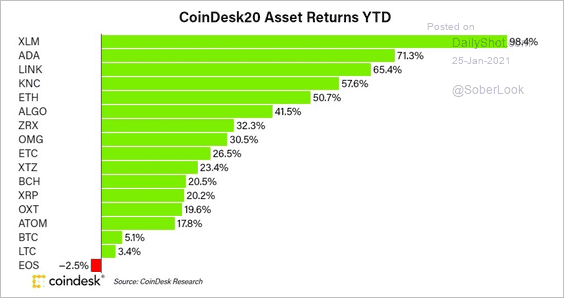

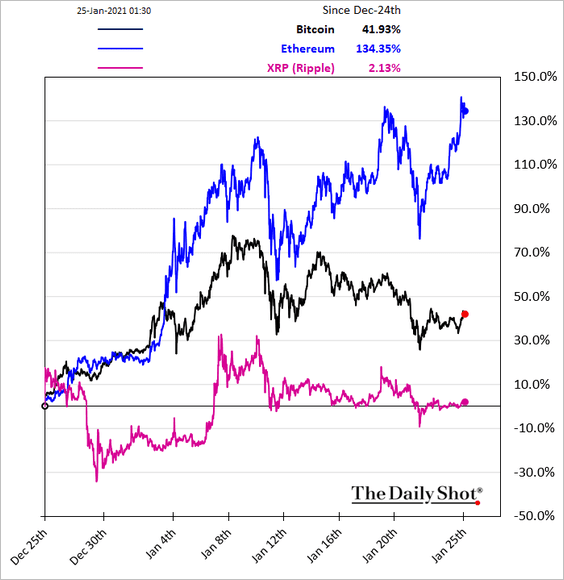

1. Here is a look at cryptocurrency returns so far this year. Bitcoin is underperforming most of its peers.

Source: @CoinDeskData

Source: @CoinDeskData

Ethereum is up more than 130% over the past month.

——————–

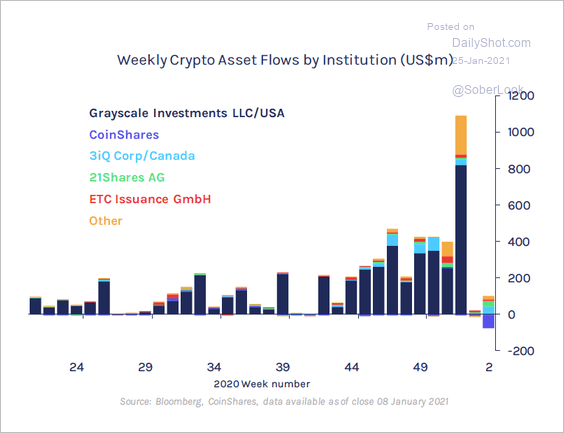

2. Inflows to digital asset investment products sharply declined last week following a record surge in demand.

Source: @CoinSharesCo

Source: @CoinSharesCo

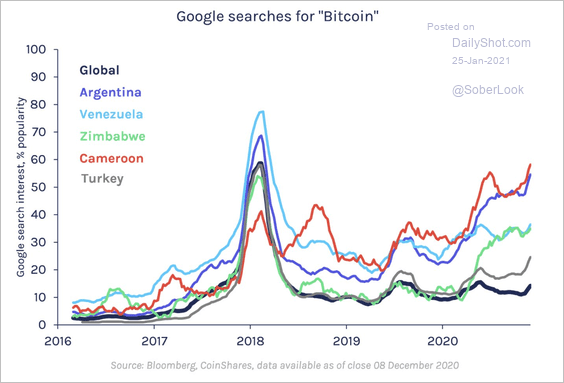

3. Google searches for Bitcoin are rising in countries where local currencies have been depreciating.

Source: @CoinSharesCo

Source: @CoinSharesCo

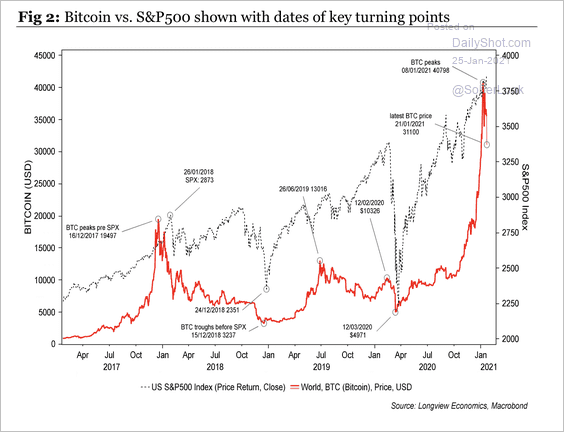

4. Bitcoin tends to peak before the S&P 500.

Source: Longview Economics

Source: Longview Economics

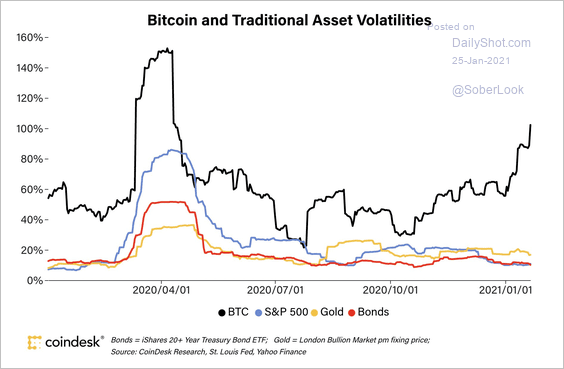

5. Bitcoin volatility reached its highest level since April 2020 while traditional markets have been relatively tamed.

Source: @CoinDeskData

Source: @CoinDeskData

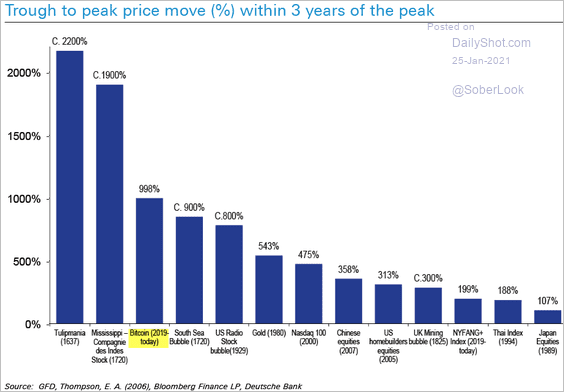

6. How does the recent Bitcoin rally compare to other bubble-like price gains throughout history?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Energy

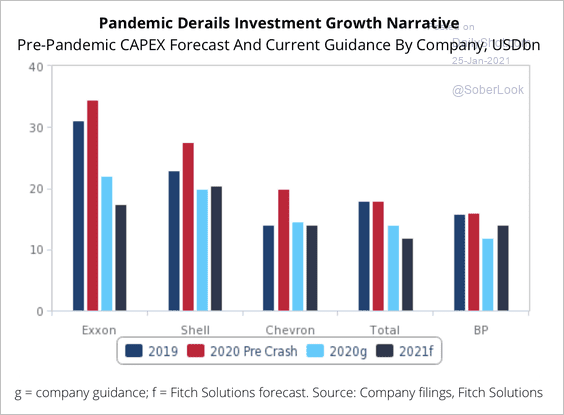

1. As set out by company guidance, capital expenditure is expected to decline by about 5% year-over-year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

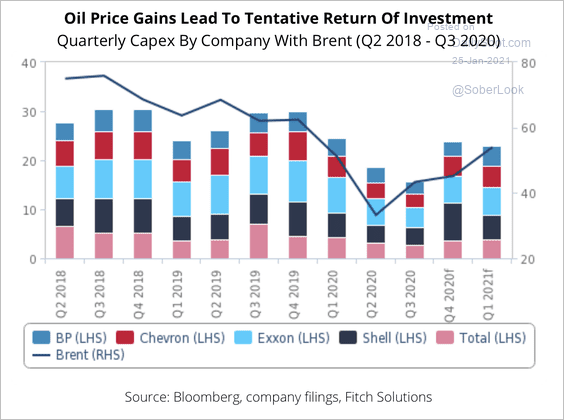

However, if oil prices continue to rise, spending could increase above early estimates from Q4.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

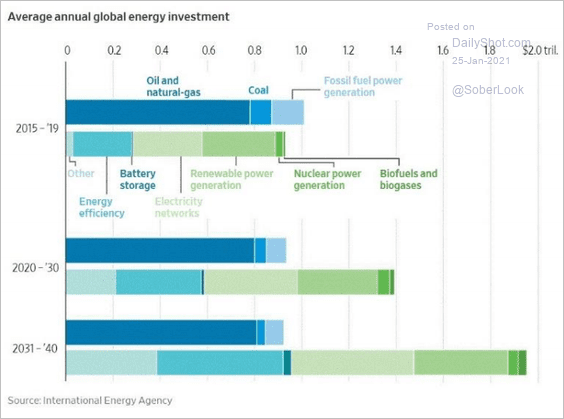

Here is a forecast for total energy investment globally.

Source: SP Mohanty Read full article

Source: SP Mohanty Read full article

——————–

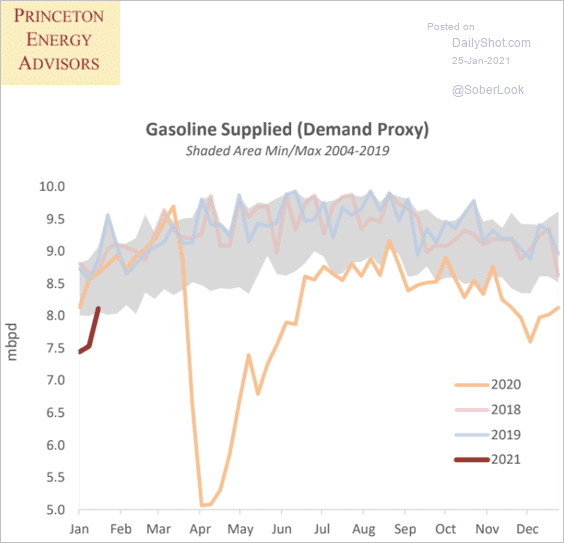

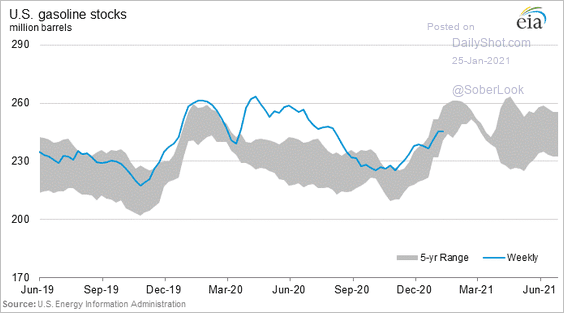

2. US gasoline demand is rebounding.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

And inventories are back inside the five-year range.

——————–

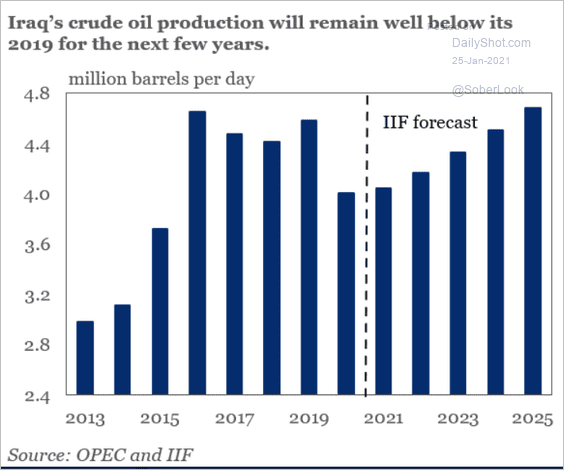

3. Iraq’s oil production will take years to return to 2019 levels.

Source: IIF Read full article

Source: IIF Read full article

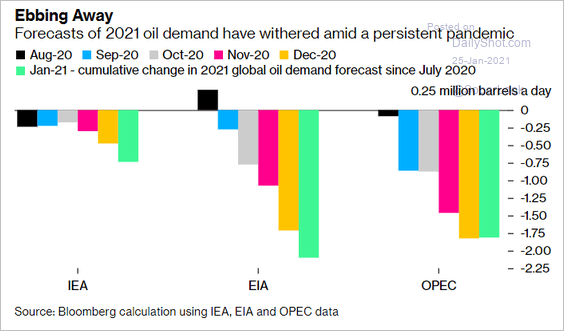

4. Forecasters have been downgrading their projections for oil demand in 2021.

Source: @business Read full article

Source: @business Read full article

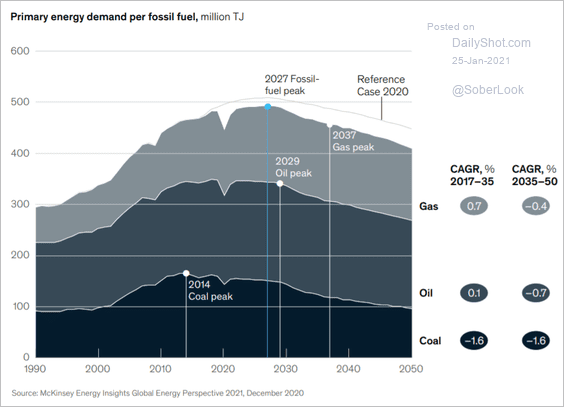

5. Will fossil fuels peak in 2027?

Source: McKinsey Read full article

Source: McKinsey Read full article

Back to Index

Equities

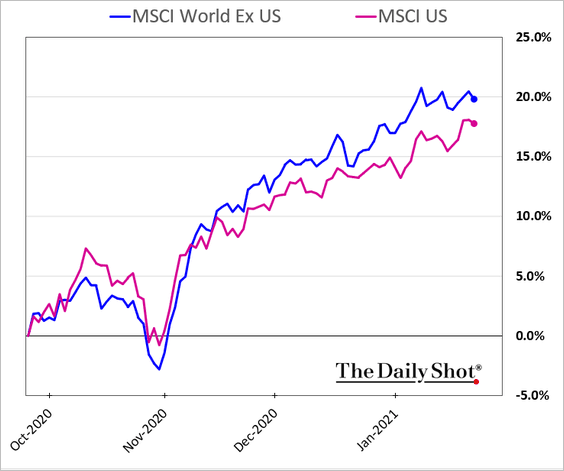

1. US stocks have been lagging the global rally in recent months.

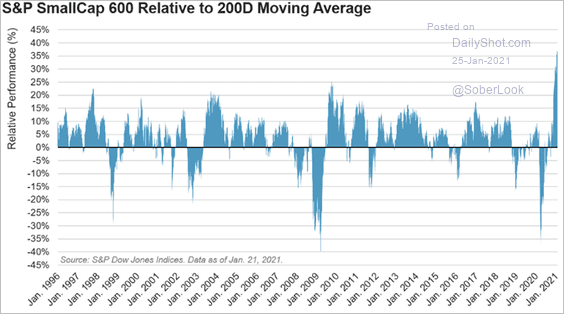

2. Here is the S&P SmallCap 600 index relative to its 200-day moving average.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

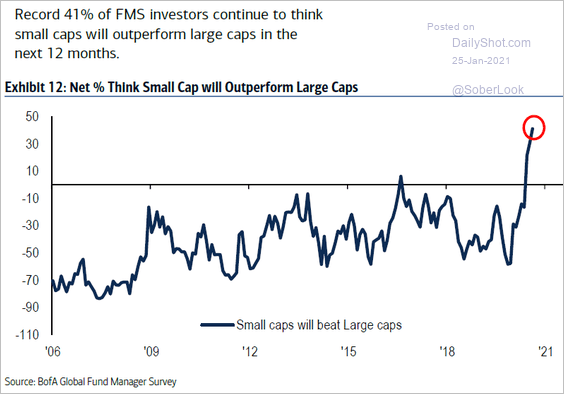

Fund managers are extremely bullish on small caps.

Source: BofA Global Research

Source: BofA Global Research

——————–

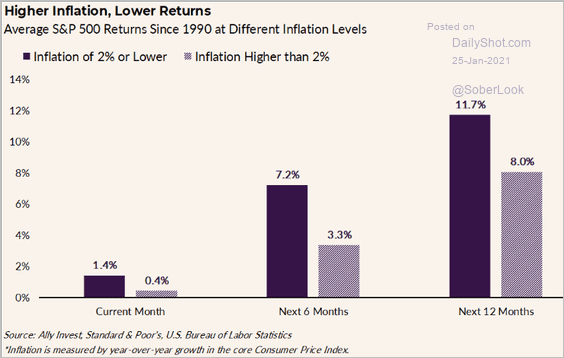

3. Stock gains tend to slow when US inflation exceeds 2%.

Source: @Ally Read full article

Source: @Ally Read full article

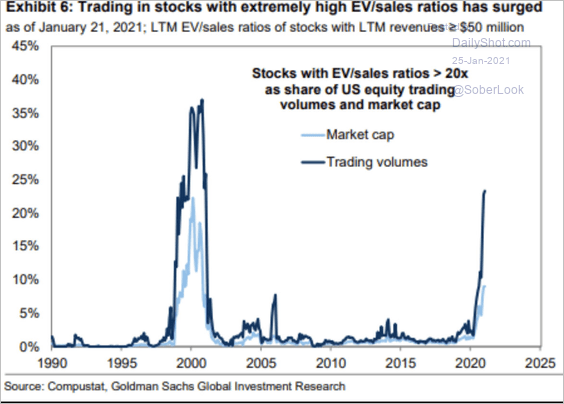

4. Trading activity in the most expensive stocks accelerated last year.

Source: Goldman Sachs, Myles Zyblock

Source: Goldman Sachs, Myles Zyblock

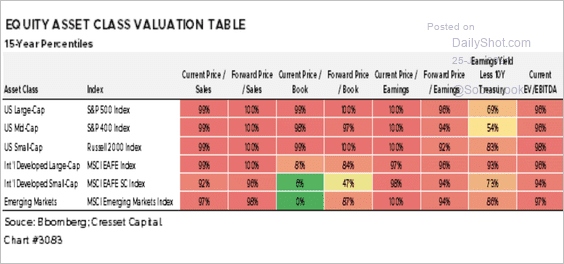

5. Here is a look at global equity valuations by 15-year percentiles. Is the upside limited now?

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

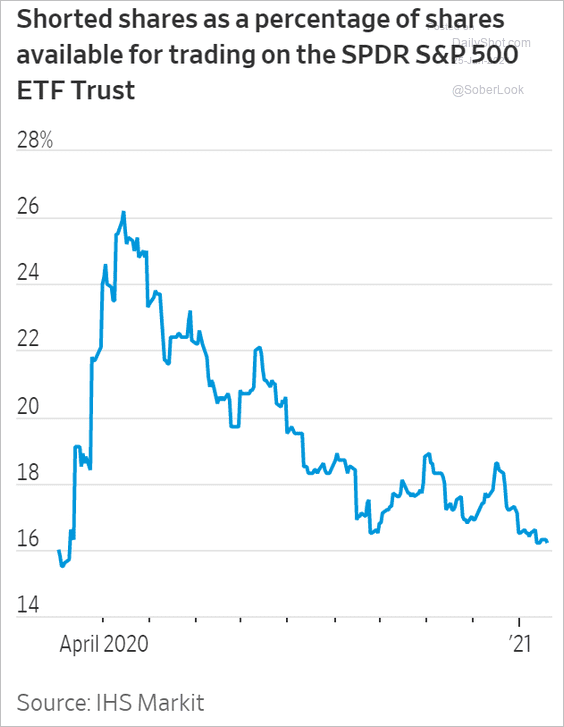

6. Short interest in SPY (the largest S&P 500 ETF) hit the lowest level since the pandemic selloff.

Source: @WSJ Read full article

Source: @WSJ Read full article

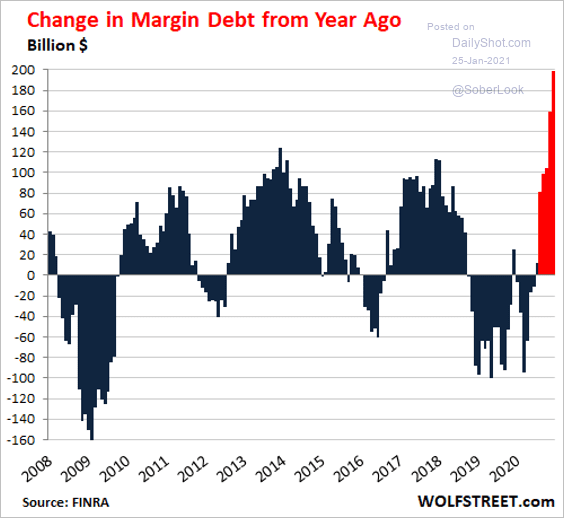

7. Margin debt spiked last year as traders became more comfortable with leverage.

Source: @wolfofwolfst Read full article

Source: @wolfofwolfst Read full article

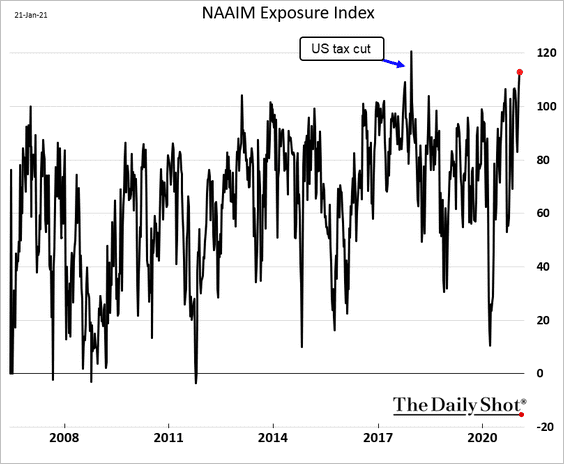

8. Active investment managers are extremely bullish.

Source: NAAIM, h/t Anastasios Avgeriou

Source: NAAIM, h/t Anastasios Avgeriou

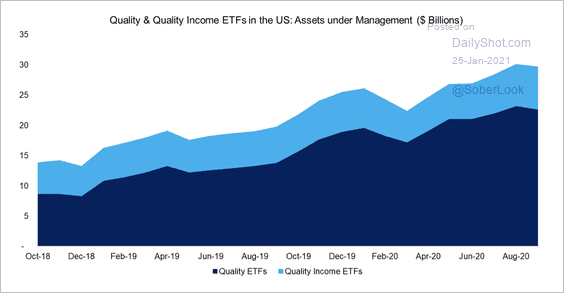

9. Quality and quality-income factor ETFs’ AUM has almost doubled over the past two years.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

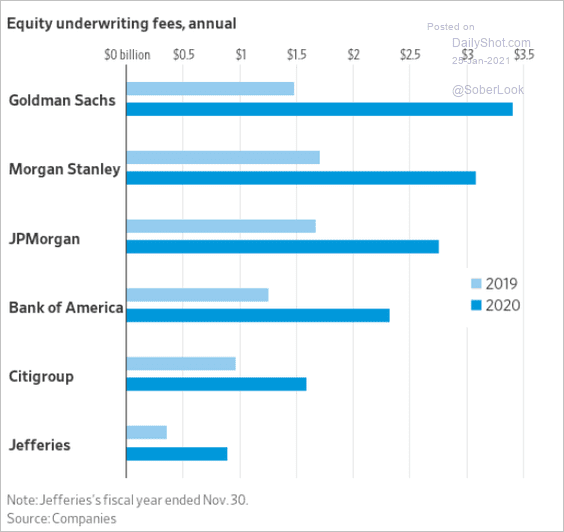

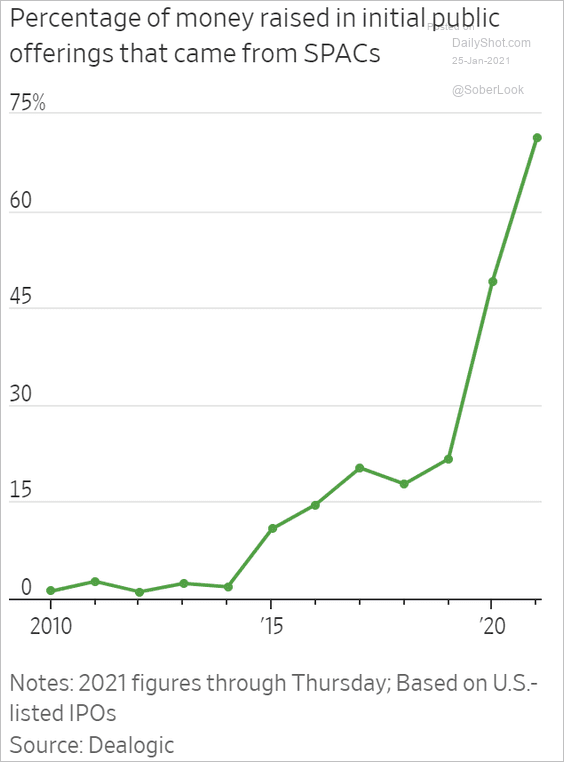

10. Banks’ equity underwriting fees jumped last year, boosted by SPACs (2nd chart).

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

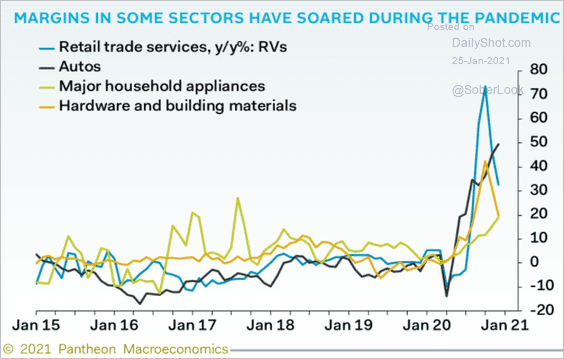

11. A number of sectors saw a sharp increase in margins last year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Alternatives

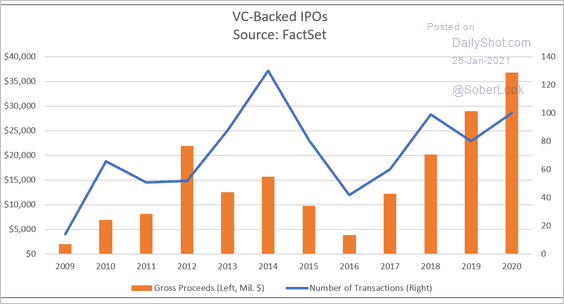

1. VC-backed IPO proceeds hit a record in 2020.

Source: @FactSet

Source: @FactSet

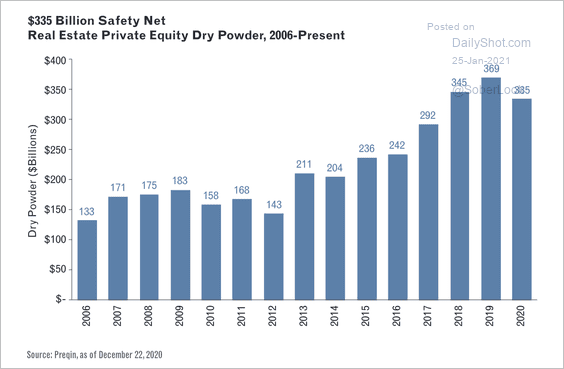

2. Real estate investment firms are sitting on $335 billion of dry powder.

Source: Park Madison Partners

Source: Park Madison Partners

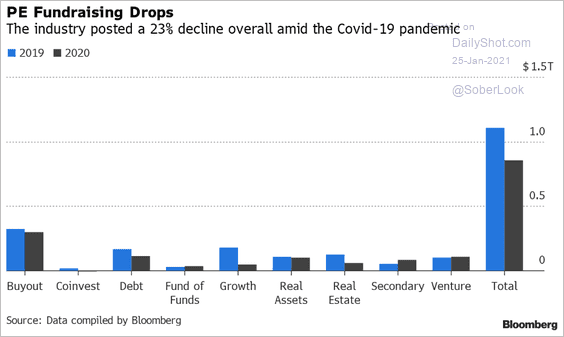

3. Private equity fundraising slowed last year.

Source: @norris_report, @MelKarsh, @TheTerminal, Bloomberg Finance L.P.

Source: @norris_report, @MelKarsh, @TheTerminal, Bloomberg Finance L.P.

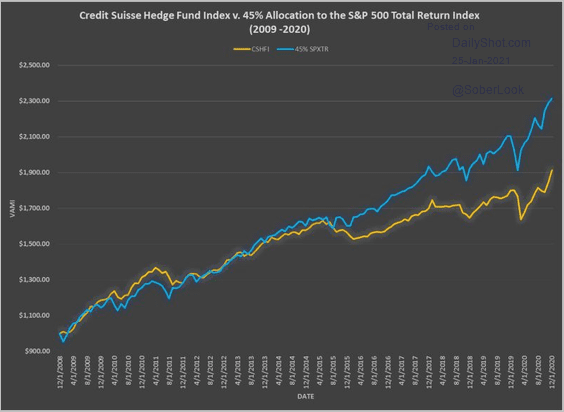

4. The Credit Suisse broad hedge fund index resembles a low-beta equity fund.

Source: Mark Serafini, Complexity Capital Management

Source: Mark Serafini, Complexity Capital Management

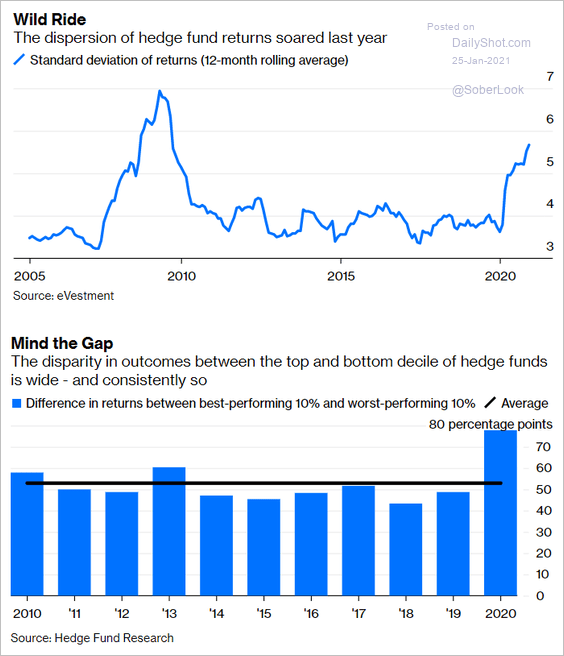

5. Hedge fund performance dispersion jumped last year.

Source: @ScouseView, @bopinion Read full article

Source: @ScouseView, @bopinion Read full article

Back to Index

Credit

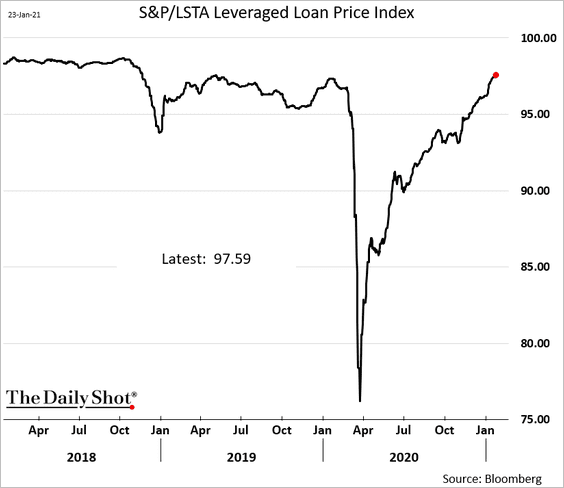

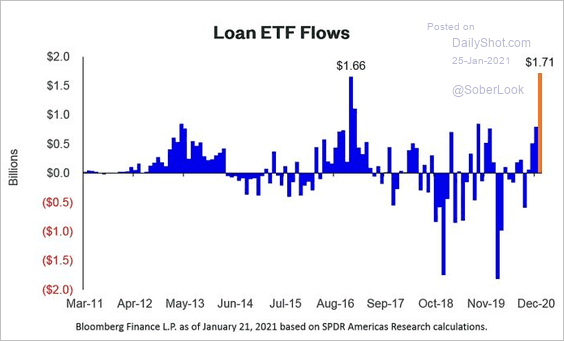

1. Leveraged loan prices have fully recovered amid robust inflows (2nd chart).

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

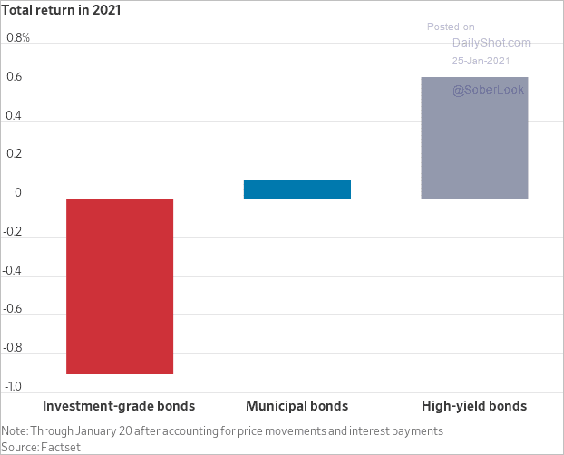

2. Investment-grade bonds underperformed this year as Treasury yields climbed.

Source: @WSJ Read full article

Source: @WSJ Read full article

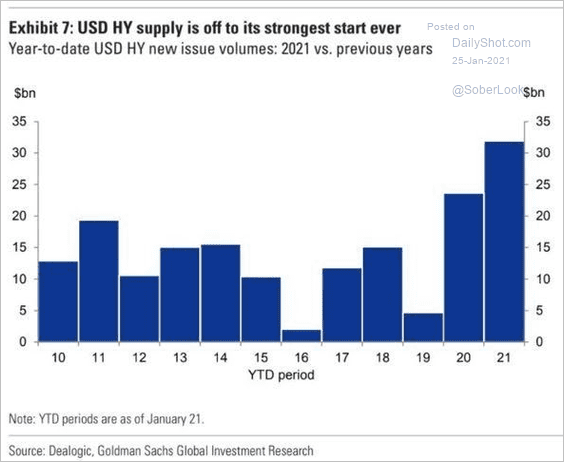

3. US high-yield bond issuance is off to its strongest start ever.

Source: Goldman Sachs, h/t James W.

Source: Goldman Sachs, h/t James W.

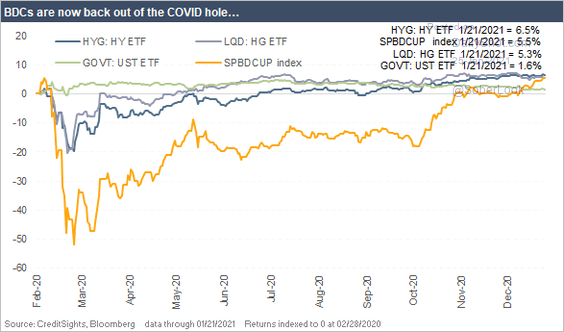

4. BDCs have now fully recovered (after being down some 50%).

Source: CreditSights

Source: CreditSights

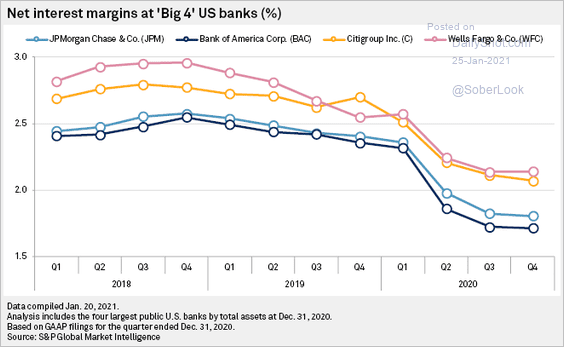

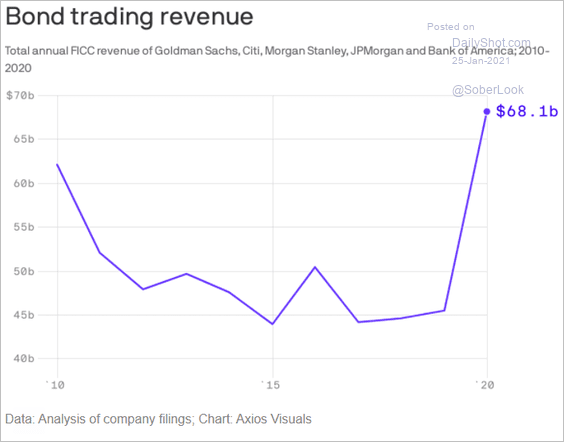

5. Bank interest margins declined sharply last year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

But bond trading revenue spiked.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Rates

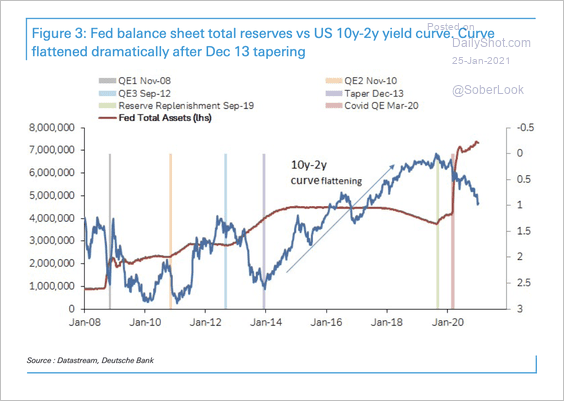

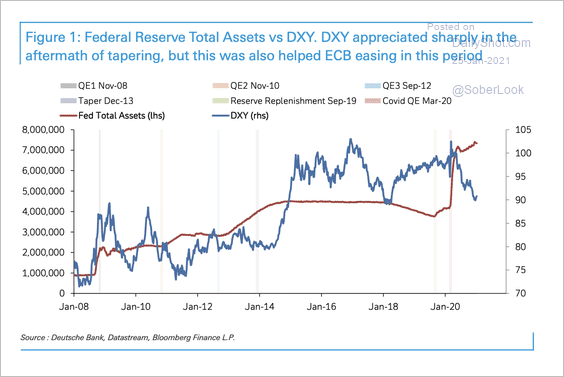

1. The Treasury curve significantly flattened following the last Fed taper.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

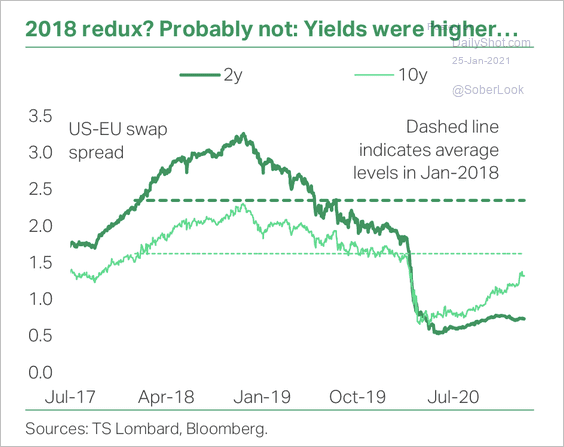

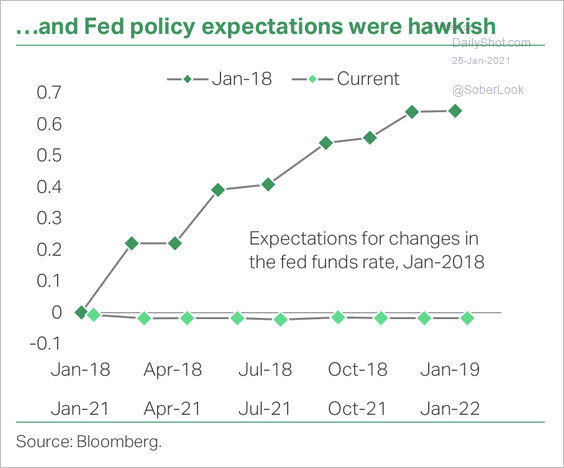

However, yields were higher during the last taper, and Fed policy expectations were hawkish (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

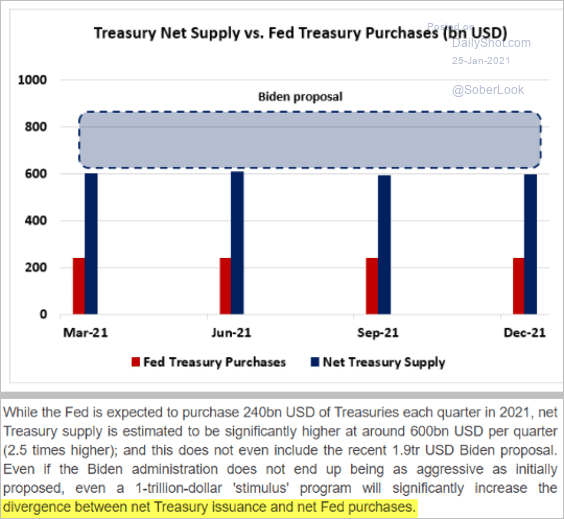

2. Will the Fed boost its bond purchases to keep up with the Treasury’s debt issuance?

Source: RothkoResearch

Source: RothkoResearch

Here is a comment from Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

Global Developments

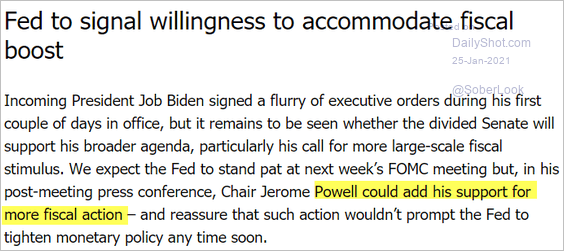

1. Will the dollar rise sharply if the Fed signals a slowdown in asset purchases? Not quite. There are notable differences this time; see rates section.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

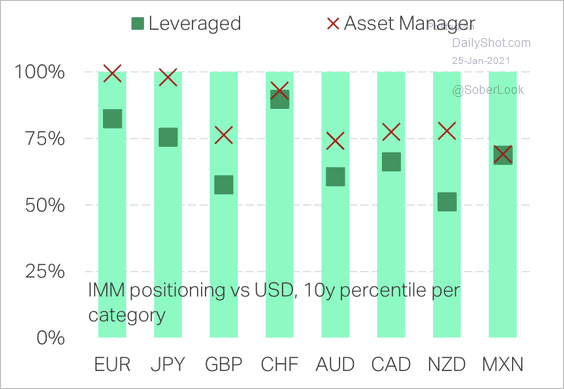

Short dollar positioning versus major currencies is at an extreme.

Source: TS Lombard

Source: TS Lombard

——————–

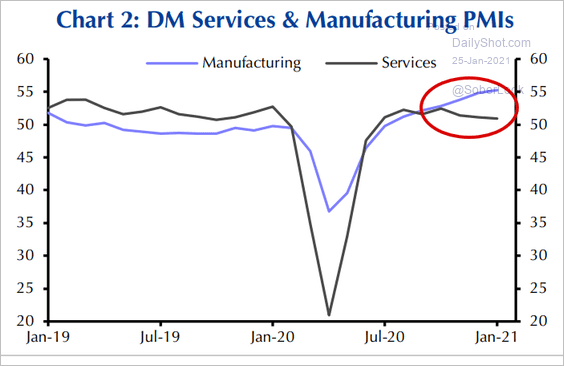

2. Manufacturing and services trends have diverged due to lockdowns.

Source: Capital Economics

Source: Capital Economics

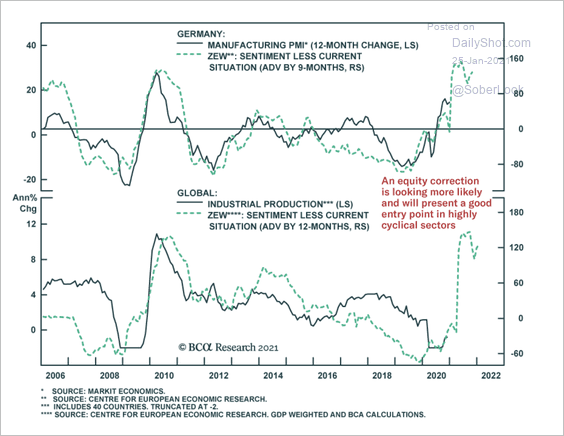

3. Global industrial production has room to rise, given positive sentiment.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

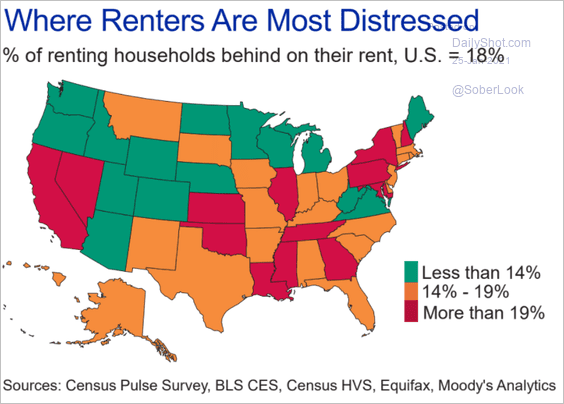

1. Households behind on their rent, by state:

Source: Moody’s Analytics

Source: Moody’s Analytics

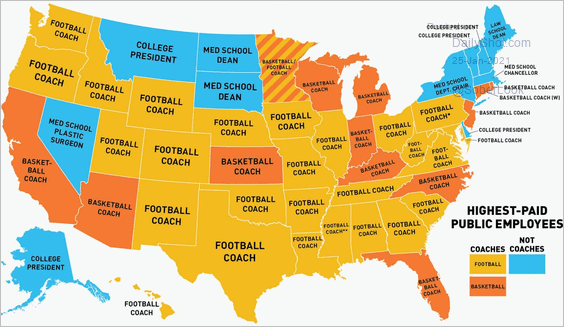

2. Highest-paid public employees:

Source: Deadspin

Source: Deadspin

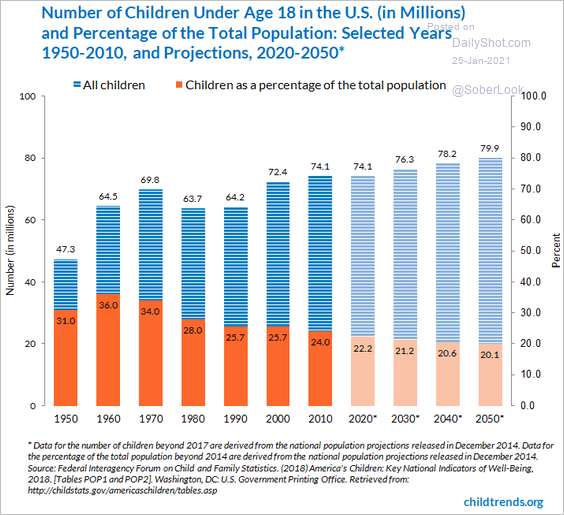

3. Children as a percentage of US population:

Source: Child Trends Read full article

Source: Child Trends Read full article

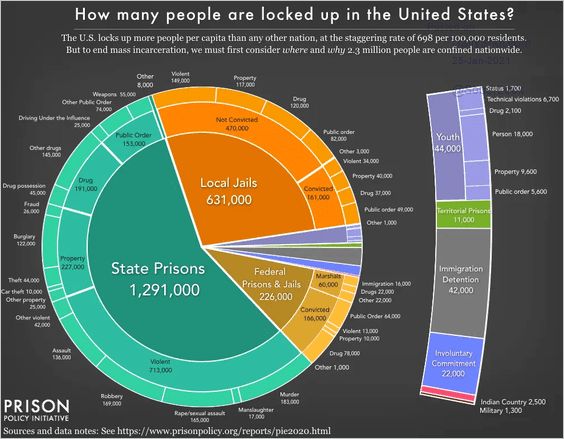

4. US prison population:

Source: Prison Policy Initiative

Source: Prison Policy Initiative

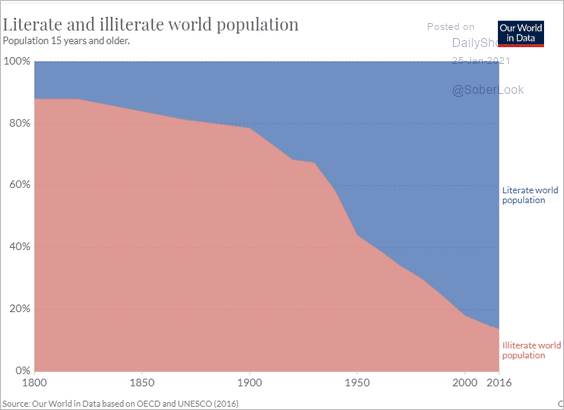

5. Literate and illiterate world population:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

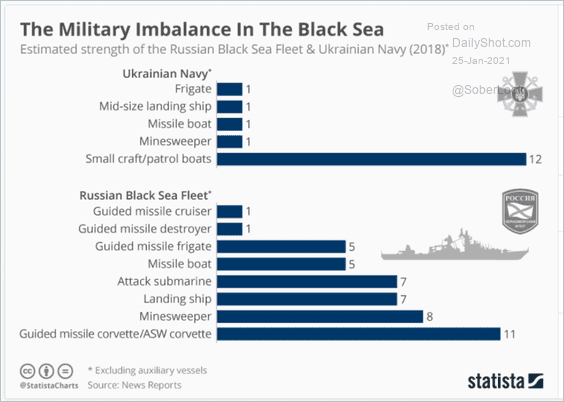

6. Russia vs. Ukraine military imbalance:

Source: Statista

Source: Statista

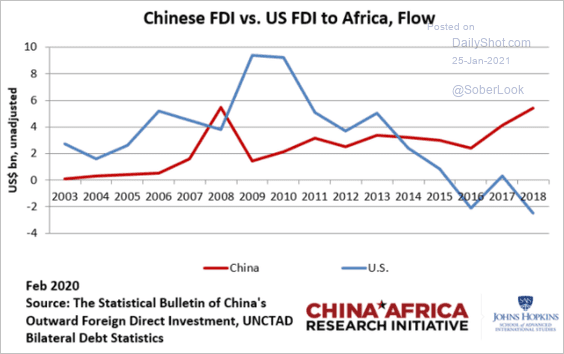

7. Foreign direct investment in Africa:

Source: China Africa Research Initiative Read full article

Source: China Africa Research Initiative Read full article

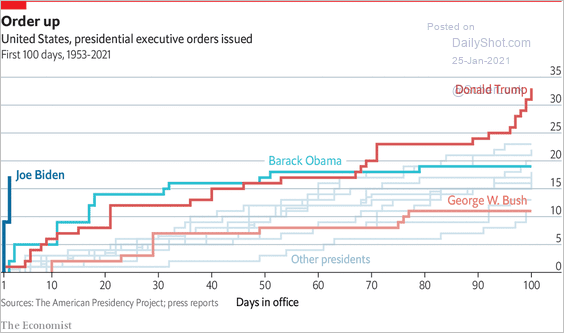

8. Presidential executive orders:

Source: The Economist Read full article

Source: The Economist Read full article

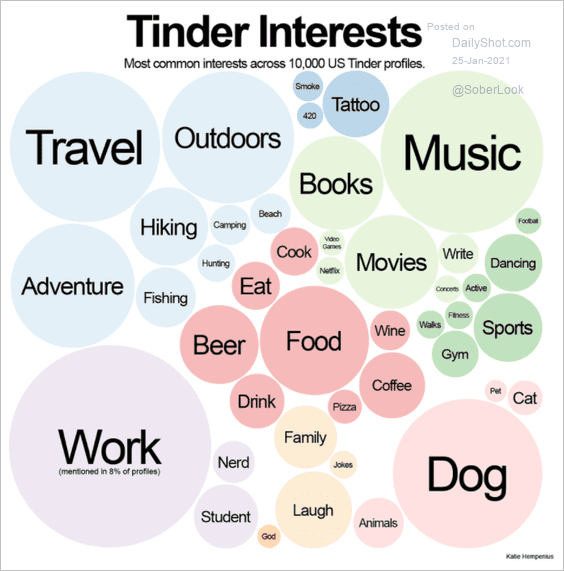

9. Tinder (dating site) profile interests:

Source: @katiehempenius

Source: @katiehempenius

——————–

Back to Index