The Daily Shot: 20-May-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

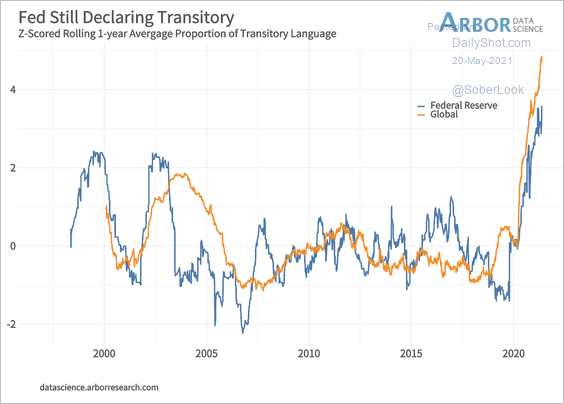

1. Let’s start with the FOMC minutes.

• There were some concerns about persistent supply-chain bottlenecks boosting prices.

A number of participants remarked that supply chain bottlenecks and input shortages may not be resolved quickly and, if so, these factors could put upward pressure on prices beyond this year. They noted that in some industries, supply chain disruptions appeared to be more persistent than originally anticipated and reportedly had led to higher input costs.

But the overall sentiment on inflation at the central bank remains dovish.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

FOMC: – Despite the expected short-run fluctuations in measured inflation, many participants commented that various measures of longer-term inflation expectations remained well anchored at levels broadly consistent with achieving the Committee’s longer-run goals.

• A few members want to have a discussion on QE tapering.

Source: Reuters Read full article

Source: Reuters Read full article

Many participants highlighted the importance of the Committee clearly communicating its assessment of progress toward its longer-run goals well in advance of the time when it could be judged substantial enough to warrant a change in the pace of asset purchases. The timing of such communications would depend on the evolution of the economy and the pace of progress toward the Committee’s goals. A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.

• Some FOMC members are becoming uneasy with “financial stability” trends (asset bubbles).

Regarding asset valuations, several participants noted that risk appetite in capital markets was elevated, as equity valuations had risen further, IPO activity remained high, and risk spreads on corporate bonds were at the bottom of their historical distribution. A couple of participants remarked that, should investor risk appetite fall, an associated drop in asset prices coupled with high business and financial leverage could have adverse implications for the real economy. A number of participants commented on valuation pressures being somewhat elevated in the housing market. Some participants mentioned the potential risks to the financial system stemming from the activities of hedge funds and other leveraged investors [a reference to Archegos Capital], commenting on the limited visibility into the activities of these entities or on the prudential risk-management practices of dealers’ prime-brokerage businesses. Some participants highlighted potential vulnerabilities in other parts of the financial system, including run-prone investment funds in short-term funding and credit markets. Various participants commented on the prolonged period of low interest rates and highly accommodative financial market conditions and the possibility for these conditions to lead to reach-for-yield behavior that could raise financial stability risks.

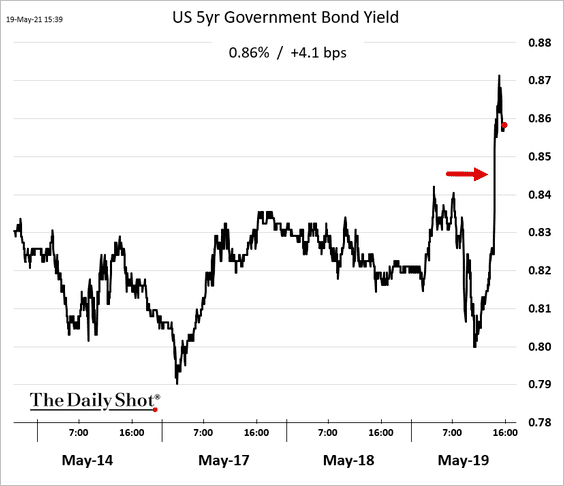

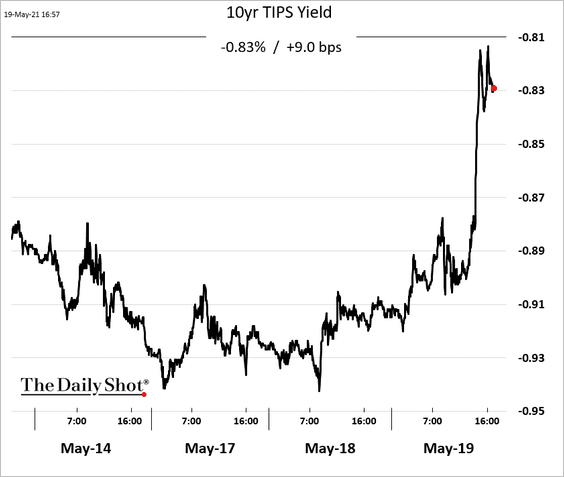

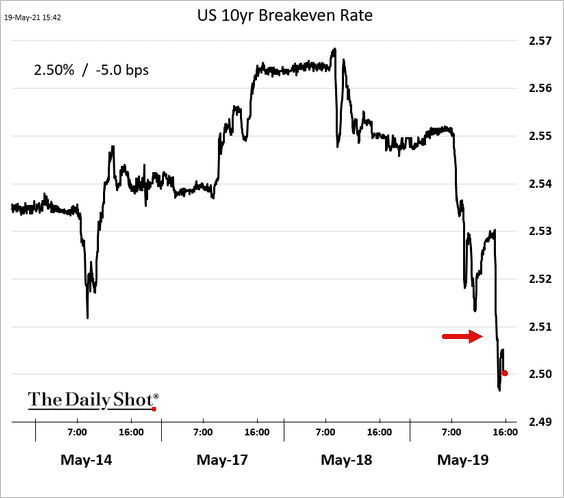

2. The FOMC is talking about a tapering discussion was a bit of a surprise. That’s not the signal the markets got from Chairman Powell.

• Both nominal (chart below) and real yields (2nd chart) jumped, …

… and inflation expectations declined.

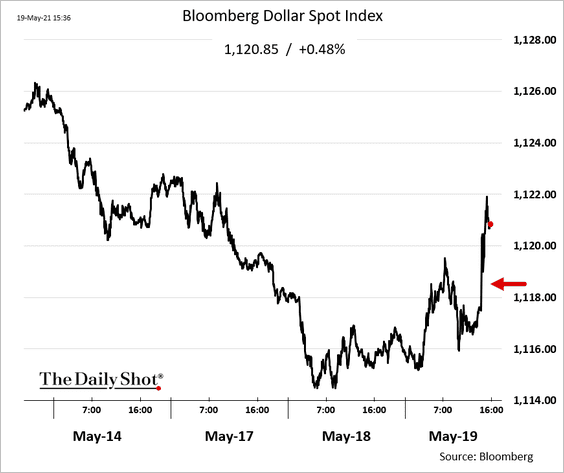

• The dollar strengthened.

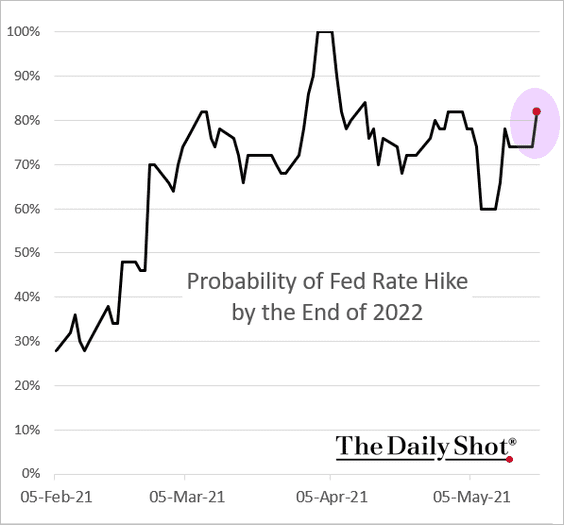

• The futures-based probability of a rate hike next year increased.

——————–

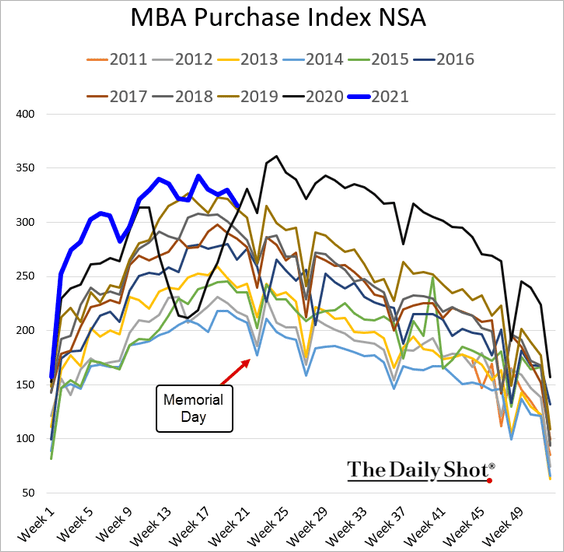

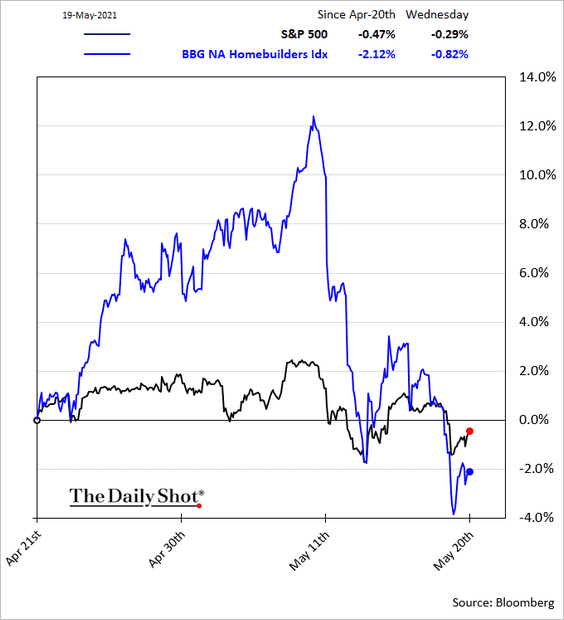

3. Mortgage applications to purchase a house have lost momentum.

As we saw yesterday, residential construction is facing some headwinds. Homebuilders’ shares have underperformed this month.

——————–

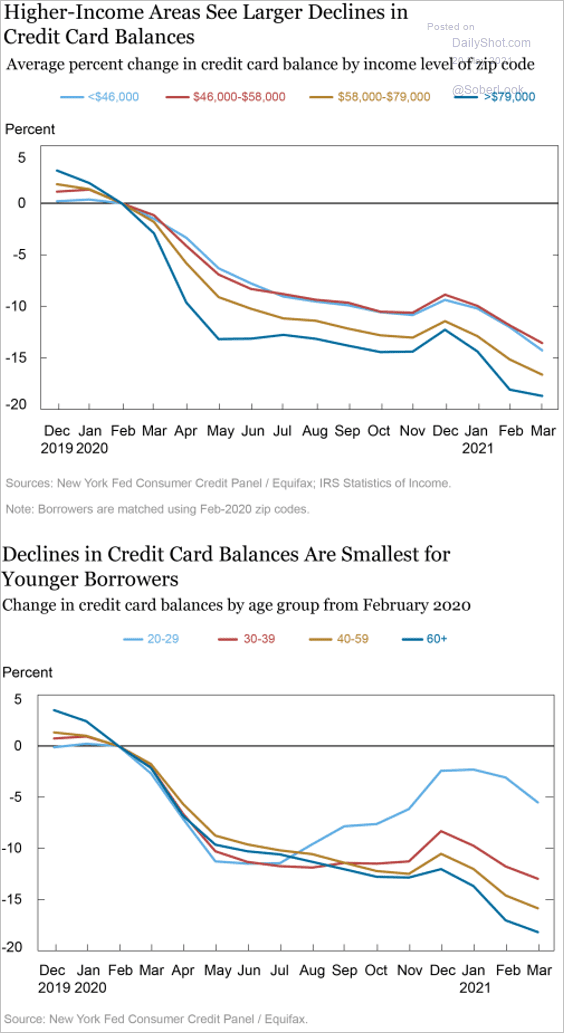

4. Next, we have some data on the recent slump in credit card balances.

Source: @GregDaco, @NewYorkFed Read full article

Source: @GregDaco, @NewYorkFed Read full article

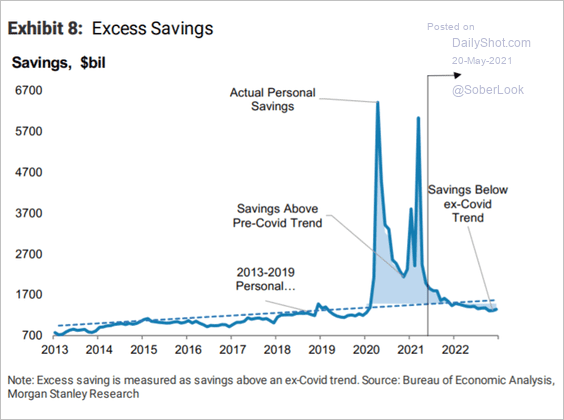

5. According to Morgan Stanley, excess personal savings will run below trend next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

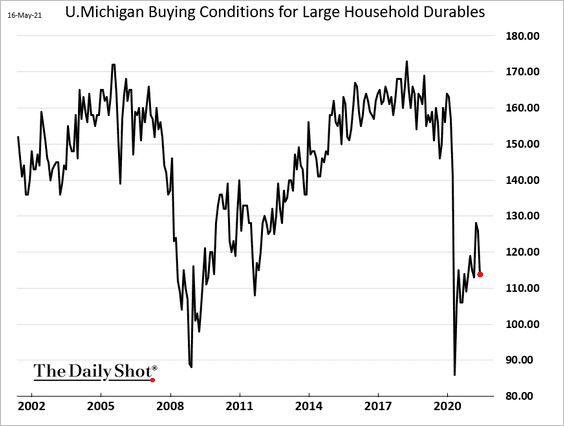

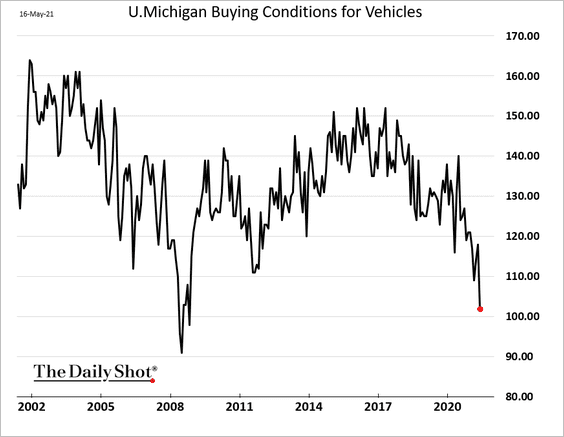

6. The U. Michigan consumer sentiment on buying conditions for vehicles and large durables remains depressed.

——————–

7. Retail sales have exceeded retail inventories for the first time in decades.

Source: @LizAnnSonders

Source: @LizAnnSonders

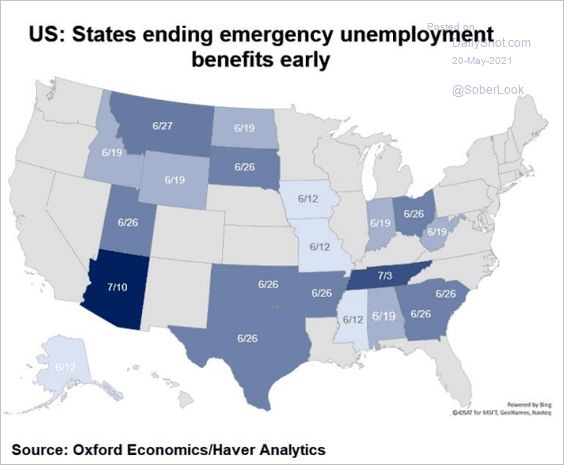

8. Many states are ending emergency unemployment benefits next month. How much will this “income cliff” impact spending?

Source: @GregDaco, @OxfordEconomics, @nanc455 Read full article

Source: @GregDaco, @OxfordEconomics, @nanc455 Read full article

Back to Index

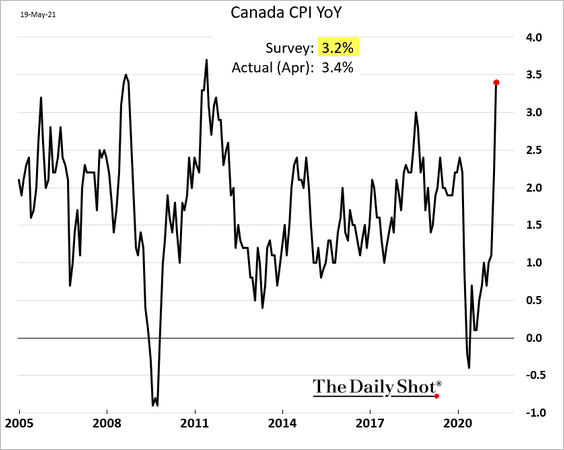

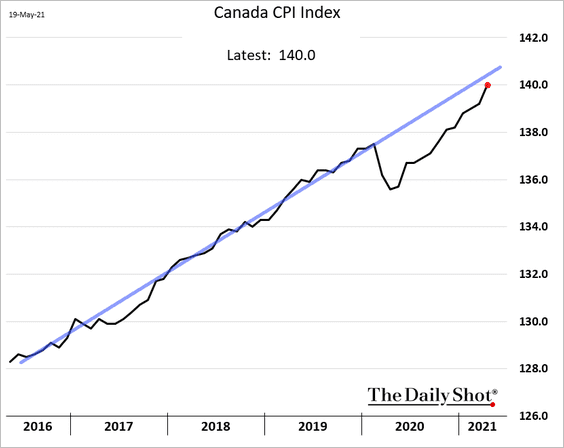

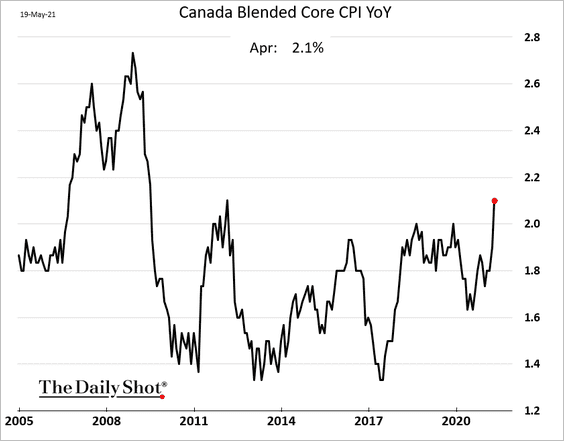

Canada

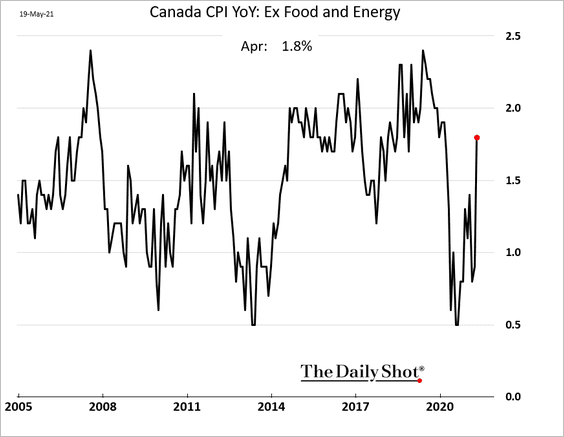

1. The CPI report was a bit stronger than expected, although much of the year-over-year gains were from base effects.

The CPI index is still below its pre-COVID trend.

• Here is the blended core CPI.

And this is the CPI ex. food and energy.

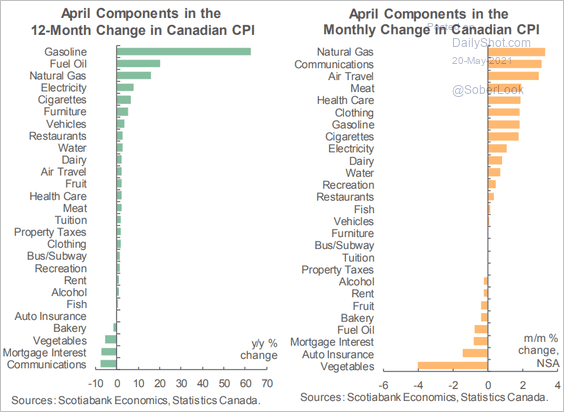

• Below are the CPI components.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

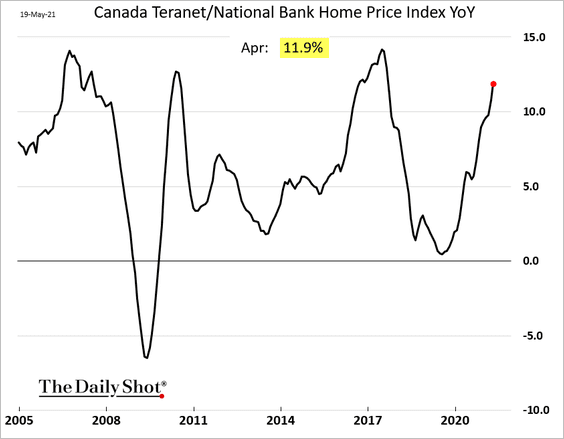

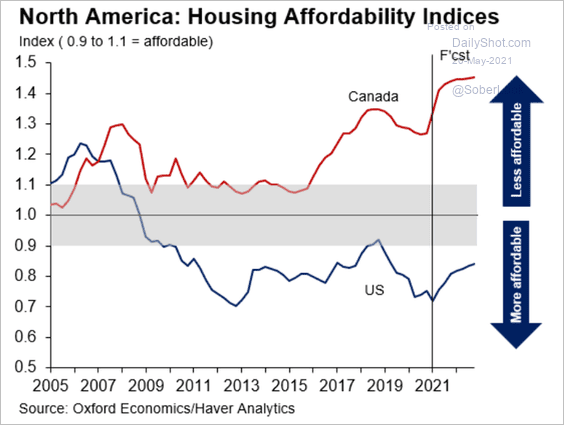

2. Home price appreciation is approaching 12%, …

… pressuring affordability.

Source: @GregDaco, @OxfordEconomics Read full article

Source: @GregDaco, @OxfordEconomics Read full article

——————–

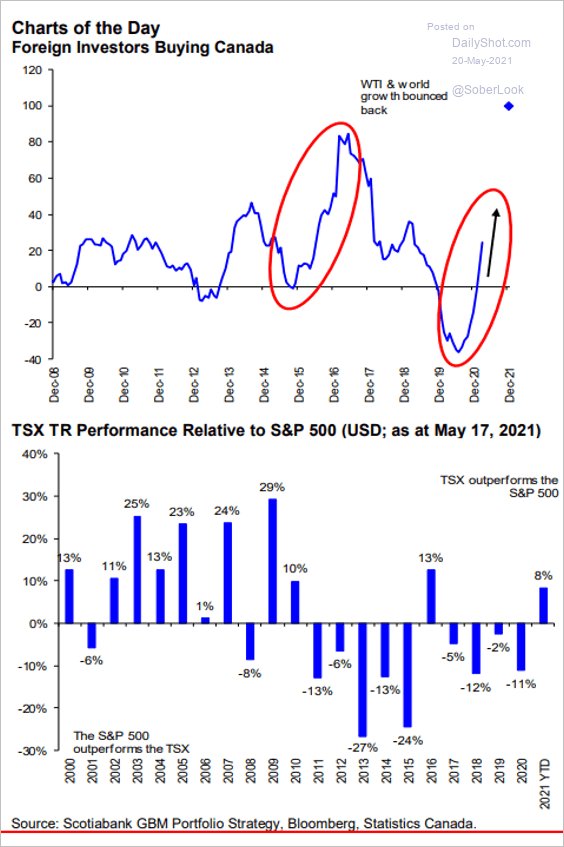

3. Foreign investors have been coming back into Canada’s stock market.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

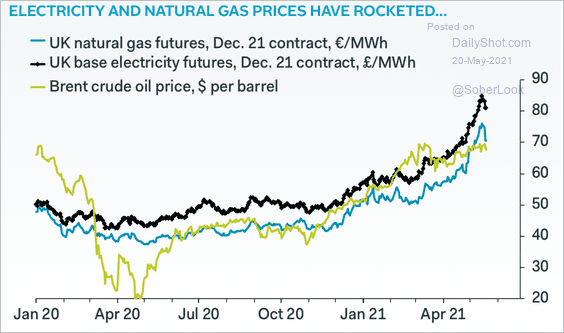

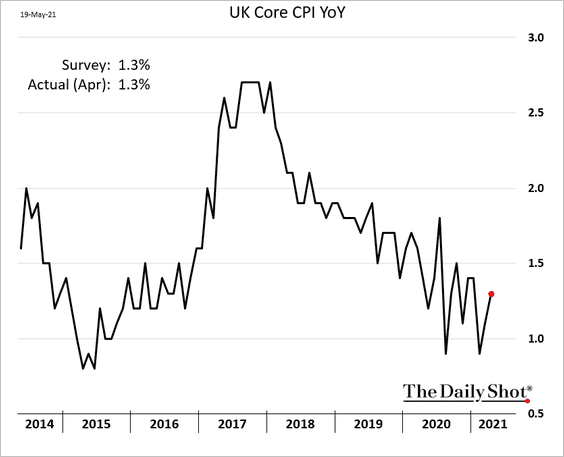

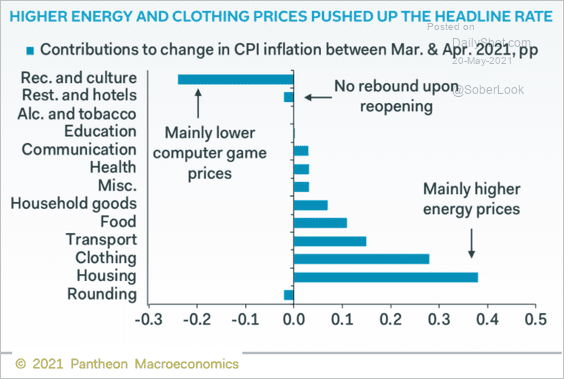

The United Kingdom

1. Outside of energy prices, …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

… consumer inflation remains mild for now.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

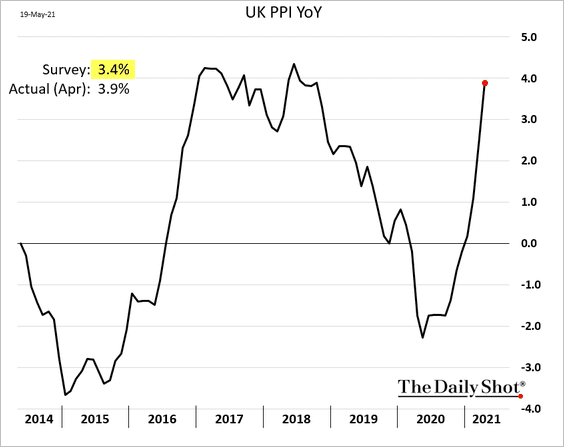

2. Producer prices, on the other hand, surprised to the upside.

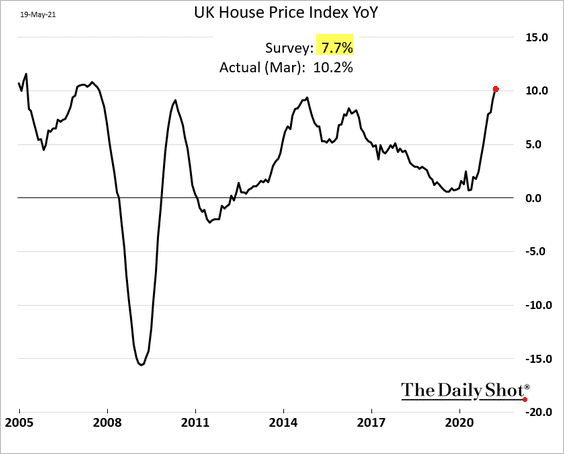

3. Home price appreciation (official figures) accelerated more than expected in March, hitting the highest level since 2007.

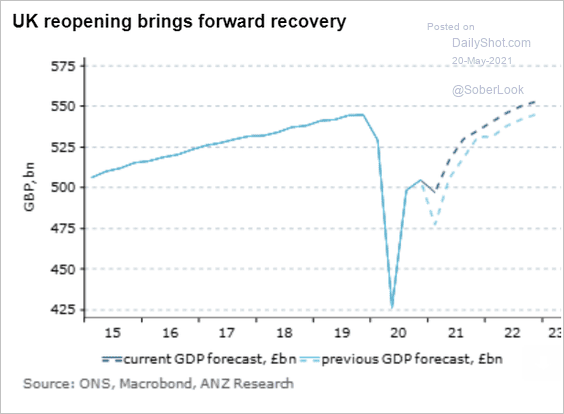

4. ANZ upgraded its GDP forecast for the UK.

Source: ANZ Research

Source: ANZ Research

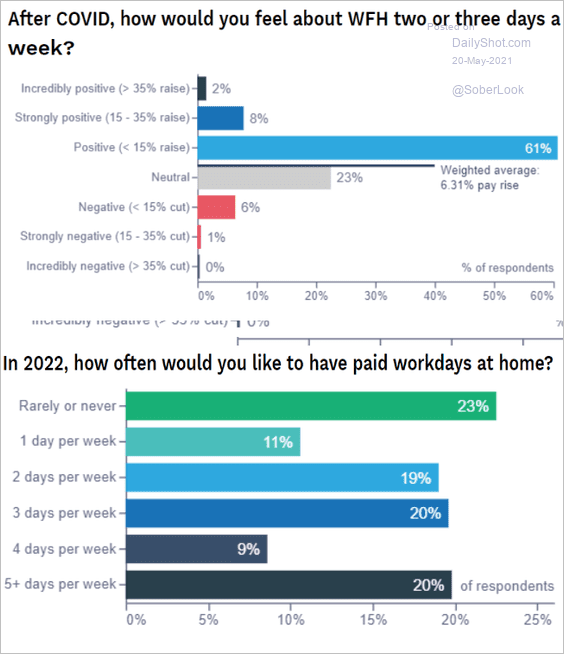

5. Working from home after COVID?

Source: Economics Observatory Read full article

Source: Economics Observatory Read full article

Back to Index

The Eurozone

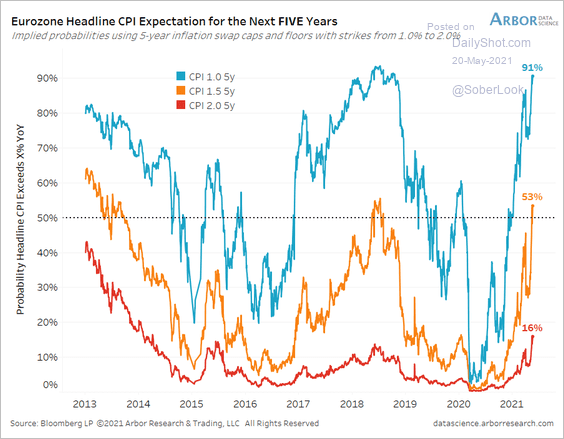

1. Inflation options are pricing in a 16% probability that the CPI will exceed 2% over the next five years.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

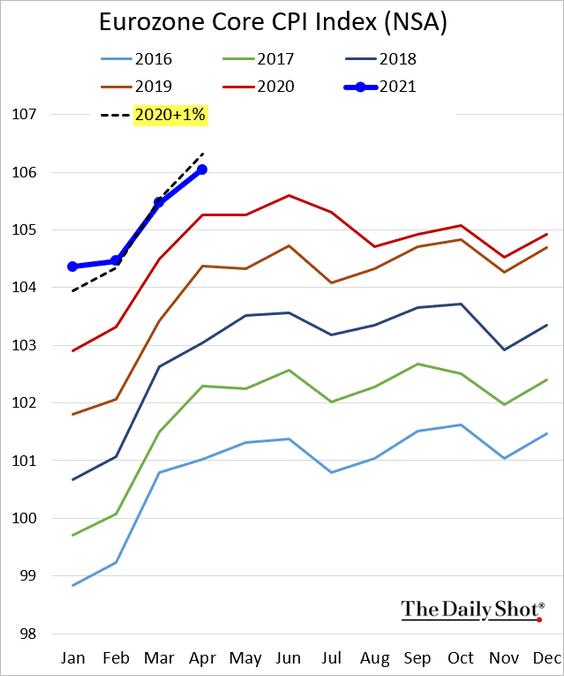

Here is the core CPI index without the usual seasonal adjustments.

——————–

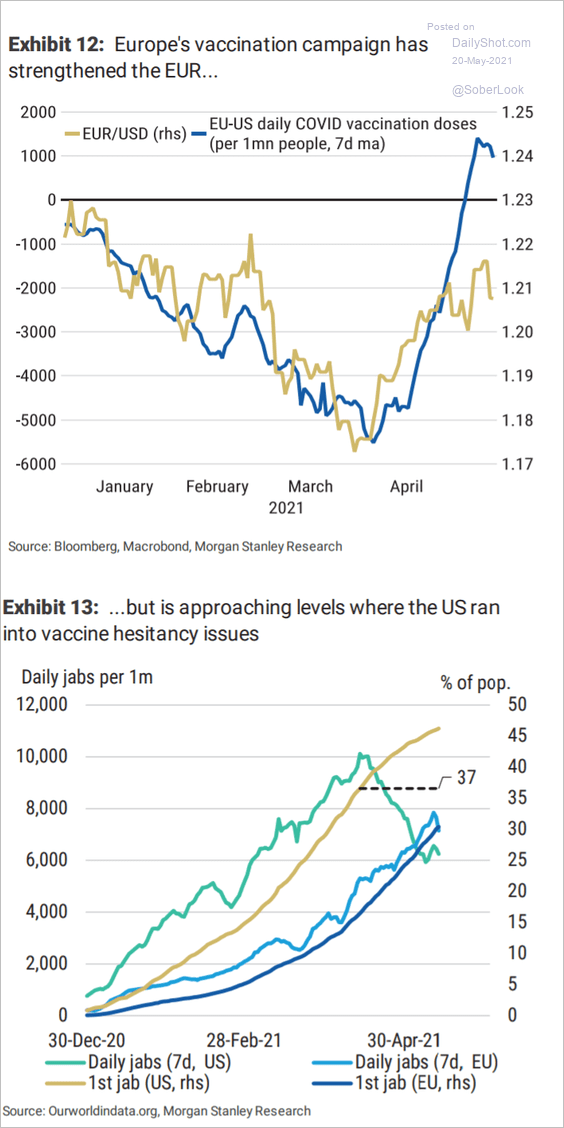

2. The vaccination progress has strengthened the euro, but will the pace slow as it did in the US?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

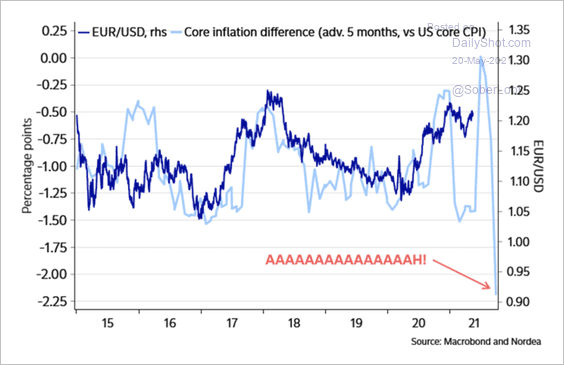

The spike in US core inflation suggests downside pressure on EUR/USD.

Source: Nordea Markets

Source: Nordea Markets

——————–

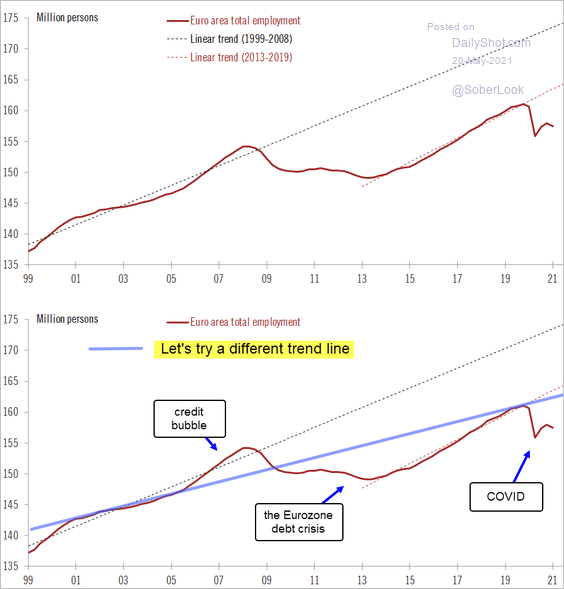

3. Weak demographics don’t bode well for employment growth over the long run. Previous trends will be difficult to sustain.

Source: @fwred

Source: @fwred

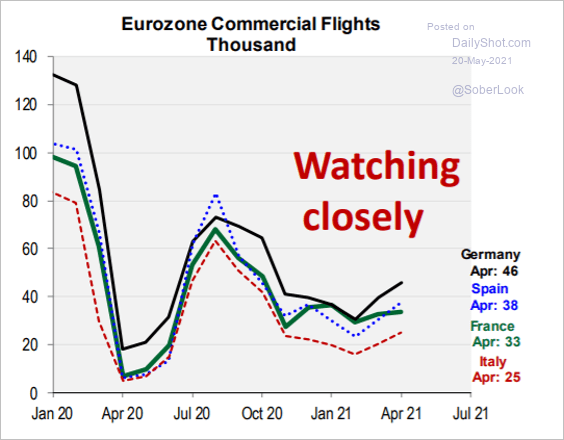

4. Will commercial flights begin rebounding?

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Europe

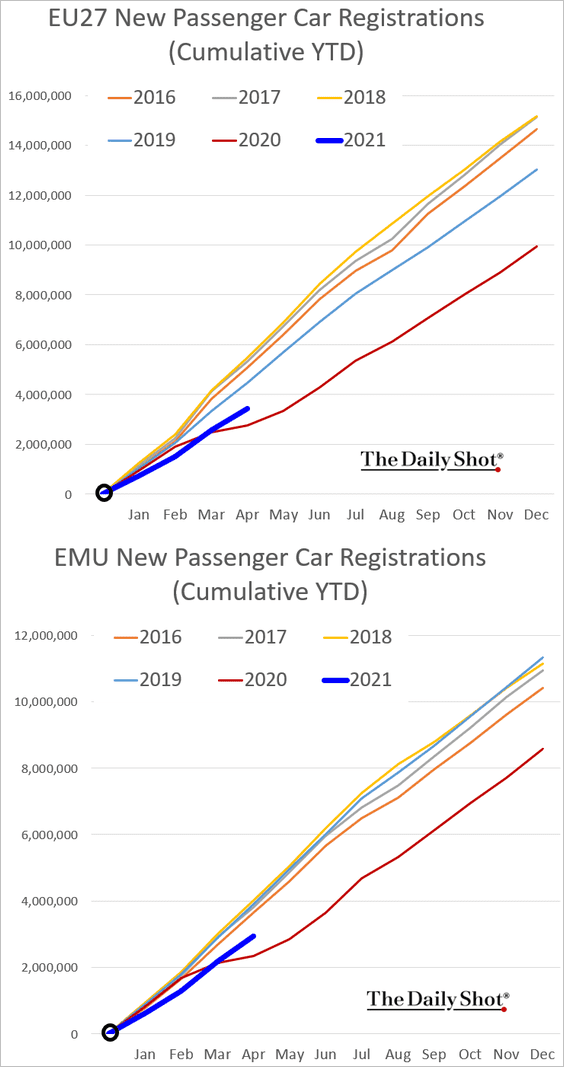

1. EU’s new car registrations remain well below previous years. The second chart shows the same trend for the Eurozone.

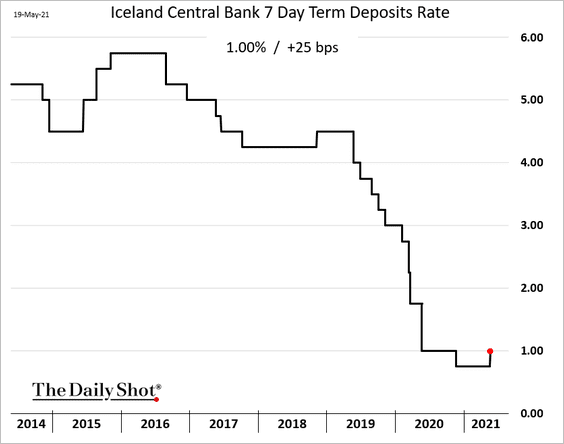

2. Iceland’s central bank hiked rates amid rising wages and stronger home prices.

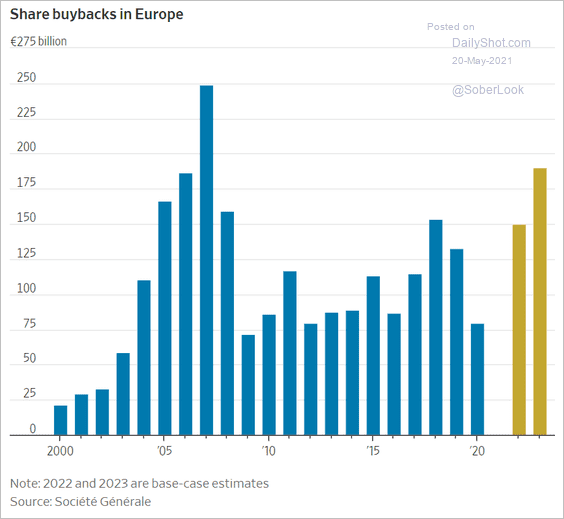

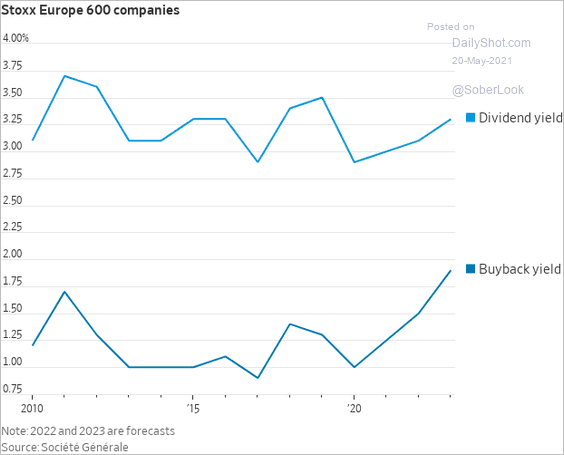

3. Share buybacks are back.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

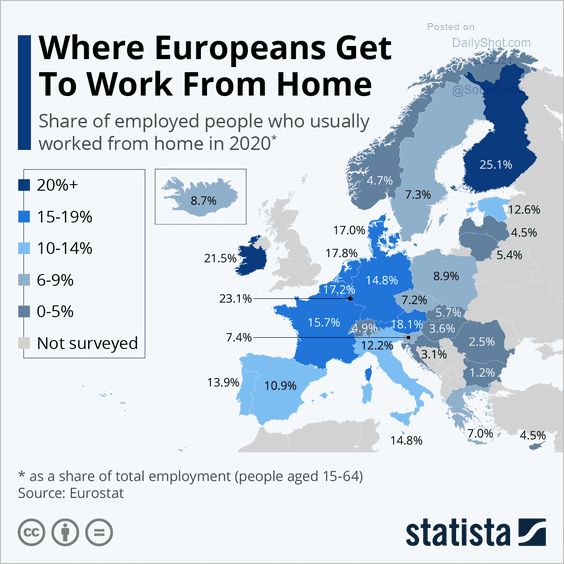

4. Working from home:

Source: Statista

Source: Statista

Back to Index

Asia – Pacific

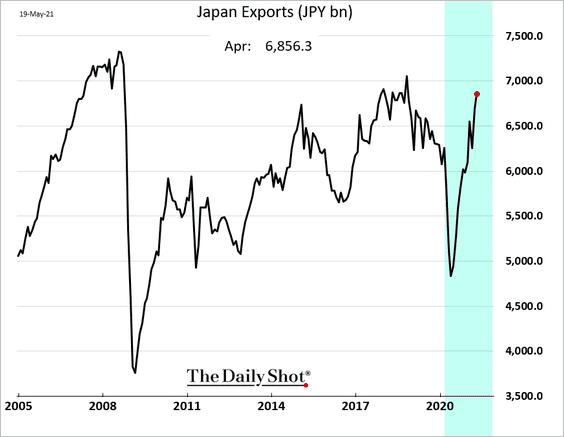

1. Japan’s April exports were 10% above pre-COVID levels.

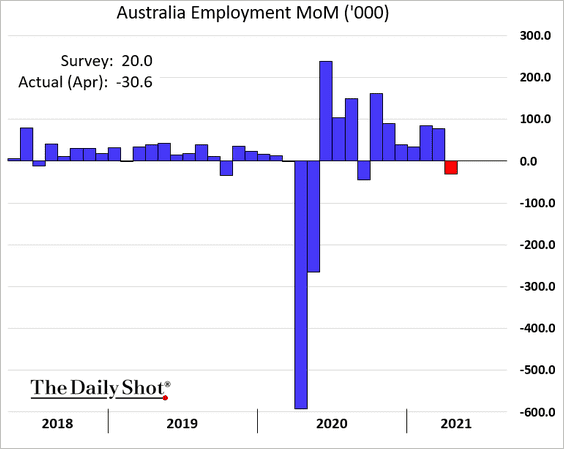

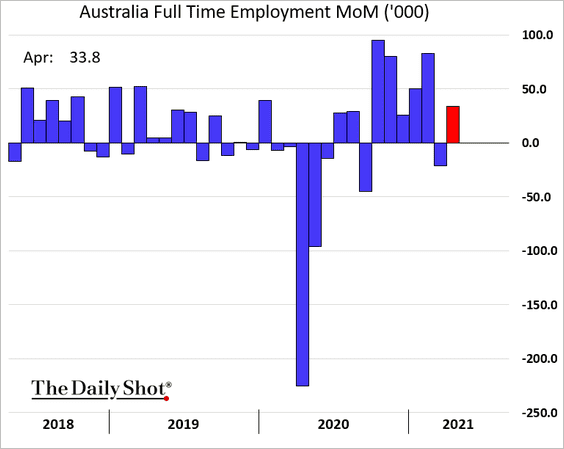

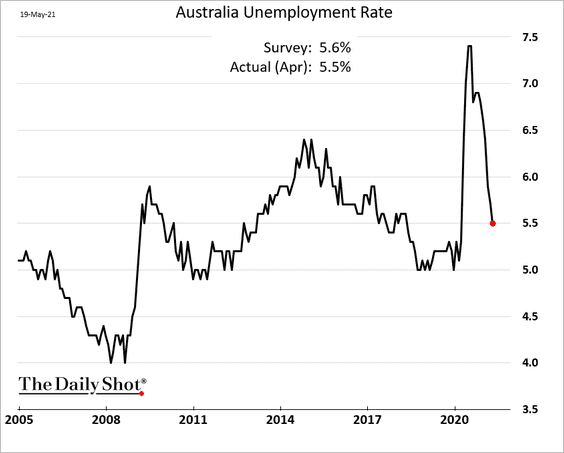

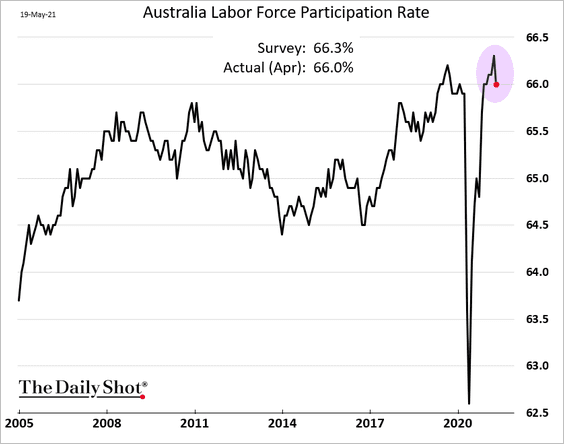

2. Australia’s employment report was mixed.

• The headline jobs number surprised to the downside.

But full-time employment improved.

• The unemployment rate declined further.

• But the participation rate also fell (although still relatively high).

Back to Index

China

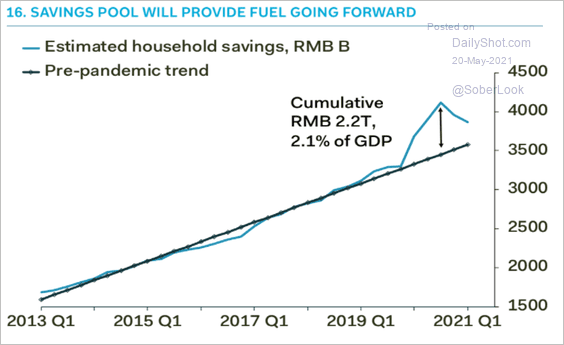

1. High savings should be a tailwind for consumption over the next few quarters.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

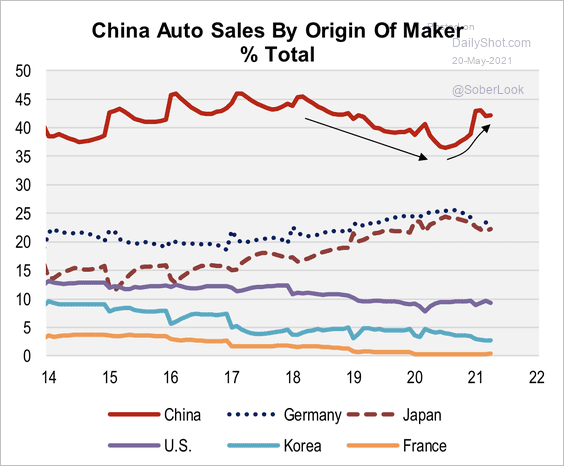

2. Car sales are shifting from foreign brands to domestic brands.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Emerging Markets

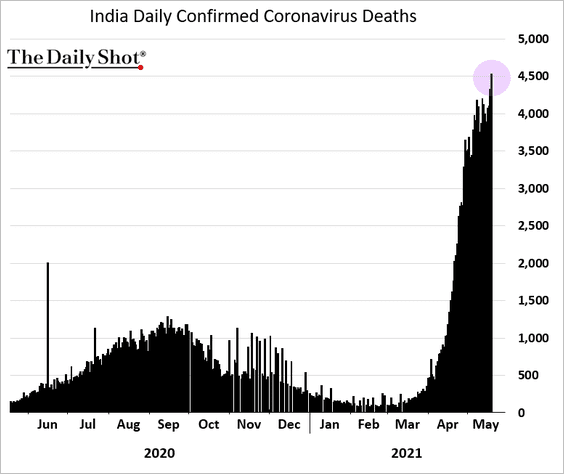

1. India’s COVID-related deaths hit a new high.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

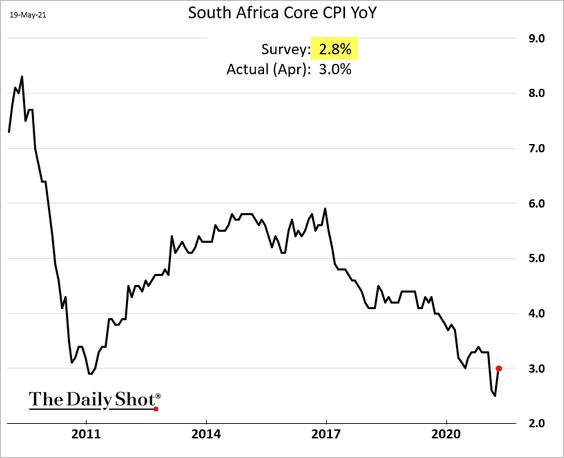

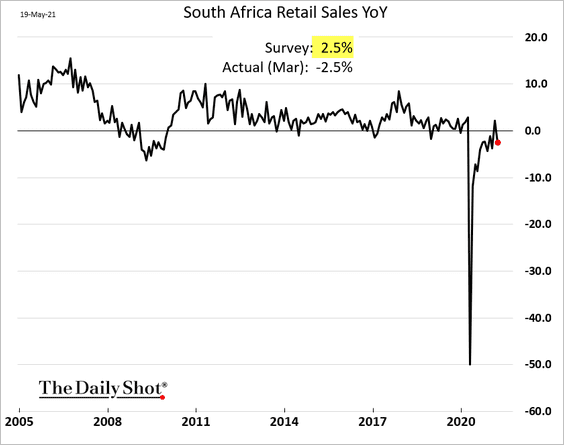

2. South Africa’s inflation has bottomed.

The nation’s retail sales unexpectedly slumped in March.

——————–

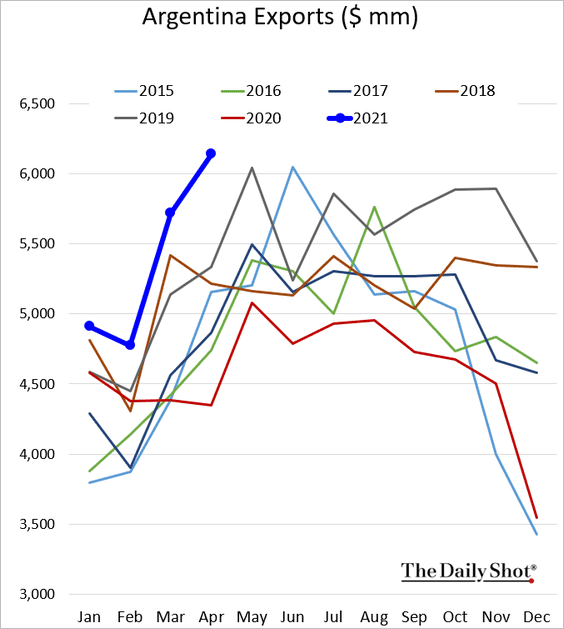

3. High soybean prices boosted Argentina’s exports.

Back to Index

Cryptocurrency

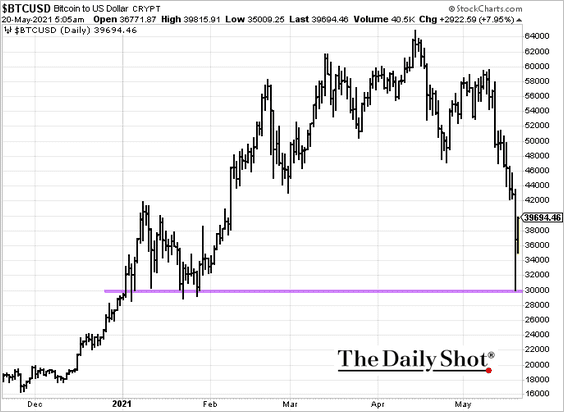

1. Cryptos tumbled as exchanges hit a snag.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

But the market stabilized.

• Bitcoin found support at $30k …

… and Ethereum at at $2k.

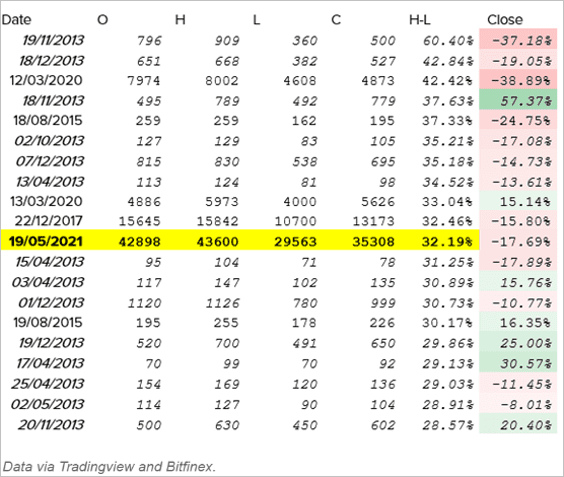

• How does the drop in bitcoin compare to previous routs?

Source: Enigma Securities

Source: Enigma Securities

• Here is the relative performance over the past month.

And this table shows the performance summary.

Source: Enigma Securities

Source: Enigma Securities

——————–

2. Coinbase hit a post-IPO low.

3. Rotation to gold continues.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

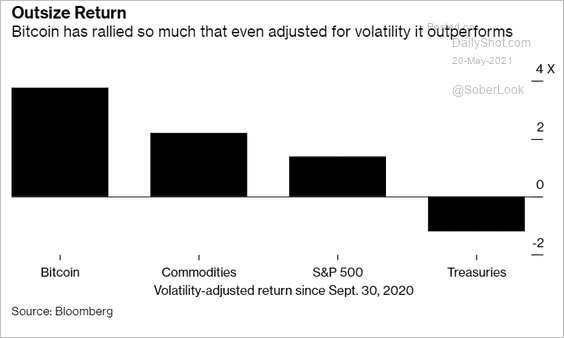

4. This chart shows bitcoin’s volatility-adjusted performance vs. other assets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

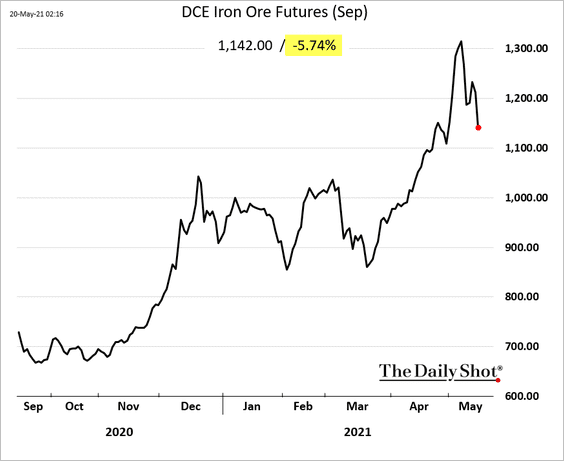

1. Iron ore remains under pressure.

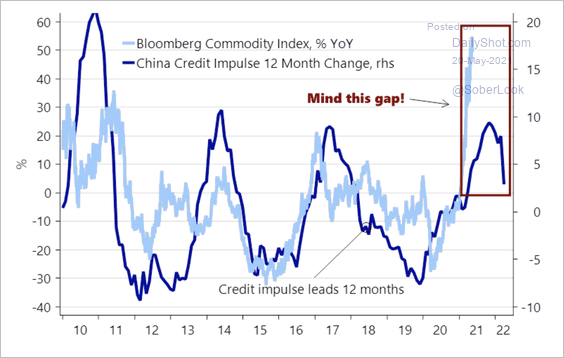

2. The decline in China’s credit impulse points to lower commodity prices.

Source: Nordea Markets

Source: Nordea Markets

——————–

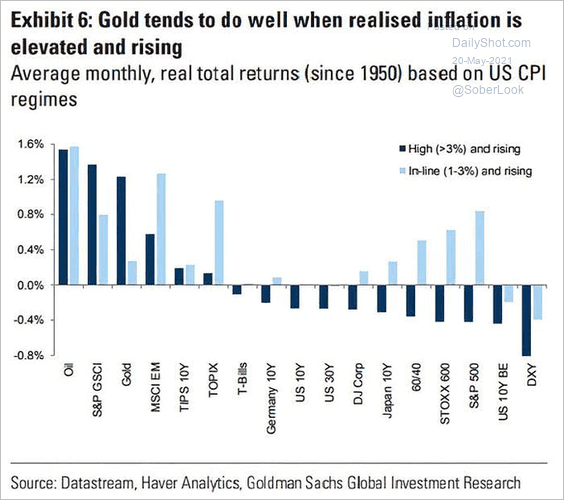

3. Gold performs well when inflation is elevated and rising.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Back to Index

Energy

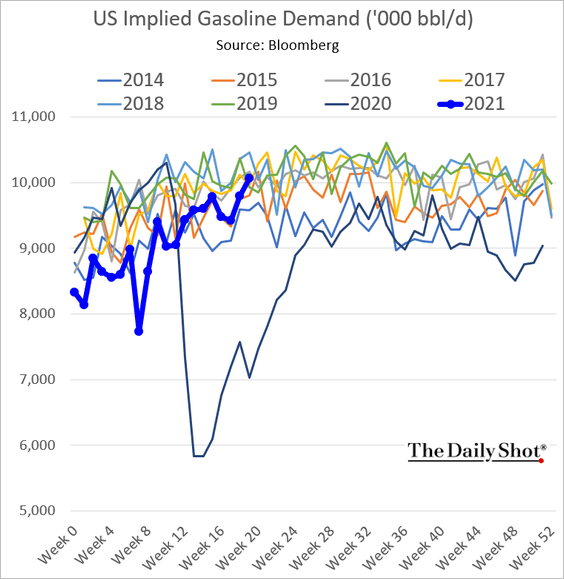

1. US gasoline demand continues to climb.

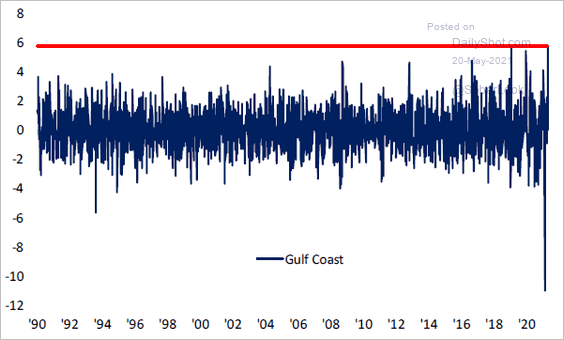

2. The Gulf Coast gasoline inventories jumped sharply following the Colonial Pipeline fiasco.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

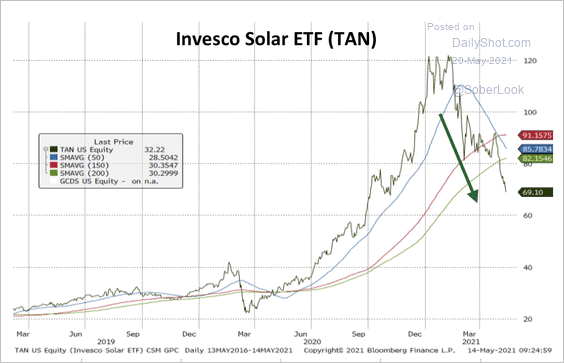

3. The Invesco Solar ETF (TAN) is under pressure.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Equities

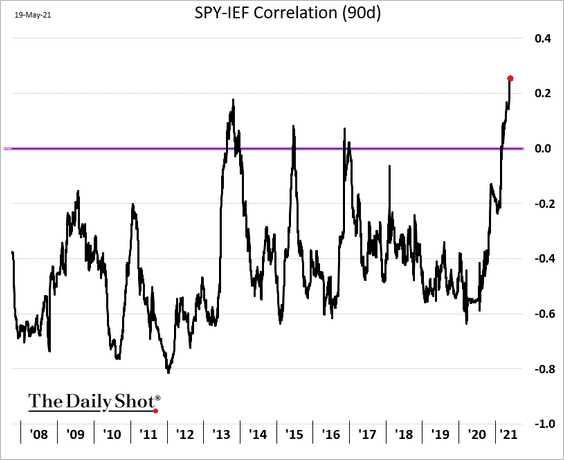

1. The stock-bond correlation is at multi-year highs.

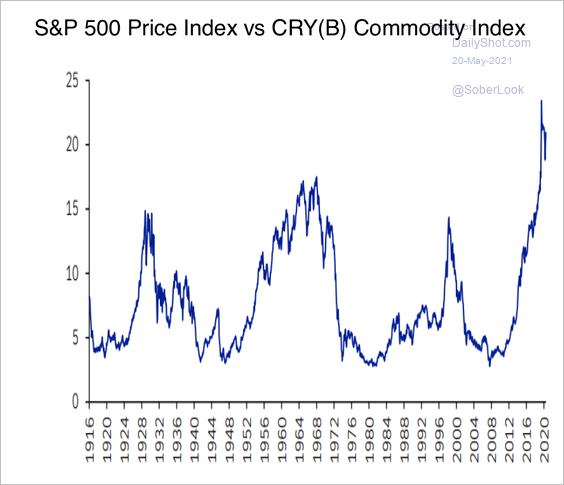

2. The S&P 500 appears stretched relative to commodities.

Source: III Capital Management

Source: III Capital Management

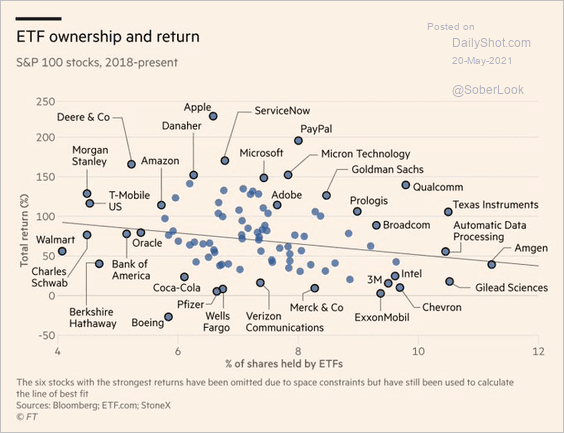

3. This scatterplot shows share ownership by ETFs vs. returns.

Source: @jessefelder, @financialtimes Read full article

Source: @jessefelder, @financialtimes Read full article

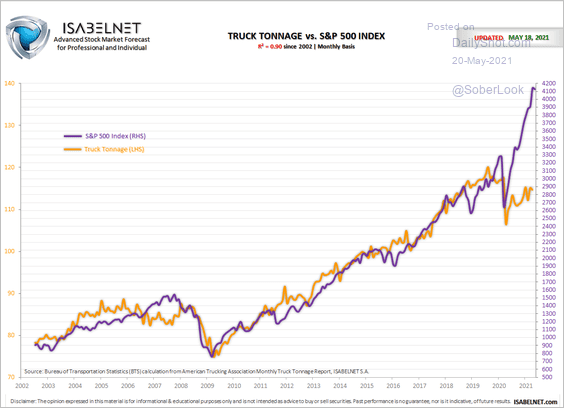

4. The S&P 500 and total US truck tonnage have diverged sharply.

Source: @ISABELNET_SA

Source: @ISABELNET_SA

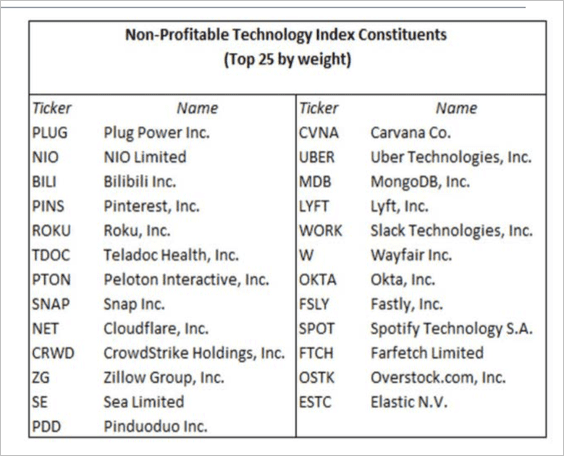

5. Here are the non-profitable tech index constituents.

Source: III Capital Management

Source: III Capital Management

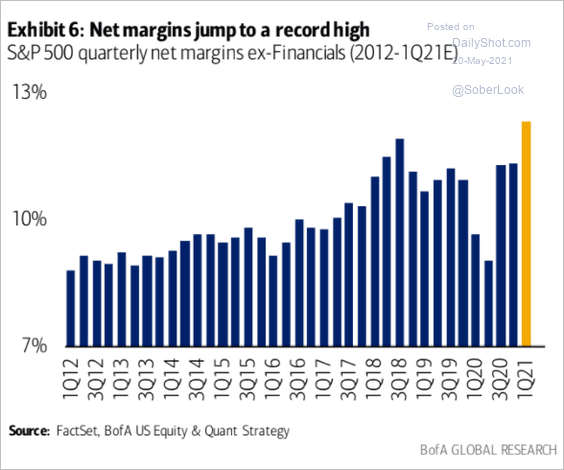

6. S&P 500 margins hit a record high.

Source: BofA Global Research

Source: BofA Global Research

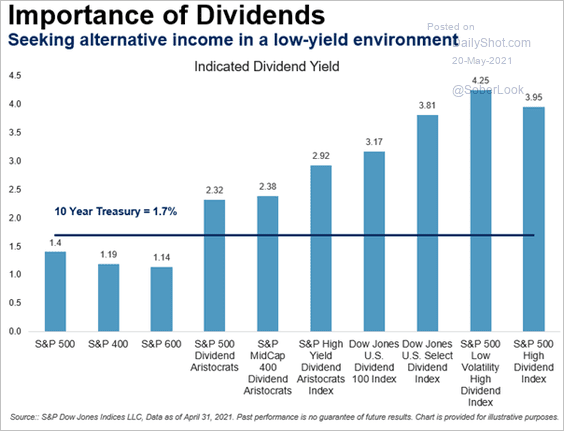

7. Below is a look at dividend yields by index.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Credit

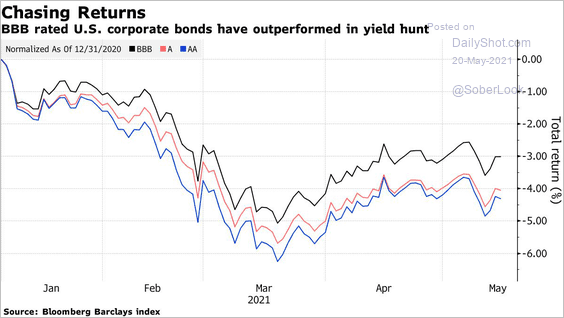

1. BBB-rated bonds have been outperforming other investment-grade debt (reach for yield).

Source: @markets Read full article

Source: @markets Read full article

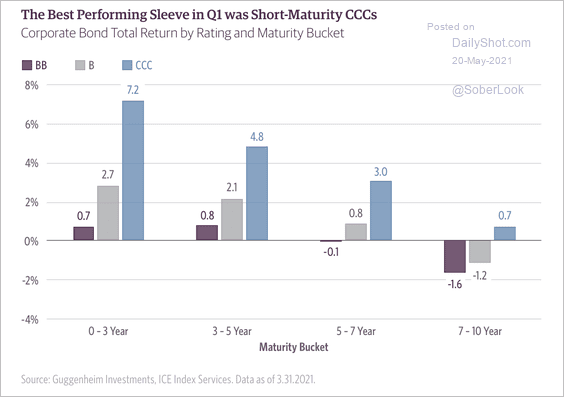

2. Front-end US CCC-rated corporate bonds outperformed over the past quarter.

Source: Guggenheim Investments

Source: Guggenheim Investments

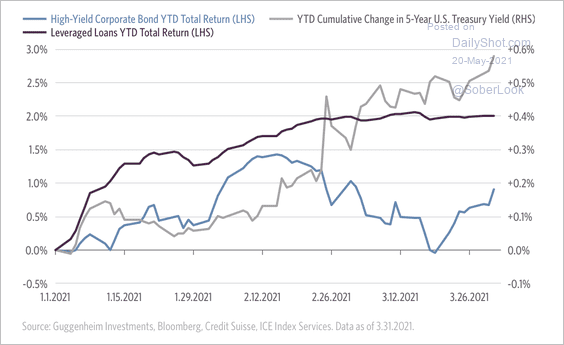

3. Unlike US high-yield corporate bonds, leveraged loan returns held up over the past few months as Treasury yields rose (due to floating-rate coupon).

Source: Guggenheim Investments

Source: Guggenheim Investments

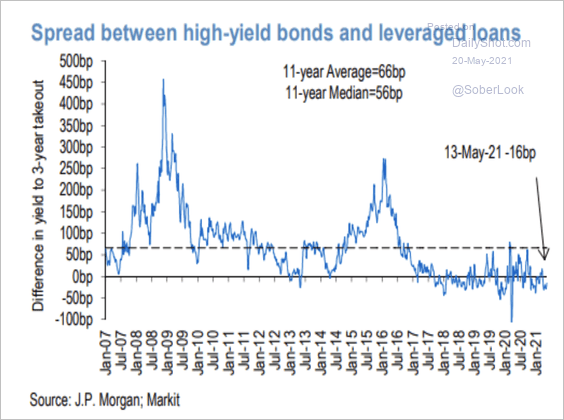

4. Leveraged loan spreads are wide relative to high-yield spreads.

Source: JP Morgan

Source: JP Morgan

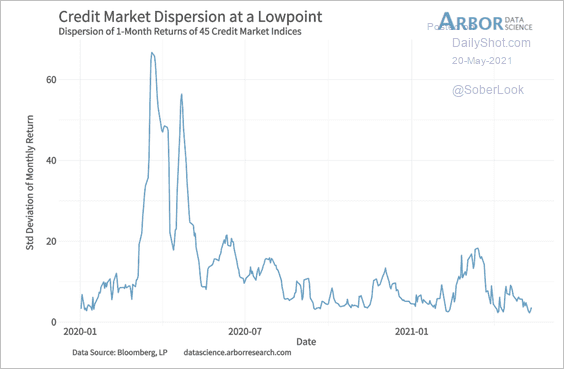

5. The return dispersion among US investment-grade corporate bonds returned to pre-pandemic lows.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

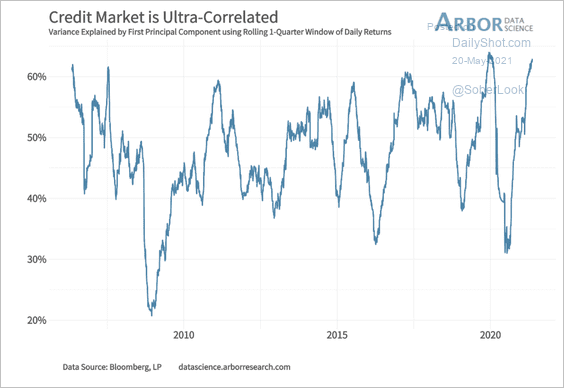

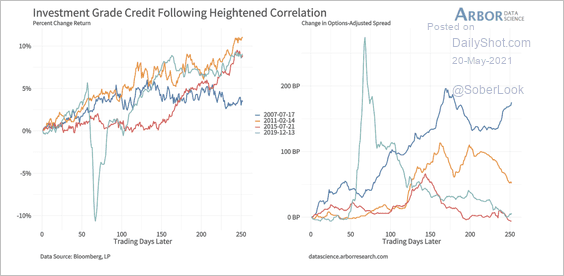

6. US corporate bond returns are highly correlated, which typically precedes wider spreads (2 charts).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

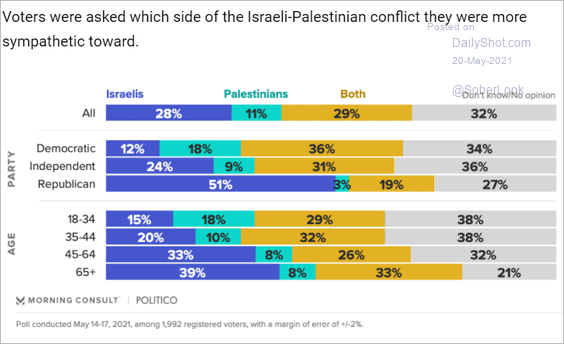

1. Americans’ views on the Israeli–Palestinian conflict:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

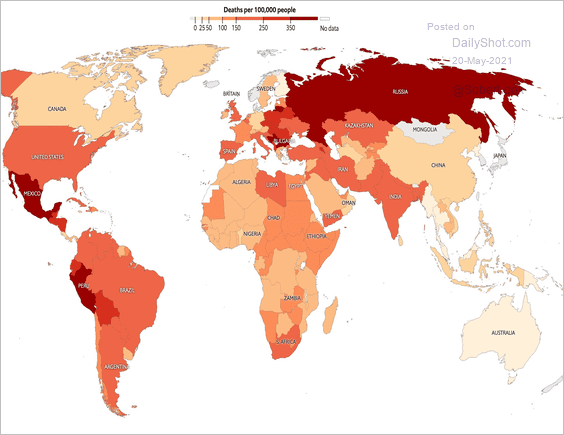

2. Estimated excess deaths (COVID-related):

Source: The Economist Read full article

Source: The Economist Read full article

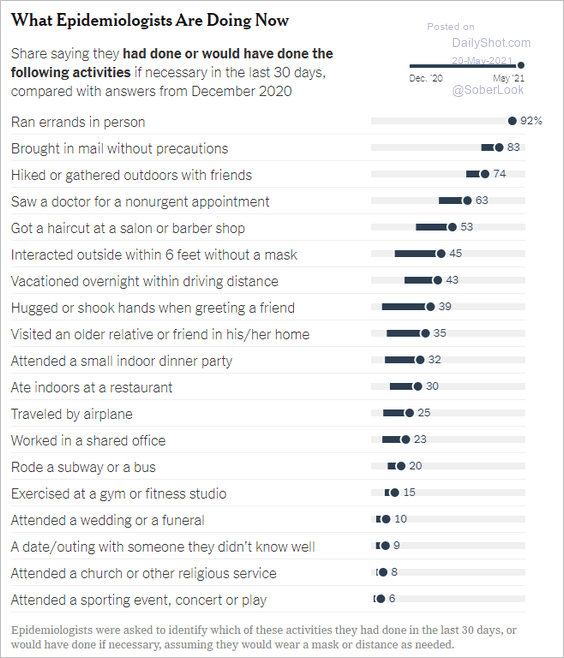

3. Epidemiologists engaging in different activities:

Source: The New York Times Read full article

Source: The New York Times Read full article

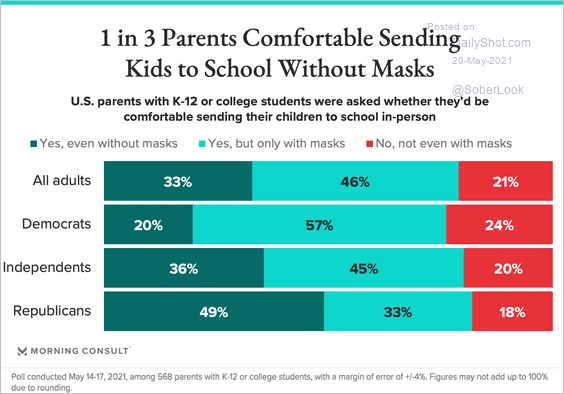

4. Sending kids to school without masks:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

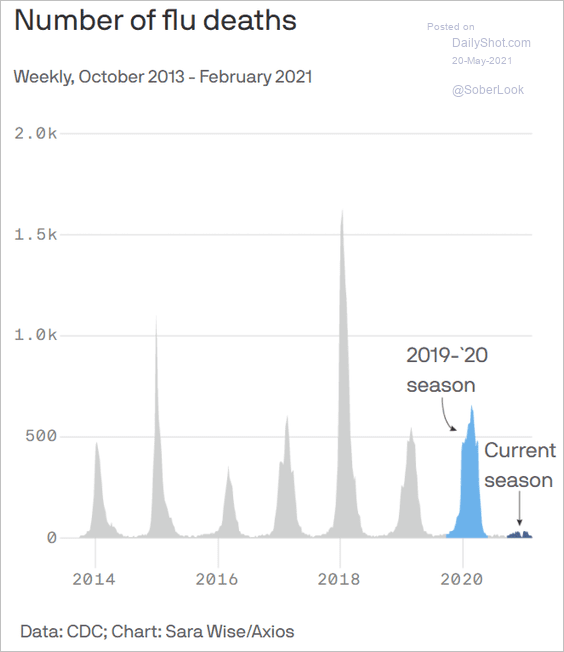

5. Flu deaths:

Source: @axios Read full article

Source: @axios Read full article

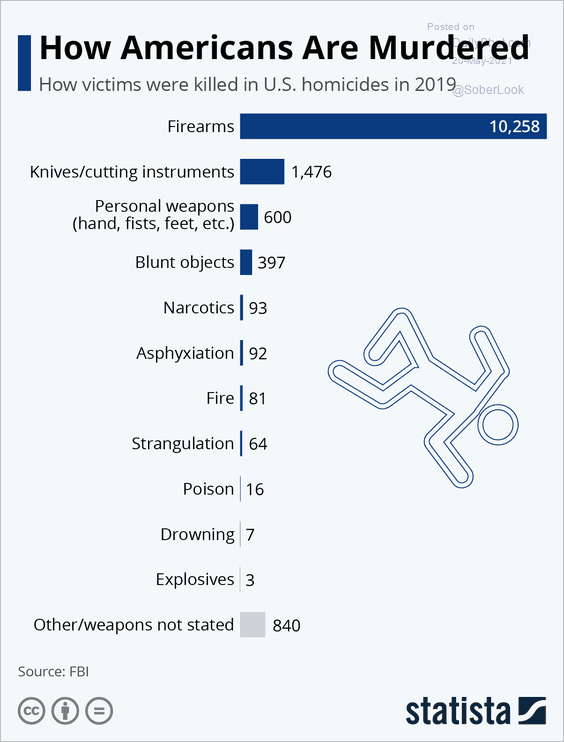

6. How Americans are murdered:

Source: Statista

Source: Statista

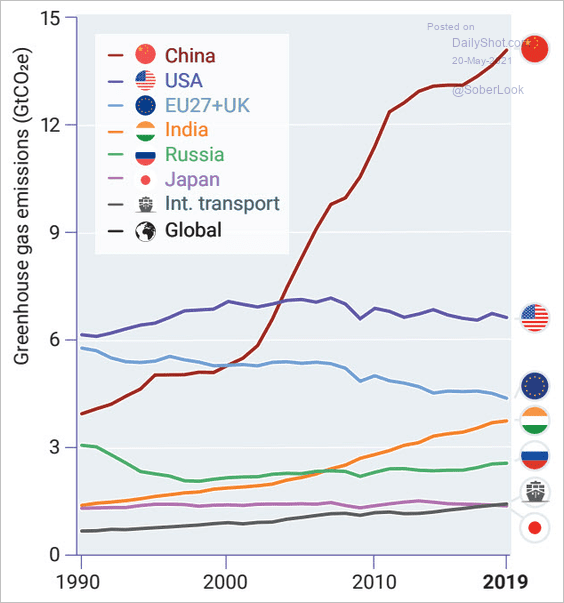

7. Absolute greenhouse gas emissions of the top six emitters:

Source: UNEP Read full article

Source: UNEP Read full article

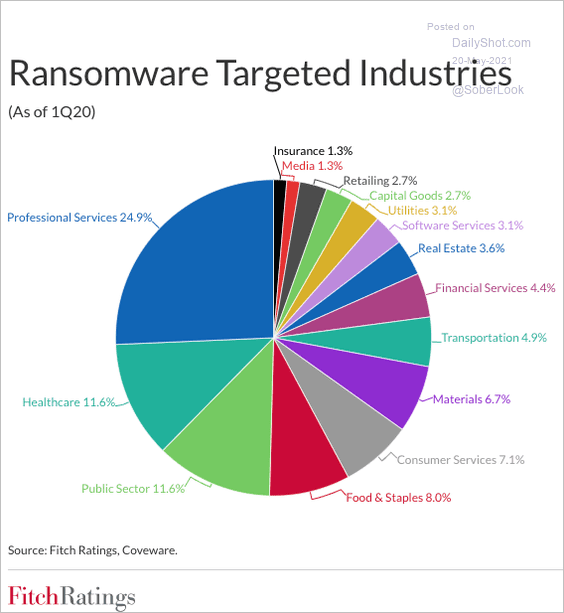

8. Ransomware-targeted industries:

Source: Fitch Ratings

Source: Fitch Ratings

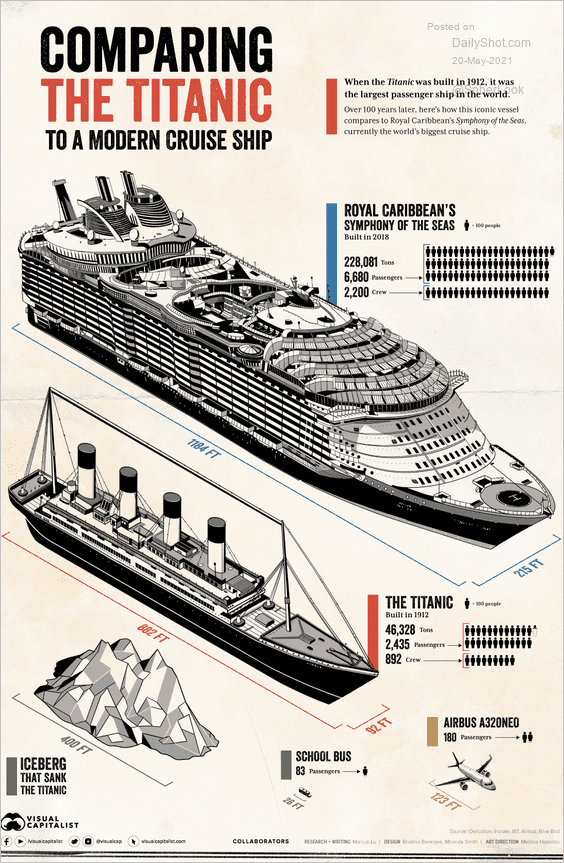

9. The Titanic vs. a modern cruise ship:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index