The Daily Shot: 24-Sep-21

• Administrative Update

• The United Kingdom

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

Administrative Update

1. If you have trouble viewing images in The Daily Shot, please see this post. Detailed instructions for Microsoft Outlook users are available here.

2. As a reminder, the links to jump to different sections do not work on iPhones/iPads. A simple workaround is to click on “View in your browser” at the beginning of the letter, which makes the links operational.

3. The Daily Shot will not be published on Friday, October 1st.

The United Kingdom

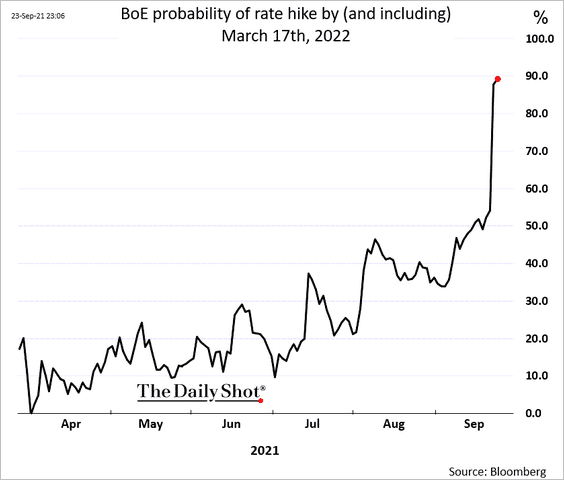

1. Despite some growth headwinds, the BoE tilted more hawkish this week. The central bank is signaling a rate hike in the “medium term.” The BoE’s statement follows the Fed’s hawkish dot-plot and taper announcement a day earlier.

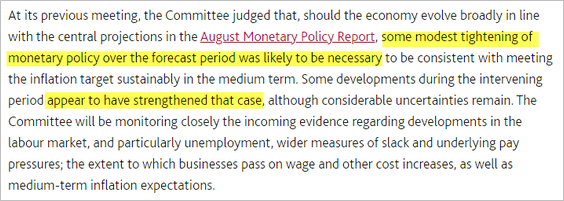

Source: MPC Read full article

Source: MPC Read full article

The MPC expects inflation to be above 4% next quarter.

Source: MPC Read full article

Source: MPC Read full article

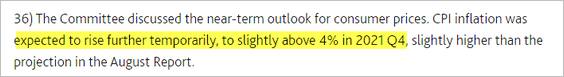

• The 2yr gilt yield jumped.

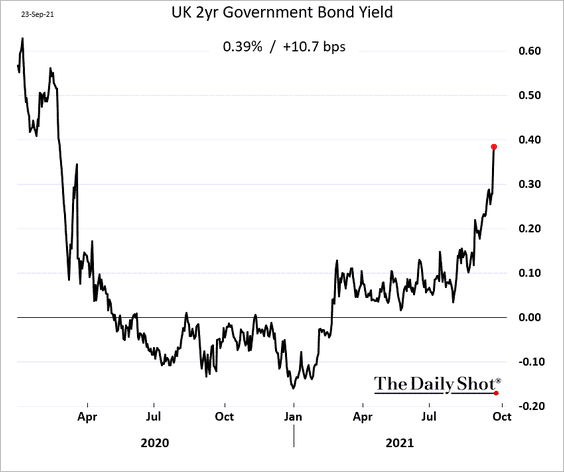

• The market-based probability of a rate hike by (and including) the March meeting is nearing 90%.

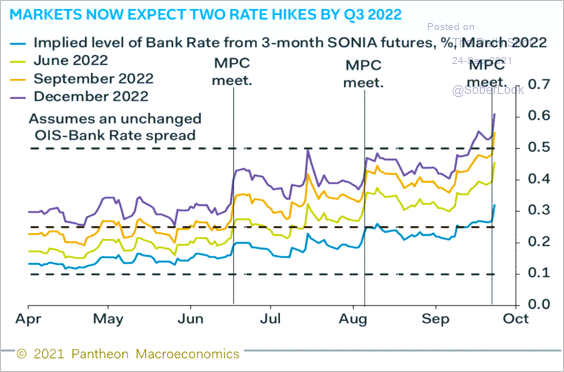

Two rate hikes are now priced in by Q3 of 2022.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

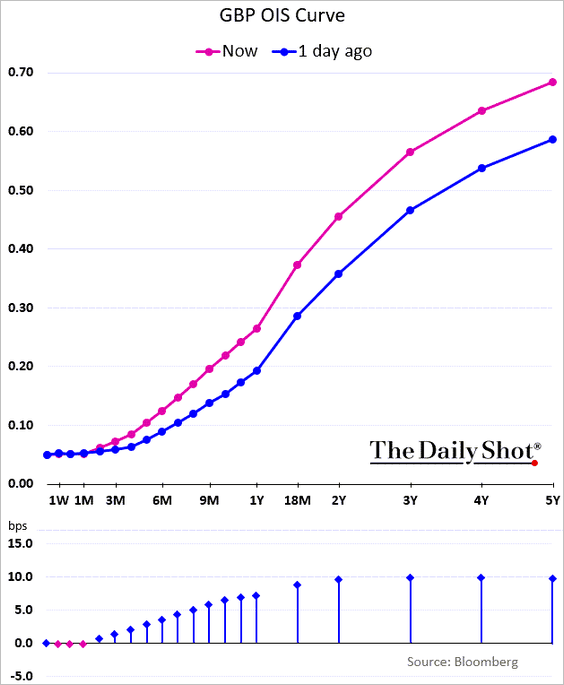

• The yield curve steepened in the short end.

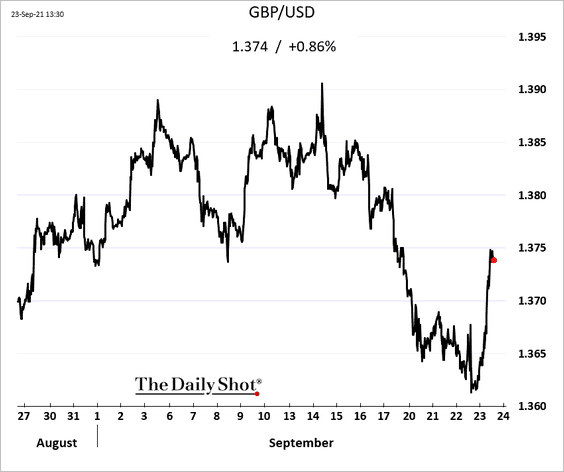

• The pound gained.

——————–

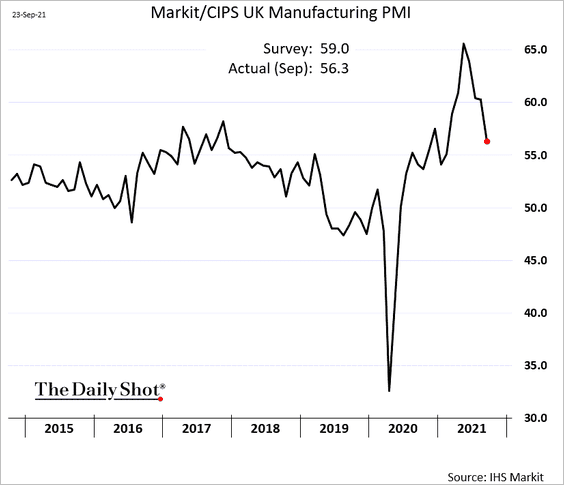

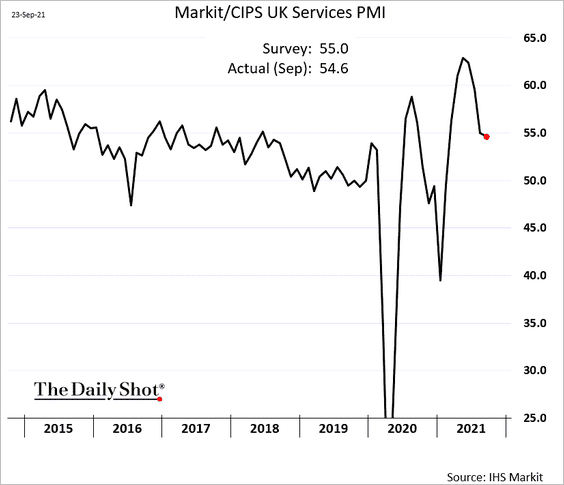

2. The September flash PMI report points to moderating growth in business activity.

• Manufacturing:

• Services:

——————–

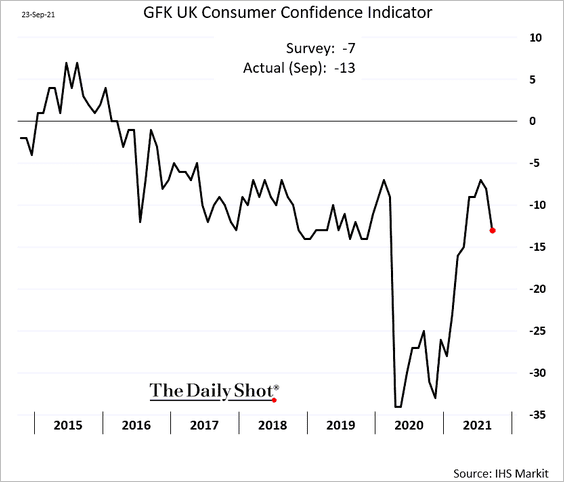

3. Consumer confidence deteriorated this month.

Rising prices and concerns about shortages are contributing to weaker sentiment.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

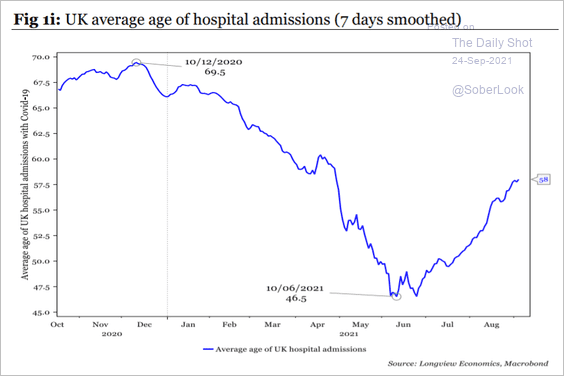

4. This chart shows the average age of hospital admissions.

Source: Longview Economics

Source: Longview Economics

The United States

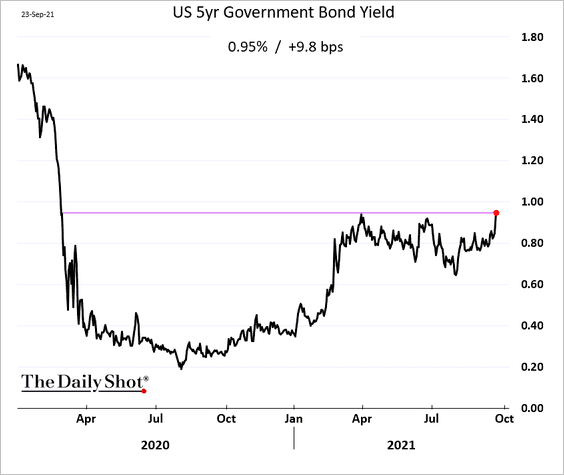

1. The 5-year Treasury yield hit the highest level since the start of the pandemic as the market prices in faster rate hikes and taper.

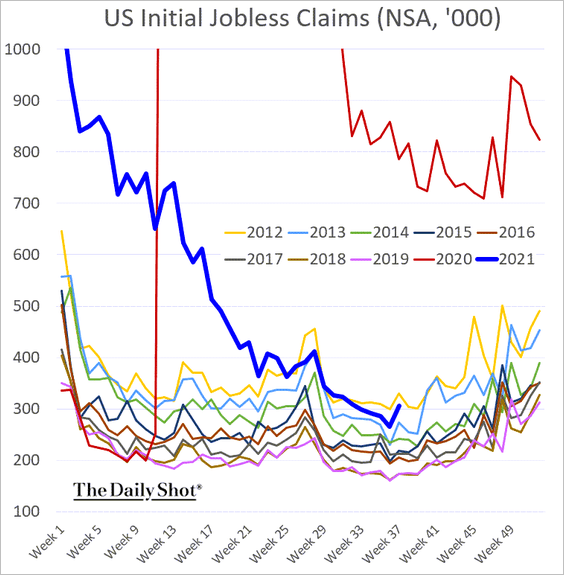

2. Initial jobless claims were higher than expected last week.

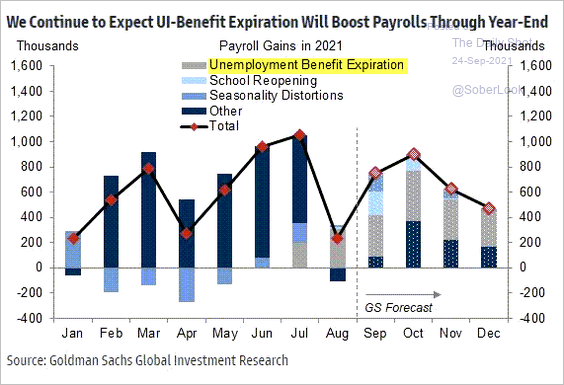

Goldman expects the expiration of emergency unemployment benefits to significantly boost payrolls this year.

Source: @LizAnnSonders, @GoldmanSachs

Source: @LizAnnSonders, @GoldmanSachs

——————–

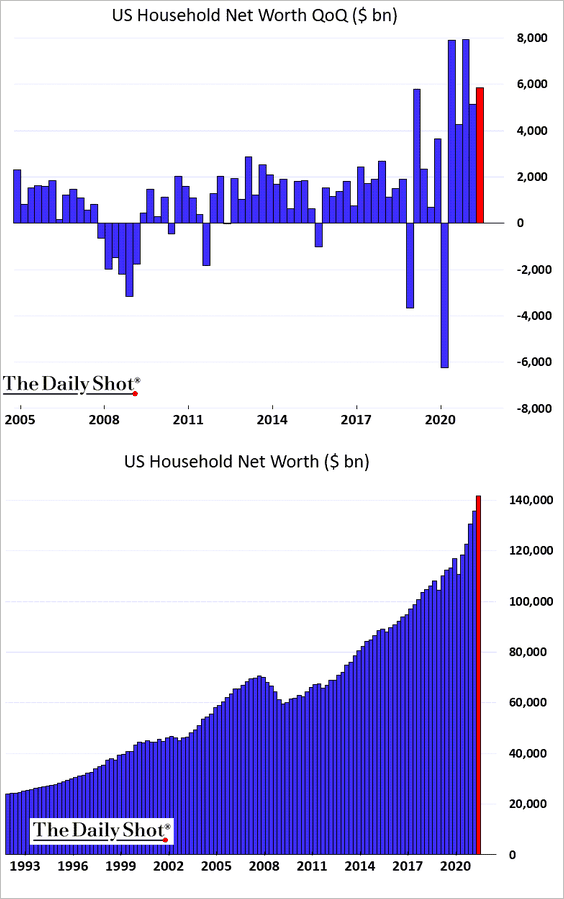

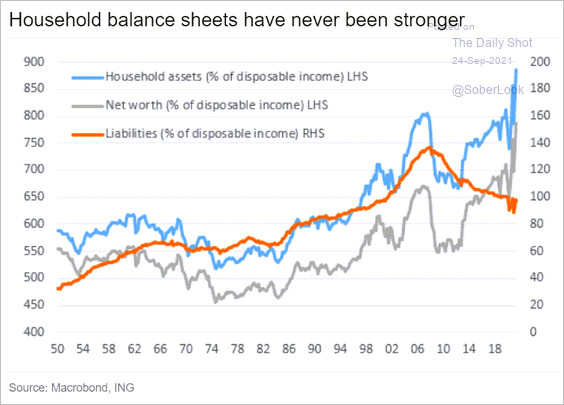

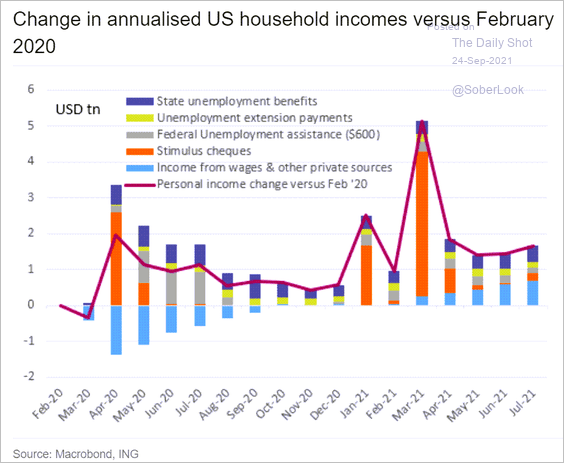

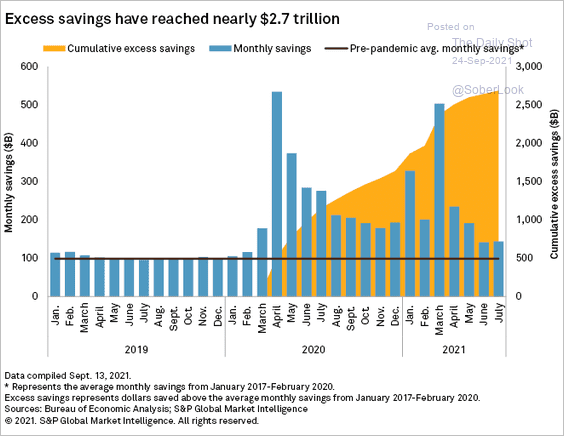

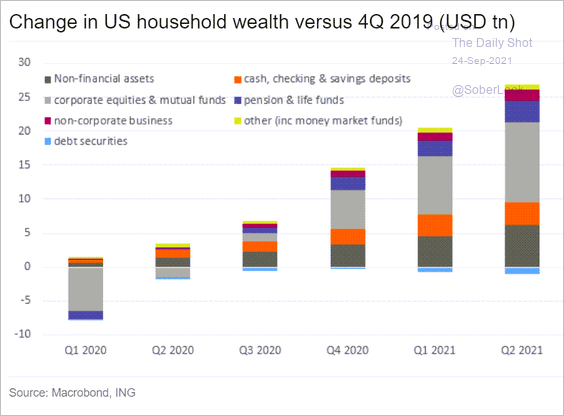

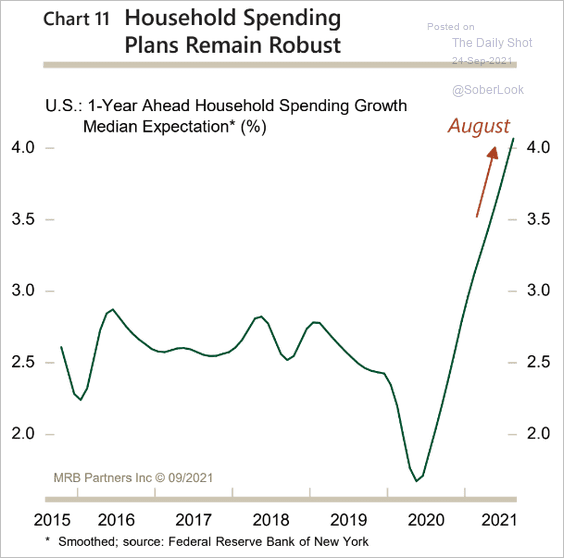

3. Next, we have some updates on US households’ financial situation.

• Household net worth continues to surge, …

… as asset values climb.

Source: ING

Source: ING

• The fiscal stimulus helped.

Source: ING

Source: ING

• Excess savings are nearing $2.7 trillion.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Here are the contributors to wealth gains.

Source: ING

Source: ING

• Spending plans remain robust.

Source: MRB Partners

Source: MRB Partners

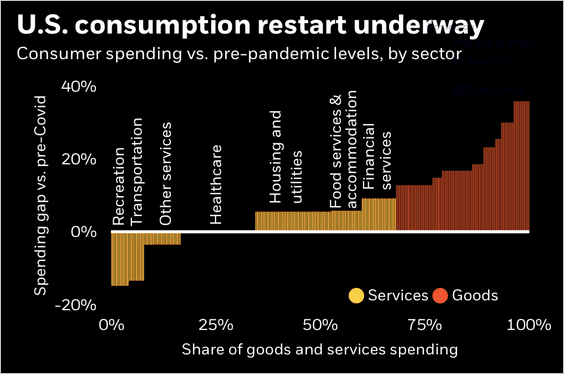

Below is a look at the rebound in consumer spending by sector.

Source: BlackRock

Source: BlackRock

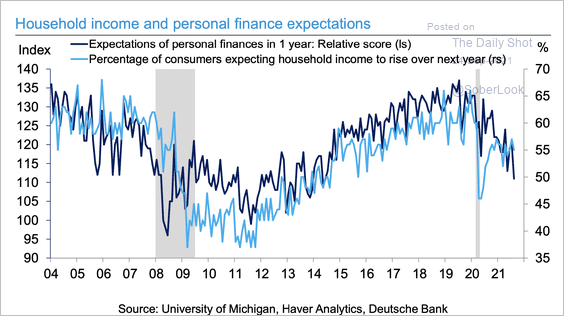

• However, US households’ view of their income and personal finances has been deteriorating.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

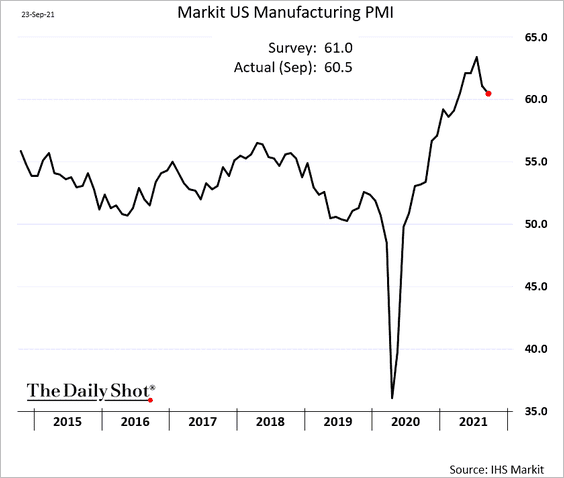

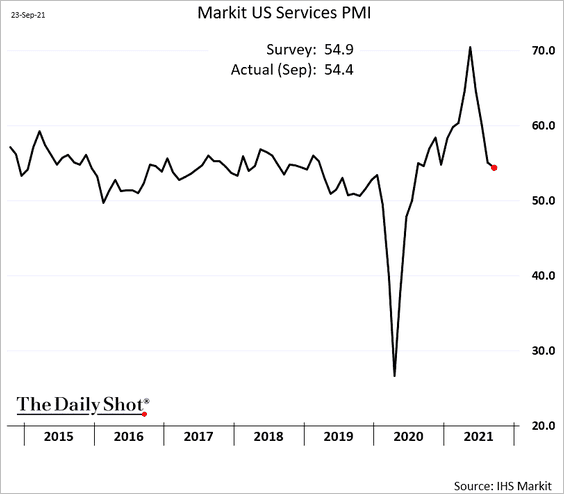

4. According to Markit’s flash PMI report, growth in business activity moderated further in September.

• Manufacturing:

• Services:

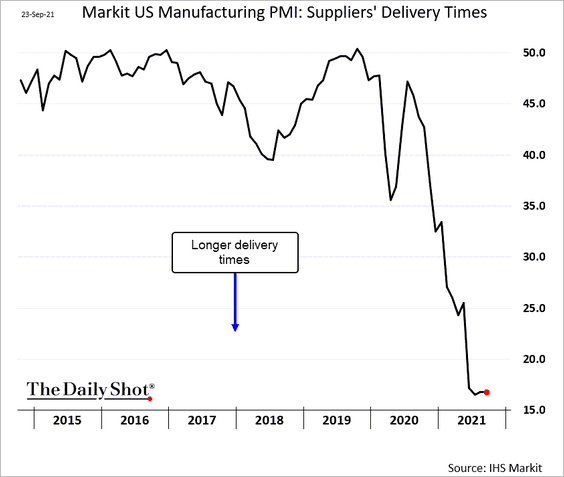

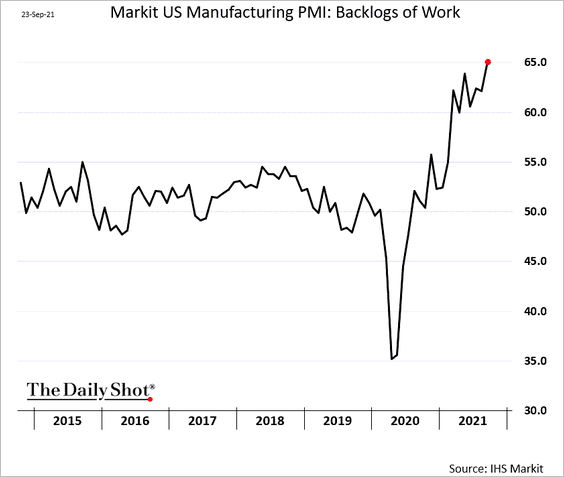

Manufacturing supply-chain issues persist.

• Supplier delivery times:

• Backlog of work:

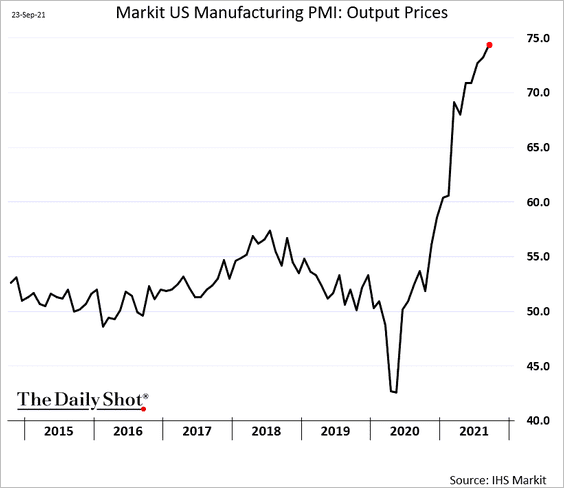

Manufacturers are increasingly boosting prices.

——————–

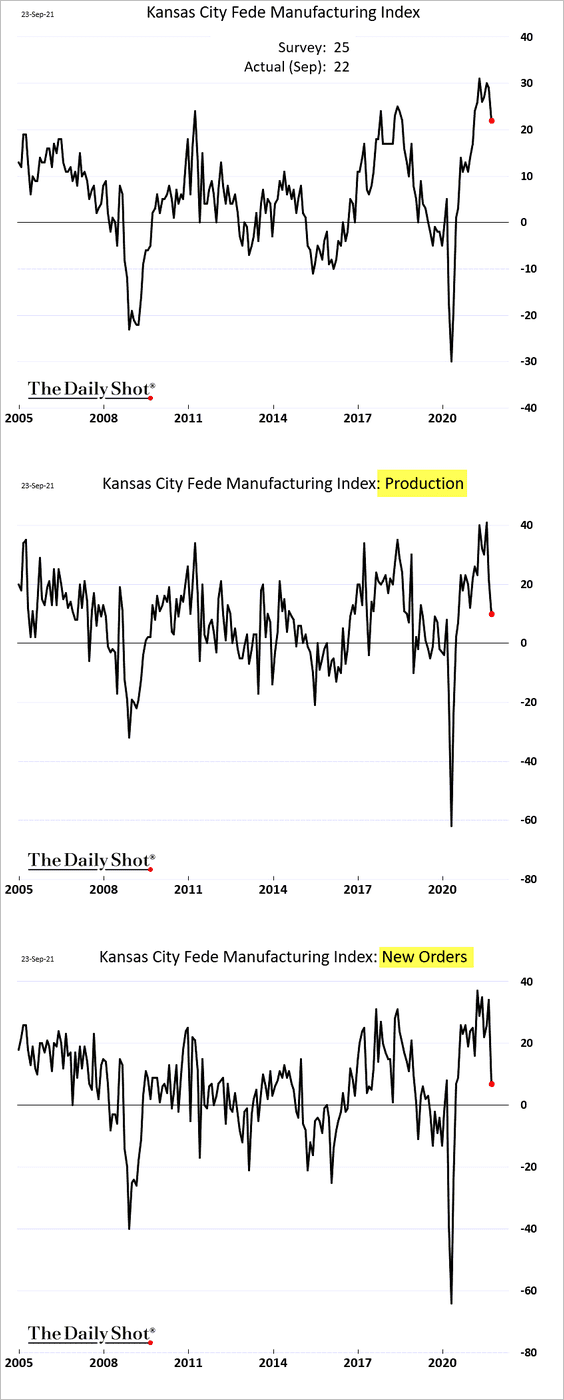

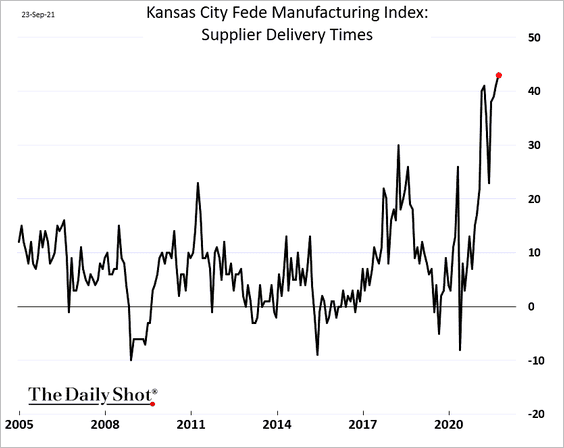

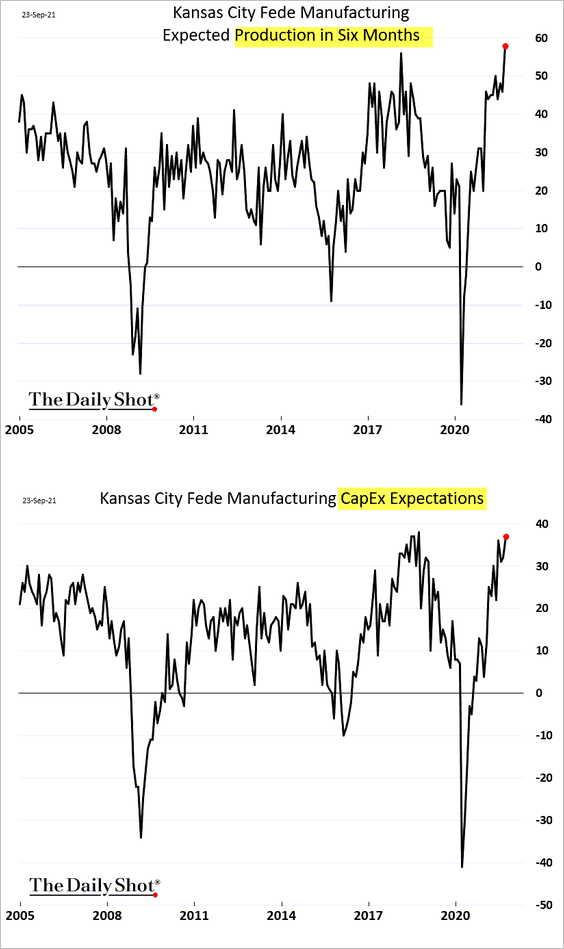

5. The Kansas City Fed’s regional manufacturing report supports the trend we see from Markit PMI (above).

Supplier problems (many related to import bottlenecks) have been getting worse.

But manufacturers are upbeat about the future.

Canada

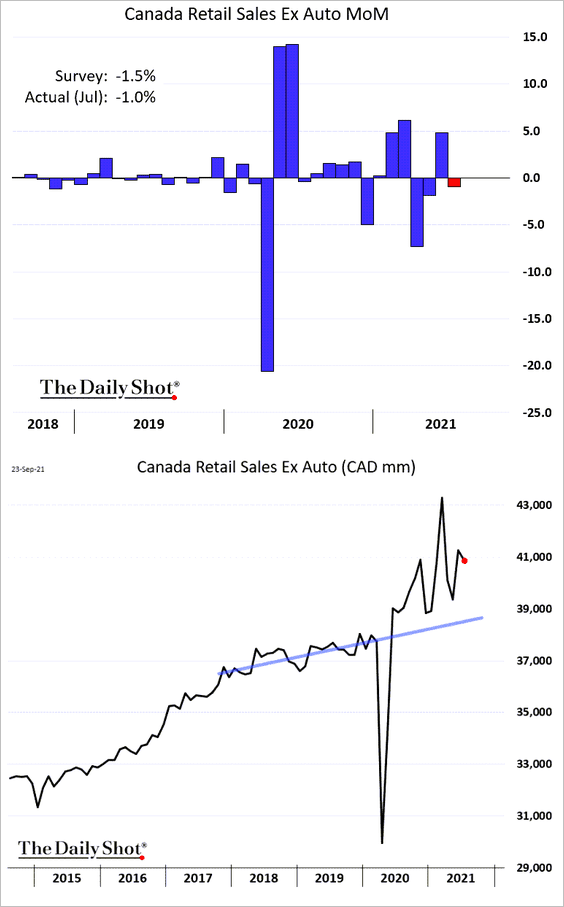

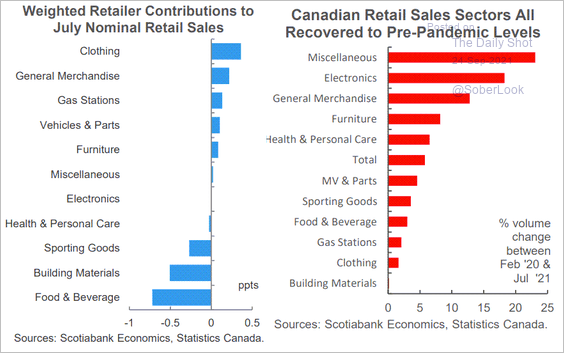

1. Retail sales held up better than expected in July.

Here is the breakdown by sector.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

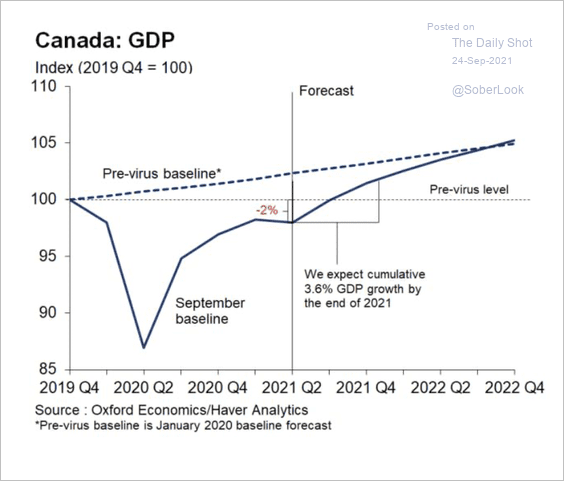

2. Oxford Economics expects GDP to return to pre-pandemic levels by the end of this year.

Source: Oxford Economics

Source: Oxford Economics

The Eurozone

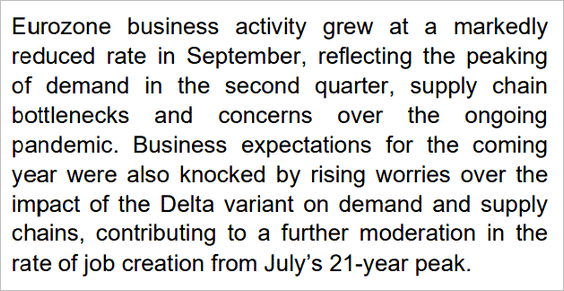

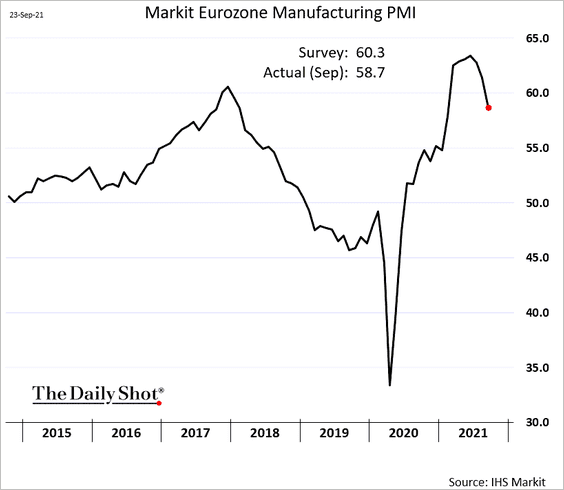

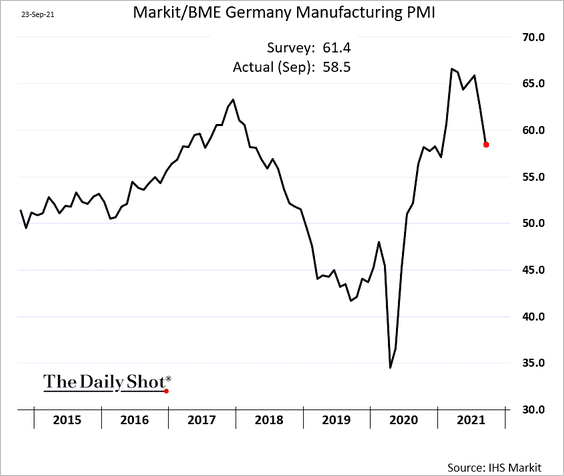

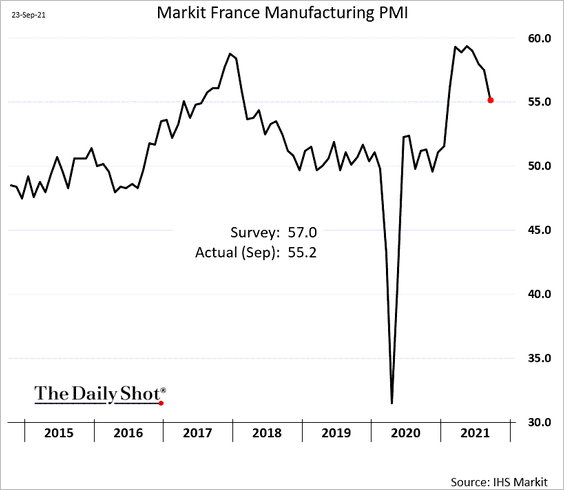

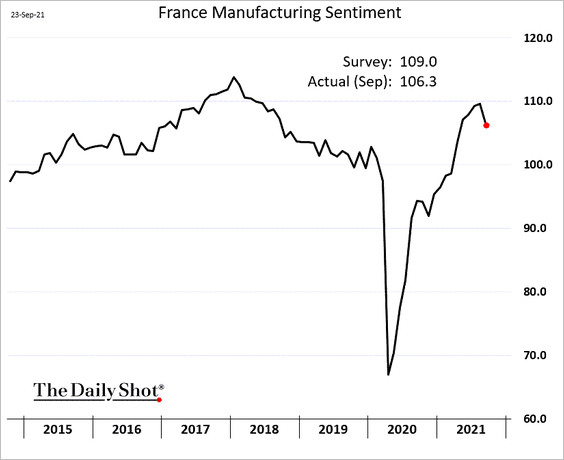

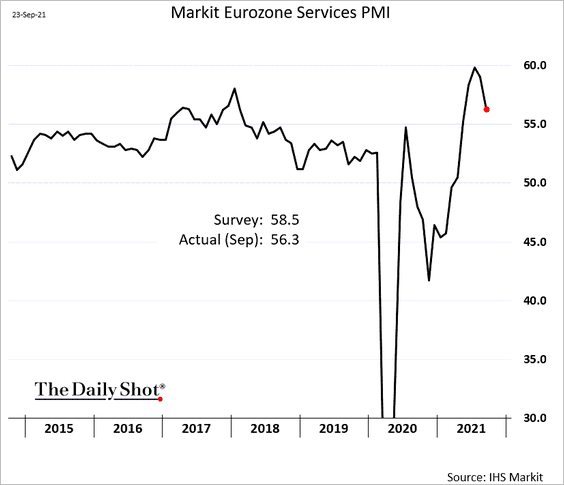

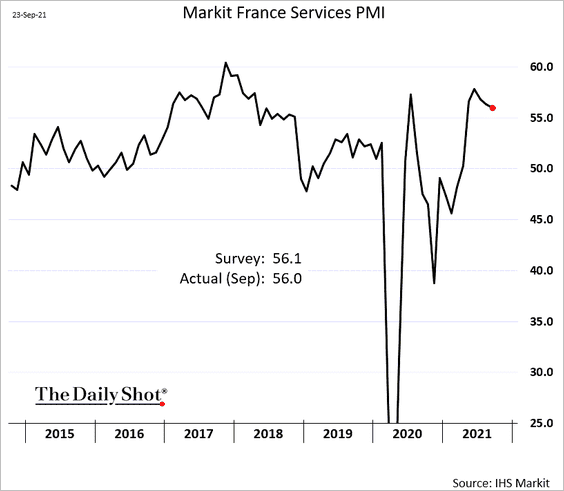

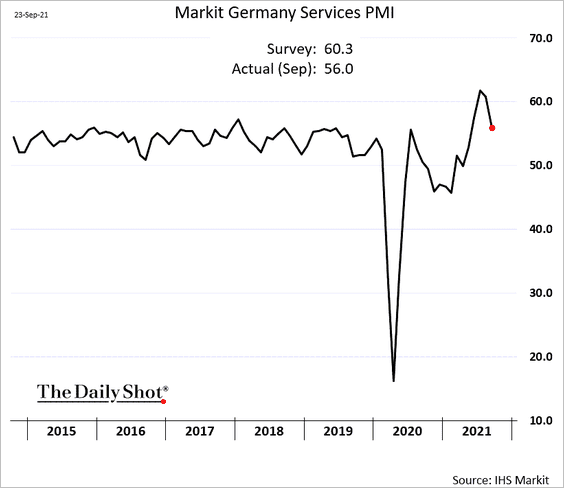

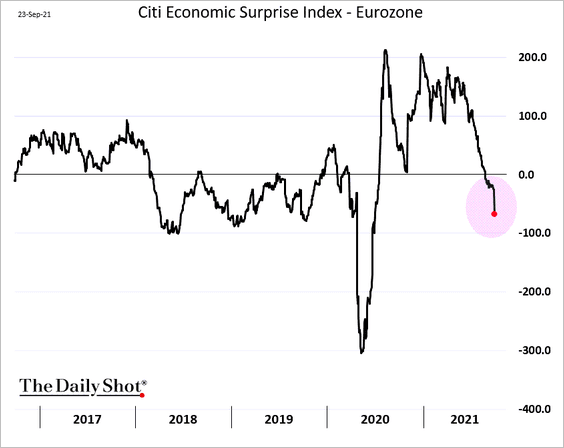

1. Growth in business activity slowed sharply, surprising to the downside.

Source: IHS Markit

Source: IHS Markit

• Manufacturing:

– The Eurozone:

– Germany:

– France:

Here is the French manufacturing confidence indicator (from a separate report).

• Services:

– The Eurozone:

– France (still relatively strong):

– Germany:

The PMI miss sent the Citi Economic Surprise Index sharply lower.

——————–

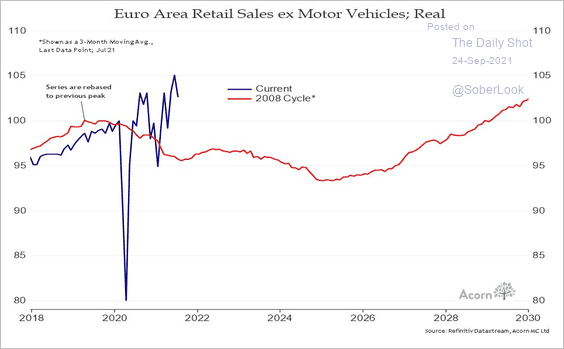

2. This chart shows the Eurozone retail sales vs. the post-2008 recovery.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

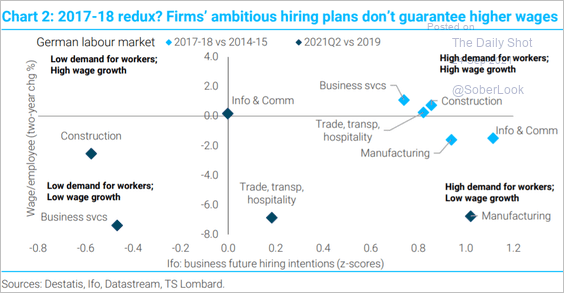

3. In recent years, increased hiring intentions have not translated into stronger wage growth.

Source: TS Lombard

Source: TS Lombard

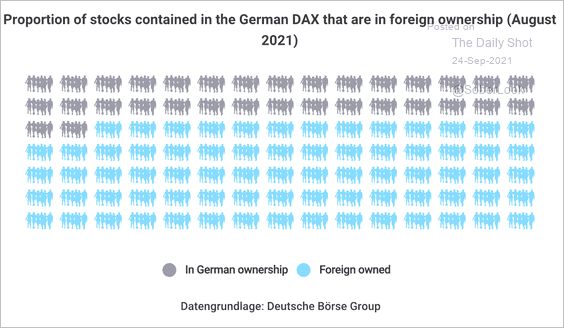

4. A large share of stocks in the German DAX Index are foreign-owned.

Source: Wette.de Read full article

Source: Wette.de Read full article

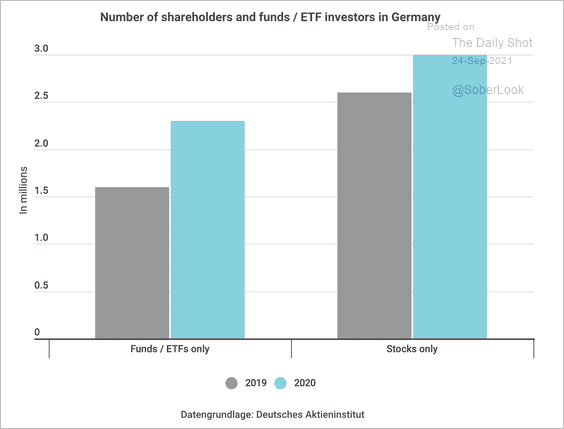

The number of German shareholders in ETFs and stocks increased last year.

Source: Wette.de Read full article

Source: Wette.de Read full article

——————–

5. Eurozone and US forward earnings estimates have diverged sharply.

Source: BlackRock

Source: BlackRock

Europe

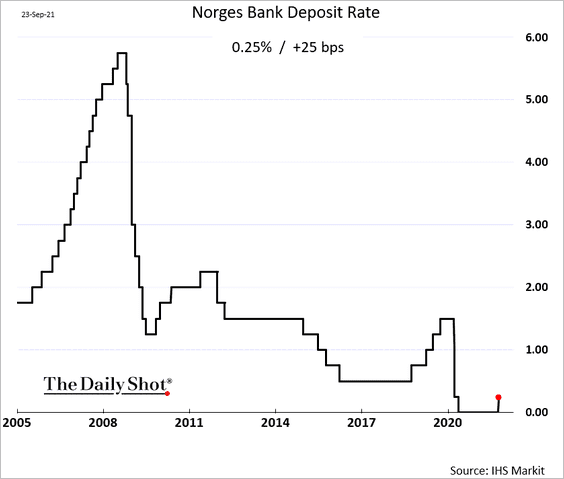

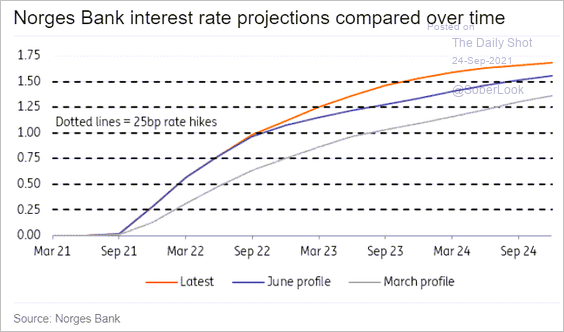

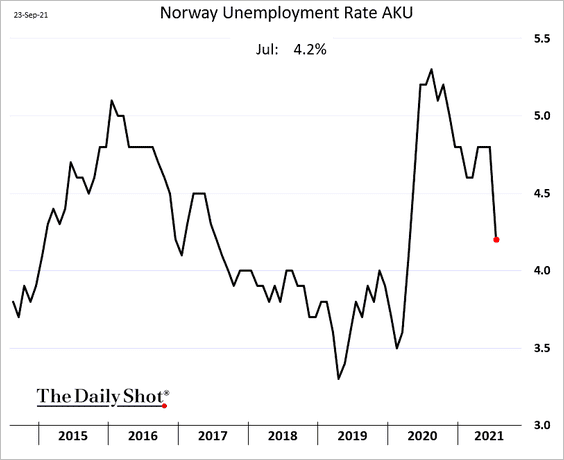

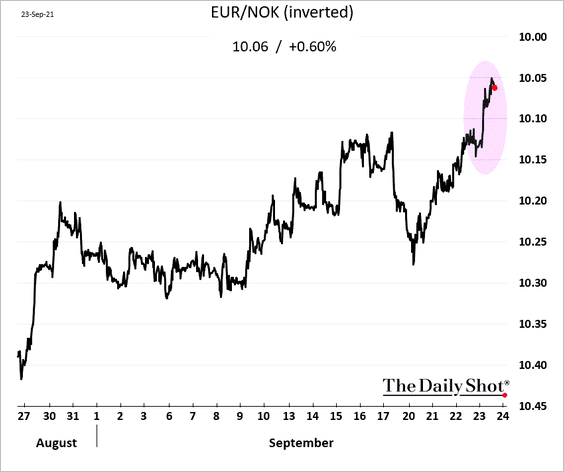

1. The Norges Bank finally hiked rates (as expected) and signaled more tightening to come.

• Here are the latest rate projections.

Source: ING

Source: ING

• The employment situation has been improving.

• The Norwegian krone advanced against the euro.

——————–

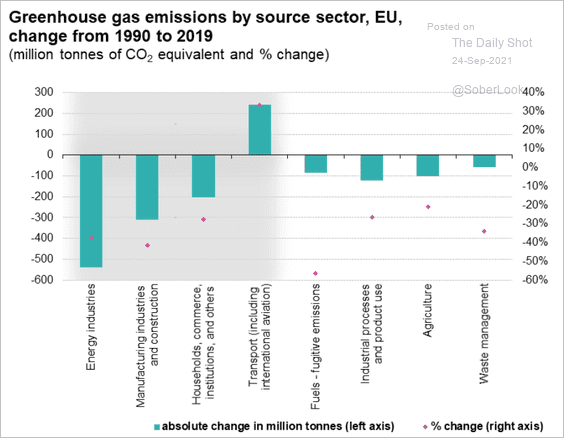

2. This chart shows greenhouse gas emissions by sector in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

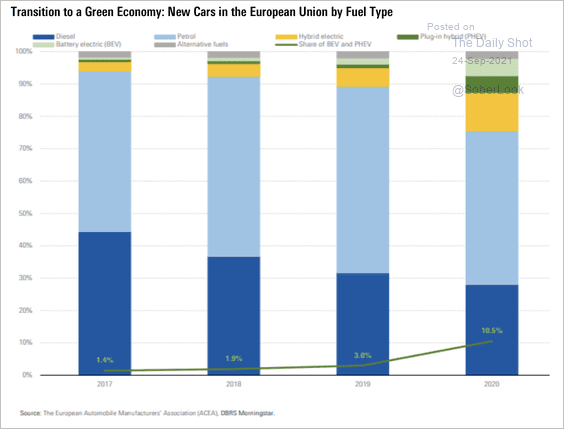

3. Hybrid vehicles make up a growing share of total new cars across the EU.

Source: DBRS Morningstar

Source: DBRS Morningstar

Japan

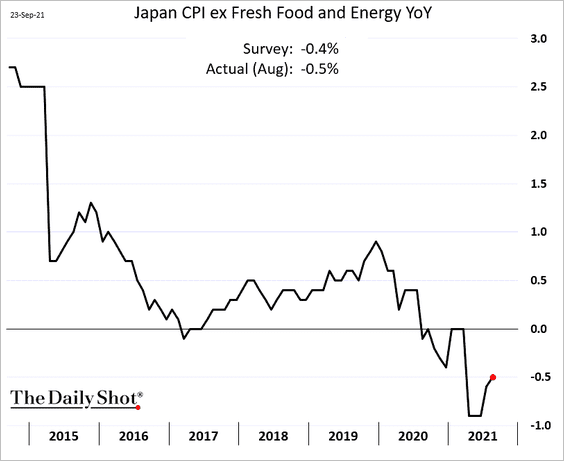

1. Inflation was lower than expected in August.

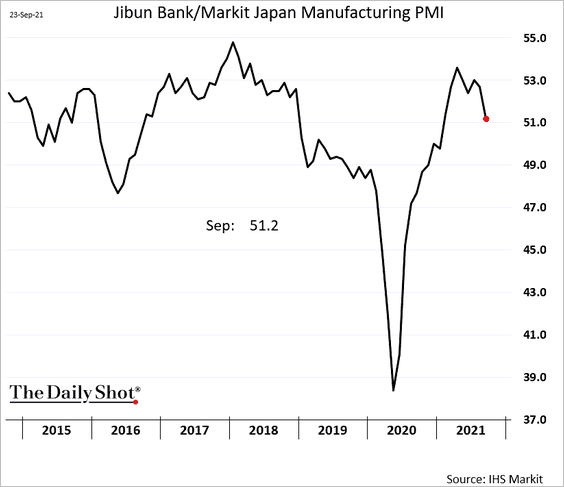

2. Growth in factory activity slowed this month.

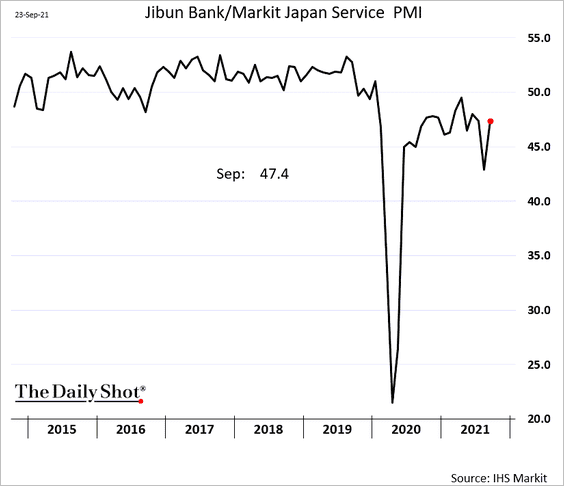

But the pressure on service businesses eased.

Asia – Pacific

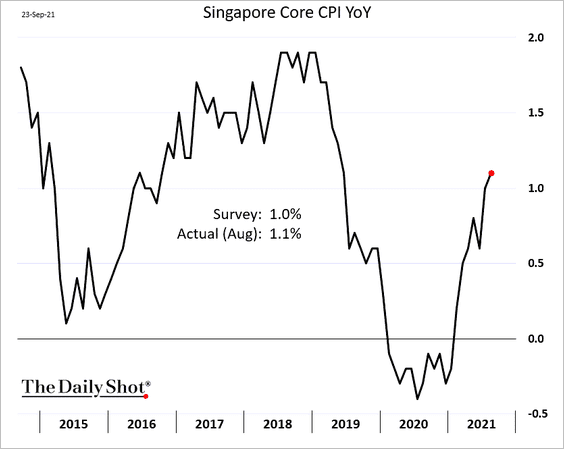

1. Singapore’s inflation continues to climb.

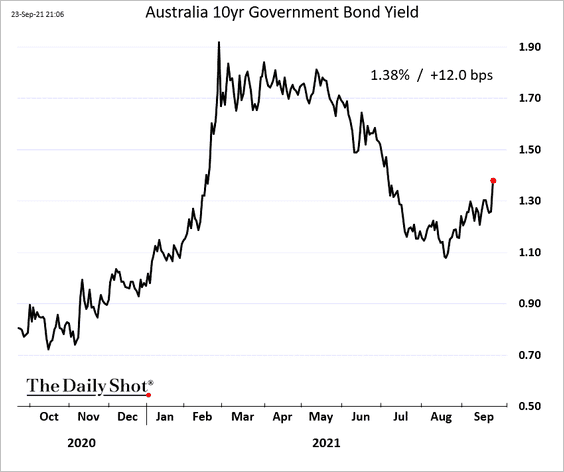

2. Australian bond yields rose sharply today, partially in response to hawkish signals from the BoE and the Fed.

China

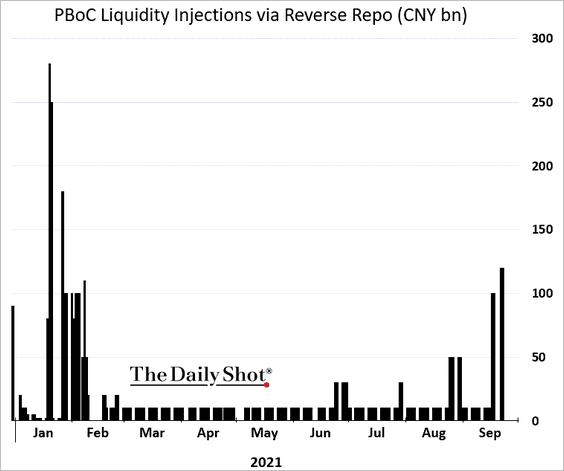

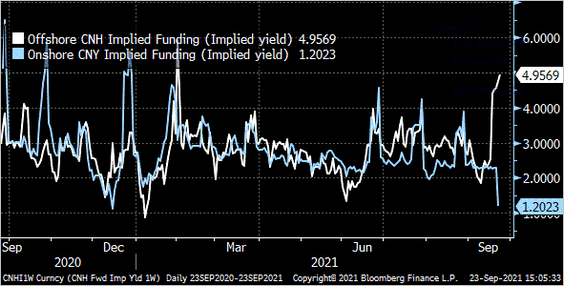

1. The PBoC continues to inject liquidity into the banking system.

As a result, the implied rates (from F/X forwards) in the onshore and offshore yuan have diverged.

Source: @Marcomadness2

Source: @Marcomadness2

——————–

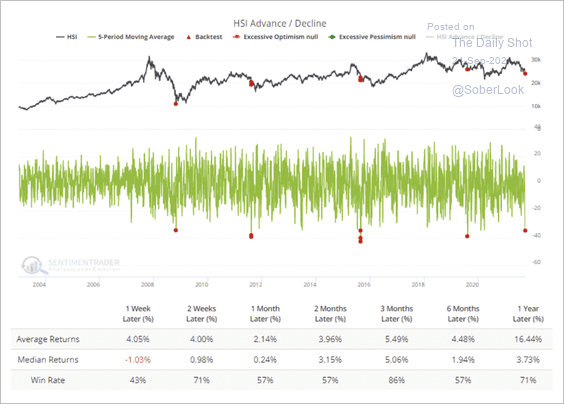

2. The number of declining stocks versus advancing stocks in Hong Kong’s Hang Seng Index reached an extreme earlier this week, which typically precedes a rebound in the months ahead.

Source: SentimenTrader

Source: SentimenTrader

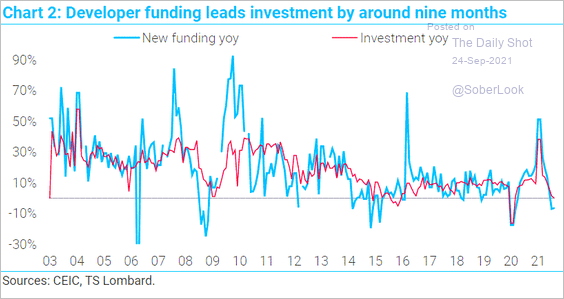

3. Tighter funding conditions for real estate developers (precipitated by the Evergrande rout) will result in deteriorating property investment.

Source: TS Lombard

Source: TS Lombard

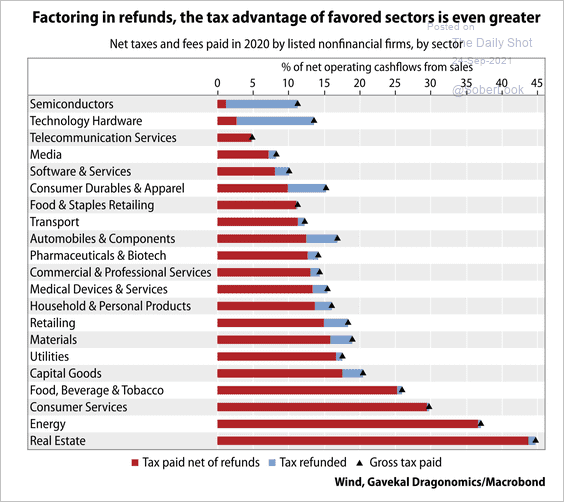

4. Favored sectors in China pay lower taxes and receive more tax rebates. This leads them to have higher returns, easier access to and lower costs of funding when compared to less favored industries.

Source: Gavekal Research

Source: Gavekal Research

5. Global VC funds have been less interested in China.

Source: KrASIA Read full article

Source: KrASIA Read full article

Emerging Markets

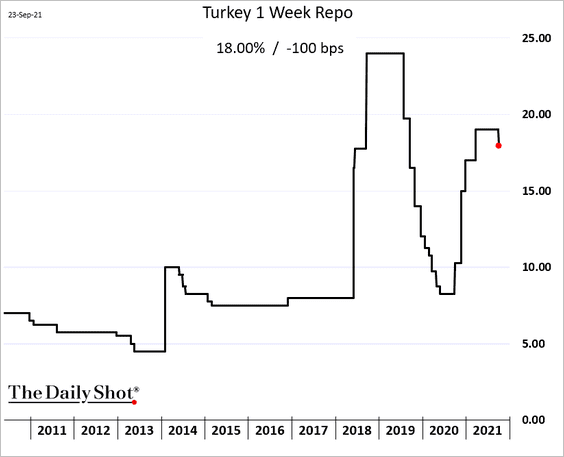

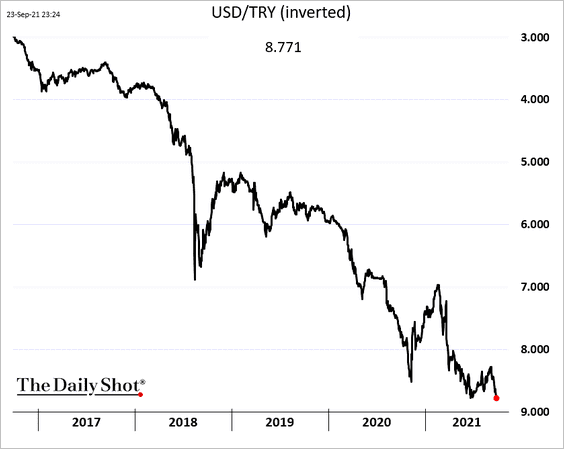

1. Turkey’s central bank unexpectedly cut rates to please Erdogan.

The lira tumbled, hitting a record low against the dollar. Inflation (which has been rampant) will accelerate further.

——————–

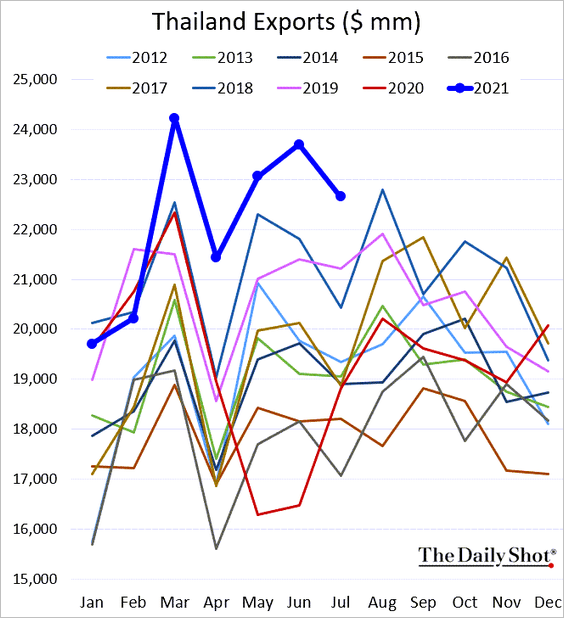

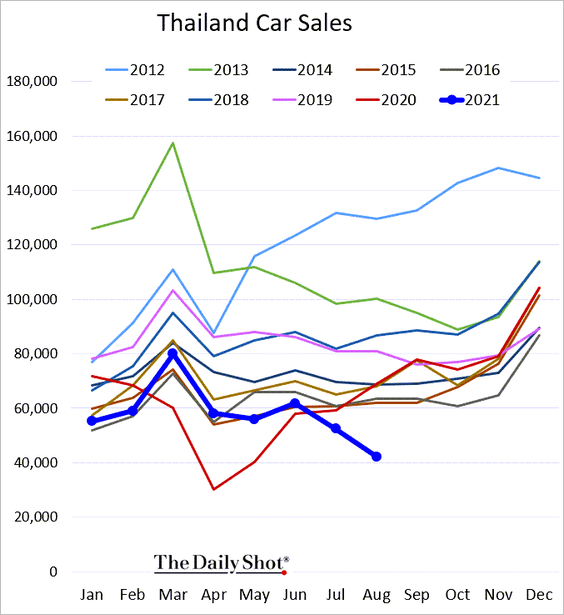

2. Thailand’s exports remain robust.

But domestic car sales are at multi-year lows.

——————–

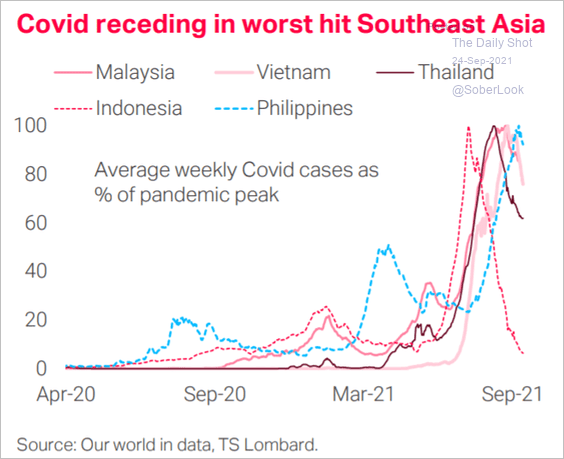

3. Southeast Asia’s COVID cases are receding.

Source: TS Lombard

Source: TS Lombard

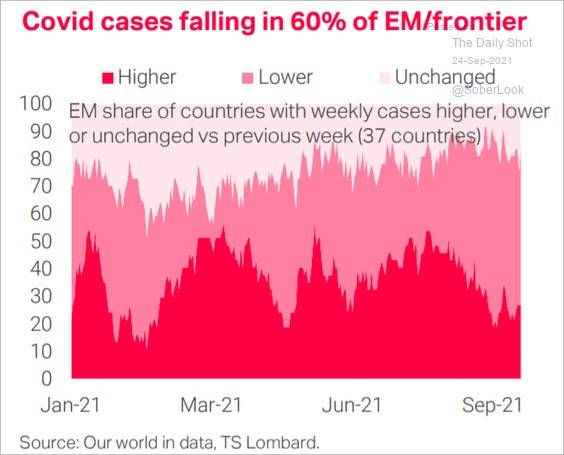

Here is the situation across EM.

Source: TS Lombard

Source: TS Lombard

——————–

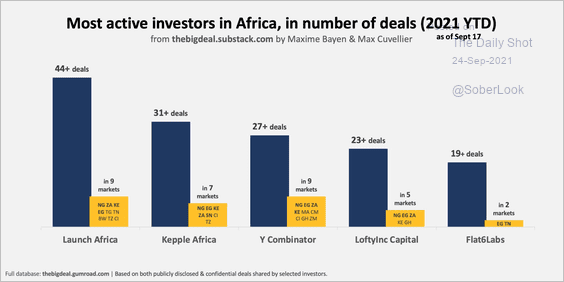

4. This chart shows the most active investors in Africa this year.

Source: Max Cuvellie Read full article

Source: Max Cuvellie Read full article

Cryptocurrency

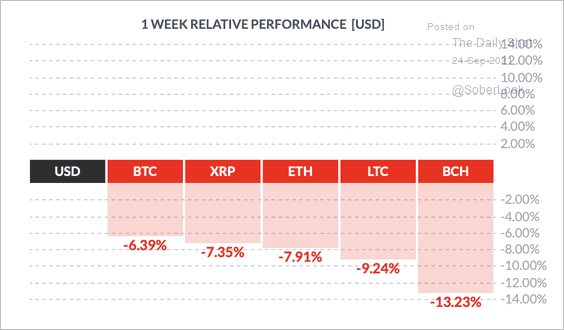

1. Similar to equities, it’s been a tough week for cryptocurrencies, although bitcoin has outperformed.

Source: FinViz

Source: FinViz

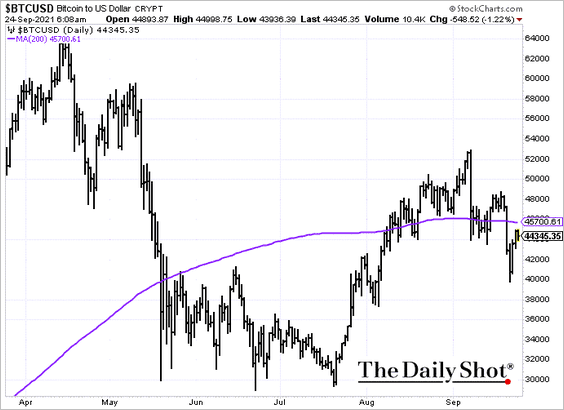

Will bitcoin breach resistance at the 200-day moving average?

——————–

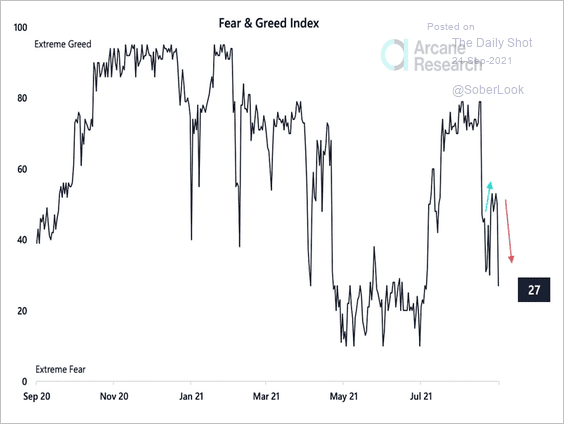

2. Bitcoin’s Fear & Greed Index shows extreme bearish sentiment after the crypto sell-off earlier this week.

Source: Arcane Research

Source: Arcane Research

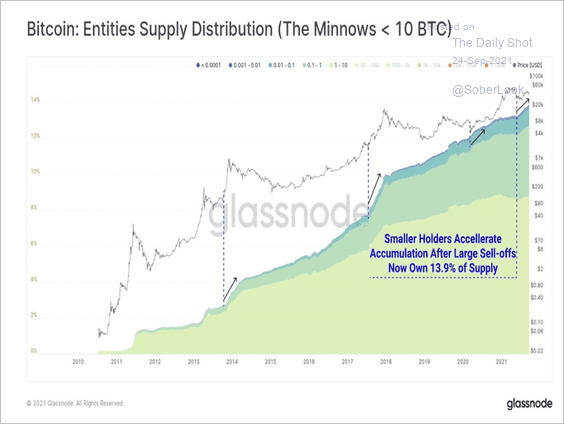

3. The chart below shows that short-term holders, or those who own fewer than 10 BTC, have accelerated their accumulation of bitcoin after large sell-offs.

Source: Glassnode

Source: Glassnode

Energy

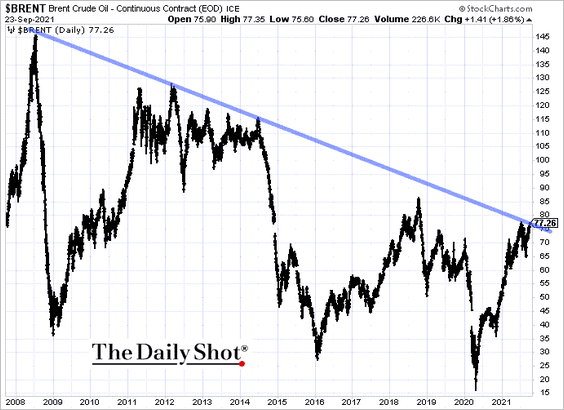

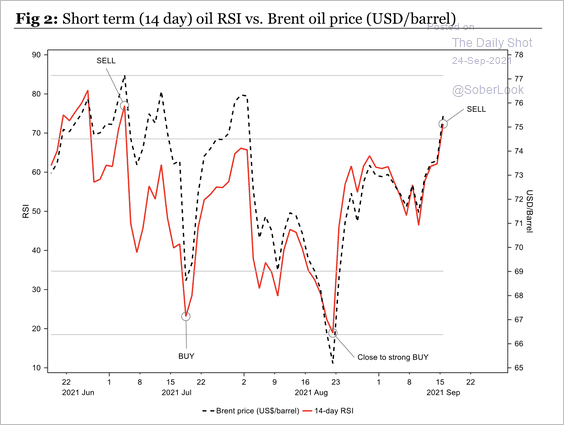

1. Brent is testing long-term downtrend resistance.

Technicals suggest Brent is overbought.

Source: Longview Economics

Source: Longview Economics

——————–

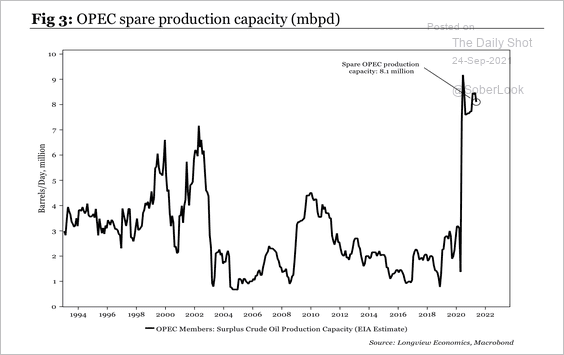

2. OPEC spare production capacity remains elevated.

Source: Longview Economics

Source: Longview Economics

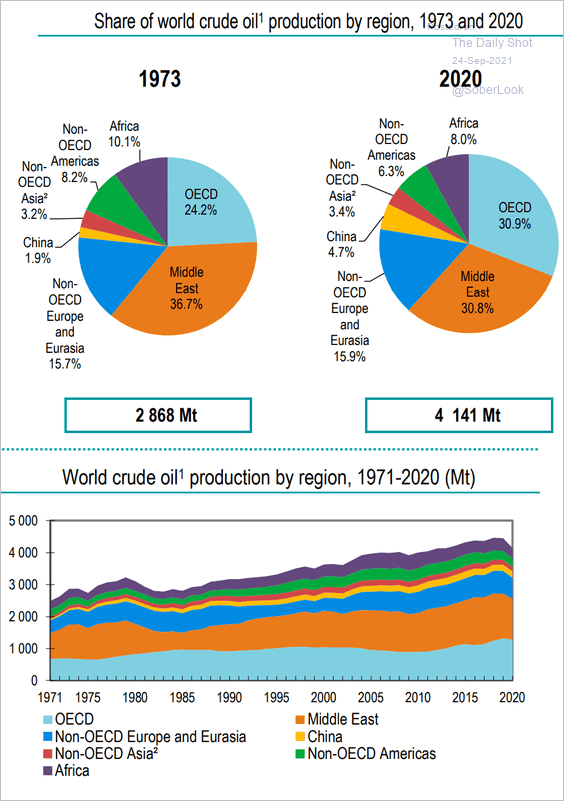

3. How has the distribution of crude oil production changed since the 1970s?

Source: IEA

Source: IEA

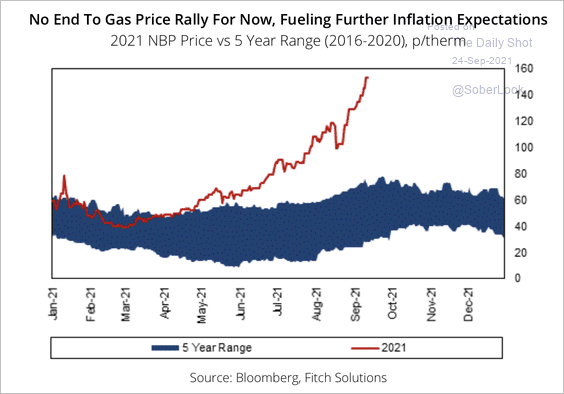

4. UK natural gas prices have rallied far beyond the 5-year range.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Equities

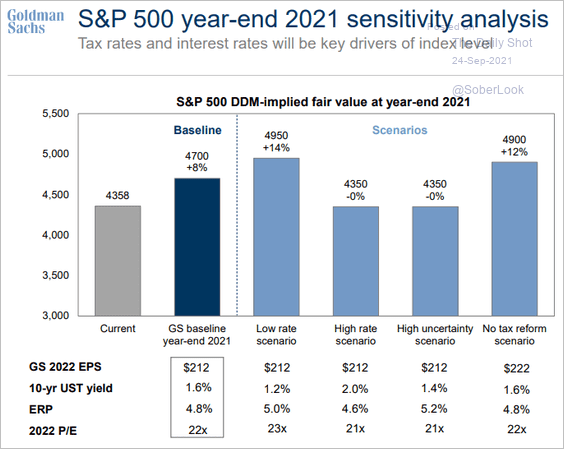

1. Let’s start with Goldman’s year-end scenario analysis for the S&P 500.

Source: Goldman Sachs

Source: Goldman Sachs

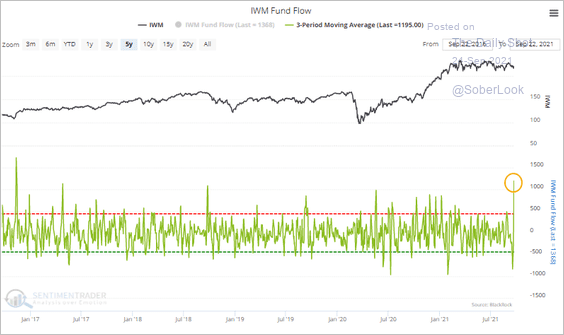

2. The iShares Russell 2,000 small-cap ETF sharply reversed outflows over the past few days.

Source: SentimenTrader

Source: SentimenTrader

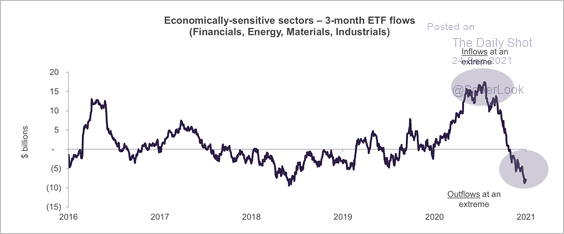

3. Cyclical sectors have seen the fastest outflows of the past decade.

Source: Truist Advisory Services

Source: Truist Advisory Services

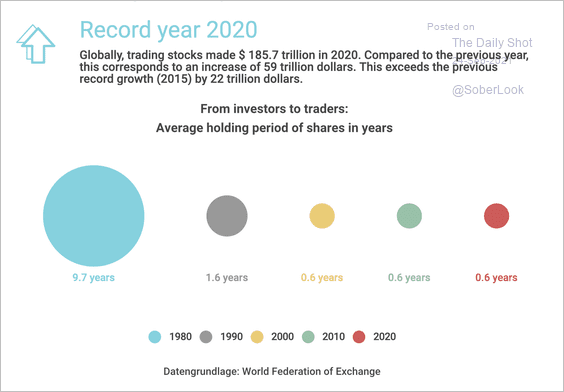

4. The average holding period of stocks has decreased over the years (globally).

Source: Wette.de Read full article

Source: Wette.de Read full article

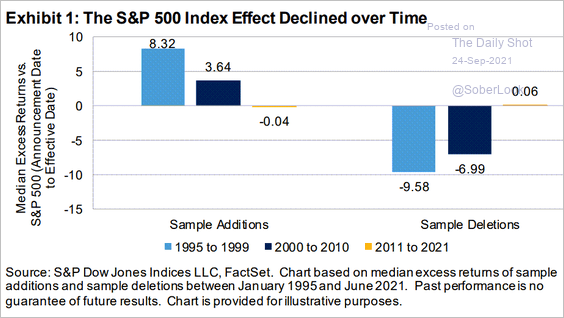

5. The boost to stock returns after inclusion in the S&P 500 has significantly diminished over time.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

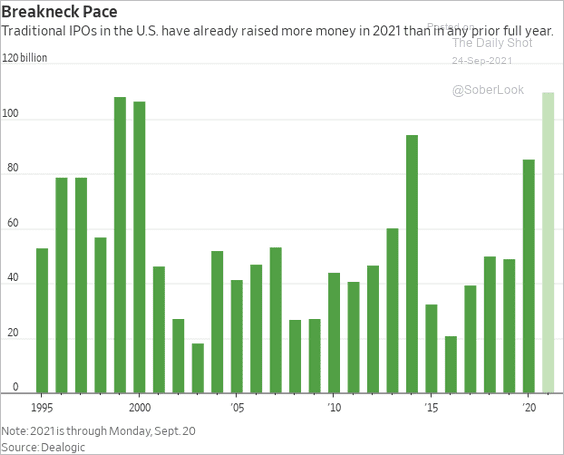

6. IPO activity remains robust.

Source: @WSJ Read full article

Source: @WSJ Read full article

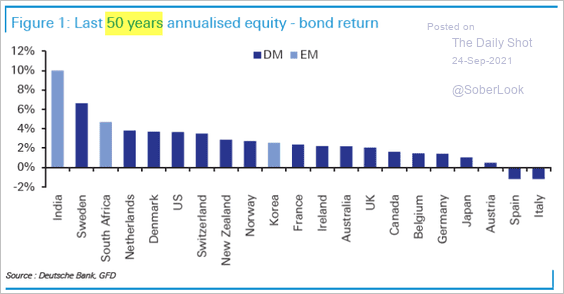

7. Finally, we have the 50-year annualized returns for stock markets around the world.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Rates

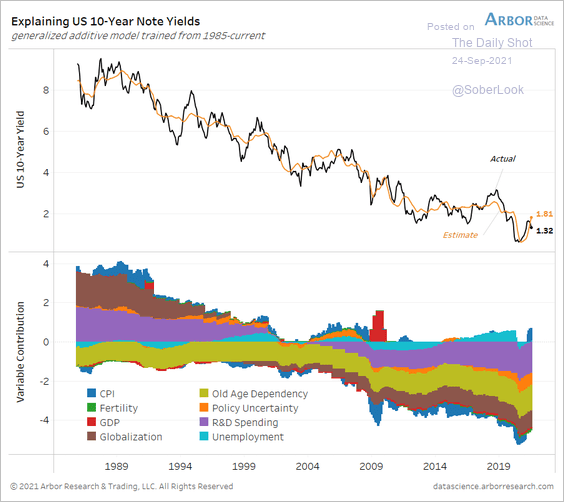

1. Which factors contributed to the remarkable decline in Treasury yields over the past three decades?

Source: @benbreitholtz

Source: @benbreitholtz

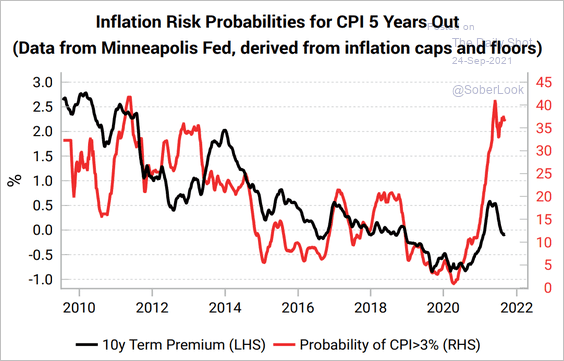

2. The Treasury term premium has diverged from longer-term upside inflation risks.

Source: Variant Perception

Source: Variant Perception

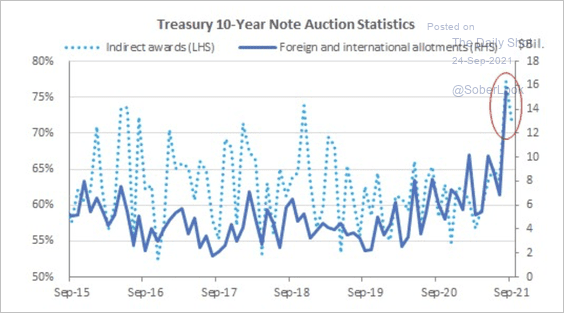

3. Demand surged for the August and September 10-year Treasury auctions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

1. Let’s start with the G-7 GDP changes since the start of the pandemic.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

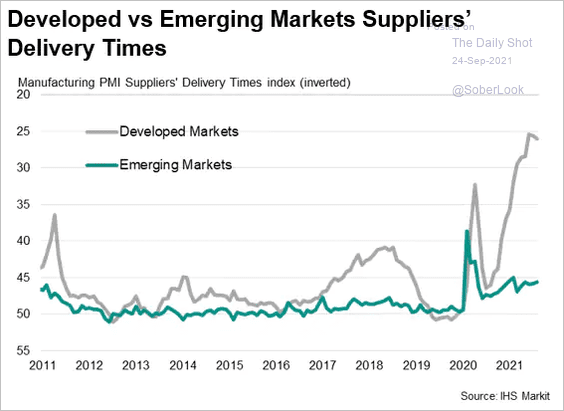

2. Supplier bottlenecks have been more severe in advanced economies.

Source: IHS Markit

Source: IHS Markit

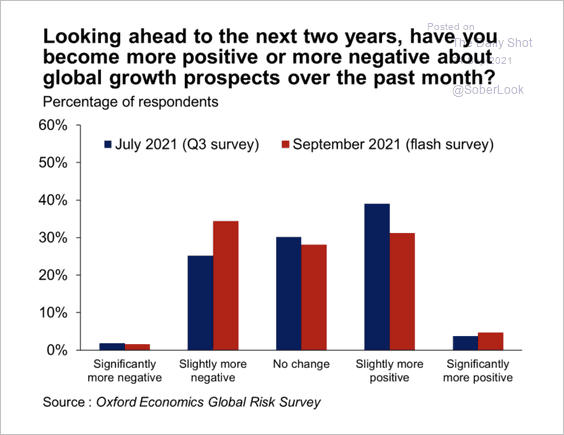

3. Businesses are becoming more pessimistic about global growth prospects, according to a survey by Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

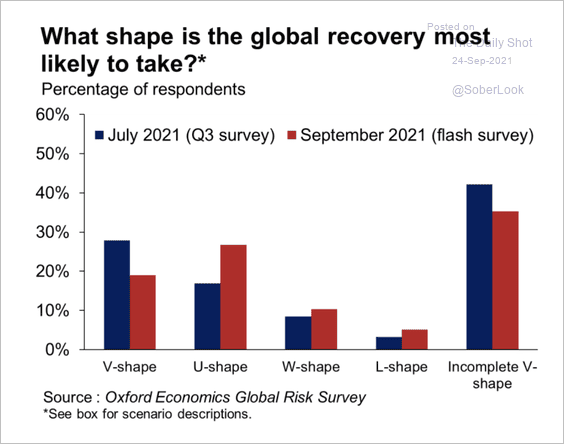

And fewer respondents expect a rapid economic recovery this month.

Source: Oxford Economics

Source: Oxford Economics

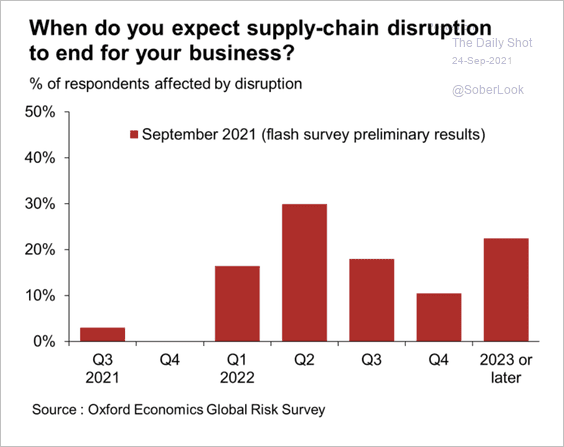

The survey also shows that most respondents expect supply chain disruptions to persist beyond the middle of next year.

Source: Oxford Economics

Source: Oxford Economics

——————–

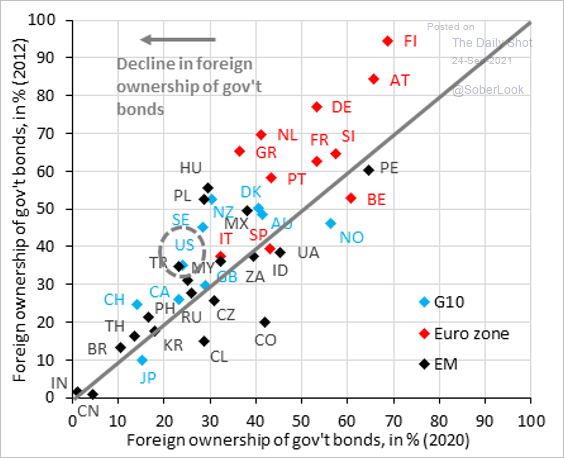

4. This scatterplot shows the changes in foreign ownership of government bonds.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

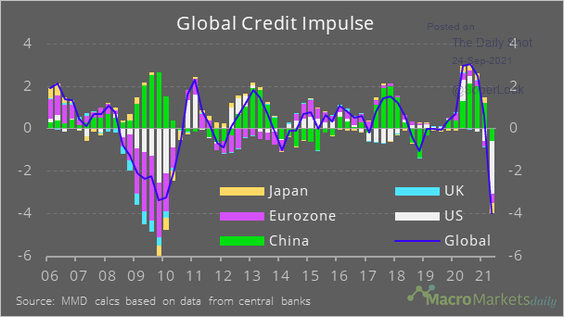

5. The global credit impulse is deep in negative territory.

Source: @macro_daily

Source: @macro_daily

——————–

Food for Thought

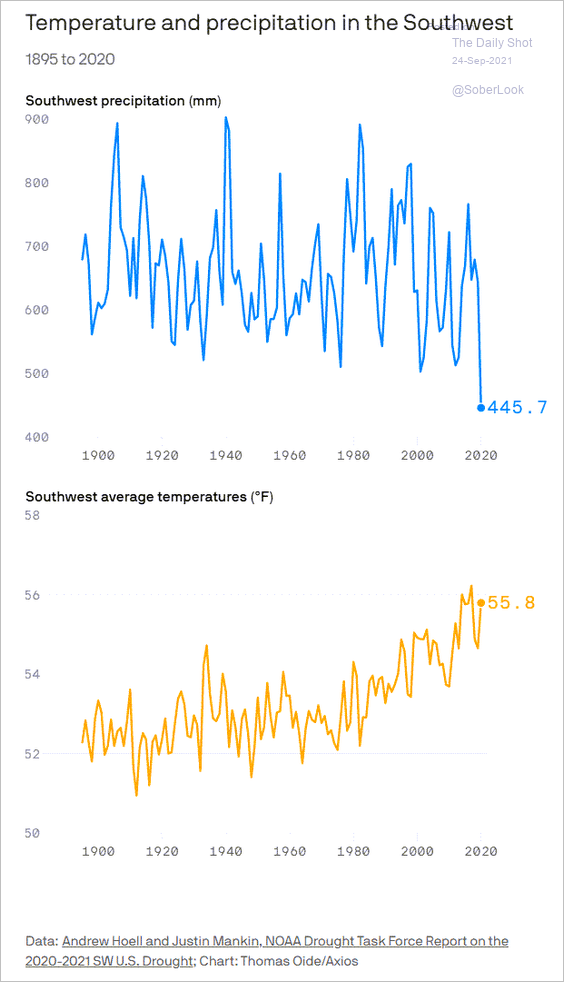

1. US Southwest drought (worst on record):

Source: @axios Read full article

Source: @axios Read full article

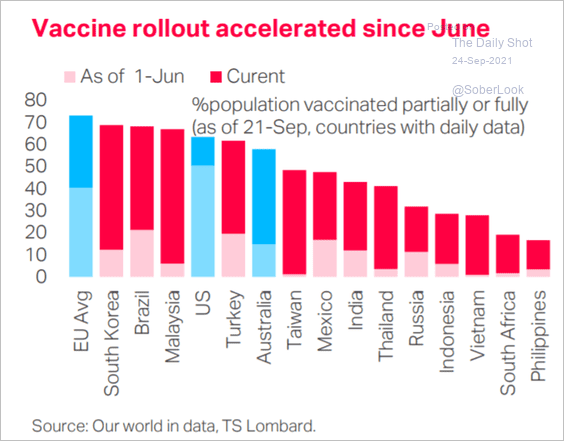

2. Vaccine rollout since June:

Source: TS Lombard

Source: TS Lombard

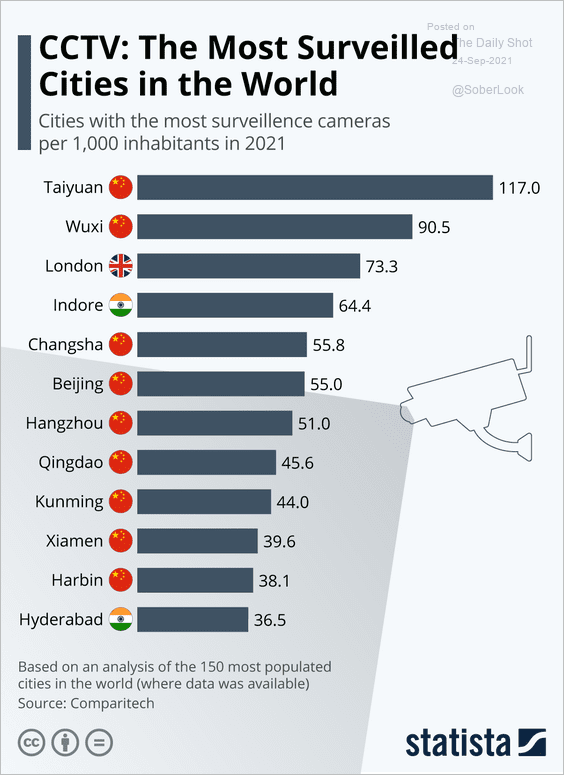

3. The most surveilled cities in the world:

Source: Statista

Source: Statista

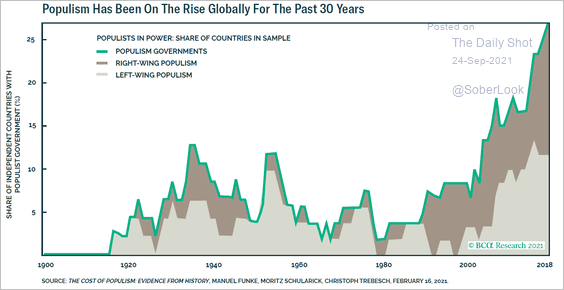

4. Rising populism:

Source: BCA Research

Source: BCA Research

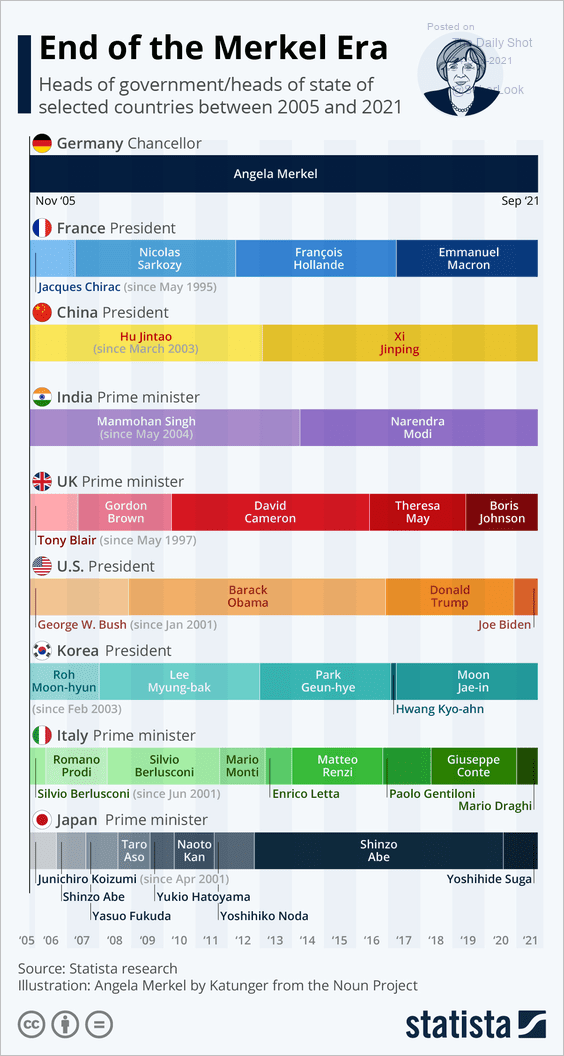

5. The Merkel era:

Source: Statista

Source: Statista

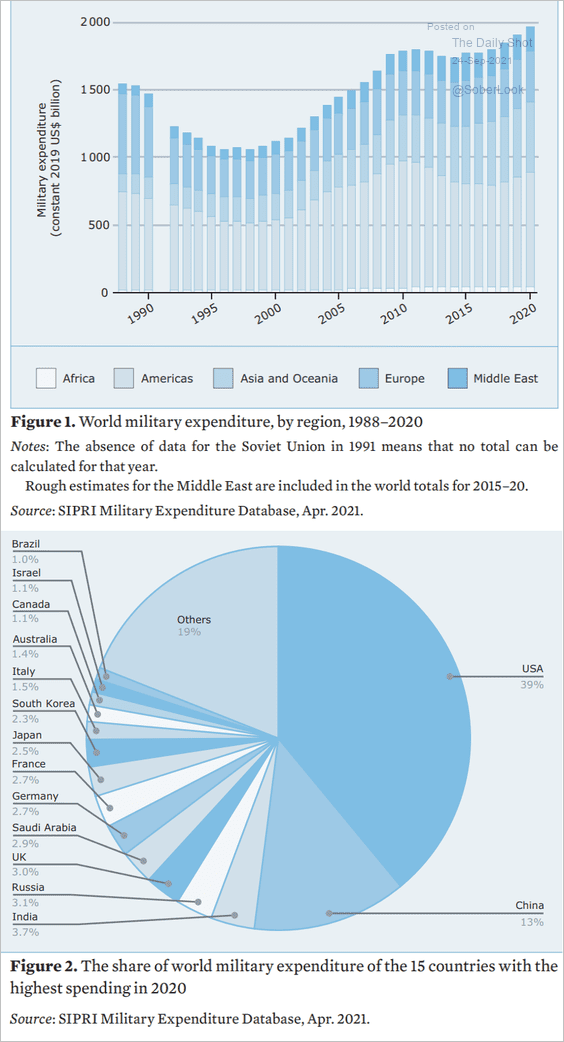

6. Global military spending:

Source: SIPRI

Source: SIPRI

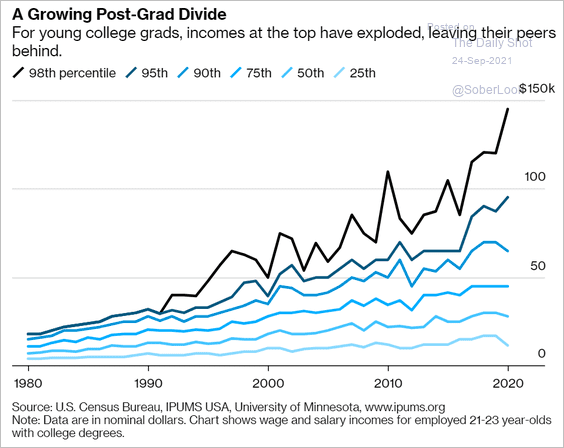

7. US new college graduates’ diverging incomes:

Source: @wealth Read full article

Source: @wealth Read full article

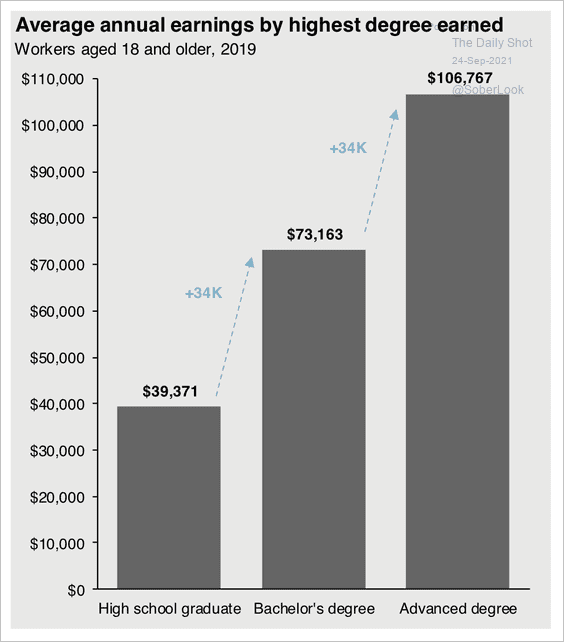

• Incomes by educational attainment:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

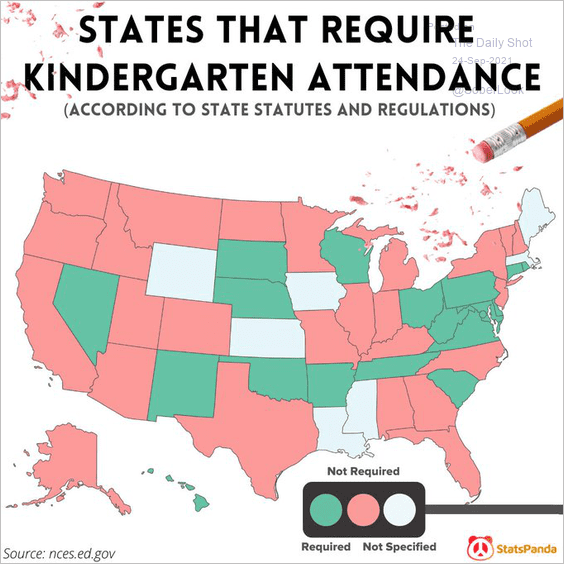

8. States that require kindergarten attendance:

Source: @statspanda1

Source: @statspanda1

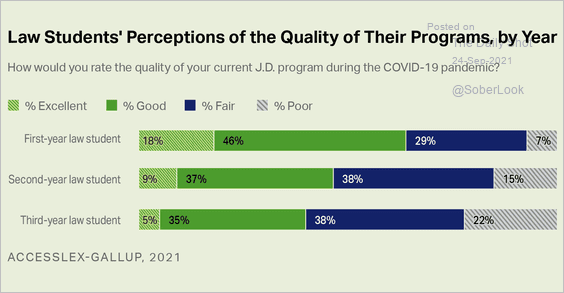

9. Quality of JD programs during the pandemic:

Source: Gallup Read full article

Source: Gallup Read full article

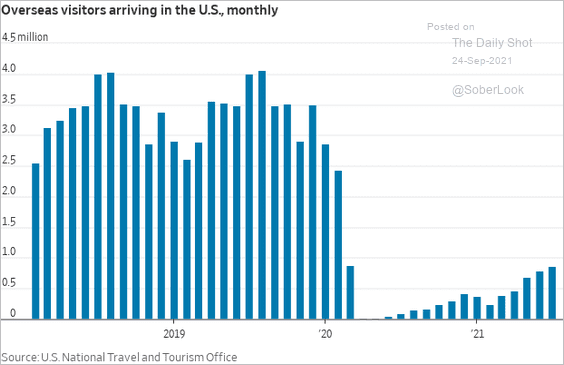

10. Visitors arriving in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

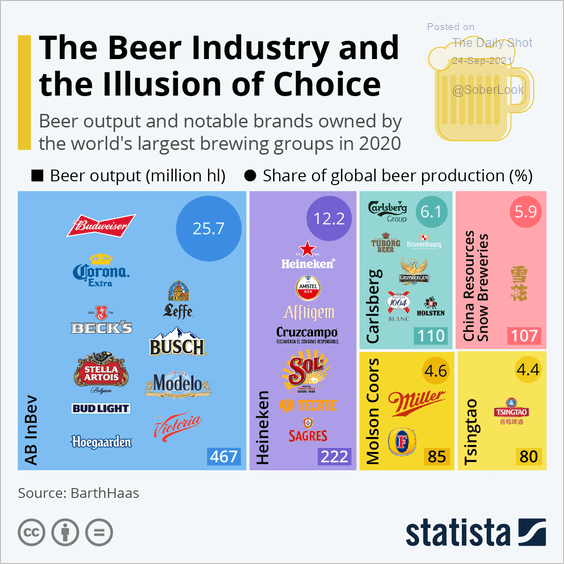

11. Beer output by the largest brewers:

Source: Statista

Source: Statista

——————–

Have a great weekend!