The Daily Shot: 12-Apr-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

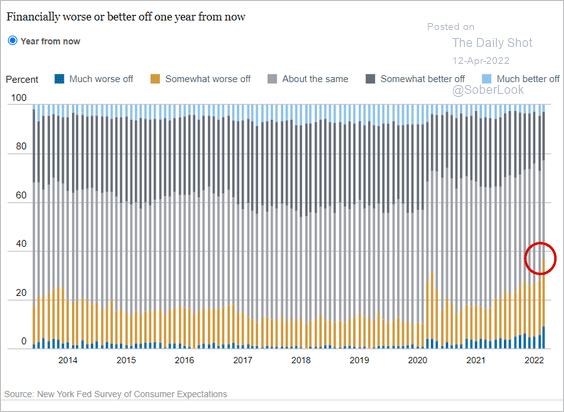

1. The percentage of Americans who expect to be worse off financially in 12 months hit the highest level in at least nine years, according to the NY Fed.

Source: NY Fed

Source: NY Fed

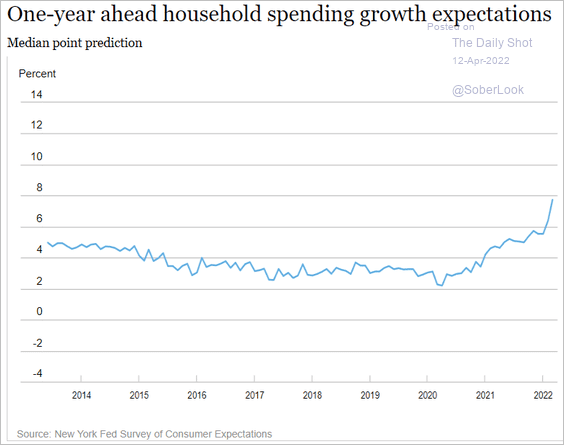

• Households increasingly expect to boost their spending as a result of rising costs.

Source: NY Fed

Source: NY Fed

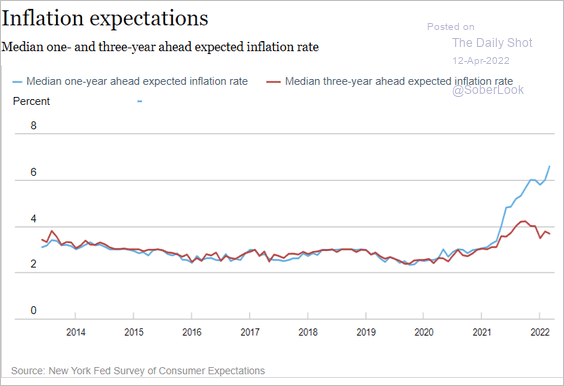

• Inflation expectations remain anchored, with the one- and three-year indicators continuing to diverge.

Source: NY Fed

Source: NY Fed

——————–

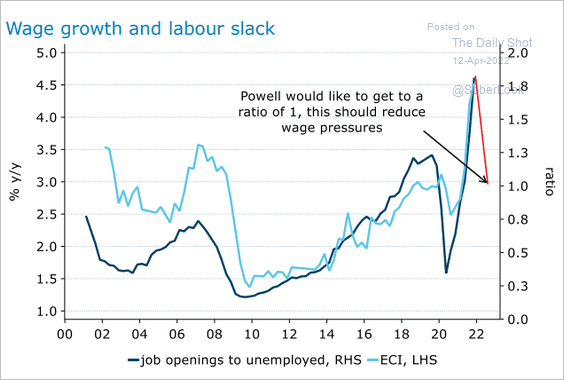

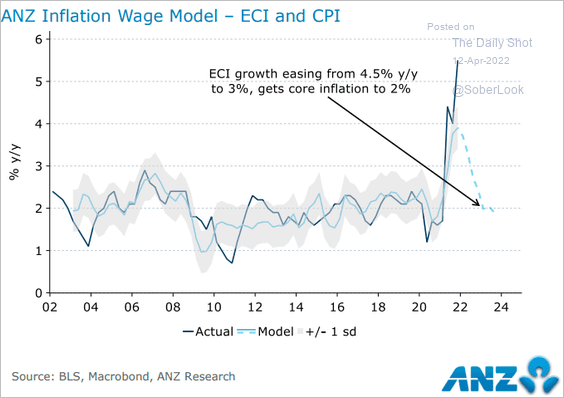

2. According to ANZ, the Fed may want to cool the labor market enough to bring the job openings-to-unemployed ratio closer to one. That would ease wage pressures, getting the Employment Cost Index (ECI) growth down to 3%.

Source: ANZ Research

Source: ANZ Research

Lower ECI growth would bring the CPI back near the Fed’s 2% objective.

Source: ANZ Research

Source: ANZ Research

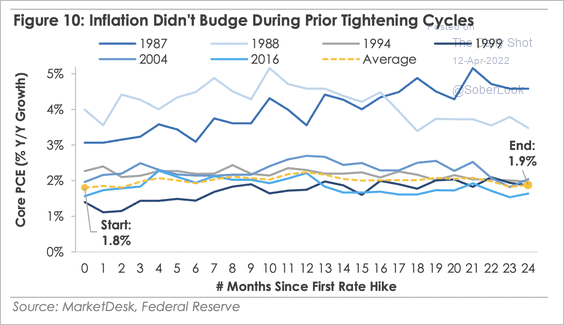

By the way, history indicates that Fed tightening has a limited impact on inflation.

Source: MarketDesk Research

Source: MarketDesk Research

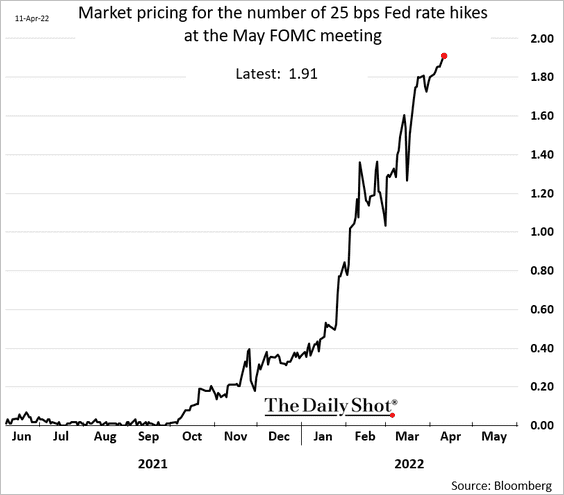

3. The market now fully expects a 50 bps rate hike in May.

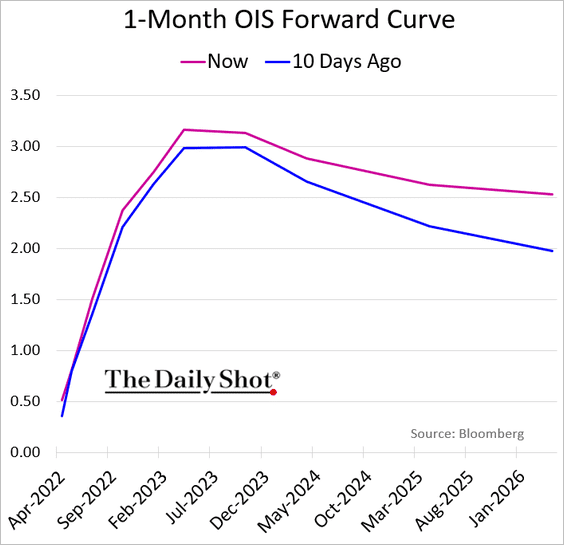

The market sees the Fed boosting rates above 3% and holding them elevated over a longer period.

——————–

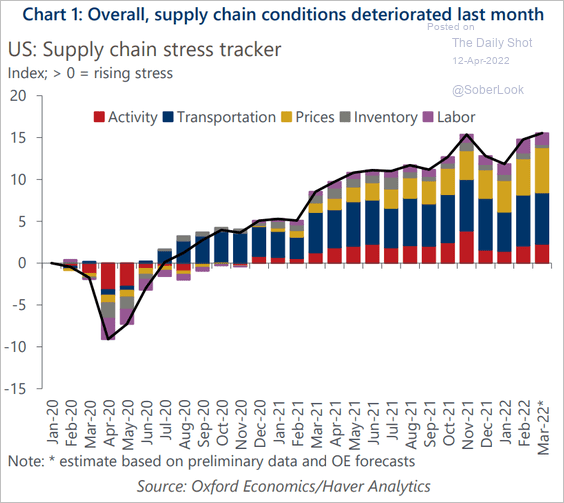

4. Supply chain stress levels remain elevated, according to Oxford Economics, with pressures now driven more by higher costs.

Source: Oxford Economics

Source: Oxford Economics

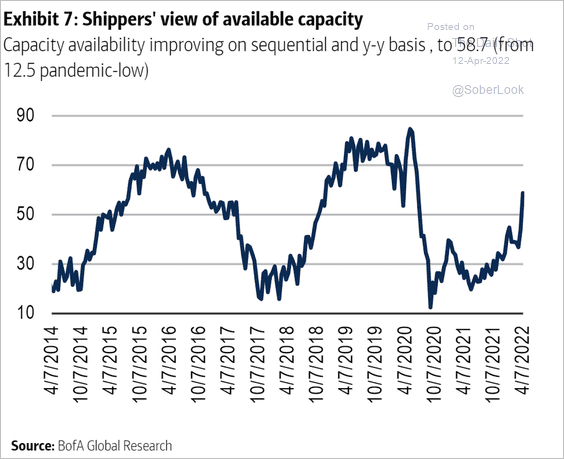

But shippers see capacity improving, …

Source: BofA Global Research; @TheStalwart

Source: BofA Global Research; @TheStalwart

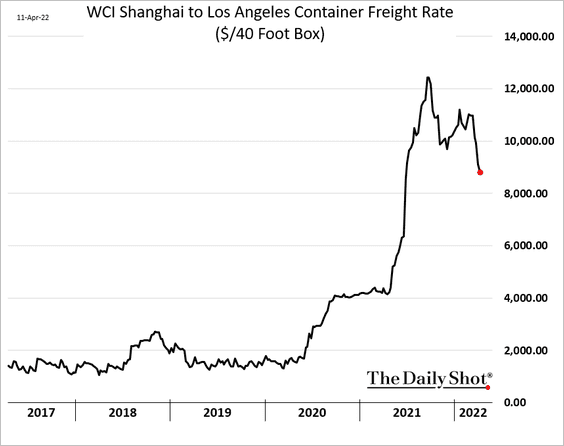

… with shipping rates from China beginning to moderate.

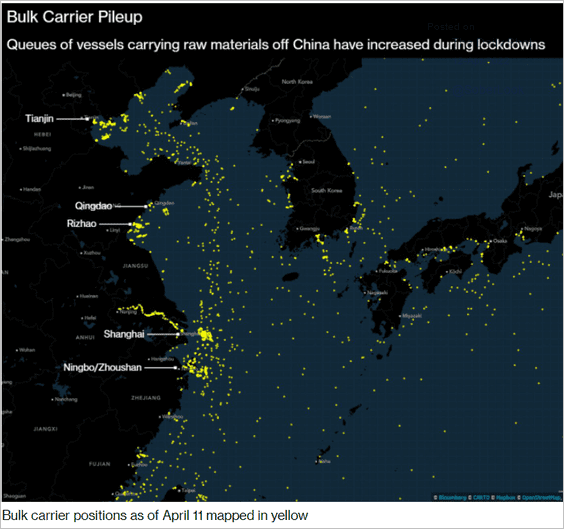

However, the COVID-related lockdowns in China are likely to make the situation worse.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

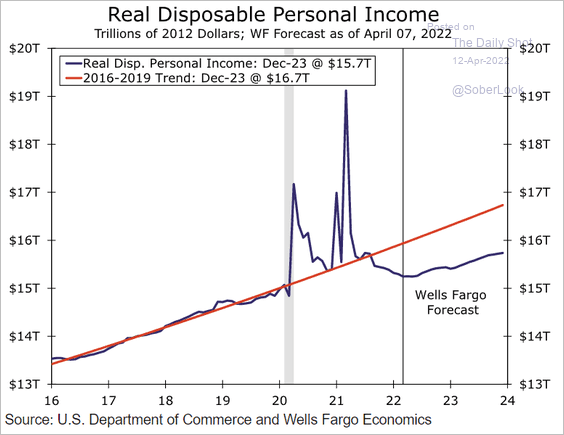

5. US real disposable income is expected to remain below the pre-COVID trend, according to Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Canada

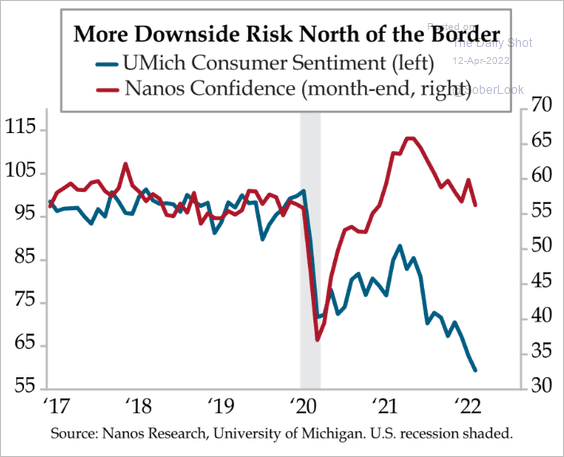

1. Deteriorating US consumer confidence points to downside risks for Canada’s sentiment.

Source: Quill Intelligence

Source: Quill Intelligence

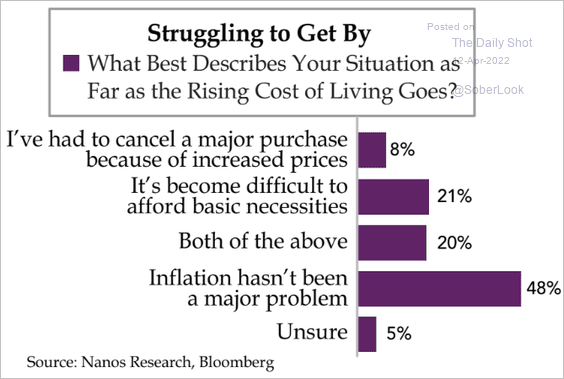

Inflation has become a major concern for Canada’s consumers.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

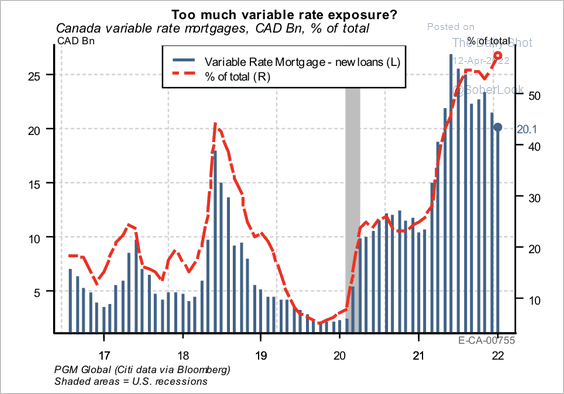

2. Banks are exposed to a surge in variable-rate mortgages.

Source: PGM Global

Source: PGM Global

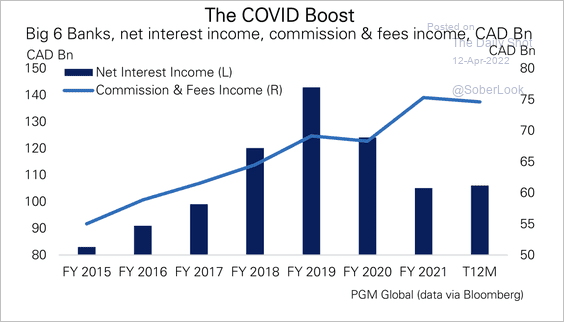

The large revenue boost for banks over the past two years came from a surge in capital market activities (higher commissions and fees). Still, despite strong mortgage originations, net interest income from core lending has fallen, according to PGM Global.

Source: PGM Global

Source: PGM Global

——————–

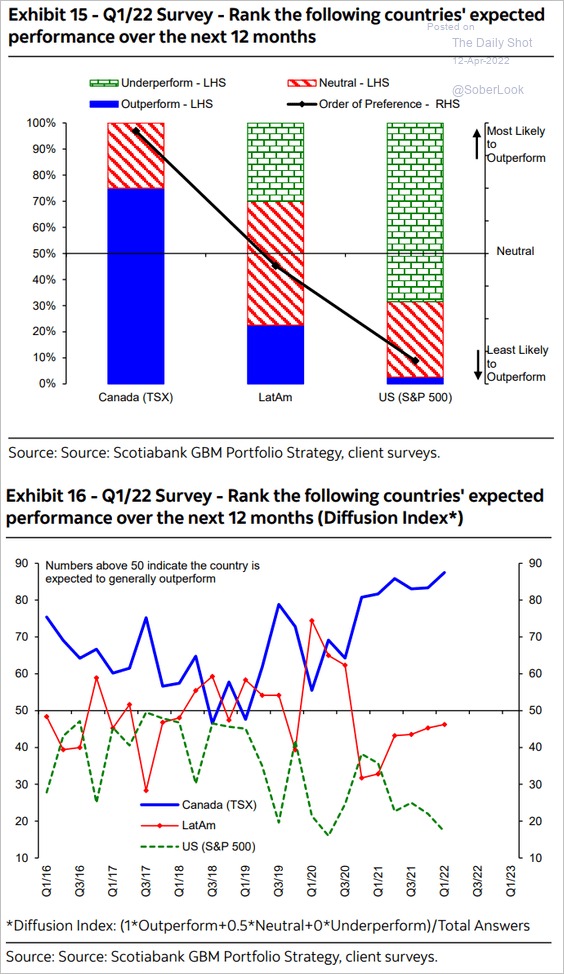

3. Investors are bullish on Canadian stocks.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

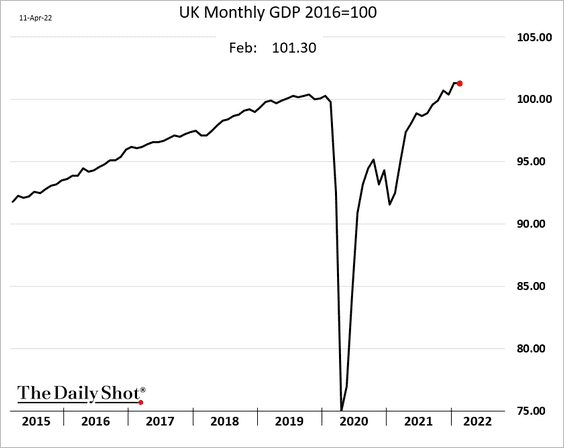

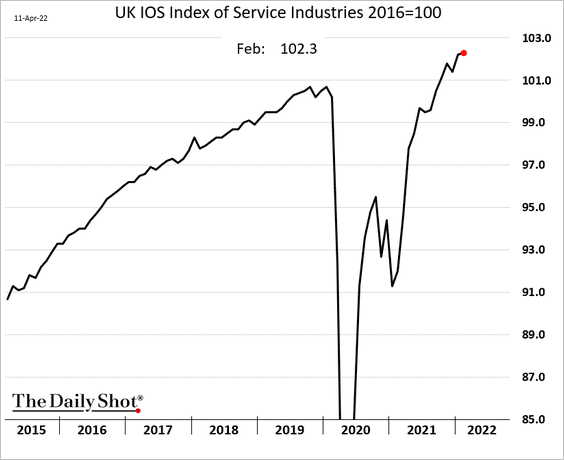

The United Kingdom

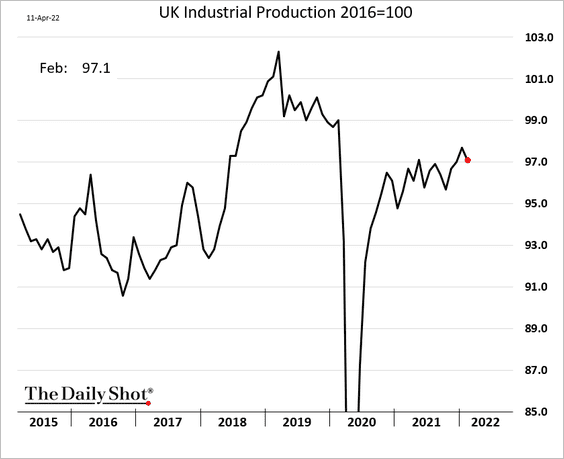

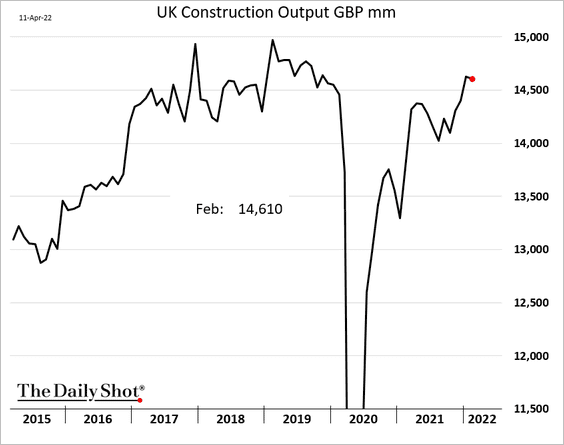

1. UK GDP growth paused in February.

Services output strengthened, …

… but manufacturing and construction activity edged lower.

——————–

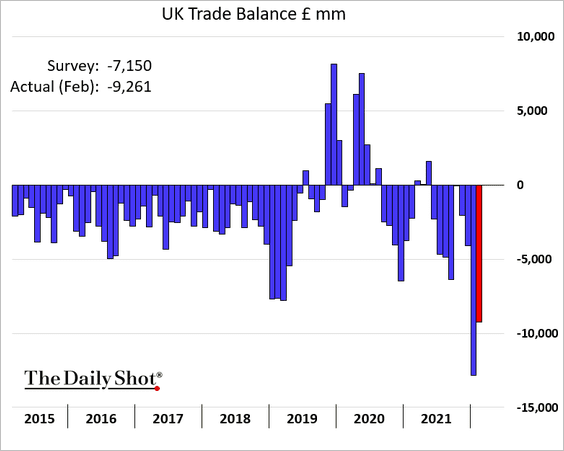

2. The trade deficit remains near record levels.

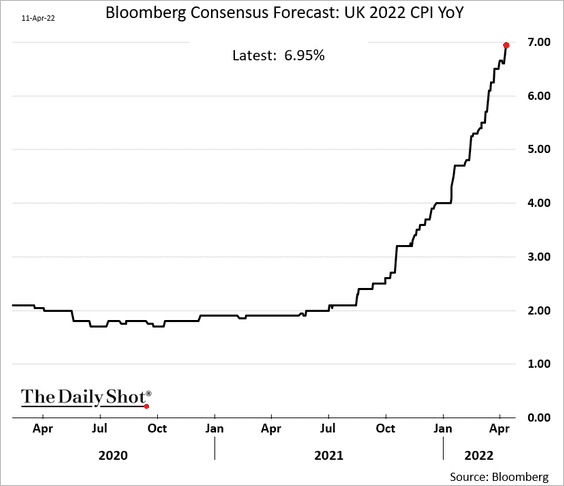

3. Economists now expect consumer prices to rise by 7% this year.

Back to Index

The Eurozone

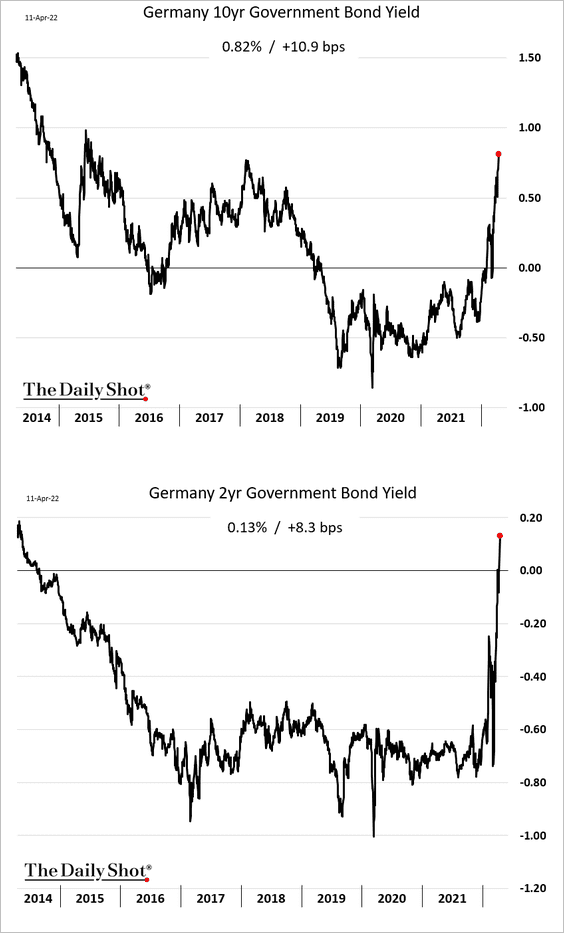

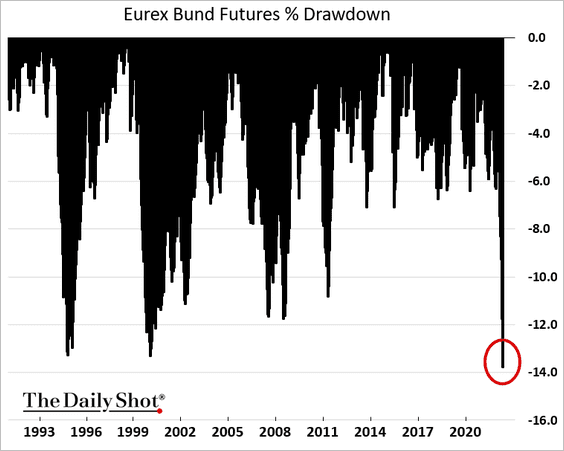

1. The Bund sell-off has been relentless.

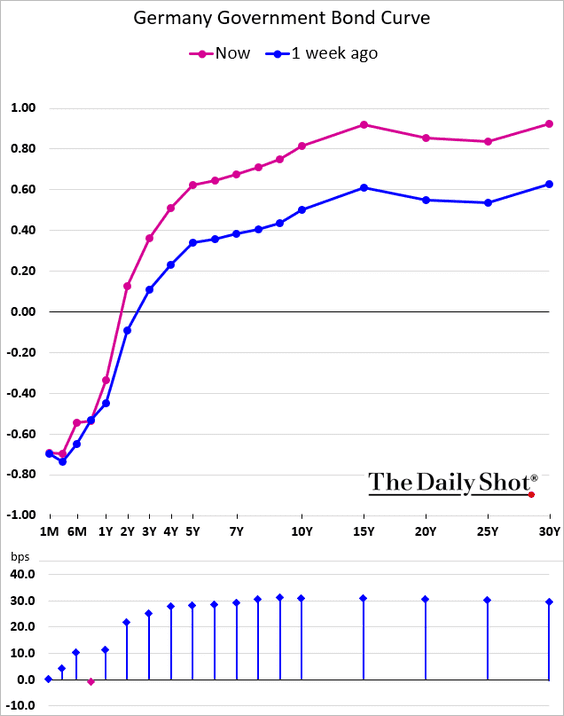

Here is the yield curve.

——————–

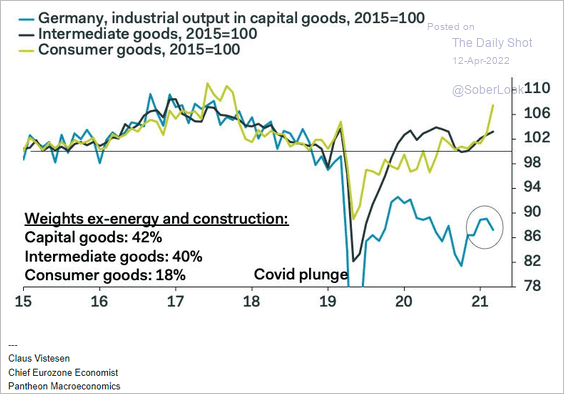

2. Germany’s industrial output has been strengthening, except in capital goods (which include vehicles).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

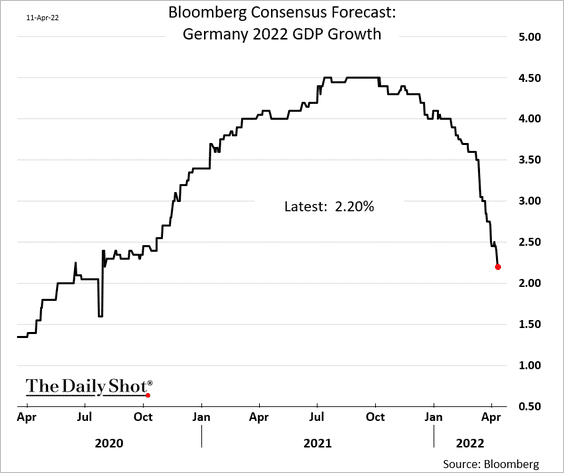

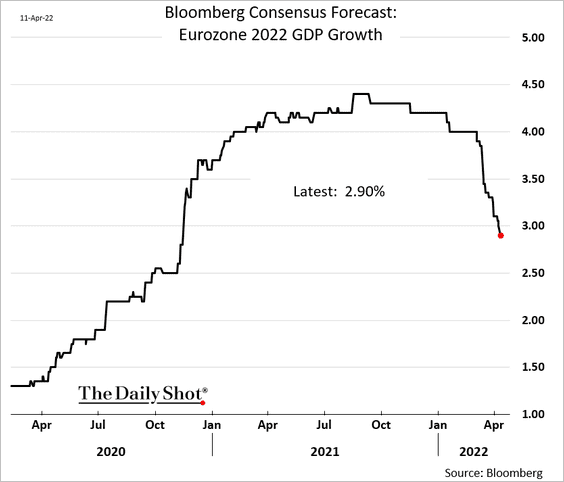

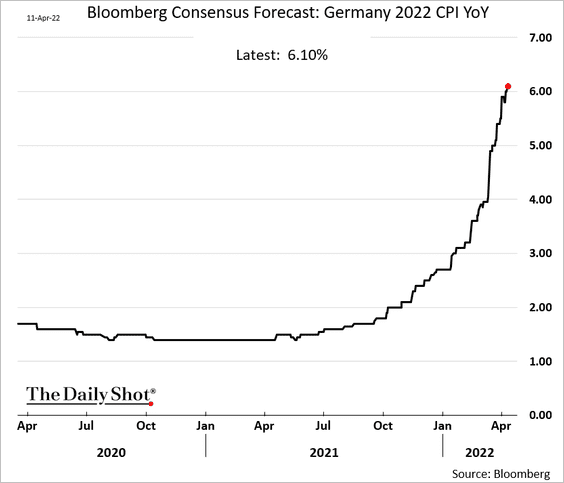

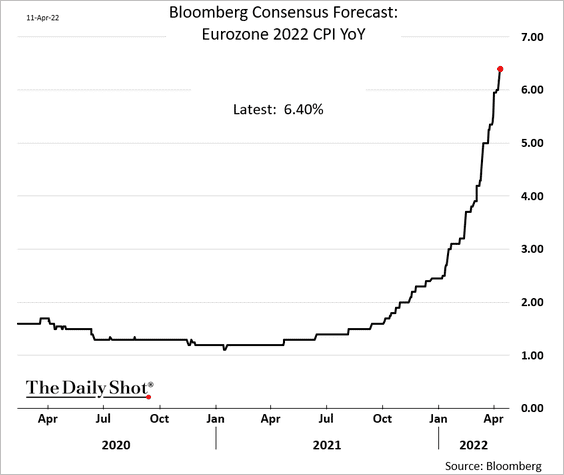

3. Economists increasingly see the Eurozone moving toward stagflation.

• GDP forecasts for 2022:

• Inflation forecasts for 2022:

——————–

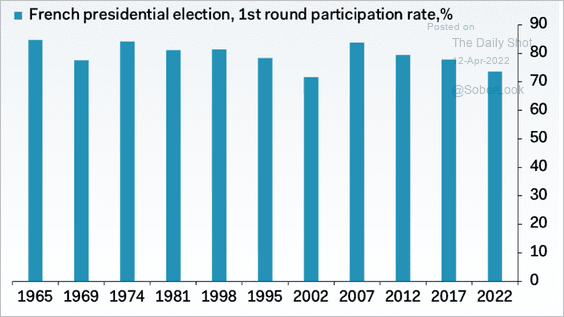

4. The participation rate in French first-round elections has been trending lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

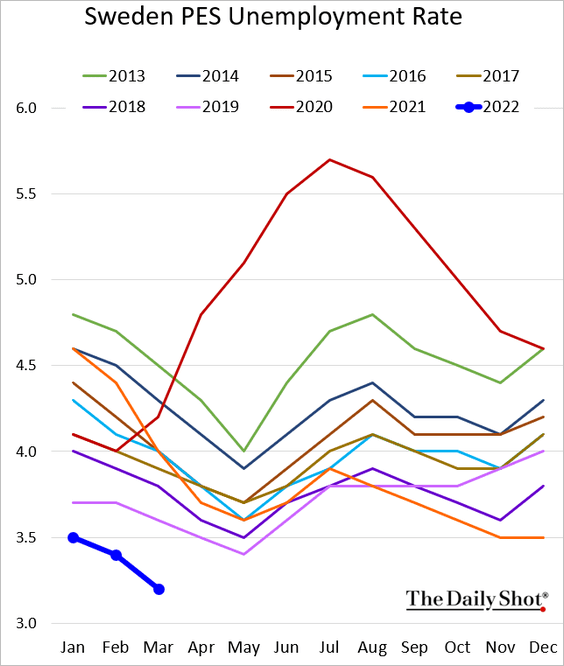

1. Sweden’s unemployment rate continues to fall.

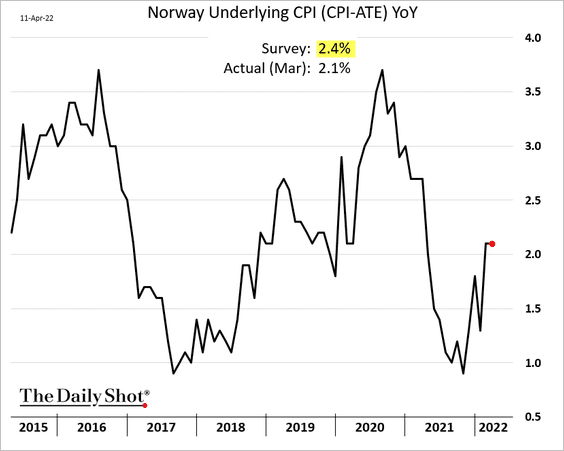

2. Norway’s consumer inflation report was surprisingly benign.

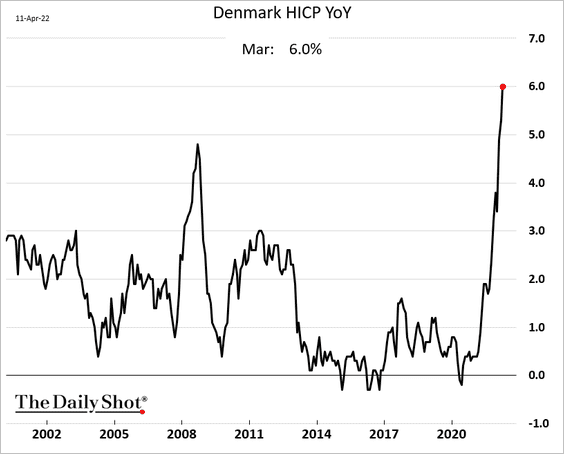

But that hasn’t been the case elsewhere in Europe.

• Denmark:

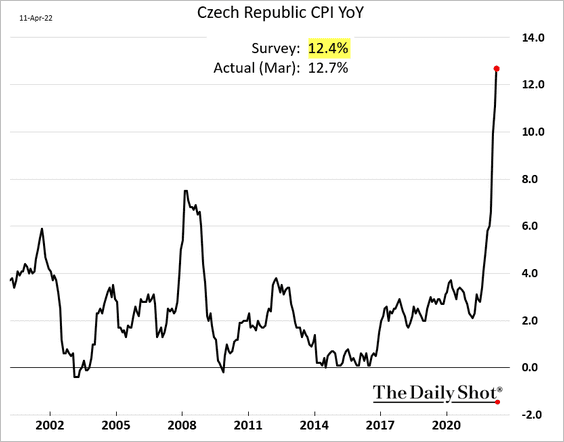

• The Czech Republic:

Back to Index

Japan

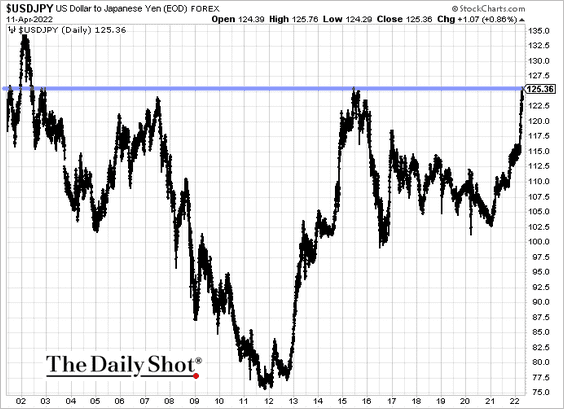

1. Dollar-yen is testing long-term resistance.

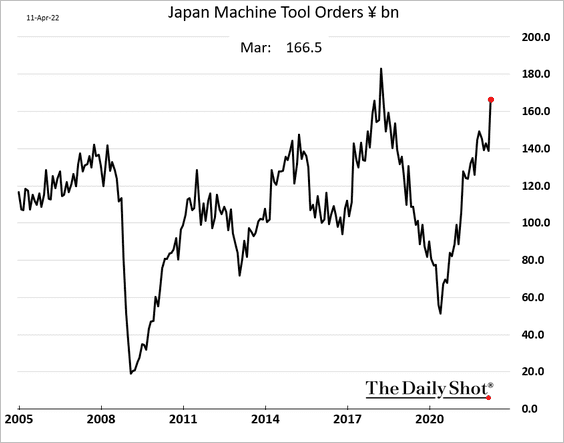

2. Machine tool orders jumped in March.

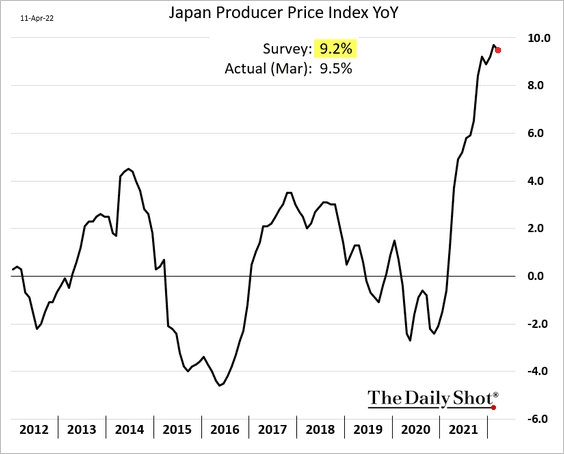

3. Producer prices continue to surprise to the upside.

Back to Index

Asia – Pacific

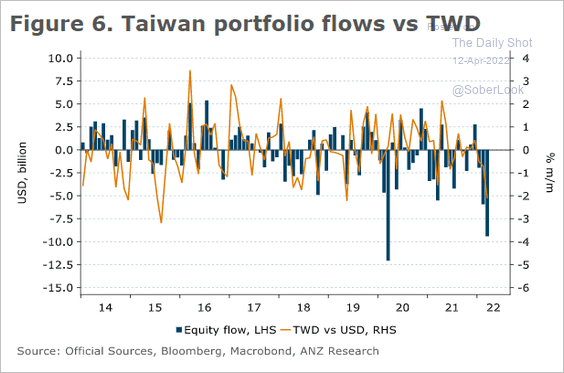

1. Taiwan’s portfolio outflows accelerated last month.

Source: ANZ Research

Source: ANZ Research

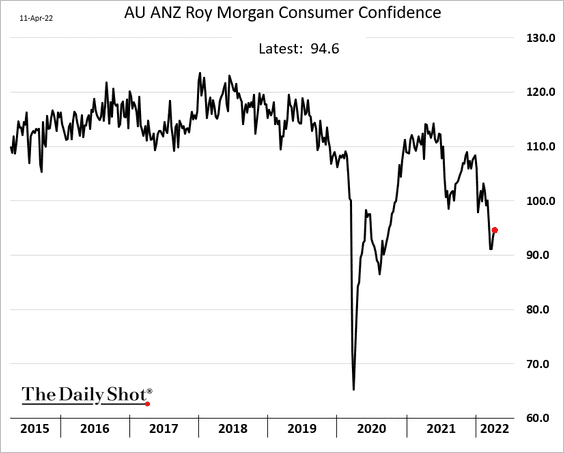

2. Australia’s consumer confidence has stabilized.

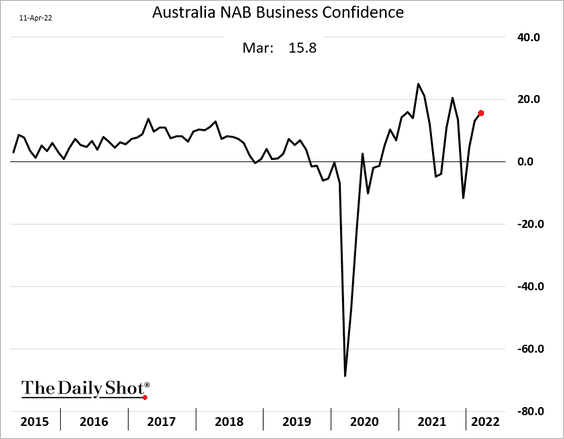

• Business confidence has rebounded.

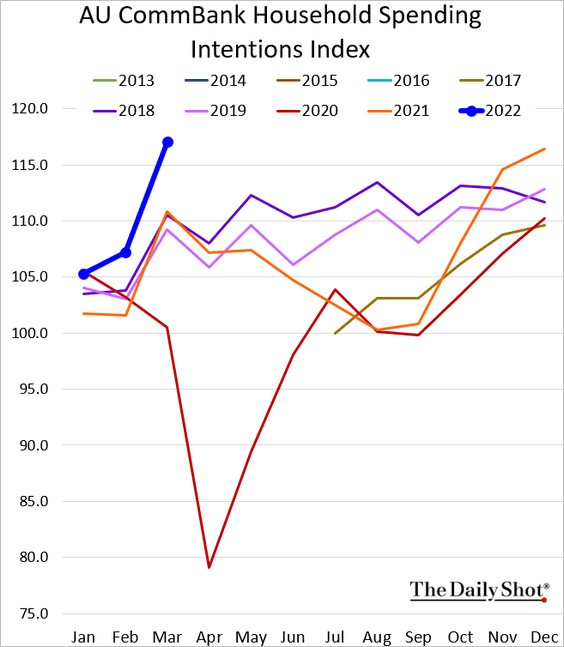

• Australians expect to spend more are prices climb.

Back to Index

China

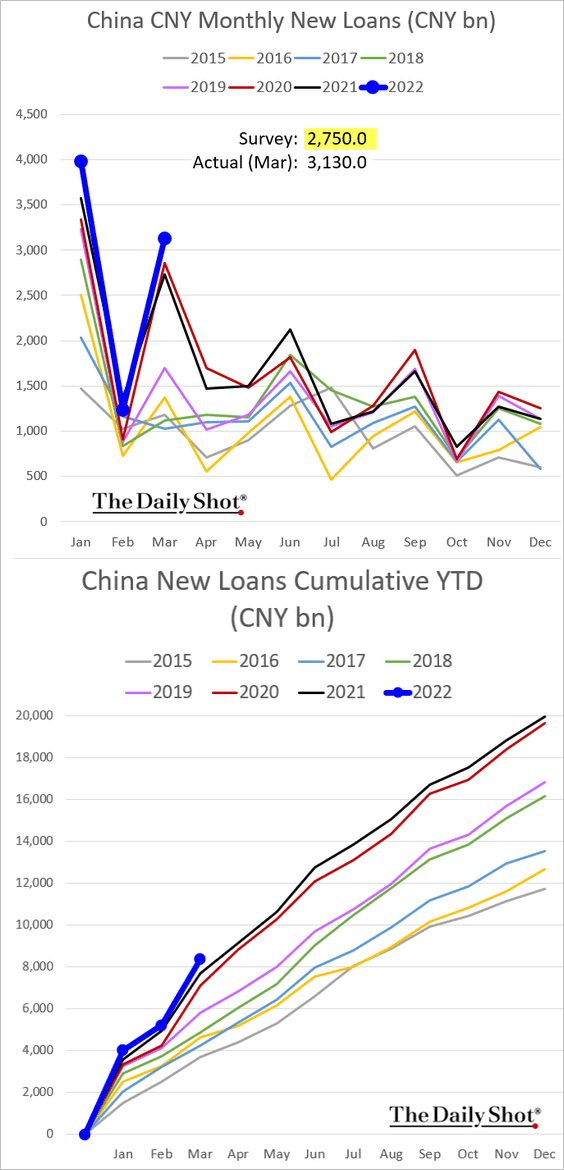

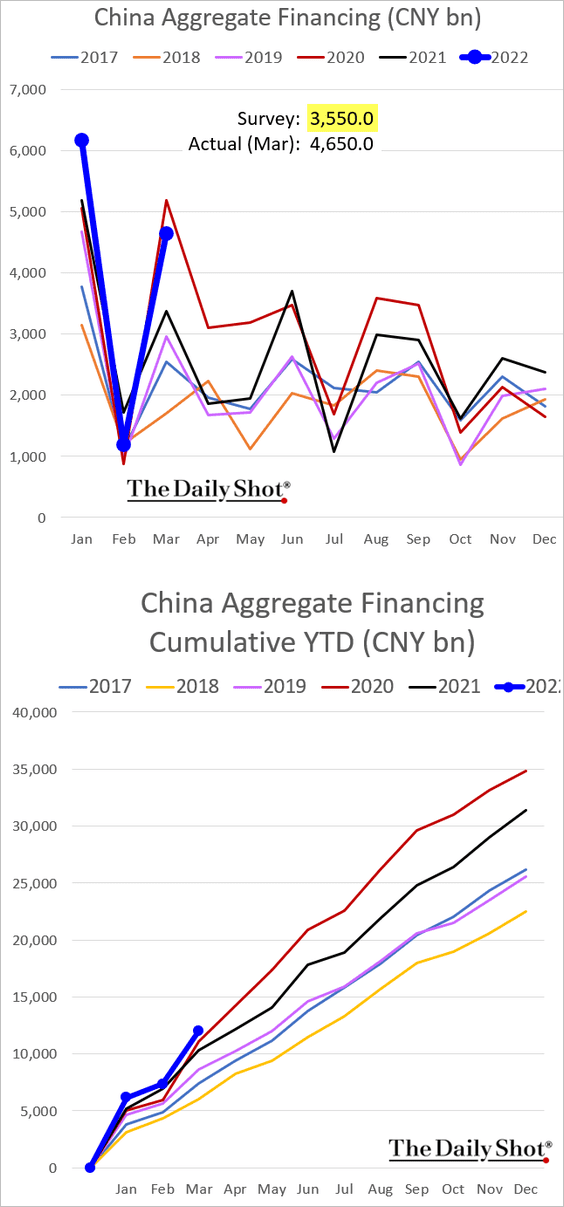

1. March loan growth topped expectations.

• Bank loans:

• Total financing:

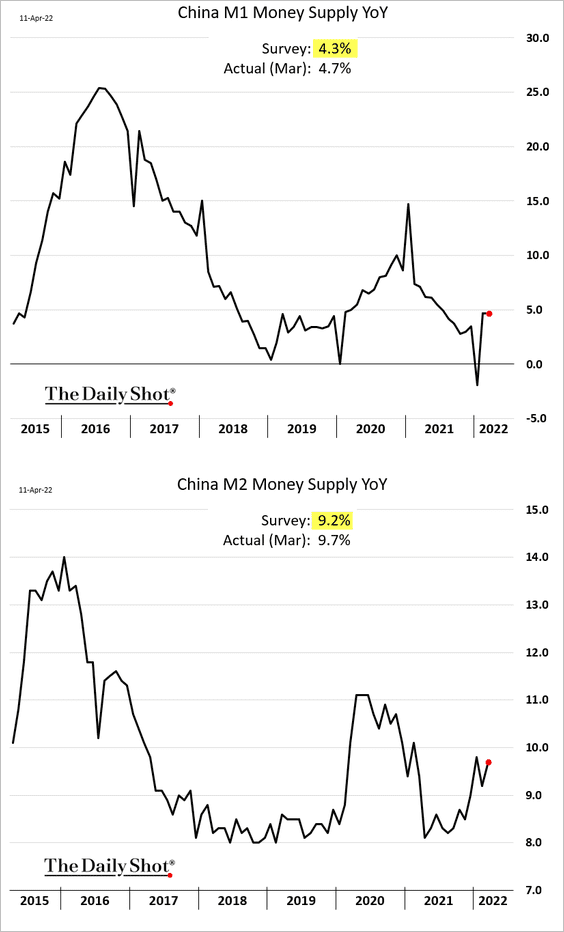

Money supply growth was also stronger than expected.

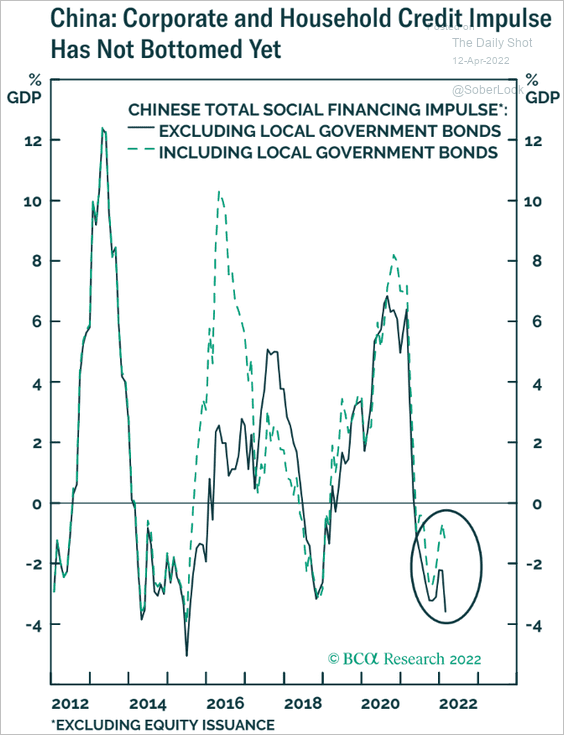

Credit impulse outside of local government debt has been soft. Are we now seeing a turnaround?

Source: BCA Research

Source: BCA Research

——————–

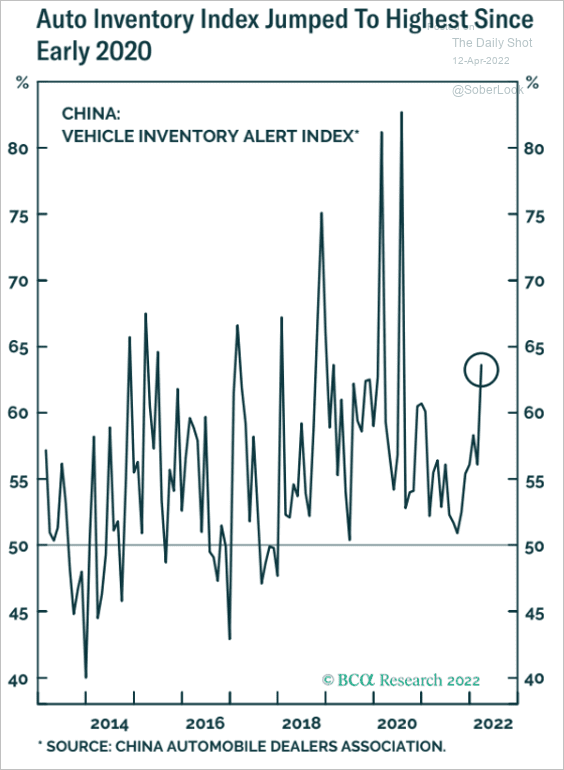

2. Auto inventories have been rising.

Source: BCA Research

Source: BCA Research

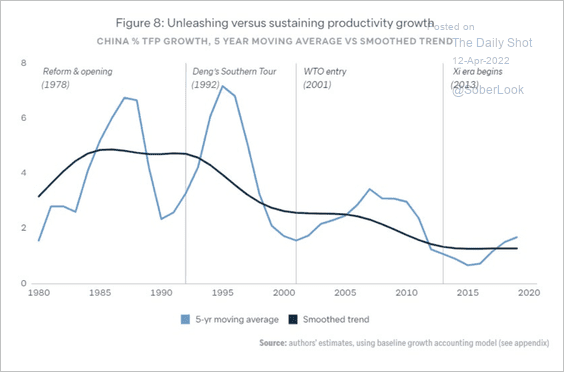

3. Productivity growth has stabilized in recent years.

Source: Lowy Institute

Source: Lowy Institute

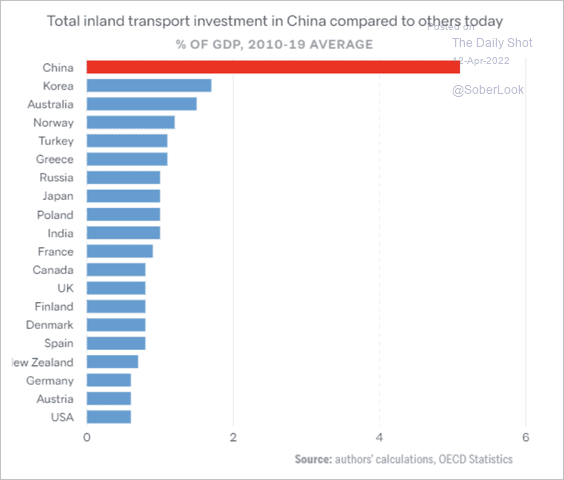

4. China invests far more in public infrastructure than other major economies.

Source: Lowy Institute

Source: Lowy Institute

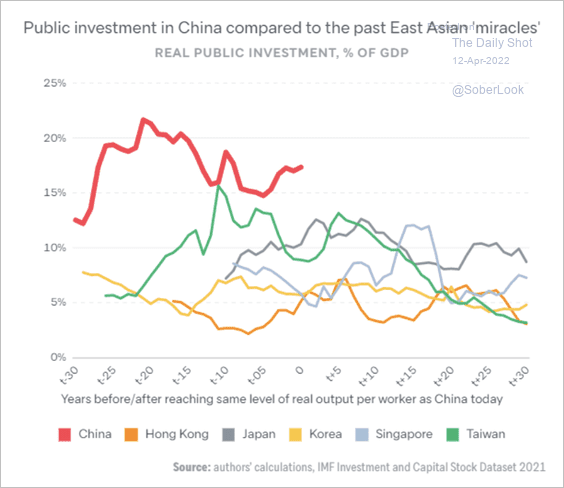

Here is a look at China’s public investment compared with other East Asian countries.

Source: Lowy Institute

Source: Lowy Institute

——————–

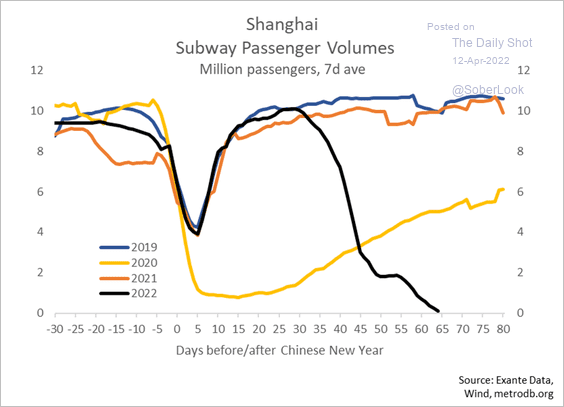

5. Shanghai’s subway system shows the extent of the lockdowns.

Source: @AndreasSteno

Source: @AndreasSteno

Back to Index

Emerging Markets

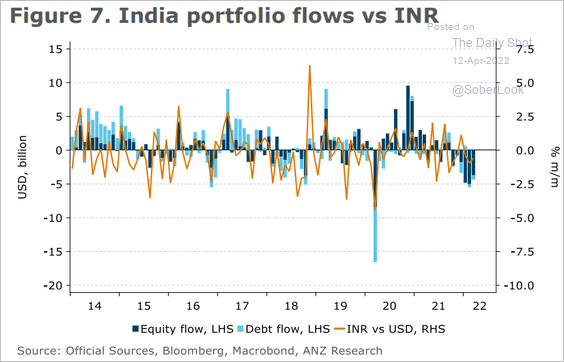

1. India’s portfolio flows remain negative.

Source: ANZ Research

Source: ANZ Research

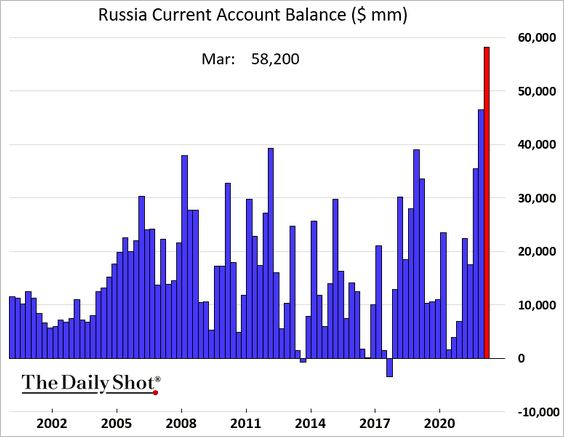

2. Russia’s current account surplus hit a record as imports slump.

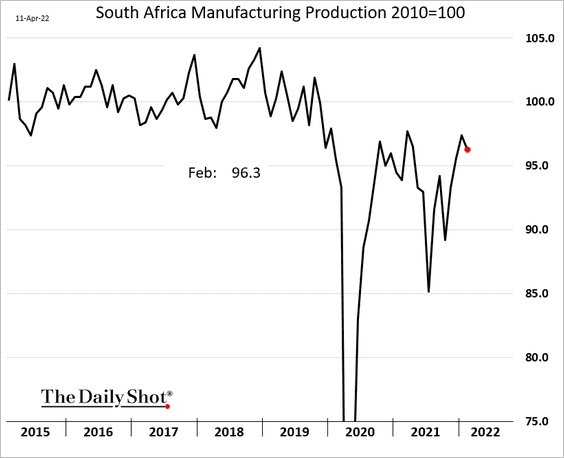

3. South Africa’s factory output edged lower in February.

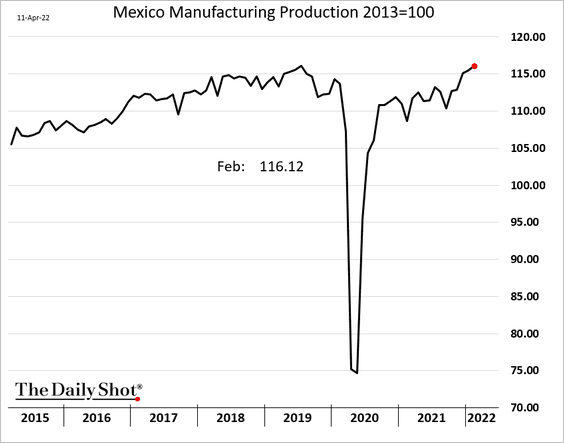

4. Mexico’s manufacturing production hit a new high.

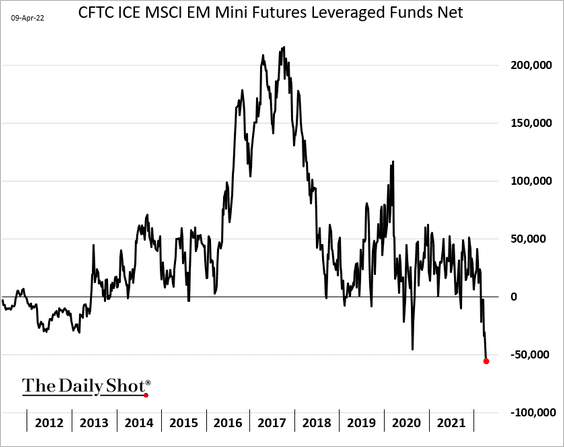

5. Hedge funds are betting against EM equities.

h/t @IshikaMookerjee

h/t @IshikaMookerjee

Back to Index

Cryptocurrency

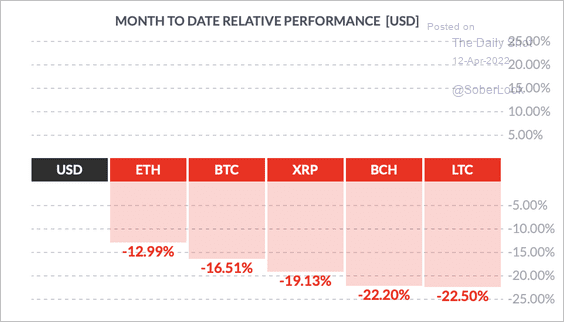

1. Cryptos are off to a rough start this month.

Source: FinViz

Source: FinViz

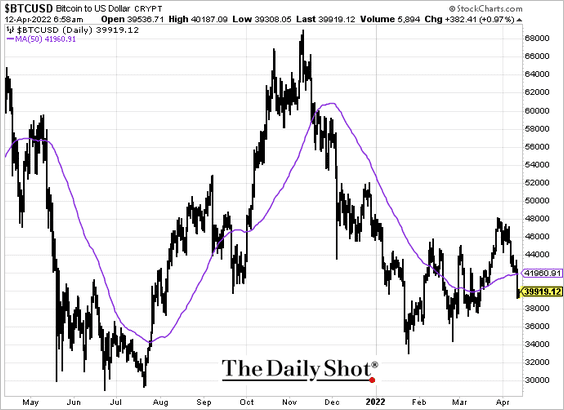

Bitcoin went through the 50-day moving average, dipping below $40k.

——————–

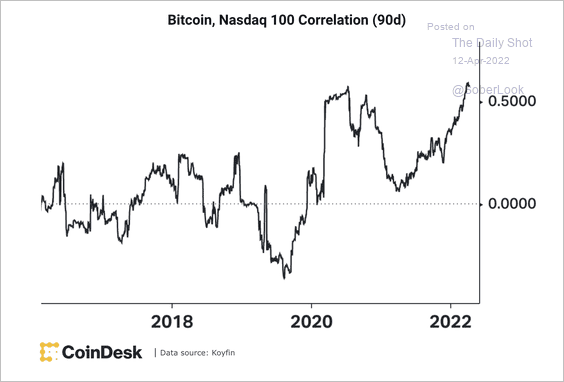

2. Bitcoin’s 90-day correlation with the Nasdaq 100 reached a new high.

Source: CoinDesk, Koyfin Read full article

Source: CoinDesk, Koyfin Read full article

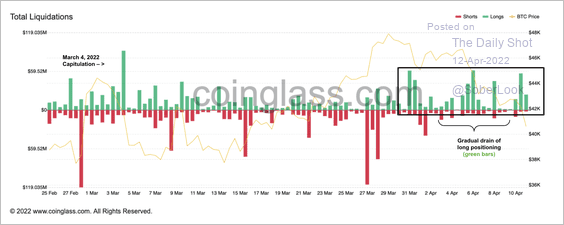

3. A spike in long BTC liquidations occurred over the weekend, although not extreme compared with early March.

Source: Coinglass Read full article

Source: Coinglass Read full article

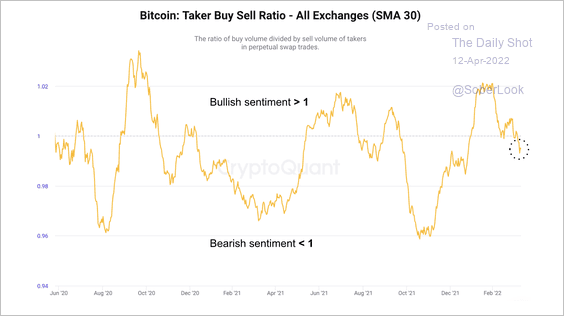

4. The ratio of bitcoin’s buy volume versus sell volume has declined this year, indicating bearish sentiment among traders.

Source: CryptoQuant Read full article

Source: CryptoQuant Read full article

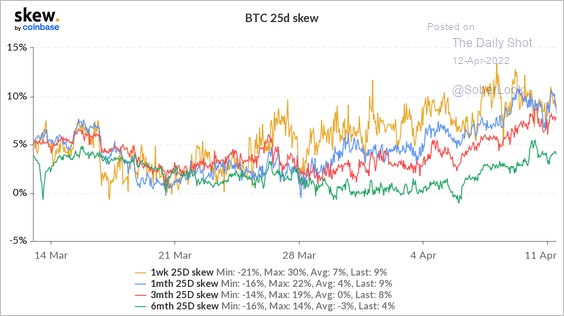

5. Bitcoin’s put/call option skews are trending higher, indicating a renewed bias for puts.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

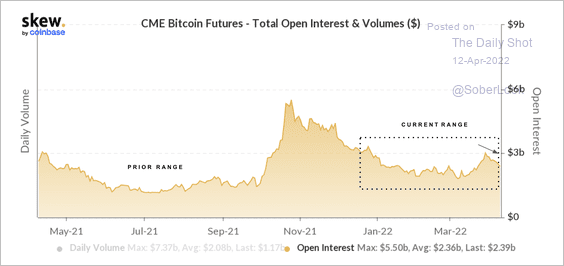

6. Open interest in CME bitcoin futures has ticked lower over the past week.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

Back to Index

Commodities

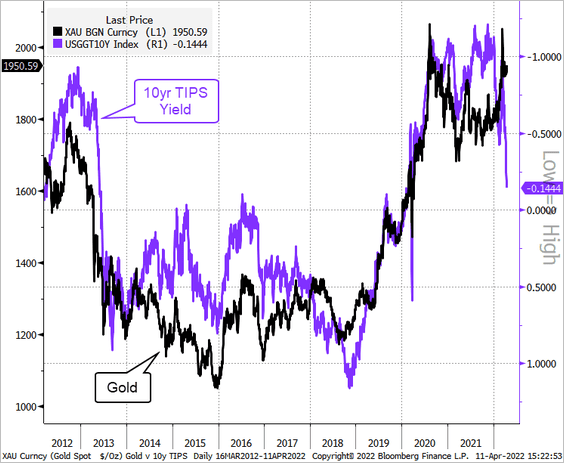

1. The surge in US real rates poses a risk for gold.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

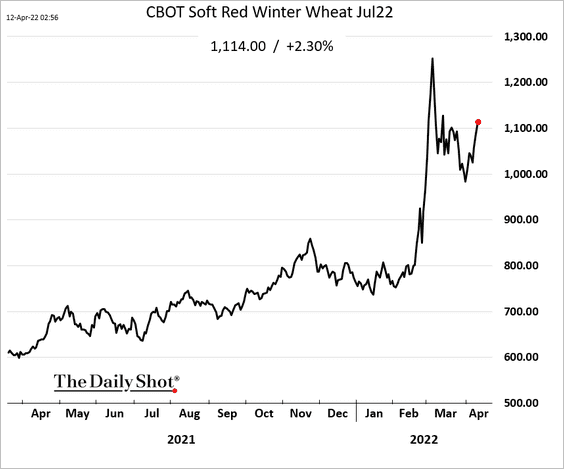

2. Wheat is rallying again.

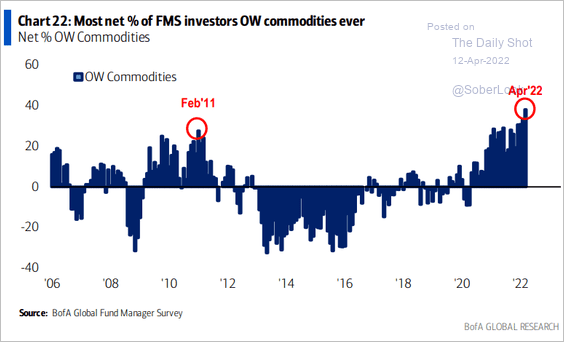

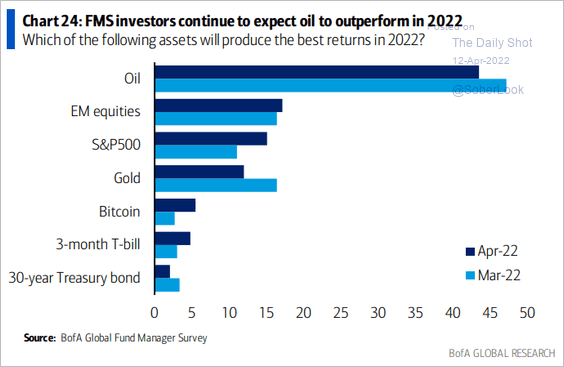

3. Fund managers love commodities.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Energy

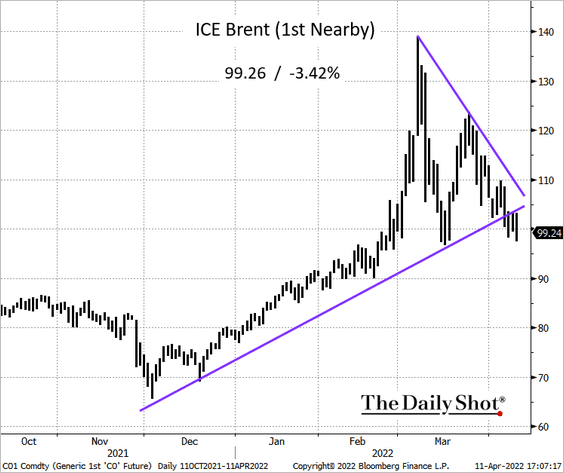

1. Brent crude dipped below $100/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

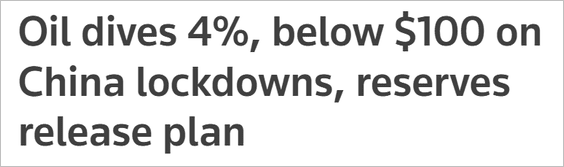

2. Fund managers see long oil/commodities as the most crowded trade, …

Source: BofA Global Research

Source: BofA Global Research

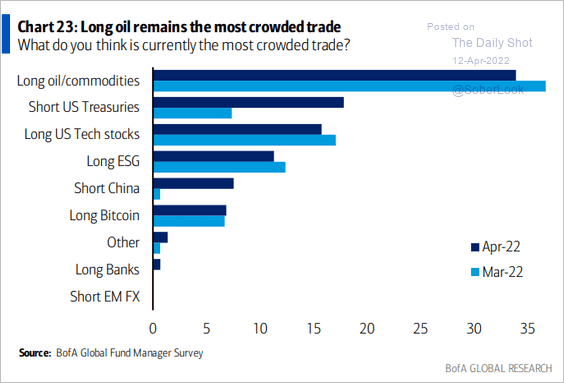

… but expect oil to outperform.

Source: BofA Global Research

Source: BofA Global Research

——————–

3. Oil backwardation continues to ease. Here is the June-July Brent futures spread.

Source: @HFI_Research

Source: @HFI_Research

4. Crack spreads are still elevated, boosting refinery margins.

Source: @HFI_Research

Source: @HFI_Research

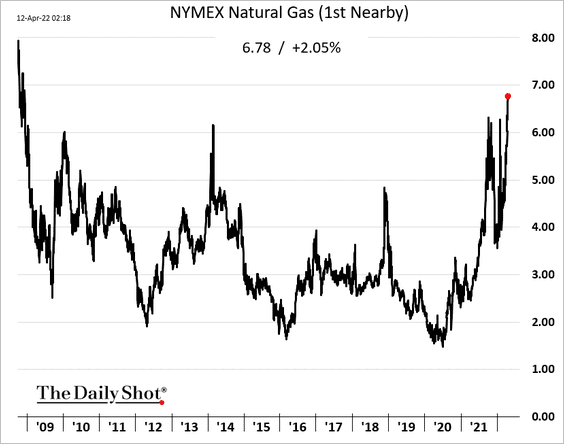

5. US natural gas is pushing toward $7/mmbtu.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

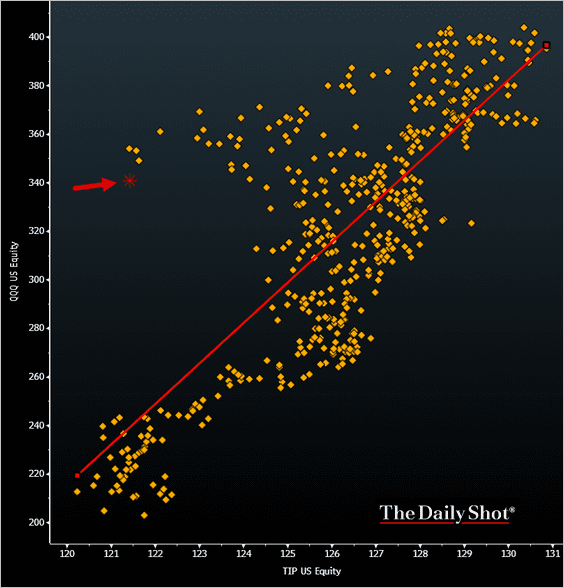

1. After ignoring rising real rates for weeks, growth stocks have taken a hit in recent days. This scatterplot shows the relationship between QQQ (Nasdaq 100) and TIP (inflation-linked Treasuries).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

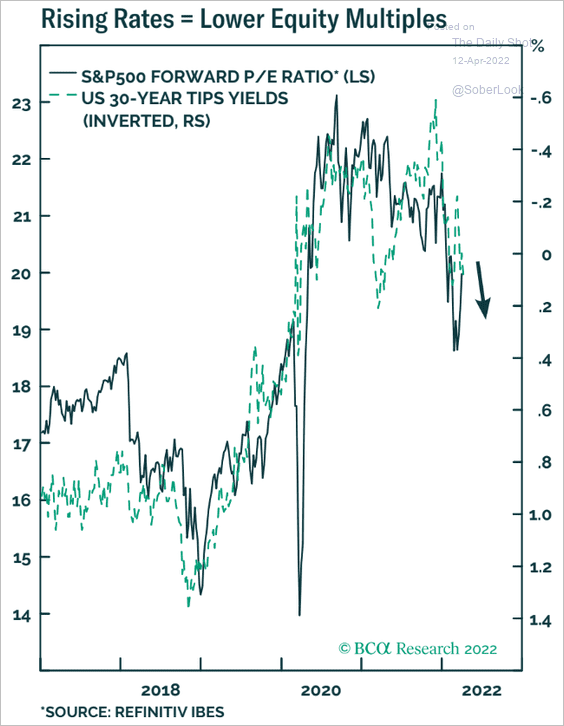

• Rising rates will continue to pressure equity multiples.

Source: BCA Research

Source: BCA Research

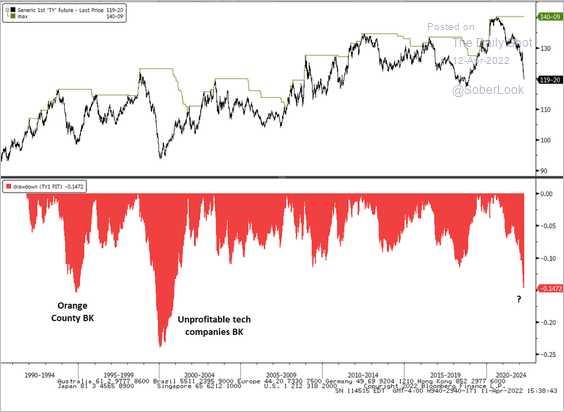

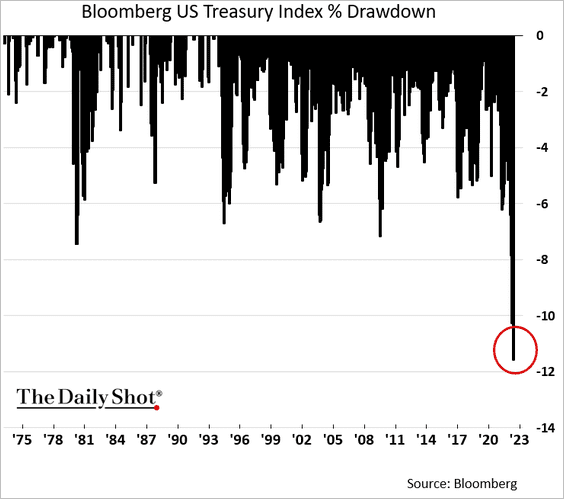

• Severe Treasury drawdowns tend to have consequences beyond the bond market.

Source: @sentimentrader

Source: @sentimentrader

——————–

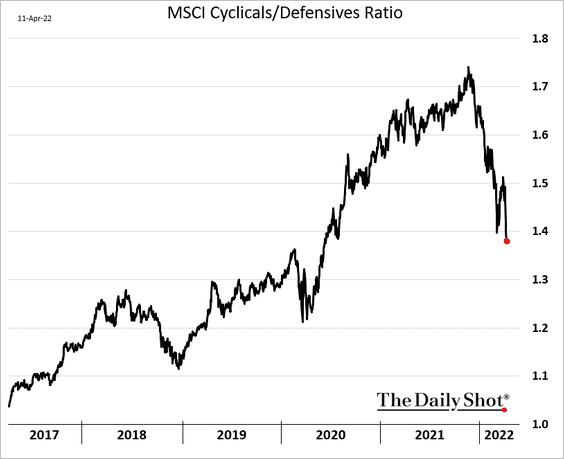

2. Cyclicals continue to lag defensive sectors.

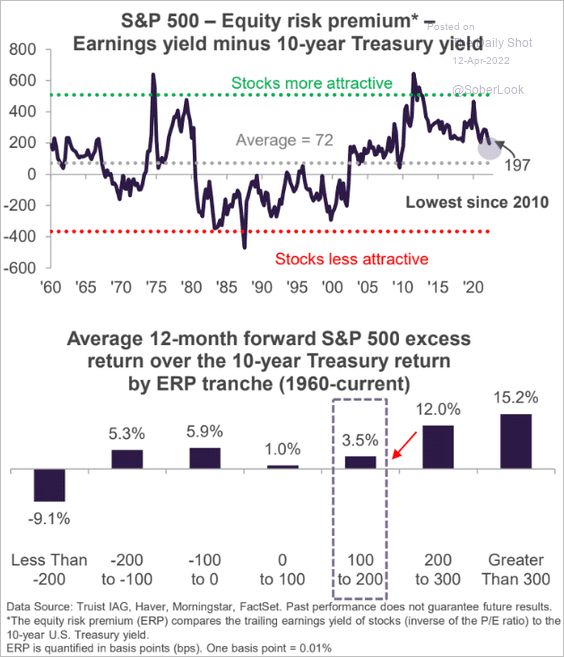

3. Depressed equity risk premium (see chart) will be a drag on returns.

Source: Truist Advisory Services

Source: Truist Advisory Services

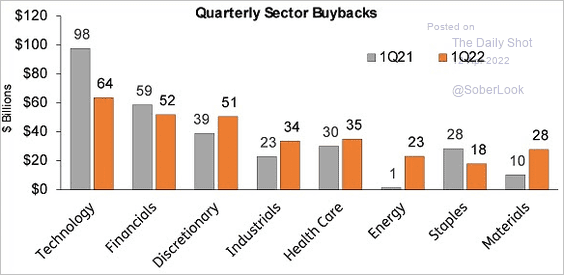

4. This chart shows share buyback activity by sector.

Source: EPFR Global Navigator

Source: EPFR Global Navigator

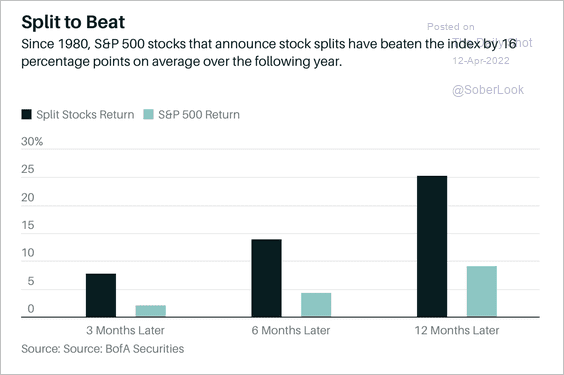

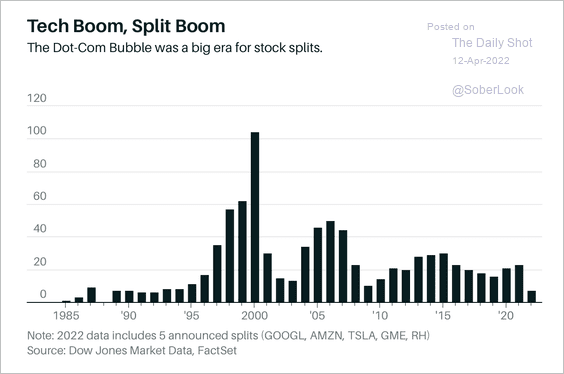

5. Companies that announce stock splits tend to outperform over the following year.

Source: Barron’s Read full article

Source: Barron’s Read full article

By the way, stock splits were popular during the dot-com boom.

Source: Barron’s Read full article

Source: Barron’s Read full article

Back to Index

Rates

1. The drawdown in the Treasury market has been extreme.

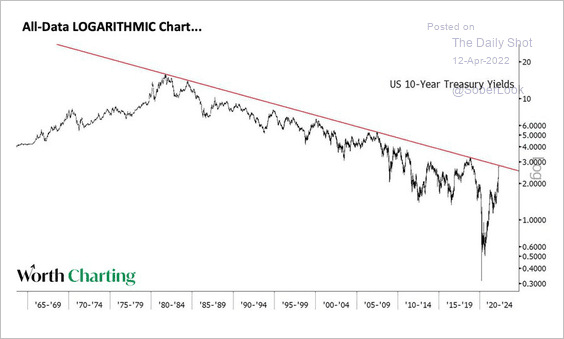

2. The 10-year Treasury yield is testing long-term downtrend resistance.

Source: @CarterBWorth

Source: @CarterBWorth

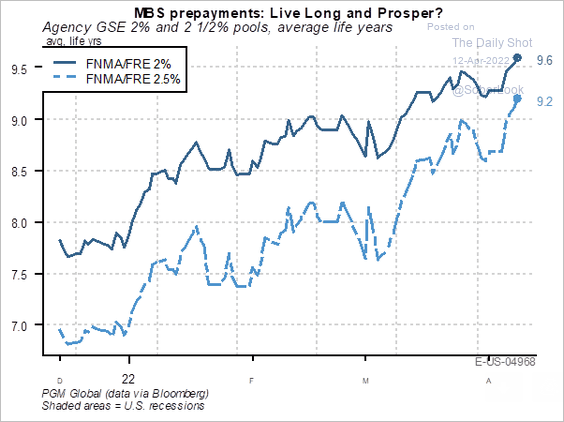

3. Increasing MBS durations (as housing refi activity collapses) exacerbated the sell-off in Treasuries. MBS portfolio managers are forced to cut duration to address rising exposure to rates.

Source: PGM Global

Source: PGM Global

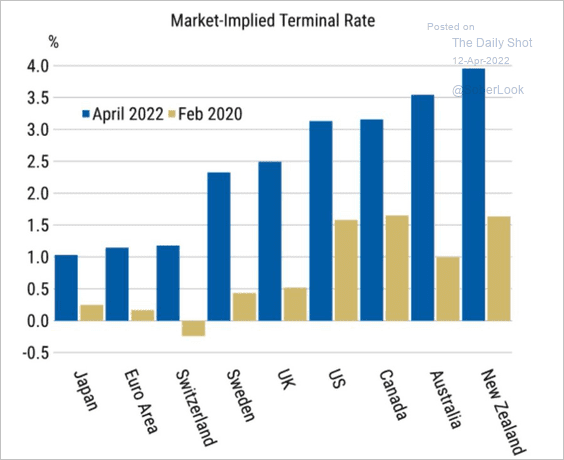

4. Finally, this chart shows market expectations for terminal rates in advanced economies.

Source: Morgan Stanley Research; @MichaelAArouet

Source: Morgan Stanley Research; @MichaelAArouet

——————–

Food for Thought

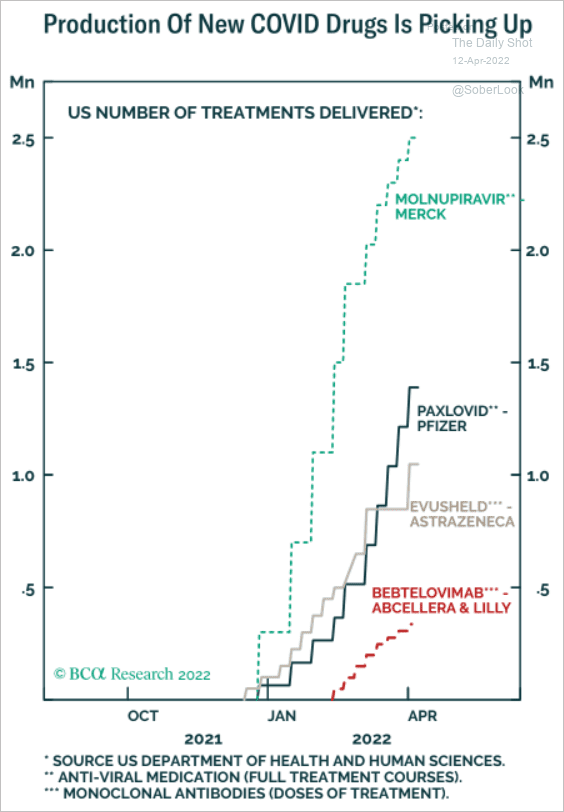

1. COVID drug production:

Source: BCA Research

Source: BCA Research

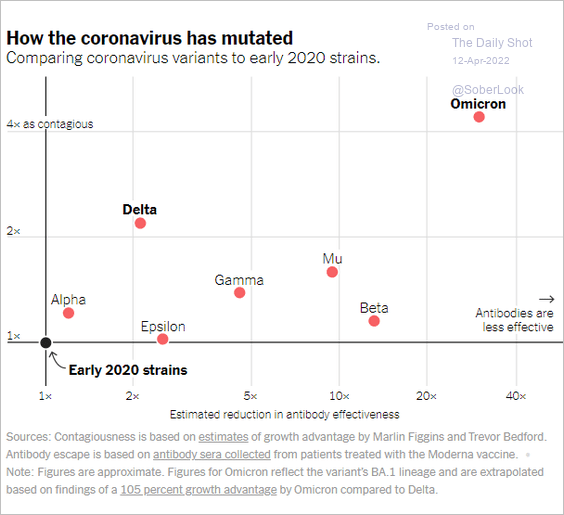

2. Contagiousness vs. reduction in antibody effectiveness:

Source: The New York Times Read full article

Source: The New York Times Read full article

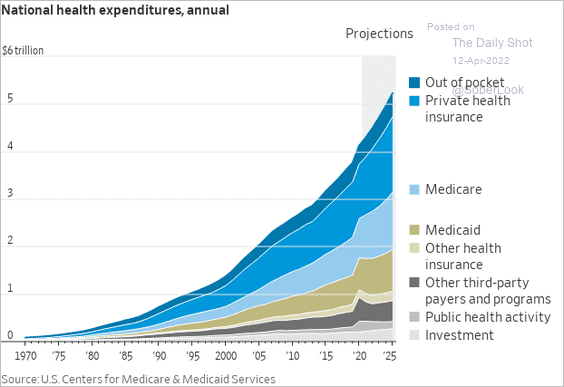

3. US health expenditures:

Source: @WSJ Read full article

Source: @WSJ Read full article

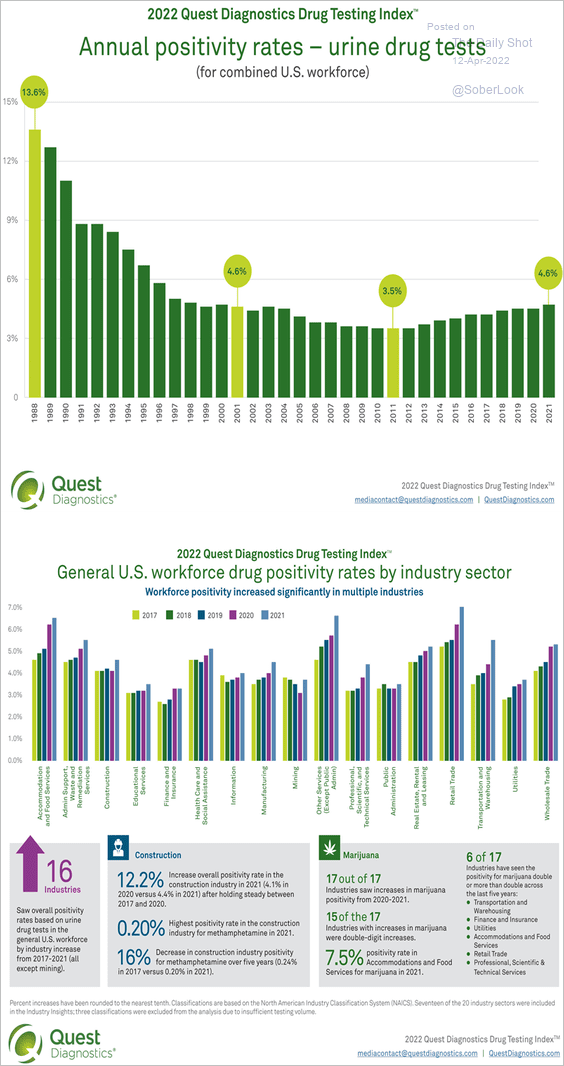

4. Urine drug test positivity rates in the US:

Source: Quest Diagnostics

Source: Quest Diagnostics

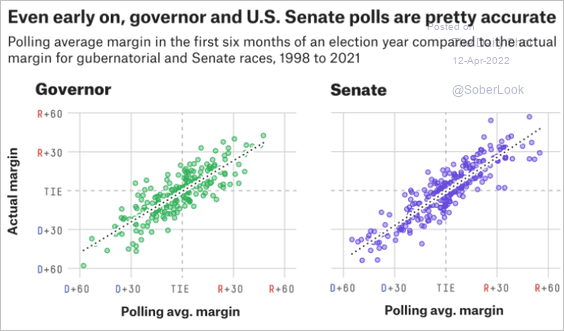

5. Polling margins in the first six months of an election year vs. actual margins:

Source: @FiveThirtyEight Read full article

Source: @FiveThirtyEight Read full article

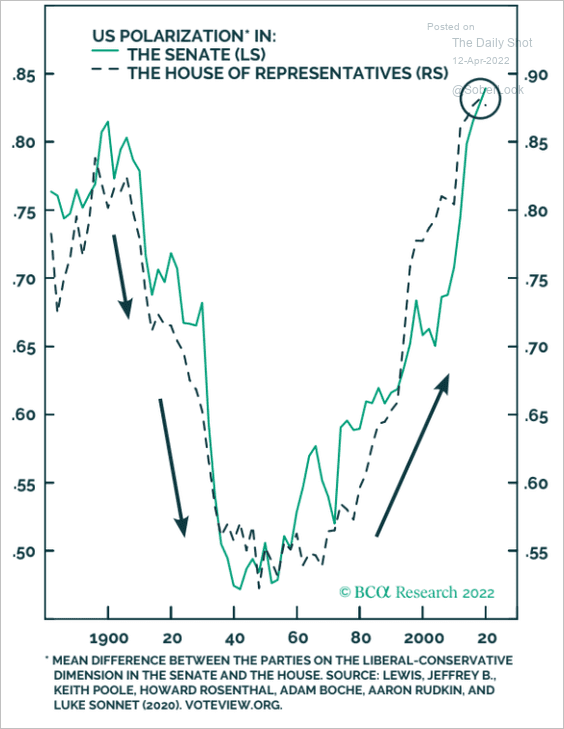

6. US political polarization over time:

Source: BCA Research

Source: BCA Research

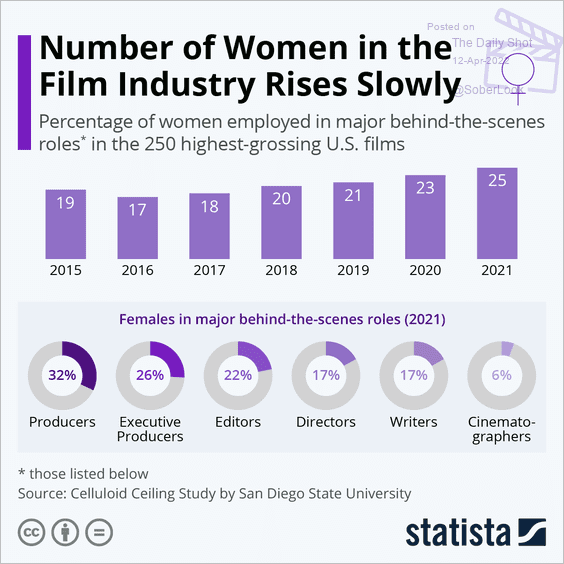

7. Women in the film industry:

Source: Statista

Source: Statista

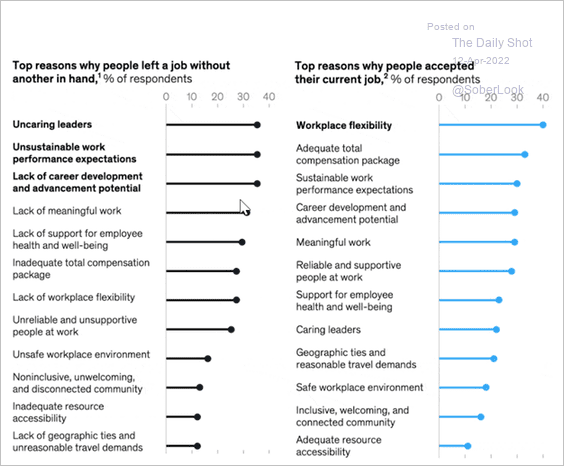

8. Why US employees have left and returned to the workforce:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

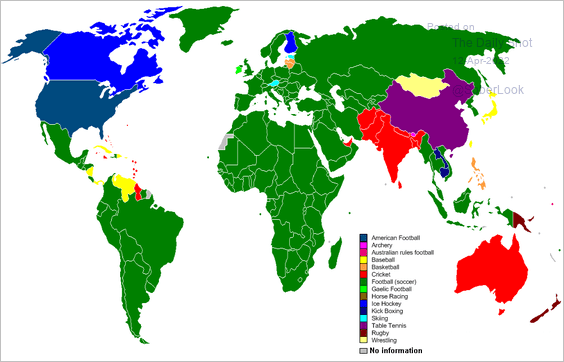

9. Most popular sports around the world:

Source: Wikimedia Commons, Earl Andrew

Source: Wikimedia Commons, Earl Andrew

——————–

Back to Index