The Daily Shot: 27-Jul-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

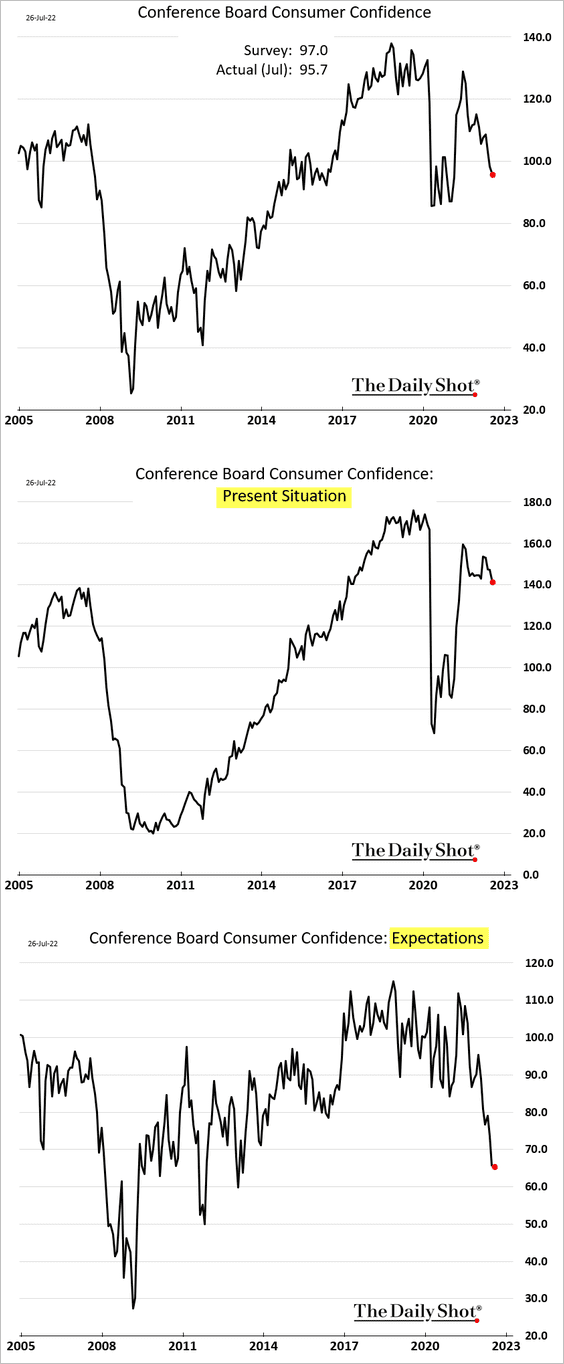

1. The Conference Board’s July consumer confidence index came in below forecasts as the “present situation” indicator edged lower.

• There is a bit more unease with the jobs market.

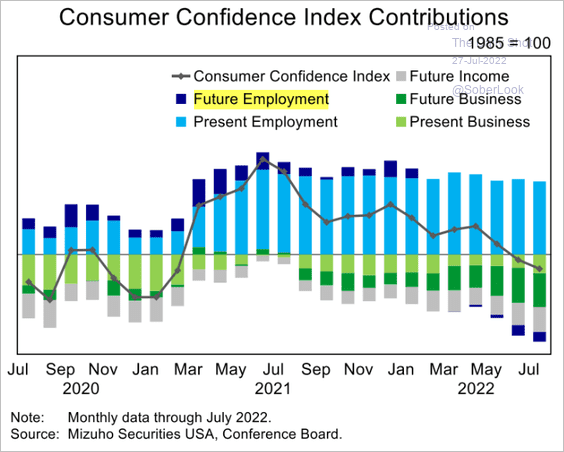

– The contributions to the headline confidence index:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

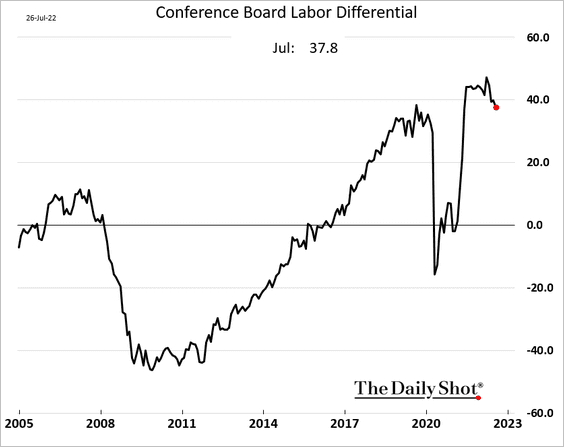

– The labor differential (“jobs plentiful” – “jobs hard to get”):

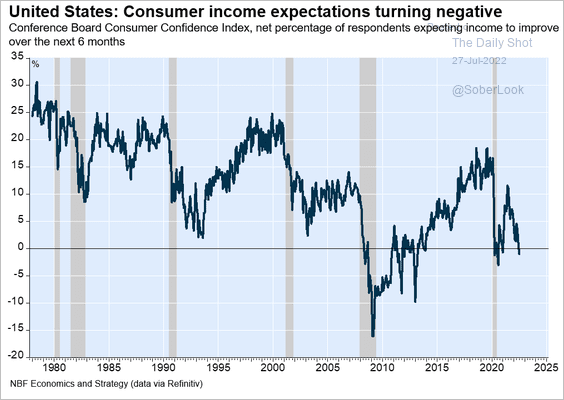

– Income expectations:

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

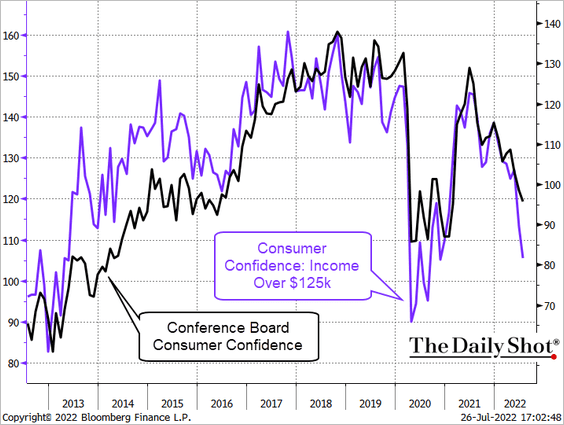

• Confidence among high-income Americans is declining rapidly, which could impact spending.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

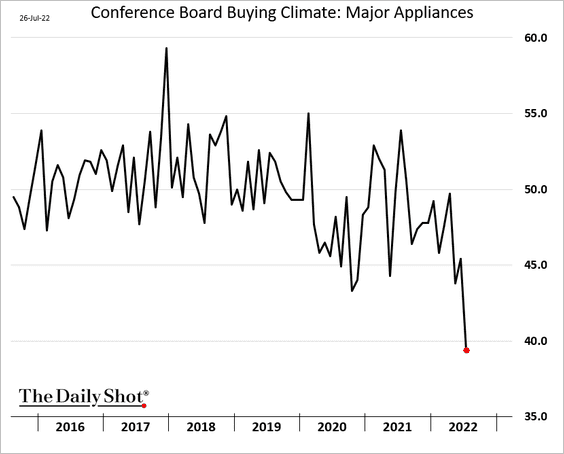

• Buying conditions for high-ticket items have deteriorated.

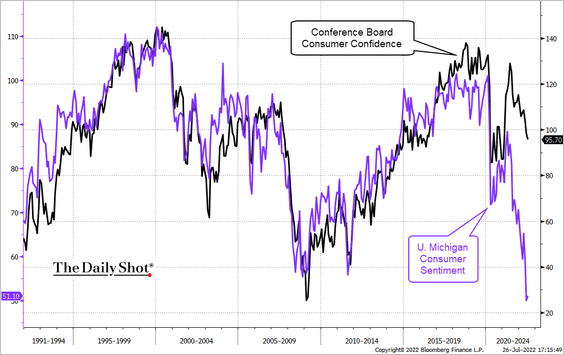

• The gap between the Conference Board’s and the U. Michigan’s sentiment indices remains wide.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

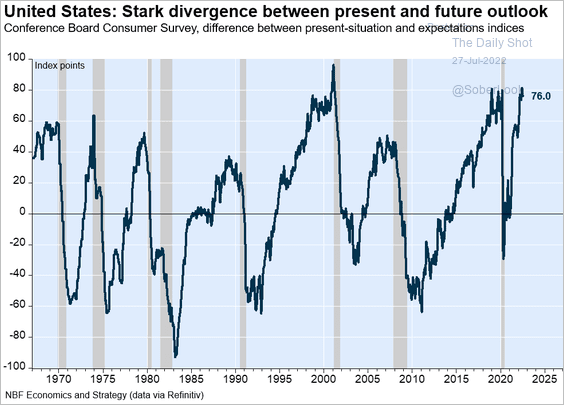

• The “present situation” vs. “expectations” index spread tends to peak ahead of recessions.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

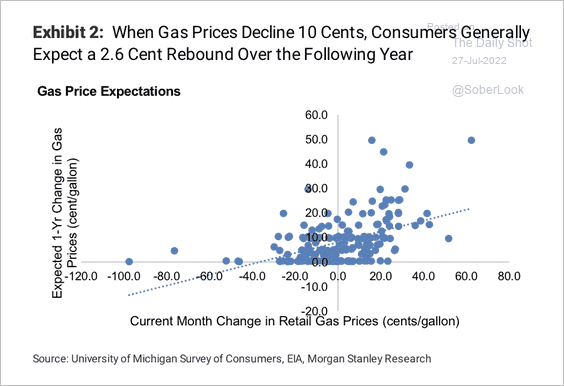

2. Households tend to expect higher gas prices over the next year after price dips. That may weigh on consumer spending.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

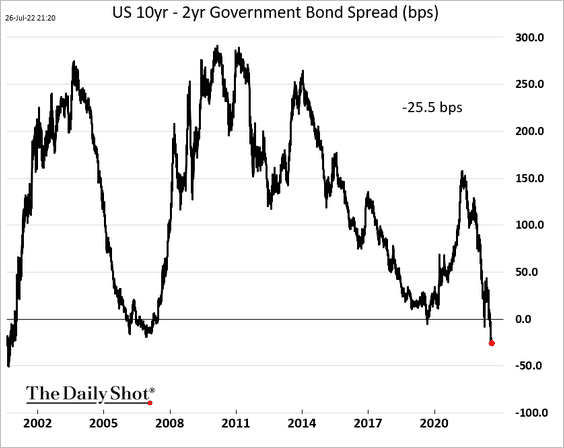

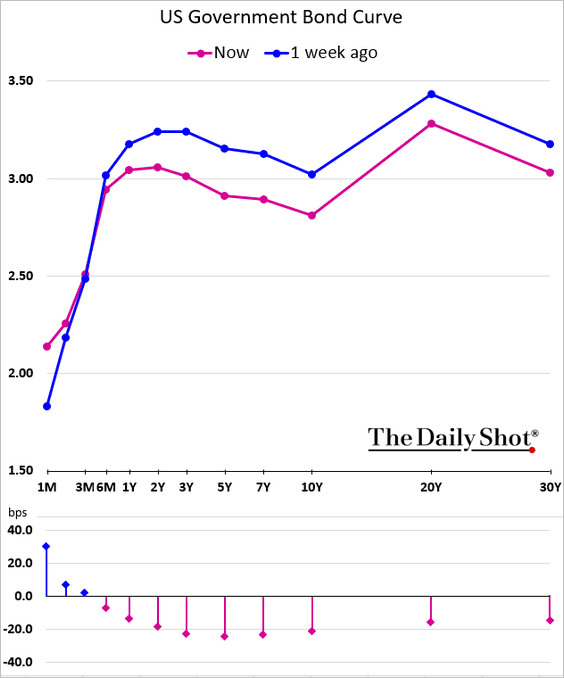

3. The Treasury curve hasn’t been this inverted since 2000.

——————–

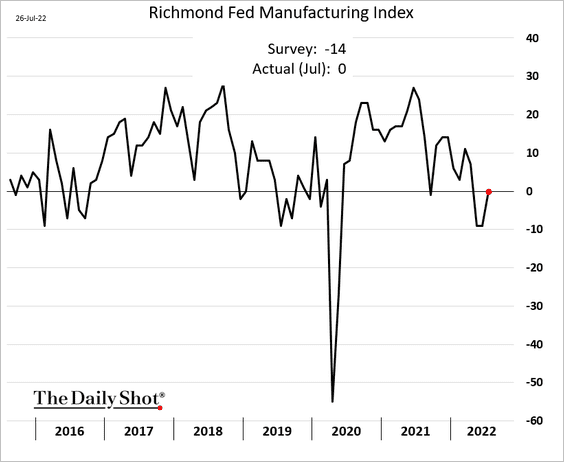

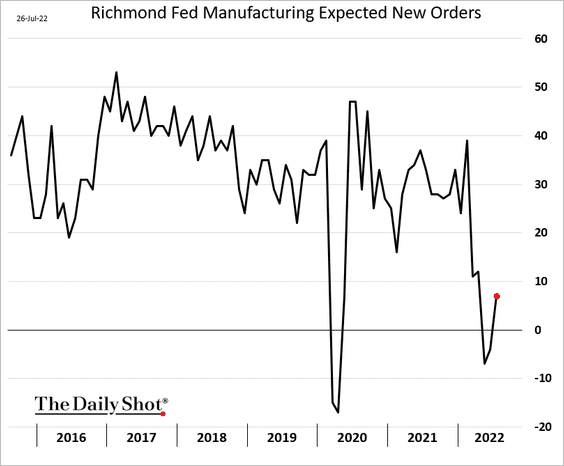

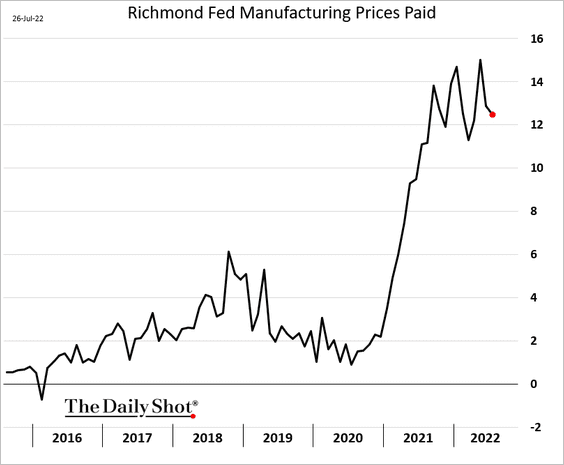

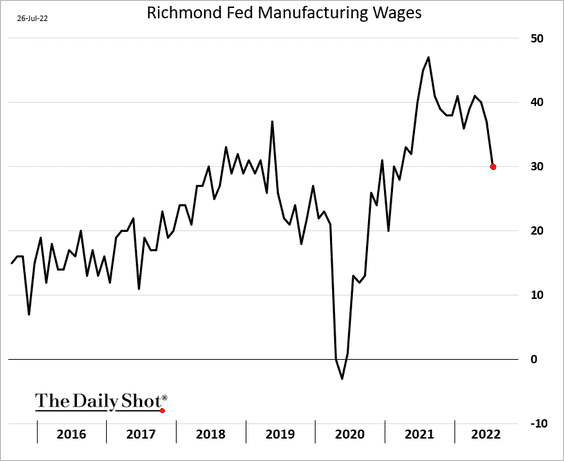

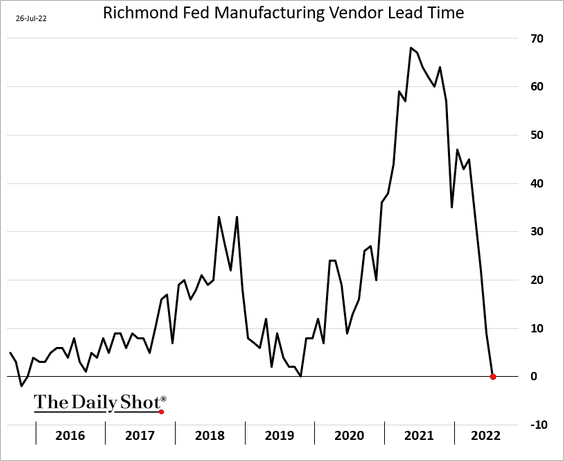

4. The Richmond Fed’s manufacturing index unexpectedly bounced this month, bucking the trend.

• The index of expected orders is back in positive territory.

• Price pressures remain extreme.

• Fewer companies are boosting wages.

• Supply bottlenecks are gone.

——————–

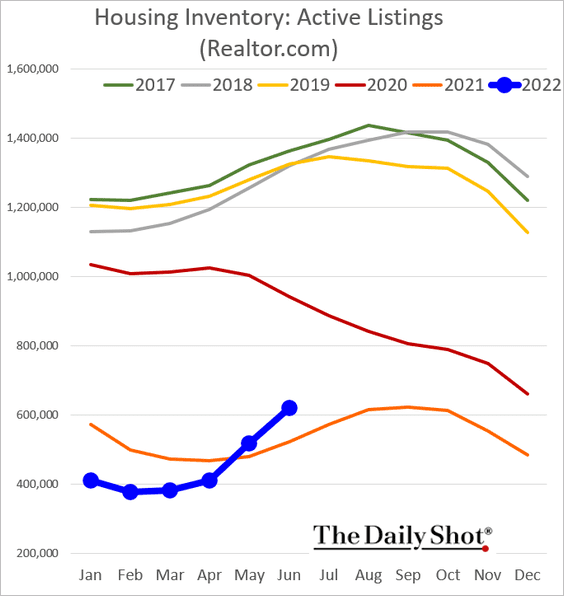

5. Next, we have some updates on the housing market.

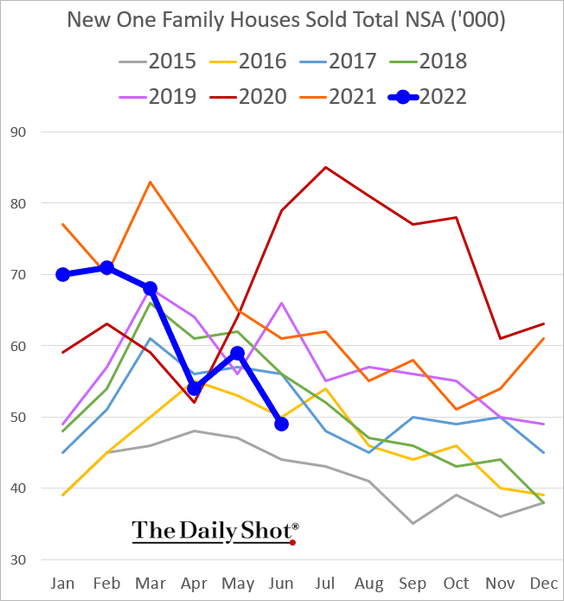

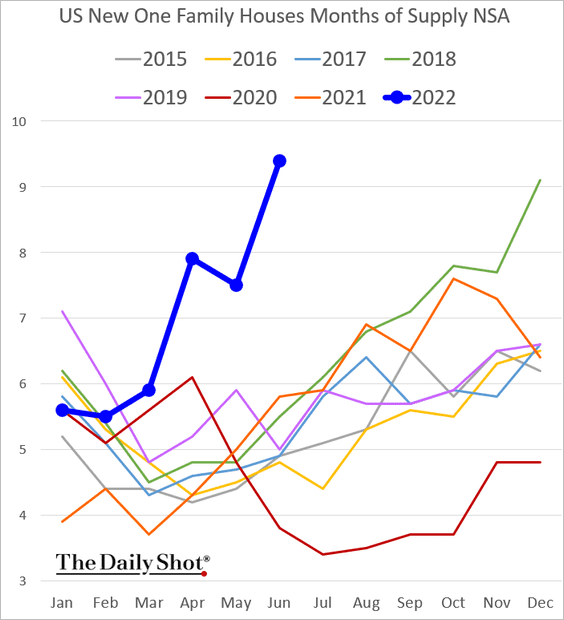

• New home sales dipped below 2016 levels last month and are now about 20% below the June 2021 volume.

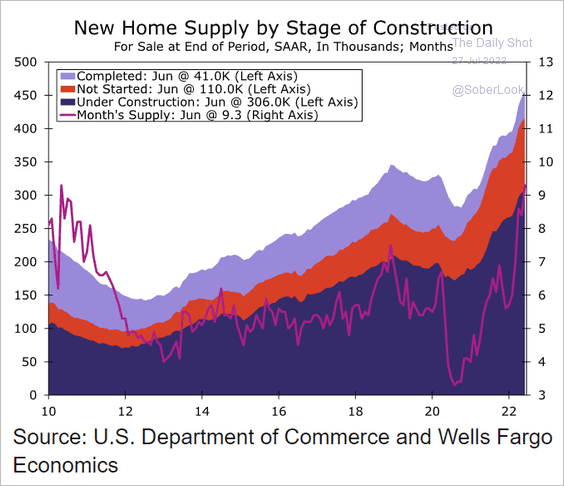

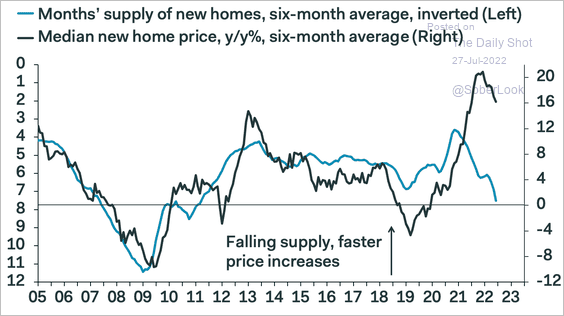

– Supplies have risen substantially.

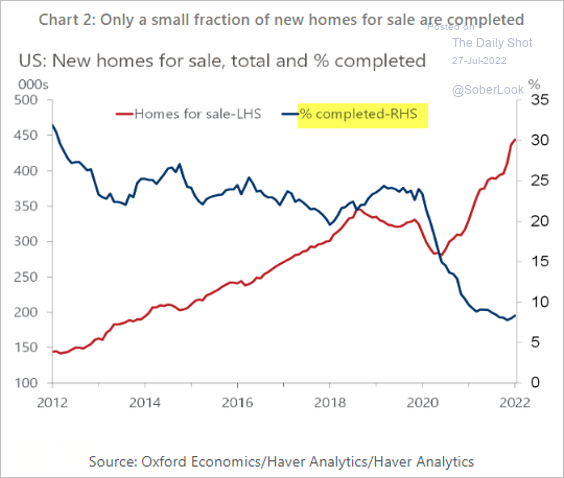

Most of the supply of new homes is not yet completed (2 charts).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: Oxford Economics

Source: Oxford Economics

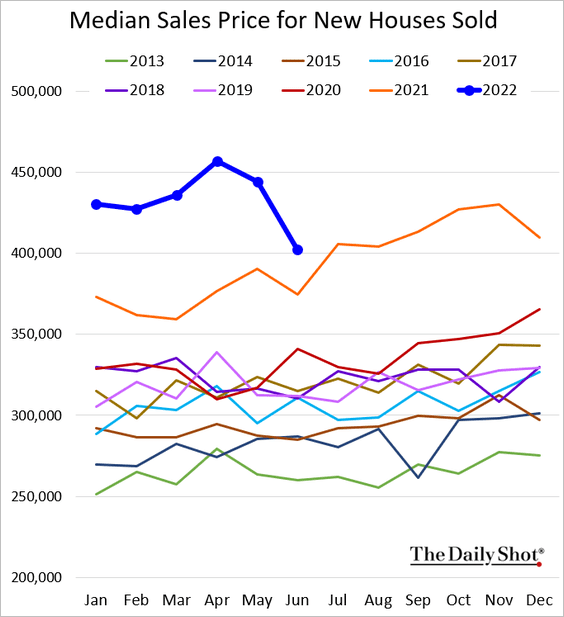

– The median price of new homes tumbled in June.

And given the increase in inventories, there are further declines ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

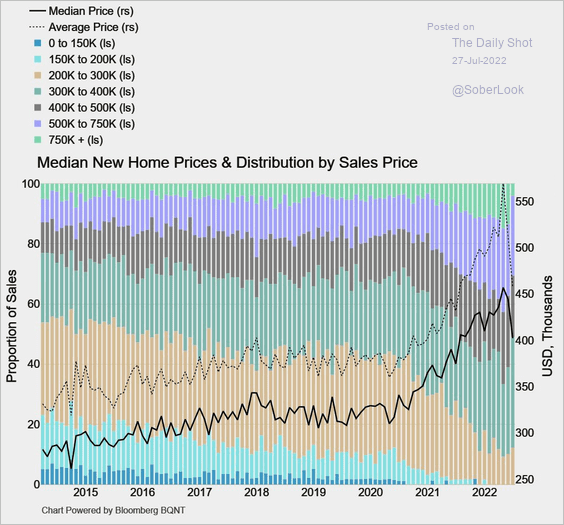

Here is the distribution of new homes by sales price.

Source: @M_McDonough

Source: @M_McDonough

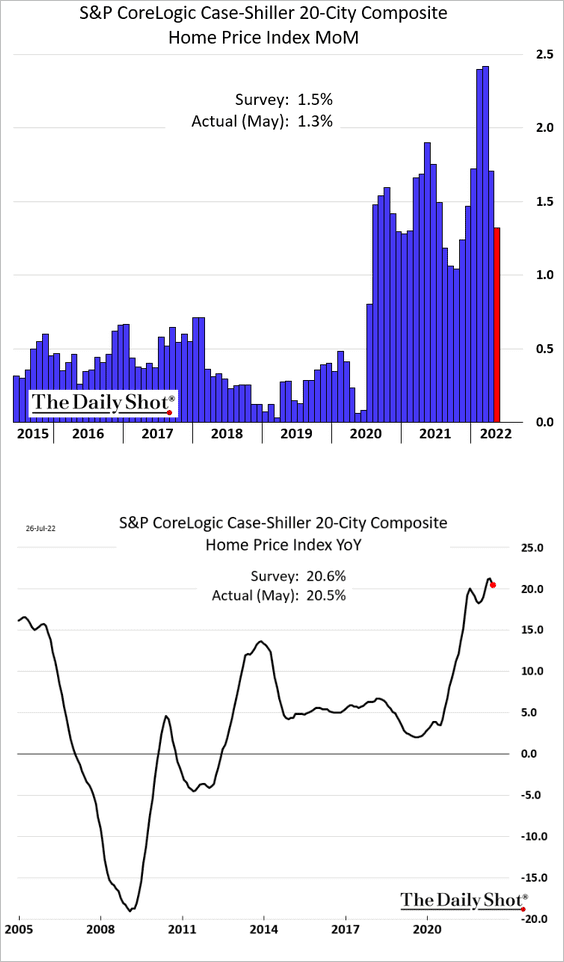

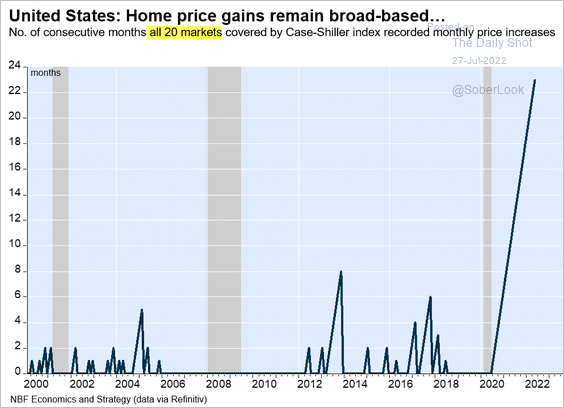

• Home price appreciation (existing homes) slowed in May but remained robust.

– Gains have been broad-based.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

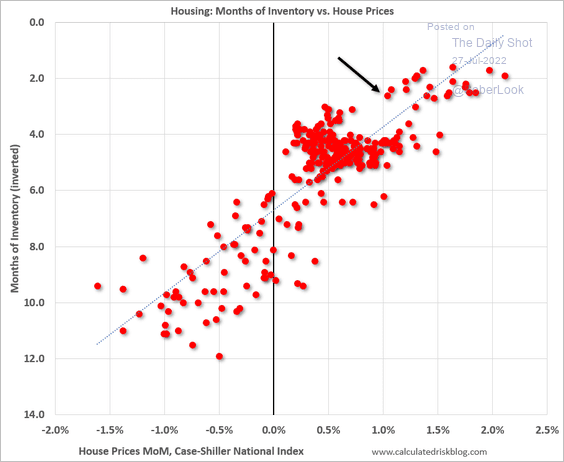

– Given the tight housing supplies, home price appreciation has not been an outlier.

Source: @calculatedrisk

Source: @calculatedrisk

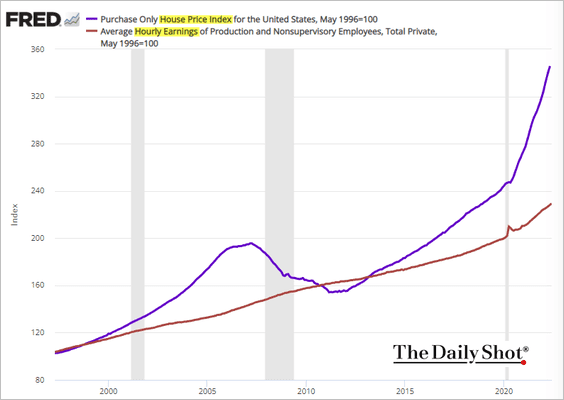

– The gap between prices and wages continues to widen. That worked fine when mortgage rates were 2.5%, but not anymore.

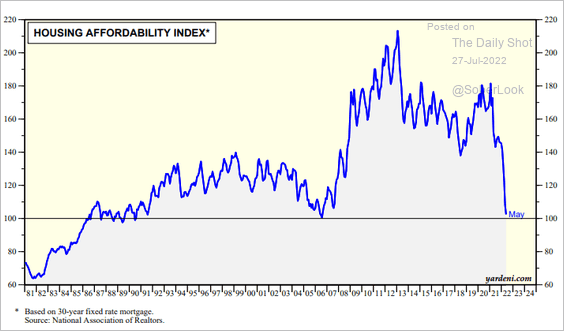

Affordability has deteriorated sharply.

Source: Yardeni Research

Source: Yardeni Research

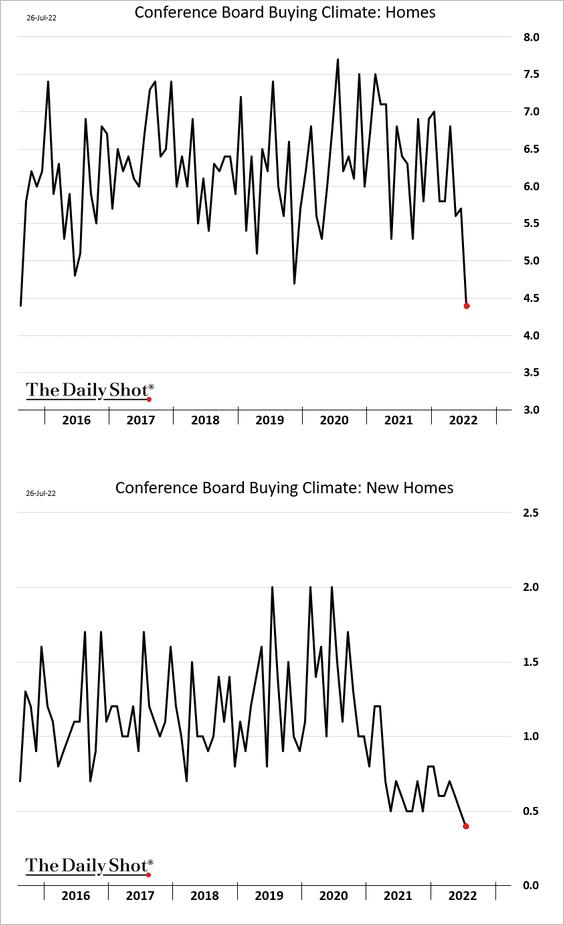

• The Conference Board’s buying climate for houses plunged this month.

• The number of active listings has been moving up.

——————–

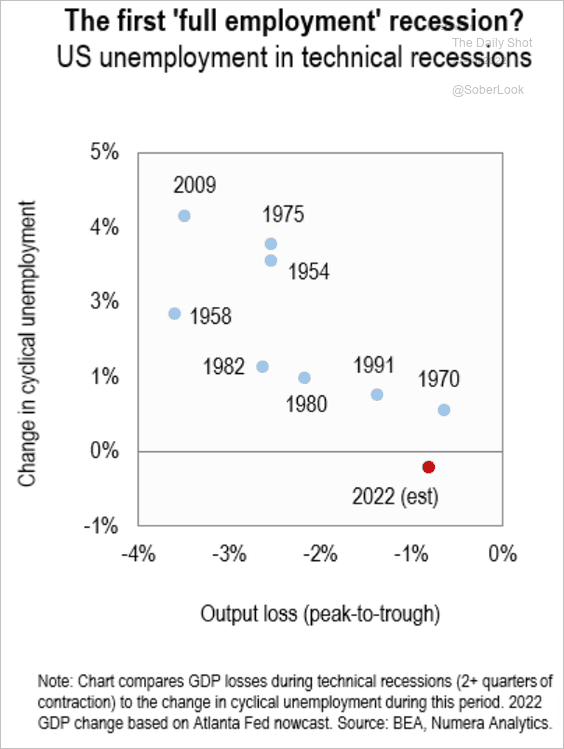

6. A GDP contraction in the second-quarter will qualify as a technical recession (two consecutive quarters of negative GDP growth). Given the labor market strength, such an outcome would be highly unusual.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

The United Kingdom

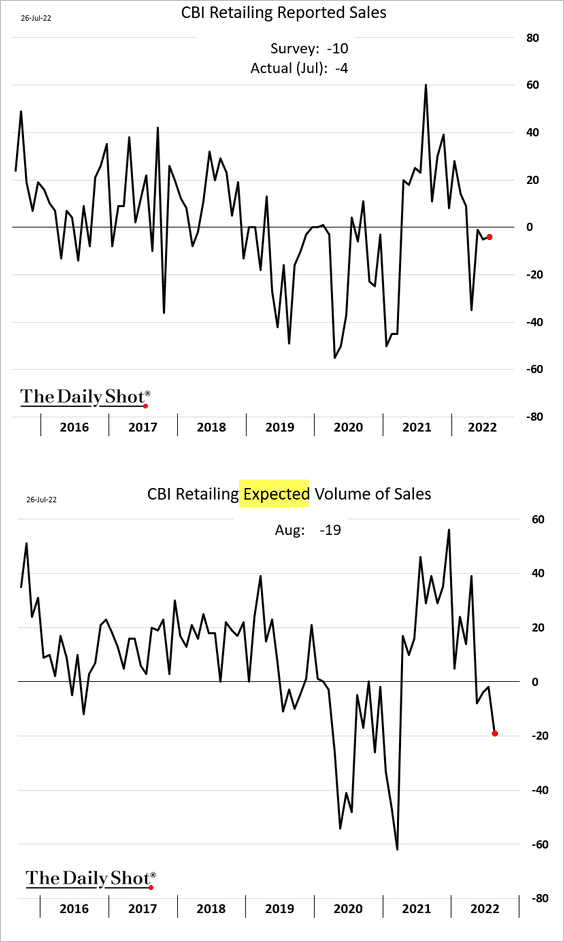

1. The CBI retail sales index held steady, but expectations weakened.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

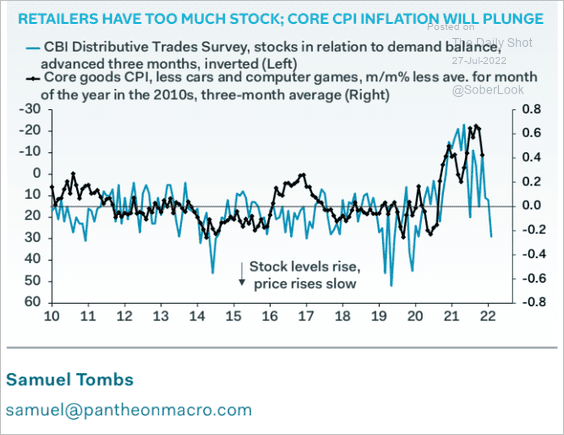

2. The CBI inventories index points to declines in core inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

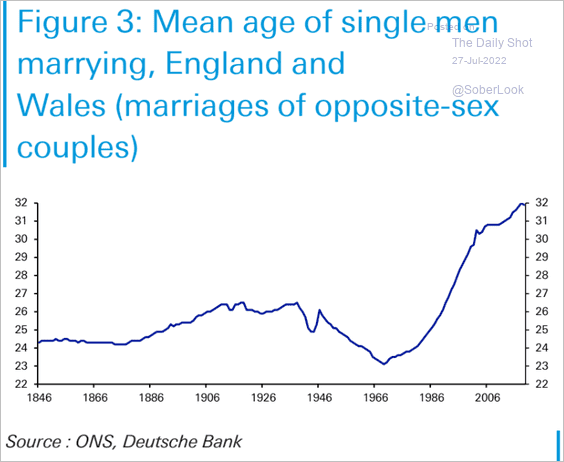

3. Marriage age continues to climb.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

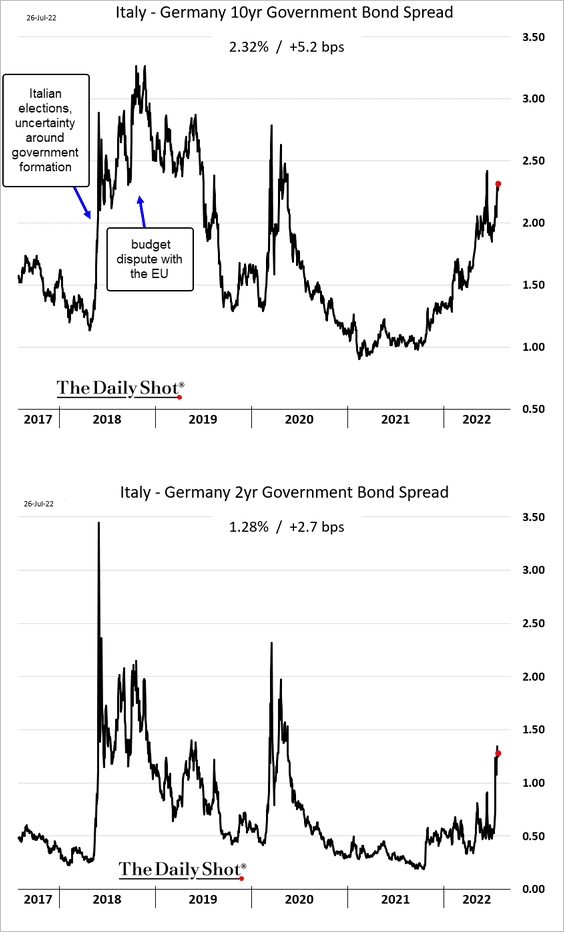

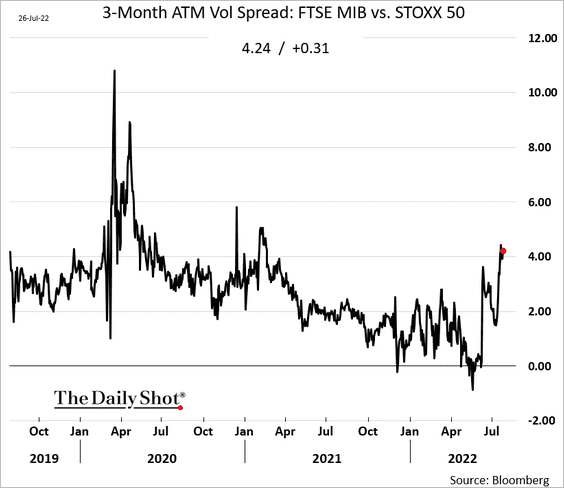

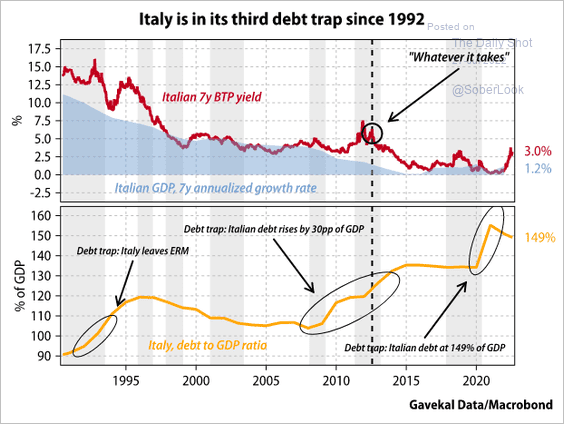

1. Let’s begin with Italy.

• Bond spreads are widening despite the ECB’s new framework to fight defragmentation.

Italian equity vol spread to STOXX 50 has been rising as well.

Investors are concerned about the upcoming election and Italy’s debt trap.

Source: Gavekal Research

Source: Gavekal Research

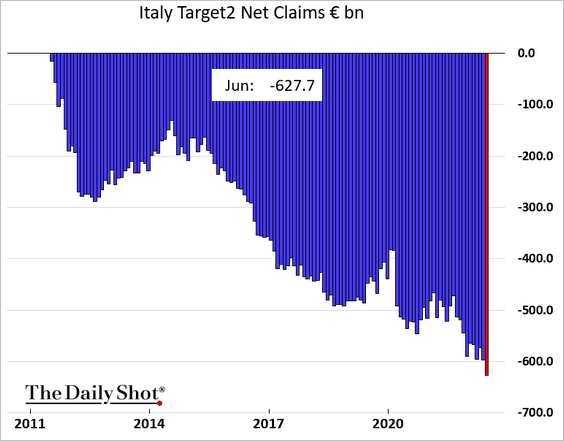

• How much does the Bank of Italy owe to the rest of the Eurosystem (mostly Bundesbank)? This is why “Italexit” is inconceivable.

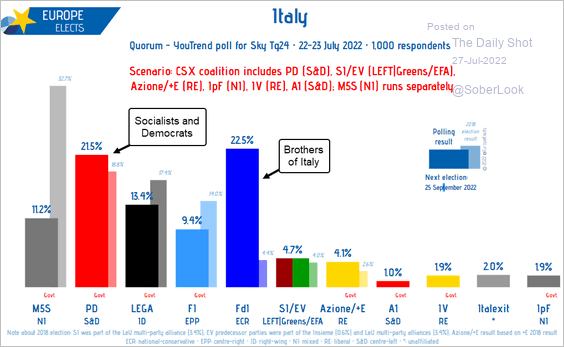

• Here are the latest polls.

Source: @EuropeElects

Source: @EuropeElects

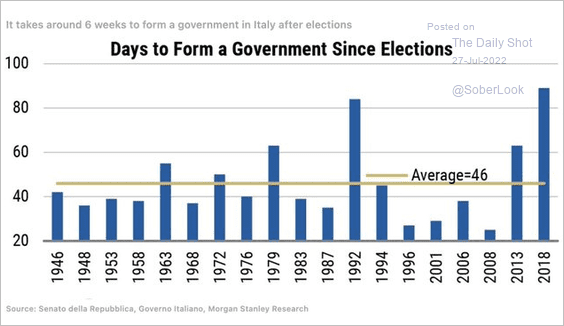

• How long will it take to form a new government after the elections?

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

——————–

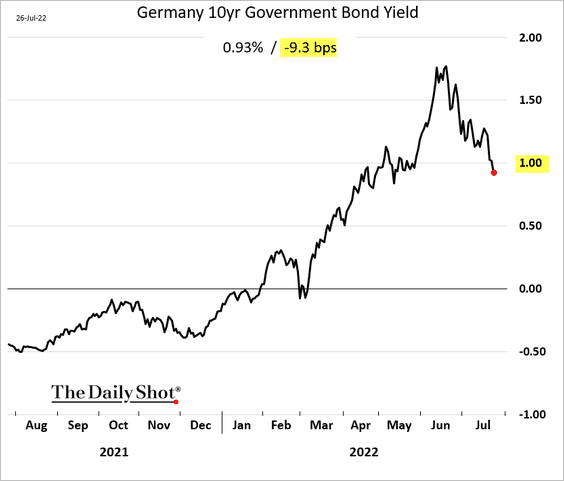

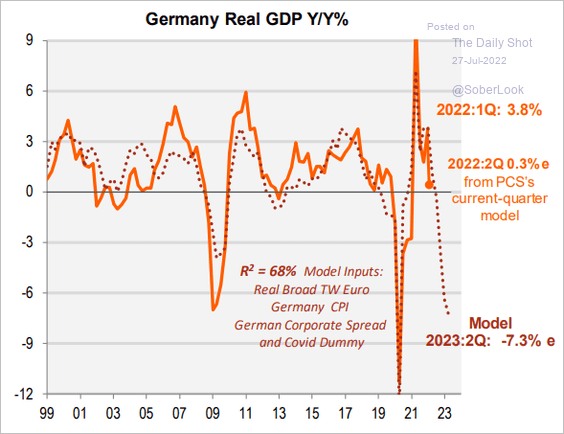

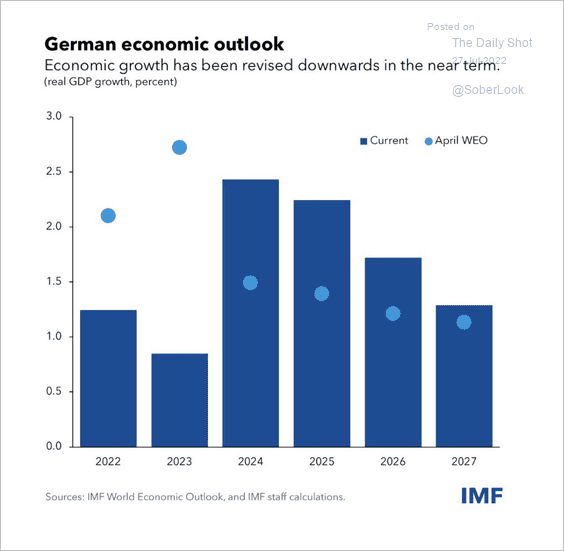

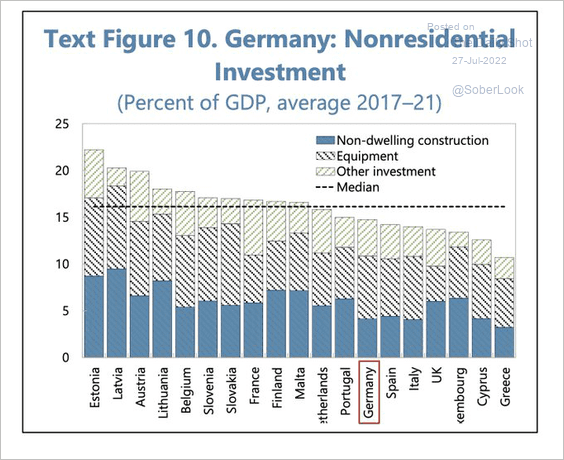

2. Next, we have some updates on Germany.

• Bund yields are falling, …

… as recession risks surge.

Source: Piper Sandler

Source: Piper Sandler

• Here is the IMF’s GDP forecast – now vs. April.

Source: IMF Read full article

Source: IMF Read full article

• Germany has the fiscal room to boost investment.

Source: @acemaxx, @IMFNews Read full article

Source: @acemaxx, @IMFNews Read full article

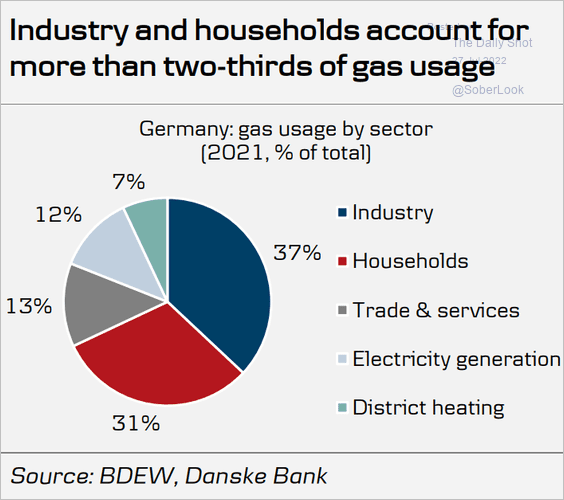

• Who is using natural gas in Germany?

Source: Danske Bank

Source: Danske Bank

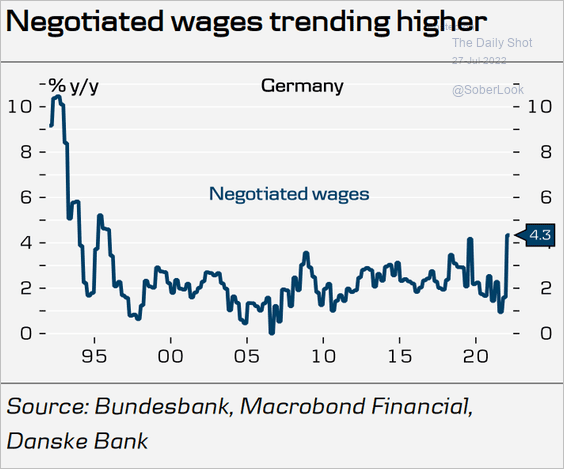

• Wages are trending higher.

Source: Danske Bank

Source: Danske Bank

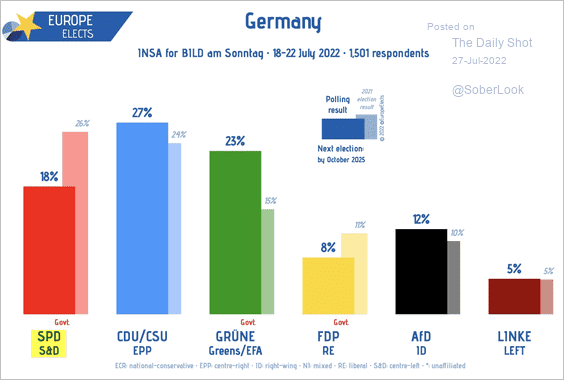

• Germany’s Social Democratic Party lost a lot of ground in the polls since last year’s elections. Greens are up.

Source: @EuropeElects Read full article

Source: @EuropeElects Read full article

——————–

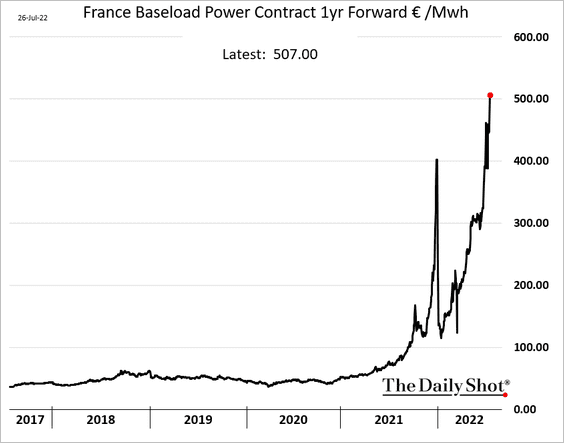

3. French electricity prices are hitting record highs.

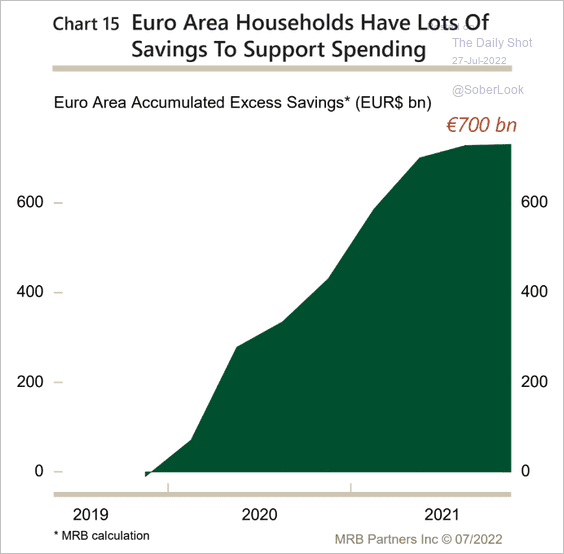

4. Eurozone households are sitting on substantial excess savings.

Source: MRB Partners

Source: MRB Partners

Back to Index

Europe

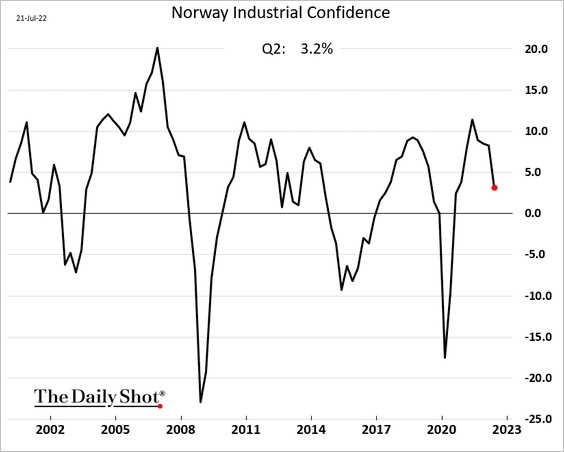

1. Let’s begin with Norway.

• Industrial confidence slipped last quarter.

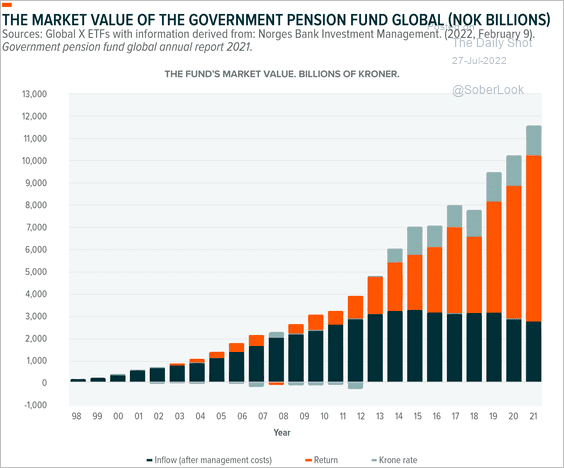

• The market value of Norway’s government pension fund has expanded toward $1.3 trillion as of the end of last year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

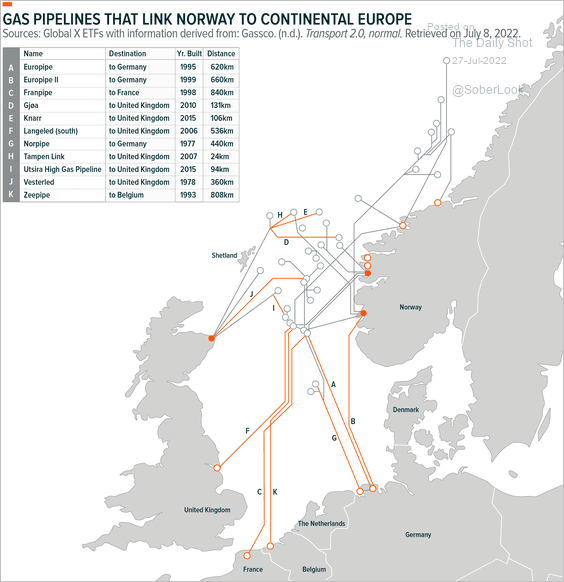

• Ten Norwegian gas pipelines are connected to Europe, with direct links to Germany, Belgium, France, and the UK.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

• Will USD/NOK’s recent break above long-term resistance hold?

——————–

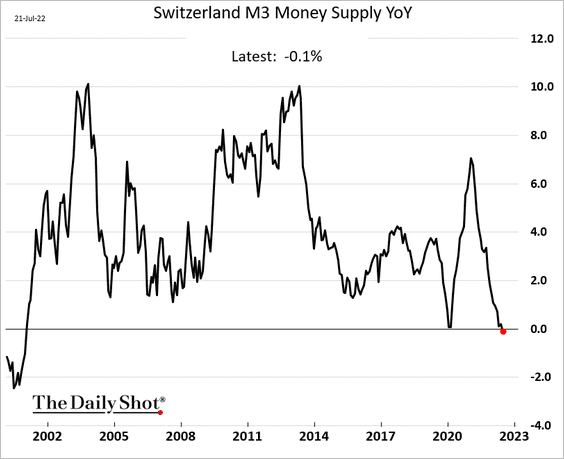

2. The Swiss broad money supply is contracting for the first time in over two decades.

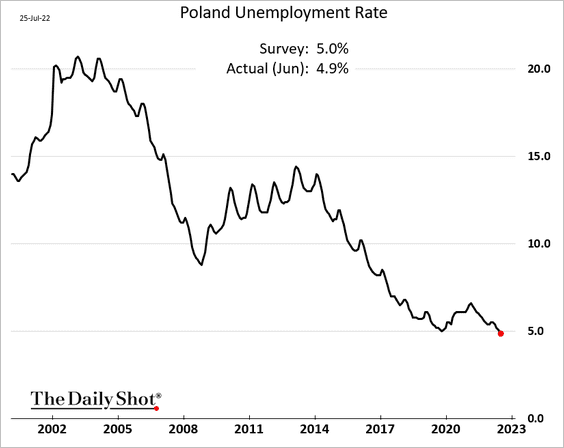

3. Poland’s unemployment rate hit a new low despite the flood of Ukrainian refugees.

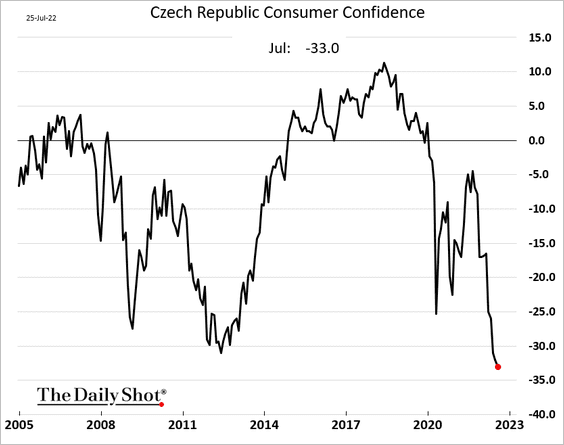

4. Czech consumer confidence is at record lows.

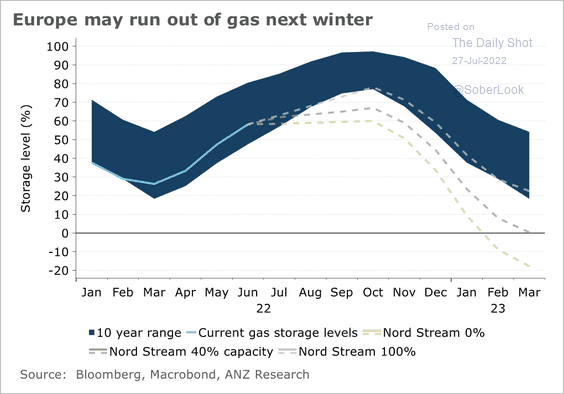

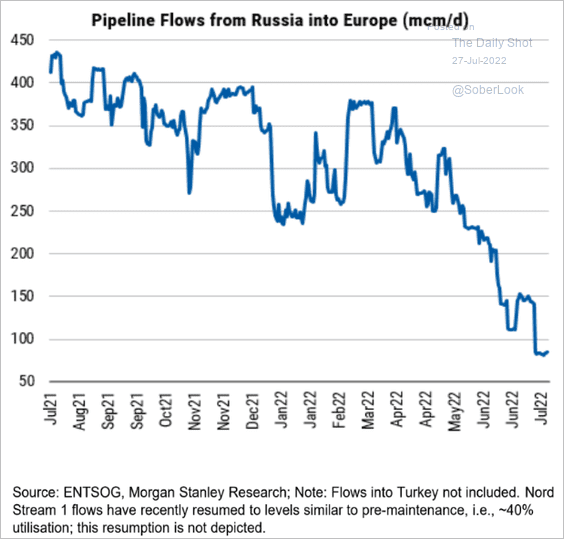

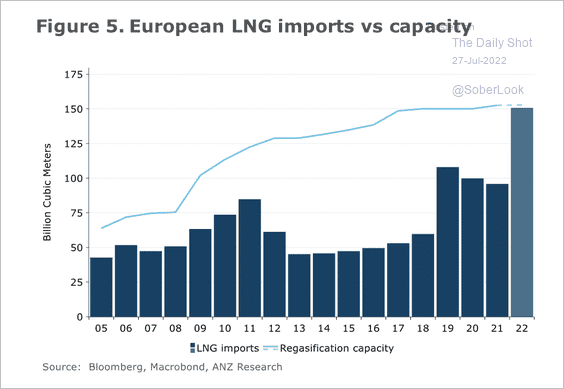

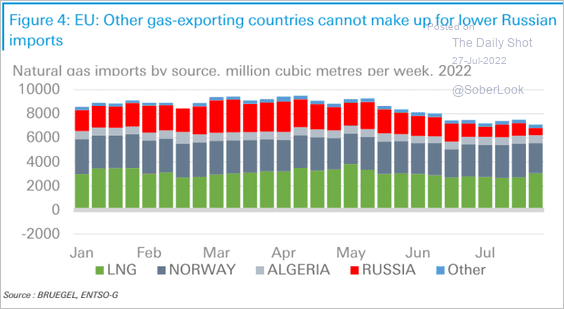

5. Europe’s gas consumption will need to fall by 5%-10% if the Nord Stream pipeline falls to 40% of capacity or stops completely, according to ANZ Research.

Source: @ANZ_Research

Source: @ANZ_Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

There is limited capacity to meet an increase in LNG import requirements.

Source: @ANZ_Research

Source: @ANZ_Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia – Pacific

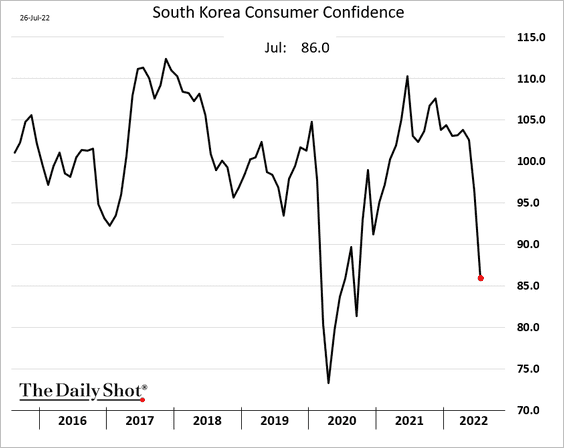

1. Soth Korea’s consumer confidence is tumbling.

2. Next, we have some updates on Australia.

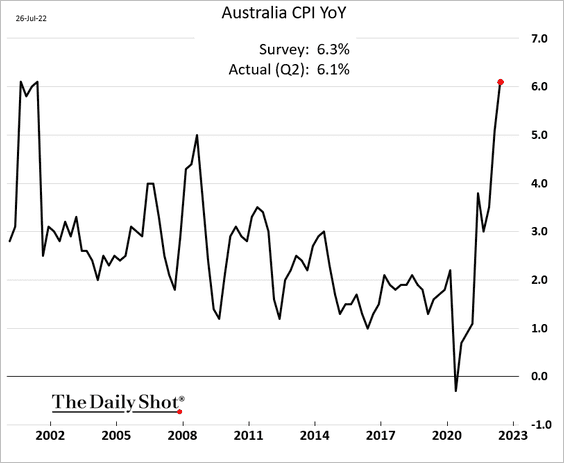

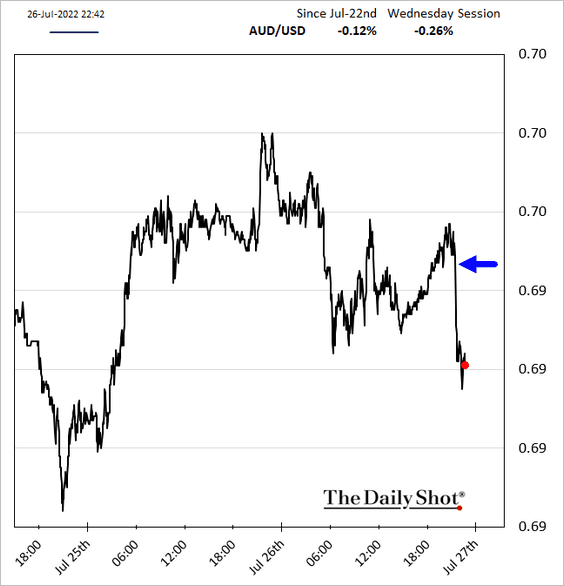

• The CPI continues to surge, but the headline index came in below forecasts.

The Aussie dollar dropped.

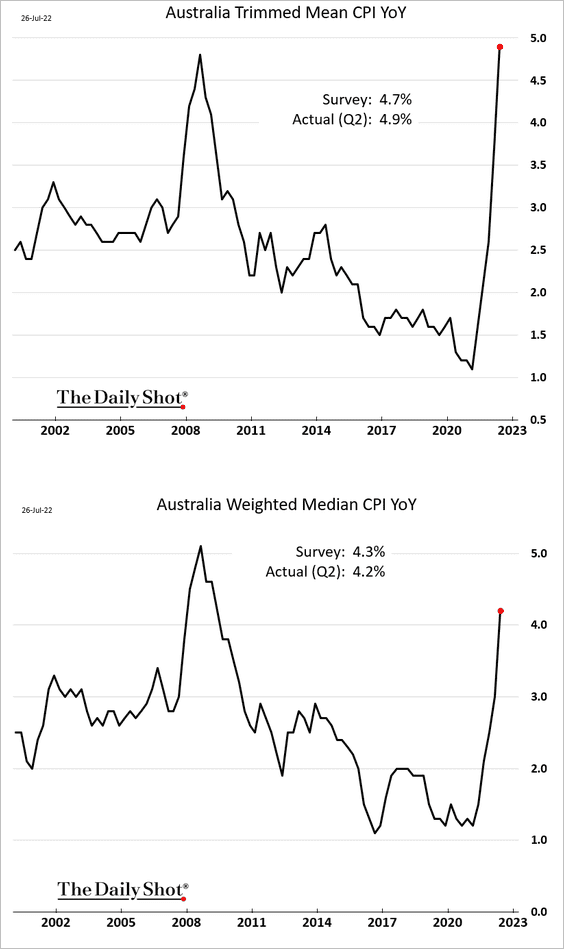

Here are the core CPI measures.

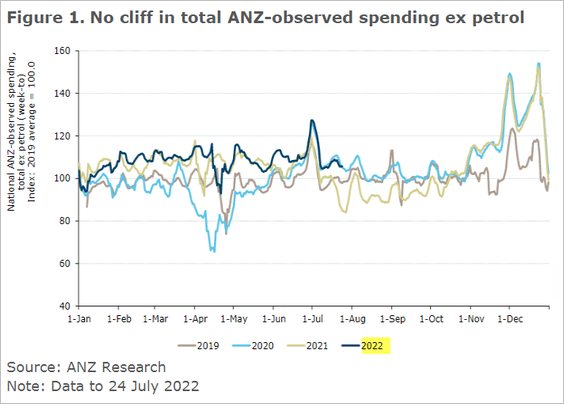

• Consumer spending is holding up despite rapidly rising prices.

Back to Index

China

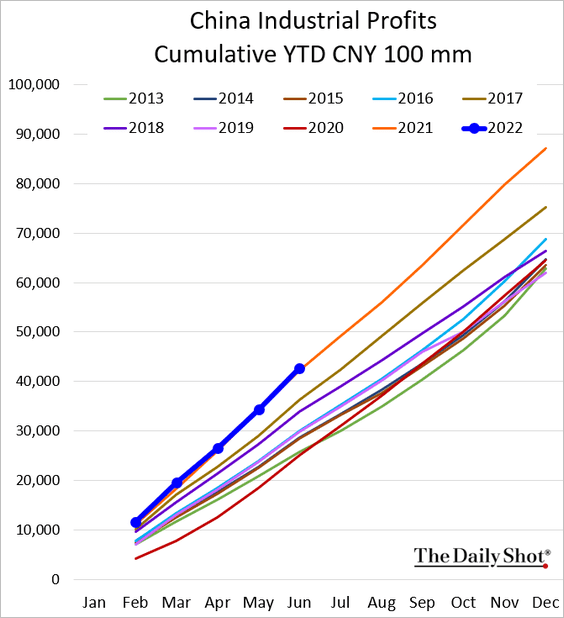

1. Industrial profits are running in line with 2021 levels.

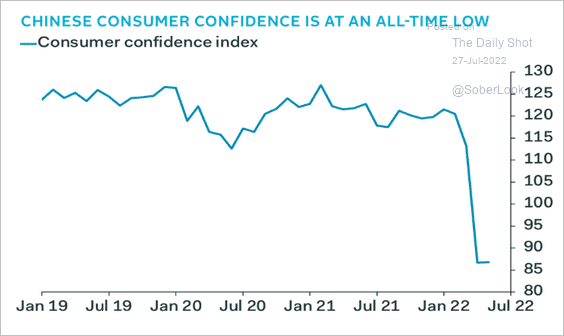

2. Consumer confidence remains depressed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

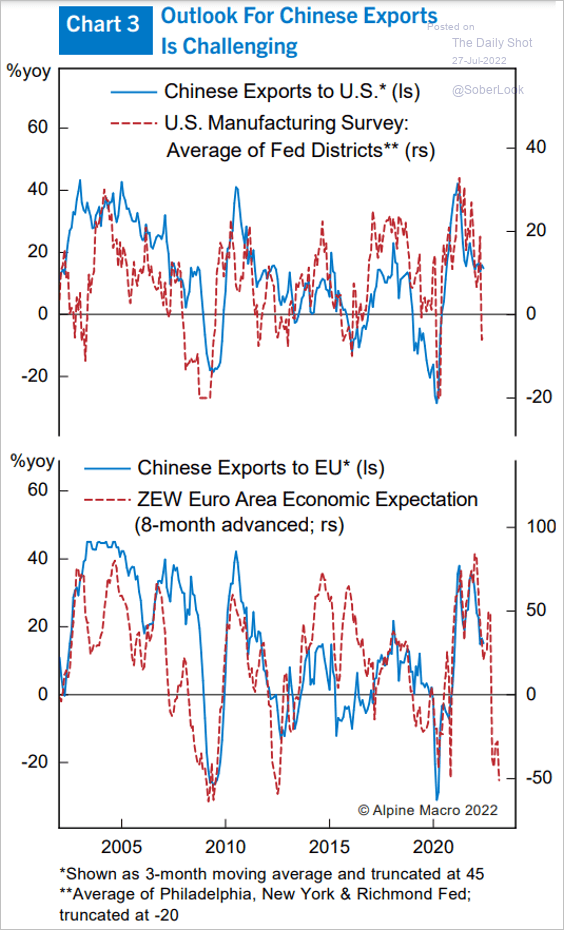

3. Exporters are facing challenges.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

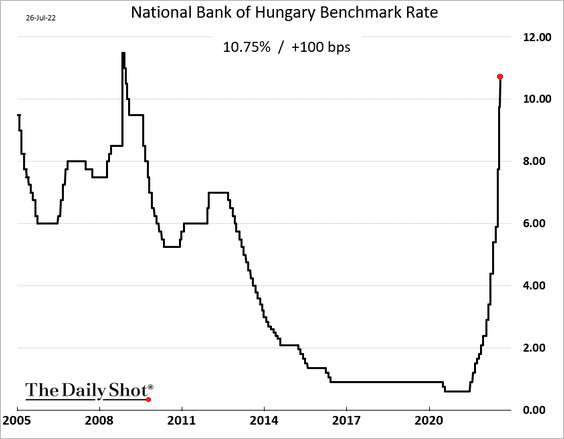

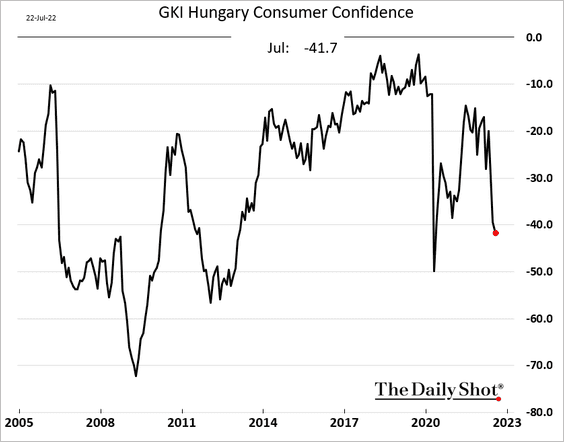

1. The Hungarian central bank hiked rates by 100 bps.

Consumer confidence has been deteriorating.

——————–

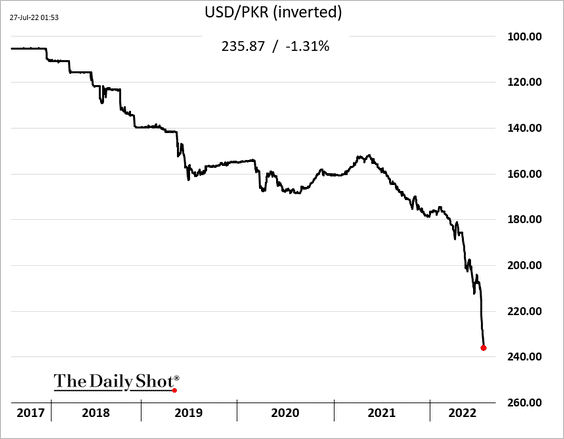

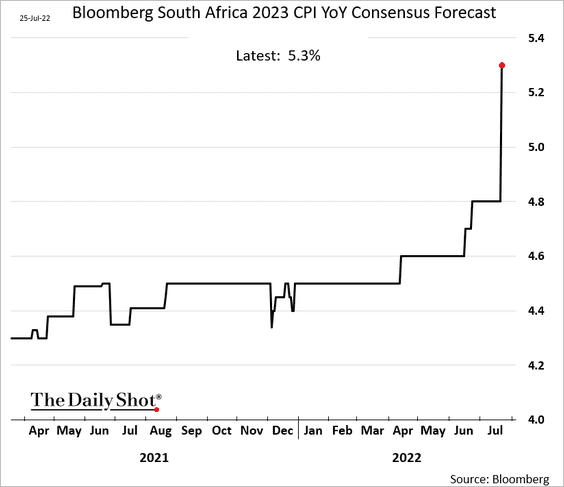

2. The Pakistani rupee keeps hitting new lows.

Source: @FaseehMangi, @karllesteryap, @markets Read full article

Source: @FaseehMangi, @karllesteryap, @markets Read full article

——————–

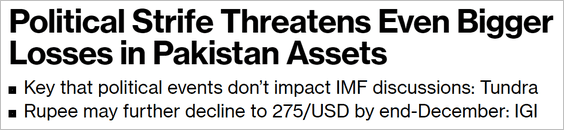

3. Economists are boosting their forecasts for South Africa’s 2023 CPI.

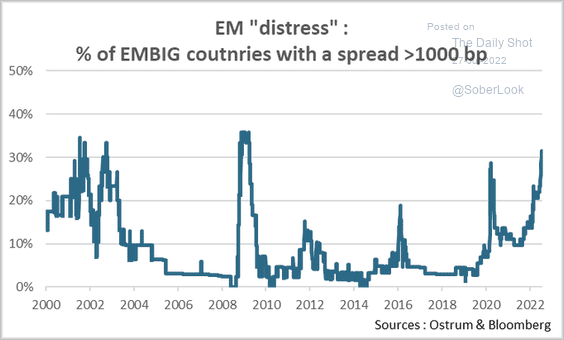

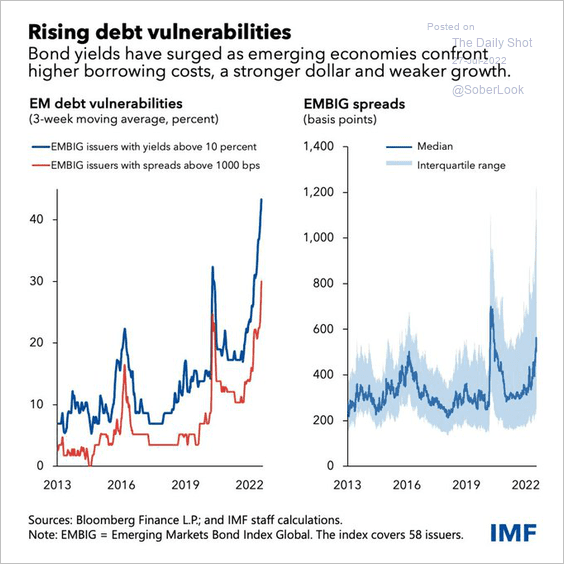

4. There is a lot of sovereign debt trading at distressed levels (2 charts).

Source: @sobata416, @JeremyWS, @bondvigilantes, @CenterPointSec, @IIF, @StephaneDeo Read full article

Source: @sobata416, @JeremyWS, @bondvigilantes, @CenterPointSec, @IIF, @StephaneDeo Read full article

Source: @TonysAngle, @IMFNews Read full article

Source: @TonysAngle, @IMFNews Read full article

Back to Index

Cryptocurrency

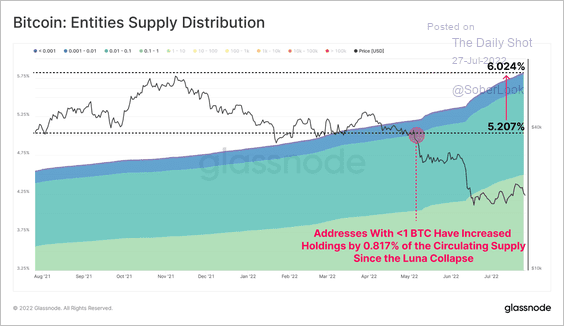

1. Small investors holding less than one BTC are starting to accumulate more tokens relative to larger holders.

Source: @glassnode

Source: @glassnode

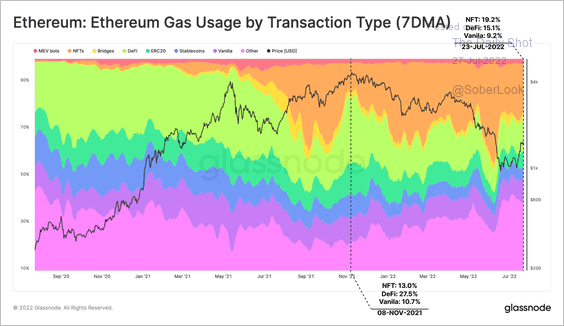

2. NFTs have accounted for more transaction activity on the Ethereum blockchain over the past year, while decentralized finance (DeFi) usage has declined.

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

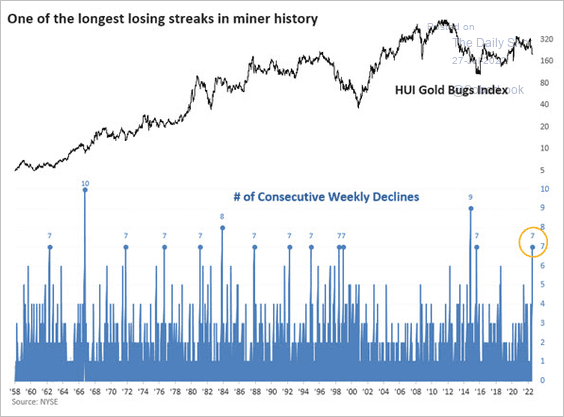

1. Gold mining stocks have experienced a steady decline in recent months and now appear oversold (2 charts).

Source: SentimenTrader

Source: SentimenTrader

——————–

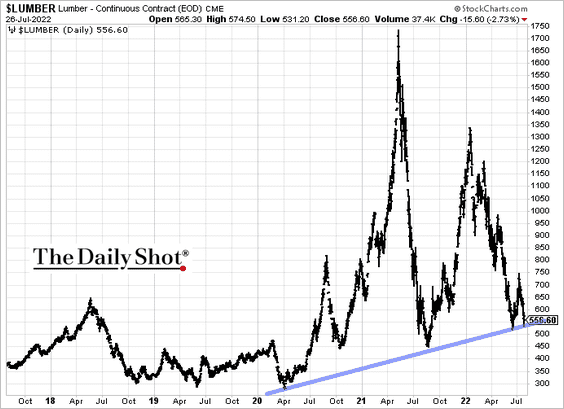

2. US lumber futures are at support.

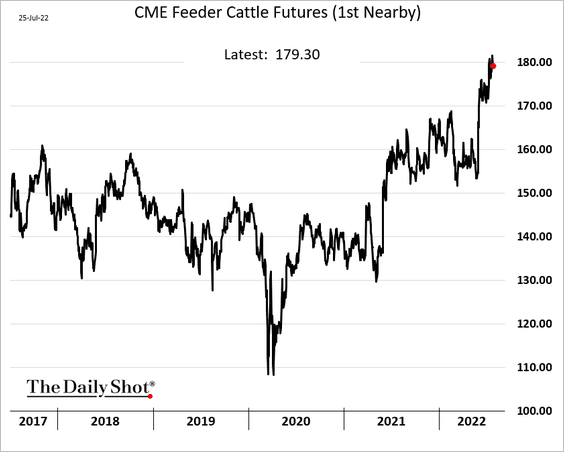

3. CME feeder cattle futures have risen substantially this year.

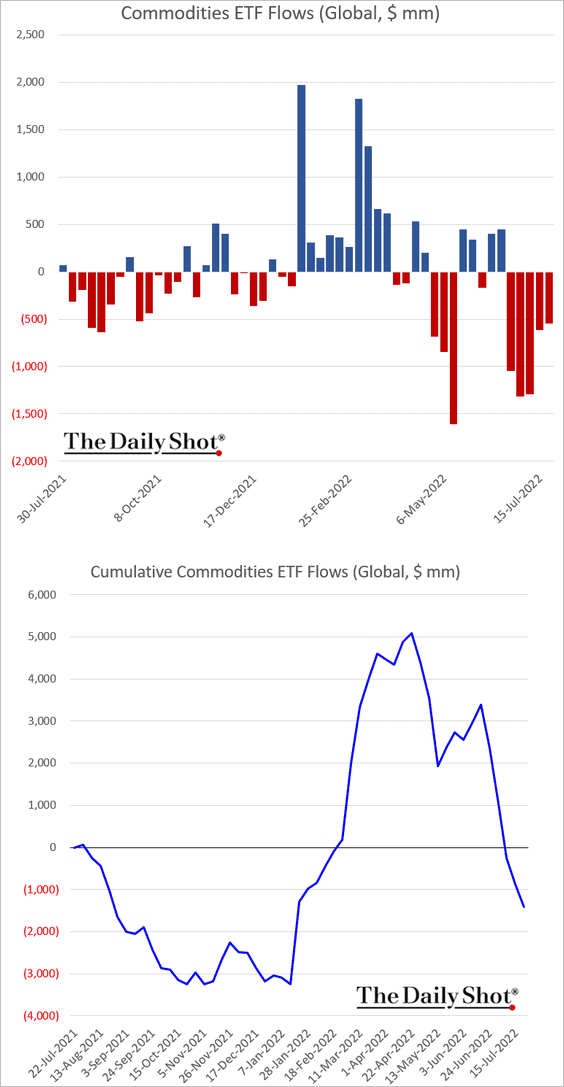

4. Commodity ETFs have been experiencing outflows.

Back to Index

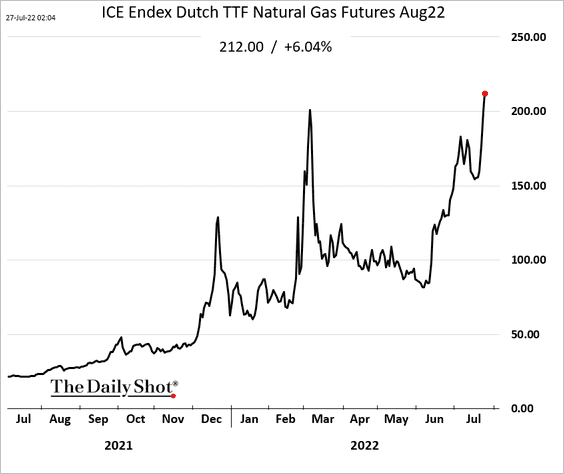

Energy

1. European natural gas futures are surging as Russia cuts supplies.

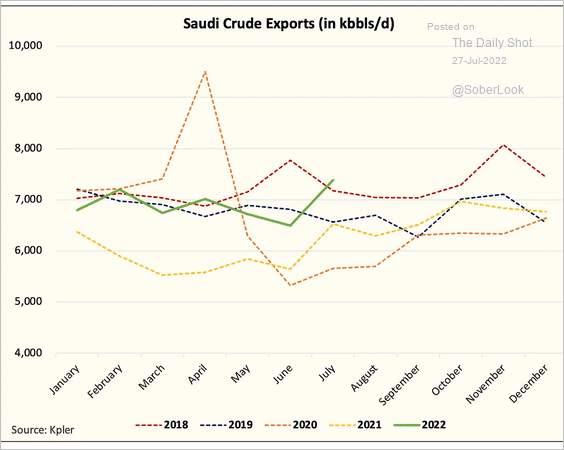

2. Saudi crude oil exports picked up in July.

Source: @HFI_Research

Source: @HFI_Research

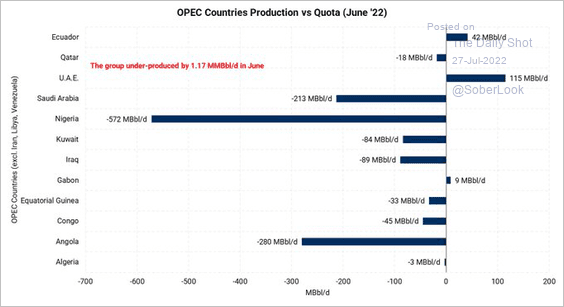

3. OPEC’s output remains below its production targets.

Source: @nhillman_energy

Source: @nhillman_energy

Back to Index

Equities

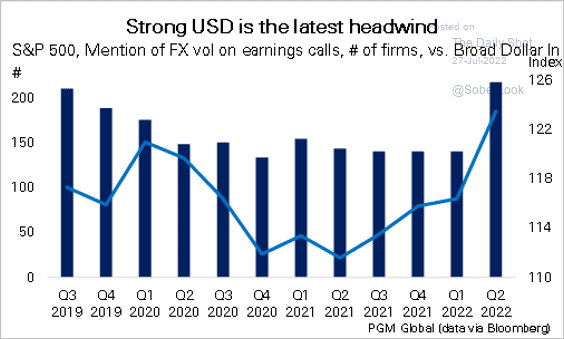

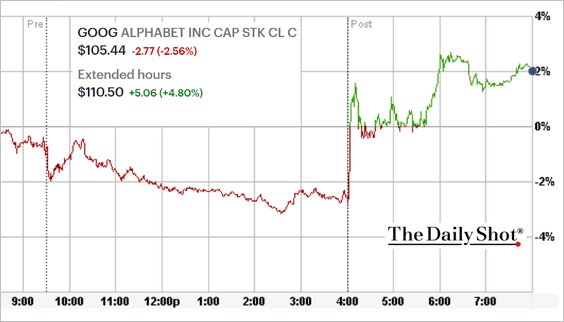

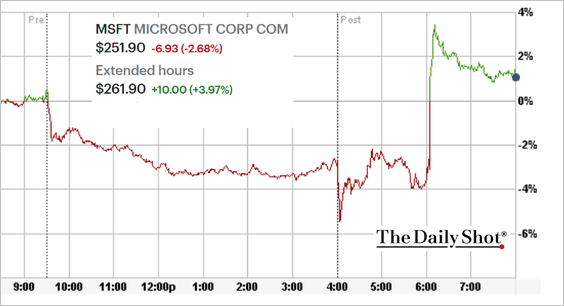

1. Google and Microsoft reported a deterioration in earnings.

Source: CNBC Read full article

Source: CNBC Read full article

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

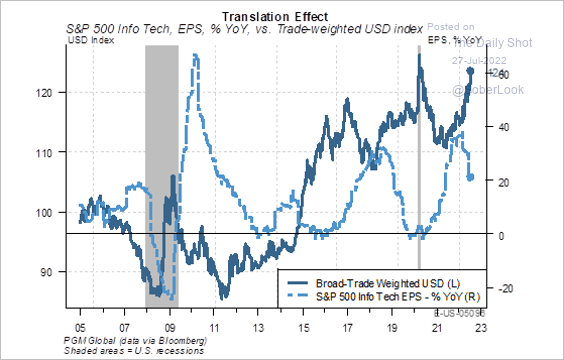

Microsoft’s results were hurt by the US dollar’s strength, which is hitting many firms that have substantial international sales (2 charts).

Source: PGM Global

Source: PGM Global

Source: PGM Global

Source: PGM Global

But the results weren’t as scary as investors feared, and Microsoft’s guidance was better than expected.

Shares jumped after the close. The market seems to be willing to look beyond the current headwinds.

——————–

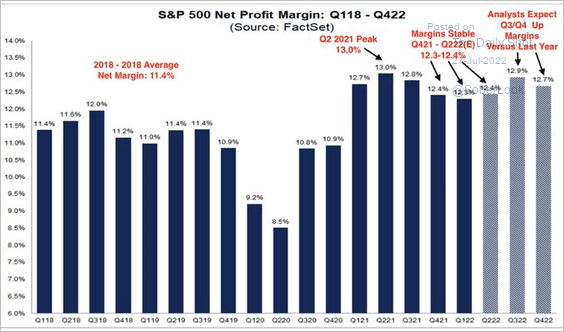

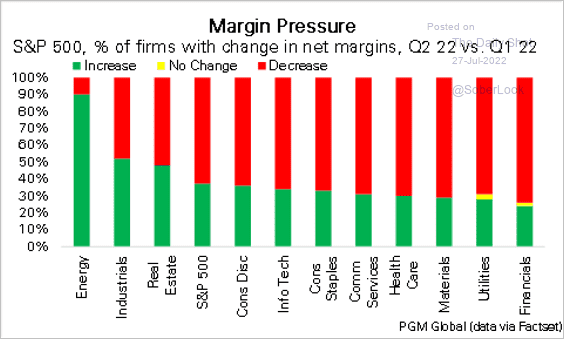

2. Are profit margin estimates too optimistic?

Source: @DataTrekMB, h/t @pav_chartbook

Source: @DataTrekMB, h/t @pav_chartbook

Is the dip in margins temporary?

Source: PGM Global

Source: PGM Global

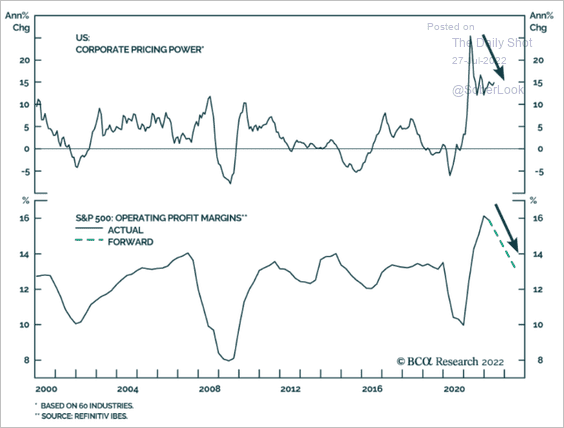

Will corporate pricing power return to pre-COVID levels?

Source: BCA Research

Source: BCA Research

——————–

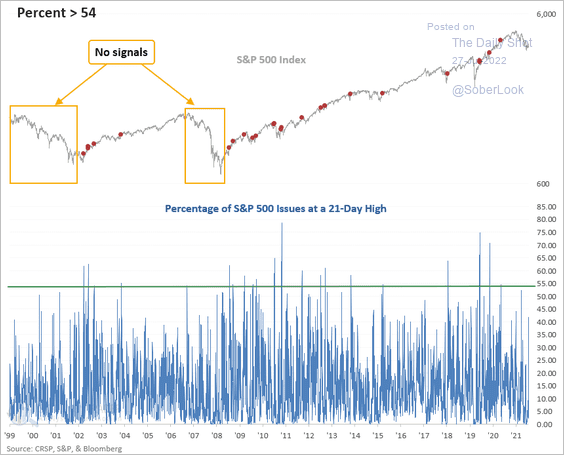

3. Historically, bear markets have passed when a majority of S&P 500 stocks reached a 21-day high. We are not there yet.

Source: SentimenTrader

Source: SentimenTrader

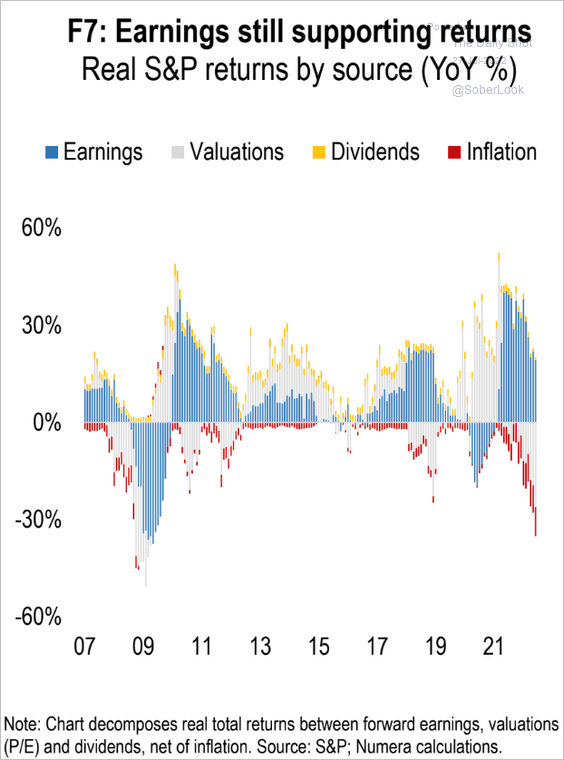

4. This chart shows the S&P 500 return attribution (including the effect of inflation).

Source: Numera Analytics

Source: Numera Analytics

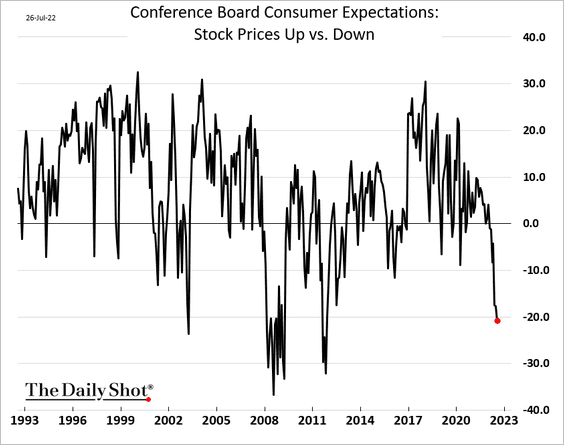

5. US consumers are increasingly bearish on the stock market.

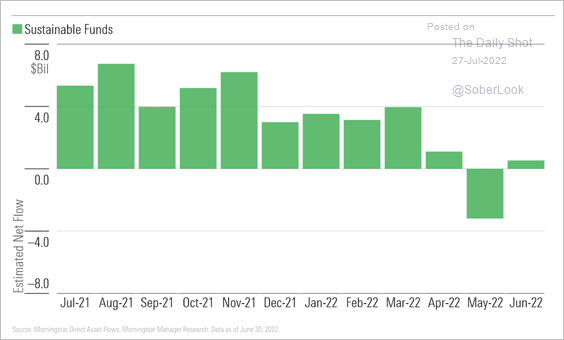

6. Sustainable funds posted rare outflows in May but bounced back slightly in June.

Source: Morningstar

Source: Morningstar

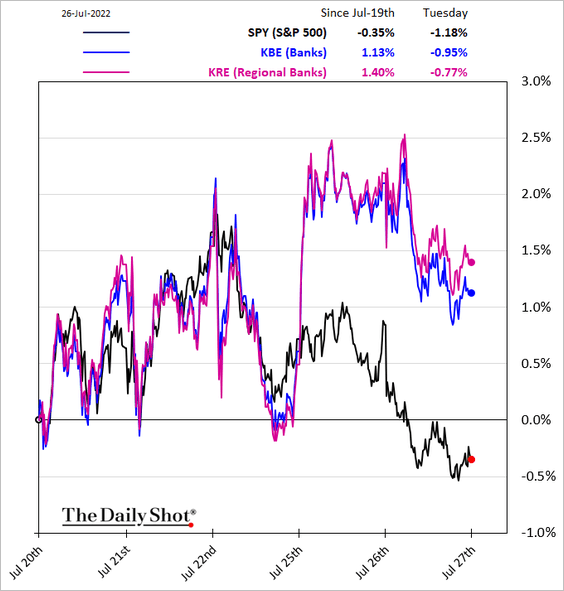

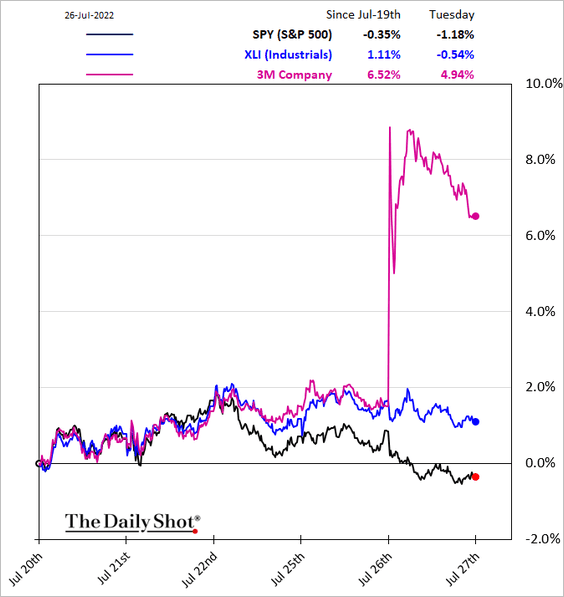

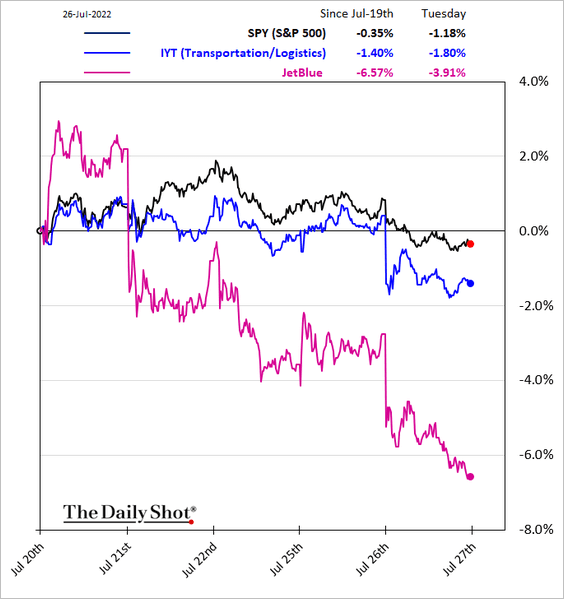

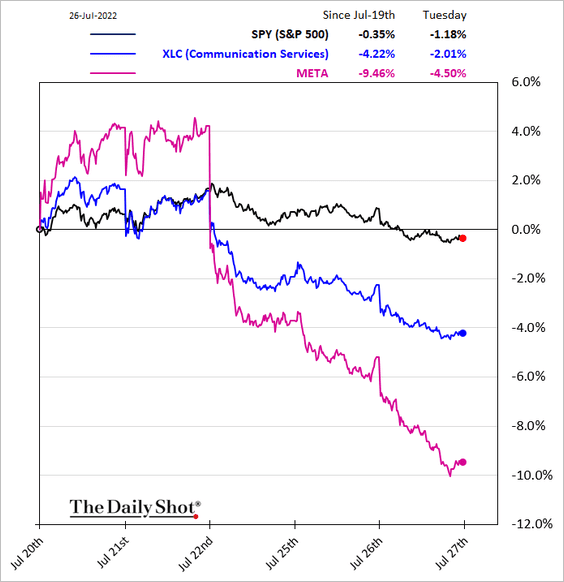

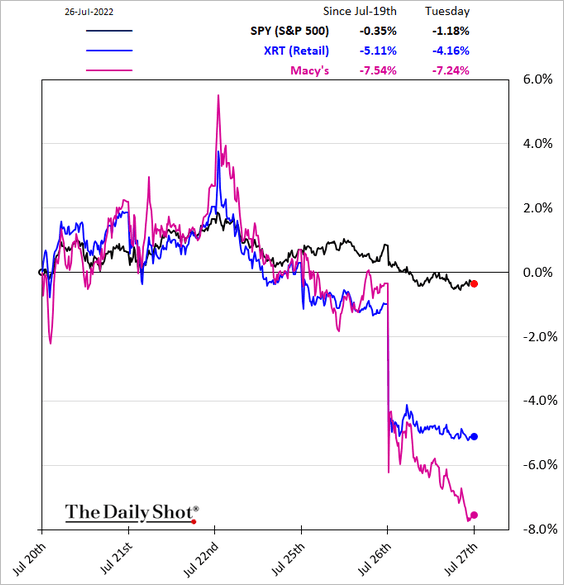

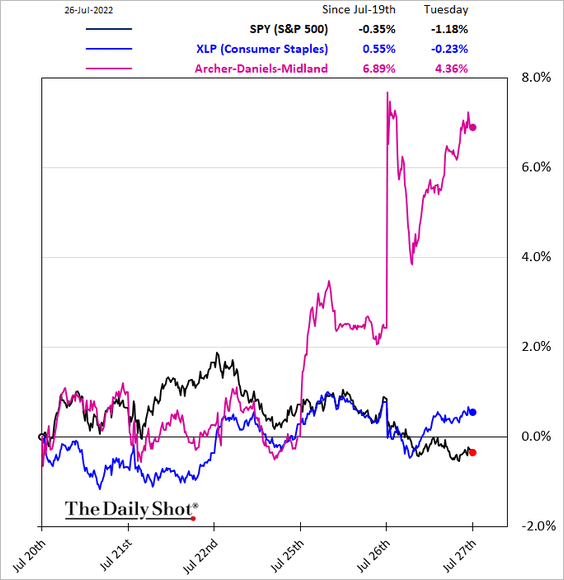

7. Next, we have some sector performance data over the past five business days.

• Banks:

• Industrials:

• Transportation:

• Communication services:

• Retail:

• Consumer staples:

Back to Index

Credit

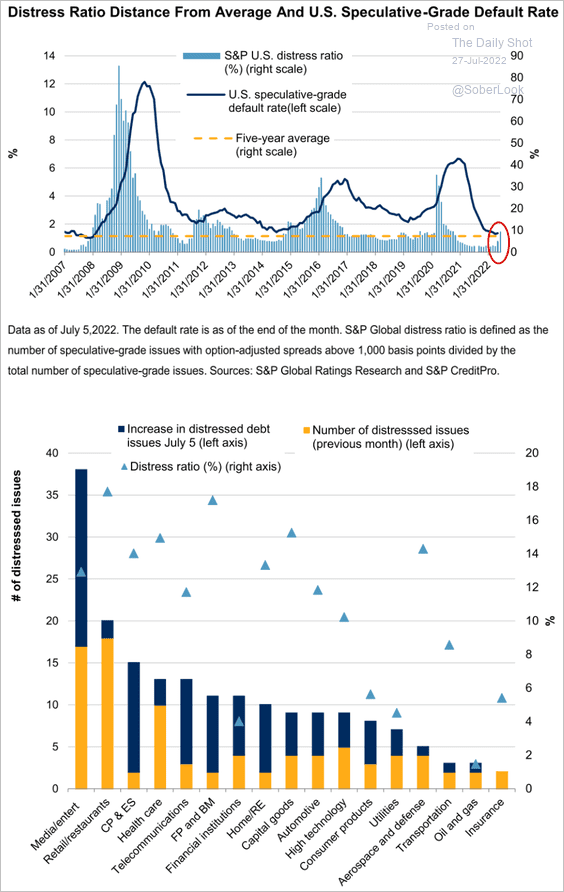

1. Let’s start with some data on the US distress ratio (see definition below).

Source: S&P Global Ratings

Source: S&P Global Ratings

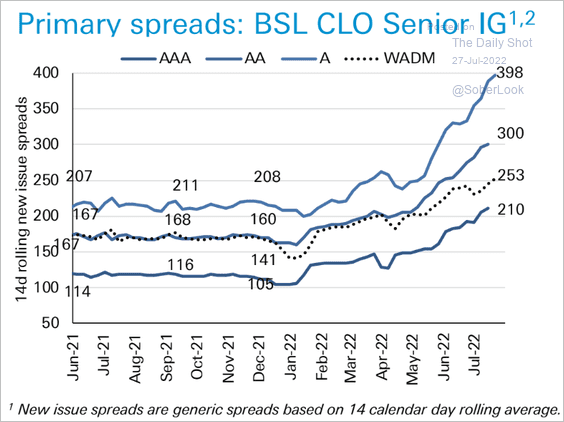

2. New-issue CLO spreads have widened substantially.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

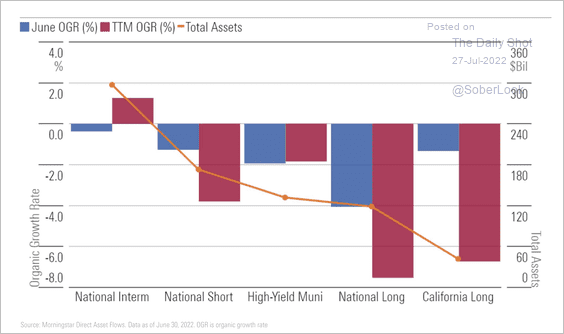

3. This chart shows a breakdown of flows across the largest muni bond categories by total assets.

Source: Morningstar

Source: Morningstar

Back to Index

Rates

1. The 10-year Treasury yield is at support.

Source: barchart.com

Source: barchart.com

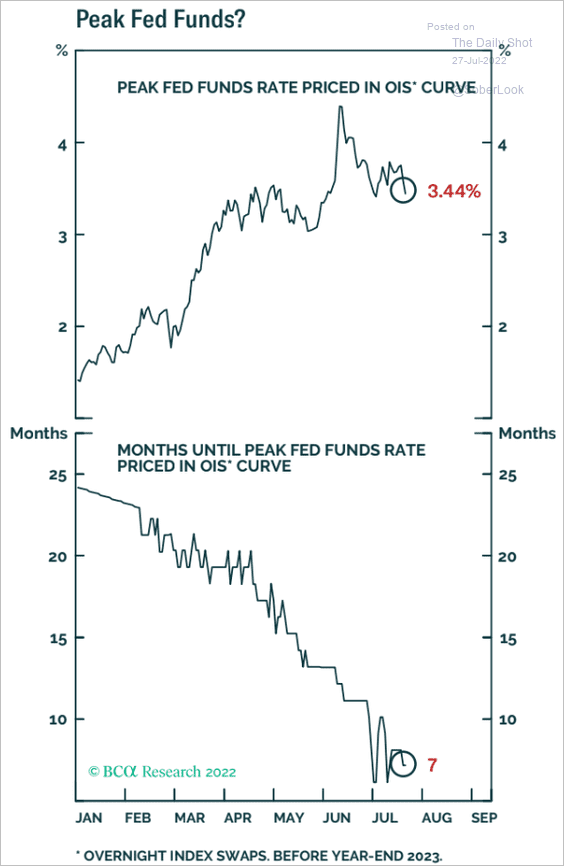

2. Seven months until we get to peak Fed tightening?

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

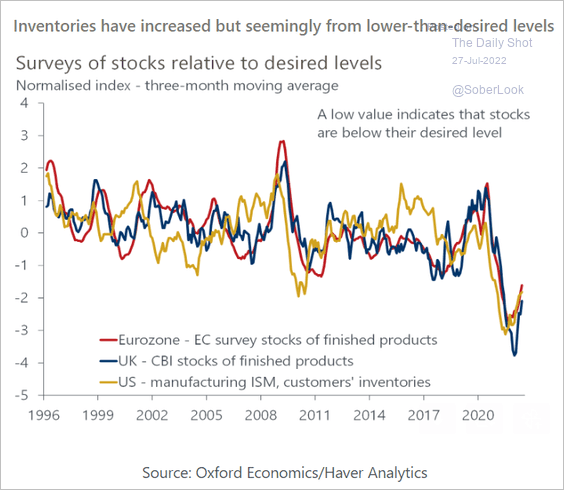

1. Bussiness surveys suggest that inventories of finished products remain tight.

Source: Oxford Economics

Source: Oxford Economics

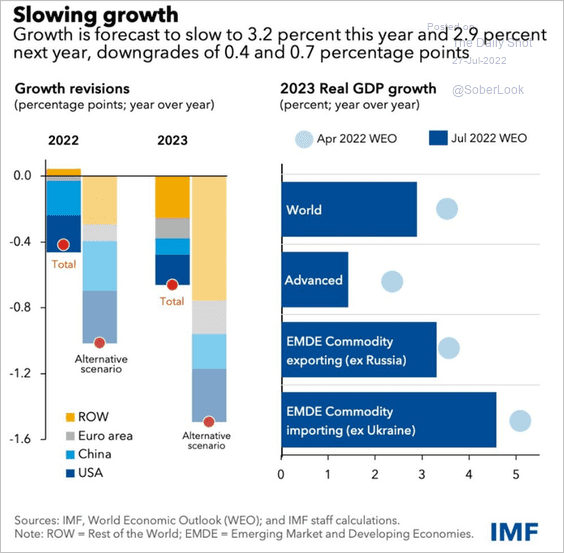

2. The IMF further downgraded its GDP growth projections …

Source: @GregDaco, @IMFNews Read full article

Source: @GregDaco, @IMFNews Read full article

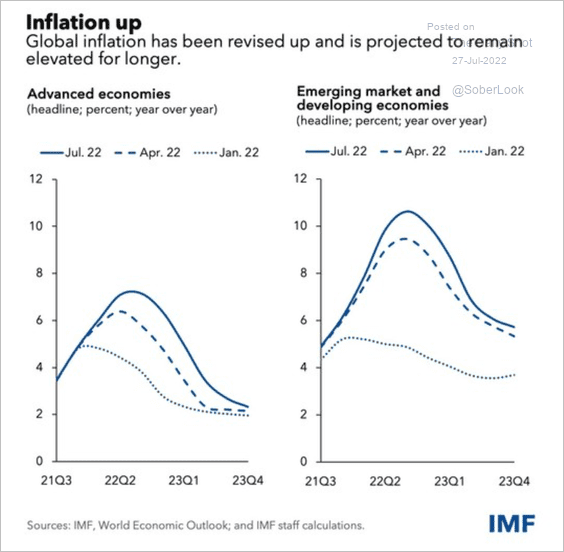

… and boosted inflation forecasts.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

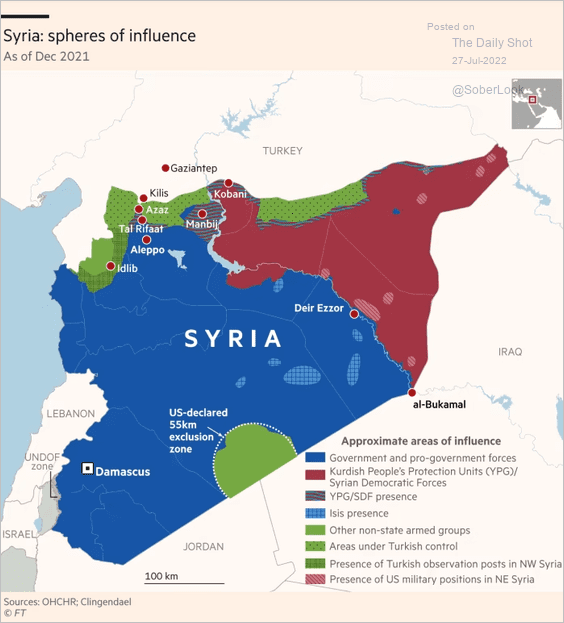

1. Who controls Syria?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

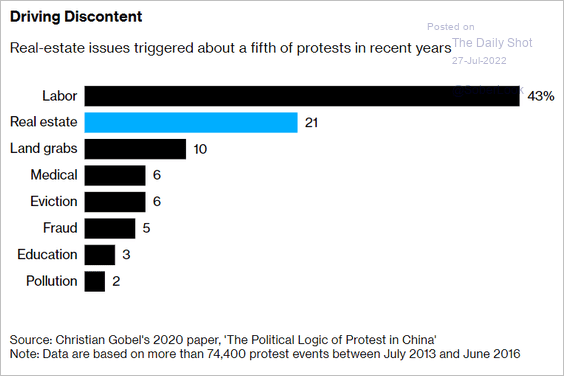

2. Protests in China:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

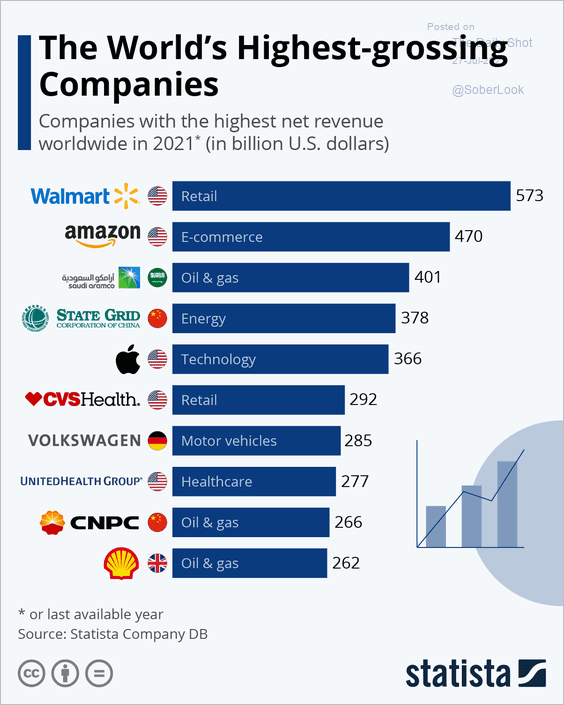

3. Companies with the highest revenue:

Source: Statista

Source: Statista

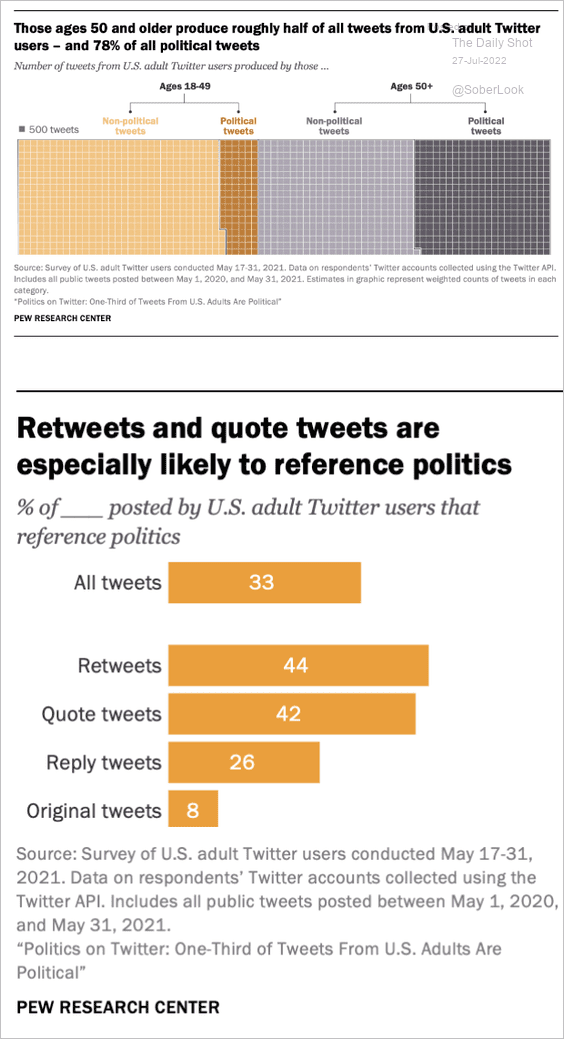

4. Politics on Twitter:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

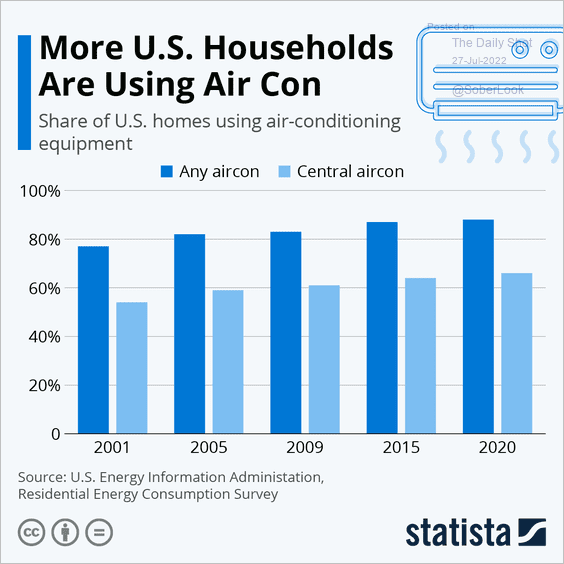

5. Using air conditioning:

Source: Statista

Source: Statista

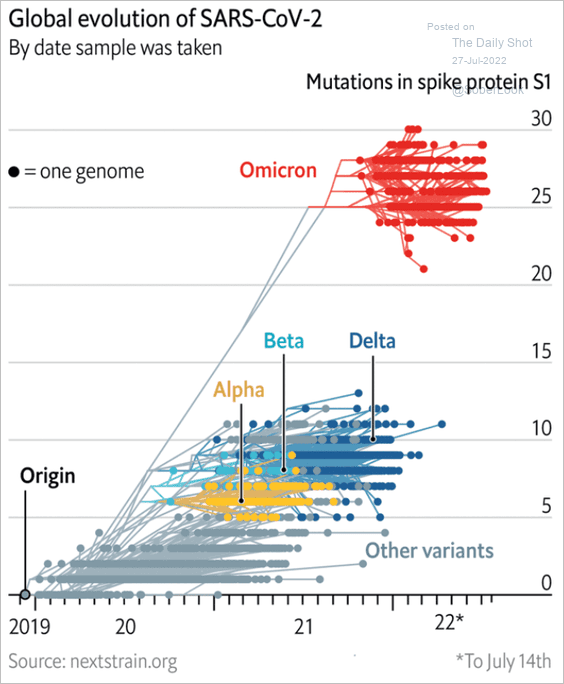

6. The evolution of COVID:

Source: The Economist Read full article

Source: The Economist Read full article

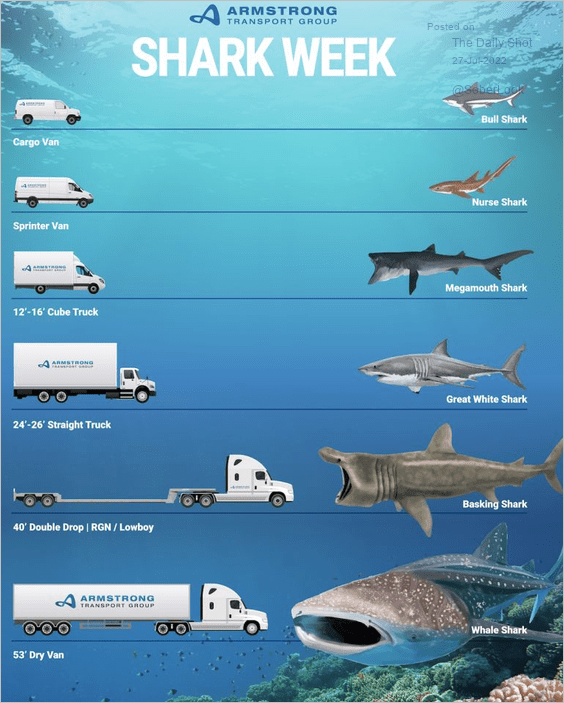

7. Shark sizes in perspective:

Source: @rrpre

Source: @rrpre

——————–

Back to Index