The Daily Shot: 28-Sep-22

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

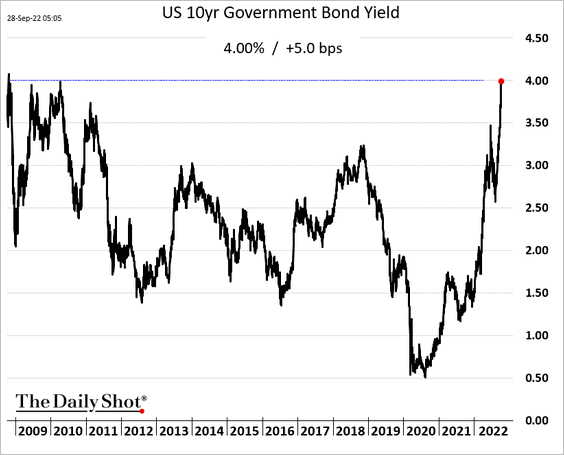

• As the 10-year Treasury yield reaches 4%, …

Source: @WSJ Read full article

Source: @WSJ Read full article

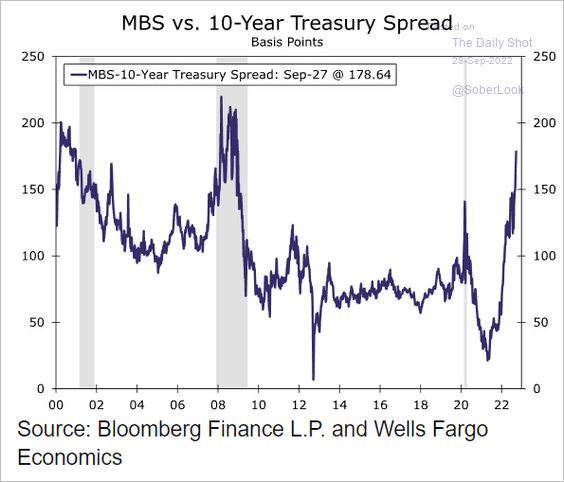

… and MBS spreads remain elevated, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

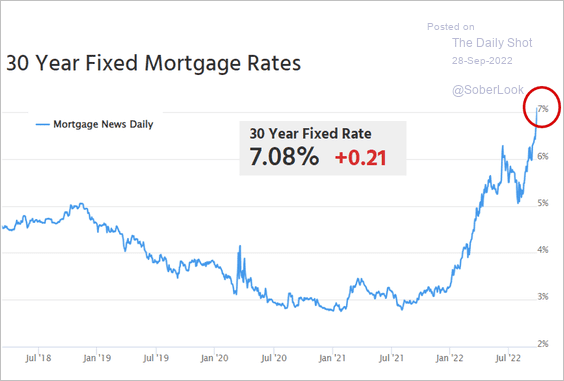

… mortgage rates hit 7%, according to the Mortgage News Daily index.

Source: Mortgage News Daily

Source: Mortgage News Daily

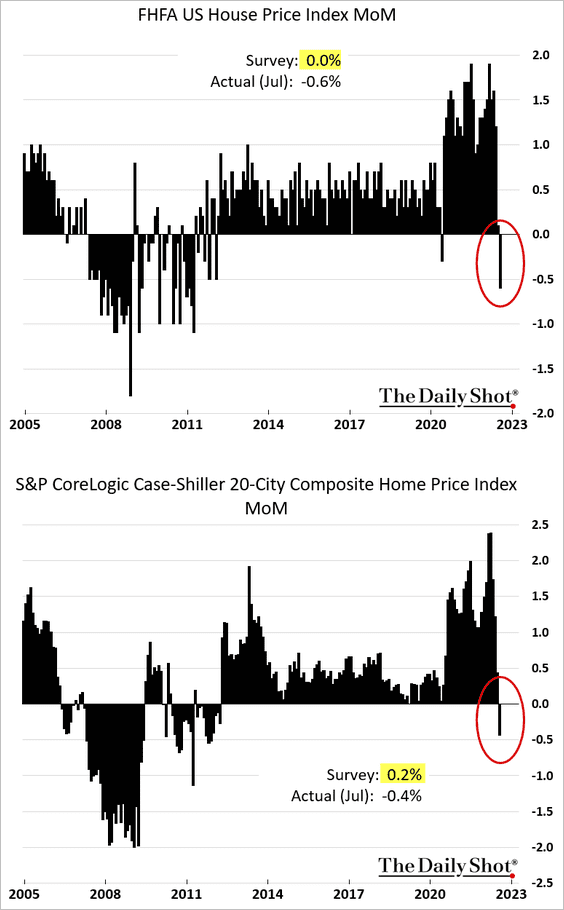

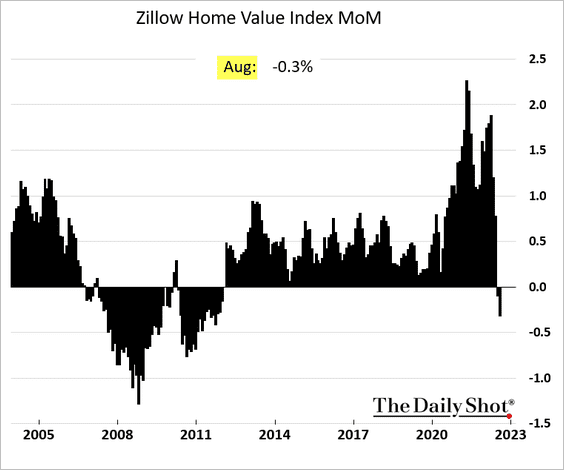

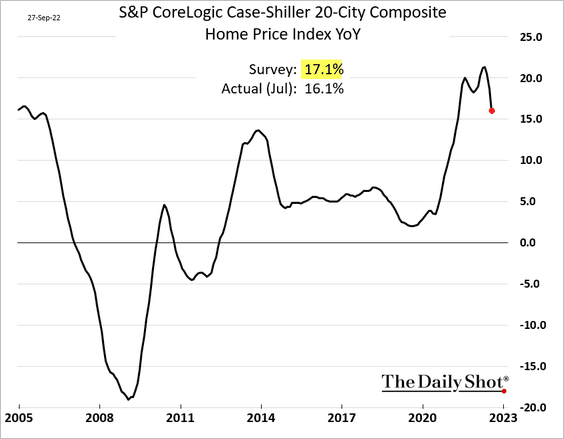

• July home price data surprised to the downside, with key indices dropping sharply.

– Based on Zillow’s data, August wasn’t any better.

– Here is the Case-Shiller index on a year-over-year basis.

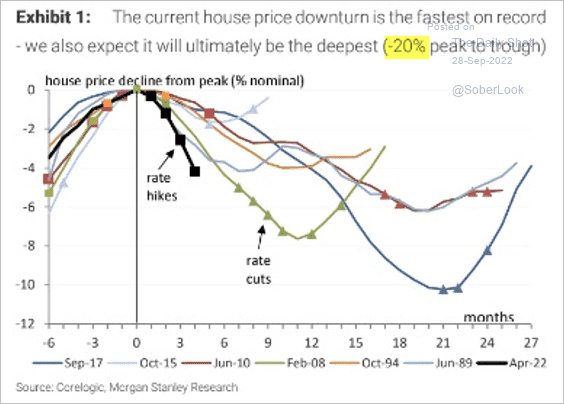

– Morgan Stanley sees a 20% decline from the peak.

Source: Morgan Stanley Research; @Scutty

Source: Morgan Stanley Research; @Scutty

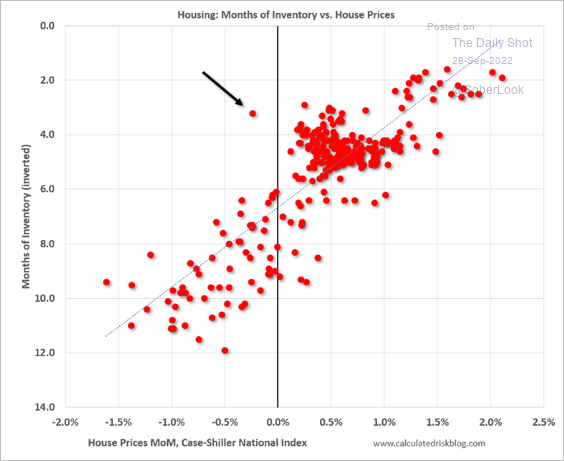

– However, inventories remain tight relative to price changes.

Source: Calculated Risk

Source: Calculated Risk

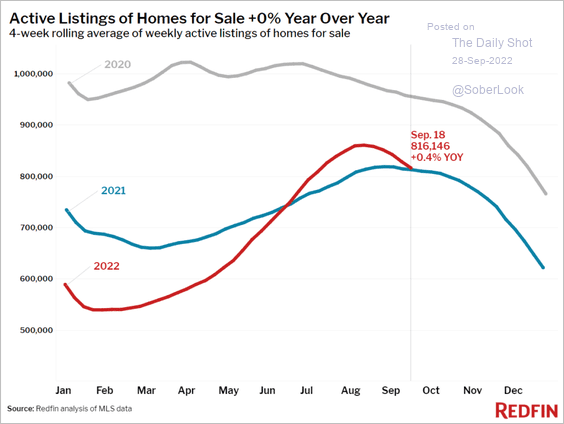

Active listings are back to last year’s levels as sellers go on strike.

Source: Redfin

Source: Redfin

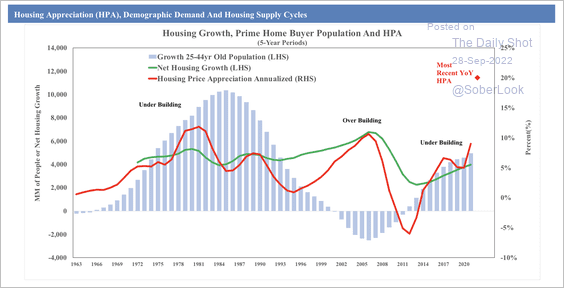

• The current housing market reflects a similar demographic demand and lack of supply as the 1970s.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

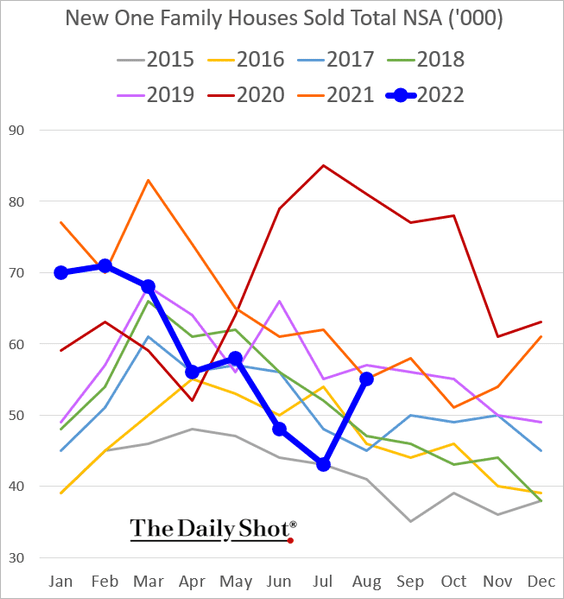

• New home sales were shockingly strong last month. This improvement will likely be reversed shortly.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

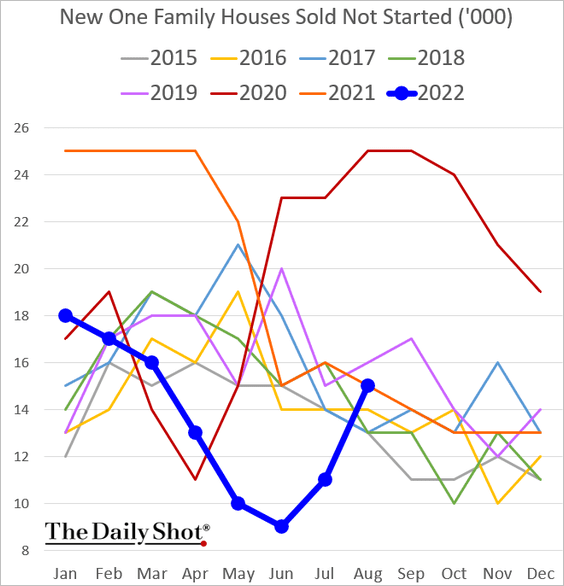

This chart shows sales of new homes that haven’t been started yet.

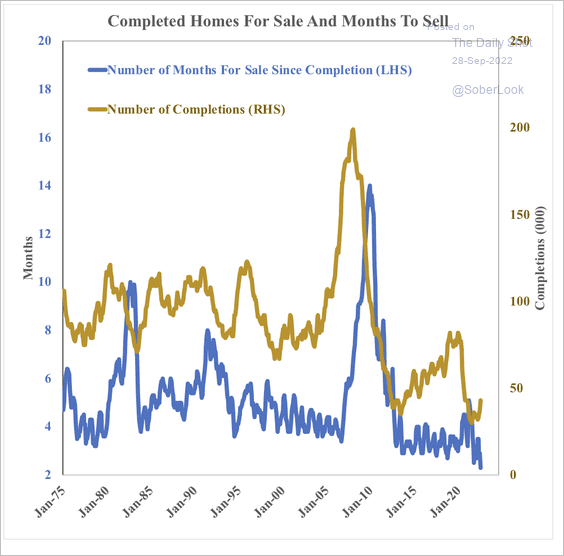

– The number of home completions remains low.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

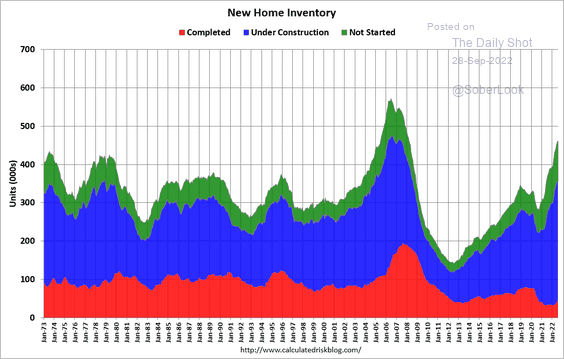

– Inventories of new homes are rising (in terms of the number of units).

Source: @calculatedrisk Read full article

Source: @calculatedrisk Read full article

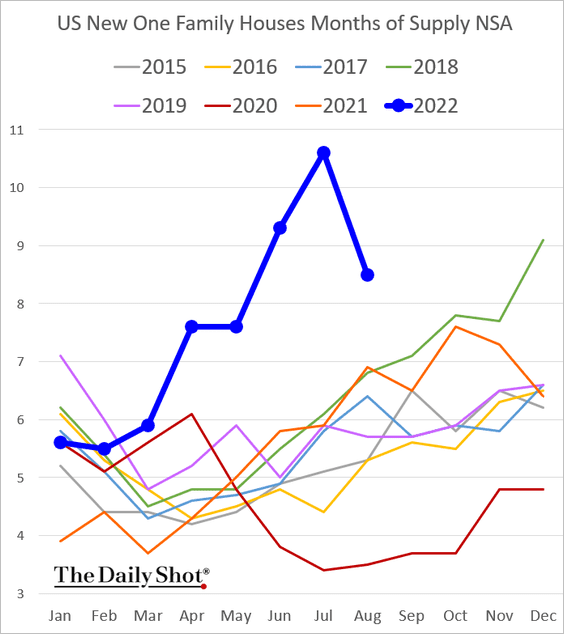

Here is a look at inventories measured in months of supply.

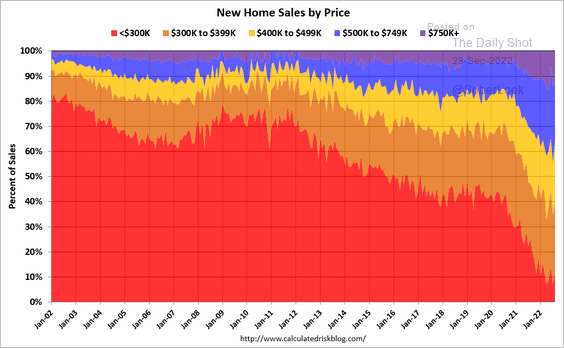

– This chart shows the distribution of new home sales prices.

Source: @calculatedrisk Read full article

Source: @calculatedrisk Read full article

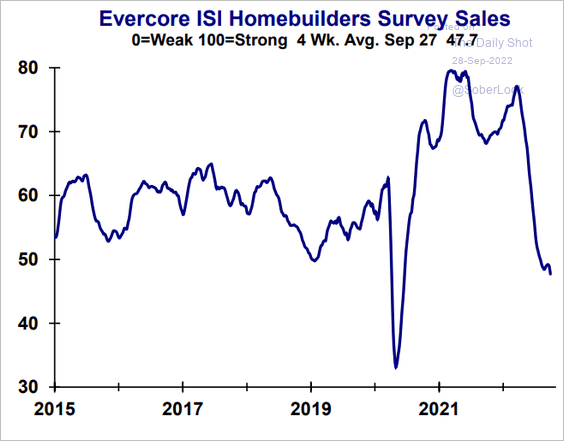

• The Evercore ISI homebuilder sentiment index continues to deteriorate.

Source: Evercore ISI Research

Source: Evercore ISI Research

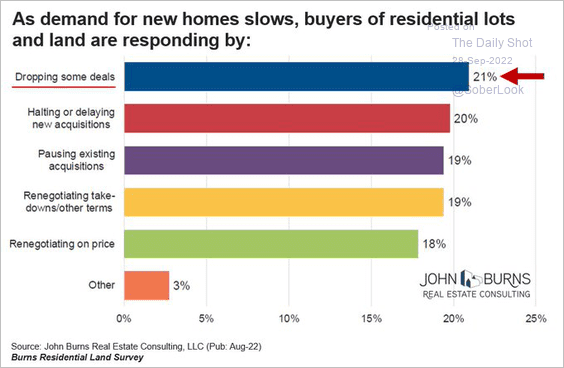

Builders are walking away from land deals as demand softens.

Source: @RickPalaciosJr

Source: @RickPalaciosJr

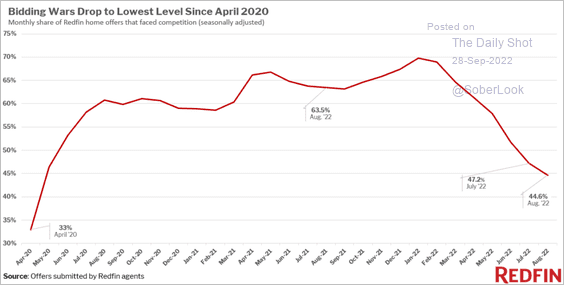

• Bidding wars hit the lowest level since April 2020.

Source: Redfin

Source: Redfin

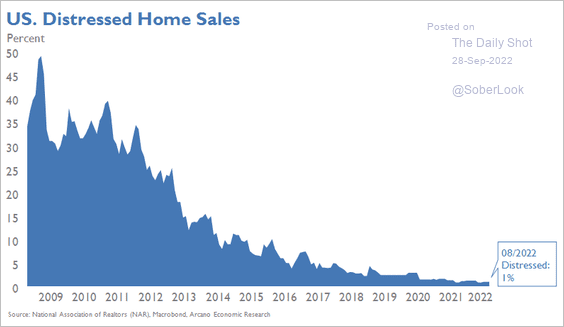

• For now, there are very few distressed home sales.

Source: Arcano Economics

Source: Arcano Economics

——————–

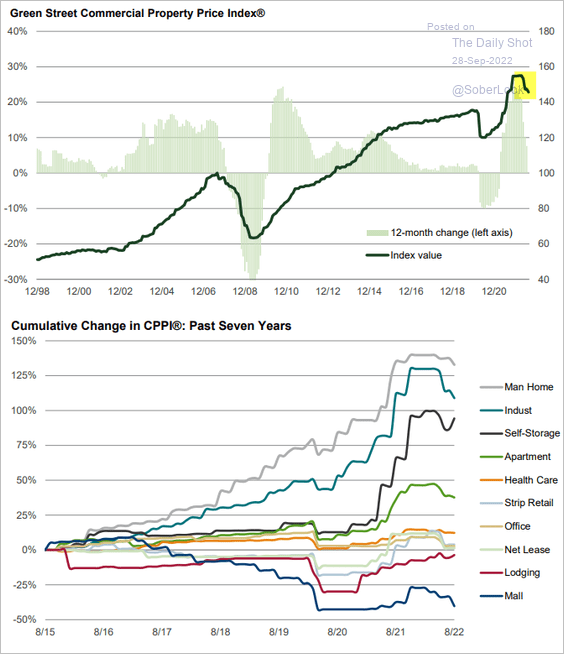

2. Commercial property prices have been declining in recent months, and there is more to go.

Source: Green Street Advisors

Source: Green Street Advisors

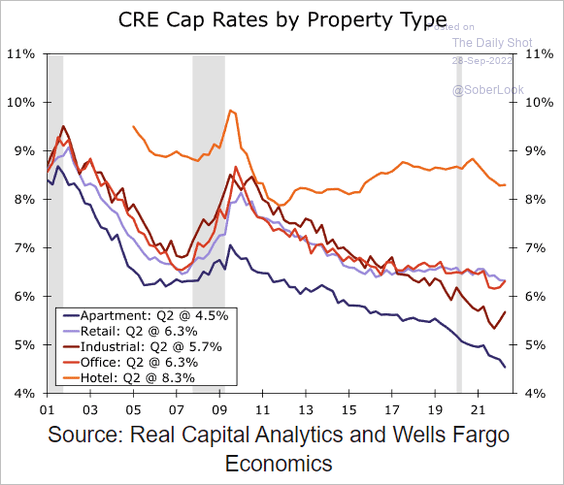

Cap rates are very low.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

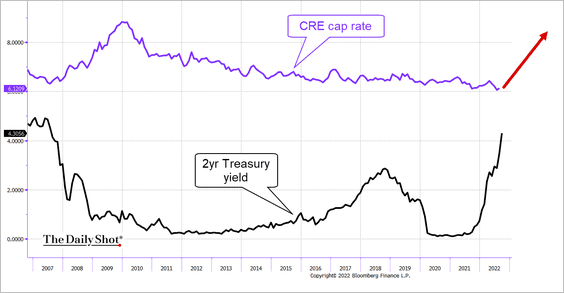

Surging Treasury yields made commercial real estate much less attractive. As the economy slows, cap rate increases will be driven by lower property prices.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

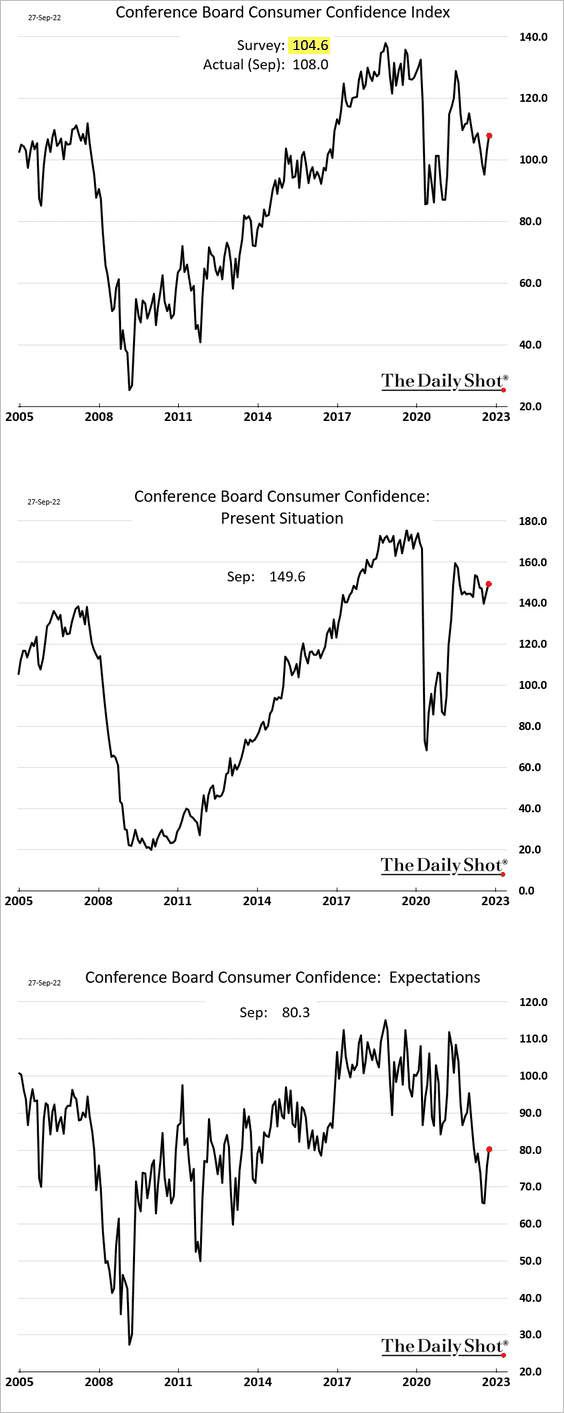

3. The Conference Board’s consumer confidence index jumped in September …

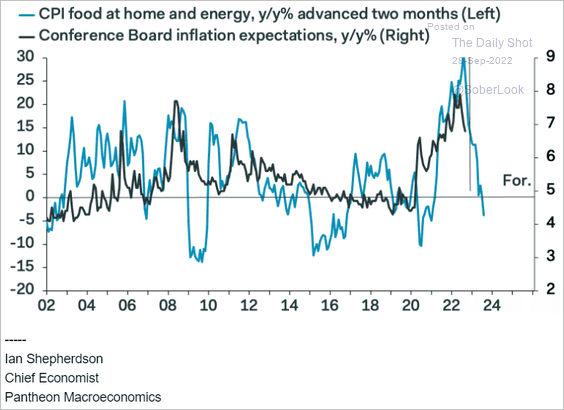

… and inflation expectations declined in response to lower gasoline prices.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

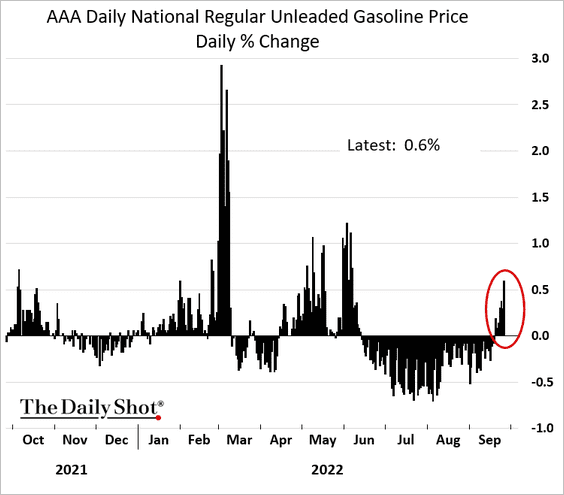

However, gasoline prices are rising again.

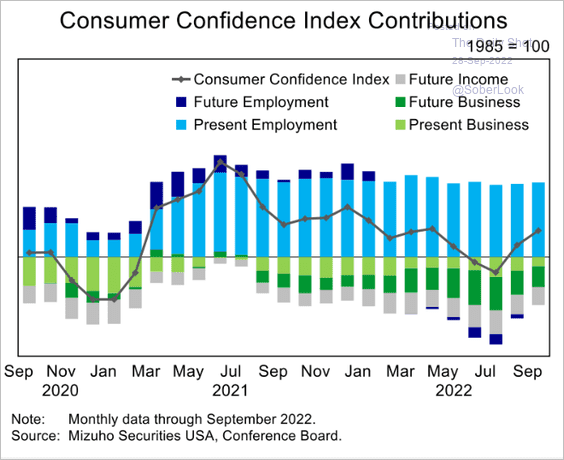

• Here are the contributions to the consumer confidence index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

4. Next, we have some updates on the labor market.

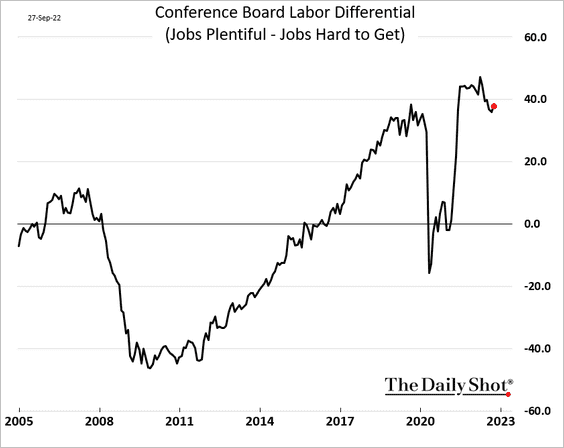

• The Conference Board’s labor differential remains elevated.

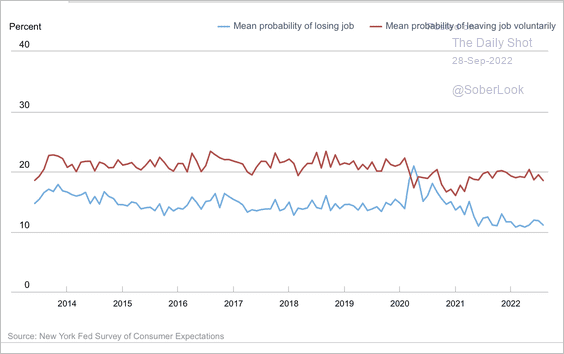

Consumers are not worried about losing their job and place a greater probability on leaving their job voluntarily, according to a Fed survey.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

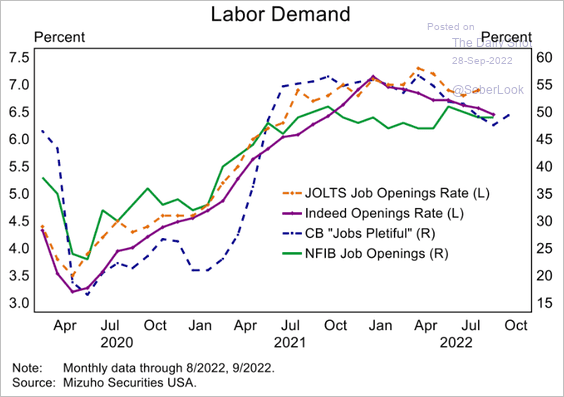

• For now, the labor market remains tight.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

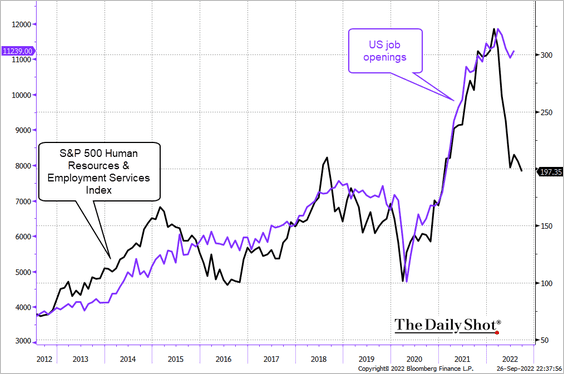

But the stock market is signaling some softening ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

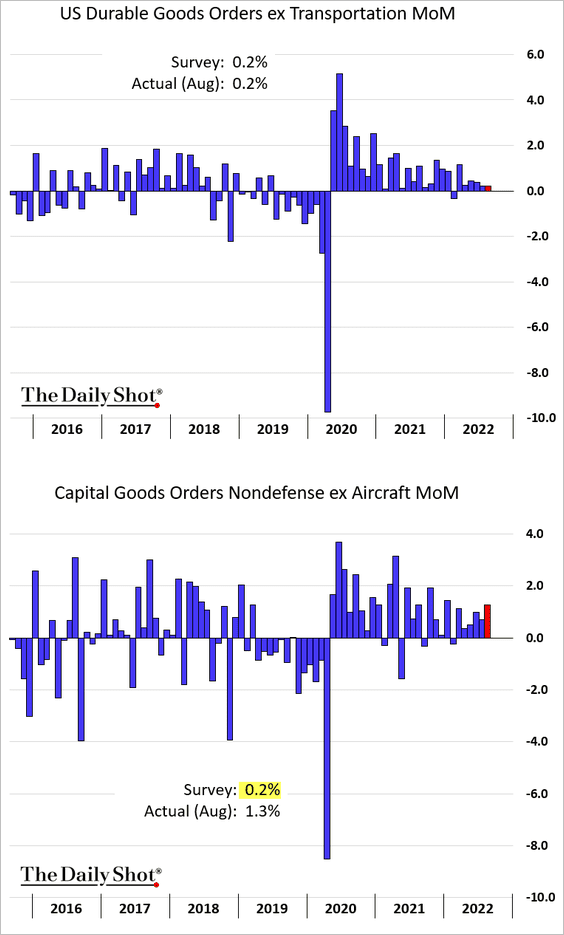

5. Durable goods orders are holding up, with capital goods demand surprising to the upside (2nd panel). It suggests that business investment remains robust.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

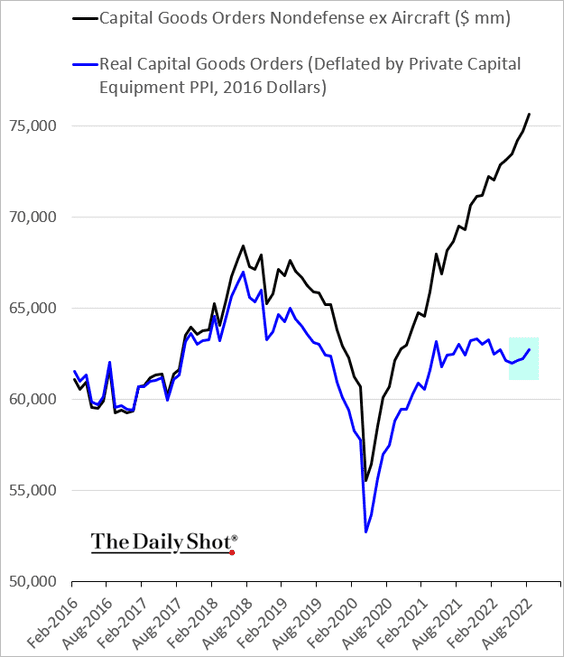

This chart shows nominal and real capital goods orders.

——————–

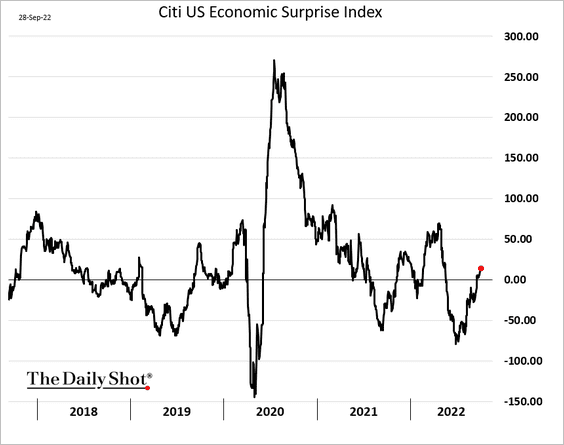

6. The Citi Economic Surprise Index is back in positive territory.

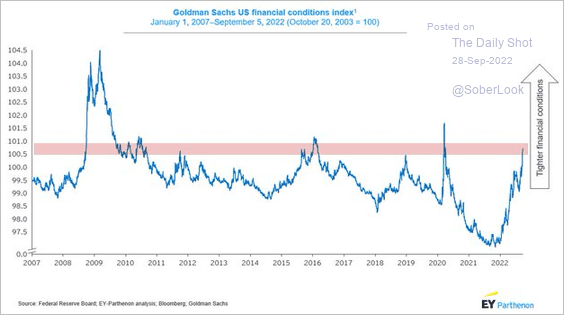

7. Financial conditions continue to tighten as yields and the dollar climb while the stock market sinks.

Source: @GregDaco, @EY_Parthenon, @EY_US

Source: @GregDaco, @EY_Parthenon, @EY_US

Back to Index

The United Kingdom

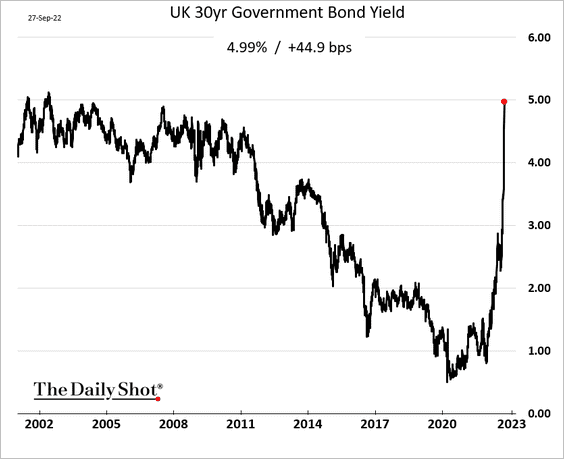

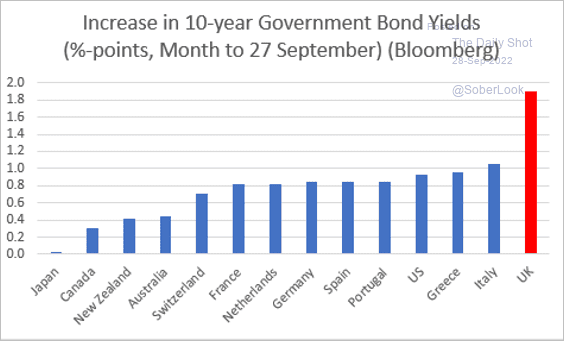

1. Gilt yields are soaring, …

Source: @julianHjessop

Source: @julianHjessop

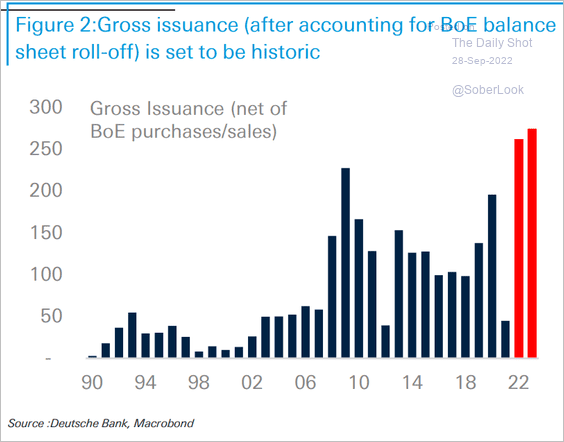

… as the market anticipates a surge in supply due to the latest fiscal stimulus announcement.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

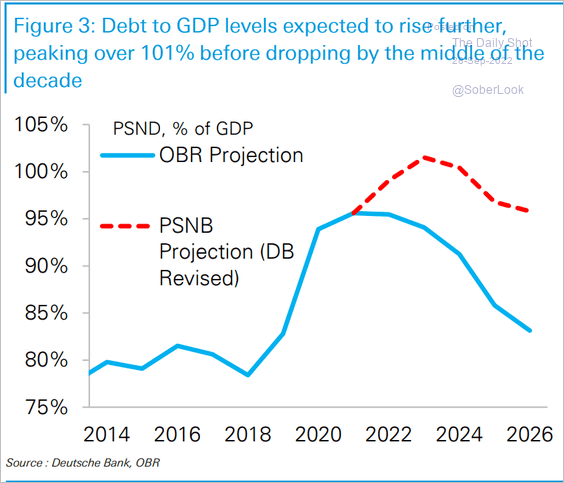

• The debt-to-GDP ratio is now expected to breach 100%, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

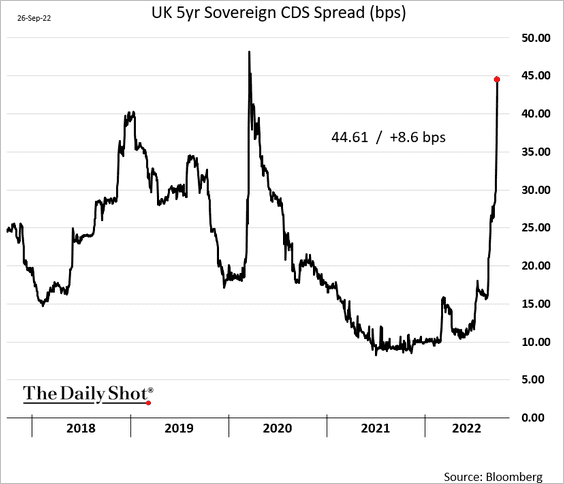

• The sovereign CDS spread continues to climb.

——————–

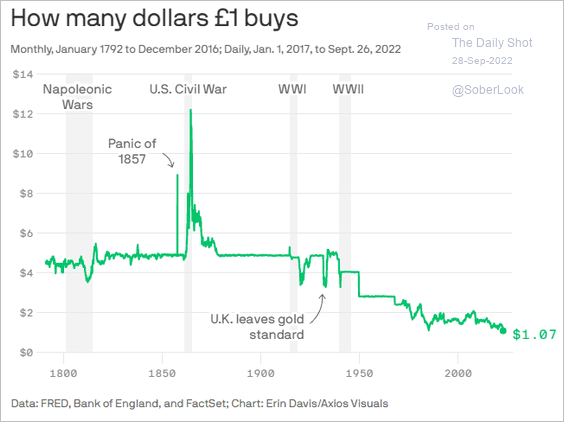

2. Here is GBP/USD going back to the late 1700s.

Source: @axios Read full article

Source: @axios Read full article

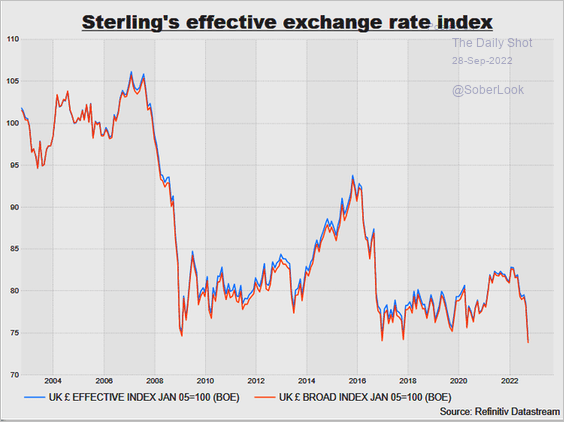

• The pound’s weakness is not just about the dollar’s strength.

Source: @reutersMikeD

Source: @reutersMikeD

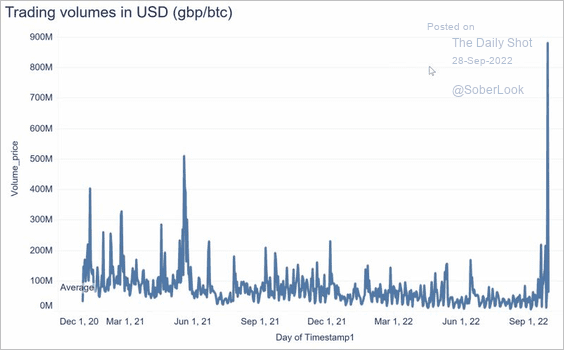

• Britons have been buying bitcoin as the pound tanks.

Source: James Butterfill

Source: James Butterfill

——————–

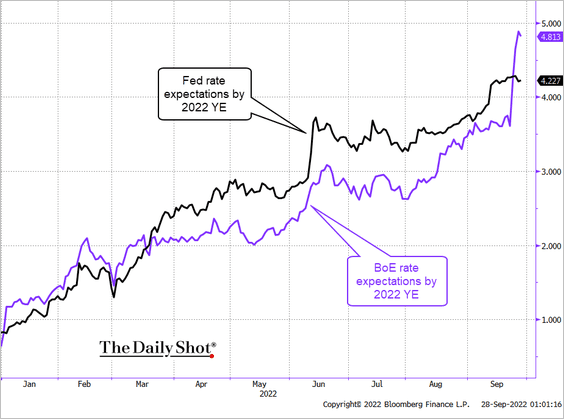

3. The UK rate hike expectations are now well above those in the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

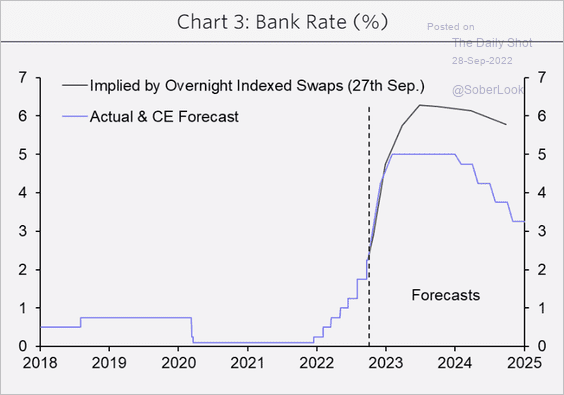

Is the market too hawkish? Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

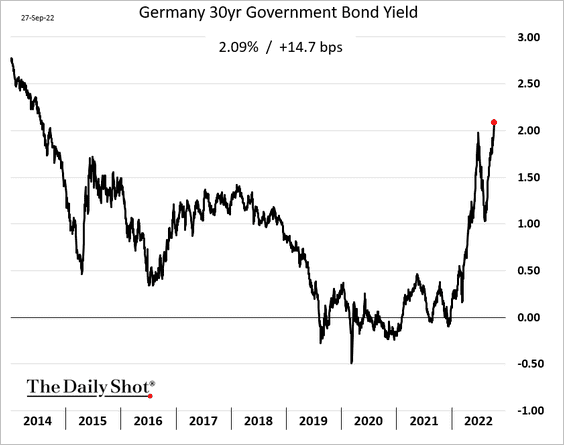

1. Let’s begin with Germany.

• Bund yields keep climbing, pushing up yields across Europe.

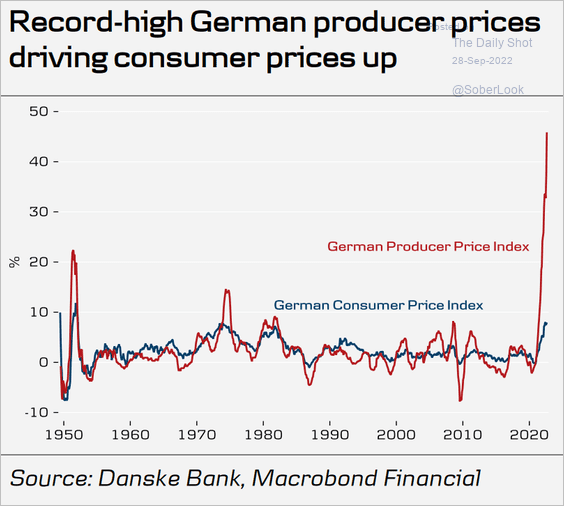

• What does the PPI spike tell us about Germany’s CPI in the months ahead?

Source: Danske Bank

Source: Danske Bank

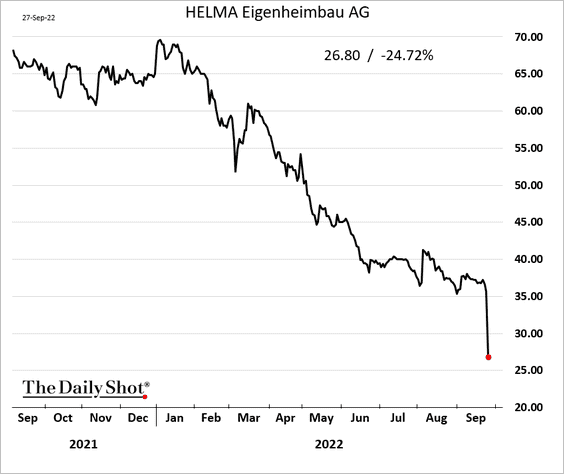

• Shares of a German homebuilder, HELMA Eigenheimbau, took a hit on poor results as the nation’s housing market struggles.

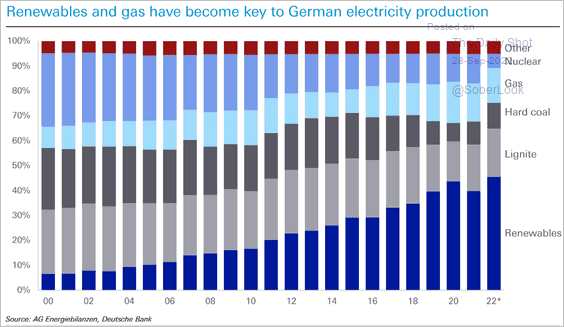

• This chart shows Germany’s electricity production by source.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

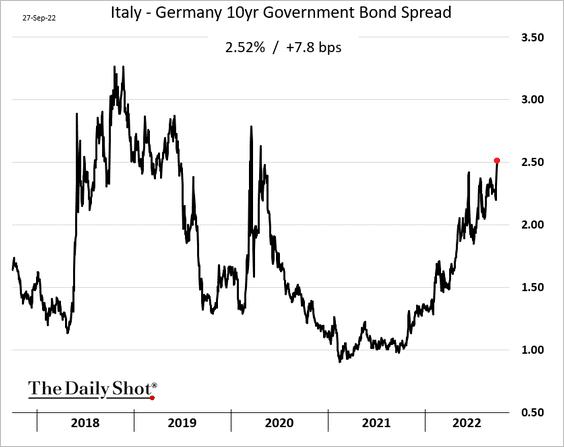

2. The Italy-Germany bond spread keeps widening.

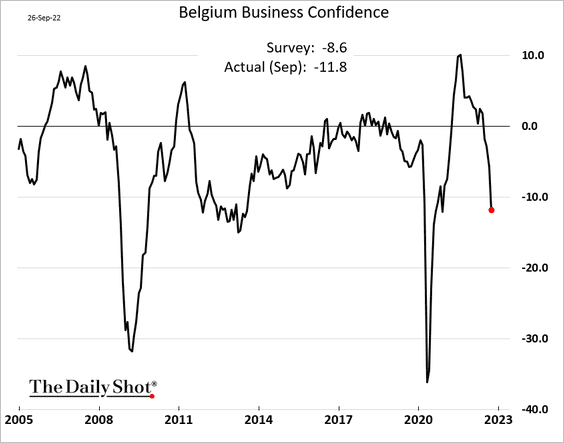

3. Sentiment continues to weaken across the Eurozone.

• Belgium:

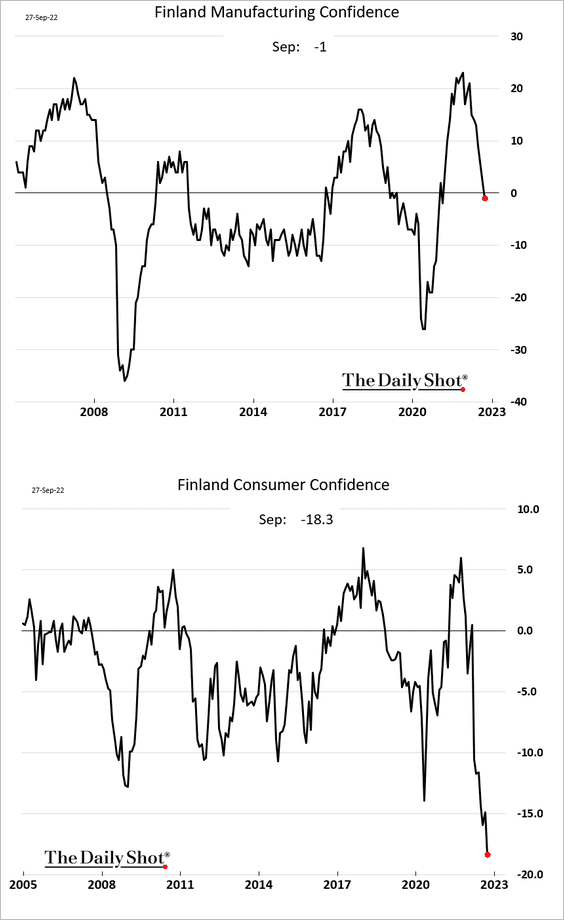

• Finland:

——————–

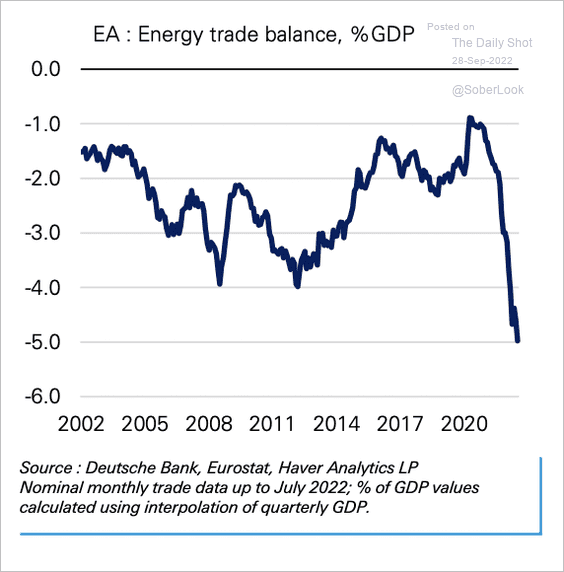

4. The euro area’s energy trade deficit has reached 5% of GDP.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

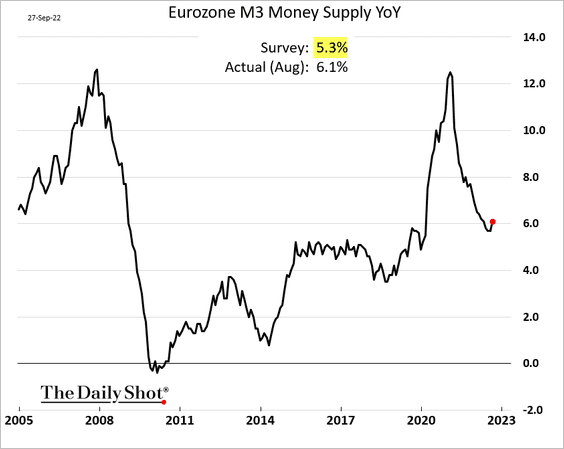

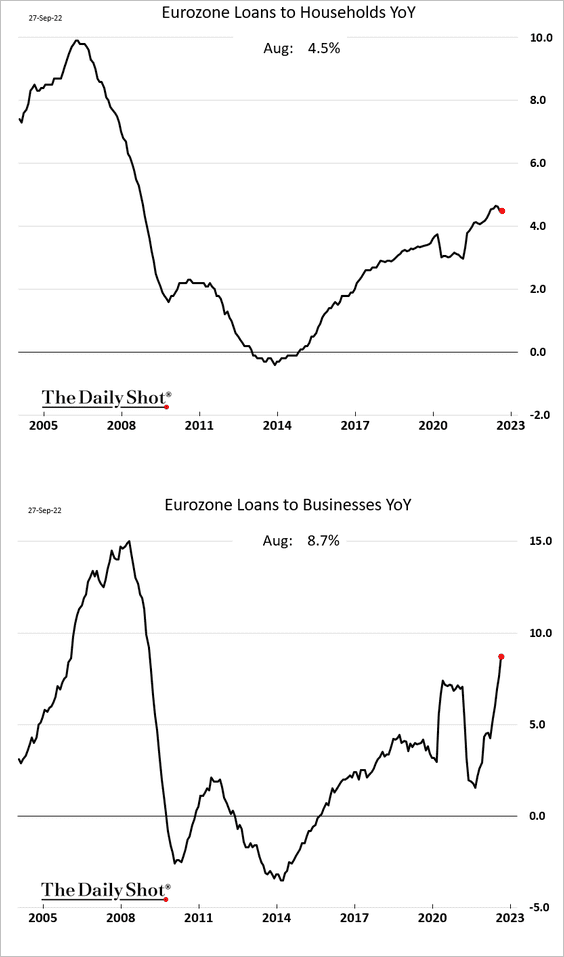

5. The broad money supply expansion surprised to the upside.

Loan growth has been robust, especially in the Eurozone’s business sector.

Back to Index

Japan

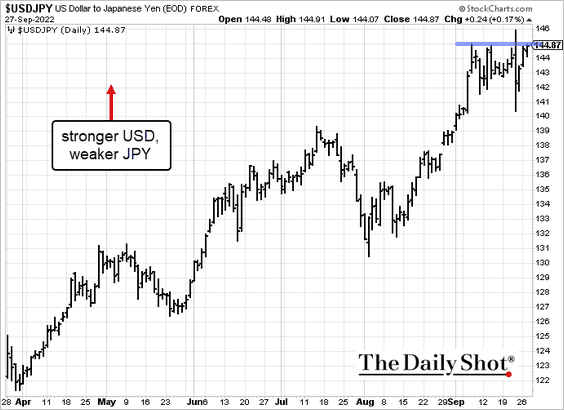

1. Another intervention on the way? USD/JPY is once again bumping up against the 145 level.

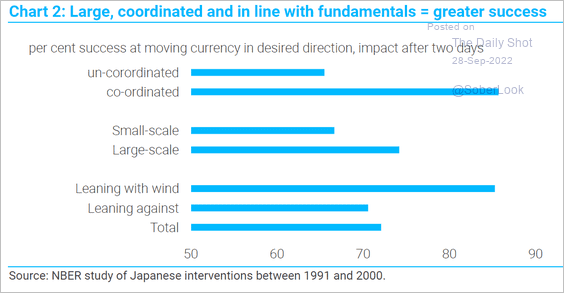

This chart shows the success rates of Japanese currency interventions.

Source: TS Lombard

Source: TS Lombard

——————–

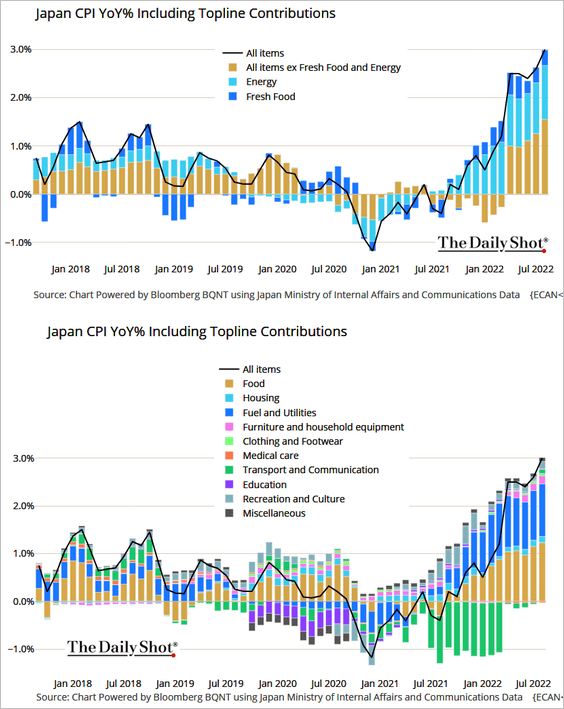

2. Next, we have the contributions to Japan’s CPI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

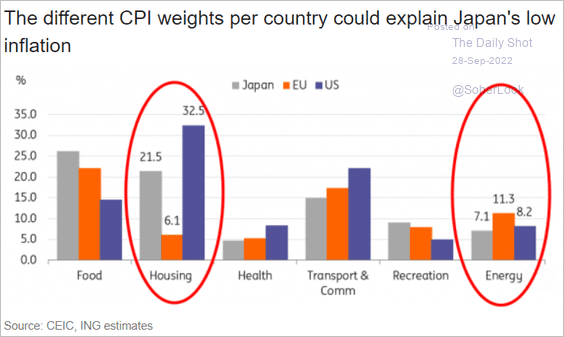

And here is a comparison of the CPI weights to the EU and the US.

Source: ING

Source: ING

Back to Index

Asia – Pacific

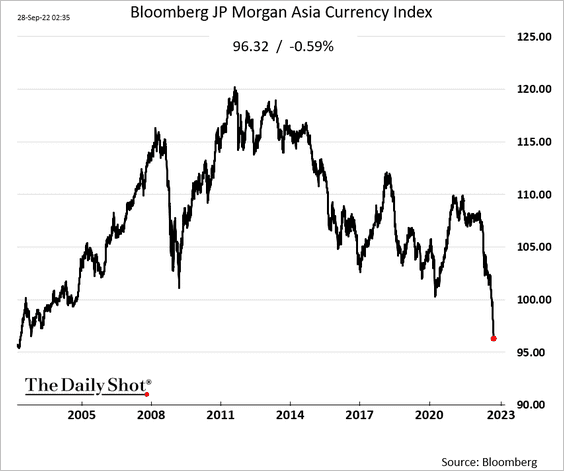

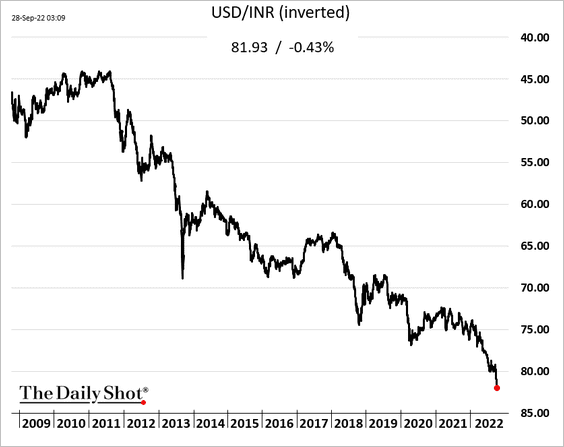

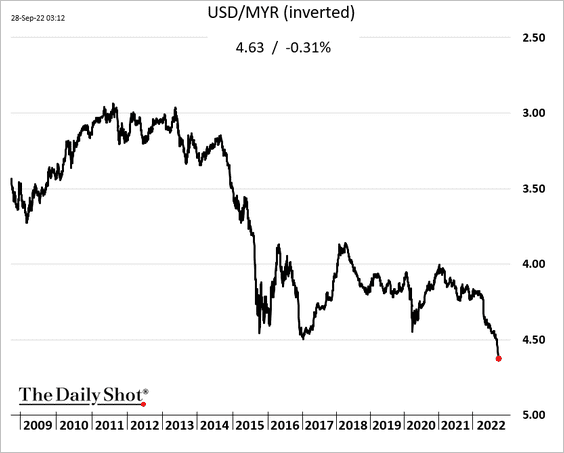

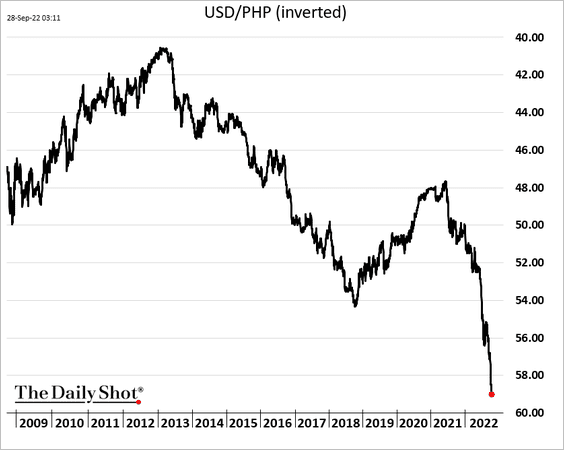

1. Asian currencies have resumed their declines.

2. Next, we have some updates on South Korea.

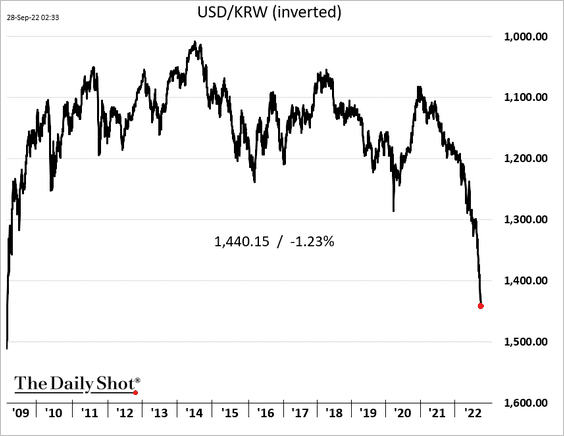

• Here is the won vs. USD. Will we see an intervention?

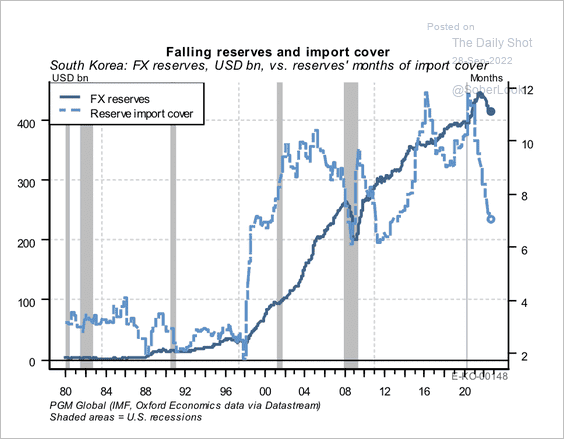

• Currency reserves have declined to reduce the drop in the Korean won. However, rising prices of imported goods, especially energy, have placed South Korea’s import cover ratio at decade lows.

Source: PGM Global

Source: PGM Global

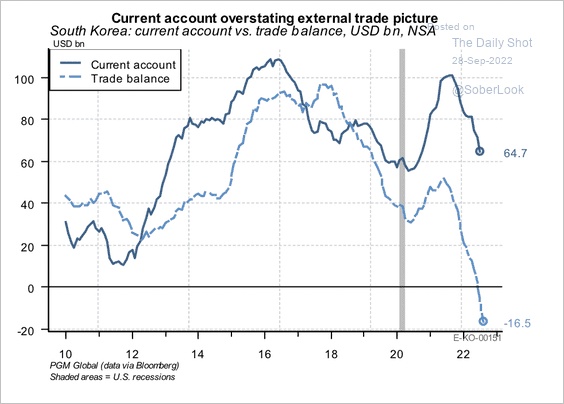

• South Korea’s current account is still holding up, mostly due to the accumulation of corporate profits, according to PGM Global. Meanwhile, the trade balance has deteriorated.

Source: PGM Global

Source: PGM Global

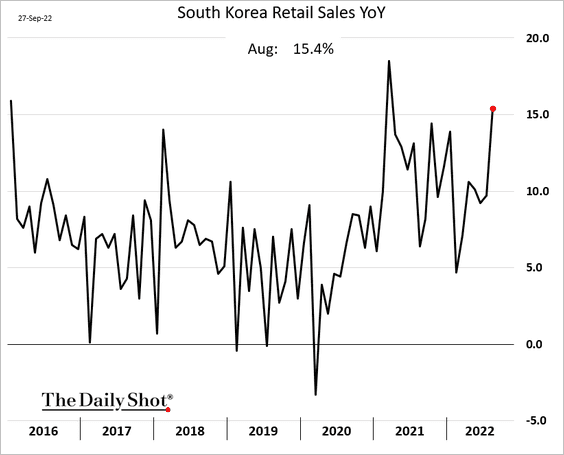

• Retail sales were robust in August.

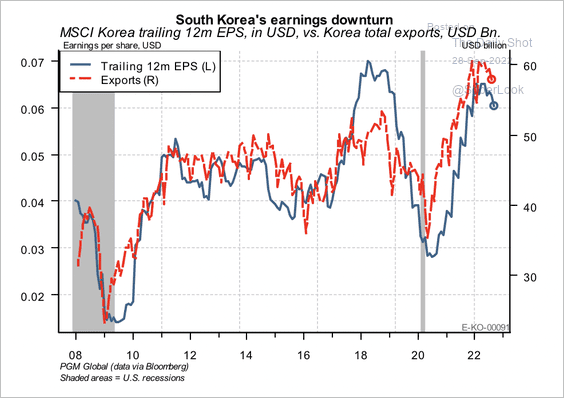

• South Korea’s earnings and exports are rolling over.

Source: PGM Global

Source: PGM Global

——————–

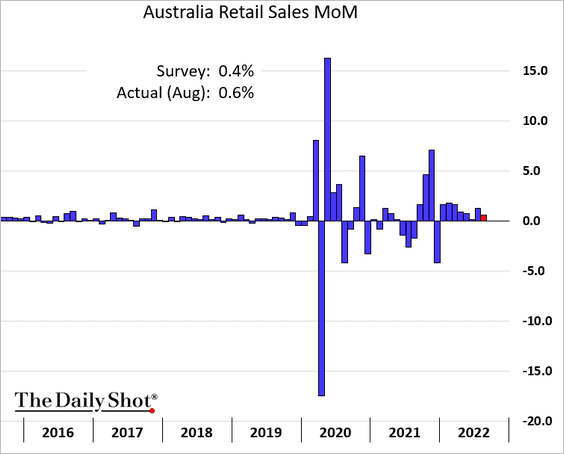

3. Australian retail sales surprised to the upside.

Back to Index

China

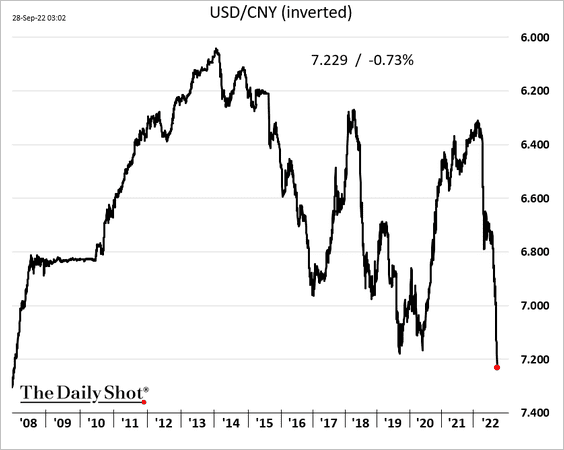

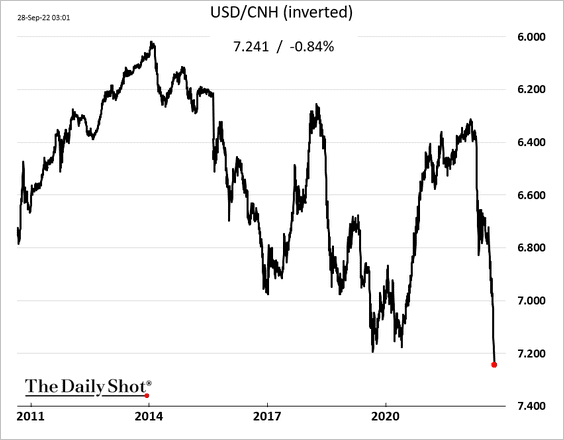

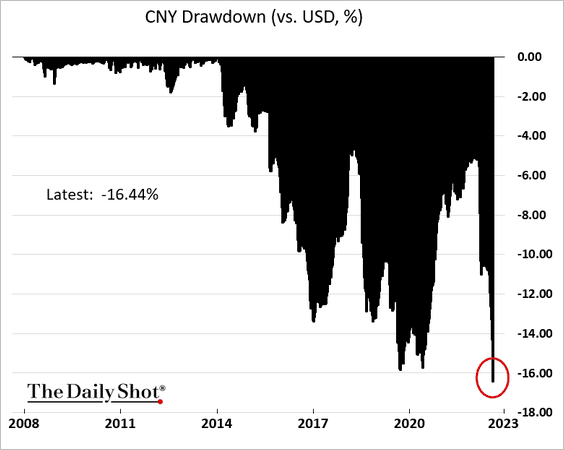

1. The PBoC has lost control of the renminbi.

The offshore renminbi hit a record low.

Source: @WSJ Read full article

Source: @WSJ Read full article

The renminbi drawdown has been unprecedented.

——————–

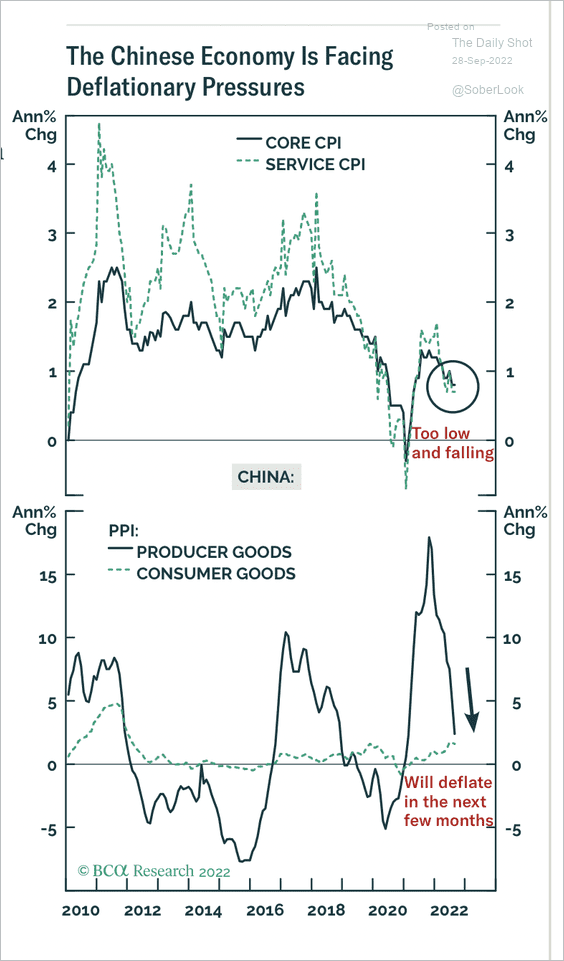

2. Inflation has decelerated rapidly. Will we see deflation?

Source: BCA Research

Source: BCA Research

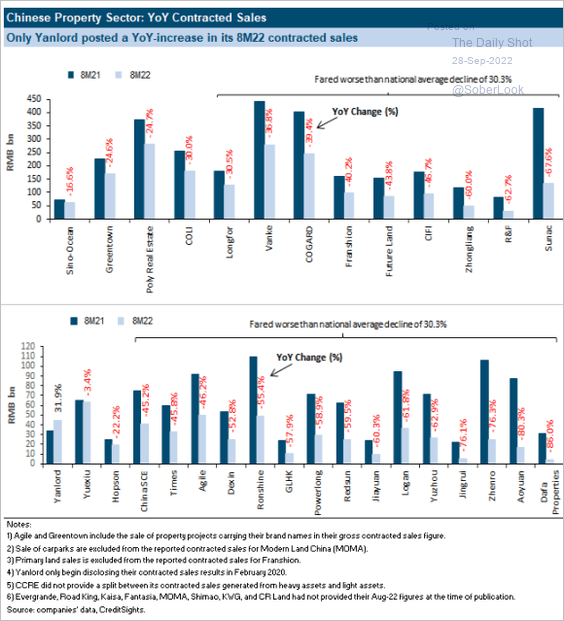

3. The declines in property sales have been broad.

Source: CreditSights

Source: CreditSights

Back to Index

Emerging Markets

1. Asian currencies are sinking, which could keep inflation elevated.

• The Indian rupee:

• The Malaysian ringgit:

• The Philippine peso:

——————–

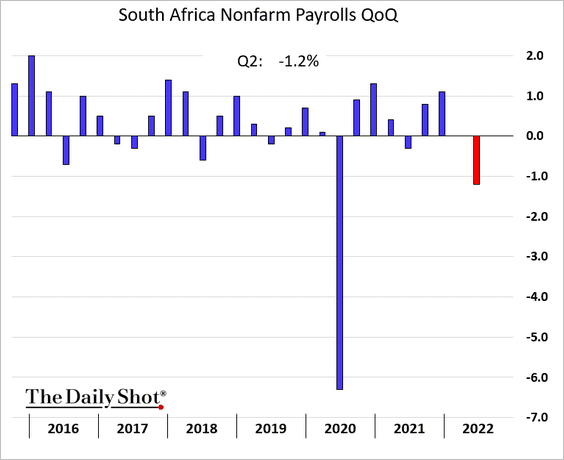

2. South Africa saw significant job losses last quarter.

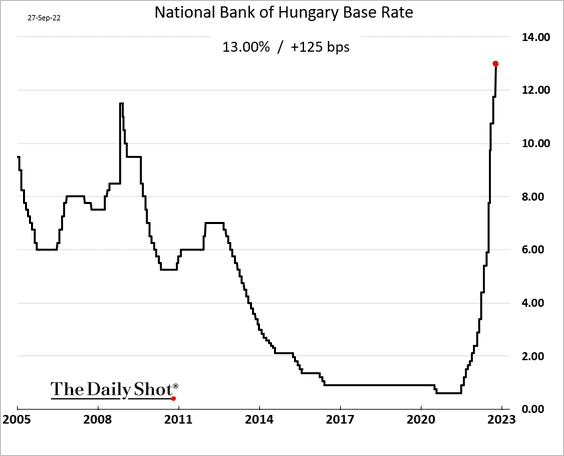

3. The Hungarian central bank took its benchmark rate to 13%.

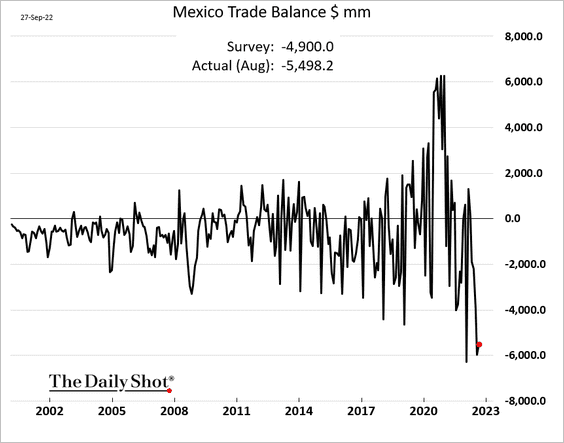

4. Mexico’s trade deficit is holding near record levels.

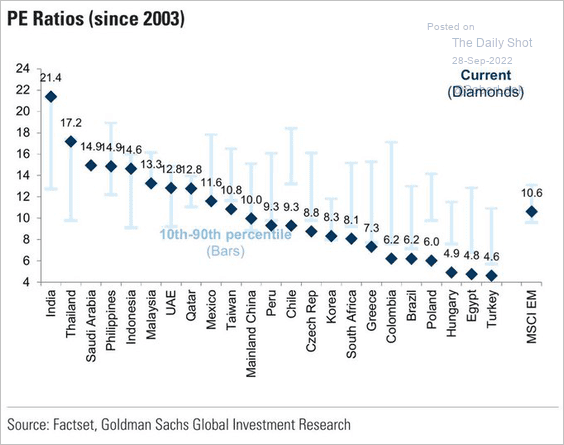

5. This chart shows equity markets’ PE ratios vs. historical ranges.

Source: Goldman Sachs; @AndreasSteno

Source: Goldman Sachs; @AndreasSteno

Back to Index

Commodities

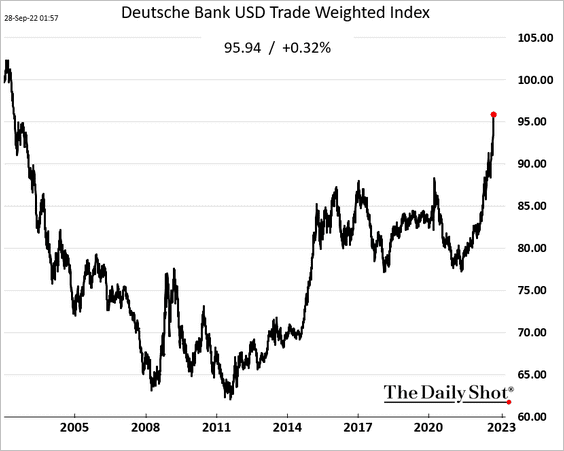

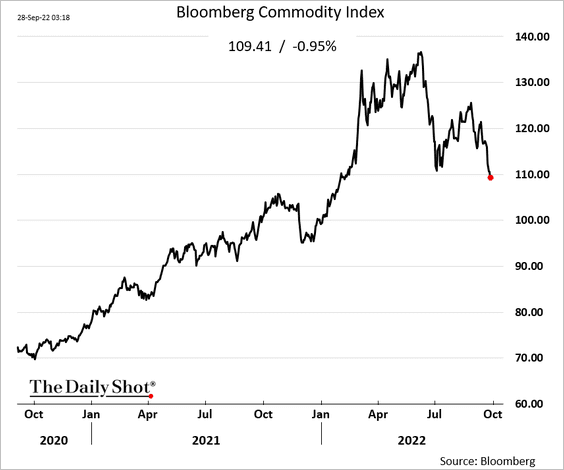

1. The US dollar continues to surge, …

… putting pressure on commodity markets.

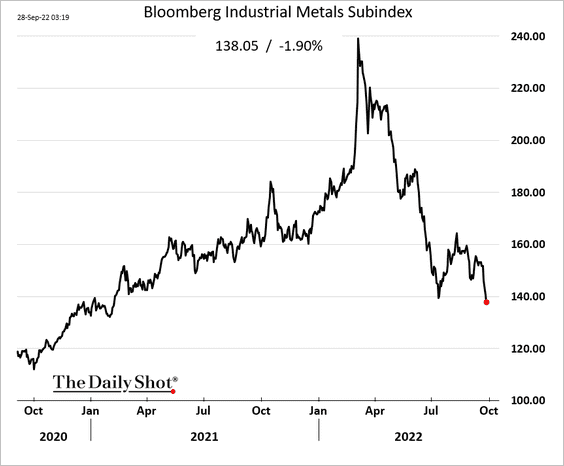

Here is Bloomberg’s industrial metals index.

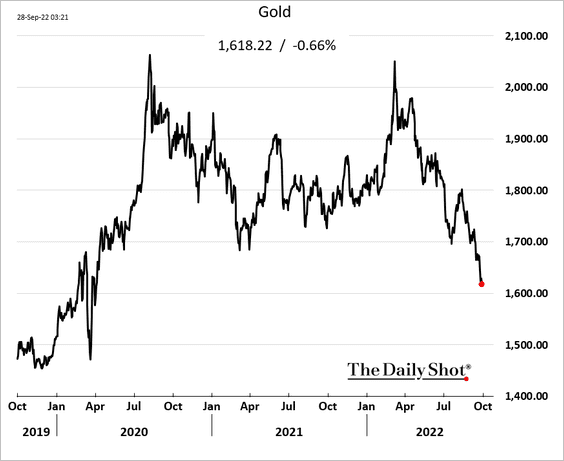

2. Gold is buckling as the dollar and real yields surge.

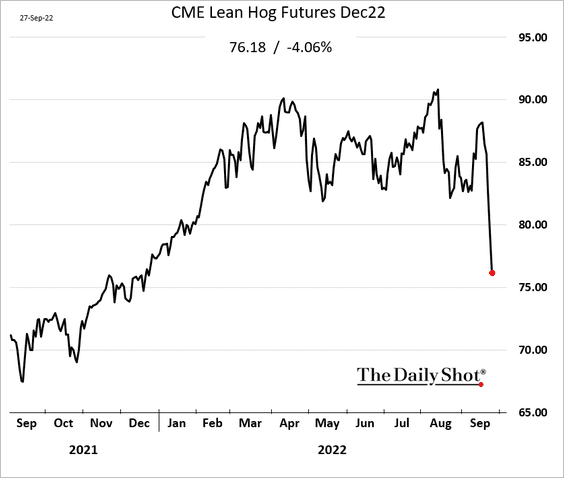

3. Chicago hog futures took a hit amid softer demand from Asia.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

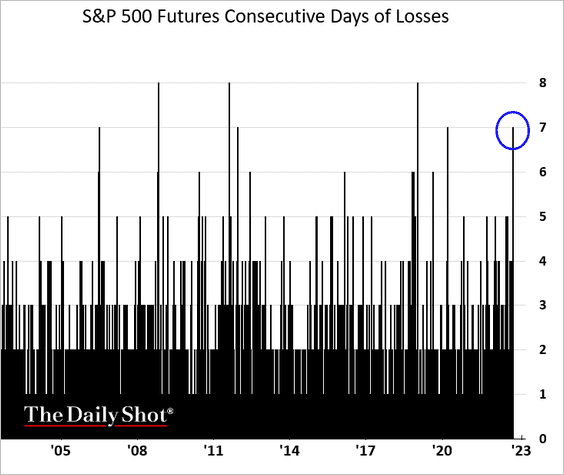

1. Stock futures point to a seventh consecutive day of losses for the S&P 500.

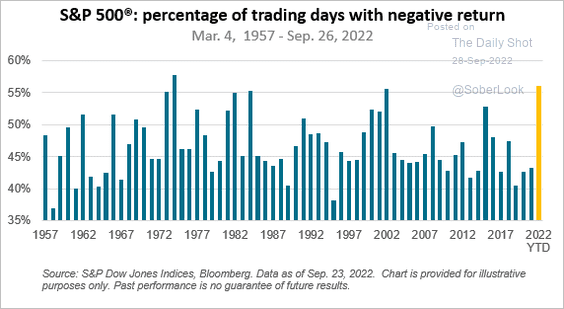

Here is the percentage of days with a negative return.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

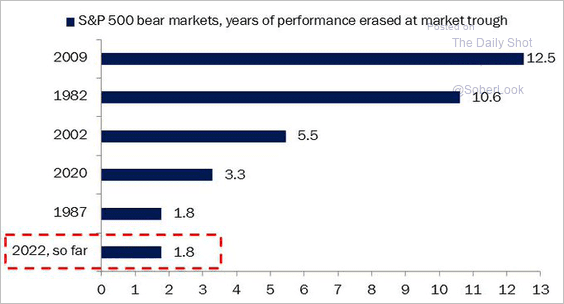

2. The S&P 500 has only given up 1.8 years of gains so far.

Source: @WolfvRotberg

Source: @WolfvRotberg

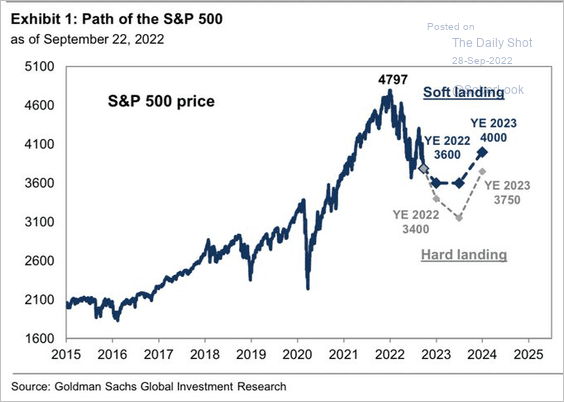

3. Hard or soft landing? Below is a forecast from Goldman.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

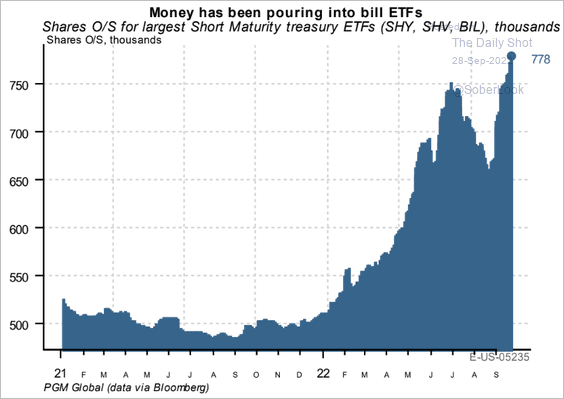

4. Spooked investors have been flooding into cash-equivalent ETFs

Source: PGM Global

Source: PGM Global

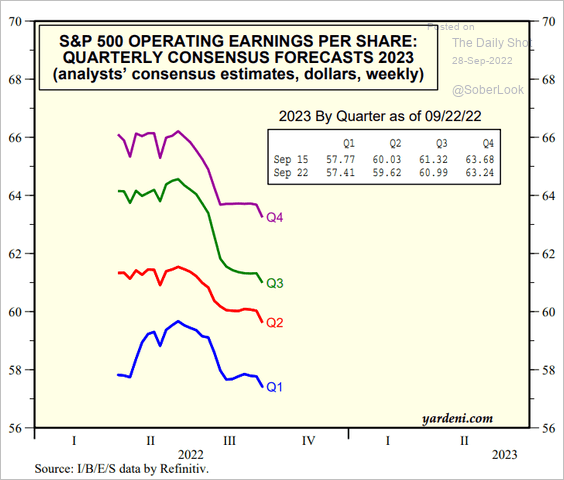

5. Earnings downgrades continue.

Source: Yardeni Research

Source: Yardeni Research

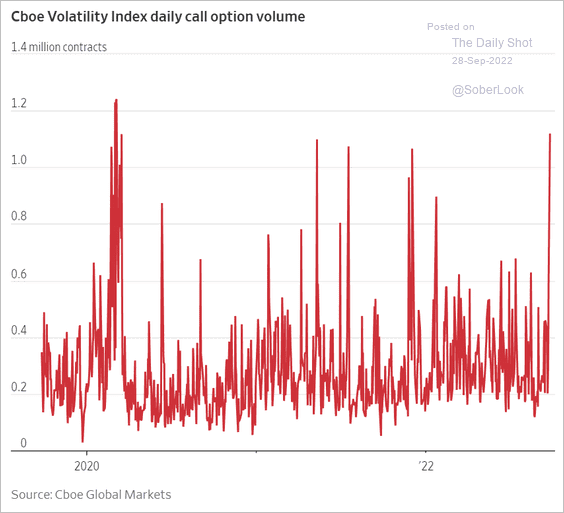

6. Traders have been buying VIX call options, preparing for another leg down in stock prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

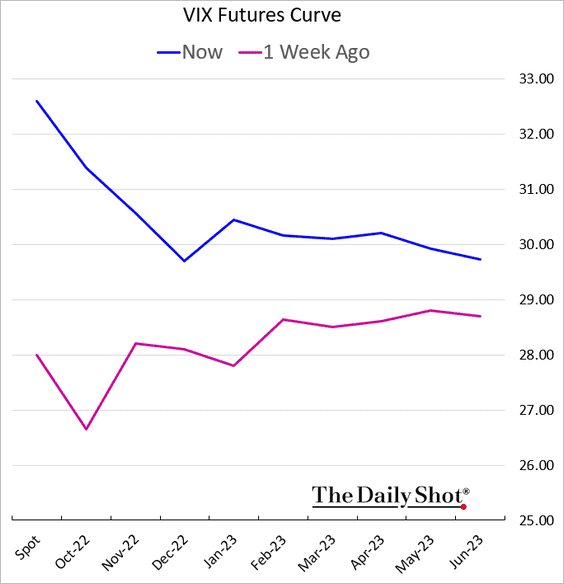

7. The VIX curve has finally inverted.

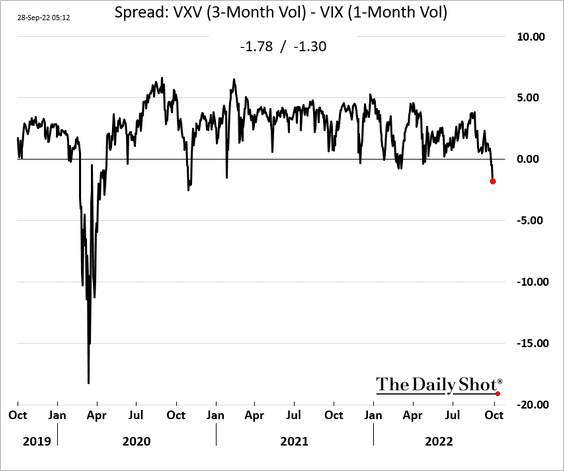

Here is the spread between VXV (3-month vol index) and VIX (1-month vol index).

——————–

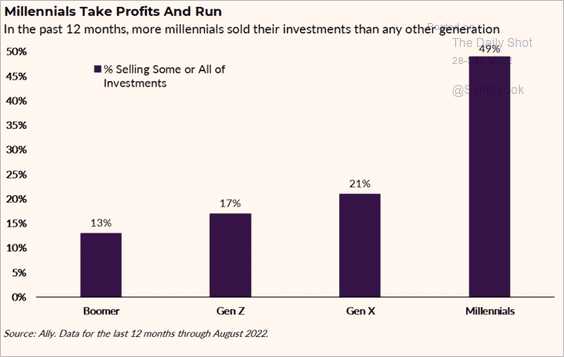

8. Millennials have been active traders.

Source: @MikeZaccardi Read full article

Source: @MikeZaccardi Read full article

Back to Index

Credit

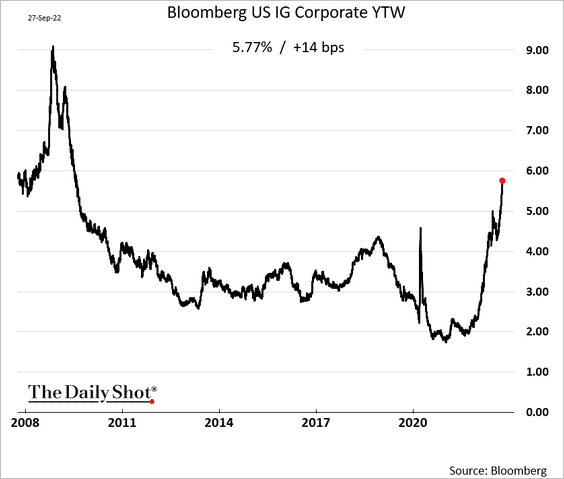

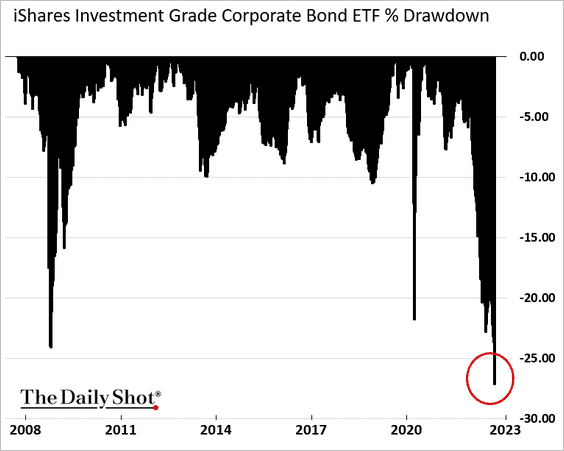

1. Corporate funding costs are surging as bond prices tumble.

Here is the drawdown for LQD.

——————–

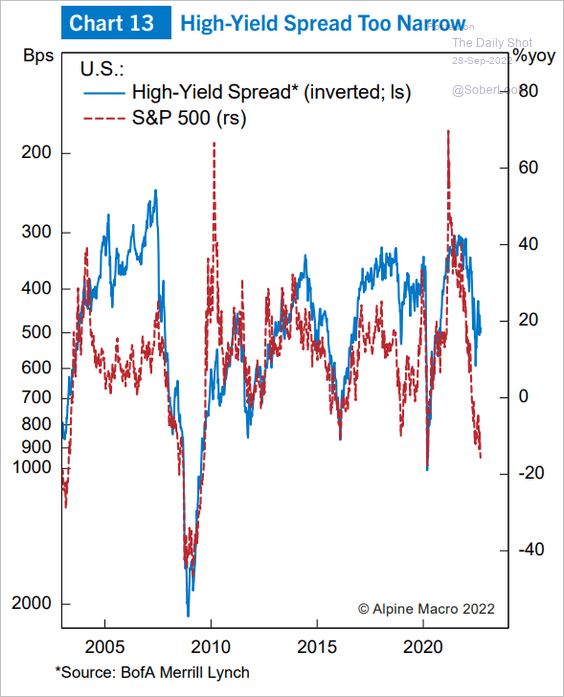

2. High-yield spreads are too tight relative to equities.

Source: Alpine Macro

Source: Alpine Macro

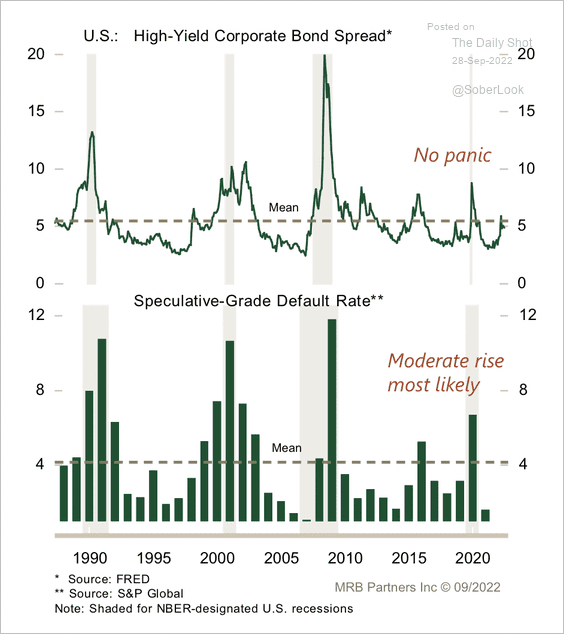

The US high-yield market is discounting a slowdown, not a recession.

Source: MRB Partners

Source: MRB Partners

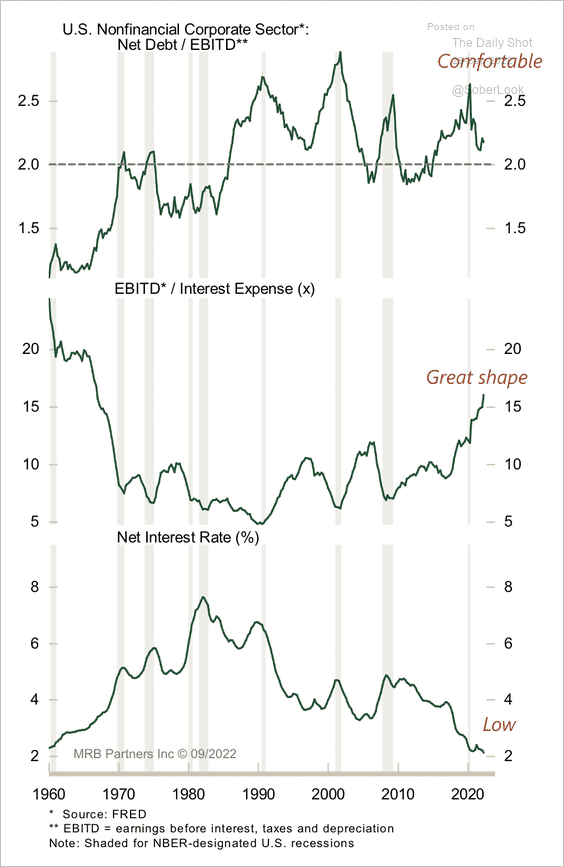

3. The US corporate debt servicing capacity is very strong.

Source: MRB Partners

Source: MRB Partners

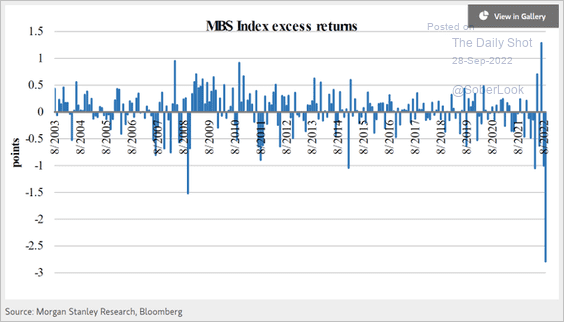

4. The MBS index underperformance has been extreme, putting upward pressure on mortgage rates.

Source: Morgan Stanley; @tracyalloway

Source: Morgan Stanley; @tracyalloway

Back to Index

Rates

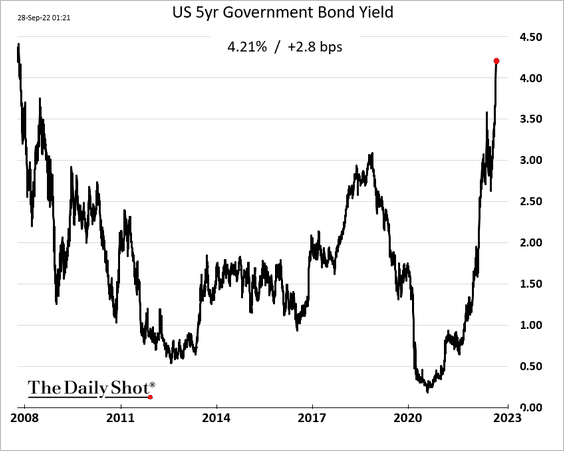

1. A weak auction sent the 5-year Treasury yield surging. Is it time to buy?

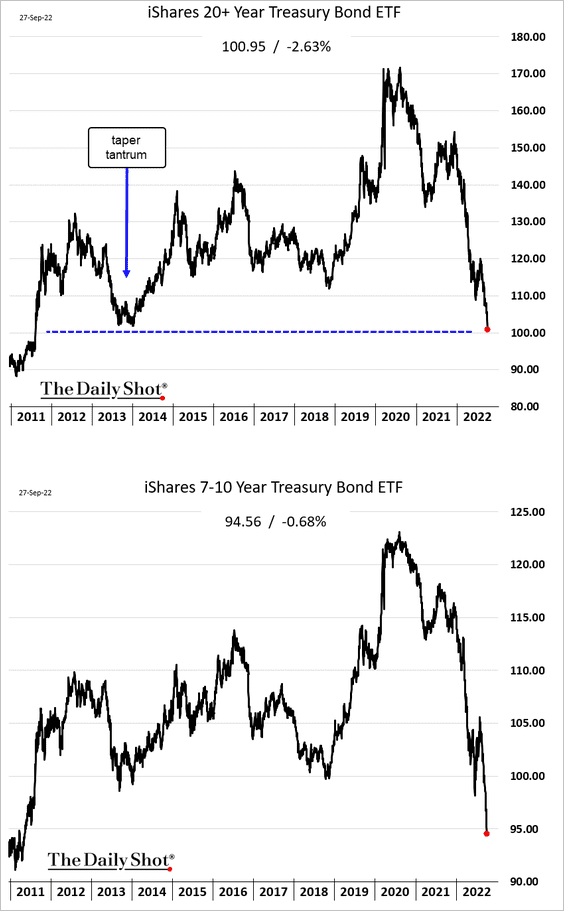

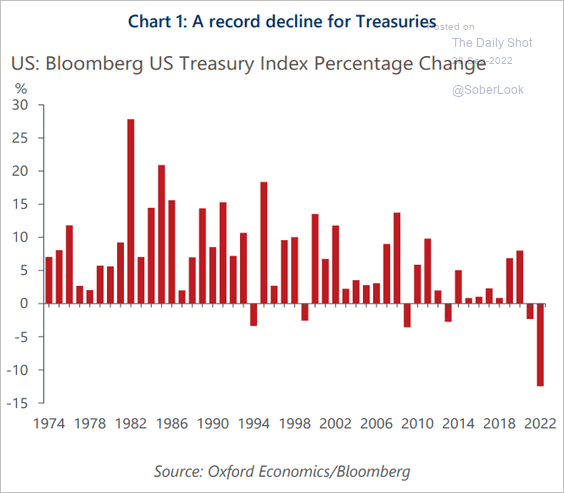

2. Here is the price performance of Treasuries over the past decade.

This year’s decline has been extreme.

Source: Oxford Economics

Source: Oxford Economics

——————–

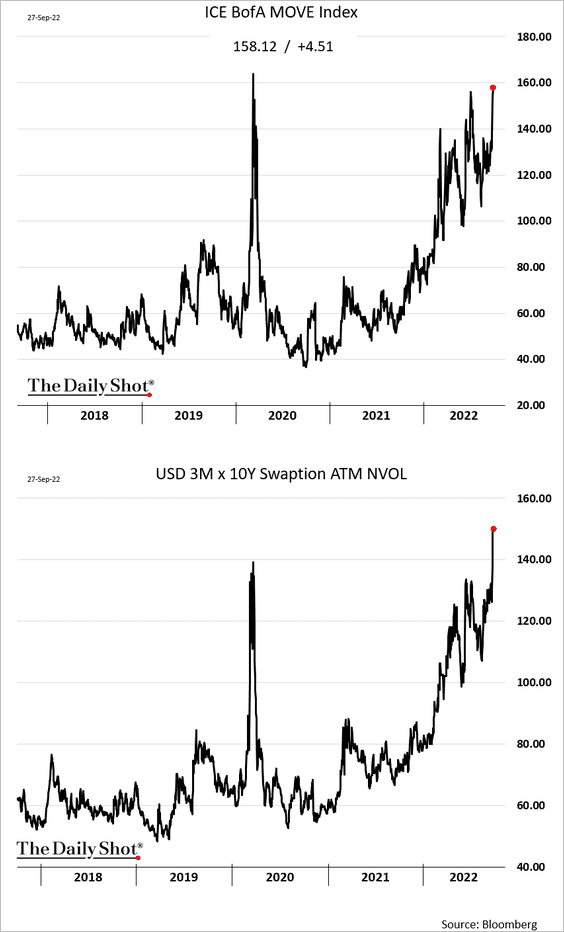

3. US rate markets’ implied volatility is surging.

Back to Index

Global Developments

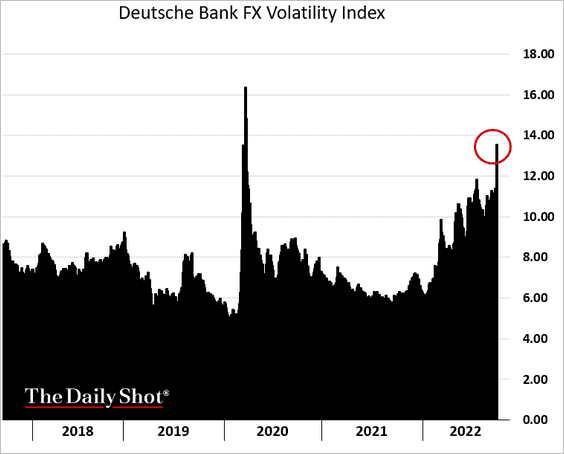

1. FX implied volatility keeps rising.

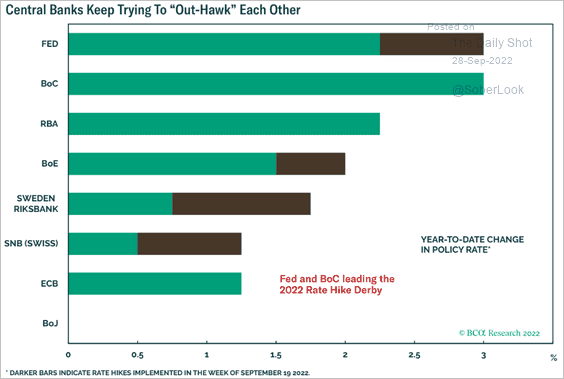

2. A race to the top …

Source: BCA Research

Source: BCA Research

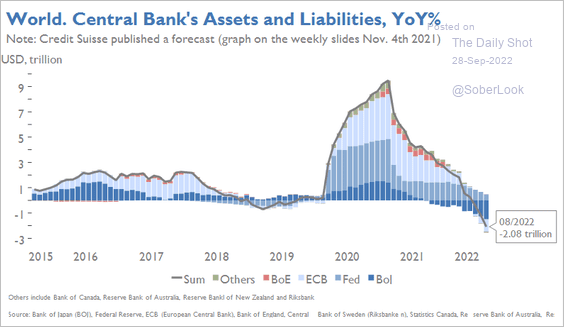

3. Central banks’ balance sheets continue to shrink.

Source: Arcano Economics

Source: Arcano Economics

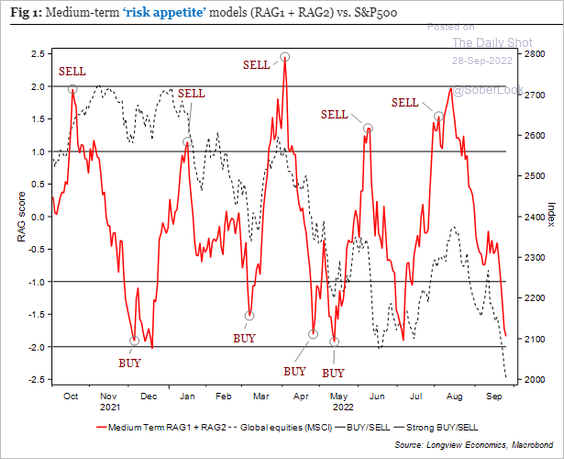

4. Global risk appetite is back at the June lows, according to Longview Economics.

Source: Longview Economics

Source: Longview Economics

——————–

Food for Thought

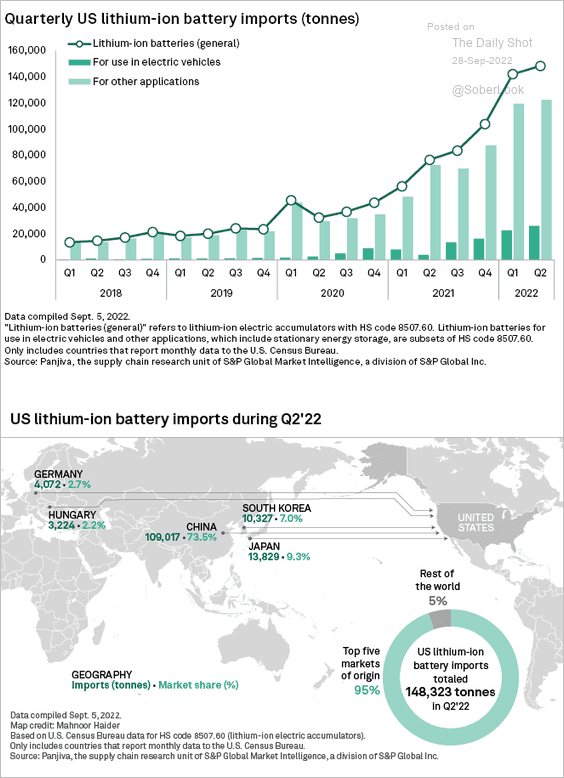

1. US lithium-ion battery imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

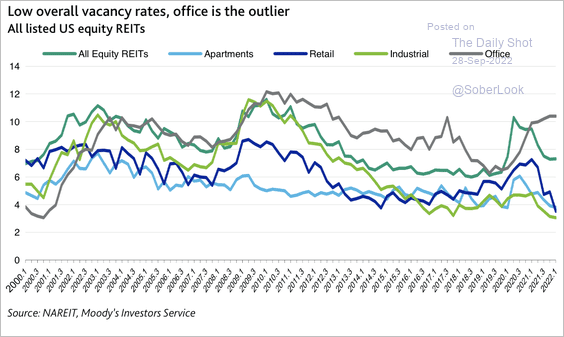

2. Commercial real estate vacancy rates in the US:

Source: Moody’s Investors Service

Source: Moody’s Investors Service

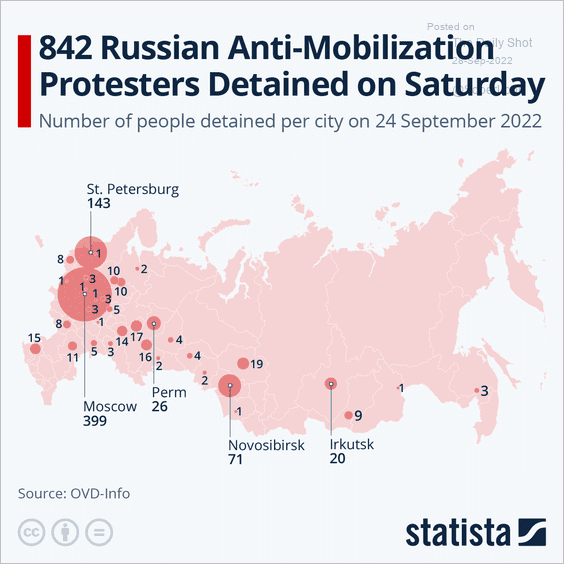

3. Russian anti-mobilization protests:

Source: Statista

Source: Statista

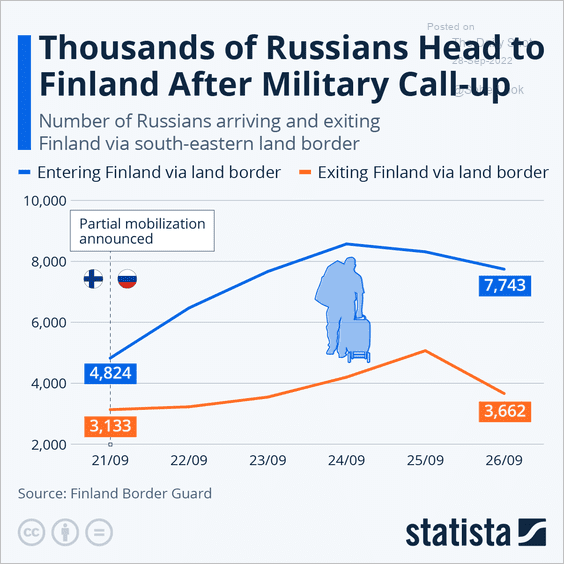

• Russians heading to Finland:

Source: Statista

Source: Statista

——————–

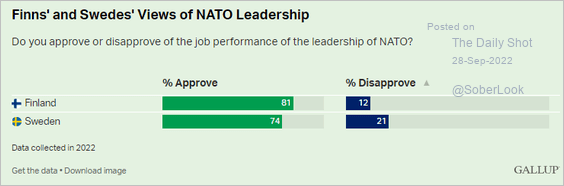

4. NATO’s job approval in Finland and Sweden:

Source: Gallup Read full article

Source: Gallup Read full article

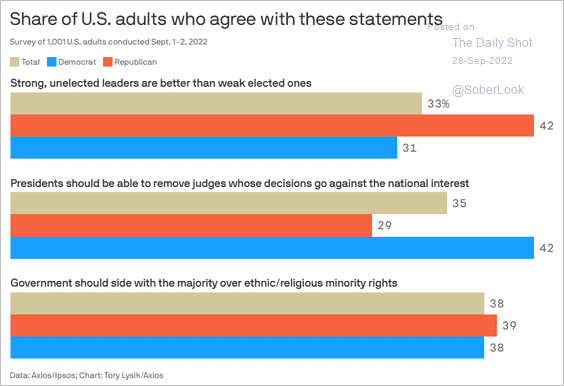

5. Support for nondemocratic norms in the US:

Source: @axios Read full article

Source: @axios Read full article

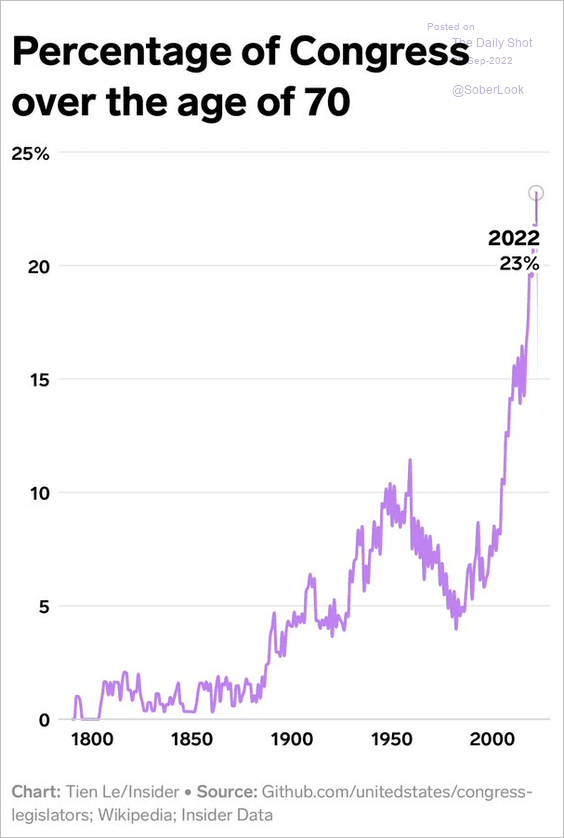

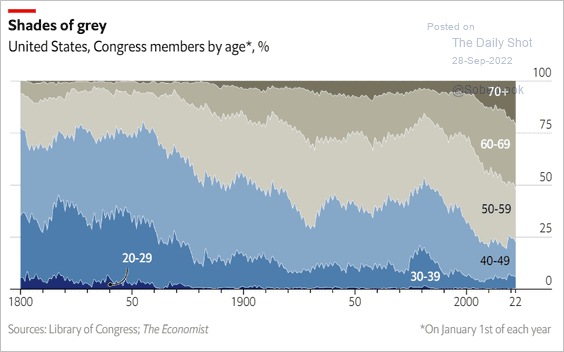

6. The oldest Congress in history (2 charts):

Source: Insider Read full article

Source: Insider Read full article

Source: The Economist Read full article

Source: The Economist Read full article

——————–

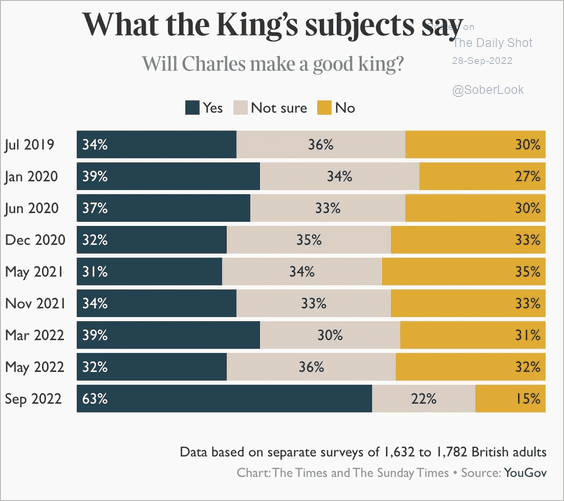

7. Will Charles make a good king?

Source: @thetimes

Source: @thetimes

——————–

Back to Index