The Daily Shot: 29-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

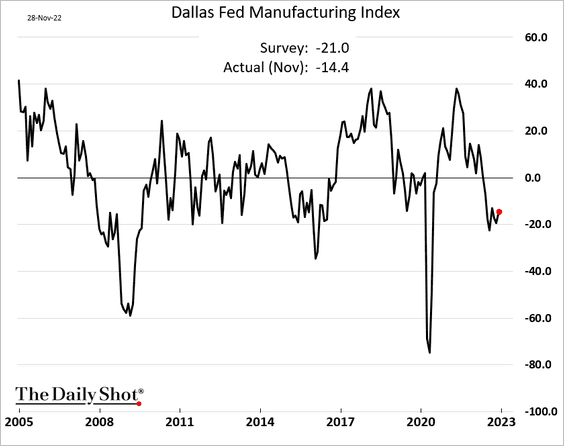

1. The Dallas Fed’s regional manufacturing index edged higher this month, but it continues to signal declining manufacturing activity.

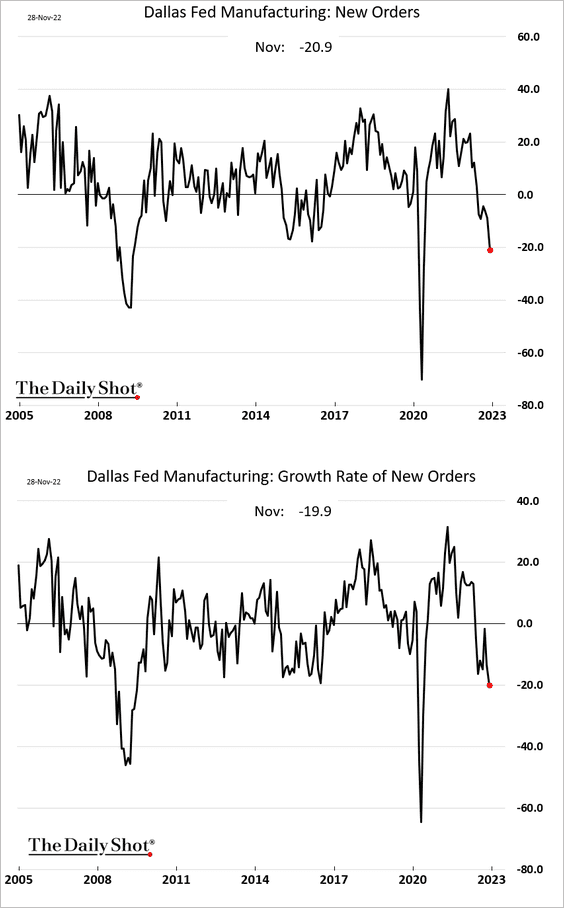

• Demand keeps deteriorating.

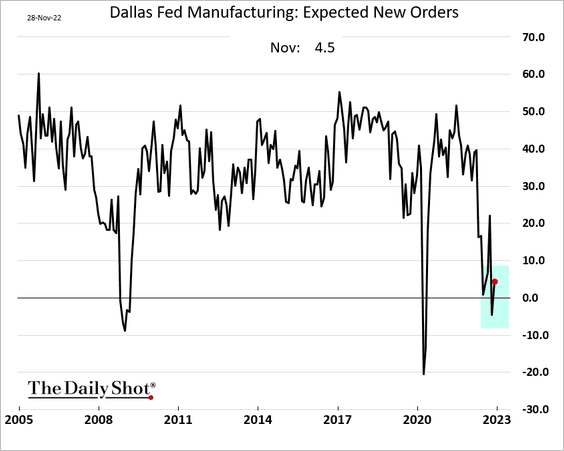

• The uptick in the headline index was driven by an improvement in expectations.

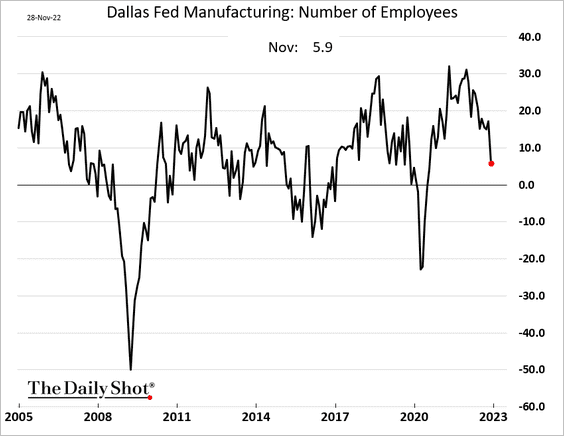

• Hiring has been slowing.

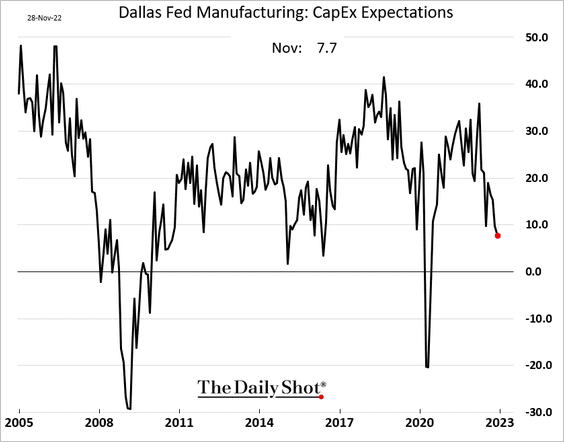

• CapEx expectations are moderating.

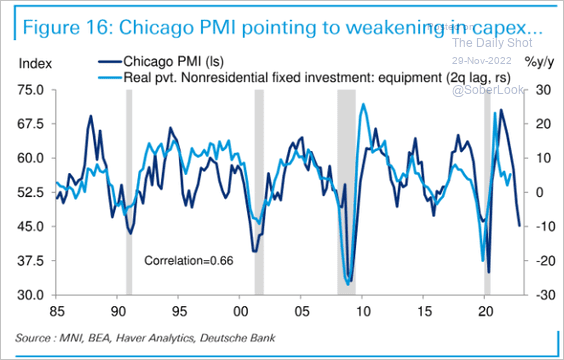

By the way, other indicators also signal slower business investment ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

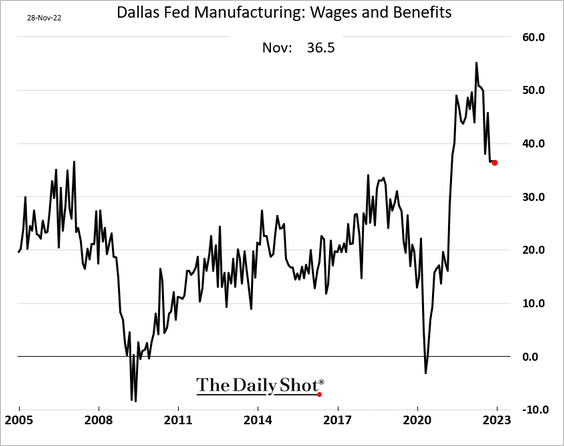

• Wage pressures are off the highs but remain elevated.

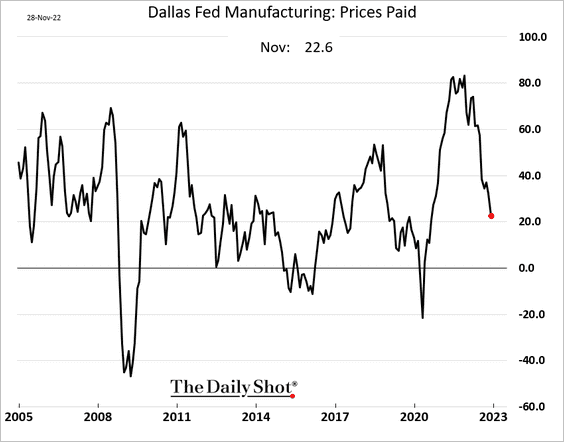

• Cost pressures are moderating.

——————–

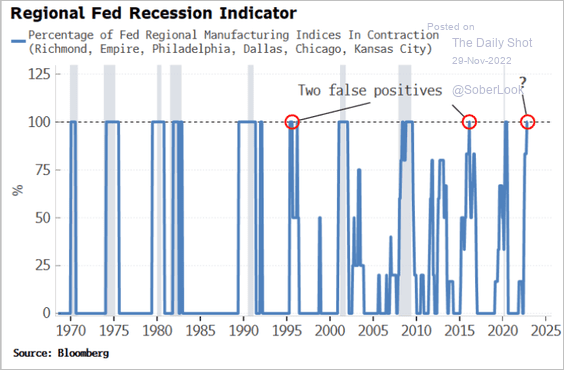

2. All the regional Fed indices (such as the one from the Dallas Fed) are now in contraction.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

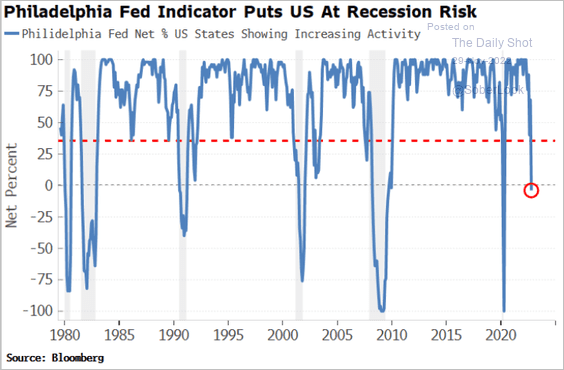

• More states are reporting declining economic activity, which typically occurs around recessions.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

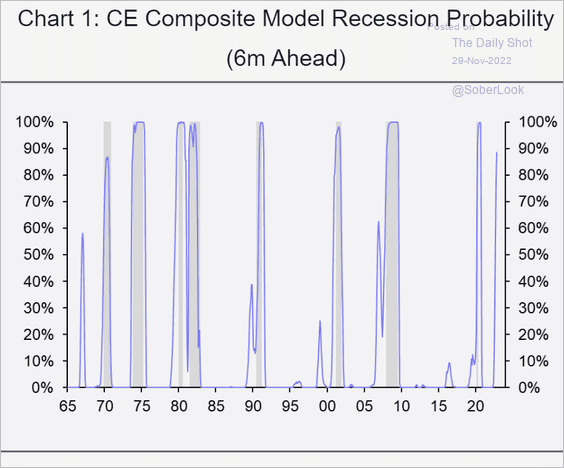

• Recession models continue to flash warning signals.

– Capital Economics:

Source: Capital Economics

Source: Capital Economics

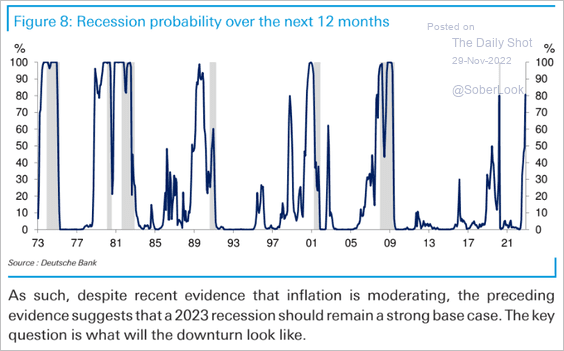

– Deutsche Bank:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

3. Next, we have some updates on the labor market.

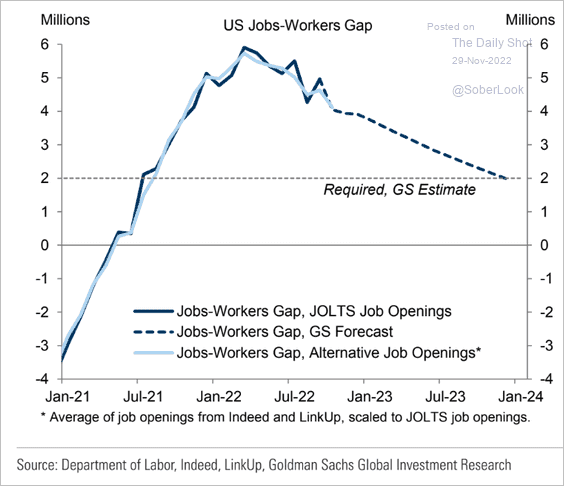

• How long will it take for the Fed to bring the labor market into balance?

Source: Goldman Sachs

Source: Goldman Sachs

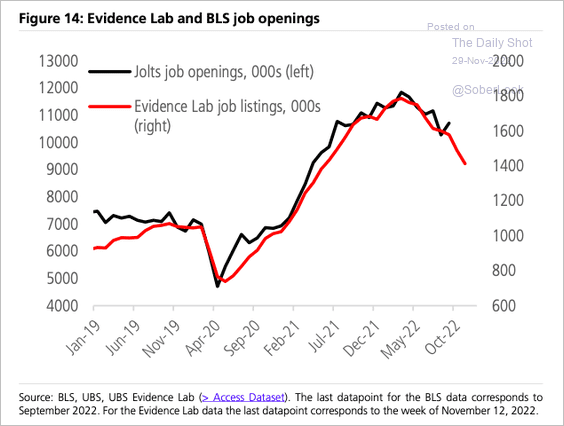

• High-frequency indicators point to further declines in job openings.

Source: UBS Research; @SamRo, h/t @dailychartbook

Source: UBS Research; @SamRo, h/t @dailychartbook

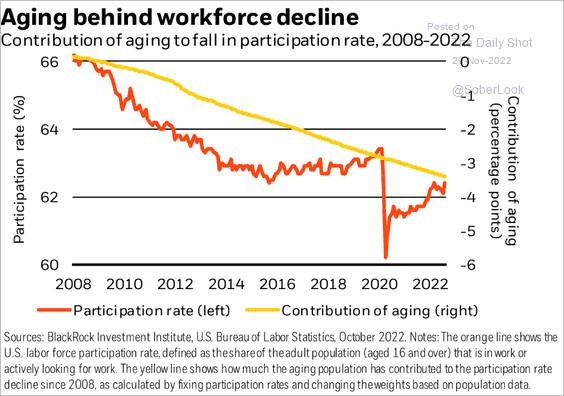

• The rebound in labor force participation is limited by demographics.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

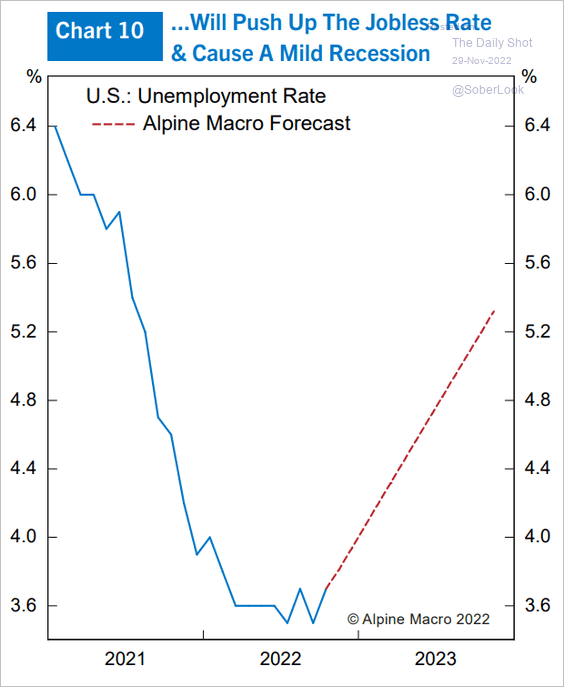

• How high will the unemployment rate get next year? Here is a forecast from Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

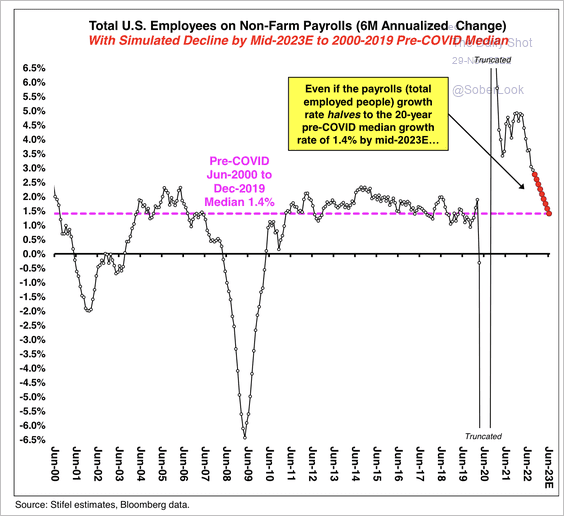

• Stifel expects payroll growth to cool toward the 20-year pre-COVID median, which would resemble a soft economic landing.

Source: Stifel

Source: Stifel

• More tech job losses ahead?

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

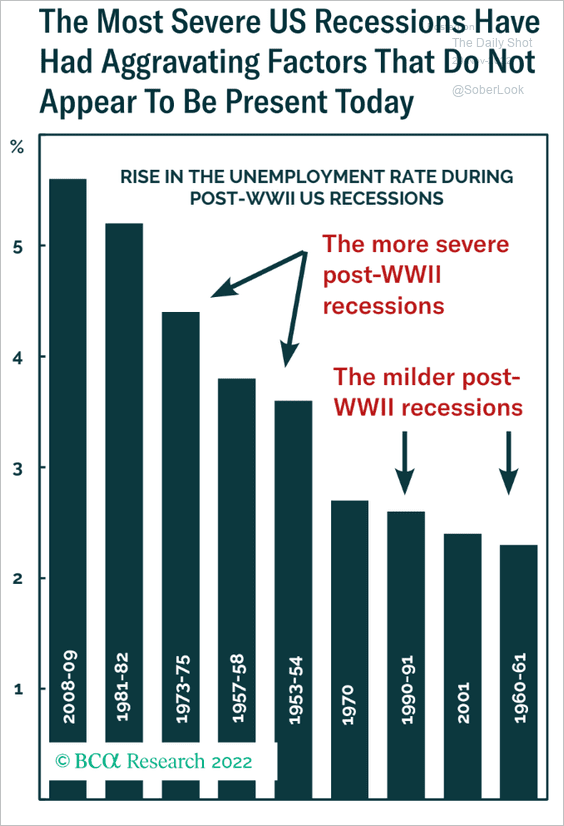

• How much does US unemployment increase during recessions?

Source: BCA Research

Source: BCA Research

——————–

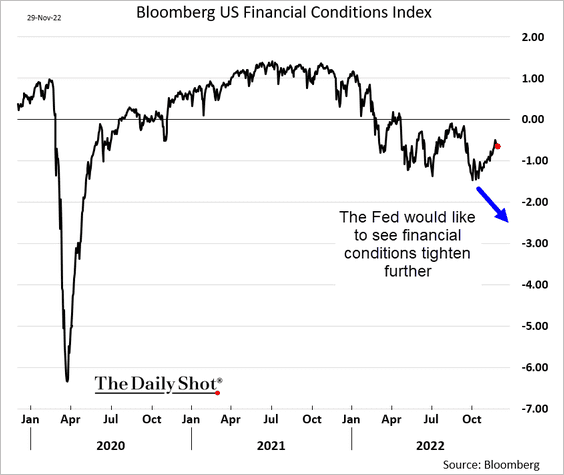

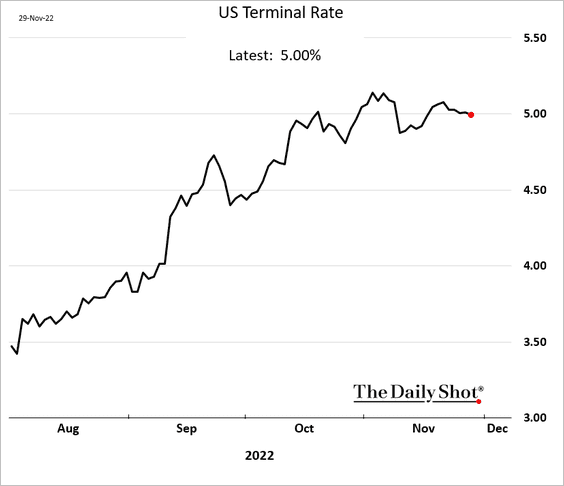

4. Fed officials have maintained a hawkish tone in recent days as they see financial conditions moving in the “wrong” direction.

Nonetheless, the terminal rate is holding at 5%.

——————–

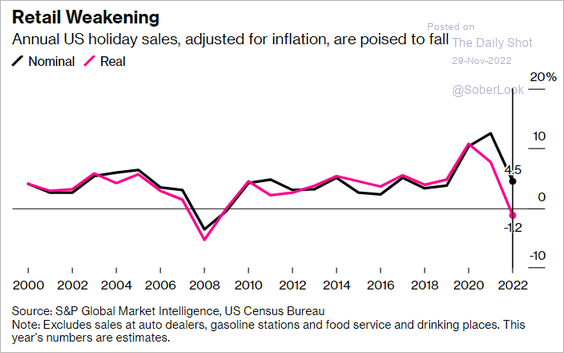

5. Real holiday sales growth is estimated to be negative.

Source: @business, @gablova, @JENeumann Read full article

Source: @business, @gablova, @JENeumann Read full article

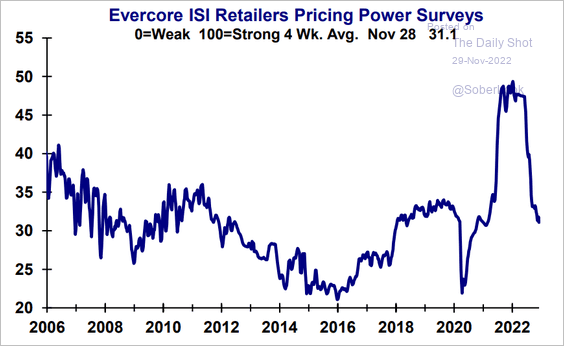

Retailers’ pricing power continues to moderate, according to data from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Canada

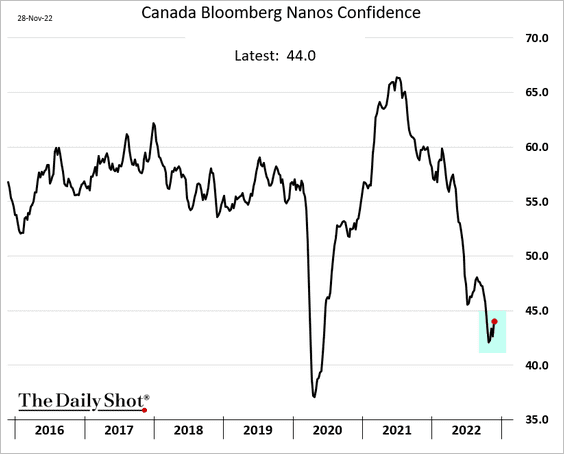

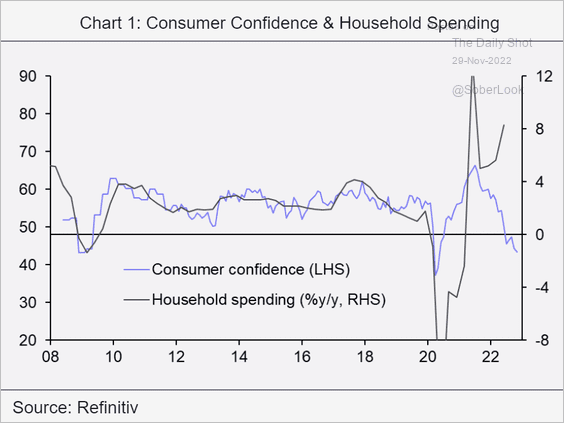

1. Consumer confidence appears to have stabilized.

Nonetheless, it points to a sharp decline in household spending ahead.

Source: Capital Economics

Source: Capital Economics

——————–

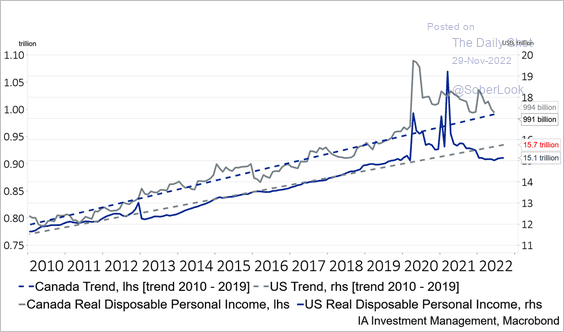

2. This chart shows Canada’s real disposable personal income compared to the US.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

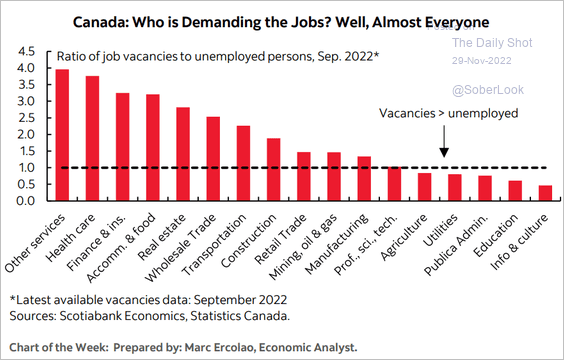

3. Labor demand remains robust.

Source: Scotiabank Economics

Source: Scotiabank Economics

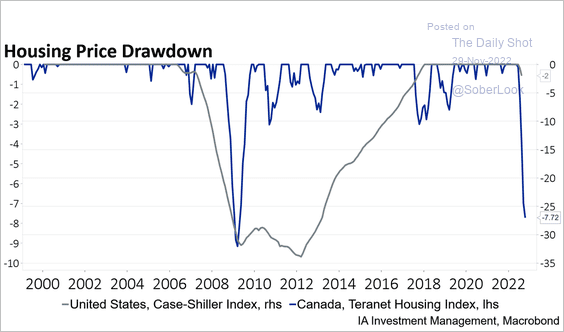

4. The housing market drawdown has been extreme.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

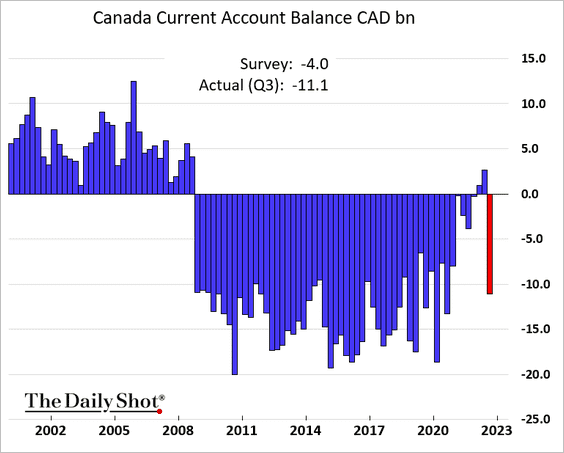

5. Canada’s current account swung back into deficit last quarter.

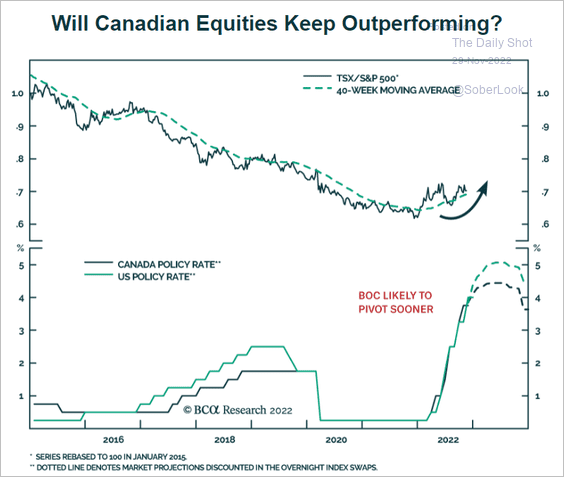

6. Will Canada’s stocks keep outperforming the US?

Source: BCA Research

Source: BCA Research

Back to Index

The United Kingdom

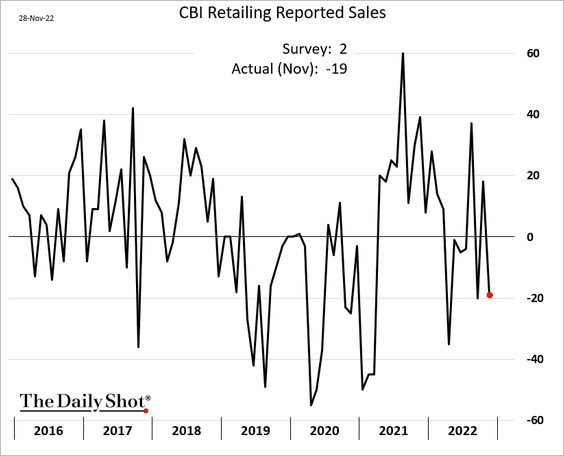

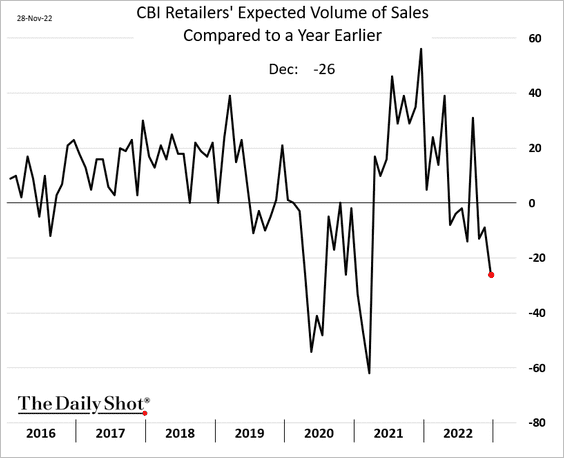

1. The CBI retail sales index unexpectedly moved into negative territory this month.

Source: CBI Read full article

Source: CBI Read full article

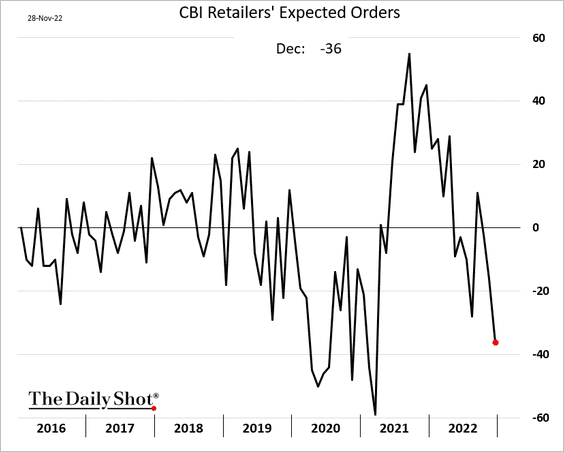

• Retailers expect to massively cut back on new orders, …

… as sales expectations slump.

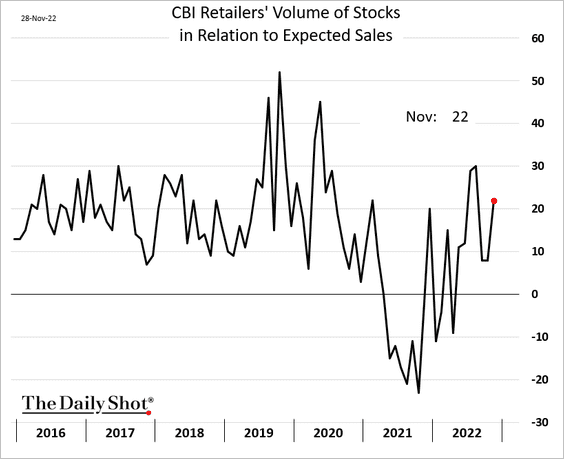

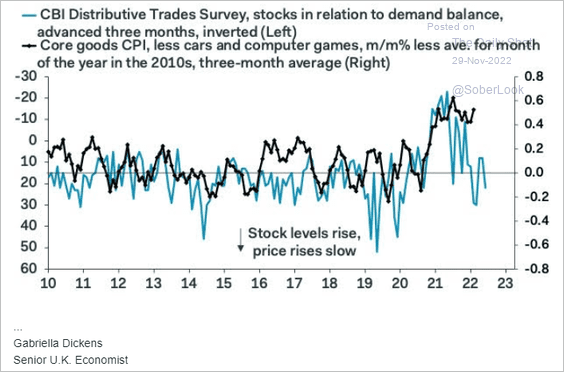

• Inventories have been rebounding, …

… which should ease price pressures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

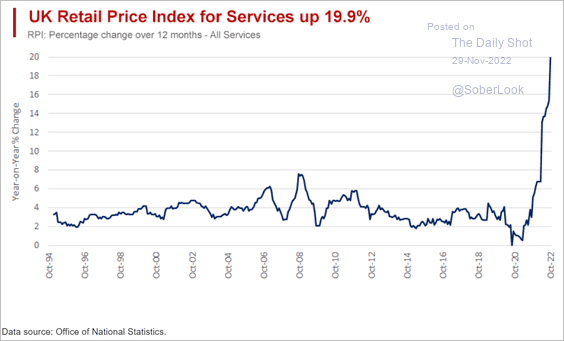

2. Retail services inflation is at 20%.

Source: World Economics Read full article

Source: World Economics Read full article

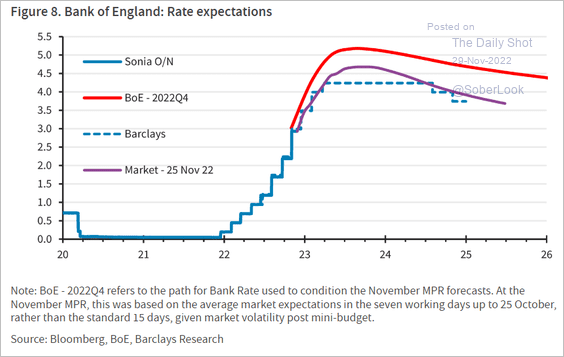

3. What terminal rate should we expect from the BoE?

• Barclays, BoE, and market forecasts:

Source: Barclays Research

Source: Barclays Research

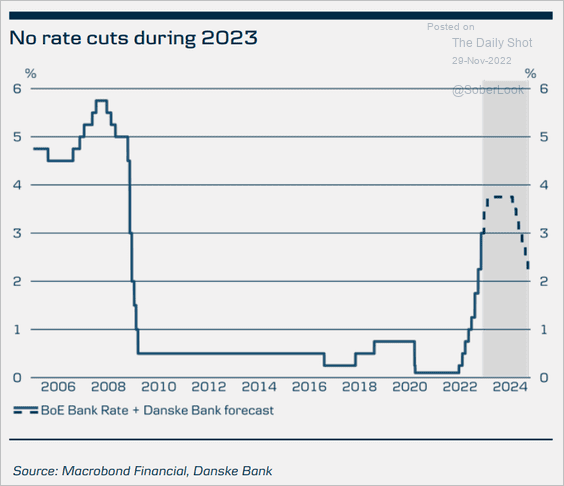

• Danske Bank:

Source: Danske Bank

Source: Danske Bank

Back to Index

The Eurozone

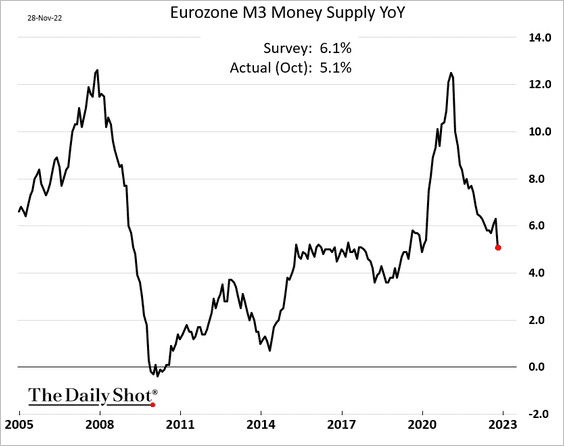

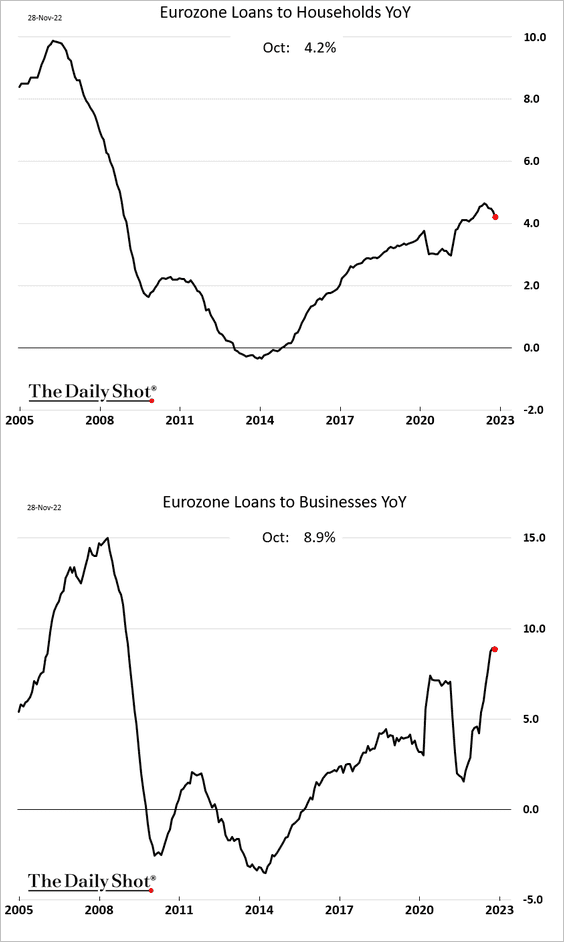

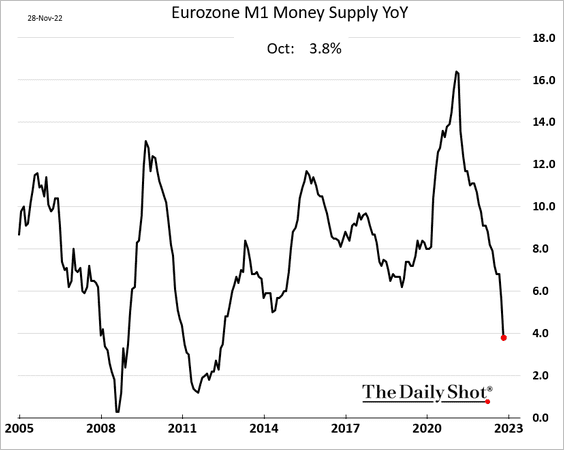

1. The money supply growth is slowing rapidly, …

… even as loan growth has been relatively robust.

The slowdown in the narrow money supply (M1) has been particularly rapid.

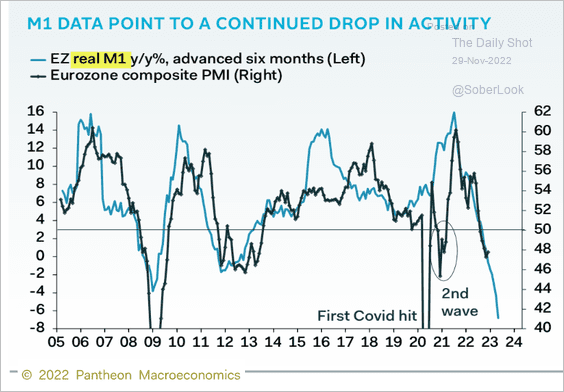

Real M1 has been contracting sharply, signaling a crash in business activity (PMI).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

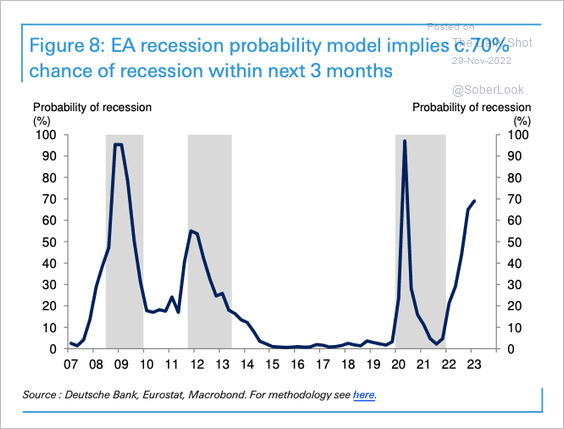

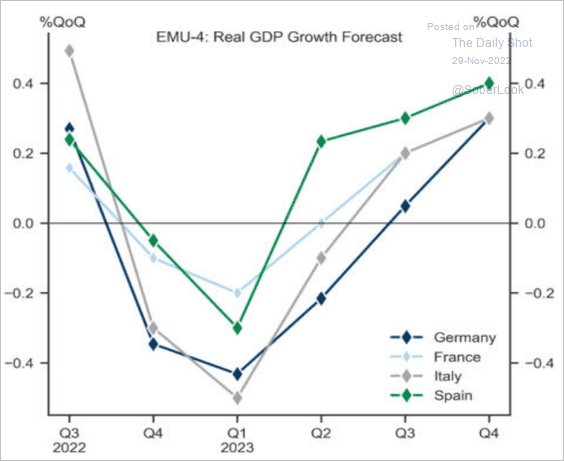

2. Deutsche Bank places a 70% chance of recession for the euro area within the next three months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

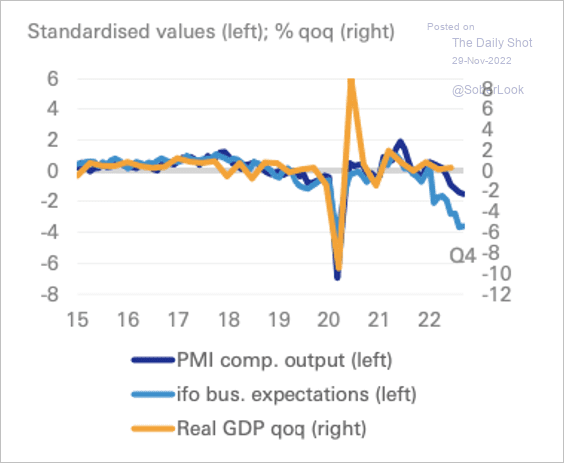

Survey data still point to a recession in Germany.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

According to Goldman, the recession has already started.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

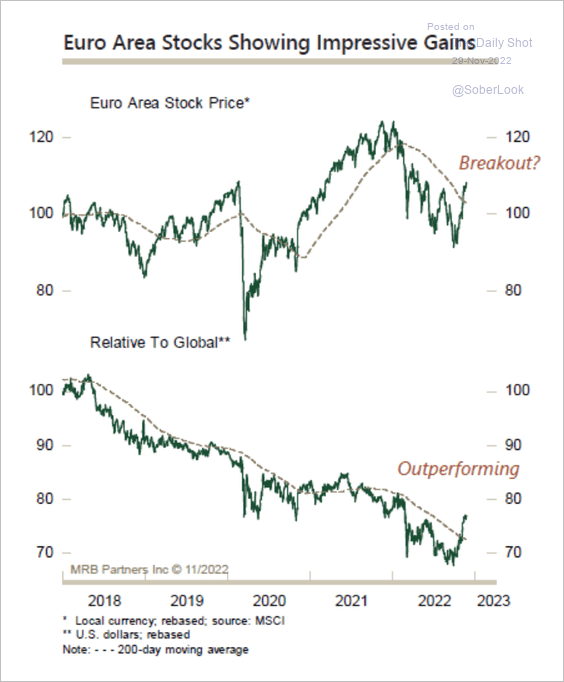

3. Euro area stocks are starting to outperform.

Source: MRB Partners

Source: MRB Partners

Back to Index

Japan

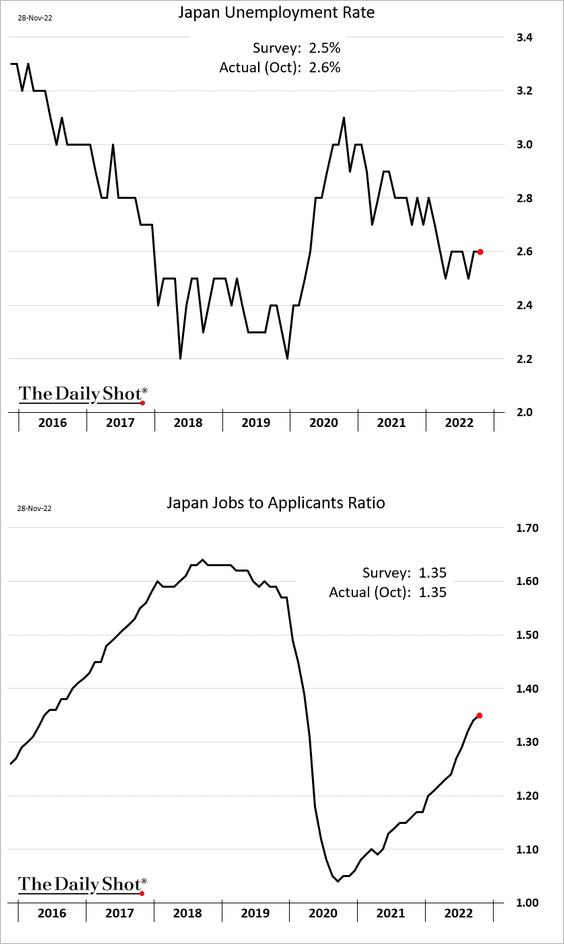

1. The unemployment rate has leveled off, but the jobs-to-applicants ratio keeps grinding higher.

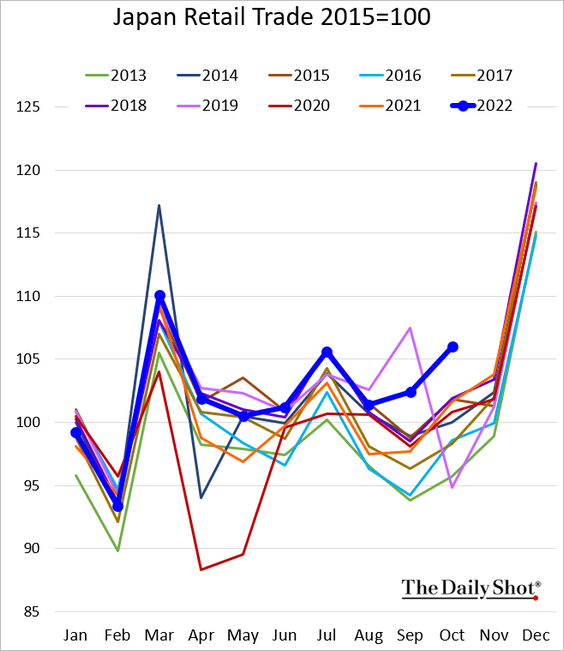

2. Retail sales remain well above last year’s levels.

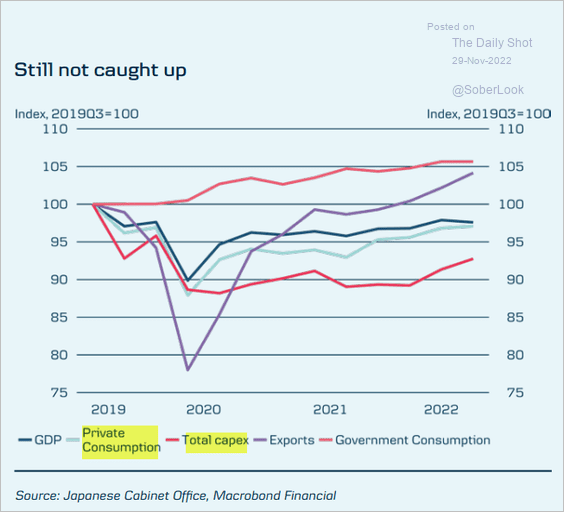

3. Private consumption and business investment remain below pre-COVID levels.

Source: Danske Bank

Source: Danske Bank

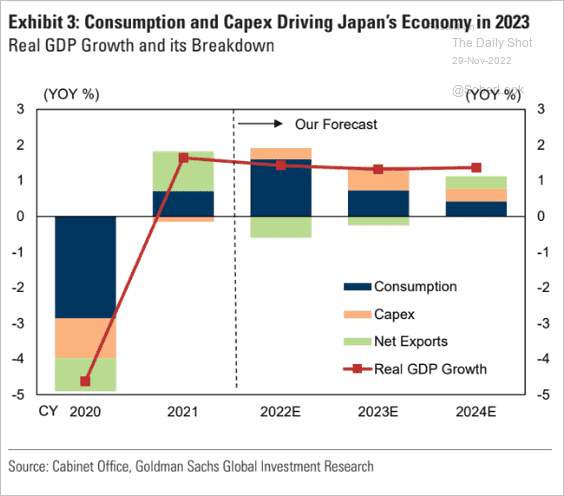

Here is Goldman’s forecast for Japan’s GDP growth.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

China

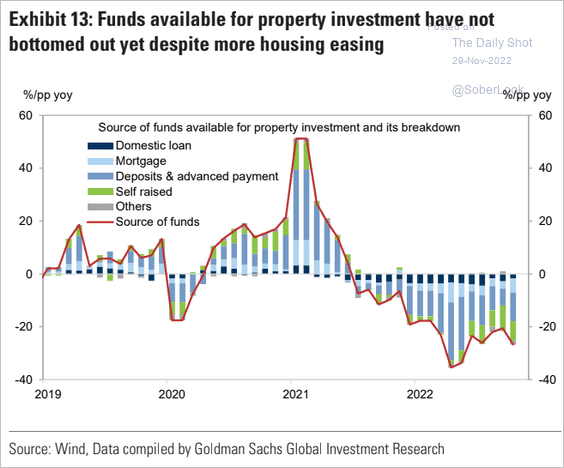

1. Developers are still struggling to meet their funding requirements.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Goldman Sachs

Source: Goldman Sachs

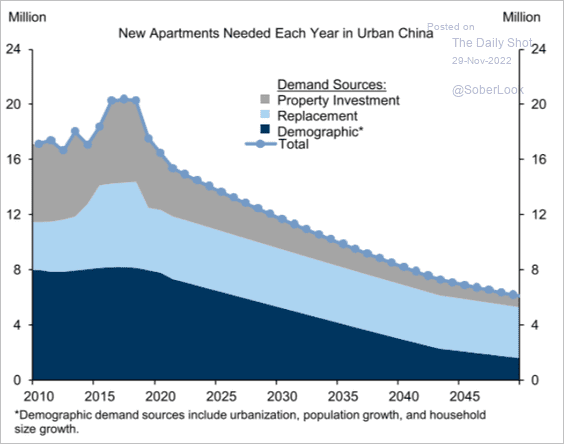

• Apartment demand is expected to keep falling.

Source: Goldman Sachs

Source: Goldman Sachs

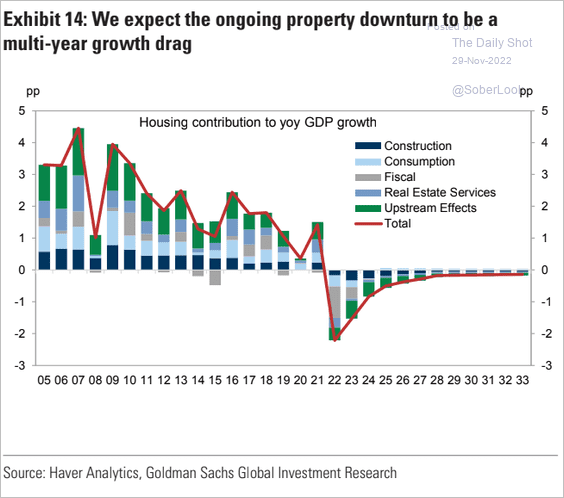

• Housing will be a drag on growth for years.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

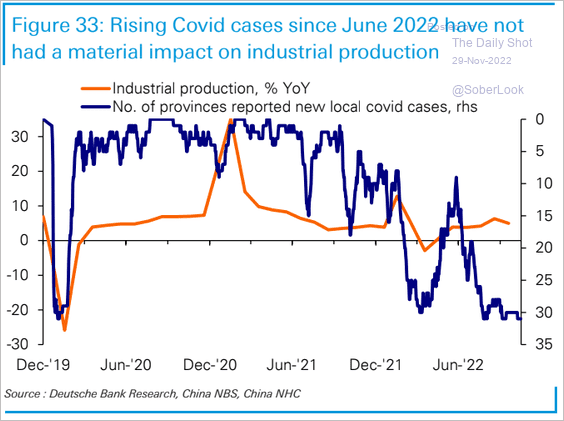

2. Lockdowns have not pulled down industrial production (at least according to official figures).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

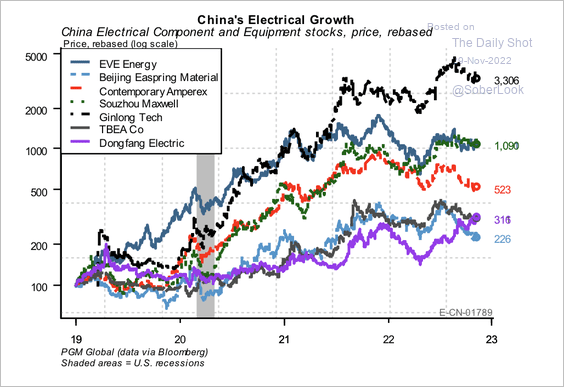

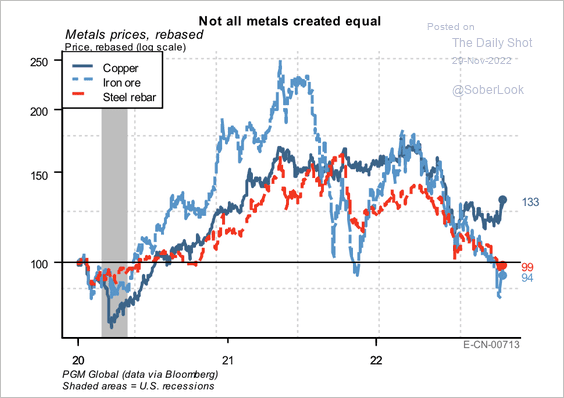

3. Chinese power and electricity stocks have benefitted from significant fixed asset investment spurred by renewable energy policies.

Source: PGM Global

Source: PGM Global

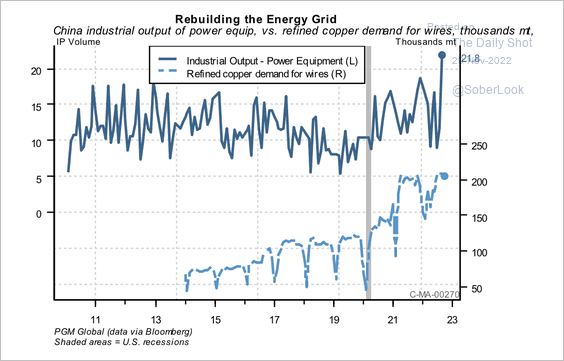

China is rebuilding its energy grid as part of its five-year plan to generate more renewable energy, according to PGM Global. That could fuel greater demand for copper.

Source: PGM Global

Source: PGM Global

——————–

4. The Shanghai Composite is holding long-term support.

Back to Index

Emerging Markets

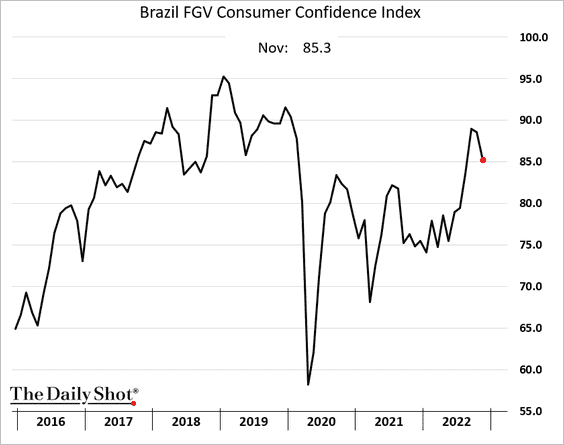

1. Brazil’s consumer confidence remains elevated.

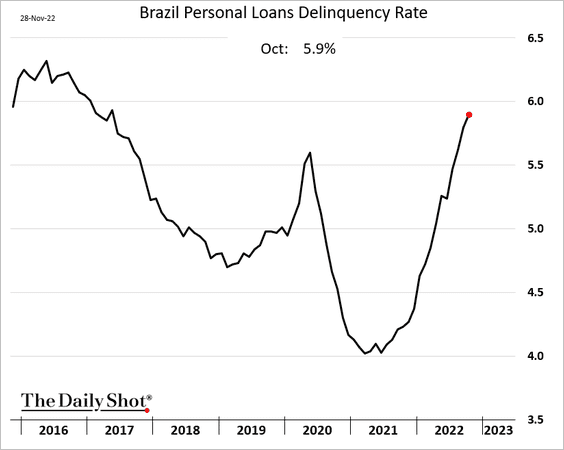

Consumer delinquency rates have been climbing.

——————–

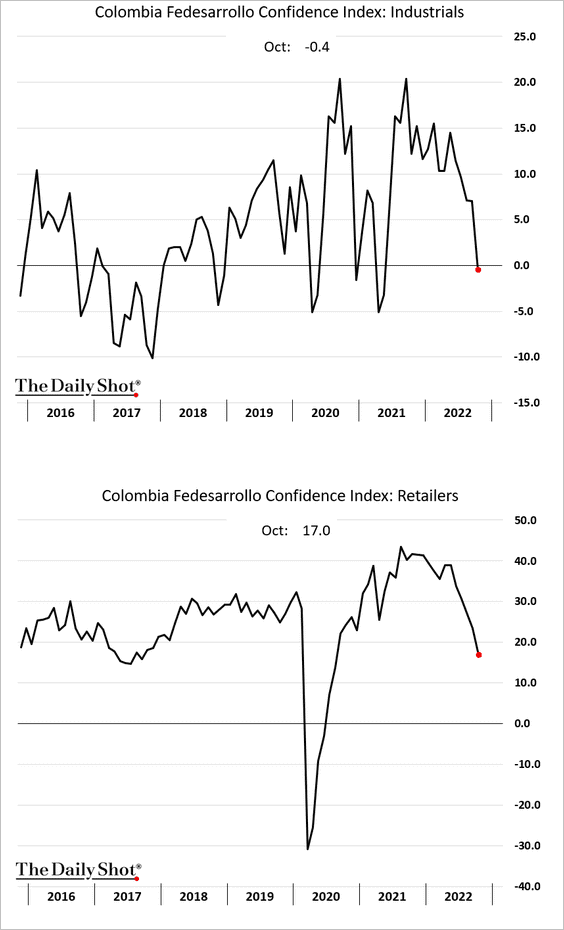

2. Colombia’s business confidence is falling.

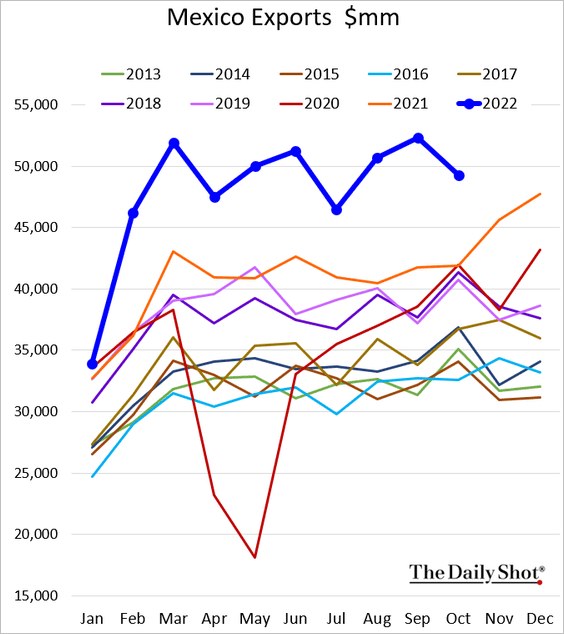

3. Mexico’s exports are starting to moderate.

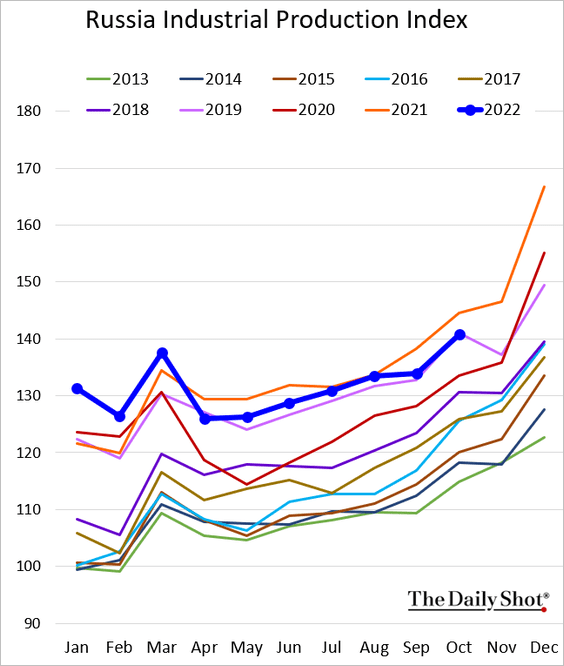

4. Russia’s industrial production is running at 2019 levels, according to government data (to be taken with a grain of salt).

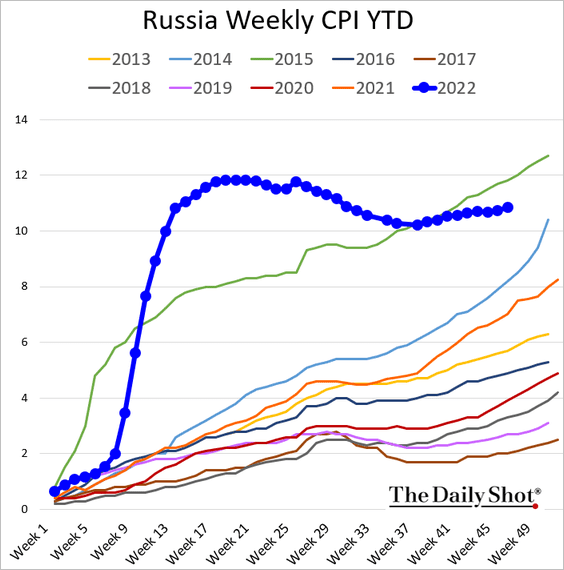

Here is the CPI.

——————–

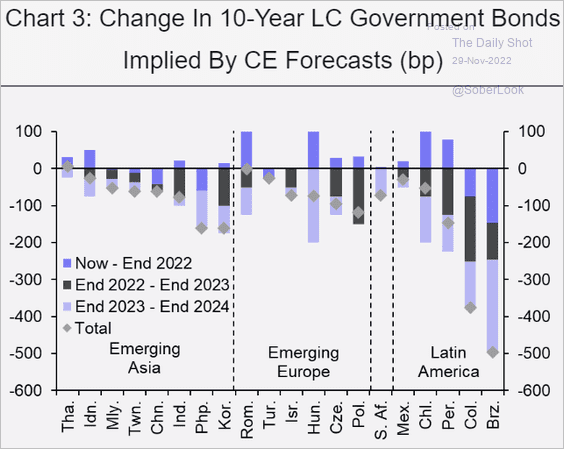

5. Next, we have the 10yr government bond yield changes expected by Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

1. BlockFi, a major crypto lender, filed for bankruptcy. The company has suspended withdrawals.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Hours after filing for bankruptcy, BlockFi announced that it is suing FTX’s founder to seize Robinhood shares that were pledged as collateral before the exchange collapsed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

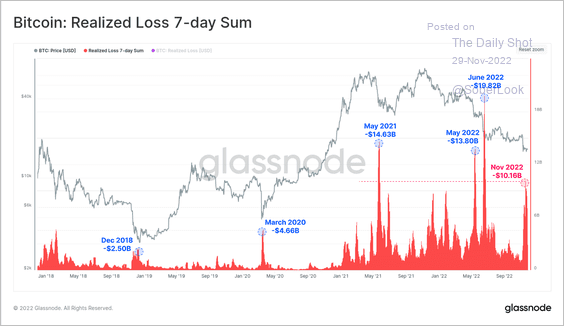

2. So far, this month has marked the fourth largest realized loss event for BTC holders on record.

Source: Glassnode Read full article

Source: Glassnode Read full article

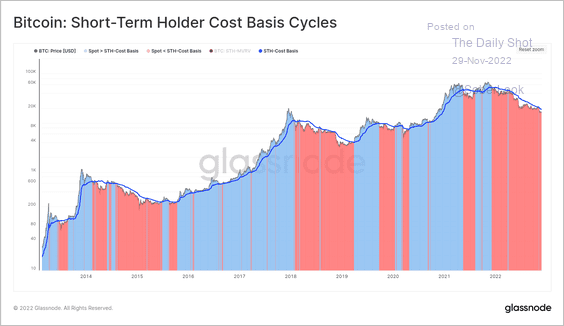

Steady bitcoin price depreciation resulted in new holders’ cost basis being above spot prices.

Source: Glassnode Read full article

Source: Glassnode Read full article

——————–

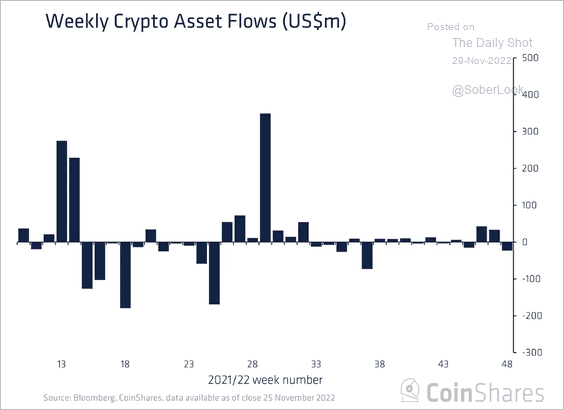

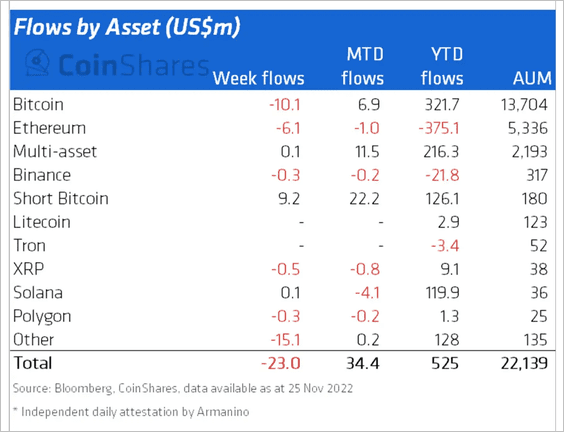

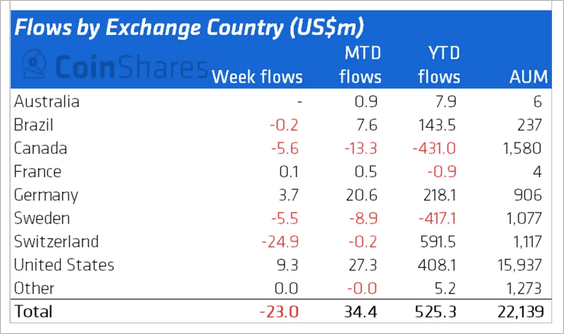

3. Crypto investment funds saw outflows last week, while short BTC products continued to attract fresh capital. (2 charts)

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Swiss-based funds accounted for a majority of outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

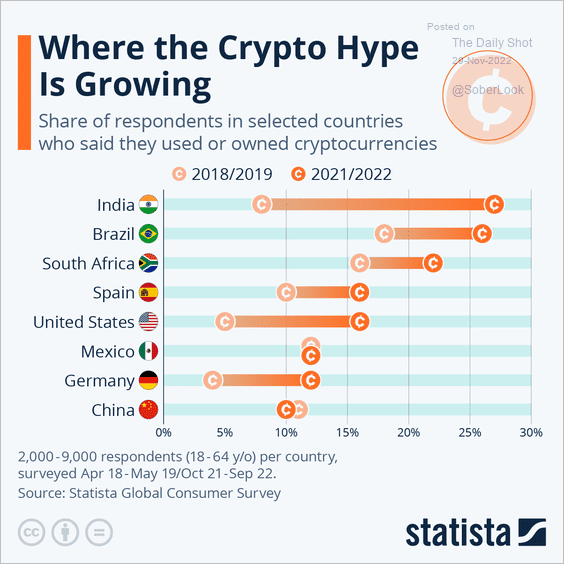

4. Which countries saw the biggest gains in crypto usage in recent years?

Source: Statista

Source: Statista

Back to Index

Commodities

1. Copper has outperformed iron ore and steel this year.

Source: PGM Global

Source: PGM Global

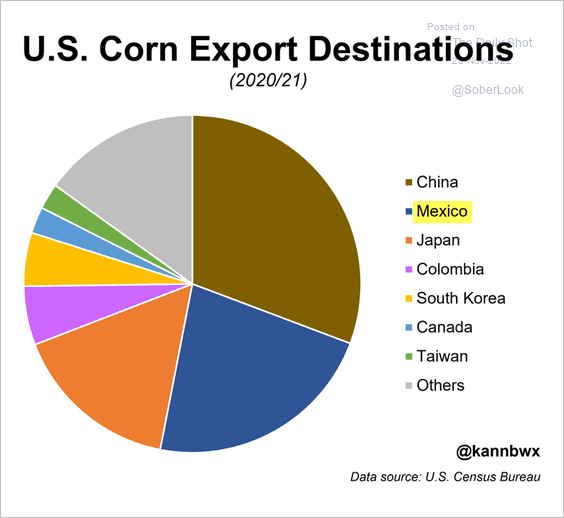

2. Are US corn exports to Mexico at risk?

Source: Reuters Read full article

Source: Reuters Read full article

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

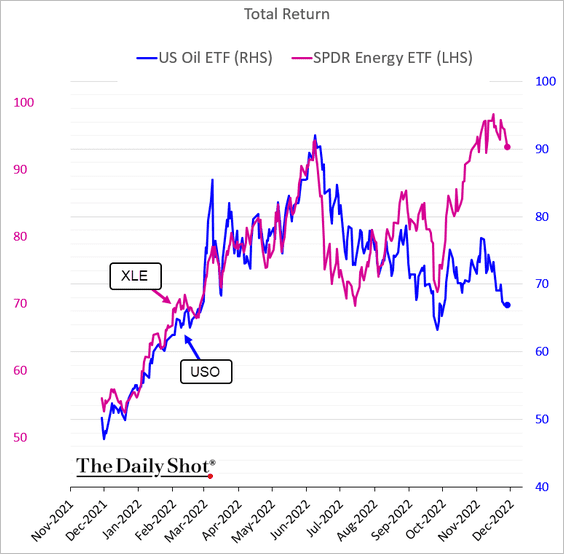

1. Energy shares have diverged from oil prices. Is the stock market expecting higher crude prices ahead?

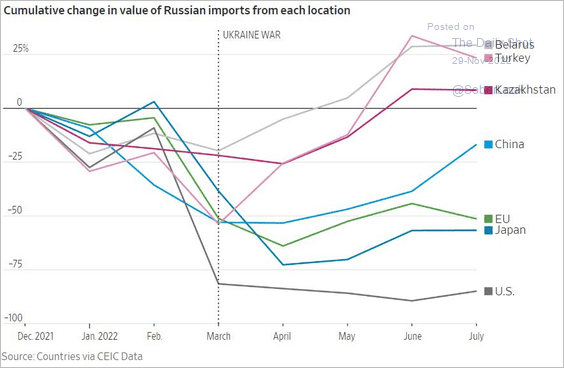

2. Here is the evolution of oil imports from Russia.

Source: @WSJ Read full article

Source: @WSJ Read full article

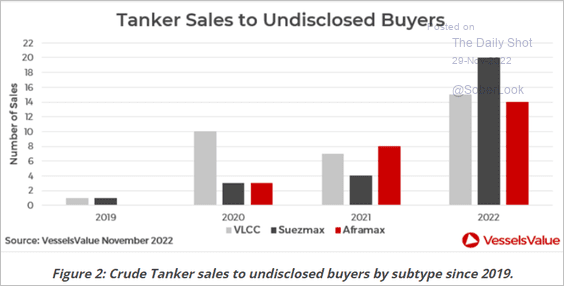

3. The “dark fleet” is getting built to move Russian oil.

Source: VesselsValue

Source: VesselsValue

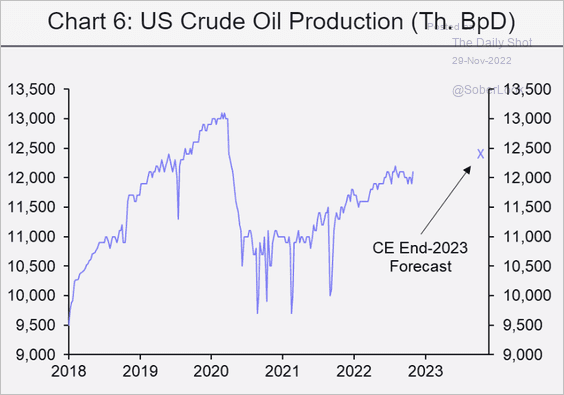

4. Here is a forecast for US oil production by the end of next year from Capital Economics.

Source: Capital Economics

Source: Capital Economics

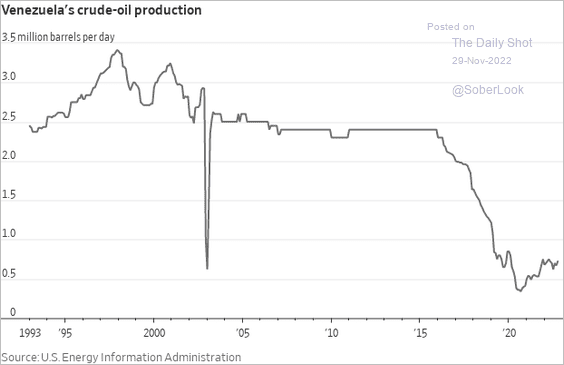

5. Finally, this chart shows Venezuela’s oil production over time.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

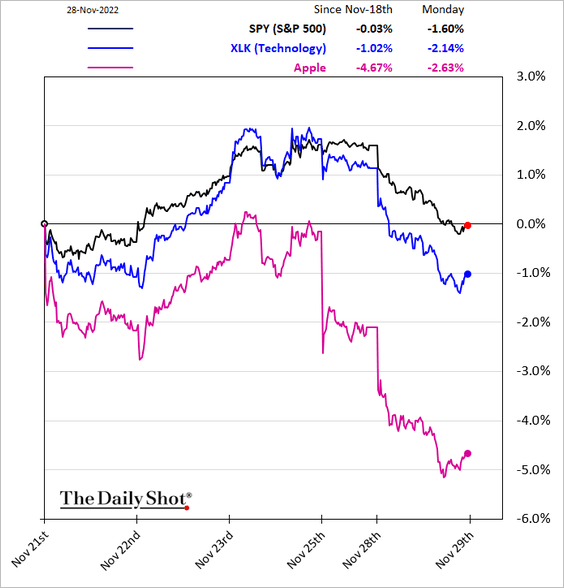

1. Here is an example of how China matters for US equities.

Source: @technology, @vladsavov Read full article

Source: @technology, @vladsavov Read full article

——————–

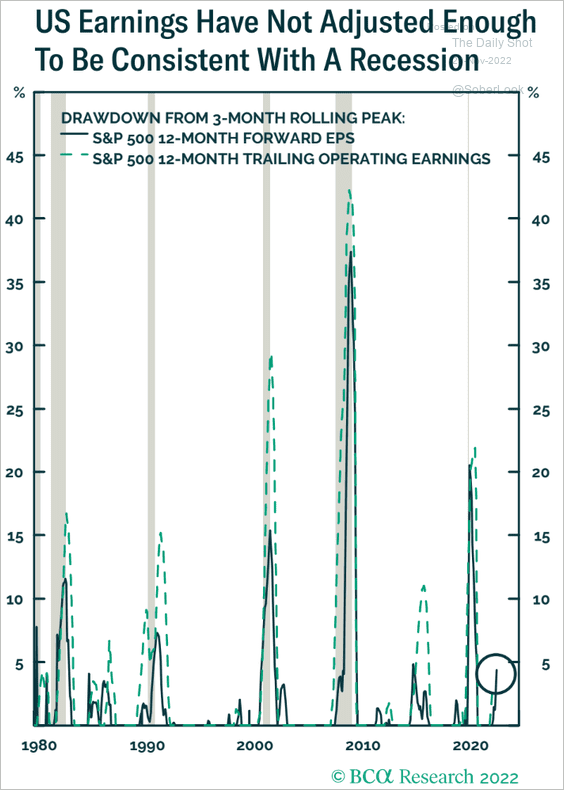

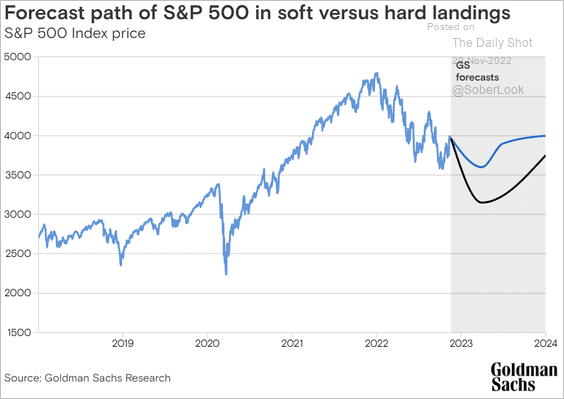

2. The market is not prepared for a hard landing in the US.

Source: BCA Research

Source: BCA Research

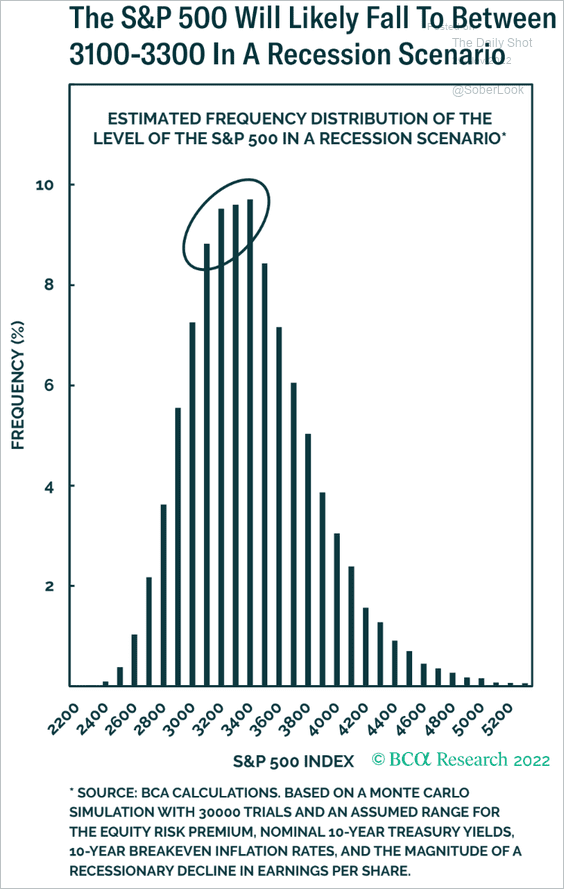

A recession will send US shares to new lows (2 charts).

Source: Goldman Sachs

Source: Goldman Sachs

Source: BCA Research

Source: BCA Research

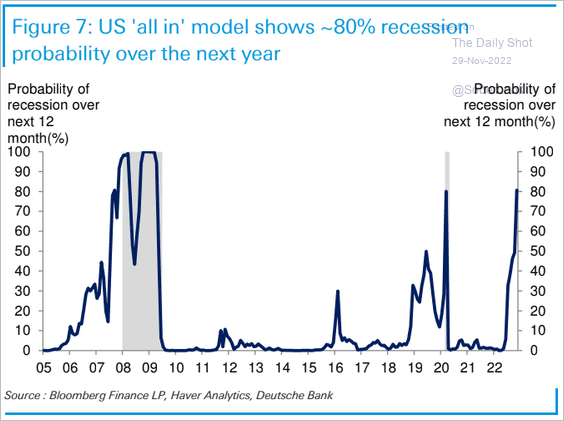

And models say that a recession is coming.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

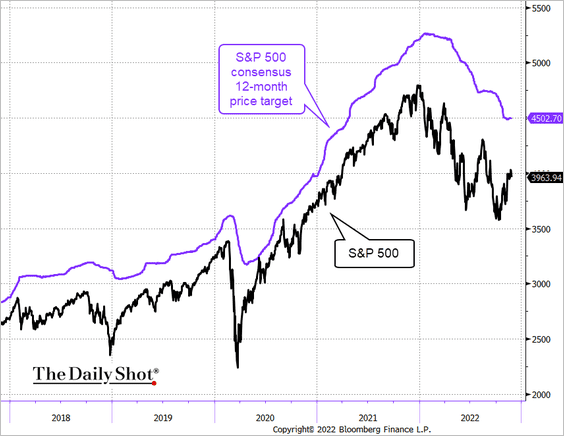

3. The consensus target price for the S&P 500 is about 14% higher in 12 months. Too optimistic?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

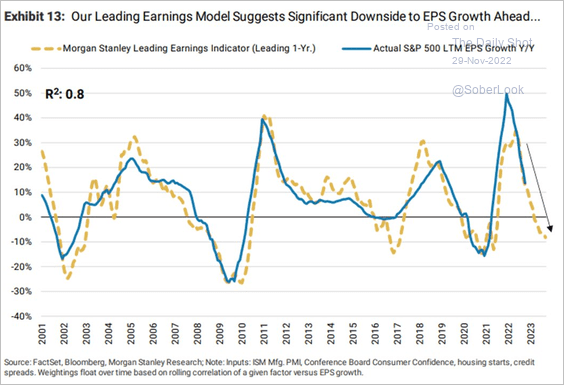

4. Morgan Stanley’s earnings indicator points to an earnings recession ahead.

Source: Morgan Stanley Research; @LLequeu

Source: Morgan Stanley Research; @LLequeu

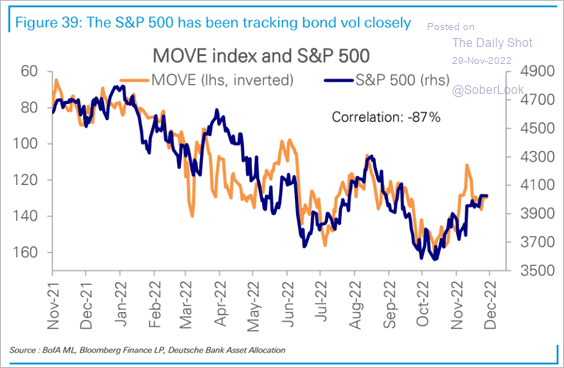

5. The S&P 500 has been correlated to Treasury market implied volatility (driven by Fed policy uncertainty).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

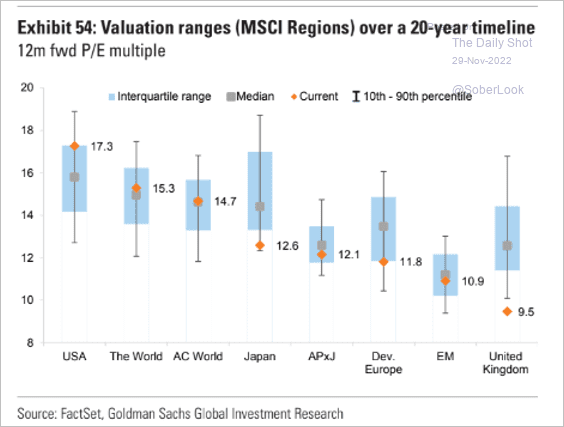

6. US stocks are expensive relative to the past 20 years’ valuations, as well as to other markets.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

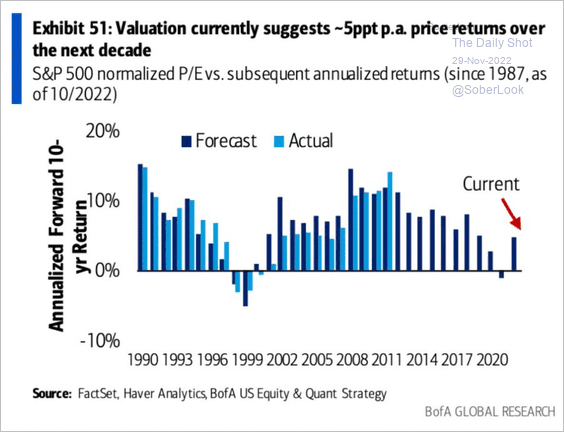

7. Current valuations suggest a 5% price return (annualized) over the next decade.

Source: BofA Global Research; @MichaelAArouet

Source: BofA Global Research; @MichaelAArouet

Back to Index

Credit

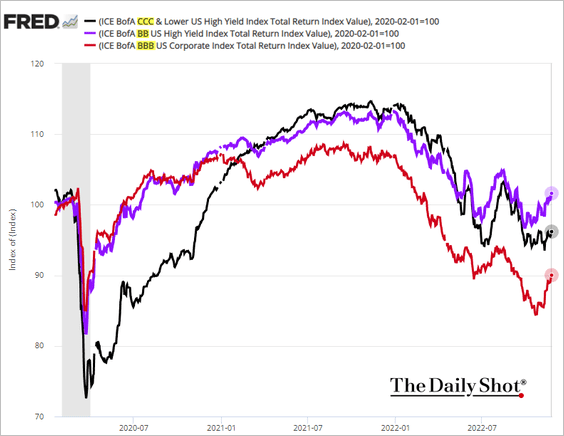

1. BB-rated bonds have outperformed BBB and CCC debt since the start of the pandemic.

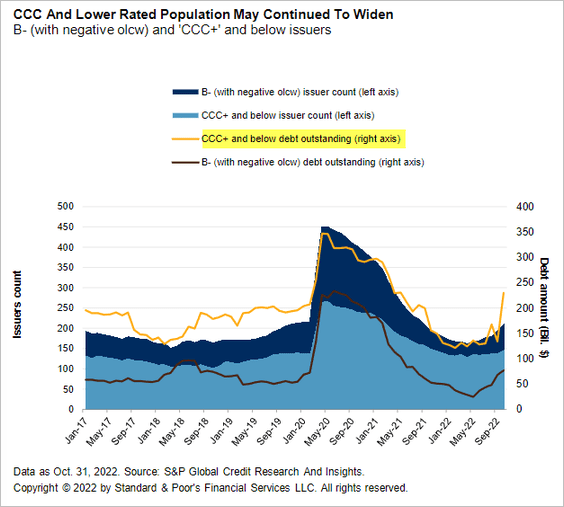

2. Stressed debt levels have been climbing.

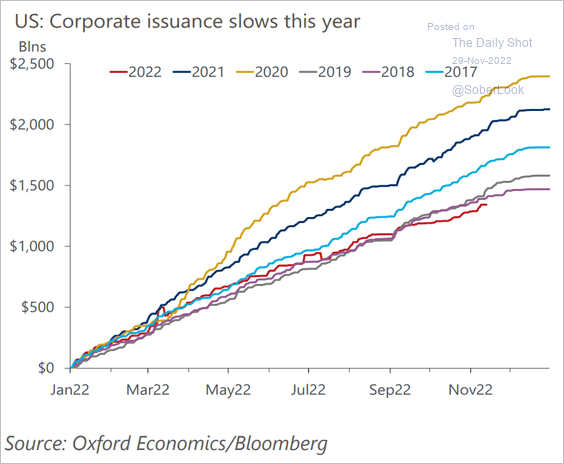

3. US corporate issuance remains at multi-year lows.

Source: Oxford Economics

Source: Oxford Economics

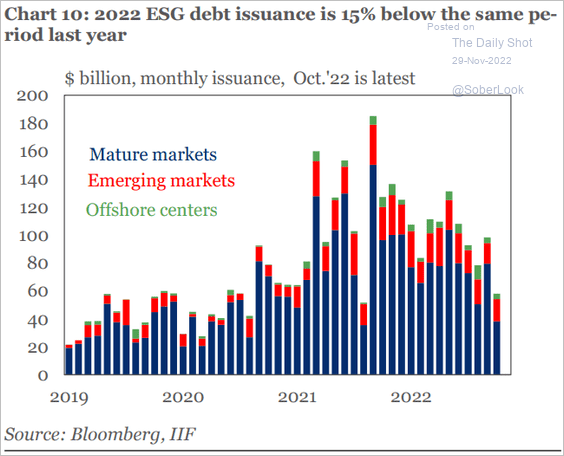

4. ESG debt Issuance is slowing.

Source: IIF

Source: IIF

Back to Index

Rates

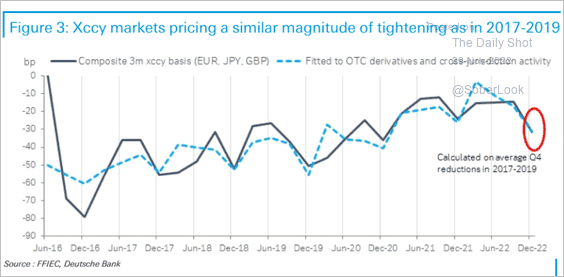

1. Cross-currency basis swaps are not pricing significant funding risks over the turn.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

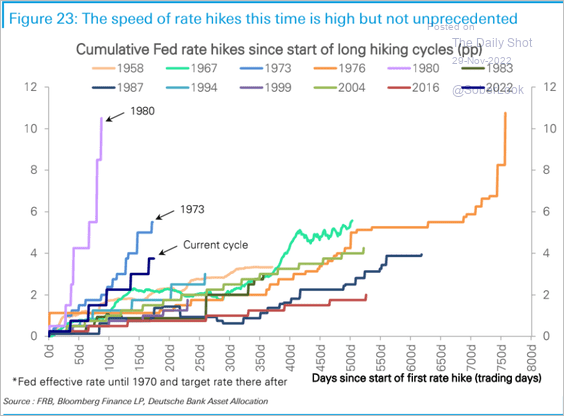

2. Here is a look at previous Fed rate hike cycles.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

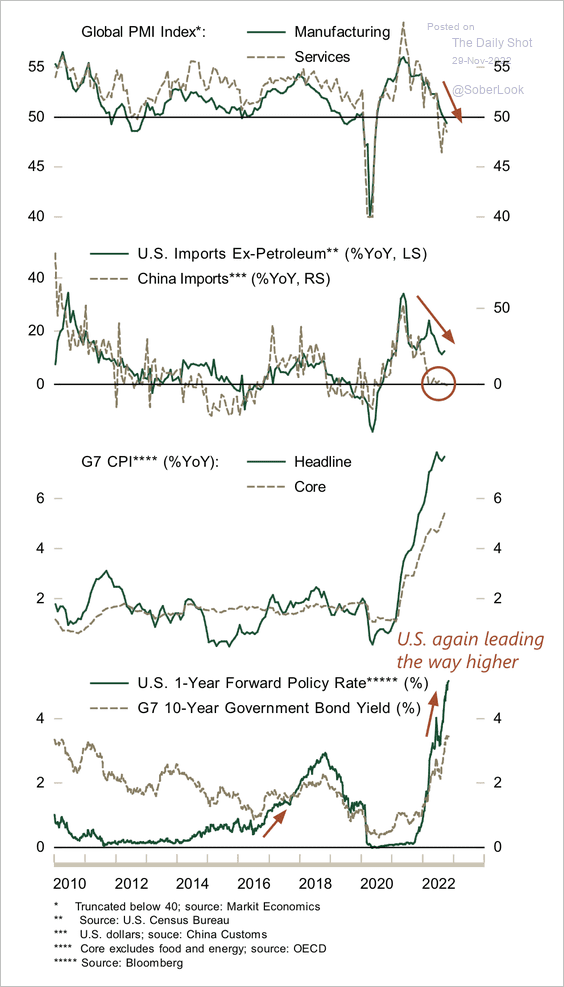

1. Global growth has slowed. Will lower inflation and interest rates follow?

Source: MRB Partners

Source: MRB Partners

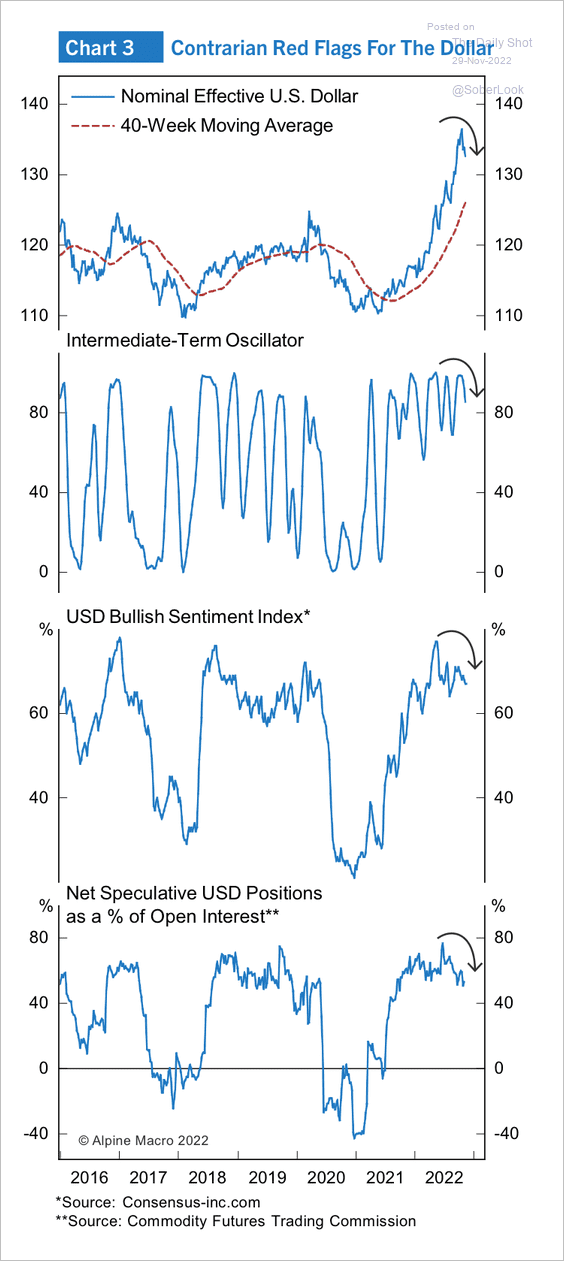

2. Some technical indicators point to a peak in the dollar. Expect some choppiness ahead.

Source: Alpine Macro

Source: Alpine Macro

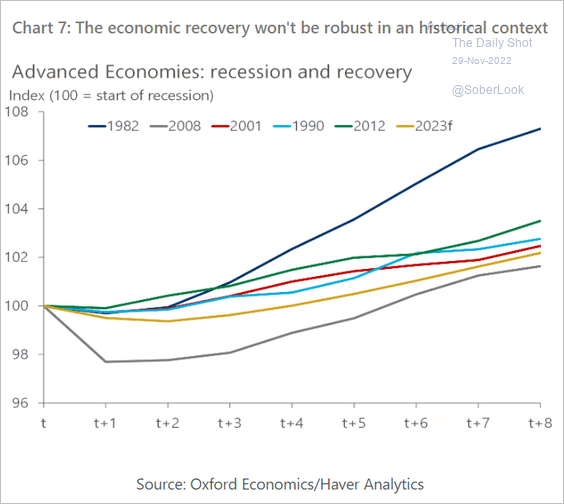

3. The recovery from next year’s economic downturn will be slow, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

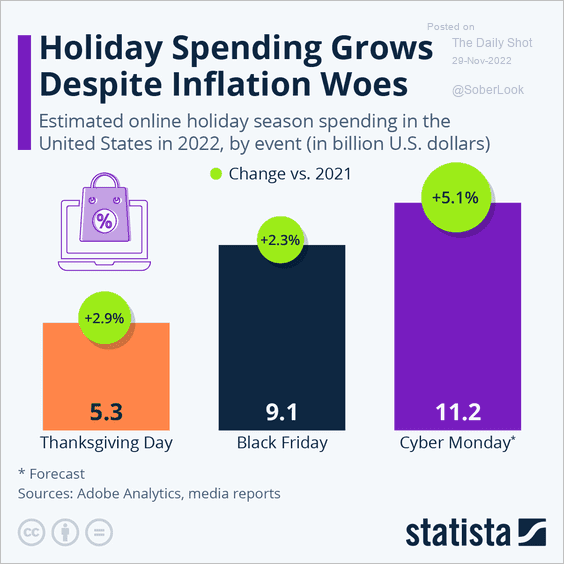

1. Holiday spending:

Source: Statista

Source: Statista

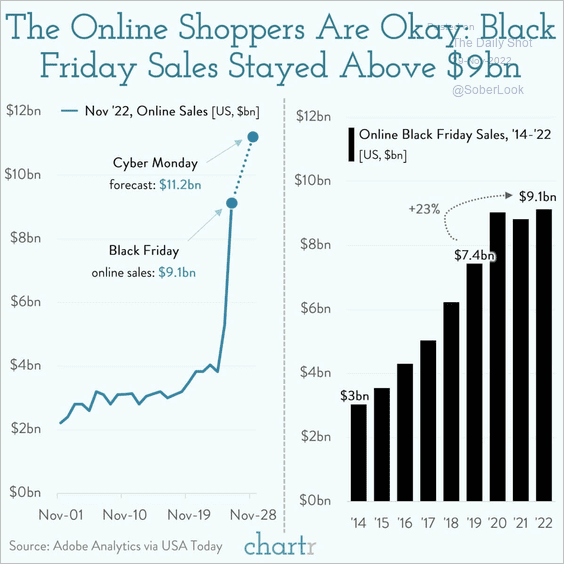

• Online holiday sales:

Source: @chartrdaily

Source: @chartrdaily

——————–

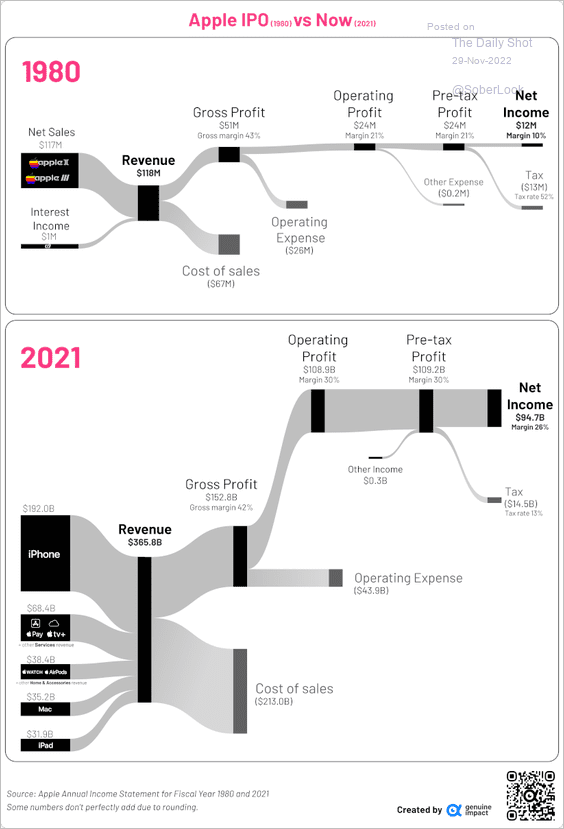

2. Apple’s financials at IPO and now:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

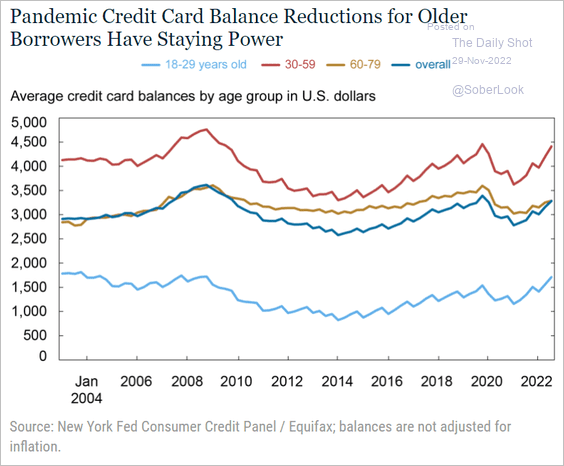

3. US credit card balances by age group:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

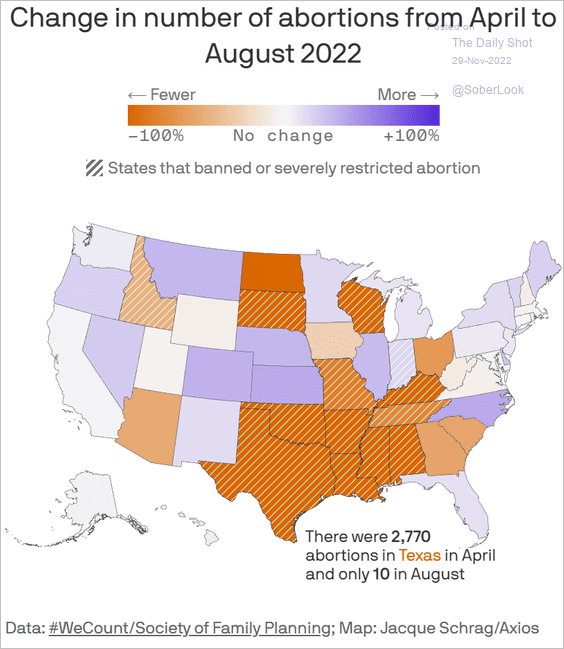

4. Change in the number of abortions from April to August:

Source: @axios Read full article

Source: @axios Read full article

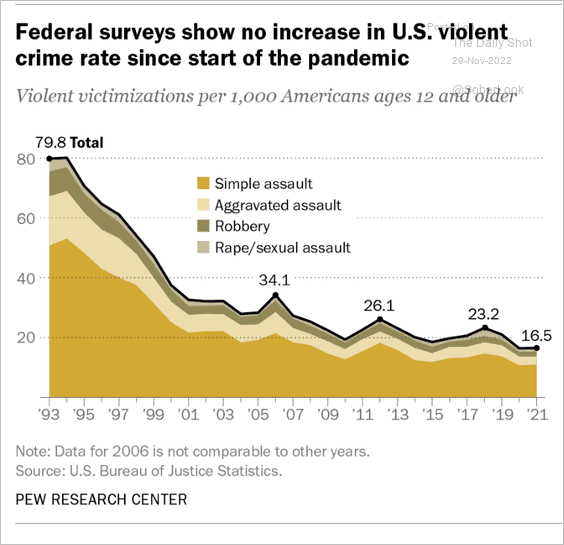

5. Violent crime rates in the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

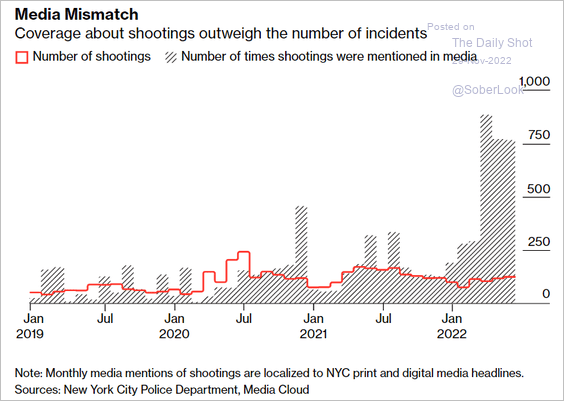

• Media coverage vs. actual shootings in NYC:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

——————–

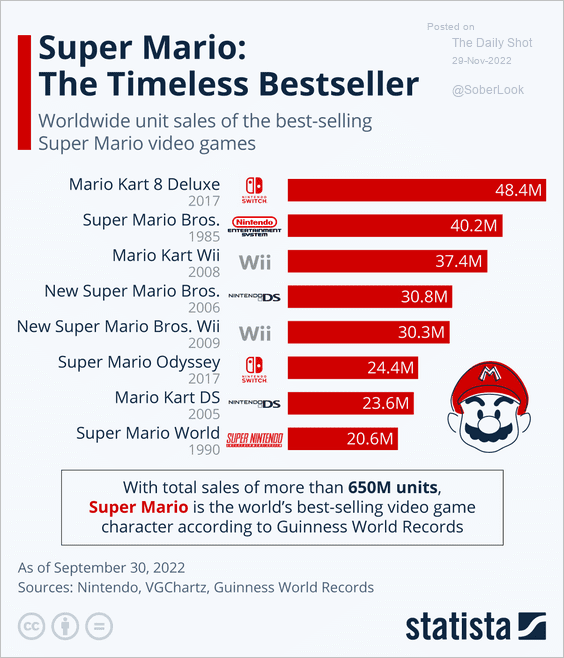

6. Best-selling Super Mario video games:

Source: Statista

Source: Statista

——————–

Back to Index