The Daily Shot: 15-Dec-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

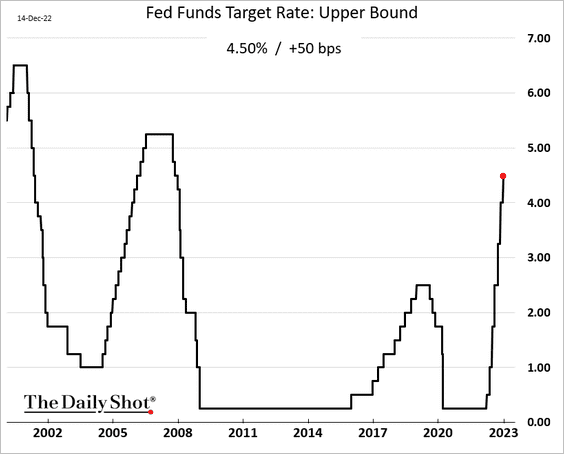

1. The Fed raised rates by 50 bps, as expected, but Chair Powell struck a hawkish tone.

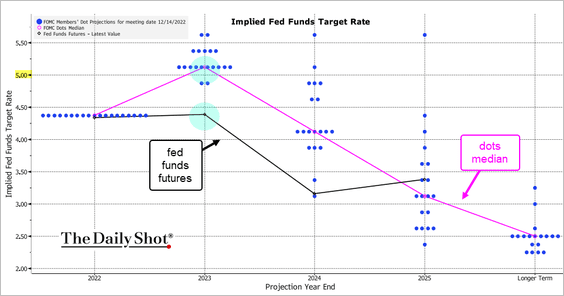

The FOMC now sees the terminal rate above 5% (dot plot below). The market, however, is well below that level. That’s surprising because Powell was quite clear about the Fed’s commitment to keep raising rates.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

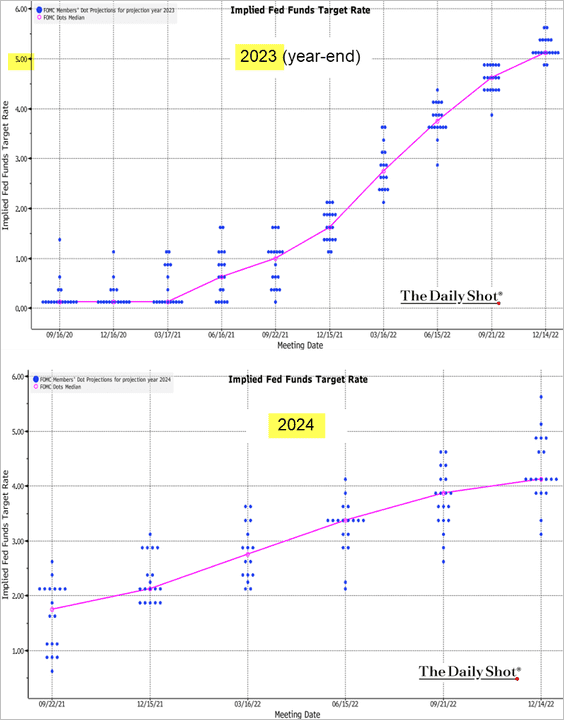

This chart shows the evolution of the dot plot for 2023 and 2024.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

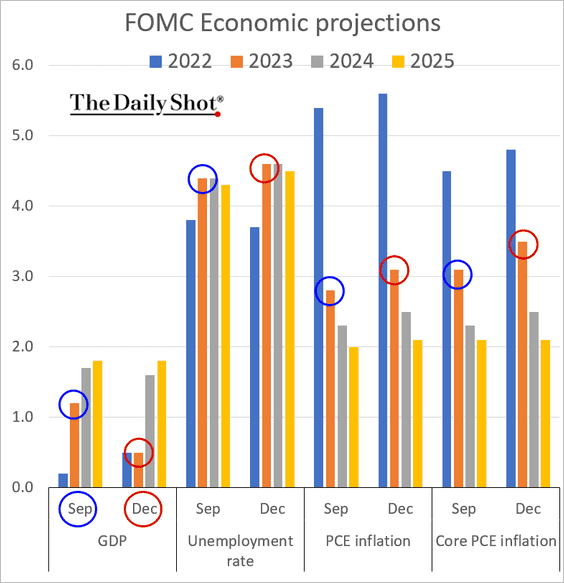

• The FOMC downgraded its projections for economic growth while boosting forecasts for unemployment and inflation. Are the unemployment forecasts too optimistic?

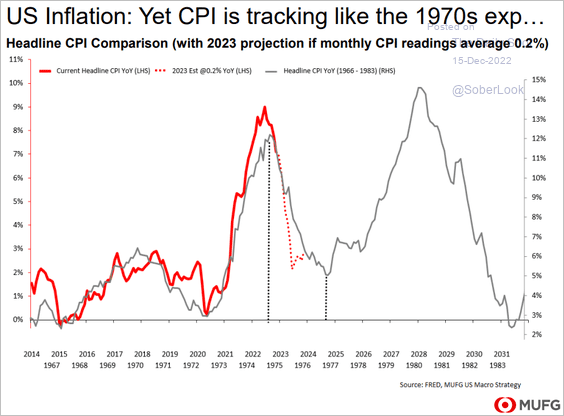

• According to Powell, the Fed still has plenty of tightening to do. The central bank is concerned about this scenario, …

Source: MUFG Securities

Source: MUFG Securities

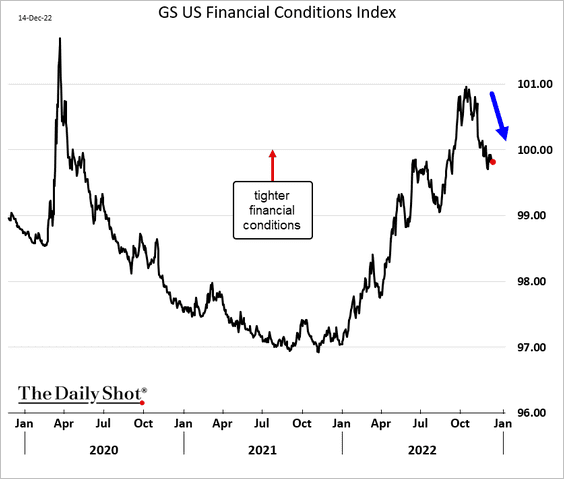

… especially with financial conditions easing in recent weeks.

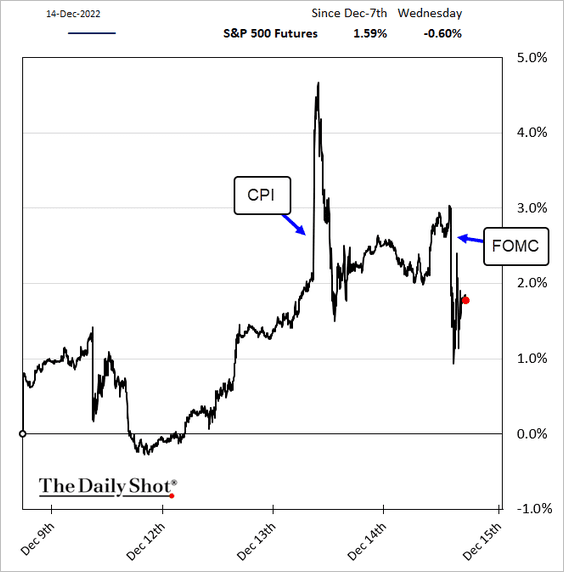

2. The market reaction was muted.

• Equities:

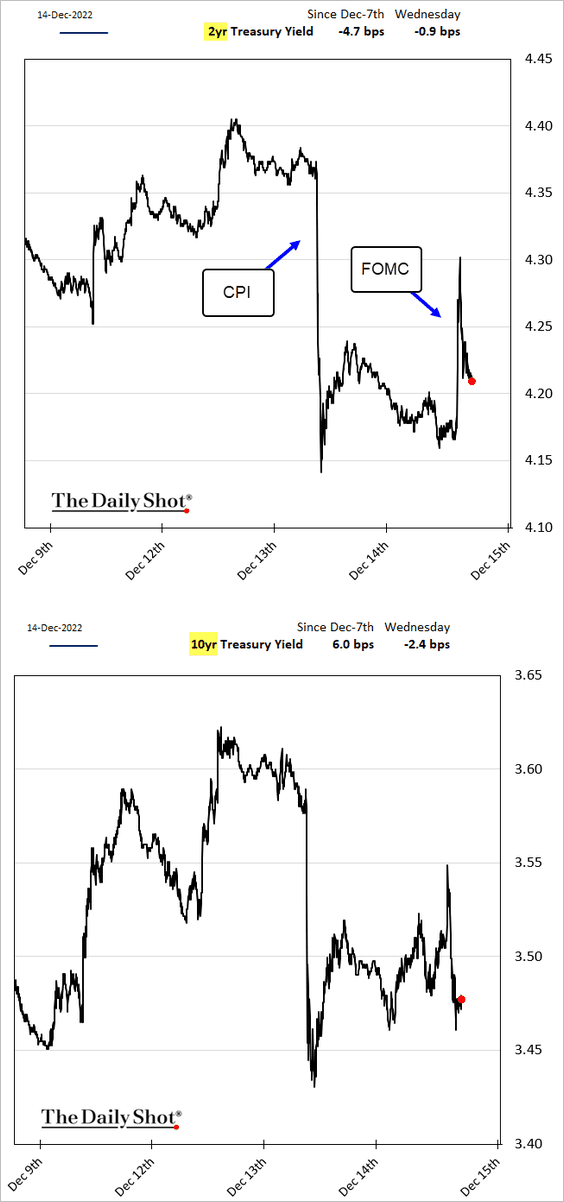

• Treasury yields:

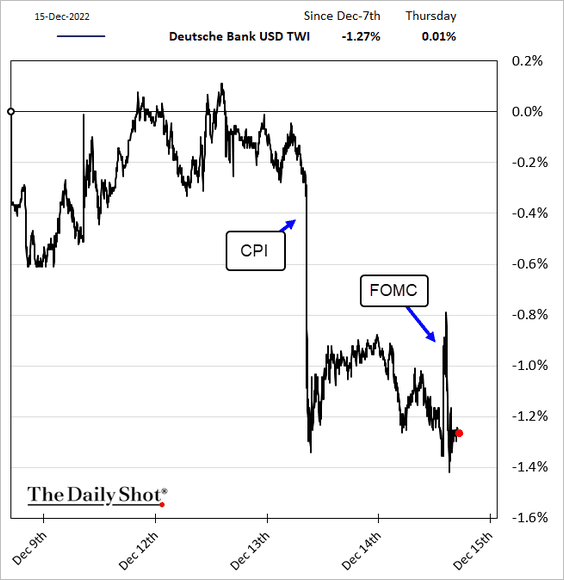

• The dollar:

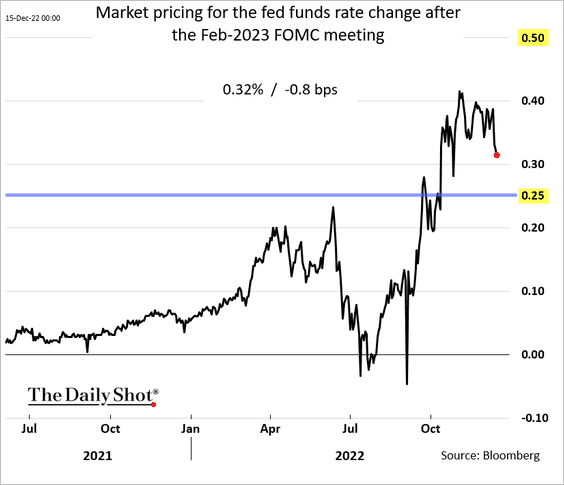

• Futures are still pricing a much higher probability of a 25 bps rate hike in February than a 50 bps increase.

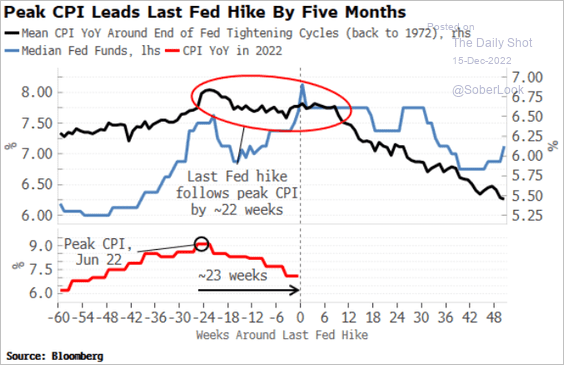

• Historically, there is a five-month lag between the peak CPI and the last Fed hike.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

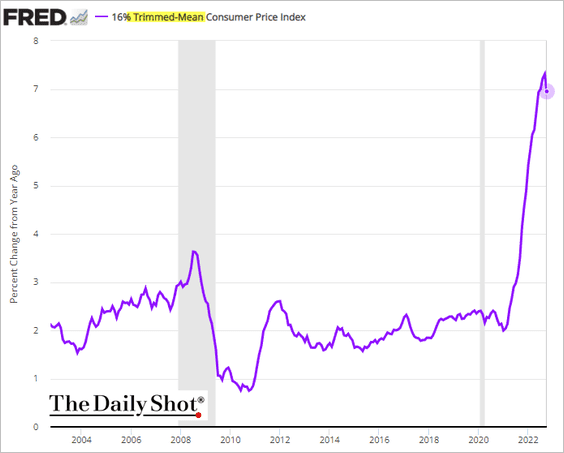

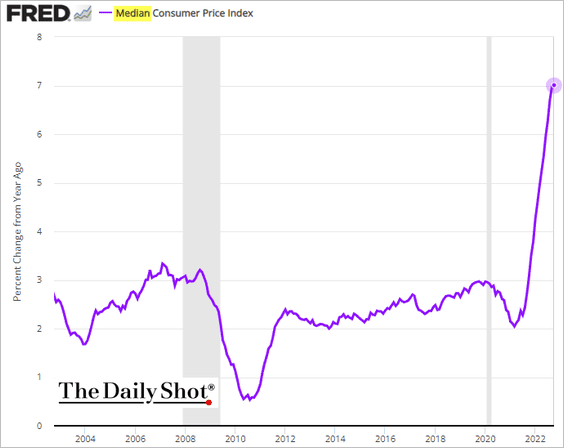

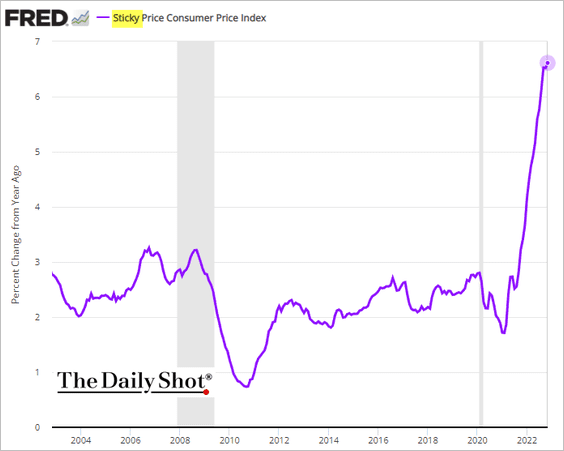

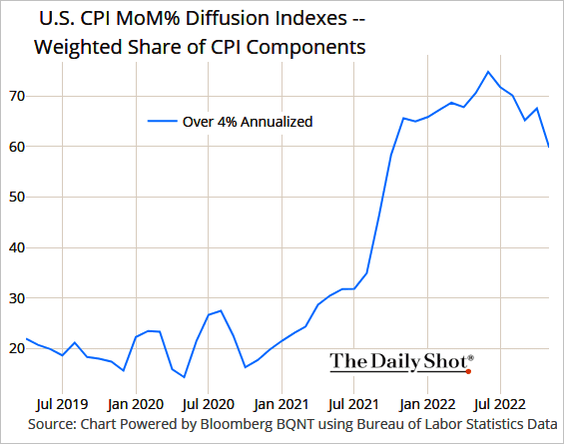

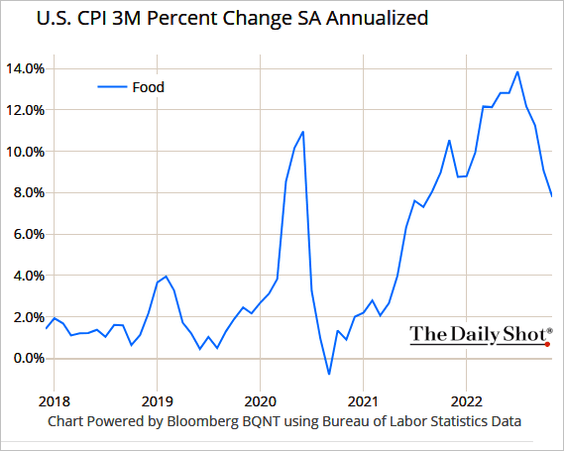

3. Next, we have some additional updates on inflation.

• Alternative measures of core inflation:

– Trimmed-mean CPI:

– Median CPI:

– Sticky CPI:

• The CPI diffusion index (share of components above 4%):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Food inflation (3-month change):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

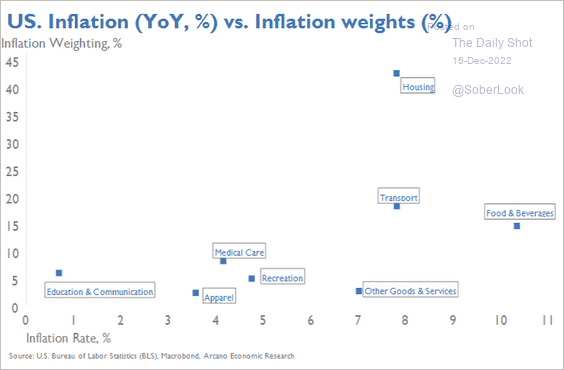

• CPI component weights vs. the inflation rate for each component:

Source: Arcano Economics

Source: Arcano Economics

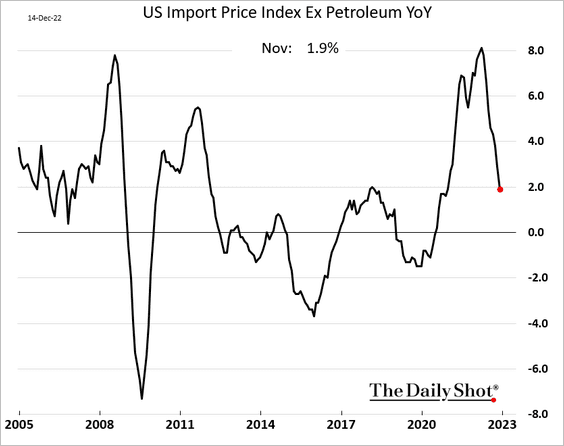

• The import price index:

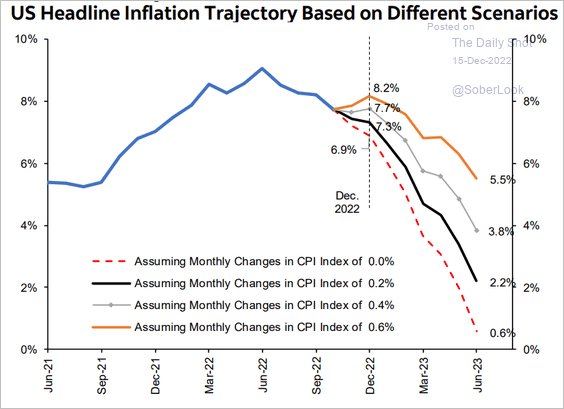

• Year-over-year inflation scenarios based on different monthly rate assumptions:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

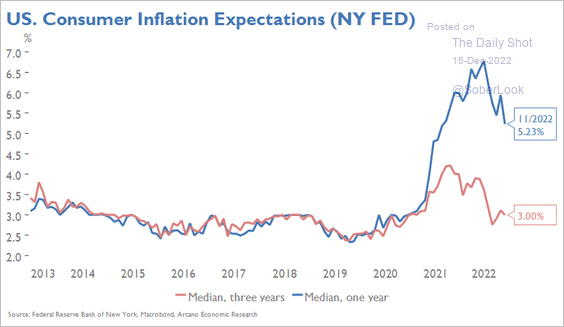

• Consumer inflation expectations:

Source: Arcano Economics

Source: Arcano Economics

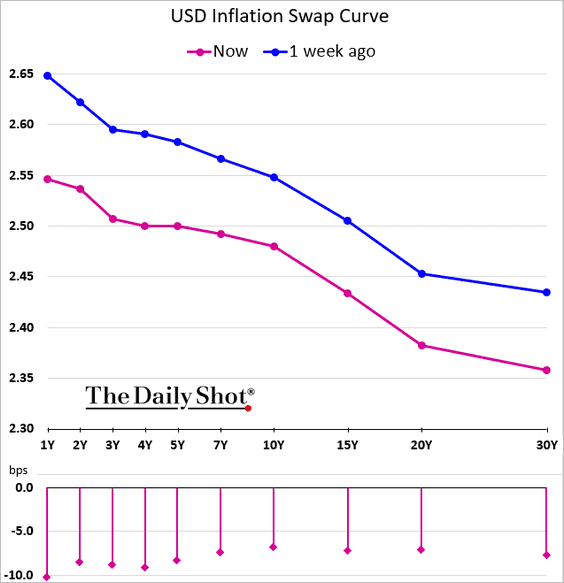

• The inflation swap curve (market-based inflation expectations):

——————–

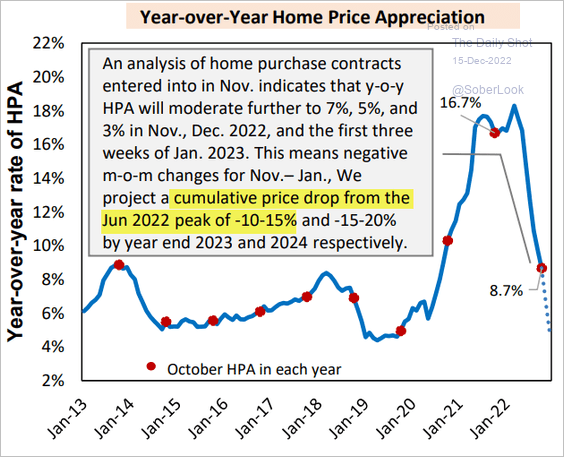

4. Now, let’s take a look at some updates on the housing market.

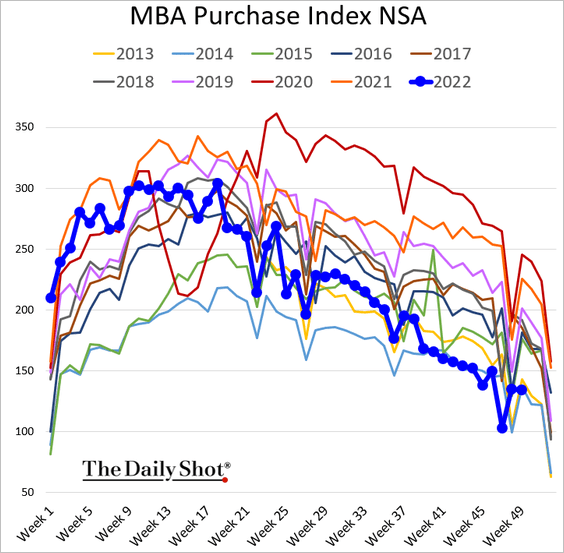

• Mortgage applications are running at 2014 levels.

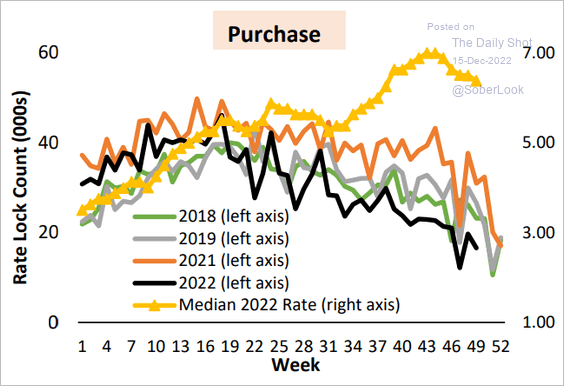

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

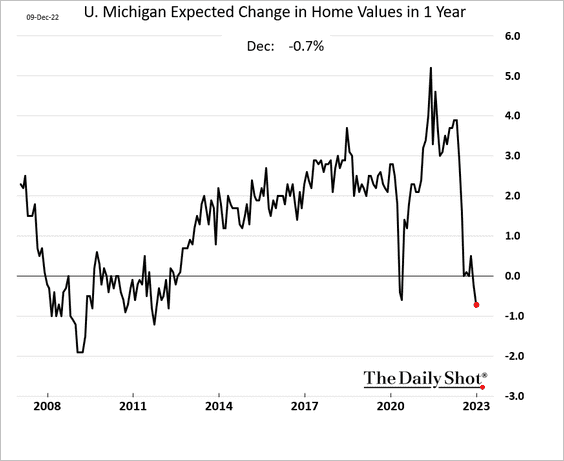

• Consumers now expect home price declines next year.

• The AEI Housing Center expects a 10-15% decline from the June peak.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

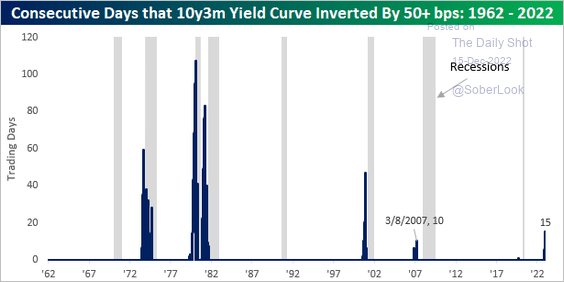

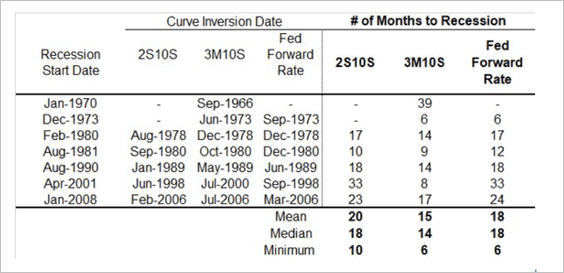

5. Below is the number of consecutive days of the 10yr/3m yield curve inversion.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Here is a look at historical time periods between yield curve inversions and recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

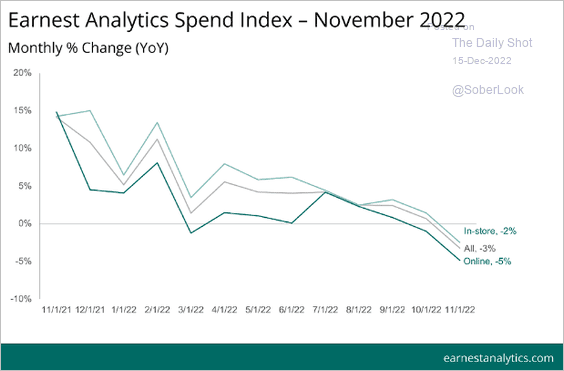

6. The Earnest Analytics Spend Index points to weak retail sales in November.

Source: Earnest

Source: Earnest

Back to Index

Canada

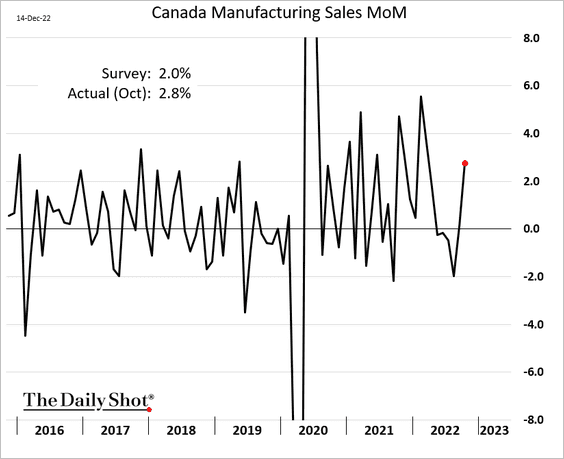

1. Manufacturing sales improved in October.

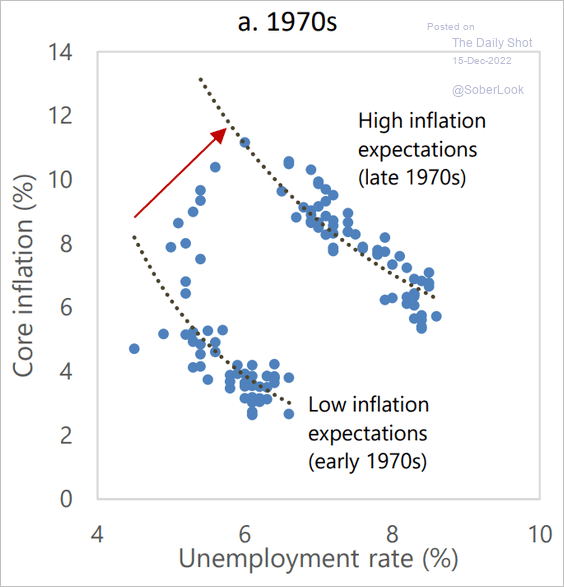

2. According to the BoC, “when inflation expectations are anchored, inflation can fall without a large rise in unemployment.”

Source: BIS Read full article

Source: BIS Read full article

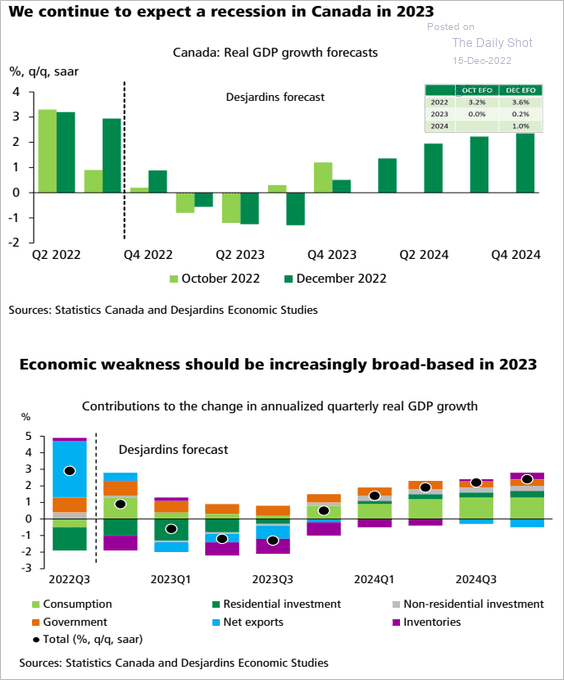

3. Desjardins is forecasting three quarters of GDP contraction next year.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

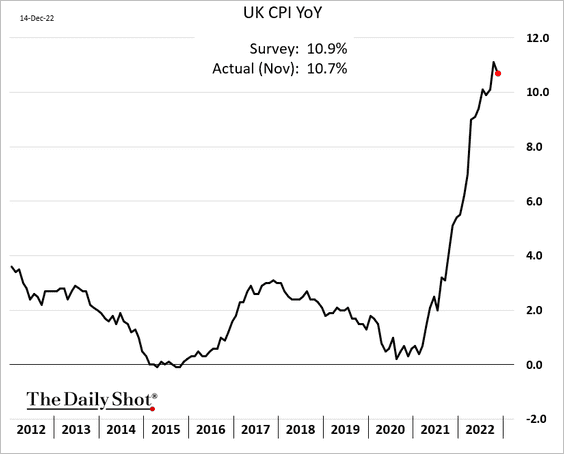

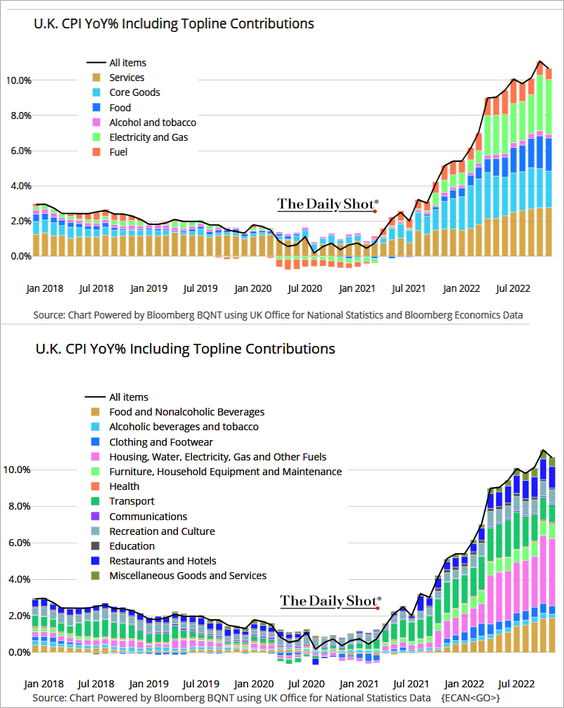

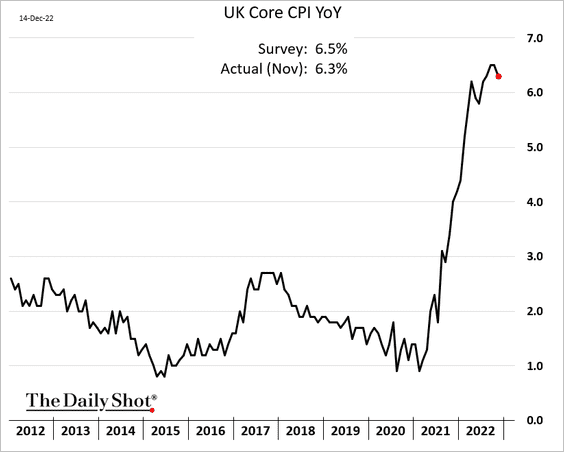

1. The CPI report was softer than expected.

• This chart shows the contributions to the headline CPI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Has inflation peaked? Here is the core CPI.

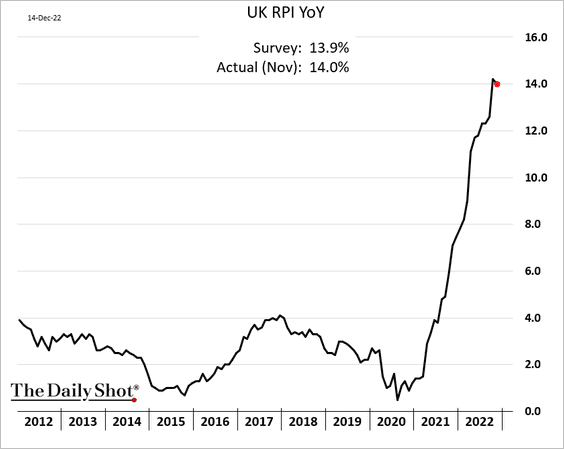

• Retail prices are still up 14% year-over-year.

——————–

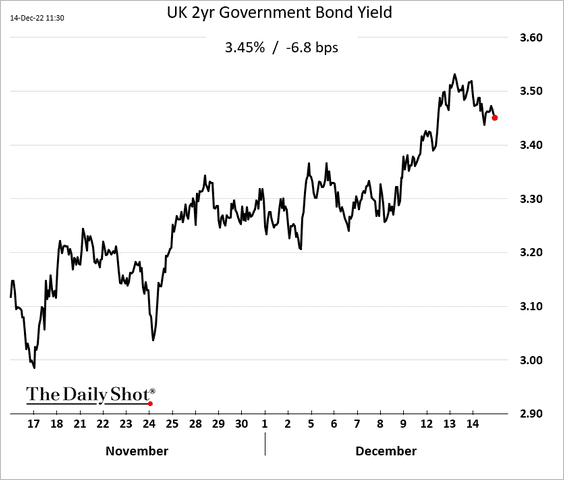

2. The 2-year yield has been moving lower.

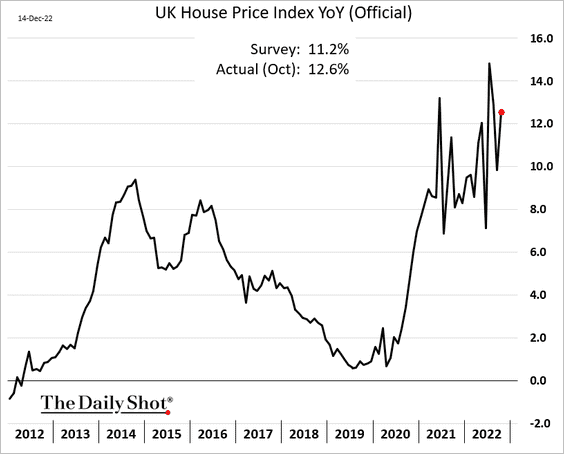

3. The official index of home price appreciation showed an increase in October.

But that’s unlikely to last.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

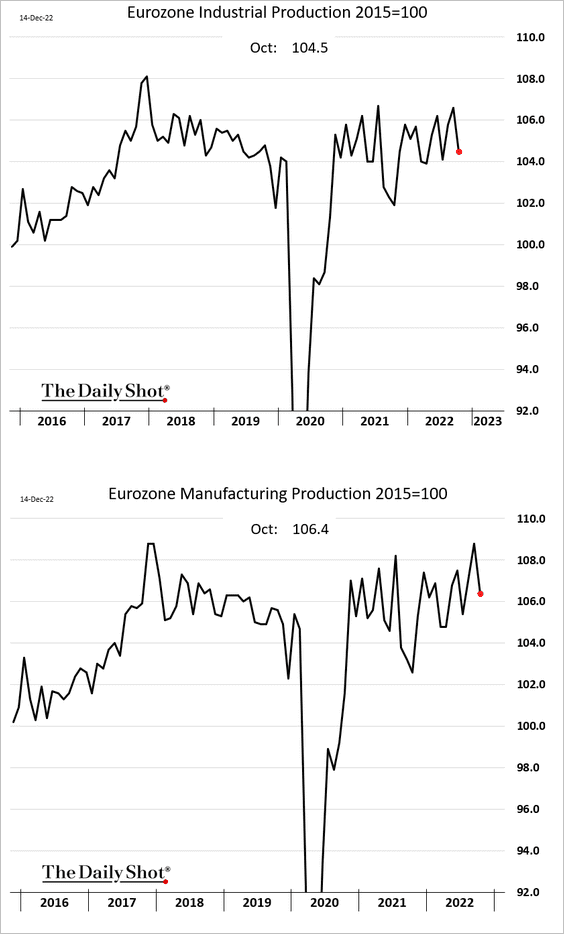

1. Industrial production declined in October.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

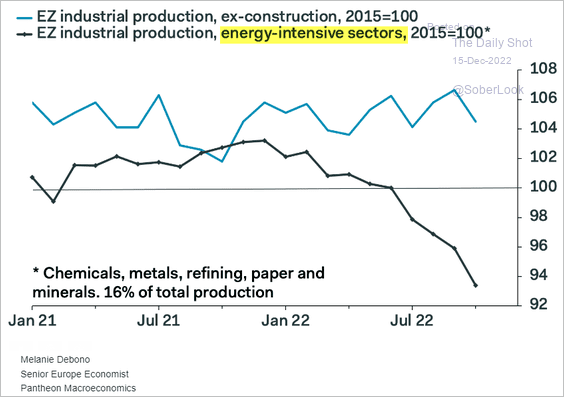

Energy-sensitive sectors have been under pressure.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

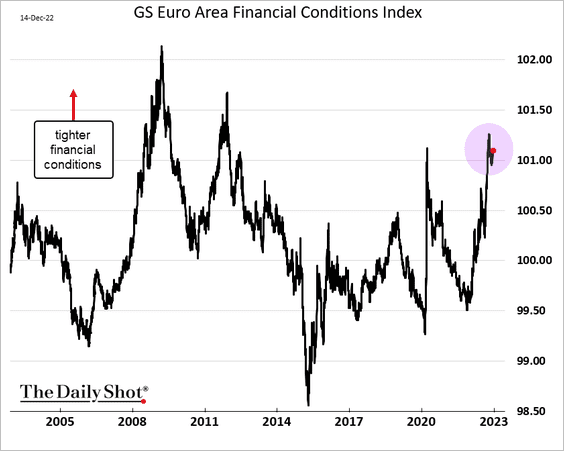

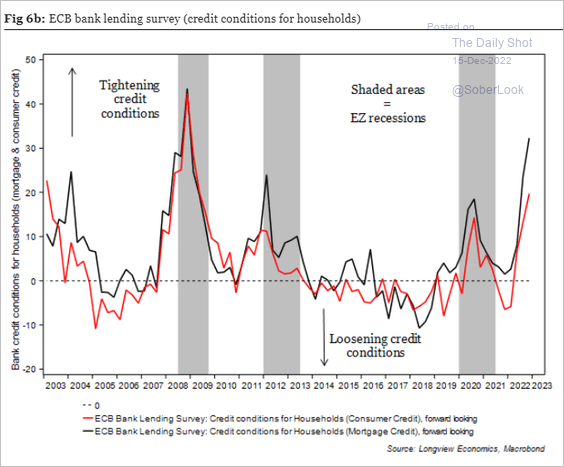

2. Financial conditions remain tight.

Tight credit conditions will be a drag on economic growth.

Source: Longview Economics

Source: Longview Economics

——————–

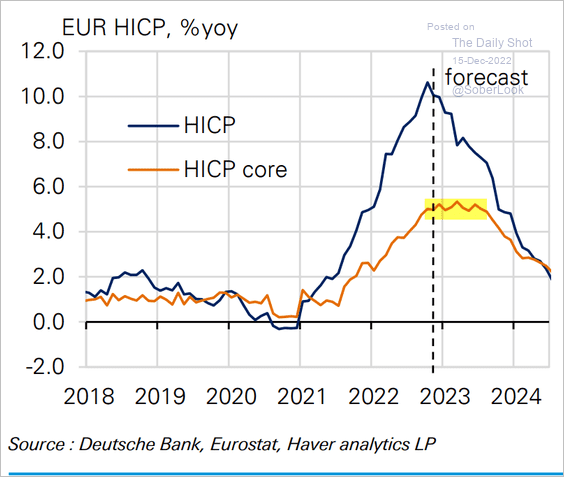

3. Core inflation is expected to remain elevated for some time.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

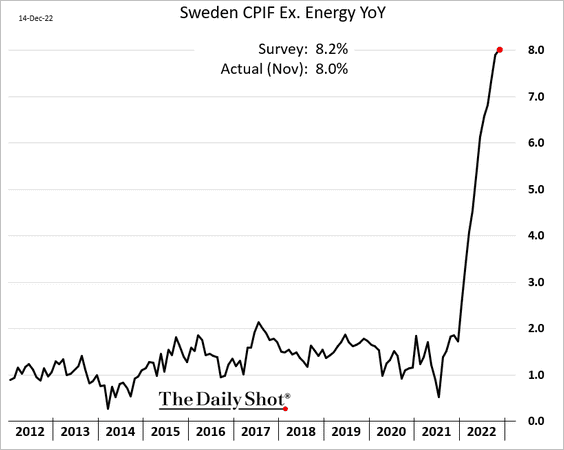

1. Sweden’s “core” inflation hit 8%, but that was below forecasts.

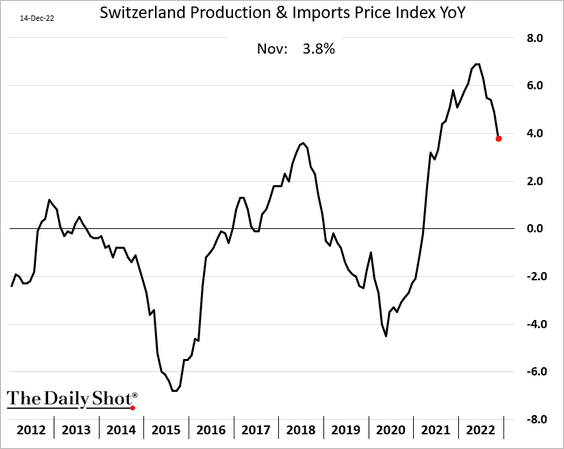

2. Switzerland’s producer and import inflation is moderating.

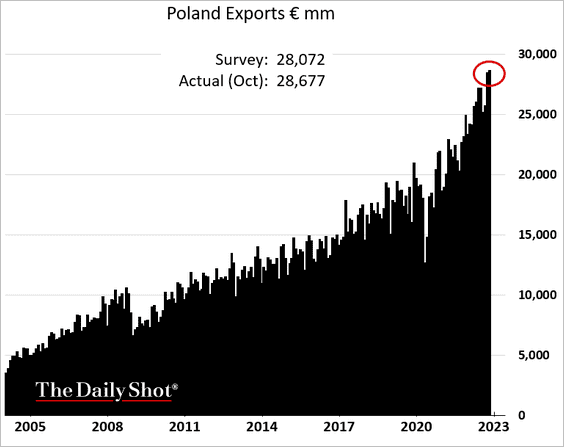

3. Poland’s exports hit a record high.

4. Europe’s semiconductor industry is lagging behind its global peers.

![]() Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Japan

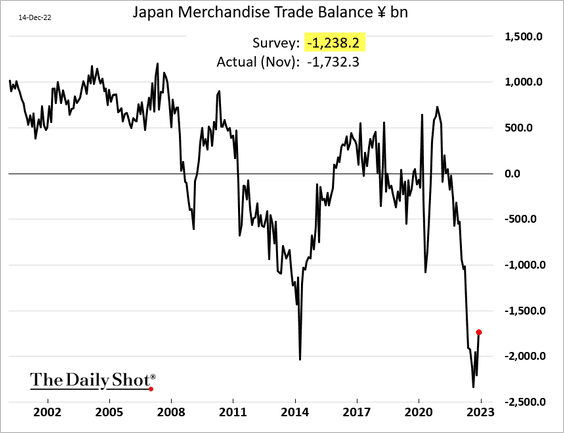

1. The trade gap narrowed less than expected last month.

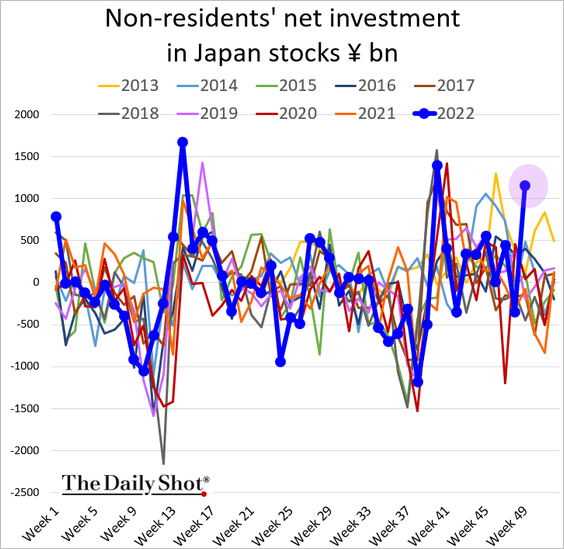

2. Foreigners bought a lot of Japanese stocks in recent days.

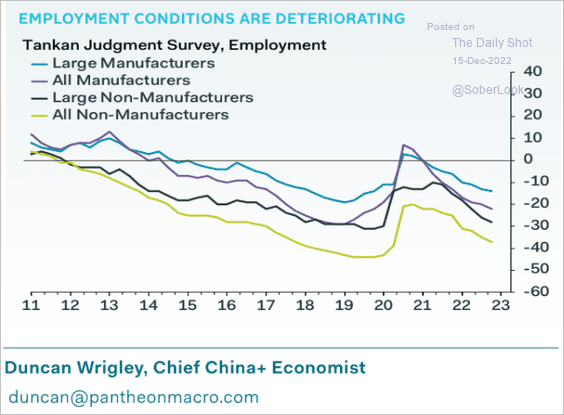

3. The Tankan survey points to softer employment conditions.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

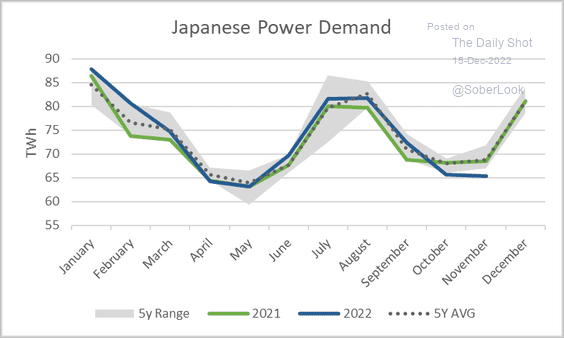

4. Warm weather reduced Japan’s power demand last month.

Source: @JoachimMoxon

Source: @JoachimMoxon

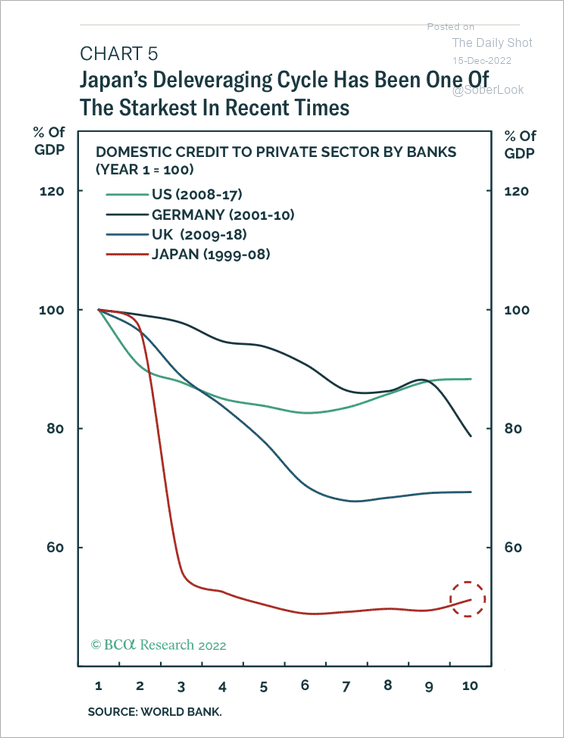

5. Japan’s deleveraging cycle was far worse than other developed nations.

Source: BCA Research

Source: BCA Research

Back to Index

Asia – Pacific

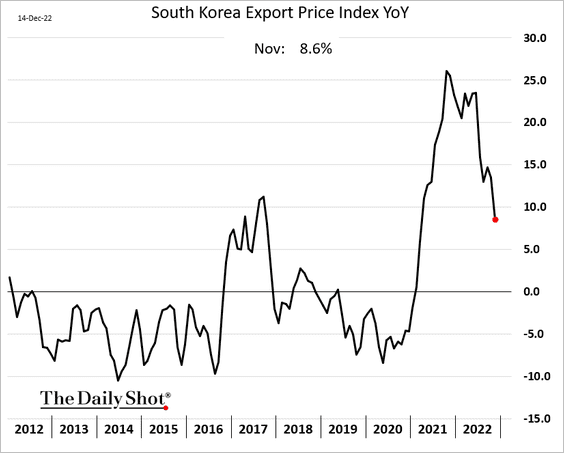

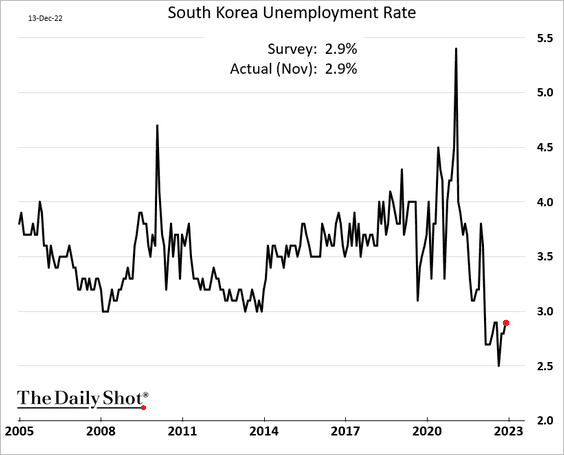

1. South Korea’s export price inflation is moderating.

Separately, South Korea’s unemployment rate remains low.

——————–

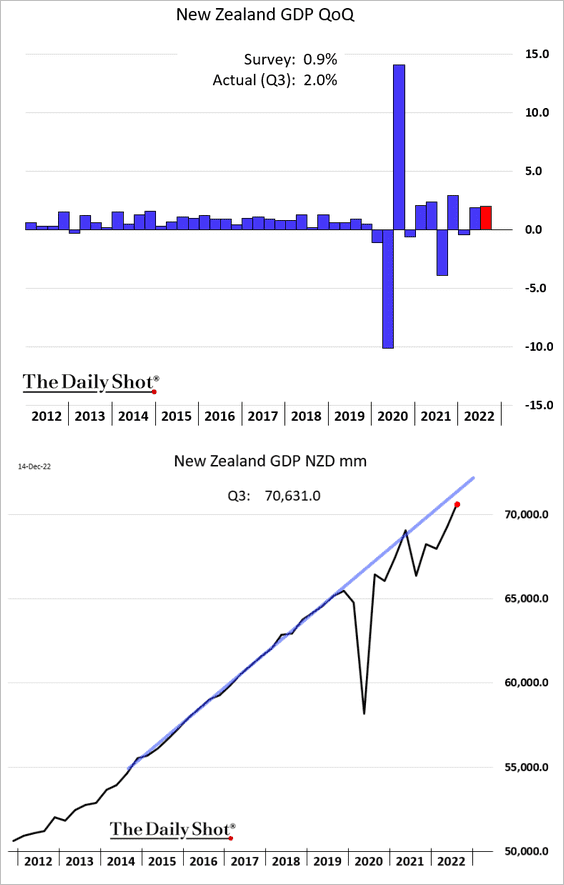

2. New Zealand’s Q3 GDP topped expectations, but this robust growth is not expected to last.

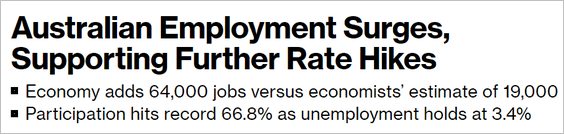

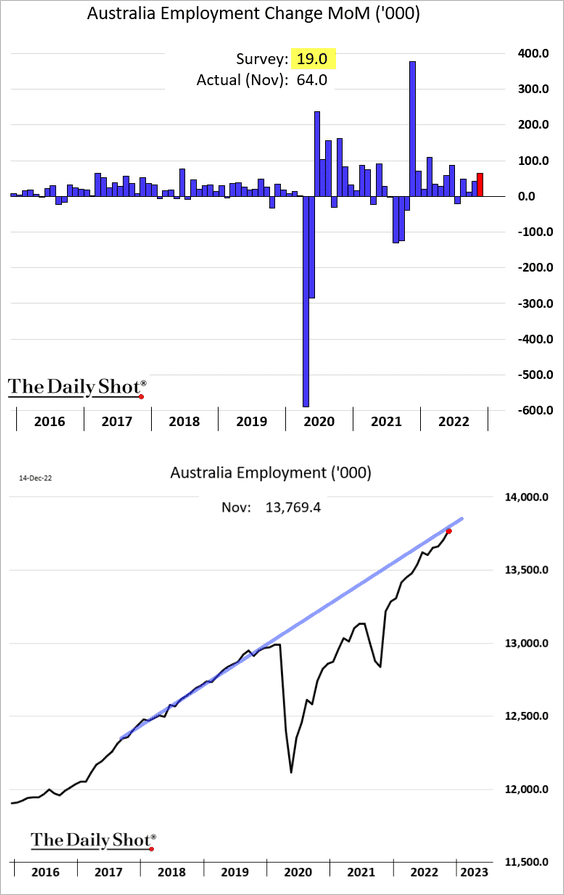

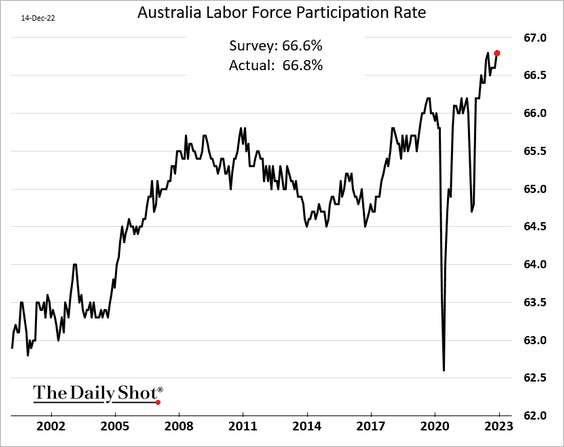

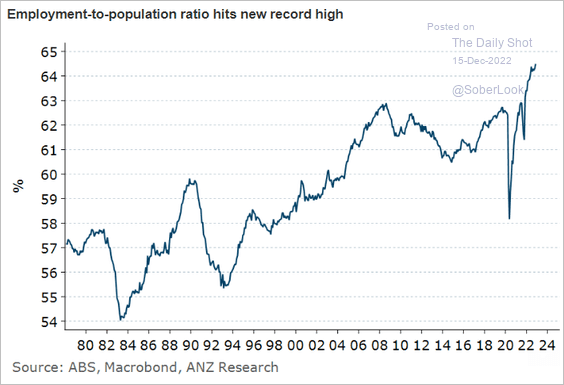

3. Next, we have some updates on Australia.

• The nation as a jobs machine. The labor market performance has been remarkable.

Source: @Swatisays, @markets Read full article

Source: @Swatisays, @markets Read full article

– Job gains (well above forecasts):

– The unemployment rate:

– Labor force participation:

– The employment-to-population ratio:

Source: @ANZ_Research

Source: @ANZ_Research

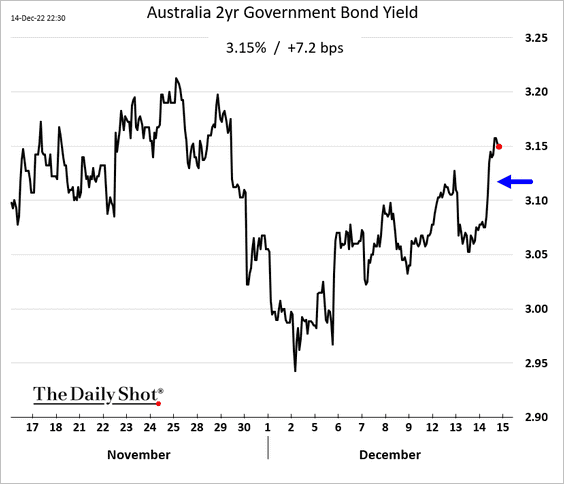

• Bond yields jumped in response to the jobs report.

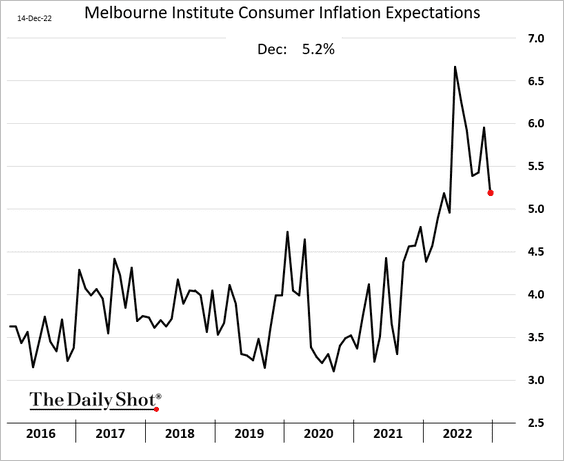

• Inflation expectations are easing.

Back to Index

China

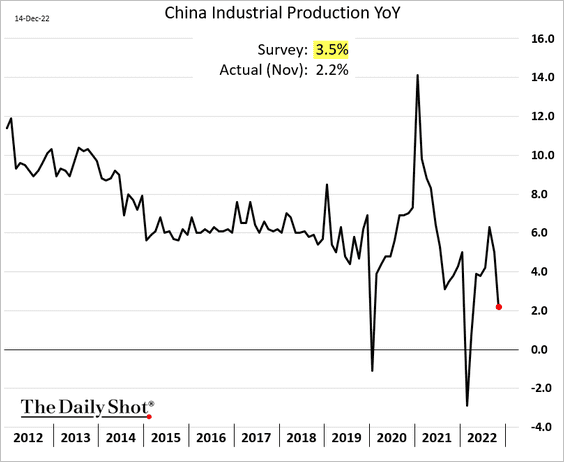

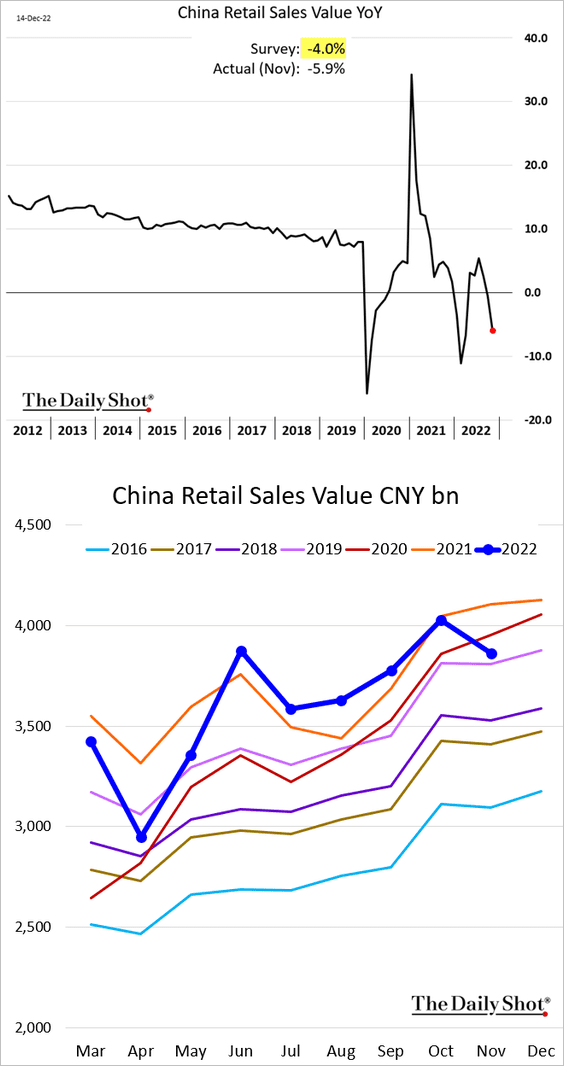

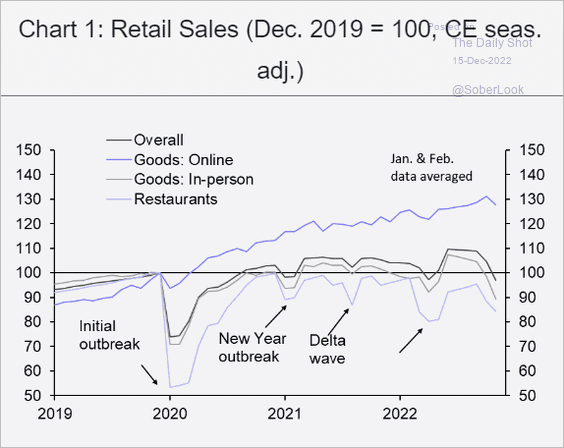

1. Lockdowns took a toll on economic activity last month.

• Industrial production:

• Retail sales:

Source: Capital Economics

Source: Capital Economics

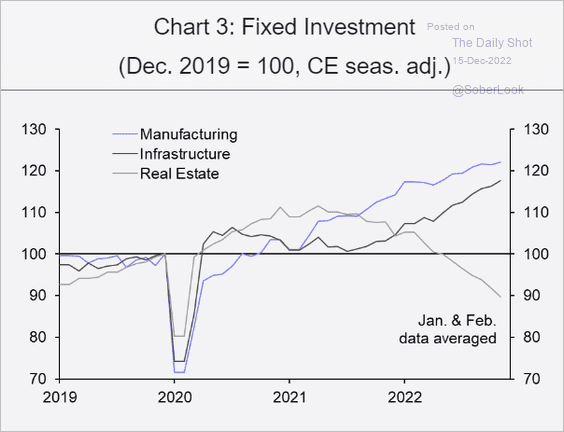

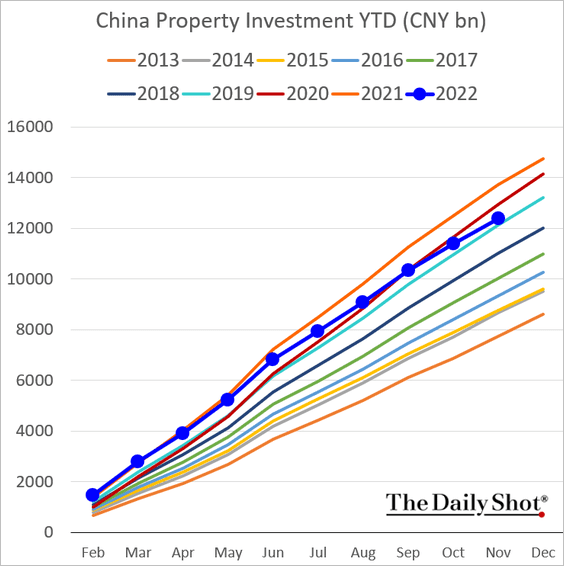

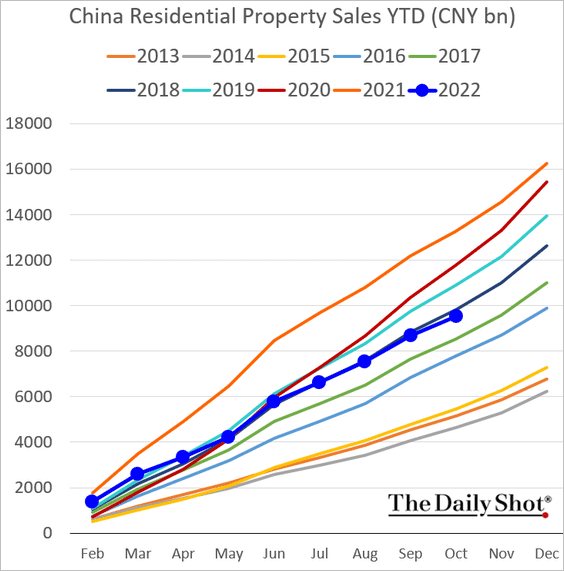

2. The property market remains a drag on growth.

• Fixed investment:

Source: Capital Economics

Source: Capital Economics

Property investment is now well below 2020 levels.

• Residential sales have deteriorated.

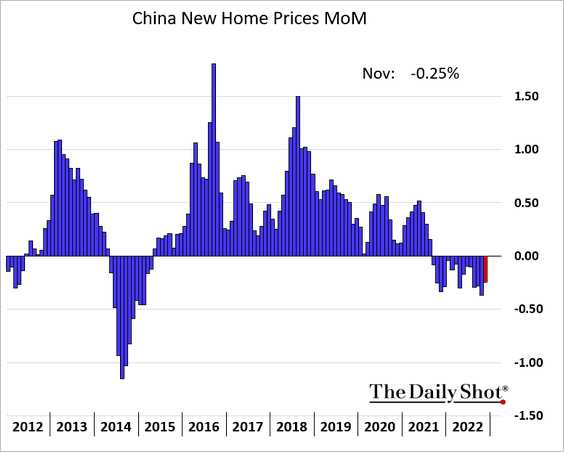

• November was the 15th month of consecutive declines in new home prices.

——————–

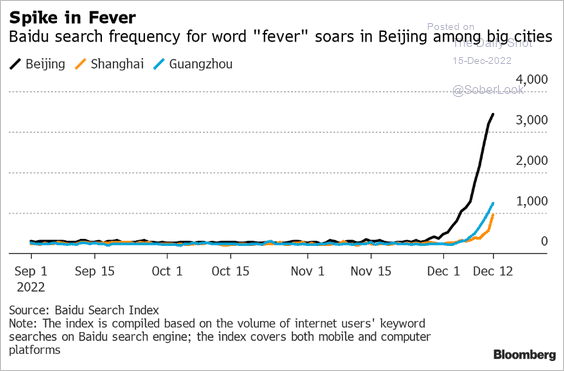

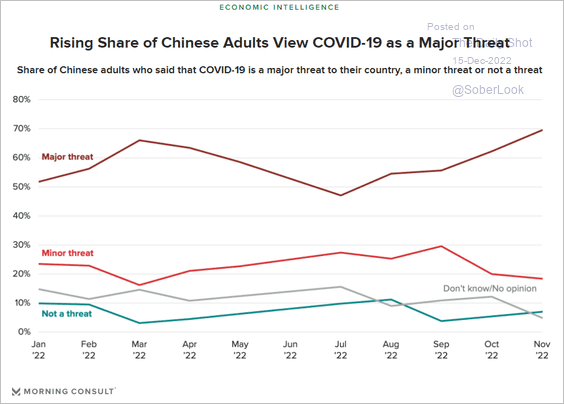

3. COVID is spreading fast.

Source: John Liu, @yujingliu_, @business Read full article

Source: John Liu, @yujingliu_, @business Read full article

Households are increasingly concerned about COVID.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

Emerging Markets

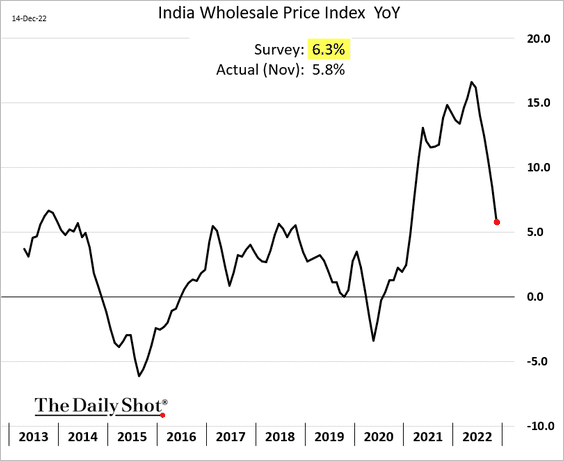

1. India’s wholesale price index surprised to the downside.

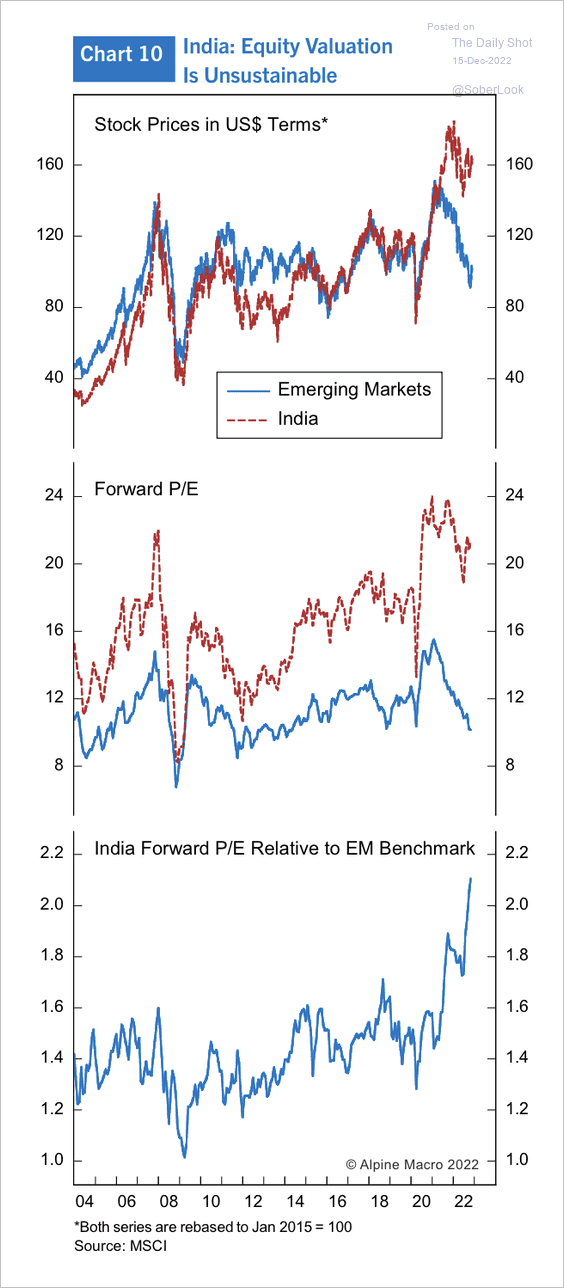

Separately, Indian equities have significantly outperformed the EM benchmark and appear overvalued.

Source: Alpine Macro

Source: Alpine Macro

——————–

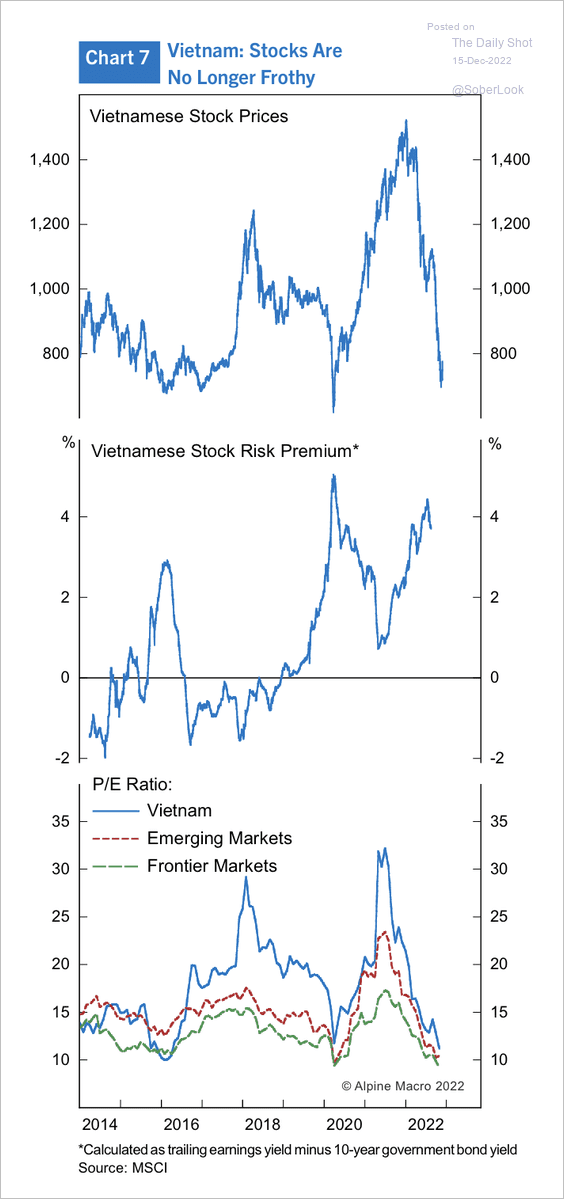

2. Vietnamese equities are trading at their lowest valuation levels in recent years, roughly on par with EM and frontier benchmarks.

Source: Alpine Macro

Source: Alpine Macro

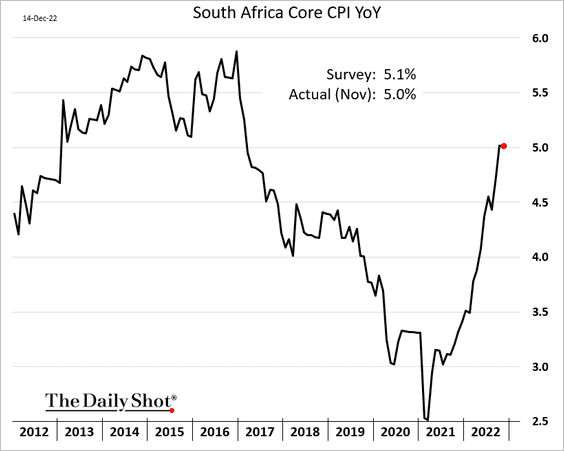

3. South Africa’s core inflation is pausing at 5%.

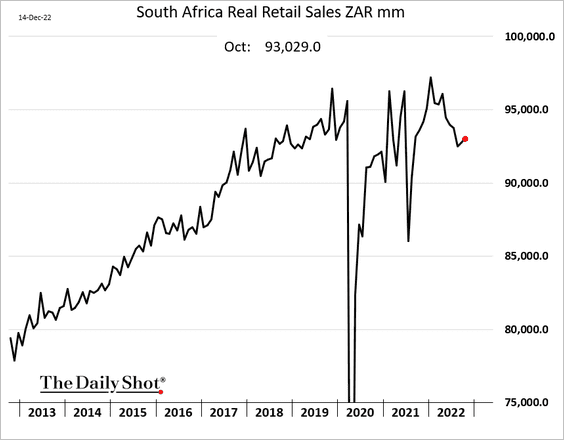

Retail sales edged higher in October.

——————–

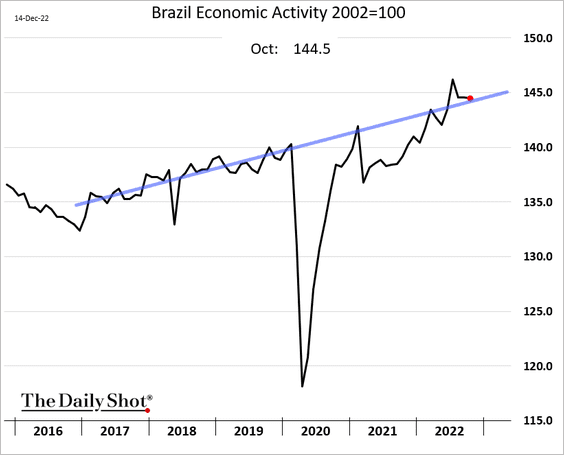

4. Brazil’s economic activity is still on the pre-COVID trend.

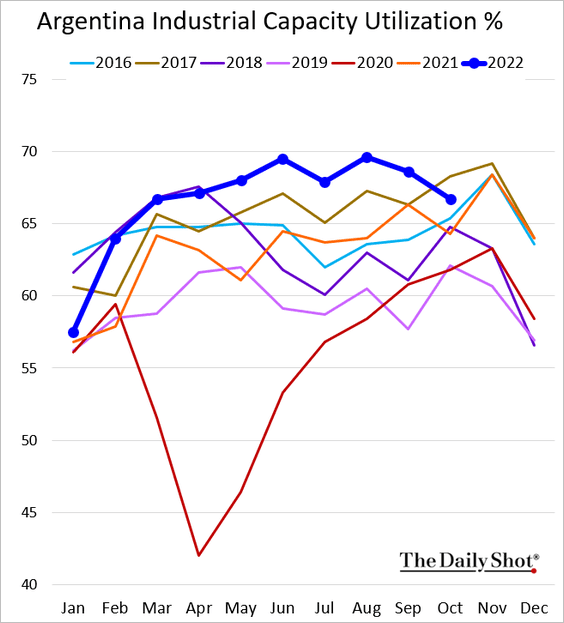

5. Argentina’s capacity utilization took a hit in October.

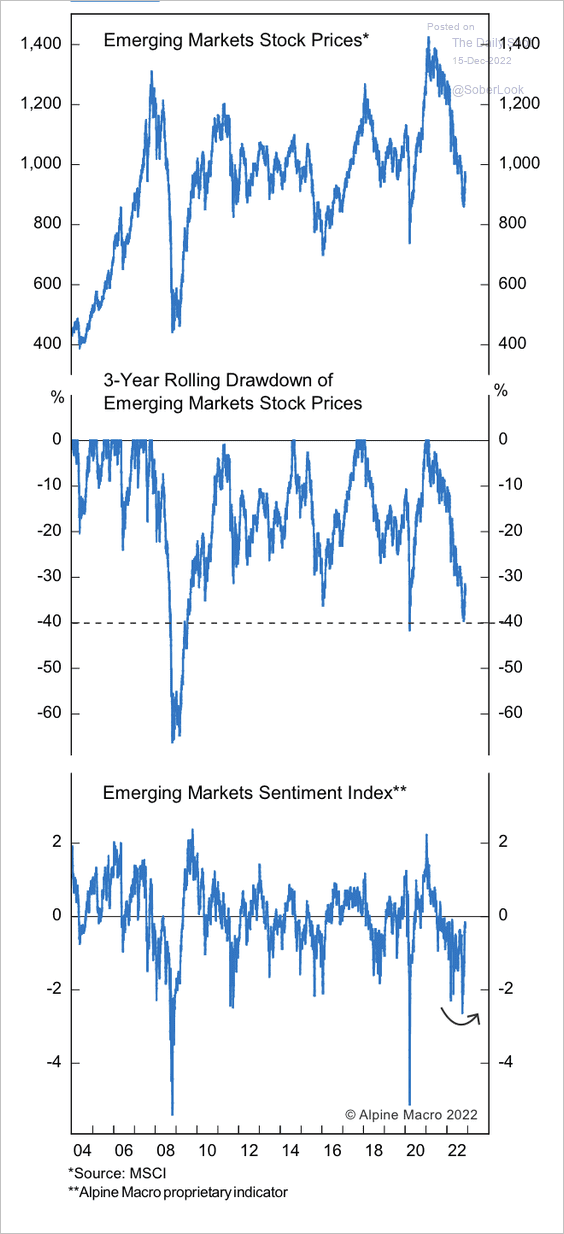

6. EM sentiment is starting to improve, according to Alpine Macro, which could signal a turnaround in equities.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Commodities

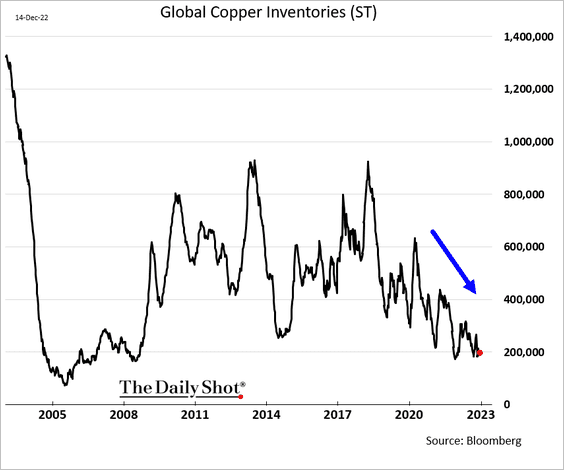

1. Global copper inventories continue to trend lower.

h/t Sungwoo Park

h/t Sungwoo Park

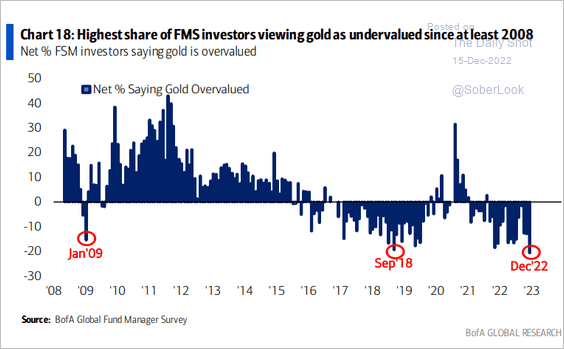

2. Fund managers view gold as undervalued.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Energy

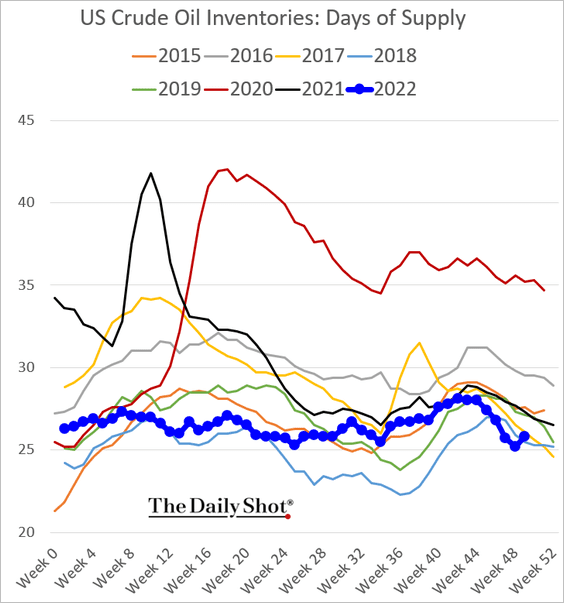

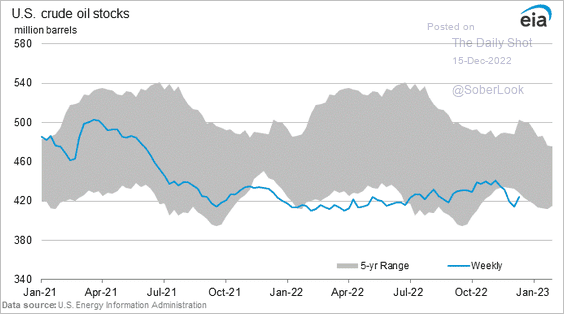

1. US oil inventories improved last week.

• Days of supply:

• Barrels:

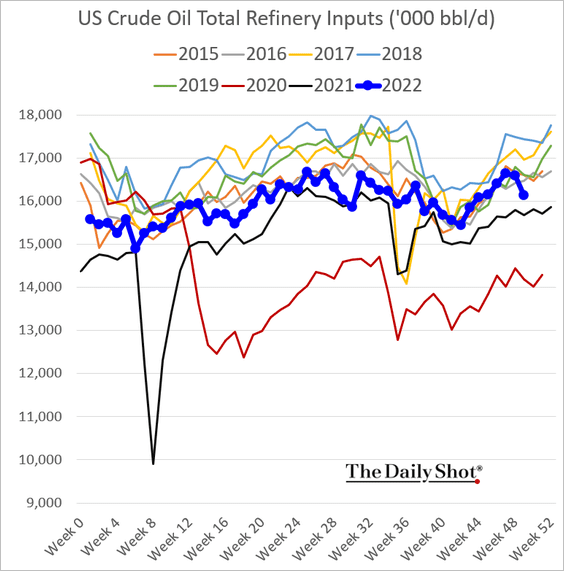

2. Refinery runs declined sharply.

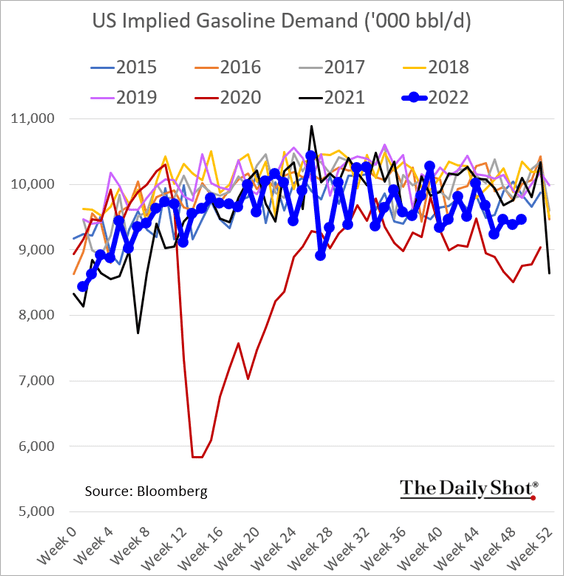

3. US gasoline demand remains soft.

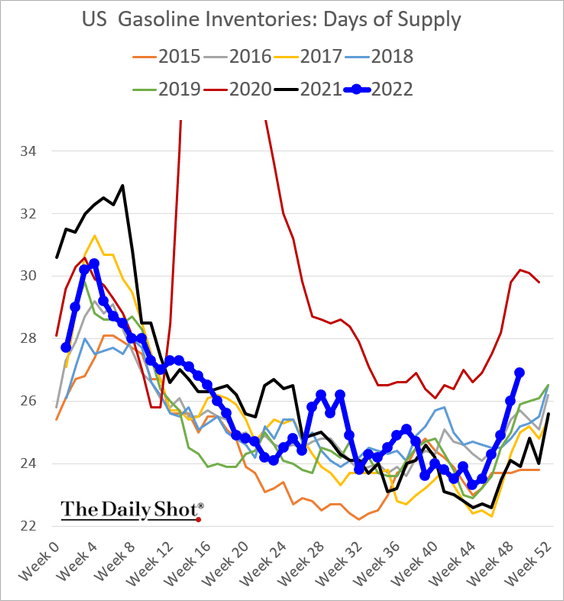

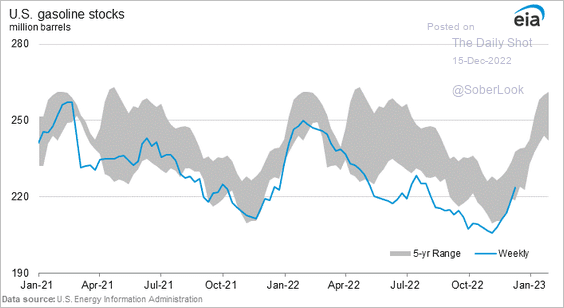

• Gasoline inventories are rising.

• Days of supply:

• Barrels:

Source: @EIAgov

Source: @EIAgov

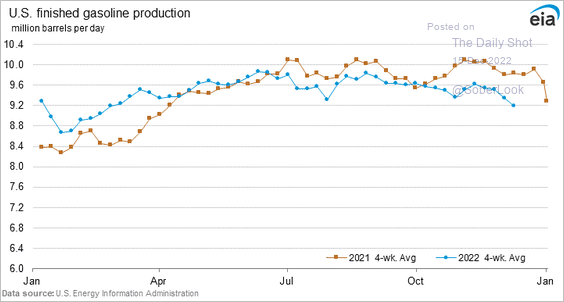

• Gasoline production has been moving lower.

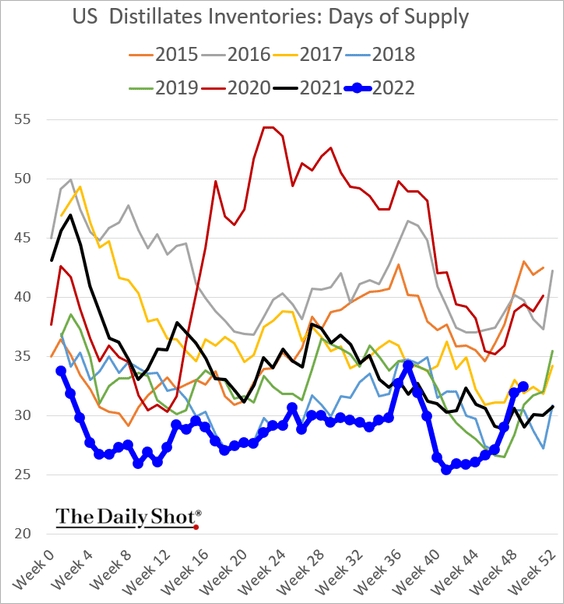

4. Distillates inventories are back at 2017 levels.

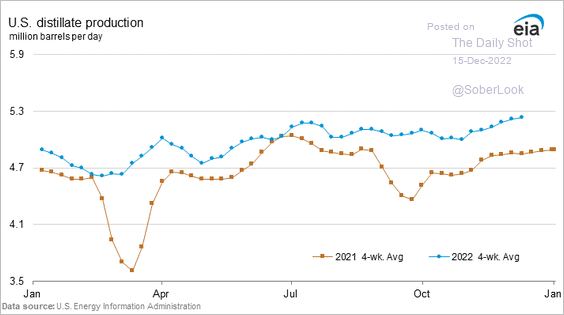

Distillates production is running well above last year’s levels.

Back to Index

Equities

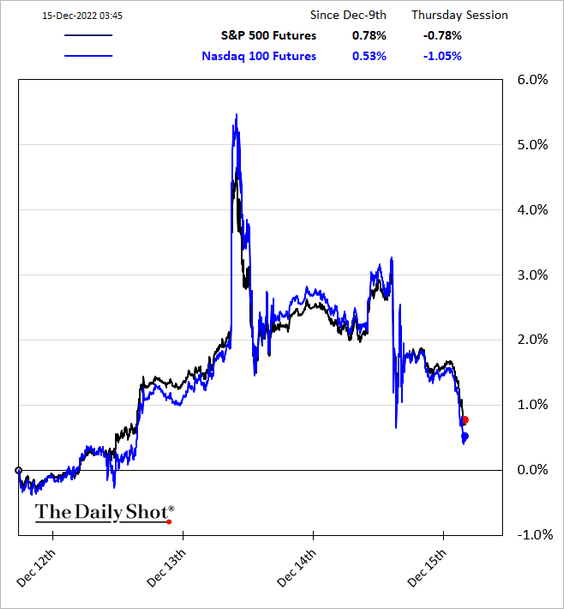

1. Stock futures are lower as the market digests the Fed’s hawkish stance.

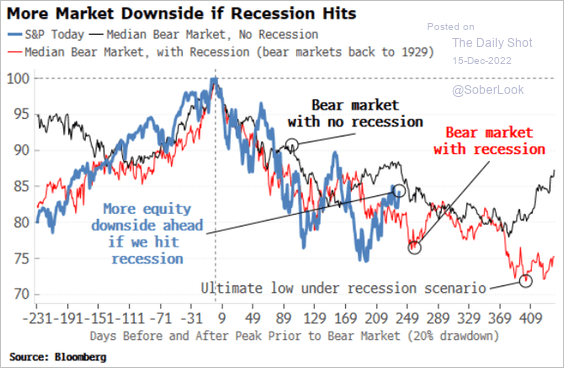

2. The recession scenario could bring further pain.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

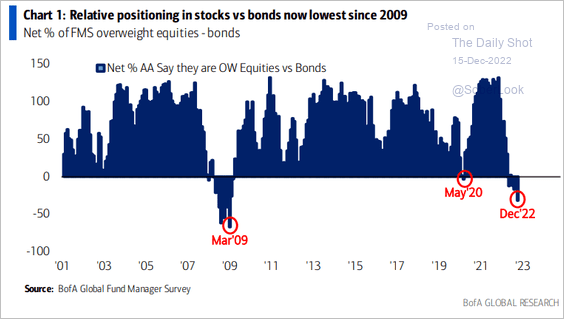

3. Fund managers’ positioning in stocks vs. bonds is very bearish.

Source: BofA Global Research

Source: BofA Global Research

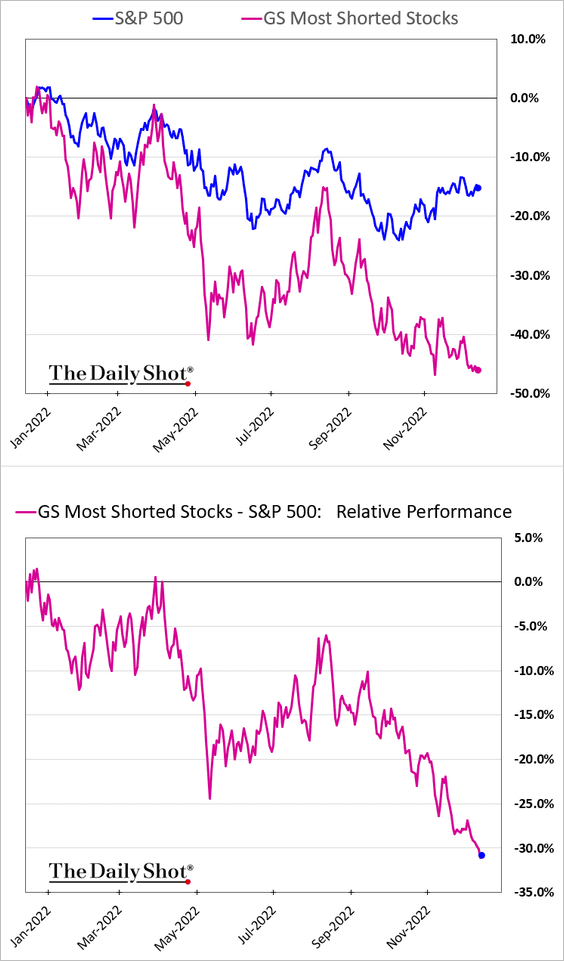

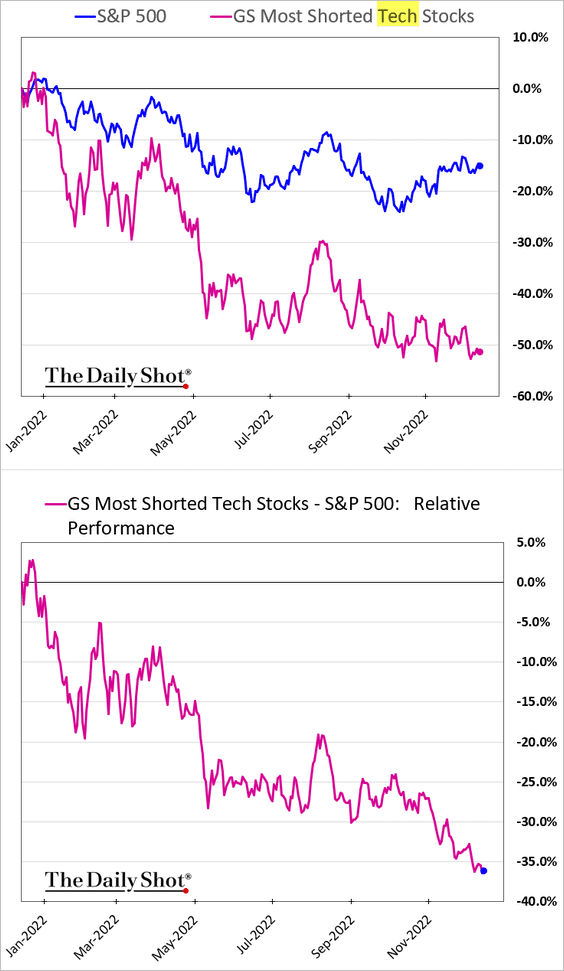

4. Short-covering has remained muted in the current rally.

Here are the most shorted tech stocks.

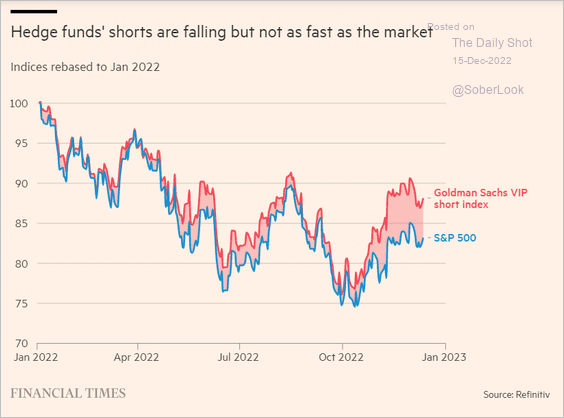

But hedge funds’ preferred short positions have outperformed lately.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

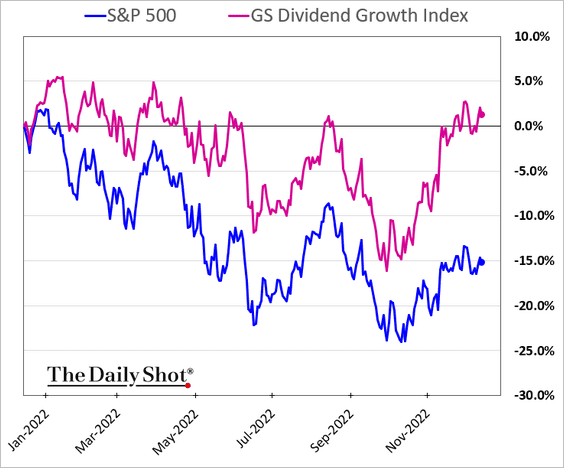

5. Dividend growers continue to outperform.

6. Next, we have some sector updates.

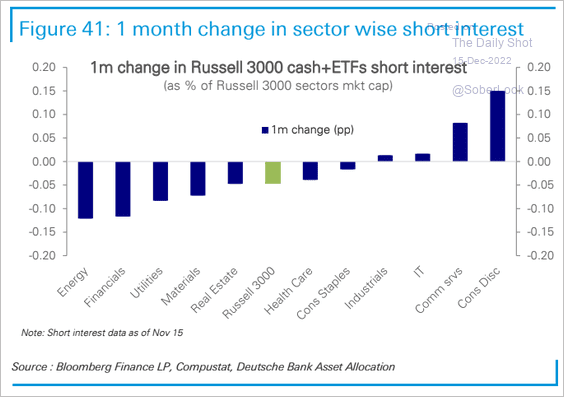

• Changes in short interest:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

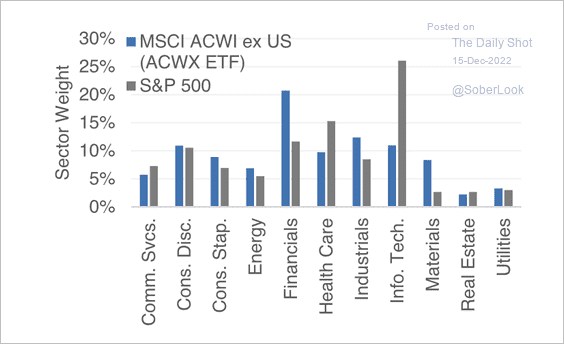

• Stock indices outside of the US tilt toward value.

Source: Evercore ISI Research

Source: Evercore ISI Research

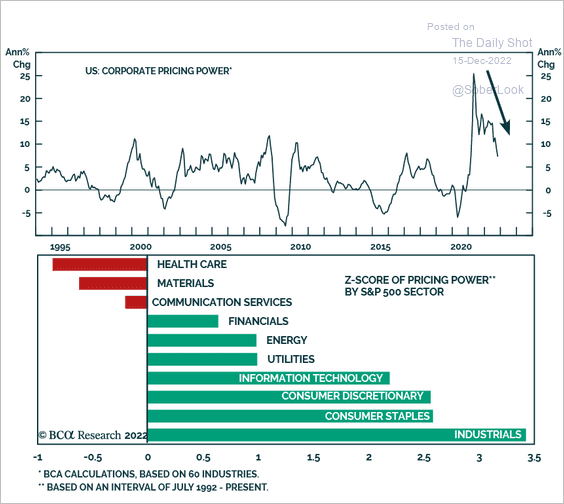

• Pricing power by sector:

Source: BCA Research

Source: BCA Research

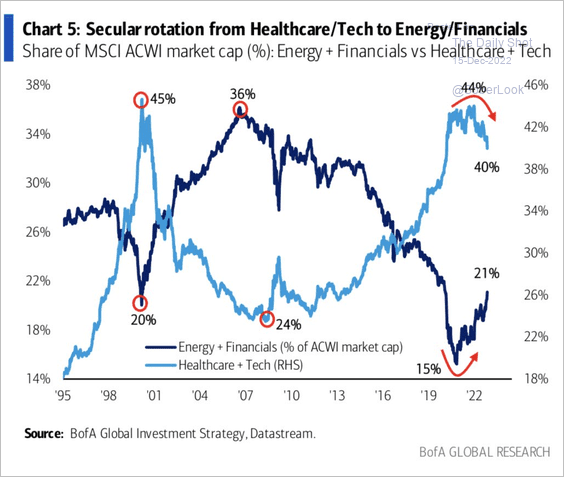

• Secular rotation from tech and healthcare to energy and financials:

Source: BofA Global Research

Source: BofA Global Research

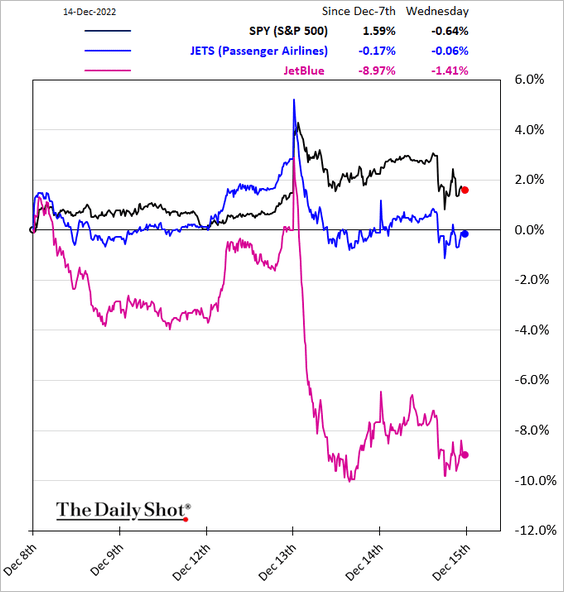

• Are airlines facing a drop in demand?

Further reading

Further reading

——————–

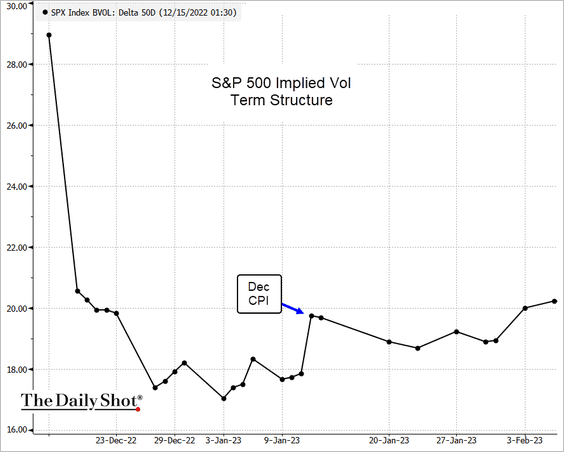

7. The front end of the vol curve remains elevated after the FOMC day.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

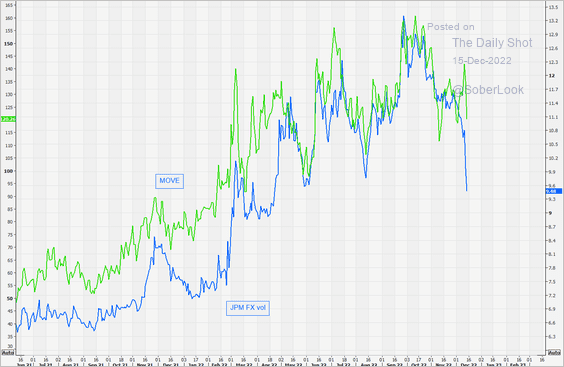

1. Currency markets’ implied volatility is dropping quickly, even as rates vol remains elevated.

Source: @themarketear

Source: @themarketear

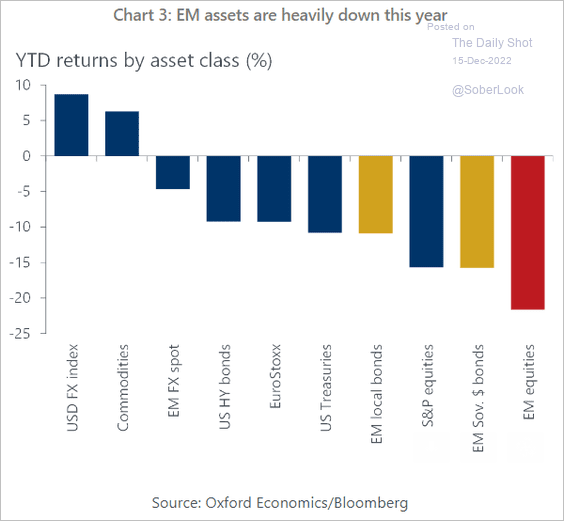

2. This chart shows year-to-date returns by asset class.

Source: Oxford Economics

Source: Oxford Economics

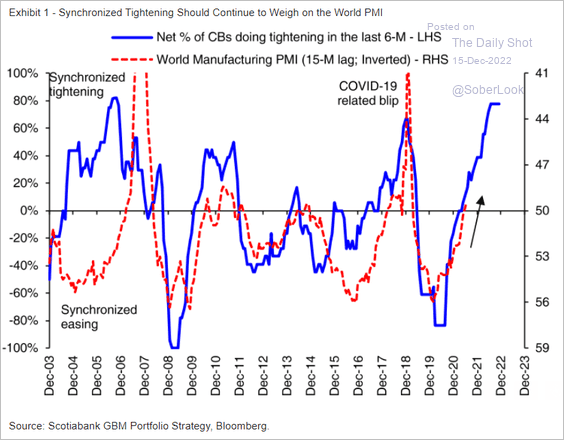

3. Central banks’ massive tightening is yet to fully make its way through the global economy.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

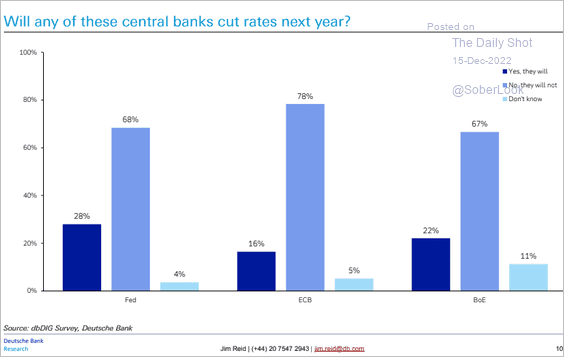

4. Will central banks cut rates next year? Here are the survey results from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

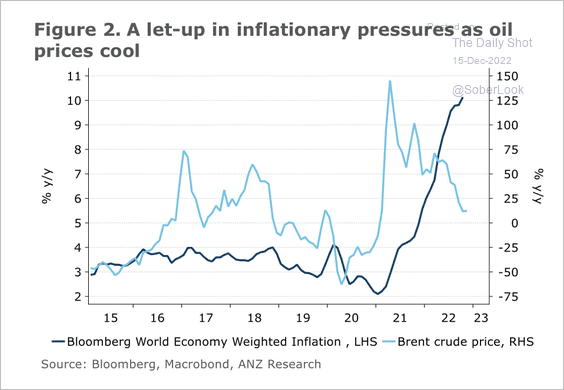

5. The decline in oil prices could result in lower global inflation.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

Food for Thought

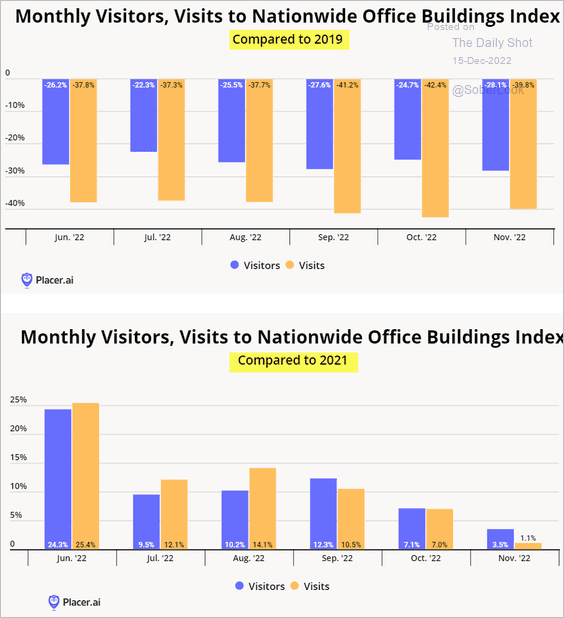

1. US office visits:

Source: Placer.ai

Source: Placer.ai

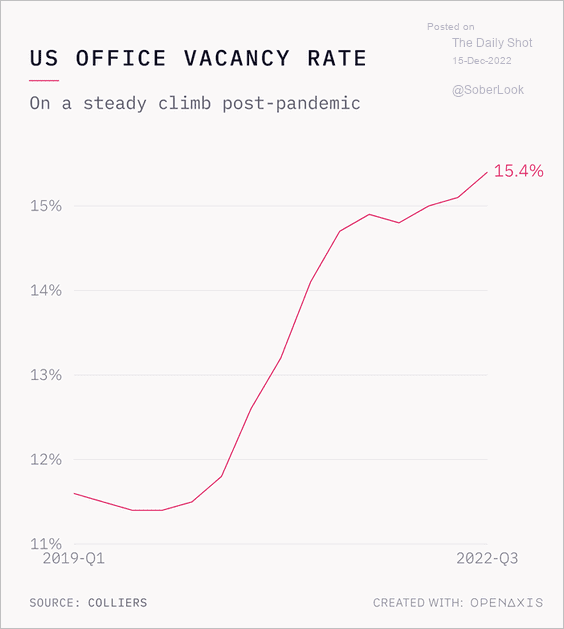

Office vacancy rates:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

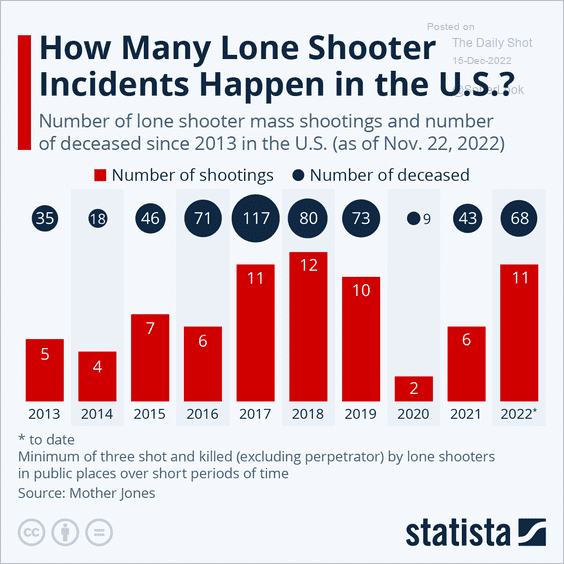

2. US lone shooter incidents:

Source: Statista

Source: Statista

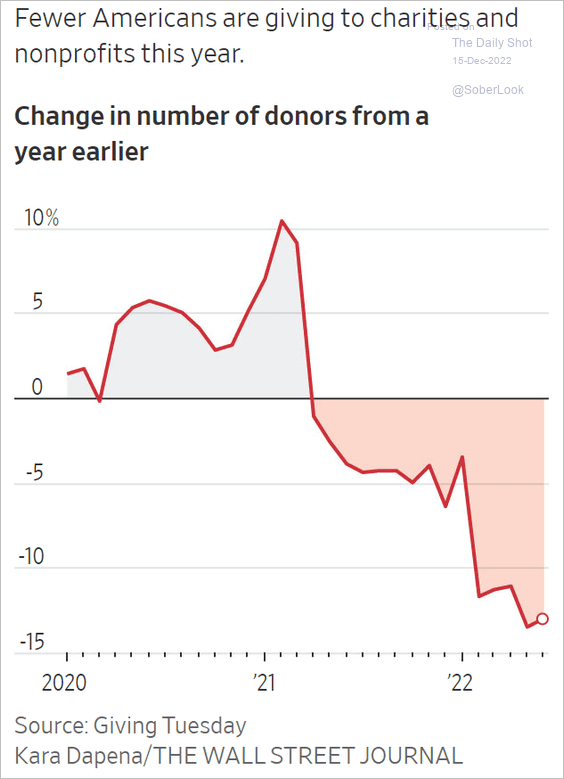

3. Year-over-year changes in the number of Americans giving to charities:

Source: @WSJ Read full article

Source: @WSJ Read full article

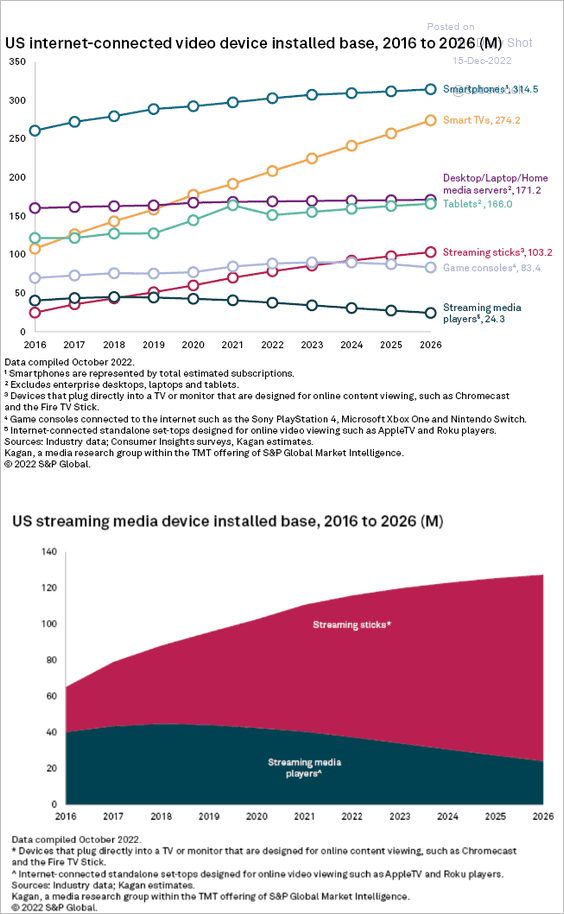

4. US internet-connected video devices:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

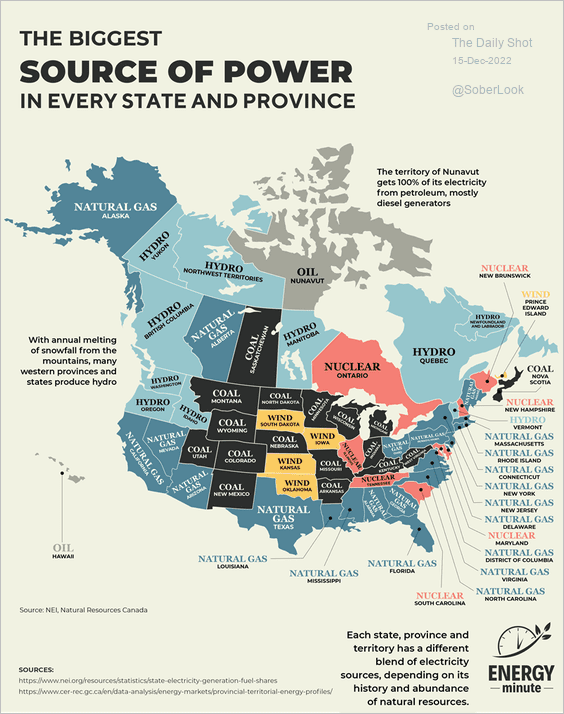

5. Biggest sources of electricity production in the US and Canada, by state/province:

Source: Energy Minute Read full article

Source: Energy Minute Read full article

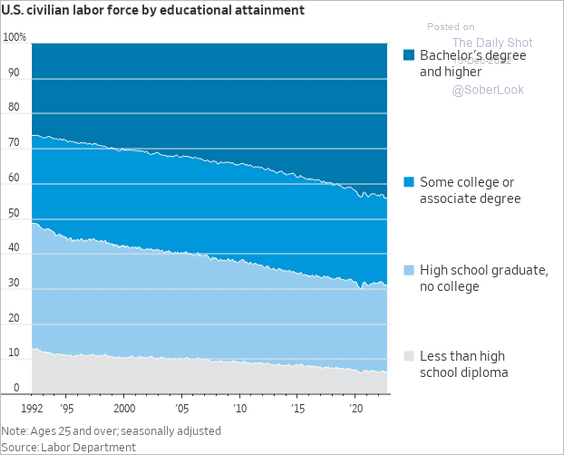

6. The US labor force by educational attainment:

Source: @WSJ Read full article

Source: @WSJ Read full article

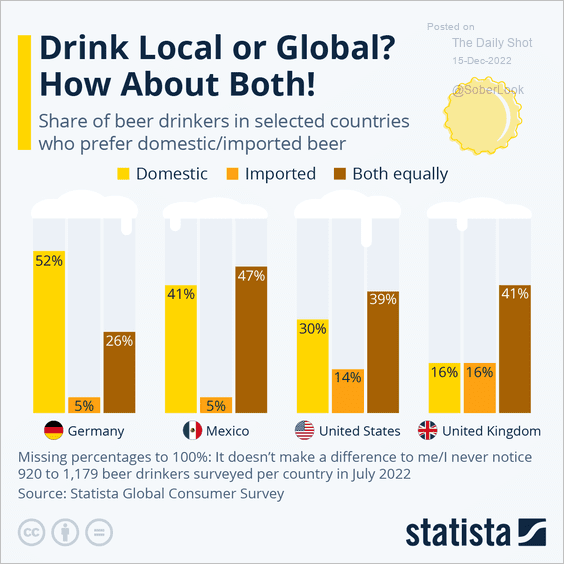

7. Domestic or imported beer?

Source: Statista

Source: Statista

——————–

Back to Index