The Daily Shot: 18-Jan-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

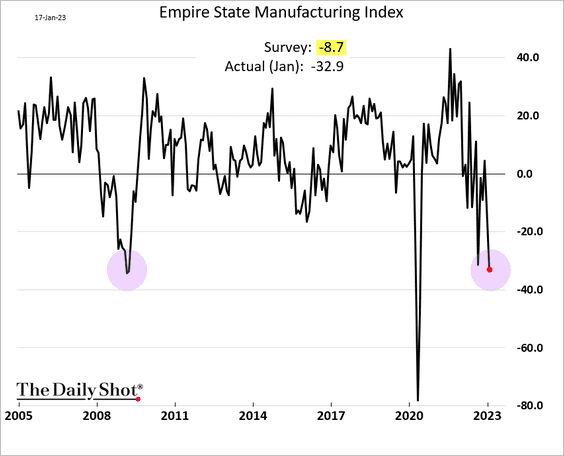

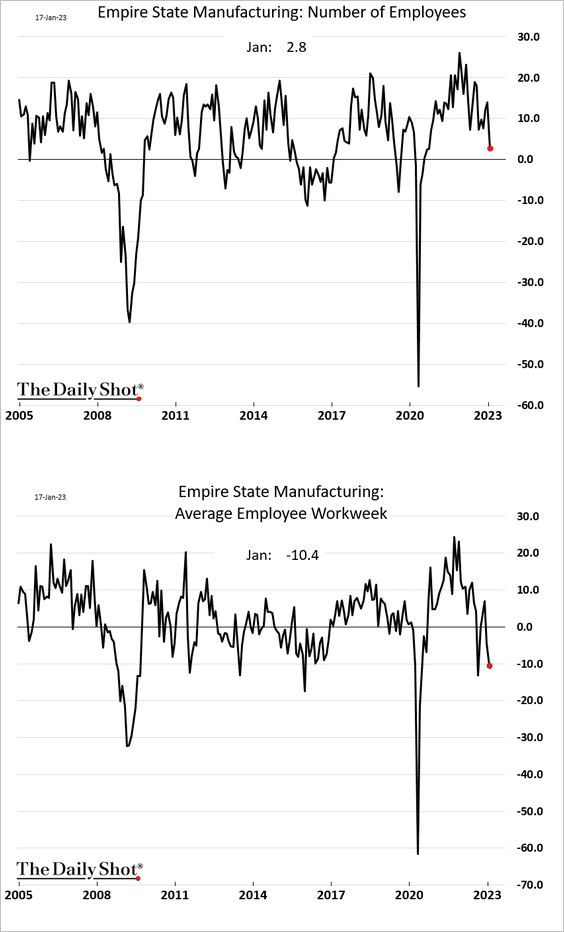

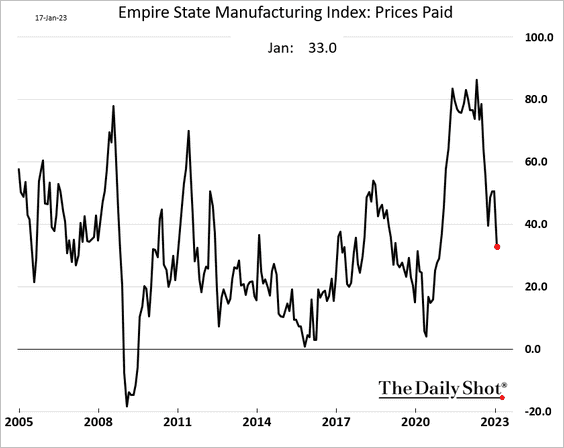

1. The first manufacturing report of the month was a disaster. The NY Fed’s regional factory activity index dipped to the 2008 lows.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

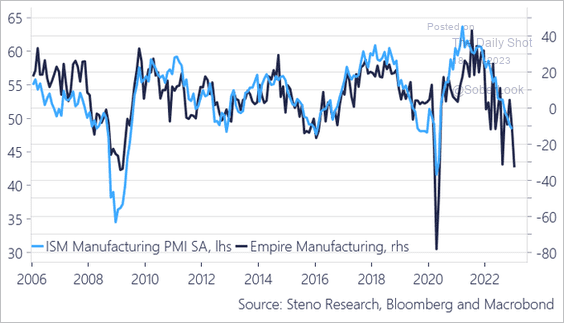

This is bad news for manufacturing at the national level (ISM).

Source: @AndreasSteno

Source: @AndreasSteno

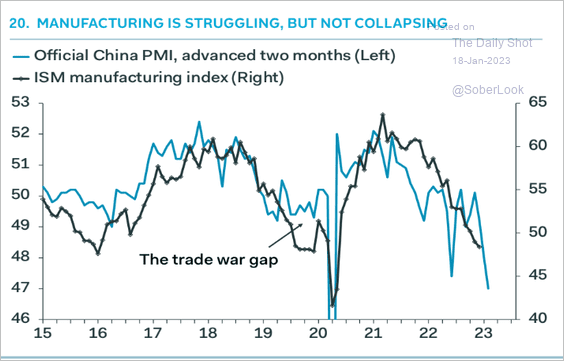

By the way, softer manufacturing activity in China also doesn’t bode well for the ISM index.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

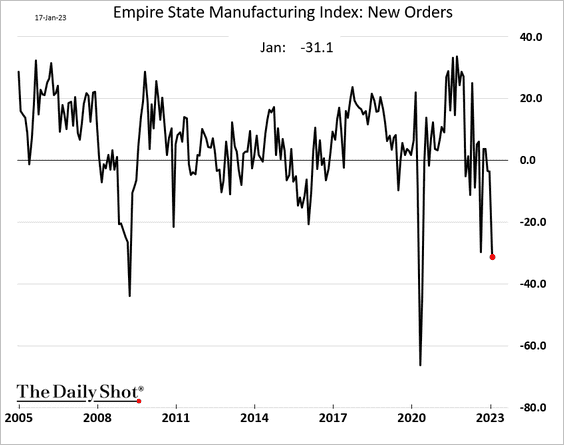

• Demand deteriorated.

• Hiring slowed as factories cut workers’ hours.

• Price pressures continue to ease.

——————–

2. Next, we have some updates on the labor market and wages.

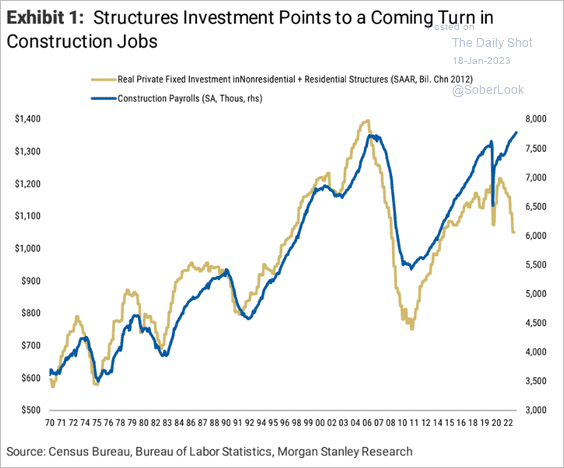

• Construction jobs will take a hit this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

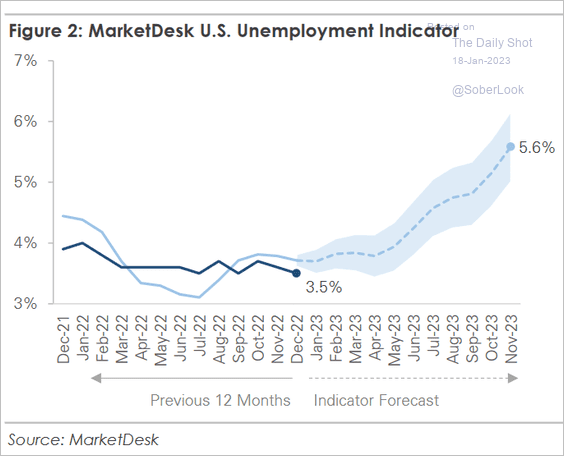

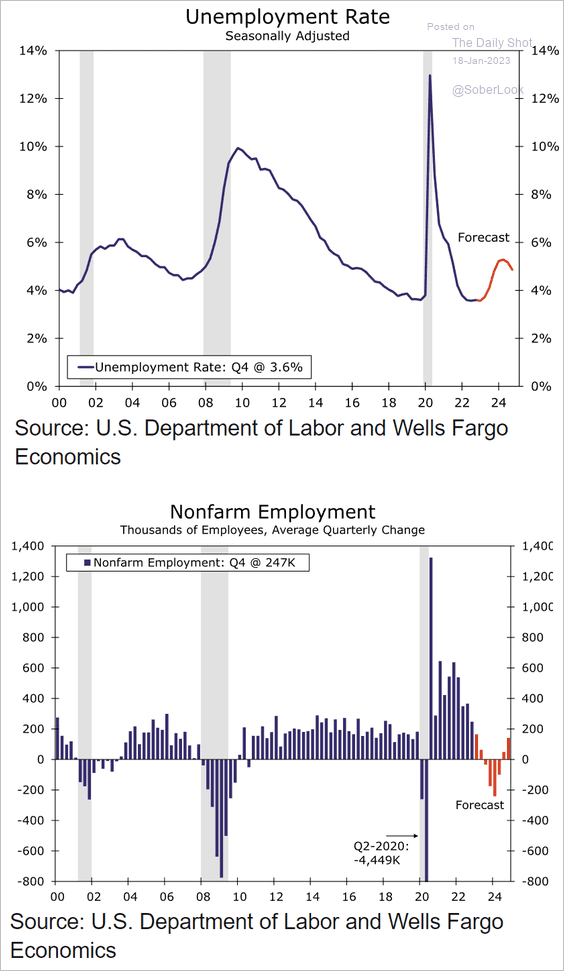

• How much will the unemployment rate climb in 2023?

– This chart shows MarketDesk’s unemployment indicator.

Source: MarketDesk Research

Source: MarketDesk Research

– And here is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

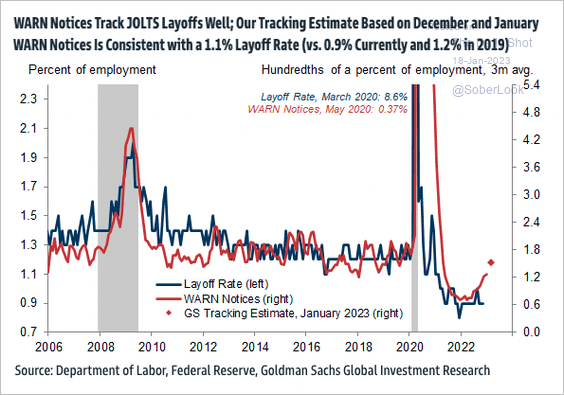

• Layoffs are on the rise but still below pre-COVID levels.

Source: Goldman Sachs; @tracyalloway

Source: Goldman Sachs; @tracyalloway

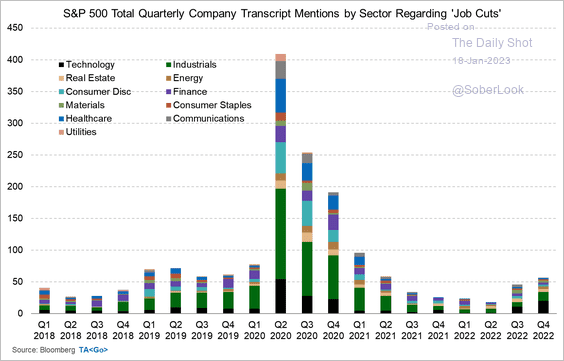

Below is Bloomberg’s count of corporate transcripts mentioning “job cuts” (by sector).

Source: @M_McDonough

Source: @M_McDonough

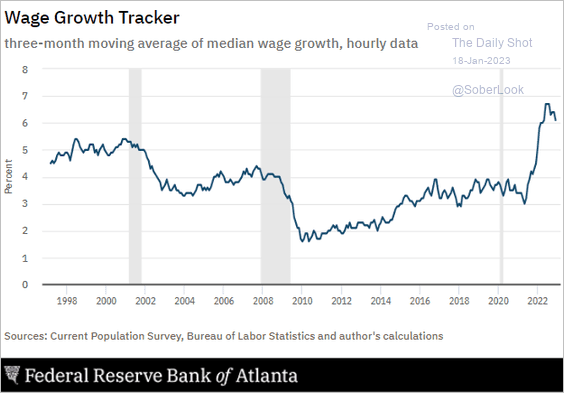

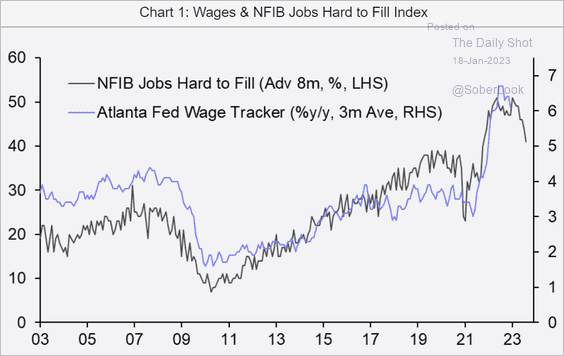

• Wage growth has peaked but remains elevated, according to the Atlanta Fed’s wage tracker.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

– With fewer small businesses complaining about finding workers, wage growth should moderate further.

Source: Capital Economics

Source: Capital Economics

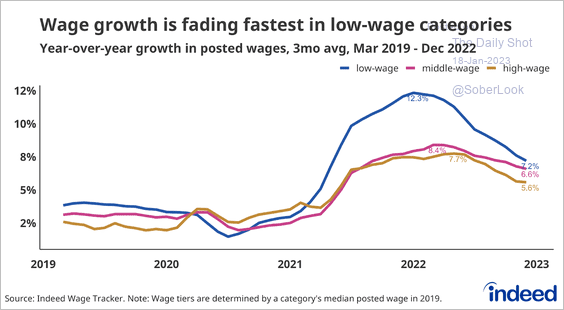

– Pay growth is slowing faster among low-wage workers.

Source: @indeed_labs

Source: @indeed_labs

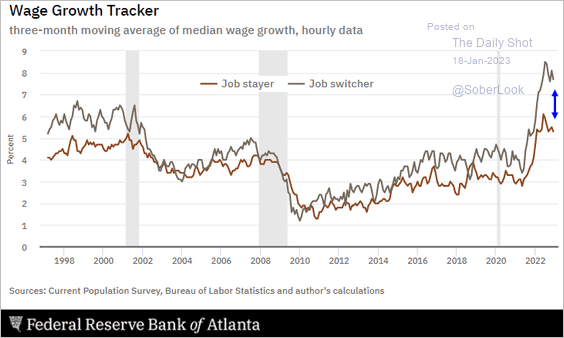

– The wage growth gap between job stayers and job switchers still signals an imbalance in the labor market (companies willing to pay a significant premium to attract workers).

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

——————–

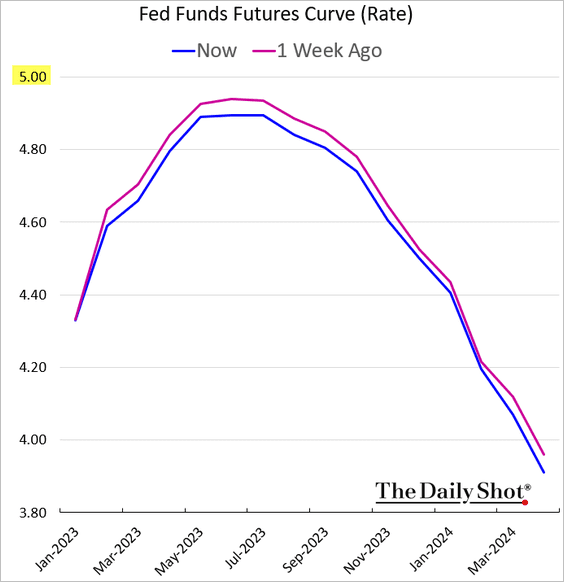

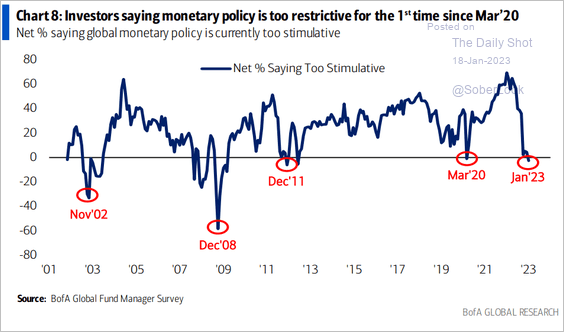

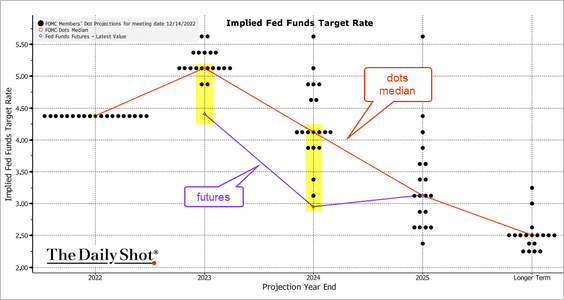

3. The market is betting that the Fed will blink before reaching 5% on the fed funds rate.

• Investors now see monetary policy as too restrictive.

Source: BofA Global Research

Source: BofA Global Research

• This chart shows the divergence between the Fed’s dot plot and the market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

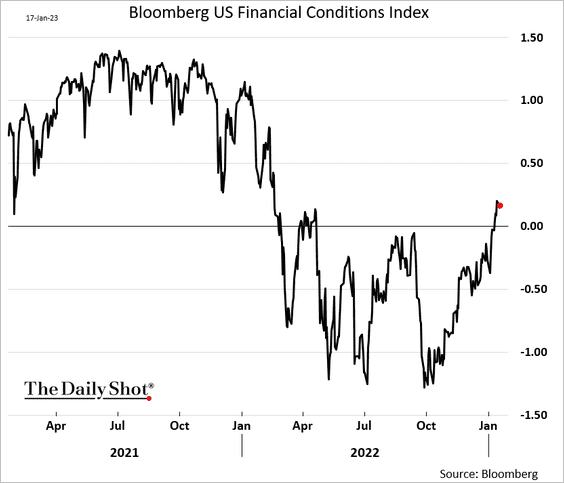

• Financial conditions continue to ease, frustrating Fed officials.

Back to Index

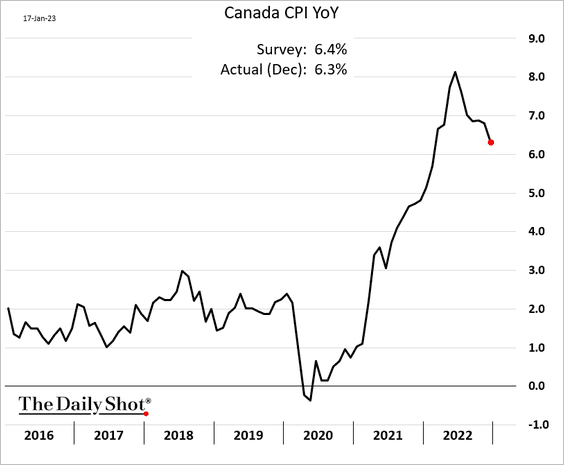

Canada

1. Inflation continues to moderate.

Source: Reuters Read full article

Source: Reuters Read full article

But core inflation remains stubbornly high.

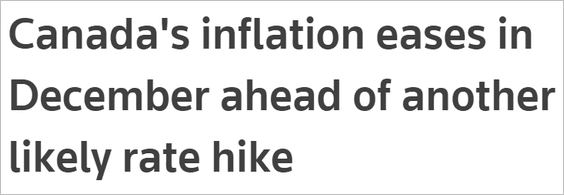

• Trimmed-mean:

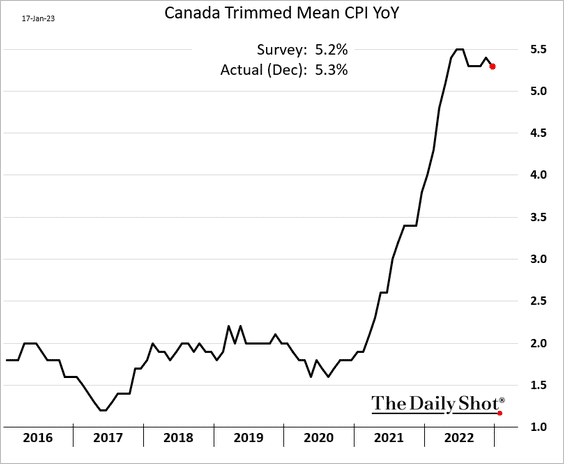

• Median:

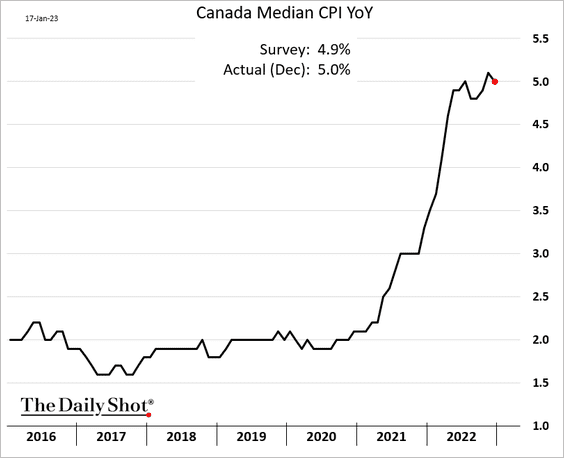

• Excluding food and energy:

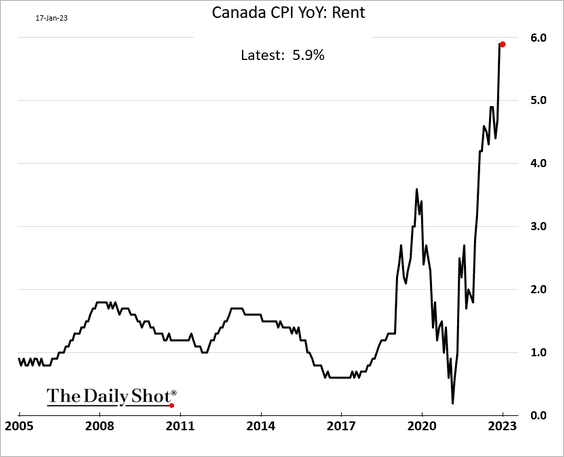

The rise in rent inflation has been severe.

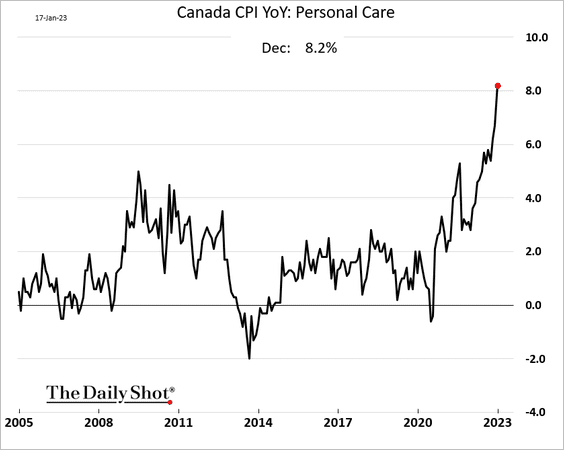

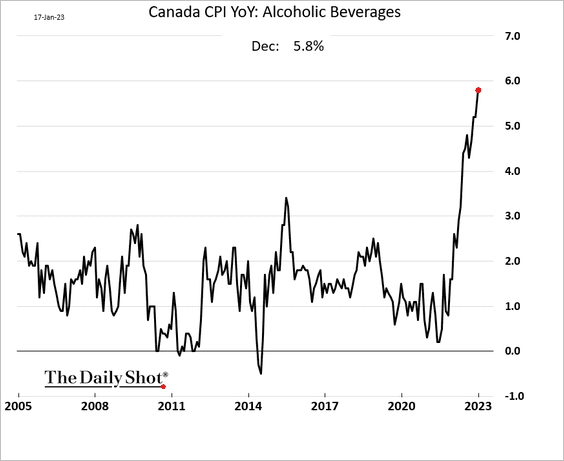

Here are a couple of other CPI components.

• Personal care CPI:

• Alcohol:

——————–

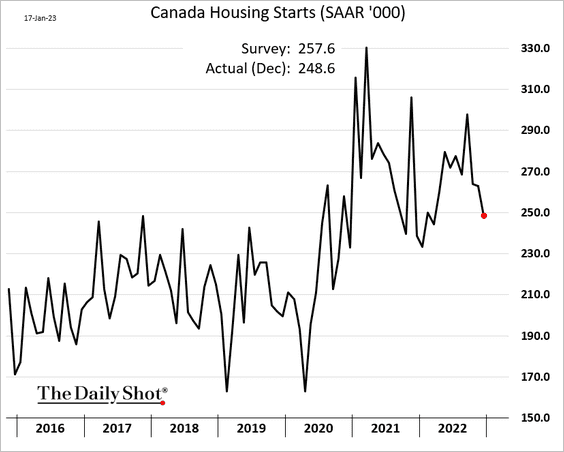

2. Housing starts slowed in December.

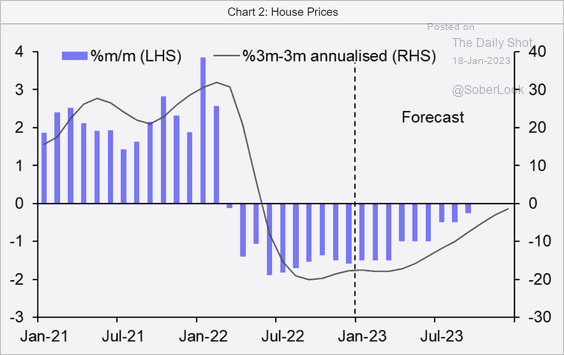

3. Home prices will stabilize later this year.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

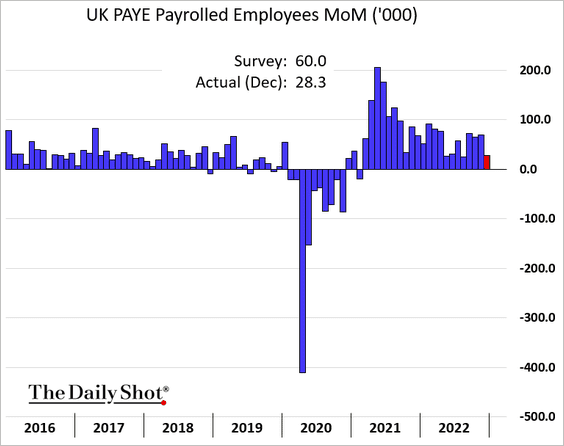

1. Payroll gains in December were smaller than expected.

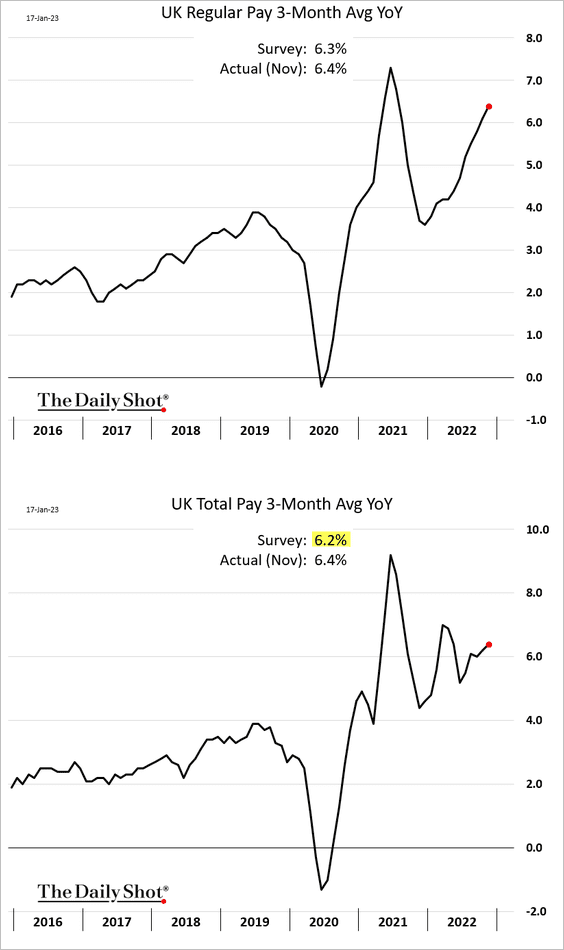

• Wages continue to surge.

Source: Reuters Read full article

Source: Reuters Read full article

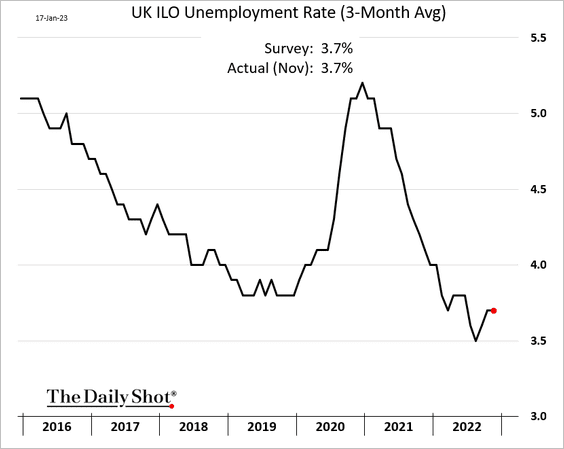

• The unemployment rate remains low.

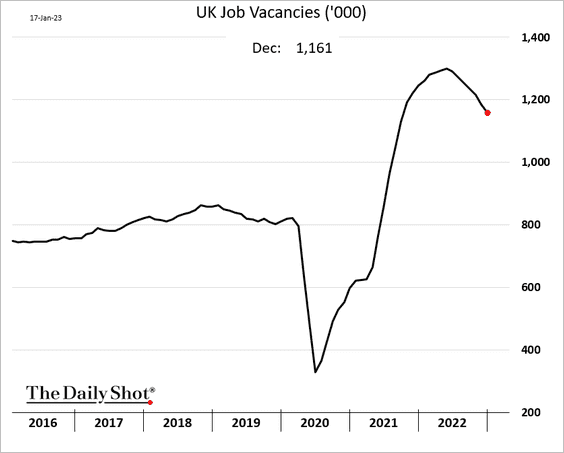

• Just like in the US, job openings have peaked but remain well above pre-COVID levels.

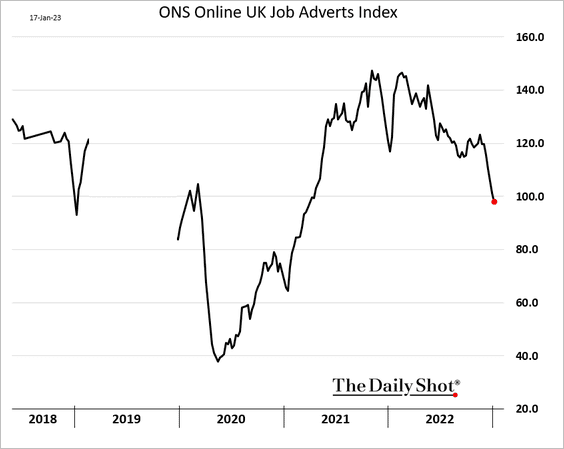

Online job ads have been falling.

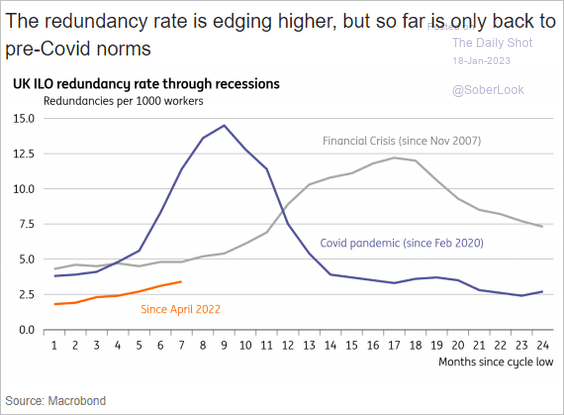

• Layoffs are edging up but are still quite low.

Source: ING

Source: ING

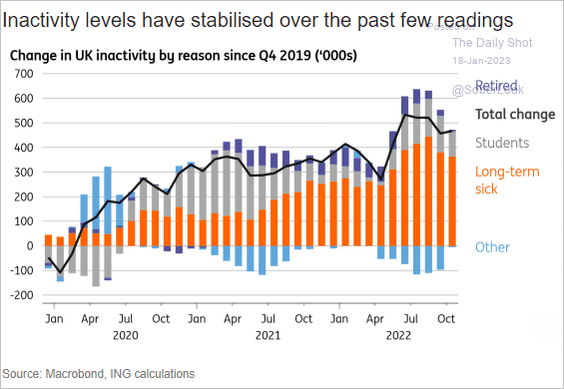

• Inactivity remains elevated.

Source: ING

Source: ING

——————–

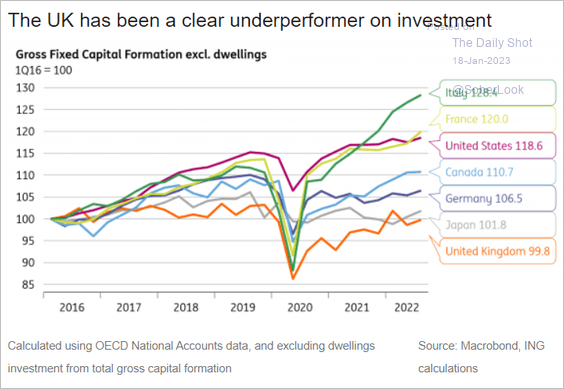

2. UK business investment has been lagging behind global peers.

Source: ING

Source: ING

Back to Index

The Eurozone

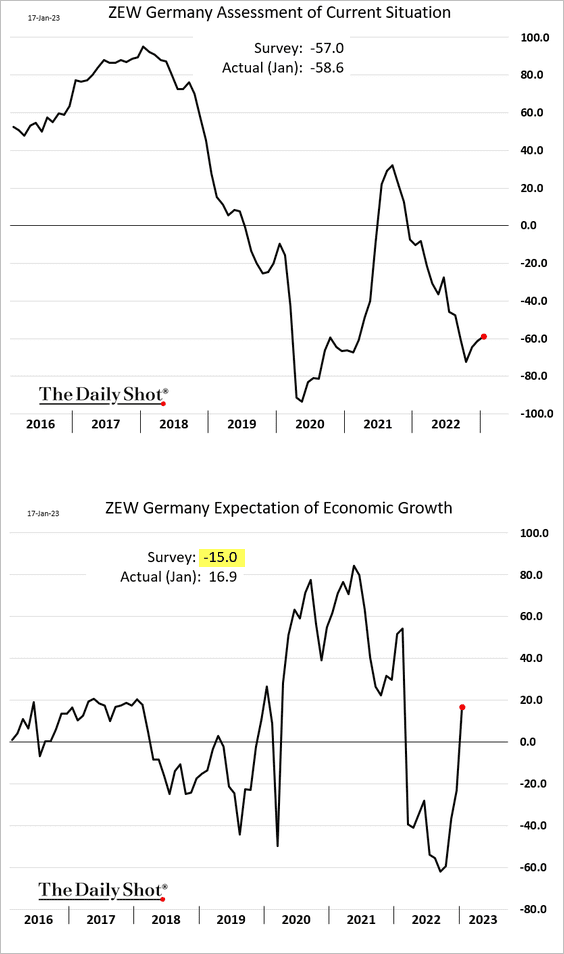

1. Germany’s economic sentiment is rebounding rapidly (2nd panel).

Source: Reuters Read full article

Source: Reuters Read full article

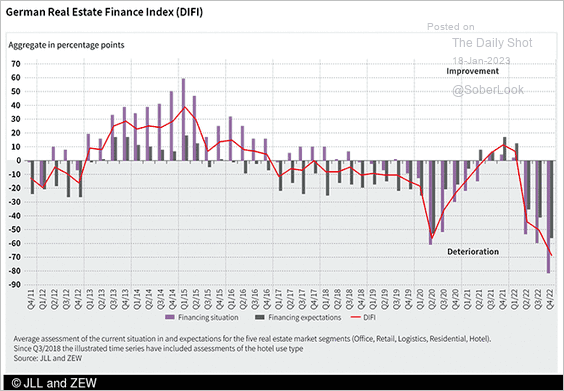

2. Germany’s real estate finance sentiment has deteriorated.

Source: ZEW

Source: ZEW

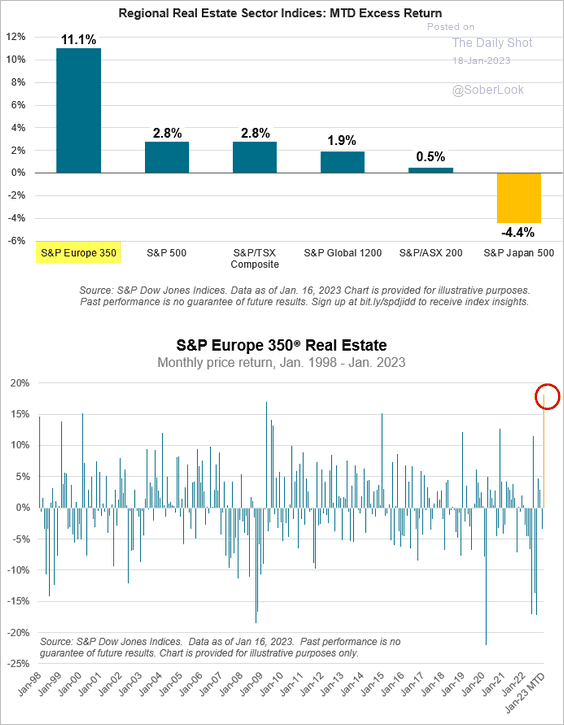

But European real estate shares have been outperforming.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

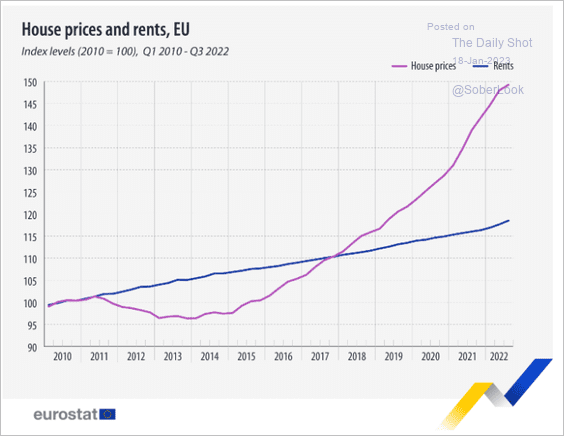

This chart shows the divergence between home prices and rents in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

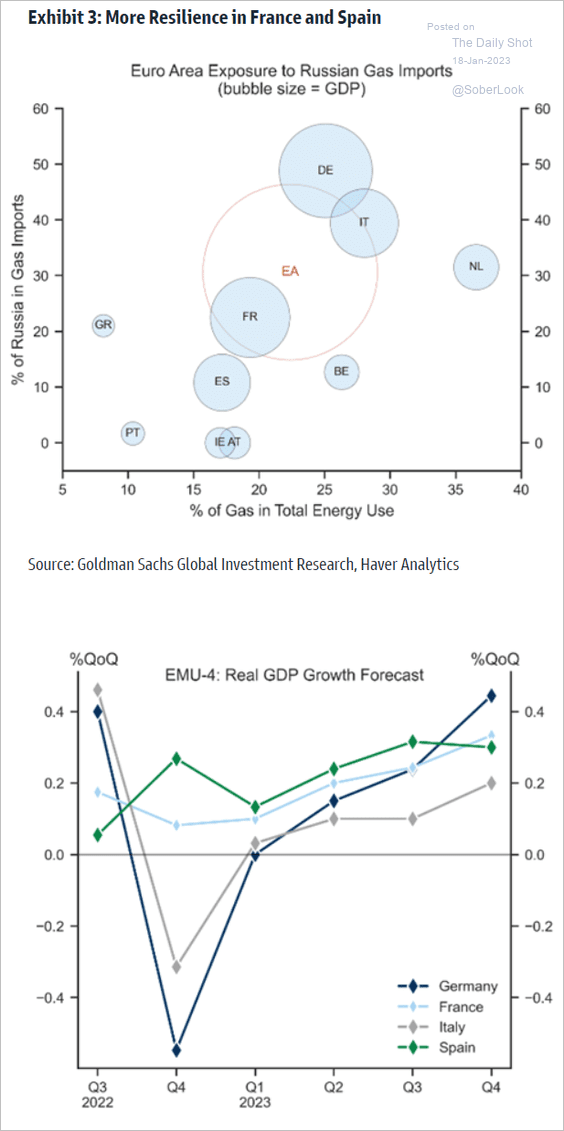

3. France and Spain are less reliant on natural gas than Germany and Italy.

Source: Goldman Sachs

Source: Goldman Sachs

4. Here is Goldman’s wage growth tracker.

![]() Source: Goldman Sachs

Source: Goldman Sachs

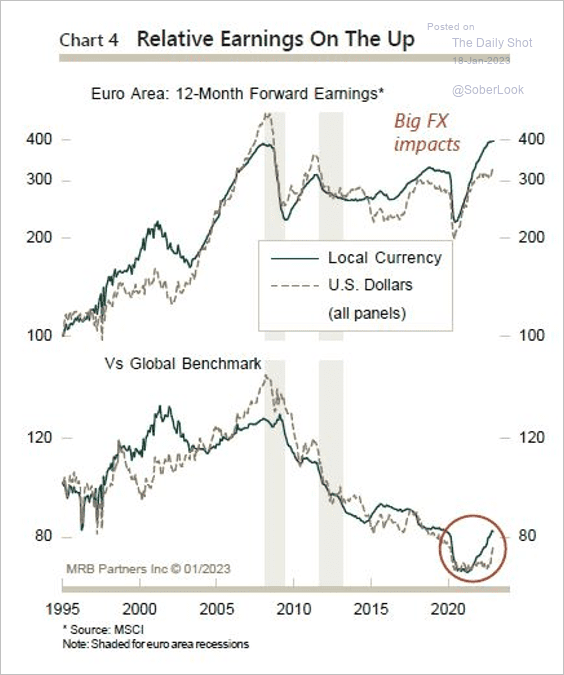

5. Euro-area corporate earnings have been resilient over the past year.

Source: MRB Partners

Source: MRB Partners

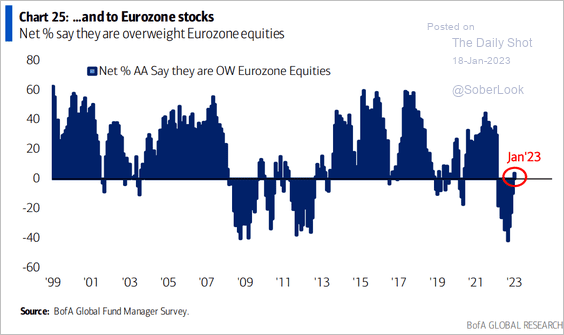

Investors are turning bullish on Eurozone stocks.

Source: BofA Global Research

Source: BofA Global Research

——————–

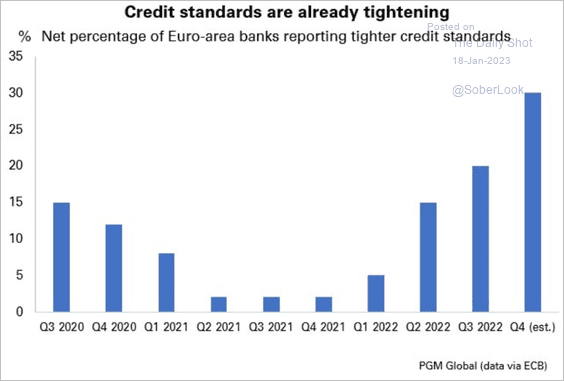

6. Credit standards have been tightening.

Source: PGM Global

Source: PGM Global

Back to Index

Japan

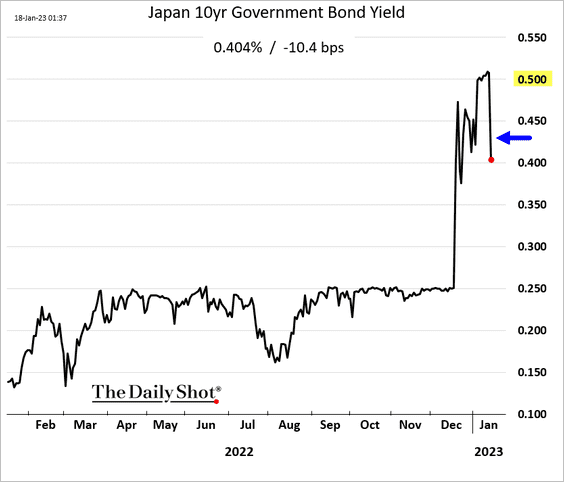

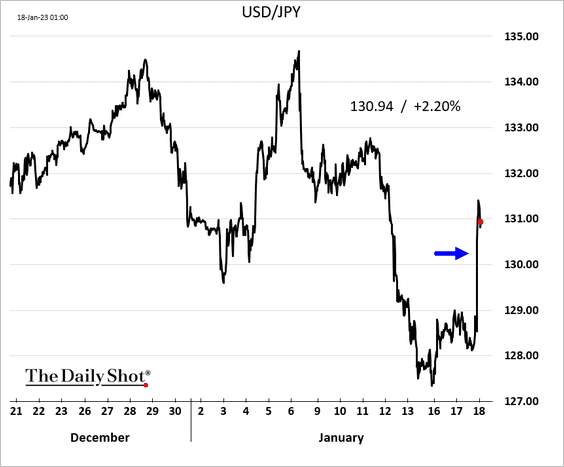

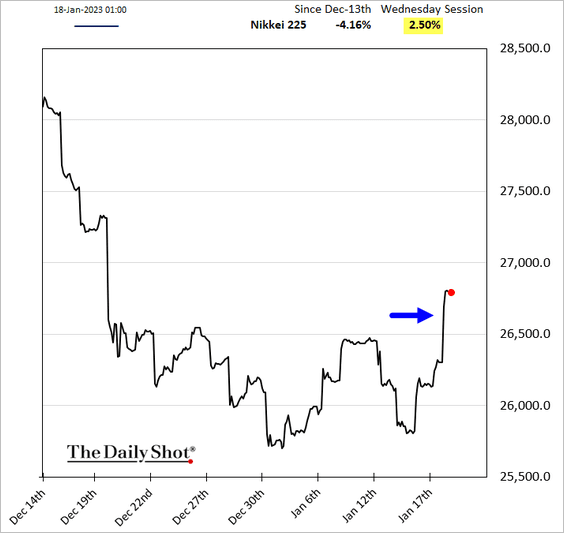

1. The BoJ is not budging on yield control.

Source: Reuters Read full article

Source: Reuters Read full article

Here is the market reaction.

• The 10yr JGB:

• Dollar-yen (chart shows USD gaining against the yen):

• Stocks:

——————–

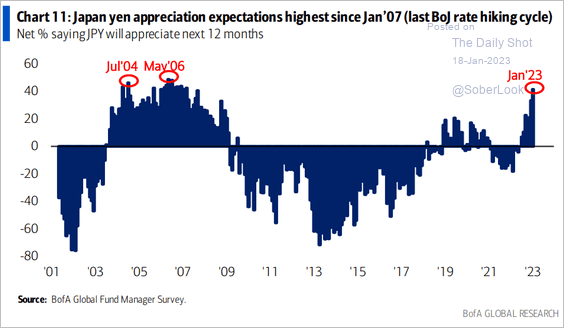

2. Is long yen a crowded trade now?

Source: BofA Global Research

Source: BofA Global Research

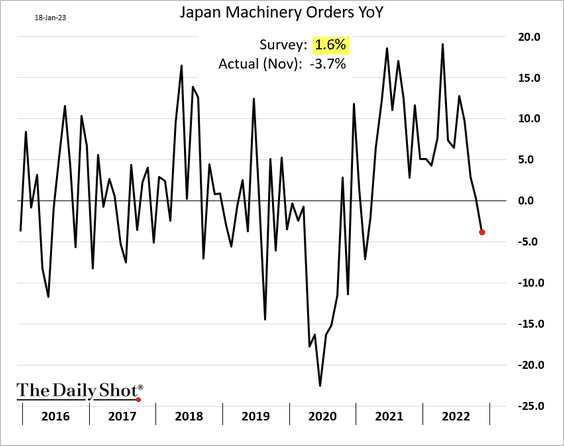

3. Machinery orders unexpectedly declined on a year-over-year basis.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Asia – Pacific

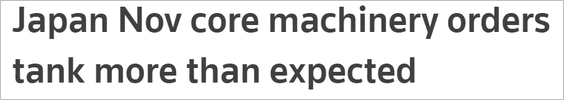

1. Taiwan’s GDP surprised to the downside(an unexpected year-over-year decline).

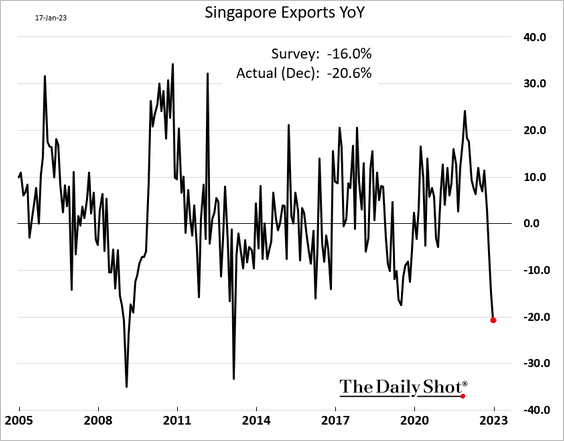

2. Singapore’s exports tumbled over 20% last year.

Source: @economics Read full article

Source: @economics Read full article

——————–

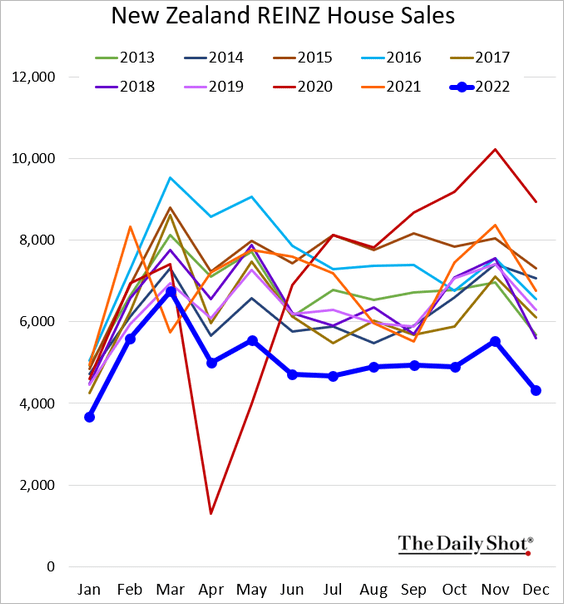

3. New Zealand’s home sales remain depressed.

Back to Index

China

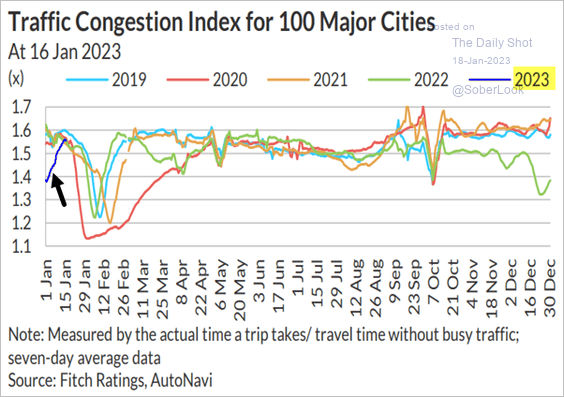

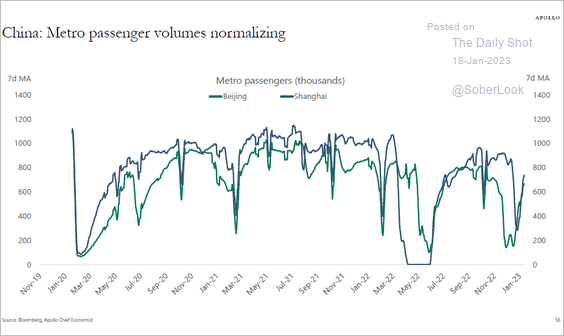

1. Mobility indicators are rebounding.

• Traffic congestion:

Source: Fitch Ratings

Source: Fitch Ratings

• Subway passenger numbers:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

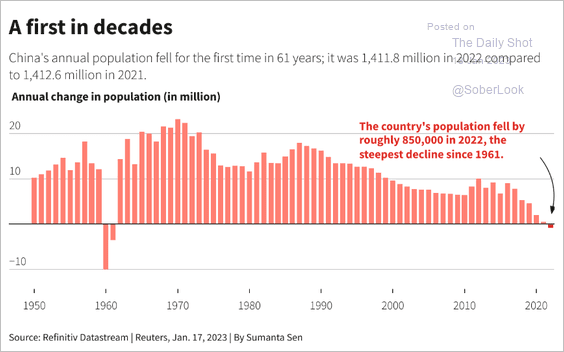

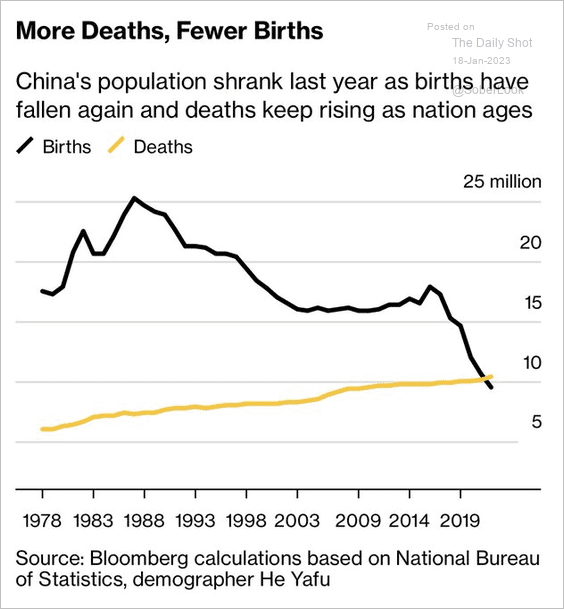

2. China’s population declined for the first time in decades.

Source: Reuters Read full article

Source: Reuters Read full article

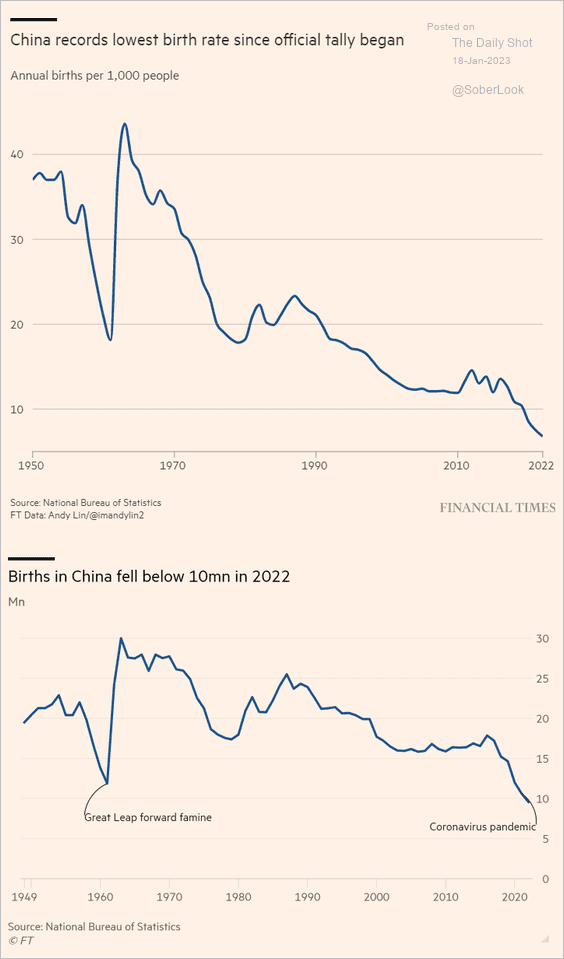

• China’s birth rate hit a record low.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

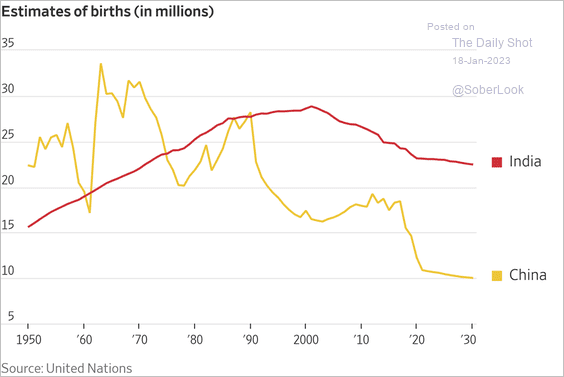

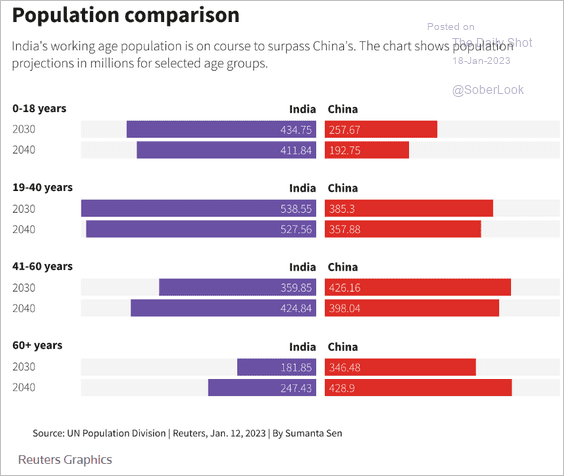

Here is a comparison to India.

Source: @WSJ Read full article

Source: @WSJ Read full article

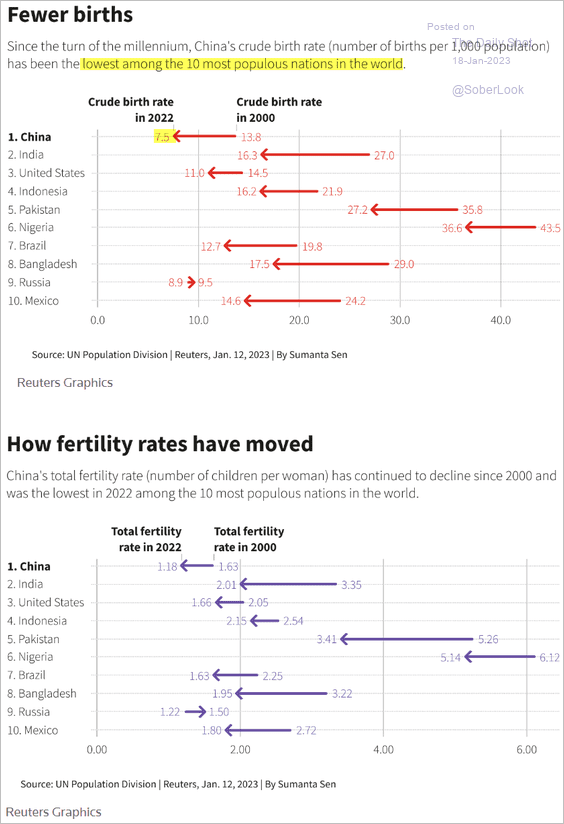

And this chart compares China’s birth rates to other economies.

Source: Reuters Read full article

Source: Reuters Read full article

• Deaths are outnumbering births.

Source: @jessefelder, @bpolitics Read full article

Source: @jessefelder, @bpolitics Read full article

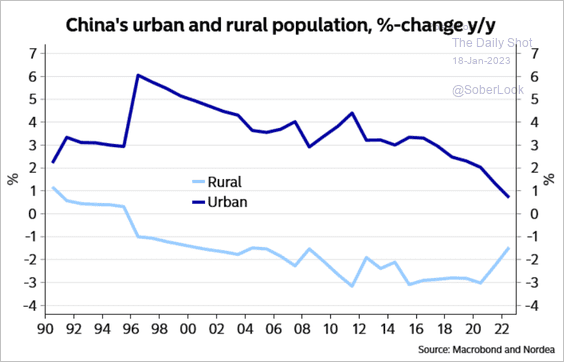

• Urbanisation has been slowing.

Source: Nordea Markets

Source: Nordea Markets

• Next, we have China’s and India’s population pyramids.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Emerging Markets

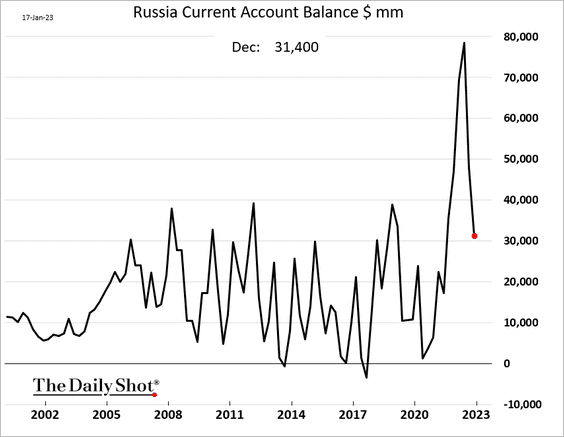

1. Russia’s current account is coming off the highs.

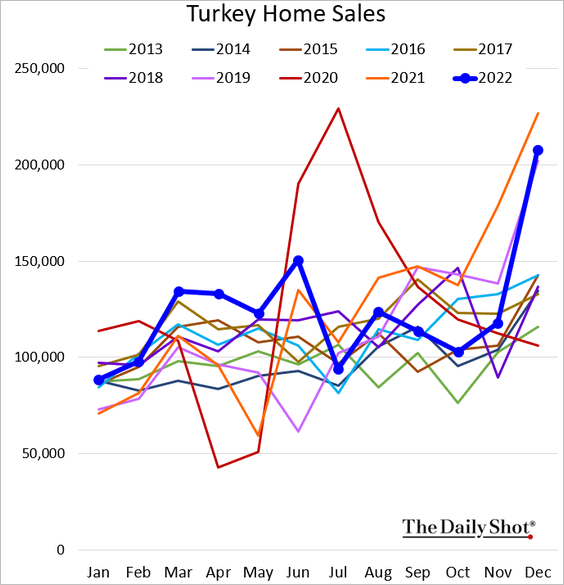

2. Turkey’s home sales remain elevated.

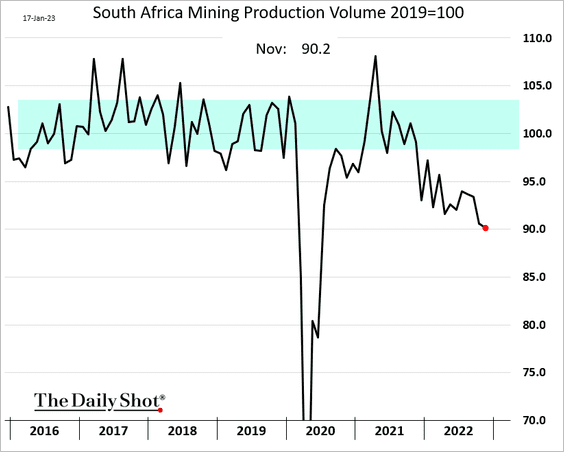

3. South Africa’s mining output continues to deteriorate.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

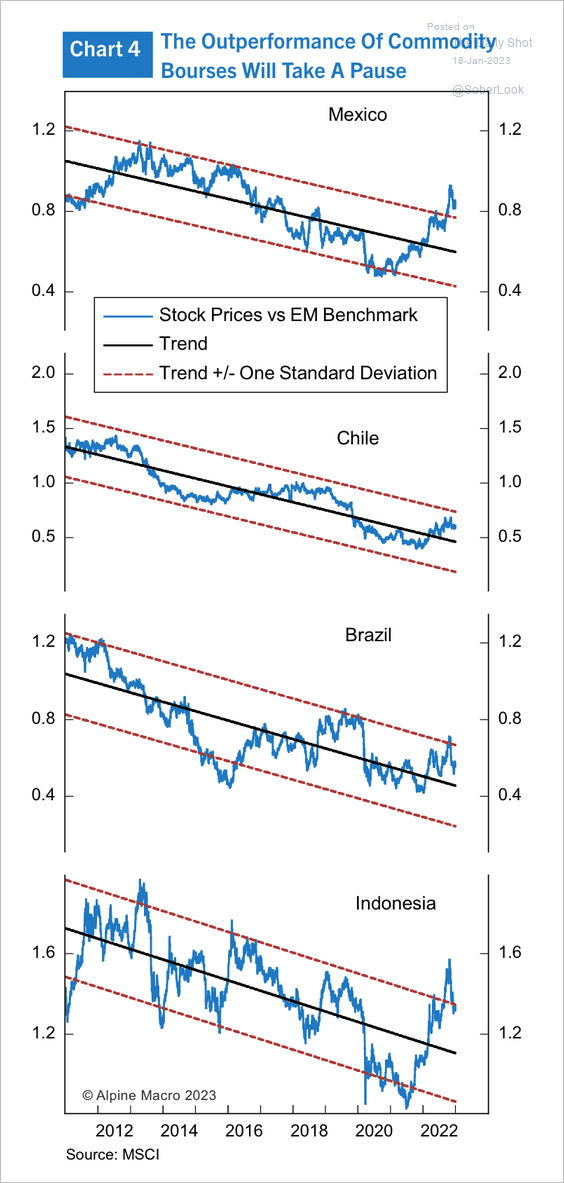

4. Commodity-sensitive countries appear overbought relative to broader EM equities.

Source: Alpine Macro

Source: Alpine Macro

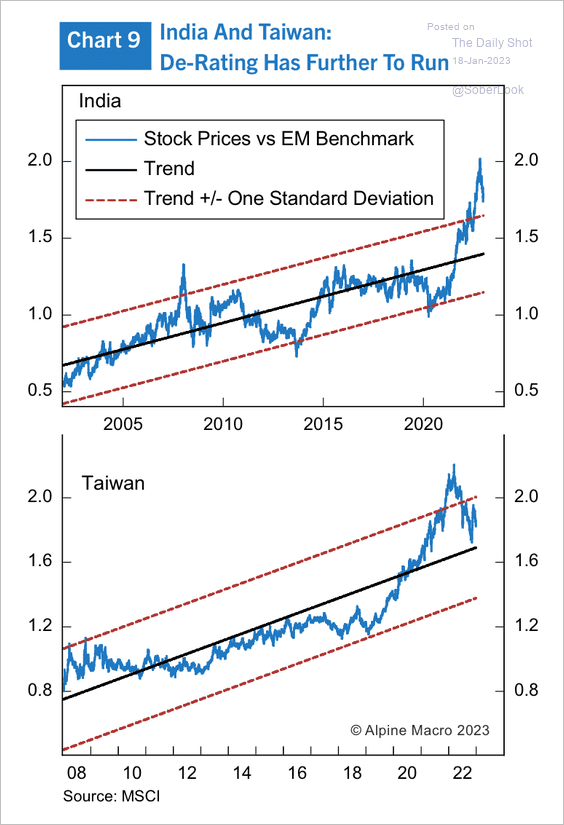

The same is true for India and Taiwan.

Source: Alpine Macro

Source: Alpine Macro

——————–

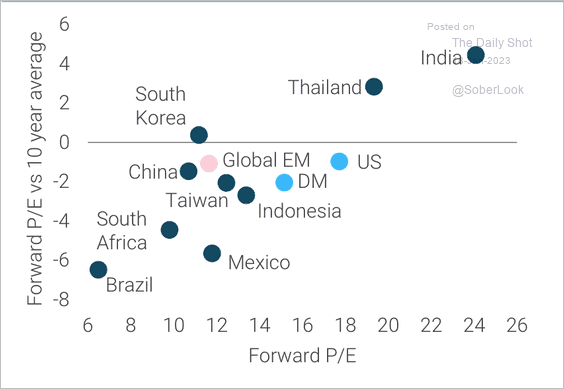

5. Many EM equity markets appear relatively inexpensive.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

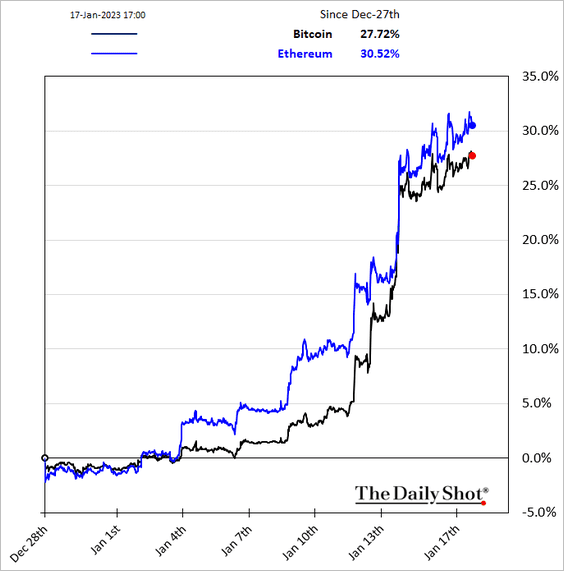

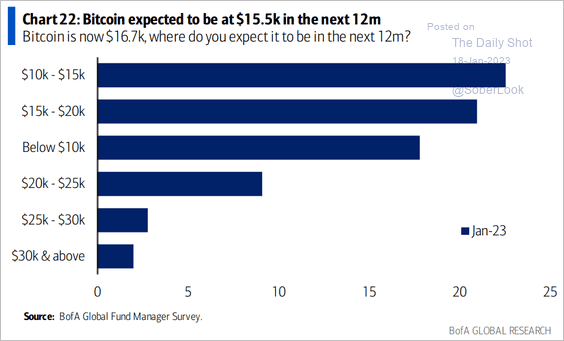

1. Bitcoin blasted past $21k.

Have investors been too bearish on bitcoin?

Source: BofA Global Research

Source: BofA Global Research

——————–

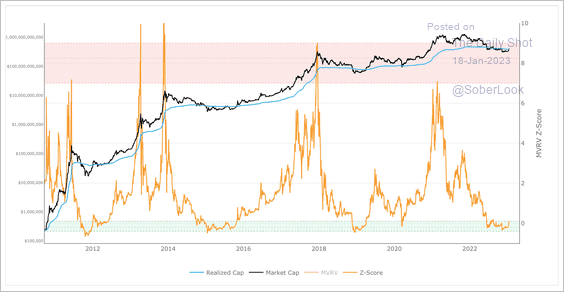

2. Bitcoin appears significantly undervalued based on its market value to realized value (MVRV).

Source: LookIntoBitcoin

Source: LookIntoBitcoin

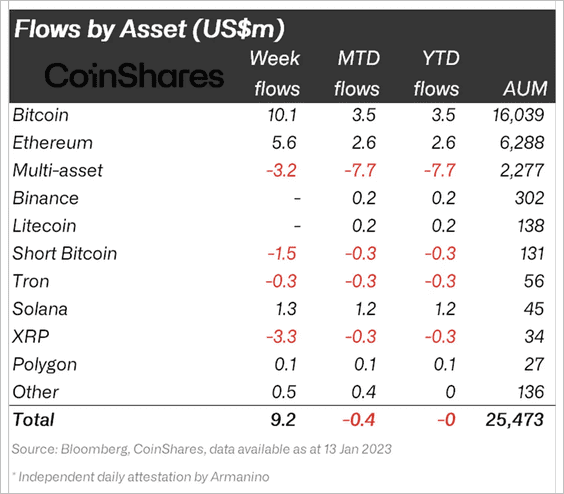

3. Crypto funds saw minor inflows last week, led by long bitcoin and ether products.

Source: CoinShares Read full article

Source: CoinShares Read full article

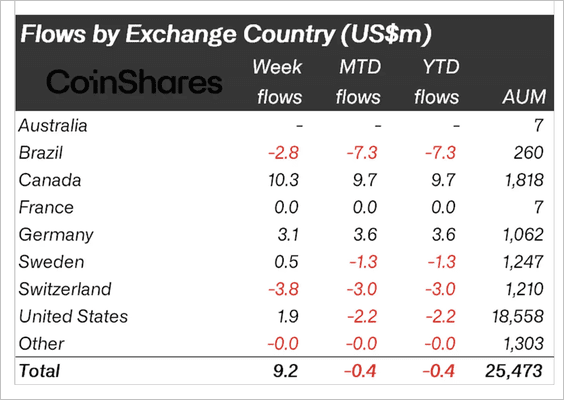

Canadian-based crypto funds led inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

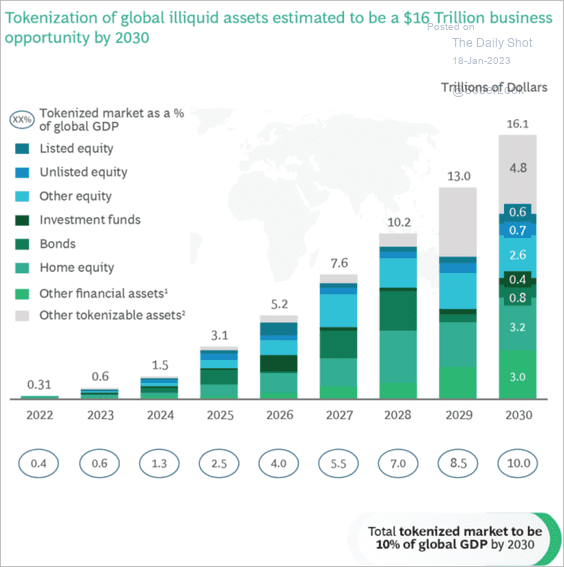

4. Asset tokenization is expected to accelerate.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Commodities

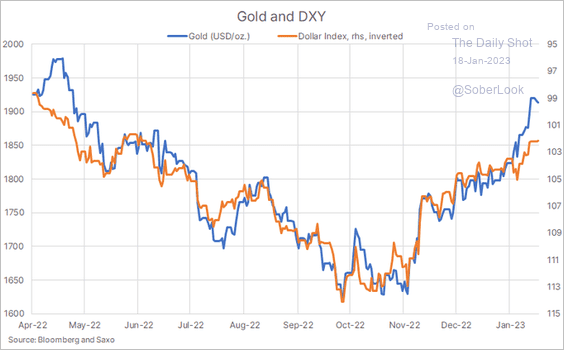

The rally in gold has been too fast relative to the dollar’s decline.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

Back to Index

Equities

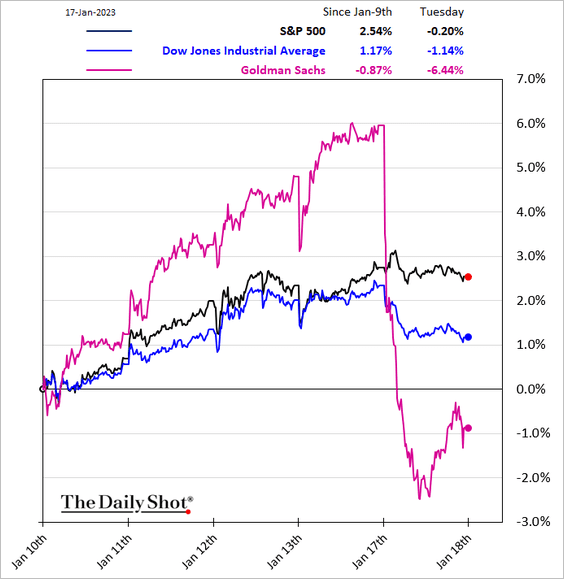

1. Financials dragged the Dow lower on Tuesday.

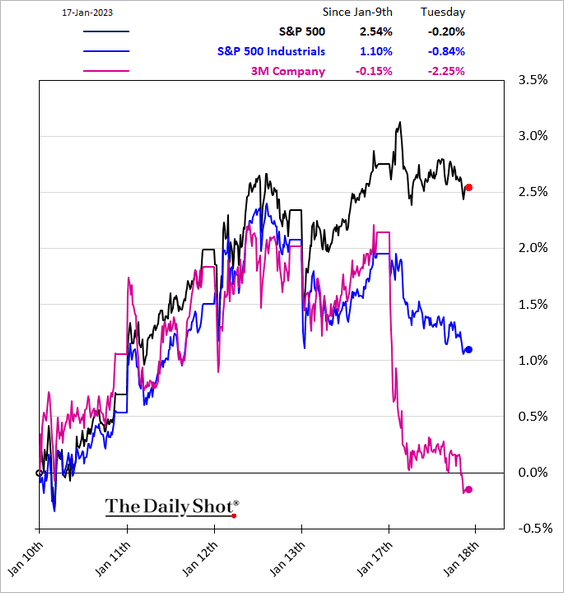

Industrials also underperformed.

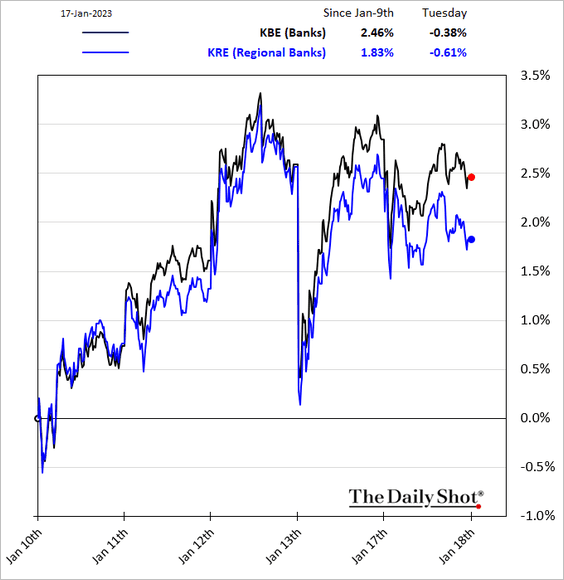

2. Regional banks are lagging behind the broad banking index.

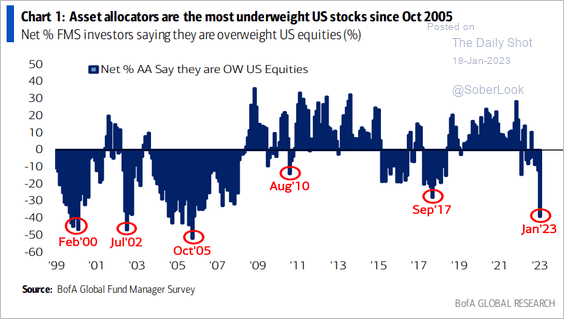

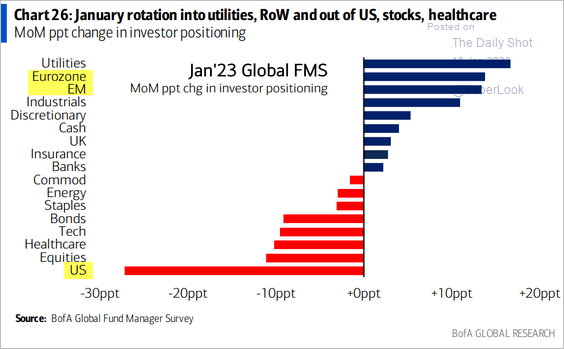

3. Global investors are underweight US shares (2 charts), …

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

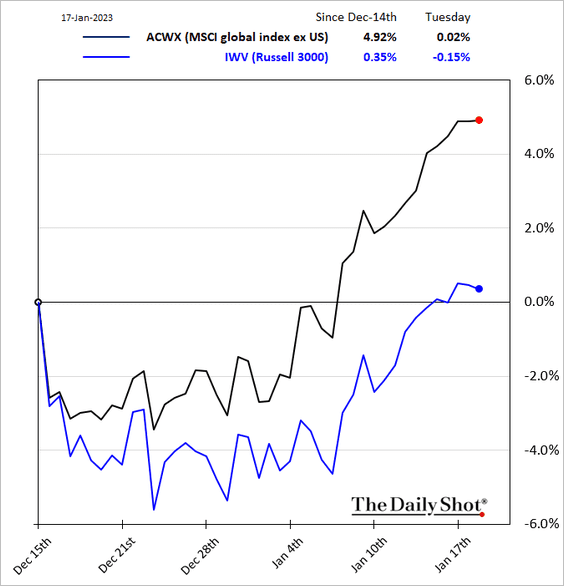

… as US stocks continue to lag.

——————–

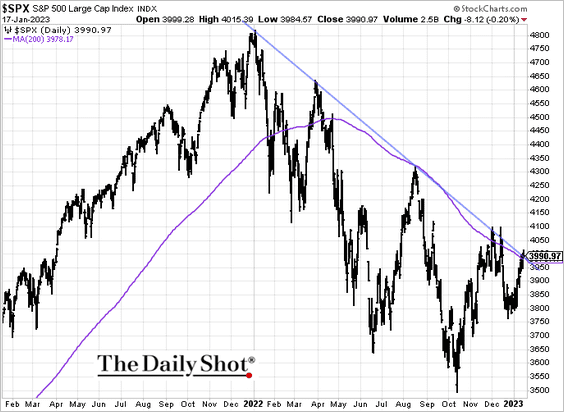

4. The S&P 500 is going to make another run at the downtrend resistance.

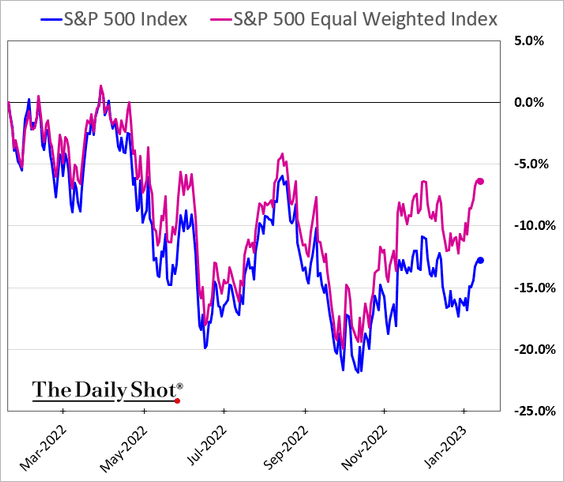

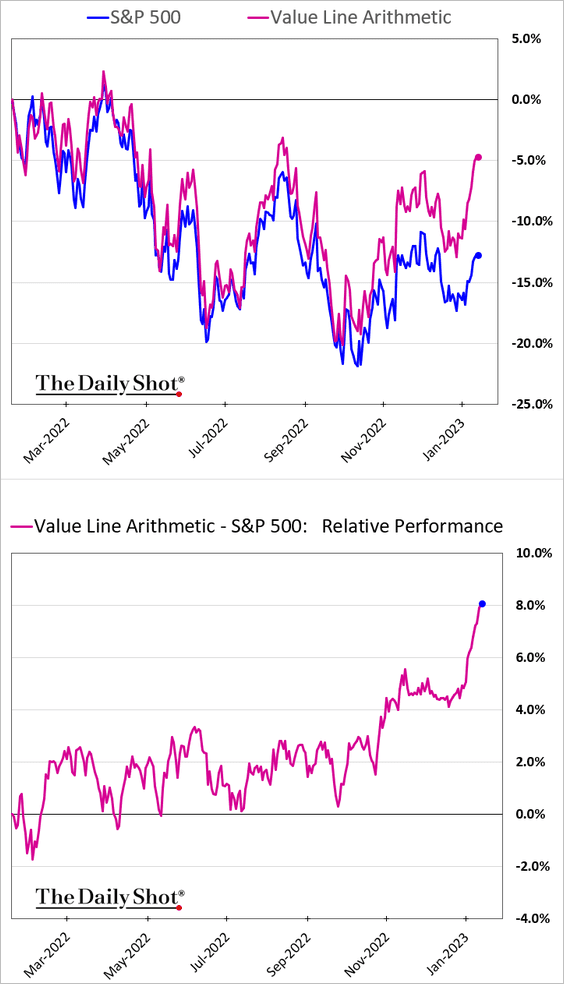

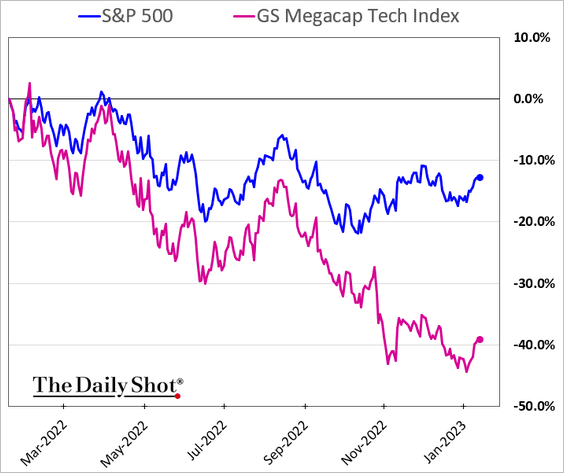

5. Equal-weighted indices continue to outperform (2 charts), …

… as mega-caps lag.

——————–

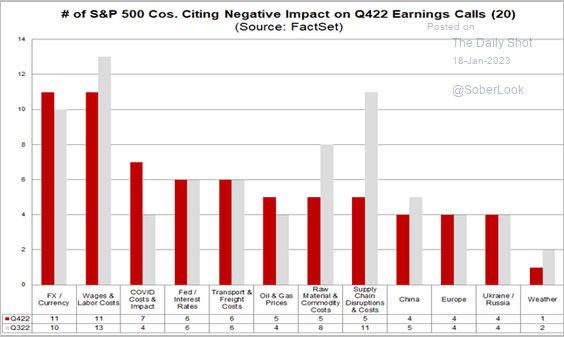

6. Which factors are having a negative impact on earnings?

Source: @FactSet Read full article

Source: @FactSet Read full article

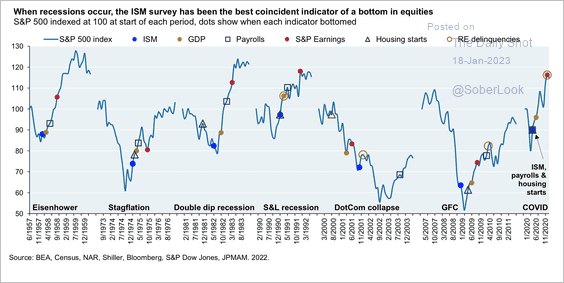

7. Historically, a trough in the ISM survey has occurred around market bottoms.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

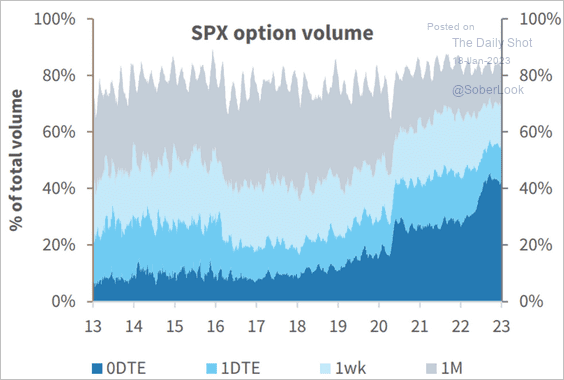

8. Options with less than 24 hours to expiration now dominate the market.

Source: @parrmenidies

Source: @parrmenidies

Back to Index

Credit

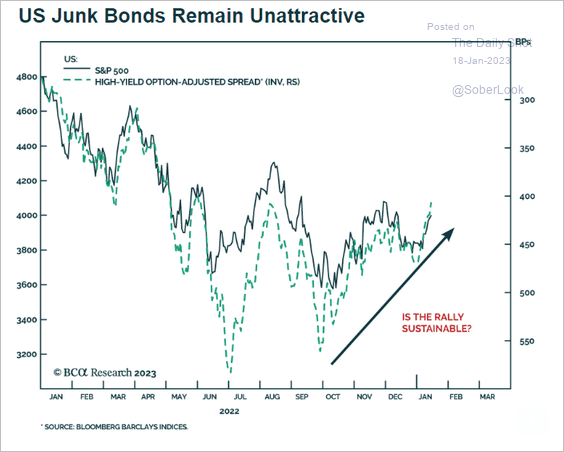

High-yield bonds have been rallying with stocks.

Source: BCA Research

Source: BCA Research

Back to Index

Rates

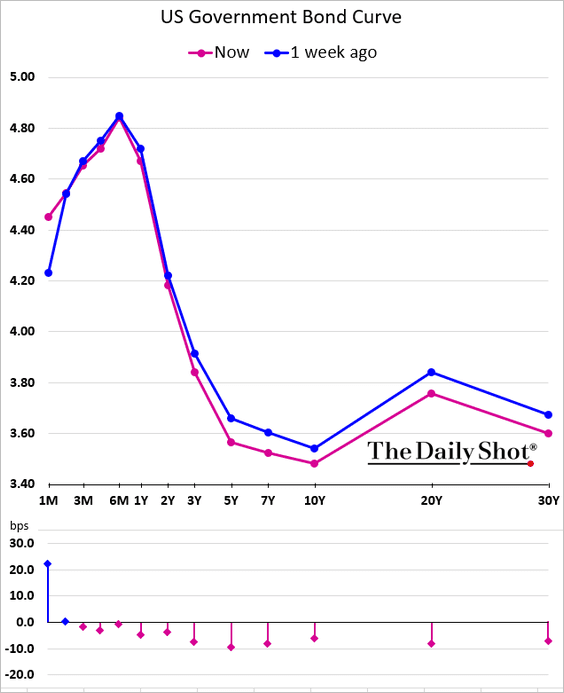

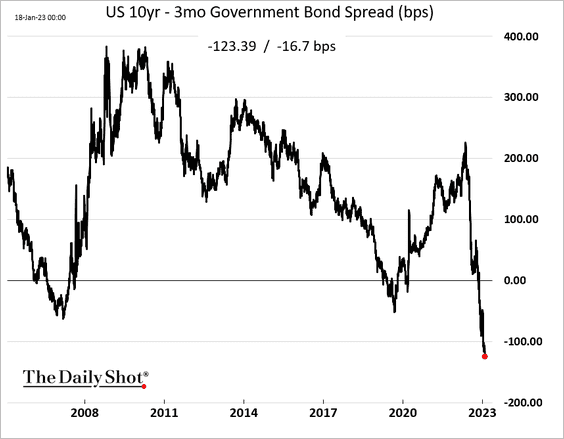

1. The Treasury curve continues to move deeper into inversion territory.

Here is the 10-year/3-month spread.

——————–

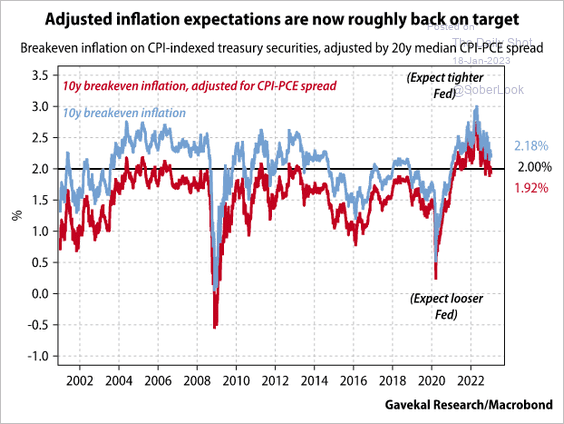

2. Long-dated inflation expectations are now roughly in line with the Fed’s target.

Source: Gavekal Research

Source: Gavekal Research

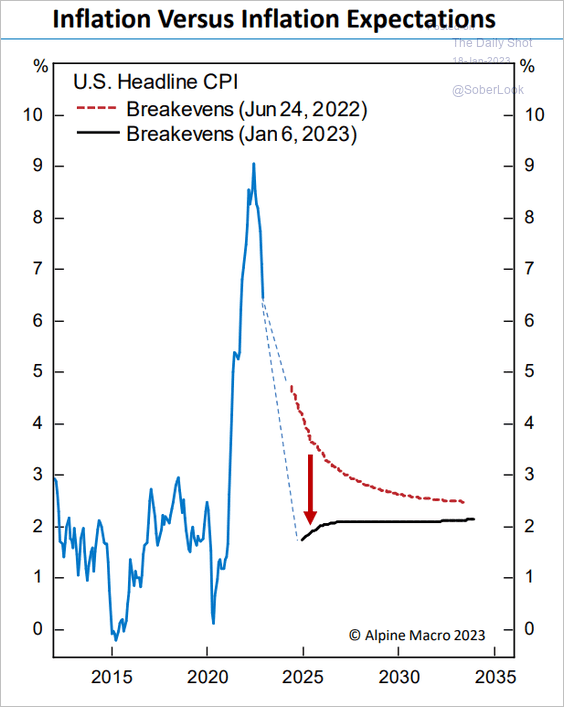

This chart shows the change in breakevens’ (inflation expectations) term structure over the past six months).

Source: Alpine Macro

Source: Alpine Macro

——————–

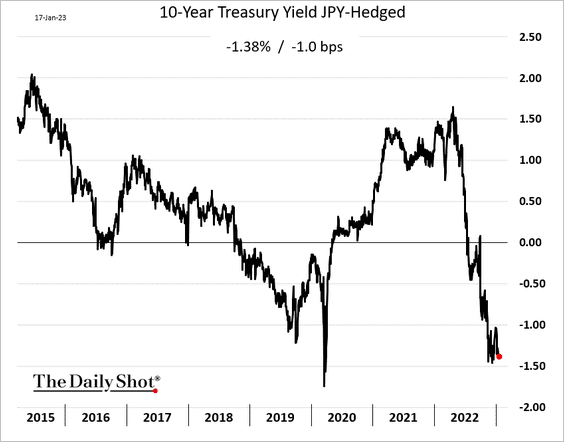

3. Treasuries remain unattractive for Japanese investors.

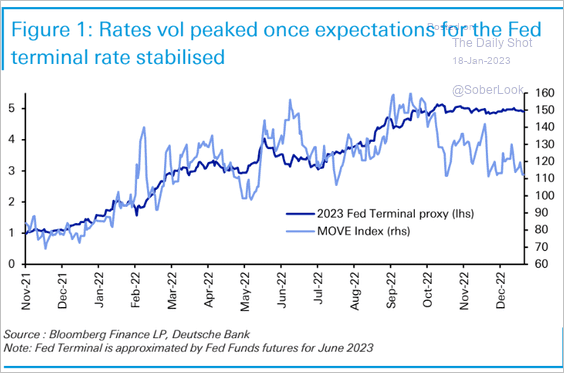

4. Stabilization in the US terminal rate expectations resulted in rates volatility peaking (MOVE).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

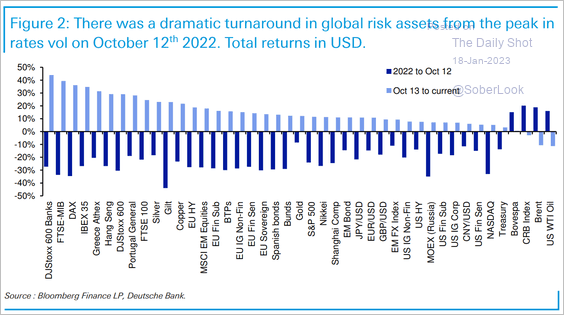

1. Global risk assets rebounded after a peak in rates vol (MOVE) in October 2022.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

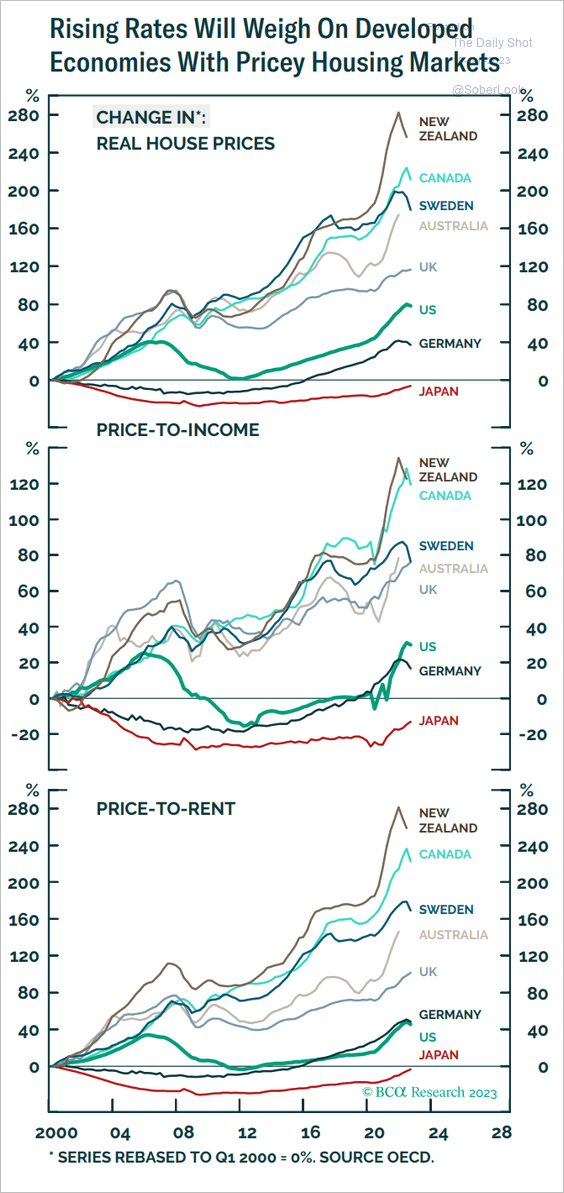

2. Next, we have some home price indices and valuations.

Source: BCA Research

Source: BCA Research

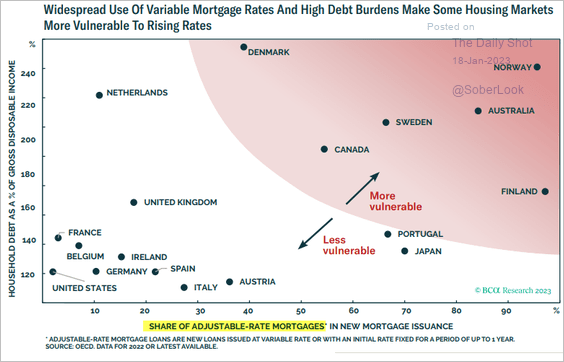

Which housing markets are most vulnerable? This scatterplot shows household leverage vs. the share of adjustable-rate mortgages.

Source: BCA Research

Source: BCA Research

——————–

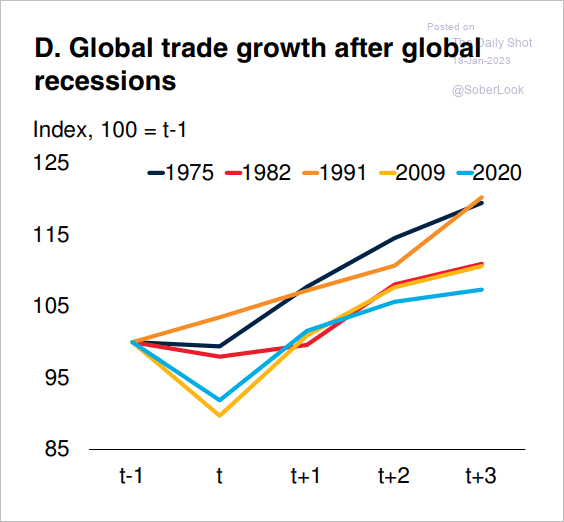

3. The COVID-era recovery in global trade has been slower than after previous recessions.

Source: World Bank Read full article

Source: World Bank Read full article

——————–

Food for Thought

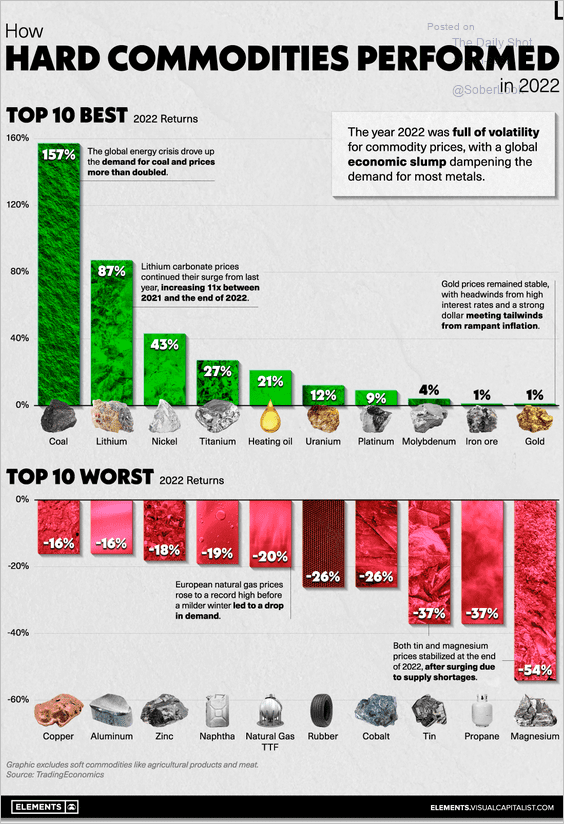

1. Best and worst-performing hard commodities in 2022:

Source: Visual Capitalist, h/t Walter Read full article

Source: Visual Capitalist, h/t Walter Read full article

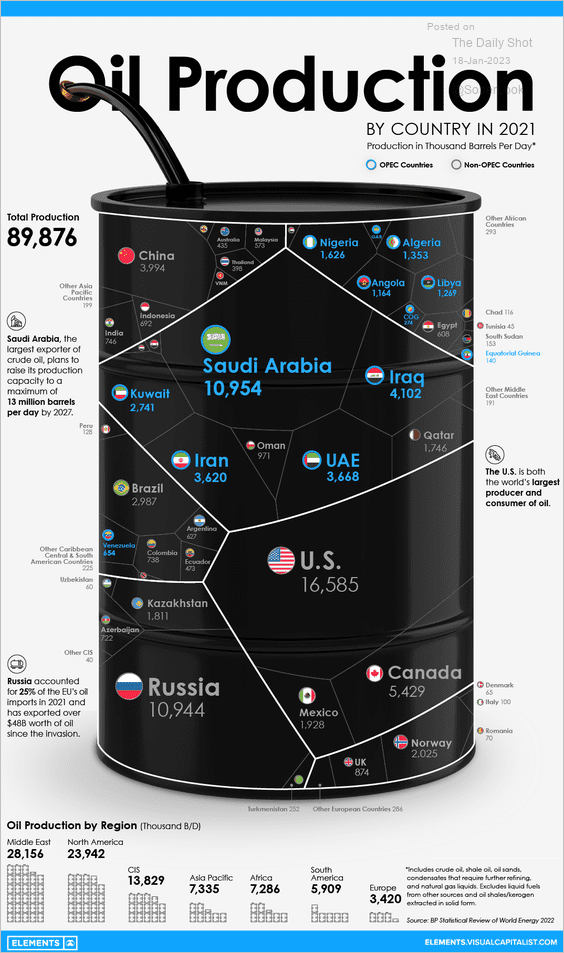

2. Global oil production:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

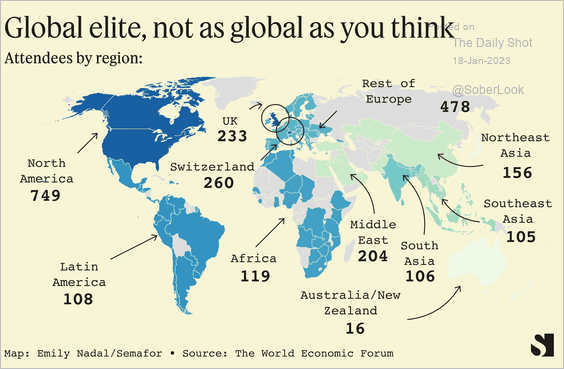

3. Davos attendees:

Source: @semafor Read full article

Source: @semafor Read full article

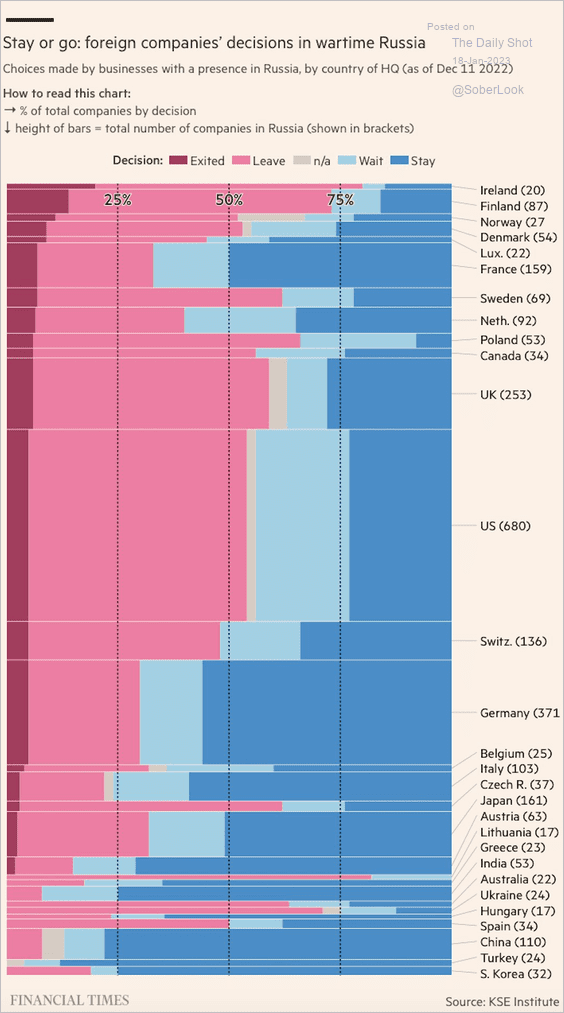

4. Share of foreign companies staying in Russia:

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

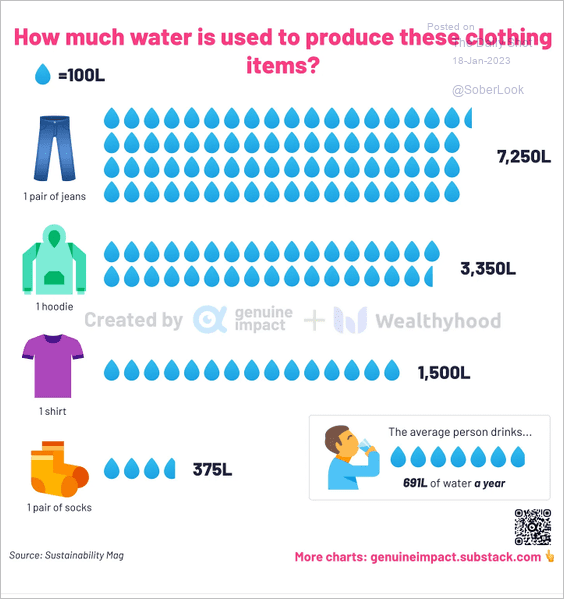

5. Water usage in clothing manufacturing:

Source: @genuine_impact

Source: @genuine_impact

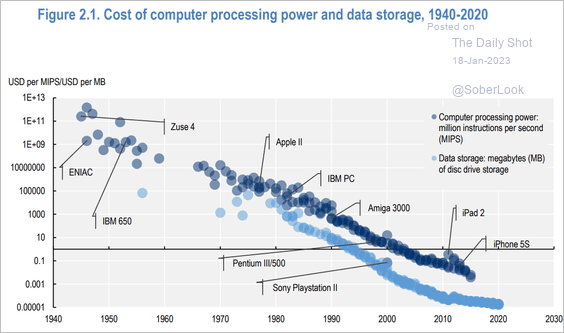

6. The cost of computer processing power and data storage:

Source: OECD Read full article

Source: OECD Read full article

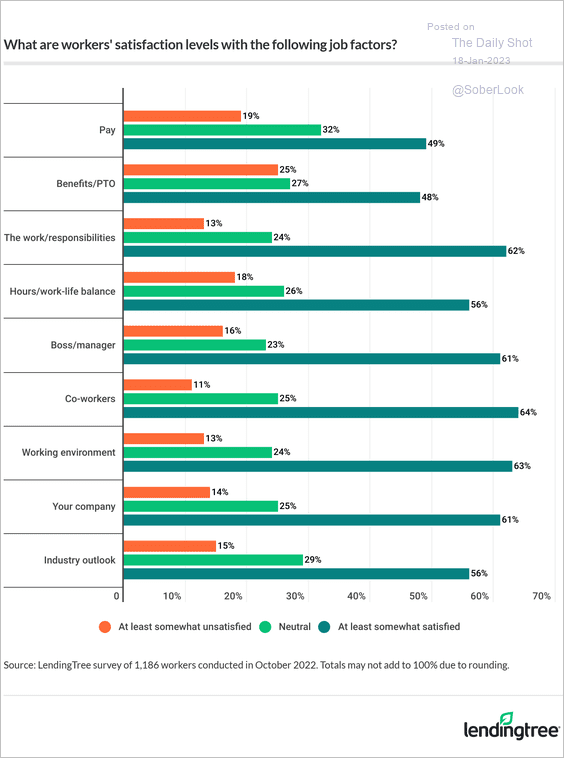

7. “Quiet quitter” worker satisfaction factors:

Source: LendingTree Read full article

Source: LendingTree Read full article

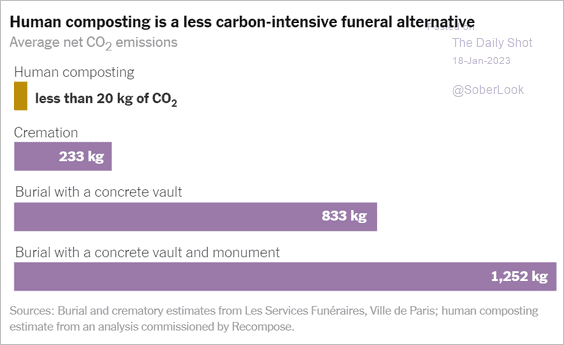

8. Human composting:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

Back to Index