The Daily Shot: 24-Feb-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

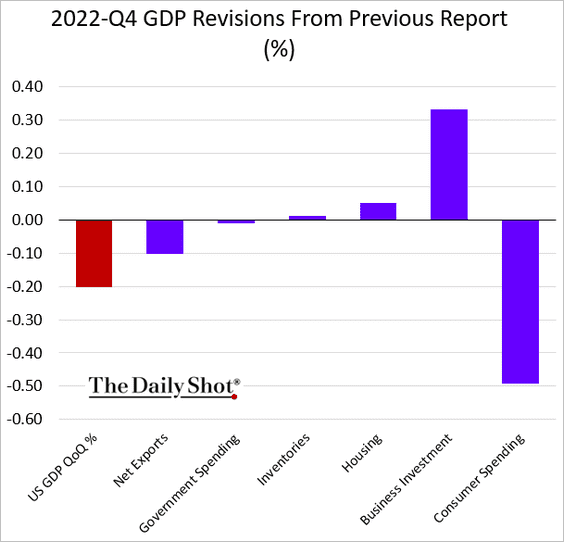

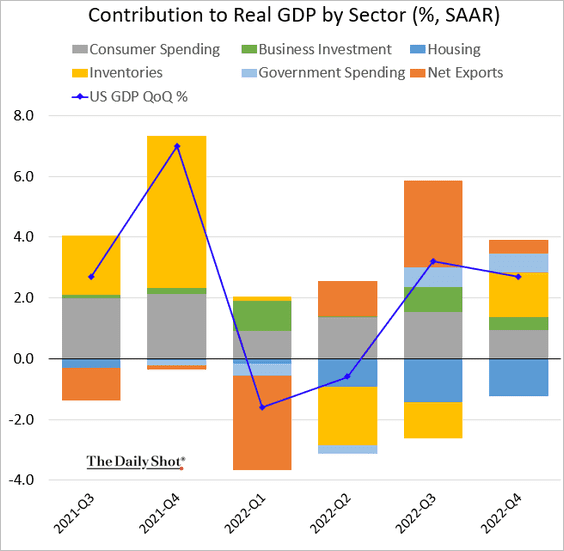

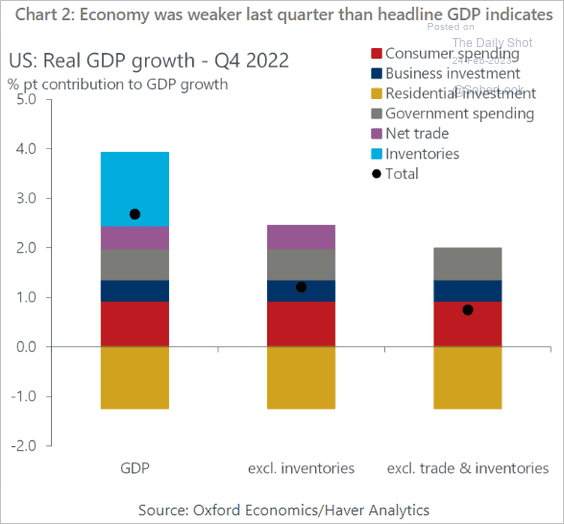

1. The Q4 GDP growth was revised lower, driven by softer consumer spending.

The underlying economy was softer than the headline GDP figures suggest.

Source: Oxford Economics

Source: Oxford Economics

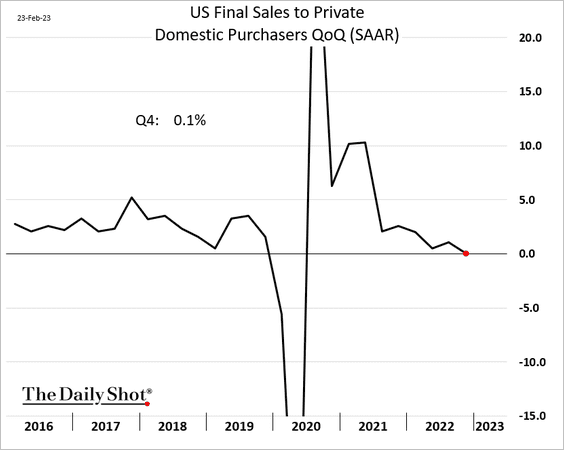

Final sales to private domestic purchasers, the “core” GDP was almost flat last quarter.

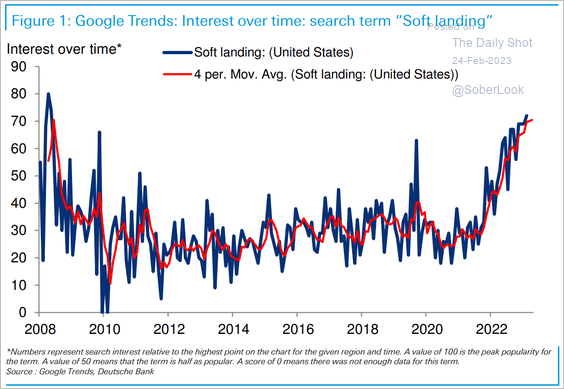

2. Google searches for “soft landing” have accelerated over the past year, reaching the highest level since 2008.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

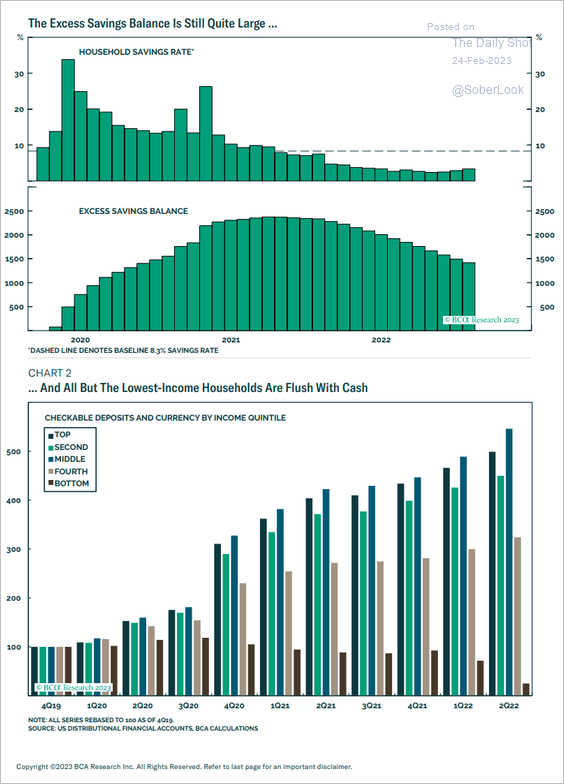

3. Households’ excess savings are still quite large.

Source: BCA Research

Source: BCA Research

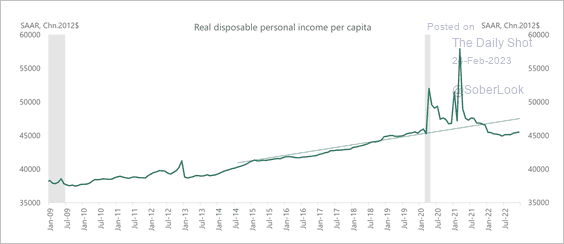

4. Real income per capita is below the pre-pandemic trend.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

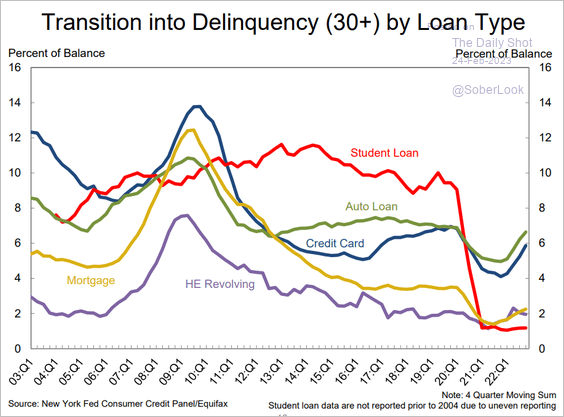

5. Consumer credit delinquencies are rebounding.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

6. Next, let’s take a look at some inflation data.

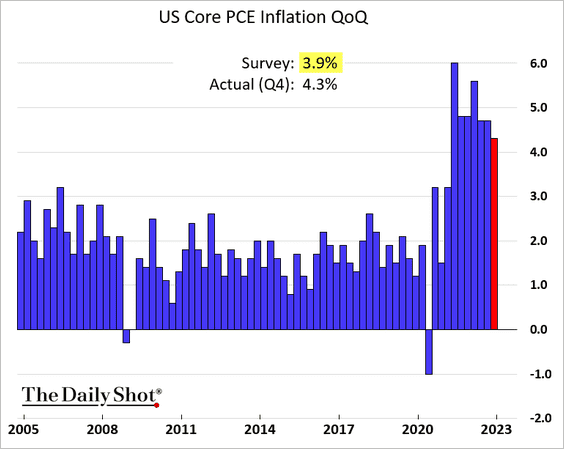

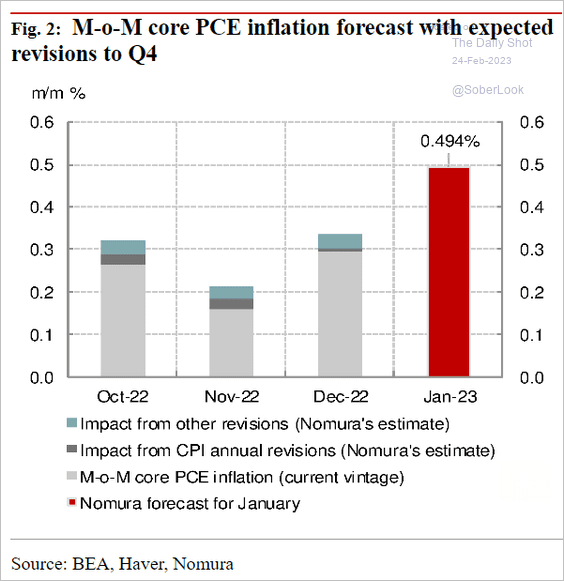

• The core PCE inflation was revised higher for Q4.

– Nomura sees a bump in January’s core PCE print from December.

Source: Nomura Securities

Source: Nomura Securities

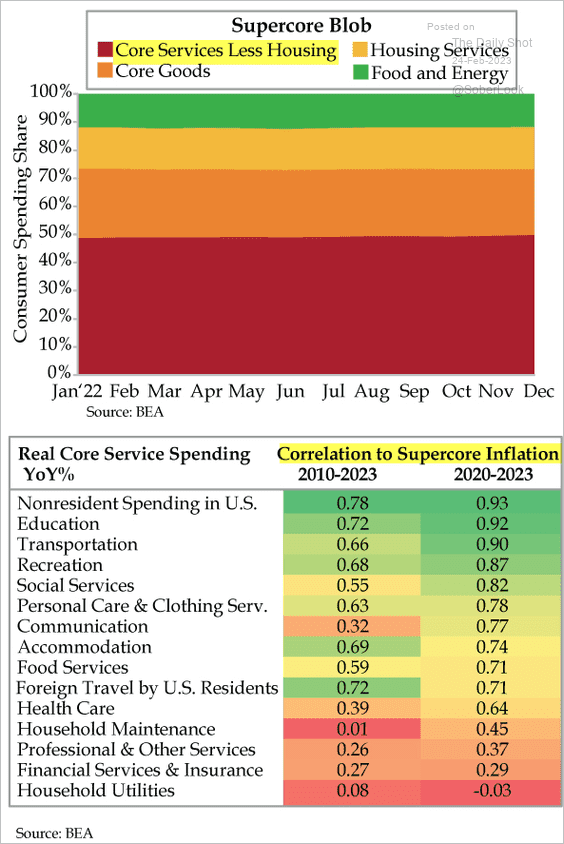

– The FOMC is focused on the core services PCE inflation excluding housing. How much of the US consumer spending is represented by this component? How correlated is it to different spending categories?

Source: Quill Intelligence

Source: Quill Intelligence

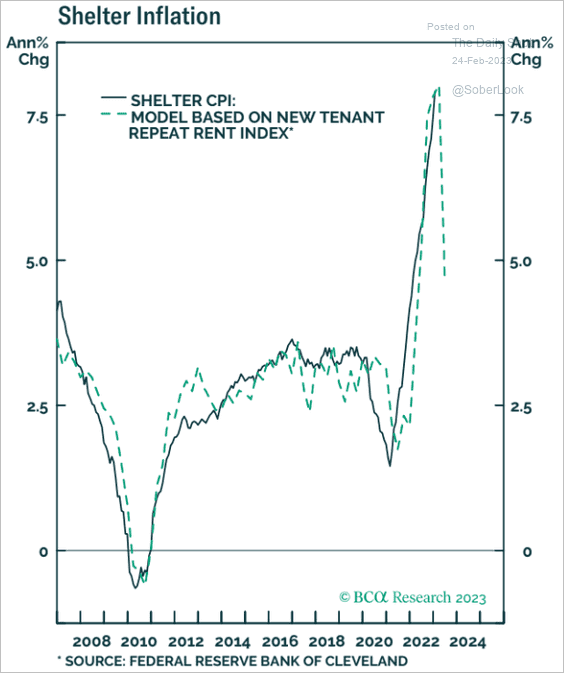

• Leading indicators continue to signal a peak in shelter inflation.

Source: BCA Research

Source: BCA Research

——————–

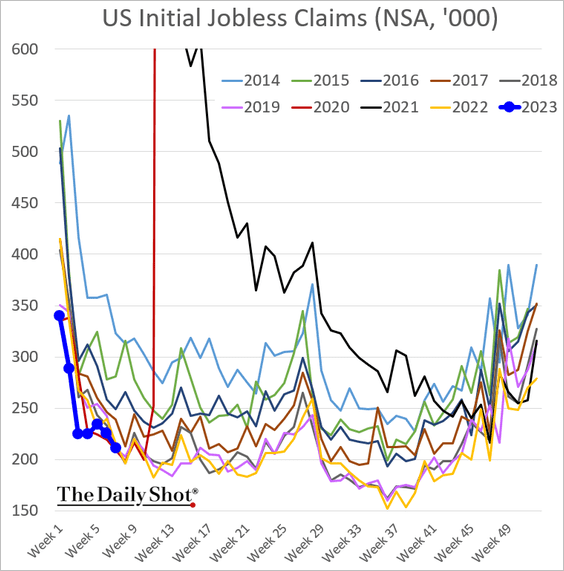

7. For now, there are no signs of the labor market loosening. Here are the initial unemployment claims.

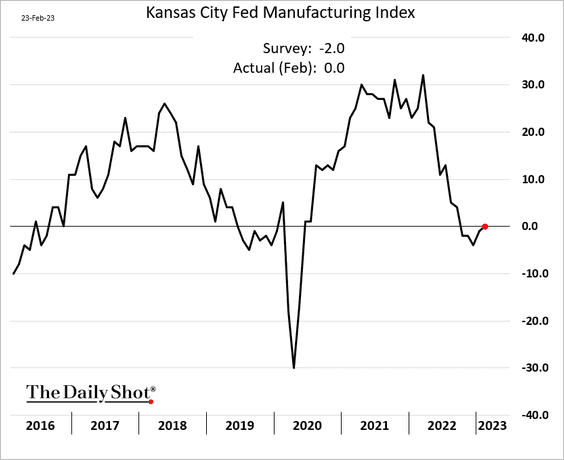

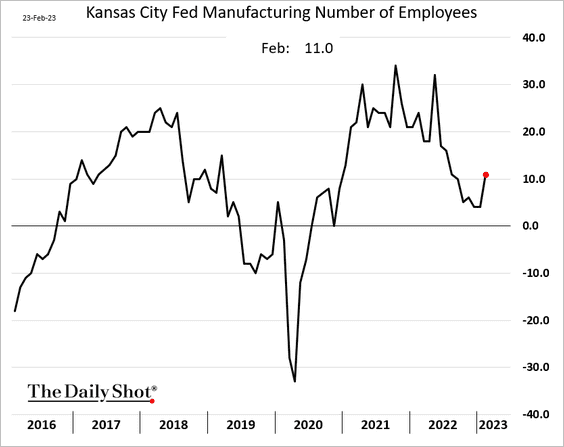

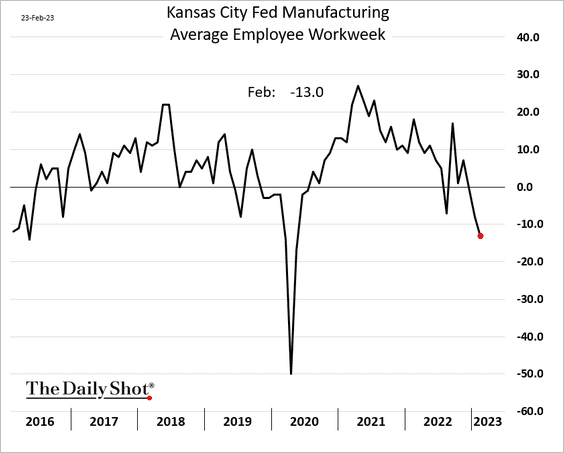

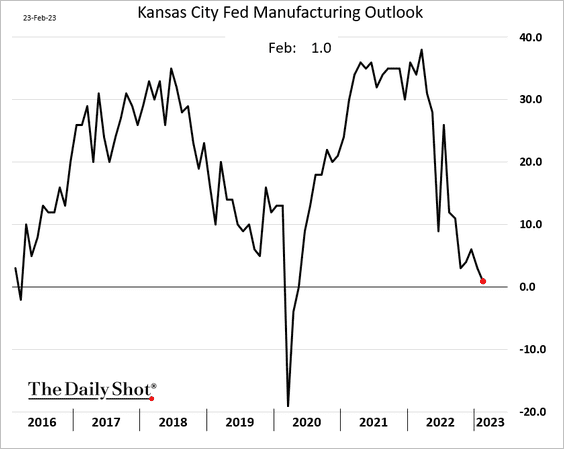

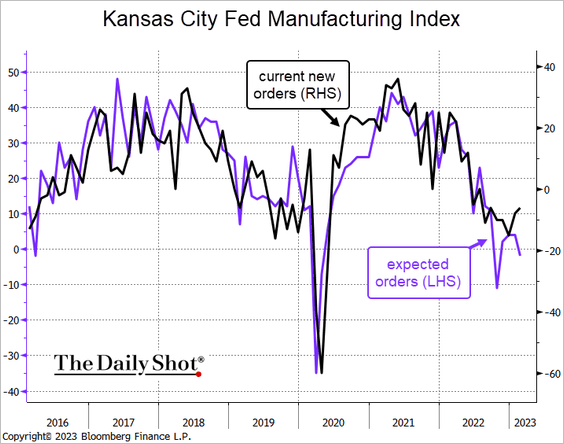

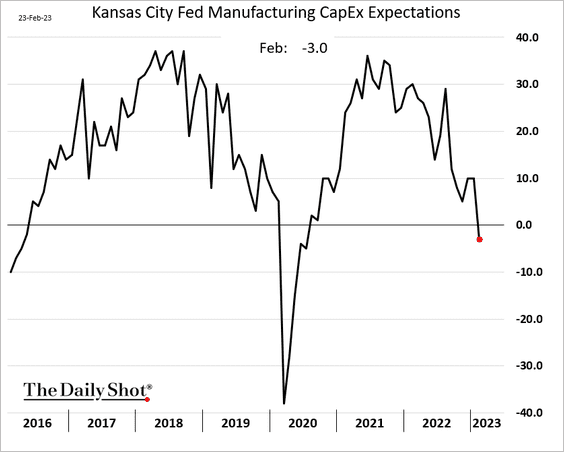

8. The Kansas City Fed’s regional manufacturing index showed some improvement this month.

• Hiring increased.

• But factories have been cutting workers’ hours.

• Manufacturers’ outlook is deteriorating.

• Expectations of new orders are diverging from current demand.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Companies expect to cut business spending.

——————–

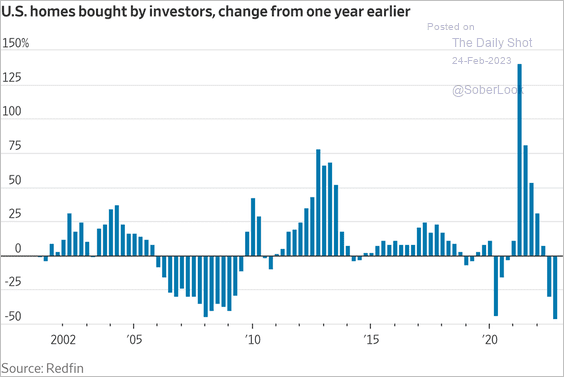

9. Finally, we have a couple of updates on the housing market.

• Home purchases by investors are down sharply versus last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

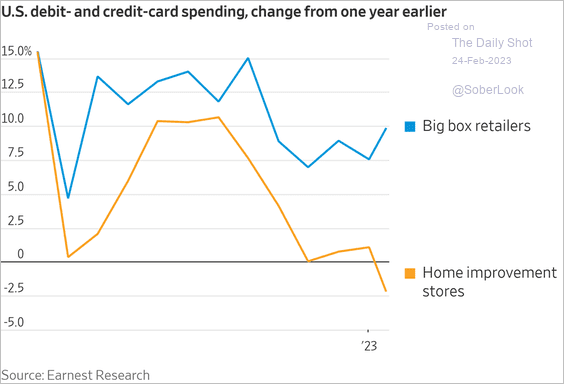

• The housing market rout is pressuring the home improvement sector …

Source: @WSJ Read full article

Source: @WSJ Read full article

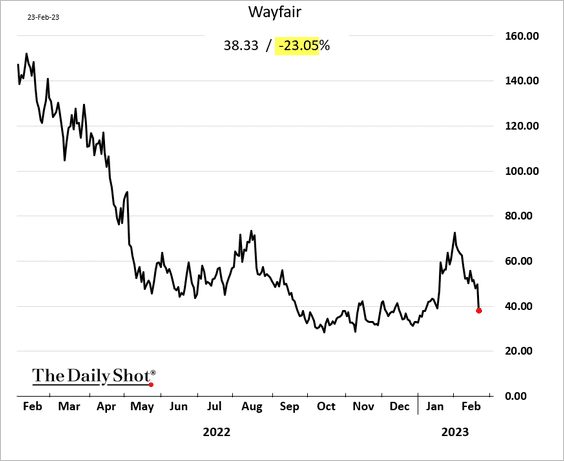

… and the furniture market.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

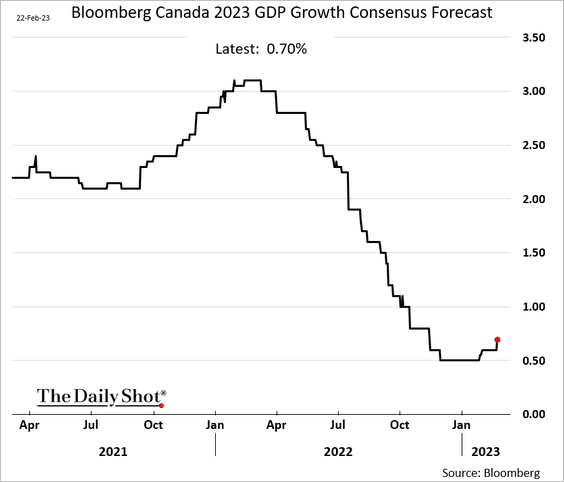

Canada

1. Economists have been gradually upgrading their forecasts for this year’s GDP growth.

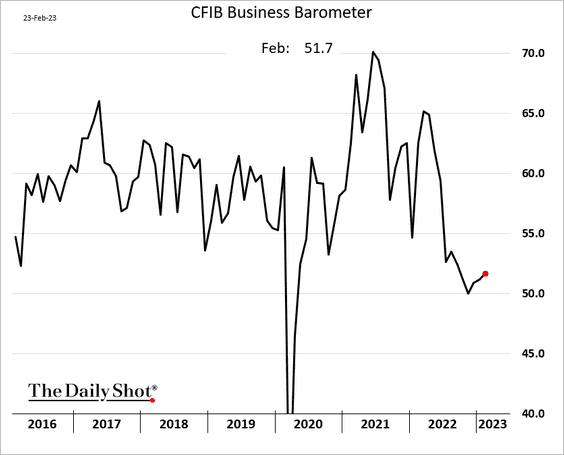

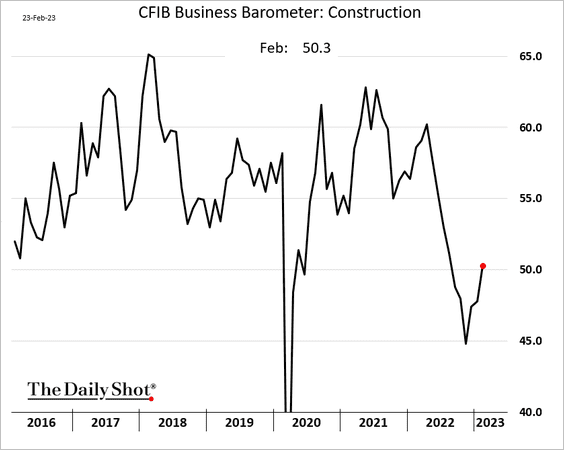

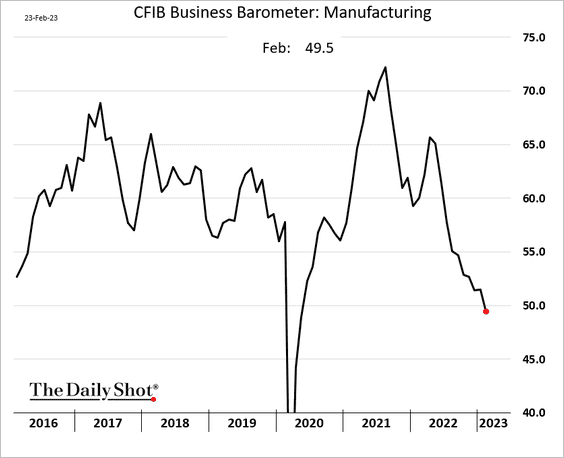

2. Small business confidence saw another modest improvement this month.

Here is the construction index.

Manufacturing continues to struggle.

Back to Index

The United Kingdom

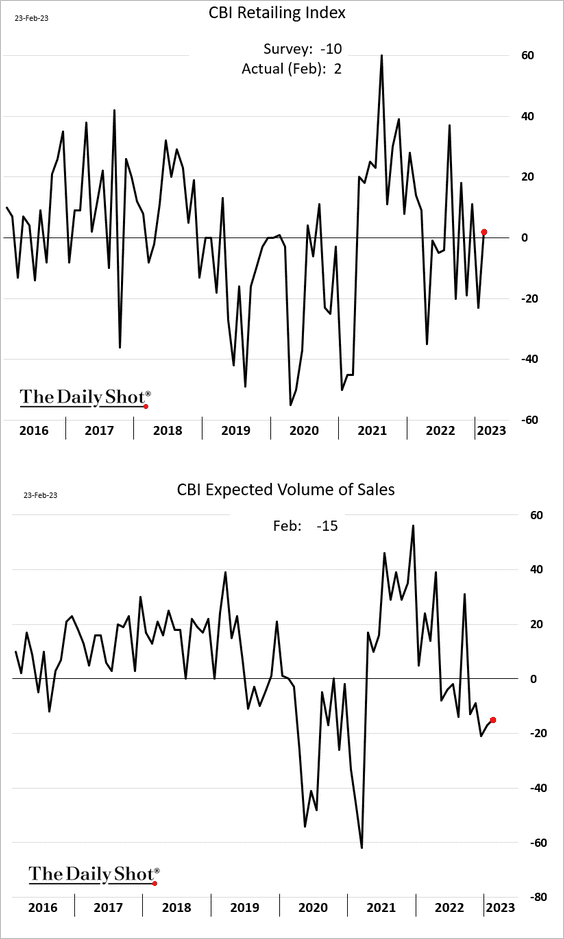

1. The CBI index signaled some improvement in retail sales. But retailers’ outlook remains depressed (2nd panel).

Source: Reuters Read full article

Source: Reuters Read full article

——————–

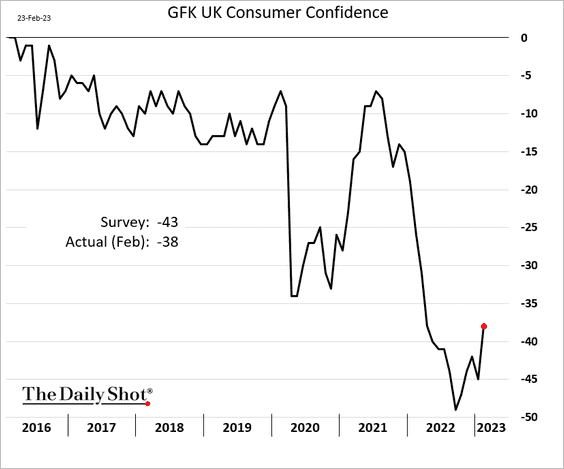

2. Consumer confidence is rebounding from the lows.

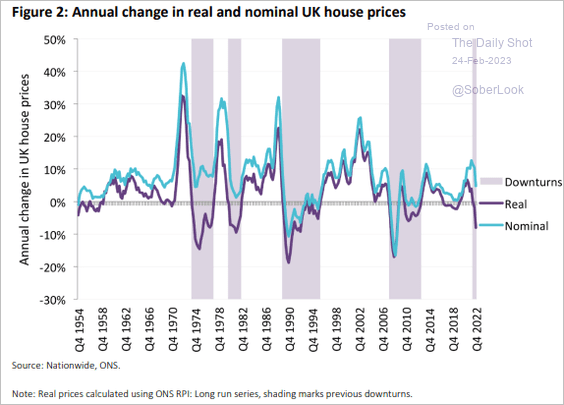

3. This chart shows nominal and real home price appreciation.

Source: @resi_analyst, @jrf_uk

Source: @resi_analyst, @jrf_uk

Back to Index

The Eurozone

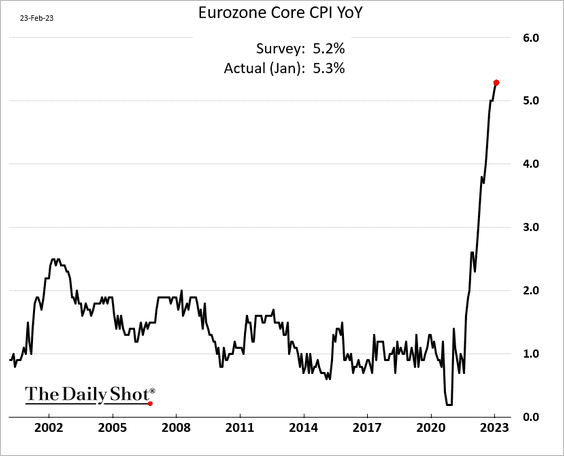

1. The January core CPI was revised higher, hitting a new record.

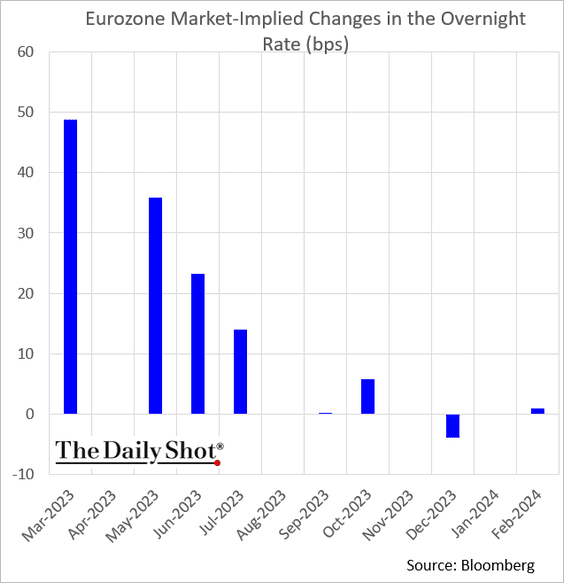

2. The market expects the ECB to hike rates by 50 bps next month, followed by more rate increases in the months to come.

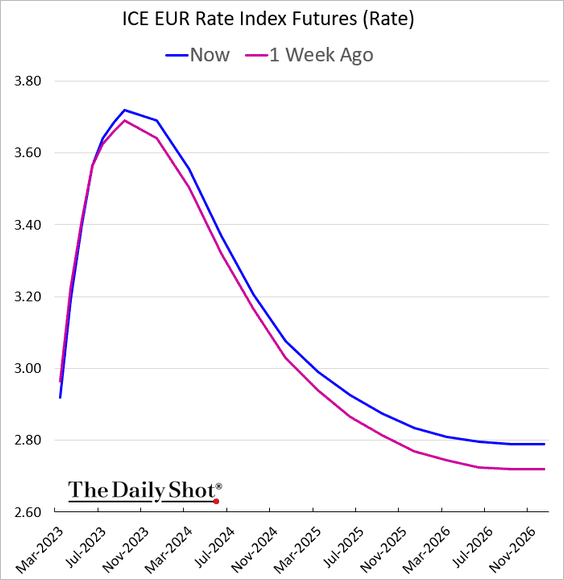

Here is the futures-implied rate trajectory.

——————–

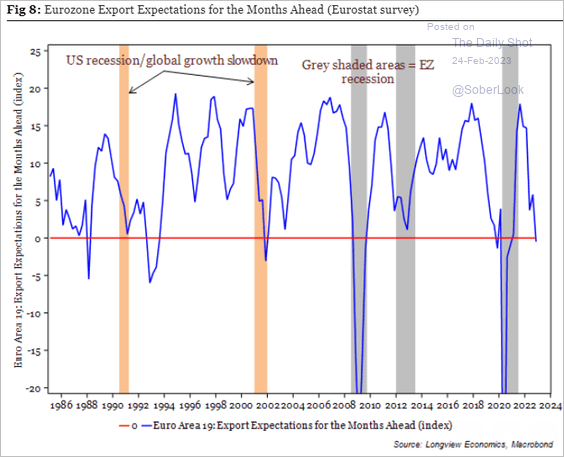

3. Export expectations have deteriorated.

Source: Longview Economics

Source: Longview Economics

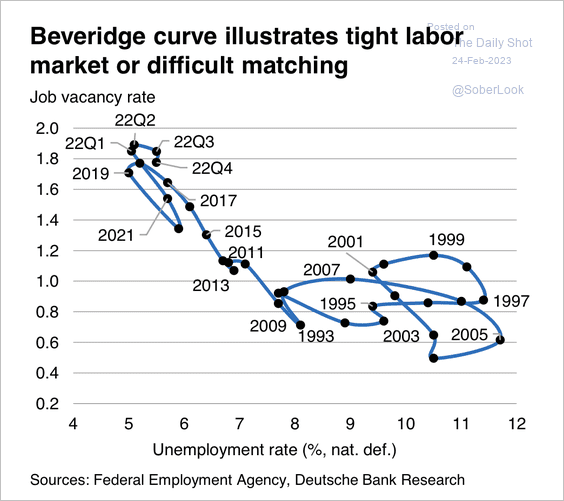

4. The German labor market remains robust.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Japan

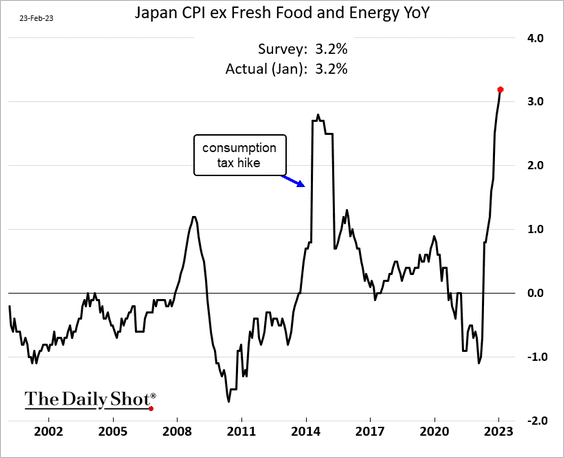

1. The core CPI hit a multi-decade high.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

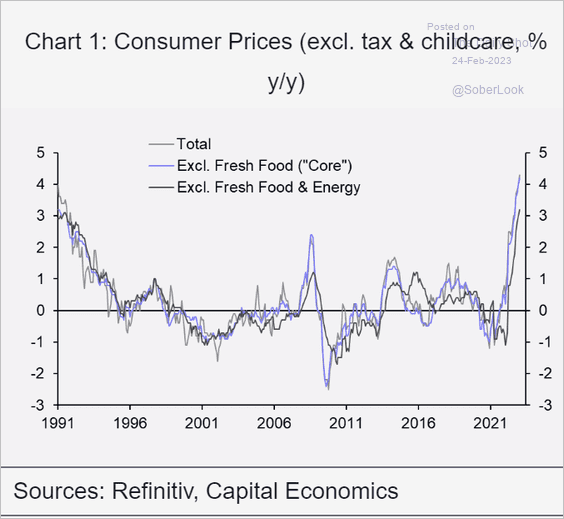

• Here are the CPI measures excluding the impact of sales tax hikes and childcare.

Source: Capital Economics

Source: Capital Economics

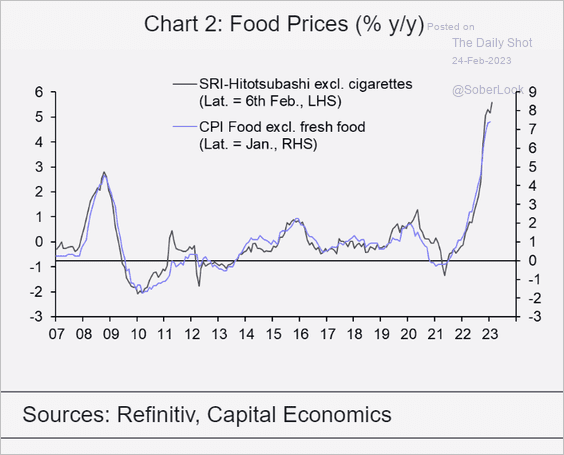

• Food inflation continues to surge.

Source: Capital Economics

Source: Capital Economics

——————–

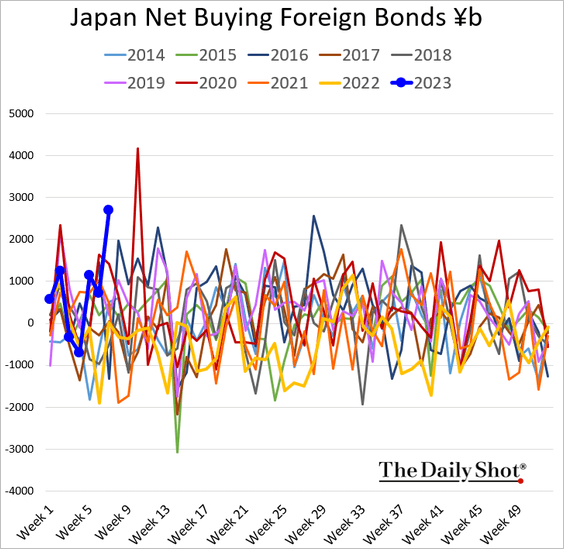

2. Japanese investors are jumping back into foreign bonds.

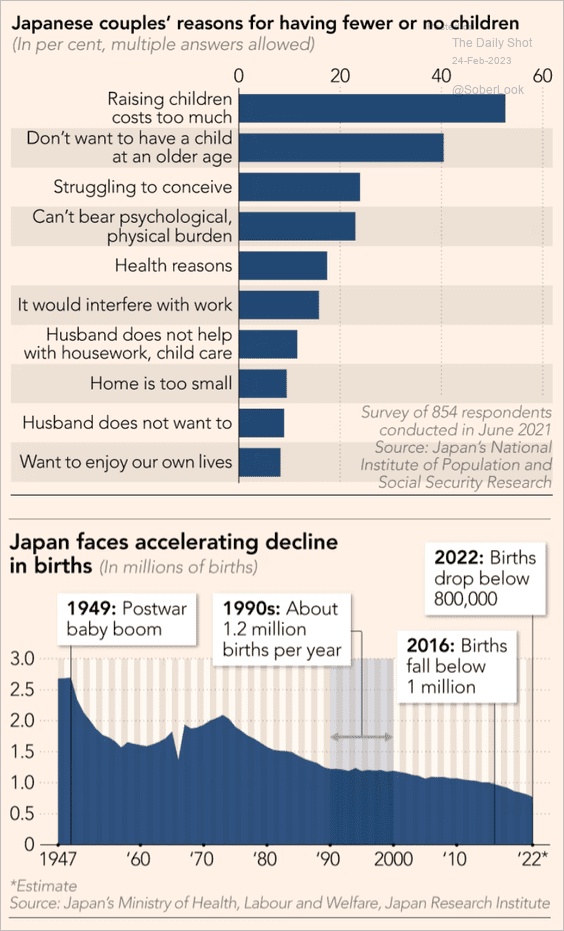

3. Here are Japanese couples’ reasons for having fewer or no children.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia – Pacific

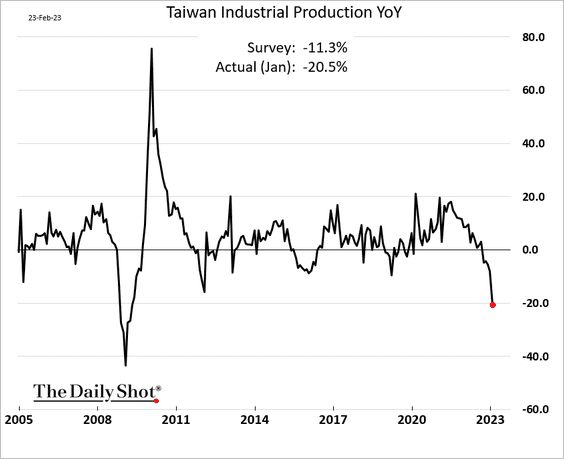

1. Taiwan’s industrial production plummeted in January.

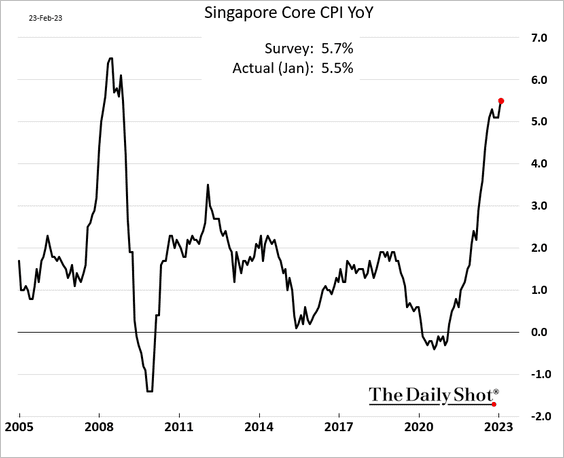

2. Singapore’s core inflation keeps rising.

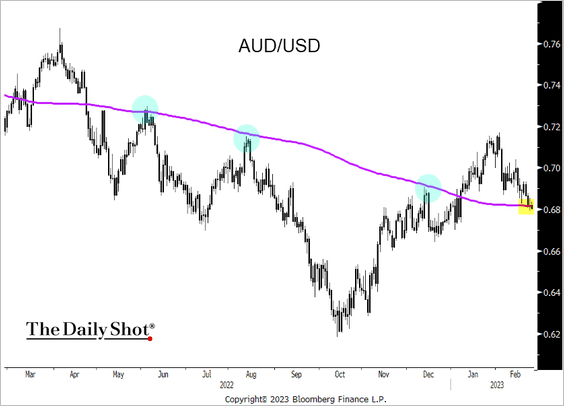

3. AUD/USD is testing support at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

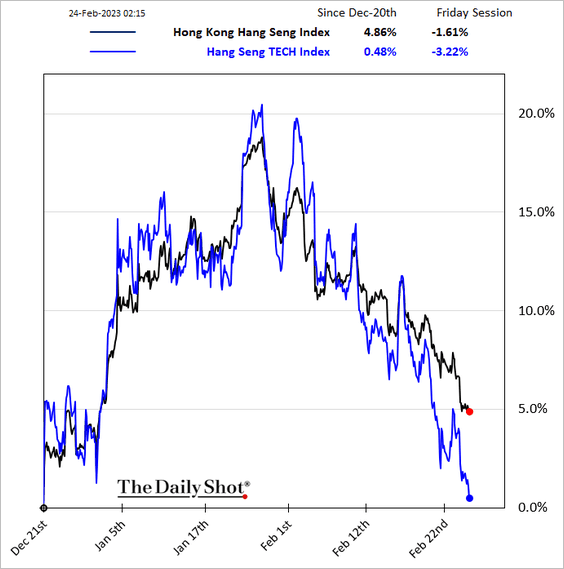

Stocks remain under pressure in Hong Kong, with tech underperforming again.

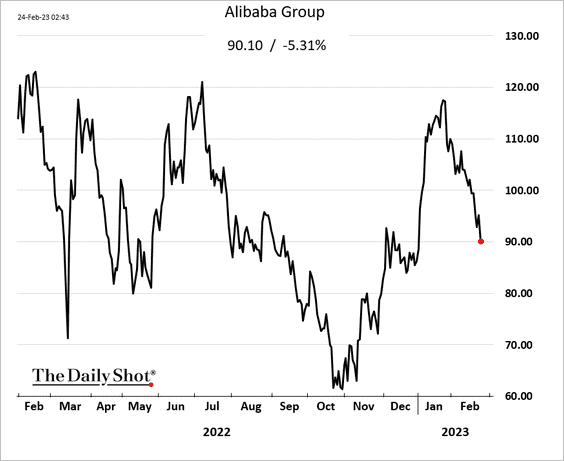

Here is Alibaba.

Back to Index

Emerging Markets

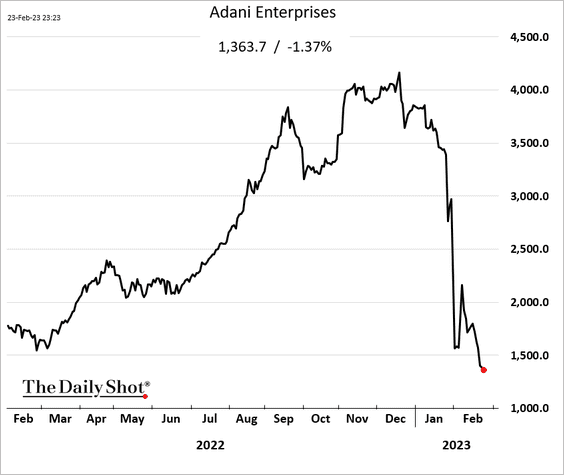

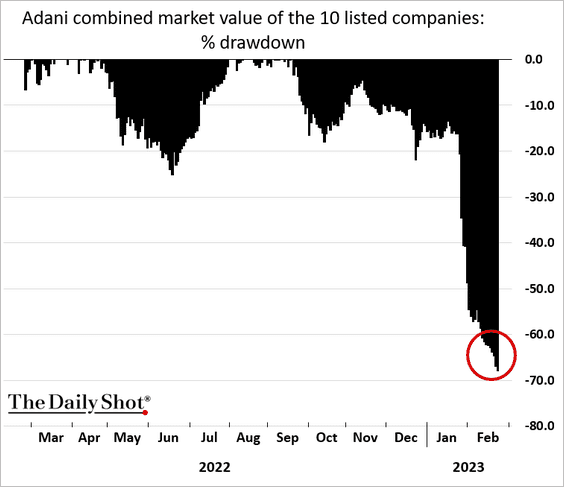

1. Shares of Adani continue to fall.

Below is the drawdown of Adani’s combined market cap of the ten listed companies.

——————–

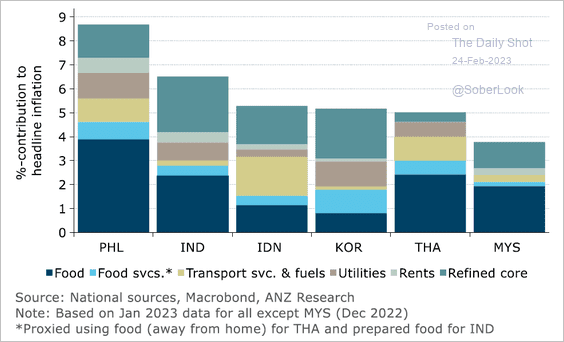

2. This chart shows the contributions to headline CPIs in Asian economies.

Source: @ANZ_Research

Source: @ANZ_Research

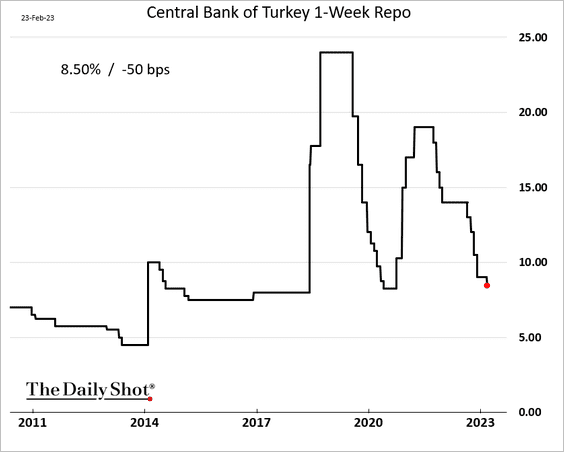

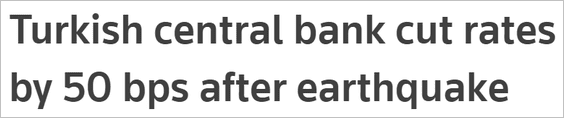

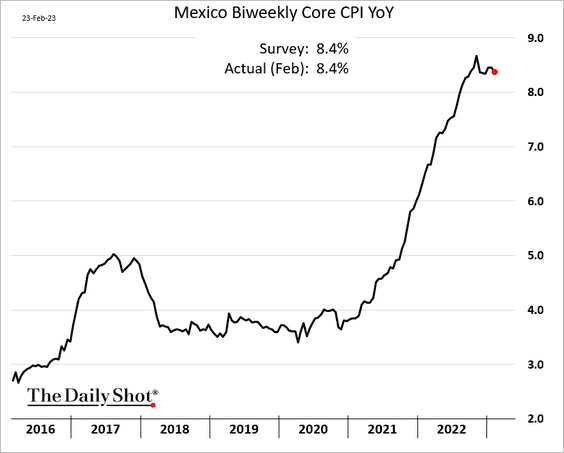

3. Turkey’s central bank delivered a smaller-than-expected rate cut (the market expected 100 bps).

Source: Reuters Read full article

Source: Reuters Read full article

The lira’s gradual devaluation continues.

——————–

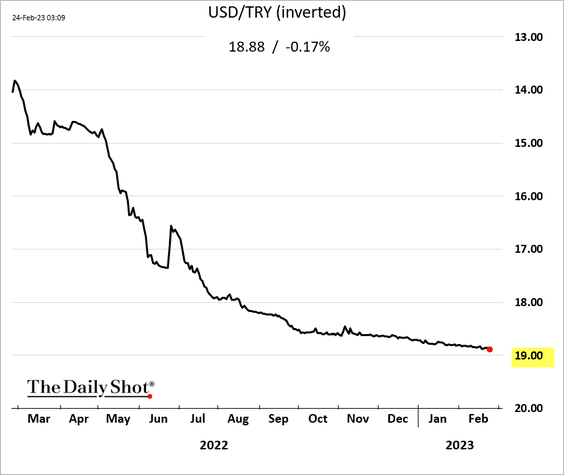

4. South Africa’s PPI is easing.

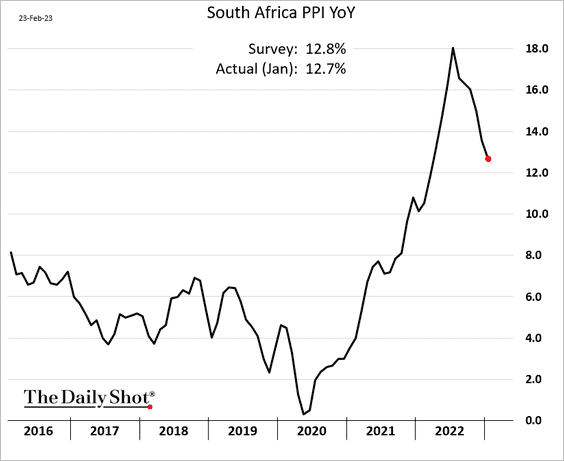

5. Mexico’s core inflation remains elevated.

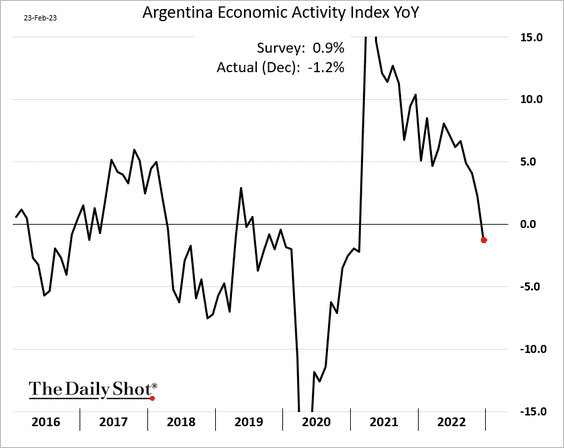

6. Argentina’s economy struggled as the year came to a close.

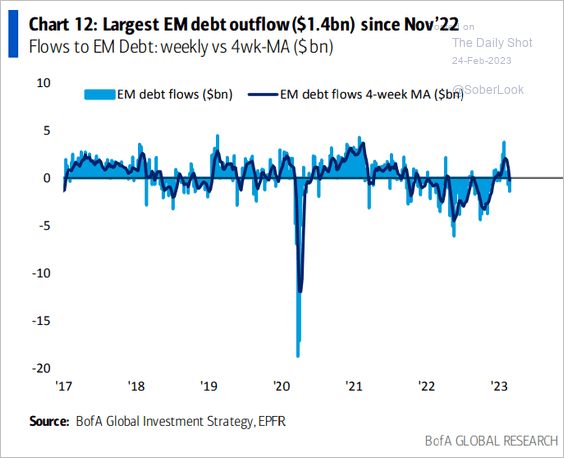

7. EM debt funds are seeing outflows.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Commodities

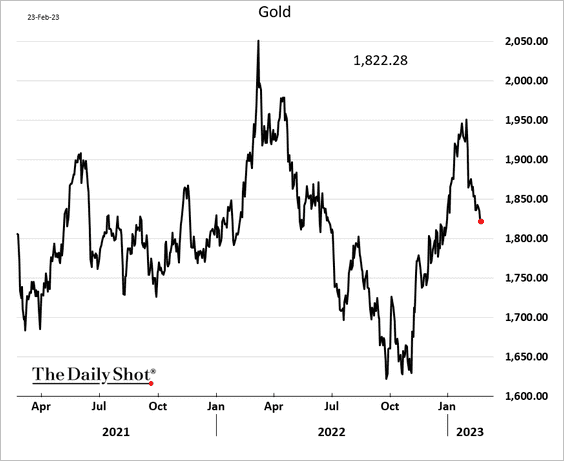

1. Gold has been retreating as yields climb.

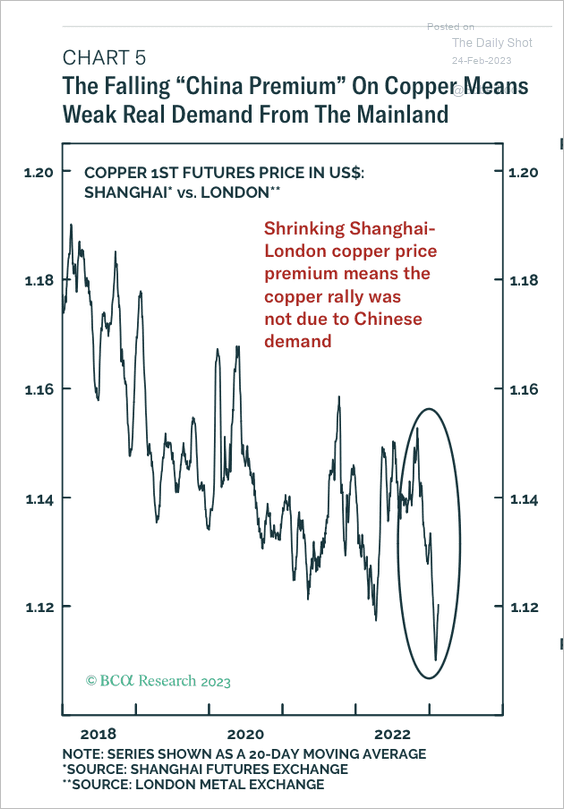

2. The Shanghai/London copper price premium narrowed, which could point to weak copper demand conditions in China.

Source: BCA Research

Source: BCA Research

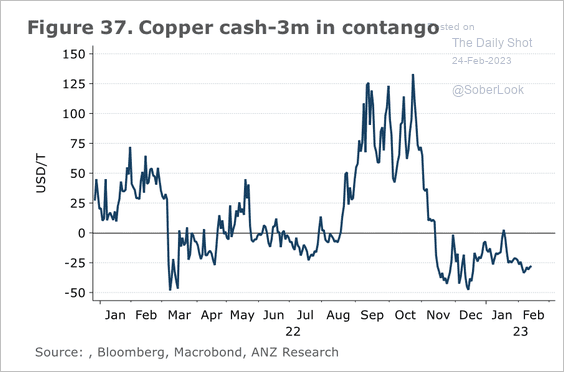

• Copper remains in contango.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

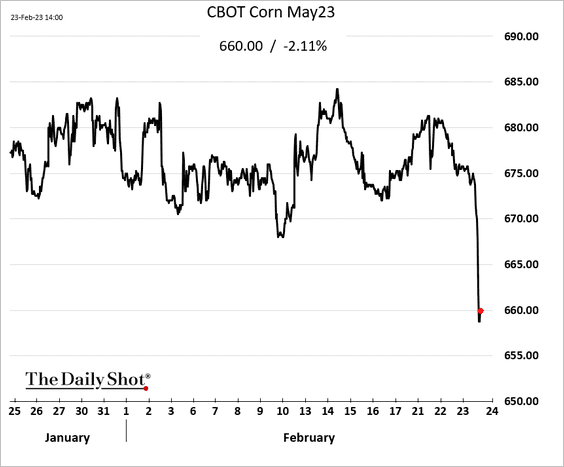

3. US corn futures took a hit on Thursday.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

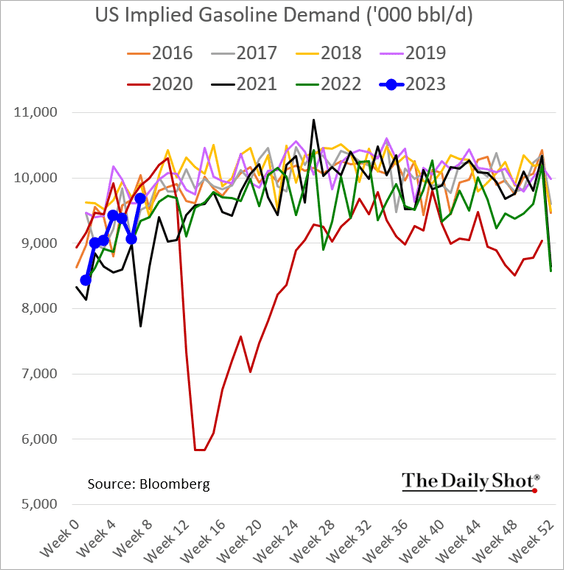

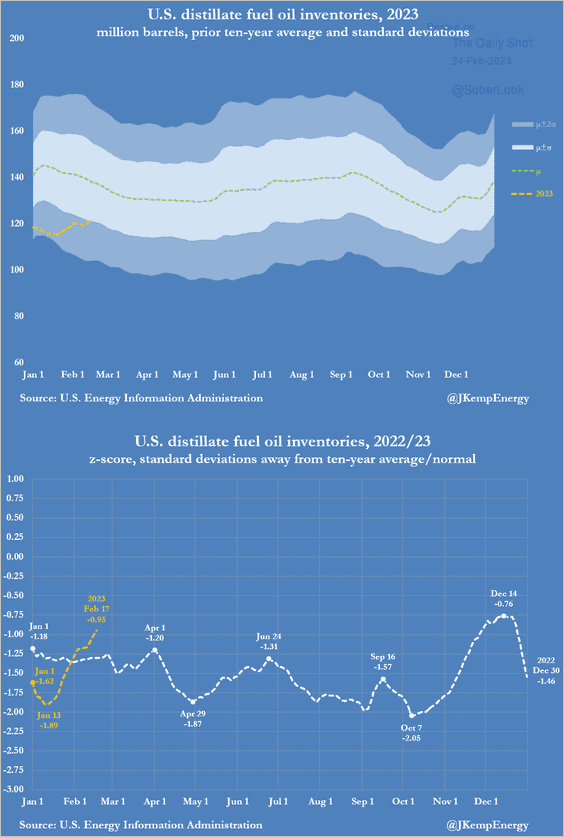

Energy

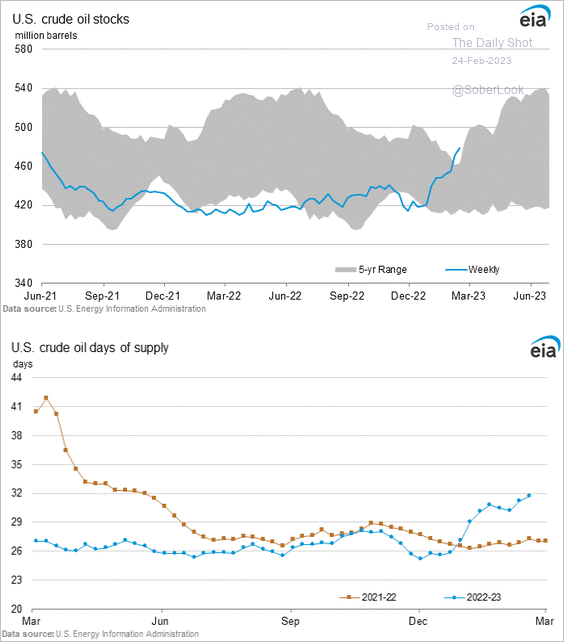

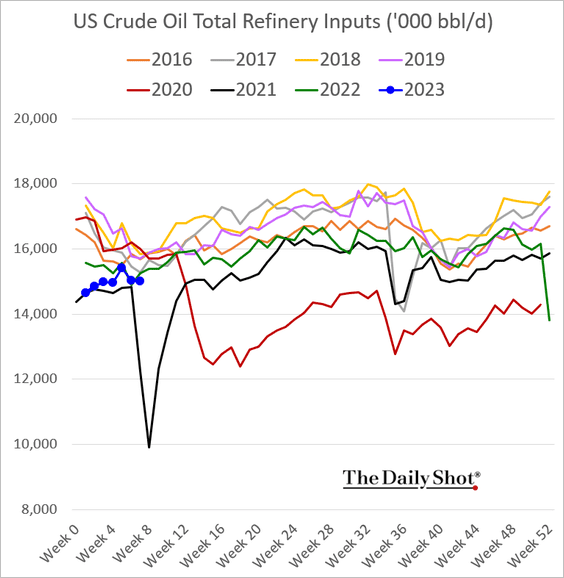

1. US commercial oil inventories are now well above the five-year average.

• Refinery inputs were very soft last week.

• US gasoline demand is rebounding.

• Distillates inventories appear to be recovering.

Source: @JKempEnergy

Source: @JKempEnergy

——————–

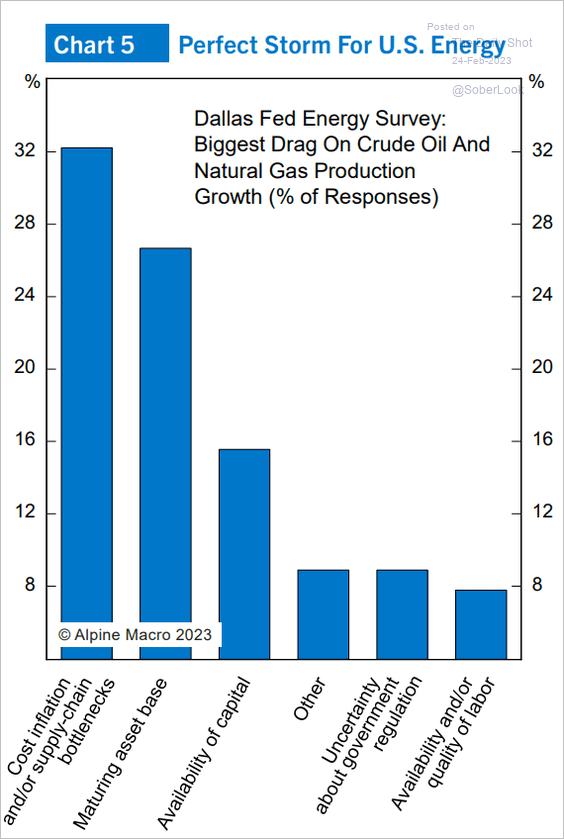

2. What factors have been the biggest drag on US O&G production?

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Equities

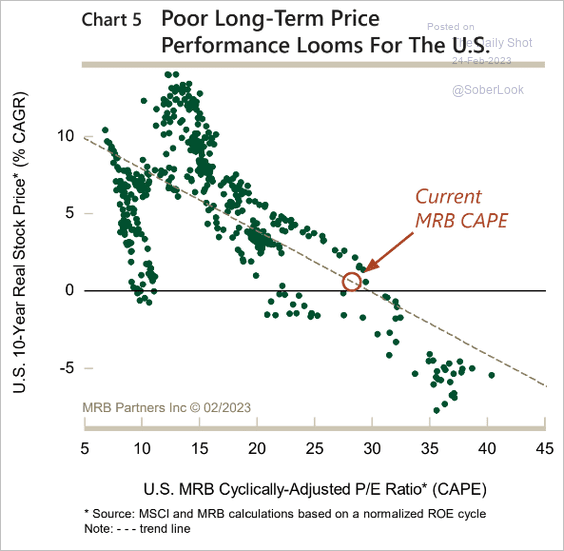

1. Rich valuations point to weak long-term returns for US stocks.

Source: MRB Partners

Source: MRB Partners

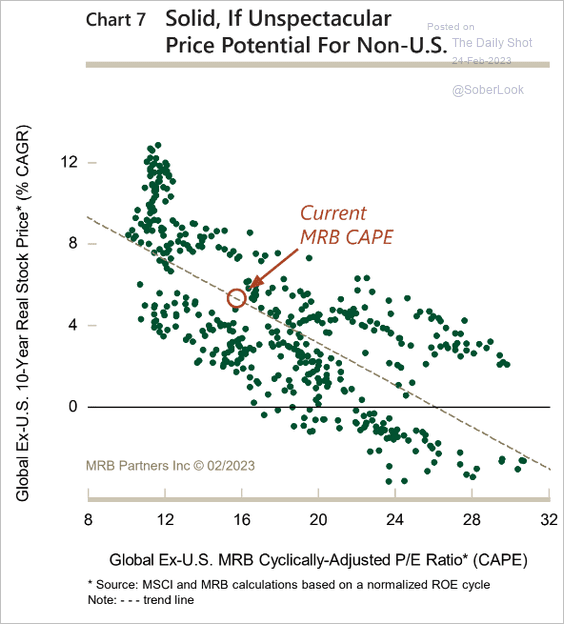

The outlook for shares outside of the US seems more favorable.

Source: MRB Partners

Source: MRB Partners

——————–

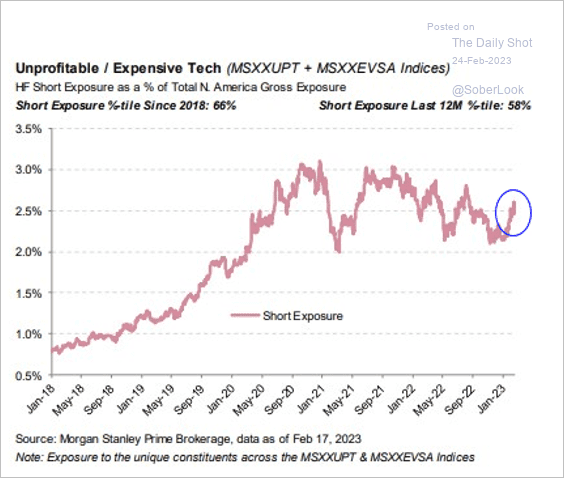

2. Hedge funds are shorting expensive/unprofitable tech shares again.

Source: Morgan Stanley Research; @luwangnyc, @markets Read full article

Source: Morgan Stanley Research; @luwangnyc, @markets Read full article

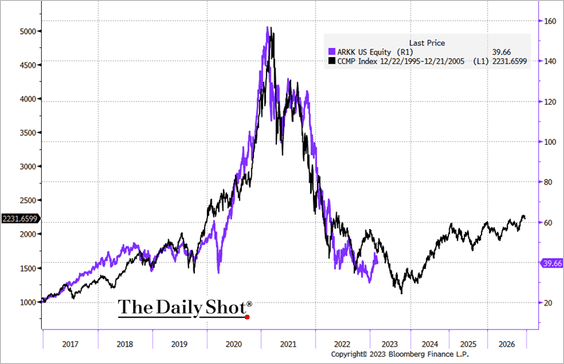

More downside for speculative stocks before recovery? Here is the dot-com analog for the ARK Innovation ETF versus the Nasdaq Composite.

——————–

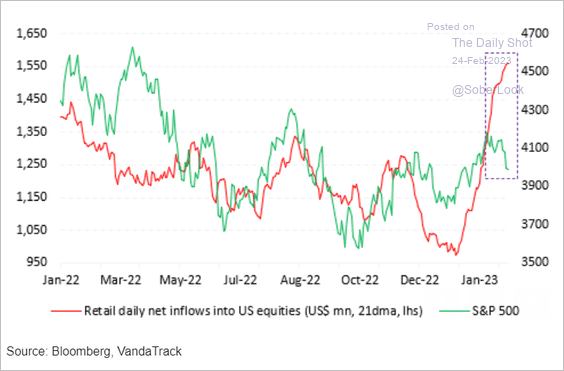

3. Retail investors’ net share purchases keep climbing.

Source: Vanda Research

Source: Vanda Research

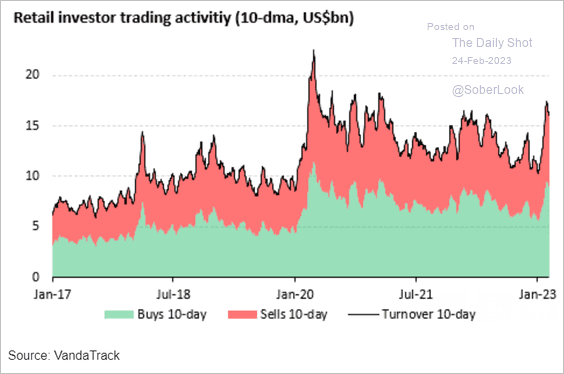

• Retail trading volumes jumped this year.

Source: Vanda Research

Source: Vanda Research

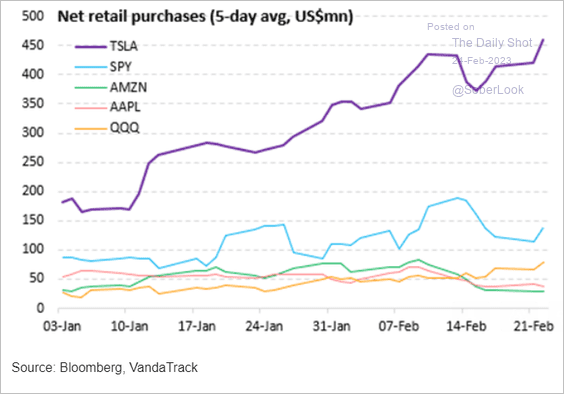

• Retail investors continue to accumulate Tesla shares.

Source: Vanda Research

Source: Vanda Research

——————–

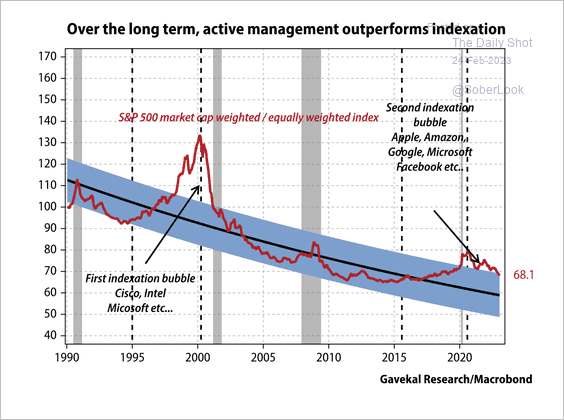

4. Over the long-term, outside of bubbles, the market-cap weighted S&P 500 index has underperformed the equal-weighted S&P 500 index.

Source: Gavekal Research

Source: Gavekal Research

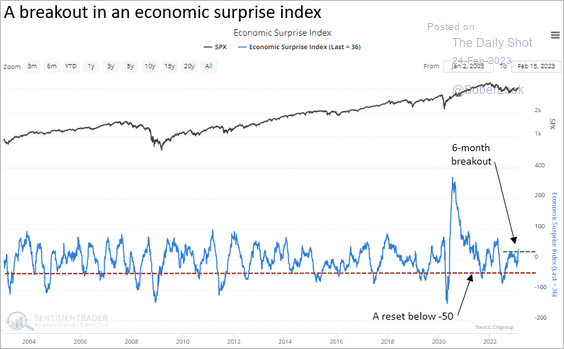

5. The Citigroup Economic Surprise Index closed at its highest level in six months. Similar breakouts have been associated with equity market strength, albeit vulnerable to whipsaws based on the broader economic cycle.

Source: SentimenTrader

Source: SentimenTrader

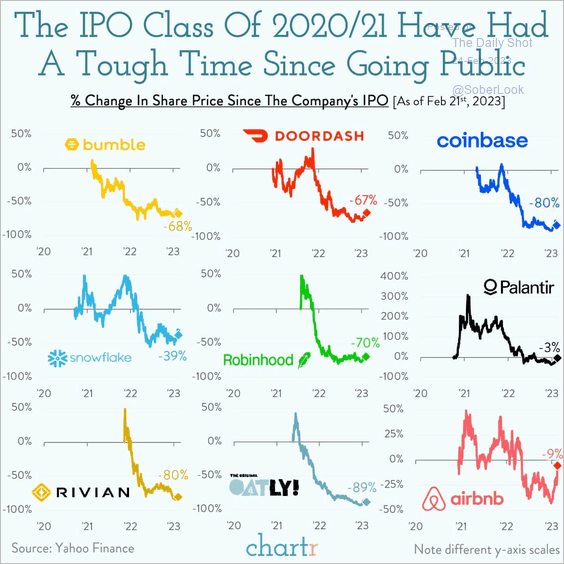

6. The 2020/21 vintage IPOs have been a disappointment for investors.

Source: @chartrdaily

Source: @chartrdaily

Back to Index

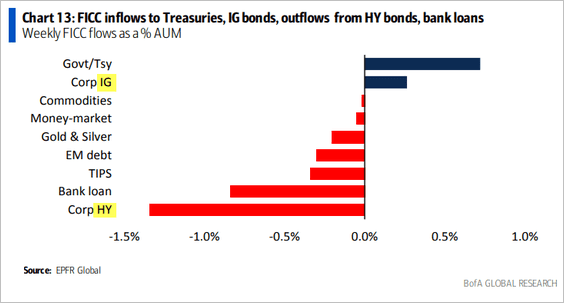

Credit

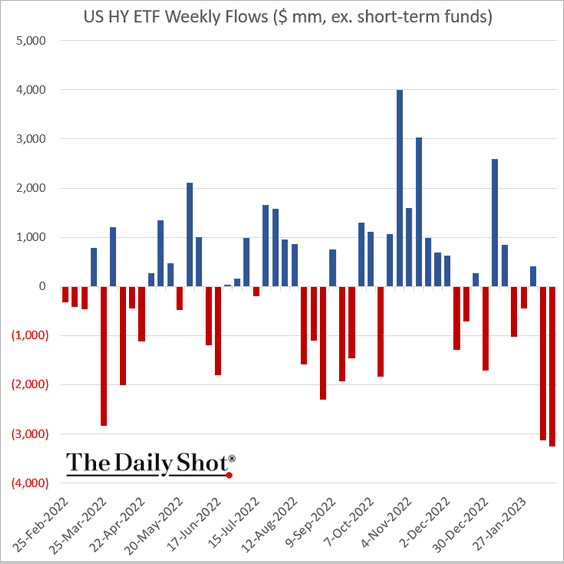

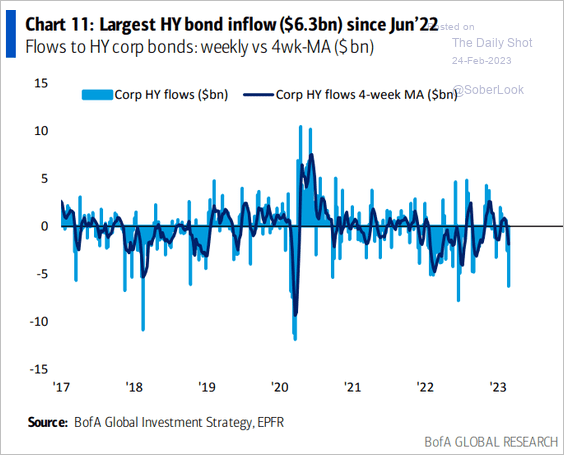

Investors continue to exit high-yield bond funds (2 charts).

Source: BofA Global Research

Source: BofA Global Research

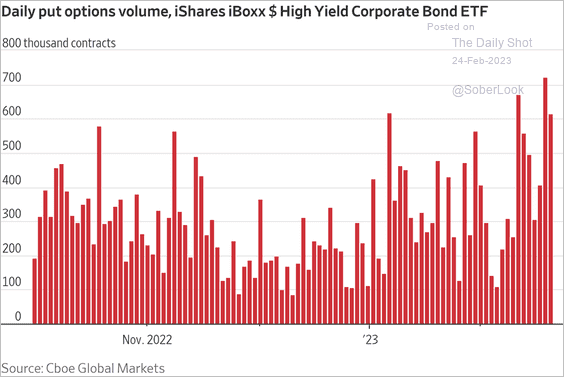

Put options volume on HYG has been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

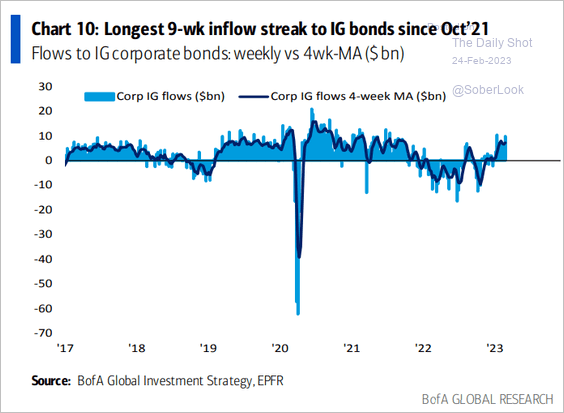

But investors still like investment-grade debt (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Rates

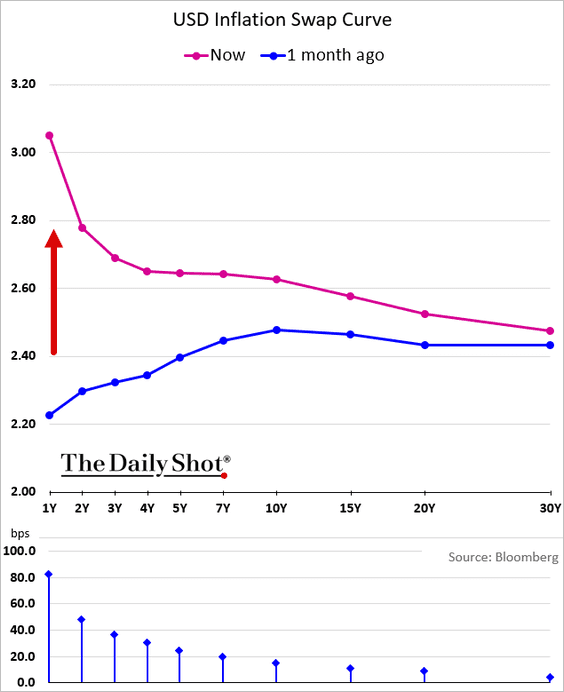

The US inflation curve is now deeply inverted as near-term inflation expectations surge.

h/t Simon White, Bloomberg Markets Live Blog

h/t Simon White, Bloomberg Markets Live Blog

Back to Index

Global Developments

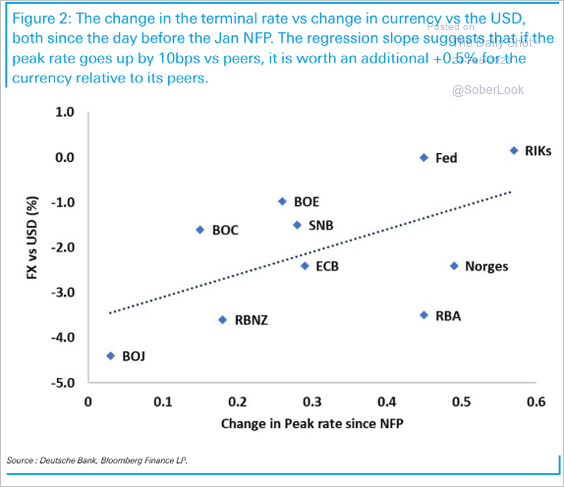

1. Exchange rates against USD have been influenced by terminal rate changes in each country following the release of the January US jobs report.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

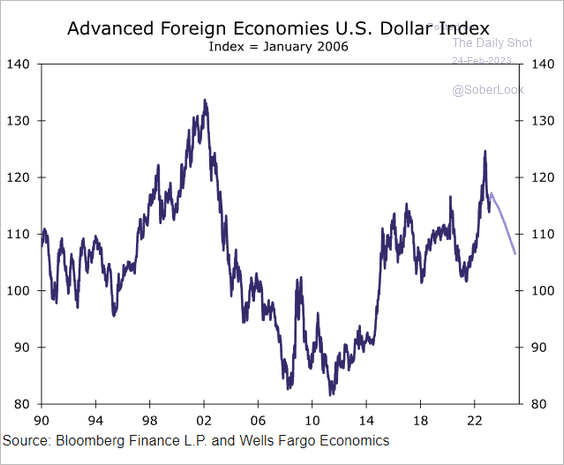

Wells Fargo sees the dollar moving lower over the next couple of years.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

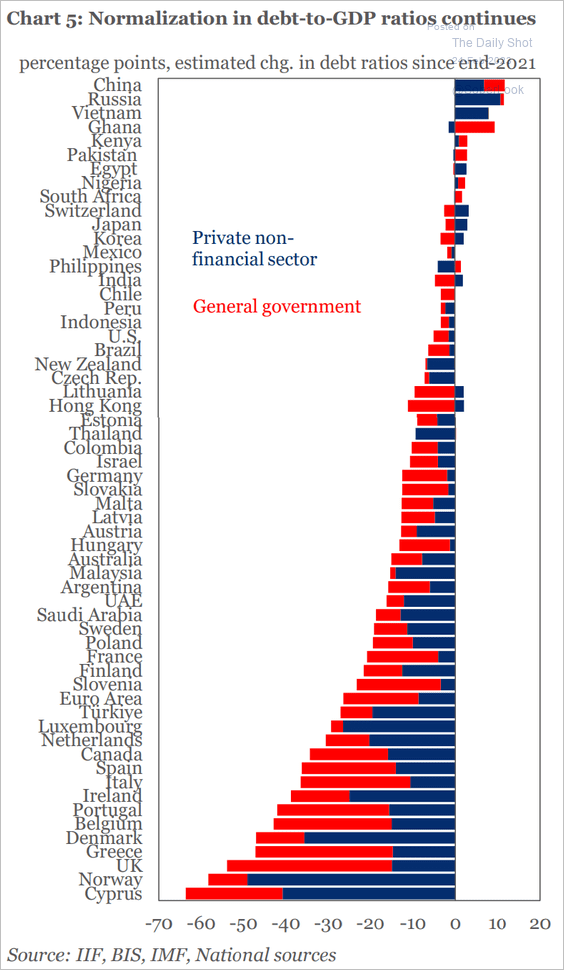

2. This chart shows the changes in debt-to-GDP ratios since 2021.

Source: IIF

Source: IIF

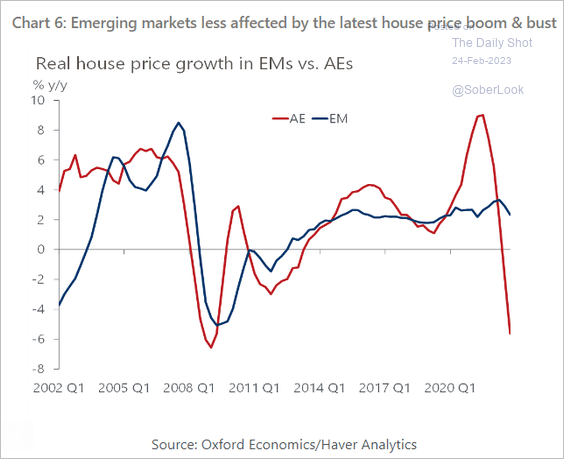

3. Home prices in advanced economies have been hit much harder than in emerging markets.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

1. Military spending in select countries:

Source: Alpine Macro

Source: Alpine Macro

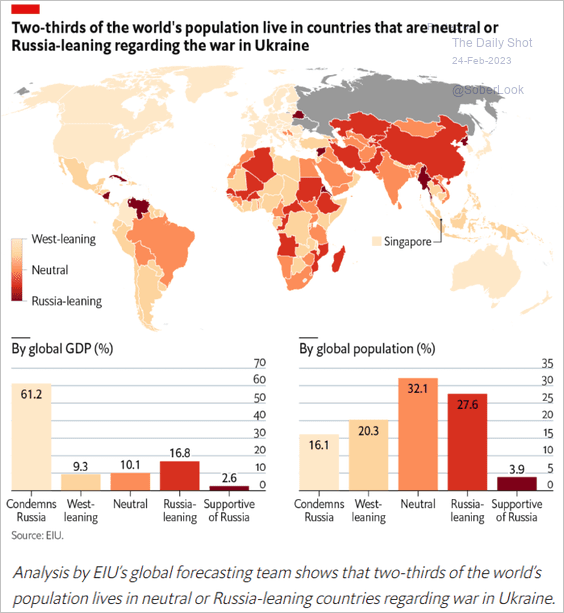

2. Support for Russia:

Source: EIU Read full article

Source: EIU Read full article

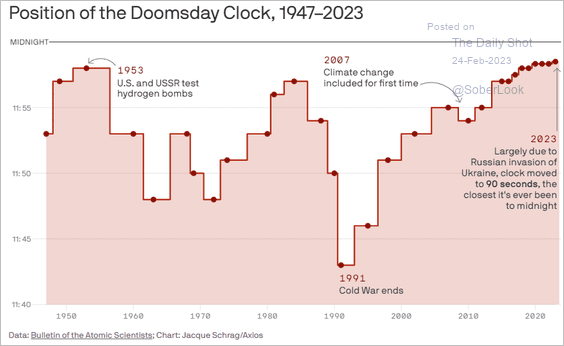

3. The Doomsday Clock:

Source: @axios Read full article

Source: @axios Read full article

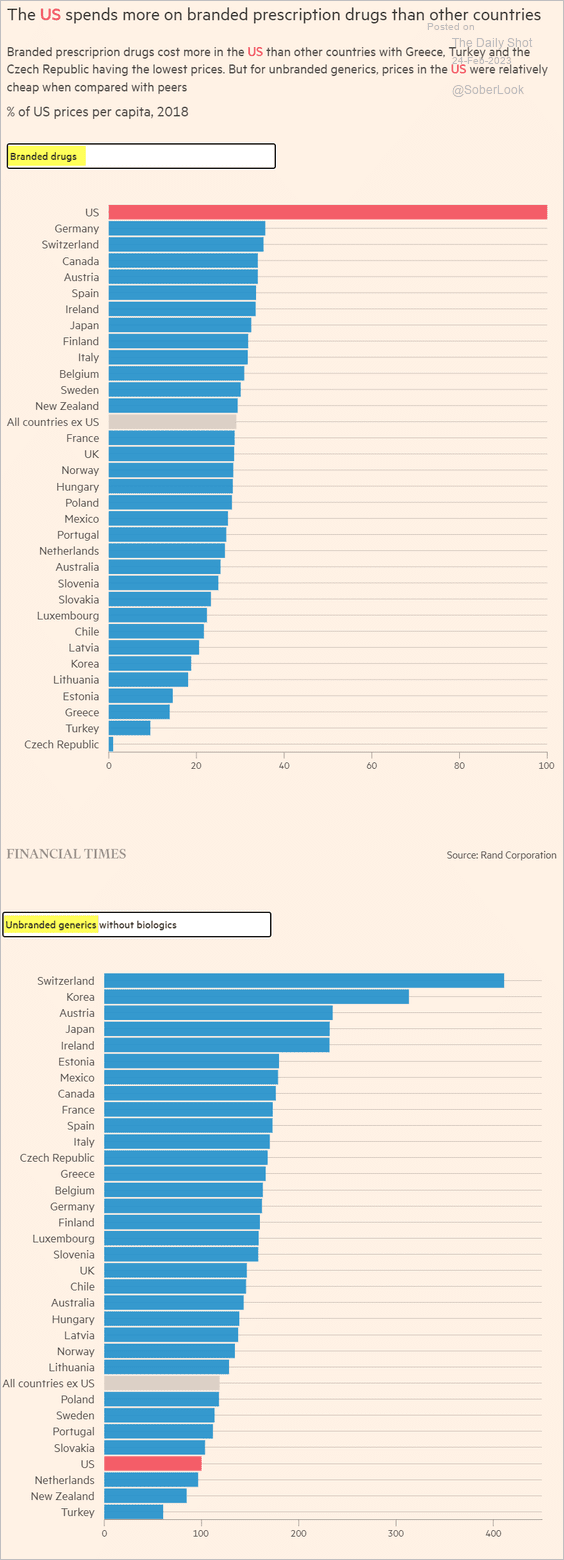

4. Brand-name vs. generic drug costs:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

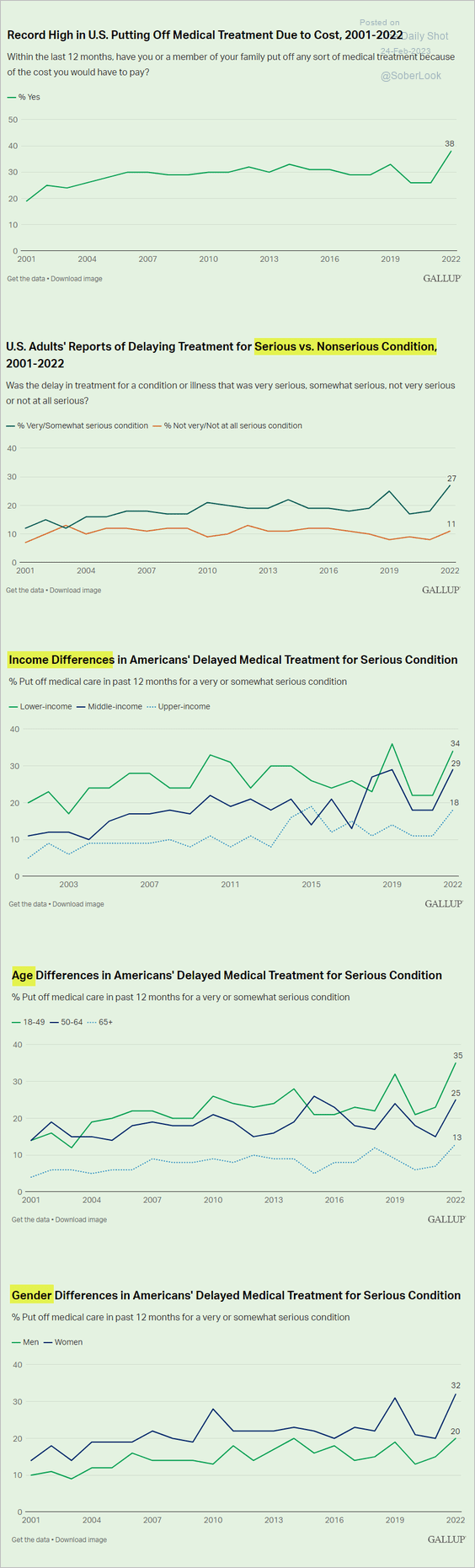

5. Delaying medical care due to cost:

Source: Gallup Read full article

Source: Gallup Read full article

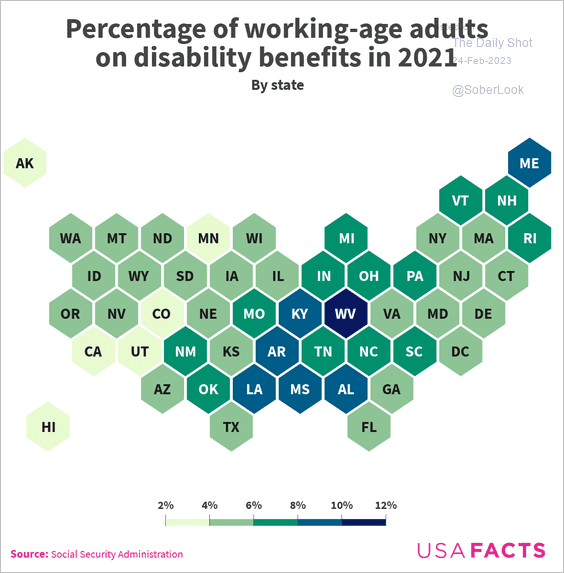

6. Disability benefits:

Source: USAFacts

Source: USAFacts

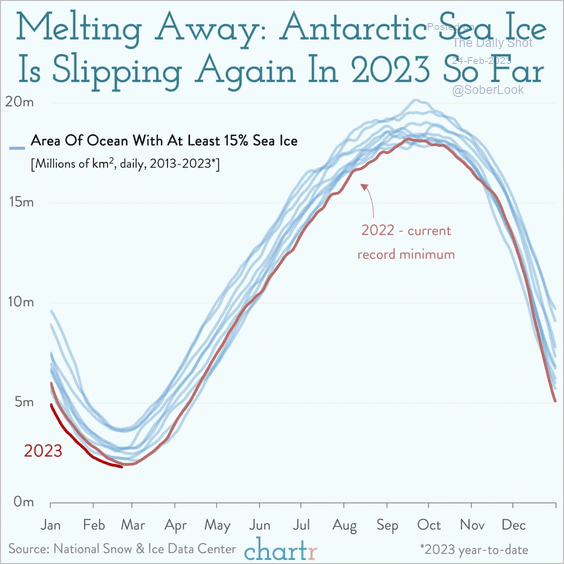

7. Antarctic sea ice:

Source: @chartrdaily

Source: @chartrdaily

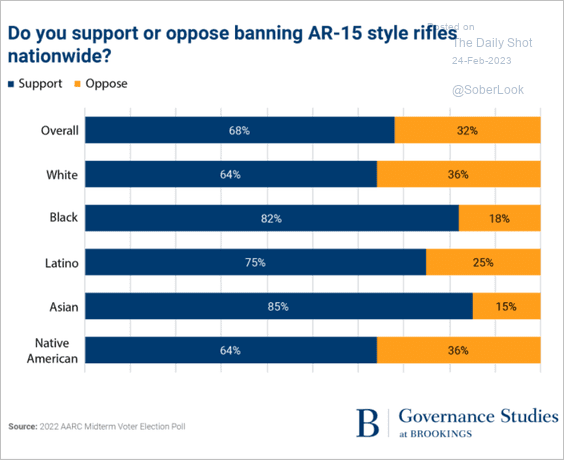

8. Views on banning AR-15 style rifles in the US:

Source: Brookings Read full article

Source: Brookings Read full article

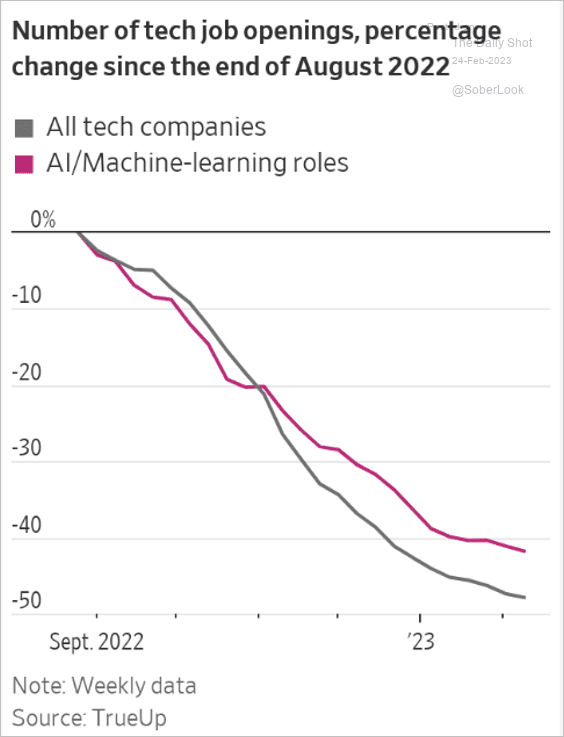

9. US tech job openings (change since August):

Source: @acemaxx, @WSJecon Read full article

Source: @acemaxx, @WSJecon Read full article

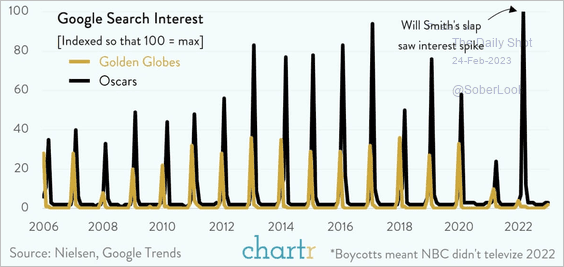

10. Search activity for Golden Globes vs. Oscars:

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index