The Daily Shot: 28-Feb-23

• The United States

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Rates

• Food for Thought

The United States

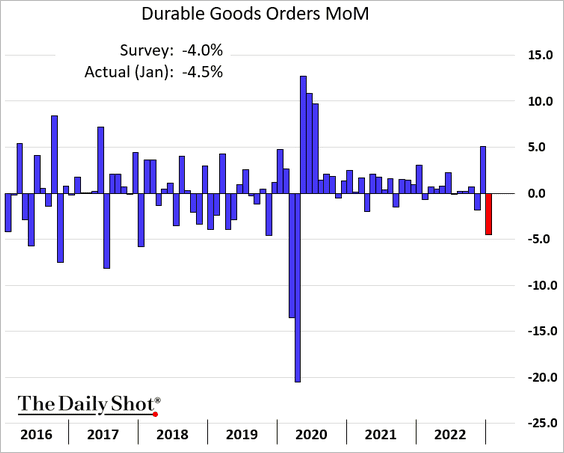

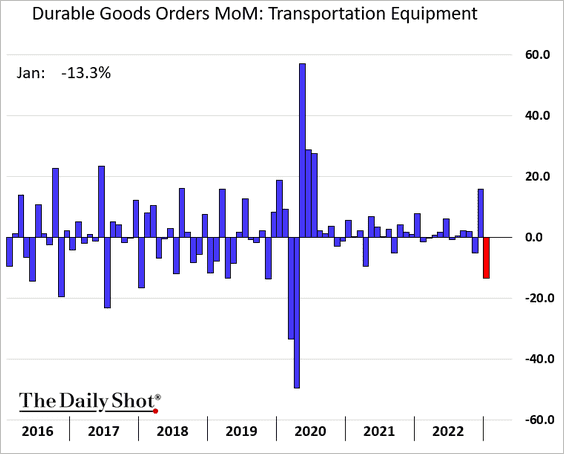

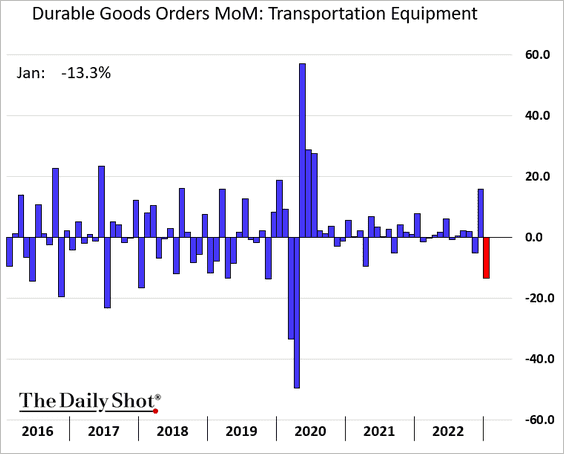

1. The headline durable goods orders index declined sharply in January, …

… as Boeing’s orders decreased from a spike of 250 aircraft in December to 55 in January.

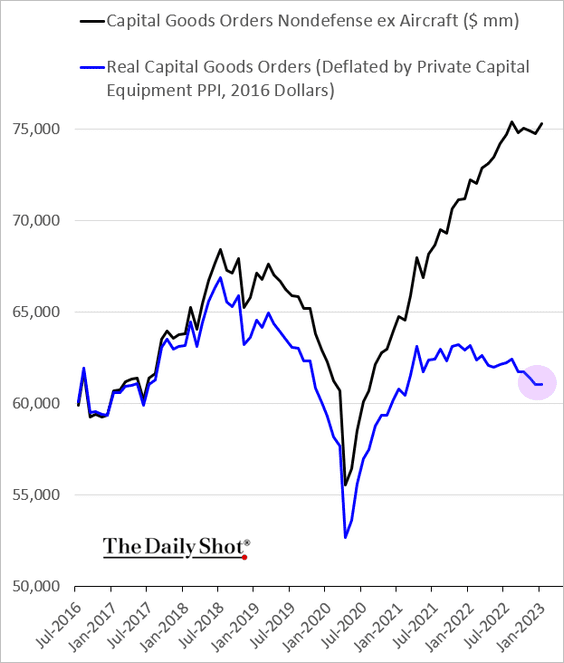

• But durable goods orders excluding transportation topped expectations. Capital goods orders, an indicator of business investment, were also robust.

Source: Reuters Read full article

Source: Reuters Read full article

• However, adjusted for inflation, capital goods orders were roughly flat last month.

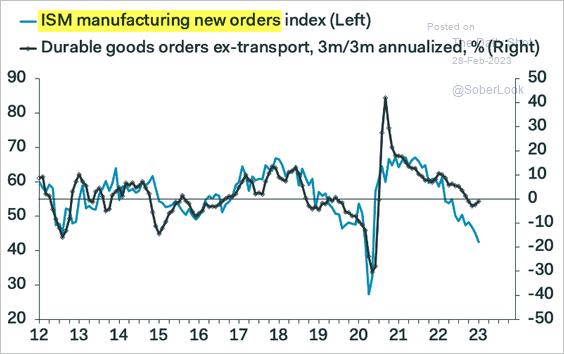

• The ISM Manufacturing PMI orders index points to weakness ahead for durable goods orders.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

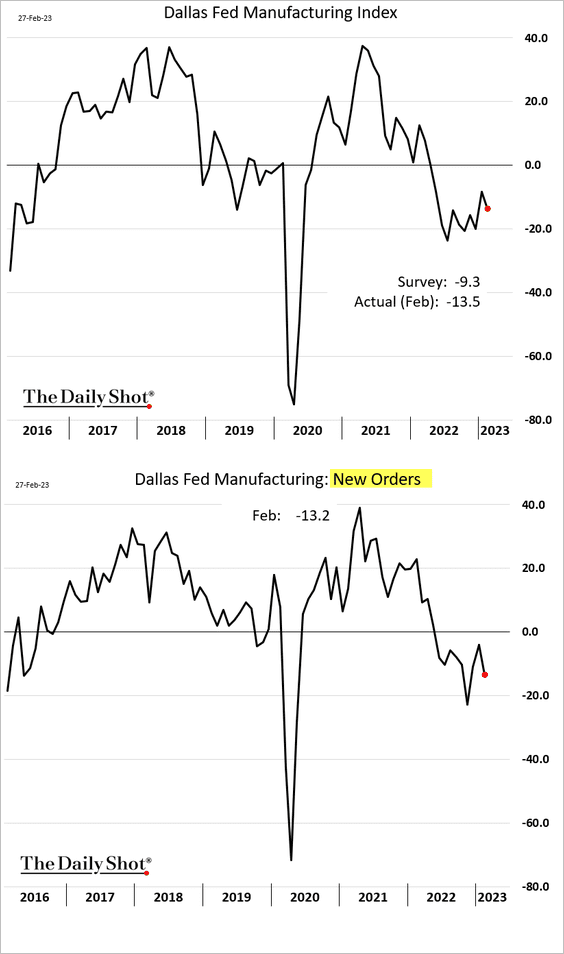

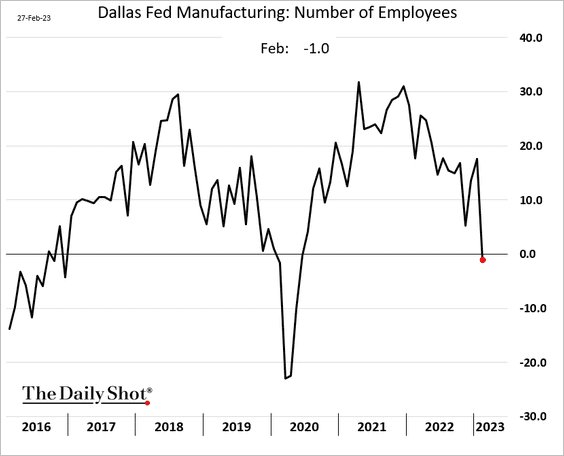

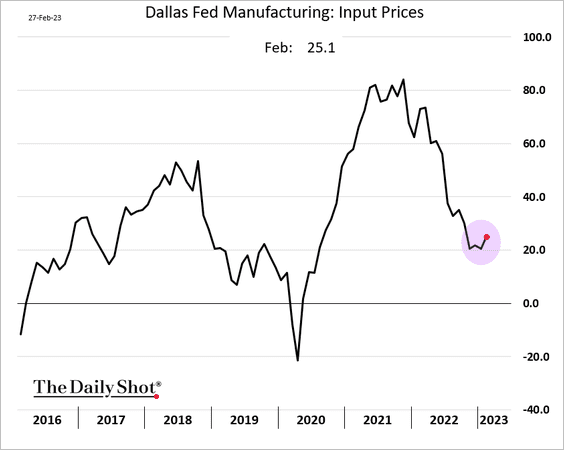

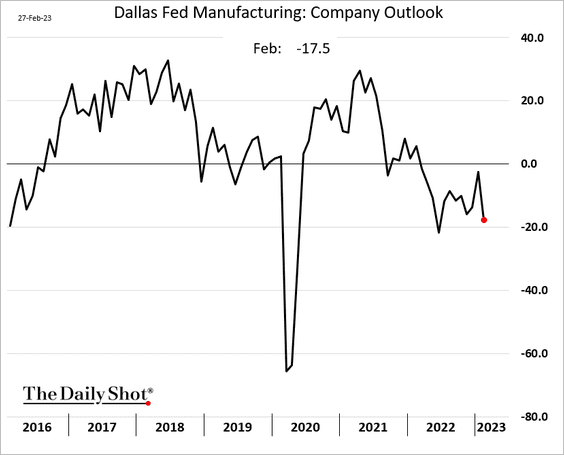

2. The Dallas Fed’s manufacturing index weakened this month as demand slumped.

• Factories reduced their workforce.

• More firms reported rising input costs.

• Outlook deteriorated.

——————–

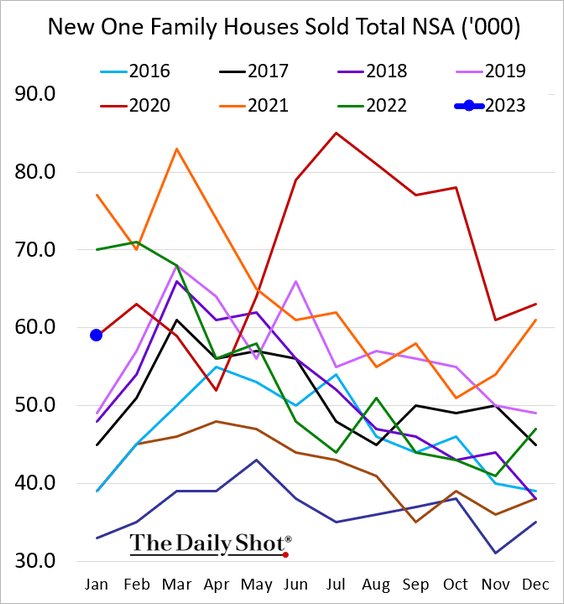

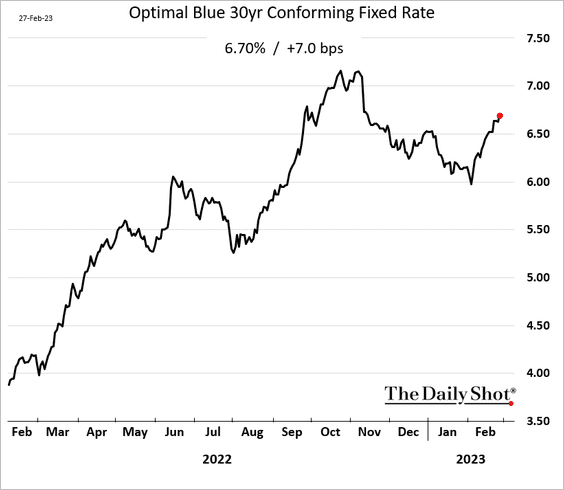

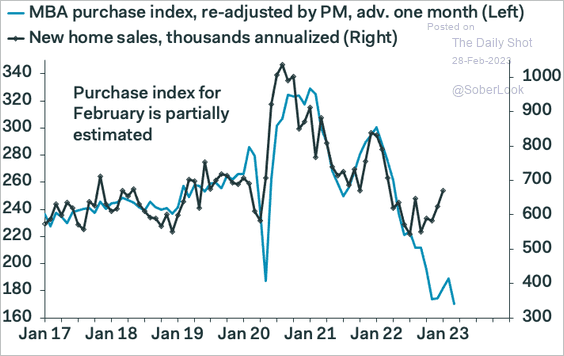

3. Next, we have some updates on the housing market.

• January new home sales topped expectations.

– But rising mortgage rates, …

… and falling mortgage applications signal more pain ahead for new home sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

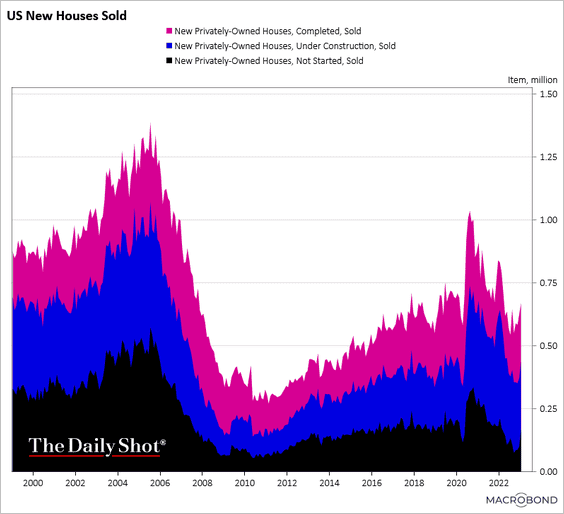

– Next, we have new homes sold by stage of construction (seasonally adjusted).

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

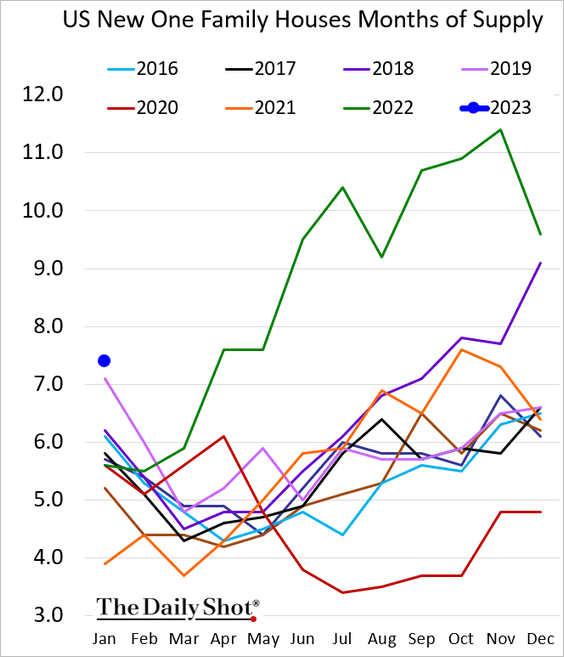

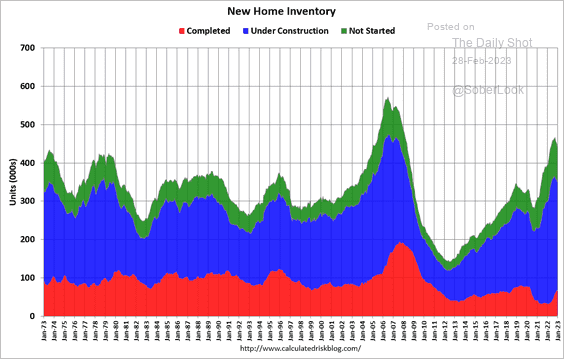

– Inventories of new homes are elevated when measured in months of supply.

This chart shows new home inventories by stage of construction.

Source: Calculated Risk

Source: Calculated Risk

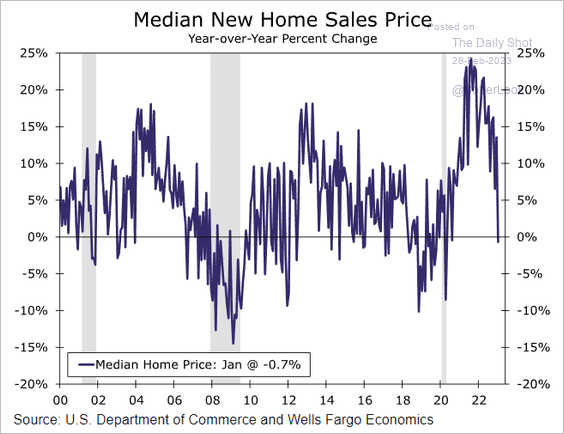

– The median new home price is now down on a year-over-year basis.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

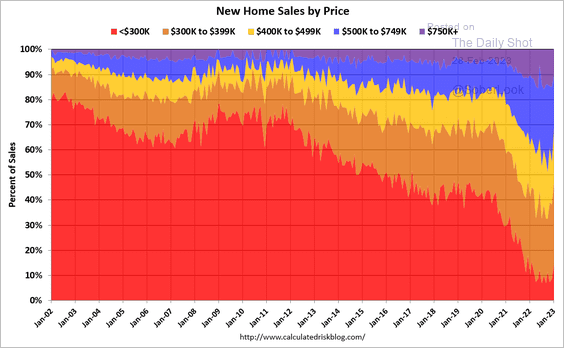

Here is the distribution of prices over time.

Source: Calculated Risk

Source: Calculated Risk

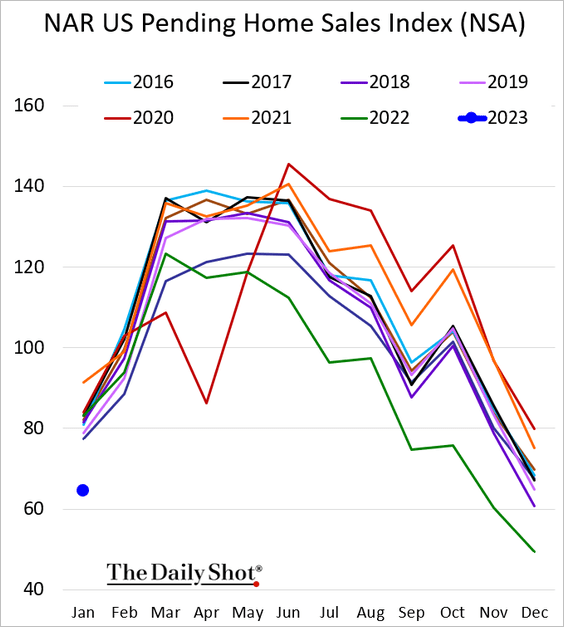

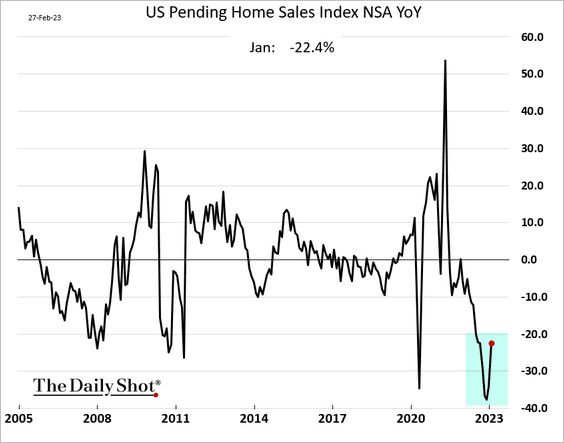

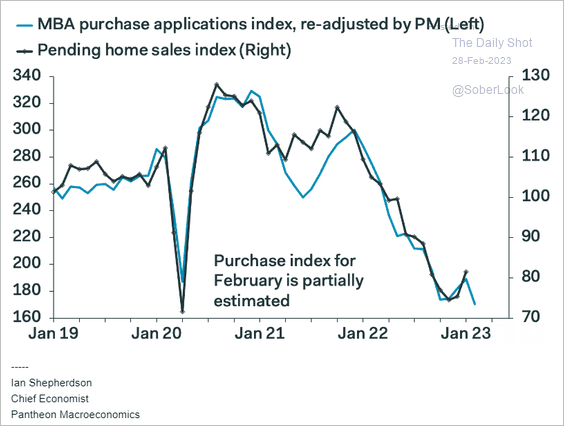

• Pending home sales were higher than expected last month, but this strength is not expected to last as mortgage rates climb, …

Source: CNBC Read full article

Source: CNBC Read full article

… and loan applications slump.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

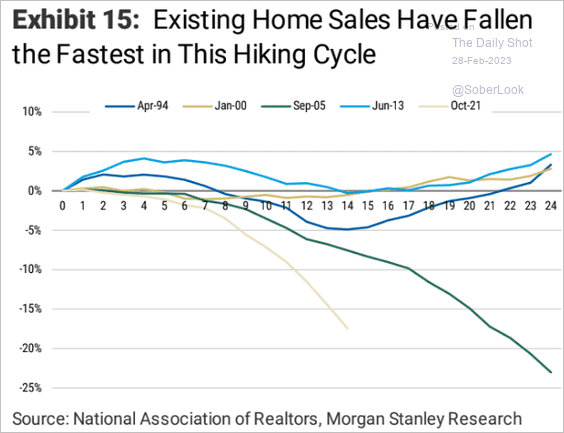

• The decline in home sales has been unusually rapid in the current rate hiking cycle.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

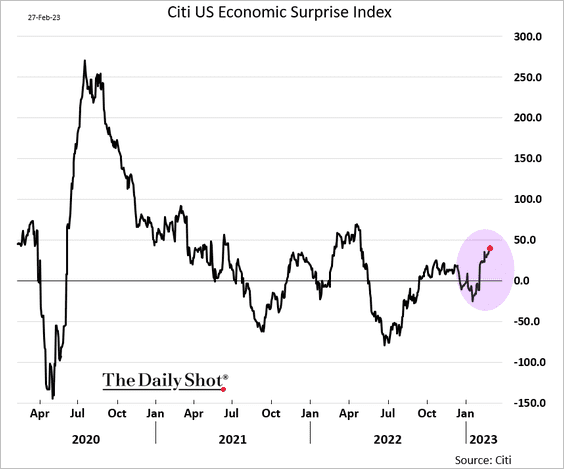

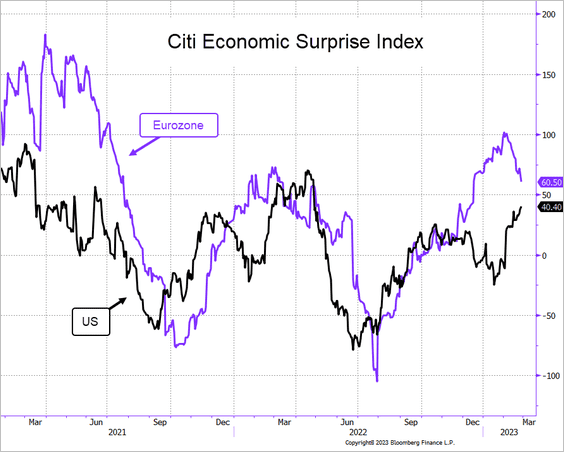

4. The Citi Economic Surprise Index continues to climb.

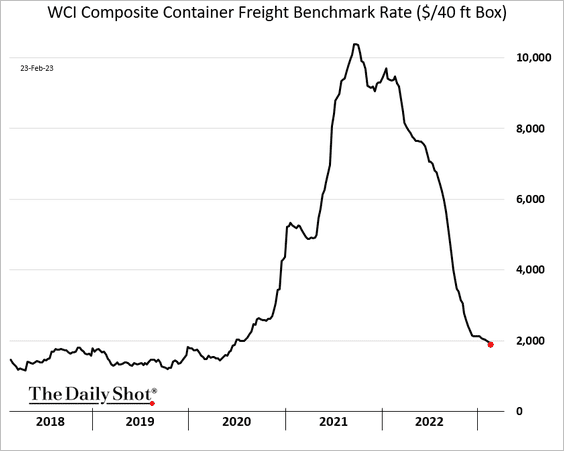

5. Container shipping costs are still drifting lower.

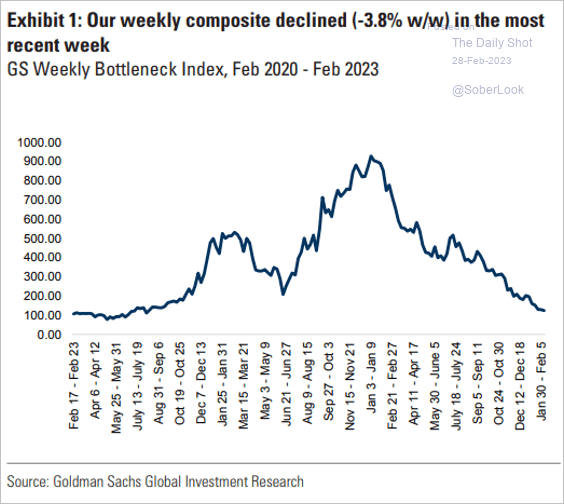

Here is Goldman’s bottleneck index.

Source: Goldman Sachs; @AyeshaTariq, h/t @dailychartbook

Source: Goldman Sachs; @AyeshaTariq, h/t @dailychartbook

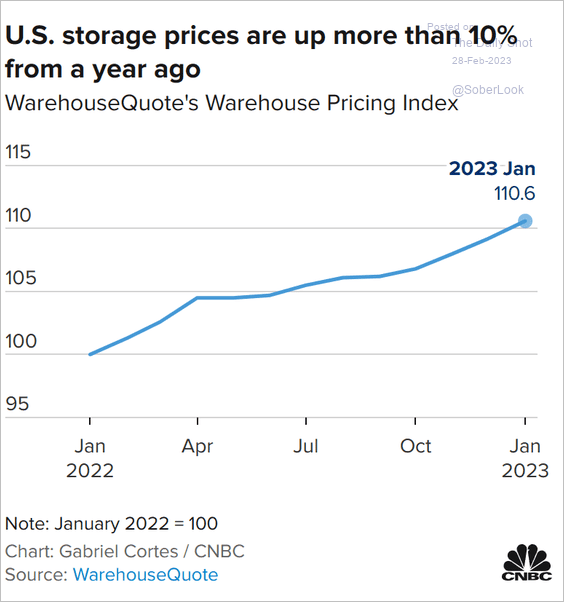

With inventories on the rise, warehouse costs have been surging.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

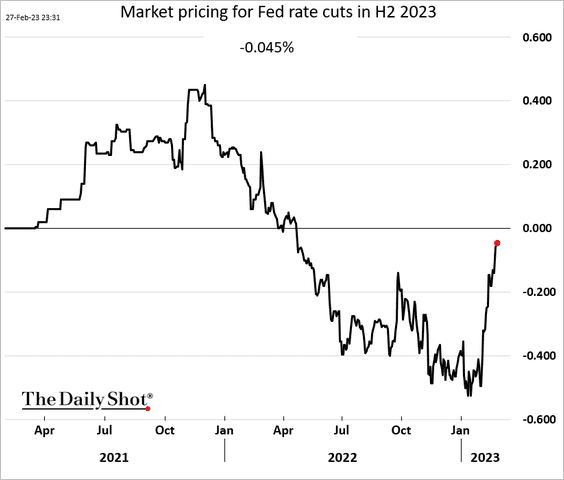

6. The market is finally coming to terms with no Fed rate cuts in 2023. Here is market pricing for the fed funds rate change in the second half of this year.

Back to Index

The Eurozone

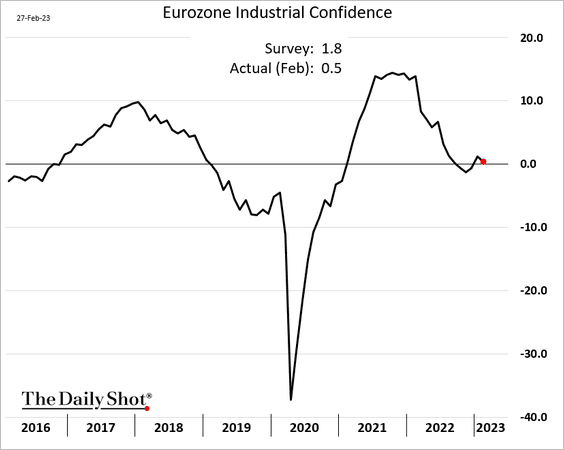

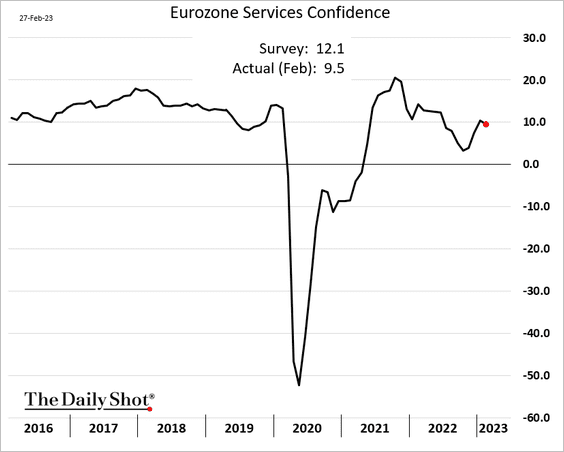

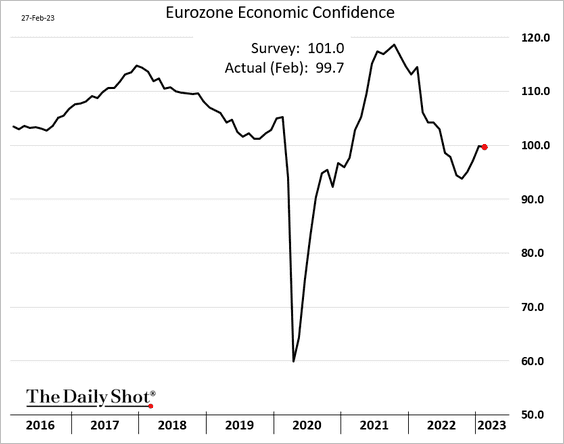

1. Industrial and services confidence indicators weakened this month, coming in below expectations.

The overall economic confidence index, which includes consumer sentiment, was flat.

——————–

2. The US and euro-area economic surprise indices continue to converge.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

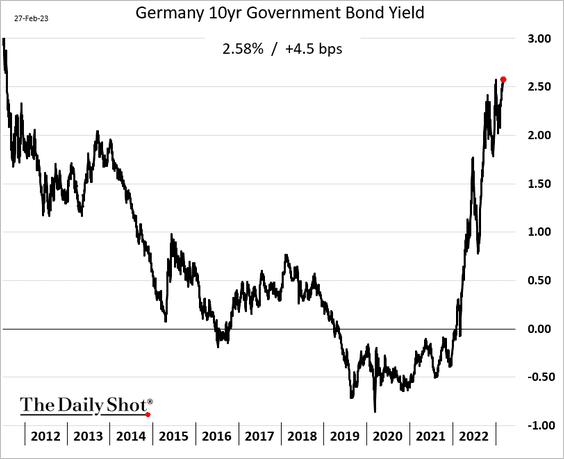

3. The 10-year Bund yield hit the highest level since 2011.

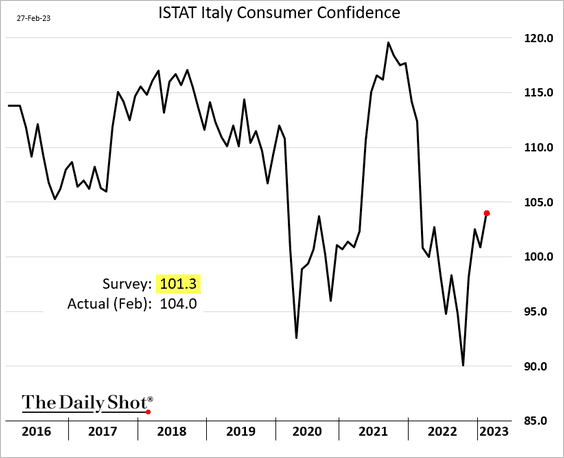

4. Italy’s consumer confidence continues to rebound.

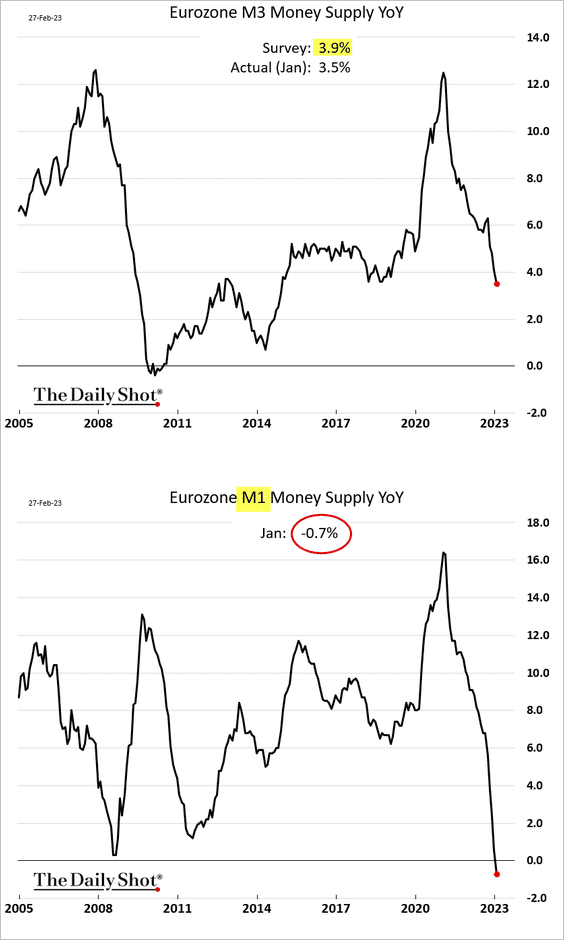

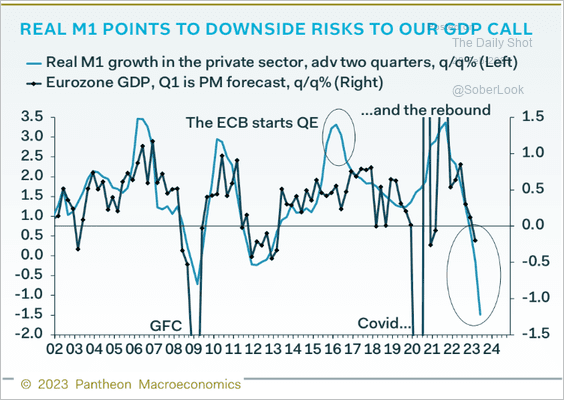

5. Euro-area monetary conditions are deteriorating rapidly, with the M1 money supply now down on a year-over-year basis.

That doesn’t bode well for economic growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

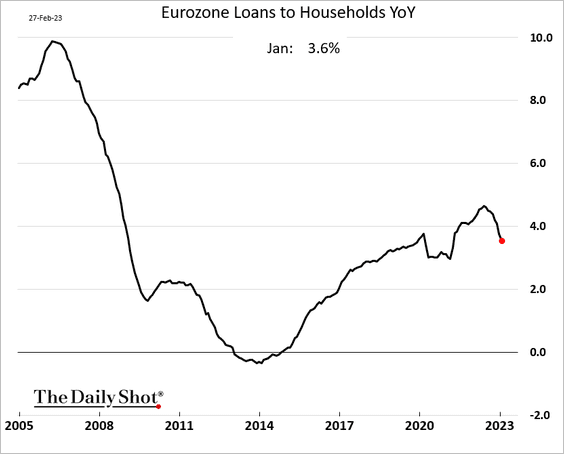

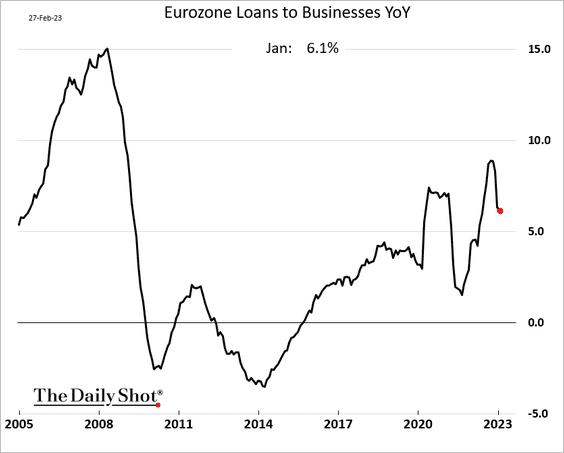

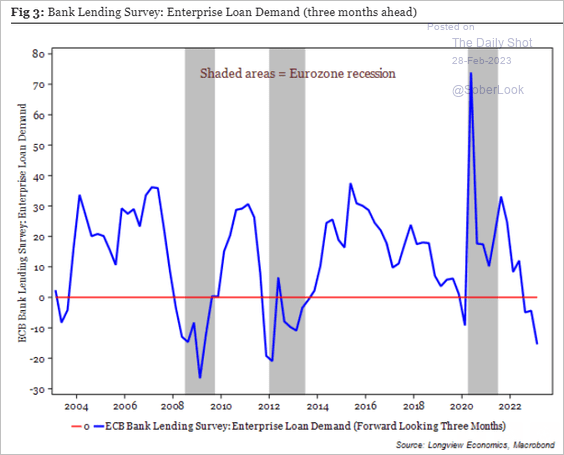

• Loan growth is slowing.

Business loan demand has tumbled.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

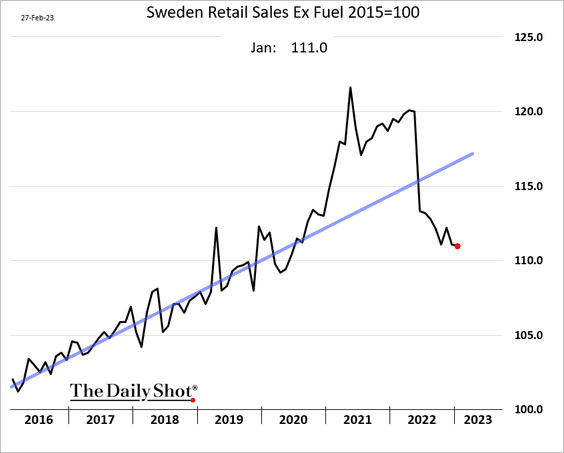

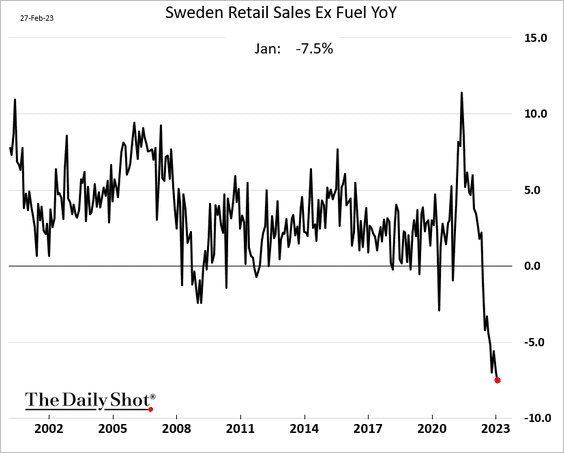

1. Sweden’s retail sales are down sharply on a year-over-year basis.

——————–

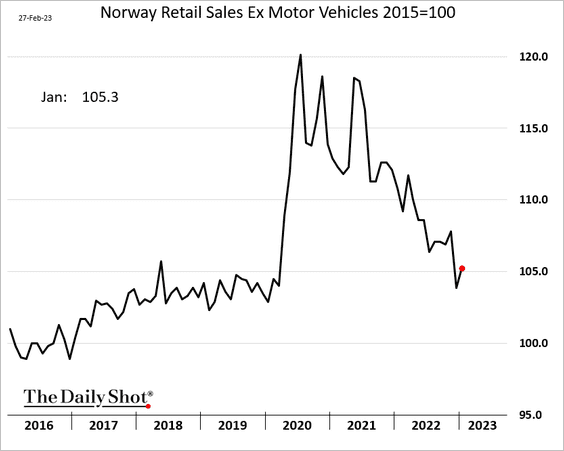

2. Norway’s retail sales edged higher in January.

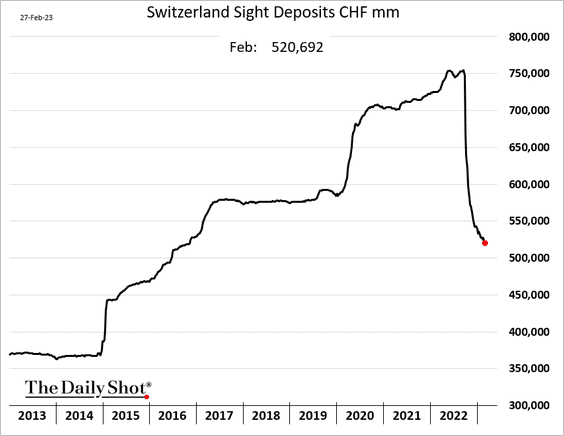

3. Switzerland’s central bank continues to remove liquidity from the financial system.

Back to Index

Japan

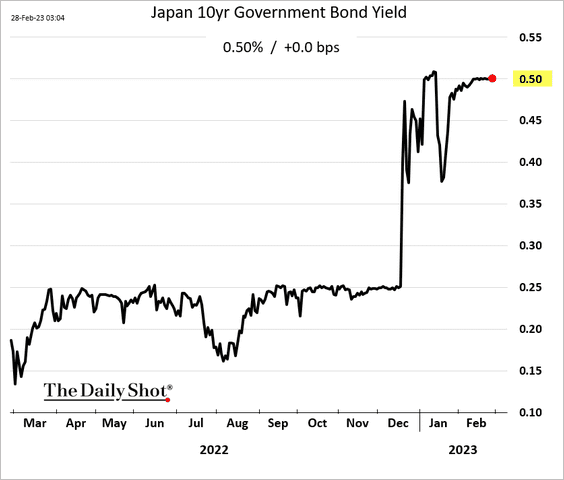

1. The 10-year JGB yield is holding at the BoJ’s cap.

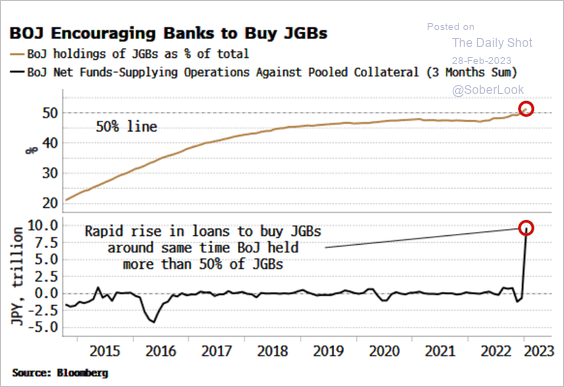

The BoJ has been helping banks finance JGB purchases.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

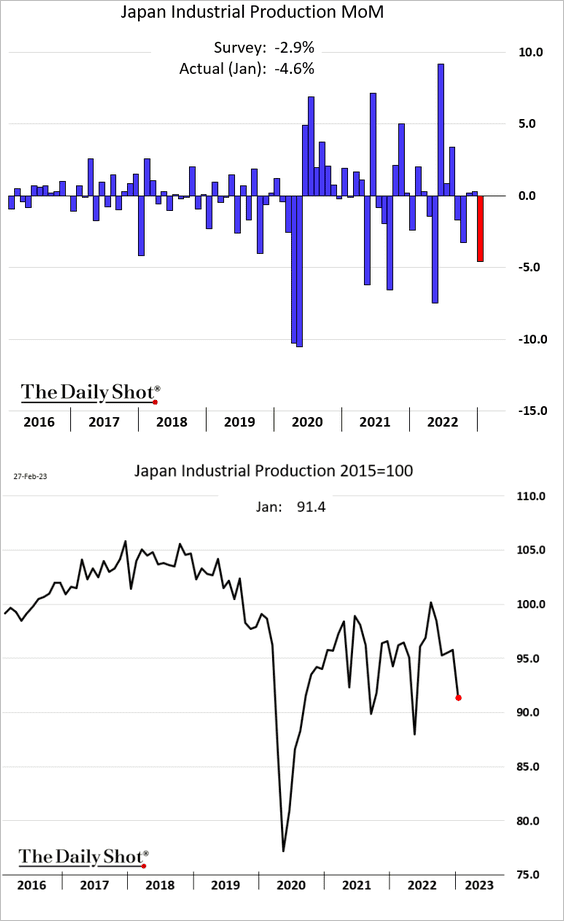

2. Industrial production declined last month.

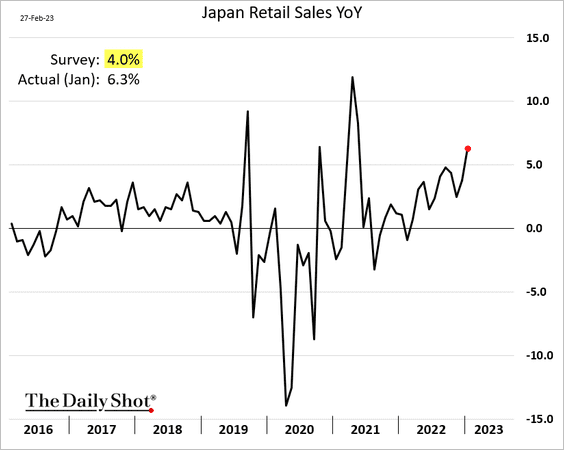

3. Retail sales were stronger than expected.

Back to Index

Asia – Pacific

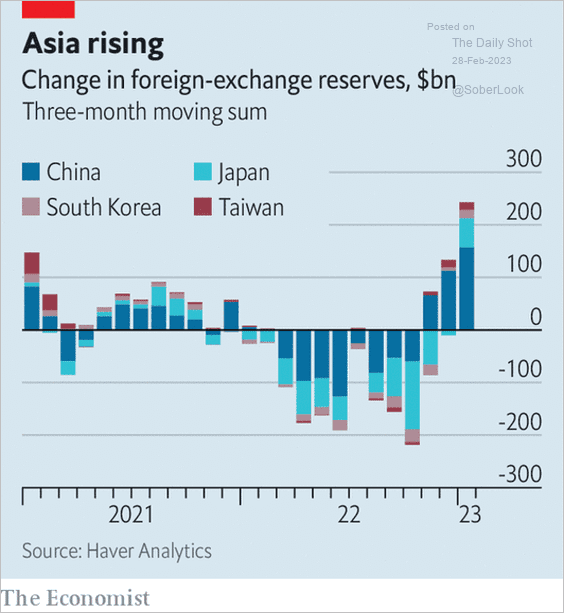

1. FX reserves have been rebounding across Asia.

Source: The Economist Read full article

Source: The Economist Read full article

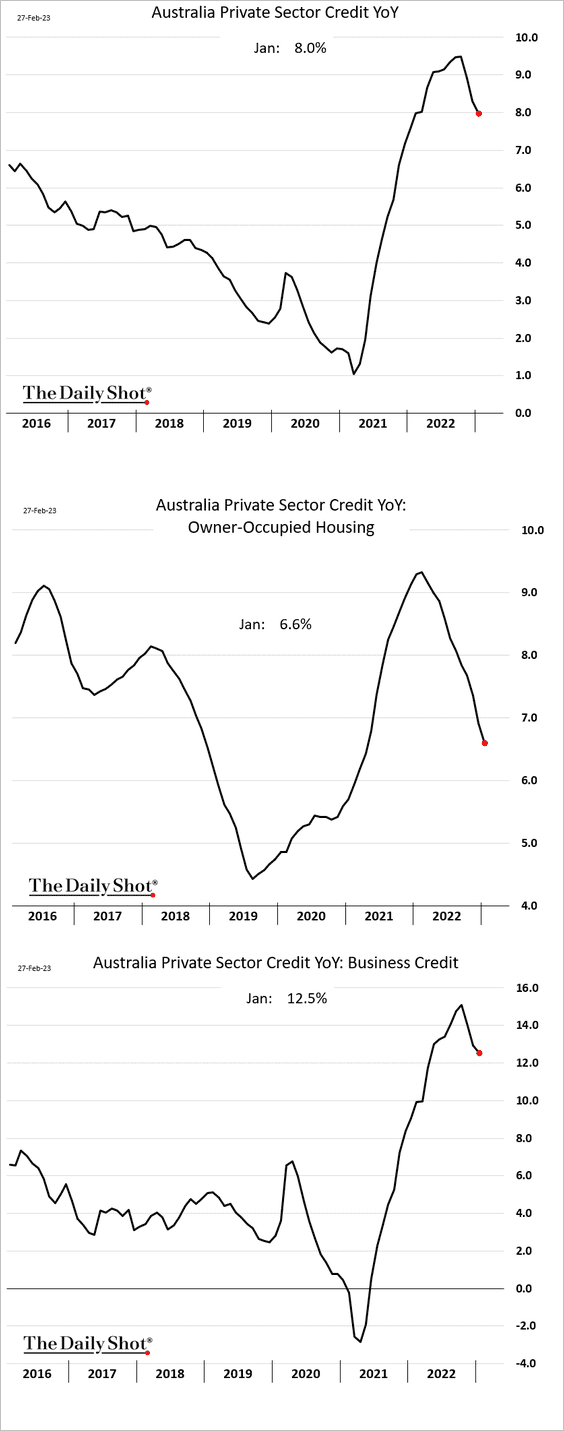

2. Australia’s credit growth continues to slow.

Back to Index

China

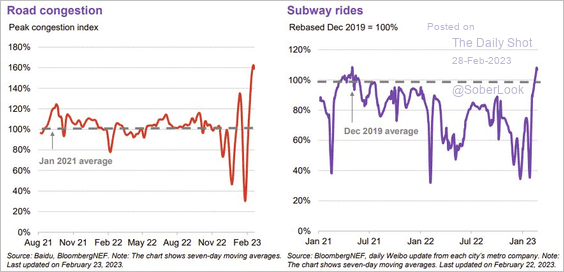

1. Mobility indicators have surged.

Source: @Marcomadness2

Source: @Marcomadness2

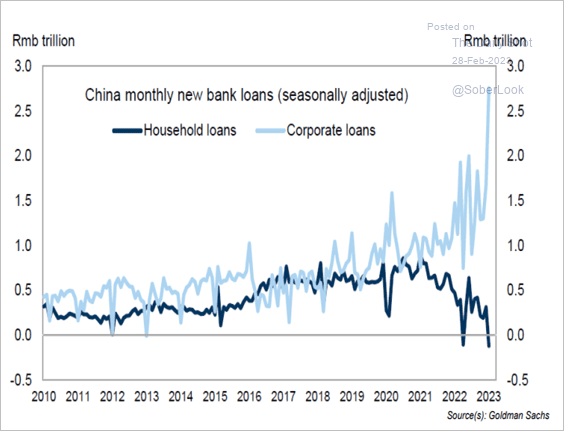

2. The divergence between corporate and household credit demand has been remarkable.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

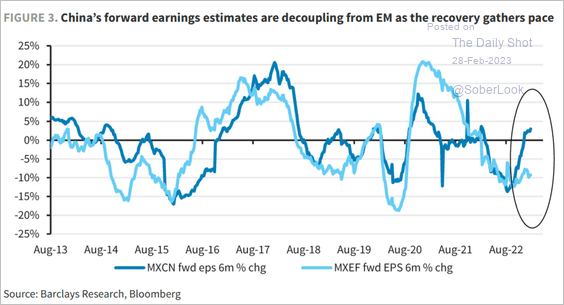

3. China’s and the overall EM forward earnings estimates have diverged.

Source: Barclays Research

Source: Barclays Research

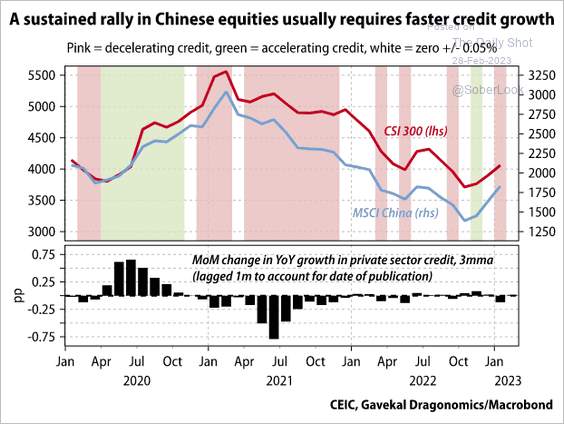

4. A sustained equity rally in China requires credit expansion.

Source: Gavekal Research

Source: Gavekal Research

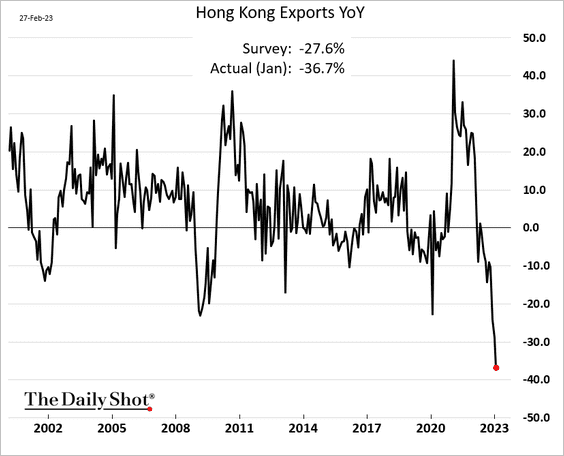

5. In January, Hong Kong’s exports were down nearly 40% on a year-over-year basis.

Back to Index

Emerging Markets

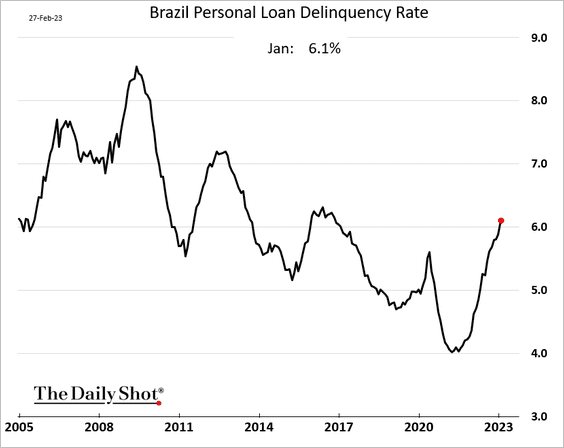

1. Brazil’s loan delinquencies/defaults continue to climb.

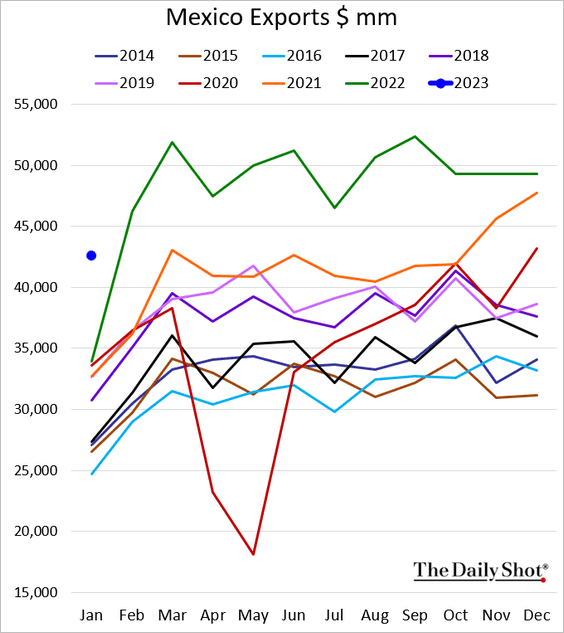

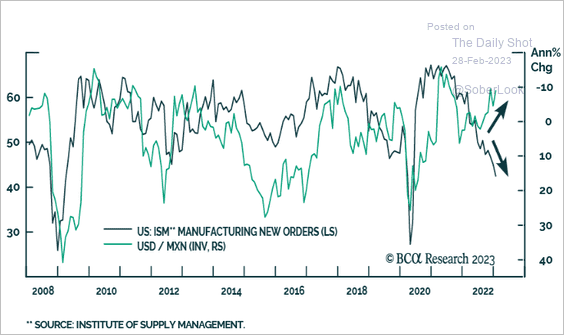

2. Mexico’s exports were surprisingly strong in January.

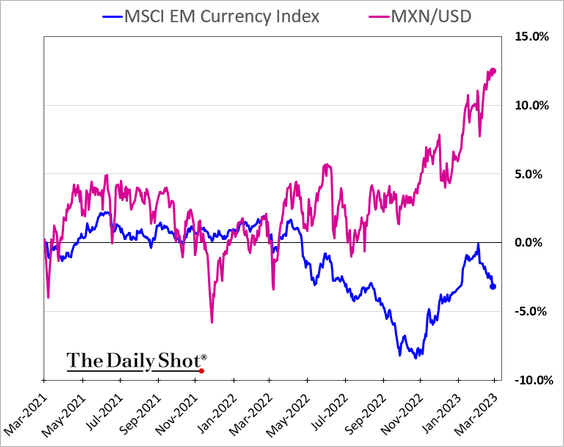

The Mexican peso has been surging …

… despite soft manufacturing orders in the US.

Source: BCA Research

Source: BCA Research

——————–

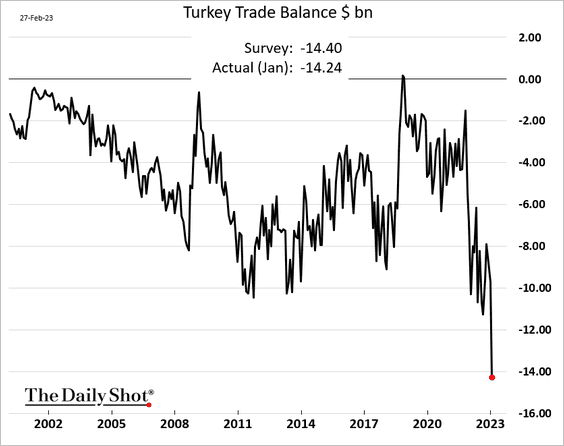

3. Turkey’s trade deficit hit a new record last month.

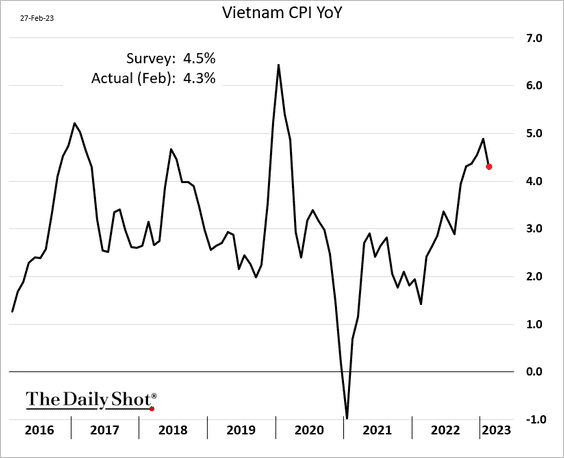

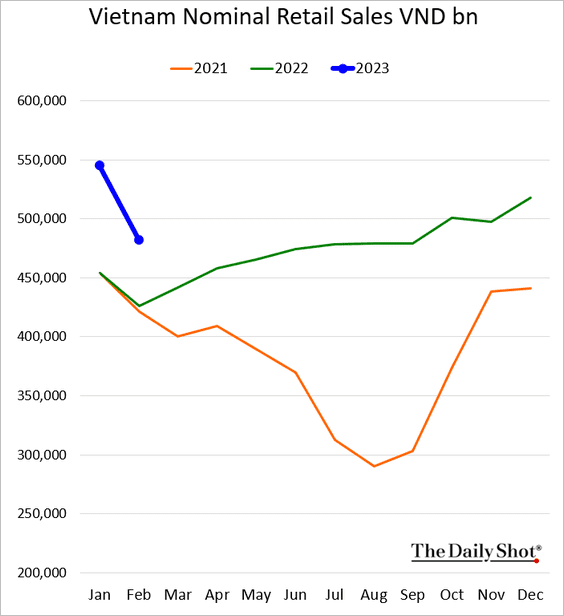

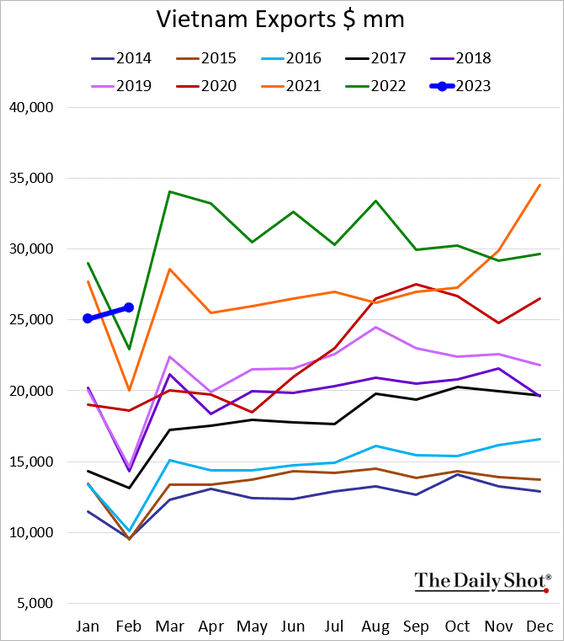

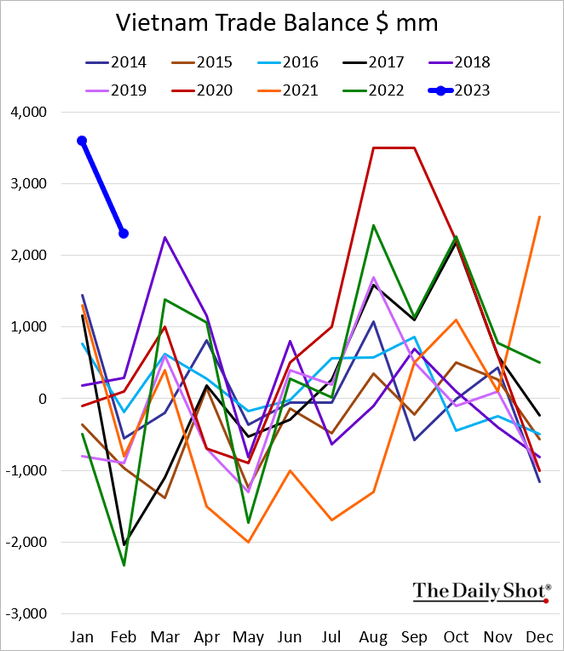

4. Vietnam’s economy shows strength.

Source: Reuters Read full article

Source: Reuters Read full article

• CPI (lower than expected):

• Retail sales:

• Exports:

Back to Index

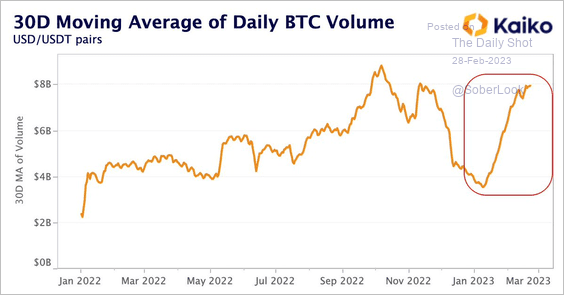

Cryptocurrency

1. Bitcoin’s trading volume accelerated over the past month.

Source: @KaikoData

Source: @KaikoData

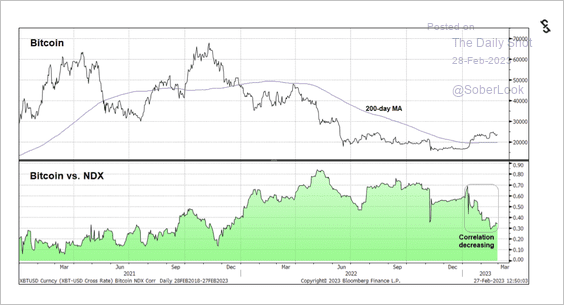

2. Bitcoin’s correlation with the Nasdaq 100 index is decreasing. The relationship is now more in-line with mid-2021 when BTC fluctuated in a tight range.

Source: @StocktonKatie

Source: @StocktonKatie

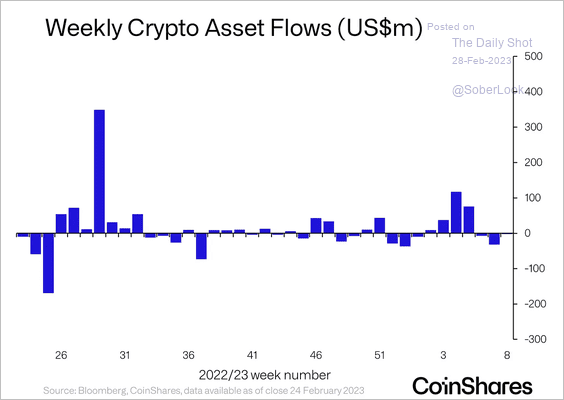

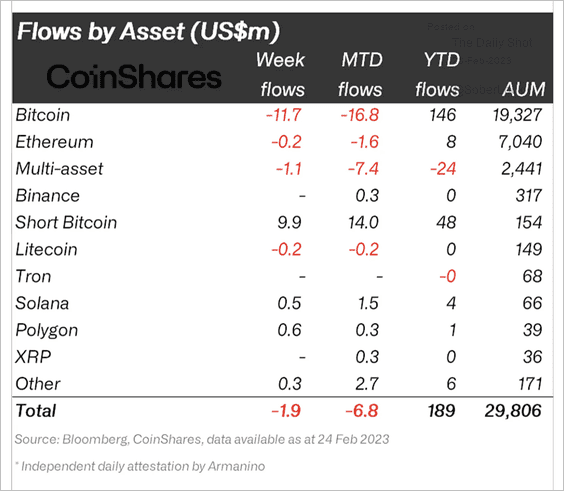

3. Crypto funds saw minor outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Investors continued to exit long-bitcoin funds and add to short-bitcoin funds.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

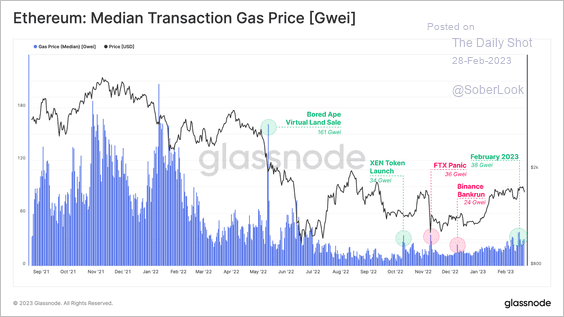

4. Ethereum gas prices are starting to tick higher, possibly reflecting an increase in network activity. The relationship with ETH’s token price can vary.

Source: Glassnode Read full article

Source: Glassnode Read full article

5. Robinhood received an investigative subpoena from the SEC related to its crypto listings and custody.

Source: @antoniabmassa, @crypto Read full article

Source: @antoniabmassa, @crypto Read full article

Back to Index

Commodities

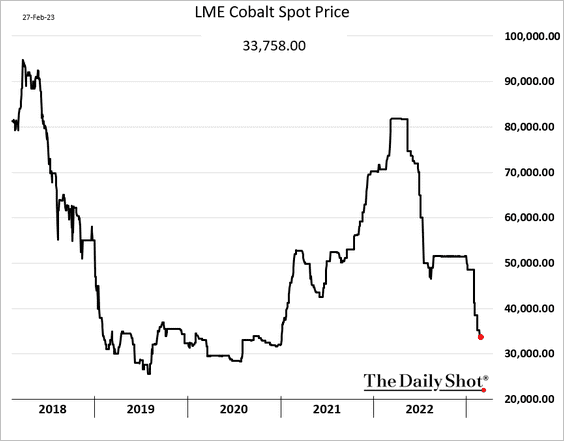

1. The cobalt bubble has popped.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

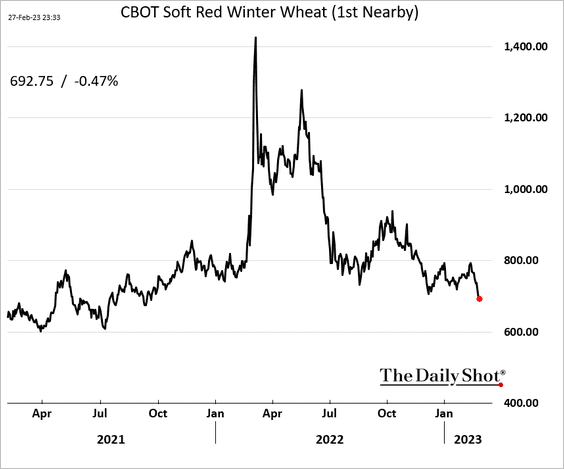

2. US wheat prices are under pressure amid favorable US weather conditions and well-supplied international markets.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

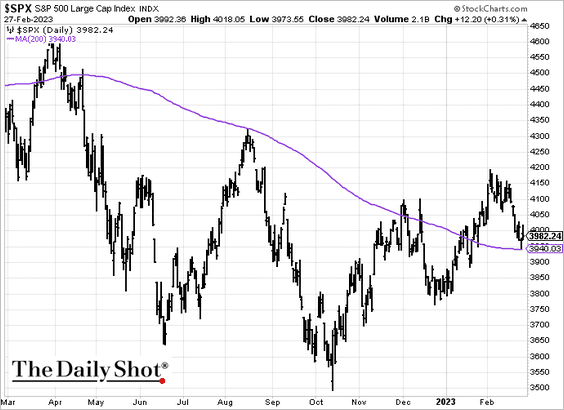

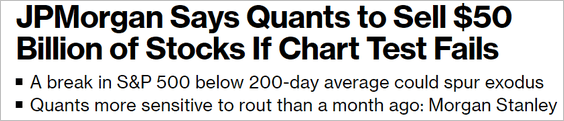

1. For now, the S&P 500 is holding support at the 200-day moving average.

We could see substantial selling if the index closes below support.

Source: @luwangnyc, @markets Read full article

Source: @luwangnyc, @markets Read full article

——————–

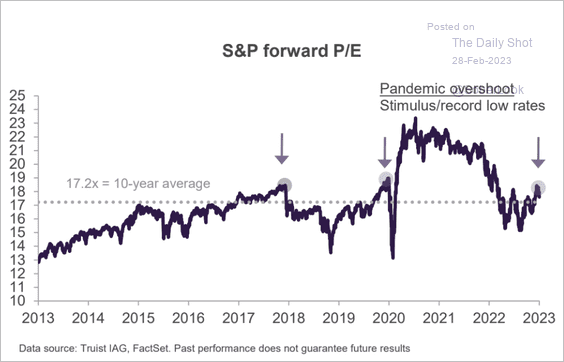

2. The market’s upside is capped by valuation.

Source: Truist Advisory Services

Source: Truist Advisory Services

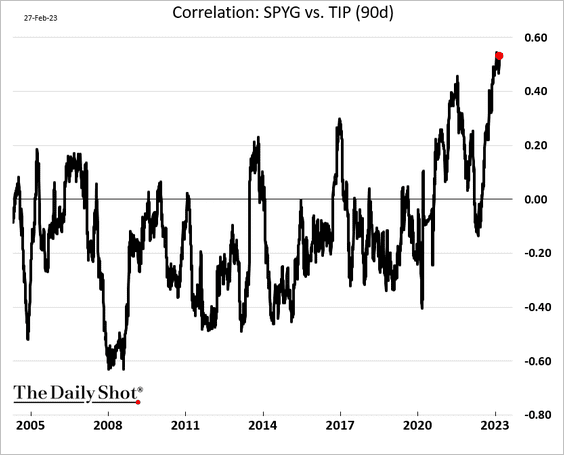

3. Growth stocks’ correlation to inflation-linked Treasuries (TIPS) is holding at multi-year highs (inverse correlation to real yields).

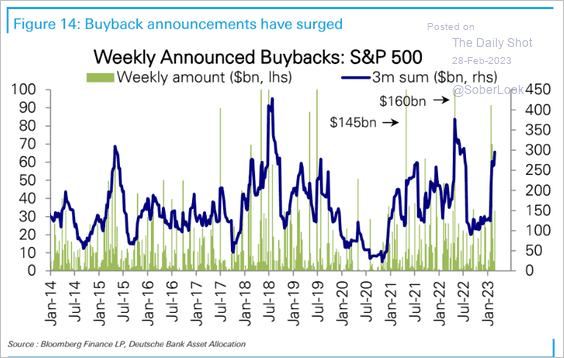

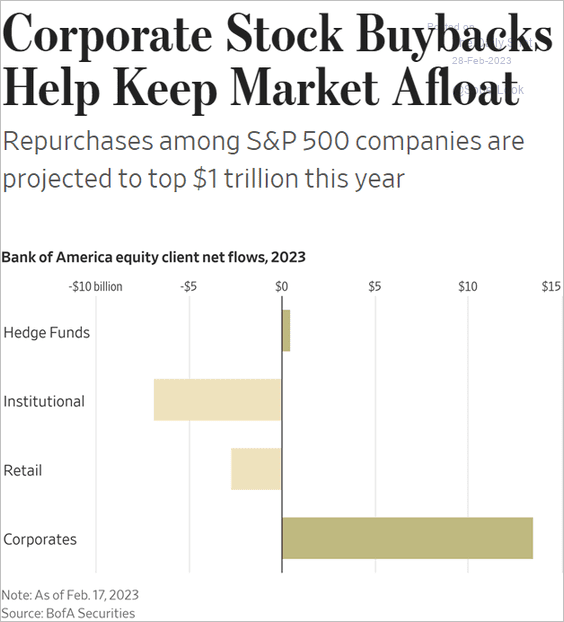

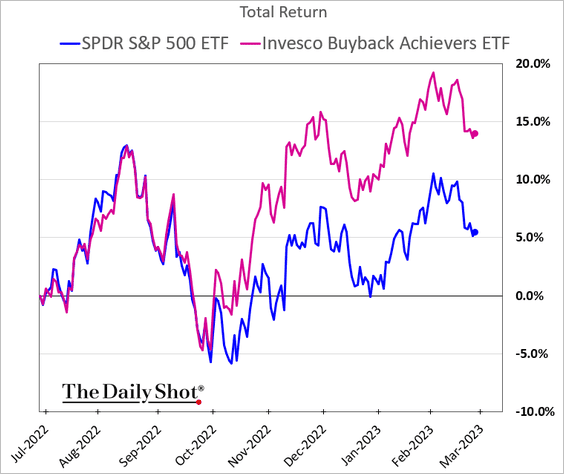

4. Share buybacks have been a tailwind for stocks (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: @WSJ Read full article

Source: @WSJ Read full article

Companies known for buying back their shares have been outperforming.

——————–

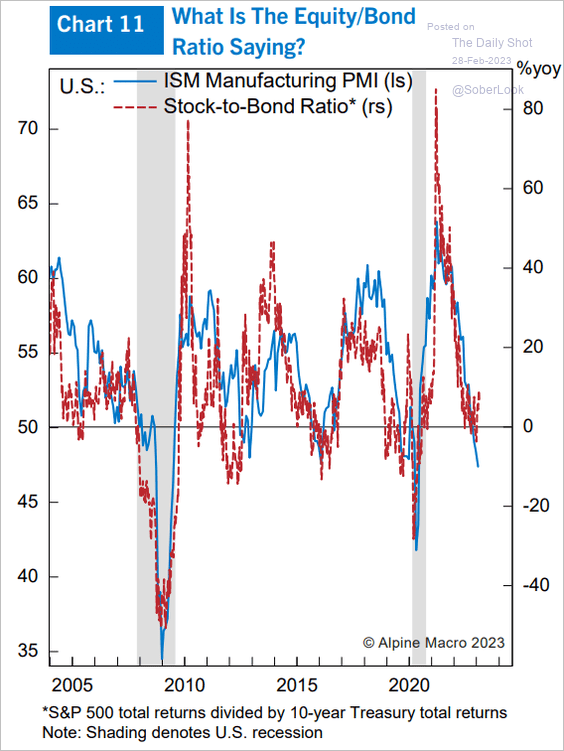

5. Either US manufacturing activity rebounds or stocks underperform bonds going forward.

Source: Alpine Macro

Source: Alpine Macro

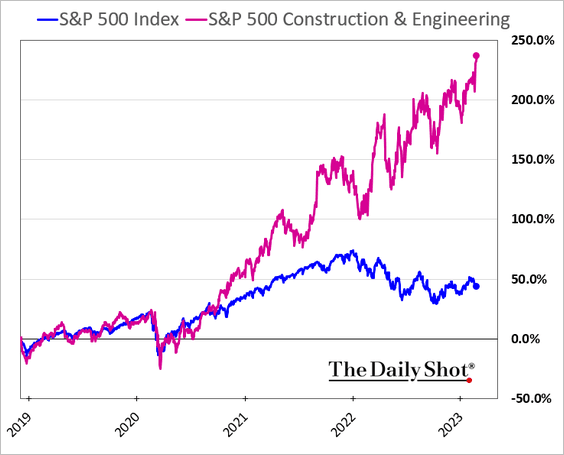

6. Infrastructure spending (ongoing and planned) has been boosting shares of construction and engineering firms.

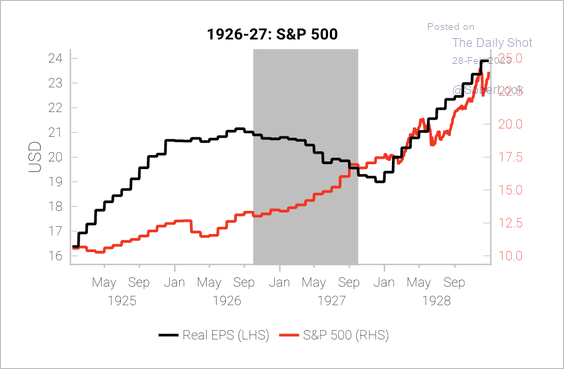

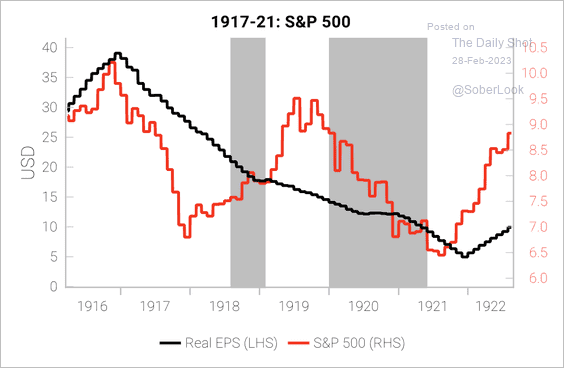

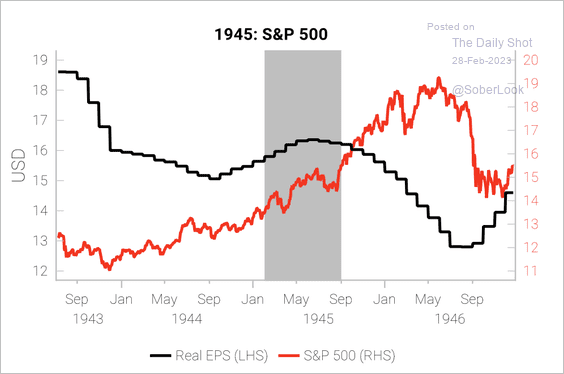

7. The S&P 500 rallied through the 1926-1927 recession, which preceded a top ahead of the Great Depression.

Source: Variant Perception

Source: Variant Perception

There were two other times the S&P 500 bottomed before the start of a US recession, according to Variant Perception. (2 charts)

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Back to Index

Rates

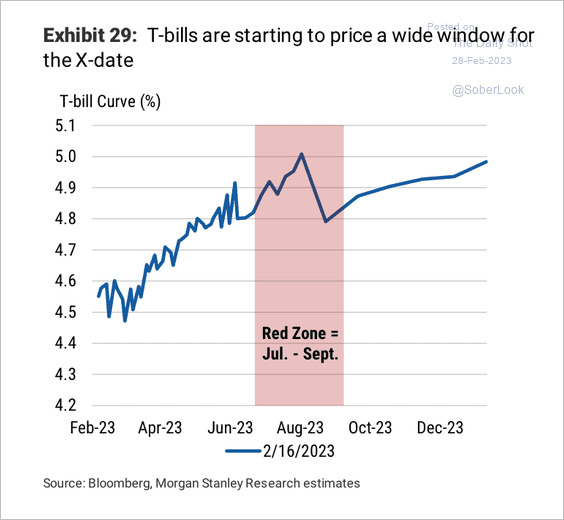

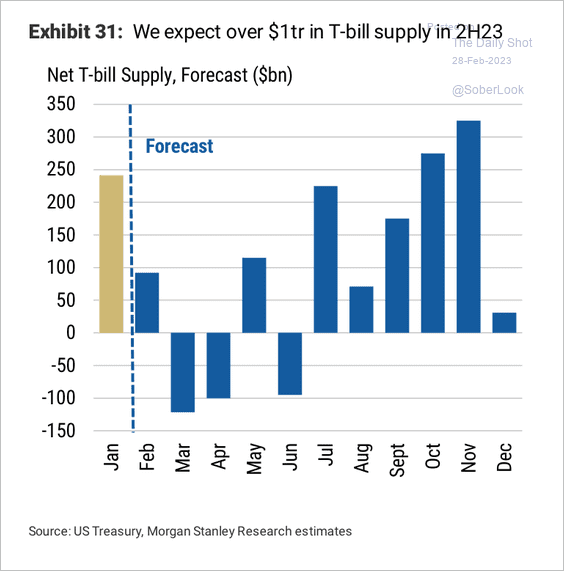

1. The T-bill curve suggests a possible X-date in August.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Morgan Stanley expects T-bill issuance to turn negative in late-February/early-March as the Treasury runs against extraordinary measures. The remaining T-bill supply could be backloaded toward the second half of this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

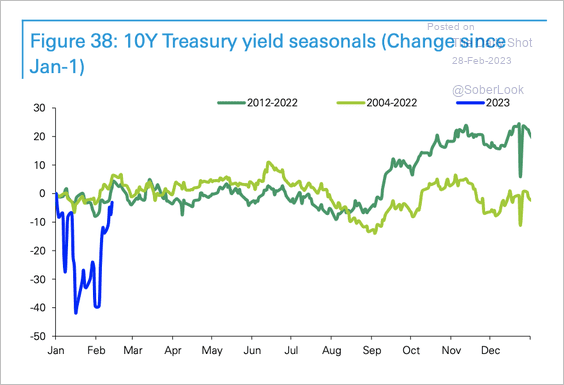

2. Seasonals suggest the 10-year Treasury yield could stabilize before a summertime drop.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

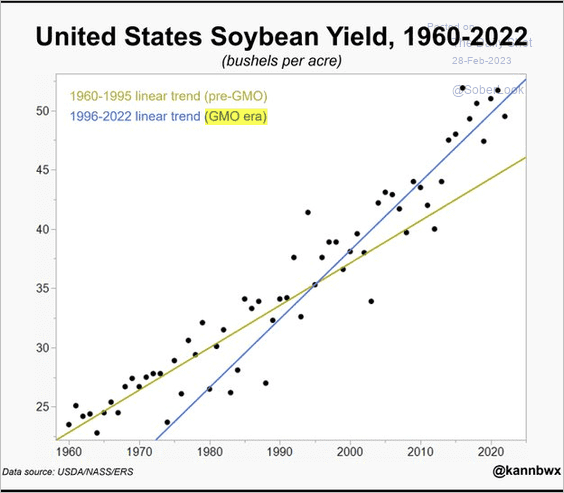

1. US soybean yields before and after the GMO era:

Source: @kannbwx

Source: @kannbwx

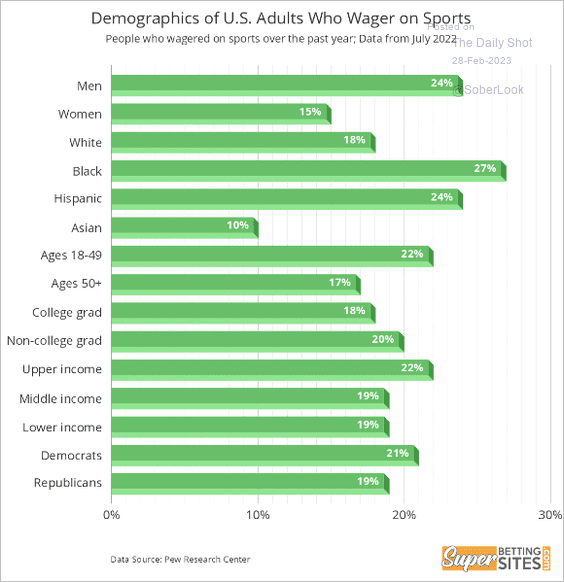

2. Sports betting demographics:

Source: SuperBettingSites

Source: SuperBettingSites

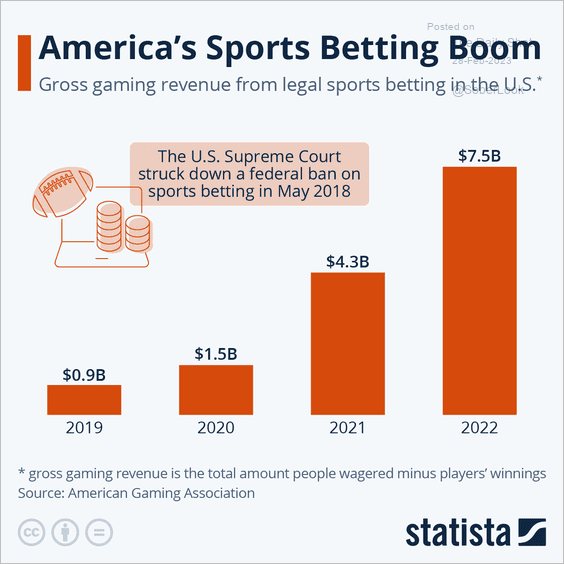

• Sports betting revenues:

Source: Statista

Source: Statista

——————–

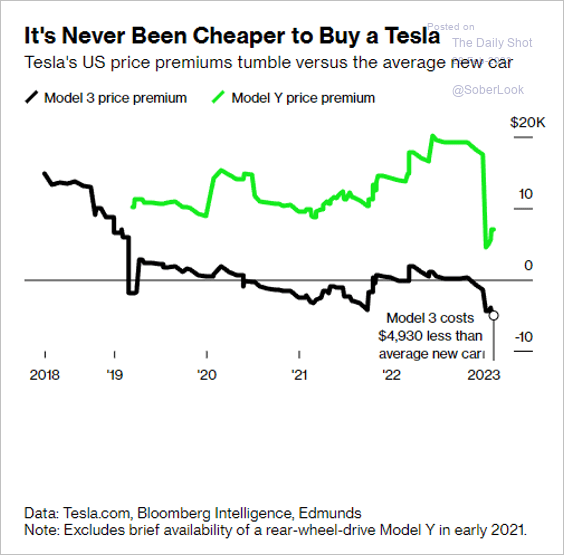

3. Tesla vehicle price premiums:

Source: @tsrandall, @business Read full article

Source: @tsrandall, @business Read full article

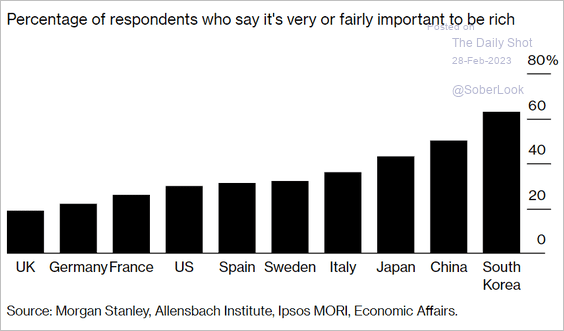

4. Is it important to be rich?

Source: @technology Read full article

Source: @technology Read full article

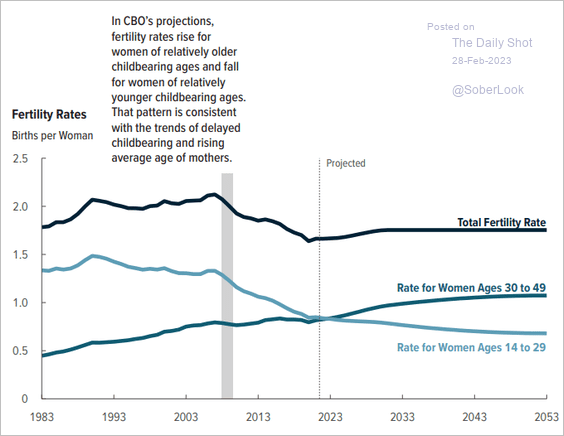

5. Projected US fertility rates:

Source: CBO Read full article

Source: CBO Read full article

6. China exporting semiconductors to Russia:

![]() Source: @WSJ Read full article

Source: @WSJ Read full article

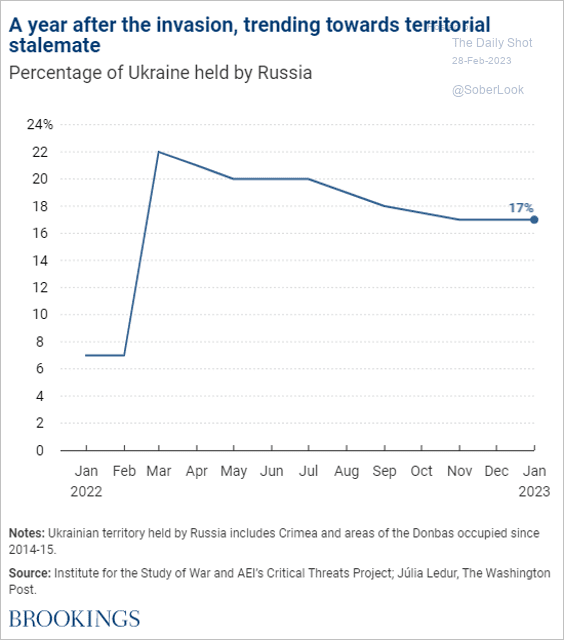

7. Ukrainian territory held by Russia:

Source: Brookings Read full article

Source: Brookings Read full article

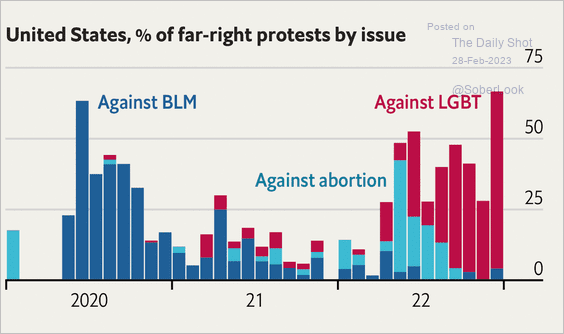

8. Far-right protests by issue:

Source: The Economist Read full article

Source: The Economist Read full article

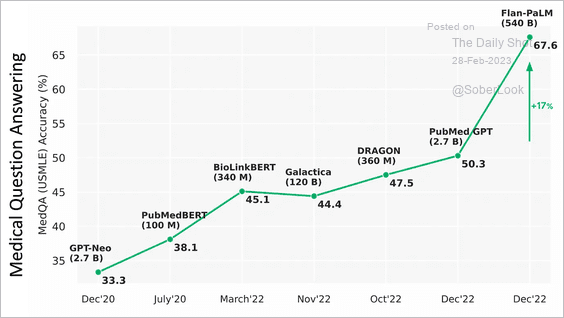

9. How accurate is AI in answering medical questions?

Source: Ground Truths Read full article

Source: Ground Truths Read full article

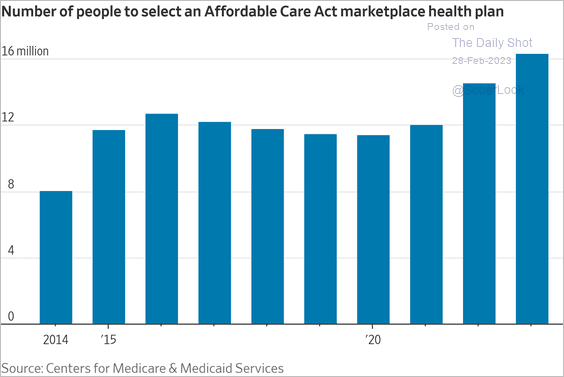

10. ACA enrollment:

Source: @WSJ Read full article

Source: @WSJ Read full article

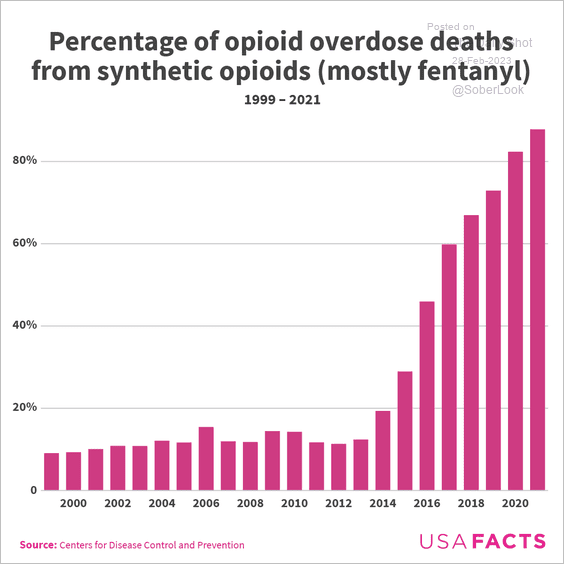

11. Opioid overdose deaths due to fentanyl:

Source: USAFacts

Source: USAFacts

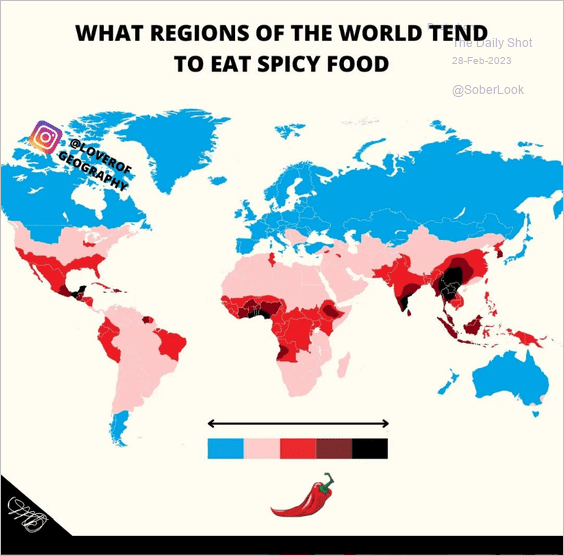

12. Preferences for spicy food:

Source: @loverofgeography

Source: @loverofgeography

——————–

Back to Index