The Daily Shot: 15-Mar-23

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

• Letter to the Editor

The United States

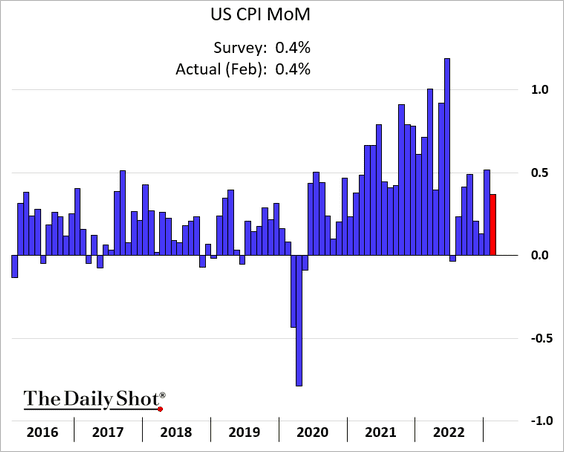

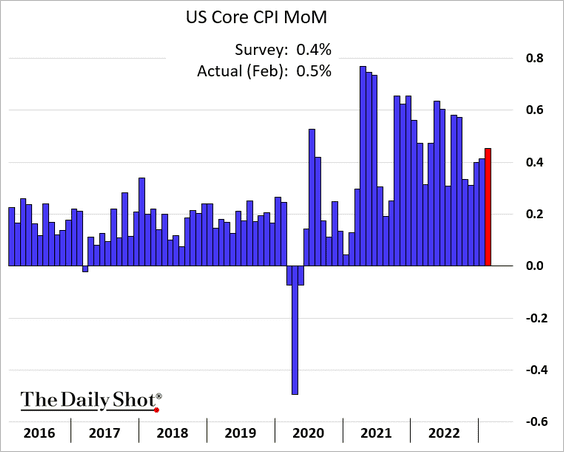

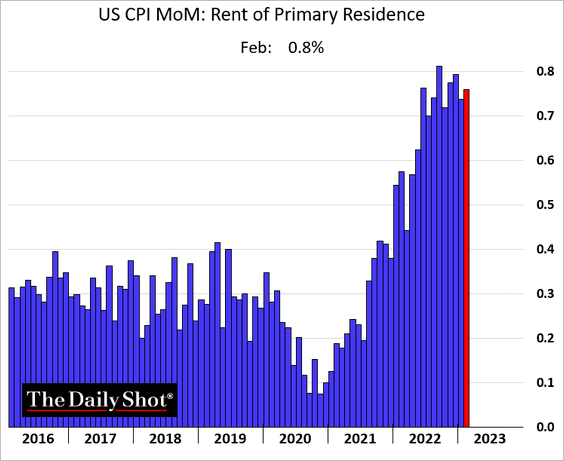

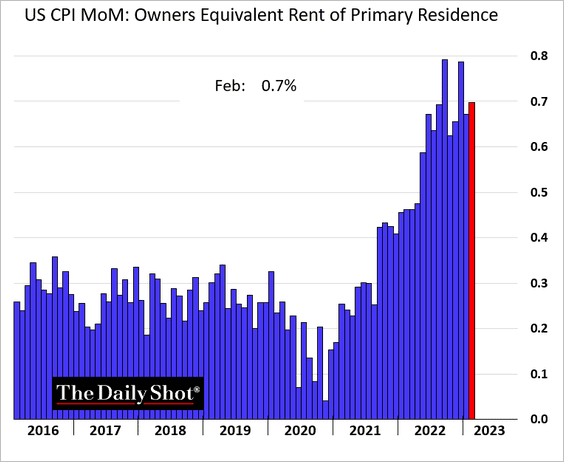

1. US consumer inflation remains persistently elevated, with housing-related CPI still running hot.

• Headline CPI (month-over-month):

• Core CPI (above consensus):

• Contributions:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

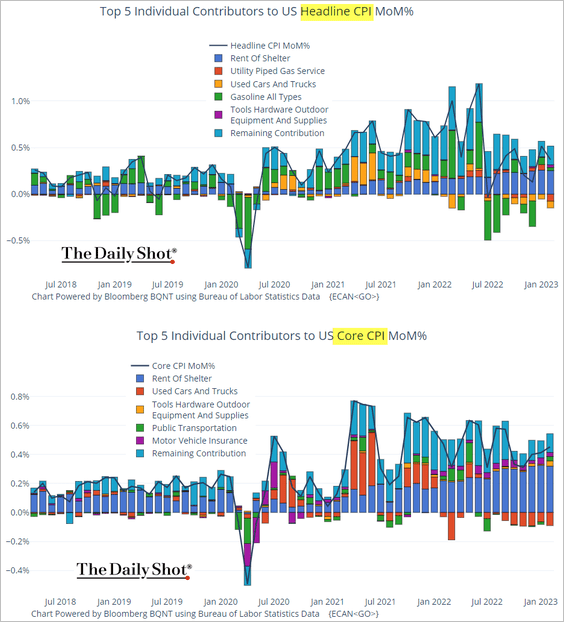

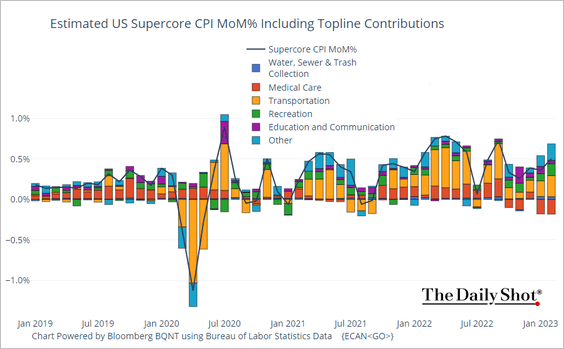

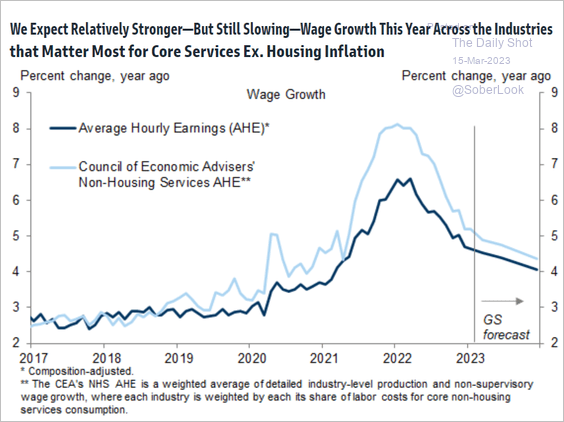

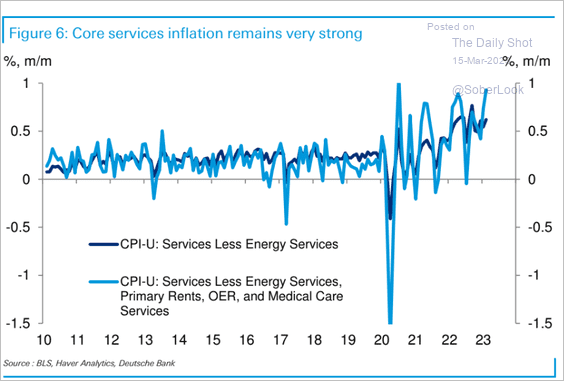

• The core services CPI excluding housing (“supercore”) has accelerated.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

This CPI component tends to be sensitive to wage growth, which has outpaced pay increases in other sectors.

Source: Goldman Sachs

Source: Goldman Sachs

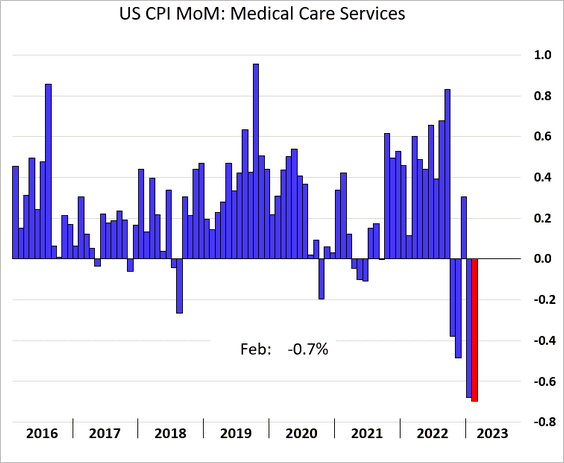

– Medical care services inflation has been negative this year, but this trend is not expected to last (and its impact on the supercore PCE inflation is limited).

Without the drop in medical care costs, the supercore CPI looks turbocharged. Despite the SVB fiasco, the FOMC will likely raise rates this month.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

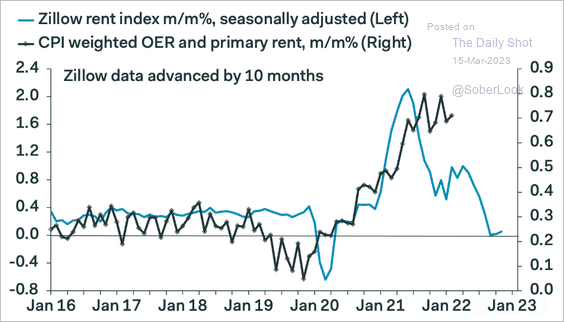

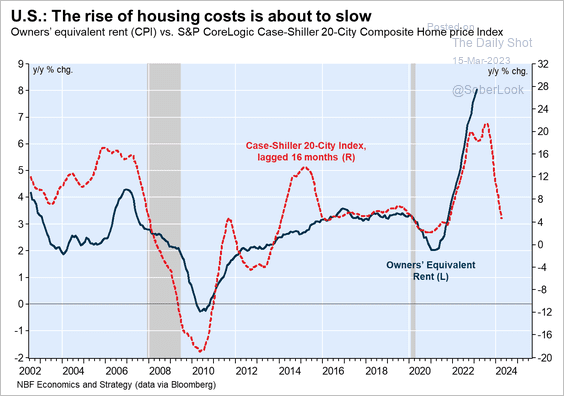

• Housing inflation continues to dominate core CPI gains (2 charts).

Leading indicators continue to signal slower housing-related inflation ahead (like watching paint dry …).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

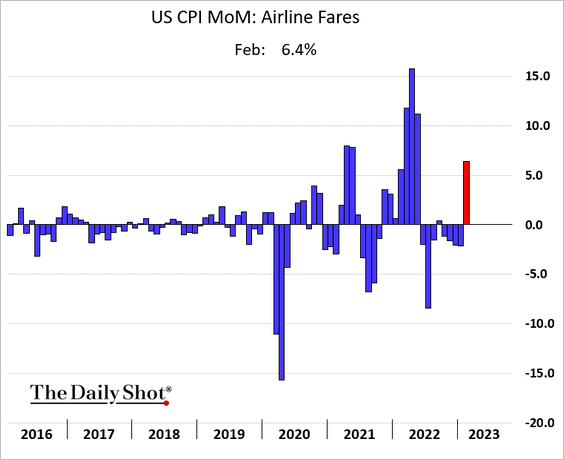

• Airline fares CPI jumped again.

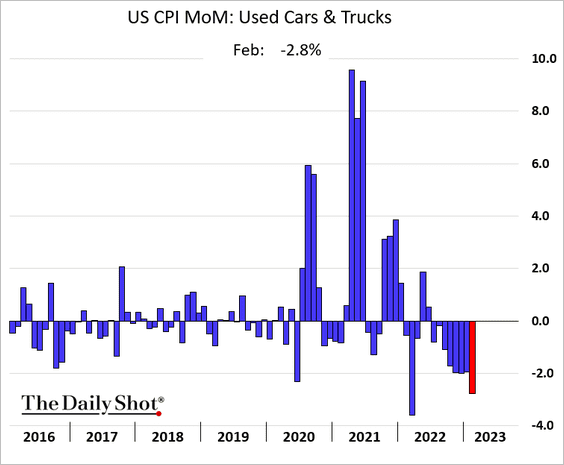

• Used-automobile CPI declined sharply last month (8th drop in a row), but this trend is about to reverse, …

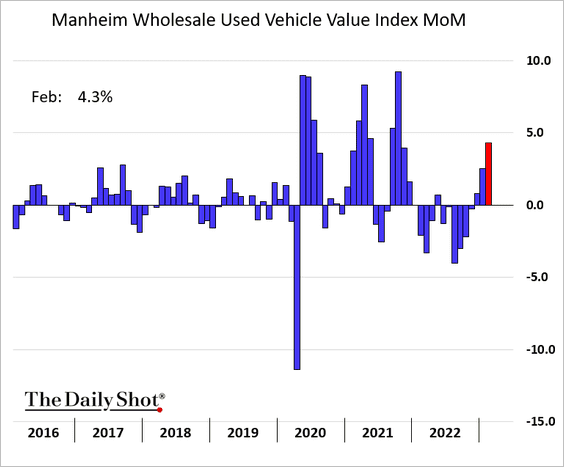

… as wholesale prices rebound.

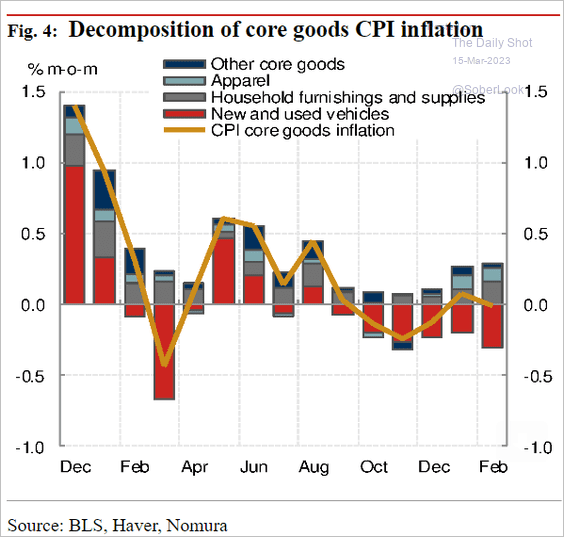

Without the help of used-car price declines, the core goods CPI will rise.

Source: Nomura Securities

Source: Nomura Securities

We will have more updates on inflation trends later this week.

——————–

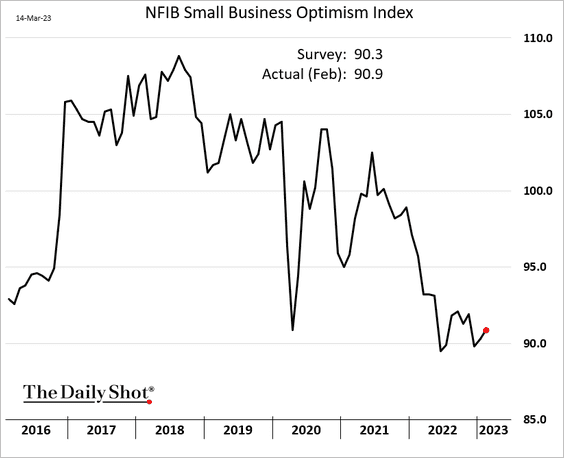

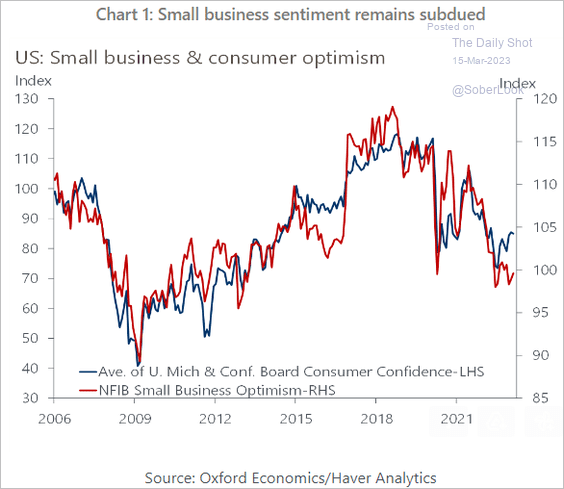

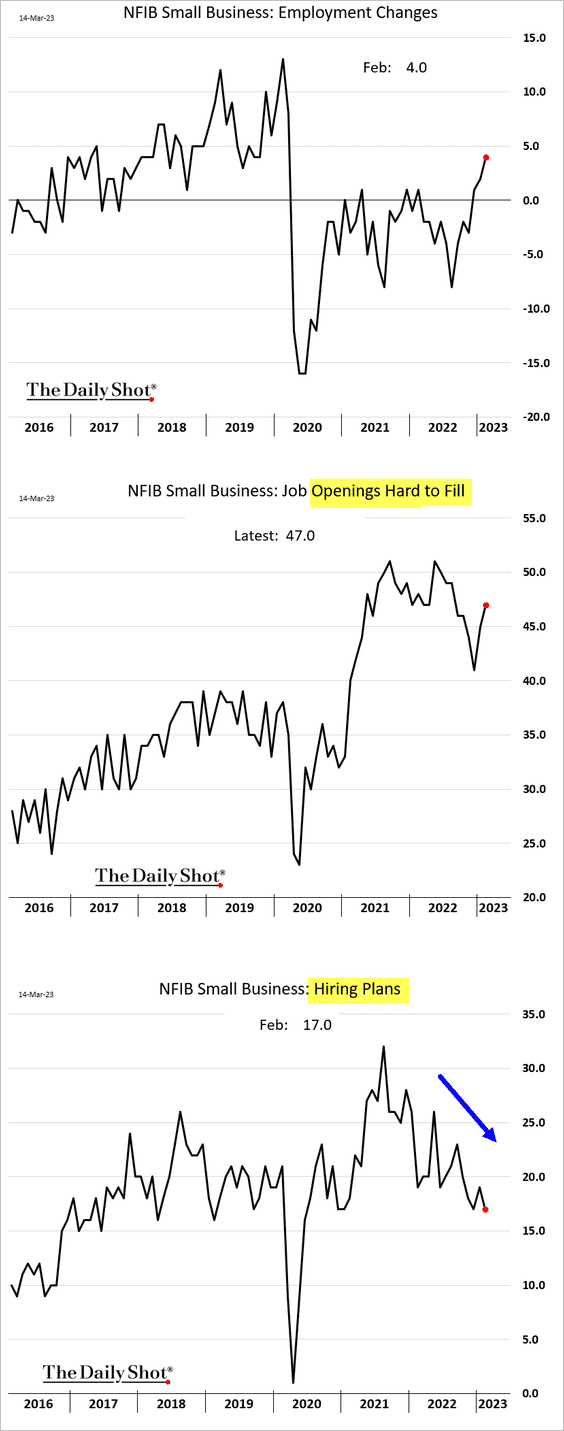

2. The NFIB small business sentiment index edged higher last month.

• The index has diverged from consumer sentiment.

Source: Oxford Economics

Source: Oxford Economics

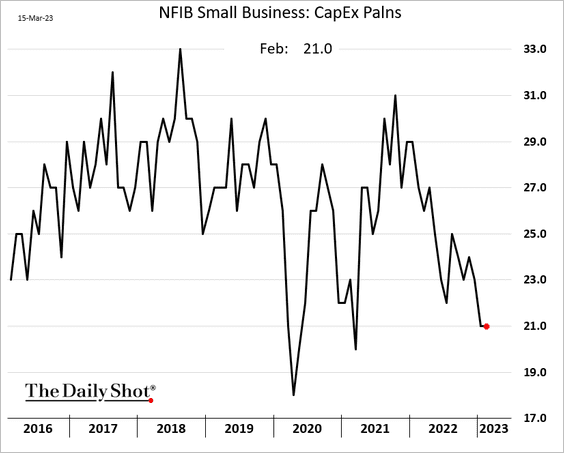

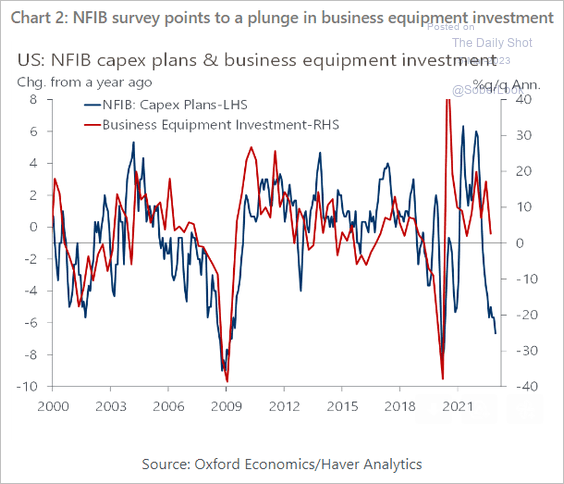

• CapEx plans remain subdued, …

… signaling a slowdown in equipment investing.

Source: Oxford Economics

Source: Oxford Economics

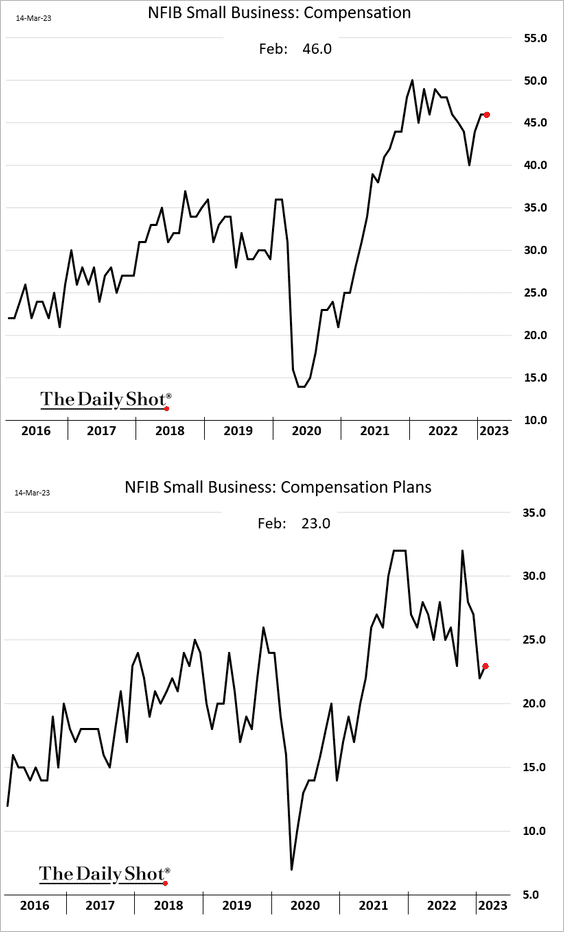

• The compensation plans index increased slightly (2nd panel).

• Hiring has strengthened, but hiring plans continue to trend lower.

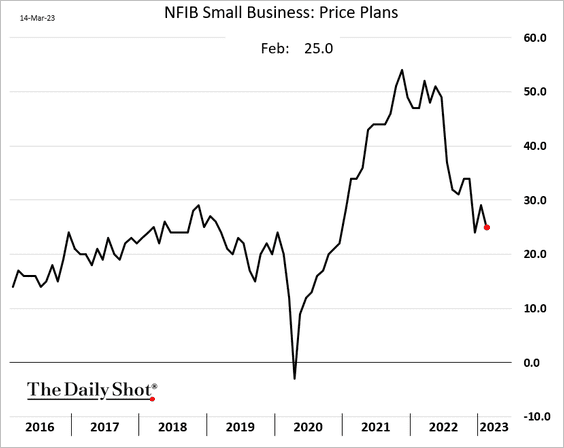

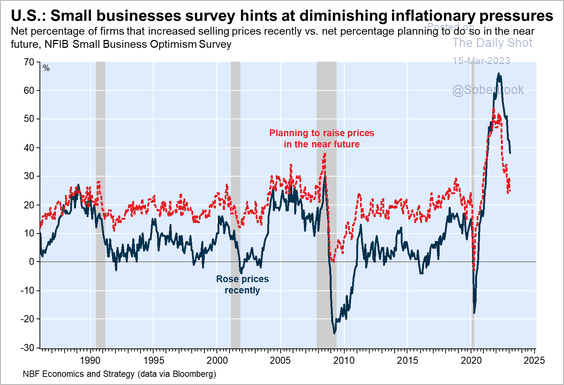

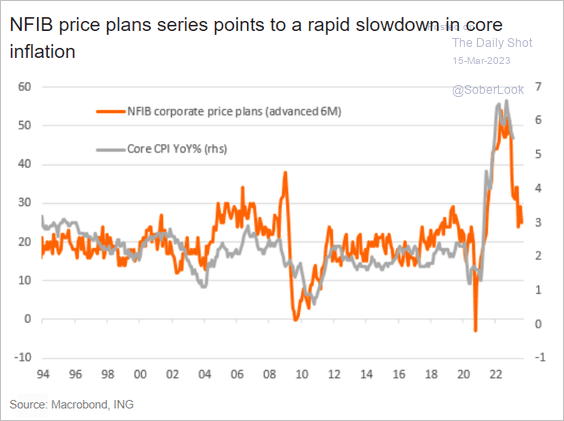

• The price plans index signals slower inflation ahead (3 charts).

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Source: ING

Source: ING

——————–

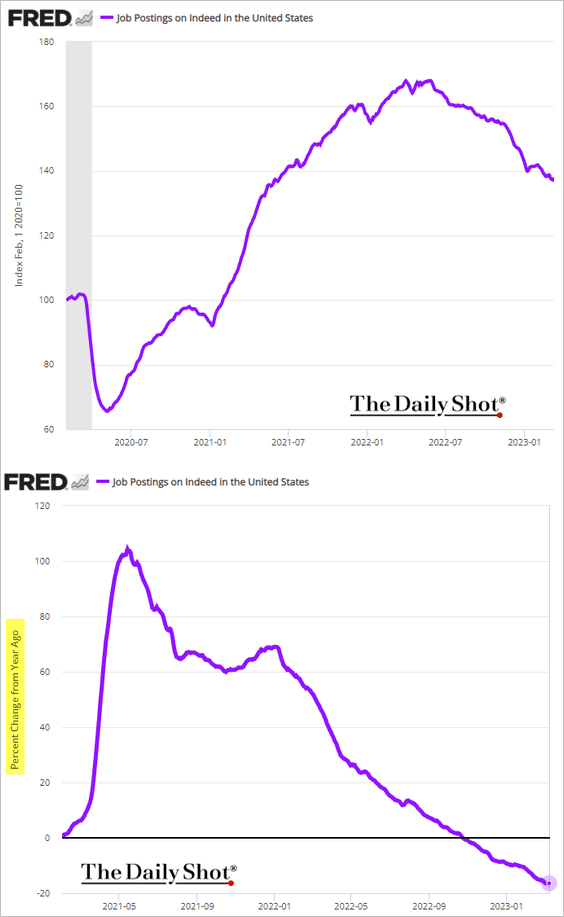

3. Job postings on Indeed are 16.4% below last year’s levels (as of March 10th).

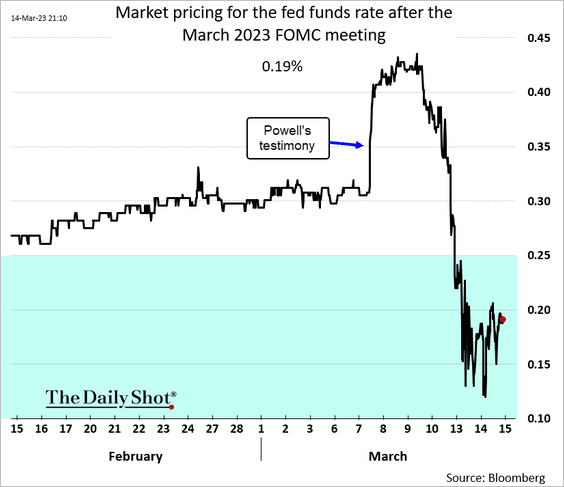

4. Markets still expect a rate hike this month, but a 50 bps increase is now off the table.

Back to Index

Canada

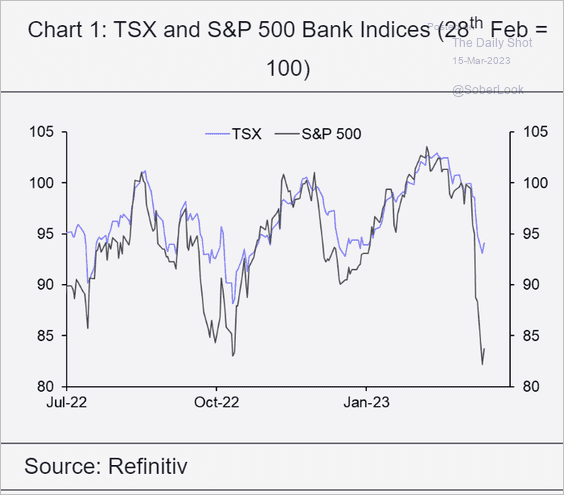

1. Canadian bank shares plummeted in response to the SVB fiasco.

Source: Capital Economics

Source: Capital Economics

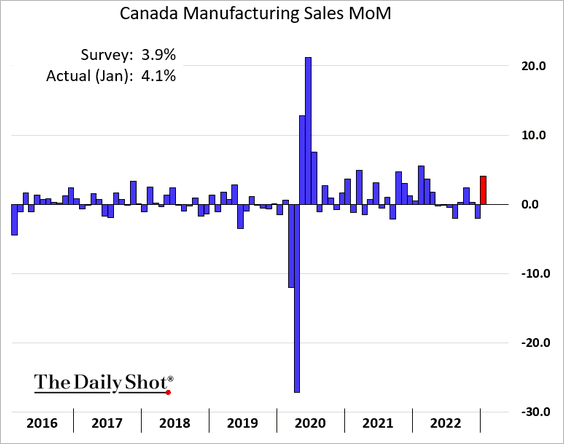

2. Manufacturing sales increased in January.

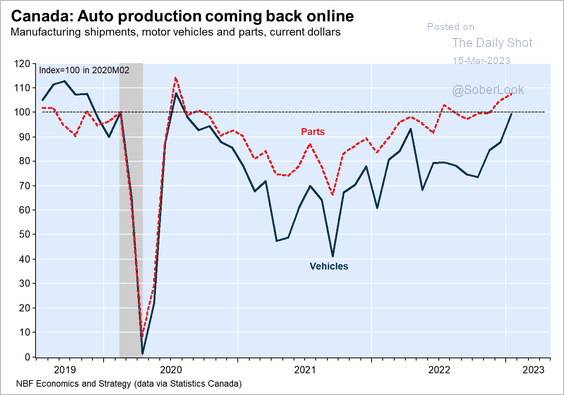

3. Auto production is rebounding.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The United Kingdom

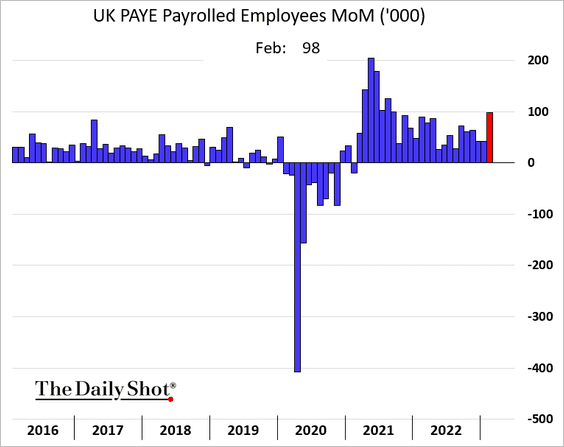

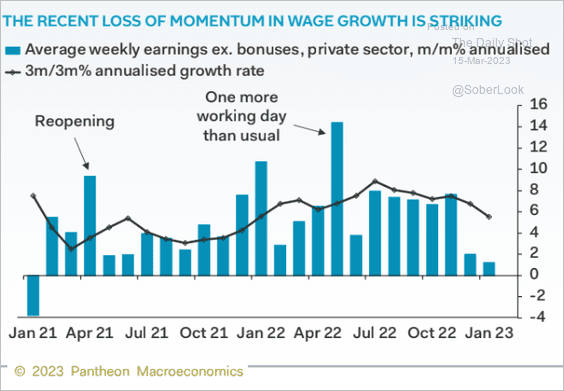

1. Payrolls jumped last month.

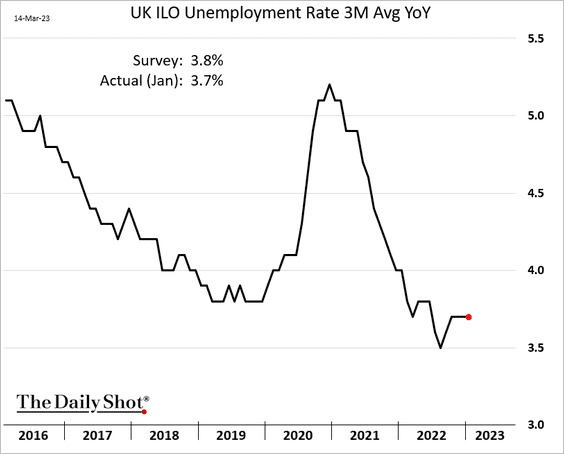

• The unemployment rate remains relatively low.

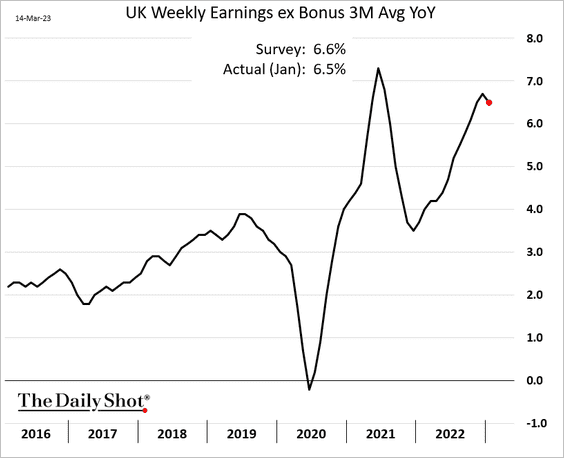

• Wage growth edged down in January.

Wage growth has been slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

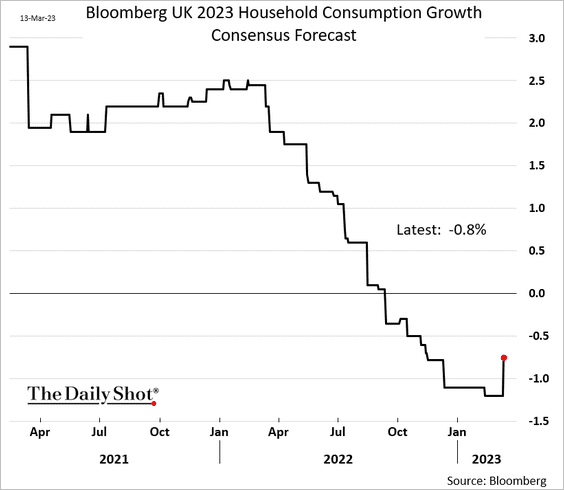

2. Economists upgraded their forecasts for household consumption growth this year, but they still expect a year-over-year decline.

Back to Index

Europe

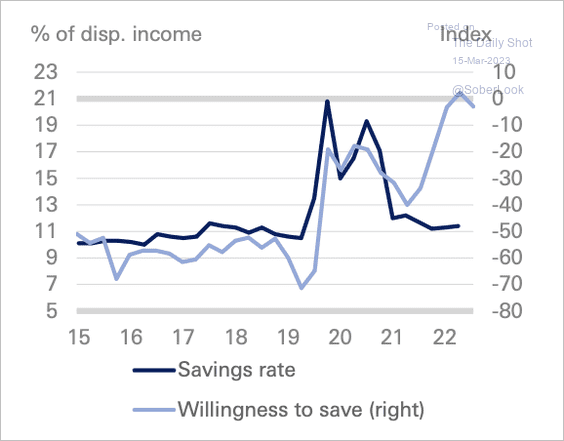

1. Germany’s household savings rate is stabilizing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

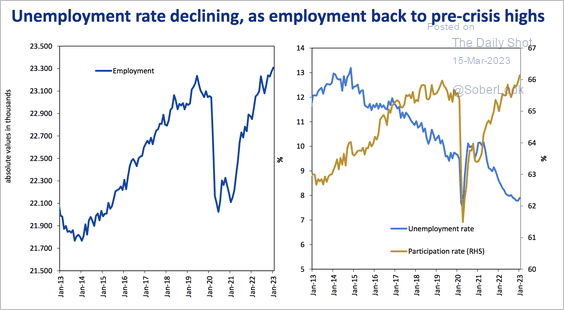

2. Italy’s employment situation continues to improve.

Source: MEF

Source: MEF

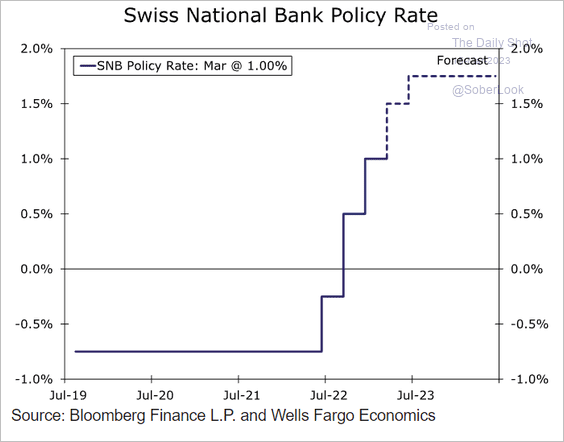

3. Wells Fargo expects more SNB rate hikes ahead, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

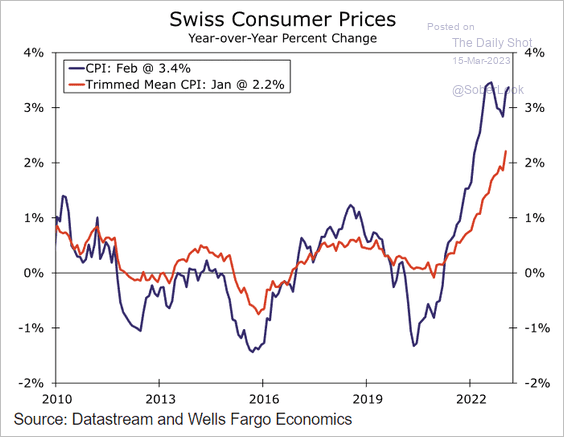

… with Swiss inflation remaining persistently high (for Switzerland).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Asia – Pacific

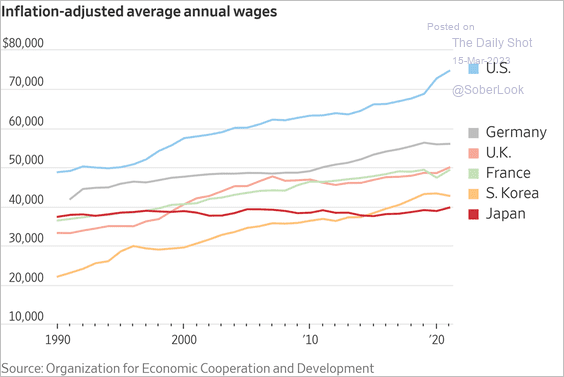

1. Japan’s real wages have been lagging other advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

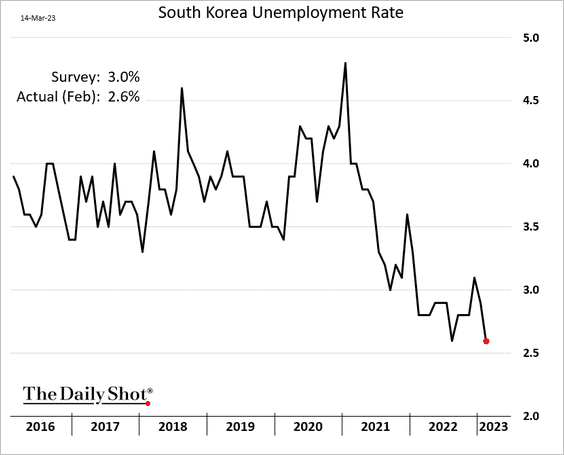

2. South Korea’s unemployment rate surprised to the downside.

Back to Index

China

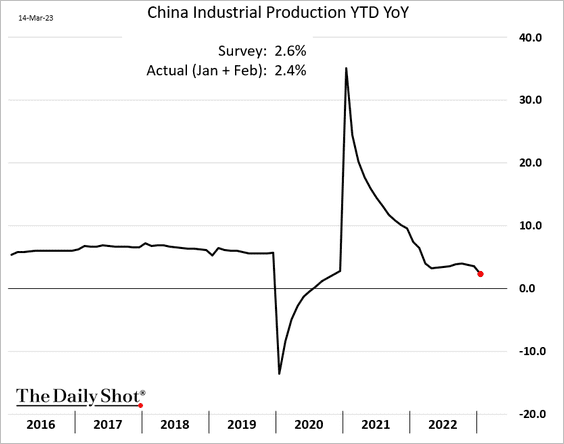

1. Industrial production was a bit lower than expected in January and February.

Source: CNBC Read full article

Source: CNBC Read full article

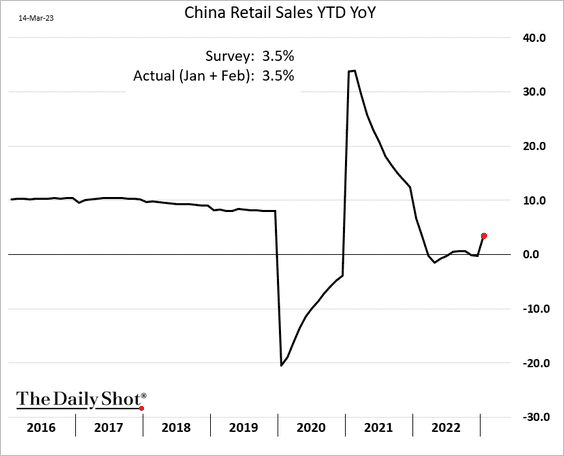

• Retail sales improved (vs. 2022).

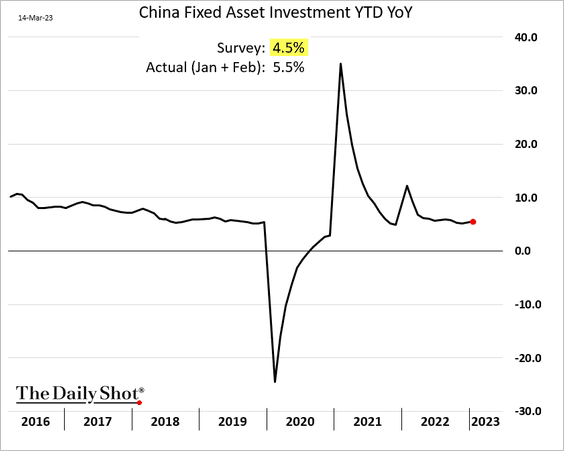

• Fixed asset investment growth is holding up well.

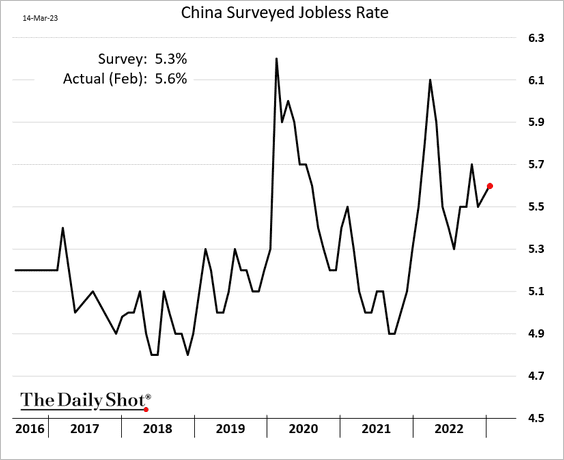

• The unemployment rate increased last month.

——————–

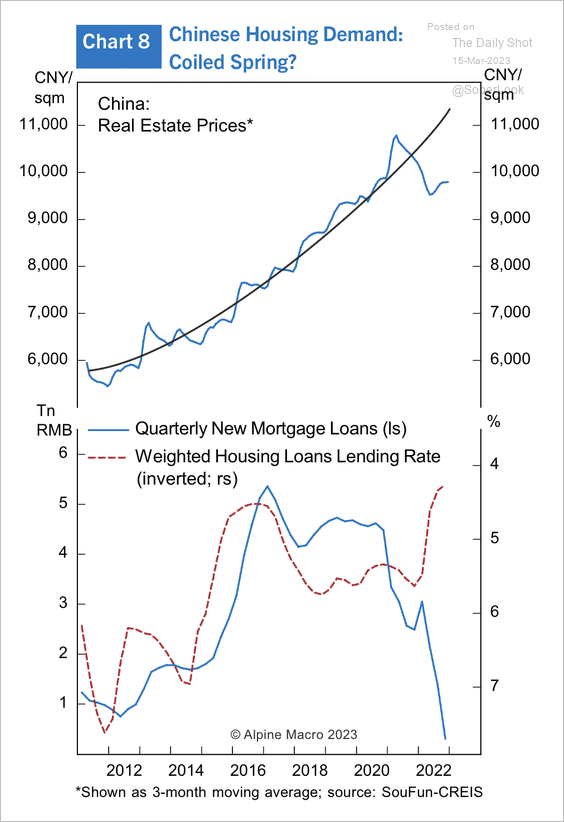

2. Will low mortgage rates spur demand for housing?

Source: Alpine Macro

Source: Alpine Macro

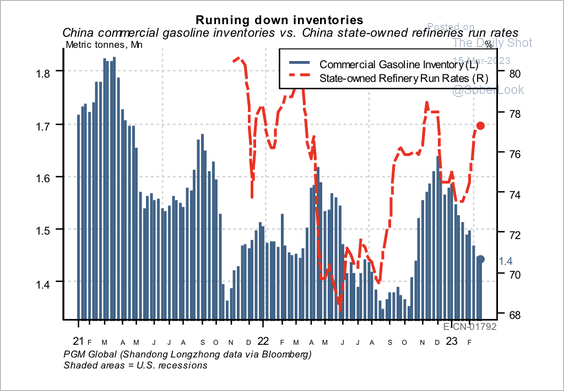

3. Commercial gasoline inventories are declining despite the increase in refinery run rates. This suggests gasoline is being consumed domestically (via reopening) and/or exported, according to PGM Global.

Source: PGM Global

Source: PGM Global

Back to Index

Emerging Markets

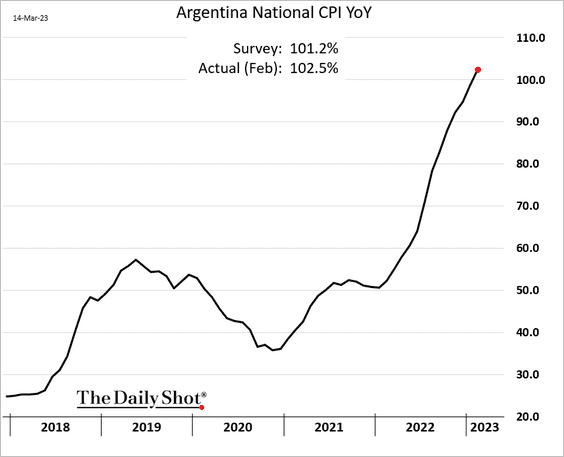

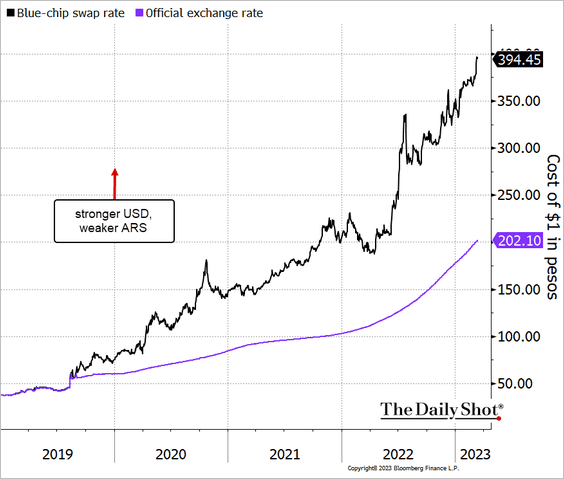

1. Argentina’s CPI exceeded 100% last month.

The gap between the official and unofficial peso exchange rates continues to widen, with the currency declines accelerating.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

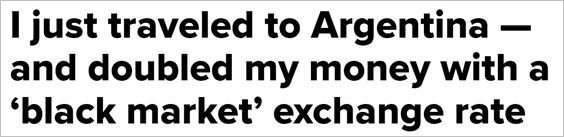

2. South Africa’s industrial output improved in January, with mining production rebounding.

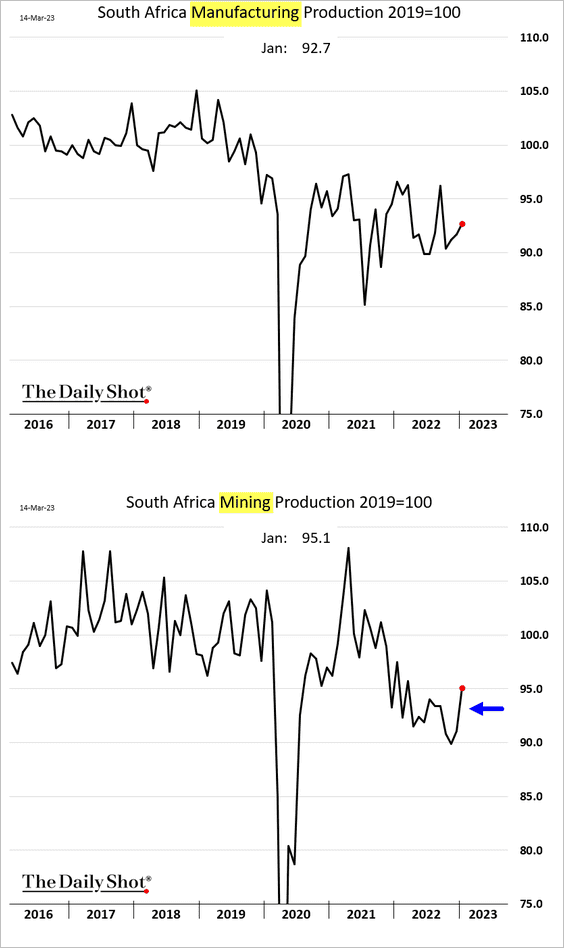

3. EM currencies have been holding up well.

Source: Capital Economics

Source: Capital Economics

Back to Index

Commodities

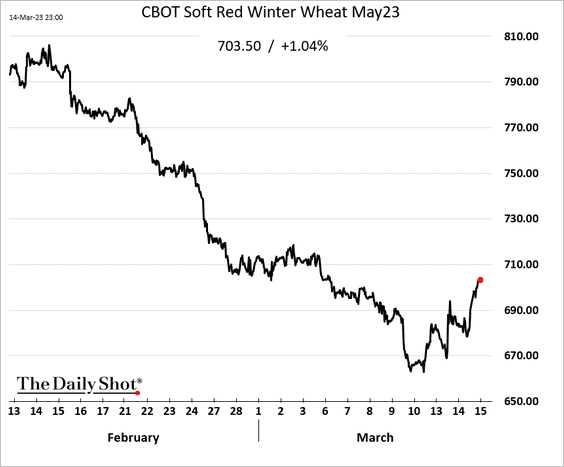

Wheat futures are rebounding.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

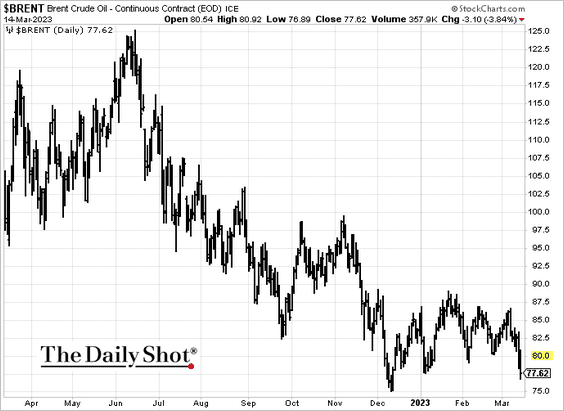

1. Brent crude dipped below $80/bbl.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

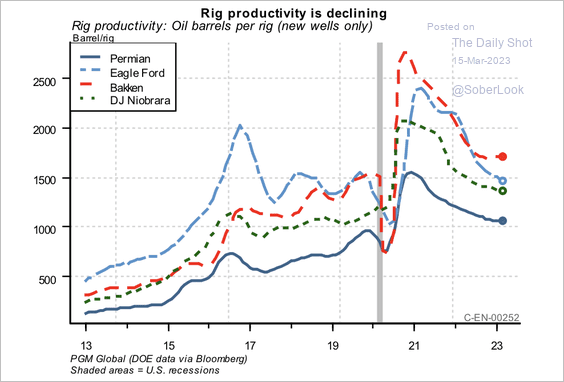

2. US rig productivity is declining, which could point to lower production ahead.

Source: PGM Global

Source: PGM Global

Back to Index

Equities

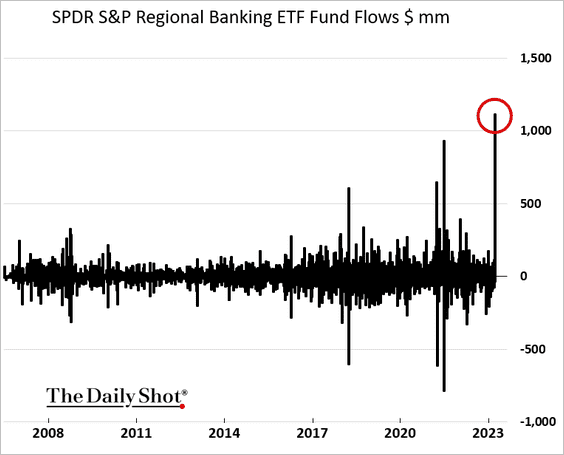

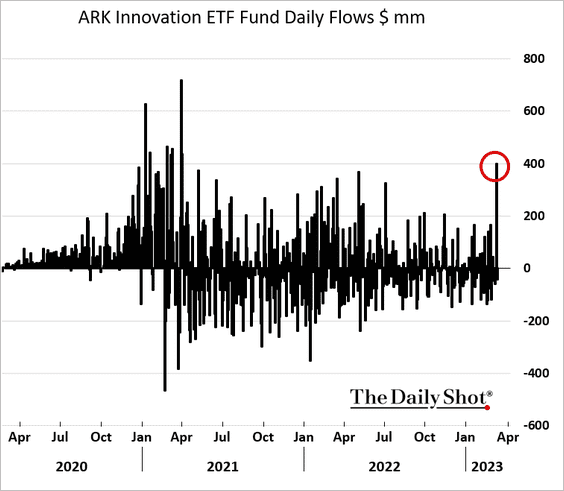

1. Inflows into the SPDR regional banking ETF surged on Tuesday.

The ARK Innovation ETF also saw a large inflow.

——————–

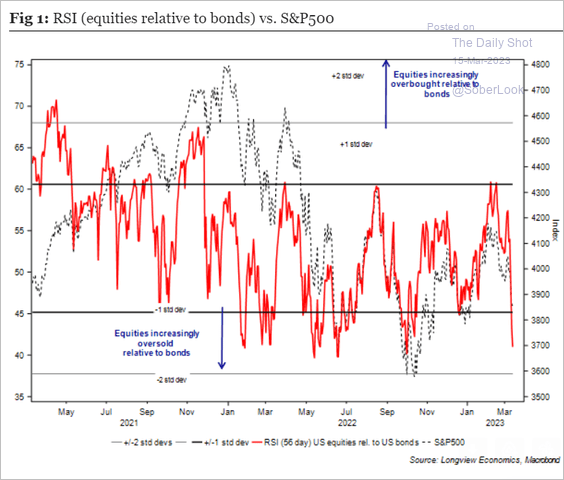

2. Are stocks now oversold relative to bonds?

Source: Longview Economics

Source: Longview Economics

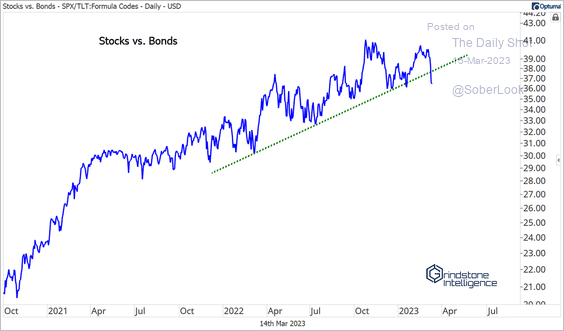

• The stock/bond ratio is breaking down.

Source: @meanstoatrend

Source: @meanstoatrend

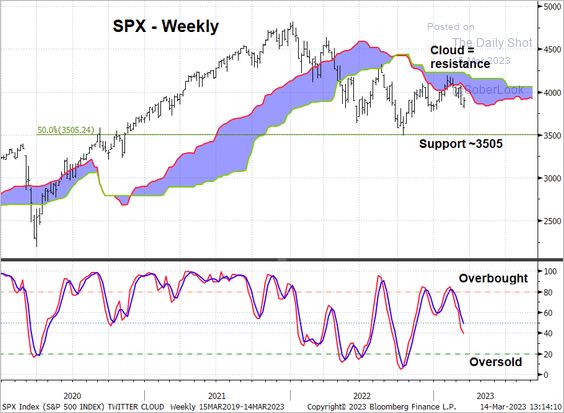

• The S&P 500 is not yet oversold, with the next major support around $3,505.

Source: @StocktonKatie

Source: @StocktonKatie

——————–

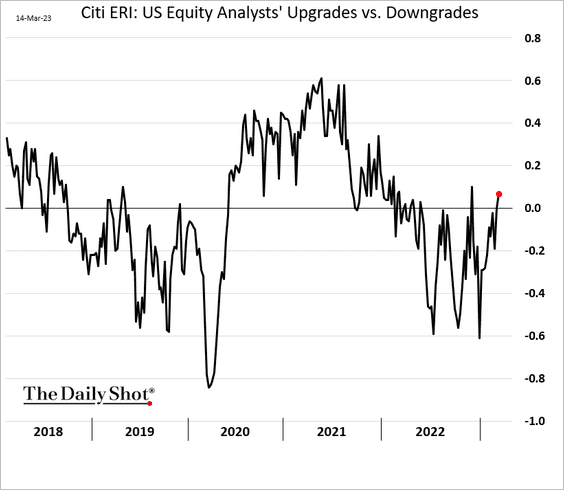

3. More analysts have been upgrading earnings estimates recently.

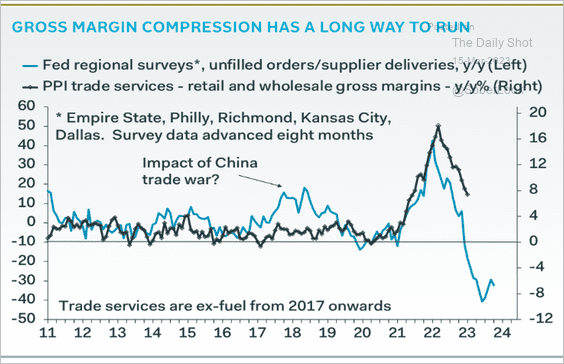

4. Corporate margin compression continues.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

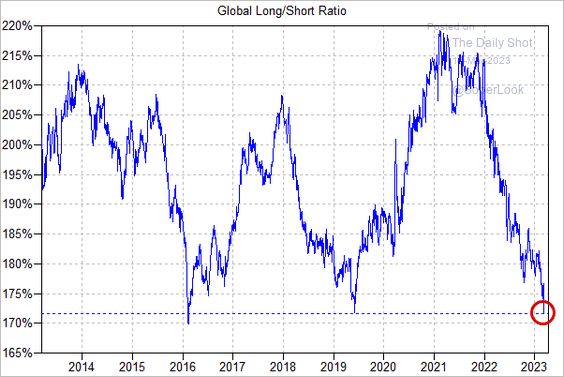

5. Hedge funds’ global long-short ratio hit a multi-year low (based on Goldman’s prime brokerage data).

Source: Goldman Sachs

Source: Goldman Sachs

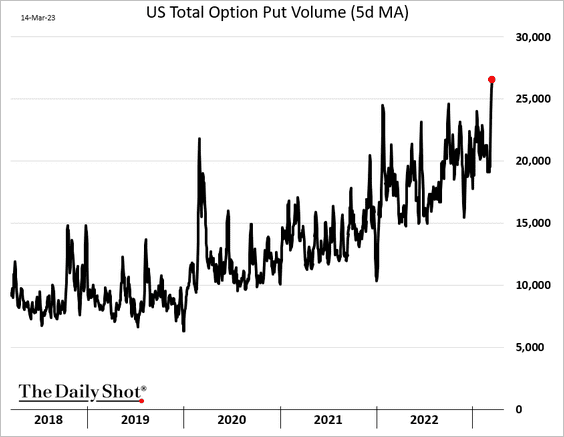

6. Put-option volumes have been rising.

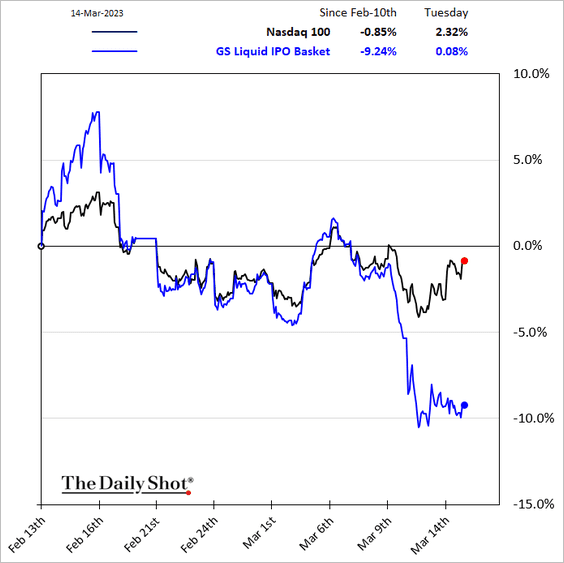

7. Post-IPO companies underperformed in the wake of the SVB collapse.

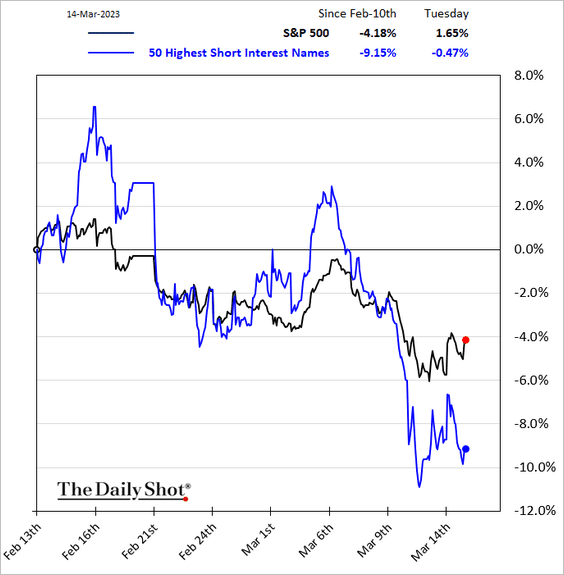

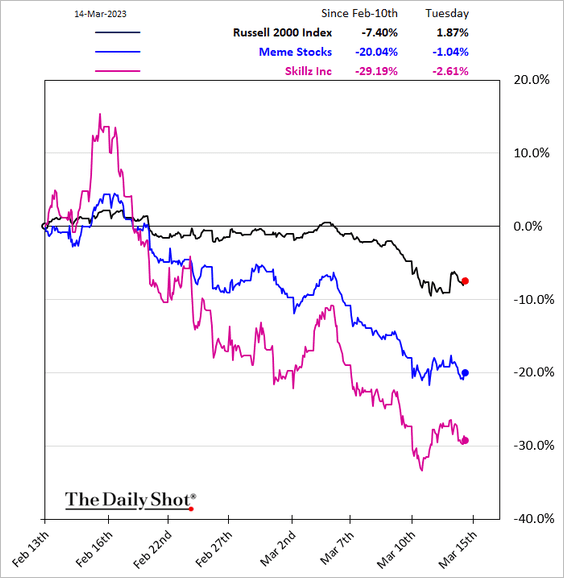

8. Speculative stocks did not participate in the market bounce on Tuesday.

• Most-shorted names:

• Meme stocks:

——————–

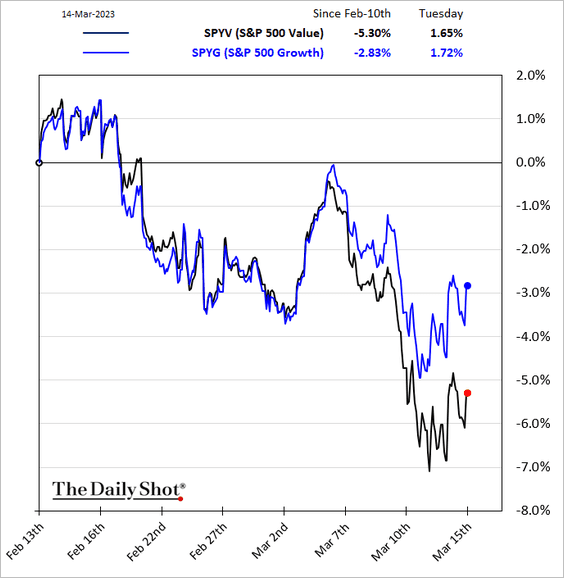

9. The growth factor has been outperforming amid pressure on banks.

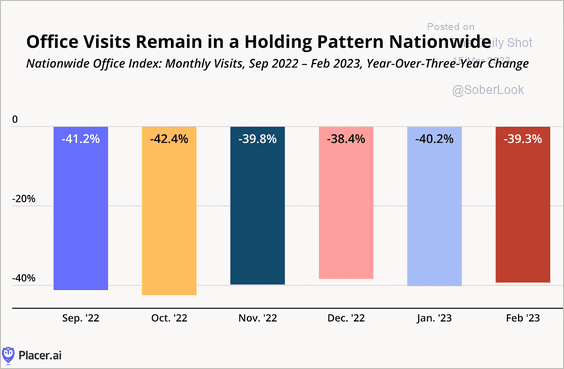

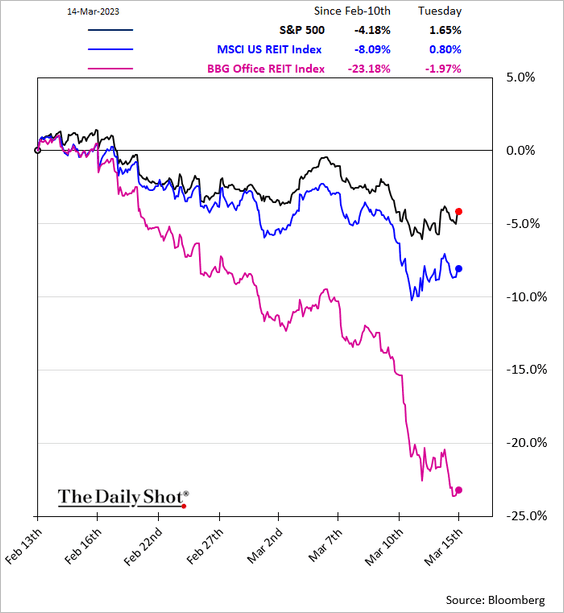

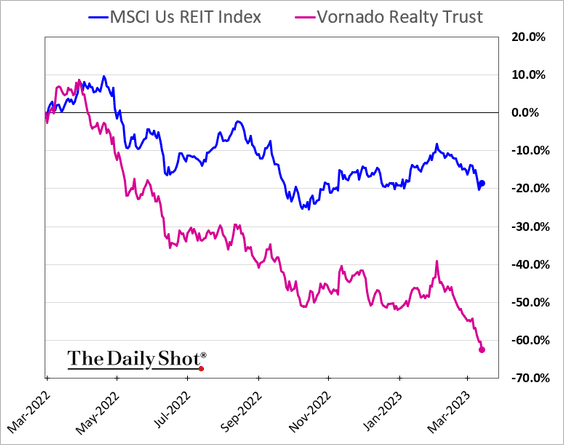

10. Office REITs are in trouble (3 charts).

Source: Placer.ai

Source: Placer.ai

Back to Index

Credit

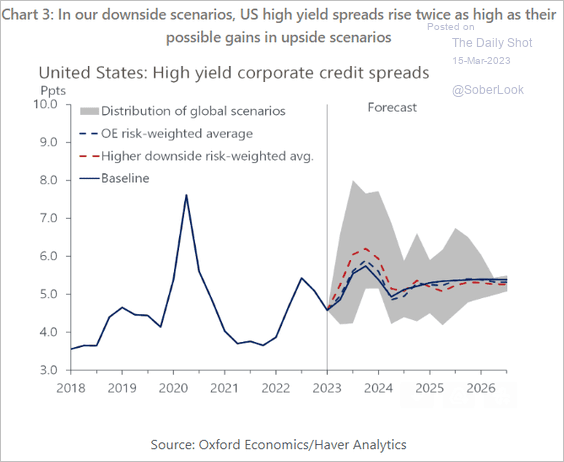

1. Are HY spreads headed higher?

Source: Oxford Economics

Source: Oxford Economics

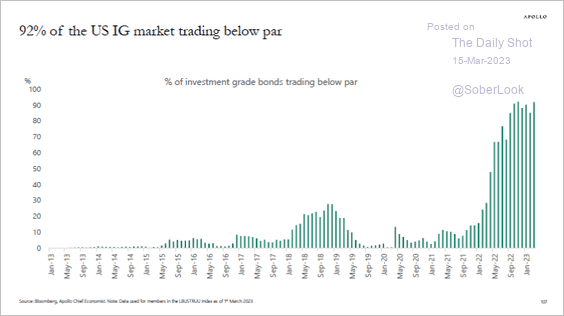

2. Most IG bonds trade below par.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

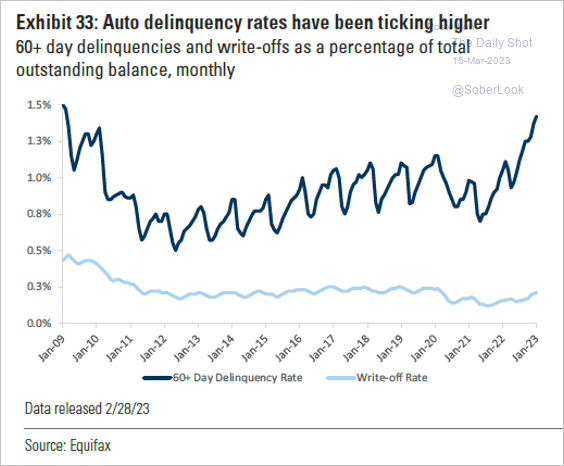

3. US auto loan delinquencies continue to rise.

Source: Goldman Sachs; @ResearchQf

Source: Goldman Sachs; @ResearchQf

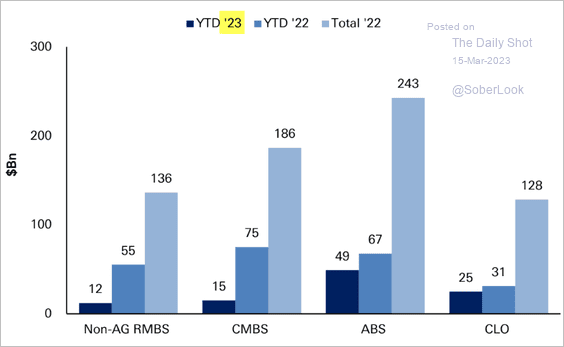

4. US structured credit issuance is running behind last year’s levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

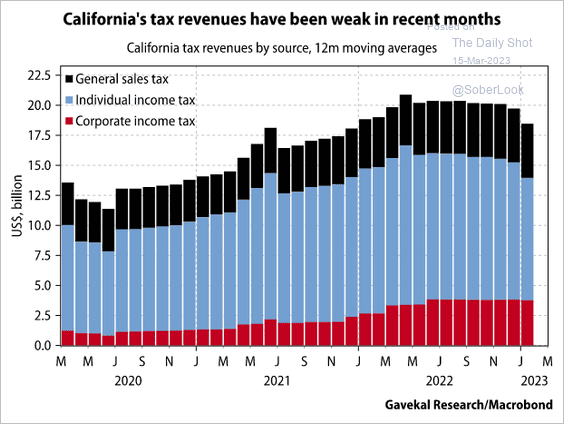

5. California’s tax revenue has been slowing.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Rates

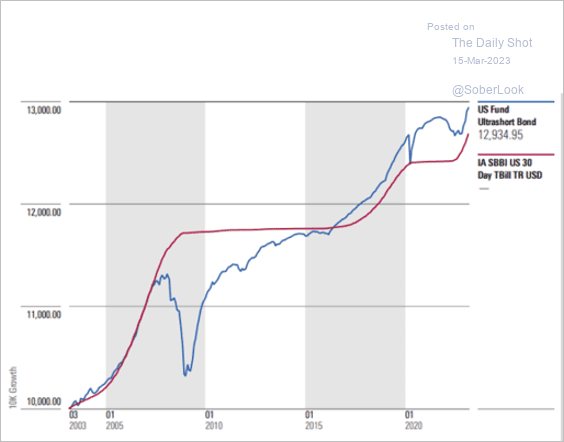

1. Ultrashort bond funds have not matched the smooth ride offered by true cash assets (index tracking the 30-day Treasury bill).

Source: Morningstar Read full article

Source: Morningstar Read full article

2. The 2-year Treasury yield is holding initial support at 4%. A breakdown would target 3.5% as next support.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Global Developments

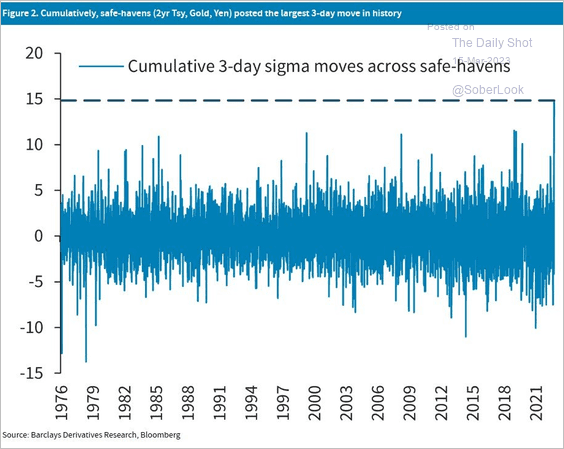

1. Flows into safe-haven assets exploded over the past couple of business days.

Source: Barclays Research

Source: Barclays Research

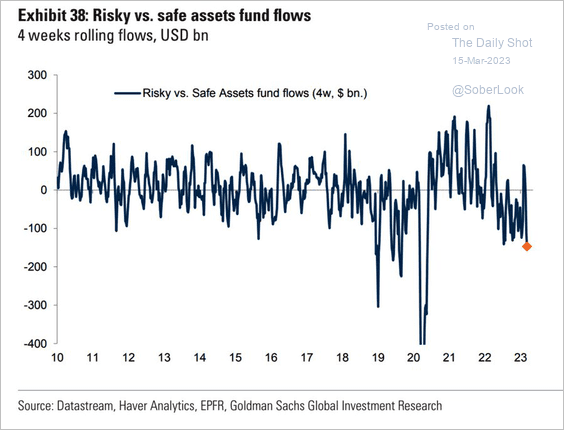

Here are the relative flows between risky and safe assets.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

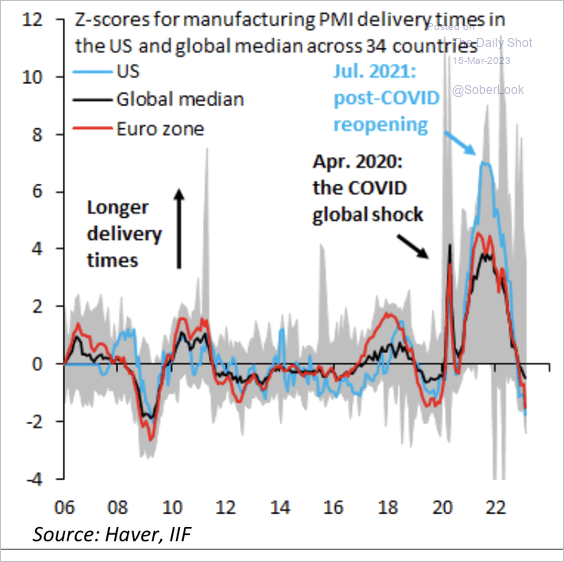

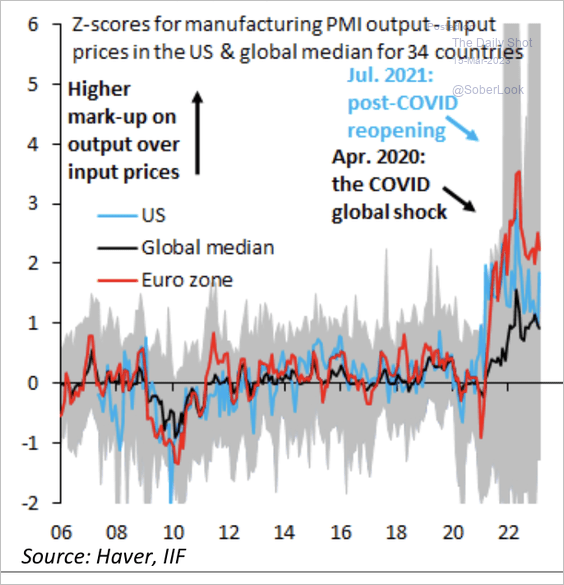

2. Delivery times have normalized, but company margins remain above pre-COVID levels. (2 charts)

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

Food for Thought

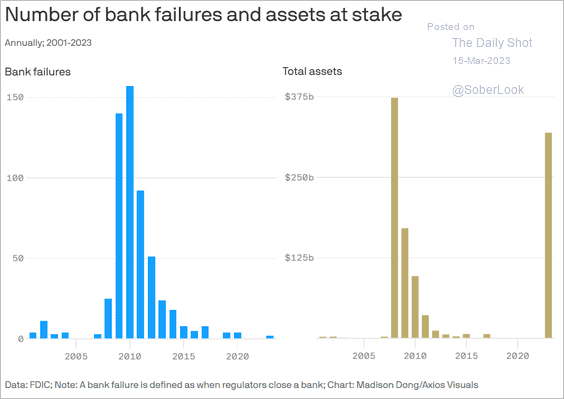

1. US bank failures over time:

Source: @axios Read full article

Source: @axios Read full article

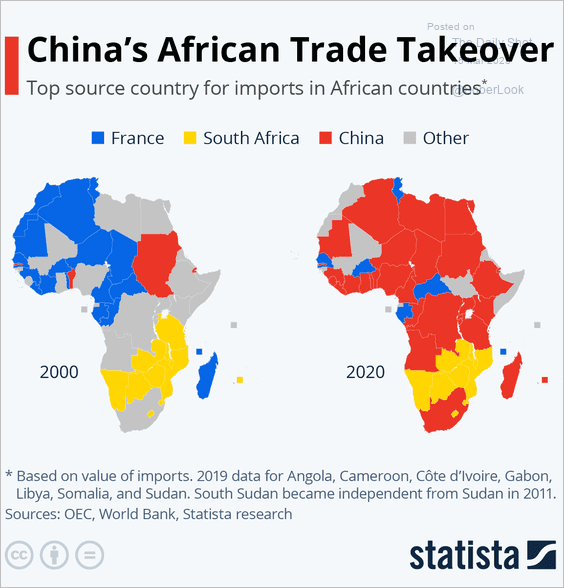

2. China’s African trade takeover:

Source: Statista

Source: Statista

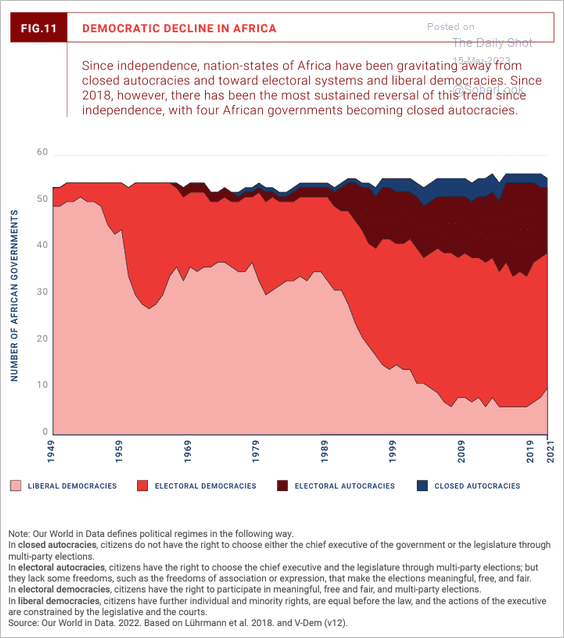

2. Democratic decline in Africa:

Source: Brookings Read full article

Source: Brookings Read full article

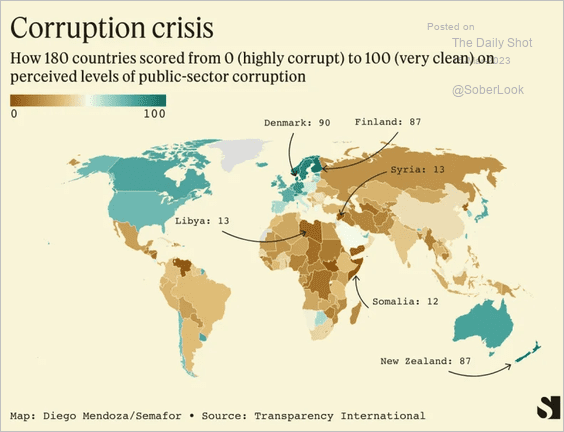

4. Corruption around the world:

Source: @prashantrao, @_godiegogo21 Read full article

Source: @prashantrao, @_godiegogo21 Read full article

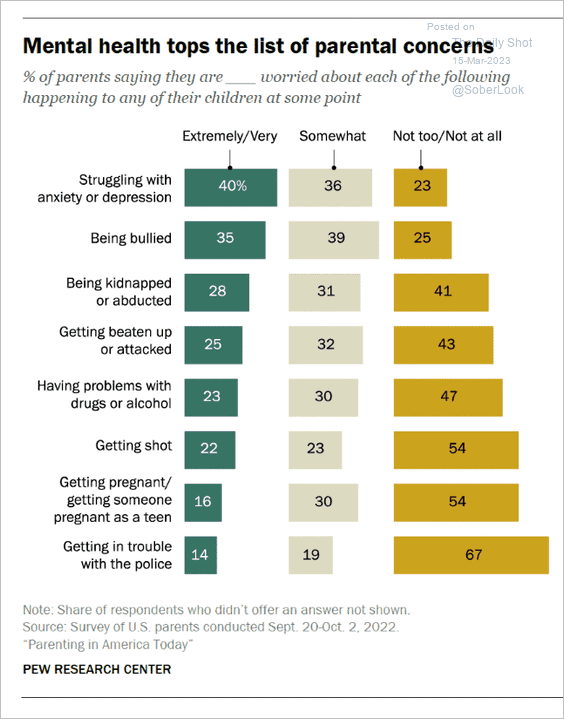

5. US parents’ key concerns:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

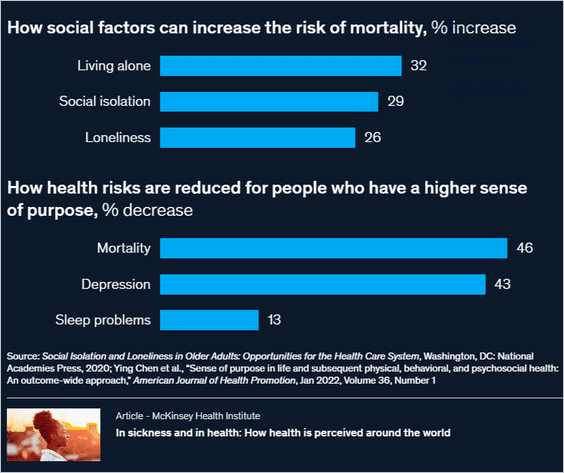

6. The Impact of social factors on sense of purpose in life and mortality:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

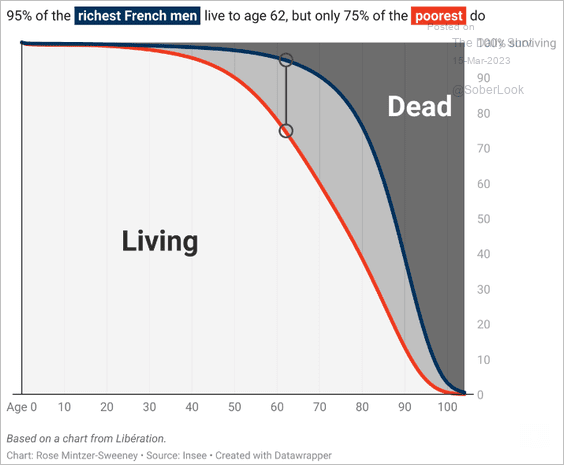

7. Survival rates for the richest and poorest men in France:

Source: @Datawrapper

Source: @Datawrapper

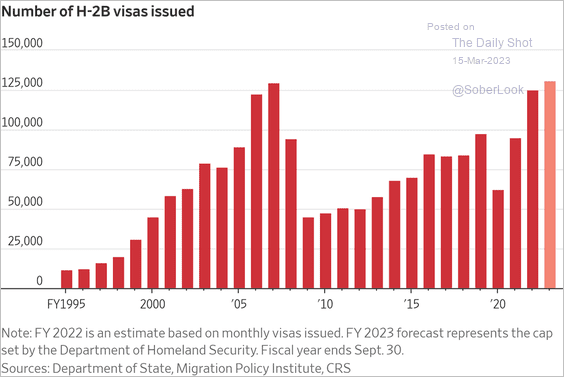

8. H-2B visas issued:

Source: @WSJ Read full article

Source: @WSJ Read full article

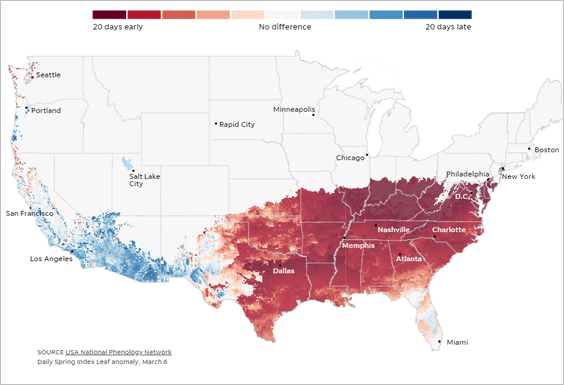

9. Earlier-than-average springtime leaf activity:

Source: USA Today Read full article

Source: USA Today Read full article

——————–

Back to Index

Letter to the Editor

From John Olert, Continental Insights

SVB and what it means more broadly from a risk and governance perspective

Financial Institutions are complex entities with a multitude of risks. Many of which can seem quite benign depending on which lens they are viewed from. SVB is a classic example. When looking through public filings its massive deposit growth was invested in long dated Mortgage Backed or Mortgage Backed related securities backed by the US Government. If you assume they were in the top of the capital structure and highly rated, that could be very comforting from a credit risk perspective.

However, when these are bought with deposits the bank had received, liquidity and interest rate risk should be deeply appreciated risks that Board is aware of and focused on. Deposits can be fleeting so what they are invested in needs to appreciate any gaps in their “expected” maturities compared to the instruments they are invested in. What is the history of these deposits or class of these deposits. 1yr, 2yr, 5yr, etc. How long do they “typically” stay on the books. These deposits are often invested in short term securities to earn something and minimize interest rate risk, while the institution waits for opportunities to deploy these funds into its loan opportunities in their core area of experience to maximize the returns for their shareholders. SVB decided to put “excess” deposits to work in long dated MBS securities. But looking at call reports from 12/31/21 and 12/31/22 there is a massive swing in fair value of the held to maturity portfolio compared to amortized cost. These was a $975 million MTM loss at 12/31/21 compared to $15,159 million on December 12/31/22. Massive.

The position was there. Were the questions being asked by the appropriate parties?

Based on the composition of SVBs board, there doesn’t seem to be the outside expertise needed to appropriately challenge management on this type of issue. Maybe they did and that will likely come to light as this is thoroughly investigated.

However, the 2022 10-K had this statement regarding interest rate risk.

The Federal Reserve raised benchmark interest rates throughout 2022 and may continue to raise interest rates in response to economic conditions, particularly inflationary pressures. Continued increases in interest rates to combat inflation or otherwise may have unpredictable effects or minimize gains on our interest rate spread.

So the board is responsible for this document. Minimize gains? With the mark to market loss being reported, an informed board member would have at least challenged this wording. The statement should have been focused on the potential to have severe losses based on what was an abundantly clear path from the Federal Reserve on interest rates.

Important to appreciate the distinction between policy expert and practitioner.

How do markets work? How do fundamental assumptions change when varied stresses present themselves? It is exceptionally helpful to have lived through early challenges, seen how things break down, mistakes made in response to unexpected developments, and how true, authentic leadership helps navigate and survive these situations. Risk professionals that have had operating, analytical, research, and internal control roles are key to ensuring all board members are appropriately informed and getting the reporting necessary to protect stakeholders. That is their duty. Growth is exceptionally important and highly desired. Having board members or an advisory firm that has been on both sides of this equation and appreciate all the plumbing (macro and micro) is essential to having a diverse and effective board in this space.

Back to Index