The Daily Shot: 30-Mar-23

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrencies

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

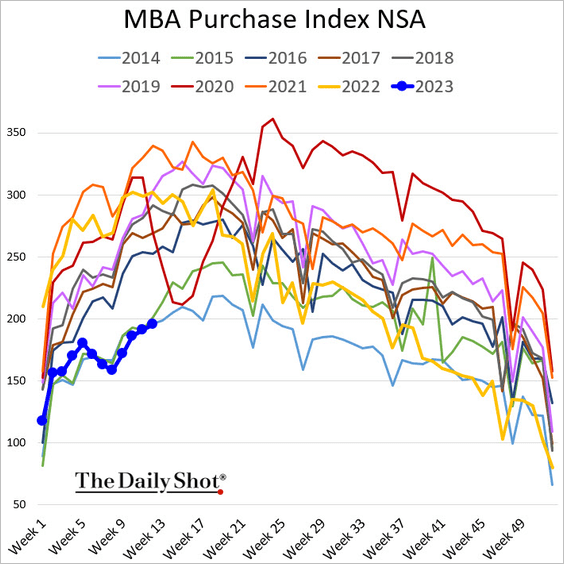

1. Mortgage applications continue to follow the 2014 trajectory.

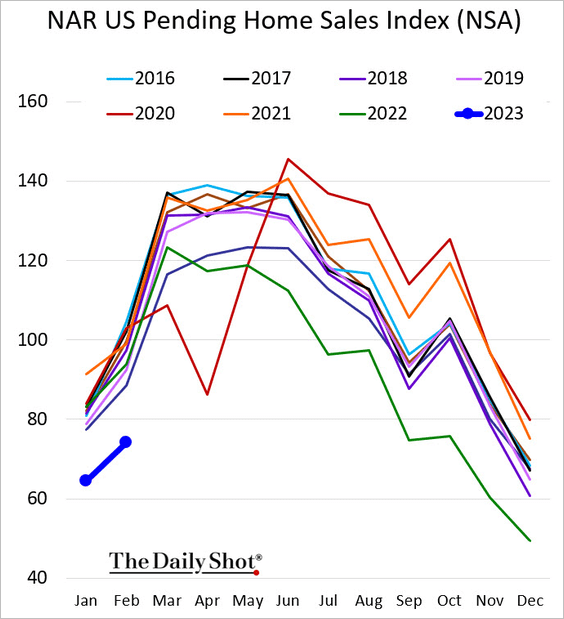

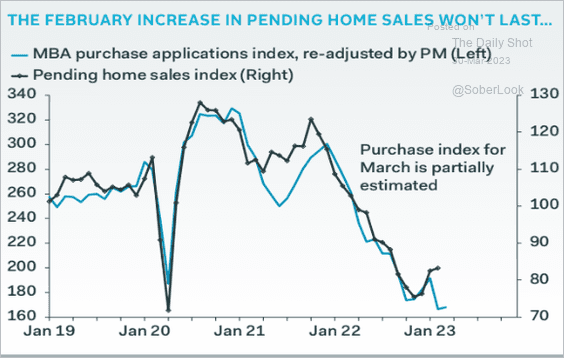

2. While still at multi-year lows, last month’s pending home sales topped expectations.

But soft mortgage applications signal more weakness ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

3. Next, we have some updates on inflation.

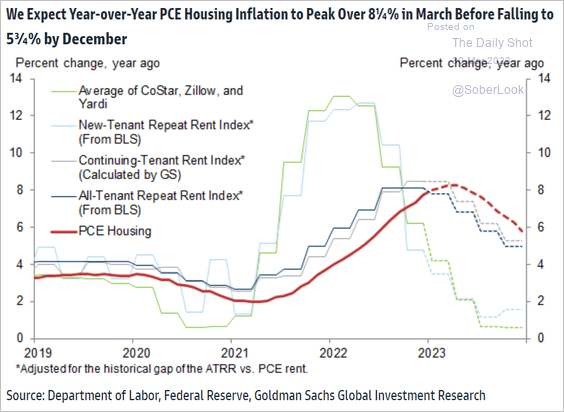

• Housing inflation is yet to peak, according to Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

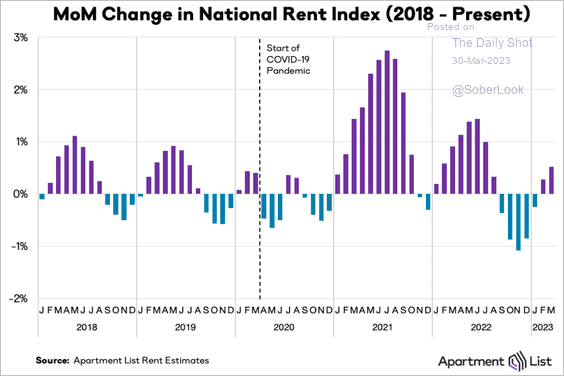

• Rents are on the rise again.

Source: Apartment List

Source: Apartment List

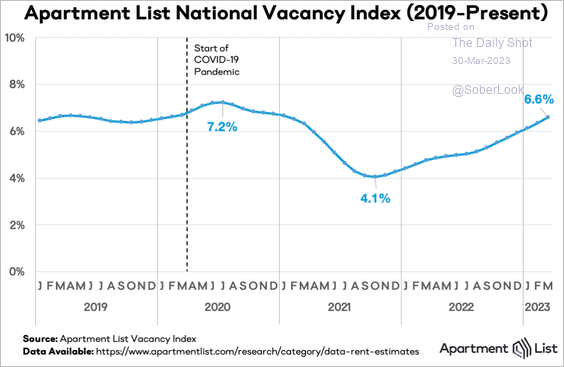

However, apartment vacancies continue to climb.

Source: Apartment List

Source: Apartment List

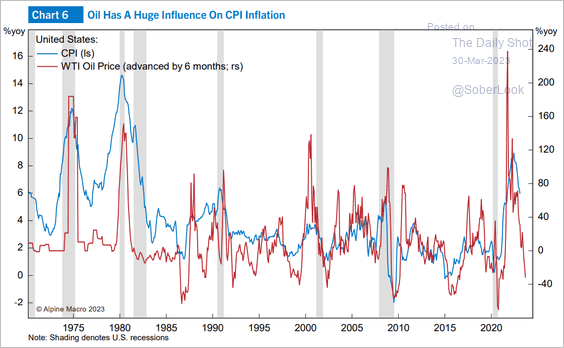

• Oil prices point to rapid declines in the headline CPI.

Source: Alpine Macro

Source: Alpine Macro

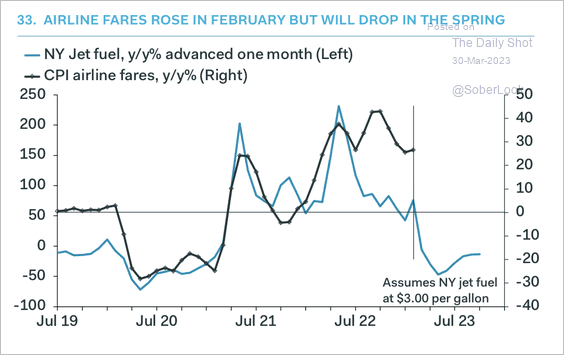

• The decline in jet fuel prices signals lower airline fares.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

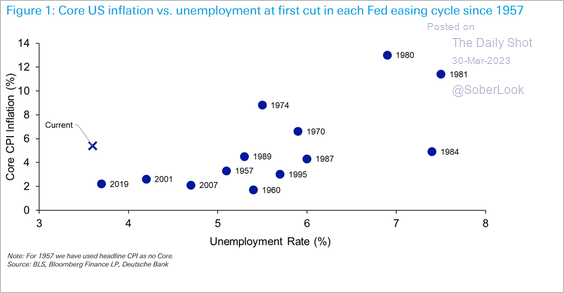

4. Historically, the Fed started to cut rates when core CPI was higher than current levels, but only in the 1970s/early-80s. Rate cuts have not happened when unemployment was this low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

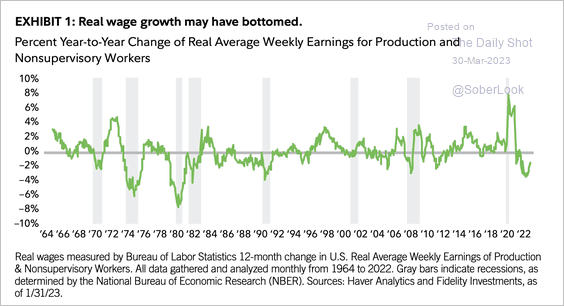

5. Real wage growth may have bottomed last fall.

Source: Denise Chisholm, Fidelity Investments Read full article

Source: Denise Chisholm, Fidelity Investments Read full article

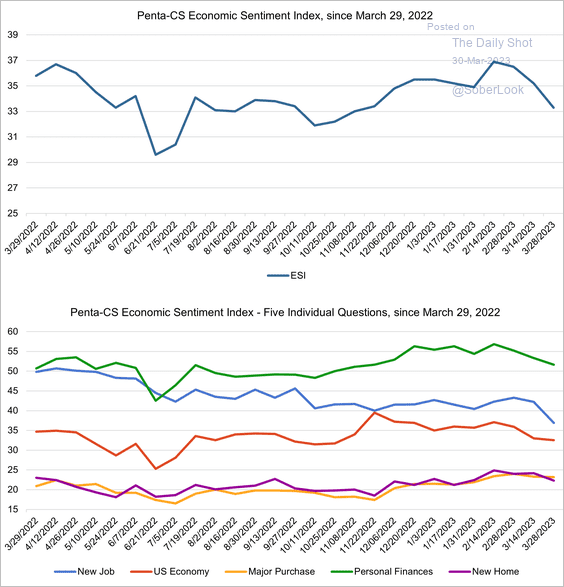

6. The Penta/CivicScience Economic Sentiment Index showed deterioration in consumer outlook going into the month-end.

Source: @PentaGRP, @CivicScience

Source: @PentaGRP, @CivicScience

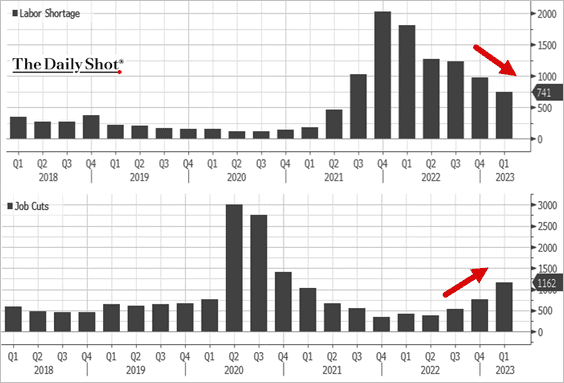

7. Fewer companies are talking about labor shortages, but more firms are mentioning job cuts.

Source: @M_McDonough, @TheTerminal, Bloomberg Finance L.P.

Source: @M_McDonough, @TheTerminal, Bloomberg Finance L.P.

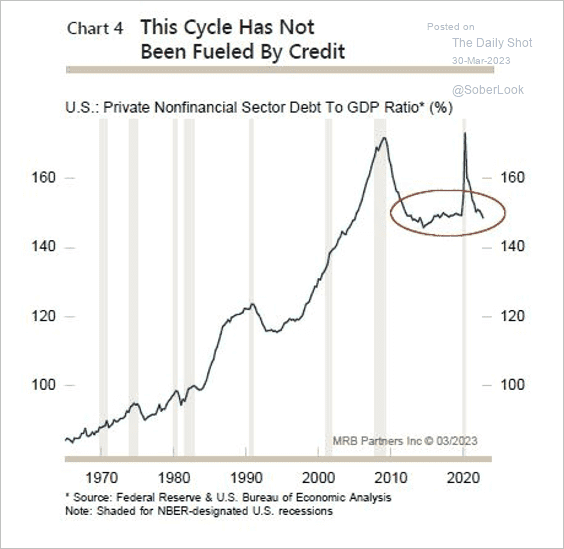

8. This economic cycle has been less dependent on credit expansion than previous ones. There could be more resilience to tighter credit conditions this time around, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

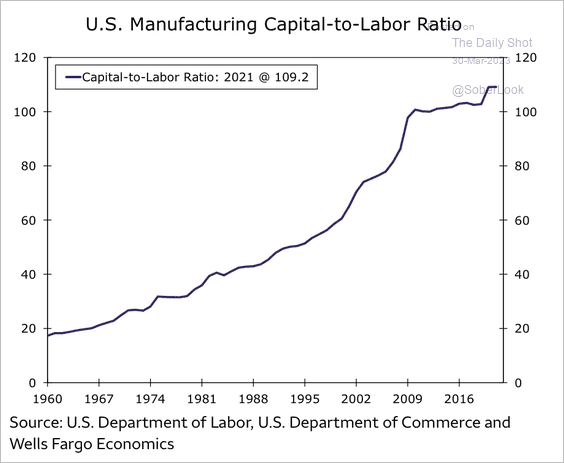

9. Manufacturers have become increasingly capital-intensive over the years.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Canada

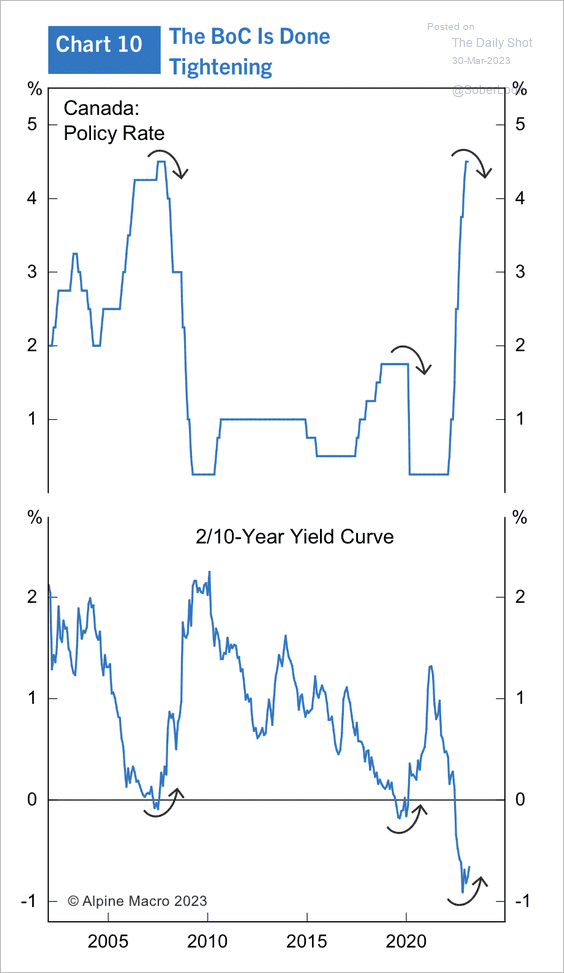

Alpine Macro expects no more rate hikes from the BoC because of declining inflation and the deeply inverted 2s/10s yield curve.

Source: Alpine Macro

Source: Alpine Macro

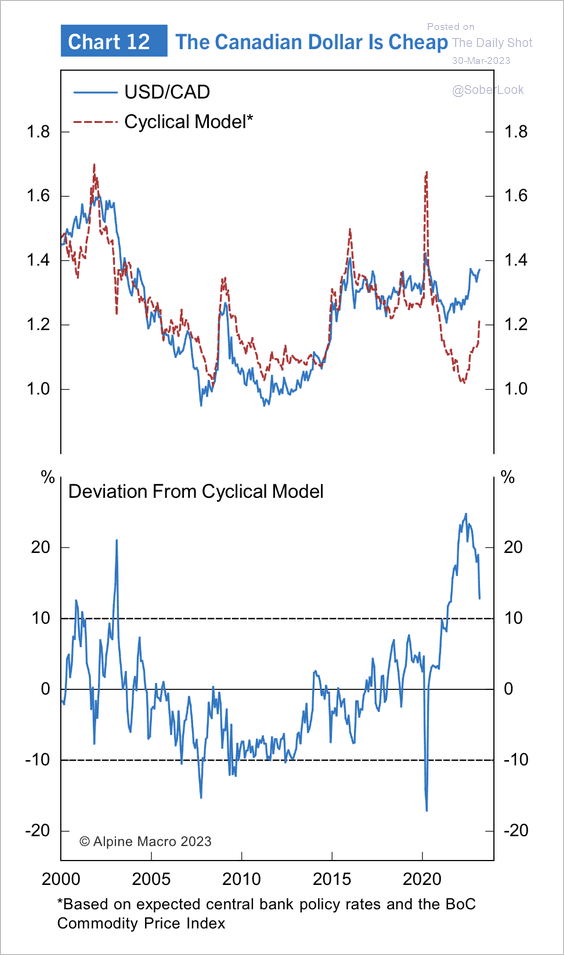

• However, there could be less scope for the BoC to cut rates than the Fed, which could benefit CAD versus USD.

Source: Alpine Macro

Source: Alpine Macro

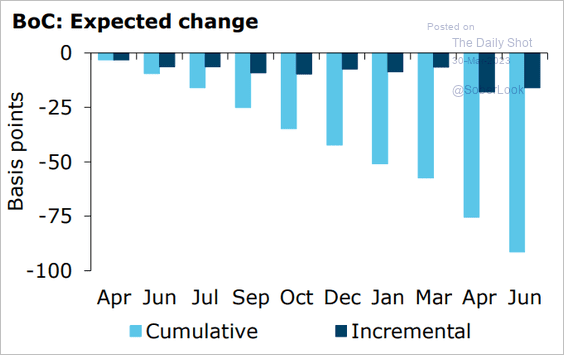

• The market sees ongoing rate cuts over the next couple of years.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

The United Kingdom

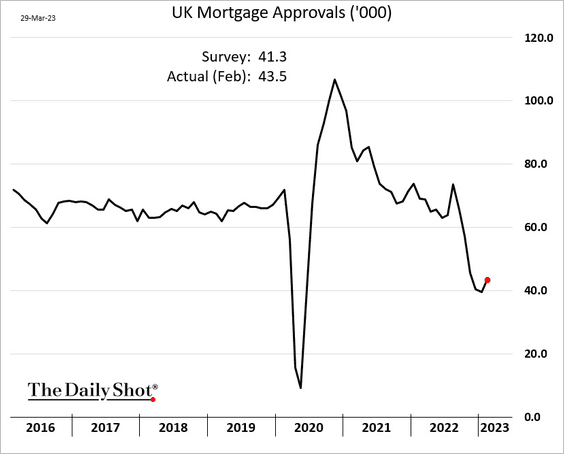

1. Mortgage approvals increased in February.

Source: Reuters Read full article

Source: Reuters Read full article

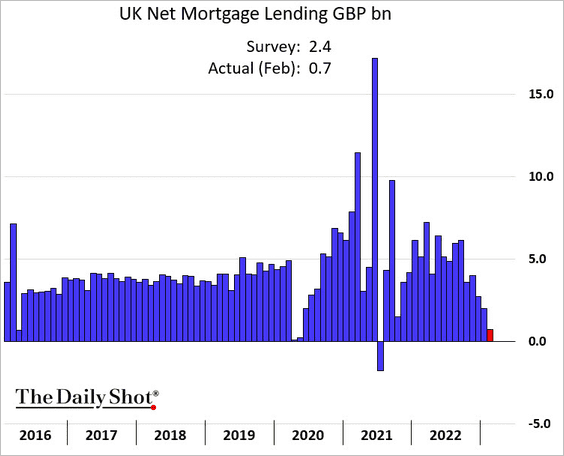

But the net amount of mortgage lending continues to decline.

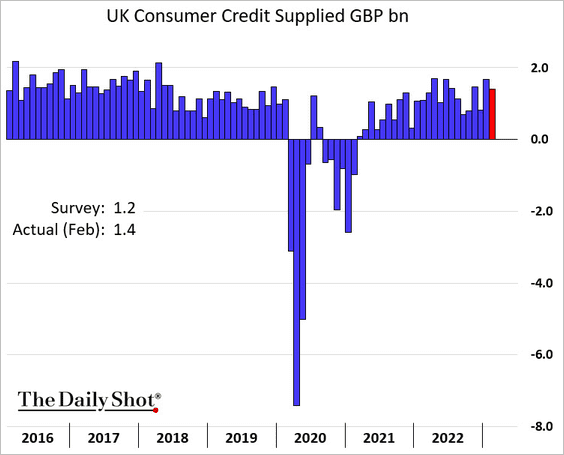

The amount of consumer credit supplied remains robust.

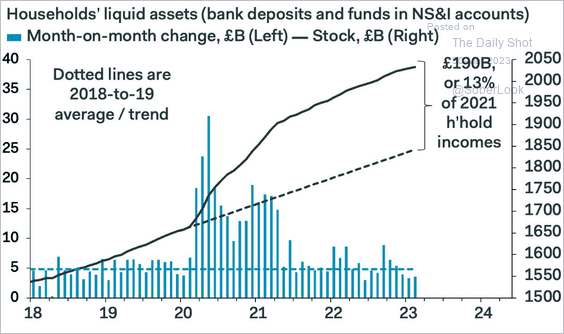

2. Households’ excess savings are still elevated.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

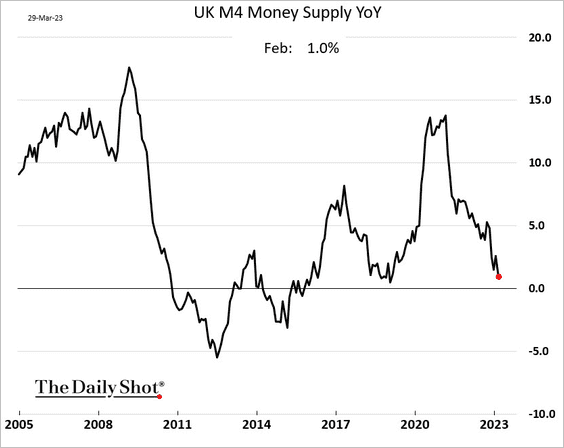

3. The broad money supply growth has been slowing.

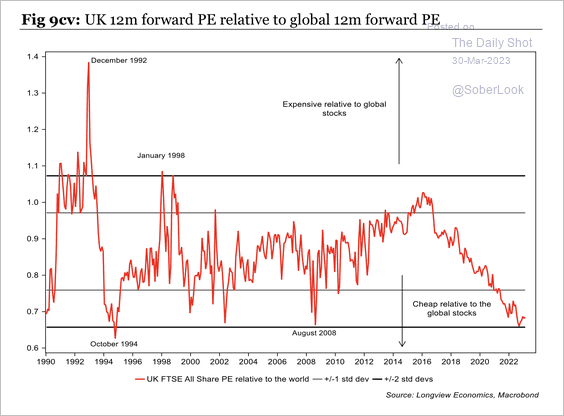

4. UK stocks appear attractively valued relative to historical levels.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

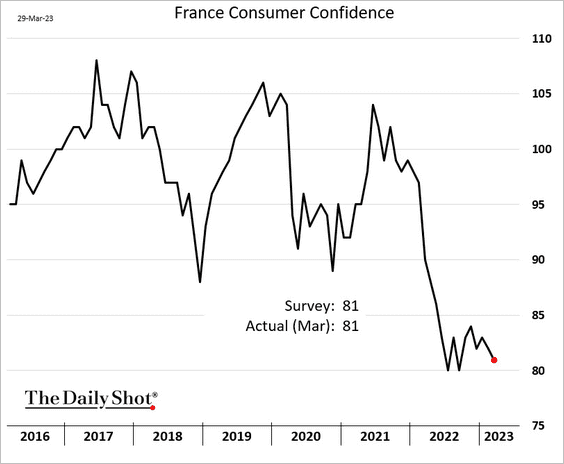

1. French consumer confidence deteriorated further this month.

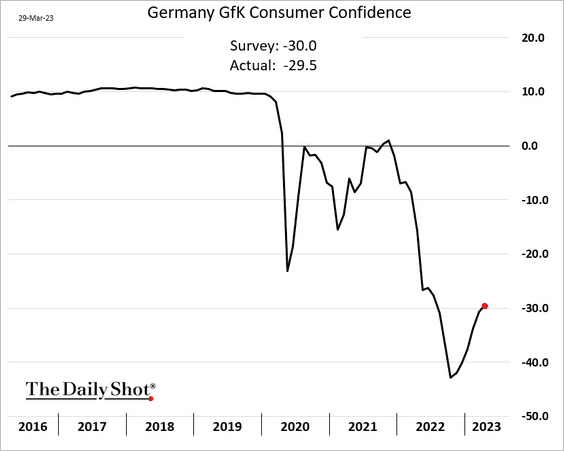

2. German sentiment is recovering but remains at depressed levels.

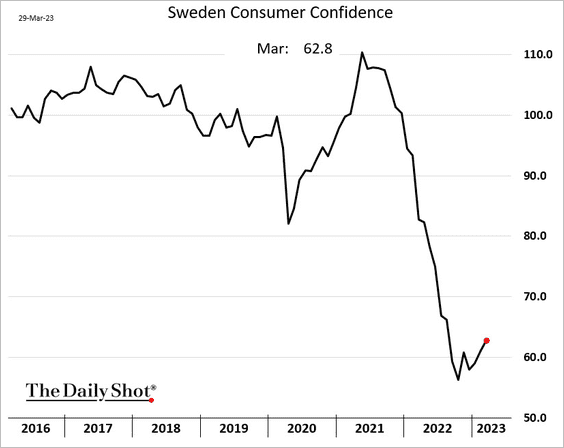

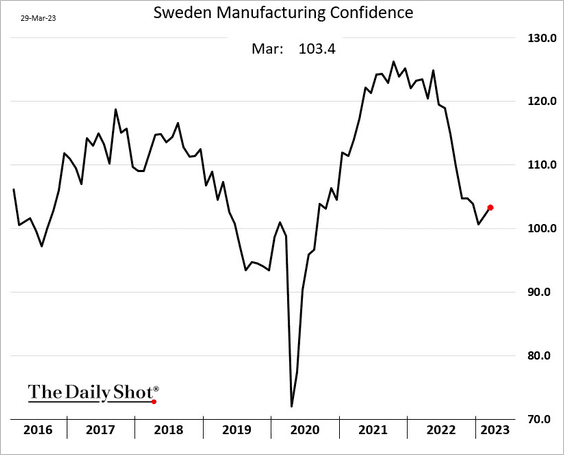

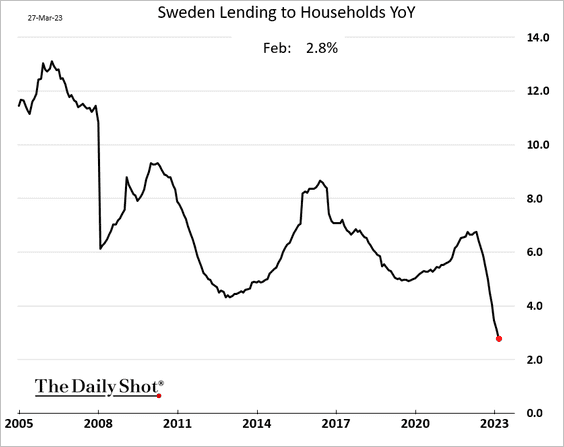

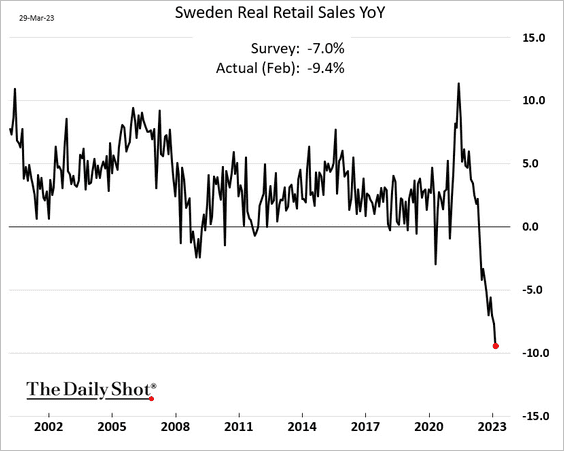

3. Next, we have some updates on Sweden.

• Consumer confidence is starting to move higher. Manufacturing sentiment also showed some improvement.

• Growth in lending to households continues to slow.

• Sweden hasn’t seen a retail sales shock like this in decades.

——————–

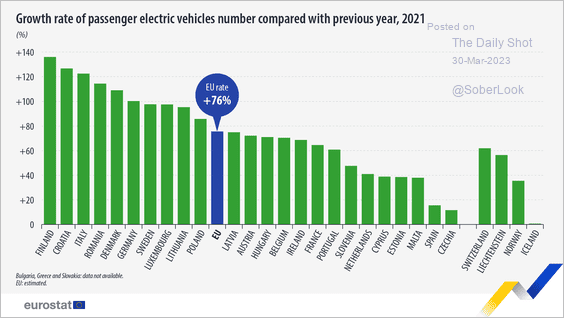

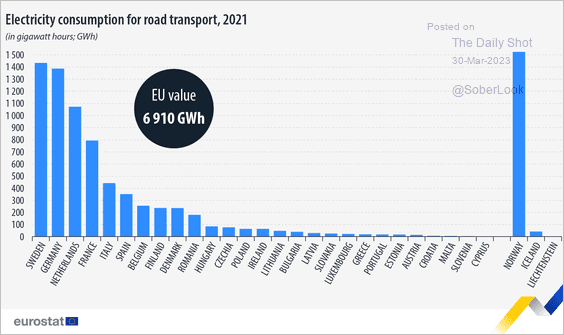

4. Next, we have some updates on the EV market.

• EV growth rates:

Source: Eurostat Read full article

Source: Eurostat Read full article

• Electricity consumption for road transport:

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

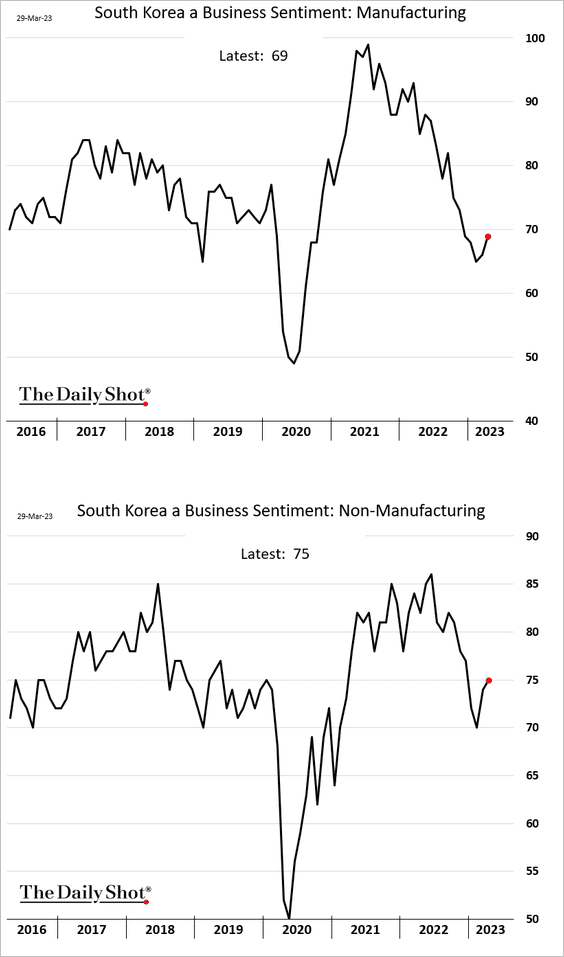

1. South Korea’s business sentiment is improving.

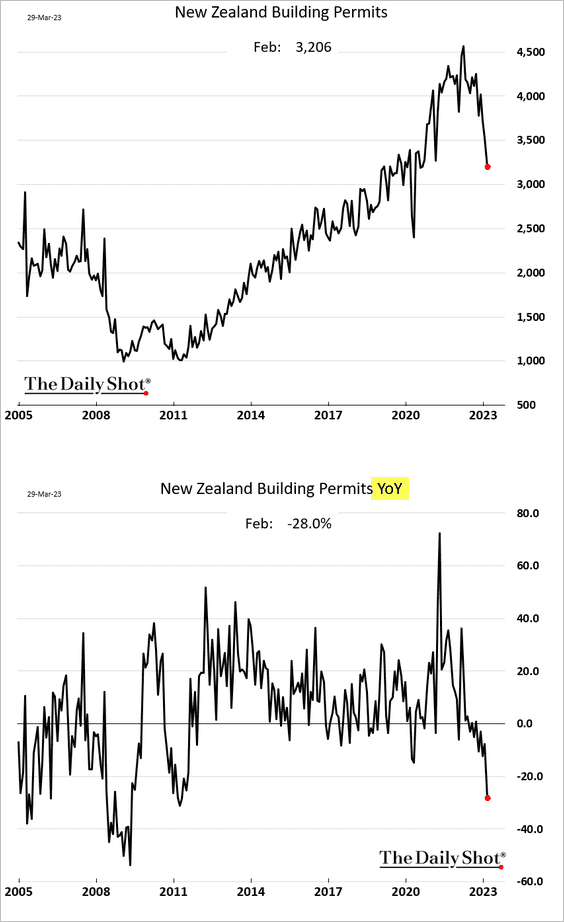

2. New Zealand’s building permits are down 28% from a year ago.

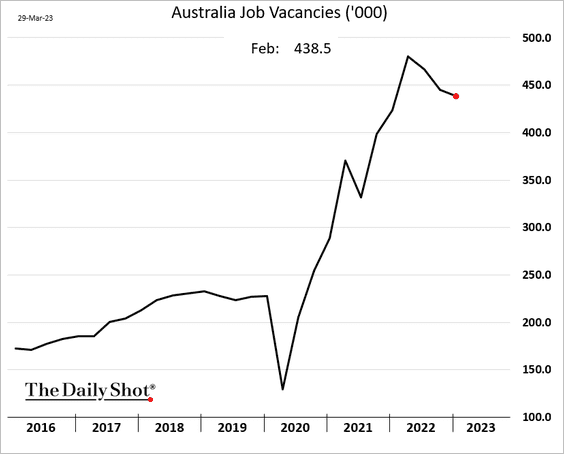

3. Australia’s job vacancies remain elevated.

Back to Index

China

1. The PBoC injected liquidity into the market, lowering the front end of the interbank rate curve.

Source: ING

Source: ING

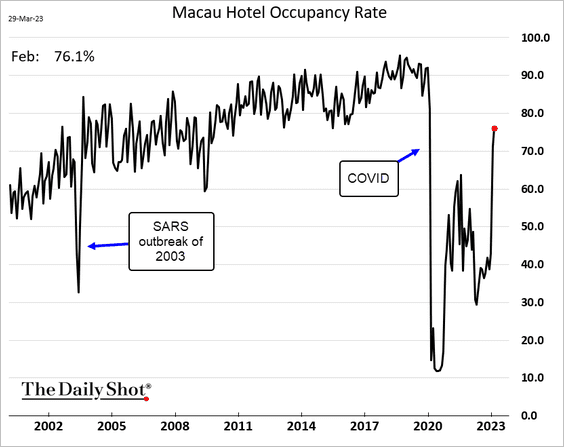

2. Macau’s hotel occupancy rate is rebounding as China reopens.

Back to Index

Emerging Markets

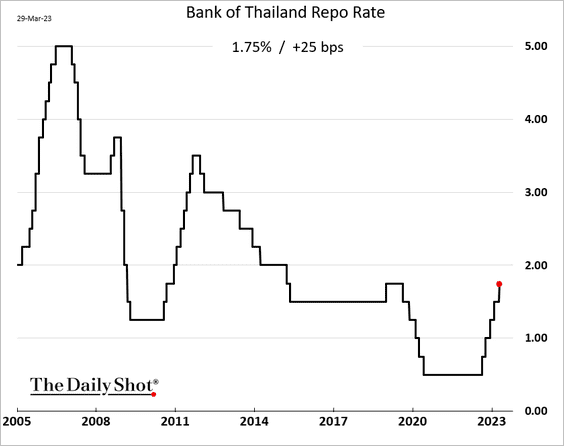

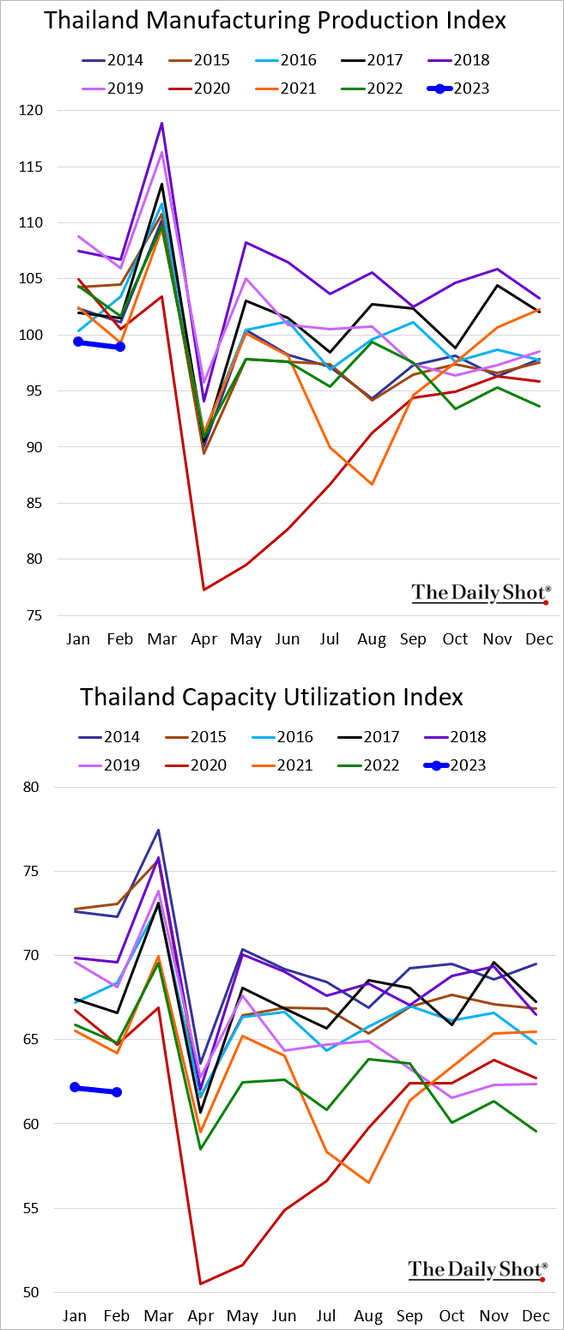

1. Thailand’s central bank hiked rates again, reaching pre-COVID levels.

Thailand’s factory output and capacity utilization have been soft.

——————–

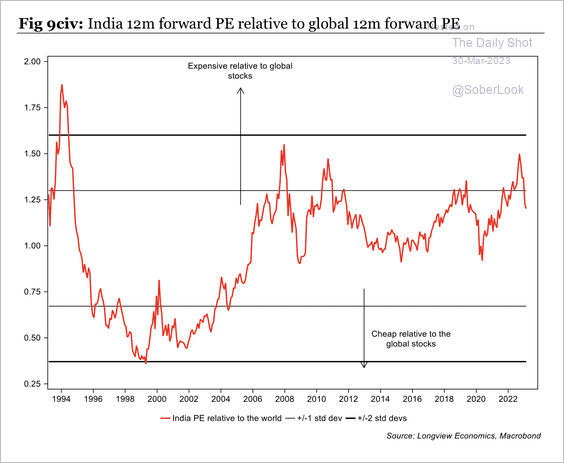

2. Indian stocks appear expensive relative to global equities.

Source: Longview Economics

Source: Longview Economics

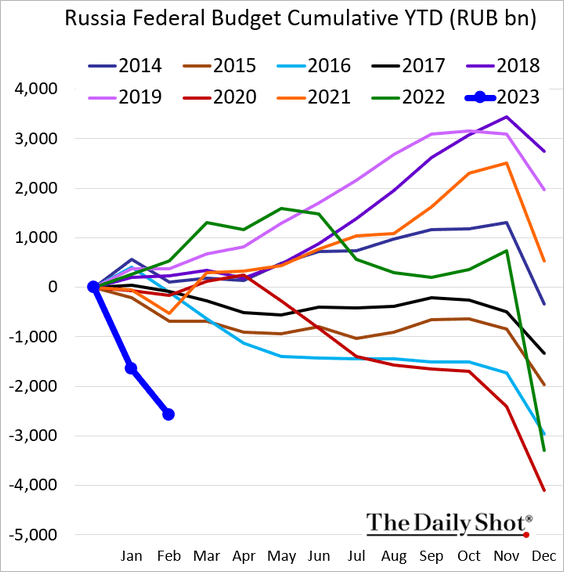

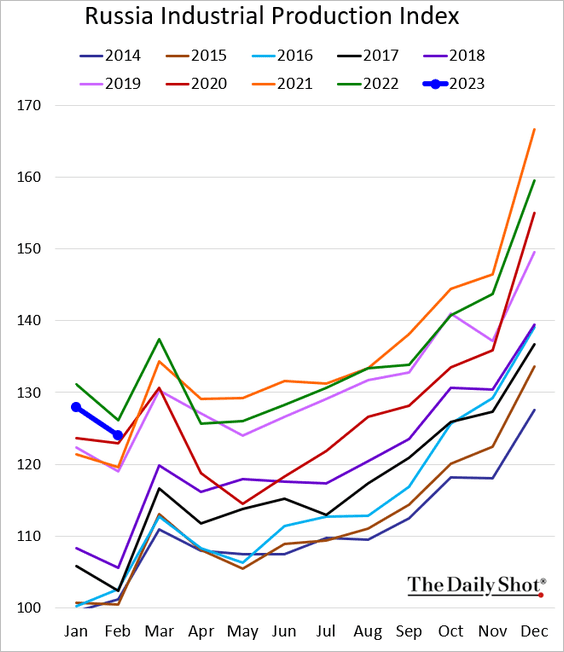

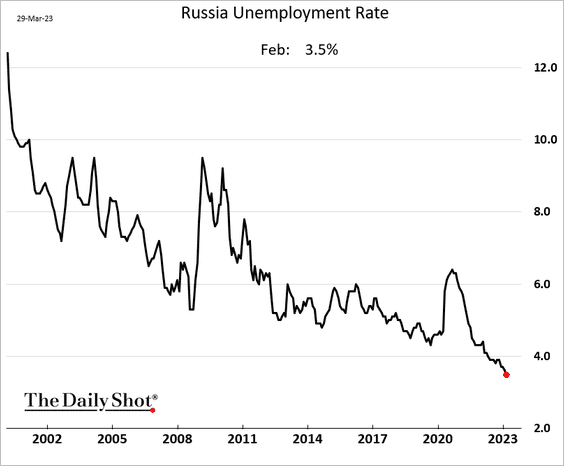

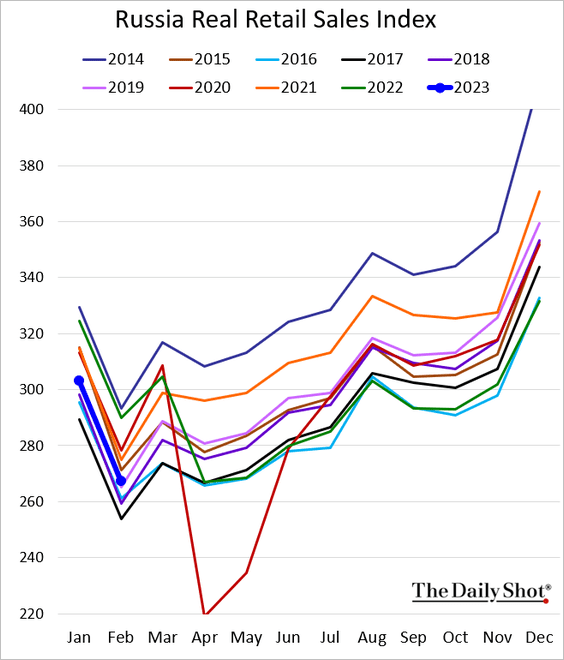

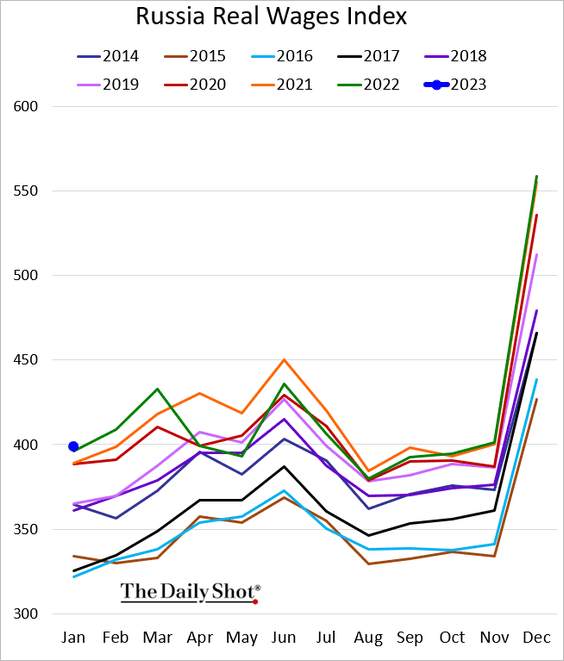

3. Next, we have some economic data reported by the Russian government (take it with a grain of salt).

• Federal government budget:

Further reading

Further reading

• Industrial production:

• Unemployment:

• Retail sales:

• Real wages:

——————–

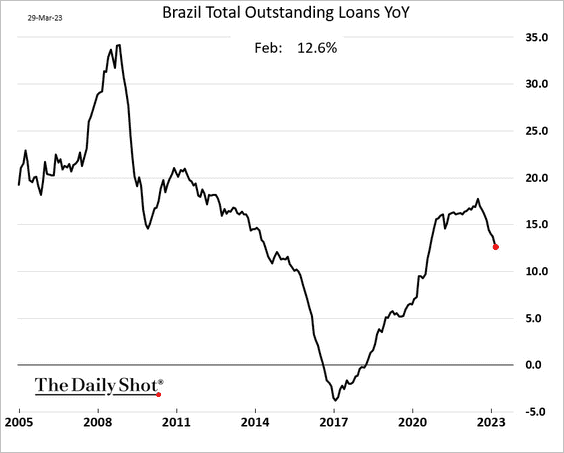

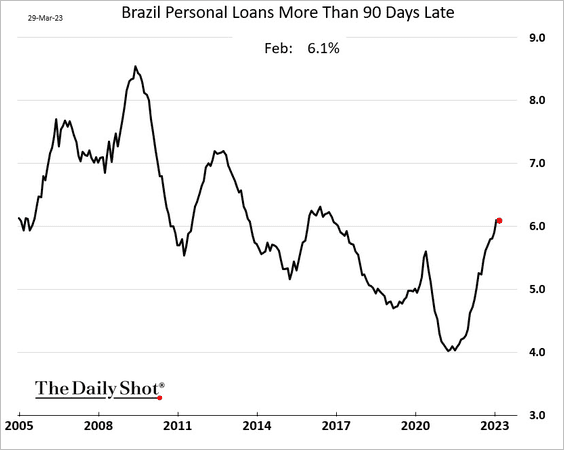

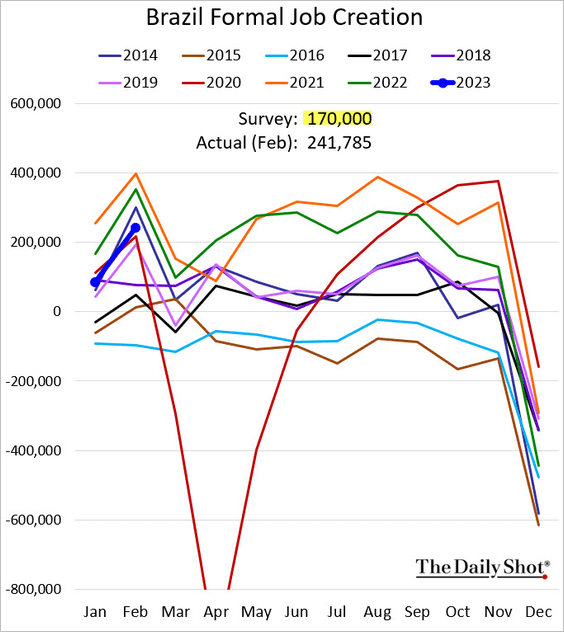

4. Finally, we have some updates on Brazil.

• Credit expansion appears to have peaked.

• Personal loan delinquencies have been rising.

• Formal job creation topped expectations

Back to Index

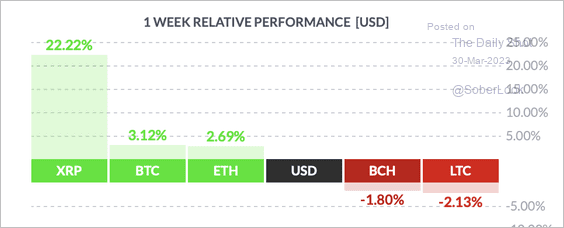

Cryptocurrencies

1. It has been a mixed week for cryptos so far, with XRP outperforming other large tokens.

Source: FinViz

Source: FinViz

2. A legal judgment on whether or not XRP is a security will establish critical precedent for the crypto industry.

Source: WIRED Read full article

Source: WIRED Read full article

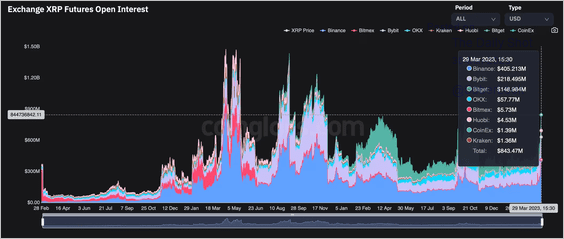

3. Open interest in XRP surged as the token reached a 10-month high on Wednesday.

Source: Coinglass Read full article

Source: Coinglass Read full article

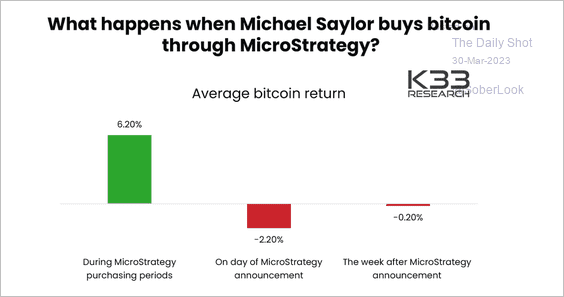

4. Here is what typically happens after Microstrategy buys BTC for its treasury reserve.

Source: @K33Research

Source: @K33Research

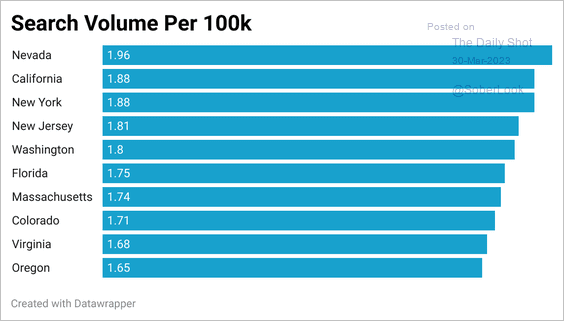

5. Below is the online search activity for crypto-related topics (population adjusted).

Source: Cryptobetting.org

Source: Cryptobetting.org

Back to Index

Energy

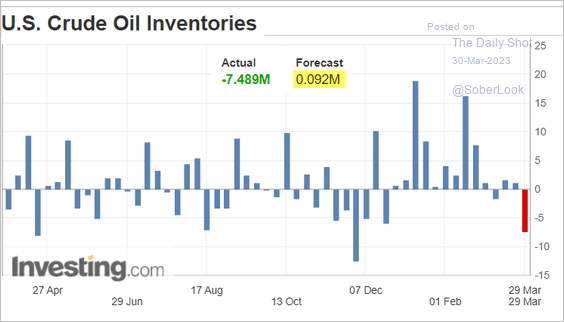

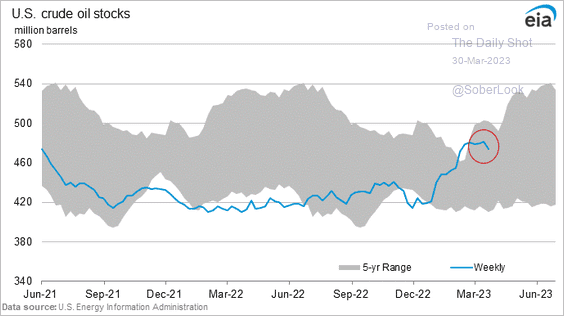

1. US crude oil inventories declined sharply last week (surprising the market).

• Week-over-week:

• Level:

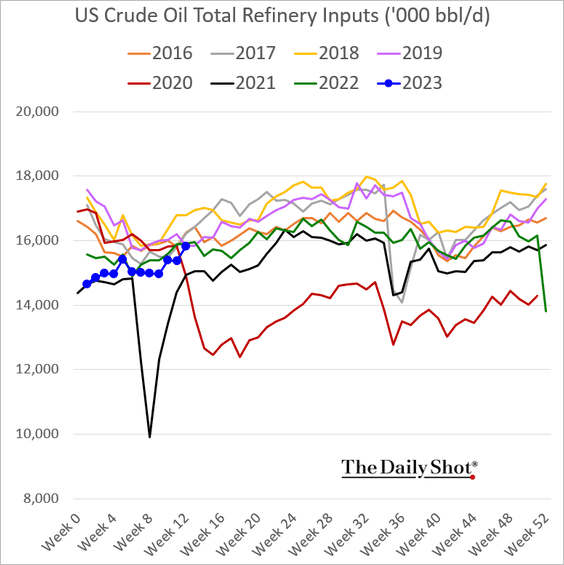

2. Refinery inputs have been rebounding.

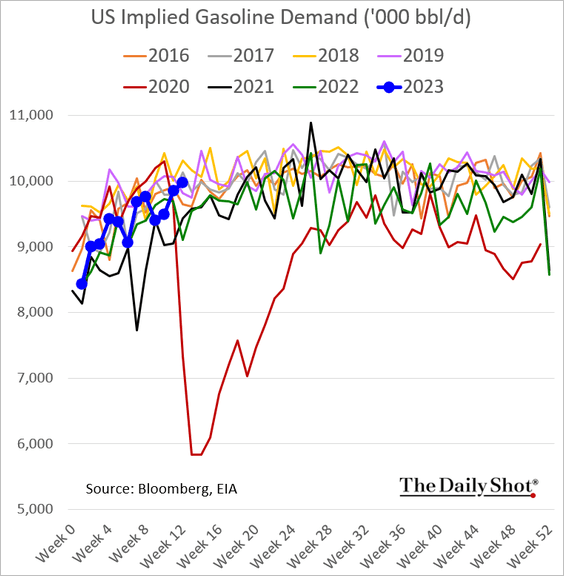

3. US gasoline demand has been stronger, …

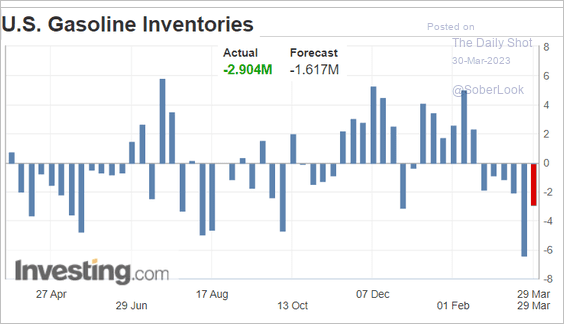

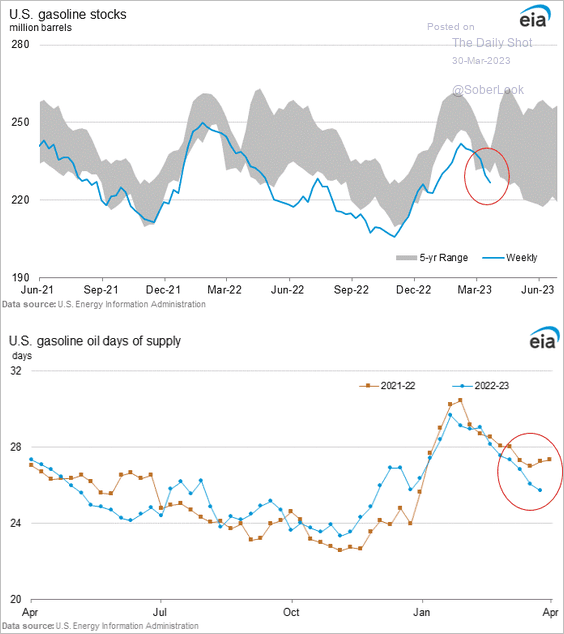

… drawing down inventories.

• Week-over-week:

• Level and days of supply:

Back to Index

Equities

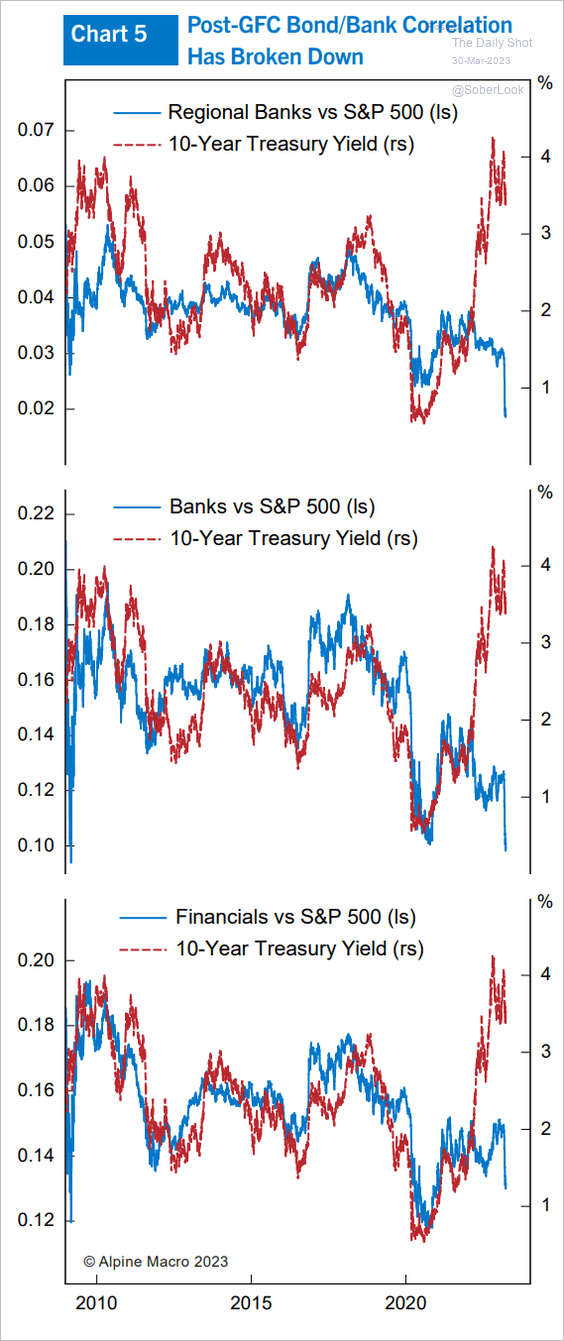

1. Financials’ share prices have massively diverged from bond yields.

Source: Alpine Macro

Source: Alpine Macro

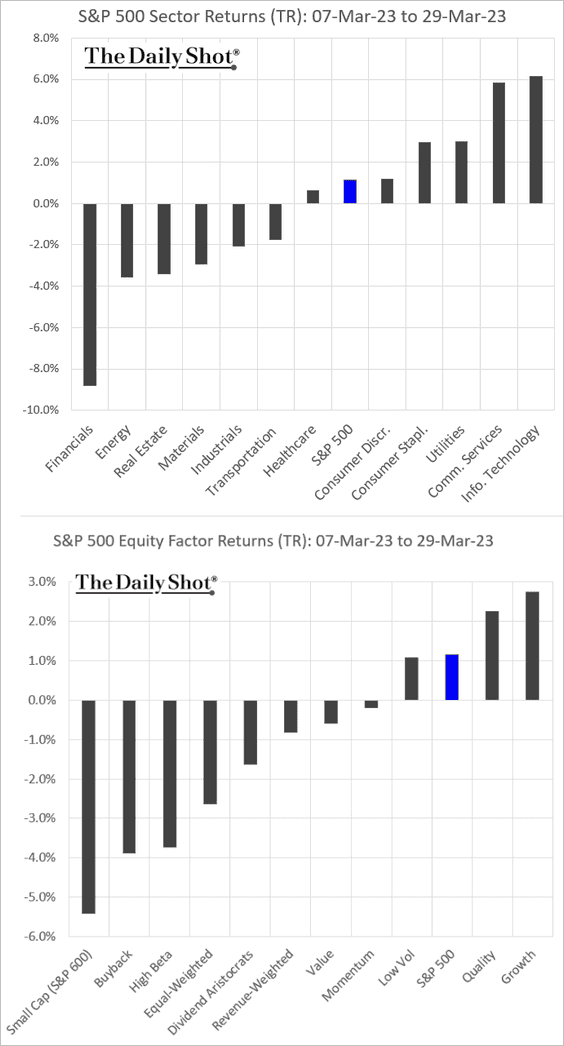

2. The dispersion of performance within sectors and equity factors has been atypical since the beginning of the banking turmoil.

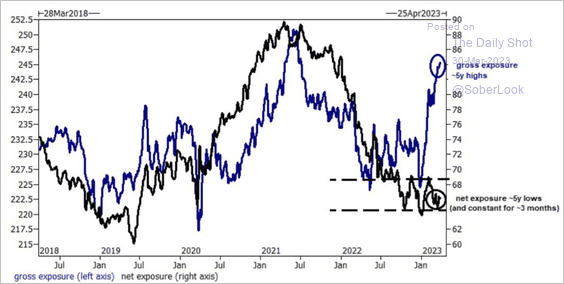

• Hedge funds have been boosting their long/short bets, while the outright exposure remains relatively low.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

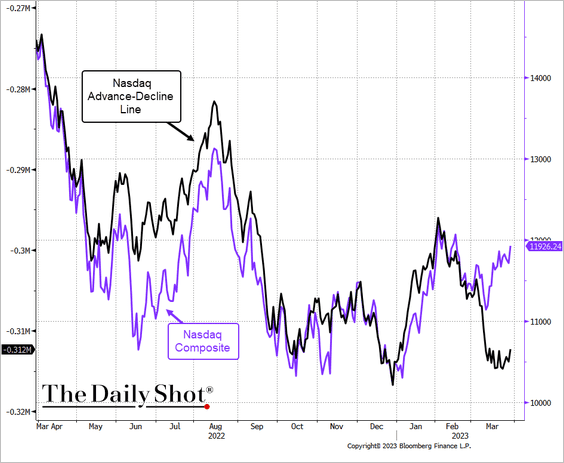

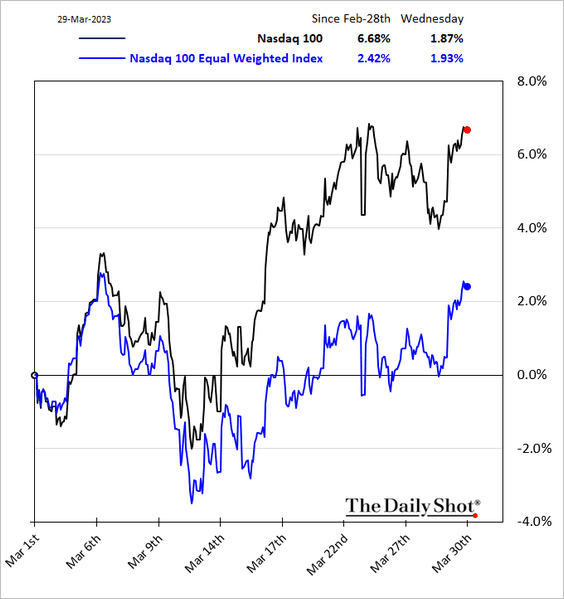

3. The Nasdaq Composite breadth has been weak.

The equal-weight Nasdaq index has underperformed.

——————–

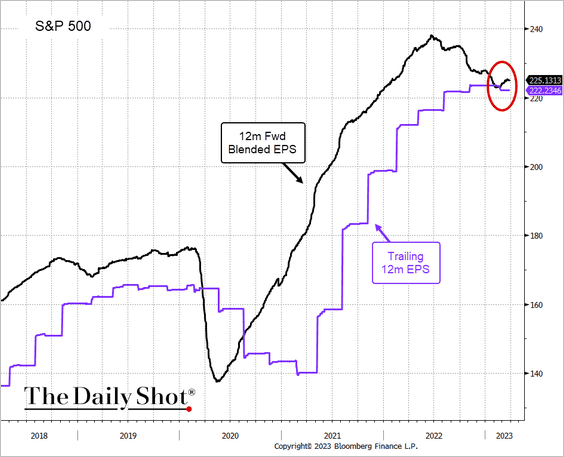

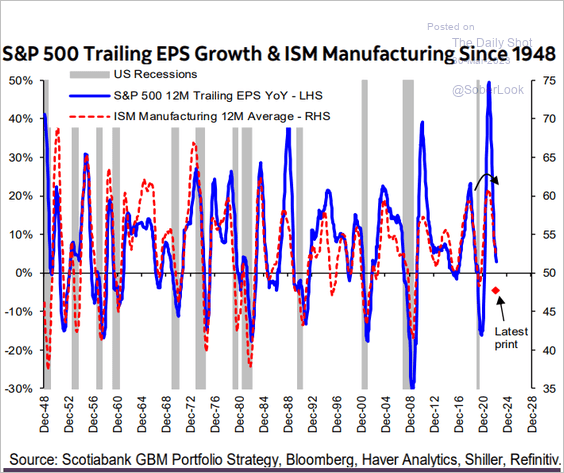

4. The S&P 500 12-month forward earnings estimates are still above the trailing EPS.

And yet, leading indicators point to an earnings recession ahead.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

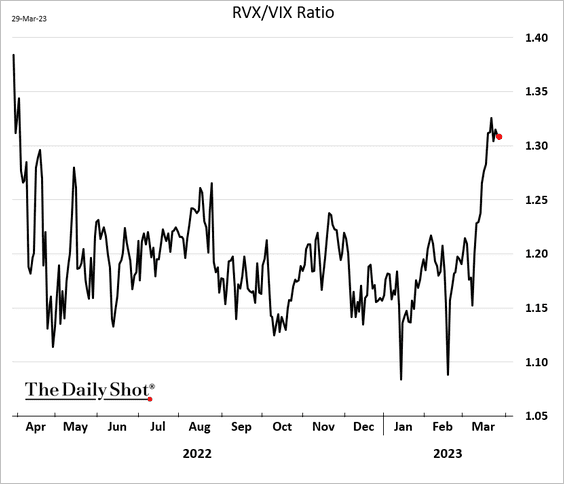

5. The Russell 2000 volatility index (RVX) remains elevated relative to VIX.

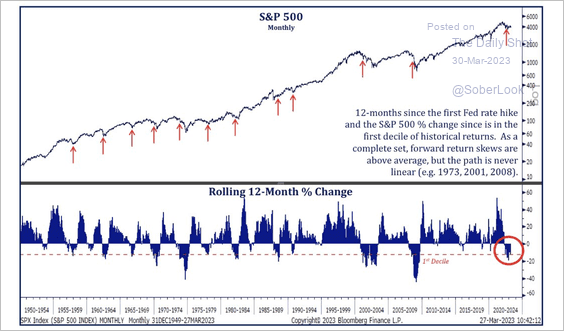

6. The S&P 500 is in the first decile of historical returns, and it has been 12 months since the first Fed rate hike. Are we near an inflection point?

Source: @Todd_Sohn

Source: @Todd_Sohn

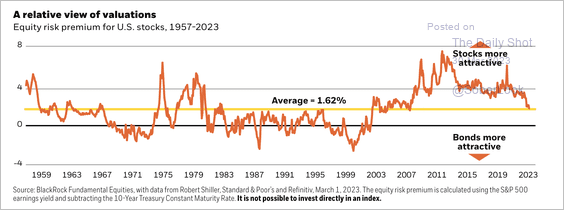

7. The US equity risk premium is back around its long-term average.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

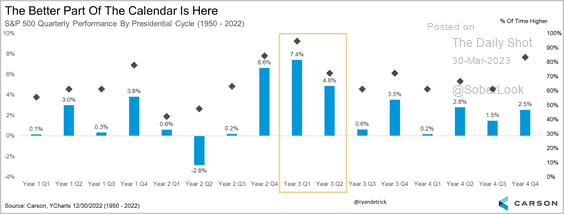

8. This is a seasonally strong period for the S&P 500.

Source: @ryandetrick

Source: @ryandetrick

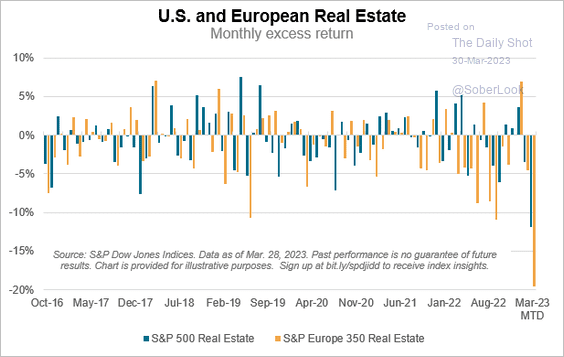

9. Real estate indices massively underperformed this month.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

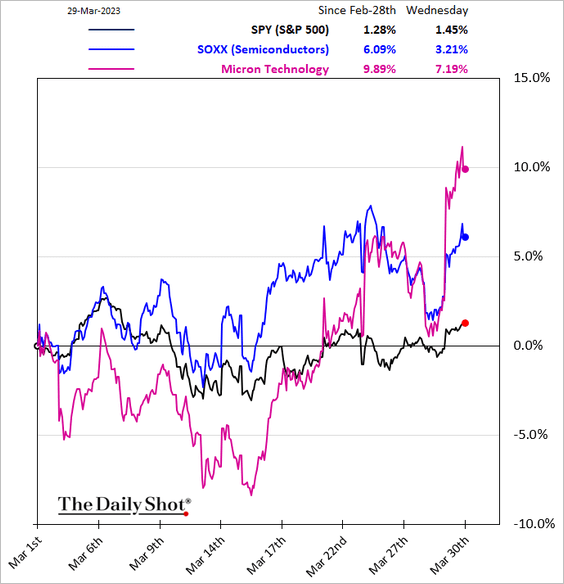

10. Semiconductor shares surged in recent days.

Source: CNBC Read full article

Source: CNBC Read full article

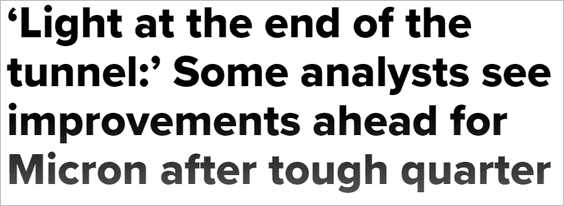

11. The S&P 500 ESG index has been outperforming.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

Back to Index

Credit

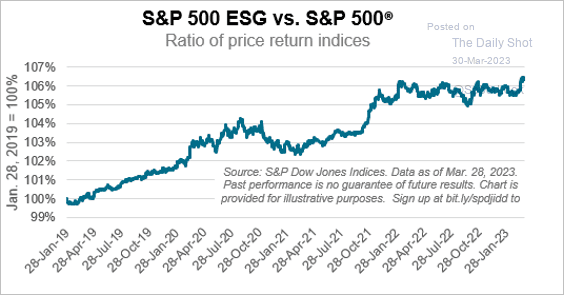

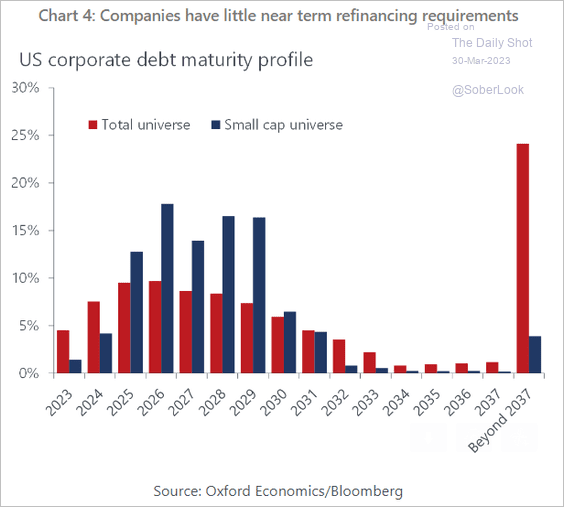

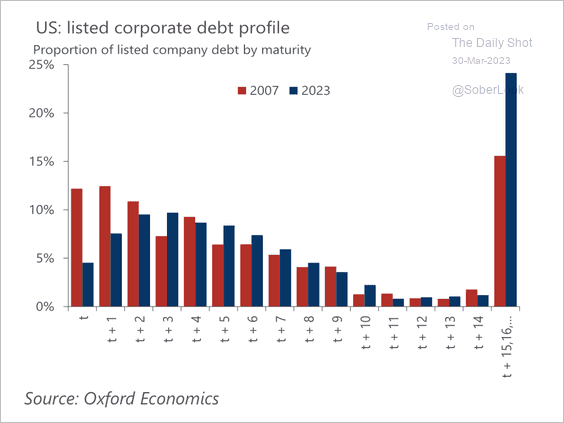

1. Small-cap interest coverage ratios are much lower than the broader market.

Source: Oxford Economics

Source: Oxford Economics

And debt maturities are much shorter.

Source: Oxford Economics

Source: Oxford Economics

The overall US corporate debt maturity has lengthened considerably.

Source: Oxford Economics

Source: Oxford Economics

——————–

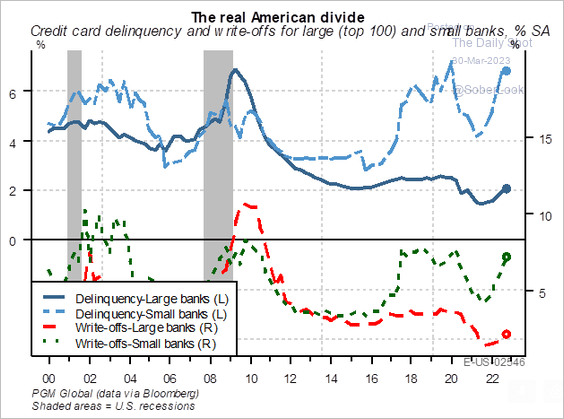

2. This chart shows credit card delinquencies at large and small banks.

Source: PGM Global

Source: PGM Global

Back to Index

Rates

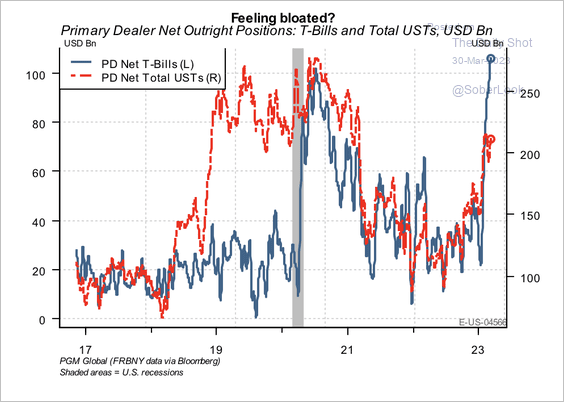

1. Primary dealers have been hoarding Treasury bills, which shows how quickly interbank liquidity has fallen, according to PGM Global.

Source: PGM Global

Source: PGM Global

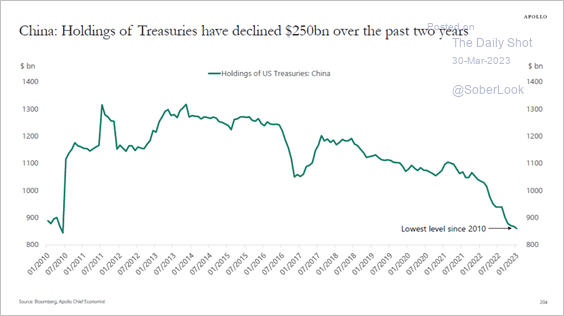

2. This chart shows China’s holdings of US Treasury securities.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

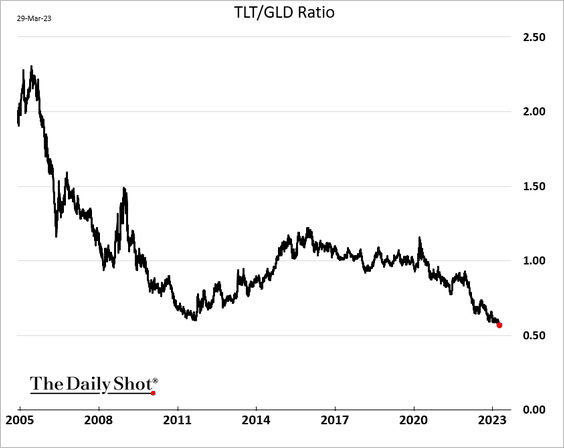

3. The ratio of long-term Treasury prices to gold hit a multi-year low.

——————–

Food for Thought

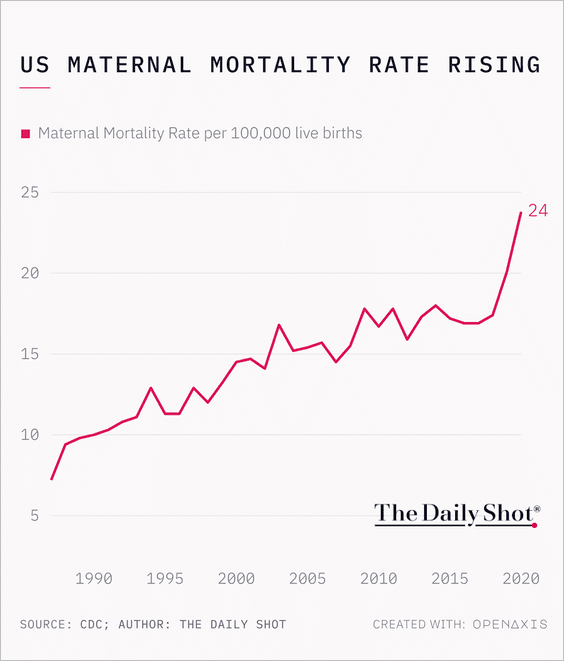

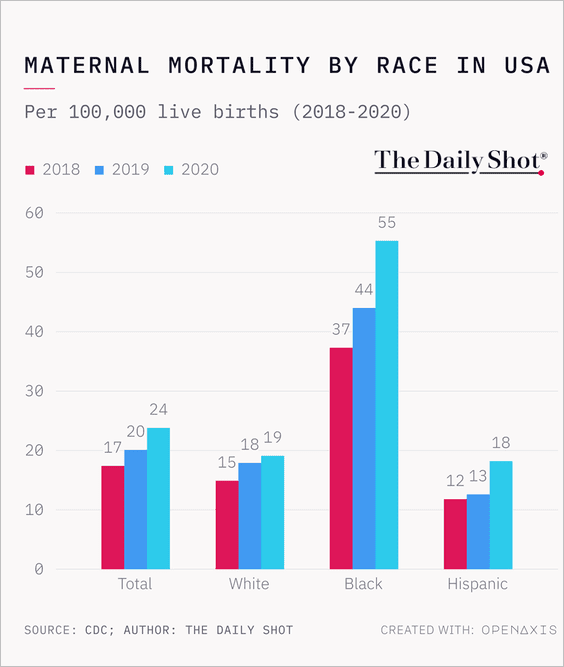

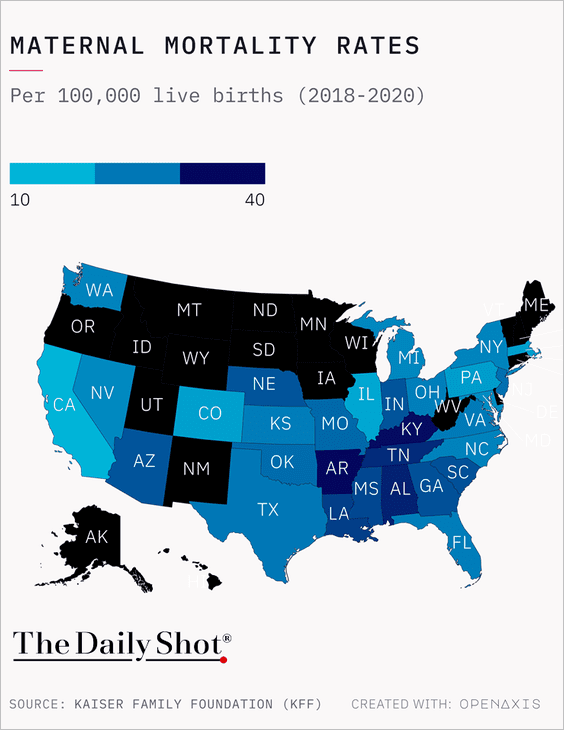

1. US maternal mortality rates (3 charts):

Source: @OpenAxisHQ

Source: @OpenAxisHQ

Source: @OpenAxisHQ

Source: @OpenAxisHQ

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

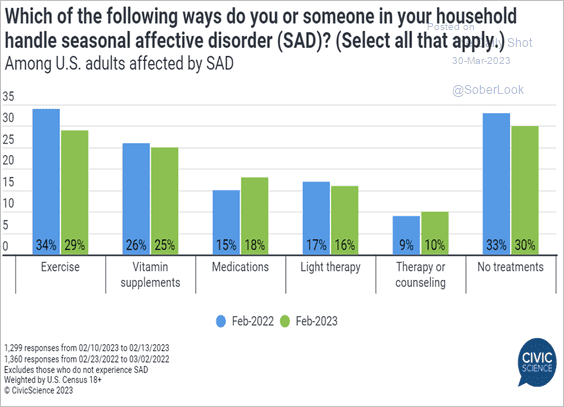

2. Treating seasonal affective disorder (SAD):

Source: @CivicScience Read full article

Source: @CivicScience Read full article

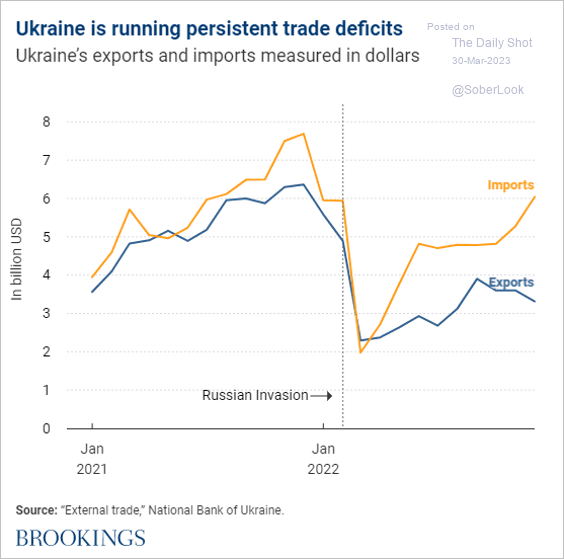

3. Ukraine’s imports and exports:

Source: Brookings Read full article

Source: Brookings Read full article

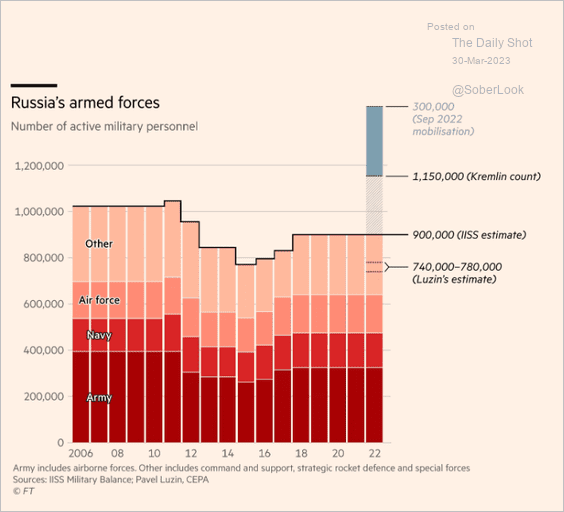

4. Russia’s armed forces:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

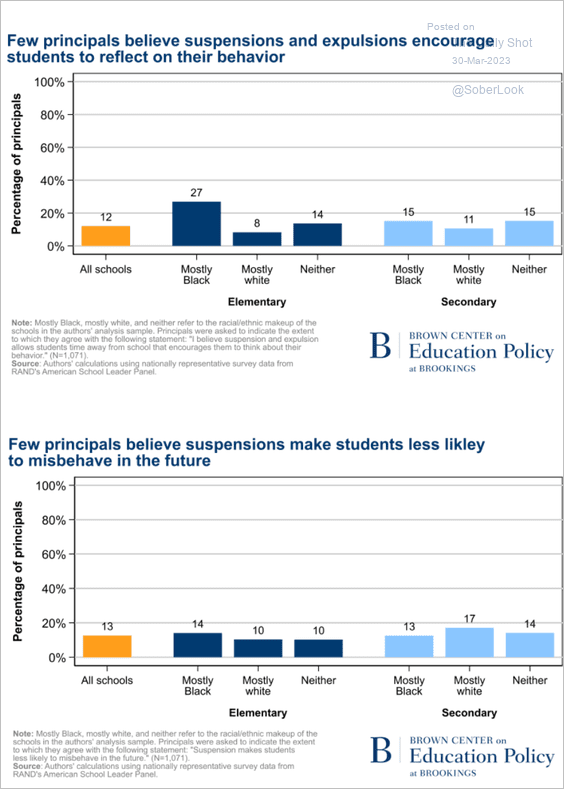

5. Principals’ views on student suspensions:

Source: Brookings Read full article

Source: Brookings Read full article

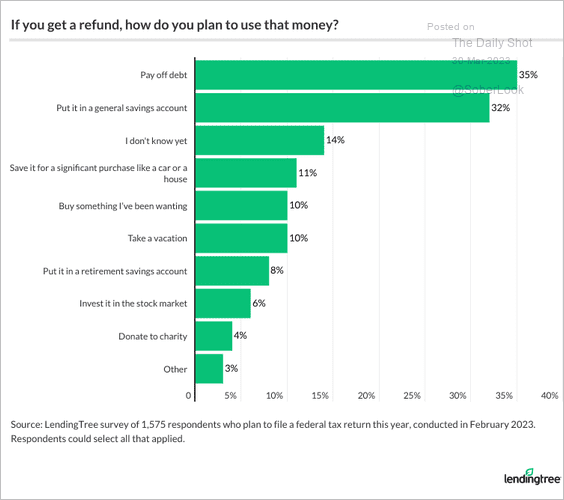

6. Spending the tax refund:

Source: LendingTree Read full article

Source: LendingTree Read full article

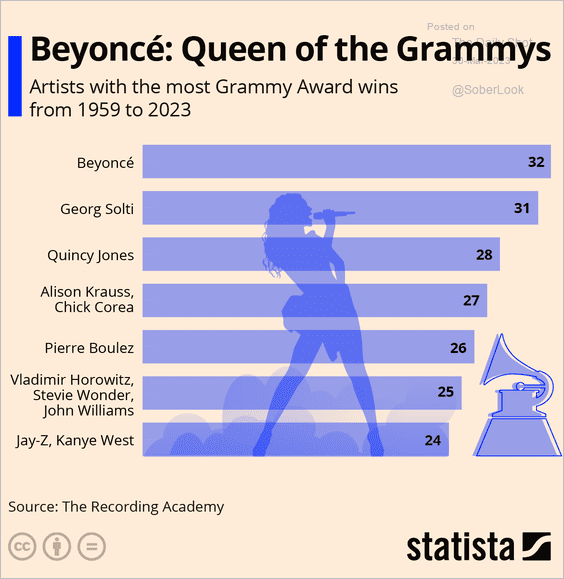

7. Artists with the most Grammy Award wins:

Source: Statista

Source: Statista

——————–

Back to Index