The Daily Shot: 31-Mar-23

• The United States

• Canada

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Food for Thought

The United States

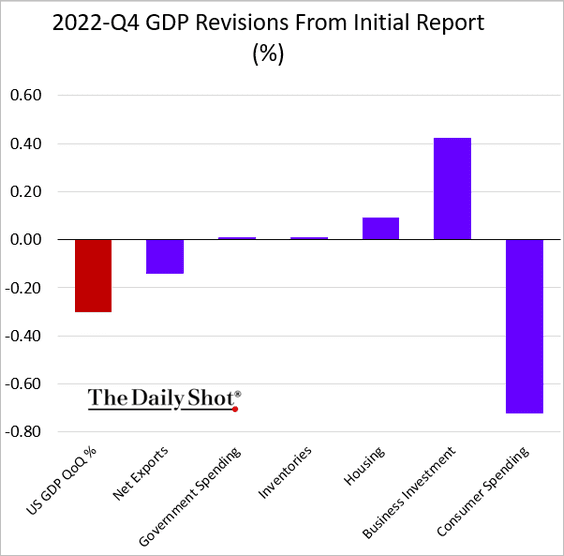

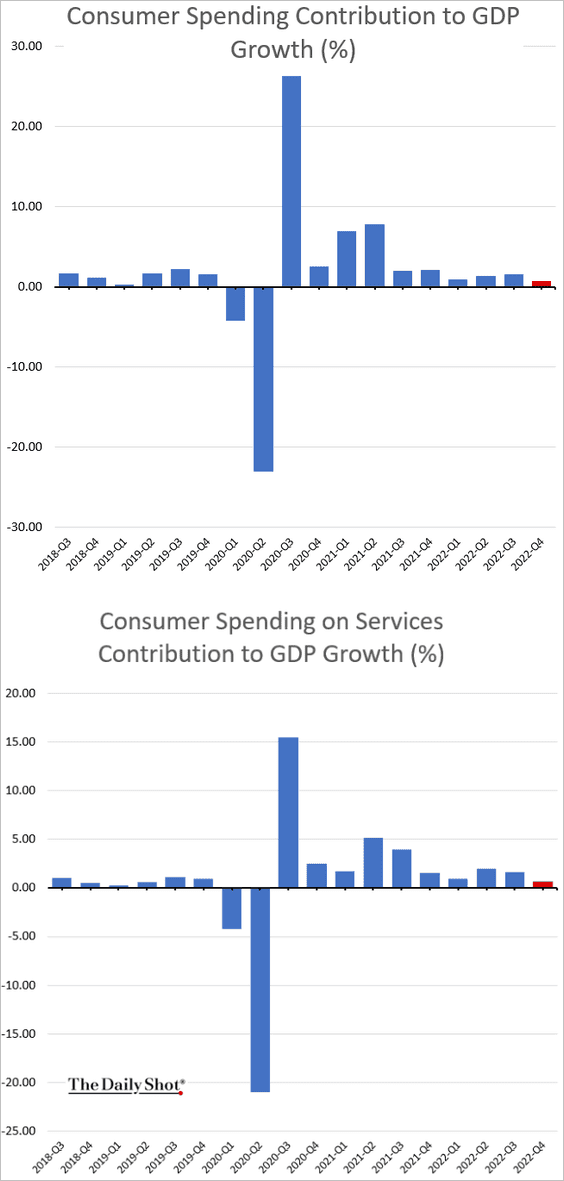

1. The fourth-quarter GDP growth was revised downwards due to weaker consumer spending compared to the initial report.

The contribution of consumer spending to GDP growth was the lowest it has been since the onset of the pandemic.

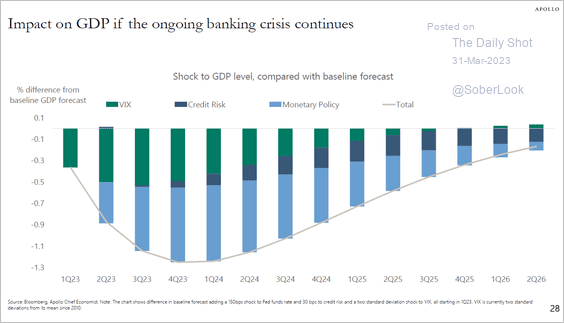

How will the latest banking stress impact GDP growth?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

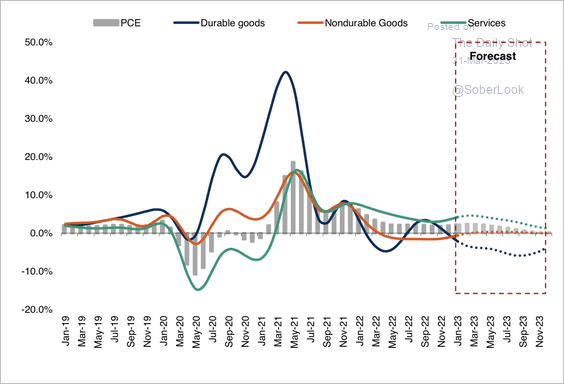

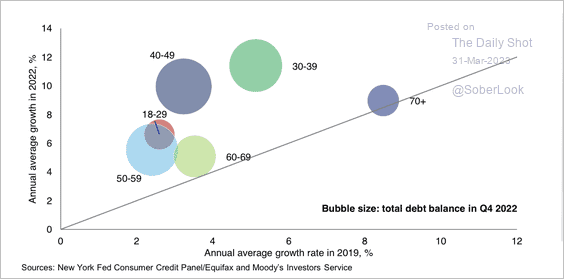

2. Moody’s expects further softening in private consumption as households face pressures from inflation and high interest rates.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Growth in household debt balances across all age cohorts last year was faster compared to pre-pandemic levels.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

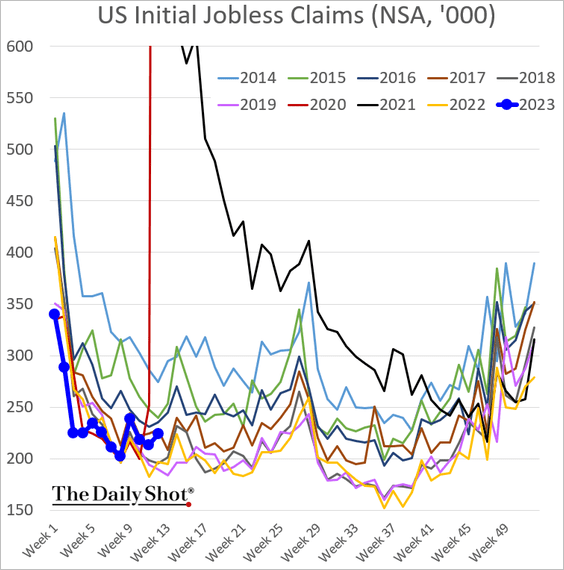

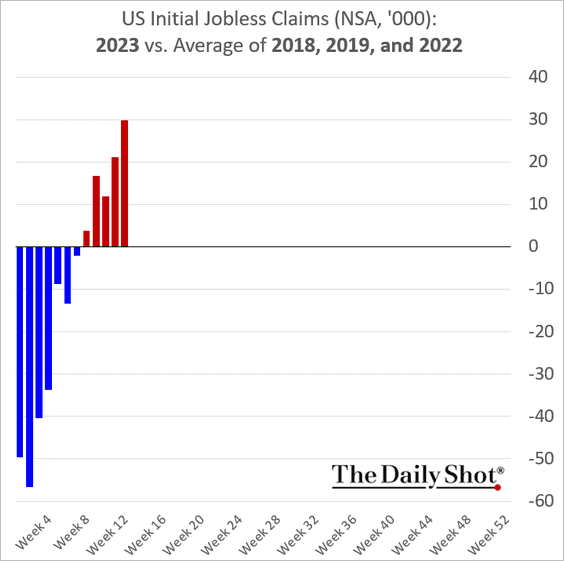

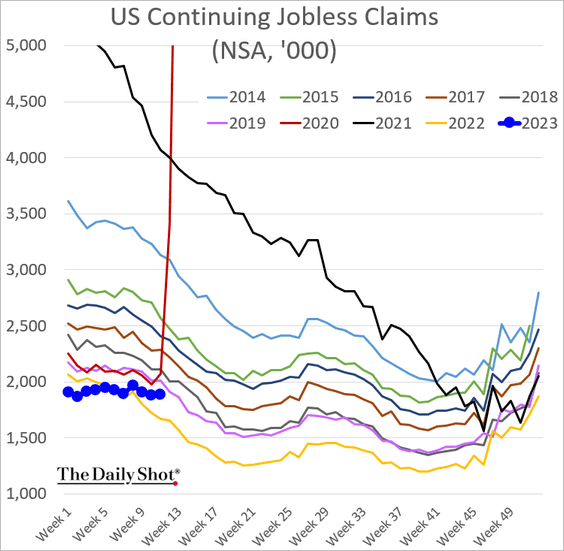

3. Initial jobless claims are showing early signs of softness in the labor market.

• Claims are now well above the average of 2018, 2019, and 2022, years with very strong labor markets.

• Continuing claims are widening the gap with last year’s levels.

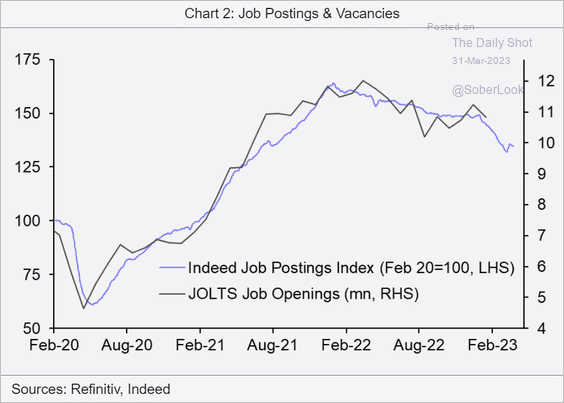

• However, job postings still signal robust demand for labor.

Source: Capital Economics

Source: Capital Economics

——————–

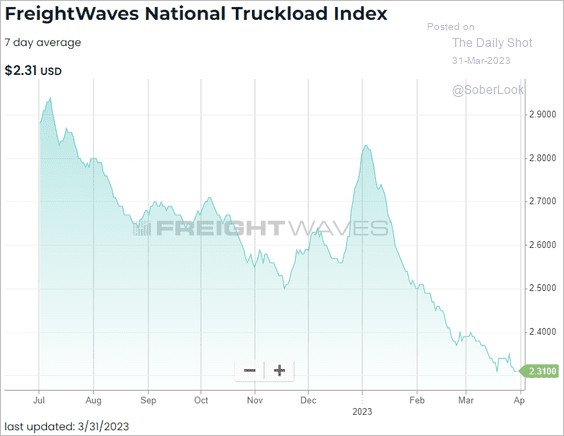

4. Truckload rates continue to fall, pointing to deteriorating shipping demand.

Source: FreightWaves

Source: FreightWaves

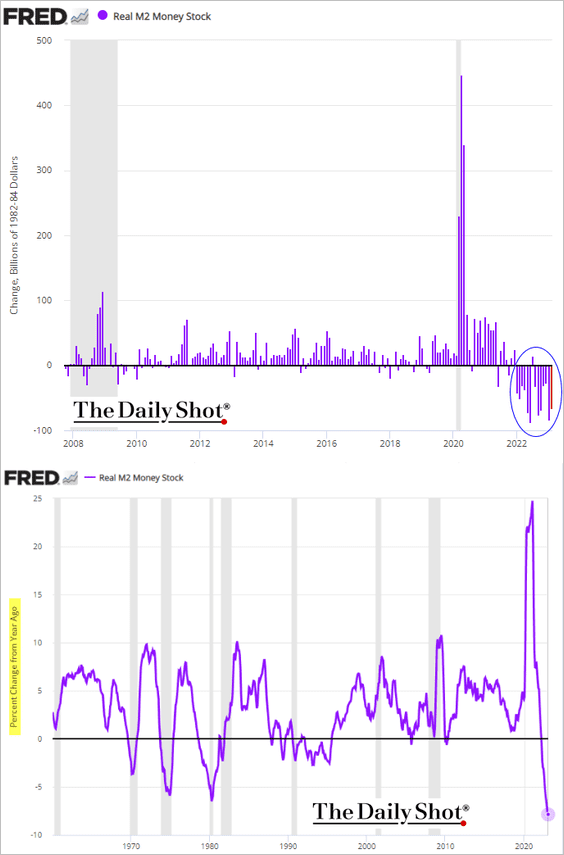

5. The US real money supply has been declining rapidly.

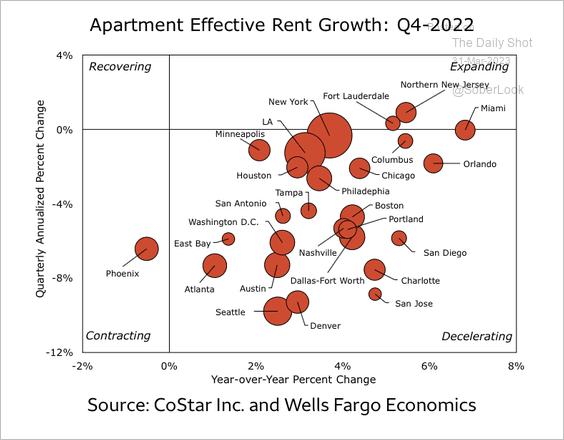

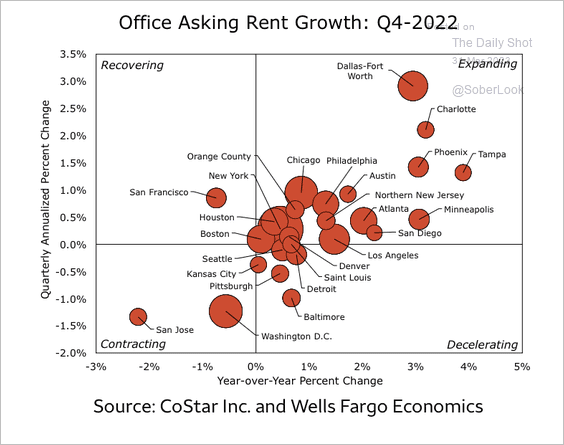

6. Here is a look at apartment and office rent growth, by city. (2 charts)

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Canada

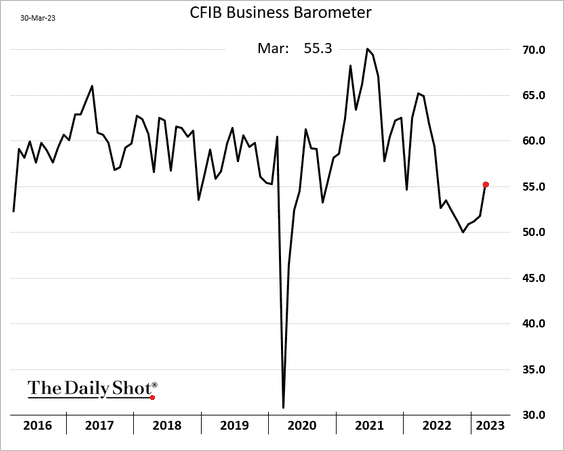

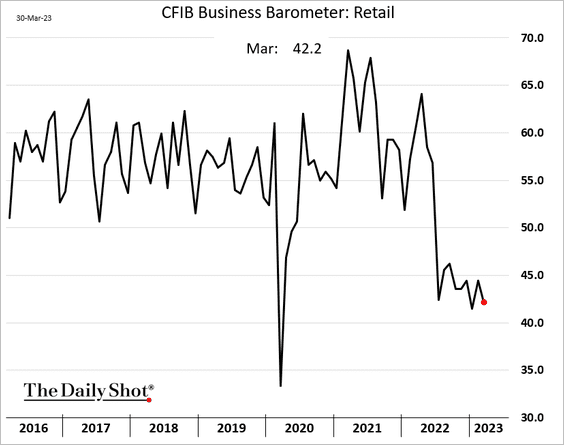

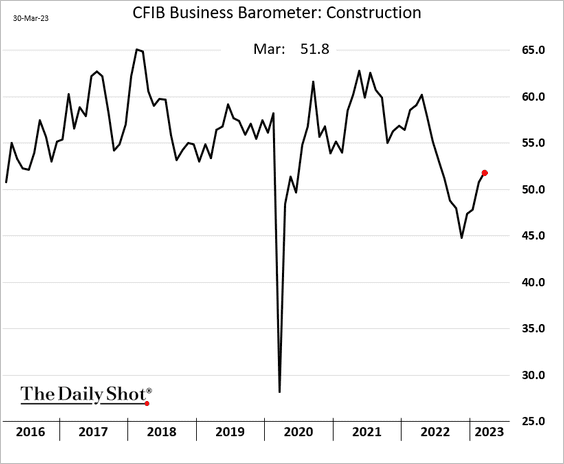

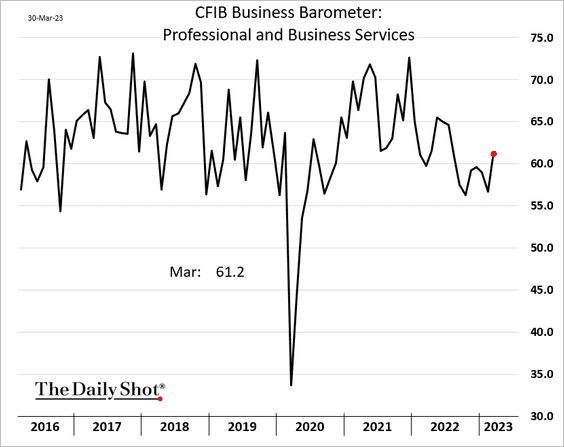

The CFIB small/medium-size business index showed an improvement this month.

Growth was uneven, and here are some examples.

• Retail:

• Construction:

• Business services:

Back to Index

The Eurozone

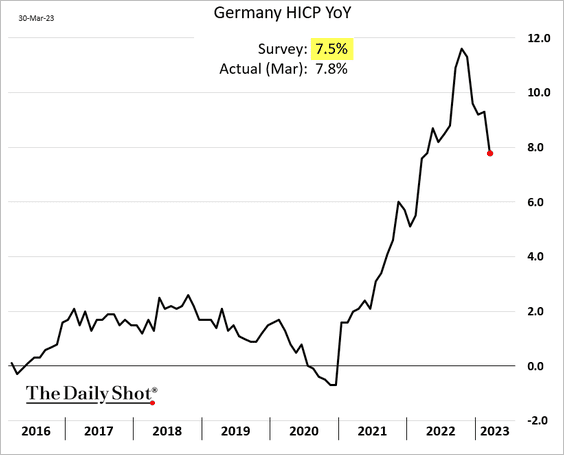

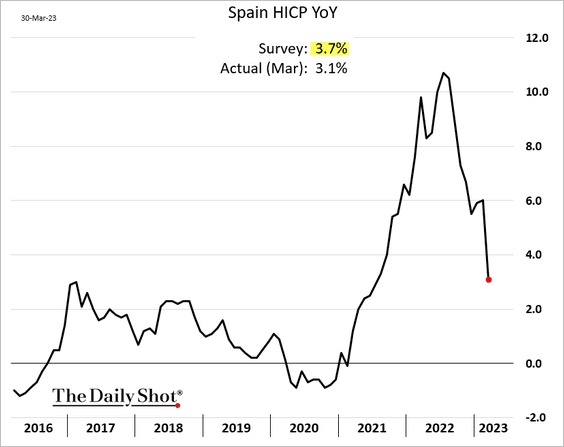

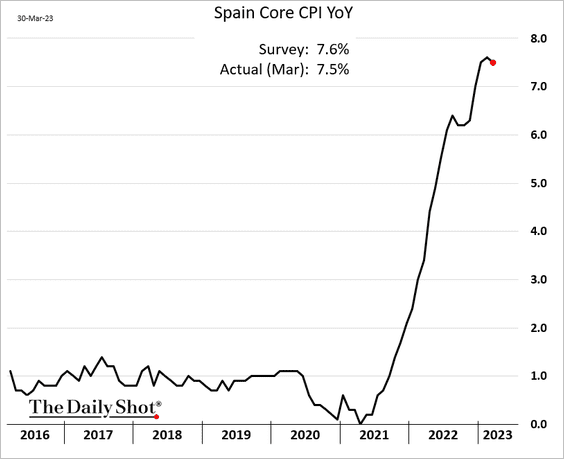

1. Inflation declined in Germany and Spain this month.

• Germany (higher than expected):

• Spain (lower than expected):

– Here is Spain’s national core CPI.

——————–

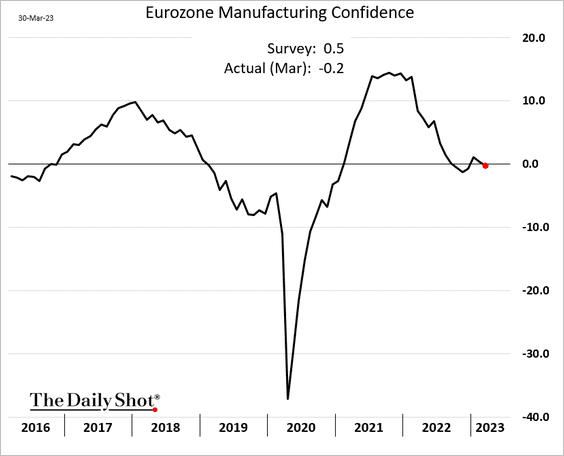

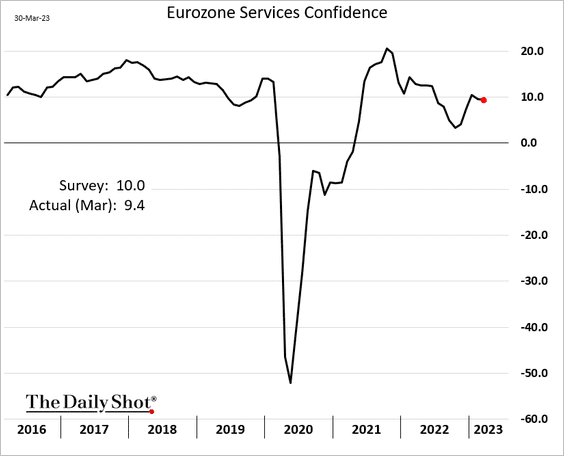

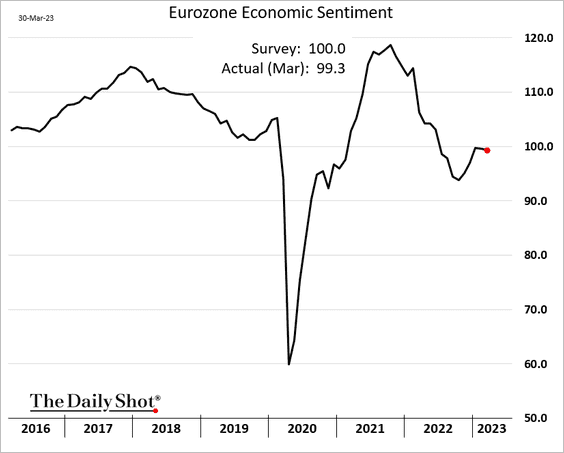

2. Eurozone business sentiment indicators edged lower this month.

• Manufacturing:

• Services:

• Economic sentiment (includes consumer confidence):

——————–

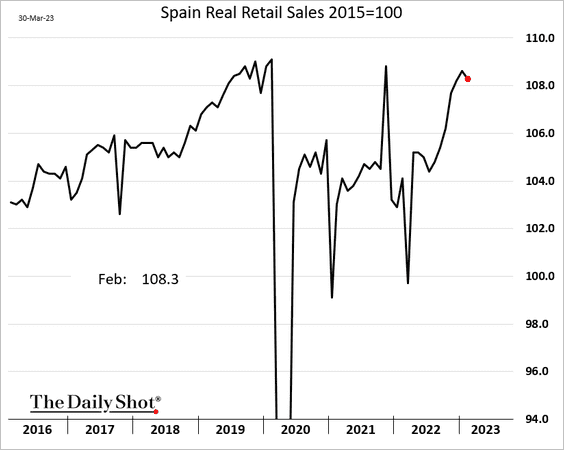

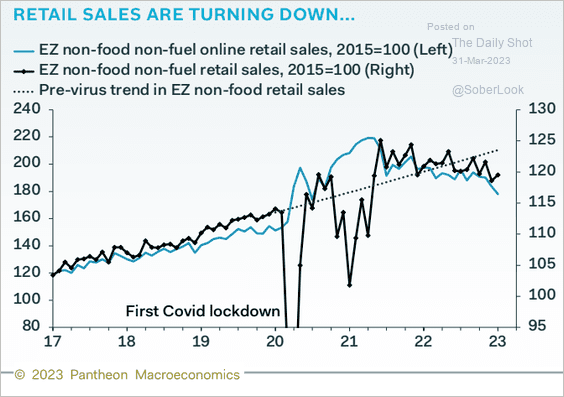

3. Spain’s retail sales declined in February.

At the Eurozone level, online sales signal weakness ahead for total retail sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

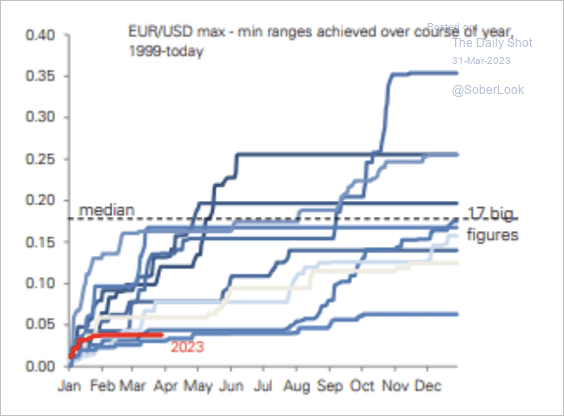

4. EUR/USD’s current range is unusually narrow. Will we see a breakout?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

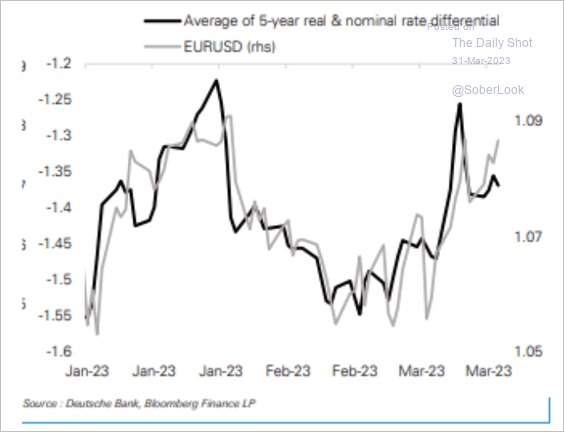

Interest rate differentials have been driving EUR/USD moves.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Japan

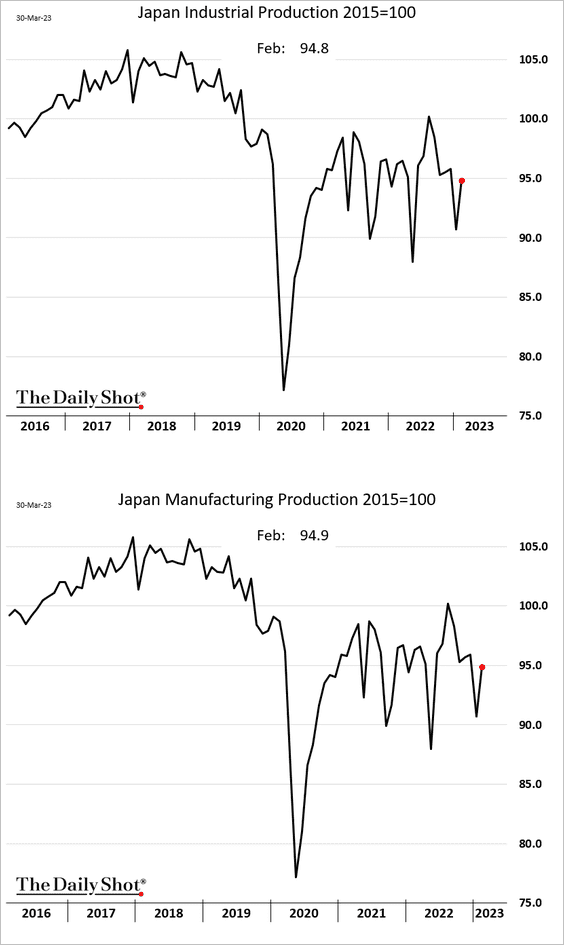

1. Industrial output improved in February.

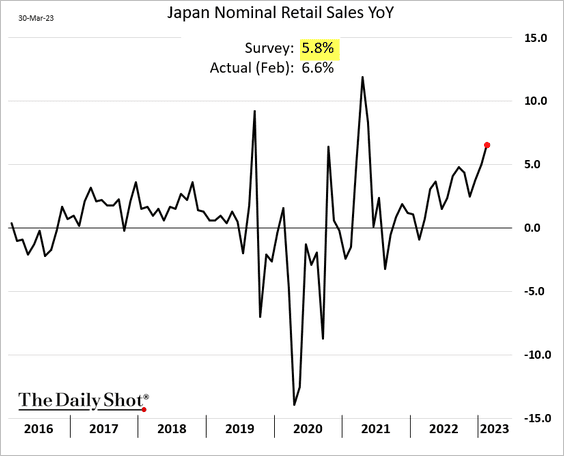

2. Retail sales topped expectations.

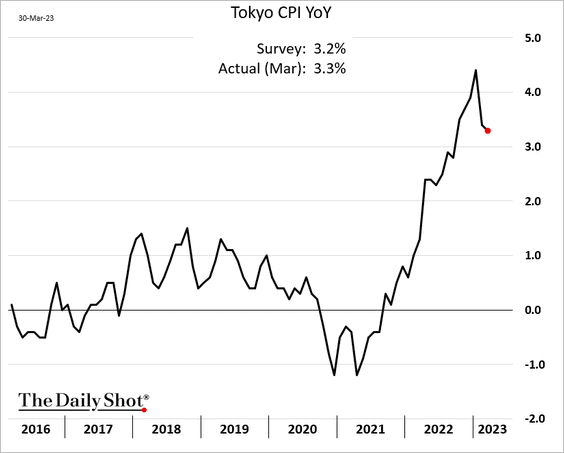

3. The March Tokyo CPI exceeded forecasts.

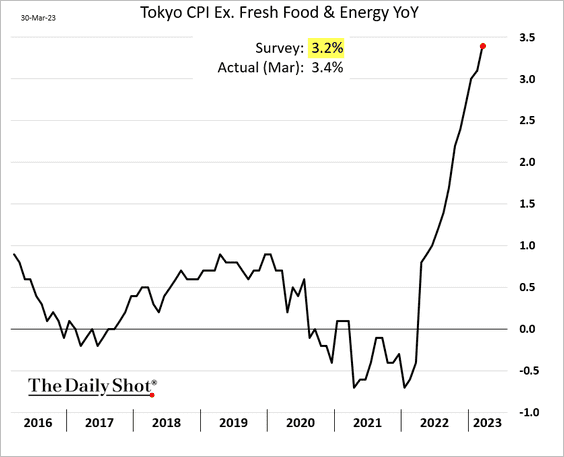

CPI excluding fresh food and energy continues to surge, …

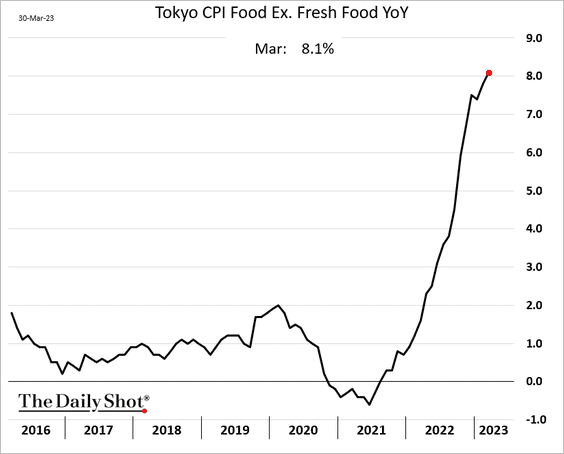

… partly driven by food (excluding fresh food).

——————–

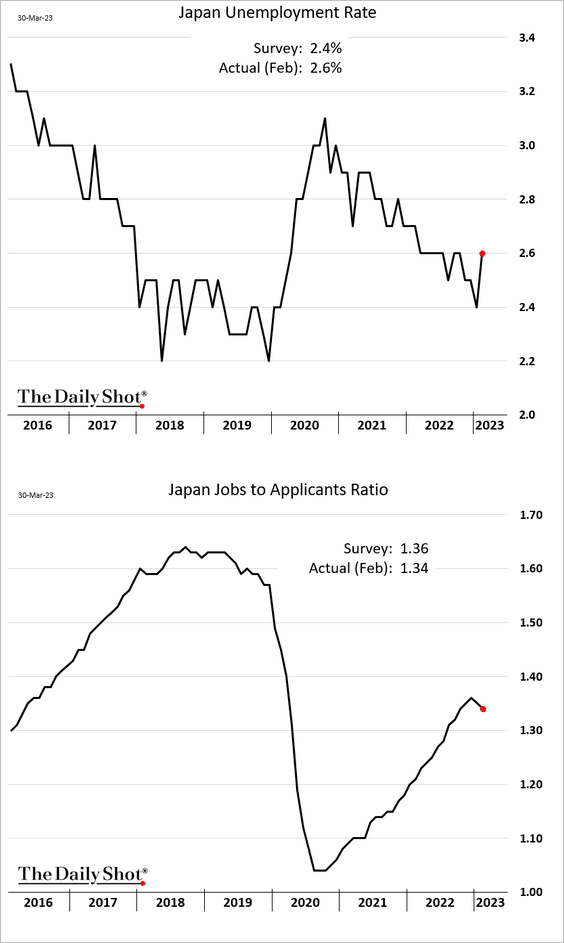

4. The labor market unexpectedly softened in February.

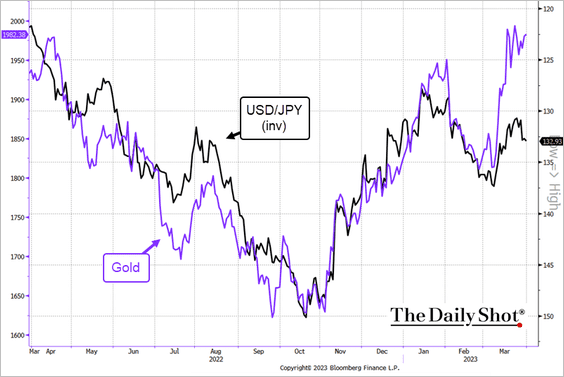

5. The yen underperformed gold as a safe-haven asset since the start of the banking turmoil.

Source: @TheTerminal, Bloomberg Finance L.P., h/t @richwesgoodman

Source: @TheTerminal, Bloomberg Finance L.P., h/t @richwesgoodman

Back to Index

Asia – Pacific

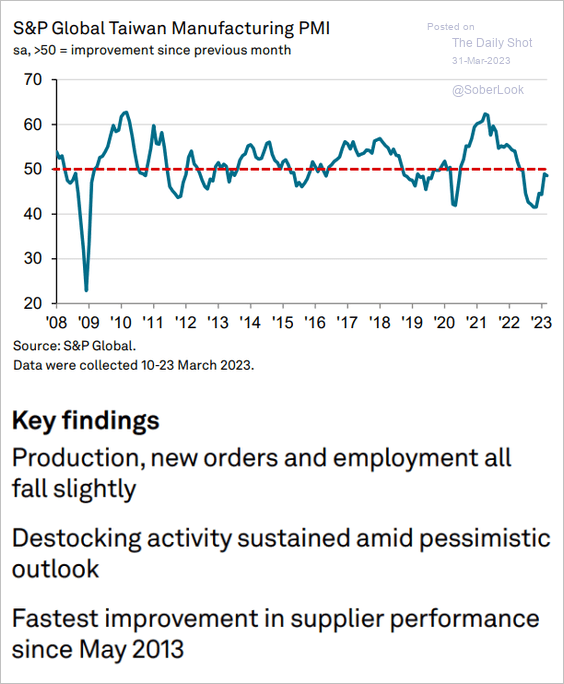

1. Taiwan’s factory activity has been gradually declining (PMI < 50).

Source: S&P Global PMI

Source: S&P Global PMI

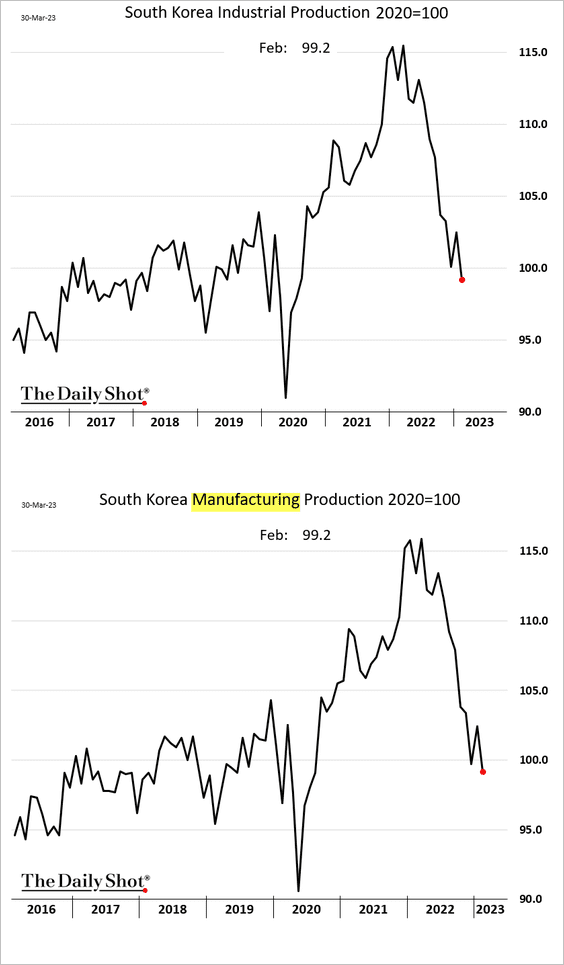

2. South Korea’s manufacturing output continues to tumble (now below pre-COVID levels).

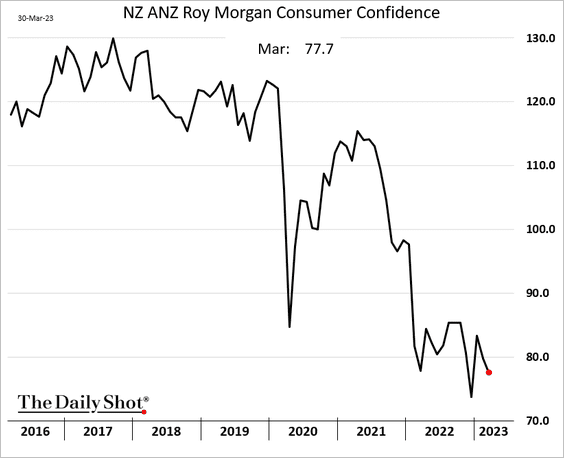

3. New Zealand’s consumer confidence remains depressed.

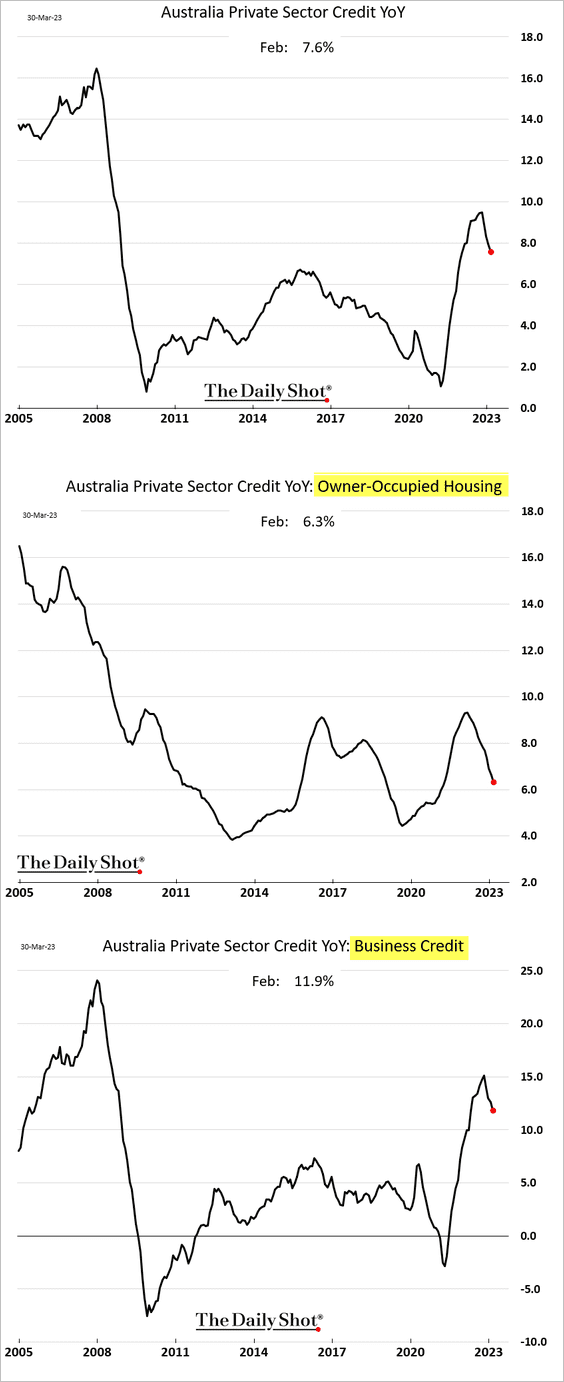

4. Australia’s credit growth has been slowing.

Back to Index

China

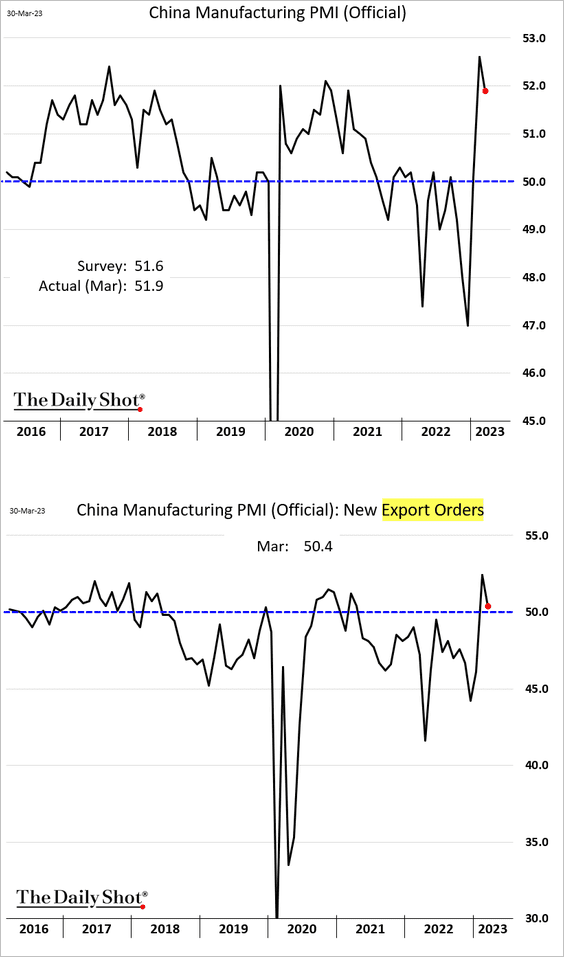

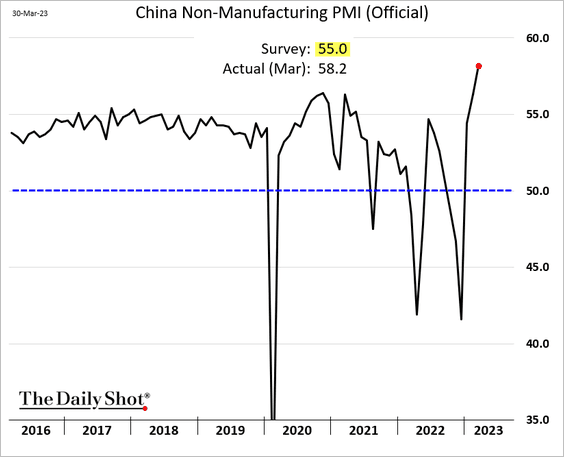

1. Official PMI indicators showed robust growth in March.

• Manufacturing (export orders growth slowed):

• Services (fastest growth in years):

——————–

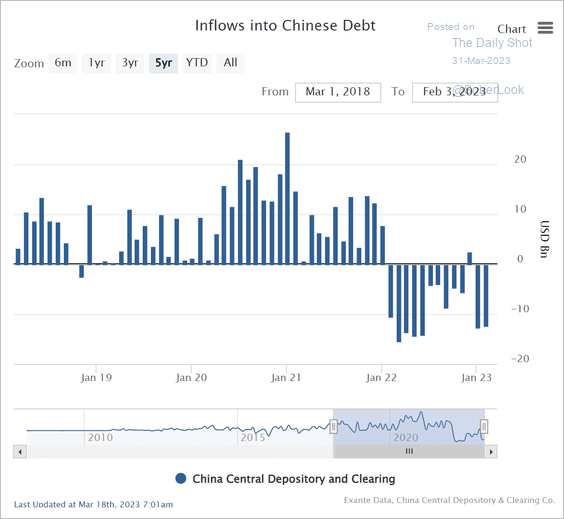

2. Chinese bonds have seen outflows over the past year.

Source: @jnordvig

Source: @jnordvig

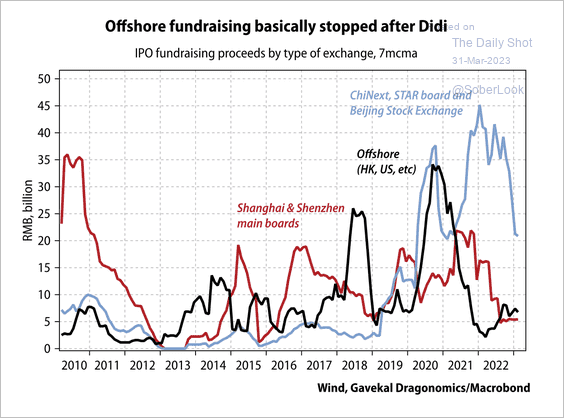

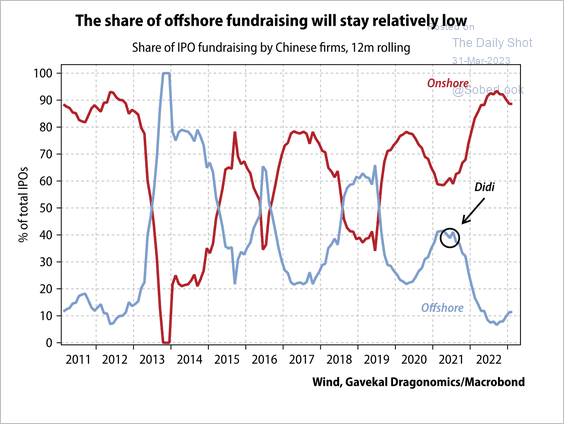

• Offshore fundraising has collapsed since July 2021, when ride-hailing firm DiDi was placed under investigation by the Chinese government.

Source: Gavekal Research

Source: Gavekal Research

• Offshore issuance for firms featuring potentially sensitive data could face regulatory roadblocks.

Source: Gavekal Research

Source: Gavekal Research

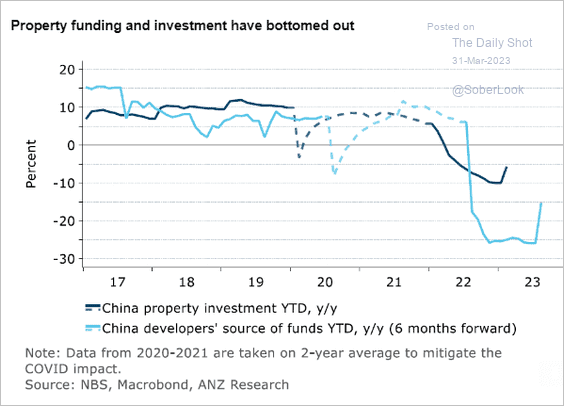

• Property funding and investment have bottomed.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Emerging Markets

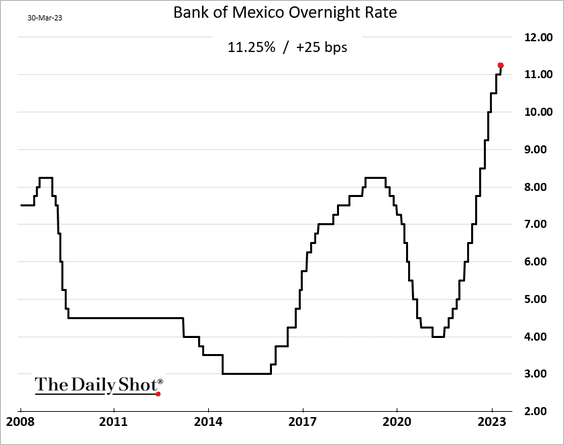

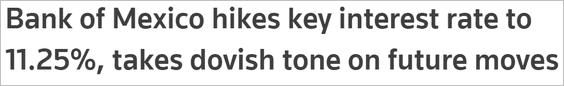

1. Mexico and Colombia hiked rates but at a slower pace.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @mayaaverbuch, @omedinacruz, @economics Read full article

Source: @mayaaverbuch, @omedinacruz, @economics Read full article

——————–

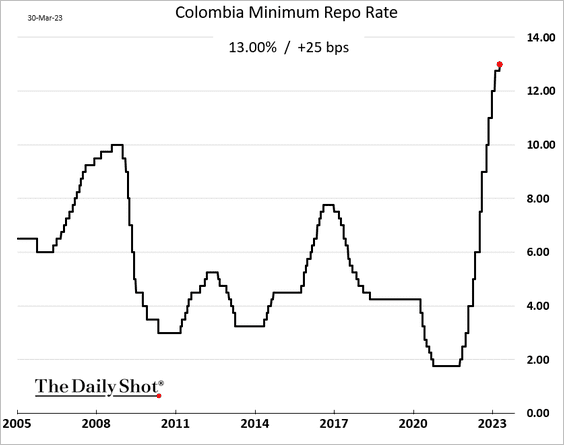

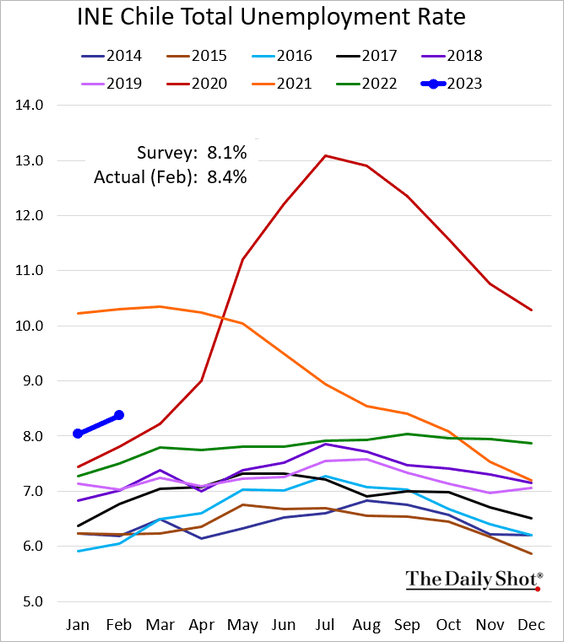

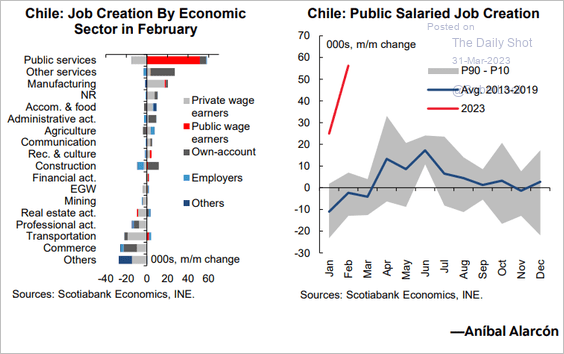

2. Chile’s unemployment rate was higher than expected in February.

The public sector kept unemployment from worsening.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

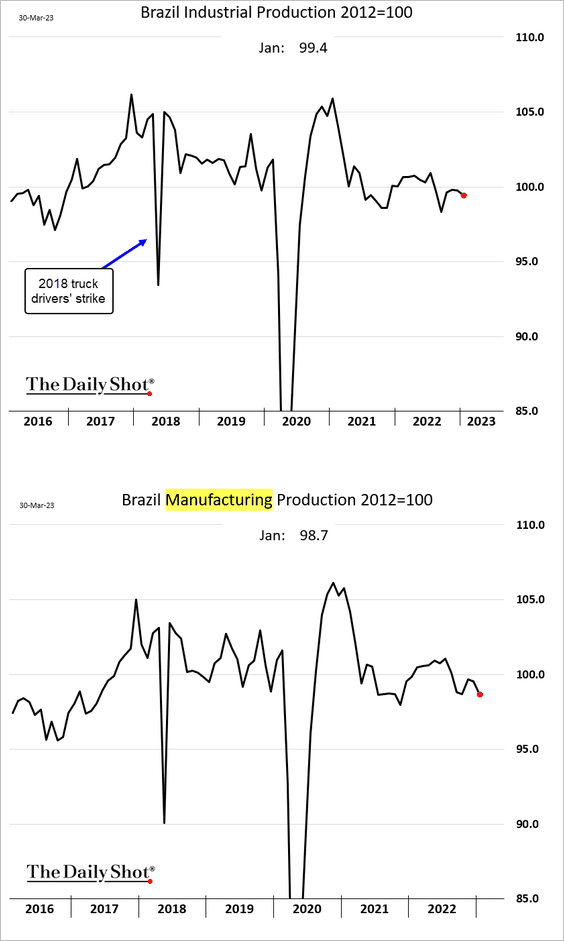

3. Brazil’s manufacturing output declined in January.

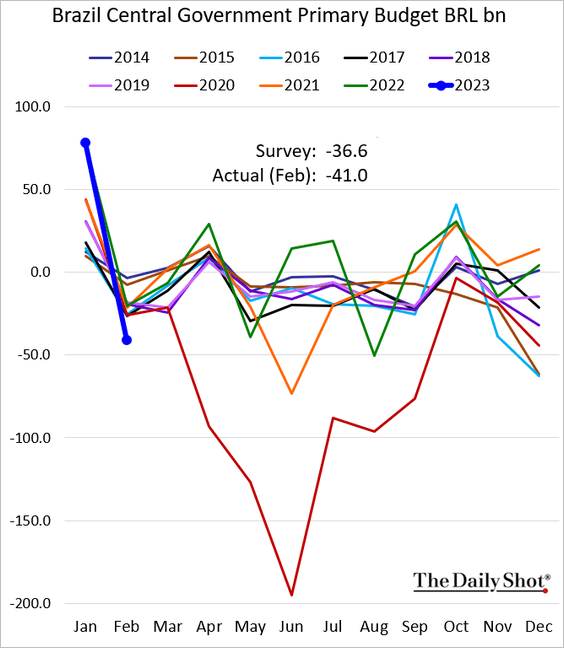

Separately, here is Brazil’s central government budget balance.

——————–

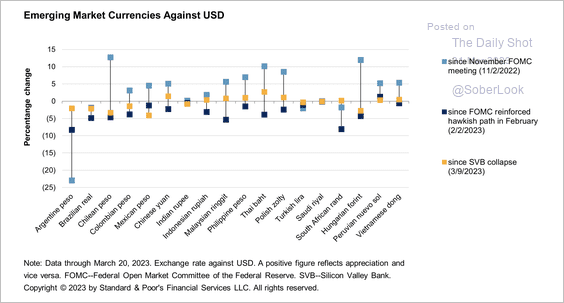

4. Most LatAm currencies have come under more pressure against the dollar this year.

Source: S&P Global Ratings

Source: S&P Global Ratings

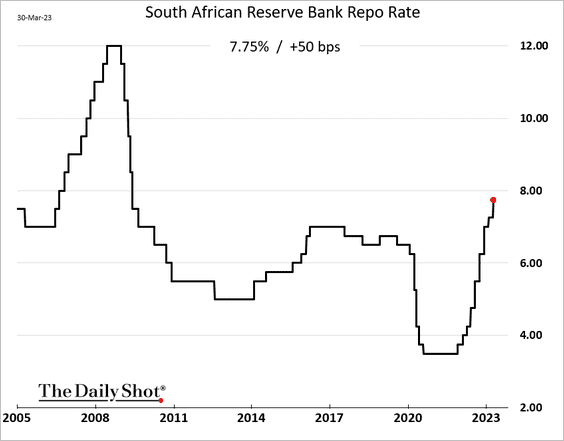

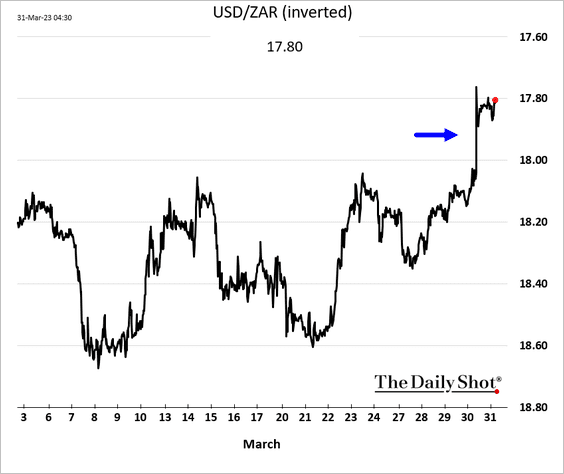

5. South Africa’s central bank hiked rates by 50 bps (the market expected 25 bps).

The rand jumped.

Source: @PrineshaNaidoo, @economics Read full article

Source: @PrineshaNaidoo, @economics Read full article

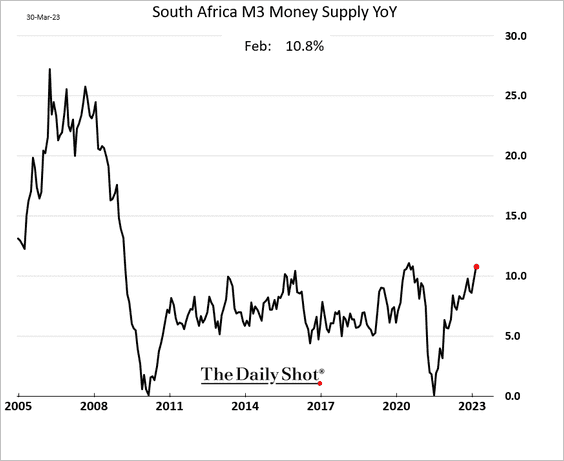

Separately, South Africa’s broad money supply growth continues to accelerate.

——————–

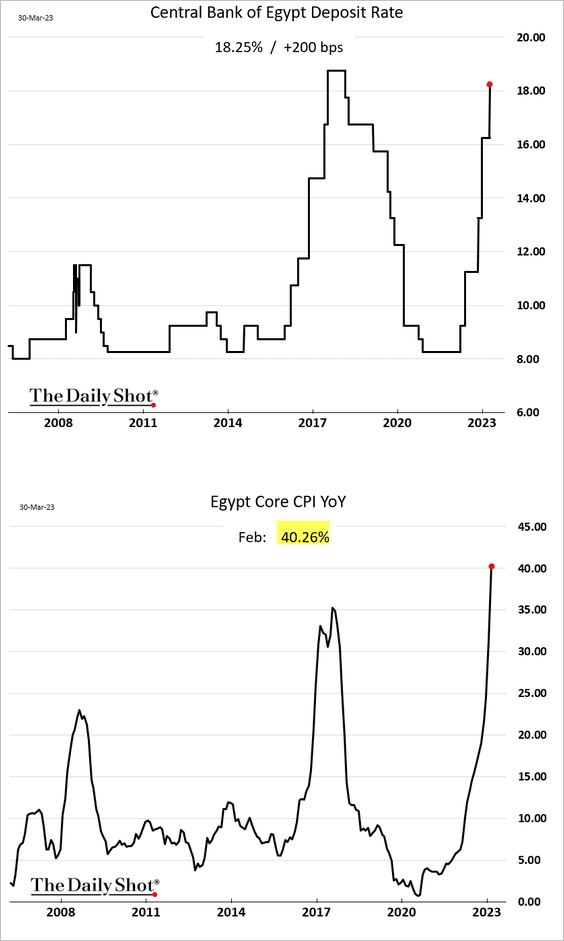

6. Egypt’s central bank hiked rates by 200 bps as devaluation-driven inflation surges.

Back to Index

Commodities

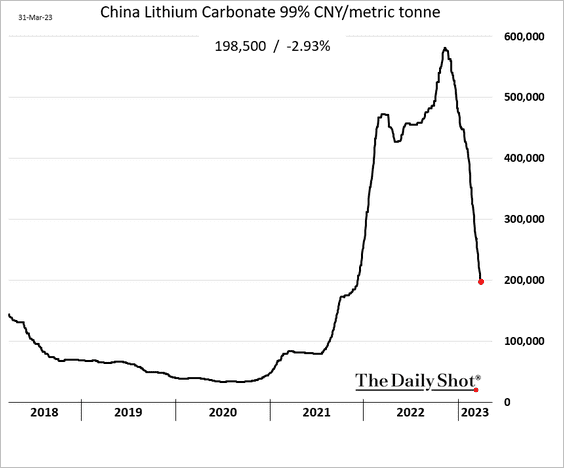

1. The lithium bubble continues to deflate.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

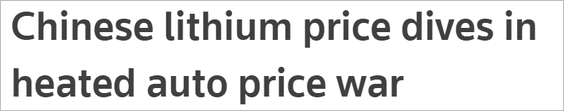

2. CME cattle futures continue to experience a massive rally that began during the COVID era.

Source: Nasdaq/Reuters Read full article

Source: Nasdaq/Reuters Read full article

Back to Index

Equities

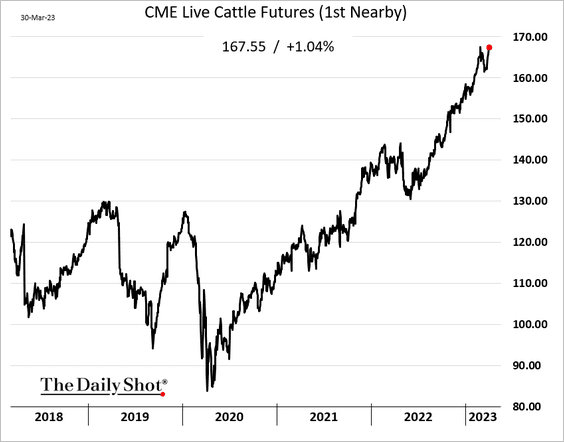

1. Stock-bond correlations are firmly in negative territory, with concerns about the banking sector and a potential recession overshadowing the monetary policy uncertainty.

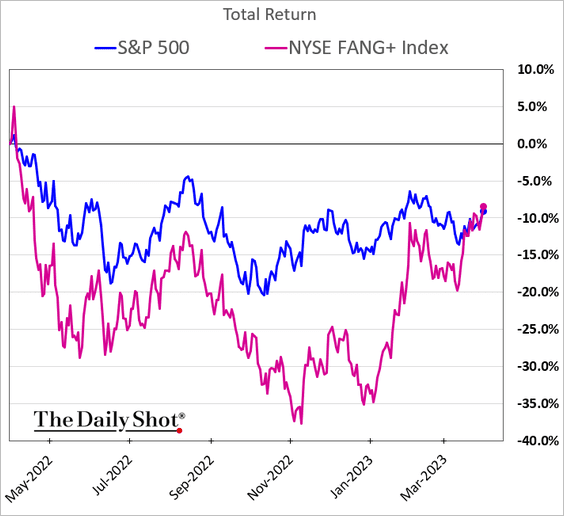

2. Mega-cap stocks have fully reversed their underperformance over the past 12 months.

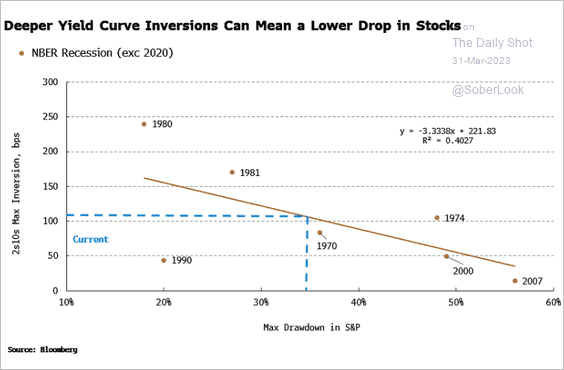

3. Deeper curve inversions tend to coincide with larger equity drawdowns in recessions.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

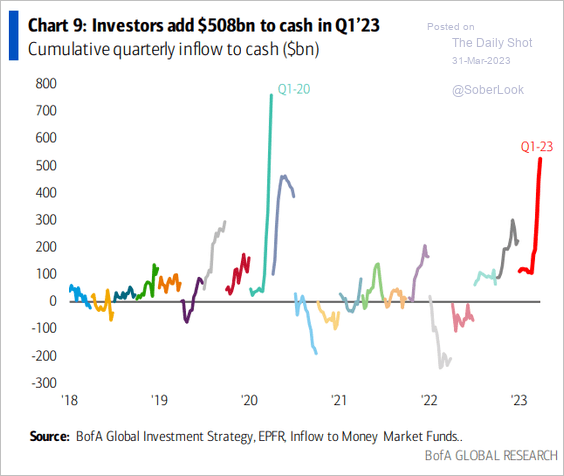

4. Investors sharply increased cash positions in Q1.

Source: BofA Global Research

Source: BofA Global Research

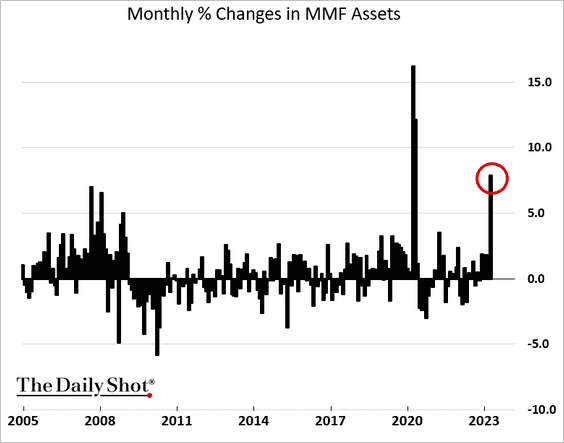

March was a good month for money market funds.

——————–

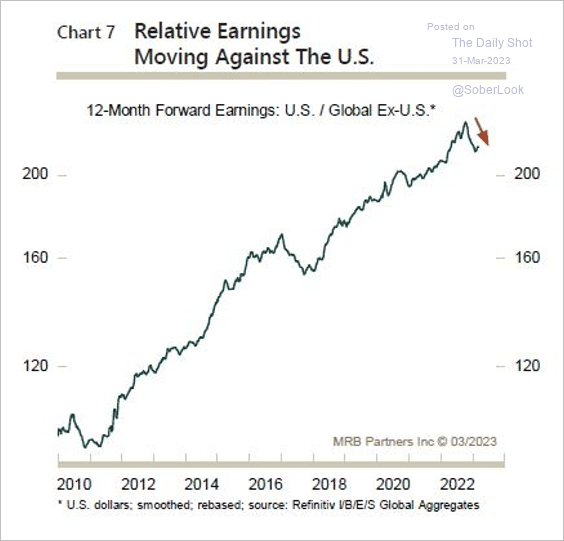

5. Forward earnings are weakening in the US relative to the rest of the world.

Source: MRB Partners

Source: MRB Partners

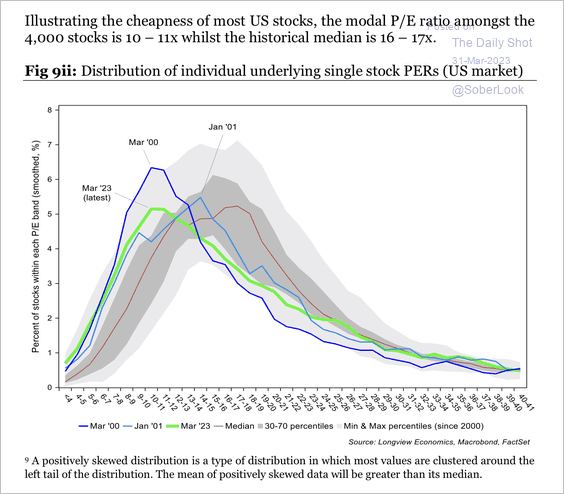

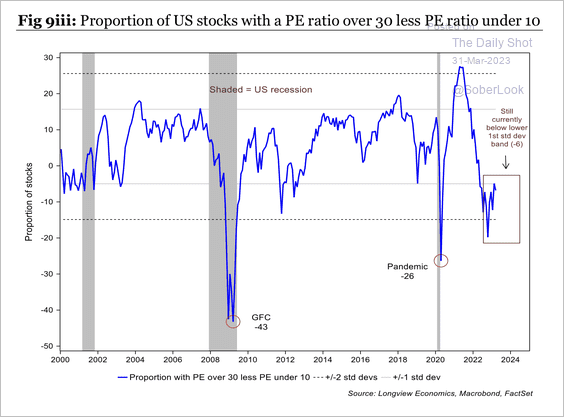

6. Despite rich valuations at the index level, there are still attractively valued single stocks within the S&P 500.

Source: Longview Economics

Source: Longview Economics

This chart shows that the US median valuation is still below average levels.

Source: Longview Economics

Source: Longview Economics

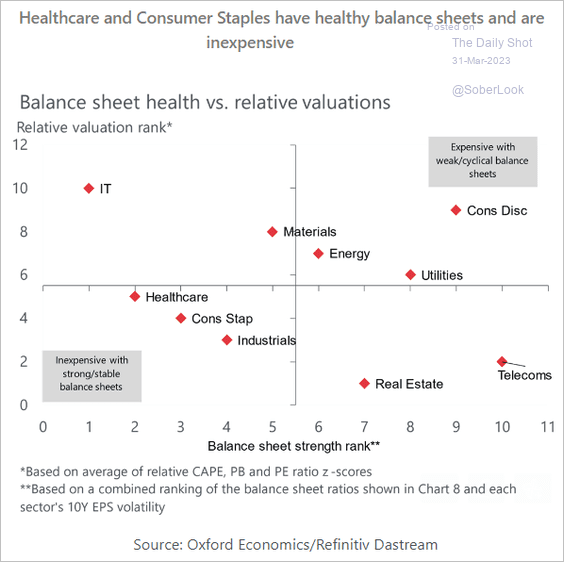

Separately, this scatterplot shows sector valuation rank (low = cheap) vs. balance sheet rank (low = strong).

Source: Oxford Economics

Source: Oxford Economics

——————–

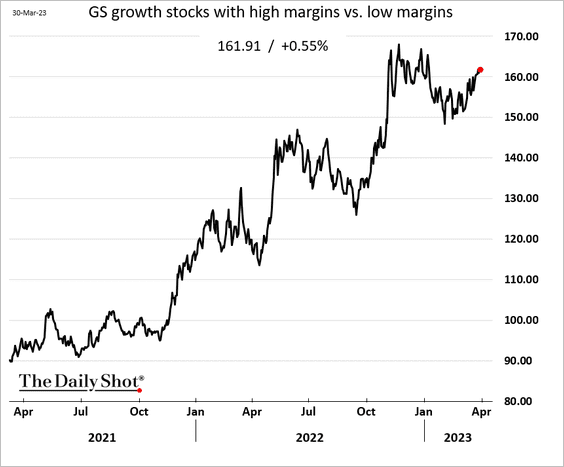

7. High-margin growth stocks have been outperforming.

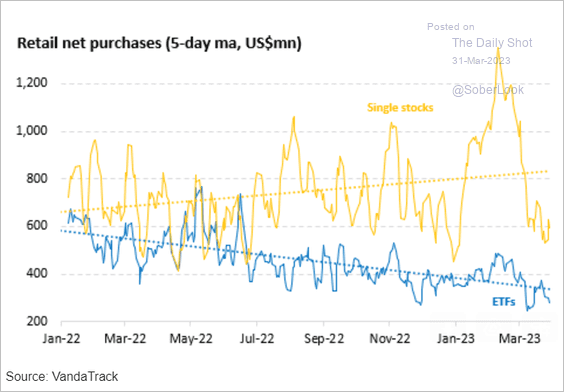

8. Retail investors have been more focused on single-stock purchases, increasingly shunning ETFs.

Source: Vanda Research

Source: Vanda Research

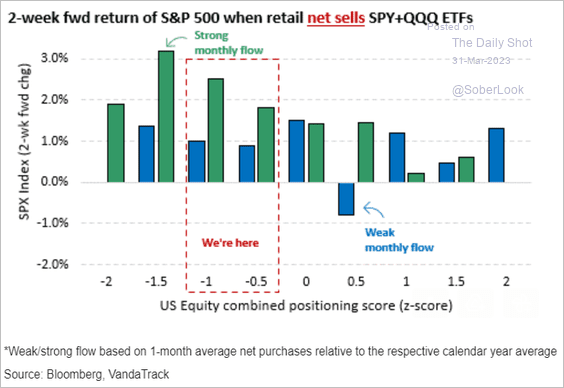

• Retail investors’ net sales of SPY and QQQ ETFs can be a contrarian signal.

Source: Vanda Research

Source: Vanda Research

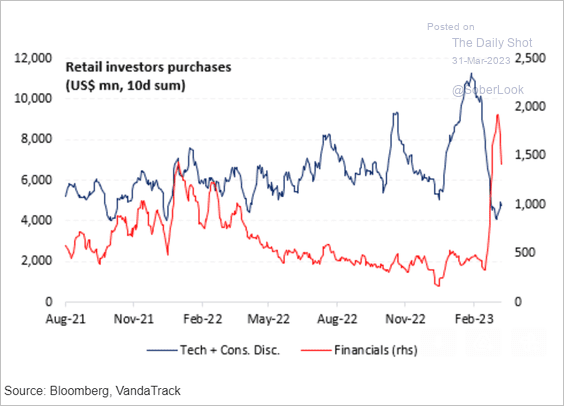

• Is retail investors’ rotation from tech to financials over?

Source: Vanda Research

Source: Vanda Research

Back to Index

Credit

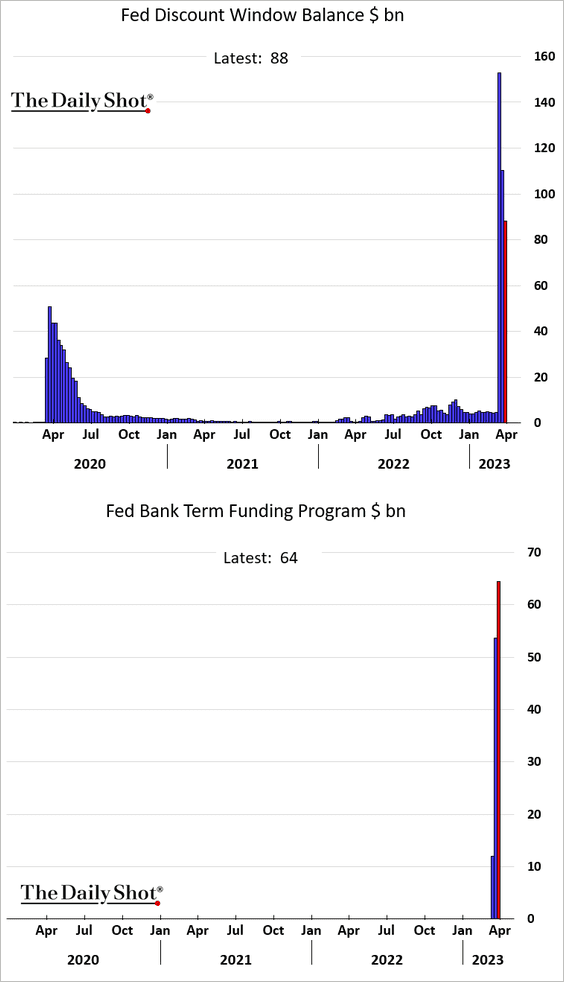

1. Some banks shifted the source of their emergency financing from the Fed’s discount window to BTFP. The net impact was a decline in funding, suggesting some easing in banking stress.

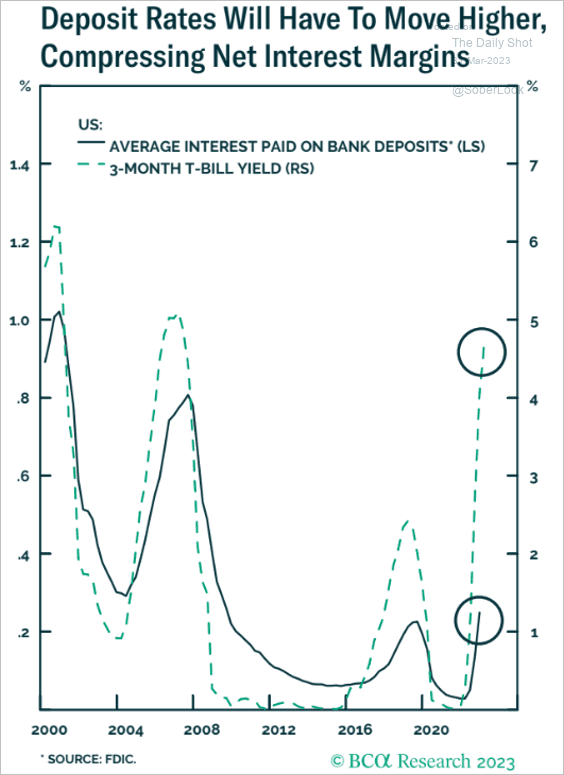

2. Smaller banks’ net interest margins will compress as deposit costs surge.

Source: BCA Research

Source: BCA Research

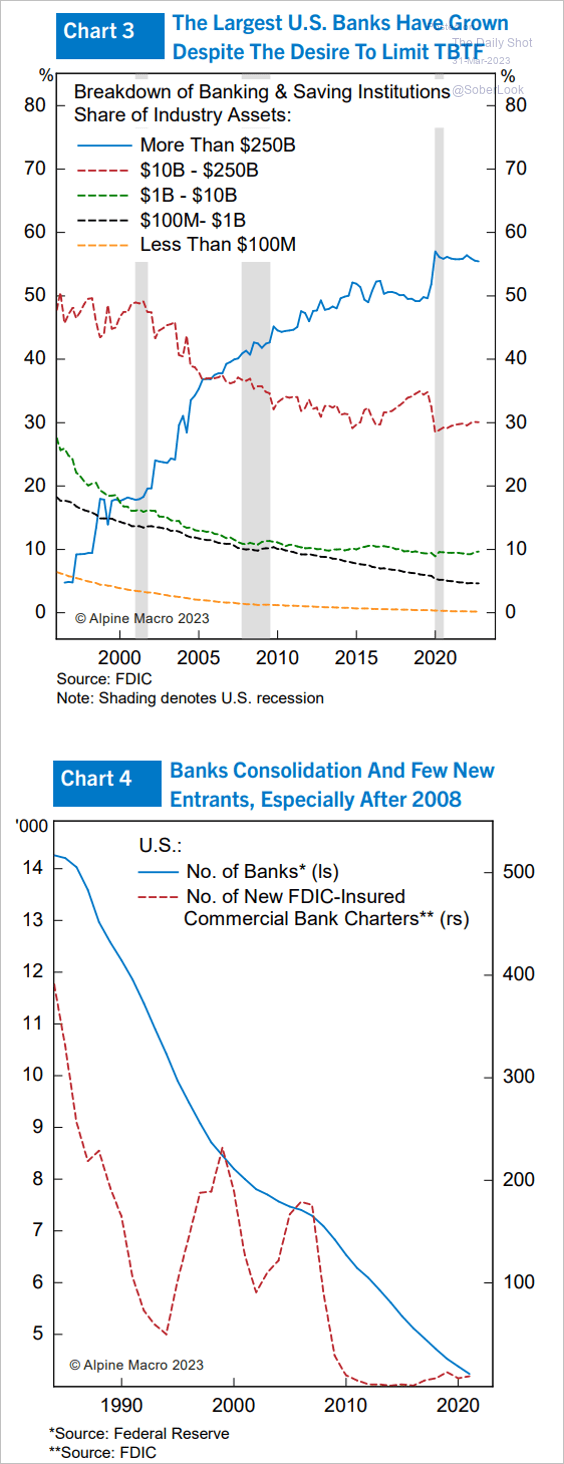

3. The US banking sector has been getting more concentrated.

Source: Alpine Macro

Source: Alpine Macro

——————–

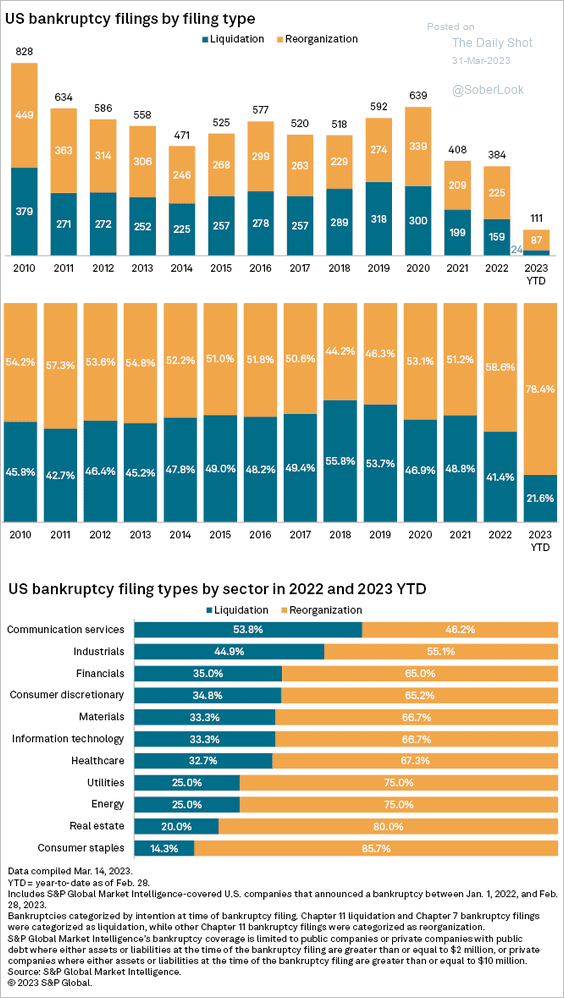

4. This chart shows bankruptcy filings by type (liquidations vs. reorganizations).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

Food for Thought

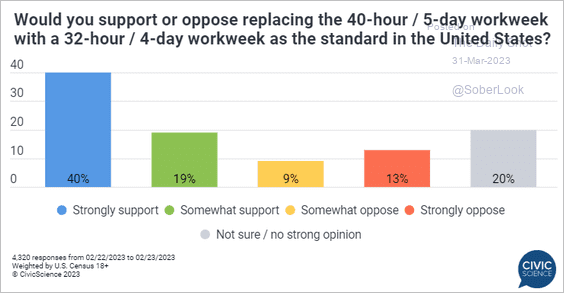

1. Support for a 4-day workweek:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

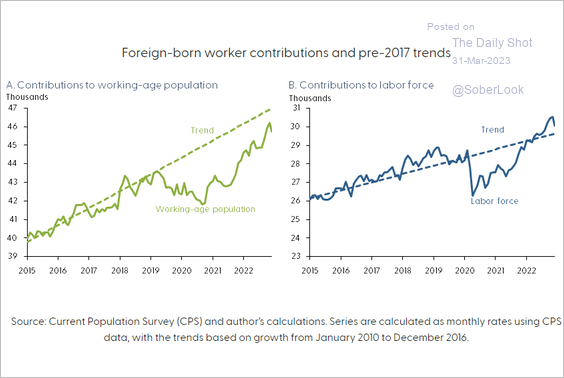

2. Foreign-born workers’ contribution to the US working-age population and the labor force:

Source: @sffed Read full article

Source: @sffed Read full article

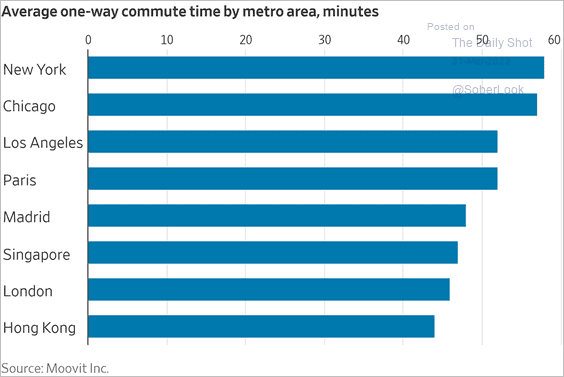

3. Average one-way commute times:

Source: @WSJ Read full article

Source: @WSJ Read full article

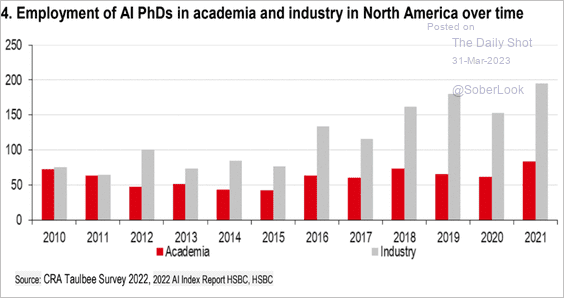

4. AI PhDs’ employment:

Source: HSBC

Source: HSBC

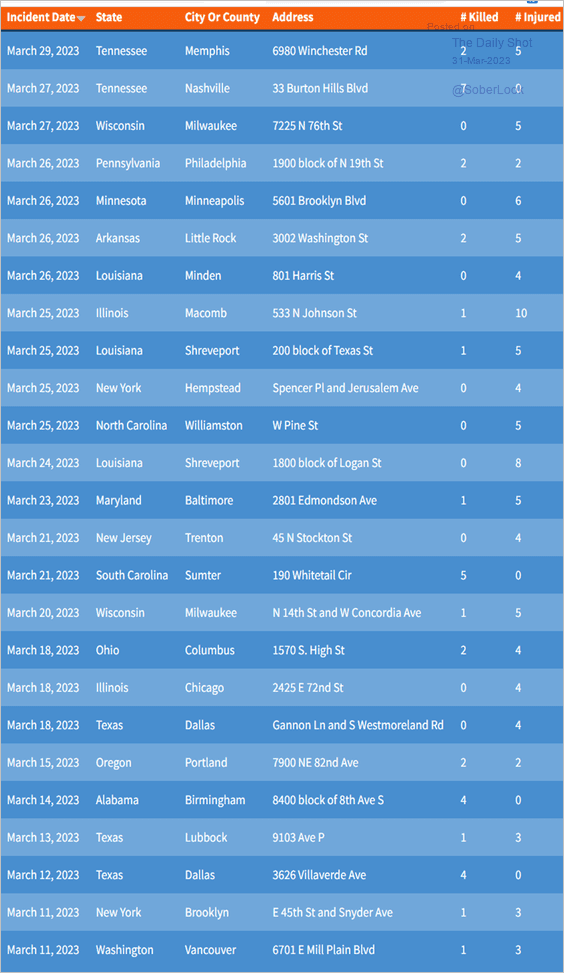

5. Nearly daily mass shootings in the US:

Source: @gundeaths

Source: @gundeaths

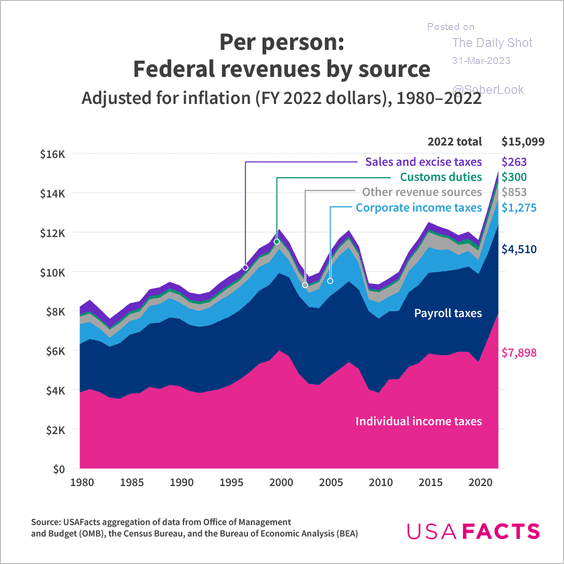

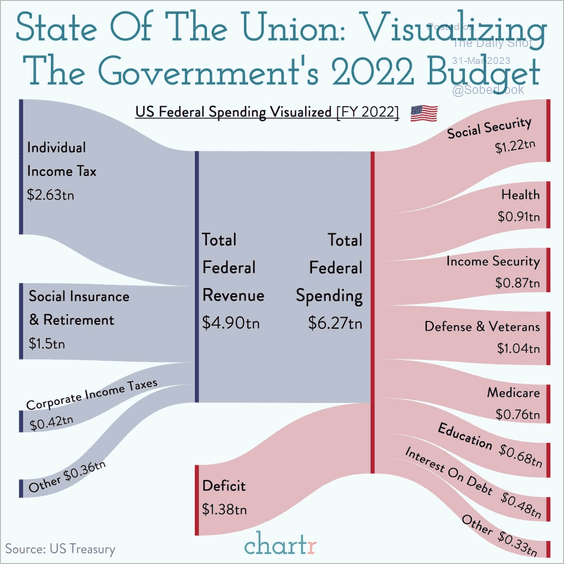

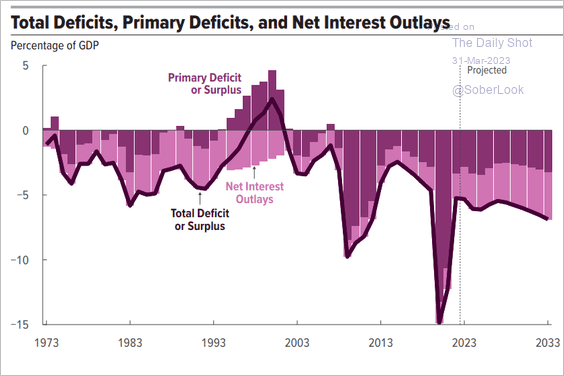

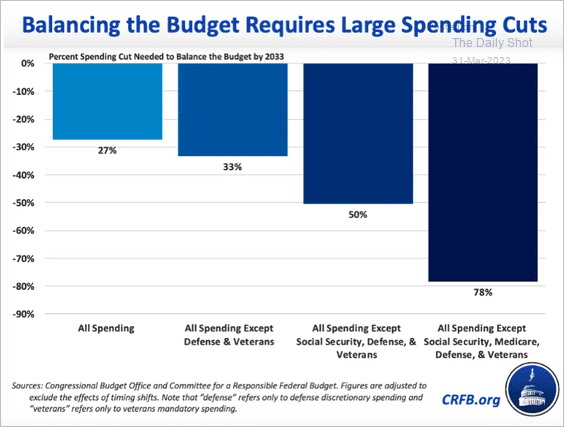

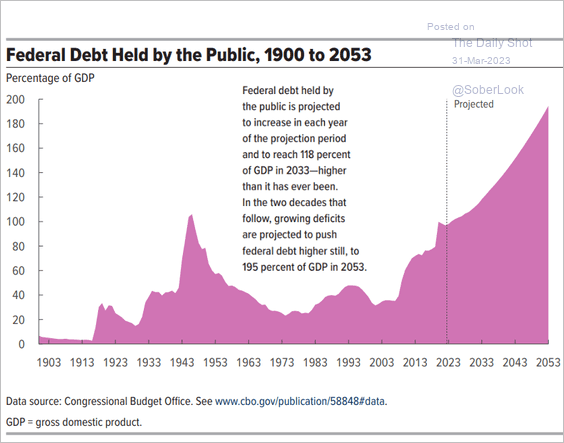

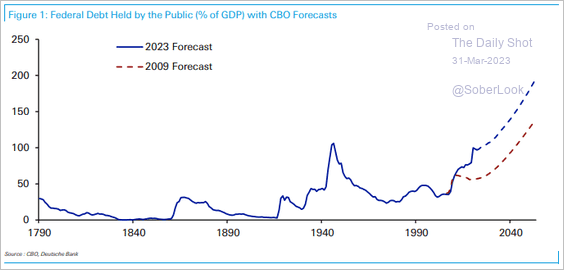

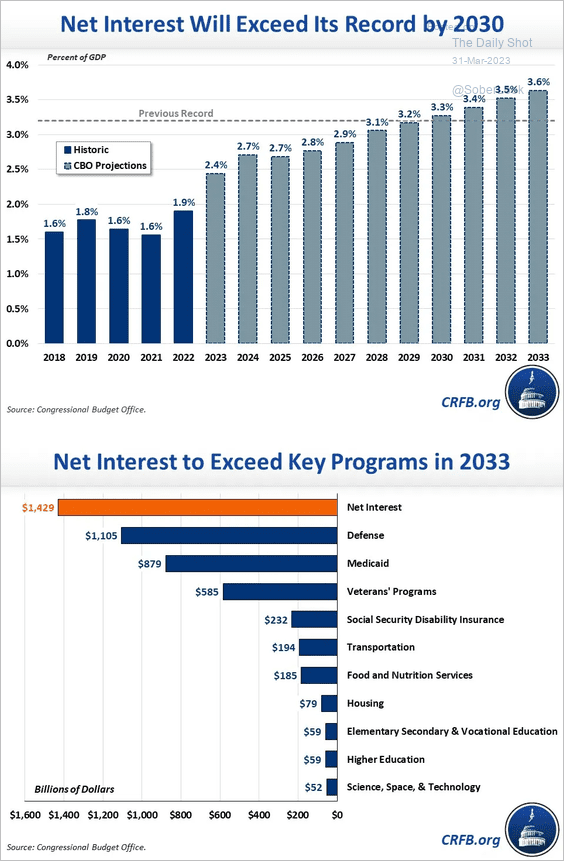

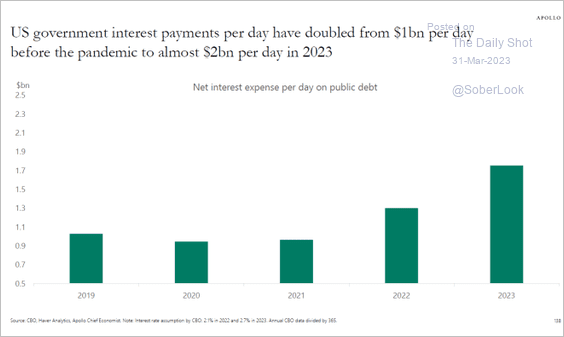

6. Next, we have some data on the US federal budget.

• Federal revenues by source (per person):

Source: USAFacts

Source: USAFacts

• Federal spending:

Source: @chartrdaily

Source: @chartrdaily

• The budget deficit:

Source: CBO

Source: CBO

• What would it take to balance the budget?

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

• Debt as a percent of GDP (2 charts):

Source: CBO

Source: CBO

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Interest payments:

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

– Interest payments per day:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

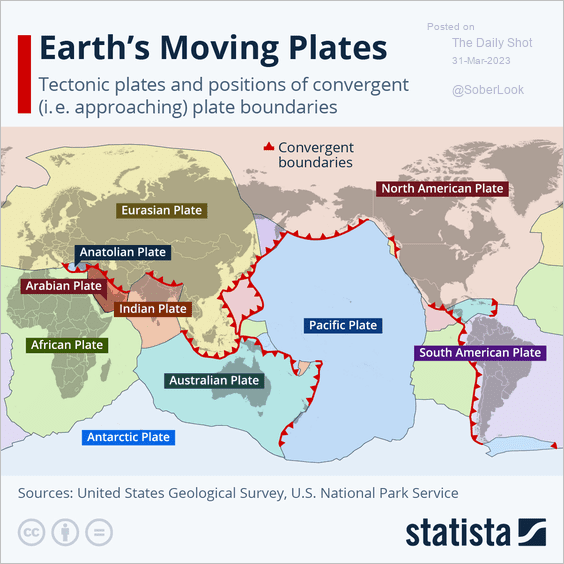

7. Tectonic plates:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index