The Daily Shot: 11-Apr-23

• The United States

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

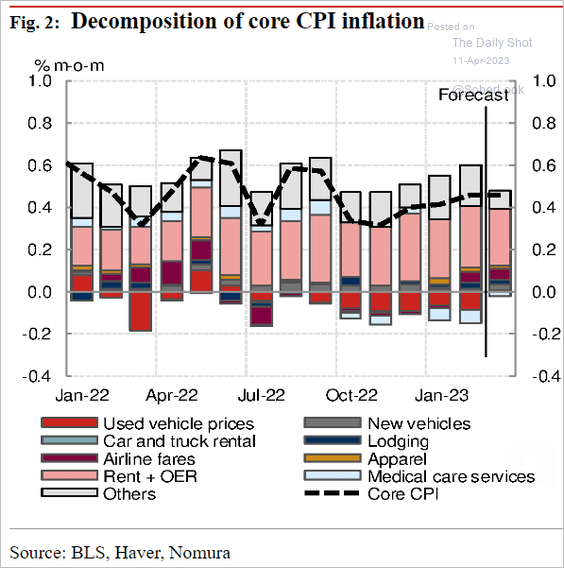

1. Let’s begin with some updates on inflation.

• Nomura expects the March core CPI to match the elevated level we saw in February.

Source: Nomura Securities

Source: Nomura Securities

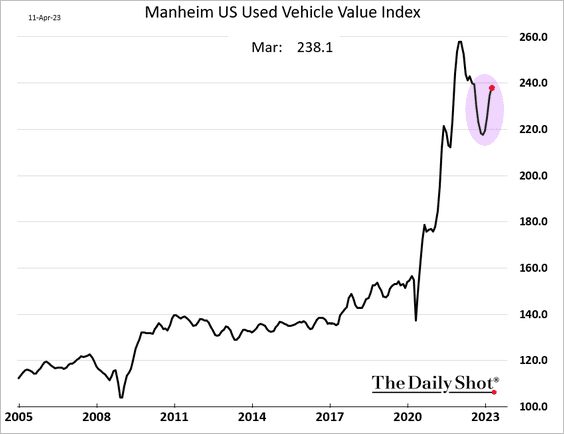

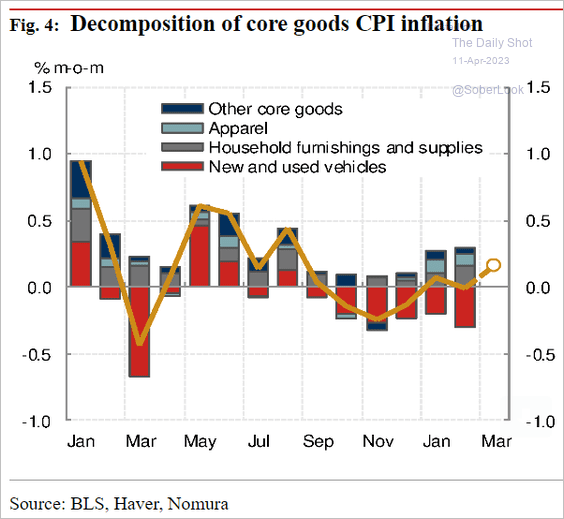

With used car prices rising again, …

… the core goods CPI is expected to climb.

Source: Nomura Securities

Source: Nomura Securities

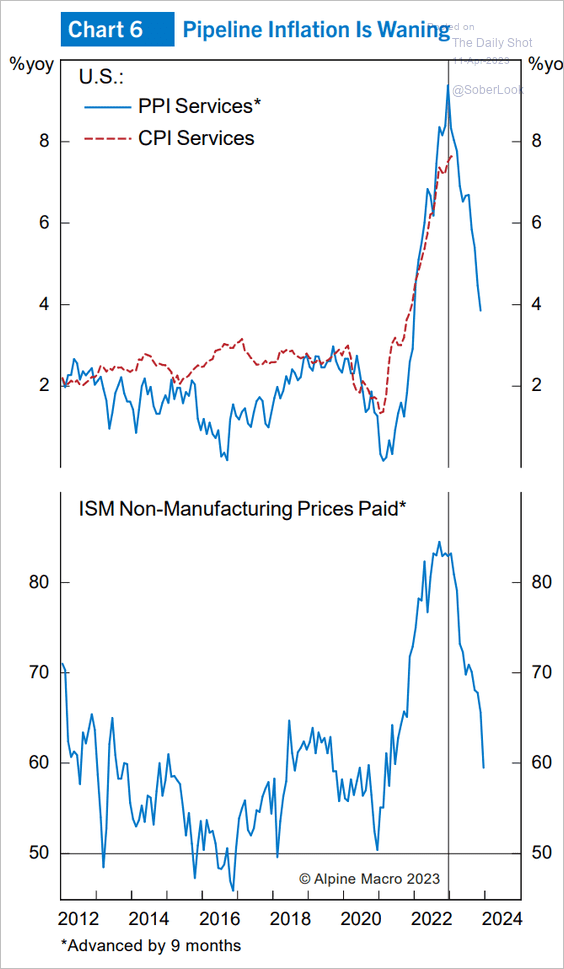

• Wholesale services cost pressures are easing, which points to slower services CPI ahead.

Source: Alpine Macro

Source: Alpine Macro

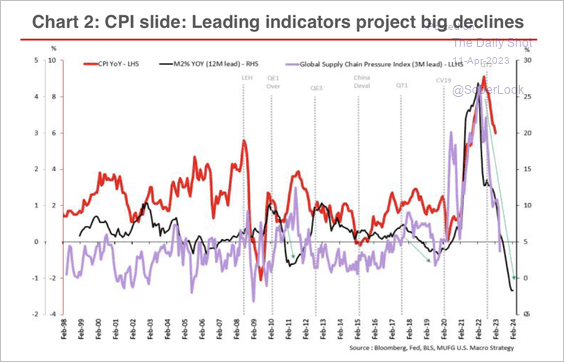

– Other leading indicators also point to large CPI declines.

Source: MUFG Securities

Source: MUFG Securities

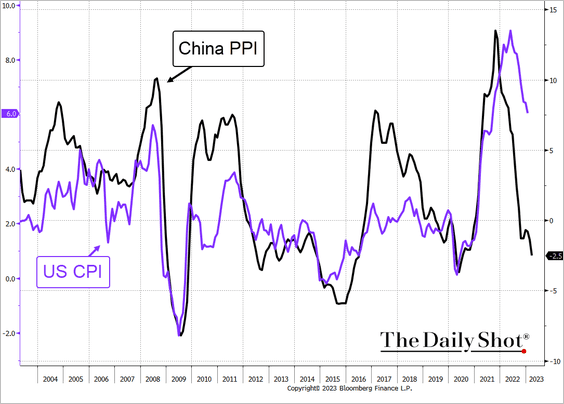

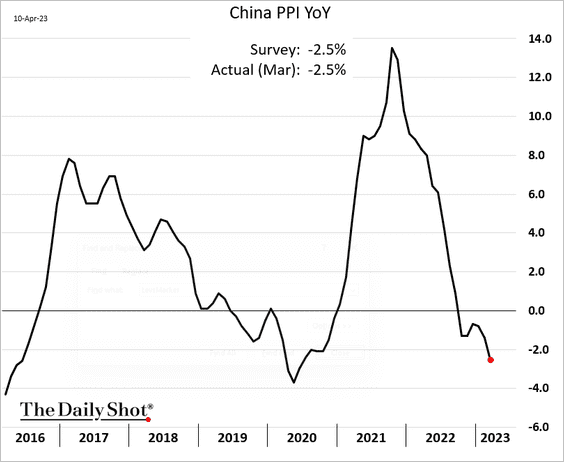

Here is China’s PPI, for example.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

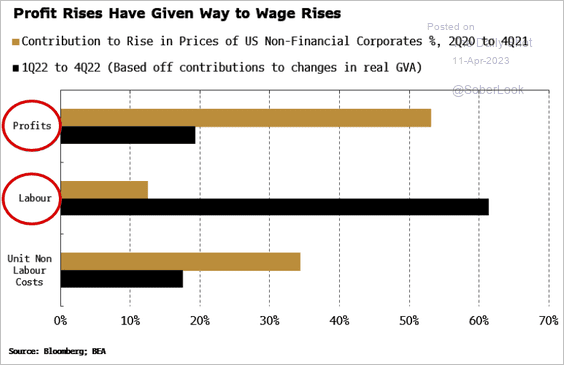

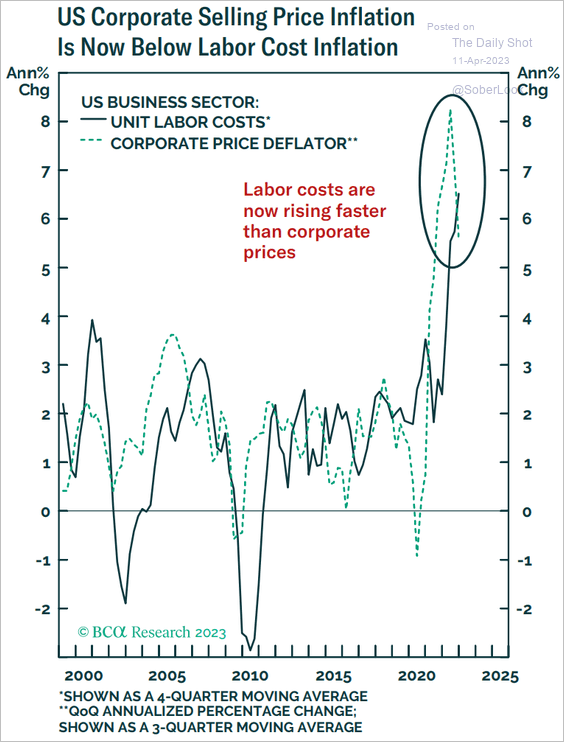

• Labor costs are now driving inflation more than profits (2 charts), …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Source: BCA Research

Source: BCA Research

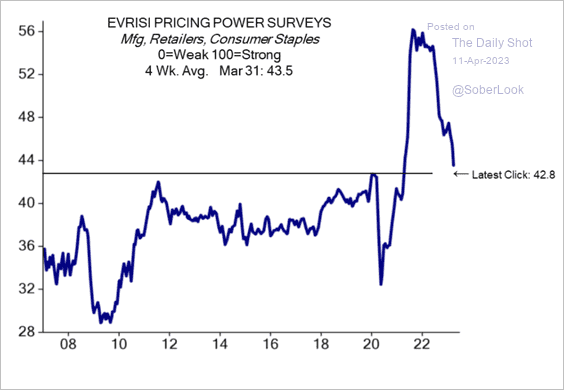

… as companies’ pricing power diminishes.

Source: Evercore ISI Research

Source: Evercore ISI Research

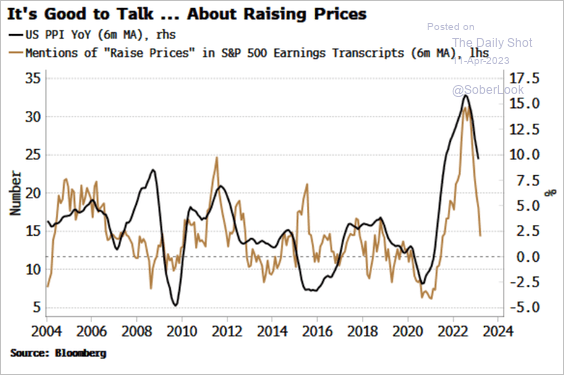

• Fewer companies are talking about raising prices.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

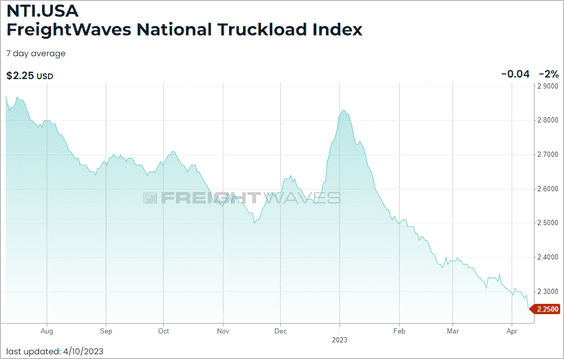

• Truck freight rates continue to sink amid soft demand.

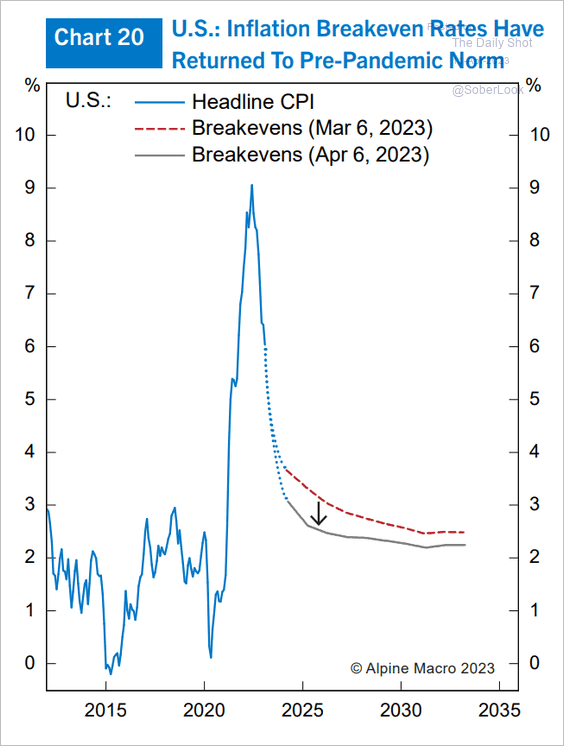

• Market-based inflation expectations are nearing pre-COVID CPI levels.

Source: Alpine Macro

Source: Alpine Macro

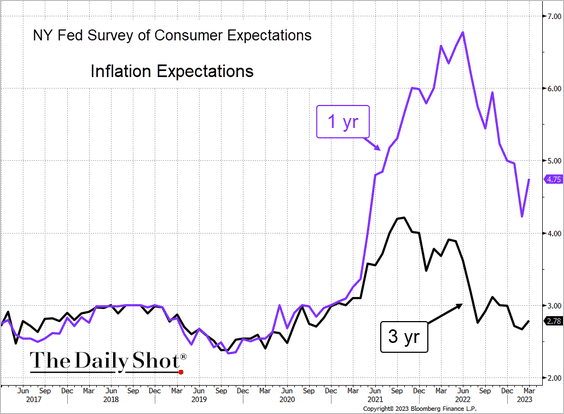

• Consumer inflation expectations climbed in March.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

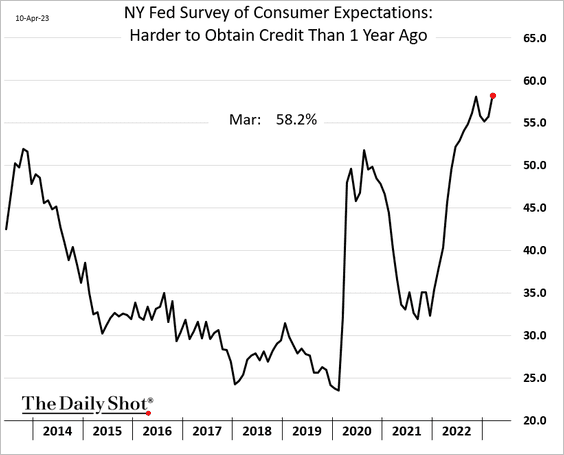

2. Consumers increasingly report that credit is harder to obtain than a year ago.

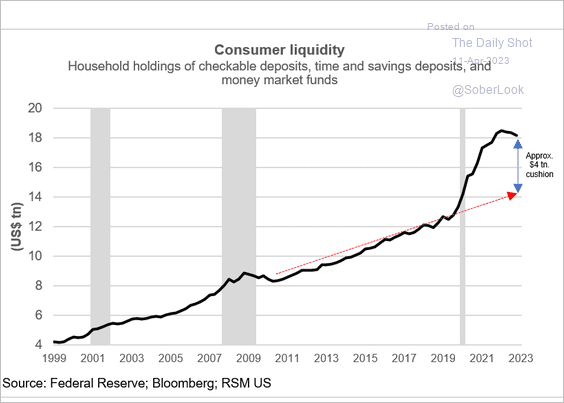

3. Households’ excess liquidity remains elevated.

Source: RSM US Read full article

Source: RSM US Read full article

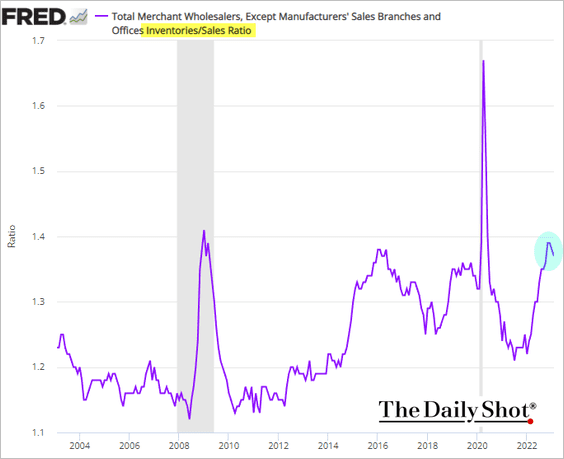

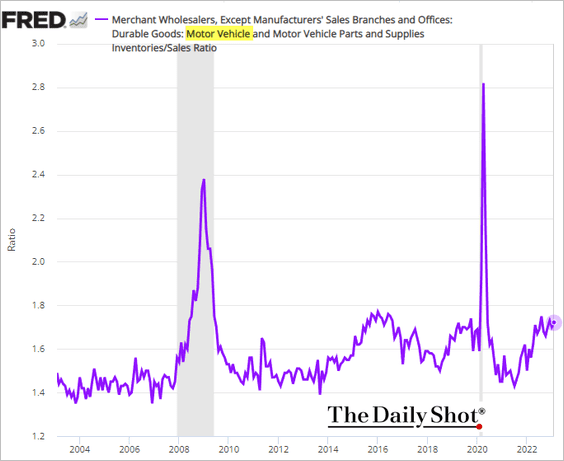

4. The wholesale inventory-to-sales ratio appears to be peaking.

The inventory-to-sales ratio for vehicles is at pre-COVID levels.

——————–

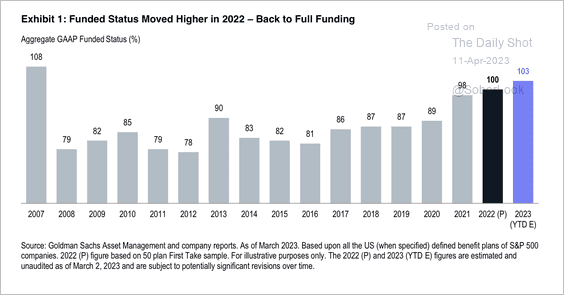

5. Pension funds have seen a notable step-up in funded levels over the past few years.

Source: Goldman Sachs

Source: Goldman Sachs

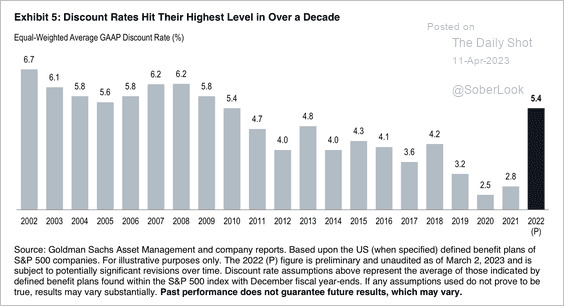

The increase in yields has enabled corporate defined-benefit plan sponsors to revise their discount rates higher.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

The Eurozone

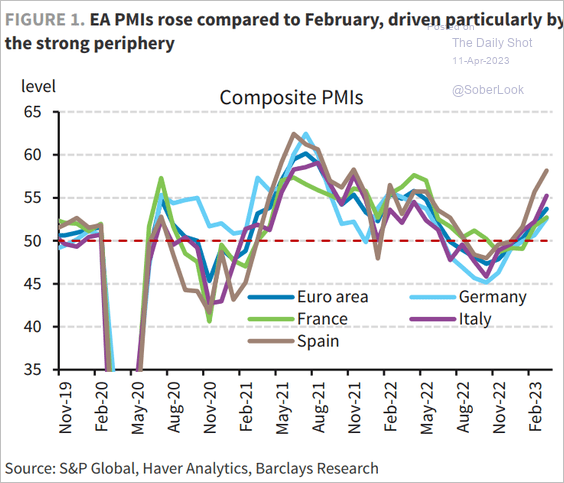

1. Economic activity in Spain and Italy has outperformed the rest of the euro area.

Source: Barclays Research

Source: Barclays Research

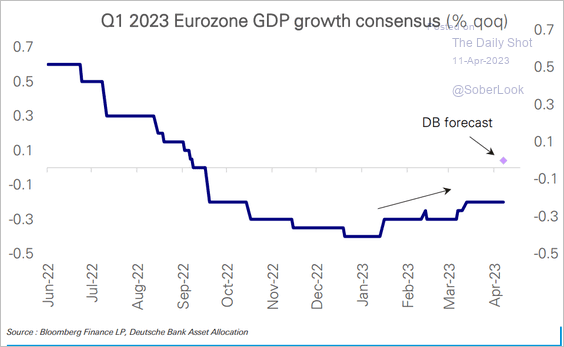

2. Deutsche Bank sees a Eurozone GDP bounce in Q1, diverging from consensus.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

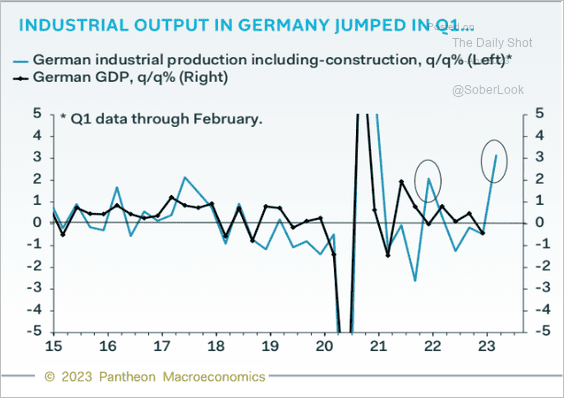

Strong industrial production in Germany points in that direction as well.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Japan

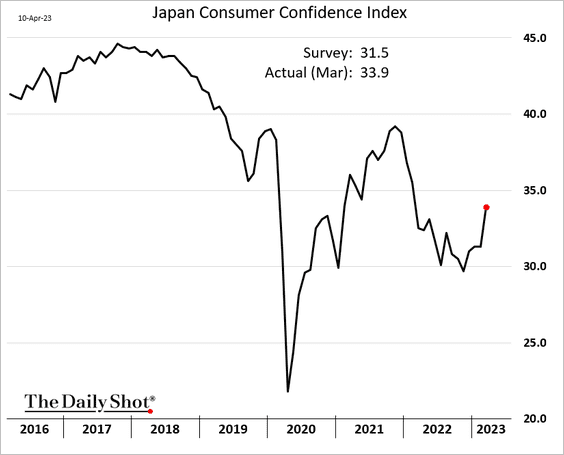

1. Consumer confidence topped expectations.

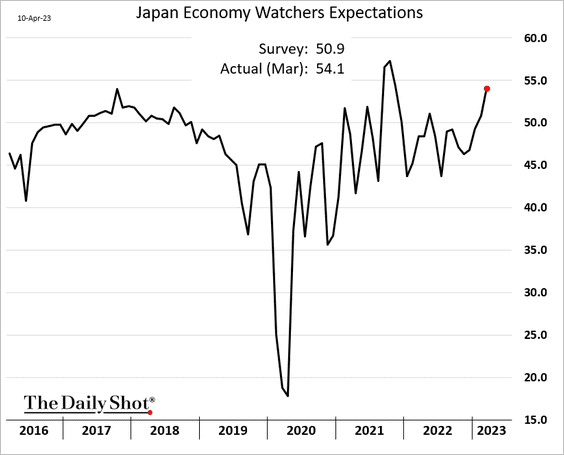

2. The Economy Watchers Survey expectations index hit the highest level since 2021.

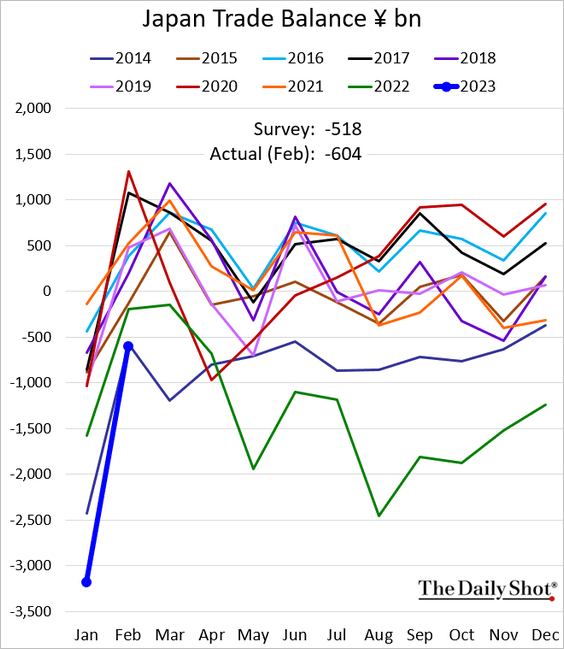

3. The trade deficit narrowed in February.

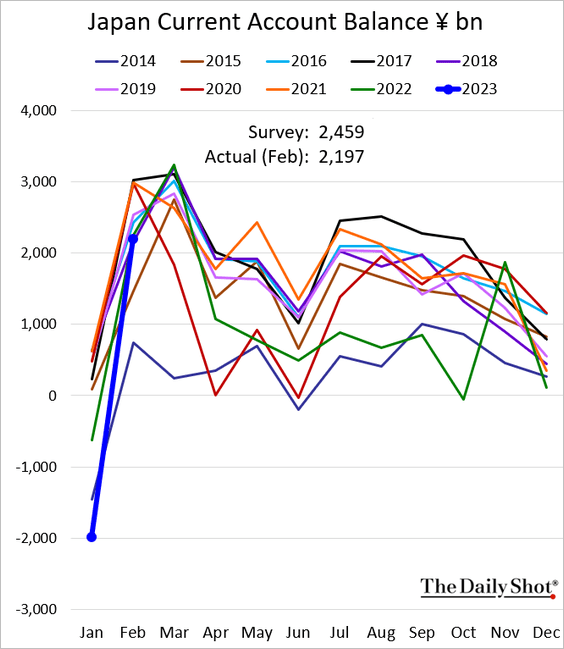

The current account swung into surplus, boosted by investment flows.

Back to Index

Asia – Pacific

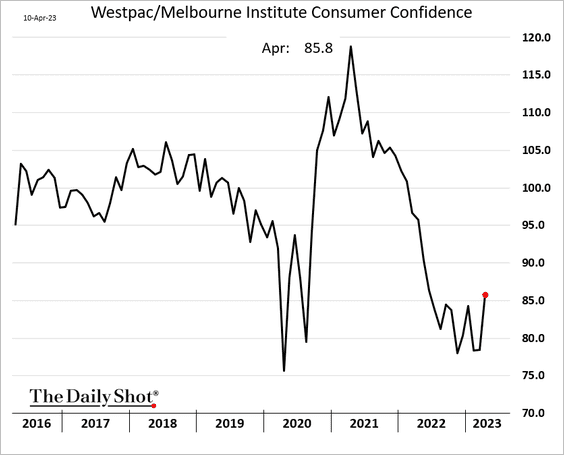

1. Australia’s consumer confidence bounced from the lows this month.

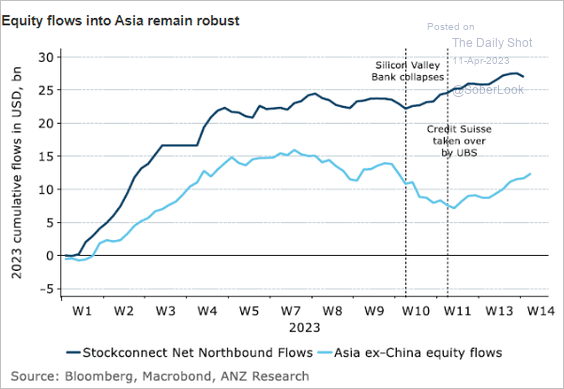

2. Equity flows into Asia remain robust.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

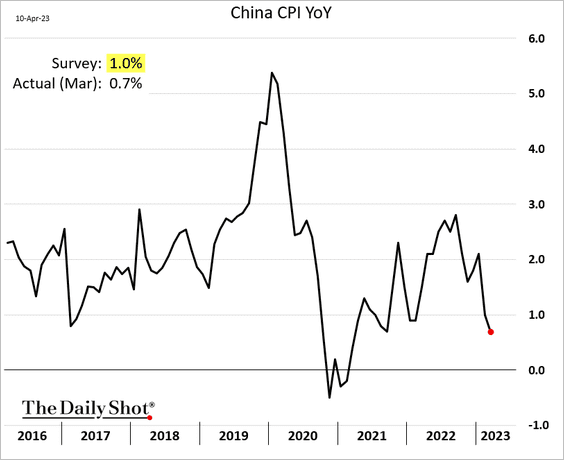

1. The CPI report surprised to the downside, …

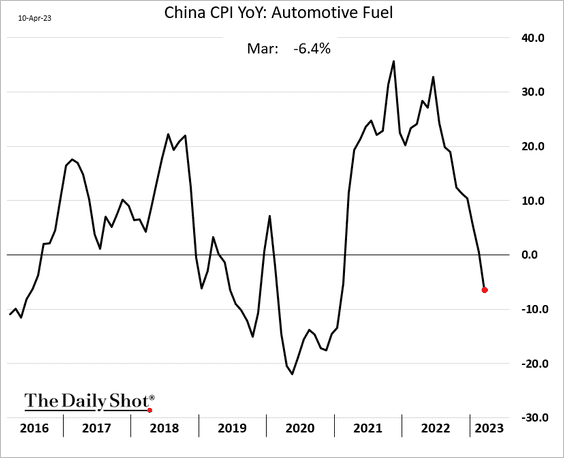

… as fuel prices ease.

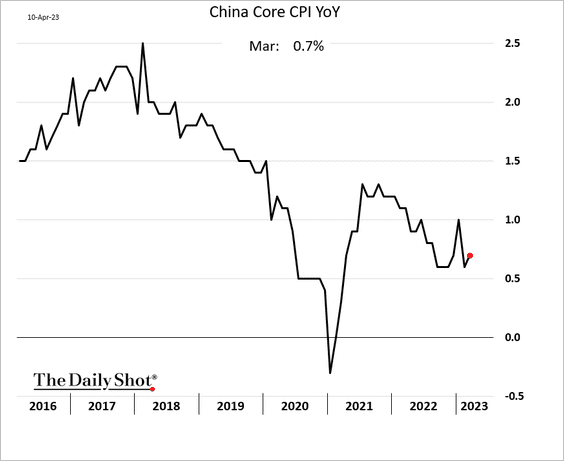

The core CPI edged higher.

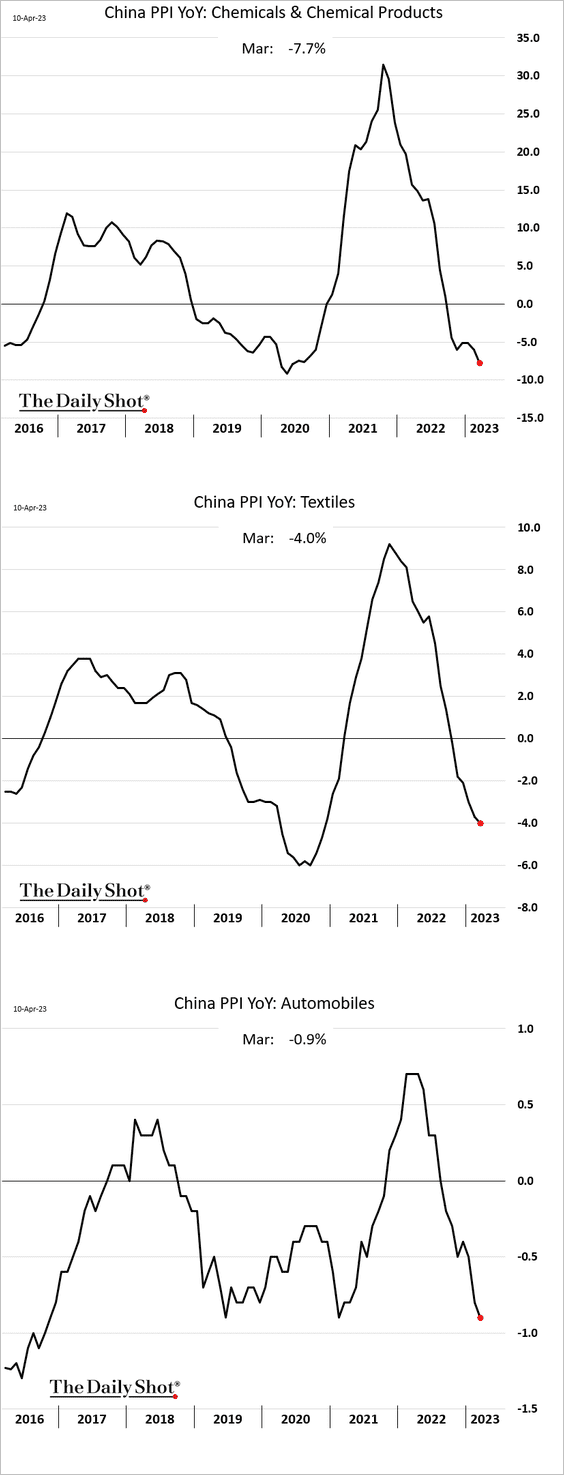

2. The PPI moved deeper into negative territory.

Here are some examples of China’s PPI components.

——————–

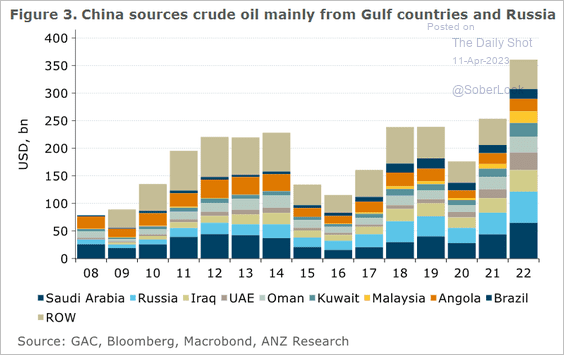

3. This chart shows China’s oil imports by source.

Source: @ANZ_Research

Source: @ANZ_Research

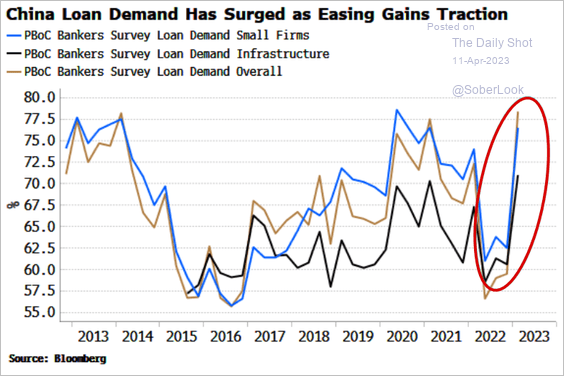

4. Loan demand has rebounded.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

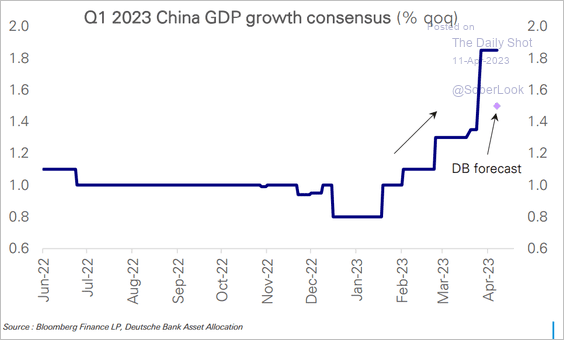

5. Deutsche Bank is less upbeat about China’s Q1 GDP growth than the consensus estimate.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Emerging Markets

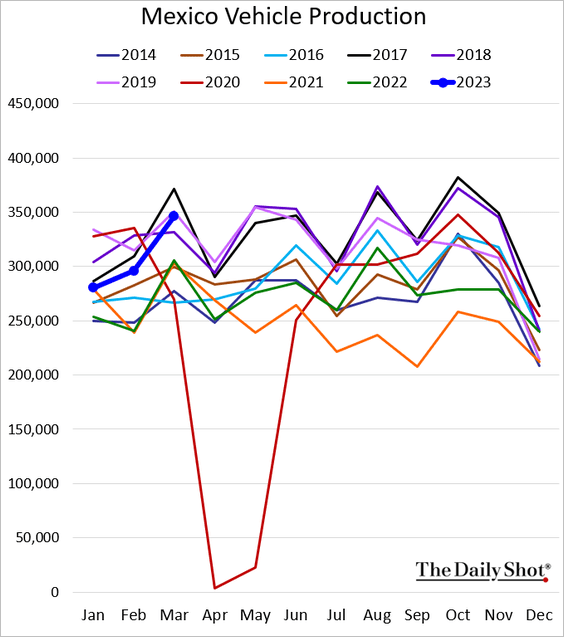

1. Mexico’s vehicle production is back to pre-COVID levels.

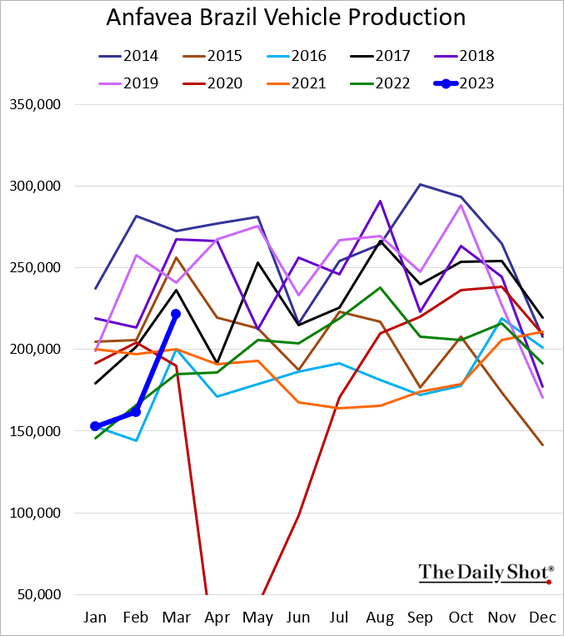

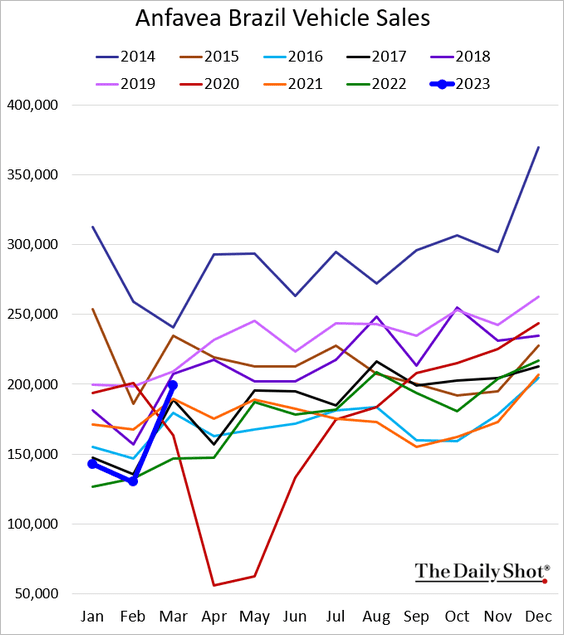

2. Brazil’s vehicle production and sales also strengthened last month.

——————–

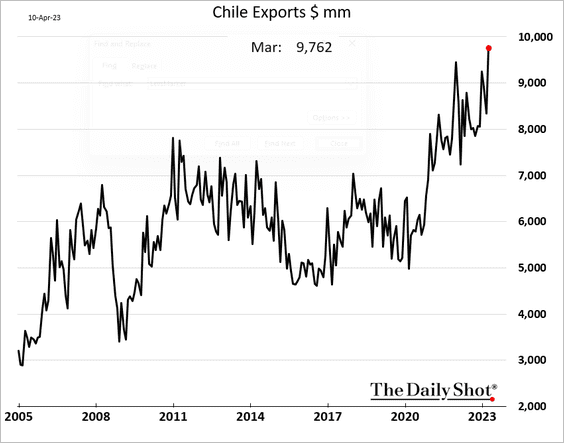

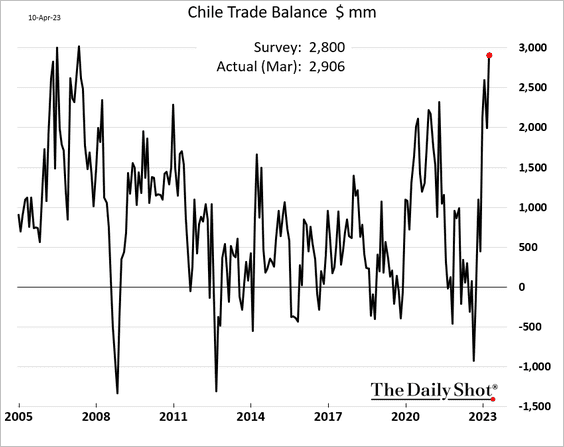

3. Chile’s exports hit a record high, …

… boosting the nation’s trade surplus.

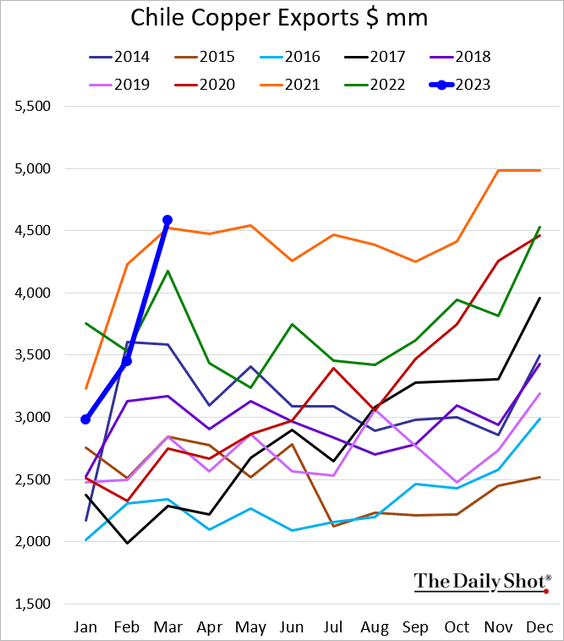

Copper exports are at a multi-year high for this time of the year (in dollar terms).

——————–

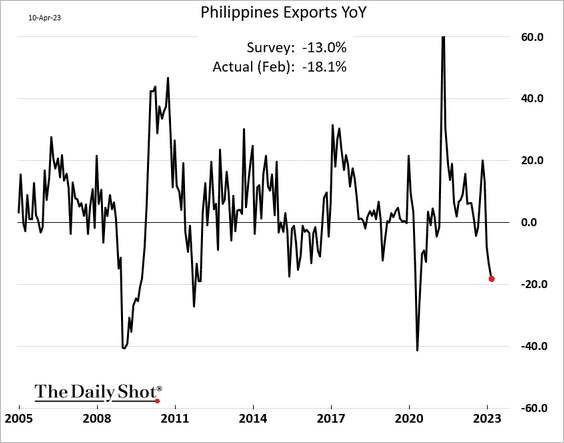

4. Philippine exports are down 18% from a year ago.

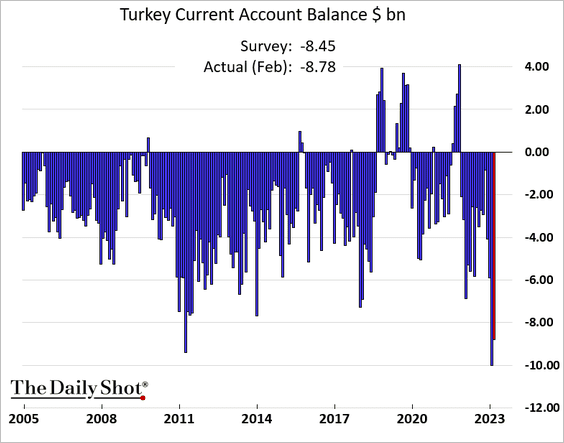

5. Turkey’s current account deficit remains elevated.

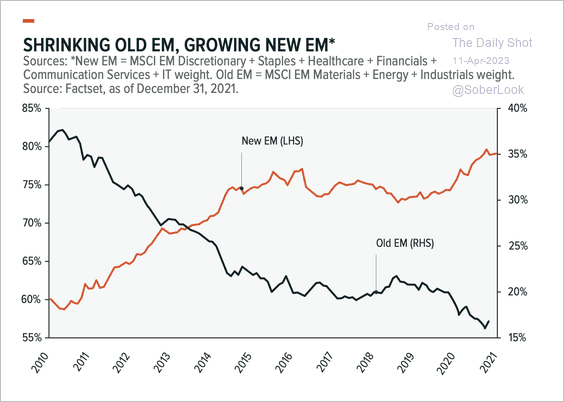

6. MSCI EM sectors tied to the consumer have increased in weight, while “old EM” sectors such as energy and industrials have declined.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Cryptocurrency

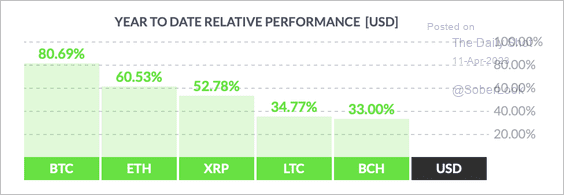

1. Cryptos are having a strong year so far, with BTC in the lead.

Source: FinViz

Source: FinViz

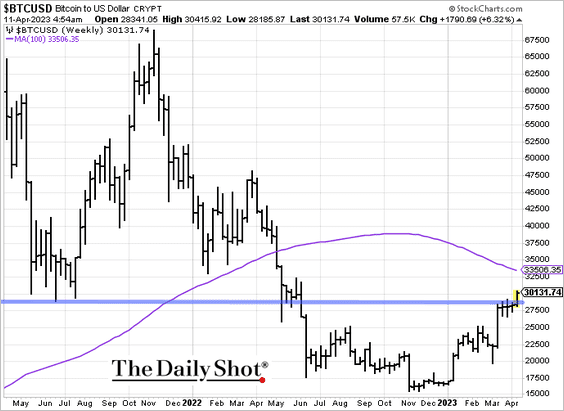

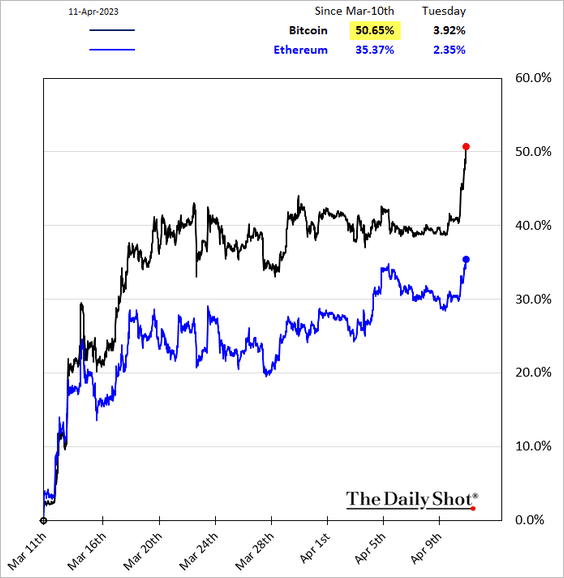

2. Bitcoin blasted past $30k and is breaking above initial resistance. If confirmed, the next hurdle could be near its 100-week moving average ($33.5K).

Bitcoin is now up 50% over the past 30 days.

——————–

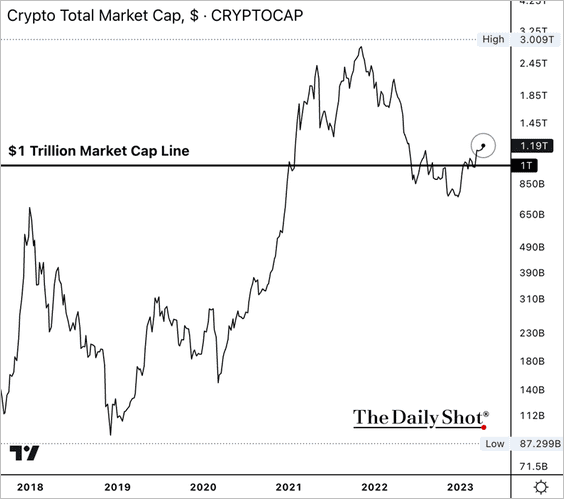

3. The total crypto market cap returned above $1 trillion last month.

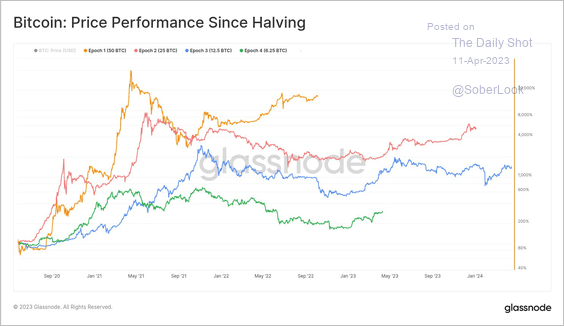

4. Here is a look at bitcoin’s price performance after previous halving cycles.

Source: @glassnode

Source: @glassnode

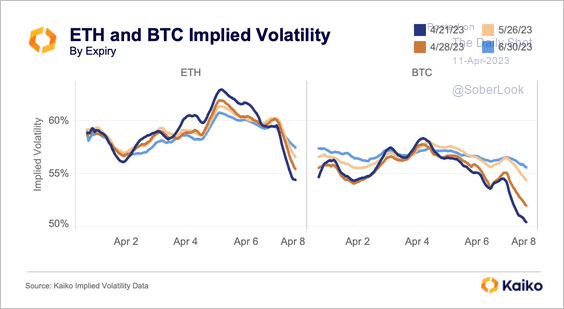

5. Bitcoin and Ether’s implied volatility is declining.

Source: @KaikoData

Source: @KaikoData

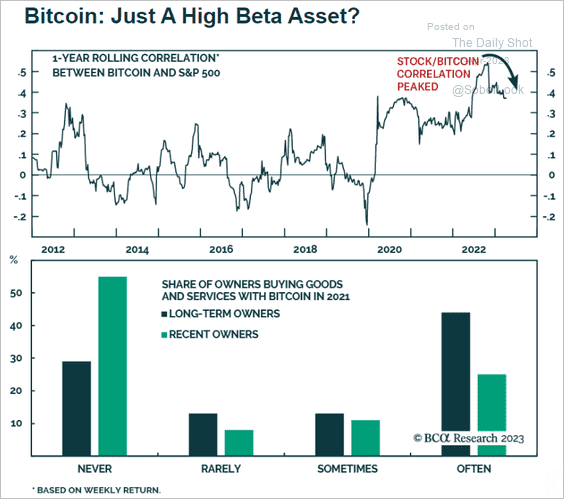

6. Recent bitcoin owners are mostly investors/speculators.

Source: BCA Research

Source: BCA Research

Back to Index

Commodities

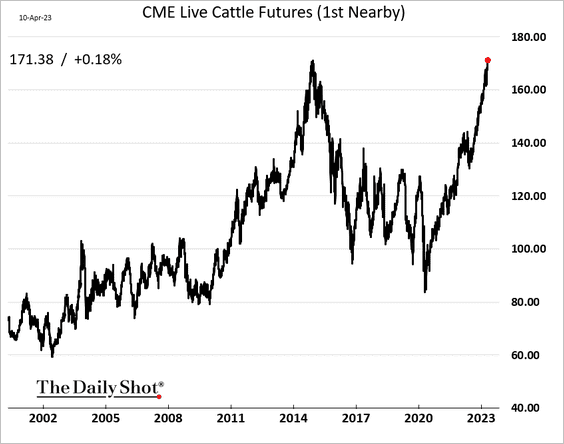

1. Chicago’s live cattle futures are trading near all-time highs after ranchers trimmed their herds in response to high feed expenses and drought in the western United States.

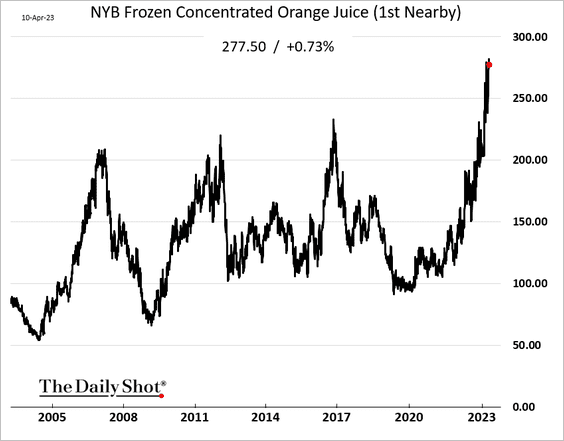

2. US frozen orange juice futures are trading near record high levels as Florida’s orange production deteriorates.

Back to Index

Energy

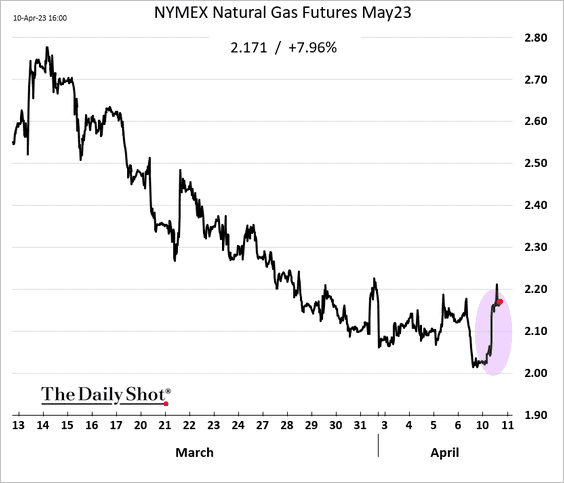

1. US natural gas futures bounced from the lows.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

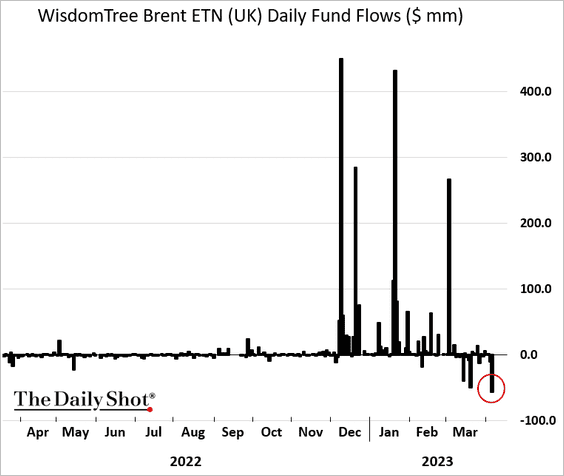

2. Brent crude oil ETN saw substantial outflows.

Further reading

Further reading

Source: @yongchang_chin, @markets Read full article

Source: @yongchang_chin, @markets Read full article

——————–

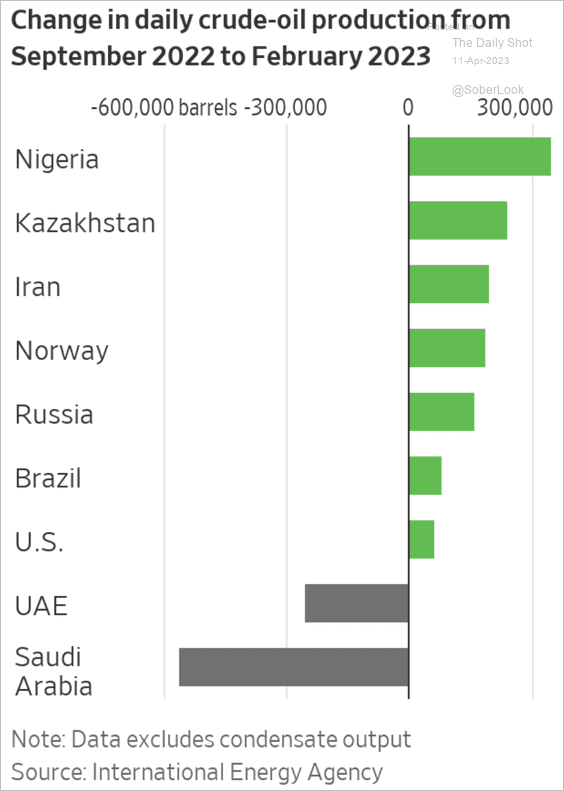

3. Saudi and UAE production cuts have been offset by other producers.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

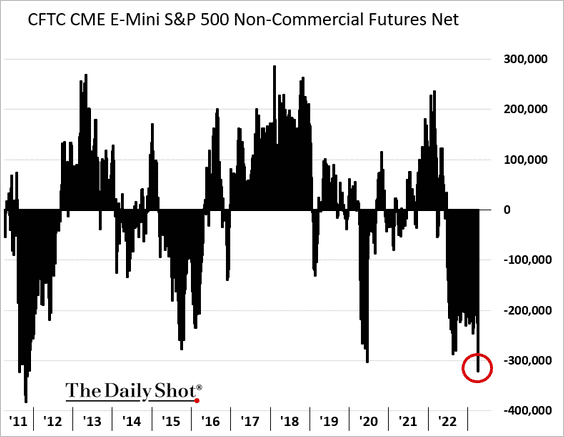

1. Speculative accounts boosted their short positions in the S&P 500 futures ahead of the CPI week.

Further reading

Further reading

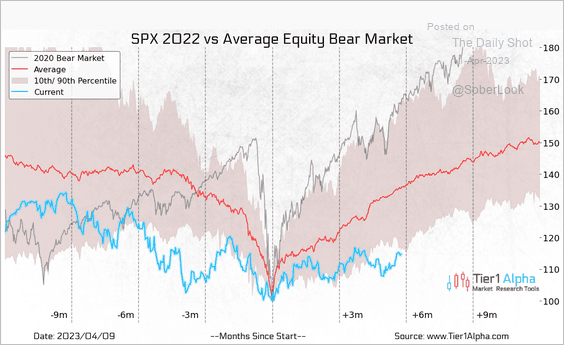

2. How does the present market path compare with previous bear-market occurrences?

Source: @t1alpha

Source: @t1alpha

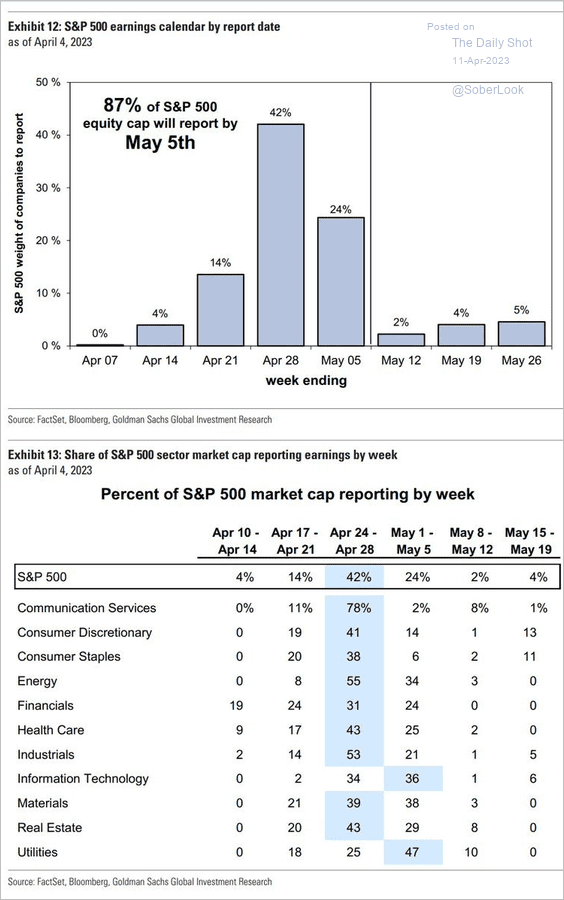

3. 87% of S&P 500 market cap will report Q1 earnings by May 5th.

Source: Goldman Sachs; @TheTranscript_; h/t @dailychartbook

Source: Goldman Sachs; @TheTranscript_; h/t @dailychartbook

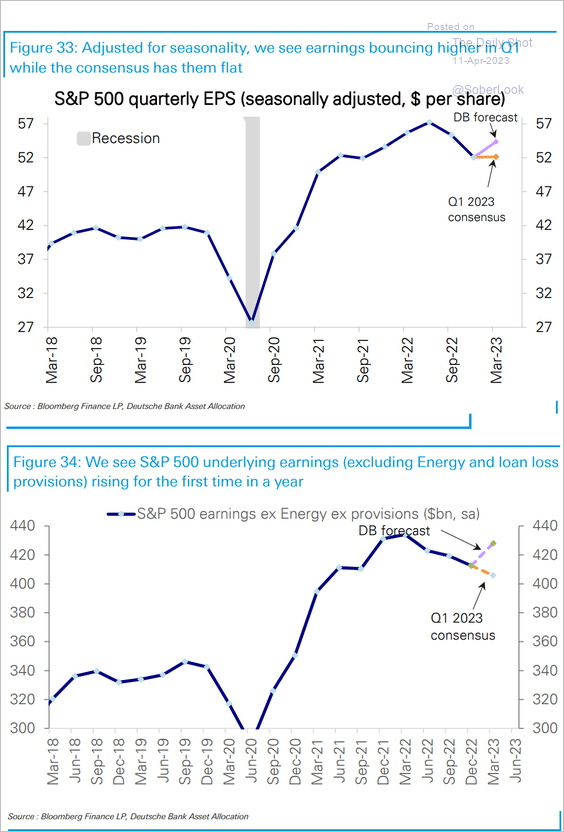

4. Deutsche Bank is more upbeat on Q1 earnings than the consensus estimates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

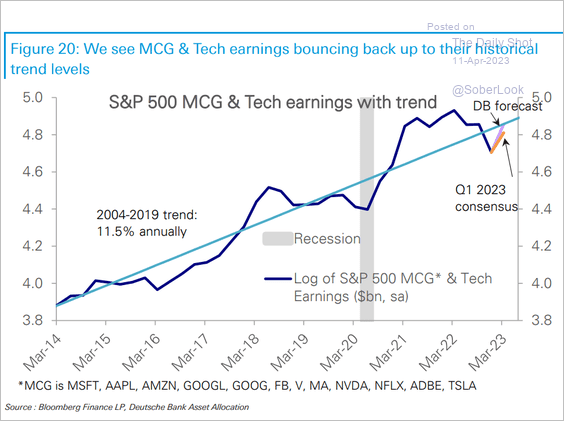

Mega-cap earnings are expected to return to the longer-term trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

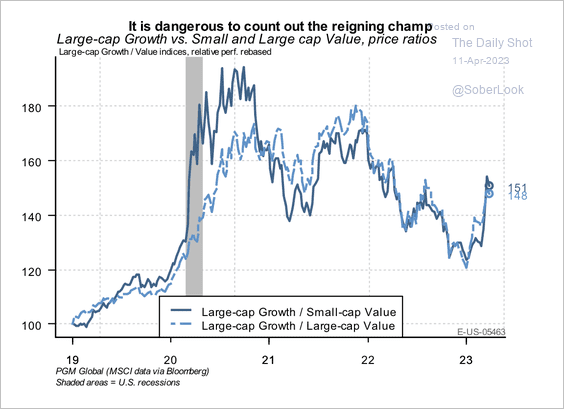

5. US large-cap growth stocks are outperforming large-and-small-cap value stocks.

Source: PGM Global

Source: PGM Global

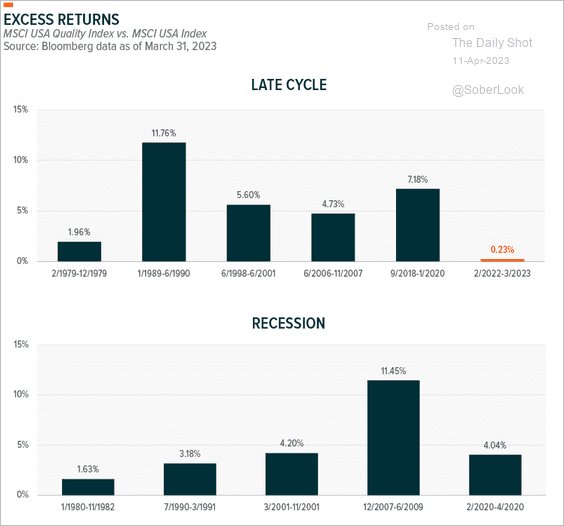

6. Historically, quality stocks outperformed during late-cycle and recession phases.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

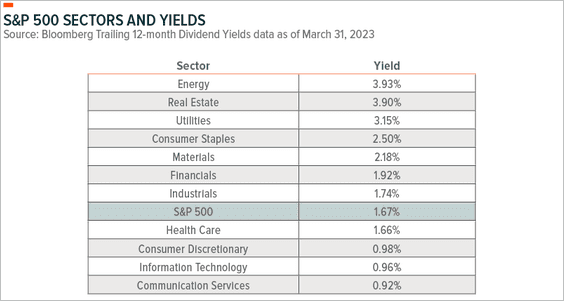

7. Here is a look at S&P 500 sector dividend yields.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

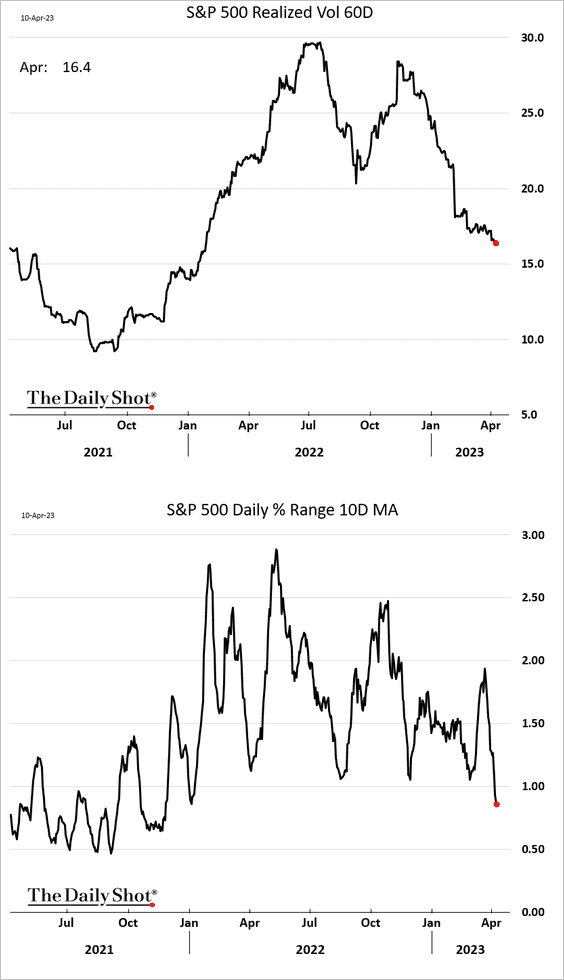

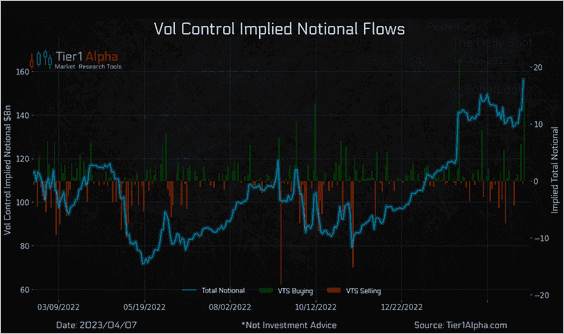

8. Stock market volatility continues to decline, …

… which tends to prompt vol-control funds to boost their equity exposure.

Source: @t1alpha

Source: @t1alpha

——————–

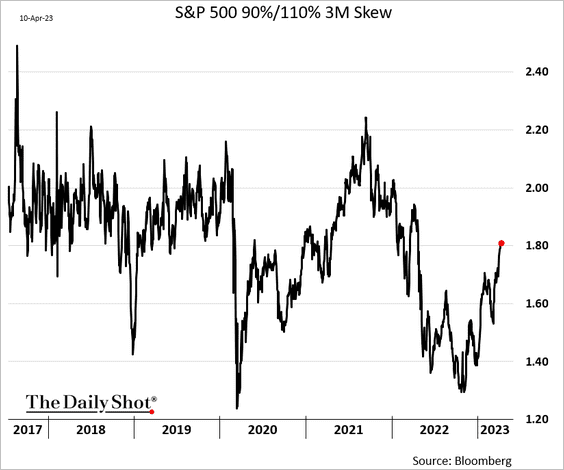

9. The S&P 500 skew is rising, pointing to increased demand for puts relative to calls.

Back to Index

Credit

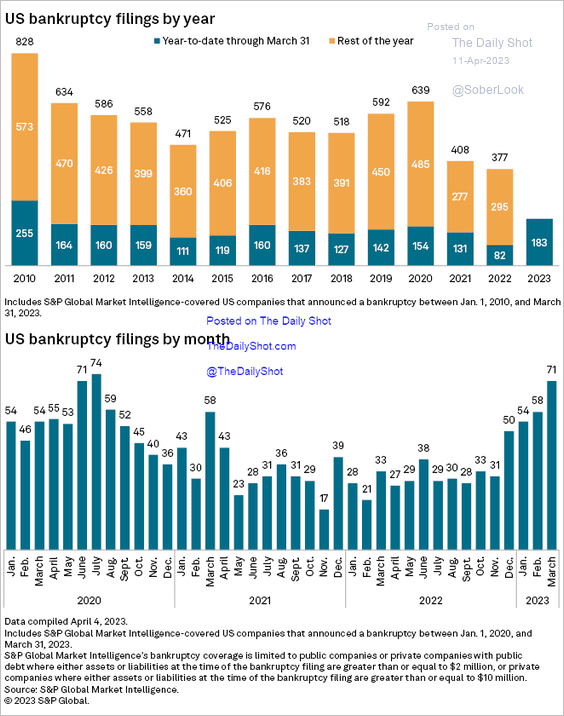

1. US bankruptcies increased sharply this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

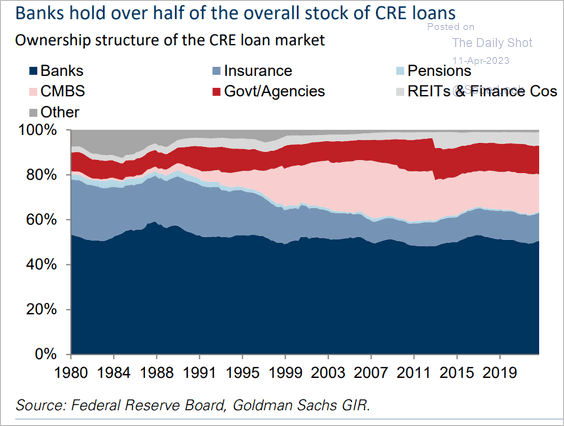

2. Who holds commercial real estate debt?

Source: Goldman Sachs

Source: Goldman Sachs

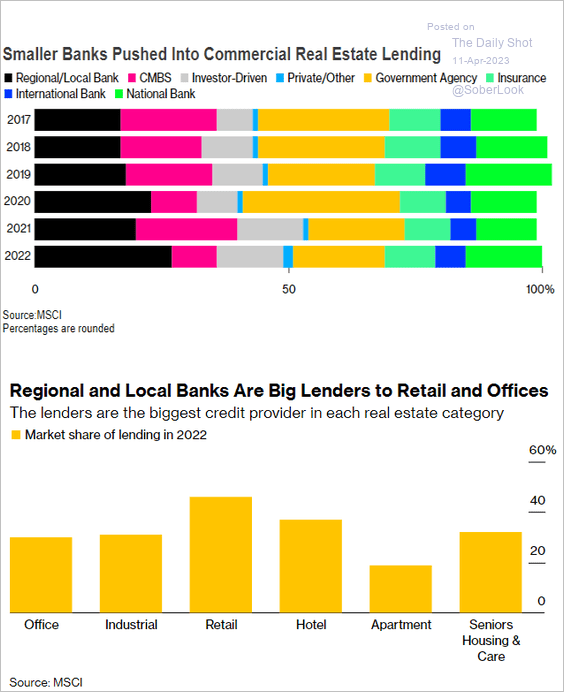

• Small/regional banks boosted their exposure to commercial real estate in recent years, …

Source: @ncallanan, @markets Read full article

Source: @ncallanan, @markets Read full article

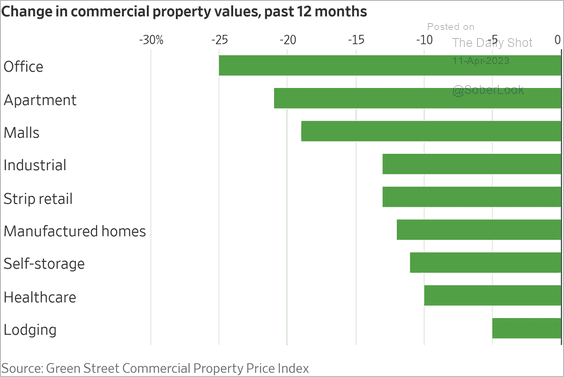

… just as property prices declined.

Source: @WSJ Read full article

Source: @WSJ Read full article

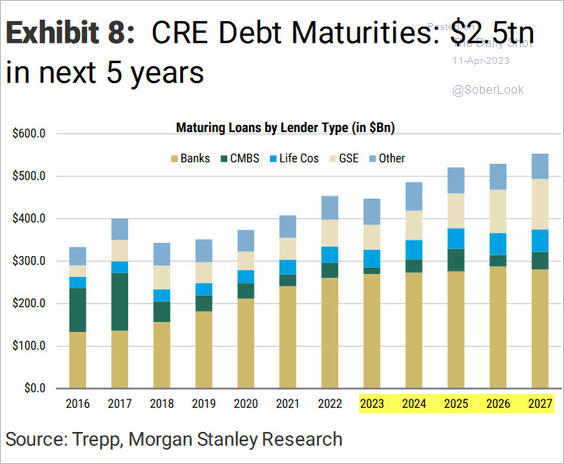

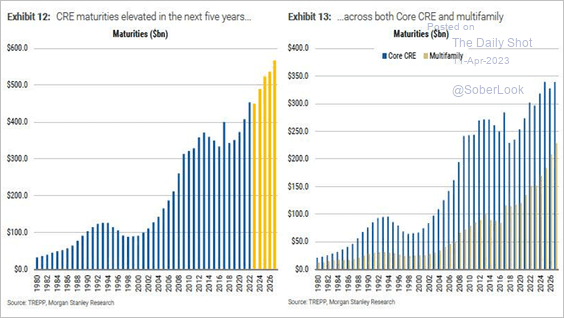

• Here is the commercial real estate debt maturity wall (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

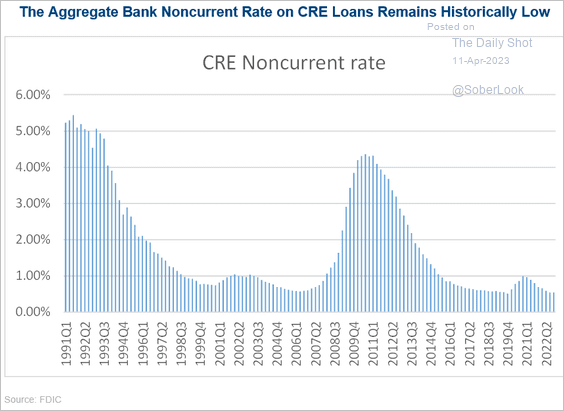

• Commercial real estate delinquency rates are low (for now).

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

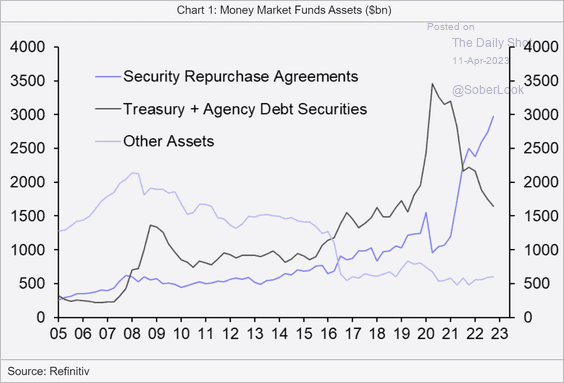

3. There is a common misconception, often perpetuated by the media, that fluctuations in bank deposits are primarily driven by depositors transferring their cash from banks to higher-yielding assets. However, when, for example, an individual purchases a Treasury bill, their bank account is credited, while the seller’s account is debited, leaving the net deposits in the banking system unchanged. In reality, there are two primary mechanisms that influence the expansion and contraction of total deposits in the banking system: bank lending and the actions of the Federal Reserve.

One of the primary mechanisms is bank lending, which operates within the framework of fractional reserve banking. Under this system, banks are required to maintain a certain percentage of their total deposits as reserves, while the remaining portion can be lent out to borrowers. When a bank grants a loan, it essentially creates new deposits in the borrower’s account. This process expands the overall amount of deposits in the banking system. Conversely, when borrowers repay their loans, deposits contract as the money is returned to the bank and reduces the outstanding loan balance.

Another significant mechanism involves the actions of the Federal Reserve, which can either “trap” or “release” deposits through various monetary policy tools. For instance, during a period of quantitative tightening, the Fed may sell Treasury bills to money market funds. The payment for these securities is then held at the Federal Reserve, effectively reducing the amount of deposits within the banking system. Similarly, when a money market fund engages in a reverse repo transaction with the Fed’s Reverse Repurchase Agreement (RRP) facility, deposits are once again trapped at the Fed and removed from the banking system. Currently, approximately 40% of money market funds’ assets are held at the RRP facility, which has withdrawn over $2 trillion of liquidity from the banking system. However, if these money market funds decide to shift their investments to other assets, deposits will return to the banking system as the trapped liquidity is released.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Capital Economics

Source: Capital Economics

Back to Index

Global Developments

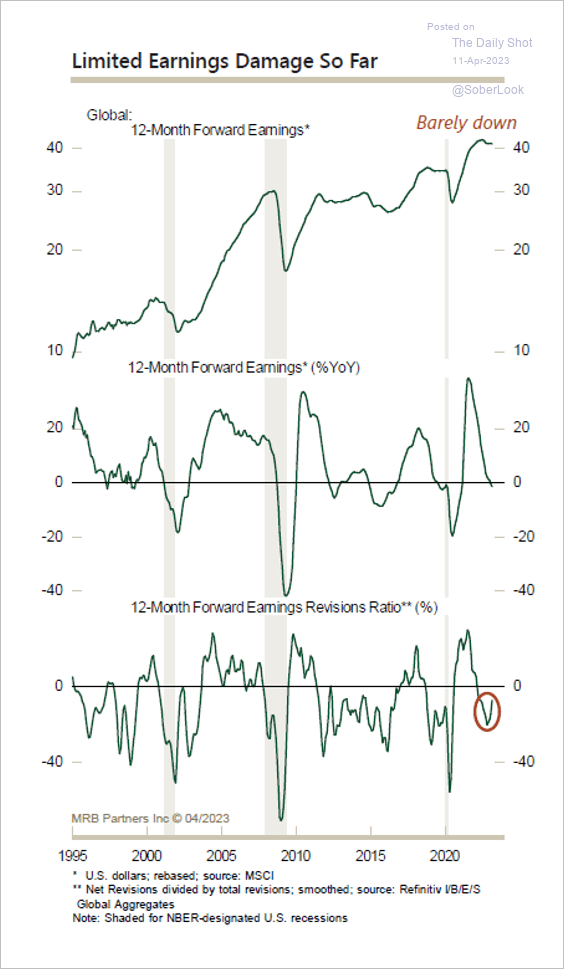

1. Global 12-month forward earnings have been sturdy despite the economic slowdown. It is only 3% below last year’s peak, and the earnings revisions ratio (net upgrades/total) is starting to recover.

Source: MRB Partners

Source: MRB Partners

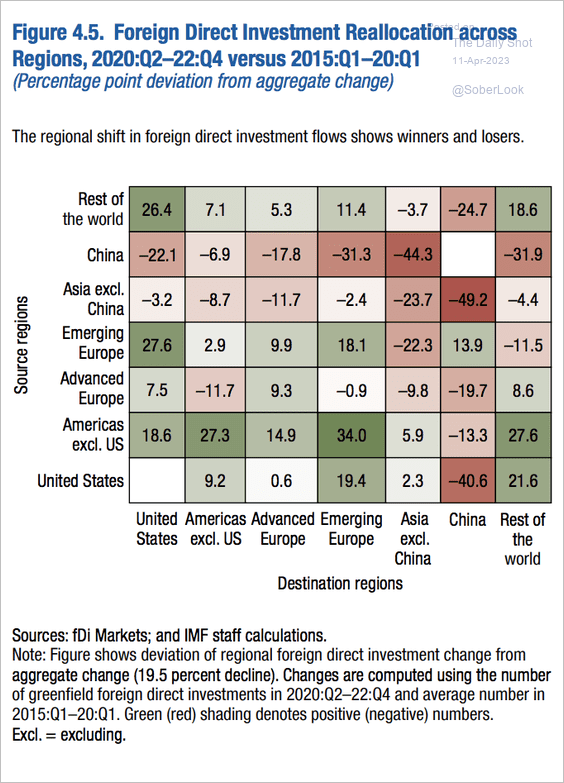

2. Here is a heatmap of foreign direct investment changes by source and destination regions.

Source: IMF Read full article

Source: IMF Read full article

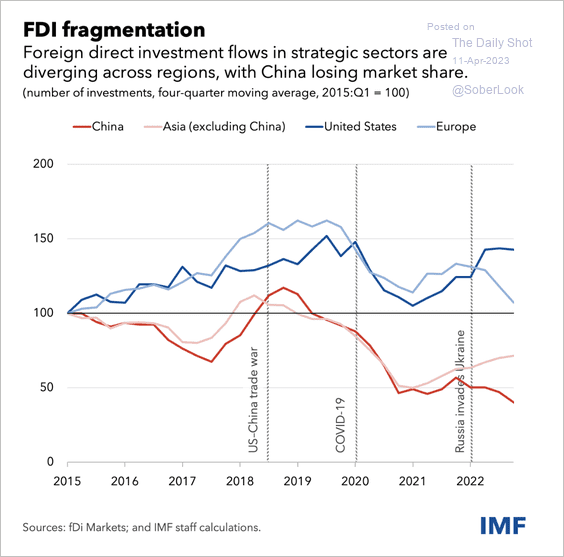

And this chart illustrates direct investment flows in strategic sectors over time.

Source: IMF Read full article

Source: IMF Read full article

——————–

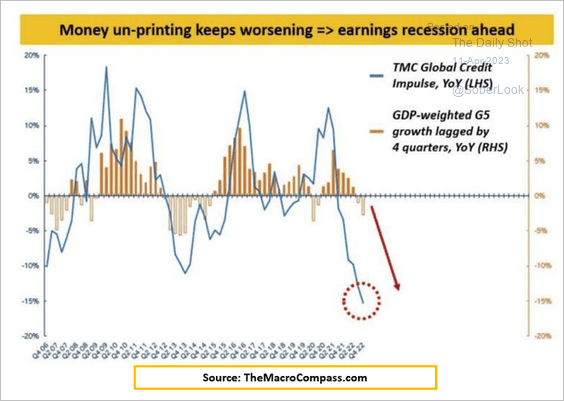

3. Weakening global credit impulse points to slower economic growth.

Source: @MacroAlf

Source: @MacroAlf

——————–

Food for Thought

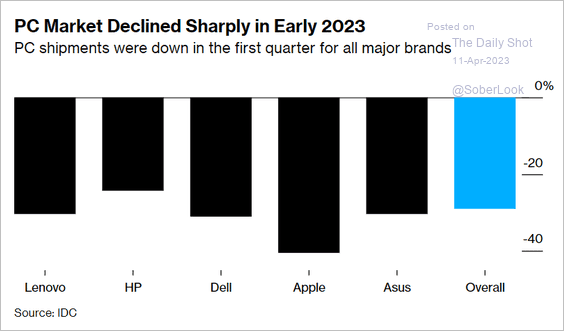

1. PC shipments in Q1:

Source: @vladsavov, @technology Read full article

Source: @vladsavov, @technology Read full article

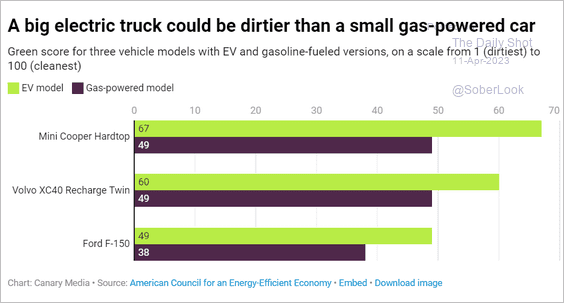

2. The “Green” score for three vehicle models:

Source: Canary Media Read full article

Source: Canary Media Read full article

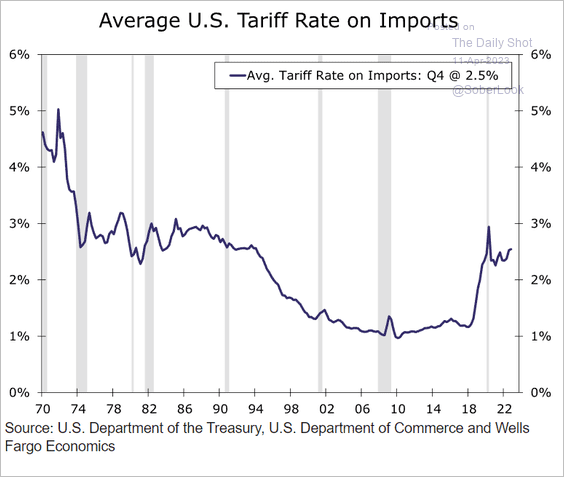

3. The US tariff rate on imports:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

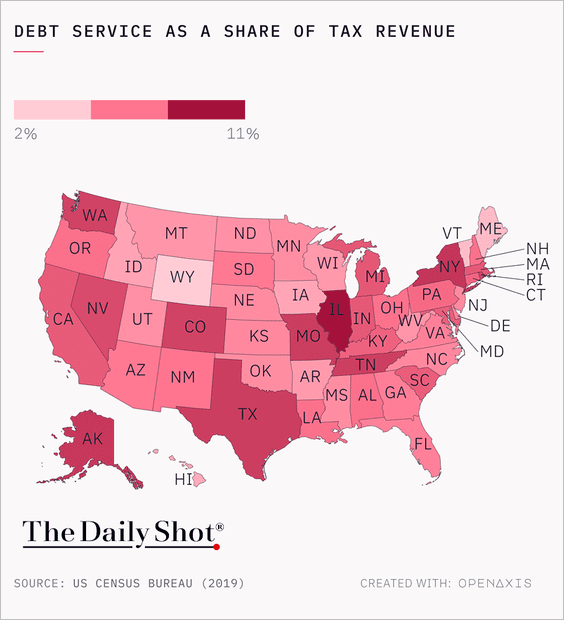

4. States’ debt service as a share of tax revenue:

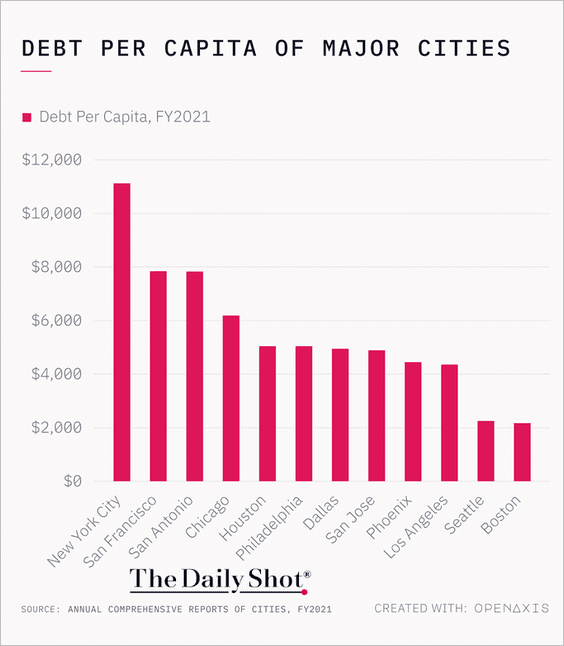

• Municipal debt per capita of major US cities:

——————–

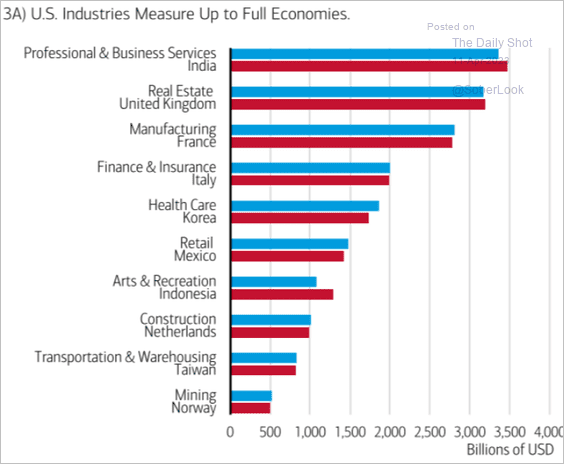

5. US industries compared to whole economies of other countries:

Source: Merrill Lynch

Source: Merrill Lynch

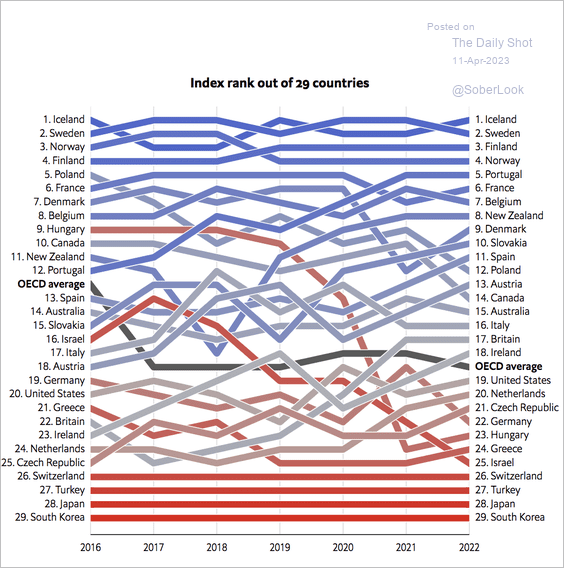

6. The Economist’s glass-ceiling index:

Source: The Economist Read full article

Source: The Economist Read full article

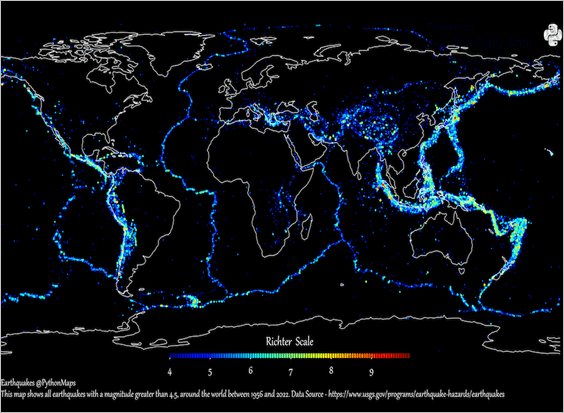

7. The World’s major earthquakes (1956-2022):

Source: @VisualCap, @PythonMaps; h/t Walter Read full article

Source: @VisualCap, @PythonMaps; h/t Walter Read full article

——————–

Back to Index