The Daily Shot: 12-Apr-23

• The United States

• Europe

• Japan

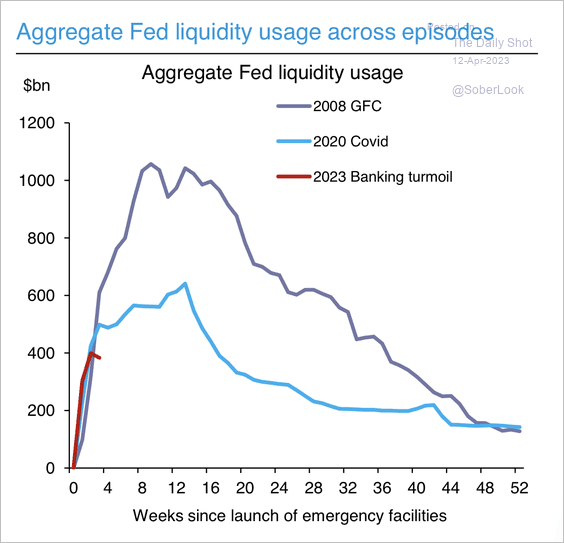

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

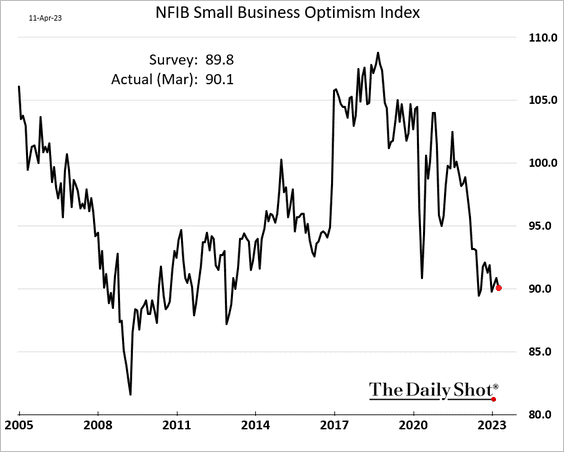

1. The NFIB small business sentiment index edged lower last month.

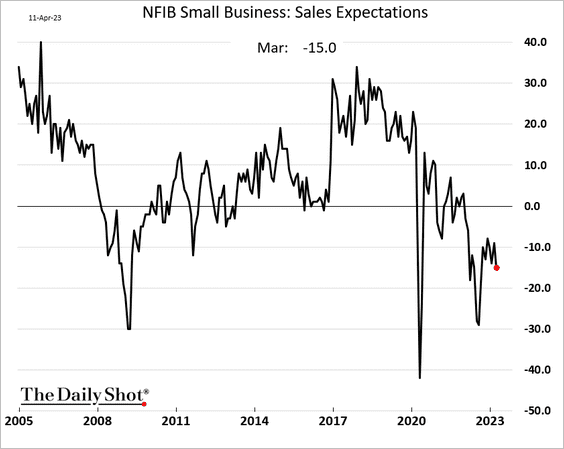

• Sales expectations remain depressed.

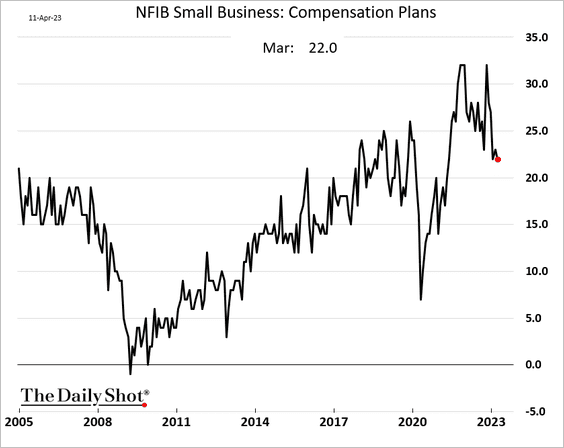

• The compensation plans index ticked down, …

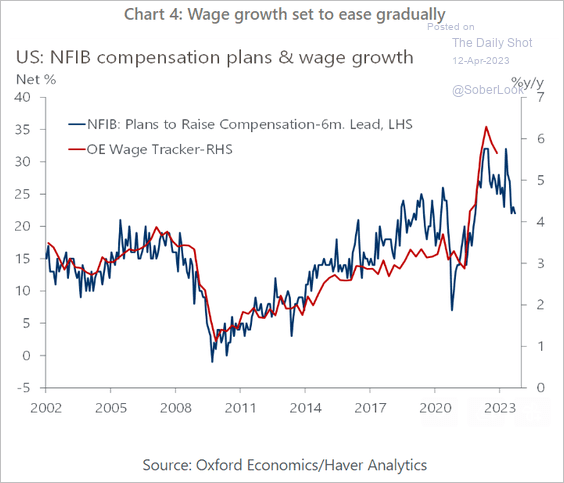

… signaling slower wage growth ahead.

Source: Oxford Economics

Source: Oxford Economics

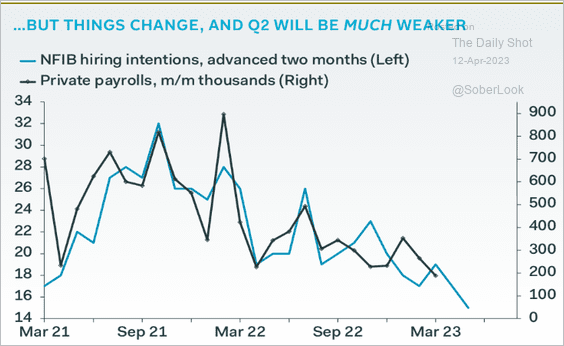

• Small businesses’ weakening hiring plans are a sign of declining national payrolls growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

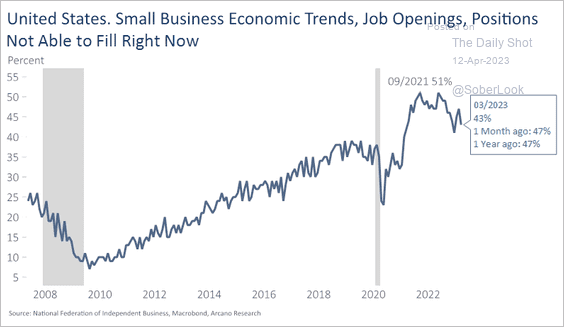

• However, many firms still can’t fill their job openings.

Source: Arcano Economics

Source: Arcano Economics

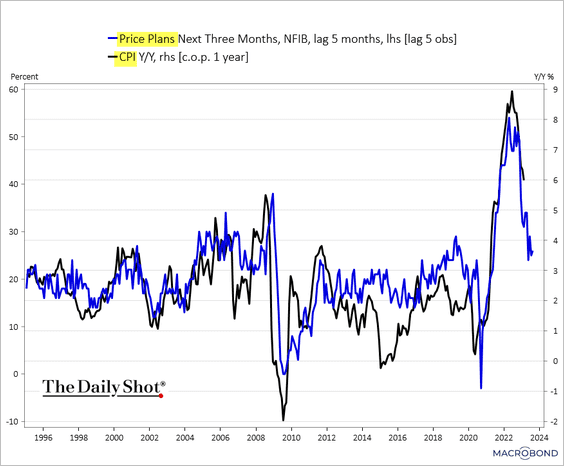

• The price plans indicator points to softer inflation ahead.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

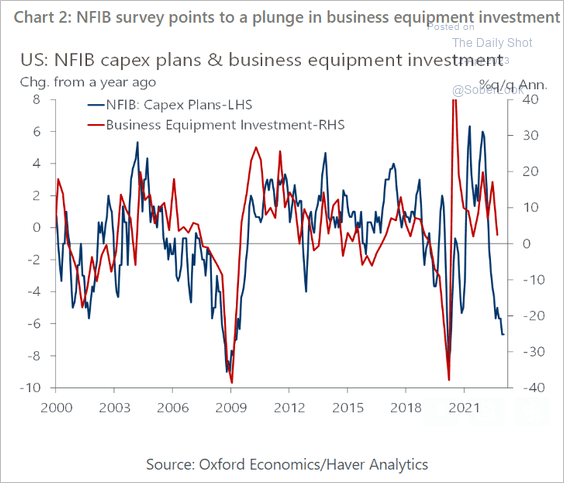

• Small firms’ CapEx plans signal sharp declines in business investment going forward.

Source: Oxford Economics

Source: Oxford Economics

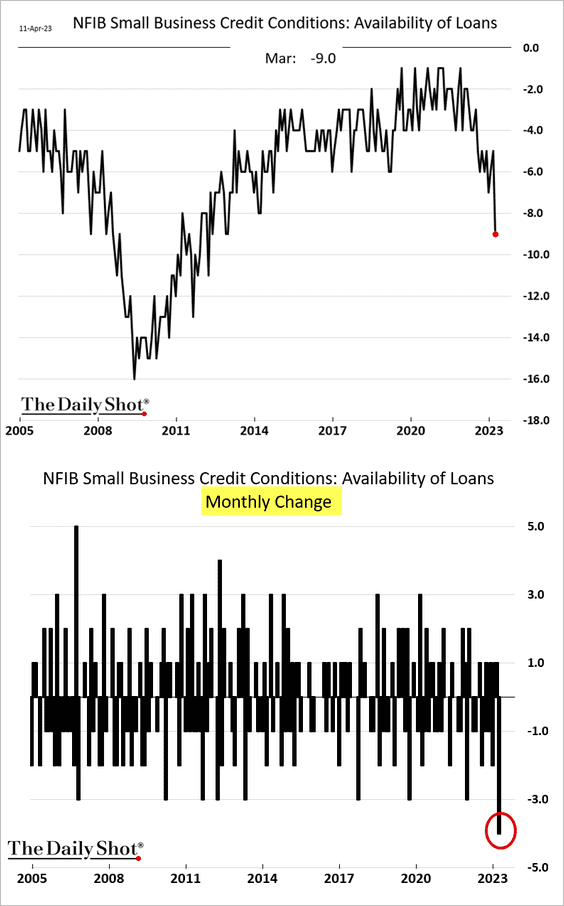

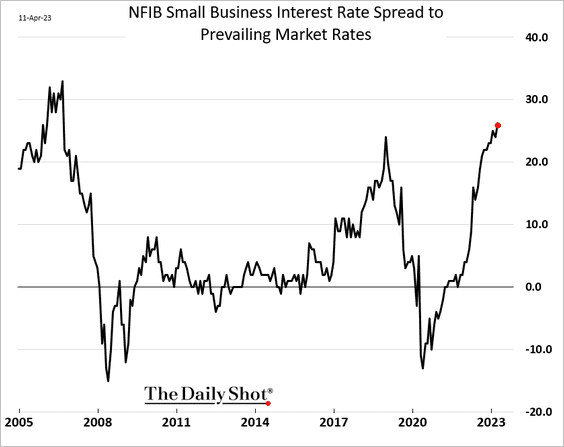

• The most striking change in the NFIB report was the deterioration in credit conditions in March.

Small firms are increasingly paying above-market rates on loans.

——————–

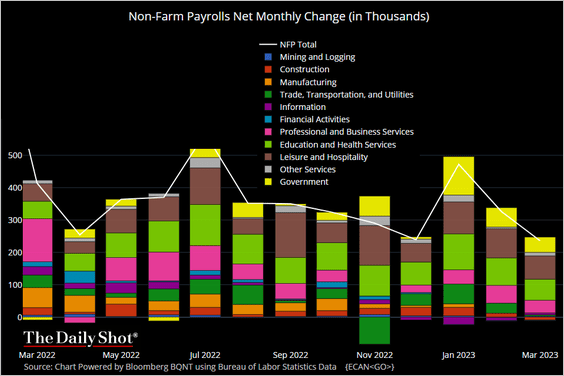

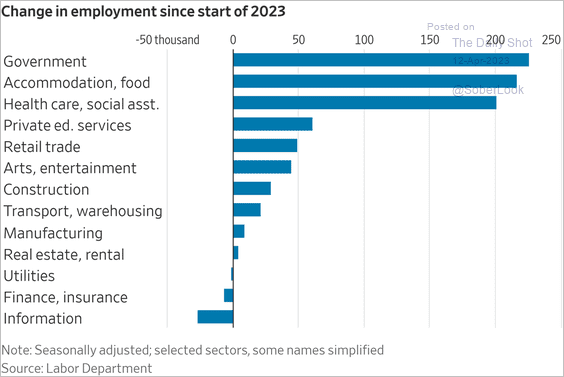

2. Next, we have some updates on the labor market.

• Here are the changes in US payrolls by sector (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @WSJ Read full article

Source: @WSJ Read full article

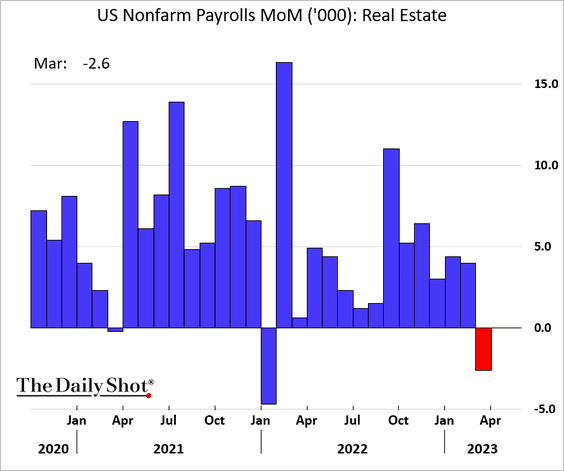

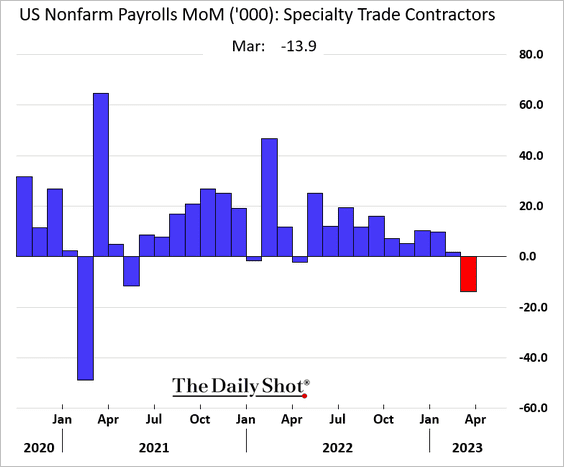

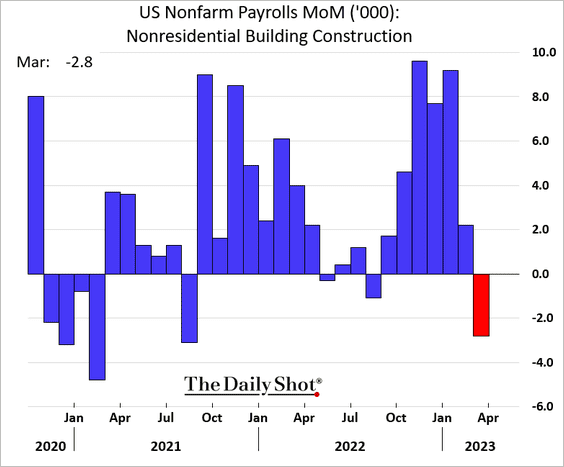

• Real estate and related sectors are seeing a pullback in hiring (3 charts).

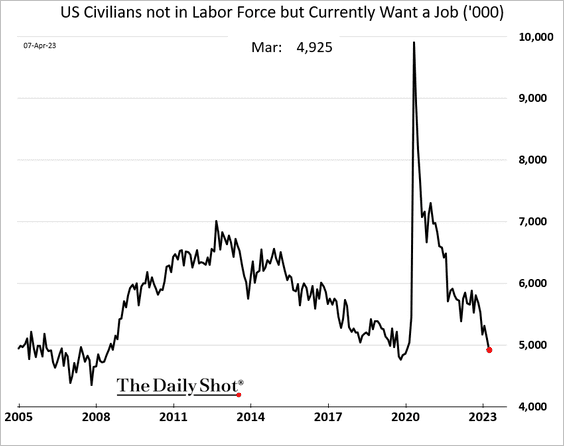

• The number of Americans on the sidelines who would like a job is near pre-COVID lows.

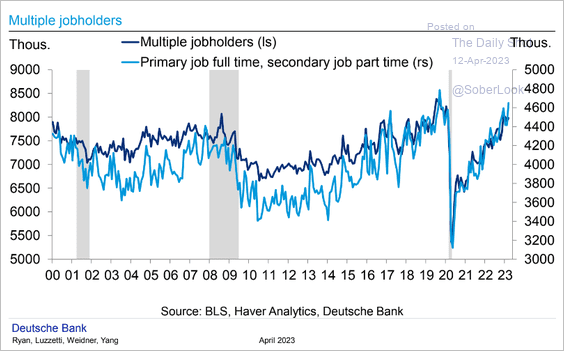

• The number of multiple jobholders continues to climb.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

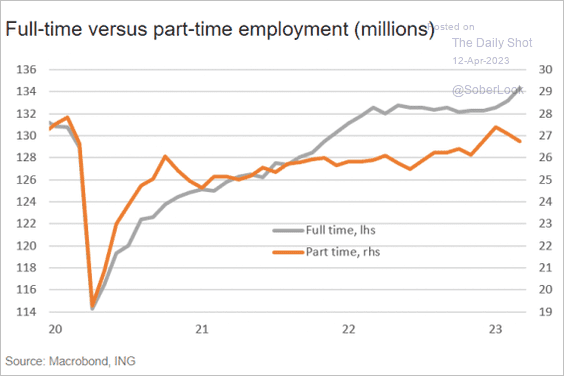

Source: MarketWatch Read full article

Source: MarketWatch Read full article

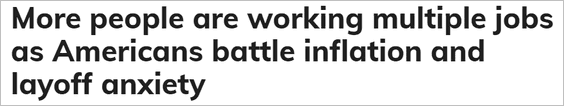

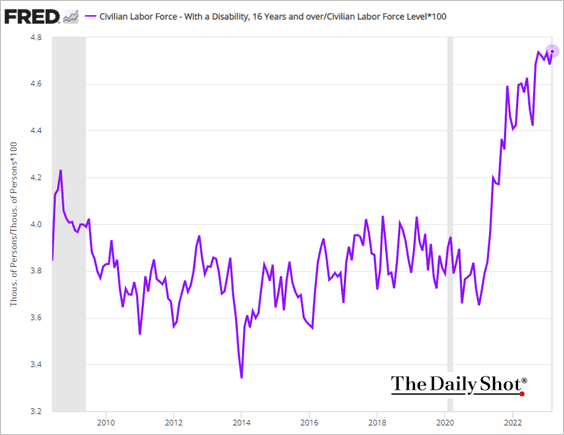

• Here are some additional trends from the jobs report.

– Rising labor force participation among Americans with disabilities:

– Full- vs. part-time employment:

Source: ING

Source: ING

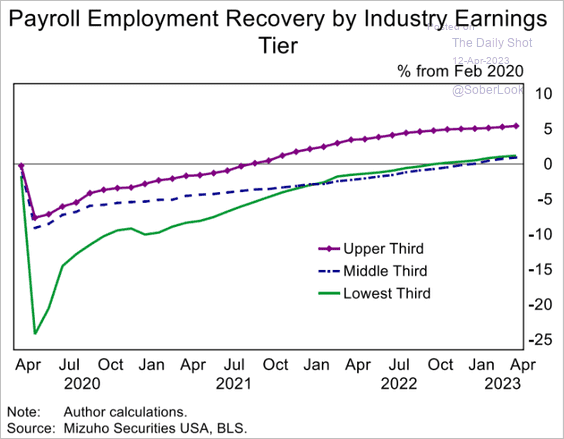

– Employment by earnings tier:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

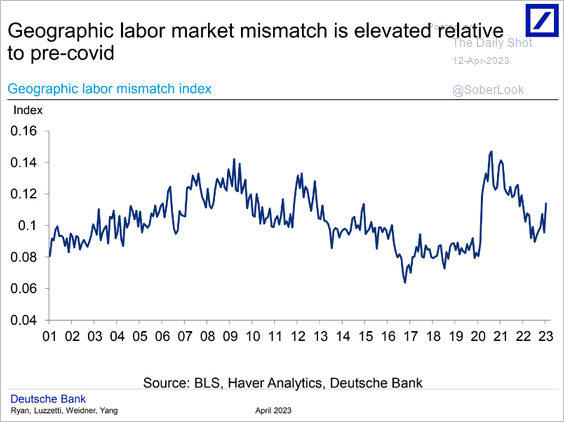

– The geographic labor market mismatch:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

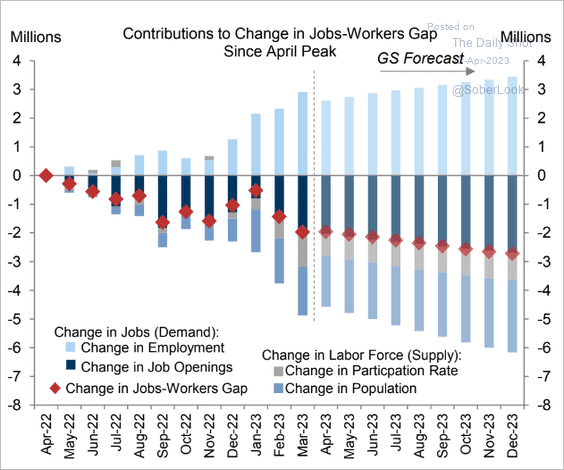

– The jobs/workers gap has been shrinking. Here are the contributions.

Source: Goldman Sachs

Source: Goldman Sachs

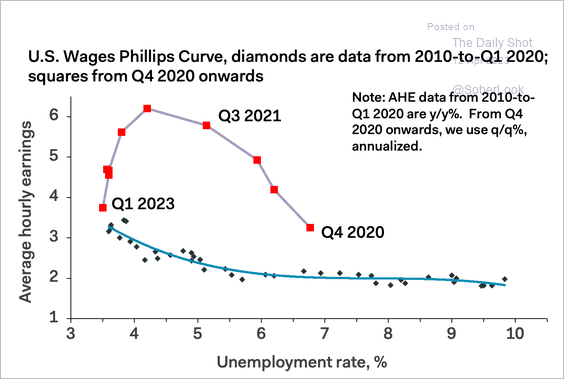

– The Phillipps Curve:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

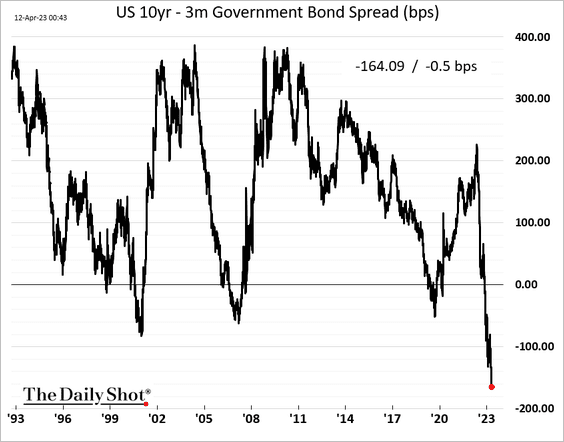

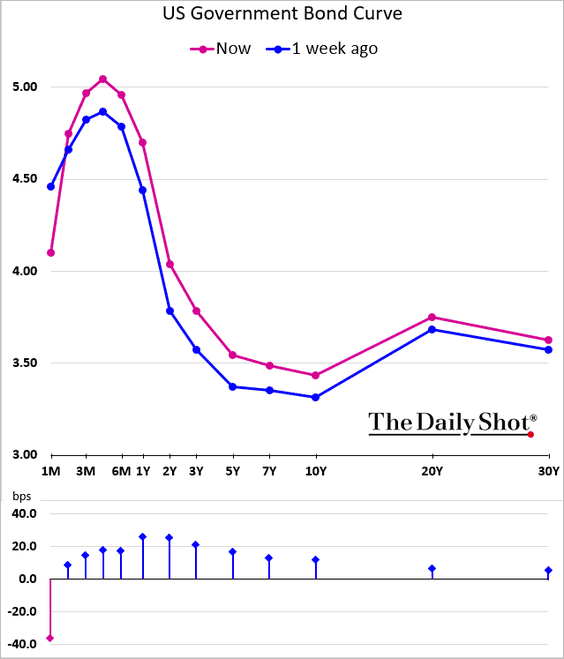

3. The inversion in the 10-year/3-month portion of the Treasury curve has been hitting multi-decade extremes.

Here are the yield curve changes over the past five business days.

Back to Index

Europe

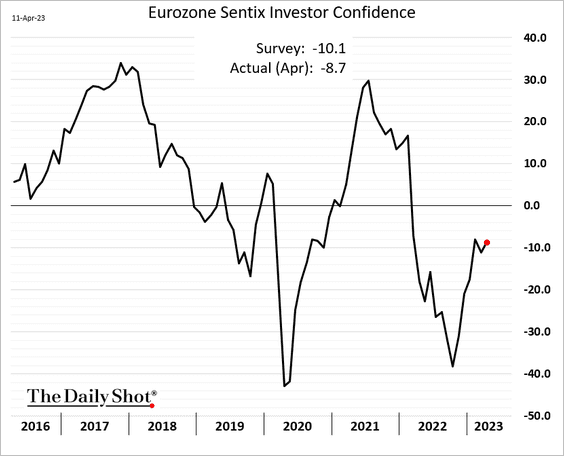

1. The Eurozone Sentix investor sentiment indicator improved this month.

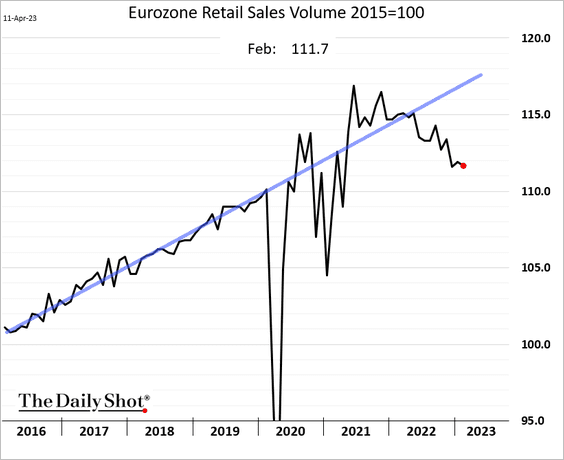

2. Euro-area real retail sales declined again in February.

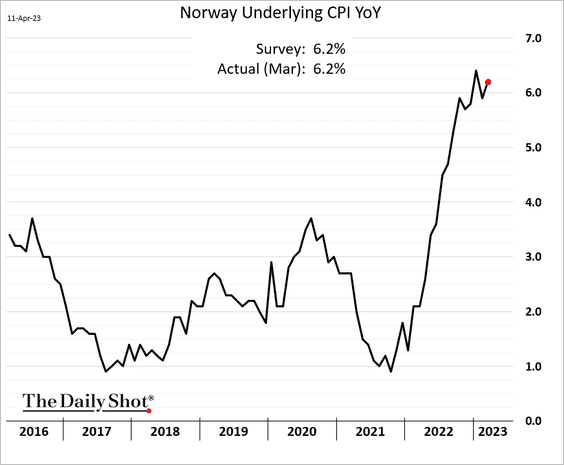

3. Norway’s underlying inflation remains elevated.

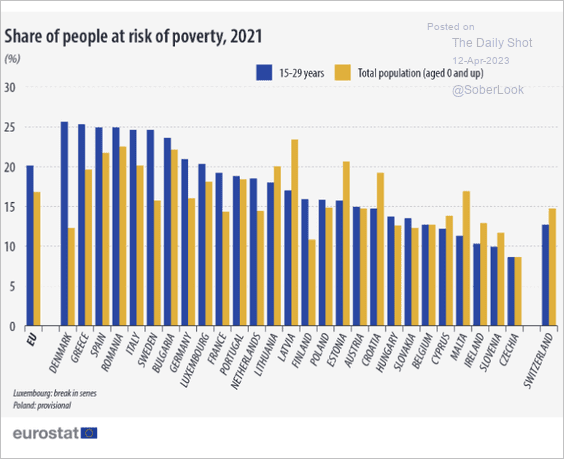

4. A significant number of young people in the EU are at risk of poverty.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

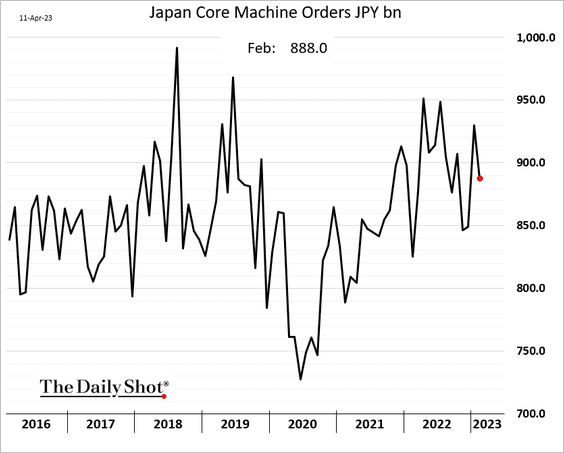

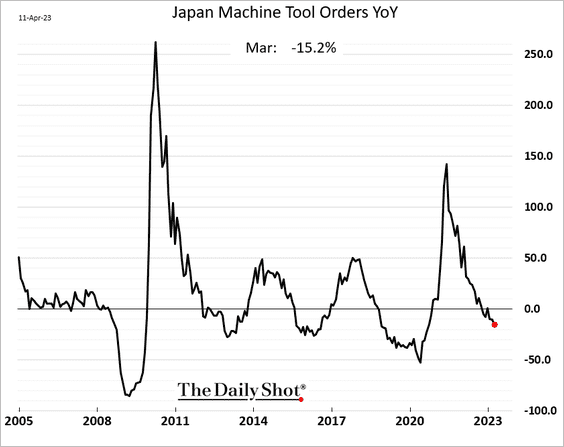

1. Machinery orders declined in February.

Machine tool orders are down 15% from a year ago.

——————–

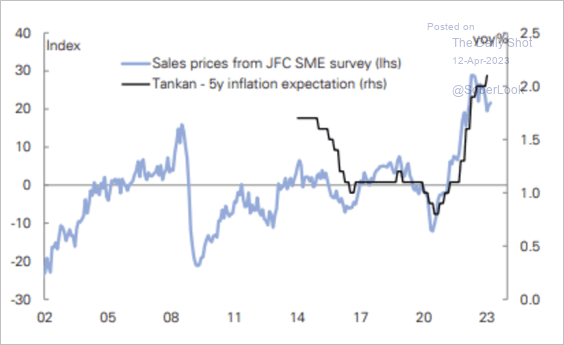

2. Japanese firms expect higher inflation despite the recent softness in sales prices.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

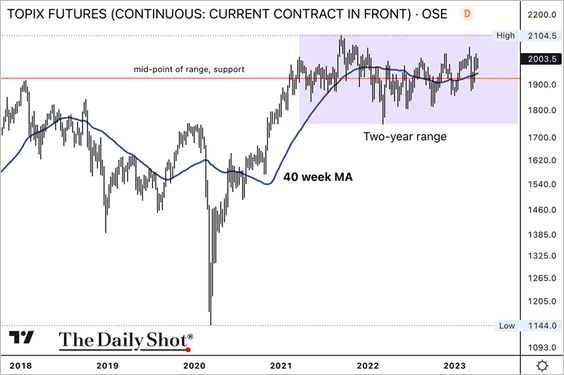

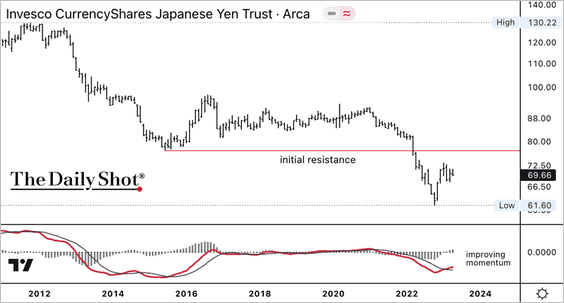

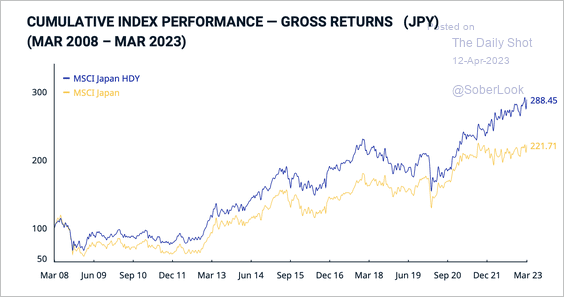

3. Next, we have some updates on the equity market.

• The TOPIX Index is holding support above its 40-week moving average, albeit confined to a two-year long range.

• The Invesco Japanese Yen ETF (FXY) is testing resistance, but long-term momentum has improved since the October 2022 low.

• High dividend yield stocks have outperformed in recent years.

Source: MSCI Read full article

Source: MSCI Read full article

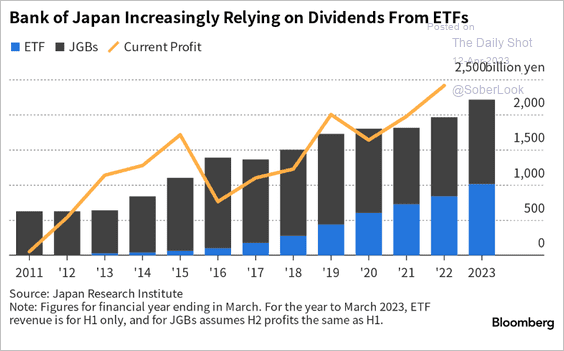

• The BoJ is collecting rich dividends from ETFs it owns.

Source: Hideyuki Sano, @TakingStock Read full article

Source: Hideyuki Sano, @TakingStock Read full article

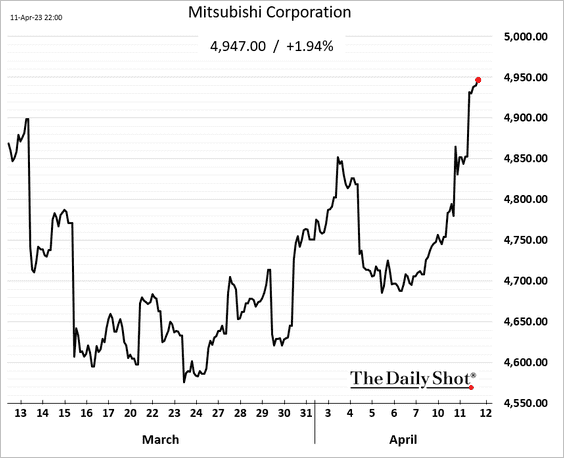

• Buffett plans to increase his investments in Japan’s biggest trading houses.

Source: Barron’s Read full article

Source: Barron’s Read full article

Back to Index

Asia – Pacific

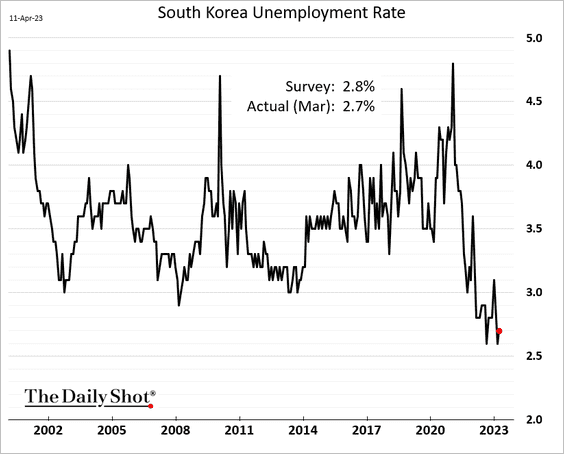

1. South Korea’s unemployment remains near multi-decade lows.

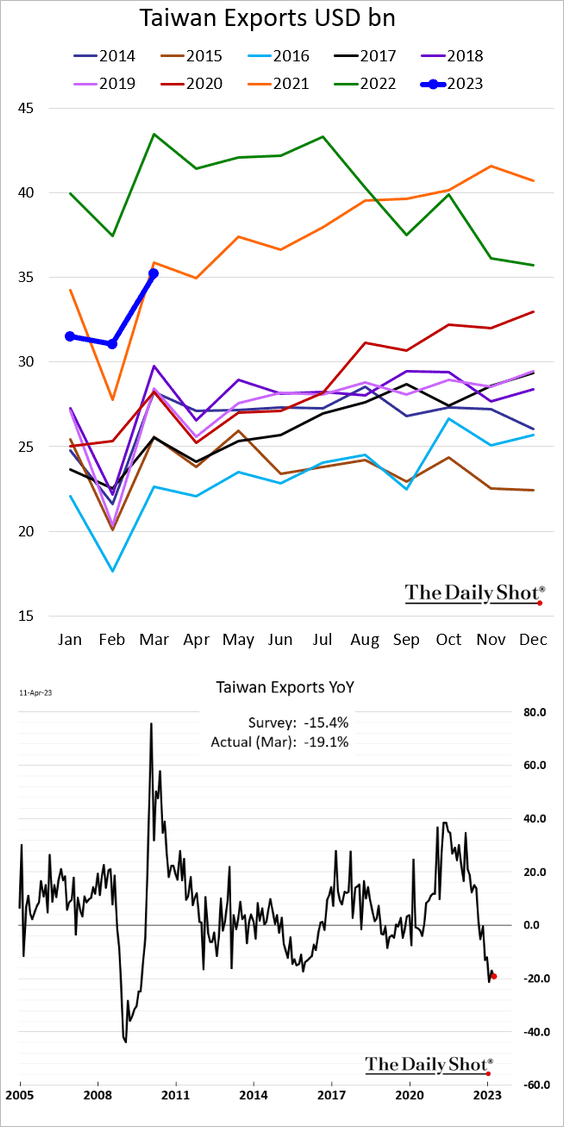

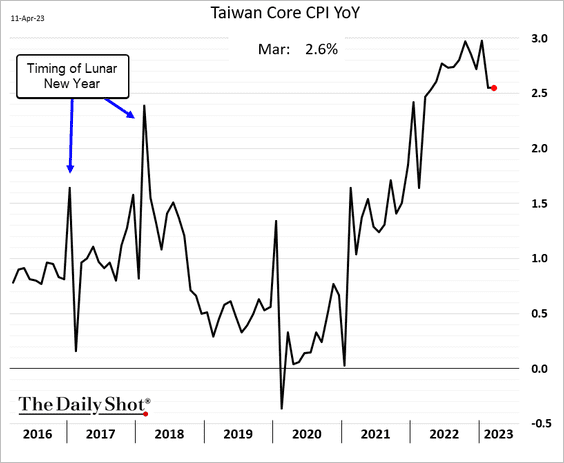

2. Taiwan’s exports were softer than expected in March.

Taiwan’s core CPI held steady last month.

Back to Index

China

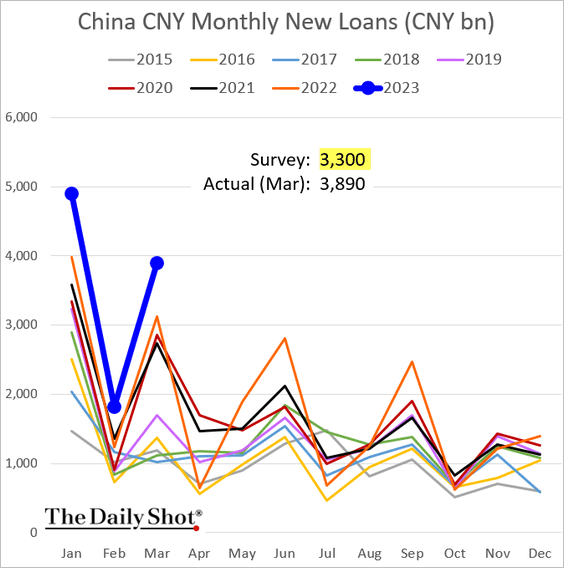

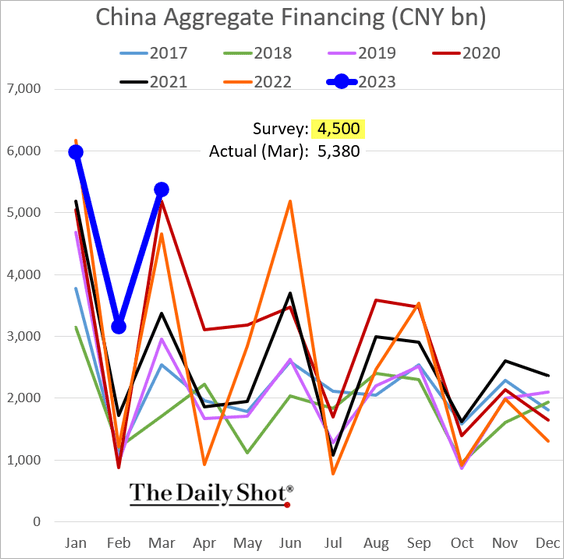

1. Credit growth topped expectations, signaling increased investment.

Source: @markets Read full article

Source: @markets Read full article

• CNY loans:

• Aggregate financing:

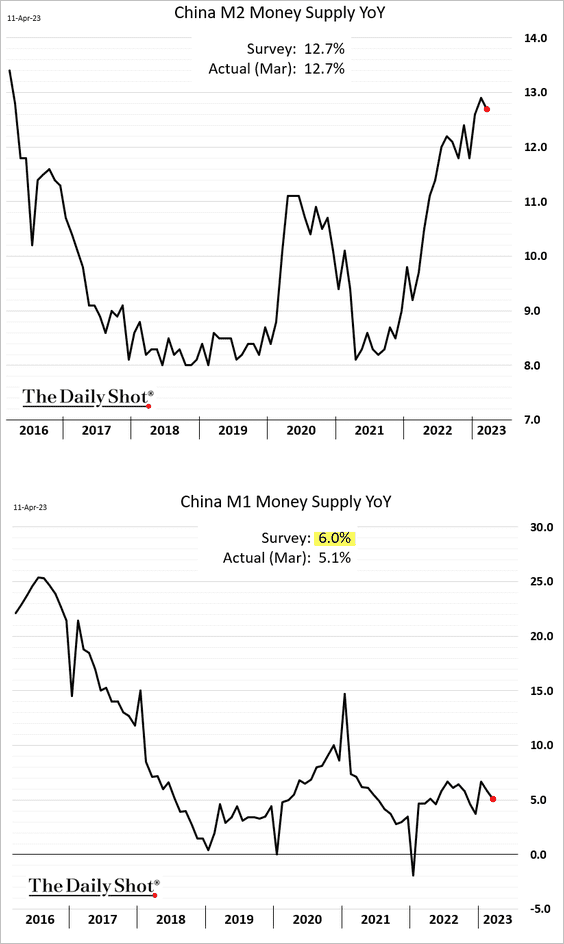

2. The money supply growth slowed.

Back to Index

Emerging Markets

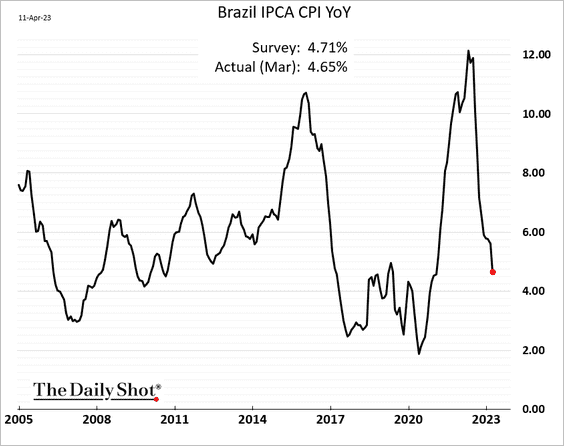

1. Brazil’s inflation declined again last month.

Source: @andrewrosati, @economics Read full article

Source: @andrewrosati, @economics Read full article

——————–

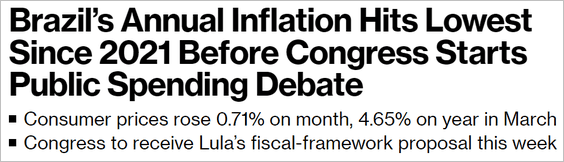

2. Mexico’s manufacturing output inched lower in February.

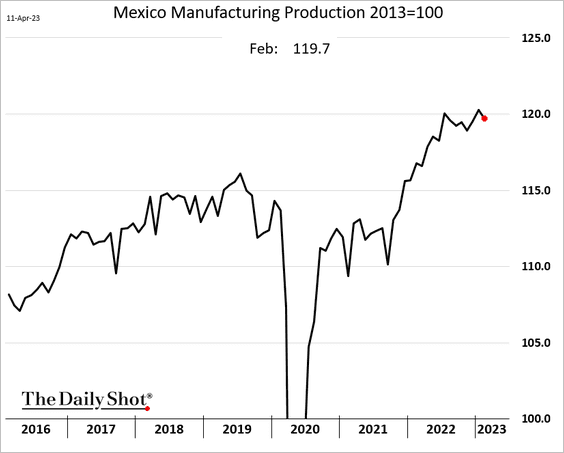

3. South Africa’s manufacturing production remains at multi-year lows.

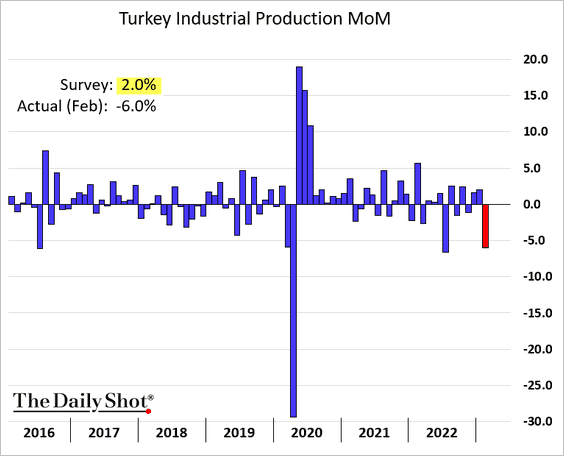

4. Turkey’s industrial production dropped sharply in February.

Source: @berilakman, @economics Read full article

Source: @berilakman, @economics Read full article

——————–

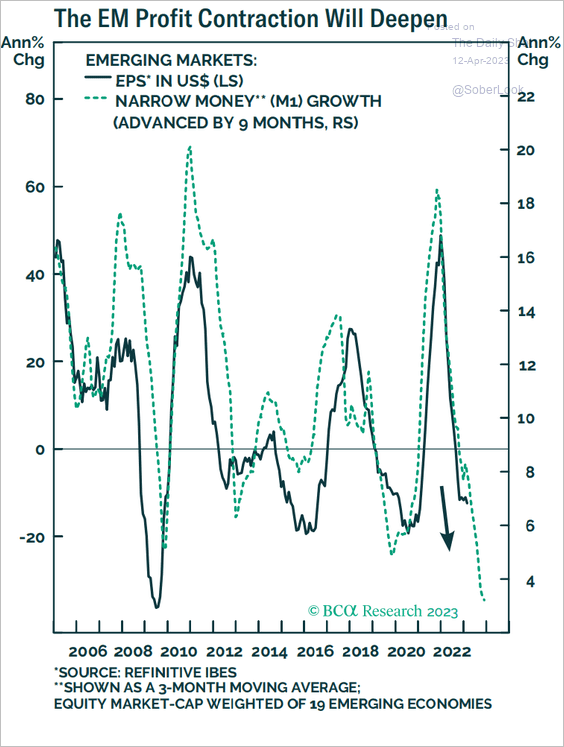

5. Tighter liquidity signals a deeper corporate profit contraction across emerging markets.

Source: BCA Research

Source: BCA Research

Back to Index

Commodities

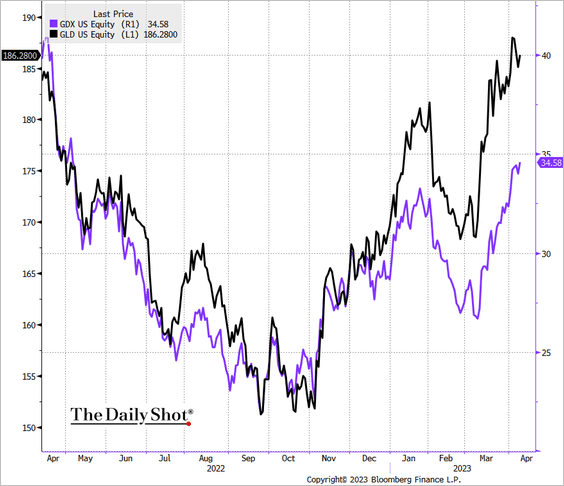

1. Gold mining shares have lagged gold prices, but the rally continues.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

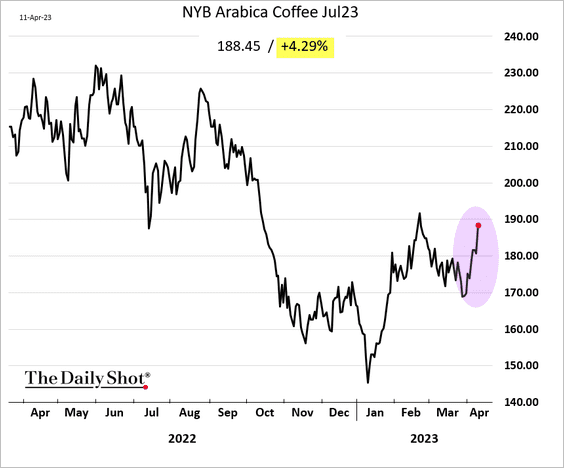

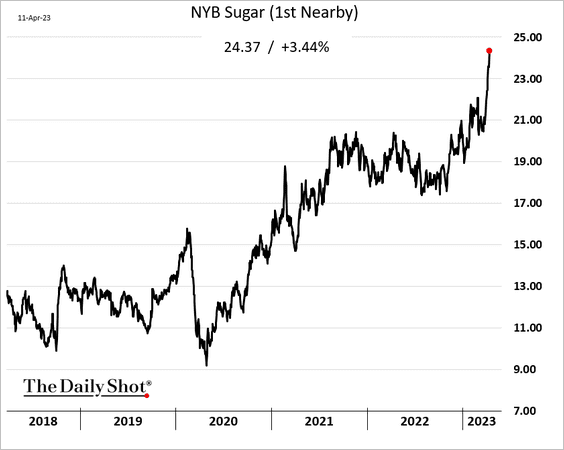

2. Softs have been on fire.

• Coffee futures are surging amid concerns over short-term supply tightness. Brazilian and Colombian farmers are in no rush to sell.

• Sugar prices are hitting multi-year highs.

Source: @MumbiGitau, @markets Read full article

Source: @MumbiGitau, @markets Read full article

Back to Index

Energy

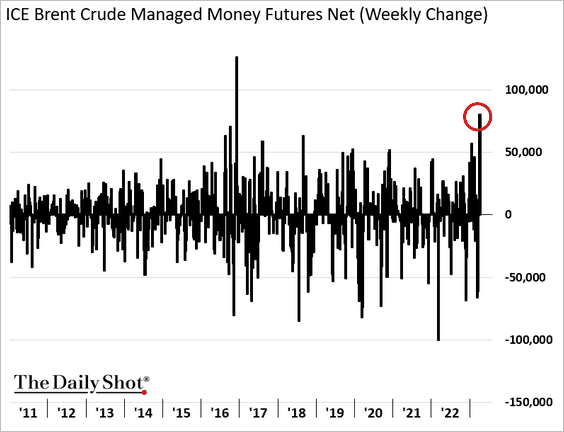

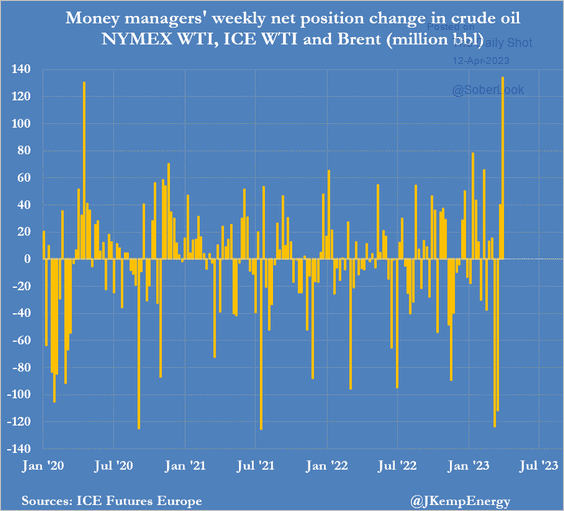

1. Asset managers were squeezed by OPEC’s surprise production cut (2 charts).

Source: @JKempEnergy

Source: @JKempEnergy

——————–

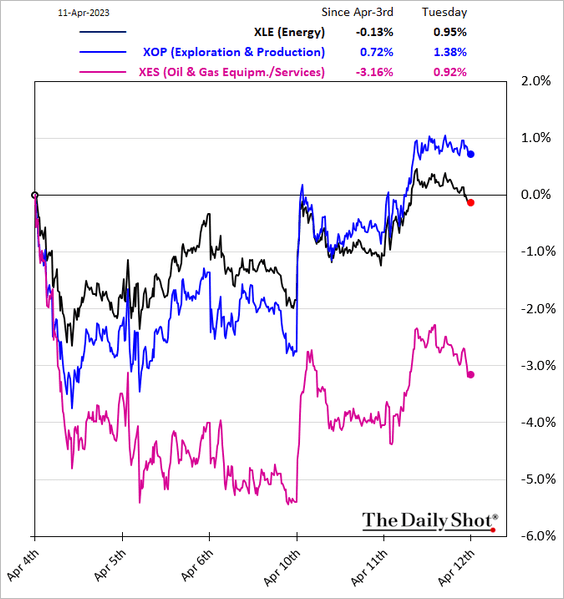

2. Shares of oil & gas services firms have been underperforming.

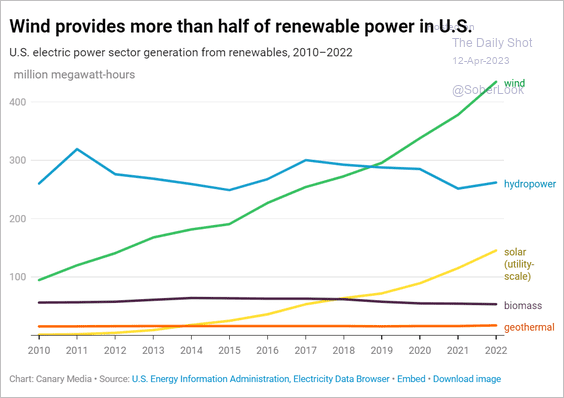

3. This chart shows US power generation from renewables.

Source: Canary Media Read full article

Source: Canary Media Read full article

Back to Index

Equities

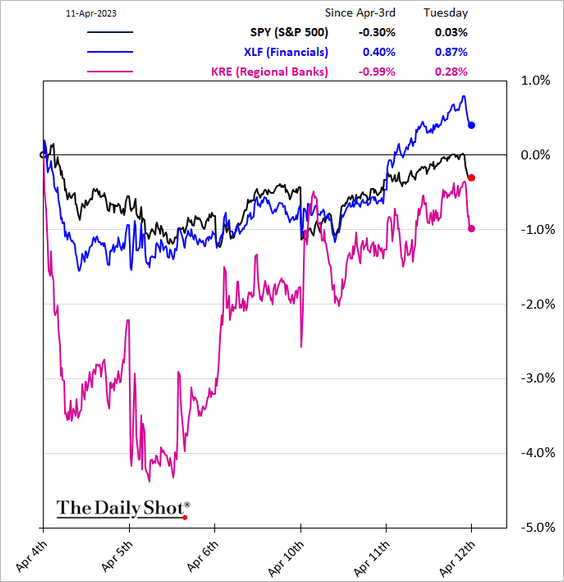

1. Financials have been rebounding.

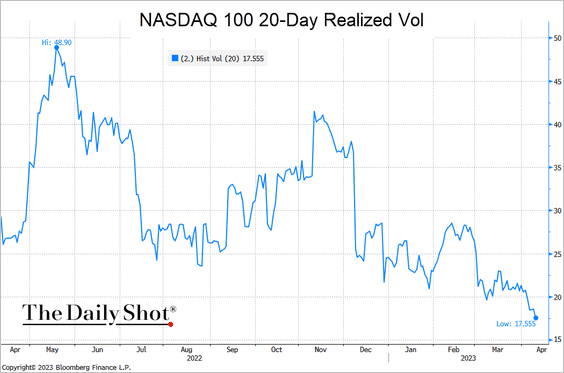

2. The calm before the storm?

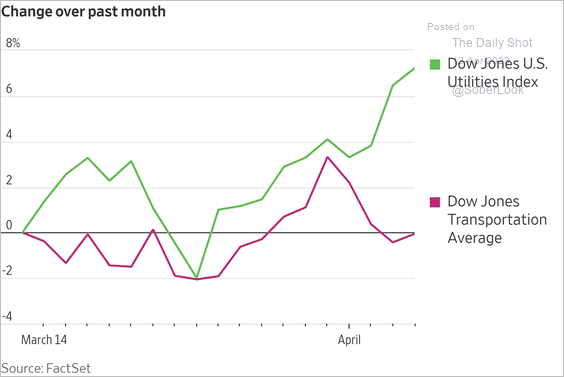

3. The market is signaling an economic slowdown.

Source: @WSJ Read full article

Source: @WSJ Read full article

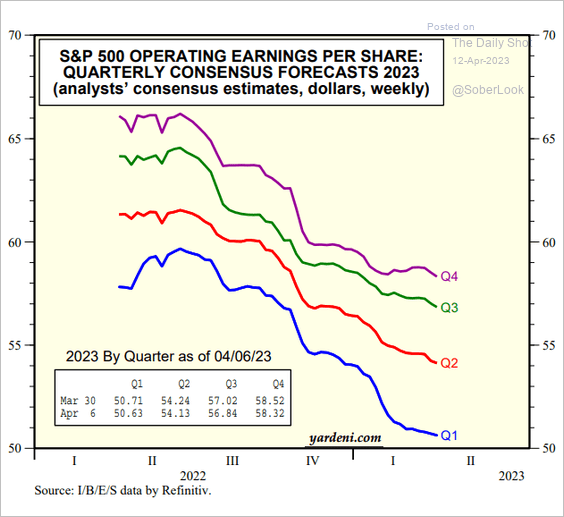

4. Analysts continue to downgrade their S&P 500 earnings estimates for 2023 and 2024.

Source: Yardeni Research

Source: Yardeni Research

Here are the estimates by quarter.

Source: Yardeni Research

Source: Yardeni Research

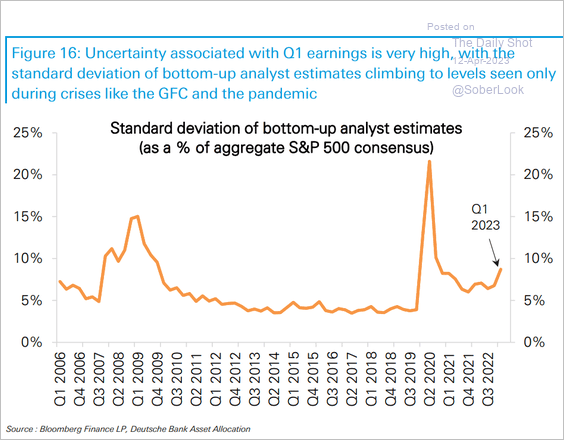

Are the Q1 downgrades overdone? There is a great deal of uncertainty associated with last quarter’s earnings.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

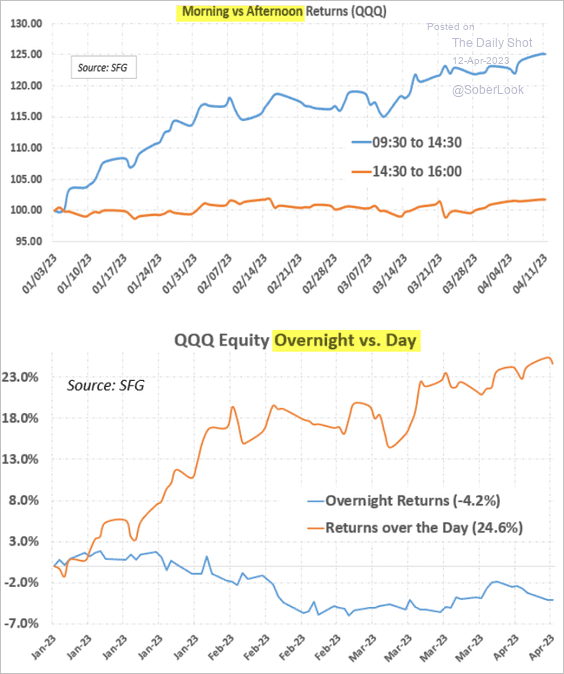

5. Here is a look at recent QQQ (Nasdaq 100) returns: morning vs. afternoon and overnight vs. day.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

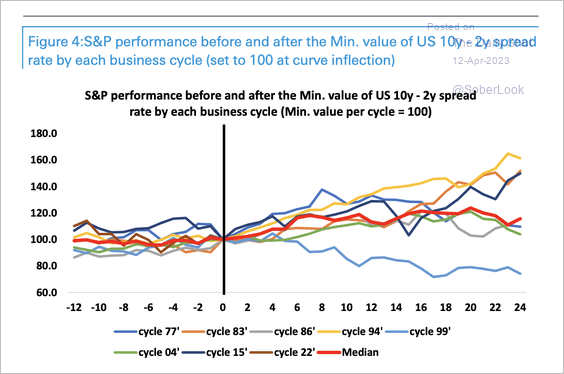

6. The S&P 500 tends to rise 12 months after a trough in the 10s/2s Treasury curve. The yield curve leads cycle recoveries by roughly four to eight quarters, while equities lead by two to three quarters, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

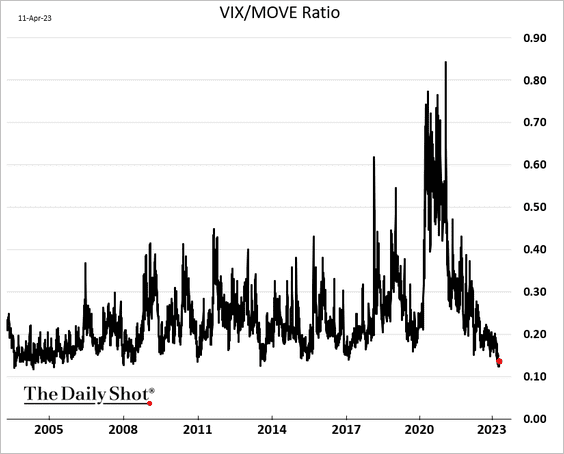

7. Equity market implied volatility remains very low relative to rates vol.

Back to Index

Alternatives

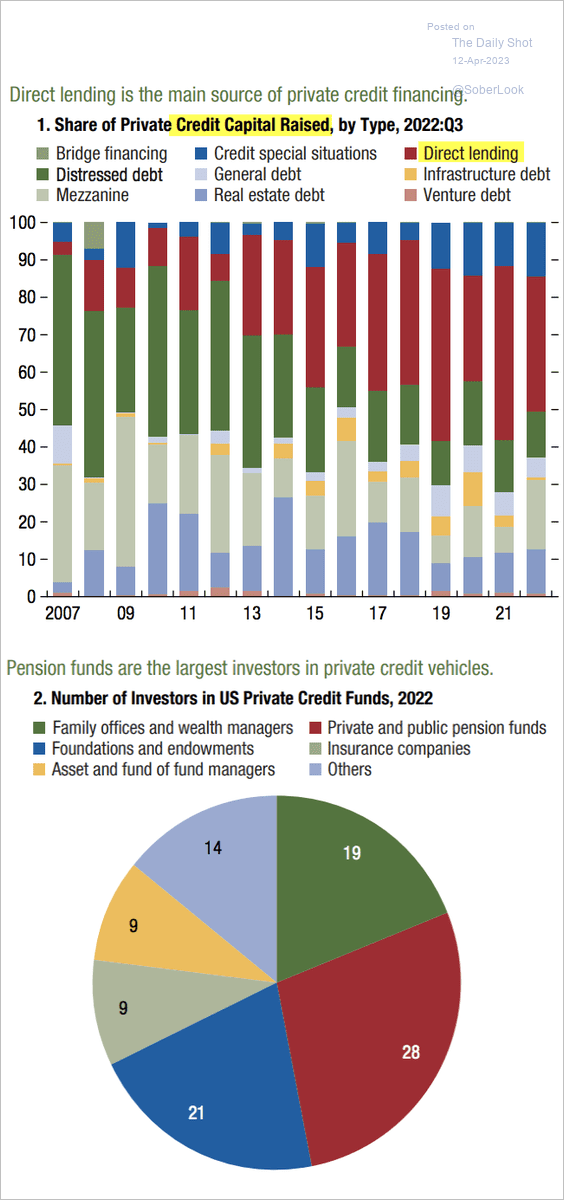

1. Let’s start with some data on private credit funds.

Source: IMF Read full article

Source: IMF Read full article

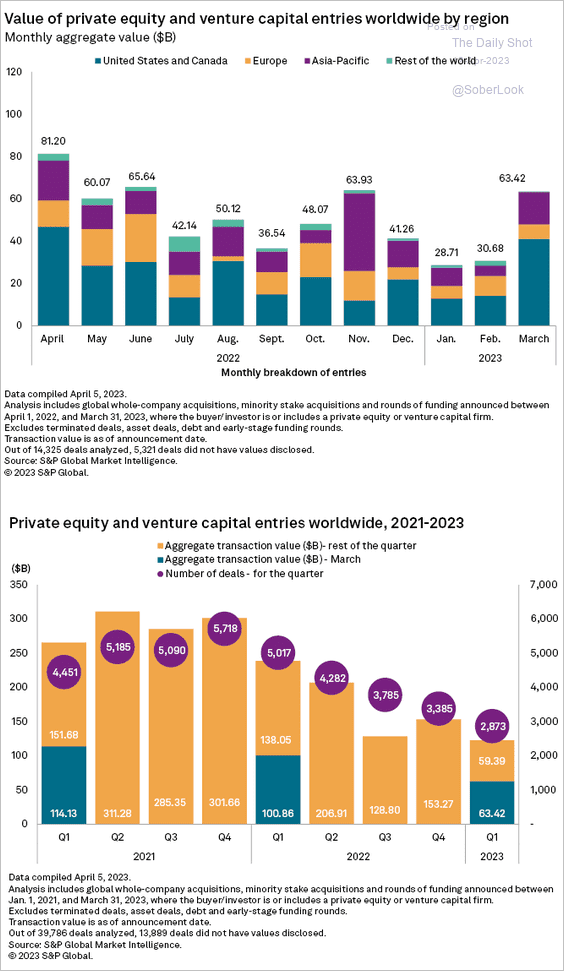

2. March saw a pickup in private equity activity.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

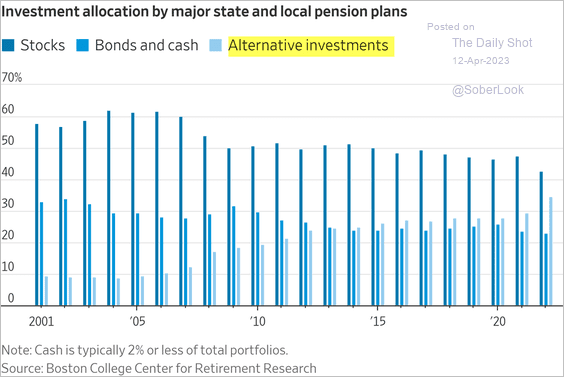

3. State and local pension plans expect higher allocations to alternatives.

Source: @WSJ Read full article

Source: @WSJ Read full article

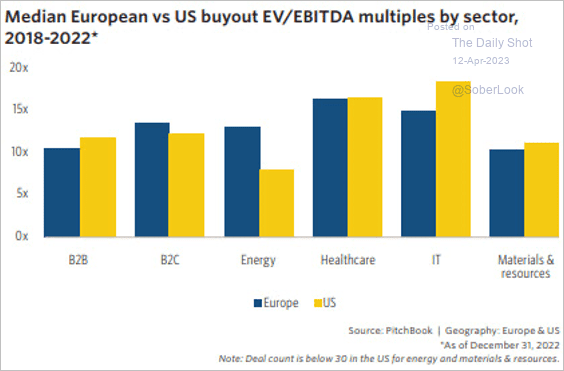

4. Information technology and healthcare have driven median buyout multiples higher in Europe and the US.

Source: PitchBook

Source: PitchBook

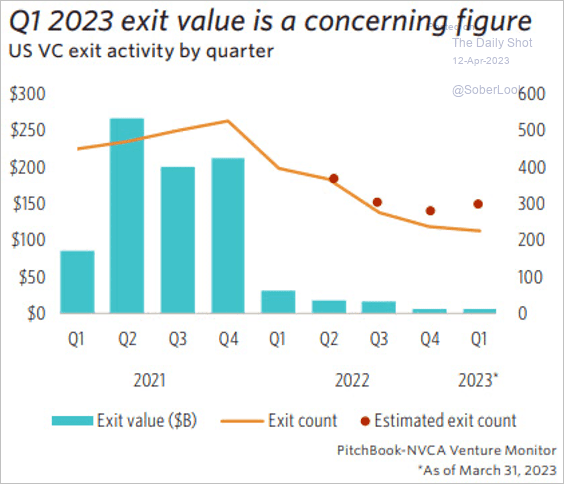

5. There has been a significant drop in venture capital exits. Companies are finding it difficult to raise money at the multiples they hoped for, leading to smaller valuation step-ups and increased dilution, according to PitchBook.

Source: PitchBook

Source: PitchBook

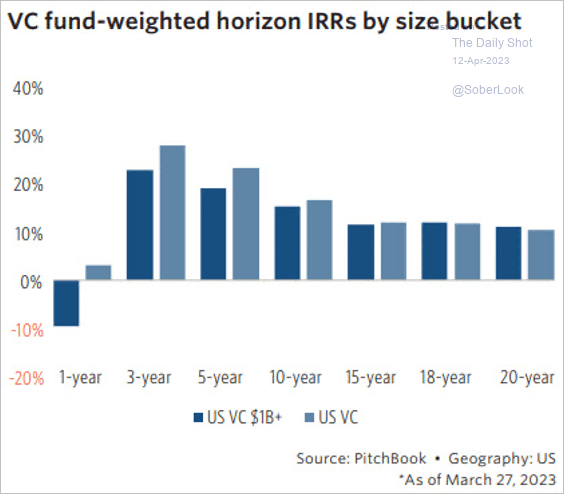

The one-year horizon performance for $1 billion+ venture capital funds is negative.

Source: PitchBook

Source: PitchBook

——————–

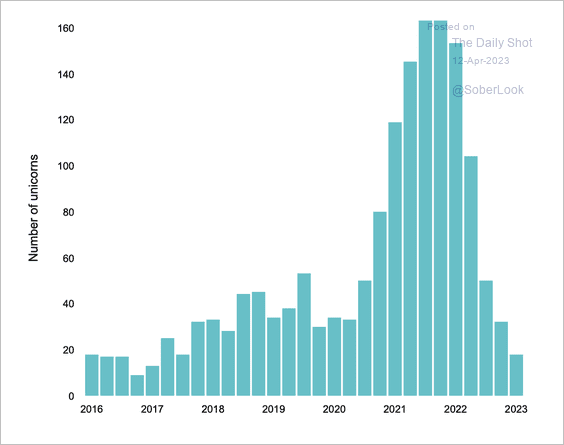

6. Globally, only 18 unicorns (startups valued at over $1 billion) were minted in Q1 at a combined valuation of $27.1 billion, according to PitchBook. This is the lowest quarterly new unicorn count since 2017.

Source: PitchBook Read full article

Source: PitchBook Read full article

Back to Index

Credit

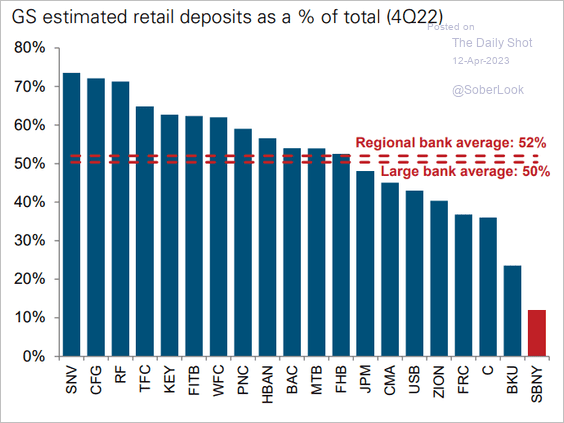

1. This chart shows retail deposits, by bank.

Source: Goldman Sachs

Source: Goldman Sachs

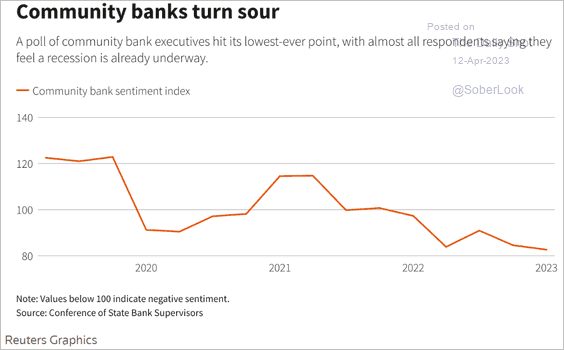

2. Community banks see a recession ahead.

Source: Reuters Read full article

Source: Reuters Read full article

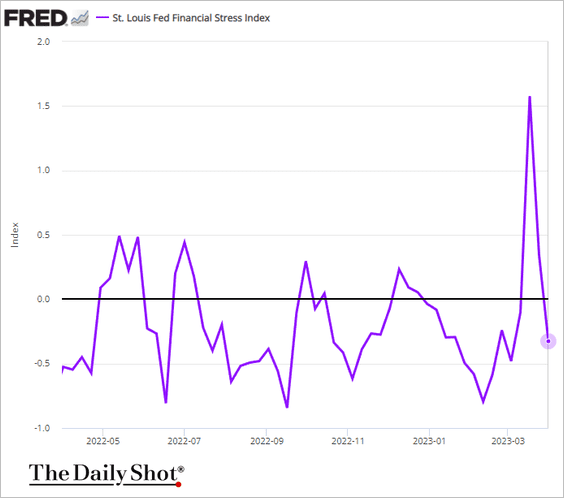

3. The St. Louis Fed Financial Stress Index is back at pre-SVB levels.

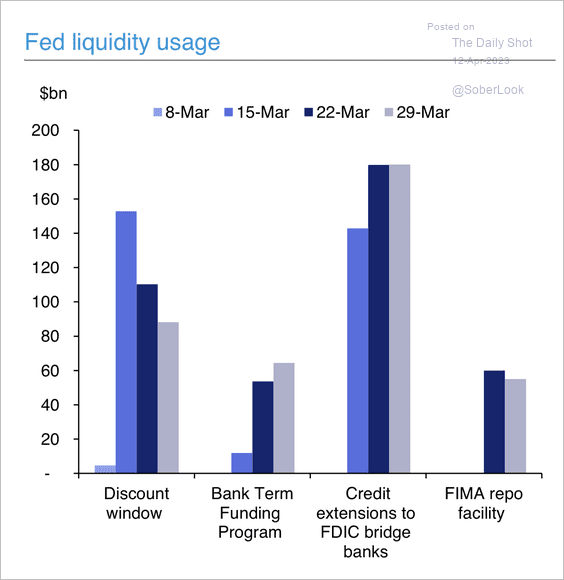

4. Here is a look at Fed liquidity usage compared to past financial shocks. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

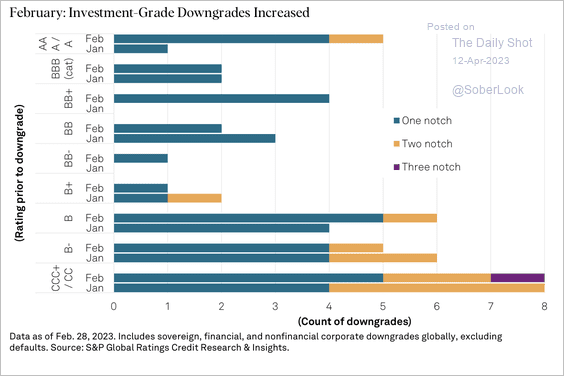

5. Investment-grade downgrades increased in February.

Source: S&P Global Ratings

Source: S&P Global Ratings

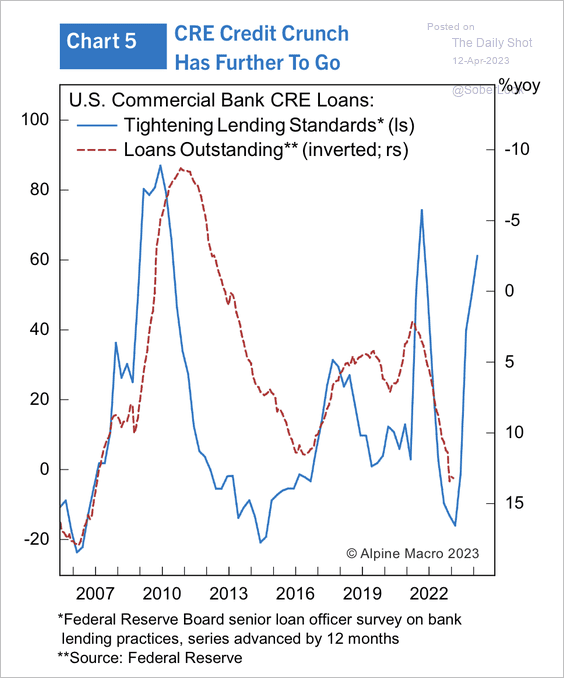

6. Higher interest rates, wider credit spreads, and tightening lending standards will make it difficult for commercial real estate borrowers to obtain new loans.

Source: Alpine Macro

Source: Alpine Macro

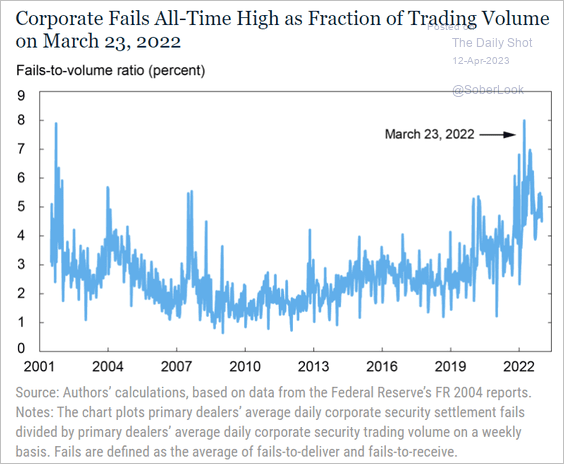

7. Corporate bond settlement fails have been very high.

Source: Federal Reserve Bank of New York Read full article

Source: Federal Reserve Bank of New York Read full article

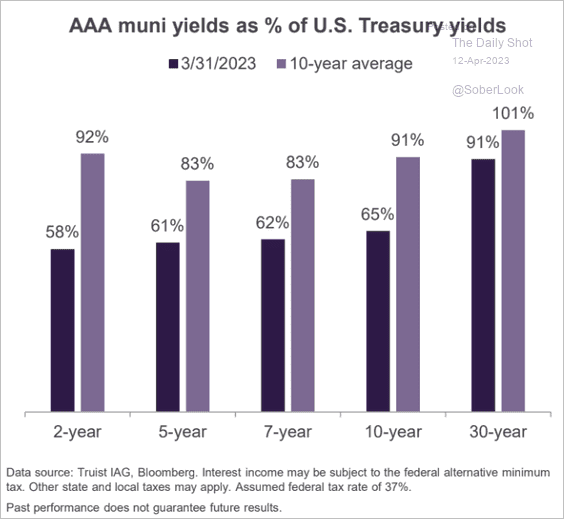

8. Munis appear to be richly priced.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Global Developments

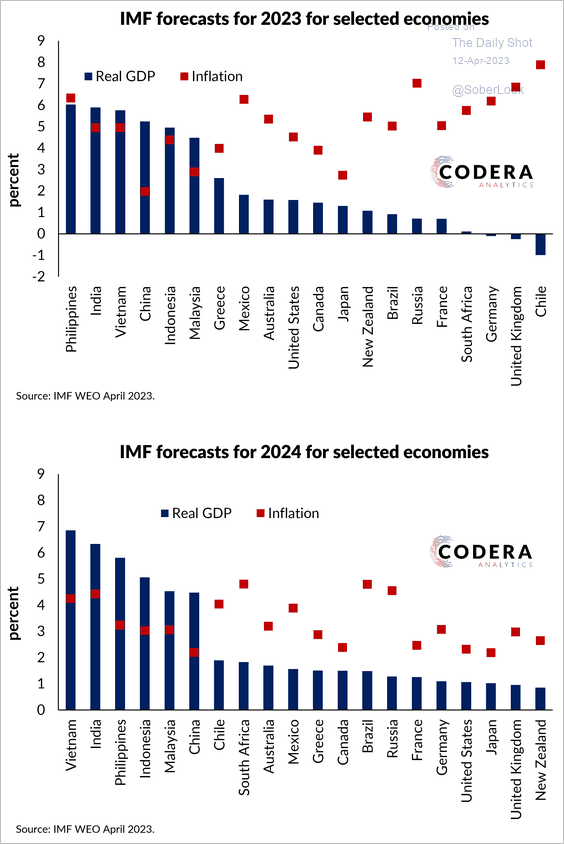

1. Let’s start with the IMF’s GDP and inflation forecasts for selected economies.

Source: Codera Analytics

Source: Codera Analytics

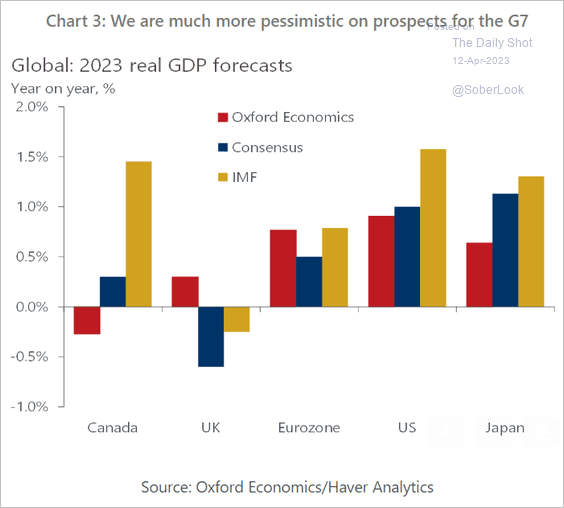

Oxford Economics has a more pessimistic outlook for G7 growth than the IMF.

Source: Oxford Economics

Source: Oxford Economics

——————–

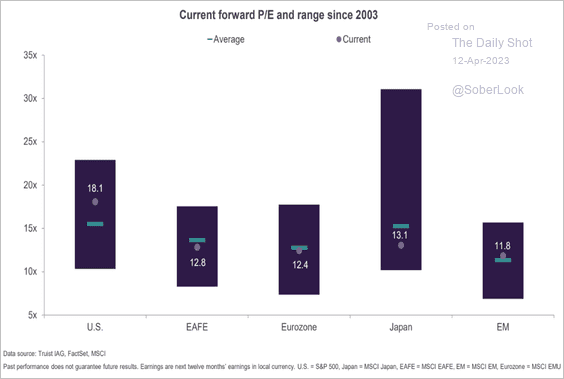

2. This chart shows global equity valuations relative to the historical average and range.

Source: Truist Advisory Services

Source: Truist Advisory Services

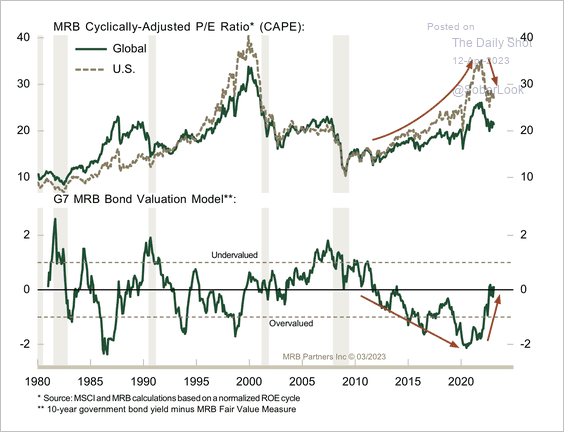

3. Global sovereign bonds became undervalued a decade ago, which preceded a bull market. Equities reached peak valuation after the post-COVID rally.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

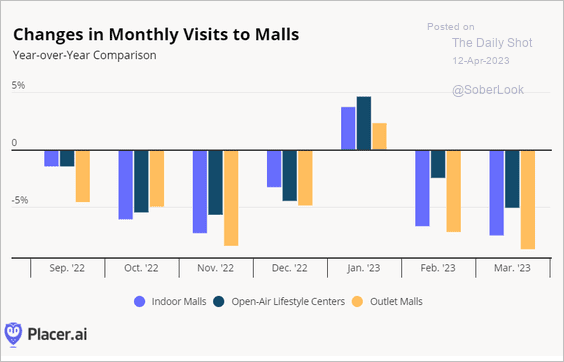

1. Mall visits:

Source: Placer.ai

Source: Placer.ai

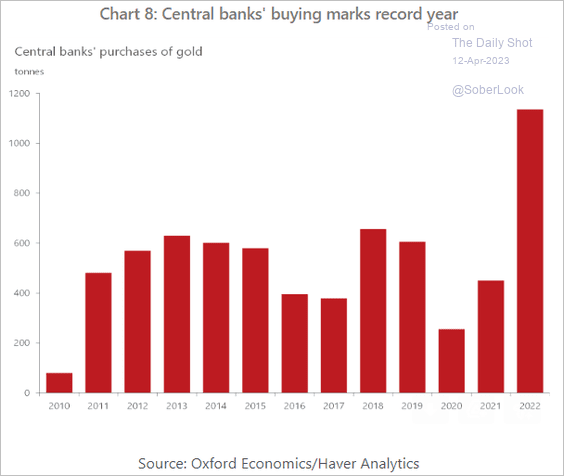

2. Central banks’ gold purchases:

Source: Oxford Economics

Source: Oxford Economics

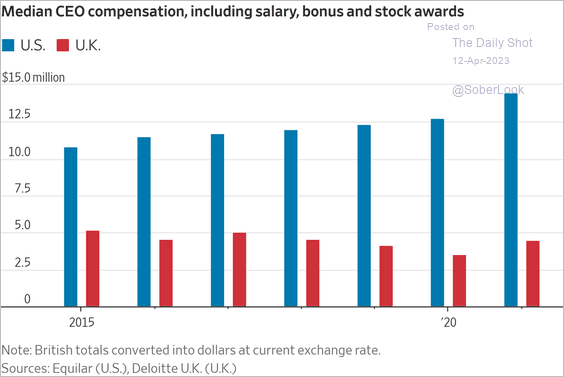

3. CEO compensation in the US and UK:

Source: @WSJ Read full article

Source: @WSJ Read full article

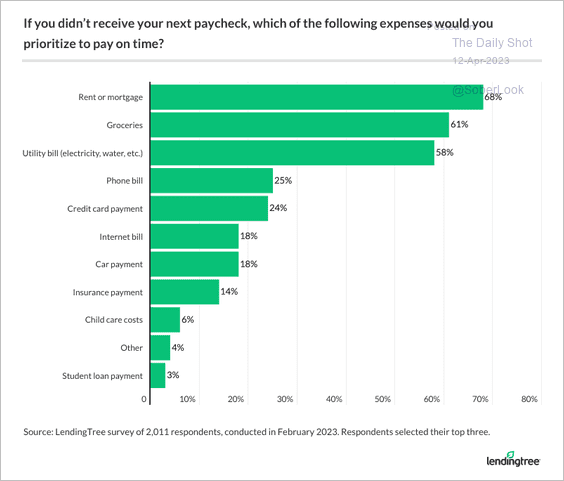

4. US households’ prioritization of payments:

Source: LendingTree Read full article

Source: LendingTree Read full article

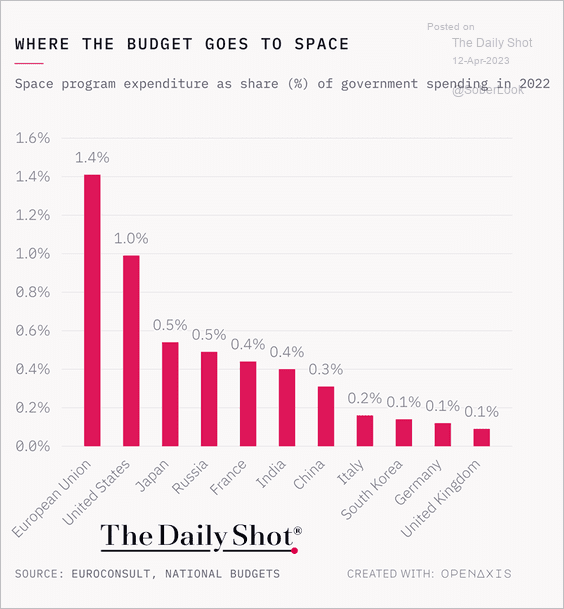

5. Space program expenditures as a share of government spending:

Source: @TheDailyShot

Source: @TheDailyShot

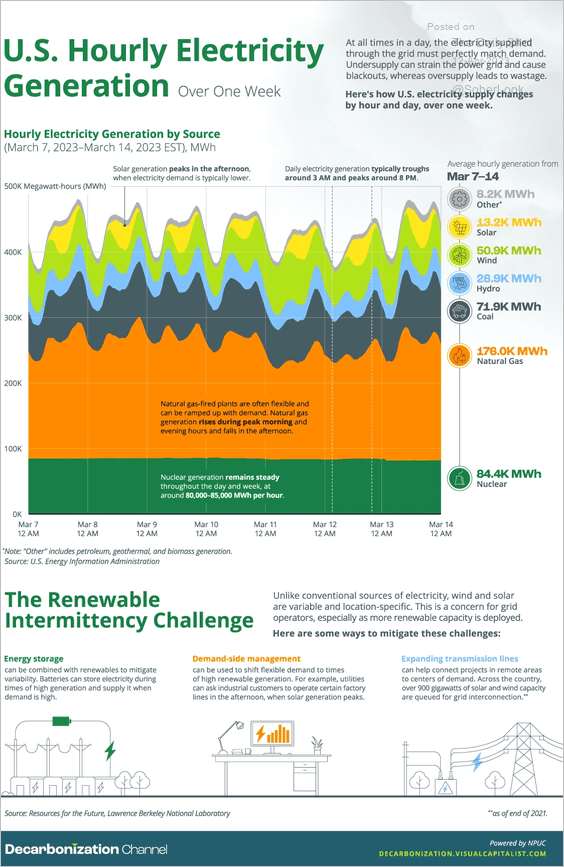

6. US hourly electricity generation by source:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

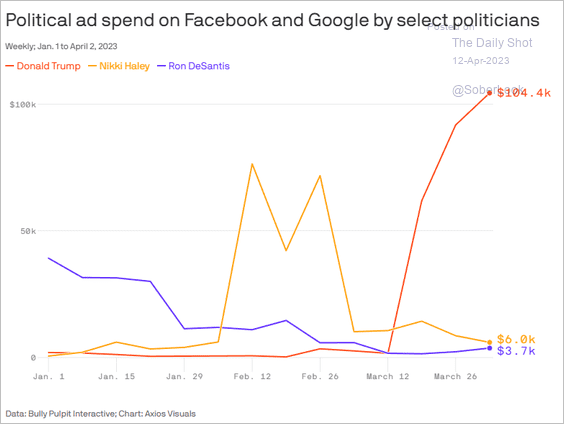

7. Political ad spending on Facebook and Google:

Source: @axios Read full article

Source: @axios Read full article

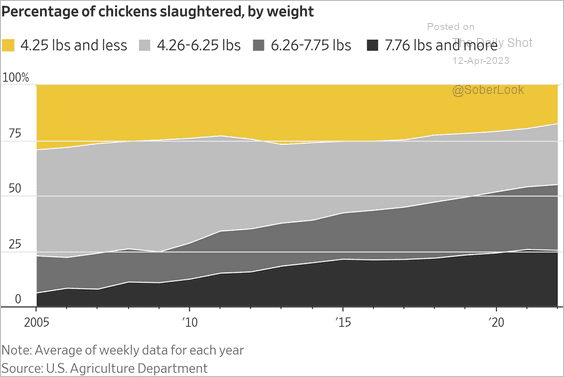

8. Big chickens:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index