The Daily Shot: 01-May-23

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

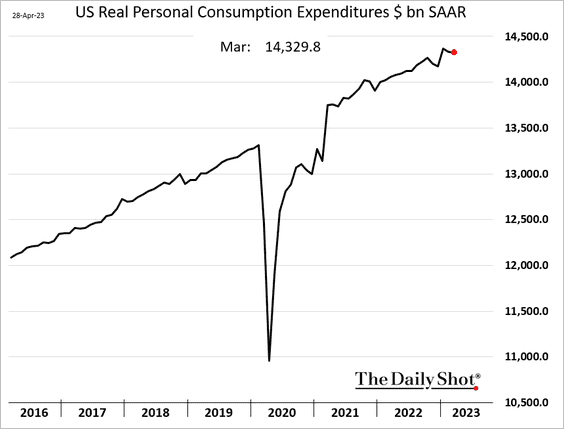

1. Consumer spending was unchanged in March (the market expected a slight decline).

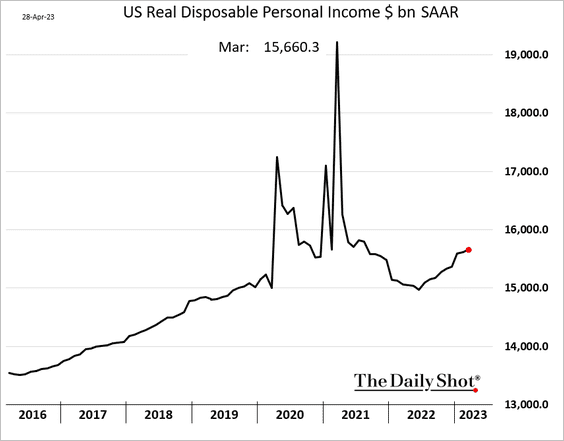

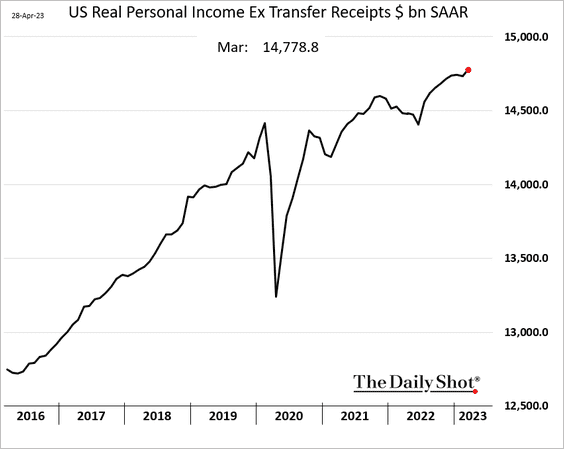

2. Incomes continue to trend higher.

• Real disposable personal income:

• Real income excluding government payments:

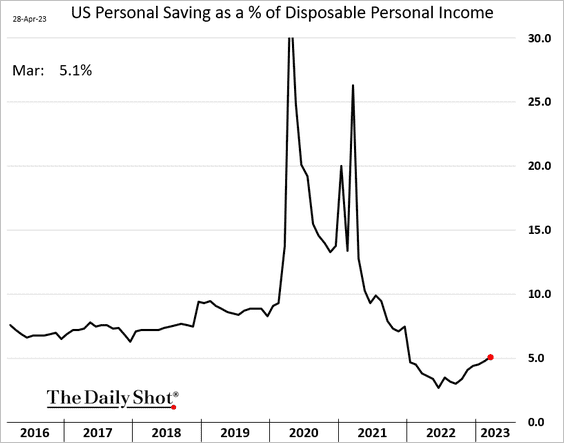

3. Personal saving as a share of disposable income is recovering.

——————–

4. Next, we have some updates on inflation.

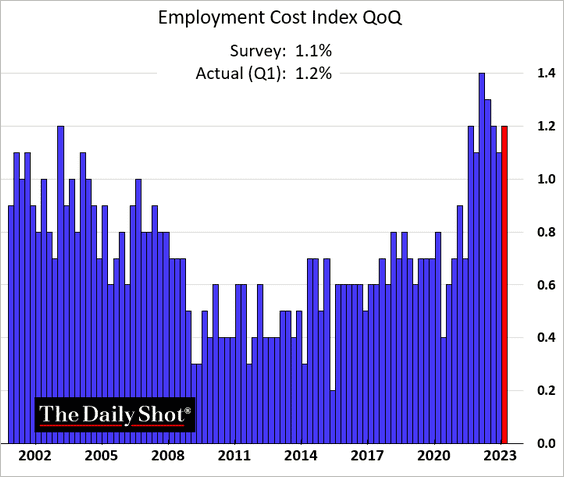

• The Q1 employment cost index topped expectations.

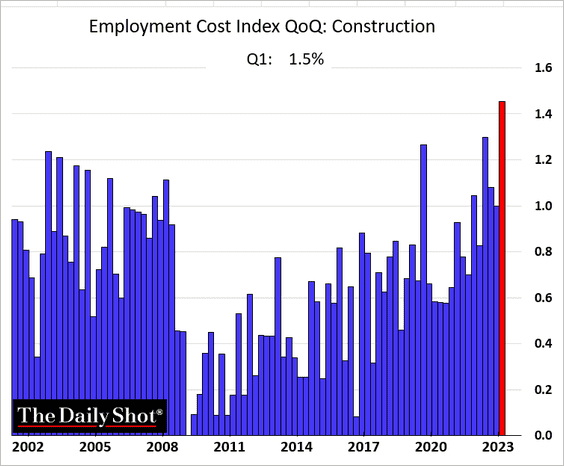

– The cost of construction crews saw the largest increase in decades.

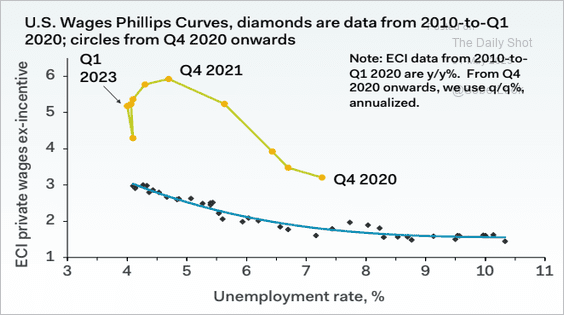

– The Phillips Curve moved in the “wrong” direction.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

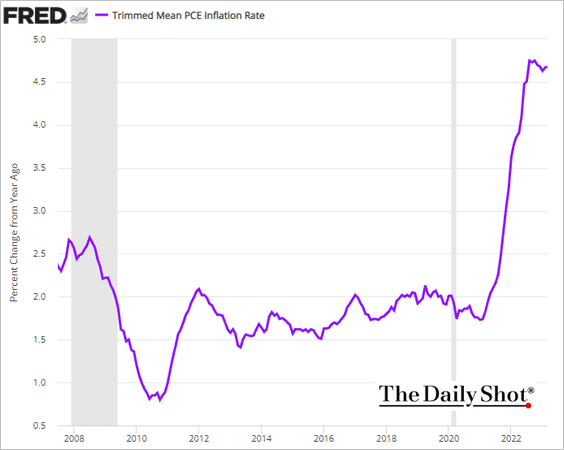

• The trimmed-mean PCE inflation (from the Dallas Fed) remains elevated.

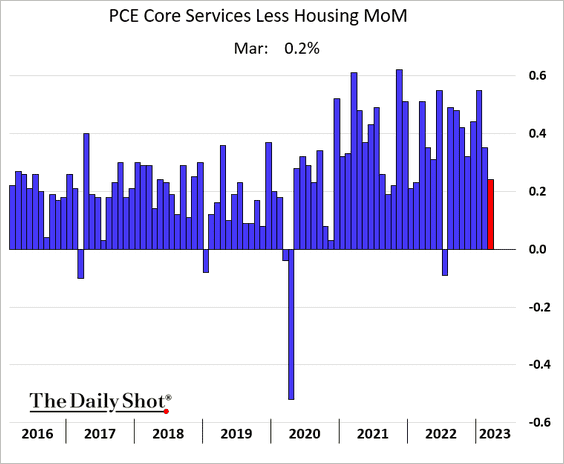

– The monthly increase in the “supercore” PCE inflation was the lowest in eight months.

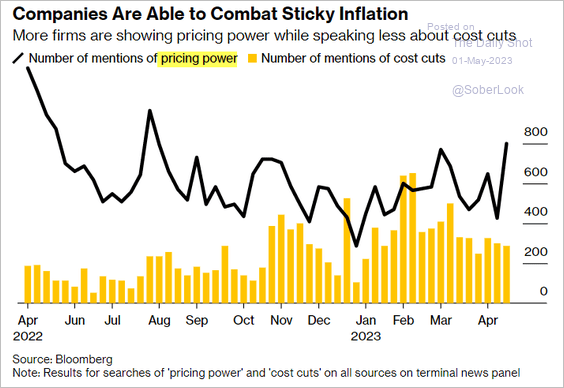

• This chart shows the number of mentions of “pricing power” vs. “cost cuts” on corporate earnings calls.

Source: @sagarikareports, @markets Read full article

Source: @sagarikareports, @markets Read full article

——————–

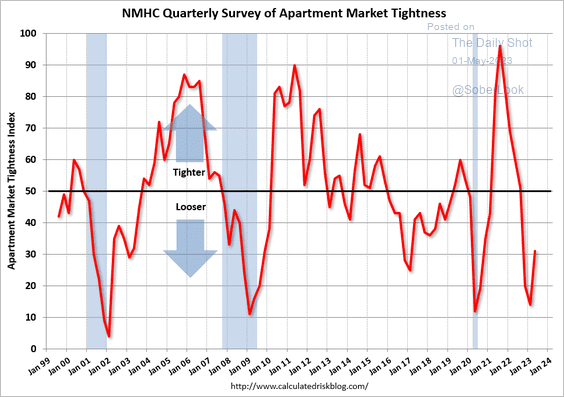

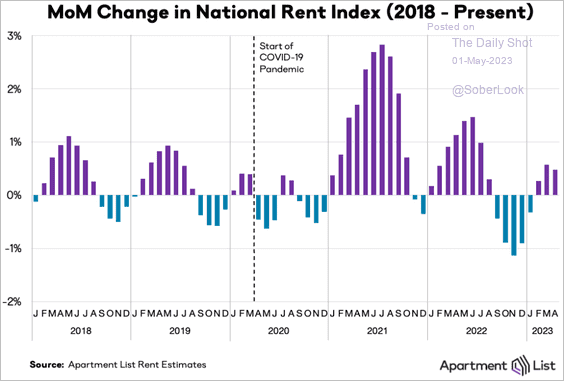

5. Apartment market continues to loosen, …

Source: Calculated Risk

Source: Calculated Risk

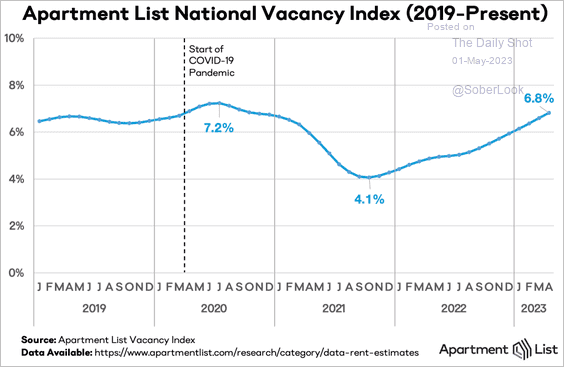

… as vacancies climb.

Source: Apartment List

Source: Apartment List

Nonetheless, rents were up again in April.

Source: Apartment List

Source: Apartment List

——————–

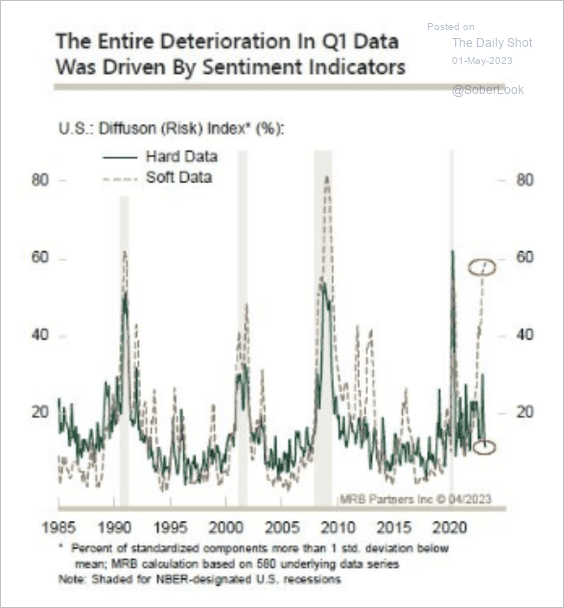

6. Economic sentiment has been sour, diverging from concrete improvements in underlying data.

Source: MRB Partners

Source: MRB Partners

——————–

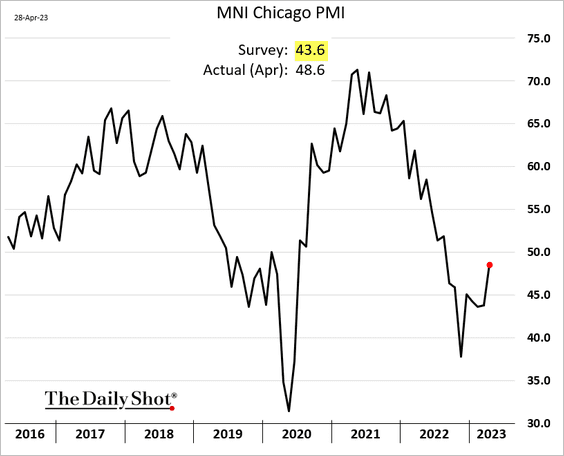

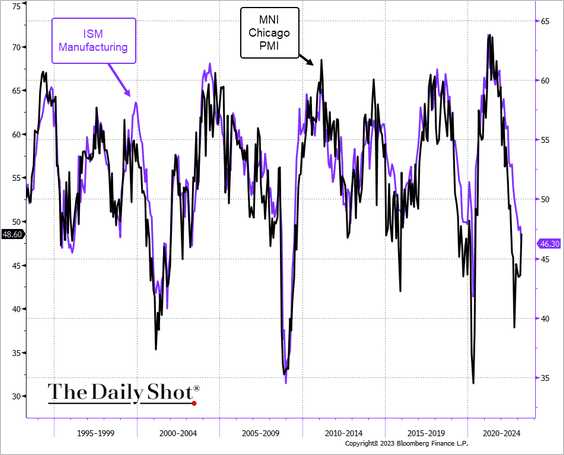

7. The MNI Chicago PMI surprised to the upside, deviating from most regional Fed surveys.

It’s unclear if we will see further weakness in the ISM Manufacturing PMI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Canada

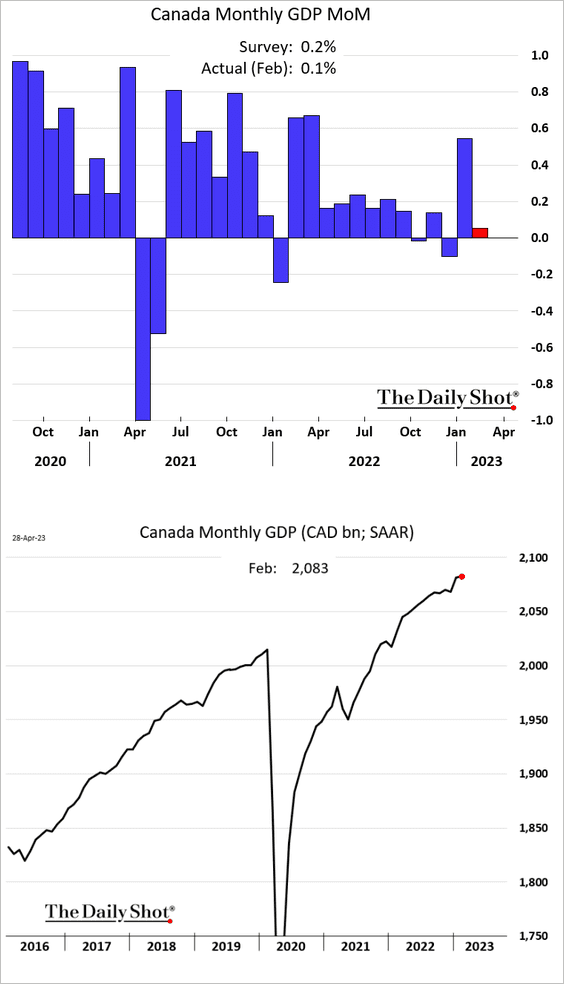

1. The February GDP gain was softer than expected. Economists see a contraction in March.

Source: Financial Post Read full article

Source: Financial Post Read full article

——————–

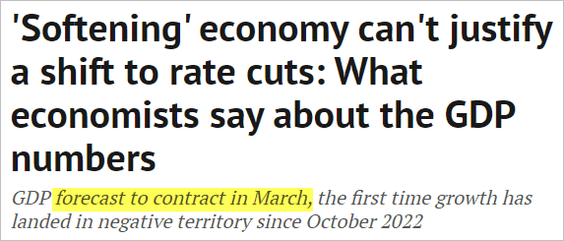

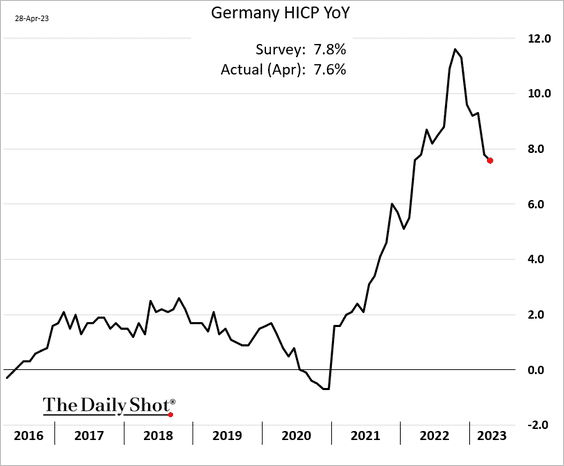

2. Canadian money market funds’ AUM has been rising rapidly.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

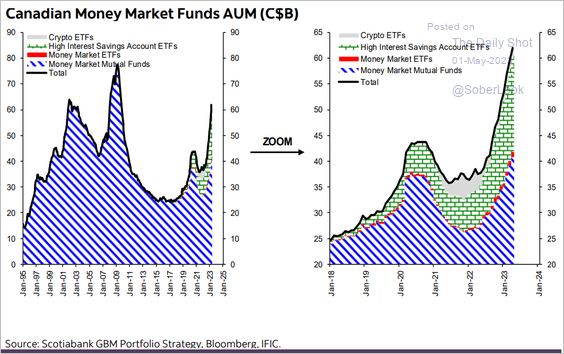

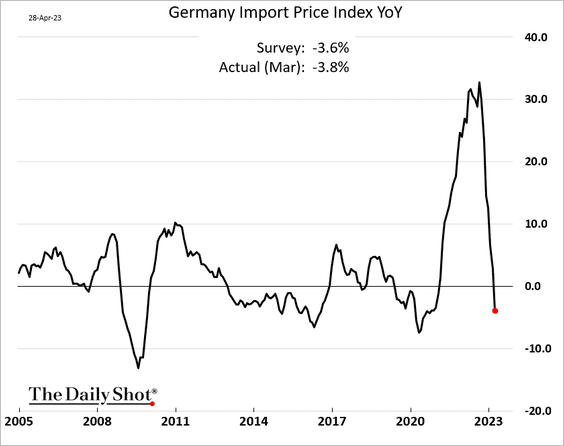

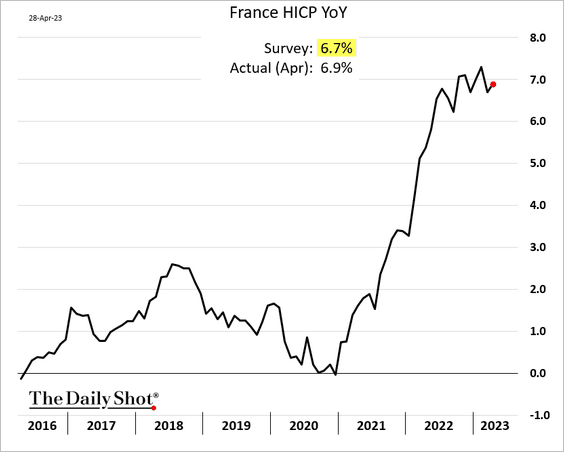

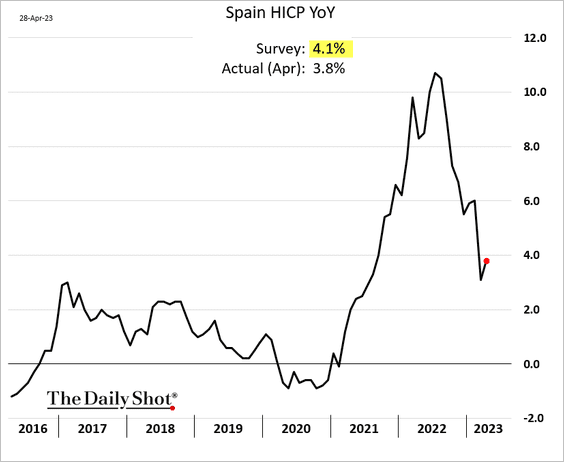

1. April inflation reports were mixed.

• Germany (below expectations) …

… helped by lower import prices.

• France (above expectations):

• Spain (below expectations):

——————–

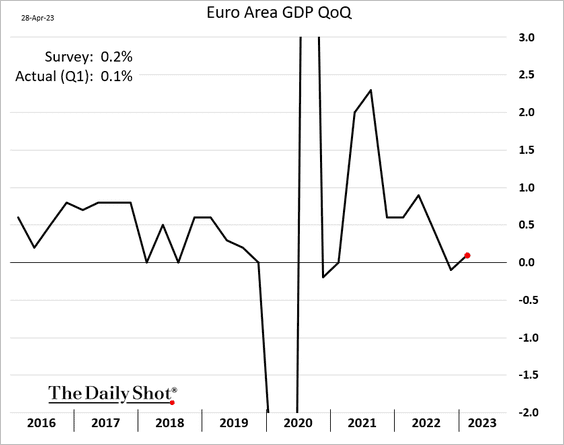

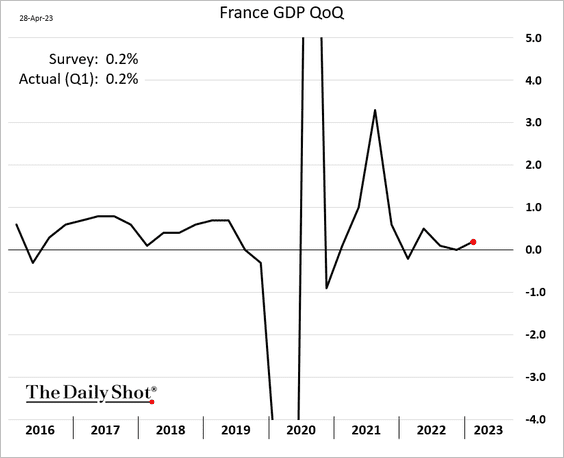

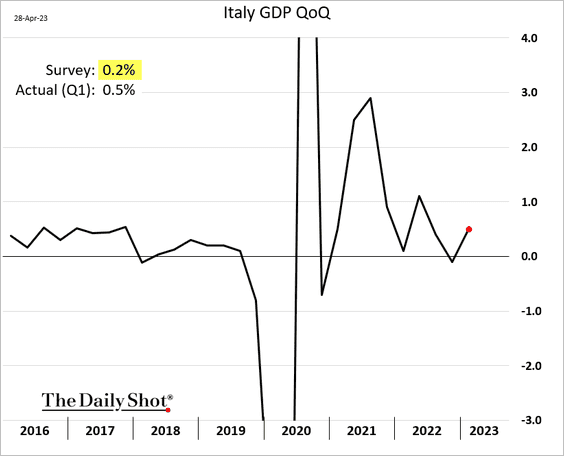

2. The Eurozone avoided a recession in Q1, but growth was below forecasts.

• France:

• Italy (big upside surprise):

Source: Reuters Read full article

Source: Reuters Read full article

——————–

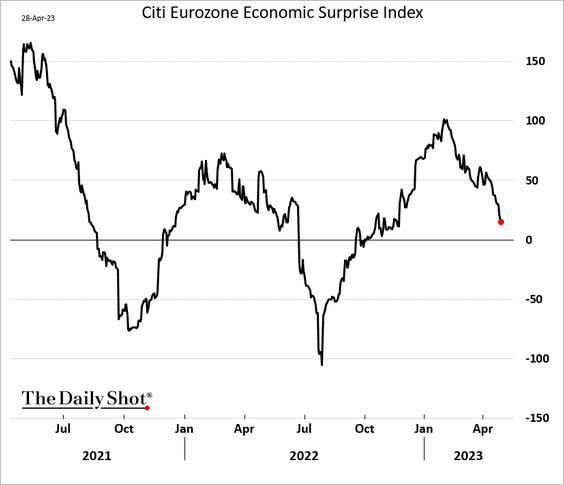

3. The Citi Economic Surprise Index has been rolling over.

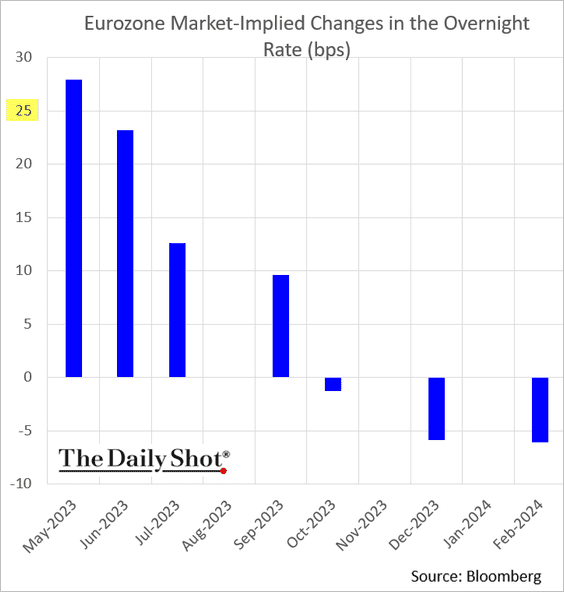

4. The market now sees a 25 bps rate hike from the ECB.

Back to Index

Europe

1. Let’s begin with Sweden.

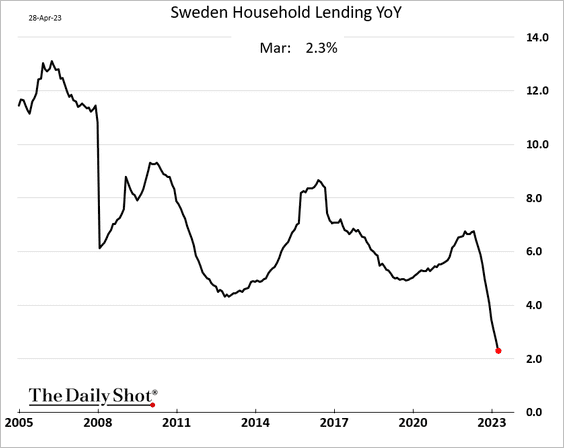

• Lending to households has been slowing.

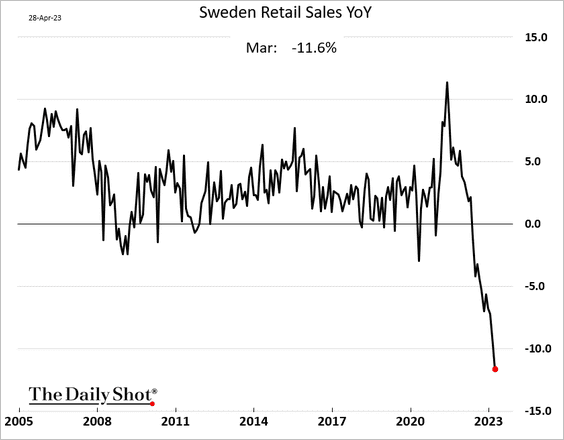

• Retail sales saw the biggest year-over-year decline on record in March.

Source: @ottummelas, @economics Read full article

Source: @ottummelas, @economics Read full article

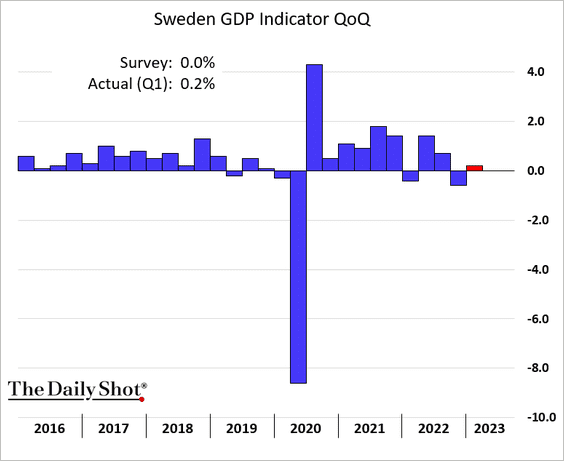

• The economy expanded in Q1.

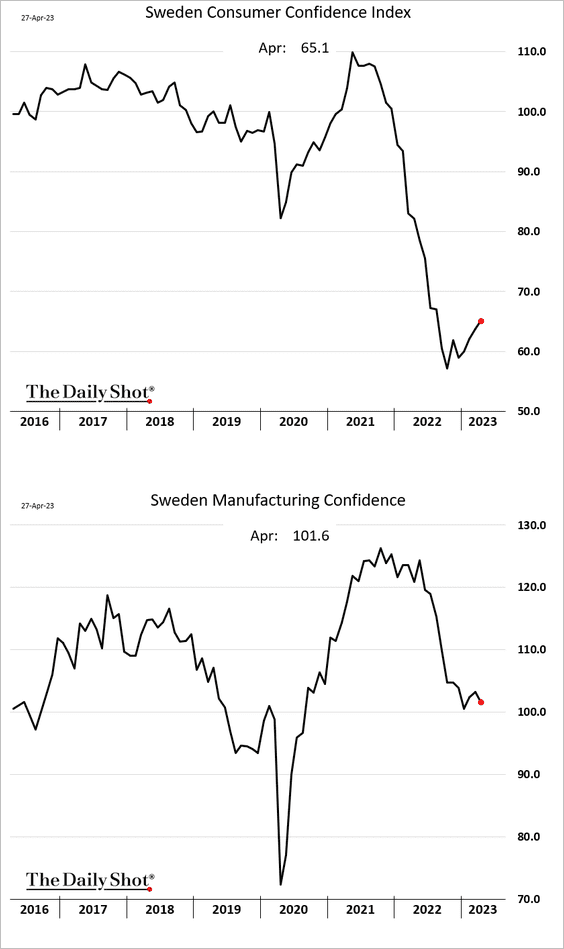

• Consumer sentiment is depressed but showed some improvement in April. Manufacturing confidence declined.

——————–

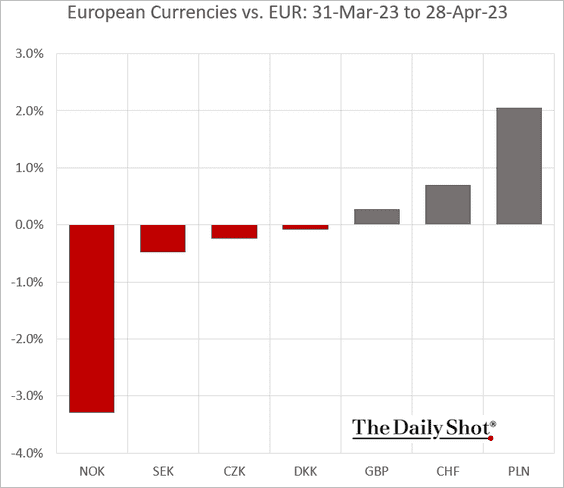

2. April was a rough month for the Norwegian krone.

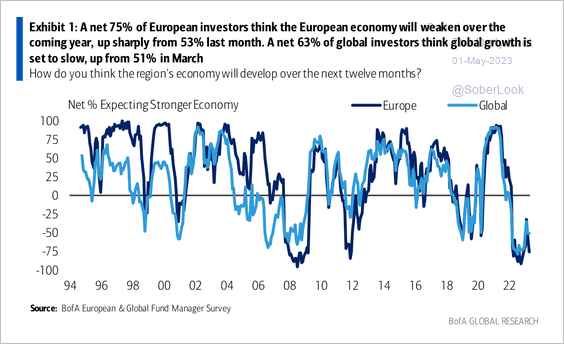

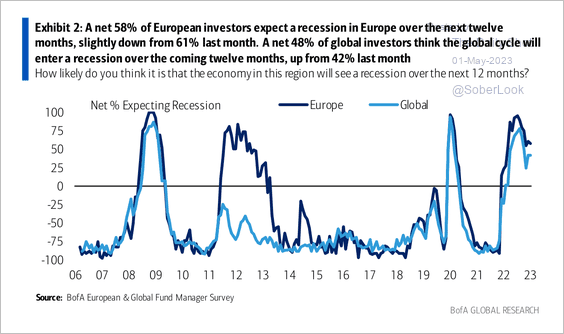

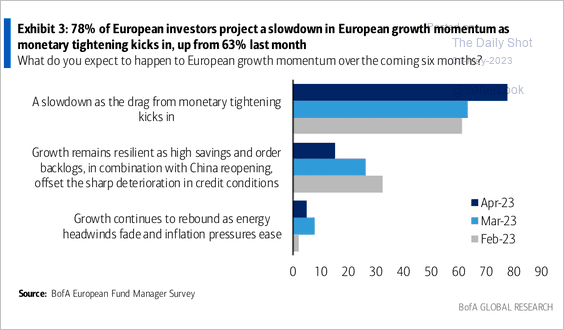

3. Most European investors surveyed by BofA think the economy will weaken over the coming year as the drag from policy tightening kicks in. Although, there is a lower probability of recession. (3 charts)

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Japan

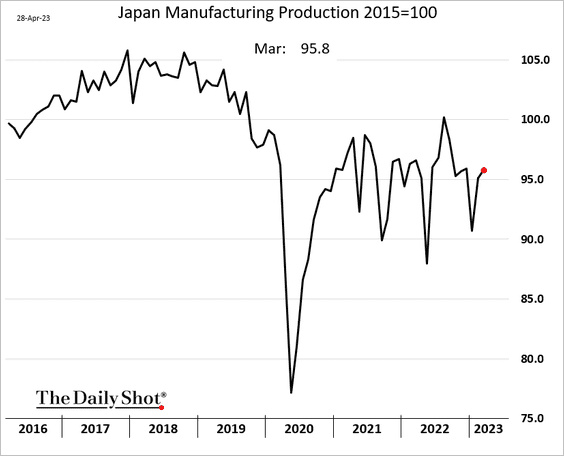

1. Industrial production edged higher in March.

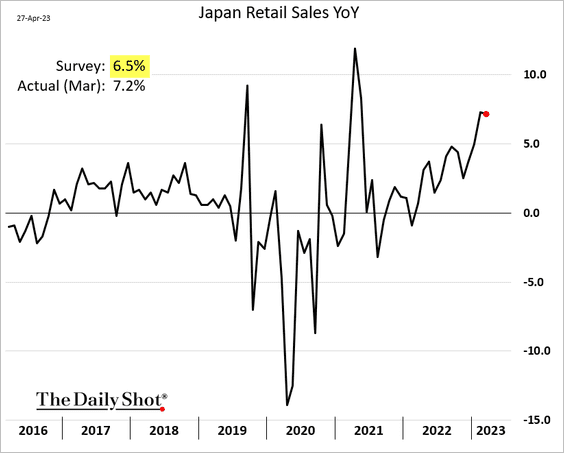

2. Retail sales topped expectations.

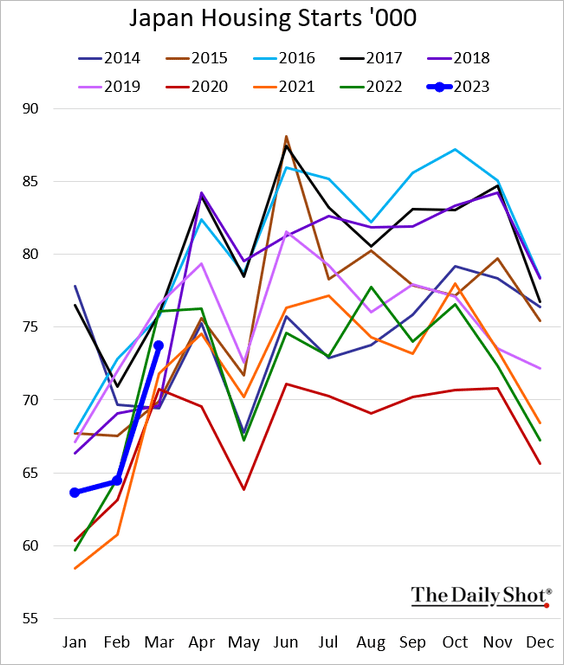

3. Housing starts were well below last year’s levels in March.

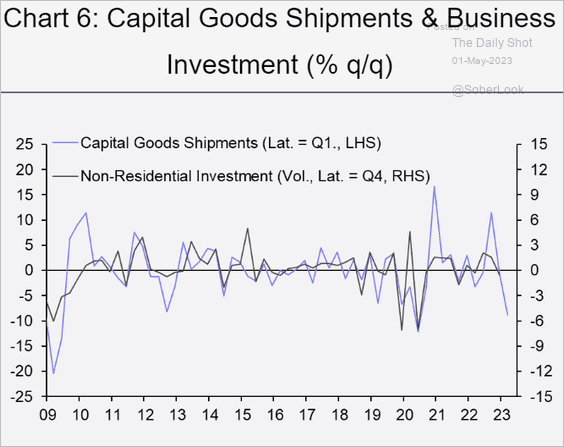

4. Investment has been slowing.

Source: Capital Economics

Source: Capital Economics

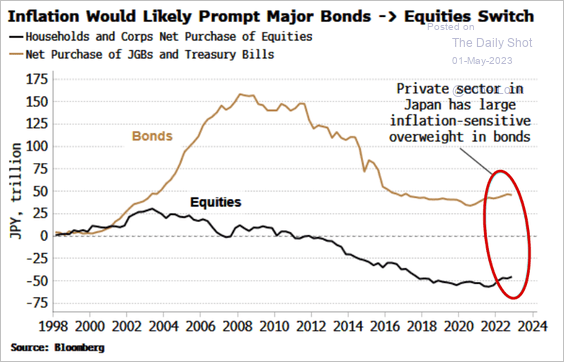

5. This chart shows the private sector’s cumulative purchases of stocks and bonds.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

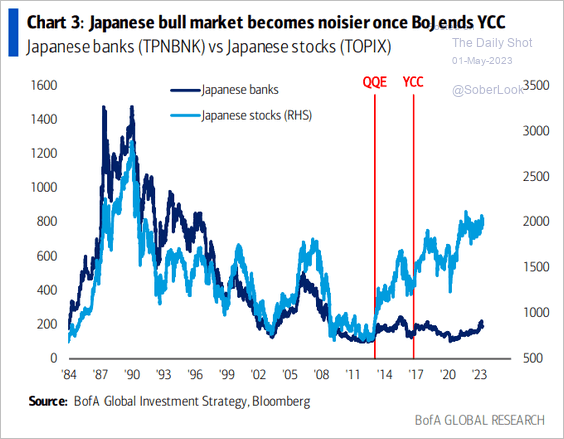

6. Bank shares have underperformed massively as a result of the BoJ’s monetary policy.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Asia-Pacific

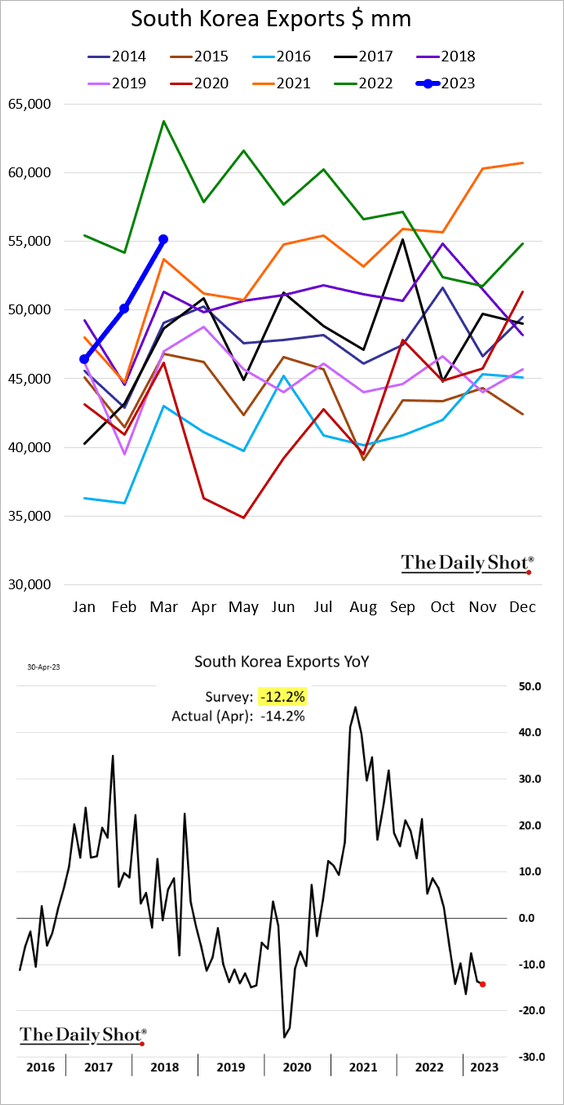

1. South Korea’s exports were 14% below last year’s levels in April.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

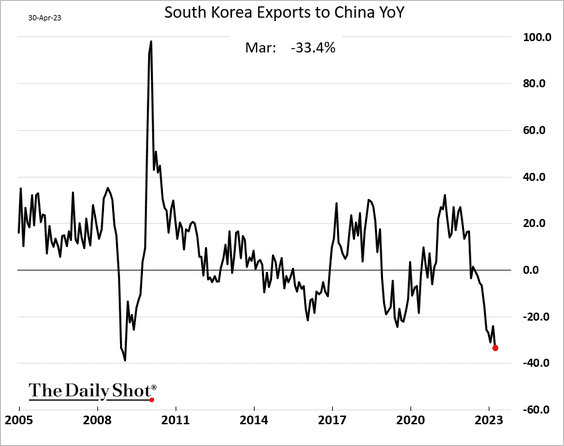

Exports to China saw the biggest year-over-year decline since the GFC.

——————–

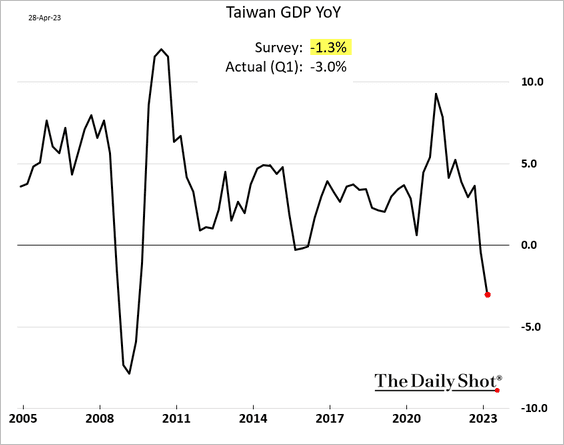

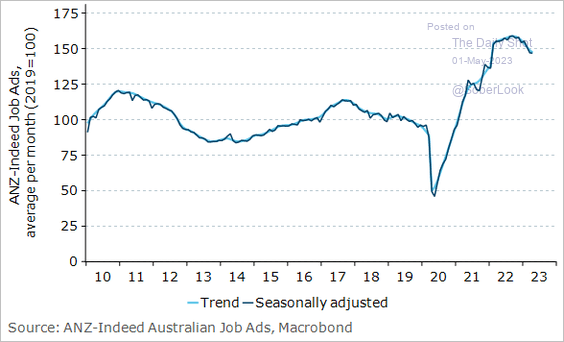

2. Taiwan’s economy slipped into a recession in the first quarter, with growth declining more than expected.

Source: @betty_hou_1108, @samsonellis, @economics Read full article

Source: @betty_hou_1108, @samsonellis, @economics Read full article

——————–

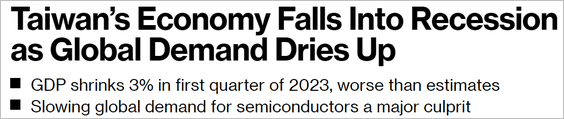

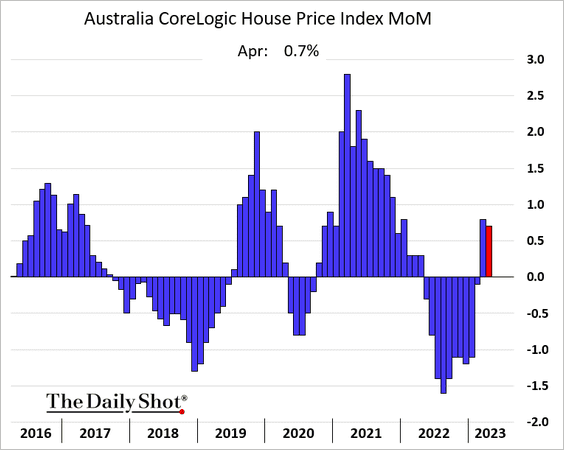

3. Next, we have some updates on Australia.

• Home prices increased again in April.

• Job openings remain well above pre-COVID levels.

Source: @ANZ_Research

Source: @ANZ_Research

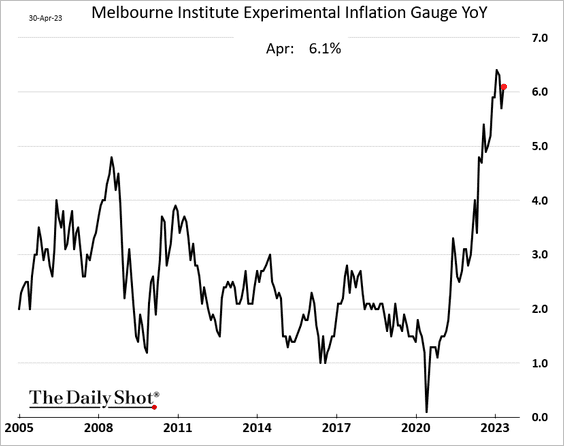

• According to the Melbourne Institute, inflation increased in April. However, the market anticipates that the RBA will maintain its current policy stance for now.

Back to Index

China

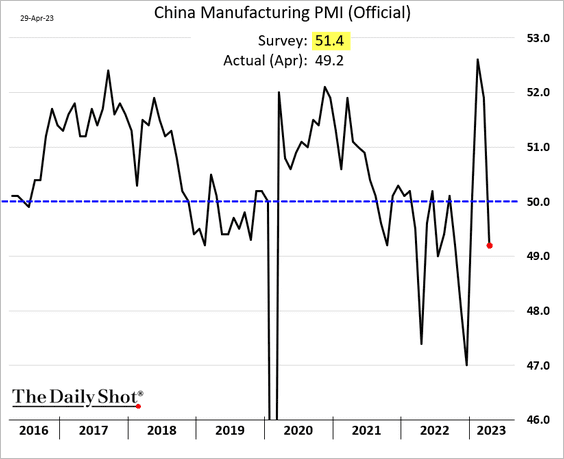

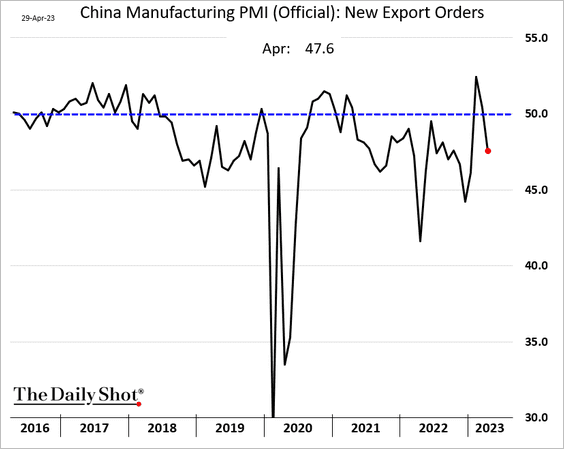

1. The official manufacturing PMI unexpectedly showed a contraction in factory activity as demand softened.

Source: Reuters Read full article

Source: Reuters Read full article

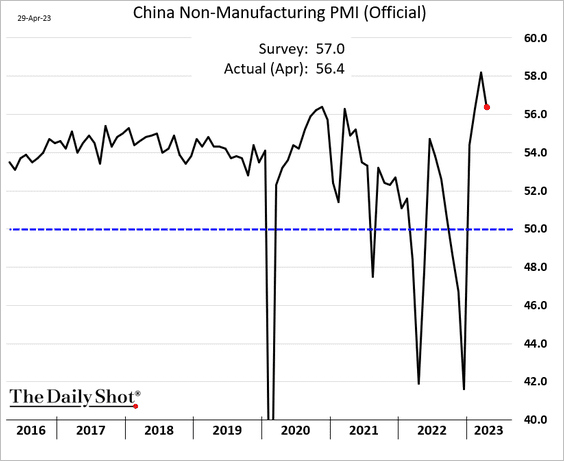

Nonmanufacturing growth remains robust.

——————–

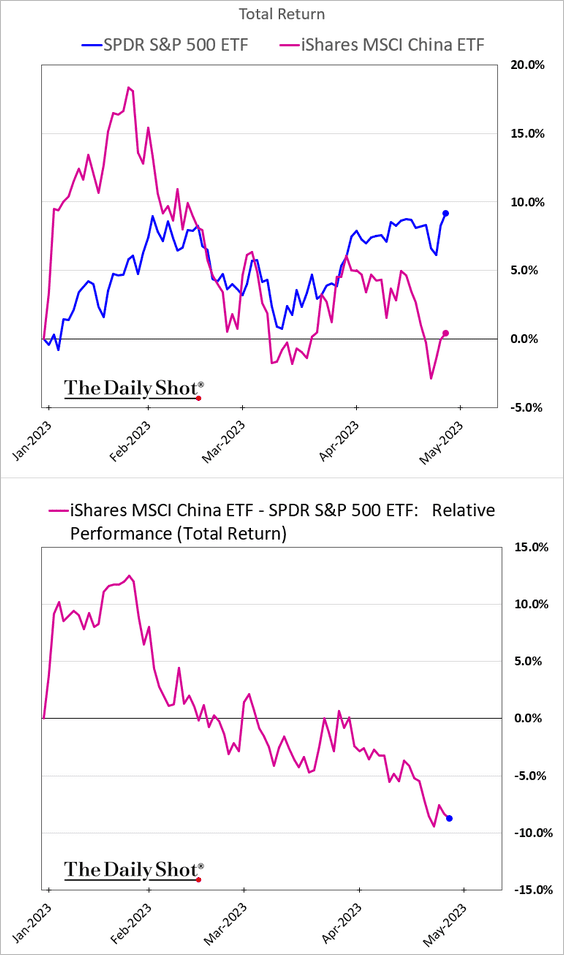

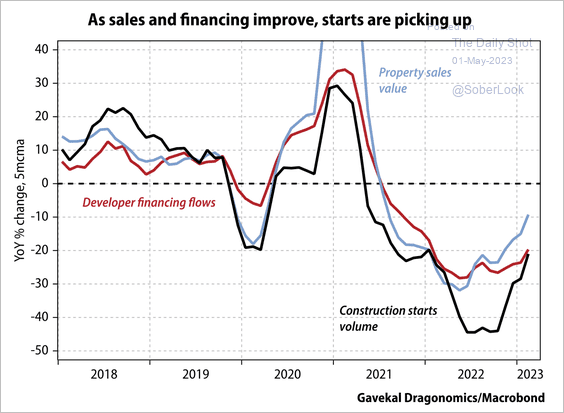

2. China’s stocks have been underperforming global peers.

• vs. the US:

• vs. other EM:

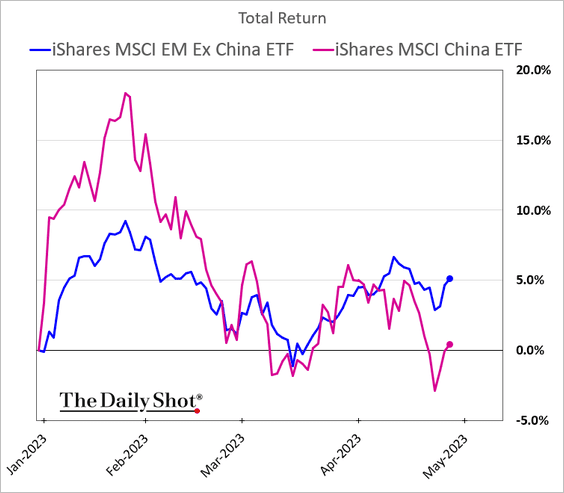

However, China-focused equity funds are seeing inflows.

Source: BofA Global Research

Source: BofA Global Research

——————–

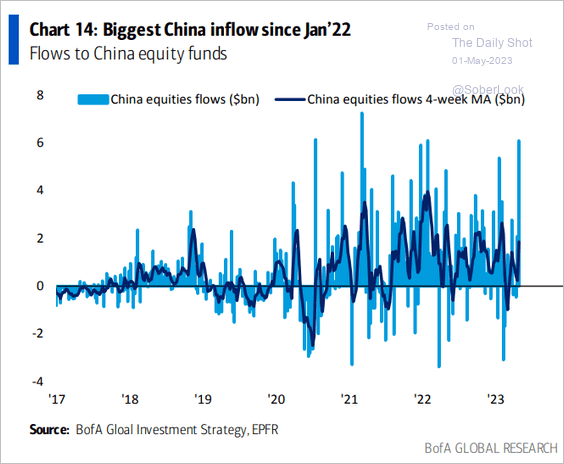

3. Construction starts are improving as developers receive more refinancing.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

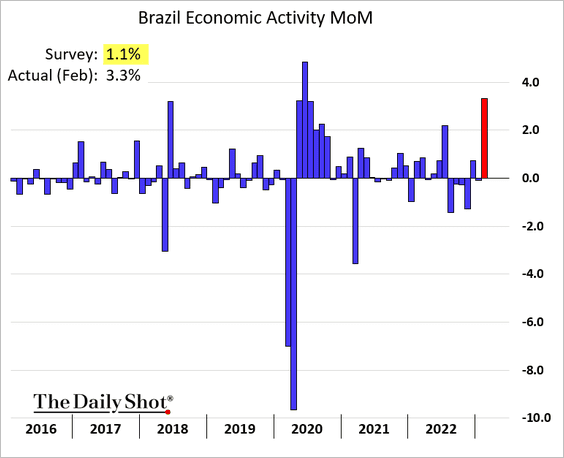

1. Brazil’s economic activity jumped in February, topping expectations.

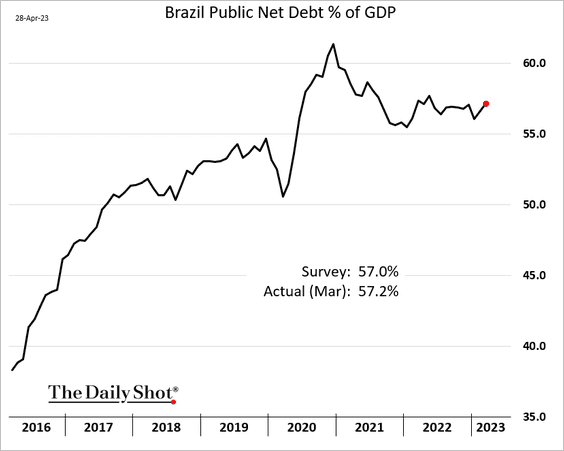

Separately, here is Brazil’s debt-to-GDP ratio.

——————–

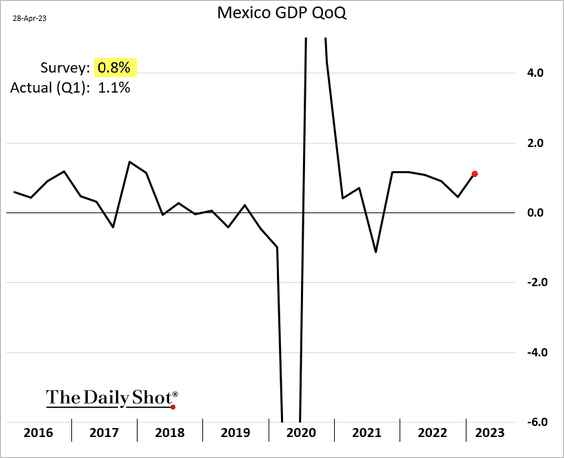

2. Mexico’s Q1 growth surprised to the upside.

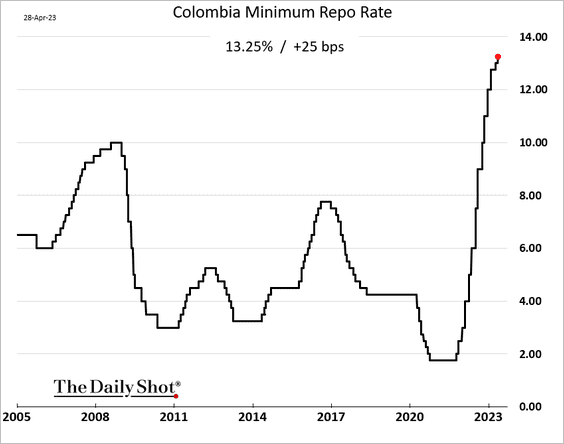

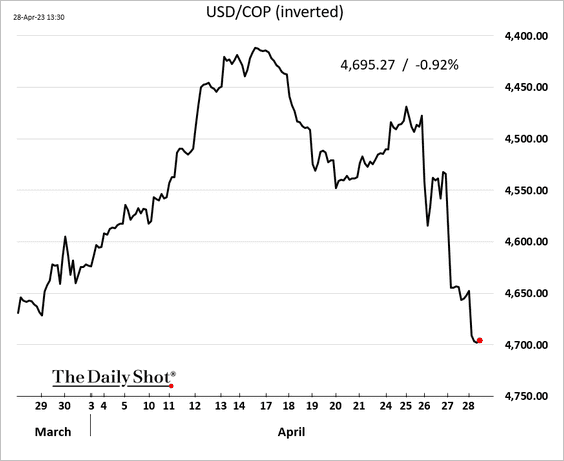

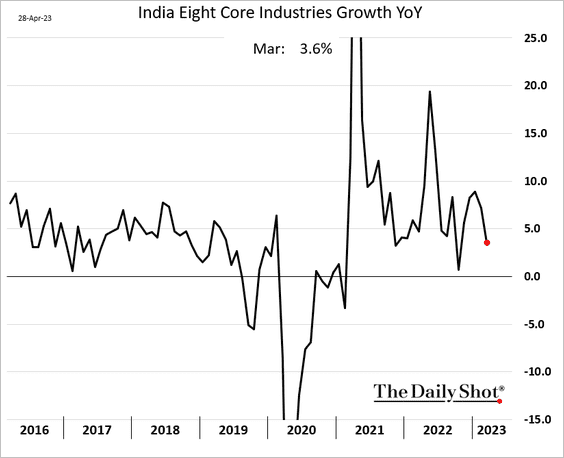

3. Colombia’s central bank hiked rates again, …

… but the nation’s assets have been weakening after the cabinet reshuffle. Here is the peso.

Source: @mjbristow, @vizcainomariae, @economics Read full article

Source: @mjbristow, @vizcainomariae, @economics Read full article

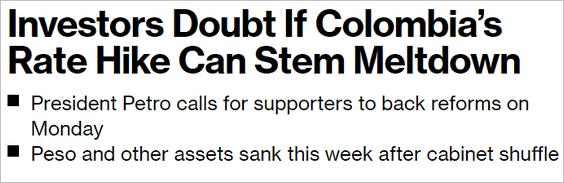

Separately, Colombia’s unemployment is near multi-year lows.

——————–

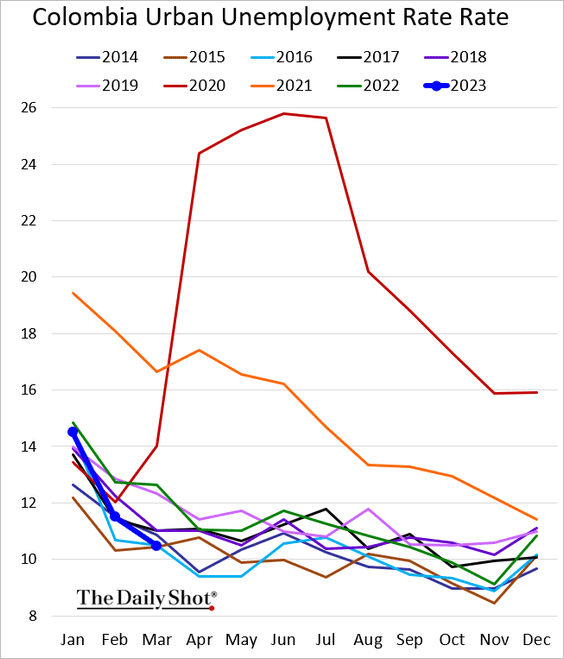

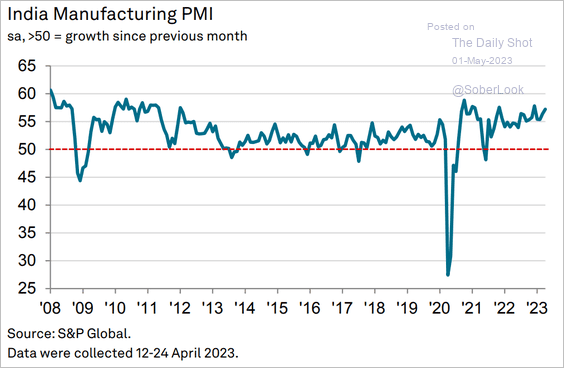

4. The growth in output of India’s eight core industries has been decelerating.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

But the manufacturing PMI signals exceptionally strong growth.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

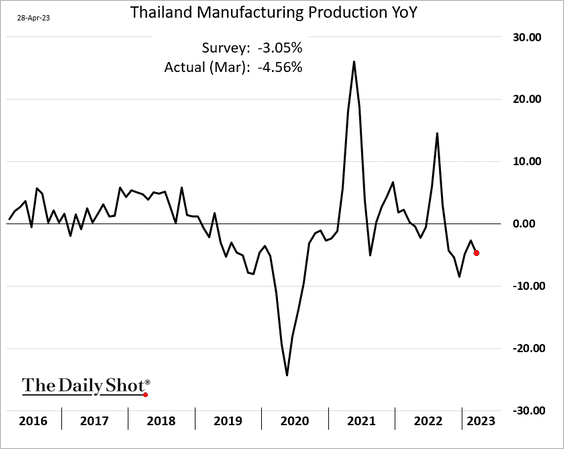

5. Thailand’s manufacturing output surprised to the downside.

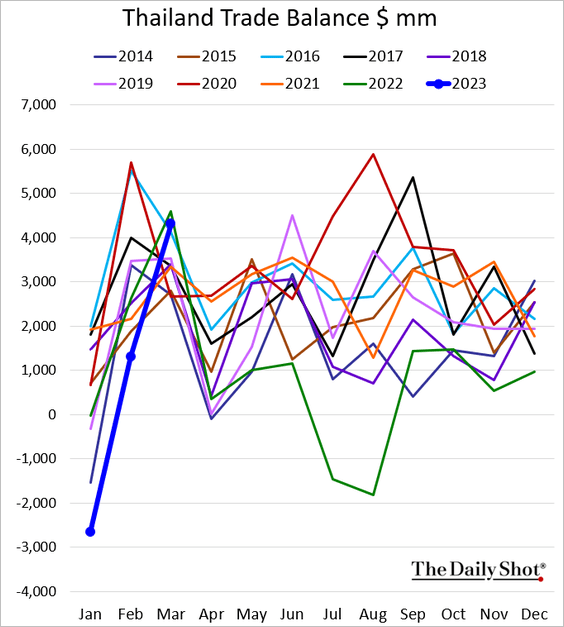

The trade balance rebounded.

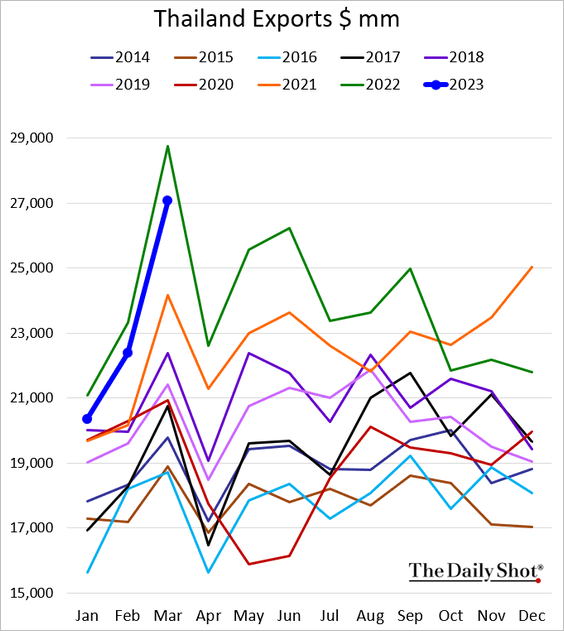

Exports are still running below last year’s levels.

——————–

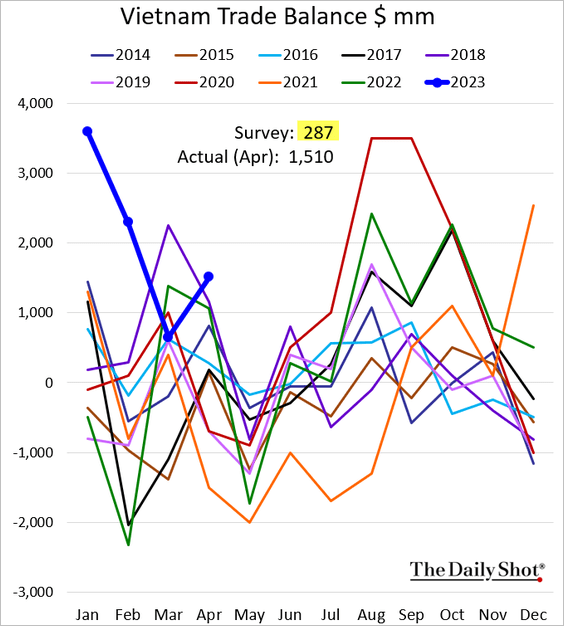

6. Vietnam’s trade surplus hit a multi-year high.

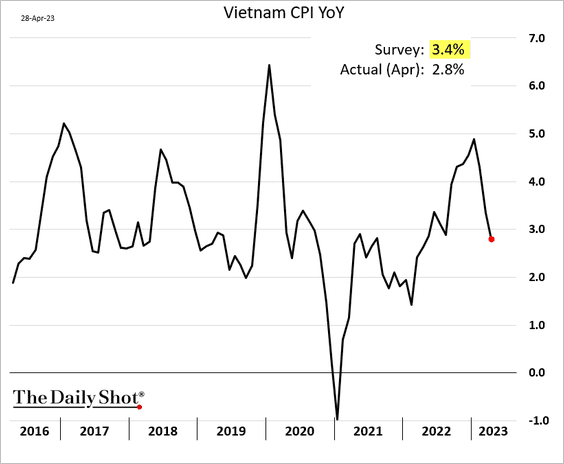

Inflation continues to moderate.

——————–

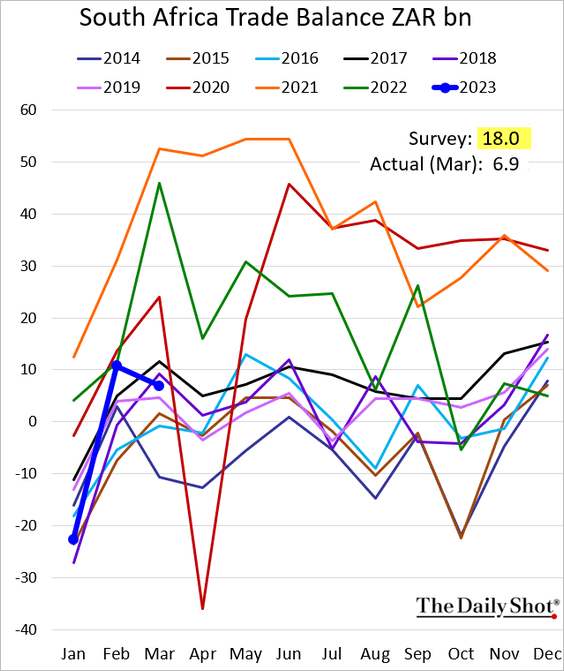

7. South Africa’s trade surplus unexpectedly declined in March.

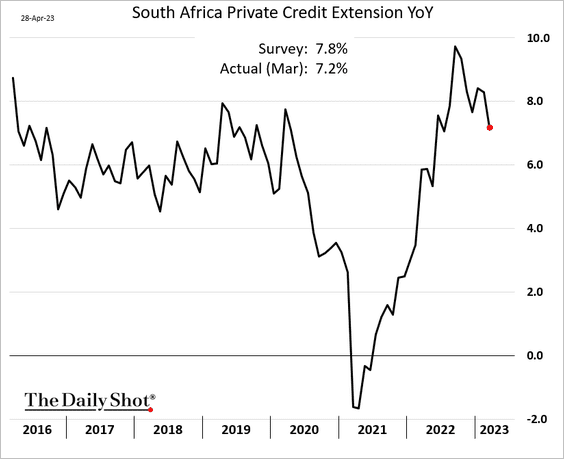

The nation’s credit growth is starting to slow.

——————–

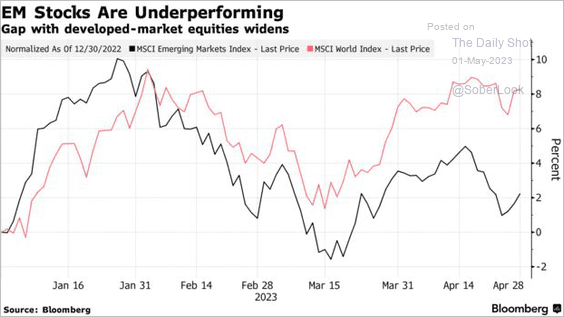

8. EM equities continue to underperform peers in advanced economies.

Source: @taniaychen, @markets Read full article

Source: @taniaychen, @markets Read full article

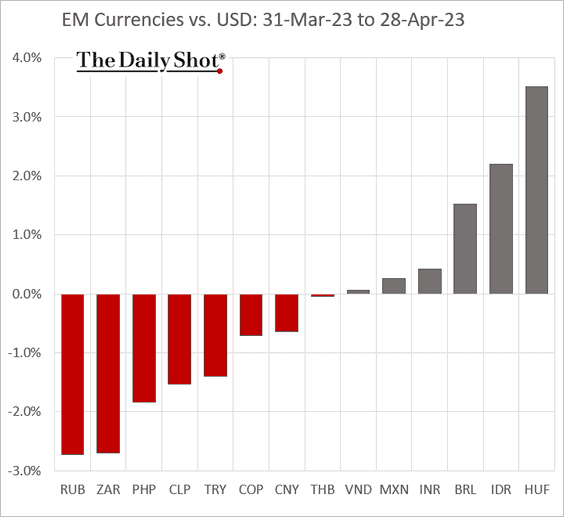

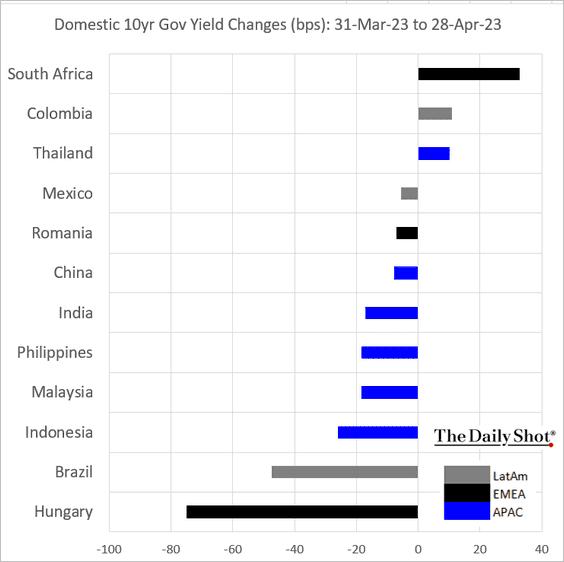

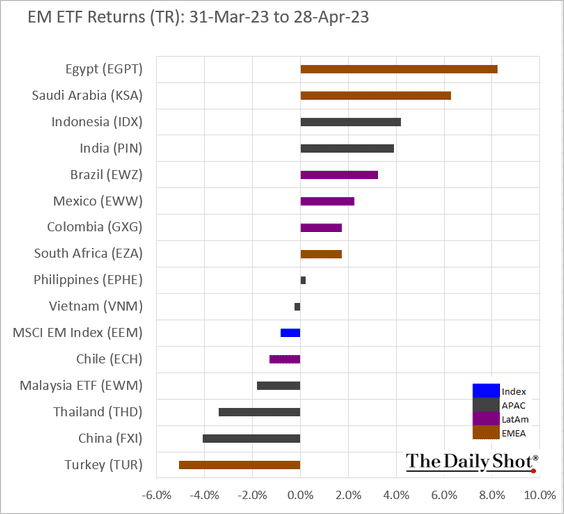

9. Next, we have some performance data for April.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

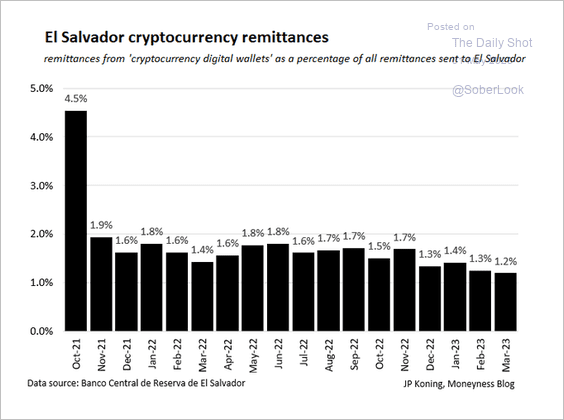

1. This chart shows El Salvador’s crypto remittances (funds denominated in crypto sent from abroad).

Source: @jp_koning

Source: @jp_koning

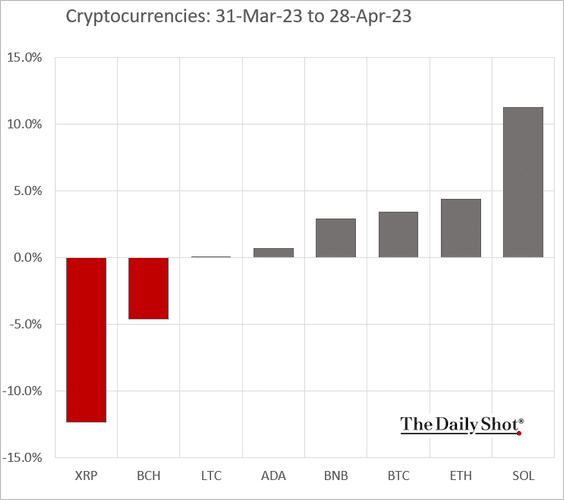

2. XRP underperformed sharply in April.

Back to Index

Commodities

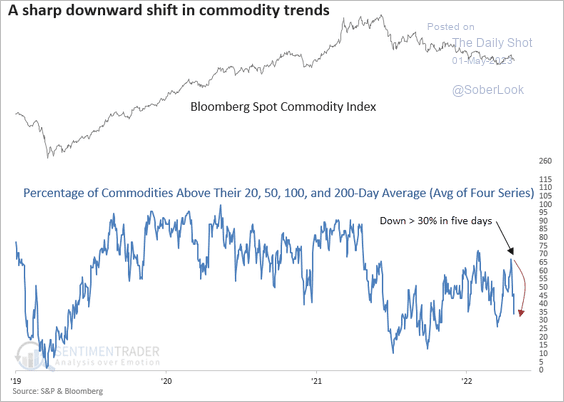

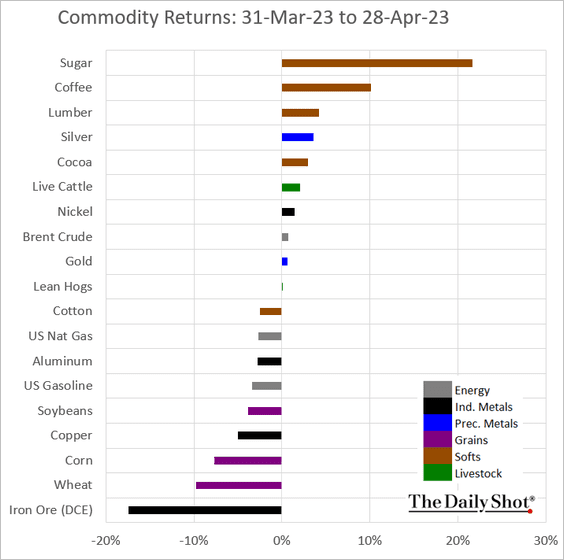

1. There is a growing dispersion among commodity price trends.

Source: SentimenTrader

Source: SentimenTrader

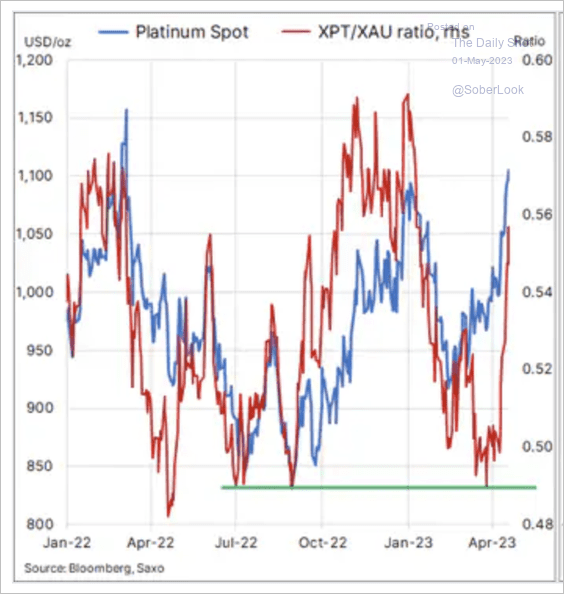

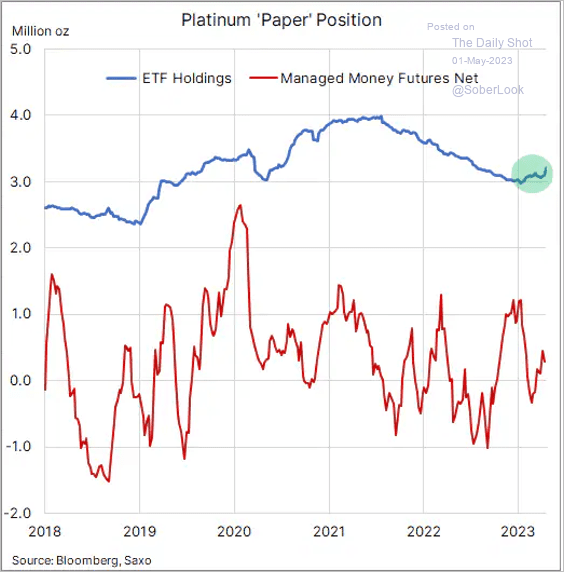

2. The platinum/gold price ratio rebounded from recent lows.

Source: Saxo Bank Read full article

Source: Saxo Bank Read full article

ETF holdings of platinum are starting to rise.

Source: Saxo Bank Read full article

Source: Saxo Bank Read full article

——————–

3. Next, we have some performance data for April across key commodity markets.

Back to Index

Energy

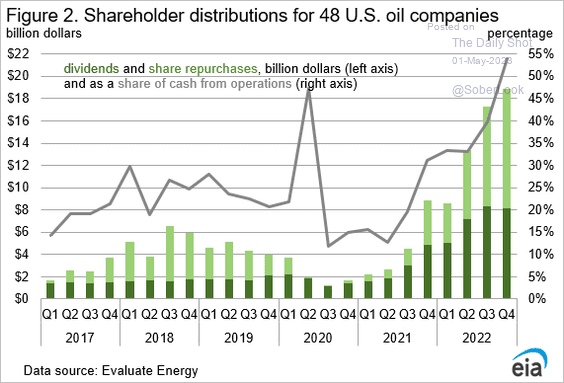

1. US oil companies’ shareholder distributions surged last year.

Source: @EIAgov

Source: @EIAgov

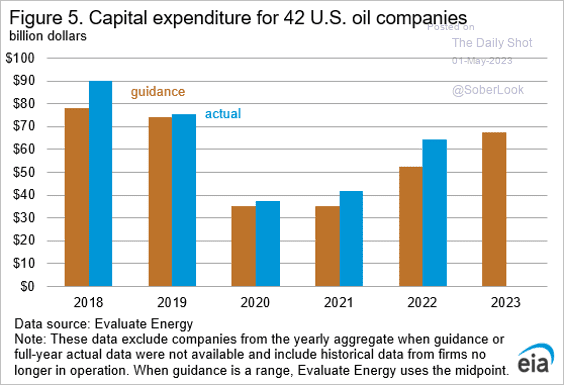

CapEx is rebounding but is still below pre-COVID levels.

Source: @EIAgov

Source: @EIAgov

——————–

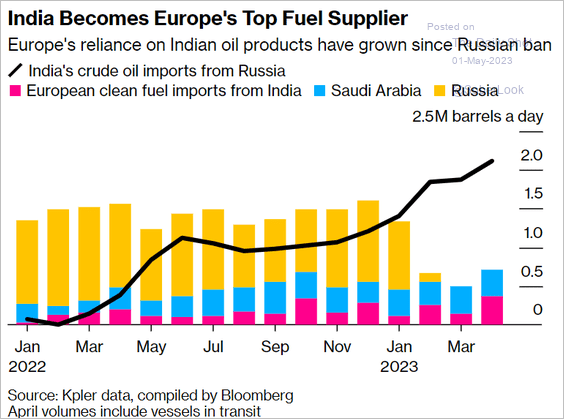

2. Some Russian oil products are finding their way to Europe via India.

Source: @CrowleyKev, @markets Read full article

Source: @CrowleyKev, @markets Read full article

Back to Index

Equities

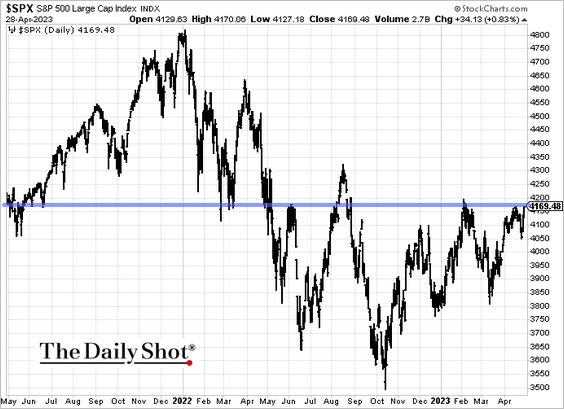

1. The S&P 500 is back at resistance.

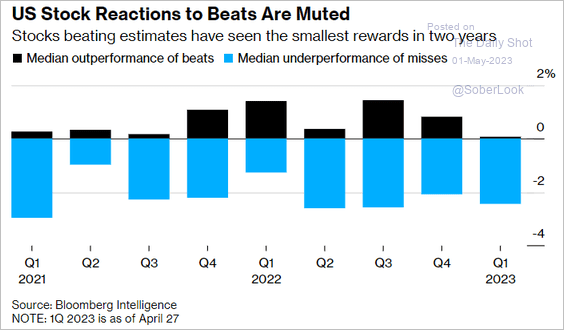

2. Enthusiasm for stocks that beat earnings forecasts has been muted.

Source: @sagarikareports, @markets Read full article

Source: @sagarikareports, @markets Read full article

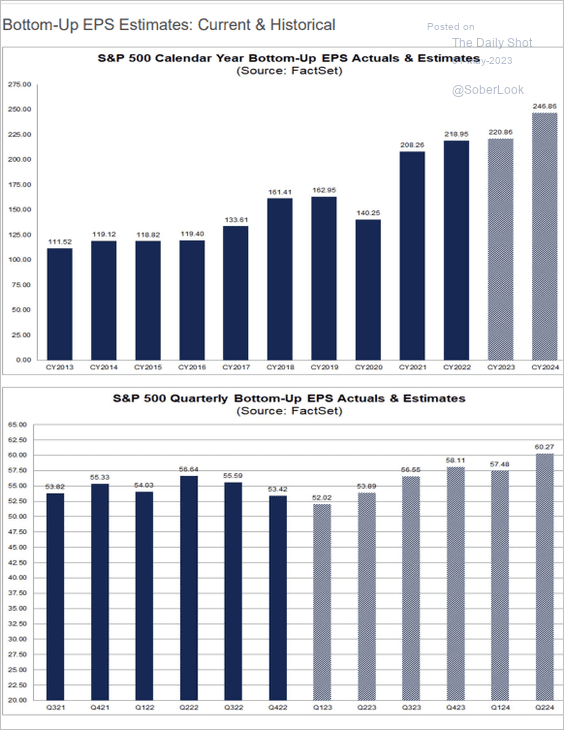

3. Earnings projections remain fairly optimistic.

Source: @FactSet

Source: @FactSet

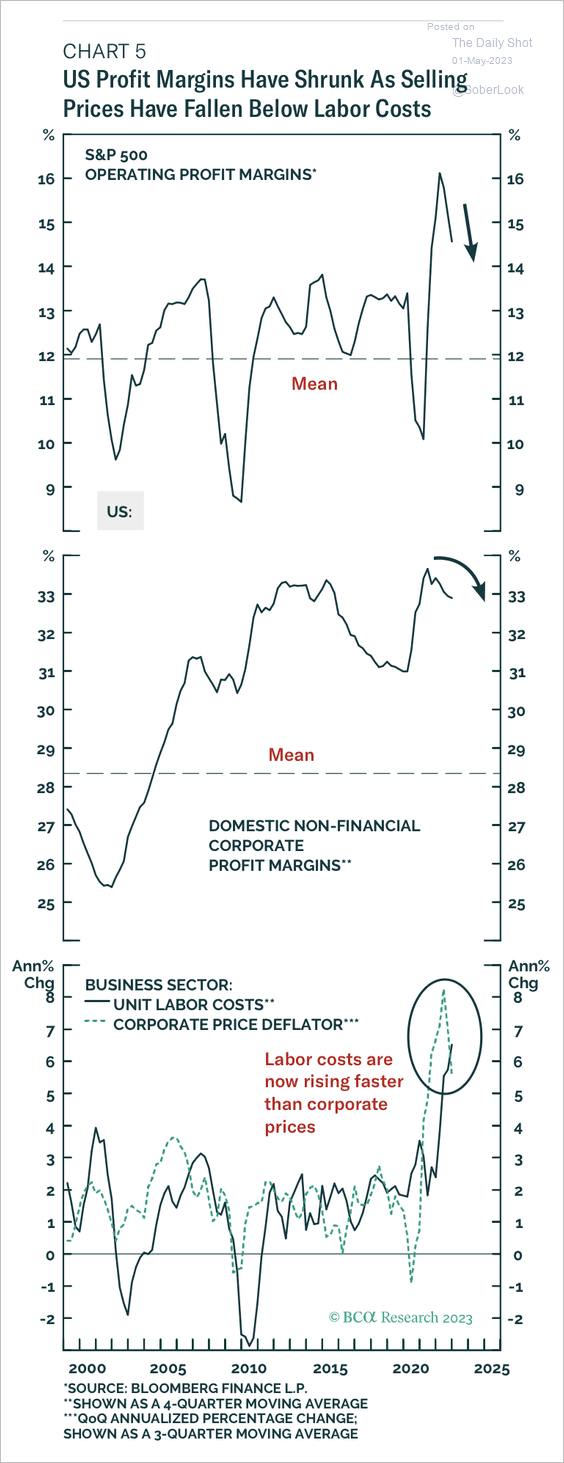

4. Profit margins have been shrinking because of high labor costs.

Source: BCA Research

Source: BCA Research

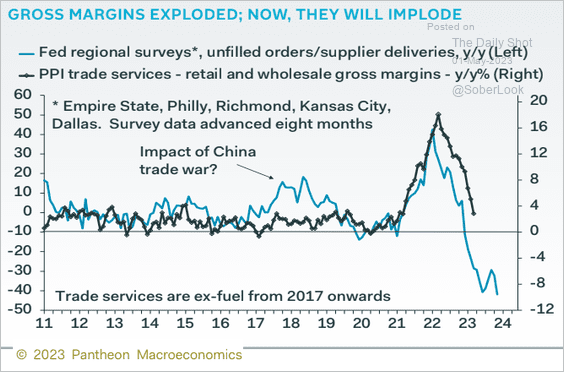

Leading indicators point to further declines in margins (PPI trade services).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

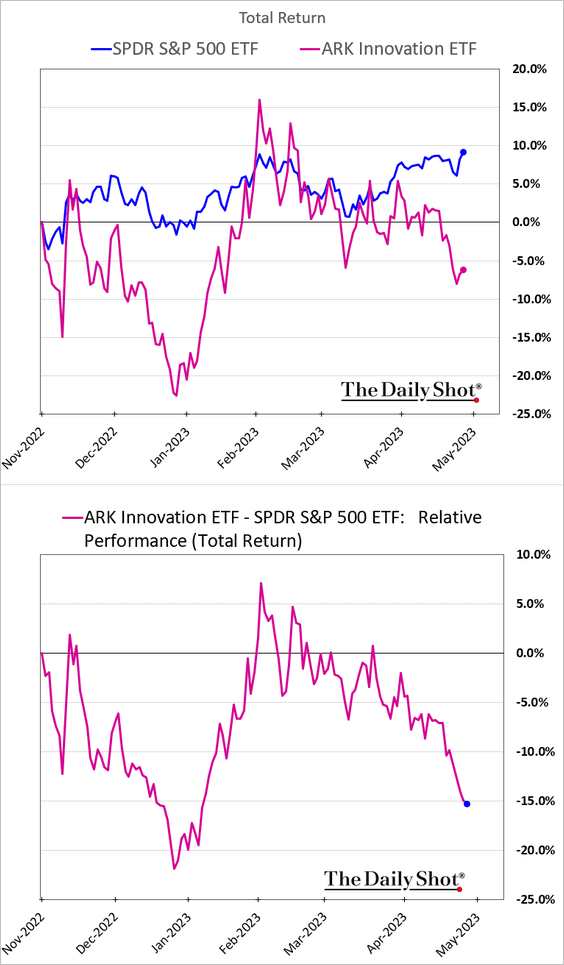

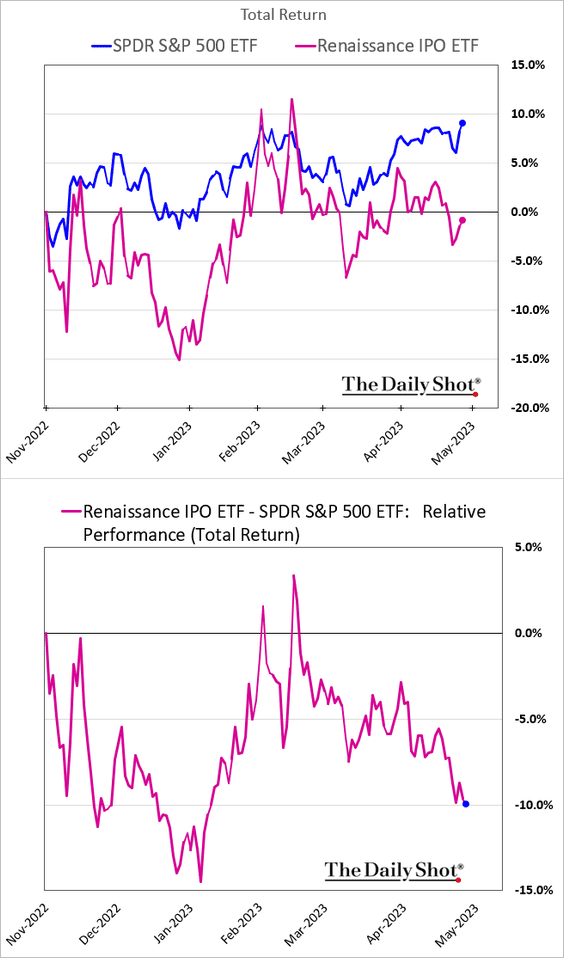

4. After the February bounce, speculative stocks have underperformed.

• ARK Innovation:

• Post-IPO stocks:

——————–

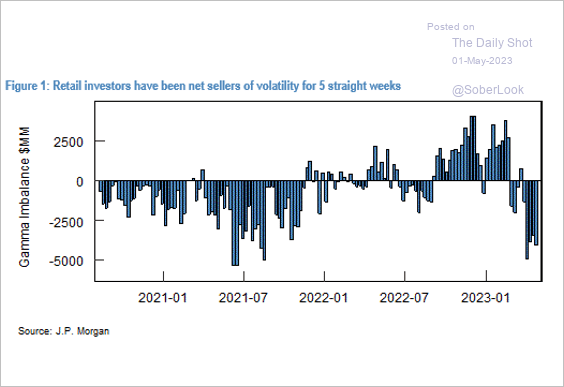

5. Retail Investors have been net sellers of vol.

Source: JP Morgan Research

Source: JP Morgan Research

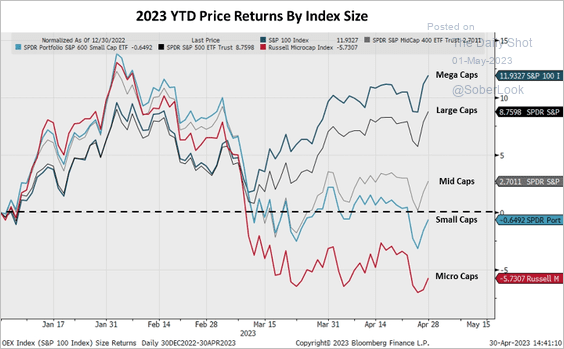

6. The divergence of performance by size has been remarkable.

Source: Piper Sandler

Source: Piper Sandler

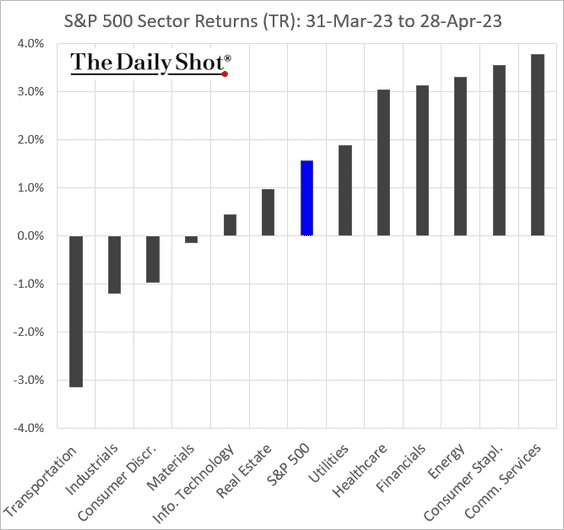

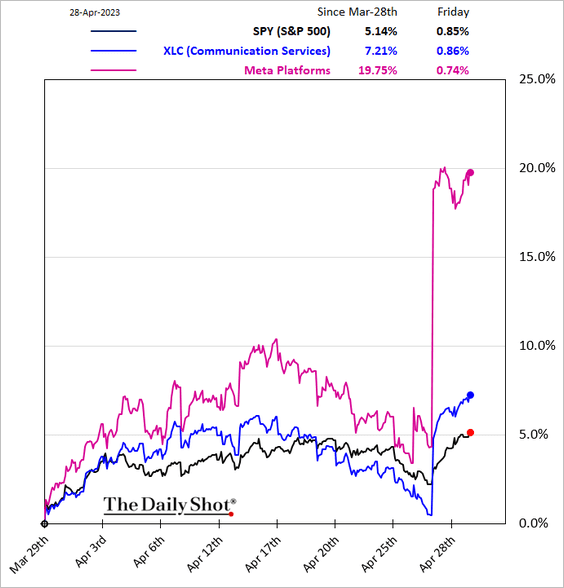

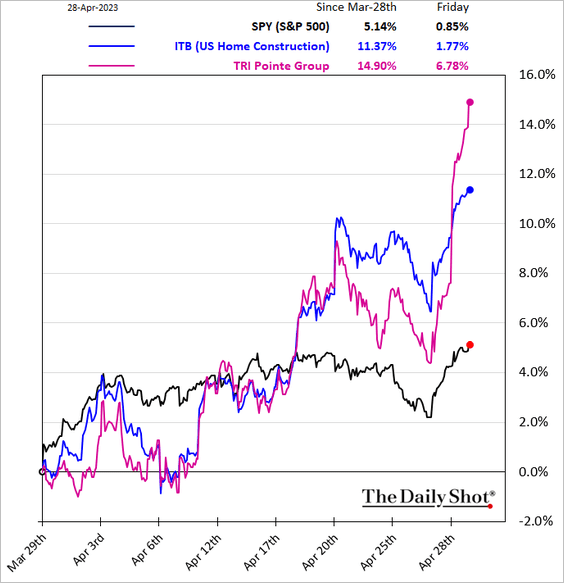

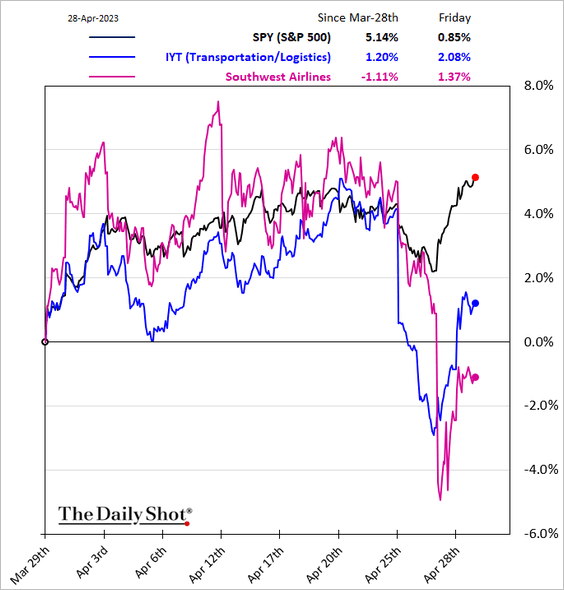

7. Next, we have some performance data for April.

• Sectors:

– Communication Services:

– Construction:

– Transportation:

——————–

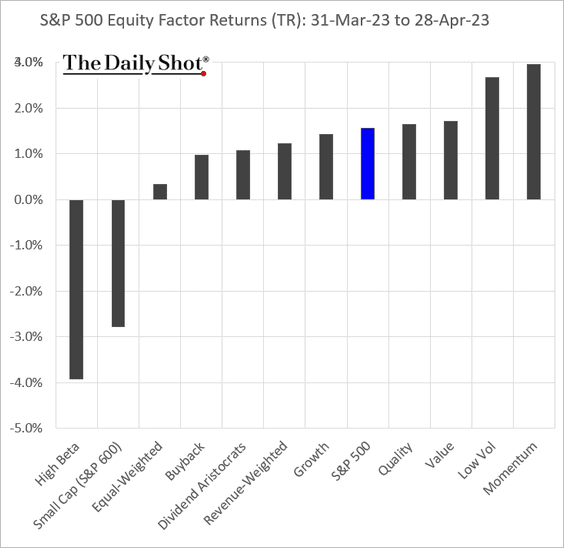

• Equity factors:

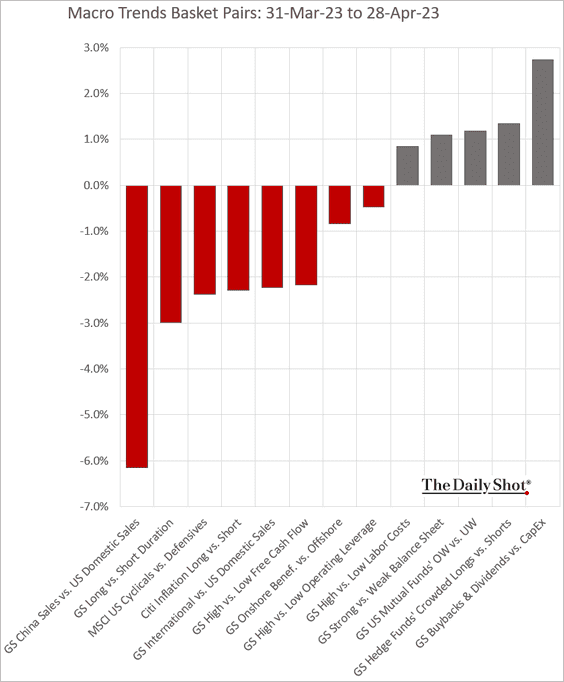

• Macro basket pairs relative performance:

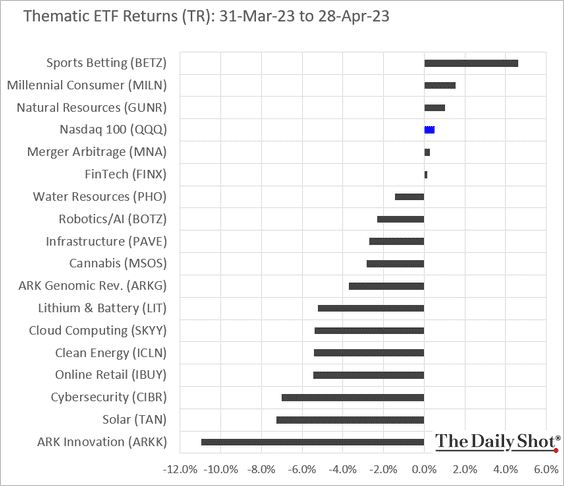

• Thematic ETFs:

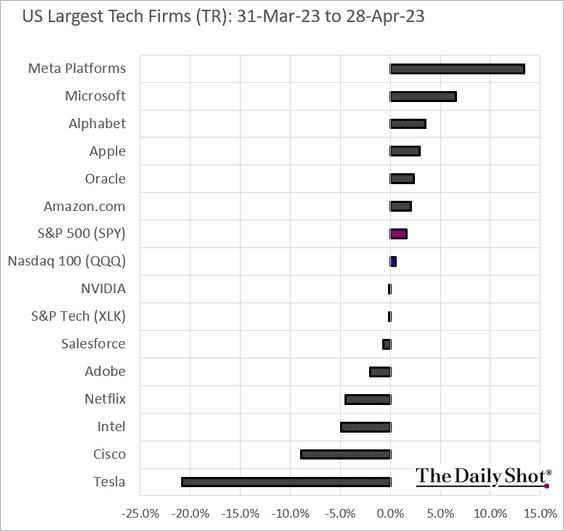

• Largest US tech firms:

Back to Index

Alternatives

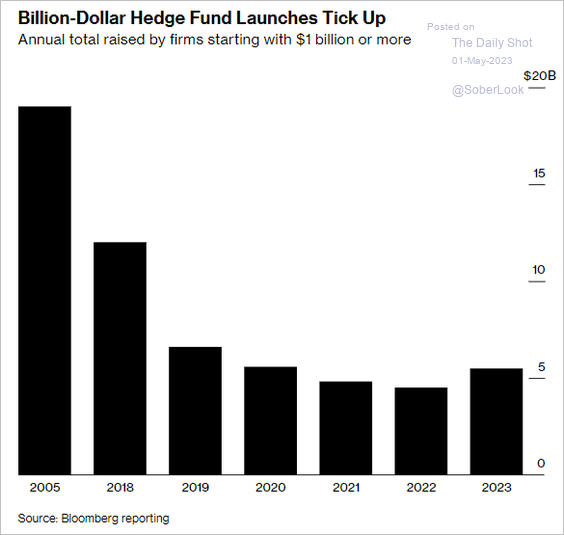

1. Large hedge fund launches increased this year.

Source: @parmarhema, @Burtonkathy, @nishantkumar07, @wealth Read full article

Source: @parmarhema, @Burtonkathy, @nishantkumar07, @wealth Read full article

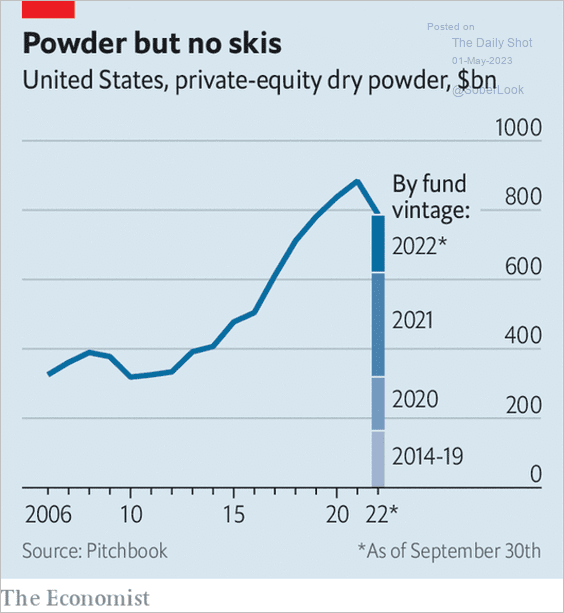

2. This chart shows PE dry powder by fund vintage.

Source: The Economist Read full article

Source: The Economist Read full article

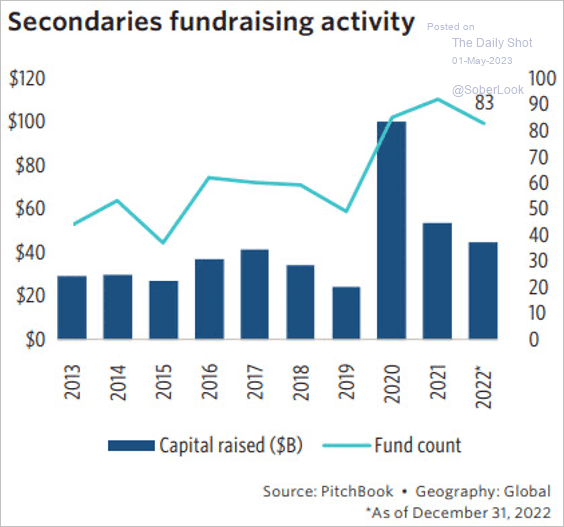

3. Secondaries’ fund count remains high, although capital raised has fallen back to average levels over the past two years.

Source: PitchBook

Source: PitchBook

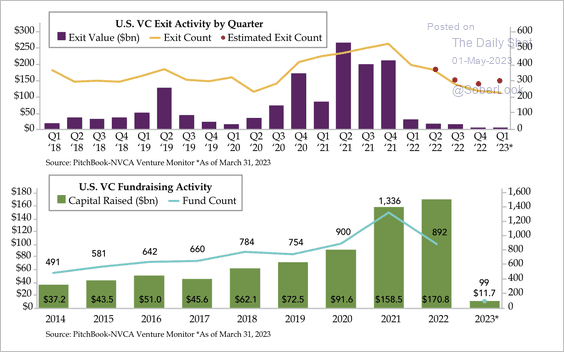

4. Exit activity and fundraising have declined.

Source: Quill Intelligence

Source: Quill Intelligence

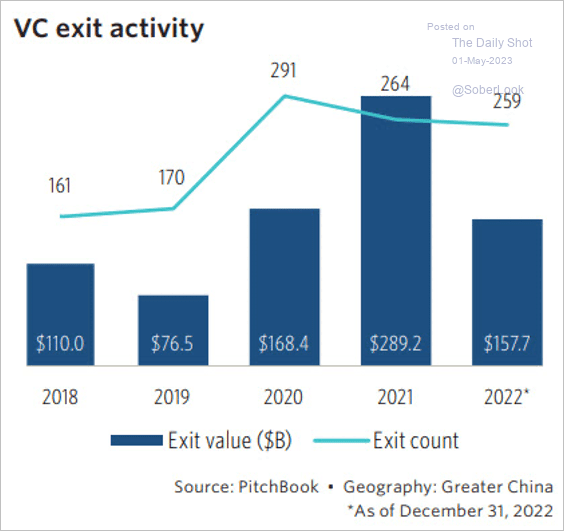

5. 2022 venture capital exits in Greater China held strong in count, although deal value fell.

Source: PitchBook

Source: PitchBook

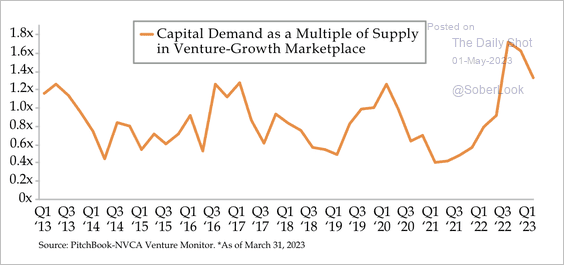

6. The imbalance between the demand and supply of venture capital is elevated.

Source: Quill Intelligence

Source: Quill Intelligence

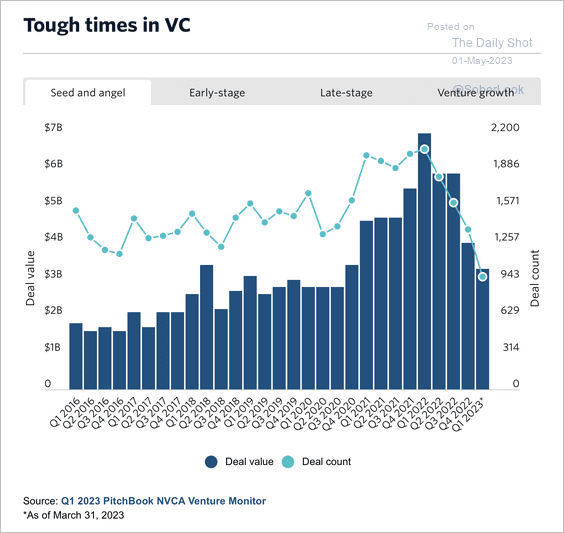

7. Venture capital activity in seed and angel rounds has significantly slowed.

Source: PitchBook

Source: PitchBook

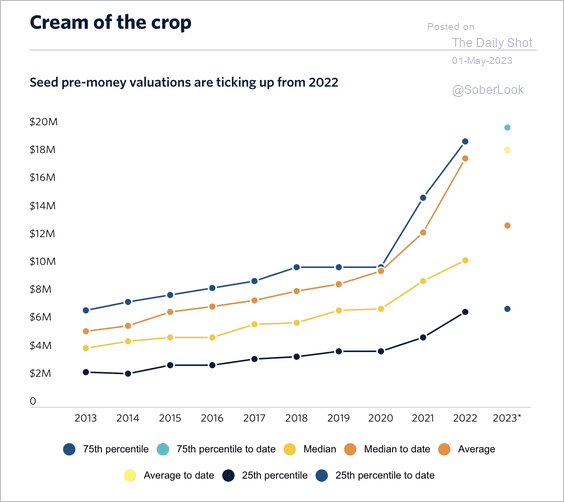

• However, seed-stage funding did not collapse last year given the influx of micro funds. There is growing interest in higher-quality companies and emerging themes such as generative AI, according to PitchBook.

Source: PitchBook

Source: PitchBook

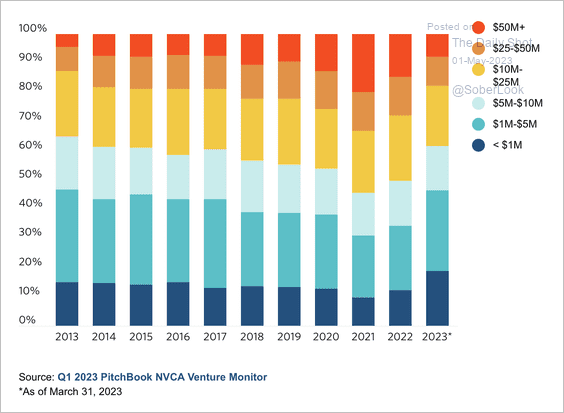

• The share of late-stage US venture capital deals over $50 million is at the lowest level since 2017.

Source: PitchBook

Source: PitchBook

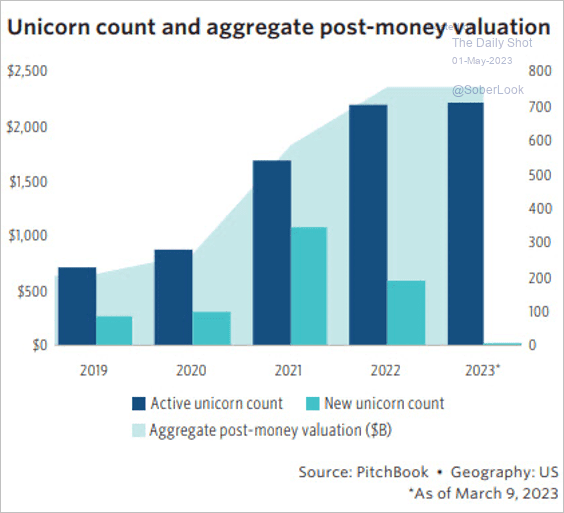

8. The pace of US unicorn creation (startups valued >$1 billion) and aggregate value has slowed.

Source: PitchBook

Source: PitchBook

Back to Index

Credit

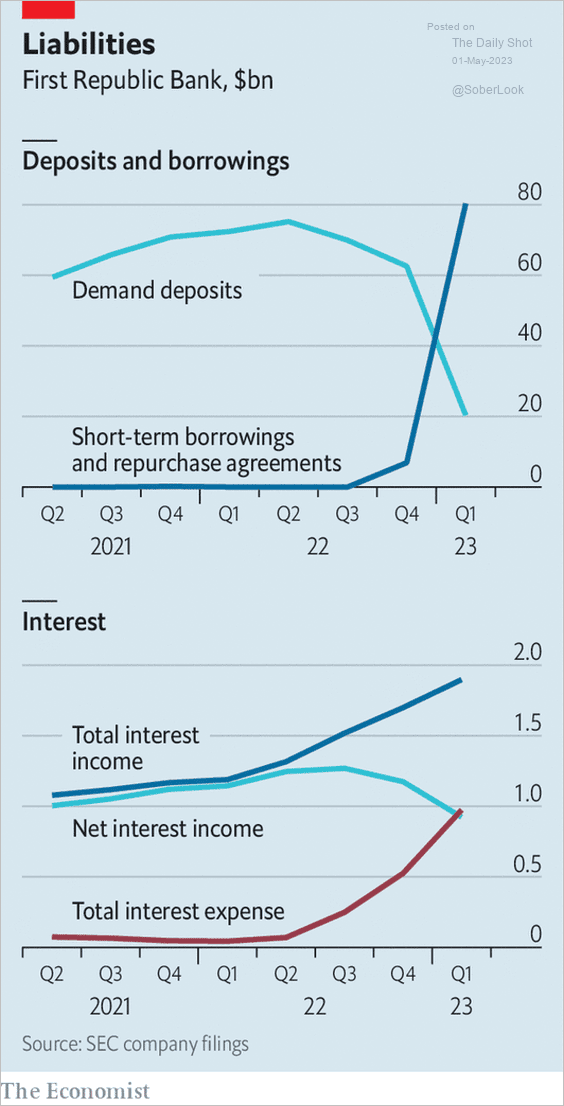

1. Regulators seized First Republic Bank and sold it to JP Morgan.

Source: @WSJ Read full article

Source: @WSJ Read full article

First Republic Bank has been on “life support” for some time.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

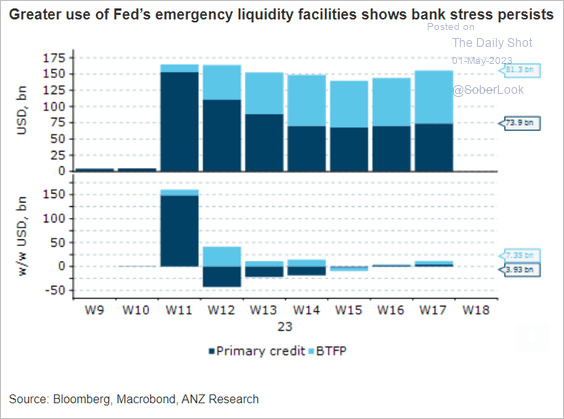

2. The Fed’s emergency funding for banks increased again last week.

Source: @ANZ_Research

Source: @ANZ_Research

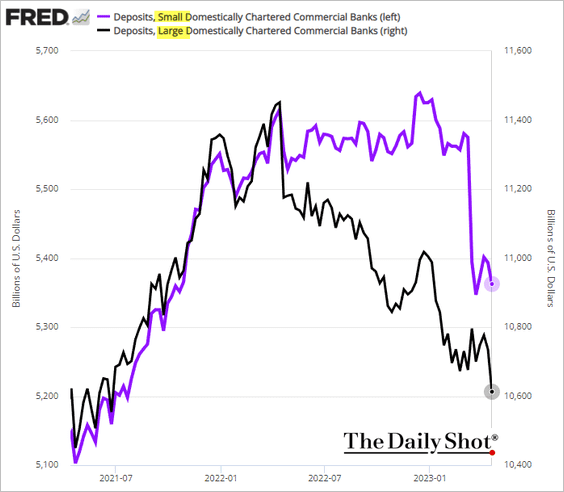

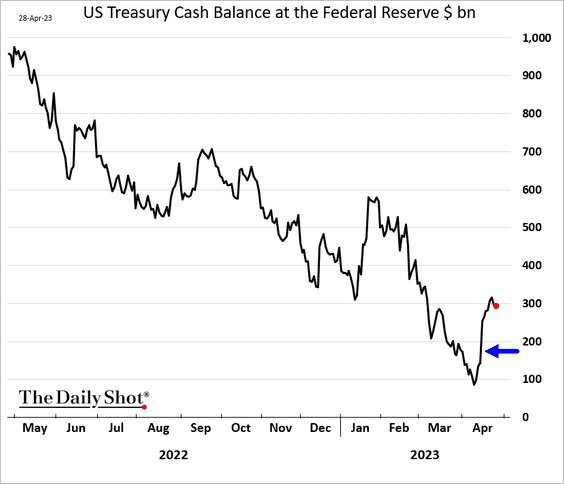

3. Bank deposits declined the week ending April 19th.

Here is why. US domestic bank deposits typically decline immediately after the tax date in mid-April, as funds are transferred from private deposits to the US Treasury’s account at the Federal Reserve, resulting in a reduction in the overall amount of deposits held by the banks.

——————–

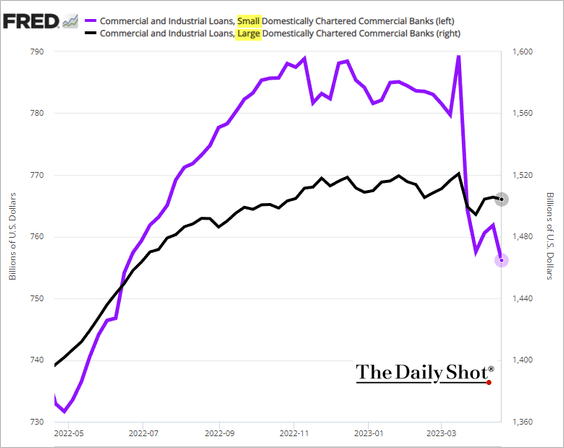

4. Business loan balances at small banks dropped since the start of the banking turmoil.

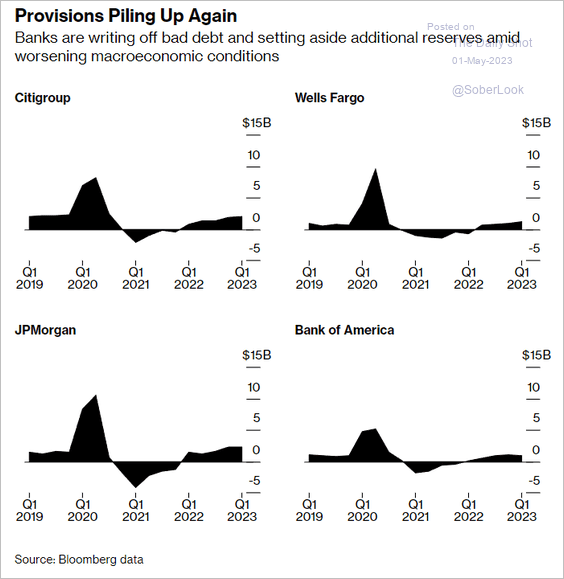

5. Loan loss provisions are rising.

Source: @ncallanan, @markets Read full article

Source: @ncallanan, @markets Read full article

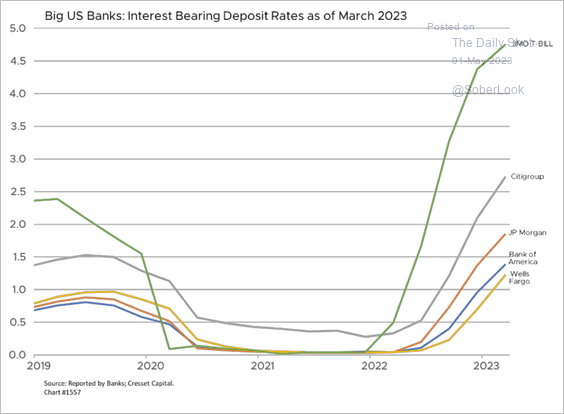

6. Big banks will likely maintain robust interest margins.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

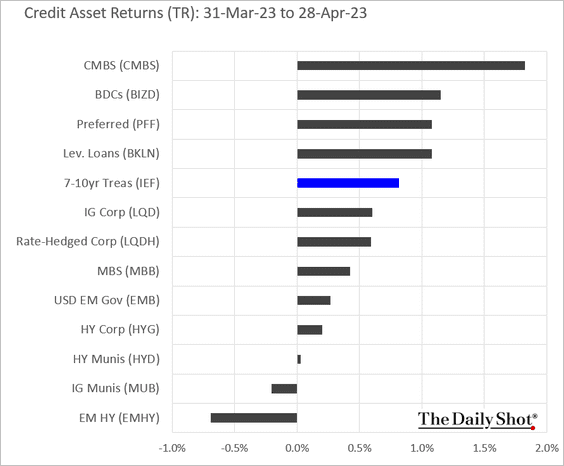

7. Finally, we have some performance data for April.

Back to Index

Global Developments

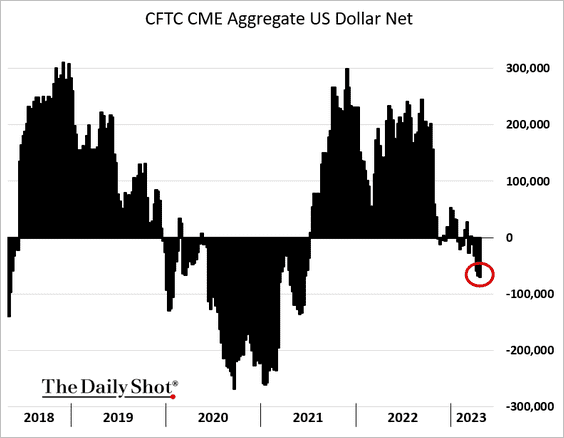

1. Hedge funds are boosting their bets against the US dollar.

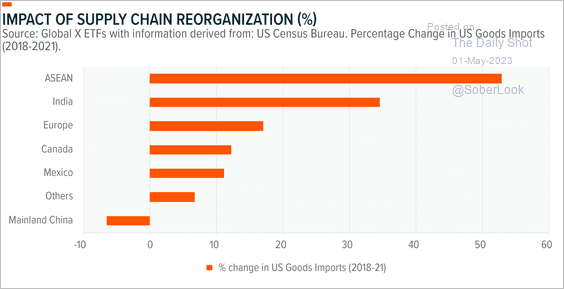

2. Which countries were the beneficiaries of the shift away from Chinese manufacturing?

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

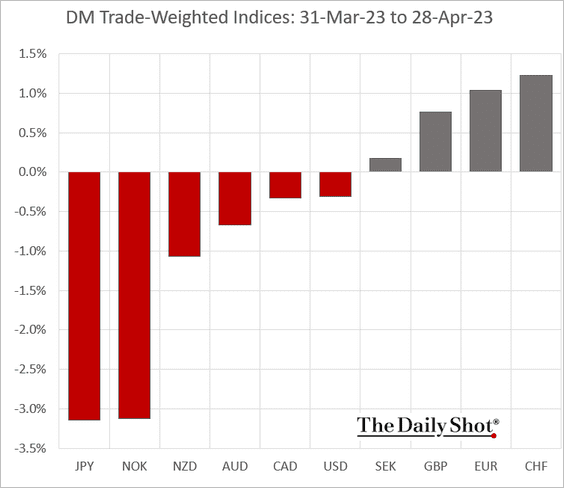

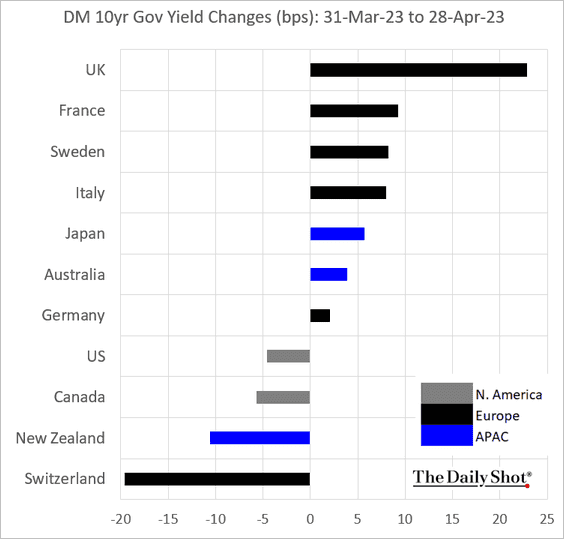

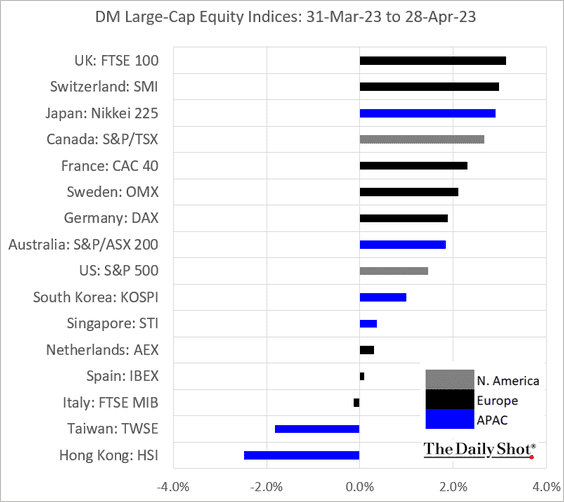

3. Finally, we have some performance data for April.

• Trade-weighted currency indices:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

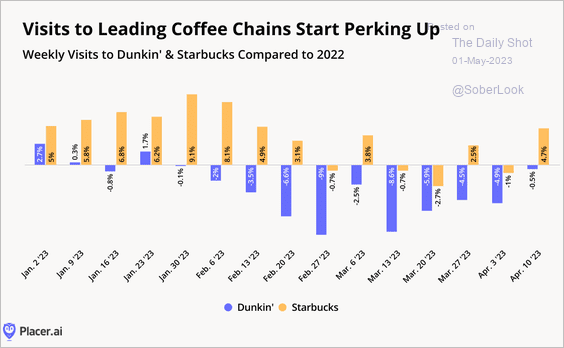

1. Visits to coffee chains:

Source: Placer.ai

Source: Placer.ai

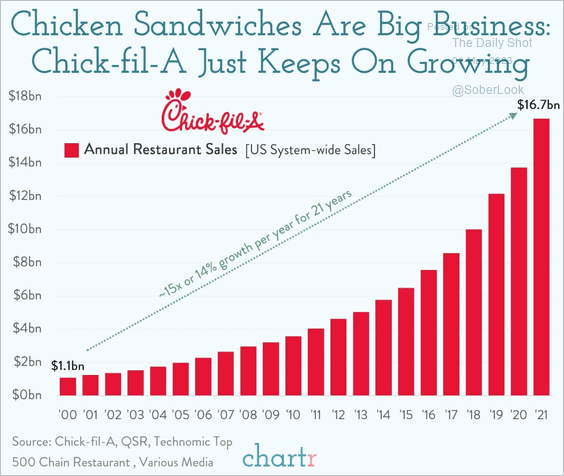

2. Chick-fil-A sales growth:

Source: @chartrdaily

Source: @chartrdaily

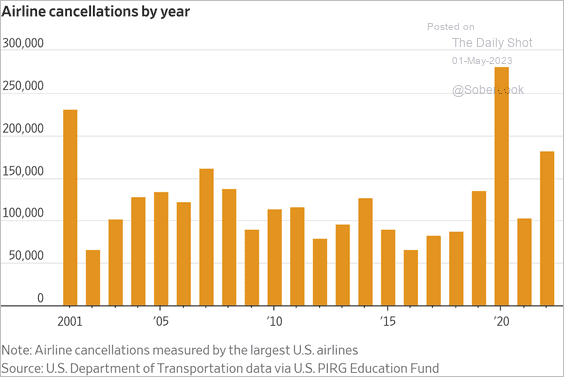

3. Airline cancellations:

Source: @WSJ Read full article

Source: @WSJ Read full article

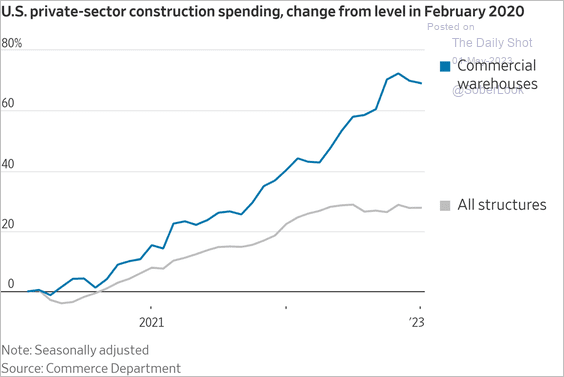

4. Construction spending on warehouses:

Source: @WSJ Read full article

Source: @WSJ Read full article

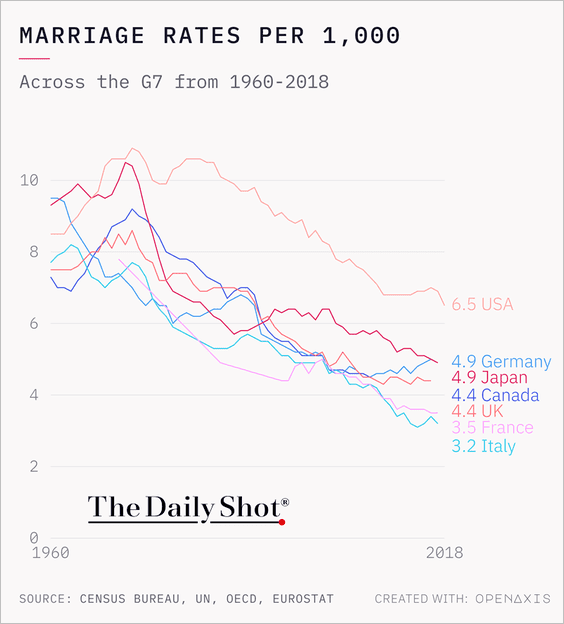

5. Marriage rates in advanced economies:

Source: @TheDailyShot

Source: @TheDailyShot

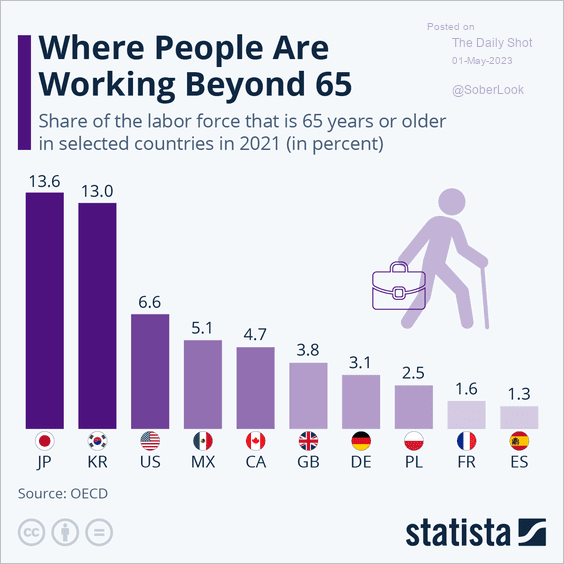

6. Working beyond the age of 65:

Source: Statista

Source: Statista

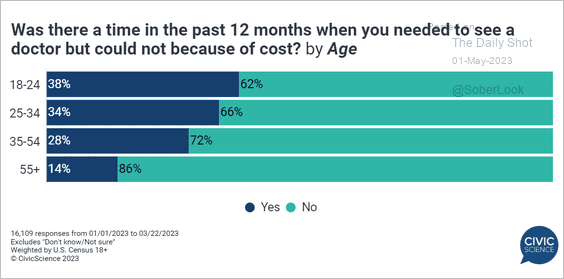

7. Adults not seeking medical care due to costs:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

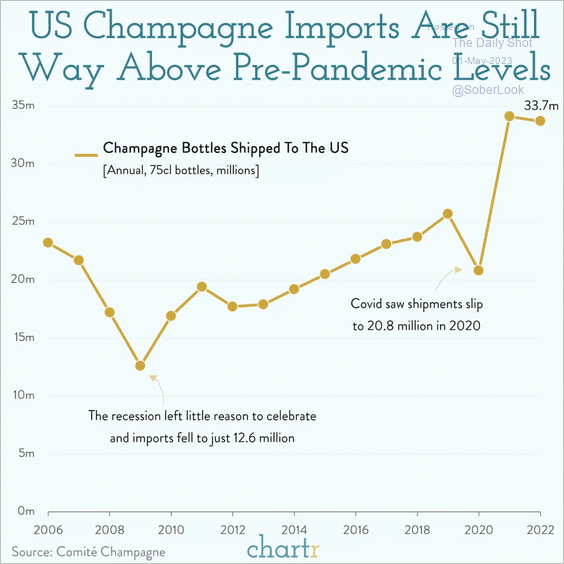

8. Champagne imports:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index