The Daily Shot: 11-May-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

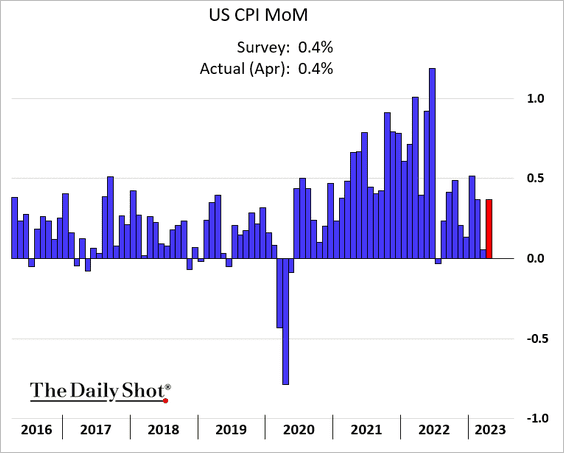

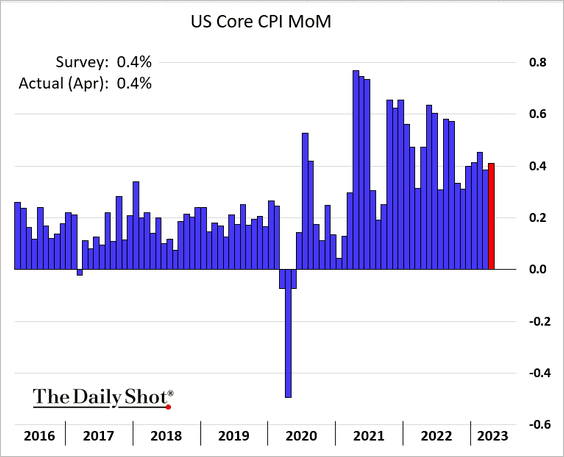

1. The CPI report was roughly in line with expectations. US inflation continues to run hot.

– Headline CPI:

– Core CPI:

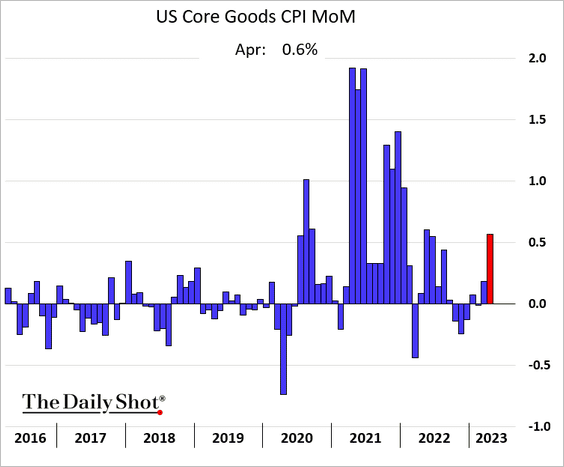

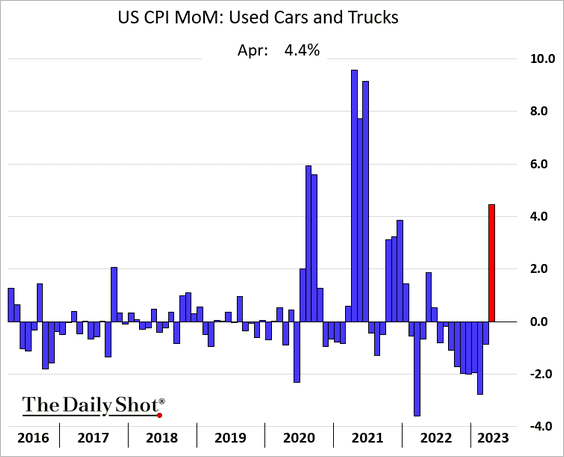

• Core goods inflation jumped, pushed higher by used vehicle prices.

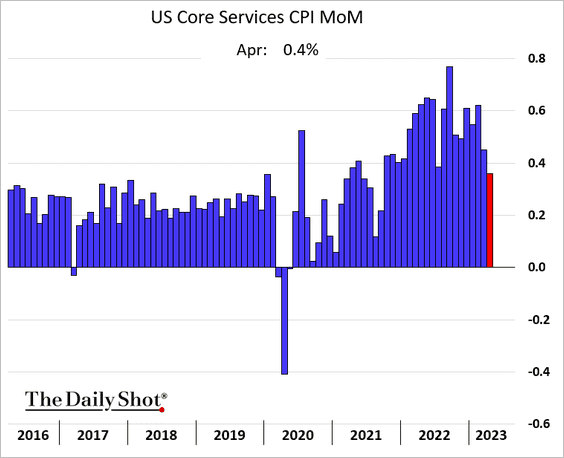

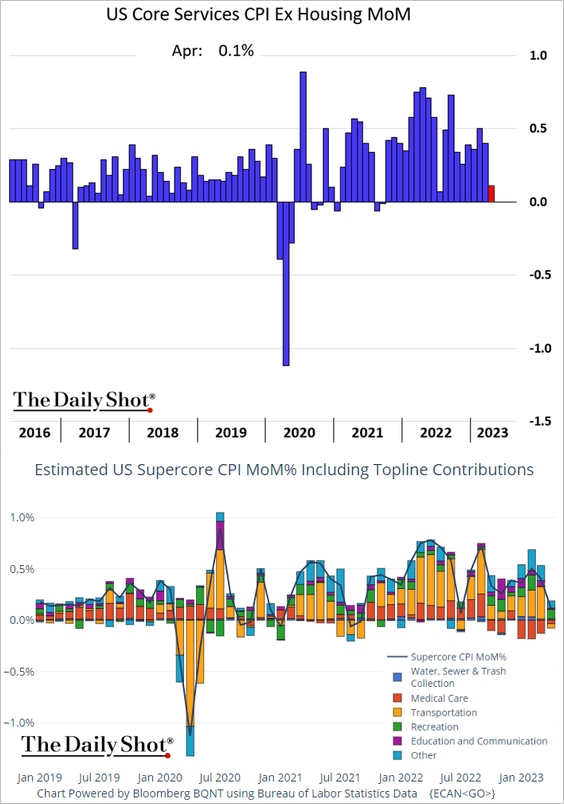

• Core services inflation slowed, which gave markets some comfort.

In particular, the markets saw the “supercore” inflation slowdown as a positive sign.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

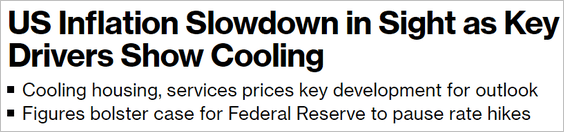

Source: @boes_, @gutavsaraiva, @readep, @economics Read full article

Source: @boes_, @gutavsaraiva, @readep, @economics Read full article

• Let’s take a look at some price trends in the automotive sector.

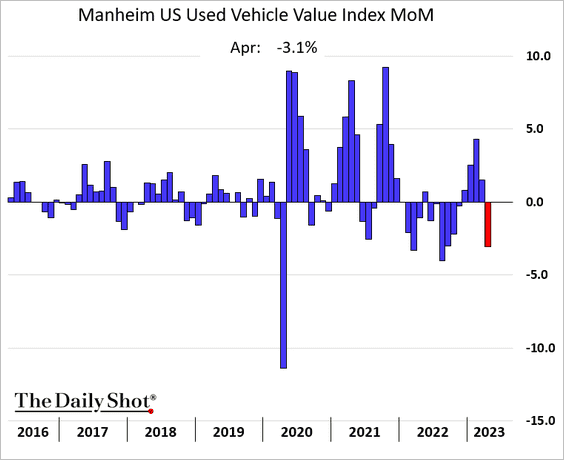

– Used car prices surged on tight supplies (as we saw in Nomura’s report yesterday).

Wholesale prices suggest that these gains will slow or begin reversing.

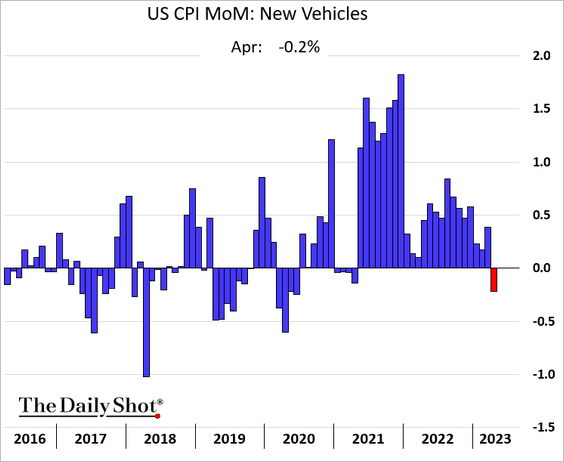

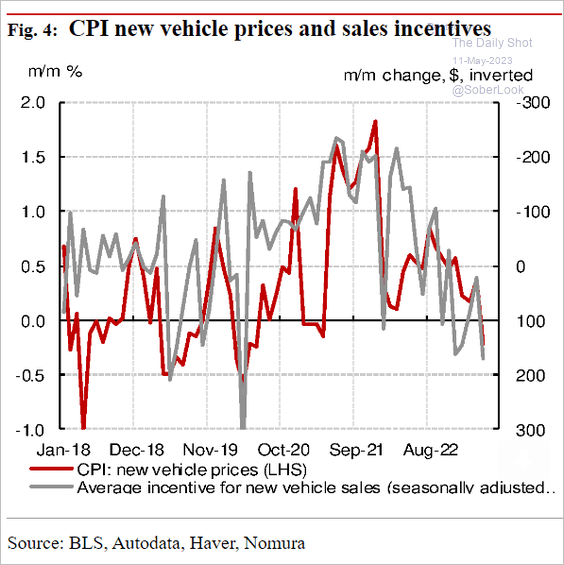

– New car prices declined for the first time in nearly two years, …

… as dealers offered incentives.

Source: Nomura Securities

Source: Nomura Securities

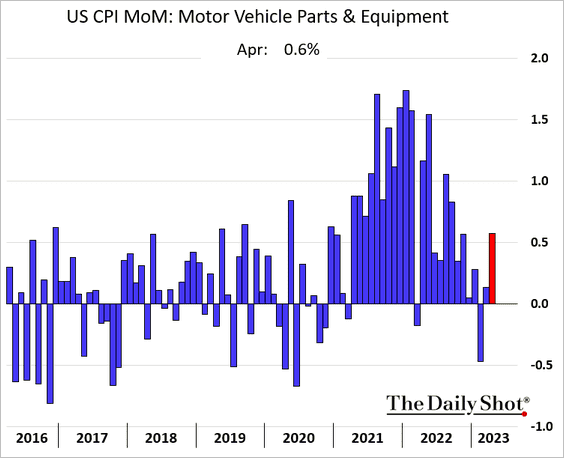

– Parts prices jumped again in April.

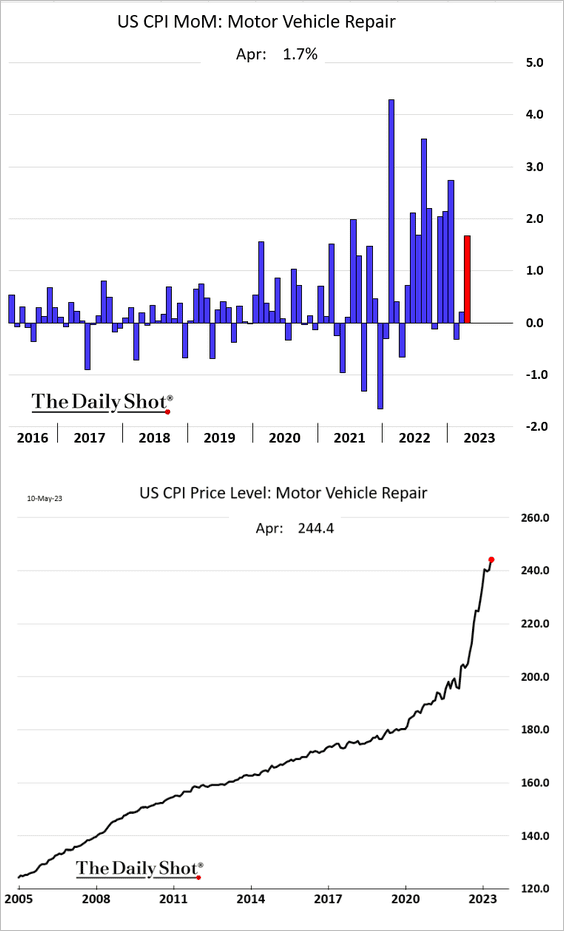

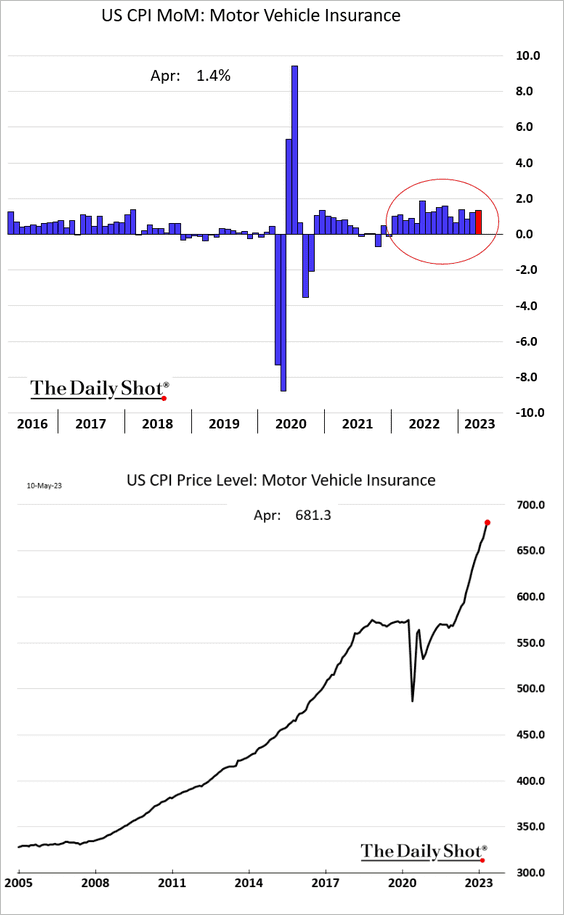

– Auto repair costs continue to surge …

… driving up auto insurance costs.

• Here are some additional CPI trends.

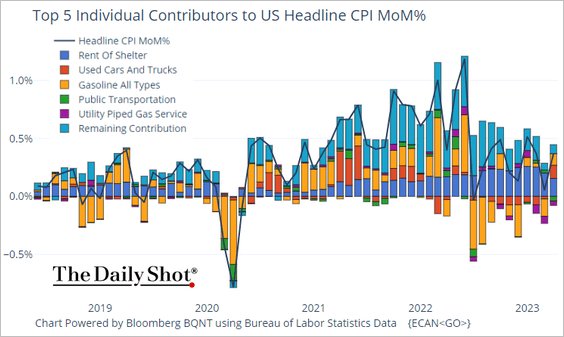

– Key contributions:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

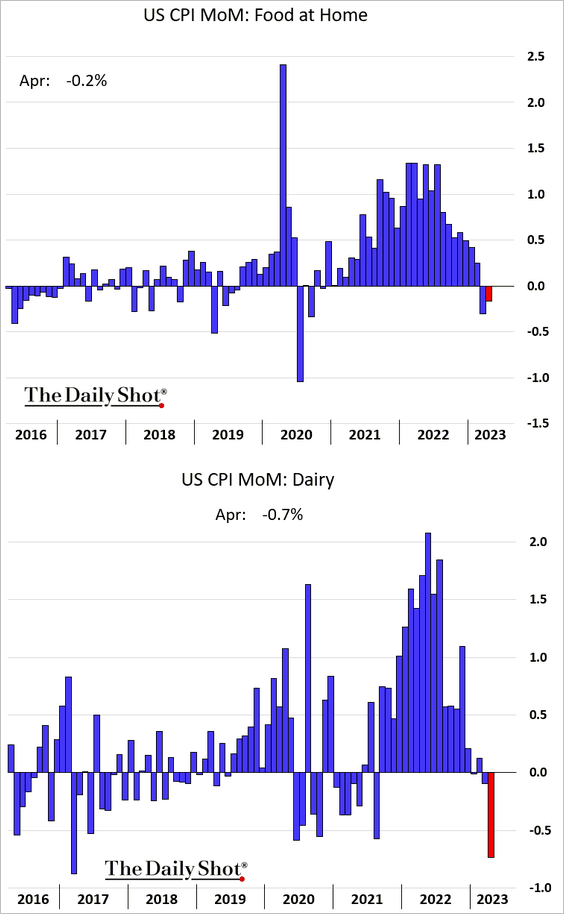

– Groceries:

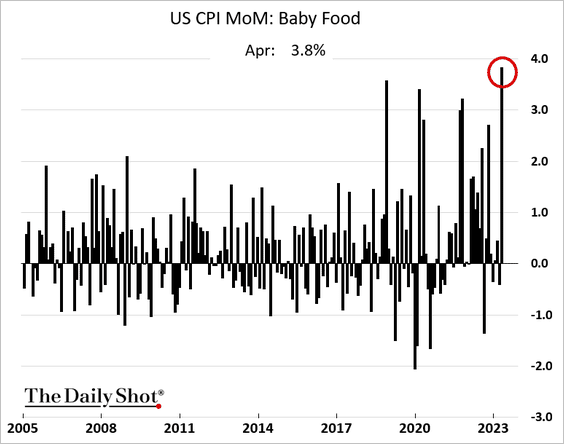

– Baby formula (biggest increase on record):

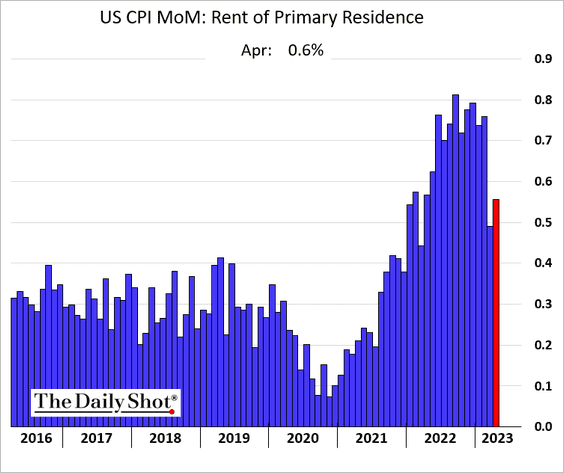

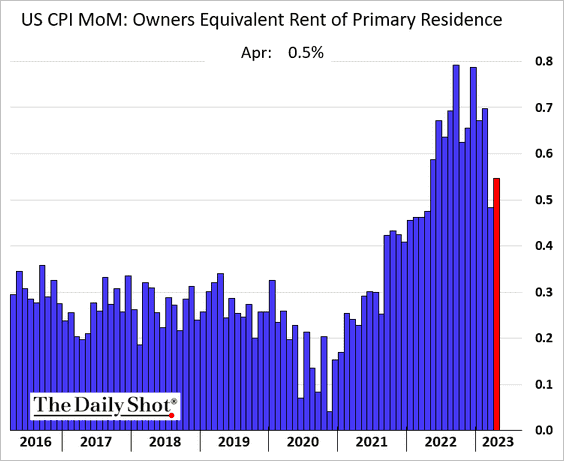

– Rent and owners’ equivalent rent (price gains were up again in April):

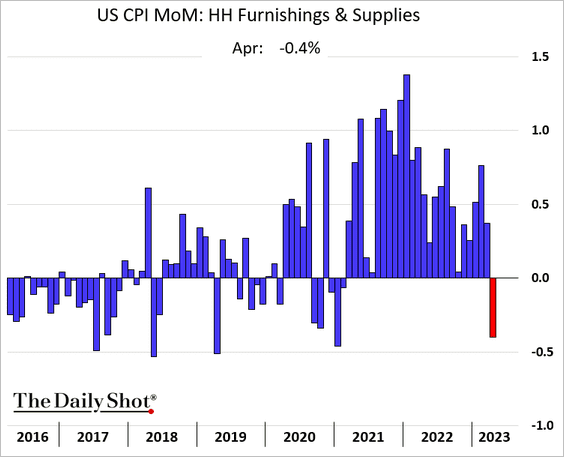

– Furniture (dented by the housing market):

We will have more updates on inflation shortly.

——————–

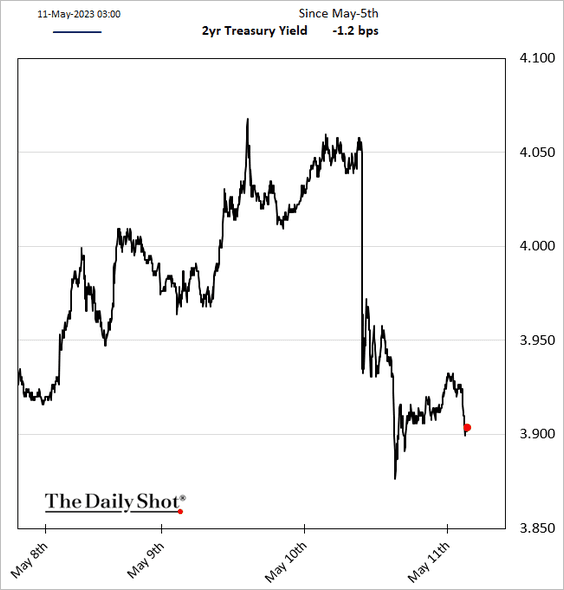

2. The market saw the CPI report as dovish, pushing yields lower.

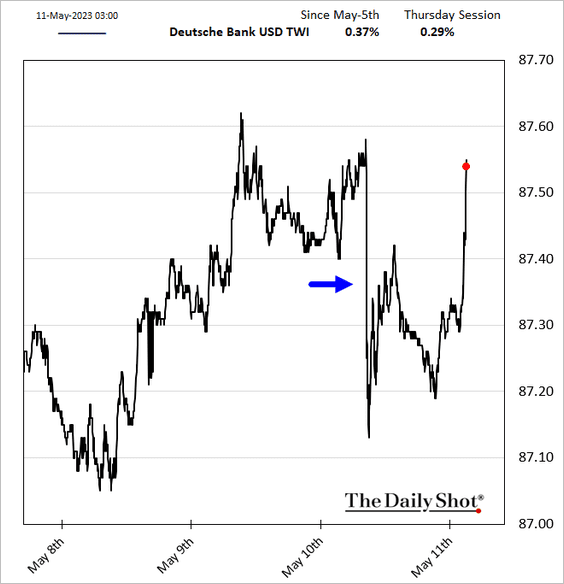

The dollar declined after the CPI report but is up this morning amid a haven bid.

——————–

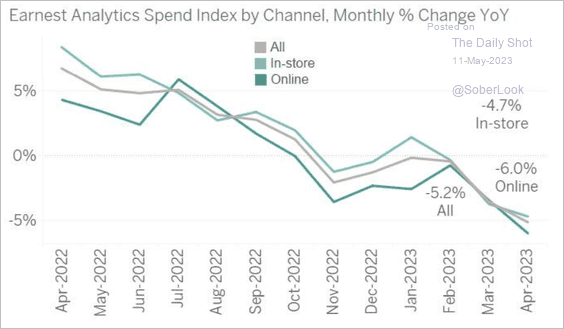

3. The Earnest Analytics Spend Index doesn’t bode well for retail sales in April, …

Source: Earnest

Source: Earnest

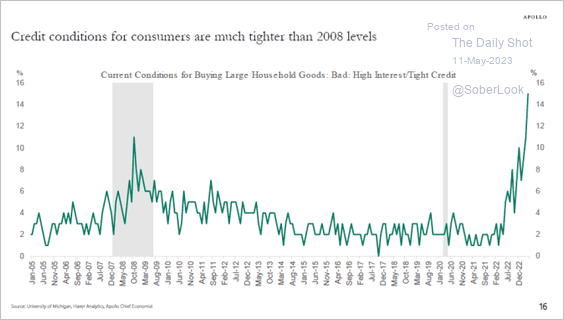

… as rate/credit conditions tighten sharply for consumers.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

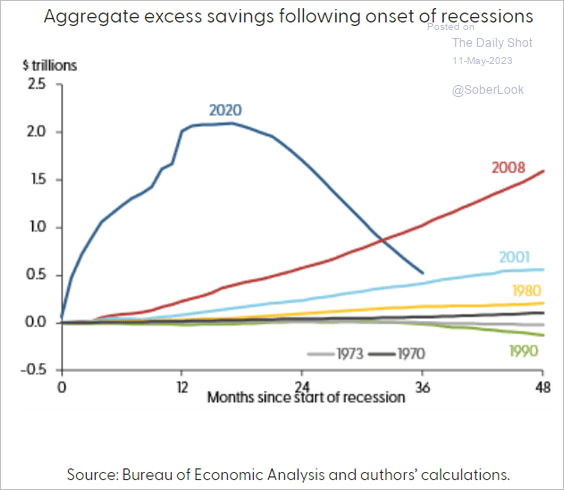

However, excess savings remain elevated for now.

Source: Hamza Abdelrahman and Luiz Oliveira, Federal Reserve Bank of San Francisco

Source: Hamza Abdelrahman and Luiz Oliveira, Federal Reserve Bank of San Francisco

——————–

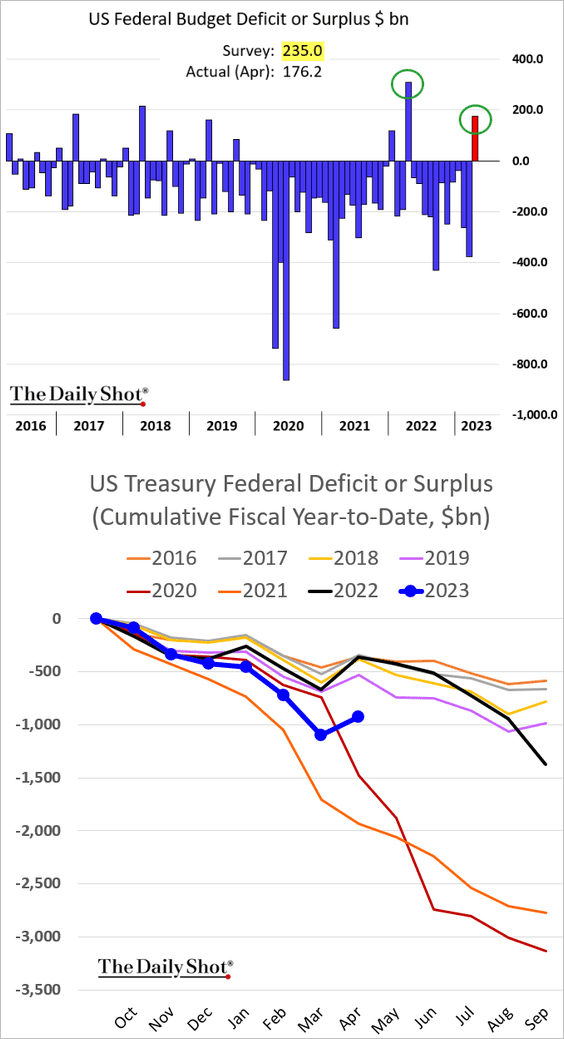

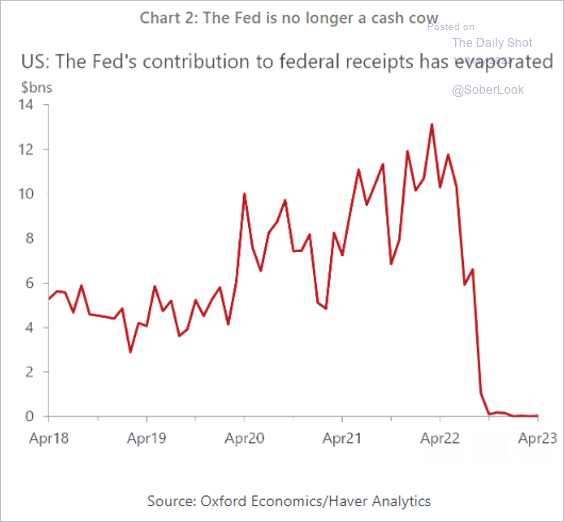

4. The April federal budget surplus was weaker than expected due to slower tax receipts.

Source: @v_dendrinou

Source: @v_dendrinou

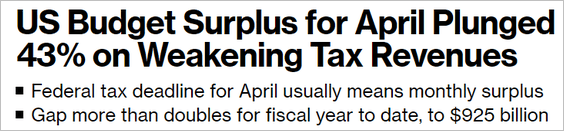

• The Fed is no longer contributing cash to the US Treasury.

Source: Oxford Economics

Source: Oxford Economics

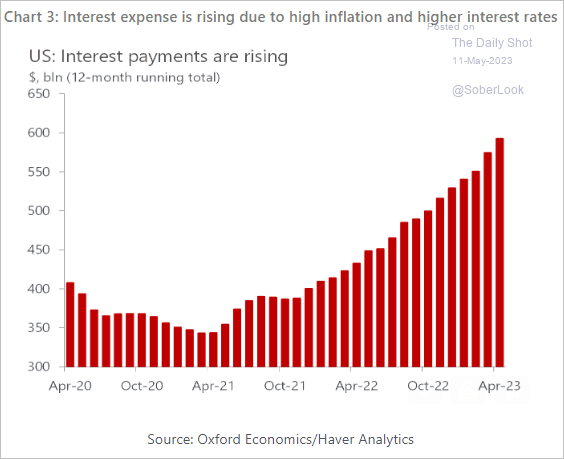

• The government’s interest expense keeps rising.

Source: Oxford Economics

Source: Oxford Economics

——————–

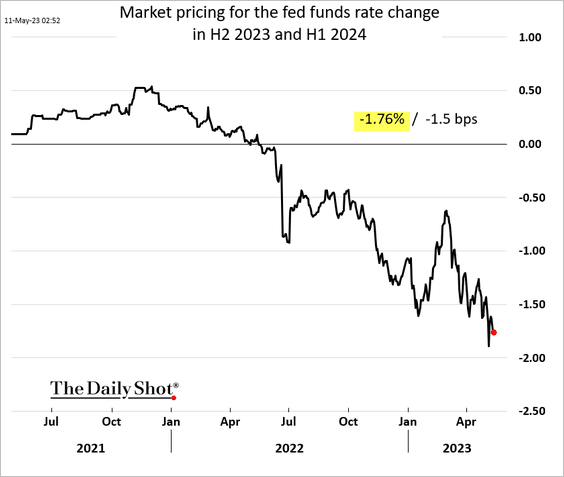

5. The market continues to expect substantial rate cuts starting in the second half of this year.

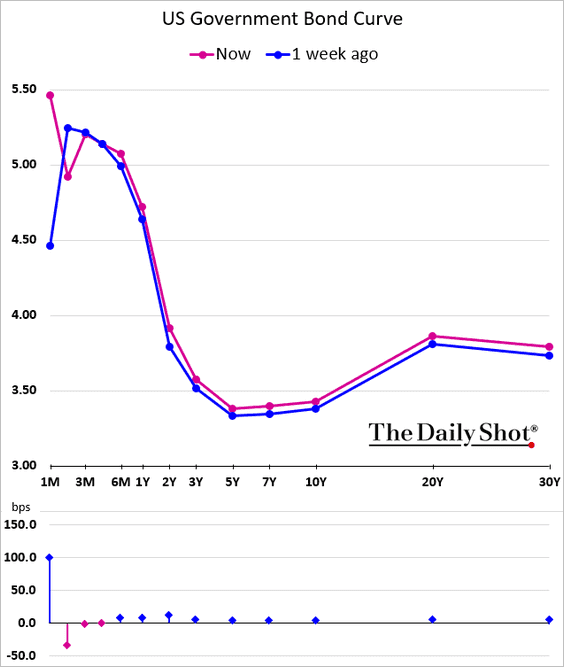

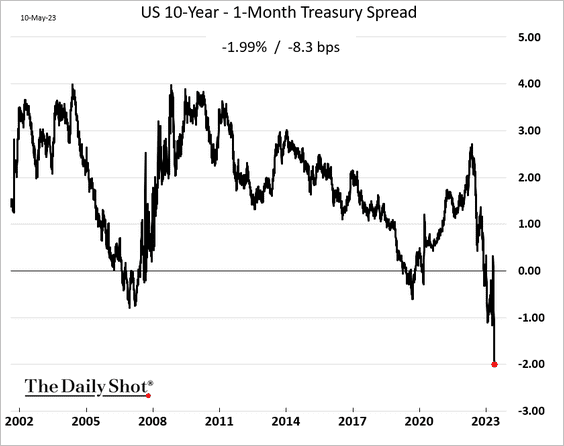

6. The 1-month T-bill yield surged well above the rest of the curve as the X-date looms.

The spread between the 10-year and the 1-month Treasury yields hit a new low.

Back to Index

Canada

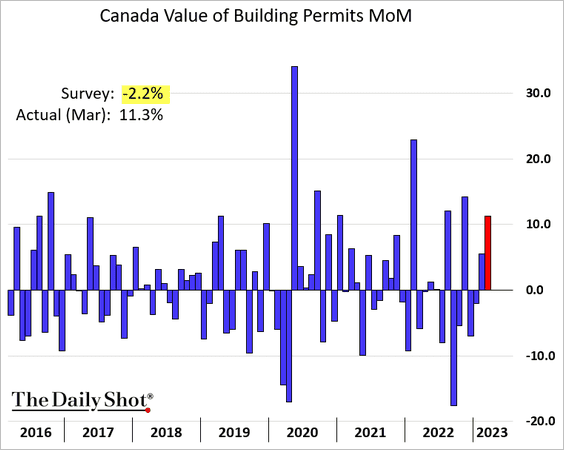

1. Building permits unexpectedly jumped in March.

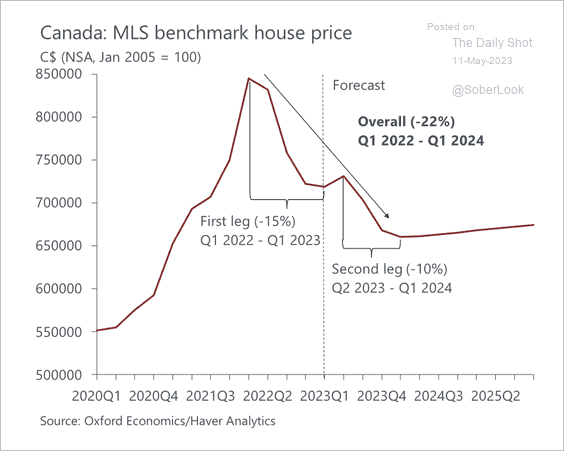

2. Oxford Economics expects house prices to fall another 10% by the end of this year, resulting in a 20%+ drawdown from the February 2022 high.

Source: Oxford Economics

Source: Oxford Economics

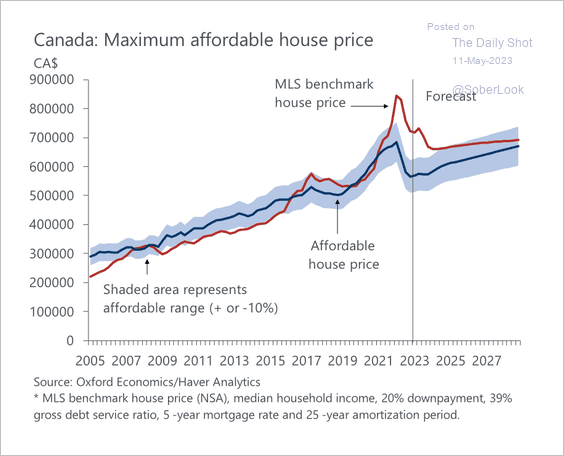

• House prices will need to fall much further to realign with affordability.

Source: Oxford Economics

Source: Oxford Economics

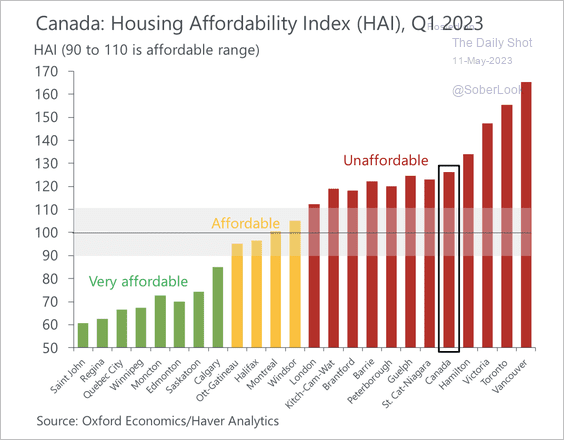

• Here is a look at house price affordability by region.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

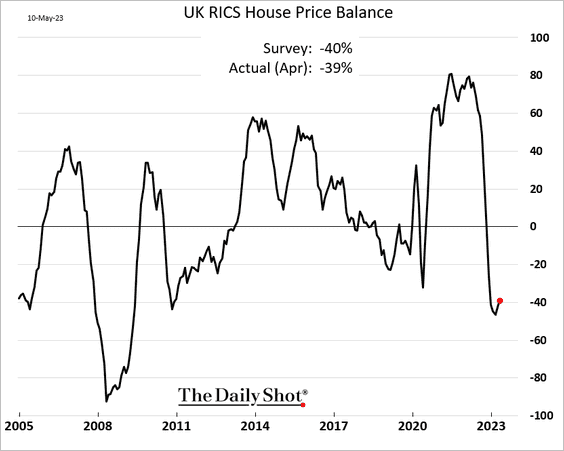

The United Kingdom

1. The housing market continues to struggle.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

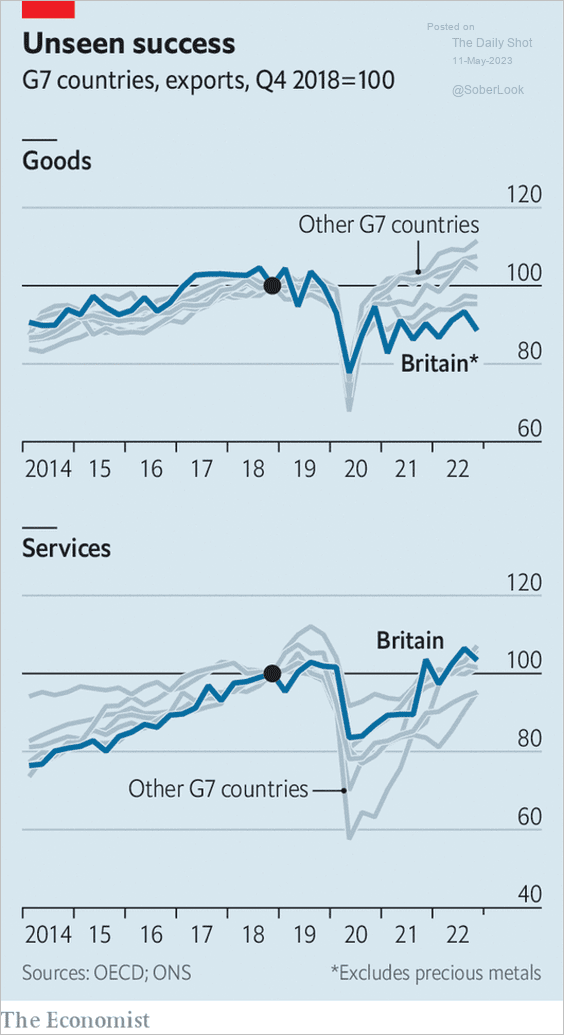

2. Services exports are experiencing significant growth.

Source: The Economist Read full article

Source: The Economist Read full article

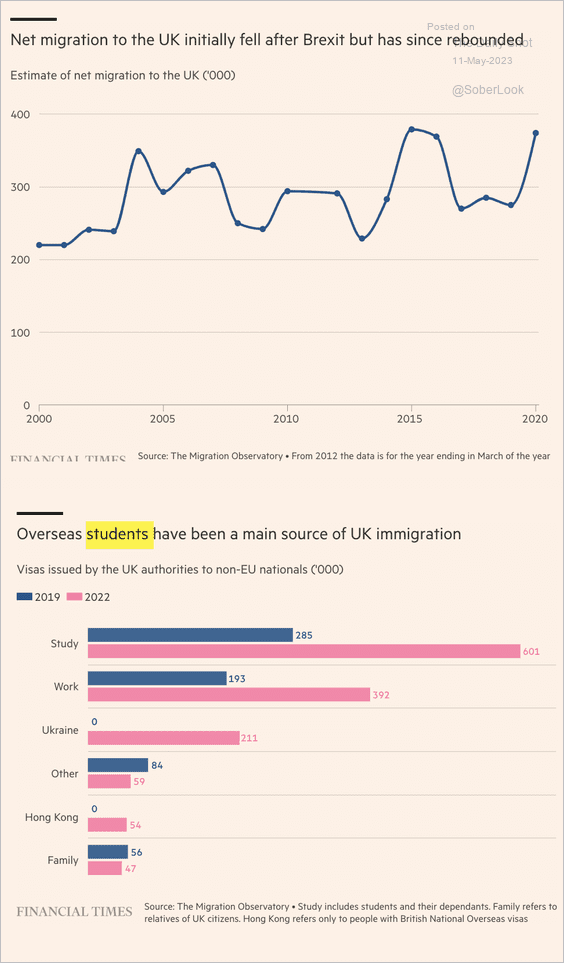

3. Net migration has rebounded.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

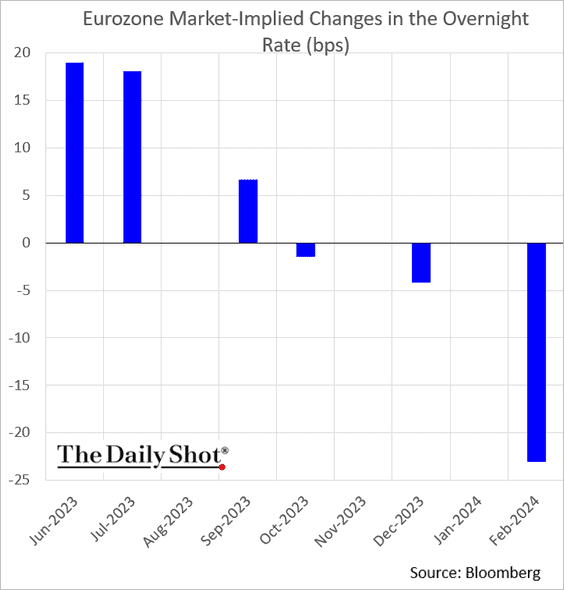

1. The market is pricing in two additional rate hikes ahead. Could we see more?

Source: @Alemrome, @jrandow, @economics Read full article

Source: @Alemrome, @jrandow, @economics Read full article

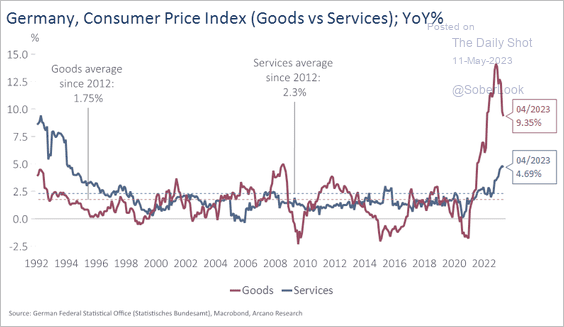

• Services inflation is yet to peak.

Source: Arcano Economics

Source: Arcano Economics

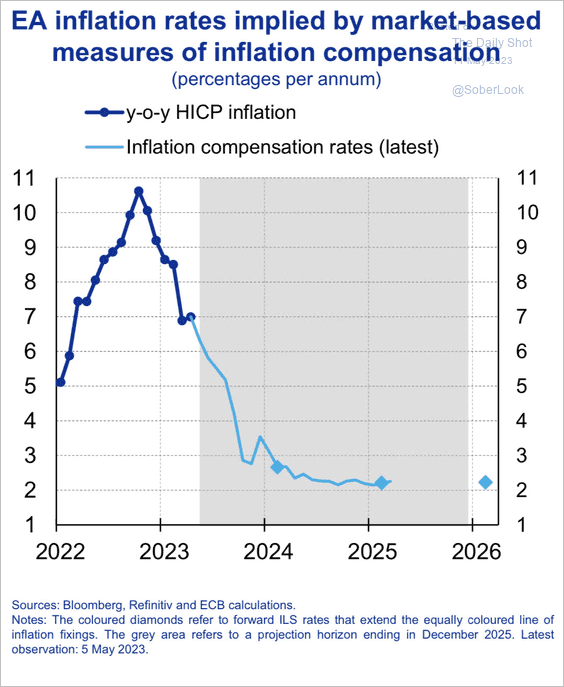

• The market is pricing a rapid moderation in the CPI.

Source: ECB

Source: ECB

——————–

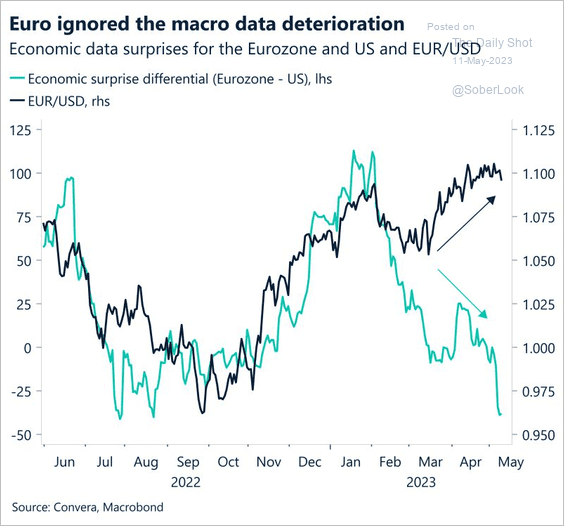

2. The economic surprise differential with the US points to downside risks for the euro.

Source: Boris Kovacevic

Source: Boris Kovacevic

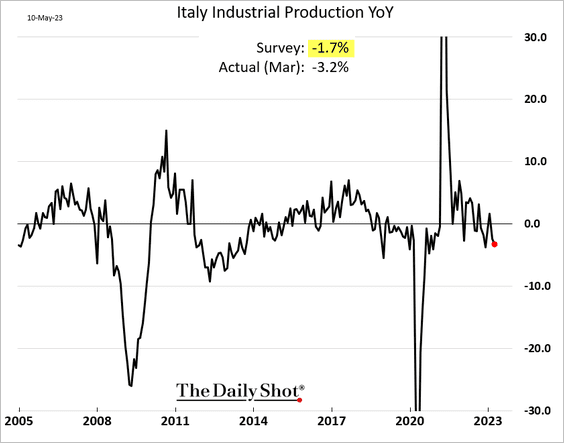

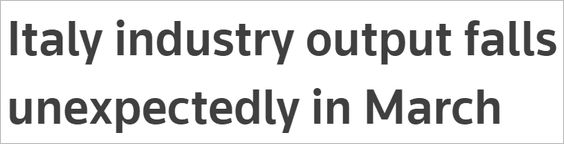

3. Italy’s industrial output is slowing.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

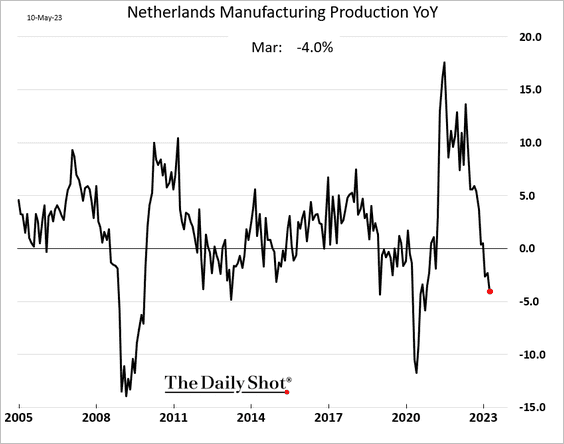

4. Dutch factory output softened further in March.

Back to Index

Europe

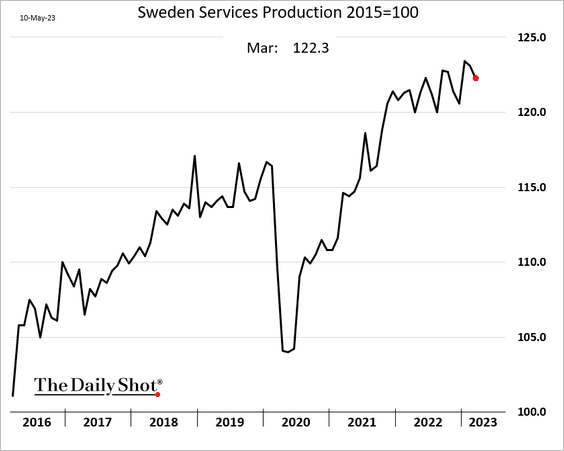

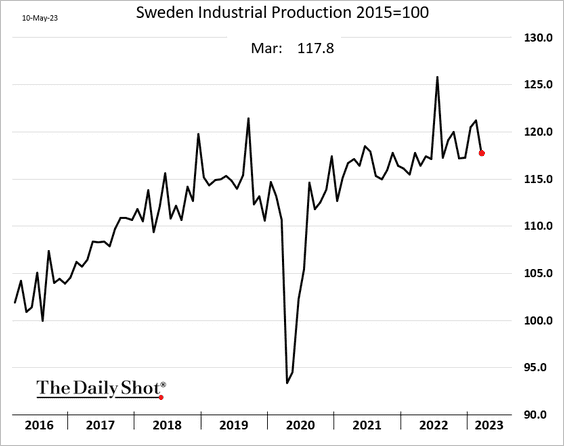

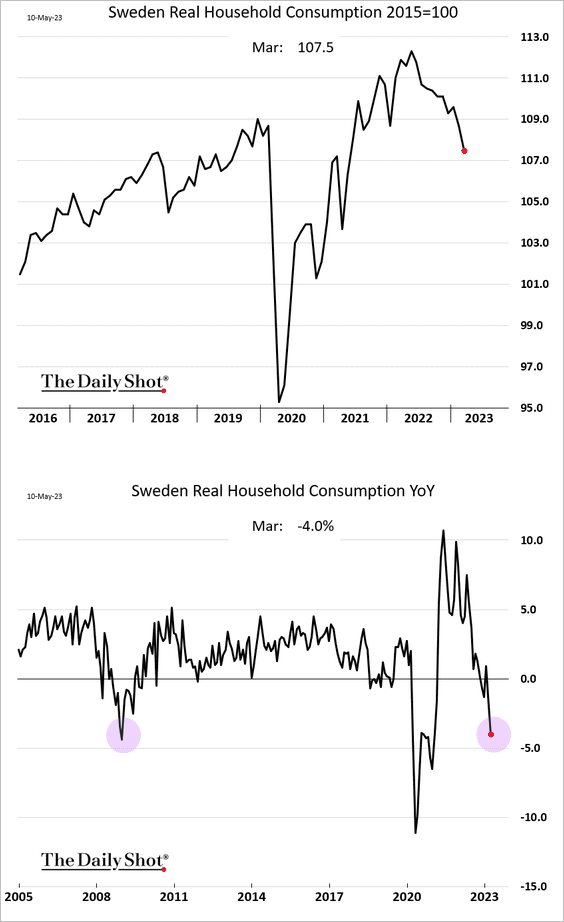

1. Sweden’s key indicators weakened in March.

• Services output:

• Industrial production:

• Household consumption (sharp deterioration):

——————–

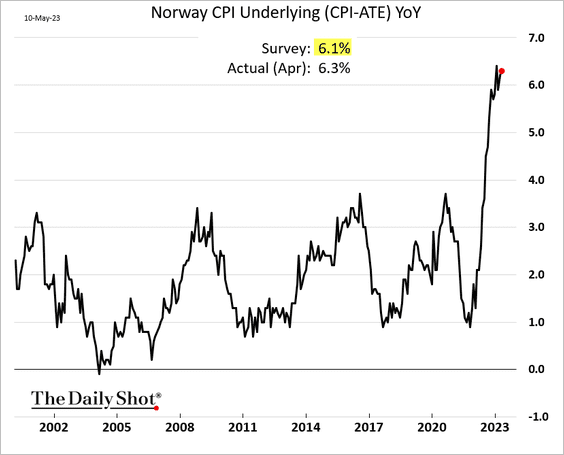

2. Norway’s inflation continues to run hot.

Source: @ottummelas, @economics Read full article

Source: @ottummelas, @economics Read full article

——————–

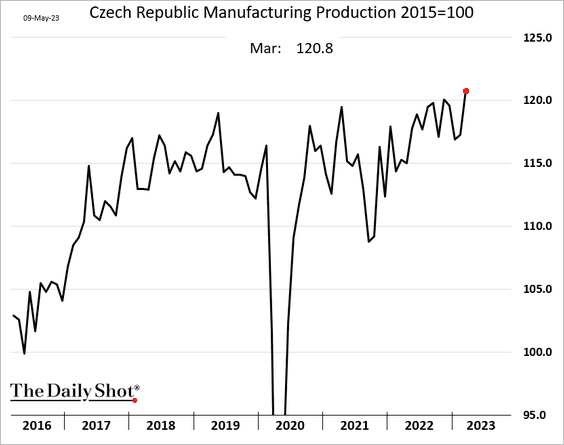

3. Czech factory output hit a record high.

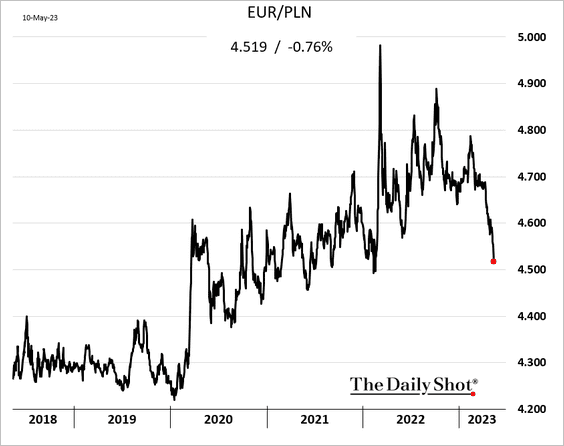

4. The Polish zloty is surging (chart shows EUR declining against PLN).

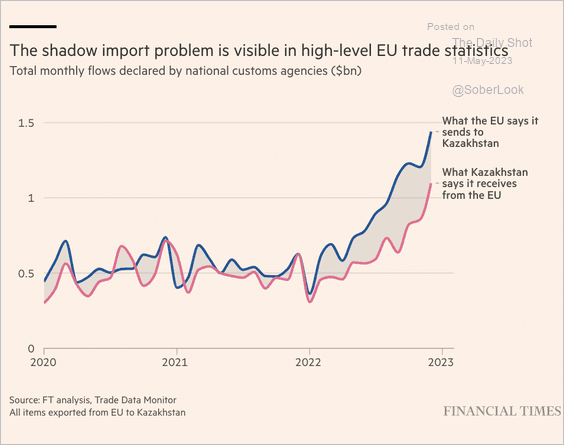

5. Despite the sanctions, the EU is trading with Russia via Kazakhstan.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

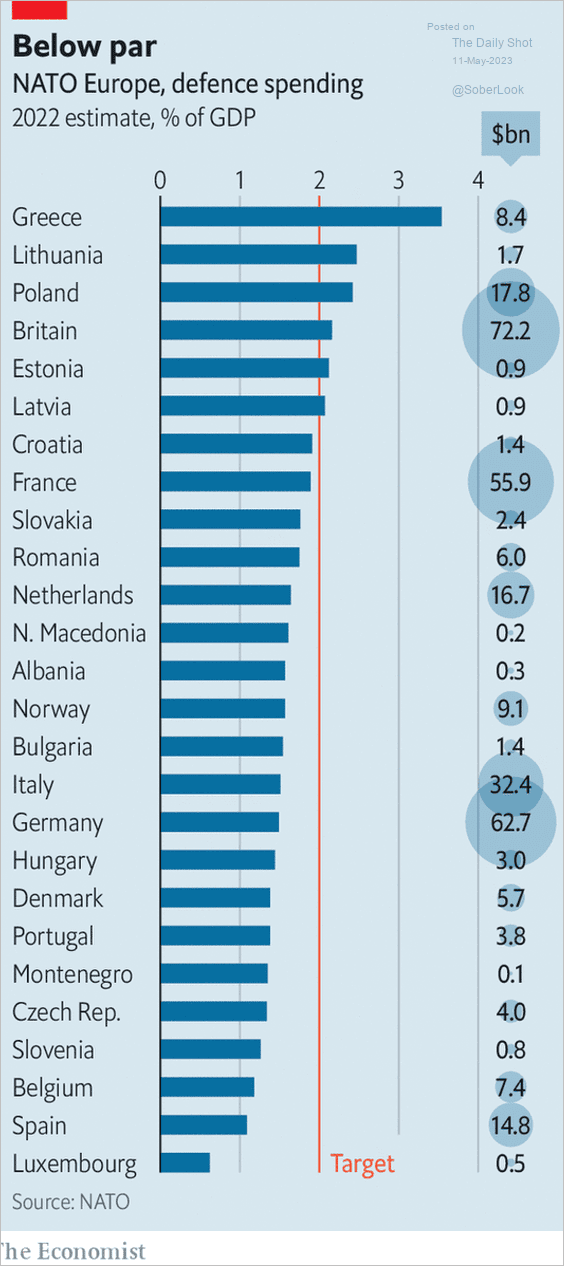

6. Here is NATO Europe’s defense spending.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Asia-Pacific

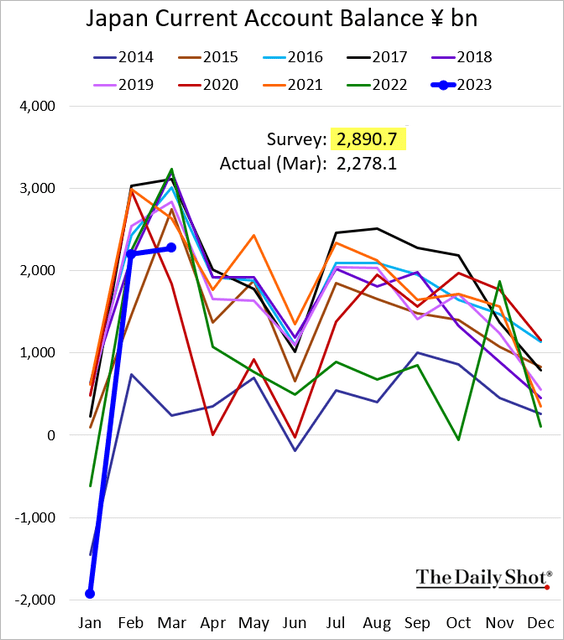

1. Japan’s current account surplus was smaller than expected in March.

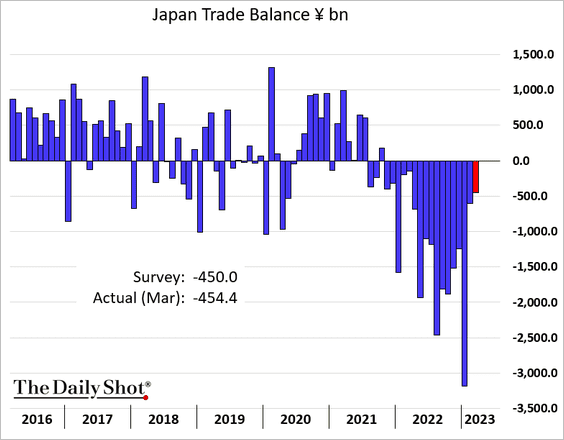

The trade deficit continues to narrow.

——————–

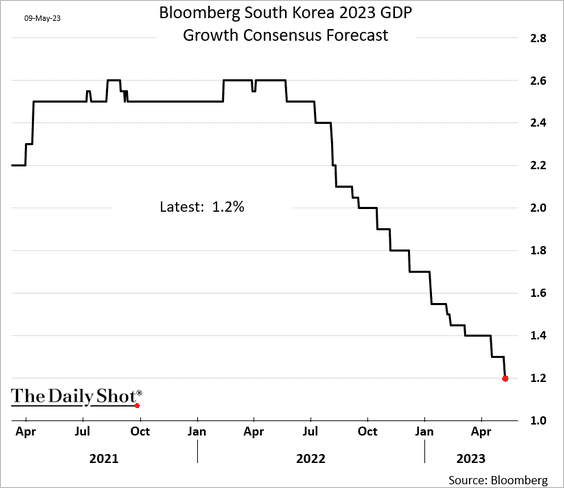

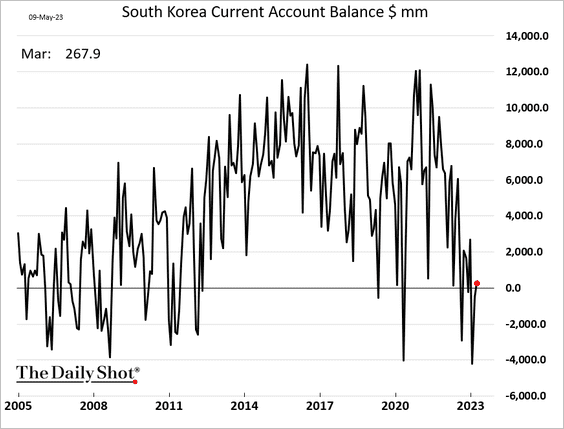

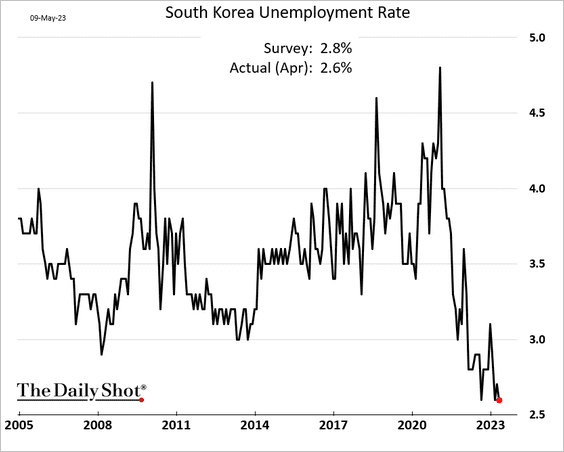

2. Next, we have some updates on South Korea.

• Economists continue to downgrade their GDP forecasts for this year.

• The current account balance is back in surplus.

• The unemployment rate is near multi-decade lows.

——————–

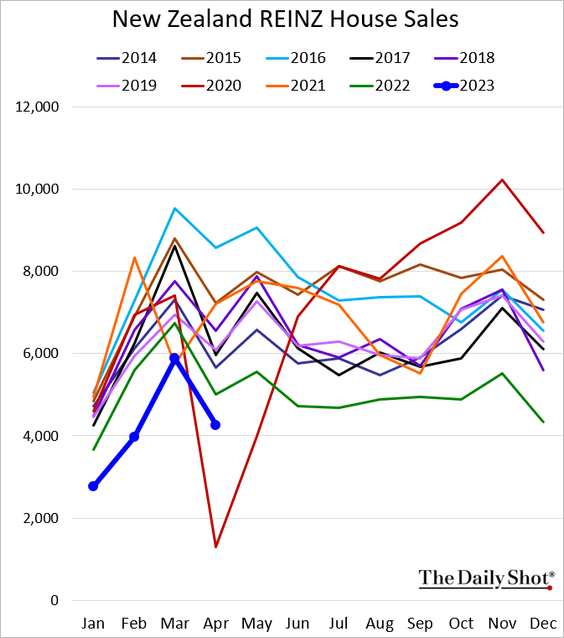

3. New Zealand’s home sales remain depressed.

Back to Index

China

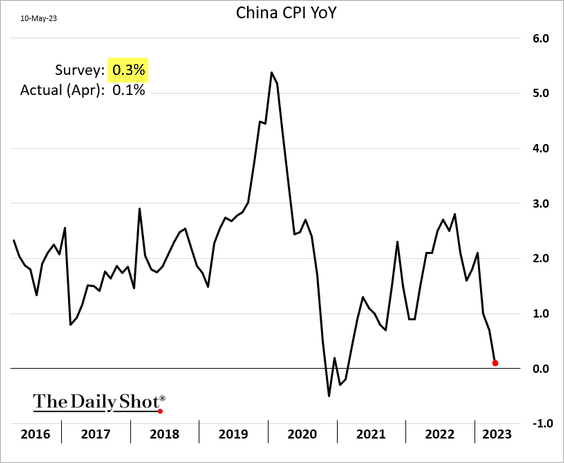

1. The CPI surprised to the downside, …

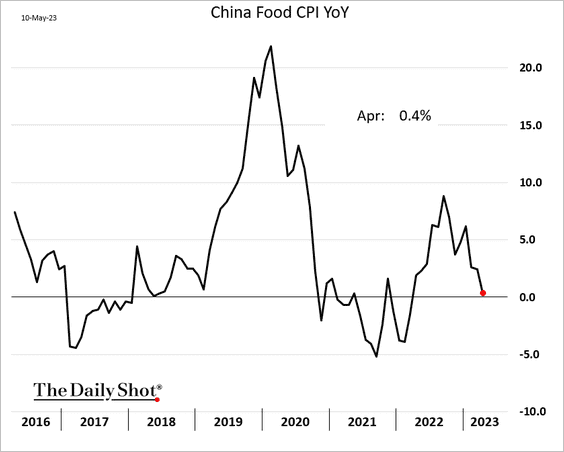

… with softer readings driven by food prices.

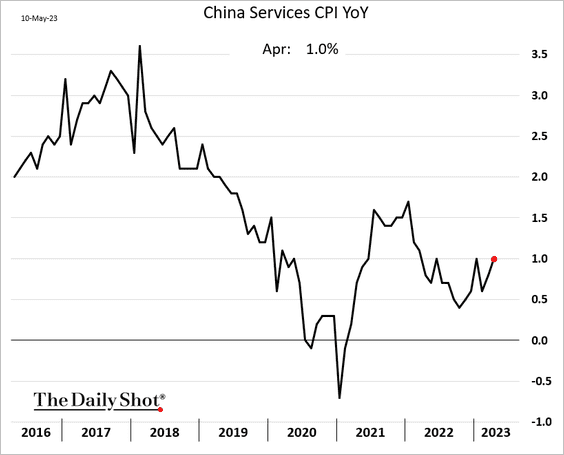

• However, services inflation climbed amid increased consumer demand.

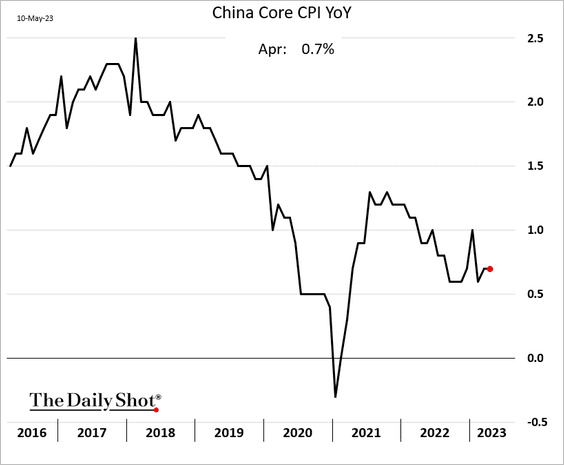

• The core CPI held steady.

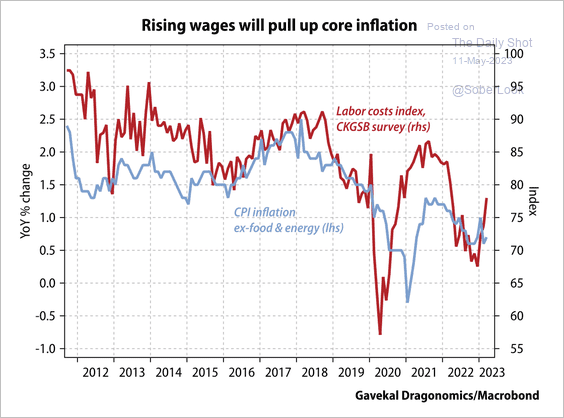

• Rising wages could boost inflation.

Source: Gavekal Research

Source: Gavekal Research

——————–

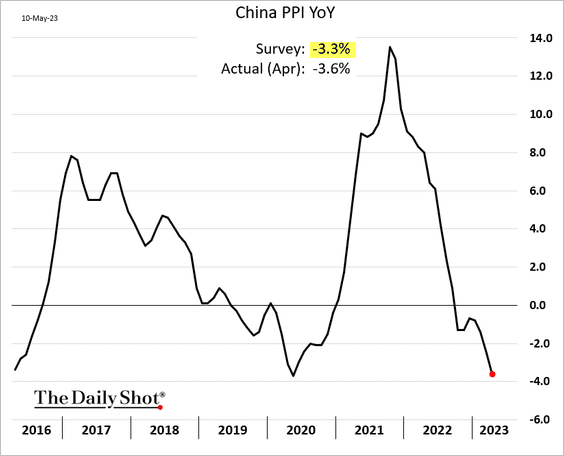

2. The PPI moved deeper into negative territory.

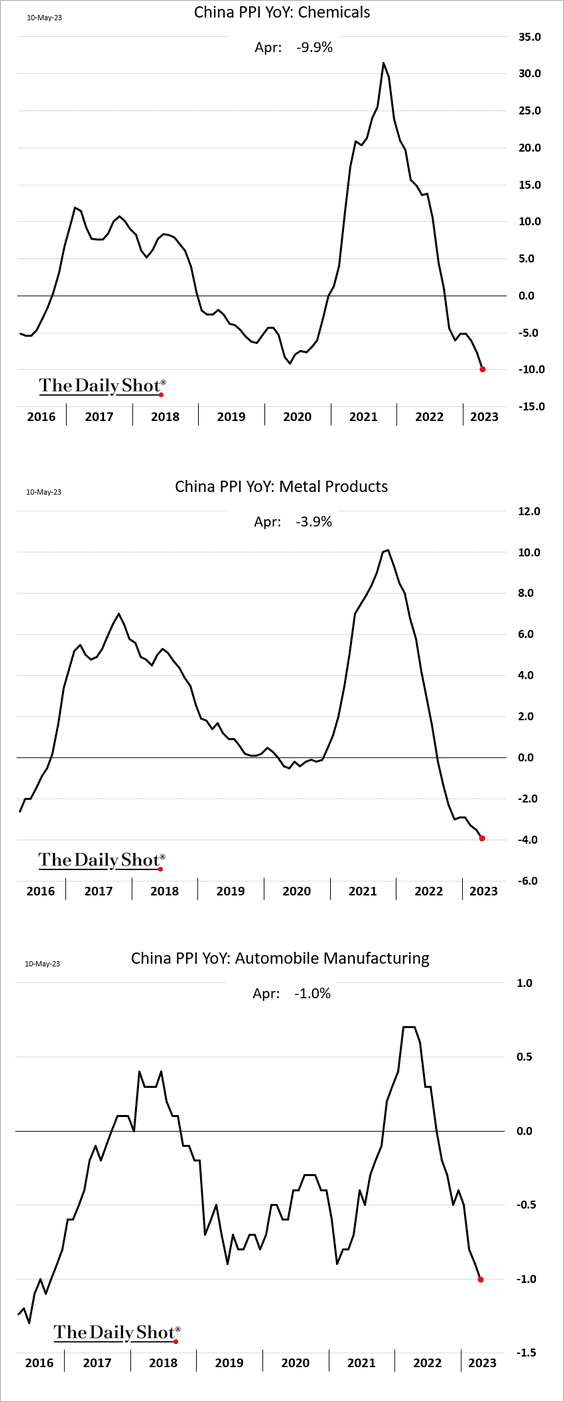

Here are some examples.

——————–

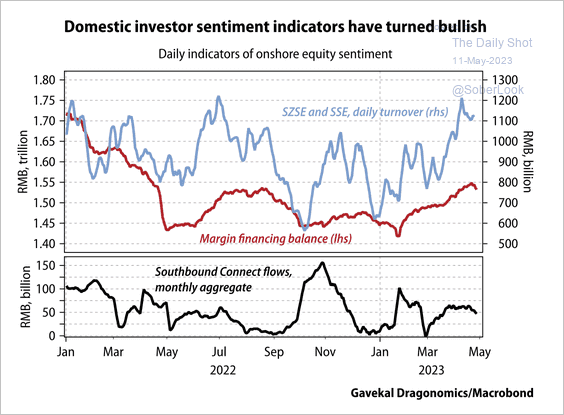

3. Domestic equity trading volumes and margin financing have picked up.

Source: Gavekal Research

Source: Gavekal Research

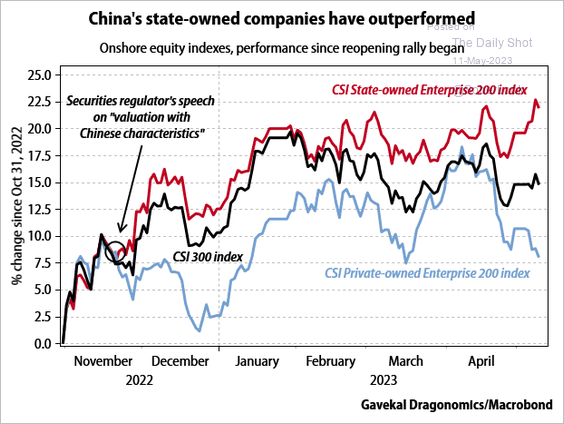

• State-owned companies have been outperforming.

Source: Gavekal Research

Source: Gavekal Research

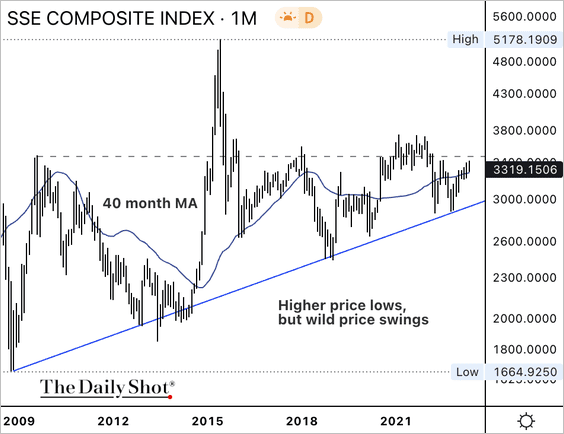

• The SSE Composite remains in a long-term uptrend, albeit volatile. A sustained break above resistance near 3,500 could attract additional buyers.

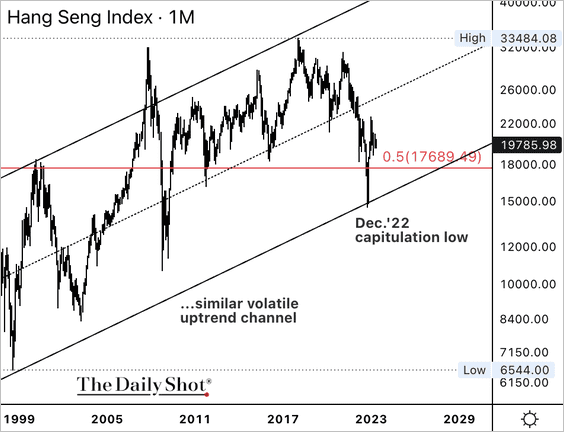

• Similarly, Hong Kong’s Hang Seng Index remains in a volatile uptrend.

——————–

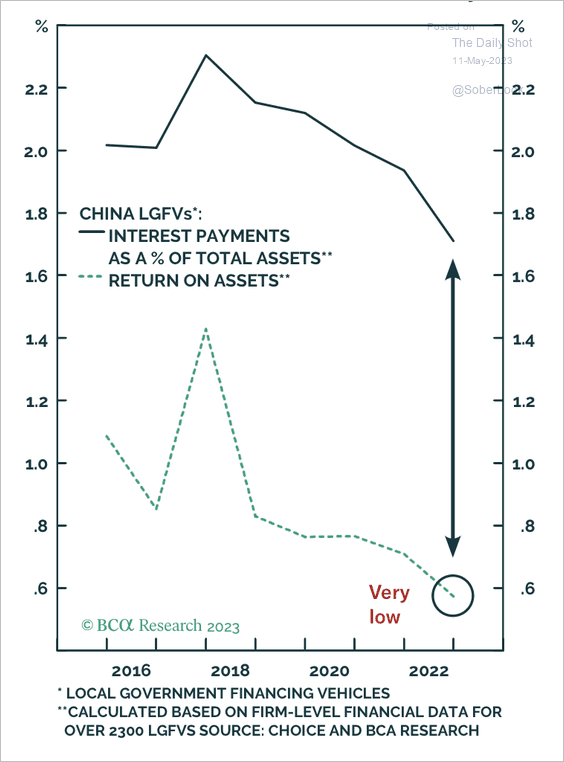

4. The return on assets on local government financing vehicles (LGFVs) is very low.

Source: BCA Research

Source: BCA Research

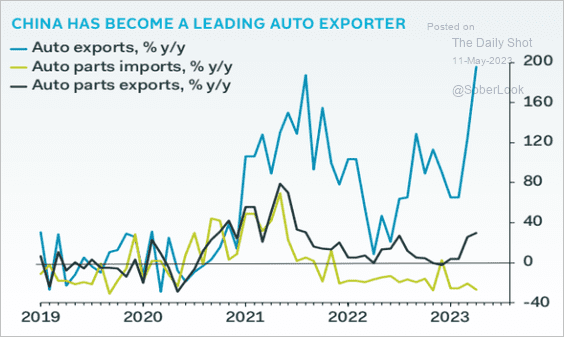

5. China is now a leading auto exporter.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

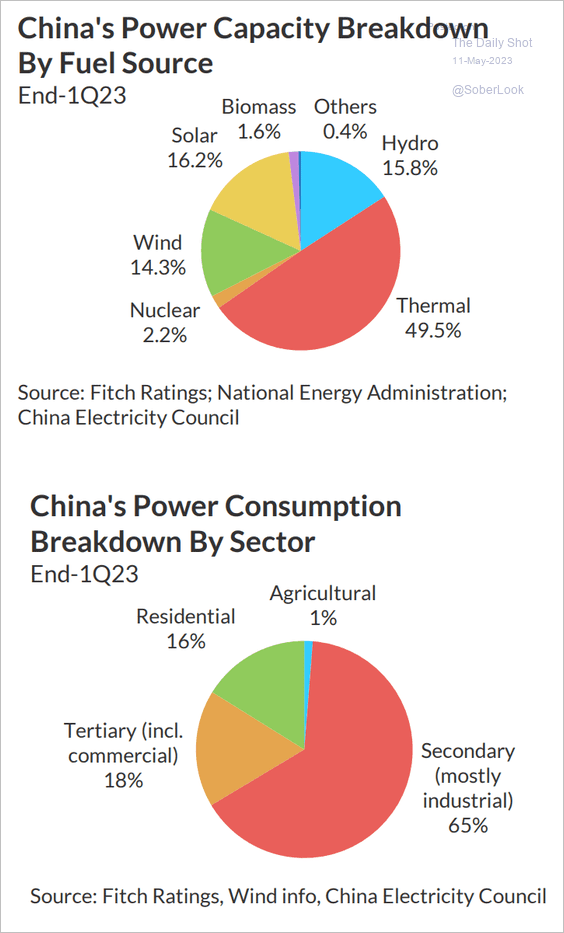

6. Next, we have the breakdowns of China’s power capacity and consumption.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

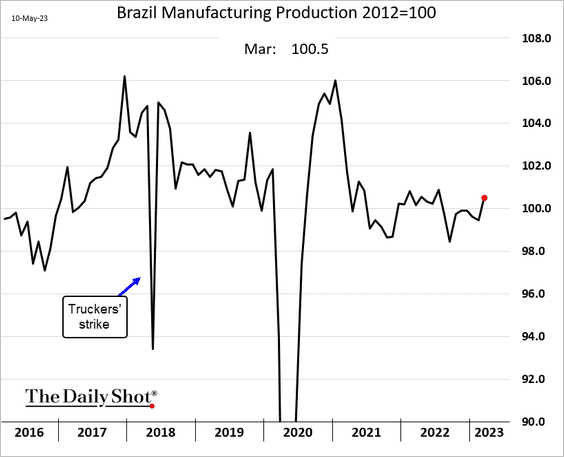

1. Brazil’s industrial production improved in March.

Source: The Brazilian Report Read full article

Source: The Brazilian Report Read full article

——————–

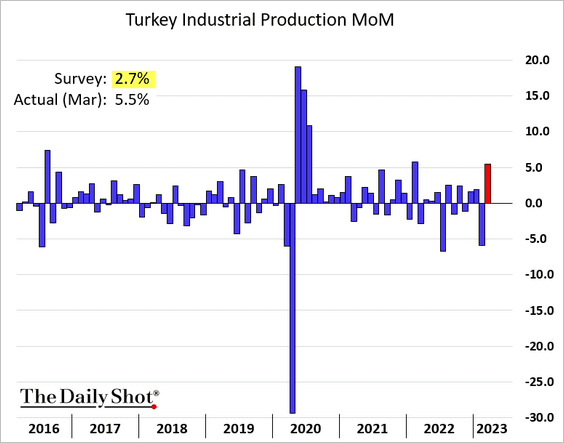

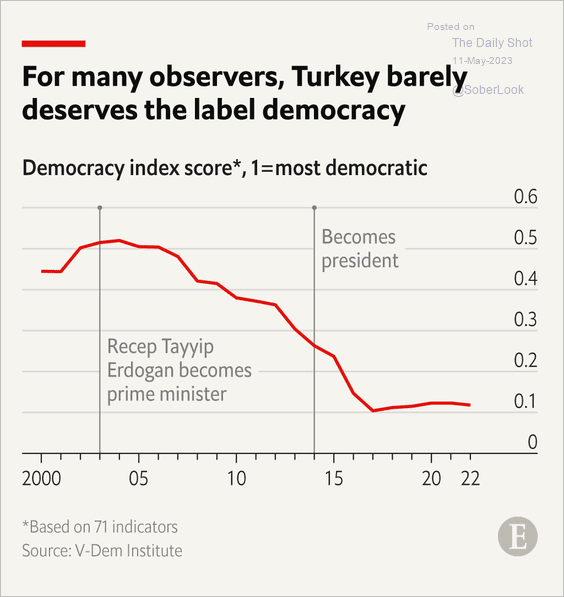

2. Turkey’s industrial production topped expectations.

Separately, according to many observers, Turkey is no longer considered a democracy.

Source: @TheEconomist Read full article

Source: @TheEconomist Read full article

——————–

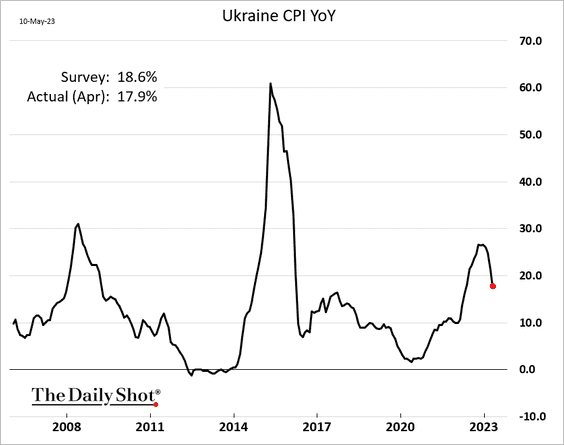

3. Ukraine’s CPI finally dipped below 20%.

Back to Index

Commodities

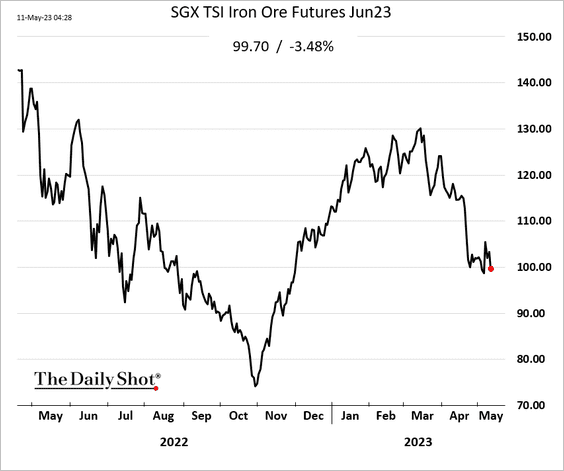

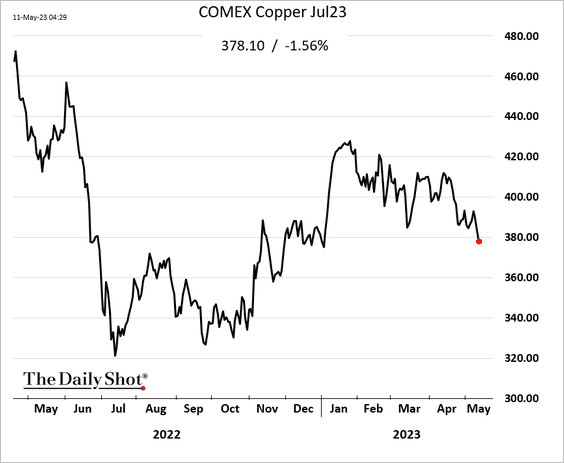

1. Industrial metals remain under pressure as concerns about China’s demand persist.

• Iron ore:

• Copper:

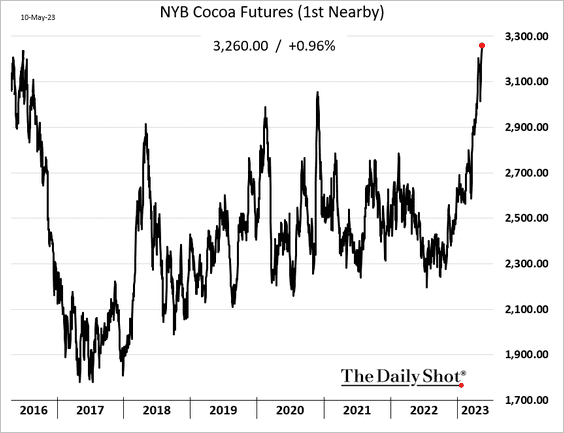

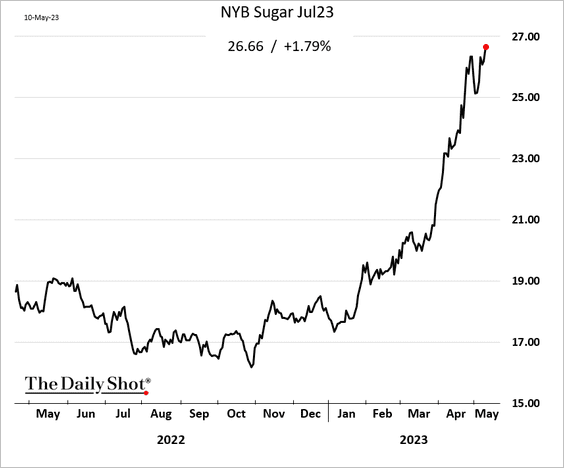

2. Softs have been performing well.

• Cocoa futures are surging in New York amid sluggish exports from Côte d’Ivoire.

• Sugar keeps climbing amid supply concerns.

Back to Index

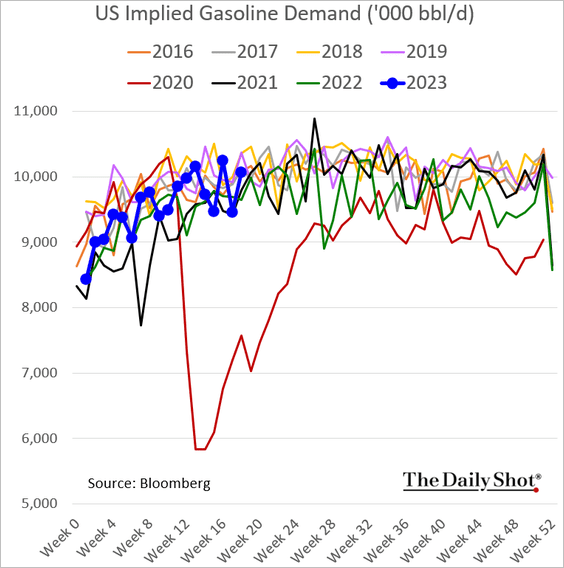

Energy

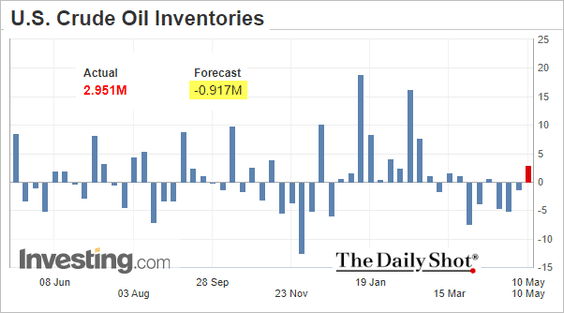

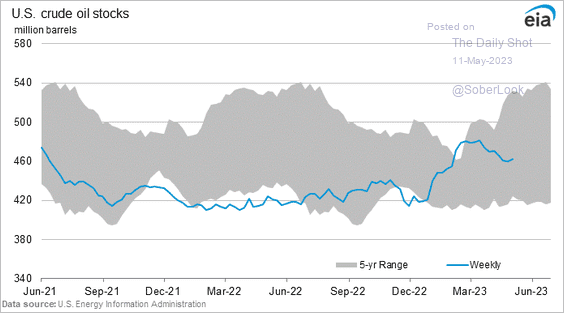

1. US oil inventories unexpectedly increased last week.

• Weekly changes:

• Level:

Source: MarketWatch Read full article

Source: MarketWatch Read full article

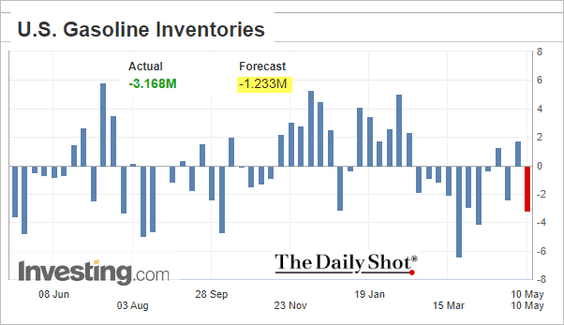

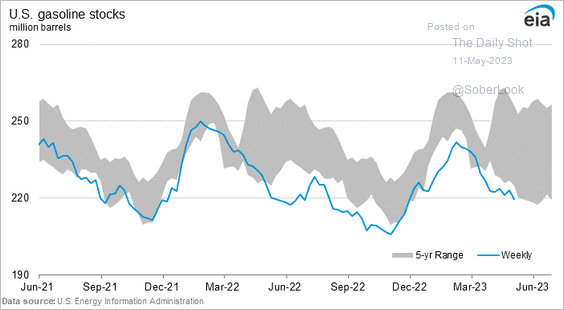

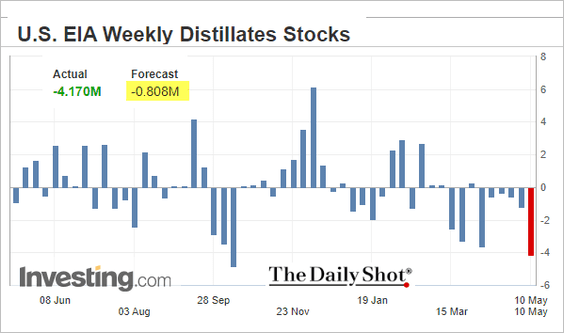

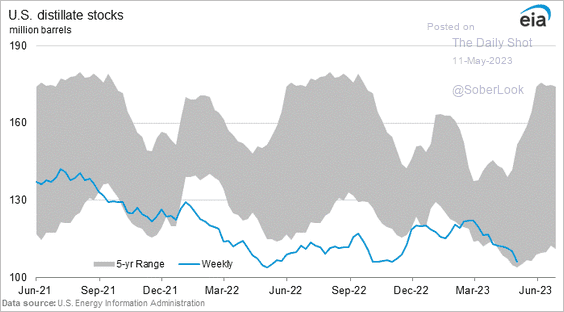

However, refined products inventories declined more than expected.

• Gasoline:

• Distillates:

Gasoline demand bounced.

——————–

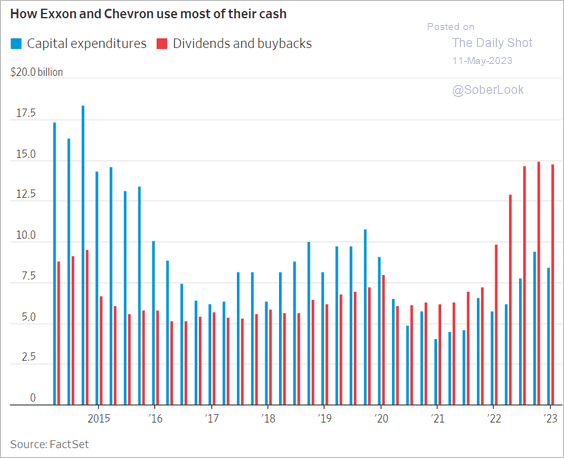

2. The largest US energy firms continue to limit CapEx despite strong cash flow. Investors want to get paid now.

Source: @WSJ Read full article

Source: @WSJ Read full article

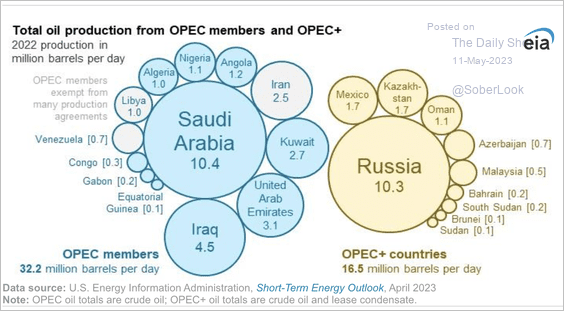

3. Here is a look at total oil production by OPEC and OPEC+.

Source: @EIAgov

Source: @EIAgov

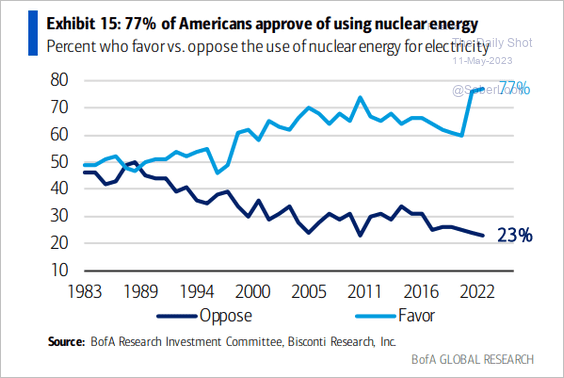

4. A majority of Americans surveyed approve of using nuclear energy.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Equities

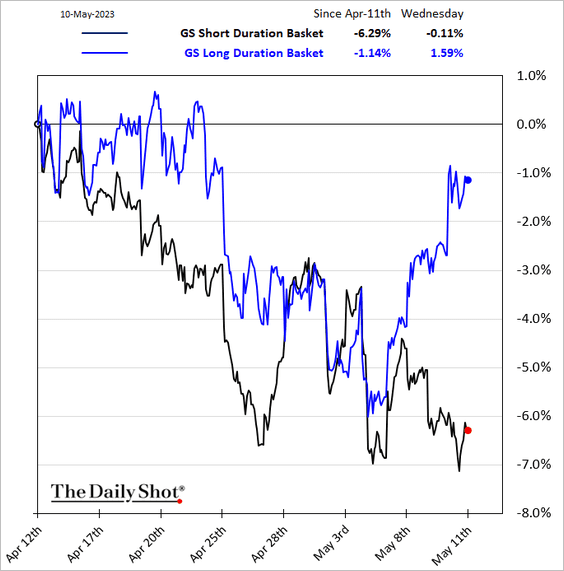

1. Long-duration equities have outperformed sharply in recent days.

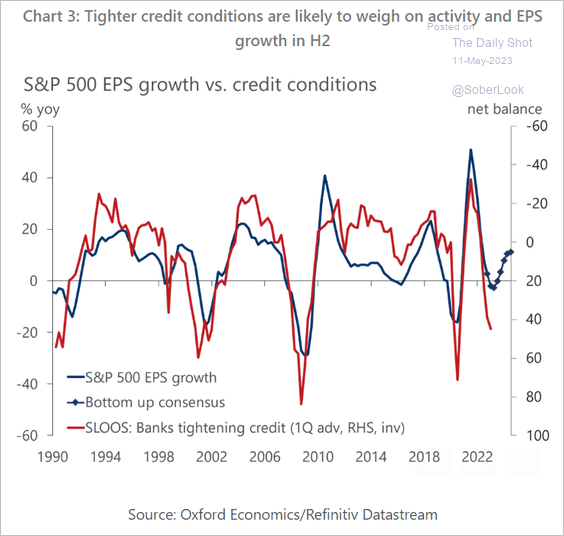

2. Tighter credit conditions will continue to weigh on earnings.

Source: Oxford Economics

Source: Oxford Economics

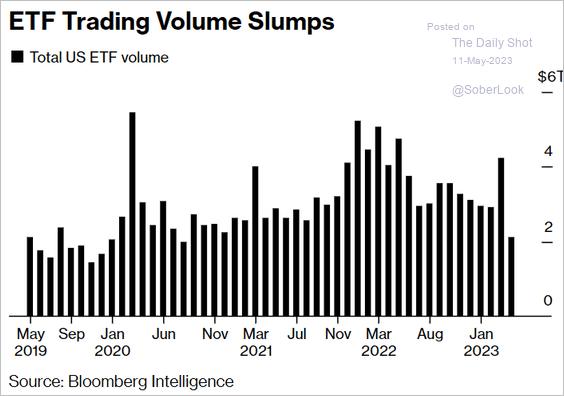

3. US ETF trading volume has slowed.

Source: @kgreifeld, @markets Read full article

Source: @kgreifeld, @markets Read full article

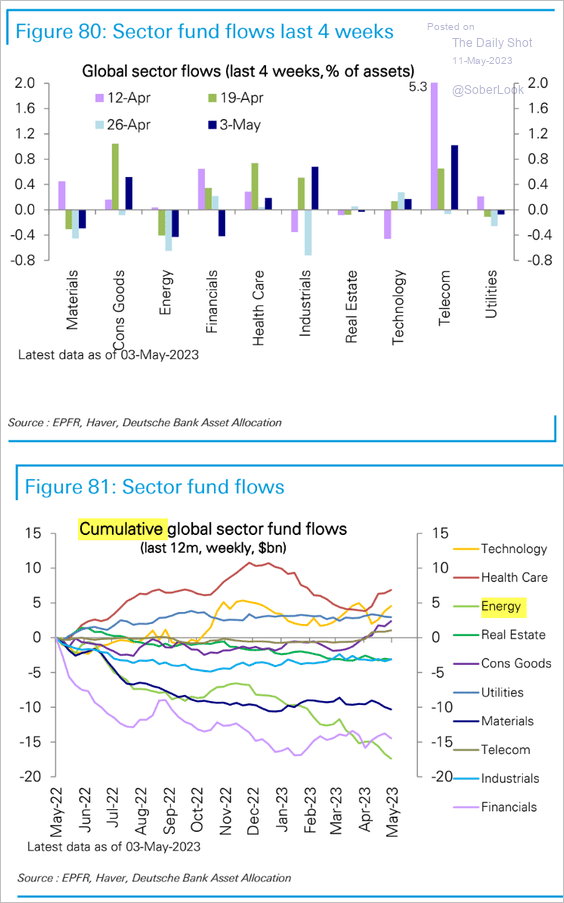

4. Next, we have some sector updates.

• Fund flows:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

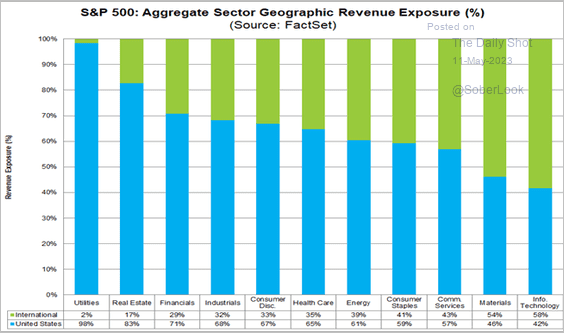

• Geographic exposure:

Source: @FactSet Read full article

Source: @FactSet Read full article

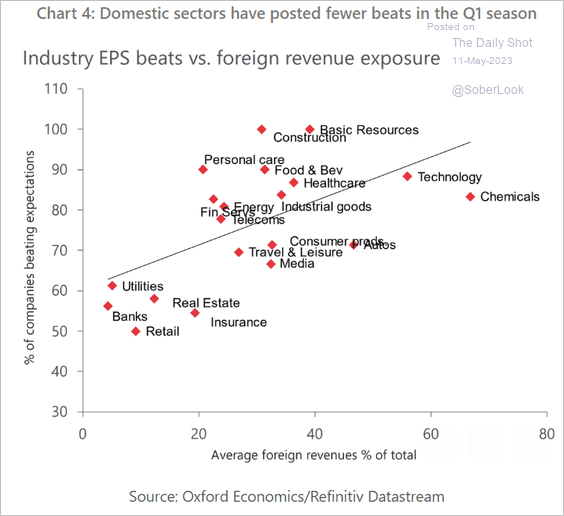

– Sector beats vs. foreign exposure:

Source: Oxford Economics

Source: Oxford Economics

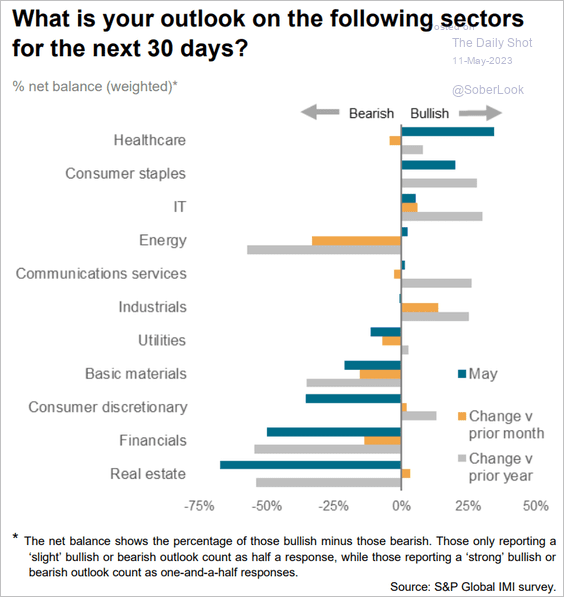

• Investment managers’ sector outlook:

Source: S&P Global PMI

Source: S&P Global PMI

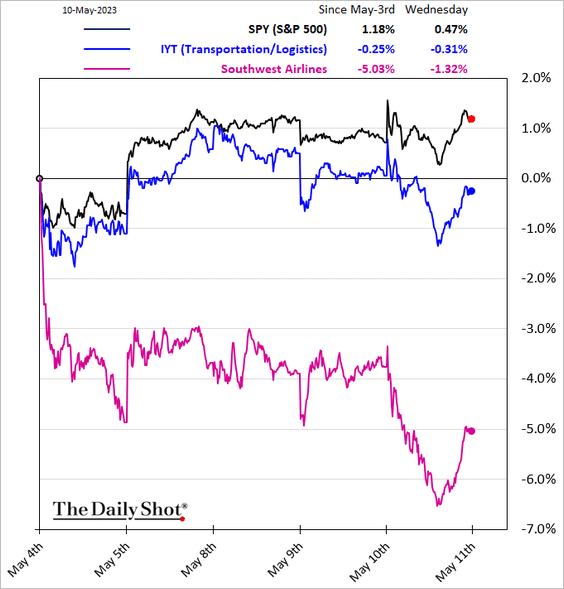

• Airline shares have sold off in recent days.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Credit

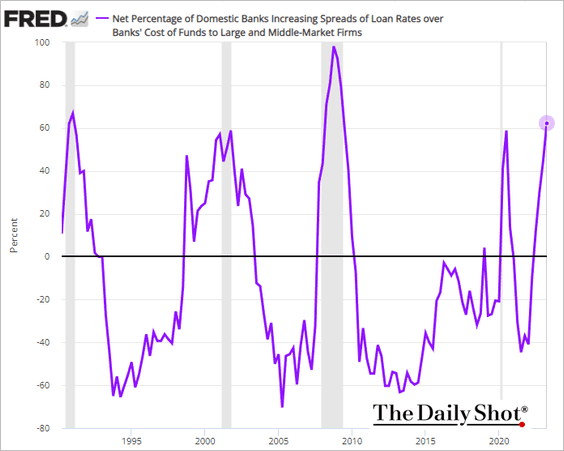

1. The share of banks increasing spreads on business loans hit the highest levels since the GFC.

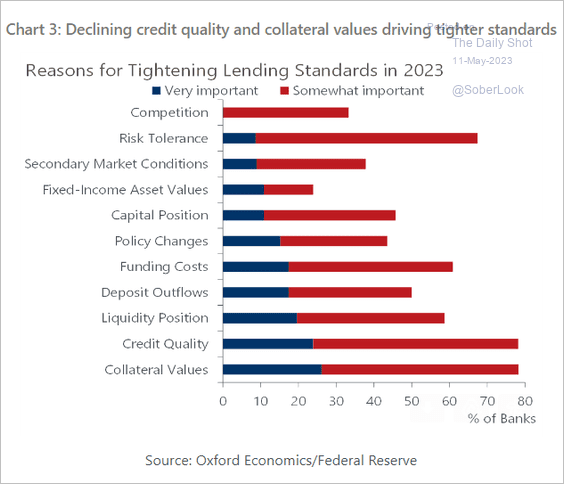

2. Here are the reasons banks have been tightening credit standards.

Source: Oxford Economics

Source: Oxford Economics

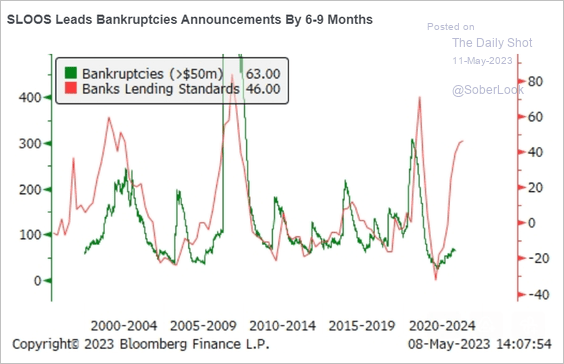

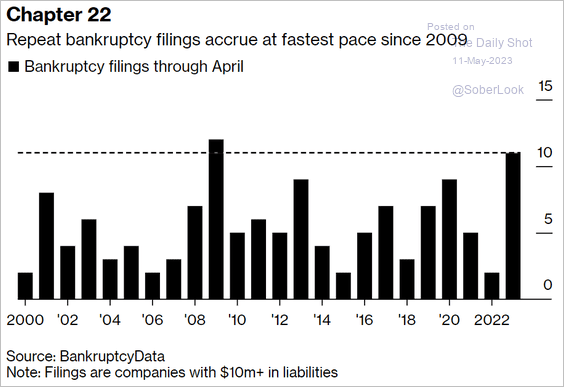

3. Bankruptcies are expected to surge.

Source: Piper Sandler

Source: Piper Sandler

Repeat bankruptcy filings haven’t been this high since 2009.

Source: @JeremyHtweets, @sparkyrandles, @markets Read full article

Source: @JeremyHtweets, @sparkyrandles, @markets Read full article

——————–

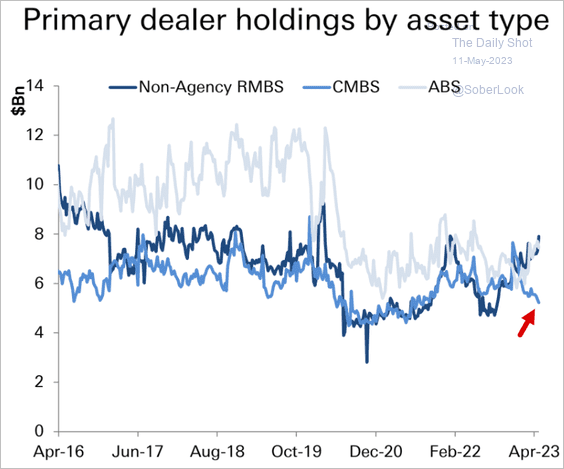

4. Dealers have cut back their CMBS holdings.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

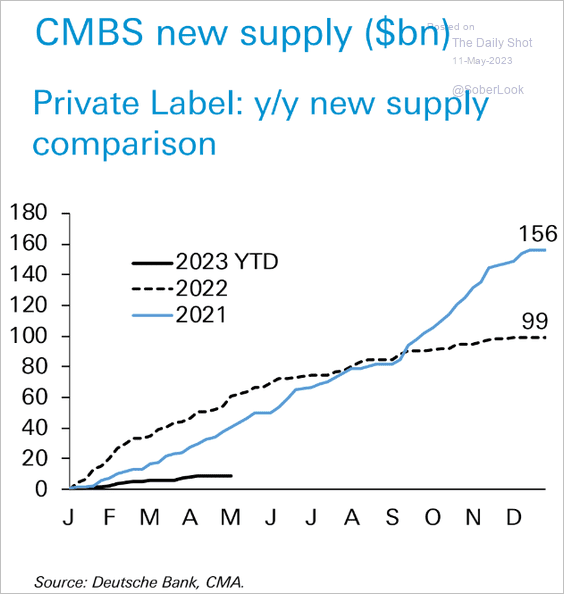

CMBS issuance has been depressed this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

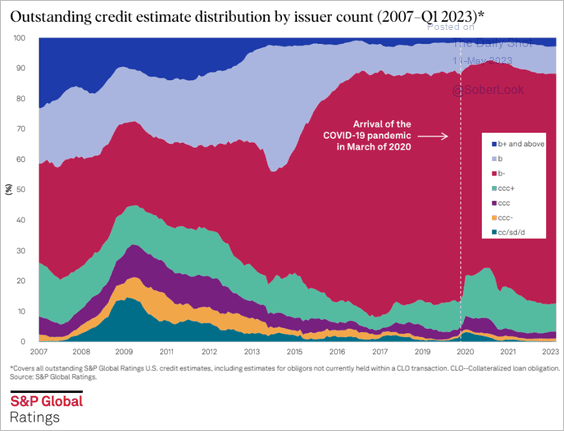

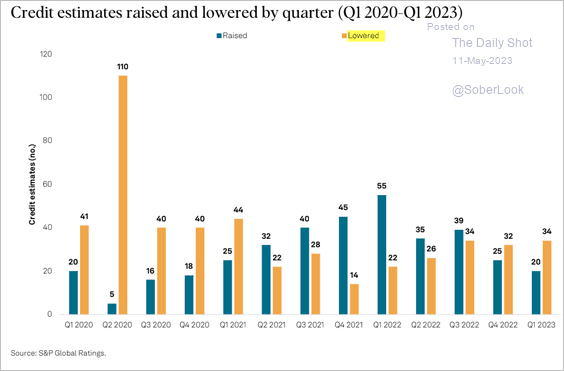

5. Middle-market CLOs use private credit estimates because public ratings are not available for smaller firms. Here is the distribution of estimates over time.

Source: S&P Global Ratings

Source: S&P Global Ratings

• More estimates have been lowered than raised over the past two quarters.

Source: S&P Global Ratings

Source: S&P Global Ratings

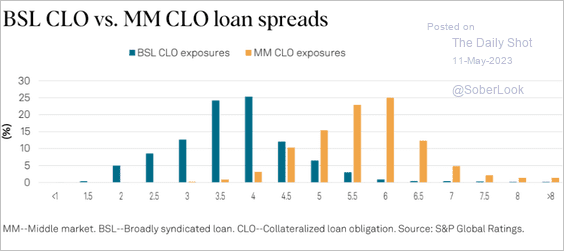

• Companies with private estimates pay much higher spreads than those with public ratings.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Global Developments

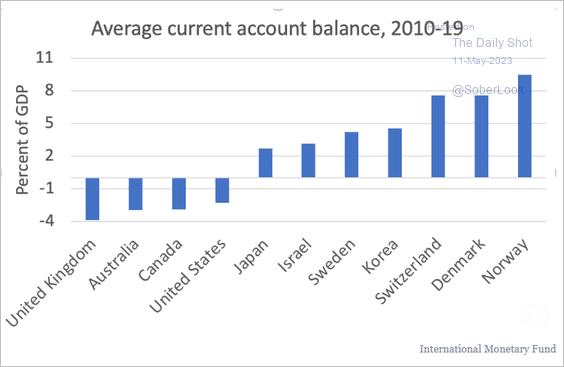

1. The UK, Australia, and Canada can maintain larger relative current account deficits than the US without their currencies dominating international reserves.

Source: @paulkrugman, The New York Times Read full article

Source: @paulkrugman, The New York Times Read full article

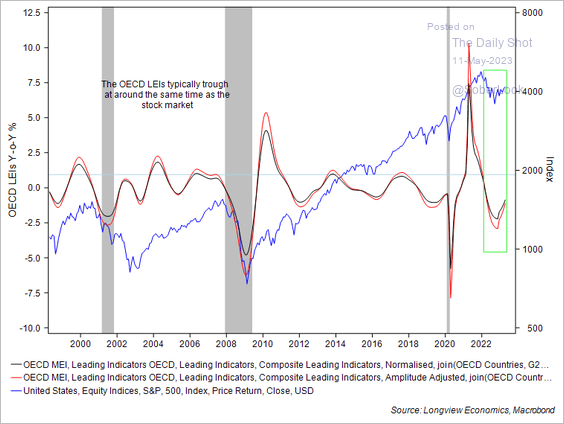

2. OECD leading economic indicators troughed around the S&P 500’s October low.

Source: Longview Economics

Source: Longview Economics

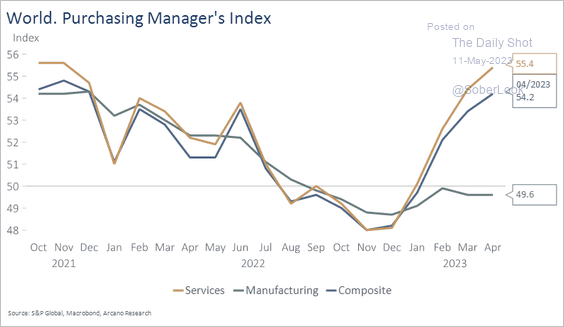

3. Global services activity continues to diverge from manufacturing.

Source: Arcano Economics

Source: Arcano Economics

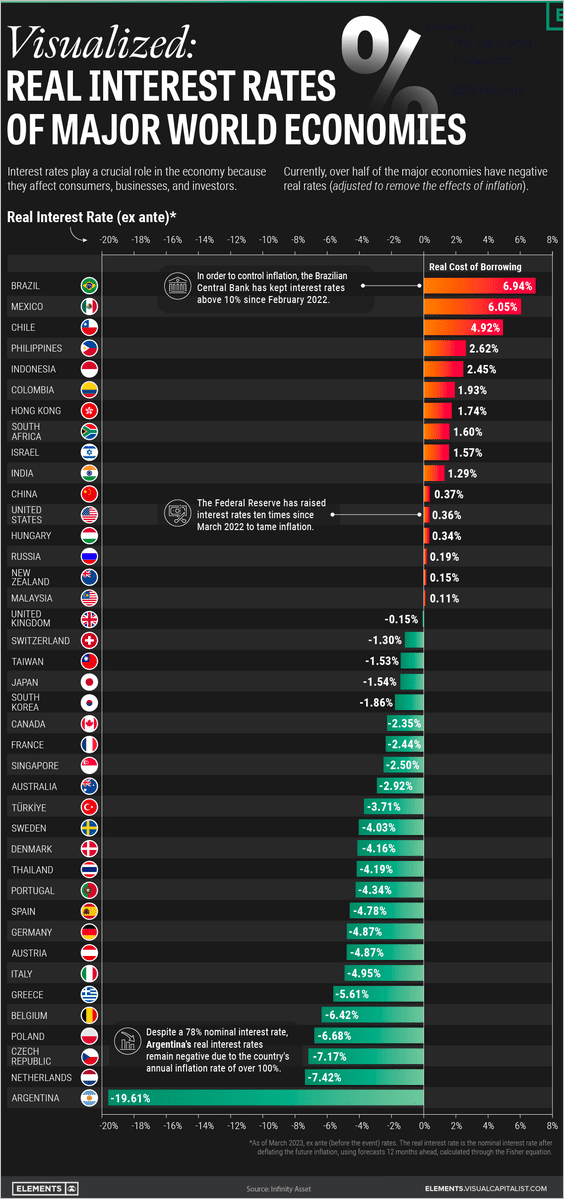

4. Here is a look at real interest rates around the world.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Food for Thought

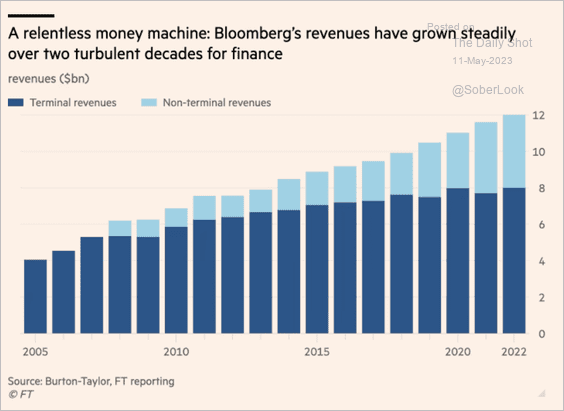

1. Bloomberg’s terminal vs. non-terminal revenues:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

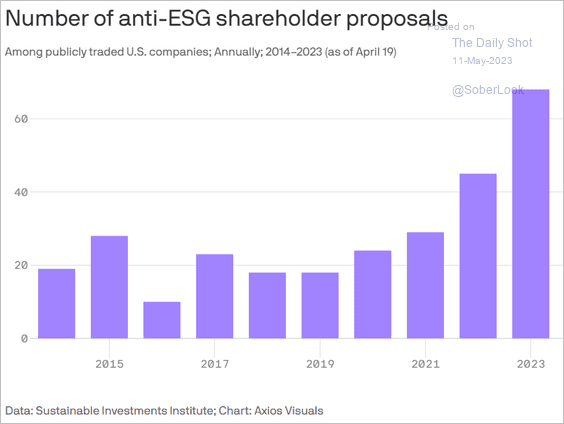

2. Anti-ESG shareholder proposals:

Source: @axios Read full article

Source: @axios Read full article

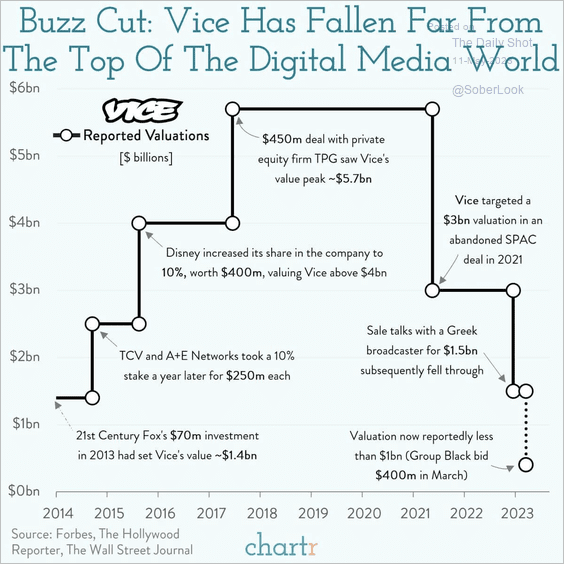

3. Vice valuation over time:

Source: @chartrdaily Further reading

Source: @chartrdaily Further reading

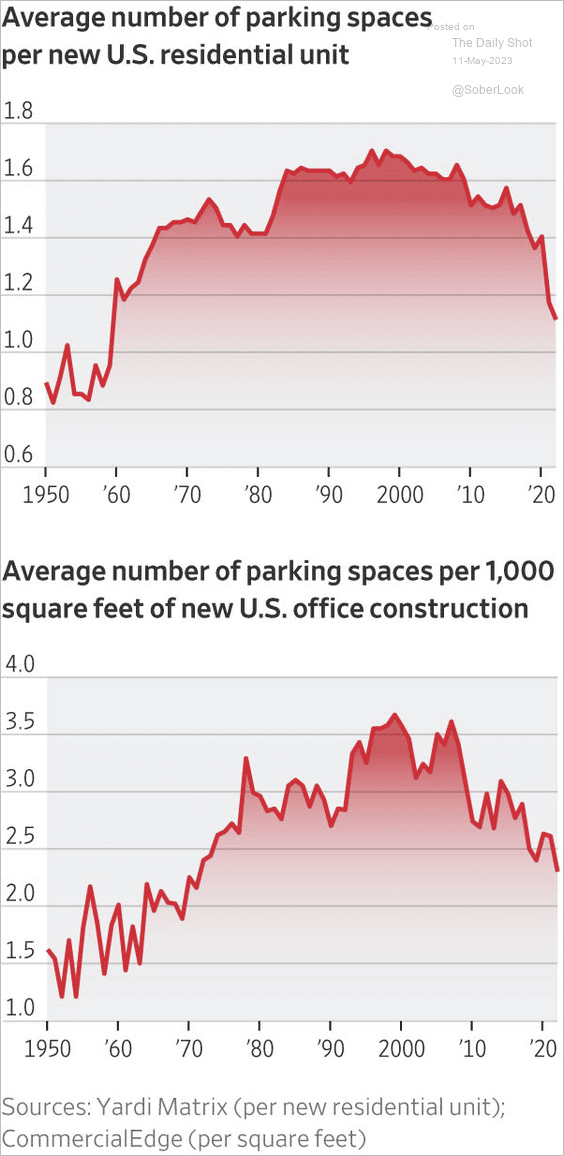

4. Cutting back on parking spaces:

Source: @WSJ Read full article

Source: @WSJ Read full article

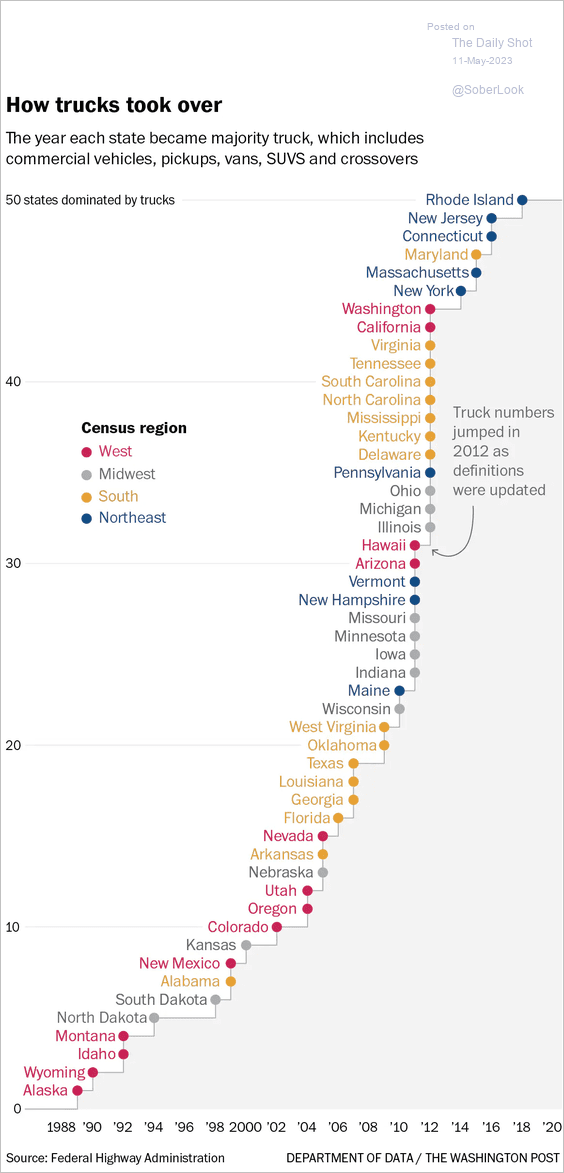

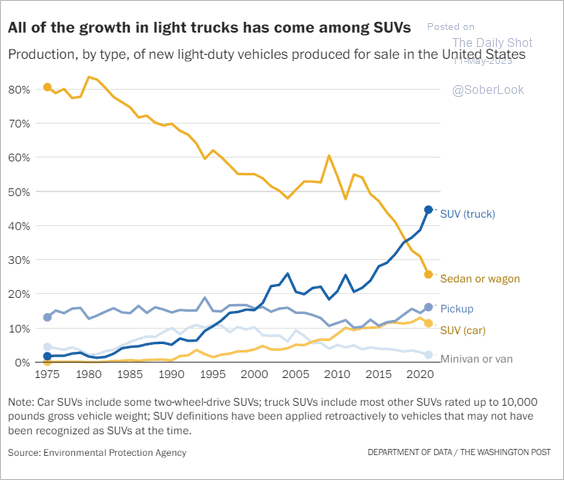

5. When did each state become “majority truck”?

Source: The Washington Post Read full article

Source: The Washington Post Read full article

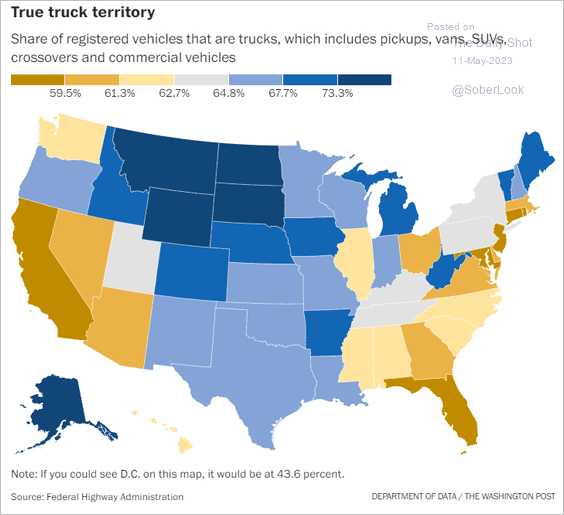

• Truck share by state:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

• Vehicle production by type:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

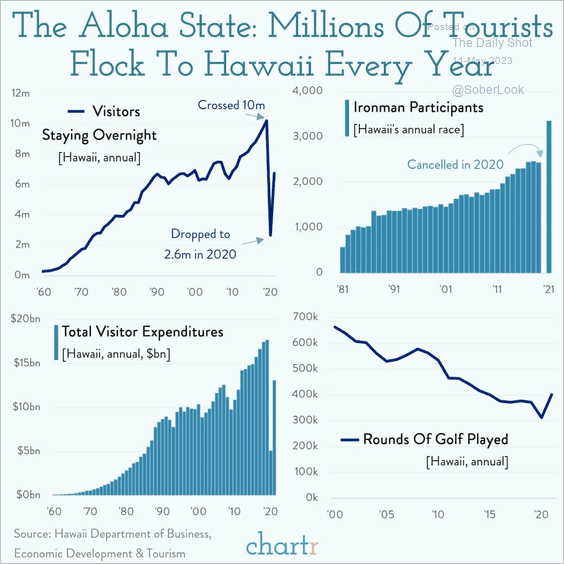

6. Hawaii tourism:

Source: @chartrdaily

Source: @chartrdaily

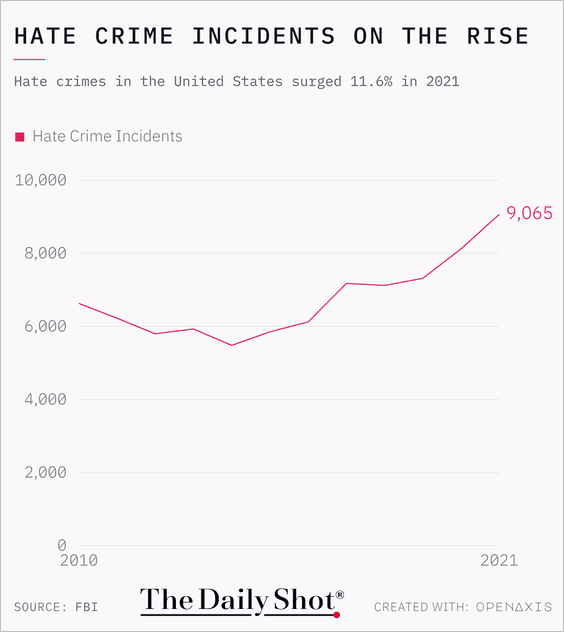

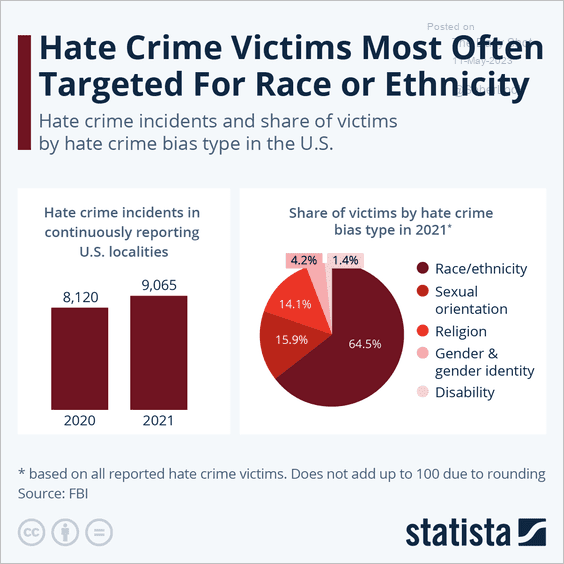

7. Hate crime incidents on the rise (2 charts):

Source: @TheDailyShot

Source: @TheDailyShot

Source: Statista

Source: Statista

——————–

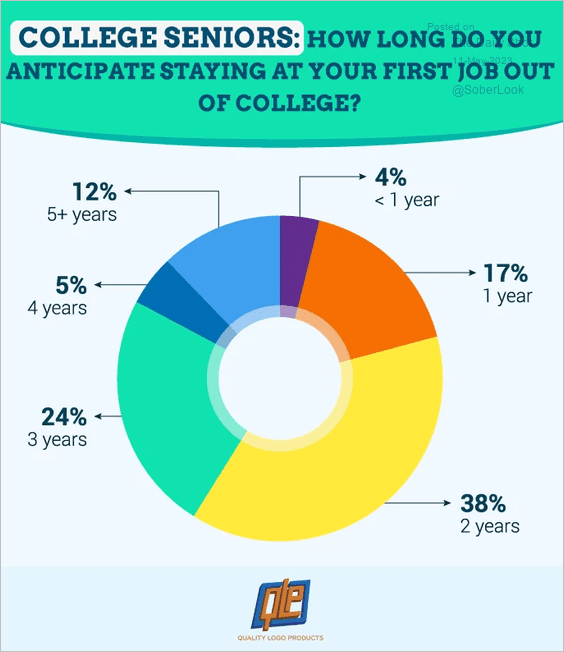

8. How long do college seniors expect to stay at their first job?

Source: Quality Logo Products

Source: Quality Logo Products

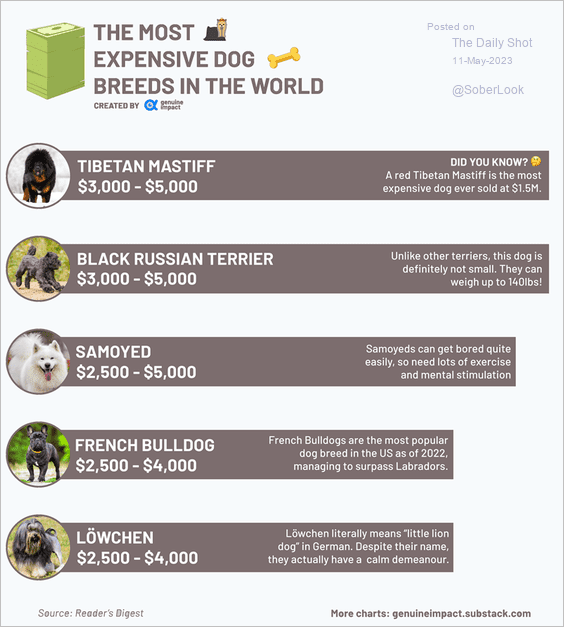

9. The most expensive dog breeds:

Source: Genuine Impact

Source: Genuine Impact

——————–

Back to Index