The Daily Shot: 25-May-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

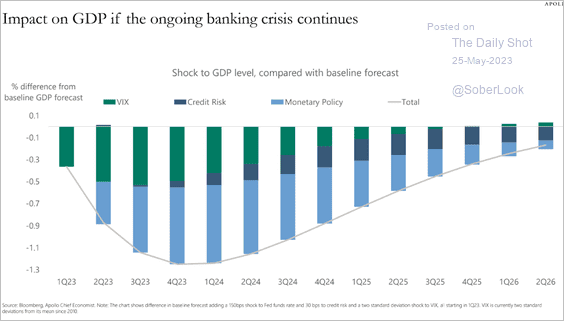

1. The FOMC minutes highlighted a committee divided over the uncertainty surrounding future interest rate hikes, given the tightening credit conditions.

In discussing the policy outlook, participants generally agreed that in light of the lagged effects of cumulative tightening in monetary policy and the potential effects on the economy of a further tightening in credit conditions, the extent to which additional increases in the target range may be appropriate after this meeting had become less certain.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Some members want to keep pushing rates higher amid stubbornly elevated inflation.

Some participants commented that, based on their expectations that progress in returning inflation to 2 percent could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings.

Others would like to pause.

Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.

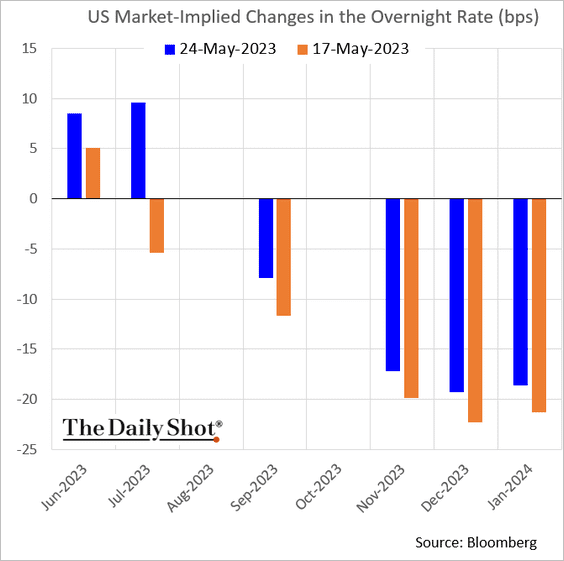

• The market saw the minutes as hawkish, boosting the probability of a rate hike in June or July.

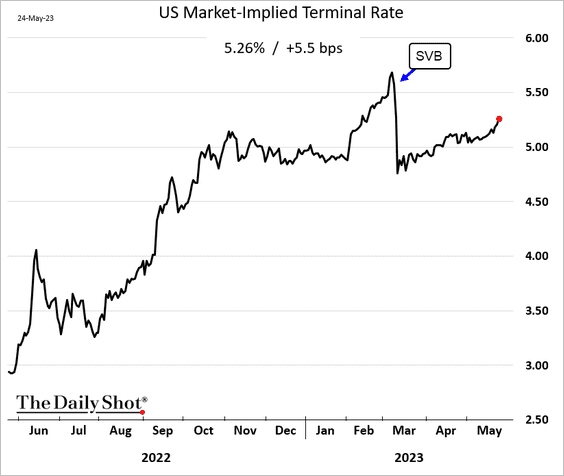

• The implied terminal rate is back above 5.25%.

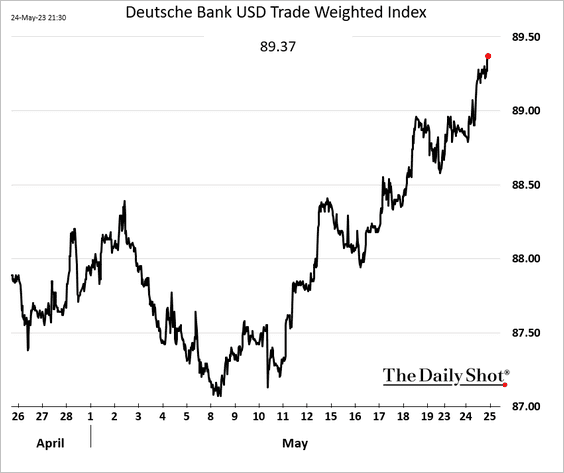

• The US dollar continues to climb.

——————–

2. Next, we have some updates on the housing market.

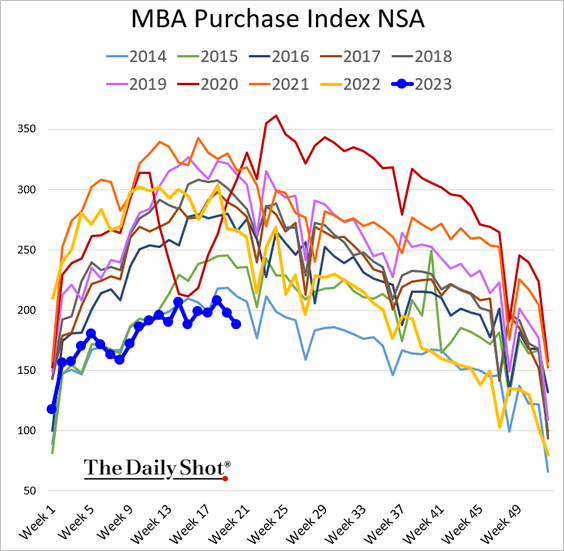

• Mortgage applications held at multi-year lows last week, …

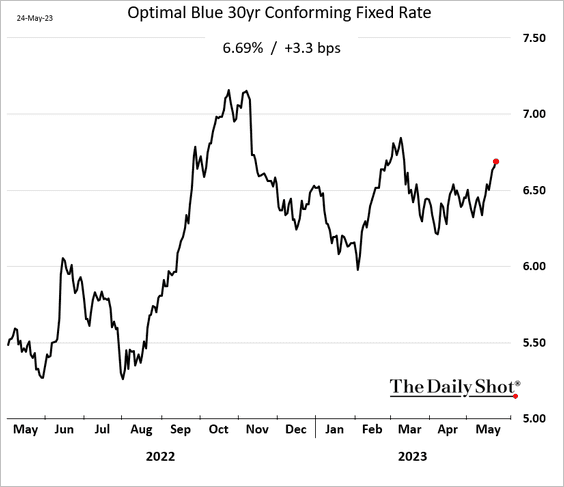

… as mortgage rates climb.

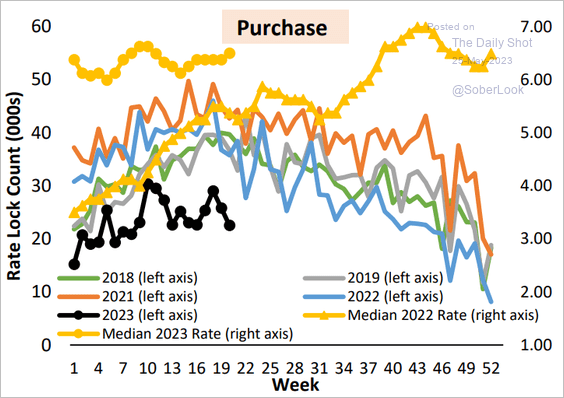

This chart shows the number of mortgage rate locks.

Source: AEI Housing Center

Source: AEI Housing Center

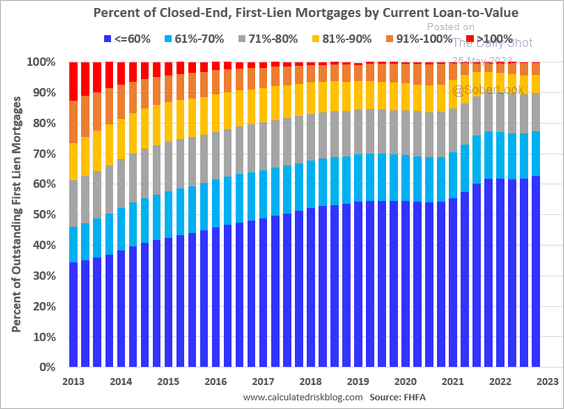

• Housing leverage is low by historical standards.

Source: Calculated Risk

Source: Calculated Risk

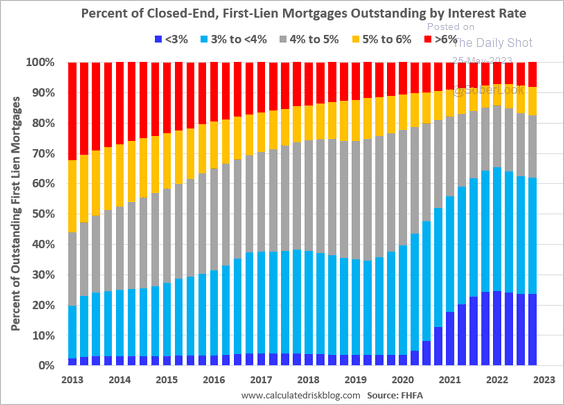

• This chart shows outstanding mortgages by interest rate. Homeowners don’t want to give up their low mortgage rates.

Source: Calculated Risk

Source: Calculated Risk

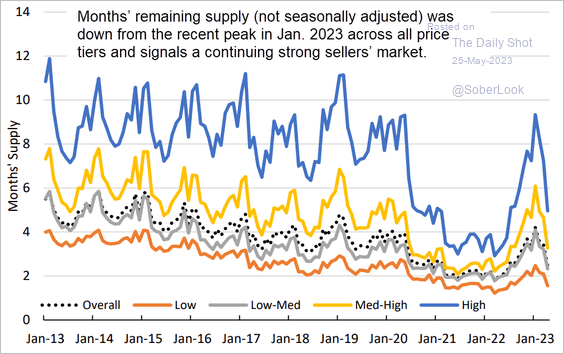

• Housing inventories have been tightening across price tiers.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

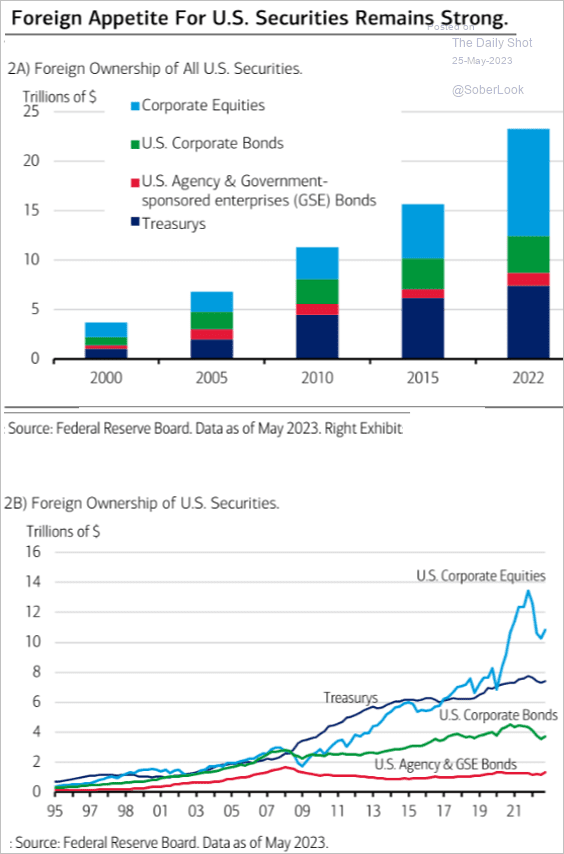

3. Foreign demand for US securities has been robust.

Source: Merrill Lynch

Source: Merrill Lynch

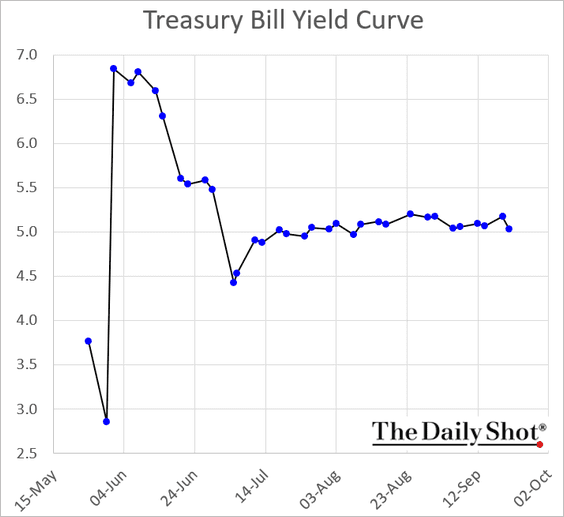

4. Fitch is threatening a potential downgrade to the US government debt rating.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

June T-bill yields continue to surge, some exceeding 7%.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

The United Kingdom

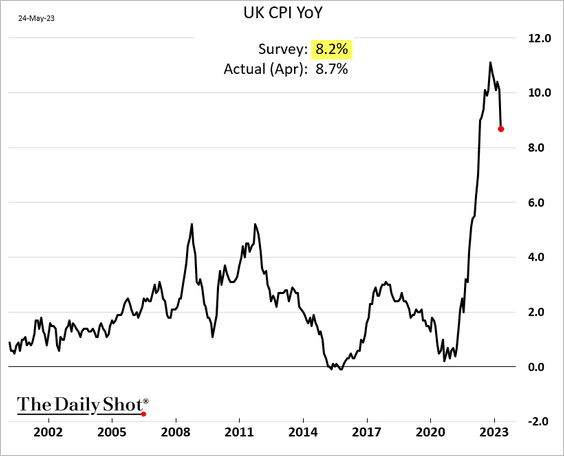

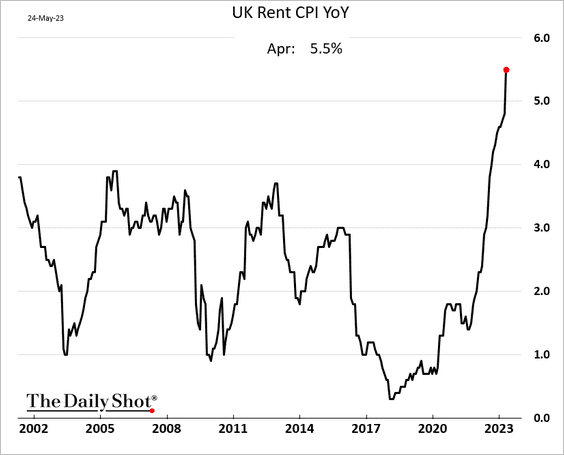

1. The US CPI report topped expectations, …

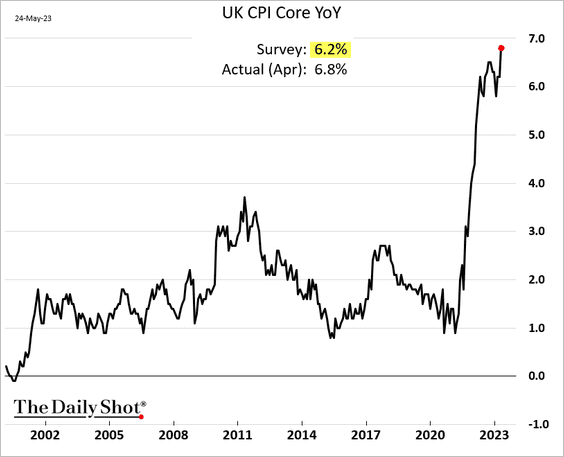

… with the core CPI hitting new highs.

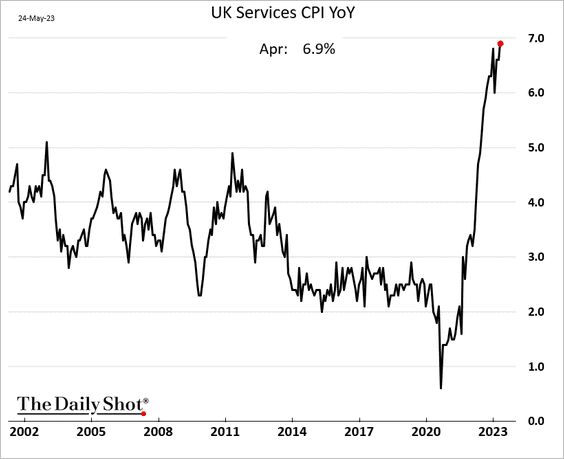

Services inflation has been stubbornly high.

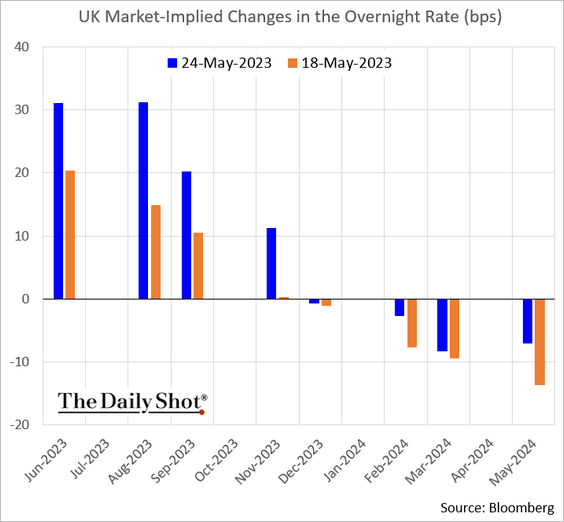

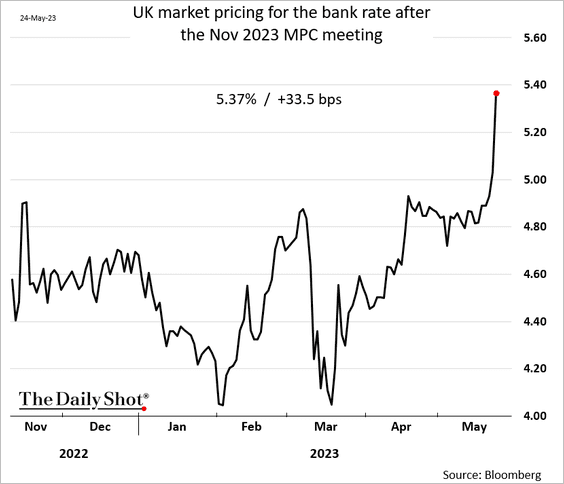

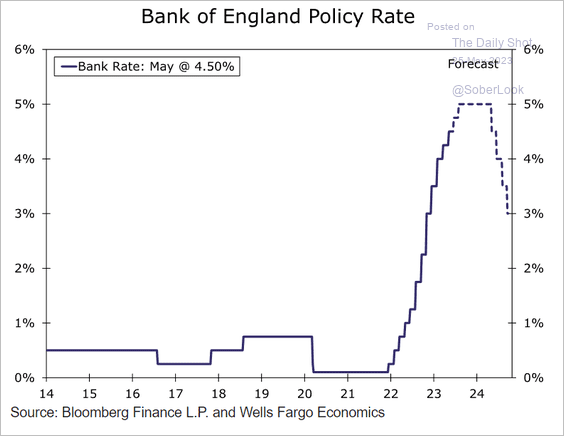

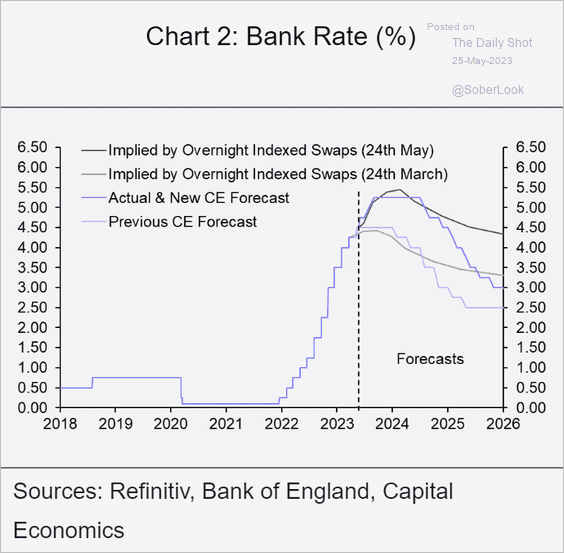

2. The BoE will have no choice but keep raising rates, potentially pushing the economy into a recession.

• The market now sees some 90 bps of rate hikes ahead.

The expected bank rate after the November MPC meeting is near 5.4%.

• Wells Fargo sees two 25 bps rate increases.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Capital Economics expects 75 bps of rate hikes in total.

Source: Capital Economics

Source: Capital Economics

——————–

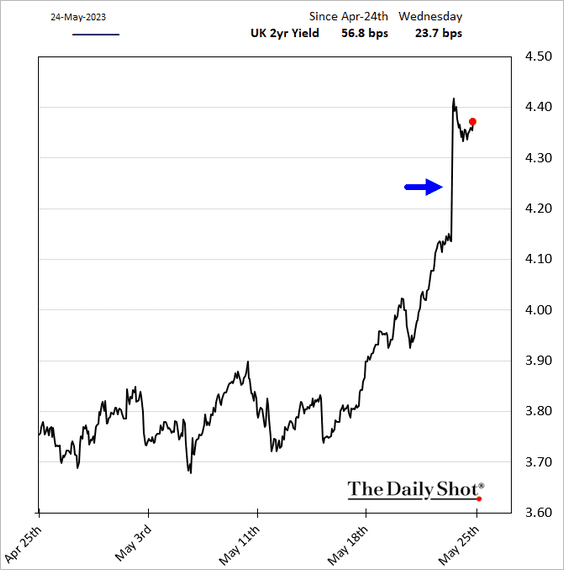

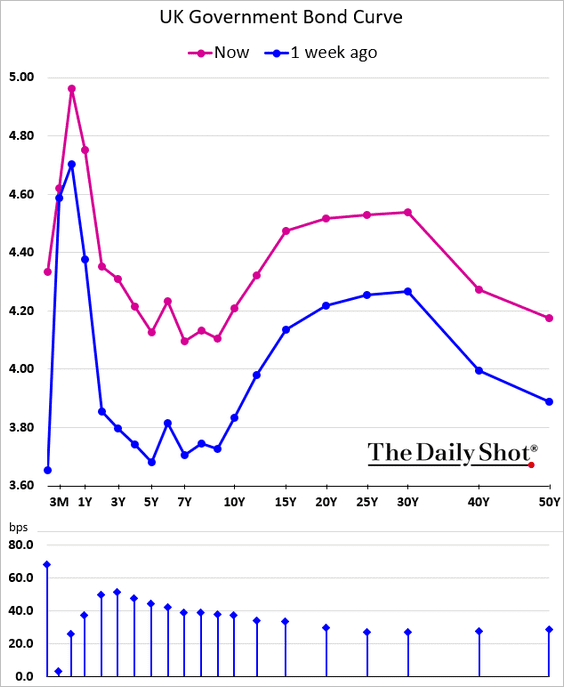

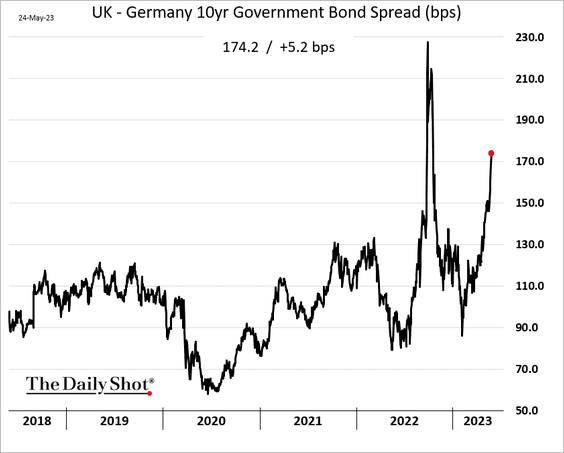

3. Gilt yields surged.

Here is the 10-year spread to Bunds.

——————–

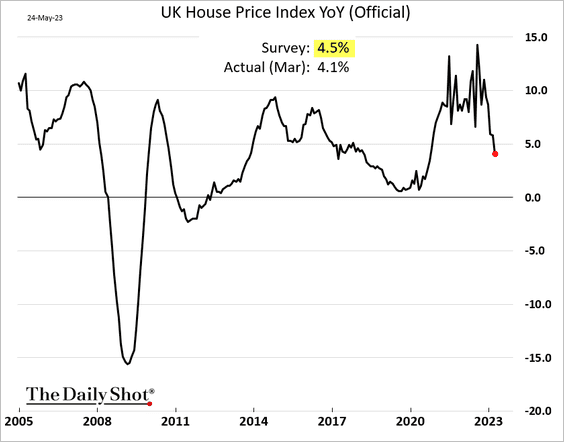

3. The official index of home prices was lower than expected in March as the housing market cools.

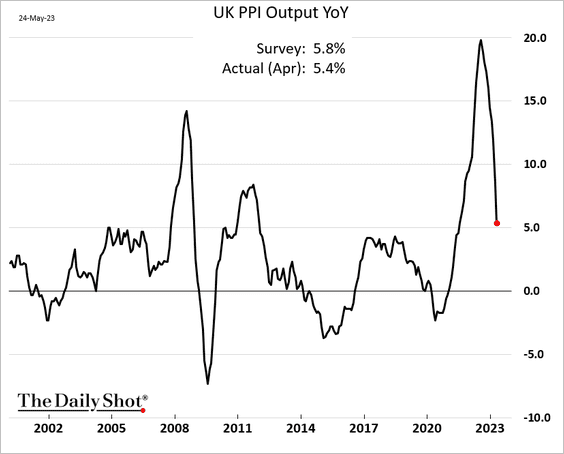

4. Producer prices are rapidly moderating as energy costs ease.

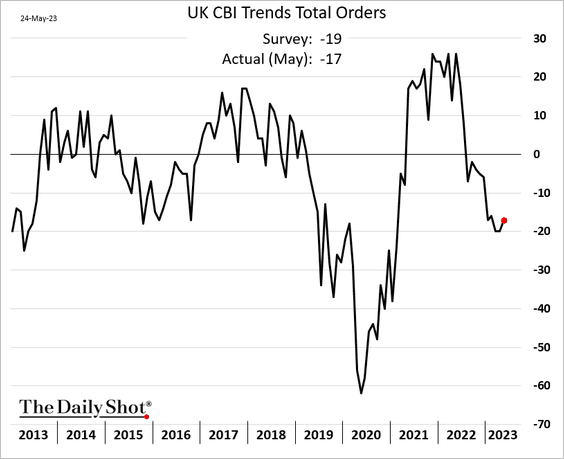

5. Industrial orders remained soft in May, according to the CBI.

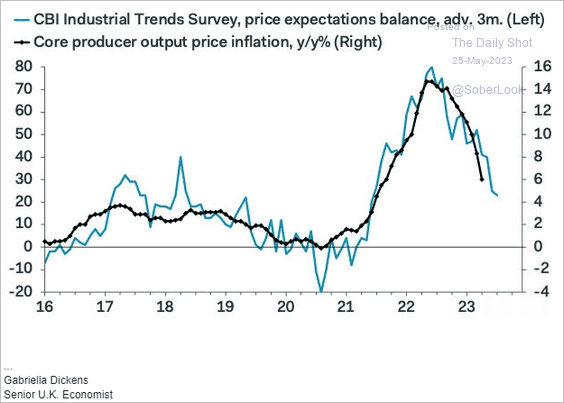

Manufacturers anticipate softer prices ahead, which will exert additional downward pressure on the PPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The Eurozone

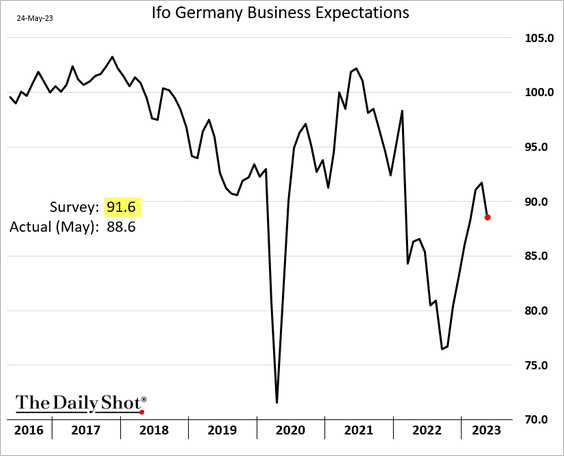

1. Germany’s Ifo index of business expectations surprised to the downside this month.

Source: Reuters Read full article

Source: Reuters Read full article

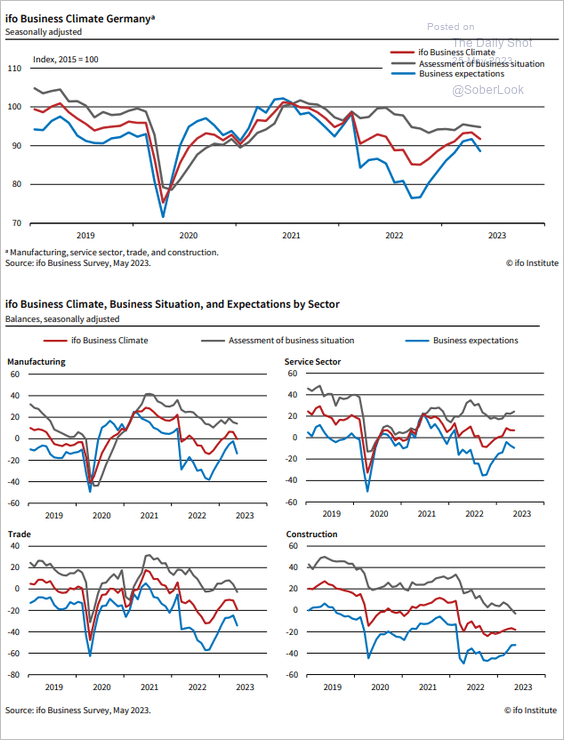

Below is the breakdown by sector.

Source: ifo Institute

Source: ifo Institute

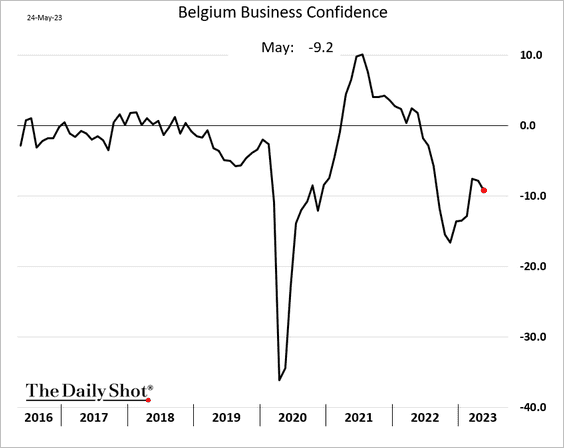

The drop in business confidence this month was not unique to Germany. Here is the indicator for Belgium.

——————–

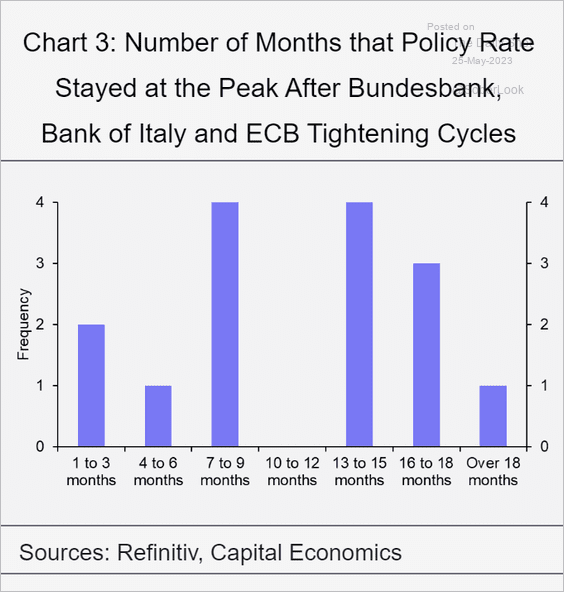

2. What is the expected timeframe for the ECB to cut rates? Here is some historical context.

Source: Capital Economics

Source: Capital Economics

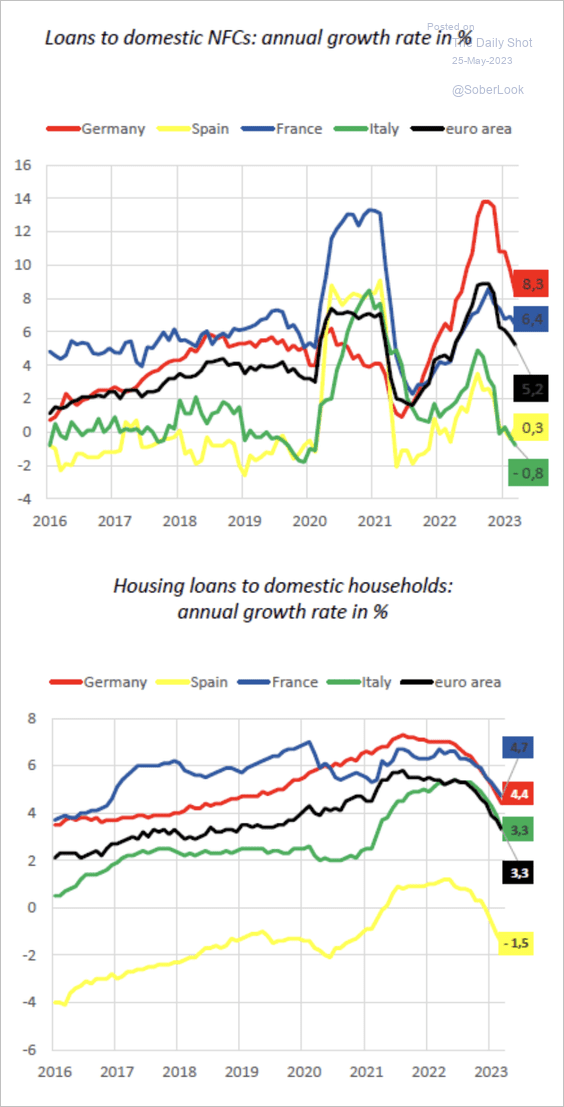

3. The slowdown in loan growth has been broad.

Source: BIS Read full article

Source: BIS Read full article

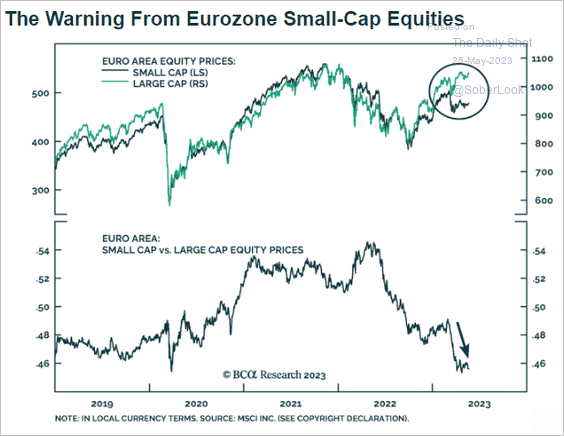

4. Euro-area small caps have been underperforming.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

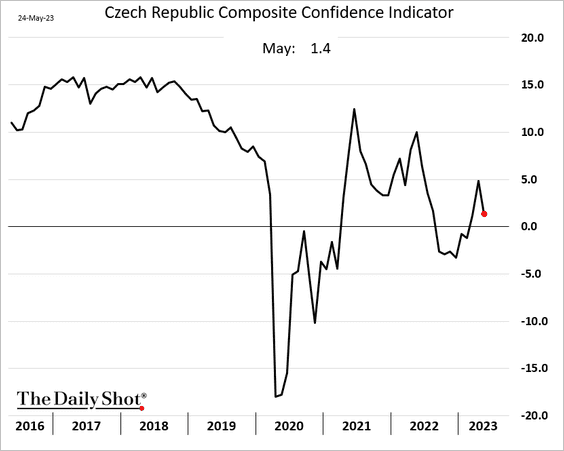

1. Similar to the observed trend in Germany, the sentiment indicator in the Czech Republic showed a decline in May.

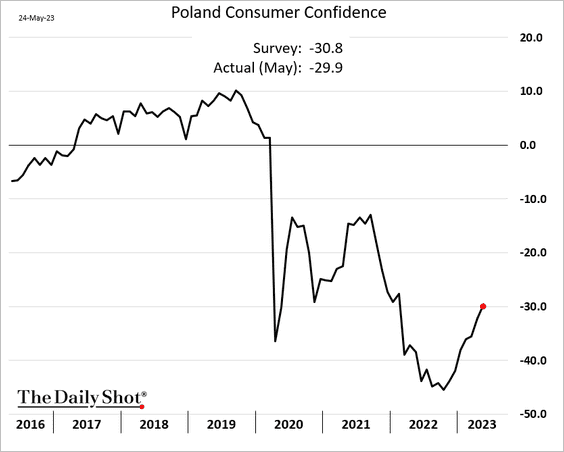

2. But Poland’s consumer confidence continues to recover.

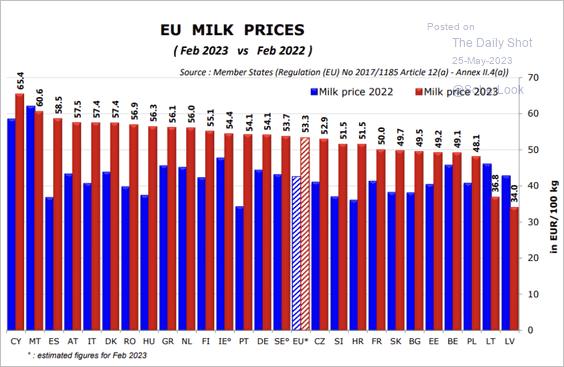

3. This chart shows milk prices across the EU.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

Japan

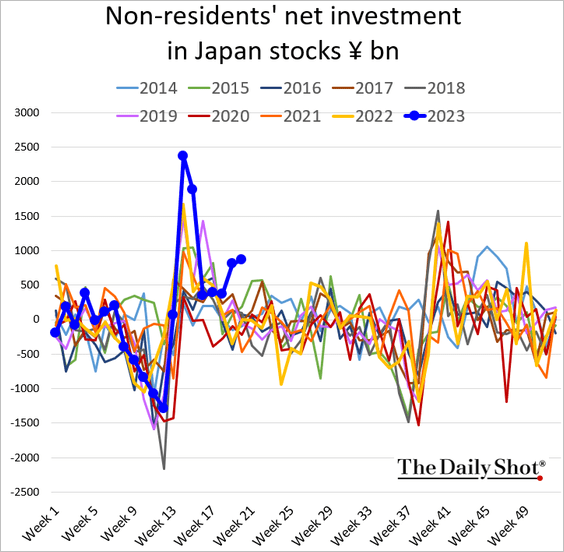

1. Foreign investments in Japanese equities remain at multi-year highs for this time of the year, …

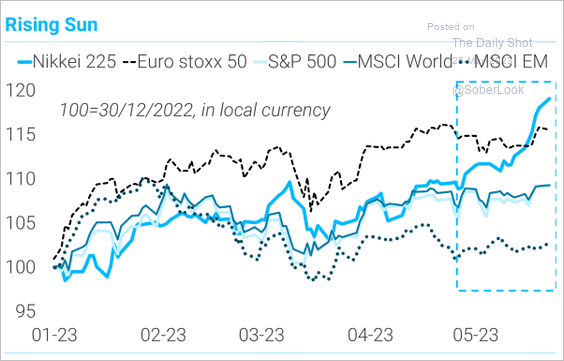

… helping the nation’s shares outperform global peers.

Source: TS Lombard

Source: TS Lombard

——————–

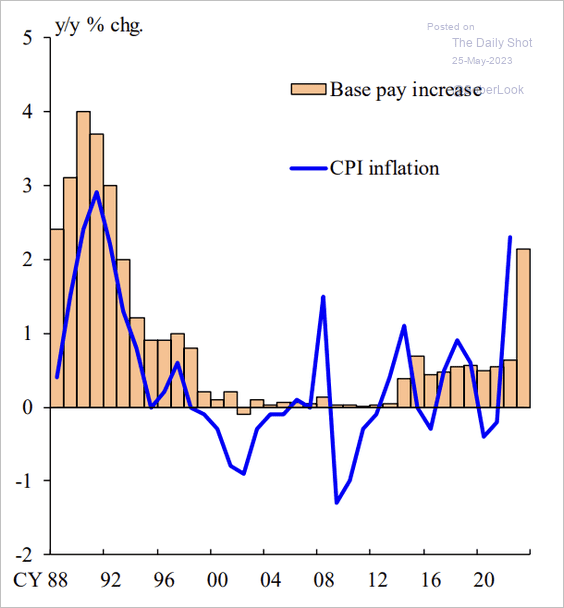

2. Here is a long-term chart of inflation and wages.

Source: BoJ Read full article

Source: BoJ Read full article

Back to Index

Asia-Pacific

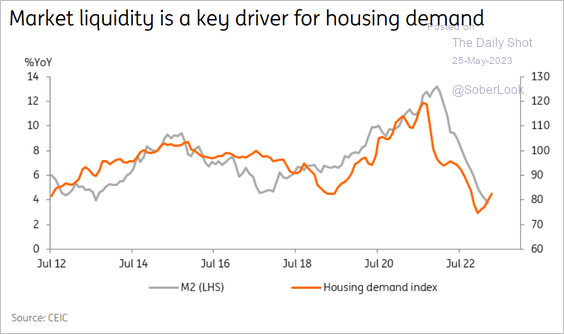

1. Tighter liquidity in South Korea has been a headwind for the housing market.

Source: ING

Source: ING

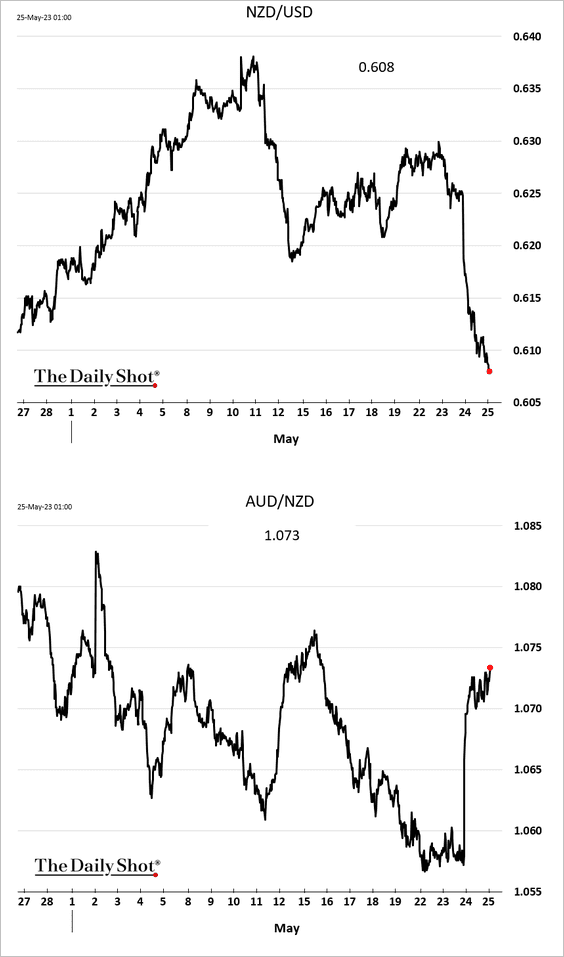

2. The Kiwi dollar selloff continued after the RBNZ dovish hike.

Back to Index

China

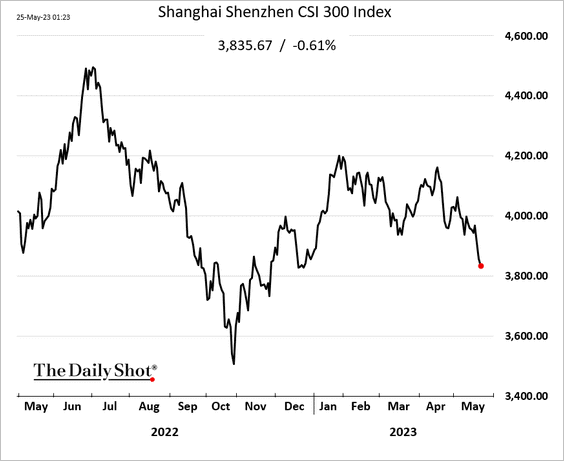

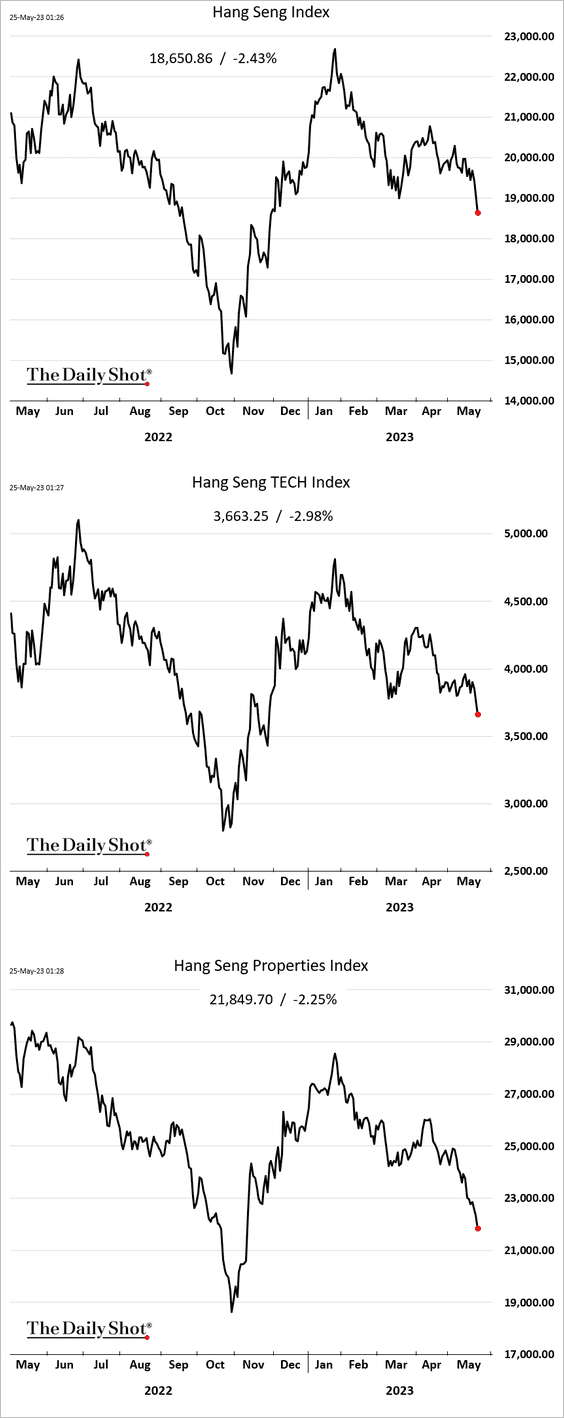

1. The Shanghai Shenzhen CSI 300 Index is now in the red year-to-date.

Stocks are tumbling in Hong Kong.

——————–

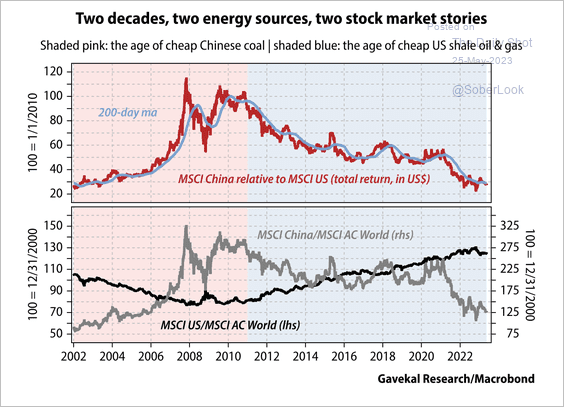

2. Chinese equities have had a poor decade, especially relative to the US.

Source: Gavekal Research

Source: Gavekal Research

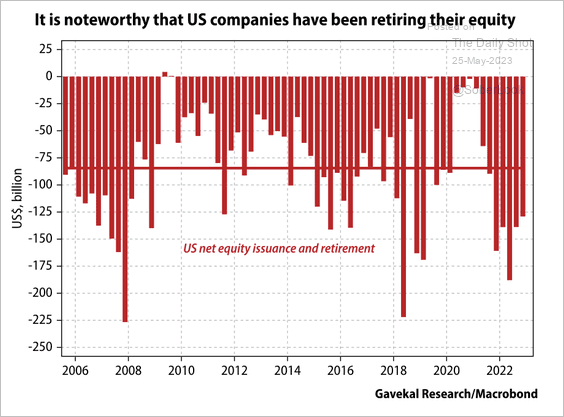

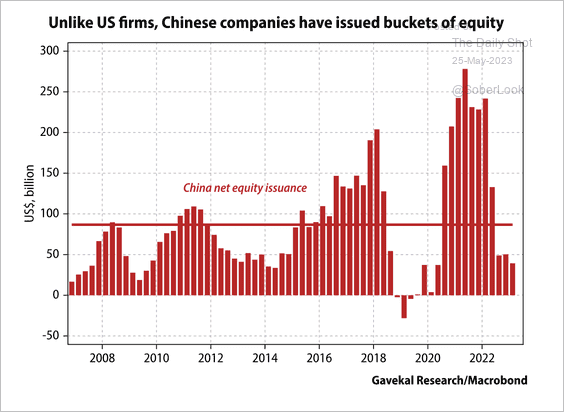

But equity issuance has been high vs. the US. (2 charts)

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

——————–

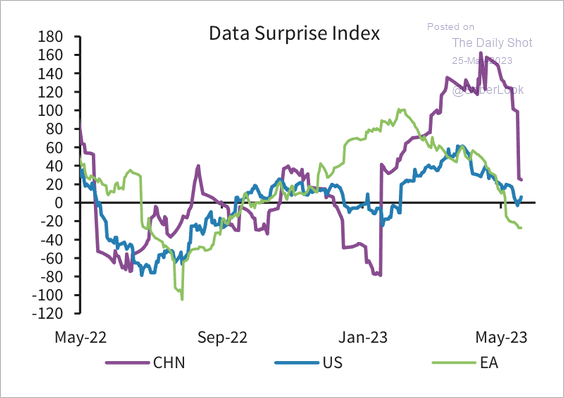

3. Economic data has surprised to the downside in recent weeks.

Source: Barclays Research

Source: Barclays Research

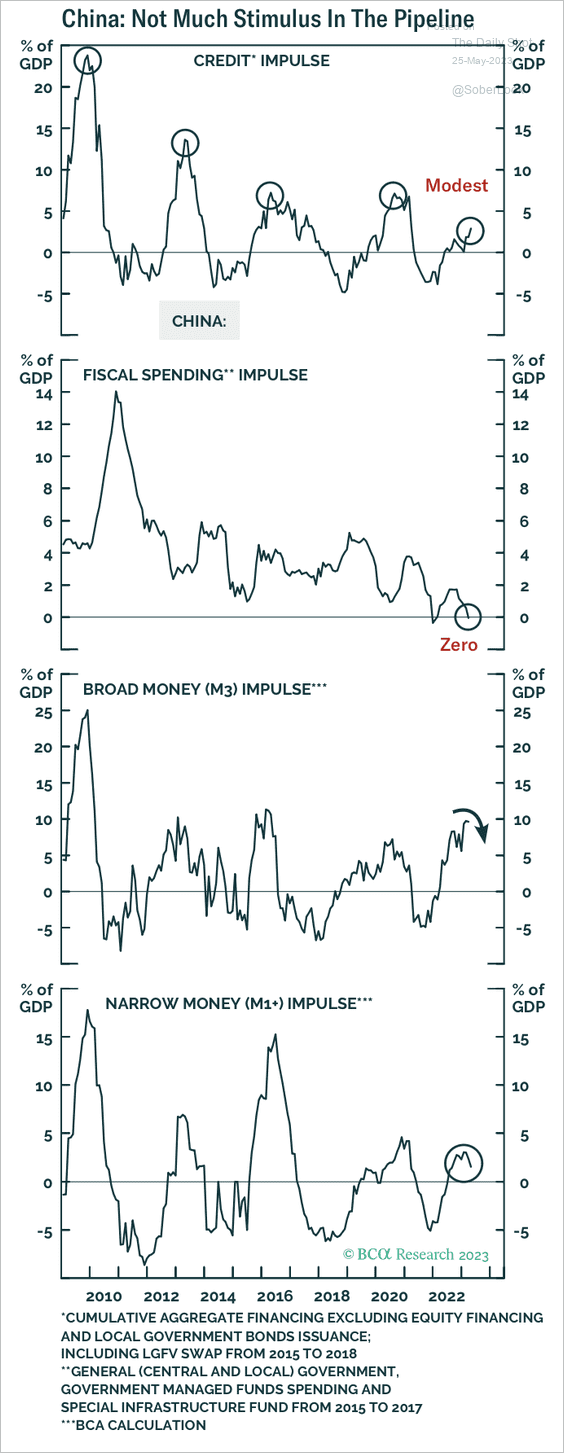

4. So far, credit, fiscal, and broad money impulses have been uninspiring.

Source: BCA Research

Source: BCA Research

:

Back to Index

Emerging Markets

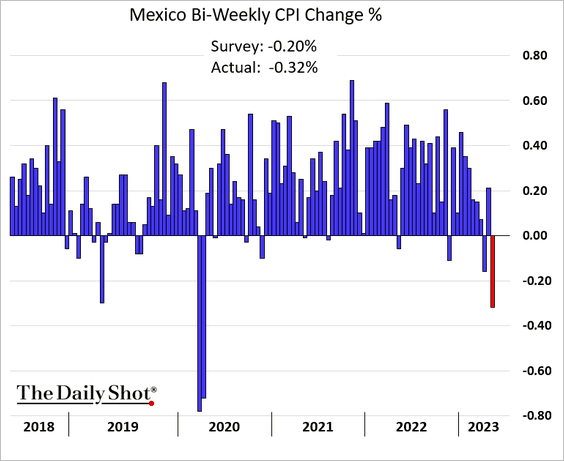

1. Mexico’s inflation declined sharply in the first half of May.

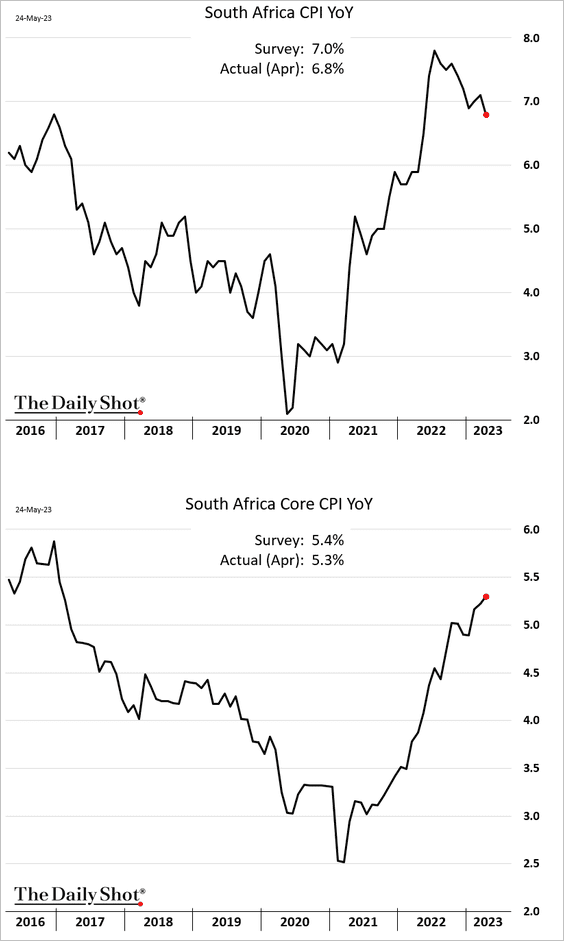

2. South Africa’s inflation print surprised to the downside, but core inflation continues to climb.

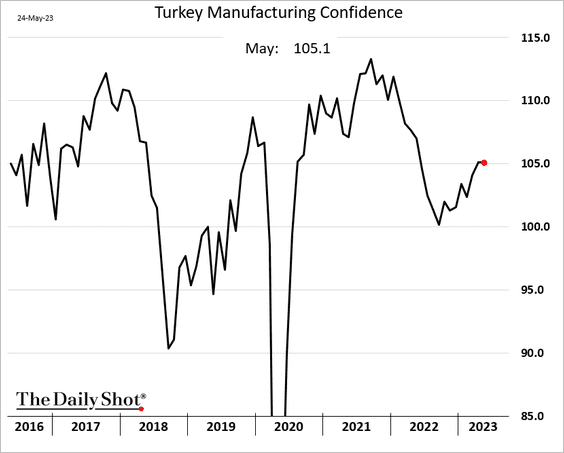

3. Turkey’s manufacturing confidence held steady in May.

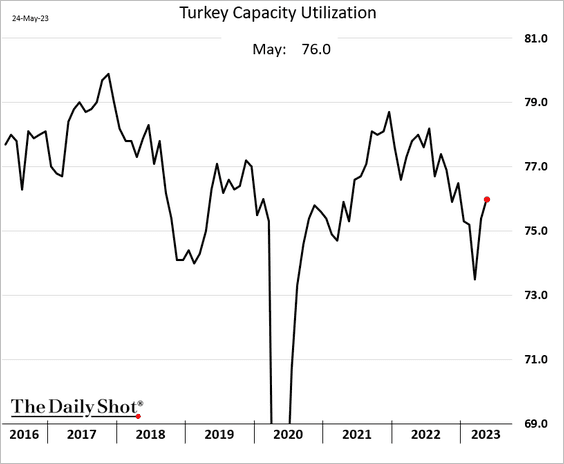

Capacity utilization is rebounding.

Back to Index

Commodities

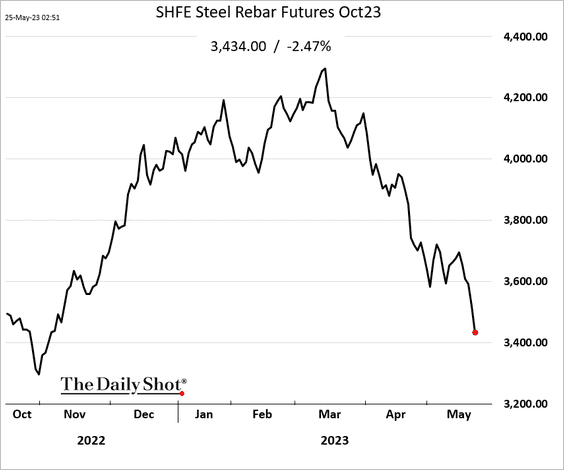

1. China’s steel prices keep tumbling, …

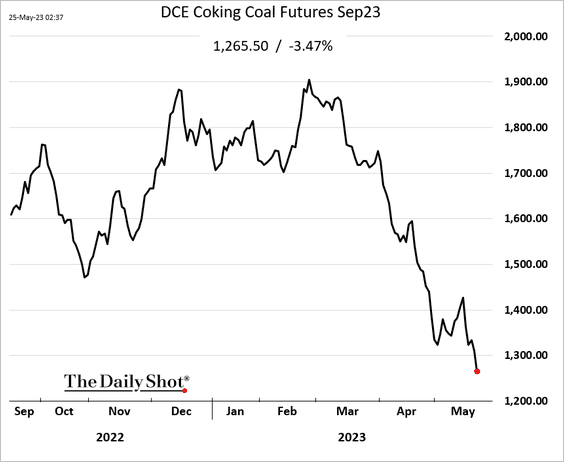

… dragging down metallurgical coal futures.

——————–

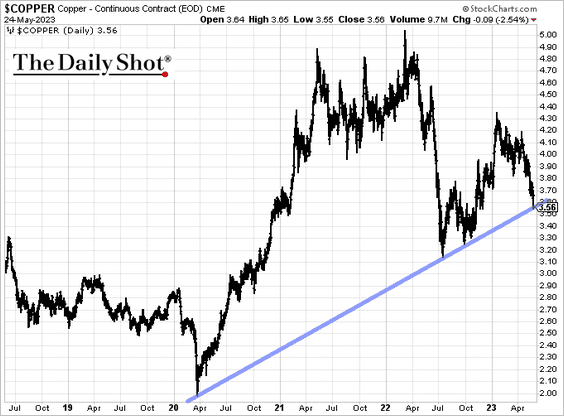

2. Copper futures are testing the uptrend support.

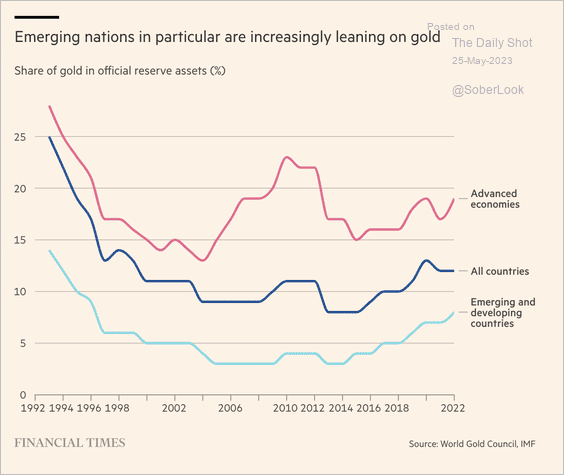

3. EM central banks have been boosting gold reserves.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

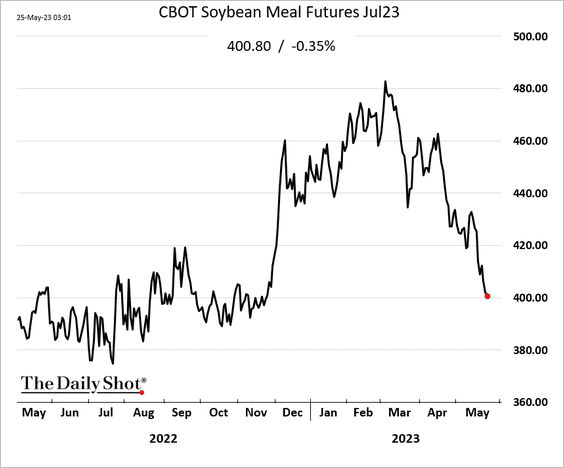

4. US soybean meal futures continue to sink.

Back to Index

Energy

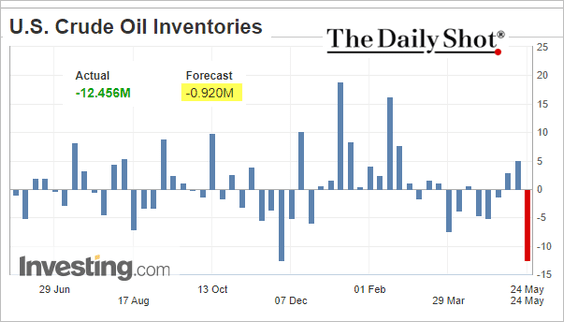

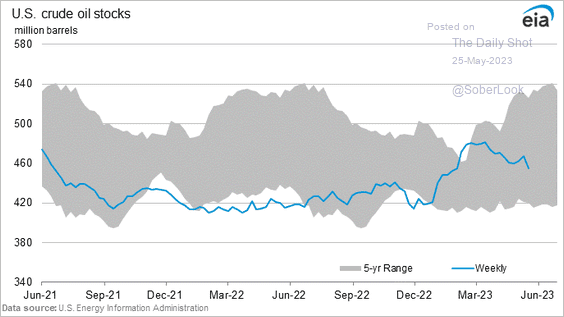

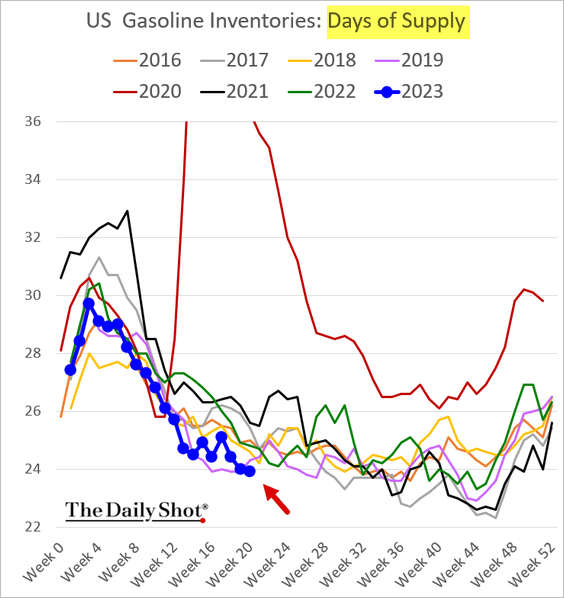

1. US oil inventories tumbled last week.

Source: Longview Economics Read full article

Source: Longview Economics Read full article

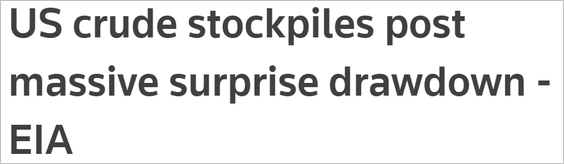

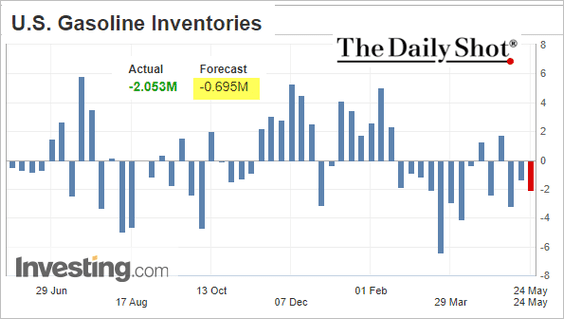

• Gasoline inventories also declined more than expected.

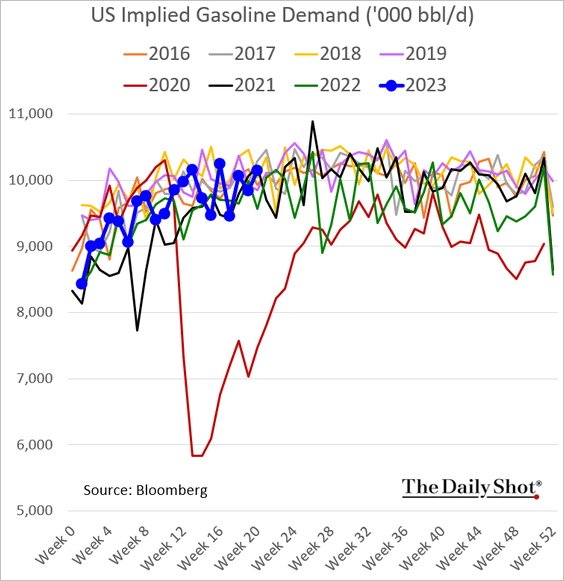

• Gasoline demand was above last year’s levels.

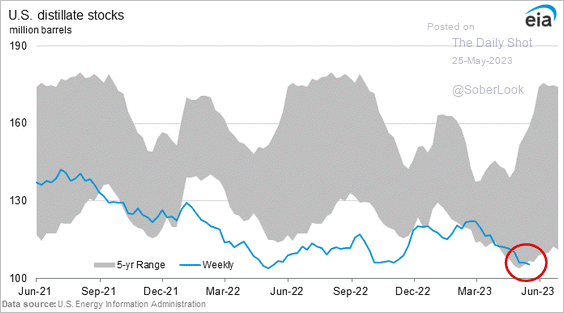

• Distillates inventories dipped below the 5-year range.

——————–

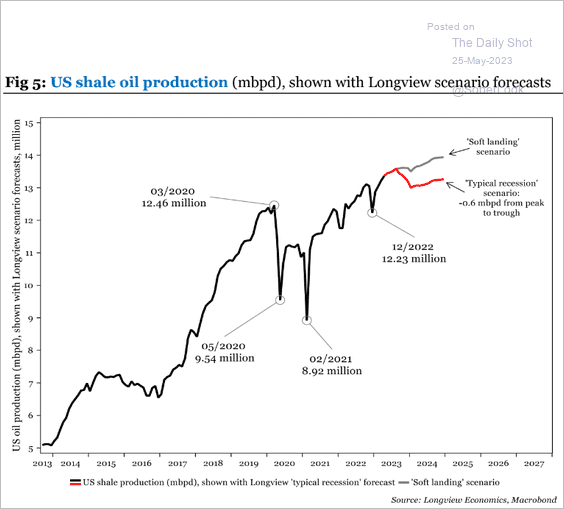

2. How will a US recession impact shale production?

Source: Longview Economics

Source: Longview Economics

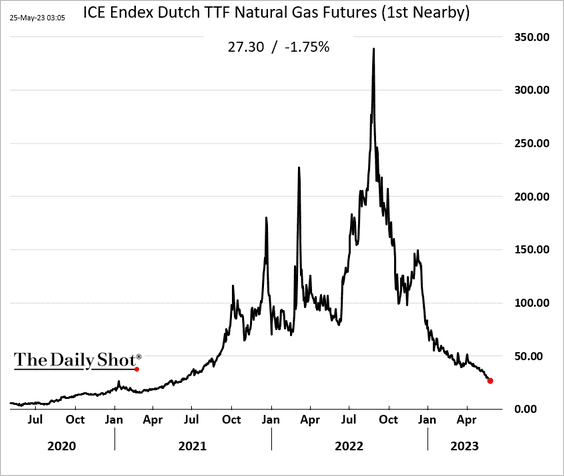

3. European natural gas prices continue to fall.

Back to Index

Equities

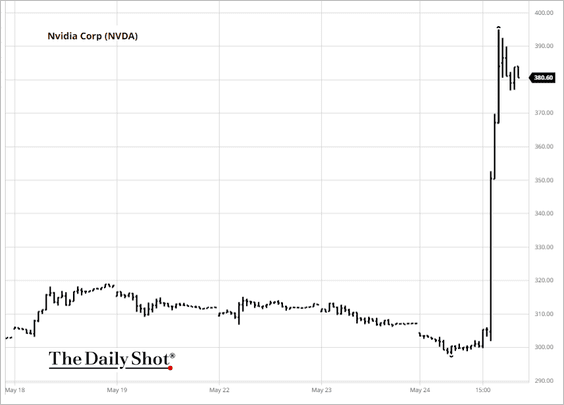

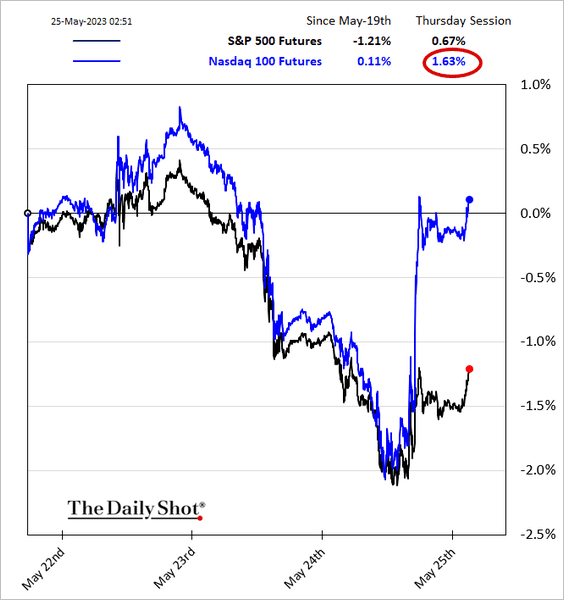

1. Nvidia shares surged on expected AI chip demand, …

Source: CNBC Read full article

Source: CNBC Read full article

Source: barchart.com

Source: barchart.com

… boosting the Nasdaq 100 futures this morning.

——————–

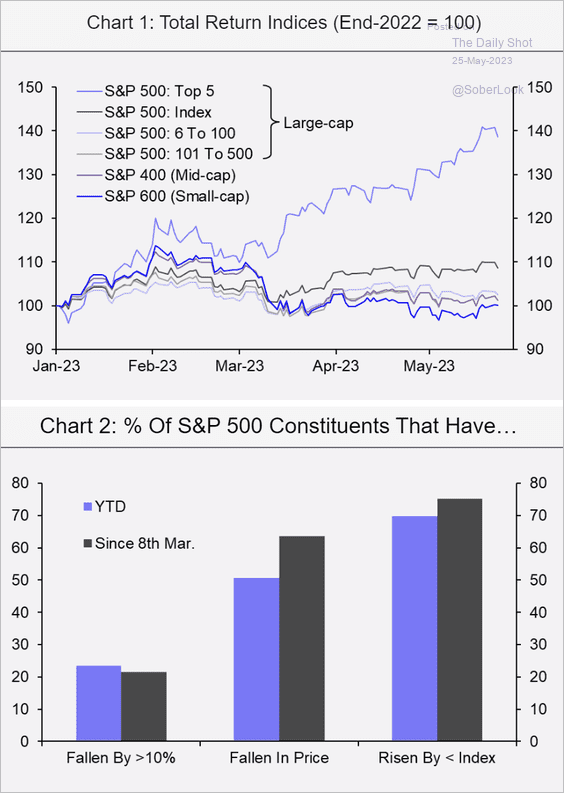

2. This rally has been quite narrow.

Source: Capital Economics

Source: Capital Economics

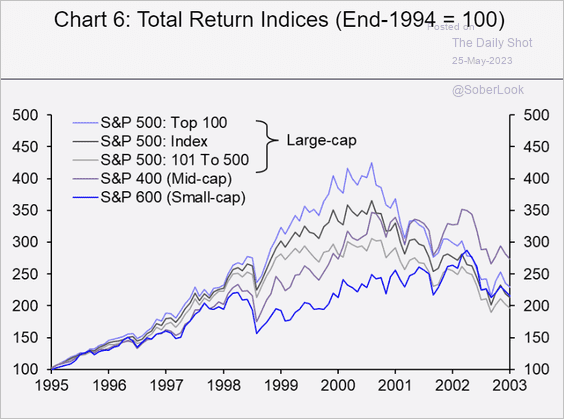

By the way, the dot-com era’s relatively narrow rally ended badly.

Source: Capital Economics

Source: Capital Economics

——————–

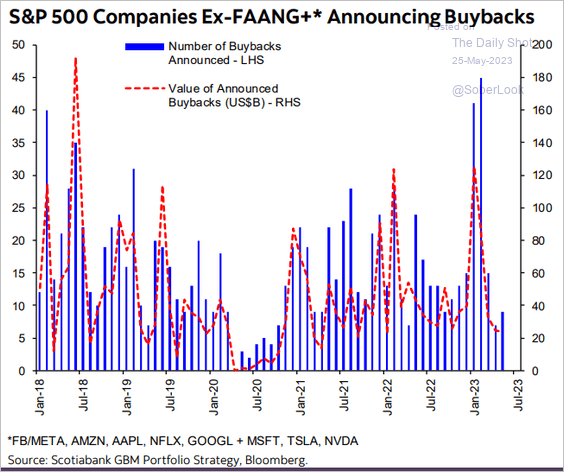

3. Outside of tech mega-caps, share buyback announcements are not particularly strong.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

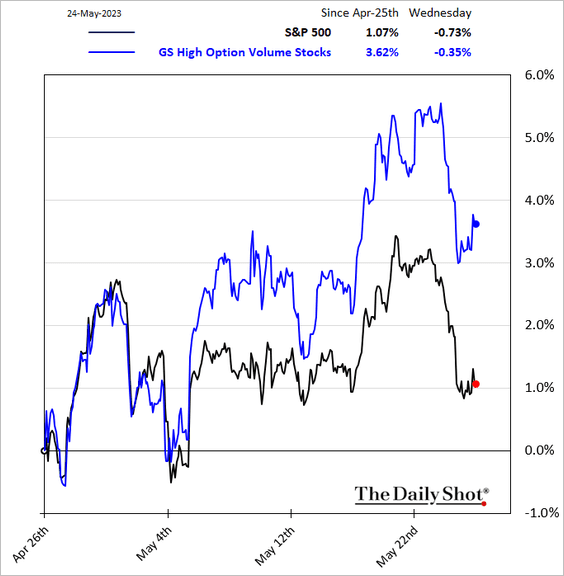

4. Shares with high options volumes have been outperforming.

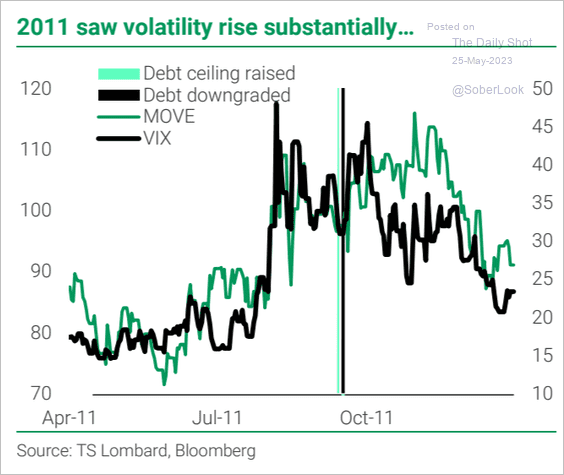

5. How much did implied volatility indices spike in 2011 in response to the debt ceiling impasse?

Source: TS Lombard

Source: TS Lombard

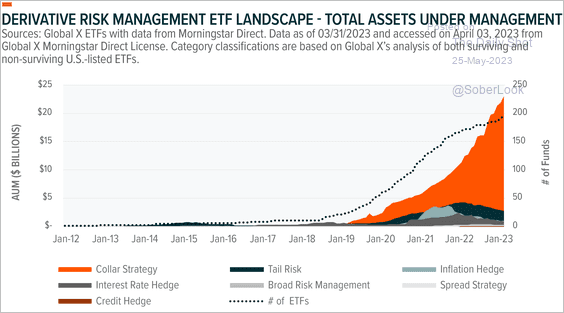

6. ETFs that use derivatives have increased assets in recent years.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

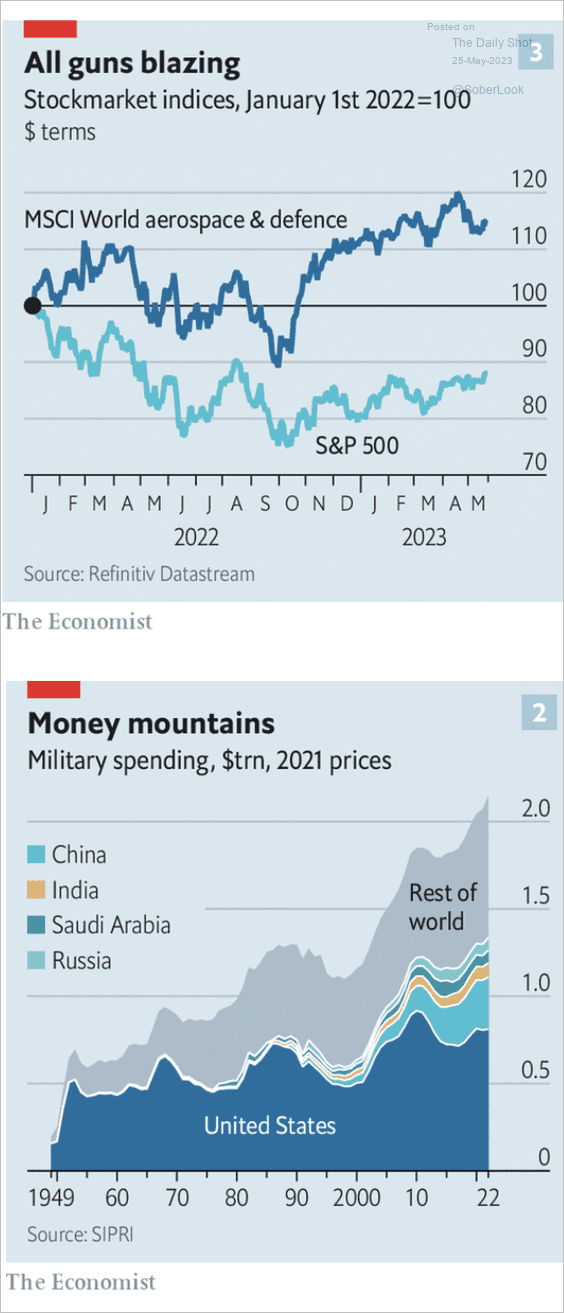

7. Defense stocks have outperformed sharply over the past year as defense spending surges.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Credit

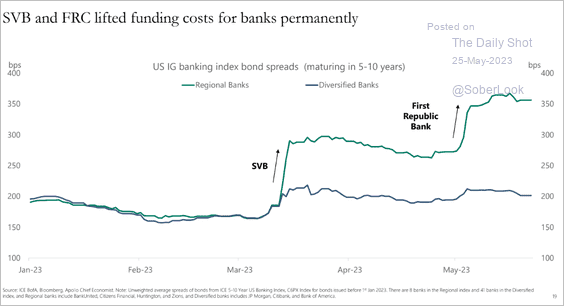

1. Regional banks’ bond spreads remain elevated.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

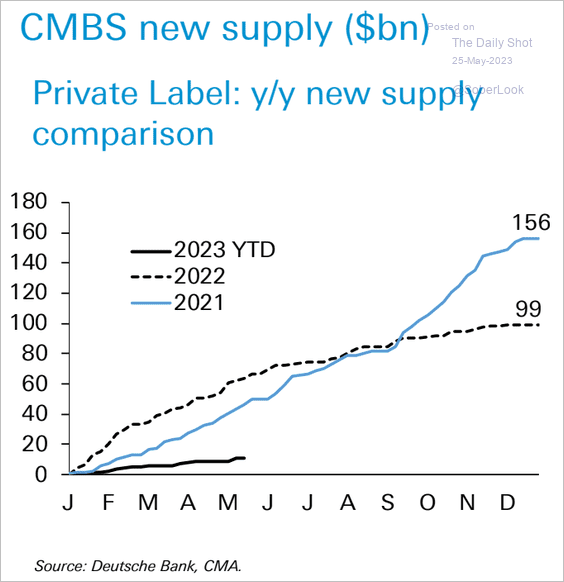

2. CMBS private label issuance is a fraction of last year’s levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

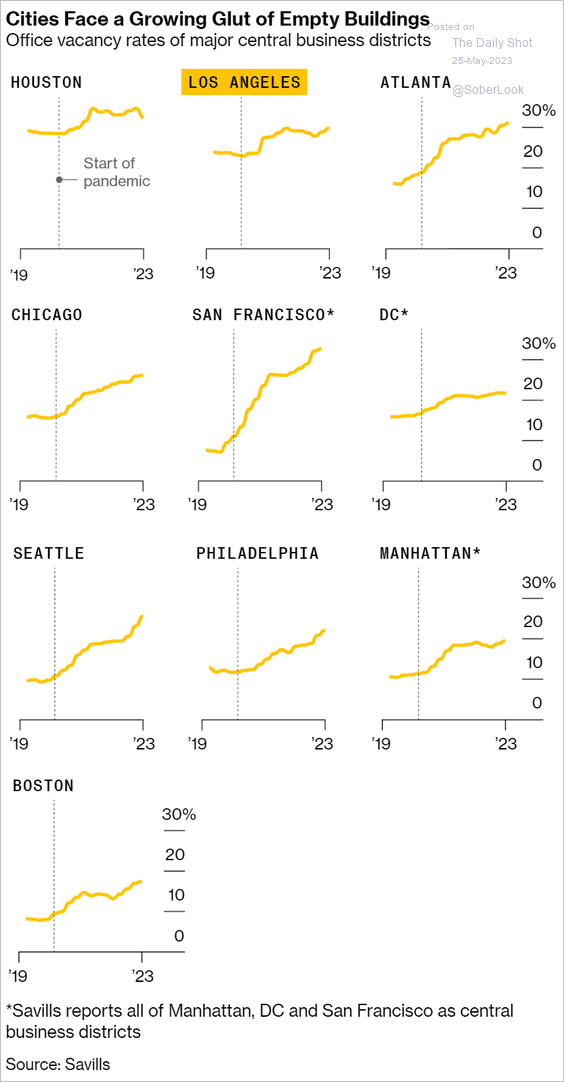

3. Office vacancy rates have been climbing.

Source: @BW Read full article

Source: @BW Read full article

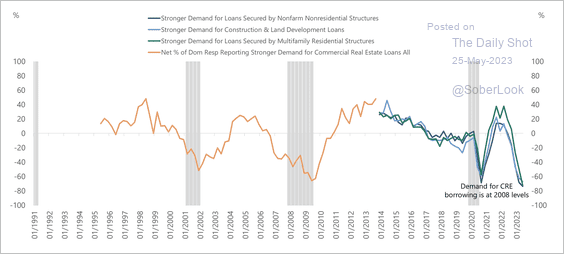

4. Demand for commercial real estate loans is back near 2008 levels.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

Food for Thought

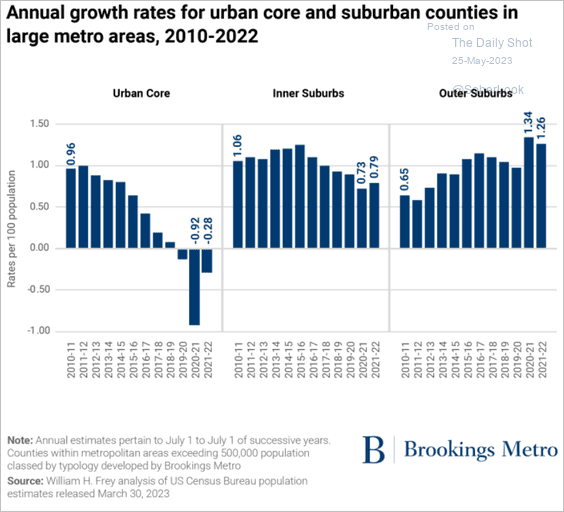

1. The shift to outer suburbs:

Source: Brookings Read full article

Source: Brookings Read full article

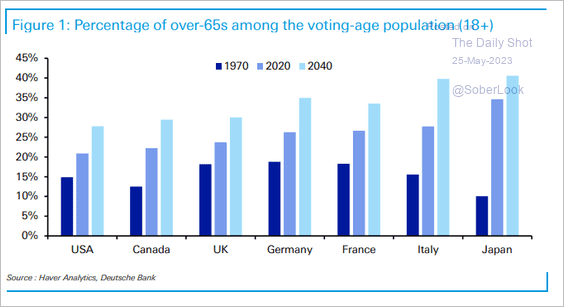

2. Older voters:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

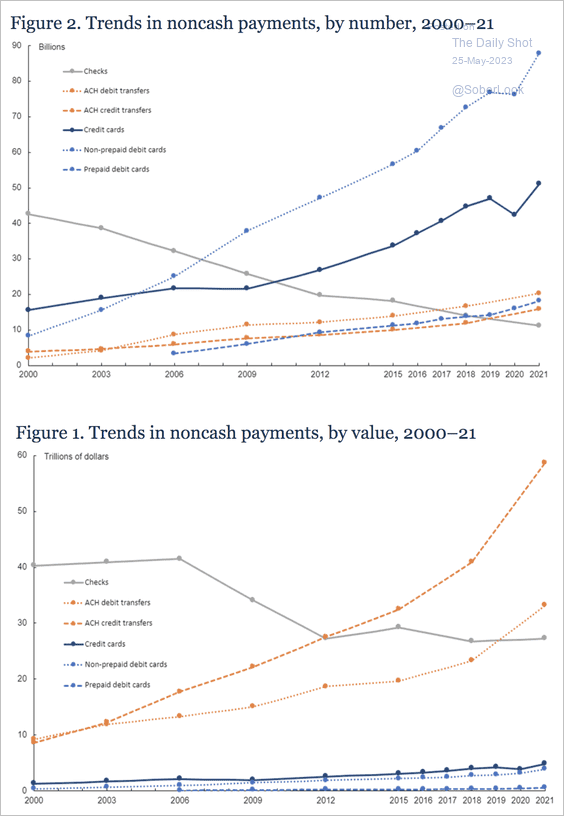

3. US non-cash payments:

Source: Board of Governors of the Federal Reserve System Read full article

Source: Board of Governors of the Federal Reserve System Read full article

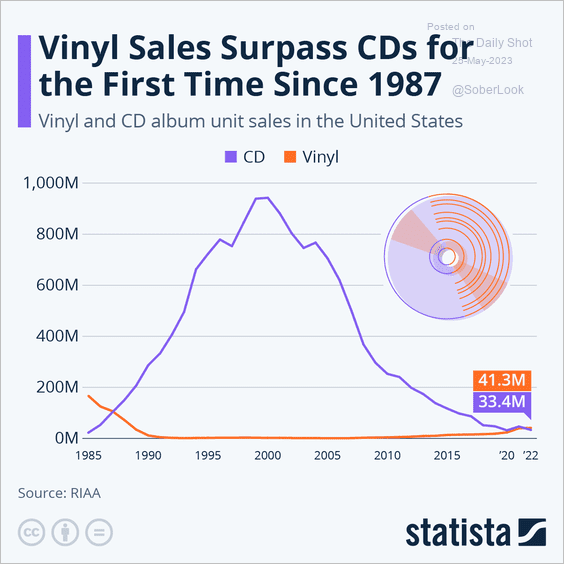

4. Vinyl vs. CD album unit sales:

Source: Statista

Source: Statista

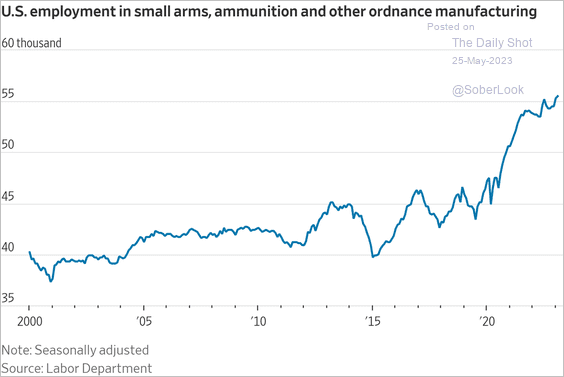

5. Weapons makers are hiring.

Source: @WSJ Read full article

Source: @WSJ Read full article

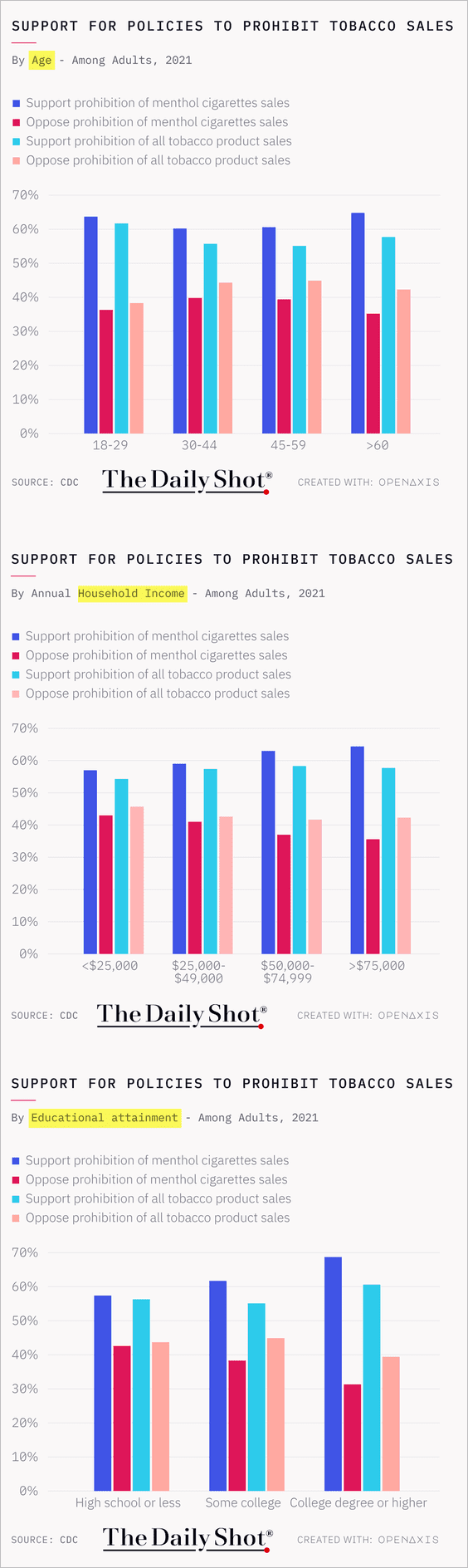

6. Views on prohibiting tobacco or menthol cigarettes:

Source: @TheDailyShot

Source: @TheDailyShot

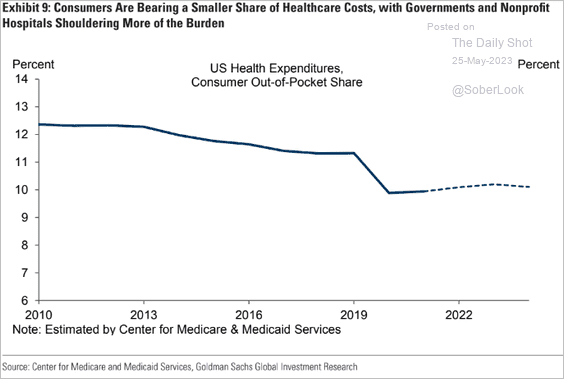

7. Consumer out-of-pocket share of US health expenditures:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

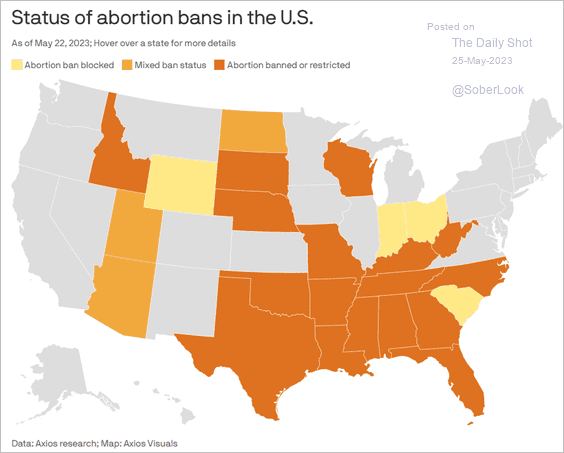

8. Status of abortion bans:

Source: @axios Read full article

Source: @axios Read full article

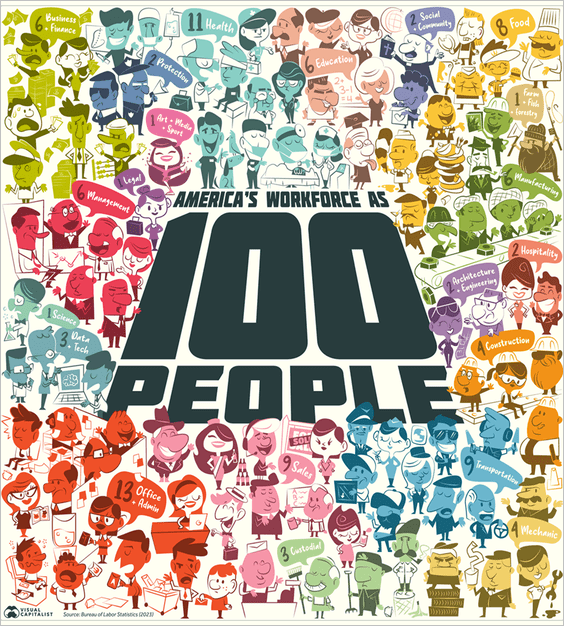

9. Visualizing the American workforce as 100 people:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index