The Daily Shot: 06-Jun-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Australia

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

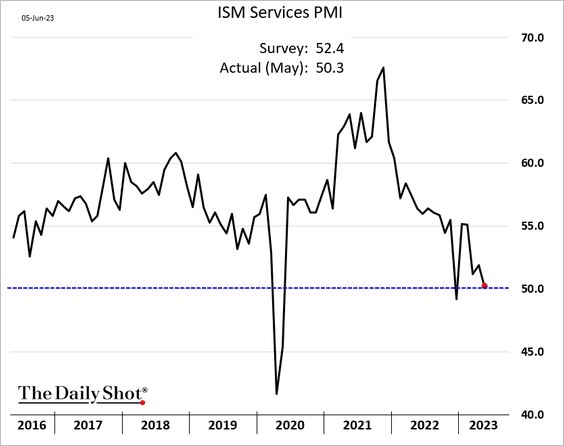

1. The ISM Services PMI signals stalled business activity growth in May.

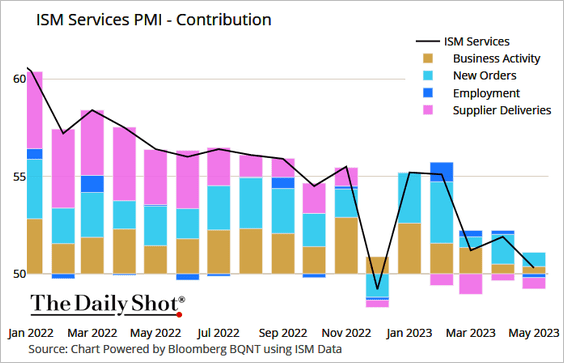

Source: MarketWatch Read full article

Source: MarketWatch Read full article

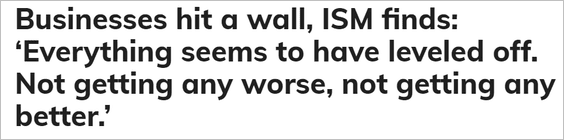

• Here are the contributions to the ISM index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

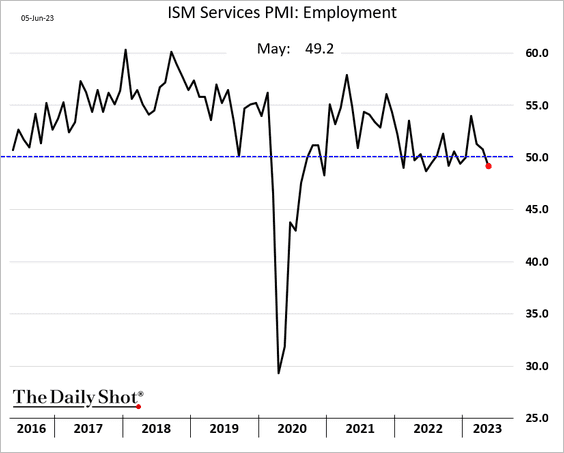

• The employment index shows staff reductions last month.

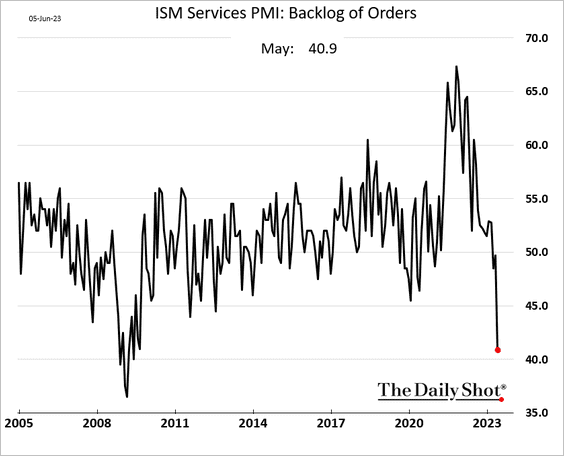

• Companies faced significant challenges in managing the influx of new orders last year, but now it seems like a distant memory.

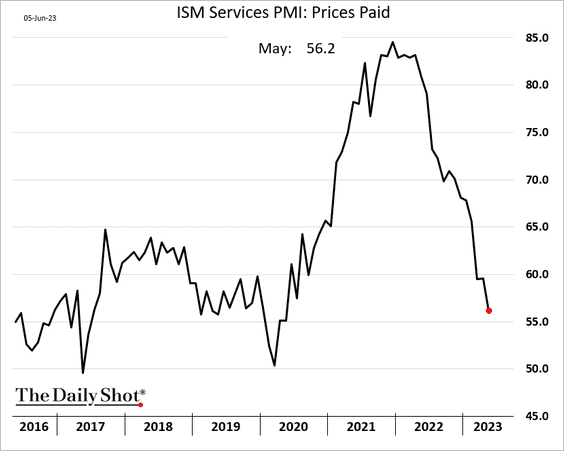

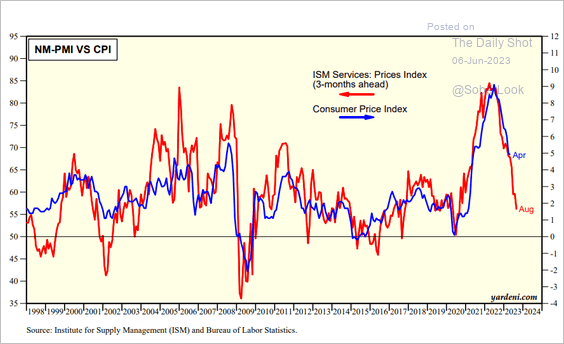

• Service-sector cost increases continue to slow, …

… which points to softer inflation ahead, …

Source: Yardeni Research

Source: Yardeni Research

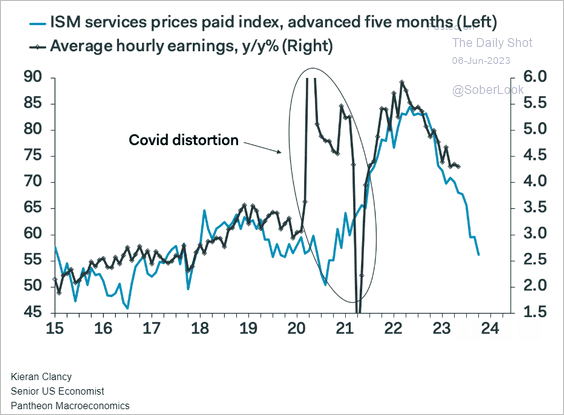

… as well as moderating wage growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

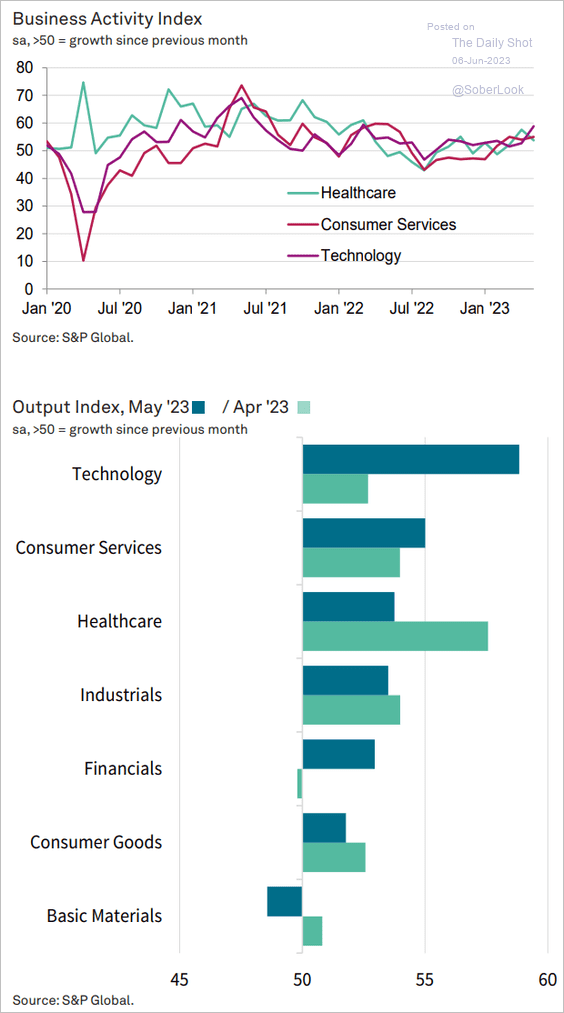

2. A separate survey from S&P Global PMI shows improvements in US tech, consumer services, and financials in May.

Source: S&P Global PMI

Source: S&P Global PMI

3. Next, we have some updates on consumer spending.

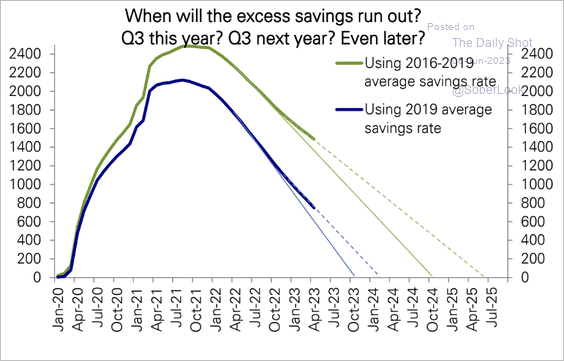

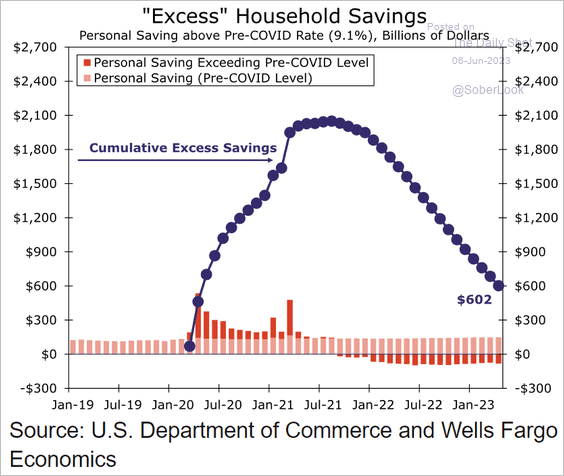

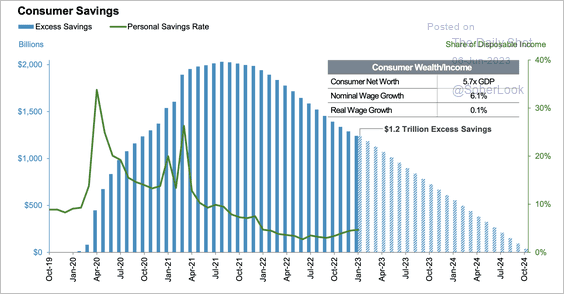

• There is some debate regarding the extent of excess household savings and the point at which this buffer is depleted.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– Wells Fargo:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

– Fidelity:

Source: Fidelity Investments Read full article

Source: Fidelity Investments Read full article

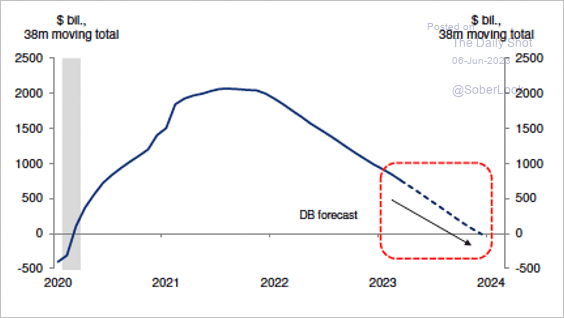

Deutsche Bank expects excess savings to be depleted by year-end…

Source: Deutsche Bank Research

Source: Deutsche Bank Research

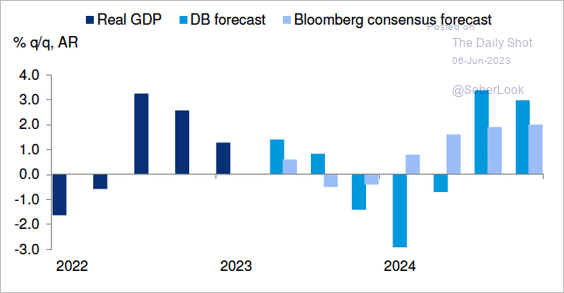

…and a later, somewhat deeper recession than consensus.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

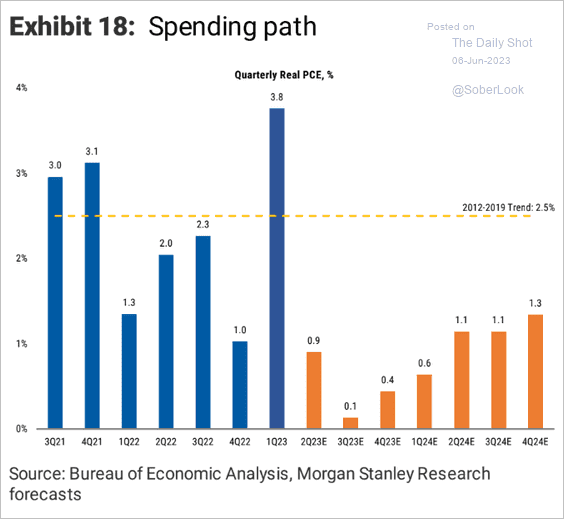

• Here is Morgan Stanley’s forecast for real consumer spending.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

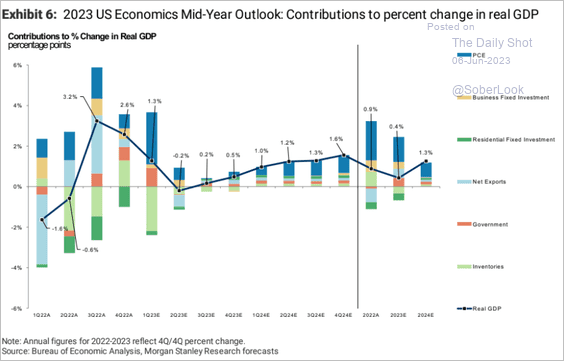

The Q3 spending dip would lead to only one negative quarter but no recession.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

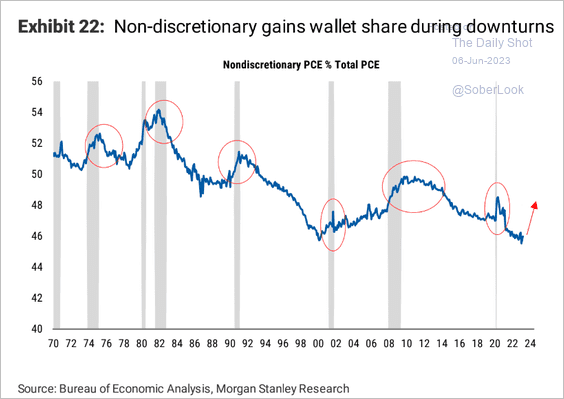

• Nondiscretionary consumer spending will become a larger portion of total expenditures.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

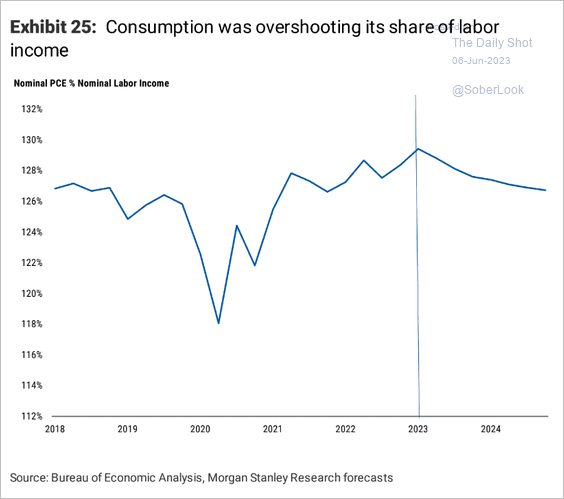

• Consumption as a share of labor income has been elevated and will turn lower.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

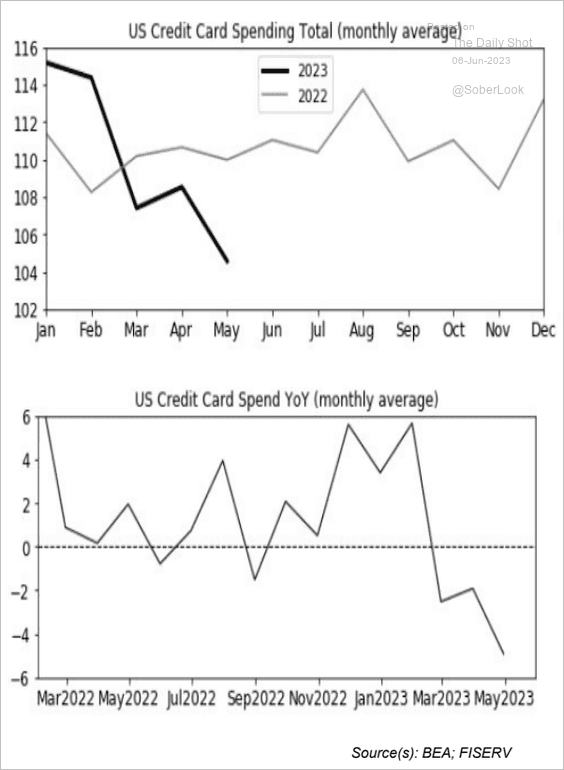

• Credit card data points to weaker spending in May.

Source: III Capital Management

Source: III Capital Management

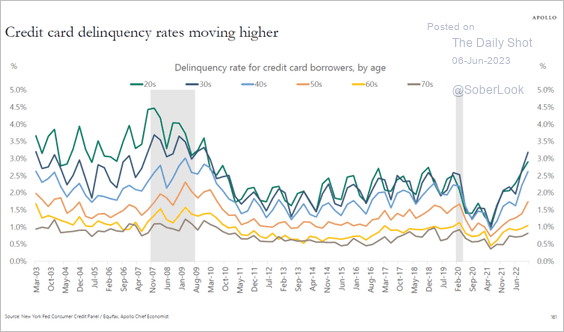

• Some cohorts are seeing the highest credit card delinquency rates since the GFC.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

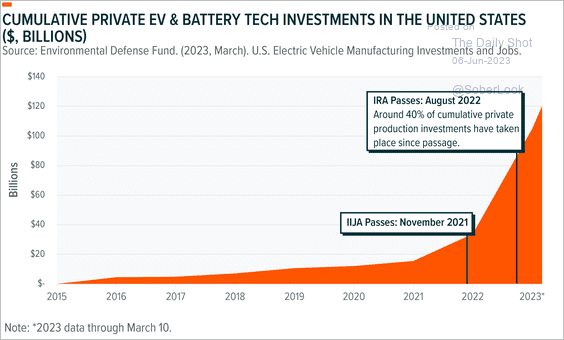

4. A significant amount of private-sector investment has been announced since the passage of the Inflation Reduction Act.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

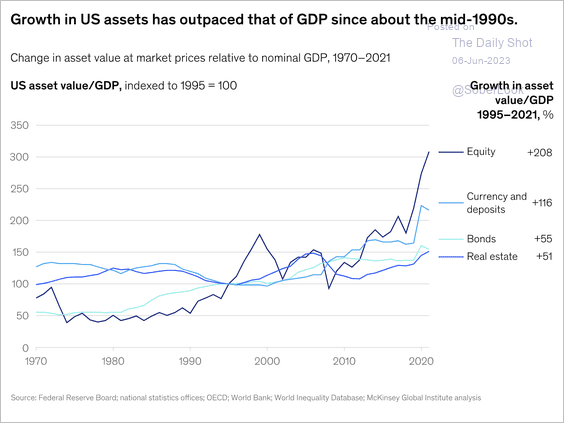

5. This chart shows asset values relative to GDP.

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

Back to Index

Canada

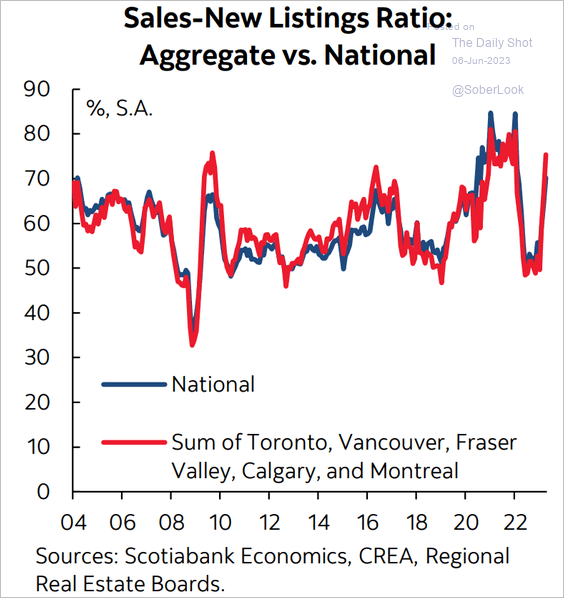

1. Regional housing data reveal a significant rebound in the market last month.

Source: Scotiabank Economics

Source: Scotiabank Economics

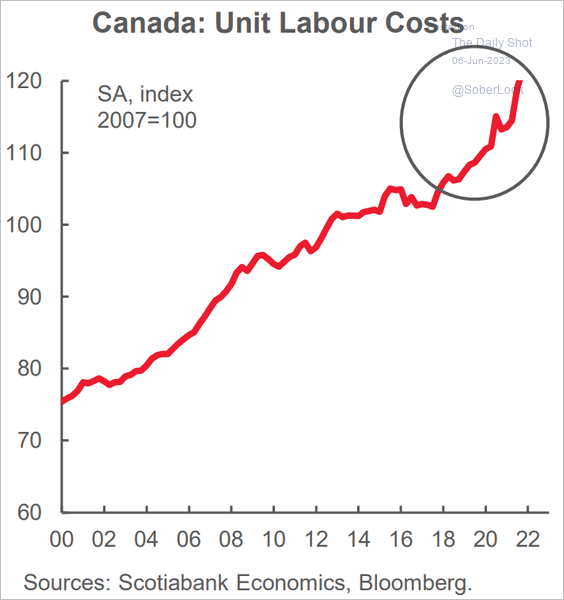

2. Labor costs have been rising quickly in recent years.

Source: Scotiabank Economics

Source: Scotiabank Economics

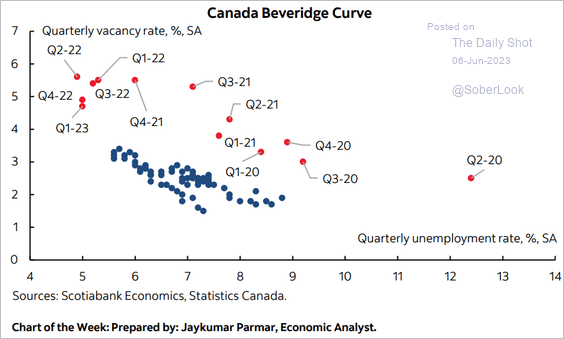

3. Here is Canada’s Beveridge Curve.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

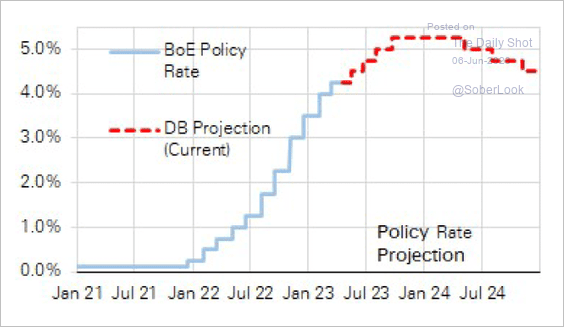

1. Deutsche Bank expects the policy rate to peak at 5.25%, with a shallow easing cycle next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

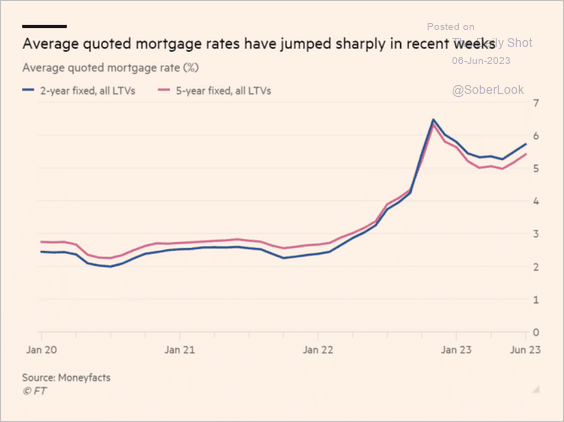

2. Mortgage rates have been rising again.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

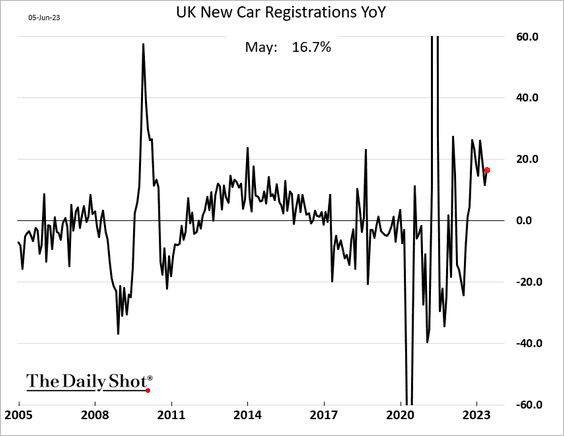

3. New car registrations remain well above last year’s levels.

Back to Index

The Eurozone

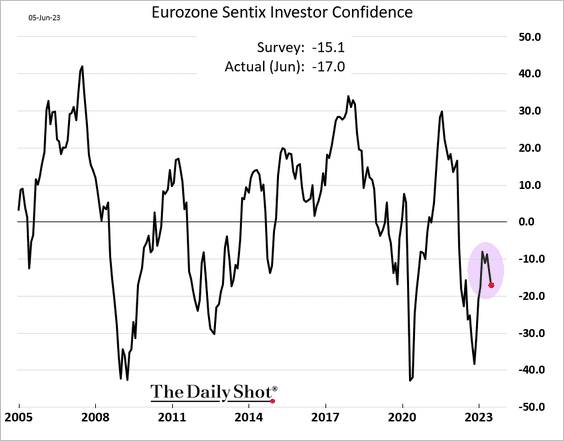

1. The Sentix investor sentiment indicator turned lower in June.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

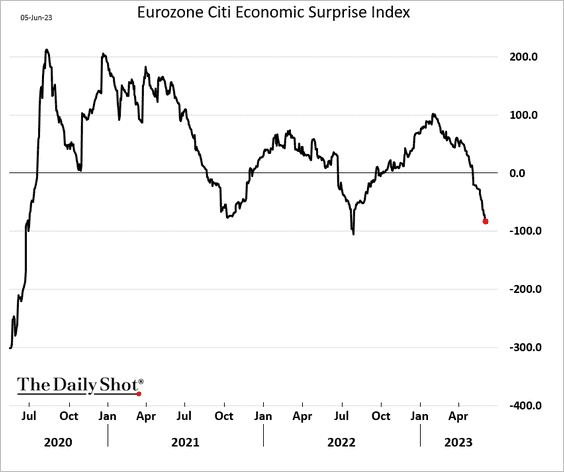

2. The Citi Economic Surprise Index is crashing.

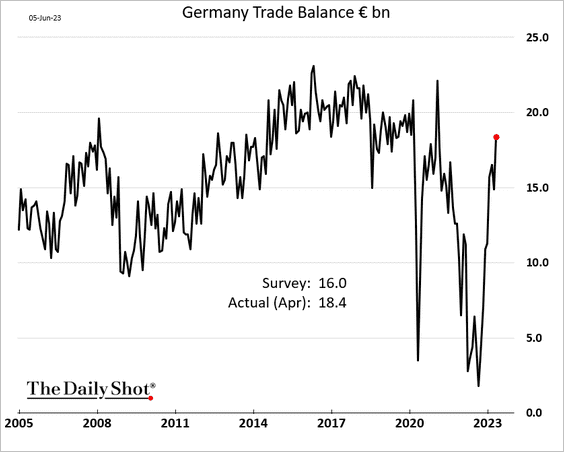

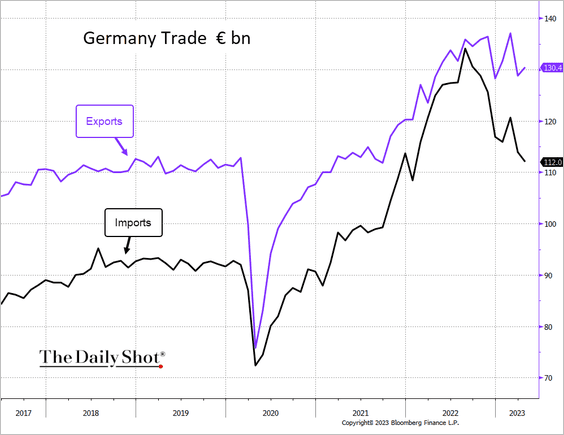

3. Germany’s April trade surplus topped expectations as terms of trade continued to improve.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

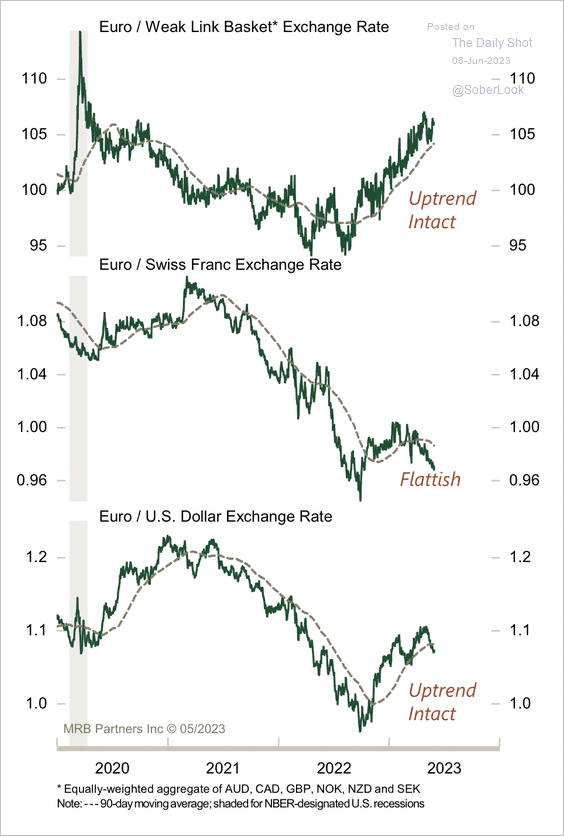

4. The Euro has consolidated its gains versus the dollar and Swiss franc this year, although its short-term uptrend remains intact versus an equal-weighted basket of interest rate-sensitive currencies such as AUD, CAD, and GBP.

Source: MRB Partners

Source: MRB Partners

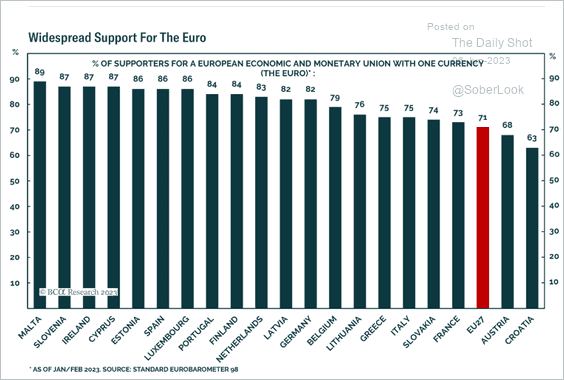

5. Popular support for the euro remains strong.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

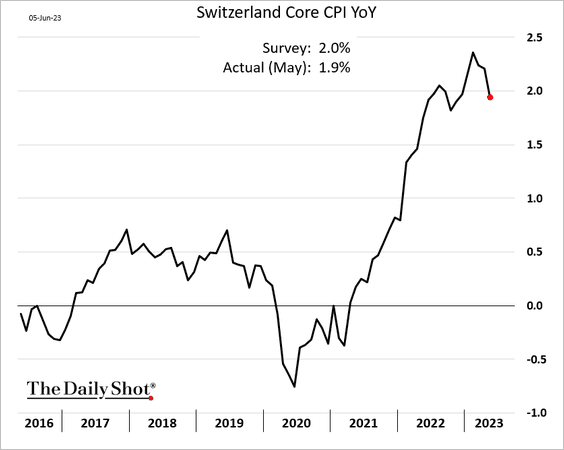

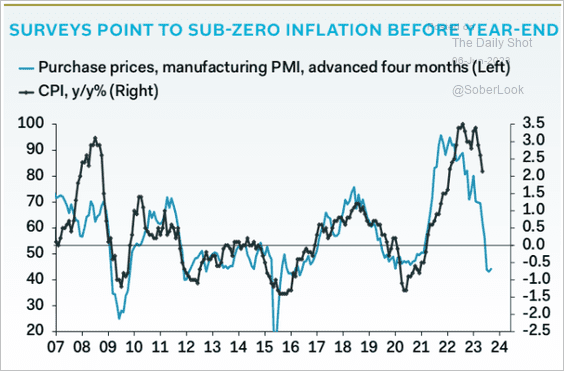

1. Swiss core inflation has peaked.

The PMI trend points to further declines in the CPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

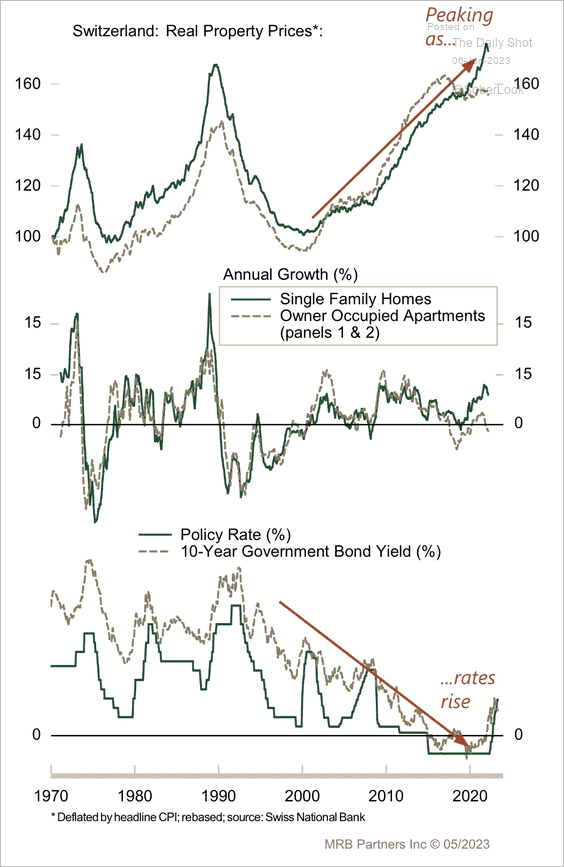

• Switzerland’s housing bubble remains a key risk.

Source: MRB Partners

Source: MRB Partners

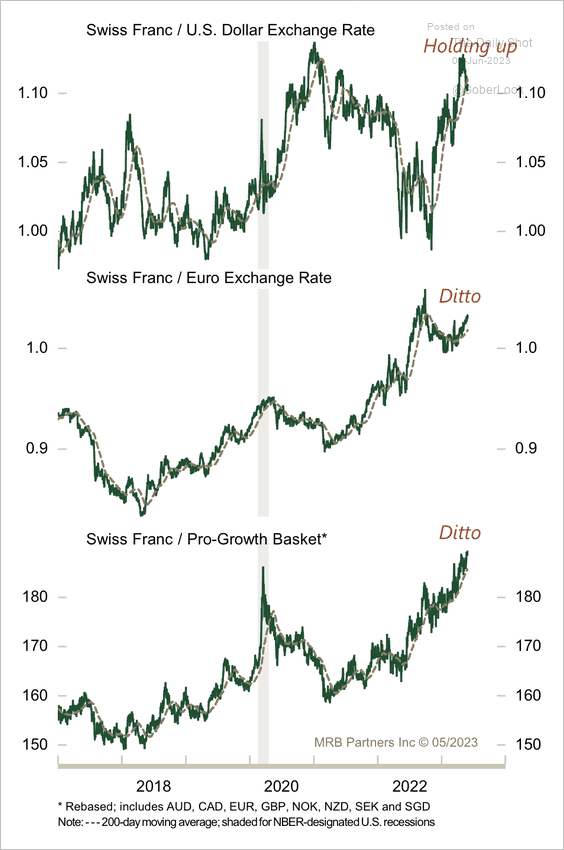

• The Swiss franc has held up this year.

Source: MRB Partners

Source: MRB Partners

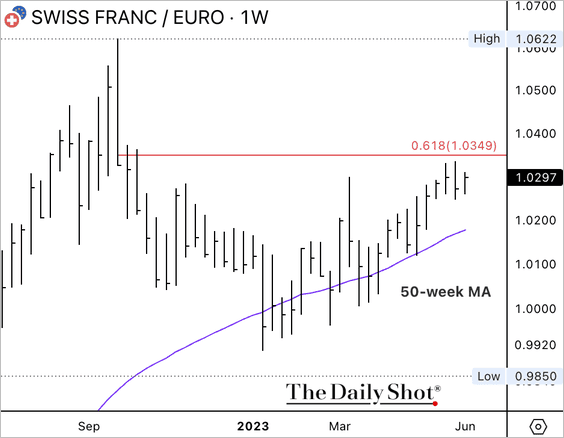

CHF/EUR is testing initial resistance. Its uptrend remains vulnerable to risk-on conditions.

——————–

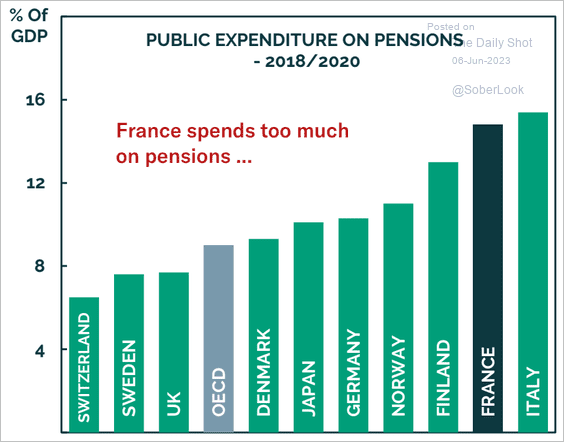

2. This chart shows public spending on pensions in select economies.

Source: BCA Research

Source: BCA Research

Back to Index

Japan

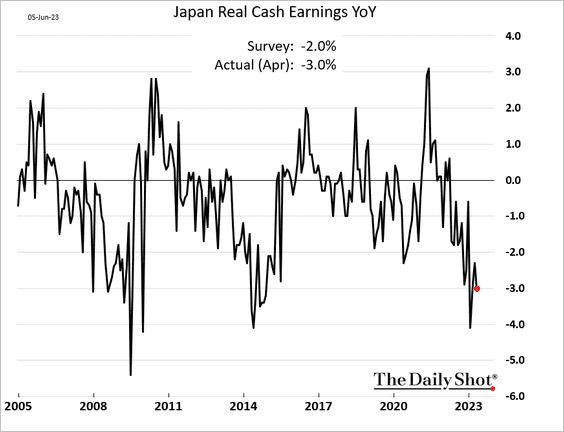

1. Real wages remain well below last year’s levels.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

——————–

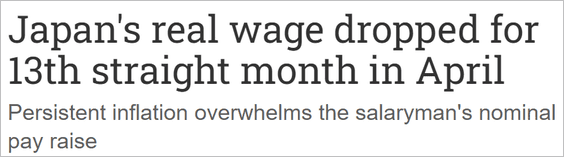

2. Household spending in April was below forecasts.

Source: Nippon Read full article

Source: Nippon Read full article

——————–

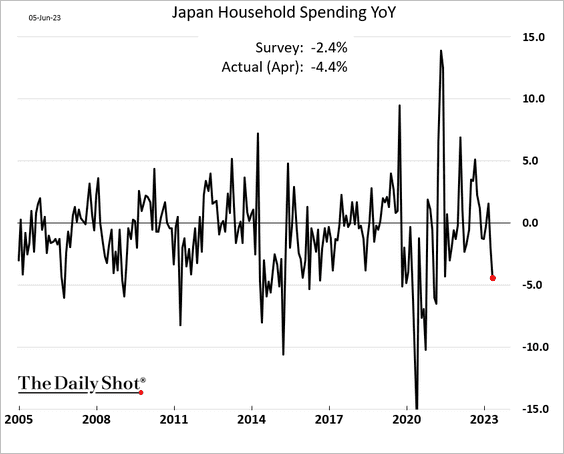

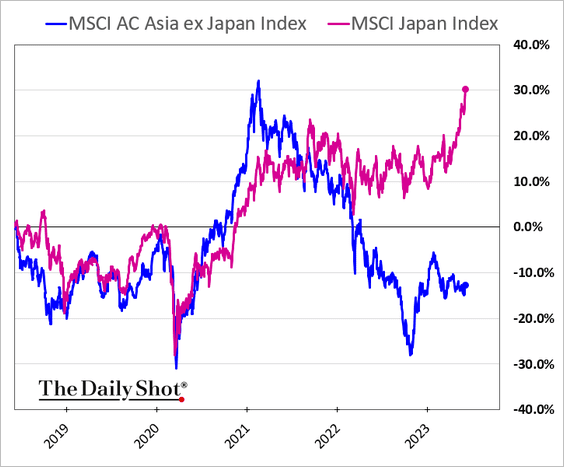

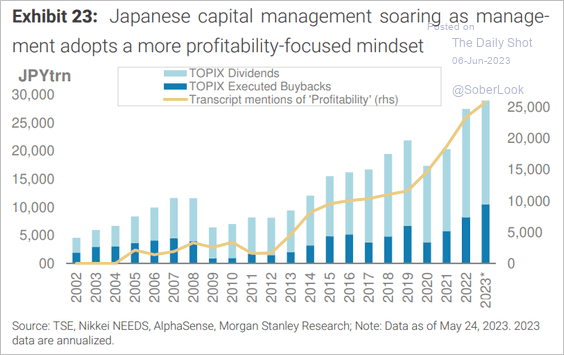

3. Japan’s stocks have widened the gap with Asian peers.

Investor-friendly corporate actions continue to be a tailwind for the stock market.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

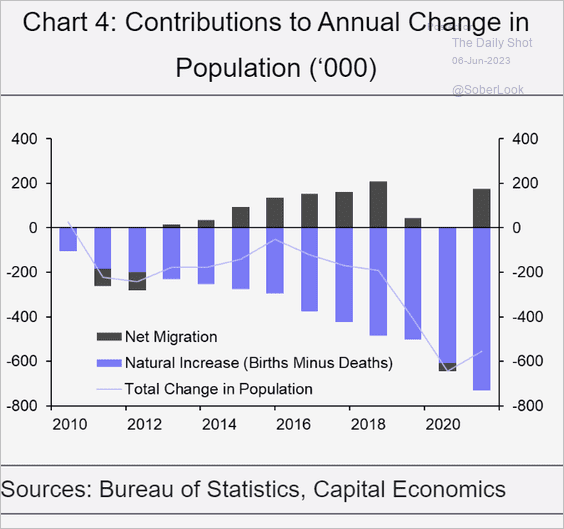

4. This chart shows the contributions to Japan’s population changes.

Source: Capital Economics

Source: Capital Economics

Back to Index

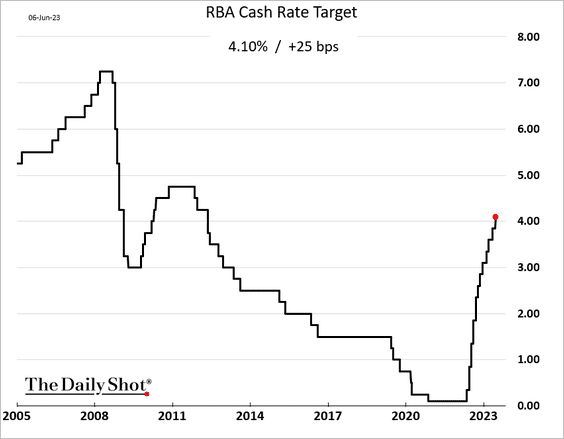

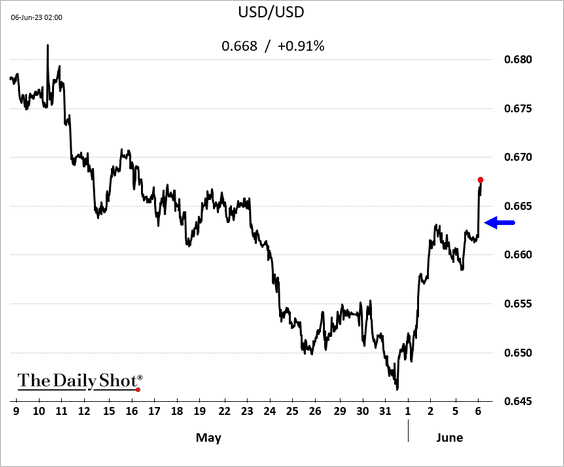

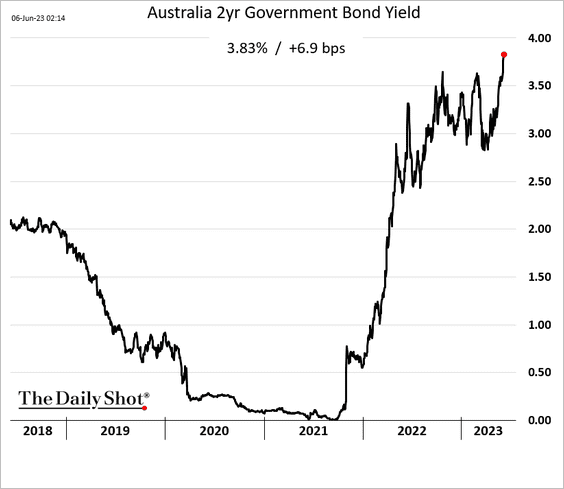

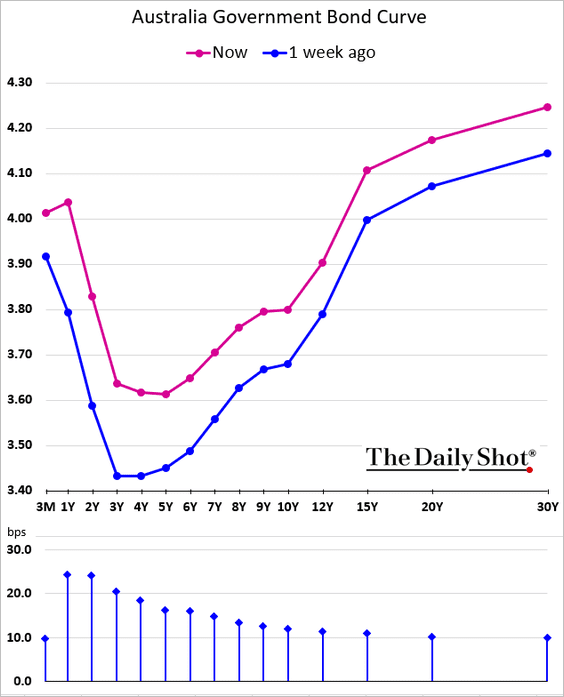

Australia

The RBA caught markets off guard with an unexpected rate hike while also cautioning about further impending increases.

Source: Reuters Read full article

Source: Reuters Read full article

The Aussie dollar and bond yields jumped.

Here is the yield curve.

Back to Index

Emerging Markets

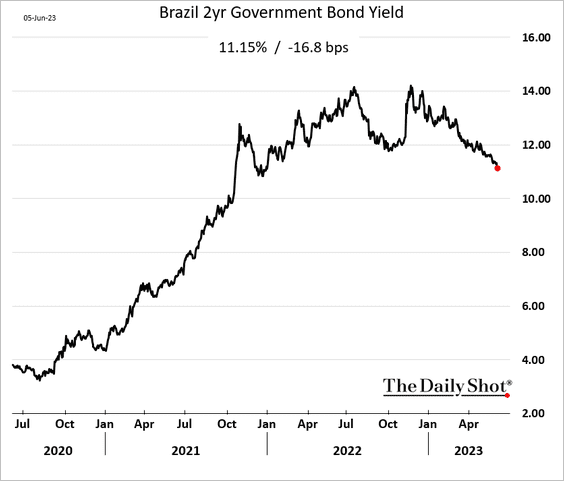

1. Let’s begin with Brazil.

• Bond yields are falling as inflation moderates.

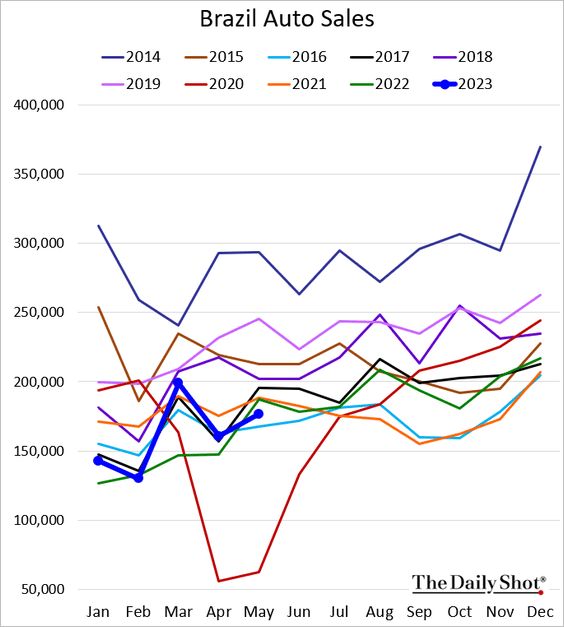

• Auto sales fell back below last year’s levels.

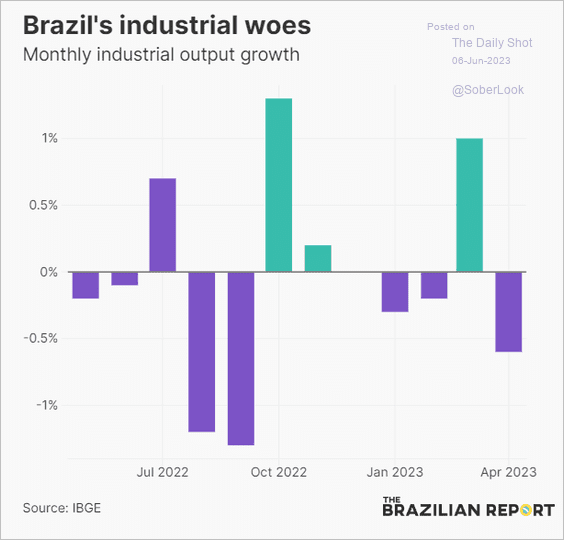

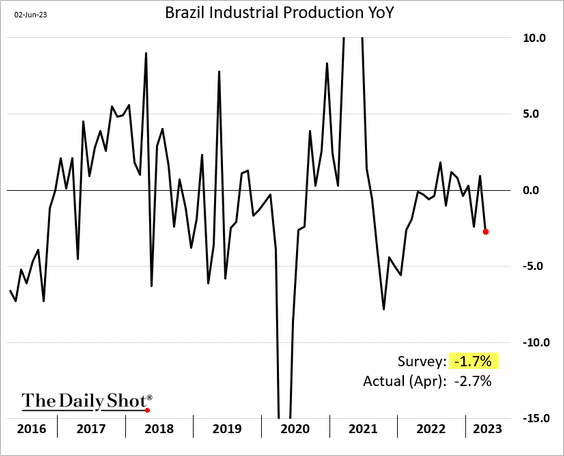

• Industrial production dropped in April.

Source: The Brazilian Report Read full article

Source: The Brazilian Report Read full article

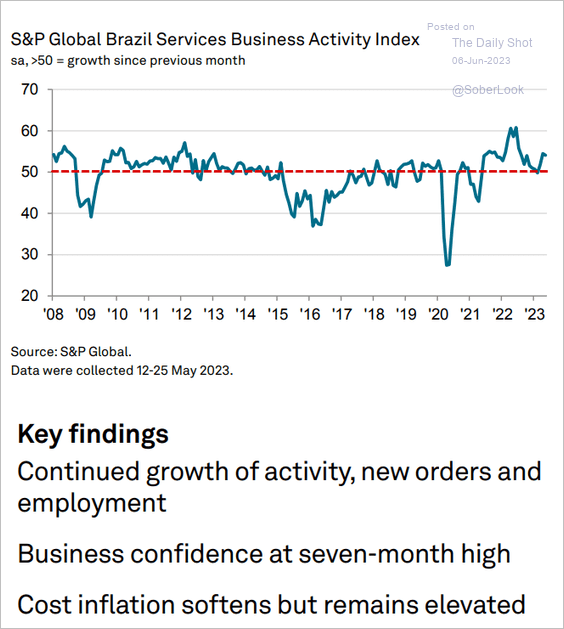

• Service firms continue to report growth.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

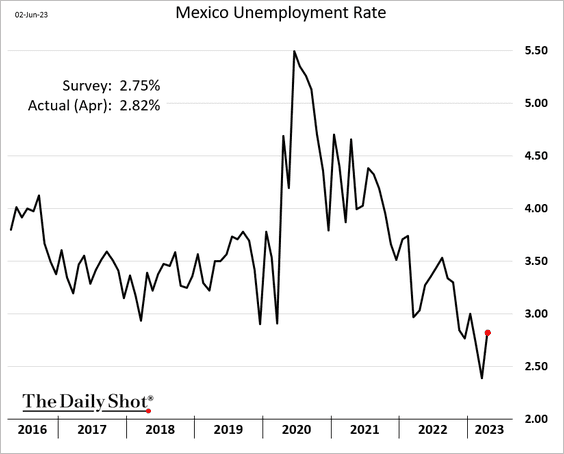

2. Mexico’s unemployment rate increased in April.

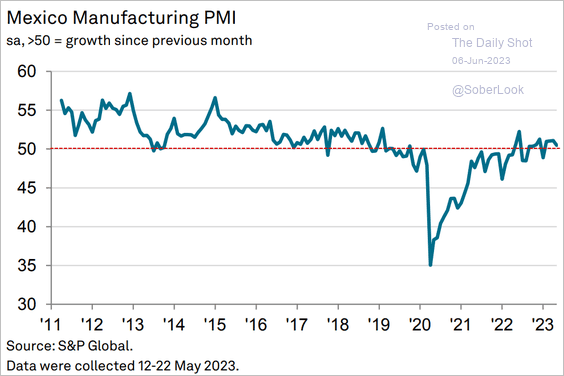

• Manufacturing growth is stalling again.

Source: S&P Global PMI

Source: S&P Global PMI

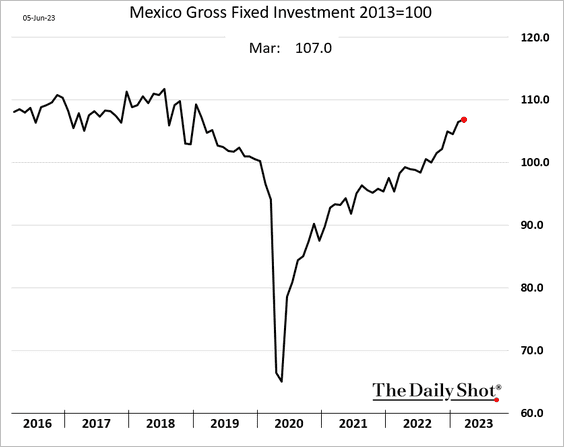

• Business investment continues to trend higher.

——————–

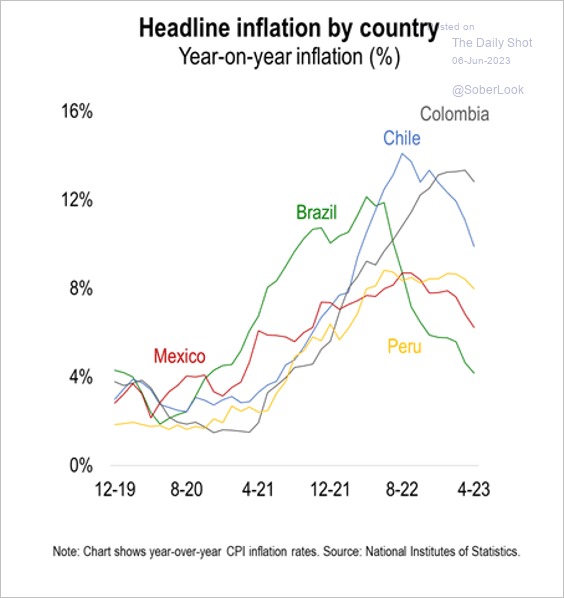

3. Here is a look at inflation across LatAm economies.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

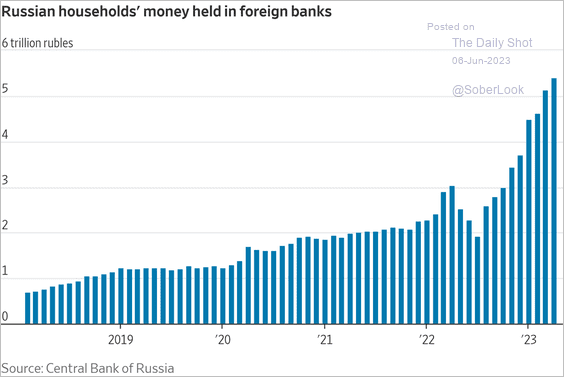

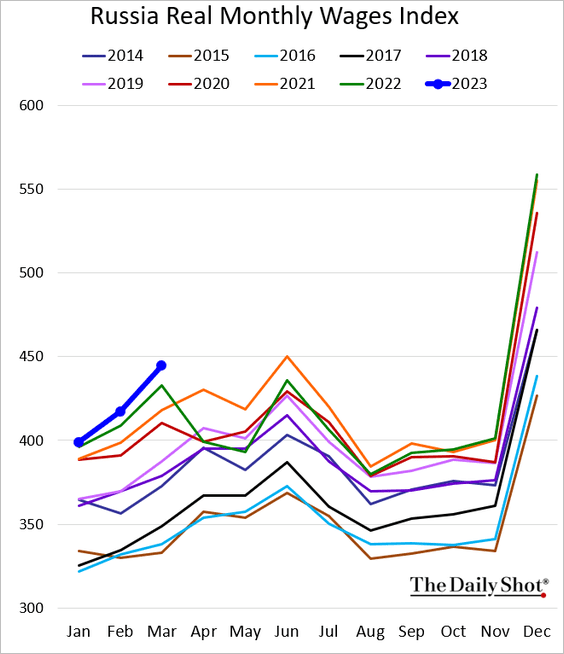

4. Next, we have some updates on Russia.

• Households have been moving cash into foreign banks.

Source: @WSJ Read full article

Source: @WSJ Read full article

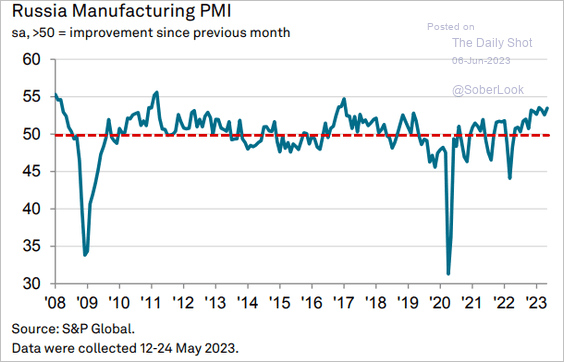

• Amidst sustained military orders, Russia’s manufacturers have reported resilient growth.

Source: S&P Global PMI

Source: S&P Global PMI

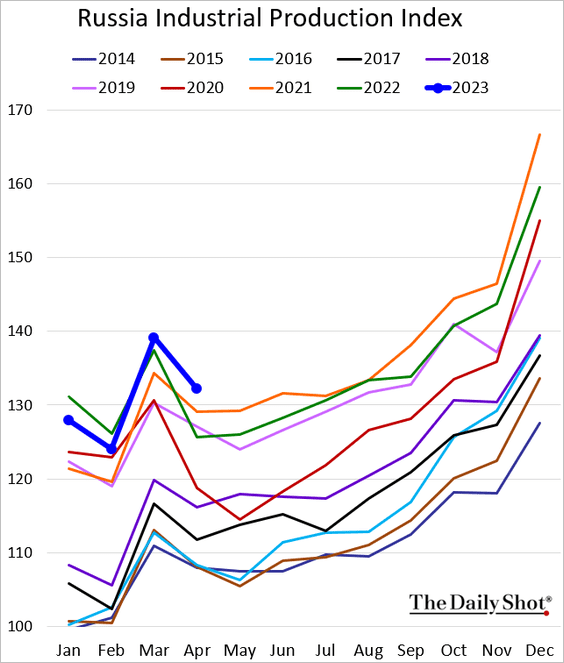

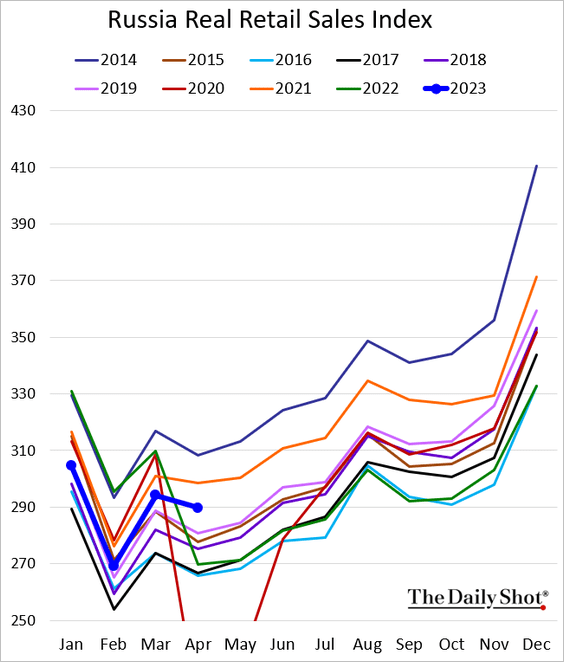

• Economic trends below are reported by the government.

– Industrial production:

– Retail sales:

– Unemployment:

– Real wages:

——————–

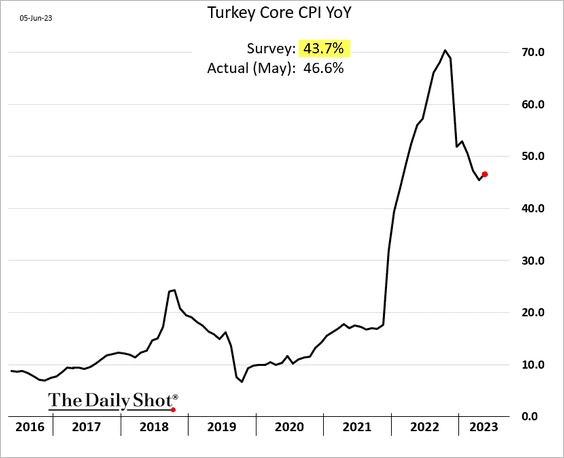

5. Turkey’s core inflation unexpectedly accelerated in May.

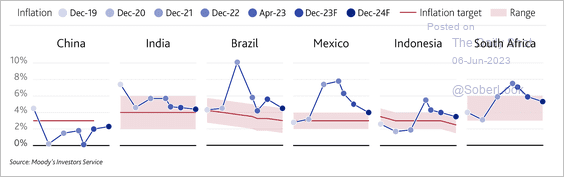

6. Inflation is already declining into target ranges in some EM countries.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Back to Index

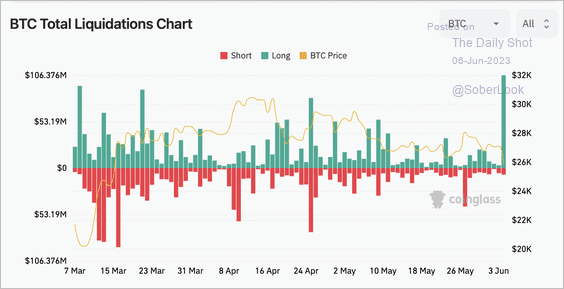

Cryptocurrency

1. Bitcoin saw a spike in long liquidations on Monday as the crypto’s price fell below $26K. News of the SEC’s lawsuit against Binance and its CEO unsettled crypto markets.

Source: Coinglass

Source: Coinglass

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

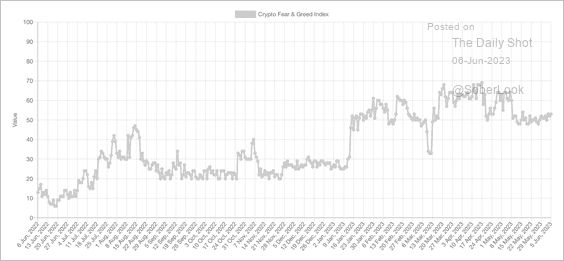

2. For now, the Crypto Fear & Greed Index is stuck in the neutral zone, declining from greed levels earlier this year.

Source: Alternative.me

Source: Alternative.me

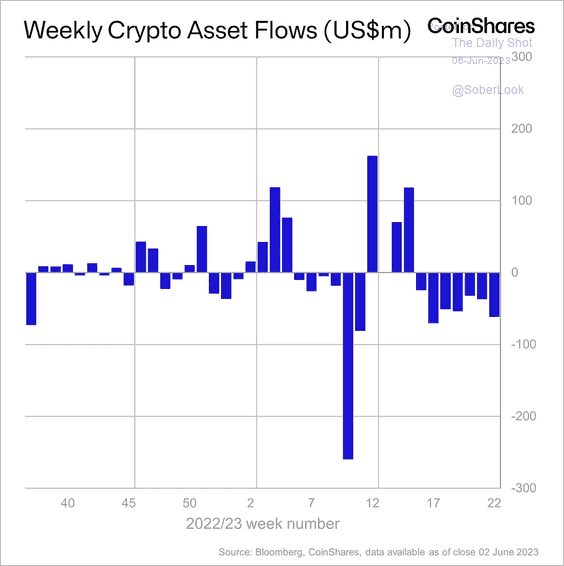

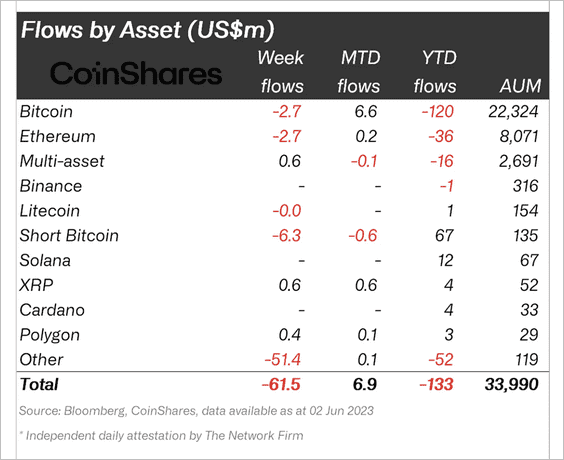

3. Crypto funds saw the seventh-straight week of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Funds that focus on Tron, a smart contract platform, saw most outflows totaling $51 million last week. Short-bitcoin focused funds also saw notable outflows, suggesting neutral sentiment among investors.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Energy

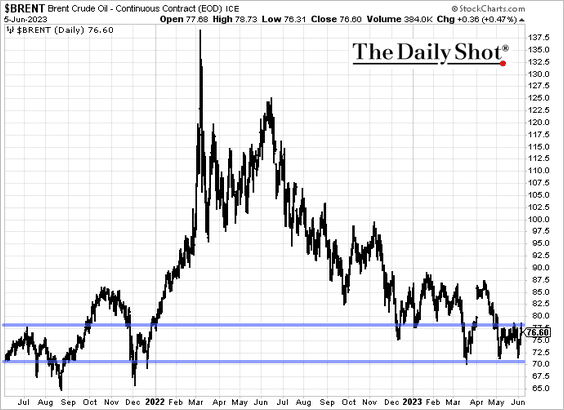

1. Despite OPEC production cuts, Brent crude remains range-bound.

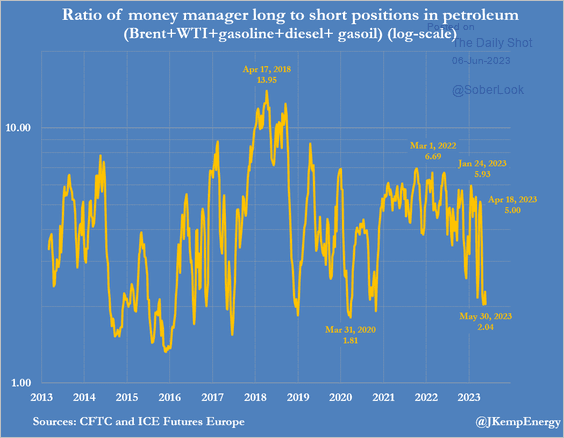

2. Money managers remain cautious on crude oil and refined products.

Source: @JKempEnergy

Source: @JKempEnergy

Back to Index

Equities

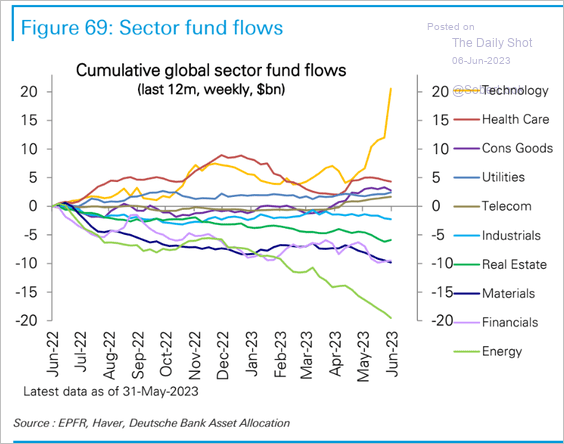

1. Let’s start with this remarkable chart of sector fund flows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

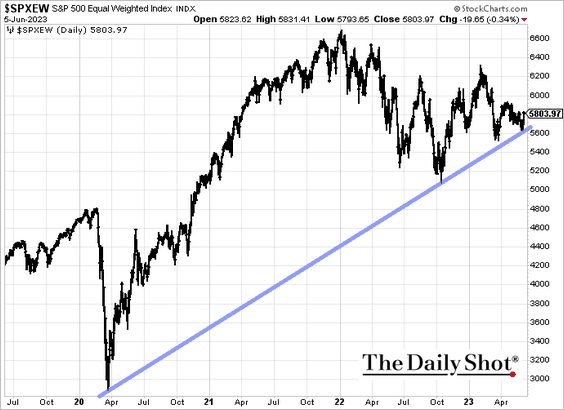

2. The S&P 500 equal-weighted index held the uptrend support.

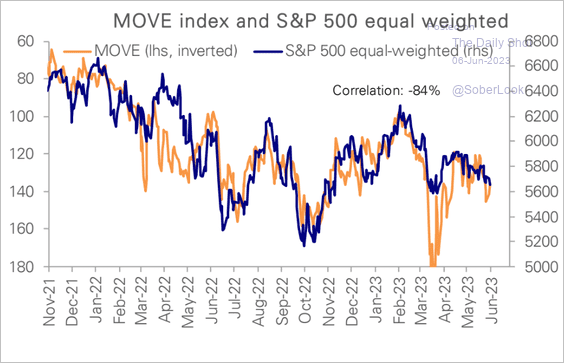

• The equal-weighted index is inversely correlated to Treasuries’ implied volatility index (MOVE).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

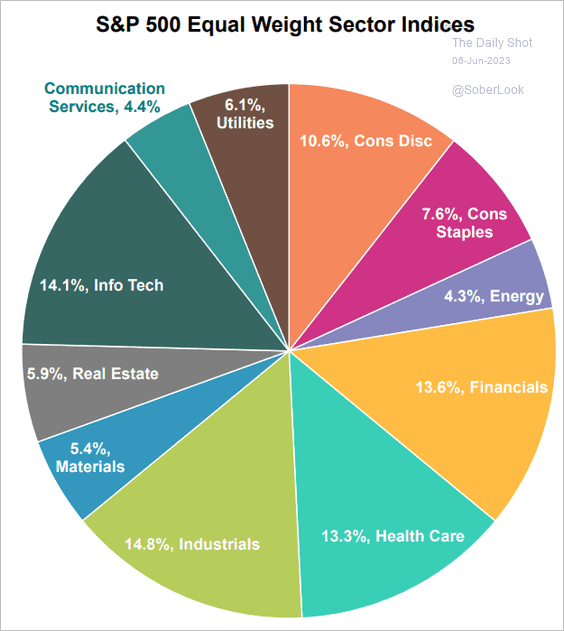

• What are the sector weights of the equal-weighted index?

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

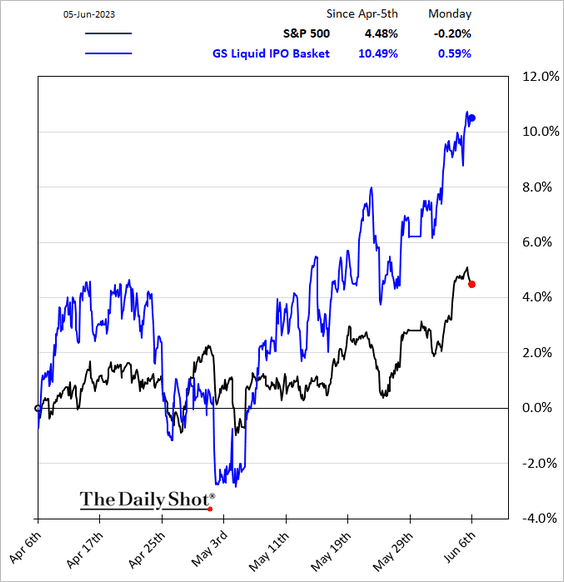

3. Post-IPO stocks have been outperforming.

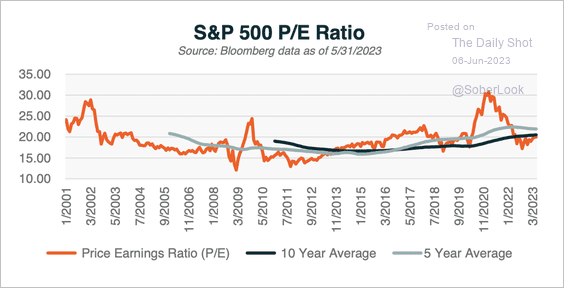

4. S&P 500’s price/earnings ratio has fallen toward its 10-year average.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

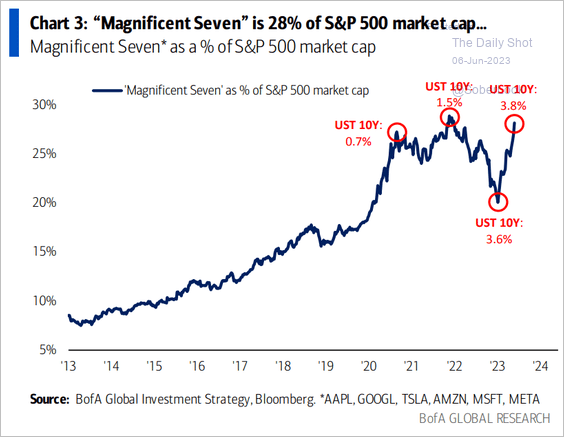

5. The high relative market value of tech mega-caps looks stretched, given the level of Treasury yields.

Source: BofA Global Research

Source: BofA Global Research

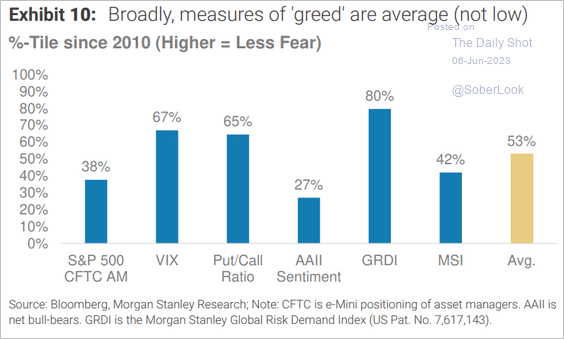

6. Here is a look at market fear indicators.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

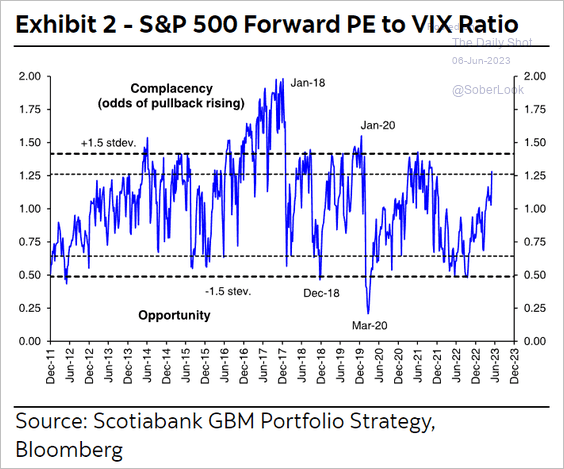

7. The S&P 500 forward PE to VIX ratio signals a growing pullback risk.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

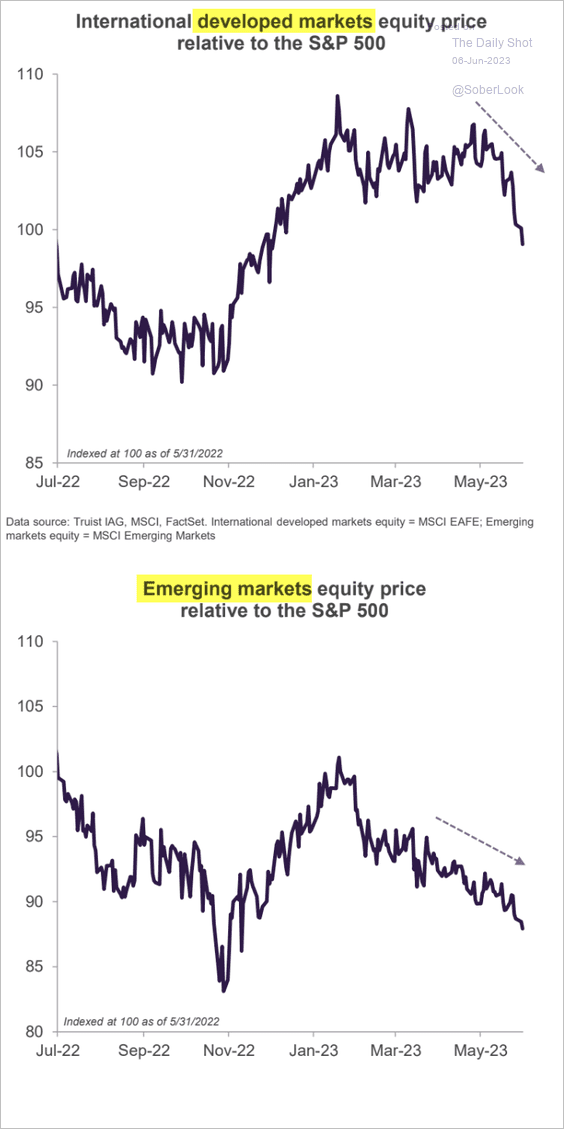

8. International markets have been underperforming the S&P 500.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Credit

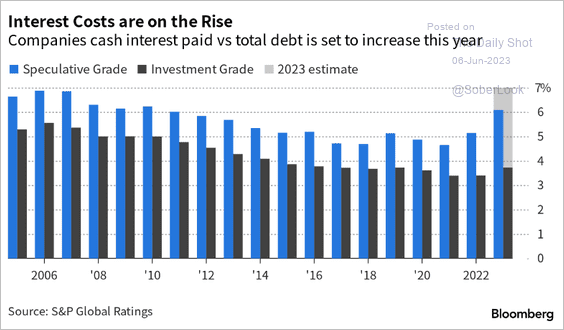

1. The debt costs of sub-investment-grade firms have soared to their highest level since 2010.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

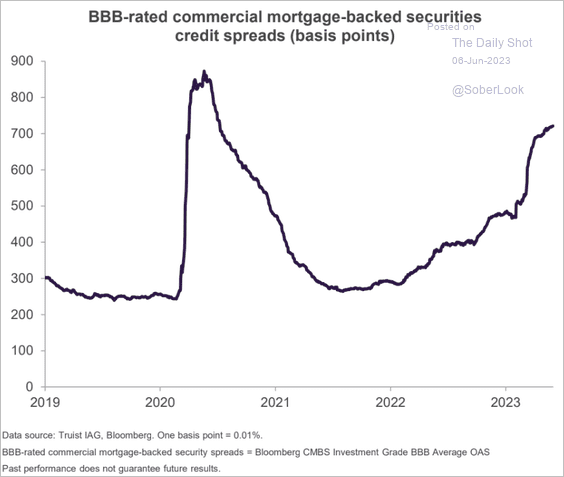

2. CMBS spreads remain elevated.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Rates

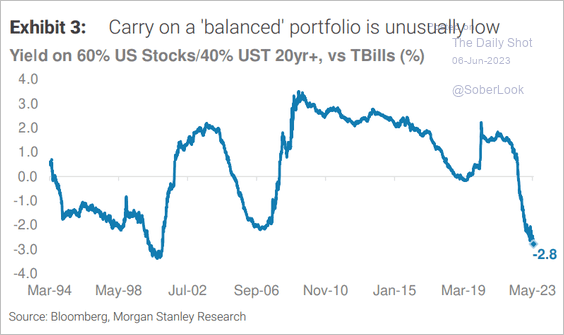

1. The inverted yield curve makes the balanced portfolio carry unattractive relative to T-bills.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

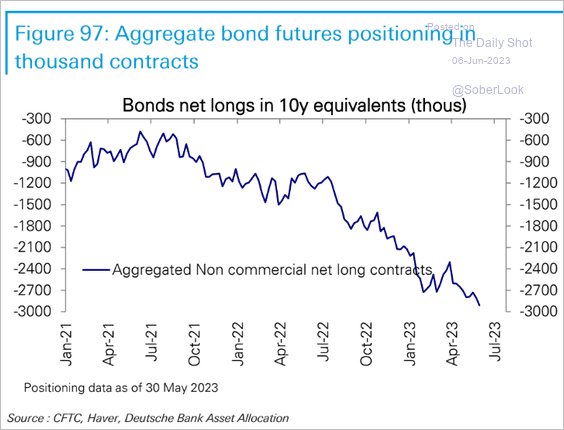

2. Treasury futures aggregate positioning remains exceptionally bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

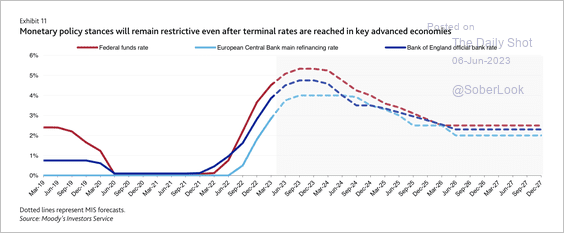

1. Moody’s expects policy rates to remain restrictive in the US, Europe, and the UK for most of next year.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

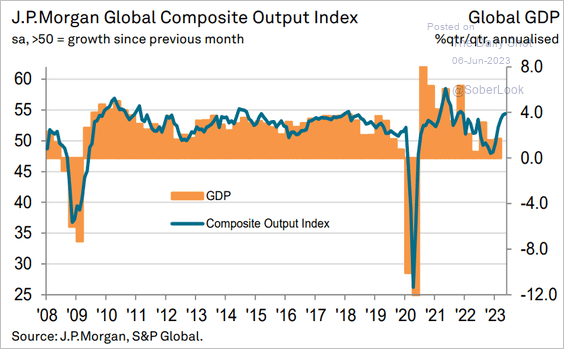

2. The global composite PMI index shows improving economic growth.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

Food for Thought

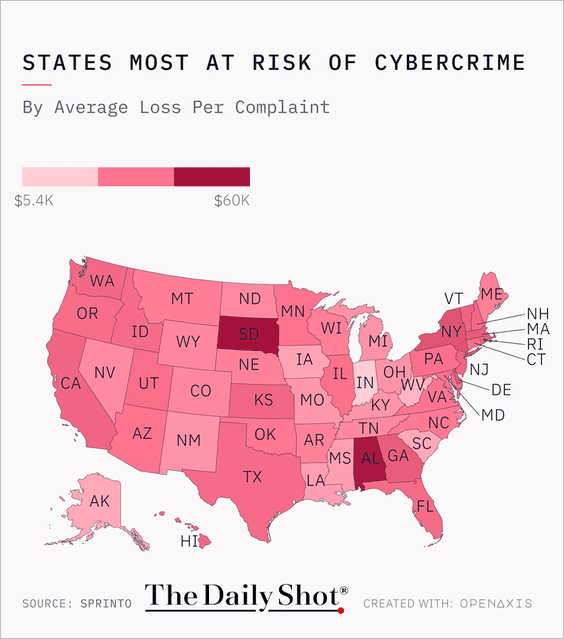

1. States with high cybercrime-related losses:

Source: @TheDailyShot

Source: @TheDailyShot

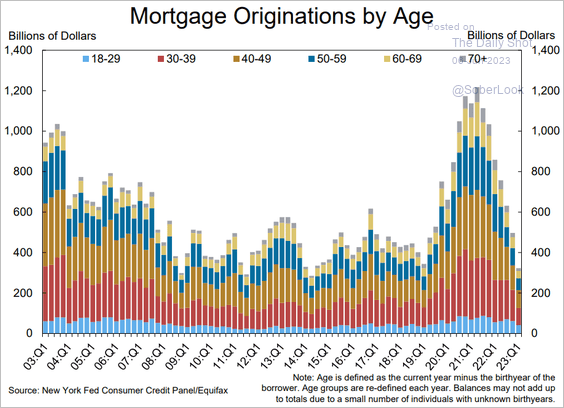

2. US mortgage originations by age:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

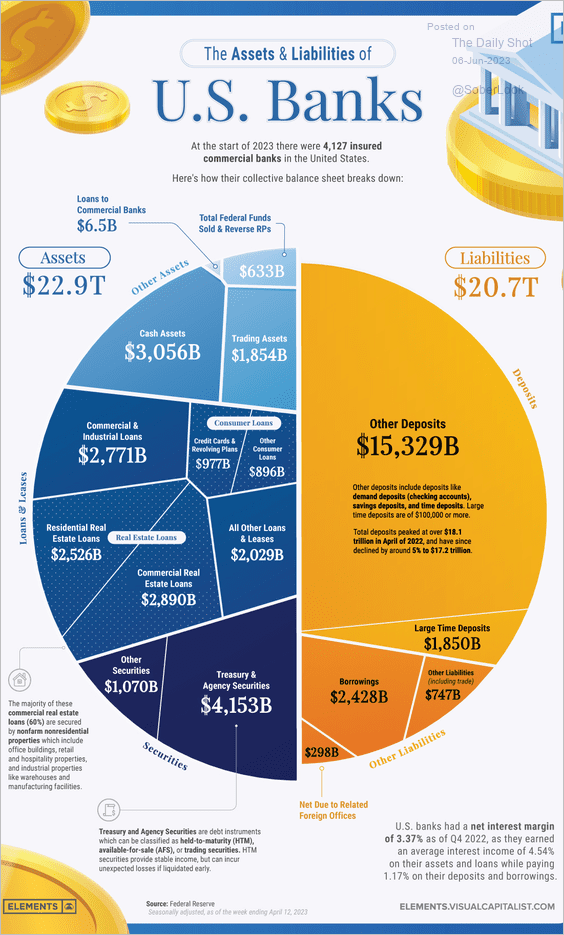

3. US banks’ assets and liabilities:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

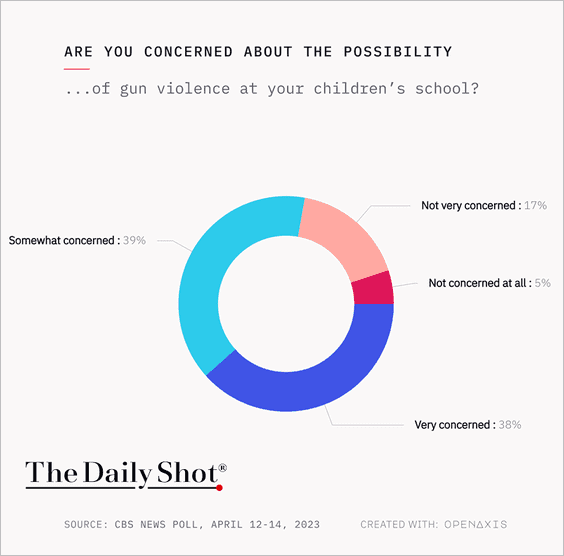

4. Concerns about gun violence at school:

Source: @TheDailyShot

Source: @TheDailyShot

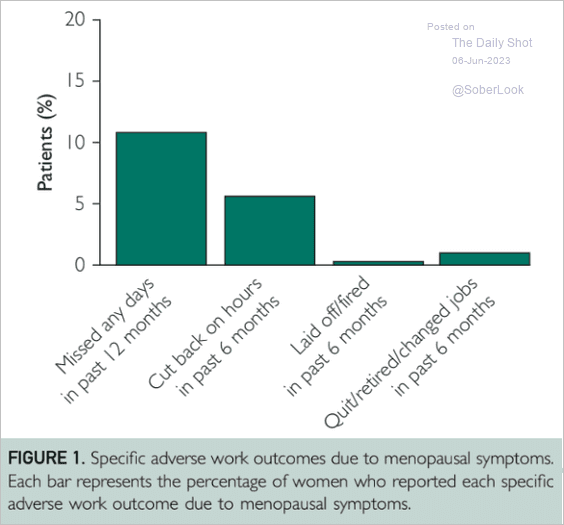

5. Adverse work outcomes due to menopausal symptoms:

Source: Mayo Clinic

Source: Mayo Clinic

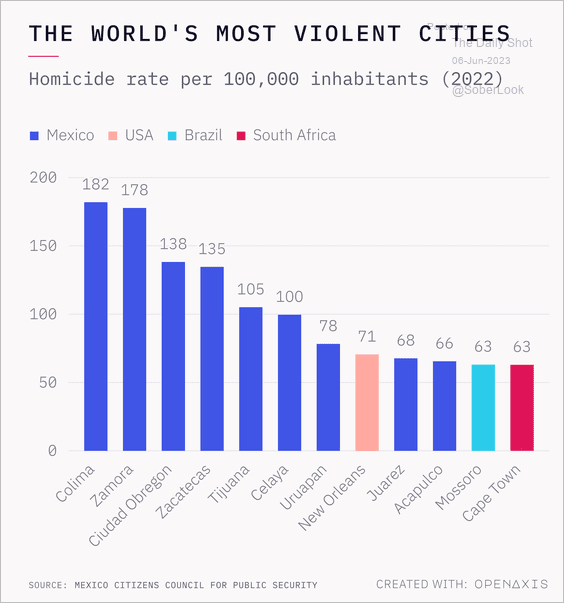

6. The most violent cities:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

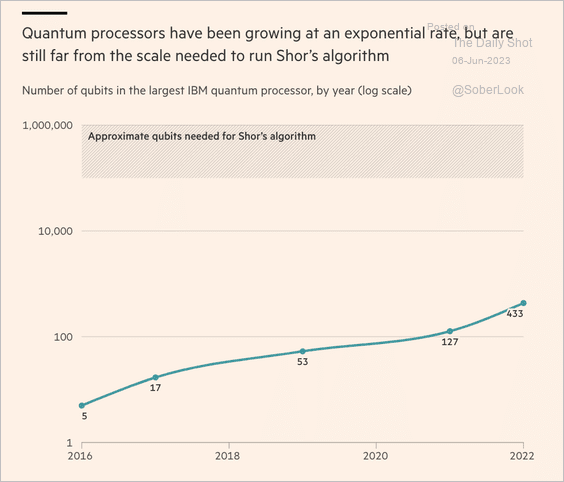

7. Quantum processors:

Source: @financialtimes Read full article Further reading

Source: @financialtimes Read full article Further reading

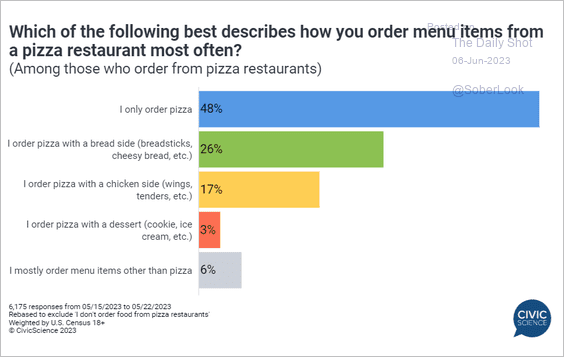

8. Ordering pizza:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index