The Daily Shot: 19-Feb-24

• The United States

• The United Kingdom

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

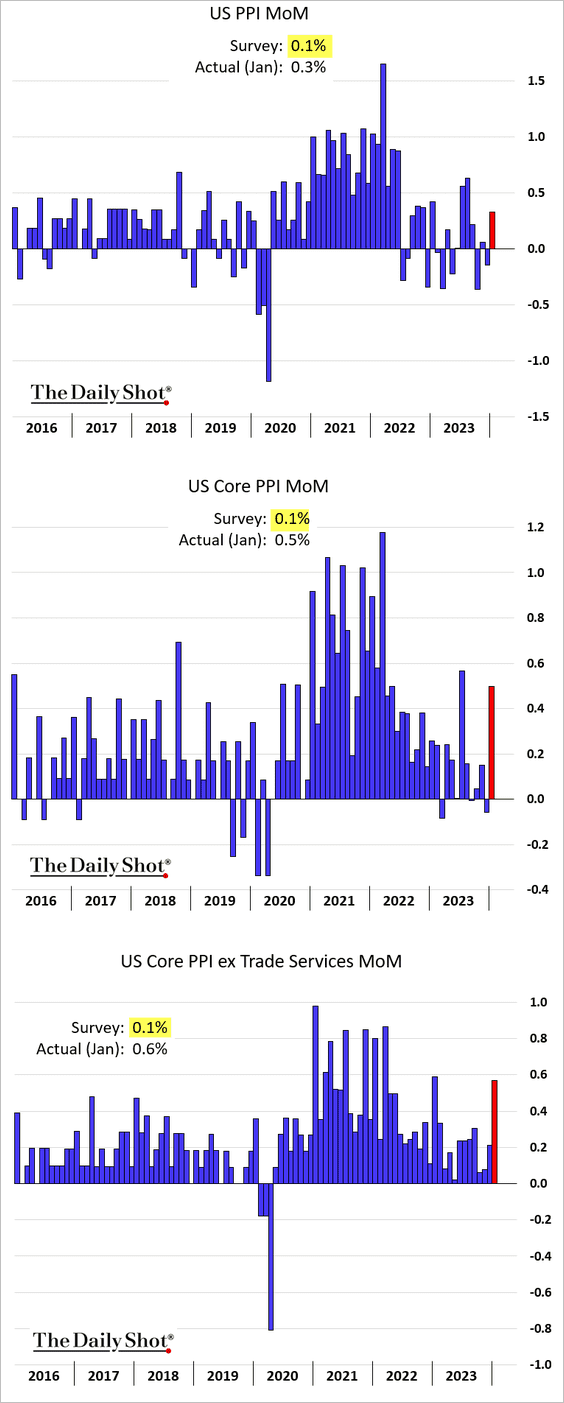

1. The January report on producer prices surpassed expectations, …

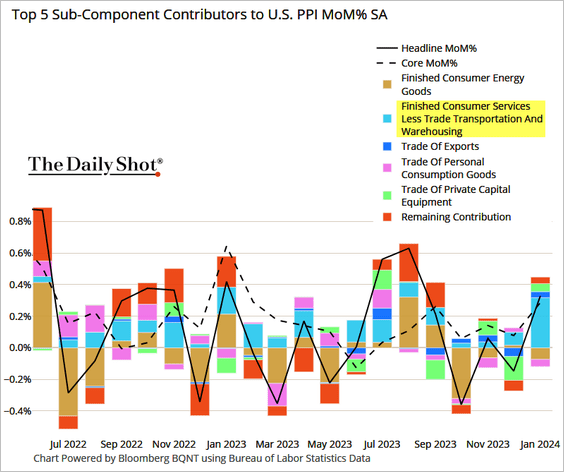

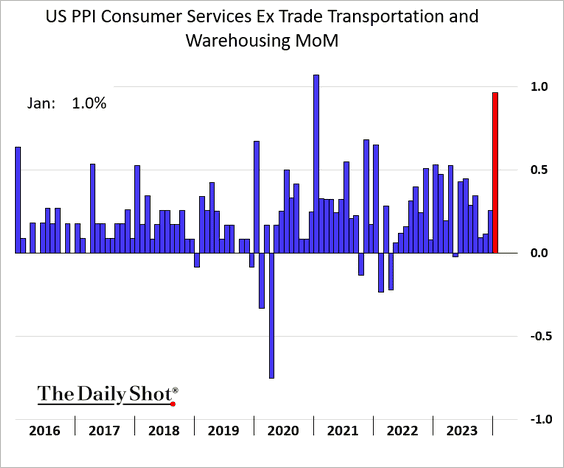

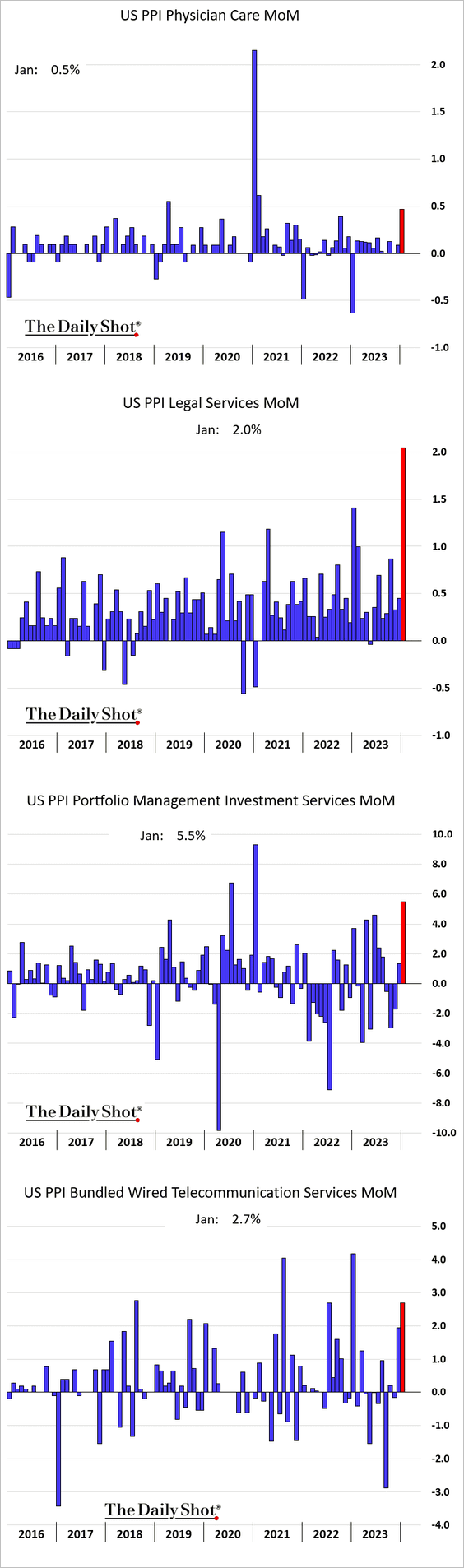

… with the increase fueled by consumer-facing services sectors (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Reuters Read full article

Source: Reuters Read full article

Here are some examples.

——————–

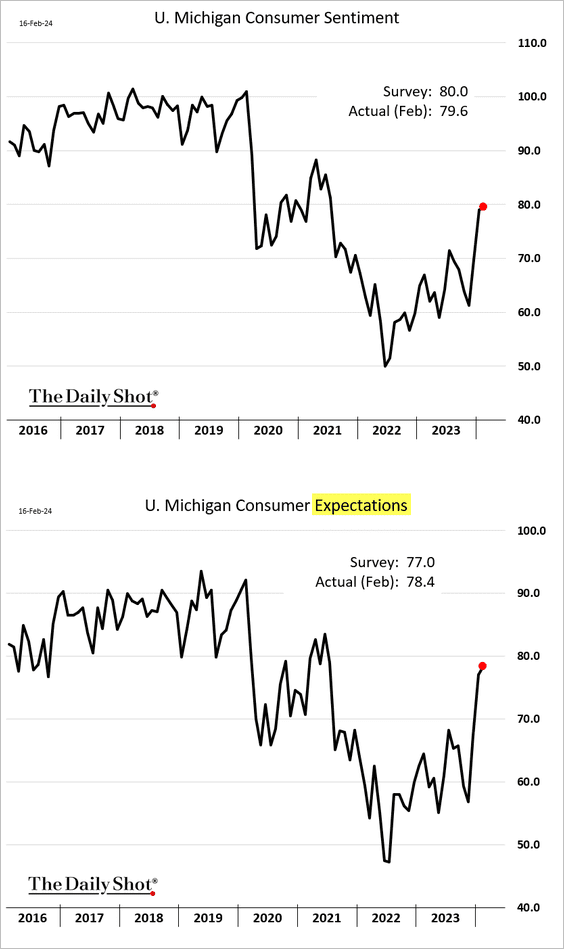

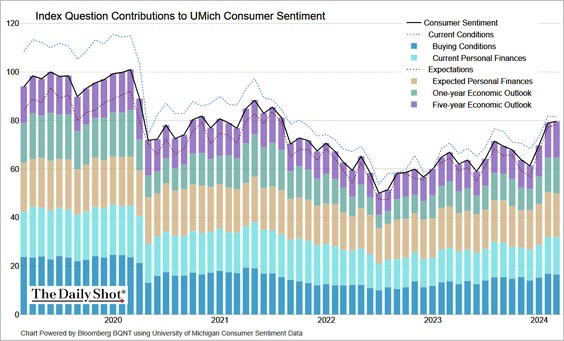

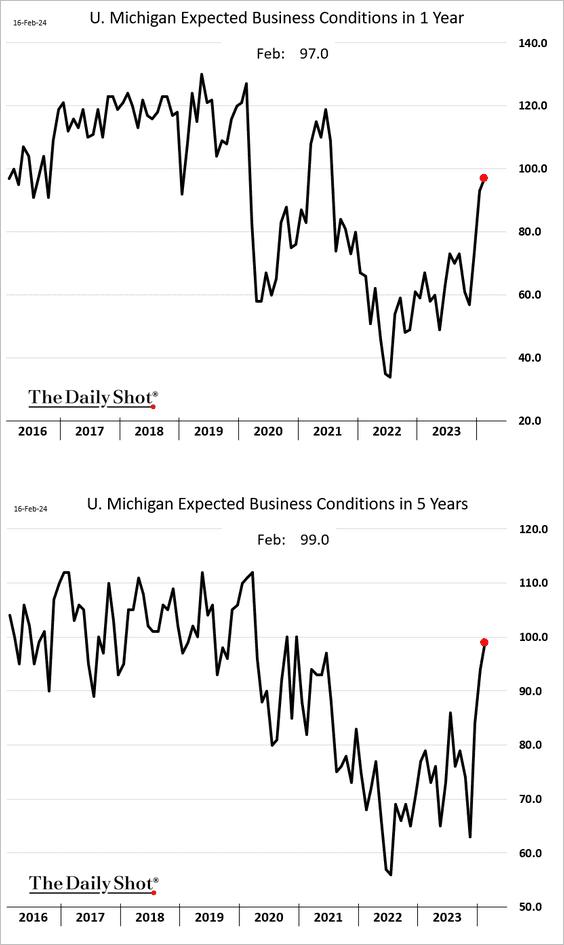

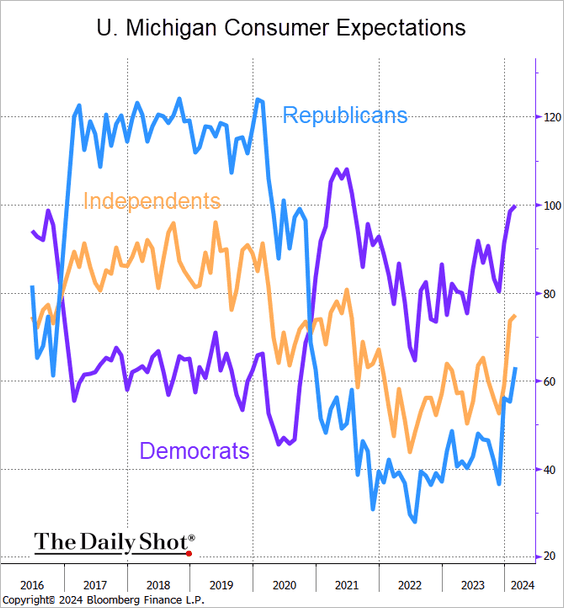

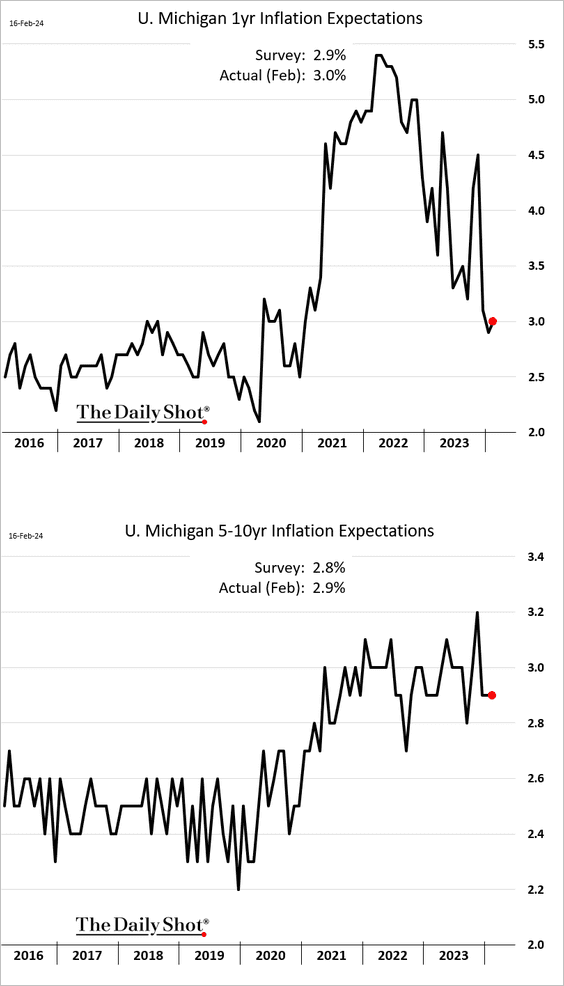

2. The U. Michigan’s consumer sentiment index edged higher, driven by another increase in the expectations component.

Here are some underlying trends.

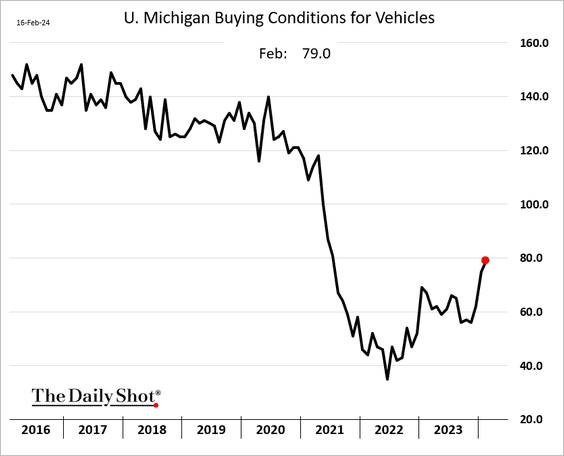

– Buying conditions for vehicles:

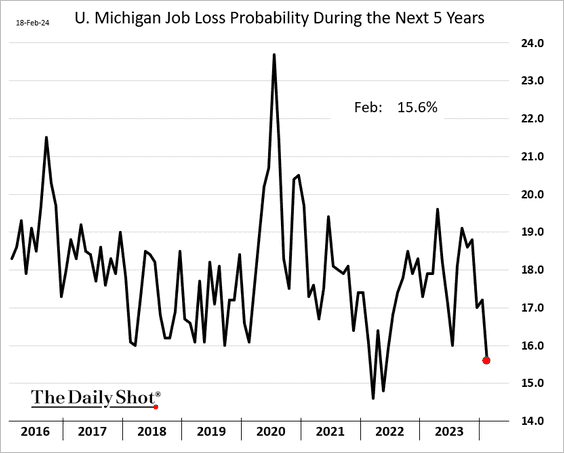

– Longer-term job loss probability:

– Expected business conditions:

– Consumer expectations by political affiliation:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

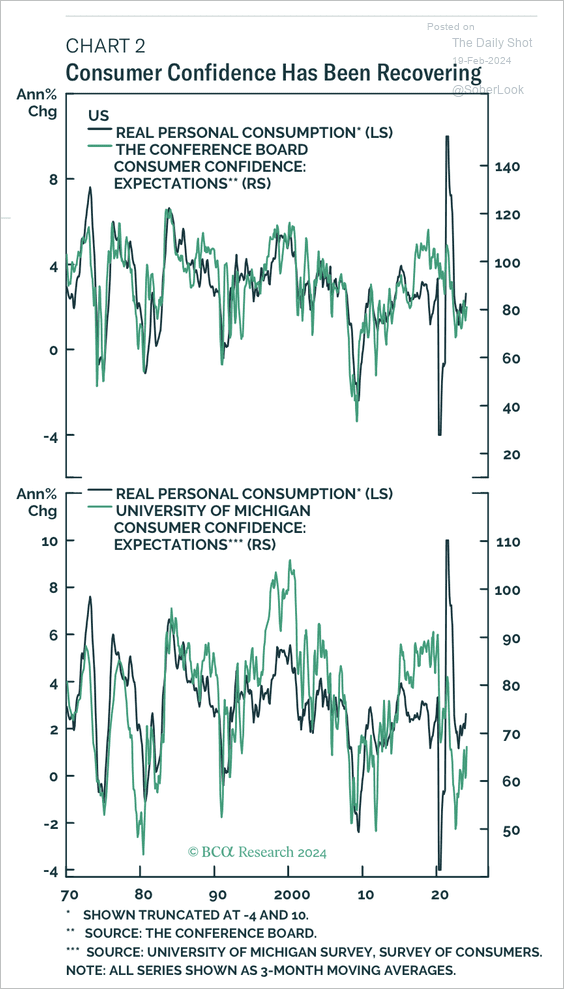

• Will we see stronger consumer spending as sentiment rebounds?

Source: BCA Research

Source: BCA Research

• Short-term inflation expectations ticked higher with gasoline prices.

——————–

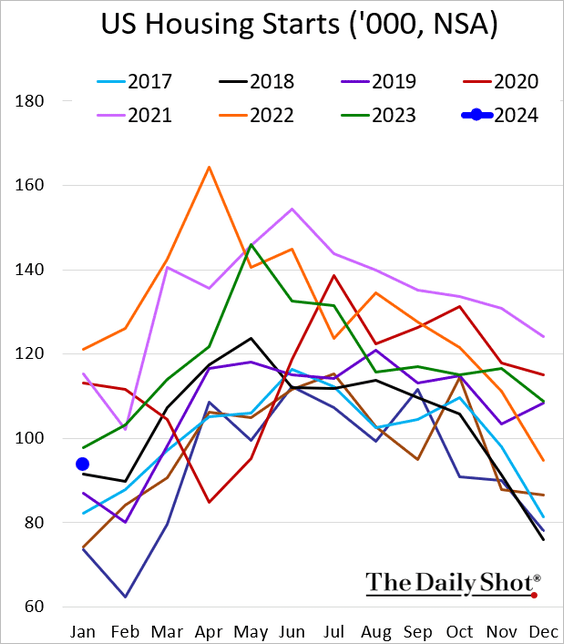

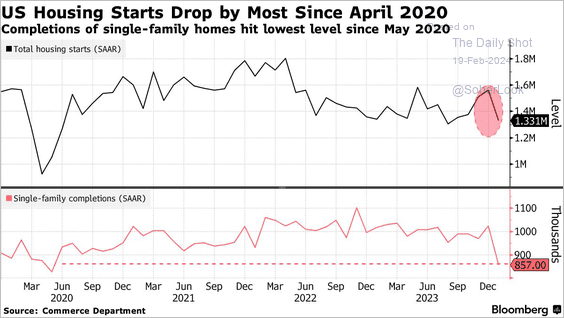

3. Housing starts softened last month, partially due to adverse weather conditions.

Source: Morningstar Read full article

Source: Morningstar Read full article

• Here is the seasonally adjusted index.

Source: @economics Read full article

Source: @economics Read full article

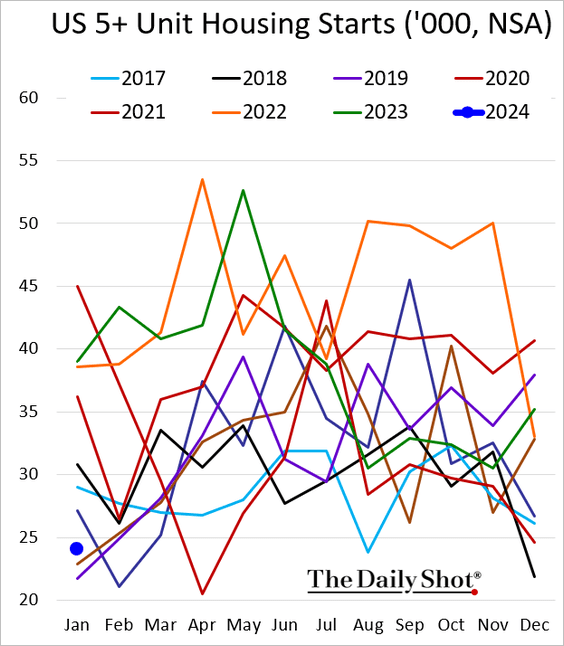

• Multifamily starts were particularly weak.

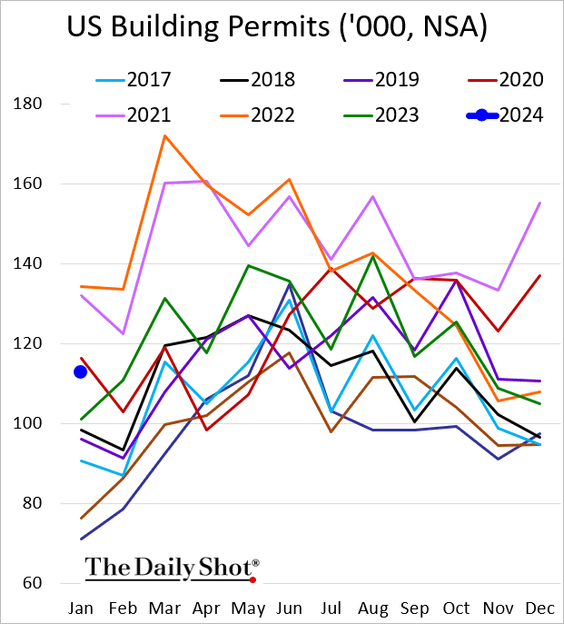

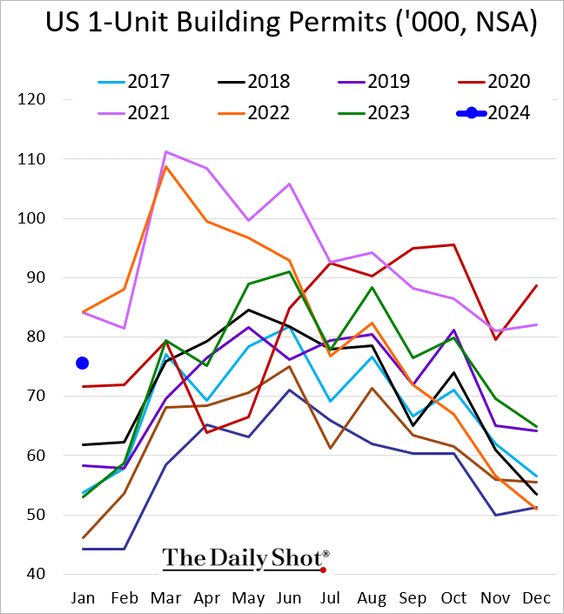

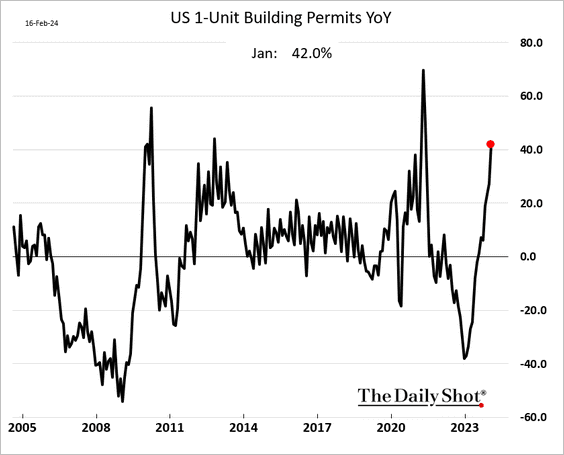

• However, building permits were above last year’s levels, …

… boosted by single-family housing (2 charts).

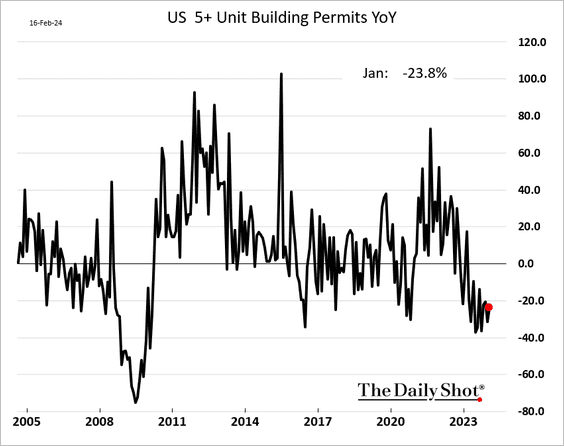

• Multi-family permits remain depressed.

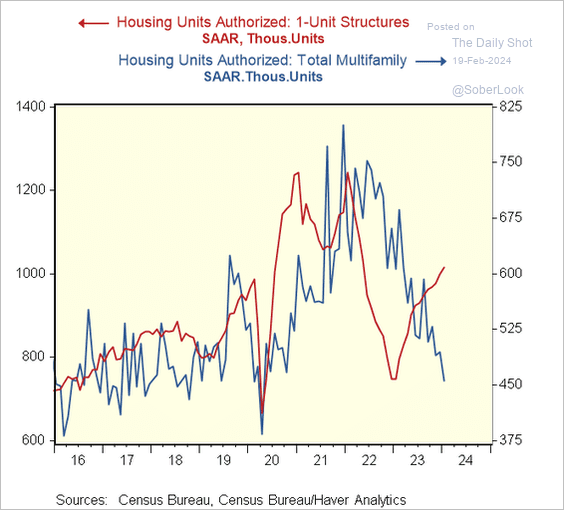

• This chart shows the seasonally adjusted building permit trends.

Source: @RenMacLLC

Source: @RenMacLLC

——————–

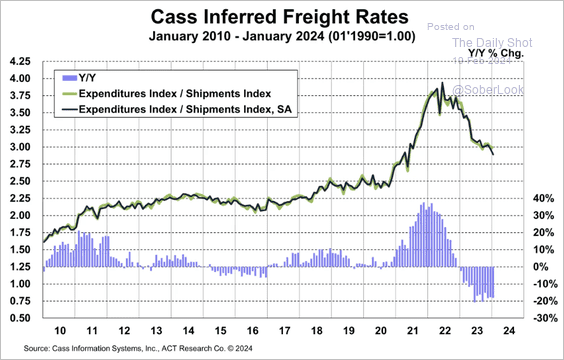

4. Freight rates continue to moderate.

Source: Cass Information Systems

Source: Cass Information Systems

Back to Index

The United Kingdom

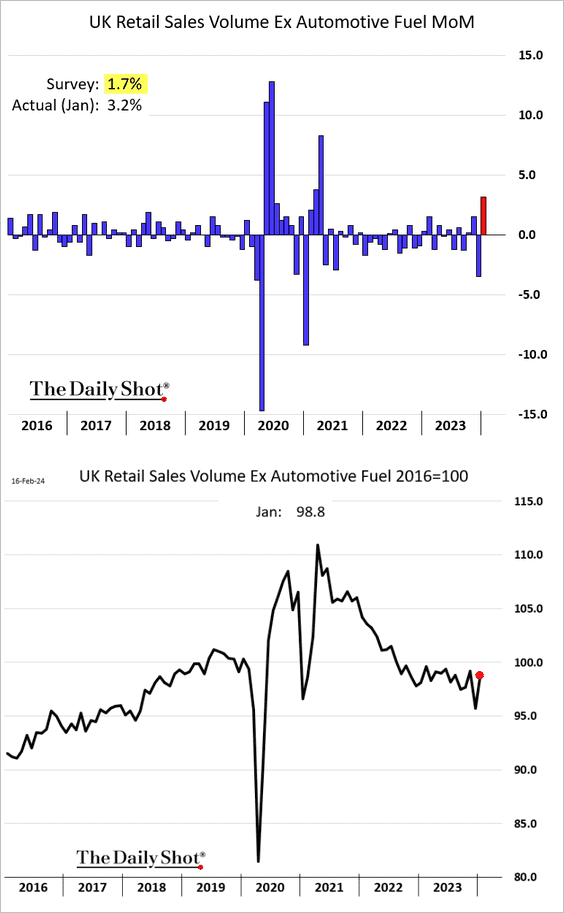

1. Retail sales rebounded last month.

Source: @economics Read full article

Source: @economics Read full article

——————–

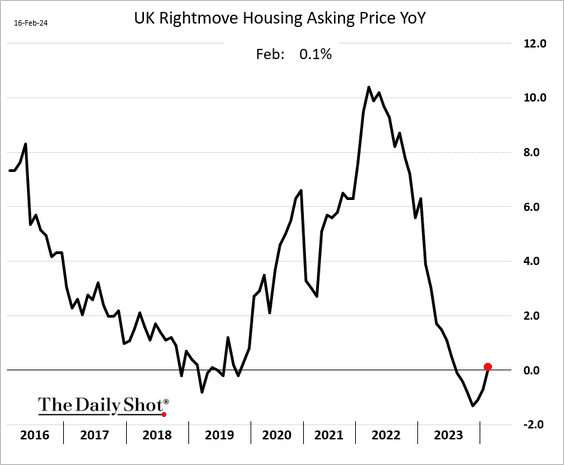

2. Home prices are now rising.

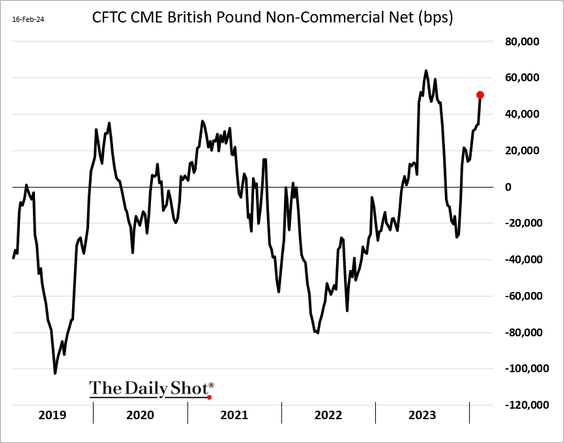

3. Traders are increasingly upbeat on the British pound.

Back to Index

Europe

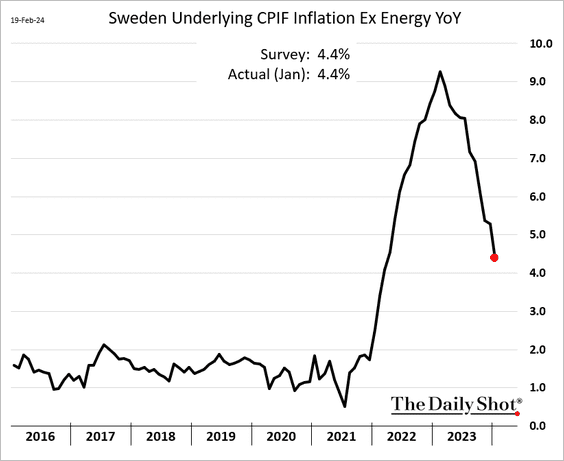

1. Sweden’s core inflation for January matched projections, reflecting an ongoing moderation in the pace of price increases.

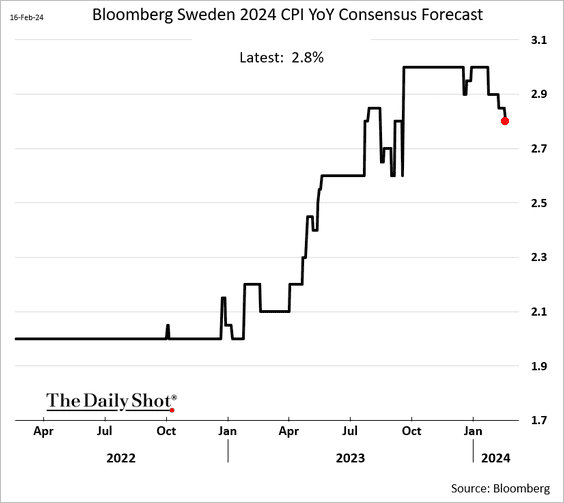

• Economists have been downgrading their forecasts for Sweden’s inflation.

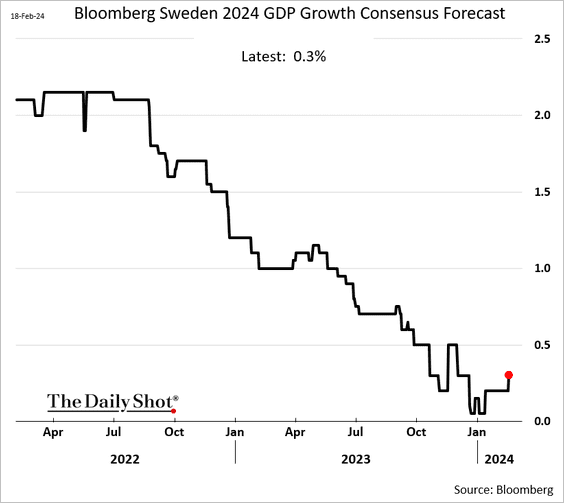

• Projections for Sweden’s economic growth this year have been adjusted upwards, yet the outlook remains subdued.

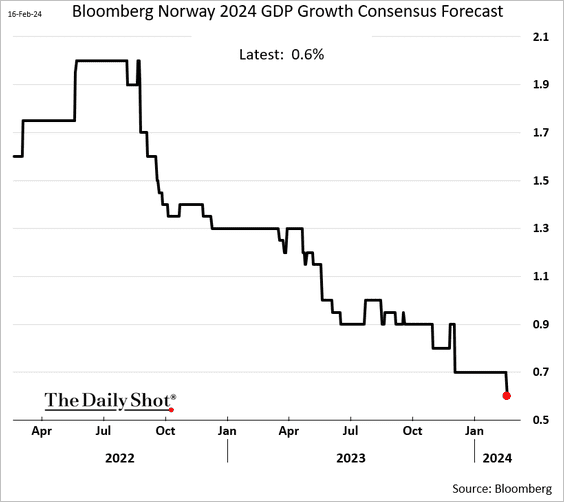

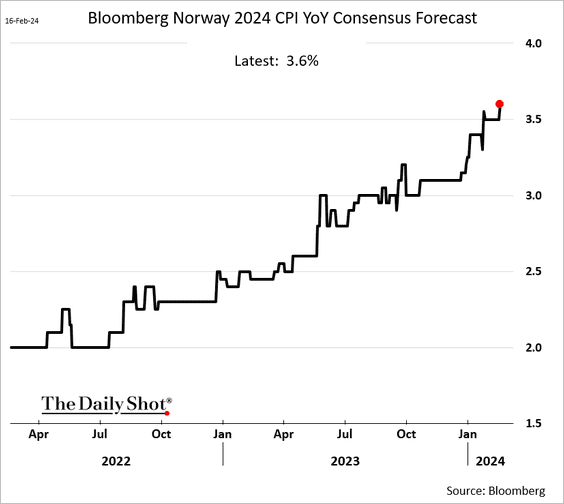

2. Economists continue to downgrade their forecasts for Norway’s growth, …

… while boosting inflation estimates.

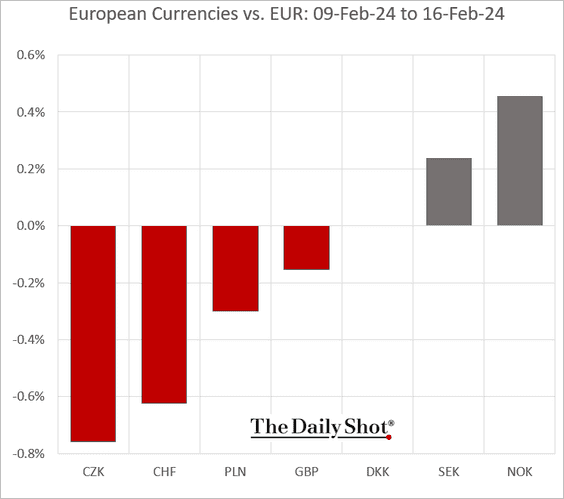

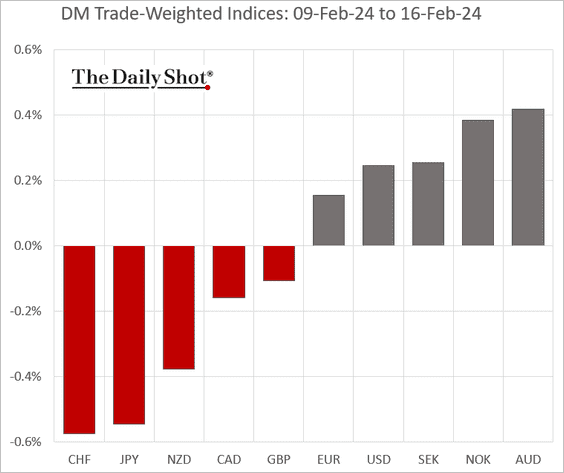

3. The Swedish krona and the Norwegian krone outperformed last week.

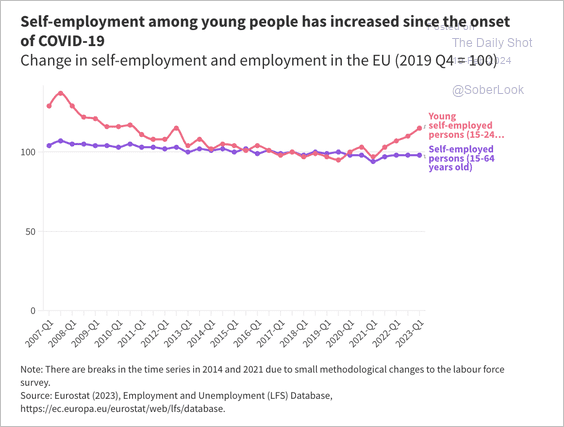

4. Here is a look at self-employment among young people in the EU.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Asia-Pacific

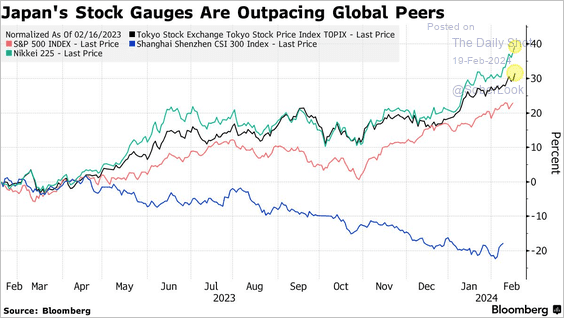

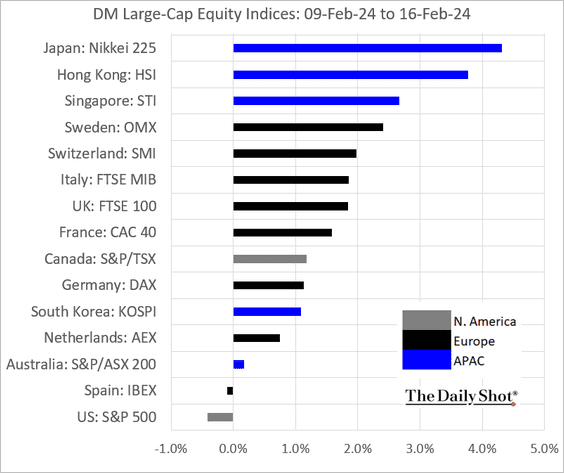

1. Japan’s shares keep outperforming.

Source: @markets Read full article

Source: @markets Read full article

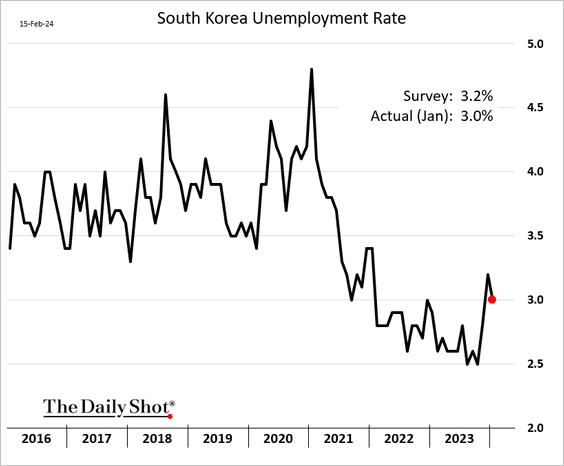

2. South Korea’s unemployment rate is back to 3%.

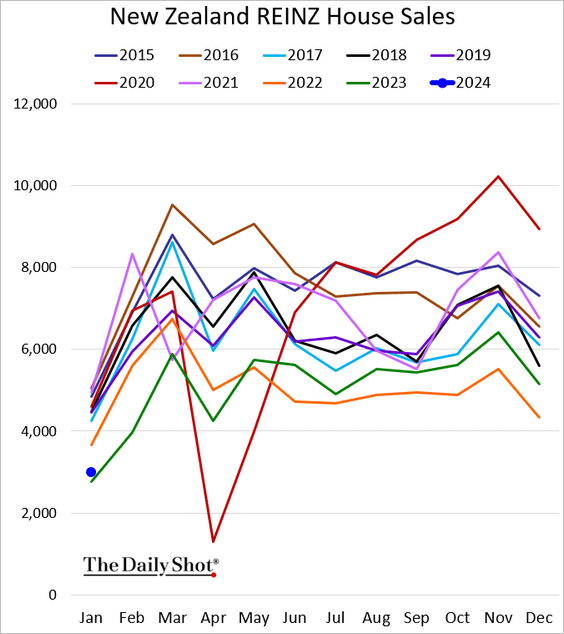

3. New Zealand’s housing sales were slightly above 2023 levels last month.

Back to Index

China

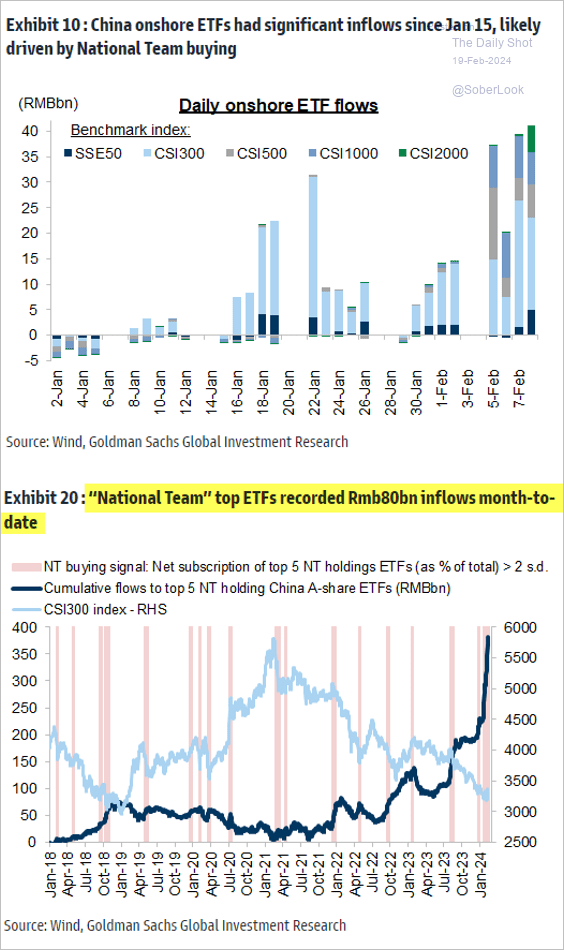

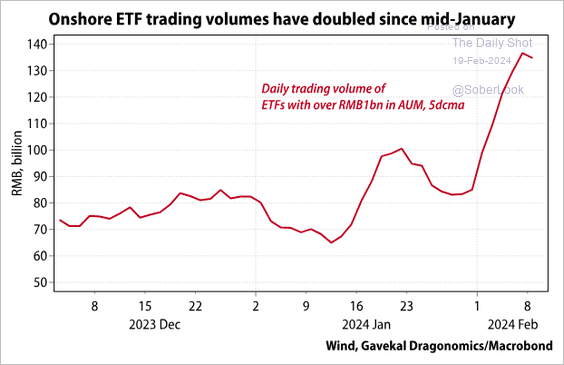

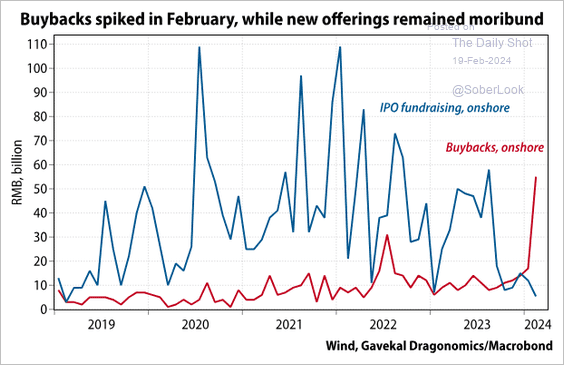

1. State-owned entities continue to bail out the stock market.

– Domestic ETF flows:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

– ETF volumes:

Source: Gavekal Research

Source: Gavekal Research

– Beijing-ordered share buybacks:

Source: Gavekal Research

Source: Gavekal Research

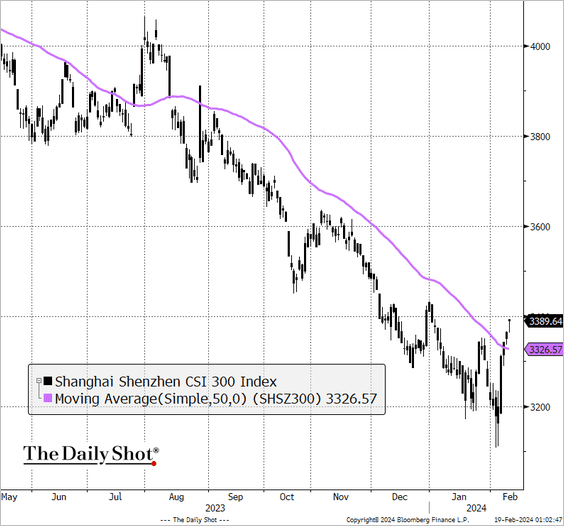

• The benchmark stock index broke above the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

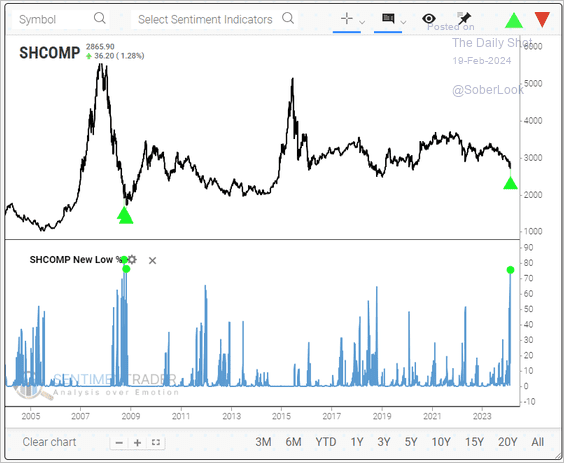

• There was a significant spike in Shanghai Composite stocks making new one-year lows last week, similar to what occurred during the global financial crisis.

Source: SentimenTrader

Source: SentimenTrader

——————–

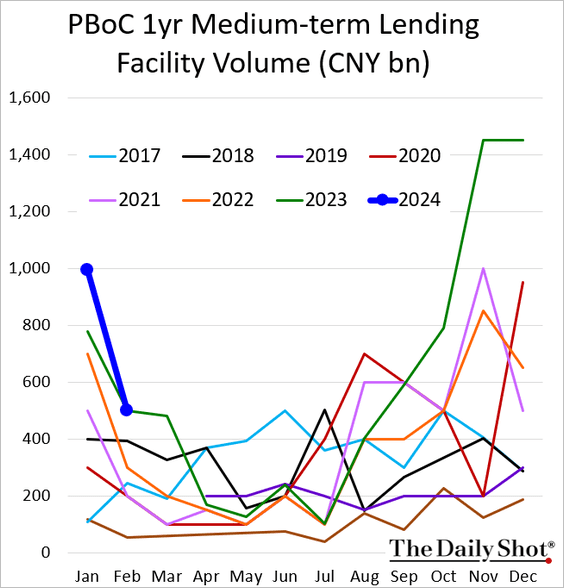

2. The PBoC’s liquidity injection via the medium-term lending facilities was modest.

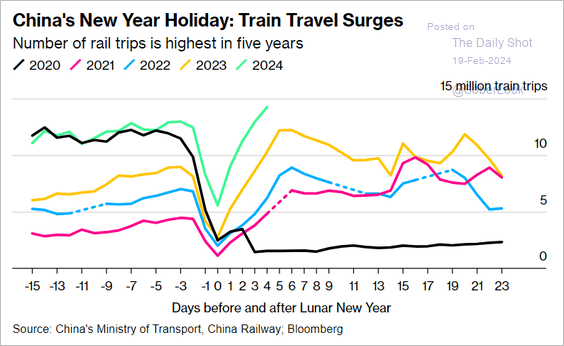

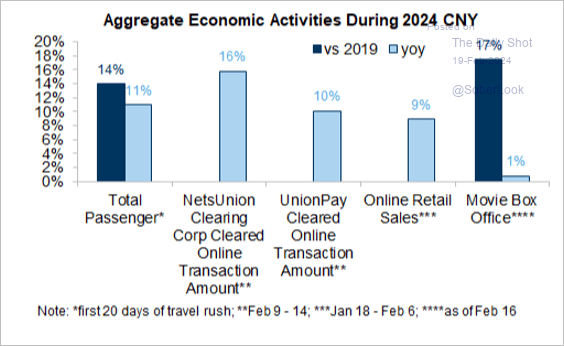

3. Holiday travel and spending has been strong (2 charts).

Source: @economics Read full article

Source: @economics Read full article

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Emerging Markets

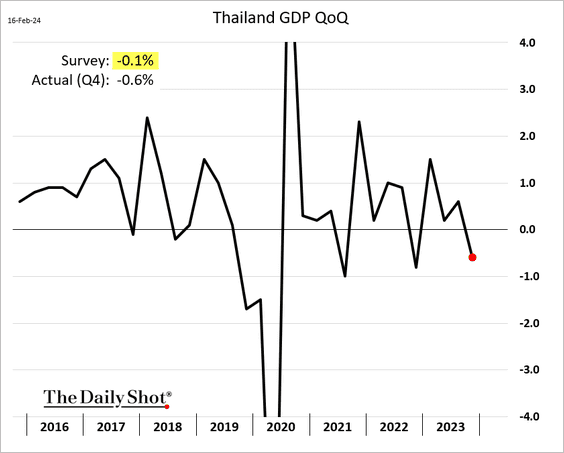

1. Thailand’s economy ended last year on a soft note.

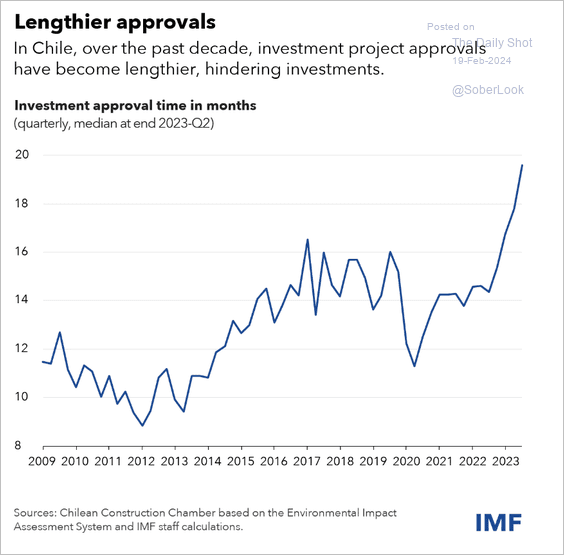

2. Chile’s investment project approvals are taking longer, capping economic growth.

Source: IMF Read full article

Source: IMF Read full article

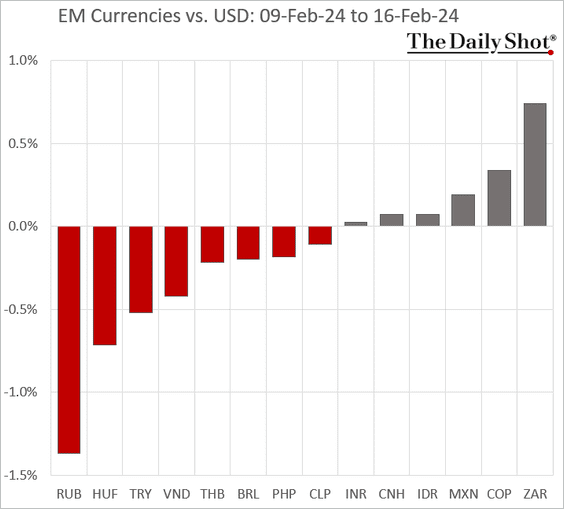

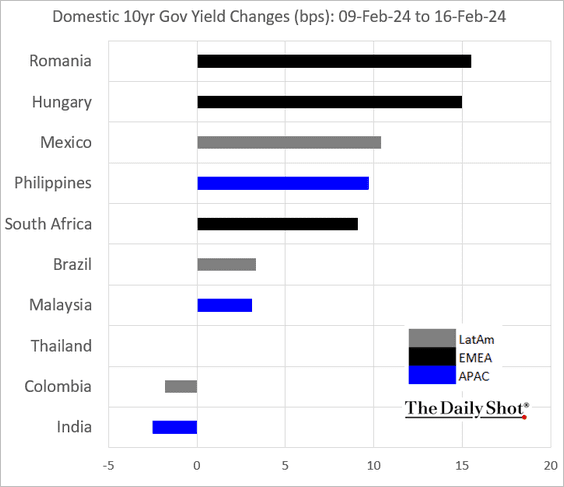

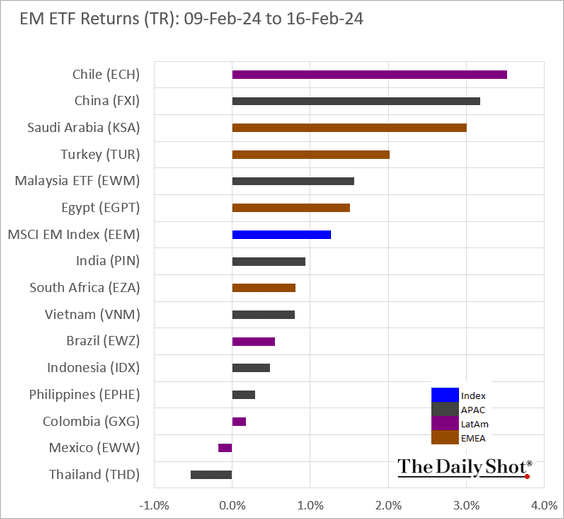

3. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

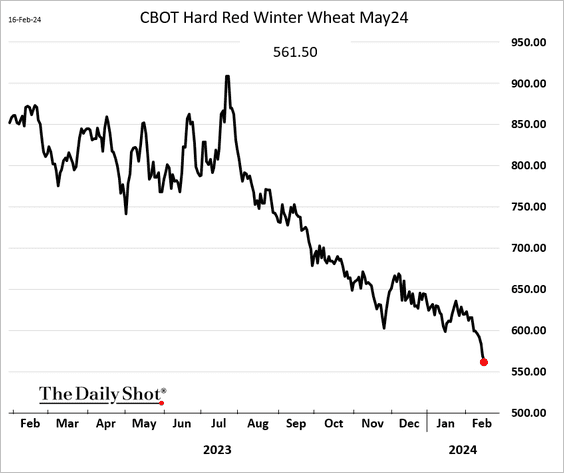

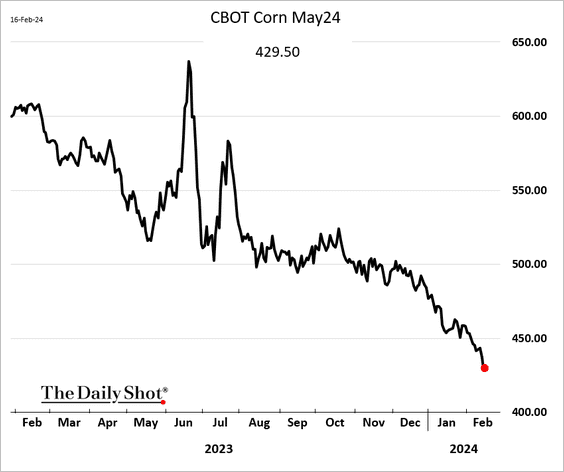

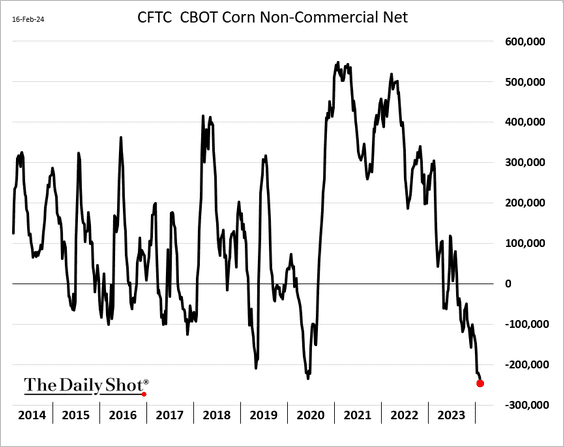

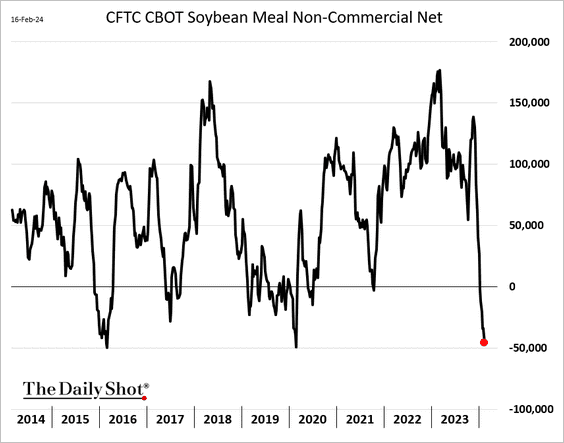

Commodities

1. Grains continue to struggle (2 charts), …

… with sentiment remaining depressed (2 charts).

——————–

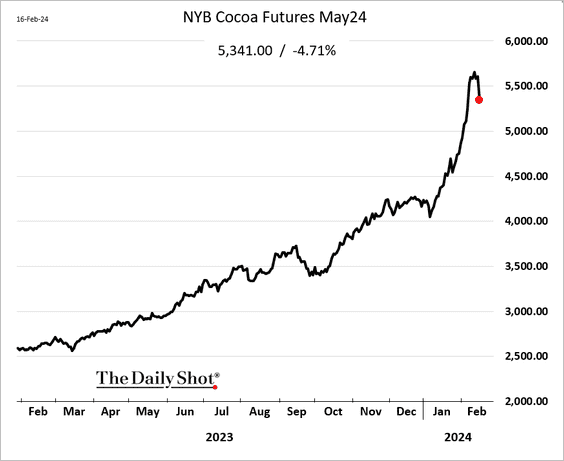

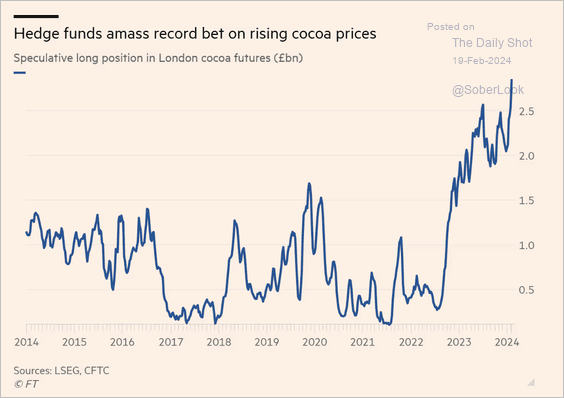

2. The cocoa rally is fading, …

… amid overextended positioning.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

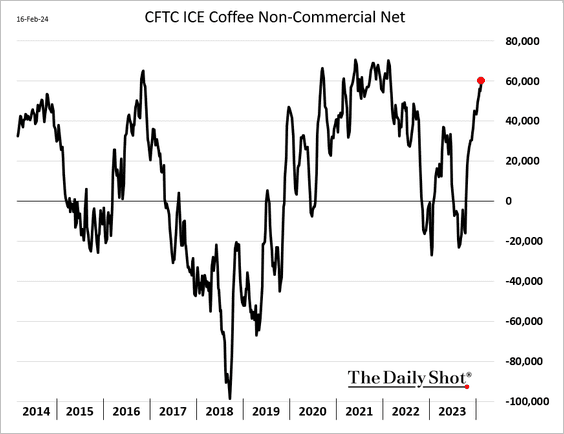

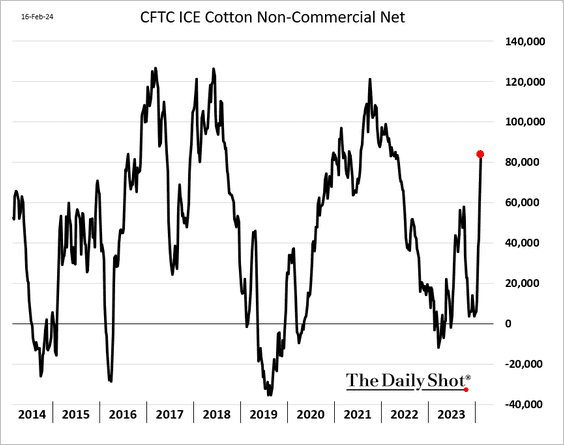

3. Traders are boosting their bets on coffee and cotton.

——————–

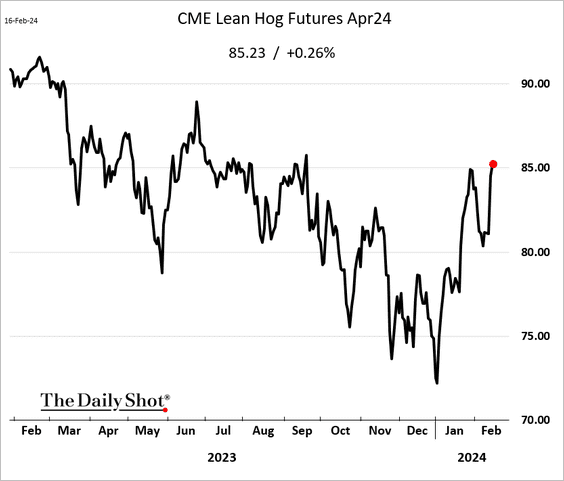

4. Chicago hog futures are rebounding.

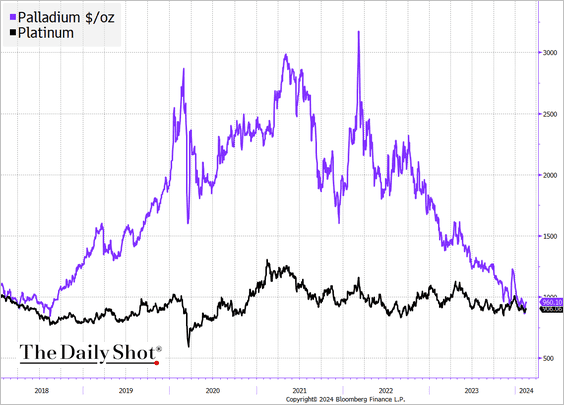

5. Palladium’s premium over platinum has closed, …

Further reading

Further reading

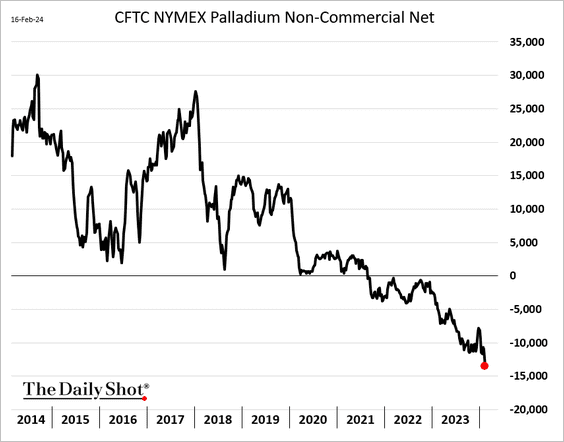

… with positioning becoming increasingly bearish.

——————–

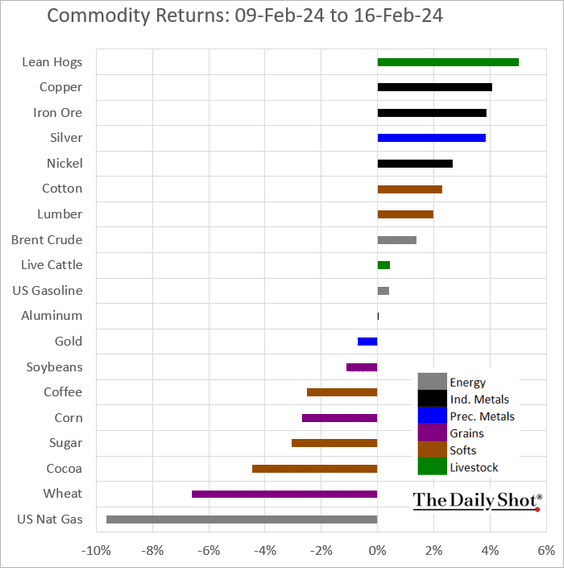

6. Here is a look at last week’s performance.

Back to Index

Energy

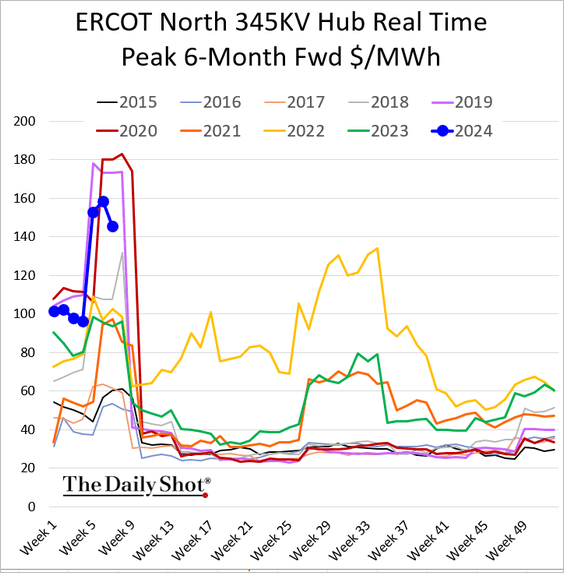

1. Texas wholesale forward power prices are well above last year’s levels.

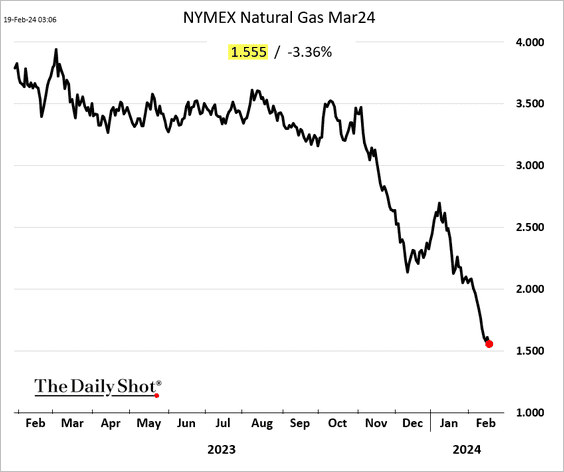

2. Natural gas futures continue to sink.

Back to Index

Equities

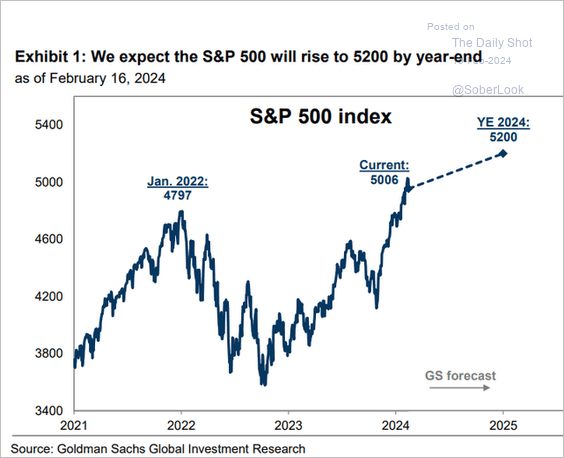

1. Goldman boosted its target for the S&P 500 this year, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Source: @markets Read full article

Source: @markets Read full article

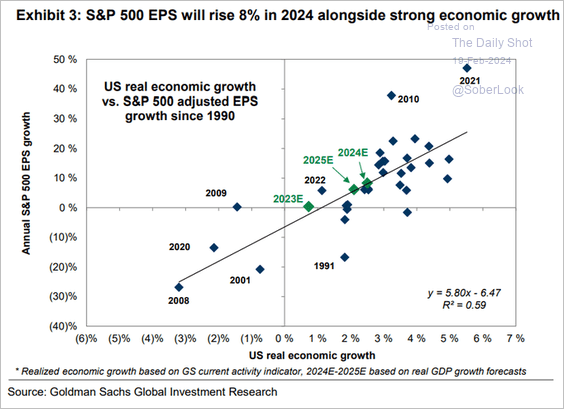

… with robust economic expansion supporting earnings growth.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

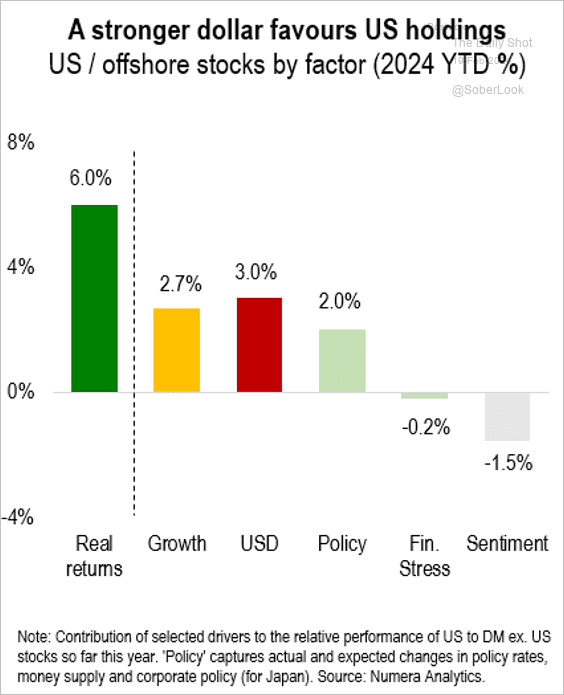

2. The stronger dollar contributed to the outperformance of US equities versus other developed market equities so far this year.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

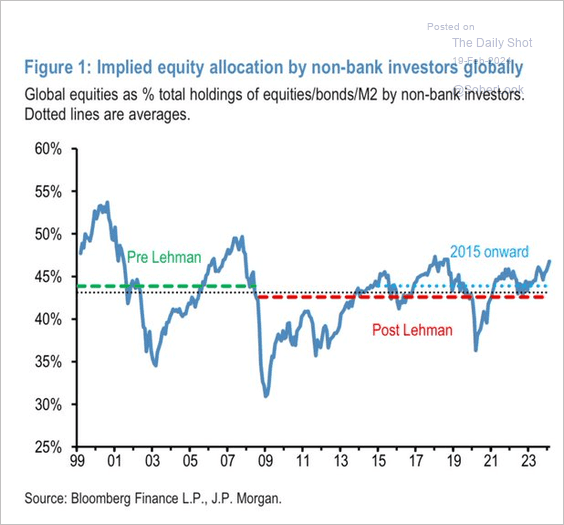

3. Globally, elevated allocations to stocks could limit gains.

Source: JP Morgan Research; @carlquintanilla

Source: JP Morgan Research; @carlquintanilla

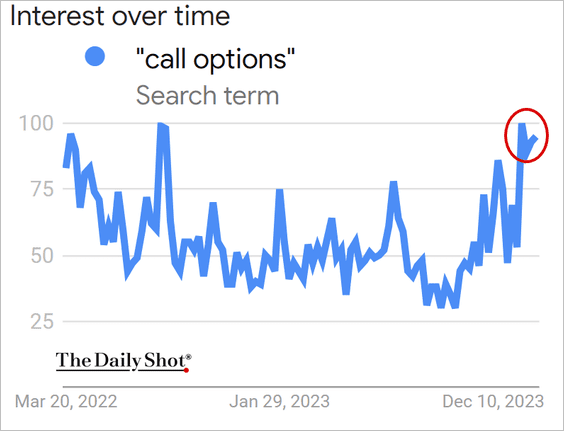

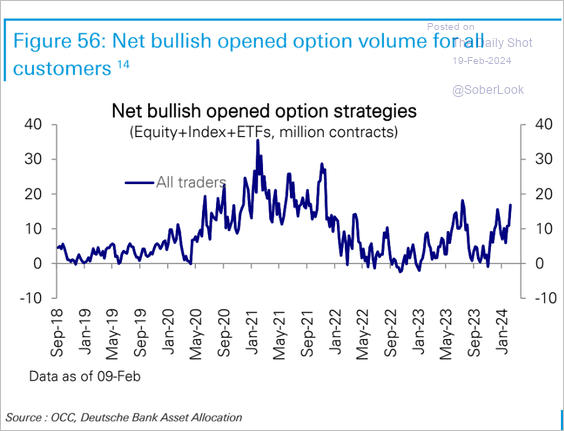

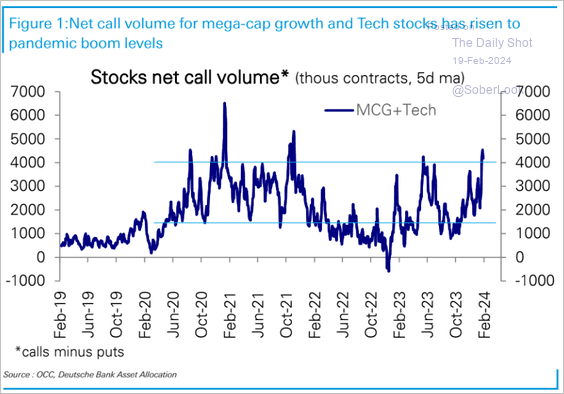

4. Sentiment is increasingly bullish.

• Search activity for “call options”:

Source: Google Trends

Source: Google Trends

• Net call options volume:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– Tech call options volume:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

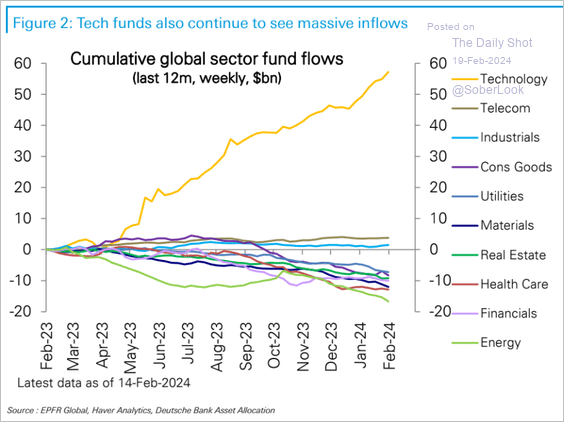

• Tech flows:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

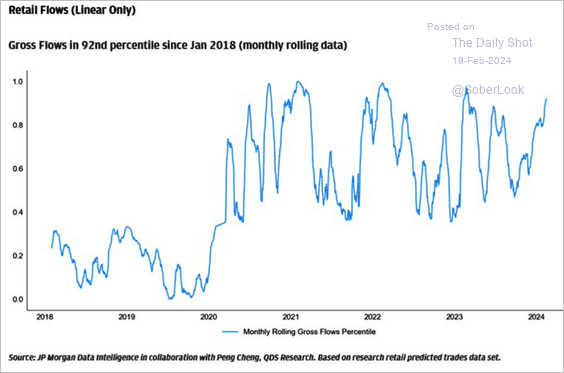

• Retail flows:

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

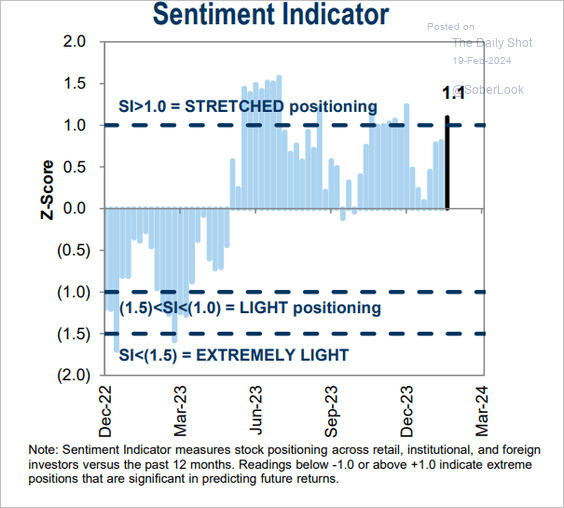

• Goldman’s positioning indicator:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

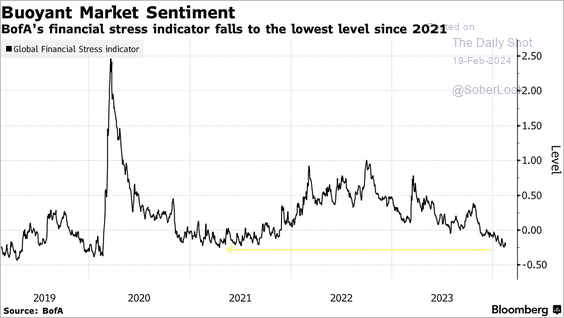

• BofA’s financial stress indicator:

Source: @markets Read full article

Source: @markets Read full article

——————–

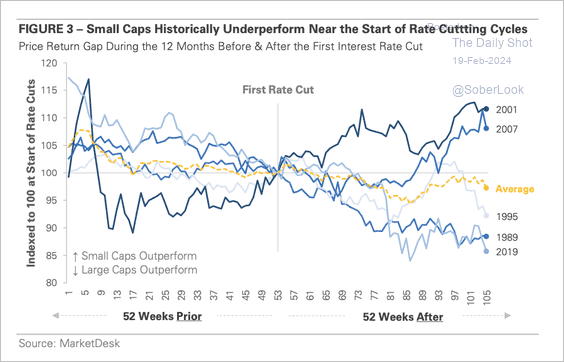

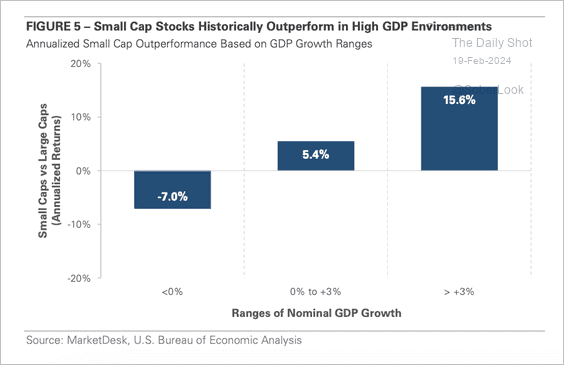

5. US small-caps typically underperform around the start of rate-cut cycles and have better odds of outperformance during high economic growth environments. (2 charts)

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

——————–

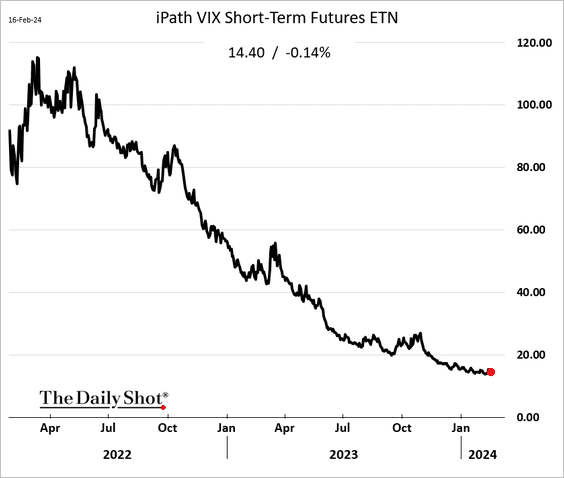

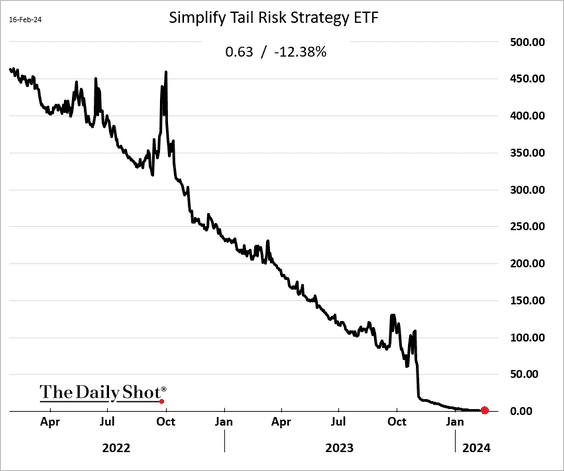

6. Long-vol strategies have been pummelled by theta decay and persistently low volatility (2 charts).

Further reading

Further reading

——————–

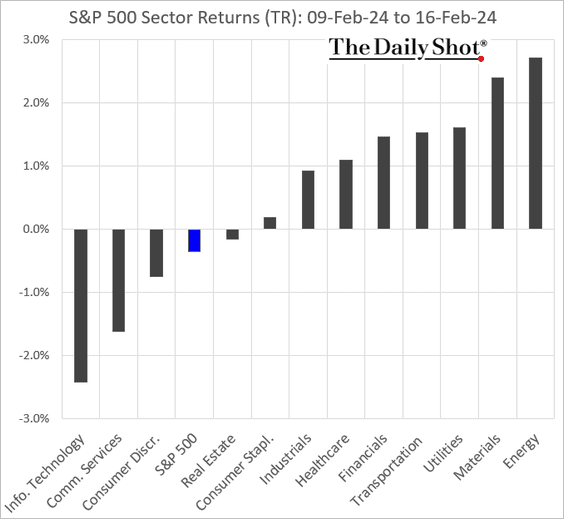

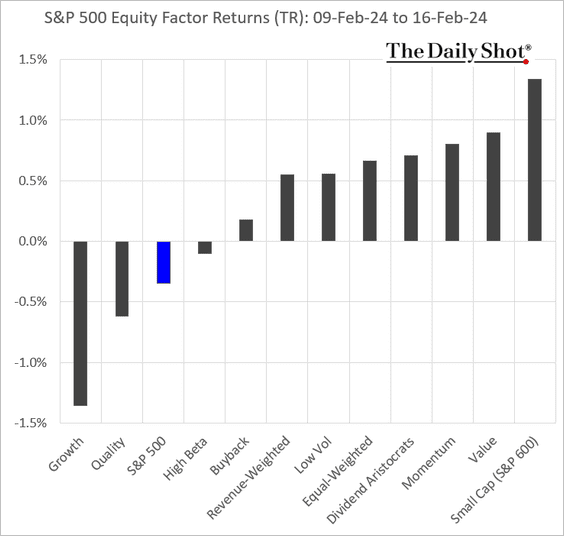

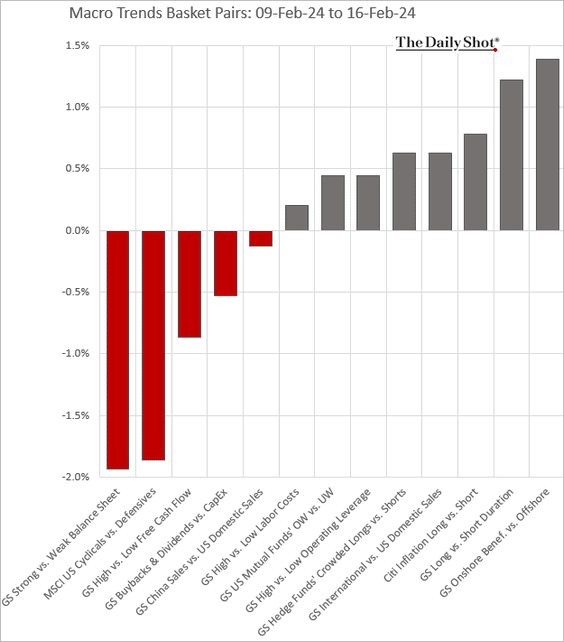

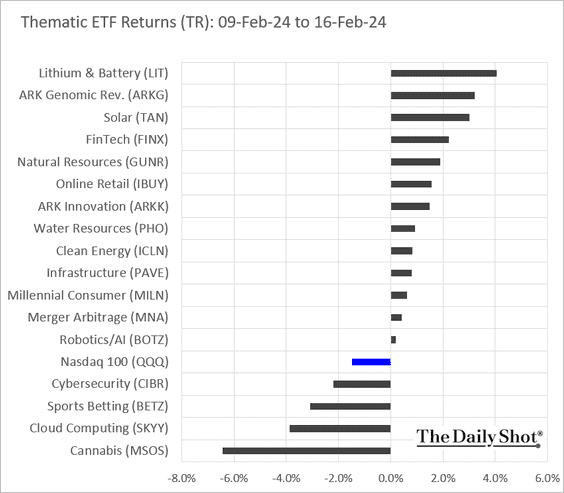

7. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

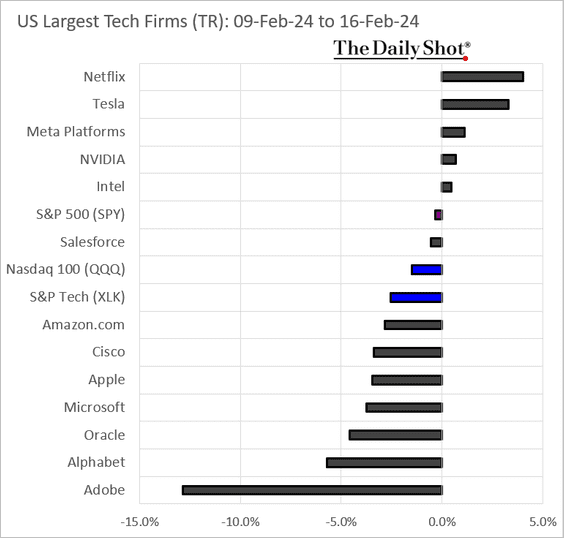

• Largest US tech firms:

Back to Index

Credit

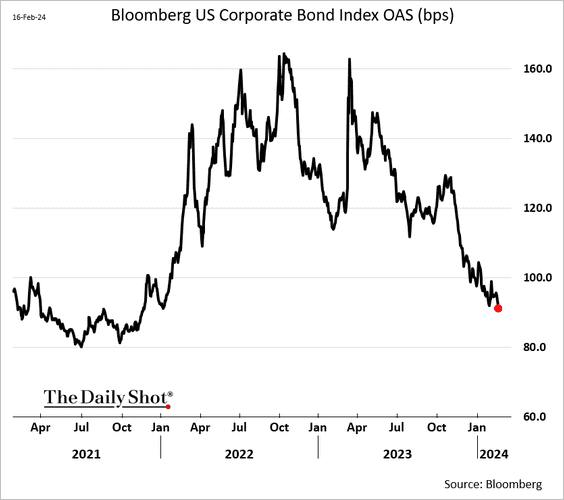

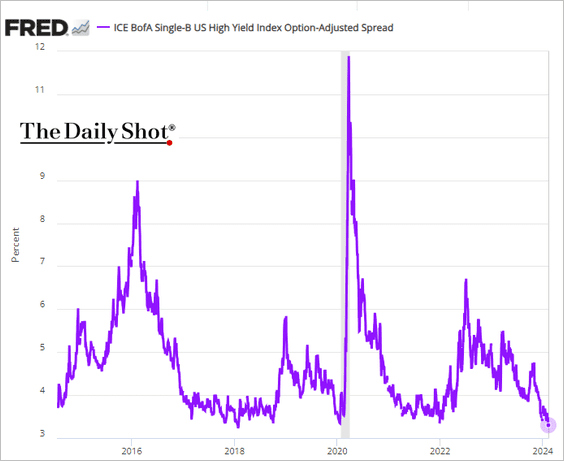

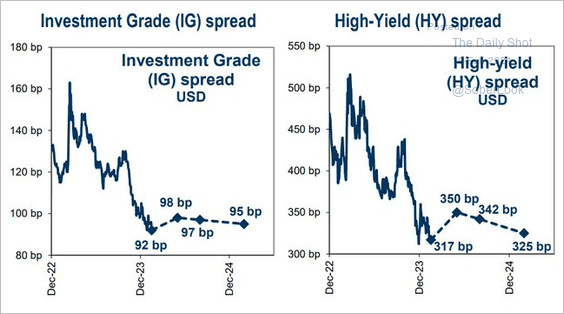

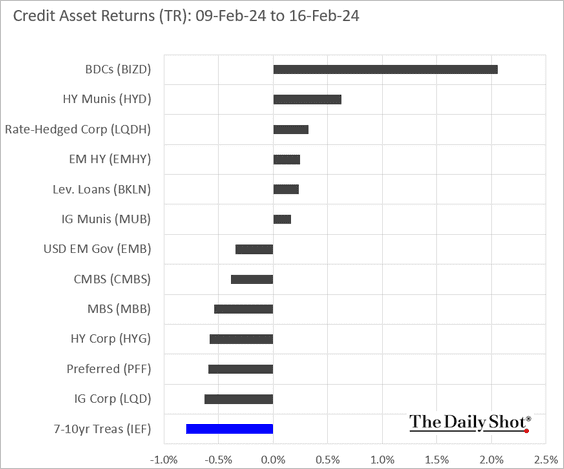

1. Corporate bond spreads continue to tighten.

• Investment-grade:

• Single-B:

Are we near the bottom for spreads?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

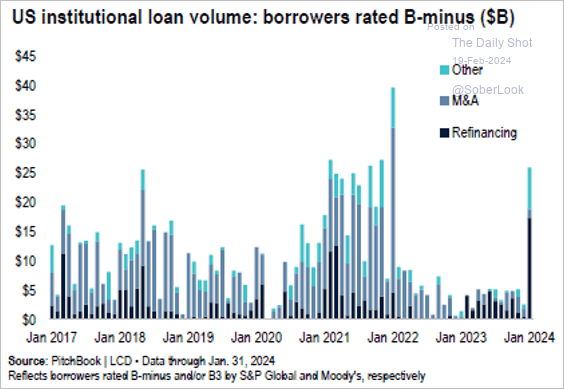

2. Low-rated borrowers are flocking to the US leveraged loan market to refinance expensive debt at a record pace.

Source: PitchBook

Source: PitchBook

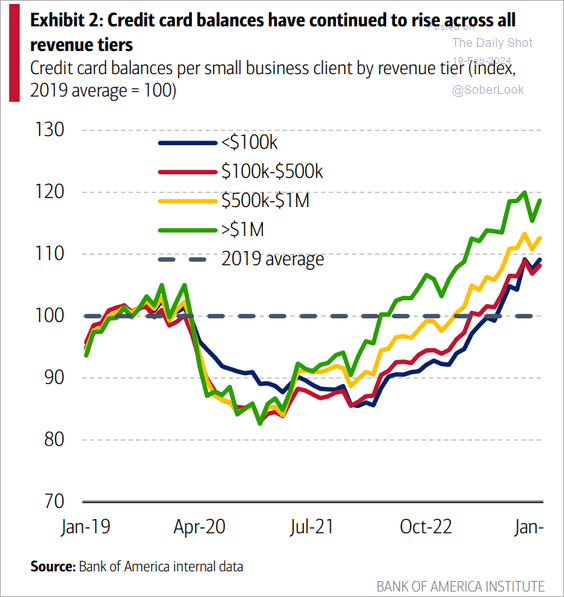

3. US small businesses continue to boost their credit card balances.

Source: Bank of America Institute

Source: Bank of America Institute

4. Here is last week’s performance across credit markets.

Back to Index

Global Developments

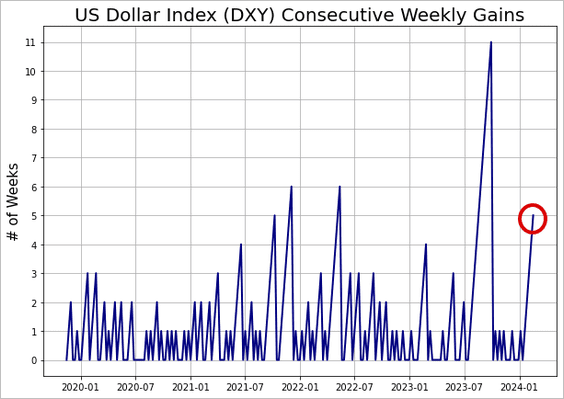

1. The dollar index has risen for five consecutive weeks.

2. Next, we have some performance data from last week.

• Currencies:

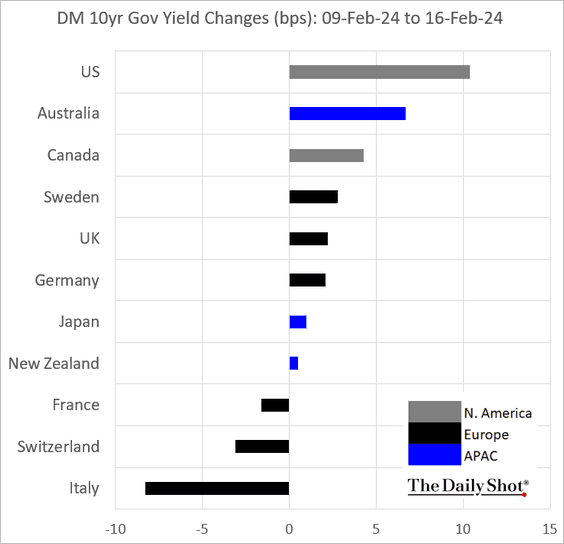

• Bond yields:

• Large-cap stock indices:

——————–

Food for Thought

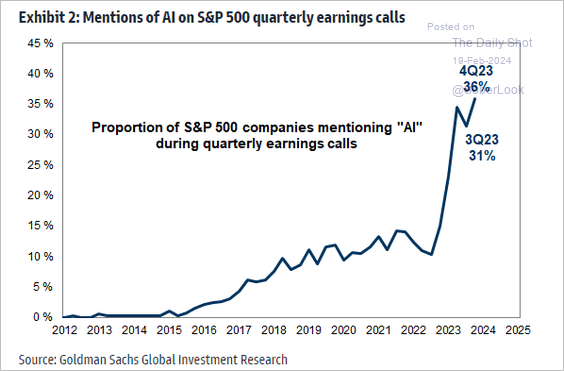

1. Mentions of AI on quarterly earnings calls:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

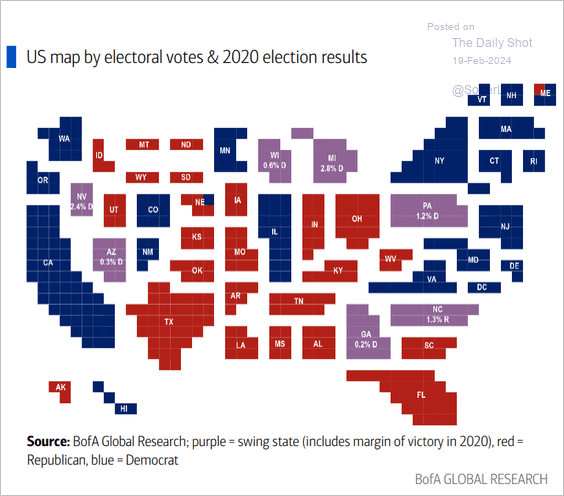

2. The electoral votes map:

Source: BofA Global Research

Source: BofA Global Research

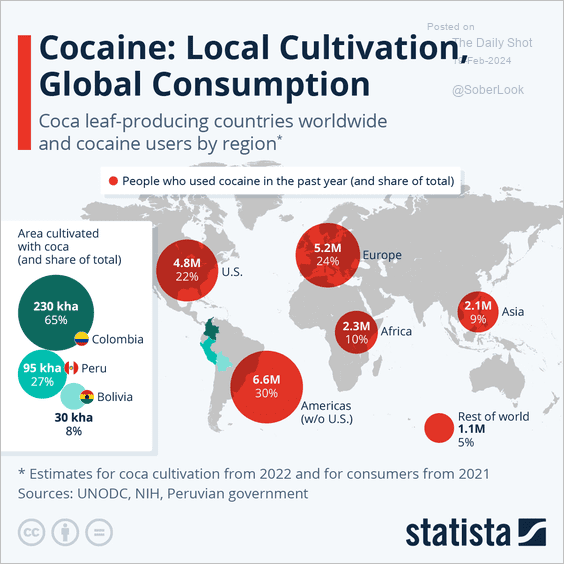

3. Cocaine production and consumption:

Source: Statista

Source: Statista

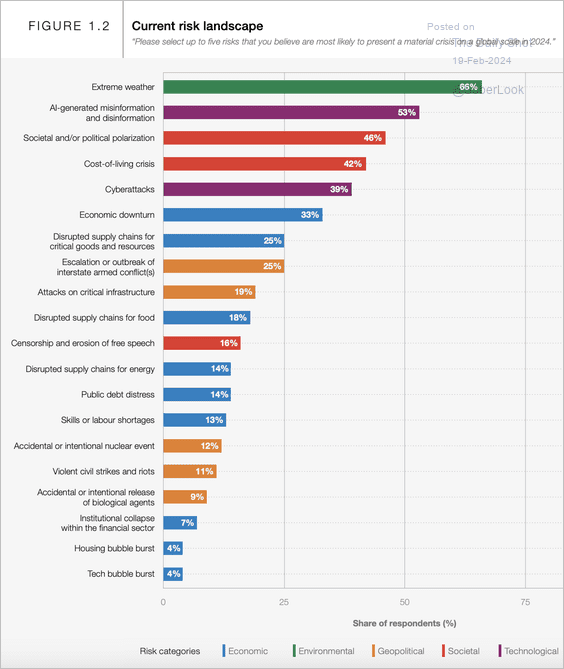

4. Risks most likely to present a crisis on a global scale:

Source: WEF Read full article

Source: WEF Read full article

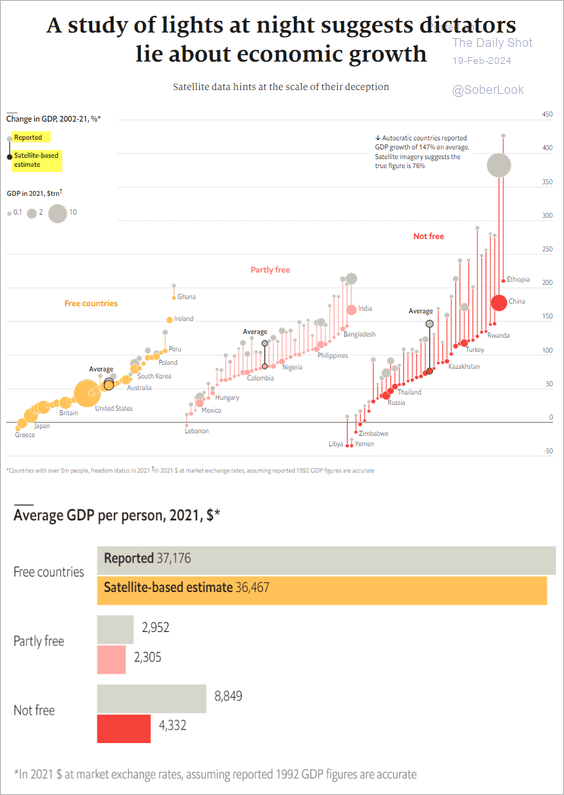

5. Autocratic countries overstating their GDP growth:

Source: The Economist Read full article

Source: The Economist Read full article

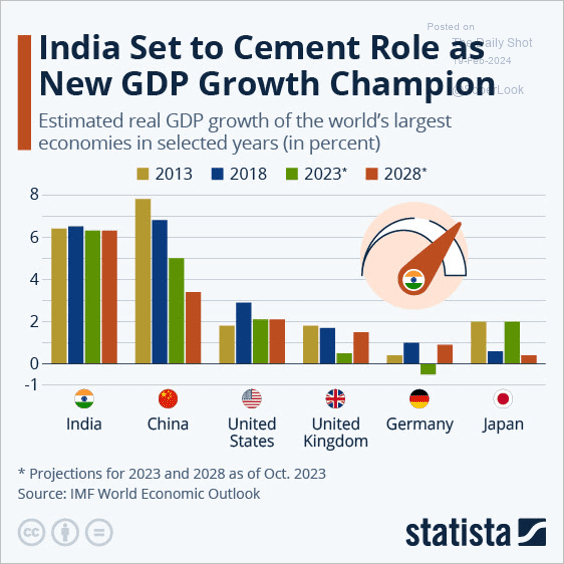

6. IMF growth forecasts:

Source: Statista

Source: Statista

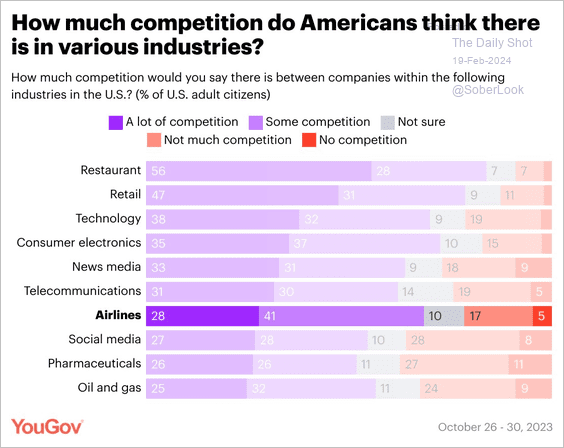

7. Views on competition across different sectors:

Source: @YouGovAmerica

Source: @YouGovAmerica

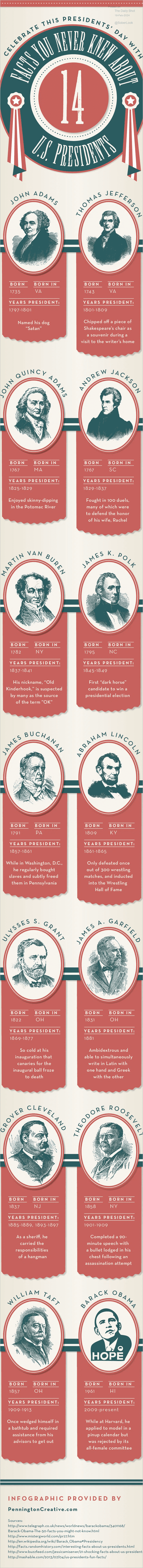

8. Some facts about 14 US presidents:

Source: Pennington Creative Read full article

Source: Pennington Creative Read full article

——————–

Back to Index