The Daily Shot: 21-Feb-24

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

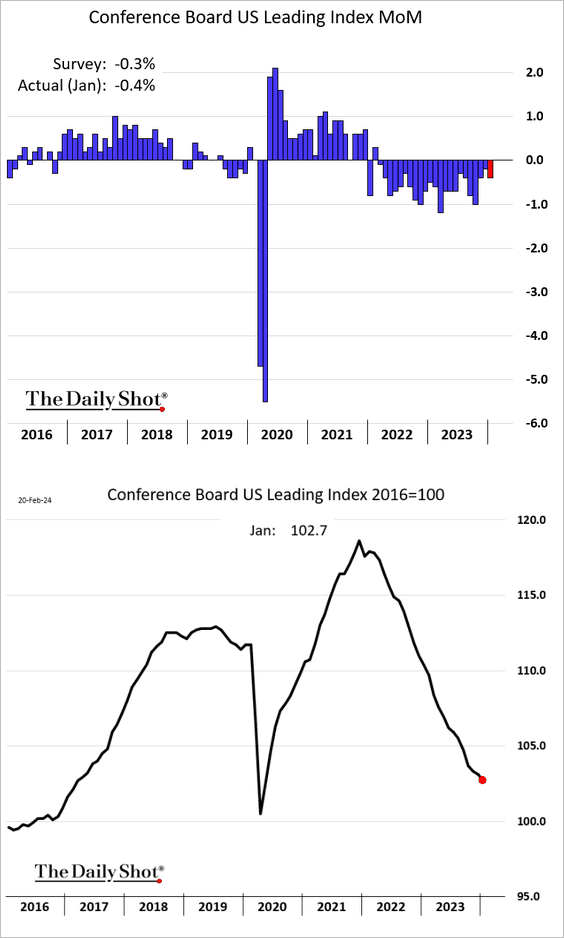

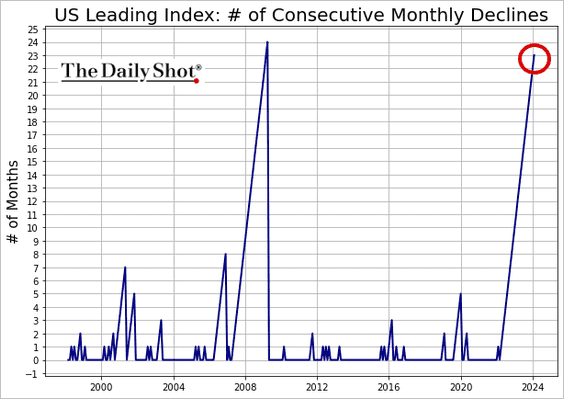

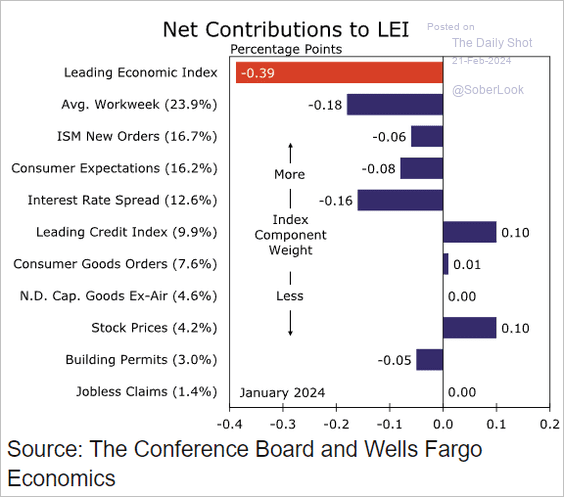

1. The Conference Board’s index of leading economic indicators declined again last month …

… for the 23rd month in a row.

• Last month’s adverse weather conditions negatively impacted the index, primarily through a sharp reduction in the average workweek.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

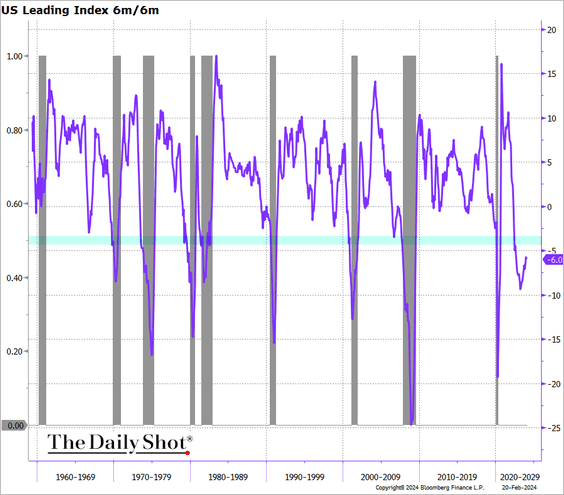

• While the six-month changes in the indicator continue to suggest recessionary conditions, the Conference Board no longer anticipates a recession.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

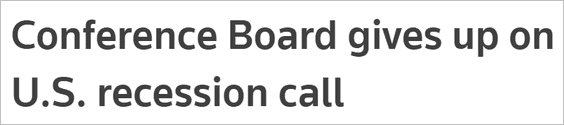

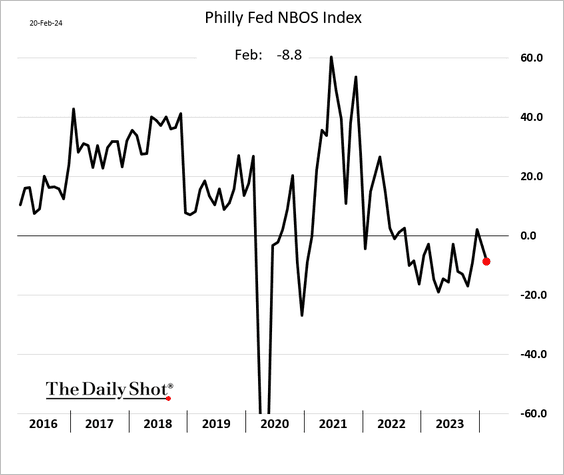

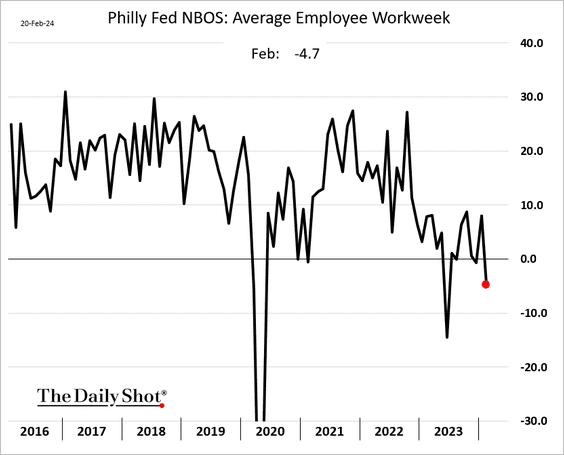

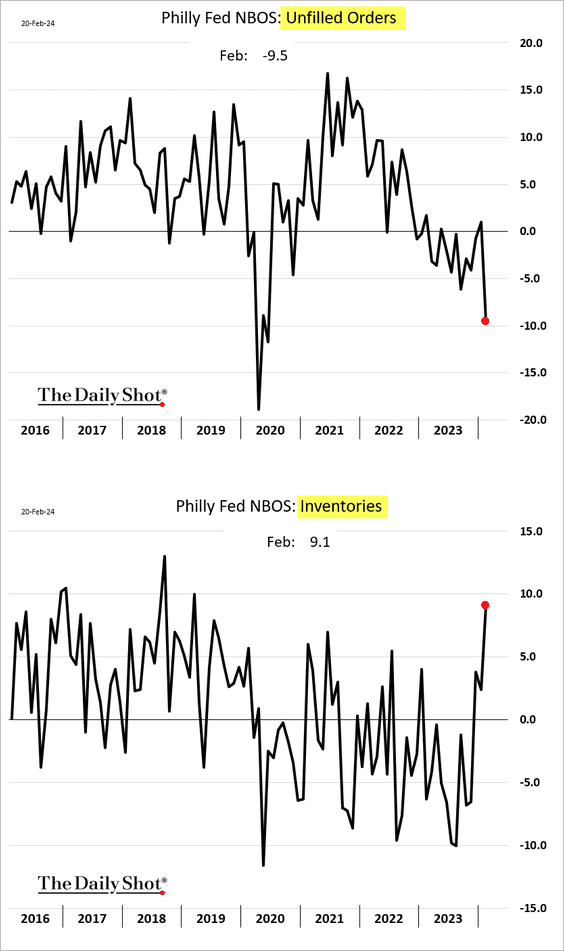

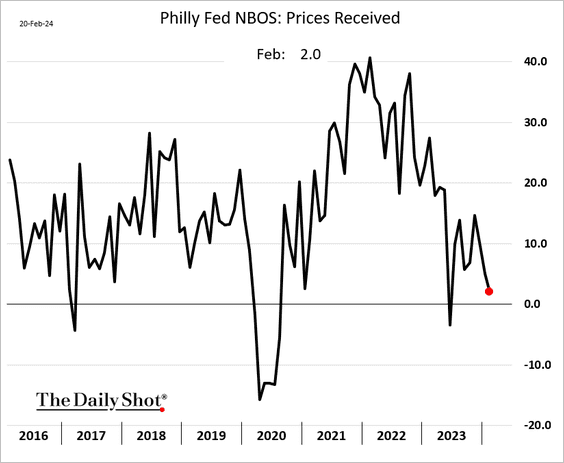

2. The Philly Fed’s regional survey of service firms moved back into contraction territory this month.

• Companies are cutting back workers’ hours.

• The report shows signs of slack demand in the region.

• Fewer firms are raising prices.

——————–

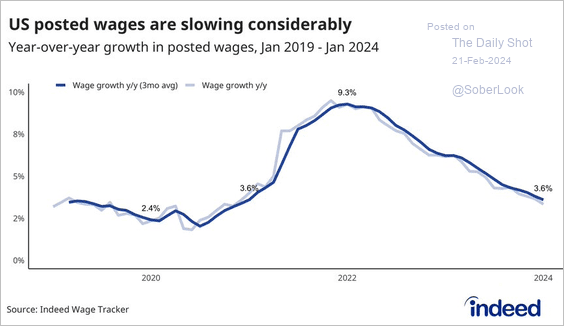

3. Growth in posted wages on Indeed continues to ease.

Source: @nick_bunker

Source: @nick_bunker

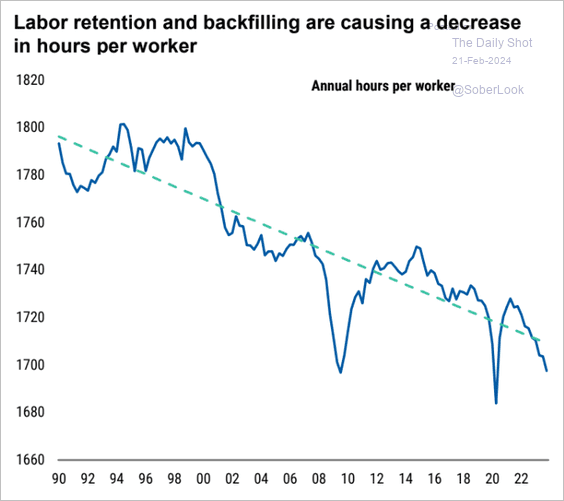

4. This chart shows annual hours per US worker over time.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

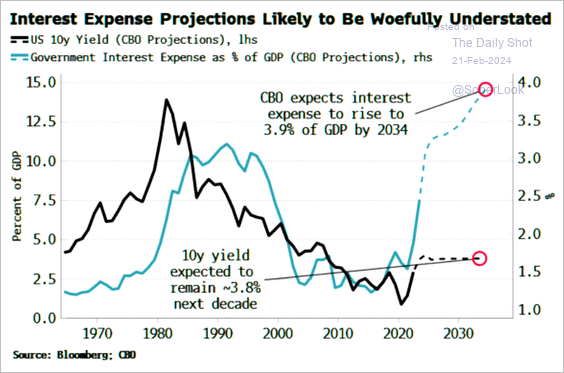

5. What if the Congressional Budget Office is underestimating the trajectory of Treasury yields?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Canada

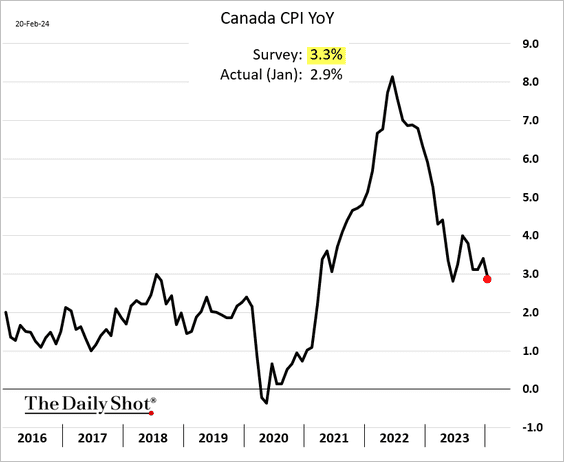

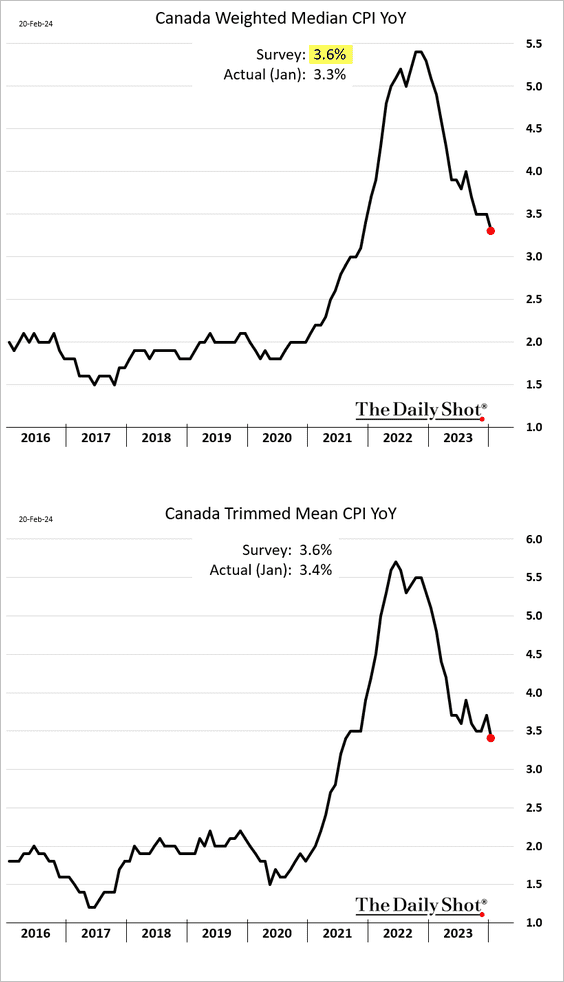

1. The January CPI report surprised to the downside.

– Headline:

– Core:

Source: @economics Read full article

Source: @economics Read full article

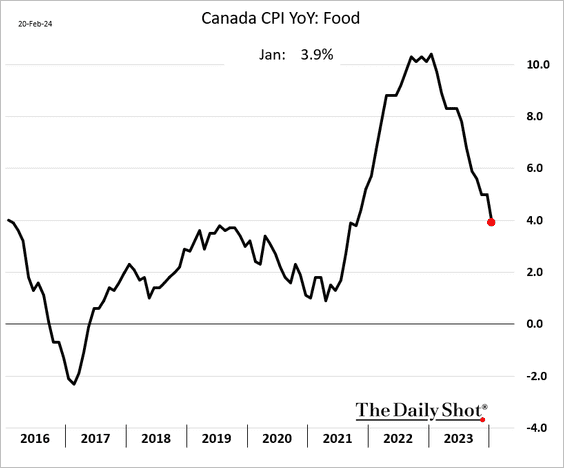

• Food inflation continues to ease.

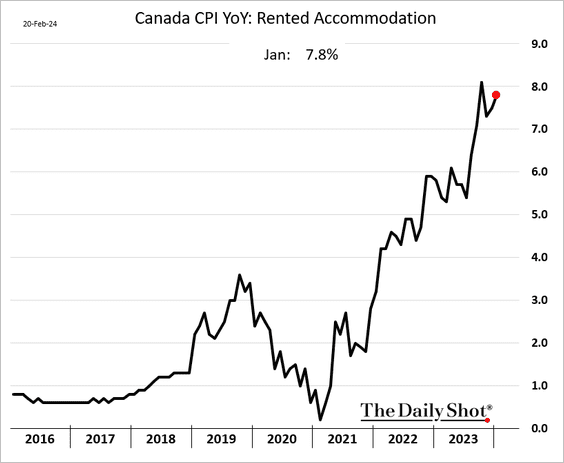

• Rent CPI remains very high.

——————–

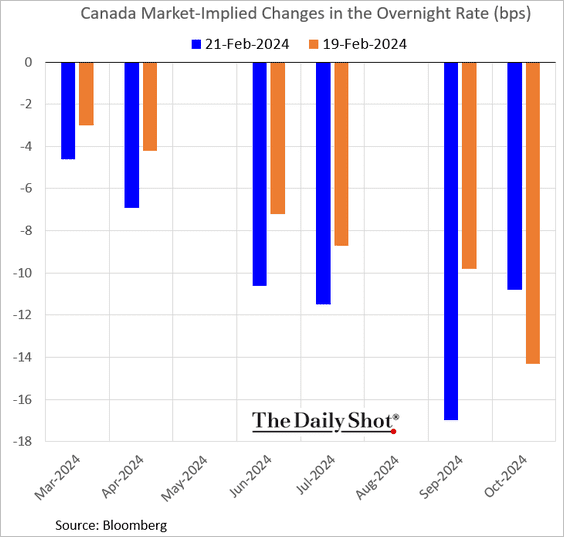

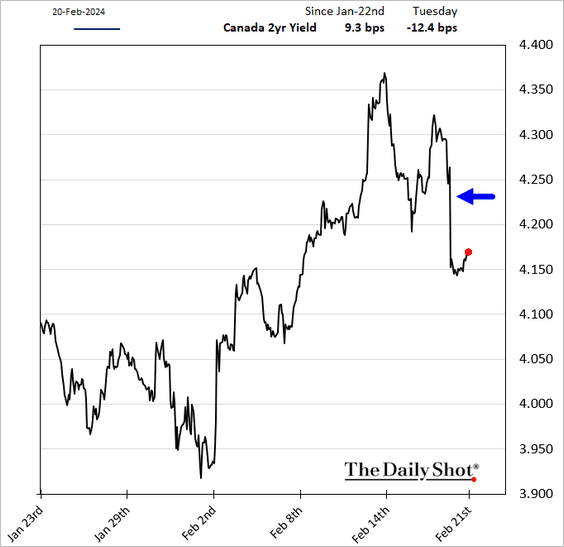

2. Rate cut expectations increased in response to the CPI report.

Bond yields dropped.

——————–

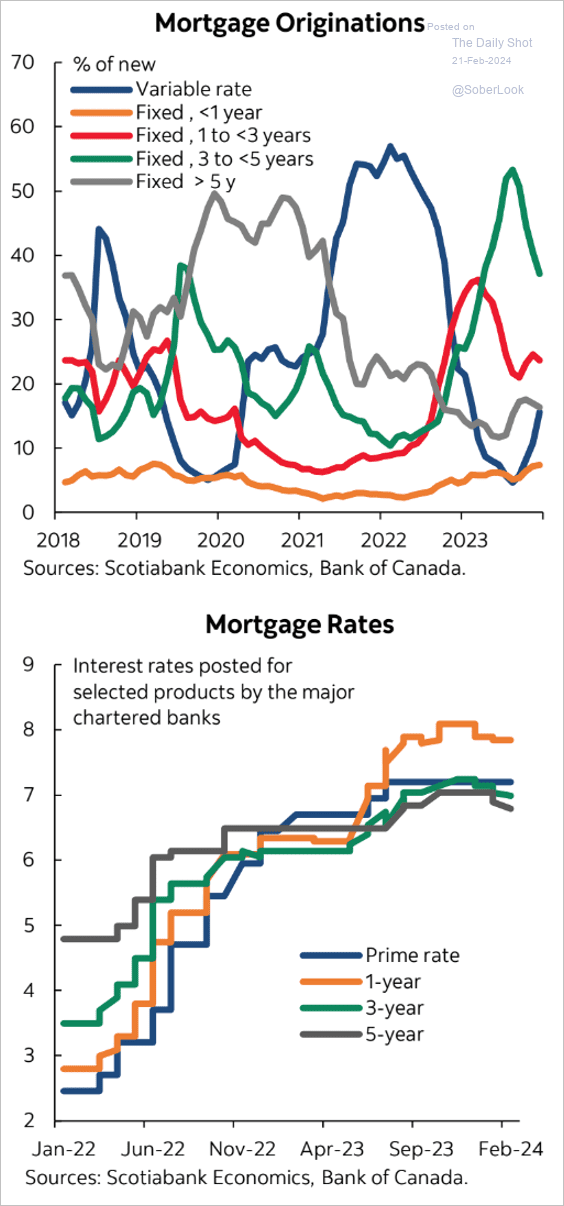

3. Here is a look at mortgage originations and mortgage rates by term.

Source: Scotiabank Economics

Source: Scotiabank Economics

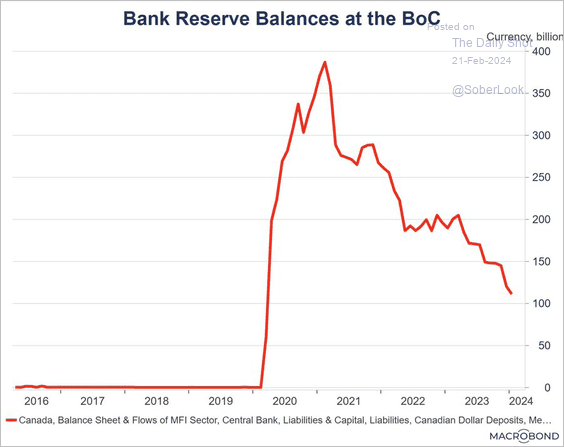

4. Reserve balances continue to fall (resulting in tighter liquidity conditions).

Source: @DavidBeckworth, @bankofcanada

Source: @DavidBeckworth, @bankofcanada

Back to Index

The Eurozone

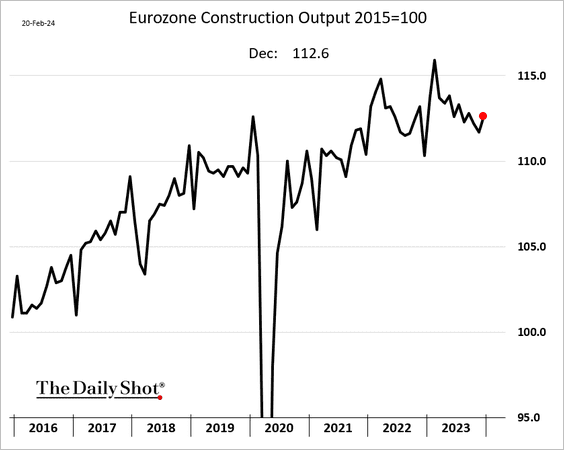

1. Construction output moved higher in December.

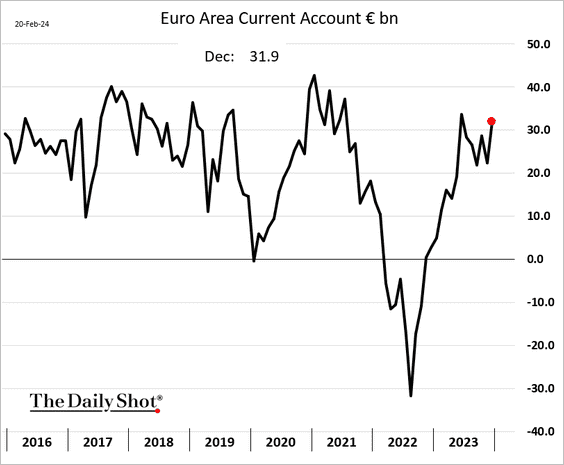

2. The current account surplus widened.

Back to Index

Europe

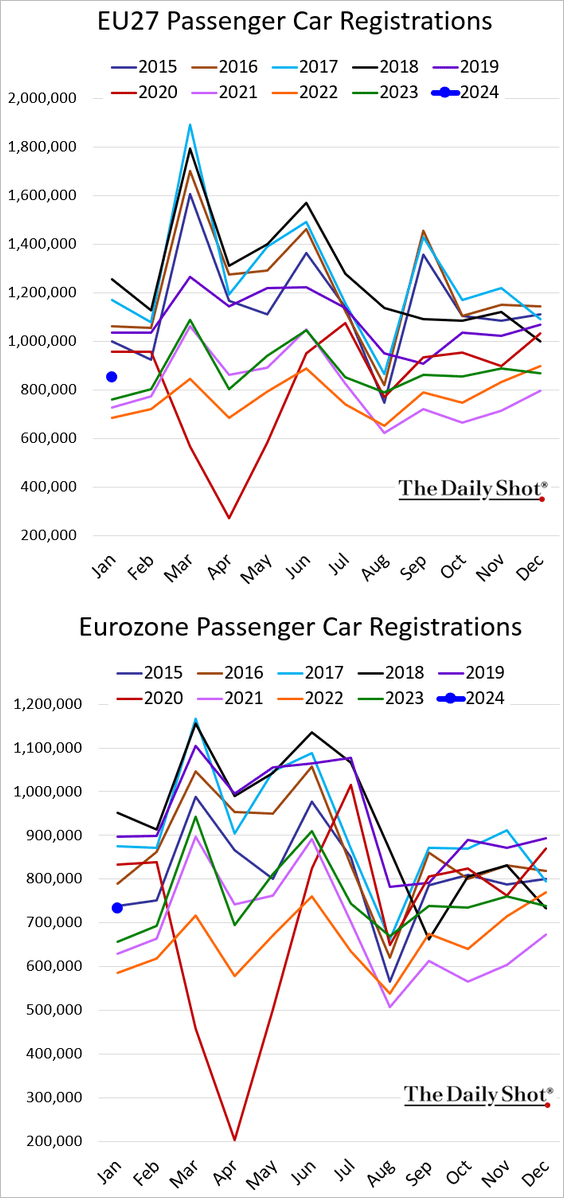

1. New car registrations in the EU were firmly above last year’s levels in January.

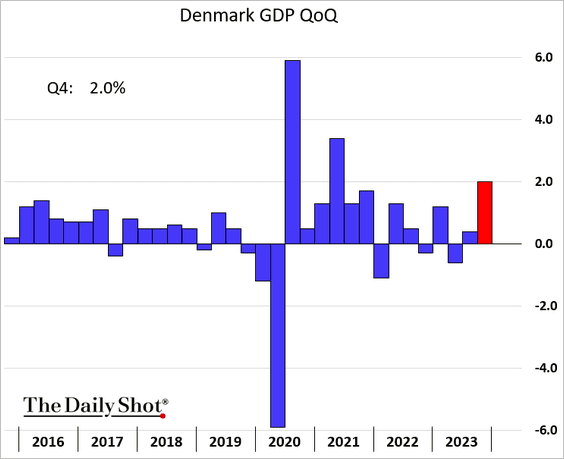

2. Denmark’s GDP surged last quarter, with revised data indicating that the country managed to avoid a recession in 2023.

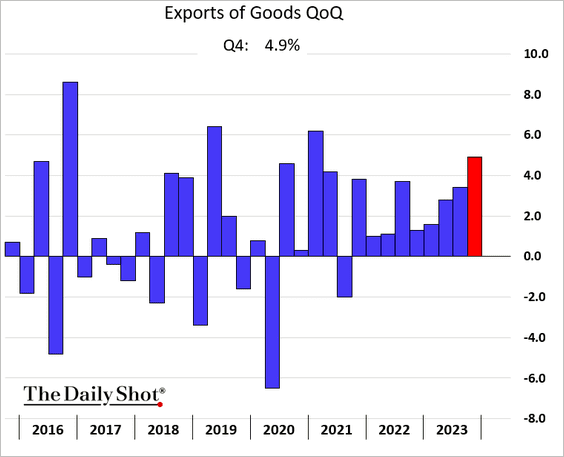

Exports jumped.

Source: @economics Read full article

Source: @economics Read full article

——————–

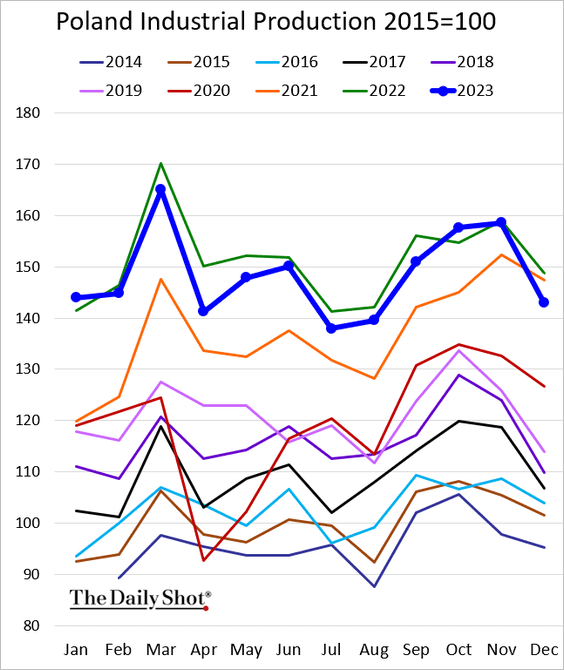

3. Poland’s industrial production finished the year on a softer note.

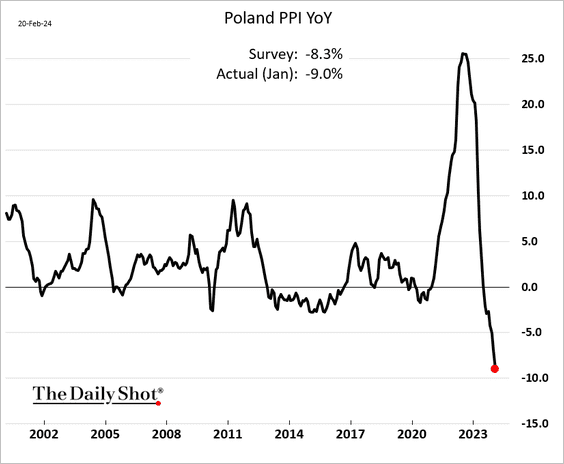

• The PPI posted a record year-over-year decline last month.

——————–

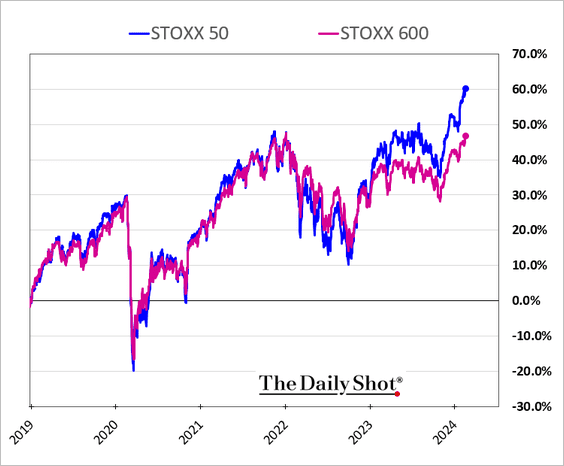

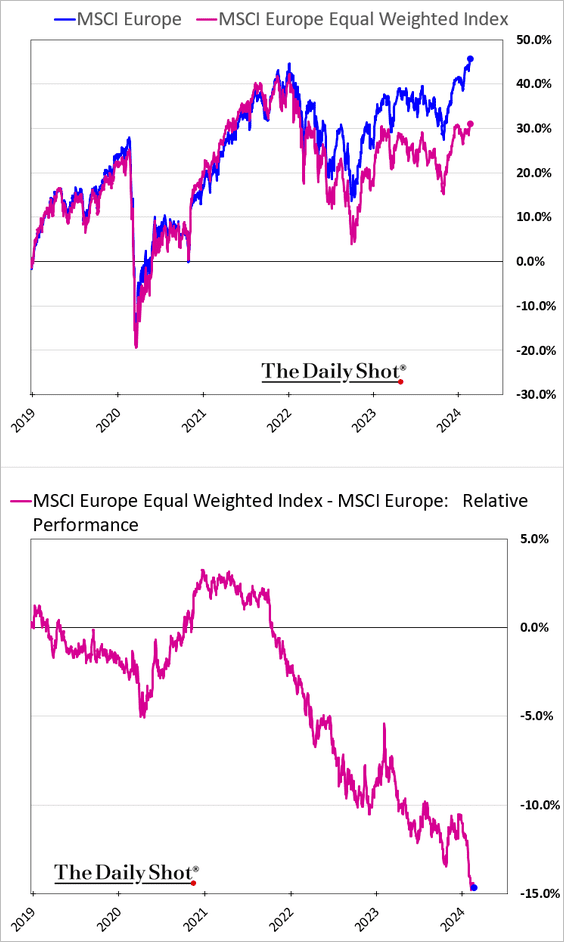

4. Shares of Europe’s biggest companies are increasingly outpacing the broader market (2 charts).

Back to Index

Japan

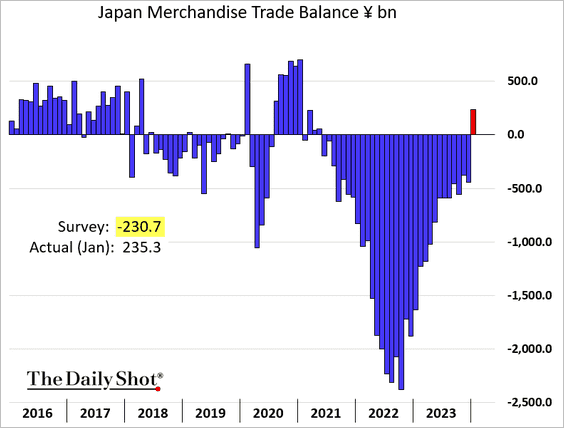

1. The seasonally adjusted trade balance unexpectedly returned to surplus last month.

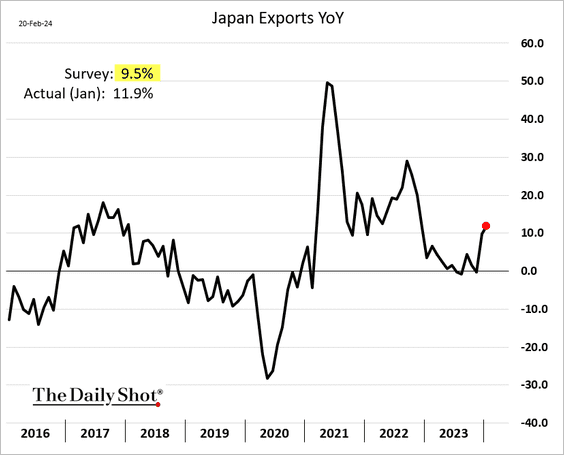

• Exports topped forecasts.

Source: @technology Read full article

Source: @technology Read full article

——————–

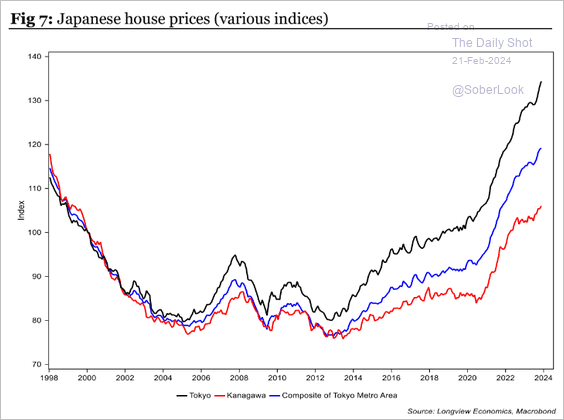

2. Home price appreciation has picked up momentum.

Source: Longview Economics

Source: Longview Economics

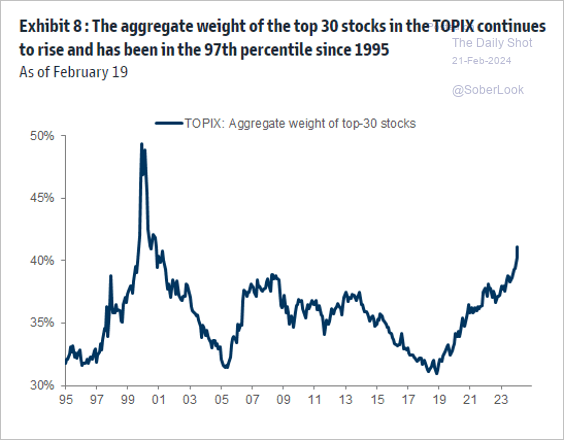

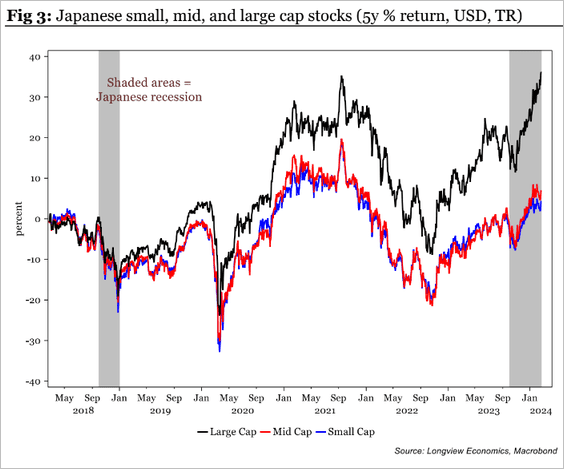

3. Japan’s equity market is becoming more concentrated, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

… as large caps increasingly outperform.

Back to Index

Asia-Pacific

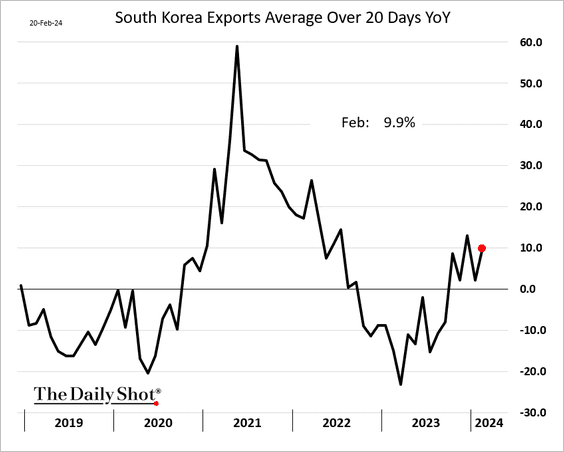

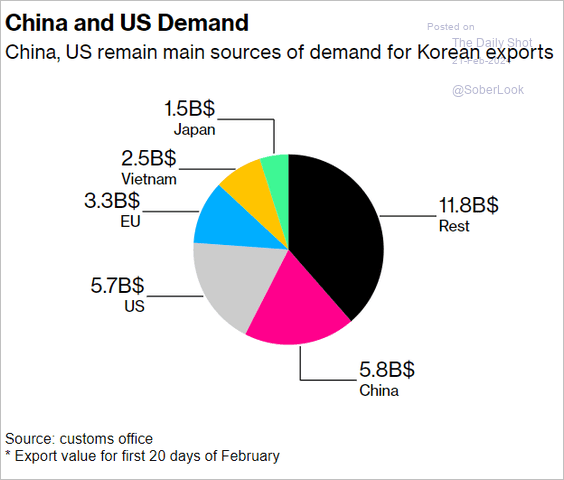

1. Let’s begin with South Korea.

• Exports held up well this month.

Source: Bloomberg

Source: Bloomberg

Source: @technology Read full article

Source: @technology Read full article

Here is the distribution of export destinations.

Source: @technology Read full article

Source: @technology Read full article

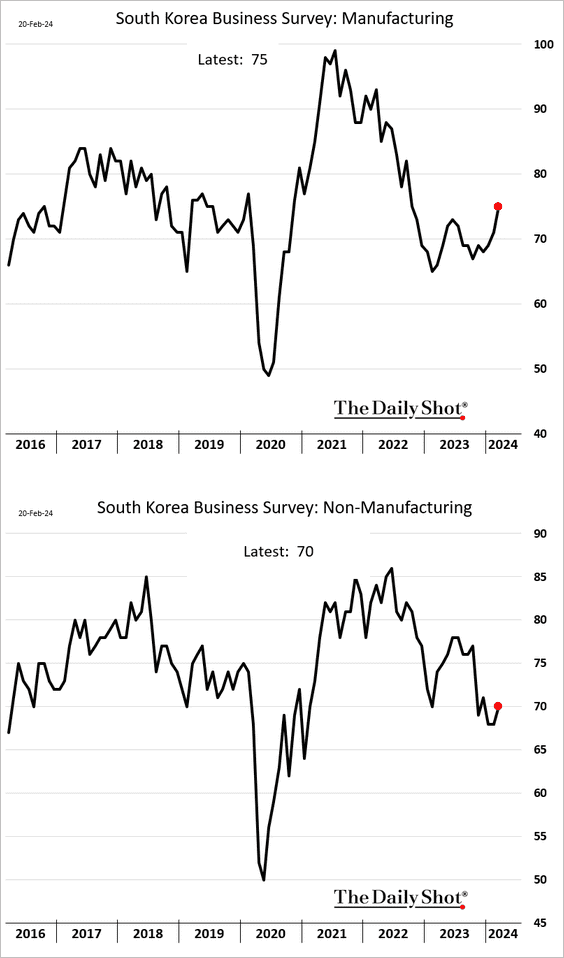

• Manufacturers are becoming more upbeat.

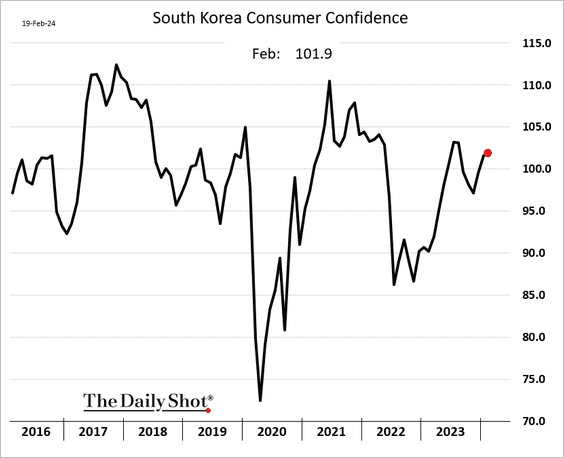

• Consumer sentiment remains robust.

——————–

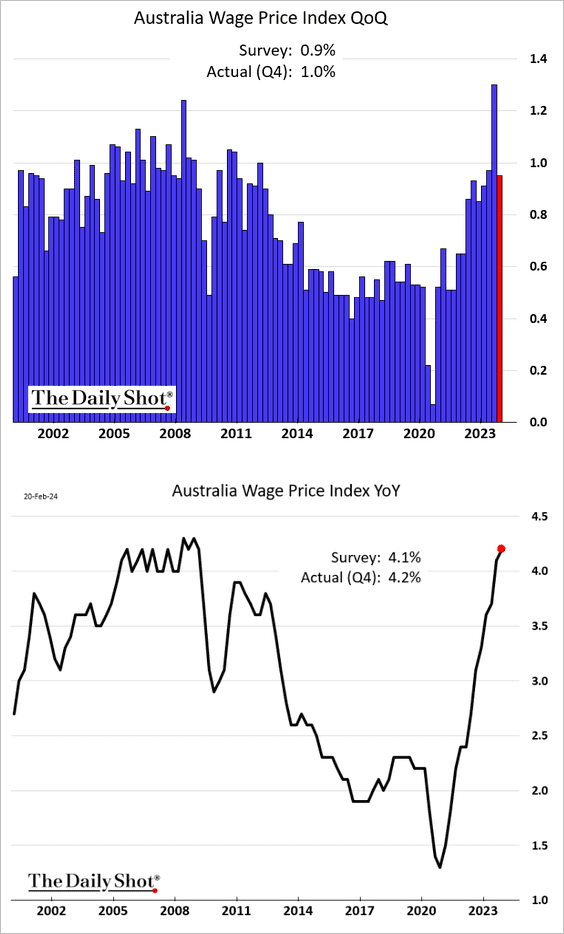

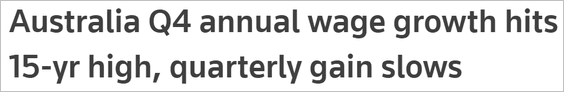

2. Next, we have some updates on Australia.

• Wage growth remained elevated last quarter.

Source: Reuters Read full article

Source: Reuters Read full article

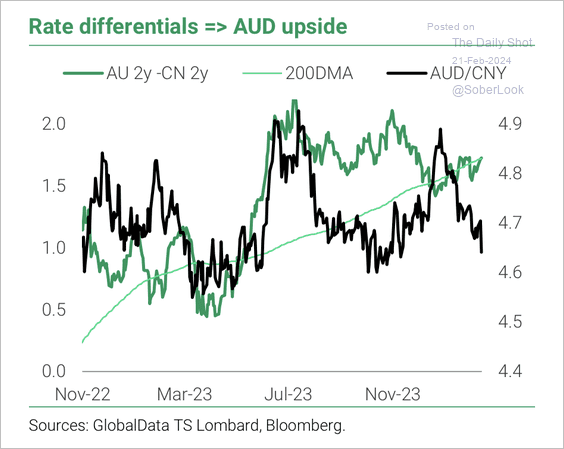

• Australia’s rate differential with China points to a higher AUD/CNY.

Source: TS Lombard

Source: TS Lombard

Back to Index

China

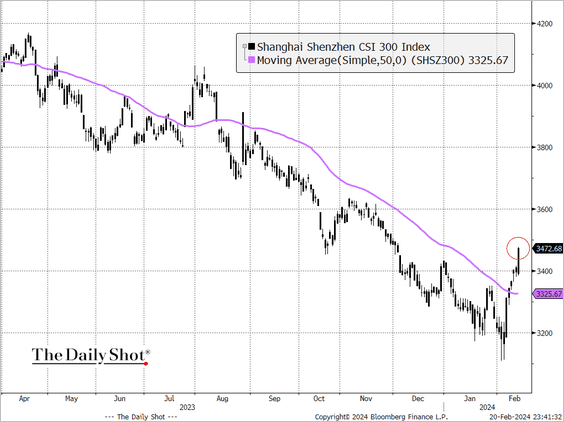

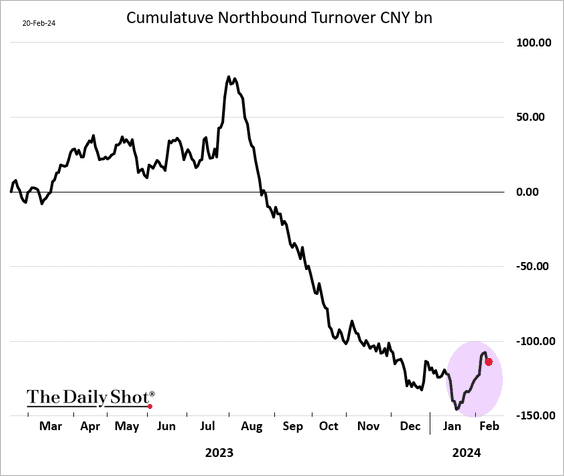

1. Stocks are rebounding as Bejing goes on a buying spree.

Capital flight from mainland stocks appears to have stopped.

——————–

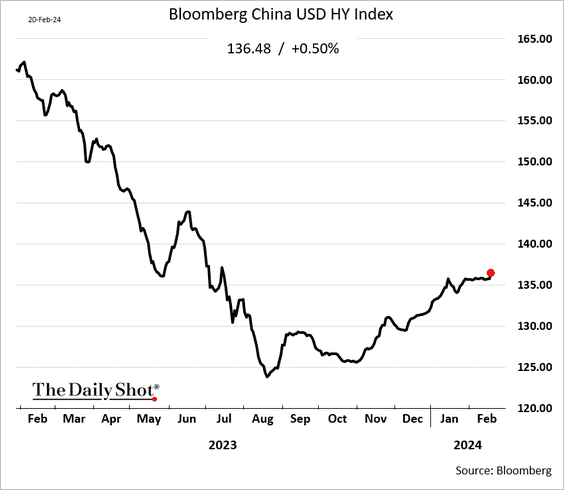

2. Dollar-denominated HY bonds are rebounding.

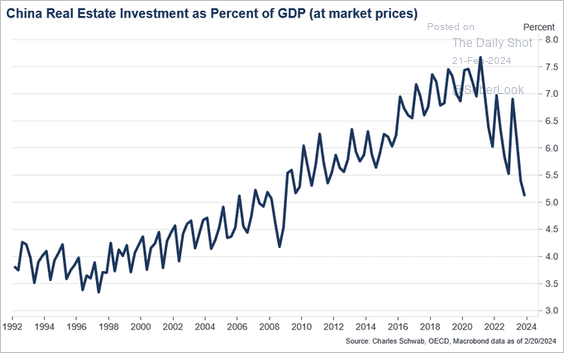

3. This chart shows real estate investment as a percent of GDP.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Back to Index

Emerging Markets

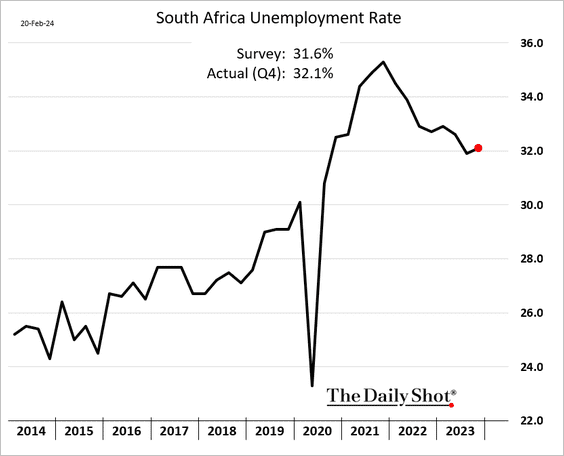

1. The decline in South Africa’s unemployment stalled last quarter.

Source: @economics Read full article

Source: @economics Read full article

——————–

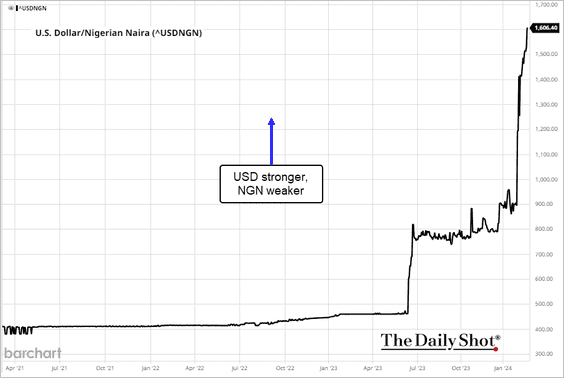

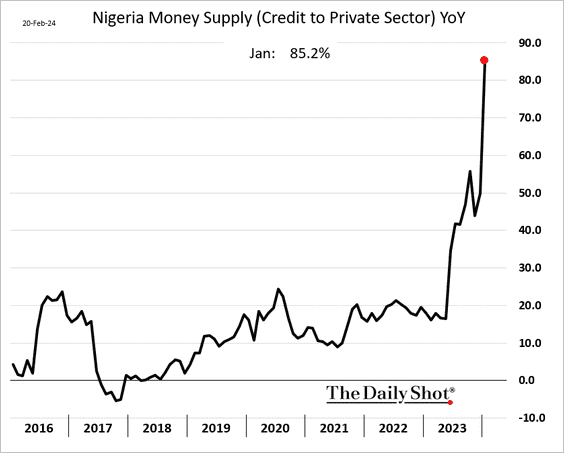

2. The Nigerian naira devaluation has been massive, …

… amid surging money supply. Inflation will accelerate.

——————–

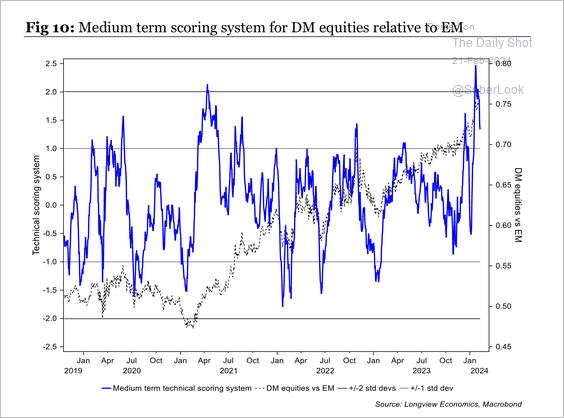

3. Tactically, developed-market equities appear stretched relative to emerging-market equities.

Source: Longview Economics

Source: Longview Economics

Back to Index

Cryptocurrency

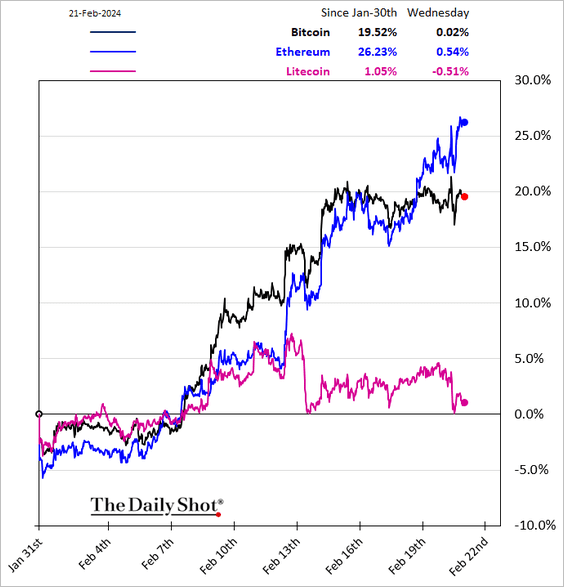

Litecoin has not been participating in the latest crypto rally.

Back to Index

Commodities

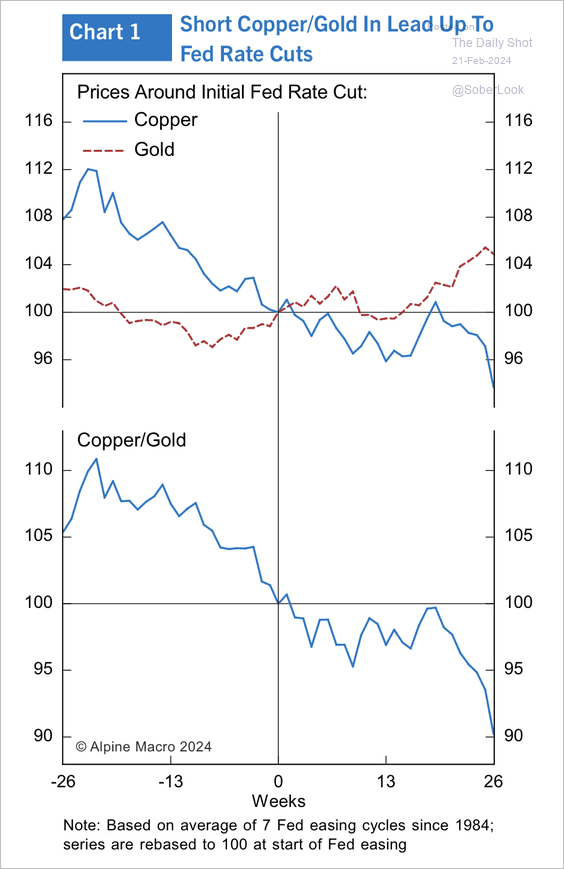

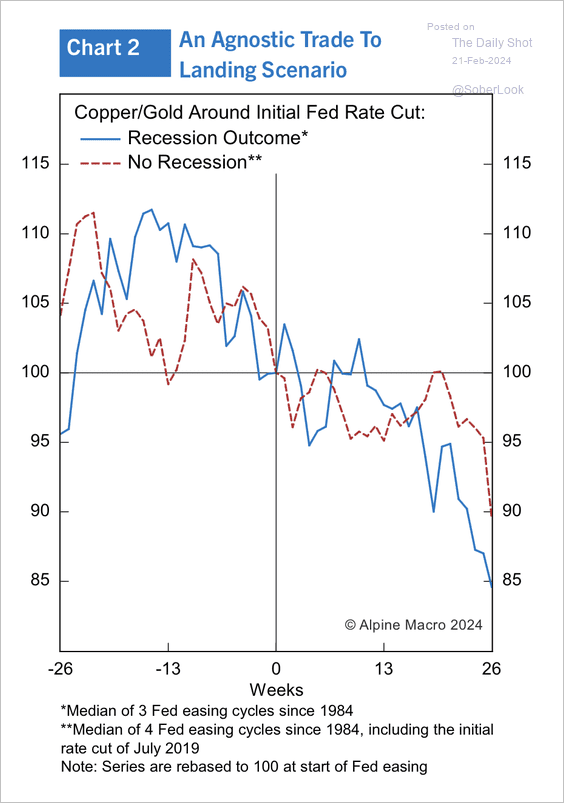

1. The copper/gold ratio typically declines around the initial Fed rate cut, regardless of the recession outcome. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

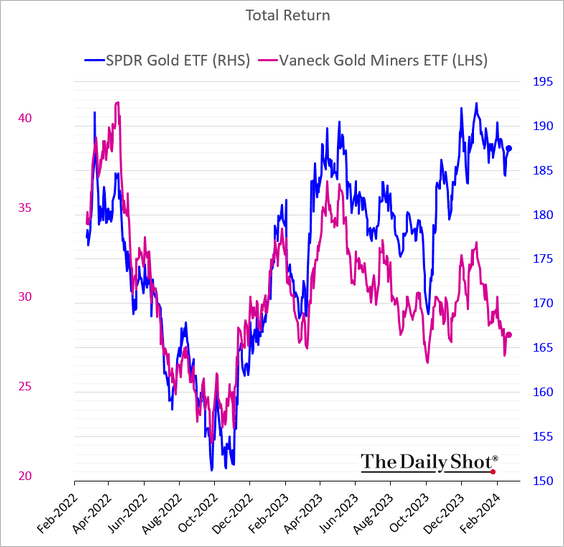

2. Shares of gold miners continue to diverge from gold.

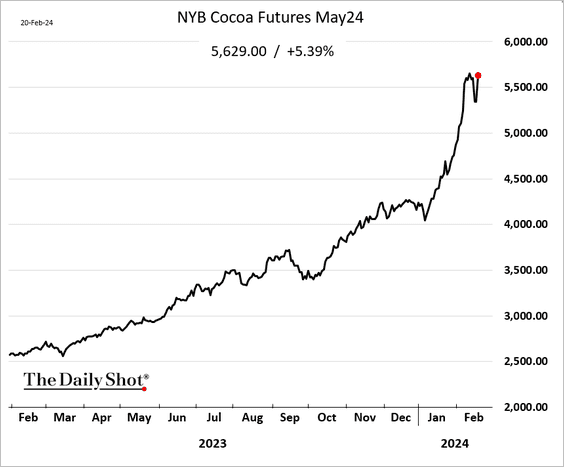

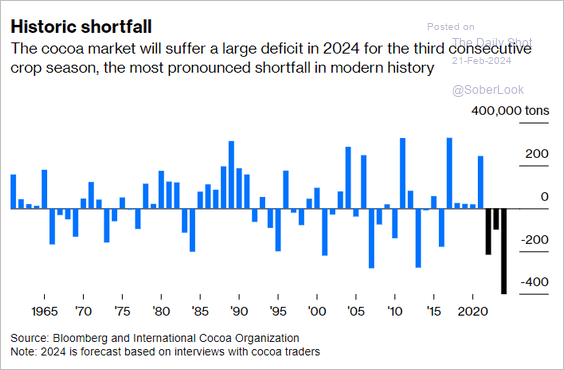

3. The rally in cocoa futures resumed on Tuesday …

… amid massive market deficit.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

Back to Index

Energy

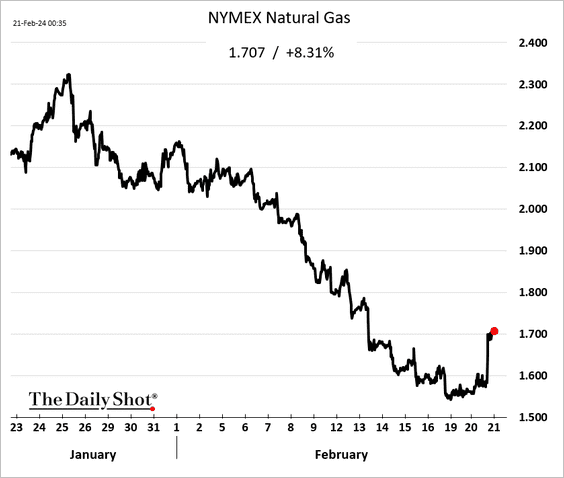

1. US natural gas futures surged following an announcement by Chesapeake Energy, a leading shale driller, detailing plans to reduce production in 2024 after experiencing a significant price drop.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

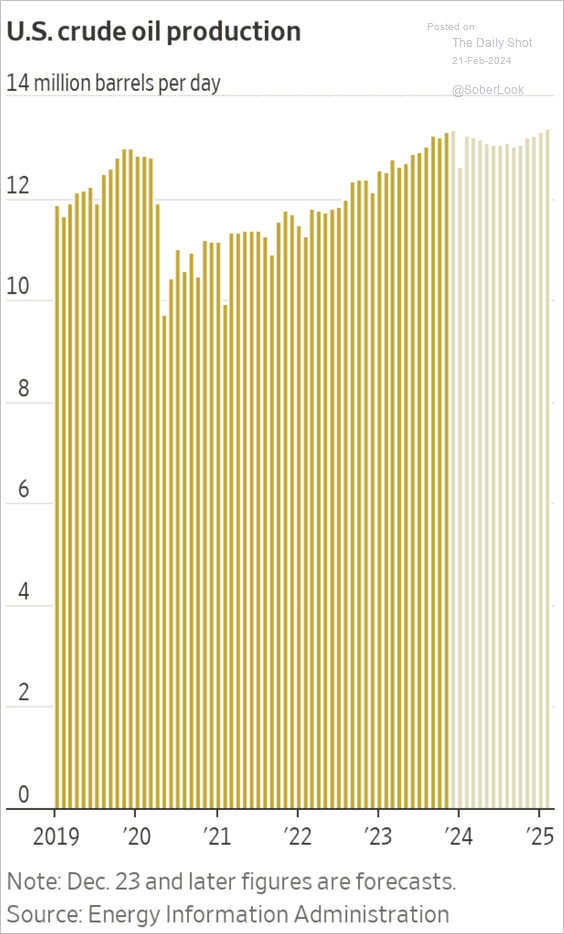

2. Is US oil production peaking?

Source: @WSJ Read full article

Source: @WSJ Read full article

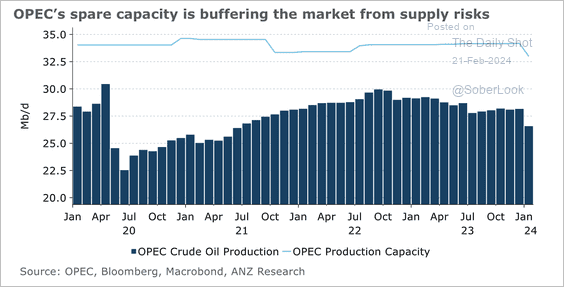

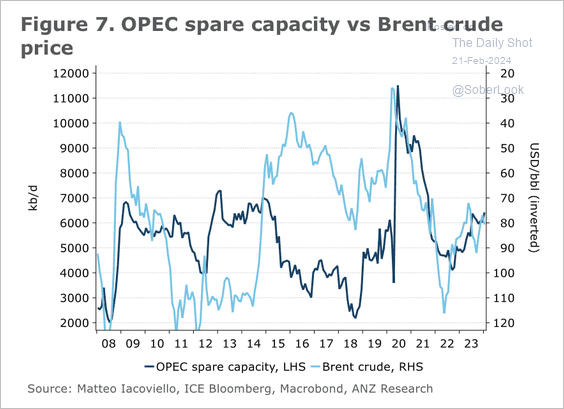

3. OPEC’s spare capacity tends to act as a safeguard against concerns of supply disruption and geopolitical risks. (2 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

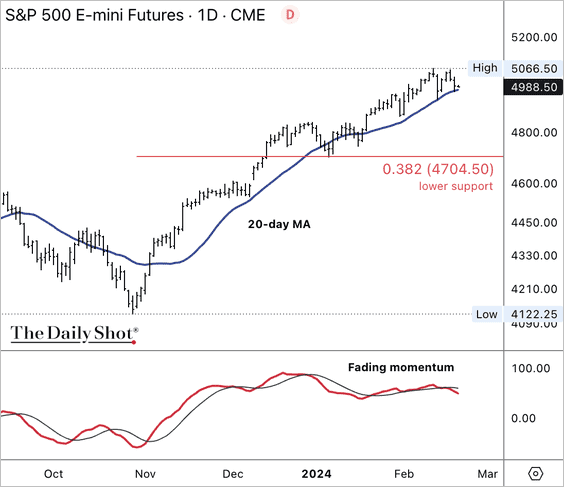

1. The S&P 500’s uptrend from the October 2023 low is losing momentum.

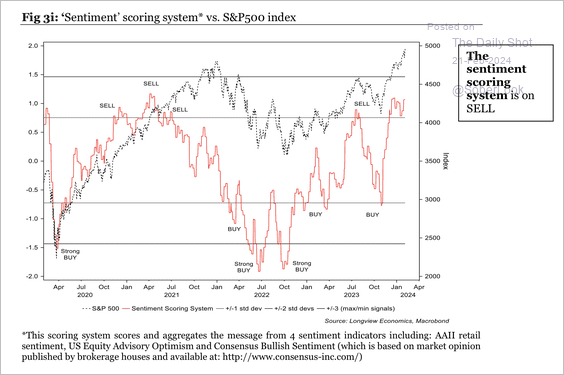

2. S&P 500 bullish sentiment appears stretched.

Source: Longview Economics

Source: Longview Economics

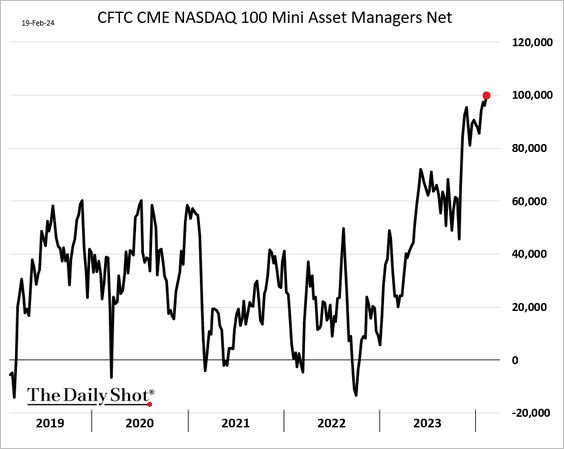

• Asset managers have been boosting their bets on Nasdaq 100 futures.

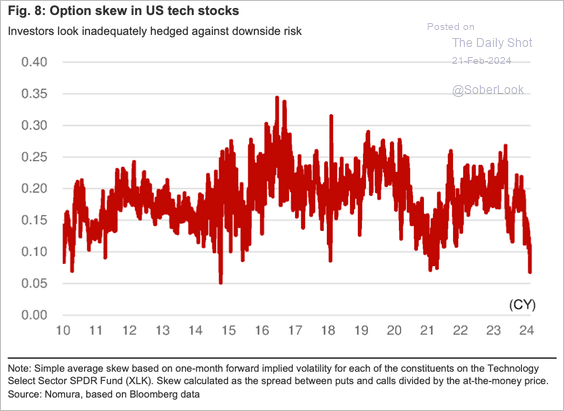

• Tech options market sentiment signals extreme optimism.

Source: Nomura; @dailychartbook

Source: Nomura; @dailychartbook

——————–

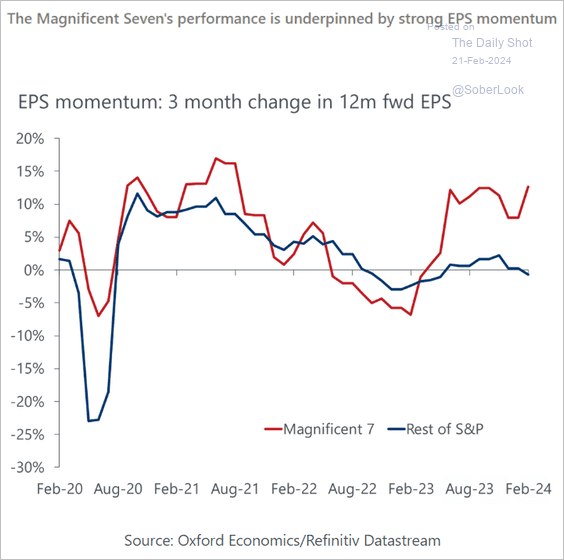

3. Earnings momentum for the S&P 500, excluding the ‘Magnificent 7,’ is deteriorating.

Source: Oxford Economics

Source: Oxford Economics

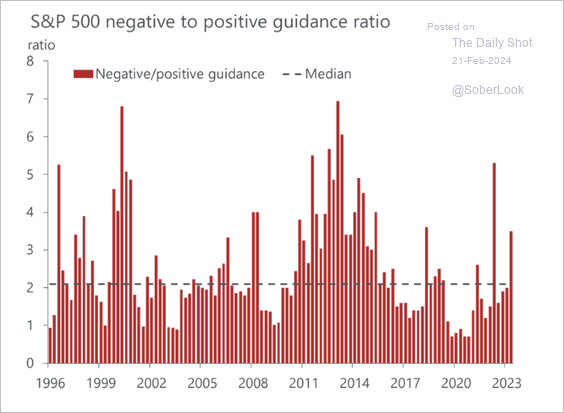

4. S&P 500 company guidance has been relatively weak.

Source: Oxford Economics

Source: Oxford Economics

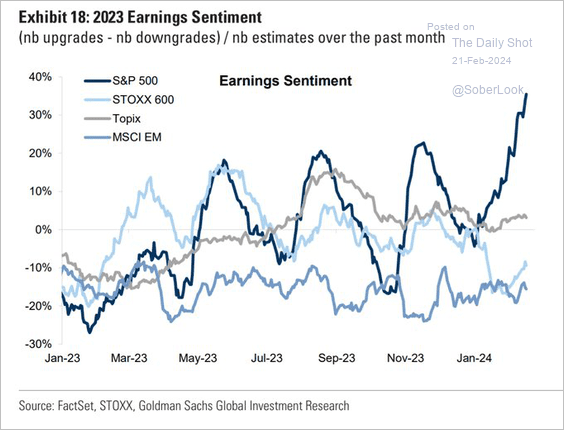

5. Here is a look at earnings sentiment globally.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

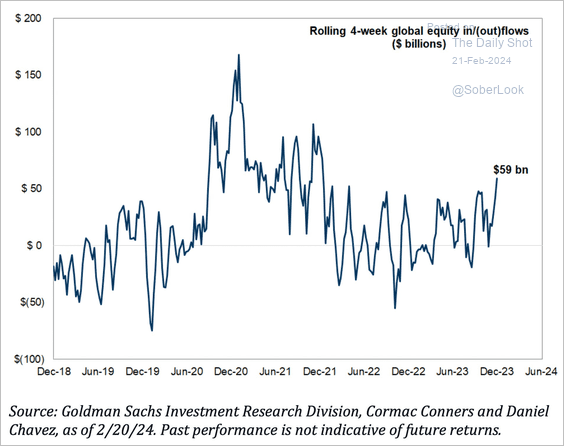

6. Passive fund flows are accelerating.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

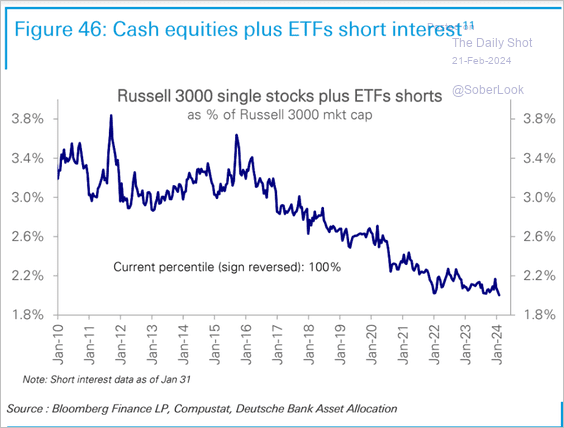

7. Short interest across large and small caps continues to trend lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

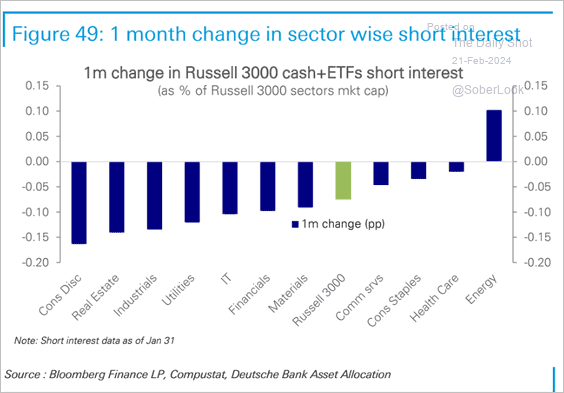

Here is the one-month change by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

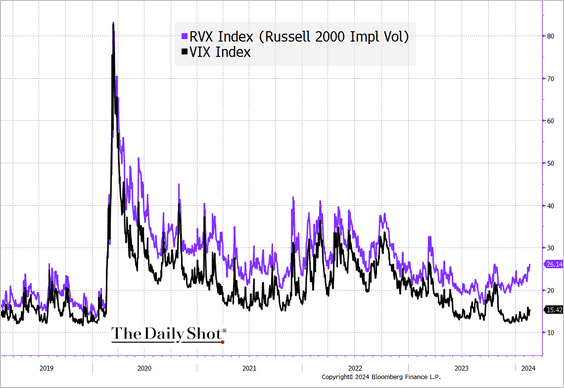

8. Implied volatility for small-cap stocks remains on a divergent path compared to that of large-cap stocks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

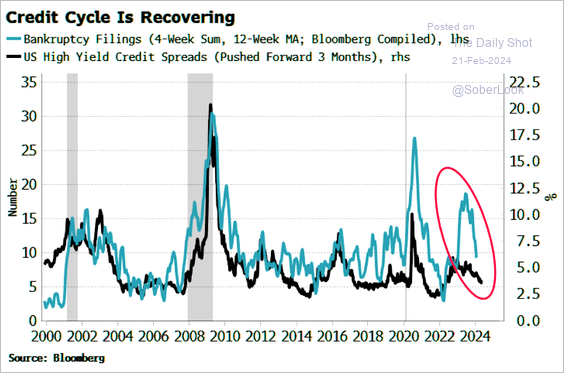

1. Bankruptcy filings have been moving lower.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

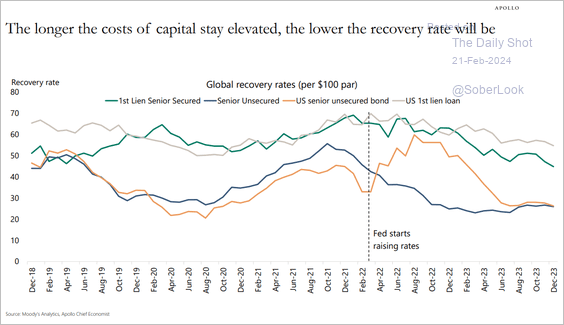

2. Corporate credit recovery rates are trending down.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

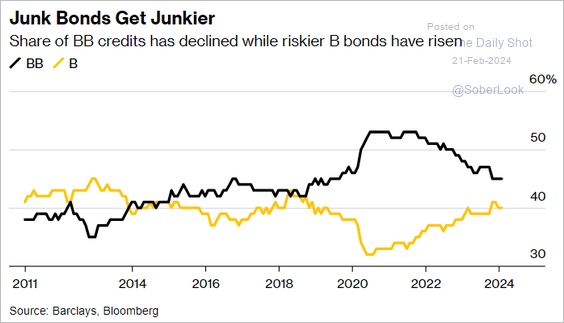

3. The share of single-B bonds in the high-yield market is increasing, while the proportion of BB-rated bonds is declining.

Source: @markets Read full article

Source: @markets Read full article

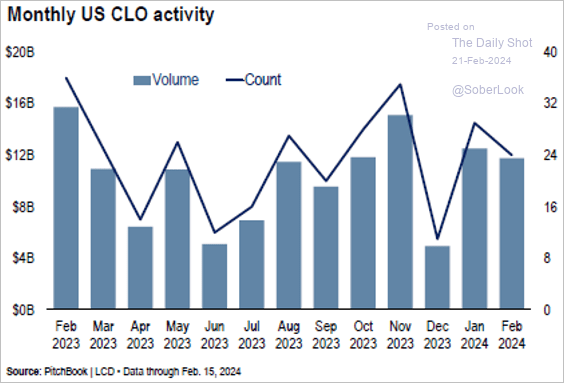

4. US CLO issuance remains robust.

Source: PitchBook

Source: PitchBook

Back to Index

Global Developments

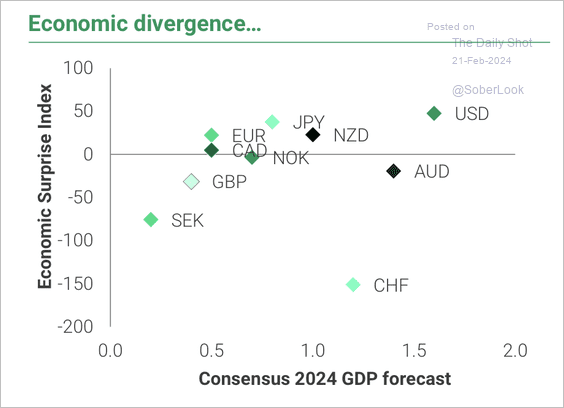

1. There is growing economic divergence within G10 nations.

Source: TS Lombard

Source: TS Lombard

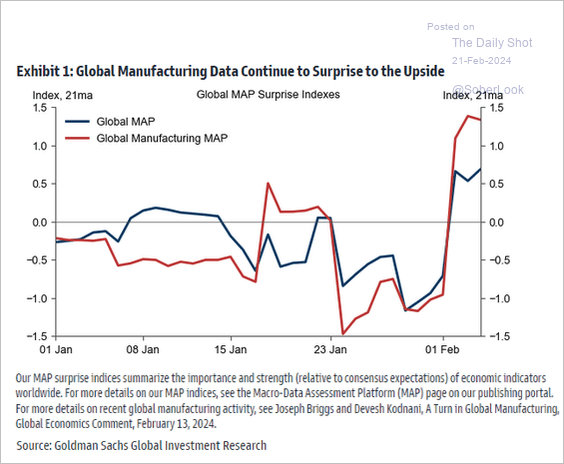

2. Manufacturing data have been surprising to the upside.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

Food for Thought

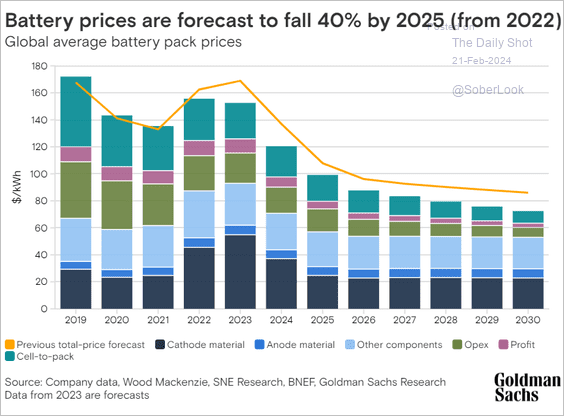

1. Battery prices:

Source: Goldman Sachs

Source: Goldman Sachs

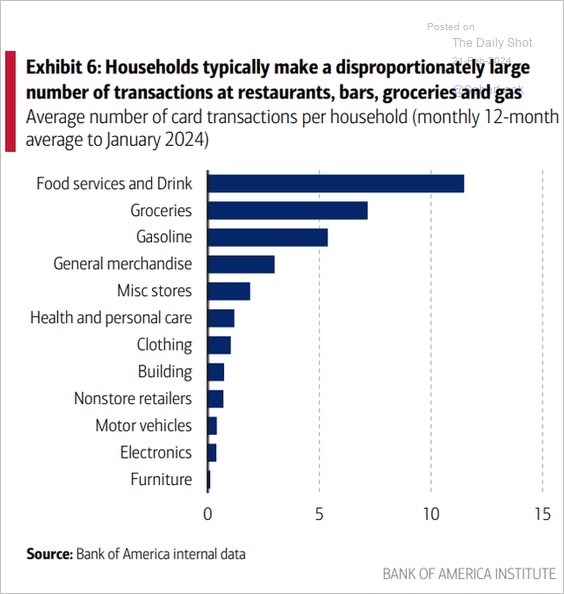

2. Number of debit/credit card transactions per month:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

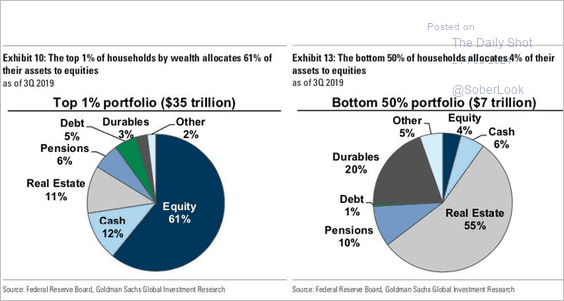

3. Wealth allocation for the top 1% and the bottom 50%:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

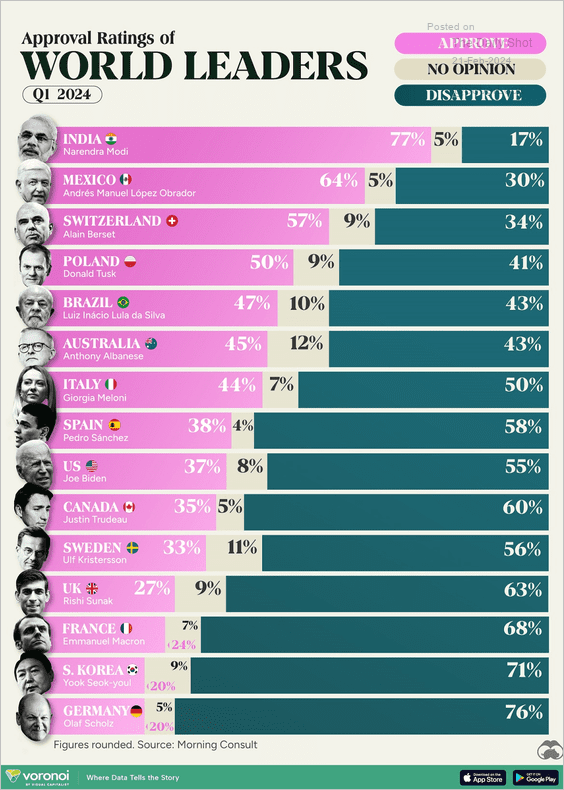

4. World leaders’ approval ratings:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

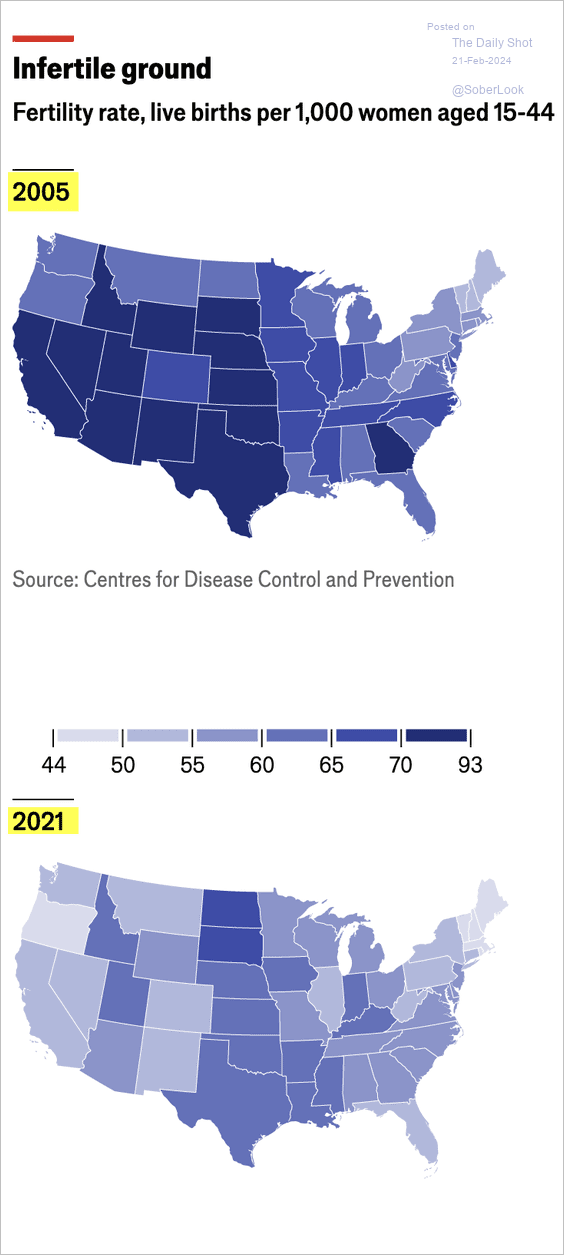

5. Fertility rates by state:

Source: The Economist Read full article

Source: The Economist Read full article

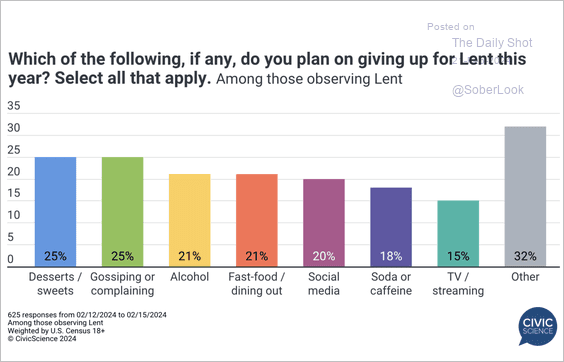

6. What do people choose to forgo during Lent?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index