The Daily Shot: 22-Feb-24

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. The FOMC remains cautious on rate cuts, with Committee members wishing to see further evidence of slowing inflation.

• FOMC Minutes: – Participants generally noted that they did not expect it would be appropriate to reduce the target range for the federal funds rate until they had gained greater confidence that inflation was moving sustainably toward 2 percent.

• Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent.

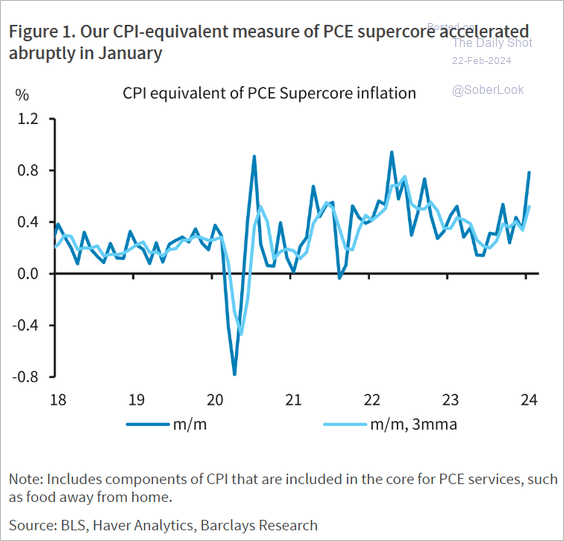

The resurgence of inflation is a significant worry, as estimates suggest a marked increase in supercore PCE inflation for January.

Source: Barclays Research

Source: Barclays Research

FOMC Minutes: – Some participants noted the risk that progress toward price stability could stall, particularly if aggregate demand strengthened or supply-side healing slowed more than expected.

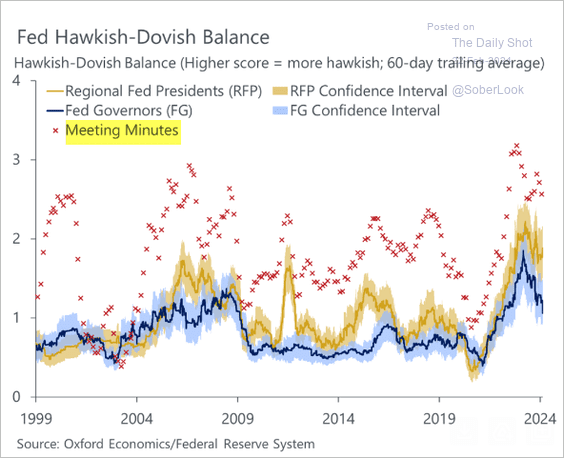

• According to the Oxford Economics tracker, the FOMC minutes remain hawkish relative to recent history.

Source: Oxford Economics

Source: Oxford Economics

——————–

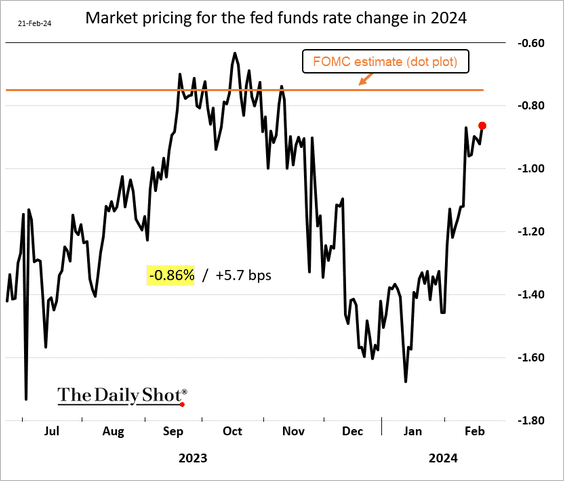

2. The market expectations for total 2024 rate cuts were scaled back further after the FOMC minutes release.

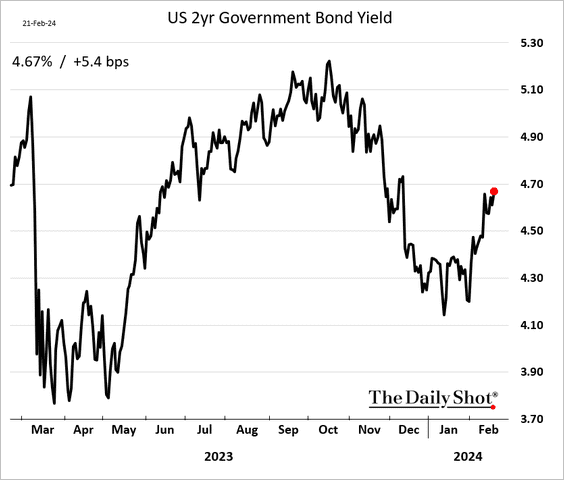

Here is the 2-year Treasury yield.

——————–

3. Below are some additional updates on inflation.

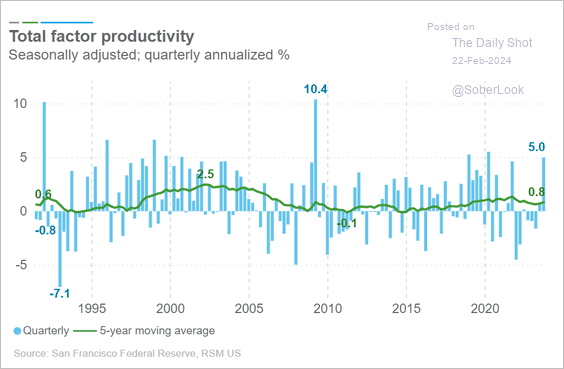

• The Fed should be encouraged by improving US productivity, which could serve to contain inflationary pressures.

Source: RSM Read full article

Source: RSM Read full article

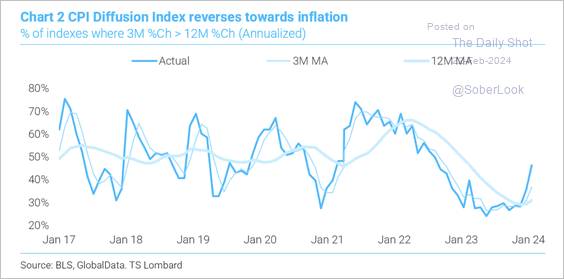

• Underlying inflation momentum is rising again.

Source: TS Lombard

Source: TS Lombard

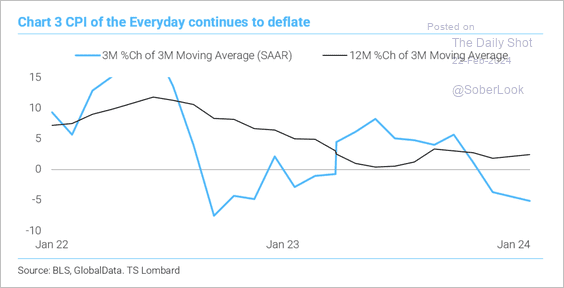

• Inflation for everyday essentials, including food-at-home and energy costs, is on a downward trend.

Source: TS Lombard

Source: TS Lombard

——————–

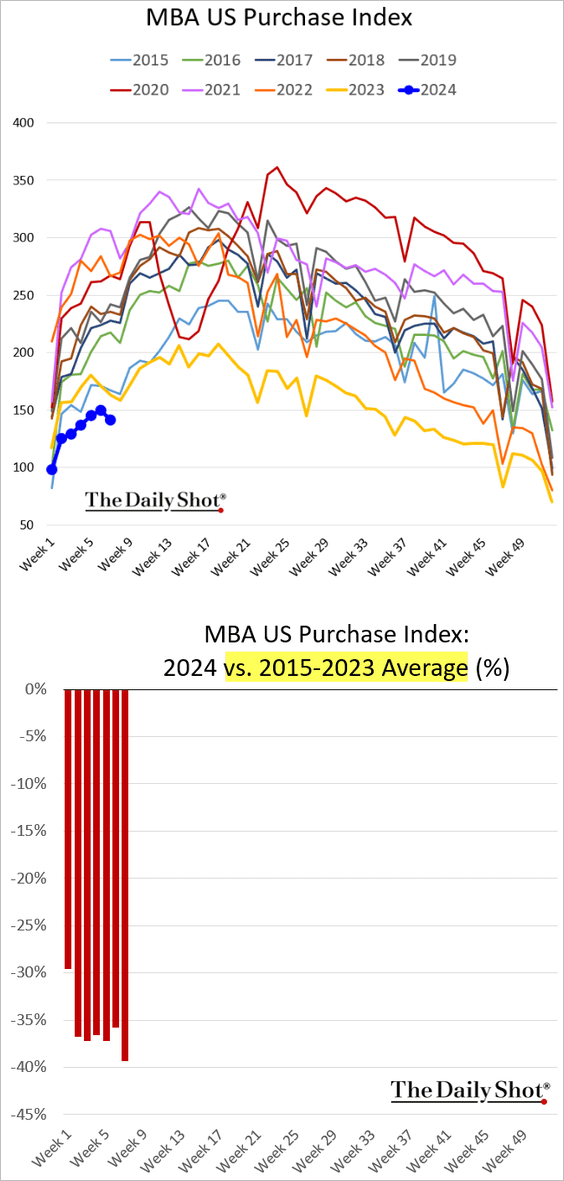

4. Mortgage applications softened last week amid higher mortgage rates.

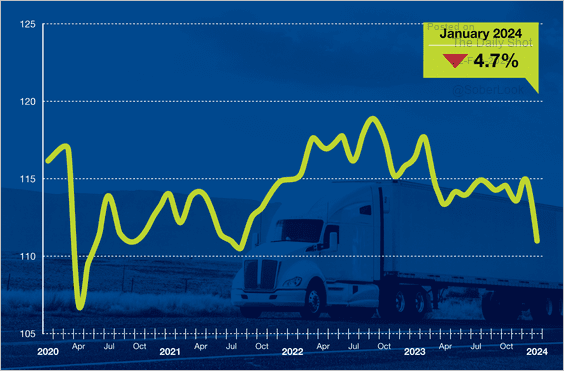

5. US truck tonnage dropped sharply in January, partially due to adverse weather conditions.

Source: ATA; h/t @dailychartbook

Source: ATA; h/t @dailychartbook

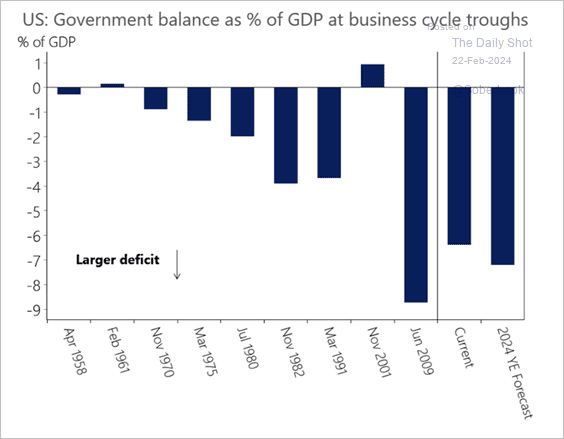

6. Historically, large budget deficits have occurred during business cycle troughs.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

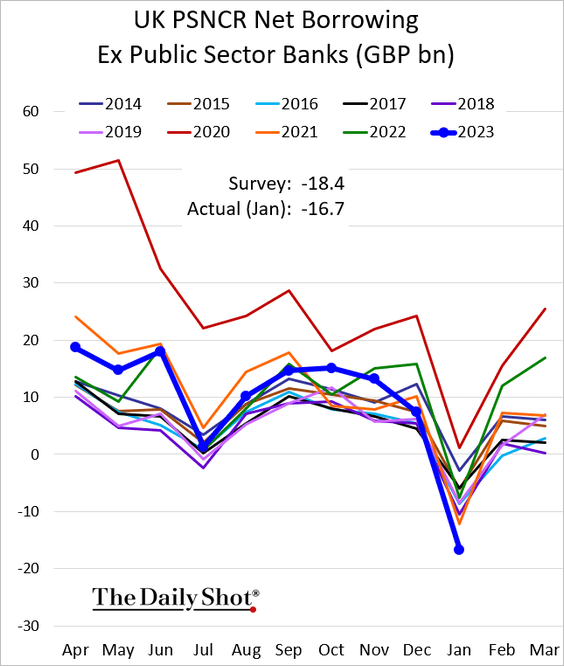

1. The UK achieved a budget surplus last month.

Source: @economics Read full article

Source: @economics Read full article

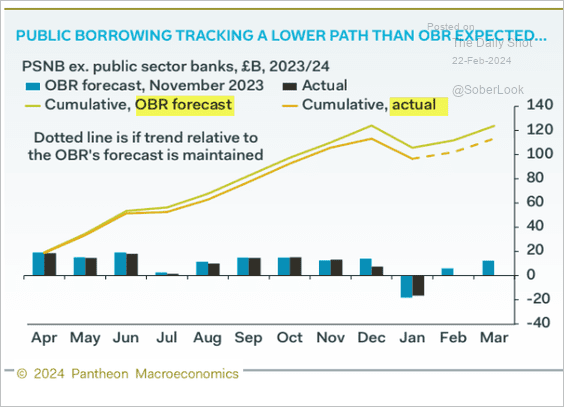

Government borrowing is running below the government’s forecasts. Are tax cuts coming?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

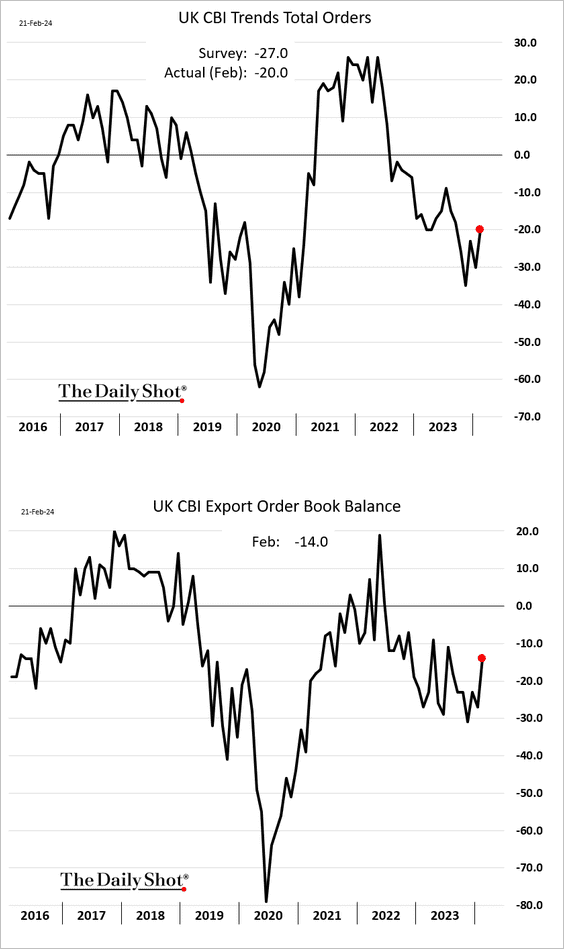

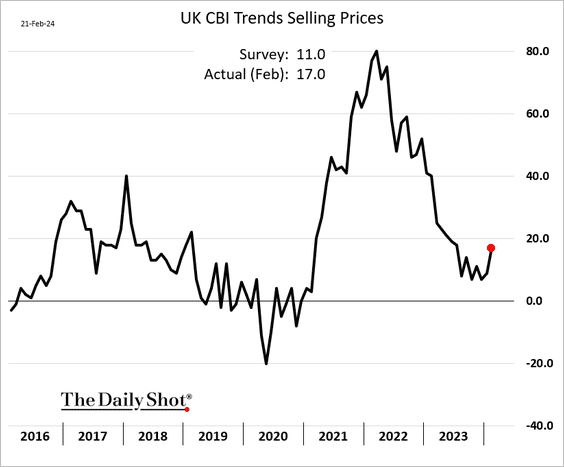

2. The slump in industrial orders eased this month.

More firms expect to be boosting prices.

——————–

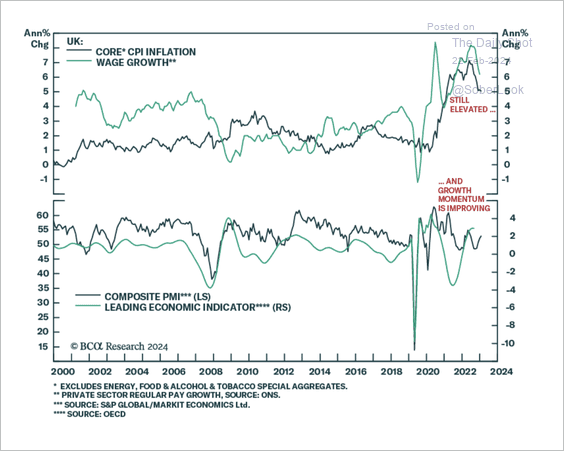

3. Improving economic growth momentum could delay a BoE pivot.

Source: BCA Research

Source: BCA Research

Back to Index

The Eurozone

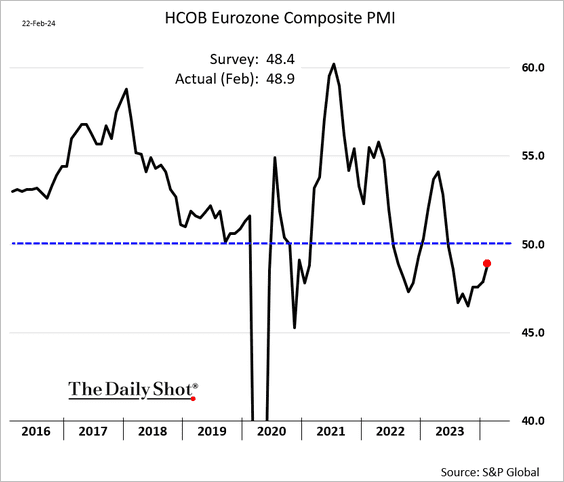

1. The downturn in euro-area business activity seems to be lessening. Here is the composite PMI.

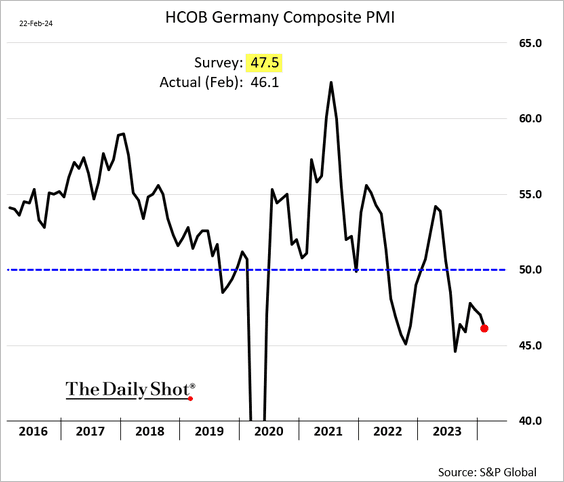

But Germany’s economy continues to struggle.

We will have more on the PMI report tomorrow.

——————–

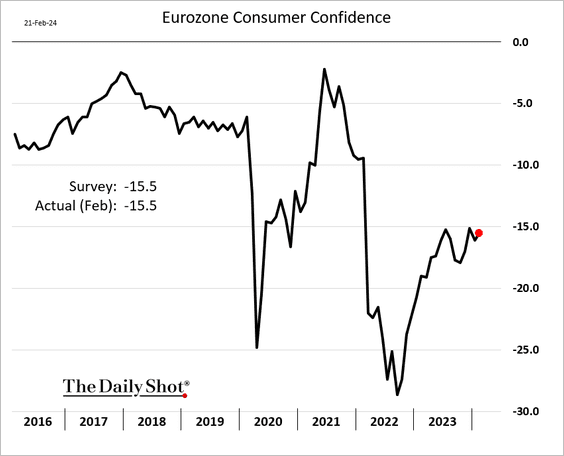

2. Consumer sentiment edged higher this month.

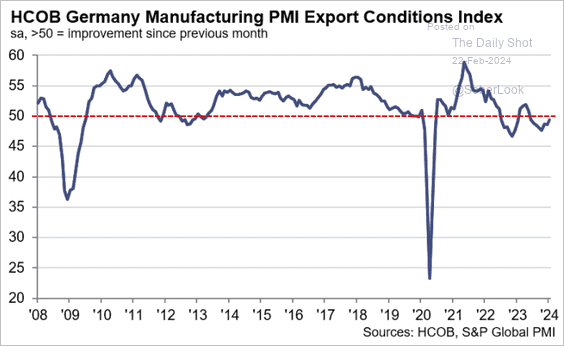

3. Germany’s export slump is easing.

Source: S&P Global PMI

Source: S&P Global PMI

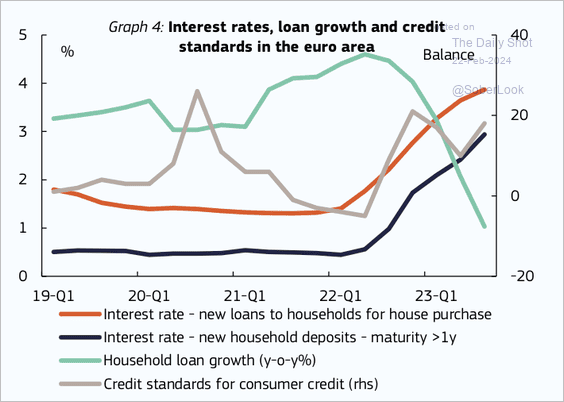

4. Euro area household loan growth has slowed amid higher interest rates and tighter credit standards.

Source: ECB

Source: ECB

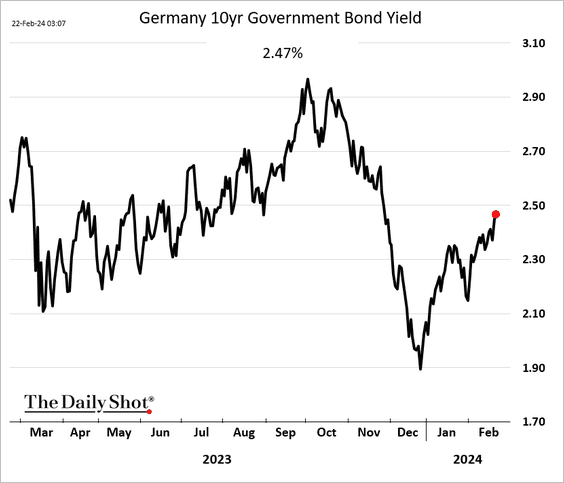

5. Eurozone bond yields continue to climb.

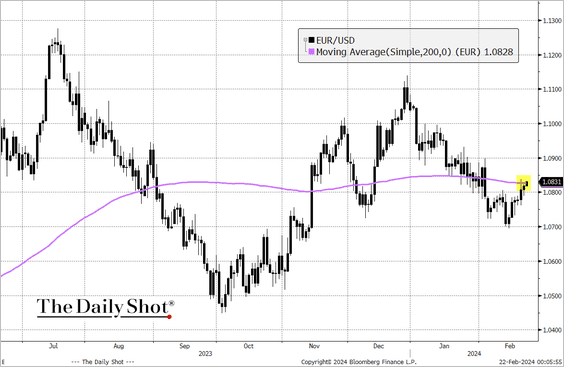

6. The euro is back at its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Japan

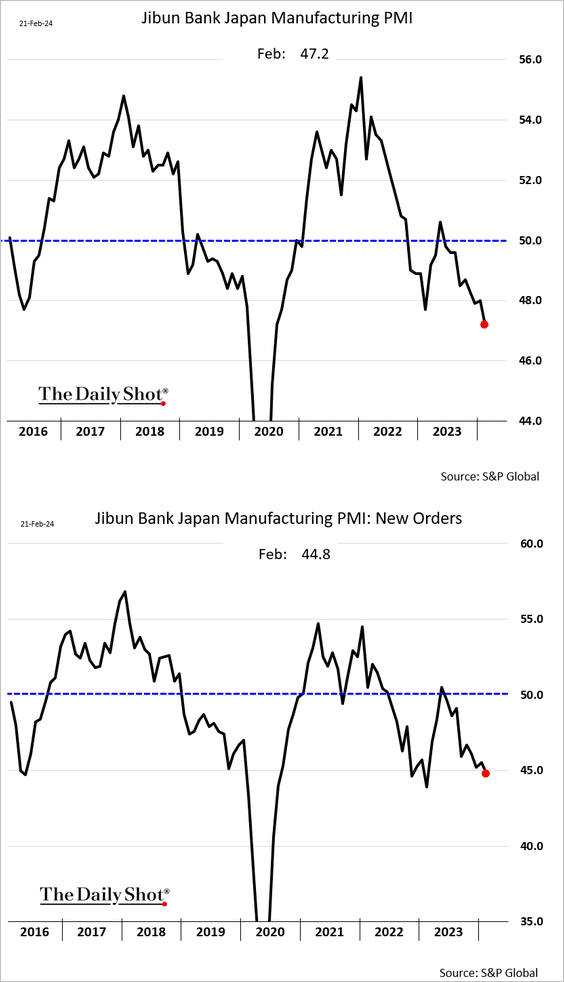

1. According to the flash PMI report from S&P Global, manufacturing activity slowed further this month.

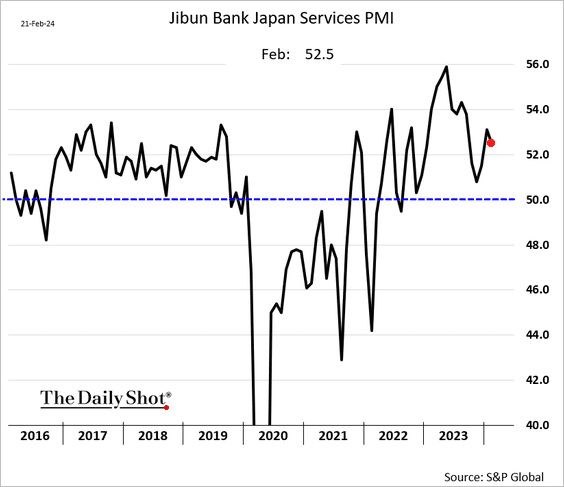

Services growth, however, is holding up well.

——————–

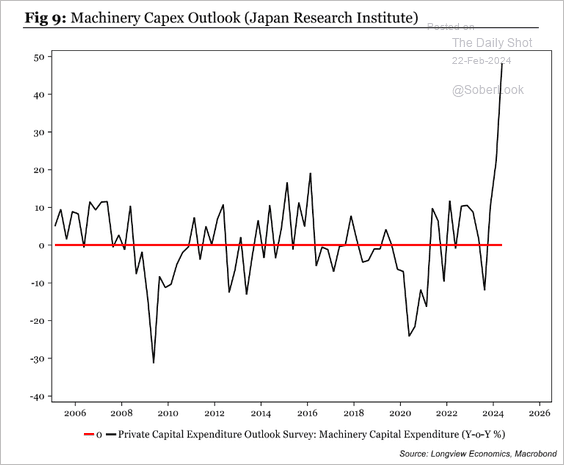

2. Machinery CapEx has been surging in recent months.

Source: Longview Economics

Source: Longview Economics

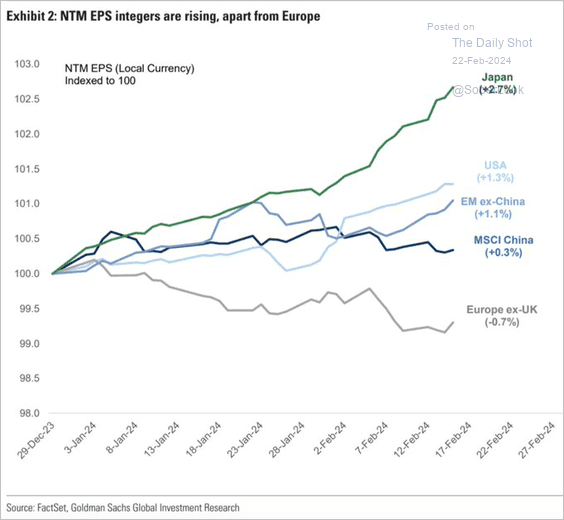

3. Forward earnings revisions in Japan are outpacing other economies.

Source: Goldman Sachs; @AyeshaTariq

Source: Goldman Sachs; @AyeshaTariq

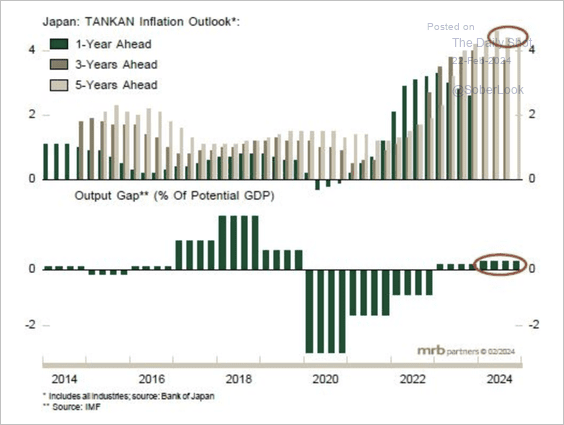

4. Inflation expectations remain high alongside a positive output gap.

Source: MRB Partners

Source: MRB Partners

Back to Index

Asia-Pacific

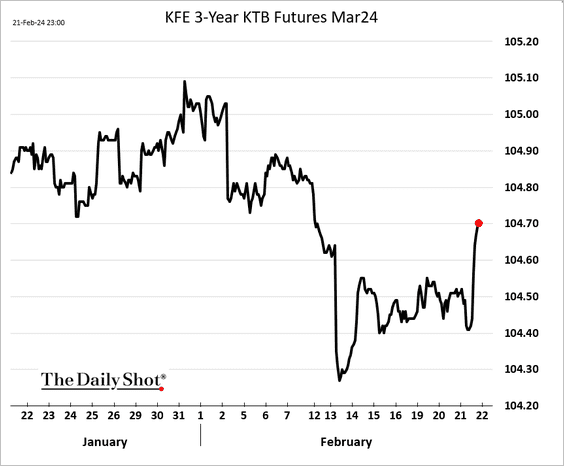

1. The Bank of Korea maintained its interest rate level, although one committee member advocated a rate reduction. That was enough to send bond futures higher.

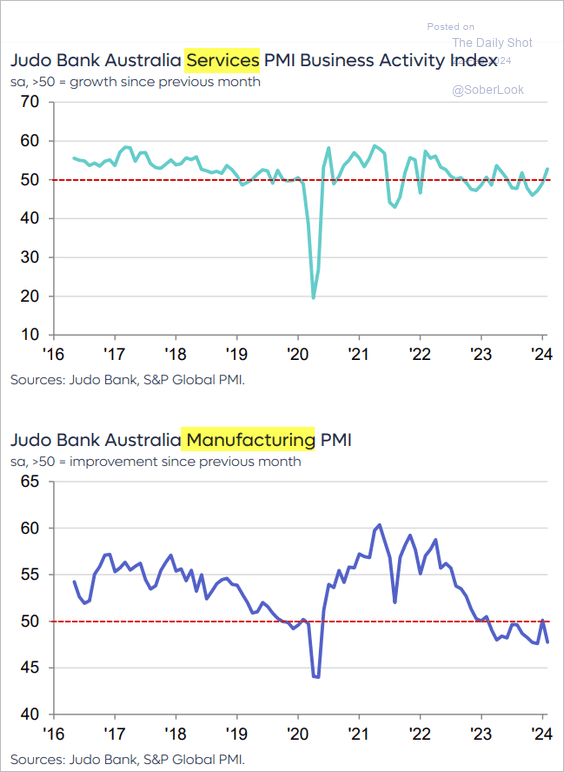

2. Australia’s services activity is back in growth territory, but manufacturing is contracting (based on the S&P Global PMI).

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

China

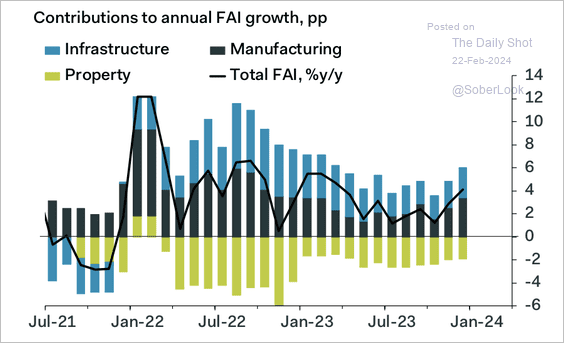

1. Stimulus via infrastructure and manufacturing has offset the negative impact of property on fixed asset investment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

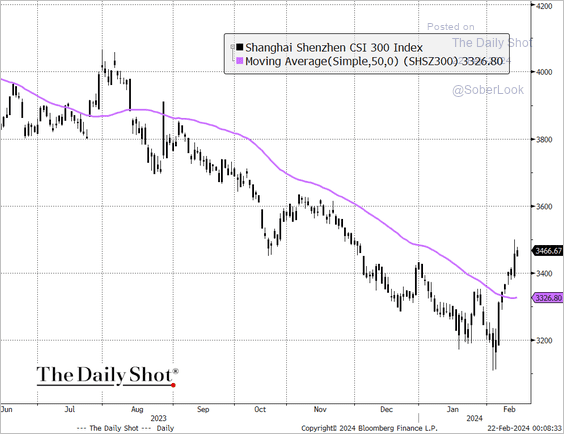

2. Stocks continue to drive higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

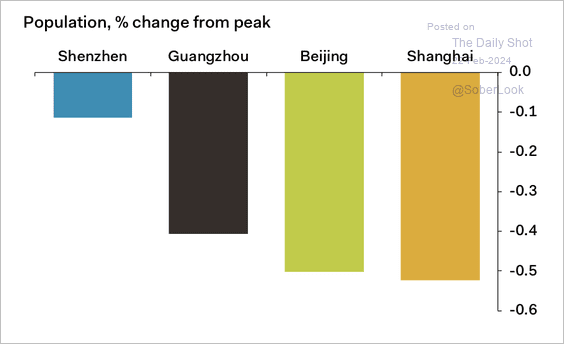

3. Tier-one cities experienced depopulation during the pandemic.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

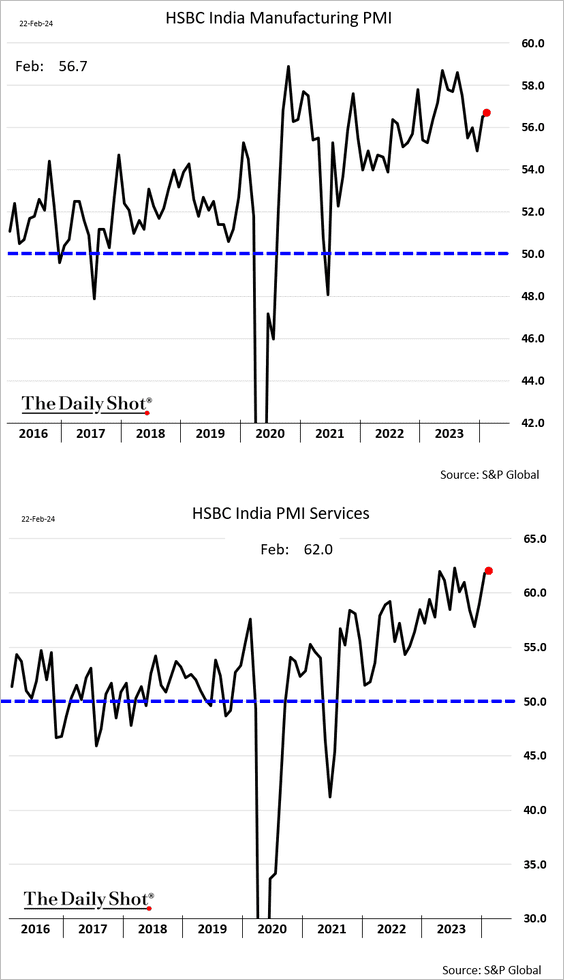

1. India’s business activity remains exceptionally strong (based on the S&P Global PMI).

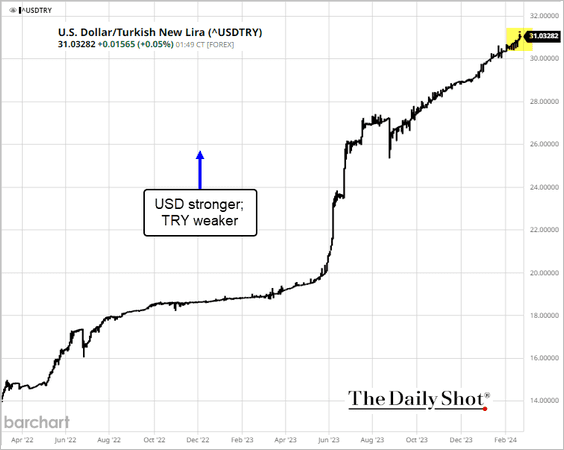

2. The Turkish lira continues to sink, weakening beyond 31 to the dollar.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

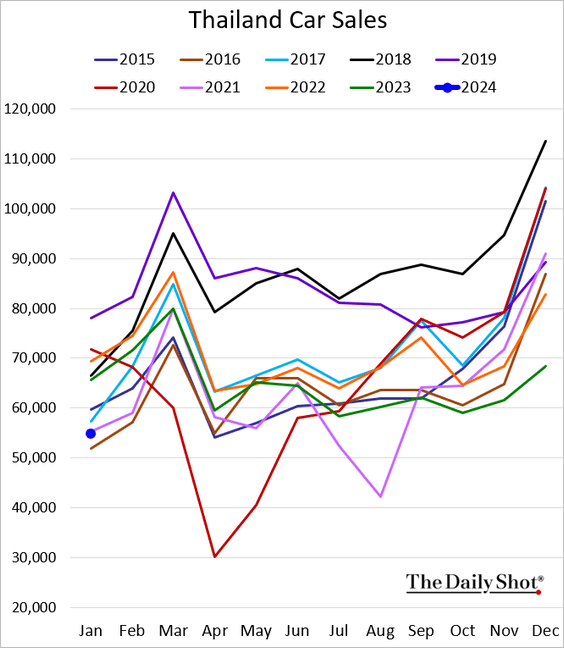

3. Thai car sales were unusually weak last month.

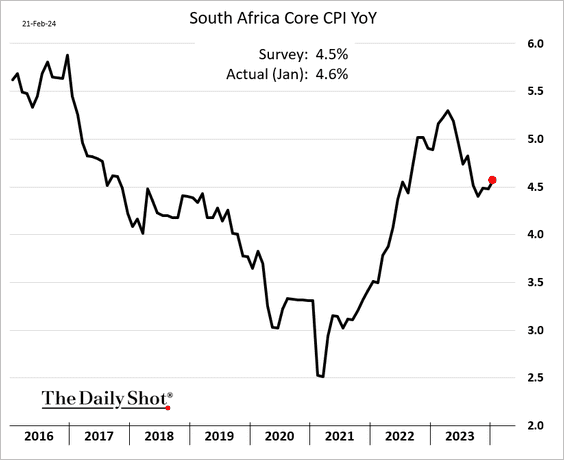

4. South Africa’s core inflation strengthened in January.

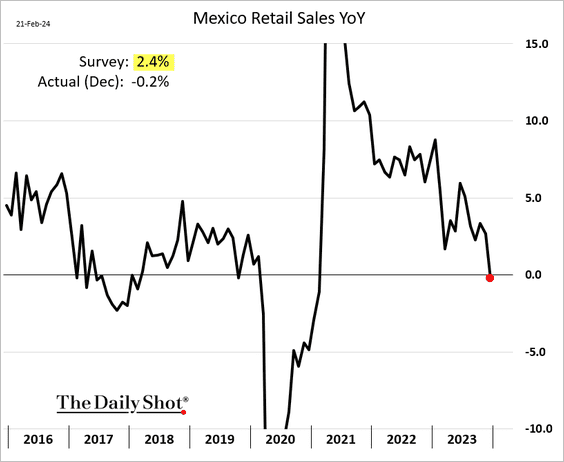

5. Mexico’s retail sales soured in December.

Back to Index

Commodities

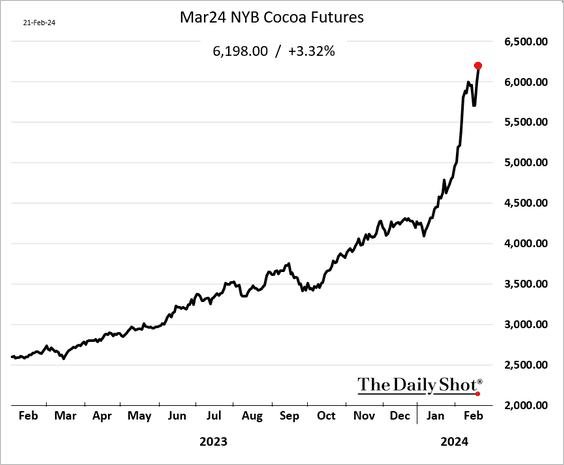

1. Cocoa futures hit another record high, …

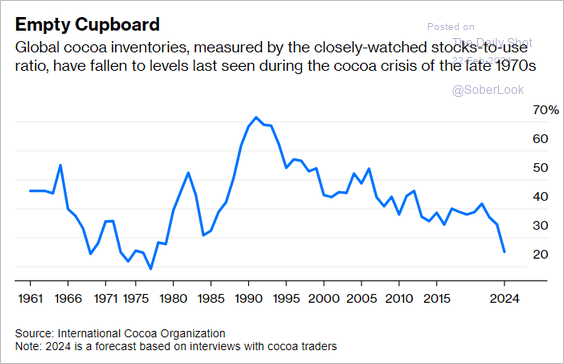

… as inventories sink.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

——————–

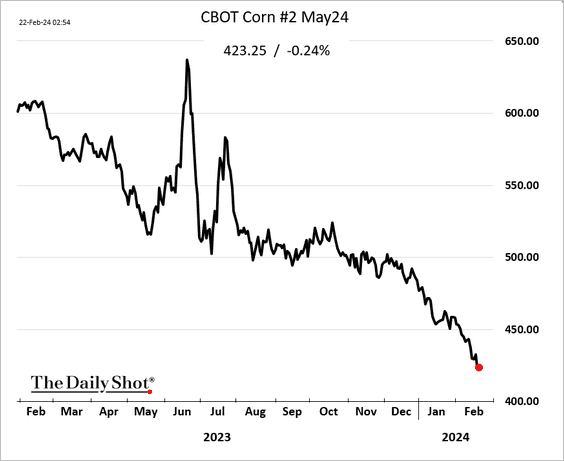

2. US corn futures remain under pressure.

Back to Index

Equities

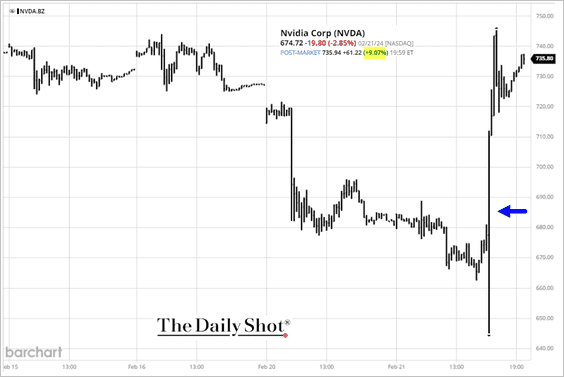

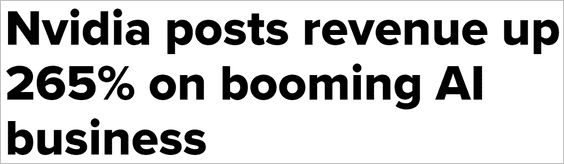

1. The market liked what it heard from Nvidia. Semiconductor demand for AI applications shows persistent strength.

Source: CNBC Read full article

Source: CNBC Read full article

Source: OpenAI

Source: OpenAI

• Open interest in Nvidia call options struck at $1,300 (some 70% above current levels) surged in recent days.

Source: @WSJ Read full article

Source: @WSJ Read full article

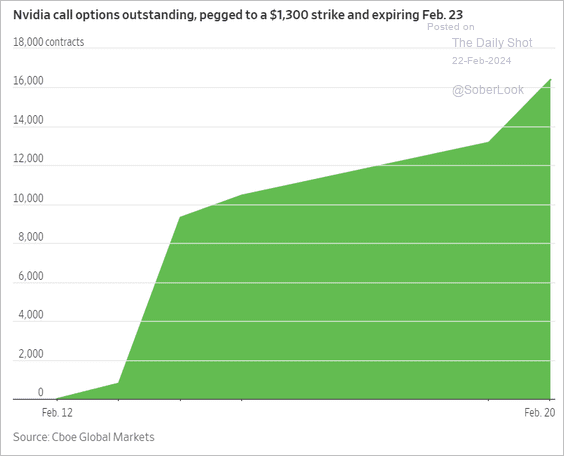

• Stock futures are up sharply.

——————–

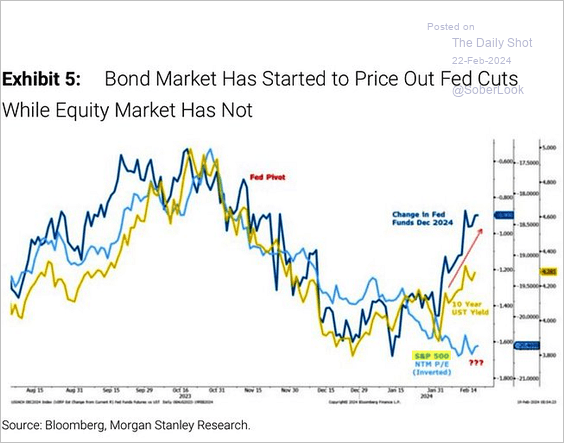

2. Rates markets have been pricing out some of the Fed rate cut expectations (see the US section). The equity market has not.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

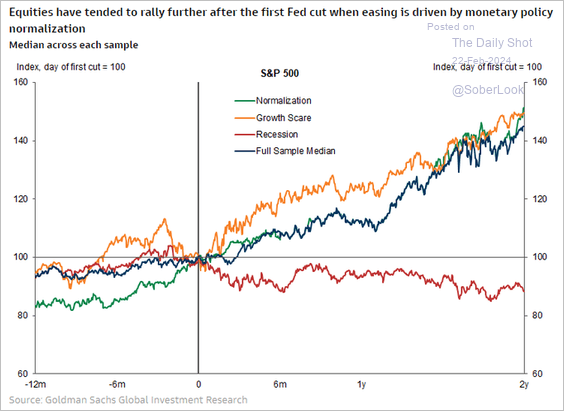

3. Stocks tend to rally further after the Fed’s first rate cuts, except in a recession scenario.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

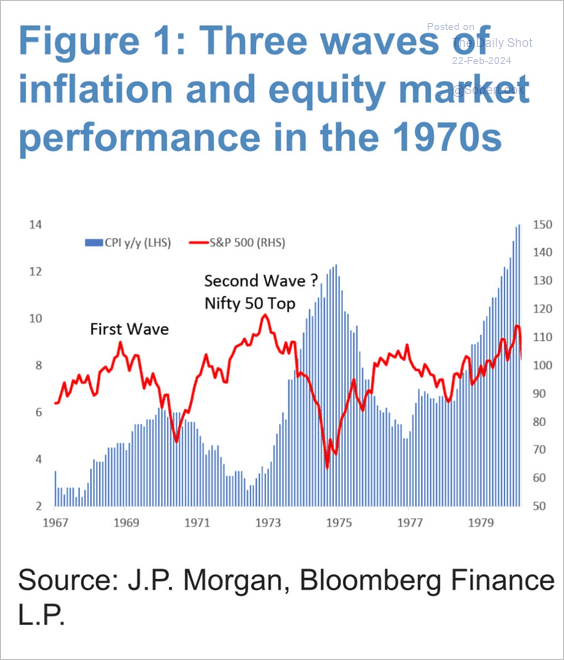

4. A second inflation wave in the US could be problematic for stocks.

Source: JP Morgan Research Further reading

Source: JP Morgan Research Further reading

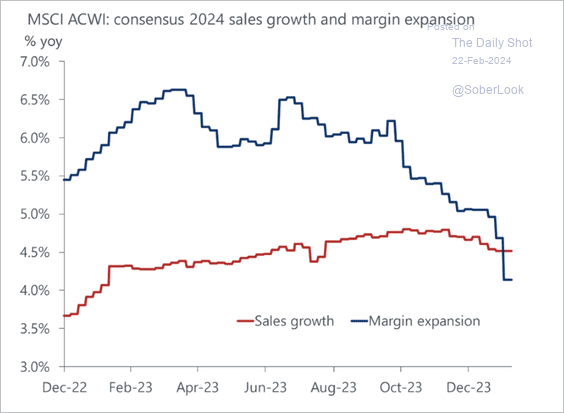

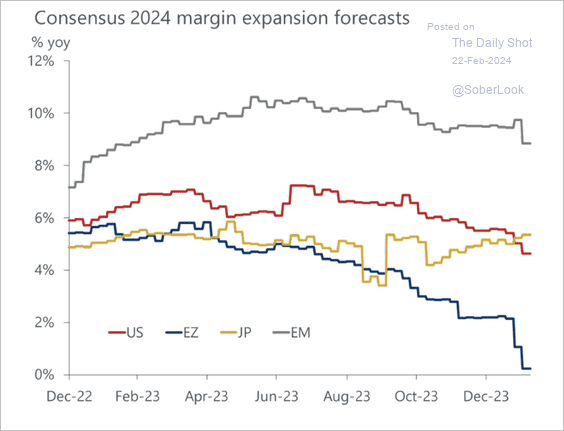

5. Consensus expectations for margin expansion have been pared back, particularly in the Eurozone and the US. (2 charts)

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

——————–

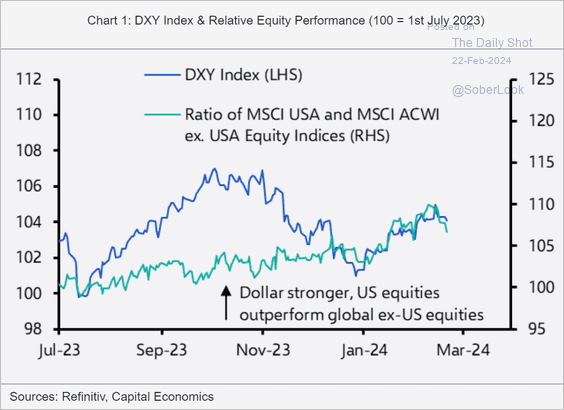

6. This year, US equity performance relative to the rest of the world has been correlated to the dollar.

Source: Capital Economics

Source: Capital Economics

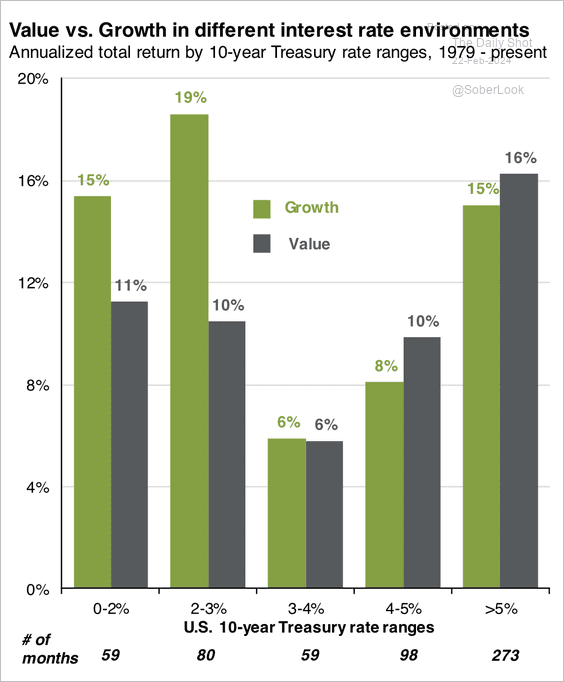

7. US growth stocks tend to outperform value stocks during low Treasury yield environments.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

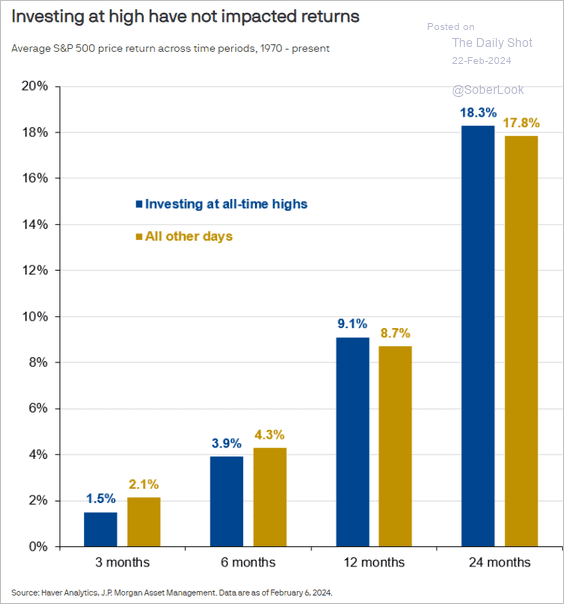

8. Historically, there has been no clear disadvantage to investing in the S&P 500 at new highs over the short or long term.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

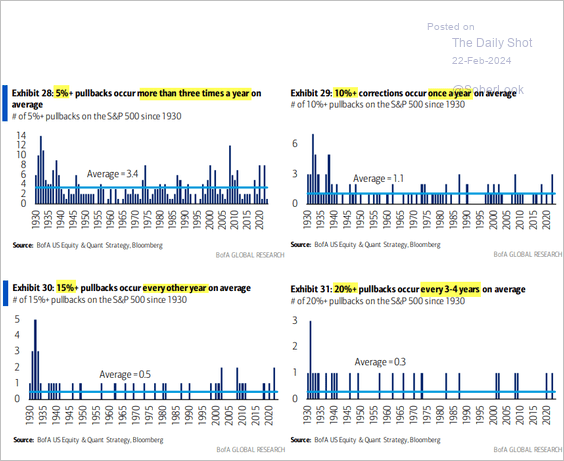

9. How often do 5%, 10%, 15%, and 20%+ pullbacks occur?

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

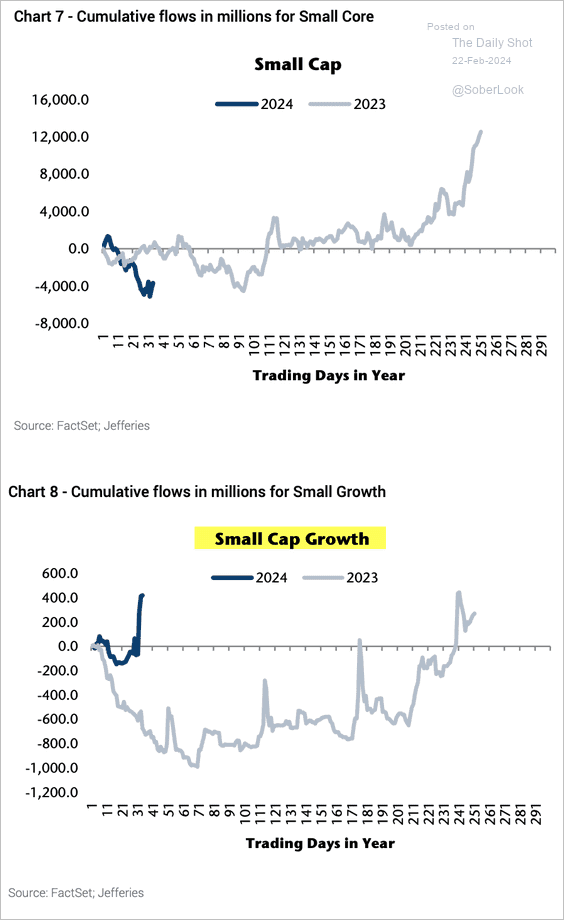

10. Fund flows into small caps have been negative this year, but small-cap growth funds are seeing inflows.

Source: Jefferies; @dailychartbook

Source: Jefferies; @dailychartbook

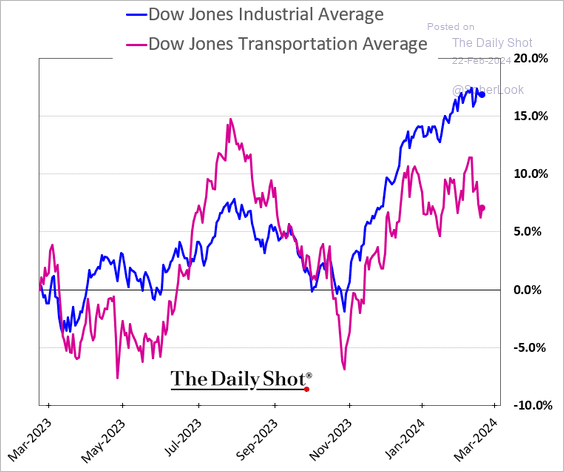

11. Transportation stocks have been lagging.

h/t @dailychartbook

h/t @dailychartbook

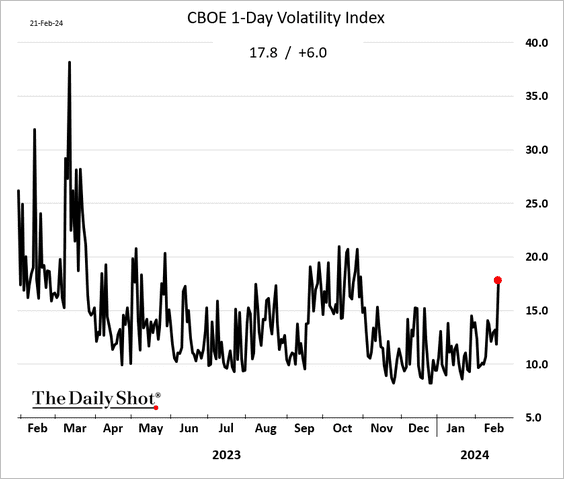

12. The CBOE’s one-day volatility index surged this week.

Back to Index

Alternatives

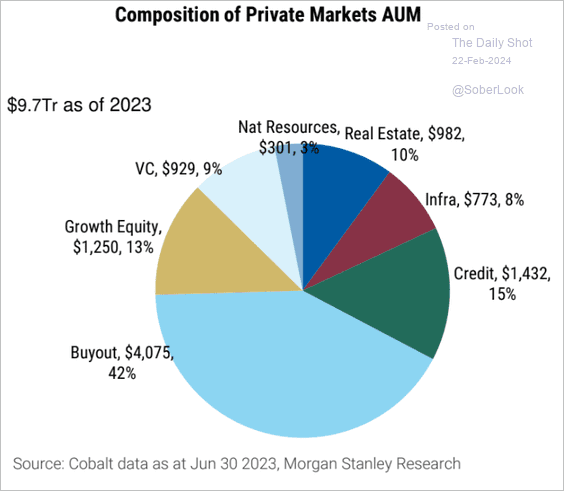

1. Let’s start with the composition of private markets’ AUM.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

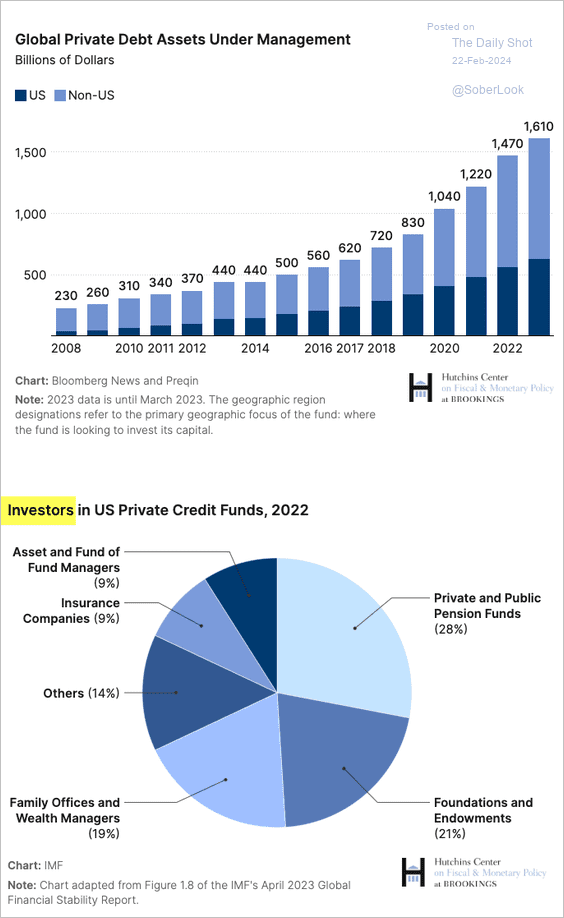

2. Here is a look at private debt markets.

Source: Brookings Read full article

Source: Brookings Read full article

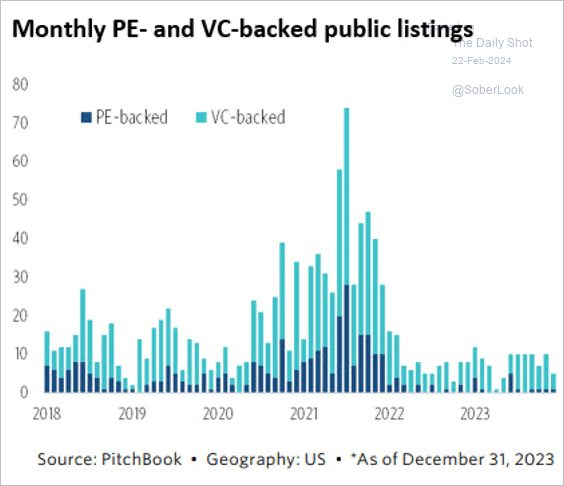

3. The US venture capital exit environment has been very weak over the past two years.

Source: PitchBook

Source: PitchBook

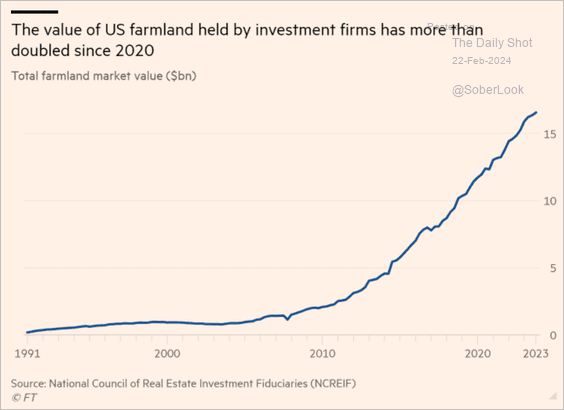

4. Investment firms are accumulating US farmland.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Credit

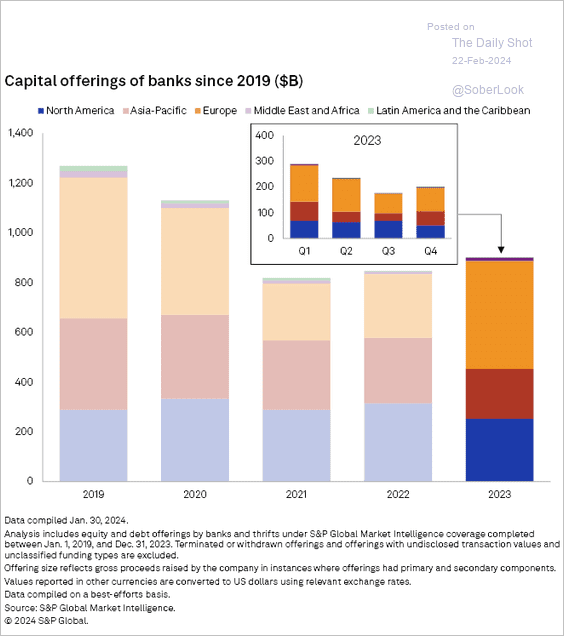

1. Bank capital offerings picked up last year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

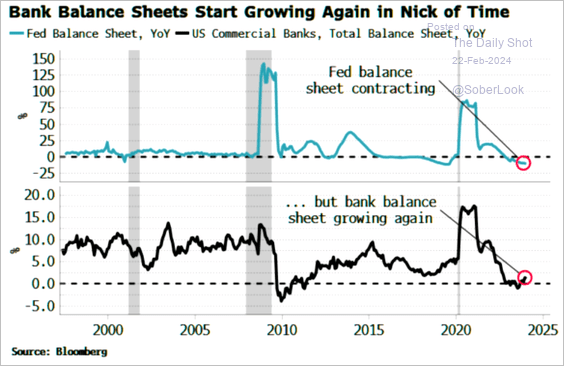

2. Banks’ balance sheets are growing again.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

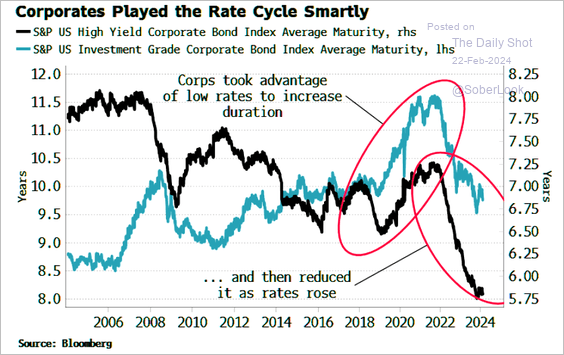

3. US large-cap corporate borrowers took advantage of exceptionally low rates after the initial COVID shock.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Rates

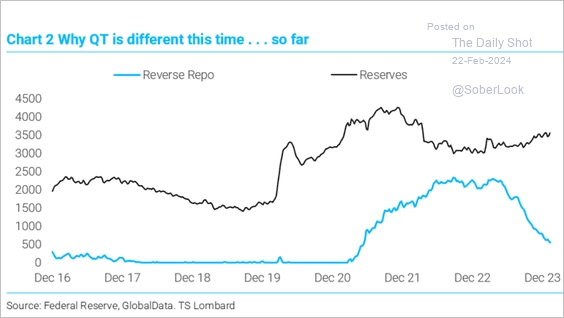

Shrinking RRP (Fed’s reverse repo facility) balances keep bank reserves elevated, allowing the US central bank to continue with QT.

Source: TS Lombard

Source: TS Lombard

However, relying solely on additional reductions in the RRP facility may not be prudent. The Federal Reserve might have to explore tapering QT to prevent excessive declines in reserves, which could lead to a scarcity of liquidity and disrupt the repo market, similar to the events of 2019.

FOMC Minutes: – In light of ongoing reductions in usage of the ON RRP facility, many participants suggested that it would be appropriate to begin in-depth discussions of balance sheet issues at the Committee’s next meeting to guide an eventual decision to slow the pace of runoff. Some participants remarked that, given the uncertainty surrounding estimates of the ample level of reserves, slowing the pace of runoff could help smooth the transition to that level of reserves or could allow the Committee to continue balance sheet runoff for longer.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Global Developments

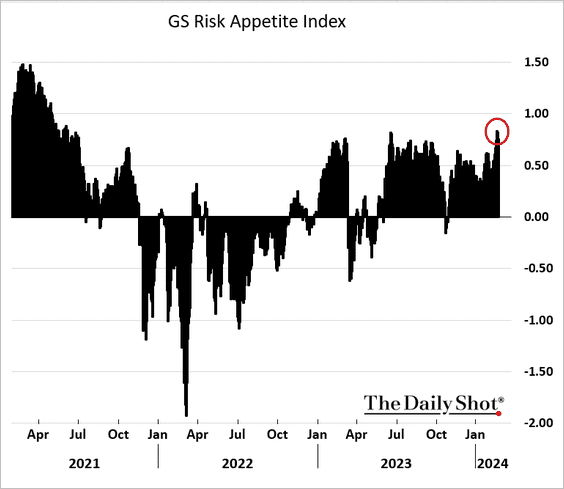

1. Goldman’s risk appetite index hasn’t been this high since 2021.

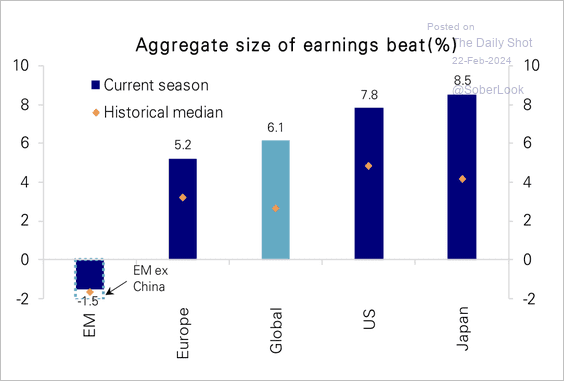

2. Japan and the US experienced significantly higher-than-average earnings outperformance in Q4, in contrast to Emerging Markets, which persistently fell short of estimates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

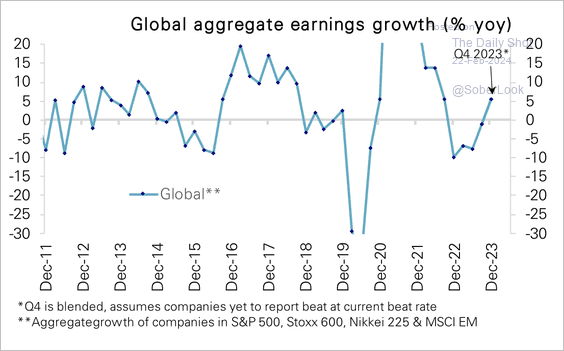

• Global aggregate earnings growth turned positive in Q4 for the first time in five quarters.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

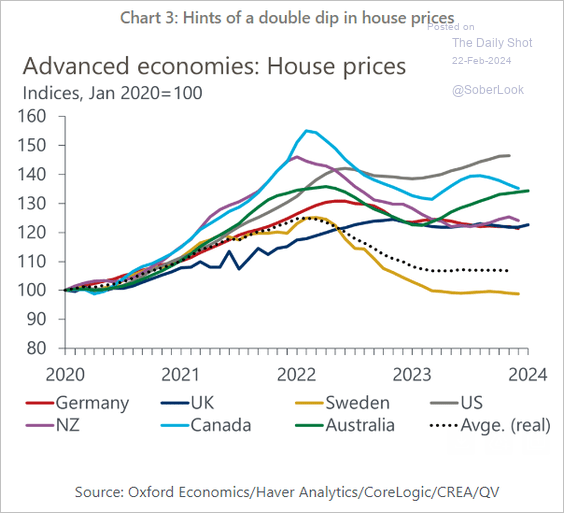

3. Here is a look at real house prices in advanced economies.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

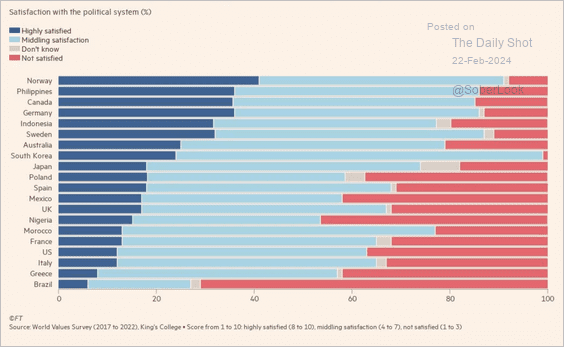

1. Satisfaction with the political system in select countries:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

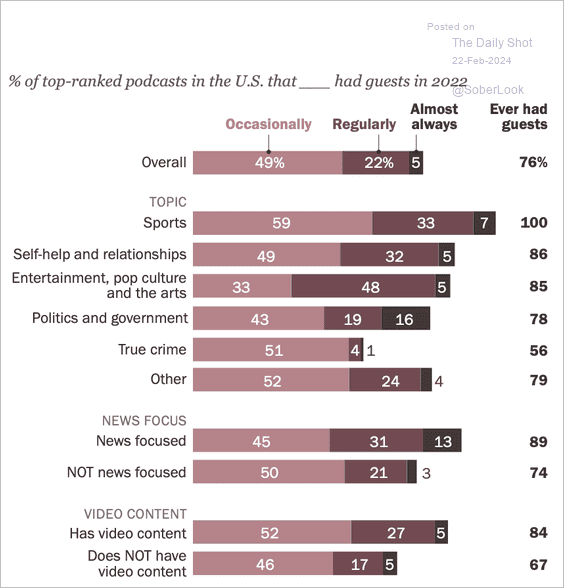

2. Top-ranked podcasts tend to bring on guests.

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

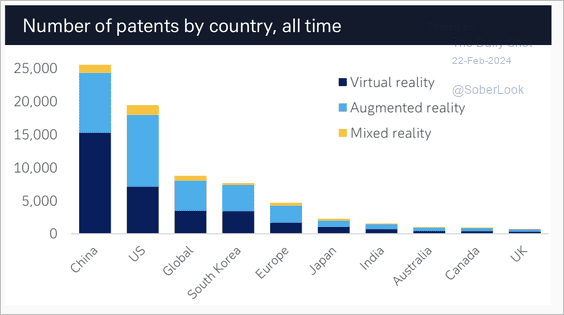

3. Virtual reality patents:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

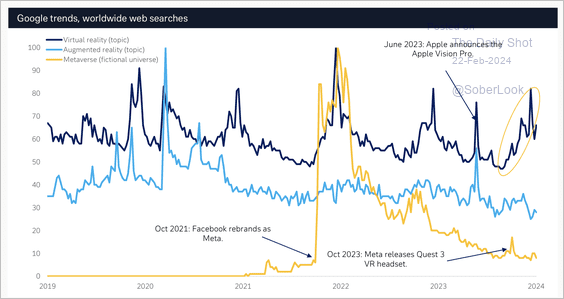

• Google search activity for virtual reality:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

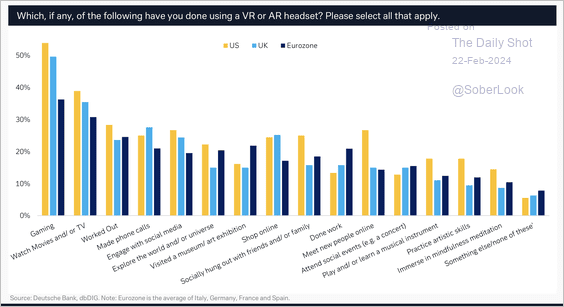

• Use of virtual reality headsets:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

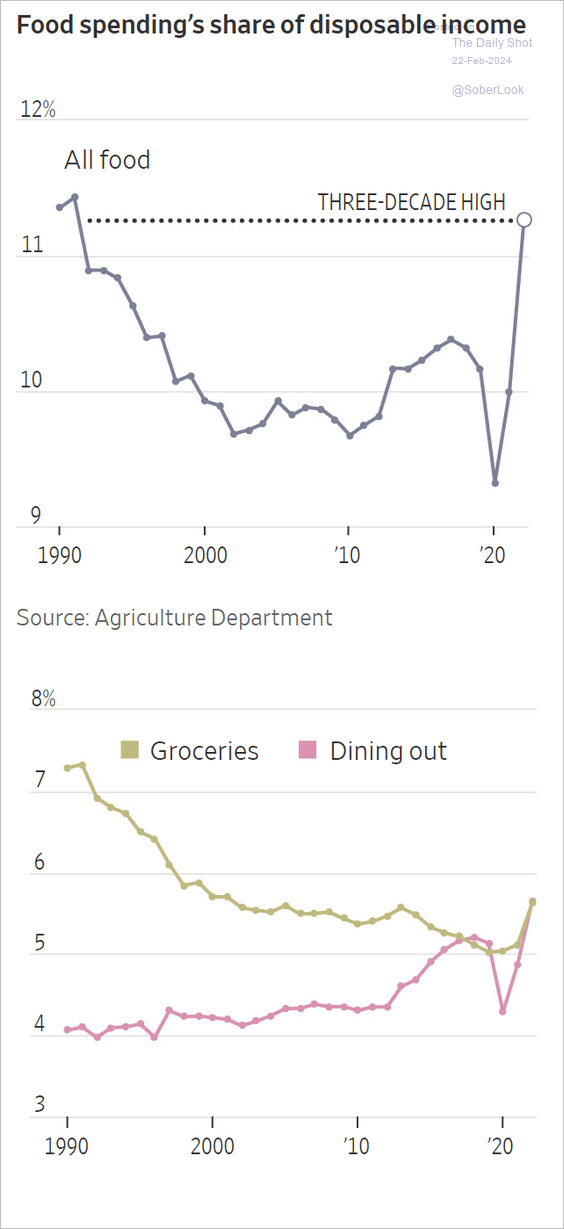

4. Food spending’s share of disposable income in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

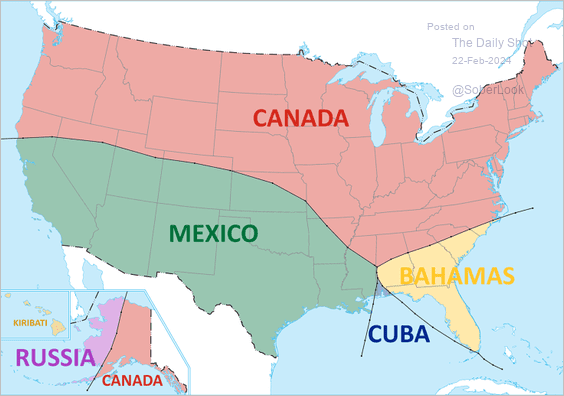

5. The nearest country:

Source: Reddit

Source: Reddit

——————–

Back to Index