The Daily Shot: 23-Feb-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

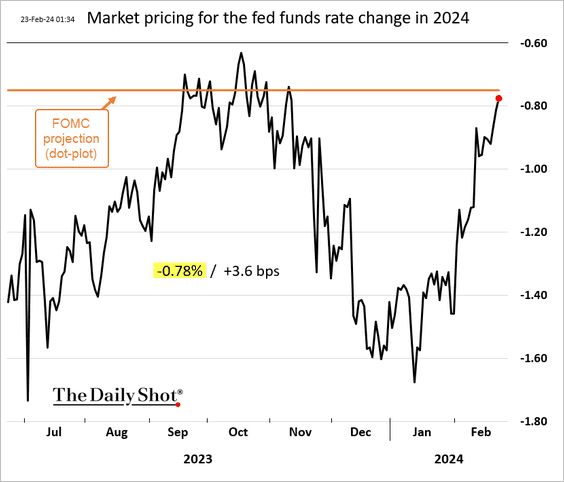

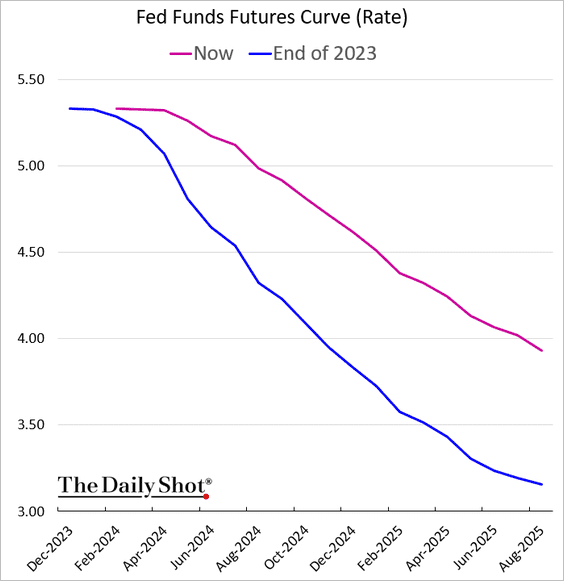

1. The Fed is aligning market expectations with its own perspective of three rate cuts this year.

• The repricing in rate cut expectations this year has been substantial.

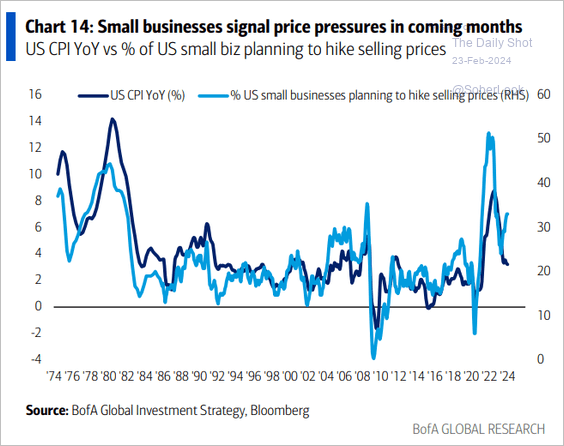

• Many economists remain concerned about a resurgence in inflation.

Source: BofA Global Research

Source: BofA Global Research

——————–

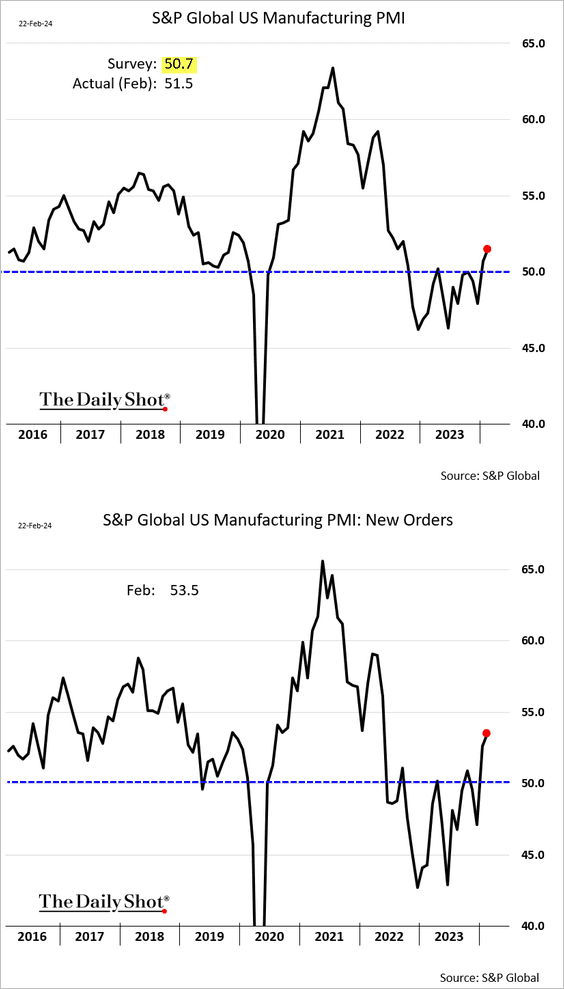

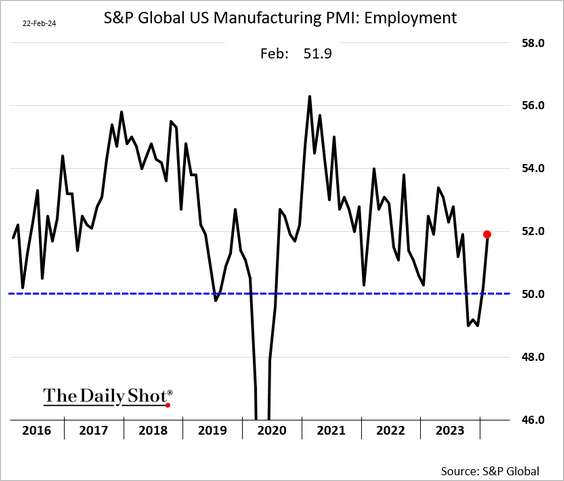

2. The flash PMI report from S&P Global showed US factory activity picking up momentum this month.

– Factories are hiring again.

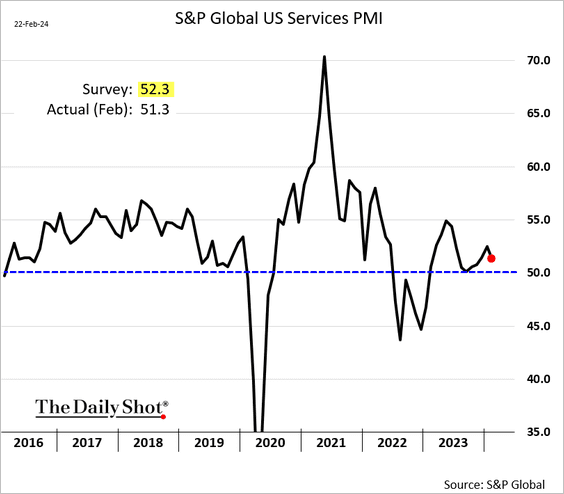

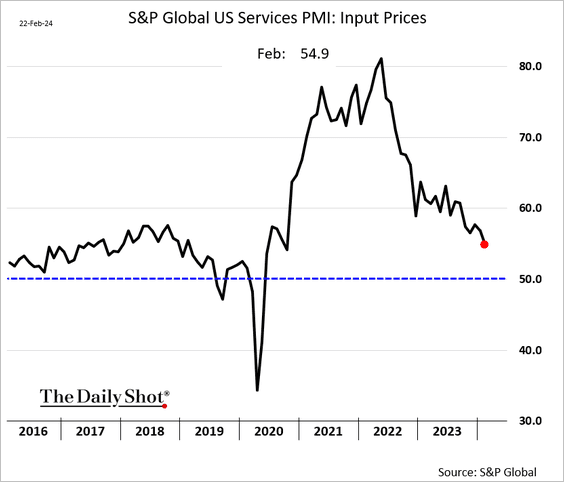

• However, service sector growth slowed.

– Fewer service firms are reporting rising costs.

——————–

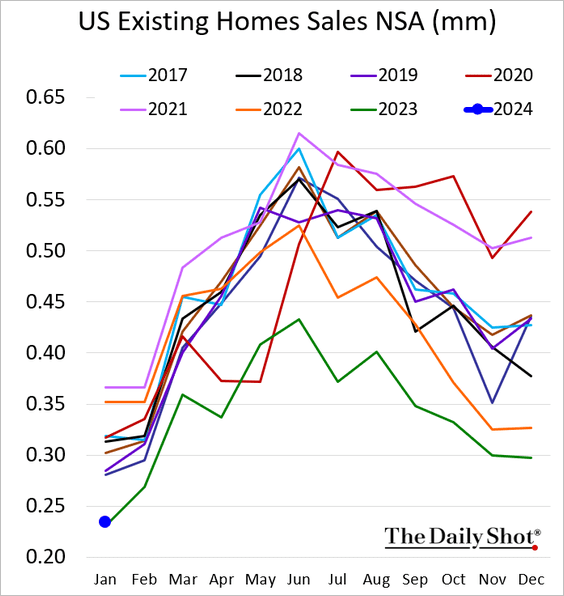

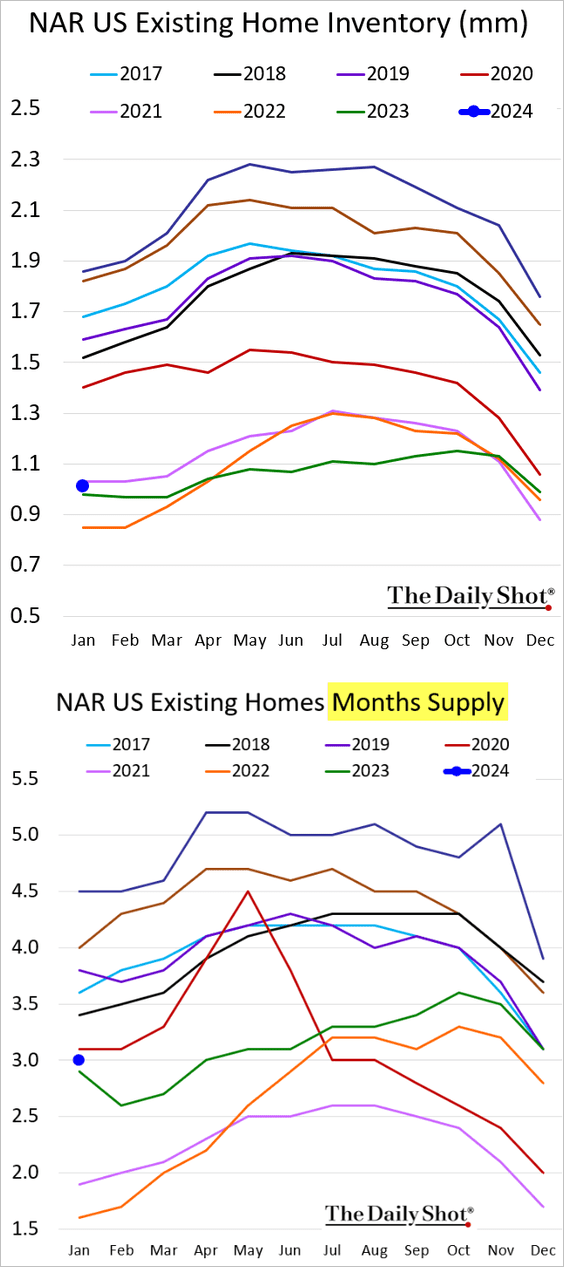

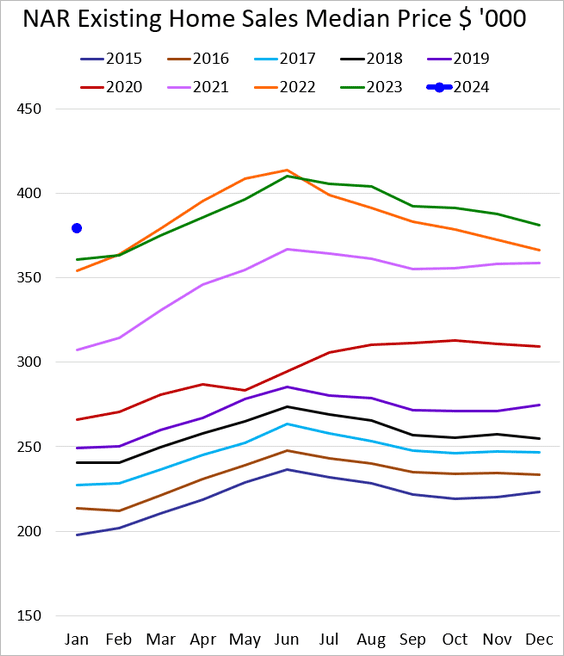

3. Existing home sales were roughly in line with 2023 levels in January.

• Inventories were slightly above last year’s levels.

• Sales prices hit a record high for this time of the year.

——————–

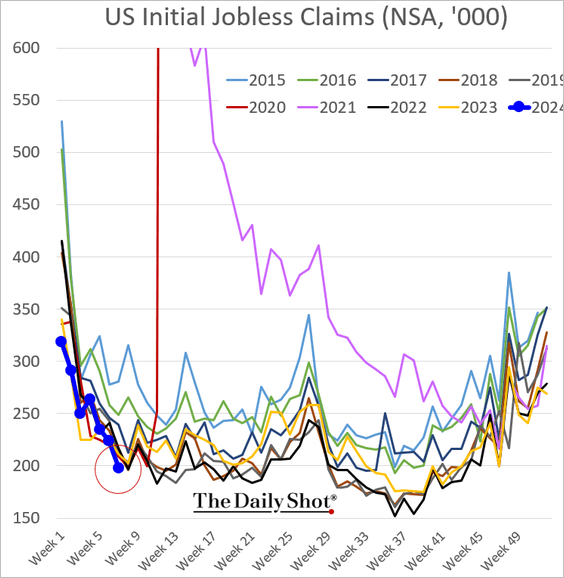

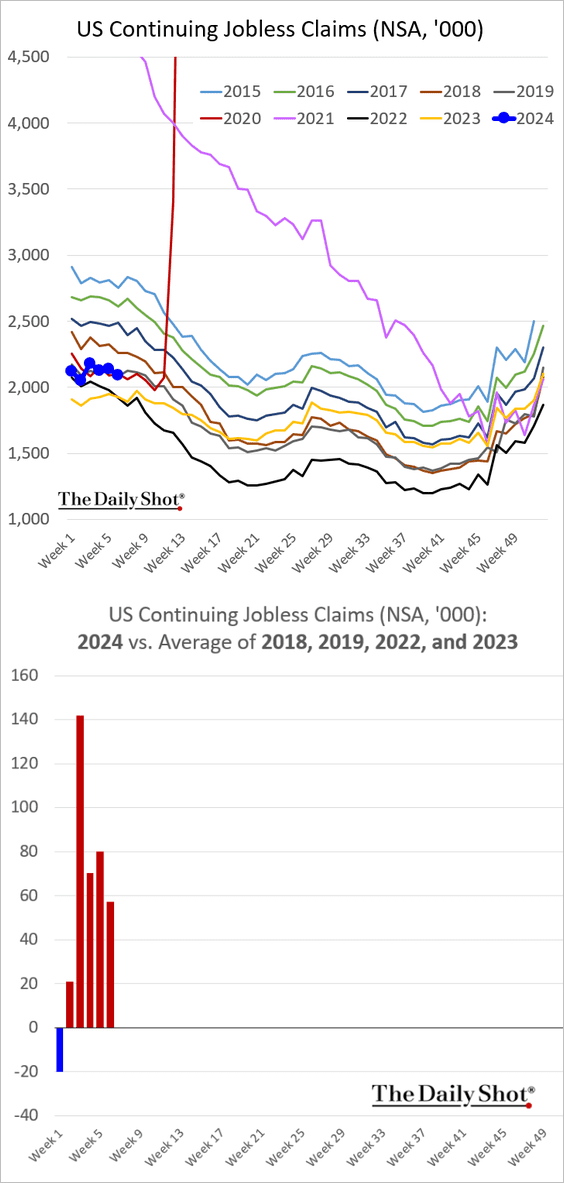

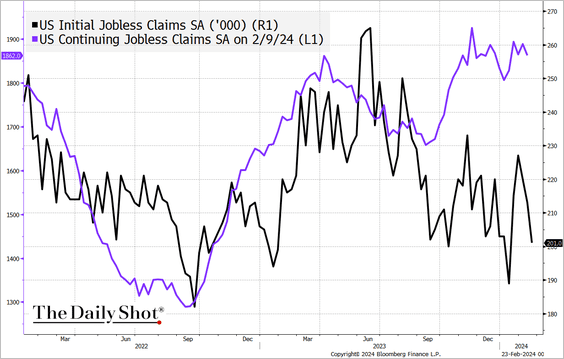

4. Next, we have some updates on the labor market.

• Initial jobless claims hit a multi-year low last week, dipping below 200k.

Source: Reuters Read full article

Source: Reuters Read full article

– However, we don’t see the same sort of declines in continuing claims.

On a seasonally adjusted basis, the trends in the two indicators have diverged sharply.

h/t Eliza Winger; @TheTerminal, Bloomberg Finance L.P.

h/t Eliza Winger; @TheTerminal, Bloomberg Finance L.P.

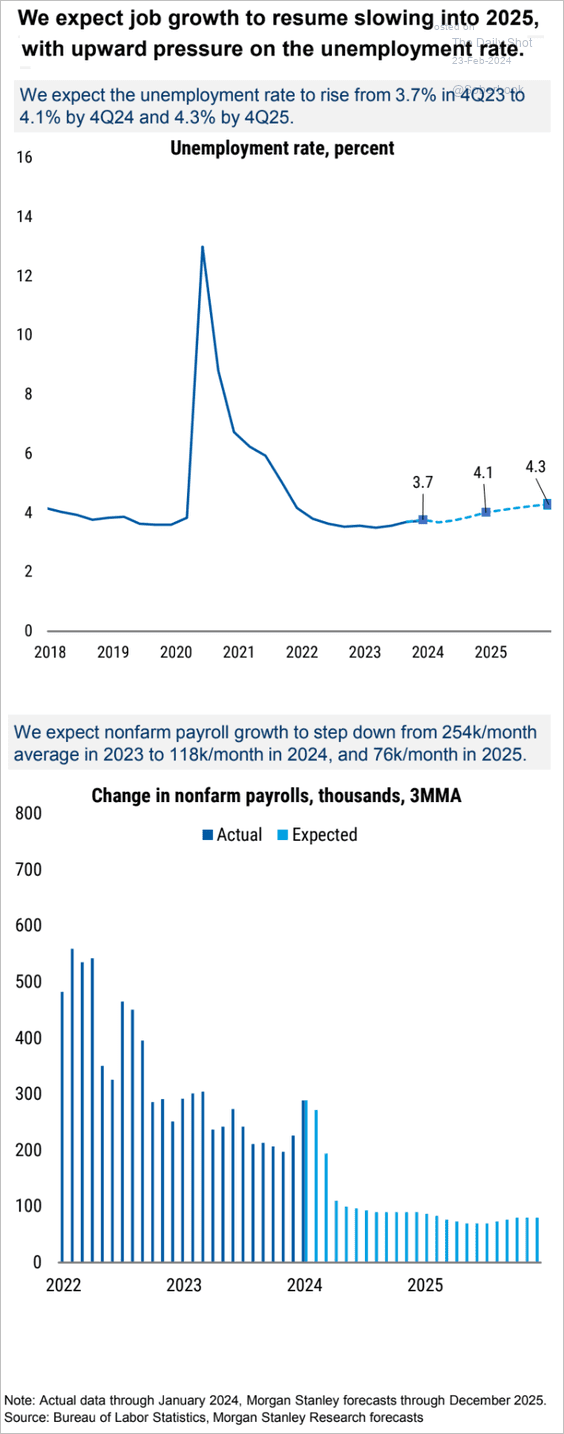

• Morgan Stanley expects the unemployment rate to move higher next year as hiring slows.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

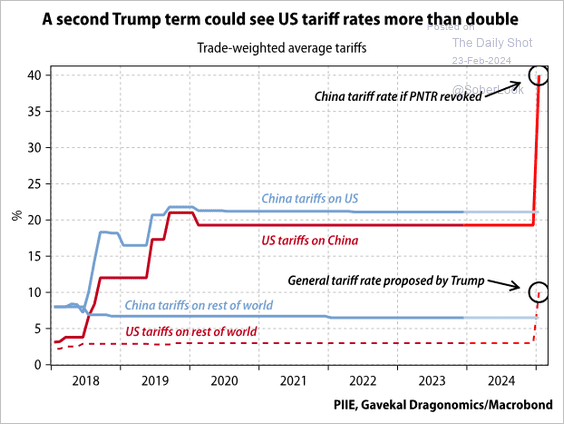

5. Tariff hikes ahead?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Canada

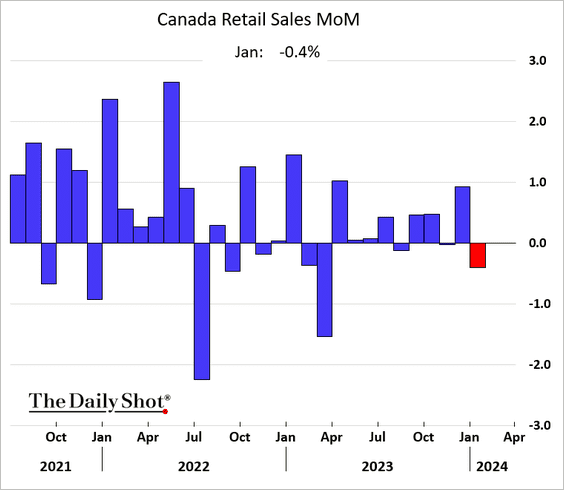

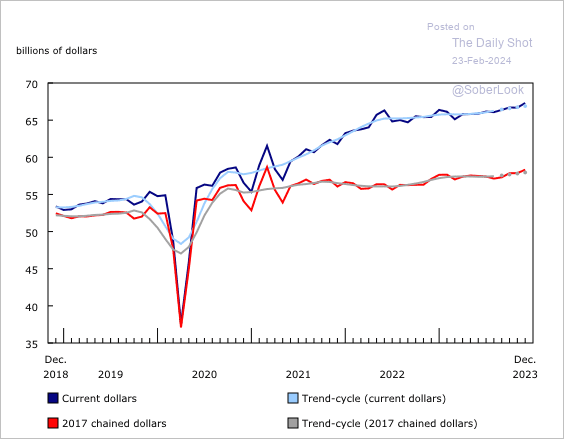

1. Canada’s retail sales jumped in December, but the advance estimate points to a pullback in January.

This chart shows the trend in real retail sales.

Source: StatCan

Source: StatCan

——————–

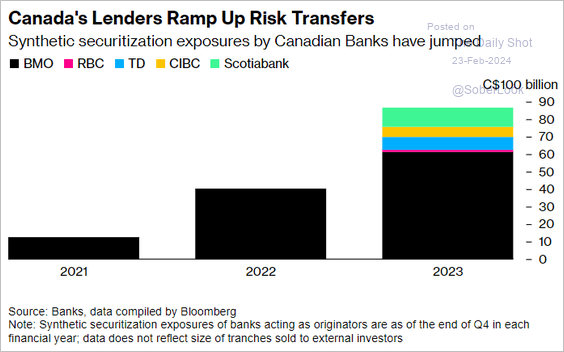

2. Canadian banks are increasingly using synthetic risk transfer transactions to reduce exposure.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

The United Kingdom

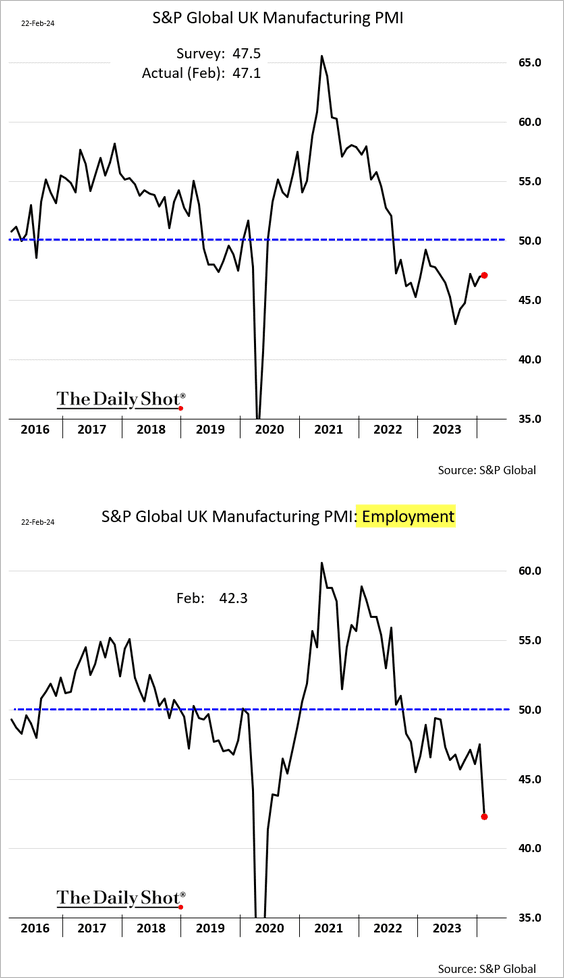

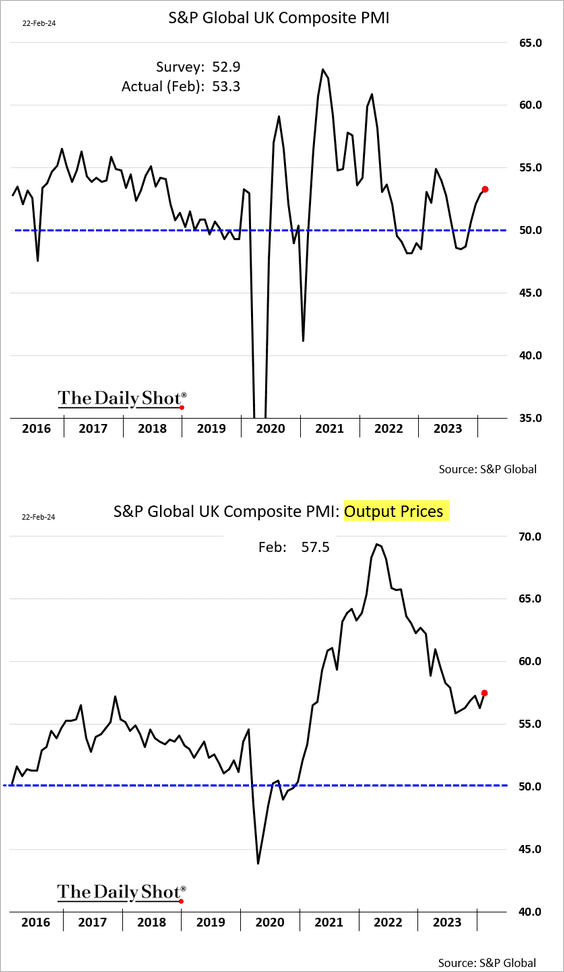

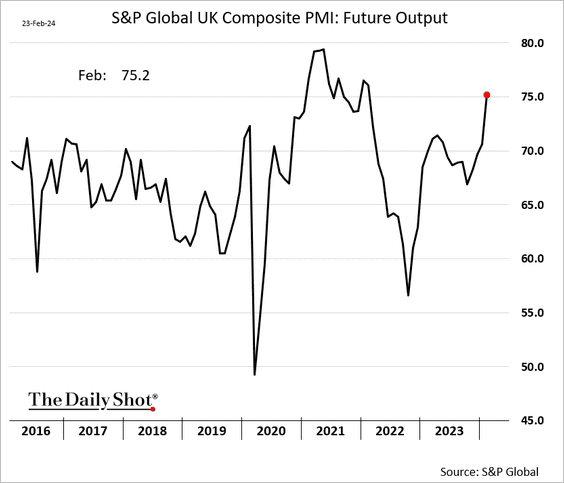

1. UK manufacturing remained in contraction mode this month, with factories rapidly reducing their workforce.

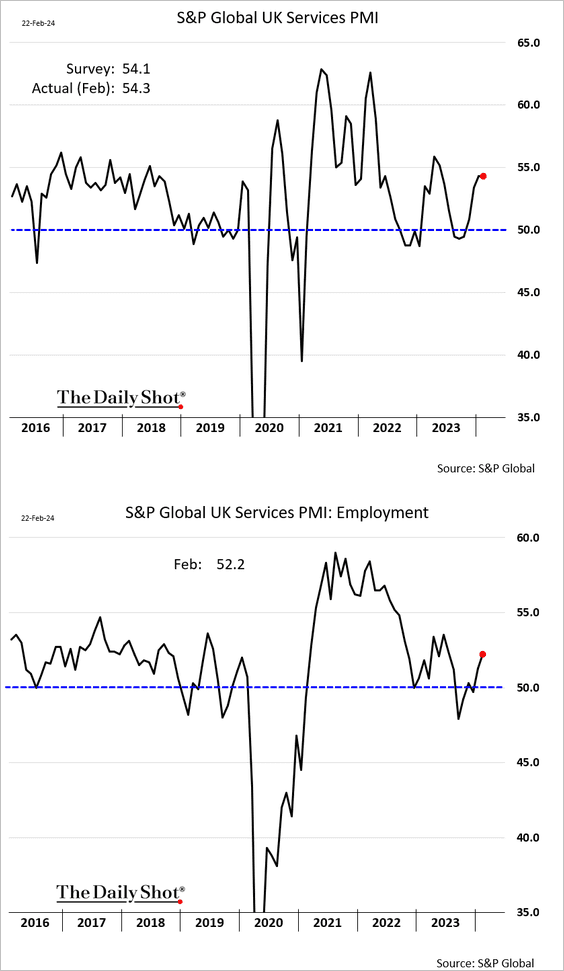

• On the other hand, service sector firms enjoyed robust growth.

• The composite PMI showed improving business activity, with more firms boosting sales prices.

Source: Reuters Read full article

Source: Reuters Read full article

• Business outlook has improved markedly.

——————–

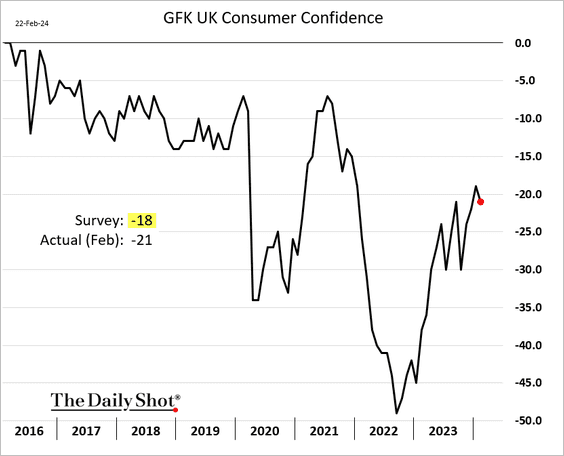

2. UK consumer confidence unexpectedly worsened this month.

Source: @economics Read full article

Source: @economics Read full article

——————–

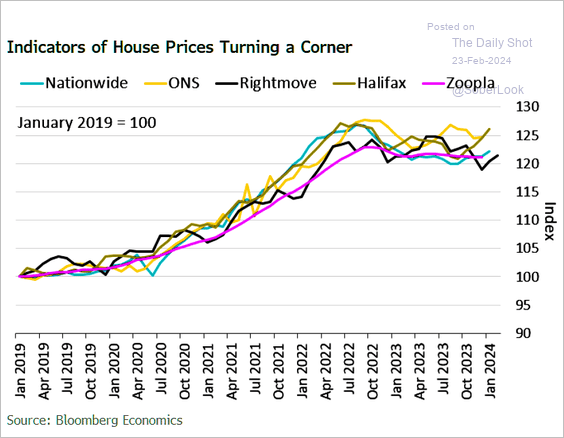

3. The housing market is exhibiting signs of recovery.

Source: @economistniraj, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @economistniraj, @TheTerminal, Bloomberg Finance L.P. Read full article

Back to Index

The Eurozone

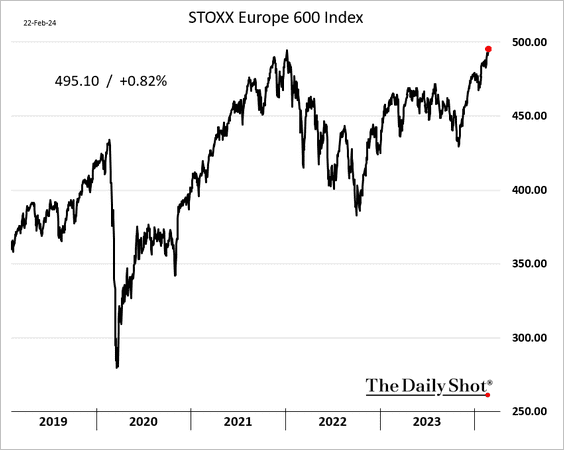

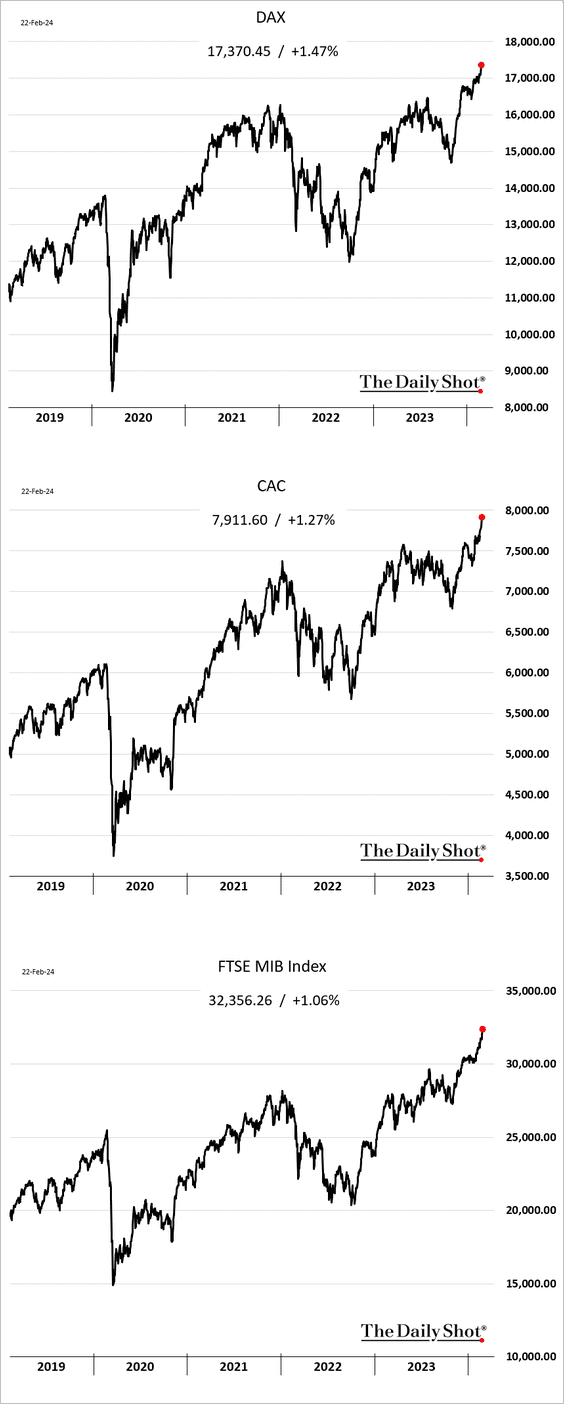

1. The STOXX 600 hit a record high, …

… as European shares surge.

——————–

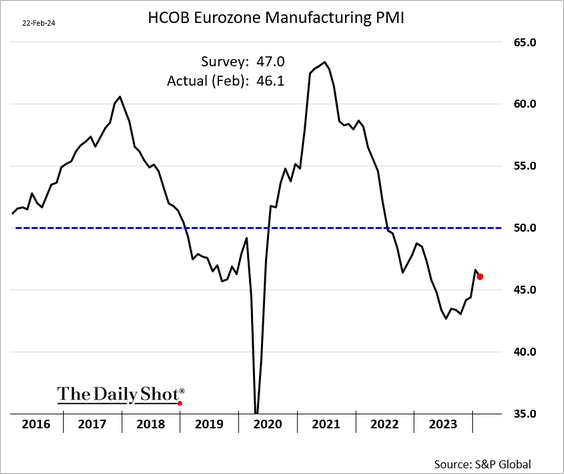

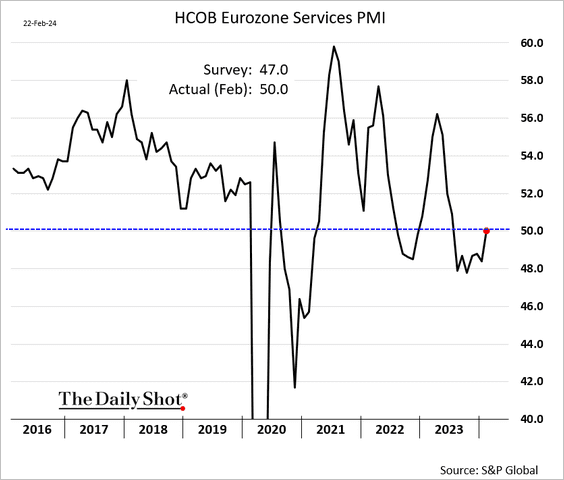

2. As we saw yesterday, the composite PMI is nearing stabilization.

Source: Reuters Read full article

Source: Reuters Read full article

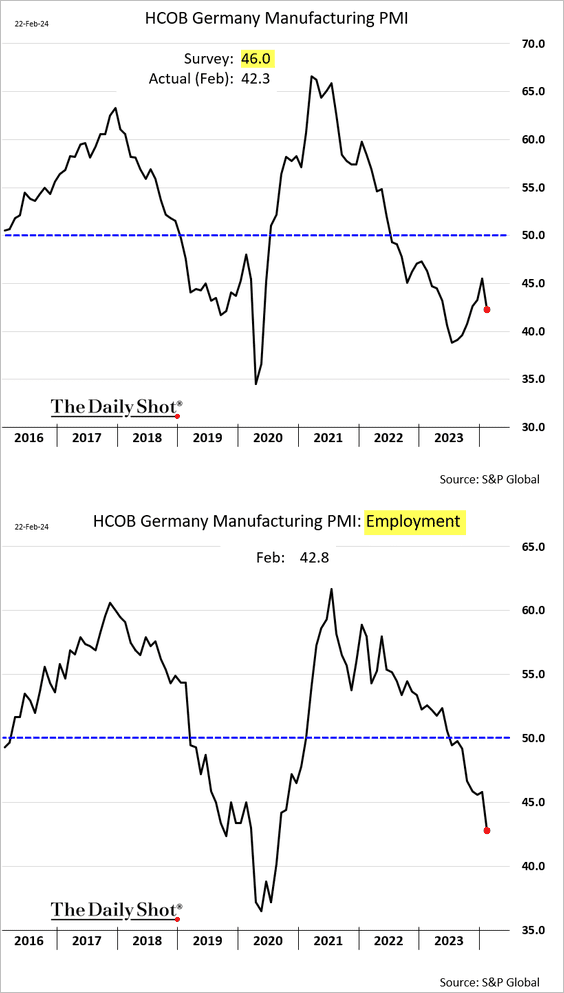

– The manufacturing sector contraction worsened, dragged lower by Germany.

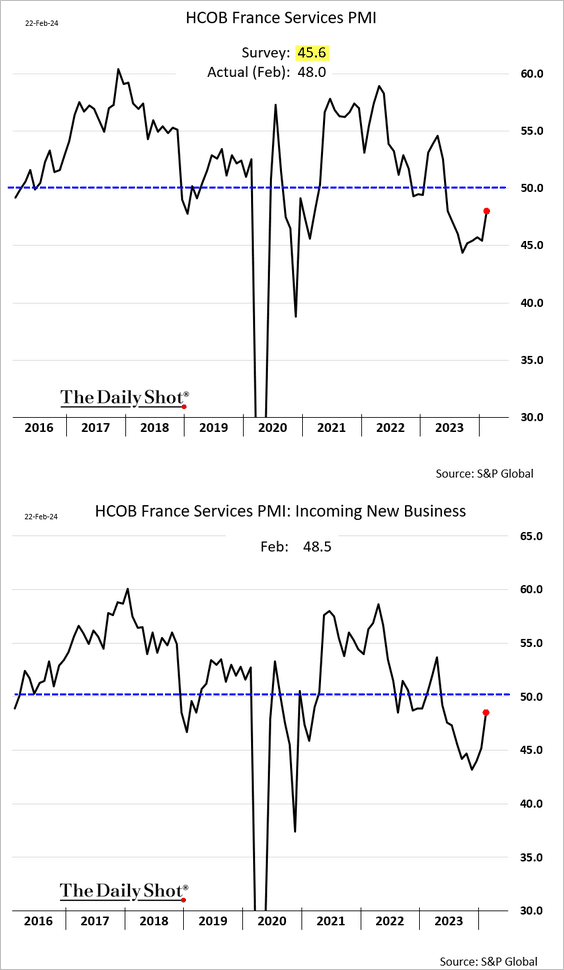

– But service sector activity stabilized, boosted by improvements in France.

• Gernmany’s factory contraction unexpectedly worsened this month. Manufacturers are rapidly cutting their workforce.

Source: Reuters Read full article

Source: Reuters Read full article

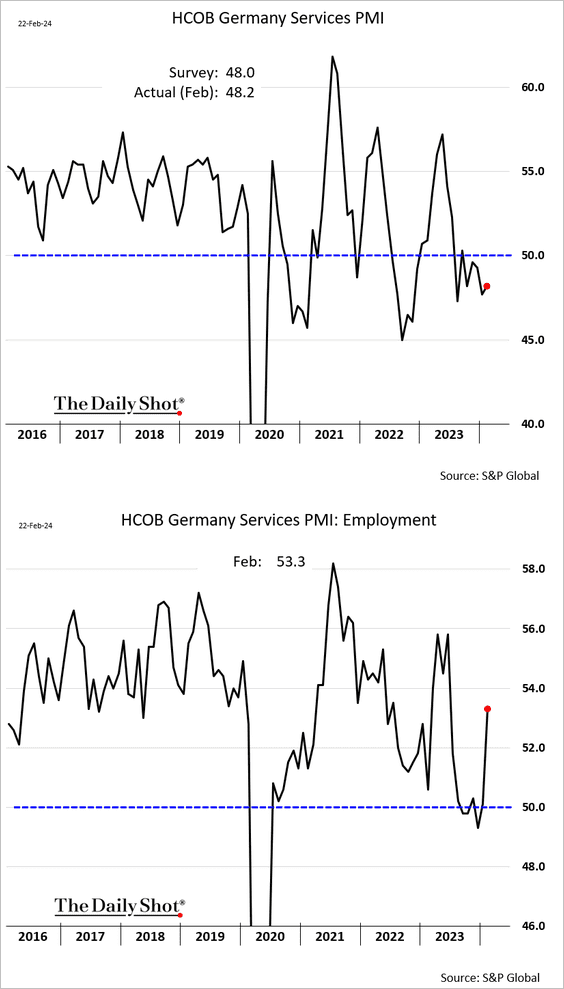

– Germany’s service sector slump eased with the resurgence of hiring.

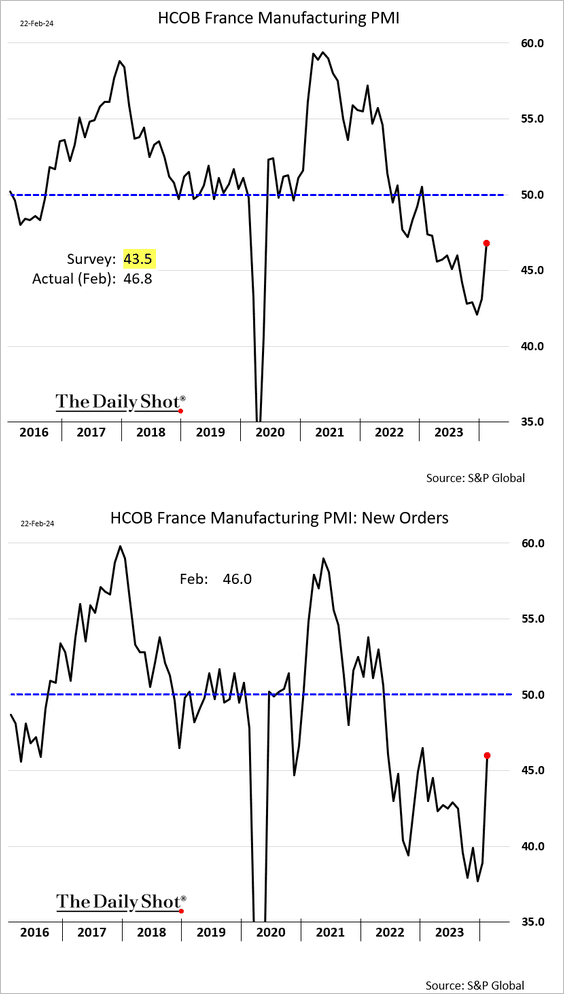

• French manufacturing and services downturn is rapidly easing.

——————–

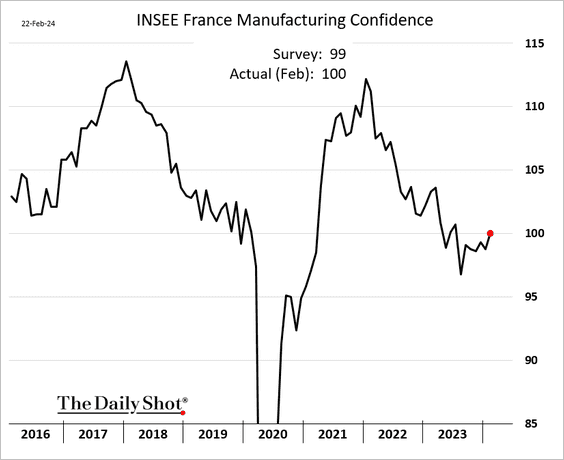

3. According to a government report, French manufacturing sentiment is starting to recover.

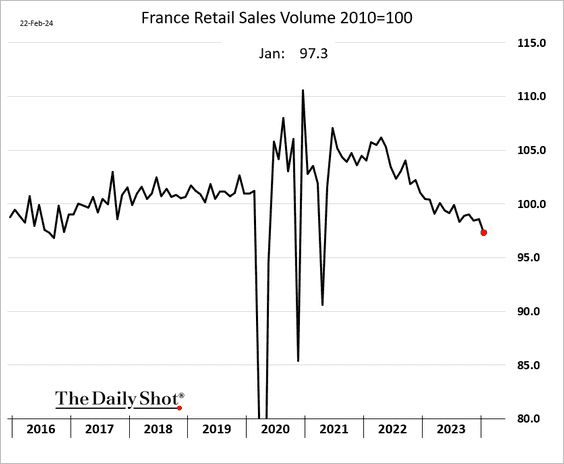

• French retail sales continued their downward trend last month.

——————–

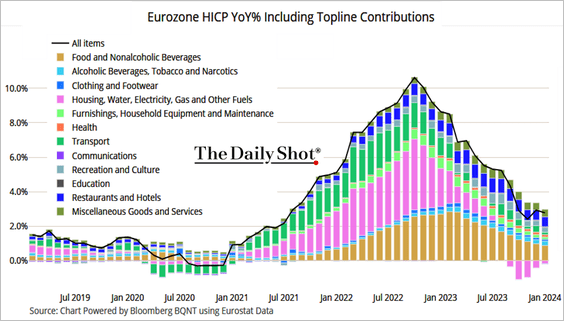

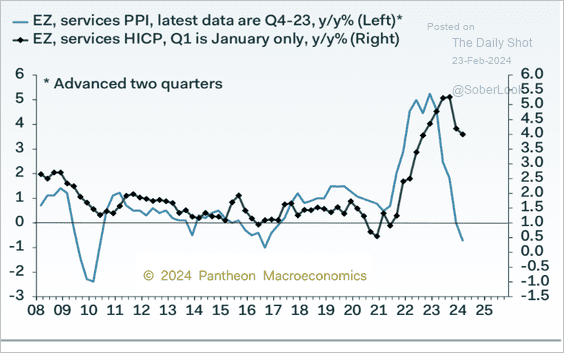

4. Here are the contributions to the euro-area CPI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Services inflation is expected to moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

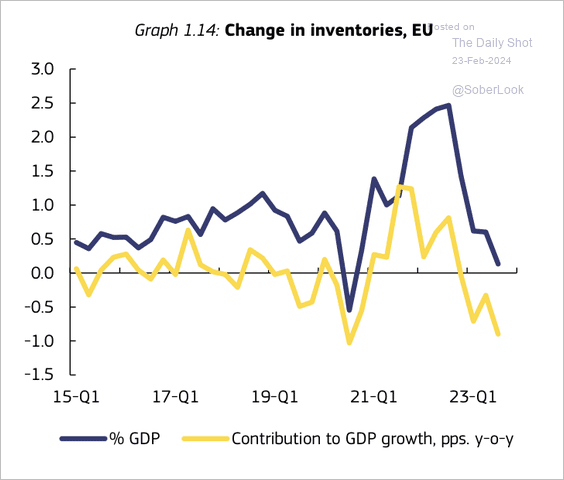

5. The drawdown of inventories has detracted from economic growth.

Source: ECB

Source: ECB

Back to Index

Japan

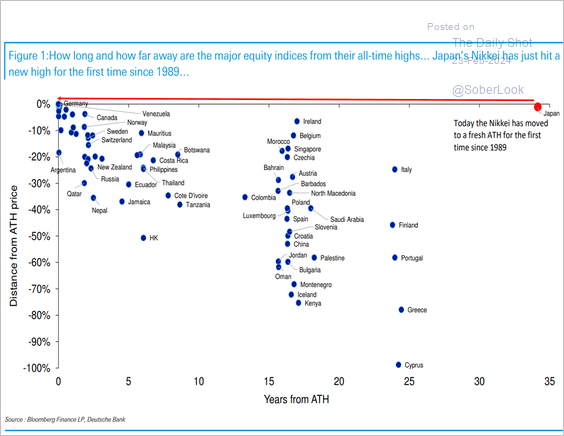

1. The Nikkei finally took out the 1989 peak.

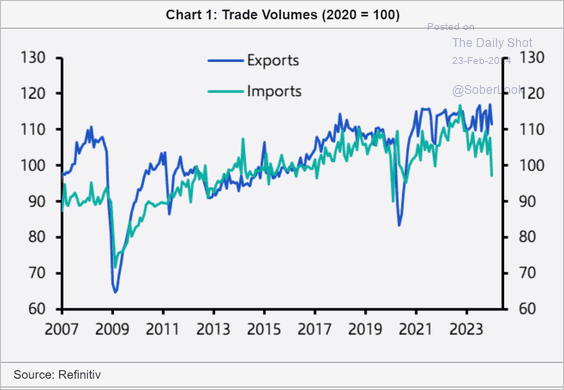

2. Imports declined almost 10% in January.

Source: Capital Economics

Source: Capital Economics

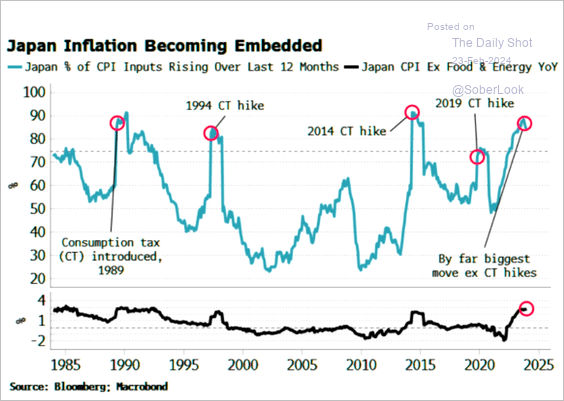

3. The current CPI breadth is similar to the levels we saw during consumption tax hikes.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

China

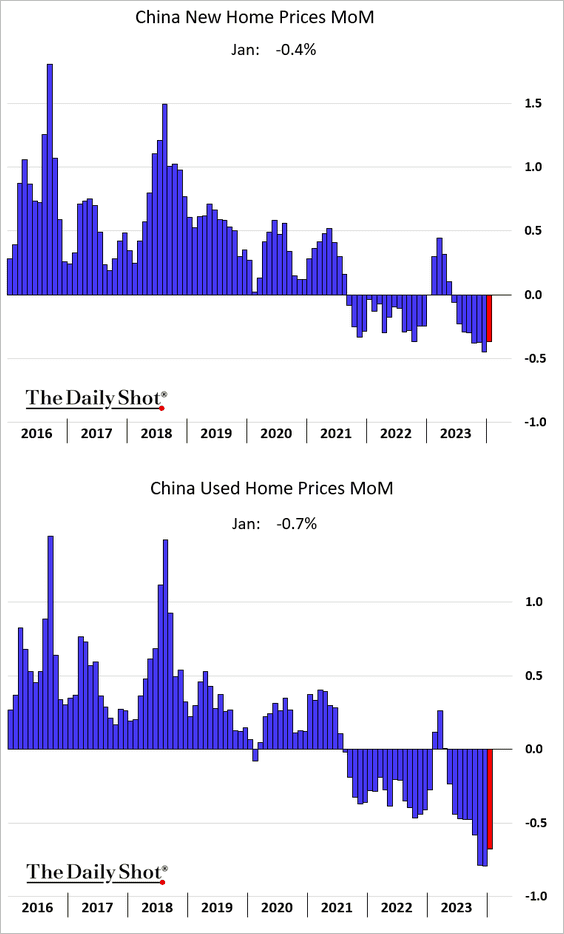

1. Home prices continue to fall.

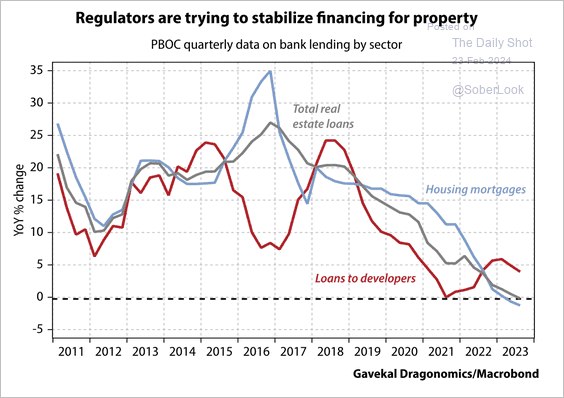

2. Loans to developers have increased in recent years while housing mortgages continued to decline.

Source: Gavekal Research

Source: Gavekal Research

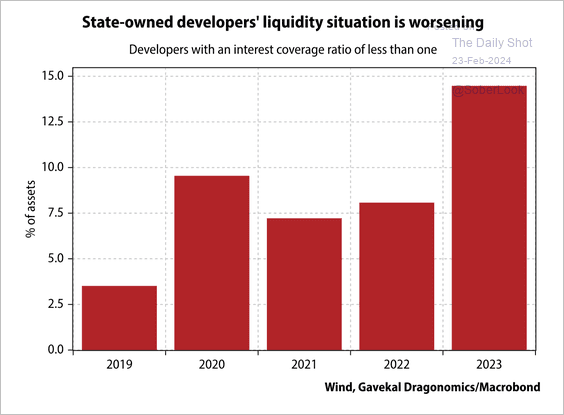

• State-owned developers could face financial distress.

Source: Gavekal Research

Source: Gavekal Research

——————–

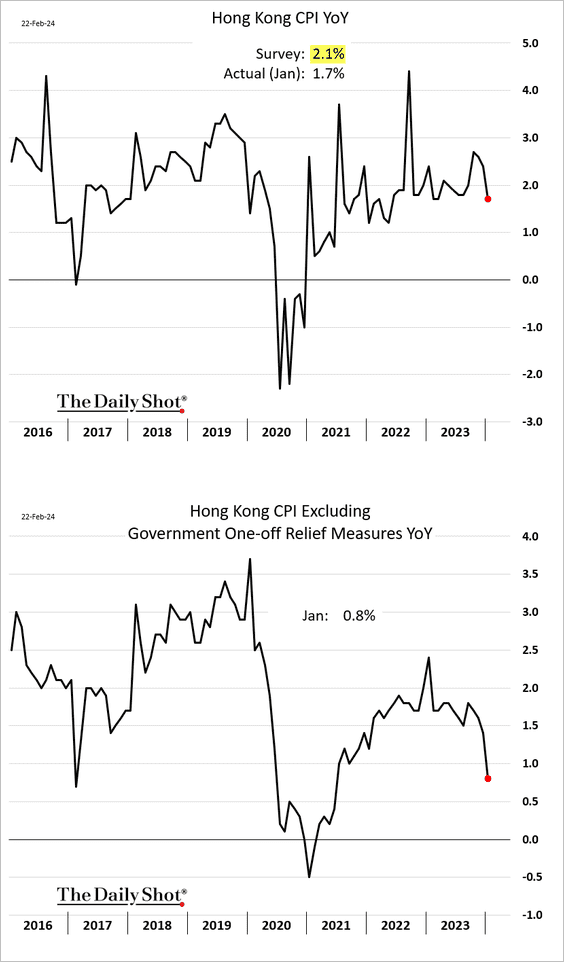

3. Hong Kong’s inflation slowed sharply last month.

Back to Index

Emerging Markets

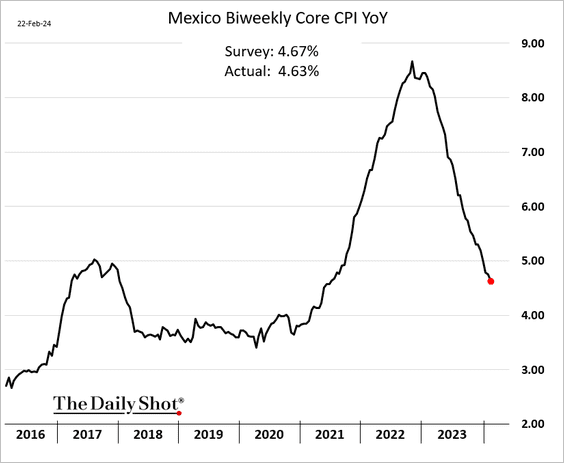

1. Mexico’s inflation continues to ease.

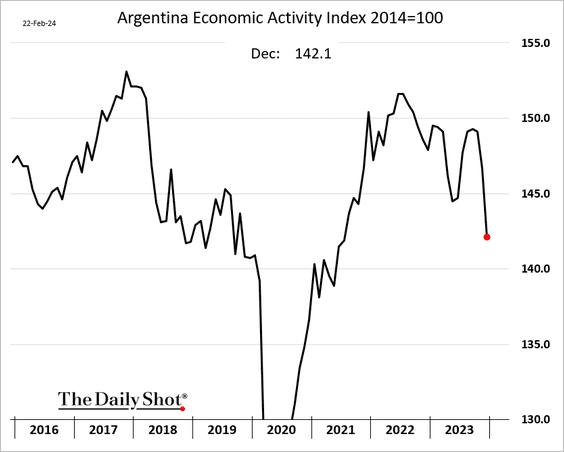

2. Argentina’s economic activity tumbled in December.

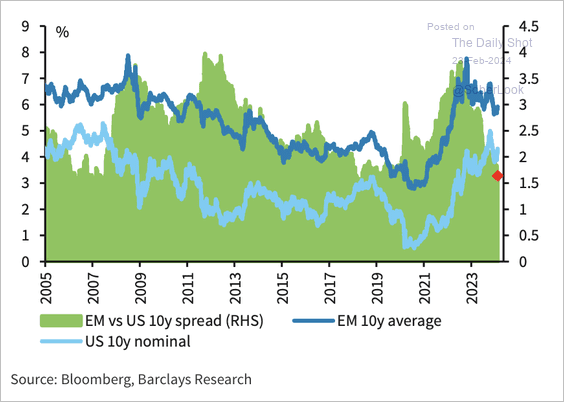

3. EM versus US rate spreads continue to compress.

Source: Barclays Research

Source: Barclays Research

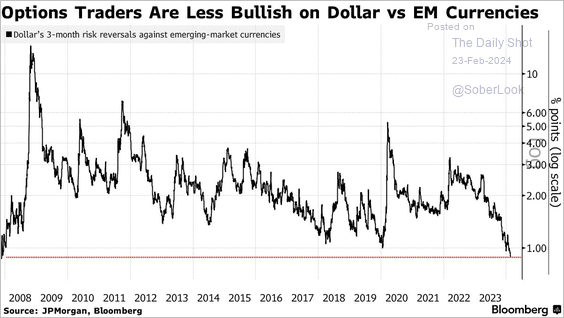

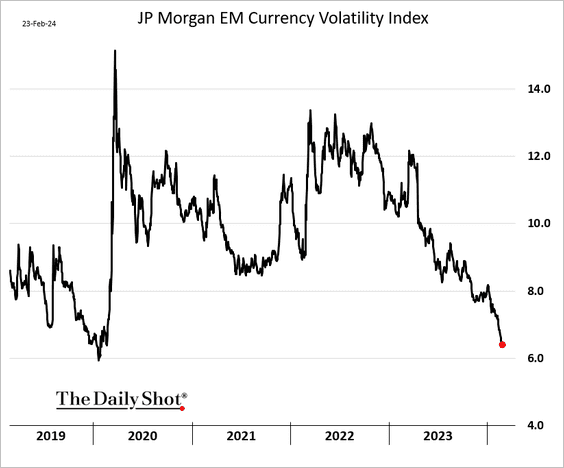

4. Options bets against EM currencies are increasingly out of favor amid improving EM exports.

Source: @markets Read full article

Source: @markets Read full article

• Implied volatility across EM currencies keeps moving lower.

——————–

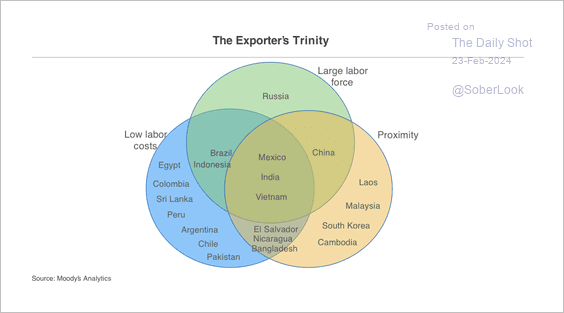

5. This exhibit shows the comparative advantage in labor and geographic proximity across EM exporters, according to Moody’s Analytics.

Source: Moody’s Analytics

Source: Moody’s Analytics

Back to Index

Cryptocurrency

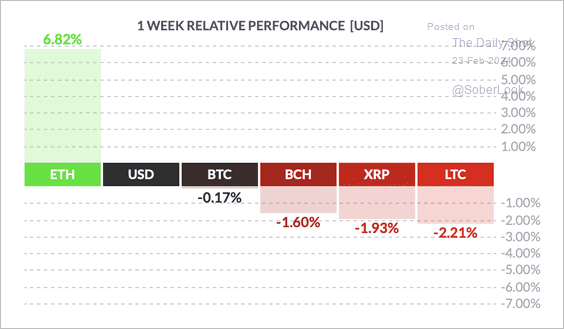

1. Ether (ETH) significantly outperformed top crypto peers over the past week, boosted by spot-ETF hopes.

Source: FinViz

Source: FinViz

Source: CoinDesk Read full article

Source: CoinDesk Read full article

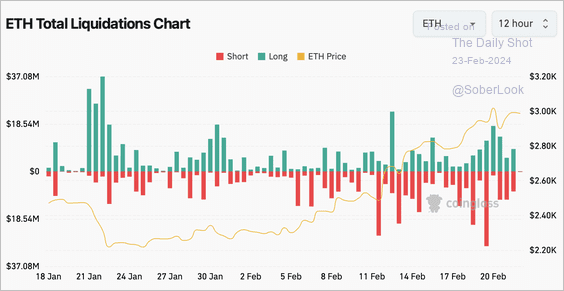

• ETH’s rally triggered a large amount of short liquidations this week.

Source: Coinglass

Source: Coinglass

——————–

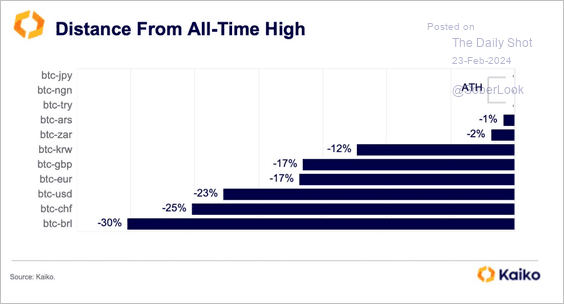

2. This chart shows the distance from all-time highs across BTC currency pairs.

Source: @KaikoData

Source: @KaikoData

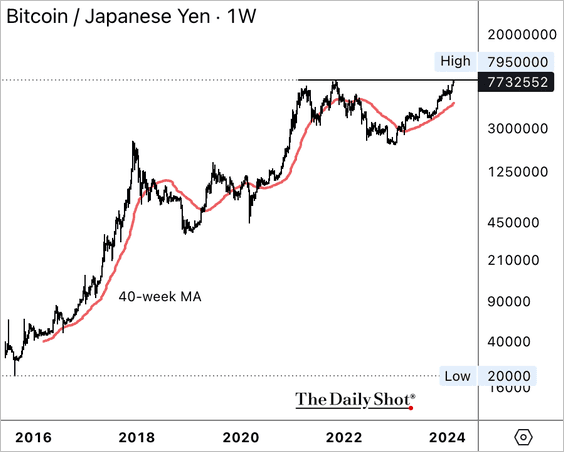

3. BTC/JPY is testing its all-time high.

Back to Index

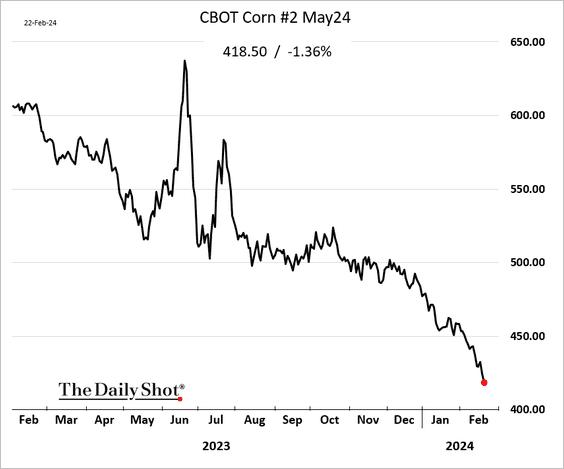

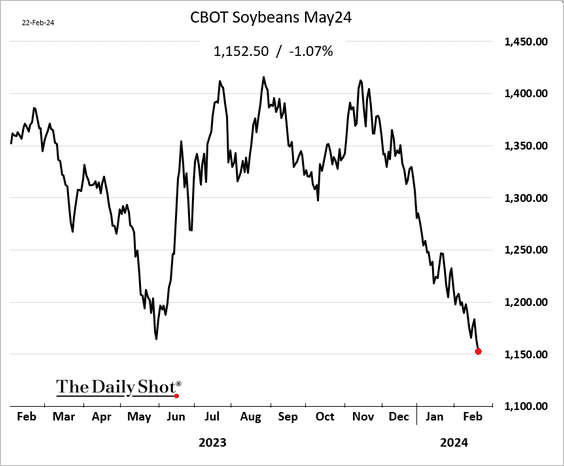

Commodities

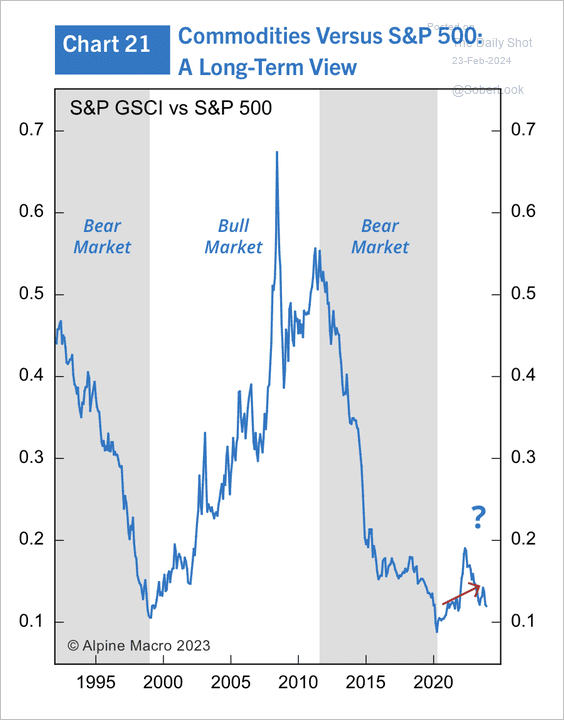

1. The post-pandemic rise in commodities versus the S&P 500 reversed amid weaker economic growth in China and global disinflation.

Source: Alpine Macro

Source: Alpine Macro

2. US farmers are confronting challenging economic conditions due to plummeting grain prices.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

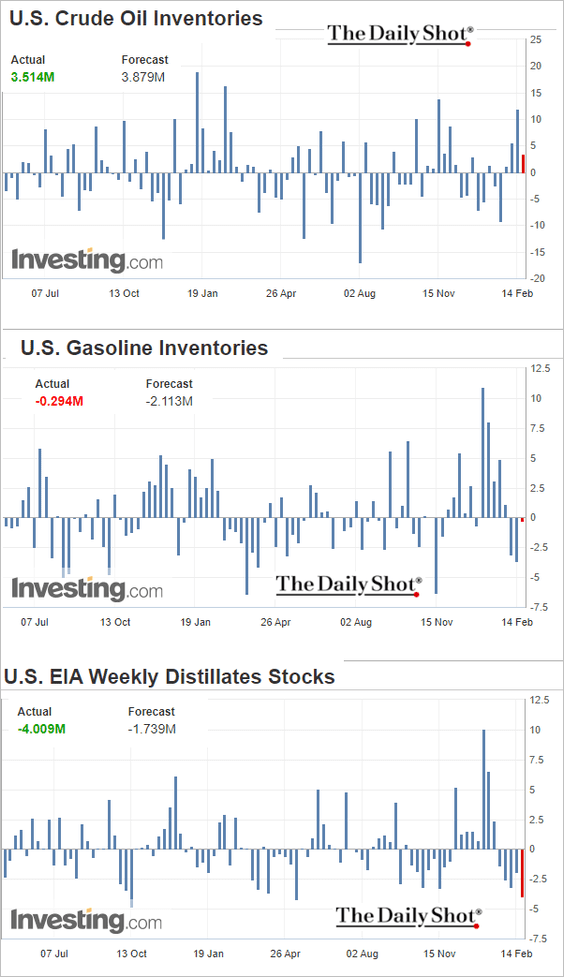

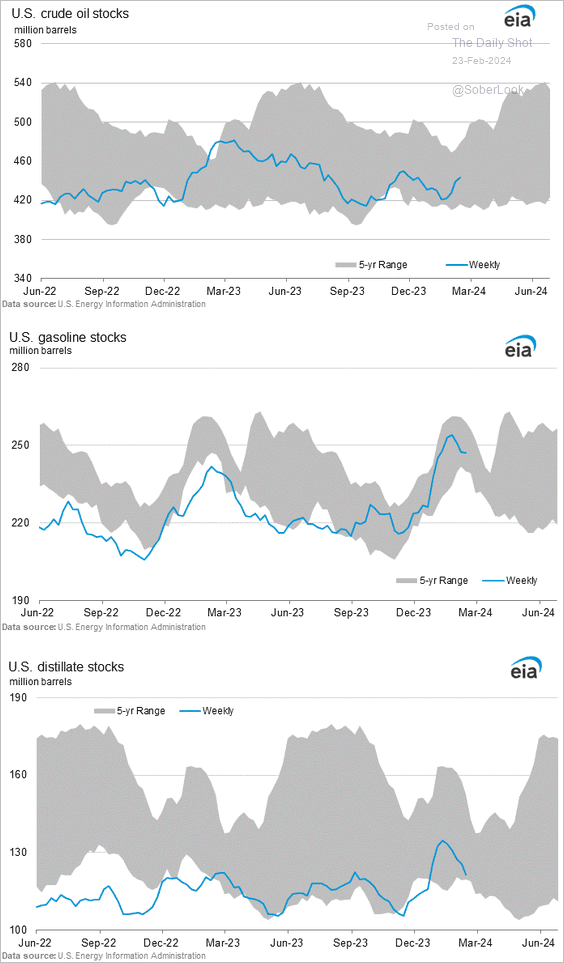

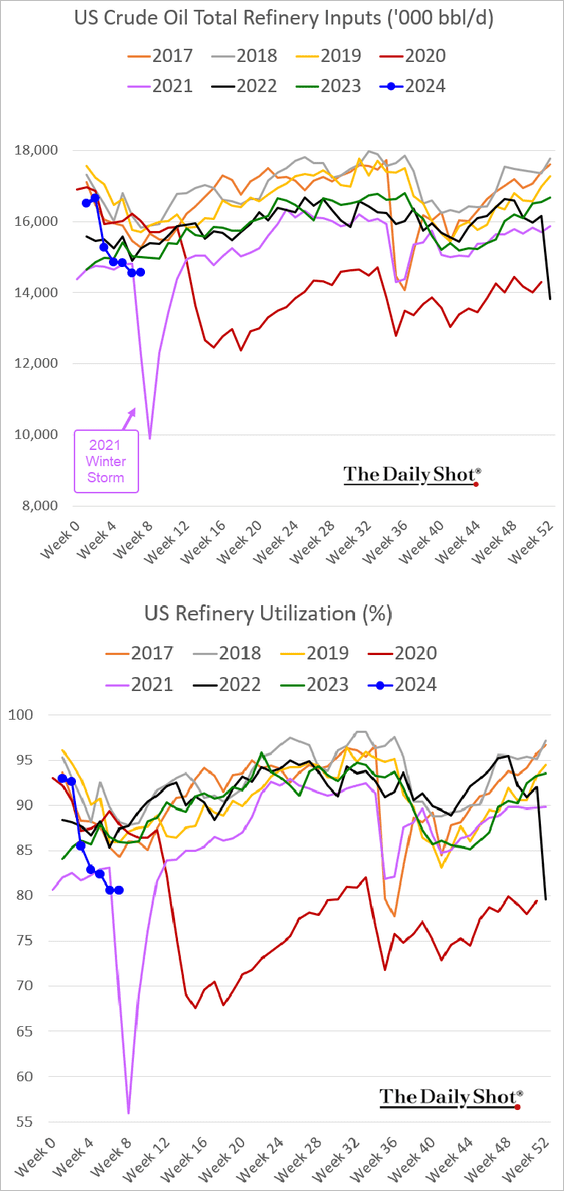

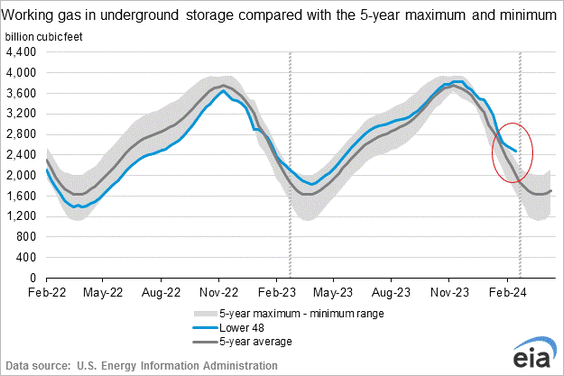

1. US crude oil inventories climbed again due to reduced refinery capacity, but distillates stockpiles tumbled last week.

– Weekly changes:

– Levels:

– Refinery runs and utilization:

• Gasoline demand was soft last week.

——————–

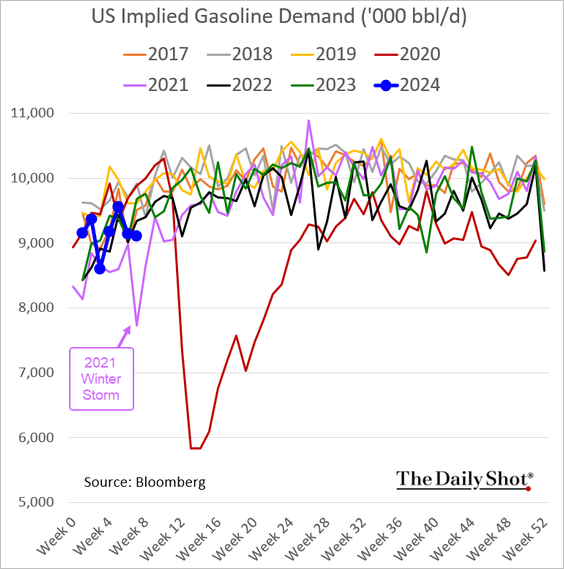

2. The declining levels of drilled but uncompleted (DUC) wells suggest that US output will slow without significant new investment.

Source: @WSJ Read full article

Source: @WSJ Read full article

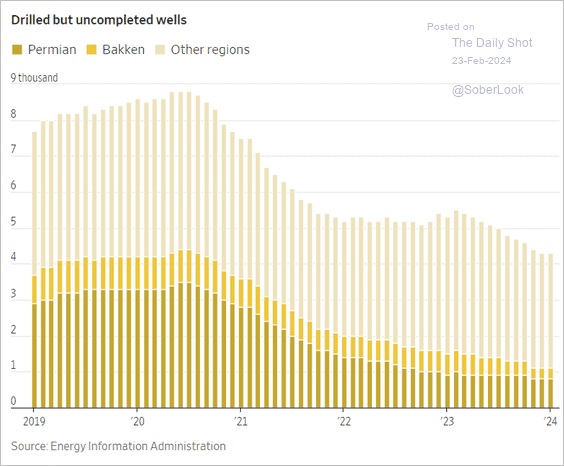

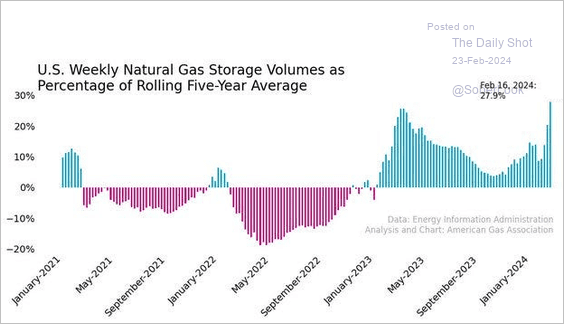

3. US natural gas in storage is now well outside the five-year range.

Source: @richardmeyerdc; h/t @dailychartbook

Source: @richardmeyerdc; h/t @dailychartbook

——————–

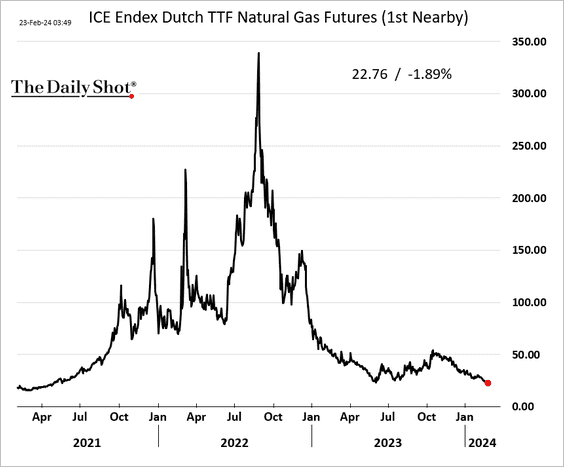

4. European natural gas futures hit their lowest level since 2021.

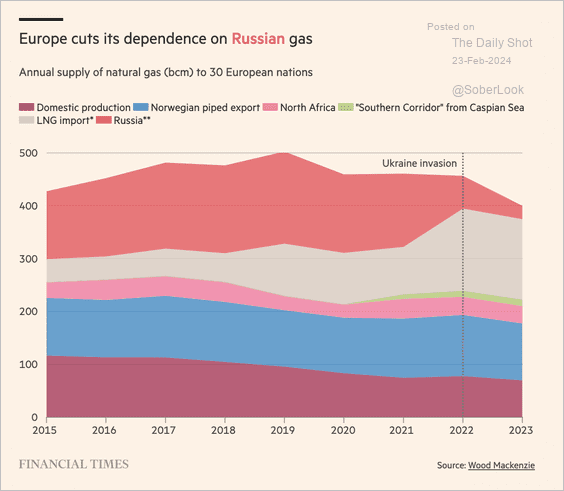

• Here is a look at how Europe cut its dependence on Russian gas.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

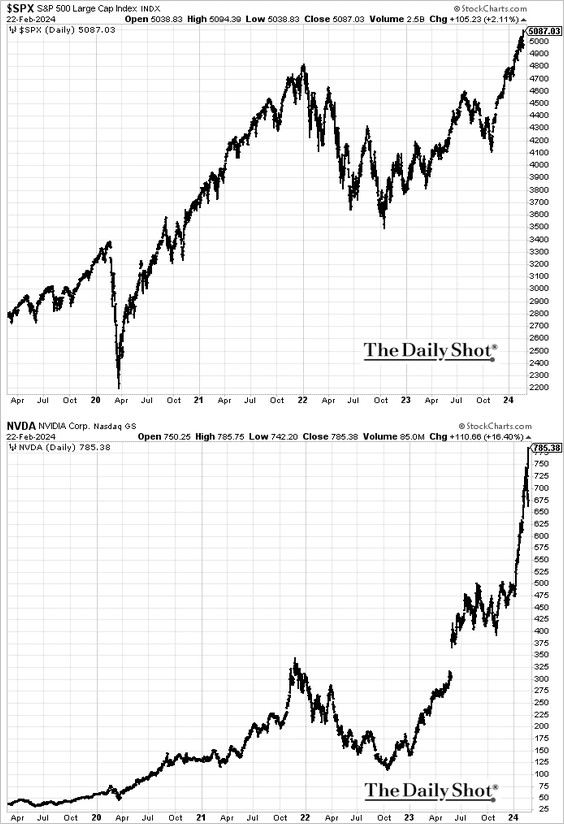

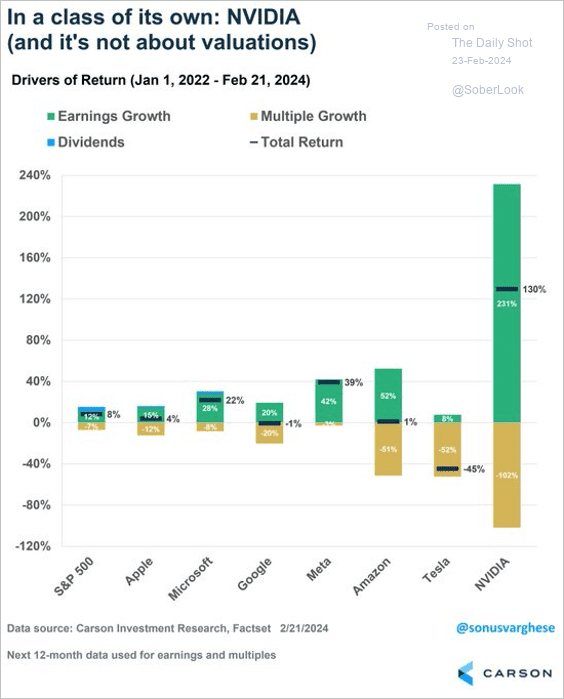

1. US indices hit record highs, fueled by Nvidia.

• Nvidia’s earnings growth stands out.

Source: @RyanDetrick, @sonusvarghese

Source: @RyanDetrick, @sonusvarghese

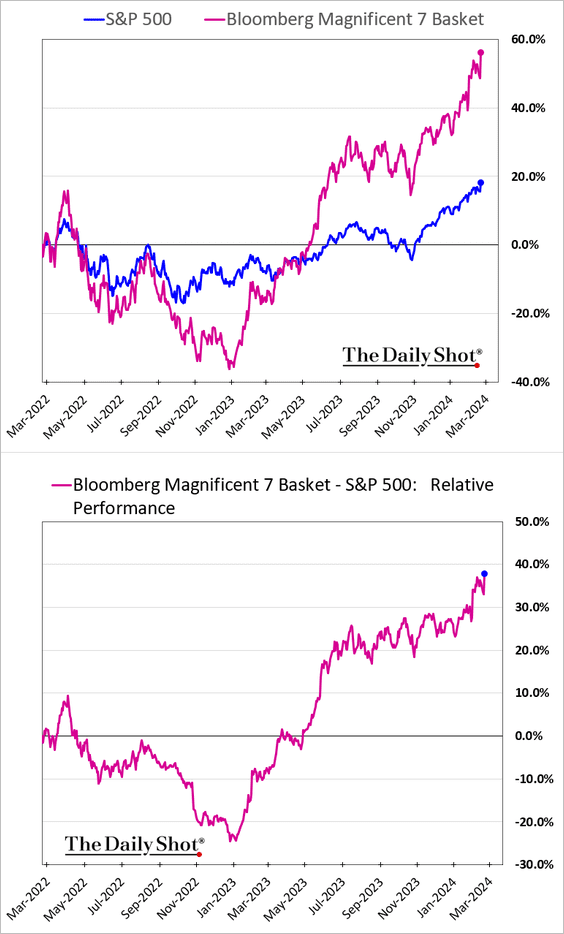

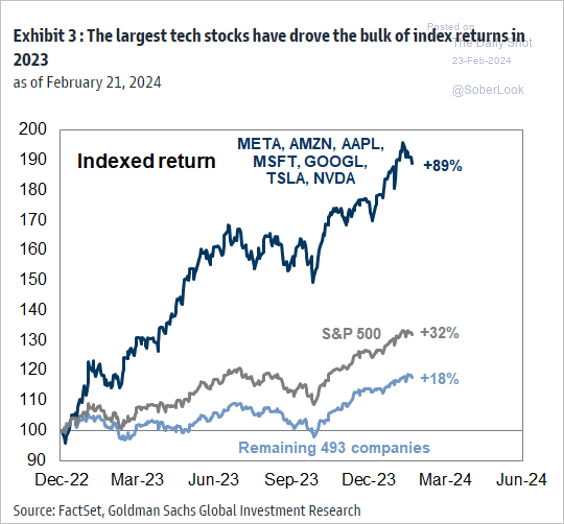

• The Magnificent 7 further widened their outperformance.

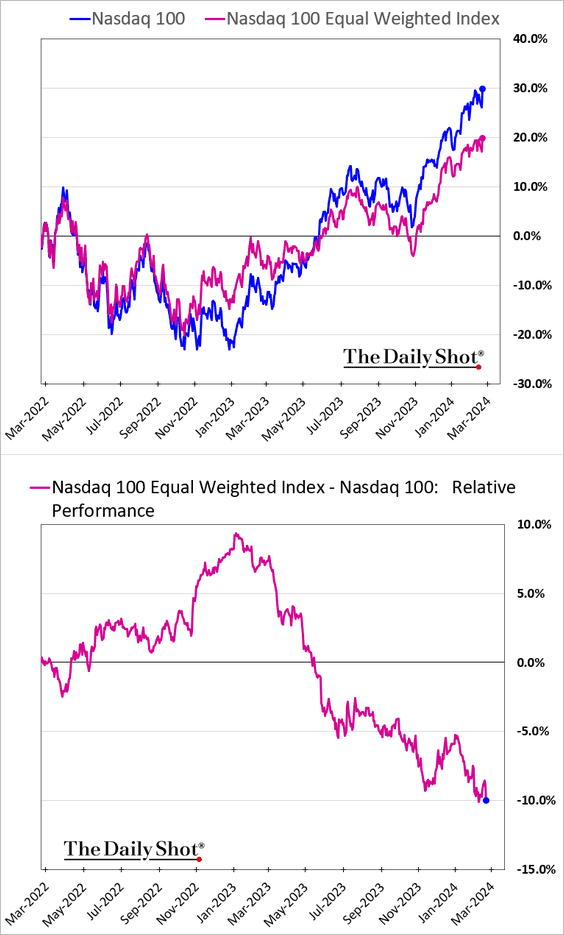

• The average stock in the Nasdaq 100 is increasingly lagging the index.

——————–

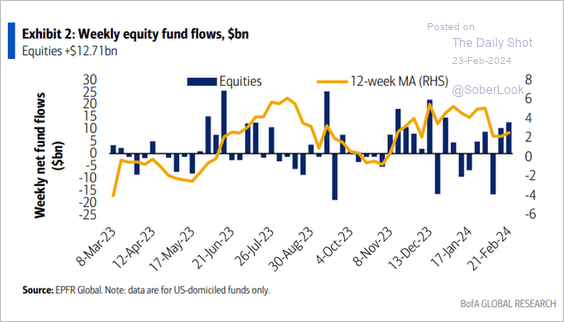

2. Equity fund flows were strong last week.

Source: BofA Global Research

Source: BofA Global Research

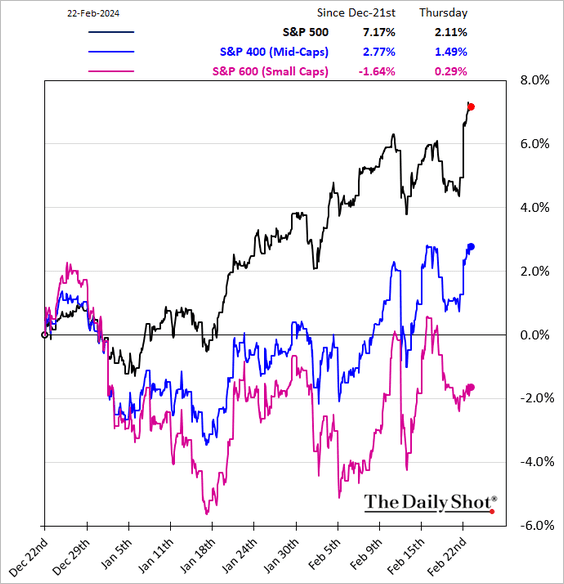

3. Small caps underperformed sharply this year.

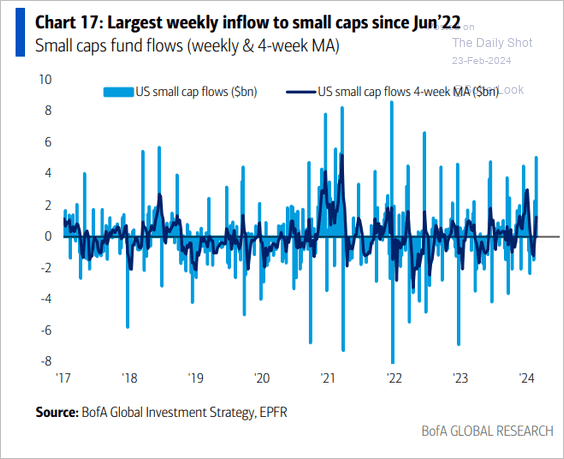

But small-cap flows have picked up.

Source: BofA Global Research

Source: BofA Global Research

——————–

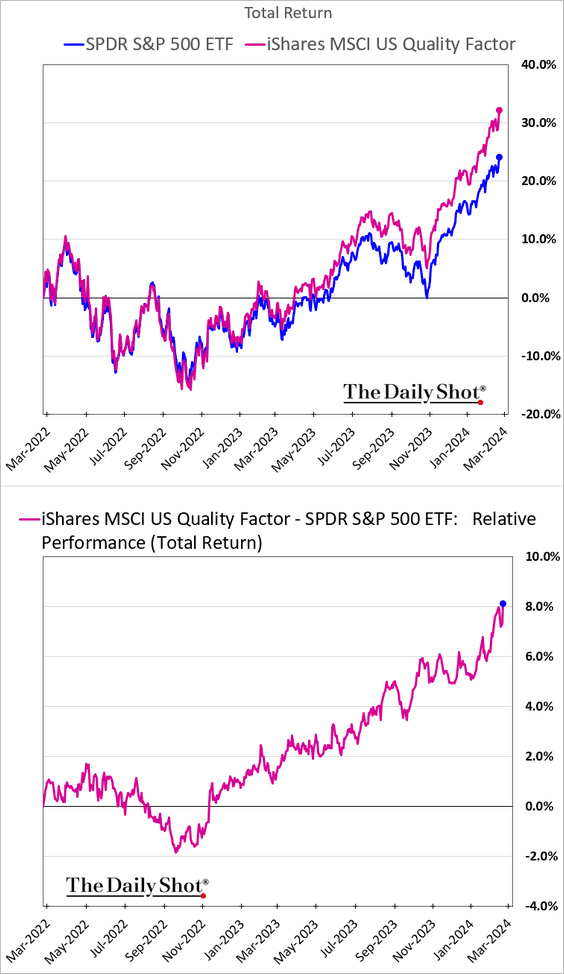

4. The quality factor has been widening its outperformance.

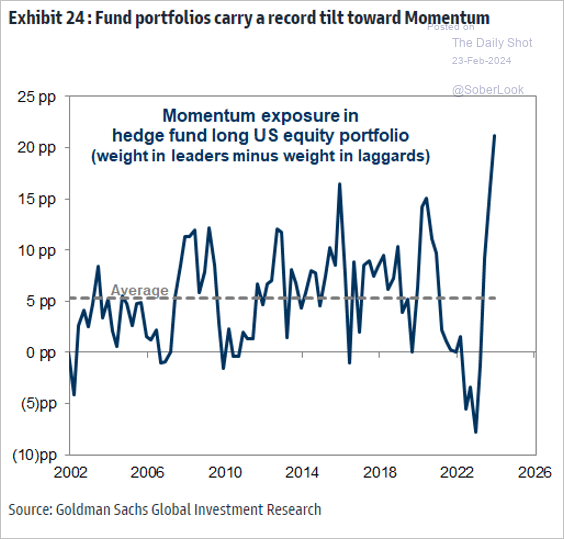

• Hedge funds are long momentum stocks, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

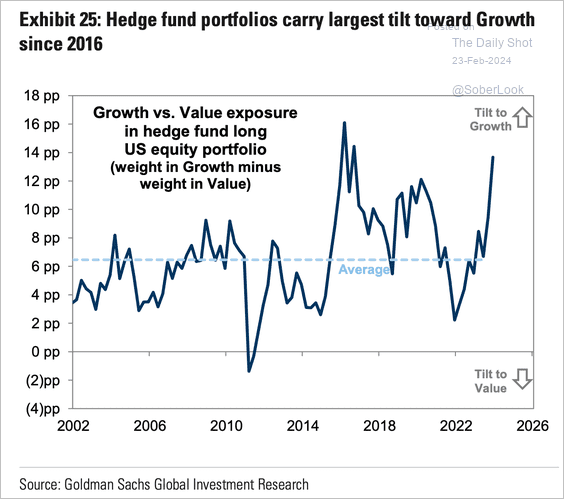

… and are tilted toward growth vs. value.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

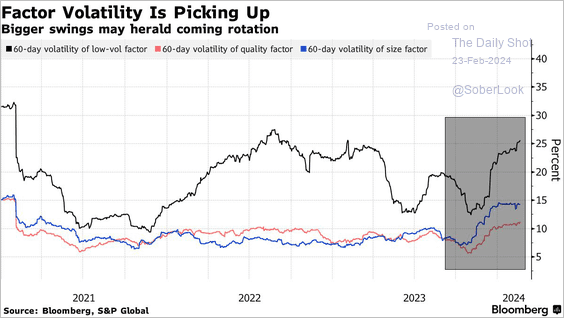

• Equity factor volatility has been trending higher, …

Source: @markets Read full article

Source: @markets Read full article

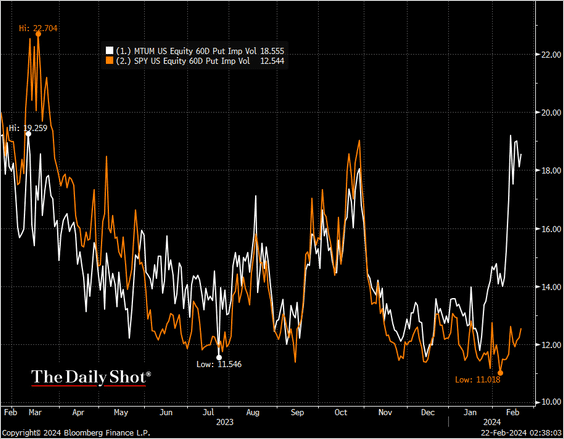

… diverging from the broader market. Here is the momentum factor 60-day implied vol relative to the S&P 500.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

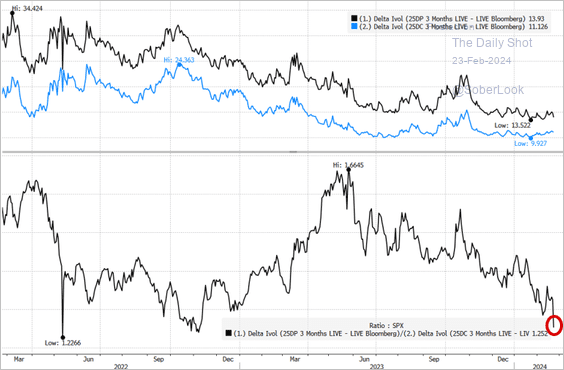

5. The S&P 500 skew remains depressed.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

6. Here is a look at the S&P 500 performance excluding the tech megacaps.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

7. This chart shows the distance from all-time highs across major equity indices.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

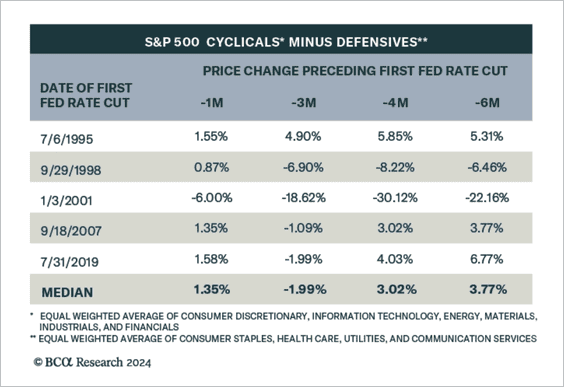

8. Historically, S&P 500 cyclical stocks underperform defensives three months after the first Fed rate cut, but outperform going further.

Source: BCA Research

Source: BCA Research

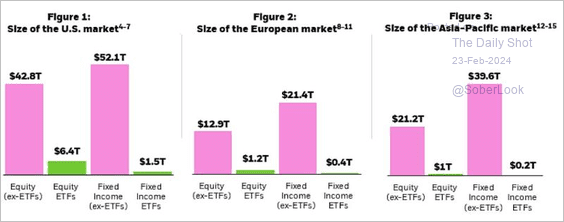

9. The ETF market share is still very small compared to total equity market cap and total debt outstanding.

Source: iShares Read full article

Source: iShares Read full article

Back to Index

Credit

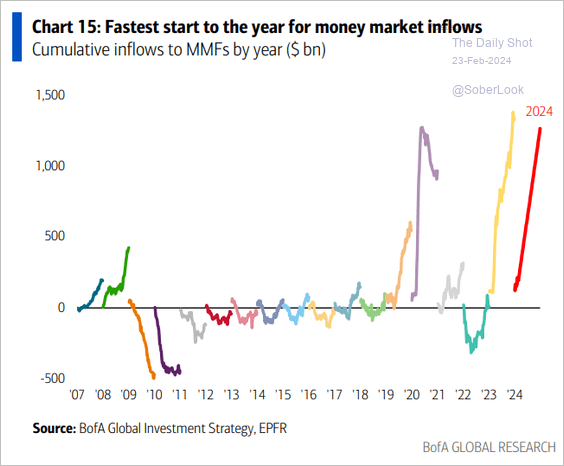

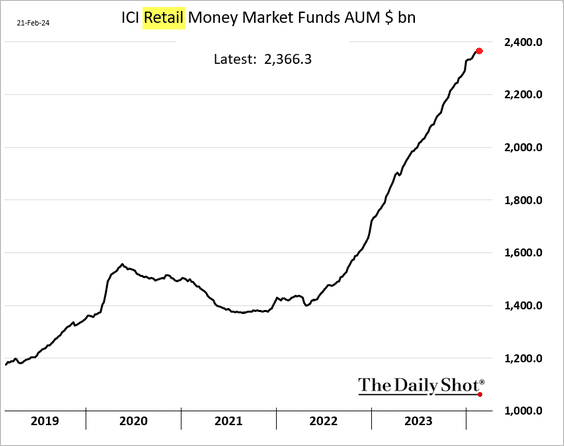

1. Money market fund inflows have been robust this year.

Source: BofA Global Research

Source: BofA Global Research

——————–

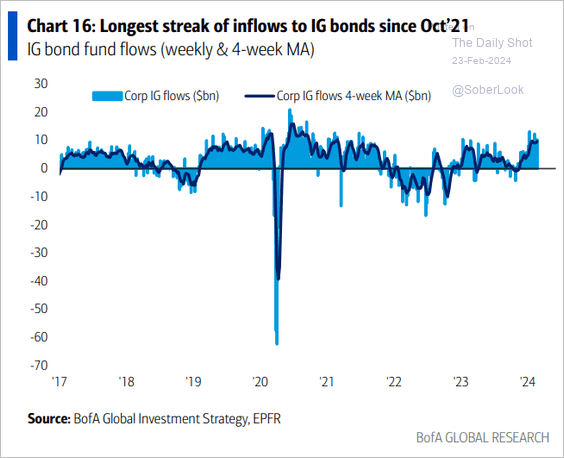

2. Investment-grade bond funds continue to see healthy inflows.

Source: BofA Global Research

Source: BofA Global Research

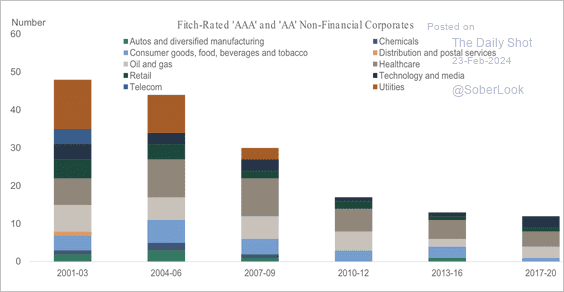

3. Fewer corporate bonds are rated AAA and AA.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Global Developments

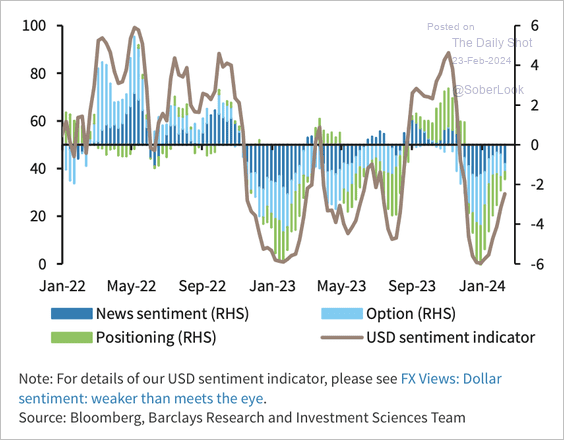

1. Dollar sentiment is improving from extreme lows.

Source: Barclays Research

Source: Barclays Research

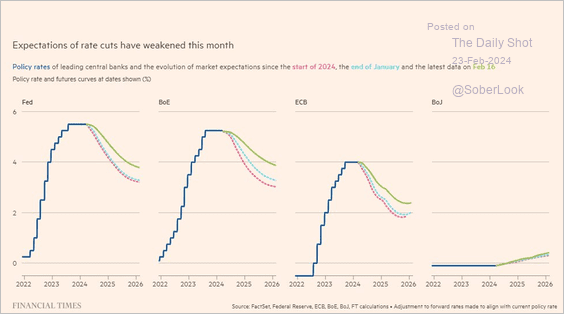

2. Rate cut expectations have moderated this month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Food for Thought

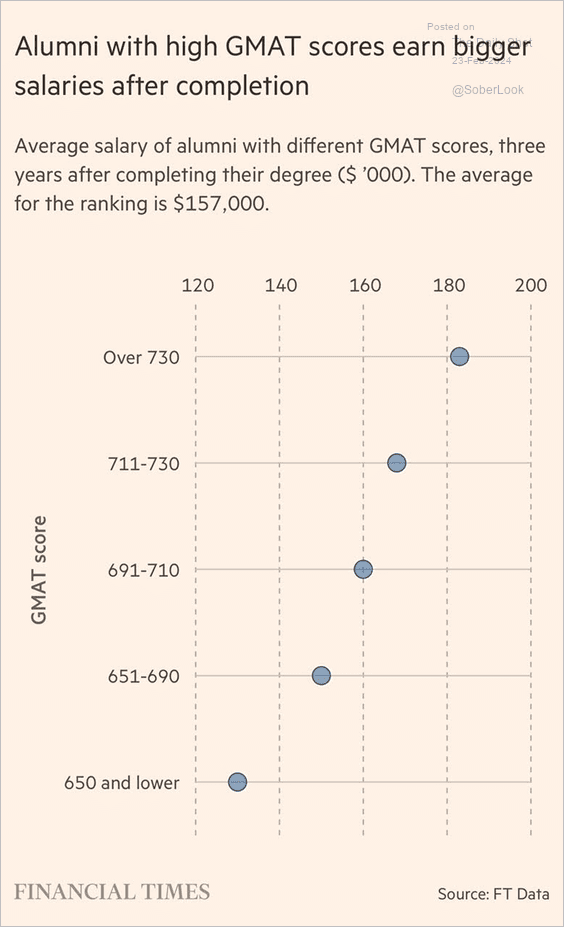

1. GMAT scores and wages:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

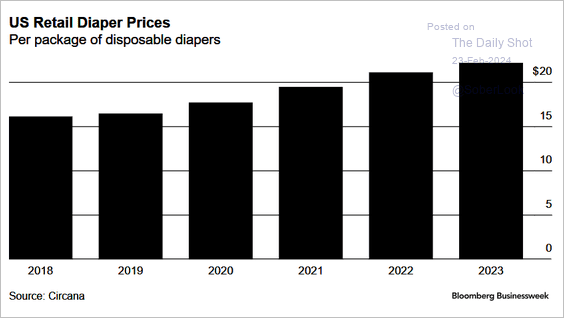

2. Diaper inflation:

Source: @BW Read full article

Source: @BW Read full article

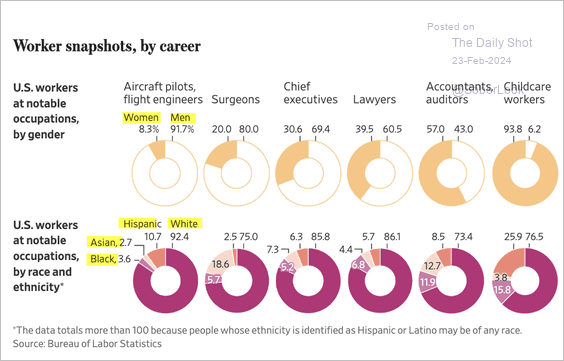

3. US worker demographics in select occupations:

Source: @WSJ Read full article

Source: @WSJ Read full article

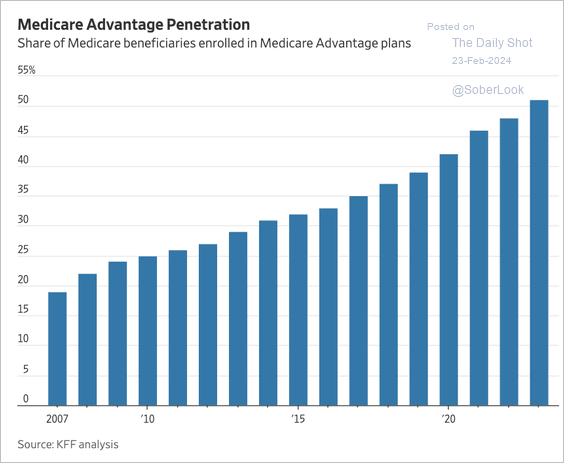

4. Medicare Advantage plans:

Source: @WSJ Read full article

Source: @WSJ Read full article

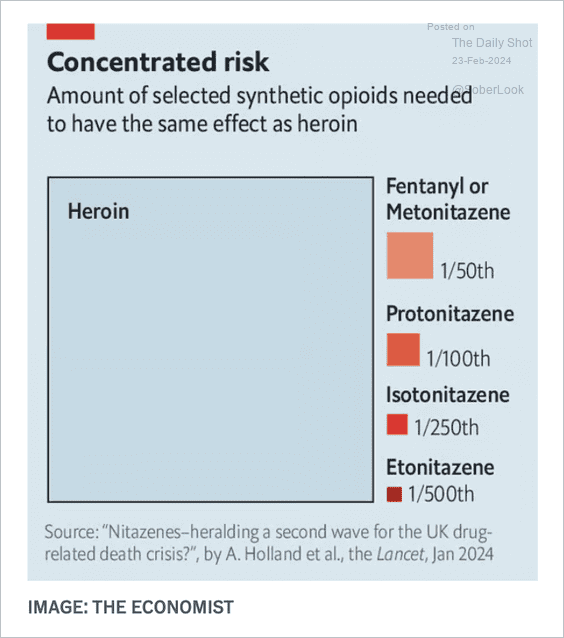

5. Synthetic opioids:

Source: The Economist Read full article

Source: The Economist Read full article

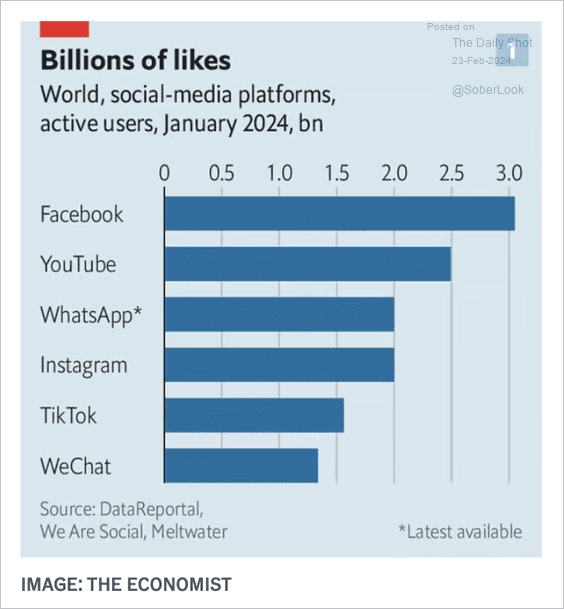

6. Social-media active users:

Source: The Economist Read full article

Source: The Economist Read full article

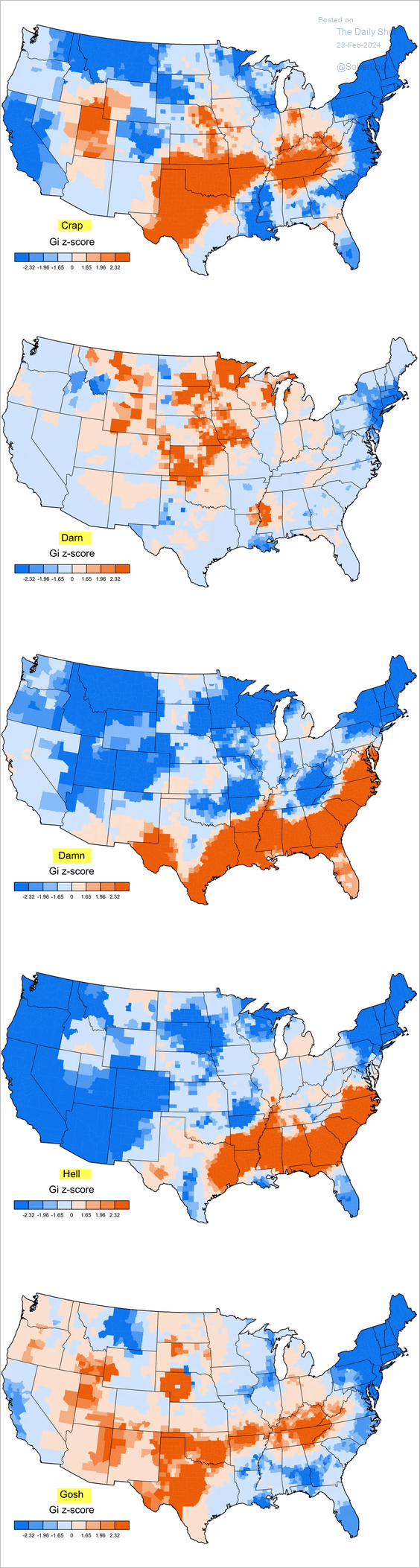

7. How popular are these words?

Source: The Washington Post

Source: The Washington Post

——————–

Have a great weekend!

Back to Index