The Daily Shot: 26-Feb-24

• The United States

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

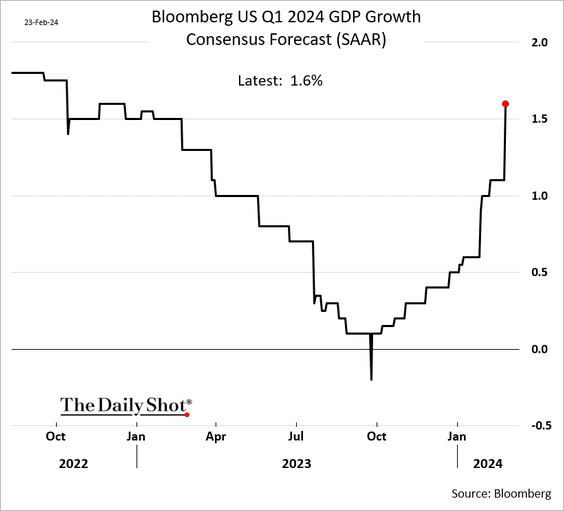

1. Economists continue to boost their projections for the current quarter’s GDP growth, …

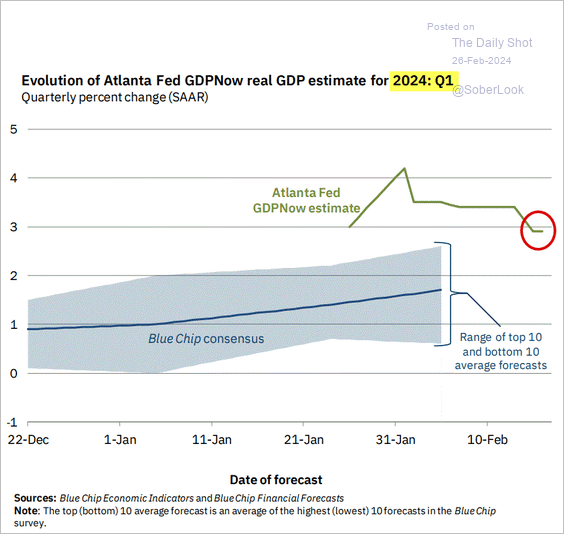

… which is nearing the Atlanta Fed’s GDPNow estimate.

Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

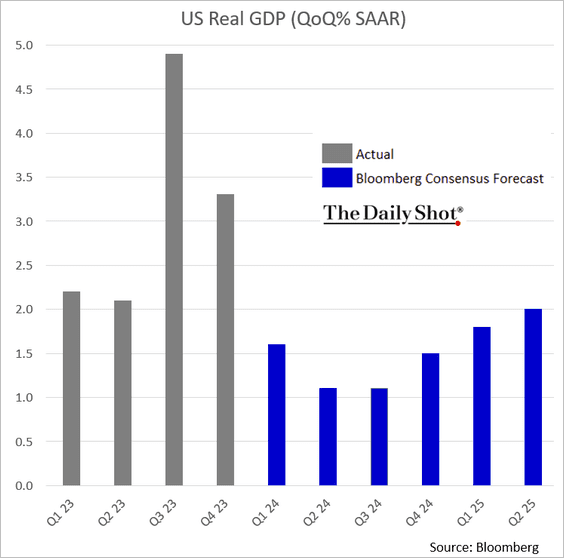

• Consensus projections show slower growth over the next couple of quarters, with momentum picking up in Q4.

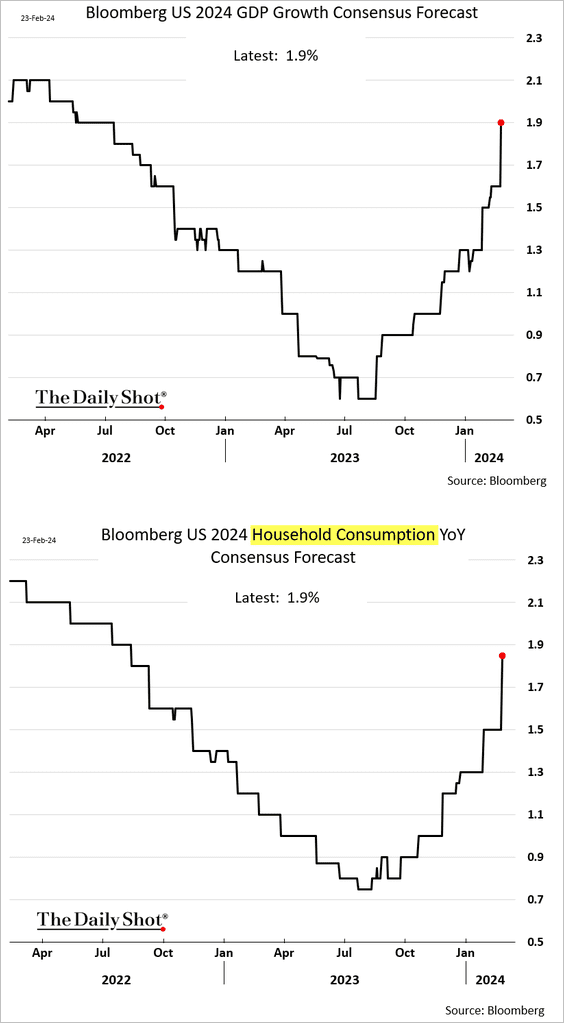

• Forecasts for the full year also continue to rise, driven by expectations of resilient consumer spending.

——————–

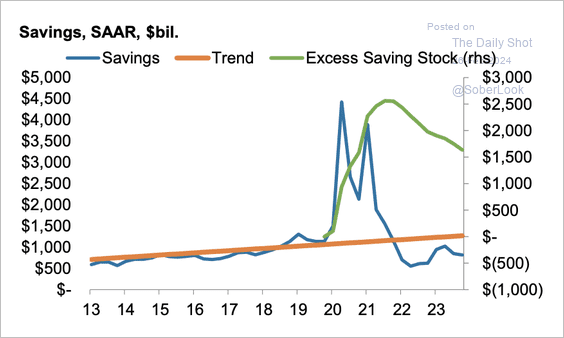

2. Based on some estimates, excess household savings are still elevated.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

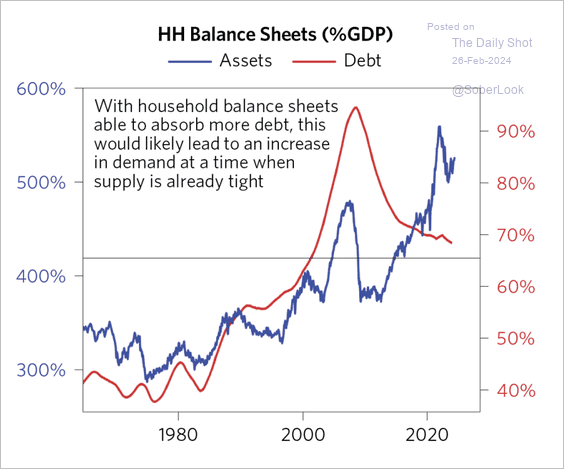

• US household assets have risen as a percent of GDP while debt has decreased.

Source: Bridgewater Associates Read full article

Source: Bridgewater Associates Read full article

——————–

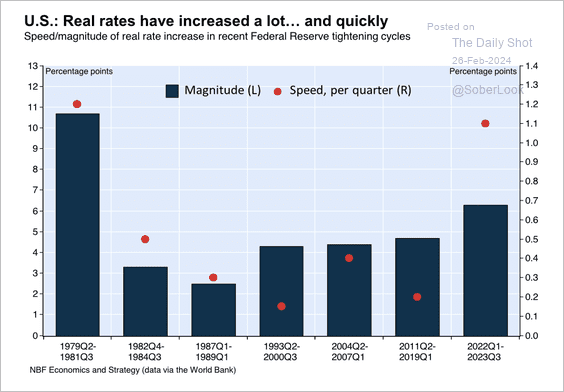

3. Rate hikes coupled with declining inflation have precipitated an exceptionally swift increase in real policy rates.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

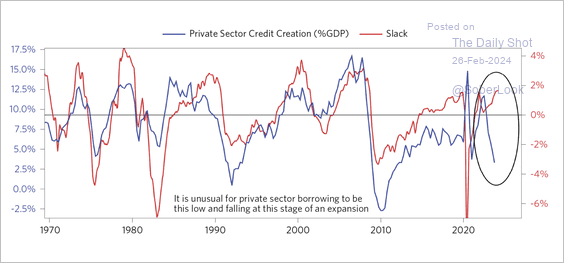

4. There has been a sharp decline in private sector credit even as the economy strengthened (characterized by a tight labor market).

Source: Bridgewater Associates Read full article

Source: Bridgewater Associates Read full article

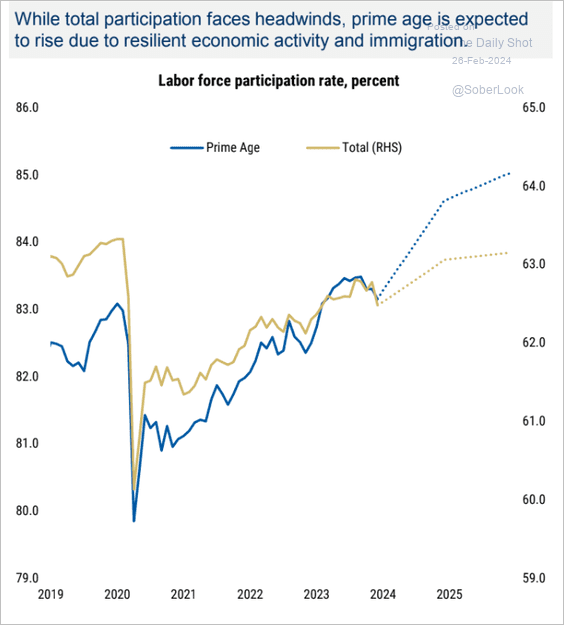

5. Morgan Stanley anticipates strong gains in prime-age labor force participation this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

The Eurozone

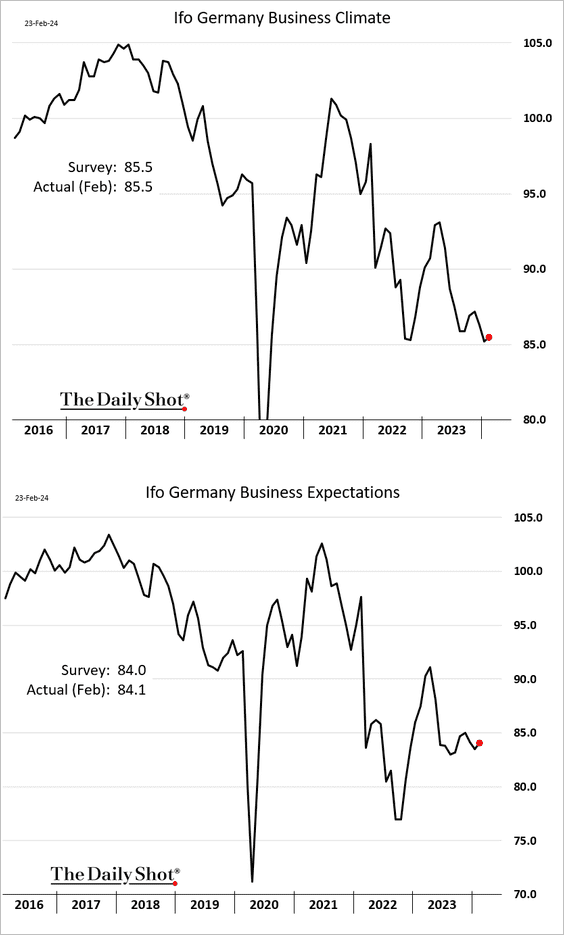

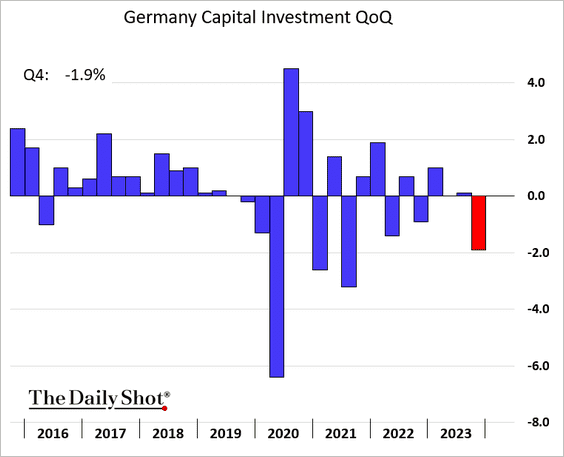

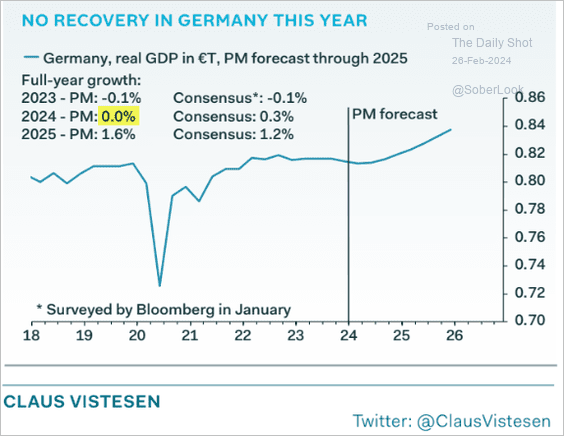

1. Let’s begin with Germany.

• The Ifo business climate index edged higher this month.

• Business investment declined sharply last quarter.

• Pantheon Macroeconomics sees no growth in Germany this year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

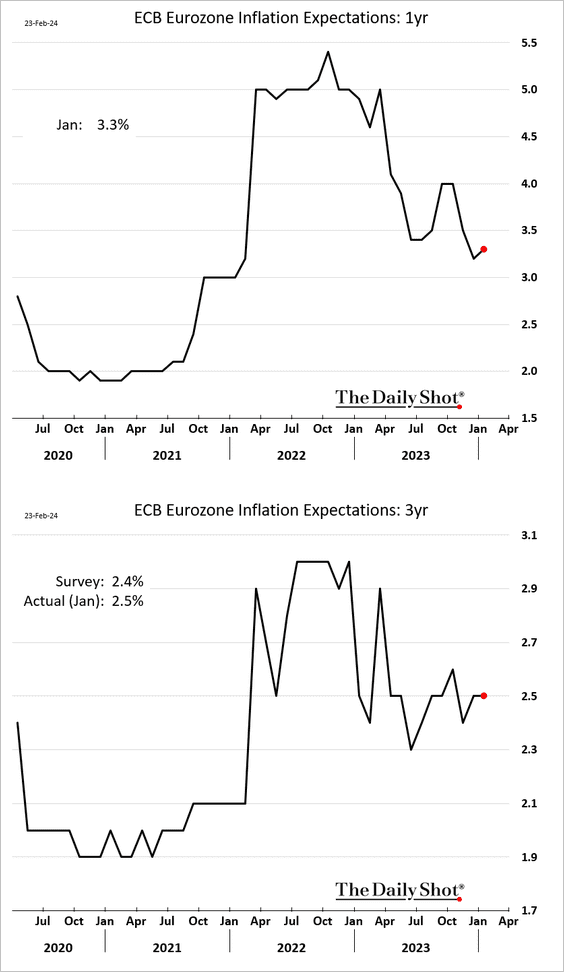

2. Short-term euro-area inflation expectations ticked higher in January.

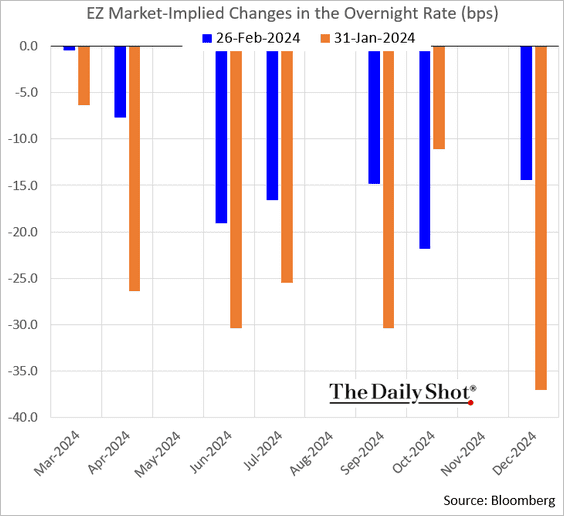

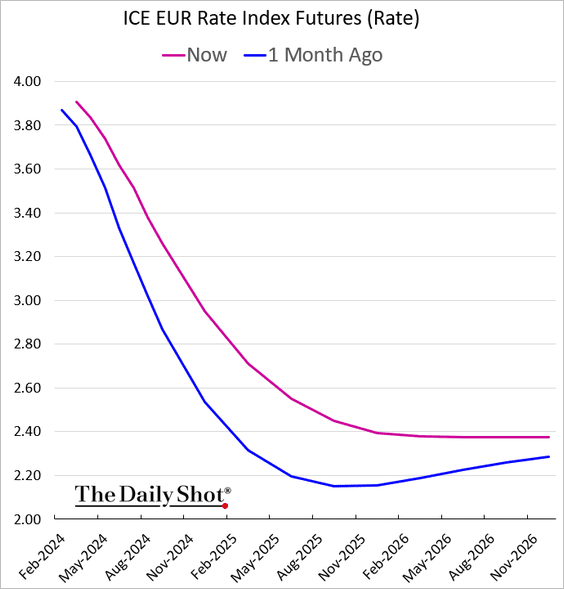

3. Market-based rate cut expectations were scaled back significantly this month.

Back to Index

Europe

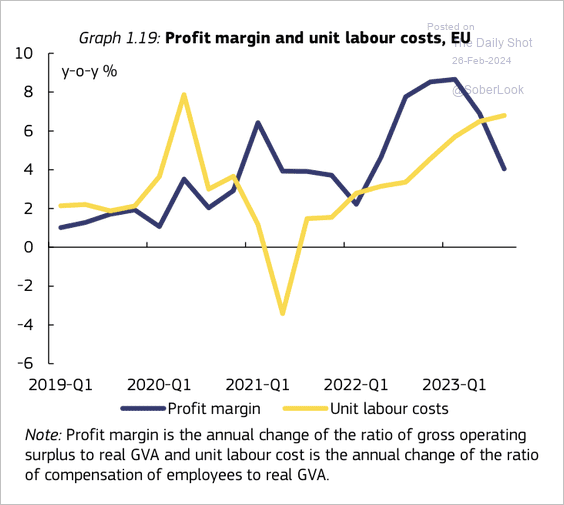

1. High unit labor costs have weighed on profit margins among EU member states.

Source: ECB

Source: ECB

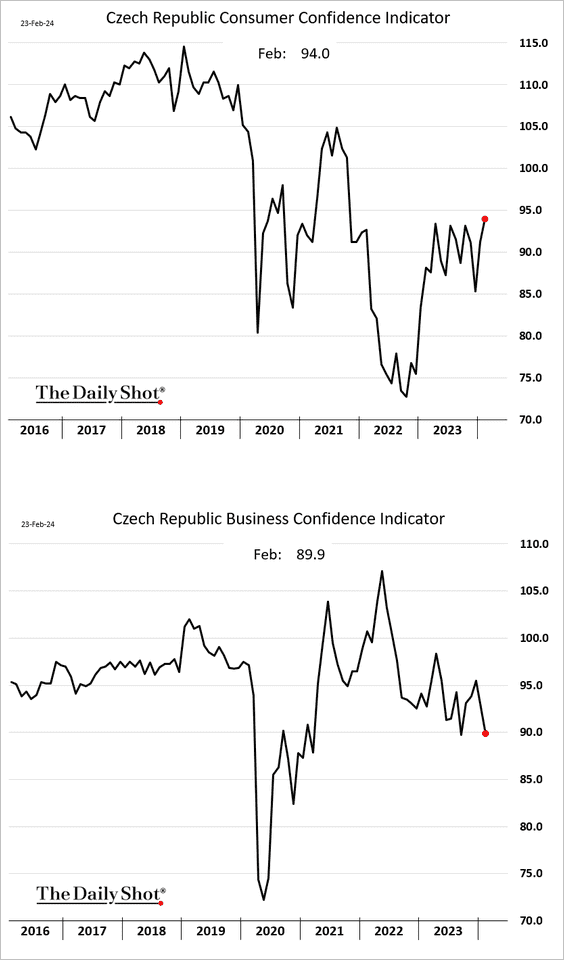

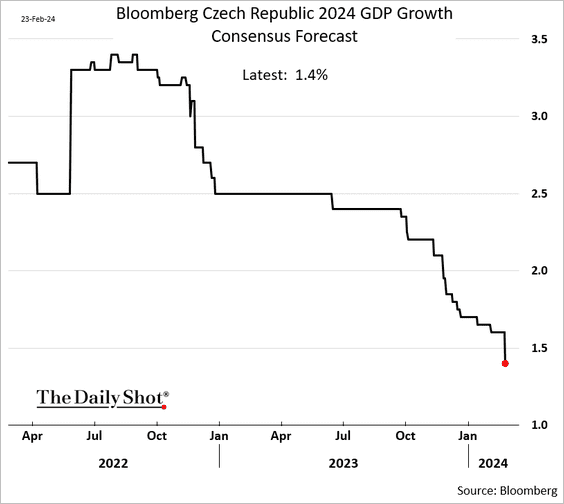

2. Czech consumer and business sentiment indicators have diverged.

• Economists continue to downgrade their estimates for economic growth in the Czech Republic this year.

——————–

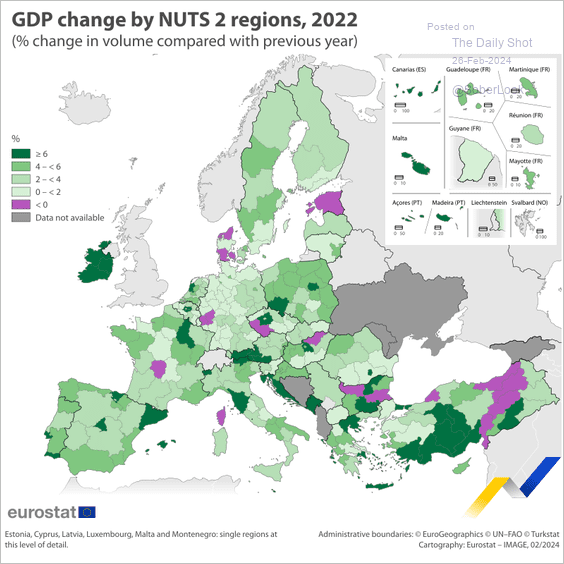

3. Next, let’s take a look at GDP growth across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

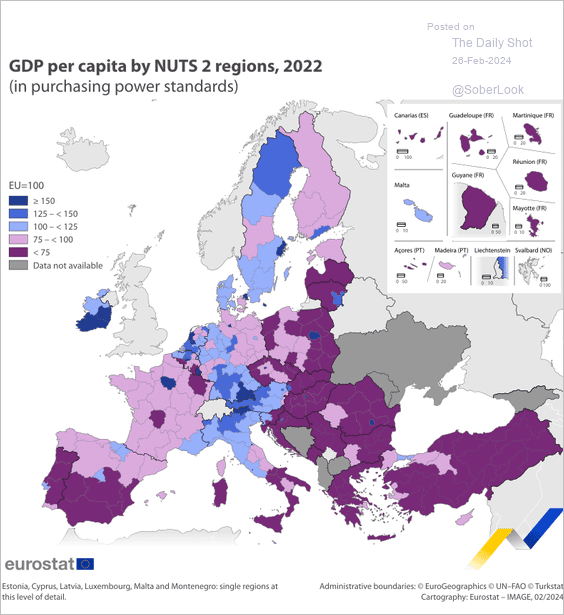

And here is the GDP-per-capita map.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia-Pacific

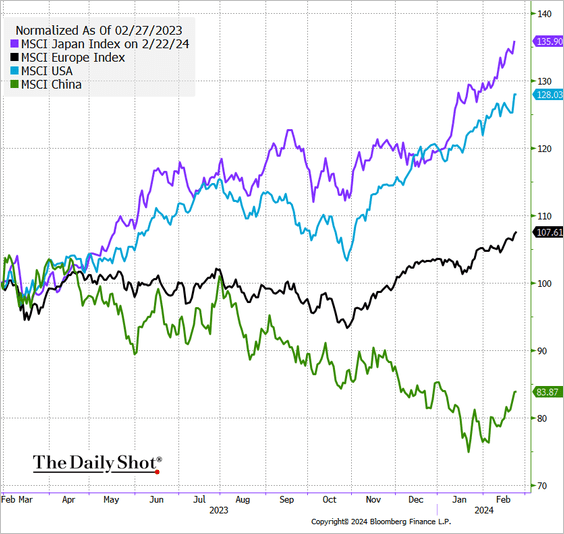

1. Japan’s shares have been outperforming.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

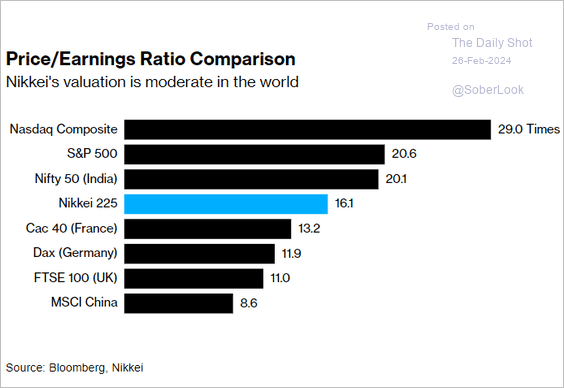

Valuations are not stretched.

Source: @markets Read full article

Source: @markets Read full article

——————–

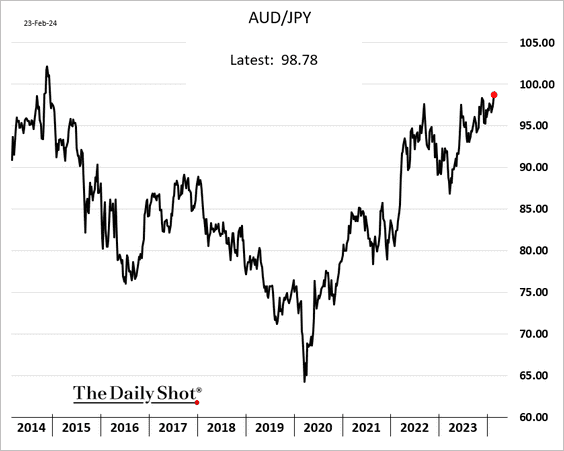

2. The Aussie-Yen rally signals improving global risk appetite.

h/t Mary Nicola, Bloomberg MLIV

h/t Mary Nicola, Bloomberg MLIV

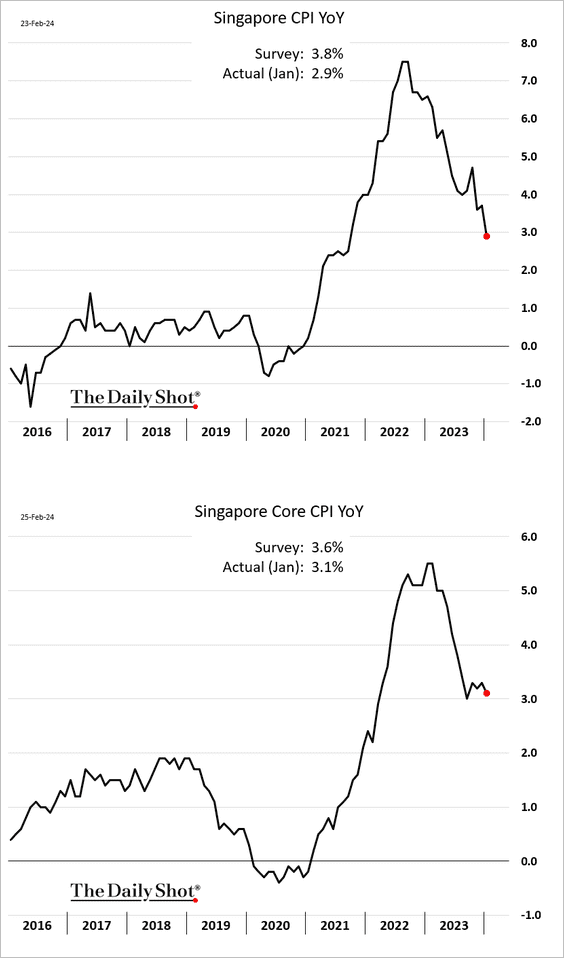

3. Singapore’s CPI surprised to the downside.

Back to Index

China

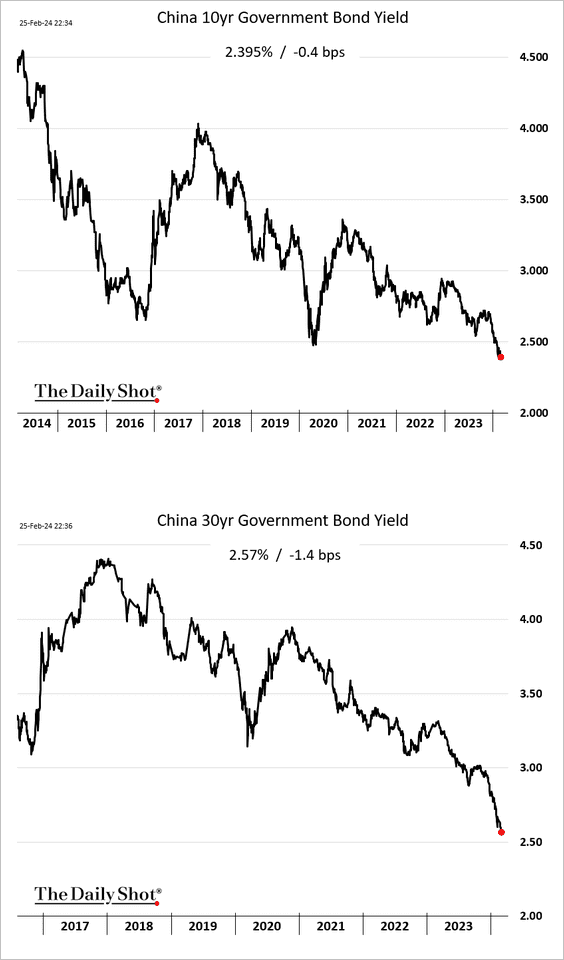

1. Bond yields continue to trend down.

2. Local government bond spreads have been tightening.

Source: @markets Read full article

Source: @markets Read full article

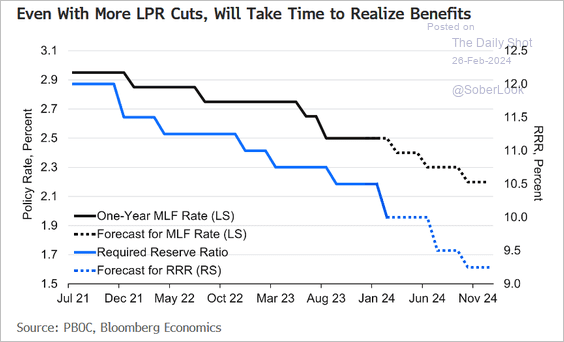

3. According to Bloomberg Economics, we will see more PBoC policy easing this year.

Source: Eric Zhu, David Qu, Bloomberg Economics Read full article

Source: Eric Zhu, David Qu, Bloomberg Economics Read full article

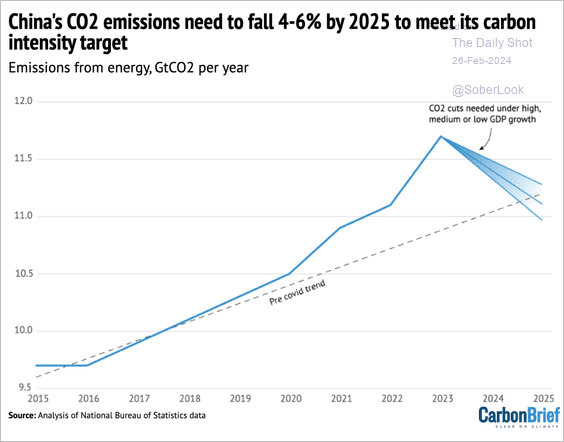

4. China has been moving further away from its carbon intensity target.

Source: Carbon Brief Read full article

Source: Carbon Brief Read full article

Back to Index

Emerging Markets

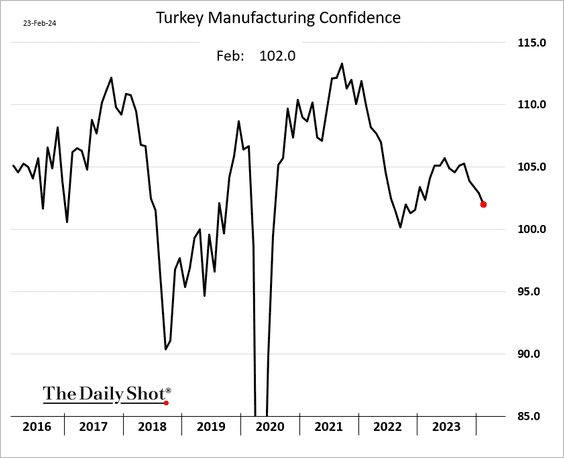

1. Turkey’s manufacturing confidence has been declining in recent months.

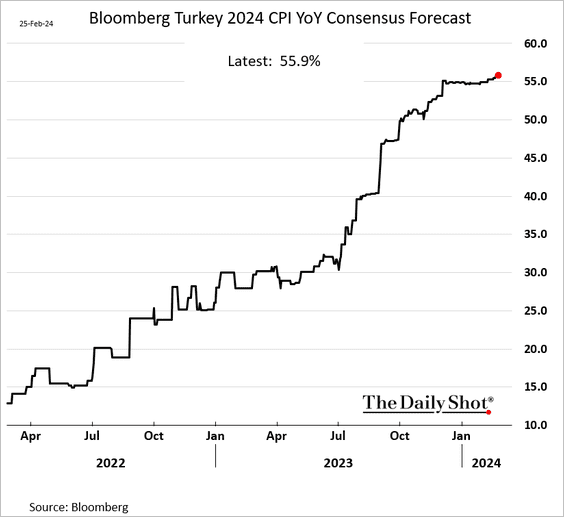

• Economists expect Turkey’s CPI to top 55% this year.

——————–

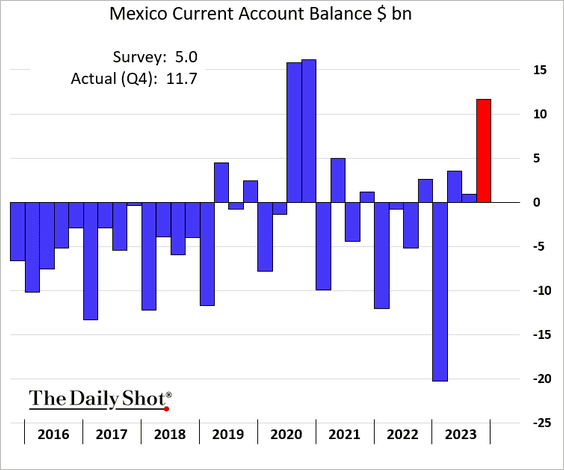

2. Mexico’s current account surplus surged last quarter.

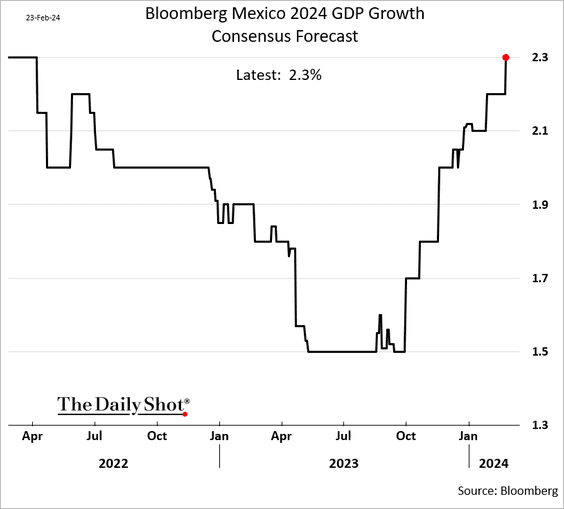

• Economists continue to boost their projections for Mexico’s GDP growth this year (along with the US).

——————–

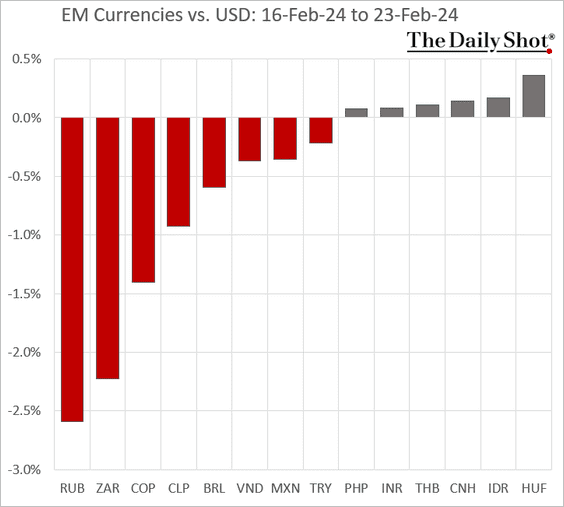

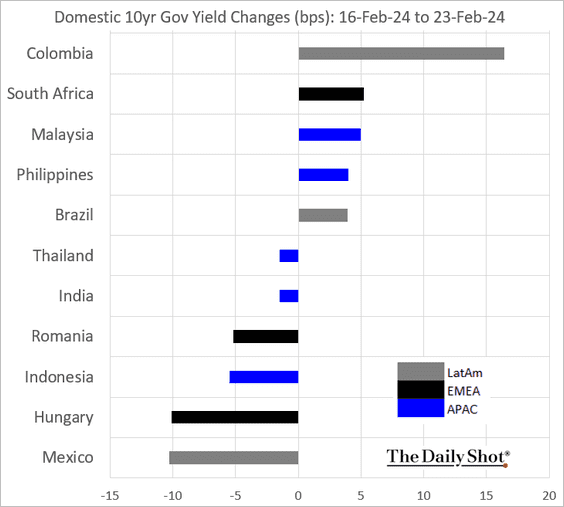

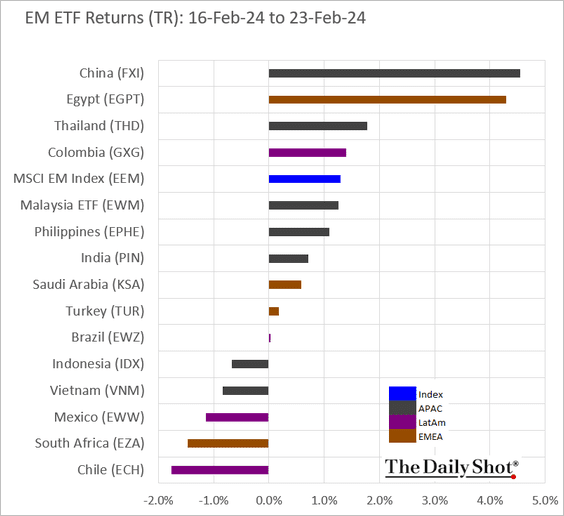

3. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

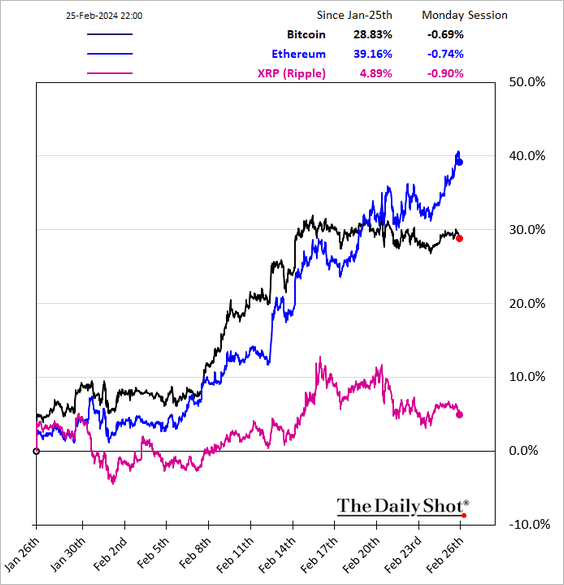

1. Ether continues to outperform.

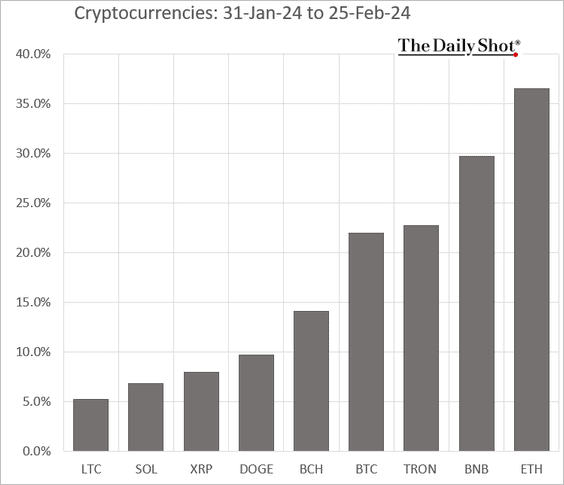

2. Here is the month-to-date performance across some of the most liquid cryptos.

Back to Index

Commodities

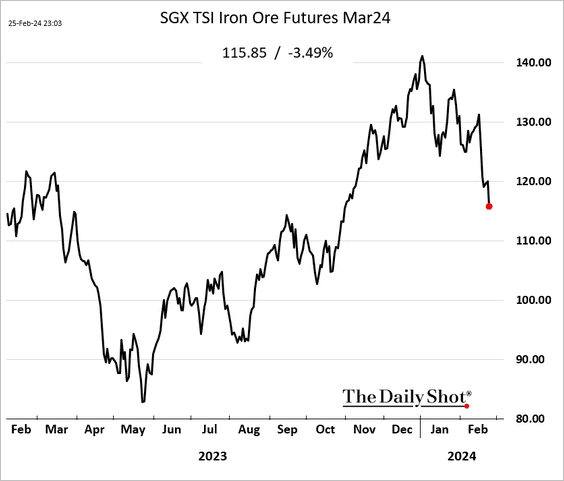

1. Iron ore is rolling over.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

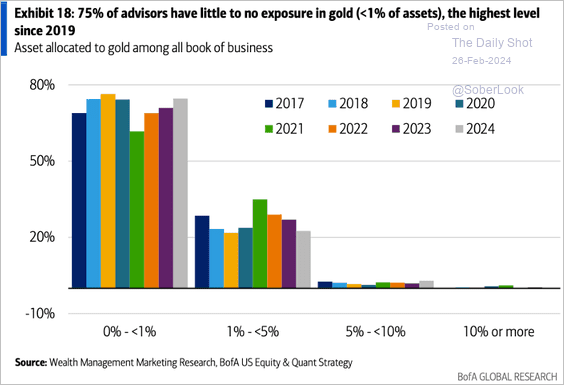

2. 75% of financial advisors have little exposure to gold, …

Source: BofA Global Research

Source: BofA Global Research

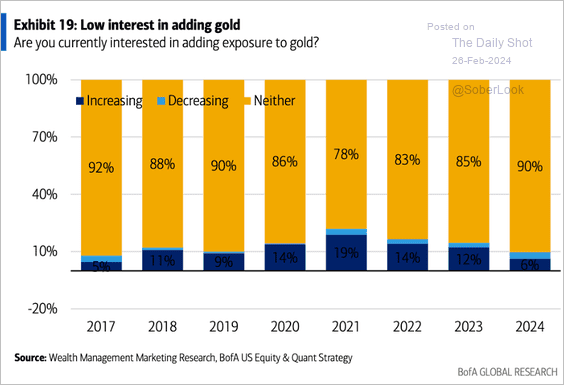

… with limited interest in boosting positions.

Source: BofA Global Research

Source: BofA Global Research

——————–

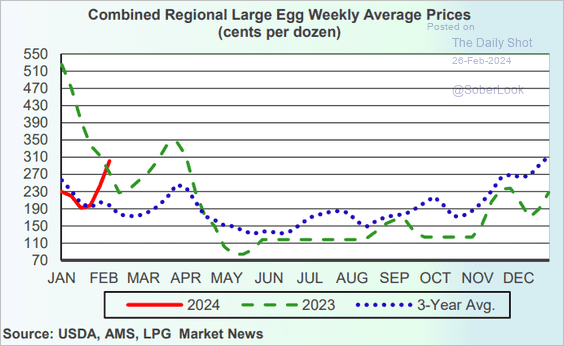

3. US egg prices are rising again.

Source: USDA Read full article

Source: USDA Read full article

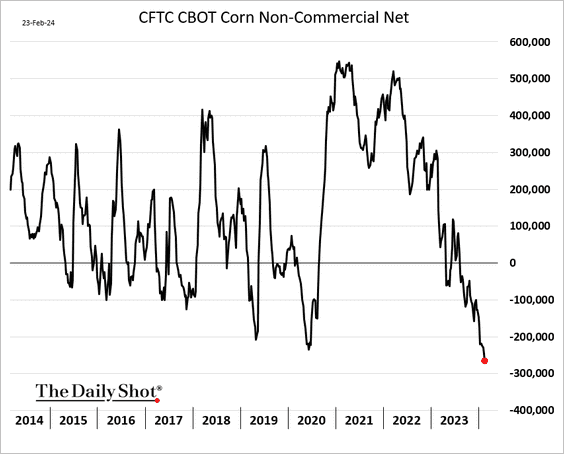

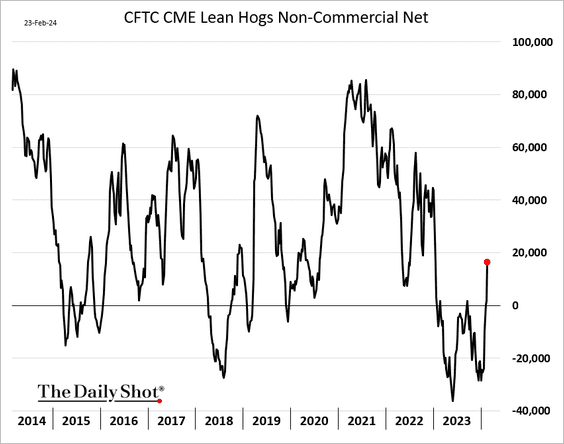

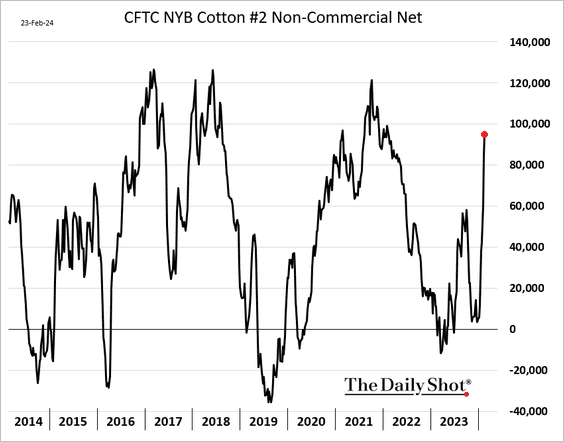

4. Next, we have some positioning trends.

• Corn:

• Hogs (shifted to bullish sentiment):

• Cotton:

——————–

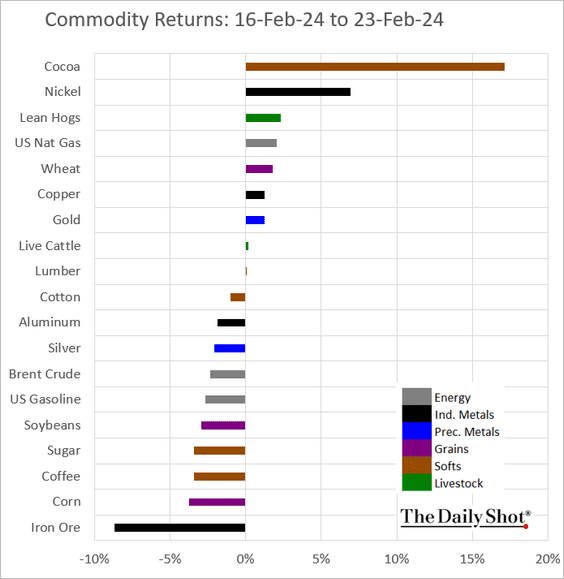

5. Finally, here is last week’s performance in key commodity markets.

Back to Index

Energy

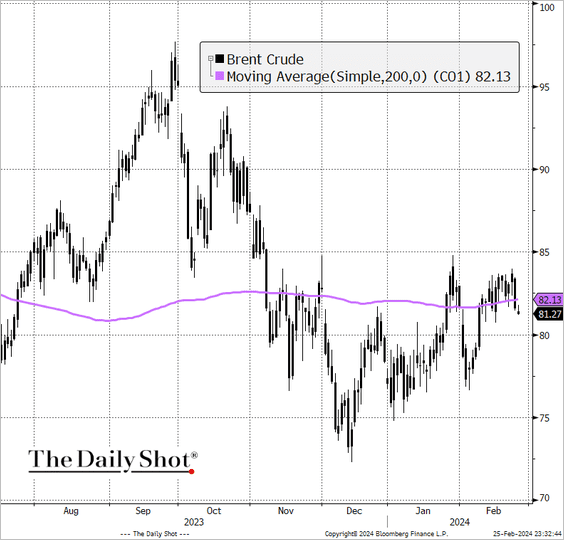

1. Brent crude is back below its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

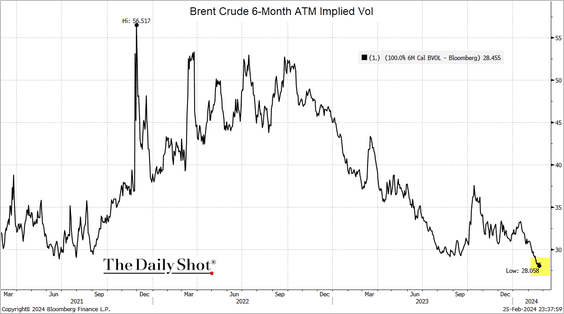

• Crude oil implied volatility has been trending lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

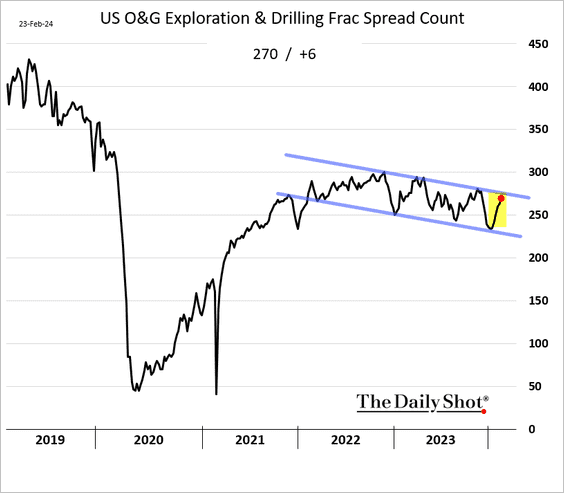

2. Fracking activity improved last week, but the downward trend persists.

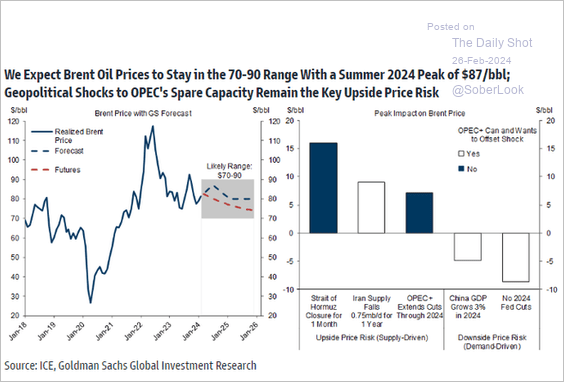

3. Goldman does not see significant gains in crude oil prices over the next couple of years, with the right-hand panel detailing the potential risks to their forecasts.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

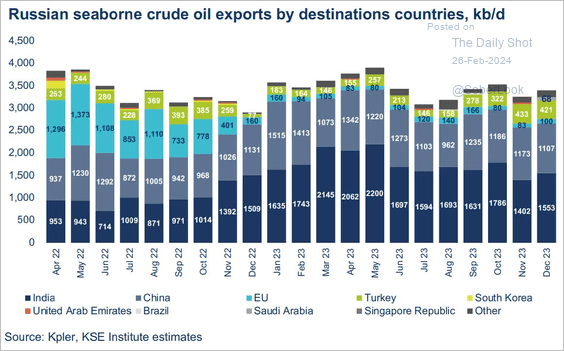

4. This chart shows the destinations of seaborne Russian crude oil.

Source: KSE Read full article

Source: KSE Read full article

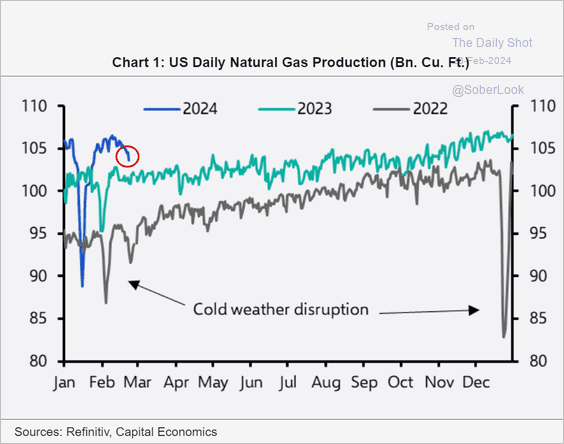

5. US natural gas production is now falling amid depressed prices.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

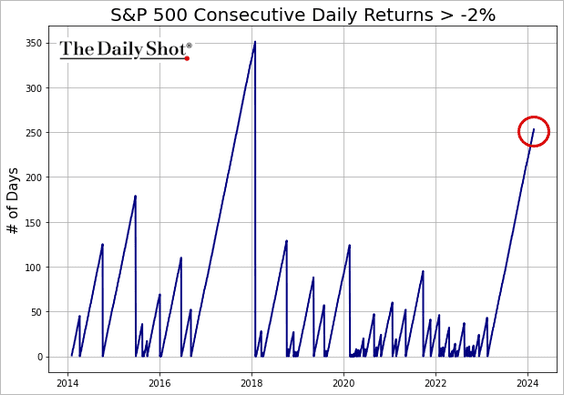

1. The S&P 500 experienced 253 trading sessions without a 2% daily drop.

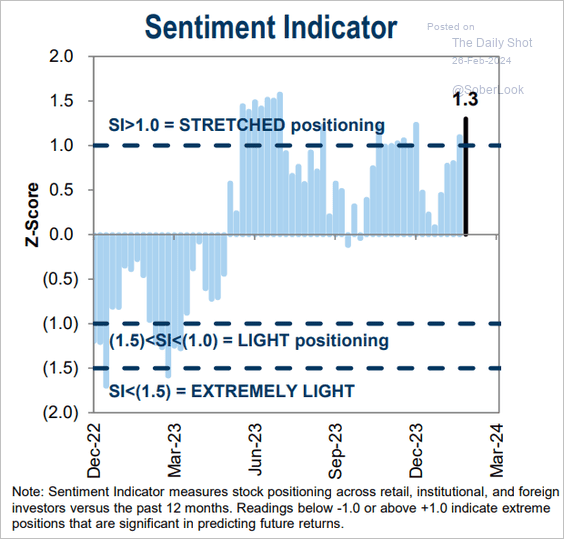

2. Goldman’s sentiment index is in “stretched” territory.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

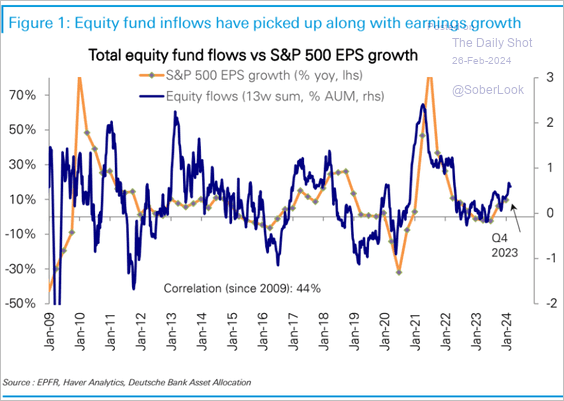

3. Equity flows have picked up in recent weeks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

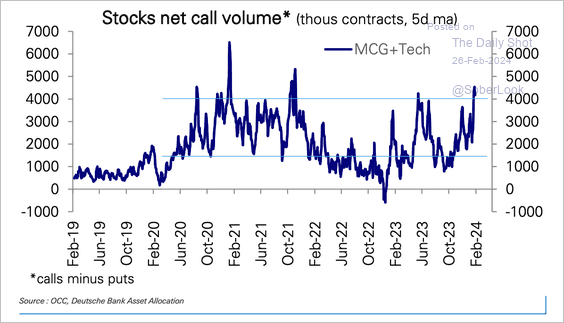

4. Net call volume for mega-cap growth and tech stocks has risen to pandemic boom levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

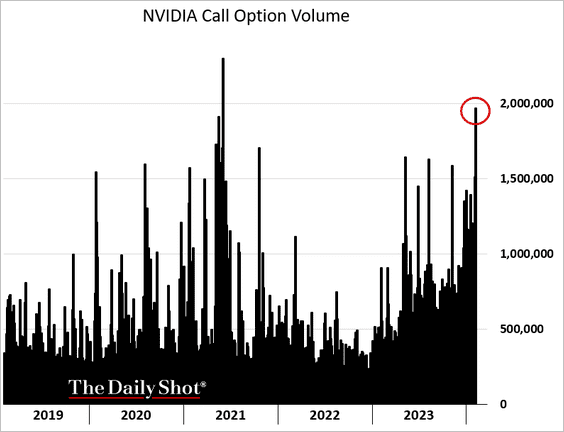

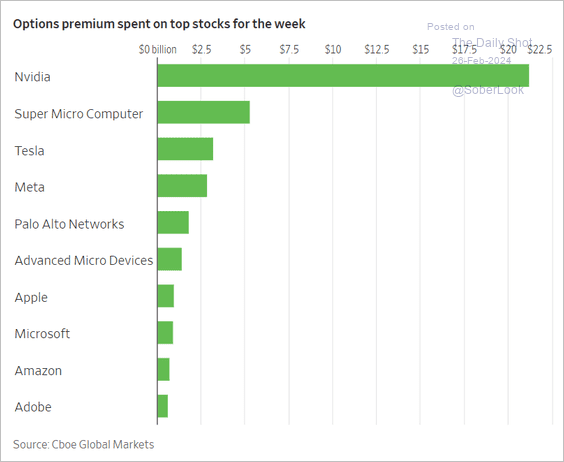

• Last week saw massive activity in Nvidia contracts among options traders. (2 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

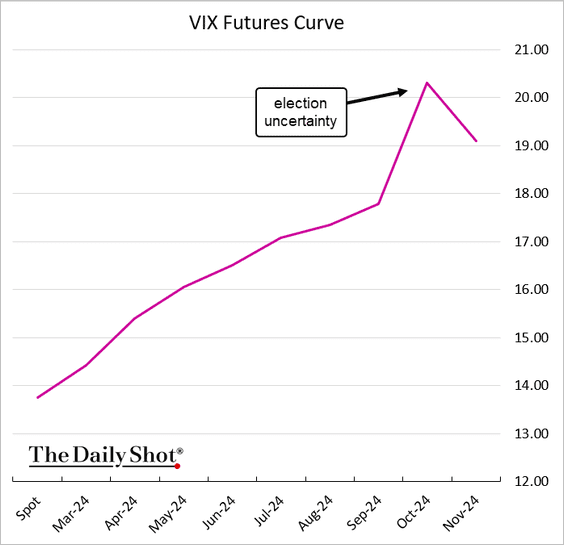

5. The VIX futures curve is pricing in the November elections’ uncertainty.

h/t Chris Murphy, Susquehanna International Group

h/t Chris Murphy, Susquehanna International Group

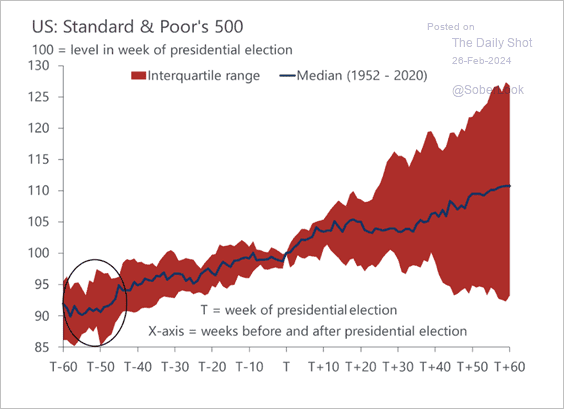

• The S&P 500 is typically range-bound during the initial presidential primary contests.

Source: Oxford Economics

Source: Oxford Economics

——————–

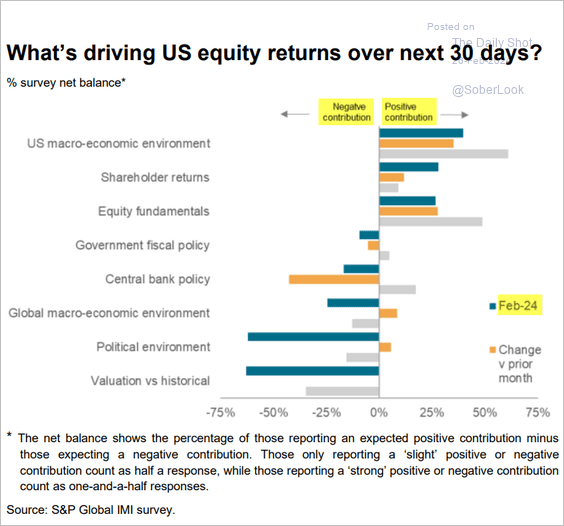

6. According to a survey of investment managers, here are the key factors anticipated to influence US equity returns over the next 30 days.

Source: S&P Global PMI

Source: S&P Global PMI

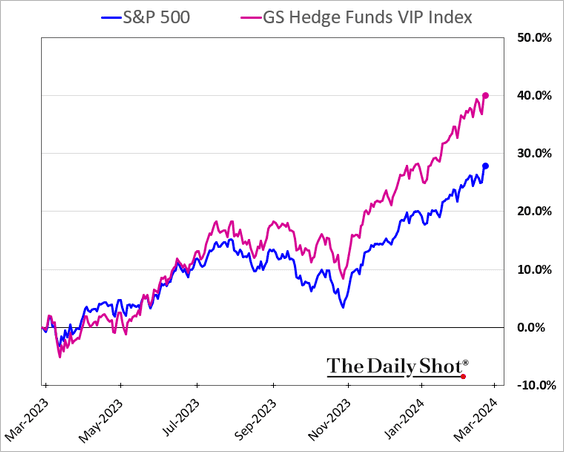

7. Hedge funds’ stock picks have outperformed over the past few months.

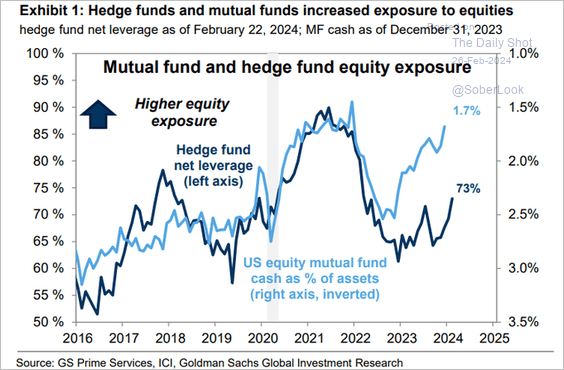

8. Both hedge funds and mutual funds have been increasing their exposure to stocks.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

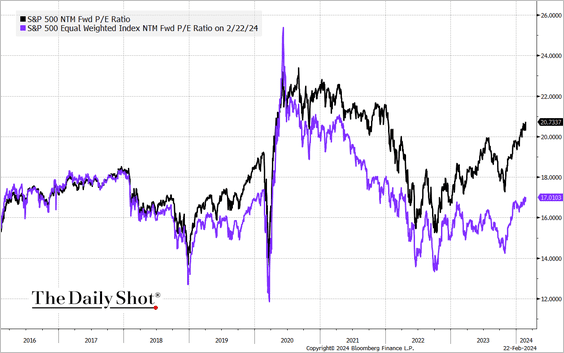

9. The valuation of the average S&P 500 stock continues to lag increasingly behind that of the overall index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

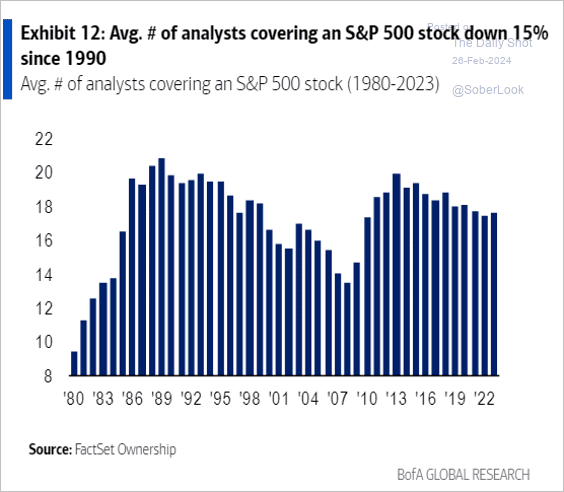

10. This chart shows the average number of analysts covering an S&P 500 stock.

Source: BofA Global Research; @GunjanJS

Source: BofA Global Research; @GunjanJS

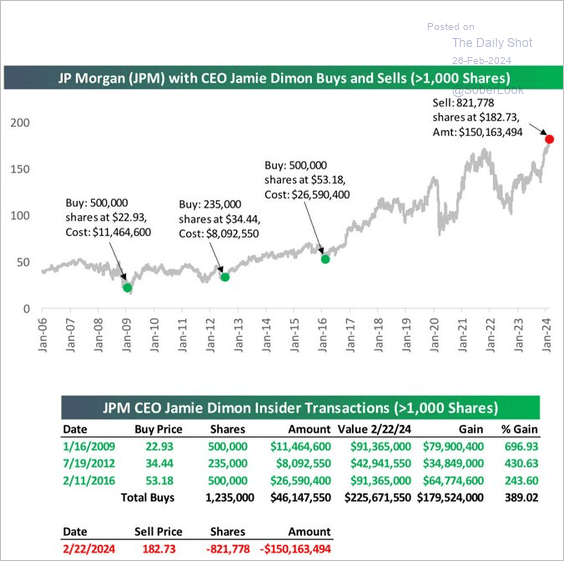

11. Here is a look at Jamie Dimon’s well-timed trades.

Source: @bespokeinvest

Source: @bespokeinvest

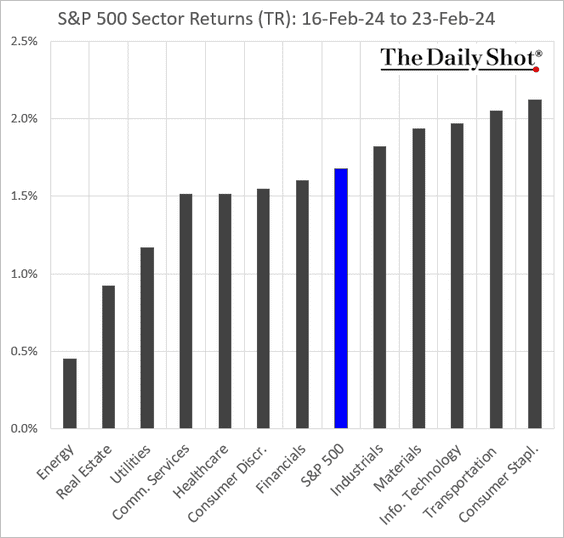

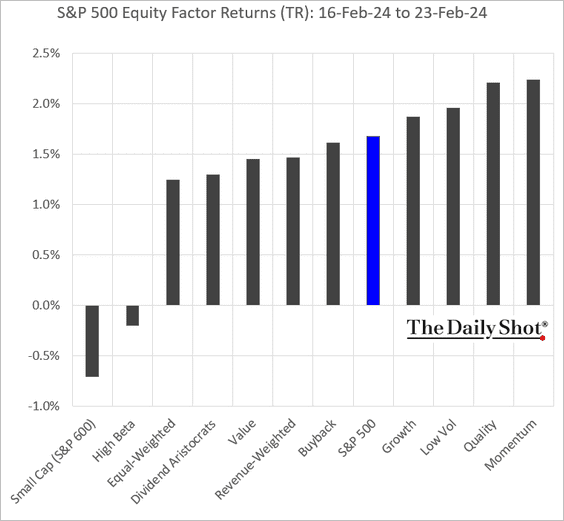

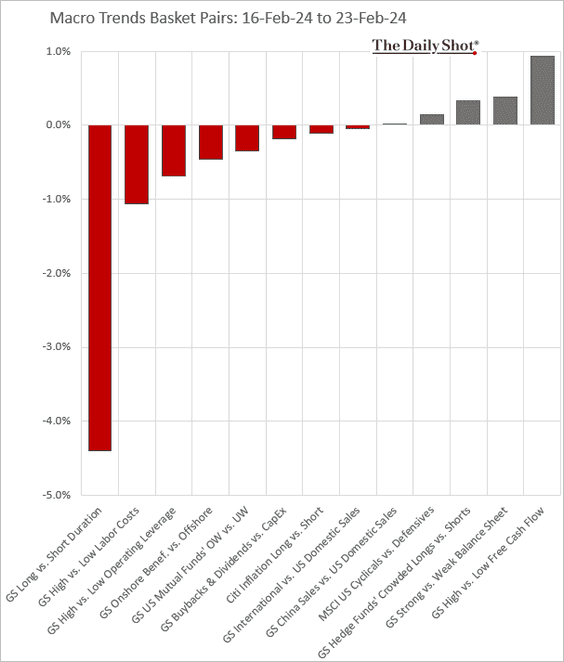

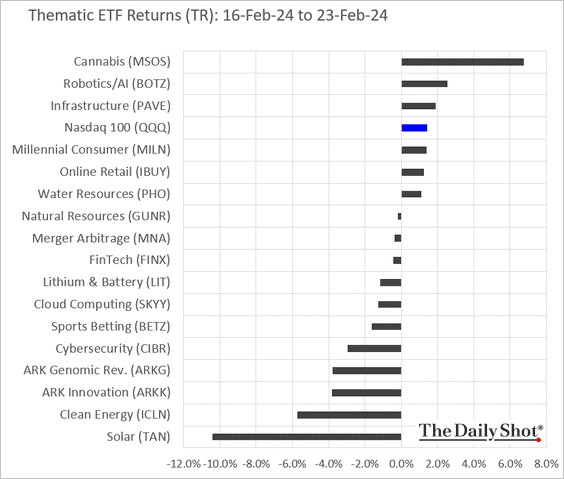

12. Finally, we have some performance data from last week.

• Sectors:

• Equity factors/styles:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

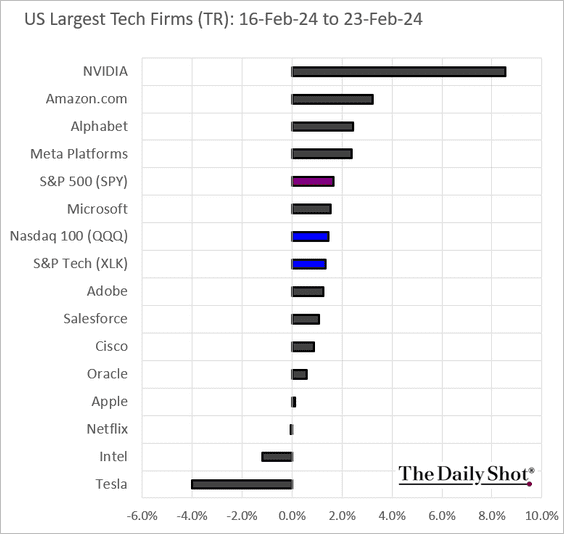

• Largest US tech firms:

Back to Index

Alternatives

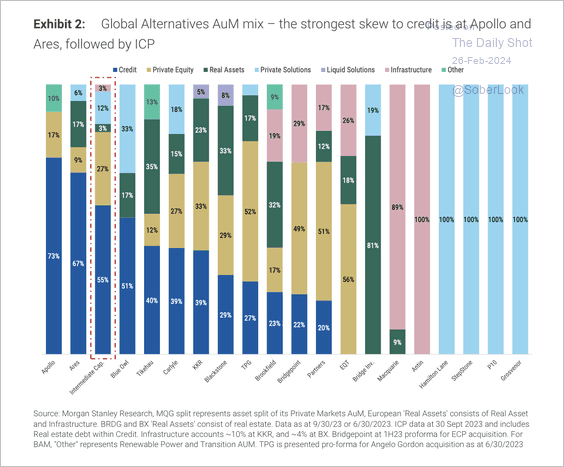

1. Let’s start with the AUM mix across major alternative asset managers.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

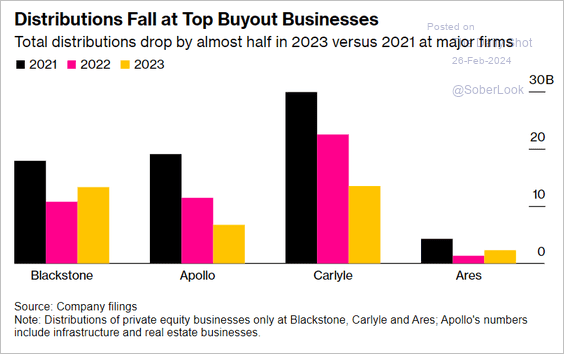

2. Buyout managers were faced with a distribution drought last year.

Source: @wealth Read full article

Source: @wealth Read full article

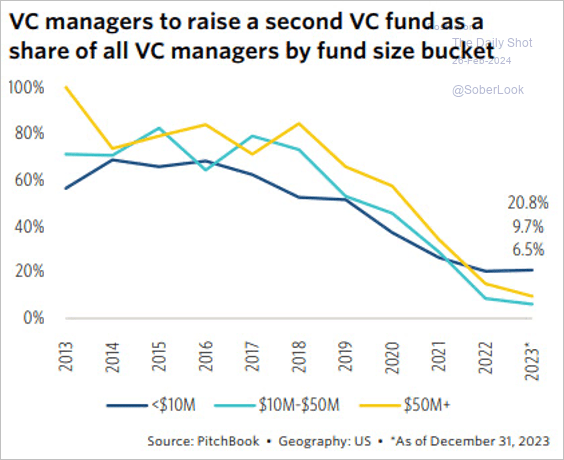

3. Fewer US venture capital fund managers are raising money for a second fund.

Source: PitchBook

Source: PitchBook

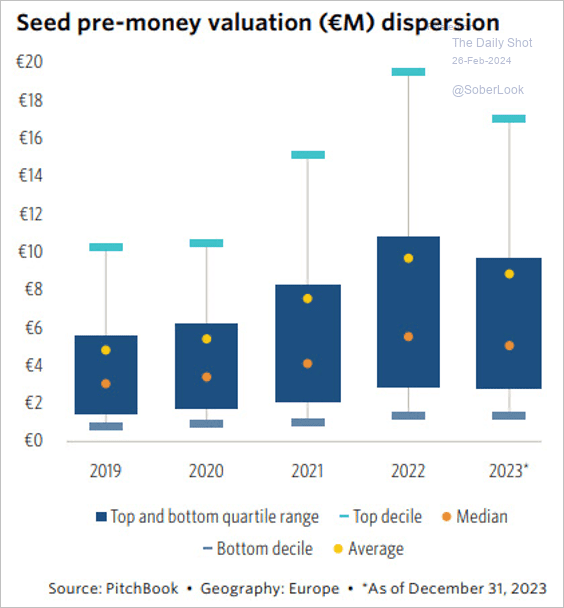

4. European pre-money valuations compressed last year, especially within the top decile.

Source: PitchBook

Source: PitchBook

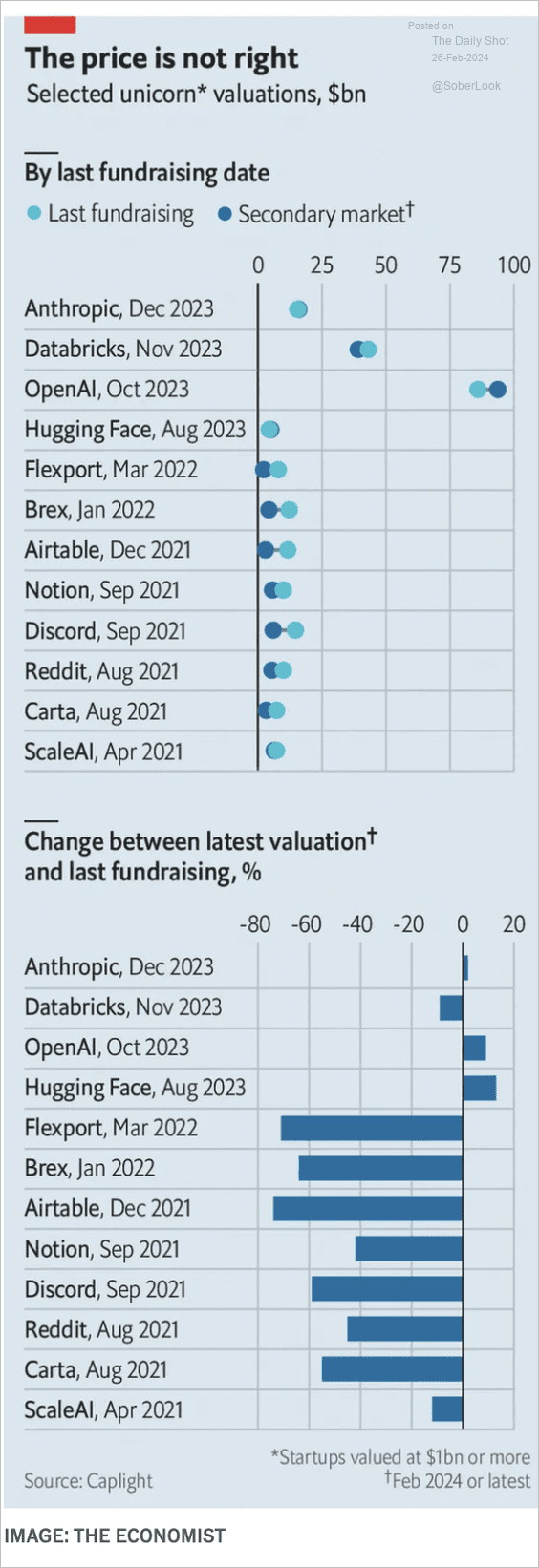

5. Here is a look at selected unicorn valuation changes.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Credit

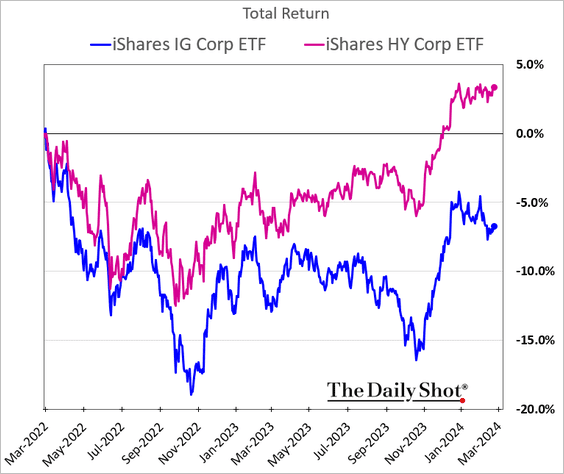

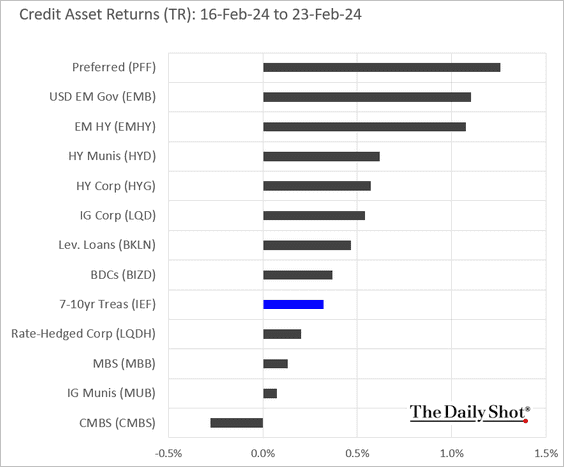

1. Corporate high-yield debt has been outperforming investment-grade bonds.

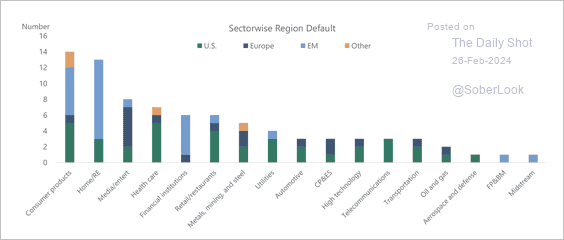

2. Here is a look at default rates across sectors and regions.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

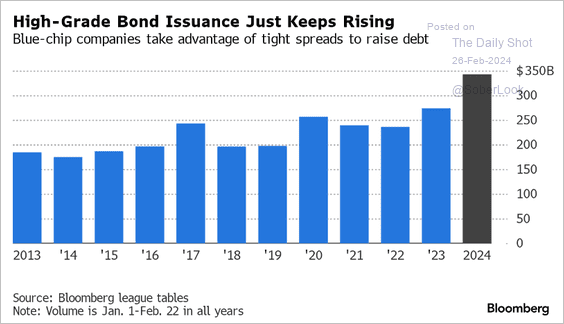

3. Blue-chip companies continue to issue record amounts of debt.

Source: @jtcrombie Read full article

Source: @jtcrombie Read full article

4. Finally, we have last week’s performance data.

Back to Index

Global Developments

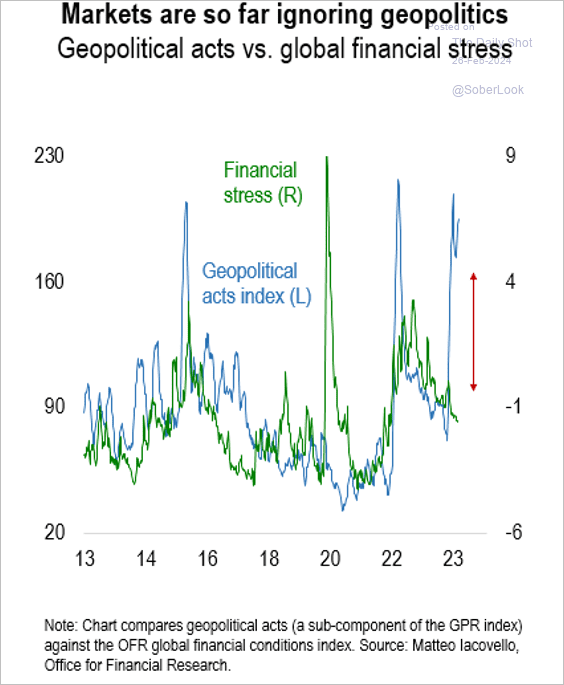

1. Financial stress remains subdued despite heightened geopolitical risk.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

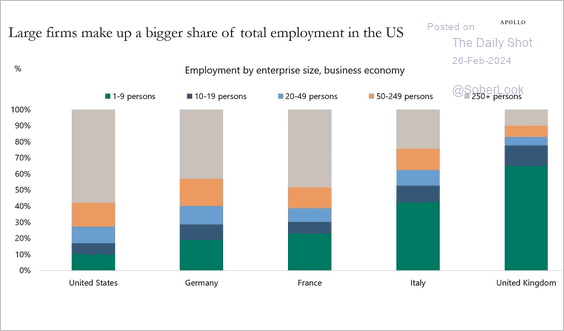

2. Here is a look at employment by enterprise size in Europe and the US.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

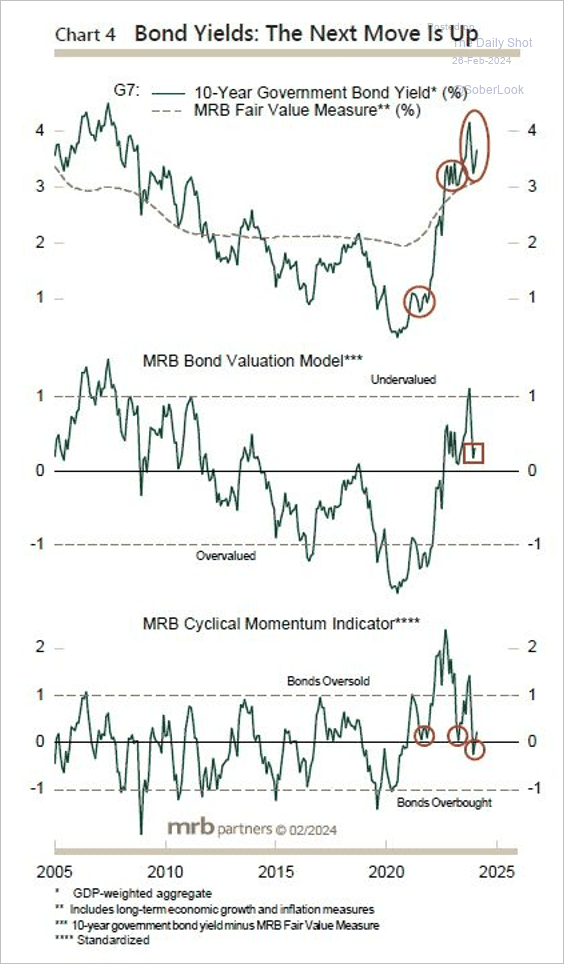

3. Short-term momentum has improved for G7 bond yields.

Source: MRB Partners

Source: MRB Partners

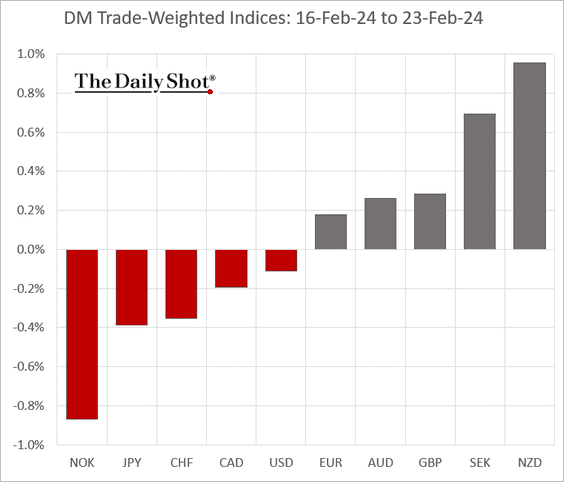

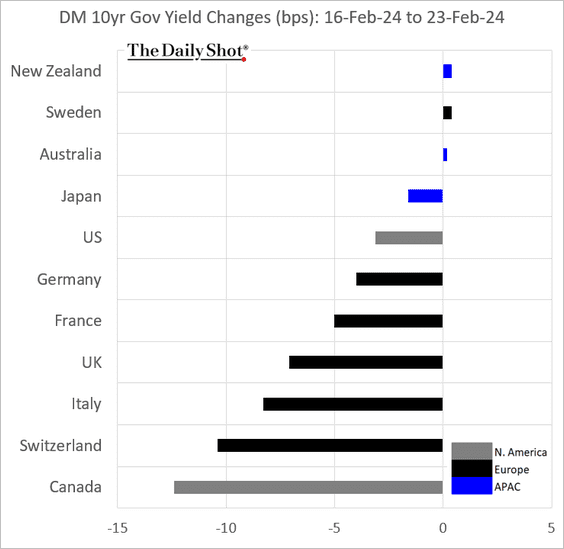

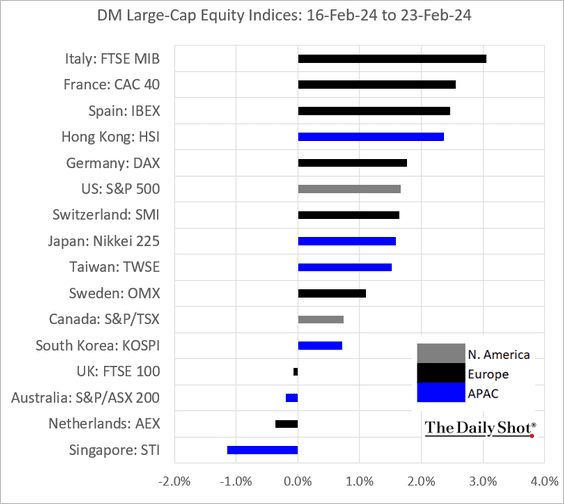

4. Next, we have some DM performance data from last week.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

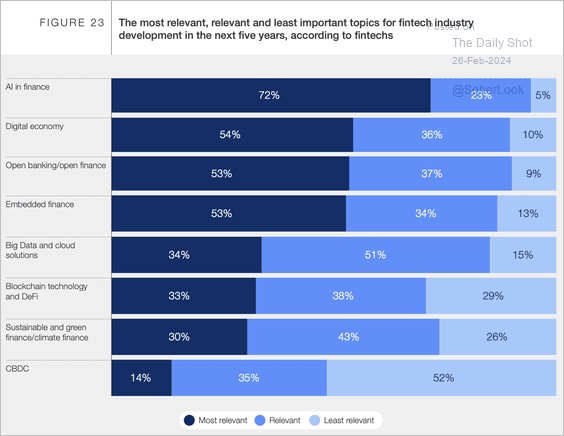

1. Key topics in fintech:

Source: Cambridge Judge Business School Read full article

Source: Cambridge Judge Business School Read full article

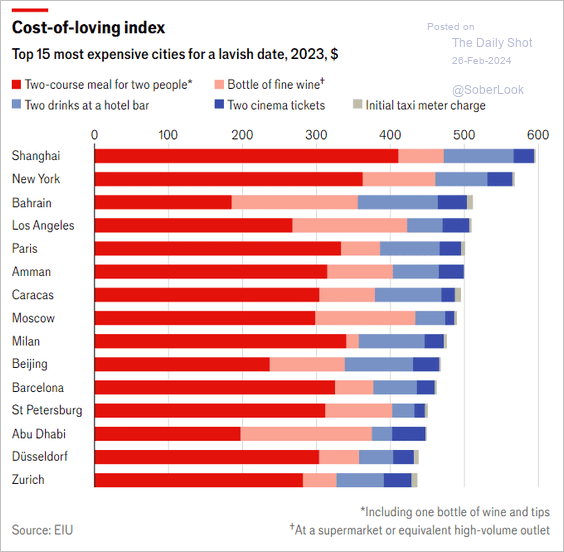

2. The cost-of-living index:

Source: The Economist Read full article

Source: The Economist Read full article

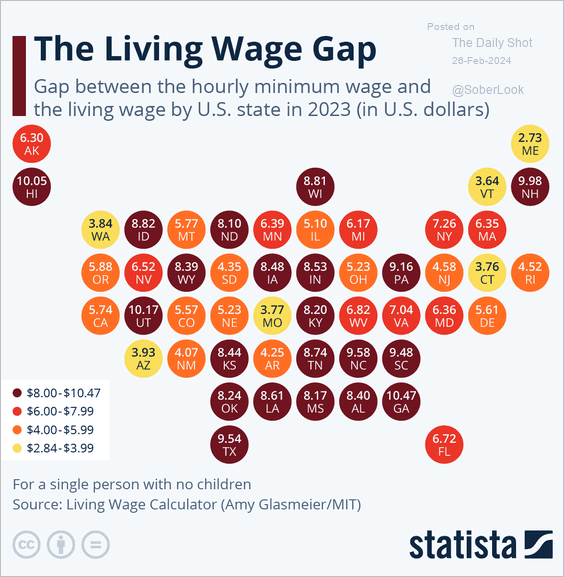

3. The living wage gap:

Source: Statista

Source: Statista

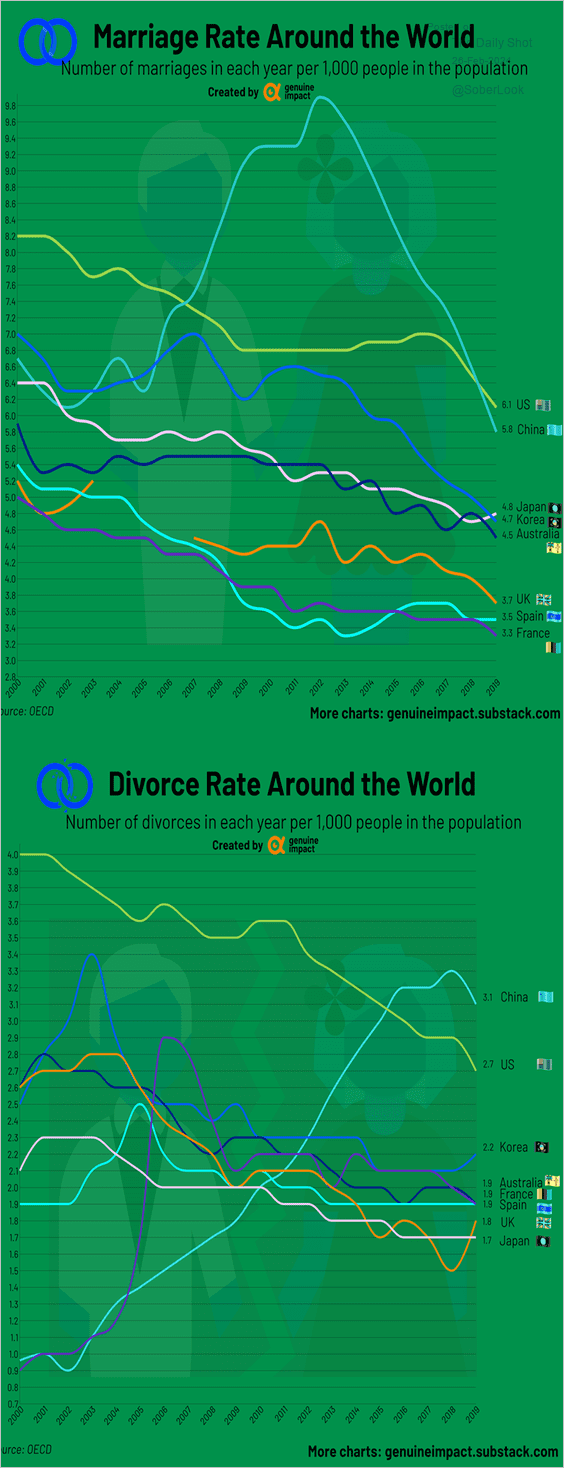

4. Marriage and divorce rates around the world:

Source: @genuine_impact

Source: @genuine_impact

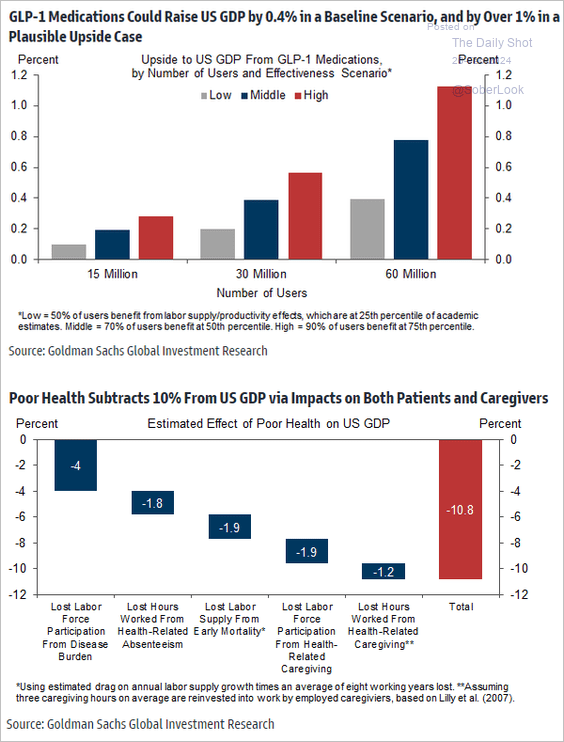

5. The impact of new weight-loss drugs on US GDP (3 scenarios):

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

6. ETFs tracking politicians’ stock trades:

![]() Source: The ETF Shelf

Source: The ETF Shelf

7. The US superimposed over the surface of the moon:

Source: Reddit

Source: Reddit

——————–

Back to Index